Investor Services

Land investment, resort projects, villa designs, the company, sustainability, market studies, land ownership, news & press, 2024: a year of growth and optimism for indonesia's tourism industry.

In the wake of the COVID-19 pandemic, Indonesia's tourism and creative economy sectors experienced a significant setback, witnessing a steep decline in foreign tourist numbers. However, recent trends indicate a promising resurgence. The first half of 2023 has seen a noticeable uptick in both domestic and international tourists, with a 12.57 percent rise from the previous year, totaling 433.57 million tourist movements.

.png)

Optimism on the Horizon

Minister of Tourism and Creative Economy, Sandiaga Uno, is optimistic about the future of Indonesia's tourism sector. He anticipates a positive outlook for 2024, with a target of welcoming 14 million foreign tourists. While these projections signify progress, they are still shy of the pre-pandemic levels seen in 2019.

During the Indonesia Tourism Outlook event held on November 28, 2023, Uno shared his expectations, stating, "The achievement of foreign tourist visits to Indonesia this year is around 11 million or above the target of 8.5 million. In 2024, we are targeting 14 million foreign tourist visits. We are optimistic that in 2025, the tourism sector will recover to normal."

Read More: NTB Prioritizes New Routes and Additional Flights: A Boost for Tourism

Key Factors Influencing Recovery

The 2023/2024 Tourism and Creative Economy Outlook report sheds light on the factors driving this recovery. According to the report, 76.19 percent of experts believe that Indonesian tourism is in the process of recovery. Among them, 46.15 percent highlight the development of quality and innovative tourism destinations as a key driver of growth.

Technology also plays a pivotal role, with 43.59 percent emphasizing its increasing importance in supporting the tourism sector. Additionally, boosting domestic tourist income is deemed essential, receiving 38.46 percent of the experts' vote.

Southeast Asia: A Fertile Ground

When it comes to foreign tourist visits, a significant 71.79 percent of experts hold an optimistic view regarding the Southeast Asian market's potential to fuel Indonesia's tourism sector. This aligns with Minister Uno's assertion that the Southeast Asia region's economy is expected to remain robust in 2023, encouraging more foreign tourist visits.

He commented, "This is good news, which will impact increasing tourist travel in the Asia-Pacific region, including Indonesia. Indonesian tourism experienced an accelerated revival this year. We initially set a target of 7.6 million foreign tourists visiting, then increased it to 8.5 million, and this year we will get 11 million visits."

.png)

In conclusion, Indonesia's tourism sector is on the path to recovery after the challenges posed by the COVID-19 pandemic. With a strong focus on quality destinations, technological advancements, and a thriving Southeast Asian market, the outlook for 2024 appears promising. Minister Sandiaga Uno's optimism reflects the concerted efforts to revive this vital sector, bringing hope and anticipation for the future.

News Article

Recent articles, expat life in lombok: a comprehensive guide to living, culture, and lifestyle, lombok’s best surf spots: a comprehensive guide to surfing paradise, what’s the must-visit spot in the gili islands, discover lombok: a hidden gem of indonesia, ready for the motogp madness in lombok see how the villages are gearing up.

Thank you! Your submission has been received!

One of our representatives will reach out to you soon.

Latest News

An Oasis of Calm: Inside Bangkok’s Floral Court Hotel

Centara signs management agreement for Varivana Resort Koh Phangan

Changzhou-Tokyo direct flights to launch, enhancing travel and trade

Kimpton Xujiahui Shanghai to open at Grand Gateway 66 by 2026

Air India launches daily non-stop flights between Delhi and Kuala Lumpur

Banyan Group opens three new resorts in East China expansion

Dusit Thani Bangkok partners with Porsche for exclusive limousine service

Boracay launches first muslim-friendly cove for inclusive Halal tourism

Vietnam joins AHRA, completing ASEAN hospitality industry representation

Tourism Australia appoints Jennifer Doig as Regional GM for Asia

Indonesia sets ambitious tourism goals for 2024 with Bali as the leading attraction

Indonesia sets a lofty 2024 tourism target of 14 million visitors, with Bali as the centerpiece, emphasizing green tourism and culinary attractions to boost its global travel appeal.

As 2023 draws to a close, Indonesia is preparing for a landmark year in 2024, with tourism at the forefront of its economic agenda. The Ministry of Tourism and Creative Economy, led by Minister Sandiaga Uno , is setting ambitious targets to elevate Indonesia’s status as a premier global destination, particularly emphasizing Bali’s role.

Bali: The Crown Jewel of Indonesian Tourism

Bali, Indonesia’s most popular vacation spot, continues to surpass tourism expectations. In 2023, Bali aimed to welcome 4.5 million international tourists, a goal nearly achieved by October, signaling a robust recovery post-COVID-19. The island’s impressive performance, including welcoming over one million tourists during the 2022 Christmas and New Year period, positions it as a pivotal player in Indonesia’s 2024 tourism strategy.

National Targets and Global Appeal

Building on this success, Minister Uno has announced a national target of 14 million foreign tourist visits in 2024, an optimistic forecast supported by the country’s current upward trajectory. In 2023, Indonesia saw 11 million foreign visits, surpassing its initial target of 8.5 million. Australia remains a significant source of tourists for Bali, with over 122,000 Australian visitors recorded in October alone.

A Focus on Green Tourism

Looking ahead to 2024, Minister Uno’s strategy includes a substantial focus on green tourism, promoting sustainable travel that balances environmental protection with economic growth. This initiative will spotlight destinations like Nirup Island Batam, Boyotomo Bintan, and Lagoi Resort Bintan in the Riau Islands.

The Riau Islands: A Key Gateway

The Riau Islands, particularly Batam City, have emerged as a crucial entry point for international tourists. In 2023, 1.5 million of the total 11 million international arrivals entered Indonesia through the Riau Islands, underscoring their strategic importance. Minister Uno aims to attract 3 million foreign tourists to the Riau Islands in 2024, matching pre-pandemic levels.

Culinary Tourism: A Unique Selling Point

The culinary sector, particularly in Batam, is a significant draw for international visitors, with a growth of nearly five percent and transactions exceeding Rp600 billion (around US$38.7 million). The minister’s vision for 2024 includes leveraging Indonesia’s diverse culinary heritage to boost tourist numbers.

Indonesia’s Broader Tourism Vision

As Indonesia gears up for a general election in February 2024, the tourism sector is poised to play a vital role in the nation’s economic development. With a holistic approach encompassing enhanced infrastructure, diverse experiences, and a commitment to sustainable tourism, Indonesia is set to solidify its position as a top global destination. The goal of 16 million foreign tourist arrivals in 2024 reflects the country’s confidence in its appeal and readiness to welcome travelers from around the world.

Indonesia, with Bali leading the charge, is on a steadfast path to redefine its tourism landscape in 2024. The focus on sustainable practices, along with the development of key regions like the Riau Islands and an emphasis on culinary attractions, positions Indonesia as a dynamic and responsible travel destination. As the world continues to open up post-pandemic, Indonesia’s blend of natural beauty, cultural richness, and innovative tourism strategies make it a must-visit location for global travelers in 2024.

Theodore Koumelis

Theodore is the Co-Founder and Managing Editor of TravelDailyNews Media Network; his responsibilities include business development and planning for TravelDailyNews long-term opportunities.

PATA Youth Symposium 2024: Shaping the future of tourism leaders

- Exploring luxury hospitality in Thailand with Nida Wongphanlert of 137 Pillars Hotels & Resorts

Thailand launches Thai Craft Showcase to promote culture and creativity

Related posts.

Marriott expands in Indonesia with five new hotels by 2030

Indonesia implements SATUSEHAT Health Pass for international travelers amid Mpox concerns

Anantara Ubud Bali Resort to open in October 2024

Agoda unveils top 10 beach destinations in Asia for 2024

Previous article, next article, safety in the skies: top ranking for leading apac airline in 2024, river books shop and chakrabongse villas & residences are a must visit in bangkok.

Thailand to launch mandatory Electronic Travel Authorization (ETA) for visa-exempt nationals

Exploring luxury hospitality in Thailand with Nida Wongphanlert of 137 Pillars Hotels & Resorts

Michael Groll appointed GM of The Landmark Mandarin Oriental, Hong Kong

ITB India 2024 wraps up, paving pathways for global travel industry

Vietnam Tourism Roadshow strengthens ties with New Zealand in Auckland

Turkish Airlines adds Sydney to network with flights via Kuala Lumpur

Penang hosts V-Malaysia 2024 Convention, boosting local economy

MyCEB appoints YB V. Sivakumar as new Chairman to drive growth

Langham and HXE partner to launch global online MICE venue booking

Phuket Overtourism: The world’s most overcrowded destination and its struggle for sustainability

AirAsia Thailand expands with new direct flights from India to Thailand

AU casinos can learn from Asia’s casino boom

Dusit Thani Bangkok reopens with a modern twist on iconic legacy

BWH Hotels expands in Vietnam with new property in Hue

AirAsia joins Heart Aerospace to shape future of electric aviation

Khiri Travel expands to the Philippines, offering authentic experiences

EXO Travel expands beyond Asia with new destination launch at World Travel Mart

Collinson report reveals Asia Pacific’s rising travel spend and preferences

Simon Beaumont appointed General Manager of Avani+ Khao Lak Resort

Japan’s tourism boom and India’s festival spending surge in 2024

Thailand MICE Visa prepaid card launched to boost business tourism

Wyndham Hotels expands to Fiji with new Ramada Encore in Labasa

The economic impact of the disastrous Olympics opening

Bhutan launches tourism services portal to enhance visitor experience

Sabre expands partnership with InterparkTriple to boost South Korea tourism

Asia Pacific airports dominate OAG Megahubs 2024 rankings

Raffles Hotel Le Royal appoints Dagmar Lyons as General Manager

Laguna Golf Lang Co promotes Central Vietnam golf in Australia

Amadeus expands distribution partnership with Virgin Australia

CAPA Airline Leader Summit 2024 focuses on aviation sustainability

AISATS unveils India’s first luxury tarmac coaches for elite travelers

Vietnam Tourism Roadshow 2024 held in Perth to boost tourism ties

Australia Next 2025 to return to Melbourne for incentive showcase

Korean Air launches direct flights from Seoul to Lisbon

Air France adds new Paris-Manila route for winter 2024

2024 Chinese Opera Festival opens in Kunshan with 87 performances

Hong Kong Airlines launches direct flights to Chiang Mai, Thailand

Southeast Asia can supply 12% of global SAF demand by 2050

Fraport sells 10% stake in Delhi Airport for $126 million

Shinta Mani appoints Benjamin Lehmann as General Manager in Siem Reap

Nepal’s Tourism Rebound: An 8.3% surge in August 2024

AirAsia launches new route from Kota Kinabalu to Ho Chi Minh

Vietnam to boost golf tourism with Greg Norman’s support

FlixBus partners with AbhiBus to transform intercity travel in India

Business travel sees strong growth fueled by increased demand in 2024

World’s largest indoor ski resort opened in hot Shanghai

Your complete beginner’s guide to Cabo villa rentals

Heymax and Visa double travel miles for Singapore MRT and bus rides

Marriott appoints Dev Dasgupta as GM of Khao Lak Resort opening 2024

Hotel101-Fort named Official Residence for Miss Asia Pacific 2024

Centara Mirage Lagoon Maldives to open on November 1, 2024

Cairns hosts Australia Next, showcasing top business event experiences

Philippines wins big at 31st World Travel Awards with 8 titles

TAT celebrates Thailand’s charm and fashion at New York Gala

DidaTravel reports surge in Chinese bookings for Thailand and Malaysia

Uzbekistan Airways launches direct Tashkent-Goa flights starting October 2024

Marriott opens Penang Marriott Complex, its 50th property in Malaysia

China’s hotel market to reach $157.46 billion by 2032

- Advertise With Us

Indonesia’s Tourism Sector Shows Positive Outlook for 2024

The tourism and creative economy sectors in Indonesia experienced a significant decline during the COVID-19 pandemic, with foreign tourist numbers dropping to approximately 4.05 million in 2020 (25 percent of 2019).

Related posts, tourists may be charged us$500 to look at komodo dragons, coronavirus ground zero in china cave is guarded and sealed, bulgarian arrested for atm skimming case shot dead, enjoying the passage of the time at sijunjung customary village, pd pasar jaya to make animal feed from jakarta’s waste, rescued sumatran tiger dies at rehabilitation centre in west sumatra.

Indonesia tourism marks a strong GDP contribution in the country that makes a wonderful nation

Wednesday, July 3, 2024

How Indonesia Gains Success in Resilient Recovery and Strategic Growth

What are the tourism strategies and initiatives taken by indonesia to promote tourism.

Indonesia sees a Optimistic Expectations for 2025 Tourism Season

Indonesia’s tourism statistics marks a surge in international tourist arrivals, tourist arrival statistics in indonesia.

Key Source Markets for Indonesia Tourism

Factors driving growth for indonesia tourism.

- Effective Health and Safety Measures: Indonesia’s implementation of stringent health protocols and a successful vaccination campaign have played a crucial role in restoring traveler confidence. These measures ensure that tourists feel safe during their visit, encouraging more people to travel to Indonesia.

- Promotional Campaigns: Aggressive marketing and promotional campaigns by the Indonesian government and tourism authorities have significantly boosted the country’s visibility on the global stage. Campaigns showcasing Indonesia’s diverse attractions, cultural heritage, and natural beauty have been particularly effective.

- Events and Festivals: High-profile events like the Bali and Beyond Travel Fair have been instrumental in attracting tourists. These events highlight Indonesia’s unique offerings and provide platforms for tourism stakeholders to engage with potential visitors.

- Infrastructure Improvements: Continued investment in tourism infrastructure, including airports, roads, and hospitality facilities, has enhanced the overall travel experience. Improved connectivity and upgraded amenities make it easier and more appealing for international tourists to visit.

- Digital Transformation: The adoption of digital technologies in the tourism sector has streamlined processes such as booking, information dissemination, and customer service. Virtual tours and online marketing have expanded Indonesia’s reach to a global audience, attracting tech-savvy travelers.

Future Outlook for Indonesia Tourism 2024-2025 Tourism Season

Tags: ‘Wonderful Indonesia’ , 2024 tourism growth , Asia travel news , Association of Indonesian Tour and Travel Agencies (Asita) , Bali travel , indonesia , indonesia tourism , Indonesia tourism statistics , Indonesia travel data , INDONESIA TRAVEL NEWS , international tourist arrivals , post-pandemic tourism recovery , Travel News

Subscribe to our Newsletters

Related Posts

- Indonesia Braces for Severe Wild fire as Summer Season Ramps Up Putting More than 1,000 Tourist Attractions at Risk

- Indonesian Tourism Ministry promotes Wonderful Indonesia in Australian cities

Select Your Language

I want to receive travel news and trade event update from Travel And Tour World. I have read Travel And Tour World's Privacy Notice .

REGIONAL NEWS

Aena’s Airports in Spain See Over 32.1 Billion Passengers in August

Friday, September 13, 2024

Discover the Algarve Coast’s Unspoiled Beauty: A Tranquil Travel Experienc

Brazil: The ultimate adventure destination

The Transportation Security Administration (TSA) announces expansion of its digi

Middle east.

Wizz Air Announces Exciting Long-Haul Flights From London To Jeddah And Milan To

Air Astana Introduces Direct Routes From Atyrau To Dubai And Astana, Almaty To A

Bali Tourism Leaders Push for Innovative Certification Program to Elevate Attrac

2024 Challenge Beijing: Triathlon Event Highlights Yanqing’s Scenic Beauty

Privacy overview.

Indonesia, Australia Agree to Grow Two-Way Trade and Investment

Indonesia, Peru Speed up Comprehensive Economic Agreement

Jakarta Composite Index Hits New Record

Kadin Ready to Strengthen Ties with New Government

Jokowi Launches Construction of MRT Jakarta East-West Line

South Korea Brings First Cell Therapy for Cancer Treatment to Indonesia

Minister: IKN Airport Runway Construction Complete

Pertamina and Vale Indonesia Partner for Sustainable Fuel Solution

Tokocrypto Secures Full Crypto Trading License

Tough Challenges Ahead for Indonesia’s Manufacturing Sector

2023 – 2024 Tourism and Creative Economy Outlook Released

- September 13, 2023

Home » 2023 – 2024 Tourism and Creative Economy Outlook Released

Antara News are reporting that Indonesia’s Ministry of Tourism and Creative Economy has released the ‘2023–2024 Tourism and Creative Economy Outlook,’ which contains comprehensive information on the latest developments in the tourism and creative economy sector. Sandiaga Uno, Indonesia’s Tourism and Creative Economy Minister said the newly launched outlook could be used as a guide by tourism and creative economy players in formulating strategic plans for 2023–2024. “I invite everyone to read the newly issued outlook. For tourism players, please ensure to see it point by point because it contains important information, including regarding Indonesia’s creative economy,” he added. Uno also sought a more comprehensive review of the outlook’s content through a focus group discussion (FGD). This could result in a number of recommendations regarding strategies or programs for developing the tourism and creative sector, say Antara News . The ministry’s deputy for strategic policies, Dessy Ruhati, explained that this year, her side is focusing on the spirit of innovation and collaboration. The guideline contains an expert survey that documents views from several leaders and experts from the tourism and the creative economy sector. In addition, the outlook also outlines the achievements of the tourism sector. Readers can also get information on the latest data and statistics, especially regarding the growth of the sector, its economic contribution, and significant events affecting it. Furthermore, she said, it covers the conditions and dynamics of the strategic environment that affects the sector, including an analysis of the macroeconomics and digital transformation that effect changes in tourism and creative economy, among others, say Antara News . “Of course, the digitalization of products and artificial intelligence have a significant role and create challenges related to intellectual property rights,” she said. She expressed the hope that going forward, digitalization and business players’ capacity-building programs would continue to remain a focus. For more details go the website of the Minister of Tourism and Creative Economy.

Source: Antara News, Minister of Tourism and Creative Economy

Get in Touch

Invest Indonesia is driven by Seven Stones Indonesia, a customer-centric company that believes in being authentic to deliver value to, and for, all stakeholders, to boost business growth and prosperity in Indonesia.

Write for Us

Andrzej barski, director of seven stones indonesia.

Andrzej is Co-owner/ Founder and Director of Seven Stones Indonesia. He was born in the UK to Polish parents and has been living in Indonesia for more than 33-years. He is a skilled writer, trainer and marketer with a deep understanding of Indonesia and its many cultures after spending many years travelling across the archipelago from North Sumatra to Irian Jaya.

His experience covers Marketing, Branding, Advertising, Publishing, Real Estate and Training for 5-Star Hotels and Resorts in Bali and Jakarta, which has given him a passion for the customer experience. He’s a published author and a regular contributor to local and regional publications. His interests include conservation, eco-conscious initiatives, spirituality and motorcycles. Andrzej speaks English and Indonesian.

Terje H. Nilsen

Terje is from Norway and has been living in Indonesia for over 20-years. He first came to Indonesia as a child and after earning his degree in Business Administration from the University of Agder in Norway, he moved to Indonesia in 1993, where he has worked in leading positions in education and the fitness/ wellness industries all over Indonesia including Jakarta, Banjarmasin, Medan and Bali.

He was Co-owner and CEO of the Paradise Property Group for 10-years and led the company to great success. He is now Co-owner/ Founder and Director of Seven Stones Indonesia offering market entry services for foreign investors, legal advice, sourcing of investments and in particular real estate investments. He has a soft spot for eco-friendly and socially sustainable projects and investments, while his personal business strengths are in property law, tourism trends, macroeconomics, Indonesian government and regulations. His personal interests are in sport, adventure, history and spiritual experiences.

Terje’s leadership, drive and knowledge are recognised across many industries and his unrivalled network of high level contacts in government and business spans the globe. He believes you do good and do well but always in that order. Terje speaks English, Indonesian and Norwegian.

Contact Our Consultants

Ridwan jasin zachrie, cfo of seven stones indonesia, jakarta.

Ridwan is one of Indonesia’s top executives with a long and illustrious career in the financial world. He holds several professional certifications including being a Certified Business Valuer (CBV) issued by the Australian Academy of Finance and Management; Broker-Dealer Representative (WPPE); and The Directorship Certification for Directors and Commissioners, issued by the Indonesian Institute of Commissioners and Directors.

His experience includes being the Managing Director at one of the top investment banking groups in the region, the Recapital Group, the CFO at State-owned enterprises in fishery industry and the CEO at Tanri Abeng & Son Holding. He’s also been an Independent Commissioner in several Financial Service companies and on the Audit and Risk Committee at Bank BTPN Tbk, Berau Coal Energy Tbk, Aetra Air Jakarta as well as working for Citibank, Bank Mandiri and HSBC. His last position was as CFO at PT Citra Putra Mandiri – OSO Group.

Ridwan has won a number of prestigious awards including the Best CFO Awards 2019 (Institute of Certified Management Accountant Australia-Indonesia); Asia Pacific Young Business Leader awarded by Asia 21 Network New York USA (Tokyo 2008); UK Alumni Business Awards 2008 awarded by the British Council; and The Most Inspiring Human Resources Practitioners’ version of Human Capital Magazine 2010.

He’s a member of the Board of Trustees of the Alumni Association of the Faculty of Law, Trisakti University, Co-Founder of the Paramadina Public Policy Institute and actively writes books, publications and articles in the mass media. He co-authored “Korupsi Mengorupsi Indonesia” in 2009, which helps those with an interest in understanding governance in Indonesia and the critical issue of corruption. Ridwan speaks Indonesian and English.

Per Fredrik Ecker

Managing director of seven stones indonesia, jakarta.

Per is the Managing Director of the Seven Stones Indonesia (SSI) Jakarta office and has more than 25-years’ experience in Indonesia, China, and Western Europe. He previously worked in senior management positions with Q-Free ASA, Siemens AG, and other companies in the telecom sector. Over the last six years, he has been the Chairman of the Indonesia-Norway Business Council (INBC) and recently become elected to be on the board of EuroCham Indonesia.

His most recent experience is within Intelligent Transport Solutions (ITS), Telecom, and other sectors within the Indonesian market. He is today through his position in SSI and by representing Norway Connect, promoting Nordic and European companies that would like to explore business opportunities in the Indonesian market. He’s also playing an active role to help create the Nordic House concept in Jakarta that will provide an excellent platform for Nordic companies entering Indonesia, where they’ll find a community that can offer support with trusted information and affordable services to enter this market.

- About ScandAsia

- Advertisement rates

Nordic News and Business Promotion in Asia

Indonesia’s tourism sector shows signs of recovery in 2023

The tourism sector in Indonesia, was hit hard by the COVID-19 pandemic, but the industry is now witnessing a positive turnaround. With the first semester of 2023 reporting around 13 percent increase in both national and foreign tourists, the country experienced a total of 433.57 million movements.

Minister of Tourism and Creative Economy, Sandiaga Uno, expressed optimism at the Indonesia Tourism Outlook event. Projecting a target of 14 million foreign tourist visits in 2024. Despite surpassing expectations for 2023, the figures are still anticipated to fall short of the 2019 pre-pandemic levels.

“This year’s accelerated revival saw us surpassing our initial target of 7.6 million foreign tourists, eventually reaching 11 million visits. With a 2024 target of 14 million, we remain confident that the sector will return to normal by 2025,” Uno stated.

Source: thebalitimes.com

Search more ScandAsia news

Related posts:.

About Miabell Mallikka

Miabell Mallikka is a journalist working with ScandAsia at the headquarters in Bangkok.

Leave a Reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Travel, Tourism & Hospitality

Absolute economic contribution of tourism in Indonesia 2014-2029

Absolute economic contribution of tourism in indonesia from 2014 to 2029 (in million u.s. dollars).

To access all Premium Statistics, you need a paid Statista Account

- Immediate access to all statistics

- Incl. source references

- Download as PDF, XLS, PNG and PPT

Additional Information

Show sources information Show publisher information Use Ask Statista Research Service

all values are estimates

The shown forecasts represent a blend of multiple input datasets from both internal (primary) and external (secondary) sources. Whereas primary data are generated via Statista's own surveys like the Global Consumer Survey , secondary input datasets are mostly sourced from international institutions (such as the IMF, the World Bank or the United Nations), national statistical offices, trade associations and from the trade press. These datasets are often incomplete as there are gaps between survey years or no or no reliable information might be available for a specific indicator in a specific country or region. Data for missing years are interpolated by various statistical means, such as linear or exponential interpolation or cubic splines. Data for missing countries or regions are imputed by considering known information from other countries or regions that are found to be similar by cluster analyses like k-means or similar procedures. Most indicators are composites of multiple input sources with slightly varying methodologies that have been processed by our analysts to be aligned and consistent with each other and with all other indicators in the KMI database. As new data becomes available or methodologies are adapted to suit changing requirements it can be possible that data is not comparable any longer with previously published data or is changed retroactively according to the new definitions. Because of the high degree of processing no specific external source can be named for each data point and all data for historical years (usually until the last finished year before the current one) have to be considered Statista estimates. Future years are mostly Statista projections These projections or forecasts are conducted by regression analyses, exponential trend smoothing (ETS) or similar techniques and extrapolate the found historical trend. '

Other statistics on the topic

- European countries with the highest number of inbound tourist arrivals 2019-2023

- Number of international tourist arrivals worldwide 2005-2023, by region

Leisure Travel

- Market cap of leading online travel companies worldwide 2023

- Leading airlines in Europe based on passenger numbers 2023

To download this statistic in XLS format you need a Statista Account

To download this statistic in PNG format you need a Statista Account

To download this statistic in PDF format you need a Statista Account

To download this statistic in PPT format you need a Statista Account

As a Premium user you get access to the detailed source references and background information about this statistic.

As a Premium user you get access to background information and details about the release of this statistic.

As soon as this statistic is updated, you will immediately be notified via e-mail.

… to incorporate the statistic into your presentation at any time.

You need at least a Starter Account to use this feature.

- Immediate access to statistics, forecasts & reports

- Usage and publication rights

- Download in various formats

Statistics on " Travel and tourism in Europe "

- International tourist arrivals worldwide 2019-2022, by subregion

- Travel and tourism's total contribution to GDP in Europe 2019-2034

- Distribution of travel and tourism expenditure in Europe 2019-2023, by type

- Distribution of travel and tourism expenditure in Europe 2019-2023, by tourist type

- Travel and tourism: share of GDP in the EU-27 and the UK 2019-2023, by country

- Travel and tourism's total contribution to employment in Europe 2019-2034

- Leading European countries in the Travel & Tourism Development Index 2023

- International tourist arrivals in Europe 2006-2023

- International tourist arrivals in Europe 2010-2022, by region

- Monthly number of inbound tourist arrivals in Europe 2019-2024

- Change in monthly tourist arrivals in Europe 2020-2023, by region

- Inbound tourism visitor growth in Europe 2020-2025, by region

- International tourist arrival growth in European countries 2019-2023

- International tourism spending in Europe 2019-2034

- Number of domestic tourist trips in EU-27 countries and the UK 2018-2021

- Number of domestic arrivals in tourist accommodation in the EU 2011-2022

- Domestic tourism spending in Europe 2019-2034

- Domestic travel and tourism spending in EU-27 countries and the UK 2019-2023

- Share of Europeans planning to take a domestic summer trip 2024, by country

- Outbound tourism visitor growth worldwide 2020-2025, by region

- Outbound visitor growth in Europe 2020-2025, by region

- Number of outbound trips from EU-27 countries and the UK 2018-2021

- European countries with the highest outbound tourism expenditure 2019-2022

- Travel intentions of Europeans in the next six months 2024, by destination

- Share of Europeans planning to travel domestically or in Europe 2023-2024

- Europeans planning domestic or European trips in the next six months 2024, by age

- Europeans planning leisure domestic or European trips 2024, by trip type

- European travelers' favorite destinations for their next European trip 2024

- Number of tourist accommodation establishments in the EU 2012-2022

- Number of overnight stays in tourist accommodation establishments in the EU 2011-2022

- Hotel market revenue in Europe 2017-2028

- Hotel market revenue in Europe 2017-2028, by region

- Share of hotel market sales in Europe 2017-2028, by channel

- Estimated EV/EBITDA ratio in the online travel market 2024, by segment

- Market capitalization of leading travel and leisure companies in Europe 2024

- Travel and tourism revenue in Europe 2019-2029, by segment

- Number of users of package holidays in Europe 2020-2029

- Number of users of hotels in Europe 2020-2029

- Number of users of vacation rentals in Europe 2020-2029

- Revenue of travel and tourism market in selected countries worldwide 2023

Other statistics that may interest you Travel and tourism in Europe

- Basic Statistic Number of international tourist arrivals worldwide 2005-2023, by region

- Premium Statistic International tourist arrivals worldwide 2019-2022, by subregion

- Basic Statistic Travel and tourism's total contribution to GDP in Europe 2019-2034

- Basic Statistic Distribution of travel and tourism expenditure in Europe 2019-2023, by type

- Basic Statistic Distribution of travel and tourism expenditure in Europe 2019-2023, by tourist type

- Basic Statistic Travel and tourism: share of GDP in the EU-27 and the UK 2019-2023, by country

- Basic Statistic Travel and tourism's total contribution to employment in Europe 2019-2034

- Premium Statistic Leading European countries in the Travel & Tourism Development Index 2023

Inbound tourism

- Premium Statistic International tourist arrivals in Europe 2006-2023

- Premium Statistic International tourist arrivals in Europe 2010-2022, by region

- Premium Statistic European countries with the highest number of inbound tourist arrivals 2019-2023

- Basic Statistic Monthly number of inbound tourist arrivals in Europe 2019-2024

- Basic Statistic Change in monthly tourist arrivals in Europe 2020-2023, by region

- Premium Statistic Inbound tourism visitor growth in Europe 2020-2025, by region

- Premium Statistic International tourist arrival growth in European countries 2019-2023

- Basic Statistic International tourism spending in Europe 2019-2034

Domestic tourism

- Premium Statistic Number of domestic tourist trips in EU-27 countries and the UK 2018-2021

- Basic Statistic Number of domestic arrivals in tourist accommodation in the EU 2011-2022

- Basic Statistic Domestic tourism spending in Europe 2019-2034

- Basic Statistic Domestic travel and tourism spending in EU-27 countries and the UK 2019-2023

- Premium Statistic Share of Europeans planning to take a domestic summer trip 2024, by country

Outbound tourism

- Premium Statistic Outbound tourism visitor growth worldwide 2020-2025, by region

- Premium Statistic Outbound visitor growth in Europe 2020-2025, by region

- Premium Statistic Number of outbound trips from EU-27 countries and the UK 2018-2021

- Premium Statistic European countries with the highest outbound tourism expenditure 2019-2022

European travelers

- Premium Statistic Travel intentions of Europeans in the next six months 2024, by destination

- Premium Statistic Share of Europeans planning to travel domestically or in Europe 2023-2024

- Premium Statistic Europeans planning domestic or European trips in the next six months 2024, by age

- Premium Statistic Europeans planning leisure domestic or European trips 2024, by trip type

- Premium Statistic European travelers' favorite destinations for their next European trip 2024

Accommodation

- Basic Statistic Number of tourist accommodation establishments in the EU 2012-2022

- Basic Statistic Number of overnight stays in tourist accommodation establishments in the EU 2011-2022

- Premium Statistic Hotel market revenue in Europe 2017-2028

- Premium Statistic Hotel market revenue in Europe 2017-2028, by region

- Premium Statistic Share of hotel market sales in Europe 2017-2028, by channel

Travel companies

- Basic Statistic Market cap of leading online travel companies worldwide 2023

- Premium Statistic Estimated EV/EBITDA ratio in the online travel market 2024, by segment

- Premium Statistic Market capitalization of leading travel and leisure companies in Europe 2024

- Premium Statistic Leading airlines in Europe based on passenger numbers 2023

- Premium Statistic Travel and tourism revenue in Europe 2019-2029, by segment

- Premium Statistic Number of users of package holidays in Europe 2020-2029

- Premium Statistic Number of users of hotels in Europe 2020-2029

- Premium Statistic Number of users of vacation rentals in Europe 2020-2029

- Premium Statistic Revenue of travel and tourism market in selected countries worldwide 2023

Further related statistics

- Premium Statistic Overnight stays for holiday trips taken by Italians Q1 2016 - Q4 2019

- Premium Statistic Number of nights spent by visitors from India in the Netherlands 2012-2017

- Premium Statistic Market share of outbound visits to the US from the GCC 2011-2021

- Premium Statistic Cultural activities practiced by French tourists in Auvergne-Rhône-Alpes 2017

- Premium Statistic Ranking of online travel and leisure shops based on revenue in the Netherlands 2018

- Premium Statistic Number of Indian nationals' departure from Delhi airport 2011-2022

Further Content: You might find this interesting as well

- Overnight stays for holiday trips taken by Italians Q1 2016 - Q4 2019

- Number of nights spent by visitors from India in the Netherlands 2012-2017

- Market share of outbound visits to the US from the GCC 2011-2021

- Cultural activities practiced by French tourists in Auvergne-Rhône-Alpes 2017

- Ranking of online travel and leisure shops based on revenue in the Netherlands 2018

- Number of Indian nationals' departure from Delhi airport 2011-2022

Trends, Growth, and Opportunity Analysis of Sustainable Tourism in Indonesia

Indonesia Sustainable Tourism Industry Analysis by Eco-tourism and Green Tourism through 2034

FMI Explores How Can Sustainable Travel Preserve Biodiversity and Support Communities as Eco-tourism Witnesses Rise in Indonesia

- Report Preview

- Request Methodology

Indonesia Sustainable Tourism Industry Outlook for 2024 to 2034

Indonesia sustainable tourism industry is set to leap forward with a CAGR of 27.3% through 2034. The industry is valued at USD 17.4 billion in 2024, and by 2034, is likely to reach USD 195 billion.

Tourists are slowly turning their focus to eco-friendly experiences with the least environmental impact. Indonesia, with its green rainforests, volcanic mountains, pristine beaches, and coral reefs, is the place that fits perfectly with this eco-tourism trend. The cultural heritage of the country is the prominent factor that makes it a highly sought-after sustainable travel destination.

What further cements Indonesia as the poster child for sustainable tourism are government initiatives for eco-friendly practices and infrastructure. However, this boom is driven by the one occurring throughout Southeast Asia, with millennials representing the most critical target audience.

The young, digitally literate, and connected demographic is particularly concerned with unique experiences and immersion in cultures-values of sustainable tourism at their core. With the rise of disposable incomes within the region, Indonesia's industry is expected to benefit greatly from this burgeoning travel demographic.

Technological advances are playing a transformative role. Online sustainable travel and eco-friendly lodging platforms make it very convenient for tourists to find and book responsible travel experiences in Indonesia.

Such businesses use digital marketing and social media to enable like-minded, eco-conscious travelers to connect with local communities and sustainable tourism operators. This kind of digital integration not only helps the industry amplify its reach but also guarantees transparency and builds trust with potential tourists.

Increasing emphasis on community-based tourism initiatives is another driver for the industry. The industry works to share responsibility for tourism activities that provide local residents with an obvious economic interest and cultural exchange. It therefore empowers local communities and ensures that tourism works for their economic and social gain. This focus on community-based tourism categorizes Indonesia as a forerunner in responsible travel practices, further propelling the country's tourism industry.

Don't pay for what you don't need

Customize your report by selecting specific countries or regions and save 30%!

Key Industry Highlights

Eco-tourism as a Prominent Trend

Travelers have been shifting away from a typical vacation more and more and instead toward experiences that respect the environment. With Indonesia's unparalleled biodiversity, ranging from lush rainforests to vibrant coral reefs, the country has an immense focus on maintaining sustainable practices.

These practices include responsible waste management and ecotourism initiatives. This positions Indonesia as one of the leaders in this booming travel sector and sets the stage for immense growth in the Indonesian sustainable tourism industry.

Millennial Mindset Fuels Travel

A region with rising disposable income in Southeast Asia, thanks largely to a tech-savvy millennial generation, is fueling a global travel boom. Products of sustainable tourism in Indonesia are increasingly matching their desire for unique experiences and cultural immersion. This opens possibilities to connect with nature and local communities responsibly. This trend is expected to continue as regional economic growth persists.

Online Booking Revolution

Online platforms specializing in sustainable travel goods and eco-accommodation are helping travelers source and book responsible travel experiences in Indonesia with ease.

These platforms are going to use social media and digital marketing to link environmental conservation-conscious travelers to local communities and operators in sustainable tourism. This digital revolution increases accessibility and creates a culture of transparency and trust between potential tourists.

Community Focus First

Where sustainable tourism transcends an environmental consciousness, it takes center stage for the betterment of local communities. Indonesia is now on the bandwagon of community-based tourism programs where there is meaningful interaction with their culture. This includes capacity building through skills sharing and development, and a direct contribution from tourism to the economic and social development of the area.

Luxury Tourism Goes Green

Eco-luxury resorts are growing where paralleling the high-end traveler's quest for sustainable experiences in luxury. Indonesia is a resort-well-placed country to caters to this growing segment of travel with luxurious accommodation facilities whose design and construction are based on eco-friendly practices. This allows discerning travelers to enjoy exclusive experiences while minimizing their environmental footprint.

Experience over Souvenirs

Trends in travel portray that nowadays, travelers are more interested in real experiences than in souvenirs. This goes on to show in-depth cultural immersion that will support sustainable tourism practices in Indonesia. One gets a deep dive into Indonesian culture by participating in traditional cooking classes and learning ancient crafts from local artisans. This experience is not only kind to the environment but also to local communities.

2019 to 2023 Indonesia Sustainable Tourism Industry Analysis Compared to Demand Forecasts for 2024 to 2034

The sustainable tourism industry in Indonesia grew at a CAGR of 27.2% between 2019 and 2023. Indonesia's sustainable tourism may have been in its nascent, germinating state from 2019 to 2023, as government drives for sustainable practices and infrastructural development could have long been underway, spurring a niche industry of ecotourism.

This early momentum would be just the thing to carry the industry forward even as the global eco-tourism movement picks up steam.

The forecasted CAGR for 2024 to 2034 is an almost identical increase of 27.3%. The biodiversity, cultural heritage, and sustainable practices can certainly position the country for a much larger share of the global eco-tourism industry in the years ahead. The steady growth associated with the industry can be attributed to its effective tapping into that source.

The stable CAGR may also suggest a movement toward a more mature and refined sustainable tourism industry in Indonesia. Future growth could be driven by their focus on nuances: responsible waste management, community engagement programs, and visitor education regarding sustainable practices.

The potential for a slowdown in other popular destinations within the sector could indirectly benefit Indonesia. Perhaps the rising regional spending capabilities, particularly among millennials, are providing steady demand for unique and eco-friendly travel experiences within Southeast Asia.

Principal Consultant

Talk to Analyst

Find your sweet spots for generating winning opportunities in this market.

Category-wise Insights

The segmentation analysis is done based on tourism type and age group. By tourism type, eco-tourism captures a 37% share of the industry in 2024. Indonesia's sustainable tourism industry, with government initiatives promoting responsible travel practices, positions the country as a leader in eco-tourism experiences. On the other hand, the age group of 26 to 35 years holds dominance, with a 34% share in 2024.

Eco-tourism Garners Popularity among Tourists in 2024

Eco-tourism segment leads the industry with a 37% share in 2024. This dominance is ruled by Indonesia's rich biodiversity. From unspoiled rainforests teaming with exotic wildlife to breathtaking coral reefs filled with marine life, Indonesia promises an uncommonly unforgettable eco-tourism experience.

The government further bolsters its appeal through efforts to promote responsible travel practices such as responsible waste management and eco-lodging options.

In a further step, infrastructure development in ecologically sensitive areas is planned to minimize environmental impact. This commitment to conserving the environment and showcasing the beauty of natural landscapes has placed Indonesia at the forefront of experiencing eco-tourism. This will attract a growing number of environmentally-conscious travelers seeking authentic and sustainable adventures.

Age Group 26 to 35 Years Dominates the Sustainable Tourism Industry in Indonesia

Travelers aged 26 to 35 are leading Indonesia's sustainable tourism industry, projected to hold a 34% value share in 2024. This age group dominates as it seeks meaningful relations not only with local communities, tradition, and the environment but also beyond the resort. On the other hand, the shifting spending habits enable them to look for eco-friendly options in travel.

Innovation in creating experiences that fit the bill and appeal to the needs of this adventurous and eco-conscious generation in Indonesia is drawing a very loyal and growing customer base. Think local food experiences, immersive cultural workshops, and responsible wildlife watching.

Indonesia is banking on this mammoth experience trend that satisfies not just millennial wanderlust but also has a great effect on a deep appreciation for the natural world and local cultures.

Competition Outlook

Indonesia's sustainable tourism industry is an area where key players continuously strive to be innovative and stay ahead of the curve in adopting environment-friendly travel practices. Renowned hotel brands like Aman Resorts and Alila Hotels & Resorts are at the forefront of sustainable actions, using everything from reducing single-use plastics to implementing renewable energy services across their entire portfolio.

These companies lead the way in environmentally friendly hospitality and in connecting with the local community. Also, they aim to improve conservation efforts and cultural preservation and enhance tourism sustainability in Indonesia on a larger scale.

Another example is EXO Travel and Destination Asia, which are putting forth such responsible tourism measures including the involvement of the local population and care for the conservation of nature. Companies have started to take a more active role by coordinating eco-friendly tourist trips to some remote parts of the Indonesian forests and advocating for community-based tourism geared towards the preservation of the country's biodiversity and culture.

Players in the position of driving economic growth are these key actors through strategic partnering with conservation organizations and community leaders. This is also parallel to the strengthening of environmental stewardship among travelers. This results in the creation of a sustainable future for the tourism industry of Indonesia.

Industry Updates

- Padma Hotels, based in Indonesia, proudly announced its transition to solar energy in 2023. With properties in Bali, Bandung, Semarang, and Karawang, Padma Hotels leads the way in sustainability by implementing Solar Power Plant (PLTS) systems. This bold move demonstrates Padma Hotels' commitment to reducing carbon footprints and setting a new standard for eco-friendly hospitality in Indonesia.

- Traveloka, Indonesia's top online travel booking site, introduced new sustainable travel options in 2023. With an eye on Southeast Asia's burgeoning industry, Traveloka aims to cater to environmentally-conscious travelers while expanding its regional presence. This initiative underscores Traveloka's dedication to responsible tourism and reflects its commitment to shaping a greener future for travel.

Get the data you need at a Fraction of the cost

Personalize your report by choosing insights you need and save 40%!

Leading Sustainable Tourism Brands in Indonesia

- Altai Travel

- Travelxism Sustainable Tour

- Sumatra Eco Travel Bukit Lawang-Tours & Treks

- Javaindo Ecotourism Tour & Services

- Exo Travel Indonesia

- Happy Trails! Asia-Indonesia

- Azimuth Adventure Travel Ltd

- Satguru Indonesia-Travel Management Company

- K.B.A Tur (PT. Karang Bali Asli Tur)

- Delokal-Travel Like Local

- Authentic Indonesia

- Trijaya Travel: Sumatra Tour & Travel Agent Medan

- Destinazones

- Wild Sumatra Tours

Key Segments of Industry Report

By tourism type:.

In terms of tourist type, the industry is categorized into eco-tourism, green tourism, soft tourism, and community tourism.

By Booking Channel:

Based on booking channels, the industry is divided into phone booking, online booking, and in-person booking.

By Tourist Type:

Tourist type segments include independent travelers, tour groups, and package travelers.

By Age Group:

Age group categories include 15 to 25 years, 26 to 35 years, 36 to 45 years, 46 to 55 years, and 66 to 75 years.

Frequently Asked Questions

How big is indonesia’s sustainable tourism industry.

The industry is estimated to reach USD 17.4 billion in 2024.

What is the Forecast for the Industry?

Demand is forecasted to rise at a 27.3% CAGR through 2034.

What is the Industry Outlook of Sustainable Tourism in Indonesia?

The industry is likely to reach USD 195 billion by 2034.

Who are the Key Players in the Industry?

Altai Travel, Travelxism Sustainable Tour, and Exo Travel Indonesia.

Which Tourism Type Leads the Industry?

Eco-tourism is set to dominate the industry in 2024.

Table of Content

Recommendations.

Travel and Tourism

Sustainable Tourism Market

REP-GB-3491

UAE Sustainable Tourism Market

REP-GB-15369

Mexico Sustainable Tourism Market

REP-GB-15371

New Zealand Sustainable Tourism Market

REP-GB-15332

Explore Travel and Tourism Insights

- Get Free Brochure -

Your personal details are safe with us. Privacy Policy*

- Get a Free Sample -

- Request Methodology -

- Customize Now -

I need Country Specific Scope ( -30% )

- Talk To Analyst -

I am searching for Specific Info.

- Download Report Brochure -

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

TheJakartaPost

Please Update your browser

Your browser is out of date, and may not be compatible with our website. A list of the most popular web browsers can be found below. Just click on the icons to get to the download page.

- Destinations

- Jakpost Guide to

- Newsletter New

- Mobile Apps

- Tenggara Strategics

- B/NDL Studios

- Archipelago

- Election 2024

- Regulations

- Asia & Pacific

- Middle East & Africa

- Entertainment

- Arts & Culture

- Environment

- Work it Right

- Quick Dispatch

- Longform Biz

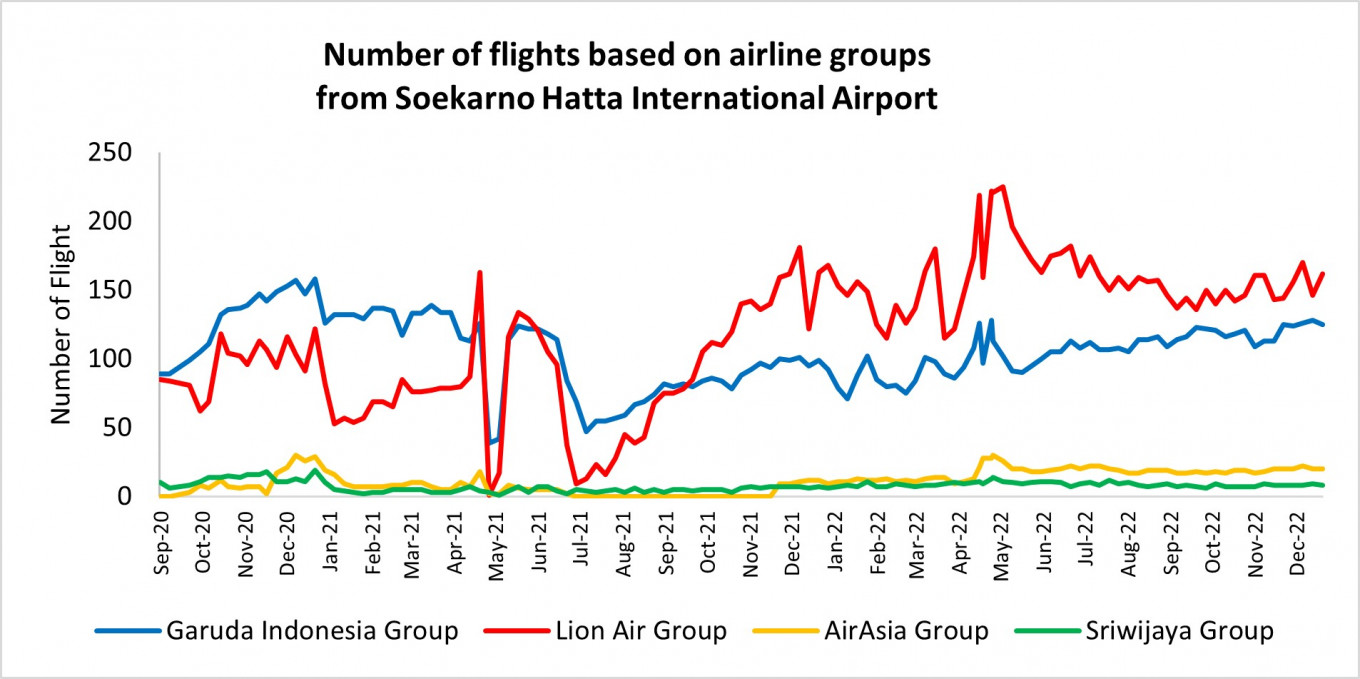

National tourism and aviation outlook in 2023

The tourism industry is one of the industries hit hard by the COVID-19 pandemic since 2020. After three years, the tourism industry is showing a gradual recovery. Room occupancy rates in several areas have also shown good signs of recovery with several regions recording a pre-pandemic level.

Share this article

Change text size, gift premium articles to anyone.

he tourism industry is one of the industries that has been hit hard by the COVID-19 pandemic since 2020. After three years, the tourism industry is showing a gradual recovery. Room occupancy rates in several areas have also shown good signs of recovery with several regions recording a pre-pandemic level.

The number of tourists visiting Indonesia has also increased gradually, although it is still far from the 2019 level. However, the recovery of tourist visits is also in line with the recovery of several neighboring countries, such as Thailand, Singapore and Malaysia, which in 2022 recorded between 25 and 30 percent from pre-pandemic level.

There are several positive factors that will drive tourism recovery in the future.

First, the government revoked the public activity restriction (PPKM) on Dec. 30, which brings fresh air to the Indonesian tourism industry. The repeal of PPKM will allow the community to travel without limiting the capacity in gathering. The recovery in the number of domestic tourists, which is faster than the recovery for foreign tourists, is also encouraging the domestic tourism industry to further recover.

Meanwhile, air-transport mobility improved at the peak of the 2022/2023 Christmas and New Year holidays. Data from the Transportation Ministry show that the movement of domestic airplanes and passengers departing on H-7 to D+10 for the 2022/2023 Christmas and New Year holidays increased when compared to the same period in 2021/2022.

Domestic aircraft movements were recorded at 28,778, an increase of 23.77 percent compared to the previous period, while domestic passenger movements amounted to 3.2 million passengers, or grew 39.06 percent compared to the previous period.

Every Monday

With exclusive interviews and in-depth coverage of the region's most pressing business issues, "Prospects" is the go-to source for staying ahead of the curve in Indonesia's rapidly evolving business landscape.

By registering, you agree with The Jakarta Post 's Privacy Policy

for signing up our newsletter!

Please check your email for your newsletter subscription.

Second, the border opening for arrivals of tourists from China, who can accelerate the number of tourists arriving in Indonesia. The Tourism and Creative Economy Ministry sets a target of between 120,700 and 255,300 of Chinese tourists arriving in Indonesia in 2023. As one of the largest market countries for tourism in Indonesia, the return of Chinese tourists can support the total target in 2023 of having foreign tourists of between 3.5 million to 7.4 million.

'Emergency Warning' trending on social media following House, MK standoff

Govt to launch new study on authenticity of Borobudur’s ‘chattra’

Trump safe after apparent assassination attempt, person in custody

Related articles, bali airport on alert over mpox, ensuring the recovery of child victims of trafficking, indonesia’s consumers: shifting in spending trends, jokowi wants coconuts as aviation biofuel, govt lost billions in social aid distribution corruption scandal: kpk, related article, more in business.

Indonesia achieves highest exports since December 2022, maintains trade surplus

Central bank digital currency momentum growing, study shows

RI eyes former mining land for solar power plants

Kaesang visits KPK to explain private jet trip

Big government: Neither efficient nor effective

Prabowo’s succession plan looms large as top diplomat readies exit

Shy, smelly penguin wins new zealand bird of the year, frenchman accused of mass abuse of wife says 'i am a rapist', seeks forgiveness, nusantara opens to public, malaysia freezes bank accounts linked to gisb after child abuse allegations, japan celebrates historic emmys triumph for 'shogun'.

- Jakpost Guide To

- Art & Culture

- Today's Paper

- Southeast Asia

- Cyber Media Guidelines

- Paper Subscription

- Privacy Policy

- Discussion Guideline

- Term of Use

© 2016 - 2024 PT. Bina Media Tenggara

to Read Full Story

Subscribe now.

- Unlimited access to our web and app content

- e-Post daily digital newspaper

- No advertisements, no interruptions

- Privileged access to our events and programs

- Subscription to our newsletters

Purchase access to this article for

Redirecting you to payment page

Pay per article.

Rp 29,000 / article

Or continue login with

- Palmerat Barat No. 142-143

- Central Jakarta

- DKI Jakarta

- +6283816779933

Your Opinion Matters

Share your experiences, suggestions, and any issues you've encountered on The Jakarta Post. We're here to listen.

Thank you for sharing your thoughts. We appreciate your feedback.

Share options

Quickly share this news with your network—keep everyone informed with just a single click!

Change text size options

Customize your reading experience by adjusting the text size to small, medium, or large—find what’s most comfortable for you.

Share the best of The Jakarta Post with friends, family, or colleagues. As a subscriber, you can gift 3 to 5 articles each month that anyone can read—no subscription needed!

- International

- Food and Drink

- Places of Interest

- Sustainable

- What's new

- Celebrating People

- Hall of Frame

- Responsible Tourism

- MP on my Mind

- MP Wellness

Bali Proposes Temporary Ban On New Hotels Amid Overtourism Concerns

Indonesia has taken a significant step to safeguard Bali 's natural beauty and cultural richness by temporarily halting the construction of new hotels, villas, and nightclubs in specific tourist areas. This crucial move aims to prevent overtourism , over-development, protect the environment, and preserve the island's cultural heritage. It reflects a proactive effort to address concerns about the impact of land development on Bali's environment and artistic integrity.

A Check On Footfalls

There have been concerns regarding the detrimental effects of unchecked development on the natural landscape and commercial interests in Bali for a while. As the island continues to attract many tourists, the mounting pressure to expand infrastructure has sparked fears that the island's distinct allure and natural splendour may be compromised.

The recent decision is part of a broader governmental initiative to restructure tourism in Bali. The central objective is to enhance the quality of tourism on the island and create more employment opportunities. It also seeks to safeguard Bali's indigenous culture, which is increasingly threatened due to rapid commercialization and uncontrolled construction. The moratorium serves as a critical step in addressing these multifaceted challenges in a comprehensive and sustainable manner.

Hermin Esti, a distinguished senior official from Indonesia’s Coordinating Ministry of Maritime and Investment Affairs, has confirmed that the government has agreed on the moratorium. The duration of the suspension is currently the subject of ongoing deliberations, as the government is carefully considering the region's long-term needs before finalising the decision.

It is reported that Bali's acting governor, Sang Made Mahendra Jaya, took decisive action on September 7th by proposing suspending construction activities. This proposal, specifically targeting four of Bali's busiest districts, addresses the pressing issue of overdevelopment for commercial purposes.

A Tourism Tax

In early 2024, Bali implemented the International Tourism Levy , a mandatory fee for incoming foreigners. This fee, around USD 10, is intended to help preserve Bali's unique cultural heritage and support sustainable tourism. International tourists visiting Bali have to pay this one-time tax and are encouraged to do so in advance through the Love Bali website or app. After paying, tourists will receive a tourism levy voucher via email, which they must keep on their smartphones to scan at Bali International Airport and sea port checkpoints.

Overtourism On The Radar

All across the world, countries have been implementing measures to combat the effects of overtourism on natural landscapes and built heritage. UNESCO, the United Nations' cultural body, recently stated that Venice should be included in a list of endangered world heritage sites. as the city is at risk of "irreversible" harm from overtourism, overdevelopment, and increasing sea levels. Italy has said it will fine all unruly tourists. Greece will limit the number of tourists visiting the Acropolis. And Japan will restrict access to Mt Fuji. The list goes on. Tourism, it seems, needs to be reigned in everywhere.

Related Stories

- Bahasa Indonesia

Indonesia Investments Report - August 2024 Edition

10 September 2024 (closed)

Jakarta Composite Index (7,761.39) +58.65 +0.76%

GDP Growth Q2-2024 5.05% (y/y)

Inflation August 2024 2.12% (y/y)

Central Bank BI 7-Day Reverse Repo August 2024 6.25%

FHTB 2022 Accelerates the Revival of Indonesia’s Tourism Industry

Bali, 8 September 2022 – The global pandemic was a massive hit to the tourism industry worldwide, but now, the industry is reviving along with the better world situation. Aiming to support Indonesia’s reviving tourism industry, PT Pamerindo Indonesia positively responds to this promising condition by presenting the return of Food, Hotel & Tourism Bali (FHTB) 2022 , which is the largest International Hospitality, Food & Beverage Trade Exhibition in Eastern Indonesia.

The 12 th edition of FHTB this year will be held at the Bali Nusa Dua Convention Center (BNDCC) on 22 – 24 September 2022. Incorporating with Retail Indonesia, FHTB 2022 will provides unprecedented access to top culinary and hospitality manufacturers, distributors, and retailers.

Event Director of FHTB 2022, Juanita Soerakoesoemah , stated that FHTB 2022 continues to accelerate the sustainable growth of Indonesia’s tourism industry after the pandemic and to embody the spirit of economic and entrepreneurial possibility in Indonesia’s tourism market. “We provide a platform and business opportunities for both domestic and international suppliers of F&B and hospitality to break into the growing needs of Indonesia’s market,” Juanita stated.

She then claimed that Indonesia’s tourism market has a decerning taste; thus, the players, such as owners of hotels, clubs, restaurants, tour operators, and distributors, as well as its retailers and wholesalers, must also meet ever-expanding requirements in fulfilling their market needs. This growth in the requirements to meet the market preferences will also affect the development of Indonesia’s tourism industry.

Statistics Indonesia (BPS) showed that foreign tourist visits to Indonesia reached 397,770 during January – May 2022. This figure increased by 616.40% (YoY) from the previous year [1] . The Ministry of Tourism and Creative Economy targets foreign tourist visits to reach 1.8 – 3.6 million, implying proceeds of approximately IDR 6.74 – 24.40 trillion in 2022 [2] .

Juanita believes that FHTB has been recognised as the premier platform to boost Indonesia’s hospitality and tourism businesses. “FHTB provides the best opportunities for suppliers to meet face to face with potential clients, and to reconnect with existing customers,” she remarked.

FHTB 2022 provides access to more than 250 exhibiting companies of the best factories, distributors, and retailers in their respective industries from 25 countries. Among the companies confirmed to join as exhibitors at FHTB 2022 are prominent names such as Hatten Bali, Nano Logistic, McLewis, Health Today, ATEJA, Amardeep, Terry Palmer, Sensatia, Prambanan Kencana, Rotaryana Prima, Duta Abadi Primantara, Kurnia Mitra Duta Sentosa, Nespresso, Lotus Food Services, Pantja Artha Niaga, Multifortuna Sinardelta, Jaddi Internasional, Libra Food Service, etc. Their precence at FHTB 2022 will attract key-trade only buyers from the region’s leading resorts, hotel chain, restaurants, importers.

Furthermore, FHTB 2022 will also feature special events and competitions during the exhibition. These feature events are a form of support from various associations in the industry that has become the best partners in presenting the exciting events such as the 11th Salon Culinaire Bali by Bali Culinary Professionals (BCP); Barnation by Asosiasi Bartender Indonesia (ABI); Indonesia Latte Art Championship (ILAC) by Specialty Coffee Association of Indonesia (SCAI); Wine Masterclass by Indonesia Sommelier Association (ISA) Bali Chapter; and Gelato Workshops by Lotus Food Services dan Carpigiani. All these events will also be accessible through the FHTB TV Programme on Youtube channel of Food & Hospitality Series_ID.

“Many feature events and competitions at FHTB 2022 that will be held through support of the respective associations as partners, will challenge the creativity, wit, and skills of the regions finest chefs, sommeliers, and baristas,” Juanita elaborated.

Additionally, the visitors of FHTB 2022 will have a chance to learn from experts in the F&B, hospitality, and tourism industries through the Industry Seminar. The seminars will be presented by several of FHTB renowned exhibitors in the related industry (Food, Hotel and Tourism Industry) to showcase and acknowledge visitors with the products and services they offer. “We bring dynamic topics into the Industry Seminar to allow visitors of FHTB 2022 gain useful insights to stay updated grow in the industry while having a chance to create business networking and connections,” she added.

FHTB 2022 provides an undisputed entry point for top international companies into Indonesia’s thriving and lucrative tourism market. This access means the biggest gathering, attended by unrivalled quality of attendees of decision makers, specifiers and end-users in the tourism, F&B and hospitality industries in Indonesia. Juanita added that all the activities in FHTB 2022, including networking, discussions, exchange of ideas, and competitions, aim to help grow business in this burgeoning marketplace of tourism in Indonesia, and also toward Making Indonesia 4.0 by 2030.

As part of Informa Markets and the Informa Group, PT Pamerindo Indonesia will run FHTB 2022 as sustainable event which focus on sustainability for long term impacts to customers, colleagues, communities, and environment where it works in. Leonarita Hutama as Marketing Communication Manager FHTB 2022 explains that sustainability (social, economic, and environmental) on FHTB is no longer nice to have but a necessary part of any activities in the event.

“ Sustainability on FHTB 2022 is not only just about the way we produce our events and products but it is also about the role that we have to play in providing a space to work in partnership together with our markets to inspire sustainable development of the industries we serve,” she concluded.

Therefore, FHTB 2022 will be held as sustainable event through a forward act in using renewable electricity, reducing paper used, reuse some products for several times along the event, and using environmental-friendly product materials.

[1] Source: Badan Pusat Statistik (BPS), Press Release, 01 July 2022 ( https://www.bps.go.id/pressrelease/2022/07/01/1874/jumlah-kunjungan-wisman-ke-indonesia-melalui-pintu-masuk-utama-pada-mei-2022-mencapai-212-33-ribu-kunjungan--dan-jumlah-penumpang-angkutan-udara-domestik-pada-mei-2022-naik-40-41-persen.html )

[2] Source: Antara, “Industri Pariwisata Indonesia Menargetkan 1,8 -3,6 Juta Wisman di 2022”, accessed through Media Indonesia.com’s webpage ( https://mediaindonesia.com/ekonomi/485513/industri-pariwisata-indonesia-menargetkan-18-36-juta-wisman-di-2022 )

The FHTB 2022 will be held for three days, 22-24 September 2022, at the Bali Nusa Dua Convention Center (BNDCC). Visitors may pre-register for free access to the three-day exhibition through the link: https://fhtbali.id/prereg/ .

Contact Person:

Leonarita Hutama

Marketing Communication Manager PT Pamerindo Indonesia [email protected]

About PT Pamerindo Indonesia

PT Pamerindo Indonesia is the leading trade fair organiser in Indonesia, established with the sole purpose of organising specialised trade exhibitions for the Indonesian market. The company has grown considerably and now regularly organises over 20 trade exhibitions in the following sectors: Baby & Maternity, Beauty, Building & Construction, Electric & Power, Food & Hotel, Laboratory, Manufacturing, Mining, Plastics & Rubber, Oil & Gas sectors. Since its inception PT Pamerindo Indonesia has organised over 200 international trade exhibitions in Jakarta, Surabaya, and Bali.

PT Pamerindo Indonesia is part of Informa Markets, a division of Informa plc. Informa Markets creates platforms for industries and specialist markets to trade, innovate and grow. Our portfolio is comprised of more than 550 international B2B events and brands in markets including Healthcare & Pharmaceuticals, Infrastructure, Construction & Real Estate, Fashion & Apparel, Hospitality, Food & Beverage, and Health & Nutrition, among others. We provide customers and partners around the globe with opportunities to engage, experience and do business through face-to-face exhibitions, specialist digital content and actionable data solutions. As the world’s leading exhibitions organiser, we bring a diverse range of specialist markets to life, unlocking opportunities and helping them to thrive 365 days of the year. For more information, please visit www.pamerindo.com & www.informamarkets.com.

Share this column

‹ Back to Business Columns

Please sign in or subscribe to comment on this column

Related Pages

- Island Concepts Indonesia Company

- Saraswati Griya Lestari Company

- Hotel Mandarine Regency Company

- Dyandra Media International Company

- Surya Semesta Internusa Company

Latest Reports

- Consumer Price Index of Indonesia: 4th Consecutive Month of Deflation 10 September 2024

- Latest Economic Data of Indonesia; Expectations for Economic Growth in Q3-2024 10 September 2024

- Indonesia Investments Releases Its August 2024 Report: 'Political Year Part II' 09 September 2024

- Analysis of Indonesia's Trade Balance: Strong Rebound in Imports 23 August 2024

- Trade Balance: Impressive Rebound in Palm Oil Shipments Support Export Performance 07 August 2024

COMMENTS

Overall, Indonesia's tourism industry shows a positive outlook, driven by its diverse attractions and proactive initiatives. This text provides general information.

During the Indonesia Tourism Outlook event held on November 28, 2023, Uno shared his expectations, stating, "The achievement of foreign tourist visits to Indonesia this year is around 11 million or above the target of 8.5 million. In 2024, we are targeting 14 million foreign tourist visits. We are optimistic that in 2025, the tourism sector ...

Cumulatively, international visitor arrivals from January to April 2024 increased by 24.85 percent compared with the same period in 2023. This increase was mainly recorded at Ngurah Rai Airport-Bali and Soekarno Hatta Airport Banten, which increased by 28.92 percent and 38.31 percent, respectively. In April 2024, the number of outbound trips ...

As 2023 draws to a close, Indonesia is preparing for a landmark year in 2024, with tourism at the forefront of its economic agenda. The Ministry of Tourism and Creative Economy, led by Minister Sandiaga Uno, is setting ambitious targets to elevate Indonesia's status as a premier global destination, particularly emphasizing Bali's role.. Bali: The Crown Jewel of Indonesian Tourism

"The achievement of foreign tourist visits to Indonesia this year is around 11 million or above the target of 8.5 million. In 2024, we are targeting 14 million foreign tourist visits. We are optimistic that in 2025, the tourism sector will recover to normal," said Uno at the Indonesia Tourism Outlook event in 2024, on Tuesday, 28th November ...

The outlook for Indonesia's tourism sector remains highly positive. With the current momentum, tourism authorities are optimistic about achieving even higher visitor numbers in 2025. Efforts will continue to focus on sustainable tourism practices, ensuring that the growth in tourist arrivals does not negatively impact the environment or local ...

In the third quarter of 2023, domestic tourist trips in Indonesia reached 192.52 million trips. This number increased by 13.36 percent compared to the third quarter of 2022 (year-on-year). Throughout the third quarter, the highest number of domestic trips occurred in July 2023, which reached 73.69 million trips.

Antara News are reporting that Indonesia's Ministry of Tourism and Creative Economy has released the '2023-2024 Tourism and Creative Economy Outlook,' which contains comprehensive information on the latest developments in the tourism and creative economy sector. Sandiaga Uno, Indonesia's Tourism and Creative Economy Minister said the newly launched outlook could be used as a guide by ...

Tourism in the economy and outlook for recovery. The tourism sector is a significant part of Indonesia's economy. ... The impacts of COVID-19 saw tourism GDP fall by 56% in 2020 to just 2.2% of the total economy. Prior to 2020, tourism in Indonesia had been steadily growing, fuelled by an influx of international visitors. In 2019 ...

The 2022 edition of OECD Tourism Trends and Policies analyses tourism performance and policy trends to support recovery across 50 OECD countries and partner economies. It examines the key tourism recovery challenges and outlook ahead, and highlights the need for co-ordinated, forward-looking policy approaches to set tourism on a path to a more ...

The Travel & Tourism market in in Indonesia is projected to grow by 7.79% (2024-2029) resulting in a market volume of US$12,110.00m in 2029.

Minister Uno, speaking at the Indonesia Tourism Outlook 2024 with the theme Investment Opportunities and Challenges for Sustainable Tourism initiated by the Tourism and Creative Economy Journalists Forum (Forwaparekraf), on 28 November 2023 at the Aone Hotel Jakarta, explained that a number of international institutions predict various ...

Table 1 shows that the start of recovery began in 2022, and continued into 2023. In fact, the recovery goes much faster than Indonesia's Tourism and Creative Economy Ministry expected. At the start of 2023 this ministry had its target for full-year 2023 foreign tourist arrivals at 7.4 million.

In March 2024, international visitor arrivals in Indonesia were 1.04 million. International visitors decreased by 1.91 percent compared with February 2024 (month-to-month) and increased by 19.86 percent compared with March 2023 (year-on-year).

The tourism sector in Indonesia, was hit hard by the COVID-19 pandemic, but the industry is now witnessing a positive turnaround. ... Sandiaga Uno, expressed optimism at the Indonesia Tourism Outlook event. Projecting a target of 14 million foreign tourist visits in 2024. Despite surpassing expectations for 2023, the figures are still ...

The absolute economic contribution of tourism in Indonesia was forecast to continuously increase between 2024 and 2029 by in total 52.8 billion U.S. dollars (+65.56 percent). After the ninth ...