An official website of the United States government

Here's how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

- A–Z Index

- Operating Status

Resources For

- New / Prospective Employees

- Federal Employees

- HR Professionals

Hours of Work for Travel

Fact sheet: hours of work for travel, description.

In limited circumstances, travel time may be considered hours of work. The rules on travel hours of work depend on whether an employee is covered by or exempt from the Fair Labor Standards Act (FLSA). For FLSA-exempt employees, the crediting of travel time as hours of work is governed under title 5 rules-in particular, 5 U.S.C. 5542(b)(2) and 5544(a)(3) and 5 CFR 550.112(g) and (j). For FLSA-covered employees, travel time is credited if it is qualifying hours of work under either the title 5 rules or under OPM's FLSA regulations-in particular, 5 CFR 551.401(h) and 551.422.

Employee Coverage

Title 5 overtime laws and regulations apply to most FLSA-exempt Federal employees, including General Schedule and prevailing rate employees. Certain employees, such as members of the Senior Executive Service, are not eligible for overtime pay or other premium pay under title 5. (See 5 U.S.C. 5541(2) and 5 CFR 550.101 for coverage rules.)

OPM's FLSA regulations apply to most FLSA-covered Federal employees. (See 5 U.S.C. 5542(b)(2) and 5544(a)(3) and 5 CFR 551.102.) An employee may determine his or her FLSA status by checking block 35 of the most recent Notification of Personnel Action (SF-50) to find out whether his or her position is nonexempt (N) or exempt (E) from the overtime pay provisions of the FLSA. Alternatively, an employee may obtain a determination from his or her servicing personnel office.

Overtime Work

In general, overtime hours are hours of work that are ordered or approved (or are "suffered or permitted" for FLSA-covered employees) and are performed by an employee in excess of 8 hours in a day or 40 hours in a workweek. (See 5 U.S.C. 5542(a), 5544(a), and 6121(6) and (7), and 5 CFR 550.111 and 551.501. Note exceptions.)

Travel That is Hours of Work Under Title 5

Under 5 U.S.C. 5542(b)(2) and 5 CFR 550.112(g), official travel away from an employee's official duty station is hours of work if the travel is-

- within the days and hours of the employee's regularly scheduled administrative workweek, including regularly scheduled overtime hours, or

- involves the performance of work while traveling (such as driving a loaded truck);

- is incident to travel that involves the performance of work while traveling (such as driving an empty truck back to the point of origin);

- is carried out under arduous and unusual conditions (e.g., travel on rough terrain or under extremely severe weather conditions); or

- results from an event that could not be scheduled or controlled administratively by any individual or agency in the executive branch of Government (such as training scheduled solely by a private firm or a job-related court appearance required by a court subpoena).

An agency may not adjust an employee's normal regularly scheduled administrative workweek solely to include travel hours that would not otherwise be considered hours of work.

Travel That is Hours of Work Under the FLSA

For FLSA-covered employees, time spent traveling is hours of work if-

- an employee is required to travel during regular working hours (i.e., during the regularly scheduled administrative workweek);

- an employee is required to work during travel (e.g., by being required to drive a Government vehicle as part of a work assignment);

- an employee is required to travel as a passenger on a 1-day assignment away from the official duty station; or

- an employee is required to travel as a passenger on an overnight assignment away from the official duty station during hours on nonworkdays that correspond to the employee's regular working hours. (See 5 CFR 551.422(a).)

Official Duty Station

"Official duty station" is defined in 5 CFR 550.112(j) and 551.422(d). An agency may prescribe a mileage radius of not greater than 50 miles to determine whether an employee's travel is within or outside the limits of the employee's official duty station for determining entitlement to overtime pay for travel.

Administrative Workweek

An administrative workweek is a period of 7 consecutive calendar days designated in advance by the head of an agency under 5 U.S.C. 6101. The regularly scheduled administrative workweek is the period within the administrative workweek during which the employee is scheduled to work in advance of the administrative workweek. (See definitions in 5 CFR 610.102. See also 5 CFR 550.103 and 551.421.)

Commuting Time

For FLSA-covered employees, normal commuting time from home to work and from work to home is not hours of work. (See 5 CFR 551.422(b).) However, commuting time may be hours of work to the extent that the employee is required to perform substantial work under the control and direction of the employing agency-i.e., productive work of a significant nature that is an integral and indispensable part of the employee's principal activities. The fact that an employee is driving a Government vehicle in commuting to and from work is not a basis for determining that commuting time is hours of work. (See Bobo decision cited in the References section.)

Similarly, for FLSA-exempt employees, normal commuting time from home to work and from work to home is not hours of work. (See 5 CFR 550.112(j)(2).) However, commuting time may be hours of work to the extent that the employee is officially ordered or approved to perform substantial work while commuting.

Normal "home-to-work/work-to-home" commuting includes travel between an employee's home and a temporary duty location within the limits of the employee's official duty station. For an employee assigned to a temporary duty station overnight, normal "home-to-work/work-to-home" commuting also includes travel between the employee's temporary place of lodging and a work site within the limits of the temporary duty station.

If an employee (whether FLSA-covered or exempt) is required to travel directly between home and a temporary duty location outside the limits of the employee's official duty station, the time the employee would have spent in normal commuting must be deducted from any hours of work outside the regularly scheduled administrative workweek (or, for FLSA covered employees, outside corresponding hours on a nonwork day) that may be credited for the travel time. (The travel time is credited as hours of work only as allowed under the applicable rules-e.g., for an FLSA-covered employee, if the travel is part of a 1-day assignment away from the official duty station.)

- 5 U.S.C. 5542(b)(2) (General Schedule employees)

- 5 U.S.C. 5544(a)(3) (Prevailing rate employees)

- 5 CFR 550.112(g) and (j), 610.102, and 610.123

- 5 CFR 551.401(h) and 551.422 (OPM's FLSA regulations)

- Decision by United States Court of Appeals for the Federal Circuit, Jerry Bobo v. United States , 136 F.3rd 1465 (Fed. Cir. 1998) affirming Court of Federal Claims decision of same name, 37 Fed. Cl. 690 (Fed. Cl. 1997).

- Section 4 of the Portal-to-Portal Act of 1947 (61 Stat. 84) as amended in 1996 by section 2102 of Public Law 104-188. (See 29 U.S.C. 254.)

Back to Top

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

Office of Human Resources Management

- Practitioners

- Compensation Policies

- Premium Pay

Was this page helpful?

Travel time as hours of work, applicability.

This information applies to GS, FP, and FWS EXEMPT and NONEXEMPT employees.

When is Travel Compensable

Time in a travel status away from the official duty station is compensable for EXEMPT and NONEXEMPT employees when the travel is performed within the regularly scheduled administrative workweek, including regularly scheduled overtime. In addition, travel is compensable for both categories of employees for purposes of meeting the daily and weekly overtime standards when it:

- Involves the performance of work while traveling, (e.g., as a chauffeur or courier);

- Is incident to work performed while traveling (e.g., a courier's travel relative to the spot where further travel to deliver a diplomatic pouch would begin);

- Is carried out under such arduous and unusual conditions that the travel is inseparable from work; or

- Results from an event which could not be scheduled or controlled administratively, including travel by an employee to such an event and the employee's return from such an event to his or her official duty station.

For a NONEXEMPT employee, travel meeting the weekly overtime standard (but not the daily overtime standard) also includes:

- Travel as a passenger on an overnight assignment during hours on nonworkdays which correspond to regular working hours; and

- One-day travel as a passenger to and from a temporary duty station (not including travel between home and the employee's normal duty station).

Who Makes the Determination

Officials to whom authority has been delegated to authorize or approve travel on official business are responsible for determining whether travel outside the regularly scheduled workweek meets any of the conditions for hours of work.

How Much Travel Time is Creditable For Pay

When travel outside the normal workweek constitutes hours of work, the following rules will apply in determining the amount of time in a travel status that is deemed hours of work for premium pay:

When is an employee in travel status . An employee is in a travel status only for those hours actually traveling between the official duty station and the point of destination, or between two temporary duty points, and the usual waiting time which interrupts travel.

When traveling by common carrier . Time in a travel status begins with the scheduled time of departure from the common carrier terminal, and ends upon arrival at the common carrier terminal located at the destination. However, when the employee spends 1 hour or more in travel between the common carrier terminal and place of business or residence, then the entire time traveling between the carrier terminal and place of business or residence (that is actual time traveling, exclusive of waiting time at the terminal prior to the scheduled departure time) counts as hours of work.

Waiting time . Usual waiting time between segments of a trip or at common carrier terminals counts as worktime for premium pay (up to 3 hours in unusually adverse circumstances, e.g., holiday air traffic, severe weather) provided travel away from the duty station is compensable because it meets any of the conditions of this Section.

Authority to Order Noncompensable Travel

Congress has not provided a remedy whereby an EXEMPT employee who performs official but noncompensable hours of travel may be compensated (57 Comp. Gen. 43, 50, 1977). A manager does, however, have the authority to schedule official travel that is noncompensable. As a requirement of 5 CFR 610.123, the manager must record the reasons for ordering such travel in a memo to be filed with the employee's Time and Attendance Report (T&A). A copy of the memo must be given the employee if the employee requests it.

Work performed while traveling . In order to meet the intent of the law as defined in the majority of Comptroller General decisions, work performed while traveling must be work which is inherent in the employee's job and which can only be performed while traveling, e.g., chauffeuring, hurricane reconnaissance performed aboard a plane flying into the eye of the hurricane, etc. Discretionary work such as review of a scientific presentation by a scientist or treaty papers by a foreign service officer enroute to a meeting is work which could be performed in an office independently of travel and does not satisfy the definition of work while traveling and is, therefore, not compensable for purposes of overtime. (B-146288, January 3, 1975)

Work incident to work performed while traveling . Travel which is incident to work performed while traveling must also meet the definition of "work performed while traveling" above. Travel which is necessary to meet another mode of travel is compensable for overtime purposes if the traveler performs work while traveling which is an inherent part of the job and which could only be performed while traveling, for example, a motor vehicle operator who is ordered to travel by plane in order to take responsibility for a truck which he or she is then to deliver to its permanent location (57 Comp. Gen. 43 (1977), or a courier who travels to pick up and deliver a pouch (B-178458, dated June 22, 1973). Travel and incidental transport of files is not within the definition since the transportation of files is work not inherent in the job (B-181632, dated April 1, 1975).

Travel under arduous conditions . Arduous means more than the inconvenience associated with long travel delays, unbroken travel, unpleasant weather, or bad roads. Prolonged travel in heavy blowing snow which makes driving difficult but stops short of endangering the employee might be considered arduous. A distinction must be made between travel which is arduous and travel which is hazardous duty. Each case must be judged on its own merits (B-193623,

July 23, 1979).

Travel resulting from an event which could not be administratively scheduled or controlled . An event that cannot be administratively scheduled or controlled implies immediate official necessity for travel. If it is discretionary when the employee begins travel, not including the minimum necessary time to make travel arrangements, the notion of immediate necessity which is implied by an event that could not be scheduled or controlled is lacking and the intent of the law as defined by the General Accounting Office is not satisfied. Therefore, time spent in such travel would not be compensable for overtime purposes

(B-186005, August 31, 1976).

Within the agency's administrative control . Whether the scheduling or timing of the event that precipitates an employee's travel was within the administrative control of the agency is strictly interpreted in decisions of the Comptroller General (CG). Travel on overtime to and from a meeting arranged at the discretion of two Federal agencies is not compensable since agencies have it within their power to ensure that the employee travels during work time (B-146288, January 3, 1975 et alia).

For the same reason, travel to and from training which is conducted by the government, under government contract or by a private institution solely for the benefit* of the government is not compensable since the government has it within its power to ensure that the start and end times of such training allow the employee to travel on work time (B-190494, May 8, 1978; also, 66 CG 620, 1987).

*In William A. Lewis et al, 69 CG 545 (1990). The CG ruled travel on overtime to and from training that is given by a private institution is compensable because government cannot control the private institution or its scheduling of the course. The Lewis opinion further held that the notion of "immediate official necessity for travel" which prior CG decisions have held must be present in travel which responds to an event that is not schedulable or controllable was established by the start time of the class. To be present when the class began, the employees had to travel on Sunday.

NOTE : The regulations which govern training time which is compensable as overtime and travel to and from training are separate and distinct. The circumstances under which premium pay may be paid while an individual is in training are covered in the section titled Premium Pay and Training.

Meeting abroad - a matter of accommodation . An employee's claim for overtime compensation for travel overseas to be present at the opening of a conference with representatives of a foreign government was disallowed. Although the employee's agency indirectly scheduled the meeting through the USAID Mission, the Comptroller General ruled the lack of governmental control envisioned by law and regulation for travel on overtime to be deemed compensable was not present. (Gerald C. Holst, B-202694, January 4, 1982; and B-222700, dated October 17, 1986).

NOTE : The Lewis decision (see discussion above) precipitated a review of CG decisions with the result that government control of events was sufficient to validate all previous decisions except one: Gerald C. Holst, was overruled. In overruling the 1986 decision, the Comptroller General found the agency to lack control of the scheduling of the meeting to an appreciable degree. Further, the start time of the opening conference established the immediate official necessity for travel. Travel, was, therefore, compensable.

Failure to plan . An employee who travels outside his or her normal tour of duty to perform maintenance on equipment so that the equipment can perform necessary functions in accordance with operational deadlines is not performing compensable travel if the maintenance responds to gradual deterioration which could have been prevented if maintenance was scheduled on a timely basis (49 Comp. Gen. 209, 1969).

Two-day per diem rule . An employee may be required to travel on his or her own time if in order to allow the employee to travel during working hours, the agency would be required to pay two days or more per diem. However, the two-day per diem rule does not of itself support an entitlement to overtime compensation for the employee. To be compensable at the overtime rate, travel must respond to an event that could not be scheduled or controlled administratively and there must be an immediate official necessity for the travel to be performed outside the employee's regular duty hours (60 Comp. Gen. 681, 1981).

Return travel . When an employee performs compensable overtime by traveling to an event which could not be controlled or scheduled, he or she is automatically eligible for compensation for return travel to his or her duty station.

Disparity in hours of work means disparate overtime entitlement . Because FLSA provides two situations in which a NONEXEMPT employee, but not an EXEMPT employee, can be paid for travel on overtime hours, (specifically, during hours on nonworkdays which correspond to regular working hours and for one-day travel as a passenger to and from a temporary duty station), it is possible for a NONEXEMPT employee to be paid for travel when an EXEMPT employee in the same situation is ineligible for overtime pay.

Share this page

- Book a Speaker

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Vivamus convallis sem tellus, vitae egestas felis vestibule ut.

Error message details.

Reuse Permissions

Request permission to republish or redistribute SHRM content and materials.

Under the FLSA, when must nonexempt employees be paid for travel time?

The Fair Labor Standards Act (FLSA) regulations require employers to pay for travel time in some circumstances. Generally, time spent traveling is compensable, unless it is normal home-to-work commute time, or when travel requires an overnight stay and the time spent traveling as a passenger falls outside of the employee's normal work hours.

When pay is required, the time spent traveling is considered hours worked and must be included when determining overtime pay obligations.

Home-to-work travel. Normal commuting time to an employee's regular worksite is not treated as hours worked under the FLSA.

Home to work on a special one-day assignment in another city . When an employee must travel out of town for work but returns home the same day, all the time spent traveling during the day is compensable, regardless of the employee's regular work hours. However, an employer may deduct the time the employee would have spent commuting to his or her regular work location.

Travel that is all in a day's work. Time spent traveling to and from different worksites during the day is work time and must be paid.

Travel away from home. When travel requires an overnight stay, any time traveling as a passenger that falls within the employee's normal work hours is compensable, regardless of what day of the week the travel takes place. Time spent traveling to an airport terminal or train station is considered commute time and is not treated as hours worked, but the time spent waiting at the terminal until arrival at the destination is compensable when it falls during normal work hours.

For example, if Meg normally works Monday through Friday, 8:30 a.m. to 5 p.m., and she is required to travel by plane on a Sunday for business in another state, her travel time on Sunday between 8:30 a.m. and 5 p.m. is compensable.

So, if Meg arrives at the airport on Sunday at 3 p.m. and at her destination at 8 p.m., the employer is required to pay her only from 3 p.m. to 5 p.m., the hours that correspond with her normally scheduled work hours.

Alternatively, if Meg drives herself or others at the direction of the employer rather than traveling as a passenger, all the time spent driving is compensable work time, regardless of Meg's normal work hours.

Driving at the direction of the employer . When employees are required to drive themselves or others, all driving time is compensable. However, when an employee is traveling to an overnight stay and has the option to use public transportation (i.e., airplane, train, bus, etc.) but chooses to drive his or her own vehicle instead, the employer can either choose to pay for all time spent traveling or pay only the travel time that occurs during normal work hours, regardless of what day of the week the employee travels (CFR 785.40). If an employee volunteers to drive others in his or her own vehicle to the overnight stay, an employee's time could be unpaid for those travel hours outside the normal work hours.

Worked performed while traveling. An employee must be paid for any time he or she is performing work. This includes time spent working during travel as a passenger that would otherwise be non-compensable.

For example, Meg normally works Monday through Friday, 8:30 a.m. to 5 p.m. She arrives at the airport on Sunday at 3 p.m. and at her destination at 8 p.m. Generally, the employer is required to pay her only from 3 p.m. to 5 p.m.; however, if Meg works on a presentation during her flight until 6:30 p.m., her employer would need to pay her from 3 p.m. to 6:30 p.m.

Some states have travel-time laws that are more generous than the federal FLSA.

Related Content

Advertisement

Artificial Intelligence in the Workplace

An organization run by AI is not a futuristic concept. Such technology is already a part of many workplaces and will continue to shape the labor market and HR. Here's how employers and employees can successfully manage generative AI and other AI-powered systems.

HR Daily Newsletter

New, trends and analysis, as well as breaking news alerts, to help HR professionals do their jobs better each business day.

Success title

Success caption

FLSA Hours Worked Advisor

Travel Time

- Home-to-Work and Return Travel

- Home-to-Work and Return Travel, Employer’s Vehicle

- Travel Other Than Home-to-Work and Return

- Work Performed While Traveling

U.S. DEPARTMENT OF LABOR 200 Constitution Ave NW Washington, DC 20210 1-866-4-USA-DOL 1-866-487-2365 TTY www.dol.gov

ABOUT THE SITE

- Freedom of Information Act

- Privacy & Security Statement

- Disclaimers

- Important Website Notices

- Plug-ins Used by DOL

- Accessibility Statement

LABOR DEPARTMENT

- Español

- Office of Inspector General

- Subscribe to the DOL Newsletter

- Read the DOL Newsletter

- Emergency Accountability Status Link

- A to Z Index

- City Council

- Council Meetings

- Regulations and Licensing

- City Structure

- Roles and Powers

- Grant Navigator

- Grants Guide

- Contracting

- Fiscal Management

- Expenditures

- City Administration

- Roles and Duties

- Data Privacy

- Human Resources

- City Career Advantage

- Discipline and Termination

- Personnel Policies and Working Conditions

- Public Safety and Health

- Public Safety Mental Health

- Fire and First Response

- Emergencies and Disasters

- Public Works

- Water and Sewer

- Parks and Recreation

- Other Utilities

- Community Development

- Economic Development

- Small City Center

- Insurance Trust

- Submit Claims Online

- Reporting Methods

- Claim Forms

- Claim Resources

- Electronic Transactions

- Changes to Coverages, Rates, and Dividend

- Municipal Liability

- Workers’ Compensation

- GatherGuard – Event Liability Insurance

- Disability Insurance

- Life Insurance

- Loss Control

- Joint Powers Considerations

- Land Use Services

- Loss Control Consultant Services

- Regional Safety Groups

- LMCIT Member Center

- For Insurance Agents

- About the Trust

- The Trust’s Creation

- The Trust’s Values and Advantage

- Trust Eligibility

- Glossary of Trust-Related Terms

- Legislative Policies

- City Policies

- Policy Development

- Policy Committees

- Law Summaries

- 2023 Law Summaries

- Focus on New Laws

- How to Advocate

- Advocacy Tips

- Advocacy Resources

- Navigating the Capitol

- Federal Relations

- Minnesota Members of Congress

- Appointments

- State of MN Appointments

- Learning & Events

- Upcoming Events

- League Events

- Non-League Events

- Online Learning

- About MemberLearn

- MemberLearn Online Courses

- Previous Events

- Recorded Webinars

- Event Handouts

- Event Photos

- Customized Learning

- News & Publications

- Latest News

- Legislative News

- General News

- For the Media

- City Announcements

- City News Roundup

- Publications

- Minnesota Cities Magazine

- Cities Bulletin

- Handbook for Minnesota Cities

- HR Reference Manual

- Minnesota Mayors Handbook

- Online City Directory

How to save a PDF

If you would like to save the page you’re viewing as a PDF document, here are the steps:

- Select the “Print” option

- A pop up window like this one should appear, ensure the Destination field is set to “Save as PDF” (this may be a dropdown or “Change” button)

- Click “Save,” then select the location and name for the file on your computer

Still not sure?

View additional instructions for the most common browsers.

Fair Labor Standards Act: Compensation for Travel Time

Published: February 1, 2023

This content conveys general information. Do not use it as a substitute for legal advice. Any attorney general opinions cited are available from the League’s Research staff.

Provides guidance in determining when compensation must be paid under the Fair Labor Standards Act (FLSA) when non-exempt employees travel for work purposes.

Your LMC Resource

Hr & benefits department.

(651) 281-1200 or (800) 925-1122

g 4 r 4 o 4 . 4 c 4 m 4 l 4 @ 4 s 4 t 4 i 4 f 4 e 4 n 4 e 4 b 4 r 4 h

- Enroll & Pay

- Prospective Students

- Current Students

- Degree Programs

Fair Labor Standard Act (FLSA) & Travel Time

General rules.

A. Excluding normal commuting time, employees should be compensated for all travel unless:

- It is overnight; or

- No work is performed.

B. An employer may rearrange the work schedule within the workweek (Sunday – Saturday) to avoid additional compensation hours that may occur because of travel time or compensable commuting time as described below. Whenever possible, the employer and employee should discuss the possibility of rearranging the work schedule prior to departure.

Commute Time

Generally, an employee is not at work until he or she reaches the work site and begins working. A. If the employee is required to report to a meeting place where he or she is to pick up materials, equipment, or other employees, or to receive instructions before traveling to the work site, time is compensable only once the employee reaches the meeting place. If the employee drives a state vehicle, to and from work, he or she does not have to be compensated for that commuting time as long as:

- Driving the vehicle between home and work is strictly voluntary and not a condition of employment;

- The vehicle is a type normally used for commuting;

- The employee incurs no costs for driving the employer’s vehicle or parking it at home; and

- The work sites are within normal commuting area of the employer’s place of business.

Note: Unless there is a contract, custom or practice providing that an employee’s regular daily travel time between home and the workplace is compensable, such travel time is not compensable. If such a contract, custom or practice exists, the travel time is compensable.

Travel During the Workday

Travel as a part of the employee’s principal activity must be counted as hours worked. If the travel is for the benefit of the employer, it is compensable.

- Example: the employee travels from job site to job site during the workday.

B. If the employee runs an errand (i.e., stops at a business or at home) for his or her own convenience, the time traveling to/from that site that adds additional time is not compensable.

- Example: the employee leaves home for the work site but stops at a shop for his or her own convenience.

C. Time spent by the driver in picking up other passengers and transporting them to a specific location is work time and therefore compensable. The time the picked-up passengers spend traveling in the car is also compensable.

Out of Town Travel - Special One Day Assignment

A. If the employee is assigned to work in another city for one (1) day and the travel is performed for the employer’s benefit and at its request, it is part of the principal activity of the employee and therefore is compensable. This is true even if the employee is traveling by common carrier since this is a special assignment and is not ordinary home to work travel. The assignment is performed for the employer’s benefit and at the employer’s special request to meet the needs of the particular and unusual assignment. B. However, in this special one-day assignment, travel time between the employee’s home and the airport or railway station is considered commute time and, therefore, is compensable.

Overnight Travel

Travel that keeps an employee away from home overnight is travel away from home. Travel away from home is work time and is compensable. A. Travel time is compensable regardless of work schedule.

- Example: Employee drives to the airport to attend a seminar and has two co–workers as passengers with him/her. Whether the trip is made during normal workdays/workhours or non-normal workdays/workhours (i.e. Saturday or Sunday for an employee who works Monday through Friday) the travel time is compensable; all three employees are compensated.

B. Time spent at a motel with freedom to use time for the employee’s own purposes is not compensable.

C. Time Zone Changes – If the time zone changes during the travel day, the hours should be calculated based upon “actual” hours when calculating compensable time on travel days. A department may wish to use Central Standard Time (CST) for travel days to assist in determining work hours. Local time should be used for all other days of the travel.

- Example: Employee left Lawrence at 9:00 a.m. CST to travel to the airport and arrived at a hotel in Phoenix at Noon Pacific Standard Time (PST) (which is 2:00 CST). Actual hours of travel are 5 hours (9 am to 2:00 CST).

- Example: Employee left a hotel in San Francisco at 8 a.m. PST (which is 10:00 a.m. CST) to travel to the airport and board a return flight. Employee returns to Lawrence at 1:00 p.m. CST (11:00 p.m. PST). Actual hours of travel are 3 hours (10:00 a.m. to 1:00 p.m. CST).

Additional Resources:

Fair Labor Standards Act (FLSA)

University Fair Labor Standards Act (FLSA) Policy

A. When the travel takes place inside or outside the employee’s normal workdays or work hours; the employee is required to be compensated for the travel time to the airport or hotel, regardless of whether the employee is a driver or a passenger. B. The employee is compensated for all required conference events that require the employee to engage in training, attend a meeting, or listen to a speaker. The employee is not compensated for time at social events, meals without speakers or meals when work is not being performed. C. An employer, or the employee with prior approval of the employee’s supervisor, may rearrange the employee’s work schedule within the workweek to avoid additional compensation hours. D. If the time zone changes during the travel day, you will need to count “actual” hours. To determine work hours on travel days, use the Central Standard Time (CST) Zone for both days in order to avoid disadvantaging the employee due to time changes. For non-travel days, use local time.

Travel Example 1 – No Adjustments to Schedules

For this example, the conference began Sunday night at 5:15 pm with a business meeting and ended on Wednesday at Noon. The employee worked his/her normal schedule the days following the conference. No time zone differences.

Total compensation for the day is 8.25 hours (for hours 9:40 am to 6:00 pm).

Total compensation for the day is 8 hours (for hours 8:00 am to Noon and from 12:30 pm to 4:30 pm).

Total compensation for the day is 9.5 hours (for hours 8:30 am – 6:00 pm)

Thursday (back in the office)

Total compensation for the day is 8 hours (for hours 8 am to 5 pm).

Friday (Back in office)

Total compensation for the week is 49.75 hours (i.e., 40 hours at regular time and 9.75 hours at compensatory time earned at the time and a half rate, i.e., 9.75 x 1.5 = 14.25).

Travel Example 2 - Adjusted Work Schedule

For this example, the supervisor has informed the employee that any hours incurred that may result in extra compensation will be adjusted in the remaining workweek. The supervisor has determined the employee should leave early on Thursday and not work on Friday. The conference began Sunday night at 5:15 pm with a business meeting and ended on Wednesday at Noon. No time zone differences.

Total compensation for the day is 8 hours (for hours 8:30 am to 4:30 pm).

Thursday (Back in Office)

Total compensation for the day is 6.25 hours (for hours 8 am to 3:15 pm). No leave is reported.

Friday (No work performed)

Total compensation for the day is 0 hours .

Total compensation for the week is 40.00 hours.

Travel Example 3 – Time Zone Change

Sunday (travel day, so using cst)..

For this example, the employee’s workstation is in Lawrence, Kansas (CST) and the conference is located in Oakland, CA, which is in the PST time zone (i.e., 2 hours earlier). The conference began Sunday night at 5:15 pm (PST) with a business meeting and ended on Tuesday at Noon (PST).

Actual times shown are CST [PST is shown in brackets]

Total compensation for the day is 8.25 hours (for hours 9:40 am to 6:00 pm CST).

Actual times shown are PST as “local” time.

Tuesday (Travel day, so using CST)

Total compensation for the day is 9.5 hours (for hours 10:30 am – 8:00 pm CST).

Total compensation for the 3 days (Sunday, Monday and Tuesday) is 25.75 hours.

FLSA and Travel Time Guidelines for Overtime Eligible Employees (Effective: 05/21/2017)The University of Kansas, Human Resources, Carruth-O’Leary Hall, Room 103, 1246 West Campus Road, Lawrence, KS 66045, 785-864-4946 (voice), 785-864-5790 (fax), [email protected] (email).

Business development

- Billing management software

- Court management software

- Legal calendaring solutions

Practice management & growth

- Project & knowledge management

- Workflow automation software

Corporate & business organization

- Business practice & procedure

Legal forms

- Legal form-building software

Legal data & document management

- Data management

- Data-driven insights

- Document management

- Document storage & retrieval

Drafting software, service & guidance

- Contract services

- Drafting software

- Electronic evidence

Financial management

- Outside counsel spend

Law firm marketing

- Attracting & retaining clients

- Custom legal marketing services

Legal research & guidance

- Anywhere access to reference books

- Due diligence

- Legal research technology

Trial readiness, process & case guidance

- Case management software

- Matter management

Recommended Products

Conduct legal research efficiently and confidently using trusted content, proprietary editorial enhancements, and advanced technology.

Fast track case onboarding and practice with confidence. Tap into a team of experts who create and maintain timely, reliable, and accurate resources so you can jumpstart your work.

A business management tool for legal professionals that automates workflow. Simplify project management, increase profits, and improve client satisfaction.

- All products

Tax & Accounting

Audit & accounting.

- Accounting & financial management

- Audit workflow

- Engagement compilation & review

- Guidance & standards

- Internal audit & controls

- Quality control

Data & document management

- Certificate management

- Data management & mining

- Document storage & organization

Estate planning

- Estate planning & taxation

- Wealth management

Financial planning & analysis

- Financial reporting

Payroll, compensation, pension & benefits

- Payroll & workforce management services

- Healthcare plans

- Billing management

- Client management

- Cost management

- Practice management

- Workflow management

Professional development & education

- Product training & education

- Professional development

Tax planning & preparation

- Financial close

- Income tax compliance

- Tax automation

- Tax compliance

- Tax planning

- Tax preparation

- Sales & use tax

- Transfer pricing

- Fixed asset depreciation

Tax research & guidance

- Federal tax

- State & local tax

- International tax

- Tax laws & regulations

- Partnership taxation

- Research powered by AI

- Specialized industry taxation

- Credits & incentives

- Uncertain tax positions

A powerful tax and accounting research tool. Get more accurate and efficient results with the power of AI, cognitive computing, and machine learning.

Provides a full line of federal, state, and local programs. Save time with tax planning, preparation, and compliance.

Automate workpaper preparation and eliminate data entry

Trade & Supply

Customs & duties management.

- Customs law compliance & administration

Global trade compliance & management

- Global export compliance & management

- Global trade analysis

- Denied party screening

Product & service classification

- Harmonized Tariff System classification

Supply chain & procurement technology

- Foreign-trade zone (FTZ) management

- Supply chain compliance

Software that keeps supply chain data in one central location. Optimize operations, connect with external partners, create reports and keep inventory accurate.

Automate sales and use tax, GST, and VAT compliance. Consolidate multiple country-specific spreadsheets into a single, customizable solution and improve tax filing and return accuracy.

Risk & Fraud

Risk & compliance management.

- Regulatory compliance management

Fraud prevention, detection & investigations

- Fraud prevention technology

Risk management & investigations

- Investigation technology

- Document retrieval & due diligence services

Search volumes of data with intuitive navigation and simple filtering parameters. Prevent, detect, and investigate crime.

Identify patterns of potentially fraudulent behavior with actionable analytics and protect resources and program integrity.

Analyze data to detect, prevent, and mitigate fraud. Focus investigation resources on the highest risks and protect programs by reducing improper payments.

News & Media

Who we serve.

- Broadcasters

- Governments

- Marketers & Advertisers

- Professionals

- Sports Media

- Corporate Communications

- Health & Pharma

- Machine Learning & AI

Content Types

- All Content Types

- Human Interest

- Business & Finance

- Entertainment & Lifestyle

- Reuters Community

- Reuters Plus - Content Studio

- Advertising Solutions

- Sponsorship

- Verification Services

- Action Images

- Reuters Connect

- World News Express

- Reuters Pictures Platform

- API & Feeds

- Reuters.com Platform

Media Solutions

- User Generated Content

- Reuters Ready

- Ready-to-Publish

- Case studies

- Reuters Partners

- Standards & values

- Leadership team

- Reuters Best

- Webinars & online events

Around the globe, with unmatched speed and scale, Reuters Connect gives you the power to serve your audiences in a whole new way.

Reuters Plus, the commercial content studio at the heart of Reuters, builds campaign content that helps you to connect with your audiences in meaningful and hyper-targeted ways.

Reuters.com provides readers with a rich, immersive multimedia experience when accessing the latest fast-moving global news and in-depth reporting.

- Reuters Media Center

- Jurisdiction

- Practice area

- View all legal

- Organization

- View all tax

Featured Products

- Blacks Law Dictionary

- Thomson Reuters ProView

- Recently updated products

- New products

Shop our latest titles

ProView Quickfinder favorite libraries

- Visit legal store

- Visit tax store

APIs by industry

- Risk & Fraud APIs

- Tax & Accounting APIs

- Trade & Supply APIs

Use case library

- Legal API use cases

- Risk & Fraud API use cases

- Tax & Accounting API use cases

- Trade & Supply API use cases

Related sites

United states support.

- Account help & support

- Communities

- Product help & support

- Product training

International support

- Legal UK, Ireland & Europe support

New releases

- Westlaw Precision

- 1040 Quickfinder Handbook

Join a TR community

- ONESOURCE community login

- Checkpoint community login

- CS community login

- TR Community

Free trials & demos

- Westlaw Edge

- Practical Law

- Checkpoint Edge

- Onvio Firm Management

- Proview eReader

Navigating the FLSA: Exempt vs. non-exempt workers

In the United States, the Fair Labor Standards Act (FLSA) applies to the majority of employers and employees. If you've never heard of the FLSA, it's the legislation that governs when an employer is required to pay an employee overtime, among other things. While some states may have their own overtime laws, the FLSA applies nationwide.

The first step to determining whether an employee may be eligible for overtime under the FLSA is to figure out if they are either "exempt" or "non-exempt." The reason being, employers typically aren't required to pay exempt employees overtime.

But what, exactly, is the different between exempt and non-exempt employees? Let's dig into that.

White collar vs. blue collar: How do they apply to FLSA?

FLSA exempt employees are often, but not always, workers whose jobs are sometimes referred to as “white collar," which usually boils down to the fact that they mostly work in an office setting. Specific job duties defined by FLSA guidelines help make the determination about a position's exemption status .

These white-collar, FLSA-exempt duties often include the types of work done by:

- Administrators

- Professional workers (that is, learned/knowledge-based positions)

- Computer and technology professionals

- Outside salespeople

Of course, many non-exempt workers may perform some of these duties, but through the FLSA, exempt status must meet these criteria and others related to compensation.

In contrast, some workers with FLSA non-exempt status work in occupations many consider to be “blue collar," which tends to refer to trade and labor-oriented work. These workers often gain the skills and knowledge to perform their jobs through on-the-job training and apprenticeships.

Of course, there are also office workers who are non-exempt, but there are few, if any, labor-intensive positions that carry exempt status.

Some blue-collar professions may include:

- Construction workers

- Electricians

Blue-collar, non-exempt workers perform skill-based work and trades, but they do not qualify as exempt because their occupation doesn't meet the standards of job duties that carry exempt status.

Pay differences for exempt and non-exempt workers

Per the FLSA, exempt employees are typically salaried workers and do not receive overtime pay. Their annual salary is often a negotiable figure that is agreed upon before the job is accepted and doesn't fluctuate even if the employee works fewer than 40 hours in a week. On the other hand, non-exempt workers are typically paid on an hourly basis and receive overtime pay for any hours worked over the standard 40 per week — although some states have their own laws that vary from this general rule.

Due to the nature of many non-exempt job positions, hourly pay often makes more sense than a fixed annual salary. That's why the FLSA sets out to ensure compensation standards for these positions, since occasionally the hours can fall short of — or exceed — the 40-hour work week.

For a worker receiving hourly pay, the FLSA standard creates overtime compensation, measured as time and a half — the hourly rate plus half.

In contrast, FLSA exempt workers are often on a fixed annual salary, but they can receive bonuses or other financial incentives. The nature of these jobs carries less of a need for reduced or extended hours beyond the 40-hour week and in some cases includes high earnings. Therefore, exempt workers do not receive overtime pay and their weekly pay stays the same even if they work fewer than 40 hours in a week.

It is also worth noting that exemption status under the FLSA usually requires that the employee receive pay of at least $684.00 each week to qualify. However, non-exempt workers may earn even higher wages but not qualify for exempt status due to their job classification or duties.

FLSA is a long and enduring piece of legislation

Workers and employers have been governed by the FLSA for decades. Over the years since it was passed, there have been numerous revisions and amendments as the workforce has changed. What has stayed the same, however, is the core function of the FLSA. Exempt and non-exempt status differentiation has long helped keep labor standards fair and workplace needs easier to pinpoint and execute.

If you would like to stay up to date regarding changes to the FLSA and other related employment law and regulations, you should try Practical Law for free today . Experience for yourself the difference Practical Law can make.

The content appearing on this website is not intended as, and shall not be relied upon as, legal advice. It is general in nature and may not reflect all recent legal developments. Thomson Reuters is not a law firm and an attorney-client relationship is not formed through your use of this website. You should consult with qualified legal counsel before acting on any content found on this website.

Related insights

Who is eligible for overtime pay under the FLSA?

How is FLSA exempt status determined in the workplace?

5 types of overtime-exempt jobs under the FLSA

Access a comprehensive collection of employment-related legal resources, including how-to guides and checklists created by our expert attorney-editors

An official website of the United States government

Here's how you know

The .gov means it's official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you’re on a federal government site.

The site is secure. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely.

What the New Overtime Rule Means for Workers

One of the basic principles of the American workplace is that a hard day’s work deserves a fair day’s pay. Simply put, every worker’s time has value. A cornerstone of that promise is the Fair Labor Standards Act ’s (FLSA) requirement that when most workers work more than 40 hours in a week, they get paid more. The Department of Labor ’s new overtime regulation is restoring and extending this promise for millions more lower-paid salaried workers in the U.S.

Overtime protections have been a critical part of the FLSA since 1938 and were established to protect workers from exploitation and to benefit workers, their families and our communities. Strong overtime protections help build America’s middle class and ensure that workers are not overworked and underpaid.

Some workers are specifically exempt from the FLSA’s minimum wage and overtime protections, including bona fide executive, administrative or professional employees. This exemption, typically referred to as the “EAP” exemption, applies when:

1. An employee is paid a salary,

2. The salary is not less than a minimum salary threshold amount, and

3. The employee primarily performs executive, administrative or professional duties.

While the department increased the minimum salary required for the EAP exemption from overtime pay every 5 to 9 years between 1938 and 1975, long periods between increases to the salary requirement after 1975 have caused an erosion of the real value of the salary threshold, lessening its effectiveness in helping to identify exempt EAP employees.

The department’s new overtime rule was developed based on almost 30 listening sessions across the country and the final rule was issued after reviewing over 33,000 written comments. We heard from a wide variety of members of the public who shared valuable insights to help us develop this Administration’s overtime rule, including from workers who told us: “I would love the opportunity to...be compensated for time worked beyond 40 hours, or alternately be given a raise,” and “I make around $40,000 a year and most week[s] work well over 40 hours (likely in the 45-50 range). This rule change would benefit me greatly and ensure that my time is paid for!” and “Please, I would love to be paid for the extra hours I work!”

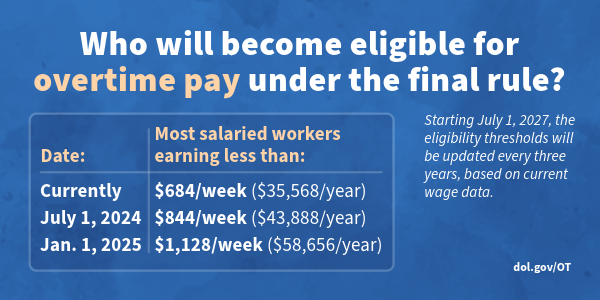

The department’s final rule, which will go into effect on July 1, 2024, will increase the standard salary level that helps define and delimit which salaried workers are entitled to overtime pay protections under the FLSA.

Starting July 1, most salaried workers who earn less than $844 per week will become eligible for overtime pay under the final rule. And on Jan. 1, 2025, most salaried workers who make less than $1,128 per week will become eligible for overtime pay. As these changes occur, job duties will continue to determine overtime exemption status for most salaried employees.

The rule will also increase the total annual compensation requirement for highly compensated employees (who are not entitled to overtime pay under the FLSA if certain requirements are met) from $107,432 per year to $132,964 per year on July 1, 2024, and then set it equal to $151,164 per year on Jan. 1, 2025.

Starting July 1, 2027, these earnings thresholds will be updated every three years so they keep pace with changes in worker salaries, ensuring that employers can adapt more easily because they’ll know when salary updates will happen and how they’ll be calculated.

The final rule will restore and extend the right to overtime pay to many salaried workers, including workers who historically were entitled to overtime pay under the FLSA because of their lower pay or the type of work they performed.

We urge workers and employers to visit our website to learn more about the final rule.

Jessica Looman is the administrator for the U.S. Department of Labor’s Wage and Hour Division. Follow the Wage and Hour Division on Twitter at @WHD_DOL and LinkedIn . Editor's note: This blog was edited to correct a typo (changing "administrator" to "administrative.")

- Wage and Hour Division (WHD)

- Fair Labor Standards Act

- overtime rule

SHARE THIS:

Trending News

Related Practices & Jurisdictions

- Labor & Employment

- Administrative & Regulatory

- All Federal

On Tuesday, April 23, 2024, the U.S. Department of Labor (“DOL”) published the final version of a rule originally proposed in September 2023, raising the salary threshold for the Fair Labor Standards Act’s (“FLSA”) exemption for executive, administrative, professional, and computer employees and the total annual compensation level for the highly compensated employee exemption. The final rule also provides for periodic, automatic increases going forward. So, what should employers know about the final rule, and how can they stay compliant with this shifting landscape?

The FLSA requires that most employees in the U.S. be paid at least the federal minimum wage for all hours worked and overtime pay at not less than one-and-one-half times their regular rate for all hours worked over 40 hours in a workweek.

However, Section 13(a)(1) of the FLSA provides an exemption from the FLSA’s minimum wage and overtime requirements for “any employee employed in a bona fide executive, administrative, or professional capacity … as such terms are defined and delimited from time to time by regulations of the Secretary [of Labor].” This exemption is commonly referred to as the “white-collar” or executive, administrative, or professional (“EAP”) exemption. For this exemption to apply, DOL regulations require that each of the following three tests must be met:

- the employee must be paid a predetermined, fixed salary (the salary basis test);

- the amount of the fixed salary paid must meet a minimum salary level (the salary level test); and

- the employee’s primary job duties must involve executive, administrative, or professional duties as defined by the regulations (the duties test).

Under existing regulations, the minimum salary level is $684 per week. Employers are permitted to use nondiscretionary bonuses and incentive payments (including commissions) to satisfy up to 10% of the minimum salary level under the EAP exemption. If the sum of the employee’s salary, nondiscretionary bonuses, and incentive payments at the end of the year is less than the minimum salary level, the employer can make a final “catch-up” payment within one pay period after the end of the year to bring the employee’s compensation up to the required level. Any catch-up payment will count only toward the employee’s prior year salary amount and not toward the salary amount in the year in which it is paid.

The FLSA’s regulations also contain a special rule for “highly compensated” employees that combines a much higher annual compensation requirement with a minimal duties test. Under the existing regulations, an employee was deemed as exempt under the highly compensated employee (“HCE”) exemption under Section 13(a)(1) if:

- the employee earns a total annual compensation of $107,432 or more, which includes at least $684 per week paid on a salary or fee basis;

- the employee’s primary duty includes performing office or non-manual work; and

- the employee “customarily and regularly” performs at least one of the exempt duties or responsibilities of an exempt executive, administrative, or professional employee.

The New Final Rule

In furtherance of what the DOL perceives as its “broad authority under the Act” to define and delimit the terms of these exemptions, the new rule will increase the minimum salary level to $844 per week (or $43,888 annually) effective July 1, 2024, which will again increase to $1,128 (or $58,656 annually) effective January 1, 2025. According to the DOL, the January 1, 2025, salary level corresponds to the 35 th percentile of the weekly earnings of full-time salaried workers in the lowest-wage U.S. Census region, which is currently the southern U.S.

The new rule will also raise the minimum annual salary threshold for the HCE exemption to $132,964 per year starting July 1, 2024, which will also increase automatically on January 1, 2025, to $151,164 per year—which amount, according to the DOL, is equivalent to the annualized weekly earnings of the 85 th percentile of full-time salaried workers nationally. The employee must receive, on either a salary or fee basis, no less than the minimum salary level then in effect as part of their total annual compensation.

The new rule also provides for automatic updates to the minimum salary level and the HCE total annual compensation threshold every three years based upon the then-current earnings data.

Legal Challenges

If past is prologue, there will invariably be challenges to the DOL’s new rule.

Readers may recall that, on May 23, 2016, the Obama-era DOL published a rule more than doubling the minimum salary level for exempt employees from $455 per week ($23,660 annually) to $913 per week ($47,476 annually). The State of Nevada and twenty other states, along with the Plano Chamber of Commerce and more than fifty-five other business groups, filed lawsuits to have the rule declared unlawful, arguing the DOL exceeded its authority in passing that rule. The cases were consolidated and decided by a federal court in Texas, which held the DOL exceeded its rulemaking authority. The 2016 final rule was, therefore, held to be unlawful and never took effect.

Then, in 2019, the Trump-era DOL issued its own new rule to raise the minimum salary level more moderately from $455 per week to the current rate of $684. In the Mayfield v. U.S. Dept. of Labor case filed in a Texas federal court in August 2022, the plaintiff sued to have that rule declared unlawful on the grounds the DOL lacked authority under the FLSA to implement salary thresholds for the white-collar exemptions. The district court sided with the DOL, citing the U.S. Supreme Court’s 1984 ruling in Chevron, U.S.A., Inc. v. Nat. Res. Def. Council, Inc . that courts should defer to an agency’s reasonable interpretation of an ambiguous statute.

The Mayfield ruling is currently on appeal before the Fifth Circuit Court of Appeals. In briefing filed on April 18, 2024, the parties agreed the new 2024 rule would not moot the case because it is a challenge to the DOL’s statutory authority to issue any salary-level rule.

Regardless of the ruling on appeal in Mayfield , the losing party is very likely to further appeal the case to the U.S. Supreme Court, which recently heard oral argument in a different set of cases challenging the Chevron deference standard.

Like the Obama- and Trump-era rules, the new Biden-era rule is likely to face direct legal challenges, and as a result, it remains unclear as of the date of this posting whether the new final rule will actually take effect on July 1, 2024.

Despite the pending (and likely future) legal challenges to the DOL’s authority to enact a salary level requirement, the new final rule will take effect July 1, 2024, unless a court stays its implementation or determines it is unlawful. In the meantime, there are several steps employers should take so that they are prepared to comply with the new salary level requirements in the event the new rule is not invalidated or, at least, stayed pending the outcome of litigation.

First, carefully review each exempt employee’s duties to ensure that they do, in fact, perform “bona fide executive, administrative, or professional” duties, as those terms are defined by the DOL regulations.

Second, for those employees who perform such duties, ensure they are paid on a salary basis, meaning their pay is not subject to reduction due to variations in the quality or quantity of their work.

Third, ensure the exempt employees earn (i) a salary equal to the then-prevailing minimum salary level and (ii) for the HCE exemption, total annualized compensation of at least $132,964 per as of July 1, 2024, and at least $151,164 per year as of January 1, 2025. If an employee is paid less than those amounts but his or her primary duties meet the other requirements for the EAP or HCE exemption, employers will need to decide whether to increase that employee’s salary to meet the new salary level or whether, instead, to reclassify the employee as non-exempt, which would require the employer to pay the individual overtime pay for all time worked beyond 40 hours in a single workweek.

The above analyses and decisions will necessarily take time, particularly for large employers with hundreds of exempt employees. As a result, the sooner employers begin to evaluate how they will comply with the new rule, the better. But to be clear, employers should not rush to implement changes too far in advance of the current July 1, 2024 effective date because, if the rule is ultimately invalidated or stayed, it may be difficult for employers to walk back any changes made in the interim, as many employers learned when the Obama-era salary level rule was enjoined.

Listen to this post

Current legal analysis, more from hunton andrews kurth, upcoming legal education events.

Sign Up for e-NewsBulletins

I am looking for…

I need support for…

- Login or other general help

- Paycheck Protection Program

Insights to help ignite the power of your people

Search SPARK

Legislation

DOL Releases Final Overtime Exemptions Rule

- Share Spark Article on LinkedIn

- Share Spark Article on Facebook

- Share Spark Article on Twitter

- Share Spark Article via Email

- Print Spark Article

The final rule updates and revises the provisions of the Fair Labor Standards Act (FLSA) exempting executive, administrative, and professional employees from minimum wage and overtime requirements.

On April 23, 2024, the United States Wage and Hour Division of the Department of Labor (DOL), released a final rule titled Defining and Delimiting the Exemptions for Executive, Administrative, Professional, Outside Sales, and Computer Employees, which becomes effective on July 1, 2024.

The Details

For an employee to be exempt from the FLSA minimum wage and overtime requirements, the employee must generally meet the following three tests:

- Salary Basis Test: Employee is paid a predetermined and fixed amount that is not subject to reduction because of variations in the quality of quantity of worked performed.

- Salary Level Test: The amount of salary paid to the employee must meet a minimum specified amount.

- Duties Test: The employee must perform executive, administrative, or professional duties.

The final rule increased the salary level test amounts but did not modify the salary basis test or the duties test provisions. The DOL also increased the amounts the regulations provide as an alternative test to the salary level test for certain highly compensated employees who are paid a salary, earn above a higher total annual compensation level, and satisfy a minimal duties test. Employees meeting the requirements of the alternative test, are also exempt from the FLSA overtime and minimum wage requirements.

The chart below provides the current amounts and future amounts that an employee must be paid to meet the salary level test and the alternative test to be exempt from the FLSA overtime and minimum wage requirements:

View a comprehensive FLSA chart of all the earnings thresholds for executive, administrative and professional employees.

Use of Bonuses and Incentive Payments to Satisfy the Salary Level Test

The final rule continues to allow up to ten percent of the salary amounts noted in the chart to be satisfied through the payment of nondiscretionary bonuses, incentive, and commission payments that are paid annually or more frequently. However, if by the end of the year the amount paid to the employee is less than 52 times the required salary amount, the employer must make one final payment sufficient to meet the required level no later than the next pay period after the end of the year.

- Review additional information and Frequently Asked Questions from DOL.

- Register for our webinar on April 25 , Overtime and Time Rounding Laws are Changing, What Employers Must Know to Prepare (Note that the webinar will also be available on-demand after the live broadcast by clicking the registration link.)

- Prior to July 1, 2024, review the salary amounts paid to any employees who are currently treated as exempt from the FLSA overtime and minimum wage requirements.

- Determine if the compensation employees are receiving is sufficient to meet the upcoming increase to the salary level test or alternative test amounts.

- If the amounts are not sufficient, then you will need to determine whether to increase the employee's salary sufficient to meet the required amount or begin to treat the employee as an FLSA non-exempt employee entitled to the FLSA overtime and minimum wage protections.

- Several states have their own test for exempt status. These tests are typically harder to satisfy. You should apply both the state and federal tests to determine an employee's status under both federal and state law.

- If you reclassify employees as non-exempt, ensure that managers are prepared to manage overtime costs and understand what hours are considered hours worked . For example, under certain circumstances, travel time and time spent performing preliminary or postliminary activities can be deemed compensable work time.

- Keep in mind that an employee's "regular rate of pay" for FLSA overtime calculation purposes is the average hourly rate calculated by dividing the total pay for employment (except the statutory exclusions) in any workweek by the total number of hours actually worked. Total pay includes for example, commissions and non-discretionary bonuses .

- If employees are reclassified as non-exempt, then their pay frequency might also need to be changed depending on state law.

- Finally, be prepared to communicate any changes to employees promptly and in writing taking into consideration any state or local requirements governing the timing of pay change notifications.

ADP Compliance Resources

ADP maintains a staff of dedicated professionals who carefully monitor federal and state legislative and regulatory measures affecting employment-related human resource, payroll, tax and benefits administration, and help ensure that ADP systems are updated as relevant laws evolve. For the latest on how federal and state tax law changes may impact your business, visit the ADP Eye on Washington Web page located at www.adp.com/regulatorynews.

ADP is committed to assisting businesses with increased compliance requirements resulting from rapidly evolving legislation. Our goal is to help minimize your administrative burden across the entire spectrum of employment-related payroll, tax, HR and benefits, so that you can focus on running your business. This information is provided as a courtesy to assist in your understanding of the impact of certain regulatory requirements and should not be construed as tax or legal advice. Such information is by nature subject to revision and may not be the most current information available. ADP encourages readers to consult with appropriate legal and/or tax advisors. Please be advised that calls to and from ADP may be monitored or recorded.

If you have any questions regarding our services, call 855-466-0790.

One ADP Boulevard, Roseland, NJ 07068

Updated on April 24, 2024

Recommended for You

Tools & resources.

Take your organization to the next level with practical tools and resources that can help you work smarter.

Recommend a Topic

Is there a topic or business challenge you would like to see covered on SPARK?

Subscribe to SPARK

Stay in the know on the latest workforce trends and insights.

Your privacy is assured.

Is there a topic or business challenge you would like to see covered on SPARK? Please let us know by completing this form.

All submissions will be reviewed and considered for use in future SPARK articles.

Important: If you need ADP service or support, visit ADP.com/contact-us/customer-service or call 1-844-227-5237.

DOL Increases Compensation Threshold for Exempt Employees

Starting July 1, 2024, employers must satisfy a higher salary threshold in order to consider employees as exempt from Fair Labor Standards Act (FLSA) overtime rules. Following proposed rulemaking in August 2023 , the U.S. Department of Labor (DOL) finalized a rule on April 23, 2024, setting the standard salary level for the “white collar” exemptions under the FLSA at $844/week as of July 1, 2024 (up from the current $684/week). The weekly salary requirement for white collar exempt employees will then increase to $1,128/week on January 1, 2025. This represents an almost 65% increase in the minimum exempt salary threshold by January 1. It is important to note that paying the minimum salary alone does not establish that an employee is properly classified as exempt. Rather, white collar exempt employees must also satisfy the relevant “duties test” under the FLSA, the content of which remains unchanged by the final rule.

The final rule also increases the total annual compensation threshold required for an employee to qualify for the FLSA’s “highly compensated employee” exemption (HCE). As of July 1, the annual total compensation [1] requirement for the HCE exemption rises to $132,964/year (up from $107,432/year). The HCE requirement further rises to $151,164/year on January 1, 2025. This represents more than a 40% increase by January 1. Of note, the January 1 threshold compensation requirement for the HCE exemption matches that used by the Federal Trade Commission to define “senior executive” in relation to noncompete agreements; however, the non-monetary criteria are not identical.

These increases will be the first since January 1, 2020. Future updates will occur every three years starting January 1, 2027, per the final rule. Future updates will use then-current wage data to determine increases. The DOL will publish a notice in the Federal Register with the new earnings levels at least 150 days prior to scheduled updates. The final rule does allow the DOL to temporarily delay a scheduled update to the salary levels when “ unforeseen economic or other conditions warrant .”

While the final rule affects a large portion of the U.S. workforce, the DOL regulations remain unchanged for the earnings thresholds for white collar exempt employees in U.S. territories, the motion picture industry, and computer employees. Also unchanged are the treatment of bonuses for the purposes of satisfying the compensation threshold. Employers may use nondiscretionary bonuses and incentive payments (including commissions) to satisfy up to 10% of the standard salary test requirements for white collar employees, so long as the bonuses are paid at least annually. Additionally, employers may use nondiscretionary bonuses and incentive payments earned during a 52-week period for calculating the compensation threshold for the HCE exemption, so long as they are not used to satisfy the weekly standard salary level portion of the exemption test.

At least 4 million workers are expected to be impacted by the final rule by 2025.

Although no litigation has yet been filed, litigation impacting the effective date and enforcement of this final rule is possible. For example, in 2016, a federal judge in Texas issued a nationwide injunction preventing a DOL final rule regarding white collar exemptions from taking effect.

In advance of the July 1 and January 1 deadlines, all employers with salaried workers should audit the exempt status and salaries for their employees to ensure compliance with the DOL’s final rule. Employers will then need to work on raising salaries and/or reclassifying any employees who no longer qualify as exempt due to the increased salary thresholds.

[1] The weekly salary level for the HCE exemption must at least match the minimum salary level for white collar employees.

Sara Alexis Levine Abarbanel

Related insights, pwfa final rule is now published — it takes effect june 18, 2024, utah enacts h.b. 55, impacting the use of confidentiality clauses in employment settlement agreements, bump in the road: federal judge selectively halts enforcement of the pregnant workers fairness act in texas.

New DOL Overtime Rule Increases Salary Thresholds for Exempt Workers

On April 23, 2024, the U.S. Department of Labor (DOL) announced its final rule change to employee exemptions under the Fair Labor Standards Act (FLSA). The rule, among other changes, increases the minimum salary threshold for certain “white collar” exempt employees by nearly $20,000 per year and provides overtime eligibility to millions of additional American workers.

The DOL’s Prior Overtime Rule

There are several overtime exemptions available under the FLSA, but the three “white collar” exemptions subject to the new rule are the executive, administrative, and professional exemptions. If an employee is deemed exempt, the employer is not required to pay overtime premiums for working more than 40 hours in a week. To qualify for these exemptions, such employees must satisfy both (i) the applicable duties test; and (ii) the salary basis test. Under the prior rules, exempt executive, administrative, and professional employees needed to earn a guaranteed salary of at least $684 per week, or $35,568 per year.

The prior DOL rules also contained a less restrictive duties test for certain “highly compensated” salaried employees (HCE) who received a total annual compensation of $107,432 or more.

The DOL’s New Overtime Rule

On August 30, 2023, the DOL announced its proposed changes to its overtime rules, covered here . On April 23, 2024, after receiving comments, the DOL announced its final rule change.

The new overtime rule raised the salary threshold for executive, administrative, and professional exempt employees, but did not change the associated duties tests. 1 As of July 1, 2024, the minimum weekly salary for these employees will increase to $844, equivalent to $43,888 annually. Starting January 1, 2025, the threshold will jump to $1,128 per week, equivalent to $58,656 annually. If employees earn less than this new threshold, they will need to be paid an overtime premium for any hours worked beyond 40 in a workweek.

It is important for employers to remember that some states have different duties and salary basis tests, and some require a daily overtime premium to be paid. For example, California currently has a $66,560 salary threshold, different duties tests, and requires an overtime premium for hours over 8 in a workday.

The new rule also provides that the FLSA salary threshold will be updated every three years to reflect the earnings of the 35th percentile of full-time salaried workers in the lowest-wage Census region. Accordingly, the new rule anticipates periodic increases to the salary threshold.

The DOL estimates that, in the first year after the new rule takes effect, approximately three million American workers exempt from overtime under the prior rules will, without some intervening action by their employers, become newly entitled to overtime under the FLSA based on the new salary threshold.

The new DOL rule also sets the HCE annual compensation level equal to the 85th percentile of earnings for full-time salaried employees nationwide. Thus, the new HCE threshold will increase to $132,964 annually by July 1, 2024, and $151,164 annually by January 1, 2025. Likewise, as with the salary threshold for the white collar exemptions, the HCE annual compensation level will be updated every three years to reflect the earnings of the 85th percentile of earnings for full-time salaried employees nationwide.

The DOL estimates that an additional 248,000 workers who earn at least $107,432 per year (the prior HCE total annual compensation level) and who meet the minimal HCE duties test but not the standard duties test would, without some intervening action by employers, become eligible for overtime under the eventual HCE total annual compensation level of $151,164 annually.