- General Liability Insurance Coverage

- Accident Medical Insurance Coverage

- Directors & Officers Coverage

- Sports Equipment Coverage

- Crime & Bond Insurance Coverage

- Sports Umbrella/Excess Coverage

- Additional Insureds

- Baseball League & Coaching Resources

- Softball League & Coaching Resources

- Covid-19 Information

- Add an Insured Badge To Your Site

- Why Choose eSports?

Baseball Insurance Coverage

Youth & adult baseball leagues.

The team at eSportsInsurance is always responsive and helpful. I have been using them for many years for liability insurance for an adult baseball league and they never disappoint. Eric Proulx

Get a Quote For…

Insurance for baseball teams & leagues.

“Rhonda at eSportsInsurance is the best. She has provided service for Creekview HS for the last couple of years and Macedonia Baseball for as long as I can remember. I highly recommend eSportsInsurance if you need insurance for any type of sport.” Tim L.

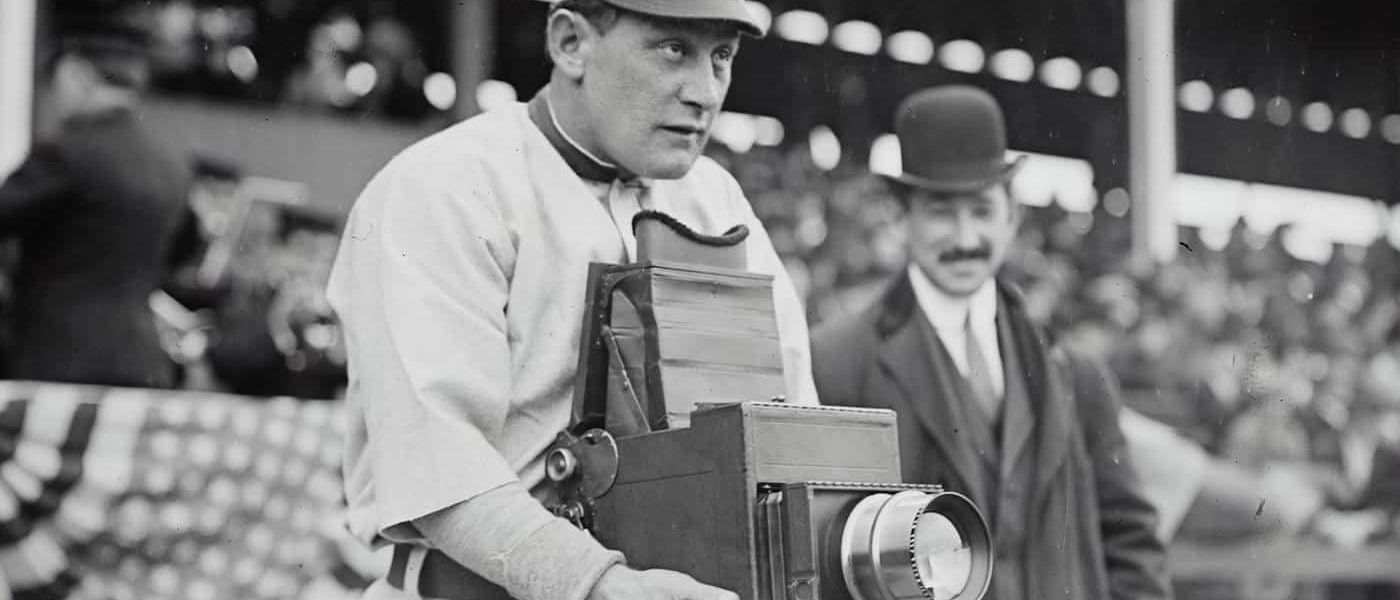

Baseball evolved from older bat-and-ball games already being played in England by the mid-18th century. This game was brought by immigrants to North America, where the modern version developed. By the late 19th century, baseball was widely recognized as the national sport of the United States.

Baseball is an excellent sport for improving coordination, speed, and more. Practicing and competing in baseball also teaches valuable skills like teamwork and perseverance. Owning or operating a baseball league or team is about providing your players these benefits, among many others.

While coaching baseball can certainly be conducted safely, there are always risks to coaching and managing baseball, operating a baseball league, team, or field, or hosting a baseball game or season. Baseball requires much less player-to-player contact than sports like football or rugby, but baseball players are still vulnerable to their own sport-specific injuries.

Even if the baseball league has taken all realistic precautions, it can still be held liable for injuries and other issues related to its events and facilities.

Our insurance policies for baseball leagues, coaches, and teams allow you to focus on providing your services with peace of mind knowing that you are protected against potential risk.

“There are three types of baseball players: those who make it happen, those who watch it happen, and those who wonder what happens.” Tommy Lasorda

Baseball League Coverage Types

We offer both general liability and accident medical insurance for various baseball programs including:

Youth Baseball

Adult baseball.

“I have been working with Rhonda at eSportsInsurance for my Baseball Academy’s insurance for the last 6 years. Awesome customer service and prompt reply to any Additional Insured/Endorsement letters requested.” Adrian B.

What Does Baseball Team Insurance Cover?

General liability insurance for baseball teams.

Our general liability insurance policy provides coverage for claims and lawsuits that allege bodily injury or property damage.

General liability covers up to a specific amount to spectators and other non-members of your organization who file a claim or lawsuit against your baseball organization. Fortunately for policyholders, investigation of the claim and adjustment of any potential payout are taken care of by the insurance company.

General liability also covers property damage that may be due to negligence on the part of the named insured.

Accident Medical Insurance for Baseball Teams

Our excess accident medical policy helps pay for out-of-pocket medical costs for an injured baseball player or coach. Injuries do happen when participating in youth and adult league baseball, and an accident medical policy can keep injured players and coaches from facing a serious financial burden due to medical bills from an injury.

Baseball injuries, in particular, may occur as a result of incidents including, but not limited to, baseball impacts, bat impacts, tripping, sprains, and strains of the legs and arms, and player collision.

Some serious and specific baseball injuries to insure against include:

- Torn Labrum

- Rotator Cuff Injuries

- Dead Arm (Shoulder Instability)

- Ulnar Collateral Ligament (UCL) Injury Of The Elbow Requiring Tommy John Surgery

- Wrist Tendonitis Or Wrist Trauma Injuries

- Pitchers Elbow

- Knee Injuries Or Tears (ACL, LCL, MCL, PCL)

Covered individuals would encompass all registered members of your organization, including participants and volunteers, so long as the injury happened during a covered activity.

The policy pays medical bills for a member who is injured at your practice or game, or during activities you sponsor, if, either the member has no health insurance, or the medical bills exceed what the member’s insurance will pay. The limits for accident medical coverage also exceed those of general liability.

“Randy Marcus did a fabulous job! He helped me get coverage quickly for some baseball camps. It was an easy and smooth process.” Brittany Crain

How Much Does Baseball Insurance Cost?

Team insurance can be $477 or it can be as low as $90 per team, through AYSAA.

There is no difference in insurance coverage cost between travel and recreational baseball .

Here’s how the cost for your baseball league breaks down.

Small Youth Leagues (1-5 Baseball Teams)

AYSAA Annual Membership Fee (per team) = $25 +

$1 Million Team Insurance

- Age groups 12 & under = $65.00

- Age groups 13-15 = $90.00

- Age groups 16-18 – $115.00

$2 Million Team Insurance

- Age groups 12 & under = $89.00

- Age groups 13-15 = $125.00

- Age groups 16-18 – $179.00

Medium-Sized Youth Leagues (6+ Baseball Teams)

- $477 annual premium for up to 75 players

- +$2 per additional player over 75

Adult Baseball Leagues

- Please inquire about adult league pricing

“Our Baseball program has 1,100 players. We started with eSportsInsurance when we had around 12 teams. That was a big deal for us at the time since they are experts in the sports field and saved us lots of money compared to other quotes at the time. A friend of mine recently asked if he could give me a quote and I gave him a shot after warning him that he wouldn’t come close. He never gave me a quote and told me to stick with my current company. Thanks eSportsInsurance. Also, give Rhonda a raise… she’s the best!” Mark M.

Get a Quote

Why choose esportsinsurance, we are sports insurance specialists, our insurance covers the real risks, we offer great rates, we provide personal service, about esportsinsurance.

Sports Insurance Specialists

eSportsInsurance has provided specialized insurance coverage for amateur youth and adult sports organizations since 1999.

Our Location

3100 Five Forks Trickum Road | Suite 101 | Lilburn, GA 30047

Travel baseball insurance.

This youth travel sport has evolved over the years, becoming an integral part of player development and an avenue for honing skills that extend beyond the diamond.

Youth travel baseball has a history that mirrors the growth and passion for the sport. What started as a local pastime has transformed into a dynamic and competitive landscape, allowing talented young players to showcase their skills on a broader stage. From local tournaments to regional competitions, travel baseball has created a pathway for aspiring athletes to elevate their game and compete at higher levels.

Beyond the thrill of competition, travel baseball fosters personal growth, resilience, and camaraderie. Players gain exposure to diverse competition, learn to adapt to different playing styles, and develop teamwork. These experiences not only shape them as athletes but also instill valuable life skills that extend far beyond the confines of the field.

The Importance of Insurance in Travel Baseball: While the journey in travel baseball is filled with excitement, there are also risks associated with the game. In the pursuit of excellence, injuries can occur, and unforeseen incidents may arise. This is where the significance of insurance comes into play.

As a league leader or coach, ensuring the safety and well-being of your players is paramount.

eSportsInsurance comprehensive insurance coverage for travel baseball leagues provides a protective shield, allowing you to focus on nurturing talent and fostering growth. Our tailored policies encompass general liability and accident medical insurance, addressing the unique challenges that travel baseball presents. From bodily injury claims to property damage, we’ve got you covered, offering peace of mind so you can lead your team with confidence.

Together, let’s continue to shape the future of youth travel baseball, where talent is nurtured, growth is inevitable, and protection is assured.

Get a quote today and embark on a season of success, knowing that your team is covered by insurance crafted with your needs in mind.

Free Downloads – For Baseball Coaches & Leagues

We’ve put together Baseball resources to help you more easily coach and lead your league. Check them out at the link below.

A Deeper Historical Dive

“Baseball is 90% mental and the other half is physical.” Former MLB catcher, Manager, & Coach , Lawrence Peter “Yogi” Berra

Baseball is a popular adult sport and one of our top-insured youth sports. With a rich history, it’s been played in North America for over 150 years.

Its deep roots can be traced back to the early 19th century, when games played with a ball and stick were popular in England and North America. In the United States, variations of the game were played in different parts of the country, with different rules and traditions. Some traces of Baseball go back to the 14th century, when it is traced back through its direct antecedents of stoolball and “tut-ball”.

The modern game of baseball is often credited to Abner Doubleday, a Civil War hero who was said to have invented the game in Cooperstown, New York, in 1839. This was derived from a 1908 commission investigating Baseball’s origins. However, there is no historical evidence to support this claim, and most experts believe that baseball evolved from older bat-and-ball games played in England and North America.

By the mid-19th century, baseball became a popular pastime in the United States. The first recorded baseball game was played in 1846 in Hoboken, New Jersey, between the Knickerbocker Baseball Club and the New York Nine. In 1857, the National Association of Base Ball Players (NABBP) was formed, which established a standard set of rules for the game.

In the years that followed, baseball grew in popularity, and professional leagues were formed. The first professional baseball league, the National Association of Professional Base Ball Players, was founded in 1871. It was followed by the National League in 1876 and the American League in 1901. The two leagues merged in 1903 to form Major League Baseball (MLB), which remains the highest level of professional baseball in North America, and the form of the sport we know and love.

While many people today assume that baseball was always a male-dominated sport, the truth is that women played a significant role in its development. In fact, the first recorded women’s baseball game took place in 1866, just 20 years after the first men’s game. Women’s teams were also playing in the late 19th and early 20th centuries, including the All-American Girls Professional Baseball League (AAGPBL), which was active from 1943 to 1954. The AAGPBL was formed during World War II when many male baseball players were drafted into military service, and it helped to pave the way for future generations of female athletes.

In the mid-19th century, children formed their own teams as adults embraced the game. Engaged school, church, and community groups organized teams for working-class boys who used baseball to improve their fitness and learn teamwork. Youth baseball became more organized in the 1920s and 1930s, and Little League Baseball was established in 1939, quickly growing to become the largest youth baseball organization in the world. The Pony League was founded in 1969 to allow older children to continue playing beyond Little League.

Over the years, baseball has seen many changes, including the introduction of new rules, new equipment, and new strategies. It has also played a significant role in American culture, inspiring literature, film, music, and art. Today, baseball is played by millions of people around the world, from amateur players in local youth leagues to professional adult athletes in the MLB.

Learn more about Baseball’s history here.

“It’s hard to beat a person who never gives up.” Former MLB catcher, Manager, & Coach Babe Ruth

Customer Feedback

“We have been with Esports for 6-7 years now as our insurance carrier for our rec baseball league, and it is so easy. Rhonda and her group have always responded to emails and got our quotes to us in a timely fashion. They also have helped us when we had to add some insurance which we didn’t know we needed to carry. I recommend this group for any of your insurance needs!” – Joseph Rafferty

More Sports Insurance Options

Wrestling Insurance Coverage

Dance Insurance Coverage

Fitness Training (Individuals & Companies) Insurance Coverage

- Concessionaire, Exhibitor & Vendor

- Event Insurance

- Sports Camps & Clinics

- Sports Events & Tournaments

- Walk/Run Events

- Baseball & Softball Training Facilities

- Sports Instructors

- Sports Teams & Leagues

- Youth Baseball Insurance

- Fitness & Dance Instructors

- Fitness Studio Insurance

- Health Club Insurance

- Personal Trainer Insurance

- Dance Studio Insurance

- Escape Room Insurance

- Golf Simulator Insurance

- Martial Arts Insurance

- Vendors, Exhibitors & Concessionaires

- Find My Quote

- View My Policy/Certificate

- File a Claim

- Request Certificate

- Additional Insured

- View My Policy

- Privacy Policy

- Legal Notices

- Commitment to EEO

- What is American Specialty Express?

- Why use American Specialty Express?

Youth Baseball Insurance Get your free quote in minutes

Prices start at $105.

Why do I need baseball team insurance?

From the first practice to a national tournament bid, youth baseball insurance protects players, teams and leagues. American Specialty Express offers coverage for teams and leagues across the country from t-ball and coach-pitch to travel teams and national tournaments. Save time and enjoy the peace of mind by working with a company that has specialized in insuring youth baseball for more than 30 years. Our youth baseball program is custom-built to meet all the insurance needs of teams and leagues in one easy-to-use, affordable plan.

Providing evidence of insurance to field owners and tournament organizers can consume a team manager’s life and drain the budget without the right insurance program. With American Specialty Express’ online system, certificates showing evidence of insurance or additional insured status can be obtained at any time and at no extra cost. There’s no limit on the number of certificates so teams won’t need to worry about practicing at multiple fields or playing in several tournaments. The coverage and limits meet the requirements of nearly all ball field owners and tournament organizers nationwide.

The following information is offered as a snapshot of the coverages provided through the American Specialty Express youth baseball insurance program. For a complete description of coverages and exclusions, the policies should be read and reviewed in detail. The precise coverage afforded is subject to the terms and conditions of the policies as issued.

Click here for directors and officers liability insurance program .

How much does youth baseball team insurance cost?

Prices can vary based on your needs, but at American Speciality Express the price of youth baseball team insurance starts at $105.

What exactly does youth baseball insurance provide?

This program is available for youth baseball teams and leagues with players up to age 18. T-ball and coach pitch are also included. A league discount applies for leagues that insure all their teams through the program. The program includes general liability and accident medical insurance with benefits and limits that satisfy the requirements of large and small tournament hosts and field owners alike. A customized abuse and molestation coverage form is automatically included for entities that conduct the appropriate background checks. For travel leagues, coverage goes where they go. Volunteers are covered, and coverage applies year-round for the same team participants. All the fundamental elements of a youth baseball program are covered by this insurance program all the way from tryouts to the team banquet.

What are some examples of when youth baseball insurance might be used?

Scenario 1: An outfielder trips on an uneven patch of ground which causes him to fall into a fence and injure his arm. He is transported to the hospital by ambulance where they determine he has suffered a fracture. The family is relieved to hear the accident medical policy is available to cover out-of-pocket medical bills because their health insurance has a large deductible. The league does not hear anything further from the family but receives a notice from the school district who owns the field that the family has brought a lawsuit against the school district. The league signed a use agreement to use the field and also named the school district as an additional insured on the league’s liability insurance policy. The school district is asking the baseball league to pay the school district’s costs to defend themselves in this case. The league reports the claim immediately to American Specialty, and who works through the matter with the injured player’s family and the school district. Scenario 2: During a practice drill, a young player is hit by a batted ball and suffers a fractured cheekbone. The player has some permanent scarring and medical bills are significant. The family hires an attorney and brings a lawsuit against the coach, the team and the league. The lawsuit argues the coach did not have proper training and that the drill was run in a way that was inherently dangerous to the players. The league’s liability insurer assigns the case to a claims adjuster and appoints and pays for legal counsel to defend the coach, team and league. The claim is ultimately settled with the family for $100,000 in addition to legal bills. The insurer pays these costs, and the coach, team and league focus their efforts on making sure the kids in their baseball program are protected and have the best experience possible. These are just a few examples where youth baseball insurance will provide defense, protect valuable assets, and allow youth baseball programs to focus on serving our youth and providing opportunities to play ball.

How can I get more information?

Although this is an online program, we are available if you have questions. Call us, chat with us online or send us an email. Our youth baseball insurance program is provided by real people who want to help—that’s what special feels like with American Specialty Express. Don’t hesitate to contact us .

Why should I purchase coverage through American Specialty Express?

American Specialty Express delivers the ability to quote and buy affordable insurance for youth baseball immediately and come back to the account anytime. Insureds can secure all necessary documentation online and, once coverage is purchased, eligible additional insureds can be added for no additional cost. Need a copy of the policy? Go online anytime to print a copy of the insurance policy/certificate of insurance, add an additional insured, review coverage or report a claim. Hopefully everything goes smoothly throughout the year, but if an accident occurs where insurance is needed, we provide an easy, hassle-free process to report and manage the claim.

Fast, easy insurance for youth baseball is just a few clicks away.

Availability

We’re ready when you are. Quotes, policies and certificates are always available—even in the middle of the night.

Answer a few straightforward questions, and you’ll have your quotes within minutes. We go the extra mile to make sure our process is fast and easy.

Our team has been trusted by the biggest Sports, Leisure and Entertainment organizations for 30+ years. That same expertise is available to every client, no matter how small.

Toll Free (800) 622-7370

- Get a Quote

- Risk Management Library (Forms, Articles, Templates, Videos)

- Agents & Brokers

- Client Services

Baseball Insurance

Protect your baseball team, league, camp, or tournament with General Liability, Accident, Directors & Officers, Crime and Equipment insurance.

Baseball Insurance for Youth and Adult Teams and Leagues

If you are associated with the below programs, click associated link below to find out more information:

- Dixie Youth

- Dixie Boys/Majors

- Dixie Softball

Insurance policies needed by typical baseball leagues

- Excess Accident with a medical limit of at least $25,000, preferably higher. This policy is a type of no fault insurance that pays medical bills on behalf of injured participants regardless of who was at fault. The coverage is excess or secondary which means that family health insurance, if any, must first respond.

- General Liability with an each occurrence limit of $1 million. It best to consider a $2 million option since many field owners require the higher limit. This policy covers certain lawsuits that allege bodily injury to a player or spectator or property damage.

- Directors & Officers Liability with an each claim limit of at least $1 million. This policy covers many types of lawsuits that are not covered by General Liability, such as wrongful termination or suspension of league administrators or players, allegations of discrimination, and failure to follow your own rules.

- Crime Insurance with a limit of at least $25,000 to protect against employee and volunteer embezzlement or confiscation of equipment or theft of cash by outsiders.

- Equipment Insurance with a limit to cover the replacement cost value of your equipment against certain perils such as theft, vandalism, wind, and fire.

In addition, some larger leagues with additional exposures may need to consider Property Insurance on buildings, Auto Insurance, and Workers’ Compensation.

For a detailed description of each policy, see our report entitled 7 Critical Mistakes to Avoid When Buying Sports Insurance .

Programs Others Have Purchased

- Individual Baseball Instructors Insurance

- Event Cancellation Insurance

- Baseball Camps & Clinics Insurance

- Baseball Tournament Insurance

- Baseball Training Facility Insurance

What Our Clients Have to Say about Our Baseball Insurance Programs

- Thank you for providing a quality baseball insurance product at an affordable rate for our league- having insurance provided peace of mind for our players as well as our field owners. Also, it opened the opportunity for more fields for our men’s baseball league. When we were in a time crunch, your ability to provide our coverage and certification documents in a timely manner allowed us to get our season started on time. We really appreciate the responsive customer service! This is the 3rd year that we have purchased coverage, and we have been very pleased by the sales experience. When a player was injured earlier this fall, we were able to promptly provide paperwork to cover his medical costs. – Central Texas Baseball League TX

- I was referred to you by a friend who had used you on more than one occasion. I was extremely pleased with the ease in obtaining a baseball insurance quote and the efficiency when binding the coverage. – Taylors Baseball SC

- I have used Sadler Sports Insurance for the past (4) Seasons in our baseball program. The price was reasonable for the coverage we needed. Also the customer service people I contacted were eager to help and answered all my questions satisfactory. Would recommend Sadler Insurance to leagues and schools alike no matter the sport. – Seymour Baseball TN

- Sure, Sadler was easy to get a firm quote on and purchase baseball insurance. As our league grew Sadler was also able to adapt to our needs quickly and with fair pricing. – Algonquin Hawks Travel Baseball Assoc. IL

- I have been very pleased with the performance of Sadler Sports for the team’s insurance needs. I am in charge of handling all the insurance issues for the team and I have found your prices to be very fair and your staff very responsive and courteous. There were several times throughout the season where I had to have updates made because of tournament requests and I was able to do this quickly and easily via email. I do most of my communications with your staff by email and they have always been helpful and pleasant to deal with. Thanks to you all for making this job a lot easier. – Colts Select Inc NJ

- We’ve been using Sadler for as long as I can remember for baseball insurance. I like it because I’m volunteering for the position I have with our Association, and like to deal with things that are easy and turnkey. – Springville Youth Association AL

Baseball generates a significant number of minor to medium severity injuries arising from being struck by pitched balls, thrown balls, batted balls, contact with ground, contact with bases, collision with opponents, and non contact injuries while running. Most of these injuries are bruise/contusions, joint sprains, or fractures.

Youth baseball players are also subject to the injuries that occur when there is a lack of supervision at the lower age levels. Examples are injuries that arise from roughhousing or swinging bats when others are too close.

Proper throwing mechanics

It’s critical that pitchers learn how to properly position their throwing arm in the pitching motion. Injury can result if positioning is incorrect during different phases of the pitching motion.

Excessive pitching

Baseball suffers from an epidemic of overuse elbow and shoulder injuries due to pitchers throwing too many pitches over the time period of a game, a week, or an entire season. Adolescent arms are still developing and pitching puts strain on joints and tendons. To avoid injuries to wrists, elbows, rotator cuffs, ligaments, and tendons can result from excessive pitching but can be largely avoided if players and coaches follow a few simple guidelines:

- Most leagues follow rules regarding the number of pitches kids can throw in a game. (See table below).

- All players should take at least 3 months off per year from overhead arm movements.

- If pitchers feel persistent pain in their throwing arm, they should not be allowed to pitch again until the pain goes away.

American Sports Medicine Institute pitching guidelines for youth:

Parents of youth baseball pitchers on independent travel and all-star teams competing in independently-operated tournaments should take extreme caution if there are no rules on pitch limits and rest. Parents may have to track their child’s pitch counts to insure recommended limits aren’t exceeded.

Coach qualifications

Lack of supervision and lack of instruction are two of the leading causes of lawsuits arising out of youth baseball. Specific supervision is one-on-one interaction between a coach and a single player or a small group of players. Elements of proper supervision include the duty to stop roughhousing, being close enough to adequately observe and intervene if necessary, and proper ratio of adults to youth. Proper instruction requires coaches be knowledgeable in baseball specific techniques and game and safety rules, and that these all of these topics are covered with the athletes.

Your child’s baseball coach should be knowledgeable in proper throwing, batting, sliding and catching techniques. Headfirst sliding for young players should be prohibited and batters should be taught how to get out of the way or turn away from a pitch aimed directly at them. The coach should be trained in first-aid and have an emergency medical plan for treatment of injuries in place at all practices and games.

Coaches and umpires should enforce the league’s severe weather policy. Policies for practices and games in extreme heat and when lightning is observed should be established in advance of the season.

Youth coaches and umpires should be certified or trained through an organization such as National Youth Sports Coaches Association (NYSCA) , which provides an appropriate education on the emotional needs of youth, the role of winning vs. having a positive experience, and the basics of safety and risk management.

Sliding into the bases

Sliding is base running strategy, but learning proper techniques of different slide styles is the key to preventing injuries. The video below illustrates how to slide safely and effectively.

Equipment safety

Proper use and fit of equipment is just as big a factor in minimizing the risk of injury. More than half of all organized sports-related injuries occur during practices, so make sure your child wears all required safety gear every time he or she plays and practices. Players should wear the following:

- Protective eyewear. Players who wear glasses should obtain protective eyewear from an eye-care professional knowledgeable of sports-safety standards.

- Catcher’s gear. Catchers must always use a catcher’s mitt and wear a helmet, face mask, throat guard, chest protector, and shin guards.

- Molded cleats. Shoes with steel spikes are usually prohibited and leagues recommend molded cleats. Make sure the shoes fit properly, allowing for side-to-side movement. Avoid hand-me downs because they will probably fit poorly and worn down cleats.

- Mouth guard. A mouth guard protects the teeth, lips, cheeks, and tongue and can even reduce the risk of head and neck injuries as concussions and jaw fractures.

- Cups. Catchers and infielders should wear protective cups.

Field safety

- Prior to play, the playing field should be inspected for holes, glass and other debris.

- Break-away or slide-over safety bases have been proven to reduce sliding injuries resulting from contact with base by a significant percentage.

- Weather conditions should be assessed prior to play and a delay/cancellation plan in place in the event of severe weather or thunderstorms with lightning.

Lightning safety and the 30/30 rule

Outdoor athletic events should be halted or postponed if a thunderstorm is six miles or less away from the site. Use the 30/30 rule for estimating how far away a storm is. Measure the elapsed time from the flash to the bang. A count of five seconds equals a distance of one mile, so a count of thirty seconds equals a distance of six miles. You need to be indoors if, after seeing lightning, you can’t count to 30 before hearing a clap of thunder. Stay indoors for 30 minutes after hearing the last clap of thunder. In most cases, when you can hear thunder, you are no longer safe.

We have a lightning fact sheet that offers more information on lightning precautions, myths, and safety tips.

Auto safety

We recommended that sports organizations that transport high school aged and younger children should require parents to transport their children whenever feasible. We also advise that 15- and 12-passenger vans should never be used when renting or borrowing vehicles to transport athletes. These vehicles have a high rollover rate. School buses, 7-passenger minivans, or passenger cars, are the preferred vehicles for team travel.

Baseball risk management content

Sadler Sports Insurance offers free risk management content for baseball leagues, including articles on important injury topics, legal forms such as waiver/release agreements and medical consent, sources for criminal background checks, sex abuse and molestation risk management programs, general ballpark safety risk management programs, awareness training videos on sex abuse and molestation protection, and how to identify and respond to safety hazards at the ballpark.

In addition, excellent baseball specific safety and risk management articles and position statements have been published by the Medical and Safety Advisory Committee of USA Baseball .

- Accident Insurance

- General Liability Insurance

- Directors & Officers Liability Insurance

- Crime Insurance

- Equipment Insurance

- Cyber Risk Insurance

- Workers’ Compensation

- Business Auto Insurance

- Property Insurance

- Sports Interruption Insurance

- Risk Management

- American Youth Football

- American Football Association

- National Alliance for Youth Sports

- National Field Archery Association

- Sportsplex Developers Association

- Teams Not Affiliated With Organizations

- State High School Assoc.

- Nat. Sports/Rec Assoc. Quote

- Teams & Leagues

- Baton Twirling

- Bicycle Touring/Cycling

- Boxing (Amateur)

- Bubble Soccer

- Cheerleading

- Cross Country

- Disabled Sports

- Field Hockey

- Figure Skating

- Frisbee Golf

- Hiking/Backpacking

- Inline Skating

- Kiteboarding

- Kneeboarding

- Lawn Bowling

- Mountain Biking

- Open Water Swimming

- Paddleboarding

- Racquetball

- Roller Derby

- Roller Hockey

- Skiing-Winter

- Snowboarding

- Track & Field

- Ultimate Frisbee

- Wakeboarding

- Wakeskating

- Wakesurfing

- Water Skiing

- Windsurfing

- Sports Camps & Clinics

- Day Camps (Non-Sports)

- Sports Combine & Showcases

- Tournament Hosts

- International Travel-Medical, AD&D

- Martial Arts

- Indoor Cycling

- Sportsplex/Facility Owners & Operators

- USABSA Baseball / Softball Academies

- Gymnastics Schools

- Cheer Schools

- Martial Arts Studios

- Trampoline Park

- Video Arcade

- Water Amusement Park

- Referee & Umpire Association Insurance

- Dance Studios

- Batting Cage Program for Baseball/Softball

- Bowling Center

- Escape Room

- Golf Driving Range

- Indoor Rock Climbing

- Miniature Golf Course

- Paintball Fields & Facilities

- Racquetball Facility

- Roller Skating Rink

- Skateboard Park

- Fitness Instructors

- Health/Fitness Clubs & Studios

- Special Events (Non-Sports)

- Weather Insurance

- Small Fair & Festival Insurance

- Vendors Insurance

- Entertainers & Performers

- Mud Run and Obstacle Course Events

- Bands and Performing Groups

- Haunted House Insurance

- Music Lesson Insurance for Instructors

- Fishing Tournament Insurance

- Hunt/Shooting/Archery Clubs

- Carriage Ride

- Intramural & Club Sports Insurance

- Multi-Sport / Multi-Operation Organizations

- Referee & Umpire Associations

- Sports Equipment Distributors

SPORTS INSURANCE SPECIALISTS

- CONTACT & CLAIMS

- AGENT & BROKER RESOURCES

- REQUEST A QUOTE

Feb 10, 2022

3 Ways to Hit a Home Run with Travel Ball Accident Protection

If you’re involved in a travel baseball league as a coach, team manager, operations manager, or league owner, you know that travel ball is a different game. The players are more serious. They train hard to improve their skills to a higher level. They play significantly more games than other leagues or school teams. They compete against the top players and teams locally and out of state. And many are hoping to catch the attention of college coaches and pro scouts .

Keeping your players safe from risk is a never-ending responsibility and top concern during the season. Fortunately, A-G Administrators can help—with sports team travel insurance that decreases the financial risk of medical costs from injuries and offers insights into keeping players healthy and performing their best.

Travel Ball Clubs Up Their Safety Game in 3 Ways with A-G Administrators

Participant accident insurance from A-G Administrators protects players and your club from the medical costs of an injury in three important ways:

1. The coverage helps pay for out-of-pocket medical bills due to injury treatment.

- Over 110,000 youth players visit the emergency room each year for baseball-related injuries such as Little League elbow , Little League shoulder , ankle sprains, concussions, muscle strains, and general overuse injuries.

- Though injuries do happen at games and practices, they can also occur traveling to and from events.

- While an injured athlete’s primary health insurance is applied to their bills first, many uncovered expenses, such as deductibles and copayments, are left for the player and their family to pay. Participant accident insurance steps in to cover these costs and free the family from the worry of treatment expenses during recovery.

- If a family doesn’t have primary health insurance, this travel baseball team insurance may be the only coverage they have to help pay the bills.

- These reports not only help keep players healthier, they show current and future players and their families that your travel ball club is fully dedicated to your players’ health and welfare.

- Given that travel ball is more expensive than rec leagues and that so much rides on performance, parents expect this level of knowledge to be put into practice.

3. This coverage can provide your club or league with a layer of protection.

- Families who feel that your club is doing its part to reduce the risk of player injury will feel confident putting their trust in you.

- Offering the coverage helps ensure that families have the financial benefits to cover medical treatment costs. It can also reduce or eliminate the risk of families pursuing litigation against the club because they feel that they have been left alone without any support when a player is injured.

3000 Youth Sports Organizations Already Take Advantage of A-G’s 3-Way Coverage to Reduce Their Club’s Risk

Are you ready to find out how A-G’s youth travel baseball insurance can help your team? We’d love to tell you more.

In addition to youth sports organizations like yours, we provide 675 colleges and universities and over 3,000 K-12 schools with participant and sports accident insurance. We offer a variety of plans to fit your situation and goals, including voluntary plans for parents to purchase or plans for you to purchase for the players. Whichever plans you choose, you’ll relax knowing that A-G is behind you and your team all season long with winning risk protection.

Contact us or have your insurance agent reach out so that one of our insurance specialists can tell you more. We look forward to connecting soon.

MORE RECENT NEWS…

May 01, 2024

A-G Administrators is now A-G Specialty Insurance

Apr 26, 2024

Young Athletes & Cardiac Arrest: How Can Schools Prevent It?

We usually think of heart attacks or sudden cardiac arrest (SCA)—when the heart abruptly loses its normal rhythm and stops beating—as something that happens to older people. After all, heart…

Mar 27, 2024

How ATs Can Ditch the Paperwork & Get More Time With Student-Athletes

More News & Press can be found in our Archive.

A-G ADMINISTRATORS

- Corporate Overview

- Our History

- News & Press Archive

- Career Opportunities

STAY IN TOUCH

Insurance programs.

- K-12 / Scholastic

- College / University

- Clubs / Leagues / Travel Teams

- National Governing Bodies

- Events / Clinics / Camps / Tournaments

- Risk Management

- Mandatory Accident Plans

- Compulsory Plans

- Voluntary Plans

- Interscholastic Sports

- Catastrophic Injury Plans

- Secondary (Excess Injury) Insurance

- Catastrophic Injury Insurance

- Participant Injury Insurance

- Athletic Dept. Travel Insurance

- Third Party Administrative Services

- Other Products

CUSTOMER SERVICE

- Contact A-G

- Submit a Claim

- Check Claim Status

- Request a Quote

- EGBAR Login

- Document Library

- Agent & Broker Resources

Valley Forge, PA USA

Ph: (610) 933-0800

Fx: (610) 933-4122

Office Hours: M-F 8:30am-6pm EST

ACHIEVE GREATNESS!™

A-G has the experience to offer the best custom coverage for every program and the best customer service to ensure a worry-free process for every claim. The nation’s most competitive K-12, collegiate and youth programs Achieve Greatness with A-G!

© 2024 A-G Administrators LLC. All rights reserved. | Privacy Policy

Explore the World with Us

Discover the World

Travel Baseball Team Insurance>Insurance for Teams and Leagues

Travel Baseball Team Insurance provides liability and injury coverage for teams during travel and play. It is essential for financial protection against accidents and lawsuits.

Securing a travel baseball team’s insurance is critical in safeguarding the financial stability and well-being of players, coaches, and the organization. Whether a team is journeying to a local tournament or participating in a series of out-of-state games, the risks associated with sports can lead to unexpected expenses stemming from medical bills, liability claims, and more.

An adequate insurance policy tailored for travel baseball teams offers peace of mind, allowing players to focus on the game while protecting the team’s budget and reputation. It’s a strategic move that underscores the importance of risk management in youth sports and promotes a proactive stance on player safety and organizational responsibility.

Table of Contents

Navigating The Essentials Of Travel Baseball Team Insurance

Travel baseball brings excitement and competition but also risks. Understanding the importance of insurance for your team secures peace of mind and protection. Let’s unravel the mystery of travel baseball team insurance and ensure your team steps onto the field covered for every slide and swing.

Why Insurance Is A Must For Teams

Injuries happen , and medical expenses can soar. Without the proper insurance, teams risk financial hardship. Moreover, potential liability issues make insurance essential. Protecting athletes and assets should be a top priority in any sports endeavor. Insurance mitigates costs from unforeseen events that could jeopardize the team’s future.

Travel Baseball Team Insurance Florida>

Travel baseball team insurance covers teams participating in tournaments, leagues, and other organized events.

This type of insurance typically includes liability coverage, which protects against claims of bodily injury or property damage from team activities. Additionally, it may cover medical expenses for players injured during games or practices and equipment coverage in case of loss or damage.

Travel Baseball Team Insurance offers peace of mind to coaches, players, and organizers, ensuring they can focus on the game without worrying about potential financial risks. View the home page link

Types Of Coverage Available

Diverse policies exist to cover the unique needs of Travel Baseball Team Insurance. Know your options>

- General Liability Insurance> This safeguards against injury claims and property damage.

- Accident Insurance> Covers medical bills if a player gets hurt.

- Equipment Insurance> Protection for gear and uniforms.

- Travel Insurance> Cover losses during travel, like trip cancellations.

Teams can opt for a single policy or a combination to meet their needs. Careful selection ensures comprehensive coverage.

Evaluating Risks And Exposures In Travel Baseball

Travel baseball teams hit the road with dreams of victory and unforgettable experiences. Yet, accidents happen. Players might get hurt. Gear can get lost. Without insurance, these misfortunes can lead to high costs. Knowing what risks exist is the first step in defending against them.

Common Injuries And Incidents

Injuries are part of the game. Sliding into bases, pitching, or flying balls can lead to mishaps. Here are common injuries that players may face:

- Sprains and Strains> Overuse of muscles can cause pain.

- Fractures> A lousy fall or hit by a ball can break bones.

- Concussions> Head injuries need immediate care.

Besides injuries, teams might deal with>

- Theft> Personal items or equipment can be stolen.

- Travel Accidents> Buses and cars can get into crashes.

Financial Impacts Of Uninsured Mishaps

The costs add up quickly. An uninsured injury or incident can drain your budget. Teams facing such situations might experience the following>

Issue Financial Impact

Medical bills for healthcare for injuries can cost thousands.

Lost Equipment Replacing gear can empty pockets.

Legal Fees Lawsuits over injuries or damages can be expensive.

Without insurance, a single mishap could jeopardize a team’s season or a player’s future in the sport. Proper coverage protects dreams and wallets alike.

Comparing Providers> Shopping For The Best Policy

Travel baseball teams often journey far and wide, risking the unexpected. Injury , property damage , and liability claims can strike at any time. Finding the right insurance policy becomes a priority. This guide analyzes how to compare providers and find the best policy for a travel baseball team.

Assessing Different Insurance Companies

Start by listing potential insurers . Look for those specializing in sports team coverage. Examine ratings and reviews left by customers on reliable websites. Consider the company’s financial stability , which indicates its ability to pay claims.

More rows as needed

Company Rating Specialization Customer Feedback

Insurance Pro A+ Sports Teams Highly Recommended

Safe Sports: A Sports Team Positive Reviews

Contact each for a quote. Prepare team information and coverage needs in advance.

Reading The Fine Print> What To Look For In A Policy

Understanding policy details is crucial. Evaluate the coverage limits and ensure they meet your team’s needs. Check for deductibles and premium costs .

- Medical expenses for injured players

- Liability coverage for claims against the team

- Equipment and property protection

- Travel coverage for tournaments away from home

Scrutinize the exclusions section to know what’s not covered. Ask about claim filing procedures and customer support availability .

Before signing, have a legal professional review the policy. This ensures complete understanding and agreement.

Understanding Policy Costs And Payment Options

Knowing the cost and how you can pay is crucial. Regarding travel baseball team insurance, insurance policies safeguard your team against unexpected events, from injuries to liability issues. Let’s explore the factors affecting insurance costs and the different payment options available for your team.

Travel Baseball Team Insurance cost>

Travel Baseball Team Insurance costs can vary depending on factors such as the level of coverage, the number of players, and the duration of the season.

On average, insurance for a travel baseball team can range from a few hundred to a few thousand dollars per year. This insurance typically covers liability for accidents or injuries during practices, games, or team events.

It may also include equipment coverage, property damage, and medical expenses. Travel baseball teams must invest in comprehensive insurance to protect players and organizations from potential financial risks.

Determining Factors In Policy Pricing

In understanding policy costs, several key factors come into play>

- Team Size> Larger teams often result in higher premiums.

- Level of Play> Competitive teams may face higher rates due to increased risks.

- Travel Frequency> Teams that travel more often might pay more for insurance.

- Insurance Coverage> Broader coverage generally equals higher policy costs.

- Claims History> Teams with previous claims may see increased rates.

Each factor impacts the final pricing of your team’s insurance policy, so consider them carefully when planning your budget.

Flexible Payment Plans For Teams

Payment flexibility can make team insurance more accessible. Here’s what teams can expect:

Payment Plan Details

Full Payment Upfront Lump-sum payment, often with a discount.

Monthly Payments Spread cost over the season, which is convenient for budgeting.

Installment Plans Several large payments are more manageable on cash flow than the total upfront.

Team administrators should consider their budget and cash flow for the best payment option.

Claims And Support> Post-incident Procedures

No one ever expects accidents to happen within their travel baseball team. But knowing how to handle claims and receive support becomes crucial when they do. The right insurance can provide peace of mind and necessary assistance. Post-incident procedures help teams return to play with confidence.

Navigating the Claims Process

Navigating The Claims Process And Travel Baseball Team Insurance

Time is essential after an incident occurs. Understanding the steps for filing a claim simplifies the process. Follow this quick guide for a smooth experience:

- Inform your insurance company of the occurrence right away.

- Collect any necessary information and documentation .

- Fill out the claims form accurately.

- Stay in contact with your insurance representative .

Insurance providers might request additional details during the process. Keep all communication records and promptly respond to any inquiries.

Support Services for Teams and Players

Support Services For Teams And Players

After filing a claim, teams and players can access support services. These services aim to aid recovery and mitigate loss. Here’s a glimpse at the available support:

- Medical assistance for injured players, including guidance on coverage for treatments.

- Equipment replacement if the gear is damaged or lost.

- Counseling services may be available to address trauma.

Reach out to your provider as soon as you need help. Support extends beyond financial coverage and includes helping teams cope and rebuild.

Preventive Measures> Beyond Purchasing Insurance

Ensuring players are protected in travel baseball goes beyond just insurance policies. A comprehensive approach to safety is vital. It assists in preventing mishaps from occurring initially. Let’s discuss the effective measures teams can undertake. Implementing safety protocols and conducting training programs are essential.

Safety Protocols To Mitigate Risks

Adopting robust safety protocols is crucial for minimizing risks in travel baseball. Leadership should ensure that:

- Equipment is regularly inspected and maintained

- Emergency plans are in place and accessible to all team members

- First-aid kits are available at every event

By putting these into practice, the likelihood of accidents can decrease significantly.

Training And Awareness Programs

Equally important are training and awareness . These programs can teach:

- The correct way to use equipment

- Proper warm-up and cool-down techniques

- Signs of injury and immediate steps to take

Knowledge empowers players and coaches to prevent incidents and respond effectively if they occur.

Frequently Asked Questions On Travel Baseball Team Insurance

Is insurance required for usssa baseball.

Yes, USSSA Baseball requires teams to have insurance. Coverage must include general liability and accident medical insurance.

How Much Does It Cost To Insure A Baseball?

The cost to insure a baseball varies based on its value, but it can typically range from a few dollars to several hundred annually.

How Does Travel Baseball Team Insurance Work?

Baseball insurance protects teams, leagues, and players from financial losses due to injuries, property damage, and liability claims. Policies cover medical costs, legal fees, and equipment or facility damage.

Do Sports Teams Insure Their Players?

Sports teams commonly insure their players against injuries and accidents to protect the athlete and the organization’s financial interests. This insurance can cover medical costs and contract obligations.

Securing the right insurance for your travel baseball team is essential. Navigate the options and safeguard your players and finances. Trust in proper coverage to ensure peace of mind, on and off the field. Embrace the game’s spirit with confidence, backed by a robust insurance policy.

Choose wisely and play fearlessly.

I am a travel specialized writer and blogger based in the USA and UK, CANADA. I have four years of experience in travel and all types of tours. So I work on solving these issues and give various tips on these issues. I handling carefully of these issues.

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

- Life Insurance

- Health Insurance

- Home Insurance

- Business Insurance

- Travel Insurance

- Pet Insurance

- Medicare Insurance

- Auto Insurance

- RV Insurance

- Business insurance: +1-866-929-3479

- Auto insurance: +1-855-210-4442

- Health insurance: +1-855-982-1671

- Home insurance: +1-855-503-6466

- Life insurance: +1-855-631-2065

- Medicare: +1-855-971-0843

Baseball Team Insurance: Baseball Insurance Quotes From $11

Home › Business Insurance › Baseball Team Insurance: Baseball Insurance Quotes From $11

Finding the right baseball insurance quotes for events, teams, and participants isn’t a walk in the park. It requires time and money. Our discussion will act as your guide. Know the policies included in baseball team insurance, how much baseball team insurance costs, and other related topics.

Also read:

- USA Softball Insurance for Teams & Tournaments

- Sports Team Insurance for Youth & Adult Clubs

- Soccer Insurance for Clubs, Teams, Leagues & Players

- US Lacrosse Insurance: Quotes From $11

- Sports Facility Insurance: Cost & Quotes From $11

Why Baseball Insurance is Important

Think of all the participants and workers in your baseball team plus those who interact with it. They include:

Administrative staff

Team physicians

Community volunteers such as student workers

As a baseball team organizer, the welfare of all these people rests entirely on your shoulders. You want them to have good times without worrying about anything.

But unless you’re a superman, preventing every issue at every time is humanly impossible. Anything can go wrong. For instance:

Coaches, players, and umpires could get injured during games or batting practices

Flying bats or balls could injure someone in the stands

Volunteers might have ulterior motives. They could steal equipment or victimize other people and players in the organization.

A car crash may occur during travel, harming occupants and causing damages

Such issues might lead to serious financial or personal harm. That’s where the right baseball team insurance steps in to mitigate these risks.

- Hockey Insurance for Clubs, Teams, Coaches & Tournaments

- Basketball Insurance: Basketball Team Insurance Quotes From $11

Baseball Team Insurance

Baseball team insurance is a specialized policy that provides coverage to team members, managers, and other individuals part of the baseball team. The policy functions to shoulder costs resulting from lawsuits, injuries, and damage to equipment owned or rented. Examples of baseball team insurance policy are:

General Liability Insurance

Inadequate supervision can cause issues. Players usually contend with a lack of spatial awareness and roughhousing, leading to injuries. Also, a foul baseball can hit a spectator.

In such cases, angry guardians, parents, and people can file lawsuits against the team managers and players. Take general liability, a type of baseball liability insurance that comes with public liability coverage , to cover third-party claims for:

Bodily harm

Property damage

Slander, defamation, and copyright infringement

Accident Insurance

Just like in any other contact sports such as boxing , injuries haunt youth baseball team players. Players collide with each other, get struck by balls, and fall even if they aren’t playing rough. But accident insurance will ensure they focus more on succeeding and less on injuries.

This baseball insurance policy covers the team members during your sanctioned activities. So if a player falls and injures themselves, the policy will take care of the treatment bills.

Baseball Equipment Insurance

Your baseball team needs equipment to succeed. If the equipment gets damaged, stolen, lost, or vandalized, you might incur extra costs. Let baseball equipment insurance help you recover what was spent.

Workers Compensation Insurance

Workers’ compensation coverage covers your staff. If a staff member gets hurt while performing their duties, the coverage will take care of the medical bills and other expenses.

Commercial Auto Insurance

Commercial auto insurance can cover vehicles transporting your players to games. Coverages included in commercial auto insurance are collision, liability, medical payments, and comprehensive.

Directors and Officers Liability Insurance

People with ill motives might falsely accuse your team leaders. Let this policy help them protect themselves.

Travel Sports Baseball Insurance

Baseball teams, whether professional or amateur, travel a lot. Many perils are associated with traveling. These don’t only delay the baseball team but also incur additional costs. The fastest solution, and the most effective one perhaps, is baseball team travel insurance. Let’s discuss the policies included:

Trip Cancellation or Curtailment Coverage

In the event the baseball team’s trip is canceled or curtailed, trip cancellation or curtailment coverage will provide money equal to the non-refundable costs. For example, the policy will give an amount equal to the money spent for vehicle rental or vehicle gas expenses. This coverage’s minimum limit is $10,000.

Personal Accident Coverage

If ever a baseball team member becomes injured while traveling, personal accident coverage will answer the cost of first aid treatment. Personal accident coverage has a minimum limit of $100,000.

Emergency Medical Expenses Coverage

Emergency medical expenses coverage functions to cover further costs if the injury needs specialized treatment. Costs covered are medicinal expenses, medical procedure expenses, and so on. The minimum policy limit of emergency medical expenses coverage is $100,000.

Missed Departure and Journey Disruption Coverage

Missing flights and vehicle breakdown incur additional costs. This is why missed departure and journey disruption coverage is included in baseball team travel insurance. This coverage will take care of lodging expenses plus the cost of renting an emergency vehicle for the baseball team to resume the trip. The minimum policy limit of missed departure and journey disruption coverage is $100,000.

Youth Baseball Team Insurance

If baseball is dangerous for adults, how much more for kids? Carriers offer baseball insurance for youth baseball teams, team managers, and independent trainers. Policies included in team youth baseball insurance are shown in the table below:

Youth Travel Baseball Team Insurance

Youth travel baseball insurance covers perils the youth baseball team might face while on the way to another state or city to do training or join a competition. Let’s discuss the specific policies included:

Trip Cancellation Policy

A trip cancellation policy in youth travel baseball team insurance covers non-refundable payment you’ve made to arrange the trip for the youth baseball team. The job of the trip cancellation policy is to return 100% of the money spent on the canceled trip.

Trip Delay Policy

The youth baseball team’s trip might get delayed. Trip delays incur extra expenses. Carriers understand how problematic extra expenses can be and offer trip delay policy on their travel baseball insurance for youth teams.

A trip delay policy provides an allowance for 5 days amounting to $1,000 in total. In other words, the policy gives $200 a day so that you can pay the extra expenses incurred by trip delays.

Emergency Accident and Medical Sickness Expense

Sickness or accidents can happen while traveling and will incur extra expenses for the youth baseball team. The youth baseball team can also get protection against this through emergency accident and medical sickness expense coverage.

Emergency accident and medical sickness expenses give up to $100,000 to the policyholder in case the youth baseball team members got sick or got injured while traveling. Covered incidents are vehicular accidents, severe motion sickness, and more.

Note that this travel baseball team insurance policy does not pay for costs if ever someone needs to be taken to the hospital. Medical costs as well as the cost needed to transfer someone to the hospital are covered by emergency medical evacuation coverage.

Emergency Medical Evacuation Coverage

Emergency medical evacuation coverage provides $1 million. This policy functions to cover costs if ever someone needs to be taken to the nearest medical facility for treatment while traveling. Covered incidents are vehicular crashes and food poisoning. Other covered incidents are named by the insurance company.

Baseball Camp Insurance

Every summer sees youths heading to baseball camps to hone their skills. They desire to learn the basics of fielding, hitting, pitching, catching, and other techniques.

Each baseball camper may have to bring their own bat, cleats, glove, sneakers, hat, water bottle, and other things. Camps usually involve competitive games.

Baseball camps need to have insurance to operate. The best coverage is through tailored baseball camp insurance which offers general liability, commercial property insurance, accident coverage, and commercial auto insurance.

Batting Cage Insurance

Baseball camps and baseball venues should opt to get batting cage insurance. On average, a batting cage from a reputable brand is $1,455 – $5,600. Batting cage insurance shoulders the cost of replacing or repairing a damaged batting cage. The policy also covers injuries to third parties using the batting cage. Policies included in batting cage insurance are equipment breakdown coverage, general liability, and excess liability.

Those renting batting cages to baseball teams, venues, and camps can get covered through batting cage business insurance, which includes general liability insurance with products and completed operations, inland marine insurance or cargo insurance, and commercial property insurance with equipment breakdown coverage and business interruption coverage.

Baseball Tournament Insurance

Baseball tournaments involve elevated competition levels, increased activities, and many attendants. So from a risk management perspective, these events come with an increased risk of injury and associated lawsuits.

The events consist of teams competing simultaneously, which means an increased number of players, trainers, admins, and spectators. Such huge events also attract sports equipment vendors, food carts , photographers, and volunteers. Unrelated activities also swarm the fields – face painting , bounce houses , and other entertainments

Many risks are associated with a baseball tournament. When they manifest, tournament organizers can be financially liable for the losses of concerned parties. This is why it’s important to get baseball tournament insurance, which includes the policies listed below:

General liability – $1 million policy limit. Pays the compensation for third-party personal injuries and property damage. Coverage applies to the tournament facility owned or rented plus any owned food stands and other amenities.

Medical expense coverage – $1 million policy limit. Pays for expenses incurred if an accident happens and affected individuals need to be taken to the nearest medical facility.

Damage to rented premises coverage – $1 million policy limit. If the tournament venue is rented and got damaged, this policy will help to pay costs if ever the facility owner files a claim to get reimbursement

Directors and officers liability coverage – $1 million policy limit. If such an accident that injured third parties was the result of mismanagement, D&O can help to pay for defense costs plus compensation.

Equipment and contents coverage – $1 million policy limit. In case equipment used for the tournament got damaged, equipment and contents coverage provides money equal to the total value of items to be replaced.

How can risks be further mitigated? Tournament organizers can engage in these risk transfer strategies:

Agreement between the tournament host and participating teams: This agreement includes an indemnification provision favoring the host and requires the teams to have stipulated insurance covers

The teams should provide a certificate of coverage evidencing general liability and other related coverages

Waiver forms (signed by the parent or player) releasing the host from liability

Youth Baseball Tournament Insurance

Youth baseball tournament insurance is specialized coverage for small-scale baseball tournaments where individuals, ages 5 – 18 years old, are the main participants. The table below shows the policies included.

Baseball League Insurance

Baseball league insurance can be categorized as major league insurance and minor league baseball insurance. It is a policy for professional baseball events. The terms of this policy conform to the insurance requirements required by sports organizations and participating teams. Refer to the table below to see the policies included:

Insurance for Little League Baseball Team Events

Little league baseball events can be covered by baseball league insurance. However, there’s also a tailored coverage that might be better – little league baseball insurance. Policies in youth baseball league insurance are:

Accident coverage – $100,000 policy limit

Liability insurance – General liability, cyber liability, and d&o liability each having $1 million policy limit

Crime insurance – $500,000 policy limit and covers disappearance and destruction of the participants’ personal effects. Note that this doesn’t cover arson.

Baseball Player Insurance and Baseball Umpire Insurance

Baseball teams have coverage for players. Also, umpires are covered by the league or tournament host’s insurance policy. But still, players and umpires can get protection for themselves.

Baseball player insurance and baseball umpire insurance are tailored insurance programs offered by sports organizations such as USSSA and NASO. Policies included in both are public liability, professional liability, and personal accident coverages.

Do Baseball Organizations Offer Team Baseball Insurance?

Baseball organizations offer insurance for member players, managers, and teams. Examples are USSSA and MLB.

Major League Baseball Organization – MLB

The Major League Baseball organization offers coverage, which many call major league baseball insurance or MLB insurance for short. MLB insurance on players and other team members is composed of:

MLB lawsuit insurance/MLB suing insurance otherwise called vanguard insurance program comprising of general liability coverage and legal liability coverage

MLB life insurance/MLB insurance for life benefits

MLB pension insurance program

MLB health insurance

Coverage is offered the moment a member makes a claim. This is because MLB sues insurance companies, it partnered with, that refuse to grant the coverage of its members. A good example is the AIG MLB lawsuit.

The United States Specialty Sports Association – USSSA

The United States Specialty Sports Association offers coverage for baseball teams and players. Baseball insurance USSSA is only available for teams registered as members. Furthermore, USSSA baseball insurance can only be purchased online.

So what are the policies included in USSSA team insurance for baseball? USSSA baseball team insurance provides liability and medical coverages for youth teams. On the other hand, adult teams only enjoy liability coverage.

Amateur Athletic Union – AAU

The Amateur Athletic Union offers coverage that many call AAU baseball insurance. It offers a $6 million general liability policy and sports accident coverage to baseball teams taking part in AAU & non-AAU sponsored baseball events.

Help others make better decisions

Baseball Insurance Cost

The average baseball team insurance cost is $45 a month or $540 a year for a $1 million general liability insurance

Travel baseball team insurance cost is $67 a month or $804 a year for a $100,000 accident coverage

Youth team travel baseball insurance cost is $69 a month or $828 a year for a $100,000 accident coverage

Youth baseball insurance costs is $43 a month or $516 a year on average for a $1 million general liability insurance

Batting cage business insurance cost is $35 a month or $420 a year for a $1 million general liability insurance with products and completed operations coverage

For further reference, here’s a table showing the pricing of the best baseball team insurance companies:

USSSA Baseball Insurance Cost

USSSA team insurance cost for baseball is determined by the age of member teams insured:

USSSA baseball team insurance cost 2021 – present is $13.33 a month or $160 a year for teams comprising of players 12 years old or younger

USSSA baseball insurance cost 2021 – present is $16.66 a month or $200 a year for teams comprising of players 12 – 15 years old

USSSA baseball team insurance cost is $20.83 a month or $249 a year for teams consisting of players 16 – 18 years old

Adult teams pay $50 a month or $600 a year for their USSSA insurance coverage

Best Baseball League, Tournament, and Team Insurance Companies

Here’s a quick review that shows the perks and drawbacks of the recommended insurance companies for baseball teams, leagues, and tournaments. Read to know their pros, cons, and monthly pricing for a $1 million general liability coverage.

CoverWallet Baseball Insurance

Gives the policyholder a certificate of insurance for free

Online policy management

Doesn’t offer baseball team travel insurance coverage

CoverWallet covers baseball teams with its sports team insurance underwritten by partners. Coverage applies to liability for third party bodily injuries and property damage. Baseball team property or equipment is covered also. CoverWallet allows the policyholder to get a free certificate of insurance, add stand-alone coverages to the existing insurance, and manage insurance online.

Best for: Baseball team insurance quotes comparison online

Average cost: $30 per month

Our rating: 10/10

Thimble Baseball Insurance

Short-term insurance for baseball tournaments and leagues

Offers certificate of insurance

Rates are lower than other short-term insurance carriers

Only offers basic insurance policies

Thimble’s baseball insurance is tailored for baseball tournaments and baseball leagues for youth and adult teams. Policies included are general liability and liquor liability. Note that Thimble’s coverage can be availed as a short-term policy lasting for hours, days, or weeks.

Bes for: Short-term baseball tournament and league insurance

Average cost: $32 per month

Chappel Baseball Insurance and NW Nations Baseball Insurance

Insurance is underwritten and managed by two companies

Fairly comprehensive general liability and accident coverage

Some customers reported that many documents are required before their claim was processed

NW Nations and Chappell insurance baseball partnership allow baseball teams to enjoy coverage that offers $2 million general liability and accident coverage. NW Nations and Chappell baseball insurance is available to youth baseball teams and adult baseball teams.

Best for: Youth baseball team and adult baseball team insurance with $2 million liability and accident coverage

Average cost: $45 per month

Our rating: 9/10

American Specialty Baseball Team Insurance

Offers coverage for baseball teams, tournaments, and leagues

Need to contact customer support for a certificate of insurance

American specialty’s perfect game baseball insurance provides coverage for baseball teams and baseball tournaments and leagues. It offers general liability and accident medical coverage. Moreover, if the policyholder wants more coverage, the company also allows the adding of coverage for abuse and molestation and non-owned/hired auto coverage.

Best for: Baseball team insurance with optional coverages

Average cost: $50 per month

Our rating: 8/10

Travel Ball Team Insurance

Very transparent rates

Accident insurance is not comprehensive

Travel ball offers $2 million general liability insurance and $100,000 accident insurance coverage in its baseball team insurance. The company states that it doesn’t implement sanction fees and hidden fees.

Best for: Baseball team insurance with transparent rates

Average cost: $52 per month

K&K Baseball Team Insurance

Offers comprehensive coverage for American Legion Baseball events

Optional policies have sub-limits

Only provides coverage for American Legion Baseball

K&K offers tailored american legion insurance for baseball teams taking part in American Legion Baseball events. The policy provides general liability and participant accident limits having optional policies with sub-limits. K&K’s american legion insurance can also be used to cover tryouts, supervised practices, baseball games, tournaments, meetings, and award banquets.

Best for: American Legion Baseball insurance

Average cost: $56 per month

Mestmaker Pony Baseball Insurance

Offers baseball team insurance with optional D&O coverage

Two modes of payment – credit/debit online and paper check

Only insures baseball teams registered with Pony

Mestmaker offers specialized insurance coverage for Pony members. Policies included are general liability and accident coverage. But note that the company also allows the customer to get an optional D&O coverage.

Best for: Baseball team insurance for Pony members

Average cost: $58 per month

Our rating: 7/10

Roberto Clemente Jr Insurance for Baseball Teams

Offers immediate coverage to baseball teams and events

Policies are underwritten by Allstate

Roberto Clemente insurance agency covers baseball teams in partnership with Allstate insurance. Coverages offered by this agency are general liability, equipment breakdown, and other commercial insurance policies underwritten by Allstate, which can be used to cover baseball teams.

Best for: Immediate coverage for baseball teams and events

Average cost: $62 per month

Compare Quotes and Select Baseball Team Insurance with the Best Coverage

Use our quotes generator and find the best travel baseball team insurance, baseball league insurance, and more. Click the “Get Quotes” button to compare quotes. Get the coverage that best fits your needs and budget.

Recent Reviews

Brandyn Longyhore Insuranker

Policy Type: Business Insurance

Company name: Hiscox Insurance

For me this company has proven to be the best to do business with and worth my hard earned money. Contractors this is your company look no further.

Anonymous Insuranker

Decent experience with Hiscox business insurance

Company name: Thimble Small Business Insurance

Best insurance ever

Coolest concept, I wish this was applied to other insurance products too.

Good company. Good and knowledgable customer service. If they don't know something they will pass you on to a more experienced rep that is more knowledgable. So far so good.

Company name: Progressive Insurance

Simple online quoting and purchase. excellent mobile app. claims filing via phone, website or app. Combines competitive rates with excellent customer experience. Progressive provides all of the coverage a small business needs. not to mention its financial strength

Company name: State Farm Insurance

Excellent business insurance coverage tailored to your business needs in good rates, professional customer service, pays claims fast and fairly. Recommended!

Company name: Mapfre Insurance

Not recommended, worst company I've dealt with. Denying claims regularly.

Company name: Next Insurance

Fastest ever online insurance quote and purchase! Also, great rates and professional customer reps that helps with whatever you need, if you need. Nice company!

Paul Burns Insuranker

Company name: Berkshire Hathaway GUARD Insurance Companies

It has been 70 days since I made a claim on the roof of my building. No one from the company will return calls. We are in hurricane season and located in Louisiana. My building is tarped to secure it.

S W Insuranker

Company name: Embroker Insurance