UponArriving

American Express Travel Notifications Guide: Are They Needed? [2021]

Offers contained within this article maybe expired.

Before you depart the country you always want to make sure that everything is in order when it comes to your credit cards and debit cards. Nothing is worse that having your transactions denied or your card frozen when you’re trying to make a purchase abroad. And to avoid this, you usually need to place a travel notification on your card.

In this article, I’ll show you whether or not you’ll need to place a travel notification on your American Express credit cards before traveling.

Interested in finding out the hottest travel credit cards for this month? Click here to check them out!

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Table of Contents

Do I need to set American Express travel notifications?

No, you do not need to set up American Express travel notifications before departing the country.

This might sound odd to you but it’s because Amex has their own technology they utilize so that they can tell if your purchases are legitimate or not.

They state :

We use industry-leading fraud detection capabilities that help us recognize when our Card Members are traveling, so you don’t need to notify us before you travel.

One way that the notifications work is when Amex tracks your purchases for travel. So they might see that you’ve made airline ticket or hotel purchases or perhaps they see that you’ve made a purchase at an airport — it’s not clear exactly what types of purchase trigger their anti-fraud detection capabilities.

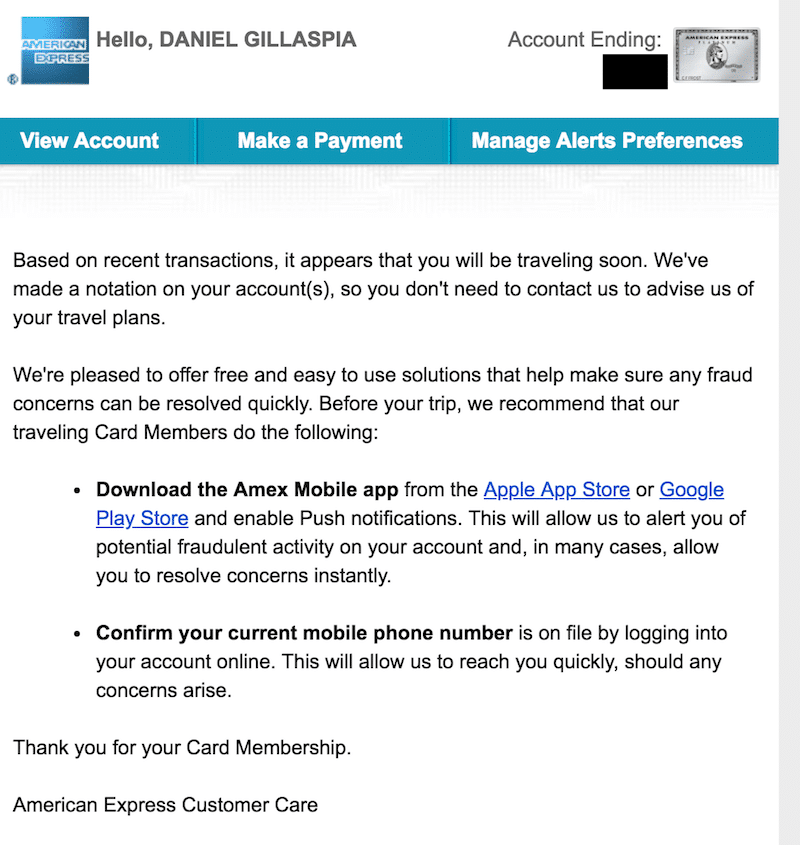

In those cases, you might receive an email like this one I received for my Platinum Card.

Based on recent transactions, it appears that you will be traveling soon. We’ve made a notation on your account(s), so you don’t need to contact us to advise us of your travel plans. We’re pleased to offer free and easy to use solutions that help make sure any fraud concerns can be resolved quickly. Before your trip, we recommend that our traveling Card Members do the following: Download the Amex Mobile app from the Apple App Store or Google Play Store and enable Push notifications. This will allow us to alert you of potential fraudulent activity on your account and, in many cases, allow you to resolve concerns instantly. Confirm your current mobile phone number is on file by logging into your account online. This will allow us to reach you quickly, should any concerns arise. Thank you for your Card Membership. American Express Customer Care

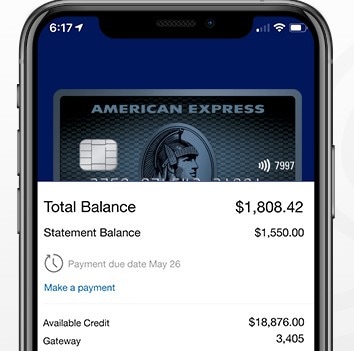

So it would be a good idea for you to download the Amex Mobile App and to monitor your notifications when traveling. That way, you might be able to quickly resolve any notifications about potential fraud. And then you’ll want to make sure that your current mobile phone number is on file and updated so that Amex can reach out to you and quickly resolve any problems.

Does the technology always work?

You might be wondering how Amex will detect that you’re traveling if you don’t use your Amex card to make travel purchases. I’m not sure how they would be able to do that either and so I’d just be on the lookout for notifications from the app about fraud if that’s the case.

I would also have the Amex customer service number saved to my phone. (It’s a good idea to have your credit card information stored somewhere as well.)

Also, I always travel with a Visa and a Mastercard because many vendors and merchants might not accept American Express cards. So it might not even be a potential fraud issue that keeps you from using your Amex card.

Also, one unique consideration to think about with American Express cards is that some of them limit their bonus earning to US establishments.

For example, the Amex Gold Card earns 4X on dining at US restaurants and 4X at US supermarkets. Meanwhile other cards like the Citi Prestige earn 5X on dining on international purchases as well. So with Amex cards, don’t forget that your bonus earnings (and sometimes other perks like Uber credits) don’t work abroad.

Related: Is the Amex International Airline Program Worth It?

You should not have to worry about travel notifications for domestic travel. However, if you are making a large purchase away from your home state you might trigger anti-fraud protection. In that case, you should have the mobile app downloaded so that you can verify your purchase and allow it to go through.

American Express does not allow you to set up travel notifications online.

There are several credit cards issued by American Express that do not charge foreign transaction fees. These include cards like the Amex Gold Card.

If your Amex card does not waive foreign transaction fees, then you will likely be charged 2.7% of your international transactions.

Unlike issuers like Chase where you can log-in and set up travel notifications online for your credit cards or even bank accounts, Amex does not require you to do this and in fact doesn’t even have the option for you to do this online. Instead, they rely on technology to predict if you’re charges abroad are fraudulent or not and then notify if there are any suspicions.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo . He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio .

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Privacy Overview

You are using an outdated browser. Please upgrade your browser to improve your experience.

Card Accounts

Business Owners

Other Accounts

Help & Support

Personal Cards

Popular Personal Cards

Business Cards

Corporate Cards

Online Travel

Travel Resources

Business Travel

Travel Money

All Insurance Services

Travel Insurance

Benefits and Offers

Manage Membership

Corporations

Using your Credit Card overseas

American Express Cards are accepted worldwide and come with an amazing list of travel benefits.

To make your holiday even more relaxing, there are a few things we suggest you do before you go.

Pre-travel checklist

- Check your Card expiry date before you leave, just to make sure it doesn’t expire while you’re overseas.

- Be aware of your Credit Card limit if you plan on spending while you’re away.

- Add your card to your Mobile wallet for convenience and safety as you travel.

- Make note of your insurance company’s phone number and your policy number in case you need to find them.

- To help avoid late payment fees, set up automatic Credit Card payments before you go.

- Don’t forget to check out our destination guides before you set off.

Should I tell American Express I’m travelling?

Thanks to American Express Fraud Protection, you don’t need to let us know when you are travelling overseas. Our robust security systems continually monitor suspicious transactions on your Account that we suspect may be fraudulent. If we detect any suspicious activity, we’ll make every effort to contact you.

Managing your Account on the go

Use the American Express ® Mobile App to manage your Account, view your transaction history, and access AMEX offers any time, any place.

Need an extra Card for your travel partner?

Apply for an Additional Card to share the benefits and convenience of your American Express® Card when you’re travelling with someone. Earn points on your spending (if eligible) and have a back up Card should anything go wrong. 3

Make every trip a rewarding one

Booking your travel

With American Express Travel Book your flight and accommodation with us and you could earn Membership Rewards points. With an airline or hotel partner Your Membership Rewards points can be transferred to book directly with a participating airline or hotel partner 1 .

Complimentary Travel Insurance

Some American Express Cards include complimentary domestic and international Travel Insurance 2 , when you book and pay for your trip with an eligible American Express Card.

Purchase Travel Insurance

We offer Card Members access to a range of insurance policies with optional extras so you can be sure to find the policy that best suits you.

Discover the Card for frequent travellers

The American Express® Platinum Card

- Access to 1,400+ airport lounges in over 650 cities across 140 countries and counting 4

- A $450 Travel Credit each Membership year to use on eligible flights, hotels and car hire with American Express Travel 5

- Transfer points to a choice of 10 major airline reward Partner Programs including Qantas Frequent Flyer and Velocity Frequent Flyer 6

What do you want from a Credit Card?

Everyone’s different, so you need a Credit Card with benefits that best suit your lifestyle. Choose the Credit Card with benefits that best suit you.

Earn Membership Rewards ® points from

everyday spending

Frequent Flyer

Maximise rewards for

Enjoy premium benefits and service

Make living your best life go further

Live life to the fullest with American Express Membership

As an American Express Card Member, you get to enjoy travel benefits that take you further, points that are more rewarding, and services that open more doors around the world.

Want to learn more about Credit Cards?

Maximise your Membership

Make sure you’re making the most of your Card benefits

Your credit limit

Everything you need to know about your Card limit

Manage your Card

We’ve made managing your Card Account easy

Life with Amex

From money-saving ideas to travel inspiration and daily life tips, get inspired to do great things and make your life more rewarding.

Terms and Conditions

1. Transferring Points . Subject to the Terms and Conditions of the Membership Rewards program available at membershiprewards.com.au . You must be a member of the airline or hotel partner program, joining fees may apply and points transferred will be subject to the terms and conditions of the applicable airline or hotel partner program. 2. Travel Insurance . American Express Card Insurances are underwritten by Chubb Insurance Australia Limited (ABN 23 001 642 020, AFSL No. 239687) under a group policy of insurance held by American Express Australia Limited (ABN 92 108 952 085, AFSL No. 291313). Access to this insurance is provided solely by reason of the statutory operation of section 48 of the Insurance Contracts Act 1984 (Cth). Card Members are not a party to the group policy, do not have an agreement with Chubb and cannot vary or cancel the cover. American Express is not the insurer, does not guarantee or hold the rights under the group policy on trust for Card Members and does not act on behalf of Chubb or as its agent. American Express is not an Authorised Representative (under the Corporations Act 2001 (Cth)) of Chubb. 3. Additional Card Members. Must be 16 years of age or over. Please note Additional Cards are referred to as Supplementary Cards in some Terms and Conditions and marketing materials. The basic Card Member will be liable to pay for all spend made by Additional Card Members.

4. The American Express Global Lounge Collection .

- The Centurion ® Lounge : Platinum Card Members have unlimited complimentary access to all locations of The Centurion Lounge. Gold Card and Green Card Additional Cards on your Platinum Account are not eligible for complimentary access. Card Members may bring up to two (2) companions into The Centurion Lounge. Children under 2 years of age can access the lounge free of charge, provided an accompanying parent or guardian is able to produce a “lap infant” boarding pass or proof of age. Guest access policies may vary internationally by location and are subject to change. To access The Centurion Lounge, the Card Member must present The Centurion Lounge agent with the following upon each visit: their valid Card, a boarding pass showing a confirmed reservation for same-day travel on any carrier and a government-issued I.D. Failure to present this documentation may result in access being denied. The Centurion Lounge is a day of departure lounge. Platinum Card Members who have landed will not be able to access the lounge. Card Members with layovers or connecting flights who produce proof can access the lounge. Platinum Card Members cannot access The Centurion Lounge more than 3 hours before the scheduled departure time on their same day, confirmed boarding pass. This does not apply to Card Members with a connecting flight. Card Members will not be compensated for changes in locations, rates or policies. A Card Member must be at least 18 years of age to enter without a parent or legal guardian. For locations with a self-service bar, the Card Member must be of legal drinking age in the location’s jurisdiction to enter without a parent or legal guardian. Must be of legal drinking age to consume alcoholic beverages. Please drink responsibly. American Express reserves the right to remove any person from the Lounge for inappropriate behavior or failure to adhere to rules, including, but not limited to, conduct that is disruptive, abusive or violent. Soliciting other Card Members for access into our lounge is not permissible. Access is subject to space availability. Hours may vary by location and are subject to change. Amenities vary among The Centurion Lounge locations and are subject to change. Services and amenities in the Lounge are complimentary, however you are responsible for any purchases and/or servicing charges you authorize our Member Services Professionals to perform on your behalf. Some American Express Cards are not eligible for all services provided by Member Services Desk. American Express will not be liable for any articles lost or stolen or damages suffered by the purchaser or visitor inside The Centurion Lounge. If we in our sole discretion determine that you have engaged in abuse, misuse, or gaming in connection with lounge access in any way or that you intend to do so, we may remove access to The Centurion Lounge from the Account. Use of The Centurion Lounge is subject to all rules and conditions set by American Express. American Express reserves the right to revise the rules at any time without notice. The Centurion Lounge – Sydney & Melbourne, Australia : Guest access policies for The Centurion Lounges in Sydney and Melbourne, Australia may vary to the Global Lounge Collection terms. For more information on the Australian Lounges access, visit amex.com.au/airportlounge

- Escape Lounges – The Centurion® Studio Partner : This benefit is available to the Platinum Card. Additional Gold Cards and Additional Green Cards on your Platinum Account are not eligible for complimentary access. Card Members receive complimentary access to any US location of the Escape Lounges. Card Member must present their valid Card, a boarding pass showing a confirmed reservation for same-day travel on any carrier and government-issued I.D. In some cases, Card Member must be 21 years of age to enter without a parent or guardian. Card Members may bring up to two companions as complimentary guests. Card Member must adhere to all house rules of participating lounges. Card Members and their guests will receive all of the complimentary benefits and amenities afforded to the Escape Lounge customers, as well as access to purchase non-complimentary items. Some product features may be subject to additional charges. Escape Lounge locations are subject to change.

- Delta Sky Club : The Platinum Card Member must present their valid American Express Card, government-issued I.D., and boarding pass to the Delta Sky Club ambassador. Boarding pass must show a reservation for a same-day Delta-marketed or Delta-operated flight departing from or arriving at the airport in which the Delta Sky Club is located. Name on boarding pass must match name on the Card. Eligible Platinum Card Members on departing flights can only access the Delta Sky Club within 3 hours of their flight's scheduled departure time. During a layover between Delta-marketed or Delta-operated flights on the same ticket, you may use the Delta Sky Club in your connecting airport at any time during the layover. Round-trip same-day travel is not considered a layover. Delta reserves the right to limit access for non-revenue standby fliers at any Delta Sky Club. Additional Gold Cards and Additional Green Cards on your Platinum Card Account are not eligible for complimentary access through The Global Lounge Collection benefit. Access to Delta Sky Club partner lounges is not permitted. Individuals must be at least 18 years of age to access Delta Sky Club, and 21 years of age to access locations with a self-service bar, unless accompanied by a responsible, supervising adult who has access to the lounge. Card Members must adhere to all House Rules of participating clubs. Participating airport clubs and locations subject to change without notice. Additional guest access and fees subject to terms and conditions of participating airport clubs. For the most current Delta Sky Club access and pricing policy, please visit delta.com/skyclub . All Delta Sky Club rules apply to Delta Sky Club membership and use. To review the rules, please visit delta.com/skyclub .

- Plaza Premium Lounges : This benefit is available to Primary, Additional and Employee Platinum Card Members. Additional Gold Cards and Additional Green Cards on your Platinum Account are not eligible for complimentary access. Card Members receive complimentary access to any global location of Plaza Premium Lounges. The Platinum Card Member may bring up to 2 guests into the lounge at no additional cost. All lounge access fees for additional guest visits will be charged directly to the Platinum Card Member’s Card, and at the prevailing retail rate, per person, per visit. Lounge access for infants under two years of age is complimentary. To access the Plaza Premium Lounges, the Platinum Card Member must present their valid Card, a boarding pass showing a confirmed reservation for same-day travel on any carrier and government-issued I.D. Failure to present this documentation may result in access being denied. The Platinum Card Member must be at least 18 years of age to enter without a parent or guardian where there is a self-service bar. In some cases, Card Member must be 21 years of age to enter without a parent or guardian. Plaza Premium Lounge reserves the right to remove any person from a lounge for inappropriate behaviour or failure to adhere to lounge rules, including, but not limited to, conduct that is disruptive, abusive or violent. Access is subject to space availability and is not guaranteed. The full Plaza Premium Lounge Facilities Terms and Conditions are available at plaza-network.com/terms. Facilities, amenities, services and hours of operation may vary among locations and are subject to change. Terms and conditions are subject to change without prior notice.

- Virgin Australia : Access is complimentary for Primary Platinum Card Member and one complimentary guest only. The Primary Platinum Card Member and guest must be travelling with Virgin Australia domestically on the same Virgin Australia flight. Access is to Virgin Australia-branded lounges in Australia only. Name on boarding pass must match the name on Platinum Card and boarding pass must be presented. The Platinum Card Member and guest must present their valid Card and same-day boarding pass (containing your Virgin Australia Velocity Frequent Flyer number and status) to Virgin Australia lounge agents. One guest per Primary Platinum Card Member permitted. All access is subject to space availability. This benefit is subject to change.

- Priority Pass TM : These Terms and Conditions govern American Express Platinum Card Members’ participation in and use of the Priority Pass™ program. Priority Pass is an independent airport lounge access program. Your Priority Pass benefit is limited to airport lounge access only. Non-lounge airport experiences in the form of credits for restaurants, cafes and bars are not available. Primary Platinum Card Members and one nominated Additional Platinum Card Member per Account are eligible for Priority Pass membership. At any visit to a Priority Pass lounge that admits guests, you may bring in 1 guest for no charge. You will be charged the prevailing retail rate for any additional guests. Some lounges do not admit guests. By enrolling in Priority Pass, you agree that you will be responsible for any additional accompanying guest visits and that your Card will be automatically charged after you have signed for the additional guest visit and it has been reported to Priority Pass by the participating lounge. Additionally, you acknowledge and agree that American Express will verify your Card account number and provide updated Card account information to Priority Pass. Priority Pass will use this information to fulfill on the Priority Pass program and may use this information for marketing related to the program. Once enrolled, Platinum Card Members whose Card account is not cancelled may access participating Priority Pass lounges by presenting your Priority Pass card and airline boarding pass. In some lounges, Priority Pass member must be 21 years of age to enter without a parent or guardian. Priority Pass members must adhere to all house rules of participating lounges. Amenities may vary among airport lounge locations. Conference rooms, where available, may be reserved for a fee. Priority Pass lounge partners and locations are subject to change. All Priority Pass members must adhere to the Priority Pass Conditions of Use, which will be sent to you with your membership package, and can be viewed at www.prioritypass.com . Upon receipt of your enrollment information, Priority Pass will send your Priority Pass card and membership package which you should receive within 4-6 weeks.

- Airspace : This benefit is available to the American Express Platinum Card. Additional Gold Cards and Additional Green Cards on your Platinum Card Account are not eligible for complimentary access. Card Member must present their valid Card, government-issued I.D. and confirmed boarding pass for same-day travel. In some cases, Card Member must be 21 years of age to enter without a parent or guardian. The Card Member may bring up to two companions into the club as complimentary guests per visit. Card Member must adhere to all house rules of participating lounges. Card Members and their guests will receive all of the complimentary benefits and amenities afforded to the Airspace Lounge customers, as well as access to purchase non-complimentary items. Some product features may be subject to additional charges. Airspace Lounge locations are subject to change.

- Lufthansa : This benefit is available to the American Express Platinum Card. Additional Gold Cards and Additional Green Cards on your Platinum Card Account are not eligible for complimentary access. Platinum Card Members have complimentary access to select Lufthansa Business Lounges (regardless of ticket class) and Lufthansa Senator Lounges (when flying business class). To access the Lufthansa lounges, Platinum Card Members must present a government issued I.D., a same-day departure boarding pass showing confirmed reservation on a Lufthansa Group flight (Lufthansa, SWISS and Austrian airlines) and a valid Platinum Card. For the current list of participating lounges and access requirements, please use the Lounge Finder feature in the American Express App or visit http://www.americanexpress.co.nz/platinumlounges . Card Members must adhere to all rules of participating lounges. Participating lounges and locations subject to change without notice. Additional guest access and fees subject to terms and conditions of participating lounges. In some Lounges the Platinum Card Member must be at least 18 years of age to enter without a parent or guardian. Must be of legal drinking age to consume alcoholic beverages. Please drink responsibly. For the most current Lufthansa rules and guest access and pricing policy, please visit https://www.lufthansa.com/de/en/lounges .

- Additional Global Lounge Collection Partner Lounges : American Express offers access to additional lounges in the Global Lounge Collection where Platinum Card Members have unlimited complimentary access to participating locations. Card Members must present their valid Platinum Card, a government-issued I.D., and a boarding pass showing a confirmed reservation for same-day travel on any carrier. Guest access and associated fees are subject to the terms and conditions of the participating lounge provider. Participation, locations, rates, and policies of lounges are subject to change without notice, and Card Members and their guests will not be compensated for such changes. Access is subject to space availability, including capacity restrictions and limited hours that may be placed on the participating lounge. Amenities, services, and hours may vary by participating lounge and are subject to change without notice. American Express will not be liable for any articles lost or stolen, or damages suffered by the Card Member or guests inside the participating lounge. For participating lounges with a self-service bar, the Card Member may be required to be of legal drinking age in the participating lounge jurisdiction to enter without a parent or legal guardian. All Card Members and their guests must be of legal drinking age to consume alcoholic beverages. Please drink responsibly. Each participating lounge may have their own policy allowing for children under a certain age to enter for free with the Card Member who is a parent or legal guardian. Card Member must adhere to all house rules of participating lounges. Participating lounges reserve the right to remove any person from the premises for inappropriate behavior or failure to adhere to rules, including, but not limited to, conduct that is disruptive, abusive, or violent. If American Express, in our sole discretion, determines that the Card Member or their guests have engaged in abuse, misuse, or gaming in connection with access to participating lounges in any way, or that the Card Member or their guests intend to do so, we may remove access to the Additional Lounges from the Account. American Express and the participating lounge reserve the right to revise the rules at any time without notice. For the most current list of participating lounges and access requirements, please use the Lounge Finder feature in the American Express App or visit http://www.americanexpress.com/au/platinumlounges .

5. Platinum Travel Credit . If your Card has a Travel Credit benefit, the Primary Card Member is eligible for an annual Travel Credit, subject to Travel Credit Terms and Conditions at americanexpress.com.au/platinumtravelcreditterms . The Travel Credit can be redeemed through American Express Travel Online on a single eligible travel booking by selecting the Travel Credit when you checkout. To redeem the Travel Credit, the full value of the Travel Credit (or more) must be charged to the eligible Primary Card. Eligible travel includes flights, hotels and car hire when you prepay in advance. The Travel Credit can be used for 365 days from the benefit anniversary date and cannot be used past the expiration date. To check the expiration date of your Travel Credit if you have not already redeemed it, please visit americanexpress.com.au/travel; log in and click ‘Travel Credit’. If your booking is cancelled, and your Travel Credit has already been used and associated statement credit applied to your account, you will forfeit your annual Travel Credit benefit and American Express may reverse the statement credits issued. You need to be able to spend on the Card to access the Travel Credit benefit and it should be credited to your Card Account within 3 business days but may take up to 30 days. Your account must be in good standing and you must have paid the annual fee and minimum payment by the due date. If you cancel your Card, change your rewards program or Card type, you will no longer be eligible for the Travel Credit.

6. Partner Programs . Subject to the Terms and Conditions of the Membership Rewards program available here . To transfer Membership Rewards points into an airline rewards or frequent guest partner program you must be a member of the partner program. Membership of the partner program is the Card Member's responsibility and is subject to the Terms and Conditions of the applicable program. A joining fee may apply.

When you’re away travelling it’s great to know, if you ever need us we’re just a phone call away. What’s more, thanks to your American Express Card, you could benefit from great benefits and rewards that will make your trip even more memorable.

How do you get in touch while you’re overseas?

No matter where you are in the world, we’ll be here when you need us 24/7. If your Card is lost or stolen, we'll make it easy for you to report it – and get it replaced as soon as possible. You'll get a new Card, usually within 48 hours. From Australia call: 1300 132 639 . From overseas call: +612 9271 8664 .

What are currency conversion fees?

American Express charges a currency conversion fee 1 of 3% of the converted amount of the transaction for each foreign currency purchase you make. So remember to factor these fees into your budget.

Shop with confidence

Card Purchase Cover

We know how frustrating it is to buy something, then have it stolen or damaged. That’s why, if you pay for your items on your eligible American Express Card, we’ll cover the repair or refund within 90 days of purchase 2 .

Fraud Protection

Enjoy peace of mind wherever you use your Card. Our Fraud Protection Guarantee covers you for unauthorised charges online, provided you notify us immediately if you suspect any fraudulent activity on your Account 3 .

Understanding your Membership benefits

Depending on the Card you hold, you could enjoy travel benefits such as complimentary travel insurance and airport lounge access to make your travel experience more enjoyable.

Use the American Express ® Mobile App to manage your Account, view your transaction history, or access AMEX offers any time, at any place.

Make your travel time even more rewarding

Airport lounge access

American Express ® Platinum Card Members receive complimentary access to over 1,300 airport lounges around the world with Priority Pass™ 4 .

Exclusive Global Dining Program

Taste , the Global Dining Program for American Express Card Members, gives tips and special offers on the best local restaurants.

Earn points as you travel

Let one holiday lead to the next and earn points for your next trip when you spend on your eligible American Express Card while travelling.

Our featured Frequent Flyer Credit Cards

The qantas american express ultimate card.

Receive a $450 Qantas Travel Credit each Membership year 5 Enjoy two Qantas Club lounge invitations each year after your first spend on selected Qantas Products and Services 6 and two entries to The Centurion ® Lounge each calendar year 7 Enjoy complimentary domestic and international travel insurance 8 when you book and pay for your trip with your Card

The American Express Velocity Platinum Credit Card

Receive a complimentary Virgin Australia return Economy domestic flight 9 Enjoy two complimentary Virgin Australia Lounge passes each Membership year 10 and two entries to The Centurion ® Lounge each calendar year 7 Enjoy complimentary domestic and domestic travel insurance 11 when you book and pay for your trip with your Card

As an American Express Card Member, you get to enjoy travel benefits that take you further, points that are more rewarding and services that open more doors around the world.

Maximise your Membership Make sure you’re making the most of your Card benefits

Your credit limit Everything you need to know about your Card limit

Manage your Account We’ve made managing your Account easy

HELLO POSSIBLE

1. Currency Conversion Fees . If you make a charge in a currency other than Australian dollars, that charge will be converted into Australian dollars. The conversion will take place on the date the charge is processed by us, which may not be the same date you make the charge. If the charge is in U.S. dollars, it will be converted directly into Australian dollars. In all other cases, it will first be converted into U.S. dollars and then into Australian dollars. However, you will only be charged one currency conversion fee. Unless a specific rate is required by law, conversion rates will be used based on interbank rates selected from customary industry sources on the business day prior to the processing date. If charges are converted by third parties prior to being submitted to us, any conversions made by those third parties will be at rates and may include a fee selected by them. 2. Card Purchase Cover . American Express Card Insurances are underwritten by Chubb Insurance Australia Limited (ABN 23 001 642 020, AFSL No. 239687) under a group policy of insurance held by American Express Australia Limited (ABN 92 108 952 085, AFSL No. 291313). Access to this insurance is provided solely by reason of the statutory operation of section 48 of the Insurance Contracts Act 1984 (Cth). Card Members are not a party to the group policy, do not have an agreement with Chubb and cannot vary or cancel the cover. American Express is not the insurer, does not guarantee or hold the rights under the group policy on trust for Card Members and does not act on behalf of Chubb or as its agent. American Express is not an Authorised Representative (under the Corporations Act 2001 (Cth)) of Chubb. 3. Fraud Protection . Provided that you notify us immediately of any fraudulent transactions and you have complied with your Card Conditions, you will not be held liable for any unauthorised charges 4. Priority Pass TM .These Terms and Conditions govern American Express Platinum Card Members’ participation in and use of the Priority Pass™ program. Priority Pass is an independent airport lounge access program. Your Priority Pass benefit is limited to airport lounge access only. Non-lounge airport experiences in the form of credits for restaurants, cafes and bars are not available. Primary Platinum Card Members and one nominated Additional Platinum Card Member per Account are eligible for Priority Pass membership. At any visit to a Priority Pass lounge that admits guests, you may bring in 1 guest for no charge. You will be charged the prevailing retail rate for any additional guests. Some lounges do not admit guests. By enrolling in Priority Pass, you agree that you will be responsible for any additional accompanying guest visits and that your Card will be automatically charged after you have signed for the additional guest visit and it has been reported to Priority Pass by the participating lounge. Additionally, you acknowledge and agree that American Express will verify your Card account number and provide updated Card account information to Priority Pass. Priority Pass will use this information to fulfill on the Priority Pass program and may use this information for marketing related to the program. Once enrolled, Platinum Card Members whose Card account is not cancelled may access participating Priority Pass lounges by presenting your Priority Pass card and airline boarding pass. In some lounges, Priority Pass member must be 21 years of age to enter without a parent or guardian. Priority Pass members must adhere to all house rules of participating lounges. Amenities may vary among airport lounge locations. Conference rooms, where available, may be reserved for a fee. Priority Pass lounge partners and locations are subject to change. All Priority Pass members must adhere to the Priority Pass Conditions of Use, which will be sent to you with your membership package, and can be viewed at www.prioritypass.com . Upon receipt of your enrollment information, Priority Pass will send your Priority Pass card and membership package which you should receive within 4-6 weeks.

5. Qantas Ultimate Travel Credit . Qantas American Express Ultimate Primary Card Members are eligible for an annual $450 Qantas Travel Credit, subject to Qantas Travel Credit Terms and Conditions available at amex.com.au/qantasultimate-travelcreditterms . The Qantas Travel Credit can be redeemed through American Express Travel Online on a single eligible travel booking for Qantas Flights (i.e. a QF flight number on your ticket) by selecting the Qantas Travel Credit when you checkout. All Qantas Flight travel is subject to Qantas Conditions of Carriage . To redeem the Travel Credit, the full value of the Travel Credit (or more) must be charged to the eligible Primary Card. The Qantas Travel Credit can be used for 365 days from the benefit anniversary date and cannot be used past the expiration date. To check the expiration date of your Qantas Travel Credit if you have not already redeemed it, please visit americanexpress.com.au/travel; log in and click ‘Travel Credit’. If your booking is cancelled, and your Qantas Travel Credit has already been used and associated statement credit applied to your account, you will forfeit your annual Qantas Travel Credit benefit and American Express may reverse the statement credits issued. You need to be able to spend on the Card to access the Qantas Travel Credit benefit and it should be credited to your Card Account within 3 business days but may take up to 30 days. Your account must be in good standing and you must have paid the annual fee and minimum payment by the due date. If you cancel your Card, change your rewards program or Card type, you will no longer be eligible for the Qantas Travel Credit. 6. Qantas Ultimate Club Lounge . Provided you are a Qantas Frequent Flyer and have registered your Qantas Frequent Flyer number with your Qantas American Express Ultimate Card, you are eligible to receive two Qantas Club Lounge Invitations each anniversary year of your Card Membership after purchasing on selected Qantas products and services using your Qantas American Express Ultimate Card. Selected Qantas products and services are Qantas passenger flights with a QF flight number purchased directly from Qantas.com.au ; Qantas Frequent Flyer and Qantas Club membership joining and/or annual fees. Subject to Qantas American Express Card Points Terms and Conditions . Subject to the Qantas American Express Card Points Terms and Conditions . Within 1-2 weeks of purchasing selected Qantas products and services, two Qantas Club Lounge Invitations will be assigned to your Qantas Frequent Flyer account. Visit the Complimentary Invitations Portal to access your invitation, link it with an eligible Qantas flight booking or find out more information. Qantas Club Lounge Invitations are valid for a single visit by one guest to a Qantas Club Lounge and must be used prior to their expiry. Invitations are subject to the Qantas Club Terms and Conditions and are not valid for Qantas International First Class Lounges, the Qantas Chairman’s Lounge, Qantas Domestic Business and or oneworld® alliance partner or associated lounges. Qantas Club Invitations cannot be carried forward to any subsequent year and must not be sold, they may only be transferred as allowed by Qantas. Invitations may be revoked or withheld if your Qantas American Express Ultimate Card account is not in good standing, if the selected Qantas products and services are refunded in full or if you have not complied with these Qantas Club Invitation Conditions, the Credit Card Terms and Conditions or the Qantas Club Lounge Access Terms and Conditions. 7. The Centurion ® Lounge. Entry into The Centurion ® Lounge is governed by the full Terms and Conditions available at amex.com.au/airportlounge . All entrants must adhere to the General Conditions of Entry. Qantas American Express Ultimate and American Express Velocity Platinum Card Members are entitled to a total of two (2) entries into The Centurion® Lounges in Australia per calendar year (1 January to 31 December). Complimentary access is available for the Card Member’s children 17 years and younger. Card Members wishing to bring additional guests may be subject to a charge that is to be processed on the Card Member's American Express Card.

8. Qantas Ultimate Card Insurance . The insurance on American Express Cards is subject to terms, conditions and exclusions (such as maximum age limits, pre-existing medical conditions and cover limits). You must use your American Express Qantas Ultimate Credit Card to pay for your trip in order to be covered under the travel insurance and pay for eligible items for those items to be covered under the retail insurance benefits. It is important you read the American Express Qantas Ultimate Credit Card Insurance Terms and Conditions and consider whether the insurance is right for you. We do not provide advice about the insurance or whether it is appropriate for your objectives, financial situation or needs. This insurance is underwritten by Chubb Insurance Australia Limited (ABN 23 001 642 020, AFSL No. 239687) under a group policy of insurance held by American Express Australia Limited (ABN 92 108 952 085, AFSL No. 291313). Access to this insurance is provided solely by reason of the statutory operation of section 48 of the Insurance Contracts Act 1984 (Cth). Card Members are not a party to the group policy, do not have an agreement with Chubb and cannot vary or cancel the cover. American Express is not the insurer, does not guarantee or hold the rights under the group policy on trust for Card Members and does not act on behalf of Chubb or as its agent. American Express is not an Authorised Representative (under the Corporations Act 2001 (Cth)) of Chubb.

9. Virgin Complimentary Flight. The complimentary domestic economy Virgin Australia return flight is only available between selected Australian cities and is available for booking by American Express Velocity Platinum Card Members after your first Card spend in the first year, and then after your first Card spend each year after the anniversary of your Membership. All flights are subject to availability and neither Virgin Australia nor American Express guarantees that seats or tickets will be available on the dates or at the times you may wish to fly. Seat availability may be limited to certain dates and/or flights and it may be more difficult to book seats around public holidays, school holidays or special events. Some flights may not have any seats available for redemption. Route availability is subject to change without notice. All travel is subject to the American Express Velocity Platinum Card Benefits Terms and Conditions available here and travel is subject to Virgin Australia Conditions of Carriage available at virginaustralia.com.

10. Virgin Australia Lounge. Two Single Entry passes to the Virgin Australia lounge will be activated on the Primary Card Member's Velocity Membership Card annually on or after each annual Card fee renewal date. Virgin Australia lounge entry passes are subject to the American Express Velocity Platinum Card Benefits Terms and Conditions . Single entry passes are valid for 12 months from the date of issue. The Virgin Australia Lounge is operated by Virgin Australia Airlines Pty Ltd in selected domestic airports in accordance with the Virgin Australia Lounge Terms and Conditions , and Lounge Rules as amended from time to time. Visit the Virgin Australia website for up-to-date information on Virgin Australia’s Lounge network.

11. American Express Velocity Platinum Card Insurance. The insurance on American Express Cards is subject to terms, conditions and exclusions (such as maximum age limits, pre-existing medical conditions and cover limits). You must use your American Express Velocity Platinum Credit Card to pay for your trip in order to be covered under the travel insurance and pay for eligible items for those items to be covered under the retail insurance benefits. It is important you read the American Express Velocity Platinum Credit Card Insurance Terms and Conditions and consider whether the insurance is right for you. We do not provide advice about the insurance or whether it is appropriate for your objectives, financial situation or needs. This insurance is underwritten by Chubb Insurance Australia Limited (ABN 23 001 642 020, AFSL No. 239687) under a group policy of insurance held by American Express Australia Limited (ABN 92 108 952 085, AFSL No. 291313). Access to this insurance is provided solely by reason of the statutory operation of section 48 of the Insurance Contracts Act 1984 (Cth). Card Members are not a party to the group policy, do not have an agreement with Chubb and cannot vary or cancel the cover. American Express is not the insurer, does not guarantee or hold the rights under the group policy on trust for Card Members and does not act on behalf of Chubb or as its agent. American Express is not an Authorised Representative (under the Corporations Act 2001 (Cth)) of Chubb.

Everything you need to know about Amex Travel

The American Express Travel portal allows you to redeem Membership Rewards points directly for travel reservations and activities rather than transfer your rewards to airline or hotel partners like Delta Air Lines SkyMiles and Marriott Bonvoy .

You also can book discounted premium tickets, use benefits like a 35% points rebate on certain bookings and even book premium hotels with additional perks through Amex Travel.

Let's explore this booking portal to uncover all its benefits and potential disadvantages.

What is the American Express Travel portal?

Amex Travel is the booking portal for most American Express cards . You can book flights, hotels, rental cars and cruises through the site, and you can pay with points, cash or a combination of the two.

How to book flights on the Amex Travel portal

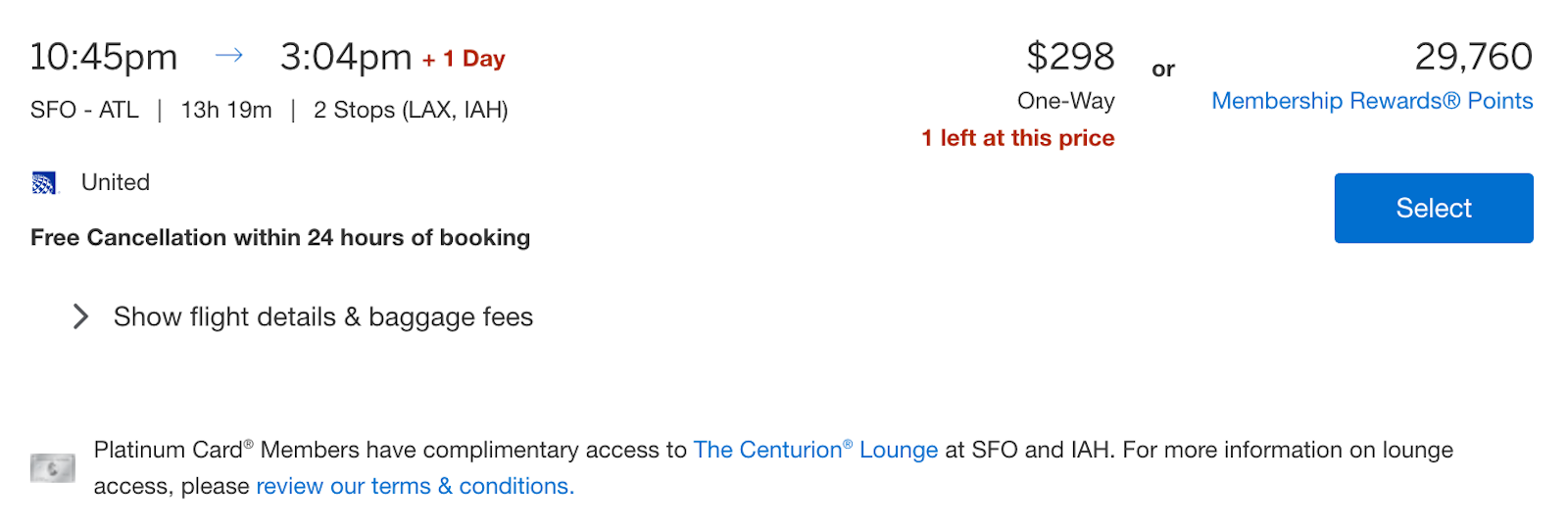

To find flights on American Express Travel, visit this webpage . The flight booking process on the Amex Travel portal is similar to other popular sites like Kayak and Orbitz. You'll find a search box where you can enter your departure and destination cities.

If you're flexible with your departure airport, you can choose an entire city, such as New York, which has multiple airports. Additionally, you can customize your booking by selecting your preferred class and the number of travelers, and choosing between one-way and round-trip flights.

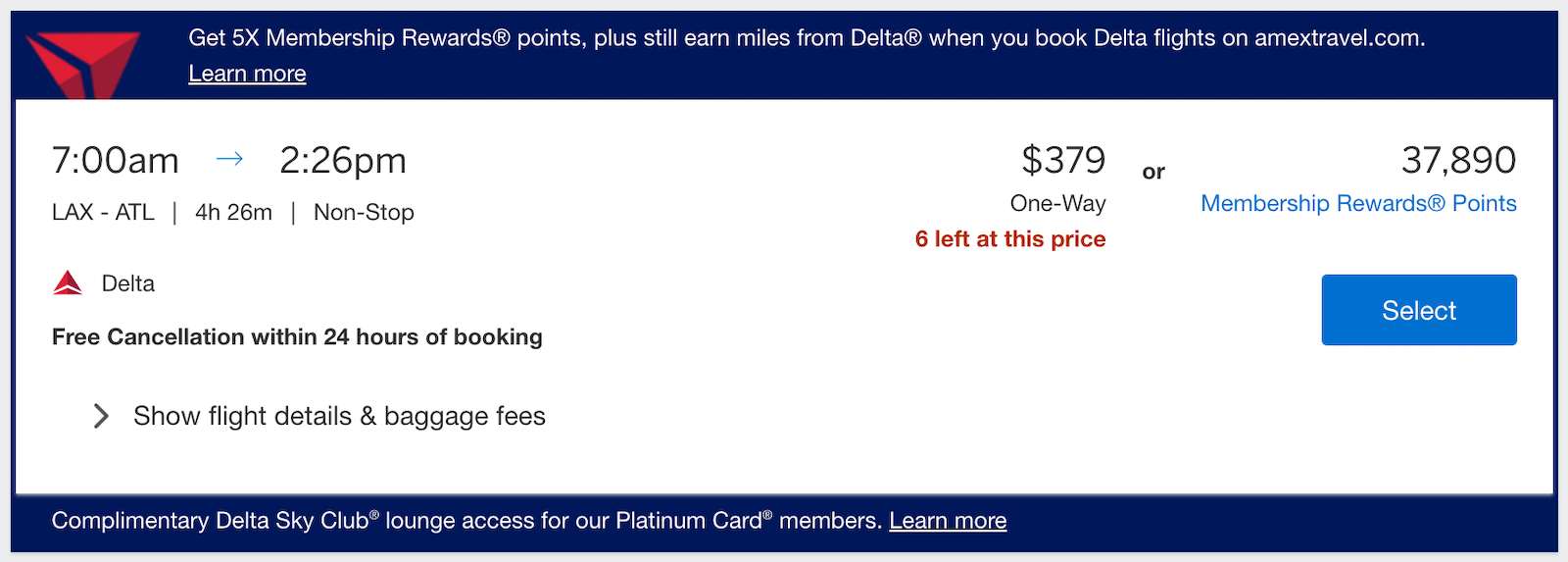

You'll see the price listed in dollars and the number of Amex Membership Rewards points during the booking process.

You can also use the options on the left-hand side to filter flights by number of stops, departure and arrival times, flight duration and airline.

Delta Air Lines is a featured airline in the Amex Travel portal. Sometimes, Delta flights appear at the top of your results, listed as "recommended," but this doesn't mean those flights are always the cheapest.

Additionally, if you have The Platinum Card® from American Express or The Business Platinum Card® from American Express and are flying from an airport with a Centurion Lounge , you'll see an indicator that a lounge is available.

Points vs. cash

When paying for your flights on Amex Travel, several American Express cards offer elevated earning rates:

You can also pay with Amex Membership Rewards points to cover the cost of your flight.

You'll see the number of points required next to the cash price of a flight. You can expect a value of 1 cent per point when using Pay with Points . However, TPG values Membership Rewards points at 2 cents apiece when you maximize Amex's transfer partners.

Related: How to redeem American Express Membership Rewards for maximum value

It's important to compare the number of points required for bookings on Amex Travel with the points you'd need to transfer to an airline program . If you can't book a flight through transfer partners and prefer to use your points, Amex Travel remains an option.

There's an additional benefit for Amex Business Platinum cardmembers: You can get 35% of your points back when paying with points on Amex Travel. This applies to first- and business-class flights on any airline plus tickets in any class on your preferred airline (the same one used for your airline incidental credits ; enrollment is required in advance). This 35% points rebate can provide a value of 1.54 cents per point, which may influence your decision to pay with cash or points.

Similarly, the Business Centurion® Card from American Express offers a 50% Pay with Points rebate on eligible flights. Note that Centurion cards are available by invitation only.

The information for the Business Centurion Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

More details about flights through Amex Travel

During the payment process, you can use points, your credit card or a combination of both. The minimum number of points you can use is 5,000, and each point is valued at 1 cent.

You can upgrade your flights using cash or points in the Amex Travel portal. This generally gives you a return of 1 cent each, and you can book using your Amex card, points or a combination of both.

During your flight search, you might come across "Insider Fares" that offer a discounted price. But to benefit from the discount, you must redeem points to cover the full fare amount.

Amex Platinum and Amex Business Platinum cardmembers have another benefit: discounted premium tickets through Amex Travel's International Airline Program . This program offers discounts on first-class, business-class and premium economy tickets from over 20 participating airlines.

To book a premium ticket using the IAP, go to the Amex Travel portal and pay with cash or points, including the Business Platinum card's 35% airline rebate. Keep in mind that not all flights are eligible and there are restrictions:

- The cardmember must travel on the itinerary.

- A maximum of eight tickets can be booked per itinerary; travel must begin and end in the U.S. or Canadian international airports.

- Tickets are nonrefundable unless stated otherwise.

- Name changes for passengers are not allowed.

Finally, note that flights booked through Amex Travel are typically treated as normal paid tickets, meaning you're eligible to earn points or miles with participating airline loyalty programs.

Related: Why I love the Amex Business Platinum's Pay with Points perk

How to book hotels on the Amex Travel portal

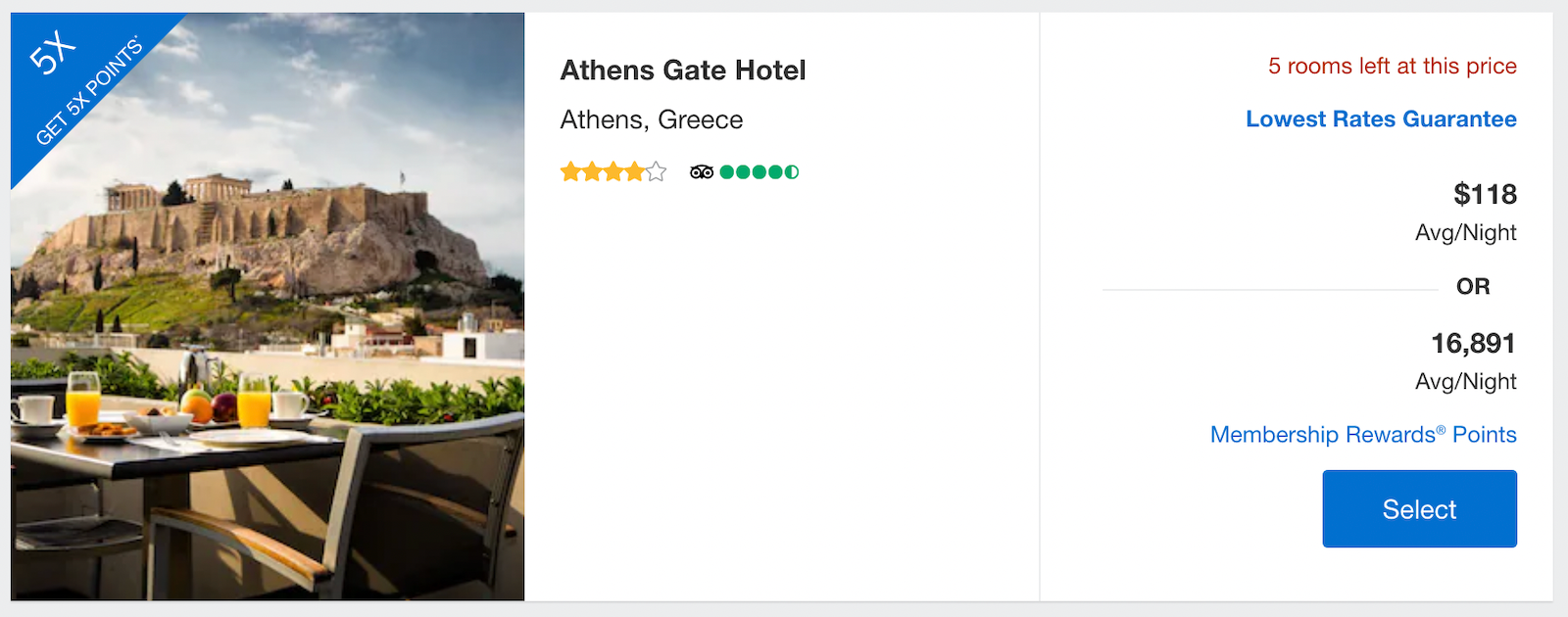

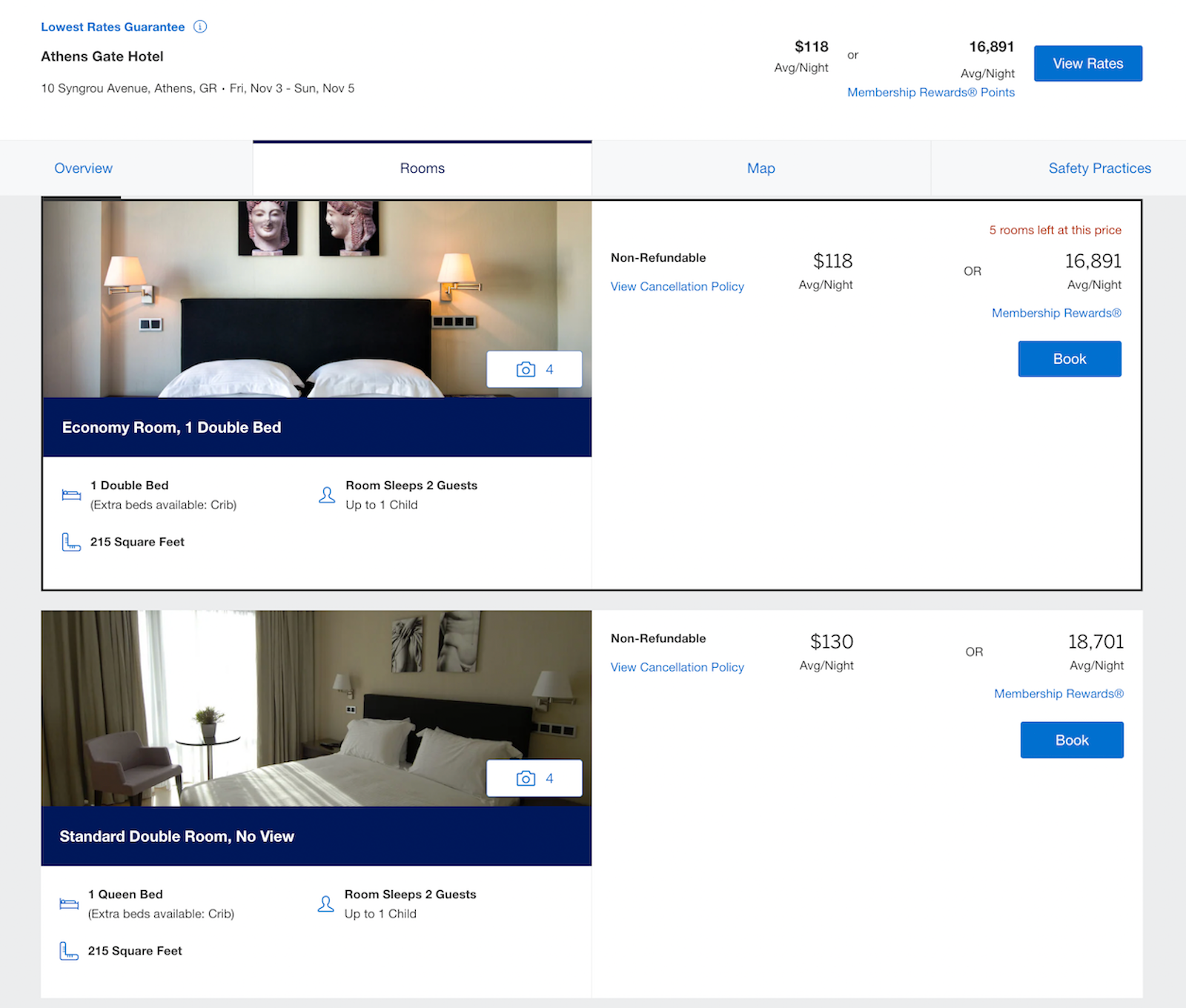

You can book hotels through American Express Travel with a Gold, Platinum or Centurion card. As with other travel portals, you can input your destination, dates, number of rooms and number of guests (with separate input fields for adults and children).

Platinum and Business Platinum cardmembers earn 5 points per dollar on prepaid hotel reservations.

After selecting your hotel, you'll choose your preferred room and pay with points or cash. If you pay with points, you'll only get a value of 0.7 cents per point (compared to 1 cent when you book flights).

Note that these are considered third-party bookings, so you likely won't earn hotel points or elite credits for your stay . While there are reports of people receiving stay credits with Marriott Bonvoy or Hilton Honors on rooms booked through Amex Travel, the hotel is not guaranteed to recognize your elite status in these programs or provide status-qualifying stay credits.

Related: 9 things to consider when choosing to book via a portal vs. booking directly

Amex Fine Hotels + Resorts

Platinum and Centurion cardholders also have access to the Fine Hotels + Resorts program through Amex Travel. This can add some great benefits to your hotel stays — and may not cost much more than booking directly with the hotel.

Here are the perks you'll receive with every FHR booking, regardless of the length of your stay:

- Room upgrade upon arrival (when available): Some room types may be excluded, but you could receive an upgrade to preferred rooms with better views or a better location in the hotel.

- Daily breakfast for two people: The provided breakfast must be, at a minimum, a continental breakfast.

- Guaranteed 4 p.m. late checkout

- Noon check-in when available

- Complimentary Wi-Fi

- Unique property amenity: The amenity varies by hotel but should be valued at $100 or more and usually consists of a property credit, dining credit, spa credit, private airport transfer or similar amenity.

You'll need to book these stays through Amex Travel, but note that FHR is considered a separate program from Amex Travel.

In addition, if you have the personal Amex Platinum , you can also get up to $200 in statement credits every year for prepaid reservations through Fine Hotels + Resorts or The Hotel Collection — which we'll discuss next. Enrollment is required.

Related: A comparison of luxury hotel programs from credit card issuers: Amex, Capital One, Chase and Citi

The Hotel Collection

A lesser-known American Express benefit is The Hotel Collection , which allows you to book in cash or with points. Those with Amex Gold, Platinum and Centurion cards have access to this program, which offers the following benefits:

- A room upgrade at check-in (if available)

- $100 on-property credit for qualifying dining, spa and resort activities

Note that The Hotel Collection bookings require a minimum stay of two nights, though they too are eligible for the $200 hotel credit on the Amex Platinum.

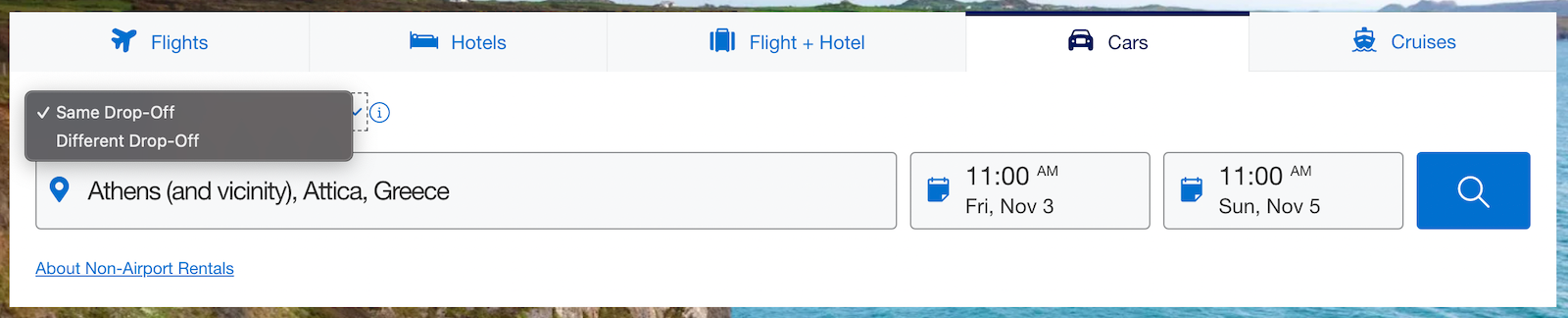

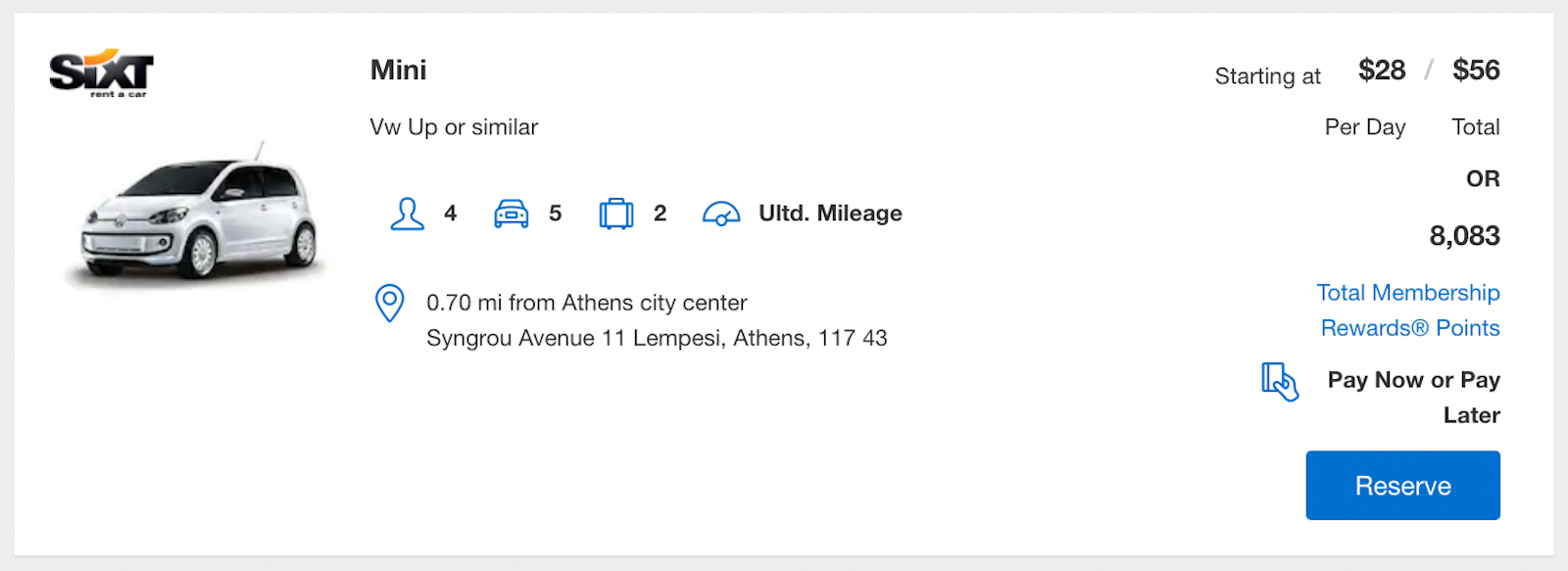

How to book rental cars and cruises on the Amex Travel portal

Reserving a car in the Amex portal is relatively simple. You'll input your pickup and drop-off times and location.

You'll see rental car prices listed in cash and points. When using Pay with Points , your points are worth 0.7 cents — just over a third of TPG's valuation of Amex Membership Rewards points.

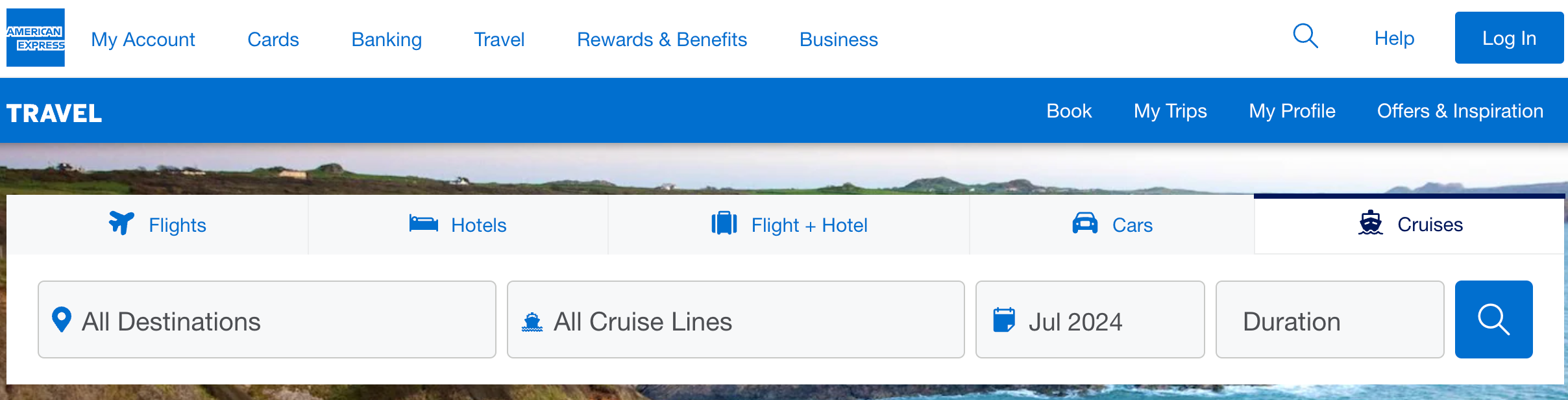

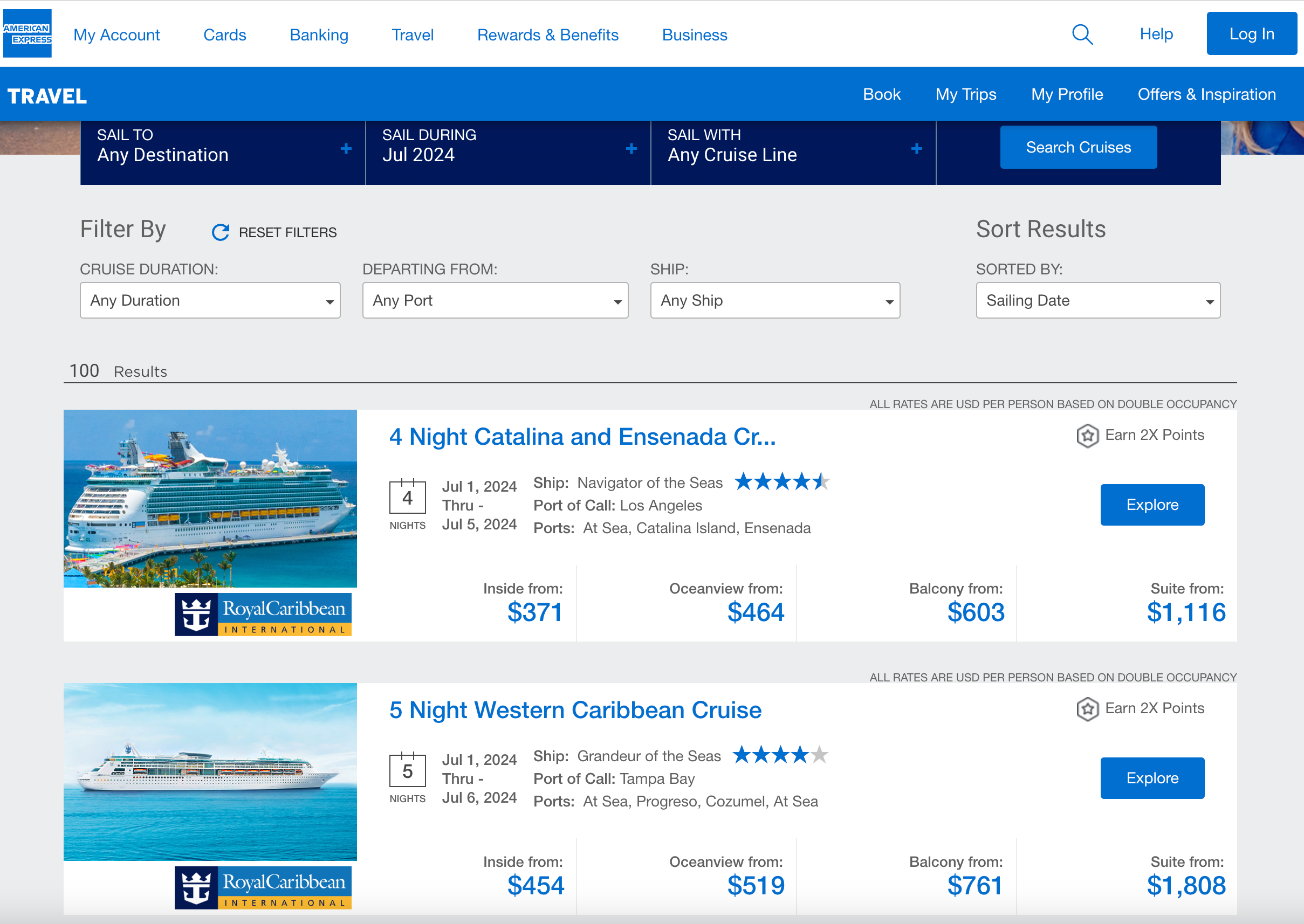

Although the format differs, you can also search for cruises on Amex Travel.

Rather than typing specific dates and numbers of passengers, you'll see four drop-down menus. These allow you to choose a destination (by region), filter by cruise lines and choose a month for travel — though not specific dates — on this first page. You can also select your desired cruise duration.

From here, you can filter by cruise duration, departure port and ship. You can sort your results by sailing date, value, price or ship rating.

On the final payment page, you can use your card or redeem points, ranging from 1 point to enough to cover the entire cost. Using points for a cruise will result in a low valuation of 0.7 cents per point, but it can be a money-saving option if you prefer not to spend cash.

There's another benefit available if you're a Platinum or Centurion cardholder (including personal and business versions of these cards): the Cruise Privileges Program .

This is available on cruises of five nights or more with select cruise lines, and it offers the following perks:

- $100-$500 in onboard ship credit (note that this cannot be used for casino or gratuity charges)

- Additional onboard amenities vary by line, such as spa vouchers, a bottle of Champagne, shore excursion credits or a private ship tour

Note that the Platinum cardmember must be one of the travelers on the cruise to enjoy these benefits.

Related: How to book a cruise using points and miles

Further things to consider about Amex Travel

When booking through the Amex Travel portal, there are a few factors to consider.

First, using Amex Membership Rewards points on Amex Travel may not provide the best value compared to transferring points to airline or hotel loyalty programs. The Pay with Points feature typically values points at 0.7 to 1 cent per point, which is far lower than our 2-cent valuation .

Additionally, the prices on Amex Travel may not always be the most competitive, so we recommend checking other platforms like Google Flights before booking your travel. Also, booking directly with hotels is advised for those seeking to utilize elite status benefits.

When you need to change your upcoming trips booked through Amex Travel, it can get complicated. You may encounter change and cancellation fees, often around $75, and making a change requires a phone call. Flight credit vouchers from cancellations can only be used for rebooking through Amex Travel via phone.

On the positive side, Amex Travel allows a 24-hour cancellation window for most reservations, and booking flights through the site generally still qualifies for earning miles and status with airline loyalty programs.

Related: Redeeming American Express Membership Rewards for maximum value

Bottom line

American Express Travel offers an array of booking options, including the ability to earn bonus Membership Rewards points on select purchases. Although you can use your points to book hotels, flights, rental cars and cruises through Amex Travel, you can get more from your points when you transfer them to Amex's airline and hotel partners .

However, there are exceptions, such as when there is no award availability for last-minute travel. In addition, Amex Travel offers perks like discounted premium flights, added benefits with Amex Fine Hotels + Resorts and a user-friendly interface. And with a simple redemption scheme that doesn't involve complicated loyalty programs and transfer partners, many Amex cardholders prefer it when planning their trips.

Additional reporting by Ryan Patterson and Kyle Olsen.

How to Set Up Credit Card Travel Notifications

Putting a travel notification on your credit card may prevent a major travel headache.

Set Up Credit Card Travel Notifications

Getty Images

Travel notifications prevent a credit card issuer from flagging a purchase you make out of the country as fraudulent.

You might be ready for an upcoming trip, but is your credit card? Depending on your card issuer, you might need to set up a travel notification for your account.

Adding a card travel notification is easy. For most credit cards, you'll follow these steps:

- Call your credit card company, log in to its website or access its app.

- Share your travel dates and locations, if applicable.

- Submit and verify your travel notification.

This will help you avoid potential hassles and embarrassing situations when you're away.

What Are Travel Notifications?

A travel notification is essentially a setting you activate on your credit card account. "Basically, you're just telling the credit card issuer you're going to be using the card outside of the normal places you (use it). That way, they don't think someone stole your credit card," says Simon Zhen, research analyst at personal finance website MyBankTracker.com.

If you're on a road trip, you could make a card purchase in one town and then try to shop in another distant location but have your card rejected. Dan Hanks, senior vice president of credit card loyalty and servicing at PNC Bank, says if a transaction appears to be fraudulent, it may be declined, even if it is a legitimate purchase. Purchase location is just one factor credit card companies consider when flagging fraudulent transactions .

"If a customer suddenly starts using a card in a place they've never been, especially in another country, it doesn't mean we'll decline them, but it increases the chance we might stop the transaction if we think it's fraud," Hanks says.

Transactions may be marked as fraudulent and your card deactivated as a precaution, particularly if your issuer can't reach you to confirm them. If you only bring one credit card on your trip, you may have a major problem on your hands. Luckily, setting up a travel notification before you leave is an easy solution.

How to Set Up Travel Notifications

A travel notification usually requires you to provide your planned destinations and trip dates to your credit card issuer. With that information, the issuer has more knowledge to weed out fraudulent transactions from legitimate ones.

You usually have a few options to set up a travel notification. First, you can call the card issuer. "Look on the back of the card, and you can find the phone number to call. You just tell the customer service rep that you'll be traveling," Zhen says. If you prefer digital communication, you can typically set up a travel notification through the credit card company's website or app.

Each credit card company has its own travel notification policies. While many companies allow you to set up travel notifications, others may not need you to tell them about your travel plans. Below are the policies of major credit card issuers:

American Express does not request travel notifications, citing industry-leading fraud detection capabilities.

Bank of America allows you to create a travel notice up to 60 days before your trip, and it can last up to 90 days from the first day of your excursion. With one travel notice, you can set up multiple itineraries for various cards. You must provide Bank of America a contact number for when you're away from home. You can also supply details about where you'll be staying, any planned layovers and other information that may help the company monitor your account for fraud while you're traveling.

According to Barclays , a travel notification is not mandatory, but it could be wise to avoid declined purchases simply because you are traveling abroad or to a different part of the U.S. Contact the bank by phone, or access your account online or with the Barclays app to set up a notification. If you will be traveling for more than 365 days, connect with the bank by phone to set up a notification.

Capital One doesn't need notification of travel plans because of the added security of the bank's chip cards.

Chase lets you set up a travel notification up to a year before your trip. The notification can last up to 90 days. You can apply the notification to multiple cards simultaneously and list multiple destinations.

Citi permits you to add a travel notification up to 180 days before your journey and up to 89 days after your trip begins. You can set the notification for more than one card and report several destinations with one travel notification.

Discover advises setting up a notification before you embark on a trip abroad. Your travel start date can be up to 24 months in the future, and travel notifications can last up to 24 months.

PNC Bank suggests notifying it of the locations and dates of your planned travel to help eliminate phone calls to confirm your account activities. You can create travel notifications up to two years before you depart, and notifications can last up to 30 days. If your travel plans exceed 30 days, you can set up more than one travel alert.

USAA recommends a travel notification to reduce the chance of your card being blocked or flagged for unusual activity. You can set up a notification up to one year before your trip, and the notification will last up to one year from your departure. USAA does not request travel destinations.

U.S. Bank allows you to establish a travel notification for any trip within the next 90 days. Notifications can last up to 90 days. If your travel plans exceed 90 days, you can set up an additional notification at a later date.

Wells Fargo favors notification of when and where you plan to travel. Wells Fargo's travel notifications do not have any time-based restrictions, so you can set up your travel alert for as long as you'll be away and not have to set up subsequent ones.

Overall, setting up a travel notification doesn't have a downside for the customer, Hanks says. Making travel notifications easy to activate is in a credit card company's best interest. And notifications reduce the chance that a real transaction may be classified as fraudulent, which makes everyone happier.

Don't Forget About Debit Cards

"Some people set up a travel notification on a credit card but forget to set one up on their debit card," Zhen says.

While credit cards offer many protections that can be useful when traveling, especially abroad, some people may still plan to use their debit cards. If you do, make sure you set up a travel notification on your debit cards, too, so your purchases on those cards don't get flagged as fraudulent transactions when you're on your next trip.

Tags: credit cards

Comparative assessments and other editorial opinions are those of U.S. News and have not been previously reviewed, approved or endorsed by any other entities, such as banks, credit card issuers or travel companies. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired.

Credit Card Travel Alerts: How to Set Them (and Why You Might Not Need To)

When you’re planning for a trip, especially an international one, you already have a huge to-do list.

You need to confirm your hotel plans, pack, check-in for your flight, and plan your activities for once you land.

The last thing that you want to happen when you arrive is to have your credit card declined.

Card issuers are constantly watching for fraud and taking steps to block scammers from using your card without your permission.

One common tactic is watching for unexpected changes in the location where you use your card. If you travel somewhere and use your credit card, your card issuer could decline it because they think s fraudster stole your card info.

Is there anything that you should do or a way to tell your card issuer when you’re traveling to make sure they don’t block your credit card?

What Are Credit Card Travel Notifications?

You can give your card issuer a credit card travel notification to help avoid having your card declined.

You’re telling your card issuer that you have travel plans, so it knows not to decline your card during your trip.

For example, if you live in Colorado and plan to fly to England, you’ll contact your card issuer and tell them when you plan to leave and when you plan to return. If the card issuer sees charges from stores in England during your travel dates, it will know they’re legitimate.

Some card issuers let you provide travel notifications through your account portal on the issuer’s website.

Usually, you’ll find the option somewhere in your account settings or personal information page.

However, things have changed:

Many card issuers don’t request, require, or even accept travel notifications anymore.

They rely on other methods to anticipate upcoming travel plans.

Why You Might Not Need to Set Them Anymore

Card issuers use multiple strategies to figure out when your traveling, even without providing a notification.

You booked travel on the card

One way that card issuers can tell if you’re planning to travel is based on your shopping habits.

If you book tickets for a flight using your credit card, your card issuer already knows that you have travel plans.

This is also true if you use your credit card rewards points to book your trip.

Since your card issuer can tell that you have travel plans based on your purchases, you don’t need to tell them about your trip.

The location of your card activity

A more subtle way for the card issuers to figure out your travel plans is based on other purchases you make.

You buy something at the airport just before you leave, your card issuer can probably guess that you’re about to get on a flight.

If your shopping habits change to include shopping at stores that people frequently use to prep for a trip that can also tip off your card issuer.

You're a frequent traveler

Card issuers also use your long-term purchase and travel history.

As a frequent flier, your card issuers probably expect you to travel on a regular basis and won’t worry about charges popping up from around the globe.

Travel Alerts for Top U.S. Card Issuers

Here are how some of the top card issuers in the US let you set travel notifications.

American Express

American Express doesn’t require travel notifications.

You don’t have to contact the company before you travel, but if you want to, you can do so by calling the number on the back of your credit card.

Bank of America

Bank of American doesn’t require travel notifications.

The bank does offer a set of advice for people travelling internationally on its website.

If you want to notify Bank of America of your travel anyway, you can do so by calling the number on the back of your card.

Capital One

Capital One says that you do not need to inform the company of travel plans because it now issues chip-based credit cards.

If you still want to let the company know, you can call the number on the back of your card.

Chase accepts travel notifications from its cardholders through its website .

You can set the notification up to a year in advance, making it easy to set the notification when you book your flights.

To set your travel notification:

- Sign in to your account and open the menu on the left side of the screen.

- Open your profile and settings

- Select more settings, then travel

- Click update

- Provide information about your destination, departure date, and return date

You can also call the company to set up your travel alert.

Citi lets you set up travel notifications through your online portal .

To set the alert:

- Visit the travel alert page

- Click Set Up/Manage and sign in to your account

- Select your card and click “add a travel notification”

- Tell Citi who will be using the card, where they’re going, and the dates of travel

You can also reach out to Citi by calling the number on the back of your card.

Discover does not require travel alerts from its customers, but you can always call the number on your card to let them know anyway.

Make Sure Your Contact Info is Up to Date

While it’s always important to make sure that your card issuer has your contact information, keeping your contact info up to date is doubly important when you’re traveling.

Your credit card issuer might not contact you frequently, but one of the times that they’ll want to reach out is when they’re trying to verify whether a purchase is legitimate or not.

If you’re traveling and your card is declined, you may receive a call from your card issuer asking you whether you tried to make the purchase.

If you say yes, they can unblock your card instantly -- letting you complete the transaction.

This can save a lot of time compared to you having to call the card issuer, navigate a phone tree, wait on hold, and explain that you were the one trying to make the purchase rather than a fraudster.

Taking a few minutes to update your contact info with all your card issuers before you travel can save you some headaches down the road.

It’s also a good way to make sure that your contact info is current so your card issuers can reach you, even when you aren’t traveling.

You might also like

Advertiser Disclosure:

We believe by providing tools and education we can help people optimize their finances to regain control of their future. While our articles may include or feature select companies, vendors, and products, our approach to compiling such is equitable and unbiased. The content that we create is free and independently-sourced, devoid of any paid-for promotion.

This content is not provided or commissioned by the bank advertiser. Opinions expressed here are author’s alone, not those of the bank advertiser, and have not been reviewed, approved or otherwise endorsed by the bank advertiser. This site may be compensated through the bank advertiser Affiliate Program.

MyBankTracker generates revenue through our relationships with our partners and affiliates. We may mention or include reviews of their products, at times, but it does not affect our recommendations, which are completely based on the research and work of our editorial team. We are not contractually obligated in any way to offer positive or recommendatory reviews of their services. View our list of partners.

MyBankTracker has partnered with CardRatings for our coverage of credit card products. MyBankTracker and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

How to Set a Travel Notice for Your Credit Cards

Susan Shain

Susan is a freelance writer who specializes in turning complex financial topics into engaging and accessible articles. She's been writing about personal finance for six years, and was previously the senior writer at The Penny Hoarder and a staff writer at Student Loan Hero. Her personal finance writing has also appeared in publications like MarketWatch and Lifehacker.

When I worked at a ski rental shop in Breckenridge, Colorado, I witnessed many international (and some out-of-state) customers’ credit cards get declined.

Not because their credit limits were too low or because they were purchasing too much — but because they failed to set up travel notifications with their card issuers.

So now, any time I travel to a foreign country, I always set up a travel notice on my credit card beforehand.

Since I travel with the Chase Sapphire Reserve® (Review), I create a Chase travel notice, but you can take this step with most major credit or debit cards. Here’s how.

What Is a Credit Card Travel Notice?

As a way to prevent fraud , your credit card issuer monitors your spending activity. If it notices a suspicious purchase — in an unusually large amount, or from a new location — it may decline the transaction. This could be more likely in countries where fraud is a bigger problem.

Which is why the answer to the question “Should I notify my credit card company when traveling?” is usually yes.

Although you can often get away with shopping in another state without triggering a red flag, international travel is another story.

By notifying your credit card of your travel plans, you’ll reduce the chances of getting your transaction declined in the checkout line — which, trust me, is never fun — and having to call your card issuer to verify your purchases. It’s still possible to have your purchases declined after setting a travel notice, but it’s much less likely.

How to Set Up Travel Notices for 8 Major Credit Card Issuers

Ready to create your first travel alert? While you could call your card issuer, it’s easier to do it online.

Here’s how to set up travel notices with eight different credit card issuers.

When you visit MoneyTips, we want you to know that you can trust what’s in front of you. We are an authoritative source of accurate and relevant financial guidance. When MoneyTips content contains a link to partner or sponsor affiliated content, we’ll clearly indicate where that happens. Any opinions, analyses, reviews or recommendations expressed in our content are of the author alone, and have not been reviewed, approved or otherwise endorsed by the advertiser.

We make every effort to provide up-to-date information; however, we do not guarantee the accuracy of the information presented. Consumers should verify terms and conditions with the institution providing the products. Some articles may contain sponsored content, content about affiliated entities or content about clients in the network. While reasonable efforts are made to maintain accurate information, the information is presented without warranty.

Chase travel notice

Because of the company’s abundant travel perks and partnership with the Visa network — which is widely accepted worldwide — Chase cards are a favorite among globetrotters.

You can create Chase travel notifications up to a year in advance for credit cards, and up to 14 days for debit cards. Your travel dates can span an entire year — if you’re away for longer, you’ll simply have to adjust your dates once you’re on the road. Chase will have your request on file within 24 hours from the time you submit.

To set up Chase travel notifications, you’ll need to log in to your account and click on the credit card you plan to use. Under the “Things you can do” dropdown menu on the right, you’ll see the “Travel notification” option. That will take you to your “Profile & Settings” page, where you’ll be able to create a travel alert.

Insider tip

Depending on the type of Chase account you have, the process may be slightly different for you. In any case, just look for your “Profile & Settings” page, and then look for a button to set a travel notice.

Alternatively, if you’re already outside the country, you can call Chase collect at 1-302-594-8200 to alert the issuer of your travel plans.

Setting up a travel notice with the Chase bank app

After logging in to the Chase mobile app, tap the profile icon (this should appear as the outline of a person) and select “My settings.” Choose “Travel” within the settings menu and tap “Update” near any credit or debit card products you’ll be taking.

This will allow you to enter the details for your upcoming trip, which can be edited at a later time. Saving this information will successfully set up a travel notice.

Our favorite Chase travel card: While many Chase credit cards are adventure-ready, we’d recommend the Chase Sapphire Preferred® Card for new travelers. Not only does it earn 2X Chase Ultimate Rewards points per dollar on travel, but you’ll also get a great introductory bonus: 60,000 bonus points after spending $4,000 on purchases in the first 3 months. You’ll also earn 5X Ultimate Rewards points per dollar on Lyft rides and travel purchased through Chase Ultimate Rewards. You can transfer the points you earn to a variety of airline and hotel loyalty programs. The Sapphire Preferred has a $95 annual fee.

American Express travel notice

Surprise! You actually can’t create an Amex travel notice.

On its site, the issuer says it uses “industry-leading fraud detection capabilities” that help it recognize when you’re on the road, thereby eliminating the need to create an American Express travel notification.