AIR MILES unveils new travel booking platform

With travel back and top of mind for Canadians, the AIR MILES Reward Program (AIR MILES) announces the launch of AIR MILES Travel, an all-new booking platform.

The improved platform offers collectors the ability to book all travel in one place and offers unprecedented earning opportunities, with more choice and enhanced flexibility. Collectors can pay for travel with their credit card and earn Miles, or use Dream Miles to fund their flight, car, hotel and more. Alternatively, collectors can choose a combination of both—ideal for continuing to build your balance while still leveraging Miles earned. Collectors will also soon have the option to finance their trip, with the launch scheduled later this year.

AIR MILES Travel offers:

Powerful earn rates for standalone travel bookings (varies by Onyx, Gold, and Blue collectors)

Earn up to 5x the Miles on bundled trips anywhere in the world (i.e., flight and accommodations or flight and car rentals)

Collectors will experience enhanced value when paying with a BMO AIR MILES Mastercard or a BMO AIR MILES World Elite Mastercard, as they will also earn 3x the Miles on the total credit card spend

Additional travel partners such as leading international and domestic airlines as well as alternative lodging options such as all-inclusive hotels and vacation homes

More travel options like tours, excursions, theme park tickets, and more to offer collectors a breadth of travel experiences around the world

Flexibility to book everything – from flights to hotels to extras - all in one platform

Trending Now

Susie grynol resigns from hac, appointed vp at marriott international.

The Hotel Association of Canada (HAC) has announced the resignation of Susie Grynol from her position as president and CEO, effective June 3rd, 2024

Distinguished women leaders within the Canadian hotel sector

To commemorate International Women’s Day 2024, Choice Hotels Canada presents the remarkable journeys of four distinguished women leaders within the Canadian hotel sector. Their stories of resilience, innovation, and…

Introducing TOOR Hotel, a new urban boutique hotel

Canadian hotelier, Sukhdev Toor has announced details about the first TOOR Hotel, a distinct lifestyle hotel and residence coming very soon to downtown Toronto.

Marriott International appoints new senior leaders to Canadian team

Marriott International has appointed Susie Grynol and Keri Robinson to its Canadian senior leadership team.

Keeping hotel industry professionals, from franchisees to operations managers to executives to suppliers, in the know with the latest stories and developments every week.

Subscribe for free to receive STAY news.

How do I book an all-inclusive or cruise with my AIR MILES Dream Miles?

Steps to book a vacation or cruise with AIR MILES and redtag.ca

There are different steps to know in order to book a vacation package with AIR MILES and redtag.ca to redeem and/or earn AIR MILES miles.

Login to the AIR MILES booking site

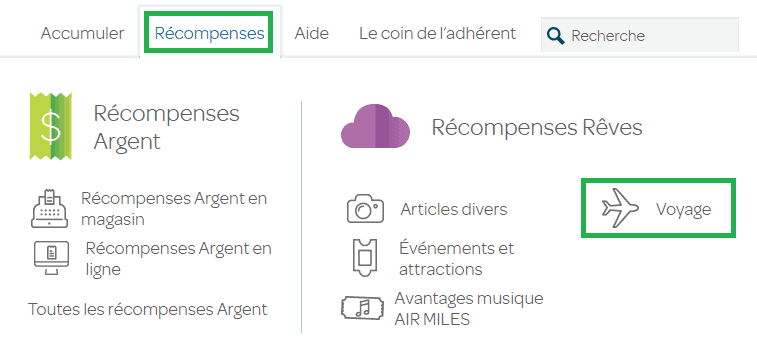

To make a booking, you must first go to the AIR MILES website and select:

On the next page, you must select:

- Discover the vacation and cruise packages

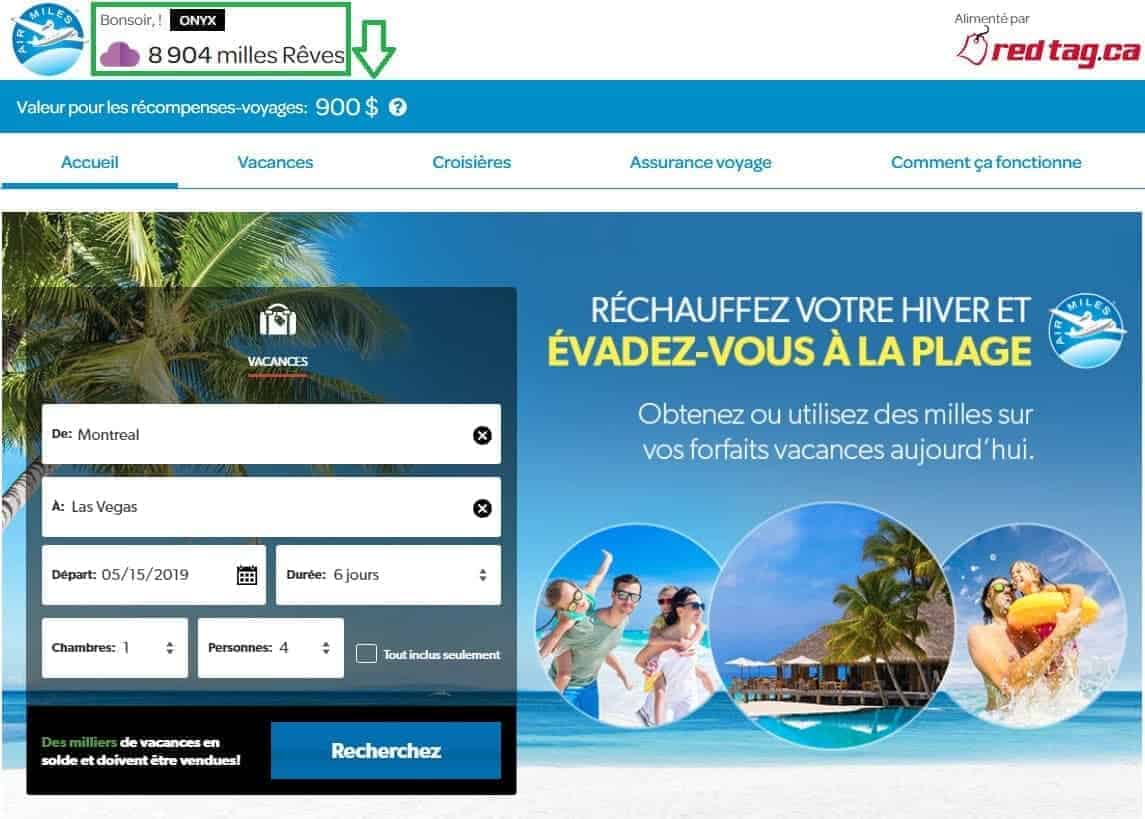

Once connected, you will land on this page, where you will find:

- Your AIR MILES Dream Miles balance

- Your AIR MILES status

- And the value of your Dream Miles for travel rewards

Booking a vacation package on AIR MILES

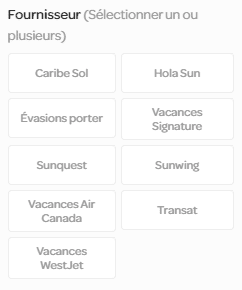

Once you have entered your search fields, a list of packages will be displayed.

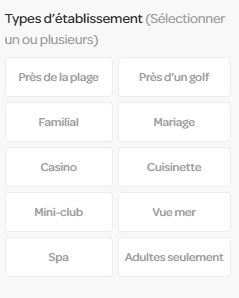

You can sort this list as you wish, with interesting categories like:

- Près de la plage

- Air Canada Vacations

- WestJet Holidays

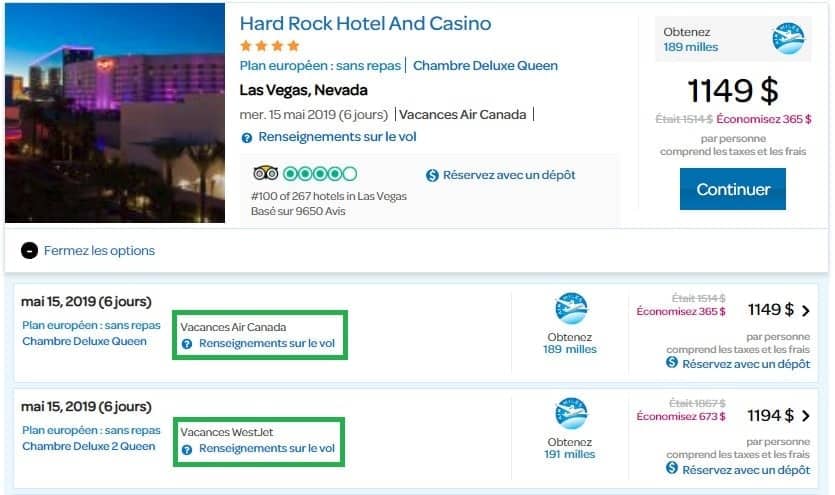

Here is the information provided in the list about a facility offering different packages:

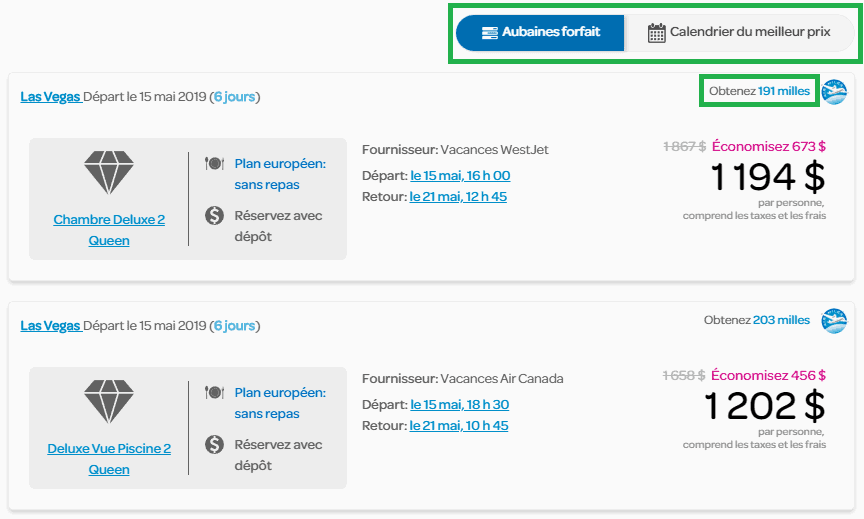

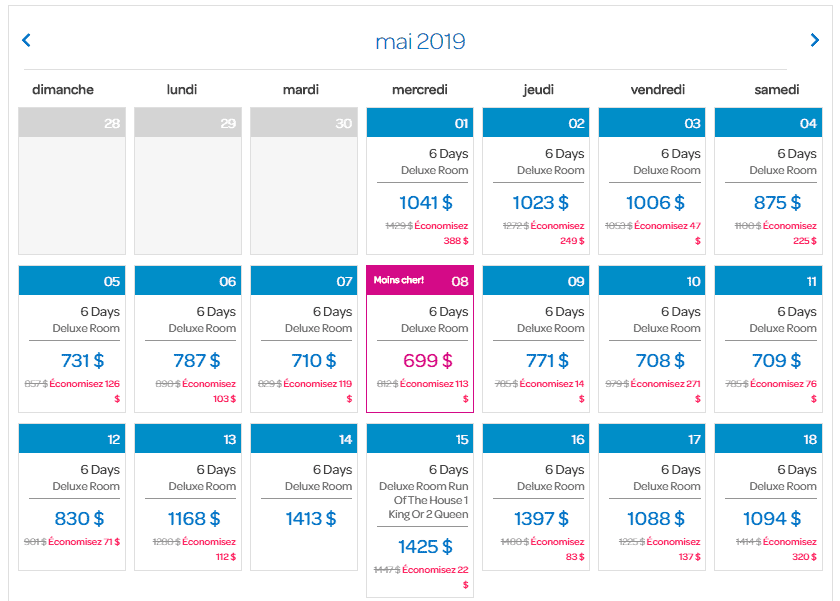

Once on the facility’s page, you will be able to choose from a whole list of vacation packages, and sort it between:

- Deals Package

- Or Calendar

I find the website to be excellent and user-friendly.

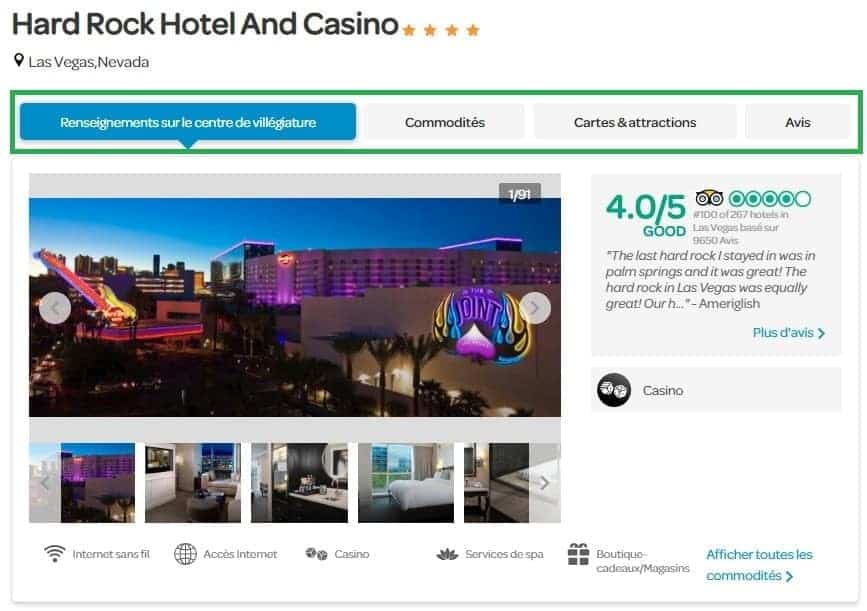

Here is all the information given about a facility:

- Amenities at the property

- Maps & attractions (shopping, activities and parks…)

- Customer reviews ( Tripadvisor / Redtag)

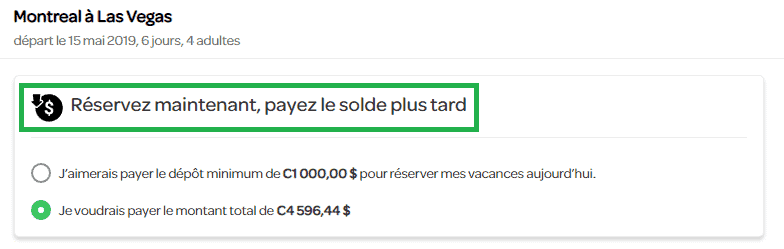

For some packages, you can pay a deposit to confirm the booking and pay the balance later.

Using AIR MILES miles for vacation packages

When you are ready to book, you will have the option to pay for the entire booking with your credit card:

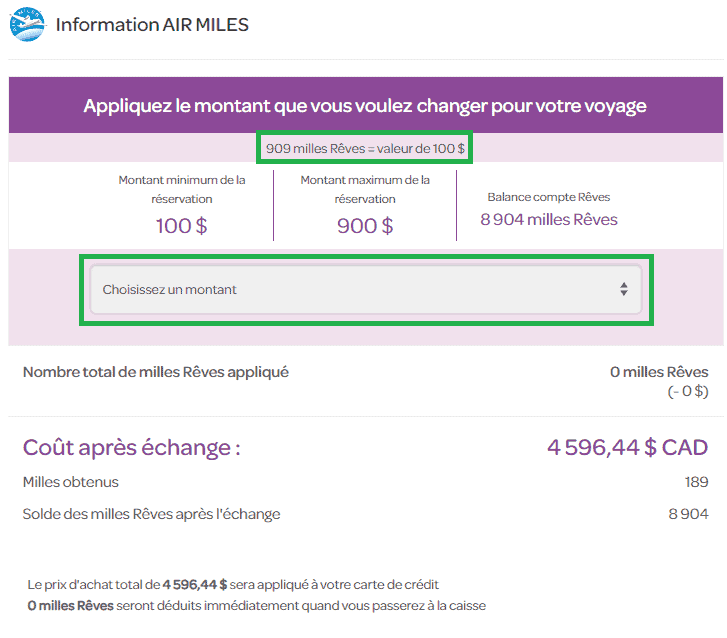

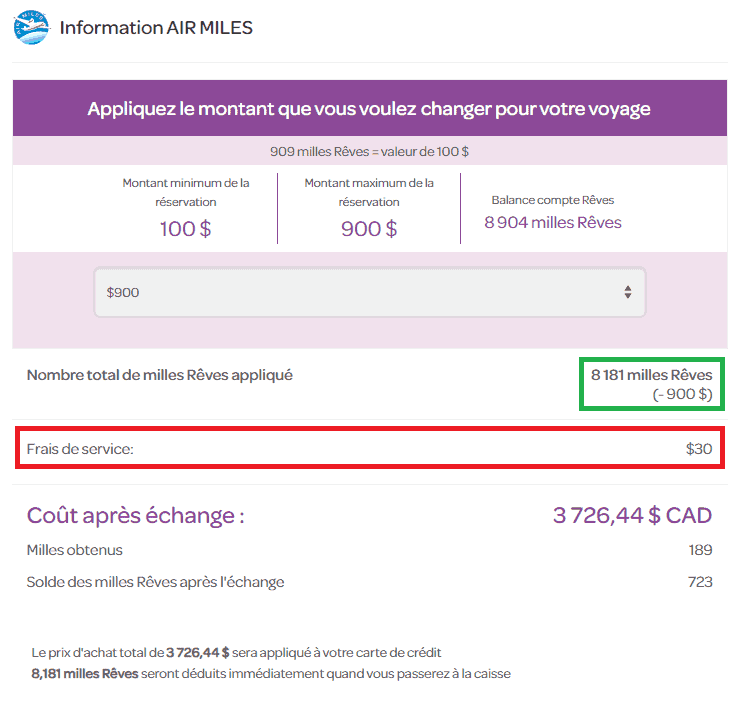

Or choose an amount of Dream Miles to use for this reservation (909 Dream Miles = $100 off)

Note that when you use miles, you get the same amount of miles as when you don’t use miles (here, 189 miles).

A $30 service charge is added when you use AIR MILES miles (regardless of the amount of miles used). 👿

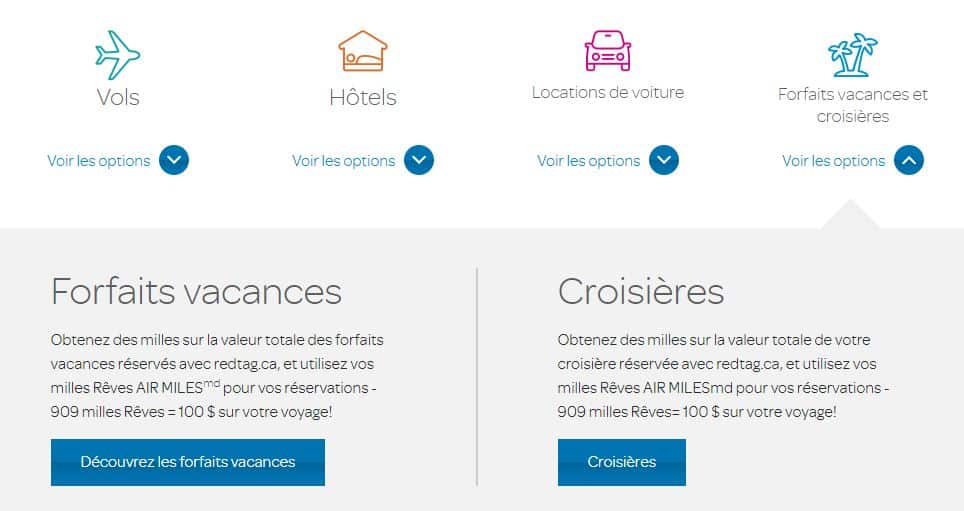

What about booking cruises?

As of December 12, 2019 , it is also possible to book cruises in the same way.

Bottom Line

The AIR MILES vacation package booking site, powered by Redtag.ca, is fun and user-friendly. Unlike Transat, you’ll find more vacation packages, including those from Sunwing, Air Canada Vacations or WestJet Vacations. This ultimately gives you more diversity.

The exchange rate of 909 Dream Miles for $100 means a value of $0.11 / Dream Mile , which is a little higher than the value of Cash Miles (95 miles = $10 or $0.105 / Cash Mile ).

If you are used to booking flights, it may be more attractive to use your Dream Miles in this way, especially for short-haul flights . It is not uncommon to be able to get a value of more than $0.20/mile… even $0.40/Dream Mile!

How to earn AIR MILES miles

There are 10 AIR MILES affiliated credit cards issued by American Express and BMO. You can find a complete list on this page .

The most interesting ones are:

- BMO ® AIR MILES ® World Elite ® * Mastercard ® *

- ® AIR MILES ® * Platinum Credit Card" href="https://milesopedia.com/en/go/amex-air-miles-platinum-credit-card/">American Express AIR MILES Platinum Business Card

AIR MILES Frequently Asked Questions about redtag.ca

Will I be able to use my AIR MILES ® Dream Miles towards the taxes for a vacation package?

Your Dream Miles can only be used towards the base price of the trip, whereas taxes and fees can be paid by credit card only.

Can I use any amount of Dream Miles for my booking?

You can only use increments of 909 Dream Miles, which converts to a cash value of $100.

Can I use Cash Miles towards a booking?

No. At this time you can’t use Cash Miles towards your booking, but you can use Dream Miles.

Does it cost anything to use my Dream Miles?

Yes, there is a $30 non-refundable processing fee, including HST, per booking when you use your Dream Miles.

What happens when redtag.ca has a promotion? Will I be eligible to also get and/or use Miles?

No, AIR MILES cannot be combined with any redtag.ca promotions and/or discounts

Do I still earn AIR MILES by paying a deposit on my booking?

AIR MILES are earned when the booking is paid in full. We can accept the deposit; however, the miles will be earned when full payment is applied

What happens if more than one person on my booking has an AIR MILES card?

Only one AIR MILES member can earn per booking.

If I booked my vacation package before this program started, can I add my AIR MILES number to the file?

The AIR MILES Program excludes previous purchases, including bookings made with a deposit.

How long will it take to see the AIR MILES earned in my account?

It may take up to 30 days from the date of final payment for the miles to be credited to your member account.

Who do I contact if I want to change, modify or cancel my booking?

Contact a redtag.ca specialist at 1-866-973-3824 who will assist you with changes on your booking if changes are permitted by the supplier. Please note that change fees may apply

What happens if I have to cancel my booking?

Cancelled reservations will result in a recalculation of earned miles and may result in the deduction of those miles. No miles will be refunded as a result of a change in benefits from a trip made; or if the booking is cancelled, AIR MILES used in the initial purchase of the trip are non-refundable and non-transferable (You can protect your AIR MILES by getting a Manulife travel insurance policy, see more information below)

How will I know how many Miles I have and/or have used?

Both Miles you get and Miles you use (if applicable) will appear in your Collector Account(s) under “Transaction History”.

I didn’t receive my booking confirmation email. Who can I contact?

Please contact redtag.ca at 1-866-973-3824

Will I be able to use my Transat Travel Certificate or Cash eVoucher through redtag.ca?

redtag.ca will not accept any Transat Travel Certificate or Cash eVouchers

Manulife Travel Insurance

In the event that you need to cancel your trip due to a risk covered in the insurance policy, your AIR MILES will be reinstated in accordance with the Terms and Conditions of the policy.

To protect your AIR MILES Reward Miles, Manulife Insurance has provided three (3) policy options:

- All inclusive

- Non-Medical Inclusive

- Trip Cancellation and Interruption

Please note: If you purchased your vacation package and used Dream Miles on airmiles.redtag.ca and decide to purchase Manulife Travel Insurance at a later date, you must return to airmiles.redtag.ca to complete this transaction.

Can I use Dream Miles to pay for my deposit?

No, you can’t use Miles to pay for your deposit or for your administration fee. You can, however, pay for your deposit using your credit card and apply Dream Miles in increments of 909 Miles at the time of booking as part of your deposit. Please note that you can’t use Miles to pay for any outstanding balance at time of final payment later on.

Couldn’t find what you were looking for?

You can contact us directly at 1-866-973-3824 .

- AIR MILES - 101

All posts by Jean-Maximilien

Suggested Reading

Choose dates

AIR MILES Blog

AIR MILES ® 101: How To Redeem AIR MILES ® Dream Miles

- Last updated: July 11, 2023

Have you heard the term AIR MILES Dream Miles and wondered what those Miles can do for you? If so, you’ve come to the right place. We’re going to give you the lowdown on how to redeem AIR MILES Dream Miles and turn your dreams into reality.

What are AIR MILES ® Dream Miles?

Is there a trip you’ve been planning, some new hot tech catching your eye, or maybe even a concert you’ve been hoping to see? Dream Miles can help you make it all happen.

In the AIR MILES Reward Program, you can allocate the Reward Miles™ that you earn into two accounts: AIR MILES Cash Account (giving you Cash Miles™) and/or Dream account (giving you Dream Miles™). Dream Miles can be saved up to be redeemed for things like a big-ticket item from our merchandise catalogue or for your next vacation. And while travel is usually what people think of when they think of Dream Miles–in fact, flights to Vancouver, Las Vegas, and London are some of our top Dream Miles redemption items–there are way more redemption options to choose from than just flights and hotels. Dream Rewards start at 250 Dream Miles.

Hot tip : you can adjust your preference at any time, so if you’re planning a trip you can set your preference to 100% Dream Miles to collect the Miles that will make that trip happen sooner.

Dream Miles vs. Cash Miles

While AIR MILES Cash Miles can be used instantly in-store and online to get things like free gas or groceries, Dream Miles can be used in a big way. They’re typically redeemed for travel, tech, home appliances, fashion, and events. You can even choose to redeem them for donations. Once you’ve set your balance preference, the Miles you earn on everyday purchases will start showing up in their allocated accounts (AIR MILES Cash account and Dream account).

The Top Three Ways to Redeem

From the latest tech to an all-inclusive trip, Dream Miles are all about rewarding yourself .

Merchandise

This is where you can really treat yourself. Once you’ve racked up enough Dream Miles to start redeeming, AIR MILES Merchandise is one of the places to go. Here, you’ll see featured picks from brands we love—like Bosch, Conair, Dyson, Samsung, Sony, and so much more—new and noteworthy items, best-sellers, travel essentials, get-them-before-they’re-gone goodies, and more. Plus, you can even earn Bonus Miles with time-limited offers when you redeem for eligible rewards. Fun fact: in 2021, air fryers were the most popular product collectors were redeeming Dream Miles for.

Entertainment

Let the good times roll. Use your Dream Miles for entertainment items and plan a fun weekend outing, date night, or birthday gift. Keep it local and go see a movie or a show or redeem your Dream Miles for an event somewhere that gives you an excuse to travel. These experiences are updated often, so be sure to check back as you earn.

AIR MILES Travel is probably what we’re best known for, and for good reason. Use your Dream Miles to book flights, hotels, cars, vacation packages, cruises, and get into select US parks. With many airline, car rental, and hotel partners, there are lots of opportunities for you to take the trip of your dreams.

It’s not only about redeeming Dream Miles either. We’re always featuring incredible redemption offers that earn you even more Miles, so you can start thinking about your next big reward as you’re securing your current one.

And don’t forget, you can redeem Dream Miles for some awesome travel essentials to make your trip unforgettable.

Pay It Forward with Donations

There’s nothing better than the feeling of giving back, and with Dream Miles it’s easy to do just that. Using our donations portal, you can select from a list of three top Canadian charities: Kids Help Phone, Motionball, and Food Banks Canada, to redeem your Dream Miles for a cash donation.

When Should I Redeem My AIR MILES Dream Miles?

The best thing about Dream Miles is that they’re used for your dreams, so redeem them on your own timeline. You can save your Dream Miles up for something for yourself or use them to book a last-minute round-trip flight within North America. Whenever you choose to redeem, your AIR MILES Dream Miles are there for life’s little and big luxuries.

Now that you know more about AIR MILES Dream Miles redemption and how to really treat yourself, it’s time to join AIR MILES and start earning those Miles to get you closer to your dreams.

* Based on the largest volume of flight redemptions made since 1992 for bookings within Canada, transborder and internationally, respectively.

All rewards offered are subject to the terms and conditions of the AIR MILES Reward Program, are subject to change and may be withdrawn without notice. To use Miles for travel, merchandise, certificate and/or event rewards, you must have accumulated sufficient Dream Miles in your collector account. Some restrictions may apply. Quantities may be limited. Collectors must pay applicable surcharges, fees, and taxes on air travel, hotel, and car rental rewards. No cancellations, exchanges or refunds for merchandise, certificates or tickets once booked or ordered. Changes, cancellations and refunds to travel bookings are subject to the rules of the booking provider and/or supplier and may be subject to additional fees. For complete details, see current Program terms and conditions available at airmiles.ca.

Related Content

New program enhancements mean even more value on essentials

How Collector Danielle achieves little wins while still reaching for her dreams

AIR MILES 101: Everything You Need To Know About eVouchers

How Collector Teresa Maximizes Flexibility with AIR MILES Rewards

- How to Choose the Right Credit Card

- How to Apply for a Credit Card

- How to Cancel a Credit Card

- Ways To Pay Off Credit Card Debt

- Why Your Credit Card Was Declined

- How to Get Out of Credit Card Debt

- What to Know About Credit Card Minimum Payments

- What Is a Credit Card and Should You Get One?

- How Do Credit Cards Work in Canada?

- What Are the Different Types of Credit Cards?

- How an International Credit Card Works

- Common Credit Card Terms and Conditions

- Credit Card Fees and Charges

Credit Card Interest Calculator

- First-Time Home Buyer Incentive

- Tax-Free First Home Savings Account

- Home Equity Loan

- How a Reverse Mortgage Works

- Home Equity Line of Credit

- Mortgage Renewal

- Getting a Second Mortgage

- How to Refinance a Mortgage

- How Does Mortgage Interest Work?

- Realtors vs Real Estate Agents vs Brokers

- Is Canada’s Housing Market Crashing?

- Types of Houses in Canada

- First-Time Home Buyer Grants and Assistance Programs

- Types of Mortgages in Canada: Which Is Right for You?

- How Does a Mortgage Work in Canada?

- What Is an Interest Rate?

- Guaranteed Investment Certificate (GIC)

- Savings Account Guide

- Common Canadian Bank Fees and Charges

- Types of Bank Accounts in Canada

- EQ Bank Review

- Simplii Financial Review

- Tangerine Bank Review

- National Bank of Canada Review

- CIBC Review

- Scotiabank Review

- TD Bank Review

- What Is Canadian Investor Protection Fund (CIPF) Coverage?

- How Capital Gains Tax Works

- Investing for Canadian Beginners

- Understanding Asset Classes in Investing

- Understanding Fixed-Income Investments

- How to Invest in Stocks

- What Are T-Bills

- What is a Bond

- What is Registered Disability Savings Plan (RDSP)

- What Are Mutual Funds

- What is an ETF (Exchange Traded Fund)

- What Is Forex Trading

- What Is Cryptocurrency and How Does It Work

- What Is a Stock

- What is Old Age Security and How Does It Work

- What is Registered Retirement Income Funds (RRIFs)

- How a Life Income Fund (LIF) Works for Retirement

- What Is An In-Trust Account

- What Is a Locked-in Retirement Account (LIRA)

- How Much Money You’ll Need To Retire

- Defined Benefit vs. Defined Contribution Pension Plans

- Can Annuities Fund Your Retirement?

- What Is a Personal Loan?

- Personal Loan Insurance: Do You Need It?

- What Is a Secured Personal Loan?

- What Is a Payday Loan?

- What Is a Pawn Loan?

- What Is a Car Title Loan?

- Small Business Loan vs Personal Loan

- Personal Loan vs. Line of Credit

- Personal Line of Credit vs Home Equity Loan:

- Personal Line of Credit vs Car Loan

- HELOC vs Personal Loan

- Debt Consolidation vs Personal Loan

- Cash Advance vs Personal Loan

- Business Loan vs Personal Loan

- Price Matching Tips to Help You Save Big

- How to save for Wedding

- How to Save Money on Groceries

- Ways to Save on Your Next Family Vacation

- Tips to Help You Save On Gas

- How to Save Money in 8 Easy Steps

- Passive Income: What It Is and How to Make It

- Budgeting 101: How to Budget Your Money

- Ways to Make Money Online and Offline in Canada

- How Do Credit Inquiries Work?

- What is the Ideal Credit Utilization Ratio?

- What Credit Score is Needed for a Credit Card?

- How to Get a Better Credit Score

- What is a Good Credit Score in Canada?

- Credit Cards

Air Miles Rewards Program in Canada: A Complete Guide

Canadians have a lot of choice when it comes to loyalty rewards programs. One of the largest (and arguably most complicated) is Air Miles. The program offers many ways to earn and redeem both miles and cash, but getting the most out of your Air Miles may require a little research, forethought and careful planning.

What is the Air Miles program?

Launched in 1992, Air Miles is one of Canada’s most popular loyalty rewards programs with nearly 10 million members. In 2023, the Bank of Montreal (BMO) acquired the Air Miles Reward Program from LoyaltyOne.

As an Air Miles member, you can earn miles by showing your membership card or entering your membership number when you shop at eligible retailers, or by using a BMO Air Miles credit card to make purchases.

After amassing a sufficient number of miles, you can redeem them for a variety of items like flights, merchandise or instant cash rebates at select retailers.

How do Air Miles work?

You can earn Air Miles in the form of Dream Miles, Cash Miles or a combination of both. After you open an Air Miles account, you’ll be asked how you want to allocate the rewards you earn. For example, you may choose to allot 20% to Dream Miles and 80% to Cash Miles, or 100% Dream Miles and 0% Cash Miles — the choice is yours. You can adjust your selection at any time.

What are Air Miles Dream Miles

Dream Miles are miles that you can redeem for non-cash rewards, such as flights, car rentals, merchandise and experiences.

What are Air Miles Cash Miles?

Cash Miles can be converted into cash or cash-like eVouchers, which are handy for online purchases.

You can only redeem Cash Miles in-store or online at participating Cash Miles partners.

Dream Miles vs. Cash Miles

Best air miles credit cards in canada.

Compare all different air miles credit cards side-by-side and find out the best card that will meet your need with special perks and benefits

How much are Air Miles worth?

Cash Miles have a specific value: You can redeem 95 Cash Miles for $10 cash towards a purchase (or eVoucher), which gives each Air Miles Cash Mile a value of 10.5 cents. You can redeem Cash Miles in $10 increments up to a total of $750 per day.

Dream Miles do not have a consistent value because they vary based on how they’re redeemed.

For example, if you redeem your Air Miles Dream Miles for merchandise, you may get a value of about 7 cents per Air Mile. However, when you redeem your Dream Miles for a hotel room, you may get a per-mile value of approximately 12 cents. These different mile valuations underscore why, to maximize the purchasing power of your Air Miles, it’s important to figure out the value before you redeem them.

In general, you get the best deal when redeeming Air Miles Dream Miles for travel.

How many Air Miles for a flight?

NerdWallet analyzed over 75 data points to compare the Air Miles redemption values of flights in 2022 and determined a “cent-per-mile” value for each flight.

Based on our analysis, the average value of 1 Air Miles Dream Mile is worth 11.35 cents.

More specifically, you can expect to get around:

- 10.10 cents per Air Miles Dream Mile for economy class redemptions.

- 12.60 cents per Air Miles Dream Mile for business class redemptions.

These values can fluctuate based on several factors, such as where and at what time of year you’re travelling (i.e., during holidays or other peak times), and how far ahead of time you book your flight.

For example, when redeeming miles for an economy ticket from Toronto to Mumbai 20 weeks in advance, the value of a single Air Mile can be as high as 22 cents, at the time of this writing. However, if you book the same ticket only one week out, each Air Mile has an approximate value of 16 cents.

Unfortunately, unlike some travel rewards loyalty programs (like Aeroplan ), Air Miles does not offer a flight chart with info about how many miles are needed to reach a particular destination.

To find the actual amount of Air Miles needed for a specific trip, you’ll need to search for flights on the Air Miles travel portal. You can adjust your dates slightly to see whether it affects the number of Air Miles required for a flight.

How to earn Air Miles

To get the most out of your rewards, select how you want to earn your miles by using the slider tool in your account profile. Choose a percentage of Cash Miles and Dream Miles that makes sense for you. For example, if you want to only redeem your miles as cash, you could set the slider to 100% Cash Miles and 0% Dream Miles.

Present your Air Miles membership card

When shopping in person or online at an Air Miles retail partner, you just need to present your card or input your membership number to earn Air Miles.

The amount of Air Miles you earn varies among retailers. For example, at the time of writing, you get 1 Air Mile per $15 dollars spent at Budget Car Rental, whereas, with Global Pet Foods, you earn 1 Air Mile for every $20 you spend.

Shop with an Air Miles credit card

A fast and easy way to accelerate your earnings is with a co-branded Air Miles credit card .

Air Miles is owned by BMO, which offers five credit cards that earn Air Miles on purchases.

Here are five BMO credit cards that earn Air Miles rewards.

- BMO AIR MILES Mastercard

- BMO AIR MILES World Elite Mastercard

- Student BMO AIR MILES Mastercard

- BMO AIR MILES World Elite Business Mastercard

- BMO AIR MILES No-Fee Business Mastercard

Use a BMO AIR MILES debit card

You can earn 1 Air Mile for every $30 you spend using a BMO Debit Card that’s attached to an Air Miles chequing account. If you also hold a BMO AIR MILES World Mastercard or BMO AIR MILES World Elite Mastercard, you can earn an extra 25 miles per month.

Shop online via the Air Miles portal and eStore

On top of earning Air Miles directly when shopping at merchants in person or online, you can earn rewards using the Air Miles shopping portal at airmilesshops.ca. Rather than going directly to a partner retailer’s website, you go through the Air Miles eStore and earn 1 Air Mile for every $20 spent.

Book travel through the Air Miles travel portal

You can earn points by booking travel-related items like flights, hotel stays and rental cars via the Air Miles travel hub.

Take advantage of Air Miles bonus offers and promotions

Air Miles partner merchants sometimes offer special promotions or bonuses that allow members to earn additional miles. You can find current promotions by checking out the Air Miles website.

Answer surveys to earn free Air Miles

You can earn miles by answering surveys online with companies like Shopper’s Voice. You can find a list of current surveys that offer rewards on the Air Miles website.

How to sign up to the Air Miles Reward Program

Air Miles membership is free and can be completed online. You must be at least 16 years old to apply.

When filling out the online application, you must provide your name, date of birth, address and email, then set up a password. Once the application is approved, you’ll receive a physical membership card in the mail within two to three weeks.

You’ll also be sent your membership number and digital card via email, so you don’t have to wait until your physical card arrives to start earning miles.

Membership is automatic for eligible BMO credit card holders.

Air Miles Onyx status

Air Miles Onyx status is the highest status tier available for the Air Miles loyalty program. You must earn 5,000 or more miles within a year to attain Onyx status or hold a BMO AIR MILES World Elite Mastercard, BMO AIR MILES World Elite Business Mastercard or BMO AIR MILES Business Mastercard. Onyx status gives you access to exclusive perks, like discounts of up to 40% on Air Miles flights, 10% off for merchandise redemptions and priority customer service.

Air Miles Gold status

Air Miles Gold status is the tier below Onyx. It’s for Air Miles members who collect between 500 to 4,999 miles in a calendar year or hold a BMO AIR MILES Mastercard or BMO AIR MILES No-Fee Business Mastercard.

Benefits for Gold status include up to 30% off the number of miles needed for certain flights and 5% off the miles required for eligible merchandise redemptions.

Is it worth joining the Air Miles program?

Air Miles is free to join, so there’s no downside to signing up. It takes very little effort to earn miles — simply show your membership card or enter the number at checkout, for example.

That said, it can take a fairly long time to earn rewards. To accumulate a significant amount of miles in a reasonable amount of time, you’d likely need to use an Air Miles credit card or constantly be looking for generous offers.

Air Miles pros

- Join for free.

- Maximize your rewards with special offers and promotions.

- Earn miles through a wide array of retail partners.

- Earn miles through one of BMO’s five Air Miles credit cards.

- Access Onyx and Gold status tiers for extra benefits.

Air Miles cons

- Redemption value is hard to determine.

- Miles cannot be transferred to other loyalty programs.

- Dream Miles cannot be converted to Cash Miles and vice versa.

- Air Miles expire if an account is inactive for 24 months.

Air Miles alternatives

One alternative to Air Miles is Air Canada’s Aeroplan points, another of Canada’s well-known travel reward programs. Aeroplan also has co-branded credit cards and an online shopping portal.

The value of an individual Aeroplan point may be lower than that of a single Air Mile when redeemed for flights, but you could be in the air faster with an Aeroplan credit card.

For example, with the BMO AIR MILES World Elite Mastercard, you can earn 3 miles for every $12 you spend at retail partners. To compare, you can earn between 1.25 and 3 Aeroplan points for every $1 you spend on purchases made with the American Express Aeroplan Reserve Card. Using the above example, you’d need to spend at least $396 to collect roughly 100 Air Miles, but just $33 to $80 to earn 100 Aeroplan points.

Finally, Aeroplan has an attractive “Family Sharing” feature that allows up to eight family members or friends to pool their points, making it easy to redeem Aeroplan points for maximum value .

Make sure you compare the Aeroplan and Air Miles features before you decide what’s best for your needs.

Frequently asked questions about Air Miles

In June 2023, the Bank of Montreal announced the completion of its acquisition of LoyaltyOne’s Air Miles Reward Program .

5,000 Cash Miles are worth $525, as 95 Cash Miles have a monetary value of $10 (giving each mile a value of 10.5 cents).

The cash value of 5,000 Dream Miles is hard to pin down since it depends entirely on how you redeem them. You can experiment with the Air Miles search tool to explore different trips and see how far your 5,000 Dream Miles can take you.

About the Authors

Georgia Rose is a lead writer on the international team at NerdWallet. Her work has been featured in The Washington Post, The New York Times, The Independent and The Associated…

Sandra MacGregor is a freelance writer who has been covering personal finance, investing and credit cards for over a decade. Her work has appeared in a variety of publications like…

DIVE EVEN DEEPER

22 Best Credit Cards in Canada for May 2024

NerdWallet Canada’s picks for the best credit cards include top contenders across numerous card categories. Compare these options to find the ideal card for you.

Interest charges don’t need to be a mystery. Use our credit card interest calculator to see how much interest you’d owe if you carry a credit card balance.

When Do Air Miles and Other Travel Rewards Expire?

Travel rewards typically expire after 18-24 months of inactivity, but there are several ways to prevent this, even if you don’t have travel plans at the moment.

- Tour Operators

- Destinations

- Hotels & Resorts

- Digital Edition Spring 2024

- Digital Edition Fall 2023

- Travel Webcast

- Agents' Choice Gala

- Suppliers Kit

- Canadian Travel Press

- Travel Courier

- Offshore Travel Magazine

- Culinary Travels

AIR MILES Unveils New Travel Booking Platform

October 18, 2023

The AIR MILES Reward Program (AIR MILES) has launched AIR MILES Travel, it all new booking platform as travel is back and top of mind for Canadians.

The innovative and improved platform offers collectors the ability to book all travel in one place and offers unprecedented earning opportunities, with more choice and enhanced flexibility.

AIR MILES Travel has introduced more ways to earn Miles, effectively setting the program apart from the competition by giving up to 12.5% in value back to travel-booking collectors.

AIR MILES Travel puts the choice back in the hands of the collector as they select how they want to pay. Collectors can pay for travel with their credit card and earn Miles, or use Dream Miles to fund their flight, car, hotel and more.

Alternatively, collectors can choose a combination of both – ideal for continuing to build your balance while still leveraging Miles earned.

Finally, collectors will soon have the option to finance their trip, with the launch scheduled later this year.

Beyond the choice and flexibility, AIR MILES Travel offers more value to the program in general, such as:

- Powerful earn rates for standalone travel bookings (varies by Onyx, Gold, and Blue collectors)

- Earn up to 5x the Miles on bundled trips anywhere in the world (i.e., flight and accommodations or flight and car rentals)

- Collectors will experience enhanced value when paying with a BMO AIR MILES Mastercard or a BMO AIR MILES World Elite Mastercard, as they will also earn 3x the Miles on the total credit card spend

- Additional travel partners such as leading international and domestic airlines as well as alternative lodging options such as all-inclusive hotels and vacation homes

- More travel options like tours, excursions, theme park tickets, and more to offer collectors a breadth of travel experiences around the world

- Flexibility to book everything – from flights to hotels to extras – all in one platform

AIR MILES is working with airline, hotel, and car rental providers, and is continuously expanding its roster of trusted travel suppliers to enrich the product offering for collectors on the new platform.

After booking on AIR MILES Travel, collectors are invited to use the Reward Miles earned to redeem for daily essentials like gas and groceries using Cash Miles or reward themselves with merchandise, fun experiences, or more travel using Dream Miles.

Shawn Stewart, President, AIR MILES Reward Program, said that: “The enhancements we’ve made to our travel booking platform are a game changer for collectors, aligned with AIR MILES’ reinvigorated commitment to increasingly invest in new ways to earn and redeem.”

Stewart continued: “AIR MILES Travel has been enhanced to ensure an exceptional and seamless travel-booking experience, showcasing the richest travel earning opportunity in the market, and thus, highlighting the improved value of being an AIR MILES collector.”

For more, go to https://bit.ly/AIRMILESTravel .

A first look at Queen Anne, Cunard’s first new ship in 14 years

Jamaica poised for continued growth in the cruise market

- Search Please fill out this field.

- Manage Your Subscription

- Give a Gift Subscription

- Newsletters

- Sweepstakes

- Airlines + Airports

Everything You Need to Know About Earning and Redeeming Airline Miles

Want to fly for free? Here's everything you need to know about earning and using airline miles.

:max_bytes(150000):strip_icc():format(webp)/Stefanie-Waldek-7eed18a8c9734cb28c5d887eb583f816.jpg)

onurdongel/Getty Images

If you're thinking about dipping your toe in the airline miles game, don't delay. While points and miles can often feel overwhelming, it's easy to handle the basics — and that's enough to get you free flights and upgrades. Best of all, every frequent flier program is free to join, and you don't even have to be a frequent flier to sign up. We're here to help you understand airline miles so that you can start boosting your travel experience ASAP.

What to Know About Airline Miles

Airline miles — sometimes referred to as airline points, frequent flier miles, or award miles — are a form of currency used in frequent flier programs. Generally speaking, you earn miles for flying with an airline, and you redeem those miles for free flights, upgrades, or other purchases. Some credit cards also have similar points and miles rewards programs, but airline miles are specific to an airline (and sometimes its partners). Airline miles are often valued anywhere from just below one cent to two cents per mile.

How to Earn Airline Miles

There are numerous ways to earn airline miles, and they vary based on the specific frequent flier program. In order to earn airline miles, you must be signed up for an airline's frequent flier program — this is free to do, and you can sign up for multiple airlines' programs.

Flying with an airline (and sometimes its partners) is the primary way most travelers earn airline miles. For each flight you take, you'll receive a certain number of miles; the exact number of miles depends on your airline's policy. Most airlines base the number of miles awarded on either the distance flown or the amount paid for the ticket. Just remember that you must input your frequent flier number on your booking to earn airline miles. (Although you can request miles after your trip if you forget to add your number before).

Using Airline Credit Cards

If you have a co-branded airline credit card , you will likely be able to earn one to three airline miles for every dollar you spend on that card. Pay attention to earning bonuses for certain categories, which vary per card. In many cases, you'll earn higher bonuses for paying for flights with your credit card directly through the airline — for example, five miles per dollar instead of one mile per dollar.

Transferring Points From Other Credit Cards

If you have a credit card that has its own points system — like Chase Ultimate Rewards, AmEx Membership Rewards , Citi ThankYou Points, and Bank of America Travel Rewards — you may be able to transfer those points into an airline frequent flier program. Airline partnerships vary by credit card issuer.

Shopping and Dining Partnerships

Some airlines have e-shopping portals through which any purchases will earn you miles. Similarly, some airlines also have dining partnerships that reward you for eating at eligible restaurants.

Related: How to Get More Miles With AAdvantage Dining — No Flights Required

Other Partnerships

Many airlines develop partnerships with rental car companies and hotel groups, so if you rent a car or book a room with one of these partners, you can actually earn airline miles. Typically you're not able to "double dip" and earn miles or points for both the airline and the travel partner, so advanced points players will want to be strategic about which account earns the points. Some airlines allow you to link your account to other businesses, too, like Lyft and Starbucks.

Me 3645 Studio/Getty Images

How to Redeem Airline Miles

Many travelers use airline miles to book free flights and pay for upgrades, but there are other ways to spend them.

Once you accumulate enough miles — at least a few thousand, but more realistically a few tens of thousands — you'll be able to spend those miles on flights. Since miles are free, you're essentially getting free flights, but there is a tiny catch. You'll still have to pay taxes and fees on the flight, which usually nets out to less than $100 per ticket.

To use miles as payment for flights, you'll need to book your flights with the airline directly, not through a third-party booking site. When you search for the flights, simply click the box that says something to the effect of "pay with miles."

You can also use miles to upgrade to a higher class of service or preferred seats within your current cabin, such as an exit row seat. After you've made your booking, check your booking on the airline's website or app to see if upgrades are available. Keep in mind that some airlines price upgrades dynamically, meaning the price will change based on demand. So if you don't like the price you see for an upgrade, you can take your chances to see if it will drop. But beware — the cabin could fill up before you find the price you like, leaving you in economy.

Other Redemptions

Each airline offers miles redemptions outside of flights and upgrades. You can use miles to pay for other aspects of air travel, from lounge memberships to top-shelf drinks in the lounges to in-flight WiFi, depending on the airline. But you can also use miles to pay for other parts of your travel experience too, including hotels, car rentals, and even special events or experiences.

Airline Miles and Elite Status

While airline miles and elite status are both part of a carrier's frequent flier program, they're two distinct branches with different purposes. Airline miles are simply an airline-specific currency, whereas elite status is a rewards program where you earn perks typically based on how much you spend and how much you fly with an airline. If you're not flying enough to achieve elite status, don't worry — you can still earn airline miles without it. But those with elite status do earn more miles per flight than non-elite members of a frequent flier program.

Kiwis/Getty Images

Tips for Making the Most of Your Airline Miles

Use award calendars to find the best deals..

The more flexible you are with timing, the more likely you are to score a great miles redemption deal. Most airlines allow you to view award flights on a calendar, showing you the best deals across an entire month. Sometimes bumping your flight earlier or later by a few days can net you huge savings.

Keep expiration dates in mind.

Each airline has a different policy when it comes to expiration dates. Some airlines have no expiration dates for miles, while others set expiration dates based on your most recent account activity. Read the fine print to ensure your hard-earned miles don't expire before you can use them.

Research change fees.

While you can typically change flights booked with miles, there's often a fee associated with any amendments, but this depends on the airline. If you want to cancel your booking made with miles, you can often redeposit those miles back into your account for a fee, with fees varying by airline.

Don't agonize over the redemption value of your miles.

It's natural to want the best bang for your buck — or in this case, redemption for your miles. But there's no reason to agonize over the value of your redemption. The threshold for a "good" redemption is unique to each individual and their circumstances at any given time. At the end of the day, anything you put your miles toward will be (mostly) free, and that's always a good price.

Related Articles

How to earn Air Miles

With over 200 partners and more than 25 years of presence in Canada, there are now many ways to earn Air Miles. If you’re an Air Miles collector, then make sure you’re aware of all the following ways to earn Air Miles.

- In-store : Show your Air Miles card in-store to get miles based on your purchases. There are over 100 retailers offering Air Miles including Shell, IGA, Sobey’s, Metro Ontario, Lowe’s, ACE, Staples, Jean Coutu, etc. You can earn double the points at these merchants if you pay with an Air Miles credit card.

- Booking hotels and car rentals : When booking with select hotel and car rental chains, you can opt to earn AirMiles instead of hotels or car rental points. This includes Alamo, Avis, Budget, National, Best Western, Holiday Inn, Crowne Plaza, etc.

- Shop online using airmileshops.ca : When making online purchases, you can earn Air Miles if you first login into Air Miles shopping portal at airmileshops.ca. Similar to rakuten.ca or greatcanadianrebates , airmileshops will reward you for your online shopping by giving you Air Miles on your purchases. The list of available online merchants is 150+ long and includes Amazon, Apple, booking.com, eBay, expedia.ca, GAP, H&M, hotels.com, Hudson Bay, Indigo, Lowe’s, Macy’s, Nike, Priceline, Reitmans, Sephora, Staples, Ticketmaster, etc.

- Book travel using travelhub.airmiles.ca : You will earn Air Miles if you book hotels, flights, car rentals or travel packages through the Air Miles travel portal.

- Promotions with partner retailers – search for them in your local flyers

- Bonus earnings on airmileshops.ca

- Targeted offers by mail or on Air Miles app

- Big nationwide promotions like Mega Miles or Shop the Block

Earn AirMiles on all your expenses with credit cards

There are more than 10 credit cards that will earn you Air Miles in Canada, but I think the following two are the best bang for your buck.

BMO AIR MILES®† World Elite®* Mastercard®*

- $120 Annual fee – First year free*

- 2,000 AIR MILES sign up bonus

- Get 3x the Miles for every $12 spent at participating AIR MILES Reward Partners*

- Get 2x the Miles for every $12 spent at eligible grocery stores*

- Earn 1 reward mile for every $12 in credit card purchases, everywhere you spend*

- 25% Discount on all AIR MILES flights in North America with no blackout periods

- Complimentary membership in Mastercard Travel Pass provided by DragonPass – No free passes

The BMO Air Miles World Elite Mastercard is widely considered the best Air Miles credit card since it earns you 1 Air Mile for every $10 spent and you get a 15% discount on air miles flights within North America. Right now, the current promotion gives you 3,000 Air Miles as a welcome bonus and the annual fee of $120 is waived for the first year. For more details, you can read my BMO Air Miles World Elite Mastercard review now .

Dream miles vs. Cash miles

Most people don’t realize is that there are two types of Air Miles: Dream miles and Cash Mile

Dream miles can be exclusively redeemed for flights, travel booking on Air Miles travel portal, merchandise or attraction tickets. Hence the term “dream.”

Cash miles can be redeemed directly in stores to reduce the cost of your purchase or can be redeemed for gift cards. Think of this as a cash back type of redemption.

One really annoying rule of Air Miles is that you need to decide if you want to earn Dream miles or Cash miles. You can allocate any percentage for Dream and Cash (e.g. 60% Dream and 40% Cash), but once those miles are in an account (Dream or Cash), they are locked in that account and can’t be transferred into the other one. The good news is that you can change your allocation percentage at any time.

How to redeem Cash Air Miles

Cash Air Miles are very easy to use. They can be redeemed at retail outlets just by swiping your Air Miles card or can be redeemed for gift cards online at a ratio of 95 Air Miles for $10.

The list of stores where you can redeem cash Air Miles is quite extensive and includes Shell, Rona, Sobey’s, IGA, Safeway, Metro (Ontario), Hudson’s Bay, Jean Coutu, Cineplex, Starbucks, ACE, VIA RAIL, Toys’R’Us, The Keg…

Air Miles merchants different based on your region so make sure you check out the complete list of stores for here

How to redeem Dream Air Miles

Dream Air Miles can be redeemed online for merchandise, attraction tickets (ex: DisneyWorld), hotels, car rentals, flights or travel packages.

Redeeming for flights is what makes Dream miles popular since they’re arguably the best way to get the most value out of Air Miles. The Air Miles redemption chart is based on distance flown, but note that they also have seasonal pricing which can increase or decrease the number of points required to get a free flight. Here are a few examples of redemption costs in miles (low season / high season) within North America:

- Toronto – Washington : 1,300 / 1,600

- Montreal – Halifax : 1,300 / 1,600

- Calgary – Portland : 1,400 / 1,700

- Vancouver – San Diego : 1,900 / 2,600

- Toronto – Miami : 2,800 / 3,500

For other continents, the number of miles required varies based on distance but flights can easily cost more than 10,000 miles. To see how many miles you need for a particular destination, you can look it up on their interactive chart here .

Since the Air Miles redemption chart is based on distance and not cost, it means that short but costly flights can yield a very good value. As an example, flights within the same province like Sandspit – Vancouver, Sept-Iles – Montreal or Labrador City – Saint-John can easily cost more than $500 but can be redeemed from 1,200 to 1,400 miles only. This is a fantastic value for Air Miles.

It’s important to note that only a limited amount of seats per flight are allocated to award redemptions so you need to book in advance or be flexible on your dates in order to book popular routes or popular dates. When redeeming for flights, the miles only cover the base fares of the flight so you would need to pay for the taxes, fees, fuel surcharges and aircraft surcharges.

When do Air Miles expire?

Technically, Air Miles don’t expire. However, your Air Miles account will become dormant if you don’t have any activity in your account in 24 months. If your account goes in dormant status, your points will be removed. If you want them back, you will need to pay $0.15 per mile to reinstate them. In other words, make sure you don’t let your account go dormant!

How my friend got $2,000 in free grocery from Air Miles in a year

A friend recently told me that he and wife redeemed $2,000 of free grocery out of Air Miles.

Remember, it takes 95 Air Miles for $10 in free groceries so they would have needed 19,000 Air Miles to claim $2,000. You would think that it would have taken them years to earn that many points, but you’d be surprised.

Earning 19,000 AirMiles seems impossible if you only consider the regular earnings from spending at participating retailers since you would need to spend $380,000. However, by focusing on signup bonuses and yearly major promotions on 2 accounts, they were able to pull it off.

Here’s the breakdown of how they earned 19,000 Air Miles in only a year:

- Signup bonus from BMO World Elite MasterCard: 2 x 3,000 = 6,000

- Spending on BMO World Elite MasterCard: 2 x 1,000 = 2,000

- Shop The Block promotion: 2 x 2,000 = 4,000

- Mega Miles promotion: 2 x 1,500 = 3,000

- Bonuses from other promotions: 1,500

- Airmilesshops.ca earnings (regular and promos) : 2,000

- Earning miles on regular spending at participating retailers: 500

- TOTAL: 19,000 Air Miles

Obviously, they relied a lot on promos, but as you can see, Air Miles can be lucrative.

Are Air Miles worth it?

My Air Miles review is positive. Although Air Miles does have ridiculous rules, the credit card signup offers and in-store promotions can give great value for little effort. It costs nothing to join, so you might as well sign up.

About Barry Choi

Barry Choi is a Toronto-based personal finance and travel expert who frequently makes media appearances. His blog Money We Have is one of Canada’s most trusted sources when it comes to money and travel. You can find him on Twitter: @barrychoi

23 Comments

We’ve chosen Cash miles for years, and currently get about $1,300 in free groceries per year. We don’t fly often as a family, and it’s usually in high season now that the kids are too old to pull out of school for a week.

That’s incredible! Air Miles Cash Miles can have good value if you shop at merchants where you can earn Air Miles.

S shadow of its former self. Now u need double or triple the amt of miles since they tried to cancel or expire earned miles. Goods also cost way more miles for the same thing. The new rules amont to a cancelation of earned miles. We switched everything to royal Bank rewards.

My complaint is that at one point Airmiles offered that you could buy extra Airmiles at 0.20$ per air mile, but when we went to redeem the Airmiles, they valued the Airmiles at 0.13$ per Airmiles, that was a loss of 0.07$ per airmile , not cool, kind of a rip off….

Generally speaking, buying any type of miles or points isn’t worth it unless there’s a really good promo going on or you have a specific reason for doing so.

I’m a collector since 1994 and it used to be really fair if You spend decent money the rewards were really good, in the last 5-6 years they are such a nickel and dime type of business always trying to cheat You by doubling or even tripling the amount of miles to get rewards really sad I was an avid fun/collector.

I think it’s rediculous how much you have to spend to receive 1 air mile…I’ve received maybe 5 times a $10 off my groceries at Sobeys…I’ve had air miles for years.. When u don’t have much money to spend it’s almost impossible To be honest…I prefer optimum points where u get 10 points for each dollar spent…with my prescriptions…and such…I get approx $40 off per month…plus going to superstore …when I can get there…which is cheaper than Sobeys….I get even more

If the only way you’re getting Air Miles is through spending you’re doing it wrong. You’re supposed to go for the promotions. That’s where you can find incredible value. Air Miles you really need to read the fine print more so than with the other programs out there so it’s a bit of a game. I got into it two years ago because of my father who’s been collecting for years he’s got at least a 40k balance last I checked his account. I myself I am already at 12k so it’s not a bad program and not hard to get points.

For reference, I am also am a fan of and collect Optimum points, Aeroplan Points, Avios Miles, Delta Miles, Marriott Points, Hilton Points & Best Western Points. Each program has a niche and strong points you just have to find them. I realize not everyone has time to learn all the programs but I try. There may be some other programs out there but so far these are the ones I have found the most value with.

All fair and excellent points. My review is based on the general public. For example, my dad has collected Aeroplan Miles for close to 40 years and all he’s claimed are free car washes. He barely uses the internet and would have no idea how to take advantage of the promos.

Exactly, it all depends on how you use the program. I meant to put my reply under one of the other reader’s responses. Good article. Thanks for giving the program a review. Already planning today with my father now how we’ll get our 7 partners for the current Shop the Block promotion going on.

Ha, I was doing the same for Aeroplan. After reading the terms and conditions, I was like this is too complicated.

Not worth the effort to me. PC Optimum is the best I’ve seen. For example, each Tuesday, they typically offer 33% back, which is available for redemption immediately. So, I’ll spend $75, get 25,000 pts added to my account which allows $25 to be discounted on my next purchase. And that’s without signing up for cards I don’t need, or rushing out to buy things I don’t need on some promotion. It’s cash, every week, on the things I need and regularly buy.

I agree, PC Optimum is a much easier and better program.

I appreciate your writing this article! I got one of those “don’t let your Air Miles expire” emails and was wondering whether to bother keeping it active. It’s clear, thanks to you, that there is value in the program for some people – those who enjoy this program are encouraged to continue to do so, but I’m out.

PC Optimum points is the best loyalty program. Airmiles are useless for travel. Most of the time the taxes, fees and surcharges are the lion’s share of the airfare, and the miles don’t provide much value. Once LCBO and Pharmaplus stopped issuing Airmiles I got nervous about the longevity of the program. I just redeemed 8900 miles for a beautiful new Samsung TV. I have 700 miles left and they are useless to me. PC points for me!

BMO Air Miles World Elite Mastercard is no longer 1 air mile per $10 spent. They quietly increased it to $12 per air mile quite a while ago without informing members about the increase. This means you must spend 20 percent more in order to keep your Onyx level privileges.

Thanks for the reminder. I’ve been meaning to update this page but I’ve been so lazy.

I have bought many items from Amazon.ca and it appears that lately I have not gotten any AM because they separate your order so that you have several charges, therefore NO AM!

I used to benefit from many good bonus offers when I purchased Shell gasoline. It required buying 30 litres twice within a period of time. I recently bought a smaller and more fuel efficient car. The problem is that the tank will not hold 30 litres. Therefore, I am not eligible for this bonus. Seems like this offer is anti-environmental. They could change the bonus offer and base it on the amount spent, rather than quantity.

What kind of car do you have? Even a SmartCar can hold 33 litres of fuel.

I have a 2012 Scion IQ. The owners manual states that the tank holds around 32 litres. The problem is that I do not want to run the car close to empty in order to have it accept the 32 litres. Nothing worse than running out of gas on the highway. I wonder if some of the hybrid vehicles hold less than 30 litres.

I must admit I had no idea that Airmiles was such a scumy organization! My dad have been collection Airmiles for as long as I can remember but for the last 4 years has been suffering from Alzheimers disease and recently I cleared out his wallet and found his trusty Airmiles card only to find that Airmiles had deleted all his Airmiles to 0. After a call to complain the best they would offer was a sorry for your luck & was there anything eles they could help me with. What a heartless scam of an organization! Please delete your Airmiles account as soon as you can before they do it for you for some reason they decide to make up in the future.

Using Air Miles to book a flight is impossible. I spent 6 hours getting one excuse after another – my postal code is not acceptable (when it is accurate) – my Passport expiry is Not in accordance with the format (it was 0) – then I tried phoning Air Miles..on Nov, 16 the answering machine totd me that they would not accept any more calls since they already had too many requests. On Nov 17 I got through via Shell Oil and BMO and waited for one hour on hold. I can oly conclude Air Miles is op0erating a scam to avoid booking flights on Dream Miles.

Leave a Comment Cancel Reply

Get a FREE copy of Travel Hacking for Lazy People

Subscribe now to get your FREE eBook and learn how to travel in luxury for less

- Book Travel

- Credit Cards

Air Miles: 4 Ideas for Redeeming Miles for Flights

Well, everyone, it’s finally happening. We’re going to talk about Air Miles.

I haven’t given Air Miles too much attention here at Prince of Travel thus far, mainly because it doesn’t quite stack up to some other programs out there in terms of the value you can extract from the program. Nevertheless, over 10 million Canadians are Air Miles collectors, and they certainly deserve to know how they can maximize the points they’ve earned, don’t they?

I’ve just added a Guide to Air Miles to the Points Programs section of the website, which provides a high-level outline of all the best ways to earn and redeem Canada’s most popular loyalty currency. We’ll start talking about the program in much more detail in future posts, but for today, I wanted to flesh out the possibilities of redeeming Air Miles for flights and provide a few practical examples of ways to book flights at a good value.

In This Post

Air miles: setting expectations, 1. short-haul flight within north america.

- 2. Long-Haul Flight within North America

3. Trip to the Canadian North

4. flying to europe or other continents.

Before delving into the redemption ideas just yet, we should talk a little bit about the general expectations of what you can accomplish with Air Miles.

First off, Air Miles’s award chart is really only useful for economy class flights, as there is no provision in the award chart for business class or First Class flights. As discussed in the Guide to Air Miles , you can book premium flights using the FlexFly perk that comes with the Amex Air Miles Reserve Card , but that’s essentially a fixed-value redemption scheme that ultimately won’t be very useful for booking flights in premium cabins that cost thousands of dollars.

Next, there are a few significant shortcomings in terms of the functionality of the Air Miles award search engine. First off, the award pricing doesn’t necessarily conform exactly to what’s given in the award chart, as there seems to be an element of dynamic award pricing involved (i.e., a more expensively priced flight might require slightly more Air Miles to book).

But even more frustratingly, the search engine won’t show you the search results if you don’t currently have enough Air Miles in your account to book! This really isn’t a consumer-friendly feature at all, as it makes it quite difficult to plan for larger redemptions with Air Miles.

Taken together, the lack of premium cabins and the lack of transparency in terms of the redemption prices mean that the value of Air Miles is generally reduced compared to a program like Aeroplan , which by comparison is excellent for flying business class and provides a clearly laid-out award chart.

Searching for value within Air Miles can therefore be quite a challenge, and I wouldn’t recommend treating the program as your main focus when collecting points. Nevertheless, Air Miles are quite easy to earn given the wealth of retail partners they have, so they’re best thought of as the “gravy” on top of the other major points programs – after all, everyone needs to book a quick, no-nonsense economy class flight every now and then, and as we’ll see below, Air Miles does provide a few pockets of value for those types of trips.

The last thing to mention relates to the nominal value of Air Miles. The “baseline” value of Air Miles should be thought of as 10.5 cents per point (cpp), because that’s the value you’re getting when you trade them in for groceries at a ratio of 95 Air Miles = $10. When you redeem Air Miles for flights, you should therefore be seeking to get a value of at least 10.5cpp, because otherwise, you’re better off just using them for groceries instead.

But 10.5cpp seems like an exceptionally high value, doesn’t it? Most of the points currencies we’re familiar with exist in the range of 1–2cpp, and something like 10cpp is usually considered to be unbelievable value.

Well, it’s really just a matter of different programs using different conventions for the nominal values of their points. While a program like Aeroplan usually quotes its mileage amounts in the five-figure range, Air Miles uses the four-figure range – for example, you can typically start to redeem flights at 1,000 Air Miles.

Accordingly, the signup bonuses and earning rates are also adjusted: while Aeroplan credit cards grant five-figure signup bonuses and earn 1 mile per dollar spent, Air Miles cards grant four-figure signup bonuses and earn 1 mile for every $10 spent, so it all works out to be the same. Don’t be fooled by this!

With all that said, let’s see if we can disprove Air Miles’s less-than-stellar reputation and hunt for some value within the program. All of the below flights are priced out for one traveller, and keep in mind the key tips that are discussed in the Guide to Air Miles : the BMO Air Miles World Elite MasterCard will get you a 15% discount on flight redemptions (which is reflected in the below examples), having Air Miles Onyx status will open up more availability, and having a companion voucher (a legacy perk of the BMO credit card) just about doubles the value of these trips if you redeem for at least two passengers.

One of the most reliable high-value uses of Air Miles is for short-haul flights within North America. This is because short-haul flights can get kind of expensive despite the limited distance they cover, opening the door to a distance-based award program like Air Miles to provide added value by covering the cost of the flight with relatively low required mileage.

Take the below long weekend trip from Toronto to Montreal, which would cost you $394 if booked with cash. The Air Miles pricing gives you the same journey for 1,594 Air Miles (taking into account the 15% discount from the BMO Air Miles World Elite MasterCard) plus $109 in taxes and fees. This works out to 19.3cpp in value, which far exceeds the baseline value of 10.5cpp that you’d get by redeeming Air Miles for groceries.

Another way to think about this is that if you didn’t redeem those 1,594 Air Miles on this flight, you could instead redeem them as $167 towards free groceries (since 95 Air Miles = $10 in free groceries). You’re therefore paying just $167 worth of grocery money plus $109 in taxes and fees (a total of $276) for your weekend trip, a much more reasonable price compared to the full fare of $394.

As a point of comparison, Aeroplan would charge you 15,000 miles plus a similar amount of taxes and fees for the same journey on Air Canada instead of WestJet. Would you rather part ways with 15,000 Aeroplan miles or 1,594 Air Miles? The answer will vary from person to person, but in general, since Aeroplan miles can be used towards much more valuable redemptions like Mini-RTW trips or premium cabin flights, it might well make more sense to use Air Miles for these “smaller” redemptions instead.

2. Long-Haul Flight within North America

While some travellers have aspirations of jetsetting around the globe, others are content with a simple trip to somewhere warm once a year during the festive periods. Reasonable airfare down south during Christmas and New Year’s… is that too much to ask for?

Apparently. Check out the below fares from Vancouver to Arizona at the end of the year:

Instead of paying the $686 cash fare, what if we took a look at Air Miles? We can book the flights for 3,536 Air Miles plus $135 in taxes and fees, netting us a value of 15.6cpp. Again, that’s better than the baseline value of 10.5cpp, so it should be considered a decent use of your Air Miles.

If we asked ourselves “how much grocery money is this equivalent too?”, we’d find that 3,536 Air Miles amounts to $371 in grocery money. Add in the taxes and fees, and you’re looking at effectively paying $506 for your flights instead of $686 – a good chunk of savings.

Note that we’re getting good value here because we’re travelling in peak season, so the cash fares are artificially high – during low season, fares on the Vancouver–Phoenix route are often as little as $300, at which point it might not make sense to redeem Air Miles. Always be sure to check your redemption ideas against the cash fares to determine if it’s a good value or not.

A few niche redemptions through Air Miles can deliver even better value. For example, visiting Churchill, Manitoba, the Polar Bear Capital of the World, can be very expensive if booked with cash. The trip below, which retails for almost $1,500, can be had for a mere 1,989 Air Miles plus $157.86 in taxes and fees. That amounts to a vertigo-inducing 63.6cpp in value!

If we were to think about this trip in terms of “grocery money”, 1,989 Air Miles is equivalent to $209 in groceries. Add in the taxes and fees and you’re effectively only paying $367 for a $1,423 flight – and thus scoring a 74% discount!

If you’re feeling even braver, you can even book a trip into the deep Canadian Arctic, which would take you to two or more destinations that are pretty cool indeed. For example, you could fly the below route from Ottawa to Edmonton, but with a few days each in Iqaluit and Rankin Inlet:

You’d piece together this trip on a segment-by-segment basis, but since each segment has an exorbitant cash price and thus gives you extremely high value for your Air Miles, the overall trip would give you an extremely high value as well.

I’ll spare you the litany of screenshots here, but in total, you’d be looking at spending:

2,040 Air Miles + $51 in taxes and fees for the Ottawa–Iqaluit flight (retails for $862)

1,193 Air Miles + $16 in taxes and fees for the Iqaluit–Rankin Inlet flight (retails for $1,446)

1,591 Air Miles + $51 in taxes and fees for the Rankin Inlet–Edmonton flight (retails for $1,637)

In total, you’re spending 4,824 Air Miles + $118 in taxes and fees, but you’re saving an eye-watering $3,945 on the retail costs of these flights. Value-wise, that amounts to 80.4cpp – this, my friends, is how you win in Air Miles.

Of course, this type of trip might not appeal to everyone, but if you do have an interest in exploring our country’s more remote Northern regions, Air Miles might well be the way to go. As a point of comparison, Aeroplan also lets you book flights on First Air and Canadian North up to the Arctic, but you wouldn’t get to customize your stopovers quite as much – and if you did want to do so, you’d have to pay for multiple awards.

Outside of North America, Air Miles tend to be less useful, and there are a few reasons why:

Economy class airfare to other continents are at a historical low, thus suppressing the average value you’d get from an Air Miles redemption

Air Miles imposes fuel surcharges on redemptions outside of North America, which can quickly eat into your savings

As a result, the occasions on which you might find it worthwhile to redeem Air Miles on long-haul international flights would be limited to when the cash fare is exceptionally high, perhaps during peak travel season. Take, for example, the below one-way flight from Toronto to Istanbul on KLM. It’ll cost you $1,117, or you could redeem 5,100 Air Miles instead, although you would have to pay the taxes, fees, and fuel surcharges totalling $387:

This gives you a value of 14.3cpp, which is good but not great. It’s about on par with the North America long-haul example from above, but pales in comparison to short-haul flights and a trip up to the Canadian North. Remember, though, as long as you’re exceeding the baseline 10.5cpp in value you’d get from redeeming for groceries, you’re coming out ahead of what the vast majority of Canadians blow their Air Miles on.

Generally, I’d say that while there are occasional opportunities in redeeming Air Miles for long-haul international flights, their optimal usage remains short-haul and long-haul flying within Canada and the United States. A very compelling strategy for the traveller who likes taking both kinds of trips, then, is to focus on Air Miles for North American flying while using another program, like Aeroplan, for the bigger long-haul trips instead.

Air Miles is a program that I’ve ignored for far too long. While it might not carry the glamor of luxury travel in cushy First Class suites, Air Miles gets the job done when it comes to those simple trips that you need to book (particularly within North America) where you’re looking for a way to avoid paying the full cash fare, and intrepid travellers will also do well to take note of the opportunities in redeeming Air Miles for travelling up to the Arctic tundra.

Overall, there are many ways to get over 10.5cpp in value from redeeming flights, and given how easily you can earn Air Miles through their vast range of retail partners, it’s a program that ought to be, if not your primary focus, then one of the many alternatives that you keep in your locker as you look to optimize your travel.

- Earn 2,000 AIR MILES ® † upon spending $3,000 in the first three months†

- Earn 1x 3x AIR MILES ® † per $12 spent at AIR MILES ® † partners†

- Earn 1x 2x AIR MILES ® † per $12 spent at grocery stores, wholesale clubs, and alcohol retailers†

- Use AIR MILES ® † for Cash Rewards or Dream Rewards†

- Minimum income: $80,000 personal or $150,000 household†

- Annual fee: $120 (rebated in the first year)†

13 Comments

Introduce your summer interns Ricky!

You may have noticed Andrew’s contributions – he’ll be helping me plan blog articles, develop the Resources section, and chip in with replying to readers’ comments!

Another one of my summer interns, Rachel, is working behind the scenes on a few other projects.

What are your thoughts on using air miles for all inclusive travel vacations to the Carribean?

It looks like Air Miles partners with Red Tag Vacations for all-inclusive trips and offers the option to redeem 909 Dream Miles for $100 towards the booking. That would work out to 11 CPM which is ahead of cash miles (a 10.5 CPM) but nothing spectacular. I would personally save my Air Miles for flight redemption since flights tend to cost more than the theoretical price, but if you’re swimming in Dream Miles, there’s nothing bad about redeeming for all-inclusive trips.

Really glad to see you covering this program! Although the redemptions on Air Miles typically aren’t as lucrative as some of the other programs out there (in particular Aeroplan), I’ve never understood why so many people simply dismiss out of hand the possibility of finding Air Miles sweet spots. There are indeed many uses for Air Miles, as you’ve pointed out.

In my own case, being based on the far edge of the country in St. John’s, Newfoundland, I’ve found Air Miles to be particularly valuable as a secondary points currency for those times when I’d rather save my Aeroplan or Amex MR points. For example, travelling from St. John’s to Toronto – something I frequently do – costs either 30K Aeroplan points or a mere 1500 to 2000 Air Miles. With taxes and surcharges being roughly the same between these programs, deciding which points currency to use is a no-brainer. In this sense, having a healthy reserve of Air Miles on hand for short-haul or domestic travel makes it easier to save up for a big international redemption using other programs.

Looking forward to seeing more posts like this one! Cheers,

Hey Justin,

I’m glad you enjoyed our Air Miles related posts, your use case is definitely one where using Air Miles makes sense, especially on a shorter flight where business class wouldn’t make much sense.

Is there anything in particular you’d like to see us cover? I think we’ve hit on the major redemption options between this article and the guide, but if there’s something we’ve missed, let us know!

Can I switch my cash miles to dream miles as I’m stuck with tons of cash miles now?

Thanks in advance.

Funny you’d ask that, I touched on that in one of our Knowledge Base articles this week: https://princeoftravel.com/knowledge/whats-better-cash-rewards-or-dream-rewards

The quick answer is unfortunately you can’t exchange already earned miles. You can redeem your Cash Miles for store vouchers (essentially gift cards) though which can be an easier way to redeem Cash Miles. That being said, it’s pretty easy to accumulate more Air Miles so you can probably build your Dream Mile stash while redeeming your Cash Miles. Happy earning!

Do you get the airline perks and loyalty points if you book with airmiles. For example if I book a westjet flight as an RBC WJ cc holder will I still get a free checkin bag and earn WJ dollars on my airmiles booked flight?

Loyalty points are typically not earned on Air Miles tickets since the fares are typically booked into a "basic" fare or a deep discount travel agency fare class. Unfortunately the only way to know the fare class is to call Air Miles and have them check the class the ticket is booking into.

In terms of airline benefits, you should be able to get the airline provided ones, as long as they don’t require you to book into a specific fare class or though a specific channel. For your example, the WestJet RBC World Elite Mastercard only requires you to have your WestJet Rewards ID on the reservation when checking-in to get the free bag. As such, you’ll be able to benefit from the checked bag benefit.

For those near YYZ, a trip to New Orleans is a great redemption.

Only non-stop flights are w/ AC which has tickets for $800+. I did a redemption for this past Easter long weekend which came out to 54.7cpp when I used the 15% BMO AM WE MC and the companion waiver.

AM redemption might also be useful if you need a positioning flight for a bigger flight somewhere else.

Thanks for your input! Been considering a NOLA trip for Mardi Gras next year, so this is something I’ll personally be keeping in mind.

I have used Airmiles to Churchill and also, used Companion voucher on the same trip

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Prince of Travel is Canada’s leading resource for using frequent flyer miles, credit card points, and loyalty programs to travel the world at a fraction of the price.

Join our Sunday newsletter below to get weekly updates delivered straight to your inbox.

Have a question? Just ask.

Business Platinum Card from American Express

120,000 MR points

American Express Aeroplan Reserve Card

85,000 Aeroplan points

American Express Platinum Card

100,000 MR points

TD® Aeroplan® Visa Infinite Privilege* Card

Up to 85,000 Aeroplan points†

Latest News

Buy Avianca LifeMiles with a Mystery Bonus

Deals May 3, 2024

Marriott Homes & Villas Promotion: Stay Two Nights, Earn 50,000 Points

Deals May 2, 2024

Hilton Honors Summer 2024 Global Promotion: Earn Double Points

Recent discussion, amex upgrade offers: green to cobalt & cobalt to gold, the beginner’s guide to td, air miles® expands earning at wholesale clubs and other retailers, the complete guide to british airways first class, rbc changes earning rates on the rbc® british airways visa infinite†, prince of travel elites.

Points Consulting

Some airline issues get you a refund, some don't. How it works | Cruising Altitude

John Schrier was traveling home to New York from Taipei, Taiwan, last month and said the flight was interminably boring.