Currently the video chat timings are 9:30am to 6:30pm from Monday to Saturday.

Call us now to secure insurance coverage for health, motor, and more. Timing: 10:00 a.m. to 07:00 p.m. every day.

Find quick answers to all your insurance queries from our self-help section.

Call us for any help with renewals or claims. Timing: 09:00 a.m. to 07:00 p.m. every day.

Join India’s leading general insurance company. Timing 09:30 a.m. to 06:30 p.m. Monday-Saturday.

Live Worry-Free, Live Smart

Secure Your Future With Our Trusted Brand

Two Wheeler

Premium Starting At Just ₹ 238/Month *

- Don't know my Registration no. Enter registration number

- this.maxLength) this.value=this.value.slice(0, this.maxLength);" maxlength="10" class="ap-input-box col-100 floatLft pad-left primary-font did-floating-input MidLifeHomePageCar_Mobile" placeholder=" " onpaste="return false;" oncopy="return false" autocomplete="off/"> Enter mobile number

- Enter Email Id

- View Prices Next

- I accept Terms & Conditions

- Don't know Registration Number

- Renew Your Car Insurance Policy

Premium Starting At Just ₹ 19/Month *

- this.maxLength) this.value=this.value.slice(0, this.maxLength);" maxlength="10" class="ap-input-box col-100 floatLft pad-left primary-font did-floating-input MidLifeHomePageBike_Mobile" placeholder=" " onpaste="return false;" oncopy="return false" autocomplete="off/"> Enter mobile number

- Renew Your Bike Insurance Policy

Premium Starting At Just ₹ 243/Month *

- Mr. Mrs. Ms. Enter full name

- this.maxLength) this.value = this.value.slice(0, this.maxLength);" maxlength="10" class="ap-input-box col-100 floatLft pad-left primary-font did-floating-input MidLifeHomePageHealth_Mobile" placeholder=" " onpaste="return false;" oncopy="return false" autocomplete="off/"> Enter mobile number

- I agree to the Terms & Conditions

- View Prices

- Renew Your Health Insurance Policy

Premium Starting At Just ₹ 306 *

- this.maxLength) this.value = this.value.slice(0, this.maxLength);" maxlength="10" id="txtOTPmobileNoTravel" class="ap-input-box col-100 floatLft pad-left primary-font did-floating-input MidLifeHomePageTravel_Mobile" placeholder=" " onpaste="return false;" oncopy="return false" autocomplete="off/"> Enter mobile number

Single Trip

Sent to Edit

Resend OTP in 60 Seconds

Why Choose Reliance General Insurance?

3 crore+ policyholders ^.

Widely loved and trusted by our customers

100+ Insurance Products

Coverage for everything that matters

100% Claim Settled #

Hassle-free claims intimation and settlement

Why You Should Trust Us With Your Insurance Needs

1.26 crore+ claims settled ##, paperless & cashless claims, direct claim settlement, reliance general insurance present at.

Network Garages **

Network Hospitals

Branches across India

Why Customers

Abbas Valliambaliyasana

30 June 2022, Gujarat

Manish Virmani

12 March 2022, Delhi

Rishabh Kumar Shukla

18 August 2022, Uttar Pradesh

Giju RojiJohn

2 September 2022, Kerala

5 February 2020, Vijayawada

08 June 2022, Haryana

Reliance Self-i Manage your Insurance Easily

A smart mobile app by Reliance General Insurance

Our Moments Of Pride

Latest Articles On Insurance

Tax benefits of owning an EV explained

Is your employer’s health insurance coverage sufficient?

Top Destinations for Adventure Travel in South Asia

Why Most Bikes Do Not Have a Reverse Gear?

Riding Your Bike Safely During Monsoon

Faqs about insurance, what is insurance.

Insurance is a legal contract between you (the policyholder) and an insurance company. Under this contract, you have to pay a certain amount of money (called a premium) to the insurance company. In exchange, the insurance company agrees to provide financial coverage for unexpected losses or damages you may experience due to sudden illness, accident and other unfortunate events.

Note that the insurance company will pay for your losses or damages as per the terms and conditions of your insurance policy. For example, if you have car insurance and your car gets into an accident, your insurance company will pay for the expenses related to repairing or replacing the damaged car parts as per the coverage limit mentioned in the policy.

In simple terms, insurance helps you to reduce or prevent a greater financial burden in the future by paying a relatively small premium today.

How many types of insurance are available in the market?

There are two main types of insurance: Life Insurance: It is a legal agreement between an insurance company and policyholder. As part of this, you have to pay monthly or annually premiums and, in return, the insurance company agrees to pay your nominee a lump sum amount upon your death. Life Insurance provides coverage for many causes of death, except suicide, pre-existing diseases, war and illegal acts.

General Insurance: It is a legal agreement between an insurance company and policyholder wherein the insurer offers protection against unexpected events that may cause financial losses. When you buy general insurance, you pay a premium on a regular basis to an insurance company. In return, the insurance company agrees to cover your valuable items against unfortunate events, including accidents, natural disasters, theft and more. General Insurance provides coverage to a wide range of things such as your car, two-wheeler, health, travel, corporate and SME.

What are the different types of General Insurance?

General Insurance is a great way to protect yourself and your belongings from unexpected losses and damages. Reliance General Insurance offers a wide umbrella of insurance products, such as motor, health, travel and Corporate & SME.

Motor Insurance: It is a type of insurance that provides financial protection to all types of vehicles, including two-wheelers, four-wheelers and commercial trucks, against any damage or loss caused by accidents, theft or natural disasters. It is mandatory to have a valid motor insurance to drive your vehicle/s on public roads in India.

Health Insurance: It is a type of insurance that offers coverage for healthcare expenses that may arise due to an unexpected medical emergency. Health insurance covers a range of medical costs, including hospitalisation, doctor fees, medicine costs and medical procedures. You can buy health insurance for yourself and/or your family depending on your needs.

Travel Insurance: This type of insurance provides financial compensation for unexpected medical and on-medical emergencies that may occur during your domestic or international trips. Travel insurance covers flight cancellation, flight delays, medical emergencies, loss of baggage and other losses or damages you may incur while travelling.

Corporate & SME Insurance: Reliance General Insurance offers insurance coverage for a variety of risks, including fire damage, marine cargo damage/theft and professional indemnity.

Why do I need to purchase an insurance policy?

If you don’t have any insurance policy, you won’t be able to completely protect yourself against unexpected events such as accidents, theft, damages and more. Buying the right insurance policy helps you to get financial protection against losses caused by different uncertainties in life.

How does an insurance policy work?

Insurance follows a risk-sharing process wherein a group of people pays a certain amount (premium) to an insurance company to protect themselves against a common risk. The insurance company uses the money from this pool to provide financial support whenever someone from the group suffers from an unexpected loss or damage. The main idea is to spread the risk across a pool of customers and reduce the cost of potential financial losses for each individual.

Why should I purchase an insurance policy from Reliance General Insurance?

Reliance General Insurance, a part of Reliance Capital, is one of the leading general insurance companies in India. We offer a comprehensive bouquet of insurance products, including Motor, Health, Travel and Corporate & SME, to fulfil each and every need of our customers. On top of this, Reliance General Insurance has a super-simple policy buying/renewal journey and super-fast claims intimation process.

What are the different types of car insurance?

Car insurance or four-wheeler insurance is an insurance policy that offers financial coverage to you for losses or damages to your vehicle owing to accidents, natural calamities, self-ignition, explosion, burglary and malicious activities. It also provides protection against third-party liabilities (property damage or death) that may arise because of your vehicle.

As per the Insurance Regulatory and Development Authority of India (IRDAI), it is mandatory to have a valid car insurance to drive your vehicle in India. Note that a car insurance premium is calculated based on your car type, model and IDV (insured declared value).

If you want to buy car insurance, Reliance General Insurance offers multiple types of car insurance policies that you can choose from based on your needs. We also have tie-ups with leading OEMs such as Hyundai , Mahindra , Toyota , Maruti Suzuki and Tata Motors to ensure that you are fully covered. Here are our car insurance plans:

Third-Party Car Insurance: Offers coverage for any damage caused by your car to a third-party vehicle or property. This policy also covers third-party bodily injury or death. Here, the third-party refers to an individual (not you) who has incurred losses or damages because of your car. As per the Motor Vehicles Act, 1988, it is mandatory to have a third-party car insurance policy for your vehicle. The IRDAI sets the premium price for third-party car insurance. It considers your vehicle engine’s cubic capacity to determine the premium.

Long-Term Car Insurance: Enables you to insure your car for up to three years. This policy covers both your own and third-party losses or damages caused by accidents; theft; fire; natural calamities like flood, typhoon, hurricane, storm, cyclone, hailstorm or frost; man-made activities like riot and strike, malicious act and terrorism; and self ignition or lightning. Reliance Long-Term Car Insurance comes with a No Claim Bonus for not raising any claims during a policy year.

Own Damage Car Insurance: Provides coverage for the expenses you incur to repair or replace parts (of your own car) damaged in an accident. This policy also covers damages to your car caused by natural disasters, including floods, earthquake and hurricane, and man-made calamities, including vandalism, riots and terrorist attacks. Reliance General Insurance also offers various add-on covers to enhance your Own Damage Car Insurance policy.

Commercial Vehicle Insurance: Provides financial protection to your commercial vehicle against losses or damages caused by riots, strikes, earthquakes, malicious activities, terrorist attacks, landslides, accidents (via external means), burglary, cyclone, hailstorm, self-ignition and lightning. Vehicles covered by this insurance are goods carrying commercial vehicles, mobile cranes, drilling rigs, mobile plants, excavators and miscellaneous vehicles with trailers. The Commercial Vehicle Insurance policy from Reliance General Insurance also includes third-party insurance.

Bus Insurance: Offers coverage to school buses and private buses (for company employees) against losses or damages caused by accidents, theft, fire or any malicious activities and natural calamities. Note that it is mandatory for every vehicle owner to have a valid third-party insurance.

Commercial Car (Taxi) Insurance: Provides coverage for third-party property damage or bodily injury caused by your commercial vehicles, such as taxis. Note that it is mandatory to have a valid taxi insurance policy as per the Motor Vehicles Act, 1988. Reliance Taxi Insurance policy comes with a No Claim Bonus, which rewards you with discounts on premium for not filing any claim during your policy period.

What are the different types of two-wheeler insurance?

Two-wheeler insurance provides financial coverage for any losses or damages to your bike or scooter that may arise due to accidents, theft, natural calamities and malicious activities. It also protects you from third-party liabilities such as damages to another person’s property and injury or death caused because of your two-wheeler.

As per the Motor Vehicles Act, 1988 it is mandatory to have a valid two-wheeler insurance policy to drive your bike or scooter on Indian public roads. The premium is calculated based on your two-wheeler’s type, model and IDV (insured declared value).

If you want to buy two-wheeler insurance, Reliance General Insurance offers three key two-wheeler insurance plans. We also have partnership with key two-wheeler manufacturers such as Honda , Bajaj , Hero , TVS , Yamaha , Royal Enfield , Suzuki , Mahindra and Kawasaki to ensure you are covered no matter which model you have. Our two-wheeler insurance policies are:

Third-Party Two-Wheeler Insurance: Offers coverage for any damage caused by your two-wheeler to a third-party vehicle or property. This policy also covers third-party bodily injury or death. Here, the third-party refers to someone who has suffered accidental damages or losses because of your two-wheeler. It is mandatory to have a Third-Party Liability Cover as per the Motor Vehicles Act, 1988. Hence, the IRDAI regulates the premium amount by taking into consideration the cubic capacity of a two-wheeler’s engine.

Long-Term Two-Wheeler Insurance: Helps you to insure your two-wheeler against accidents, fire explosion, self-ignition, natural calamities, riots, strikes, malicious activities and terrorist attacks for a longer duration (two, three and five years). This policy covers both your own and third-party damages. Reliance Long-Term Two-Wheeler Insurance policy comes with a No Claim Bonus, which rewards you with premium discounts for not filing any claim during your policy period.

Own Damage Two-Wheeler Insurance: Provides financial support to repair or replace parts (of your own two-wheeler) that were damaged due to fire explosion, self-ignition, burglary and theft. This policy also covers damages to your two-wheeler caused by natural disasters, including flood, typhoon, hurricane and earthquake, and man-made calamities, including riots, strikes, terrorist acts and malicious activities.

How many health insurance does Reliance General Insurance offer?

Health insurance is a type of insurance that helps you pay for unexpected medical expenses and treatments. In exchange for a monthly or yearly premium, an insurer agrees to provide medical coverage for hospitalisation, daycare services, surgical treatments, consultation charges and other medical costs.

Every individual has a unique set of health insurance needs. That is why there are multiple types of health insurance plans available in the market. The main ones are Individual Health Insurance, Family Health Insurance, Senior Citizen Health Insurance, Personal Accident Insurance and Critical Illness Health Insurance.

If you want to health insurance, Reliance General Insurance provides a range of health insurance policies. We also have partnerships with 10,000+ network hospitals to ensure that you don’t only get easy-access to medical services but enjoy cashless treatments. Our health insurance policies include:

Health Gain Insurance: Enables you to customise your health insurance policy. You can choose from the Plus, Power and Prime plans as per your needs. This no-compromise insurance plan offers coverage to you and/or your family for modern treatments, hospitalisation expenses, ambulance expenses, accidental death and more. You can get coverage up to ₹1 crore, discount of up to 40% on the premium and no room rent limits.

Health Infinity Insurance: Offers coverage for inpatient care, pre- and post-hospitalisation, special treatments, AYUSH treatments, medical expenses and more. This limitless insurance policy offers limitless benefits, including coverage up to ₹5 crore, discount of up to 35% on the premium, OPD cover, maternity cover, emergency ambulance and restoration of your sum insured for unrelated illness or injury.

Super Top-Up Insurance: Serves as a backup insurance plan that can help you pay for your surplus medical expenses incurred during emergencies. This health insurance policy offers coverage for inpatient, day care or outpatient treatments, domiciliary hospitalisation, ambulance expenses, maternity expenses and more. It offers sum insured between ₹5 lakh and ₹1.30 crore and discount of up to 35% on the premium.

Arogya Sanjeevani Policy: Provides coverage for inpatient care, special treatments, day care procedures, pre- and post-hospitalisation, emergency road ambulance, AYUSH treatments and more. It has a sum insured ranging ranging between ₹50,000 to ₹10 lakhs. You can also customise this policy as per your requirements.

HealthWise Health Insurance: Offers coverage for health check-ups, medical expenses, hospitalisation and more.

Hospi Care Insurance: Offers coverage for certain surgical procedures and hospitalisation expenses.

Saral Suraksha Bima: Provides financial protection to you and/or your family against accidental disability or death. You also get a lump sum benefit of up to 100% of the sum-insured value.

Personal Accident Insurance: Provides coverage for injuries or death caused by an accident. This policy covers your medical expenses and offers financial support when you suffer from accidental total/partial disability or death.

Critical Illness Insurance: Offers financial protection to you against certain life-threatening and lifestyle-disabling diseases. With this policy, you get a lump sum amount to cover for your medical expenses.

Corona Rakshak Insurance: Provides coverage to you against COVID-19 related expenses. With this policy, you get a lump sum payment when you are diagnosed with COVID-19 and hospitalised for a minimum of 72 hours.

Corona Kavach Insurance: Offers financial protection to you and your family against medical expenses incurred due to COVID-19 infection. It covers hospitalisation expenses, home treatment expenses, AYUSH treatment and more.

Group Mediclaim Insurance Policy: Provides comprehensive coverage to your workers against unexpected medical expenses.

Wellness: Offers holistic healthcare services and wellness programmes for both individuals and corporates.

How many travel insurance policies are available in the market?

Travel Insurance is a type of insurance that provides financial coverage for your domestic or international trips against unforeseen risks, including medical expenses, loss of passport, trip delay, trip cancellation and interruption, loss and delay of checked-in luggage and home burglary.

Travel insurance is valid from the start day of your trip to the last day of your trip or until the time you reach your home country. Note that travel insurance requirements keep changing for every country. There are certain countries where is it mandatory for tourists to have a valid travel insurance. Make sure to check a country’s travel insurance requirements before booking your trip.

If you are planning a trip, Reliance General Insurance can help to protect yourself and your belongings during your travel. We offer a range of unique travel insurance policies that gives you the peace of mind you need during your trip. These are:

International Travel Insurance: Offers coverage for your international trip against multiple possible risks. You can use this policy to cover unexpected medical expenses, home burglary, loss of luggage and other travel-related problems. Reliance General Insurance also offers automated policy extension (up to 30 days) in case of a medical emergency or evacuation.

Schengen Travel Insurance: Provides coverage to travellers visiting Schengen countries like Switzerland, Spain, Italy, France, Germany, Portugal, Denmark and more. Use this policy to cover unforeseen medical expenses, loss of passport, delay or loss of checked-in baggage, accidental death, personal accidents and liabilities. Note that it is compulsory to have a medical coverage of at least Euro 30,000 to get a Schengen Visa.

Asia Travel Insurance: Provides financial protection to travellers visiting Asian countries like Thailand, Dubai, Singapore, Malaysia, Mauritius, China and more. You can use this policy to cover sudden medical expenses, loss of passport, delay or loss of checked-in baggage, accidental death, personal accidents and liabilities, financial emergency assistance, hijack distress allowance and trip delay.

Annual Multi-Trip Travel Insurance: Offers continuous and flexible coverage for multiple international trips within a year. You can use this policy to cover unanticipated medical expenses, daily allowance in case of hospitalisation, delay or loss of checked-in luggage, trip interruptions and cancellations, loss of passport and missed connections during your trip. If you’re a frequent traveller, buying an Annual Multi-Trip Travel Insurance would be more economical for you.

Senior Citizen Travel Insurance: Offers financial support to senior citizens who are travelling domestically or internationally against unexpected medical expenses, loss or delay of checked-in luggage, loss of passport, personal accident, compassionate visits, accidental death and personal liabilities. You can avail add-ons such as hospitalisation daily allowance, financial emergency assistance and home burglary insurance by opting for Silver, Gold or Platinum Senior Citizen Travel Insurance plan.

Student Travel Insurance: Provides financial protection to students who are travelling abroad for educational purposes. You can opt this policy to cover expenses caused by unexpected accidents or illnesses, loss of checked-in baggage, personal liabilities, compassionate visits and study interruptions.

What are the different types of Corporate & SME Insurance?

Corporate and SME insurance is a type of insurance that provides protection to your business, irrespective of its size or industry. It helps to safeguard your business against various risks and uncertainties that can impact your operations, products, finances and reputation. These risks include property damage, employee illness or injury, business interruption, third-party liabilities and product loss or damage.

Corporate and SME insurance policies are customised to meet the unique requirements of different businesses. For example, marine cargo insurance provides coverage against the risks associated with the transportation of goods, including loss or damage due to accidents, natural disasters, piracy and theft.

Reliance General Insurance provides a wide range of policies to cater to the specific needs of different businesses. These include:

Professional Indemnity Insurance: Provides financial protection to doctors, chartered accountants, management consultants, lawyers, architects and consultant engineers against any legal expenses and damages caused by allegations of professional negligence and error. This policy covers all the costs, expenses and fees incurred for the investigation, defence and settlement of any allegation.

Employee’s Compensation Insurance Policy: Provides financial support to your employees if they get injured or die as a result of or during their employment. This coverage is mandatory under the Employee Compensation Act 1923, Common Law and Fatal Accidents Act 1855. Any commercial company can buy this policy.

Director’s and Officer’s Liability Insurance: Offers protection to your company’s directors and key officers against the financial consequences of any legal claims and lawsuits that may arise due to their decisions or actions. This policy can be purchased by public liability, non-profit and private organisations.

Marine Cargo Insurance Policy: Offers coverage to your cargo (goods being transported by land, sea or air) against any possible mishap. It provides protection against risks such as fire or explosion, ship collision and sinking, theft, malicious damages and natural calamities. This policy helps you to protect your cargo from the time it leaves the warehouse or place of origin until it reaches its final destination.

Shopkeepers Package Policy: Offers coverage to small- and medium-sized shopkeepers against theft or damage to their shop structure and its contents. This policy also covers breakdown of all mechanical and electrical appliances, legal liability toward employees and third parties, money in transit or in safe, and more. You can customise the cover as per your requirement.

Pardhan Mantri Fasal Bima Yojana: Provides financial coverage to farmers against unexpected crop loss or damage caused by adverse weather conditions, pests and crop diseases. All farmers, including tenant farmers, are eligible for this policy. Note that only the crops notified by the State Government are covered.

Contractor’s Plant and Machinery Insurance: Offers protection to the plants and machinery used at your project site against physical loss or damages caused by accidents, fire, burglary and riots. You can also customise this policy by opting for add-on covers for clearance and removal of debris, express freight, air freight, third party liability and terrorism.

Standard Fire and Special Perils Policy: Offers protection to your properties, including house, office, shop and factory, against losses or damages caused by fire and related perils such as lightening, storm or cyclone, explosions, riots, strikes and malicious damages. You can also enhance the cover for your insured property by opting for add-ons such as Spoilage Material Damage Cover, Impact Damage Cover, Leakage and Contamination Cover and more.

Reliance Contractor All Risk: Provides coverage to your civil construction projects against loss or damage to construction material, plant, machinery and temporary structure such as sheds and offices. It also comes with a third party liability coverage. Note that this policy covers civil project like building construction, road, dam, bridges on land or rivers or creeks, flyover and tank construction.

Reliance Erection All Risk: Offers coverage to machinery, plant, equipment, civil work and other material work at your project site against physical loss or damage caused by fire, lightning, burglary, explosion, and natural disasters such earthquake and floods. This policy also comes with a third party liability coverage.

Is it mandatory to buy an insurance?

The main idea behind purchasing an insurance is protecting yourself against unforeseen financial risks. But you are legally required to purchase some types of insurance. For example, it is mandatory to have a valid motor insurance to drive a vehicle legally in India.

How to choose the right insurance plan?

You can start by listing down your specific requirements and doing a thorough research on different policies available in the market. Look for the plan that offers wide coverages and comprehensive benefits. Make sure that the insurance company you are planning to buy a policy from is a trusted company with extensive hospital/garage/branch network and a high claim settlement ratio.

How is the policy premium determined?

Different insurance policies have different premium amount. Some of the factors that are taken into account to determine a premium includes your age, the type of insurance coverage, the amount of coverage, your personal information, your ZIP code and more.

How long does it take to buy an insurance policy from Reliance General Insurance?

It won’t take more than a couple of minutes to buy a policy from us.

How can I pay for my policy purchase?

You can use cash, cheque, debit card, credit card, net banking and mobile wallets to buy a policy from Reliance General Insurance.

What are the documents required to buy an insurance policy?

You need to provide your proof of your identity, age and health conditions. Specifically, the documents needed are:

Identity proof: This includes your passport, Aadhar card, driving licence, PAN card and Voter ID card.

Age proof: This includes your birth certificate, passport, Aadhar card, driving licence and Voter ID card.

Medical reports: You need to provide the necessary medical reports if you are buying a policy for any pre-existing diseases or health conditions.

How to file an insurance claim?

Reliance General Insurance has a very streamlined and easy claim process. Just visit our website or download our Reliance Self-i app to file claims instantly. There, provide details about the incident, including the date, time, location and any other relevant information. You can also call our customer service executives on our helpline number +91 22-48903009 if you have any queries.

How does an insurance claim get processed?

Reliance General Insurance has a very streamlined claims processing and settlement method. It includes four steps:

Claim notification: You need to notify us about the claim as soon as possible. You can do this by either raising a claim request on our Reliance Self-i app or visiting our website and initiating a claims request via the Claims tab on the menu bar. You can also call our customer service executives on our helpline number +91 22-48903009 .

Claim registration: Once you have notified us about the claim, we will register the claim and assign a claim number to you. You need to provide all the necessary details related to the incident, including the date, time, location, and cause of the loss or damage.

Insurance surveyor: We will then assign a surveyor to investigate your claim and evaluate your loss or damage. The surveyor will also determine whether the losses or damages are covered under your policy. We will approve or deny your claim based on the surveyor’s investigation and evaluation.

Claim settlement process: We have two claim settlement processes - Cashless and Reimbursement. If you opt for the cashless process, we will directly settle the bills with our network hospitals or garages. With the reimbursement process, you have to pay all the bills and submit them along with the claim form to the surveyor/us for settlement.

How long does it take to get an insurance claim?

The time it takes to receive an insurance claim payment depends on several factors, such as the type of insurance policy, the nature or severity of the claim and the insurance company's policies and procedures.

How many claims can I make in a year?

Generally, there is no limit to the number of claims you can make if you don’t surpass the sum assured of your policy. (Unless you have purchased a product with limits)

How will my claim get processed if I have insurance from two different insurers?

Your claim will be processed and settled on a proportionate basis. In simple terms, you get compensated based on the coverage limit determined under each policy. You will not get paid twice for the same losses or damages as both the insurance companies will work together to determine their respective contribution toward the claim settlement. They will ensure that the total amount you receive as compensation does not exceed the actual cost of the loss or damage.

How can I renew my existing insurance policy?

You just have to visit our website and click on the Renewal tab on the menu bar. Fill in your details and make the payment. You can also download our Reliance Self-i app or call our customer service executives on our helpline number +91 22-48903009 to renew your existing policy.

How can I pay for my insurance renewal?

There are multiple ways to renew your existing insurance policy. Depending on your convenience and preference, you can opt for either online or offline payment mode.

Online payment: You can renew your insurance policy from the comfort of your home using online payment options such as credit/debit cards, net banking, UPI and mobile wallets, including Paytm, PhonePe and GPay and Amazon Pay.

Offline payment: You can renew your insurance policy offline by visiting your insurance company's office or through an insurance agent and making the payment with cash or cheque.

What are the documents required to renew my policy?

You may need to submit a copy of your previous insurance policy document to renew your existing policy. You may also need to submit your updated identification proof, address proof and other important documents (such as vehicle registration certificate or health-check-up report).

How long does it take to renew an existing policy from Reliance General Insurance?

We offer a super-fast policy renewal process. It won’t take more than a couple of minutes to renew a policy from us.

Can I increase my sum insured when I renew my existing insurance plan?

Yes, you can easily increase your sum insured when renewing your existing insurance. Here’s how it works for different insurance products:

Health insurance: You can generally increase the sum insured of your health insurance policy at the time of renewal. However, this may be subject to certain conditions such as your age and health condition. Some health insurance policies from Reliance General Insurance also come with a Cumulative Bonus benefit that lets you increase your sum insured for every claim-free year. Another option to increase your overall coverage is by purchasing an additional insurance policy or a top-up plan.

Motor insurance: You can increase your motor insurance coverage at the time of policy renewal. You can do this by opting for options such as a higher third-party liability cover or a comprehensive policy with add-ons such as zero depreciation or engine protect cover. It is important to note that your premium and coverage amount is affected by factors such as IDV, driver's age, driving history, location, the type of vehicle being insured and claim history.

Travel insurance: Travel insurance is usually a one-time contract that provides coverage for a specific trip or duration. You can easily renew or extend your policy as per your needs. However, your premium will be influenced by factors such as the policy coverage, duration and any changes in your health status or travel plans. If you are a frequent traveller, it is advisable to opt for multi-trip or annual travel insurance policies that cover multiple trips during a year.

Corporate & SME insurance: You can easily increase your sum insured for your Corporate & SME Insurance during the renewal period. However, note that the premium amount will be affected by factors such as your claim history, changes in business operations or industry regulation, risk management practices and market conditions.

When should I renew my insurance policy?

You should renew your insurance policy before it expires to avoid a lapse in coverage. Reliance General Insurance starts sending renewal reminders about 45-90 days prior to the policy expiry date. We send multiple SMS, WhatsApp messages and Reliance Self-i notifications to highlight the date by which you need to renew your existing policy.

Disclaimers:

*Car Insurance: The premium mentioned for car Insurance is excluding taxes for the private car model Maruti Suzuki Alto 800 with cubic capacity of less than 1000 cc for a 1 year Own Damage Insurance policy for an IDV of ₹2,34,728. Premium used is 2,853/year as on 1 March 2023 and then converted into a per month basis, which gives us Rs.238/month (2,853/12).

*Two-Wheeler Insurance: The premium mentioned is excluding taxes for the private two-wheeler model TVS Jupiter with cubic capacity of less than 110 cc for a 1 year Own Damage Insurance policy for an IDV of 34,766. Premium used is 233/year as on 1 March 2023 and then converted into a per month basis, which gives us Rs.19/month (233/12).

*Health Insurance: The premium mentioned is excluding taxes for single person ageing between 5 years to 20 years with individual health policy for Sum Insured of ₹3 lakhs considering no adverse health conditions/pre-existing disease/medical conditions with waiting period of 3 years. For more details, please refer to the policy wordings. Premium used is 2,919/year converted into a month which gives us Rs.243/month (2,919/12).

*Travel Insurance: The premium mentioned is excluding taxes for a medical sum insured of $25,000 for an Individual of 20 years on an Asia trip of 4 days. This is applicable for Asia plan only.

**The number of garages mentioned is the total of all the garages empanelled across the country for different vehicle categories.

^The total no. of customers insured data is for FY22 and has been picked up from the number of lives insured for Health, Personal Accident, Overseas Travel, Domestic Travel, Workmen Compensation and Crop Insurance, Weather LOB & Fire LOB provided by IRDAI count that is master policy count. Other than these LOBs, we have also provided data for the number of certificates issued.

#This is the overall claim settlement ratio for FY 2023-24 without claim outstanding at the start of the financial year as per public disclosure of Reliance General Insurance Co. Ltd.

##The number of claim settled mentioned above is for the number of claims paid from FY15 to FY23 across all line of businesses and are in lines with the data reported to IRDAI

- Select Product * Private Car Two Wheeler Health Insurance Travel Insurance Home Insurance Critical Illness Individual Personal Accident Office Package Select Product*

- Select Product Type * Buy New Renewal Select Product Type*

- this.maxLength) this.value = this.value.slice(0, this.maxLength);"> Enter mobile number

Thanks for the information. Our Customer Care will get back to you.

Reliance LiveSmart Travel Insurance

Reliance General Insurance Company Limited is wholly owned subsidiary of Reliance Capital, of the Anil Dhirubhai Ambani Group. The company has strong presence in large number of cities and offers products for both individuals and corporate. It was one of the first companies to receive ISO 9001:200 certification across all its functions and products.

Toll Free - 1800 3009

Reliance LiveSmart Travel Insurance is a comprehensive plan that covers you against unexpected medical and financial emergencies, while travelling abroad, and ensures that your trip is convenient and hassle free.

Unique Features of Reliance LiveSmart Travel Insurance

Policy with zero paperwork and affordable premiums

Choose from a variety of plans – for individuals or for the entire family

Cover for trips of different durations

Plans covering maximum destinations, inclusive or exclusive of USA and Canada

No medical check-ups till the age of 70 years

Eligibility Criteria for Reliance LiveSmart Travel Insurance

Product benefits of reliance livesmart travel insurance, exclusions for reliance livesmart travel insurance.

- Insured Person is traveling against the advice of a Physician; or is travelling for the purpose of obtaining treatment.

- Any Pre-existing Condition or any complication arising from it

- While under the influence of liquor or drugs.

- Through deliberate or intentional, unlawful or criminal act, error, or omission.

- Whilst participating as the driver, co-driver or passenger of a motor vehicle during motor racing or trial runs.

- Any pre-existing injury or condition

- Pregnancy except from ectopic pregnancy

- Racing on wheels or horseback, winter sports, canoeing in white water rapids and bodily contact sports

- Treatment rendered by a doctor who shares the same residence as the insured or who is a member of the insured persons family

- Mental illness, stress, psychiatric or psychological disorders

Here’s a list of things your policy won’t cover:

- Pre-existing medical conditions, unless it’s a life-threatening condition

- Expenses incurred due to suicide, self inflicted injury, mental disorder, alcohol/drug abuse, HIV/AIDS

- Issues faced due to theft or loss of passport when left unattended, or unreported to local police authorities

- Traveling against the advice of a physician

- Loss of checked baggage - no partial loss or damage shall become payable

- War or nuclear threat in the country where you’re travelling

Claim Process for Reliance LiveSmart Travel Insurance

Service provider is to be informed in each & every medical treatment. Non Intimation may invalidate the claim.

Service Provider details

National Toll Free No. 1800-209-55-22 Land line No's : (+91-22-67347843*/ 44 *) (Charges Applicable) Fax: (+91 22 6734 7888) Email Id: [email protected]

- Bonus History / Fund Performance

- Latest News

- Submit Comment

- Call Us: 86559 86559

- Select City* Mumbai Delhi Bangalore Hyderabad Pune Chennai Kolkata Nashik Others

- Best overall

- Best for exotic trips

- Best for trip interruption

- Best for family coverage

- Best for long trips

How we reviewed international travel insurance companies

Best international travel insurance for may 2024.

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

If you're planning your next vacation or trip out of the country, be sure to factor in travel insurance. Unexpected medical emergencies when traveling can drain your bank account, especially when you're traveling internationally. The best travel insurance companies for international travel can step in to provide you with peace of mind and financial protection while you're abroad.

Best international travel insurance

- Best overall: Allianz Travel Insurance

- Best for exotic travel: World Nomads Travel Insurance

- Best for trip interruption coverage: C&F Travel Insured

- Best for families: Travelex Travel Insurance

- Best for long-term travel: Seven Corners Travel Insurance

How we rate the best international travel insurance »

Compare the best international travel insurance companies

As a general rule, the most important coverage to have in a foreign country is travel medical insurance , as most US health insurance policies don't cover you while you're abroad. Without travel medical coverage, a medical emergency in a foreign country can cost you. You'll want trip cancellation and interruption coverage if your trip is particularly expensive. And if you're traveling for an extended period of time, you'll want to ensure that your policy is extendable.

Here are our picks for the best travel insurance companies for international travel.

Best overall: Allianz

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Good option for frequent travelers thanks to its annual multi-trip policies

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Doesn't increase premium for trips longer than 30 days, meaning it could be one of the more affordable options for a long trip

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Some plans include free coverage for children 17 and under

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Concierge included with some plans

- con icon Two crossed lines that form an 'X'. Coverage for medical emergency is lower than some competitors' policies

- con icon Two crossed lines that form an 'X'. Plans don't include coverage contact sports and high-altitude activities

- Single and multi-trip plans available

- Trip cancellation and interruption coverage starting at up to $10,000 (higher limits with more expensive plans)

- Preexisting medical condition coverage available with some plans

Allianz Travel Insurance offers the ultimate customizable coverage for international trips, whether you're a frequent jetsetter or an occasional traveler. You can choose from an a la carte of single or multi-trip plans, as well as add-ons, including rental car damage, cancel for any reason (CFAR) , adventure sport, and business travel coverage. And with affordable pricing compared to competitors, Allianz is a budget-friendly choice for your international travel insurance needs.

The icing on the cake is Allyz TravelSmart, Allainz's highly-rated mobile app, which has an average rating of 4.4 out of five stars on the Google Play store across over 2,600 reviews and 4.8 out of five stars from over 22,000 reviews on the Apple app store. So, you can rest easy knowing that you can access your policy and file claims anywhere in the world without a hassle.

Read our Allianz Travel Insurance review here.

Best for exotic trips: World Nomads

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Coverage for 200+ activities like skiing, surfing, and rock climbing

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Only two plans to choose from, making it simple to find the right option

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. You can purchase coverage even after your trip has started

- con icon Two crossed lines that form an 'X'. If your trip costs more than $10,000, you may want to choose other insurance because trip protection is capped at up to $10,000 (for the Explorer plan)

- con icon Two crossed lines that form an 'X'. Doesn't offer coverage for travelers older than 70

- con icon Two crossed lines that form an 'X'. No Cancel for Any Reason (CFAR) option

- Coverage for 150+ activities and sports

- 2 plans: Standard and Explorer

- Trip protection for up to $10,000

- Emergency medical insurance of up to $100,000

- Emergency evacuation coverage for up to $500,000

- Coverage to protect your items (up to $3,000)

World Nomads Travel Insurance offers coverage for over 150 specific activities, so you can focus on the adventure without worrying about gaps in your coverage.

You can select its budget-friendly standard plan, starting at $79. Or if you're an adrenaline junkie seeking more thrills, you can opt for the World Nomads' Explorer plan for $120, which includes extra sports like skydiving, scuba diving, and heli-skiing. And World Nomads offers 24/7 assistance, so you can confidently travel abroad, knowing that help is just a phone call away.

Read our World Nomads Travel Insurance review here.

Best for trip interruption: C&F Travel Insured

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Offers 2 major plans including CFAR coverage on the more expensive option

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Cancellation for job loss included as a covered reason for trip cancellation/interruption (does not require CFAR coverage to qualify)

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Frequent traveler reward included in both policies

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Up to $1 million in medical evacuation coverage available

- con icon Two crossed lines that form an 'X'. Medical coverage is only $100,000

- con icon Two crossed lines that form an 'X'. Reviews on claims processing indicate ongoing issues

- C&F's Travel Insured policies allow travelers customize travel insurance to fit their specific needs. Frequent travelers may benefit from purchasing an annual travel insurance plan, then adding on CFAR coverage for any portions of travel that may incur greater risk.

C&F Travel Insured offers 100% coverage for trip cancellation, up to 150% for trip interruption, and reimbursement for up to 75% of your non-refundable travel costs with select plans. This means you don't have to worry about losing your hard-earned money on non-refundable travel costs if your trip ends prematurely.

Travel Insured also stands out for its extensive "reasons for cancellation" coverage. Unlike many insurers, the company covers hurricane warnings from the National Oceanic and Atmospheric Administration (NOAA).

Read our C&F Travel Insured review here.

Best for family coverage: Travelex

Trip cancellation coverage for up to 100% of the trip cost and trip interruption coverage for up to 150% of the trip cost

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Options to cover sports equipment

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Option to increase medical coverage

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Can cancel up to 48 hours before travel when CFAR option is purchased

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Affordable coverage for budget-conscious travelers

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Includes generous baggage delay, loss and trip delay coverage

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Optional "adventure sports" bundle available for riskier activities

- con icon Two crossed lines that form an 'X'. Only two insurance plans to choose from

- con icon Two crossed lines that form an 'X'. Medical coverage maximum is low at up to $50,000 per person

- con icon Two crossed lines that form an 'X'. Pricier than some competitors with lower coverage ceilings

- con icon Two crossed lines that form an 'X'. Some competitors offer higher medical emergency coverage

Travelex travel insurance is one of the largest travel insurance providers in the US providing domestic and international coverage options. It offers a basic, select, and America option. Read on to learn more.

- Optional CFAR insurance available with the Travel Select plan

- Trip delay insurance starting at $500 with the Travel Basic plan

- Emergency medical and dental coverage starting at $15,000

Travelex Travel Insurance offers coverage for your whole crew, perfect for when you're planning a family trip. Its family plan insures all your children 17 and under at no additional cost. The travel insurance provider also offers add-ons like adventure sports and car rental collision coverage to protect your family under any circumstance. Got pets? With Travelex's Travel Select plan, you can also get coverage for your furry friend's emergency medical and transportation expenses.

Read our Travelex Travel Insurance review here.

Best for long trips: Seven Corners

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Diverse coverage options such as CFAR, optional sports equipment coverage, etc.

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Available in all 50 states

- con icon Two crossed lines that form an 'X'. Prices are higher than many competitors

- con icon Two crossed lines that form an 'X'. Reviews around claims processing are mixed

- Trip cancellation insurance of up to 100% of the trip cost

- Trip interruption insurance of up to 150% of the trip cost

- Cancel for any reason (CFAR) insurance available

Seven Corners Travel Insurance offers specialized coverage that the standard short-term travel insurance policy won't provide, which is helpful if you're embarking on a long-term trip. You can choose from several plans, including the Annual Multi-Trip plan, which provides medical coverage for multiple international trips for up to 364 days. This policy also offers COVID-19 medical and evacuation coverage up to $1 million.

You also get the added benefit of incidental expense coverage. This policy will cover remote health-related services and information, treatment of injury or illness, and live consultations via telecommunication.

Read our Seven Corners Travel Insurance review here.

How to find the right international travel insurance company

Different travelers and trips require different types of insurance coverage. So, consider these tips if you're in the market to insure your trip.

Determine your needs

- Consider the nature of your travel (leisure, business, or adventure) and the associated risks (medical emergencies, trip cancellations, etc.).

- Determine your budget and the amount of coverage you require.

- Consider the duration of your trip and the countries you'll be visiting, as some policies won't cover specific destinations.

Research the reputation of the company

- Look for the company's reviews and ratings from reputable sources like consumer advocacy groups and independent website reviews.

- Check the provider's financial stability and credit ratings to ensure it can pay out claims reliably.

- Investigate the company's claims process to ensure it can provide timely support if you need to file a claim.

Compare prices

- Get quotes from multiple providers to compare rates and coverage options.

- See if the company provides discounts or special offers to lower your cost.

- Look at the deductible or any out-of-pocket expenses you may have to pay if you file a claim to determine if you can afford it.

Understanding international travel insurance coverage options

Travel insurance can be confusing, but we're here to simplify it for you. We'll break down the industry's jargon to help you understand what travel insurance covers to help you decide what your policy needs. Bear in mind that exclusions and limitations for your age and destination may apply.

Finding the best price for international travel insurance

Your policy cost will depend on several factors, such as the length of your trip, destination, coverage limits, and age. Typically, a comprehensive policy includes travel cancellation coverage costs between 5% and 10% of your total trip cost.

If you're planning an international trip that costs $4,500, you can expect to pay anywhere from $225 to $450 for your policy. Comparing quotes from multiple providers can help you find a budget-friendly travel insurance policy that meets your needs.

We ranked and assigned superlatives to the best travel insurance companies based on our insurance rating methodology . It focuses on several key factors, including:

- Policy types: We analyzed company offerings such as coverage levels, exclusions, and policy upgrades, taking note of providers that offer a range of travel-related issues beyond the standard coverages.

- Affordability: We recognize that cheap premiums don't necessarily equate to sufficient coverage. So, we seek providers that offer competitive rates with comprehensive policies and quality customer service. We also call out any discounts or special offers available.

- Flexibility: Travel insurance isn't one-size-fits-all. We highlight providers that offer a wide array of coverage options, including single-trip, multi-trip, and long-term policies.

- Claims handling: The claims process should be pain-free for policyholders. We seek providers that offer a streamlined process via online claims filing and a track record of handling claims fairly and efficiently.

- Quality customer service: Good customer service is as important as affordability and flexibility. We highlight companies that offer 24/7 assistance and have a strong record of customer service responsiveness.

We consult user feedback and reviews to determine how each company fares in each category. We also check the provider's financial rating and volume of complaints via third-party rating agencies.

International travel insurance FAQs

The best insurance policy depends on your individual situation, including your destination and budget. However, popular options include Allianz Travel Insurance, World Nomads, and Travel Guard.

You should pay attention to any limitations regarding covered cancellations, pre-existing conditions, and adventure activities. For example, if you're worried you may have to cancel a trip for work reasons, ensure that you've worked at your company long enough to qualify for cancellation coverage, as that is a condition with some insurers. You should also see if your destination has any travel advisories, as that can affect your policy.

Typically, your regular health insurance won't cover you out of the country, so you'll want to make sure your travel insurance has adequate medical emergency coverage. Depending on your travel plans, you may want to purchase add-ons, such as adventure sports coverage, if you're planning on doing anything adventurous like bungee jumping.

Travel insurance is worth the price for international travel because they're generally more expensive, so you have more to lose. Additionally, your regular health insurance won't cover you in other countries, so without travel insurance, you'll end up paying out of pocket for any emergency medical care you receive out of the US.

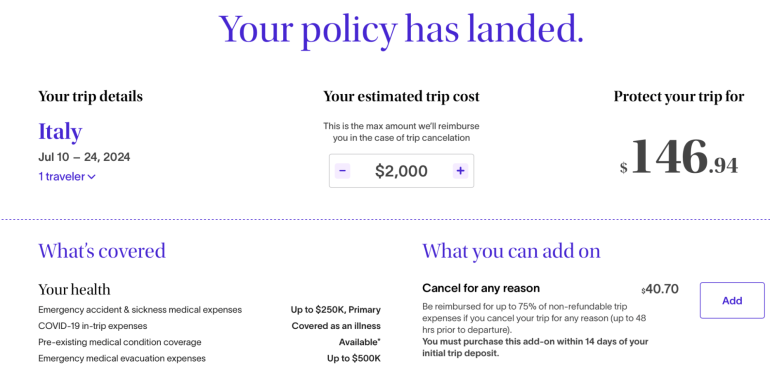

You should purchase travel insurance as soon as possible after making payment on your trip. This makes you eligible for add-ons like coverage for pre-existing conditions and CFAR. It also mitigates the chance of any losses in the days leading up to your trip.

- Main content

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Roth IRAs Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Debt relief Best debt management Best debt settlement Do you need a debt management plan? What is debt settlement? Debt consolidation vs. debt settlement Should you settle your debt or pay in full? How to negotiate a debt settlement on your own

- Debt collection Can a debt collector garnish my bank account or my wages? Can credit card companies garnish your wages? What is the Fair Debt Collection Practices Act?

- Bankruptcy How much does it cost to file for bankruptcy? What is Chapter 7 bankruptcy? What is Chapter 13 bankruptcy? Can medical bankruptcy help with medical bills?

- More payoff strategies Tips to get rid of your debt in a year Don't make these mistakes when climbing out of debt How credit counseling can help you get out of debt What is the debt avalanche method? What is the debt snowball method?

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best personal loans

Auto Insurance

Best car insurance

Best high-yield savings

CREDIT CARDS

Best credit cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Travel Insurance

Cheapest travel insurance of May 2024

Mandy Sleight

Heidi Gollub

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Updated 5:50 a.m. UTC May 2, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

WorldTrips is the best cheap travel insurance company of 2024 based on our in-depth analysis of the cheapest travel insurance plans. Its Atlas Journey Preferred and Atlas Journey Premier plans offer affordable travel insurance with high limits for emergency medical and evacuation benefits bundled with good coverage for trip delays, travel inconvenience and missed connections.

Cheapest travel insurance of 2024

Why trust our travel insurance experts

Our team of travel insurance experts analyzes hundreds of insurance products and thousands of data points to help you find the best travel insurance for your next trip. We use a data-driven methodology to determine each rating. Advertisers do not influence our editorial content . You can read more about our methodology below.

- 1,855 coverage details evaluated.

- 567 rates reviewed.

- 5 levels of fact-checking.

Best cheap travel insurance

Top-scoring plans

Average cost, medical limit per person, medical evacuation limit per person, why it’s the best.

WorldTrips tops our rating of the cheapest travel insurance with two plans:

- Atlas Journey Preferred is the cheaper travel insurance plan of the two, with $100,000 per person in emergency medical benefits as secondary coverage and an optional upgrade to primary coverage. It’s also our pick for the best travel insurance for cruises .

- Atlas Journey Premier costs a little more but gives you $150,000 in travel medical insurance with primary coverage . This is a good option if health insurance for international travel is a priority.

Pros and cons

- Atlas Journey Preferred is the cheapest of our 5-star travel insurance plans.

- Atlas Journey Premier offers $150,000 in primary medical coverage.

- Both plans have top-notch $1 million per person in medical evacuation coverage.

- Each plan offers travel inconvenience coverage of $750 per person.

- 12 optional upgrades, including destination wedding and rental car damage and theft.

- No non-medical evacuation coverage.

Cheap travel insurance for cruises

Travel insured.

Top-scoring plan

Travel Insured offers cheap travel insurance for cruises and its Worldwide Trip Protector plan gets 4 stars in our rating of the best cruise travel insurance .

- Worldwide Trip Protector offers $1 million in emergency evacuation coverage per person and a rare $150,000 in non-medical evacuation per person. It also has primary coverage for travel medical insurance benefits, which means you won’t have to file medical claims with your health insurance first.

- Cheap trip insurance for cruises.

- Offers a rare $150,000 for non-medical evacuation.

- $500 per person baggage delay benefit only requires a 3-hour delay.

- Optional rental car damage benefit up to $50,000.

- Missed connection benefit of $500 per person only available for cruises and tours.

Best cheap travel insurance for families

Travelex has the best cheap travel insurance for families because kids age 17 are covered by your policy for free when they’re traveling with you.

- Free coverage for children 17 and under on the same policy.

- $2,000 travel delay coverage per person ($250 per day) after 5 hours.

- Hurricane and weather coverage after a common carrier delay of any amount of time.

- Only $50,000 per person emergency medical coverage.

- Baggage delay coverage is only $200 and requires a 12-hour delay.

Best cheap travel insurance for seniors

Evacuation limit per person

Nationwide has the best cheap travel insurance for seniors — its Prime plan gets 4 stars in our best senior travel insurance rating. However, Nationwide’s Cruise Choice plan ranks higher in our best cheap travel insurance rating.

- Cruise Choice has a $500 per person benefit if a cruise itinerary change causes you to miss a prepaid excursion. It also has a missed connections benefit of $1,500 per person after only a 3-hour delay, for cruises or tours. But note that this coverage is secondary coverage to any compensation provided by a common carrier.

- Coverage for cruise itinerary changes, ship-based mechanical breakdowns and covered shipboard service disruptions.

- Non-medical evacuation benefit of $25,000 per person.

- Baggage loss benefits of $2,500 per person.

- Travel medical coverage is secondary.

- Trip cancellation benefit for losing your job requires three years of continuous employment.

- No “cancel for any reason” (CFAR) upgrade available.

- Missed connection coverage of $1,500 per person is only for tours and cruises, after a 3-hour delay.

Best cheap travel insurance for add-on options

AIG offers the best cheap travel insurance for add-on options because the Travel Guard Preferred plan allows you to customize your policy with a host of optional upgrades.

- Travel Guard Preferred upgrades include “cancel for any reason” (CFAR) coverage , rental vehicle damage coverage and bundles that offer additional benefits for adventure sports, travel inconvenience, quarantine, pets, security and weddings. There’s also a medical bundle that increases the travel medical benefit to $100,000 and emergency evacuation to $1 million.

- Bundle upgrades allow you to customize your affordable travel insurance policy.

- Emergency medical and evacuation limits can be doubled with optional upgrade.

- Base travel insurance policy has relatively low medical limits.

- $300 baggage delay benefit requires a 12-hour delay.

- Optional CFAR upgrade only reimburses up to 50% of trip cost.

Best cheap travel insurance for missed connections

TravelSafe has the best cheap travel insurance for missed connections because coverage is not limited to cruises and tours, as it is with many policies.

- Best-in-class $2,500 per person in missed connection coverage.

- $1 million per person in medical evacuation and $25,000 in non-medical evacuation coverage.

- Generous $2,500 per person baggage and personal items loss benefit.

- Most expensive of the best cheap travel insurance plans.

- No “interruption for any reason” coverage available.

- Weak baggage delay coverage of $250 per person after 12 hours.

Cheapest travel insurance comparison

Via TravelInsurance.com’s website

How much does the cheapest travel insurance cost?

The cheapest travel insurance in our rating is $334. This is for a WorldTrips Atlas Journey Preferred travel insurance plan, based on the average of seven quotes for travelers of various ages to international destinations with a range of trip values.

Factors that determine travel insurance cost

There are several factors that determine the cost of travel insurance, including:

- Age and number of travelers being insured.

- Trip length.

- Total trip cost.

- The travel insurance plan you choose.

- The travel insurance company.

- Any add-ons, features or upgraded benefits you include in the travel insurance plan.

Expert tip: “In general, travelers can expect to pay anywhere from 4% to 10% of their total prepaid, non-refundable trip costs,” said Suzanne Morrow, CEO of InsureMyTrip.

Is buying the cheapest travel insurance a good idea?

Choosing cheaper travel insurance without paying attention to what a plan covers and excludes could leave you underinsured for your trip. Comparing travel insurance plans side-by-side can help ensure you get enough coverage to protect yourself financially in an emergency for the best price.

For example, compare these two Travelex travel insurance plans:

- Travel Basic is cheaper but it only provides up to $15,000 for emergency medical expense coverage. You’ll also have to pay extra for coverage for children.

- Travel Select will cost you a bit more but it covers up to $50,000 in medical expenses and includes coverage for kids aged 17 and younger traveling with you. It also offers upgrades such additional medical coverage, “cancel for any reason” (CFAR) coverage and an adventure sports rider that may be a good fit for your trip.

Reasons to consider paying more for travel insurance

Make sure you understand what you’re giving up if you buy the cheapest travel insurance. Here are a few reasons you may consider paying a little extra for better coverage.

- Emergency medical. The best travel medical insurance offers primary coverage for emergency medical benefits. Travel insurance with primary coverage can cost more than secondary coverage but will save you from having to file a claim with your health insurance company before filing a travel insurance claim.

- Emergency evacuation. If you’re traveling to a remote location or planning a boat excursion on your trip, look at travel insurance with a high medical evacuation insurance limit. If you are injured while traveling, transportation to the nearest adequate medical facility could cost in the tens to hundreds of thousands. It may make sense to pay more for travel insurance with robust emergency evacuation coverage.

- Flexibility. To maximize your trip flexibility, you might consider upgrading your travel insurance to “ cancel for any reason” (CFAR) coverage . This will increase the cost of your travel insurance but allow you to cancel your trip for any reason — not just those listed in your policy. The catch is that you’ll need to cancel at least 48 hours before your trip and will only be reimbursed 50% or 75% of your trip expenses, depending on the plan.

- Upgrades. Many travel insurance plans have optional extras like car rental collision and adventure sports (which may otherwise be excluded from coverage). These will cost you extra but may give you the coverage you need.

How to find the cheapest travel insurance

The best way to find the cheapest travel insurance is to determine what you’re looking for in a travel insurance policy and compare plans that meet your needs.

“Travel insurance isn’t one-size-fits-all. Every trip is different, and every traveler has different needs, wants and concerns. This is why comparison is key,” said Morrow.

Consider the following factors when comparing cheap travel insurance plans.

- How often you’re traveling. A single-trip policy may be the most cost-effective if you’re only going on a single trip this year. But a multi-trip travel insurance plan may be cheaper if you’re going on multiple international trips throughout the year. Annual travel insurance policies cover you for a whole year as long as each trip doesn’t exceed a certain number of days, usually 30 to 90 days.

- Credit card has travel insurance benefits. The best credit cards offer perks and benefits, and many offer travel insurance-specific benefits. The coverage types and benefit limits can vary, and you must put the entire trip cost on the credit card to use the coverage. If your trip costs more than the coverage limit on your card, you can supplement the rest with a cheaper travel insurance plan.

- The coverage you need. When looking for the best travel insurance option at the most affordable price, only buy extras and upgrades you really need. A basic plan may only provide up to $500 in baggage insurance, but if you only plan to take $300 worth of clothes and accessories, you don’t need to pay more for higher coverage limits.

Is cheap travel insurance worth it?

Cheap travel insurance can be worth it, as long as you understand the plan limitations and exclusions. Taking the time to read your policy, especially the fine print, well before your trip can ensure there won’t be any surprises about what’s covered once your journey begins.

“If a traveler is looking for coverage for travel delays, cancellations, interruptions, medical and baggage — a comprehensive travel insurance policy will provide the most bang for their buck,” said Morrow. But if you’re on a tight budget and are only worried about emergency medical care and evacuation coverage while traveling abroad, stand-alone options are cheaper.

Before buying travel insurance, you should also consider what your health insurance will cover.

“Most domestic health insurance plans, including Medicare, will not cover medical bills abroad,” said Morrow. Even if you’re staying stateside, you may find value in an affordable travel insurance plan with medical coverage if you have a high-deductible health plan (HDHP).

A cheap travel insurance plan is better than none at all if you end up in a situation that would have covered some or all of your prepaid, nonrefundable trip expenses.

Methodology

Our insurance experts reviewed 1,855 coverage details and 567 rates to determine the best travel insurance . From those top-scoring travel insurance plans, we chose the most affordable for our rating of the cheapest travel insurance.

Insurers could score up to 100 points based on the following factors:

- Cost: 40 points. We scored the average cost of each travel insurance policy for a variety of trips and traveler profiles.

- Medical expenses: 10 points. We scored travel medical insurance by the coverage amount available. Travel insurance policies with emergency medical expense benefits of $250,000 or more per person were given the highest score of 10 points.