- Skip to main content

- Skip to "About this site"

Language selection

- Français

- Search and menus

Canada at a Glance, 2022 Travel and tourism

- Table 23 Top domestic activities by decrease and by increase, third quarter 2021 compared with third quarter 2019

- Chart 31 Non-resident visitors arriving in Canada by commercial aircraft, June, 2019 to 2022

- Chart 32 Passengers carried by Canadian Level I air carriers, monthly, 2019 to 2022

Travel and tourism… in brief

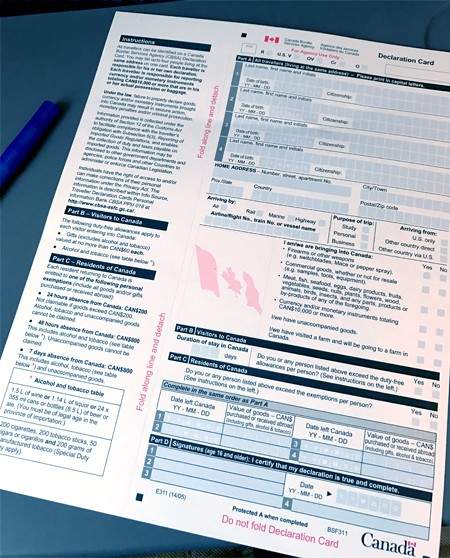

With the onset of the COVID-19 pandemic in 2020, travel and tourism were among the first- and hardest-hit sectors of the Canadian economy. Travel restrictions, border closures and business closures drastically curtailed non-resident arrivals to Canada and altered the travel behaviour of Canadians. As a result, some passenger industries, including airlines and urban transit, were devastated, while others continued to provide essential freight services, including rail and trucking. The food and accommodation industries, along with travel agencies and charter and sight-seeing activities suffered as the flow of international visitors to Canada was reduced to a trickle.

Did you know?

- April 2020 marked the first full month of border restrictions enacted around the world, which brought international travel to and from Canada to a virtual stop. The number of non-domestic arrivals to Canada from overseas countries (countries other than the United States) fell by 96.6%, while those from the United States were down 96.8%.

- Over two years later, in June 2022, the number of international arrivals landing at Canadian airports was nearing levels recorded before the pandemic. Estimates of non-resident visitors totalled 846,700, up sharply compared with the 26,200 arrivals observed in June 2021.

- The impact of the COVID-19 pandemic was far more damaging to the airline industry than any other global event, including the terrorist attacks of September 11, 2001, or the severe acute respiratory syndrome (SARS) outbreak in 2003, which were both associated with year-over-year drops of more than 25% in air passengers. In April 2020, Canada’s airlines reported a year-over-year drop of 97.0% in passengers carried.

- Just over two years later, in May 2022, the 5.3 million passengers on scheduled and charter services reported by Canada’s major airlines were the highest monthly total since before the pandemic. The industry has now recovered over three-quarters (77.3%) of its pre-pandemic traffic.

- During the busy summer travel season, from July to September 2021, fewer Canadians attended festivals or fairs, performances such as plays or concerts, or sporting events as spectators. Compared with the same period in 2019, relatively fewer Canadians reported attending such events, with declines of 82.1% for fairs and festivals, 74.5% for performances such as plays and concerts, and 48.2% for sporting events.

- By contrast, over the same period, more Canadians were engaging in outdoor activities. For example, relatively more travellers reported hiking or backpacking (+47.8%), cycling (+42.7%) and golfing (+35.9%) in the summer of 2021 as part of their domestic vacations.

To learn more

Travel and tourism statistics (statcan.gc.ca)

More information

Note of appreciation.

Canada owes the success of its statistical system to a long-standing partnership between Statistics Canada, the citizens of Canada, its businesses, governments and other institutions. Accurate and timely statistical information could not be produced without their continued co-operation and goodwill.

Standards of service to the public

Statistics Canada is committed to serving its clients in a prompt, reliable and courteous manner. To this end, the Agency has developed standards of service which its employees observe in serving its clients.

Published by authority of the Minister responsible for Statistics Canada.

© His Majesty the King in Right of Canada, as represented by the Minister of Industry, 2022

All rights reserved. Use of this publication is governed by the Statistics Canada Open Licence Agreement .

Catalogue no. 12-581-X

Frequency: Annual

Table of contents

Main page A word from the Chief Statistician Population Immigration Racialized groups Indigenous People Accessibility and persons with disabilities LGBTQ2+ people Women Health Education Criminality Digital society Housing Prices and inflation Impacts of COVID-19 Labour Economy International trade Travel and tourism Agriculture Environment For more information

Please note: For an optimal experience, dashboard data is best viewed on a laptop or desktop computer, due to the complexity of the data presented.

Search This Site...

Top Search Terms

- Featured Reports

Tourism Outlook

- Traveller Behaviour

- City Comparative

Welcome to the Canadian Tourism Data Collective

Fueling canada's hosting economy.

The Canadian Tourism Data Collective is a new, centralized national platform that will serve as a two-way street for sharing and accessing tourism data. The Data Collective harnesses the power of data, research, and insights (and that’s a lot of power!) and shares information in an accessible and secure environment that encourages collaboration and conversation across and beyond the tourism ecosystem.

About us & FAQ

Here’s How It Works

Tourism Performance Indicators

Designed for industry stakeholders and Canadians who want to understand the current state of Canada’s tourism industry, explore the latest data and recent trends on tourism visitation and revenue.

Explore the Data

Source: Statistics Canada, Table 24-10-0055-01

Total overnight arrivals year-to-date (Jun. 2024)

Year-over-Year growth year-to-date (Jun. 2024)

Proportion of 2019 levels year-to-date (Jun. 2024)

Total tourism revenue year-to-date (Q1 2024)

115% proportion of 2019 levels +5% year-over-year growth

Domestic tourism revenue year-to-date (Q1 2024)

121% proportion of 2019 levels +5% year-over-year growth

International tourism revenue year-to-date (Q1 2024)

97% proportion of 2019 levels +7% year-over-year growth

Source: Statistics Canada, National Tourism Indicators

Data and Insights On Demand

Anticipate future tourism spending and activity based on global and domestic travel trends. Plan strategically and with confidence, aligning tourism activities with forecast travel patterns.

Forecast future tourism visitation and spending driven by domestic and international travel, exploring multiple potential paths for growth opportunities.

Track and analyze the health of Canada’s tourism sector at a glance, with timely insights into key performance indicators such as visitor arrivals, traveller spending, and occupancy rates.

Examine the value and impact of tourism in communities across Canada with destination-focused insights that drill deep into tourism spending by region.

Wealth & Wellbeing Index - Preview

Monitor tourism’s impact in economic, social, and environmental sustainability and resilience at both national and provincial/territorial levels with this comprehensive benchmark.

TourismScapes

Scale and plan your tourism efforts using geospatial data that provides insights into hosting economies.

Discover what motivates people to travel, explore factors influencing travel behaviours, and learn about travellers' perceptions of Canada as a destination through in-depth, timely visitor data from Destination Canada’s key markets.

Global Traveller Research Program (GTRP) - More coming soon!

Develop destination-specific marketing strategies and make informed strategic decisions with traveller intelligence from DC’s target markets.

Segmentation Program - Coming soon!

Analyzes psychographics and behaviours of travellers in Destination Canada’s top 10 markets to create in-depth profiles of traveller values and motivators.

Canadian Travel Insights

Use robust and timely insights on Canadian travel consumer perceptions, attitudes, behaviours, and motivators to inform smart tourism planning.

Develop place-specific marketing strategies and make informed strategic decisions with traveller intelligence from Destination Canada's target markets.

Scale and plan your tourism efforts using geospatial data that provides insights into local hosting economies.

Use robust and timely insights on Canadian travel consumer perceptions, attitudes, behaviours, and motivators to inform smart tourism planning.

Latest Reports

Quarterly Tourism Snapshot

Quarterly Tourism Snapshot - Q1 2024, an ongoing monitor of the performance of Canada's tourism sector.

Year-in-Review Overnight Arrivals

Annual research infographic summarizing annual data on international overnight arrivals to Canada in 2023.

Monthly Overnight Arrivals

Monthly research infographic summarizing the latest data on international overnight arrivals to Canada in June 2024.

Sign Up for Destination Canada News

Stay in the know – get the latest Destination Canada news and updates delivered straight to your inbox.

Subscribe and get the latest Destination Canada news and updates delivered straight to your inbox.

SIGN UP NOW

Do you currently work in the tourism industry? *

What type of tourism data is priority for you?

- Tourism Performance

- Tourism Indicators

- Traveller and Marketing Insights

- Tourism Outlook and Forecast

- Destination Development

- Tourism Advancement and Global Competitiveness

- Social License and Resident Sentiment

- Air Capacity and Connectivity

- Accommodation and Occupancy

- Sustainability

- Tour Operators

- Destinations

- Hotels & Resorts

- Agent Feedback

Deals & Incentives

- On Location

- Industry Experts

- Sphere – HomeBased

Digital Editions

- Subscribe today!

- Hotels and Resorts

- Types of Travel

Subscribe Now

Top Story Berlin, Saxony, Rothenburg and more: GNTO’s destination partners shine bright

Hotels and Resorts Free connectors with ACV for Sandals and Beaches Resorts in Jamaica

Contests Travel agent portal WheelsUpNetwork rebrands to Global Agents

Airlines Low pay for junior Air Canada pilots poses possible hurdle to proposed deal

Sign Up for Travelweek

More Featured News

Policies Airlines could be charged millions in new fee proposal from transport regulator

Cruise What’s new for Uniworld in 2025: A new ship, itineraries and cruise extensions

Destinations Floods in Central Europe threaten new areas; heavy rains also flood parts of Italy

Airlines Alaska Airlines completes its acquisition of Hawaiian Air, which will remain a separate brand

Hotels and Resorts What’s the RIU difference? “Service, and the best value for money,” says Kaestner

Nassau Paradise

Beach Bound: Guide to Experiencing the Beautiful Beaches of The Bahamas

Where to Eat in Nassau & Paradise Island in 2024

Top 9 Couples’ Experiences in Nassau & Paradise Island

Eco-Friendly Adventures in Nassau & Paradise Island

Marketplace

Pc – voyages: accounting and bookkeeping specialist, manulife – business development manager.

- Submit a Job

Travel Agent Partner Familiarization Trips Ghana 2024-2025

Save the date for special St. Maarten fam this December

Annual Conference – THIA Events 2024

Granite Events – Fall 2024 Ontario

Luxury Caribbean Cruise on Celebrity Cruises

Join us Down Under and Start Exploring all that Australia has to Offer

Germany is open, and we are thrilled to welcome you back!

WestJet’s new video is the ultimate feel-good, holiday tear-jerker

Top news of the week.

Destinations Berlin, Saxony, Rothenburg and more: GNTO’s destination partners shine bright

Learning Centre

“You are not just a number at TTAND” and here’s why

The power of routine: How travel advisors can thrive as summer ends

How to ramp up your productivity

Nexion Travel Group names 2024 winners; Foster shares plans to step down

travelweek September 12, 2024

travel professional Fall 2024

Cruise TravelBrands adds Riverside Luxury Cruises to its portfolio

Agent feedback sponsored by sphere.

Kathleen Penner’s can-do attitude with Canva proves inspiring for many more agents

Survey shows growth in home based agents, new entrants during pandemic

Tips from a veteran travel advisor on how to close the sale and set service fees

Insights and inspiration from 2023: A memorable year for the industry, and for Travelweek

Travelweek group, travelweek has been keeping travel agents up to date with the latest news for more than 40 years..

In addition to the weekly printed Travelweek publication and monthly Travel Professional, we have many exciting digital marketing channels like Travelweek Daily newsletter, the Learning Centre and French-language Profession Voyages, plus full warehousing and distribution capabilities with ENVOY Networks.

Founded in 1930 to encourage the development of tourism in Canada, TIAC serves today as the national private-sector advocate for this once $105 billion sector. Based in Ottawa, TIAC takes action on behalf of Canadian tourism businesses and promotes positive measures that help the industry grow and prosper.

TIAC is responsible for representing tourism interests at the national level, and its advocacy work involves promoting and supporting policies, programs and activities that will benefit the sector's growth and development.

TIAC's membership reflects partnerships among all sectors of the industry, and provincial, territorial and regional tourism associations, enabling the association to address the full range of issues facing Canadian tourism.

Vision and Mission

Our vision: To lead the Canadian tourism industry to be the most competitive in the world.

Our mission: To be the voice of Canada’s tourism industry and improve its global competitiveness as an international destination through leadership and advocacy.

- Secured permanent base funding for Destination Canada funding to $95.5 million per year;

- $8.6 million dedicated to Aboriginal Tourism development through Indigenous and Northern Affairs Canada;

- $13.6 million dedicated to Statistics Canada’s collection of tourism statistics, including provincial data collection;

- Significant investments to maintain Parks Canada land and the Trans-Canada trail;

- Significant infrastructure investments supporting tourism industry;

- Successful Trade Mission to China in October 2016 through government funding to offset costs for SMEs;

- Announcements for 7 new visa application centers (VACs) in China;

- Promoted and achieved the expansion of the number of Visa Application Centres (VACs) to 135 worldwide;

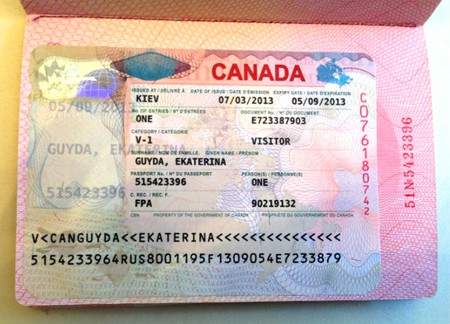

- Mexican visa requirements lifted completely, and Brazilian, Romanian and Bulgarian visas lifted for eligible travellers;

- TIAC’s recommendations to reduce aviation costs in the Canada Transportation Act included in expert panel’s final report;

- Introduction of new ten-year multiple entry visa, facilitating repeat visitors to Canada in select markets; and more …

TIAC Successes

2022 Successes

- Held CRA sessions on C-2 support programs for Coalition members to have questions answered

- Submitted a comprehensive pre-budget submission to the federal government with industry input and support positioning key advocacy recommendations into three priority areas: Financial Supports; Branding and Barriers and the Labour Shortage LINK

- Successfully advocated for testing requirements to be updated to include the option of antigen pre-arrival test for fully vaccinated travellers o Held an industry-wide briefing with Public Health Agency of Canada

- Hosted a successful Hill Week from February 15-17, 2022 with over 50 meetings

- Restart of the cruise in Canadian waters – much work and advocacy done by the TIAC Cruise Committee

- Significant work undertaken with Tourism HR Canada and government partners to begin addressing the tourism labour challenge

- Successfully advocated for testing requirements to be updated to remove the requirement for pre-travel testing, and move mandatory random testing offsite

- Submitted a comprehensive submission to the federal government with input from national counterparts and members across the country, in advance of the new Federal Tourism Growth Strategy LINK

2021 Successes

- After months of advocating for sector specific support, Bill C-2 passed on December 17th. The new support ensures Canada's Tourism Industry; the "Hardest Hit Sector" will continue to receive wage and rent relief and save thousands of businesses and jobs. LINK

- TIAC welcomed the reintroduction of a Minister of Tourism with the appointment of the Honourable Randy Boissonnault as the new Minister of Tourism and Associate Minister of Finance. LINK

- Tourism and Hospitality Recovery Program : We knew that the wage and rent subsidy programs were slated to sunset at the end of October. So, we continued to push for a tailored solution. A demonstration of our efforts came when, as the first commitment on the campaign trail, Prime Minister Trudeau announced support for the hardest hit sectors, including a transition program that was very much aligned with the survival plan the Coalition had been advocating for. TIAC wrote many letters, made many phone calls, set up many meetings with Members of Parliament, Department officials and Senators, and appeared before the Standing Committee on Finance, as well as countless times in the media fighting for this bill. In December, we saw the greatest acknowledgement of these efforts. Bill C2: An Act to provide further support in response to COVID-19 was passed by both the House of Commons and the Senate. LINK

- The Prime Minister announced a standardized Canadian COVID-19 proof of vaccination, noting that Canada was engaging with international partners to obtain recognition abroad, so the tool could be used to facilitate travel around the world. This was a win for the tourism industry as TIAC had been advocating for one pan Canadian proof of vaccination system. We know that since then there is much confusion regarding the Omicron variant and the changing travel rules and restrictions. Our biggest priority through this is clarity for the industry, and ensuring we continue to advocate for one process. As we start to see provinces and territories reacting with their own measures, we need to ensure we are vocalizing the need to not move backwards into a fragmented system. LINK

- The U.S. accepted travelers immunized with vaccines approved by the WHO– including Canadians who have received the Oxford-AstraZeneca vaccine. Encouraged to see this as TIAC continues to advocate for a national proof of vaccination in Canada, and for travelers with vaccinations approved by the WHO - in addition to those approved by Health Canada - to be welcomed back. LINK

- The lifting of the government's international ban on non-essential travel was very welcome as we continue to build consumer confidence in travel again. TIAC advocated for this through the Coalition of Hardest Hit Businesses.

- The ban on cruise in Canadian waters was rescinded four months early due to advocacy work. Effective November 1, 2021, cruise ships were permitted in Canadian waters. Canada is working with the cruise ship industry, and other domestic and international partners, to support safe cruise ship travel in spring 2022. This allowed for ability to plan for 2022 season. LINK

- TIAC has been working tirelessly with industry partners requesting targeted support for the tourism industry. The TRF provided $500 Million in support for the tourism sector over a two-year period. The majority of the funding, $485 million, will be delivered by Regional Development Agencies (RDAs) directly to tourism businesses and organizations to help aide in the creation of new tourism experiences, or enhance existing ones. Of this $485 million, a minimum of 10% will be invested in Indigenous tourism projects. LINK

- TIAC announced the launch of the #OpentheBorder campaign, calling on the federal government to commit to a plan for reopening the Canada-U.S. border. The campaign focused on getting Canadian decision-makers to acknowledge the urgent need and to commit to a date to open the border, before the summer tourism season was lost. As a part of this campaign, TIAC hosted a number of Parliamentary and Congressional panels to discuss border reopening. The first included Beth Potter, MP Wayne Easter, Congressman Brian Higgins, and political reporter Althia Raj.

- Two press conferences with ALL PTTIAs (13) involved and supporting Tourism Week and the Open the Border campaign

- TIAC formed a national Cruise Committee, comprised of representatives from the five cruise regions: Atlantic Canada, Quebec, Ontario, British Columbia and Northern Canada. This advisory committee works hand in hand with TIAC to identify cruise-related issues and provide recommendations.

- Relaunch of Tourism Round Table - TIAC as Co Chair. The Roundtable is focused on raising awareness on the barriers to travel and tourism caused by restrictions and testing requirements. We know there are more effective ways to protecting Canadians while also encouraging and facilitating travel. LINK

- Sector-specific acknowledgment for tourism in 2021 Federal Budget. LINK

- Hosted Industry Webinars providing updates on industry support efforts and partner plans. LINK

- Launch of TIAC 'Member Talk' - a monthly session open to membership to ask questions to the TIAC senior team. LINK

- Coordination of Town Hall events in partnership with Destination Canada and provincial and territorial associations. LINK

- Government announced a program change to CEWS to base year-to-date revenue comparison on 2019 revenue. LINK

- Coordinating the 2021 Tourism Week campaign for industry coast to coast to coast. Encouraging Canadians to take the Tourism Week pledge to travel in Canada this year. TIAC and tourism Week was featured on many significant media outlets. Tourism Week kicked off with a press conference held on May 21 at 11am EST. Representatives from every Provincial and Territorial Association were in attendance, as well as Destination Canada. A big focus of this year’s Tourism Week was on showcasing the solidarity of the industry, and celebrating its resilience. 34 individual media registered for the conference, including CBC, National Geographic and the Globe and Mail. A press release was distributed following the conference, followed by press releases each day from May 23 – May 30. TIAC highlighted a different region of the country each day of Tourism Week. LINK

- Coordination and execution of 2021 virtual advocacy days including TIAC Board Members in advance of the 2021 Federal Budget. Coordinated our first-ever, virtual Hill Week, online meetings with over 100 MPs.. LINK

- Launch of the 2021 Tourism Recovery Plan developed by the Tourism Recovery Committee. Comprised of tourism leaders from across Canada, representing all sectors of the visitor economy. It produced 2 reports with recommendations. This group met on a weekly basis to share status updates, ideas, and participate in dialogue on challenges and priorities for policy change and emergency support programs. LINK

- RRRF Funding Dedicated to Tourism outlined in Fall Economic Statement.

- Through TIAC's advocacy, HASCAP rollout was expedited and became available to industry in February 2021. LINK

- Elevating Canadian Experiences National Program delivered more than 100 capacity-building sessions in both culinary tourism development and winter/shoulder season development to over 4000 tourism operators and destination partners in 2020 and early 2021. We also supported the development of nine regional tourism development strategies. We also developed a suite of legacy tools from the program that is available to all Canadian tourism operators and destination partners. LINK

- Deployment of a weekly COVID-19 update outlining media and advocacy updates for the industry. LINK

- The undertaking of no less than six industry surveys including analysis of data and dissemination of information to stakeholders and partners on the state of the industry as well as the federal government on the effectiveness of relief programs. LINK

2020 Successes

- The Tourism Industry Association of Canada named one of WTM Virtual World Travel Leaders, the annual recognition of companies and individuals from around the globe which have had a positive impact on a specific region or sector. LINK

- Commissioned the State of the Industry Report, a monthly snapshot of recent global, regional and domestic tourism health and economic updates, and insights on the impact of COVID-19 on the travel and tourism industry’s path to recovery. LINK

- Partnership with The Globe and Mail to encourage Canadians to choose a summer holiday exploring Canada. LINK

- Successful execution of the first-ever virtual Tourism Congress with over 3,000 registered attendees. LINK

- Specific mention and recognition of tourism in the November 2020 Fall Economic Statement. LINK

- Hardest Hit mentioned in speech from the throne and fall economic statement through efforts with the Coalition of Hardest Hit Businesses. LINK

- Tweaks to CEWs, CERS, other relief programs for tourism.

- Immigration rates

- Coordination of Town Hall events in partnership with Destination Canada and provincial and territorial associations.

- Development and deployment of a weekly COVID-19 update outlining media and advocacy updates for the industry. LINK

- As a result of COVID, DC has redirected $30M through Provincial Marketing Organizations to support DMO marketing campaigns.

- $40M through the RRRF fund is directed to support DMOs.

- TIAC hosted 2020 Tourism Week.

- Introduction of a COVID recovery plan.

- Wage subsidy program (CEWS) to keep labour force employed +CERB program to help those who have lost their jobs weather the storm + Changes to EI program to support laid-off employees - Recent promises in the Throne Speech indicate that this program will be extended through summer 2021.

- Creation of the COVID-19 Recovery Committee, with representation from regions across Canada and from all sectors of the tourism economy.

- Work Share program extended from 38 to 76 weeks – allowing businesses operating at lower capacity to keep employees on the payroll and share resources.

- Waived EI waiting period for those in quarantine.

About our Membership

TIAC's membership is as diverse as our country itself. We represent:

- Over 600 members and thousands of affiliate members from coast to coast to coast

- Over 1.8 million Canadians whose jobs depend on the economic activity generated by travel and tourism

- Large national and multinational companies as well as small- and medium-sized enterprises

- Airports, attractions, concert halls, convention centres, duty-free shops, festivals & events, restaurants & foodservices, arenas, transportation, travel services, travel trades, destination and provincial/territorial marketing organizations, suppliers, travel media, and educational institutions

Join TIAC today

For additional information

Please contact:

Jennifer Taylor Vice-President, Business Development & Member Relations 902-698-0984 [email protected]

- Meet The TIAC Senior Team

- Board of Directors

- Advisory Committees

- RFP: Tourism Congress & Canadian Tourism Awards

Join our mailing list

- Visit Parliament Visit

- Français FR

Research publications

About this publication

Executive Summary

1 introduction, 2 global travel and tourism, 3.1 general, 3.2 key details for 2019, 3.3 travel by canadians, 3.4 indigenous tourism, 3.5 canada–united states tourism, 3.6 international competitiveness, 4.1 destination canada, 4.2 federal tourism strategy, 4.3.1 2008–2013, 4.3.2 2016–2017, 4.3.3 2019, 4.3.4 2021, 4.4 other government players, 5 looking ahead.

Canada’s multi-billion-dollar tourism sector employs hundreds of thousands of Canadians and is supported by all levels of government.

In 2020, due to the COVID-19 pandemic, global tourism and travel sector revenue decreased by 49% from the previous year, to US$4.7 trillion. Global tourism employment fell by 19% to 272 million jobs. Similarly, the Canadian sector earned $49.5 billion in 2020, a decline of 40% from 2019, while domestic employment fell to 1.6 million direct and indirect jobs, a decrease of 24%. About 28% of Canadian tourism revenue is generated from inbound visits.

In 2019, Canadians made 37.8 million foreign trips consisting mainly of 27.1 million visits to the United States. Additionally, Canadians made 10.7 million trips to other countries, most frequently Mexico (1.8 million), Cuba (964,000), the United Kingdom (770,000), China (666,000) and Italy (619,000).

According to the World Economic Forum’s Travel & Tourism Competitiveness Report 2019 , which ranks the most competitive countries for travel and tourism, Canada ranked ninth out of 140 countries studied, down from eighth place in 2013. Canada ranked first in several sub-categories, such as safety and security, environmental sustainability and air transport infrastructure. Conversely, Canada was found to be deficient in several areas, including price competitiveness and international openness.

Other studies have found that tourism demand is concentrated in Canada’s largest cities, with Toronto, Vancouver and Montréal accounting for 75% of overall visitors and most of this activity taking place during the summer months. There are also challenges stemming from labour shortages, a lack of investment and promotion, and a lack of coordination of tourism policy between all levels of government.

Destination Canada (formerly the Canadian Tourism Commission) is a federal Crown corporation responsible for national tourism marketing and is governed by the Canadian Tourism Commission Act . In 2019, the federal government announced Creating Middle Class Jobs: A Federal Tourism Growth Strategy , which is based on the following three pillars: building tourism in Canada’s communities; attracting investment to the visitor economy; and renewing the focus on public-private collaboration.

Between 2008 and 2020, the federal government invested approximately $1 billion in the tourism industry. In 2021, it announced another $1 billion in funding, including the Tourism Relief Fund.

If international borders continue to reopen and the industry continues its steady overall growth of the recent years prior to the pandemic, it will again contribute to Canada’s economic well-being. And although the United States continues to be Canada’s biggest tourism trading partner, stakeholders might continue their efforts of focusing on more growth-oriented, lucrative emerging markets to better diversify tourism interests to help Canada fulfil its tourism potential.

Canada’s tourism industry is an important contributor to Canadian economic growth. This industry – which comprises hospitality and travel services to and from Canada – is a multi-billion-dollar business that employs hundreds of thousands of Canadians and is supported by all levels of government. This HillStudy provides information about Canada’s tourism industry, travel patterns of visitors to and from Canada, the importance of the United States (U.S.) to Canada’s tourism economy and the role of the federal government.

The global tourism sector suffered substantial declines in activity due to the COVID-19 pandemic. Since this HillStudy incorporates data from 2019 and 2020, special attention should be paid to both explicit tourism figures and relative comparisons to previous years due to the extraordinary effects of the pandemic.

According to the Tourism Industry Association of Canada, “travel and tourism” includes “transportation, accommodations, food and beverage, meetings and events, and attractions,” such as festivals, historical/cultural institutions, theme parks and nature settings. 1

The World Travel & Tourism Council’s latest annual research explains the COVID 19 pandemic’s impact on the global travel and tourism sector:

- The sector suffered a loss of almost US$4.5 trillion in revenues worldwide, standing at US$4.7 trillion in 2020.

- In 2019, the sector contributed 10.4% to the global gross domestic product (GDP); this decreased to 5.5% in 2020 due to ongoing mobility restrictions.

- In 2020, 62 million jobs were lost, representing a drop of 18.5% of global sectoral employment, leaving just 272 million employed compared to 334 million in 2019.

- Globally, domestic visitor spending decreased by 45% and international visitor spending declined by 69.4%. 2

3 The Canadian Tourism Industry: Facts and Figures

Only about 28% of Canadian tourism revenue (about $21.3 billion) is generated from inbound visits. The remainder represents domestic spending – i.e., what Canadians spend on domestic and foreign tourism activities. Table 1 provides further information about the industry’s recent performance.

Note: Domestic spending includes spending while on a trip in Canada, spending on airfares with Canadian carriers on outbound trips and spending on tourism-related goods, e.g., camping equipment. International spending includes spending while on a trip in Canada but excludes any pre-trip purchases. GDP refers to gross domestic product.

There are two ways to categorize jobs in tourism:

- Jobs in tourism-dependent industries – the total number of jobs in industries where a significant portion of the revenue is in tourism; this includes accommodation, passenger transportation, food and beverage, entertainment and recreation, and travel services.

- Jobs directly supported by tourism – the share of jobs in the economy servicing visitors as opposed to local clients. These are jobs that would not exist without visitors; e.g., in food and beverage, a certain portion caters to local clients, and the portion that caters to visitors is captured in this number.

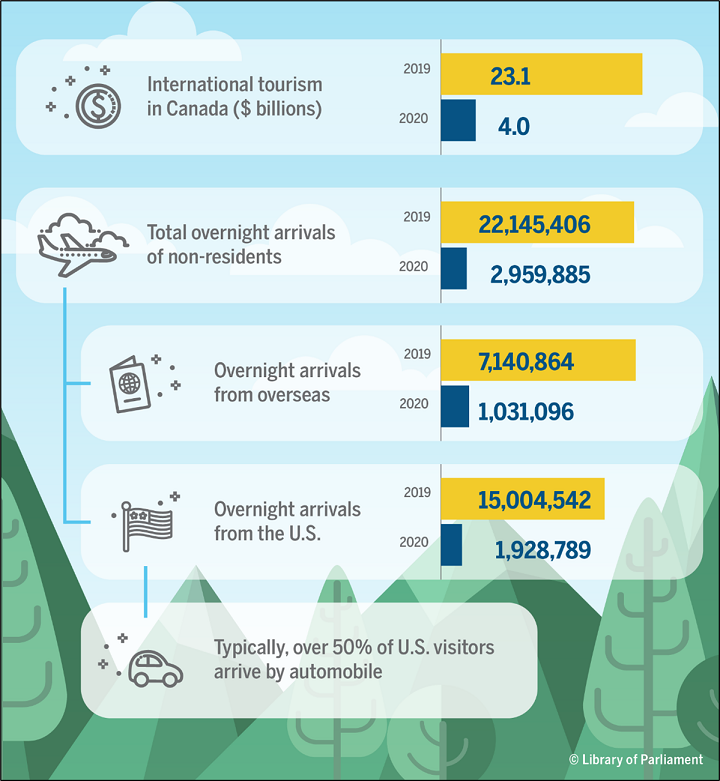

Figure 1 provides further details about international arrivals to Canada.

Figure 1 – Selected Information on International Arrivals to Canada

According to Destination Canada, prior to the pandemic, Canada benefited from the fact that the tourism sector was booming globally. Since 2000, tourism has been growing approximately three to four times faster than the global population and about 1.5 times faster than the overall global GDP . Furthermore, notwithstanding the COVID-19 pandemic, this was expected to continue into the mid-2020s. In fact, 2017’s travel and tourism sector growth of 4.6% exceeded the global GDP growth rate of 3.7%; that is, for the seventh successive year, the sector outpaced global GDP growth, which itself had the strongest growth a decade. 3

However, even with this strong performance, Canada’s tourism industry potential remains significantly underdeveloped. Specifically, even though it has outpaced global population and GDP growth, Canadian tourism growth has lagged behind global tourism growth for several years (see section 3.6 of this Hill Study). 4

Moreover, tourism represents a much smaller fraction of Canada’s exports when compared to peer countries such as the U.S., Japan, the United Kingdom and Australia. Studies suggest there is an opportunity for Canada to more than double its international arrivals and associated revenues by 2030. 5 This could be achieved, in part, by capitalizing on “substantial opportunities to increase the number of tourists to Canada from the United Kingdom, China, France, Germany and Australia.” 6

Beyond its role in helping to create revenue and both direct and indirect jobs in the Canadian tourism industry, the efficient promotion of tourism can be seen as a valuable investment in Canada’s overall economy. A 2013 Deloitte study has shown that “a rise in business or leisure travel between countries can be linked to subsequent increases in export volumes to the visitors’ countries.” 7

In 2019, the Canadian tourism sector had its best year on record, reaching 22.1 million international overnight arrivals, a 4.8% increase over the previous year. Similar to other years, the vast majority (67.7%) came from the U.S.; the top three non-U.S. sources of visitors were the U.K. (875,632), China (715,474) and France (668,490). 8

Destination Canada reported that “air and sea arrivals from the Europe region were mostly on par with 2018 levels, with the exception of France, which led the region (+7.0%).” 9 However, there were mixed results from the Asia-Pacific region as the biggest decline came from the region’s largest market, China (-9.1% in air and sea arrivals), with smaller downward trends from Japan (-1.9%) and Australia (-0.4%). More positively, air and sea arrivals from South Korea were slightly ahead of 2018 levels, while India led the region in year-over-year growth (+9.1%). 10

In North America, the U.S. provided an increase in arrivals on overnight trips entering Canada by air and auto of 6.4%. Mexico was the only one of Destination Canada’s long-haul markets to record double-digit year-over-year growth in overnight arrivals by air and sea (12.3%) in 2019. 11

Canada’s rising popularity among Chinese travellers is particularly noteworthy, as China is now Canada’s second-largest overseas tourism source after the U.K. 12 This is partly attributable to Canada’s having been granted Approved Destination Status by the Chinese government. In 2018, Canada welcomed a record 737,000 Chinese tourists, “surpassing the 700K mark for the first time and doubling the number of annual travellers since 2013, with an average annual growth rate of 16%.” 13 Travelling mainly during July and August, “Chinese tourists spend on average about $2,850 per trip to Canada, staying for around 30 nights.” 14

In 2019, Canadians made 37.8 million foreign trips consisting mainly of 27.1 million visits to the U.S. Although travel to the U.S. declined by 2.3% in 2019 compared to 2018, Canadians “spent $21.1 billion on their trips to the United States in 2019, up 4.8% from a year earlier.” 15

Additionally, Canadians made 10.7 million trips to other countries, the most common of which were Mexico (1.8 million), Cuba (964,000), the U.K. (770,000), China (666,000) and Italy (619,000). 16

Canadians also enjoy travelling within the country, making 275 million domestic trips in 2019, down 1.0% from 2018. Spending on trips within Canada declined 0.3% year over year to $45.9 billion. 17 The top locations were Ontario (116.5 million visits), Quebec (56.9 million visits), British Columbia (34.2 million) and Alberta (32.4 million); this includes both intra and inter-provincial/territorial domestic travel. 18

Canada’s Indigenous tourism sector is diverse and comprises different business models. Although its key drivers of employment and GDP come from air transportation and resort casinos, “it is the cultural workers, such as Elders and knowledge keepers, who define many of the authentic Indigenous cultural experiences available to tourists in Canada.” 19 Moreover, when compared with Indigenous tourism enterprises without a cultural focus, those involved in cultural tourism rely more on visitors from foreign markets as part of their customer base.

Prior to the pandemic, Canada’s Indigenous tourism sector had been rapidly outpacing overall Canadian tourism activity. Specifically, the Indigenous tourism sector’s GDP rose 23.2% between 2014 and 2017, reaching $1.7 billion. 20

Lastly, Indigenous tourism businesses cite access to financing as well as marketing support and training as some of the main barriers to growth. 21

Given its proximity and long shared border, the U.S. is by far the biggest source of Canada’s tourism visitors: in 2018, about two-thirds of all foreign visitors were Americans, 57% of whom arrived by automobile. 22 The U.S. is also the most visited foreign destination by Canadians.

U.S. arrivals to Canada reached 14.44 million in 2018, up 1% over 2017 and the highest level recorded since 2004. American tourists like to take advantage of their long weekends for travel, with Memorial Day (the last Monday in May), Independence Day (4 July) and Labour Day (the first Monday in September) contributing to the largest weekend spikes in road arrivals in 2018. 23

Americans spend around $700 per trip to Canada, staying an average of five nights. In 2018, they preferred mainly nature-based activities, including natural attractions, hiking or walking in nature, and viewing wildlife. 24

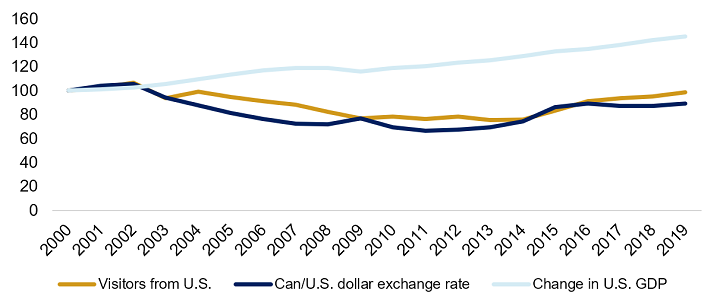

As shown in Figure 2, analysis of various factors over a 20-year period shows that the number of Americans travelling to Canada relates more to the Canadian/U.S. dollar exchange rate than to changes in the U.S. GDP .

Figure 2 – Index Comparing the Number of U.S. Visits to Canada, the Canadian/U.S. Dollar Exchange Rate and the Change in the U.S. Gross Domestic Product (GDP), 2000–2019 (2000 = 100)

Source: Figure prepared by the Library of Parliament using data obtained from Statistics Canada, “ Chart 1: Tourists to Canada from abroad, annual ,” The Daily , 20 February 2020; Federal Reserve Bank of St. Louis, “ Canadian Dollars to U.S. Dollar Spot Exchange Rate ,” FRED, Database, accessed 20 August 2021; and World Bank, “ GDP (constant 2010 US$) – United States ,” Database, accessed 20 August 2021.

According to the World Economic Forum’s Travel & Tourism Competitiveness Report 2019 , Canada ranked ninth out of 140 countries studied, down from eighth place in 2013. 25 Canada was ranked first in several sub-categories, such as safety and security, environmental sustainability and air transport infrastructure.

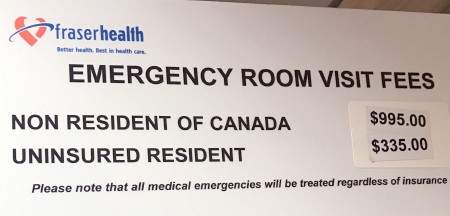

In contrast, Canada was found to be deficient in several areas, such as price competitiveness and international openness (e.g., visa requirements, air service agreements).

A 2018 report further indicated the following challenges facing the Canadian tourism sector:

- CONCENTRATED DEMAND – Toronto, Vancouver and Montréal (Canada’s three largest cities) account for 75% of all visitors, and most of this activity takes place during the summer months. Plus, 70% of visitors to Canada come from the U.S., making the sector very vulnerable to the vagaries of the American economy.

- ACCESS – Coming to (and travelling within) Canada can be expensive, difficult and time-consuming; this is true for travel both inter-regionally (e.g., visiting a national park from a large city) and within urban centres.

- LABOUR SHORTAGES – Similar to many sectors that service the public, the tourism industry has been facing labour shortages for some time. In fact, this sector “could face a shortage of 120,000 people by the mid-2020s, and up to 230,000 people by 2030.”

- LACK OF INVESTMENT/PROMOTION – As hotels face up to 95% occupancy during the summer months, there are insufficient room-nights for additional large-attendance events such as conventions, conferences and festivals. Also, compared to peer countries, Canada spends less on marketing and promotion per international tourist arrival (in some cases up to 20% less). One of the contributing factors is that most tourism businesses are small enterprises that face difficulties in securing capital.

- GOVERNANCE – Given that the sector is extremely diverse and made up of many destinations in different regions, successful efforts for one region or operator will not necessarily carry over to other parts of the country or service providers. Also, as tourism policies and programs are spread across numerous organizations within every level of government, making a well-coordinated and integrated Canadian approach is difficult. 26

These assessments suggest that even though Canada is doing well in certain areas, other jurisdictions may be greatly improving their ability to attract international tourism. Changing trends in consumer preferences may also play a role in determining which destinations may be more popular than others at any particular time.

4 The Role of the Federal Government

Destination Canada is a federal Crown corporation responsible for national tourism marketing and is governed by the Canadian Tourism Commission Act . It targets the following markets “where Canada’s tourism brand leads and yields the highest return on investment”: Australia, Canada, China, France, Germany, Japan, Mexico, the U.K. and the U.S. 27

In 2019, the federal government announced its new tourism strategy entitled Creating Middle Class Jobs: A Federal Tourism Growth Strategy . It is based on the following three pillars:

- BUILDING TOURISM IN CANADA’S COMMUNITIES – expand from the concentration of international visitors to Canada’s three largest cities over a few (mostly summer) months by helping communities “exploit and develop the characteristics that make them special. In so doing, they will be better able to convince tourists to get off the beaten path, explore the lesser-known parts of the country, and to visit during the off-peak seasons.”

- ATTRACTING INVESTMENT TO THE VISITOR ECONOMY – to combat the lack of investment in Canada’s tourism sector, the strategy aims to improve coordination among jurisdictions and help attract private investment by establishing “Tourism Investment Groups in every region of Canada to enable the development of impactful tourism projects, including large-scale destination projects.”

- RENEWING THE FOCUS ON PUBLIC–PRIVATE COLLABORATION – with the establishment of the Economic Strategy Table for Tourism, the federal government aims to stimulate and sustain growth in Canada’s tourism sector by working collaboratively with industry to ensure that tourism is on the front lines of economic policy making. This could include addressing “the high cost of travelling to and within Canada, labour shortages and the lack of investment. It could also look at competitiveness, sustainability, the sharing economy and digital platforms.” 28

Part of the focus on improving tourism has been improving accessibility. To that end, in 2018, the Government of Canada introduced Bill C-81, the Accessible Canada Act , which “aims to achieve a barrier-free Canada through the proactive identification, removal, and prevention of barriers to accessibility in all areas under federal jurisdiction, including transportation services such as air and rail.” 29 The bill received Royal Assent in 2019.

4.3 Federal Funding Initiatives

In 2008–2009, the federal government invested over $500 million in the tourism industry to develop facilities and events, and to promote tourism. This is in addition to investments in other areas that affect tourism, such as improvements for Parks Canada and border services. 30 In 2013, funding of $42 million was allocated to improve visa services, 31 an area where Canada has been found to be deficient.

Since 2016, the regional development agencies have allocated over $196 million to tourism businesses, and the Business Development Bank of Canada has provided more than $1.4 billion in financing. Export Development Canada assists Canadian tourism businesses that aim to expand into global markets. 32 Budget 2017 provided Destination Canada with permanent funding of $95.5 million per year for tourism-related work, up from $58 million. 33

Budget 2019 announced that starting in 2019–2020, $58.5 million over two years would go towards the creation of a Canadian Experiences Fund. The Fund supports “Canadian businesses and organizations seeking to create, improve or expand tourism-related infrastructure—such as accommodations or local attractions—or new tourism products or experiences.” These investments would focus on tourism in rural and remote communities, Indigenous tourism, winter tourism, inclusiveness (especially for the LGBTQ2 communities) and farm-to-table/culinary tourism. 34

Additionally, Budget 2019 included $5 million to Destination Canada for a “tourism marketing campaign that will help Canadians to discover lesser-known areas, hidden national gems and new experiences across the country.” 35

Budget 2019 also included the establishment of the Economic Strategy Table dedicated to tourism, which will bring together “government and industry leaders to identify economic opportunities and help guide the Government in its efforts to provide relevant and effective programs for Canada’s innovators.” 36

Announced in Budget 2021, the Tourism Relief Fund is a $500 million national program that is part of a $1 billion package to support the Canadian tourism sector. 37 Its goal is to position Canada as a destination of choice when domestic and international travel is once again deemed safe (i.e., post-pandemic) by:

- empowering tourism businesses to create new or enhance existing tourism experiences and products to attract more local and domestic visitors; and

- helping the sector reposition itself to welcome international visitors by providing the best Canadian tourism experiences to the world. 38

Initiatives under this fund will help tourism businesses and organizations adapt their operations to meet public health requirements; improve their products and services; and position themselves for post-pandemic economic recovery. 39

Part of this funding includes Destination Canada’s $2-million investment along with $950,000 of in-kind support to the Indigenous Tourism Association of Canada to “support the recovery of Indigenous tourism businesses.” 40

Several federal government institutions also play key roles in shaping the outcome of Canada’s tourism economy. For example, the federal government is responsible for the following:

- establishing ticket taxes and travel tariffs;

- providing customs and border services; and

- addressing matters related to national security.

The National Capital Commission and Parks Canada also help ensure that iconic Canadian places are protected and preserved for current and future visitors to enjoy. As well, provincial and territorial governments help develop and promote tourism in Canada.

The Canadian tourism industry was greatly affected by the global COVID-19 pandemic. However, if international borders continue to reopen and if the industry continues its steady overall growth of the recent years prior to the pandemic, tourism will again contribute to Canada’s economic well-being. And although the U.S. continues to be Canada’s biggest tourism trading partner, stakeholders might continue their efforts of focusing on more growth-oriented, lucrative emerging markets to better diversify tourism interests and help Canada fulfil its tourism potential.

- World Travel & Tourism Council, Economic Impact Reports . [ Return to text ]

- Ibid. [ Return to text ]

- Ibid., p. 7. [ Return to text ]

- Destination Canada, China . [ Return to text ]

- Statistics Canada, “ Canadians made fewer trips within Canada and around the world in 2019 ,” The Daily , 9 December 2020. [ Return to text ]

- Ibid., p. 14. [ Return to text ]

- Ibid., p. 15. [ Return to text ]

- Destination Canada, United States . [ Return to text ]

- Destination Canada, Who we are . See also the Canadian Tourism Commission Act , S.C. 2000, c. 28. [ Return to text ]

- Innovation, Science and Economic Development Canada, “ Creating Middle Class Jobs: A Federal Tourism Growth Strategy ,” Creating Middle Class Jobs: A Federal Tourism Growth Strategy . [ Return to text ]

- Ibid.; and Accessible Canada Act , S.C. 2019, C. 10. [ Return to text ]

- Government of Canada, “ Chapter 3.1: Connecting Canadians With Available Jobs –Temporary Resident Program ,” Jobs, Growth and Long-Term Prosperity: Economic Action Plan 2013 , Budget 2013. [ Return to text ]

- Government of Canada, “ Chapter 2: Building a Better Canada – Launching a Federal Strategy on Jobs and Tourism ,” Investing in the Middle Class , Budget 2019. The Government of Canada’s regional development agencies are the Atlantic Canada Opportunities Agency (ACOA); Canada Economic Development for Quebec Regions (CED); Canadian Northern Economic Development Agency (CanNor); Federal Economic Development Agency for Southern Ontario (FedDev Ontario); Federal Economic Development Agency for Northern Ontario (FedNor); Prairies Economic Development Canada (PrairiesCan); and Pacific Economic Development Canada (PacifiCan). [ Return to text ]

- Government of Canada, “ Chapter 2: Building a Better Canada – Launching a Federal Strategy on Jobs and Tourism ,” Investing in the Middle Class , Budget 2019. “LGBTQ2” refers to lesbian, gay, trans, queer and Two-Spirit. [ Return to text ]

- Government of Canada, Tourism Relief Fund . [ Return to text ]

- Destination Canada, Destination Canada providing $2 million in funding to Indigenous Tourism Association of Canada ( ITAC ) . [ Return to text ]

© Library of Parliament

- 44 th Parliament, 1 st Session

- 43 rd Parliament, 2 nd Session

- 43 rd Parliament, 1 st Session

- 42 nd Parliament, 1 st Session

- 41 st Parliament, 2 nd Session

- 41 st Parliament, 1 st Session

- 40 th Parliament, 3 rd Session

- 40 th Parliament, 2 nd Session

- 40 th Parliament, 1 st Session

- 39 th Parliament, 2 nd Session

- 39 th Parliament, 1 st Session

- 38 th Parliament, 1 st Session

- 37 th Parliament, 3 rd Session

- 37 th Parliament, 2 nd Session

- 37 th Parliament, 1 st Session

Related content

- Legislative summaries

- Trade and investment series

- See complete list of research publications

- Publications about Parliament

- Library Catalogue

Travel & Tourism - Canada

- It is predicted that Canada's revenue in the Travel & Tourism market will increase and reach US$17.03bn in 2024.

- Over the next four years, a steady annual growth rate (CAGR 2024-2029) of 2.26% is expected, resulting in a projected market volume of US$19.04bn by 2029.

- The Hotels market is currently the largest market in the country's Travel & Tourism market with a projected market volume of US$7.08bn in 2024.

- By 2029, the number of users is anticipated to increase to 20.25m users.

- It is noteworthy that the user penetration rate is predicted to decline slightly from 63.4% in 2024 to 70.2% by 2029.

- The average revenue per user (ARPU) is expected to be US$0.69k.

- Canada's online sales in the Travel & Tourism market are also projected to witness a significant rise, contributing to 82% of total revenue by 2029.

- In terms of global comparison, Canada's revenue generation is relatively small.

- The United States, for instance, is expected to generate the highest revenue of US$214bn in 2024.

- Canada's Travel & Tourism industry is heavily impacted by the COVID-19 pandemic, resulting in a significant decline in international visitors.

Key regions: Malaysia , Europe , Singapore , Vietnam , United States

Definition:

The Travel & Tourism market encompasses a diverse range of accommodation services catering to the needs and preferences of travelers. This dynamic market includes package holidays, hotel accommodations, private vacation rentals, camping experiences, and cruises.

The market consists of five further markets.

- The Cruises market covers multi-day vacation trips on a cruise ship. The Cruises market encompasses exclusively passenger ticket revenues.

- The Vacation Rentals market comprises of private accommodation bookings which includes private holiday homes and houses as well as short-term rental of private rooms or flats.

- The Hotels market includes stays in hotels and professionally run guest houses.

- The Package Holidays market comprises of travel deals that normally contain travel and accommodation sold for one price, although optional further provisions can be included such as catering and tourist services.

- The Camping market includes bookings at camping sites for pitches using tents, campervans, or trailers. These can be associated with big chains or privately managed campsites.

Additional Information:

The main performance indicators of the Travel & Tourism market are revenues, average revenue per user (ARPU), users and user penetration rates. Additionally, online and offline sales channel shares display the distribution of online and offline bookings. The ARPU refers to the average revenue one user generates per year while the revenue represents the total booking volume. Revenues are generated through both online and offline sales channels and include exclusively B2C revenues and users for the above-mentioned markets. Users represent the aggregated number of guests. Each user is only counted once per year. Additional definitions for each market can be found within the respective market pages.

The booking volume includes all booked travels made by users from the selected region, independent of the departure and arrival. The scope includes domestic and outbound travel.

Prominent players in this sector include online travel agencies (OTAs) like Expedia and Opodo, as well as tour operators such as TUI. Specialized platforms like Hotels.com, Booking.com, and Airbnb facilitate the online booking of hotels and private accommodations, contributing significantly to the market's vibrancy.

For further information on the data displayed, refer to the info button right next to each box.

- Bookings directly via the website of the service provider, travel agencies, online travel agencies (OTAs) or telephone

out-of-scope

- Business trips

- Other forms of trips (e.g. excursions, etc.)

Travel & Tourism

- Vacation Rentals

- Package Holidays

- Analyst Opinion

Canada's Travel & Tourism market is a dynamic sector that continues to evolve with changing consumer preferences and global trends. Customer preferences: Travelers in Canada are increasingly seeking unique and authentic experiences, moving away from traditional tourist hotspots to explore off-the-beaten-path destinations. There is a growing demand for sustainable and eco-friendly travel options, as well as a preference for personalized and customized travel itineraries. Trends in the market: One notable trend in the Canadian Travel & Tourism market is the rise of adventure tourism, with more travelers looking for adrenaline-pumping activities such as hiking, skiing, and wildlife watching. Additionally, the popularity of food and wine tourism is on the rise, as travelers seek out culinary experiences and local delicacies across the country. Local special circumstances: Canada's vast and diverse landscape offers a wide range of attractions for travelers, from the stunning Rocky Mountains in the west to the picturesque coastlines in the east. The country's rich indigenous culture and heritage also play a significant role in shaping the tourism landscape, with many travelers seeking out authentic indigenous experiences. Underlying macroeconomic factors: The stable economy and favorable exchange rate in Canada have contributed to the growth of the Travel & Tourism market, making it an attractive destination for both domestic and international travelers. Government initiatives to promote tourism, along with investments in infrastructure and transportation, have further boosted the sector's growth.

- Methodology

Data coverage:

Modeling approach:

Additional notes:

- Sales Channels

- Travel Behavior

- Destination Shares

- User Demographics

- Global Comparison

- Key Market Indicators

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

- Get immediate access to all Market Insights, reports & statistics

- Download data in multiple formats for collaborative research

- Includes usage & publication rights for sharing data externally

Language selection

- Français fr

WxT Search form

The canadian tourism sector.

From: Innovation, Science and Economic Development Canada

Helping Canadian tourism businesses welcome domestic and international visitors.

The Federal Tourism Growth Strategy

Canada's Federal Tourism Growth Strategy sets a way forward to:

- grow the sector

- attract investment

- increase stability

Innovation, Science and Economic Development Canada launched a Federal Tourism Growth Strategy, which sets a course for growth, investment and stability.

Learn about the strategy

- Read the new strategy

- Learn about the public consultation process

Latest news for tourism businesses

View all news

Subscribe to updates

On this page

Supports and tools for businesses in the tourism sector, spotlight on canadian tourism, destination canada: "a world of opportunity".

- Careers in tourism

Travel and tourism data

Learn more about supports and resources available to help businesses in the tourism sector improve their products and services to welcome Canadian and international visitors.

- Tourism Growth Program

- Indigenous Tourism Fund

- Canada Digital Adoption Program

- Budget 2023: Supporting the Growth of Canada's Tourism Sector

- Past programs

- GC Business Insights newsletter

Don't know where to start? Ask your regional development agency . You'll find targeted advice and support available in your region.

The Indigenous Business Navigator Service groups help from across the Government of Canada all in one place.

Canada Business app

Find government support for businesses.

Business Benefits Finder

Answer a few questions. Get a tailored list of programs and services. Watch your business grow.

Tourism businesses showcasing all that our country has to offer.

Photo location: Carcross, Yukon | Photo credit: Enviro Foto

Indigenous tourism

First Nations, Métis and Inuit people have captivating histories and distinct cultures. Tourists are eager to learn more about them from Indigenous tourism businesses. The Government of Canada is helping through the Indigenous Tourism Fund .

Photo location: Somerset Island, Nunavut

Rural and remote tourism

Canada is one of the largest countries in the world. Many Canadians live in rural and remote areas. It's time to use tourism as an economic driver. This will create good jobs in communities across the country. Learn about the Government of Canada's Economic Development Strategy for rural Canada .

Photo location: Canada

2SLGBTQI+ tourism

Canada is a top destination for 2SLGBTQI+ travellers. Tourism businesses: get inspired! See how destinations across Canada are welcoming this group .

Photo location: Montreal, Quebec

Francophone tourism

Bonjour! Bienvenue! Canada is a key destination for francophones from here and abroad. Find out if you're doing the most to attract this target market .

Destination Canada has a new strategy. This tourism roadmap aims to give Canada a competitive edge on the global stage. Read " A World of Opportunity ."

Photo location: Saint Malo, Manitoba

Careers in Tourism

Considering a career in a very inclusive sector with jobs across the country? Opportunities abound to shape the future of tourism in Canada.

Visit Tourism HR Canada to learn more.

Photo location: Nahanni River, Northwest Territories

The Canadian Tourism Data Collective went live in May 2024. It provides real-time insights, data and analytics. This in turn will fuel the growth of Canadian tourism.

Visit the Statistics Canada website to find important data about travel and tourism in Canada.

Interested in gaining insight on small and medium-sized enterprises in the sector? Read the SME Profile: Tourism Industries in Canada, 2020 report.

The Honourable Soraya Martinez Ferrada Minister of Tourism

A message to Canada's tourism business owners and operators:

"Canada is a tourism superpower. We have what the world wants, from majestic mountains to dynamic downtowns.

"What you do is much more than a job: you are ambassadors for Canada. You are often the first Canadian that a foreign tourist meets when they arrive and the last one they see before heading home."

Read the full ministerial message.

Did you find what you were looking for?

If not, tell us why:

You will not receive a reply. Telephone numbers and email addresses will be removed. Maximum 300 characters

Thank you for your feedback

Canadian Business Travel is Forecast to Return to Pre-Pandemic Levels in 2024, Reaching $25.9 Billion USD and 13.5% Annual Growth

GBTA’s Canada Conference spotlights the resurgence in business travel spending, evolving industry trends, recognition of association volunteers and introduction of new regional leaders

Business travel in Canada is poised for a strong, evolving future, according to the takeaways and forecasts unveiled during the Global Business Travel Association (GBTA) Canada Conference 2024 held in Toronto this week, April 22-24. As the premier trade association and “voice” of the global business travel industry, GBTA welcomed business travel professionals, companies and guests from across Canada and beyond to the Beanfield Centre for its 20th annual regional event.

Over 600 registered business travel buyers, suppliers and other attendees, including over 50 exhibiting companies, came together for main stage presentations, panel conversations and education sessions. The event also included recognition of GBTA’s Canadian volunteers and the conference’s legendary “Big Night Out” networking event. Strong Forecast and Outlook for Business Travel in Canada An eagerly anticipated aspect of the Conference, GBTA released the Canada-specific forecast from its Business Travel Index™ (BTI) Outlook report along with other research highlights, insights and trends ahead for the industry. According to data from the latest GBTA BTI report, business travel spending in Canada is expected to recover to its pre-COVID level this year, which is one year later than the broader North American region but parallel to the global rate of recovery.

For 2024, GBTA forecasts indicate Canadian business travel spending is anticipated to reach $25.9 billion USD, representing annual growth of 13.5%. This outpaces both global (11.8%) and United States (9.2%) growth forecasts. In 2019 before the pandemic, Canadian business travel had reached $25.7 billion USD.

Other key GBTA research takeaways for the Canada business travel sector included:

- Canadian travel buyers expect to spend more on business travel in 2024, with nearly three in five (59%) planning for their companies’ spend to be higher compared to last year.

- Nearly two-thirds (65%) of Canadian travel buyers expect their company will take more business trips this year compared to last year , but two in five (18%) expect the same volume of business trips.

- When asked about challenges, Canadian buyers and suppliers cited financial concerns at the top of their list, namely the rising cost of travel, overall economic conditions and corporate budgets not keeping pace with needs.

- In the 2023 GBTA BTI’s worldwide survey of business travelers, 57% of Canadian business travelers who responded say they traveled the same amount or more than they did pre-pandemic.

- 55% said they blended travel (i.e. combining leisure travel with their business trips) more than they did in 2019.

- They reported spending an average of $884 USD per business trip in 2023.

- 82% said business travel is worthwhile in achieving their business objectives.

New National and Regional GBTA Leadership Takes the Stage

Janette Acosta Sanchez, who joined GBTA in February as Country Director for Canada, took the conference’s main stage for the first time, leading key sessions and reiterating the organization’s commitment to educate, communicate and advocate for a thriving post-pandemic Canadian business travel industry.

“Canada is a truly diverse country, marked by a variety of cultures, mindsets and priorities. There are no ‘one size fits all’ solutions and GBTA is squarely focused on creating a sustainable, successful future for the Canadian business travel industry. A strong business travel industry is essential to the region, from ensuring our future workforce to making Canada one of the top economies for global business travel,” said Sanchez.

Along with Acosta Sanchez and an esteemed group of presenters, panelists and guests, Cristina Scott, GBTA Senior Vice President for the Americas, also addressed the conference’s attendees for the first time since joining GBTA in August 2023.

“One of GBTA’s pillars is uniting the business travel community, and we recognize Canada has a unique travel market, filled with diversity in its people and priorities. With so much going on in our industry right now as we continue to discover what a post-pandemic business travel sector looks like, we are committed to making sure Canada’s voice is heard while we look ahead and navigate the future of business travel together,” said Scott.

Conference Celebrates a Milestone, Recognizes Volunteers and Delivers Actionable Education and Takeaways

GBTA Board of Directors President, Mark Cuschieri, opened the conference by noting 2024 marks 20 years GBTA has held a Canada Conference.

GBTA’s head of Government Relations and Community Affairs, Shane Downey, discussed the association’s advocacy priorities and actions taken globally and in Canada. He also led a discussion with expert panelists on how the travel industry is responding to government initiatives and seeking solutions. Additionally, a main stage fireside chat on the country’s accessibility standards included Canadian government officials.

GBTA again recognized outstanding volunteers in Canada for their contributions. Award recipients are:

- GBTA Volunteer Inspiration Award : Patrick Doyle, Chief Commercial Officer for Flight Claim

- Business Travel Service Award winners for Canada : Jennifer Urquhart, Director, Strategic Sales at Enterprise Mobility, and Charles Crowder, Head of Global Airline Relationships at ARC Corporation

Education sessions focused on critical priorities and opportunities in the Canadian business travel sector including travel manager needs of the future; traveler evolution and the passenger journey; embracing Artificial Intelligence (AI) and other technologies; the continuing roll-out of New Distribution Capability (NDC); and sustainability in business travel. The event also included numerous buyer and supplier sessions, networking opportunities, and a special welcome event for new and returning industry professionals. The Canada Conference’s concluding main stage was an “Ask Me Anything” session with supplier and buyer panelists who answered questions about various topics related to the Canadian business travel landscape.

GBTA also announced it will host its 21 st Canada Conference again at the Beanfield Centre in Toronto April 28-30, 2025.

To view photos from the GBTA Canada Conference-Toronto, visit the event gallery here . Interviews about the latest developments from industry leaders at the conference’s Broadcast Studio will be uploaded to GBTA’s YouTube channel in the next few days.

- GBTA Convention 2024

- GBTA On Demand

- Member Dashboard

- Member Directory

- GBTA Leadership

- US Chapters

- Sustainability

- Industry Job Openings

- Sponsor & Exhibit

- Past Events

- Global Equity Program

- GBTA Committees

- GBTA Chapters

- GBTA Ladders

- Member & Networking

Tour Operators

Destinations.

- Hotels & Resorts

- Digital Edition Spring 2024

- Digital Edition Fall 2023

- Travel Webcast

- Voices of Travel

- Agents' Choice Gala

- Agents' Choice survey results

- Canadian Travel Press

- Travel Courier

- Agents' Choice 2023

- Agents' Choice 2022

- Offshore Travel Magazine

- Culinary Travels

TICO issues closure advisory for Canada Jetlines & Canada Jetlines Vacations

TICO has provided an update for customers who booked travel with Canada Jetlines and Canada Jetlines Vacations. Canada Jetlines ceased operations on Aug. 15, 2024 and was declared bankrupt on Sept. 11, 2024. Canada Jetlines Vacations, a TICO-registered travel retailer and tour operator, terminated its TICO registrations on Sept.11, 2024. For...

Four Seasons introduces new ultra-luxe private jet itinerary

Acv offering free connecting flights for 7 sandals resorts, rit vacations introduces exciting new tours for 2025, windstar expands in the south pacific with shorter itineraries, air france to serve 170 destinations for winter 2024/2025, exodus adventure travels partners with priority pass.

Leading luxury hospitality company Four Seasons is once again setting the standard in...

From now through Oct. 11, 2024, all new ACV bookings made to any of the seven Sandals Resorts or...

Celebrating 24 years of excellence, RIT Vacations has released its 2025 travel...

Windstar is significantly expanding its itineraries for the line in the South Pacific: the only...

During the 2024-2025 winter season (running from November 2024 to March 2025), Air France will...

Exodus Adventure Travels has formed an agreement with Priority Pass™, the world's original...

UPDATED: Industry Relieved as Air Canada, ALPA reach tentative deal

ACTA urges Air Canada, pilots to negotiate and ‘come to a resolution’

Air Canada urges federal government to direct arbitration to avert disruption

TICO has provided an update for customers who booked travel with Canada Jetlines and Canada Jetlines Vacations. Canada Jetlines ceased operations on Aug. 15, 2024 and...

Goway launches new Nordic product line with 14 itineraries

Leading luxury hospitality company Four Seasons is once again setting the standard in experiential travel with the introduction of a new itinerary, Grand Horizons, as...

Oceania Riviera to sail Alaska in 2025

Trinidad and Tobago’s food and music festival in T.O. saw record crowds

Los Cabos is getting more direct flights from Canada this fall/winter

Visit Orlando brings Sunshine Tour to Ottawa, Montreal

Windstar is significantly expanding its itineraries for the line in the South Pacific: the only region other than the Mediterranean where Windstar sails...

Travel Industry Today

Friday, 20 September 2024

YOU WANT TO COMPLAIN? CTA considers a new plan for ticked travellers

A new proposal from the country's transport regulator would charge airlines $790 for each passenger complain it resolves – regardless of which party wins the dispute. The Canadian Transportation Agency (CTA) has launched a one-month consultation on the proposed reforms, which would apply to valid customer complaints processed and settled by the regulator. MORE

HOW TO RECOUP COSTS WHEN TRAVELLING TO AN EVENT THAT GETS CANCELLED

Ariella Kimmel and Mandi Johnson were grabbing a bite to eat in Vienna, when their August trip to the Austrian capital was upended. The Canadian duo had travelled to the city to see Taylor Swift in concert only to learn her shows would be cancelled because of two men plotting to launch an attack on fans outside the venue, Ernst Happel Stadium. MORE

CATSA UPGRADE SPEEDS SECURITY LINES

At YVR, removing laptops and liquids from your carry-on at security is a thing of the past, thanks to a fresh use of half-century-old technology. Vancouver is the first flight hub in the country to deploy CT scanners in a bid to detect explosives and other threats, according to CATSA. And the agency plans to install the technology, which provides 360-degree views via computerized X-ray imaging, at airport checkpoints across the country in the coming years. MORE

EAST OR WEST? 5 FACTORS TO WEIGH IN PLANNING A CARIBBEAN CRUISE

As you start planning your dream cold weather getaway, the first question to ask is where are you headed? It may not clear as you scan cruise websites, but there are two main routes around the Caribbean: Eastern and Western. They go back to the days of sailing ships and originally developed because of the trade winds and the ease of hopping between islands. MORE

CHERISHED LOUISBOURG LIGHTHOUSE SHINES ON

To mark its 100th anniversary this year, the Louisbourg Lighthouse, which stands at the same location as the first lighthouse in Canada originally built in Cape Breton in 1734, has revealed a full refurbishment designed to help the historic structure on for another century MORE

LISTENING IN New musical takes audiences on a ‘Joyride’ with Roxette

Furthering the ‘90s musical revival, Malmö Opera in Sweden is hosting ‘Joyride the Musical,’ a new feel-good production paying tribute to the music of Swedish pop band Roxette. The musical takes audiences on a joyful, humorous journey that since its debut Sept. 6 has received rave reviews from audiences, comprised in large part by international visitors. MORE

CHECK OUT OUR SPECIAL INFOCUS EDITIONS:

JUST IN CASE YOU MISSED YESTERDAY’s STORIES:

FRUSTRATION IN THE RANKS Could pilots reject Air Canada deal?

Low entry-level pay in the tentative deal between Air Canada and its pilots could be a stumbling block ahead of a union vote on the agreement, some aviators and experts say. While the tentative agreement's cumulative 42 percent wage hike over four years applies to all flight crew – a big topline gain after a decade of two per cent annual raises – many could still feel left out of the windfall. MORE

TICO LISTS CLAIMS PROTOCOLS FOR CANADA JETLINES

The Travel Industry Council of Ontario has posted a closure advisory, including claims protocols, for Canada Jetlines, which ceased operations on Aug. 15, and was declared bankrupt on Sept. 11, 2024. On the same date, Canada Jetlines Vacations terminated its TICO registrations. MORE

RIU ‘AMPLIFIES’ ITS MESSAGE TO CANADA