- Search Search Please fill out this field.

What Is a Traveler’s Check?

- How It Works

- Where to Get Traveler's Checks

- Where to Cash Traveler's Checks

- Pros and Cons

- Alternatives to Traveler's Checks

The Bottom Line

- Personal Finance

Traveler's Check: What It Is, How It's Used, Where to Buy

Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia.

:max_bytes(150000):strip_icc():format(webp)/Julia_Kagan_BW_web_ready-4-4e918378cc90496d84ee23642957234b.jpg)

Investopedia / Eliana Rodgers

A traveler’s check (sometimes spelled "cheque") is a once-popular but now largely outmoded medium of exchange utilized as an alternative to hard currency and intended to aid tourists. The product is typically used by people on vacation in foreign countries. It offers a safe way to travel overseas without the risks associated with losing cash. The issuing party, usually a bank, provides security against lost or stolen checks.

Traveler’s checks have increasingly been supplanted by credit cards and prepaid debit cards.

Key Takeaways

- Traveler’s checks are a form of payment issued by financial institutions.

- These paper cheques are generally used by people when traveling to foreign countries.

- They are purchased for set amounts and can be used to buy goods or services or be exchanged for cash.

- If your traveler's check is lost or stolen it can readily be replaced.

- Once widely used, traveler’s checks have largely been supplanted today by prepaid debit cards and credit cards.

How Traveler’s Checks Work

A traveler’s check is for a prepaid fixed amount and operates like cash, so a purchaser can use it to buy goods or services when traveling. A customer can also exchange a traveler’s check for cash. Major financial service institutions issue traveler’s checks, and banks and credit unions sell them, though their ranks have significantly dwindled today.

A traveler’s check is similar to a regular check because it has a unique check number or serial number. When a customer reports a check stolen or lost, the issuing company cancels that check and provides a new one.

They come in several fixed denominations in a variety of currencies, making them a safeguard in countries with fluctuating exchange rates , and they do not have an expiration date. They are not linked to a customer’s bank account or line of credit and do not contain personally identifiable information, therefore eliminating the risk of identity theft. They operate via a dual signature system. You sign them when you purchase them, and then you sign them again when you cash them, which is designed to prevent anyone other than the purchaser from using them.

Many banks, hotels, and retailers used to accept them as cash, although some banks charged fees to cash them. However, with the rising worldwide use of credit cards and prepaid debit cards—such as the Visa TravelMoney card, which offers zero liability for its unauthorized use—it is getting much harder to find institutions that will cash traveler’s checks.

History of Traveler’s Checks

James C. Fargo, the president of the American Express Company, was a wealthy, well-known American who was unable to get checks cashed during a trip to Europe. In 1891, a company employee, Marcellus F. Berry, believed that the solution for taking money overseas required a check with the signature of the bearer and devised a product for it. American Express and Visa still use the British spelling on their products.

Where to Get Traveler's Checks

Companies that still issue traveler's checks today include Visa and AAA . They often come with a purchase fee. AAA now offers members pre-paid international Visa cards instead of paper checks.

In the U.S., they are available primarily from American Express locations. You can also buy traveler's checks online from the American Express website, but you need to be registered with an account. Visa offers traveler's checks at Citibank locations nationwide, as well as at several other banks.

American Express, Visa, and AAA are among the companies that still issue traveler’s checks.

Where to Cash Traveler's Checks

If you want to convert your traveler's checks into cash (instead of spending them directly), you can often deposit them normally at your bank. Many hotel or resort lobbies will also provide this service to guests at no charge. American Express also provides a service to redeem traveler's checks that they issue online to be deposited into your bank account.

Advantages and Disadvantages of Traveler's Checks

Traveler's checks are handy for tourists who do not want to risk losing their cash or having it stolen while abroad. Because traveler's checks can be reported lost or stolen and the funds replaced, they provide peace of mind. This was particularly a concern before credit cards and ATMs were widespread and affordable worldwide for most travelers. At the same time, these paper checks are now a bit outdated and come with a fee to purchase, making them potentially more expensive and cumbersome than using plastic or electronic payments.

Replaced if lost or stolen

Widely accepted around the world

Convenient to use

They don't expire

Must have the physical check to use it

Incurs a fee to purchase

Limited number of issuers today

Alternatives to Traveler's Checks

The most obvious alternative is to use a credit or debit card issued by a bank that works worldwide and charges low or no foreign exchange fees on purchases or ATM withdrawals. If your bank doesn't allow for this or charges high fees, then prepaid travel cards are the modern version of traveler’s checks. They allow you to get local currency from ATMs and make purchases with merchants—effectively eliminating the need for traveler’s checks.

Prepaid cards are not linked to your bank account, which prevents anybody from draining your checking account if the card gets lost or stolen—and you can’t go into debt. Credit cards offer similar (or better) protection, but you might not want to use your everyday card abroad. By using a dedicated travel card, you avoid spreading your card numbers around, which means you can be less vigilant about monitoring your accounts when you get back home. Visa and MasterCard both offer prepaid cards designed for use abroad. Those cards are available online, through travel agents, and at banks or credit unions.

Travel cards should feature low ATM fees, technology that lets you operate like a local in foreign countries, emergency cash when you lose the card, and “zero liability” fraud protection. That said, prepaid cards can be expensive, so you need to compare fees against your other cards to decide whether or not a travel card makes sense.

For U.S. citizens living abroad for extended periods, maintaining checking and other bank accounts in the United States provides several advantages, and many checking accounts are friendly for foreign transactions .

Where Do You Buy Traveler's Checks?

You can buy still buy traveler's checks from Visa and a handful of other financial institutions. To buy them, visit a location or check the website of an issuing institution. You may need a photo ID in order to set up an account.

How Do You Cash Traveler's Checks?

Some hotels, resorts, and currency traders will cash traveler's checks in exchange for local currency. However, with the rising prevalence of credit and debit cards fewer locations cash traveler's checks.

What Do You Do With Traveler's Checks?

Traveler's checks are a secure way of carrying money while abroad. Many businesses in the tourism industry will cash traveler's checks, and they can also be deposited into a bank account. Because the checks can be easily replaced, they have a lower risk of theft or loss. However, traveler's checks have fallen out of favor due to the increased convenience of credit cards and prepaid debit cards.

Traveler's checks were once a popular way to carry money while vacationing abroad. They are sold in fixed denominations, and can be used for purchases or cashed like an ordinary check. Traveler's checks can be easily replaced, making them less risky than carrying large amounts of cash. However, they have fallen out of favor due to the convenience of using credit or debit cards.

Sparks, Evan. “ Nine Young Bankers Who Changed America: Marcellus Flemming Berry .” ABA Banking Journal, June 26, 2017.

Time Magazine. " Travel (April, 1956): The Host with the Most ."

American Express. " Travelers Cheques ."

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1214857151-7489c879345246b0bacefaf1d88a3738.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Traveler’s Checks When Traveling Abroad — Useful or Outdated?

Christy Rodriguez

Travel & Finance Content Contributor

88 Published Articles

Countries Visited: 36 U.S. States Visited: 31

Keri Stooksbury

Editor-in-Chief

35 Published Articles 3228 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

Table of Contents

What are traveler’s checks, how to buy and use traveler’s checks, what to do if traveler’s checks are stolen, best ways to use traveler’s checks, cons of using traveler’s checks, other alternatives, money tips for traveling abroad, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

When traveling abroad, you might wonder how to pay for things once you arrive. Should you bring currency on your trip? Which currency should you bring? Can you get money once you arrive? How much cash should you carry at once?

Many of these questions can be answered by using traveler’s checks. Traveler’s checks might seem like an outdated choice, but they can still be useful in certain situations.

In this article, we’ll explain what traveler’s checks are, how they work, and when they might be worth the hassle. We’ll also explore other more common alternatives and give tips for obtaining foreign currency.

Traveler’s checks are documents that can be used like standard paper checks and cash. Travelers purchase them before they leave home to exchange for cash in the local currency when they arrive at their destination.

These checks are printed in varying denominations, and each check is uniquely numbered so that it can be replaced quickly if lost or stolen.

Banks, hotels, and merchants were once very used to accepting traveler’s checks. These places liked traveler’s checks because of the safeguards that were put in place. Basically, as long as the original signature matched the signature made at the time of the purchase, payment is guaranteed — eliminating any “bounced checks.”

Now, with the increased use of credit and debit cards (especially those with no foreign transaction fees ), prepaid cards, and ATMs on every corner, traveler’s checks have become less popular.

You may find it difficult to find banks or hotels that accept them , and if you do, you might be at the mercy of their business hours to cash them in.

You can still buy and use traveler’s checks in the U.S. and other countries.

Where To Buy Traveler’s Checks

You can find traveler’s checks offered by companies like American Express and Visa . You can also go to your local AAA office to purchase them.

The best place to purchase traveler’s checks is from your own bank, but unfortunately, many banks no longer offer traveler’s checks, including Chase, Wells Fargo, and Bank of America.

If you’re not sure if your bank offers traveler’s checks, it’s worth contacting them to confirm. If you are a customer, banks typically waive any fees to obtain them and this can add up because other companies can add on a 1% to 3% fee on top of the base currency amount that you request.

In order to obtain a traveler’s check, you will need to:

- Either go in person to an eligible bank or visit the website of the traveler’s check issuer.

- Select the total amount of currency to purchase.

- Submit payment, including any fees.

How To Use Traveler’s Checks

Once you have the traveler’s checks, you need to know how to use them. Traveler’s checks work a bit differently than other forms of currency. Here are the steps you’ll need to take:

- Sign the checks immediately. Follow the issuer’s instructions to find out where to sign (and only sign once).

- Leave evidence of your traveler’s check purchase somewhere safe. If checks get lost or stolen, you’ll need to provide proof of purchase along with check numbers to get a refund. Leave those details with a friend or save them online for easy remote access.

- Complete the payee and date fields. Once you have confirmed that the payee or bank will accept traveler’s checks, fill out the payee and date fields.

- Sign the check again. You must complete this portion in-person to ensure that the signature matches the original. You may also need to show some sort of identification as well. This is key to keeping traveler’s checks secure.

- If checks get lost or stolen, contact the issuer immediately. You may be able to get replacement checks locally, and the issuer needs to know which checks to cancel.

Traveler’s checks don’t expire , so if you don’t use them you can either keep them for future use or deposit them into your bank account once you’re home.

If all of your cash is stolen while you’re traveling abroad, you’ll have next to no chance of getting it back.

However, if this happens with your traveler’s checks, you’ll likely get them replaced as long as you’ve complied with your check issuer’s purchase agreement . This is the primary benefit of traveling with traveler’s checks.

Bottom Line: Treat your traveler’s checks like cash. If you lose your checks, you may not get replacements if your check issuer has reason to believe you didn’t safeguard them appropriately.

Here’s what to do if your traveler’s checks are lost or stolen:

- Call the customer service phone number provided by your issuer or find it by accessing their website.

- Provide proof that the check is yours by submitting the check number, proof of purchase, and your identification. It’s important to have easy access to this information for this reason.

- If required by your issuer, provide evidence that you have reported your stolen check to the police.

- Be sure to return any other refund paperwork requested.

If you don’t comply, you could experience delays or even have your claim denied. After you’ve reported your missing check, your provider will void it and issue you a new check.

Some issuers even pledge to get replacement checks out to you within 24 hours !

The following are situations when you might consider using traveler’s checks:

1. No Access to Credit or Debit Card

If you don’t have a credit card or a debit card tied to your bank account, a traveler’s check could be a safe alternative to simply carrying lots of cash abroad.

This tip also applies if your particular credit or debit card isn’t accepted abroad. This is more likely to happen if your card is something other than a Visa or Mastercard , as those credit cards claim the widest global network.

2. Limited Access to ATMs

In many places, you can easily get cash in the local currency at an ATM once you arrive. This wouldn’t be a problem in Europe, for example, but ATMs are rare in some parts of the world. In addition, ATMs can malfunction, networks can be down, and machines might even run out of cash.

Traveler’s checks allow you to get local currency at participating banks, hotels, and other foreign locations without regard for these potential problems.

3. Access Good Exchange Rates

Buying traveler’s checks can help you avoid bad exchange rates. If you decide to exchange currency once you arrive, you might not get the best conversion rates by doing this at the airport.

By purchasing traveler’s checks before you leave, you can lock in a set amount at the current exchange rate.

Read our guide for the best places to exchange currency .

4. Avoid Common Credit or Debit Fees

If your credit or debit card charges a foreign transaction fee , you can be charged a fee every time you make a purchase with your card in a foreign country. If your card also charges ATM fees, these fees can add up quickly.

To avoid these fees, it might make sense to use traveler’s checks. Although there may be a fee involved when you purchase or cash a traveler’s check, it might still be less than other fees your credit or debit card may charge.

Hot Tip: If your card charges a foreign transaction fee, it will typically be 3% of each purchase you make.

5. As an Added Safety Measure

If you’re traveling to a potentially unsafe region, traveler’s checks keep your money secure. Even if you’re in a relatively safe place, anyone who enters your room or has access to your bags could search for your money.

The main benefit of traveler’s checks is that they reduce your risk of theft or loss. Since they can’t be cashed without your signature and often require a photo ID, they are less appealing to thieves or pickpockets. They can also be easily replaced if you provide the issuer with the proper information.

Here are some reasons that might discourage you from using traveler’s checks:

1. Limited Availability for Use

In much of Europe and Asia, traveler’s checks are no longer widely accepted and cannot be easily cashed — even at the banks that issued them.

This means that cashing in traveler’s checks might require hunting down a bank branch or hotel that accepts them during business hours.

Bottom Line: Those relying solely on traveler’s checks may find that they are unable to cash them in many remote or rural locations.

2. Not All Banks Offer Them

Certain major banks, such as Bank of America, no longer offer traveler’s checks at all. This might mean ordering traveler’s checks online well in advance of your travel plans or having to find a new bank that offers them.

3. Potential for Additional Fees

If a company does offer traveler’s checks, it typically charges fees for both buying and cashing in a traveler’s check. While some banks offer them for free if you are a customer, others charge between 1% to 3% of the total purchase amount.

Check the math for your own situation, but using traveler’s checks could actually cost more than using an ATM or credit card abroad.

4. Bulky Paperwork

Not only are traveler’s checks a hassle to carry, but most companies also require that you keep proof of purchase for the checks to verify the check numbers if they are lost or stolen.

Both of these just add up to keeping track of additional paperwork.

Obviously, traveler’s checks aren’t your only option when it comes to obtaining foreign currency. Here are some other options you should consider.

Cash is convenient and relatively easy to exchange. You can bring money from home into a foreign bank or currency exchange location almost anywhere in the world. It can be easily exchanged without the worry of multiple bank fees or ATM fees adding up.

Hot Tip: Be aware: if you exchange your money in tourist areas, you might be hit with a bad exchange rate.

On the downside, carrying paper money is a risk since it can’t be replaced if stolen.

A debit card can be used at an ATM to collect cash. While not all ATM machines (especially in more rural places) accept foreign debit cards, you will find that most do.

Depending on your bank, you might even have to pay both an out-of-network ATM and an international ATM fee for this convenience.

Hot Tip: An out-of-network ATM fee is typically between $2 to $3.50 per transaction in 2021 and a typical international ATM fee can range from $2 to $7 per transaction (plus a 3% conversion fee), depending on your bank and card.

Most restaurants and stores accept foreign debit cards, but carrying a form of backup currency is always wise . Additionally, foreign transaction fees can add up quickly if you are using your debit card frequently.

Credit Card

Like debit cards, credit cards are small and easy to carry. Mastercard, Visa, and more recently, American Express , are widely accepted in other countries, so you can rest easy knowing you will be able to complete your purchases. You can also limit fees by getting a credit card with no foreign transaction fees .

A credit card also comes with fraud protection. You can dispute fraudulent charges and get them removed from your account if reported timely.

Hot Tip: While you can use a credit card for ATM transactions, you will be hit with a cash advance fee . It’s best to avoid doing this, if possible.

Prepaid Card

If you have difficulty getting approved for a credit card , a prepaid card could be a good alternative. You simply load the card with money from your bank account and use it as a debit card at an ATM or as a credit card at merchants and hotels.

While prepaid cards are locked with a PIN number, they can sometimes be difficult to use at ATM machines. Additionally, fees for foreign currency transactions can be as high as 7% , depending on the card.

Hot Tip: Booking hotels, airfare, or activities online will require either a credit card, debit card, or prepaid card.

Do Your Research

Know which types of currency are accepted at your destination and how much of each type (if any) you should bring. Especially be aware of any cash you might need on arrival (to obtain a visa , exchange upon arrival, etc.) in case you can’t immediately locate an ATM or a currency exchange office.

Carry a mix of cash, cards, and maybe even traveler’s checks. Ideally, the cards you bring with you shouldn’t have foreign transaction fees or ATM fees . Having some variety also helps if one of your cards isn’t accepted or your cash is lost or stolen.

Tell Your Bank You Are Traveling

Always be sure to let your bank and credit card issuers know where you’re going and when so that your card isn’t declined when you try to make a purchase due to unusual activity.

If you exchange money at your bank, you will likely also get a better exchange rate.

Don’t Keep All of Your Money in 1 Place

Keep some of your currency or an extra card locked in your hotel room’s safe or in a money belt . In the terrible instance that you lose your purse or wallet, you would still have immediate access to additional money.

We’ve shown that traveler’s checks aren’t necessarily the most convenient way to take currency abroad, but depending on if you have limited access to debit or credit cards or they aren’t accepted where you are traveling, it might be worth it to bring some along.

Overall, if you’ve decided that traveler’s checks can be of use to you, taking some, along with some cash and a debit, credit, or prepaid card, may just be the smartest way to travel.

Frequently Asked Questions

Can you still buy traveler's checks.

While many larger banks are no longer offering traveler’s checks, they are still available at American Express and other smaller banks and credit unions. It is worth asking if your bank offers them and at what cost.

How much does it cost to buy traveler's checks?

While some banks offer them for free if you are a customer, others charge between 1% and 3% of the purchase amount.

What is the purpose of a traveler's check?

A traveler’s check offers a safer option than carrying around money. There are multiple safeguards in place to prevent fraud and if the checks are lost or stolen, they can be easily replaced.

Can you cash old traveler's checks?

Traveler’s checks do not expire. You can cash them in at any time — typically even at banks that don’t offer them for sale. This means you can go to your own bank and redeem your traveler’s checks.

To do this, date them, fill out the “Pay To” field (to your bank), and countersign in the presence of the cashier . Any unused value will be returned to you in cash.

Can I buy traveler's checks online?

American Express is the only large bank that offers traveler’s checks online. Its website offers a step-by-step process to order them.

You should check with your local bank or credit union to see if they might also offer this benefit.

Was this page helpful?

About Christy Rodriguez

After having “non-rev” privileges with Southwest Airlines, Christy dove into the world of points and miles so she could continue traveling for free. Her other passion is personal finance, and is a certified CPA.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

![travellers cheque in banking IHG One Rewards Traveler Credit Card — Review [2024]](https://upgradedpoints.com/wp-content/uploads/2023/06/IHGOneTravelerCard.png?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

Find out more about sending money to your location of choice.

Read our range of money transfer and banking guides.

Reviews and comparisons of the best money transfer providers, banks, and apps.

Unlock efficient global money movement for your business.

A Guide to Travellers Cheques

Once a foreign currency staple, this form of prepaid funds has existed for hundreds of years, designed as a way to allow payment from one person to another across currencies. As the financial services sector continues to shift to online solutions , we look at how, where and why travellers cheques are used, as we discuss the relevance of this form of currency.

What are travellers cheques?

The history of the travellers cheque spans as far back as 1772 when the first of its kind was issued by the London Credit Exchange Company, in the UK. Over the coming centuries the concept became popularised on a global scale, with major banks and financial institutions adopting this form of travel money in the 20th century. American Express became the largest issuer of travellers cheques and continues to offer these services to customers to this day.

A safe and convenient method of payment for anyone travelling to foreign territories, these pre-printed cheques hold a fixed amount which can be used worldwide across a range of currencies. Designed to facilitate payments from one person to another, using different currencies, travellers cheques were initially seen as a more practical way for individuals to carry their spending money.

Travellers cheques had their heyday in the late 20th century, reaching peak popularity in the mid-90s, before alternatives such as credit and debit cards became more widely available and easier to manage financial transactions. It was reported in 2018 that a mere 1.5% of Britons use travellers cheques, a rapid decrease over the course of two decades.

How do you use travellers cheques?

When you first receive your travellers cheques, you will be required to sign each one before use, as a way of verifying your signature. Each cheque will have a fixed value (usually $20, $50, $100, $500 etc.) as well as a unique serial number which can typically be found in the top right corner.

It is important to take note of these serial numbers as they will be referenced in any case of lost or stolen cheques. Unlike cash, if anything happens to your travellers cheques, the original vendor will be able to issue a refund for the exact same value. This added level of security is why this payment method was seen as revolutionary when first introduced.

As well as signing upon receipt, you will also need to sign each travellers cheque when used by a retailer or exchanged for cash. The act of signing your name as a form of security is somewhat outdated, given the modern technologies in place nowadays.

When accepted by retailers, a travellers cheque will be treated like local currency, which means you should receive any change in the standard, local currency.

Where can I get travellers cheques?

Due to dwindling demand, travellers cheques are not as readily available as they once were. However, they can still be acquired from some banks and financial institutions, post offices and currency exchange offices, like Travelex.

One thing to note is you may be required to settle the handling, commission or cash-in fees that often accompany travellers cheques, and these can be expensive, amounting to 2 - 3% in some cases. This cost is another reason they are no longer as frequently used.

Where can I use travellers cheques?

Generally, travellers cheques are still accepted all over the world, albeit harder to find vendors selling them and retailers accepting them as legal tender. Consider your destination before deciding on this form of travel money: if you are travelling to major cities there is more chance of you finding somewhere to cash your cheques or use them for in-store purchases. However, more remote destinations may not be equipped or able to accept this type of funds.

How safe are travellers cheques?

The original blueprint for travellers cheques was a paper payment method which could be used as foreign currency but was more secure than handling cash. At the height of its popularity, travellers cheques were generally considered much safer than cash due to the added security of their unique serial numbers, meaning customers could cancel and replace cheques if need be. These numerical codes were a money-back guarantee for anyone whose cheques were misplaced, destroyed or stolen. Another added benefit, if your travellers cheques are intercepted, you will not be vulnerable to bank fraud, as they are in no way connected to your bank account, unlike credit or debit cards.

Financial security measures have evolved greatly since the inception of travellers cheques, however, with the introduction of PIN codes, two-factor authentication, fingerprint touch ID and facial recognition, to name a few forms of fintech security commonly available now. With this in mind, the concept of a travellers cheque no longer measures up in terms of fraud protection and data encryption.

Travellers cheque vs. Cashiers cheque: What is the difference?

In terms of appearance, a travellers cheque looks nearly identical to a standard issue cashier's cheque: but are they similar in any other ways?

A cashiers cheque is issued by a bank or financial institution and is designed to be processed quickly, by the individual whose name is printed on the cheque. Conversely, a travellers cheque is for use overseas, is loaded with prepaid foreign currency - usually USD or GBP - and does not have a name or account number printed on it, although it does require a signature. Because travellers cheques do not have any bank details printed on them, they are deemed safer than cashiers cheques in terms of potential for fraudulent use. In addition to this, they are paid for when printed, meaning it is not possible for a travellers cheque to bounce.

What are the alternatives?

Credit or debit cards.

If you are worried about travellers cheques not being widely accepted where you are going, then this form of travel money will offer more flexibility. Using your regular bank cards overseas provides a record of spending and offers maximum convenience, but there are also some frequently flagged concerns. Primarily these concerns focus on the sky-high fees and below-average exchange rates related to using your debit or credit card abroad. This isn’t always the case, however, as many banks and financial institutions offer travel credit cards, tailored to suit the needs of frequent flyers.

Travel money cards

Prepaid travel money cards are the modern equivalent to travellers cheques and have become very popular. This is largely due to the fact that they are totally separate from your regular bank account, allowing users to spend their balance freely without the worry of potential fraud or overspending. Preloaded with funds, travel money cards often help limit additional currency exchange charges. In addition to this, in spite of fluctuating currency rates, these cards let customers lock-in a favourable exchange rate ahead of time.

International bank accounts

If you are headed overseas for a sustained period of time, it could be more convenient and cost-effective to open a bank account in your destination country. You would be subject to the relevant security and eligibility checks but this decision pays off if you are making regular international money transfers or being paid in a different currency by foreign clients. Find out more about this option by reading our guide: How to Open a Bank Account Overseas.

Due to the growing alternative digital payment methods available nowadays, it seems this age-old travel money no longer measures up in terms of accessibility, cost and convenience. When travellers cheques were originally launched, ATM withdrawals were not commonplace for travellers, and digital point of sale systems had not been invented. Nowadays, it is easy to access local currency using an assortment of different payment methods such as debit or credit cards, travel money cards or money transfer apps .

The best option for anyone who is reluctant to use their debit or credit card overseas, would be to use a prepaid travel money card. Prepaid travel money cards are a safer and more widely used alternative to travellers cheques, and customers do not need to seek out a bank to use them, are not required to sign for each transaction and security measures in place are far more advanced. This method enables customers to secure multiple foreign currencies, locking in the optimum exchange rate for your currency pairing ahead of your trip abroad. Use our comparison tool to ensure you receive the most competitive exchange rates for your international money needs.

Related content

Related content.

- A Guide to Travel Money Cards Travel money cards are a popular payment method for individuals headed abroad. Customers will load funds onto the card, using the money as foreign currency when overseas, much like a debit card is used at home. Also known as travel money prepaid cards or currency cards, they facilitate free foreign transactions and overseas ATM withdrawals. May 3rd, 2024

- Revealed: Summer Cruises Increase your CO2 Emission by 4700% per KM vs Train Travel Travelling by cruise ship rather than train this summer could increase passengers’ CO2 emissions each kilometre by 4716%, MoneyTransfers.com can reveal. May 3rd, 2024

- 10 Years of Data Predicts the Go-to Holiday Destinations for Brits Now COVID Is Over To establish the expected changes to tourism and GBP(£) spend abroad going forwards, MoneyTransfers.com analysed 10 years' worth of UK travel data from the Office for National Statistics (ONS) - 2009 - 2019, to discover and predict where Brits will be travelling to in the next 10 years now that travel is well and truly back on again since Covid! May 3rd, 2024

.jpg)

- Millennial Guide For Baby Boomers & Generation X We looked over the stats for the past few years, and found that out of £1.5 billion payments abroad, 1 in 5 debit cards payments are made by the UK residents travelling abroad and credit card payments made outside the UK has increased in recent years, reaching 467 million payments. May 3rd, 2024

Contributors

April Summers

Capital One Main Navigation

- Learn & Grow

- Life Events

- Money Management

- More Than Money

- Privacy & Security

- Business Resources

All about traveler’s checks, plus modern alternatives

January 18, 2024 | 1 min video

Getting ready to travel? One thing to think about is how you’ll make purchases while you’re away. Traveler’s checks aren’t as common as they used to be. So you might want to consider modern alternatives that may offer the advantages of traveler’s checks and more.

Read on to learn more about the ins and outs of traveler’s checks. And find out about other options—for example, credit cards, prepaid cards and mobile wallets—that could help make the most of your trip.

Key takeaways

- Traveler’s checks are paper documents that can be exchanged for local currency or used to buy goods and services abroad.

- Traveler’s checks feature unique serial numbers, making them replaceable if they’re lost or stolen.

- Fees may apply when purchasing and exchanging traveler’s checks.

- There are modern alternatives to traveler’s checks that you may find more convenient.

Earn 75,000 bonus miles

Redeem your miles for flights, vacation rentals and more. Terms apply.

What is a traveler’s check?

A traveler’s check is a paper document you can use for making purchases when you’re traveling, typically in other countries. It can be used as cash or a regular check.

Traveler’s checks—you may also see them referred to as “cheques”—are generally printed with a unique serial number. This means you may be able to get a refund if your checks are lost or stolen. The checks are usually available in set denominations—$20 and $50, for example.

How do traveler’s checks work?

Traveler’s checks may be accepted at participating merchants like hotels, restaurants and stores. Just keep in mind that there could be fewer participating merchants than there used to be.

When you purchase your checks, you may notice that they have a space for two signatures:

- First signature: You might be asked to sign each of your traveler’s checks when you buy them. If not, you may want to sign them as soon as possible.

- Second signature: You’ll usually sign your traveler’s checks again when you’re making purchases.

This dual signature method is meant to provide extra security and ensure that only the purchaser is able to use them. The merchant can verify that the second signature matches the first.

How to cash in traveler’s checks

You can use traveler’s checks like cash to pay for goods and services at participating merchants. You’ll typically sign the check in front of the merchant at the time of the purchase.

While traveling, you may also be able to redeem your traveler’s checks for local currency at financial institutions or your hotel.

Potential fees associated with traveler’s checks

It’s possible that certain fees may apply to traveler’s checks. For example, you may need to pay a fee when you purchase them or when you exchange them for currency once you get to your destination. There might also be a fee for depositing unused checks into your bank account.

Where to get traveler’s checks

While traveler’s checks might be harder to find than they used to be, they’re still available. You may be able to purchase them at some banks, credit unions and travel-related service organizations.

Pros and cons of traveler’s checks

Take a look at some of the potential pros and cons of traveler’s checks:

When to use a traveler’s check

You might consider using traveler’s checks in certain situations, including:

- When you don’t have a credit or debit card. Some people may prefer to travel using modern payment options like credit and debit cards. But if you don’t have either, you may find traveler’s checks to be an acceptable alternative.

- When you can’t access an ATM. If you find yourself in a place that doesn’t have an ATM on every corner, you can instead use your checks at merchants that accept them.

- When you want to exchange them for local currency. When you get to where you’re going, you might want to have some local currency on hand. You may be able to exchange your traveler’s checks for currency at certain banks or other financial institutions.

Modern alternatives to traveler’s checks

There are a number of alternatives to traveler’s checks—options you may find faster, easier and more convenient. Here are a few to consider when you’re comparing your choices:

Credit cards

Carrying a credit card may be easier than carrying traveler’s checks. Plus, credit cards can be helpful for making large and online travel purchases like plane tickets and hotel reservations. That’s especially true with travel credit cards , which you could use to earn rewards on travel-related purchases.

Some credit cards may also come with benefits that could be useful while traveling. They might include things like protection from unauthorized charges and the ability to use a mobile app to track your purchases .

Keep in mind that foreign transaction fees may come into play when you use your credit card overseas. While this fee might vary between credit card companies, it could generally be in the range of 1%-3% of your purchase. You may also be charged a currency conversion fee. This fee is often part of a foreign transaction fee.

Some companies don’t charge foreign transaction fees. For example, none of Capital One’s U.S.-issued credit cards charge this fee. View important rates and disclosures .

If you’re traveling with your credit card, your credit card issuer may want to be alerted before you go. That’s because it might flag your purchases as fraudulent if it notices purchases made in an unfamiliar location. Thanks to the added security of its chip cards, Capital One doesn’t require this notification.

See if you’re pre-approved

Check for pre-approval offers with no risk to your credit score.

Debit cards

When you’re traveling, a debit card can be just as easy to carry around as a credit card. And like a credit card, it can help protect against fraud.

The big difference: A credit card lets you “borrow” money for purchases, while a debit card uses the money in your checking account to make purchases.

It may be helpful to carry a debit card when you’re visiting a country that generally favors cash transactions. In that case, you could use your debit card at an ATM to get cash once you’ve reached your destination. And that may be safer than bringing cash with you and exchanging it for local currency once you’ve arrived.

Keep in mind that you could be charged ATM fees when you use a debit card abroad. According to the Consumer Financial Protection Bureau (CFPB), some banks and credit unions don’t charge customers a fee for using their ATMs. But they might charge you if you’re not a customer—and that could be in addition to a fee charged by the operator of the ATM.

Also, be mindful that some banks may charge a foreign transaction fee when you make purchases abroad with a debit card. You may also be charged a currency conversion fee—often, this fee is folded into the foreign transaction fee.

Some banks, though, don’t charge foreign transaction fees. For example, Capital One doesn’t charge this fee for its 360 Checking account .

If you take a debit card on your travels, your bank may ask you to notify it beforehand. That’s because it could notice transactions made in an unfamiliar location and potentially freeze your account. Capital One doesn’t require this notification , thanks to the added security of your chip card.

Prepaid cards

Like credit cards and debit cards, prepaid cards may be easier to carry around than cash. They may also offer some protection against loss, theft or fraud once you register them.

But with a prepaid card, you don’t “borrow” money like you do with a credit card—or use money from your checking account, like with a debit card. Instead, you typically add money to a prepaid card before using it.

According to the CFPB, there are a few ways you can add funds to a prepaid card. For example, you can transfer money from your checking account or load funds at some retailers or financial institutions.

You might be charged one or more fees for using a prepaid card. The CFPB notes that if you get your prepaid card from a retailer, you should find a summary of fees on the card’s packaging. If you get your card from a different provider—online or over the phone, for example—the provider needs to share this information on paper or electronically.

Mobile wallet

You’ll probably have your phone with you when you’re traveling, right? Using a mobile wallet to make purchases is another modern alternative to traveler’s checks.

A mobile wallet is essentially a digital version of your real wallet. Depending on the wallet, you may be able to store things like credit cards, debit cards, prepaid cards, boarding passes, hotel reservations, event tickets and other types of personal data.

Mobile wallets can be convenient, allowing you to make quick and easy payments using your phone or other mobile device when you’re on the go. And they typically use advanced technology that prevents your actual account numbers from being stored in the wallet.

There are lots of mobile wallets to choose from. Researching your options could help you see which will work best while you’re traveling. Keep in mind, some merchants might not take mobile wallet payments.

Traveler’s checks in a nutshell

Traveler’s checks can be a helpful way to pay for things abroad, but there are also more modern options available today, like credit cards, debit cards, prepaid cards and mobile wallets. And with a travel credit card, you could earn rewards on your travel-related purchases.

Ready to upgrade the way you pay before your next trip? Compare Capital One travel credit cards today to find the best option for you, no matter where you’re headed.

Related Content

How do travel credit cards work.

article | February 8, 2024 | 7 min read

Should you send a credit card travel notice?

article | April 25, 2024 | 3 min read

What you should know about foreign transaction fees

article | May 23, 2024 | 7 min read

- Global Citizen

- Money Works

- Global Issues

- Getting Around

- WU Partners

- Regional News

- Europe & CIS

- Middle East & Africa

- Asia & Pacific

Understanding Traveler’s Checks: A Complete Guide

Are you planning to splurge on experiences, gifts, and food while you are abroad on your next international vacation? Leave your cash at home and bring a traveler’s check instead. While debit and credit cards have made traveler’s checks largely obsolete, it may be a viable option for your next trip. Learn about traveler’s checks, how to use them, and whether you should bring them on your next vacation.

What is a traveler’s check?

A traveler’s check contains a fixed amount of money and operates like cash. Bring a traveler’s check to a merchant to buy goods or services while traveling abroad. You can get traveler’s checks from financial institutions like banks and credit unions.

Traveler’s checks can come in a variety of currencies, so you can designate the appropriate currency for the country you’re planning to travel to. Traveler’s checks are great protective measures against both fluctuating exchange rates and personal theft. They come in fixed denominations that aren’t as volatile as normal exchange rates and they don’t expire. To protect you against theft, you must sign them when you purchase and cash them, so criminals will have a harder time duplicating your signature when attempting to use your traveler’s checks.

Alternatively, you can also convert your traveler’s checks into cash, which can then be deposited into your bank. Hotels may also cash traveler’s check with no charge. If you end up not using the full amount on your traveler’s check, you can conveniently return the funds to your bank account.

Download the Western Union app

If you need a convenient way to transfer money abroad, do it from your fingertips with the Western Union app. It allows for fast and secure transfers from USD to the currency of your choice.

Download the app now

Should you use a traveler’s check?

Traveler’s checks were primarily used before the popularization of credit cards and prepaid debit cards. Even so, traveler’s checks are still a worthwhile option for your next trip.

Benefits of traveler’s checks

Some benefits of traveler’s checks are:

- Replaceability: If a traveler’s check is lost or stolen, you can replace it. Each traveler’s check comes with a unique serial number. Call the check issuer to report it lost or stolen. They will likely require you to provide evidence of your purchased check through its serial number and your proof of identity.

- Convenience : Traveler’s checks operate like cash and are easy to use for purchases. You just need to load the amount you need, and you can use them around the world.

- No expiration : You don’t have to worry about traveler’s checks expiring. You can buy them when you want to and use them whenever you need them.

Cons of traveler’s checks

Some cons of using traveler’s checks are:

- Outdated: With the popularization of prepaid debit cards and credit cards, traveler’s checks are outdated. You can use credit cards and prepaid debit cards similarly to traveler’s checks.

- Fees: When you buy a traveler’s check, there is an additional fee. You can avoid this by using a debit or credit card instead.

- Limited issuers: Traveler’s checks aren’t available at all financial institutions. Unless your bank offers them nationwide, it can be hard to find them.

Send money with Western Union

If your friend or family member is traveling internationally, you can send them money with Western Union. Help them avoid fees from traveler’s checks by visiting our website or downloading the Western Union app . If you prefer to send money in person, you can visit one of our agent locations .

Send money today

Similar Blogs

What is the currency in türkiye currency and payment, what is the currency in morocco currency and payment, what is the currency in colombia currency and payment, how easter is celebrated in colombia.

- Customer Care

- Intellectual Property

- Terms & Conditions

Cookie Settings

Royal Mail strikes are expected in November.

We advise all our customers to order their travel money this month to reduce any inconvenience caused from any upcoming delays or backlogs next month.

Compare Exchange Rates

- Currency Converter

- Convert British Pounds To Australian Dollars

- Convert British Pounds To Euro

- Convert British Pounds to Japanese Yen

- Convert British Pounds To Turkish Lira

- Convert British Pounds To US Dollars

- Convert Australian Dollars To British Pounds

- Convert Euro To British Pounds

- Convert Japanese Yen To British Pounds

- Convert Turkish Lira To British Pounds

- Convert US Dollars To British Pounds

Found yourself stuck with travellers cheques? Here's how you can exchange your travellers cheques to cash.

JANUARY 2021

Before we start talking about exchanging your travellers cheques into cash, let's start at the beginning.

What exactly is a travellers cheque? According to the Oxford dictionary, it is defined as "a cheque for a fixed amount that may be cashed or used for payments abroad after endorsement by the holder's signature". Traveller's cheques used to be available in several currencies such as US dollars, Canadian dollars, pounds sterling, Japanese yen, Chinese yuan and Euros.

Travel Money

I have British Pounds

1 GBP = Your exchange rate

1 GBP = Real exchange rate

- Transfer Type

- Low cost transfer - 369.39 GBP fee Send money from your bank account

- Advanced transfer - 369.39 GBP fee Send from your GBP account outside the UK

The more you order the lower the fee

I want to buy

These rates are available only when you pay online - rates in branch will differ

Last updated on

Source: compareholidaymoney.com

*We capture the exchange rates being offered by airports and high street providers once a month and calculate what spread they are taking off the live interbank rate. We then compare that to what rates we are offering to calculate the savings you can make if you use us.

*Your potential saving has been calculated using our exchange rate and the most expensive provider's rate in the market at a given point in time.

They were seen as a safer alternative to carrying physical cash around and at one point in time, very popular amongst tourists. Restaurants, bars, shops and most businesses would happily accept them as a travellers cheque could never "bounce". The issuer will unconditionally guarantee payment of the face amount. For reference only, the organization that produces a traveller's cheque is known as the issuer. The bank or financial institution that sells the travellers cheques is the agent of the issuer and the traveller who buys the cheque is the purchaser. The shop or restaurant you go into and use the cheque is known as the merchant.

The most well known issuers of travellers cheques were Thomas Cook, Bank of America and American Express. However, since the 1990s there has been a great decline in their use as cash, pre paid cards, ATMs, multi currency cards and credit cards have taken over when spending money abroad.

Now it is very difficult to use travellers cheques abroad. In fact most businesses will not accept them and they have indeed become an obsolete.

How can I exchange my travellers cheques?

Even though these cheques can no longer be used in shops when you go on your next holiday, they have no expiry date and there are still some ways that you can cash them in but just expect a poor exchange rate when you do exchange them for cash.

1) Your local Post Office

Luckily, you can still walk down your high street and into your local Post office to exchange your travellers cheques into cash. The exchange rate you do this at will probably be poor and there may even be associated fees but this is at least a quick and simple solution. Remember to take your proof of ID with you, this could be your photographic driver's licence or passport.

2) Visit your local bank

A few banks still allow account holders to deposit Travellers Cheques to their personal bank account and so it may be worth checking with your bank first to see if you can exchange your travellers cheques with them directly and they deposit the GBP equivalent directly into your current account. Once again, if you go in person to your local bank branch will be asked to present photographic ID that includes your signature for sign off of these cheques.

3) Go online

It is also worth visiting the issuer's website directly to get guidance on redeeming your travellers cheques.

For example, if your travellers cheque has American Express logo on them, you can click on this link American Express Travelers Cheques. The page provides you with your nearest location to exchange your Travellers cheques in person and also provides an option to redeem them online.

Alternatively, if your travellers cheques are issued by Travelex, Thomas Cook, Mastercard or Interpayment Visa you can use their encashment form found here encashment-form-newv5.pdf (travelex.co.uk)

Generally speaking, exchanging your travellers cheques into cash requires you to print out and complete a form from the issuer. You will be asked to complete the details of the currency denominations of your travellers cheques and also to keep a record of their respective serial numbers. Additionally, since this process is done online and not over the counter in front of a clerk, they will request a copy of your proof of identification which also includes your signature. This can be a photograph drivers license or a passport. For larger amounts they may even request a proof of address - so a recent utility bill or bank statement.

Make sure you have the above at hand when filling these forms out to make things quicker for you

What are the alternatives to taking travellers cheques?

Travel money is a very easy and cheap way to spend money abroad. To find the best exchange rate, simply go online and compare exchange rates and any associated fees that foreign exchange providers are offering.

Some foreign exchange companies may say no commission and no fees on top but may in fact hide their fees within the exchange rate. So, instead of purchasing your travel money at the real exchange rate, you may be offered something away from that rate and this is the spread which incorporates their fees.

Other companies are easier to buy travel money online from as they are transparent. The Currency Club for example, offers their best exchange rates on any currency and additionally gives you access to review the live interbank exchange rate before you confirm your transaction giving you complete transparency. You can then easily compare how much you can save. The company will deliver the travel money directly to your home, fully insured by 1pm using with you selecting the day that suits you best.

Credit cards (pre paid and others)

There has been a significant increase in travellers using their cards abroad. Of course a pre paid currency card helps travellers to budget, as you top up only the amount you wish to spend. Additionally, like travellers cheques they can be a safer option in the event that your card is stolen.

However, the problem arises when you visit a place that does not accept cards. In which case you are at the mercy of taking cash out of ATMs when abroad and this can work out to be very expensive.

Not only may you get charged withdrawal fees each time, but the exchange rate may also be very poor since ATMs are also charging you for the convenience of having cash on tap!

The safest and most sensible solution is to always have some travel money and perhaps one other alternative. This way, it's easier to stick to a budget and it means you will not need to waste your time or money visiting ATMs when abroad.

Buy Traveller Cheques

As an alternative to cash, we offer the best currency exchange rates on travellers cheques. They are safest ways to carry money around. In the event that the travellers cheques are lost or stolen you can report this and receive a replacement immediately.

Make sure you sign each travellers cheque when you receive them from us and keep the serial numbers in a safe place before you travel so you are protected in the event that your cheques are lost or stolen. When you want to make a purchase or exchange them for cash, just sign the travellers cheque in the designated area in the presence of the acceptor, along with your passport (you may be required to show your passport when you decide to use them).

Then you're good to go!

We can buy back your leftover euros so you can always transact at the best GBP to EUR exchange rate with no hidden fees.

Send money abroad in Euro (EUR) at low cost with our best exchange rates

Get your rate on the move.

Download our app to place travel money orders, send funds abroad and get alerts on the go.

You are using an outdated browser. Please upgrade your browser to improve your experience.

Manage My Account

Help With My Account

Manage My Card

Help With My Card

Travel Services

Travel Benefits

Help With Travel

Insure Myself

Insure My Possessions

Help With Insurance

Benefits And Offers

Manage Membership

Corporate Payment Solutions

Accept Our Cards

Help With Business

Frequently Asked Questions

Top Actions

Top Questions

It appears that JavaScript is either disabled or not supported by your web browser. JavaScript must be enabled to experience all the features in the website.

American Express® Travelers Cheques

Travelers cheques are backed by american express.

For more than a century American Express Travelers Cheques have helped travellers protect their money. Travelers Cheques may be refunded if lost or stolen. (Terms, conditions and restrictions apply. Identification and proof of purchase required.)

Travelers Cheques never expire

Unused Travelers Cheques can be used for future trips or redeemed.

Redeeming your Travelers Cheques.

1. Redeem your Travelers Cheques with American Express Travel Related Services Company, Inc

You can call American Express customer service on ( 0008000404722 ) to register a direct redemption claim (1) . You can find additional contact numbers based on your location or alternatively Email us. Click here to register for our secure Email service.

2. Deposit your Travelers Cheques with your Bank

Some banks allow account holders to deposit Travelers Cheques (subject to bank’s policies and procedures) - including foreign currency Travelers Cheques - to their bank account. Please check with your bank if they allow deposit of Travelers Cheques. (Clearing fees may apply.)

3. Exchange your Travelers Cheques for Local Currency

Travelers Cheques are welcomed at thousands of locations worldwide (Exchange fees may apply). Click / Tap below to find locations near you (2) .

(1) American Express usually process claims & initiate payments within 5 business days. However, when documents are required to process the claim, it can take up to 30 days, from when the documents are received, for a claim to be processed & a payment initiated. Travelers Cheque Encashment service is provided by American Express Travel Related Services Company, Inc.

(2) It is highly recommended that you call the location prior to your visit and verify fees, limits, restrictions, exchange rates and availability.

May be refunded if lost or stolen*

24/7 customer support

Accepted at thousands of locations worldwide

Never expire

Travelers Cheques Service Centre

Get help with your Travelers Cheques and find answers to common questions about them

How to use Travelers Cheques

As soon as possible, sign your name on the upper signature line to help protect yourself in case of loss or theft.

Write down your serial numbers and keep them with you when you travel, separated from your Travelers Cheques.

Safeguard your Travelers Cheques as you would cash.

To redeem, sign your Travelers Cheque on the lower signature line in front of the person accepting your Cheques.

Lost or Stolen Travelers Cheques

American Express Travelers Cheques are safe and secure. If they are ever lost or stolen, the funds may be refunded.*

WHAT TO DO IF YOUR CHEQUES ARE LOST OR STOLEN

1. Locate serial numbers

Have the serial numbers for your lost or stolen Cheques on hand when you call.

Call an American Express Travelers Cheque Customer Service Centre on ( 0008000404722 ) or find the contact number for your current location as soon as possible to report the loss and open a claim. Service Centres handle claims 24 hours a day, 7 days a week.

3. Receiving your refund

If your claim is approved we will help determine the best way for you to obtain a refund.

* Terms, conditions and restrictions apply. Identification and proof of purchase required.

Why are Travelers Cheques safe and secure?

Travelers Cheques are safe and secure because if they are ever lost or stolen, they may be refunded.

Where do I sign my Travelers Cheques?

Travelers Cheques should be signed on the upper signature line as soon as possible after purchase.

USING TRAVELERS CHEQUES

Where are Travelers Cheques accepted?

There are thousands of foreign exchange partners in countries around the world where you can exchange your American Express Travelers Cheques for local currency. Click here to find places to redeem your Travelers Cheques. It may also be possible to redeem your Travelers Cheques directly for goods and services. Check first though with the merchant.

Can I redeem my Travelers Cheques directly with American Express? If you are unable to find or visit a nearby location to redeem your Travelers Cheques please call Customer Service on ( 0008000404722 ) or find the contact number for your current location or alternatively Email us. Click here to register for our secure Email service. Redemption of your Travelers Cheques directly with American Express may take longer than 30 days, depending on the circumstances of the request. There may be restrictions on the currency and method of redemption and the value of Travelers Cheques that can be directly redeemed.

How do I cash Travelers Cheques?

Simply present the Cheque at the exchange or merchant location. Make sure the acceptor watches while you countersign the Cheque on the lower signature line. Photo identification may be required. We strongly recommended you retain and carry your original purchase receipt with you when you travel. Commission charges may apply and can vary by country or exchange partner. Exchange limits may apply due to local regulations and exchange policies.

What happens if I sign my Travelers Cheques in the wrong place, or if my signatures don't match?

Acceptance of Travelers Cheques is based on the acceptor watching the customer sign the Cheque on the lower signature line, and then comparing that signature with the original signature on the upper signature line . The acceptor must observe the customer signing the Cheque. If the signatures are a reasonable match, the Cheque should be accepted. Photo identification may be required at the discretion of the Acceptor. As always, if the acceptor is unsure, they should call an American Express Travelers Cheque Customer Service Centre.

Is there a fee to cash Travelers Cheques?

Commission charges may apply and can vary by country and/or exchange partner. Before you travel we recommend that you click here to find the most convenient Travelers Cheque exchange locations, along with any information about fees that they have shared with us.

Do Travelers Cheques expire?

Travelers Cheques do not expire. Unused Travelers Cheques can be used for future trips.

What should be done with a deceased person's unused Travelers Cheques?

A refund can be arranged for the unused Travelers Cheque to the next of kin or beneficiary. Please call Customer Services on ( 0008000404722 ) or find the contact number to find the customer service number for your current location or alternatively Email us. Click here to register for our secure Email service. What happens if my Cheques are lost or stolen?

Lost or stolen Travelers Cheques may be refunded.* Please call Customer Services on ( 0008000404722 ) or find the contact number for your current location.

For other questions regarding Travelers Cheques, please call Customer Services on ( 0008000404722 ) or find the contact number for your current location or alternatively Email us. Click here to register for our secure Email service.

Terms and Conditions

Following are the terms and conditions for obtaining a refund for lost or stolen Travelers Cheques.

PURCHASE AGREEMENT

Read this Agreement carefully. By either buying, signing, accepting or using these American Express®Travelers Cheques (“Cheques”), you agree to everything written here: You agree (a) To sign your Cheques immediately in the upper left corner, (b) Not to resell, consign, or take any similar action to transfer your Cheques to any other individual, company or entity for resale or reuse.

American Express Travel Related Services Company, Inc. (“Amexco”) will replace or refund the amount shown on any lost or stolen Cheque in accordance with applicable laws and only if you meet all of the requirements below:

BEFORE LOSS

- You have signed the Travelers Cheque in the upper left-hand corner in permanent ink.

- You have not signed the Cheque in the lower left-hand corner.

- You have not given the Cheque to another person or company to hold or keep, or as part of a confidence game.

- You have not used the Cheque in violation of any law, including as part of an illegal bet, game of chance or other prohibited action.

- Your Cheque has not been taken by court order or by government action.

- You have safeguarded the Cheque as a prudent person would safeguard a like amount of cash.

- You promptly notify Amexco of the loss or theft of the Cheque.

- You promptly report all facts of the loss or theft to Amexco and also to the police if Amexco asks you to.

- You promptly inform Amexco of the serial number of the lost or stolen Cheque and the place and date of its purchase.

- You promptly complete Amexco's refund forms and provide Amexco with acceptable proof of your identity.

- You give Amexco all reasonable information and help requested to make a complete investigation of the loss or theft. Amexco reserves the right to investigate the loss or theft and to verify compliance with this Purchase Agreement and shall not be responsible for any delays resulting from such an investigation.

- Please note that for quality assurance purposes your telephone call to Amexco may be monitored or recorded and that you consent to such monitoring and recording.

NO STOP PAYMENT

Amexco cannot stop payment on any Cheque.

Sign your Cheques immediately in the upper left hand corner.

Still need help?

If you would like to call us please call customer services on ( 0008000404722 ) or click on “Phone” icon below to get the Customer Service Phone number for your current location

If you would like to send us an Email

click the “Email” icon below to register for our secure Email service.

American Express stopped issuing Travelers Cheques, so they’re no longer available for purchase.

Support is available by phone and the American Express website for customers to redeem valid Travelers Cheques.

Travelers Cheques remain backed by American Express and have no expiration date.

- Skip to main content

- Skip to primary sidebar

Business Jargons

A Business Encyclopedia

Traveler’s Cheque

Definition: The Traveler’s cheque is an exchange medium that can be used as a substitute for the hard currency. As the name suggests, these cheques are issued to the individuals who travel on vacations to overseas.

The Traveler’s cheque provides a lot of convenience to those who travel to foreign countries, as they are not required to carry excess cash along with them and can use these cheques as a currency to facilitate the purchases. The merchants and other business accept the traveler’s cheque as a currency, provided the original signatures on the cheque (the cheque signed at the time of its issue) matches the signature done at the time purchases are initiated.

Here, the issuer of the Traveler’s cheque unconditionally guarantees the payment of the undersigned value, irrespective of the cheque being fraudulently issued or lost or stolen. This means that the traveler’s cheques are never bounced unless the issuer becomes bankrupt or goes out of business. The payee receiving the cheque, can deposit it with the Bank, as done in the case of ordinary cheques and can get the payment credited to his account.

One of the advantages of traveler’s cheque is that it never expires, this means, the purchaser can keep the unused cheque with him to use it anytime in the future. There are four parties involved in the Traveler’s cheque transaction:

- The Issuer or Obligor , an organization that produces the traveler’s cheque

- An Agent , the bank or any other party that sells the cheque

- The Purchaser , the person who buys it

- The Payee or Merchant , a person to whom the cheque is handed over in exchange for goods and services.

The Traveler’s cheque can be replaced by the issuer, in case it is lost or stolen. This requires the purchaser of the cheque to maintain a copy of cheque receipt or its number in a safe custody so that it can be produced to the issuer to get the cheque replaced. The traveler’s cheques are available in varied currencies such as US Dollars, Great Britain Pounds (GBP), Japanese Yen (JY), Australian Dollars (AUD) and Canadian Dollars (CAD).

Related terms:

- Cheque Truncation System

- Concentration Banking

- Foreign Draft

- Risk Hedging with Swaps

- Co-Branded Credit Cards

Reader Interactions

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

If You Have Old Traveler's Checks Lying Around, Here's Why You Should Cash Them ASAP

By Jason Cochran

03/07/2023, 6:15 PM

For a long time, the standard advice about traveler's checks has been conditional: You can still buy them, but be prepared for them to be refused at many places.

Traveler's checks hail from an era before ATMs, credit cards, prepaid debit cards, and digital wallets, when travelers had to bring large sums of money with them to pay for their adventures. The traveler's check enabled people to remain well-funded without the risk of carrying actual cash.

But we no longer need to carry ready funds wherever we go. We have digital payments. And as that global technology has grown, the systems that handle archaic proxy forms of payment such as traveler's checks have vanished.

Many former issuers of traveler's checks, such as Thomas Cook, Bank of America, Chase, and AAA, have either discontinued their traveler's check programs or gone out of business altogether.

Yet there are still some consumers out there who seek out this form of payment out of familiarity.

American Express acts like they're still worthwhile. ("Travelers Cheques mean peace of mind," the Amex website promises .) So does Visa , which issues them through its banking partners.

Don't succumb. You could end up stuck with the checks after you get back home.

Previously, if you still had some traveler's checks in your possession after a trip, you could redeposit them in your bank account. After all, they never expire.

But now big financial institutions have changed the rules.

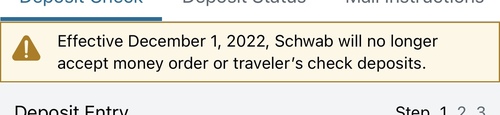

Last December, Charles Schwab, a major player in consumer investing, announced that it would no longer accept traveler's checks as deposits. (The company also announced it would no longer accept mobile deposits of money orders.) The warning was quietly slipped into a tiny box in the Charles Schwab app.

Financial institutions, like airlines, tend to imitate one another's consumer products. Your bank may follow suit, if it hasn't already.

In Chase's case, sales of traveler's checks were halted in 2015, but Chase still accepts them on deposit for now.

Many banks, though, will simply refer you back to the company that originally underwrote the transaction, so getting your cash might involve detective work and mailing the old checks to Europe to petition for a refund.

Yet a lot of online travel tips still present traveler's checks as an uncommon-but-viable option.

A 2022 post by First Republic Bank sold them as "still a worthy option to consider," and a 2022 post from Capital One warned there may be a fee to deposit unused traveler's checks, but didn't mention that many banks aren't even capable of doing that anymore.

I tested ChatGPT with a question about how to obtain traveler's checks for a vacation. Because the A.I. software is fed by all the bad information online, the chatbot told me traveler's checks "have become less common in recent years," but then nonetheless proceeded to instruct me how and where to buy some.

ChatGPT never warned me that I could potentially have trouble cashing the leftovers after my trip ends.

If you research more carefully, you can find stories of people who run across old traveler's checks but have a hard time locating anyone to redeem them—even at the buyer's own bank or the institution named on the check.

If you can't use traveler's checks easily and you can't easily get your money back afterward, they're not what I'd call a viable option anymore.

One statistic that's frequently cited online states that more than $1 billion in unredeemed traveler's checks are still circulating. Many of those checks are leftovers from long-ago vacations that came in under budget or vestiges of well-meaning grandparents who assumed buying traveler's checks as gifts was as safe as buying a bond.

Although that $1 billion figure may not be accurate, there's still no doubt that heaps of old traveler's checks are out there, forgotten in the backs of closets, sock drawers, and safe deposit boxes. The avenues for getting the value back out of the checks are swiftly closing.

So it's time to call it. Traveler's checks should never be used.

More to the point, if you have any old traveler's checks somewhere, get the value back out of them as soon as possible.

And don't buy any more ever again. Not unless you want to run the risk of locking your hard-earned money into pieces of paper.

When it comes to travel, any company that is still issuing traveler's checks probably shouldn't be. Consider them dead.

- All Regions

- Australia & South Pacific

- Caribbean & Atlantic

- Central & South America

- Middle East & Africa

- North America

- Washington, D.C.

- San Francisco