- Introduction to Amex Travel

- Amex Membership Rewards Overview

- Amex Travel Benefits

- Amex Travel Drawbacks

- Amex Credit Cards

Booking with American Express Travel

- Amex Fine Hotels & Resorts

- The Hotel Collection

Navigating American Express Travel: Benefits, Booking, and Tips in 2024

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate credit cards to write unbiased product reviews .

The information for the following product(s) has been collected independently by Business Insider: American Express® Green Card, Amex EveryDay® Preferred Credit Card, Amex EveryDay® Credit Card. The details for these products have not been reviewed or provided by the issuer.

- The American Express Travel Portal works much like an online travel agency for Amex cardholders.

- Use Membership Rewards points, cash, or combine both to book flights, hotels, cars, and more.

- Some cardholders get exclusive deals including luxury hotel benefits and premium flight discounts.

- Read Business Insider's guide to the best American Express cards .

This guide explains what you need to know about booking airfare, hotels, and more through the Amex Travel Portal — and how to make the most of your Amex points.

Introduction to American Express Travel

The American Express Travel Portal is a one-stop website for booking flights, hotel stays, rental cars, cruises, and vacation packages. This third-party travel booking platform is primarily designed for people who have an Amex card that earns Membership Rewards points , like The Platinum Card® from American Express, American Express® Gold Card, The Business Platinum Card® from American Express, or American Express® Business Gold Card.

American Express Membership Rewards Overview

The American Express Membership Rewards program is one of the most popular and valuable credit card "currencies" because rewards can be used in a variety of ways . You can use Membership Rewards points to pay down your credit card balance.

You can also purchase gift cards, merchandise, food delivery, and more, in addition to booking travel through the Amex Travel Portal. You can also transfer Membership Rewards points over 20 Amex airline and hotel partners including Delta , British Airways, and Hilton .

How Amex Travel benefits American Express cardholders

Amex Travel functions much the same way as online travel agencies (OTAs) such as Expedia or Booking.com, allowing you to search for and book flights, hotels, rental cars, vacation packages, and cruises.

Anyone can use Amex Travel, but the best deals and benefits are reserved for American Express cardholders. When you have a credit card that earns Amex Membership Rewards points, you'll have to option to pay for your booking with points (if it's prepaid), your Amex card, or a combination of both. Additionally, you'll earn bonus points when you pay for travel with a Membership Rewards credit card.

The Amex Travel portal is also where Amex Platinum Card, Amex Business Platinum Card, Amex Gold Card, and Amex Business Gold Card members can access The Hotel Collection to receive room upgrades and an onsite credit to use at participating hotels.

And if you have a Amex Platinum Card or Amex Business Platinum Card, you'll have access to the International Airline Program , which offers lower fares for international premium-class travel on over 20 airlines, and the Fine Hotels & Resorts collection for hotel stays.

Always compare the cash price of an airline ticket or hotel room before you transfer any type of flexible points to a travel partner. In some cases, you'll pay fewer points by redeeming points for a paid booking instead of an award flight or stay.

Benefits of American Express Travel

As with any OTA, there are pros and cons to using Amex Travel. Here are some of the main considerations for you to understand.

Use your Amex points at any time

One of the biggest benefits is being able to redeem your points for travel without having to worry about award charts, blackout dates, or transfer partners. Amex Travel makes it simple to use your points, even with independent hotels and smaller airlines without a popular loyalty program.

You'll still earn airline miles and elite-qualifying miles

You won't earn points or elite night credits when you book a hotel with Amex Travel, but you can earn airline and work toward elite qualification on flights, as long as your frequent flyer number is on the reservation.

Earn bonus points when paying with certain Amex cards

Some American Express cards earn bonus points for travel booked through the Amex travel portal. For example, Amex Platinum Card earns 5 points per dollar spent on airfare booked with Amex Travel or directly with airlines on up to $500,000 in spending per year, and the Amex Gold Card earns 3x points in the same categories with no limit.

Platinum cardholders get discounts on premium airfare

Amex Platinum Card and Amex Business Platinum Card members can access discounts on international premium-class flights through the International Airline Program, and sometimes save hundreds of dollars per ticket.

Get bonus perks at luxury hotels through Amex Fine Hotels and Resorts and The Hotel Collection

Platinum cardholders can book through the Amex Fine Hotels and Resorts program within the travel portal, which gets you upgrades, free breakfast, and elite-like benefits at participating properties. Gold and Platinum cardholders can also book through The Hotel Collection, another program also found within Amex Travel, to get extras including onsite credits and other perks.

Downsides of American Express Travel

Now that we've listed a number of Amex Travel benefits, there are some drawbacks that may significantly impact your booking strategy.

You won't earn hotel credit or elite status when booking through Amex Travel

Most hotels will not let you earn loyalty program points or elite credits on stays booked through Amex Travel, and you may not be able to use your hotel elite status benefits during your stay. This is because most properties consider the Amex travel portal to be a third-party booking site, and elite benefits usually apply only when you book directly with the hotel.

This drawback won't matter as much at smaller chains or boutique hotels, but you'll need to weigh the benefits of booking through Amex if you're chasing elite status with a major chain such as Marriott or Hilton.

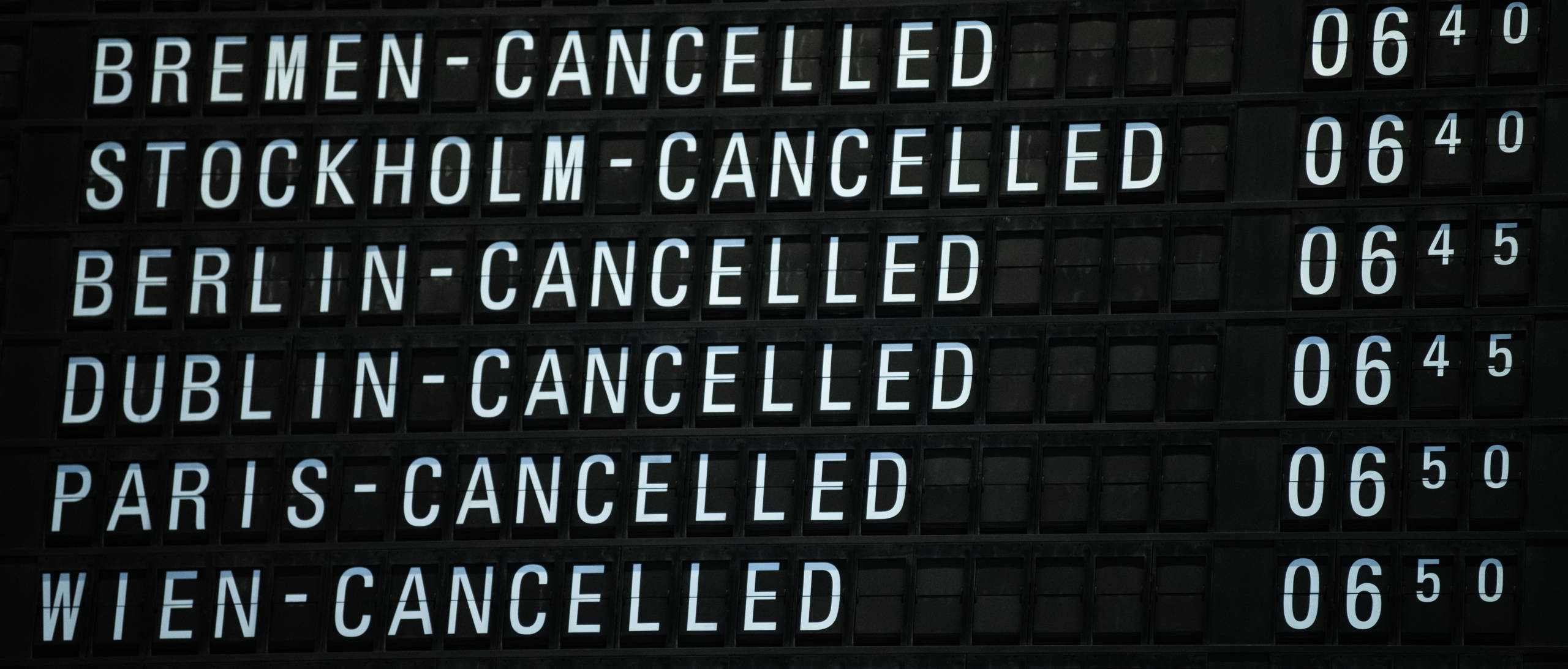

Trip changes, interruptions, and cancellations can be harder to change through Amex Travel

Many airlines allow you to change your flights these days, especially if you booked a refundable fare or are willing to pay some additional fees. But when you book through a third-party website like Amex Travel, you may get mixed messages regarding which company you should contact if you need to change your travel plans.

During the early days of the COVID-19 pandemic, for example, many travelers ping-ponged back and forth between customer service representatives at the airline that canceled their flight home, as well as those from the third-party OTA that sold them their ticket.

American Express Membership Rewards cards

Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel (on up to $500,000 per calendar year) and on prepaid hotels booked with American Express Travel. Earn 1X Points on other purchases.

See Pay Over Time APR

Earn 80,000 Membership Rewards® points

Good to Excellent

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Long list of travel benefits, including airport lounge access and complimentary elite status with Hilton and Marriott (enrollment required)

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Annual statement credits with Saks and Uber

- con icon Two crossed lines that form an 'X'. Bonus categories leave something to be desired

- con icon Two crossed lines that form an 'X'. One of the highest annual fees among premium travel cards

If you want as many premium travel perks as possible, The Platinum Card® from American Express could be the right card for you. The annual fee is high, but you get a long list of benefits such as airport lounge access, travel statement credits, complimentary hotel elite status, and more.

- Earn 80,000 Membership Rewards® Points after you spend $8,000 on eligible purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card®. The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- The American Express Global Lounge Collection® can provide an escape at the airport. With complimentary access to more than 1,400 airport lounges across 140 countries and counting, you have more airport lounge options than any other credit card issuer on the market. As of 03/2023.

- $155 Walmart+ Credit: Save on eligible delivery fees, shipping, and more with a Walmart+ membership. Use your Platinum Card® to pay for a monthly Walmart+ membership and get up to $12.95 plus applicable taxes back on one membership (excluding Plus Ups) each month.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card®.

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $189 CLEAR® Plus Credit: CLEAR® Plus helps to get you to your gate faster at 50+ airports nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Card. CLEARLanes are available at 100+ airports, stadiums, and entertainment venues.

- Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 year period for TSA PreCheck® application fee for a 5-year plan only (through a TSA PreCheck® official enrollment provider), when charged to your Platinum Card®. Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card®. That's up to $50 in statement credits semi-annually. Enrollment required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card® to your Resy profile.

- $695 annual fee.

- Terms Apply.

To get the most from the Amex Travel Portal, you'll need a card that earns American Express Membership Rewards points . There are a number of options including premium cards, small business credit cards, and cards with a low or no annual fee.

Personal cards that earn Amex Membership Rewards points include:

- The Platinum Card® from American Express (read our Amex Platinum card review )

- American Express® Gold Card (read our Amex Gold card review )

- American Express® Green Card (read our Amex Green card review )

- Amex EveryDay® Preferred Credit Card (read our Amex EveryDay Preferred card review )

- Amex EveryDay® Credit Card (read our Amex EveryDay card review )

Small business Amex Membership Rewards cards include:

- The Business Platinum Card® from American Express (read our Amex Business Platinum card review )

- American Express® Business Gold Card (read our Amex Business Gold card review )

- The Blue Business® Plus Credit Card from American Express (read our Amex Blue Business Plus card review )

Now let's take a look at each part of the Amex Travel portal.

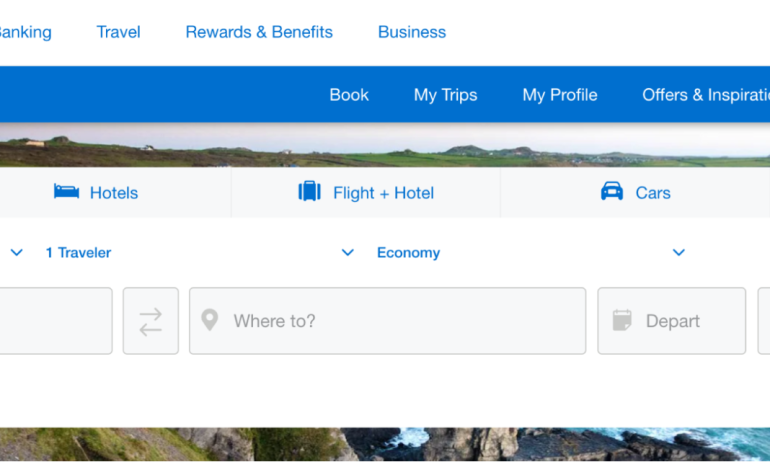

Book flights through Amex Travel

To get started, navigate to American Express Travel and click the "Flights" tab on the homepage, then enter your departure airport, destination, travel dates, and the number of passengers. You'll also select whether you want a round-trip or one-way flight, class of service, and if you prefer non-stop flights.

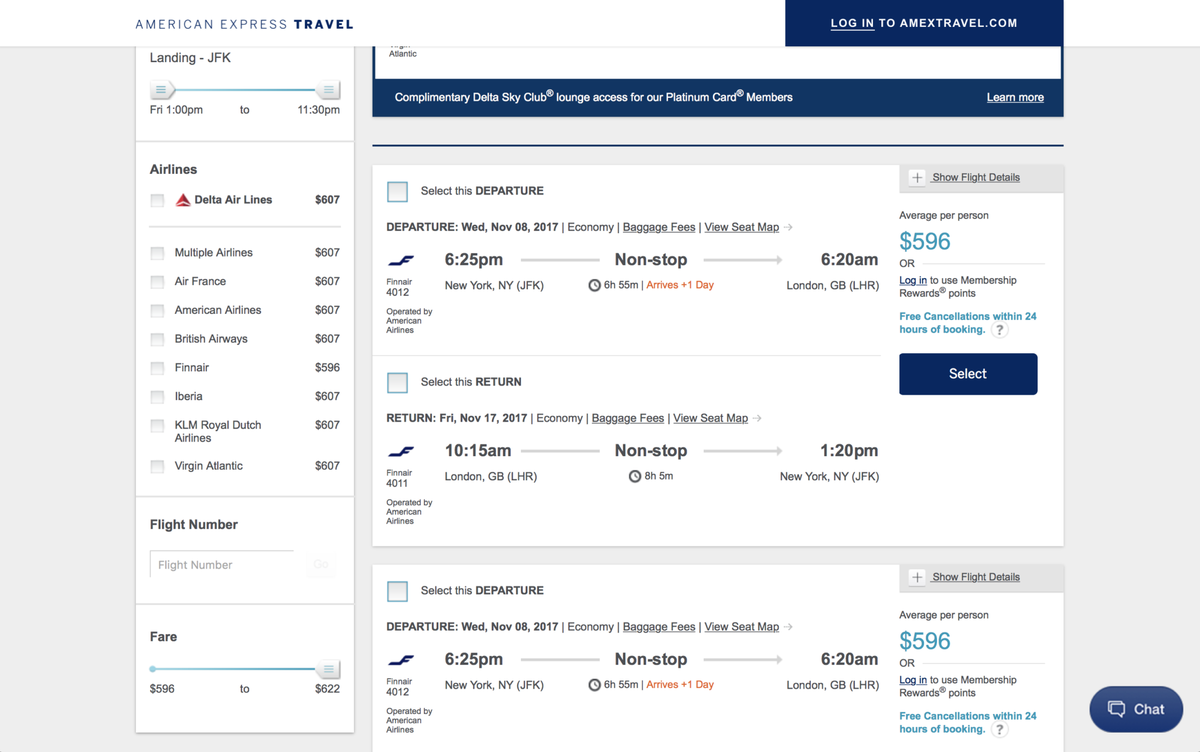

On the next page, you'll see a list of flight options with a set of filters on the left side of the screen. You can filter based on the number of stops, departure and arrival time, airline, fare type, and any available benefits from your cards.

American Express has a preferred relationship with Delta, so you'll see Delta flights listed first when they're available. Further down the list, flights are arranged by price, starting with the lowest. Next to each option, you'll see how many bonus points you'll earn and any other perks you'll receive.

For example, I have Amex Platinum Card and see a note that says I can enter the Delta Sky Club or Centurion Lounge when I fly out of LaGuardia in New York. The search results also remind me that Delta is a featured airline and I'll earn 5x points on my booking.

The fares you'll see are often the same as what you'll find on other websites, including booking directly with the airline. Sometimes they're an extra few dollars so it's worth double-checking, but for the most part, they're similar.

Note that Amex normally charges a fee of $6.99 per domestic ticket and $10.99 per international ticket you book through the website. This fee is waived if you have a Amex Platinum Card or Amex Business Platinum Card. You can purchase a maximum of nine tickets per transaction.

Remember that you'll still earn miles and have your airline elite status recognized when you fly as long as your frequent flyer number is attached to your reservation when you book through a third-party OTA. If you forget, you can always add it through the airline later on.

Note that you will not see budget airlines listed on AmexTravel.com. That includes popular options like Norwegian, Southwest, Spirit, Sun Country, and others. Because of this, there may be cheaper options available that aren't displayed, so it's worth double-checking directly if you have a low-cost airline you like to fly.

Book with cash, points, or a combination of both — or set up a Buy Now, Pay Later plan

If you have a Membership Rewards-earning card, you can use your points to partially or completely pay for travel on the Amex Travel portal, including flights, hotels, cruises, and car rentals.

You can also choose to pay entirely with your Amex card, and there's a new payment option. Amex personal cardholders now have the choice, at checkout, to pay for their flight over time with Plan It — Amex's buy now, pay later feature.

Plan It is an existing program, but the ability to set up a payment plan directly at checkout with Amex Travel is brand new. Cardholders can create up to three plans to pay for flight purchases of $100 or more in monthly installments with a fixed monthly fee and no interest.

You'll see each option on the final payment screen: select to use all points, all cash, a combination of both, or set up monthly installments with Plan It.

Note that when you use points and cash, you must redeem a minimum of 5,000 points. Each point is worth 1 cent toward airfare, so this comes to at least $50 toward your trip.

No matter how you pay, you'll be able to earn miles and credit toward elite status when you fly because they're all treated as cash bookings by the airlines.

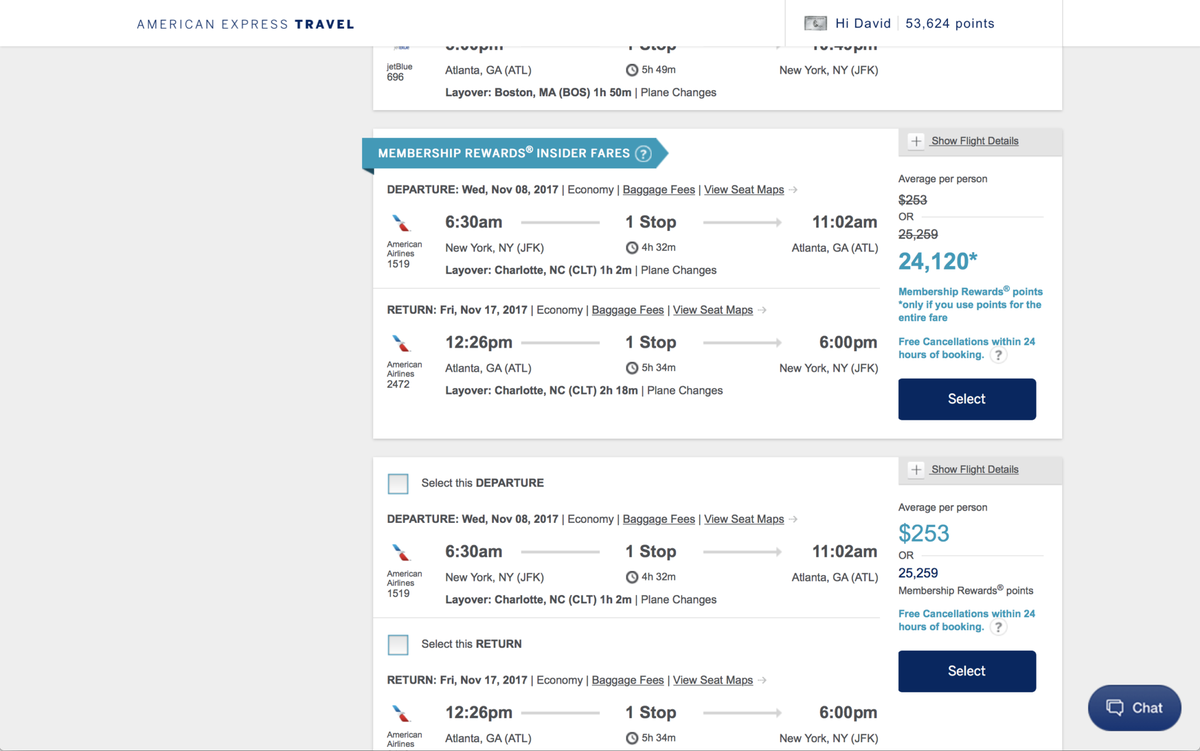

If you have Amex Business Platinum Card and choose to use points to pay for your flights, you'll receive 35% of your points back as a rebate for economy fares on your selected airline , up to 500,000 points per calendar year. You'll get this same rebate on business or first-class flights on any airline as well.

Insider Fares displayed on the Amex Travel Portal

Flights with Insider Fares are an exception to the rules above, which are directly discounted exclusively for Amex customers.

Your points are worth a little more than 1 cent each on Insider Fares, and the exact value varies based on the flight. These fares are only available with points bookings, and you must use your Membership Rewards points to cover the entire fare cost. As a result, you won't see these fares in the Amex Travel portal if you don't have enough points to cover the flight.

Don't forget the International Airline Program if you have a Platinum Card

If you have Amex Platinum Card or Amex Business Platinum Card, you also have access to the International Airline Program , which offers lower fares on premium-class international travel. More than 25 airlines participate in the program, and savings can be substantial compared to published fares.

You can buy discounted fares in premium economy, business, or first-class through this program. The exact savings you'll get varies based on the airline and route, but can often be several hundreds of dollars. That's a great deal if you're someone who books paid travel to fly internationally.

Read more: You can transfer Amex points to 22 loyalty programs to book travel, from first class to Japan on ANA to hotel stays with Hilton

You can cover much of the card's annual fee with the savings from just one well-priced booking. There's also no limit to how much you can save, or how often you can take advantage of the lower fares offered here.

Book hotels through Amex Travel

Booking a hotel stay functions much the same as the flight booking process. Make sure the "Hotels" tab is selected, then enter your trip details.

Again, you have the opportunity to use cash, points, or a combination of both to pay for your stay (the Plan It feature isn't available through Amex Travel for hotel bookings). Prices are usually similar to booking directly, but some of the big-chain hotels cost a few dollars more, presumably because Amex is adding their commission to the cost.

An important reminder: There is one major caveat to booking hotels through American Express Travel, or any third-party booking site for that matter. You will not earn hotel points or elite status credit and likely will not have your elite status recognized when you book through the portal. If you care about earning points and elite status, you should avoid booking through third-party sites like this one.

However, if you're booking an independent or boutique hotel that isn't part of any rewards programs or like the simplicity of booking this way, this isn't an issue. And sometimes the hotel you choose is based on location or other personal preferences.

Book with Fine Hotels & Resorts: Amex Travel's luxury hotel program

What is amex fine hotels & resorts.

The Amex Fine Hotels and Resorts (FHR) program offers select American Express card members exclusive benefits at over 1,300 hand-picked luxury properties. The list is vetted and periodically reviewed to ensure every hotel and resort meets Amex's exacting standards. American Express isn't the only credit card issuer to curate a luxury hotel booking program , but Amex Fine Hotels and Resorts sets the standard among them.

Properties are added to and (occasionally) removed from the Fine Hotels and Resorts program over time, so the list isn't static. You'll find far-flung tropical beach escapes, stately mountain ski lodges, lavish city digs, and tranquil countryside retreats in dozens of countries worldwide. These properties range from high-end to very high-end, with many charging thousands of dollars per night. In short, Amex Fine Hotels and Resorts isn't a good fit for traveling on a tight budget, but not all prices are stratospheric, and the program benefits can elevate any stay regardless of cost.

Who can book American Express Fine Hotels and Resorts stays?

To book an Amex FHR stay, you must have an The Platinum Card® from American Express , The Business Platinum Card® from American Express , or Centurion Card (also known as the Black Card). Different versions of the Platinum card are all eligible, including co-branded cards from Charles Schwab and Morgan Stanley. These are all premium cards that carry hefty annual fees in exchange for high-end benefits .

You must use your eligible card to book your stay, and payment must be made in the primary card member's name. That means you generally can't book Fine Hotels and Resorts stays for other people, though you can book additional rooms for your party.

You can book online through the landing page for Amex Fine Hotels and Resorts or by searching for hotels at American Express Travel and limiting the results to Fine Hotels and Resorts properties. You can also book over the phone by calling the number on the back of your card.

Note that Amex also curates a second list of properties called The Hotel Collection, which is available to those with the American Express® Gold Card and American Express® Business Gold Card , as well as to Platinum and Centurion cardholders. The Hotel Collection is a step down from the Fine Hotels and Resorts program, but still offers high quality and valuable benefits.

Maximizing Amex Fine Hotels & Resorts

There are multiple benefits of booking with American Express Fine Hotels & Resorts. People with the Amex Platinum Card or Amex Business Platinum Card have access to the Fine Hotels & Resorts program , which is a collection of over 1,000 hotels worldwide that offer special perks when booking through Amex, including:

- Noon check-in when available

- Guaranteed 4 p.m. checkout when available

Daily breakfast for two

- Room upgrade upon arrival when available

Complimentary Wi-Fi

- Experience credits, like property credits to use at a spa, dining credits, or another unique amenity (often worth $100 or more)

Exact benefits vary by property and can add serious value to your booking.

I've used this benefit a couple of times and was pleased by how seriously the hotels considered their part in the program. Having late checkout at 4 p.m. can essentially add an extra day to your stay, and comes in handy when you have a late flight. And early check-in can help you get settled sooner if you have a morning arrival.

Again, you likely won't earn points and elite status if the hotel has its own rewards program. Some people report earning hotel points despite booking through Amex, but it's not guaranteed and I wouldn't count on it.

That said, the perks you get can be substantial, so it's worth considering on a case-by-case basis whether you want to earn hotel points or use Amex Fine Hotels and Resorts. You can use your benefits to book up to three rooms at a time, and you'll be able to use your perks on all of them.

Amex Fine Hotels and Resorts Benefits

Cardholders who book through American Express Fine Hotels and Resorts get a set of explicit core benefits, some guaranteed and consistent across the whole portfolio, and others that depend on availability and vary from one property to the next.

Room upgrade upon arrival

When you check in for a stay booked through Amex Fine Hotels and Resorts, you're eligible for an upgrade to a higher-category room or one with a better view in the same category. Upgrades depend on availability, so you're more likely to be offered one when demand is low — don't expect to get bumped from a standard room to the presidential suite when you show up at a busy resort on a holiday weekend.

Upgrades have the most upside of Amex Fine Hotels and Resorts benefits, but also the greatest variance. The distinctions between hotel room categories are often murky, so an "upgrade" sometimes means getting a room that was recently renovated (for better or worse) or one with an extra amenity you may not care about.

On the other hand, upgrades are not limited to a single category, so you very well could end up in that presidential suite with some good fortune and timing. If you're willing to risk it, you can try to game the upgrade benefit by identifying the room categories at your property and booking one category below the room you really want. Not all room categories are eligible for upgrades, so call ahead if you need clarification.

Amex Fine Hotels and Resorts describes this benefit as a complimentary breakfast for up to two people per room, which is generally accurate. However, the benefit terms clarify that the breakfast is valued at a minimum of $60 per room per day. You may be charged for purchases exceeding that amount, so breakfast isn't strictly "complimentary" depending on menu prices and how much you order.

The daily breakfast benefit is another that varies widely between properties. Some offer a specific complimentary option in one restaurant (like a breakfast buffet). Others offer a range of specific complimentary options in one or more venues, and some simply offer daily statement credits to offset qualifying on-property charges up to the preset amount, even covering multiple transactions.

If this makes the benefit sound unpredictable, don't worry. In my experience, daily breakfast benefit options have always been explained clearly at check-in for Amex Fine Hotels and Resorts stays.

Experience credit

When you book at an Amex Fine Hotels and Resorts property, you're guaranteed an experience credit of at least $100 toward eligible on-property charges. The amount and nature of the experience credit are clearly indicated for each property when you book.

The benefit is most commonly provided as a statement credit to offset food and beverage charges, spa services, or any purchases billed to your room. However, in some cases, it comes in the form of a specific experience (like a complimentary meal or massage) rather than a credit. The baseline value is $100, but you'll often receive more. I've seen on-property credits offered up to $200, and some of the experiential options have sticker prices well beyond that amount.

You're eligible for the experience credit regardless of how long you stay — even a single night qualifies. That makes it an exceptional value for shorter stays.

Early check-in and late check-out

While the benefits above provide fairly well-defined value, these two are harder to quantify. Nonetheless, early check-in and late check-out are useful in the right conditions, like when you have a morning arrival or evening departure.

Early check-in at Amex Fine Hotels and Resorts starts at noon and is subject to availability; if your room is unavailable, then you'll have to wait until it's ready. Regardless of the official early check-in time, some hotels will accommodate you before noon if they can.

Unlike early check-in, the late 4 p.m. checkout is guaranteed. In my experience, Fine Hotels and Resorts properties are proactive about honoring this benefit, so you shouldn't have to worry about your key demagnetizing prematurely or hotel staff entering the room while you're still in it.

The final core benefit of the Amex Fine Hotels and Resorts program is free Wi-Fi, which is guaranteed even if the property normally charges for it. At properties where Wi-Fi charges are folded into another mandatory fee (like a resort fee), a daily credit will be applied to your bill at checkout to offset the cost.

Other benefits of booking with American Express Fine Hotels and Resorts

Aside from the core benefits listed above, there are other perks of booking with the Fine Hotels and Resorts program, some more tangible than others.

First, Amex maintains a list of special offers available at select properties. These include complimentary nights (like a free fourth night), discounts on nightly room rates, on-property credits, and more, all provided in addition to the core benefits. Special offers show up in standard Fine Hotels and Resorts searches, so you don't have to browse the linked page to find them.

Next, Fine Hotels and Resorts bookings are eligible for the Amex Amex Platinum Card's up to $200 annual hotel credit (minimum two-night stay), so you can stack that discount on top of the other benefits you receive. You'll also earn 5 points per dollar for booking Amex Fine Hotels and Resorts stays with your Amex Platinum Card.

Finally, you may receive an elevated level of service when you check in as a Fine Hotels and Resorts guest. That has consistently been my experience, especially comparing stays at a single property booked through Amex versus other channels. The differences in service are subtle and hard to define, but palpable.

Important considerations for booking with American Express Fine Hotels and Resorts

The terms and conditions of the Amex Fine Hotels and Resorts program are mostly benign to cardholders, but there are a few potential pitfalls and other details to keep in mind.

Reservations are mostly prepaid

When you book through Amex Fine Hotels and Resorts, you typically pay for room charges and taxes up front, while additional charges (like resort fees and incidentals) are paid at the property. You can sometimes opt to put down a deposit rather than prepay the entire reservation. Either way, bookings are mostly cancelable, but Amex does not impose a universal cancellation policy, so keep yourself out of trouble by reading the hotel's cancellation policy in the listing before you book.

Benefits are non-transferable

All perks and credits must be used during your stay (i.e., prior to checkout). You can't save or bank them for later, so use them or lose them.

Back-to-back stays count as one

If you or your party book separate stays at the same property within a 24-hour period, it will be considered a single stay and only eligible for one set of Fine Hotels and Resorts benefits. In other words, you can't rack up multiple experience credits by making separate reservations on consecutive nights at the same property.

Benefits apply to multiple rooms

You can book up to three rooms for an Amex Fine Hotels and Resorts stay, and all three are eligible for the full slate of benefits. That adds a lot of value to the program for those traveling in a group.

You must present a valid Amex card in your name at check-in

In addition to booking Fine Hotels and Resorts stays with an eligible American Express card, you must present a valid Amex card at check-in to cover incidentals. However, the card you check in with doesn't have to be the one you used to make your reservation. If you canceled your Amex Platinum Card or simply forgot to bring it, for example, you could provide another Amex card. The terms say the card you present must be in the name of the primary guest, but my wife and I had no trouble presenting my Amex card at check-in for a reservation in her name.

Hotel rewards and elite benefits are not guaranteed

Many hotels offer rewards and elite benefits only when you book directly. As a result, booking through a third party like Amex Fine Hotels and Resorts may cause you to miss out on those perks. From my own experience and anecdotal evidence, reward outcomes are unpredictable. I've sometimes earned rewards automatically, sometimes earned them upon request, and sometimes been denied. Case in point: The Bellagio Las Vegas honored my MGM status and waived resort fees for one Fine Hotels and Resorts stay, but flatly refused to do so for another.

You can pay with points, but you shouldn't

Amex lets you redeem Membership Rewards points for Fine Hotels and Resorts stays, but the redemption rate is only 1 cent per point. That's far below our average valuation of 1.8 cents for Amex points , so save your points for transfers to airline and hotel partners (or other award redemptions that provide a better return).

Leveraging The Hotel Collection for additional value

If you have Amex Platinum Card, Amex Business Platinum Card, Amex Gold Card, or Amex Business Gold Card, you can also access the Hotel Collection, which also offers room upgrades and a $100 onsite credit for dining, spa, or resort activities at 600+ hotels.

The Hotel Collection is entirely separate from Fine Hotels and Resorts, and has different hotels that participate with minimal overlap. When you book through Amex, Platinum cardmembers will earn 5x points per dollar on prepaid bookings, and Gold cardmembers will earn 2x points.

You can pay with cash at the time of booking or at hotel checkout after your stay. Or you can pay with points, or a combination of points and cash on prepaid bookings only. And there's the same guidance about earning hotel points here, too. You might decide you'd rather have the $100 hotel credit rather than points, depending on the hotel.

To use this benefit, you must book a minimum stay of two nights, and can't book consecutive stays within 24 hours of each other. This benefit is available for up to three rooms per stay. So if you book three rooms at the same time, you can get a total onsite credit of $300 between three rooms maximum.

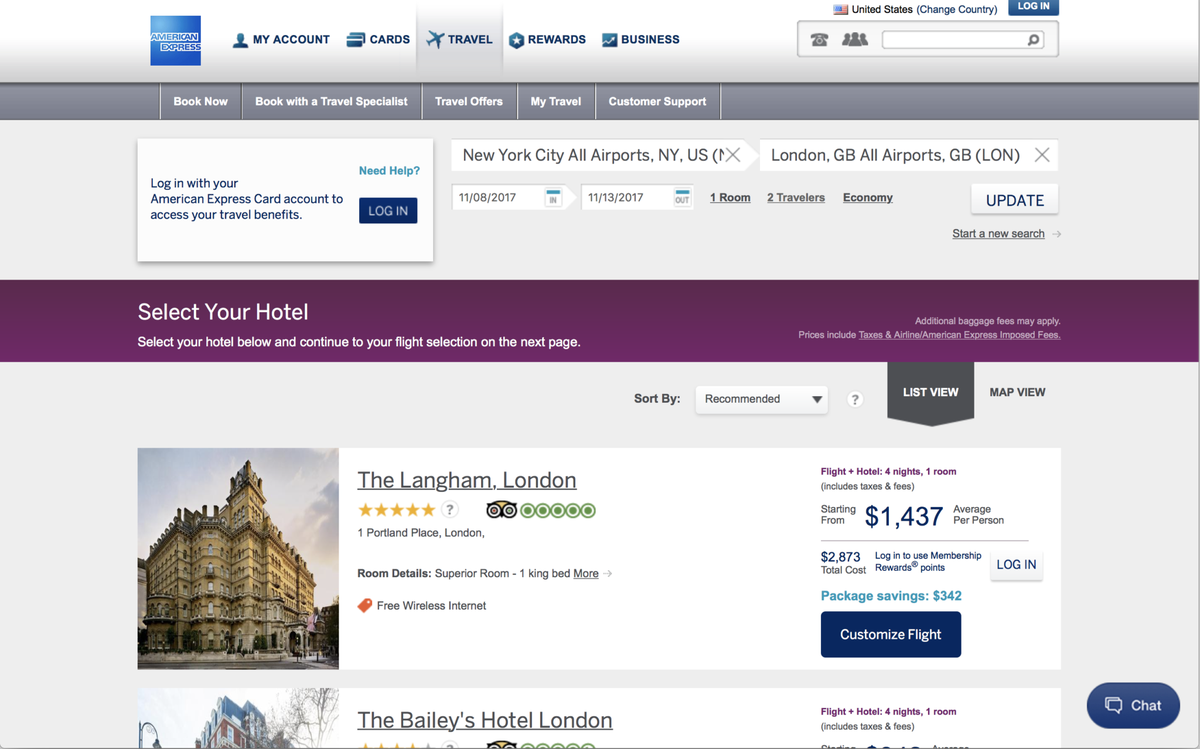

Book Flight + Hotel packages through American Express Travel

The point of booking a vacation package is usually to save money, take advantage of a promotion, simplify the booking process, or all of these. You can search for a flight and hotel, then pay one price for everything.

Amex doesn't give you a breakdown of how much the flights and rooms cost, and only shows savings on selected hotels. However, when you search for flights and hotels individually and compare the prices, you'll find the savings are often hundreds of dollars, especially on longer trips.

To book, select the "Flight + Hotel" tab and enter where you want to go, along with the number of travelers and how many rooms you want to reserve.

You'll see a list of hotels, along with the price per person, total price, and cost if you want to pay for the trip with your Membership Rewards points. Select the hotel you want to stay at, then you'll see a list of flight options. The cheapest flights are already included in the price, but you can select alternate flights for an upcharge.

Likewise, the cheapest room options are displayed in the base price, but you can pay more for a different room, like a mountain or beach view, a double or king room, or a suite, depending on what's available at the hotel you select.

I priced out a couple of packages. For the first, I didn't find any notable differences. Booking flights and hotel separately cost nearly the same. But for another, the savings were substantial even though they weren't explicitly stated on the Amex Travel portal. It's worthwhile to compare, especially if you're interested in earning points if the hotel participates in a loyalty program. Otherwise, prices are comparable or better in most cases.

Similar to booking airfare separately, for each airline ticket you purchase as part of a package, you'll pay $6.99 per domestic ticket and $10.99 per international ticket. This fee is waived if you have a Amex Platinum Card or Amex Business Platinum Card. You can purchase a maximum of nine tickets per transaction.

Personal and business Platinum cardholders will earn 5x points on their package, and other Membership Rewards cards earn 2x points.

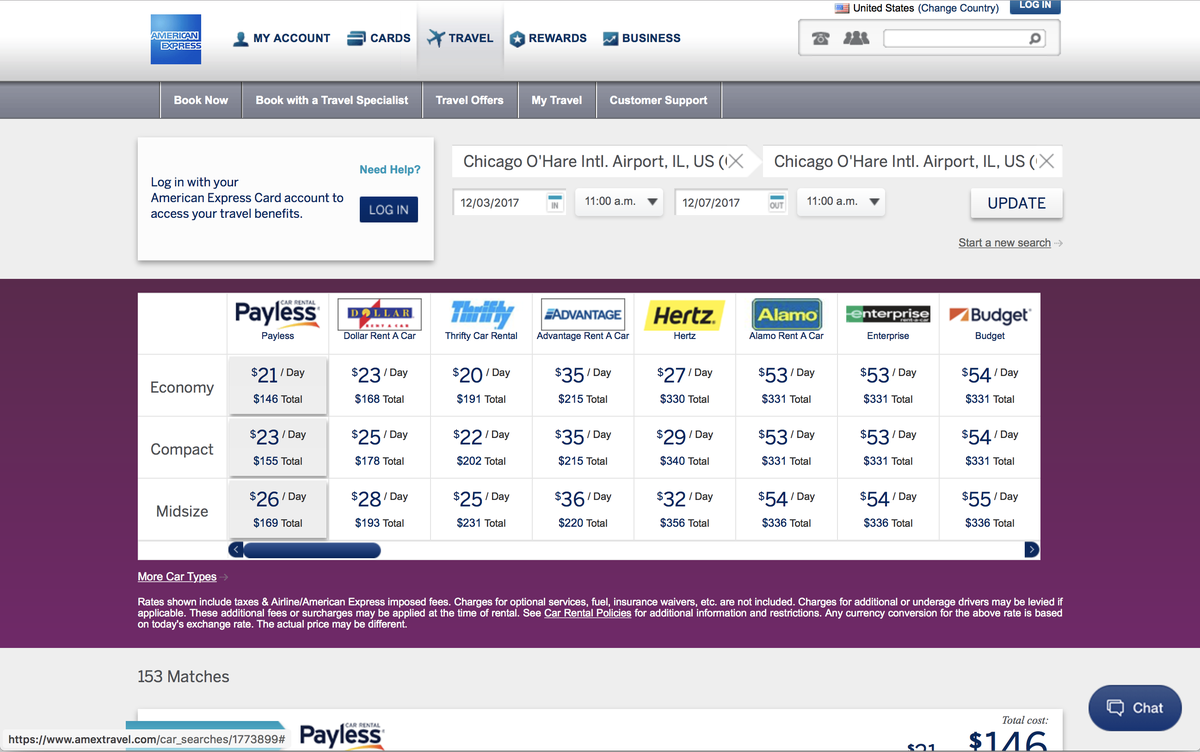

Book car rentals through the Amex Travel Portal

You can also rent cars through American Express Travel. Just type in the city or airport where you want to pick up a car and the dates and times you'll need it under the "Cars" tab.

You'll see a list of your options starting with the lowest price. At a glance, you can see the price per day, total price, and what's included with the car. On the left side, you can add filters for the car type, price, rental car company, and any special features you're looking for (like an automatic transmission and four-wheel drive).

Prices are usually the same or comparable to other booking sites or booking directly. However, I always check a couple of different places to make sure I'm getting the best deal. It's worth comparing, especially if you're looking to add a second driver to the reservation, or need to drop the car off later in the day. I've found different sites can vary a lot in pricing, so recommend shopping around.

You can use cash, points, or a combination to pay for prepaid rentals, or use cash to pay at the counter.

When you use your Membership Rewards card to pay for your rental, you'll earn 2x points.

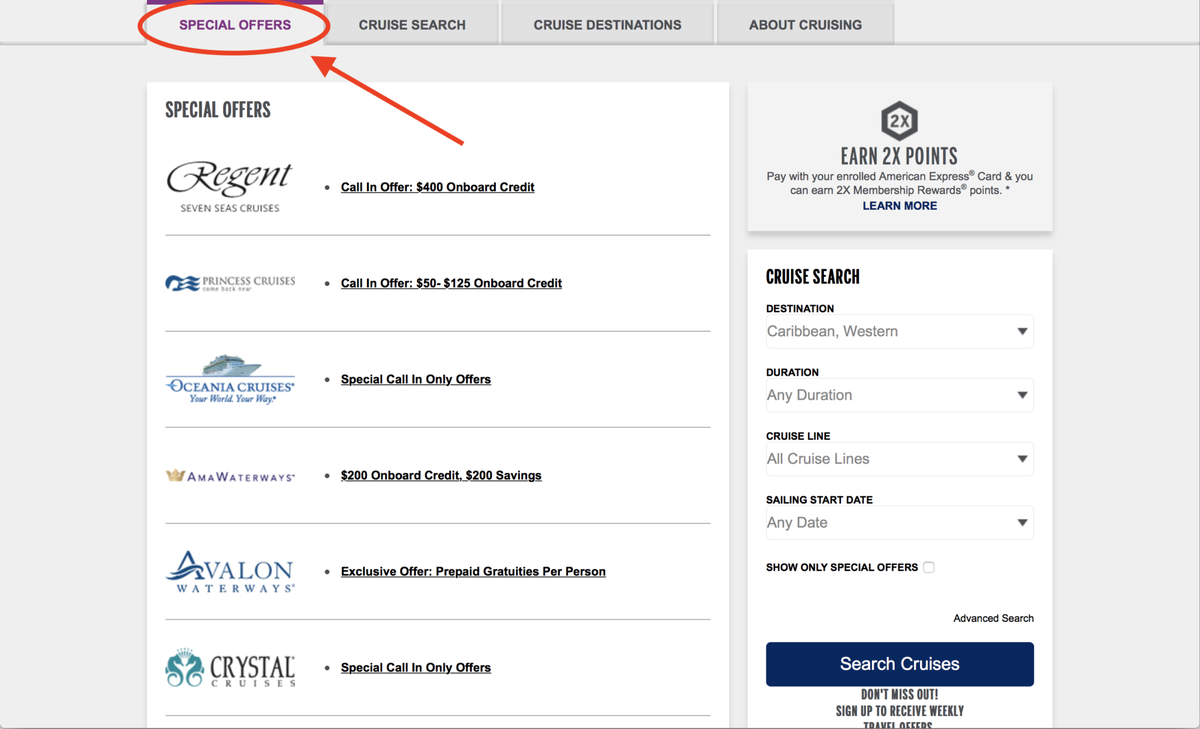

Book cruises with American Express Travel

You're able to book a cruise on most of the popular cruise lines around the world through American Express Travel under the "Cruises" tab on the homepage. I found the prices were similar to other booking sites with the main difference being the specific promotions, like onboard credits or prepaid gratuities. Certain websites also run sales, so it's worth shopping around if you're not committed to a particular route or ship.

After you enter where you want to go and how many nights you'd like to spend on the water, you're taken to a list of results, along with a prominent section for special offers, which are mostly onboard credits. This is worth exploring to get some ideas if you're open.

And if you have Amex Platinum Card or Amex Business Platinum Card, you can also take advantage of the Cruise Privileges program, which partners with several big-name cruise lines. When you book through Amex Travel, you'll receive an onboard stateroom credit worth up to $100 to $300, and another exclusive amenity that varies by cruise line like premium wine or extra food options.

If you have the Amex Green Card, you'll earn 3x points per dollar spent booking your cruise through Amex Travel. All other Membership Rewards-earning cards earn 2x points.

American Express Travel Frequently Asked Questions

Yes, people who don't have Amex credit cards can still book travel through the American Express portal.

After you log into your Amex Travel account, you can find all of your travel reservations by clicking on the "My Trips" tab toward the top right of the page.

If you need to change or cancel a reservation, you can do so online through your AmexTravel.com account, or by calling 1-800-297-2977.

How can I use my Membership Rewards points to book travel?

Amex cardholders can use Membership Rewards points to book flights, hotels, and more directly through the American Express Travel website or app, often with the option to pay with points, by card, or a combination of both.

Yes, booking through American Express Travel can grant you access to exclusive benefits like room upgrades, early check-in/late check-out, and complimentary breakfast at participating Fine Hotels & Resorts and The Hotel Collection properties.

Many American Express cards offer complimentary travel insurance benefits, including travel accident insurance, baggage insurance, and car rental loss and damage insurance. Coverage details and eligibility may vary by card.

For rates and fees of The Platinum Card® from American Express, please click here.

For rates and fees of the American Express® Gold Card, please click here.

For rates and fees of The Blue Business® Plus Credit Card from American Express, please click here.

For rates and fees of the American Express® Business Gold Card, please click here.

For rates and fees of The Business Platinum Card® from American Express, please click here.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

- Main content

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

American Express Travel: Your Guide to Booking Flights, Hotels, Car Rentals, & Cruises

Jarrod West

Senior Content Contributor

441 Published Articles 1 Edited Article

Countries Visited: 21 U.S. States Visited: 24

Keri Stooksbury

Editor-in-Chief

34 Published Articles 3189 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

Director of Operations & Compliance

1 Published Article 1178 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

Table of Contents

What is amextravel.com, why should you use amextravel.com, booking flights with amextravel.com, amextravel.com hotel programs, flights+hotel packages, rental cars, amextravel.com insiders, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

American Express is best known as a credit card issuer, but the company also offers other products and services, including travel booking and planning using AmexTravel.com.

While AmexTravel.com is available for anyone (not just cardmembers), holding an Amex card can definitely help you get extra value when using the program.

Here’s a look at what AmexTravel.com is, what services it provides, what the cost to use, the best ways to use it, and when it’s worth using!

At its most basic, AmexTravel.com is an online travel booking portal (or “online travel agency”) just like Expedia , Kayak , and Orbitz .

You can use it to book a whole trip or just a flight, hotel (or flight + hotel packages), rental cars, or even cruises. If you’d like extra assistance from a customer service agent, you can book by phone as well.

Flights booked through the portal can be subject to small fees. However, sometimes the benefits can make these fees worth it, and they’re waived for holders of the Platinum Card ® from American Express .

There are also a few “sub-categories” that fall under the AmexTravel.com umbrella, including the Hotel Collection and Fine Hotels and Resorts .

The main reason to book with AmexTravel.com is the incredible customer service . If you run into any problems during your trip (like delays, cancellations, over-bookings, etc.), you can connect with a live travel agent by phone 24/7 who will work with you to find a solution.

Additionally, if you hold an Amex credit card that earns Membership Rewards points, you can often earn 2x points or more by using it to pay for travel services booked through AmexTravel.com.

Hot Tip: If you use your Amex Platinum card , you can earn 5x Membership Rewards points on flights booked directly with airlines or with AmexTravel.com.

Fees for Using the Portal

Anytime you book a flight through AmexTravel.com (either on its own or as part of a package), you’ll pay a fee of $6.99 for domestic flights and $10.99 for international flights .

These fees are waived if you have the Amex Platinum card and are logged into your account.

If you choose to book a flight by phone rather than online, there’s an added $39 phone service fee .

If you make changes to your flight, there’s a $39 reissue fee in addition to whatever fee the airline charges. This only applies to advance changes, not changes due to problems like canceled flights .

Below, we’ll take a look at how to use AmexTravel.com to book flights, hotels, vacation packages, rental cars, and cruises.

Searching for Flights

Searching for flights with AmexTravel.com is similar to other online travel agencies. You can search by city or by specific airport, select your departure and return dates, and click whether you want to search for lower fares within 3 days of your chosen dates.

On the results page, American Express lists the most relevant Delta result at the top highlighted as a “featured airline.” The featured airline is followed by the lowest available fares.

When you scroll down, you can use the controls on the left sidebar to filter the results by the number of stops, departure/arrival times, airline, or even specific flight number.

By default, flights are displayed in price order starting with the lowest, except for a featured Delta flight at the top (when available). At the top of the search window above the results, all available airlines are shown, as well as the lowest available price with each airline.

Insider Fares

Depending on your search, you may see a blue tab labeled “Insider Fares Available” above some of the airlines listed at the top of the search window.

These are discounted fares, and they only apply if you pay for the entire flight with Membership Rewards rather than cash. Note that cash prices are rounded to the nearest dollar.

If you’re logged in and have enough Membership Rewards points to cover the entire flight, you will be able to see these discounted fares.

For example, in the below search, you’ll see an example of an Insider Fare available for purchase. The Insider Fare offered a slight discount rather than just matching the cash price in points with each point worth 1 cent (more on that below).

The difference can be fairly minimal. In the JFK-ATL example above, the discount was from 25,259 Membership Rewards points to 24,120 — changing the value from 1 cent per point to about 1.05 cents per point .

Amextravel.com charges a fee to book, but they bundle this into the displayed price. The fee is $6.99 per domestic ticket or $10.99 per international ticket. These fees are waived as a benefit of the Amex Platinum card , just make sure you’re logged into your Amex account when booking.

Hot Tip: AmexTravel.com now offers Trip Cancel Guard coverage that you can add when purchasing flights via AmexTravel.com whether paying with an American Express card, with Membership Rewards points using the Pay With Points option, or a combination of both. It provides for reimbursement of up to 75% of the cost of the non-refundable prepaid flight expense, penalty and change fees caused by the cancellation, or the amount of any expired vouchers/flight credits received for the canceled flight. Coverage is applicable when your flight is canceled for any reason and is valid until 2 full calendar days prior to your trip’s originally scheduled departure date.

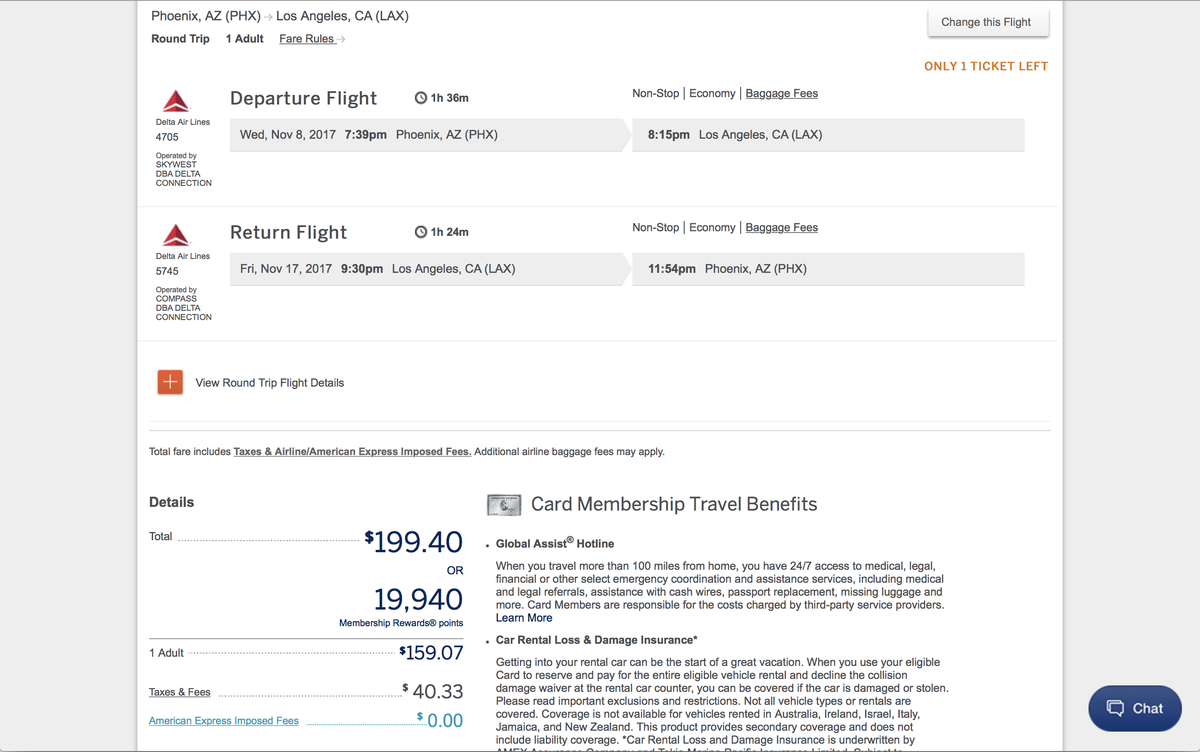

When searching several different flights across different online travel agents, we found similar results to the below example each time.

To compare prices, we searched multiple online travel agents and portals using the same search parameters: departing John F. Kennedy-New York (JFK), arriving at London-Heathrow International (LHR), round-trip, 1 traveler, economy, and nonstop on specific dates.

We selected the lowest-priced nonstop flight available through AmexTravel.com: a Finnair flight operated by Oneworld partner , American Airlines.

When searching on AmexTravel.com, the flight was $595.86. This breaks down to $133 in base fare and $462.86 of government, airline, and American Express-imposed fees.

We received the same search results when we replicated this search on Finnair’s U.S. website, Kayak, and Orbitz.

In a second search, we looked for a domestic round-trip from Phoenix Sky Harbor (PHX) to Los Angeles International (LAX) on the same dates. This flight was priced at $199.40. Keep in mind, you would usually see this rate plus the $6.99 Amex booking fee, but again, this is waived for Amex Platinum cardholders.

When cross-referencing this itinerary on Delta’s website, we found the same price listed for a regular economy fare of $199.40. However, there was a basic economy option that was a bit cheaper, which was not available through AmexTravel.com.

Other online travel portals, including Orbitz and Kayak , listed the same price.

This means, if you’re already set on the specific itinerary you want to fly, booking through AmexTravel.com can often cost the same as booking directly with the airline, or through a third party . This assumes you receive waived booking fees for being an Amex Platinum cardholder.

However, what if you’re just looking for the cheapest flight on a particular day? If you do a general search for a route on set dates, will AmexTravel.com find the same rates as other portals? In our experience, the answer is no.

In our example search, here are the lowest available regular economy non-stop flights we could find between New York (any airport) and London (any airport) when searching the same set of dates on a few different websites (sorted by price ascending):

*Including a $10.99 AmexTravel.com booking fee.

The reason for these results is likely due to the fact that the Amex portal doesn’t include some low-cost carriers like Norwegian, so travel portals that do will often win on price.

Even excluding the low-cost carriers, though, other portals like Expedia and Orbitz were able to offer lower fares by about $15.

That said, AmexTravel.com was able to find about the same fares you would find when booking directly with an airline.

Hot Tip: If you hold The Business Platinum Card ® from American Express you can get a 35% rebate on select flights when you pay with points through AmexTravel.com.

There are actually 3 programs offered for booking hotels:

The Hotel Collection

- Fine Hotels and Resorts

- AmexTravel.com booking (standard)

What Is The Hotel Collection?

The Hotel Collection is a program through AmexTravel.com only available to holders of certain cards:

- The American Express ® Gold Card and the American Express ® Business Gold Card

The Amex Platinum card and the Business Platinum Card ® from American Express

The Centurion card

Perks of The Hotel Collection

When you book a hotel through The Hotel Collection, you get certain perks including:

- Room upgrade at check-in (if available)

- Up to a $100 hotel credit for on-site amenities like the restaurant, bar, room service, or spa

- Ability to use Pay With Points on prepaid reservations

- 3x Membership Rewards points for Amex Gold cardholders on prepaid bookings

- 5x Membership Rewards points for Amex Platinum cardholders on prepaid reservations

- Up to $200 credit each year towards prepaid hotel reservations with either The Hotel Collection (2-night stay) or Fine Hotels and Resorts with select credit cards

Usually, American Express guarantees that any hotel booked through AmexTravel.com will have the lowest publicly-available rates (prepaid rates only), but this rule does not apply to bookings through The Hotel Collection per the terms & conditions . Be certain to check multiple booking options to ensure you’re getting the best deal.

Rooms have to be booked through AmexTravel.com. That means that if you book directly through the hotel or another service, you won’t get the perks, even if the hotel is a part of The Hotel Collection and you pay for the stay with your American Express card.

Further, you must stay a minimum of 2 nights , and you cannot book consecutive stays within 24 hours of each other.

The good news is that these benefits are available for up to 3 rooms per stay . So if you book 3 rooms for family members, you’ll get a total hotel service credit of up to $300.

Hotel Points and Elite Benefits

Typically, you won’t earn points through a hotel loyalty program if you book through a third party, and this includes the AmexTravel.com portal.

Further, you won’t get any elite benefits that you might otherwise be entitled to if you have status with that hotel chain.

Bottom Line: The Hotel Collection is potentially useful if you’re planning to pay with your eligible Membership Rewards-earning card. This comes at the expense of hotel-specific elite benefits, including points and elite credits in any hotel loyalty program.

American Express Fine Hotels and Resorts

What is the fine hotels and resorts program.

AmexTravel.com runs a second hotel program called Fine Hotels and Resorts (FHR). It can be a little bit confusing since it sounds like it would overlap with the Hotel Collection, but that’s not the case.

The Fine Hotels and Resorts program is exclusive to Amex Platinum cardholders (personal or business) , as well as those with the invitation-only Centurion Card .

FHR includes different hotels and resorts than The Hotel Collection, with minimal overlap. The FHR collection tends to be more geared toward leisure travelers who wish to book stays at higher-end properties.

Perks of Fine Hotels and Resorts

Booking hotels through the Fine Hotels and Resorts collection entitles you to a handful of potentially valuable perks, including:

- Early noon check-in (when available)

- Room upgrade on arrival (when available)

- Daily breakfast for 2 people

- Guaranteed 4 p.m. late checkout

- Complimentary Wi-Fi

- A unique amenity valued at $100 or more; examples include a property credit, dining credit, spa credit, or similar amenity

Unlike The Hotel Collection, rooms booked through Fine Hotels and Resorts are not all prepaid. In fact, most are standard rates that you’ll pay for at the end of your stay when you check out. In comparing several properties, including the Park Hyatt in Chicago, we found rates identical to the non-prepaid rates when booking directly through the hotel.

However, keep in mind that the hotel may directly offer prepaid and early-purchase options which may be much cheaper, though you won’t benefit from the Fine Hotels and Resorts perks.

There are fewer terms with Fine Hotels and Resorts than with The Hotel Collection. You must book through AmexTravel.com/FHR to receive the benefits .

As with The Hotel Collection, if you book directly with the hotel or through a different travel agency or portal, you won’t be able to claim FHR benefits even if it’s a participating hotel. Other terms vary by property.

Good news here! Unlike stays booked through The Hotel Collection, stays through American Express Fine Hotels and Resorts count as “qualifying rates” for hotel loyalty programs. That means if you’re staying at a hotel that’s part of a loyalty program, you’ll be able to earn points and receive the relevant benefits if you hold elite status.

Hot Tip: Want to know about the differences between these programs? Dig into our dedicated guide on the differences between the Hotel Collection and Fine Hotels & Resorts .

Standard Hotel Booking

Searching hotels.

Searching for hotels at AmexTravel.com works more or less the same as with flights. You enter your city, dates, number of rooms, and guests. You can check a box to have properties from The Hotel Collection and Fine Hotels and Resorts displayed at the top.

Of course, if you’re interested in booking through either of those programs, you could also just book on their dedicated pages.

By default, search results are ranked by “recommended,” which seems to be decided by an algorithm factoring in price, location, and reviews.

Terms vary by the specific hotel and rate you book, so make sure to read the fine print.

The site can be a bit confusing when trying to compare prices since American Express doesn’t include all taxes and fees in the price displayed (while some hotel websites do).

For example, we searched for a 4-night stay at the Hyatt Regency London – The Churchill. American Express quoted an average of $337/night, which should make the total stay around $1,348. When you go to book, though, the total with fees is $1,625.

While it initially looks more expensive to book directly with Hyatt (where the cost is quoted at $404/night), that price includes all taxes and fees , so you’ll actually pay $1,611, or $14 less.

Our search for the Marriott Regent Park yielded similar results. It’s listed at $233/night in the search function, which implies the total to be $932.

In reality, once you click through, the total is $1,120. Booking directly with Marriott, rates are listed at $261/night, but that includes taxes and fees — for a total prepaid rate of $1,080.

For the 2 hotels in question, here’s how total prices compared through different portals (sorted by price ascending):

In both tickets, AmexTravel.com was within a few dollars of the other online travel agencies, which were all more expensive than booking directly through the hotel’s website.

Similar to The Hotel Collection, rates booked through AmexTravel.com aren’t eligible for elite benefits or hotel loyalty points.

Bottom Line: Like most other online travel portals and agencies, prices can vary between AmexTravel.com and the hotel’s direct booking channel. You won’t get elite benefits or hotel points, so it might be worth booking directly if those are valuable to you.

Like with many online travel portals and even airline websites, you can book packages that include flights and hotels through AmexTravel.com. Usually, the point of booking these packages is to get a discount, special perks, or promotions.

Searching for Packages

The search window for Flights+Hotels is simple: input airports (or cities), dates, number of travelers, and rooms. Results are listed in a recommended order by default just like when searching for a standard hotel.

Terms vary by the specific package you book, so make sure to read the fine print !

As with standalone flight reservations, AmexTravel.com charges a fee to book Flights+Hotel packages: $6.99 per domestic ticket or $10.99 per international ticket .

Again, these fees are waived for holders of the Amex Platinum card or the Centurion card.

In the results field, a total starting price per person is listed, including all taxes and fees with the cheapest flight option. American Express also lists how much you’re saving with the package, although this is missing for some hotels.

Once you select the hotel, you can customize your flight. The total price changes based on which flight you select.

In a sample search, we chose the Hyatt Regency London – The Churchill, and picked the cheapest nonstop flight: British Airways flight, which was Newark Liberty International (EWR) to LHR and London-Gatwick (LGW) to JFK. The package came to $1,446 per person, or $2,892 total.

Compare Flights+Hotel to Booking Separately

Annoyingly, AmexTravel.com doesn’t show a breakdown of hotel and airfare costs and fees; instead, it just displays a total per person.

For comparison, you can search the flight and hotels separately. We tried searching for the flight first on the same day.

We found Finnair flights operated by American Airlines for $660 per person — an option that wasn’t offered as part of the package (although with the booking fee, the flights should have been $671). When we filtered the search to British Airways only, it showed a ton of options for $671.

Searching hotels next, we again chose the Hyatt Regency London – The Churchill’s lowest prepaid rate. It was listed as $337 per night for 1 room (plus taxes and fees), for a total of $2,031. For the 2 flights and the hotel, that comes to a total of $3,351, or $1,675.50 per person.

In this case, booking the trip as a package saves almost $460, even though the search results page didn’t highlight any savings specifically.

The main downside to booking a package is that you have less flexibility. Say you want to change hotels for part of the trip or maybe stay with a friend for the last few days. This isn’t an option because you must book a single hotel for the entire time between your flights. It can also make solutions harder to find if there are any problems — although the AmexTravel.com customer support should make up for that.

Bottom Line: If you’re using AmexTravel.com and your plans allow for the lack of flexibility, you might be able to save a lot of money with a package. Just make sure to compare the listed price to booking everything separately. Note that you can’t book a package retroactively: you have to book the flights and hotel at the same time.

AmexTravel.com also offers a rental car booking service. You can make reservations from rental stations at airports and elsewhere.

To search for rental cars, simply enter an airport or city . You can also click a button to search near a specific address.

Results are shown in a handy grid format, with each column showing a different rental company, and each row displaying the pricing for a different category of car (economy, compact, midsize, and so on).

Bookings of up to 4 days are charged a daily rate, while bookings 5-7 days are charged on a weekly basis. There are specific rates for weekends and weekdays, as well as monthly options, with specific details varying by the rental agency.

In several sample searches, prices were generally consistent with other online travel agencies — though sometimes lower by $1-$2/day. Prices were identical to booking with the rental company directly.

Bottom Line: Renting a car through AmexTravel.com doesn’t get you any benefits above what you’d receive for paying with your credit card, such as the collision damage waiver for paying with your Amex Platinum card. However, the convenient search page makes it a great option for comparing multiple prices at once.

AmexTravel.com also offers tools to book cruises . In addition to letting you search for cruises all over the world, AmexTravel.com periodically highlights special offers on cruises, usually in the form of credits to use onboard.

Searching for Cruises

To search for cruises, you need to enter the region you want to travel in, the cruise line(s) you want to travel with (or search all available lines), the month you’re planning the trip for, and the approximate length of the cruise you want.

Results are shown in order, from the lowest-priced option to the highest . Note that this is based on the lowest available rate; hovering over any result will show all available cabin types and the corresponding prices.

Under each result, the information shown includes the port of departure/return, date of departure, and ports visited.

Hot Tip: Wondering what to pack for your time at sea? Check out our ultimate cruise-based packing list — it’s printable and complete with tons of tips and advice!

Cruise rates booked through AmexTravel.com were within $1-2 of rates found on other online travel agents and websites . We found identical prices on the various cruise company websites — though each online travel portal and cruise line offers different promotions, so it might be worth comparing them.

For example, during a sample search for a weeklong Caribbean cruise in December, we found that Royal Caribbean was offering a $50 onboard credit if you booked directly.

Special Offers

On the search results page, you might notice a tab labeled “Special Offers.” Those offers are generally onboard credits, but can also include discounts or other special features. If you aren’t committed to a specific cruise line, these are often worth exploring.

Cruise Privileges Program

Those with the Amex Platinum card have special access to the Cruise Privileges Program . Like the Fine Hotels and Resorts program, this is only available on specific cruises, although it’s more limited than FHR.

It includes onboard credit (often higher than otherwise offered) and a special onboard amenity, like complimentary dinner for 2 or a bottle of premium champagne.

Bottom Line: It can be worth booking a cruise through AmexTravel.com, especially if there are special offers. Make sure to compare different booking sites , though, as some may have better or exclusive promotions.

AmexTravel.com offers a feature called Travel Insiders. When you use the program, American Express connects you with a travel expert who can help you plan an itinerary based around your desired destination. Fees vary based on location, length of the trip, and details of the itinerary.

AmexTravel.com can be a very useful tool when booking flights, hotels, vacation packages, cruises, or rental cars. In many cases, it may not offer the best rate options , but it’s worth comparing to other booking sites and airlines or hotels directly.

If you have an American Express card that offers access to the Hotel Collection or Fine Hotels and Resorts, the perks can be very worthwhile.

Additionally, the extra Membership Rewards points you earn by booking through AmexTravel.com can be valuable, as long as the price is right.

Aside from the Hotel Collection and Fine Hotels and Resorts, the real value of AmexTravel.com is in the customer service provided. Booking a trip on your own is easy — dealing with problems when they arise can be less so!

If you book through AmexTravel.com, you’ll have easy access to someone who can help you get on a new flight, find a new hotel, or manage whatever other issues come up day or night. So if you’re looking to have that extra support, then AmexTravel.com might be a great choice for you!

The information regarding the Centurion ® Card from American Express was independently collected by Upgraded Points and was not provided nor reviewed by the issuer.

For rates and fees of The Platinum Card ® from American Express, click here . For rates and fees of The Business Platinum Card ® from American Express, click here . For rates and fees of the American Express ® Gold Card, click here . For rates and fees of the American Express ® Business Gold Card, click here .

Frequently Asked Questions

What is american express travel.

AmexTravel.com is an O nline T ravel A gency (OTA), just like Orbitz , Kayak , or Expedia . You can book flights, hotels, rental cars, or cruises through AmexTravel.com.

Do I need an American Express card to use Amex Travel services?

Whether or not you have an American Express card, you can book flights, hotels, rental cars, or cruises through AmexTravel.com. If you do have an Amex card, you might be eligible for certain perks or rewards.

Does American Express Travel cost anything?

If you book a flight through AmexTravel.com, there’s a small fee ($6.99 for domestic flights, $10.99 for international) that fee is waived for Amex Platinum, Amex Business Platinum, and Centurion cardmembers. Other services, like hotels and cruises, do not have fees.

Why should I book with American Express Travel?

AmexTravel.com has very helpful customer service resources. If you have any problems with your trip (like a canceled flight), you can call an agent who can help solve the issue.

Was this page helpful?

About Jarrod West

Boasting a portfolio of over 20 cards, Jarrod has been an expert in the points and miles space for over 6 years. He earns and redeems over 1 million points per year and his work has been featured in outlets like The New York Times.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

![american express travel online American Express Cash Magnet Card – Full Review [2024]](https://upgradedpoints.com/wp-content/uploads/2018/07/American-Express-Cash-Magnet-Card.png?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Debt relief Best debt management Best debt settlement A debt management plan: Is it best for you? What is debt settlement and how does it work? Debt consolidation vs. debt settlement Should you settle your debt or pay in full? How to negotiate a debt settlement on your own

- Debt collection Can a debt collector garnish my bank account or my wages? Can credit card companies garnish your wages? What is the Fair Debt Collection Practices Act?

- Bankruptcy How much does it cost to file for bankruptcy? What is Chapter 7 bankruptcy? What is Chapter 13 bankruptcy? Can medical bankruptcy help with medical bills?

- More payoff strategies Tips and tricks to get of your debt in a year Don't make these mistakes when climbing out of debt How credit counseling can help you get out of debt What is the debt avalanche method? What is the debt snowball method?

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best personal loans

Auto Insurance

Best car insurance

Best high-yield savings

CREDIT CARDS

Best credit cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Credit Cards

The complete guide to the Amex Travel portal

Carissa Rawson

Allie Johnson

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Robin Saks Frankel

Published 7:39 a.m. UTC Feb. 28, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

onurdongel, Getty Images

The American Express Travel portal offers valuable benefits to American Express cardholders, including special prices. Depending on which card you hold, you may also be able to pay for travel with Membership Rewards® points and get access to perks such as discounted airfare and specialty benefits at luxury hotels. Let’s take a look at how the Amex Travel portal works, whether the benefits are worthwhile and who can access Amex Travel’s website.

- American Express Travel offers hotels, vacation rentals, flights, rental cars and cruises.

- Luxury hotel benefits and discounted airfare are two benefits of booking through Amex’s travel portal.

- American Express cardholders can access Amex Travel.

How to book travel through the Amex Travel portal

Booking travel through the Amex Travel portal requires you to have an online account associated with an Amex card. While you can complete a search on the Amex Travel website without logging in, you will need to do so in order to make a booking.

After you choose whether to book a flight, hotel, vacation rental, vacation package, rental car or cruise, you’ll need to enter your travel details.

For example, if you want to book a flight through Amex Travel, you’ll need to put in your departure airport and destination as well as your dates of travel. The site will then bring up a list of matching results.

You can filter based on when the flights take off as well as how many stops you’re willing to tolerate, among other options.

The Amex Travel site offers a wide variety of hotel stays and flights, but you’ll always want to double check elsewhere before booking since it doesn’t always feature every option.

Once you’ve selected a booking, you’ll be taken through the checkout process. This includes providing your personal information and can also include seat requests and adding in loyalty program numbers.