- September 25, 2023

DOING HOSPITALITY BUSINESS IN NIGERIA: UPDATES FROM NIGERIA’S NEW TOURISM LAW

A. Introduction

1. In January 2023, the erstwhile President of Nigeria ( President ), Muhammadu Buhari, assented to the Nigerian Tourism Development Authority Act 2022 ( Act ) to regulate the Nigerian tourism industry ( Industry ). The Act which expressly repealed the now former Nigerian Tourism Development Corporation Act , is the new specific and substantive legislation for the Industry. In this brief, we explore the potentials of the Act in bringing the much yearned for development in the Industry, highlighting its significant introductions and reforms. This brief takes special interest in the soft infrastructure, especially funding that the Act brings in its wake, with the view of pointing Industry players in the right direction along with the deserving conversations to be had.

B. The Regulators :

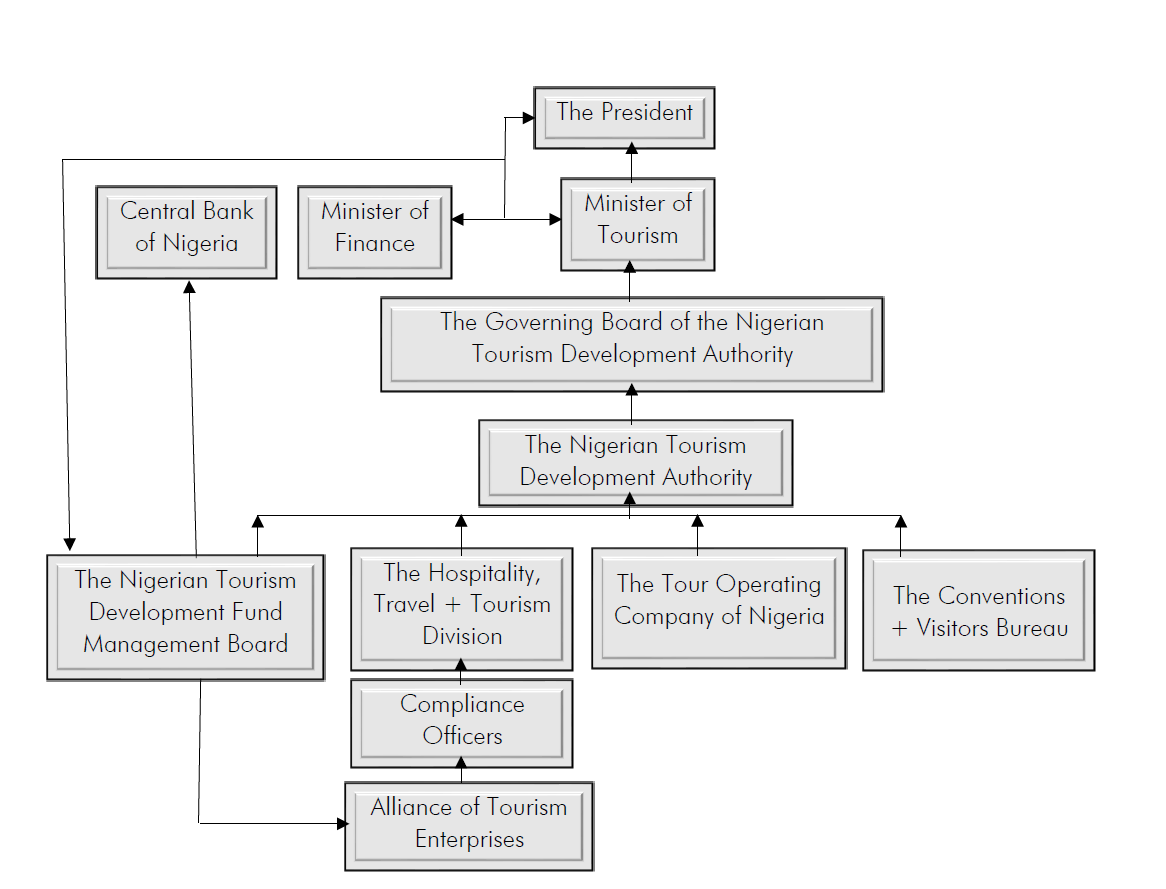

2. The Act creates a rather complex and multi-layered regulatory structure with differing institutions best pictured in this organogram:

3. Summarily, at the apex of the Industry’s regulation is the President who appoints his Ministers, the Chairman of the Governing Board of the Nigerian Tourism Development Authority (the Board ) and the Director-General of the Nigerian Tourism Development Authority (the Authority ). The Board supervises the Authority, although the Minister can directly give instructions to the Authority. Details of the other institutions shall be seen in the other aspects of this brief.

C. The Hospitality, Travel and Tourism Division:

4. Prior to the conversation on the opportunities that the Act provides, focus must be had on the scope of its enforcement powers. Significant in this regard is the Authority’s Hospitality, Travel and Tourism Division (the Division ) which is empowered with the following far-reaching responsibilities of the Authority, to wit, the:

4.1 classification, accreditation, and grading of tourism organisations in accordance with standards set by the Authority; and

4.2 imposition and enforcement of the Authority’s sanctions.

5. The powers of the Authority to accredit and grade all tourism establishments ( Accredited Members ) is expressed to be in furtherance of creating an Alliance of Tourism Enterprises (the Alliance ) that meet with the Authority’s standards of quality assurance, consumer protection, public health, and safety.

6. Accreditation and renewal of accreditations is an annual compliance requirement that must be met by all tourism organisations between April 1 and September 30. This means that all tourism organisations must obtain their accreditation and Accredited Members, their renewal, all before September 30 of every year.

7. Failure to be accredited or renew accreditation are offences punishable with a minimum fine of N 200,000 or imprisonment of a term not more than two years, or both, plus a further fine of N 5,000 for each day during which the offence continues.

8. Accreditation is stated to confer such benefits as:

8.1 certification of and promotion by the Authority;

8.2 recognition by the World Tourism Organisation;

8.3 eligibility for:

8.3.1 specific fiscal or tax reliefs or exemptions including custom duty exemptions;

8.3.2 financial incentives, subsidy, grants, and concessionary interest loans from the Tourism Development Fund (the Fund );

8.3.3 in respect of some hotels, the authorization of the Central Bank of Nigeria ( CBN ) for them to buy and sell foreign exchange.

9. To ensure compliance with the Act, the Authority is empowered to appoint Compliance Officers who are statutorily empowered to:

9.1 enter, inspect, examine and undertake such investigation of any Accredited Member’s hospitality facility;

9.2 notify (Improvement Notice) Accredited Members to take measures to rectify any defects or meet prescribed standards within a specified period failing which the Compliance Officer will serve a Notice of Non-compliance on the Accredited Member. A further refusal to comply with an Improvement Notice will result in loss of membership of the Alliance, and issuance of a Public Notice Disclaimer.

D. Nigeria’s New Tourism Development Fund:

10. The Act creates the Fund to be managed by the Nigerian Tourism Development Fund Management Board (the Board ). The Fund has a wide range application, including to fund tourism development and related projects in the areas of, tourism:

10.1 capacity building (education/training)

10.2 entrepreneurship

10.3 export

10.4 financial incentives (subsidy, grants, and concessionary interest loans)

10.5 infrastructure

10.6 market research

10.7 promotion and marketing

11. The Fund which will be kept with CBN in accordance with the Federal Single Account Policy, will be sourced from:

11.1 The Federal Government of Nigeria’s ( FGN ) seed capital, intervention fund, contribution, loans, or grants.

11.2 Donations from States and the Federal Capital Territory; Local Government Areas; Ministries, Departments and Agencies of Governments; private organisations and individuals.

11.3 3% of the Tourism Development Levy (which we shall shortly touch on).

11.4 Revenues from the Authority’s projects, investments, and services.

11.5 Sums approved by the President, following the joint pre-approvals of the Ministers of Tourism and Finance.

12. The Act creates a Tourism Development Levy (the Levy ) which is to be imposed by the Authority on:

12.1 tourism visas at such rate as to be determined;

12.2 hotel rooms at 1% of the room rate or such rate as to be determined by the Authority;

12.3 outbound (of Nigeria) travelers at such rate as to be determined by the Authority;

12.4 such other basis as the Authority may prescribe.

E. Nigeria’s New Tour Operating Company:

13. The Authority is required to set up a tour operating company (the Company ) that will render tour services within and outside Nigeria. The Company, which is mandated to operate offices in the Nigeria’s geo-political zones to encourage tourism, will be ran commercially for it to generate and manage its revenues. We note that as a commercial enterprise, the Company enjoys no special commercial status as it is bound to adhere with the rules of fair competition which entails the obligation to operate competitively alongside other private commercial entities in accordance with Nigeria’s competition law.

F. The Conventions + Visitors Bureau:

14. The Authority shall establish and manage a Conventions and Visitors Bureau (the Bureau ) to oversee destination marketing and promote Nigeria as a top destination for events. In this wise, the Bureau will engage in biddings for Nigeria to host international events.

G. Conclusion:

15. The Act should bring with it the hope of greater development in the Industry. This is an aspirational statement that will require the implementation of the Act to validate. In other words, we need to see the Act in operation to know if Nigeria has gotten it this time around. With the global tourism industry trending at almost 5% of global GDP, the Industry’s current less than 2% of Nigeria’s GDP has room for significant improvement. That improvement will be birthed on the altar of pragmatism and progressivism; two concepts that reflect a high dose of “flexibility”. The flexibility required will ultimately be that of the Legislature who must be alert to monitor the Act in action and be ready to amend it if at all it attempts to stifle the Industry. The Act was made for the Industry and not vice versa. All hands must thus be on deck to ensure that the growth of the Industry remains the theme of discourse. Perhaps the discourse may lead to ensuring that the horse is finally put before the cart by revisiting and restating Nigeria’s 33 year old 1990 Tourism Policy to bring it line with the realities of modern, post-Covid, tourism.

16. Last mention must be made of the Levy and other taxes that tourism businesses are currently subject to. With +20 different tax obligations in the Industry owed to Nigeria’s 3 tiers of Government, the Levy is arguably another nail on the coffin of the Industry; not especially with the wide powers given to the Authority to determine most of the rates. We conclude with the poser whether existing taxes cannot be employed to meet the funding obligations of the Act.

Please do not treat the foregoing as legal advice as it only represents the public commentary views of the authors. All enquiries on this Brief should please be directed at:

Bidemi Olumide Managing Partner [email protected]

Joseph Ajah Senior Associate [email protected]

Uwemedimo Atakpo Jnr

Associate [email protected]

Oghenekaro Isiorho

Associate [email protected]

More Articles

HOST COMMUNITIES DEVELOPEMENT TRUSTS UNDER THE PIA: POLICY VS. PRACTICE

The Petroleum Industry Act (PIA) was enacted in 2021 to regulate Nigeria’s oil and gas industry. One of its key provisions is the establishment of Host Communities Development Trusts under Chapter 3 of the PIA. The introduction of the Host Community Development Trust was aimed at addressing the existing gaps in catering to the needs of host communities, under an unregulated CSR structure adopted by oil operators, and to aid the development of the economic and social infrastructure of communities in petroleum producing areas.

REGULATION OF KEY PLAYERS IN THE NIGERIAN PENSION INDUSTRY: AN APPRAISAL OF SECTION 77 OF THE PENSION REFORM ACT 2014

The Nigerian pension industry stands as a critical pillar in the nation’s socio-economic landscape to ensure the financial security of millions of retired citizens. A key feature of the Nigerian Contributory Pension Scheme (“CPS”) that has aroused commendation is the bifurcation of the management and custody of pension funds between licensed Pension Funds Administrators (“PFAs”) and Pension Fund Custodians (“PFCs”), respectively.

FINANCING RENEWABLE ENERGY PROJECTS IN NIGERIA

As the name indicates, renewable energy refers to energy that is generated from natural sources which replenishes itself at a rate higher than the rate of consumption. They are also referred to as clean energy. Examples of this class of energy include solar energy, wind energy, geothermal energy, hydropower, and bioenergy. In contrast to renewable energy, fossil fuels are non-renewable sources of energy that are limited in nature and contribute to carbon emissions which harm the ozone layer.

Follow AO2LAW on Twitter

Ao2law calendar.

- Top Stories

- Arts & Books

- Entertainment

- World Stage

- Photo Story

Blueprint Newspapers Limited

Blueprint gives you the latest Nigerian news in one place. Read the news behind the news on burning National issues, Kannywood, Videos and the Military

Tourism: Now that NTDA Act is law, what next?

A new chapter is about to open in the tourism industry following the signing into law of an Act sent to the National Assembly a long time ago. ELEOJO IDACHABA writes on what awaits the sector according to industry players.

For years, the tourism industry that is supposed to be a major driver of revenue for the country had remained a shadow of itself; no thanks to the absence of an enabling legal instrument to enable the sector function like a statutory government agency with revenue generation at the background while not jettisoning growth.

During the administration of former president Olusegun Obasanjo up till the late Umar Yar’Adua, the sector witnessed phenomenal growth. Unfortunately, the gains were not preserved by subsequent administrations; that was when Otumba Olusegun Runsewe was at the helm of affairs at the Nigeria Tourism Development Corporation (NTDC). His stewardship actually saw Nigeria achieving some successes.

Although not much was achieved in those years, to a large extent, the sector threw Nigeria up for reckoning in so many ways. For instance, that was when the All Nigeria Cultural Festival usually held in Abuja was enunciated even though it was ditched later. Subsequent administrations after then to date have painfully treated the sector with disdain. In fact, one of the conspiracies against the sector was the abrogation of the status of its parent ministry. As a consequence, it was transferred to be supervised by the Ministry of Information that has no semblance with tourism.

As a result of this, tourism remained comatose, placing excuse on lack of enabling act until recently.

In early February 2023, President Muhammadu Buhari appended his signature to the Nigerian Tourism Development Authority Bill and Related Matters, 2022, thereby repealing the Nigerian Tourism Development Corporation Act, cap. N.137, laws of the Federation of Nigeria 2004.

With the new bill the Nigerian Tourism Development Authority is expected to develop and promote Nigeria as a travel and tourism destination by encouraging people living in Nigeria to take their holiday in the country while encouraging those abroad to visit Nigeria. By this, the new act is to discourage the culture of Nigerians paying huge foreign currencies for tourism abroad. According to the new bill, the authority shall be a body corporate with perpetual succession and a common seal and may sue and be sued in its corporate name.

Part of the details states that, “There shall be established a governing board of the authority which shall consist of a part-time chairman who shall be appointed by the president and shall be a person of proven integrity and experience in the field of hospitality, travel and tourism, a director general, two representatives from Federation of Tourism Association of Nigeria (FTAN), one member representing public interest who must be a private tourism practitioner and other government agencies like Customs, NIPC, SON, Nigeria Police, NIHOTOUR, Immigration, Ministry of Foreign Affairs, among others. This development is to take the sector to the next level of effective collaborations, regulations and revenue generation.

The director-general of NTDA, Mr. Folorunsho Coker, said, “The new law is speaking of temporary issues in tourism. It is not a draconian law. It is collaboration between states and the federal government towards driving revenue in the tourism and hospitality industry.

“It is about a tourism trust fund which is now a vehicle in use to invest in tourism assets. We must understand that if the laws are not right, investments will not come in.

“The operation of an old law in a dynamic environment that is constantly changing will not get us to where we want to be. Dubai, South Africa and Kenya amended their laws during Covid-19 pandemic and they thrived, but we did not.

“However, I will do a comprehensive breakdown of the new law and share it with the 36 states. I will invite the 36 commissioners of tourism to Abuja, so that we can sit down, discuss, reach an agreement and take it to the next level.

“If you could recall, fantastic legal frameworks were given to the telecommunication and banking sector and we had positive results. It is time for tourism to flourish with the help of the new law.

“I want to thank those that made the new law possible. NTDC is now NTDA, and it is going to be a different ball game that will sanitise the sector and generate huge revenue to the country.”

This is just as President Muhammadu Buhari has also signed the National Institute for Hospitality and Tourism (NIHOTOUR) bill into law.

The information was contained in a statement by the special assistant (Technical) to the director general of NIHOTOUR, Joesef Karim.

The law established the institute for training, certification and registration of hospitality, travel and tourism personnel in Nigeria.

Necessity of the new law

Justifying the necessity of an enabling act, head of legal unit of the new NTDA, Mrs. Funebi Otu Umondak, noted that the old law was over 20 year-old, obsolete and not helpful to the agency and the industry.

“We are grateful to Buhari for signing the bill into law. This law now made it possible for collaborations with states, local governments, private sector and international organisations and also made provision for Tourism Fund to help industry players grow and develop the economy. There would also be an alliance that will make tourism more attractive to everyone in the sector.

“What is important and key is the collaboration and partnership with stakeholders to make tourism better and flourish for our great nation.”

Immense benefits

Speaking on the sideline of this development, a tourism expert, Paul Adalikwu, said it has the magic wand to transform the sector for the good of the industry. “As it is, there is no reason why the industry should not experience a shift. It has been redundant for a while because operators and of course potential investors were looking out for areas of potential benefits that would be mutually agreed by all until now. What the drivers of the new law needs now is to create the awareness to attract investors. There are a lot of incentives in the new act that would be beneficial both to tourists, fun seekers, investors and government,” he said.

According to him, what the new act would do to the industry is akin to what the telecommunications act has done to telephony in Nigeria. He, therefore, advised everyone with genuine interest in tourism to partner with NTDC in evolving a new phase for the industry.

Another tourism expert, Mr. Ini Akpabio, said over the years, the industry has been the whipping child of the government because it had been left to fend for itself without any sense of direction.

Akpabio, who is the current chairman of Akwa Ibom Tourism Board and former chairman of NANET Suite, Abuja, said regrettably that the former state of the industry is the reason many erstwhile tourism initiatives did not survive few years after their conception.

“I ran a successful tourism outfit in Abuja, but due to lack of enabling environment, making progress became a herculean task such that one needed to rely on bank overdraft to stay afloat, but for how long? I want to believe that we are in for a new deal following this new law,” he said.

Before the new Act was signed into law recently by President Buhari, opposition to it had mounted way back in 2017. For instance, a group, Nigeria Hotels Association, had openly expressed its disapproval of the new law.

Mr. Lanre Awoseyin, the president of the association, had in 2017 criticised the Senate’s passage of the bill for an Act to amend the NTDC Act No 81 of 1992.

He had said that the contents of the bill were against the spirit of the constitution of the country, therefore advised President Buhari not to assent the bill, as according to him, the bill proposes that accreditation, registration and grading of hotels should all be handled by the NTDC.

He said that the bill also stated that one per cent of hoteliers’ charges each year would be remitted to the federal government, describing the remittance as outrageous, obnoxious and abnormal.

He said tourism and hotels are on the Residual List to be managed by the state government and not the federal government.

“The Constitution states that tourism and hotel management are under the Residual List, to be controlled by the state government and not the federal government. In spite of the private sector’s objection to the bill, the National Assembly still went ahead to pass it. Therefore, we urge the president not to sign it and disregard it.”

The Senate had, on October 19, passed the Nigerian Tourism Development Corporation Act (Repeal and Re-enactment) Bill, 2017, until it was signed recently after being subjected to scrutiny by all stakeholders.

Related Posts

Towards achieving sustainable development goals (SDGs)

May 25, 2024 May 25, 2024

How climate change, insecurity threatening Nigeria’s food security

Bolanle Onagoruwa, Virginia Etiaba: Where are they now?

May 24, 2024 May 24, 2024

About ELEOJO IDACHABA

- Contributors

- What's New

- Other Sports

- Marie Claire

- Appointments

- Business News

- Business RoundUp

- Capital Market

- Communications

- BusinessAgro

- Executive Motoring

- Executive Briefs

- Friday Worship

- Youth Speak

- Social Media

- Love and Relationships

- On The Cover

- Travel and Places

- Visual Arts

- Corporate Social Responsibility

- Philanthropy

- Social Impact

- Environment

- Mortgage Finance

- Real Estate

- Urban Development

- Youth Magazine

- Life & Style

- Love & Life

- Travel & Tourism

- Brand Intelligence

- Weekend Beats

- Ibru Ecumenical Centre

- News Feature

- Living Healthy Diet

- Living Wellbeing

- Guardian TV

- FG postpones inauguration of varsities governing councils

- My removal an act of God, says deposed Emir of Gaya

- Former EFCC chairman, Ibrahim Lamorde, dies at 61

- Lagos govt announces traffic diversion on major expressway

- Kano police vow to obey court order stopping Sanusi's reinstatement

Hotels and hospitality establishments grading, classification regulations

Introduction According to BusinessDictionary.com, there is no globally accepted, industry recognised benchmark(s) for the grading, rating or classifying of Hotels and other Hospitality Establishments.

Large Hotel Chains and Hotel Associations in different countries however have some globally recognised Guide which though is/are only implemented within the Hotel Chain or Association.

Presently in Nigeria, one of the Codified legal framework in this area is the Nigerian Tourism Development Corporation Act from which the Hospitality and Tourism Establishments (Registration, Grading and Classification) Regulations were made.

There is also for Lagos State, the Lagos State Hotel Licensing Law which authorises the Lagos State Ministry of Tourism and Intergovernmental Relations, through the Lagos State Hotel Licensing Authority, to classify, regulate, standardise and grade hospitality and other tourism businesses in Lagos State.

Guide to Grading and Classification Criteria Hospitality and Tourism Establishments are required to be graded and classified based on the minimum operating standards of the facilities and the services provided, managed and maintained in each Grade or Class of such establishment.

A review of the various Grading or Classification Criteria in different countries reveals the following common minimum requirements for each Class or Grade of Hotel, Restaurant, or such other Hospitality Establishment. Some of these minimum requirements are examined in the following paragraphs.

ONE STAR – A One-Star Hotel has some modest, limited range of facilities, furnishing and refreshment with at least ten (10) ensuite bedrooms. It adheres to a high standard of facilities-wide cleanliness. Such Hotels generally have an accessible location with onsite representatives on a 24 hour, seven days a week basis.

TWO STAR – This grade of Hotel offers a higher standard of accommodation, with at least 20 better-equipped ensuite bedrooms than a One Star Hotel. Each Guest Room must have a telephone and a coloured television. It must also have a minimum parking area for at least 10 guests cars.

THREE STAR – This grade of Hotel offers more spacious, nicer, better-equipped furnished ensuite rooms when compared to One Star and Two Star Hotels. It also has high-class decorations, coloured television in the ensuite rooms, showers, central air-conditioning, valet and room service,

one or more bars and lounges in the Hotel, on-site Restaurant, and a small fitness centre with a standard swimming pool. It must also have a minimum of 30 ensuite rooms in a more high-brow location of the City where it is located.

FOUR STAR – A Four Star Hotel comes with exceptionally well furnished ensuite rooms, with central air-conditioning, room and valet service, excellent restaurant and cuisine, concierge, porterage and luggage handling services, laundry, standard swimming pool and other recreational facilities. The location and environment where the Hotel is situated should be suitable for a Hotel with international standards. A Four Star Hotel also offers at least 50 ensuite rooms – 20% of which must be Suites and 25% must be single rooms.

A Four Star Hotel must also have at least one serviced elevator for its Guests, and another service elevator for its staff. Other facilities that it must have include: – fire detection facilities, closed circuit television (CCTV), a dining room, an internationally trained Manager, car park for at least 50 cars, Reception/Information Counter, Conference and Banquets Halls. At least 70% of its employees must be professionally trained. FIVE STAR – This is usually an internationally recognised branded Hotel, offering the highest standards and luxuries in its premises, with some of the finest architecture, ambience, accommodation, amenities, range of top-class guests and services provided. A Five Star Hotel should have a gym, a bigger sized Swimming Pool, Cuisines, more than one Restaurant, Casino, on-site shopping facilities and other in-premises recreational facilities.

A Five Star Hotel also offers at least one serviced lift/elevator for its Guests and another lift for its employees and goods. It must have at least 100 bedrooms; 25% of these rooms must be Suites and 20% must be Single Rooms. It must also have Gardens, a Lawn or Roof Garden, Reception and Information Centre, 24hours Concierge and Porter Service, a central Air-Conditioning System, CCTV, Wake-up Call Service, Conference and Banquet Halls, at least 2 Restaurants, Dining Rooms, 24hours coffee shop, a well-equipped Bar and a Car Park for at least 50 Guest cars.

Its manager must be internationally trained and should speak, where possible, more than one internationally recognised language. At least 80% of its other personnel must be trained in providing the highest quality of hospitality services.

Classification of Restaurants For Restaurants, their classification or grading is usually in One, Two, Three or Four Crown classification. Offences

It is an offence for any owner or Manager of any Hospitality, Leisure or Tourism Establishment to use any Star or Crown other than the one approved by the Hospitality Regulator. Fines and terms of imprisonment apply where such owner or manager is found guilty of any grading or classification infraction.

The Hospitality Regulator also has the legal authority to seal any business premises that constantly breaches any of the above Grading or Classification Regulations.

Conclusion A nationally transparent, buyers and sellers accepted good-faith Criteria and Regulations for the grading and classifying of Hotels and other Hospitality Establishments is very important in building consumer confidence and trust in the Hospitality, Tourism and other leisure sectors of the economy.

• Oserogho is of Oserogho & Associates, Lagos.

cancel reply

You must be logged in to post a comment.

Why are you flagging this comment?

I disagree with this user

Targeted harassment - posted harassing comments or discussions targeting me, or encouraged others to do so

Spam - posted spam comments or discussions

Inappropriate profile - profile contains inappropriate images or text

Threatening content - posted directly threatening content

Private information - posted someone else's personally identifiable information

Before flagging, please keep in mind that Disqus does not moderate communities. Your username will be shown to the moderator, so you should only flag this comment for one of the reasons listed above.

We will review and take appropriate action.

Get the latest news delivered straight to your inbox every day of the week. Stay informed with the Guardian’s leading coverage of Nigerian and world news, business, technology and sports.

Please Enable JavaScript in your Browser to Visit this Site.

Legal Framework of Tourism in Nigeria

Introduction.

Nigeria is blessed with exotic cultures which have overtime become sources of tourist attractions. The richness and diversity of the Country’s cultural heritage, coupled with its beautiful landscapes makes tourism a potential economic driver and foreign exchange earner for the country.

The fortune of Tourism in any socio-economic setting, like other sectors of the economy, is shaped by a number of factors, such as security, transport infrastructure, the hospitality industry, etc. Arguably the most far-reaching of these factors is the legal and regulatory regime. In Nigeria, legal skirmishes between the Federal Government and the States’ Governments over regulatory control appear to have plunged the sector into a flux and may have left industry players uncertain as to the state of the law and which master to defer to.

Legal and Regulatory Framework

The Constitution of the Federal Republic of Nigeria 1999 (As Amended), has no express provision on the regulation of tourism; the only provision therein is item 60(d) of the Exclusive Legislative List of the Second Schedule (Part 1) to the 1999 constitution which empowers the National Assembly to make laws for the “establishment and regulation of authorities for the Federation or any part thereof to regulate tourist traffic”. This provision was ordinarily perceived to be the constitutional basis for the Federal Government’s overriding control over the tourism sector and it was on this premise that the NTDC Act empowered the NTDC to register, grade and classify hospitality firms across the Country.

Though the constitution makes no provision for the definition of tourist traffic, the Apex Court in Nigeria held in the case of A.G Federation v. A.G. Lagos State that tourist traffic means the ingress and egress of tourist in Nigeria. The implication of the decision of the Court in this case is that the legislative and oversight powers of the National Assembly are limited to just immigration activities of tourist. Thus, notwithstanding the combined provisions of Item 60(d) & Item 68 of the Exclusive Legislative List which empower the Federal Legislature to make laws relating to “tourist traffic” and matters incidental thereto, such laws/regulations may only go as far as is necessary for the purpose of tourist immigration only.

In the referenced case of A.G Federation v. A.G Lagos State , the Federal Government sued the Lagos State Government seeking the judicial interpretation on who has the power to register, grade and classify hospitality concerns in the country. The Federal Government sought a declaration that the Lagos State legislation[2] of licensing and grading hospitality establishments is in conflict with the provisions of Section 4(2)(d) of the Nigerian Tourism Development Act 1992 (NTDA) and therefore, invalid, by reason of its purported inconsistency.

The Supreme Court dismissed the Federal Government’s case and held that the Lagos State House of Assembly is the body entitled – to the exclusion of any other legislative body – to enact laws in the state in the field of tourism and with respect to registration, classification and grading of all hospitality and tourism enterprise in Lagos State.

In a recent development, the Federal High Court appeared to further endorse States’ control in the hospitality arm of tourism in Nigeria. Some hospitality services companies challenged the validity of the Hotel Occupancy and Restaurant Consumption Tax Law in Suit No: FHC/L/CS/360/2018 – The Registered Trustees of Hotel Owners and Managers Association of Lagos v . A.G. Lagos State & Anor. In this case, the hoteliers sought a determination of the court as to whether the provisions of the VAT Act have covered the field with respect to goods and services consumed in hotels, restaurant and event centres in Lagos State and therefore, whether the provisions of the Hotel Occupancy and Restaurant Consumption (Fiscalisation) Regulations 2017, which are in relation to the same taxes, inoperative.

In resolving the issue in dispute, the court held that the power to impose, charge and collect tax pertaining to the supply of goods and services consumed in hotels, restaurants and event centres is on the residual list in the Schedule to the Constitution, and as such, is within the legislative competence of the Lagos State House of Assembly. The Court stated further that being a residual matter, those specific incidents of taxation are within the exclusive legislative competence of a state and that the various provisions of the VAT Act which deals with services consumed in hotels, restaurants and event centres are therefore inconsistent with the Constitution and void to the extent of that inconsistency.

One may have noted that the regulatory disputes have so far, revolved around the hospitality industry and the hospitality industry usually seems to hold the limelight in discussions on tourism. However, the tourism sector depends on a complex grid of industries and regulatory infrastructure to thrive.

Security is vital to the growth of tourism and constitutes a major tourist concern. Thus, safety of lives and property have always been important prerequisite for the attraction of international tourists. In Nigeria, the Police is under the exclusive remit of the federal government, pursuant to Item 45 of the Second Schedule to the Constitution. Thus, within the context of law enforcement, the federal government retains a very central role in the growth of tourism in Nigeria.

Similarly, a lot of the infrastructure needed in the industry are equally within the remit of the federal government. Examples include:

- Railways and Transportation (on federal trunk roads)

- food and pharmaceuticals (drugs)

The import is that, notwithstanding the decisions of the Courts analyzed in this paper, the federal government remains a major stakeholder in the tourism sector and its revenue stream can be significantly grown through the sector.

I am in agreement with the decisions of the Courts which empowers states to regulate the tourism enterprises within their respective states. This is because the tourism needs and potential of states vary. So, it behoves each state to decide which aspect of tourism they want to grow and invest in. However, there is equally a need for collaboration between the Federal and State government.

By way of recommendation, a Joint States’ Advisory Board could be created, whose membership will include the Chairman of each State Board and a representative(s) of the Federal Government. The purpose of this is to promote standardisation. The responsibility of the Board would be to create minimum operational standards in the hospitality and tourism industry and also promote uniformity in the regulation of the industry.

Please Share This

Authored by, lexavier partners.

Our practice areas include Litigation and Alternative Dispute Resolution, Banking and Corporate Finance, Capital Markets, Corporate and Commercial, Energy and Natural Resources, Tourism, Aviation, Telecommunications, Real Estate, Intellectual Property and Labour Relations.

Quick Links

- News & Insights

- Conference Papers

Practice Area

- Aviation & Maritime

- Banking and Corporate Finance

- Information Technology

- Capital Market Operations

- Corporate and Commercial Practices

- Intellectual property &Technology

Contact Details

M : 0805 906 9275 E : [email protected] Business Hours : Monday-Friday: 8:00am – 6:00pm

Lagos Office 89B Ojo Lane, Off HFP Way Dolphin Estate Ikoyi, Lagos.

© 2024 Lexavier Partners - All Rights Reserved

Website by yooudee, looking for a lawyer to talk to.

‘NIHOTOUR Act will change tourism in Nigeria’

THE National Institute for Hospitality and Tourism Establishment Bill 2022 was signed into law by President Muhammadu Buhari this week. The NIHOTOUR act became the first federal tourism law passed by the National Asssembly since the country’s advent to civilian rule in 1999. By this law, NIHOTOUR becomes the only federal tourism agency to effectively derive its mandate through a law passed by the National Assembly rather than inherited military fiat. The NIHOTOUR act of 2022 is expected to change a lot of things in Nigeria’s travel and tourism industry. A credible source within NIHOTOUR, who would rather remain anonymous since he was not mandated to speak to this newspaper, said the signing of the bill into law was a major milestone that would impact positively on the industry. He spoke on how NIHOTOUR was able to achieve this and the impact it would have on the Nigeria tourism industry: “This is a welcome development and I think it has to do with the tenacity of purpose by the present leadership of the institute. All these years, we have not been given teeth to bite, because with the act, we are able to do a lot of things in the industry. “Most times, a lot of people who are able to take our courses believe that since there was no act, our courses cannot be used, maybe in their organisation for promotion; without the act, those that the needed to pursue other degrees cannot do that; and if you want to have affiliation with some of these universities so that our students could go in and pursue their degrees,one of the things they will keep on asking us is where is our act. “You remember, when the institute was established, we have the project document… But that one, again, does not convince them. I believe with the signing of the bill into law, we will be able to do a lot of things and out impact in the industry more than than it was in the past.” He listed some of the things NIHOTOUR could do with the act: “We will be able to sign some MoUs with some universities for our students to pursue their degrees further. You know we run post graduate degree programmes and also diploma programmes. So, we can have relationship with some of these universities and the students can go further. “Secondly, based on what we have in the act, we are to certify personnels in the industry. This will also help us to be able to do that. Also, within the industry, we have some personnel that we would want to train. So, we would be able to train them. Before, we cannot do that because we don’t have the act. “ For instance, there was a time we wanted one of these foreign organisations to help us with some funds. They asked whether we have any act setting us up. So, with this, we will be able to reach out to them and know that we will be able to attract a lot of funds for the development of the institute.” The NIHOTOUR source also spoke on its impact in the Nigerian tourism industry. He said: “You know that our mandate is to provide training for personnel in the industry. To the larger Nigeria, we will be able to do more of this training. I want to assure you that in some of the areas where our presence has not not been felt, they will be able to feel our presence.”

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

To read this content please select one of the options below:

Please note you do not have access to teaching notes, a review of the hotel industry in nigeria: size, structure and issues.

Worldwide Hospitality and Tourism Themes

ISSN : 1755-4217

Article publication date: 11 April 2016

The purpose of this paper is to provide an overview of the dynamics that define, govern and shape the tourism and hospitality sector in Nigeria, in particular, the hotel industry with respect to its size, structure and salient issues that impact on it.

Design/methodology/approach

To explain the dynamics within the hotel sector, primary survey data from STR Global were used. In addition, content analysis of secondary data from government, education and industry sources were used to identify the issues within the industry.

The findings show positive indicators for employment and further expansion within the hotel sector in Nigeria. However, the lack of supporting institutions, legal frameworks and industry representation makes the management of human resources an area of concern.

Research limitations/implications

The findings of this research are limited due to the sample size and to the lack of publicly available data from government, education and industry. However, the implications suggest the need for a research agenda for the tourism and hospitality industry in Nigeria. This will create the framework to understand and improve best practices particularly with institutional frameworks, employment and human capital development.

Originality/value

The gap in the literature concerning any systematic review of the hotel industry in Nigeria makes this research timely, as it synthesises widely different sources into a coherent whole. This will help to form a reference point for future research in the field.

- Human capital development

- Hospitality education

- Hotel industry review

- Tourism and hospitality

Acknowledgements

Guest editor’s note: On November 11, 2015, the newly elected Federal Government of Nigeria created a Ministry of Information and Culture to oversee information, culture, national orientation and tourism in the country, a policy which in effect confers a non-priority status on the tourism industry.

Nwosu, B. (2016), "A review of the hotel industry in Nigeria: size, structure and issues", Worldwide Hospitality and Tourism Themes , Vol. 8 No. 2, pp. 117-133. https://doi.org/10.1108/WHATT-10-2015-0042

Emerald Group Publishing Limited

Copyright © 2016, Emerald Group Publishing Limited

Related articles

We’re listening — tell us what you think, something didn’t work….

Report bugs here

All feedback is valuable

Please share your general feedback

Join us on our journey

Platform update page.

Visit emeraldpublishing.com/platformupdate to discover the latest news and updates

Questions & More Information

Answers to the most commonly asked questions here

Increasing Investment Attractiveness Of Nigeria's Hospitality Industry: Legal And Other Considerations

Contributor

Introduction

The Hospitality and Tourism Industry (HTI) has the potential to bolster Nigeria's investment landscape and achieve increased contribution to our Gross Domestic Product (GDP). Given Nigeria's population and natural endowments, a steady investment in infrastructure and HTI friendly policies, coupled with sensitisation efforts to encourage in-country vacations and thereby conserving Nigeria's forex reserves - would be positive factors in this regard. Nigeria's abysmal ranking (129 th out of 136 countries) in the Global Travel and Tourism Competitive Index 2017 , should provide necessary impetus (coupled with efforts at improving Nigeria's Ease of Doing Business ) to underpin government and stakeholder actions to deliver impactful outcomes, manifesting in improved ranking in future editions.

There have been diverse initiatives to promote the HTI, though arguably not enough to intensively spur the needed growth. The HTI was accorded preferred sector status by the Federal Government (FG) in 1999 with incentives such as tax holidays and import duty exemption on tourism-related equipment whilst some States, like Lagos and Cross River have designated specific areas as tourism development zones (Lekki Tourism Zone/ Tinapa Resort etc.) making acquisition of land easier. The Minister of Information and Culture had launched the Economic Value of Geospatial Services in Nigeria - a collaboration with Google to create street mapping of Nigeria potentially showcasing the country's rich tourism sites to the world.

The Minister of Information and Culture also disclosed that the FG had inaugurated the Presidential Council on Tourism which will be working closely with the United Nations World Tourism Organization (UNWTO) to implement the long abandoned Nigeria Tourism Master Plan focused on strengthening institutional capacity of the Nigeria tourism sector.

This article seeks to discuss HTI's potential in attracting investment and routing traffic to Nigeria's tourist destinations through applicable legal and other instruments.

Substance & Optics: Unbundling Tourism Potential in Nigeria

Whilst other countries have continued to provide the right investments to make their countries attractive tourist destinations; security challenges, poor infrastructure, especially unavailability of steady power supply, have continued to deter potential tourists from Nigeria. One fall out of the foregoing is the global 'price notoriety' of Nigerian hotels, they are considered as overpriced.

Another impediment is the burden of multiplicity of taxes weighing down HTI: hotel operators are liable to Company Income Tax (CIT), Tertiary Education Trust Fund Tax (TET Fund Tax), Value Added Tax (VAT), Industrial Training Fund (ITF) Contribution and Consumption Tax in some States like Lagos Hotel Occupancy and Restaurant Consumption Tax. The recent automated monitoring of Consumption tax initiated by Lagos State Government, has generated another form of controversy between hotel operators in Lagos State and the Lagos State Government.

In its recent decision, the Supreme Court (SC) in AG Lagos State v. Eko Hotels Limited (2018) 36 TLRN 1 held that the imposition of Sales Tax (ST) on the Defendant constituted double taxation, since VAT was also chargeable in the same transaction. Following the SC's ratio in this case, its earlier decision in AG Lagos State v. AG Federation [2013] 16 NWLR (Pt.1380), 383 where it validated the Hotel Occupancy & Restaurants Consumption Law (HORCL) which imposes tax equivalent to the ST on hotel operators in Lagos State in addition to VAT appears to have been impliedly overruled. However, the SC needs to expressly make a pronouncement on this issue.

Another challenge encountered by HTI is regulatory conflicts and competition: the Federal and State Governments' respectively vies to regulate hotels, resulting in duplicative compliance requirements, instead of complementary inter-government oversight for sector advancement. AG Lagos State v. AG Federation (supra) provided the opportunity for the SC to hold that it is States that have powers to regulate hotels since hotel is not included in the Exclusiv e and Concurrent Lists of Parts 1 & 2, Second Schedule 1999 Constitution. The FG therefore lacks the constitutional vires to make laws outside its legislative competence: hotel regulation being a residual matter is reserved for States' Houses of Assembly.

New trends are daily evolving in the HTI. For example, conventional hotel and flight reservations are being disrupted by entrants like hotels.ng, wakanow.ng and travelstart.ng amongst other operators who have continued to shape the HTI through bespoke services. Another major global digital disruptor is the Airbnb model (working with individuals who are willing to sub-let spaces in their homes for a fee), which reportedly made revenues of US $1 billion in Q3, 2017 alone.

No doubt the hospitality space in Nigeria would be transformed with the potential entrance of initiatives such as Airbnb. It is expedient that the Nigerian Government put in place, and ensure the enforcement of adequate policies to ensure that Nigerian HTI develop in line with emerging global trends. By so doing, operators in the HTI will take advantage of the enhanced tourism activities and economic benefits of Nigeria's HTI. This will increase competitiveness in the country's HTI.

Increasing Private Sector Participation in the Hospitality and Tourism Industry

New operators are emerging in the HTI whilst existing operators are also upgrading their operations. For example, Carlson Rezidor, owners of Radisson Blu brand which recently welcomed a second Lagos hotel to its fold, made known its plans to invest about US$400 million in Nigeria in the next four (4) years and also open additional six (6) hotels in Nigeria under its various brands, Transcorp Hotel recently commenced construction of a 25 storey hotel building project in Ikoyi, Marriott , Accor , Hilton are also looking to improve and increase their investment in Nigeria by constructing new hotel apartments. These developments illustrates importance of the HTI in contributing to Nigeria's economy.

In order to enhance and foster participation in the HTI, the FG is set to enact the Nigeria Tourism Development Authority (NTDA) Bill 2017 (the NTDA Bill), harmonised version of which was passed by the Nigerian Senate in October, 2017. Currently, Nigerian Tourism sector is regulated by the Nigerian Tourism Development Corporation (NTDC) Act, Cap. N137 LFN, 2004. Enacted in 1992, and with some of it provisions held to be unconstitutional by the Supreme Court in AG Lagos State v. AG Federation (supra), the NTDC Act is expected to be repealed by the passage of the NTDA Bill .

A perusal of the NTDA Bill , points to FG's intention to create an enabling environment for practitioners in the industry, particularly the introduction of Tourism Development Fund, sections 26 and 27, NTDA Bill . The various sources of the Fund include monies provided by the FG, donations from other tiers of government as seed capital by way of intervention fund, contribution, loan, grant; monies borrowed and capital raised by the Authority under the Bill or any other enactment including such sums as may be received by the Authority from other sources. Others include monies earned by the operation of any project, enterprise financed from the fund or investment and other sums collected or received by the Authority for services rendered; and other monies that the Minister of Finance in consultation with the Minister may determine with the approval of the President.

The Fund would be utilised for funding tourism development and tourism related projects/programs including: marketing and promotion of tourism, capacity building, market research and development of tourism infrastructure, amongst others. Section 17 NTDA Bill, also established the Conventions and Visitors Bureau focusing on destination marketing as well as involvement in international biddings for hosting rights of events.

The initial draft of the NTDA Bill proposed a Tourism Development Levy ( section 30 ) which was to be generated from tourism visa fee, tourism development contribution levy of 1% per room rate or flat rate or any rate as may be prescribed by the Authority, levy on corporate Nigeria comprising an approved minimum percentage of interest rate on banks, telecommunication and other corporate entities and from such other levies or fees as the Authority may prescribe. However, after much controversy on this Levy, it was deleted from the final Bill passed by the National Assembly. Unlike the NTDC, the NTDA Bill excluded the State and Local Government from the National Tourism Board, this is perhaps in a bid to give effect to the Supreme Court judgment in AG Lagos v. AG Federation (supra).

Moreover, there are incentives for practitioners in the industry which arguably, have not been fully utilised. For example, section 37, Companies Income Tax Act (CITA), Cap C21 LFN, 2004 provides a 25% income tax exemption to hotel operators where the income is in convertible currencies derived from tourists by a hotel and such income is put in a reserved fund to be utilised within five (5) years for building of new hotels, conference centres and new facilities for the purpose of tourism development. This CITA provision aims at combating the financial challenges faced by hotel operators given the long gestation periods of most hotel projects. Investors in the HTI are also allowed to maintain domiciliary accounts with no compulsion to convert their foreign currencies receipts into Naira, section 15(4) Foreign Exchange (Monitoring and Miscellaneous Provisions) Act, Cap. F34, LFN 2004.

The tourism plans of various States, is an indication that the HTI will experience a positive turn around in the nearest future. Lagos State for instance has three hundred and twenty- seven (327) parks and gardens. Significant events like Osun-Oshogbo Festival (Osun State), Calabar Carnival (Cross-River State), Ojude-Oba Festival (Ogun State), Durbars (Kano and many Northern State), etc. awareness attract tourists and spices up Nigerian HTI.

Undoubtedly, creating an enabling environment for HTI would ensure steady growth with increased revenue potential through taxes: at the corporate (profits) level; on transactions (VAT and Consumption Tax on goods and services); and Personal Income Tax of direct and indirect employees. This is apart from the positive and impactful spill over effects for the wider economy. It is therefore prescient that sector friendly policies be put in place to encourage investment in the HTI. If HTI potential in Nigeria is to be unlocked, government at all levels must put in place holistic policy with well thought out implementation strategy.

All hands will need to be on deck to ensure the improvement of Nigerian HTI, avoiding mistakes and errors from the past and embracing modern development trends including technology. Hotel and hospitality staff should utilise the opportunity of enhanced foreign training and exposure. Various industry opportunities resident in Nigeria should foster new energy, spawning a competitive landscape that hopefully, a favourable business environment will make more appealing to investors and tourists. All said and done, a positive outlook beckons and all stakeholders should make it realisable.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

Media, Telecoms, IT, Entertainment

Mondaq uses cookies on this website. By using our website you agree to our use of cookies as set out in our Privacy Policy.

- Africa Collective

Business Insider Edition

- United States

- International

- Deutschland & Österreich

The Nigerian tourism and hospitality industry is making significant strides through healthy partnerships

Nigeria was expected to be the fastest-growing hospitality market with a projected 12 percent compound annual increase from 2019 to 2023 according to a PwC projection. In early 2020 however, the COVID-19 pandemic spread globally, and the tourism industry was one of the worst-hit.

Globally, the tourism industry contributes about 10 per cent to the global GDP. This was expected to rise in four years with significant upward movement in Mauritius, Kenya, Nigeria, and South Africa. In Nigeria, the contribution of travel and tourism to Nigeria's GDP was 5.1 per cent in 2019. In 2020 however, the upward trajectory slowed down due to the pandemic.

Recommended articles

With the ban on international and even local travel shortly after the outbreak of the viral infection in Nigeria, non-essential travels were suspended. Travel for work and holidays were put on hold and the nation as well as the rest of the world was forced to go virtual as a method of work and entertainment. Due to this, hotels, tourist attractions, and air transportation were some of the industries hinged on tourism that were badly affected.

Job loss in the travel and tourism industry

The World Travel & Tourism Council estimates that 1 in 10 workers in the world work in the hospitality industry. This translates to 1 in 10 workers losing their jobs as a result of the industry being grounded because of the pandemic. From March 2020 to around March 2021, many countries announced a ban on international travel and closure of restaurants and hotels while also limiting gatherings. All these measures were put in place to reduce the spread of the virus. However, they also affected employment in the travel and hospitality sector.

The Regional Director of the World Travel and Tourism Council, Andrew Brown revealed that “$4.5tn was lost by the tourism and hospitality sectors as a result of the COVID-19 pandemic worldwide and over 770,000 jobs were lost in the sector in Nigeria alone.”

This figure also closely follows the estimation that 1 in 10 Nigerians lost his/her job in the tourism industry which also affected those whose goods or services are either directly or indirectly connected to it.For example, the production of in-flight magazines in Nigeria took a hit when the tourism industry suffered as a result of the pandemic. While magazine production would be appropriately considered a media and communication sector, its target audience is tied to the travel industry which ultimately meant that those who worked in the editorial, photography, copywriting, news gathering, typesetting, printing, and distribution department of the magazine lost their jobs during the aforementioned period.

Companies that also provide cleaning services, entertainment and advertising for travel and tourism companies also had to lay off their workers, reduce their pay or in some cases, keep them officially employed while not paying them during the heat of the COVID-19 pandemic.

Beyond the examples mentioned above, there are more sectors and industries whose existence is reliant on providing goods and services to the tourism sector or are part of the supply chain that need the industry to thrive for them to benefit. The people in these sectors belong to the so-called ‘other 9’ whose industries are not considered a part of travel and tourism but essentially dependent on the sustained operation of the tourism sector for survivability.

What does the future hold?

As the world is trying to adapt to the changes brought by the pandemic, the hospitality industry is also making a steady albeit slow return. Research by Jenny Southan, a travel editor and founder of Globetrender, projected that “ as people think more carefully about the way they travel, they will seek out hotels and travel companies that are doing everything they can to minimise their impact on the planet. We can also expect accreditation to gain prominence, as consumers look for reassurance from legitimate “eco-tourism” certifications (Visitors) will want to book trips that leave them feeling better than before when they return home. Wellness tourism will be increasingly popular.”

Globally, there is an optimistic projection that the hospitality industry will make a remarkable return. However, only the prepared can make a quick return, and to do so requires understanding the uniquely changing needs of customers and clients. Nigeria needs to take a proactive approach in order to be at par with global best practices and not wait for others to take advantage of the relatively small market that is just making a return.

A Harvard Business Review article referenced partnerships between or among companies as a means for providing shortcuts for companies racing to improve their production efficiency and quality control. This symbiotic relationship provides an essential opportunity for rapid growth in a period where quick recovery and adaptation to change is necessary.

According to Deloitte, “In an environment of dramatically lower revenues, high fixed costs, less than optimal asset returns, and the need to conserve capital, hospitality organisations will need to determine which areas to prioritise and invest in. They will need to find the right balance between investment and conservation, one that achieves the highest ROI in the near to medium term. Some of these decisions will endure; others may not. But the decisions made in the months to come will have a lasting impact on the operating models of the hospitality sector for years to come.”

This level of preparedness is evident in the way Radisson Blu Anchorage Hotel, a respected hospitality brand, and part of Nigeria’s leading investment holding company, Honeywell Group Limited (HGL), is fostering an alliance with the Bank of Industry to provide a basis for the recovery of the hospitality industry in Nigeria.

This partnership is hinged on mutual respect nurtured by the positive track record of Honeywell group over the years. Our impressive performance before the pandemic coupled with a sustained positive service delivery during the pandemic shows a clear path of contributing toward the growth of Nigeria’s economy.

Nigeria needs more of these important partnerships in the hospitality sector to give it a much-needed boost.

Our relationship with the BOI has been a beneficial relationship and the Bank of Industry has proven to be a valuable business partner. The bank has supported us in building our brand as a foremost hospitality business .”

With this sort of institutional support long term, the projected growth in Nigeria’s tourism industry which faltered due to the pandemic, can recover, and possibly reach the expected height.

According to Deloitte , “the COVID-19 pandemic will eventually fade. The economy will recover, and the hospitality sector—from restaurants to hotels, casinos to sports—will regain its footing and look forward with confidence to a successful, thriving future. Now is the time for companies to act, adapt to the new normal, position themselves for nimbleness, and thrive in the years ahead.”

Written by Kemi Adeoye, Chief Financial Officer at Honeywell Group Limited

This is a featured post.

FOLLOW BUSINESS INSIDER AFRICA

Thanks for signing up for our daily insight on the African economy. We bring you daily editor picks from the best Business Insider news content so you can stay updated on the latest topics and conversations on the African market, leaders, careers and lifestyle. Also join us across all of our other channels - we love to be connected!

10 most loved airlines in Africa, according to online survey

10 african countries that consume the most alcohol, how to convert btc to naira efficiently using the best rates in the market, my private jet trip to usa cost less than flying kenya airways - ruto, the israeli war reportedly reaches africa, 5 african countries with us military bases, weapons systems, and troops, best african countries for entrepreneurship, top african countries that have the best work-life balance, sudan's army forges closer ties with russia amidst civil war.

List of African countries every African can visit without a visa in 2024

5 African countries that have the highest number of satellites in space

DRC special unit tasked with interrogating the Americans involved in the DRC coup

The royal couple reveals the best gift they received from nigeria.

- Commentaries

- Business News

- lawyers Events

- Government Policies

Buhari Signs Nigerian Tourism Development Authority Act 2022

President Muhammadu Buhari has signed Nigerian Tourism Development Authority Act, 2022, into law.

Director-General of NTDC, Chief Folarin Coker, said the Act repeals Nigerian Tourism Development Corporation Act, Cap. N137, Laws of Federation of Nigeria 2004.

‘It will develop and promote Nigeria as a travel and tourism destination,’ he said.

Coker noted that the Act will encourage collaboration with states, private stakeholders, government agencies and international bodies, while the authority will regulate the industry with states.

He added: “The tourism alliance will create platforms for stakeholders to benefit from international leveraging, tax reliefs/ incentives, national and international publicity.

‘’In line with international best practices, every tourism-reliant country regulates the industry via a national body.

“The new tourism law ensures uniformity of standards for regulating Hospitality and Tourism Establishments (HTE). Nigeria cannot afford to have 36 standards for regulating HTEs…

“All states can have their tourism laws assented to by governors, irrespective of the new NTDA law. The new law provides for a Tourism Partnership Alliance, where willing stakeholders under the alliance can be regulated as well as benefit from the federal advantages, which the alliance has to offer.”

Coker said the tour operating company, under the law, serves as a benchmark to private firms and stakeholders and not as a competitor.

UNI LAW FACULTIES

N20,000 Monthly Stipend “Laughable” — LAWSAN Raps NELFUND Implementation

O.B. Lulu-Briggs Foundation Affirms Support For Legal Education, Awards Scholarships To...

FG Sets 5% Limit On Temporary Appointments For Senior Lecturers &...

AGF Calls For Review Of ECOWAS Court To Avoid Conflicts With...

AGF Fagbemi Calls For Scrapping State Electoral Commissions To Empower Local...

Lawyers In Business Institute [LIBI] Launches Land-Banking Scheme For Lawyers And...

AGF Fagbemi Vows: No One Will Be Held Outside Nigeria’s Laws,...

Lawyers events.

Advance Your Career: NIALS & ILA Offer Intensive Certificate Course in...

Don’t Miss Out: ESQ’s Fintech Law And Policy Training — Your...

Eswatini King, 7 Govs, Ribadu, Olukoyede, Tuggar Others To X-Ray Economic...

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

The Nigerian Consumer and Hospitality Services: Interrogation of the Law and Policy

2019, International Journal of Law, Humanities & Social Science

The Nigerian Tourism Sector is an evolving one in terms of law and policy as it affects the protection of the consumer of hospitality services. The need to adopt global best practices for enhanced consumer protection calls for the evaluation of the vexed and challenging issues that negatively affect guests and tourists in the Hospitality Industry via case by case review. The prevalence of unsatisfactory services rendered by the service providers called “Inn-keepers or hoteliers” and their employees, insecurity, inadequate protection of the chattels particularly the vehicles, defective facilities, misrepresentation, negligent driving and the facilities being used as a safe haven for the perpetration of criminal activities are common problems that have become endemic in the sector so much so that there are plethora of criticisms and calls for robust legal framework to effectively check the trend and regulate the industry. In the United Kingdom, the aforementioned issues have since been addressed by the enactment of the Hotel Proprietors Act of 1956. This paper is aimed at addressing issues bedevilling the hotelier-guest relationship, the liability regime for the negligence of the former in the tourism sector in the light of the regulatory framework with a view of improving consumer satisfaction in the hospitality industry. Advocacy for replication of law and policies from climes like the United Arab Emirates, United Kingdom, United States of America and Israel with experience and economic benefit with a view to portraying shortcomings, relevance and adaptation by the Nigerian Government at Federal, State and Local Government Levels. It is posited that when available legal and institutional policy framework is put in place as well as enforced in Nigeria. The degree of care owed by the hotelier to his guest and unsettled judicial conflicts between Hon. Justice Anya and Adeyi’s authorities will be addressed as it concerns the protection of the consumer in the tourism/hospitality sector.

Related Papers

Edinburgh Law Review

Paul J. du Plessis

Sweetie Feranmi

Gonzalo Casanova Ferro

We aim to synthetically describe the phenomenon the accommodation business constitutes and its legal framework in Argentina, as well as displaying its pressing challenges.

Hospitality & Society

claudio michelon , Luís Duarte d'Almeida

Successful accounts of analogy in law have two burdens to discharge. First, they must reflect the fact that the conclusion of an argument by analogy is a normative claim about how to decide a certain case (the target case). Second, they must not fail to accord relevance to the fact that the source case was authoritatively decided in a certain way. We argue in the first half of this paper (Sections 2 to 4) that the common view of the structure of analogical arguments in law cannot overcome these hurdles. In the second half (Sections 5 to 7) we develop an original account that aims to succeed where others failed.

Murtala M Alamai

Sopia Infante

RELATED PAPERS

Shannon Lee Dawdy

Chris Guilding

Orhan Akova

Lukman Abdurraheem

Samuel Acheampong

Ishmael Mensah

International Journal of Contemporary Hospitality Management

Michael Symons

Prof. Konstantinos Andriotis

Prof. Sutheeshna Babu S

Kuwata Goni

Nonso Ewurum, PhD

Michael Kissi

Marvellous C Ahuama

Hospitality and Tourism Management Association of Nigeria

Opemipo A Ijose

Marriage and Family Review

Michele Grottola

Shingirirai Patsanza

Guido Smorto

Welcome Message

Pavit Tansakul

International Conference for Tourism and Business

RYAN T LIBA

International Journal of Hospitality Management

Simon Darcy

The experience of marginal rental housing in Australia

Anitra Nelson , Tony Dalton

Journal of Social History 46(1)

Maurizio Peleggi

Australian Housing and Urban Research Institute Final Report Series

Anitra Nelson

RELATED TOPICS

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

The Regulatory Requirements for the Operation of Restaurants in Nigeria

Published by harlem on february 5, 2022 february 5, 2022.

INTRODUCTION

The word restaurant is derived from the French verb “ restaurer ”, which means to restore or refresh, and thus by usage means an establishment that offers food and drink for sale. The restaurateur is the person in charge of the restaurant. [1]

It is no doubt that food production is one of the most lucrative businesses in Nigeria today as it thrives even when other commodities experience poor sales. This is because eating is a necessity. It is indeed the number one need of man.

Apart from the fact that there must be sufficient financial, human, and other resources for the operation of a restaurant business in Nigeria, compliance with the regulatory requirements is paramount as well. Considering the growing demand for restaurants in Nigeria due to the expansion of the mid-income group, growing urbanization, and busy lifestyle of Nigerians, individuals who operate restaurant businesses in Nigeria must be well guided by the regulatory laws set concerning registration and licensing.

Considered in the light of the above, therefore, this article seeks to highlight the regulatory requirements for the operation of a restaurant business in Nigeria.

REGISTRATION AT CORPORATE AFFAIRS COMMISSION (CAC)

As a first vital step, the Companies and Allied Matters Act, 2020 (CAMA) requires any entity seeking to do business in Nigeria to be registered by Corporate Affairs Commission (CAC). An individual seeking to operate a restaurant in Nigeria has the option of registering either as a sole proprietorship [2] , a limited partnership [3] , a limited liability partnership [4] or a private limited liability company. [5] The individual is required to make an application to the Corporate Affairs Commission (CAC) in the prescribed form accompanied with the necessary documents provided by the Companies and Allied Matters Act, 2020 (CAMA).

REGISTRATION AT NIGERIAN TOURISM DEVELOPMENT CORPORATION (NTDC)

The Minister of Culture and Tourism in the exercise of his powers to make regulations requiring the classification or grading of hotels, restaurants, and nightclubs and prescribing standards for their upkeep [6] provided the Regulation of Hospitality and Tourism Establishments (Registration, Grading, and Classification) Regulations 1995.

By the provisions of the regulations, all Hospitality and Tourism Enterprises must be registered. [7] This registration forms the basis for the classification and grading scheme to be undertaken by NTDC. Restaurants fall under the categories of registrable enterprises under the regulations. The regulations state as follows:

For purposes of these Regulations, Hospitality or Tourism Establishments may be graded as follows-

(b) food service establishments – restaurants, fast food, food canteen, cafe, cafeteria, coffee shop, snack bar, and bukataria. [8]

The regulation on the registration of Hospitality and Tourism enterprises provides that the Proprietor or operator of every Hospitality and Tourism Establishment is to ensure that within sixty days from the commencement of operations, applies to the Corporation in the prescribed form for the registration on payment of such fee as may be prescribed by the Corporation from time to time. [9] The Corporation in turn issues a certificate of registration to the applicant upon fulfillment of necessary conditions. It should be noted that no person shall operate a Hospitality or Tourism Establishment unless he has obtained and has a current certificate of registration from the Corporation. [10]

PENALTY FOR NON-COMPLIANCE

The regulation stipulates that any restauranteur who fails to comply with the rules shall be liable to a fine of ₦2,000.00 (Two Thousand Naira Only) for failure to make an application for registration within the specified time and an additional sum of ₦1,000.00 (One Thousand Naira Only) for every week the violation continues. [11]

A restaurant operator is required to comply with the various tax laws applicable to the state where his/her business is situated. Federal and State tax regulatory bodies like the Federal Inland Revenue Service and the Ministry of Internal Revenue of different States regulate the taxation of restaurants in Nigeria. Some of the Taxes applicable are as follows:

- Companies Income Tax (CIT)

For a company incorporated to carry on the business of a restaurant, it is mandated that it complies with the provisions of the Companies Income Tax Act (CITA) if the company is such that has more than N100 Million Naira turnover or a turnover between N25 Million and N100 Million. The payable tax is paid via Tax Identification Number. [12]

The Personal Income Tax is imposed on individuals who are either in employment or who are running their small businesses, under a business name or partnership. [13] This, therefore, means restaurant operators are captured in this definition.

Personal Income tax levied on restaurant operators is classed as direct assessment which is an assessment raised directly on self-employed persons (eg. Professionals, Contractors, Traders, Landlords, etc). The self-employed person is required to without notice or demand, file a return of income earned in the preceding year using Tax Form A. [14]

- Value Added Tax

Value Added Tax (VAT) is a consumption tax paid on purchased products or services rendered. [15] Usually, the standard rate for VAT is 7.5%. [16] it should be noted that all taxable persons are mandated to immediately register for the tax upon the commencement of business as defined in Section 46 of the VAT Act. [17] The penalty for failure to register is a fine of N10,000 to N50,000 for the first month of default, and a fine from N5,000 to N25,000 for Subsequent months in which failure continues. [18] Every taxable business owner is expected to file for their VAT monthly returns not later than the 21st day following the month of transaction. [19]

- Hotel occupancy and Restaurant Consumption Tax

The Hotel occupancy and Restaurant Consumption Tax is an additional tax levied on restaurants in states such as Lagos State which imposes a sales/consumption tax of 5% on services provided in restaurants within the state. [20] This tax is imposed on goods and services consumed in hotels, bars, restaurants, and event centers within Lagos State. It is payable by the consumers who purchase these goods and services. The hotels, bars, restaurants, and event centers serve as collecting agents for the Lagos Inland Revenue Service (LIRS). Restaurant owners/ operators are required to remit the tax to the LIRS on or before the 20th day of each calendar month in a format prescribed by section 6 of the Law. [21]

LICENSES/PERMITS

To operate in the food industry, every entity must be duly licensed having performed the requirements and obtained the license/permit. Worthy of note is the fact that the type of license to be obtained varies by location and type of restaurant in operation. These are discussed below:

- F OOD P ERMIT

Persons carrying on restaurant business in Nigeria are required to apply for a food permit and licenses within the Local Government of the state where the restaurant is located before the commencement of operations.

The National Agency for Food and Drug Administrator and Control (NAFDAC), a federal government agency created under the National Agency for Food and Drug Administration and Control Act of 1993 which is the regulatory body for the production and manufacturing of food and drugs also requires that those who sell food in commercial quantity obtain a Good Hygiene Practice (GHP) License from NAFDAC before commencing business operations. [22] A GHP license is issued upon satisfaction that the equipment of the food processor meets certain standards and that the food handlers possess the required certification. [23]

- ALCOHOL LICENSE

An alcohol/liquor license is required to be obtained by any organizational entity, producer, or manufacturer that wants to produce or sell alcohol in Nigeria. The Liquor (Licensing) Regulation of various States regulates the procedure for obtaining an alcohol license in Nigeria. In Lagos state, the sale of alcoholic drinks is regulated by the Liquor (Licensing) Law of Lagos State. [24] Where alcohol will be sold in a restaurant, the owner is required to obtain a license from the licensing tribunal of the Local Government Area.