ATO Reasonable Travel Allowances

‘Reasonable’ allowances received in accordance with ATO’s reasonable travel allowances schedules are not required to be declared as income, and can be excluded from the expense substantiation requirements.

Per diem rate schedules of amounts considered reasonable are set out in Tax Determinations published by the Tax Office annually.

Tax Ruling TR 2004/6 describes the substantiation exception for expenses which are in line with the prescribed reasonable allowance amounts.

2021, 2022, 2023 and 2024 rates and for prior years are set out below.

The annual determinations set out updated ATO reasonable allowances for each financial year for:

- overtime meal expenses – for food and drink when working overtime

- domestic travel expenses – for accommodation, food and drink, and incidentals when travelling away from home overnight for work

- overseas travel expenses – for food and drink, and incidentals when travelling overseas for work

On this page:

2017- 18-Addendum

More information

Substantiation rules

Substantiation in practice

Alternative: Business travel expense claims

Distinguishing Travelling, Living Away and Accounting for Fringe Benefits

See also: Super for long-distance drivers – ATO

Allowances for 2023-24

The full document in PDF format: 2023-24 Determination TD TD 2023/3 (pdf).

The 2023-24 reasonable amount for overtime meal expenses is $35.65.

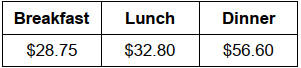

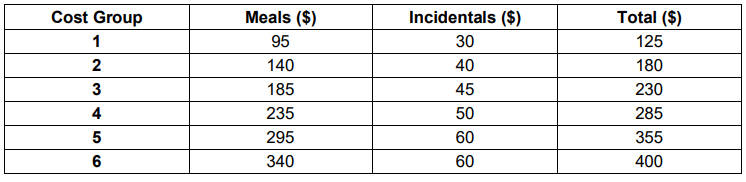

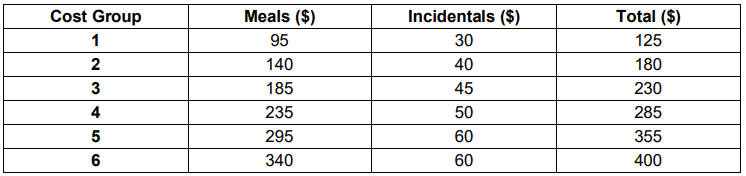

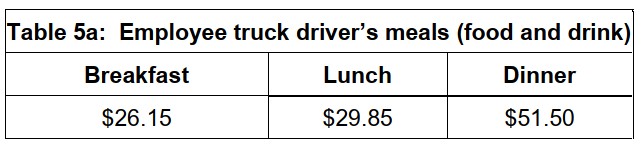

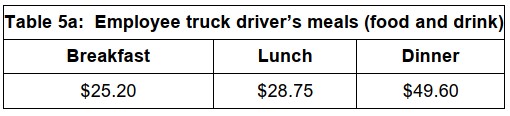

Reasonable amounts given for meals for employee truck drivers (domestic travel) are as follows:

- breakfast $28.75

- lunch $32.80

- dinner $56.60

For full details including domestic and overseas allowances in accordance with salary levels, refer to the full determination document:

2023-24 Domestic Travel

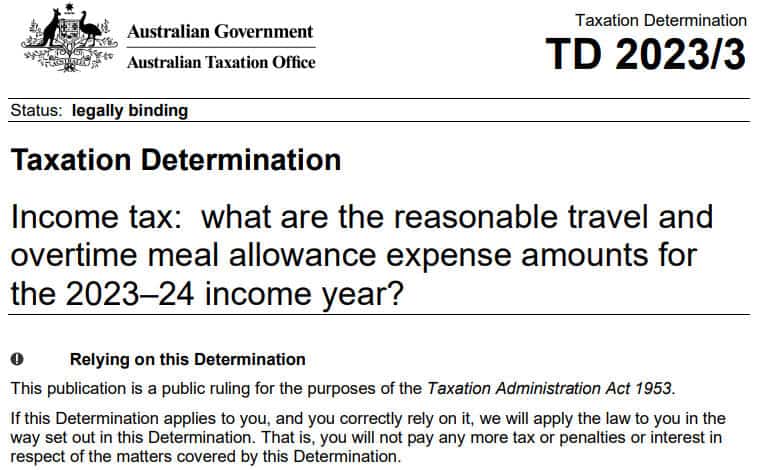

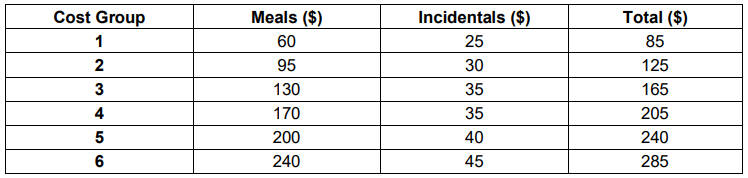

Table 1:Salary $138,790 or less

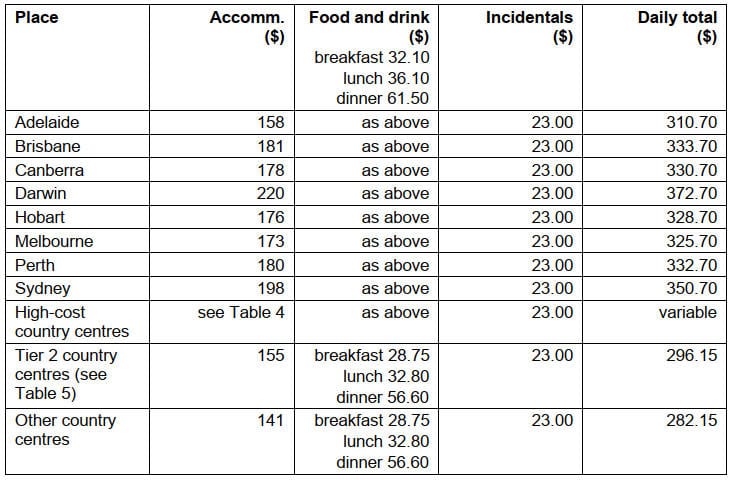

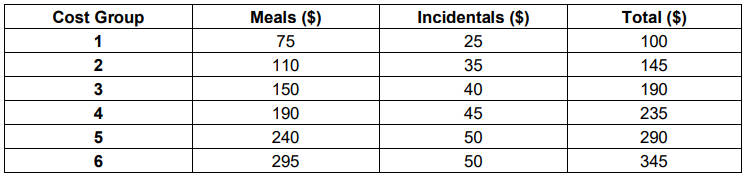

Table 2: Salary $138,791 to $247,020

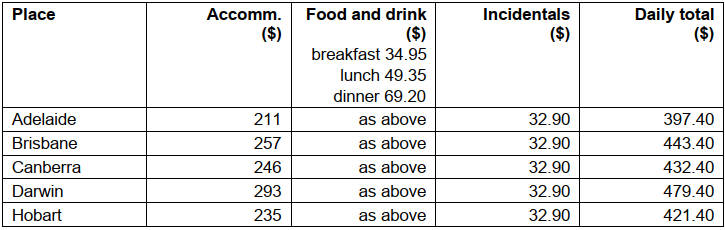

Table 3: Salary $247,021 or more

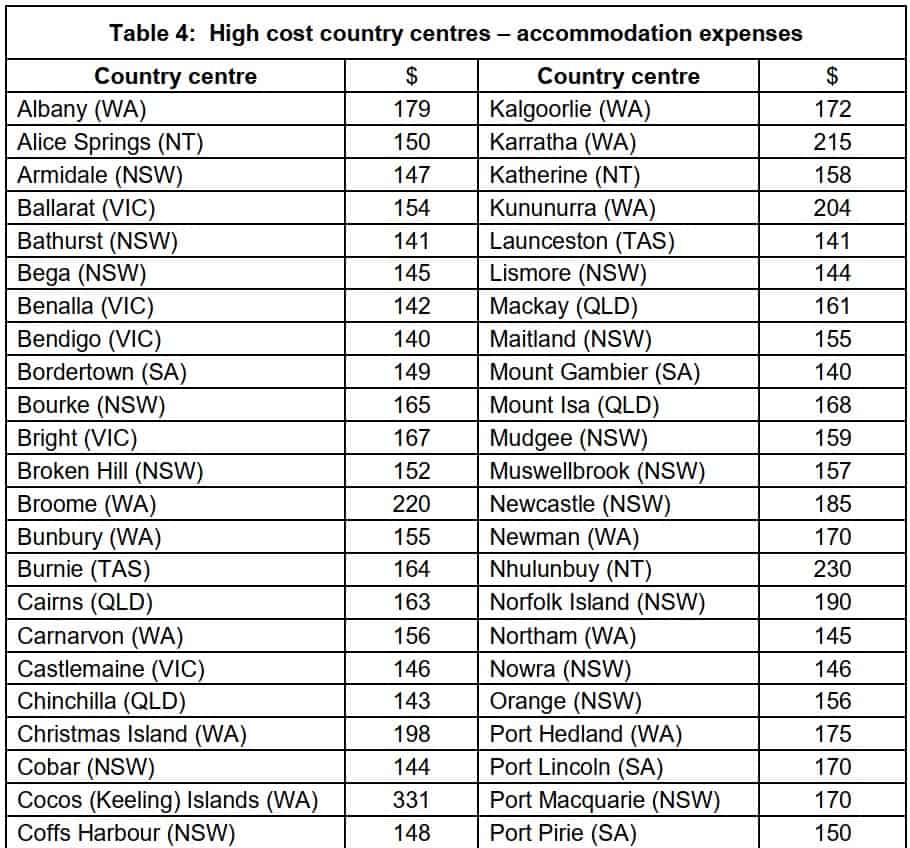

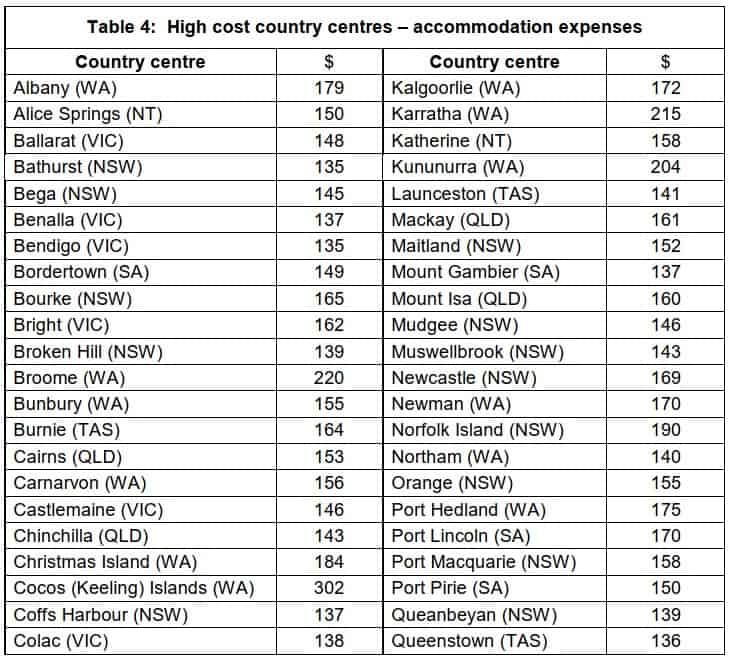

Table 4: High cost country centres accommodation expenses

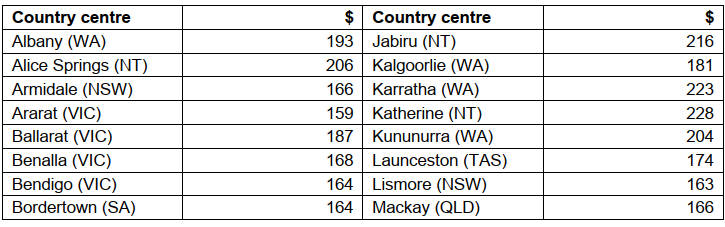

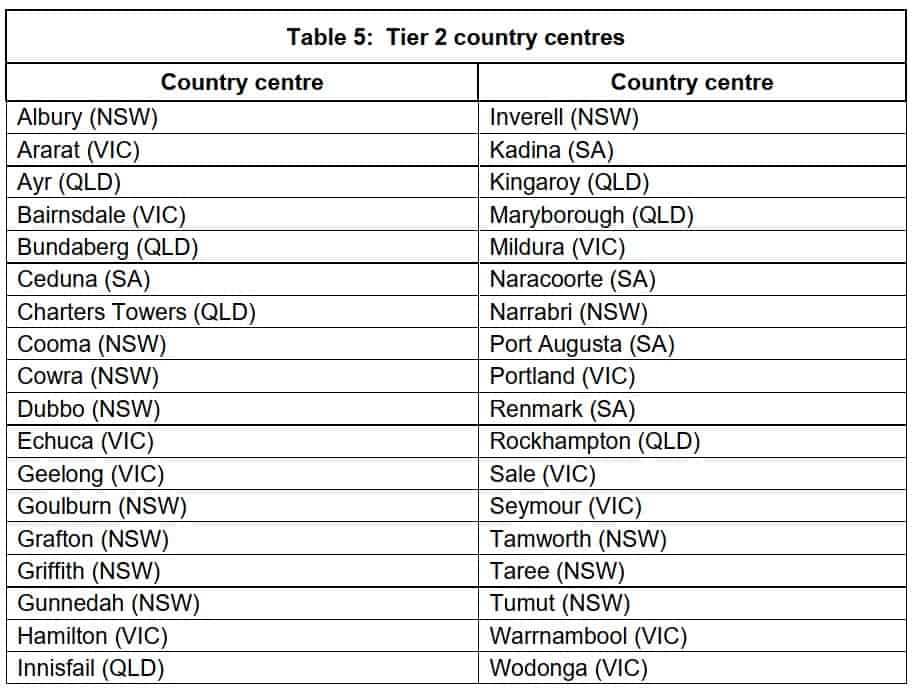

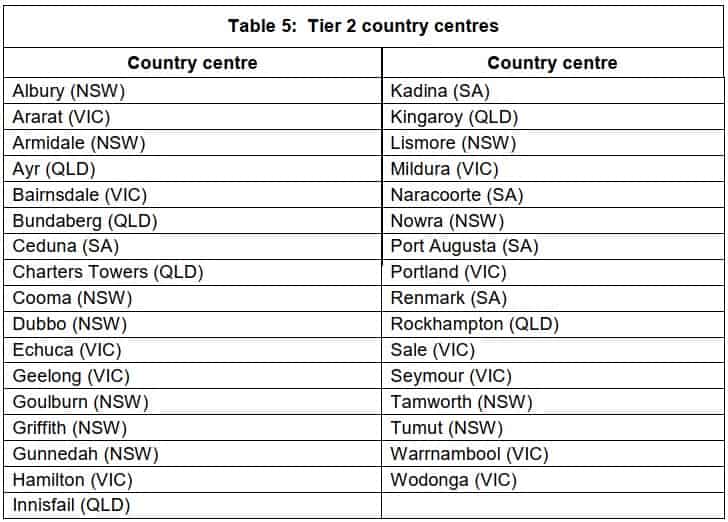

Table 5: Tier 2 country centres

Table 5a: Employee truck driver’s meals (food and drink)

2023-24 Overseas Travel

Table 6: Salary $138,790 or less

Table 7: Salary $138,791 to $247,020

Table 8: Salary $247,021 or more

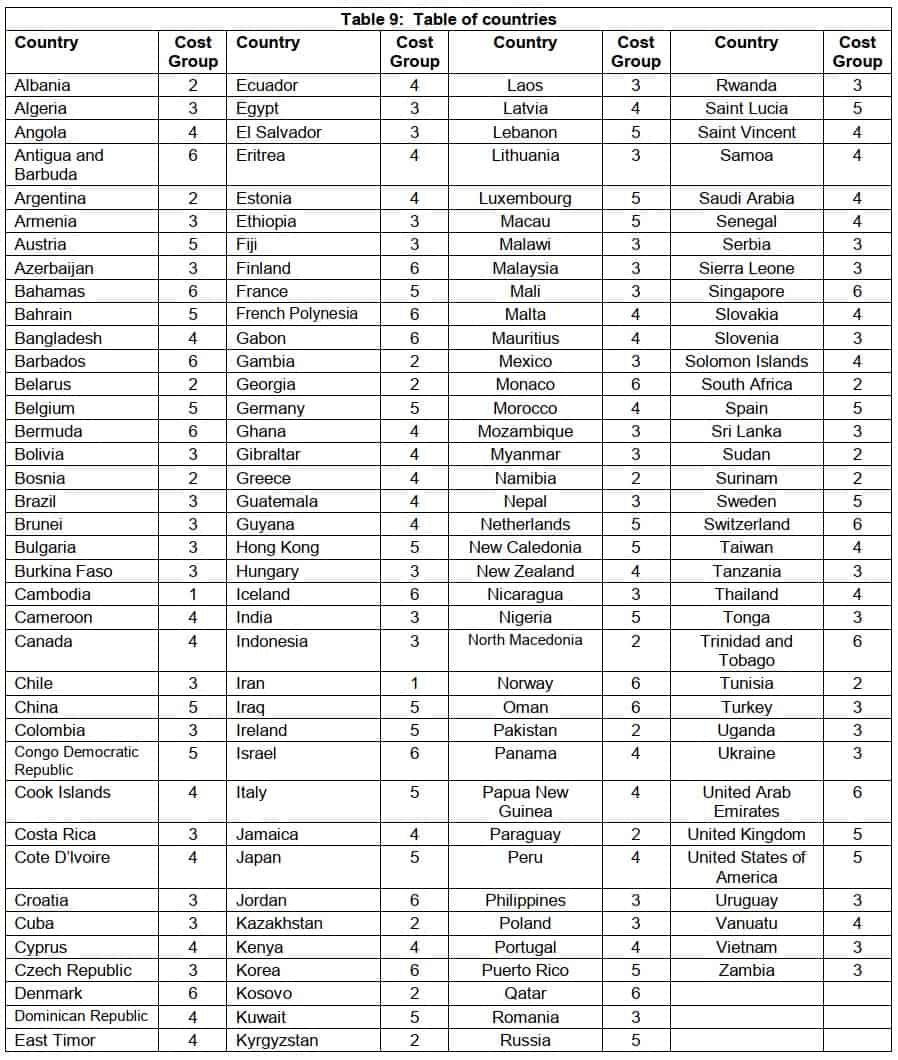

Table 9: Table of countries

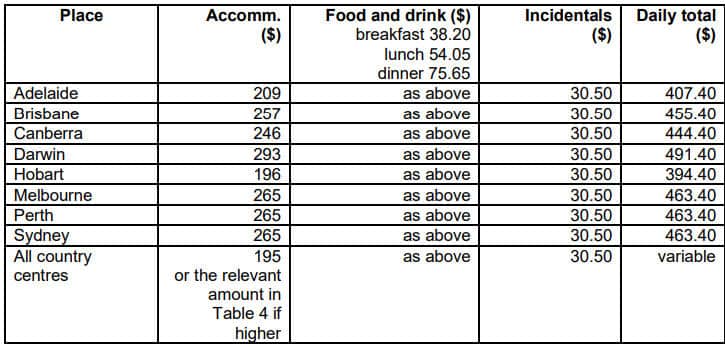

Table 1:Reasonable amounts for domestic travel expenses – employee’s annual salary $138,790 or less

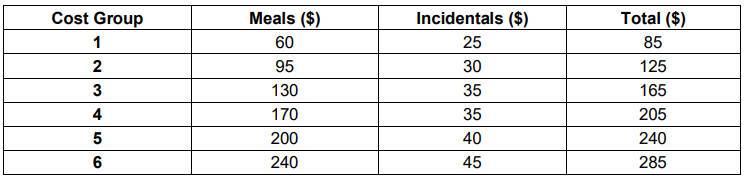

Table 2: Reasonable amounts for domestic travel expenses – employee’s annual salary $138,791 to $247,020

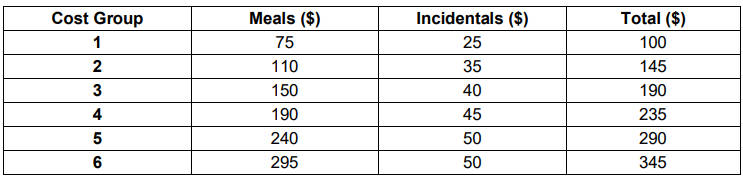

Table 3: Reasonable amounts for domestic travel expenses – employee’s annual salary $247,021 or more

Table 4: Reasonable amounts for domestic travel expenses – high-cost country centres accommodation expenses

Table 5a: Reasonable amounts for domestic travel expenses – employee truck driver’s meals (food and drink)

Table 6: Reasonable amounts for overseas travel expenses – employee’s annual salary $138,790 or less

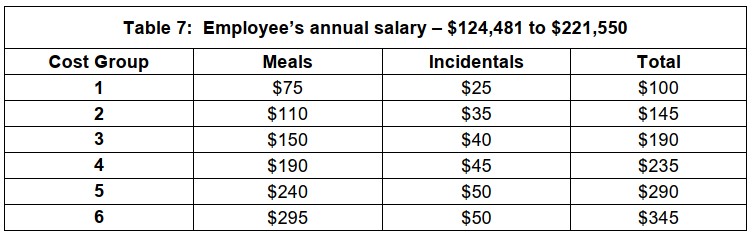

Table 7: Reasonable amounts for overseas travel expenses – employee’s annual salary $138,791 to $247,020

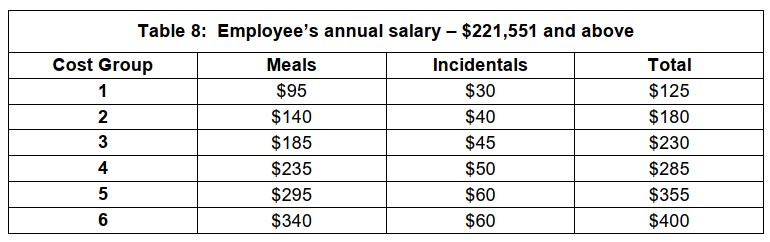

Table 8: Reasonable amounts for overseas travel expenses – employee’s annual salary $247,021 or more

Allowances for 2022-23

The full document in PDF format: 2022-23 Determination TD 2022/10 (pdf).

The 2022-23 reasonable amount for overtime meal expenses is $33.25.

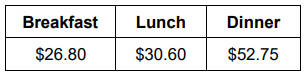

Reasonable amounts given for meals for employee truck drivers are as follows:

- breakfast $26.80

- lunch $30.60

- dinner $52.75

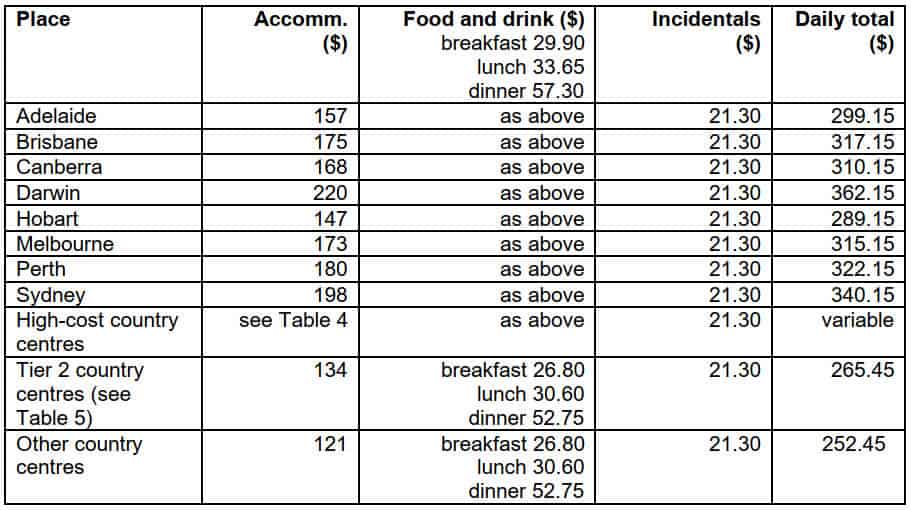

2022-23 Domestic Travel

Table 1: Salary $133,450 and below

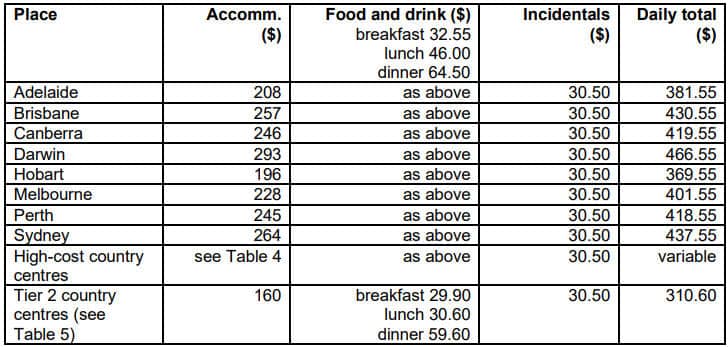

Table 2: Salary $133,451 to $237,520

Table 3: Salary $237,521 and above

2022-23 Overseas Travel

Table 6: Salary $133,450 and below

Table 7: Salary – $133,451 to $237,520

Table 8: Salary – $237,521 and above

Table 1: Reasonable amounts for domestic travel expenses – employee’s annual salary $133,450 and below

Table 2: Reasonable amounts for domestic travel expenses – employee’s annual salary $133,451 to $237,520

Table 3: Reasonable amounts for domestic travel expenses – employee’s annual salary $237,521 and above

Table 4: Reasonable amounts for domestic travel expenses – high-cost country centres accommodation expenses

Table 5a: Reasonable amounts for domestic travel expenses – employee truck driver’s meals (food and drink)

Table 6: Reasonable amounts for overseas travel expenses – employee’s annual salary $133,450 and below

Table 7: Reasonable amounts for overseas travel expenses – employee’s annual salary $133,451 to $237,520

Table 8: Reasonable amounts for overseas travel expenses – employee’s annual salary $237,521 and above

Allowances for 2021-22

The full document in PDF format: 2021-22 Determination TD 2021/6 (pdf).

The document displayed with links to each sections is set out below.

For the 2021-22 income year the reasonable amount for overtime meal expenses is $32.50

2021-22 Domestic Travel

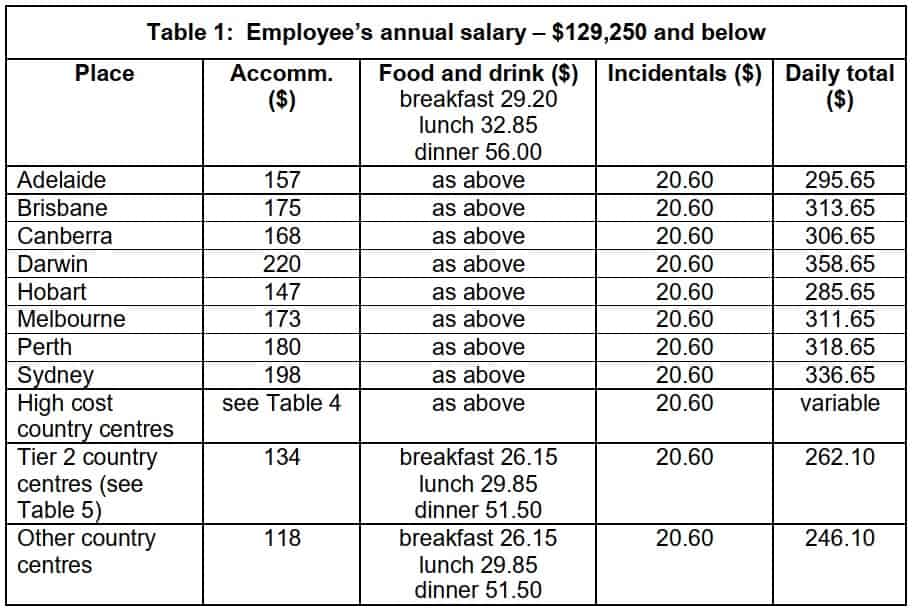

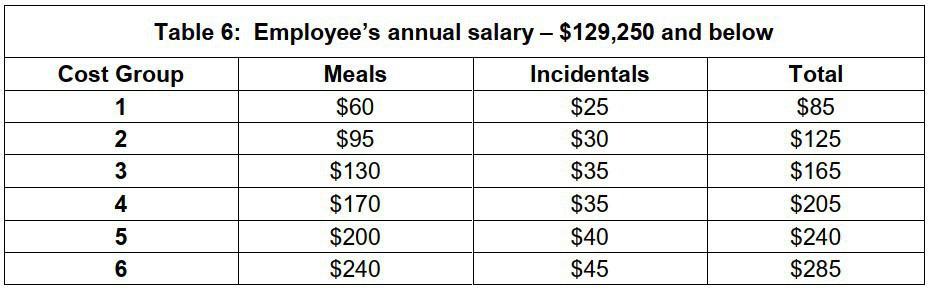

Table 1: Salary $129,250 and below

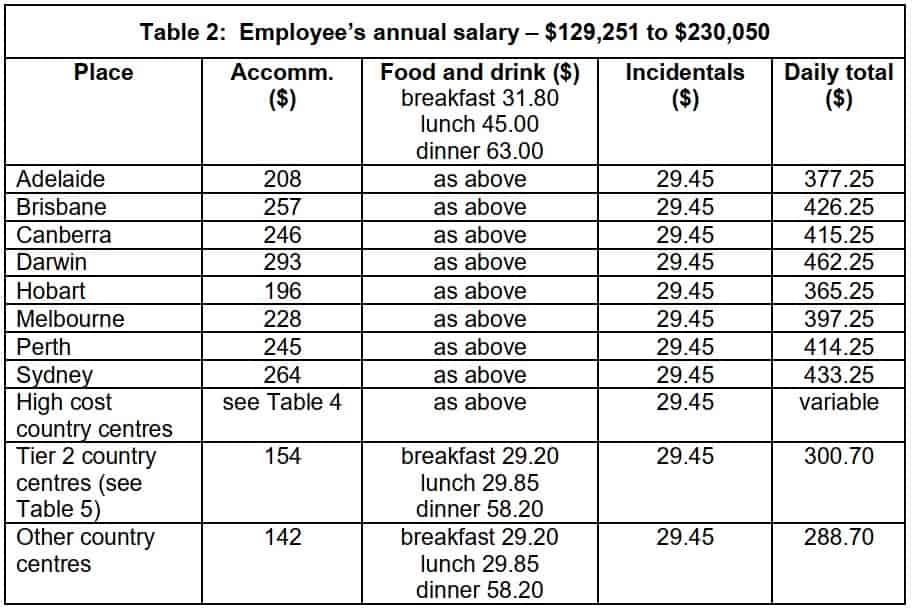

Table 2: Salary $129,251 to $230,050

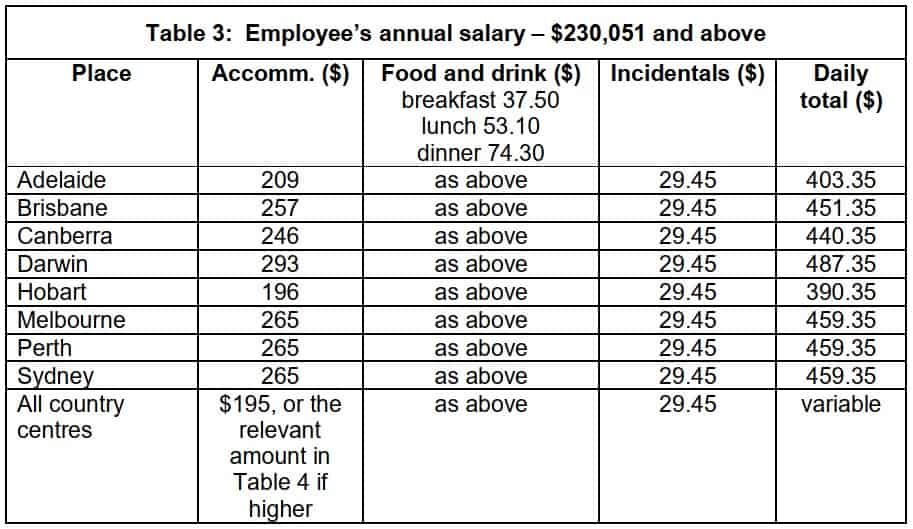

Table 3: Salary $230,051 and above

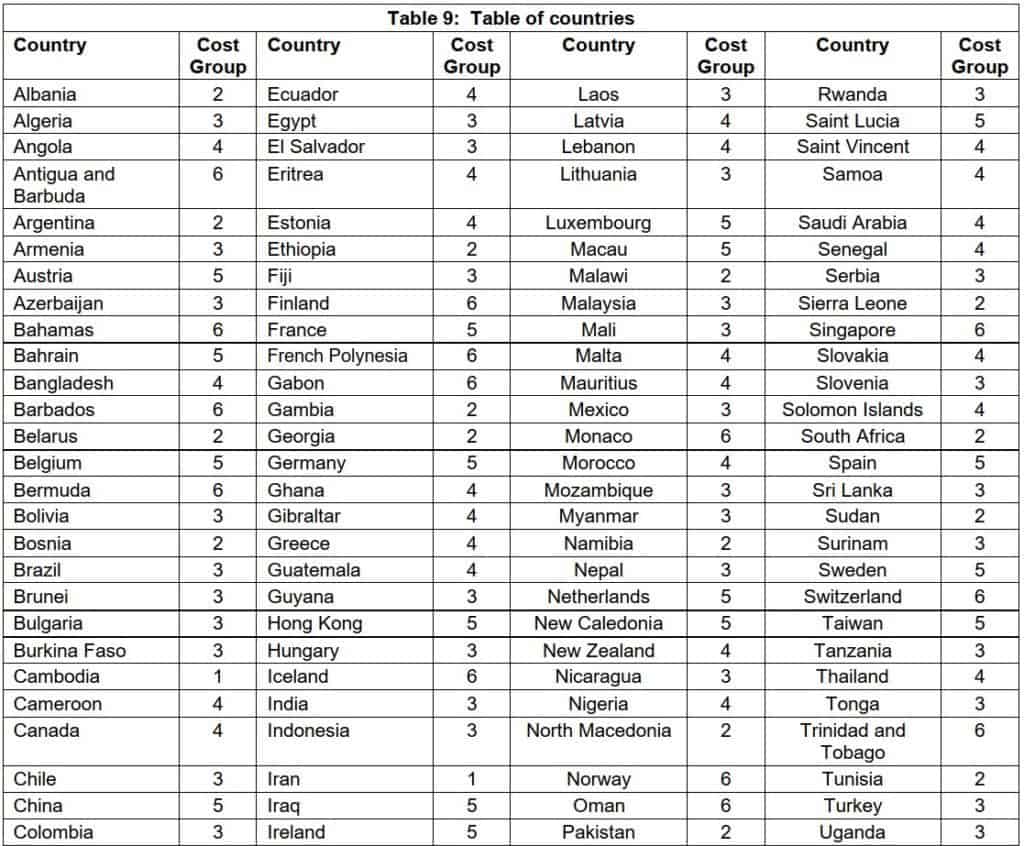

2021-22 Overseas Travel

Table 6: Salary $129,250 and below

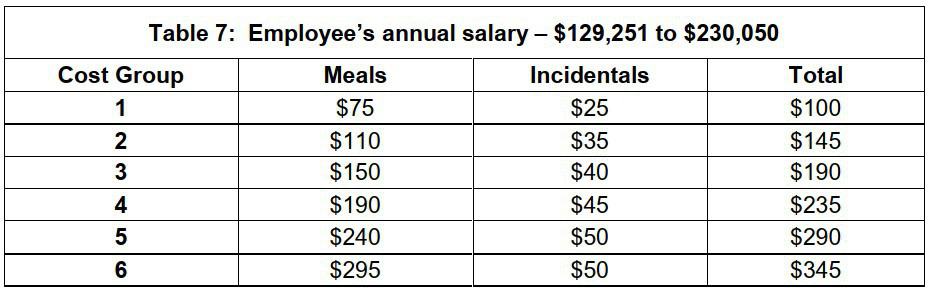

Table 7: Salary – $129,251 to $230,050

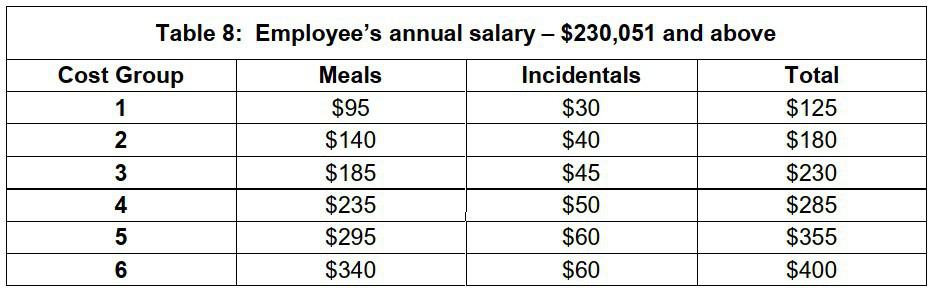

Table 8: Salary – $230,051 and above

2021-22 Domestic Table 1: Employee’s annual salary – $129,250 and below

2021-22 Domestic Table 2: Employee’s annual salary – $129,251 to $230,050

2021-22 Domestic Table 3: Employee’s annual salary – $230,051 and above

2021-22 Domestic Table 4: High cost country centres – accommodation expenses

2021-22 Domestic Table 5: Tier 2 country centres

2021-22 Domestic Table 5a: Employee truck driver’s meals (food and drink)

2021-22 Overseas Table 6: Employee’s annual salary – $129,250 and below

2021-22 Overseas Table 7: Employee’s annual salary – $129,251 to $230,050

2021-22 Overseas Table 8: Employee’s annual salary – $230,051 and above

2021-22 Overseas Table 9: Table of countries

Allowances for 2020-21

Download full document in PDF format: 2020-21 Determination TD 2020/5 (pdf).

The document displayed with links to each section is set out below.

For the 2020-21 income year the reasonable amount for overtime meal expenses is $31.95 .

2020-21 Domestic Travel

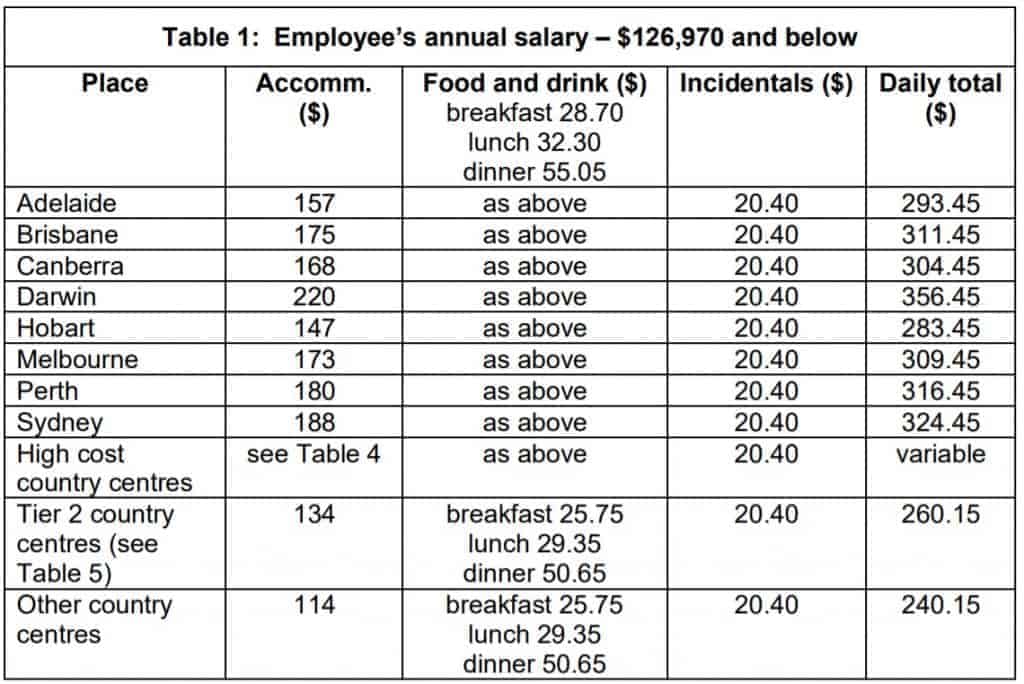

Table 1: Salary $126,970 and below

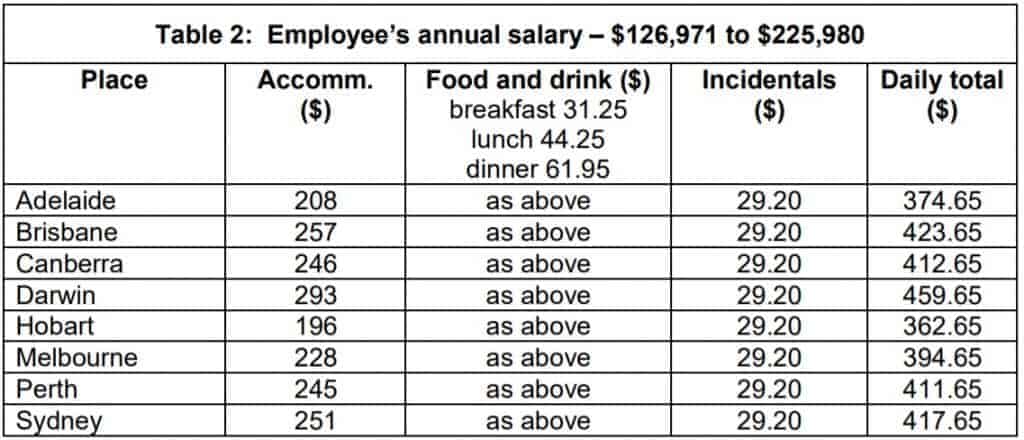

Table 2: Salary $126,971 to $225,980

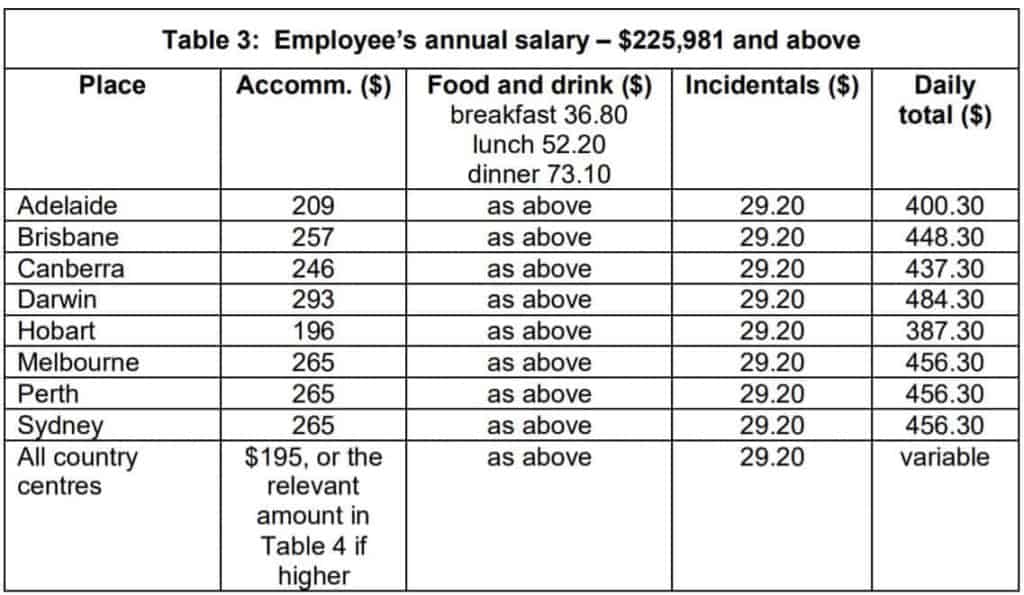

Table 3: Salary $225,981 and above

2020-21 Overseas Travel

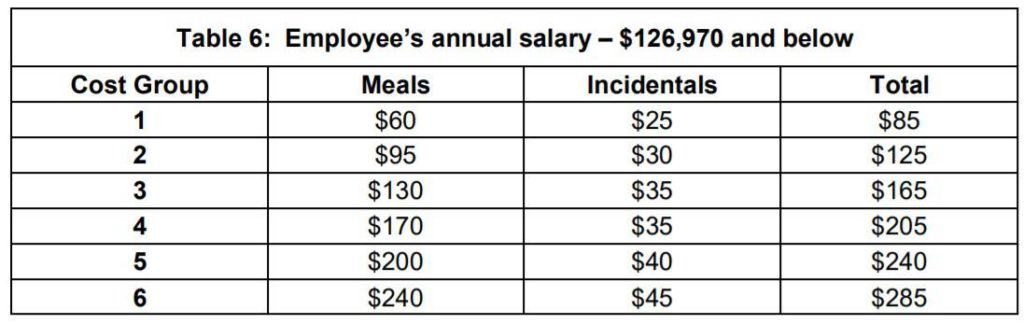

Table 6: Salary $126,970 and below

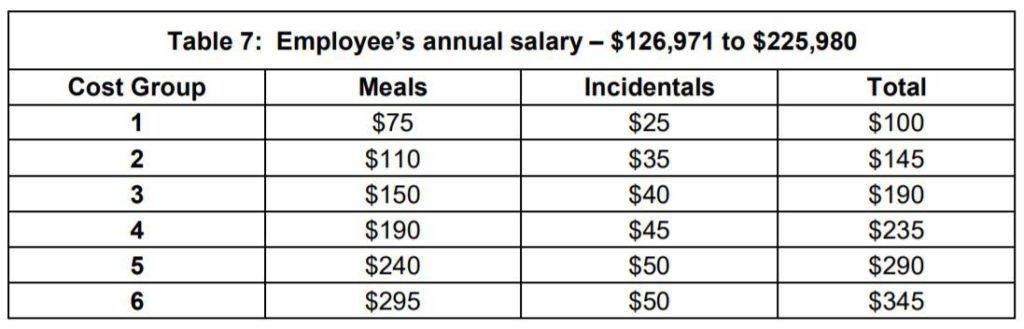

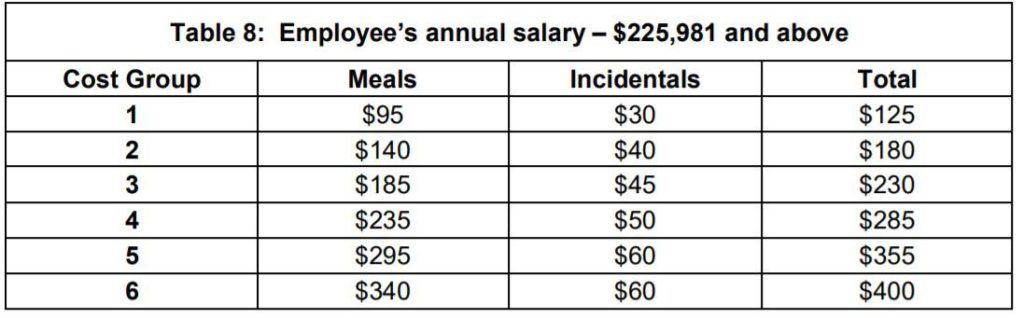

Table 7: Salary – $126,971 to $225,980

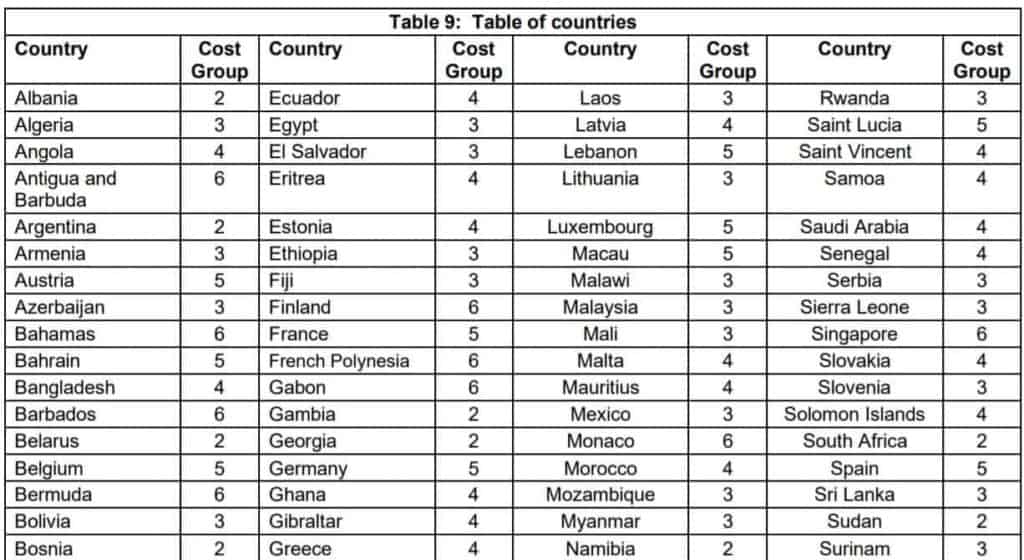

Table 8: Salary – $225,981 and above

2020-21 Domestic Travel 2020-21 Domestic Table 1: Employee’s annual salary – $126,970 and below

2020-21 Domestic Table 2: Employee’s annual salary – $126,971 to $225,980

2020-21 Domestic Table 3: Employee’s annual salary – $225,981 and above

2020-21 Domestic Table 4: High cost country centres – accommodation expenses

2020-21 Domestic Table 5: Tier 2 country centres

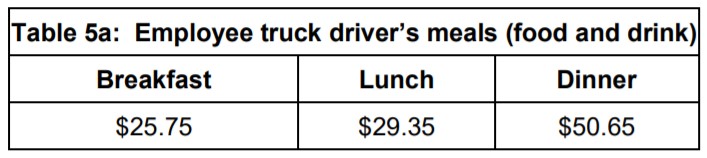

2020-21 Domestic Table 5a: Employee truck driver’s meals (food and drink)

2020-21 Overseas Travel 2020-21 Overseas Table 6: Employee’s annual salary – $126,970 and below

2020-21 Overseas Table 7: Employee’s annual salary – $126,971 to $225,980

2020-21 Overseas Table 8: Employee’s annual salary – $225,981 and above

2020-21 Overseas Table 9: Table of countries

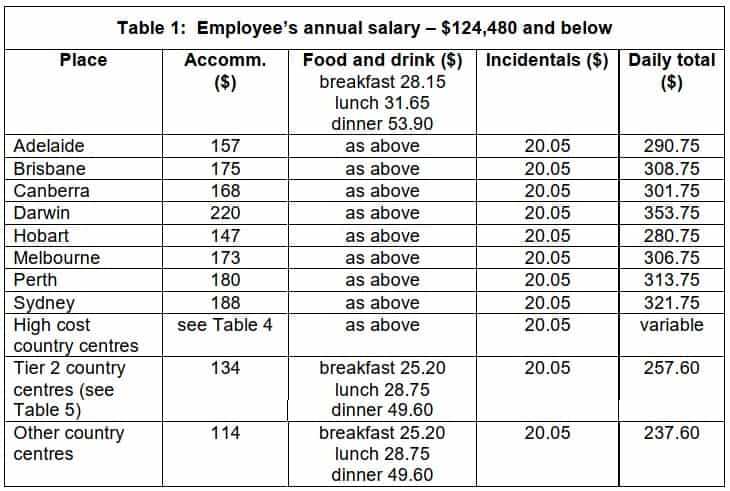

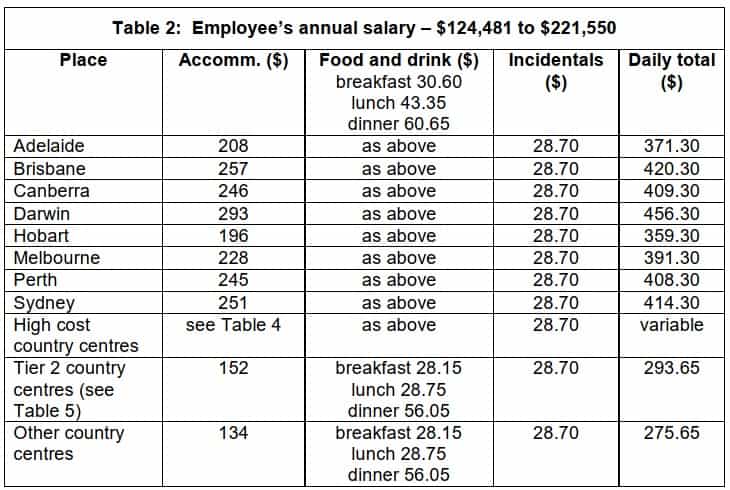

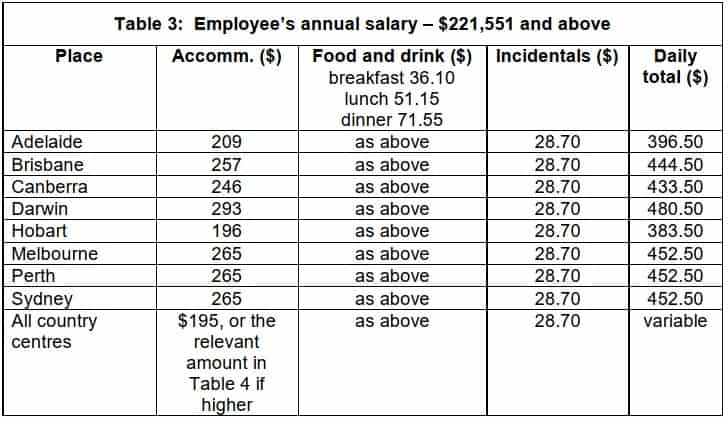

Allowances for 2019-20

The determination in sections:

Domestic Travel

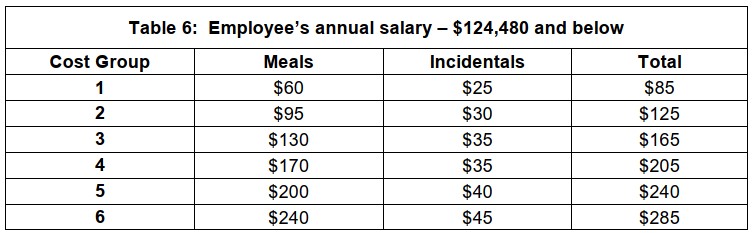

Table 1: Employee’s annual salary – $124,480 and below

Table 2: Employee’s annual salary – $124,481 to $221,550

Table 3: Employee’s annual salary – $221,551 and above

Table 4: High cost country centres – accommodation expenses

Table 5a: Employee truck driver’s meals (food and drink)

Overseas Travel

Table 6: Employee’s annual salary – $124,480 and below

Table 7: Employee’s annual salary – $124,481 to $221,550

Table 8: Employee’s annual salary – $221,551 and above

For the 2019-20 income year the reasonable amount for overtime meal expenses is $31.25.

The reasonable travel and overtime meal allowance expense amounts commencing 1 July 2019 for the 2019-20 income year are contained in Tax Determination TD 2019/11 (issued 3 July 2019).

Download the PDF or view online here .

Domestic Travel Table 1: Employee’s annual salary – $124,480 and below

Domestic Travel Table 2: Employee’s annual salary – $124,481 to $221,550

Domestic Travel Table 3: Employee’s annual salary – $221,551 and above

Domestic Travel Table 4: High cost country centres – accommodation expenses

Domestic Travel Table 5: Tier 2 country centres

Domestic Travel Table 5a: Employee truck driver’s meals (food and drink)

Overseas Travel Table 6: Employee’s annual salary – $124,480 and below

Overseas Travel Table 7: Employee’s annual salary – $124,481 to $221,550

Overseas Travel Table 8: Employee’s annual salary – $221,551 and above

Overseas Travel Table 9: Table of countries

Substantiation and Compliance

Taxation Ruling TR 2004/6 explains the the way in which the expenses can be claimed within the substantiation rules, including the requirement to obtain written evidence and exemptions to that requirement.

Allowances which are ‘reasonable’ , i.e. comply with the Reasonable Allowance determination amounts and with TR 2004/6 are not required to be declared as income and are excluded from the expense substantiation requirements.

These substantiation rules only apply to employees. Non-employees must fully substantiate their travel expense claims. Expenses for non-working accompanying spouses are excluded.

Key points :

To be claimable as a tax deduction, and to be excluded from the expense substantiation requirements, travel and overtime meal allowances must:

- be for work-related purposes; and

- be supported by payments connected to the relevant expense

- for travel allowance expenses, the employee must sleep away from home

- if the amount claimed is more than the ‘reasonable’ amount set out in the Tax Determination, then the whole claim must be substantiated

- employees can be required to verify the facts relied upon to claim a tax deduction and/or the exclusion from the substantiation requirements

- an allowance conforming to the guidelines doesn’t need to be declared as income or claimed in the employee’s tax return, unless it has been itemised on the statement of earnings. Amounts of genuine reasonable allowances provided to employees(excludng overseas accommodation) are not required to be subjected to tax withholdings or itemised on an employee’s statement of earnings.

- claims which don’t match the amount of the allowance need to be declared.

The Tax Office has issued guidance on their position.

[11 August 2021] Taxation Ruling TR 2021/4 reviews the tax treatment of accommodation and food and drink expenses, and provides 14 examples which distinguish non-deductible living expenses from deductible travelling on work expenses. FBT implications for the ‘otherwise deductible’ rule and travel and LAFHA allowances are also considered.

[11 August 2021] Practical Compliance Guideline PCG 2021/3 (which finalises draft PCG 2021/D1 ) provides the ATO’s compliance approach to determining if allowances or benefits provided to an employee are travelling on work, or living at a location.

For FBT purposes an employee is deemed to be travelling on work if they are away for no more than 21 consecutive days, and fewer than 90 days in the same work location in a FBT year.

See also: Travel between home and work and LAFHA Living Away From Home

The issue of annual determination TD 2017/19 for the 2017-18 year marked a tightening of the Tax Office’s interpretation of the necessary conditions for the relief of allowances from the substantiation rules, which would otherwise require full documentary evidence (e.g. receipts) and travel records. (900-50(1))

For a full discussion of the issues, this article from Bantacs is recommended: Reasonable Allowance Concessions Effectively Abolished By The ATO .

Prior to 2017-18

In summary: Prior to 2017-18 the Tax Office rulings stated the general position that provided a travel allowance was ‘reasonable’ (i.e. followed the ATO-determined amounts) then substantiation with written evidence was not required. “In appropriate cases”, however employees may have been required to show how their claim was calculated and that the expense was actually incurred.

What changed

The relevant wording was changed in the 2017-18 determination to now require that more specific additional evidence be available if requested. This additional evidence is not prescribed in the tax rules, but represents a higher administrative standard being applied by the Tax Office.

The required evidence includes being able to show:

- you spent the money on work duties (e.g. away from home overnight for work)

- how the claim was worked out (e.g. diary record)

- you spent the money yourself (e.g. credit card statement, banking records)

- you were not reimbursed (e.g. letter from employer)

Other requirements highlighted by the Bantacs article include:

- a representative sample of receipts may be required to show that a reasonable allowance (or part of it) has actually been spent (TD 2017/19 para 20)

- hostels or caravan parks are not considered eligible for the accommodation component of a reasonable allowance because they are not the right kind of “commercial establishment”, examples of which are hotels, motels and serviced apartments (para 14)

- reasonable amounts for meals can only be for meals within the specific hours of travel (not days), and can only be for breakfast, lunch or dinner (para 15), and therefore could exclude, for example, meals taken during a period of night work.

Tip : The reasonable amount for incidentals still applies in full to each day of travel covered by the allowance, without the need to apportion for any part day travel on the first and last day. (para 16).

Alternative: business travel expense claims

With the burden of proof on ‘reasonable allowance’ claims potentially quite high, an alternative is to opt for a travel expense claim made out under the general substantiation rules for employees, or under the general rules for deductibility for businesses.

The kind of business travel expenses referred to here could include:

Airfares Accommodation Meals Car hire Incidentals (e.g. taxi fares)

The Tax Office has an article describing how to meet the requirements for claiming travel expenses as a tax deduction. See: Claiming a tax deduction for business travel expenses

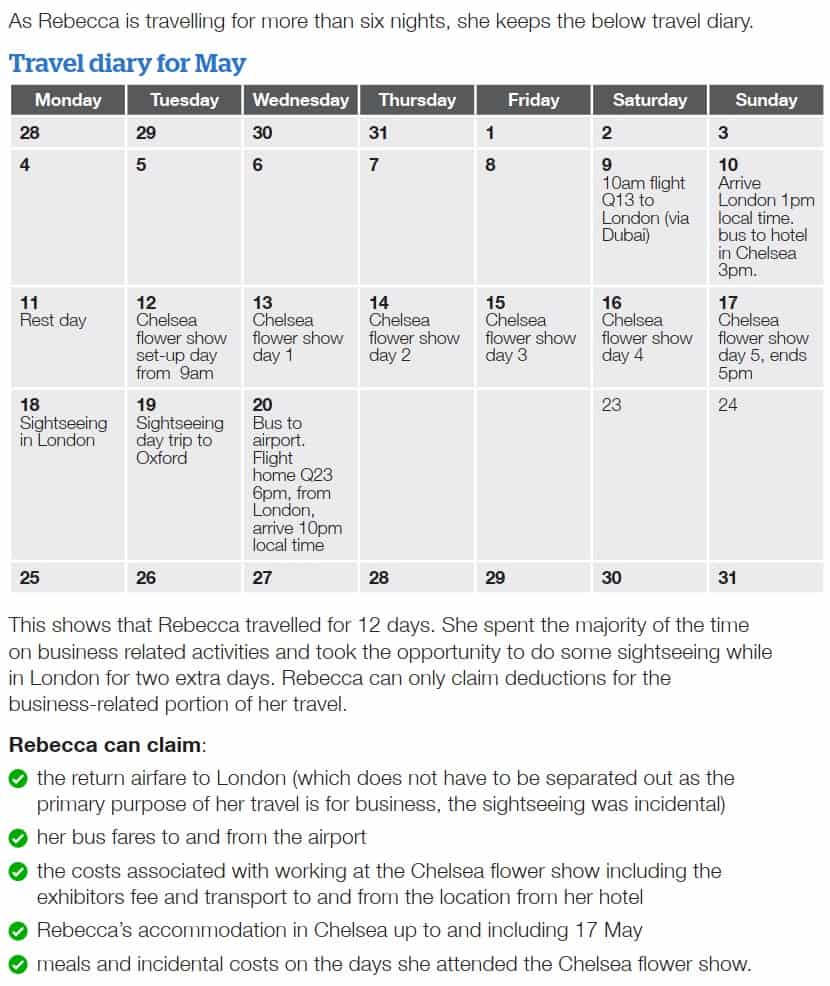

Travel diary

A travel diary is required by sole traders and partners for overnight expenses and recommended for everyone else (including companies and trusts).

It is important to exclude any private portion of travelling expense which is non-deductible, or if paid on behalf of an employee gives rise to an FBT liability.

For example the expenses of a non-business associate (e.g. spouse), the cost of private activities such as sight-seeing, and accommodation and associated expenses for the non-business portion of a trip.

Airfares to and from a business travel destination would not need to be apportioned if the private element of the trip such as sightseeing was only incidental to the main purpose and time spent.

This is an example of a travel diary for Rebecca who owns a business as a sole trader landscape gardener. (courtesy of ATO Tax Time Fact Sheet )

Allowances for 2018-19

For the 2018-19 income year the reasonable amount for overtime meal allowance expenses is $30.60 .

The meal-by-meal amounts for employee long distance truck drivers are $24.70, $28.15 and $48.60 per day for breakfast, lunch and dinner respectively.

This determination includes ATO reasonable allowances for

(a) overtime meal expenses – for food and drink when working overtime (b) domestic travel expenses – for accommodation, food and drink, and incidentals when travelling away from home overnight for work (particular reasonable amounts are given for employee truck drivers, office holders covered by the Remuneration Tribunal and Federal Members of Parliament) (c) overseas travel expenses – for food and drink, and incidentals when travelling overseas for work

Allowances for 2017-18

An addendum was issued modifying paragraphs 23 to 30 of determination TD 2017/19 setting out the new reasonable amounts, and consolidated into TD 2017/19 as linked above. For reference purposes, the first-released version of TD 2017/19 issued 3 July 2017 is linked here .

2017-18 Addendum: ATO reinstates the meal-by-meal approach for truck drivers’ travel expense claims

On 27 October 2017 the ATO announced the reinstatement of the meal-by-meal approach for truck drivers who claim domestic travel expenses for meals. The following new reasonable amounts have now been included in an updated version of the current ruling (see on page 7):

For the 2017-18 income year the reasonable amount for overtime meal allowance expenses is $30.05 .

This determination contains ATO reasonable allowances for:

- overtime meals

- domestic travel

- employee truck drivers

- overseas travel

- $24.25 for breakfast

- $27.65 for lunch

- $47.70 for dinner

The amount for each meal is separate and can’t be combined into a single daily amount or moved from one meal to another.

See: ATO media release

Allowances for 2016-17

For the 2016-17 income year the reasonable amount for overtime meal allowance expenses is $29.40 .

Allowances for 2015-16

Download the PDF or view online here . For the 2015-16 income year the reasonable amount for overtime meal allowance expenses is $ 28.80 .

Allowances for 2014-15

Allowances for 2013-14

The reasonable travel and overtime meal allowance expense amounts for the 2013-14 income year are contained in Tax Determination TD 2013/16 . For the 2013-14 income year the reasonable amount for overtime meal allowance expenses is $ 27.70 .

Allowances for 2012-13

The reasonable travel and overtime meal allowance expense amounts for the 2012-13 income year are contained in Tax Determination TD 2012/17 . For the 2012-13 income year the reasonable amount for overtime meal allowance expenses is $27.10

Allowances for 2011-12

The reasonable travel and overtime meal allowance expense amounts for the 2011-12 income year are contained in Tax Determination TD 2011/017 . For the 2011-12 income year the reasonable amount for overtime meal allowance expenses is $26.45

This page was last modified 2023-06-28

- ATO Community

- Legal Database

- What's New

Log in to ATO online services

Access secure services, view your details and lodge online.

What is a travel allowance?

Check if the payment you receive from your employer is a proper travel allowance.

Last updated 25 April 2023

About travel allowances and travel allowance expenses

A travel allowance is money your employer pays you to cover the costs you might incur when you travel away from your home overnight to perform your work duties.

We call these costs 'travel allowance expenses'.

Your travel allowance may or may not be shown on your income statement or payment summary.

Definition of a travel allowance

For an allowance to be a travel allowance, it must be:

- reasonably capable of meeting your expected costs

- for travel that involves sleeping away from home overnight

- a payment to cover a specific journey

- payment as an allowance

- paid to cover travel allowance expenses

Expected costs

The travel allowance you receive from your employer must reasonably be expected to cover the costs you will incur while travelling overnight for work. It needs to be more than a token amount.

Example: allowance not expected to cover costs

Josh is a server engineer who is travelling from Melbourne to Hobart for a week in order to oversee some upgrades to that office. He receives an allowance of $5 a day for his meal expenses.

The allowance Josh receives from his employer couldn't reasonably be expected to cover the costs of buying 3 meals per day. This means the allowance isn't a travel allowance.

As Josh is travelling away from his home overnight for work, Josh can claim a deduction for the amount he spends on meals while he is in Hobart. Josh must keep written evidence of all his meal expenses.

Sleeping away from home overnight

The travel allowance must be an amount you receive for travel that involves you sleeping away from your home overnight to perform your employment duties.

You will not be sleeping away from home overnight if you usually work overnight and occasionally have a short sleep partway through your shift. However, if you take your mandatory long or major rest break while you are travelling away from your home to perform your employment duties, you will meet this condition.

Example: not sleeping away overnight

Freya is a management consultant who works in Sydney. Under her work agreement she receives a meal allowance if she works away from the office for the day.

When Freya visits her clients interstate, she flies to the interstate location in the morning and returns home the same evening. In these circumstances, Freya receives a meal allowance from her employer.

As Freya doesn't sleep away from home overnight, the allowance she receives is not a travel allowance and she can't claim a deduction for any meals she buys.

Specific journey

Allowances that don't cover a specific work journey are not travel allowances.

Example: allowance not paid for specific work journeys

Greg is the regional sales manager for a telecommunication company. As part of his employment duties, he needs to travel to all the stores in his region. Often he has to stay away from his home overnight when he travels.

In recognition of his travel, his employer pays him an allowance of $3,000 a year regardless of how much travel he does.

This allowance is not a travel allowance. The amount is not paid to cover specific journeys and would be paid whether or not he does any overnight travel.

Greg can claim a deduction for the cost of his accommodation, meals and incidental expenses when he travels away from home overnight for work purposes, provided he keeps written evidence of his expenses (and a travel diary if he is away for 6 or more nights in a row).

Payment as an allowance

The amount you receive from your employer must be a separate payment you receive as an allowance. The amount can't be rolled into your salary and wages.

Example: allowance rolled into salary and wages

Idris used to be paid a travel allowance under his employment contract, but he gave up the allowance 2 years ago for an increase in his base pay. The increase in his base pay is not a travel allowance.

Idris can claim a deduction for the cost of his accommodation, meals and incidental expenses when he travels away from home overnight for work purposes, provided he keeps written evidence of his expenses (and a travel diary if he is away for 6 or more nights in a row).

Travel allowance expenses

To be a travel allowance, the allowance must be a payment to cover travel allowance expenses.

This means a travel allowance must cover:

- accommodation

- meals (food or drink)

- incidental expenses.

A travel allowance doesn't have to cover all those expenses. The allowance may still be a travel allowance if it is only paid to cover 1–2 of these expenses.

If the allowance you receive covers an expense other than accommodation, food or drink or incidental expenses, it will not be a travel allowance.

Example: allowance paid to cover food or drink

Helen is travelling from Perth to Darwin to facilitate corporate training for 3 days. She receives a travel allowance to cover her meal expenses (food and drink) but nothing for incidental expenses. Her employer pays for her accommodation directly.

The allowance Helen receives to cover her meal expenses is a travel allowance.

Helen can claim a deduction for her meals, and any incidental expenses she incurs, when she travels to Darwin for 3 days, provided she keeps written evidence of her expenses.

Helen can't claim a deduction for the accommodation expenses her employer pays directly as she doesn't incur an expense.

Example: allowance not paid to cover travel allowance expenses

Minsun works as a salesperson and once a month she must go on a week-long sales tour of regional centres.

Minsun uses her personal car for this trip and receives an allowance from her employer to cover the costs of using her own car.

As the allowance she receives doesn't cover travel allowance expenses, it is not a travel allowance.

- ATO Community

- Legal Database

- What's New

Log in to ATO online services

Access secure services, view your details and lodge online.

Car and travel expenses 2022

You may be able to claim deductions for work-related car expenses and work-related travel expenses.

Last updated 25 May 2022

'Work-related car expenses' and 'work-related travel expenses' are expenses you incur in the course of performing your job as an employee. You claim deductions for them at items D1 and D2 .

Complete item D1 Work-related car expenses 2022 for work-related expenses for a car you owned, leased or hired under a hire purchase agreement (and the expense is not a travel expense which you show at item D2 Work-related travel expenses 2022 ).

Complete item D2 for the following work-related car and travel expenses:

- expenses for vehicles with a carrying capacity of one tonne or more, or nine or more passengers (for example, utility trucks and panel vans)

- expenses for motorcycles

- short-term car hire

- public transport fares

- bridge and road tolls

- parking fees

- petrol, oil and repair costs relating to work-related travel you did in a car owned or leased by someone else

- meal, accommodation, and incidental expenses you incurred while away overnight for work.

The deductions include the cost of trips you undertake in the course of performing your work duties, which may also include trips between your home and your workplace if:

- you used your car because you had to carry bulky tools or equipment that you used for work and could not leave at your workplace (for example, an extension ladder or cello)

- your home was a base of employment (that is, you were required to start your work at home and travel to a workplace to continue your work for the same employer)

- you had shifting places of employment (that is, you regularly worked at more than one site each day before returning home).

Work-related car and travel expenses also include the cost of trips:

- between two separate places of employment when you have a second job, providing one of those places is not your home

- from your normal workplace or your home to an alternative workplace that is not a regular workplace (for example, a client’s premises) while you are on duty

- from an alternative workplace that is not a regular workplace back to your normal workplace or directly home.

If the travel was partly private, you can claim only the work-related part.

You cannot claim normal trips between your home and your workplace, even if:

- you did minor work-related tasks at home or between home and your workplace

- you travelled between your home and workplace more than once a day

- you were on call

- there was no public transport near work

- you worked outside normal business hours

- your home was a place where you ran your own business and you travelled directly to a place of employment where you worked for somebody else.

- Transport and travel expenses

Award transport payments

If you received an award transport payment that was paid under an industrial law or award in force on 29 October 1986, see Award transport payments .

Where to go next

- Go to question D1 Work-related car expenses 2022 .

- Return to main menu Individual tax return instructions 2022 .

- Go back to Claiming deductions 2022 .

Employee travel allowance rates 2022-23

- Linkedin - external site

- Twitter - external site

- Facebook - external site

Capital city zones

Rates effective on and from 1 July 2022 to 30 June 2023

Search capital city boundaries

Capital City Zones - Excluding Canberra

*High season is 1 April to 30 November. *Low season is 1 December to 31 March.

Capital City Zone - Canberra

As at 28 August 2022

1 Canberra TA rates are set in line with Remuneration Tribunal (Members of Parliament) Determination 2022 - Travelling Allowance, in accordance with Clause 55.6 of the Commonwealth Members of Parliament Staff Enterprise Agreement 2020-2023 .

Regional Centres

As at 1 July 2022

Related content

Parliamentarian travel allowance rates - current, office holder travel allowance rates - current, booking domestic and international travel.

Acknowledgement of Country

The Independent Parliamentary Expenses Authority acknowledges the traditional owners and custodians of country throughout Australia and acknowledges their continuing connection to Land, Waters and Community.

We pay our respects to the people, the cultures and the Elders past, present and emerging.

CPT to SVO (Cape Town to Moscow) Flights

Direct flights only

Last Minute Flights from CPT to SVO

Best airfare and ticket deals for cpt to svo flights are based on recent deals found by expedia.com customers within the past 7 days., cheapest cpt to svo flights, cape town to moscow flights.

Whether it’s for an obligation or the sake of your sanity, sometimes you need to get away. Maybe you need flights from Cape Town to Moscow to attend your cousin’s wedding, to pitch a business idea to your boss, or perhaps simply to treat yourself to a mini vacation. Regardless of the reasons behind packing your bags and needing to find the cheapest flights from CPT to SVO, we’ve got you covered here at Flights.com.

We present you with some of the hottest deals on airfare so stop that Google flights search. We want you to spend less on your flight from Cape Town to Moscow, so you can spend more during your getaway. With Flights.com, you’ll find it simple to land airline tickets with itineraries matching your travel schedule. What’s more, we provide you with all the information you need to confidently make reservations on your family, business, or personal trip.

Frequently Traveled Flights from Cape Town

- Cape Town to Chennai (CPT - MAA)

- Cape Town to Mombasa (CPT - MBA)

- Cape Town to Washington (CPT - DCA)

- Cape Town to Kalispell (CPT - FCA)

- Cape Town to Adana (CPT - ADA)

- Cape Town to Seattle (CPT - SEA)

- Cape Town to New York (CPT - LGA)

- Cape Town to Shanghai (CPT - SHA)

- Cape Town to Miami (CPT - MIA)

- Cape Town to Peoria (CPT - PIA)

Popular Flights to Moscow

- Larnaca to Moscow (LCA - SVO)

- Seattle to Moscow (SEA - SVO)

- New York to Moscow (LGA - SVO)

- Miami to Moscow (MIA - SVO)

- Almaty to Moscow (ALA - SVO)

- Glasgow to Moscow (GLA - SVO)

- Luqa to Moscow (MLA - SVO)

- East Midlands to Moscow (EMA - SVO)

- Tampa to Moscow (TPA - SVO)

- Frankfurt to Moscow (FRA - SVO)

Popular Destinations

- Flights to Moscow

- Flights to Northern Europe

- Flights to Eastern Europe

- Flights to Khimki

- Flights to Krasnogorsk

- Flights to Vnukovo

- Flights to Mytishchi

- Flights to Dmitrov

- Flights to Lyubertsy

- Flights to Razvilkov

- Flights to Perepechino

- Flights to Odintsovo

- Flights to Istra

- Flights to Kotelniki

- Flights to Ershov

- Flights to Putilkovo

Popular Airlines

- Alaska Airlines

- American Airlines

- Delta Air Lines

- Frontier Airlines

- Hawaiian Airlines

- Jetblue Airways

- Spirit Airlines

- Turkish Airlines

- United Airlines

km travel chesterfield 2024 brochure prices

This is our KM Travel Tour Operators page, we have listed the full address of KM Travel as well as phone numbers and websites. KM Travel is in Chesterfield, KM Travel may offer holiday tours, sightseeing tours, and general city tours in Chesterfield.

If you have used KM Travel before be sure to leave your own comment or rating on the city tour or holiday tour that you went on so other poeple wishing to use this company can read fair and honest reviews before the book there holiday with KM Travel. Please remember that KM Travel may offer much more that just UK holiday tours, UK Coach Tours and city tours so remember to contact the travel agents company using the details below to find out more information.

Latest KM Travel Reviews

- Transportation (Chesterfield)

- KM Travel Chesterfield

Chesterfield, United Kingdom

Related places.

- Get directions

- Photos page

QR code, vCard

Activate map

Business hours

Reviews of km travel chesterfield.

- Things to Do

- Restaurants

- Holiday Rentals

- Travel Stories

- Add a Place

- Travel Forum

- Travellers' Choice

- Help Centre

Lovely holiday - KM British & European Coach Holiday

- Europe

- United Kingdom (UK)

- England

- Yorkshire

- South Yorkshire

- Barnsley

- Barnsley - Things to Do

- KM British & European Coach Holiday

Brilliant holiday to Torquay, tinsel & turkey 20 th November to Belgrave Sands hotel. The hotel was... read more

Thanks to all at KM TRAVEL especially our driver courier Matt who made the trip more enjoyable and... read more

Trains Moscow to Elektrostal: Times, Prices and Tickets

- Train Times

- Seasonality

- Accommodations

Moscow to Elektrostal by train

The journey from Moscow to Elektrostal by train is 32.44 mi and takes 2 hr 7 min. There are 71 connections per day, with the first departure at 12:15 AM and the last at 11:46 PM. It is possible to travel from Moscow to Elektrostal by train for as little as or as much as . The best price for this journey is .

Get from Moscow to Elektrostal with Virail

Virail's search tool will provide you with the options you need when you want to go from Moscow to Elektrostal. All you need to do is enter the dates of your planned journey, and let us take care of everything else. Our engine does the hard work, searching through thousands of routes offered by our trusted travel partners to show you options for traveling by train, bus, plane, or carpool. You can filter the results to suit your needs. There are a number of filtering options, including price, one-way or round trip, departure or arrival time, duration of journey, or number of connections. Soon you'll find the best choice for your journey. When you're ready, Virail will transfer you to the provider's website to complete the booking. No matter where you're going, get there with Virail.

How can I find the cheapest train tickets to get from Moscow to Elektrostal?

Prices will vary when you travel from Moscow to Elektrostal. On average, though, you'll pay about for a train ticket. You can find train tickets for prices as low as , but it may require some flexibility with your travel plans. If you're looking for a low price, you may need to prepare to spend more time in transit. You can also often find cheaper train tickets at particular times of day, or on certain days of the week. Of course, ticket prices often change during the year, too; expect to pay more in peak season. For the lowest prices, it's usually best to make your reservation in advance. Be careful, though, as many providers do not offer refunds or exchanges on their cheapest train tickets. Unfortunately, no price was found for your trip from Moscow to Elektrostal. Selecting a new departure or arrival city, without dramatically changing your itinerary could help you find price results. Prices will vary when you travel from Moscow to Elektrostal. On average, though, you'll pay about for a train ticket. If you're looking for a low price, you may need to prepare to spend more time in transit. You can also often find cheaper train tickets at particular times of day, or on certain days of the week. Of course, ticket prices often change during the year, too; expect to pay more in peak season. For the lowest prices, it's usually best to make your reservation in advance. Be careful, though, as many providers do not offer refunds or exchanges on their cheapest train tickets.

How long does it take to get from Moscow to Elektrostal by train?

The journey between Moscow and Elektrostal by train is approximately 32.44 mi. It will take you more or less 2 hr 7 min to complete this journey. This average figure does not take into account any delays that might arise on your route in exceptional circumstances. If you are planning to make a connection or operating on a tight schedule, give yourself plenty of time. The distance between Moscow and Elektrostal is around 32.44 mi. Depending on the exact route and provider you travel with, your journey time can vary. On average, this journey will take approximately 2 hr 7 min. However, the fastest routes between Moscow and Elektrostal take 1 hr 3 min. If a fast journey is a priority for you when traveling, look out for express services that may get you there faster. Some flexibility may be necessary when booking. Often, these services only leave at particular times of day - or even on certain days of the week. You may also find a faster journey by taking an indirect route and connecting in another station along the way.

How many journeys from Moscow to Elektrostal are there every day?

On average, there are 71 daily departures from Moscow to Elektrostal. However, there may be more or less on different days. Providers' timetables can change on certain days of the week or public holidays, and many also vary at particular times of year. Some providers change their schedules during the summer season, for example. At very busy times, there may be up to departures each day. The providers that travel along this route include , and each operates according to their own specific schedules. As a traveler, you may prefer a direct journey, or you may not mind making changes and connections. If you have heavy suitcases, a direct journey could be best; otherwise, you might be able to save money and enjoy more flexibility by making a change along the way. Every day, there are an average of 18 departures from Moscow which travel directly to Elektrostal. There are 53 journeys with one change or more. Unfortunately, no connection was found for your trip from Moscow to Elektrostal. Selecting a new departure or arrival city, without dramatically changing your itinerary could help you find connections.

Book in advance and save

If you're looking for the best deal for your trip from Moscow to Elektrostal, booking train tickets in advance is a great way to save money, but keep in mind that advance tickets are usually not available until 3 months before your travel date.

Stay flexible with your travel time and explore off-peak journeys

Planning your trips around off-peak travel times not only means that you'll be able to avoid the crowds, but can also end up saving you money. Being flexible with your schedule and considering alternative routes or times will significantly impact the amount of money you spend on getting from Moscow to Elektrostal.

Always check special offers

Checking on the latest deals can help save a lot of money, making it worth taking the time to browse and compare prices. So make sure you get the best deal on your ticket and take advantage of special fares for children, youth and seniors as well as discounts for groups.

Unlock the potential of slower trains or connecting trains

If you're planning a trip with some flexible time, why not opt for the scenic route? Taking slower trains or connecting trains that make more stops may save you money on your ticket – definitely worth considering if it fits in your schedule.

Best time to book cheap train tickets from Moscow to Elektrostal

The cheapest Moscow - Elektrostal train tickets can be found for as low as $35.01 if you’re lucky, or $54.00 on average. The most expensive ticket can cost as much as $77.49.

Find the best day to travel to Elektrostal by train

When travelling to Elektrostal by train, if you want to avoid crowds you can check how frequently our customers are travelling in the next 30-days using the graph below. On average, the peak hours to travel are between 6:30am and 9am in the morning, or between 4pm and 7pm in the evening. Please keep this in mind when travelling to your point of departure as you may need some extra time to arrive, particularly in big cities!

Moscow to Elektrostal CO2 Emissions by Train

Anything we can improve?

Frequently Asked Questions

Go local from moscow, trending routes, weekend getaways from moscow, international routes from moscow and nearby areas, other destinations from moscow, other popular routes.

Na Ulitse Yalagina 13B Apartments

Trending Questions

Property policies, frequently asked questions, how much does it cost to stay at na ulitse yalagina 13b apartments, what are the check-in and check-out times at na ulitse yalagina 13b apartments, does na ulitse yalagina 13b apartments provide airport transfer services, what amenities and services does na ulitse yalagina 13b apartments have, does na ulitse yalagina 13b apartments have a swimming pool, does na ulitse yalagina 13b apartments have fitness amenities, does na ulitse yalagina 13b apartments provide wi-fi, does na ulitse yalagina 13b apartments have non-smoking rooms, does na ulitse yalagina 13b apartments have a restaurant, is parking available at na ulitse yalagina 13b apartments, popular hotels, popular attractions, explore more.

Expedia Rewards is now One Key™

Elektrostal, visit elektrostal, check elektrostal hotel availability, popular places to visit.

- Electrostal History and Art Museum

You can spend time exploring the galleries in Electrostal History and Art Museum in Elektrostal. Take in the museums while you're in the area.

- Cities near Elektrostal

- Places of interest

- Yuri Gagarin Cosmonaut Training Center

- Peter the Great Military Academy

- Central Museum of the Air Forces at Monino

- History of Russian Scarfs and Shawls Museum

- Balashikha Arena

- Balashikha Museum of History and Local Lore

- Bykovo Manor

- Pekhorka Park

- Ramenskii History and Art Museum

- Malenky Puppet Theater

- Drama Theatre BOOM

- Likino Dulevo Museum of Local Lore

- Noginsk Museum and Exhibition Center

- Pavlovsky Posad Museum of Art and History

- Saturn Stadium

- Fairy Tale Children's Model Puppet Theater

- Fifth House Gallery

- Church of Vladimir

- Malakhovka Museum of History and Culture

- Orekhovo Zuevsky City Exhibition Hall

Destinations in May

Destinations in 2024.

Please note prices are based on two persons sharing a twin/double room. Single room supplements may apply, please call check single availability/price.

Comments are closed.

- Destinations

- Hotel Information

- Private hire

- Special offers / Late availability

- Travel Insurance

- Employment Opportunities

NEW CHRISTMAS TOUR 2024 - Bournemouth - Norfolk Royale Hotel - BROCHURE ADDITION . 2024 EUROPEAN HOLIDAYS - Early release - ITALY - Lake Garda / Alassio Click here to download our 2024 Brochure All Our Holidays Include In The Price: Free Door to Door Taxi ( Subject to Area ) ~ Luxury Coach Travel ~ Reserved Coach Seats . Personally Selected ...

www.kmchesterfield.co.uk

KM Travel of Barnsley, South Yorkshire. Request a brochure by: Calling: 01226 245564 email: [email protected] . download: click here to download the 2024 Tour Brochure.

KM Travel is in Chesterfield, KM Travel may offer holiday tours, sightseeing tours, and general city tours in Chesterfield. If you have used KM Travel before be sure to leave your own comment or rating on the city tour or holiday tour that you went on so other poeple wishing to use this company can read fair and honest reviews before the book ...

What people are saying. " HOLIDAY TO BLACKPOOL ". Oct 2023. Thanks to all at KM TRAVEL especially our driver courier Matt who made the trip more enjoyable and a credit to the co... " Lovely place enjoyed it clean need a bit of investment there ". Aug 2022. Stayed at ilfracombe Devon 14 to 20 Aug the coach was lovely our driver Tony was ...

Reviews, contact details and business hours of KM Travel Chesterfield at 27 Stephenson Place, Chesterfield, Derbyshire. Check out nearby places on a map. Write a review. Log in. ... 21:03 Tuesday, 23 April 2024: Business hours. Monday: 9:00 am - 4:30 pm: Tuesday: 9:00 am - 4:30 pm: Wednesday: 9:00 am - 4:30 pm: Thursday: 9:00 am - 4:30 ...

KM Travel of Barnsley, South Yorkshire. Tel: (01226) 245564 [email protected] . Home. Booking Guide Request Brochure Customer Information Contact Us. ... Our 2024 British Coach Holiday Brochure is now available to download and available shortly from our Market Street office in paper form.

5. £339. Nil. Please note prices are based on two persons sharing a twin/double room. Single room supplements may apply, please call check single availability/price. Price Includes: * Luxury Coach Travel * Local Departure Points. * En-suite bedrooms * Excursions. * Half Board Accommodation.

Page List. (Click on the page required to be linked with that page in the brochure) Page 1 - Front cover. Page 2 - Introduction. Page 3 - Contact information. Customer information. Page 4 - How to make a booking. Holiday index January to June. Page 5 - Holiday index June to December.

Our 2024 UK Brochure is OUT NOW! Order yours today. 01246 474747 Opening Times Brochures . Menu (current) Home Holidays Day Trips ... A-Line Travel 15 Soresby Street Chesterfield S40 1JW 01246 474747 [email protected] . A-Line Travel, Company number 13060548

Lovely holiday. Review of KM British & European Coach Holiday. Reviewed 9 December 2023. Just back from a T&T break at Exmouth. The hotel and food were brilliant, and the driver James was the best. However we had a bad start after waiting nearly one and a half hours in cold and rain at Ilkeston for the coach. I know there was traffic problems ...

Geeveetravelchesterfield, Chesterfield. 1,657 likes · 24 talking about this · 29 were here. DOOR TO DOOR COACH HOLIDAYS DAY TRIPS AND PRIVATE HIRE

Thankyou received our brochure in the post , I see you have new for 2024 Kynren weekend , we went last year and its the most amazing show I've seen well worth going recommended to everybody. 22w. Robert Lindley. Can I have a brochure please 9 monsal crescent Barnsley S71 3PY. 15w.

KM Travel of Barnsley, South Yorkshire. Tel: (01226) 245564 [email protected] . Home. Booking Guide Request Brochure Customer Information Contact Us. Skip to content. Request a brochure by: Calling: 01226 245564 . email: [email protected] download: ... Please note prices are based on two persons sharing a twin/double room ...

Central Air Force Museum The Central Air Force Museum, housed at Monino Airfield, 40 km east of Moscow, Russia, is one of the world's largest aviation museums, and the largest for Russian aircraft. 173 aircraft and 127 aircraft engines are on display, and the museum also features collections of weapons, instruments, uniforms (including captured U2 pilot Gary Powers' uniform), other Cold War ...

The journey from Moscow to Elektrostal by train is 32.44 mi and takes 2 hr 7 min. There are 71 connections per day, with the first departure at 12:15 AM and the last at 11:46 PM. It is possible to travel from Moscow to Elektrostal by train for as little as or as much as . The best price for this journey is . Journey Duration.

KM Travel of Barnsley, South Yorkshire. Tel: (01226) 245564 [email protected] . ... we guarantee excellent customer service and affordable prices. ... Winter/Spring 2024. Blackpool 2024 Potters Resorts 2024. Our booking office is located at: 52, ...

2022 Brochure . Page List ... All Our Holidays Include In The Price: Free Door to Door Taxi ( Subject to Area ) ~ Luxury Coach Travel ~ Reserved Coach Seats . Personally Selected Hotels ~ En-suite Bedrooms ~ Free Varied Excursions . Telephone: 01246 -556617 ...

Prices at Na Ulitse Yalagina 13B Apartments are subject to change according to dates, hotel policy, and other factors. To view prices, please search for the dates you wish to stay at the hotel. What are the check-in and check-out times at Na Ulitse Yalagina 13B Apartments? The check-in time is after 14:00 and the check-out time is before 12:00.

Cities near Elektrostal. Places of interest. Pavlovskiy Posad Noginsk. Travel guide resource for your visit to Elektrostal. Discover the best of Elektrostal so you can plan your trip right.

Trans-Siberian Railway Prices

- Trans-Siberian Railway Tickets

- Trans-Siberian Railway Ticket Booking

- Trans-Siberian Railway Car Classes

- Travel Procedure

- Trans-Siberian Railway Route

- Guides & Gadgets

Home » Prices and Trans-Siberian Tickets » Trans-Siberian Railway Prices

Ticket prices for the Trans-Siberian Railway also depend on the current ruble exchange rate.

Is the Trans-Siberian Railway expensive?

Before starting on your Trans-Siberian Railway adventure you naturally want to know what the entire trip will cost. Although this sounds like a simple question, it is pretty difficult to answer. The Trans-Siberian Railway price of travel depends on the following factors:

- Which travel class do I want to use? The price for a first class ticket is about three times the price of a 3rd class ticket

- Am I willing to buy the tickets myself and assume responsibility for the organisation of the trip?

- How many stopovers do I want to make? The more breaks, the higher the total price.

- What sort of accommodation do I want? Will it be a luxury hotel or will a hostel dormitory be sufficient?

- What tours and excursions would I like to go on?

- What is the current exchange rate for rubles?

Basically, everything from a luxury to a budget holiday is available. If you buy yourself a 3rd Class nonstop ticket at the counter, a few hundred Euros will cover the price. All you will experience is a week on the Trans-Siberian train and will see nothing of the cities on the way. There is, however, any amount of room for upward expansion. Everyone makes different choices about which aspects they are willing to spend money on. I personally prefer to save money on accommodation and railcar class, visit as many cities and do as many trips as possible. To enable better classification of your travel expenses I have contrasted two typical traveler types. In the third column you can calculate the total cost of your own journey on the Trans-Siberian Railway. Please keep in mind that these are only rough estimations and not exact prices.

The all-in costs seem fairly high at first. However, they cover everything and it is quite a long journey taking four weeks. Many people forget to consider that when looking at the list. We should also deduct the running costs for food and leisure at home. I think most visitors to this page will classify themselves somewhere between the two categories, that is around the € 2,000 – € 2,500 range. When comparing these prices with other travel packages, you get the impression that it is hardly worthwhile travelling individually on the Trans-Siberian Railway. Please keep in mind that most packages last no more than 14 days and you are herded like cattle through the most beautiful locations.

If you spend less time on the Trans-Siberian Railway you will, of course, pay less. I chose this particular travel length because I prefer not to do things by halves. If you fulfill your dream of travelling on the Trans-Siberian Railway, enjoy it and don’t rush things. But it’s up to you, of course. Try playing around with the form a bit to find the appropriate price for your trip.

- Trans-Siberian Railway Tickets »

COMMENTS

TD 2022/10 Status: legally binding Taxation Determination TD 2022/10 Page 1 of 13 Taxation Determination Income tax: what are the reasonable travel and overtime meal allowance expense amounts for the 2022-23 income year? Relying on this Determination This publication is a public ruling for the purposes of the Taxation Administration Act 1953.

For the 2019-20 income year the reasonable amount for overtime meal expenses is $31.25. The reasonable travel and overtime meal allowance expense amounts commencing 1 July 2019 for the 2019-20 income year are contained in Tax Determination TD 2019/11 (issued 3 July 2019). Download the PDF or view online here.

To be a travel allowance, the allowance must be a payment to cover travel allowance expenses. This means a travel allowance must cover: accommodation; meals (food or drink) incidental expenses. A travel allowance doesn't have to cover all those expenses. The allowance may still be a travel allowance if it is only paid to cover 1-2 of these ...

The reasonable amount for overtime meal expenses is $33.25 for the 2022-23 income year. Domestic travel. The reasonable amount for accommodation applies only for short stays in commercial ...

A travel allowance is a predetermined amount of money provided by an employer to an employee to cover the expenses associated with travelling for work-related purposes. The ATO considers a travel allowance to be tax-free if it meets the following conditions: The travel is required as part of the employee's job duties.

On 17 February 2021, the Australian Taxation Office (ATO) released the following new guidance in relation to whether an employee is "travelling on work" or otherwise, and the income tax and fringe benefits tax (FBT) treatment of associated travel expenses: Draft Taxation Ruling TR 2021/D1: Income tax and fringe benefit tax: employees ...

Current national employee travel allowance rates including commercial and non-commercial rates. ... 29 June 2022. Employee travel allowance rates - 2021-22. Employee travel allowance rates 2020-21. 30 June 2020. Employee travel allowance rates 2020-21. Employee travel allowance rates 2019-20. 7 April 2019.

The Australian Taxation Office has issued new rates for reasonable travel expenses for the 2021/22 financial year. Tax Determination TD2021/6 sets out the rates for employee taxpayers who travel within Australia or overseas for work-related purposes and receive travel allowances. Substantiation requirements do not apply if accommodation, food ...

The ATO provides guidelines for the use of the allowance, and the reasonable amount is outlined below for places within and outside of Australia in the ATO websites. Table 1: Reasonable amounts for 20121-2022 for employee earning $129,250 and below:

'Work-related car expenses' and 'work-related travel expenses' are expenses you incur in the course of performing your job as an employee. You claim deductions for them at items D1 and D2.. Complete item D1 Work-related car expenses 2022 for work-related expenses for a car you owned, leased or hired under a hire purchase agreement (and the expense is not a travel expense which you show at item ...

Yulara (NT) $774. $258. Unspecified Locations. $399. $133. 1 This means locations: outside a 30 kilometre radius of Parliament House. outside a 10 km radius from the GPO in Sydney, Melbourne, Brisbane, Perth or Adelaide or five km from the major airport servicing the city.

Commercial. Non-commercial. Canberra 1. $289. $289. $299. $299. 1 Canberra TA rates are set in line with Remuneration Tribunal (Members of Parliament) Determination 2022 - Travelling Allowance, in accordance with Clause 55.6 of the Commonwealth Members of Parliament Staff Enterprise Agreement 2020-2023. Search capital city boundaries.

The Australian Taxation Office has issued new rates for reasonable travel expenses for the 2021/22 financial year. Tax Determination TD2021/6 sets out the rates for employee taxpayers who travel within Australia or overseas for work-related purposes and receive travel allowances. Substantiation requirements do not apply if accommodation, food ...

Find airfare deals on cheap tickets from Cape Town (CPT) to Moscow (SVO) and save on your next flight with Flights.com.

Holiday index January to June. Page 5 - Holiday index June to December.... Our 2024 UK Brochure is OUT NOW! Order yours today. 01246 474747 Opening Times Brochures . Menu (current) Home Holidays Day Trips ... A-Line Travel 15 Soresby Street Chesterfield S40 1JW 01246 474747 [email protected]. A-Line Travel, Company number 13060548...

ATO Moscow Staff Erik W. Hansen Retail Sector Impacted By Slowing Economy and Inflation Retail Foods Russian Federation RSATO036 11/28/2014 Required Report - public distribution . Post: SECTION I. MARKET SUMMARY Retailing has been one of the fastest growing industries within the Russian economy over the

When comparing these prices with other travel packages, you get the impression that it is hardly worthwhile travelling individually on the Trans-Siberian Railway. Please keep in mind that most packages last no more than 14 days and you are herded like cattle through the most beautiful locations.