Get Your Schengen Insurance

- Hospitalisation expenses up to 30,000€

- Assistance in the event of illness/injury and death

- Coverage in the Schengen area

Extend Your Coverage

- Hospitalisation expenses up to 60,000€

- Assistance in the event of illness/injury and death

- Coverage in the Schengen area + European Union

- Return/relocation and lodging expenses of a companion

Before traveling, please check the guidelines provided by the World Health Organization, the European Union and your local government. Important restrictions are applied to the Schengen Area and visas are likely to be limited to specific travels only. Our travel insurance policies are made to protect you against unforeseeable events, such as sudden illnesses or accidental bodily injuries. We remind you that epidemics and/or infectious diseases such as CoVid 19 are excluded from our policies.

Schengen travel insurance

Europ Assistance makes it easy for you to select and purchase your travel insurance online. Your insurance will be ready in a matter of minutes and our insurance certificates are recognized by embassies, consulates and visa centers around the world , which helps you acquire a Schengen visa for your next trip to Europe. You will immediately receive the certificate and you will be able to download it at any time in any of our six languages : English, French, Spanish, German, Russian or Chinese.

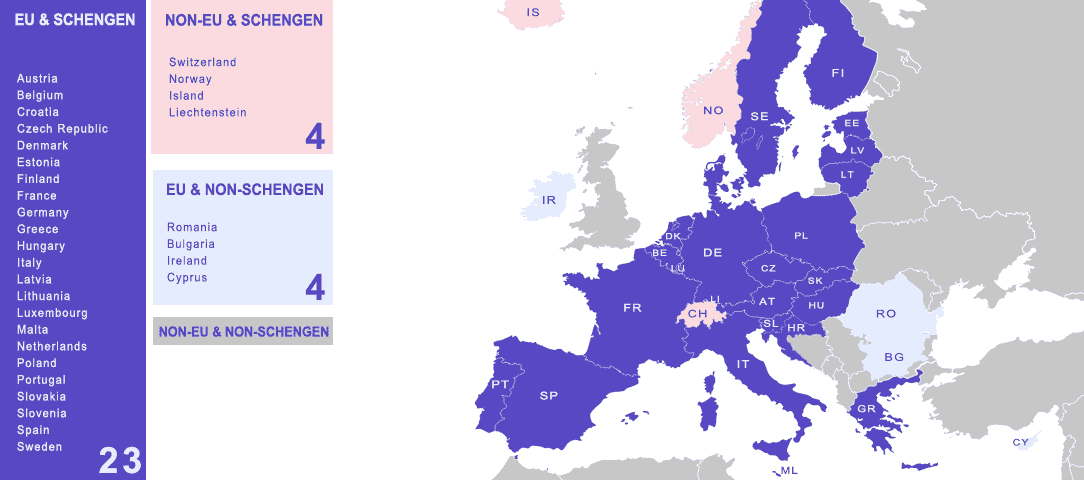

Which countries are in the Schengen area?

The Schengen area is made up of 26 countries (and 3 microstates) where travelers and residents can move freely from state to state without a passport, as there is no longer common border control between Schengen states. Travel insurance is highly suggested for all travelers, and for most countries is mandatory , as it is needed to obtain the visa to enter the Schengen area. You can obtain your visa application form from the country you plan to enter through first or the one you plan to spend the most time in.

The leading Schengen travel insurance provider

When you choose Europ Assistance as your Schengen visa travel insurance provider, you also get the support and expertise of 750,000 partners . If something goes wrong, not only will your medical expenses be properly reimbursed, but you will also get help from competent medical professionals at qualified medical centers, no matter where you are. During stressful situations or emergencies abroad, communicating in your native language can be a source of comfort. When such a situation occurs, you can trust that Europ Assistance will be there to help you 24/7 .

If you wish to subscribe for more than 20 people, please contact us

Travel dates

- Country of residence All travellers are from the same country of residence : Yes No

A Schengen visa is not required for your trip, however, you should still consider purchasing travel insurance. You can travel with peace of mind and are covered throughout the European Union with our Schengen Plus cover.

- Hospitalisation expenses up to 60,000€

- Coverage in the Schengen area + European Union

Trustpilot 4.8/5 based on our lovely customers reviews.

Insure your Schengen trip in a minute

2,480,086 wordwide insured days!

24/7 assistance

Refund in case of visa refusal

Instant insurance certificate

International healthcare network

Please fill out the form below or contact us by email or by chat

By ticking this box you acknowledge that:

Schengen Travel Insurance for Europe

If you’re planning to travel to Europe, specifically to any of the countries within the Schengen area, you’ll need to purchase Schengen travel insurance ahead of your trip. Here, we’ll guide you through all you need to know about Schengen travel insurance before you travel.

Visa Travel Insurance is a trusted partner of worldwide visa companies:

How it works

Get the Schengen travel insurance fit your embassy, consulate and visa center requirements in less than a minute

Compare travel insurance

Between the 4th world leader Allianz, Axa, Europ Assistance and Mutuaide

Field a form

with your informations be aware passport number needed !

Receive your certificate

immediately and explore the world with peace of mind!

Schengen Travel Insurance companies

Worldwide trusted partner network

The International Leader of Medical Assistance in the world with 54,000,000 files processed per year.

The 2nd International Leader of Medical Assistance in the world with 15,100,000 files processed per year.

The 3rd International Leader of Medical Assistance in the world with 10,000,000 files processed per year.

Mutuaide is the Groupama subsidiary that has specialized in assistance and affinity insurance for over 40 years.

We can cover you for your Schengen trip

Here is our guarantees

Medical Expenses

In case of illness or injury (up to €100,000) Emergency dental expenses included

Medical rapatriation

In case of illness or injury (Actual Cost) Transfer of mortal remains included

Travel assistance

24/7 Before and during your trip(s) Information, Support, and Services

Luggage & valuables

Theft, loss, destruction or delivery delayed

Costs for search and rescue at sea or in the mountains are covered for the insured.

Air Ticket Cancellation

Illness, injury or death for the Insured Person and his relatives

Other guaranties

- Terrorist Attack

- Legal fees abroad & Advance of bail abroad

- Early return in case of death in the Insured person Family

- Accompanying minor children

- Organisation of services

- Assistance in case of loss or theft of papers abroad

- Transport of a Companion in the event of Medical Repatriation

- Visit by a relative

- Legal Assistance

- Medical information and advice

- Transport of a Companion in the event of Hospitalisation

- Assistance of domestic Animals

- Costs of additional stay

- Extension of hotel stay due Illness or Injury

- Lodging expenses of a Companion in the event of Hospitalisation

- Transmission of urgent messages

They travel with us and they are happy!

Find out our (lovely) Schengen customers feedbacks.

What is Schengen travel insurance?

Schengen travel insurance is specifically designed to meet the requirements for any travelers visiting any of the 27 countries within the Schengen zone. To qualify for a Schengen short-term visa or long-term visa, travelers need to provide proof of adequate travel insurance.

The Schengen zone is the area of free movement within Europe, where citizens and travelers can move between countries without the need for border checks or multiple visas. Therefore, Schengen travel insurance covers you for travel through all those European countries who are part of the Schengen free movement area . This will allow you to be flexible during your trip and visit multiple countries on your Schengen visa, should you choose to.

Do you need travel insurance for a Schengen visa?

There are several types of Schengen visa available – the transit visa, the short-stay visa and national long-stay visa but the most common is the short-stay visa, allowing you up to 90 days within the Schengen Zone in a 180 day period.

One of the principle requirements for being granted a Schengen visa is to have a travel insurance certificate that covers you in all states within the Schengen area. This ensures that any potential fees relating to medical repatriation, urgent medical attention and/or emergency hospital treatment or death, are covered whilst you are staying in one of the Member States. Because of the free movement agreement between all the countries within the Schengen area, having travel insurance for just one country is not adequate.

What type of travel insurance is needed for a Schengen visa?

You’re free to pick an insurance policy of your choice, but you’ll need to check that the policy you choose is 100% compliant with the embassy, consulate or visa center requirements where you are making your Schengen visa application.

In order to be compliant with a Schengen visa, your travel insurance policy must meet specific criteria set out by the Schengen Agreement. It must cover you for the entire duration of your stay, must be valid within all countries of the Schengen zone, and must have a minimum coverage of €30,000 for medical expenses or repatriation (Emergency medical).

However, every embassy is different, and there can also be additional demands made, depending on where you are applying for your visa. Some embassies, for example, require you to include Covid cover, or to take out an annual policy. You may be required to choose an insurance policy with no deductible (excess), or one with no maximum day limit per trip.

Searching for a 100% compliant Schengen Travel Insurance?

What’s the difference between europe travel insurance & schengen travel insurance .

Europe travel insurance and Schengen travel insurance are very similar and often confused. Many travelers searching for Europe Travel Insurance are in fact in need of Schengen visa travel insurance, or visa-versa. Schengen travel insurance covers all those European countries who are part of the Schengen free movement area. This includes most countries within the European Union, with the exception of Bulgaria, Cyprus, Ireland and Romania. It also includes a number of non EU-states – Iceland, Norway, Switzerland and Liechtenstein – who have joined the Schengen zone. However, if your trip includes European countries which are not included in the Schengen area – such as the UK – you’ll need Europe travel insurance instead. This will insure you for all the Schengen member states, as well as those outside the Schengen zone. A Schengen travel insurance policy is necessary in order to obtain the Schengen visa, but most European travel insurances meet the Schengen visa requirements as well as covering some additional countries. Be sure to check the terms and conditions of your Europe travel insurance policy to be sure it meets the Schengen requirements. Both Europe and Schengen travel insurance will cover you for a range of unforeseen travel expenses, including medical expenses, during your Europe trip.

What’s the difference between Schengen travel insurance & Schengen travel medical insurance?

Schengen travel medical insurance is included within the Schengen travel insurance cover, and is the minimum requirement in order to apply for a Schengen visa.

Schengen travel insurance and Schengen travel medical insurance are essentially the same insurance, except that Schengen travel insurance will also cover you for a range of additional guarantees.

In addition to medical coverages, this broader travel insurance can cover other travel emergencies such as…

- Air ticket cancellation: Reimbursement of your air tickets costs in the event of a cancellation

- Additional stay: Coverage of additional accommodation costs in case your return is delayed.

- Lost or stolen belongings: Coverage for the loss or theft of personal belongings, including luggage, passports, and valuable items.

- Sports : Coverage for sports injuries or accidents, including search and rescue costs.

- Travel assistance: Access to 24/7 support services for travel-related issues , such as medical referrals, translation services, and travel advice, before and during your trip.

- Covid insurance: Specific cover for Covid related expenses such as quarantine or additional medical expenses.

If I’m exempt from needing a visa, do I still need European travel insurance?

Not all travelers require a Schengen visa in order to visit the Schengen area. If you are exempt from needing a visa, having a European travel insurance policy is not a legal requirement.

Nonetheless, it is highly recommended to purchase insurance for your trip, since medical costs within Europe can be very expensive for non-citizens. Having European travel insurance in place gives you peace of mind during your travels, and allows you the flexibility of changing your travel plans and visiting different European countries during your trip.

Who is exempt from needing a visa?

If you meet one of the following requirements, then you may be exempt from needing a Schengen visa:

- You are a citizen of a country that has a visa-free arrangement with the Schengen zone, such as the USA, Australia, United Kingdom and Canada. Citizens from these countries can freely enter the Schengen zone without needing a visa and are permitted for short-term stays. You can find the full list of exempt countries on European website .

- You are traveling on a diplomatic passport, official passport or other type of special passport.

- You are a British citizen. Since Brexit, British citizens can stay within the Schengen zone for up to 90 days in a 180 day period, provided that you are visiting as a tourist or for certain other reasons (You can check it on the UK government website) such as journalism or medical treatment. You can travel to any number of countries within the Schengen area during this 180 day period, providing that your total time within the zone does not exceed 90 days.

How to find the best Schengen Travel Insurance?

The easiest way to find the best travel insurance for a Schengen visa is to use a comparison tool. Insurté’s travel insurance comparison tool gathers information on multiple insurance providers to help you identify which policy is best suited to your needs.

You can filter your results according to the type of trip you want – single-trip or multi-trip – as well as the region you want to cover – for example, worldwide cover if you’re globe-trotting.

Some of the most well known insurance providers offering Schengen visa travel insurance include Axa, Allianz, Europ Assistance and Mutuaide.

Where can I find the cheapest travel insurance Europe

It’s always worth shopping around when you are choosing travel insurance, especially if you are looking to find the cheapest insurance options available. There are also ways to reduce the cost of your insurance by modifying your requirements.

Using Insurté’s insurance comparison tool will allow you to compare prices of different policies and select the cheapest travel insurance for Europe.

The cheapest travel insurance options are going to be those that offer a more basic level of cover. Reducing the length of your stay will also bring down your cover, as will increasing your deductible (or excess).

Where can I find a comprehensive Schengen travel insurance

To ensure you have a premium policy that will protect you against all unforeseen events during your travels, you’ll want to opt for a comprehensive Schengen travel insurance .

Comprehensive options will have higher thresholds in the payouts they offer and may include more specific options such as Covid cover. They may also be deductible free, meaning in the moment of a crisis you won’t need to pay out anything yourself. When searching for comprehensive insurance, be sure to review the policy terms and conditions carefully to understand what is and isn’t covered. Consider factors such as:

- Coverage limits: Opt for higher coverage limits to avoid any nasty surprises.

- Deductibles : Choose options without deductibles.

- Additional Benefits: Look for additional benefits like air ticket cancellation coverage, lost baggage protection and sports.

- Customer reviews: Check that previous customers have had a positive experience with the insurer.

How much does Schengen travel insurance cost?

The cost of your Schengen travel insurance will vary widely depending on which insurance provider you go with and the level of coverage you select. Overall cost will depend on the length of your stay, as well as specific guarantees that you want covered. Including high risk activities such as skiing can result in a more expensive policy.

On average you might expect to pay from €21 for a Schengen travel insurance policy for a short-term stay.

The cheapest options will include basic insurance policies that offer minimal coverage. More comprehensive policies come at a higher premium, but offer additional benefits and have higher cover limits.

Looking for a cost estimation ?

Schengen travel insurance faqs, do you need travel insurance for europe.

Travel insurance is a legal requirement if you are traveling to one of the countries within the Schengen zone and need a visa. Since the majority of European countries are included in the Schengen zone, most travelers to Europe will therefore need travel insurance.

For those traveling to a European country that is not in the Schengen zone – for example, the UK or Ireland – or for travelers who do not require a visa, travel insurance is not a legal requirement but is highly recommended . Medical costs can be very high in European countries for non residents, and so European travel insurance will give you peace of mind during your trip.

Yes, travel medical insurance is mandatory in order to be granted a Schengen visa. This includes short-term visas of up to 3 months, as well as multiple-entry visa (multi-trip) and long stay visa. Travel insurance must meet specific criteria, including covering costs for medical emergencies and repatriation of up to €30,000.

It’s important to carefully review the terms and conditions of each policy to ensure it complies with the Schengen requirements and provides adequate coverage for your travel needs.

When applying for your visa, you’ll need to take proof of your insurance cover with you to the embassy, along with any other paperwork necessary for your visa application.

Why compare Schengen travel insurance?

Before you take out your insurance policy, you’ll want to be sure you’re getting the best coverage for your trip, as well as the best value for money. It’s therefore important that you take time to review the available options and compare them. Using a comparison tool is a fast and effective way to compare offers from different providers and find the best cover. As with any purchase, no two products are the same. Prices can vary between different insurance providers, as can the type of coverage they offer. The length of your visit, levels of coverage provided and deductibles will all impact the type of cover you’ll want.

When do I need to buy Schengen travel insurance?

You’ll need proof of your Schengen visa travel insurance when you apply for your Schengen visa, so it’s advisable to purchase your travel insurance well in advance. That said, it is possible to apply for the insurance immediately before your appointment, if you are short on time.

Remember you will need to print your insurance certificate in time to include it in your visa application paperwork.

If your visa application is unsuccessful, you can apply for a 100% refund from Insurté within 14 days of your visa refusal.

Do I need deductible or no deductible insurance ?

Insurance policies with deductibles typically have lower premiums and can be more attractive at the outset. However, they can increase the risk of you needing to pay out of pocket when you make a claim.

Some embassies require travelers to take out an insurance policy with no deductible, so it is important to check with your visa center before taking out insurance.

Do I have to buy my insurance from my country of departure ?

There are no requirements on where you buy your travel insurance. With online providers offering a wide range of choices when it comes to insurance products, you can browse all options online and purchase your insurance from any country, regardless of your country of origin.

The only requirement made by the EU is that the insurance cover must be recoverable from within the Schengen country in which you are staying in at the time of the claim.

Is my choice of insurance restricted based on my nationality?

No, Insurté’s insurance panel cover travelers of any nationality, and can be purchased from any country.

Can I get a refund in case of visa refusal ?

Some customers are not granted a Schengen visa upon application. This is a frustrating situation that may require you to change or cancel your travel plans.

Insurté guarantees a 100% refund on any insurance policy in case of an unsuccessful visa application. To claim your refund, you will need to provide us with official proof of your visa refusal, within 14 days of receiving it. Reach out to our team via the contact form on our website to arrange a refund.

Do I need Schengen visa insurance if I'm traveling to French overseas territories?

France has a number of overseas territories that, although part of France, are not considered part of the Schengen area. You therefore do not need a Schengen visa if traveling to these regions. Instead, unless exempt, non EU nationals will need to apply for a visa specific to that region. Likewise, your mandatory travel insurance will need to be specific to this region, and you won’t require travel insurance for a Schengen visa.

French overseas territories include:

- Martinique,

- French Guiana

- Saint Pierre and Miquelon

- Saint-Barthelemy

- the Collectivity of Saint Martin

- Wallis and Futuna

- French Polynesia

- New Caledonia

- French Southern and Antarctic Lands

In all cases, travel insurance is highly recommended when visiting the French overseas territories, to be sure you are taken care of in case of an emergency. You can find out more about the specific visa requirements for these regions here .

Do I need Schengen Visa insurance if I’m traveling to Caribbean parts of the Kingdom of the Netherlands ?

In addition to the Netherlands in Europe, the Kingdom of the Netherlands also comprises three Caribbean islands: Aruba, Curacao and St. Maarten. As with French overseas territories, these regions do not form part of the Schengen area and therefore do not require a Schengen visa.

Travel insurance is always highly recommended when you are traveling to these regions, so that you are fully covered for any incident during your trip. It’s important to check the specific entry requirements of the Caribbean territory you intend to visit.

Is my worldwide travel insurance compliant with Schengen requirements?

If you are a backpacker, remote worker, business traveler or travel regularly for any other reason, you may already have worldwide travel insurance in place. In this case, your worldwide travel insurance plan, whether it’s for a single trip or multi-trip, should be compliant with Schengen requirements, as most worldwide insurance packages cover all countries within the Schengen zone.

All Insurté worldwide travel insurance policies are 100% compliant with Schengen requirements. So you can continue to globe-trot without any extra hassle.

Are all VTI.travel insurances recoverable in a Schengen Member state?

European Union regulations (Decision 810/2009 of 13 July 2009) state that in order for insurance cover to be considered adequate for a visa application, claims against the insurance company must be recoverable from within the Schengen Member state you are staying in at the time of the claim.

Insurté works with leading European insurers within the global health network, and all VTI.travel insurers comply with this regulation. Any insurance claim made during a stay in the Schengen area would be recoverable from within any Schengen Member state.

Can I insure my Schengen travel if I’m 65 years old, 75 years old or more than 80 years old ?

Some insurance providers have age restrictions and do not provide cover to those over 65, 75 or 80 years old. Fortunately Insurté has no upper age limit. We provide cover to travelers of any age, so you can enjoy exploring Europe, whatever your age.

By selecting the upper age limit in our comparison tool, we’ll make sure we present you with the best insurance cover for your age group.

Where can I compare Schengen travel insurance?

You can compare Schengen travel insurances using the Insurté comparison tool.

Our tool will help you identify which insurance providers are best suited to your needs, depending on pricing and extent of cover. You can filter your search according to single or multi-trip, number of travelers and length of stay, and browse the options to compare policies.

Let’s get in touch!

Do you need help to book your insurance or need assistance?

TRAVEL INSURANCE

Visa Travel Insurance

Annual Travel Insurance

24/7 support

NAVIGATE SAFE

Insurté – Insurance Broker – 5 Ter Rue du Magasin à Poudre 14000 Caen (France) Registered with the Caen (France) Register of Business and Companies under number 523 065 860 and with ORIAS under number 10 056 187. Insurte is subject to the control of the French Prudential and Resolution Supervisory Authority (ACPR), located at 4 Place de Budapest, CS 92459, 75436 Paris Cedex 09 (France).

General Conditions of Use

Legal notice

Privacy Policy

Cookies Policy

Insurte © 2022

You are using an outdated browser. Please upgrade your browser to improve your experience.

- For Individuals

- For Governments

- #TravelAgain

- #DoNotFallForFraud

Secure your overseas trip with Travel Medical Insurance

Get your Travel Medical Insurance with COVID-19 coverage from reputed global insurers for travel in the new normal.

Travelling from*

- South Korea

- Afghanistan

- Aland Islands

- Antigua Barbuda

- Ascension and Tristan da Cunha

- Bosnia & Herzegovina

- Burkina Faso

- Cape Verde Islands

- Cayman Islands

- Central African Republic

- Christmas Islands

- Cocos Islands

- The Democratic Republic of the Congo

- Czech Republic

- Dominican Republic

- El Salvador

- Equatorial Guinea

- French Polynesia

- Guinea Bissau

- British Indian Ocean Territory

- British Virgin Islands

- Caribbran Netherlands

- Ivory Coast

- Faroe Islands

- French Guiana

- Liechtenstein

- Marshall Islands

- Saint Barthelemy

- Saint Kitts Nevis

- Saint Martin

- Saint Pierre and Miquelon

- Hong Kong SAR

- Isle of Man

- Korea, Republic of

- Myanmar (Burma)

- The Netherlands

- New Caledonia

- New Zealand

- Norfolk Islands

- Northern Mariana Islands

- North Macedonia

- Palestinian Territories

- Papua New Guinea

- Philippines

- Puerto Rico

- Saint Helena

- Saint Lucia

- Saint Vincent Grenadines

- Sao Tome & Principe

- Saudi Arabia

- Sierra Leone

- Sint Marteen

- Solomon Island

- South Africa

- South Sudan

- Sudan, Republic of

- Svalbard and Jan Mayen

- Switzerland

- Taiwan, China

- The Holy See

- Timor Leste

- Trinidad & Tobago

- Turkmenistan

- Turks Caicos Islands

- United Arab Emirates

- United Kingdom

- United States of America

- Vatican City

- Virgin Islands of the United States

- Western Sahara

- Vietnam (Online eVisa)

- Lesotho Permits

- Korea, Democratic People's Republic of

- Ghana Permits

- Lithuania Temporary Residence Permit

- Lithuania (E-Resident card)

- Lithuania TRP and National Visa

- Falkland Islands

- Finland Residence Permit

- Faroe Iceland

- Thailand (Online eVisa)

- American Samoa

- Pitcairn Island

- Wallis and Futuna Islands

- Bouvet Island

- Akrotiri and Dhekelia

- Baker Island

- Clipperton Island

- South Georgia and the South Sandwich Islands

Travelling to*

- Schengen countries

By clicking 'Get Now,' I agree to the terms and conditions & understand that my personal data may be shared with VFS Global insurance partners.

Going on a trip abroad is exciting, but emergencies can happen, and if they do, it can be expensive and challenging affair. You can take some of your stress away by booking a travel medical insurance policy with Covid-19 coverage at competitive pricing from global insurers. Don't forget that for Schengen visa applications, travel insurance is mandatory.

Travel Medical Insurance

Emergency medical coverage, including COVID-19 treatment costs.

Competitive pricing from global insurers.

Global medical insurance coverage for evacuation and accidents.

Cancellation and trip delay coverage.

Protection for loss of passport and travel documents.

Frequently asked questions

View all FAQ's

1 . What is Travel Medical Insurance?

Travel Medical Insurance is designed to cover your emergency medical expenses while traveling abroad. In the event of an unexpected illness, injury, or medical condition during your trip, your travel medical insurance plan will reimburse you for the treatment costs, up to the limits specified in the plan.

2. Why do I need Travel Medical Insurance?

Travel Medical Insurance provides coverage for various risks that may arise during your overseas travel, including medical emergencies, COVID-19, and loss of passport. The coverage offered ensures an additional layer of protection against potential financial losses. For more detailed information on the coverage, please refer to the Travel Medical Insurance policy documents.

3. Why should you buy Travel Medical Insurance online?

Purchasing overseas travel insurance online is a convenient way to access a wide range of best plans at competitive prices from global insurers. This allows you to choose a suitable plan without incurring any extra commissions.

4. How much will overseas Travel Insurance cost?

The cost will depend on the kind of overseas Travel Medical Insurance policy you opt for, and it will vary from country to country. Multiple underlying health conditions will determine the final insurance premium you will have to pay.

5. How far in advance should I purchase Travel Medical Insurance?

It's best to purchase travel insurance within the first 14 days of your initial trip.

With Travel Medical Insurance assistance provided by VFS Global, you can book your insurance and submit your visa application together.

Even if you missed purchasing the insurance plan before or during the visa application process, you can still buy Travel Medical Insurance by visiting our website.

Our Valued Partners

Modal title

Terms and Conditions:

The VFS Global website may contain links to third-party sites promoting various products and/or services that VFS Global does not own or operate. These links to websites are in the nature of paid advertising and are not verified by VFS Global.

These links are provided for convenient access. Access to these links is voluntary and does not indicate that VFS Global endorses or is associated with any of these third-party websites. Users are requested to use these links at their own discretion, risk, and cost when dealing with these websites, and neither VFS Global nor its officers, employees, or agents shall have any responsibility or liability of any nature whatsoever for these other third-party websites/links or any other information contained in them.

Use of Your Personal Information:

In the event that you wish to avail of any of our collaboration partners' products or services, you agree and understand that by proceeding to avail of these products and services, you consent to share your personal information with them. By clicking on the box below, you confirm that you have provided your consent to us sharing your personal information with our collaboration partners for the purpose of providing products and services and receiving quotes from them.

For more information about how we use your personal information, please review our Privacy Policy. You can also review our partners' Privacy Policies - you'll be able to find these on their websites when you click through to the next page.

- About Chubb Travel Insurance

- What is covered?

- What is not covered?

- When am I covered?

- Where can I travel?

- Who is covered?

- COVID-19 Cover

- Preparing to Travel

- At Your Destination

- When the Unexpected Happens

- Planning Your Travel

- Chubb Assistance

- Relating to COVID-19 Cover

- Types Of Plan & Eligibility

- Medical Cover

- Baggage Cover

- Sports And Sporting Equipment

- Trip Cancellation

Personalise your travel insurance coverage

Chubb travel insurance has got you covered with plans for every type of traveller enjoy 20% off now*, *valid from 1 may 2024 to 16 june 2024. click here for the terms and conditions., 4 plan types with customisable benefits catered to every traveller, destination and budget.

Our most affordable plan with basic coverage, especially tailored for travellers heading to Batam, Bintan, and Malaysia.

A starter plan for worldwide travels (excluding Cuba) with higher coverage limits than our Saver Plan.

The most popular option for both leisure and business travellers as it offers comprehensive benefits and cover limits.

Our most comprehensive plan with extensive range of cover and the highest coverage limits.

Why choose Chubb?

Quality travel cover at an affordable price.

With more than 50 years of insurance experience and many millions of travellers served, Chubb Travel Insurance offers high-quality insurance to travellers. We have plan option for all types of travellers, from frequent flyers and families to holidaymakers on a budget, adventure seekers and sports enthusiasts.

Fast, fair and efficient handling of claims

Experience has taught us the importance of being proactive when managing claims. Chubb understands that a fast, fair and efficient approach to claims handling will bring about an expedited outcome, and can help to deliver an improved result.

Access to a global team of travel experts

Purchasing travel insurance from Chubb means access to a truly global network. In addition to our wealth of local expertise, Chubb's operation in Singapore is backed by our extensive global travel network and breadth of resources to serve your every need.

24-hour overseas emergency assistance

When you purchase Chubb Travel Insurance, you are instantly covered by Chubb Assistance, our 24-hour overseas emergency hotline that provides the support that you expect in your time of need, anywhere, anytime.

Travel Smarter with Chubb Travel Insurance. Get an instant quote now!

You may contact us via the following:.

Chubb Insurance Singapore Limited

138 Market Street

Level 11-01 CapitaGreen

Singapore 048946

Chubb Travel Insurance Customer Service

For general enquiries and claims, call (65) 6398 8776 (Mondays to Fridays, 9.00am-5.00pm,excluding Public Holidays)

For 24-hour overseas emergency assistance,call (65) 6836 2922

Chubb Worldwide Offices

For the mailing address, telephone

number and email address of any Chubb

office in our global network, use our

office locator.

Chubb. Insured.™

- About Chubb

- Chubb Insurance

© Chubb Insurance Singapore Limited. This policy is underwritten by Chubb Insurance Singapore Limited. Co. Regn. No. 199702449H. Full details of the terms, conditions and exclusions of this insurance are provided for in the policy documentation. Please read our Terms of Use , Licensing Information and Privacy Policy .

- Single Trip Travel Insurance

- Annual Multi-Trip Travel Insurance

- Family Travel Insurance

Schengen Travel Insurance

- International Health For Individuals

- International Health for SME

- Travel Insurance Promotion

- COVID-19 Alerts

Allianz Travel Insurance

Your Travel Cancellation Insurance protects you against costly cancellation charges should you be unable to take your holiday as planned.

Payment of cancellation costs. If you are unable to travel, we will pay 100% of the cancellation costs for tariffs without deductible.

Personal quarantine. We will pay the costs in the event of personal quarantine.

Travel Assistance. 24/7 contact emergency service.

Traveller between 0 - 79 is eligible for application.

please fill all required fields

Insurance for travelling in the Schengen zone and Europe

Allianz travel insurance for the schengen zone and europe, the joys of europe, at your feet.

With a full Schengen zone visa, you could be exploring Rome on Monday, shopping in Paris by Thursday, and lounging on a beach in Mallorca by Saturday.

From visiting history-packed museums to skiing in the Alps, from night's out in Berlin to water sports in the south of France: the Schengen zone has it all.

And a Schengen visa gives you the power to enjoy it.

Benefits Highlights

Swipe to view more

Designed for essential travel and medical coverages only

Well-balanced coverages for most type of travels

From S$ 25.20

Inclusive of an extensive scope of travel protection

Core Benefits

- Selected COVID-19 Cover*

- Overseas medical expenses

- Travel delay and emergency transportation benefits

- Travel inconveniences including trip curtailment and travel delay, medical expenses, and emergency transportation benefits

- Travel personal accident, rental car excess, and lost travel documents benefits

- Personal liability and sports benefits

You have to pay for emergency medical or dental treatment while on your trip.

With Selected Covid-19 Coverage*

You have to pay for emergency medical care (including Covid-19-related) or dental treatment while on your trip.

You have to cancel your trip before you depart.

With Selected Covid-19 coverage*

You have to cancel your trip before you depart because you or your travelling companion are diagnosed with Covid-19 and/or are required to quarantine; or a family member is diagnosed with Covid-19 (or other covered reason)

Your travel plans are delayed while you are on your trip.

Your travel plans are delayed while you are on your trip because you or your travelling companion are diagnosed with Covid-19 and are required to quarantine (or other covered reason) - sublimits apply - please refer to the policy wording

Transportation is needed following a medical emergency while on your trip.

With Selected Covid-19 Coverage

Transportation is needed following a medical emergency (including Covid-19 diagnosis, or other pandemic or epidemic) while on your trip. This includes emergency local emergency transportation and medical repatriation to Singapore if needed.

Up to S$ 1,000,000

Search and Rescue: S$ 10,000

More Benefits

You have to end your trip early and need to recover unused trip costs.

Trip Curtailment: You have to end your trip early and need to recover unused trip costs.

Trip Incident include

- Early Return (You have to end your trip early and need to recover transportation cost for return home.)

- Trip Continuation (Your travel plans are interrupted, but you continue your trip.)

- Extended Stay (Your travel plans are interrupted and you need to recover additional accommodation and transportation costs you have incurred. (Maximum of SGD$300 per day for 5 days)

Subject to the terms, conditions, exclusions and benefits limits of the policy wording. For more information please click on the Policy Wording to read the Allianz Travel Policy Wording.

*There is no cover for lockdowns, changes in government alert levels, quarantine or mandatory isolation applying to a population or part of a population.

Why is Allianz Travel Insurance suitable for Schengen zone travel?

- Immediate certificate of insurance after payment*

- All policies exceed the €30,000 minimum Schengen zone medical coverage

- Repatriation of remains

- 24/7 Emergency Assistance

- Fast, fair, online cliams**

*You must have travel insurance before you can proceed with your Schengen visa application.

**Subject to the terms, conditions, exclusions and benefits limits of the policy wording. For more information please click on the Policy Wording to read the Allianz Travel Policy Wording .

Choose from Bronze, Silver, and Platinum policies

Allianz Travel Insurance offers products for every budget and need.

Platinum offers the highest level of cover - and peace of mind - with up to S$1,000,000 cover for Overseas Emergency and Dental (69 years old and below); up to S$15,000 if you need to cancel your trip before you depart; up to S$15,000 for trip interruption; and up to S$7,000 for baggage loss, damage and theft. It also includes cover for a number of other events. Please see the Policy Wording for details.

Silver cover includes the same benefits above, but with lower maximum limits. See Policy Wording for details.

Bronze is ideal for those on a budget, with up to S$200,000 coverage for Overseas Emergency and Dental (69 years old and below). See Policy Wording for details.

Which countries are in Schengen?

Documents required to apply for a schengen visa.

Visa application form - filled out and signed.

Two recent photos - taken within the last three months.

A valid passport not older than 10 years.

Reservations or itinerary - this must include the dates when you enter and exit Schengen, with flight numbers.

Certificate of travel insurance - with minimum 30,000-euro medical cover and repatriation of remains cover.

Proof of accommodation - this could be:

- Letter of invitation from the host you will be staying with

- Rental agreement

- A hostel or hotel booking

Proof of financial means

You must prove you have enough funds to cover your trip in the Schengen area.

- Bank account statement - showing sufficient funds, no older than 3 months.

- Sponsorship letter - confirming the sponsor or host will be supporting you financially for the duration of your trip to the Schengen area, accompanied by a bank statement from the sponsor, no older than 3 months.

- A combination of your bank account statement and letter of sponsorship.

Proof that visa fee has been paid - €80 for adults; €40 for children aged 6-12 years old.

You may not need a Schengen visa

Allianz travel insurance for european trips without schengen visa.

Allianz Travel Insurance offers a range of benefits for your trip to Europe, whether applying for a Schengen visa - or travelling visa-free on a Singapore passport.

- Our team is ready to help organise emergency medical assistance, 24/7

- Includes Selected Covid-19 Coverage**

- Advance payment for in-patient services, where accepted*

- Safeguard against travel delays, curtailments, and cancellations

- More than 30 years of travel insurance expertise

You should submit your Schengen visa application at the consulate of the country you plan to base yourself in. If you normally reside in Singapore, for example, you should lodge your application with the consulate or embassy of your destination in Singapore.

If you plan to visit several Schengen states, you should apply for your visa in the country you plan to arrive in first.

A 'short stay' Schengen visa allows you to stay in the Schengen area for 90 days in a 180-day period.

The exact length of validity of your visa is shown under the heading Duration of visit. '01' indicates a single-entry visa; '02' a double-entry visa, and 'MULT' a multiple-entry visa.

As a rule of thumb, it will take 15 calendar days to process your visa application. However, it may take between 30 and 60 days in some cases.

Due to the possibility of a longer processing time, you should apply for your visa as early as possible.

A Schengen visa might be ideal for people who live, work or study in Singapore, but do not hold a Singapore passport (and therefore do not benefit from visa-free entry to the 27 Schengen nations).

For example, those working or studying in Singapore with a Thai, Filipino or Vietnamese passport would need to apply for a Schengen visa to visit the Schengen area.

Allianz Travel Insurance offers travel cover for different needs:

Single Trip cover: Designed for people who are only likely to make one or two trips in the next year.

Annual cover: Coverage for a full 12 months, unlimited trips (maximum 90 days per trip).

Related Articles

Help is just a phone call away

For 24/7 Emergency Assistance during your trip

Please call +65 6995 1118

For claims enquiries

Call: +65 6327 2215

Mon – Fri, 9:00 - 17:30 Singapore Time

e-mail: [email protected]

For customer service

call: +65 6327 2210

What Is Schengen Travel Insurance?

Quick answer.

S chengen travel insurance is a specific type of travel insurance policy tailored to meet the travel medical coverage requirements set by the 27 (soon to be 29) European destinations within the Schengen Area. Travelers must present proof of sufficient coverage as part of the Schengen visa application process.

Schengen member countries have abolished their internal borders, allowing more accessible travel within the area. While this is incredibly convenient, some travelers may need a visa to visit Schengen countries. And one of the requirements to obtain that visa is to purchase sufficient travel medical insurance coverage.

Read on to learn more about Schengen visa travel insurance requirements and find the best travel insurance policy for your upcoming trip.

Table of contents

What is schengen travel insurance, schengen countries, visa and travel insurance requirements for the schengen area, key coverages in schengen travel insurance, how to get schengen travel insurance, schengen travel insurance faqs, summary of money’s guide to schengen travel insurance.

Schengen travel insurance is designed for travelers entering the Schengen zone, which comprises 27 (soon to be 29) European nations that have abolished internal borders.

Many visitors, including citizens from non-EU countries like India and China, must obtain a travel visa to enter the Schengen Area. And a requirement for a Schengen Visa is to have insurance covering at least €30,000 (around $32,720) in medical costs.

However, there are exemptions. For example, U.S. citizens and residents of countries such as Canada, Brazil and Mexico don’t need a Schengen visa or travel insurance for stays of up to 90 days within a 180-day period.

The Schengen Area consists of a diverse tapestry of countries. Among the member nations are some of the best places to visit in Europe , including France, Italy, Germany, Spain, Greece and the Netherlands.

Here’s the complete list:

Ireland and Cyprus are the only E.U. member states not currently part of the Schengen Agreement.

Having a valid U.S. passport allows you to spend up to 90 days within a 180-day period in the Schengen Area, whether for tourism or business purposes.

Once officially admitted, you can travel freely within the member countries without passing through customs each time. Stays under 90 days don’t require a visa for U.S. nationals, but your passport should be valid for at least six months past your travel dates.

Short stays don’t require travel medical insurance either, though travel insurance may still be worth it . That could be especially true if you plan to participate in adventure sports or other high-risk activities.

Travel insurance generally also covers cancellations and delays. Purchasing a policy could pay off if you’ve booked expensive, non-refundable flights or accommodations and didn’t purchase them with one of the best travel credit cards that offer insurance.

European Travel Information and Authorisation System (ETIAS)

Travel requirements for European Union countries are projected to change by mid-2025. Visa-exempt travelers to all 27 (soon to be 29) Schengen countries and Cyprus will need an ETIAS authorization.

Here’s what you need to know:

- You must complete an online application and pay a small fee for an ETIAS authorization.

- The authorization is tied to your passport and is valid for three years or until your passport expires.

- With a valid travel authorization, you can enter 30 European countries for short stays of up to 90 days within a 180-day period.

- ETIAS authorization does not guarantee entry into any of these countries. You still have to present your passport and documents at the border.

- The above applies to people from the U.S., Canada and dozens of other countries, so check the E.U.’s official travel website or your country’s embassy for more information. An ETIAS is not a visa and doesn’t mandate travel medical insurance.

Schengen visa requirements

You’ll need a visa if you’re from a visa-exempt country, like the U.S., and planning to stay in the Schengen Area beyond the 90-day threshold. Regardless of the length of the stay, nationals traveling from certain countries always require a visa.

Determine which Schengen country you’ll spend most of your time in and check with their official tourism or embassy website for instructions on applying for a visa. The embassy will inform you about the required documentation and instructions to meet their regulations.

Schengen visa processing time can vary depending on your country of origin and your destination country, so be sure to start the process as early as possible.

Besides the application form, the following are required to obtain a Schengen visa:

- Valid passport: Your passport must be valid for at least three months after departure.

- Passport photo: You must submit a picture of yourself that complies with the International Civil Aviation Organisation (ICAO) standards.

- Travel medical insurance: You must carry at least €30,000 (approximately $32,720) in coverage for medical emergencies, hospitalization and repatriation that’s valid in the entire Schengen Area for the duration of your stay.

- Documentation: You must provide evidence of the purpose of your visit through supporting documentation, demonstrate you have the financial means to cover expenses and accommodations and show intent to return to your home country after the stay.

- Fingerprints: Most, but not all, applicants will be required to submit their fingerprints along with their application.

Consulates of particular countries may require additional documentation.

Understanding what travel insurance covers can help you plan a worry-free journey. While plans and coverage options vary by company, here’s a breakdown of what Schengen travel insurance generally covers.

- Medical expenses: Travel medical insurance covers the cost of treating unexpected illnesses or injuries you suffer during your trip, up to your policy limits. These include the cost of medications, hospitalization and other essential medical treatments.

- Medical repatriation: Some travel medical policies also include emergency medical evacuation or repatriation, which covers some of the costs of transporting you back home or to a different medical facility to receive necessary medical treatment.

- Repatriation of remains: As the name suggests, this coverage will pay (up to your policy limits) for expenses related to transporting your body or cremated remains to your home country or point of origin.

- 24/7 Travel Assistance: Travel insurance companies generally offer round-the-clock assistance services, including language support, help recovering lost passports or prescriptions and even booking accommodations and medical transportation.

Note that some companies may require you to meet a deductible for the travel medical plan to start paying out.

Other travel-related coverage options

Most travel insurers sell policies covering medical emergencies and travel-related inconveniences such as delays, cancellations, lost luggage, and more. While you don’t need these coverage options to obtain a Schengen visa, you may still find them worthwhile.

- Trip cancellation and trip interruption: Covers non-refundable expenses if you need to cancel or cut your trip short due to unforeseen events like illness or accidents.

- Baggage loss or delay: Helps cover the cost of replacing essential items if your baggage is lost or delayed by a specified number of hours.

- Delayed flights and missed connections: Provides compensation for additional expenses caused by inconveniences such as delays or missed connections.

It’s easy to buy travel insurance for your Schengen Area trip. Many providers offer policies that fulfill the visa requirement and include additional coverage that can be tailored to your needs.

Here are some steps to help you get the right coverage.

1. Research reputable travel insurance providers

Most travel insurers bundle travel medical insurance coverage with trip cancellation, interruption, and other coverage options. If you only want to satisfy Schengen visa requirements, look for a provider that explicitly markets Schengen travel insurance or offers stand-alone travel medical coverage.

2. Select a plan that meets your needs and get a quote

Remember that you may not need trip insurance beyond the €30,000 in travel medical coverage required for a Schengen visa, so read plan details carefully to avoid buying unnecessary coverage.

It also pays to shop around and get quotes from several insurers, as travel insurance costs between 3% and 14% of the total cost of your trip, depending on the company and policy you choose.

3. Read your policy details

When shopping for travel insurance online, you’ll typically find that most companies include a policy summary or schedule. This document outlines critical details such as the policy’s coverage limits and exclusions. Carefully reading it can help you avoid surprises and frustration if you ever need to file a claim.

If you still have questions after reading the policy summary, contact the insurer before finalizing your purchase.

4. Get to know the claims process

Similarly, reading about your insurance provider’s claims process can save you time and energy in an emergency. Your policy summary should include a list of documents you’ll be required to provide as part of the claims process, which may include receipts and medical bills.

After a covered incident, contact your insurer through the company’s website or mobile app as soon as possible. Most insurers also offer travel assistance services around the clock.

5. Purchase and safeguard your policy

You will need proof of your travel medical insurance plan to apply for a Schengen visa. Keep your insurance certificate in a secure yet accessible location, whether a digital version on your smartphone or a physical printout in your travel folder.

It may also be a good idea to share a copy of your policy with a trusted friend or family member back home so they can contact your insurance provider if you cannot request medical assistance due to an emergency.

Should I get travel insurance for Europe?

Travel insurance, especially within the Schengen Area, is not just recommended but often mandatory. To obtain a visa to visit the Schengen zone, you must show proof of having sufficient travel medical insurance.

How much travel insurance do I need for Europe?

What countries does europe travel insurance cover.

- The first step before you travel to any Schengen country is to determine whether you need a visa and, therefore, mandatory travel medical insurance for a Schengen visa.

- Check with your country’s embassy, Department of Foreign Affairs or the tourism website of the country you plan to visit for specifics about medical travel insurance for Schengen visa requirements.

- You don’t need a visa or international travel insurance if you have a valid U.S. passport and are visiting the Schengen zone for less than 90 days in a 180-day period.

- If you’re a U.S. national planning to visit the Schengen Area for more than 90 days, you must apply for a visa and secure adequate travel health insurance (at least €30,000 in travel medical and repatriation coverage).

© Copyright 2024 Money Group, LLC . All Rights Reserved.

This article originally appeared on Money.com and may contain affiliate links for which Money receives compensation. Opinions expressed in this article are the author's alone, not those of a third-party entity, and have not been reviewed, approved, or otherwise endorsed. Offers may be subject to change without notice. For more information, read Money’s full disclaimer .

IMAGES

VIDEO

COMMENTS

Medical insurance for a Schengen visa from Singapore must meet the following criteria: Must cover a minimum of €30,000 (around 46,045 SGD as of November 2021) on medical bills and repatriation. It must be valid for the entire duration of your trip. It must be valid in the entire Schengen Zone. Coverage for all expenses related to urgent ...

Allianz Travel Insurance for European trips without Schengen visa. Allianz Travel Insurance offers a range of benefits for your trip to Europe, whether applying for a Schengen visa - or travelling visa-free on a Singapore passport. Our team is ready to help organise emergency medical assistance, 24/7. Includes Selected Covid-19 Coverage**.

The coverage includes medical expenses, hospitalisation , baggage loss and delayed flights. The only difference is that Schengen travel insurance policies offer at least € 30,000 (~S$44,000) of medical coverage, which must include repatriation of remains. Be sure to review the terms of the policy you're considering buying so you can ...

The leading Schengen travel insurance provider. When you choose Europ Assistance as your Schengen visa travel insurance provider, you also get the support and expertise of 750,000 partners.If something goes wrong, not only will your medical expenses be properly reimbursed, but you will also get help from competent medical professionals at qualified medical centers, no matter where you are.

As a trusted Singapore travel insurance provider, we provide coverage that goes beyond borders. Allianz Travel insurance policies are designed to protect you against unforeseen circumstances such as trip cancellations, medical emergencies, lost luggage, flight delays, and more.

While allowing you to enjoy a peaceful visit of all the countries of the Schengen area, our travel insurance is cheap. For a one week stay, it starts at €22 (approx. US$23). Length of stay (days) 1 to 8. 9 to 16. 17 to 24. 25 to 31. 32 to 45. 46 to 62.

AXA is the number one provider of travel insurance for trips to Europe and offers assistance 24/7, as well as other options and tailor-made products. Other coverage available includes our Europe Travel insurance, costing €33 per week, or Schengen Multi Trip insurance, which is perfect for regular travelers and available for €328 for a year ...

Buy your AXA travel insurance online. Get a Schengen visa travel insurance policy now. Submit the certificate with your visa application. Take advantage of our money-back guarantee. Get Schengen insurance.

In general, travel insurance costs about 3 - 10% of your total prepaid and non-refundable trip expenses. The cost of travel insurance depends on two factors for AXA Travel Protection plans: Total Trip cost: The total non-prepaid and non-refundable costs you have already paid for your upcoming trip. This includes prepaid excursions, plane ...

Schengen travel insurance is specifically designed to meet the requirements for any travelers visiting any of the 27 countries within the Schengen zone. To qualify for a Schengen short-term visa or long-term visa, travelers need to provide proof of adequate travel insurance. The Schengen zone is the area of free movement within Europe, where ...

Here for you, 24/7. Our affordable travel insurance covers flight delay, trip cancellation, lost baggage, medical expenses up to S$1,000,000 with Covid-19 add-on and more.

Go on unlimited number of trips in a year and travel for up to 90 days per trip with DirectAsia Singapore annual travel insurance plans. Voyager 250. Voyager 500. Voyager 1000. Medical Expenses whilst Overseas. S$250,000. S$500,000. S$1,000,000. Loss or Damage to Personal Belongings.

Travel Medical Insurance is designed to cover your emergency medical expenses while traveling abroad. In the event of an unexpected illness, injury, or medical condition during your trip, your travel medical insurance plan will reimburse you for the treatment costs, up to the limits specified in the plan. 2.

Quality Travel cover at an affordable price. With more than 50 years of insurance experience and many millions of travellers served, Chubb Travel Insurance offers high-quality insurance to travellers. We have plan option for all types of travellers, from frequent flyers and families to holidaymakers on a budget, adventure seekers and sports ...

Travel Easy protects your losses from travel cancellation to flight delays, stolen travel documents, overseas medical expenses incurred due to accidental injuries or onset of sickness*, and follow-up medical treatment after your trip. COVID-19 travel insurance coverage is automatically included for Single Trips and Annual Plans.

Each policy specifies the level of coverage for medical costs abroad : €100,000 for the Europe Travel and Multi Trip policies, and €30,000 for our Low Cost Schengen Insurance option. They are available to purchase whatever your age and nationality, at no extra cost. They meet the standards required by the European Union countries in order ...

Greater and flexible coverage that allows you to change your travel dates for any reason. 24/7 Emergency travel assistance. Rental vehicle excess¹. S$1,500. Loss or damage of baggage & personal belongings². S$5,000. Accidental death & disability3. S$100,000. Overseas medical expenses4.

Annual Multi-Trip Policy. Applicant. At least 18 years old and. A Singapore Resident 1. Aged between 18 and 69 years old (both ages inclusive) and. A Singapore Resident 1. Insured Persons. Child (ren) must be at least 1 month old and below 18 years old 2, and adult (s) must be at least 18 years old and. All insured persons must be Singapore ...

Travel Insurance. Get comprehensive and affordable coverage for your travels. Enjoy 45% ^ off Per-Trip Travel Insurance and 20% ^ off Yearly Travel Insurance. Buy now. Travel advisory (for trips to China, Taiwan, Israel, Jordan, Lebanon and Egypt) China Guangdong Province: For all travellers purchasing a policy for an upcoming trip (s) to China ...

To get travel insurance Singapore online from ACKO, follow these six steps: Step 1: To begin, click here or download our app from Play or App Store. Step 2: Choose from our standard plan or customise your plan. Step 3: Give us the dates on which your trip will start and end. Step 4: Choose the coverage you want.

Allianz Travel Insurance for European trips without Schengen visa. Allianz Travel Insurance offers a range of benefits for your trip to Europe, whether applying for a Schengen visa - or travelling visa-free on a Singapore passport. Our team is ready to help organise emergency medical assistance, 24/7. Includes Selected Covid-19 Coverage**.

Many visitors, including citizens from non-EU countries like India and China, must obtain a travel visa to enter the Schengen Area. And a requirement for a Schengen Visa is to have insurance ...

A health insurance plan can be purchased offline by visiting a nearby branch. However, if you do not want to step out, here is how you can quickly invest in the best health insurance in India: Step 1: Visit the home page and click on any of the insurance policy options as per your need, for instance, health insurance or travel insurance