We've detected unusual activity from your computer network

To continue, please click the box below to let us know you're not a robot.

Why did this happen?

Please make sure your browser supports JavaScript and cookies and that you are not blocking them from loading. For more information you can review our Terms of Service and Cookie Policy .

For inquiries related to this message please contact our support team and provide the reference ID below.

trading higher

trading lower

Carnival Corp

Key statistics.

2.00 mean rating - 25 analysts

2024 (millions USD)

About Carnival Corp (CCL.N)

Company information.

Carnival Corporation is a leisure travel company. The Company’s portfolio of cruise lines, including AIDA Cruises, Carnival Cruise Line, Costa Cruises, Cunard, Holland America Line, P&O Cruises (Australia), P&O Cruises (UK), Princess Cruises and Seabourn. The Company's segment includes North America and Australia (NAA), Europe, Cruise Support and Tour and Other. The NAA Segment include Carnival Cruise Line, Princess Cruises, Holland America Line, P&O Cruises (Australia) and Seabourn. The Europe Segment include Costa Cruises (Costa), AIDA Cruises (AIDA), P&O Cruises (UK) and Cunard. Its Cruise Support segment includes its portfolio of port destinations and other services. Its Tour and Other segment represent the hotel and transportation operations of Holland America Princess Alaska Tours and other operations. Its tour company owns and operates hotels, lodges, glass-domed railcars and motorcoaches which comprise its Tour and Other segment.

Contact Information

+ 1 ( 305 ) 5992600

https://www.carnivalcorp.com/

Water Transportation

Executive Leadership

Income statement.

2023 (millions USD)

Balance Sheet

Source: LSEG New Tab , opens new tab - data delayed by at least 15 minutes

Markets Performance

Commodities chevron, currencies chevron, rates & bonds chevron, stocks chevron, latest news.

Carnival's Princess banner is revising itineraries of two of its cruises undertaking a global voyage next year, amid uncertainties in the Red Sea, the cruise operator said on Tuesday.

This Cruise Life

2024 carnival shareholder benefit (valid through december 2024).

One of the most viewed pages on our site is about the benefits you receive for being a shareholder with your favorite cruise line. These benefits can be quite rich! In fact, in 2023 Carnival Corporation provided shareholders up to $250 in onboard credit – but that offer ended on February 28, 2024. This article walks you through changes to the new 2024 Carnival Shareholder Benefit along with big updates to the process requesting benefits.

2024 Carnival Shareholder Benefit Update

Good news, cruisers: Carnival Corporation has extended the shareholder benefit program once again! However, unlike previous years, the cruise operator only extended the program through this year. That’s right, the current program only applies to sailings completed by December 31, 2024 .

According to Carnival, all benefits remain the same from last year for North America Brands:

2024 Shareholder Benefit Requirements

In order to qualify for the 2024 Shareholder Benefit Program, you must own at least 100 shares of Carnival Corporation (CCL) stock. As of the time of this writing, that would be an investment of $1,665. Had you purchased the stock at Carnival’s 52-week low, it would have only cost you $837. Even at today’s stock price, just two 14-day cruises and three 7-day cruises recoups half your investment!

For current $CCL stock price information, refer to Google Finance .

All Carnival Corporation Brands Participate

It’s important to note that all of Carnival Corporation’s brands participate in the Carnival Shareholder Benefit program. While the amount of onboard credit varies by region, each brand maintains a tiered amount based on the length of your sailing. The following Carnival Corporation brands participate in the 2024 Carnival Shareholder Benefit Program:

- Carnival Cruise Line

- Princess Cruises

- Holland America Line

- Costa Cruises

- AIDA Cruises

- P&O Cruises

Carnival Rolls Out New Way to Submit for Shareholder Benefit

Many have written to us about changes to the process on requesting the Carnival Shareholder Benefit. Over the past year, Carnival Corporation tested an updated process through an app called StockPerks. A quick search will bring up countless Facebook threads and cruise message board posts with questions about the app.

On our last attempt to request via email (the old way), we received this message from Carnival:

Carnival Corporation has engaged Stockperks to implement a more automated and streamlined process for the processing of shareholder benefits. During the ongoing transition phase, shareholders may be redirected to Stockperks to engage with our updated redemption process. The Stockperks service is governed by Stockperks’ Privacy Policy, Terms of Service, and may be subject to other Stockperks policies and terms.

So what does this mean? It means a big change for how to request your Shareholder Benefit going forward.

How to Request Carnival Shareholder Benefits in 2024

With the full transition to StockPerks, Carnival now requires you to download the StockPerks app from either the Apple or Google Play Store depending on your device. While the download was quite simple, there were quite a few steps before we could actually submit our request.

Check out our Stockperks Job Aid that walks you through step-by-step how to create your Stockperks account and request your Shareholder Benefit.

Important: You must submit your request at least 3 weeks prior to your sailing.

Fine Print and Disclaimers

When talking about Shareholder Benefits, the stock market, and free onboard credit, there are some big disclaimers:

- Carnival Shareholder Benefit is available to shareholders who own a minimum of 100 shares of Carnival Corporation stock

- Carnival Shareholder Benefit available on sailings through December 31, 2024

- Requests for Carnival Shareholder Benefit must be submitted at least 3 weeks prior to your sailing (repeating this in case you missed the red bold text above!)

- Only one Carnival Shareholder Benefit can be used per stateroom (i.e., if multiple people in the stateroom own at least 100 shares of Carnival Corporation stock, only one credit will be awarded per stateroom)

- Employees, travel agents cruising at travel agent rates or interline rates, tour conductors, or anyone else cruising at a reduced-rate or on a complimentary basis are excluded from the Carnival Shareholder Benefit offer

- Carnival Shareholder Benefit is non-transferable (i.e., you cannot give your Shareholder Benefit to another cruiser)

- Carnival Shareholder Benefit can not be redeemed for cash and cannot be used for casino credits/charges charged to your onboard account

- You can not use your Carnival Shareholder Benefit to pay for gratuities*

- As with any stock purchase or investment, there is market risk. You could lose money with the investment. Additionally, as you buy/sell stock, there could be tax implications. Nothing on this page should be used to make an investment or tax decision and I retain zero liability for any decisions you may make

*While the official documents state that the Carnival Shareholder Benefit cannot be used to pay gratuities, we’ve not seen this enforced (cruise boards also confirm this). According to the official Carnival Shareholder Benefit Program, the onboard credit cannot be used, however, your mileage may vary.

Carnival Shareholder Benefit Recap Video

Check out our video recap on the benefits of being a Carnival Shareholder. We’re currently working on an updated video for 2024 that includes StockPerks details.

12 thoughts on “2024 Carnival Shareholder Benefit (valid through December 2024)”

Will by pass this “opportunity”. Need to include date of birth, email address, and average annual income. In the next section of an additional site, one needs to identify what investment group the shares are held in, then allow access using your name and password. Did not include this or any other further information. Deleted the origianl application. Contacted Holland America and poke with a surpervisor who informed me, “there is “no other option”. If stockperks not used the share holder will not recieve the on board credit.

Thanks for your comment, Rita. I talk about these very things in the StockPerks Step-By-Step I’m creating!! If you can get past the fact that a 3rd party is asking for your income (which is kind of odd, no?), StockPerks does provide a manual option for providing your statement so you don’t have to give them access to your financial institution:

Automatic broker connection : The app’s recommended option Manual statement upload : the app warns that this takes longer, however, is required if you have an account with Fidelity, Edward Jones, or Ally

I’ll get the one-pager posted hopefully early next week. In there, I give tips and tricks on how to get the benefit without the risk.

I am a stickler for NOT giving out unnecessary information. As Rita stated in her review, it does ask for income – but did not require an answer – so I left it blank. DOB and email address is typical to locate your booking information and send you a reply so no issues there. There was no way I was going to provide my financial log in info but I easily uploaded a recent statement with all the info blocked out, just as I used to do via email to get credit the old way. It was really quick. Only issue I have is having 2 accounts and doing all the work over again for my spouse. Its getting annoying that everyone has their own required app but hopefully this one will pay off with other perks.

Thanks for the tip that “Annual income” is not a required field. I missed that when I first signed up! I’m also glad to hear that the statement upload worked for you without a hitch!

I just posted a complete step-by-step article for those setting up StockPerks for the first time. A post like this would have helped me, so I’m hoping it’ll reduce some pain for others. Enjoy your shareholder benefits!!

We have 250 shares of carnival shares. Who do we send a copy of these too.

That’s awesome; shareholder benefits ahoy! To request your benefit, you’ll need to download the StockPerks app and submit proof of ownership through the app. You can refer to our StockPerks step-by-step job aid that walks you through the process for help.

At this point I’m a pissed off stockholder. OBC is the only benefit of owning CCL, it no longer pays dividends and has languished as a growth stock. I will not allow Stockperks / Carnival to mine my investments for information to sell. The OBC is too minor for the cost of cruising with one of their lines.

Sorry for the frustration with the stock; it’s been a bumpy ride the past couple of years, for sure. While it took a little time to adjust to the new Stockperks process, it’s been pretty smooth now that we’ve got the hang of it. Plus, for us, it’s provided more than $5k in benefit, so it’s a no-brainer investment on our end. Of course, everyone’s experience varies. Best wishes on your portfolio. -Mark

At the risk of “beating a dead horse”, I’d like to add my total agreement with the previous comments regarding dissatisfaction with using the Stockperks app and the information it requires. I didn’t even know I had to do this until I couldn’t figure out why I wasn’t getting any response from Cunard for onboard credit. It does make me question whether there’s a point to continue with Carnival stock.

I guess it all depends: is it worth $100 to go through an extra step of submitting via an app? Back in the day when we had to FAX proof in, I never once missed the opportunity to claim OBC. I’d say faxing was much worse than the new process. I created a Stockperks Job Aid that provides a cruise tip on how to avoid giving Carnival Corp. access to all of your account info. It’s an extra step you need to do once, but hopefully, that reduces some heartburn! -Mark

I received this notice from Stockperks denying my request. Is this noted in the Fine Print & Disclaimers? Unfortunately, your application for onboard credit on your upcoming reservation (Booking #: xxxxx departing on 2024-08-18) has not been approved as it did not meet the Terms & Conditions. Specifically, you are not eligible for the onboard credit because: This booking is a restricted discounted reservation and is not eligible for onboard credit.

Hi Tim! Sadly, the fine print and disclosures state that the Carnival Shareholder Benefit excludes anyone sailing on a reduced-rate or on a complimentary basis. Now, “reduced rate” does not mean when Carnival runs a sale on their website. Instead, it refers to casino offers, travel agent offers, free/significantly discounted sailings, etc.

Hopefully, StockPerks declining your application means you already got an AMAZING deal on the cruise you have booked!! -Mark

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- Premium News

- Biden Economy

- EV Deep Dive

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds

- Top Mutual Funds

- Highest Open Interest

- Highest Implied Volatility

- Stock Comparison

- Advanced Charts

- Currency Converter

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Mutual Funds

- Credit cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Personal Loans

- Student Loans

- Car Insurance

- Morning Brief

- Market Domination

- Market Domination Overtime

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

What's the highest carnival cruise lines stock has ever been, and can it get there again.

Carnival (NYSE: CCL) is firing on all cylinders right now. The business is seeing strong demand and posting record revenue. Shares have soared 45% in the past 12 months, rising faster than the broader S&P 500 .

But this cruise line stock still has a long way to go to generate a positive investment return for some of its longtime shareholders. These investors are likely still very much in the red.

Along the same vein, what's the highest price Carnival shares have ever traded for? And can the stock get to that level again?

Smooth sailing

In January 2018, shares of Carnival established their all-time high price of $66.19. This was a successful investment, as it soared 86% in the five years prior to reaching this milestone.

Of course, this was achieved thanks to impressive financial performance. Between fiscal 2012 and fiscal 2017, diluted earnings per share rose at an annualized pace of 16.5%. Consumers were very much interested in taking cruise ships thanks to the favorable macro backdrop.

Recovery mode

Carnival shares were already in the midst of a major downtrend even before the coronavirus pandemic disrupted everything. In 2020, the business was forced to halt operations, which dried up revenue. Carnival had to raise massive amounts of debt just to stay afloat.

As of this writing, the stock trades 79% below its peak. This is despite the company reporting record sales of $5.4 billion in the three-month period that ended Feb. 29 (Q1 2024).

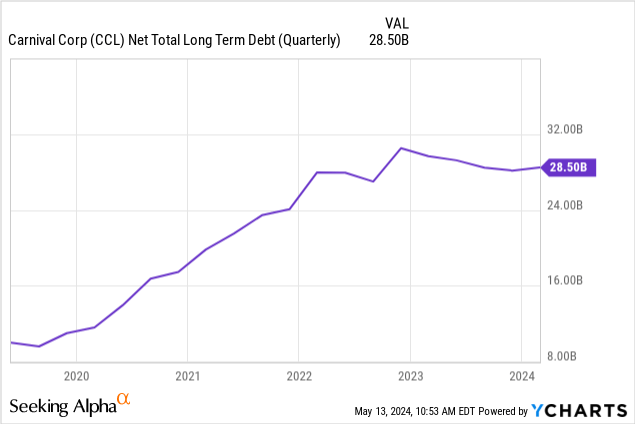

The dip is likely because Carnival is in a troubled financial situation. It has posted a massive cumulative net loss in the past few years, although the business could finally be turning toward consistent profitability in the not-too-distant future. Carnival currently carries $31 billion of debt on the books.

For the stock to get back to its high-water mark, it would need to skyrocket 339%. Never say never, but that seems like a tall order that won't happen for a very long time, if ever.

Should you invest $1,000 in Carnival Corp. right now?

Before you buy stock in Carnival Corp., consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Carnival Corp. wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $566,624 !*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of May 13, 2024

Neil Patel and his clients have no position in any of the stocks mentioned. The Motley Fool recommends Carnival Corp. The Motley Fool has a disclosure policy .

What's the Highest Carnival Cruise Lines Stock Has Ever Been, and Can It Get There Again? was originally published by The Motley Fool

Recommended Stories

3 no-brainer stocks to buy with $50 right now.

These stocks have incredible long-term potential if you can hold tight.

1 Cheap Stock Down 79%: Is It a No-Brainer Buying Opportunity?

In the minds of investors, not all businesses have fully recovered from the pandemic.

Cruise Stocks Rise After Norwegian Boosts Outlook

Cruise operators' shares rose Monday after Norwegian Cruise Line Holdings lifted its full-year outlook, citing seeing strong demand. The company said ahead of an investor day today that it had continued to see strong demand and record bookings so far this year, prompting the company to raise its outlook for adjusted earnings per share to $1.42 from $1.32. The cruise operator said that it was targeting $2.45 in adjusted profit per share by the end of 2026.

Stock market today: Nasdaq composite ticks higher to a record after a quiet day on Wall Street

Most U.S. stock indexes edged higher after a quiet day of mixed trading Monday following their latest winning week. Traders are putting an 88% probability on the Fed cutting its main interest rate at least once this year, according to data from CME Group.

Huge News for Lucid Stock Investors

Lucid stock investors have at least one massive catalyst for growth to look forward to in 2024.

1 Wall Street Analyst Thinks AbbVie Stock Is Going to $200. Is It a Buy at Around $165?

Revenue growth during what should be a disastrous patent cliff is encouraging.

Where Will Alibaba Stock Be in 5 Years?

This probably isn't a great time to bet on China.

Carnival: Set To Cruise Back Up (Rating Upgrade)

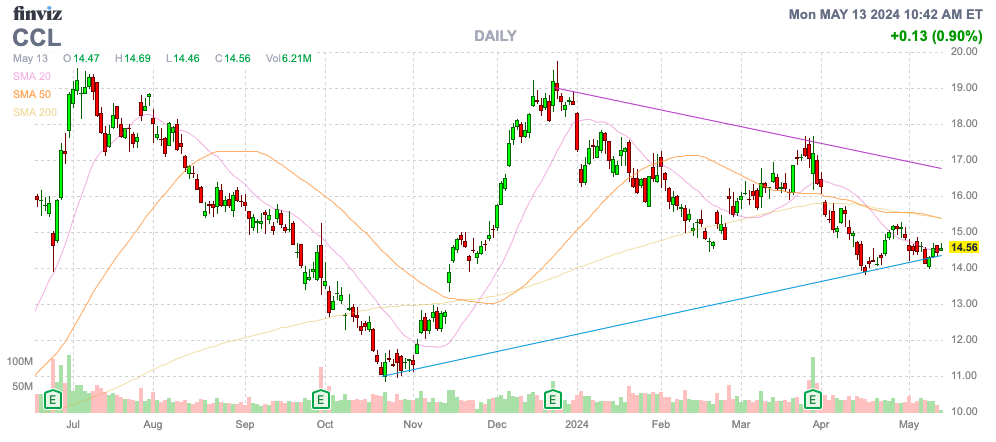

- Carnival Corporation & plc stock has trended down to $14, providing an opportunity for investors to buy back in.

- The upcoming August quarter is expected to bring strong earnings finally for Carnival, with a quarterly profit topping $1 per share.

- Carnival's positive cash flows will help boost profits through debt repayment and cutting interest expenses.

- The stock trades at just 10x FY25 EPS targets, with upside potential from higher sales growth.

- Looking for a portfolio of ideas like this one? Members of Out Fox The Street get exclusive access to our subscriber-only portfolios. Learn More »

robyvannucci/iStock Unreleased via Getty Images

After hitting a double top around $20 at the end of 2023, Carnival Corporation & plc ( NYSE: CCL ) has trended back down, providing the opportunity to get back into the cruise line stock. Carnival is now entering a period of strong earnings and cash flows to reposition the company. My investment thesis is now more Bullish, with the stock back down at $14.

Back To Big Profits

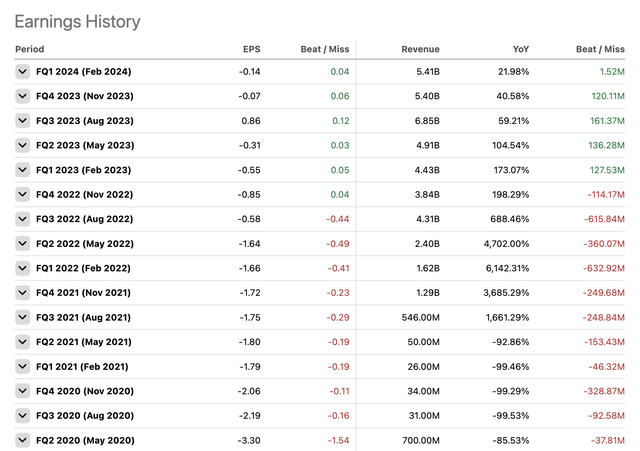

Unlike the other major cruise lines, Carnival hasn't reported massive profits yet. The company reported losses for the last 2 quarters and only has 1 quarterly profit since the Covid shutdown started in early 2020.

Seeking Alpha

The whole investment story changes with the upcoming start of the August quarter. Carnival is set to report a quarterly profit topping $1 per share, and the cruise line might only report another quarterly loss in the seasonally slow February quarter.

As noted in prior research , Carnival crams the best 3 months into the same quarter with June, July, and August reported during the FQ3 quarter while the other cruise lines spread out these months for more consistent quarterly results in the last 3 quarters of the year.

In addition, the cruise line just completed the wave season with record bookings per the CEO on the FQ1 '24 earnings call :

Most important, we achieved all-time high booking volumes at considerably higher prices. In fact, our North American and European brands both set booking records in the first quarter with pricing strong across all core deployments and across all quarters. Prices ran up double-digits on limited inventory left for Q2. They ran considerably higher for our peak summer period in Q3. And they were also considerably higher for Q4 while still building on our occupancy advantage.

Carnival now enters the period where positive cash flows should help boost profits via debt repayment and cutting interest expenses. As an example, the company just redeemed second lien debt at a 9.875% rate after FQ1 '24 generated $1.4 billion in free cash flow on $1.8 billion in operating cash flows from surging advanced sales.

Total customer deposits reached $7.0 billion, up $1.3 billion from the FQ1 '23 level . These advanced sales provide the cruise line with both an indication of the strong demand and cash flows to begin repaying debt.

Paying Down Debt

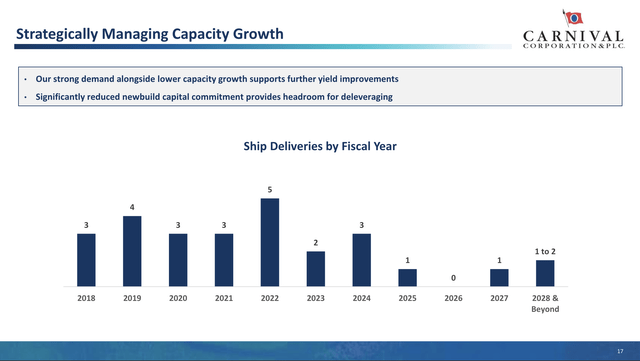

Carnival still has a net debt of $28.5 billion, and the company is entering a phase where new ship deliveries are very minimal. The cruise line has already had 2 ships delivered in FY24, with only 3 more ship deliveries through the end of FY27.

Carnival FQ1'24 Presentation

Capital expenditures are limited to $2.3, $3.0, and $2.4 billion for the next 3 years, respectively. Carnival forecasts $5.63 billion worth of adjusted EBITDA this year, providing the cash flows to slash the debt loads further.

The recent $1.8 billion debt repayment on nearly 10% debt already lowers interest expenses by $180 million annually. Carnival just reported FQ1 results, where net interest expenses dipped to $438 million, down from $483 million from the prior quarter.

The consensus estimates have EPS jumping from $1.00 in FY24 to $1.71 in FY26. Carnival just needs to cut interest expenses in half over the next few years to account for the EPS growth, while the company forecasts higher yields from bookings.

The cruise line still has a long path to investment grade debt, with the company at 5x leverage ratios now. The current bookings situation and demand scenario support Carnival continuing down the path of producing positive cash flows to repay debt and simply boost earnings from cutting interest expenses.

The recent Viking Holdings ( VIK ) IPO possibly placed some pressure on Carnival. The IPO raised $1.5 billion, and Carnival was probably a source of funds for some of the investors.

The key investor takeaway is that Carnival is finally on the footsteps of returning to consistent profits, even in any seasonally tough quarters. The stock becomes a bargain down at $14 with the earnings potential of the cruise line as better operations boost profits and the company simply repaying debt provides an extra boost to earnings.

Investors should use the recent weakness to buy back into Carnival stock.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you'd like to learn more about how to best position yourself in under valued stocks mispriced by the market to start May, consider joining Out Fox The Street .

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.

This article was written by

Stone Fox Capital (aka Mark Holder) is a CPA with degrees in Accounting and Finance. He is also Series 65 licensed and has 30 years of investing experience, including 10 years as a portfolio manager.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

About ccl stock, more on ccl, related stocks, trending analysis, trending news.

What's the Highest Carnival Cruise Lines Stock Has Ever Been, and Can It Get There Again?

Carnival (NYSE: CCL) is firing on all cylinders right now. The business is seeing strong demand and posting record revenue. Shares have soared 45% in the past 12 months, rising faster than the broader S&P 500 .

But this cruise line stock still has a long way to go to generate a positive investment return for some of its longtime shareholders. These investors are likely still very much in the red.

Along the same vein, what's the highest price Carnival shares have ever traded for? And can the stock get to that level again?

Smooth sailing

In January 2018, shares of Carnival established their all-time high price of $66.19. This was a successful investment, as it soared 86% in the five years prior to reaching this milestone.

Of course, this was achieved thanks to impressive financial performance. Between fiscal 2012 and fiscal 2017, diluted earnings per share rose at an annualized pace of 16.5%. Consumers were very much interested in taking cruise ships thanks to the favorable macro backdrop.

Recovery mode

Carnival shares were already in the midst of a major downtrend even before the coronavirus pandemic disrupted everything. In 2020, the business was forced to halt operations, which dried up revenue. Carnival had to raise massive amounts of debt just to stay afloat.

As of this writing, the stock trades 79% below its peak. This is despite the company reporting record sales of $5.4 billion in the three-month period that ended Feb. 29 (Q1 2024).

The dip is likely because Carnival is in a troubled financial situation. It has posted a massive cumulative net loss in the past few years, although the business could finally be turning toward consistent profitability in the not-too-distant future. Carnival currently carries $31 billion of debt on the books.

For the stock to get back to its high-water mark, it would need to skyrocket 339%. Never say never, but that seems like a tall order that won't happen for a very long time, if ever.

Should you invest $1,000 in Carnival Corp. right now?

Before you buy stock in Carnival Corp., consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Carnival Corp. wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $566,624 !*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of May 13, 2024

Neil Patel and his clients have no position in any of the stocks mentioned. The Motley Fool recommends Carnival Corp. The Motley Fool has a disclosure policy .

- Royal Caribbean Cruises-stock

- News for Royal Caribbean Cruises

Wall Street Favorites: 3 Cruise Stocks with Strong Buy Ratings for May 2024

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

Cruising is back in a big way. But you don’t have to enjoy cruising to start looking for cruise stocks to buy. All you have to do is remember a few key statistics from the 2024 State of the Cruise Industry report published by the Cruise Lines Industry Association.

First, after years of struggling to reach 2019 levels, cruise travel in 2023 reached 107% with 31.7 million passengers. And the number of travelers was up in virtually every region. Global cruise capacity is expected to grow by at least 10% in the next five years.

Plus, the core cruise traveler is less than 40 years old, so there’s little danger of consumers getting aged out. 10% to 13% of Millennials and Gen-Z travelers are comfortable traveling alone, which fits other trends in our society.

And when you consider that cruising currently only accounts for about 2% of the travel and tourism sector, there’s plenty of room for growth. So before you finalize those vacation plans (possibly a cruise), you should look at these attractive cruise stocks.

Royal Caribbean (RCL)

Royal Caribbean (NYSE: RCL ) came roaring back to pre-pandemic revenue level and, more importantly, profitability in 2023. Not surprisingly, RCL stock has been up more than 84% in the last 12 months, making it one of the top-performing stocks in its sector and the entire market. And since reporting earnings in late April, Royal Caribbean stock has surpassed pre-pandemic levels.

Also, in that earnings report, the cruise line raised its full-year guidance and reported refinancing $1.25 billion in debt . That should alleviate concerns about the company’s debt-to-equity ratio of 3.54.

Like many cruise lines, Royal Caribbean forecasts strong demand for the remainder of the year. And the company is successfully monetizing those passengers. In the last quarter, it reported a 14% increase in the adjusted gross margin per passenger per cruise day. Plus, 100% of this additional revenue flows to the company’s bottom line.

In addition to that positive news, RCL stock has an attractive valuation of just 12x forward earnings. With the company’s plans to launch four new cruise ships in the next two years, you can see why RCL stock belongs on your list of cruise stocks to buy.

Norwegian Cruise Line Holdings (NCLH)

It took a while, but Norwegian Cruise Line Holdings (NYSE: NCLH ) is finding some smooth sailing. In 2023, the company reported $8.55 billion in revenue , pushing the cruise line’s revenue above 2019. That revenue growth continued in the first quarter of 2024. Norway recorded $2.2 billion in revenue, which was 20% higher year-over-year.

On the earnings front, the news was even better as Norwegian turned a loss of 37 cents per share in the first quarter of 2023 into a 16-cent per share gain. That beat even the bullish expectations for 12 cents per share.

Moving forward. Norwegian expects gross capacity growth to increase at a compound annual growth rate of 6% through 2028. The company also increased its full-year guidance in key areas such as adjusted net income and EBITDA.

However, NCLH stock is down about 9% in the 30 days ending May 15, 2024. This seems to be a bit of an overreaction to the company’s revenue, which, although higher than the prior year, missed analysts’ estimates by 1.99%.

Viking Holdings (VIK)

Viking Holdings (NYSE: VIK ) went public via an initial public offering ( IPO ) on May 1, 2024. The stock debuted at $26.45, now over $28 per share.

Some of that enthusiasm is due to the fact that the IPO market has been dry for the last few years. However, a bigger reason is that Viking Holdings is not a new company. And it’s a company with a history of being profitable as a private company.

The company offers a distinctly premium cruising experience targeted to affluent consumers with features such as no children on board and no on-board casinos. The company also cruises to niche destinations that these consumers will embrace.

There’s a lot to like about VIK stock. However, before you decide if Viking is one of your cruise stocks to buy, you’ll want to pay attention to the company’s first earnings report as a publicly traded company. That will occur on May 29, 2024. If the company delivers revenue and earnings, and more importantly, the forward guidance analysts expect, a $28 price target may be a floor and not a ceiling.

On the date of publication, Chris Markoch did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines .

Chris Markoch is a freelance financial copywriter who has been covering the market for over five years. He has been writing for InvestorPlace since 2019.

More From InvestorPlace

- The #1 AI Investment Might Be This Company You’ve Never Heard Of

- Musk’s “Project Omega” May Be Set to Mint New Millionaires. Here’s How to Get In.

- Legendary Investor Predicts: “Forget A.I. THIS Technology Is the Future”

The post Wall Street Favorites: 3 Cruise Stocks with Strong Buy Ratings for May 2024 appeared first on InvestorPlace .

Royal Caribbean Cruises News MORE

Related stocks.

English (USA)

English (UK)

English (Canada)

English (India)

Deutsch (Deutschland)

Deutsch (Österreich)

Deutsch (Schweiz)

Français (France)

Français (Suisse)

Nederlands (Nederland)

Nederlands (België)

- Top Capitalization

- United States

- North America

- Middle East

- Sector Research

- Earnings Calendar

- Equities Analysis

- Most popular

- NIPPON ACTIVE VALUE FUND PLC

- TESLA, INC.

- KEYWORDS STUDIOS PLC

- MICROSOFT CORPORATION

- AMD (ADVANCED MICRO DEVICES)

- RYANAIR HOLDINGS PLC

- VOLKSWAGEN AG

- Index Analysis

- Indexes News

- EURO STOXX 50

- Currency Cross Rate

- Currency Converter

- Forex Analysis

- Currencies News

- Precious metals

- Agriculture

- Industrial Metals

- Livestock and Cattle

- CRUDE OIL (WTI)

- CRUDE OIL (BRENT)

- Developed Nations

- Emerging Countries

- South America

- Analyst Reco.

- Capital Markets Transactions

- New Contracts

- Profit Warnings

- Appointments

- Press Releases

- Security Transactions

- Earnings reports

- New markets

- New products

- Corporate strategies

- Legal risks

- Share buybacks

- Mergers and acquisitions

- Call Transcripts

- Currency / Forex

- Commodities

- Cryptocurrencies

- Interest Rates

- Asset Management

- Climate and ESG

- Cybersecurity

- Geopolitics

- Central Banks

- Private Equity

- Business Leaders

- All our articles

- Most Read News

- All Analysis

- Satirical Cartoon

- Today's Editorial

- Crypto Recap

- Behind the numbers

- All our investments

- Asia, Pacific

- Virtual Portfolios

- USA Portfolio

- European Portfolio

- Asian Portfolio

- My previous session

- My most visited

- Momentum stocks

- Multibaggers

- Undervalued stocks

- Dividend Kings

- Dividend Aristocrats

- Digital Health and Telemedicine

- Semiconductors

- Powerful brands

- In Vino Veritas

- Unusual volumes

- New Historical Highs

- New Historical Lows

- Top Fundamentals

- Sales growth

- Earnings Growth

- Profitability

- Rankings Valuation

- Enterprise value

- Top Consensus

- Analyst Opinion

- Target price

- Estimates Revisions

- Top ranking ESG

- Environment

- Visibility Ranking

- Stock Screener Home

- Financial Data

- Oversold stocks

- Overbought stocks

- Close to resistance

- Close to support

- Accumulation Phases

- Most volatile stocks

- Top Investor Rating

- Top Trading Rating

- Top Dividends

- Low valuations

- All my stocks

- Stock Screener

- Stock Screener PRO

- Portfolio Creator

- Event Screener

- Dynamic Chart

- Economic Calendar

- Our subscriptions

- Our Stock Picks

- Thematic Investment Lists

Carnival Corporation

Pa1436583006, hotels, motels & cruise lines, carnival & : aida cruises expands its cooperation with kiel-based bicycle manufacturer my boo.

With the purchase of 1000 new bamboo bikes, the cruise company is supporting local value creation and educational projects in Ghana

A bike tour on the Easter Islands or exploring the eternal city of Rome by e-bike: bike excursions are very popular with AIDA guests. Following the successful launch of the collaboration with my Boo in fall 2019, AIDA Cruises is stepping up its commitment and equipping the AIDA fleet with a total of 1092 bamboo bikes from the Kiel-based bicycle manufacturer for the first time this year. It all started with AIDAnova. On April 6, 2024, the biking crew in Hamburg took delivery of 126 new cross bikes and e-bikes. As part of the regular changeover, all other ships in the AIDA fleet will gradually be equipped with bikes from my Boo, with between 84 and 126 e-bikes and cross bikes depending on the ship class.

"Our guests have already had many positive experiences with the bamboo bikes produced for AIDA in Kiel and Ghana. We are delighted to be able to offer excursions with bikes from my Boo on all AIDA ships in the future. By expanding our cooperation, which started already in 2019, we are also supporting the commitment of our partners in Ghana to promote local jobs and sustainable value creation. ", says Frank Bönsch, Vice President Guest Commerce at AIDA Cruises.

Climate-friendly transportation & support for social projects

AIDA currently offers cycling excursions in 241 ports in 93 countries: From Antigua to Cyprus, from A for Aarhus to Z for Zeebrugge, AIDA guests can explore the diverse landscapes and most beautiful cities around the globe by bike and e-bike. By choosing a bicycle as an environmentally friendly mode of transportation during their shore excursions, AIDA guests actively contribute to reducing their personal CO2 footprint.

At the same time, guests are cycling with the bamboo bikes for a good cause: the young Kiel-based business my Boo supports social projects in Ghana with the proceeds. By selling the bikes, the company finances and runs its own school, which currently has more than 500 pupils, and at the same time creates secure and fairly paid jobs. Over 30 young people have already been given a permanent job with prospects.

Further information about the AIDA Cruises excursion program can be found at https://aida.de/erlebnisse/fitness/an-land .

Attachments

- Original Link

Carnival plc published this content on 08 April 2024 and is solely responsible for the information contained therein. Distributed by Public , unedited and unaltered, on 08 April 2024 13:41:06 UTC .

Latest news about Carnival Corporation

Chart carnival corporation.

Company Profile

Income statement evolution, analysis / opinion.

Josh Weinstein, Carnival CEO: China exit, debt reduction, bright outlook

December 29, 2023 at 10:46 am EST

Carnival Corporation : Caught in the middle

Ratings for Carnival Corporation

Analysts' consensus, eps revisions, quarterly earnings - rate of surprise, sector cruise lines.

- Stock Market

- News Carnival Corporation

- Carnival & : AIDA Cruises expands its cooperation with Kiel-based bicycle manufacturer my Boo

IMAGES

VIDEO

COMMENTS

Find the latest Carnival Corporation & plc (CCL) stock quote, history, news and other vital information to help you with your stock trading and investing. ... Costa Cruises, AIDA Cruises, P&O ...

Visit: www.aida.de. Carnival Cruise Line, also known as America's Cruise Line, is a leader in contemporary cruising and operates a fleet of ships designed to provide fun and memorable vacation experiences at a great value. Visit: www.carnival.com. Costa Cruises delivers Italy's finest at sea, bringing modern Italian lifestyle to its ships ...

Financial Performance. In 2023, CCL's revenue was $21.59 billion, an increase of 77.46% compared to the previous year's $12.17 billion. Losses were -$74.00 million, -98.79% less than in 2022.

AIDA Cruises is the market leader in the German-speaking cruise market. Home of the smile, AIDA Cruises is the epitome of a premium-quality, relaxing cruise and operates one of the world's most state-of-the-art fleets. Visit: www.aida.de. Carnival Cruise Line, also known as America's Cruise Line, is a leader in contemporary cruising and ...

Aida Cruises owns and operates cruise lines which serve the German passenger market. Company profile page for Aida Cruises Ltd including stock price, company news, executives, board members, and ...

Costa cruises will begin sailing from Sep 6, while AIDA cruises is scheduled to resume on Nov 1. The brands will begin operation in a gradual, phased-in manner with six initial ships and limited ...

On December 21, 2021, AIDA Cruises took delivery of its newest cruise ship AIDAcosma in Bremerhaven from the Meyer shipyard in Papenburg, Germany. It is the company's second newbuilding powered by liquefied natural gas (LNG) - currently the maritime sector's most advanced technology for reducing emissions.

Carnival Corporation is a leisure travel company. The Company's portfolio of cruise lines, including AIDA Cruises, Carnival Cruise Line, Costa Cruises, Cunard, Holland America Line, P&O Cruises ...

2024 Shareholder Benefit Requirements. In order to qualify for the 2024 Shareholder Benefit Program, you must own at least 100 shares of Carnival Corporation (CCL) stock. As of the time of this writing, that would be an investment of $1,665. Had you purchased the stock at Carnival's 52-week low, it would have only cost you $837.

ROSTOCK, Germany, Aug. 28, 2020 /PRNewswire/ -- AIDA Cruises, the leading cruise line in Germany and a part of Carnival Corporation & plc (NYSE/LSE: CCL; NYSE: CUK), today announced that it will offer cruises this fall and winter that combine the fascination of a cruise trip with an unforgettable holiday experience to several popular destinations.. Due to the coronavirus pandemic, the ...

In 2023, the German market leader for cruises vacation will put another ship of its new generation into service. AIDAnova, the first newbuilt of this ship class, will join AIDA Cruises' fleet this autumn. She will then be followed by the two sister ships of this series in spring of 2021 and in 2023.

Get The Latest CUK Stock Analysis, Price Target, Earnings Estimates, Headlines, and Short Interest at MarketBeat. ... Costa Cruises, AIDA Cruises, P&O Cruises, and Cunard brand. Additionally, it sells its cruises primarily through travel agents, tour operators, vacation planners, and websites. Carnival Corporation & plc was founded in 1972 and ...

This benefit is available to shareholders holding a minimum of 100 shares of Carnival Corporation or Carnival plc. Employees, travel agents cruising at travel agent rates or interline rates, tour conductors or anyone else cruising at a reduced-rate or on complimentary basis are excluded from this offer. This benefit is non-transferable, cannot ...

MIAMI, Sept. 4, 2018 /PRNewswire/ -- Carnival Corporation & plc (NYSE/LSE: CCL; NYSE: CUK), the world's largest leisure travel company, and its AIDA Cruises brand, the leading cruise line in ...

STOCK PERFORMANCE GRAPHS ..... 67 CORPORATE AND OTHER INFORMATION ..... 69. COMPANY Carnival Corporation & plc is the largest global cruise company and among the largest leisure travel ... AIDA CRUISES Shareholder Guest Services Am Strande 3d 18055 Rostock, Germany Tel 49(0) 381 20270805 Fax 49(0) 381 2027 0601 Email: [email protected]

AIDA Cruises is a German cruise line founded in the early 1960s and organized as a wholly owned subsidiary of Costa Crociere S.p.A., which in turn belongs to Carnival Corporation & plc.Based in Rostock, Germany, AIDA Cruises caters primarily to the German-speaking market; as seagoing "club resorts", AIDA ships have on-board amenities and facilities designed to attract younger, more active ...

Carnival (NYSE: CCL) is firing on all cylinders right now. The business is seeing strong demand and posting record revenue. Shares have soared 45% in the past 12 months, rising faster than the ...

The stock becomes a bargain down at $14 with the earnings potential of the cruise line as better operations boost profits and the company simply repaying debt provides an extra boost to earnings.

Thanks to the growing shore power infrastructure in Northern Europe, AIDA Cruises has reached another milestone on its decarbonization path. With AIDAsol, the first cruise ship in the AIDA fleet could already be connected to shore-side facilities in four out of five ports during its voyage from April 16 to 21, 2023, in Rostock-Warnemünde, Aarhus (Denmark), Kristiansand (Norway) and Hamburg.

Before you buy stock in Carnival Corp., consider this: The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Carnival ...

The cruise company left its outlook for capacity unchanged at 105.1% but boosted guidance for net yield as well to 7.2% from about 6.4%. Norwegian stock is currently down some 20% versus its year ...

InvestorPlace - Stock Market News, Stock Advice & Trading Tips. Cruising is back in a big way. But you don't have to enjoy cruising to start looking for cruise stocks to buy. All you have to do ...

Thanks to the opening of further facilities in its European cruise destinations, the company extended the use of shore power to ports in Norway and the UK in 2022. Innovation leader AIDA Cruises has been investing in a future-proof and sustainable cruise market for many years as part of its Green Cruising strategy.

Home of the smile, AIDA Cruises is the epitome of a premium-quality, relaxing cruise and operates one of the world's most state-of-the-art fleets. Visit: www.aida.de Carnival Cruise Line, also known as America's Cruise Line, is a leader in contemporary cruising and operates a fleet of ships designed to provide fun and memorable vacation ...

Carnival Corporation & plc is the largest global cruise company, and among the largest leisure travel companies, with a portfolio of world-class cruise lines - AIDA Cruises, Carnival Cruise Line ...

Carnival Corporation is the world's No. 1 cruise ship line. The group operates Carnival Cruise Line, Holland America Line, Princess Cruises, Seabourn, Cunard, AIDA Cruises, Costa Cruises, P&O Cruises and P&O Cruises Australia. Net sales break down by activity as follows: - sale of cruises (98.8%).

Carnival plc is traded on the London Stock Exchange under the symbol CCL and as an ADS on the New York Stock Exchange under the symbol CUK. Carnival is the only company in the world to be included in both the S&P 500 index in the US and the FTSE 250 index in the UK. ... AIDA Cruises is the market leader in the German-speaking cruise market ...

The stock shot up 5.8% NCLH, +5.30% in morning trading, making it the S&P 500's SPX best performer. The company said it now expects 2024 adjusted earnings per share of $1.42, which compares with ...

lnk Stock. View All. home porthole. Cruising. Investors. Media. Sustainability. Show All. AIDA Cruises is the market leader in the German-speaking cruise market. Home of the smile, AIDA Cruises is the epitome of a premium-quality, relaxing cruise and operates one of the world's most state-of-the-art fleets.

14-Night Land and Cruise Experience Highlights America's Roots with Nation's Capital, Philadelphia, Williamsburg & MoreFT. LAUDERDALE, Fla., May 13, 2024 /PRNewswire/ -- Princess guests discovering the scenic east coast on a 2025 Canada & New England cruise sailing out of New York City can now immerse themselves in historic America as they tour the nation's capital, interact with early ...