- Information for...

What are you looking for?

England domestic overnight trips and day visits: subnational data.

- Using your device

Find the latest domestic overnight and day trip data for regions, counties, local authorities and towns. Data points are based on the Great Britain Tourism Survey (GBTS) and Great Britain Day Visits Survey (GBDVS) and cover the number of domestic trips British residents took, the number of nights and total expenditure. For further information, please contact [email protected] .

Visitation of England counties for domestic overnight trips and day visits (September 2021-October 2023)

In these tables, you will find England counties and their volume and value of domestic overnight trips and day visits. For counties, volume and value data is published using two-year averages. The most recent data is for the two-year period from October 2021 to September 2023. For more information, please see the first tab ‘user guide’ in the Excel file shared below.

The below overnight trip data is based on all places visited on a trip (not just the main place as the previous data) , meaning each county visited overnight counts the trip and spend is proportioned to each country based on the number of nights spent in the county.

Please note that due to methodological changes, this data is not directly comparable to data up to 2019.

NOTE: This statistical release contains annual provisional estimates for 2023. This series will now be subject to a methodological review. Following this review, estimates published in this release will change. Please use caution in interpreting or using the provisional figures published here. Please see our Statement on methodological review for more details.

Report highlights

- For OVERNIGHT TRIPS , based on the annual average of total trips, the top counties were Greater London (18.3 million), Greater Manchester (5.5 million), West Midlands (4.7 million), Cornwall (4.5 million), and Devon (4.4 million).

- For HOLIDAY TRIPS , the top counties were Greater London (4.9 million), Cornwall (2.2 million), Devon (2.2 million), North Yorkshire (2.1 million) and Cumbria (1.8 million).

- For TOURISM DAY VISITS , the top counties were Greater London (174.5 million), Greater Manchester (43.9 million), West Midlands (35.7 million), Hampshire (33.9 million) and Kent (31.8 million).

View the report

Gbts-dvs, county level volume and value, 2 year average sep2023.

Click to view the data.

Visitation of England counties for domestic overnight trips and day visits (April 2021 - March 2023)

For counties, data is published as a two-year annual average. The below data is for the two-year period from April 2021 - March 2023. (Please note that due to methodological changes, this data is not directly comparable to data up to 2019.)

Please note: The below data is based on locations of the MAIN place stayed in on their overnight trip.

- For overnight trips, based on the annual average of total trips, the top counties were Greater London (14.4 million), Greater Manchester (4.2 million), Cornwall (4.0 million), West Midlands (3.8 million) and North Yorkshire (3.6 million).

- For holiday trips, the top counties were Greater London (3.7 million), Cornwall (2.1 million), North Yorkshire (2.0 million), Devon (1.8 million) and Lancashire (1.8 million).

- For tourism day visits, the top counties were Greater London (150.5 million), Greater Manchester (36.8 million), West Midlands (32.2 million), Hampshire (30.3 million) and Kent (30.2 million).

GBTS_GBDVS County level tables_Apr 21-Mar 23 data (published 20 October 2023).xlsx

Visitation of local authorities and other areas for overnight trips (2017 to 2019).

For other geographical areas of England (local authorities, towns, counties and LEP areas), data is published using three-year averages only. The most recent data is for the three-year period from 2017 to 2019.

An introduction to this analysis is also available (Word 269 KB).

- On average, there were 12 million trips to London per year from 2017 to 2019 .

- These equated to 28 million nights per year for London .

- The annual total spend for these trips to London was £2.9 billion .

Visitation of local authorities & other areas 2017-2019 (overnight trips).xlsx

View the full findings

Visitation of local authorities and other areas for overnight and day trips (2017 to 2019)

A combined spreadsheet has been produced for local authorities, including data from both the Great Britain Tourism Survey (GBTS) (which includes domestic overnight trips) and the Great Britain Day Visits Survey (GBDVS) to create a combined total of all domestic trips to local authorities.

The GBDVS annual reports include many analyses at regional level. The reports also include an appendix providing results for counties and towns, again using three-year averages. Historical reports are on the GBDVS archive page .

- London experienced 309.3 million visits , with a total expenditure of £13.6 billion .

- Greater Manchester saw 36.8 million visits , with a total expenditure of £2.4 billion .

- Cornwall and the Isles of Scilly recorded 24.9 million visits , with a total expenditure of £874 million .

View the report

Visitation of local authorities & other areas for overnight & day trips (2017-2019).xlsx, most visited towns for overnight trips (2017 to 2019).

The most visited towns data is published using three-year averages, listing the most-visited English towns by trip numbers and spend – in total, for holiday trips, and for business trips. The most recent data is for the three-year period from 2017 to 2019.

- The top five most visited towns overall were: London, Manchester, Birmingham, Liverpool and Bristol .

- The top five towns most visited for holidays were: London, Scarborough, Manchester, Blackpool and York .

- The top five towns most visited for business were: London, Birmingham, Manchester, Bristol and Leeds .

Most visited towns 2017 to 2019 (overnight trips).xls

England domestic tourism day visits summary (2017).

This document provides a summary of the number of day trips and spend per day by regions and visitor demographics, for domestic tourism day visits taken in England in 2017.

- England saw a total of 1.5 billion day visits , with 327.5 million visits to London and 231.9 visits to South East England .

- Nationwide, the most popular main activity for day visits was ‘visiting friends or family for leisure’ , on a total of 359.8 million visits.

- 896.7 million travelled using their own car , or one belonging to friends or family. 266.4 million used public transport; 19.4 were on an organised coach tour.

England domestic tourism day visits summary (2017).pdf

Related resources.

- For more facts and figures about tourism in England (including English regions, counties and towns), explore our intelligence on accommodation occupancy , accommodation stock and visitor attractions , or find information about inbound visits and spend .

- Our domestic sentiment tracker is another tracking survey we run to understand domestic intent for short breaks and holidays within the UK (including the English regions) and abroad.

Explore our curated information for...

Everything you need to inspire your clients. Discover new products, experiences and itinerary ideas – plus useful resources and the latest market insights.

Reach new customers and increase your profitability. Drive sales with our tools, events and training, find out about quality assessment and get expert guidance from the England Business Advice Hub.

Build sustainable and valuable growth. Learn about England’s new destination management structure, find expert advice, and boost your proposition with our training and toolkits.

Access resources for business events to support your business development and event strategy. Discover England, Scotland and Wales' business event offering for your next conference, incentive, exhibition or event.

Discover our media centres, image and video library and latest press releases, plus contacts for our corporate and consumer press teams.

Studying tourism at school, college or university? We’ve gathered essential resources and data for students of tourism, plus information about our internships.

Cookies on GOV.UK

We use some essential cookies to make this website work.

We’d like to set additional cookies to understand how you use GOV.UK, remember your settings and improve government services.

We also use cookies set by other sites to help us deliver content from their services.

You have accepted additional cookies. You can change your cookie settings at any time.

You have rejected additional cookies. You can change your cookie settings at any time.

- Society and culture

- Sports and leisure

- The People and Nature Surveys for England: Data and publications from Adults' survey year 1 (April 2020 - March 2021) (Official Statistics)

The People and Nature Survey for England: Data and publications from Adults survey year 1 (April 2020 - March 2021) (Official Statistics) main findings

Updated 5 April 2023

Applies to England

© Crown copyright 2023

This publication is licensed under the terms of the Open Government Licence v3.0 except where otherwise stated. To view this licence, visit nationalarchives.gov.uk/doc/open-government-licence/version/3 or write to the Information Policy Team, The National Archives, Kew, London TW9 4DU, or email: [email protected] .

Where we have identified any third party copyright information you will need to obtain permission from the copyright holders concerned.

This publication is available at https://www.gov.uk/government/statistics/the-people-and-nature-survey-for-england-data-and-publications-from-adults-survey-year-1-april-2020-march-2021-official-statistics/the-people-and-nature-survey-for-england-data-and-publications-from-adults-survey-year-1-april-2020-march-2021-official-statistics-main-finding

1. Main findings

The People and Nature Survey (PANS) collected responses from a representative sample of 24,994 adults across England between April 2nd 2020 and March 31st 2021, providing key information on how people experience and think about the environment. Findings from this data include:

More than six in ten people had visited green and natural spaces in the last 14 days:

- 62% of adults visited a green and natural space in the last 14 days.

- The average number of visits to green and natural space in the last 14 days was 4.

- 29% of adults had not visited green and natural spaces in the last 14 days.

Pandemic restrictions affected people’s time spent outdoors:

- Across the year, staying at home to stop coronavirus spreading and due to Government restrictions was the most commonly reported reason for not spending free time outdoors in the last 14 days (by 48% of people), over and above several other common reasons for not getting outdoors (e.g. bad/poor weather and poor health/illness at 31% and 14% respectively).

- 41% of people who had not visited green and natural spaces in the last 14 days cited ‘contracting or spreading coronavirus’ as one of their concerns. This option was more often chosen than any other concern/worry (e.g. lack of facilities and antisocial behaviour) across the year.

Many people found solace in nature during the pandemic:

- Just over 4 in 10 (42%) people agreed that they had increased their time spent outside, and nearly a third (30%) agreed that they had increased the amount of time they spent noticing nature and wildlife since the start of coronavirus restrictions.

- People reported that both nature/wildlife (40%) and visiting green and natural spaces (43%) had been more important to their well-being during the pandemic.

Gardens and urban/local green spaces were important for spending time outdoors:

- Of those with access to a garden or allotment space (8% had no access), 79% of people said they spent time in it at least once a week and 34% said they did this for their health and well-being.

- Over the course of the year, urban green spaces (such as a park, field, or playground) were the most commonly visited green and natural spaces in the last month (by 49% of respondents).

More people thought the quality of local green and natural spaces had improved rather than reduced:

- 4 in 10 (40%) of people thought that the quality of green and natural spaces close to where they live had improved in the last 5 years, whereas 2 in 10 (20%) thought they had reduced in quality.

- Adults from households with higher income (>£50k) were more likely to say that quality of green and natural spaces had improved over the last 5 years (45%) than those with a lower income (e.g. 31% of those with a household income <£15k.

Almost everyone agreed that spending time outdoors is beneficial for their physical and mental health:

- 94% of adults felt that spending time outdoors was good for their physical health, and 92% thought it was also good for their mental health.

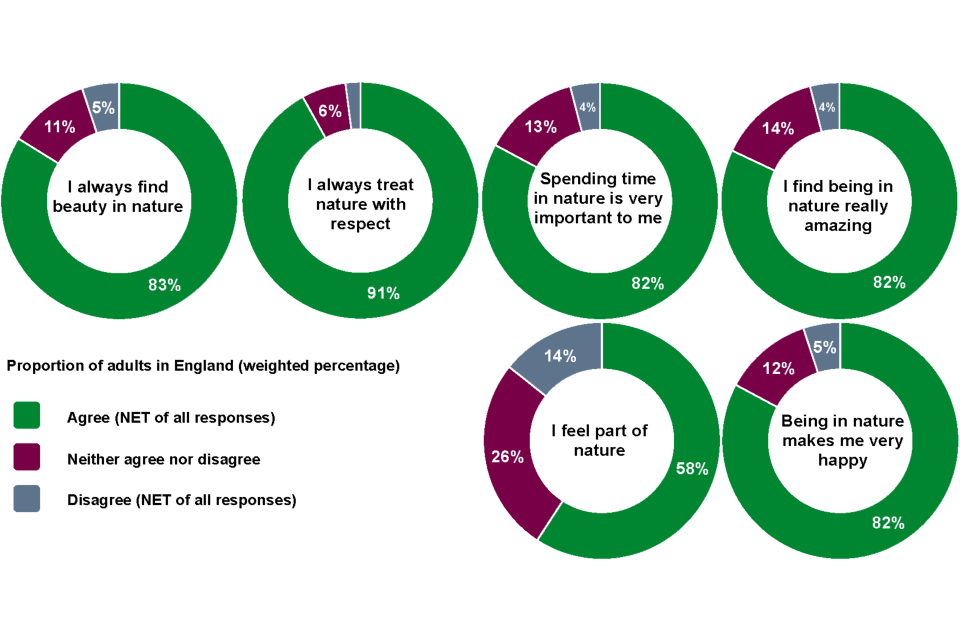

- 82% of adults reported that being in nature made them very happy, indicating high levels of nature connection among respondents.

Most people said that protecting the environment was important to them:

- ‘The environment/climate change’ was given by respondents as the third most important issue facing the UK (chosen by 22% of people), after ‘the coronavirus pandemic’ (63%) and ‘the economy’ (35%).

- Over 8 in ten people (86%) said that protecting the environment was important to them.

- Less than a third of people said they often or always did any one of the listed social actions for the environment (e.g. 28% voting for political parties with strong environmental policies and 24% signing petitions or participating in campaigns or demonstrations about environmental issues).

- Adults undertook a range of household, gardening, and broader lifestyle behaviours that are positive for the environment and 83% said they were going to make changes to their lifestyle to protect the environment.

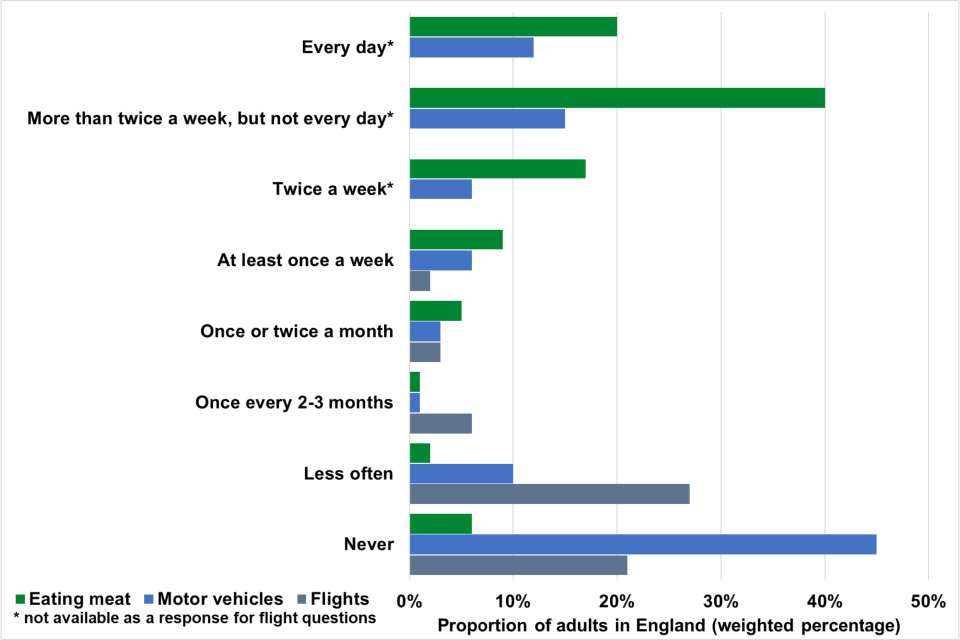

- Six in ten (60%) of adults said they eat meat more than twice a week (6% never eating meat), nearly 3 in 10 (27%) adults said they drive to work or a place of study in a car, motorbike or van (45% never do this), and more than 1 in 10 (11%) of adults took a flight at least once every 2 to 3 months (71% doing this once a year or less and of these 21% never flying).

Access, engagement, and connection to nature are not equal across groups:

- Having a lower household income, fewer qualifications, living in a more deprived area and being in bad health (and in some instances being unemployed) were all associated with greater risk of low engagement with and access to nature and the outdoors. This included fewer visits to green and natural spaces in the last 14 days, seeing coronavirus as a barrier to getting outdoors, reduced access to garden space or an allotment, and lower likelihood of reporting that ‘being in nature makes me happy’.

- Differences in the way groups access, engage with, and connect to nature were also found based on age, gender, region, ethnicity, illness and whether children were in the household or not.

2. Other pages in this release

The People and Nature Survey for England, led by Natural England, is one of the main sources of data and statistics on how people experience and think about the environment. It began collecting data via an online panel (adults aged 16 years and older) in April 2020, and runs continuously, in line with Government Statistical Service guidance on data collection during the COVID-19 pandemic.

The Official Statistics in this publication are based on a survey of 24,994 adult respondents conducted online continuously between April 2nd 2020 and March 31st 2021 (inclusive). Throughout this bulletin, “the year” refers to this period.

Alongside this publication, a spreadsheet containing relevant data tables for Year 1 of the survey has been published and monthly data from Year 1 of the survey can also be viewed. Data tables have been generated using the specific People and Nature Survey weight. See Methods and Limitations for more details.

Further information about the People and Nature Survey for England (including information on methods, strengths and limitations, and Official Statistics status) is available . To receive updates on the survey, including data releases and publications, sign-up via the People and Nature User Hub .

Results from this survey for April 2020 - March 2021 were collected during social contact restrictions and legal restrictions on meeting others outdoors in England. This page summarises the latest advice on accessing green spaces safely.

3. Official Statistics

Releases from the People and Nature Survey that use the specific weighting method (as opposed to the interim weighting method) are designated as Official Statistics. For justifications behind this designation, please see our brief statement . Natural England have developed the methodologies used in the production of these statistics whilst ensuring adherence to the Code of Practice for Statistics.

4. Group differences in engagement with nature

For each of the questions asked in this survey, responses given were compared between different groups to highlight any variation across the population in the way people engage with nature based on: age, gender, ethnicity, region, income, educational attainment, number of children in the household, working status, health, long-term illness and the relative level of deprivation in the area they live (see section 11 Methodological note ). Tables 2, and 4 to 7 summarise these findings for 6 key questions.

Table 1- Demographic variables used to look at differences in the way people engage with nature between April 2020 and March 2021

5. time spent in green and natural spaces.

From April 2020 to March 2021, just over six in ten adults (62%) had visited a green and natural space at least once in the last 14 days. On average people had visited green and natural spaces 4 times in the past 14 days (not including 10% who answered ‘don’t know/prefer not to say’). Across the year, 29% of people reported no visits at all to green and natural spaces in the last 14 days.

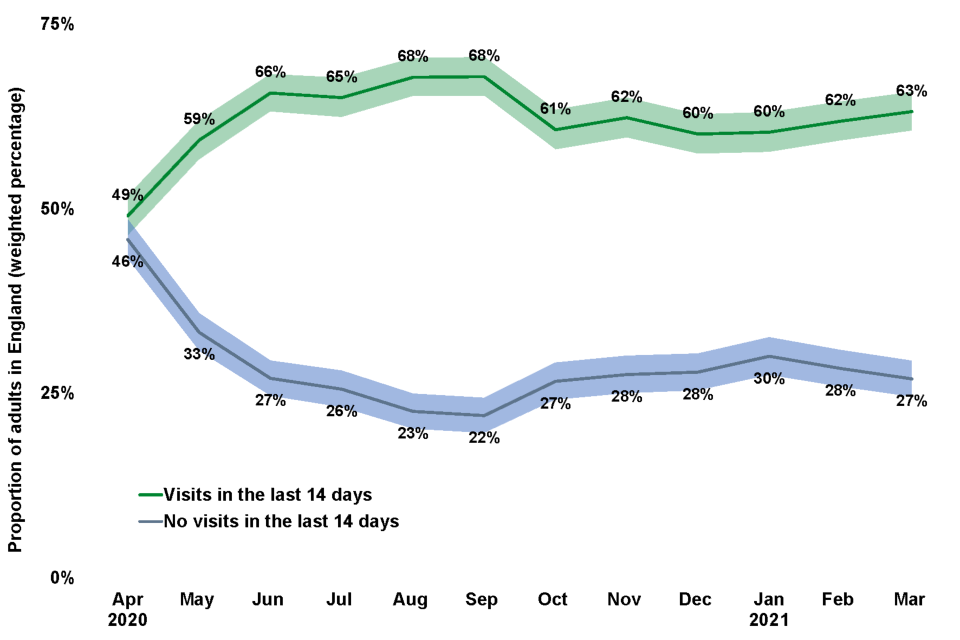

There was variation between months, with the proportion of adults that had taken a visit in the last 14 days highest between June and September 2020, and lowest in April (49%) 2020 (Figure 1).

Figure 1: Proportion of adults in England (weighted percentage) visiting a green and natural space in the last 14 days. The highest proportion was recorded between June and September 2020 (68%) and lowest in April 2020 (49%).

Figure notes Source: Q6 / No_Of_Visits: How many times, if at all, did you make this type of visit to green and natural spaces in the last 14 days? (1) Data collected between April 2nd 2020 and March 31st 2021 (inclusive). (2) The samples for this question were 1,868 (April), 1,898 (May), 1,872 (June), 1,889 (July), 1,856 (August), 1,866 (September), 1,854 (October), 1,869 (November), 1,863 (December), 1,860 (January), 1,868 (February) and 1,900 (March) respondents. (3) See Glossary for 95% confidence interval of the mean.

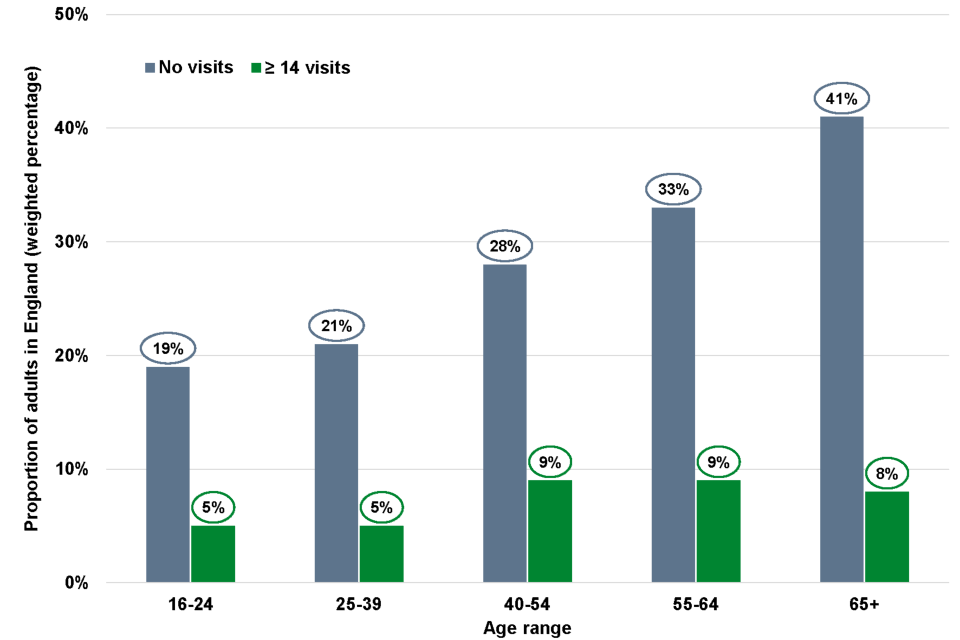

People aged 40+ were more likely than people under the age of 40 to have visited green and natural spaces every or almost every day in last 14 days. However, a higher proportion of people aged 40+ than people under the age of 40 had also made no visits at all in the last 14 days (Figure 2).

Figure 2: Proportion of adults in England (weighted percentage) grouped by age range who had visited a green and natural space at least 14 times in the last 14 days versus those who had not taken a visit in the last 14 days. As age increases, so does the proportion of those reporting no visits to a green and natural space in the last 14 days. However, people aged 40+ were more likely than those under 40 to have visited green and natural spaces at least 14 times in the last 14 days.

Figure notes Source: Q6 / No_Of_Visits: How many times, if at all, did you make this type of visit to green and natural spaces in the last 14 days? Q62 (S_Q2): What was your age last birthday? Q62 (S_Q2_bands): In that case, which of these age groups do you fall into. (1) Data collected between April 2nd 2020 and March 31st 2021 (inclusive). (2) The samples for this question were 2,906 (16-24), 5,567 (25-39), 5,575 (40-54), 3,354 (55-64) and 5,061 (65+) respondents.

Table 2: Adults ‘who had not visited green and natural spaces at all in the last 14 days’ by demographic group (statistically significant differences within groups marked with ‘X’), from April 2020 to March 2021. Those who had not visited green and natural spaces at all in the last 14 days were more likely to be aged 40+, women, live outside of London and the SE, have a lower household income, have no qualifications, have no children in the household, be unemployed or not working, in bad health, with no long-term illness at all or a long-term illness that has greater impact, or live in the most deprived areas.

6. experiences of nature and the pandemic.

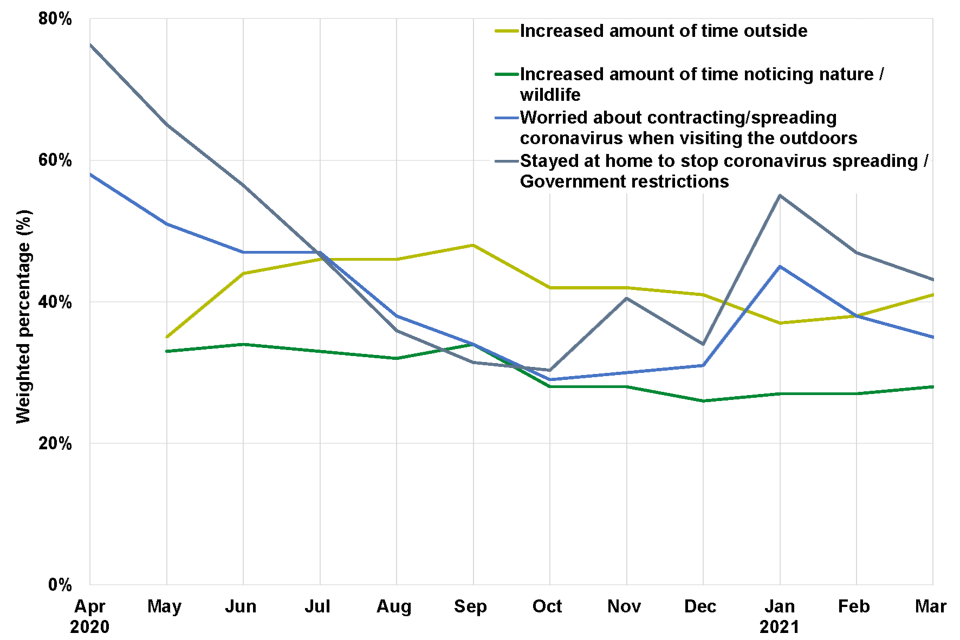

Survey respondents were asked to reflect on their experiences since the coronavirus restrictions began. Overall, around 4 in ten (42%) adults said that they had increased the time they spent outside since coronavirus restrictions began. However, this varied depending on the month, with fewer people saying they had increased the time they spent outside since coronavirus restrictions began when asked in May 2020 (35%), and January (37%) and February 2021 (38%).

Overall, nearly a third of adults (30%) also said that they had increased the amount of time they spent noticing nature and wildlife since coronavirus restrictions began. Again, this showed variation depending on the month they were asked. People were more likely to say they had increased the amount of time they spent noticing nature and wildlife since coronavirus restrictions between May and September 2020 (ranging from 32% to 34%), than between October and March 2021 (ranging from 27% to 28%) (Figure 3).

Four in ten (40%) of people agreed that nature and wildlife was more important than ever to their well-being and a similar amount (43%) felt that visiting local green and natural spaces had been more important to their well-being since the coronavirus restrictions began.

Figure 3: Proportion of adults in England (weighted percentage) and their experience of nature during the pandemic, by month.

Figure notes Source: CV_Q2A Since the coronavirus restrictions began, have you increased the amount of time spent on any of the following? Spending time outside Noticing nature / wildlife M2B_Q4A Thinking about visiting green and natural spaces, are you concerned or worried by Contracting or spreading coronavirus M2B_Q2 What was the main reason for not spending free time outdoors in the last 14 days? Stayed at home to stop coronavirus spreading / Government restrictions (1) Data collected between April 2nd 2020 and March 31st 2021 (inclusive). (2) The samples for this question were: CV_Q2A 0 (April), 2,083 (May), 2,083 (June), 2,087 (July), 2,079 (August), 2,082 (September), 2,082 (October), 2,083 (November), 2,083 (December), 2,080 (January), 2,072 (February) and 2,097 (March) respondents. M2B_Q4A and M2B_Q2 958 (April), 754 (May), 647 (June), 605 (July), 569 (August), 567 (September), 676 (October), 687 (November), 729 (December), 715 (January), 696 (February) and 694 (March) respondents. (3) Only a subset of reasons have been presented - see the other results for all reasons.

Although some people reported more time outside and greater engagement with nature since the start of the pandemic, widespread concern about accessing the outdoors due to the pandemic was also evident. Overall, 41% of adults who had not visited green and natural spaces in the last 14 days cited ‘contracting or spreading coronavirus’ as one of their concerns. This option was more often chosen than any other concern/worry (e.g. lack of facilities and antisocial behaviour) across the year.

Staying at home to stop coronavirus spreading and government restrictions were together cited as a main reason for not spending free time outdoors by 48% of adults who had not visited a green or natural space in the last 14 days (Table 3). These adults were most likely to report staying at home to stop coronavirus spreading and government restrictions as a reason for not getting outdoors in April 2020 (76%). This percentage steadily decreased over the course of 2020, reaching its lowest in October (30%) and December 2020 (34%) but showing a slight increase in November (40%), and maintaining higher levels between January (55%) and March 2021 (43%).

Table 3: Main reasons reported for not spending free time outdoors in the last 14 days by adults who had not visited a green or natural space in the last 14 days, from April 2020 to March 2021. The three top reasons for not spending time outdoors were ‘Staying at home to stop coronavirus spreading/government restrictions’, ‘Bad/poor weather’, and ‘Poor physical health (or illness)’.

Table 4: adults who reported ‘staying at home to stop coronavirus spreading/government restrictions’ as a reason for not spending free time outdoors by demographic group (statistically significant differences within groups marked with ‘x’), from april 2020 to march 2021. those who thought coronavirus had been stopped them spending time outside were more likely to be older, women, white, live in the sw, have lower household income, have no or non-degree level qualifications, have no children in their household, not working, in bad health, or without a long-term illness., 7. local green and natural spaces, 7.1 gardens.

Overall, 76% of people said they had access to a private garden, 9% had access to a shared garden, 10% a private outdoor space that was not a garden, and 3% an allotment at a council or community run site (some with more than one of these).

Just under one in ten (8%) people said they did not have access to any form of garden or other listed outdoor spaces. Those adults without a garden were also more likely to have made no visits to green or natural space (33%) in the last 14 days than those with a private garden (29%).

Of those with access to a garden or one of the other listed outdoor spaces, 79% reported spending time in it at least once a week and of these, 28% used it every day. Overall, 9% said they never used it.

The most common reasons chosen for spending time in the garden were for fresh air (65%), to do gardening and maintenance (42%), for mental health and well-being (34%), to take a break (27%) and to connect to nature and watch wildlife (22%).

Table 5: Adults ‘without access to a garden or other listed outdoor space’ by demographic group (statistically significant differences within groups marked with ‘X’), from April 2020 to March 2021. Those without access to a garden or allotment were more likely to be younger, from an ethnic minority group, live in London, have lower household income, have no qualifications, have no children in their household, be unemployed or a student, have fair/bad/very bad health, or live in the most deprived areas.

7.2 visits to local green and natural spaces.

Urban green spaces (such as a park, field, or playground) had been visited by almost half (49%) of respondents, making them the most commonly visited green and natural space in the last month (see Q2-M1_Q2 in the questionnaire for full list of green and natural spaces visited).

For 94% of adults’ most recent visits to green and natural spaces, respondents said their journey to this place started from home (rather than work, holiday accommodation or other locations) and that if they travelled to get there, 70% said they got there by foot/walking rather than using transport.

Table 6: Adults who had ‘visited an urban green space in the past month’ by demographic group (statistically significant differences within groups marked with ‘X’), from April 2020 to March 2021. Those who had visited urban green space in the past month were more likely to be younger, men, from mixed/multiple or Asian/Asian British ethnic background, live in London, have higher household income, have a degree or other qualification, have children in their household, be a student or in employment, have fair/good/very good health, or live in the most deprived areas.

7.3 quality of local green and natural spaces.

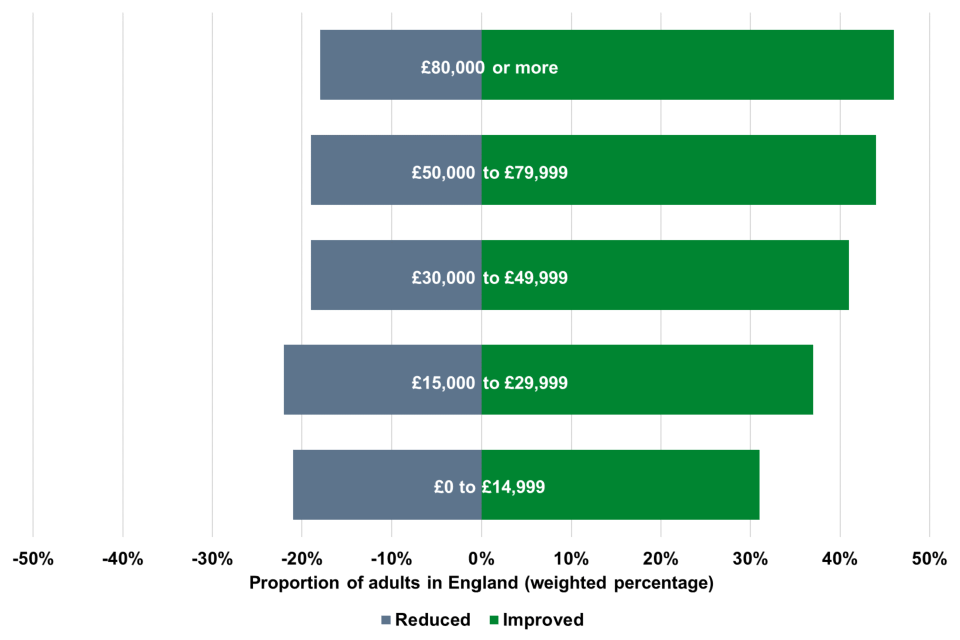

Reflecting on the quality of green and natural spaces close to where they live, 40% of people thought it had improved a little or a lot, whereas 20% thought it had reduced in quality in the last 5 years. This varied depending on income, whereby higher income groups were more likely to say the quality of green and natural spaces close to them had improved in the last 5 years (Figure 4).

Figure 4: Perceived reduction/improvement in the quality of local green spaces in the last five years split by household income. From April 2020 to March 2021, higher income groups were more likely to say the quality of their green and natural spaces close to them had improved in the last 5 years.

Figure notes Source: M1_Q3 Thinking of the green and natural spaces close to where you live, have they improved or reduced in the last 5 years, or have they not changed? Q69 (Income): Which of the following best describes your total annual household income before tax? (1) Data collected between April 2nd 2020 and March 31st 2021 (inclusive). (2) The samples for this question were 4,040 (£0 to £14,999), 8,041 (£15,000 to £29,999), 7,137 (£30,000 to £49,999), 3,687 (£50,000 to £79,999), 1,950 (£80,000 or more) respondents. (3) Responses taken from NET reduced and NET improved values. Reductions in the quality of local green spaces have been expressed as negative values. (4) Only a subset of reasons have been presented - see the see other results for all reasons.

Looking at specific indicators of quality, around two thirds of people thought that their local green and natural spaces were accessible (within easy walking distance for most people; 65%), that they were good places for mental health and well-being (71%), places to see nature (70%), a high enough standard that people want to spend time there (69%), places that encourage physical health and exercise (69%), good places for children to play (67%), and good places to meet other people (63%).

8. Nature connection and well-being

The majority (94%) of adults who had visited green and natural spaces in the last 14 days felt that spending time outdoors was good for their physical health, and 92% thought it was also good for their mental health. Several questions are used as part of the ‘ Nature Connection Index ’ to indicate whether people experience a connection to nature (Figure 5). As one example, on average 82% of people over the year agreed that being in nature made them very happy. This peaked in April (87%) and May 2020 (85%) and did not go lower than 79% (in December 2020) in agreement throughout the course of the year.

Figure 5: Percentage of people agreeing/disagreeing with Nature Connection Index questions. From April 2020 to March 2021, 91% agreed they always treat nature with respect, 83% agreed they always find beauty in nature, 82% of people agreed that being in nature made them very happy, 82% agreed spending time in nature is very important to them, 82% agreed they find being in nature really amazing and 58% agreed they feel part of nature.

Figure notes Source: M1_Q6 How much do you agree or disagree with the following: I feel part of nature. Being in nature makes me very happy. I find being in nature really amazing. M4_Q8 How much do you agree or disagree with the following: I always find beauty in nature. I always treat nature with respect. Spending time in nature is very important to me. (1) Data collected between April 2nd 2020 and March 31st 2021 (inclusive). (2) Responses taken from NET reduced and NET improved values. (3) The samples for this question were 23,314 (M1_Q1) and 4,527 (M4_Q8). (4) Only a subset of reasons have been presented - see other results for all reasons. Percentages will not add up to 100%.

Table 7: Adults ‘agreeing that being in nature makes them very happy’ by demographic group (statistically significant differences within groups marked with ‘X’), from April 2020 to March 2021. People were more likely to agree that being in nature makes them very happy if they were age 25+, women, not Black or Black British, live in the SE, have higher household income, have a degree or other qualification, are not unemployed or a student, are in good/very good health, have an illness that does not impact them, or are living in a less deprived area.

9. environmental attitudes and actions, 9.1 attitudes.

Across the year, health, the NHS and coronavirus were cited by respondents as one of the most important issues facing the UK at the moment (63%), followed by the economy (35%), and then the environment and climate change (22%). Some variation was seen depending on the month people were asked, with health and coronavirus more commonly chosen between April (80%) and May 2020 (72%), the economy more commonly chosen in May 2020 (42%) and fewer people people choosing the environment and climate change around May and July 2020 (both at 18%).

When asked how important protecting the environment was to them personally, adults responded similarly irrespective of the time of year, with an average of more than 8 in ten people (86%) saying that protecting the environment was important or very important to them personally over the course of the year.

9.2 Social action

People reported taking social action to look after the environment in several ways. A third of people (33%) reported often or always picking up litter when they see it. Around a quarter of people said they often or always vote for political parties with strong environmental policies (28%), sign petitions or participate in campaigns or demonstrations about environmental issues (24%) and/or try to persuade others to do more for the environment (23%).

Adults reported other social action for the environment, including donating money to environmental organisations (16%), contacting an MP or council member about an environmental issue (12%), posting online content relating to the environment (12%) and/or volunteering for an environmental cause (10%). All these actions, apart from voting for political parties with strong environmental policies, were more commonly reported by those under the age of 40.

9.3 Lifestyle behaviours

Table 8 shows adults’ reporting on their lifestyle choices and behaviours that could demonstrate care for the environment. However, it should be noted that motivations for these environmentally friendly behaviours was not asked.

Table 8: Individual lifestyle choices and behaviours that were completed by individuals in the last month, from April 2020 to March 2021. The most reported behaviours were recycling items (85%), followed by bringing your own bags when shopping (81%), and switching off lights and appliances to save energy/to protect the environment (73%).

The most common actions taken at home to improve water and energy efficiency include, 49% of people saying they have a water meter, 41% using water efficient appliances (e.g. dual flush toilets, water efficient washing machines or water efficient shower heads), and 38% using a smart meter or smart home device. A further 18% said their energy was supplied by a renewable source (e.g. solar panels, green tariff) and 19% said they had chosen none of these actions. In the garden, 35% of adults also said they encourage wildlife into their garden or other outdoor space (e.g. feeding birds).

Six in ten (60%) adults said they eat meat more than twice a week, and of these 20% eat it every day. Less than 1 in ten (6%) said they never eat meat. Nearly 3 in 10 (27%) adults said they drive to work or a place of study in a car, motorbike, or van more than twice a week, but nearly half (45%) said they never drive to work or a place of study in a car, motorbike, or van. More than 1 in 10 (11%) adults took a flight at least once every 2 to 3 months, but the majority (71%) said they took one once a year or less, including 21% who never fly (Figure 6).

Figure 6: Proportion of adults in England (weighted percentage) showing lifestyle choices and behaviours.

Figure notes Source: M4_Q13A How often do you do the following? Eat meat; Drive to work or place of study in a car/ motorbike or van. M4_Q13B How often do you take flights on an aeroplane? (1) Data collected between April 2nd 2020 and March 31st 2021 (inclusive). (2) The samples for this question were 4,930 (M4_Q13A) and 4,930 (M4_Q13B). (3) Not all responses are shown. “Every day”, “More than twice a week, but not every day” and “Twice a week” were not available as a response to question M4_Q13B.

9.4 Making changes

83% of adults said they were going to make changes to their lifestyle to protect the environment. Of the 16% who said they would not, 51% said they already do as much as they can, 33% said they like their lifestyle and don’t want to change, and 22% said it is too difficult or they don’t know how.

10. Other results

The spreadsheets accompanying this report include data and summaries on a greater number of areas and on the areas already presented in more detail. The full list of areas covered includes:

General experiences of green and natural spaces:

- Frequency of time spent outside in past 12 months

- Places visited

- Quality of local space

- General/local greenspace standards

- Nature connection

Visits taken to green and natural spaces in last 14 days:

- Total number of visits

- Main visit in past 14 days: destination/s, start place, distance, duration, activities, benefits of visit, transport, who with, physical exertion, money spent, reason for visit, quality of place/s visited

- Reasons for not visiting/barriers

Children (asking parent/guardian):

- Visit partners

- Benefits of time outdoors

- Reasons for not spending more time outdoors

- Time spent in private garden

Environmental attitudes:

- Importance of protecting the environment

- Reasons to look after the environment

- Concern about damaging natural environment

- Perceived variety of animal / plant life

- Concern about loss of variety

- Environmental issues that are of concern

- Environmental social action

- Environmental lifestyle choices

- Eating meat

- Aeroplane use

- Water waste

- The amount of things bought

- Responsibility for environmental damage

- Frequency of time spent in gardens

- Importance of gardens

- Reasons for spending time in garden

- Benefits of time in garden

- Description of garden

- Wildlife friendly gardening behaviours

11. Methodological note

Results from all surveys are attempts to estimate “true values” in a wider population. Therefore all survey statistics come with an associated margin of error within which the “true” population measure is expected to lie. All differences between groups in this report have been tested for statistical significance; that is, the difference between two compared values are significant even after we have accounted for the margins of error.

Differences between groups were tested using Chi-square tests. Unless otherwise specified, all commentary in the report focuses exclusively on differences that are statistically significant at a 95 per cent confidence level. This means that if the survey was conducted 100 times, a finding of the same nature would be found in at least 95 cases.

Bespoke weights for the People and Nature Survey for England have been applied to this statistical release. These bespoke weights have been generated using regression modelling and include a large number of significant demographic variables (Urban / Rural, Region, Age by Gender, Working Status by Gender, Long lasting health condition, Number cars/vans, Education, Ethnicity, Dog ownership, Presence of children under 16).

Applying weights to data, while tending to make the quoted figures more representative of the population of interest, has the effect of reducing the effective sample size of the data. As such, the effective base size, which is used in any statistical testing, is smaller than the unweighted base size and this has the effect of increasing the confidence intervals around the survey estimates. This effect has been taken into account when determining whether or not differences between survey estimates described throughout the report are statistically significant. Therefore, while the base sizes reported throughout this report are the actual base sizes, the statistical analysis is based on the effective base.

Further information about the survey’s methodology can be found here.

12. Strengths and Limitations

Information about the survey’s strengths and limitations can be found here.

13. Glossary

Visits to green and natural spaces are defined in this survey as visits to green spaces in towns and cities (e.g. parks, canals); the countryside (e.g. farmland, woodland, hills and rivers); the coast (e.g. beaches, cliffs) and activities in the open sea; This includes: visits of any duration (including short trips to the park, dog walking etc.). They do not include time in gardens; outside spaces visited as part of someone’s job; or time spent outside the UK. Additional questions are asked about private gardens.

95% confidence interval is a range of values around a calculated statistic (e.g. the mean) that you are 95% certain contains the true value of that statistic. For example, where there is a mean value of 49 with a 95% confidence interval of 2, we would be 95% certain that the true mean of the population was in the range of 47-51 (i.e. 49 -2 and 49 + 2). Please note that the People and Nature Survey uses quota sampling and confidence intervals here were calculated as if the data were generated from a random probability sample.

14. Contact

Natural England welcomes feedback on these monthly indicators, questions, and suggestions for analysis for future releases. Please contact the team by email: [email protected]

If you would like to receive further information on the survey, including data releases, publications and survey changes, then visit our User Hub and sign-up to the mailing list at the bottom of the page (best viewed in Google Chrome). After signing up, if you do not receive a confirmation email please check your ‘Junk’ or ‘Spam’ folder. The Senior Responsible Officer for this publication is Dr Katherine Burgess [email protected]

15. Pre-release access

This publication did not undergo review outside of the People and Nature Survey for England data production and quality assurance team.

16. Related links

Coronavirus - guidance on accessing green spaces safely: Latest government guidance on using green spaces and protecting yourself and others.

Natural England operational update: Coronavirus information on how Natural England is facing the challenges posed by Coronavirus.

People and Nature questionnaire: Includes link to People and Nature Survey questions.

People and Nature Survey information: Further information on the People and Nature Survey for England.

Coronavirus (COVID-19): safer public places - urban centres and green spaces: Guidance for the owners and operators of urban centres and green spaces to help social distancing.

The Countryside Code Statutory guidance on respecting, protecting and enjoying the outdoors.

People and Nature Survey respondents can also answer ‘In another way (specify)’. However, sample sizes were not large enough for those that answered ‘In another way (specify)’ to be able to conduct robust analysis. ↩

For some questions with small sample sizes, all ethnic minority groups are reported as one group. Please see section Strengths and Limitations for more information. ↩

Long-term illness and its impact on day-to-day functioning were measured using the Government Statistical Service standard measure for disability. The full measure was missing from months April to August 2020. Due to this missing data, we are unable to look at disability as defined by this measure, but instead make comparisons separately between ‘no illness’ and ‘any illness’, and the impact of illness on ability to carry out day-to-day activities (‘yes, a lot’, ‘yes, a little’, or ‘not at all’). ↩

Participant home full postcodes were mapped on to area-level deprivation statistics for those living in each lower-layer super output area. England’s official measure of relative deprivation—the Index of Multiple Deprivation (IMD)—was used which ranks all neighbourhoods in England according to the level of deprivation. For the purposes of analyses, participants have then been categorised as either living within the ‘30% most’ or ‘70% least’ deprived areas of England. ↩

Is this page useful?

- Yes this page is useful

- No this page is not useful

Help us improve GOV.UK

Don’t include personal or financial information like your National Insurance number or credit card details.

To help us improve GOV.UK, we’d like to know more about your visit today. We’ll send you a link to a feedback form. It will take only 2 minutes to fill in. Don’t worry we won’t send you spam or share your email address with anyone.

- Travel, Tourism & Hospitality ›

- Leisure Travel

Travel and tourism in the United Kingdom - statistics & facts

How many tourists visit the uk, travel planning and behavior of british tourists, key insights.

Detailed statistics

Travel and tourism's total contribution to GDP in the UK 2019-2022

Distribution of travel and tourism expenditure in the UK 2019-2022, by type

Travel and tourism's total contribution to employment in the UK 2019-2022

Editor’s Picks Current statistics on this topic

Current statistics on this topic.

Travel, Tourism & Hospitality

Inbound tourist visits to the UK 2002-2022

Destinations

Leading UK cities for international tourism 2019-2022, by visits

Leading outbound travel destinations from the UK 2019-2022

Related topics

Recommended.

- Hotel industry in the UK

- Travel agencies in the United Kingdom (UK)

- Travel and tourism in Europe

- Vacation travel behavior in the United Kingdom (UK)

- Package holidays in the United Kingdom (UK)

Recommended statistics

- Basic Statistic Travel and tourism's total contribution to GDP in the UK 2019-2022

- Basic Statistic Distribution of travel and tourism expenditure in the UK 2019-2022, by type

- Basic Statistic Distribution of travel and tourism expenditure in the UK 2019-2022, by tourist type

- Basic Statistic Travel and tourism's total contribution to employment in the UK 2019-2022

- Premium Statistic Median full-time salary in tourism and hospitality industries in the UK 2023

- Premium Statistic CPI inflation rate of travel and tourism services in the UK 2023

Travel and tourism's total contribution to GDP in the UK 2019-2022

Total contribution of travel and tourism to GDP in the United Kingdom (UK) in 2019 and 2022 (in billion GBP)

Distribution of travel and tourism spending in the United Kingdom (UK) in 2019 and 2022, by type

Distribution of travel and tourism expenditure in the UK 2019-2022, by tourist type

Distribution of travel and tourism spending in the United Kingdom (UK) in 2019 and 2022, by type of tourist

Travel and tourism's total contribution to employment in the UK 2019-2022

Total contribution of travel and tourism to employment in the United Kingdom (UK) in 2019 and 2022 (in million jobs)

Median full-time salary in tourism and hospitality industries in the UK 2023

Median annual gross salary for full-time workers in tourism and hospitality industries in the United Kingdom (UK) in 2023, by industry (in GBP)

CPI inflation rate of travel and tourism services in the UK 2023

Consumer price index (CPI) inflation rate of travel and tourism services in the United Kingdom (UK) from May to December 2023

Inbound tourism

- Basic Statistic Inbound tourist visits to the UK 2002-2022

- Premium Statistic Inbound tourist visits to the UK 2019-2022, by purpose of trip

- Basic Statistic Leading inbound travel markets in the UK 2019-2022, by number of visits

- Premium Statistic Leading inbound travel markets in the UK 2023, by growth in travel demand on Google

- Premium Statistic Number of overnight stays by inbound tourists in the UK 2004-2022

- Premium Statistic International tourist spending in the UK 2004-2024

- Premium Statistic Leading inbound travel markets for the UK 2019-2022, by spending

- Premium Statistic Leading UK cities for international tourism 2019-2022, by visits

Number of overseas resident visits to the United Kingdom (UK) from 2002 to 2022, with a forecast for 2023 and 2024 (in millions)

Inbound tourist visits to the UK 2019-2022, by purpose of trip

Number of overseas resident visits to the United Kingdom (UK) from 2019 to 2022, by purpose of trip (in millions)

Leading inbound travel markets in the UK 2019-2022, by number of visits

Leading inbound travel markets for the United Kingdom (UK) in 2019 and 2022, by number of visits (in 1,000s)

Leading inbound travel markets in the UK 2023, by growth in travel demand on Google

Leading inbound travel markets in the United Kingdom (UK) over the previous 30 and 90 days as of June 2023, ranked by growth in travel demand on Google

Number of overnight stays by inbound tourists in the UK 2004-2022

Number of nights spent by overseas residents in the United Kingdom (UK) from 2004 to 2022 (in millions)

International tourist spending in the UK 2004-2024

Spending of international visitors to the United Kingdom from 2004 to 2022, with a forecast for 2023 and 2024 (in billion GBP)

Leading inbound travel markets for the UK 2019-2022, by spending

Leading inbound travel markets for the United Kingdom (UK) in 2019 and 2022, by spending (in million GBP)

Cities and towns in the United Kingdom (UK) ranked by international visits in 2019 and 2022 (in 1,000 visits)

Outbound tourism

- Premium Statistic Number of outbound tourist visits from the UK 2007-2022

- Premium Statistic Outbound tourism visits from the UK 2019-2022, by purpose

- Premium Statistic Leading outbound travel destinations from the UK 2019-2022

- Premium Statistic Leading outbound travel markets in the UK 2023, by growth in travel demand on Google

- Premium Statistic Number of outbound overnight stays by UK residents 2011-2022

- Premium Statistic Outbound tourism expenditure in the UK 2007-2022

Number of outbound tourist visits from the UK 2007-2022

Total number of visits abroad from the United Kingdom (UK) from 2007 to 2022 (in millions)

Outbound tourism visits from the UK 2019-2022, by purpose

Number of visits abroad from the United Kingdom (UK) from 2019 to 2022, by purpose (in millions)

Leading countries visited by residents of the United Kingdom (UK) in 2019 and 2022 (in 1,000 visits)

Leading outbound travel markets in the UK 2023, by growth in travel demand on Google

Leading outbound travel markets in the United Kingdom (UK) over the previous 30 and 90 days as of June 2023, ranked by growth in travel demand on Google

Number of outbound overnight stays by UK residents 2011-2022

Number of overnight stays abroad by residents of the United Kingdom (UK) from 2011 to 2022 (in 1,000s)

Outbound tourism expenditure in the UK 2007-2022

Total expenditure on visits abroad from the United Kingdom (UK) from 2007 to 2022 (in million GBP)

Domestic tourism

- Premium Statistic Domestic overnight trips in Great Britain 2010-2022

- Premium Statistic Domestic tourism trips in Great Britain 2018-2022, by purpose

- Premium Statistic Number of domestic overnight trips in Great Britain 2023, by destination type

- Premium Statistic Number of tourism day visits in Great Britain 2011-2022

- Premium Statistic Total domestic travel expenditure in Great Britain 2019-2022

- Premium Statistic Domestic overnight tourism spending in Great Britain 2010-2022

- Premium Statistic Expenditure on domestic day trips in Great Britain 2011-2022

- Premium Statistic Average spend on domestic summer holidays in the United Kingdom (UK) 2011-2023

Domestic overnight trips in Great Britain 2010-2022

Number of domestic overnight trips in Great Britain from 2010 to 2022 (in millions)

Domestic tourism trips in Great Britain 2018-2022, by purpose

Number of domestic overnight trips in Great Britain from 2018 to 2022, by purpose (in millions)

Number of domestic overnight trips in Great Britain 2023, by destination type

Number of domestic overnight trips in Great Britain in 2023, by destination type (in millions)

Number of tourism day visits in Great Britain 2011-2022

Number of tourism day visits in Great Britain from 2011 to 2022 (in billions)

Total domestic travel expenditure in Great Britain 2019-2022

Total domestic tourism spending in Great Britain from 2019 to 2022 (in billion GBP)

Domestic overnight tourism spending in Great Britain 2010-2022

Annual domestic overnight tourism spending in Great Britain from 2010 to 2022 (in billion GBP)

Expenditure on domestic day trips in Great Britain 2011-2022

Annual expenditure on domestic tourism day visits in Great Britain from 2011 to 2022 (in billion GBP)

Average spend on domestic summer holidays in the United Kingdom (UK) 2011-2023

Average spend on 'staycation' summer holidays according to Britons in the United Kingdom (UK) from 2011 to 2023 (in GBP)

Accommodation

- Premium Statistic Number of accommodation businesses in the United Kingdom (UK) 2008-2021

- Premium Statistic Number of accommodation enterprises in the United Kingdom (UK) 2018-2021, by type

- Premium Statistic Turnover of accommodation businesses in the United Kingdom (UK) 2008-2021

- Premium Statistic Turnover of accommodation services in the United Kingdom (UK) 2015-2021, by sector

- Premium Statistic Number of hotel businesses in the United Kingdom (UK) 2008-2021

- Basic Statistic Most popular hotel brands in the UK Q3 2023

- Premium Statistic Consumer expenditure on accommodation in the UK 2005-2022

Number of accommodation businesses in the United Kingdom (UK) 2008-2021

Number of enterprises in the accommodation industry in the United Kingdom (UK) from 2008 to 2021

Number of accommodation enterprises in the United Kingdom (UK) 2018-2021, by type

Number of enterprises in the accommodation industry in the United Kingdom (UK) from 2018 to 2021, by sector

Turnover of accommodation businesses in the United Kingdom (UK) 2008-2021

Turnover of accommodation businesses in the United Kingdom (UK) from 2008 to 2021 (in million GBP)

Turnover of accommodation services in the United Kingdom (UK) 2015-2021, by sector

Turnover of accommodation services in the United Kingdom (UK) from 2015 to 2021, by type (in million GBP)

Number of hotel businesses in the United Kingdom (UK) 2008-2021

Number of hotel and similar accommodation businesses in the United Kingdom (UK) from 2008 to 2021

Most popular hotel brands in the UK Q3 2023

Most popular hotel brands in the United Kingdom (UK) in 3rd quarter of 2023

Consumer expenditure on accommodation in the UK 2005-2022

Consumer spending on accommodation in the United Kingdom (UK) from 2005 to 2022 (in million GBP)

Travel behavior

- Premium Statistic Attitudes towards traveling in the UK 2023

- Premium Statistic Travel frequency for private purposes in the UK 2023

- Premium Statistic Travel frequency for business purposes in the UK 2023

- Premium Statistic Share of Britons taking days of holiday 2019-2023, by number of days

- Premium Statistic Share of Britons who did not take any holiday days 2019-2023, by gender

- Premium Statistic Share of Britons who did not take any holiday days 2019-2023, by age

- Premium Statistic Leading regions for summer staycations in the UK 2023

- Premium Statistic Preferred methods to book the next overseas holiday in the UK October 2022, by age

- Premium Statistic Travel product bookings in the UK 2023

- Premium Statistic Travel product online bookings in the UK 2023

Attitudes towards traveling in the UK 2023

Attitudes towards traveling in the UK as of December 2023

Travel frequency for private purposes in the UK 2023

Travel frequency for private purposes in the UK as of December 2023

Travel frequency for business purposes in the UK 2023

Travel frequency for business purposes in the UK as of December 2023

Share of Britons taking days of holiday 2019-2023, by number of days

Share of individuals taking days of holiday in the United Kingdom from July 2019 to May 2023, by number of days

Share of Britons who did not take any holiday days 2019-2023, by gender

Share of individuals who did not take any days of holiday in the United Kingdom from July 2019 to November 2023, by gender

Share of Britons who did not take any holiday days 2019-2023, by age

Share of individuals who did not take any days of holidays in the United Kingdom (UK) from July 2019 to November 2023, by age

Leading regions for summer staycations in the UK 2023

Leading regions for travelers' next summer staycation in the United Kingdom as of May 2023

Preferred methods to book the next overseas holiday in the UK October 2022, by age

Preferred methods to book the next overseas holiday among individuals in the United Kingdom (UK) as of October 2022, by age group

Travel product bookings in the UK 2023

Travel product bookings in the UK as of December 2023

Travel product online bookings in the UK 2023

Travel product online bookings in the UK as of December 2023

- Premium Statistic Travel & Tourism market revenue in the United Kingdom 2018-2028, by segment

- Premium Statistic Travel & Tourism market revenue growth in the UK 2019-2028, by segment

- Premium Statistic Revenue forecast in selected countries in the Travel & Tourism market in 2024

- Premium Statistic Number of users of package holidays in the UK 2018-2028

- Premium Statistic Number of users of hotels in the UK 2018-2028

- Premium Statistic Number of users of vacation rentals in the UK 2018-2028

Travel & Tourism market revenue in the United Kingdom 2018-2028, by segment

Revenue of the Travel & Tourism market in the United Kingdom from 2018 to 2028, by segment (in billion U.S. dollars)

Travel & Tourism market revenue growth in the UK 2019-2028, by segment

Revenue growth of the travel and tourism market in the United Kingdom (UK) from 2019 to 2028, by segment

Revenue forecast in selected countries in the Travel & Tourism market in 2024

Revenue forecast in selected countries in the Travel & Tourism market in 2024 (in billion U.S. dollars)

Number of users of package holidays in the UK 2018-2028

Number of users of package holidays in the United Kingdom from 2018 to 2028 (in millions)

Number of users of hotels in the UK 2018-2028

Number of users of hotels in the United Kingdom from 2018 to 2028 (in millions)

Number of users of vacation rentals in the UK 2018-2028

Number of users of vacation rentals in the United Kingdom from 2018 to 2028 (in millions)

Further reports Get the best reports to understand your industry

Get the best reports to understand your industry.

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

Number of International Visitors to London

Visit Britain publish data relating to international visitors to the UK. They produce the data in two formats - individual spreadsheets for each region that are updated annually, and a single spreadsheet for all regions, containing less detail but updated quarterly.

Data shows London totals for nights, visits, and spend. Data broken down by age, purpose, duration, mode and country. This data is also available from Visit Britain website, including the latest quarterly data for other regions.

All data taken from the International Passenger Survey (IPS).

Some additional data on domestic tourism can be found on the Visit Britain website, and Visit England both overnight tourism and Day visits pages.

Data on accomodation occupancy levels is also available from Visit England .

An overview of all tourism data for London can be found in this GLAE report ' Tourism in London '

Further information can be found on the London and Partners website.

Comparisons of international tourist arrivals with other world cities are produced by Euromonitor and in Mastercard's Global Destination Cities Index of 2012 , 2013 , 2014 , and 2015 .

This dataset is included in the Greater London Authority's Night Time Observatory. Click here to find out more.

Request Access to Number of International Visitors to London

You must be logged in to request access to this dataset.

Update Frequency

Smallest geography.

More Like This...

Cookies on GOV.UK

We use cookies to collect information about how you use data.gov.uk. We use this information to make the website work as well as possible.

You can change your cookie settings at any time.

BETA This is a new service – your feedback will help us to improve it

Find open data

Find data published by central government, local authorities and public bodies to help you build products and services

Data topics

Business and economy.

Small businesses, industry, imports, exports and trade

Crime and justice

Courts, police, prison, offenders, borders and immigration

Armed forces, health and safety, search and rescue

Students, training, qualifications and the National Curriculum

Environment

Weather, flooding, rivers, air quality, geology and agriculture

Staff numbers and pay, local councillors and department business plans

Government spending

Includes all payments by government departments over £25,000

Includes smoking, drugs, alcohol, medicine performance and hospitals

Addresses, boundaries, land ownership, aerial photographs, seabed and land terrain

Employment, benefits, household finances, poverty and population

Towns and cities

Includes housing, urban planning, leisure, waste and energy, consumption

Airports, roads, freight, electric vehicles, parking, buses and footpaths

Digital service performance

Cost, usage, completion rate, digital take-up, satisfaction

Government reference data

Trusted data that is referenced and shared across government departments

Domestic Leisure Trends for the Next Decade

Domestic leisure trends for the next decade – workshop pack.

This workshop pack, complete with speaker notes, data and graphics, contains everything you need to implement the trends information on this site within your organisation.

Domestic Leisure Trends for the Next Decade – Report

This brand new VisitEngland report contains information, data, analysis, expert commentary and case studies that complement the trends presented on this site.

- Think Tank Summary

- Demographics

- VisitEngland Insights

Trends Report

- The Next Decade

- Future of the Staycation

About This Project

IMAGES

VIDEO

COMMENTS

Gain a deeper knowledge of travel and tourism with our industry-leading data and analysis. We provide expert research into the inbound and domestic visitor landscape across the nations - designed to help inform your business decisions, expand your expertise and identify key growth markets. These resources cover a wide range of topics, trends ...

Attractions in England reported a 42% increase in the volume of total visits from 2021 to 2022, however, this is still 35% below 2019 levels. Places of Worship and Museums / Art Galleries received the highest increase in visits year on year (117%) and (114%) respectively. The Natural History Museum was the most visited free attraction in 2022 ...

Recent patterns: Official data from the International Passenger Survey is available to September at time of writing. This shows that visits to the UK were 8% down on 2019 (though 30% up on the same period in 2022) and the value of visitor spending set a new record, 10% up on 2019 in nominal terms (and 23% up on 2022) although 9% down on 2019 in real terms (i.e. taking inflation into account ...

England: Volume: day visits increased in 2023 vs 2022 with the first half of the year showing stronger growth, likely due to the impact of COVID-19 in early 2022. Value: Spend was up vs 2022 in both nominal and real (inflation adjusted) terms. Average spend per visit: was up vs 2022 in nominal terms but in real terms it saw a slight decline. Regions: London saw the largest share and strongest ...

Explore our England Business Advice Hub, resources for destination partners and business events stakeholders and ways to work with us. ... Find the latest consumer and industry data and insights on domestic and inbound tourism in the UK, Britain and England. ... VisitBritain and The National Lottery have teamed up to launch a new promotion to ...

The domestic sentiment tracker was launched in May 2020 in collaboration with VisitScotland and Visit Wales. Initially, the objective was to track trip intentions in reaction to the Covid-19 crisis and understand the trajectory of tourism recovery in the UK. Gradually, the survey started addressing the cost of living crisis and its impact on ...

From International Passenger Survey (IPS), quarterly data. Annual estimates on visits and spending in the UK by overseas residents, by purpose and region of visit. New methods were introduced for producing the 2019 estimates and where back dated to 2009. The datasets presented since then contain estimates produced using the new method.

England saw a total of 1.5 billion day visits, with 327.5 million visits to London and 231.9 visits to South East England . Nationwide, the most popular main activity for day visits was 'visiting friends or family for leisure', on a total of 359.8 million visits. 896.7 million travelled using their own car, or one belonging to friends or ...

Data collection was not restarted at the Eurotunnel vehicle terminal until July 2022. ... (£98 in 2019 and £100 in 2022) but average spend per visit remained high at £843; this was £696 in 2019 but £875 in 2021. UK residents spent £58.5 billion on visits abroad in 2022, an increase of £43.0 billion compared with 2021. The average spend ...

Version 3 May 2013 1 England Tourism Factsheet Economic Impact Tourism in England contributes £106bn to the British economy (GDP) when direct and indirect impacts are taken into account, supporting 2.6 million jobs. When only direct impacts are taken into account (i.e. excluding aspects such as the supply chain), the contribution is £48bn, with 1.4 million jobs directly supported.

Overall, the number of overseas visits to the UK totaled just above 31 million in 2022, increasing by nearly 25 million from 2021 but remaining below pre-pandemic levels. In 2023, overseas visits ...

The People and Nature Survey for England: Data and publications from Adults survey year 1 (April 2020 - March 2021) (Official Statistics) main findings ... Main visit in past 14 days: destination ...

UK residents spent £15.5 billion on visits abroad in 2021, an increase of 13% compared with modelled data for 2020. The average spend per visit was £808 in 2021. Values for 2020 are not known, but this was an increase from £670 in 2019. Some of this increase is because of the longer time spent abroad.

Main points. Overseas residents made 40.9 million visits to the UK in 2019, an increase of 0.6 million compared with 2018. There were 93.1 million visits overseas by UK residents in 2019, an increase of 3% compared with 2018. UK residents spent £62.3 billion on visits overseas in 2019, an increase of 7% compared with 2018.

In terms of the distribution of travel and tourism spending in the UK, leisure spending constituted the dominant share, slightly increasing in 2022 compared to 2019 as business spending declined ...

This dataset shows how many people visited Attractions in Lincolnshire by calendar year. Visitor numbers for a wide range of attractions are shown, along with other key information such as entrance fees. The data's source is the Annual Survey of Visits to Visitor Attractions, run by Visit England. (As usual with survey data there are some ...

Visit Britain publish data relating to international visitors to the UK. They produce the data in two formats - individual spreadsheets for each region that are updated annually, and a single spreadsheet for all regions, containing less detail but updated quarterly. Data shows London totals for nights, visits, and spend.

UK residents spent £13.8 billion on visits abroad in 2020, a fall of 78% compared with 2019. The average spend per visit has decreased from £670 in 2019 to £578 in 2020, contributing to the overall decrease in spending. Overseas spending in the UK also fell to £6.2 billion; this was 78% less than in 2019 (Figure 2).

Visit Britain Visit England Visit Britain Visit England Tourism Data Summary June 2021 Source: STEAM 2020 Business Trips by overseas and GB Visitors. Top Towns by Overseas Visitors Top Towns by GB ... DATA WITHOUT THE EXPRESS WRITTEN PERMISSION OF STR GLOBAL IS STRICTLY PROHIBITED. Prepared by North West Research & Strategy 0151 237 3521

Find data published by central government, local authorities and public bodies to help you build products and services. Search data.gov.uk. Search Data topics. Business and economy. Small businesses, industry, imports, exports and trade. Crime and justice.

This workshop pack, complete with speaker notes, data and graphics, contains everything you need to implement the trends information on this site within your organisation. ... 7 Reasons to Visit England in 2019 Visit England England is a country that is full of history, culture, and natural beauty. From visiting famous...