- How to Choose the Right Credit Card

- How to Apply for a Credit Card

- How to Cancel a Credit Card

- Ways To Pay Off Credit Card Debt

- Why Your Credit Card Was Declined

- How to Get Out of Credit Card Debt

- What to Know About Credit Card Minimum Payments

- What Is a Credit Card and Should You Get One?

- How Do Credit Cards Work in Canada?

- What Are the Different Types of Credit Cards?

- How an International Credit Card Works

- Common Credit Card Terms and Conditions

- Credit Card Fees and Charges

Credit Card Interest Calculator

- First-Time Home Buyer Incentive

- Tax-Free First Home Savings Account

- Mortgage Renewal

- Home Equity Loan

- How a Reverse Mortgage Works

- Home Equity Line of Credit

- Getting a Second Mortgage

- How to Refinance a Mortgage

- How Does a Mortgage Work in Canada?

- How Does Mortgage Interest Work?

- Realtors vs Real Estate Agents vs Brokers

- Is Canada’s Housing Market Crashing?

- How to Save Money on Your Next Renewal

- First-Time Home Buyer Grants and Assistance Programs

- Types of Houses in Canada

- Types of Mortgages in Canada: Which Is Right for You?

- What Is an Interest Rate?

- Guaranteed Investment Certificate (GIC)

- Savings Account Guide

- Common Canadian Bank Fees and Charges

- Types of Bank Accounts in Canada

- EQ Bank Review

- Simplii Financial Review

- Tangerine Bank Review

- National Bank of Canada Review

- CIBC Review

- Scotiabank Review

- TD Bank Review

- What Is Canadian Investor Protection Fund (CIPF) Coverage?

- How Capital Gains Tax Works

- Investing for Canadian Beginners

- Understanding Asset Classes in Investing

- Understanding Fixed-Income Investments

- How to Invest in Stocks

- What Are T-Bills

- What is a Bond

- What is Registered Disability Savings Plan (RDSP)

- What Are Mutual Funds

- What is an ETF (Exchange Traded Fund)

- What Is Forex Trading

- What Is Cryptocurrency and How Does It Work

- What Is a Stock

- What is Old Age Security and How Does It Work

- What is Registered Retirement Income Funds (RRIFs)

- How a Life Income Fund (LIF) Works for Retirement

- What Is An In-Trust Account

- What Is a Locked-in Retirement Account (LIRA)

- How Much Money You’ll Need To Retire

- Defined Benefit vs. Defined Contribution Pension Plans

- Can Annuities Fund Your Retirement?

- What Is a Personal Loan?

- Personal Loan Insurance: Do You Need It?

- What Is a Secured Personal Loan?

- What Is a Payday Loan?

- What Is a Pawn Loan?

- What Is a Car Title Loan?

- Small Business Loan vs Personal Loan

- Personal Loan vs. Line of Credit

- Personal Line of Credit vs Home Equity Loan:

- Personal Line of Credit vs Car Loan

- HELOC vs Personal Loan

- Debt Consolidation vs Personal Loan

- Cash Advance vs Personal Loan

- Business Loan vs Personal Loan

- Price Matching Tips to Help You Save Big

- How to save for Wedding

- How to Save Money on Groceries

- Ways to Save on Your Next Family Vacation

- Tips to Help You Save On Gas

- How to Save Money in 8 Easy Steps

- Passive Income: What It Is and How to Make It

- Budgeting 101: How to Budget Your Money

- Ways to Make Money Online and Offline in Canada

- How Do Credit Inquiries Work?

- What is the Ideal Credit Utilization Ratio?

- What Credit Score is Needed for a Credit Card?

- How to Get a Better Credit Score

- What is a Good Credit Score in Canada?

- Credit Cards

Expedia for TD Review: What You Need to Know

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own.

Put TD Rewards points to work through the Expedia for TD platform, an Expedia portal exclusively for TD credit cardholders that offers the highest redemption value possible for hard-earned TD points.

How does Expedia for TD work?

Is it worth getting expedia for td.

- How to earn TD rewards

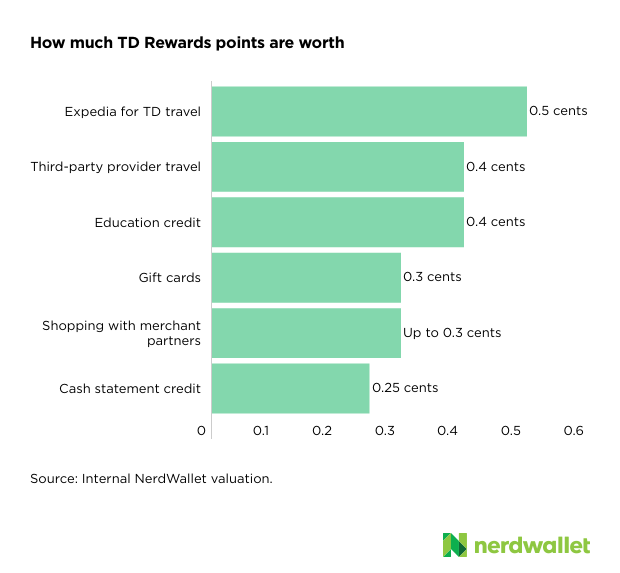

How much are TD Rewards points worth?

How to redeem your points on expedia for td, does expedia for td price match, how to log in to expedia for td, pros and cons of expedia for td.

Expedia for TD is an Expedia platform for TD Bank credit cardholders.

TD cardmembers log into the Expedia for TD platform to browse travel deals and redemption options, which include vacation packages, accommodations, exclusive deals and more. TD points are worth more when redeemed through the Expedia for TD platform. Purchasing travel through the platform with a TD credit card earns accelerated TD points.

Expedia.ca vs. Expedia for TD

Expedia.ca is an online travel agency that can be used to book airfare, cruises, hotel accommodations, car rentals and more.

Expedia for TD is an Expedia platform exclusively for customers with credit cards that earn TD Rewards. TD cardholders who earn cash back or Aeroplan points with their cards can’t access the platform.

Other notable differences between Expedia for TD and Expedia.ca? The former offers accelerated TD Rewards points for money spent on travel purchases through Expedia for TD and a dedicated support team for TD customers, while the latter does not.

Outside this, Expedia for TD is not unlike its parent platform, Expedia.ca. Cardholders can browse and book flights, hotel stays, car rentals, cruise tickets and more.

TD Rewards points are most valuable when redeemed through Expedia for TD. The platform, accessed at expediafortd.com, also offers an accelerated earn rate of up to 9 TD Rewards points per $1 spent on travel bookings.

Additional Expedia for TD perks include its price-matching policy on hotels and travel packages and dedicated 24-hour customer support. There are a couple of drawbacks, though. The platform is only for TD credit cardholders who earn TD Rewards points. Plus, there are limitations to Expedia for TD’s price matching — time restrictions apply, and refunds are only issued on flight and hotel packages.

How to earn TD rewards

Some TD credit cards earn TD Rewards points. Earn rates vary.

TD credit cards that earn TD rewards

The following TD credit cards earn TD Rewards points:

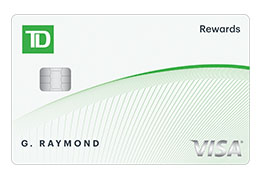

- TD Rewards Visa Card.

- TD Platinum Travel Visa Card.

- TD First Class Travel Visa Infinite Card.

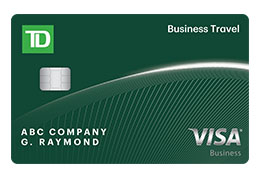

- TD Business Travel Visa Card.

For those interested in earning the most TD Rewards Points per dollar, the TD First Class Travel Visa Infinite Card and the TD Business Travel Visa Card carry the highest earn rates. This makes them the best cards for individuals and businesses, respectively.

TD credit cardholders will get the most bang for their buck by redeeming their TD Rewards points through Expedia for TD.

Expect to get around 0.25 to 0.5 cents per TD Rewards point, according to NerdWallet analysis.

The value of TD Rewards points varies depending on the redemption method, but TD Rewards points are at their most valuable when used to redeem travel offers through the Expedia for TD portal. Cardholders can expect to get 0.5 cents per TD Rewards point for travel purchases made through Expedia for TD.

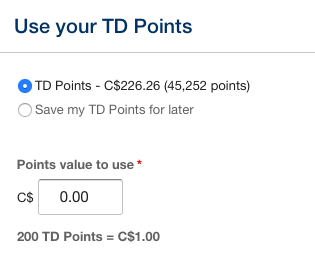

Cardholders must have at least 200 TD Rewards Points — worth $1 — to make a redemption through the Expedia for TD portal.

To redeem your TD points on the Expedia for TD platform:

- Register your TD Rewards account on TD’s website.

- Log into Expedia for TD with your username and password.

- Find the travel offer you’d like to purchase.

- Book your offer through the online Expedia for TD portal or by phone.

- Redeem your TD Rewards Points when you book.

Expedia for TD redemption options

The Expedia for TD booking portal offers numerous redemption options:

- Car rentals.

- All-inclusive vacations.

- Train travel.

How to maximize TD Rewards points

Even if your TD points don’t entirely cover the cost of your booking through the Expedia for TD portal, paying the difference with your TD credit card earns you accelerated points — which gets you closer to another free or discounted travel experience.

Let’s say you book a $500 Air Canada round-trip flight to the Dominican Republic through the Expedia for TD portal. You use 50,000 TD Rewards points towards the booking. This reduces the cost of your trip by $250. You put the outstanding $250 balance on your TD credit card.

Since you can earn up to 9 TD Rewards points for $1 spent through the Expedia for TD portal, the $250 you put on your TD credit card earns you 2,250 TD Rewards Points — which is a value of $11.25 back in your pocket.

Looking for a travel rewards credit card?

We compared the best options in Canada.

Yes. Customers can take advantage of price matching through the Expedia for TD portal — also called Expedia’s Price Guarantee.

How does price matching work?

Expedia will refund the difference if you find cheaper travel packages or accommodations after booking through the Expedia for TD portal. But there are two important caveats. Expedia will only issue a refund if you find:

- A less expensive flight and hotel package within 24 hours of booking.

- A cheaper hotel rate up to 48 hours before check-in.

Pros and cons of Expedia for TD price matching

- Get refunded the difference between your booking and a cheaper travel deal.

- Limited to hotel stays and flight and hotel packages.

- Time restrictions apply.

Once you’ve registered your TD Rewards account on TD’s website, you can log in to Expedia for TD from:

- tdrewards.com.

- expediafortd.com.

Expedia for TD customer service

Expedia for TD has a dedicated support team for TD credit cardholders. The team can be reached by phone at 1-877-222-6492 24 hours a day.

3 tips for using Expedia for TD

Make the most of your TD Rewards points and the Expedia for TD platform with the following tips:

1. Book through Expedia for TD instead of TD’s “Book Any Way.”

Your TD Rewards points are worth 0.5 cents per point when redeemed for travel purchases booked through Expedia for TD. You can also book travel experiences through third-party travel websites and agencies — what TD calls its “Book Any Way” redemption option — but your points won’t go as far. Expect to receive 0.4 cents per point for the first $1,200 of any Book Any Way travel redemption request, and 0.5 cents per point for any amount over $1,200 for the same Book Any Way travel redemption.

2. Use your TD credit card to cover outstanding expenses from Expedia for TD bookings.

You’ll earn TD Rewards points at an accelerated rate when you use your TD credit card to cover outstanding expenses on the Expedia for TD platform. Different cards earn points at different rates:

- TD Rewards Visa earns 4 TD points for every $1 spent on travel purchases through the platform.

- TD Platinum Travel Visa earns 6 TD points for every $1 spent on travel purchases through the platform.

- TD First Class Travel Visa Infinite earns 8 TD points for every $1 spent on travel purchases through the platform.

- TD Business Travel Visa earns 9 TD points for every $1 spent on travel purchases booked online and 6 TD points for every $1 spent on travel purchases booked by phone through the platform.

3. Don’t wait to shop around.

Expedia for TD will only honour its price-matching policy under specific circumstances. If you’ve booked a flight and hotel package, you have just 24 hours to submit a refund request to Expedia for TD if you find a cheaper package. Hotel bookings have a more generous timeframe: Expedia for TD will issue a price-matching refund up to 48 hours before check-in.

- Redeem TD Rewards points for flights, hotel stays, car rentals, cruise tickets and more.

- Earn up to 9 TD Rewards points for every $1 spent on travel purchases through Expedia for TD.

- Receive an annual $100 travel credit when booking through Expedia For TD. (Limited to TD First Class Travel Visa Infinite Cardholders).

- Take advantage of Expedia’s price-matching policy to secure the lowest rates for hotels and hotel/flight packages.

- Dedicated Expedia For TD support team available 24 hours a day.

- Limited to TD credit cardholders who earn TD Rewards.

- Price matching limitations apply.

Frequently asked questions about Expedia for TD

TD points never expire so long as you remain a TD cardholder with an account in good standing. If you don’t earn or redeem any TD Rewards points for at least one year, your account will be deemed inactive. At this time, TD may close your account and offer you the opportunity to redeem your TD Rewards points by a specified date.

There’s no cost associated with accessing the Expedia for TD platform. The travel package options on Expedia for TD are no different than those offered on Expedia.ca, but only certain TD credit cardholders can gain access to it.

About the Author

Shannon Terrell is a lead writer and spokesperson for NerdWallet, where she writes about credit cards and personal finance. Previously, she was a writer, editor and video host for financial…

DIVE EVEN DEEPER

Compare Canada’s Best Credit Cards for August 2024

NerdWallet Canada’s picks for the best credit cards include top contenders across numerous card categories. Compare these options to find the ideal card for you.

Interest charges don’t need to be a mystery. Use our credit card interest calculator to see how much interest you’d owe if you carry a credit card balance.

15 Best Travel Credit Cards in Canada for August 2024

Explore the best travel credit cards in Canada for daily spending, flexible travel rewards, big welcome bonuses and more.

How to Choose a Travel Credit Card

With so many cards, rewards programs and benefits available, choosing the right travel credit card can be overwhelming. However, once you’ve got one in your wallet, you can reap the rewards on your next trip.

This browser is not supported. Please use another browser to view this site.

- All Save & Spending

- Credit cards

- Newcomers to Canada

- All Investing

- ETF finder tool

- Best crypto

- Couch potato

- Fixed rates

- Variable rates

- Mortgage calculator

- Income property

- Renovations + maintenance

- All Insurance

- All Personal Finance

- Finance basics

- Compound interest calculator

- Household finances

- All Resources + Guides

- Find a Qualified Advisor

- Monthly budget template

- ETF Finder Tool

- Student money

- First-time home buyers

- Guide For New Immigrants

- Best dividend stocks

- Best online brokers

- Where to buy real estate

- Best robo-advisors

- All Columns

- Making sense of the markets

- Ask a Planner

- A Rich Life

- Interviews + profiles

- Retired Money

Advertisement

By Keph Senett on January 4, 2022 Estimated reading time: 6 minutes

Expedia For TD: How to maximize your TD travel rewards credit card

Book your flights, hotels and accommodation through the Expedia For TD travel portal to make the most of the travel rewards you earn with your TD Visa.

You’ve surely heard of travel site Expedia, and you’ve heard of TD Bank. But have you ever booked travel through the Expedia For TD website? The program, which marries the travel service with the banking brand, delivers substantial earnings and deals to travellers who book through their branded portal and pay with a TD credit card . Let’s take a look at how the program works, and how to reap the most rewards.

About Expedia For TD

Expedia For TD is a segment of the TD Rewards environment, so the “currency” you’re collecting is TD Rewards Points that can be redeemed for merchandise, gift cards, cash and, importantly, travel. Another major benefit of the TD travel program is that it’s flexible. It allows you to use your Points to book your flights, hotels, cruises and excursions directly with any provider you choose. You can use your Points for these purchases, even up to 90 days after the fact. (However, when you book through Expedia For TD, points must be redeemed at the time of purchase.)

When you log into Expedia For TD , you’ll see a TD-branded version of the Expedia site. Here, you can redeem your TD Rewards Points for flights, hotels, car rentals and more, but the real incentives come by way of redemption rate, flexibility and earnings. If you redeem through Expedia For TD, no matter what you book, your redemption rate is $0.005 per point.** This is better than the rate you’d get by cashing in on other non-travel rewards. Additionally, you can collect within the TD Rewards environment and outside of it simultaneously. So, when you use Points on purchases at Expedia For TD, you can still collect from your separate airline rewards program. Finally, using the portal assigns bonus points to TD credit cardholders, which can multiply—sometimes dramatically—the number of Points you earn on travel purchases. Conveniently, you don’t have to wait until you’ve racked up thousands of Points to redeem: you can start using your Points as soon as you’ve accumulated 200. There’s even a dedicated 24/7 support line to help you make your bookings.

Are there any drawbacks I should watch out for?

Expedia For TD advertises a price guarantee, but you should be aware that it is time-limited. The company will refund the difference on a flight and hotel package within 24 hours of booking, or a hotel rate up to 48 hours prior to check-in.

The best Expedia For TD credit cards in Canada

- TD First Class Travel Visa Infinite Card

TD Rewards Visa Card

Td first class visa infinite card.

Annual fee: $139

- Up to 8 TD Rewards points per $1 on travel

- 6 points per $1 on groceries and restaurants

- 4 points per $1 on recurring bills

- 2 points per $1 on all other purchases

Welcome offer: earn up to $700 in value, including up to 75,000 TD Rewards Points and no Annual Fee for the first year. Conditions Apply. Account must be approved by September 3, 2024.

Card details

Expedia For TD is available to you if you hold any TD Rewards credit card, but the TD First Class Travel Visa Infinite Card gets our recommendation for its high earn rate and bonus points potential. The First Class Travel Visa Infinite Card also includes an excellent suite of travel insurance benefits including medical, trip interruption and automotive, and while it fails to offer airport lounge access, it does entitle you to a discount. However, these perks don’t come cheap. The First Class Travel Visa Infinite Card has a minimum annual income requirement of $60,000 and carries an annual fee of $139, though new applicants can have the first year fee rebated (along with the $50 fee for an additional cardholder).

While this is a solid travel rewards card , new applicants in particular will benefit greatly from the welcome bonus. TD clients with an All-Inclusive banking account may be able to get the $139 annual fee rebated on an ongoing basis, so it’s worth speaking with a representative before you sign up. Frequent travellers who are comfortable shopping through the ExpediaforTD.com portal will get the highest earn rate on travel spends and, at a return of 4.5% (8 points per $1) when redeemed for travel spends, the savings will be noticeable. The included insurance package can also help you save a bundle.

Annual fee: $0

- 4 TD Rewards points per $1 spent on travel purchases made through Expedia for TD

- 3 points per $1 on groceries and restaurants

- 3 points per $1 on gas, transit and streaming

- 2 points per $1 on recurring bill payments

- 1 point on all everything else

Welcome offer: earn a value of $50 in TD Rewards Points to use on eligible Amazon.ca purchases, plus no Annual Fee. Conditions Apply. Account must be approved by January 6, 2025.

If you’re annual fee-averse, consider the TD Rewards Visa, which will help you bump up your TD Rewards Points by offering 4 points per $1 spent at Expedia For TD, 3 points per $1 spent on groceries and restaurants, 2 points per $1 spent on recurring bills, and 1 point per $1 everywhere else. Though not quite as generous in rewards as the other cards in this article, the 4 points: $1 ratio on travel purchases through the online portal results in a return far better than available on most other no-fee cards. This card does not include travel insurance, but it gives cardholders a discount at Avis and Budget car rentals.

Which card is the best option for me?

Every card in the TD Travel Rewards program is worth a look, but the best option will depend on you. If you want to avoid an annual fee you’ll benefit from the TD Rewards Visa, and if you’re willing to pay the $139 annual fee and the minimum income of $60,000 doesn’t disqualify you, the First Class Travel Visa Infinite Card is an effective way to cash in on the program. But the TD Platinum Travel Visa also does a good job with no income requirement and a lower annual fee. Choose the card that makes the most sense for you.

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email

About Keph Senett

Comments cancel reply.

Your email address will not be published. Required fields are marked *

I am unable to reach Expedia for TD to cancel flights due to the Coronavirus. I have held on for many hours with music playing and with no music. Can you advise how to speak to customer service? I am currently out of the country (Canada) and just don’t know how to go about this if TD for Expedia 18772226492 are taking many hours of my holding on and not answering my call. I am aware there must be many people wanting to Angel their flights. This is my third day of trying to reach them

Cancel their flights

I waited on hold for six hours. When my call was answered, the representative was more than helpful. Hard to wait on hold, but worth the effort in these trying times.

The TD business travel is no longer same as first class They reduced to 3 points per dollar

Related Articles

Are GICs a good investment right now?

Presented By

MCAN Wealth

Making sense of the markets this week: August 11, 2024

Japan’s carry trades spook the markets, mixed U.S. earnings are in, Shopify surges, oil and potash remain profitable.

Credit Cards

The best travel credit cards in Canada for 2024

These impressive travel cards can help turn your everyday spending into flights, hotels and more.

Real Estate

Yes, a cottage is an investment property—here’s how to minimize capital gains tax

Should you “invest” in a cottage? And if you do, what happens when you sell it, give it away...

The after-effect of market lows: a drop in fixed mortgage rates

Some investors might look at their portfolios, but Canadians getting a mortgage (or renewing one) should keep an eye...

Why did the stock markets fall?

Financial markets around the world stabilize after Monday’s fall. Here’s what to know about how we got here.

The best no-fee credit cards in Canada for 2024

These cards have no annual fee and still boast perks like cash back, travel insurance and more.

The best credit cards in Canada for 2024

Find the credit cards in Canada that offer the most rewards and the lowest fees, based on the latest...

The best secured credit cards in Canada for 2024

For those unable to qualify for a traditional credit card, a secured card can be an important tool for...

Why is booze so expensive in Canada?

Making, let alone serving, alcoholic beverages is an invariably complex manufacturing process that’s affected by cost inflation from all...

How to use TD Rewards points to reduce travel costs

by Anne Betts | Jul 3, 2024 | Travel Hacking | 5 comments

Updated July 3, 2024

Is the TD Rewards program worth it? How does the program work? What are the various ways to use TD Rewards points to reduce travel costs ? What qualifies as a travel cost?

After several years of earning and redeeming TD Rewards points for travel, I’ve found the program to be beneficial. Here is my review.

Table of Contents

What are TD Rewards Points?

Td rewards credit cards, td first class travel visa infinite card, what are td rewards worth, (i) expedia for td, (ii) book any way, what qualifies as book any way travel, (i) expedia for td, is the td first class travel visa infinite worth it, what i like, what i don’t like.

TD refers to the Toronto-Dominion Bank. TD’s propriety loyalty program is called TD Rewards. The rewards currency is TD Rewards Points. To improve readability, I’ll refer to the points as ‘TD Rewards.’

TD Rewards can’t be converted to any other loyalty currency, or transferred to another loyalty program. It used to be possible to convert TD Rewards to Aeroplan on a product switch to a TD Aeroplan-branded card at a rate of 4:1. However, since April 2019, this is no longer the case.

Points don’t expire as long as your TD Rewards-earning credit card account is in good standing. If you close your credit card account (and don’t have another TD Rewards-earning credit card), you’ll have 90 days to redeem any points left in the account. But, if you lose access to Expedia For TD, they’ll be redeemable at the lower ‘book any way’ value.

As a general rule, points in any in-house program should be redeemed or transferred to another credit card earning the same rewards currency before cancelling or product switching a card.

How to earn TD Rewards

TD Rewards can be earned from a credit card sign-up bonus, through everyday spend on the credit card, and the occasional promotion.

TD offers four credit cards earning TD Rewards:

- TD Platinum Travel Visa Card

- TD Rewards Visa Card

- TD Business Travel Visa Card

TD offers very few points-earning promotions.

The best way to stay abreast of these opportunities is via promotional emails from TD.

For travellers, the best of the three personal credit cards is the First Class Travel Visa Infinite, last overhauled on October 30, 2022.

TD offers promotions on the TD First Class Travel Visa Infinite with elevated sign-up bonuses of up to 135,000 points and an annual fee waiver ($139) in the first year.

According to the terms and conditions, the offers aren’t available to customers who have activated and/or closed a TD First Class Travel Visa Infinite Account in the last 12 months. However, this may or may not be enforced. Also, a product switch from a lower-tier card may be eligible for the full promotional benefits.

The TD First Class Travel Visa Infinite also includes:

- a birthday bonus of 10% of the points earned in the 12 months preceding the primary cardholder’s birthday (up to a maximum of 10,000 points)

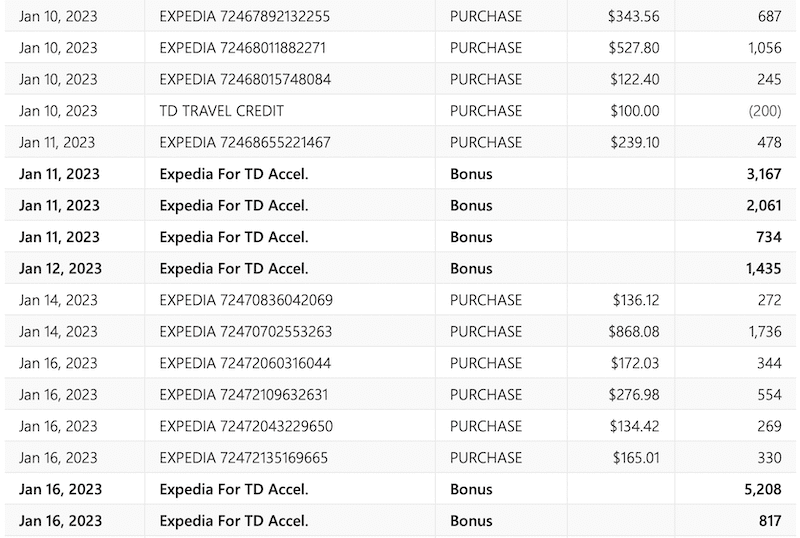

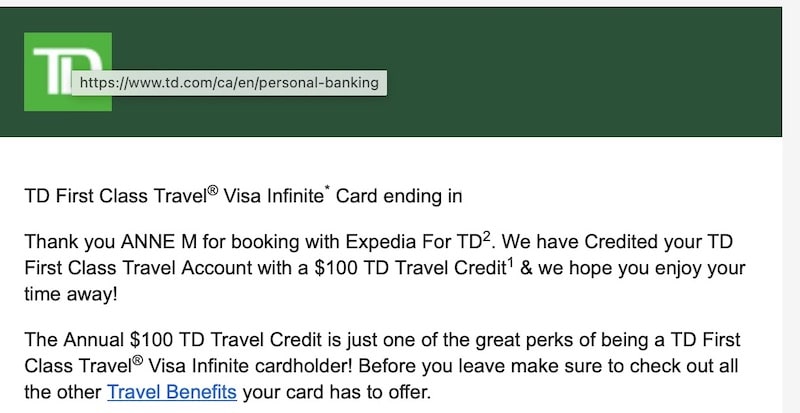

- an annual TD Travel Credit of $100 each calendar year on certain bookings (hotel, motel, lodging, vacation rental, or vacation package) of $500 or more at Expedia for TD in cash, points, or a combination of points and cash.

- a free Uber One membership for 12 months

The earning rate on the TD First Class Travel Visa Infinite is:

- 8 points per dollar for travel booked online or by phone at Expedia for TD

- 6 points per dollar spent on groceries and at restaurants

- 4 points per dollar on regular recurring payments

- 2 points per dollar on all other purchases

There’s a $25,000 cap on spending at the accelerated rates. After that threshold is reached, the earning rate decreases to the base rate of 2 points per dollar.

At first glance, the earning rate on the TD First Class Visa Infinite looks very attractive. That’s because many reward programs can be redeemed at one cent per point (e.g., 10,000 points = $100). With TD Rewards, the best possible redemption rate is 0.5 cents per point (e.g., 10,000 points = $50).

TD’s in-house travel portal is called Expedia For TD, operated by Expedia.

There are two ways to redeem TD Rewards for travel purchases:

- Expedia for TD

- ‘Book Any Way’

Each has a different redemption value.

For travel booked through Expedia For TD, points are valued at $0.05 (200 points = $1).

For the most part, Expedia for TD mirrors what’s available on Expedia. However, there are gaps in the inventory. Also, some folks have reported higher prices on Expedia for TD, compared to what’s posted on Expedia.

For what it’s worth, that hasn’t been my experience. For example, a search for a specific hotel in Halifax revealed the best price at Expedia when compared with other booking sites.

The (almost) same price for the same property appeared at Expedia for TD.

‘Book Any Way’ covers travel purchased from travel providers other than Expedia For TD. This allows you to book and redeem points for travel products that don’t appear on Expedia. This includes the option to book last-minute deals or discounted travel at prices that are cheaper than what’s listed at Expedia.

However, TD Rewards are valued at $0.04 (250 = $1) on the first $1,200 of a Book Any Way travel purchase. The value increases to $0.05 (200 = $1) for any amount that is over $1,200 on the same purchase. This is useful for ‘big-ticket’ bookings such as vacation packages or apartment rentals.

Keep in mind that when purchasing from a provider other than Expedia For TD:

- you’re earning x2 TD Rewards Points (instead of x8 at Expedia for TD); and

- you’re redeeming at a lower value of $0.04 (instead of $0.05).

The program has a broad view of what qualifies as travel. Flights, accommodation, cruises, vacation packages (usual stuff) are eligible. Expenses such as theatre tickets, golf fees, resort excursions, restaurant bills, gasoline, taxi fares, and parking may qualify if they’re incurred while travelling.

How to redeem TD Rewards for travel

The most convenient way is to book online by signing in to TD Rewards, and entering the Expedia For TD portal to shop for travel.

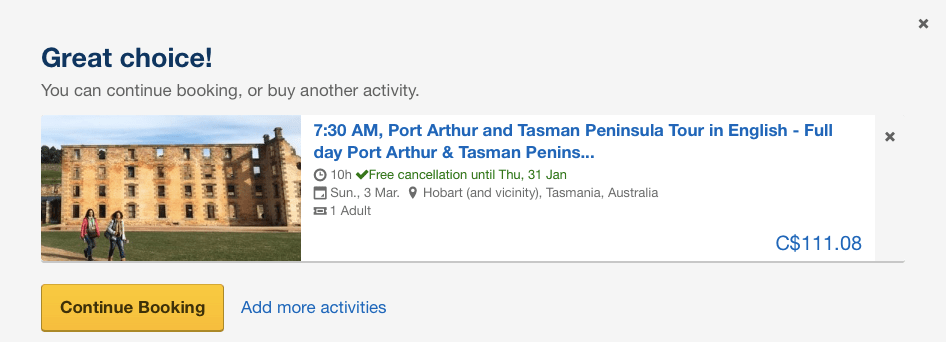

When you’re ready to make a decision, one click takes you to your chosen travel product.

Another click takes you to the payment page with helpful pre-populated fields showing the name of the cardholder, credit card, TD Rewards account balance, and its monetary value.

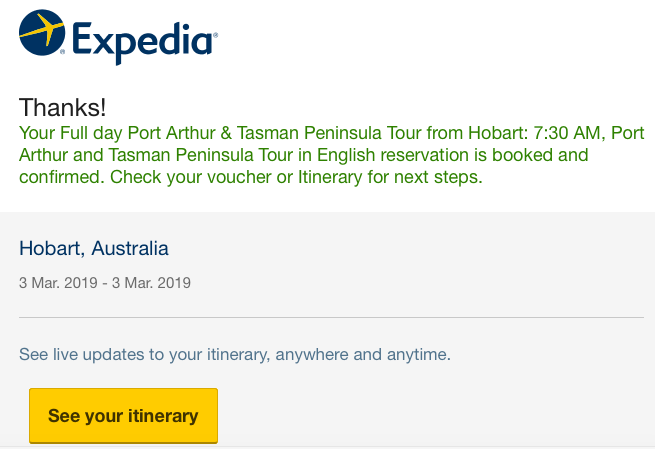

Within moments, an email arrives from Expedia for TD with the booking confirmation and details.

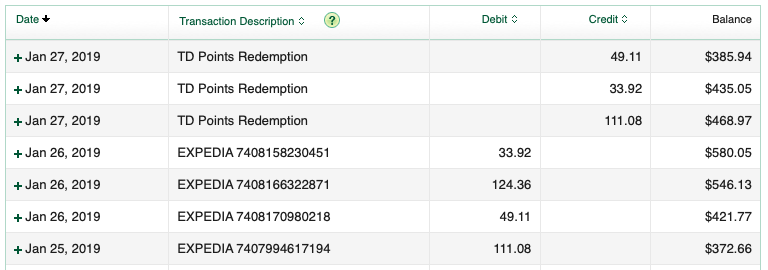

With the “use points” option, the entire travel purchase, including taxes and fees, will be charged to your credit card. But, because you used TD Rewards Points, you’ll receive a credit on your credit card statement within 5 days after the charge, equal to the number of points used.

For the best return, anything appearing at Expedia should be booked online through Expedia For TD and redeemed in this way. Another option is to book by telephone (at Expedia for TD). The points multiplier of x8 for using Expedia For TD will be earned on each booking. Travel purchases and their respective statement credits will appear as separate line items.

- Make a travel-related purchase using the credit card earning TD Rewards.

- Wait until the charge posts to your credit card account.

- Call TD Rewards within 90 days of the transaction date of the purchase, and ask to have points applied.

- The points will be deducted from your points balance available at the time the points are redeemed, not the transaction date of the purchase.

- The amount credited towards the purchase will be equal to the value of the points redeemed. If there are insufficient points available to cover the entire amount, the remaining cost will be posted on the account for payment.

Both redemption routes (Expedia For TD and Book Any Way) allow payment in any combination of points and cash.

Note: Travel usually delivers the best rate of return. However, TD Rewards can be redeemed for merchandise (at an average of 0.23 cents per point), gift cards (0.25), tuition, or paying down a student loan debt (0.4), or as a credit against your credit card account (0.25). These redemption values are shared with thanks to Credit Card Genius for their research and analysis.

If the following applies to you, I say YES :

- You purchase a considerable amount of travel through Expedia (for TD).

- You’re likely to make a single purchase of $500 or more at Expedia for TD to earn the annual travel credit of $100.

- You like the idea of offsetting a variety of travel costs with various rewards programs.

- You’re not loyal to any particular hotel brand and you use a variety of accommodation that’s bookable through Expedia (for TD).

- You’re able to tap into a fee waiver and decent sign-up bonus.

- You have a TD All-Inclusive Banking Package. This requires a minimum daily balance of $5,000 in your account. It entitles you to a $29.95 monthly fee rebate ($22.45 for seniors aged 60 or older). It includes an annual fee rebate of your choice of one of five select TD credit cards. The TD First Class Travel Visa Infinite is one of the cards. The rebate covers the fees for the primary cardholder and one supplementary cardholder.

- You can make use of the travel insurance benefits.

- You use Expedia sparingly. You don’t use it enough to justify paying the annual fee of $139 (beginning in the second year under a -first-year-free promotion).

- Most of your flights are award bookings using frequent flyer miles or points. When you do purchase a revenue ticket, you book flights directly with an airline because of better service in the event of booking irregularities, flight cancellations, and overbooked flights.

- You’re a member of one or more hotel loyalty programs. You book directly with the respective program to earn loyalty points, status credits, and other benefits.

- The other credit cards in your wallet have superior earning power on everyday-spend categories such as groceries, gas, transit, and dining, and/or earn flexible points that are convertible to other reward programs offering better redemption values.

Is the TD Rewards program worth it?

The TD Rewards program shouldn’t be viewed as a frequent flyer program but one where it’s possible to cut trip costs by redeeming points for miscellaneous travel expenses.

For a personal credit card, I believe the best of the bunch is the TD First Class Travel Visa Infinite Card. What did I think of TD Rewards and the TD First Class Travel Visa Infinite Card?

- When used exclusively for travel bookings at Expedia for TD, the TD First Class Travel Visa Infinite Card offers an appealing return of 4%. Otherwise, a mixture of earn rates puts the return somewhere between 1% and 4%.

- For the most part, Expedia has a solid reputation. The company carries some weight in the travel world and could be a useful ally if things don’t go as planned with a small, independent tour operator. However, I’d never use Expedia for expensive long-haul flights. Overbooked flights, delays, cancellations, and other disruptions can put passengers in a zone where neither the airline nor the OTA (Online Travel Agency) will provide assistance.

- I like Expedia For TD’s large inventory of accommodation options, including hostels and apartments, at a variety of price points. I’ve also been impressed by the attractiveness of refundable bookings. For example, the same property at Booking might be refundable up to a month out, whereas at Expedia, it might be refundable up until the day before arrival. This limits reliance on trip cancellation insurance.

- TD’s recent overhaul of the TD First Class Travel Visa Infinite that included a $100 annual travel credit is a welcome benefit. It requires a purchase of $500 or more at Expedia for TD once in a calendar year (that is relatively easy to accomplish when booking accommodation). Triggering the credit requires no intervention on a cardholder’s part as as an email and secure message from TD arrives within 48 hours. This effectively reduces the annual fee of $139 to $39, a compelling reason to keep the card.

- There’s also the option to book tours and experiences. Other propriety programs (e.g., AMEX Travel) don’t offer a similar range and variety of travel products.

- I love the online system for booking travel at Expedia For TD, and redeeming points against the purchase. It involves inserting a minimal amount of information, and a few clicks to complete the process. Within seconds, the booking confirmation arrives by email.

- Anything appearing at Expedia for TD is bookable online from anywhere in the world. Expedia For TD’s online booking process is convenient, user-friendly, and efficient.

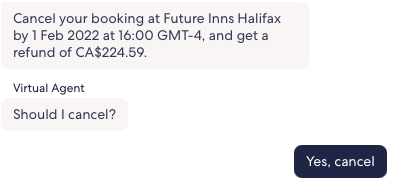

- The same applies to the online process for changing a reservation or using Expedia for TD’s Virtual Assistant to cancel refundable bookings. Sign in, select the booking, hit the cancel button, and receive notification that the refund will be sent within 48 hours.

- The range of travel expenses redeemable as Book any Way travel is impressive.

- With the accelerated earn rate of 6 points per dollar resulting in a 3% return on groceries and dining, I’ve appreciated having the TD First Class Travel Visa Infinite Card in my wallet at restaurants that don’t accept American Express (Cobalt and Scotiabank Gold cards that both earn x5 points on dining).

- TD has a no-fee credit card (TD Rewards Visa Card) that earns TD Rewards. This presents an option to product switch from the TD First Class Travel Visa Infinite (or any other credit card earning TD Rewards) to protect your points and keep a TD Rewards account active.

- TD has a generous approach to product switches that encourage clients to try different credit card products. Some switches provide access to full promotional benefits. In addition, there are cases where clients have been able to hold more than one TD First Class Travel Visa Infinite Card at the same time.

- For credit card cancellations and product switches, TD offers prorated refunds of annual fees.

- The TD All-Inclusive Banking Package presents an option to obtain an annual fee rebate.

- TD’s EasyWeb account management system is efficient and user friendly. After product switching or applying for a new TD credit card, I’ve had the card, with the credit card number, appear in my account within a few hours. On a product switch, the ‘switched-from’ card can be used the following business day to earn points in the ‘switched-to’ card’s rewards program. This is handy to start working on the new card’s Minimum Spend Requirement without having to wait for the new card to arrive by mail.

- There will be others who don’t agree but in my opinion, of the ‘big five,’ TD has the best customer service. For the most part, I’ve found Customer Service Representatives to be helpful, patient, and well informed. Those I’ve dealt with have been more than willing to follow up on requests, listen to, and consider, my interpretation of terms and conditions when it differs from theirs, and seek information from advisors and supervisors.

- To extract maximum value on travel purchases and redemptions, customers need to use Expedia For TD. When purchasing travel from other providers (at an earn rate of 2 points per dollar), and redeeming points using ‘Book any Way’ at the lower redemption value, each point is valued at only 0.8 cents (or 0.8% return).

- At the present time, the program doesn’t have a flight rewards chart where it could be possible, as with other reward programs, for members to extract greater value when redeeming points for flights. For example, the CIBC Rewards (Aventura) Flight Reward Chart offers the potential of a 2.2% return.

- For more information on the CIBC Rewards program, see How to use CIBC Aventura points to reduce travel costs

- Expedia for TD’s Virtual Assistant works well on uncomplicated bookings such as obtaining a refund before the fully refundable date. However, in the case of complications, the Virtual Assistant is hopeless. For example, in Warsaw, the guide on a scooter tour was a no-show on the day of the tour (so it was past the refundable period) and trying to get the Virtual Assistant to retrieve the booking was impossible, despite inserting my answers to each question asked.

- As a rewards currency, TD Rewards has limited value. It’s not convertible to any other program, and it has a fixed maximum value of $0.05 per point.

- While obtaining a fee rebate is an attractive proposition, doing so on a TD Aeroplan-branded credit card might make more sense for Aeroplan account holders. Aeroplan is capable of delivering much greater value than TD’s fixed-value system.

- I’m not fond of having two-tiered redemption values for travel purchases. Other in-house programs such as Scene+ make no distinction between travel booked through the program’s travel portal, and that from another provider. Redemption values are the same.

- For more information on the Scene+ program, see How to use Scene+ points to reduce travel costs

- If a customer has two credit cards earning TD Rewards, it’s possible to merge the points into one account but it must be done by an agent. Unlike other programs such as RBC Avion, it can’t be done online. And disappointingly, fewer than 10,000 TD Rewards cannot be moved from one account to the other.

- The TD First Class Travel Visa Infinite Card doesn’t stand out among its competitors. It’s competing with travel credit cards that offer lounge membership and complimentary passes, companion/buddy passes, NEXUS fee rebates, free checked baggage, concierge services, and no FX (foreign exchange) fees. However, as mentioned earlier, the annual $100 travel credit helps fill a much-needed gap in its attractiveness as a travel credit card.

- The insurance benefits are on par with other premium credit cards. Personally, I’ll never use them. For emergency medical insurance, an annual multi-trip plan from an insurer of my choice is a better fit for my age and travel style. The trip cancellation/interruption doesn’t apply because a covered trip is one where “the full cost has been charged to Your Account and/or using Your TD Points.” Like many other travellers, my trips are funded from a variety of sources using a mixture of miles, points, and cash.

- It’s both a blessing and a curse but I’ve been surprised by the types of charges flagged by TD’s fraud detection program. This results in a rejection of the charge and a freezing of my credit card until it’s sorted.

The fact that TD has hitched its rewards wagon to Expedia makes it an interesting proposition. I’m impressed with Expedia For TD’s online portal for booking and redeeming points for travel (and changing a reservation or cancelling via the Virtual Assistant), and the First Class Travel Visa Infinite’s x8 points multiplier on Expedia for TD bookings. For heavy Expedia users, it’s an attractive addition to a credit card portfolio.

I’ve been impressed by recent promotional offers with annual fee waivers and sign-up bonuses of up to 135,000 points. It demonstrates that TD is interested in attracting new customers. To keep them, TD could be more creative with additional travel benefits. Reinstating the option for cardholders to convert TD Rewards to Aeroplan would be a welcome start.

TD needs to increase the value of Book-any-Way redemptions, and introduce an online system for applying points against those purchases. While the Scene+ coding system for travel purchased from other providers isn’t perfect, their system is capable of presenting the vast majority of travel purchases to users for redeeming points online. TD needs to craft an online redemption system that’s as user-friendly as their booking system.

As a fixed value program, TD Rewards can’t match the value achievable with programs such as Aeroplan, British Airways’ Avios, and other frequent flyer programs. But, with the extensive inventory of travel products bookable at Expedia For TD, and the range of travel expenses redeemable as Book any Way travel, it can certainly occupy a very useful secondary corner of a diversified miles-and-points portfolio.

If you found this post helpful, please share it by choosing one of the social media buttons. Also, what do you think of the TD Rewards program? Please add your thoughts in the comments. Thank you.

Might you be interested in my other miles-and-points posts?

- How to use Scene+ points to reduce travel costs

- How to use CIBC Aventura points to reduce travel costs

- When a no-FOREX-fee credit card isn’t the best travel choice

- Polaris review of United Airlines’ lounge and in-flight experience

- Is the BMO Air Miles World Elite MasterCard a good deal?

- 9 Effective ways of meeting Minimum Spend Requirements

Pin for later?

I’m curious if the prices are jacked a bit through the TD Expedia site. For example, I looked at the Park Lane Hotel in Manhattan. For a five night stay in a 1 Queen Bed City View room, , TD Rewards Expedia site said it would be $2222.97, all taxes, fees all in. Looking at the same room through hotels.com or Trivago, I got the same room, all in price of $1723.72/$1743 respectively. When I apply my current Rewards amount of $836 against the $2222.97, I’m left paying $1386.97, which is only around $336 less, even though I used $836! Is Expedia always more expensive? I looked at more than a few other hotels and they are all much cheaper on hotels.com and Trivago.

Thanks for dropping by. While I never experienced price differences between Expedia and Expedia For TD, some people have reported differences, both in inventory and prices. I’ve just done a search for a five-night stay at the Park Lane Hotel in Manhattan (October 12 to 17) and found the same price at Expedia, Hotels and Booking. I couldn’t access Expedia for TD as I no longer have a TD Rewards credit card. Each of the three sites showed a regular price of $466/$468 and a discounted price of $372 for a total price of $1860. It sounds as though Expedia for TD hasn’t adjusted the regular price yet. What I would do is call Expedia for TD and ask them to match the Expedia price (if that’s what you find for your dates on expedia.ca). Good luck!

Excelent article!

Can you clarify when you got the $100 credit? The “in a calendar year” part confuses me. If I booked accommodations via ExpediaForTD over $500 for the first time this year (March 2023), will I get the $100 travel credit right away? within this year? or Jan 2024?

Trackbacks/Pingbacks

- Why the Best Western loyalty program is good for travellers - Packing Light Travel - […] Is the TD Rewards program worth it? […]

- 25 Tips on earning Aeroplan miles - Packing Light Travel - […] Is the TD Rewards program worth it? […]

- What’s the best use of Scotia Rewards? - Packing Light Travel - […] Is the TD Rewards program worth it? […]

- Lounge and flight review of United Airlines’ Polaris experience - Packing Light Travel - […] Is the TD Rewards program worth it? […]

- Minimizing Aeroplan taxes, fees and surcharges - Packing Light Travel - […] Is the TD Rewards program worth it? […]

- What is the best credit card with trip cancellation, trip interruption and flight delay insurance for trips on points - Packing Light Travel - […] Is the TD Rewards program worth it? […]

- Finding Aeroplan flights: a step-by-step guide - Packing Light Travel - […] Is the TD Rewards program worth it? […]

- Is the BMO Air Miles World Elite MasterCard a good deal? - Packing Light Travel - […] Is the TD Rewards program worth it? […]

- Is a no-FOREX-fee credit card always the best choice for international travel? - Packing Light Travel - […] Travelling the world on miles and points. Is the TD Rewards program worth it? […]

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Search this site

Welcome to Packing Light Travel. I'm Anne, a dedicated carry-on traveller. For information on the site, please see the About page.

Book: The Ernie Diaries

Packing Light

Join the mailing list for updates, and access to the Resource Library.

You have Successfully Subscribed!

Connect on instagram, if you find this information useful, subscribe to the newsletter and free access to packing lists, checklists, and other tools in packing light travel's resource library..

Your email address will never be shared. Guaranteed.

Pin It on Pinterest

Exciting news for TD Rewards members

Members can earn and redeem points on vacation packages, flights, hotels, car rentals and more. Who doesn't like to save?

Book an all-inclusive package on Expedia For TD

Sign in to use your td points on everything from vacation packages to flights, hotels, car rentals and more.

Book now and enjoy these benefits:

Access booking information on My Trips and easily change or cancel your travel plans on your own at any time of the day

Vacation in even more destinations, like Cancun, Riviera Maya, Punta Cana, Montego Bay and Greece

Pay for travel with TD Rewards Points and earn points at a faster rate

Top all-inclusive stays in Mexico

Top all-inclusive stays in dominican republic, top all-inclusive stays in the caribbean.

Expedia For TD: How To Redeem TD Rewards Points?

Expedia is one of the largest online travel booking websites used in the world. Expedia offers its services to customers of various institutions in Canada, such as TD.

For example, TD customers can use the Expedia for TD portal to use their TD Rewards points for travel.

Difference between Expedia.ca and ExpediaforTD.com

Expedia and Expedia for TD are similar platforms: you will find the same prices for the same types of travel. You will be able to book a flight, a hotel room or rent a car.

However, Expedia for TD is only available to selected TD Rewards credit cardholders . Through the Expedia for TD platform, you can redeem your TD Rewards points for travel. There are no blackout dates or restrictions.

While Expedia.ca has its own program: Expedia Rewards .

Which travel to book on Expedia for TD

With Expedia for TD, you can book:

- Vacation packages

- All-inclusive vacation

- Hotel nights

- Rental cars

Don’t forget to use the TD First Class Travel ® Visa Infinite* Card to benefit from travel insurance . And to earn more TD Rewards points!

How to redeem points with Expedia for TD

Redeeming TD Rewards points through the Expedia for TD portal is easy:

- Log in to Expedia for TD

- At the top right, you will see the number of TD Rewards points available and the redeemable value in dollars

- Choose the trip that suits you

At checkout, choose to use your TD points. The text in the green square will tell you the amount and points required. Each 200 points reduces the cost of the trip by $1 .

You can also complete the payment with your credit card if you do not have enough TD Rewards points available.

There you go ! Congratulations on your TD Rewards points savings. We love it!

How to redeem TD Rewards points with Book Any Way Travel

On the TD Rewards page , log in to your profile.

Then, in the Redeem section, click on Book Any Way Travel .

On the next page, click on Redeem your TD Points now .

Enter the requested travel transaction information, then click Next.

The trip must have been purchased within the last 3 months .

You’ll need to confirm the operation and select the number of points to redeem. Each 250 TD Rewards points reduces your bill by $1.

You may receive an error when making this exchange of Book Any Way Travel. Call Customer Service at 1-800-983-8472.

How to earn TD Rewards points

To use the Expedia for TD portal, you must be a TD credit cardholder participating in the TD Rewards program.

For example, with the TD First Class Travel MD Visa Infinite* Card, you can earn 8 TD Rewards points per dollar when you book travel through Expedia for TD.

Another way is to use this practical card for everyday purchases:

- 6 points / $1 for your grocery and restaurant purchases

- 4 points / $1 for recurring bill payments made to your account

- 2 points / $1 for all other purchases

$ 100 TD Travel Credit for hotel, lodging or vacation packages

Plus, with the TD First Class Travel ® Visa Infinite* Card , you’ll receive a $100 TD travel credit on your first eligible travel purchase between January 1 and December 31 of each year.

On January 1, the $100 credit becomes available again. However, it does not accumulate from year to year if not used.

A purchase eligible for travel credit includes :

- the purchase of a stay at a hotel, motel, tourist accommodation or vacation rental of $500 CDN or more through Expedia for TD; or

- the purchase of a vacation package of $500 CAD or more from Expedia for TD, which includes hotel, motel, tourist accommodation or vacation rental and transportation.

All that matters is that $500 or more (in a single transaction) must be charged to the TD credit card, including fees and taxes . Then, 2 to 3 days later, you’ll receive an e-mail from TD confirming the application of the $100 travel credit.

Then the travel credit will simply appear in your account!

Here are the top three TD credit cards that earn TD Rewards points:

- TD First Class Travel ® Visa Infinite* Card

With the TD First Class Travel® Visa Infinite* Card , you can earn up to 75,000 TD Rewards Points † and a rebate on the annual fee for the first year :

- 20,000 TD Rewards Points for the first purchase made with your Card †

- 55,000 TD Rewards Points if you spend $5,000 within 180 days of opening †

- A birthday bonus equal to 10% of the TD Rewards points you’ve earned in the past year, up to a maximum of 10,000 TD Rewards Points †

Get an Annual Fee Rebate for the first year †

With the TD First Class Travel® Visa Infinite* Card , you get:

- 8 TD Rewards Points † for every $1 you spend when you book travel through Expedia ® For TD

- 6 TD Rewards Points † for every $1 you spend on Groceries and Restaurants

- 4 TD Rewards Points † for every $1 you spend on regularly recurring bill payments set up on your Account

- 2 TD Rewards Points † For every $1 you spend on other Purchases

This TD credit card is one of the best TD travel rewards cards.

- TD Platinum Travel Visa* Card

With this new welcome offer for the TD Platinum Travel Visa* Card , you can get up to 50,000 TD points and a first-year annual fee rebate :

- Welcome Bonus of 15,000 TD Rewards Points when you make your first Purchase with your Card † .

- 35,000 TD Rewards Points when you spend $1,000 within 90 days of Account opening † .

Get an Annual Fee Rebate for the first year † .

There is no minimum income requirement for this TD credit card.

- TD Rewards Visa* Card

You can earn 15,152 TD Rewards points with the TD Rewards Visa* Card for a limited time. It’s worth about $50 on Amazon.ca .

With the TD Rewards Visa* Card , you earn:

- 4 TD Rewards Points for every $1 you spend when you book travel through Expedia ® For TD †

- 3 TD Rewards Points for every $1 you spend on Groceries and Restaurants † .

- 2 TD Rewards Points for every $1 you spend on regularly recurring bill payments set up on your Account †

- 1 TD Rewards Point per dollar on other purcases †

The TD Rewards Visa* Card has no annual fee and comes with Purchase Security and Extended Warranty Protection.

Frequently asked questions about Expedia for TD

What is expedia for td.

Expedia for TD is TD’s travel booking platform. This site is reserved exclusively for TD credit cardholders.

How does Expedia for TD work?

Expedia for TD is similar to any other travel booking website. You can pay for your trip with your credit card and/or with your TD Rewards points.

How do I use my TD Rewards points to book through Expedia for TD?

To find out how many TD Rewards points you have before booking with Expedia for TD, check your TD online statement. You can also track your points on the TD Rewards portal.

What is the value of a TD Rewards point?

One TD Rewards Point is worth 0.5 cents .

On Expedia for TD, you can use your TD Rewards points in increments of 200 points for a value of $1.

Which TD credit cards are available in Canada for Expedia on behalf of TD?

Many TD credit cards allow you to earn TD Rewards points and book travel through Expedia for TD :

- TD Business Travel Visa* Card

How do I contact Expedia for TD by phone?

You can call Expedia for TD at 1-877-222-6492.

If you would like to book a cruise with Expedia for TD, please call 1-800-707-7327.

All posts by Jean-Maximilien Voisine

Suggested Reading

How to redeem TD Rewards for gift cards

The TD Rewards site has a tab dedicated to gift cards. The number of points required to make a redemption differs depending on the merchant, but in most cases, it’s a rate of 400 points for $1. That’s half the value of what you get when redeeming on Expedia for TD or .25 cents per point.

Clearly using your points for gift cards is not a good value, but TD Rewards does occasionally have promos where gift cards cost 25% less in points to make a redemption. Even then, it would still cost you 300 points for $1, so that’s .33 cents per point. It’s a better value than the regular rate, but it’s still lower than travel redemptions.

How to redeem TD Rewards for merchandise

Similar to almost all other loyalty programs, TD Rewards has a merchandise catalogue with hundreds of items that you can purchase with your points. Some things that have been available in the past include:

- Hair clippers

- Small and major appliances

- Gaming consoles

Admittedly, TD Rewards has one of the better merchandise that’s available from some of your favourite retailers. They seem to have more categories and products available compared to other programs. That said, the redemption rate is still not the best since the dollar value of your points would fall between .15 – .30 cents each. That said, TD Rewards does run quite a few promos where it takes fewer points to make a redemption, so your point value could get as high as .40 cents, which is not bad.

How to redeem TD Rewards for cash

When logged into TD Rewards, you’ll see a tab to redeem your points for cash. While it’s always appealing to have your bill reduced by simply redeeming your points, this is arguably the lowest value possible. It’ll cost you 200 points for $ 1 off, which is a value of .25 cents per point. Although this is the same rate as gift cards, there are never any promos for cash redemptions. You’re basically stuck at .25 cents per point which is terrible. Unless you’re experiencing financial distress, avoid cash redemptions.

Do TD Rewards points expire?

No, TD Rewards points do not expire as long as you have an active account in good standing. If you choose to close or switch your account, you’ll lose your points immediately, so use up your points before making any changes. In the past, when you switched from the TD First Class Travel Visa Infinite to the TD Aeroplan Aeroplan Visa Infinite, you could transfer your points, but that’s no longer allowed.

How TD Rewards compare to others

TD Rewards is a solid loyalty travel program that will appeal to people who want something simple. Since you can book on Expedia for TD or book on your own, there are no blackout dates or award redemption charts to worry about. The only real “negative” aspect of TD Rewards is a lack of fixed point flight redemption chart like American Express Membership Rewards has. That means the value of TD Rewards points is limited to 0.5 cents per point. In addition, with American Express Membership Rewards, there’s no devaluation to your points when you book any type of travel.

Although the TD credit cards that are offered are decent, many of the best travel credit cards in Canada have better sign up bonuses. That said, TD Rewards is near the bottom end of my rankings of Canada’s bank travel programs . Those who don’t want to think about maximizing value will rank TD Rewards higher, but I think the program is lacking.

It’s also worth mentioning that Aeroplan points are arguably better than TD Rewards since they can have a higher value, and there are multiple TD Aeroplan credit cards. For example, if you opted for the top-tier TD Aeroplan Visa Infinite Privilege Card , not only would you earn TD Aeroplan points, but you would also get benefits such as a Priority Pass membership, extended warranty protection, discounts at Avis rent-a-car, trip cancellation coverage, purchase security, and trip interruption insurance.

How to earn TD Rewards points

You can earn TD Rewards points via TD credit cards. The quickest way to earn TD Rewards points is from the various sign up bonuses, but you’ll obviously also earn points on all of your eligible purchases. TD has 3 personal credit cards that earn you TD Rewards points: TD Rewards Visa, TD Platinum Travel Visa Card, and the TD First Class Travel Visa Infinite Card. There’s also a TD Business Travel Visa that earns you TD Rewards I’ve highlighted their TD First Class Travel Visa Infinite Card below as it’s easily the most popular one.

TD First Class Travel Visa Infinite Card

- $139 annual fee – First year free

- Earn 20,000 TD Rewards points after your first purchase

- 55,000 additional points when you spend $5,000 in the first 180 days

- Annual $100 travel credit (accommodations & vacation packages)

- Birthday bonus of up to 10,000 points

- Earn 8 points per $1 spent when you book on Expedia for TD

- Earn 6 points per $1 spent on groceries and dining

- Earn 4 points per $1 spent on recurring bills

- Earn 3 per $1 spent on all other purchases

The TD First Class Travel Visa Infinite is TD’s flagship credit card. It doesn’t earn you as many TD Rewards points as the TD Platinum Travel Visa card, but it’s arguably more popular. I suspect the reason it’s such a popular card is that you can get the annual fee waived every year if you have a TD All-inclusive plan. Even if you don’t have that plan, the annual fee for the first year is usually free.

The standard welcome bonus for cardholders is typically worth 20,000 points, but TD often runs promotions where you can earn an additional 40,000 – 80,000 TD Rewards points as long as you meet their minimum spend requirement. Since one TD Reward point is worth 0.5 cents each, that’s $500 in value you’re getting if the welcome bonus is worth up to 100,000 points. It’s definitely worth monitoring the current TD First Class Travel Visa Infinite offer as they can sometimes be incredibly valuable.

It’s worth mentioning that the TD First Class Travel Visa Infinite Card is one of the eligible TD credit cards that can earn you Starbucks Rewards partnership. All you need to do is login to your TD app, tap My TD Rewards, the select Starbucks from the partners list.

If you prefer a card with no annual fee, there’s the TD Rewards Visa Card . It earns you 2 TD Rewards Points for every $1 in grocery purchases, restaurant & fast food purchases.

Final thoughts

Despite the lack of redemption options with your points, TD Rewards is still a decent travel loyalty program. Points are easy to accumulate and are easy to use with no blackout dates. Without any transfer partners, TD will always be one of the less popular bank loyalty programs. Many consumers want options. Being partnered with Expedia is great, but giving consumers less value when they book their own travel is a bit ridiculous. Oddly enough, the TD mobile app doesn’t connect you right to Expedia for TD.

About Barry Choi

Barry Choi is a Toronto-based personal finance and travel expert who frequently makes media appearances. His blog Money We Have is one of Canada’s most trusted sources when it comes to money and travel. You can find him on Twitter: @barrychoi

We redeemed ours for Home Depot gift cards and got $175 off a Weber BBQ and now husband just got the card and we will book our interisland Hawaii flights with the bonus points. Straightforward program and easy to use.

Gift cards are such a low value, I’m surprised you guys used your points for that.

Great review Barry. However, I consider the combination of the Scotia Passport Visa Infinite and Scotia’s rewards program far superior because of the absence of foreign transaction fees. I think that’s paramount when selecting a travel rewards card (and its associated rewards program) because you are obviously interested in travel and presumably some portion of your travel is outside of Canada. If you’re retired like we are and spend a good portion of your year outside the country, those 2.5% (or higher) fees add up quickly and can dwarf the $100-$200 in annual card fees. The bottom line is everyone should run the numbers based on their own spending patterns to determine which card and rewards program will deliver the best value. In our case, it wasn’t even close.

In my ranking of all the programs, I have TD at #6 and Scotia at #3 so I agree with your assessment. Although TD doesn’t have a card with no forex fees, there are many cards without an annual fee and with no froex fees so I don’t consider that a major deal-breaker.

Hi Barry, I agree that it shouldn’t be a must-have “deal-breaker.” But I do believe forex fees is something people should definitely be taking into account when estimating total return value and comparing travel cards and travel rewards programs. For some who only spend two weeks outside Canada every year, it won’t make a big difference, but they shouldn’t ignore it.

I really love your articles.

Like Mike said, there are programs out there that are better than this for a lot of people. Really read the small print before choosing. I completely agree on that foreign exchange thing. It’s got me really looking at the Amazon credit card for Canada right now because TD is really biting me on that.

I’d love to see you write a piece comparing the travel dollar values of these ‘point collection programs’ (for example: td versus scotia versus pc).

Although maybe you have and I just haven’t found that article yet.

Although I haven’t compared any programs head to head, I do have reviews for almost every individual program. I also have a general article ranking all of the programs.

https://www.moneywehave.com/canadas-bank-travel-rewards-programs-ranked/

[…] TD Rewards is a good program and I recommend it to anyone who wants an easy program to understand. However, TD Rewards still ranks low compared to others for a few reasons. Although you can redeem 200 points for $1 off ExpediaForTD, you need 250 points for $1 when using the Book Any Way feature which decreases the value of your points. […]

Leave a Comment Cancel Reply

Get a FREE copy of Travel Hacking for Lazy People

Subscribe now to get your FREE eBook and learn how to travel in luxury for less

The Complete Guide to Expedia for TD

Josh Bandura Mar 7, 2024 / TD Canada Trust / Leave a comment

Travel can be expensive, so looking to other tools, such as miles and points to lower costs, is a great option for many Canadians. While there are many standalone loyalty programs, most banks offer their own loyalty programs to build brand loyalty and provide added value for their customers.

TD Bank has its own loyalty program called TD Rewards which is used with Expedia for TD, their own co-branded travel booking platform. Customers can redeem their TD Rewards through Expedia for TD for travel-related purchases to save on costs for their next vacation.

Let’s take a look at everything you need to know about Expedia for TD and how you can utilize your TD Rewards points to get the most value.

What is Expedia for TD?

Expedia for TD is a third-party online travel agency available exclusively to TD customers who hold an active TD Rewards earning credit card.

Eligible TD customers can make travel bookings on Expedia for TD and redeem their TD Rewards points , the in-house loyalty program currency of TD Bank. Expedia for TD may also offer exclusive travel discounts and deals for members when making bookings.

Not only can TD Rewards points be redeemed on Expedia for TD, but cardholders who make purchases on Expedia for TD with their TD Rewards earning credit card will earn TD Rewards points at an accelerated earning rate. With that in mind, if you were already going to make a reservation with a third-party hotel booking website , consider using Expedia for TD to earn even more points per dollar spent on your travel purchase.

What Redemptions Can I Make with Expedia for TD?

Expedia for TD is similar to other online travel agencies, allowing customers to book and redeem their TD Rewards points toward a number of travel expenses. These expenses include flights, hotels, car rentals, all-inclusive vacations, cruises, train travel, and other travel activities.

When redeeming points toward these travel purchases, customers can use TD Rewards points to cover the entire purchase (if they have enough points) or use a combination of TD Rewards points and cash.

What Credit Cards are Linked to Expedia for TD?

TD offers four credit cards that earn TD Rewards and thus can be used on Expedia for TD: three personal credit cards and one business credit card.

Personal Credit Cards

The TD First Class Travel Visa Infinite card is the best card that earns TD Rewards points but it does have an annual fee of $139. However, this card is the only one that has a minimum income requirement, requiring either an annual personal income of $60,000 or an annual household income of $100,000.

The TD First Class Travel® Visa Infinite* card earns TD Rewards points and gives cardholders the opportunity to earn 8x TD Rewards on purchases at Expedia for TD.

Check out our TD First Class Travel Visa Infinite card review for more information.

In 2024, we awarded this card as the Best Fixed Value Points Credit Card.

The TD First Class Travel Visa Infinite card earns 8 TD Rewards points for every dollar spent on travel purchases at Expedia for TD, 6 TD Rewards points for every dollar spent on eligible grocery and restaurant purchases, 4 TD Rewards points for every dollar spent on regularly recurring bill payments, and 2 TD Rewards points for every dollar spent on all other purchases.

The TD Platinum Travel Visa card is the second best card that earns TD Rewards points but it does have an annual fee of $89. This card has no minimum income requirement.

The TD Platinum Travel card earns TD Rewards points and gives cardholders the opportunity to earn 5x TD Rewards on purchases at Expedia For TD.

The TD Platinum Travel Visa card earns 5 TD Rewards points for every dollar spent on travel purchases at Expedia for TD, 3 TD Rewards points for every dollar spent on grocery purchases and recurring bill payments, and 2 TD Rewards points for every dollar spent on all other purchases.

The TD Rewards Visa card is the only no annual fee credit card that earns TD Rewards points. This card has no minimum income requirement.

The TD Rewards Visa* Card earns TD Rewards points and gives cardholders the opportunity to earn 4x TD Rewards on purchases at Expedia For TD.

The TD Rewards Visa card earns 4 TD Rewards points for every dollar spent on travel purchases at Expedia for TD, 3 TD Rewards points for every dollar spent on groceries and restaurant purchases, 2 TD Rewards points for every dollar spent on recurring bill payments, and 1 TD Rewards point for every dollar spent on all other purchases.

Business Credit Cards

The TD Business Travel Visa card is the only business credit card that has the ability to earn TD Rewards.

The TD Business Travel card earns TD Rewards points and gives cardholders the opportunity to earn 9x TD Rewards on purchases at Expedia for TD.

The TD Business Travel Visa card earns 9 TD Rewards points for every dollar spent on travel purchases at Expedia for TD, 6 TD Rewards points for every dollar spent on purchases in foreign currencies, 6 TD Rewards points for every dollar spent on restaurant purchases and recurring bill payments, and 2 TD Rewards points for every dollar spent on all other purchases.

How to Use Expedia For TD

If you are interested in redeeming TD Rewards points through Expedia for TD, visit the Expedia for TD website and log in. The booking process is very similar to using any third-party online travel agency.

Once logged in, you will be presented with the search bar. You can select the type of travel booking you are interested in making and fill out the applicable details. For this example, I will walk through a hotel booking on Expedia for TD but it is very similar when making a flight booking, rental car reservation, or other travel purchase.

Once you search, you will be presented with several available properties for the specific date. When booking through Expedia for TD, it will show the cash rate in addition to how many TD Rewards points can be redeemed to pay for this stay.

Select the hotel or resort you are interested in staying at and the room type. Notice that it also says I will earn “up to 3,143 TD Rewards points” on this booking. That earning rate only applies if I pay entirely in cash for this booking and use my credit card which earns TD Rewards points.

Once you select your room type, you will arrive on the payment page. On this page, there is a separate box for redeeming TD Rewards points. Users can select how many TD Rewards points they want to apply towards their booking. Redemptions must be made in increments of 200 TD Rewards points, which means whole dollar value increments.

If the entire booking cannot be paid for using TD Rewards points, customers will need to use a credit card to cover the remaining cash cost. Ensure you use your credit card that earns TD Rewards points to maximize the return on your spending.

Is Expedia for TD the Best Redemption for My TD Rewards Points?

Yes, if you hold a TD credit card that earns TD Rewards points , redeeming them with Expedia for TD for travel purchases is the best value you can expect to receive from your earned points. Redemptions through Expedia for TD allow you to cash out your TD Rewards points at 0.5 cents per point, meaning 10,000 TD Rewards points are worth $50 CAD.

If you don’t want to use Expedia for TD, the second best option is to utilize the “Book Any Way Travel” feature. This allows customers to book travel on their TD Rewards earning credit card through any other vendor, such as a hotel booking directly through Marriott Bonvoy or Hilton Honors . Once the eligible charge is posted on the card, customers can redeem TD Rewards points at a rate of 0.4 cents per point, meaning 10,000 TD Rewards points are worth $40 CAD.

TD Rewards points can also be redeemed for gift cards, merchandise, statement credit, or education credit. However, these redemptions are all worth less than booking with Expedia for TD or using “Book Any Way Travel”, so always look to redeem your TD Rewards points for travel purchases, preferably through Expedia for TD, to get the most value.

If you hold a credit card that earns TD Rewards points, understanding the ins and outs of the Expedia for TD program is an important factor in ensuring you get the greatest possible value out of your points.

Frequently Asked Questions

No, Expedia for TD does not have an app. The normal Expedia app cannot be used for Expedia for TD.

If you have any questions about Expedia for TD, you can call their customer support at 1-877-222-6492. You can also contact customer support on the Expedia for TD website for help via email or chat.

Since Expedia for TD is an online travel agency, discount codes offered by an airline cannot be applied to any bookings made on Expedia for TD. Those discount codes are typically only usable when you book directly with the airline on their website.

TD Rewards points are worth 0.5 cents per point when redeemed on Expedia for TD. This means that 10,000 TD Rewards points are worth $50 CAD when redeemed towards an eligible travel purchase on Expedia for TD.

Yes, Expedia for TD will price match travel rewards. However, price matching only applies to hotels and flight-hotel package bookings. If you want to price match, reach out to Expedia for TD customer support.

Before using Expedia for TD, you will need to register for a TD Rewards account here and ensure your TD Rewards credit card is linked and available on the account.

Once you are registered, you can visit the Expedia for TD website and log in using your credentials.

- Latest Posts

Josh Bandura

Latest posts by josh bandura ( see all ).

- New RBC Credit Card Offer (August 2024) - Aug 2, 2024

- Flight Award Redemptions: Change & Cancellation Fees - Aug 2, 2024

- New BMO Credit Card Offers (August 2024) - Aug 1, 2024

- Tangerine Money-Back Credit Card vs. Rogers Red Mastercard: Which is Best? - Jul 26, 2024

- Hilton & AutoCamp: Glamping on Miles & Points - Jul 19, 2024

Review: JetBlue Mint Business Class (A321)

American express (us) & no lifetime language (nll) offers, leave a comment cancel reply.

All comments are moderated according to our comment policy. Your email address will NOT be published.

Save my name, email, and website in this browser for the next time I comment.

Subscribe to our newsletter .

This site uses Akismet to reduce spam. Learn how your comment data is processed .