6 Best Cruise Insurance in Singapore to Keep You Safe Onboard [year]

Keep yourself safe with the best cruise insurance in Singapore!

Singapore Business Owners

For the travel-starved, going on a cruise to nowhere is an option. However, with COVID-19’s impact on travel restrictions, cruise insurance is all the more important to protect yourself and your loved ones.

In this article, we shortlisted the top 7 cruise insurance in Singapore for your next cruise to nowhere!

1. AIG Travel Guard Direct

AIA recognises that travelling has taken on a new norm. and thus enhanced their market-leading travel insurance coverage, Travel Guard Direct with more COVID-19 coverage for cancellations or interruptions to your cruise holiday due to covered conditions. However, do note that this is only applicable for selected plans.

2. FWD Travel Insurance

As we see more rule changes to regulations on social gatherings in Singapore, it makes it even harder for those who have pre-planned cruise trips, only to have them cancelled at the last minute due to changes in regulations.

The FWD Travel Insurance provides coverage in many areas of a cancelled trip, trip disruption and also a postponed trip before you leave Singapore.

3. Allianz Cruise Insurance

Like many plans available in the market, OneTrip Prime includes key benefits like trip cancellation/interruption, emergency medical and emergency transportation. We also like them for their pre-existing medical condition coverage. Kids 17 and under are covered for free when traveling with a parent or grandparent.

With Allianz Global Assistance, a 24-Hr Hotline Assistance has a multilingual assistance team available to tend to your travel emergencies.

4. Sompo Travel Insurance

Customers have a choice between the Essential plan or a higher coverage Superior plan. The Superior plan has up to $200,000 in medical expenses coverage and up to $4000 in trip cancellation and postponement.

As we see more and more insurers stepping up to provide travel-related coverage, we recognise its paramount importance in protecting us amid these trying times.

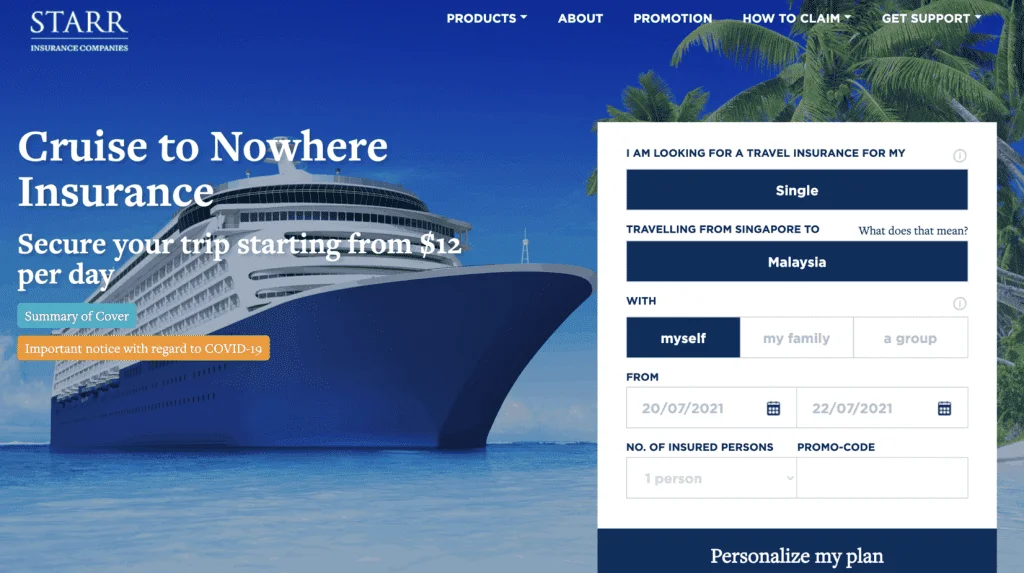

5. Starr Cruise Travel Insurance

Good news! There is an ongoing promotion for the Starr Cruise To Nowhere Travel Insurance where you’ll get a S$10 PayNow voucher from SingSaver when you sign up. With this, secure your trip starting from $12 per day with flexible coverage that allows you to create a travel insurance plan with different types of coverage and add-ons for your specific needs.

6. MSIG Travel Easy

If your plans go awry and you cancel your cruise vacation, the MSIG TravelEasy plan provides a comprehensive cover with over 50 benefits. We like them for their emergency medical evacuation benefits where across all Travel Easy plan types, emergency medical evacuation and repatriation is at a high limit of $1,000,000.

Do you have any reviews and comments to share regarding our choices for the best cruise insurance in Singapore?

While SBO is committed to supporting our local businesses, we welcome any feedback and anonymous sharing regarding your experience with the above-listed best cruise insurance picks in Singapore.

We hope that this guide will be useful in helping you to make a better decision when it comes to finding the best cruise insurance in Singapore.

Explore More Content

- Best in Singapore

You may be interested in these

9 best car insurance in singapore that are popular among car owners [2024], 12 best personal accident insurance in singapore to give you a peace of mind [2024], 7 best life insurance in singapore to get the necessary protection [2024], 10 best cancer insurance in singapore to protect yourself [2024], 8 best home insurance in singapore for a safer home [2024], sbo business listings.

Discover local experiences & opportunities

Hip & Knee Orthopaedics

Scented Candles Singapore – ZENDLE SG PTE. LTD.

Linkflow Capital Pte Ltd

The Hearing Centre

Get latest updates from SBO sent right into your inbox!

The Finest Cruise Insurance in Singapore

Taking a cruise is a thrilling experience that offers a unique combination of adventure and leisure on the vast ocean. You must plan for the unexpected and make sure you are at ease as you embark on your marine adventure from Singapore. Introduced in Singapore, Cruise Insurance is your defense against unforeseen mishaps and crises while cruising the colorful seas. We’ll navigate the complexities of cruise insurance in this guide, going over the many coverage options and helpful extras that promise to make your trip on the seas worry-free. Set sail with assurance as we discuss the essentials of obtaining all-inclusive cruise insurance that is customized for your particular journey.

Best Cruise Insurance in Singapore

Outdoor activities and expanded terrorist coverage are among the more than 50 services that MSIG insurance offers coverage for. Additional vital medical protection is also provided, such as accident benefits for pregnancies.

There is no upper age restriction for their premium plan, which also covers pre-existing medical illnesses, international hospitalization fees, and emergency medical evacuation and repatriation. They do provide some of the best cruise insurance in Singapore with this selection.

Highlights:

- Easy claim process

- Adventurous activities coverage

Good customer experiences. In fact, most consumers evaluate pricing upfront prior to insurance purchases. I evaluated MSIG services & their excellent customer responsiveness is impressive, including travel claims, and helper claims. I will repeatedly buy their products & highly recommend them to others, including family members . – Pei Hoon Lee

FWD Singapore

One of the most famous internet insurance companies on the island is FWD Singapore, which has won several awards for its work. They provide a variety of travel insurance benefits, including reimbursement for delays due to haze or inclement weather, unlimited medical evacuation coverage, and more.

Additionally, they provide a range of insurance solutions, from basic protection to premium protection, in the case of theft or damage to your belongings, as well as delays in transportation or luggage. The insurance is more practical for use in emergencies because it can be simply claimed using your mobile app.

- Worldwide emergency assistance

- Fraudulent personal credit card usage

- Additional coverage

Exceptional insurer with competitive products. Always a breeze to speak to their hotline. Their staff is helpful and knowledgeable. Recently made a claim on PA policy through their app as advised by the hotline and the process was very fuss-free. The claim was paid out quickly too. Impressed! – Joan Wang

AIG provides a wide range of insurance choices, including travel insurance that gives thorough protection. They can help you deal with any issue, including pre-departure bother, medical attention, travel or aircraft delays, personal injury, delayed baggage, and more.

Their insurance policies cover all travel charges such as transportation, lodging, Visa, and excursion costs in the event of trip cancellation or issues with the lodging provider.

You may use your insurance coverage whenever and wherever you need it with the help of the finest cruise insurance in Singapore, which provides 24/7 international travel support services through its international service centers across the globe.

- 24/7 in-house global assistance

- Inclusive medical services

- Responsive claims

AIG is very reliable. Their staff is also very helpful and friendly. They are knowledgeable and are able to answer my questions, and if they don’t, they will investigate and revert to me promptly. I will go with AIG anytime! – Sivashanmugam S

Starr Cruise Travel Insurance

The good news is that there is a new deal for the Starr Cruise to Nowhere Travel Insurance, and when you join up, SingSaver will give you a S$10 PayNow coupon. Plan your travel starting at $12 per day with a number of coverage options and add-ons customized to your requirements with this in mind.

- Medical expenses up to SG$1,000,000 including in and outpatient expenses and treatments

- Seamless and Cashless claims via PayNow

- Personal accident benefit of up to SG$500,000 maximum limit, covering 18 different insured events of disablement and accidental death

It’s been a week since my first-ever vacation in Europe. If it weren’t for Starr’s affordable rates, I never would have had travel insurance during my trip. Made me more confident to explore the place and just have fun. If you’re a first-time traveler like me, I highly recommend them . – John David Armecin

From organizing family holidays to going on solo experiences, NTUC offers a variety of travel services. Their comprehensive coverage includes personal accidents, medical costs, loss and damage to personal items, delays in travel or luggage, and other services.

Their two insurance plans, which mostly focus on medical support, are available to you. Thus, they may be the finest Singapore cruise insurance for you if you’re traveling with parents and other loved ones who have pre-existing conditions.

- Family members coverage

- Overseas study protection plan

Concepts were explained clearly and concisely. All in all, it was an eye-opening experience. The trainer is very competent and experienced. He shared a few of his past experiences as a paramedic and it gave us a better understanding and insights into the requirement of a First-Aid Responder . – Sayed Abdul Rasyid

Singlife with Aviva

Travel delays, illegal purchases, accidental incapacity, and death are all covered by the range of travel insurance solutions provided by Aviva. They offer dependable service with round-the-clock, every day of the week, emergency travel help.

Additionally, they provide specialized travel insurance for international sporting events, weddings, and picture shoots. As a consequence of these advantages, they have developed a reputation for offering some of the best cruise insurance in Singapore.

- Basic and enhanced insurance plans

- Offers a variety of travel insurance options

Had a great claims experience under the Group Insurance policy I have with Aviva. The customer Service Exec was extremely helpful and helped with a letter of guarantee which resulted in cashless hospitalization. All in all, they did what they suppose to do – paid my claim! – Sapna Kalra

Finally, as you are ready to go off on the magical voyage of a cruise from Singapore, getting Cruise Insurance becomes the compass that leads you through uncharted territory. It takes foresight to navigate the shifting waves, but with the correct coverage, you can cruise with assurance that unforeseen hiccups won’t ruin your nautical journey. Cruise insurance in Singapore is your go-to resource for security against lost bags, medical problems, and canceled trips. Allow the knowledge that you will have complete coverage to accompany you on your journey and add to the excitement of discovery, making every second spent at sea a once-in-a-lifetime opportunity. Good luck on your journey!

Do check out our list of Home Insurance and have time to check their services.

Frequently Asked Questions

What insurance do you need for cruise?

Can you add cruise insurance after booking, do cruise ships have insurance, why do i need cruise insurance for my trip from singapore, what does cruise insurance in singapore typically cover, are there specific cruise insurance options for different destinations from singapore, can i purchase cruise insurance after booking my cruise from singapore, do cruise insurance policies in singapore cover pre-existing medical conditions.

You might be interested in

Related Lists

- The Finest Maid Insurance Policies in Singapore

- The Finest Business Insurance in Singapore

- The Finest Motorcycle Insurance in Singapore

We curated the top Cruise Insurance in Singapore. Check out their services and let us know if they serve you the best way possible.

Product Currency: SGD

Product Price: 100-200

Product In-Stock: InStock

Best Debt Consolidation Plan Interest Rates for 2024

Best Education Loan Interest Rate for 2024

Best Car Loans Interest Rates for 2024

Best Grocery Credit Cards 2024

Discover the top-rated products and services in Singapore with our comprehensive reviews. Singapore’s Finest is your gateway to informed decisions and unparalleled quality. Elevate your consumer experience with insights that matter.

+65 8756 2812

- List My Business

- Tell Us Your Story

- Advertise With Us

- Submit Exclusive Deals

- About SG’s Finest

- Service Category

- Report An Issue

Get the latest news directly to your inbox.

Life Moments

The Travel Insider

Inspire the globetrotter in you with the first one-stop travel portal in Southeast Asia designed by a bank that inspires, helps you plan, and lets you book in one place.

- Compare Accounts

- Deposits Fees & Charges

- Terms and Conditions for Accounts & Services

- Notices, News & Announcements

Skip to higher interest with UOB One Account

Get up to 6% p.a. interest in just two steps. Apply now and get up to S$210 cash! T&Cs apply. Insured up to S$100k by SDIC.

Card Privileges

Card services.

- Compare Cards

- Commercial Cards

- Card Activation

- Overseas Card Use

- Card Application Status

There's a card for everyone. Click here to find out more on the sign-up offers.

Borrow services.

- Home Loan Calculator

- Property Valuation Tool

- Car Loan Instalment Calculator

Balance Transfer

Get instant cash at 0% interest and low processing fees. Select from flexible tenors of 3, 6 or 12 months.

Wealth Insights

Investment solutions, featured solutions.

- Funds Selector

- Fund Updates

- Product Providers

- CPFIS and SRS Corporate Action Information

Wealth on UOB TMRW. Designed around you.

View and manage your portfolio in one place. Invest, insure, and convert FX easily with just a few taps.

General Insurance

Life insurance.

- List of Product Providers

- ATM / Branch Locator

SimpleInsure

Get PRUCancer 360 from just S$3.70 per week. Sign up now and enjoy 35% off your first-year premium. T&Cs apply.

Digital Banking

Personal internet banking, other banking services.

- Forgot Username/Password

- TMRW Guides

- UOB PIB and TMRW FAQs

- E-Payment User Protection Guidelines and FAQs

Meet UOB TMRW, the all-in-one banking app built around you and your needs. Bank. Invest. Reward. Make TMRW yours.

For Individuals

For companies, uob subsidiaries.

- SUSTAINABILITY

- UOB personal internet banking

- UOB INFINITY

- UOBAM invest

- UOB coe open bidding

- UOB kay hian

- UOB rewards

InsureCruise

Enjoy every moment of your cruise with peace of mind. Get 10% off* when you purchase InsureCruise from now till 31 July 2024. *Terms and conditions apply.

Enjoy 10% off when you apply now! Till 31 July 2024. View Promotion Terms and Conditions here

Planning a cruise?

InsureCruise offers comprehensive and affordable coverage so you can enjoy every moment of your cruise holiday with peace of mind.

Protect yourself against unforeseen circumstances including COVID-19*, with InsureCruise.

Extensive coverage

Receive essential coverage before and during your trip; from trip cancellations, accidents, to serious illness (including COVID-19) and food poisoning medical expenses ^ . ^ Exclusions apply.

Daily stay allowance

Receive financial relief if you are hospitalised due to accident or serious illness (including COVID-19).

Disinfecting house expenses

Receive reimbursement of up to S$500 per household.

Before your trip

During your trip, frequently asked questions.

- What is the age eligibility for InsureCruise? Applicant age from 1 to 80 years old is eligible to purchase this travel insurance.

- I perform an Antigen Rapid Test (ART) before my trip and the result is “Positive”. I have to cancel my trip. Will InsureCruise cover my trip expenses? Yes, if your trip is cancelled due to yourself being diagnosed with COVID-19, we will provide a reimbursement of the irrecoverable expenses. The cover is effective only if this travel insurance is purchased before you become aware of any circumstances which could lead to the cancellation of the trip and the occurrence of any of the insured events must happen seven (7) days prior the commencement of the trip. However, please note that this travel insurance does not cover any costs associated with test kits.

- Besides trip expenses, what other insurance benefits will InsureCruise cover me if I contract COVID-19? If you have been fully vaccinated and still diagnosed with COVID-19 and is required to be admitted to the hospital or community care facility or community recovery facility for treatment of COVID-19, this travel insurance will pay you S$100 per day up to 7 days for each complete day stay. Such event is to happen at least seven (7) days prior the commencement of the trip We will also pay you a lump sum benefit of S$100 upon your discharge from the facility with a minimum five (5) days of treatment. In addition, we will reimburse you up to S$500 for the expense required to engage a licensed contractor to disinfect your house. Please refer to the policy contract for more information.

- Can I still apply if I have just recovered from COVID-19? Yes, you can still apply for InsureCruise as COVID-19 is not considered as a Pre-existing condition.

- I came down with food poisoning after consuming my buffet dinner in the cruise. Will my medical expenses be covered? Yes, InsureCruise will reimburse you for the medical expenses incurred within forty-eight (48) hours from the date of the incident that gave rise to the food poisoning happening during your trip. Please refer to the policy contract for more information.

- Can I purchase InsureCruise for my family or friends? Yes, you may. Please ensure you have their consent before purchase and to inform them upon successful purchase of this travel insurance.

- When does InsureCruise cover commence? The insurance commences when you leave your place of residence or business in Singapore (whichever is the later) and ends at the time of return to your residence or business in Singapore or expiry of the Certificate of Insurance/ Schedule (whichever is the earlier). Trip Cancellation starts seven (7) days prior the commencement of the trip.

- If I cancel my InsureCruise policy, can I get a premium refund? There is no refund of insurance premium paid once the Certificate of Insurance and/or Schedule is issued and premium charged.

- How can I make a claim? You may contact our Claims Division at 6222 7733 during UOI business hours. We will advise you on the claim procedure depending on the type of claims. UOI’s business hours Monday to Thursday: 8:45am to 5:45pm Friday: 8.45am to 4.45pm Closed on weekends and public holidays.

Important information

Important notice and disclaimers.

The above is provided for general information only and is not a contract of insurance. Full details of the terms, conditions and exclusions of the insurance are provided in the policy and will be sent to you upon acceptance of your application by United Overseas Insurance Limited ("UOI"). You may wish to seek advice from a qualified adviser before making a commitment to purchase the product. In the event that you choose not to seek advice from a qualified adviser, you should consider carefully whether this product is suitable for you. United Overseas Bank Limited ("UOB") does not hold itself out to be an insurer or insurance broker. The insurance products and services stated herein are provided by UOI.

Policy Owners’ Protection Scheme

These policies are protected under the Policy Owners' Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for these policies are automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact your insurer or visit the General Insurance Association (GIA) or SDIC websites ( www.gia.org.sg or www.sdic.org.sg ).

Here's something else you might need

Insuredrive.

UOB’s car insurance, also called InsureDrive, is a plan that gives you the flexibility to decide on the coverage you need.

InsureTravel

Be protected before, during and after your trip with InsureTravel

InsureStaycay

Protect yourself against unforeseen circumstances including COVID-19*, with InsureStaycay. Enjoy 10% off** when you buy now! *Terms and conditions apply

Articles for you

How mortgage insurance can protect your family

Is your home adequately covered against the unexpected?

Assessing your insurance needs

Distributed by:.

Underwritten by:

We're here to help

Have a question.

Make TMRW yours, download now!

We use cookies to improve and customise your browsing experience. You are deemed to have consented to our cookies policy if you continue browsing our site.

Cruise Insurance Singapore: Protect Your Trip with Peace of Mind

If you’re planning a cruise holiday , it’s important to consider purchasing cruise insurance to protect yourself from unexpected events. Cruise insurance can provide coverage for a range of situations, including trip cancellation, medical emergencies, lost or stolen luggage, and more. In Singapore, there are several options for cruise insurance policies, each with their own unique benefits and coverage details.

When considering cruise insurance, it’s important to understand the coverage details of each policy. Some policies may offer more comprehensive coverage than others, such as coverage for pre-existing medical conditions or Covid-19 related cancellations. It’s also important to consider any additional benefits or features that may be included, such as emergency assistance and support or travel insurance extensions and add-ons. By understanding the details of each policy, you can choose the right cruise insurance policy to meet your needs and budget.

Key Takeaways:

- Cruise insurance can provide coverage for unexpected events such as trip cancellation, medical emergencies, and lost luggage.

- When considering cruise insurance, it’s important to understand the coverage details of each policy and any additional benefits or features that may be included.

- By choosing the right cruise insurance policy to meet your needs and budget, you can enjoy your cruise holiday with peace of mind.

Understanding Cruise Insurance in Singapore

If you are planning to go on a cruise, it is important to understand the importance of cruise insurance. In this section, we will explain what cruise insurance is, why it is essential, and the differences between cruise insurance and standard travel insurance.

What Is Cruise Insurance?

Cruise insurance is a type of travel insurance that provides coverage specifically for cruises. It covers a range of events that may occur during your cruise, such as trip cancellations, trip interruptions, trip delays, missed connections, lost or stolen baggage, and medical emergencies. Some cruise insurance policies may also include coverage for pre-existing medical conditions.

Why Is Cruise Insurance Essential?

Cruise insurance is essential because it provides coverage for events that are unique to cruising. For example, if your cruise is cancelled due to bad weather, or if you miss your cruise departure due to a flight delay, cruise insurance can reimburse you for the cost of your trip. Additionally, if you become ill or injured during your cruise, cruise insurance can cover your medical expenses, which can be very expensive if you need to be evacuated from the ship.

Differences Between Cruise Insurance and Standard Travel Insurance

While cruise insurance is a type of travel insurance, it provides more comprehensive coverage than standard travel insurance. Standard travel insurance typically covers events that may occur during any type of trip, such as trip cancellations, trip interruptions, and medical emergencies. However, it may not provide coverage for events that are unique to cruising, such as missed ports of call, cruise itinerary changes, and shipboard medical expenses.

In summary, cruise insurance is essential if you are planning to go on a cruise. It provides comprehensive coverage for events that are unique to cruising, such as missed ports of call and shipboard medical expenses. Be sure to compare policies and coverage levels to find the best cruise insurance policy for your needs.

Comprehensive Coverage Details

When it comes to cruise insurance , it’s essential to know what you’re covered for. Here are the key coverage details you should know before you set sail.

Medical Coverage on the High Seas

One of the most important aspects of cruise insurance is medical coverage . In case of a medical emergency, you want to know that you’re covered. Look for a policy that offers comprehensive medical coverage, including emergency medical expenses, medical evacuation, and repatriation.

Trip Cancellation and Interruption Benefits

Another important aspect of cruise insurance is trip cancellation and interruption benefits. You want to make sure that you’re covered in case you need to cancel or interrupt your trip due to unforeseen circumstances. Look for a policy that offers coverage for trip cancellation, trip interruption, and trip delay.

Coverage for Theft, Loss, and Damage

Cruise insurance should also offer coverage for theft, loss, and damage. This includes coverage for your personal belongings , such as luggage, cameras, and electronics. Look for a policy that offers comprehensive coverage for theft, loss, and damage.

Personal Accident and Liability Provisions

Finally, cruise insurance should offer personal accident and liability provisions. This includes coverage for accidental death and personal accident benefits . You should also look for a policy that offers liability coverage in case you are held responsible for damage or injury to others.

Overall, cruise insurance is essential for any family heading out on a cruise. With comprehensive coverage, you can enjoy your holiday with peace of mind, knowing that you’re covered in case of any unforeseen circumstances.

Navigating Covid-19 and Cruise Insurance

If you’re planning a cruise holiday, it’s essential to consider the potential risks of Covid-19 and ensure you have adequate insurance coverage. Here are some things to keep in mind when navigating Covid-19 and cruise insurance.

Covid-19 Coverage Options

Many travel insurance plans now offer Covid-19 coverage, including coverage for medical expenses related to Covid-19 and trip cancellation due to Covid-19. When selecting a cruise insurance plan, make sure to check whether it includes Covid-19 coverage and what exactly is covered.

Some plans may only cover medical expenses related to Covid-19 if you contract the virus while on the cruise, while others may also cover medical expenses related to Covid-19 if you contract the virus before the cruise and are unable to travel.

Understanding Quarantine and Medical Evacuation

In the event that you or a fellow passenger on your cruise contract Covid-19, it’s important to understand the quarantine and medical evacuation procedures. Some cruise lines may have their own quarantine procedures in place, while others may require passengers to quarantine in a designated facility on land.

If you require medical evacuation due to Covid-19, it’s important to have insurance coverage that includes emergency medical evacuation. This coverage can help cover the cost of transportation to a medical facility that can provide the necessary care.

When selecting cruise insurance, make sure to carefully review the policy to ensure it includes coverage for Covid-19-related medical expenses and emergency medical evacuation. Keep in mind that coverage may vary depending on the plan and the insurance provider.

By taking the time to carefully review your options and select a comprehensive cruise insurance plan that includes Covid-19 coverage, you can enjoy your cruise holiday with peace of mind knowing that you’re protected in the event of an emergency.

Choosing the Right Cruise Insurance Policy

Going on a cruise can be an exciting adventure, but it’s important to stay protected with the right insurance policy. Here are some key considerations to keep in mind when choosing a cruise insurance policy in Singapore.

Comparing Providers: MSIG, AIG, and Others

When it comes to choosing a cruise insurance provider, there are several options available in Singapore. MSIG, AIG, FWD Travel Insurance, Starr Cruise Travel Insurance, Allianz Travel, and Singlife Travel Insurance are some of the popular choices. It’s important to compare the policies of each provider to determine which one offers the best coverage for your needs.

MSIG offers a comprehensive travel insurance policy that covers medical expenses, personal accident, and trip cancellation among other benefits. AIG’s travel insurance policy also offers similar coverage, including protection for travel delays and lost baggage.

Key Terms and Conditions to Consider

Before purchasing a cruise insurance policy, it’s important to read the policy wording and understand the key terms and conditions. Look out for the coverage limits, deductibles, and exclusions to ensure that you’re fully aware of what’s covered and what’s not.

Some policies may have specific requirements, such as pre-existing medical conditions or age restrictions. Make sure you meet these requirements before purchasing a policy to avoid any issues with claims in the future.

Understanding Policy Exclusions

While cruise insurance policies offer a range of benefits, it’s important to understand the policy exclusions. For example, most policies won’t cover you if you cancel your trip due to work-related reasons or if you’re travelling to a country with a high risk of terrorism.

Other exclusions may include pre-existing medical conditions, extreme sports, and pregnancy-related issues. Make sure you’re aware of these exclusions before purchasing a policy to avoid any surprises later on.

In summary, choosing the right cruise insurance policy involves comparing providers, understanding key terms and conditions, and being aware of policy exclusions. By doing your research and selecting a policy that meets your needs, you can enjoy your cruise with peace of mind knowing that you’re fully protected.

Additional Benefits and Features

When it comes to cruise insurance, it’s important to consider the additional benefits and features that are available to you. Here are some of the most important features that you should look out for when selecting a cruise insurance policy.

Baggage and Personal Belongings Cover

One of the main benefits of cruise insurance is that it can provide cover for your baggage and personal belongings. This means that if your luggage is lost, damaged or stolen during your trip, you can make a claim to cover the cost of replacing your items. Some policies may also offer cover for baggage delay, which means that if your luggage is delayed for a certain amount of time, you can claim for expenses such as clothes and toiletries.

Adventurous Activities and Sports Coverage

If you’re planning on taking part in adventurous activities or sports during your cruise, it’s important to make sure that your insurance policy covers you for these activities. Some policies may exclude certain activities, such as scuba diving or bungee jumping, so it’s important to check the policy wording carefully. If you’re planning on taking part in any activities that are not covered by your policy, you may need to take out additional cover.

Other benefits and features that you may want to consider when selecting a cruise insurance policy include:

- Emergency medical and dental cover

- Personal liability cover

- Trip cancellation and curtailment cover

- Missed departure cover

- Legal expenses cover

Make sure you read the policy wording carefully to understand exactly what is covered and what is excluded. This will help you to choose the right policy for your needs and ensure that you are fully protected during your cruise.

Maximising Your Cruise Insurance Plan

Going on a cruise is an exciting adventure, but it’s important to make sure you have adequate insurance coverage to protect you and your loved ones in case of any unforeseen circumstances. Here are some tips to help you maximise your cruise insurance plan:

Family and Group Insurance Plans

If you’re travelling with family or a group of friends, consider getting a family or group insurance plan. This can often be more cost-effective than individual plans, and it ensures that everyone in your group is covered. Some insurance providers even offer discounts for family or group plans, so be sure to check for any promotions or discounts available.

Leveraging Promotions and Discounts

When shopping for cruise insurance, be sure to look out for promotions and discounts. Some insurance providers offer discounts of up to 10% off the total premium for purchasing a policy online or for signing up for an annual plan. Make sure to read the fine print and understand the terms and conditions of any promotions or discounts before making a purchase.

Additionally, some credit cards offer complimentary travel insurance as a cardholder benefit. Check with your credit card issuer to see if you’re eligible for this benefit and if it extends to cruise holidays.

In conclusion, taking the time to research and understand your cruise insurance options can save you a lot of stress and money in the long run. Consider family or group plans, look out for promotions and discounts, and always read the fine print to ensure you’re getting the coverage you need.

Travel Insurance for Every Journey

Travelling is an exciting adventure, but it comes with its own set of risks. That’s why it’s important to have travel insurance to protect yourself and your loved ones from unforeseen events that may occur during your trip. In Singapore, there are many options available to choose from to suit your specific needs.

Annual and Single Trip Options

If you are a frequent traveller, an annual plan may be the best option for you. This type of plan covers multiple trips throughout the year, making it more cost-effective than purchasing a single trip plan for each trip. On the other hand, if you are only travelling once in a while, a single trip plan may be more suitable for your needs.

NTUC Income offers both annual and single trip options with different tiers of coverage to choose from. Their plans cover a wide range of benefits, including medical expenses , trip cancellations, and personal accidents.

Specialised Coverage for Unique Needs

If you have unique needs that require specialised coverage, there are options available for you as well. For example, if you are going overseas to study, you may want to consider purchasing an overseas study protection plan. This type of plan covers expenses related to medical emergencies, loss of personal belongings, and more.

When it comes to cruising, it’s important to have coverage that is tailored to the unique risks that come with being on a ship. AIG Travel Guard Direct offers cruise insurance that covers medical expenses, trip cancellations, and more specifically for cruise trips.

In conclusion, travel insurance is an essential part of any journey. Whether you are travelling for business or pleasure, there are options available to suit your specific needs. Ensure you choose a plan that provides adequate coverage for your trip and gives you peace of mind.

Practical Considerations for Cruise Travellers

Cruising is a wonderful way to explore the world and create unforgettable memories. However, it is important to be prepared for any travel disruptions or delays that may occur during your trip. Here are some practical considerations to keep in mind when purchasing cruise insurance in Singapore.

Dealing with Travel Disruptions and Delays

Travel disruptions and delays can be frustrating and stressful, especially when you are on a tight schedule. When purchasing cruise insurance, make sure it covers trip cancellations and travel delays. This will provide you with financial protection in case your trip is cancelled or delayed due to unforeseen circumstances such as bad weather, strikes, or mechanical breakdowns.

In addition, it is important to choose a policy that offers 24/7 travel assistance. This will give you access to a team of experts who can help you navigate any travel disruptions or delays and provide you with support and advice.

The Importance of an Easy Claim Process

When purchasing cruise insurance, it is important to choose a policy with an easy claim process. This will ensure that you can receive reimbursement quickly and easily in case of a covered event.

Look for a policy that offers online claims submission and a simple claims process. This will save you time and hassle and ensure that you can get back to enjoying your trip as soon as possible.

In conclusion, purchasing cruise insurance in Singapore is an important consideration for any traveller. By keeping these practical considerations in mind, you can ensure that you are prepared for any travel disruptions or delays and have peace of mind knowing that you are financially protected.

Exploring Regional Cruise Destinations

When it comes to cruising, Singapore is an excellent starting point for exploring the beautiful destinations in the region. With a range of cruise lines, including Royal Caribbean, offering various itineraries, you can choose from a range of destinations that cater to your interests and preferences.

Cruising to Malaysia and ASEAN Countries

Malaysia is one of the popular destinations for cruise lovers, with ports such as Malacca, Langkawi, and Penang offering a range of cultural and scenic attractions. You can explore the ancient temples and architecture in Malacca, go island hopping in Langkawi, or indulge in the local culinary scene in Penang.

ASEAN countries such as Thailand, Indonesia, and Vietnam are also popular cruise destinations. With ports such as Phuket, Bali, and Ho Chi Minh City, you can explore the beautiful beaches, cultural landmarks, and historical sites that these countries have to offer.

Island Stops and Shore Excursions

One of the highlights of cruising is the opportunity to visit beautiful islands and go on exciting shore excursions. Whether you want to go snorkelling in crystal clear waters, explore the local markets, or visit historical landmarks, there are plenty of options to choose from.

Some of the popular island stops in the region include Phuket, Bali, and Langkawi. You can also go on shore excursions to explore the cities and towns near the ports, such as Malacca, Penang, and Ho Chi Minh City.

When planning your cruise, make sure to check the itinerary and see what island stops and shore excursions are included. You can also book additional excursions through the cruise line or explore on your own.

Overall, cruising to regional destinations such as Malaysia and ASEAN countries offers an exciting and unique way to explore the beauty and diversity of the region. With a range of options available, you can choose the perfect itinerary to suit your interests and preferences.

Insurance for the Modern Cruiser

In today’s digital age, insurance companies are embracing innovative ways to cater to modern cruisers. Digital innovations have revolutionised the insurance industry, making it more convenient for travellers to access and manage their policies.

Digital Innovations in Insurance

With the rise of digital platforms, insurance companies now offer seamless online experiences for purchasing and managing cruise insurance. This includes easy-to-navigate websites that provide comprehensive information about coverage, benefits, and claims processes. Additionally, you can now conveniently compare different insurance plans, ensuring you find the best option for your cruise needs.

FWD Singapore and PayNow Voucher

FWD Singapore has introduced a new and exciting way to enhance the insurance experience for modern cruisers. By partnering with PayNow, FWD Singapore offers a convenient and secure payment method, allowing you to easily purchase your cruise insurance. Furthermore, FWD Singapore provides exclusive PayNow vouchers, adding extra value to your insurance purchase. This innovative approach not only simplifies the payment process but also rewards you for choosing FWD Singapore as your insurance provider.

Ensuring Financial Protection at Sea

Going on a cruise is an exciting adventure, but it’s important to ensure that you have the right cruise insurance to protect yourself financially in case of unexpected events. Here are some of the ways cruise insurance can provide financial protection:

Coverage for Serious Illness and Hospitalisation

One of the biggest concerns when you’re on a cruise is falling ill and needing medical attention. Cruise insurance can provide coverage for serious illnesses and hospitalisation, so you don’t have to worry about expensive medical bills. Some policies may even cover emergency medical evacuation, which can be incredibly expensive without insurance.

Financial Security Against Accidents and Death

Accidents can happen anywhere, even on a cruise ship. Cruise insurance can provide financial security in case of accidents or death. This can include coverage for accidental injury, disability, and accidental death. It’s important to review the policy carefully to understand the maximum limit for each type of coverage.

In addition to these two main areas of coverage, cruise insurance may also provide coverage for trip cancellation, trip interruption, and lost or stolen luggage. It’s important to review the policy carefully to understand what is covered and what is not.

Overall, cruise insurance is an important investment to ensure that you have financial protection while at sea. Make sure to review the policy carefully and understand the coverage limits to ensure that you have the right level of protection for your needs.

Special Offers and Travel Insurance Perks

If you’re planning to go on a cruise, you’ll want to make sure you have the right travel insurance to protect you and your loved ones. Fortunately, there are some great special offers and travel insurance perks available in Singapore that can help you save money and get the coverage you need.

Aviva and Singlife Promotions

Aviva and Singlife travel insurance are two of the most popular providers in Singapore, and they both offer some great promotions for cruise travellers. For example, Aviva offers a 35% discount on their travel insurance plans if you purchase them online. They also offer a free gift with purchase, such as a luggage tag or travel adapter.

Singlife travel insurance, on the other hand, offers a 20% discount on their plans if you purchase them through their mobile app. They also offer a free $10 Grab voucher with purchase, which can come in handy if you need to get around during your trip.

Exclusive Benefits for Frequent Cruisers

If you’re a frequent cruiser, you may be eligible for some exclusive benefits and perks. For example, some travel insurance providers offer discounts or special coverage for those who take multiple cruises per year.

Additionally, some cruise lines offer their own travel insurance plans that come with exclusive benefits, such as priority boarding, onboard credit, and more. Be sure to check with your cruise line to see if they offer any special perks for those who purchase their travel insurance.

Overall, there are plenty of special offers and travel insurance perks available in Singapore that can help you save money and get the coverage you need for your next cruise. Be sure to shop around and compare different providers to find the best deal for you.

Compliance and Underwriting Standards

When it comes to cruise insurance, it’s important to understand the underwriting process and regulatory compliance standards that insurers must adhere to. This ensures that you have peace of mind knowing that your policy is valid and reliable.

Understanding Insurance Underwriting

Underwriting is the process by which an insurer assesses the risk of insuring a particular individual or group. During this process, the insurer evaluates various factors such as your age, health, travel destination, and the duration of your trip. Based on this evaluation, the insurer determines the premium you need to pay and the coverage you will receive.

It’s important to be honest and transparent during the underwriting process. Any discrepancies or false information can result in your policy being voided or your claim being denied. Therefore, make sure you provide accurate and truthful information to ensure that you are adequately covered.

Regulatory Compliance for Peace of Mind

In Singapore, all insurers are regulated by the Monetary Authority of Singapore (MAS). This regulatory body ensures that insurers comply with strict guidelines and standards to ensure that they are financially stable and capable of paying out claims.

Insurers must also comply with the Insurance Act and regulations, which set out the minimum requirements for insurance policies. These regulations cover areas such as the terms and conditions of the policy, the coverage provided, and the claims process.

By choosing a reputable insurer that is compliant with these regulations, you can have peace of mind knowing that your policy is valid and reliable. Additionally, you can be confident that you will receive the coverage you need in the event of an emergency.

In summary, understanding the underwriting process and regulatory compliance standards is crucial when choosing a cruise insurance policy in Singapore. By choosing a compliant insurer and providing accurate information during the underwriting process, you can ensure that you are adequately covered and have peace of mind during your trip.

Emergency Assistance and Support

When you’re on a cruise, you want to have peace of mind knowing that you’re protected in case of an emergency. That’s why it’s important to choose a cruise insurance policy that offers comprehensive emergency assistance and support.

Unlimited Medical Evacuation Coverage

If you or a loved one becomes seriously ill or injured while on your cruise, you may need to be medically evacuated to a hospital on land. This can be an expensive and complicated process, but with the right cruise insurance policy, you can have unlimited medical evacuation coverage.

This means that you won’t have to worry about the cost of an air ambulance or other transportation to get you to the care you need. Instead, your insurance will cover the cost of the evacuation, so you can focus on getting better.

Support for Fraudulent Credit Card Usage

Unfortunately, credit card fraud can happen anywhere, including on a cruise ship. If your credit card is stolen or used fraudulently while you’re on your cruise, you could be left with a big bill to pay.

That’s why it’s important to choose a cruise insurance policy that offers support for fraudulent credit card usage. This means that if your credit card is stolen or used fraudulently while you’re on your cruise, your insurance will cover the cost of any unauthorised charges.

With comprehensive emergency assistance and support, you can enjoy your cruise with peace of mind knowing that you’re protected in case of an emergency.

Travel Insurance Extensions and Add-Ons

When it comes to cruise travel insurance in Singapore, it’s important to get the right coverage to ensure peace of mind during your trip. However, basic travel insurance plans may not always include all the coverage you need. Fortunately, many insurers offer extensions and add-ons to their plans to help you tailor your coverage to your specific needs.

Overseas Medical Expenses and Evacuation

One important extension to consider is overseas medical expenses and evacuation coverage. This coverage can help you pay for medical expenses incurred while travelling abroad, including emergency medical treatment, hospitalisation, and even medical evacuation if necessary. This is particularly important for cruises, as medical facilities on board may be limited.

When looking for this type of coverage, make sure to check the coverage limits and exclusions. Some policies may have limits on the amount of coverage provided, while others may exclude certain activities or pre-existing conditions.

Travel Cancellation and Postponement Options

Another important add-on to consider is travel cancellation and postponement coverage. This can help you recoup some or all of your travel costs if you need to cancel or postpone your trip due to unforeseen circumstances, such as illness, injury, or a family emergency.

When considering this type of coverage, make sure to check the covered reasons for cancellation or postponement. Some policies may only cover specific reasons, such as illness or injury, while others may have broader coverage. Additionally, make sure to check the coverage limits and exclusions, as well as any deductibles or copays that may apply.

Overall, adding extensions and add-ons to your cruise travel insurance plan in Singapore can help ensure that you have the coverage you need for a worry-free trip. Just make sure to carefully review the policy details and choose the options that best fit your needs and budget.

Protecting Your Belongings While Cruising

When you are on a cruise, it is important to protect your belongings from loss or damage. Here are some tips to help you protect your belongings while cruising.

Delayed Baggage and Property Loss

Delayed baggage and property loss can be a major inconvenience while on a cruise. To protect your belongings from loss or damage, you can consider purchasing cruise insurance that includes coverage for delayed baggage and property loss. MSIG TravelEasy and Ergo TravelProtect are two options that offer such coverage.

In addition to purchasing insurance, you can take some steps to protect your belongings. For example, you can pack a carry-on bag with essential items such as medication, a change of clothes, and toiletries. This will ensure that you have the essentials even if your luggage is delayed or lost.

Starr TraveLead and ERGO TravelProtect Options

Starr TraveLead and ERGO TravelProtect are two options to consider when purchasing cruise insurance. Starr TraveLead offers coverage for medical expenses, trip cancellations, and trip interruptions. ERGO TravelProtect offers coverage for medical expenses, trip cancellations, and baggage loss.

When selecting a cruise insurance policy, it is important to read the policy carefully to ensure that it meets your needs. Look for policies that offer coverage for the specific risks that you are concerned about.

In conclusion, protecting your belongings while cruising is important to ensure that you have an enjoyable and stress-free vacation. By purchasing cruise insurance that includes coverage for delayed baggage and property loss, as well as taking some simple steps to protect your belongings, you can enjoy your cruise with peace of mind.

Engaging in Safe and Secure Travel

When planning your next cruise holiday, it is important to consider the safety and security of your trip. While cruises can be a fun and exciting way to travel, there are potential risks that come with being out at sea. That’s where cruise insurance comes in – it can help protect you and your loved ones from unexpected events that may occur during your trip.

The Role of Cruise Insurance in Ensuring Safety

Cruise insurance is designed to provide you with financial protection in case of unforeseen circumstances such as trip cancellations, medical emergencies, lost or stolen baggage, and more. It is important to note that most basic travel insurance plans cover cruise holidays, but you may want to consider purchasing additional coverage specifically tailored to cruising.

For example, if you are planning a cruise to Singapore, you may want to look for cruise insurance Singapore providers that offer coverage for cruise-specific events such as missed port departures, itinerary changes, and emergency medical evacuation from the ship.

In addition to purchasing cruise insurance, there are other steps you can take to ensure a safe and secure trip. These include:

- Researching the cruise line and ship before booking to ensure they have a good safety record and security measures in place.

- Keeping your valuables in a safe or locked suitcase while on board.

- Following safety instructions provided by the crew, including emergency drills and evacuation procedures.

- Being aware of your surroundings and avoiding any risky behaviour while on shore excursions.

By taking these precautions and purchasing cruise insurance, you can enjoy your holiday with peace of mind knowing that you are prepared for any unexpected events that may occur.

Frequently Asked Questions

What exciting benefits does cruise insurance offer for travellers.

Cruise insurance offers a range of benefits that can provide peace of mind during your cruise holiday. Apart from covering medical expenses for unexpected illnesses or injuries, it can also cover you for trip cancellations, lost or stolen luggage, and trip interruptions. Some policies also offer coverage for missed connections, emergency medical evacuations, and 24-hour emergency assistance.

How can you ensure your cruise is fully covered by insurance post-booking?

To ensure that your cruise is fully covered by insurance, it’s important to read the policy documents carefully and understand what is covered and what is not. You should also consider purchasing your insurance as soon as you book your cruise to ensure that you are covered for any unforeseen events that may occur before your departure.

Which types of unforeseen events are typically covered by cruise insurance policies?

Typically, cruise insurance policies cover unforeseen events such as trip cancellations, trip interruptions, missed connections, lost or stolen luggage, and emergency medical evacuations. Some policies may also cover you for pre-existing medical conditions, but this may vary depending on the provider.

Are there any special clauses to look for when choosing insurance for a cruise holiday?

When choosing insurance for a cruise holiday, it’s important to look out for special clauses that may affect your coverage. For example, some policies may exclude coverage for certain activities such as scuba diving or bungee jumping. You should also check if the policy covers you for any pre-existing medical conditions or if there are any age restrictions.

How does cruise insurance differ from standard travel insurance?

Cruise insurance differs from standard travel insurance in that it is specifically tailored for cruise holidays. It typically offers higher coverage limits for medical expenses, trip cancellations, and lost or stolen luggage. It may also cover you for missed connections, emergency medical evacuations, and 24-hour emergency assistance.

Can you highlight the advantages of purchasing insurance from providers like NTUC or MSIG for a cruise?

Providers like NTUC and MSIG offer cruise insurance policies that cover a range of unforeseen events and offer high coverage limits for medical expenses and lost or stolen luggage. They also provide 24-hour emergency assistance and offer competitive premiums. Additionally, they may offer discounts for purchasing online or for purchasing policies that cover multiple trips.

You Might Find The Following Interesting...

Discover the best places to buy miele vacuum cleaners in singapore, buy bar stools singapore: elevate your home bar game today, smart card buy online: the convenient way to shop in singapore, where to buy dermalogica in singapore: your ultimate guide to finding your perfect skincare products, forklift repair services in singapore: get your equipment running like new, buy bart tickets online: easy and convenient way to travel in singapore, live seafood restaurant singapore: where to find the freshest catch, portable monitor singapore: the ultimate solution for on-the-go productivity, things to do in buangkok square singapore, escrow services singapore: secure and hassle-free transactions, where to buy sumikko gurashi in singapore: a guide to cute and quirky finds, buy used washing machine online: affordable and convenient option for singaporeans, buy google pixel 3 xl in singapore: the ultimate guide for tech enthusiasts, bradford brand: the rising star in singapore’s fashion scene, shop directly from taobao in singapore: your ultimate guide, score affordable style: buy cheap handbags online in singapore, vending machines singapore: revolutionizing snack and beverage access, branded document holder: keep your papers safe and stylish, where to buy weighted blanket in singapore: your ultimate guide, best dry cleaning service singapore: experience top-quality cleaning services today.

Singapore Travel Insurance

Travel insurance for singapore.

Known for its mouthwatering hawker fare, dazzling skyline, and the ever-so-iconic Marina Bay Sands, Singapore is a combination of cultural delights and modern wonders. As you plan your exciting journey to the Lion City, it's essential to consider the unexpected twists and turns that can arise during your travels. In this guide, we'll unravel everything you need to know about travel insurance for your Singaporean adventure.

- What should your Travel insurance cover for a trip to Singapore?

How does Travel Insurance work in Singapore?

- Do I need Travel Insurance for Singapore?

- How much does Travel Insurance cost for Singapore?

- Our Suggested AXA Travel Protection Plan

- What types of medical coverage does AXA Travel Protection plans offer?

- Are There Any COVID-19 restrictions for Travelers to Singapore?

Traveling with pre-existing Medical Conditions?

What should your travel insurance cover for a trip to singapore.

At a minimum, your travel insurance to Singapore should cover trip cancellation, trip interruption and emergency medical expenses. When it comes to international travel, the US Department of State outlines key components that should be included in your travel insurance coverage. AXA Travel Protection plans are designed with these minimum recommended coverages in mind.

- Medical Coverage – The top priority is making sure your health is in order. With AXA Travel Protection, you can have access to quality healthcare during your trip overseas in the event of unexpected medical emergencies.

- Trip Cancellation & Interruptions – Assistance against unexpected trip disruptions can dampen the mood, AXA Travel Protection offers coverage against unforeseen events.

- Emergency Evacuations and Repatriation – In situations where transportation is dire, AXA Travel Protection offers provisions for emergency evacuation and repatriation.

- Coverage for Personal Belongings – AXA offers coverage for your belongings with assistance against lost or delayed baggage.

- Optional Cancel for Any Reason – For added flexibility, AXA offers optional Cancel for Any Reason coverage, allowing you to cancel your trip for non-traditional reasons. Exclusive to Platinum Plan holders.

In just a few seconds, you can get a free quote and purchase the best travel insurance for Singapore.

Imagine you're all set for your vacation to Singapore. You've got your itinerary planned, bags packed, and excitement levels through the roof. However, your flight encounters unexpected delays due to severe weather conditions. Here's where AXA Travel Protection’s "Trip Delay" coverage comes to assist. While waiting for the skies to clear and your flight to take off, you find comfort in knowing that your policy offers coverage for additional expenses incurred during the delay. Whether it's the cost of a meal at the airport or an unplanned overnight stay in a hotel, your travel insurance has got you covered. In times of escalating challenges, AXA is here to assist you in devising a strategic course of action. Here’s the full list of benefits AXA Travel Protection Plans have to offer:

Medical Benefits:

- Emergency Medical Expenses: Should you fall ill or have an accident during your trip, your policy may offer coverage for medical expenses, including hospital stays and doctor's fees.

- Emergency Evacuation & Repatriation: In case of a serious medical emergency, your policy may include provisions for evacuation to the nearest appropriate medical facility or repatriation.

- Non-Emergency Evacuation & Repatriation : In non-medical crises (e.g., political unrest), your policy may cover evacuation or repatriation, subject to policy terms.

Pre-Departure Travel Benefits:

- Trip Cancellation: You may be eligible for reimbursement if you cancel your trip due to a sudden illness or injury.

- COVID-19 Travel Insurance: Coverage is available for trip cancellation and medical expenses related to COVID-19, subject to policy terms and conditions.

- Trip Delay: If your flight faces delays due to unforeseen circumstances, you may have coverage for additional expenses such as meals and accommodations.

Post-Departure Travel Benefits:

- Trip Interruption: In case of an unexpected event, you could be eligible for reimbursement for the unused portion of your trip.

- Missed Connection: If you miss a connecting flight due to delays or cancellations, this coverage may help with expenses like rebooking fees and accommodations.

Baggage Benefits:

- Luggage Delay: If the airline delays your checked baggage, your policy might offer reimbursement for essential items like clothing and toiletries.

- Lost or Stolen Luggage: In the unfortunate event of permanent loss or theft of your luggage, your policy may offer reimbursement for its value, assisting you in replacing your belongings.

Additional Optional Travel Benefits:

- Rental Car (Collision Damage Waiver): Exclusive to Gold & Platinum plan policy holders, this optional benefit gives travelers extra coverage on their rental car against damage and theft.

- Cancel for Any Reason: Exclusive to Platinum plan policy holders; this optional benefit gives travelers more flexibility to cancel their trip for any reason outside of their standard policy.

- Loss Skier Days: Exclusive to Platinum plan policy holders, this optional benefit offers reimbursement to mitigate some costs associated with pre-paid ski tickets that you or your traveling companion cannot use due to specified slope closures.

- Loss Golf Days: Exclusive to Platinum plan policy holders, this optional benefit offers reimbursement to mitigate the expenses linked to prepaid golf arrangements that you or your travel companion are unable to utilize due to specified golf closures.

Do I need Travel Insurance for Singapore?

Starting February 13, 2023, visitors to Singapore are no longer mandated to have travel insurance. However, it's highly advised for all travelers to consider obtaining a thorough travel insurance policy that includes coverage for medical emergencies, trip cancellations, and delays. Why? There are several reasons:

Singapore, known for its top-notch healthcare, might surprise you with unexpected medical costs. With coverage for emergency medical expenses, you're offered coverage and assistance for any unforeseen life events.

Lost Baggage: Airlines sometimes mishandle baggage, and the last thing you want is to be without your essentials in an unfamiliar place. Travel insurance offers to cover the cost of replacing necessary items, allowing you to continue.

Despite Singapore's efficient travel network, unexpected delays can happen. The "Trip Delay" benefit comes in handy, covering extra expenses like meals and accommodation so your travel hiccups do not turn into headaches.

How much does Travel Insurance cost for Singapore?

In general, travel insurance costs about 3 – 10% of your total prepaid and non-refundable trip expenses. The cost of travel insurance depends on two factors for AXA Travel Protection plans:

- Total Trip cost: The total non-prepaid and non-refundable costs you have already paid for your upcoming trip. This includes prepaid excursions, plane tickets, cruise costs, etc.

- Age: Like any other insurance type, the correlation is rooted in increased health risks associated with older individuals. It's important to note that this doesn't make travel insurance unattainable for older individuals.

With AXA Travel Protection, travelers to Singapore will be offered three tiers of insurance: Silver, Gold and Platinum . Each provides varying levels of coverage to cater to individual's preferences and travel needs.

Our Suggested AXA Travel Protection Plan

AXA presents travelers with three travel plans – the Silver Plan , Gold Plan , and Platinum Plan , each offering different levels of coverage to suit individual needs. Given that Singapore hospitals often do not accept U.S. health insurance or Medicare, we genuinely recommend travelers to consider purchasing any of these plans, particularly for the crucial coverage they offer for emergency accident and sickness medical expenses. The Platinum Plan is your go-to choice if you're looking for extra coverage for Singapore’s experience. " Cancel for Any Reason " offers greater flexibility for those unexpected twists in your travel plans and the "Rental Car (Collision Damage Waiver)" offers assistance when you're out exploring Singapore's stunning landscapes in a rental car. For avid golfers planning a swing through Singapore’s world-class golf courses, the "Loss Golf Days" benefit is exclusive to Platinum plan policyholders. This optional benefit steps in to offer reimbursement for pre-paid golf arrangements that you might be unable to utilize due to specified golf closures.

What types of medical coverage do AXA Travel Protection plans offer?

AXA covers three types of medical expenses:

- Emergency medical expenses

- Emergency evacuation & repatriation

- Non-medical emergency evacuation & repatriation

Emergency Medical: Offers coverage when unexpected health issues happen, like broken bones, burns, sudden illnesses, or allergic reactions.

Emergency Evacuation and Repatriation: Can cover your immediate transportation home in the event of an accidental injury or illness.

Non-Medical Emergency Evacuation and Repatriation: Comes into play when you urgently need to leave a place for reasons not related to health. This coverage may assist with evacuation in non-medical situations, such as natural disasters or civil unrest.

Are there any COVID-19 restrictions for travelers to Singapore?

Entry into Singapore for all travelers is permitted without the need for entry approvals, pre-departure tests, on-arrival tests, quarantine, or mandatory COVID-19 travel insurance.

Traveling with preexisting medical conditions can complicate your plans, but with AXA Travel Protection, we're here to support you during your trip.

Traveling with pre-existing medical conditions can complicate your plans, but with AXA Travel Protection, we're here to support you during your trip. Our Gold and Platinum plans offer coverage for pre-existing medical conditions. The Platinum plan, in particular, is our highest-offered choice for travelers who want our highest coverage limits and optional add-ons,

What does this mean for you? If you've got a medical condition that's been hanging around, you can qualify for coverage under our Gold and Platinum plans with a pre-existing medical condition , so long as it’s within 14 days of placing your initial trip deposit and in our 60-day look-back period. We're here to ensure you travel easily, no matter your health situation.

1. Can you buy travel insurance after booking a flight?

You can buy travel insurance even after your flight is booked.

2. When should I buy Travel Insurance to Singapore?

Purchasing travel insurance for your trip is advisable as soon as you have made your initial trip deposit (prepaid and non-refundable trip costs.) AXA Travel Protection offers coverage as soon as you purchase your protection plan. We can give coverage against unforeseen events before you leave for your trip. Additionally, our policies offer coverage for preexisting medical conditions and Cancel for Any Reason if you purchase your protection within 14 days of making your initial trip deposit.

3. Do Americans need travel insurance in Singapore?

From February 2023, Singapore no longer requires travel insurance for visitors, but it's still advised. Given Singapore's reputation for outdoor activities like kayaking and hiking, having travel insurance is essential for emergencies.

4. What is needed to visit Singapore from the USA?

Documents required for entering Singapore include a passport valid for a minimum of six months, an SG Arrival Card (which you can obtain via the ICA website), bank statements demonstrating adequate funds for your stay in Singapore, and a confirmed onward or return flight ticket.

5. What happens if a tourist gets sick in Singapore?

If you become sick in Singapore, travelers with AXA Travel protection can contact the AXA Assistance hotline at 855-327-1442 . Contact information is typically provided within the insurance documentation. Please ensure to read through your policy details and information.

Disclaimer: It is important to note that Destination articles are for editorial purposes only and are not intended to replace the advice of a qualified professional. Specifics of travel coverage for your destination will depend on the plan selected, the date of purchase, and the state of residency. Customers are advised to carefully review the terms and conditions of their policy. Contact AXA Travel Insurance if you have any questions. AXA Assistance USA, Inc.© 2023 All Rights Reserved.

AXA already looks after millions of people around the world

With our travel insurance we can take great care of you too

Get AXA Travel Insurance and travel worry free!

Travel Assistance Wherever, Whenever

Speak with one of our licensed representatives or our 24/7 multilingual insurance advisors to find the coverage you need for your next trip.

JavaScript has been disabled on this browser. For a seamless experience, please enable the option to run JavaScript on this device

- Forms Centre

- Self-Service

Beware of phishing scams. For more information, please visit our Safety Tips page.

The GST rate will increase to 9% on 1 January 2024. Visit this page for more information.

Travel Guard ® Direct

√ Up to $80 in eCapitaVouchers (Single Trip Plan)

√ Luggage & travel data (Annual Multi-Trip Plan)

√ Promo code AIGTGD

√ Promo till 19 May 2024

Make a claim

- Renew Annual Travel

- Make Changes to Your Travel Policy

- Request for Proof of Cover Letter

Current Promotion

May Travel Promotion

Use promo code: aigtgd for annual multi-trip and single trip plans. .

Promotion is valid till 19 May 2024 . T&Cs apply.

AIG Travel Assistance Services

Get 24/7 travel assistance exclusively to AIG policyholders. We operate globally across 8 service centres, with a team that is proficient in over 40 languages , providing comprehensive support for travel or medical emergencies abroad.

Top 3 reasons to buy Travel Guard® Direct

QUICK QUOTE

To get a quick quote, select the destination you are travelling to:.

SINGLE TRIP COVERAGE

The maximum length of each insured trip is 182 days.

ANNUAL COVERAGE

The Insured Policyholder(s) will be covered for an unlimited number of trips made during the Policy Period. The maximum length of each insured trip is 90 days

Policy Type

The policy type shows which people are insured under the policy. You can choose from either Individual or Family cover.

If you choose Individual cover this policy insures you only.

If you choose Family cover this policy insures you and/or your spouse and/or your children.

- Under a Per Trip policy, the family must depart from and return to Singapore on the same itinerary together as a family for cover to apply.

- Under an Annual Multi-Trip policy, cover will apply to you or your spouse whilst travelling separately of each other; however your children must be accompanied by you and/or your spouse for the entire trip for cover to apply.

Group/ Couple

Select this option if you have individuals travelling together on the same dates and to the same destination.

For Group/ Couple up to a maximum of 10 individual policies on the same transaction.

Region 2 Destinations

Brunei Darussalam, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Vietnam

Argentina, Bahrain, Bangladesh, Belize, Bolivia, Brazil, Chile, China (excluding Tibet), Colombia, Costa Rica, Ecuador, El Salvador, Guatemala, Guyana, Honduras, Hong Kong SAR - China, India, Kuwait, Macau SAR - China, Maldives, Mexico, Mongolia, Nicaragua, Oman, Pakistan, Panama, Paraguay, Peru, Qatar, Sri Lanka, Suriname, Taiwan - China, Thailand, United Arab Emirates, Uruguay, Venezuela

Region 3 Destinations

Region 1, Region 2, Australia, Japan, South Korea, New Zealand, Nepal, Tibet - China and the rest of the world.

(Exclude Cuba, Iran, Syria, North Korea or the Crimea region)

Modal Message

Please select coverage type

travelCoverageType

We do not provide Annual Multi Trip for Group

travelPolicyType

Please select policy type

Please select destination(s)

Please select region of travel

Please provide start date

Please provide end date

Please select if you are going on a cruise

Please select if only 1 adult is travelling

Please provide age

less than or equal to

Please provide valid age

greater than or equal to

Please enter age of at least 2 travellers

Please select no of travellers

Key Benefits

Before you buy, travel alerts, testimonials.

COVID-19 Benefits & FAQ

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact AIG Asia Pacific Insurance Pte. Ltd. or visit the AIG, GIA or SDIC websites ( www.AIG.sg or www.gia.org.sg or www.sdic.org.sg ).

Case Study Illustration

Learn more about AIG's Travel Guard Direct

- Policy Wording (issued on/after 24 September 2022)

- Policy Wording (issued on/before 23 September 2022)

Enquiries: 6419 3000 24-hour overseas emergency assistance hotline : 6733 2552 Travel claims : 6224 3698

Enquire online

Send an enquiry

Policy Changes

Make changes to your policy

You might like

AIG On the Go driving app

Score your driving performance and get up to 15% off your AIG vehicle insurance premium.

- Car Insurance

- Corporate Employee Insurance

- Critical Illness Protect360

- Early Critical Illness Insurance

- Fire Insurance

- Home Protect360

- Home ProtectLite

- Hospital Income Insurance

- Maid Insurance

- Mobile Phone Insurance

- Accident Protect360

- Family Protect360

- Singapore Travel Pass

- Travel Insurance

- Business Packages

- Casualty Insurance

- Corporate Travel360

- Engineering Insurance

- Keyman Insurance

- Property Insurance

- Agent Recruitment

- Intermediary Login

- Our Corporate Profile

- Ethics Policy

- News and Media Releases

- HLAH Background and Regional Subsidiaries

- Check Claim Status

- Claim Forms

- Guide To Claims Process

- REGIONAL SERVICES

SAFE TRAVELS START WITH SINGAPORE'S BEST COVID-19 TRAVEL INSURANCE

Protect Yourself with Singapore’s Best COVID-19 Travel Insurance

Important Notice

The Ministry of Foreign Affairs has put up travel advisories against non-essential travel to Israel and Palestinian Territories, and to Iceland. Please click here if you intend to or have purchased a travel plan to these areas.

current promotion

Purchase your travel insurance policy with HL Assurance and you’ll have the chance to win a flight ticket of your choice to your dream destination. The more you purchase, the more points you earn and the more chances of winning! Terms apply.

How to participate.

Get your dream holiday!

Protect you and your family with our COVIDSafe Travel Protect360.

Stand a chance to WIN a flight ticket of your choice

Single Trip

Travel insurance promotion 45% discount, ncd th customer + 1 buddy + ncd-->.

Be protected from COVID-19 with the new travel insurance offer in Singapore – COVIDSafe Travel Protect360! Not only will you be covered for Overseas Medical Expenses and Trip Cancellation due to COVID-19 under our travel protection plan, but we are also now rewarding you with No Claim Discount. *Terms apply.

Please refer to below Single Trip Travel Insurance Promotion Terms and Conditions for more redemption details.

Annual Unlimited