Suggested companies

Allianz partners usa.

Faye Travel Insurance Reviews

In the Travel Insurance Company category

Visit this website

Company activity See all

Write a review

Reviews 4.7.

Most relevant

My first experience with Viking…

My first experience with Viking Cruises. The Viking Staff were very helpful and looked out for their guests. I would definitely do another cruise with Viking. Many couples have had long experience. On this trip was a couple who had taken 15 cruises because they had always experienced good times and good experiences.

Date of experience : April 23, 2024

Reply from Faye Travel Insurance

Carole - Thanks for bringing us along. We hope we’re invited on your next adventure! -Gal, Head of Customer Experience at Faye

Faye is the way to go.

My refund was given in about a week ....when I first submitted my claim I receive an email almost immediately! I called today to check on it..and as I was speaking to Erica ..a notification came thru that my refund was there she is the nicest c/s person I ever had and I will definitely use Faye in the future !!

Date of experience : April 21, 2024

Maxine, thanks so much for leaving such an amazing review! We are overjoyed to hear that we met your expectations and were able to provide you with peace of mind during your travels! Spread your love of Faye with friends and fam to earn up to $50 via the Faye app. All you have to do is log in to the app and click ‘Share Faye’ on your profile page in the app. Send your unique link to your loved ones and once they buy a policy, you can earn $10 (up to 5 times) for each policy bought. More information in the app. -Gal, Head of Customer Experience at Faye

Our guide/driver to the Holland…

Our guide/driver to the Holland windmills exposed us to his upper respiratory infection and 4 out of five got it a week before returning home and still have it. One of us (me) has been to the ER. Are we still covered by Faye when we return?

Hi Peggy - Our coverage ends when you return home from your trip. However, Any expenses you have related to your sickness that occurred during your vacation can be filed for a claim. One of our claims specialists will contact you directly to assist you with your claim and address any further questions. -Jeff, VP of Claims at Faye

Making Changes

I wanted to make a change to my travel dates and anticipated spending a fair bit of time and cost to do so. I am happy to say I was wrong. Less than two minutes on the app and lickety split, I was done. What amazing customer service - fast, friendly and easy as can be.

Date of experience : April 24, 2024

Thank you so much, Leslie. We love hearing you had a positive experience with Faye and we hope to travel with you again soon! -Gal, Head of Customer Experience at Faye

Travel Insurance in Israel

I'm in Israel - it's been easy to get full travel insurance through the app and communication has been exceptional. They helped me find the nearest urgent care and let me know exactly what to do to file a claim. Then followed up with me via email to see how I felt! I didn't end up going to the doctor and haven't needed a claim (thank goodness). But so far, I will continue to use Faye for my travel insurance needs just based on my initial interactions.

Date of experience : April 19, 2024

Hey Carine, we appreciate the kind words! We pride ourselves on fast and proactive service, no matter where you are in the world. Looking forward to your next adventure. -Gal, Head of Customer Experience at Faye

Excellent Service

I became unexpectedly ill before my expensive trip and Faye Travel Insurance stepped up to help me. They did not give me any hassle and reimbursed me for all items that I could not get a refund for. There is documentation that needs to be submitted but that is to be expected. Excellent service.

Date of experience : April 17, 2024

Terri, feedback like yours motivates us to continue delivering exceptional service and comprehensive coverage to all our customers. We hope to see you again soon! -Gal, Head of Customer Experience at Faye

Insurance that you hope you never use!

Hidden behind the curtain, knew you were there because we paid for it, but never needed the assistance. Seems like all other insurance plans… might need it but hope we don’t. Could be a “life-saver” but in reality, never used. Not really sure if was worth the $$$ unless it is needed!

Date of experience : April 18, 2024

Dedicated Reader - So glad to hear that you chose Faye to protect your trip. Our goal is to go the distance to protect you - from the little details to the big destinations, and every moment in between. -Gal, Head of Customer Experience at Faye

Traveling Europe with confidence!

It was wonderful knowing we would have assistance if anything happened during our extensive trip to Europe! Thankfully we did not need the services!

Date of experience : April 20, 2024

S, we are delighted to have played a part in ensuring your trip was worry-free. Faye is here to assist you with any future travel needs. Wishing you many more safe and memorable journeys ahead! -Gal, Head of Customer Experience at Faye

No issues tested our coverage

No issues tested our coverage. Having this coverage, however, eased our minds for an enjoyable trip.

Bonnie, we are delighted to have played a part in ensuring your trip was worry-free. Faye is here to assist you with any future travel needs. Wishing you many more safe and memorable journeys ahead! -Gal, Head of Customer Experience at Faye

I liked the peace of mind it gave me…

I liked the peace of mind it gave me that if anything illness or sickness or freak accident happened, I was fully covered

We’re so happy to hear we were able to give you the peace of mind to enjoy your trip to the fullest, Jeri. Thanks for bringing us along for the journey. -Gal, Head of Customer Experience at Faye

The willingness to help when things at…

The willingness to help when things at airport went south, I appreciate the quick response.

Thank you, James, for sharing your experience. We hope to travel with you again and continue providing you with excellent coverage and care on all your future adventures! -Gal, Head of Customer Experience at Faye

I have no incident to report but…

I have no incident to report but someone close to me had an incident while traveling recently and I just wanted to share that your team is doing a wonderful job! Speaks highly of your service so I plan to continue to use your service. Thank you!

Date of experience : April 13, 2024

Hey Jake, we appreciate the kind words! We pride ourselves on fast and proactive service, no matter where you are in the world. Looking forward to your next adventure. -Gal, Head of Customer Experience at Faye

Grateful in Athens

I got sick while on a tour to Turkey and Greece. I reached out to Faye to check on procedure and their responsiveness has been tremendous! They have checked on how I’m doing, if I need anything else and offering help to get my claim looked after. So far, very impressive!

Marilyn - We hope you're feeling better! We're glad to hear that you chose Faye to protect your trip and that you had such a positive experience. Our goal is to go the distance to protect you - from the little details to the big destinations, and every moment in between. -Gal, Head of Customer Experience at Faye

Faye Travel Insurance

Easy to make application and purchase the policy. Very thankful we did not have to use it.

James - Thanks for bringing us along. We hope we’re invited on your next adventure! -Gal, Head of Customer Experience at Faye

Extension of travel days

I decided to extend my travel from 15 days to 17 days after I bought the policy. I called the insurance company and got to talk to an agent right away and was told there would be no problem and no additional charge. I received the revised policy promptly.

Date of experience : April 14, 2024

Ken, feedback like yours motivates us to continue delivering exceptional service and comprehensive coverage to all our customers. We hope to see you again soon! -Gal, Head of Customer Experience at Faye

Broken foot in Vietnam

After my wife broke her foot in Vietnam, Team Faye was at our side from the moment she was in the hospital to her return to Maine 12 days later. All airline flights were well arranged, and the bonus was an escort doctor the entire way home. Each of our communications was answered promptly and professionally. We felt like Faye was our guardian angel. We can’t thank you enough! Bob and Jan Baldwin

Date of experience : March 17, 2024

Hey Bob & Jan, we appreciate the kind words! We pride ourselves on fast and proactive service, no matter where you are in the world. We hope your foot is doing better and we're looking forward to your next adventure. -Jeff, VP of Claims at Faye

The representative was excellent

The representative was excellent. She followed up after learning that my wife fell and needed medical attention. She seemed to take a personal interest in us. This was unexpected and pleasantly surprising. If the claim process goes as well as all my interaction has gone so far I will be delighted.

Date of experience : April 09, 2024

Hi Lindsay, we appreciate the kind words! We pride ourselves on fast and proactive service, no matter where you are in the world. Looking forward to your next adventure. -Gal, Head of Customer Experience at Faye

No harm no need!

Last year we had the unfortunate need to use Faye's services and the experience with Faye was fantastic. The good news is there were no incidents needing their help! Thank goodness!

Date of experience : April 11, 2024

John, thanks for your trust in us, and we look forward to being your go-to choice for travel insurance & assistance in the future! -Gal, Head of Customer Experience at Faye

Horrible company

Horrible company, do not buy it from them, we purchased travel insurance for April 21 2024 trip, my wife got injured and we had to cancell our trip. We have no problem with the Airline and hotel they cancell out ticket and refund immidiately; only this company Faye they refuse to cancell the policy and they said I purchased too early and now it is too late to cancell the policy. It is such a rip off company I will contact my CC company if Faye does not resolve this refund issue. Reply to Faye: Unfortunately it is a "Credit" not a refund, so basically you just keep my money and hope I do not use in in two years; it is still did nor resolve my issue and I am out of $288 for no reason!

Hi WKT - We’re incredibly sorry to hear how frustrated you are. Our policy is that you can cancel your travel insurance plan and receive a full refund up to 14 days after purchasing as long as your trip didn’t start yet, you have not incurred a loss and you haven’t filed a claim. A friendly FYI that this is stated in the FAQs section of our website. Given the circumstances, we reached out to you via email to offer you a credit valid for 2 years to cover a future policy with Faye once your wife is feeling better. We hope to turn this around and travel with you on a future adventure. -Gal, Head of Customer Experience at Faye

Seamless buying experience…

"I recently had a seamless experience with Faye when I needed to purchase and cancel travel insurance for my trip. Despite facing initial difficulties with obtaining a Schengen Visa, Faye made the process of buying and cancelling the insurance incredibly easy and hassle-free. I was impressed with the exceptional service and will definitely use Faye for all my future travel needs."

Date of experience : April 16, 2024

Hey Rue, we appreciate the kind words! We pride ourselves on fast and proactive service, no matter where you are in the world. Looking forward to your next adventure. Also, if you want to share Faye with friends and earn $10 (up to 5 times) for each policy bought. You can do so via the Faye app. Simply log in to the app and click ‘Share Faye’ on your profile page in the app for your unique link. More information in the app. -Gal, Head of Customer Experience at Faye

- Travel insurance plans

Compare Faye Travel Insurance

- Why You Should Trust Us

Faye Travel Insurance Review 2024

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

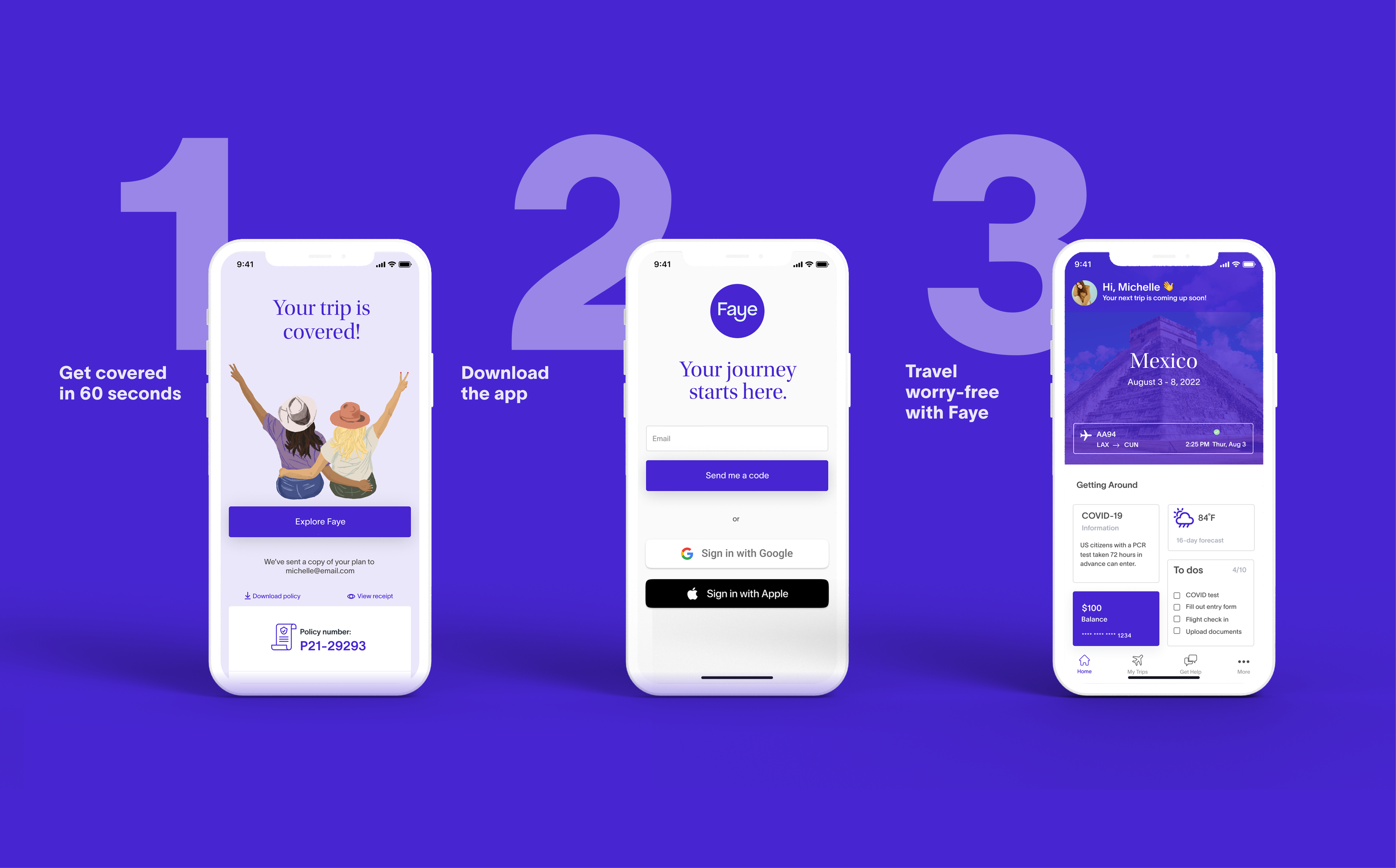

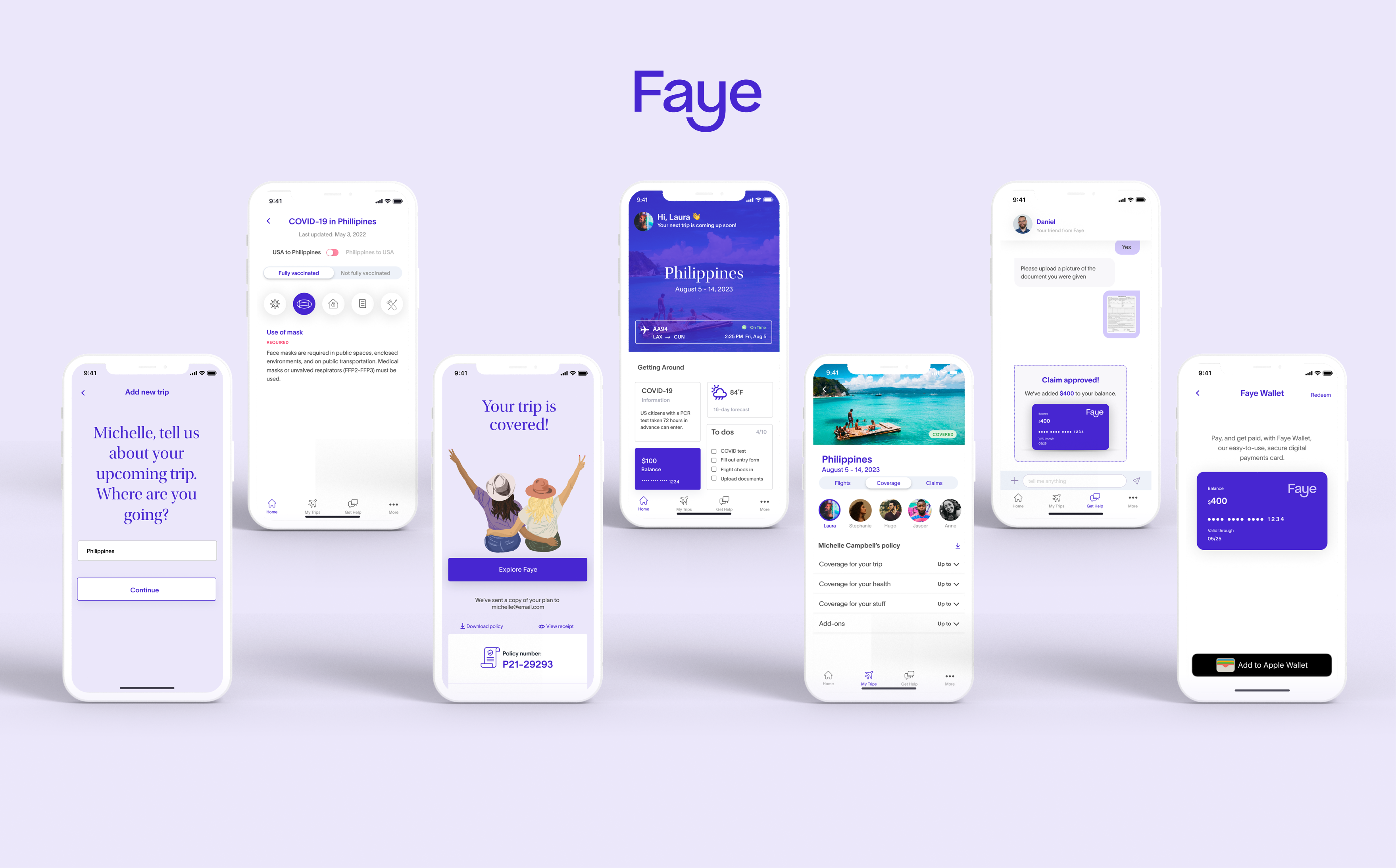

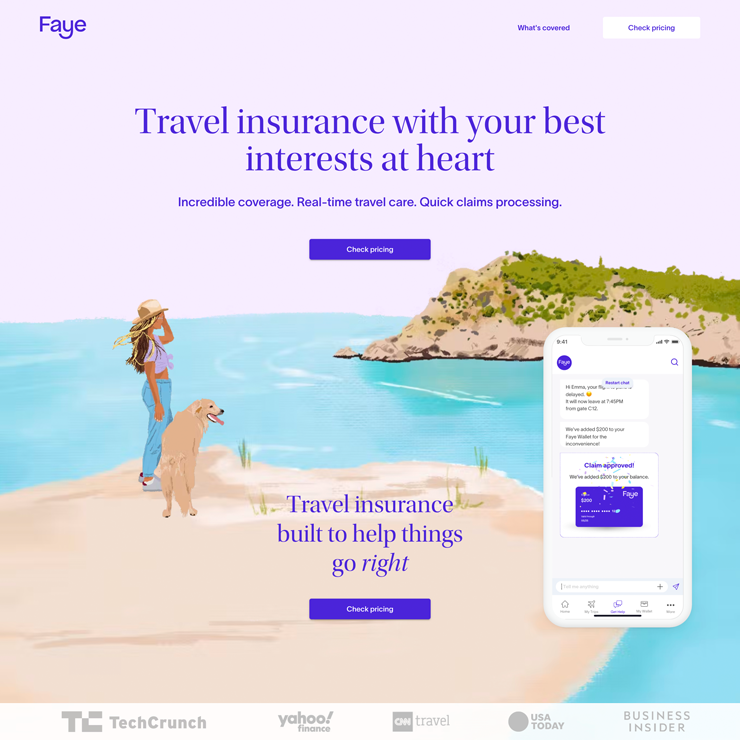

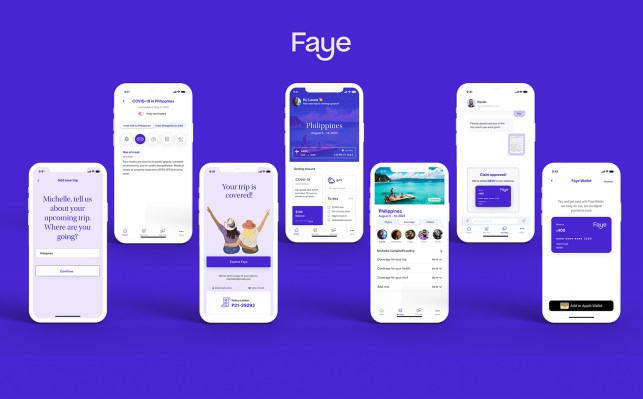

At its core, Faye Travel Insurance is the first fin-tech startup providing a modern take on travel insurance. This Faye travel insurance review finds the company prides itself on offering a fully-digital experience. This digital push means its consumers can buy a policy, submit claims, and receive payouts seamlessly through a mobile app.

Faye puts your travel insurance options in the palm of your hand. However, everyone's travel insurance needs differ. Online access is only one of the things travelers look for. So it's essential to read the fine print before you pay for the best travel insurance for your needs. Here's a closer look at what you need to know before buying a Faye travel insurance plan.

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Customers love the product and claims process

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Easy online quoting process

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Add-ons including pet care, rental car coverage, and cancel for any reason

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Easy debit cards for claims payment on your trip

- con icon Two crossed lines that form an 'X'. Only available to US citizens

- con icon Two crossed lines that form an 'X'. May be harder for non-tech savvy buyers

Faye Travel Insurance Review: Types of Policies Offered

Faye Travel Insurance starts with one base plan boasting that it provides "whole trip" travel insurance to protect "your trip, your health, and your stuff." It also offers riders to customize your coverage for a fee.

Here's what's included in the base plan:

Additional coverage options from Faye

In addition to the base plan, Faye Travel Insurance offers a robust selection of riders or supplemental policies buyers can add to the plan for an additional cost. The riders are the same in the US and abroad.

These include:

- Adventure and extreme sports protection: up to $250,000 (international trips) or $50,000 (domestic trips) for accidental & sickness expenses. Users should read the policy to ensure their plans qualify.

- Vacation rental damage protection: applicable for short-term rentals like Airbnb and VRBO or other rentals. Faye will reimburse you up to $3,000

- Cancel for Any Reason: up to 75% of the nonrefundable insured trip cost

- Pet Plan Bundle: up to $2,500 for vet expenses and $250 for kenneling if your trip is extended unexpectedly

- Rental car care (for cars renting within the U.S. and Canada only): up to $50K in coverage for accidental damage by collision, vandalism, natural disaster or theft related to your rental car

You can compare pricing on an April trip to France for one traveler. The base cost came back as $145.69. The price to add riders is listed on the right.

Always check your other insurance policies if you're looking for specific coverage types not included in this list. You might be surprised at the coverage automatically available to you. For example, US auto insurance will extend to rental cars in the US. You can talk to your auto insurance company about any international travel. However, we know it can be hard to know what coverage you need. As such, Personal Finance Insider conducted a 2023 winter travel insurance survey of 971 US adults in December through Momentive AI Audience .

However, Faye offers many essential coverages automatically with riders to supplement for more unique situations.

Faye Travel Insurance Cost

The average cost of travel insurance can vary widely. Your premium will depend on several factors, including your trip destination, trip duration, age, insurance plan, and any additional coverage options you select beyond the plan's limits.

To give you a better idea of what to expect, we asked the team at Faye Travel Insurance to run a few quotes for this review.

According to its calculations, one person heading on a two-week trip to the Philippines and Thailand at a total estimated trip cost of $2,500 would pay $136.44 for Faye's base plan. However, if travelers wanted to add on optional coverage for vacation rental damage and extreme adventure sports, the cost would increase to $202.96.

Domestically, a couple heading to Hawaii for one week with an estimated trip cost of $3,000 could expect to pay $201.02 for a base plan with no additional upgrades.

How to File a Claim with Faye

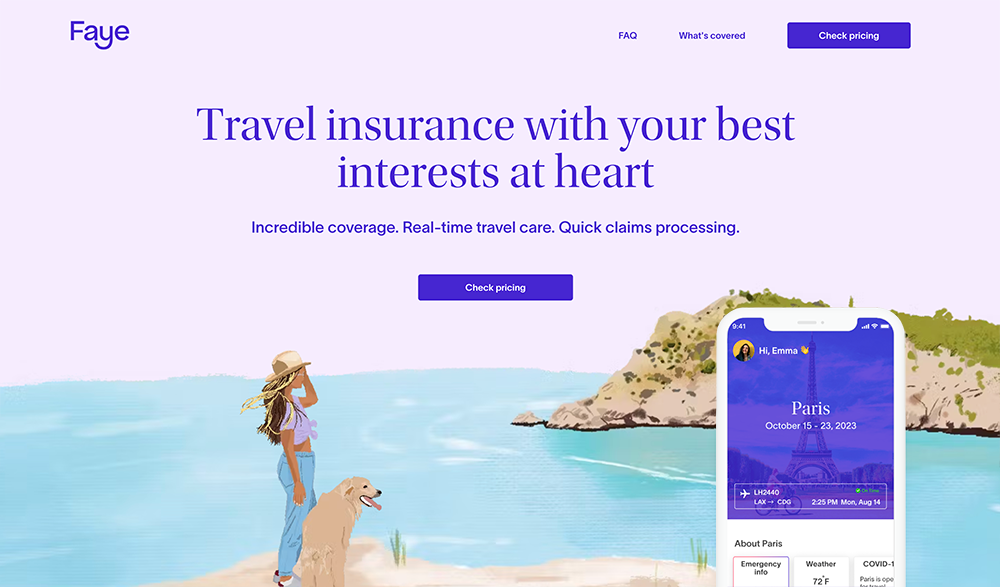

The easiest way to submit a claim with Faye Travel Insurance is through its mobile app. The app has a 24/7 chat feature to ensure you get the assistance you need as quickly as possible.

You can also contact Faye via phone or email. Domestic travelers should call +1-833-240-7056, while international travelers should dial +1-804-482-2122. If you wish to contact the company via email, [email protected] is the best address.

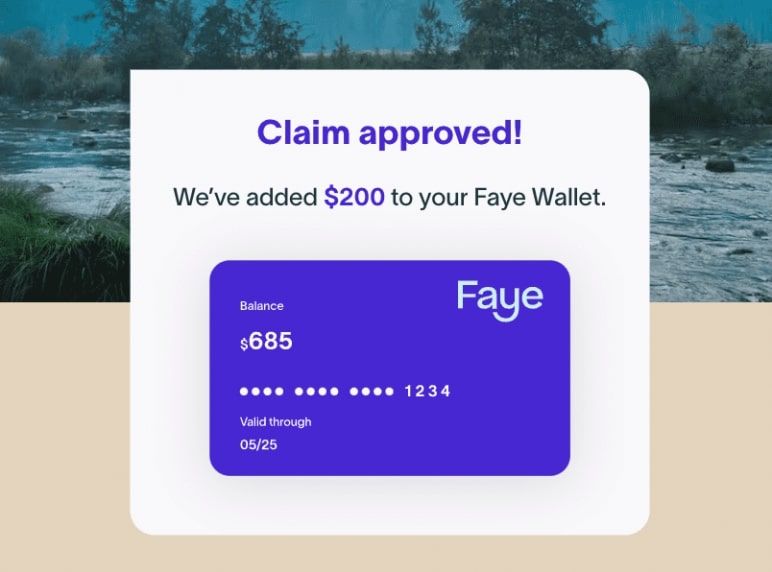

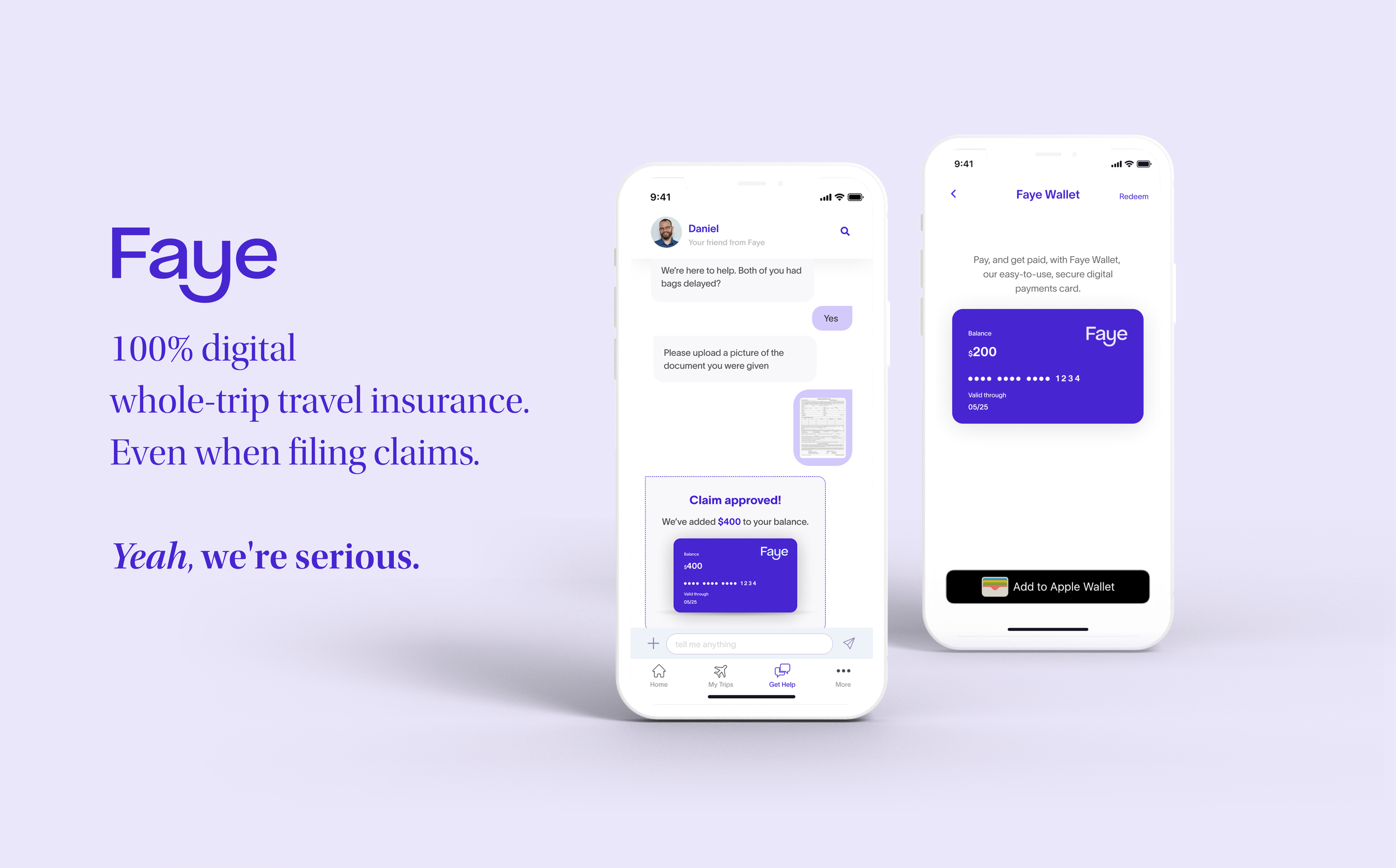

Notably, one thing that sets Faye's claims process apart from other travel insurance providers is that any payouts you receive will be deposited directly into your Faye Wallet. The Faye Wallet works similarly to an Apple Pay account, allowing Faye's team to process claims faster. You can immediately access the money to pay for things like dog kenneling, replacing everyday toiletries and clothes, and more.

Learn more about how Faye Travel Insurance compares to top travel insurance providers.

Faye vs. AIG Travel Insurance

While both Faye Travel Insurance and AIG offer apps for travel insurance customers, AIG's app is currently only available to those with corporate bookings. In short, vacationers lack access to the app. Faye, on the other hand, has apps for both IOS and Android users.

Faye may be the way to go if you're more comfortable navigating the insurance process on your phone or don't plan to take a computer. Still, AIG may provide more options if you want more control over your claim limits.

AIG offers three levels of comprehensive travel insurance with varying limits. The company also has annual travel insurance plans, which may be a good fit if you plan to go on multiple trips this year. Overall, premiums are similar between the two companies.

AIG Travel Insurance Review

Faye vs. Allianz Travel Insurance

One of Faye Travel Insurance's main benefits is that it offers a large selection of add-on options that allow you to tailor your coverage to fit your needs. These include riders like a pet policy or an adventure sports rider.

At this time, Allianz only offers supplemental rental car insurance policies in addition to its comprehensive insurance plans.

However, Allianz may present a more straightforward and comprehensive option if you're not in the market for hyper-specialized coverage. Both companies include emergency medical transportation and costs in base plans. Overall, Allianz is typically the more affordable option between the two.

Allianz Travel Insurance Review

Faye vs. World Nomads Travel Insurance

On the whole, Faye Travel Insurance and World Nomads travel insurance are relatively similar. Both offer comprehensive insurance plans, coverage for extreme sports, and 24/7 claims assistance. However, it's the finer details that set the two companies apart.

For its part, Faye's most significant selling point is its mobile app and quick transfer of funds to its card. It also has the option to add on those tailored additional coverage riders, such as its pet plan bundle, cancel for any reason coverage, and vacation rental damage protection.

In contrast, World Nomads has two comprehensive plans, which means you can select your claim limits. Plus, the company allows you to extend your coverage if you stay away from home longer than you'd planned.

World Nomads premiums may also be more competitive depending on where you're going.

World Nomads Travel Insurance Review

Why You Should Trust Us: How We Reviewed Faye Travel Insurance

While reviewing Faye Travel Insurance, we compared its offerings to other reputable travel insurance providers. Specifically, we compared the available plan options, add-ons, claim limits, coverages, exclusions, and typical policy costs.

Choosing the best policy for you and your co-travelers is about finding a policy with the right type of coverage and sufficient claim limits. Of course, price is a significant factor for many consumers. But specialty riders for daredevils and other details help consumers make the right decision. As such, we take all that into account. You can read more about how we rate travel insurance products here .

Faye Travel Insurance FAQs

Although Faye is relatively new in the travel insurance industry, it's built an excellent reputation among its customers.

Take a look at this selection of reviews from some of the most trusted review sites:

User "Kliment," told Consumer Affairs , "We spent 11 days traveling throughout the Middle East, incl the World Cup in Qatar. Obtaining, paying, and managing the travel policy was extremely easy and seamless. The policy was issued immediately with zero hassle or asking for tedious documentation. Much better value than previous insurers we've used. Highly recommended."

Meanwhile, a reviewer named Elizabeth told TrustPilot : "Booked a trip to Argentina and Chile. The purchase process was super quick and simple. [I] also had a great experience chatting with the Faye team in-app and over email."

Faye has two customer assistance hotlines, one for domestic and one for international travelers. Contact numbers are:

- Domestic: +1-833-240-7056

- International: +1-804-482-2122.

You can also process claims in-app with Faye's 24/7 chat feature or via email at [email protected] .

The company's plans are available in all states except Washington and Missouri.

Faye can also not sell travel to residents of these US territories: United States Virgin Islands, Northern Mariana Islands, Guam, American Samoa, and Puerto Rico.

You'll have 14 days after purchasing your policy with Faye to receive a full refund, as long as the trip has yet to start and no claims have been submitted.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

- Main content

My Honest Experience with Faye Travel Insurance

03/19/2023 by Kristin Addis Leave a Comment

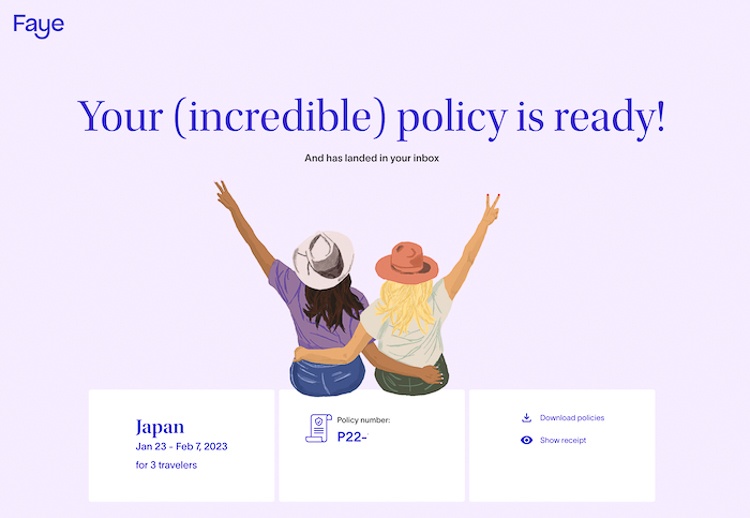

Is Faye Travel Insurance worth using? With so many companies out there, how do you pick the right one? This is my first hand experience buying, filing a claim, and getting reimbursed with Faye on my most recent trip to Japan.

I decided to purchase Faye for my most recent trip to Japan, and they asked me to write a review of their product. However, getting sick on my trip, fully utilizing the insurance, and filing a claim weren’t planned (how could it be?) and the following is my first-hand account of how it all went down. Also, any links in this post that you purchase through support me at no extra cost to you:

Table of Contents

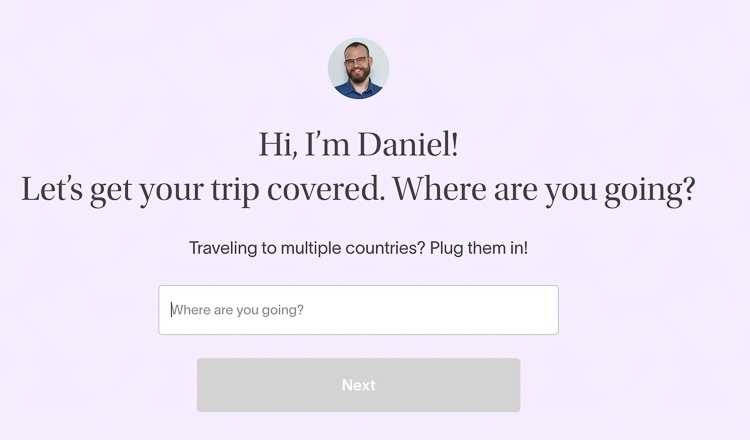

Buying Faye Travel Insurance

Buying travel insurance usually starts with inputting dates, reading as much fine print as possible, and hoping it all works out if you need to make a claim. Having used four different companies over the past decade, it’s been a similar experience every time.

Faye had quite a different interface, though, which you can check out here . It felt much more human to me.

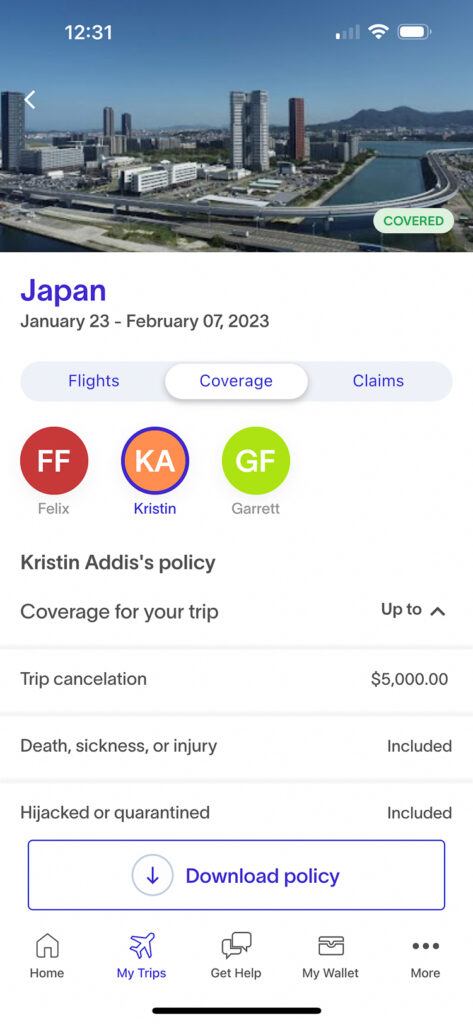

You’ll begin by putting in your location, dates, and amount of travelers with you. The policy quote will have the main points, with a link at the bottom to read the full policy. Keep in mind that preexisting conditions can be covered as long as you purchase your plan within 14 days of your initial trip deposit, and are medically able to travel when you purchase your plan.

Price-wise, it worked out to under $100 per person for our two-week trip. My policy included up to $5000 in trip interruption coverage, including inconveniences like delays, rental lock-outs, delays at security, and late arrival.

It also included COVID-19 coverage, medical evacuation, and an option to add rental car care, adventure and extreme sports protection, and vacation rental damage protection. Depending on what you select (and where you’re based), you can pick the options that best suit your needs.

Once I purchased, I was emailed the policy summary as well as the full coverage pamphlet.

The whole process took about 5 minutes.

Using the App

Faye is the first travel insurance that encouraged me to download an app for my trip. I input my flight details and had the insurance coverage info noted in the app as well.

For the most part, insurance is something you buy and forget about, until you really need it.

Since I did get sick, the app came in handy when I needed to make a claim.

Getting Medical Care Abroad

Unfortunately, I developed a cough that re-awakened my childhood asthma during my first few days in Japan. It was tough to sleep due to the wheezing.

I looked around for some doctors on Google maps before picking one who had stellar reviews and took walk ins. Before seeking medical care in Tokyo , I checked the app and read my policy again to make sure I didn’t have to use a pre-approved doctor or get any paperwork specific to my insurance for the doctor to fill out – two areas where claims sometimes get denied by travel insurance providers.

Not seeing any requirements like that, I made my appointment, got there, and paid in cash. The appointment and medications came out to just under USD $90. I received a receipt detailing the diagnosis along with the medications prescribed and what I paid. It was two pages in total.

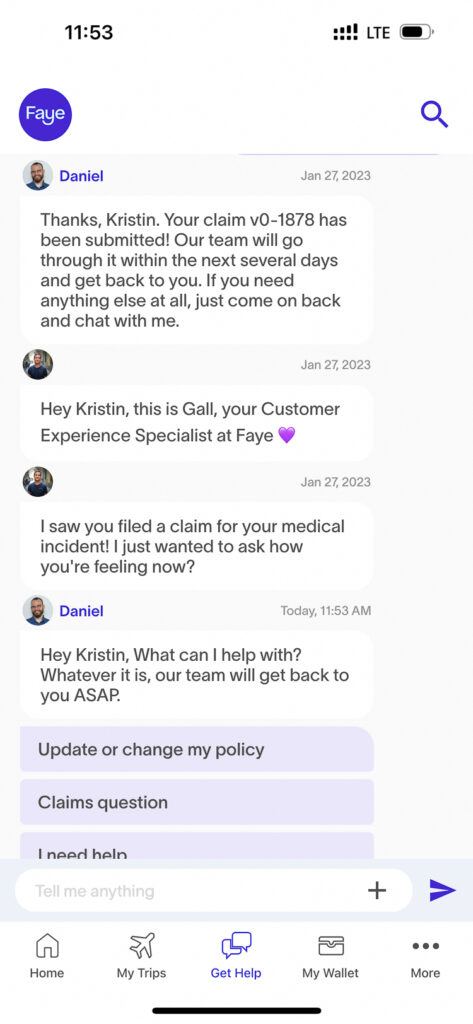

Making a Claim with Faye

Immediately after coming back from my appointment, I opened the app and started chatting with Faye. I wanted to see if it was really that easy to file a claim, get it approved, or if I would run into a bunch of red tape.

I took photos of the receipts and uploaded them to the chat. I didn’t let them know that I was writing this review. I wanted to be treated like a normal customer and have the same experience that anyone would have.

I received a follow up check in message asking how I was feeling a few days later which, to be honest, I ignored since we were in the full swing of the trip.

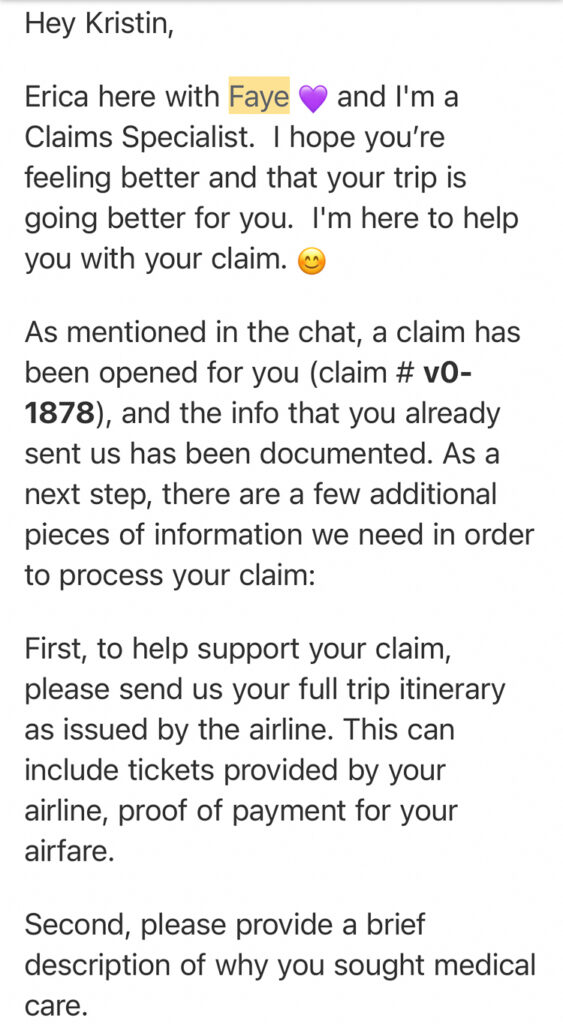

I received my first email on February 10, about two weeks after initiating the chat. It was from a real person, and she was my point of contact from then onward. I provided proof of the trip ( flight receipts ) and sent a brief description of why I sought care per her email instructions. It took me maybe 3 minutes to collect the info and briefly describe my symptoms and why I sought care.

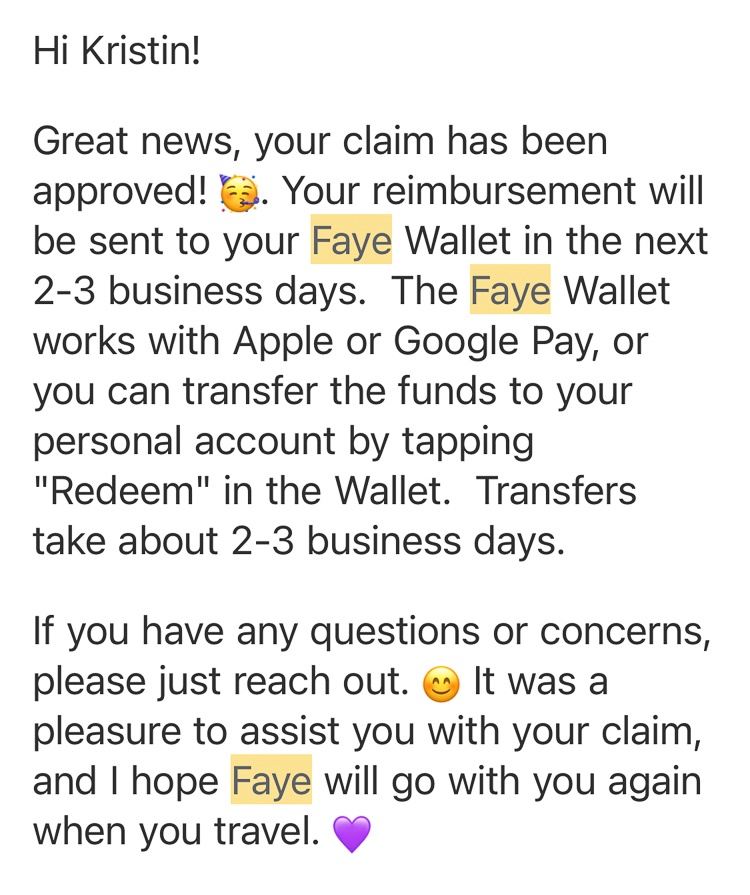

A handful of days later, I received a claims summary and soon thereafter was informed my claim had been approved in full.

I was honestly shocked I hadn’t needed to call, follow up, or argue my case any further. It’s how it should be, but it’s just not what I’ve come to expect from insurance.

From there, the balance was reflected in the app under the wallet tab, available to withdraw to my bank account or you can add your Faye digital debit card to your phone’s wallet (Apple Wallet or Google Wallet) and tap to pay, and use towards anything you please. The whole process took less than a month.

My Take on Faye

I was honestly impressed by how easy the whole process was from purchasing insurance, to understanding what I needed to do to get reimbursed, to actually getting reimbursed. As mentioned earlier, the whole thing felt straightforward, personalized, and human , which isn’t usually how insurance feels to me.

Of all the insurance I’ve used, this is one that I will use again.

Keep in Mind

This was my personal experience using this insurance, but it can always vary based on the fine print, the policy that you choose, and what you need to be reimbursed for.

Most travel insurance is not a complete one size fits all product. If you’re traveling with super expensive camera gear, for example, read the fine print and decide if you need an additional policy to cover your gear (you probably do). Make sure the trip interruption and cancellation suit your desires and expectations, and get clear on coverage for certain activities you’re participating in. Additionally, buy insurance as soon as you put down your trip deposits, as you lose pre-existing medical coverage if you wait more than 14 days from that initial purchase.

Although travel insurance is an additional trip expense, it’s one of those things that’s important to have when you really need it. Thankfully my medical expenses were low, but you never know! Depending on the severity of the situation, I could have been tens of thousands in the hole without coverage.

Based on my experience I would absolutely recommend Faye travel insurance. It was quick, easy, and I liked having access to a person I could chat with when I really needed it. No hours on the phone, no headaches, and no feeling like I was ignored.

You can explore your options here !

*This post was brought to you in partnership with Faye Travel Insurance. All opinions on the travel insurance are my own, as always. Your trust comes first!

About Kristin Addis

Kristin Addis is the founder and CEO of Be My Travel Muse, a resource for female travelers all around the world since 2012. She's traveled solo to over 65 countries and has brought over 150 women on her all-female adventure tours from Botswana to the Alaskan tundra.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

subscribe to our newsletter

This site uses Akismet to reduce spam. Learn how your comment data is processed .

You are using an outdated browser. Please upgrade your browser to improve your experience.

At ConsumersAdvocate.org, we take transparency seriously.

To that end, you should know that many advertisers pay us a fee if you purchase products after clicking links or calling phone numbers on our website.

The following companies are our partners in Travel Insurance: Travel Guard Insurance , Travelex , TravelInsurance.com , Seven Corners , Generali Global Assistance , Trawick International , Squaremouth , John Hancock , and Faye .

We sometimes offer premium or additional placements on our website and in our marketing materials to our advertising partners. Partners may influence their position on our website, including the order in which they appear on the page.

For example, when company ranking is subjective (meaning two companies are very close) our advertising partners may be ranked higher. If you have any specific questions while considering which product or service you may buy, feel free to reach out to us anytime.

If you choose to click on the links on our site, we may receive compensation. If you don't click the links on our site or use the phone numbers listed on our site we will not be compensated. Ultimately the choice is yours.

The analyses and opinions on our site are our own and our editors and staff writers are instructed to maintain editorial integrity.

Our brand, ConsumersAdvocate.org, stands for accuracy and helpful information. We know we can only be successful if we take your trust in us seriously!

To find out more about how we make money and our editorial process, click here.

Product name, logo, brands, and other trademarks featured or referred to within our site are the property of their respective trademark holders. Any reference in this website to third party trademarks is to identify the corresponding third party goods and/or services.

- Travel Insurance

- Faye Review

Faye Travel Insurance Review

The following companies are our partners in Travel Insurance: Travel Guard Insurance , Travelex , TravelInsurance.com , Seven Corners , Generali Global Assistance , Trawick International , Squaremouth , John Hancock , and Faye .

We sometimes offer premium or additional placements on our website and in our marketing materials to our advertising partners. Partners may influence their position on our website, including the order in which they appear on a Top 10 list.

The analyses and opinions on our site are our own and our editors and staff writers are instructed to maintain editorial integrity. Our brand, ConsumersAdvocate.org, stands for accuracy and helpful information. We know we can only be successful if we take your trust in us seriously!

To find out more about how we make money and our editorial process, click here.

How is Faye rated?

Overall rating: 4.8 / 5 (excellent), faye plans & coverage, coverage - 4.8 / 5, emergency medical coverage details, baggage coverage details, faye financial strength, financial strength - 4.8 / 5, faye price & reputation, price & reputation - 4.7 / 5, faye customer assistance services, extra benefits - 4.8 / 5.

Our Comments Policy | How to Write an Effective Comment

Customer Comments & Reviews

- 'Cancel for any reason' available

- Includes emergency medical expenses

- Quick claims & reimbursements in App with 24/7 support

- Includes trip cancellation, baggage delay/loss, and flight delays

Related to Travel Insurance

Top articles.

- Trip Cancellation Insurance – What is Covered?

- Do I Really Need Travel Insurance?

- Emergency Travel Insurance Coverage

- Common Parasites and Travel-Related Infectious Diseases

Suggested Comparisons

- Travel Guard Insurance vs. Travelex

- Allianz Global Assistance vs. Travel Guard Insurance

- Allianz Global Assistance vs. Berkshire Hathaway

- Allianz Global Assistance vs. Travelex

- Or via Email -

Already a member? Login

- Best Extended Auto Warranty

- Best Used Car Warranty

- Best Car Warranty Companies

- CarShield Reviews

- Best Auto Loan Rates

- Average Auto Loan Interest Rates

- Best Auto Refinance Rates

- Bad Credit Auto Loans

- Best Auto Shipping Companies

- How To Ship a Car

- Car Shipping Cost Calculator

- Montway Auto Transport Reviews

- Best Car Buying Apps

- Best Websites To Sell Your Car Online

- CarMax Review

- Carvana Reviews

- Best LLC Service

- Best Registered Agent Service

- Best Trademark Service

- Best Online Legal Services

- Best CRMs for Small Business

- Best CRM Software

- Best CRM for Real Estate

- Best Marketing CRM

- Best CRM for Sales

- Best Free Time Tracking Apps

- Best HR Software

- Best Payroll Services

- Best HR Outsourcing Services

- Best HRIS Software

- Best Project Management Software

- Best Construction Project Management Software

- Best Personal Loans

- Best Fast Personal Loans

- Best Debt Consolidation Loans

- Best Loans for Bad Credit

- Best Personal Loans for Fair Credit

- HOME EQUITY

- Best Home Equity Loan Rates

- Best Home Equity Loans

- Best Checking Accounts

- Best Free Checking Accounts

- Best Online Checking Accounts

- Best Online Banks

- Bank Account Bonuses

- Best High-Yield Savings Accounts

- Best Savings Accounts

- Average Savings Account Interest Rate

- Money Market Accounts

- Best CD Rates

- Best 3-Month CD Rates

- Best 6-Month CD Rates

- Best 1-Year CD Rates

- Best 5-Year CD Rates

- Best Jumbo CD Rates of April 2024

- Best Hearing Aids

- Best OTC Hearing Aids

- Most Affordable Hearing Aids

- Eargo Hearing Aids Review

- Best Medical Alert Systems

- Best Medical Alert Watches

- Best Medical Alert Necklaces

- Are Medical Alert Systems Covered by Insurance?

- Best Online Therapy

- Best Online Therapy Platforms That Take Insurance

- Best Online Psychiatrist Platforms

- BetterHelp Review

- Best Mattress

- Best Mattress for Side Sleepers

- Best Mattress for Back Pain

- Best Adjustable Beds

- Best Home Warranty Companies

- American Home Shield Review

- First American Home Warranty Review

- Best Home Appliance Insurance

- Best Moving Companies

- Best Interstate Moving Companies

- Best Long-Distance Moving Companies

- Cheap Moving Companies

- Best Window Replacement Companies

- Best Gutter Guards

- Gutter Installation Costs

- Best Window Brands

- Best Solar Companies

- Best Solar Panels

- How Much Do Solar Panels Cost?

- Solar Calculator

- Best Car Insurance Companies

- Cheapest Car Insurance Companies

- Best Car Insurance for New Drivers

- Same-day Car Insurance

- Best Pet Insurance

- Pet Insurance Cost

- Cheapest Pet Insurance

- Pet Wellness Plans

- Best Life Insurance

- Best Term Life Insurance

- Best Whole Life Insurance

- Term vs. Whole Life Insurance

- Best Travel Insurance Companies

- Best Homeowners Insurance Companies

- Best Renters Insurance Companies

- Best Motorcycle Insurance

Partner content: This content was created by a business partner of Dow Jones, independent of the MarketWatch newsroom. Links in this article may result in us earning a commission. Learn More

Faye Travel Insurance Review (2024)

Sarah Horvath is one of the home service industry’s most accomplished writers. Her specialties include writing about home warranties, insurance, home improvement and household finances. You can find her writing published through distributors like HouseMethod, Architectural Digest, Good Housekeeping and more. When not writing, she enjoys spending time in her home in Orlando with her fiance and parrot.

Tori Addison is an editor who has worked in the digital marketing industry for over five years. Her experience includes communications and marketing work in the nonprofit, governmental and academic sectors. A journalist by trade, she started her career covering politics and news in New York’s Hudson Valley. Her work included coverage of local and state budgets, federal financial regulations and health care legislation.

Faye travel insurance can reimburse you for nonrefundable expenses if your travel plans go awry or you’re hurt while on vacation. An entirely online provider, Faye boasts 24/7 customer service and streamlined payments through its proprietary app. But is travel insurance worth the cost — and what can you expect your Faye travel insurance policy to cover?

Read on to learn more about how Faye travel insurance compares to the top travel insurance providers .

- Average Cost: $256

- BBB Rating: N/R

- AM Best Score: A (excellent)

- Medical Expense Max: $250,000

- Emergency Evacuation Max: $500,000

Our Take on Faye Travel Insurance

We gave Faye Travel Insurance an overall score of 4.6 out of 5 stars and ranked it #1 as the best travel insurance provider with an entirely online experience. Faye’s online application is simple, allowing you to get a quote in as little as 60 seconds, and the company’s free app makes filing a claim just as easy. While Faye’s pricing is a bit higher than other insurance providers, its all-in-one app and around-the-clock support might be worth it for some travelers .

In addition to a mobile offering and 24/7 customer support, Faye also includes extra benefits like $2,000 coverage for sporting equipment and $50 towards replacement passports. This coverage, plus Faye’s generous baggage coverage, could be valuable for those who travel with items that would be difficult or expensive to replace. Faye might be a less valuable choice for travelers who are more likely to require medical coverage, as its evacuation and medical bill reimbursement limits are lower than competitors.

Pros and Cons of Faye

How faye scored in our methodology.

We rated Faye Travel Insurance 4.6 out of 5 stars . The company is our overall top pick for travel insurance due to its comprehensive travel insurance plan, variety of add-on options and strong reputation for customer service.

Compare Faye to the Other Travel Insurance Providers

Use the table below to compare the costs and coverages of Faye to other top-rated travel insurance companies.

What Does Faye Travel Insurance Cover?

Faye Travel Insurance is a relatively new insurance provider, opening its doors in 2022. However, the company has quickly set itself apart with its app-based offerings. Those who prefer a more streamlined, digital policy experience may prefer the Faye app, which offers benefits like:

- Real-time travel alerts

- Customer support from real humans

- A fully digital claims process

While the Faye app is available as a free download for both Android and iOS devices, it is not required to buy insurance or file a claim. You can utilize Faye’s website to check policy pricing or email the company to file a claim. The app also features the Faye Wallet option, which allows you to get paid directly after filing a claim.

Faye offers a single insurance policy, which includes the following standard benefits:

- 100% of trip cancellation costs

- 150% of trip costs for emergency interruptions

- Up to $250,000 in coverage for emergency medical expenses, including COVID-19

- Up to $500,000 in emergency medical evacuation coverage

- Up to $100,000 in non-medical emergency evacuation coverage

- $300 per day reimbursement for flight delays, up to $4,500

- Up to $200 for covered in-trip inconveniences, capped at $600

- $150 reimbursement per item for lost or damaged baggage, up to $2,000

- $200 reimbursement for baggage delays that last at least six hours

- Up to $2,000 in coverage for lost or damaged professional or sporting equipment

- $50 for lost passports and credit cards

Faye travel insurance covers pre-existing medical conditions as long as you purchase a policy within 14 days of making your initial trip deposit. You also must be medically able to travel when you purchase coverage.

When compared to other travel insurance providers, Faye’s coverage is average in terms of baggage and delays. Faye also falls a bit short with its medical evacuation coverage . For example, competitors like Nationwide and Travel Insured International offer up to $1 million in evacuation coverage at similar price points. This might make Faye a less appealing choice if you’re planning international travel to a rural area with limited access to medical care.

Optional Riders

Even the best travel insurance coverage will not cover every situation and cancellation. Riders are add-ons that extend your coverage to include more unique circumstances. Faye travel insurance currently allows you to customize your travel insurance policy with the following extra coverages:

- Cancel for any reason (CFAR) coverage: All travel insurance companies specify a list of covered reasons that qualify you for reimbursement if you must cancel your travel plans. Some common covered reasons include the death of a family member, legal obligations or natural disasters. Adding CFAR coverage to your Faye travel insurance policy offers more flexibility in regard to cancellations. With CFAR coverage, you will be reimbursed for up to 75% of non-refundable trip costs when you cancel your trip for any reason — even those not included in your policy. To qualify, you must initiate the cancellation at least 48 hours before your departure.

- Rental car care : This add-on reimburses you for up to $50,000 in rental car damage or theft-related expenses if you’re involved in an accident abroad or if the vehicle is stolen.

- Adventure and extreme sports protection : Like most competing travel insurance provider options, Faye’s coverage for medical expenses excludes bills resulting from extreme sports. If you plan to parasail, scuba dive or engage in any other extreme outdoor activities, you can extend medical evacuation and expense reimbursement coverage with this rider.

- Vacation rental damage protection : This rider reimburses you for up to $3,000 in repair or replacement costs if you damage the rental property you’re staying in.

- Pet care : If your trip is interrupted or canceled while you’re abroad, you could end up with unanticipated pet care expenses. This add-on reimburses you for up to $2,500 in veterinary expenses and $250 for kenneling if you arrive back home later than expected.

Add-on pricing is proportional to the value of your trip and may vary based on the amount of time you’re traveling and your destination.

Faye Travel Insurance Policies

Based on our research, we found that Faye offered a single insurance policy for both domestic and international trips. To help you get an idea of Faye’s travel coverage, we requested a quote for a seven-day trip from the state of Washington to Cancun, Mexico. The following coverages were included in Faye’s standard policy and are based on quotes we obtained in October 2023

- CFAR Coverage: Add-on available (reimburses up to 75% of nonrefundable costs)

- Trip Delay: $300 per day (maximum payout of $4,500)

- Trip Interruption and Cancellation: 100% reimbursement for cancellation and 150% reimbursement for interruption

- Baggage Coverage: $300 for baggage delay and up to $2,000 for damaged baggage (capped at $150 per item)

- Medical Coverage: $250,000 coverage for medical expenses and $500,000 coverage for emergency medical evacuations

Faye’s policies also include up to $2,000 reimbursement for lost or damaged sporting and professional equipment, and $50 to compensate for lost passports or credit cards. These unique inclusions can make Faye worth the price if you’re traveling with specialized equipment and want to add extra peace of mind.

How Much Does Faye Cost?

The average cost of a Faye travel insurance policy is $256 , but ranges from $130-$482 depending on your trip details.

Some of the factors that affect the price of travel insurance include:

- Your travel destination and home state

- The total value of your trip

- The dates you’re traveling

- When you made your first trip deposit

Based on our Faye travel insurance review, Faye is not the most competitively priced provider. After comparing a few sample trips between providers, we found that Faye’s prices were about 31% higher than competing insurers offering comparable coverage. However, it’s important to remember that travel insurance premiums are highly customizable and personalized — we still recommend getting a quote from Faye before choosing your insurance plan.

To give you an idea of the cost of Faye Travel Insurance policies, we obtained the following quotes for seven different international trips. All trips are one week long, but vary in number of travelers, traveler age and trip destination.

Use the chart below to compare Faye's average cost to competitors:

Read More: Travel Medical Insurance For Travelers Visiting The United States

Does Faye Offer 24/7 Travel Assistance?

If you’re traveling internationally for the first time, it can be reassuring to know your travel insurance provider offers around-the-clock assistance in your native language. Faye offers 24/7 customer support through its Apple and Android apps and over the phone. If you don’t need urgent assistance, you can direct any questions about your policy to its customer support team via email at [email protected] .

Faye Customer Reviews

Reading third-party reviews of previous customer experiences can help you anticipate the type of service you’ll receive from a travel insurance provider. Overall, Faye maintains higher-than-average customer reviews, with about 84% of Trustpilot users rating the company 4.5 out of 5 stars . However, Faye is not currently accredited nor rated by the Better Business Bureau (BBB).

Many customer reviews note that Faye was helpful and efficient when issues occurred while traveling. Multiple customers report it was easy to get in touch with a Faye representative when they needed it most, and that claims were paid out quickly. However, some customers expressed frustration regarding difficulties finding a medical provider using Faye’s app in some countries. Some customers also reported issues regarding policy “fine print” or a lack of communication with representatives.

“…I had an allergic reaction in Thailand, and Faye saved the day and reimbursed me for my hospital bill. [The representative] was there for all the steps after. I’m so grateful! “ —Elena via Trustpilot “We purchased Faye for a month-long trip to Argentina, where my partner suddenly experienced a serious medical situation which resulted in him getting hospitalized in Buenos Aires for almost a week. We ended up having to interrupt our trip because of this, going home two weeks earlier than planned. Faye’s customer support was super responsive through the app, giving us assistance and guidance every step of the way.” —Liran S. via Trustpilot “During my recent trip to Turkey, I was offered medical help via Air Doctor but it did not work. The app struggled to find a local doctor for telemedicine. Disappointing. ” —Vivekandand B. via Trustpilot “Bought insurance for a seven-day trip with a hurricane in the forecast. Once I filed a claim, [Faye] told me [the hurricane] was foreseeable since it had already been named and I could not cancel the insurance because I had made a claim. Do not waste your money on this.” —Paula s. Via Trustpilot

How To File a Claim with Faye

Filing a claim with Faye starts with the company’s mobile app. Here is an overview of the general process:

- Access the Faye app : Begin by opening the Faye mobile application on your device.

- Navigate to "Get Help": Within the app, locate the "Get Help" tab, and then click on the "Claim Questions" tab.

- File a new claim: In the "Claim Questions" section, select the option to "File a new claim."

- Specify your claim reason: You will be prompted to give a reason for filing a claim. Choose the appropriate category, whether it's related to your health or other claims such as rental car coverage.

- Provide trip details and explanation: Enter essential information about your trip, including dates and destinations. Additionally, explain the circumstances that led to your claim.

- Upload supporting documents: To substantiate your claim, upload relevant supporting documents. These may include flight tickets, hotel reservations or any other travel-related receipts.

- Submit your claim: Once you've filled in the required details and attached the necessary documents, you can submit your claim through the app.

- Alternative method: If you don’t have the Faye app, you can still file a claim by sending an email to [email protected]. Make sure to include the same information you would provide through the app so Faye can assist you effectively.

Faye aims to process all claims within 48 hours of submission. You can check for live updates through the Faye app — another benefit of choosing Faye as your travel insurance provider.

The Bottom Line: Is Faye Travel Insurance a Good Choice?

Overall, Faye can be a strong travel insurance choice for those traveling with valuable items or looking for a digital policy experience. With special coverage for lost sports equipment and up to $4,500 in baggage reimbursements, Faye offers generous coverage limits for your belongings. But this coverage comes at a cost that is higher than some other leading providers. Faye may not be the best choice if you are traveling on a budget and seeking cheap coverage options .

We recommend requesting quotes from at least three travel insurance providers before deciding on a policy.

Frequently Asked Questions About Faye Travel Insurance

What company underwrites faye travel insurance policies.

Faye travel insurance policies are underwritten by the United States Fire Insurance Company. The United States Fire Insurance Company boasts an A+ rating with the credit agency A.M. Best, indicating the company is financially stable enough to pay out claims.

What is travel insurance?

Travel insurance coverage is a type of protection that reimburses you for non-refundable trip costs if your travel plans are unexpectedly canceled or interrupted. Travel coverage includes coverage for medical expenses you incur abroad and evacuation expenses if you’re forced to leave your destination early. Most policies will also cover lost or damaged baggage.

Is Faye trip insurance legit?

Faye travel insurance is a legitimate company, backed by the well-rated United States Fire Insurance Company. While not every customer reports a positive experience with Faye, most customers report that the company provided a payout after filing a claim.

How does Faye travel insurance work?

As is the case with most travel insurance providers, Faye travel insurance works on a reimbursement-based model. This means you’ll need to cover any medical or travel expenses you incur abroad and apply for a reimbursement later. A Faye underwriter will then look at your coverage, determine if you’re eligible for a payout and calculate your reimbursement.

Methodology: Our System for Rating Best Travel Insurance Companies

- A 30-year-old couple taking a $5,000 vacation to Mexico.

- A family of four taking an $8,000 vacation to Mexico.

- A 65-year-old couple taking a $7,000 vacation to the United Kingdom.

- A 30-year-old couple taking a $7,000 trip to the United Kingdom.

- A 19-year-old taking a $2,000 trip to France.

- A 27-year-old couple taking a $1,200 trip to Greece.

- A 51-year-old couple taking a $2,000 trip to Spain.

- Plan availability (10%): We look for insurers with a variety of travel insurance plans and the ability to customize a policy with coverage upgrades.

- Coverage details (29%): We review the baseline coverage each company offers in its cheapest comprehensive plan. A provider with robust coverage earns full points, including baggage delay and loss, COVID-19 coverage, emergency evacuation and medical coverage, trip delay and cancellation coverage, and more. Companies also receive points for offering a variety of policy add-ons like accidental death and dismemberment, extreme sports, valuable items, cancel for any reason coverage and more.

- Coverage times and amounts (34%): We compare each company’s waiting periods and maximum reimbursement amounts for baggage, travel and weather delays. Companies that offer customers reimbursement after fewer than 12 hours of delays earn full points in this category. We also reward travel insurance providers that cover more than 100% of trip costs in the event of cancellations or interruptions.

- Company service and reviews (17%): We look for indicators that a company is well-prepared to respond to customer needs. Companies with an established global resource network, 24/7 emergency hotline, mobile app, multiple ways to file a claim and concierge services score higher in this category. We assess reputation by evaluating consumer reviews, third-party financial strength and customer experience ratings, specifically from AM Best and the Better Business Bureau (BBB).

For more information, read our full travel insurance methodology.

A.M. Best Disclaimer

More Resources:

Faye Travel Insurance Review [2024]: My Honest Opinion

![faye travel insurance complaints Faye Travel Insurance Review [2024]: My Honest Opinion](https://assets-global.website-files.com/63d1baf79ce0eb802868785b/63f7e3ecf77a521c39d44aef_63e8b4e43e7a3257b95e1305_faye%2520travel%2520insurance.jpeg)

The right travel insurance can make or break your trip. Travel accidents happen, and you need coverage you can trust. Find out if you can trust Faye travel insurance in this in-depth guide.

Getting travel insurance before you even step on the airplane is essential.

Some destinations or activities even require proof of insurance. Did you know some bucket-list destinations like Everest Base Camp or Machu Picchu requires travelers to have different kinds of coverage?

Being well-informed about all kinds of travel insurance options like Seven Corners and World Nomads will put you one step ahead when choosing the right insurance provider.

Faye is one of many companies you can pick from to purchase travel insurance, so what makes them stand out from the rest?

Should they be trusted? I've digged into what exactly they offer and what Faye customers have been saying about their services so you wouldn't have to. Find out what I think about Faye!

What is Faye?

Faye is a new digital travel insurance provider that started in 2022 with a mission to provide broad coverage and excellent care for travelers. Their app is simple to use on any mobile device or web browser and is free to download from the App Store or Play Store.

Faye is currently only available to US residents, excluding Montana, Washington, Missouri, New York, and Pennsylvania residents.

However, they assure that they're working on reaching coverage for residents in all 50 states. Faye offers coverage in the US and many other international destinations, excluding Iran, Iraq, Syria, North Korea, Ukraine, and Russia.

How to Purchase Travel Insurance with Faye

To purchase travel insurance with Faye, download the app from the app or visit their website. Fill in your trip and contact details to receive an immediate quote. You can see the dollar value coverage for your trip and how much it will cost.

Additional add-ons to tailor your plans, like pet coverage, car rental care, and extreme sports protection, can also be purchased.

What Does Faye Cover?

Faye covers 3 of the main areas most standard travel insurance providers will cover, like your health, your baggage, and your transport, with stellar 24/7 assistance.

Your Health

Faye has your health in mind when it comes to travel. With Faye, you have

- Covid-19 related expenses like quarantine coverage and non-refundable cancellation costs

- Medical evacuation up to 500k

- Medical expenses up to 250k

- Pre-existing medical conditions

- Lost or damaged belongings up to 2k

- Coverage includes gadgets like your laptop or phone

- Trip cancellation due to illness or travel provider bankruptcy

- Trip delay due to factors outside your control, like passport theft or flight delay

- Trip interruptions

- Missed connections due to factors outside your control

- Non-medical emergency evacuation

- Rental car care

- Cancel for any reason

- Vacation rental damage

- Adventure and extreme sport coverage

In the unfortunate event that something disrupts your trip, Faye has you covered.

Other Great Features of Faye

Free to use.

The app is free to download on your phone or access from the web. It's also free to get a quote for any trip you have in mind, with no sneaky sales tactics or guilt-tripping.

Wide Coverage

Faye has wonderfully comprehensive coverage that protects your health, trip, and stuff, giving you peace of mind and allowing you to focus on the time of your life. They also have additional add-ons to help tailor to travelers with unique needs.

Easy Management

Once you've purchased a plan with Faye, it's easy to view, print, and manage any aspect of your plan in the app.

Dedicated Team

Faye has a friendly and knowledgeable customer service team available 24/7 to help you manage your plans or claim.

Quick Reimbursement

If you need to make a claim, Faye is quick to respond. Depending on the circumstances, you'll be reimbursed within 48 hours of submitting a claim.

Faye Cancellation Policy

You can cancel your insurance policy up to 14 days after purchasing and receive a full refund if your trip has yet to start.

Faye also offers an optional "cancel for any reason" add-on available to use on any of their plans.

This means you can cancel your trip up to 48 hours before departure for any reason and still receive 75% of your non-refundable trip costs back. That means if you get sick, have to work, or decide not to go, you're still covered!

What are People Saying About Faye?

There have been many articles written about Faye since its launch in 2022. Yahoo Finance and Tech Crunch had overwhelmingly positive things to say about Faye. They won a 2022 Magellan Awards Silver with Travel Weekly for Best Online Travel Services Marketing App.

Customers who've submitted claims are over the moon regarding the quality of attention and service they received with Faye. The majority of claims were processed quickly in less than 48 hours.

Faye has a glowing review on Trustpilot of 4.7/5, with only a few disgruntled customers giving the company a 1-star review.

Is Faye Worth it?

With overwhelmingly positive reviews from businesses and customers alike, Faye travel insurance has proven to be one of the best travel insurance providers. I think they're one of the better travel insurance options out there.

It's an all-in-one, easy-to-use app that makes purchasing travel insurance straightforward and hassle-free. It is, however, frustrating that it's yet to be available to customers in all US states and worldwide.

But if you want to avoid the lengthy paperwork and telephone calls that traditional insurance companies offer, give Faye a try.

Our Rating: 4.1/5

- Easy to use

- Amazing range of coverage

- Attentive customer service

- Only available for US residents

- Not currently available in all US states

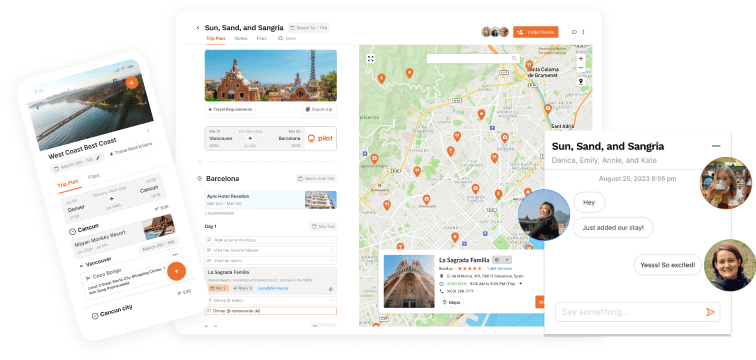

Cover All Your Bases with Pilot

Now that you're travel insurance is covered, it's time to get cracking with the fun stuff. Building an epic travel itinerary with Pilot can be as simple as signing up for Faye!

Disclosure : Pilot is supported by our community. We may earn a small commission fee with affiliate links on our website. All reviews and recommendations are independent and do not reflect the official view of Pilot.

Satisfy your wanderlust

Get Pilot. The travel planner that takes fun and convenience to a whole other level. Try it out yourself.

Trending Travel Stories

Discover new places and be inspired by stories from our traveller community.

Related Travel Guides

Allianz Travel Insurance Review (2024): Are they legit?

Travelex Review: Are travelers getting the best insurance?

Make the most of every trip.

You won’t want to plan trips any other way!

The trip planner that puts everything in one place, making planning your trip easier, quicker, and more fun.

- Meet the Team

- Work with Us

- Czech Republic

- Netherlands

- Switzerland

- Scandinavia

- Philippines

- South Korea

- New Zealand

- South Africa

- Budget Travel

- Work & Travel

- The Broke Backpacker Manifesto

- Travel Resources

- How to Travel on $10/day

Home » Budget Travel » Meet Faye – The Travel Insurance Smart Wallet (UPDATED 2024)

Meet Faye – The Travel Insurance Smart Wallet (UPDATED 2024)

As we enter the warm months of 2022, more of us than ever are desperately needing a vacation more than ever. The last couple of years of lockdowns and bad news has left many people burned out and in deep need of a change of scenery.

But at the same time, two years of stop-start travel restrictions and geographically flavoured COVID variations has left a lot of prospective travellers almost afraid to travel.

This is why it is more important than ever that travellers pay extra special attention to travel insurance and make sure they get good coverage from the right provider.

With that in mind, we are today going to introduce you all to Faye, an industry disrupting travel insurance provider that may have just revolutionised the way we see insurance with their tech based, insurance wallet interface.

Faye Travel Insurance At A Glance

Faye is a fin-tech insurance platform available to residents of 43 different US states – and soon to be all 50. Their comprehensive travel protection covers your health, your trip, your stuff and if you want, even your pet. The company’s mission is to help things go right , rather than waiting for things to go wrong, and they do this by offering travel insurance that you can buy, review and manage entirely through an easy-to-use app.

If you ever need to make a claim, you simply log in to the app, click to chat, upload all the necessary info and the claim will be assessed within 48 hours, with reimbursements on approved claims paid immediately to Faye Wallet, the company’s secure digital payments card that works exactly like Google Pay and Apple Pay. This means you don’t have to pay out of pocket for what you need, when you need it most.

In addition, you can chat with Faye’s support team of travel experts 24/7, anywhere in the world.

In summary, we have tried and tested a lot of different insurance providers and we have never found one like this.

Do You Need Travel Insurance?

It is estimated that only around 25% of Americans purchase travel insurance before taking a vacation trip whereas globally, the figure is closer to 50%. So why exactly are Americans less likely to take out travel insurance ?!! Well the reasons for this anomaly are not entirely clear, but it may be that a lot of Americans mistakenly believe that they are covered and think they do not need travel insurance. And whilst some American health insurers may cover overseas treatment, others will not.

Furthermore, health insurance is only ever one single aspect of what travel insurance is about. In summary, it is possible that 75% of American travellers are NOT adequately insured against mishaps.

Whilst travel insurance is rarely ever mandatory for entering a country or joining a tour, there are many reasons why you should consider it. Ultimately it is a matter of personal choice but we at The Broke Backpacker NEVER take a trip without insurance – over a decade of travel, it has come to our rescue enough times for us to learn that value exceeds its cost.

Anyway, we have written a full article asking if you need insurance which you can read at your leisure if you are so inclined!

What Can Travel Insurance Cover?

In a nutshell, travel insurance is designed to indemnify you against financial loss caused by unexpected problems that occur in relation to a trip you have booked. Travel insurance can cover trip cancellations (ie, if you are forced to cancel your trip) , lost luggage (more common than you might think), theft whilst travelling and of course the cost of medical treatment if you get dengue fever.

All travel insurance policies are different. Some cover specific aspects of a trip whereas others are more comprehensive. Coverage amounts different between policies as do coverage amounts (the amount you are insured for).

Look, we get you are not exactly intending to get mugged in Paris but it does happen. Likewise, whilst you are naively trusting of the airline to safely deliver your suitcase to the conveyor belt at Charles de Gaulle, it may well end up in Timbuktu instead. Therefore if we were you, we would look very closely at travel insurance – or instead you could just read on….

We’ve tested countless backpacks over the years, but there’s one that has always been the best and remains the best buy for adventurers: the broke backpacker-approved Osprey Aether and Ariel series.

Want more deetz on why these packs are so damn perfect? Then read our comprehensive review for the inside scoop!

Why We Love Faye Travel Insurance

Before we tell you why we think Faye is awesome, we are going to tell you why everybody else sucks.

The two biggest problems we have with the traditional travel insurance industry are as follows;

- Bureaucracy and Paperwork

Most travel insurance policies are long and wordy and can even feel like they are designed to trick us into thinking we are covered when we are not. Many of us finish reading them and feel confused rather than well-informed.

Aside from that, if we ever need to make a claim, insurers seem to relish in a sadistic delight making us complete endless forms and providing countless documents. To be fair, they probably don’t intend for it to be like this, it is simply that they are still using business practices from the paper age even though we are well into the tech age.

- Delays in Making Claims

So yeah, it can take weeks or even months for most insurers to pay out on successful claims. This means that if the airline loses your bag at the start of a trip, you finally get the money to buy new clothes a month after the trip ends. If you end up in hospital abroad and rack up a whopping bill, you may be forced to pay it out of your own pocket whilst your insurer ‘ums and ahs’ over reimburses you.

We could have added a 3rd point to this list which is insurers wriggling out of worthy and legitimate claims but that’s perhaps getting a bit controversial for this time of day. But believe us here, standard, traditional travel insurance companies are notorious for their seemingly bottomless ability to offer up disappointment.

Like a knight in shining armour riding in to save us from the malevolent dragons of travel insurance, enter Faye who are here to rescue the entire travel insurance industry.

Faye is a US based, fin-tech-travel-insurer whose industry leading innovative platform was created to be efficient and user friendly with an emphasis on resolving claims fast . Users can buy and manage a Faye policy without the need for any paperwork whatsoever. Policyholders can download the Faye app to review and manage their coverage.

When the need to make a claim arises, policyholders contact Faye through the app, tell them what has happened and submit the necessary info. In some cases, you’ll qualify for instant reimbursements (like baggage and flight delay). Once all the required details are provided, Faye will aim to resolve your claim in 48 hours. Unheard of.If successful, funds are then credited to the policyholders Faye Wallet on their phone instantly.

So, let’s imagine you arrive at the airport in Tulum to find that the airline has lost your luggage (they lose 25 million bags per year ). You now have no bermuda shorts or floral shirts to wear on your hard earned beach vacation. With Faye, all you need to do is contact them via the app, scan the airline’s lost luggage document, and Faye can immediately add money to your Faye Wallet to go to H & M and buy yourself some new threads.

Of course, if the issue you need help with is a lost or stolen phone then you will not be able to log in to your account to get help or access your funding wallet. In these cases you will need to find a good old fashioned landline, give them a call and they can arrange a bank transfer instead.

Faye Example Policy Details

In case you need more details about Faye’s travel insurance policy, then we have set out the finer details below. Friendly FYI – this list is simply an example of what’s available to a US resident, traveling internationally, buying a policy at least three days before their scheduled departure date.

Trip cancellation

Pre-departure coverage if you cancel your trip for covered reasons

Faye can offer cover up to $40,000 of your non-refundable trip costs per plan.

Trip interruption

When you must unexpectedly cut your trip short or extend it

Faye can offer cover up to $40,000 of non-refundable trip costs per plan as well as additional transportation expenses.

When you’re stranded in transit due to reasons outside of your control

Faye can offer reimbursement up to $300/day in expenses if you’re delayed 6 hours or more (capped at $4,500).

Trip inconvenience

When you’re inconvenienced during your trip due to a covered reason

Faye can offer payment up to $200 for each trip inconvenience you experience, capped at $600.

Missed trip connection

When you miss your trip departure due to a delay caused by a covered event

Faye can offer reimbursement up to $200 if your delay of 3 hours or more due to a covered reason causes you to miss your trip

Non-medical emergency evacuation

When, due to a covered event, you’re transported from a place of danger to a place of safety

Faye can offer cover up to $100K in costs.

Get 15% OFF when you book through our link — and support the site you love so dearly 😉

Booking.com is quickly becoming our go-to for accommodation. From cheap hostels to stylish homestays and nice hotels, they’ve got it all!

COVID-19 in-trip coverage

Coverage of emergency medical and trip delay and trip interruption expenses if you become ill with COVID-19 in-trip.

COVID-19 is treated as any other sickness.

Emergency accident & sickness medical expenses

Coverage of emergency expenses if you experience sudden illness or injury in-trip

Faye can offer cover up to $250K in costs for international trips and up to $50,000 for domestic trips.

Pre-existing medical conditions

Coverage of medical conditions that started prior to the purchase of this plan

Faye can offer cover as long as you purchase your plan within 14 days of purchasing your trip and are medically able to travel at the time of purchase.

Emergency medical evacuation expenses

Coverage of transportation in the case of illness or injury that is acute, severe or life threatening when adequate medical treatment is not available in the immediate area

Faye can offer cover up to $500K in costs when it comes to medical evacuation coverage .

Lost or damaged belongings

Reimbursement for lost, stolen, or damaged luggage.

We reimburse you up to $2K total per trip.

Lost passport or credit cards

You probably know what this means right?

Faye can offer reimbursement up to $50 for each (subject to the limit for Baggage and Personal Effects – see above).

Baggage delay

Reimbursement for out of pocket expenses, like clothing and toiletries, if your luggage is delayed

Faye can offer reimbursement up to $200 if your bags are delayed for 6 hours or more, or up to $300 if it’s been 12 hours or more.

Furthermore Faye also offers additional add ons, pet cover and rental car cover too but as these are kind of niche points, we have not covered them here.

Final Thoughts on Faye

As we have seen, the travel insurance sector is widely considered to be something of a necessary evil. However, it seems that the market is about to get a solid kick in the back side.

In all honesty, we have never come across a travel insurance provider quite like Faye. Their business model and interface offers users clear and transparent policies that are fast and easy to claim on. If you are taking a trip, then why not visit their site to get a quote ?

And for transparency’s sake, please know that some of the links in our content are affiliate links . That means that if you book your accommodation, buy your gear, or sort your insurance through our link, we earn a small commission (at no extra cost to you). That said, we only link to the gear we trust and never recommend services we don’t believe are up to scratch. Again, thank you!

Aiden Freeborn

Share or save this post

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Notify me of followup comments via e-mail.

- Best Travel Insurance 2024

- Cheapest Travel Insurance

- Trip Cancellation Insurance

- Cancel for Any Reason Insurance

- Seniors' Travel Insurance

- Annual Travel Insurance

- Cruise Insurance

- COVID-19 Travel Insurance

- Travel Medical Insurance

- Medical Evacuation Insurance

- Pregnancy Travel Insurance

- Pre-existing Conditions Insurance

- Mexico Travel Insurance

- Italy Travel Insurance

- France Travel Insurance

- Spain Travel Insurance

- Canada Travel Insurance

- UK Travel Insurance

- Germany Travel Insurance

- Bahamas Travel Insurance

- Costa Rica Travel Insurance

- Disney Travel Insurance

- Schengen Travel Insurance

- Is travel insurance worth it?

- Average cost of travel insurance

- Is airline flight insurance worth it?

- Places to travel without a passport

- All travel insurance guides

- Best Pet Insurance 2024

- Cheap Pet Insurance

- Cat Insurance

- Pet Dental Insurance

- Pet Insurance That Pays Vets Directly

- Pet Insurance For Pre-Existing Conditions

- Pet Insurance with No Waiting Period

- Paw Protect Review

- Spot Pet Insurance Review

- Embrace Pet Insurance Review

- Healthy Paws Pet Insurance Review

- Pets Best Insurance Review

- Lemonade Pet Insurance Review

- Pumpkin Pet Insurance Review

- Fetch Pet Insurance Review

- Figo Pet Insurance Review

- CarePlus by Chewy Review

- MetLife Pet Insurance Review