Everything you need to know about Dubai tourist taxes

Are you budgeting enough for your trip to Dubai?

Whilst Dubai is well-known as a tax-free earnings haven for many of its international expatriate workers, make no mistake there are many other taxes along the way!

In this tourist tax guide, we talk you through what sort of taxes you can expect to pay as a visitor to the UAE, how the 5% VAT introduced in 2018 works and refunds available to tourists.

You can read our complete guide to Dubai money matters here

Dubai Hotel Taxes

When you are booking a hotel online for Dubai it is VERY likely you are being quoted the gross price for just the hotel room, NOT the taxes, which are payable directly to the hotel.

These taxes on Dubai hotels have changed significantly over the years, but as at 2023, you can expect to pay:

- Municipality fee 7%

- Property service charge 10%

- “Tourism Dirham Fee” per room, per night 7 – 20 AED (varies depending on the grade of hotel, also called Hotel Tax or City Tax)

Learn more about the best places to stay in Dubai here!

The hotel tax system down the road in Abu Dhabi is slightly different. If you would like to learn more about local tourism taxes in Abu Dhabi, pop over to this guide .

Dining Taxes in Dubai

When you are dining in a hotel restaurant or ordering room service, you can also expect the following charges to be added to your dining bill:

- Service Charge

- Municipality fee

In restaurants not attached to a hotel, you should expect to only pay 5% VAT.

You are not required as a restaurant customer to leave a tip in the UAE. Many will either round up or add 10-15% if they are happy with the service.

In a food court fast food outlet in Dubai, you should expect to pay:

- Only the 5% VAT. This should be included in your advertised price.

Purchasing food in a supermarket

- All supermarket food is subject to the 5% VAT; there are no zero-rated food items. The price on the shelf already includes VAT.

Learn more about the best places to dine in Dubai here

What about alcohol in Dubai? Is it taxed?

As you might know, alcohol IS available for non-Muslims in Dubai from licensed outlets.

It comes at a cost, though, as “ excise tax ” (AKA Sin Tax) is added for the pleasure. You won’t see it as this excess is added at the importation stage of the sale process. As a consumer, you will only see a separate line item for the VAT, and any hotel service charges.

PLEASE NOTE: For a trial period 1 January to 31 December 2023 the excise tax on alcohol has been removed, so drink prices in Dubai emirate should become cheaper.

If you have a liquor license for home consumption ( now also available for tourists ), the final 30% tax at the retail stores will be removed in 2023 (albeit how much of the 30% cut will be passed on to consumers is yet to be seen).

Other taxes and excises in Dubai

So as you’re starting to see, there are no income taxes but plenty of indirect taxes to be wary of!

Again, you will not notice excise as a consumer as they are paid by the importing wholesaler, but items such as carbonated drinks, energy drinks, sweetened drinks, tobacco and tobacco products also incur between 50-100% excise.

Dubai Tax Refund for Tourists Scheme

When VAT was first introduced in 2018, tourists still had to pay the full amount of VAT.

Since 18 November 2018, tourists only temporarily in the UAE can now apply for a VAT refund , operated by Planet, on behalf of the Federal Tax Authority. There are, of course, conditions:

- Goods must be purchased from a retailer who is participating in the ‘Tax Refund for Tourists Scheme’.

- Goods are not excluded from the Refund Scheme of the Federal Tax Authority.

- You must have the explicit intention to leave the UAE in 90 days from the date of supply, along with the purchased supplies.

- You must export the purchased goods out of the UAE within three months from the date of supply.

- The process of purchase and export of goods must be carried out according to the requirements and procedures determined by the Federal Tax Authority.

- Minimum spend 250 AED.

You can learn more about the Tax Refund for Tourists Scheme on the Planet website.

Before you go… More important things you should know when planning a trip to Dubai

- Pop into our essential planning information page, it includes everything you need to know about getting around Dubai , a handy guide on what to pack , and top tips for first-timers on the do’s and don’ts, laws, and customs to be aware of.

- Check out this incredible list of 150+ places you should visit when you’re in Dubai .

- Pick up a Dubai Pass from iVenture or a Go City Dubai Pass to save up to 50% on top Dubai attractions.

- Don’t forget to pack your travel insurance !!!

- Discover the best areas to stay in Dubai , or bag a bargain on your accommodation here:

Take me back to the Dubai Travel Blog for more handy Tips for planning a Dubai trip

Please note we are not a travel agency. This site is a travel blog to help newcomers to the UAE and transit passengers self plan their trip, we cannot book your flights, hotels, visas or connections for you. We may make a small commission if you click on any of our recommendation links . Dubai Travel Planner

You may also like

Babymoon bliss in dubai: pamper yourself before parenthood, is it ok to visit dubai in july..., discover the best dubai sim cards for hassle-free..., 2 days in dubai; ultimate highlights itinerary, where to watch uefa euro 2024 in dubai, is dubai that hot what to expect visiting....

Thank you for providing such relevant tourist tax info. I shall spend my money in another country.

Leave a Comment Cancel Reply

Save my name, email, and website in this browser for the next time I comment.

Our corporate organisation

The people behind the brand

Projects that enhance the Dubai visitor experience

- Our services

Study tourism and shape Dubai's travel stories

Delivering local expertise

Take visitors on a journey

Become an safari adventure guide

Become an expert of the Dubai offering

Raising service standards for exceptional visitor experiences

Official press releases from DET

The latest industry circulars and legislative news

The latest industry research and insights from DET

Full list of establishments that adhere to the official safety measures

Send us a message and we will do our best to help

Report wrongdoing within the industry

- Legislative news

DTCM Tourism Dirham Administrative Resolution No 2 of 2020

Prescribing the Rules for Calculating, Collecting, and Paying the Tourism Dirham Fee in the Emirate of Dubai

Laws and Decrees DET Events 7 Jan 2020, Corresponding to , UAE - Dubai

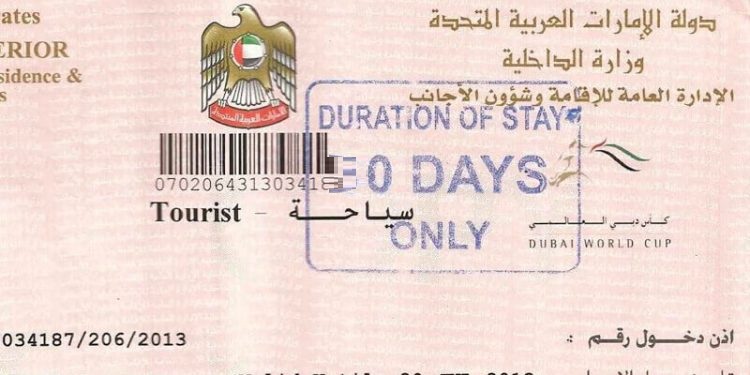

Issuance of a single-entry tourist visa

Quick links.

This link will direct you to an external site that may have different policies for use of content and privacy than the site of the General Directorate of Residency and Foreigners Affairs - Dubai.

Please note that GDRFA Dubai do not manage external websites linked from GDRFA Dubai website, therefore in some situations, the external website might open in different language than your preferred language, and users might need to switch to their preferred language on the external website itself.

Use toggle below to switch the contrast

Listen to the content of the page by clicking play on Listen

Use the buttons below to increase or decrease the text size

Tourist Taxes in the UAE: What Travelers Need to Know

- In the UAE, tourist tax regimes are different across the country. Not all of the Emirates apply such a tax.

- With the introduction of these taxes, hotels and accommodation providers have increased their prices accordingly.

- This Practice Note discusses the tax regime applicable to accommodation, known in the UAE as the “tourist tax” or the “tourism dirham fee”.

Definitions

- Tourist tax : Tax levied by some UAE Emirates on each room occupied in hotels and furnished apartments across the country.

- Hotel and furnished apartments : Hotels, resorts, hotel apartments, guesthouses, budget hotels, floating hotels, holiday homes, and other hotel establishments.

- Guest : A natural person staying at any hotel establishment in return for payment.

- DCTCM : The Dubai Corporation for Tourism and Commerce Marketing.

- DTCM : The Department of Tourism and Commerce Marketing

- TCA : Abu Dhabi Tourism and Culture Authority.

In recent years, the United Arab Emirates (UAE) has become an undeniable tourist hotspot. Its mix of modern skylines, rich cultural history, and luxury experiences that cannot be found anywhere else has captivated travelers. From the awe-inspiring design of Dubai to the historical treasures of Abu Dhabi, the UAE has become a magnet for travelers looking for a taste of luxury and adventure. But behind this tourism lies a financial facet that underpins the nation's thriving tourism sector: The tourist tax.

The tax landscape in the UAE extends far beyond just the Value Added Tax (VAT). In this dynamic fiscal environment, various forms of taxes and levies are in place to support government revenues and ensure the smooth functioning of public services. While VAT is a significant contributor, there are several other types of taxes and charges that individuals and businesses should be aware of including service charges, municipality fees, and city taxes.

One notable taxation element in the UAE is the tourist tax. This specific tax is defined separately from the aforementioned service charges, municipality fees, and city taxes. The tourist tax is distinct in that it primarily targets visitors and tourists who are staying in accommodations such as hotels, resorts, and other lodging establishments. This tax is levied in addition to any city or municipality taxes that might apply.

The tourist tax is an essential source of revenue for the UAE as it helps offset the costs associated with tourism infrastructure, marketing, and promotion. It also ensures that the burden of financing these activities is shared between tourists and the local population. The revenue generated from the tourist tax is crucial for maintaining and enhancing the country's status as a top tourist destination while providing visitors with world-class experiences during their stay.

Among all these varying charges imposed, this Practice Note focuses only on the tourist tax as defined above which may be applied in addition to city or municipality taxes.

In the UAE, a tourist tax is imposed in three Emirates: This tax is imposed and administered differently in each Emirate, namely:

- Ras Al Khaimah.

In contrast to their counterparts, Fujairah, Ajman, Sharjah, and Umm Al Quwain do not specifically institute a tourist tax. Instead, these Emirates predominantly rely on a mix of other forms of taxation for tourists: city or municipality taxes, service charges, and the Value Added Tax (VAT).

The fixed tourist tax applies per room and per night in the following accommodations:

- Hotel apartments,

- Guesthouses,

- Budget hotels,

- Floating hotels,

- Holiday homes, and

- Other hotel establishments located in the Emirates where such a tax exists.

The proportional fee applies on the total hotel bill.

The current scenario is less complex in comparison to making reservations directly with hotels. The majority of tour operators include all applicable taxes and charges associated with hotel accommodations into the overall cost of the vacation package. The majority of tour providers, but not all.

Depending on the Emirate, the tourist tax rate will vary:

- In Abu Dhabi, hotels typically impose a tourism fee of 6% on guests' hotel bills, along with a fixed fee of AED 15 per room per night. However, as of June 2018, this fee structure was temporarily adjusted to promote tourism and attract investments in the UAE's tourism sector. During this period, the tourism fee was reduced to 3.5% from its previous 6% and the fixed nightly fee dropped to AED 10 from AED 15. It is worth noting that there has not been a specified end date provided for this reduction in fees.

In addition to these temporary adjustments, Abu Dhabi also applies other charges to hotel bills. These include a municipal tax of 4% (which was reduced to 2% between 2018 and 2020), a service charge of 10%, a 5% VAT, and the tourist tax of AED 15 per night (reduced AED 10 between 2018 and 2020). It is important to mention that the "Tourism Dirham" fee is not dependent on the star rating of the hotel and is charged uniformly unlike Dubai and Ras Al Khaimah which has its own classification of categories.

- In Dubai, a fee also known as the "Tourism Dirham Fee" is applied on a nightly basis per room with a maximum duration of 30 consecutive nights. The fee amount is determined based on the classification category of the accommodation with the following rates in effect: (1) for 5-star hotels and deluxe apartments, the fee is AED 20 per bedroom per night, (2) for 4-star establishments and superior apartments, the fee stands at AED 15 per bedroom per night, (3) while 3-star and 2-star properties, as well as ordinary apartments, are subject to a fee of AED 10 per bedroom per night, and (4) 1-star establishments, guest houses, and hostels incur a fee of AED 7 per bedroom per night. In Ras Al Khaimah, like in Dubai, the tourist tax is charged per room and per night, and assessed according to the classification category of the hotel and furnished apartments and in accordance with the following amounts: municipal tax - 7%, service charge - 10%, VAT - 5%, while the "Tourism Dirham Fee" is exactly the same as in Dubai. Tax Collection

In Dubai, the tax is collected by the hotel and paid to the DCTCM before the 16th day of the month following collection. Hotels must maintain audited accounting books to record all “Tourism Dirham Fee” transactions. Monthly and yearly account statements of room occupancy must be provided to the DTCM. In Abu Dhabi, the tourist dirham fee is collected by the hotel directly from the guest and paid to TCA . This is added to the Department of Municipal Affairs' government budget. In Ras Al Khaimah, the tourism fee is collected by the hotel directly from the guest and then paid to the Ras Al Khaimah Tourism Development Authority. Overall, the tourist tax plays a pivotal role in sustaining the UAE's position as a top tourist destination and helps ensure that the costs associated with tourism are shared between tourists and the local population. As the nation continues to attract visitors with its blend of modernity and cultural richness, the careful administration of these taxes remains crucial for supporting the country's growth and enhancing the visitor experience.

Legislation

- Dubai Executive Council Decision No. 2/2014 on the Adoption of the Tourism Dirham in the Emirate of Dubai

- Dubai Executive Council Decision No. 10/2014 on the Amendment of the Dubai Executive Council Decision No 2/2014

- Dubai Municipal Regulation No. 2/2006 Concerning the Municipality Fee on Sales of Hotel Establishments in the Emirate of Dubai[1]

- Ras al Khaimah Emiri Decree No. 20/2015 Concerning the Approving of the Tourism Dirham amended by Ras al Khaimah Emiri Decree No. 7/2016

Taxes in tourist facilities - Official portal of the UAE Government[2]

Recent Journal

General understanding of commercial tenancy contracts in the emirate of dubai, financial rights of married women in the uae: navigating the marriage contract and personal status law, tax disputes and litigation, get in touch, are you sure.

you want to delete this item...

Log In or Sign Up

Welcome to almeshwar.

MAP-FOR-TOURIST.COM

Maps for tourists \ UAE \ Tourist taxes in UAE - Complete Guide

Tourist taxes in UAE - Complete Guide

Page update - Sep 17, 2022

On this page we will talk about taxes and fees from tourists in the UAE. Usually this refers to the money that tourists have to pay in hotels on top of the declared cost of stay, or fees for entry, exit or stay in the country. The UAE has several types of such tourist fees. Let's look at all of them.

This page was updated in September 2022. Despite the coronavirus pandemic, tourist taxes are not being eliminated, but rather the opposite. Abu Dhabi had reduced tourist taxes in effect since 2018. But now the tourist taxes have returned (raised again). More details below on this page.

No money is taken from tourists at the entry or exit of the UAE. Only the visa can be paid. The visa rules vary for different countries. For some the visa is free of charge, for some is paid.

There are taxes for staying in hotels. Each emirate has its own set. The main negative is that when declaring the price for staying in hotels in the UAE, these fees are almost never included.

For example. You calculate your vacation budget in the UAE and conclude that you can pay USD 60 for a hotel room. You visit booking.com or another search engine, and find a suitable hotel for USD 60. But as a result, you have to pay not USD 60, but USD 78. Agree, it's extremely unpleasant. In order to be prepared for such moments, read this page to the end.

Additional taxes for tourists in the UAE are:

1. VAT tax was introduced on January 1, 2018, is 5%;

2. A special tax "Tourism Dirham" exists in Dubai, Abu-Dhabi, Ras Al-Khaimah. The rate depends on the stars of the hotel;

3. Surcharge "service", actually a federal tax of 10%;

4. Municipal tax, taken to the local budgets, differs in different emirates.

If you go on vacation with a package tour

The situation is simplified compared to direct hotel booking. Most tour operators have all taxes and charges at the hotel included in the cost of the travel package. Most tour operators, but not all. Therefore, when buying a tour package you should ask a simple question to a travel agent, "What other surcharges are waiting in the hotel?" Depending on the answer, calculate the real cost of the vacation.

Sometimes, comparing the cost of vacation in the UAE on package tours and on your own, the tours seem much more expensive. However, if you take into account all these hotel taxes, the prices are approximately equal. Be ready to think and calculate, and you will not lose money.

If you are traveling on your own

Remember that the prices on official hotel websites, booking.com, and other hotel finders are usually quoted without taxes and charges. But if you pay in advance by credit card or at the hotel you have to pay the full price. How much more? It depends on the emirate and hotel category.

Taxes and fees are sometimes written nearby by the small print. You should pay attention to the small prints.

Emirate of Dubai

In the Emirate of Dubai: municipal tax - 7% (reduced since June 2018, previously it was 10%), service charge - 10%, VAT - 5%. "Tourism Dirham" tax depends on the category of the hotel. Charged per bedroom per night. That is:

- If you live in an ordinary room (one bedroom), you pay 1 rate per night, and it does not matter how many people live and how many beds;

- If you live in hotel in two rooms, but only one of them is a bedroom, you pay 1 rate per night, and it doesn't matter how many people live or how many beds;

- But if you live in an expensive two-bedroom, you pay 2 rates per night. If there are 3 bedrooms, you pay 3 rates, and so on.

See our page " Money in the UAE " for the current exchange rate.

The full price of accommodation per night:

Let's take the following example

Sheraton Grand Hotel 5* in Dubai. The official website states a price of AED 650. See the first (left) screenshot below. Of course, this is without taxes. But as soon as you start booking a room, the full price appears - AED 816,25, see the second (middle) screenshot below.

The calculation is correct: Full Price = Price + 22.5% + AED 20 (for 5 stars).

If you look at the room offer at the same Sheraton Grand hotel on booking.com, you will see the addition in small letters "+AED 178 taxes and charges". That is the taxes, see the third (right) screenshot below.

An important point! The Sheraton Grand is as honest as can be in the UAE. They do not show you the total price right away, but you see it before you pay and enter the guest information. Not all hotels are so honest, it happens that people find out about taxes and fees already in the hotel. Be vigilant!

Emirate of Abu Dhabi

In the Emirate of Abu Dhabi: municipal tax - 4% (in 2018-2020 was reduced to 2%), service charge - 10%, VAT - 5%, tourism fees - 6% (in 2018-2020 was reduced to 3.5%).

"Tourism Dirham" - 15 dirhams per night (was reduced to 10 in 2018-2020). Does not depend on the stars of the hotel.

Full room rate per night:

In fact, tourists in Abu Dhabi pay a little more money. Some hotels add another tax for the travel industry, which actually does not affect tourists at all. If this goes on, other emirates will also follow this bad practice.

Emirate of Ras Al Khaimah

In the emirate of Ras Al-Khaimah: municipal tax - 7%, service charge - 10%, VAT - 5%.

"Tourism Dirham" is exactly the same as in Dubai.

Full price per night:

Emirates of Ajman , Sharjah , Fujairah

In Sharjah, Ajman, Fujairah emirates: 10% city tax, 10% service charge and VAT 5%.

Some hotels in these emirates include a municipal tax in the initial price of the stay. There are even hotels which include an additional service charge. So be on the lookout for cheaper hotels and compare prices!

Emirate of Umm Al Quwain

In the Emirate of Umm Al Quwain there is a 5% municipal tax, 10% service charge and VAT of 5%.

What else do you need to know?

- On what other current expenses await, read the page " How much money to take in the UAE ".

map-for-tourist.com © 2020-2024

- Area Guides

- Building Guides

- School Guides

- Floor plans

- Market Trends

- Life at Bayut

Everything you need to know about taxes in the UAE

- Corporate Tax

- Tourist Tax

- Contact Tax Authorities

The UAE attracts people from across the globe for its lifestyle and favourable taxation policies. The high standards of living are backed by a robust economy. All consumers and companies operating in the region have to pay different taxes in the country. This handy UAE taxes guide covers the different taxes in the UAE that apply to goods and services, as well as the tax percentages consumers have to pay.

WHAT ARE THE DIFFERENT TAXES IN THE UAE?

Major infrastructure, public parks, markets and healthcare facilities are funded by the UAE Government. To provide greater conveniences to residents, the authorities decided to reduce the dependence of the country’s revenue stream on hydrocarbons and thus, implemented different taxes. These taxes also help regulate certain products that are harmful to society.

Let’s now look at the different taxes applicable in the UAE and answer the most frequently asked questions about these extra charges.

IS THERE INCOME TAX IN THE UAE?

One of the most frequently asked questions is whether there is any personal income tax in the UAE. Please note that the UAE does not charge direct income tax on individuals residing in the country.

VAT IN THE UAE

Value Added Tax, commonly known as VAT, is one of the most important taxes in the UAE for consumers. This indirect tax is payable for goods and services and is levied at each stage of the supply chain. This UAE tax was introduced on 1st January 2018.

VAT is usually borne by the end-users, with businesses generally collecting and accounting for VAT. Registered businesses collect VAT on behalf of the Federal Tax Authority (FTA), which is responsible for implementing VAT and other taxes in the UAE. They can then apply for refunds and rebates every quarter.

WHAT IS THE VAT PERCENTAGE IN THE UAE?

VAT in the UAE is charged at 5%.

WHAT IS THE VAT APPLICABLE ON?

Value Added Tax in the UAE applies to the supply of all goods and services, including food and beverage, commercial buildings, hotels and serviced accommodation, jewellery and electronic services.

However, certain items are zero-rated or exempt from VAT tax in the UAE. The list includes:

- Private and public school education

- International transport of goods and passengers

- Sale or rent of residential buildings

- Activities by not-for-profit organisations

- Local public passenger transport

- Certain investment precious metals, amongst others

WHICH BUSINESSES HAVE TO REGISTER FOR VAT?

Businesses must register to collect VAT if their taxable imports and supplies exceed AED 375,000. However, companies whose taxable imports and supplies are below AED 375,000 but above AED 187,500 can choose to register for VAT if they wish.

VAT applies to tax-registered businesses in the mainland and free zones. However, free zones recognised as ‘designated zones’ are considered outside the UAE for VAT purposes. This means that the transfer of goods between designated zones is VAT exempted.

DO TOURISTS HAVE TO PAY VAT IN THE UAE ?

Yes, tourists have to pay VAT when making purchases in the UAE. However, they can request refunds at their departure port*. For instance, travellers can request VAT refunds at the Dubai International Airport through self-service kiosks when departing the country.

*Presently, VAT refund for tourists in the UAE is only possible if they purchase products from retailers participating in the “Tax Refund for Tourists Scheme.”

EXCISE TAX IN THE UAE

Excise Tax is a type of indirect tax in the UAE that is levied on specific goods, including products that are harmful to people’s health or the environment. Authorities introduced the excise tax in the UAE in 2017; however, new excise tax rates were announced in December 2019. The end customer bears the cost of the excise tax.

Excise tax in the UAE is implemented to curb the consumption of harmful products and create a new revenue source to fund public services.

WHICH GOODS IS EXCISE TAX APPLICABLE TO?

Wonder ‘what items have excise tax in the UAE?’ Well, the excise tax applies to:

- Tobacco products

- Carbonated drinks (does not include sparkling water)

- Energy drinks

- Electronic smoking devices and tools (and liquids used in these devices)

- Sweetened drinks

WHICH GOODS ARE EXEMPTED FROM EXCISE TAX?

The list of products exempted from excise tax in the UAE includes:

- Ready-to-drink beverages (with at least 75% milk or milk substitutes)

- Baby food or baby formula

- Beverages for special dietary needs as recognised under Standard 654 of the GCC Standardization Organization

- Beverages consumed for medical uses as recognised under Standard 1366 of the GCC Standardization Organization

WHAT ARE THE EXCISE TAX RATES IN THE UAE?

The excise tax percentage in the UAE for eligible goods is as follows:

- 50% for carbonated drinks

- 100% for energy drinks

- 100% for tobacco products

- 100% on electronic smoking devices and tools (and on liquids used in these devices)

- 50% on products with added sugar/other sweeteners

CORPORATE TAX IN THE UAE

Currently, corporate tax only applies to specific industries or companies in the UAE such as oil companies and branches of foreign banks. Also, each emirate has its corporate tax rate.

However, from June 2023, a 9% new corporate tax in the UAE will be enforced on company profits. Businesses with profits up to AED 375,000 will not be taxed. Similarly, companies working on natural resources extraction will remain on the Emirate level corporate taxation.

TOURIST TAX IN THE UAE

Tourists in the country have to pay a special tax at restaurants, hotels, hotel apartments and resorts. These facilities may charge one or more of these taxes in the UAE:

- 10% on room rate

- 10% as service charge

- 10% as municipality fees

- City tax (which ranges between 6% – 10%)

- 6% as tourism fee

In 2014, the Tourism Dirham Fee in Dubai was introduced to be charged by hotels, hotel apartments, guest houses and holidays homes in the emirate. This Tourism Dirham Fee is charged per room per night and ranges between AED 7 to AED 20, depending on the hotel rating.

The Tourism Dirham Fee for different categories of hotels is as follows:

- Five-star hotel or resort: AED 20

- Four-star hotel or resort: AED 15

- Three-star and two-star hotel: AED 10

- One-star hotel: AED 7

The tourism fee is charged at 4% in Abu Dhabi. Daily charges in the UAE capital also include a municipality room fee, AED 15 per room per night.

FREQUENTLY ASKED QUESTIONS

I have a specific tax-related query. who should i contact.

If you want to know more about UAE taxes, contact the Federal Tax Authority (FTA). This government entity is responsible for implementing federal taxes such as VAT or excise tax. You can contact the FTA at 600-599-994.

I HAVE QUESTIONS ABOUT THE TOURISM DIRHAM. WHO DO I GET IN TOUCH WITH?

For more information on the Tourism Dirham in Dubai, contact the Dubai Tourism Authority at 600-555-559.

To learn more about the tourism and municipality fees in Abu Dhabi, contact the Department of Culture and Tourism at 800-555.

And that concludes our guide to the various taxes in the UAE. We hope this resource answers your questions about the present tax system in the UAE.

If you want to rent or buy a property in the UAE, check out which real estate transactions are exempted from VAT . Tourists leaving the country via the capital city can read more about VAT refunds at Abu Dhabi International Airport .

Subscribe to MyBayut to know more about life in the UAE!

Leave a Reply Cancel Reply

Enjoy blighty’s best at the top British restaurants in Dubai

Savour the cheesy goodness: Best pizza places in Ras Al Khaimah

How to start off your business on the right foot?

- Residential Plot

Sliding Sidebar

Everything You Need to Know About Abu Dhabi Tourist Taxes

Abu Dhabi may be well known as a tax-free earnings haven for many of its international expatriate workers, but, make no mistake, there are many other taxes along the way!

In this Abu Dhabi tourist tax guide, we’ll explain what sort of taxes you can expect to pay as a visitor to the UAE, how the 5% VAT introduced in 2018 works, the 2023 tourism tax updates and refunds available to tourists.

You can read our complete guide to Abu Dhabi money matters here – including the average cost of food & hotels in Abu Dhabi

Abu Dhabi Hotel Taxes

Dining taxes in abu dhabi, what about alcohol in abu dhabi is it taxed, other taxes and excises in abu dhabi, abu dhabi tax refund for tourists scheme.

When you are booking a hotel online for Abu Dhabi, it is VERY likely you are being quoted the gross price for just the hotel room – BEFORE many taxes which are payable directly to the hotel.

The taxes on Abu Dhabi hotels have changed significantly over the years, but as of 1 September 2023, you can expect to pay:

- VAT 5% (should be included in the price you’re quoted)

- Property Service Charge 10%

- Tourism Fee 4% (reduced from 6%)

- Municipality Fee 4%

- Destination Fee abolished (was 15 AED per room, per night)

This can put the total cost of your quoted stay at nearly 20% more than the listed price on booking platforms.

If you are booking through an agency or a package tour, be very specific in asking whether these taxes have been included or excluded so there are no nasty shocks when you arrive at your accommodation in Abu Dhabi .

Visiting Dubai? Pop over here to learn about the slightly different local taxes that are applied to hotel stays in Dubai Emirate.

When you are dining in a hotel restaurant, ordering room service or drinks at a bar, you can also expect the following charges to be added to your bill:

- Service Charge 10%

- Municipality fee 4%

- Tourism Fee 4%

In restaurants not attached to a hotel, you should expect to pay only the 5% VAT, which by law should be included in the listed price of a menu item.

You are not required as a restaurant customer to leave a tip in the UAE. Many customers will either round up or simply add 10-15% if they are happy with the service, but there’s not an expectation as you’d find in North America, for example.

In a food court fast food outlet in Abu Dhabi, you should expect to pay:

- Only the 5% VAT. This should be included in your quoted price.

Purchasing food in a supermarket

- All supermarket food is subject to the 5% VAT; there are no zero-rated food items.

Learn more about the best places to dine in Abu Dhabi here

As you might know, alcohol IS available for non-Muslims in Abu Dhabi from licensed outlets.

Alcohol incurs tax at the point it is imported, though you won’t see this tax broken down as a separate line item on your purchase, it’s built into the supplier’s cost. The only tax you will see as the consumer is VAT, which is included in the shelf price.

- NB a 30% alcohol tax was applicable for a few years in Abu Dhabi emirate, but this was abolished in 2023.

If you are consuming the drink in a bar or restaurant, VAT, municipality, tourism and service charges will apply as above.

Other items in Abu Dhabi and the UAE that you may not realise are additionally taxed include carbonated drinks, energy drinks, electronic smoking devices and tobacco products. The excise tax on these goods is 50 to 100%.

When VAT was first introduced in 2018, tourists still had to pay the full amount of VAT.

Since 18 November 2018, tourists only temporarily in the UAE can now apply for a VAT refund , operated by Planet, on behalf of the Federal Tax Authority. There are, of course, conditions:

- Goods must be purchased from a retailer who is participating in the ‘Tax Refund for Tourists Scheme’.

- Goods are not excluded from the Refund Scheme of the Federal Tax Authority.

- You must have the explicit intention to leave the UAE in 90 days from the date of supply, along with the purchased supplies.

- You must export the purchased goods out of the UAE within three months from the date of supply.

- The process of purchase and export of goods must be carried out according to the requirements and procedures determined by the Federal Tax Authority.

- You will receive 85% of the total VAT amount paid, minus a fee of 4.80 dirhams per Tax-Free tag

- Minimum spend 250 AED.

You can learn more about the Tax Refund for Tourists Scheme on the Planet website .

We hope this guide helps you better understand the taxes that will be applied during your time in Abu Dhabi emirate.

Before you go… Important things to consider when planning a trip to Abu Dhabi

- Pop into our essential planni ng information page ; it includes everything you need to know about getting around Abu Dhabi , a handy guide on what to pack and top tips for first-timers on the dos and don’ts, laws, and customs in the UAE .

- Start planning your itinerary around the 60+ top places to visit in Abu Dhabi

- Don’t forget to pack your travel insurance !

- Discover the best places to stay in Abu Dhabi , or bag a bargain on your accommodation here:

Take me back to the Abu Dhabi Travel Blog

Please note we are not a travel agency. This site is a travel blog to help newcomers to the UAE self plan their trip, we cannot book your flights, hotels, visas or connections for you. We may make a small commission if you click on any of our hotel or tour recommendation links . Abu Dhabi Travel Planner

You may also like

Unique summer camps in abu dhabi 2024, exciting activities in abu dhabi during july 2024, eid al adha public holiday & fireworks in..., sun-soaked splendors: why abu dhabi still sizzles in..., jump into these awesome abu dhabi events &..., new yas bay water taxi: here’s what you..., rules for tourists in abu dhabi: do’s and..., abu dhabi weather & exciting events to experience..., abu dhabi grand mosque dress code & etiquette..., 12 unmissable abu dhabi cultural attractions for your....

This website uses cookies to improve your experience. We'll assume you're ok with this, but you can opt-out if you wish. Accept Learn More

Before you fly

UAE Visa Information

There may still be COVID-19 travel restrictions in some countries. Check our COVID-19 hub before you travel.

Do I need a visa for the UAE?

You’ll find information about visas below. Use our quick visa search tool to see if you need a visa and the passport requirements for visiting the UAE.

UAE visa on arrival

Preapproved uae visas, prearranged uae visas, sponsoring someone to visit the uae, contact information, 30-day visit eligibility.

If you are a passport holder of the below country or territory, no advance visa arrangements are required to visit the UAE. Simply disembark your flight at Dubai International and proceed to immigration, where your passport will be stamped with a 30-day visit visa free of charge.

90-day visit eligibility

If you are a passport holder of one of the below countries or territories, your passport will be stamped with a multiple entry 90-day visit visa that's valid for 6 months from the date of issue, and for a stay of 90 days in total. Citizens of the below European countries are also entitled to apply for a pre-arranged visit visa if their 90-day visa on arrival has been fully utilized.

180-day visit eligibility

If you hold a Mexican passport you’re eligible for a multiple entry 180-day visit visa that's valid for 6 months from the date of issue, and for a stay of 180 days in total.

Dubai immigration procedures

As an added security measure, Immigration Authorities at Dubai International are now conducting random eye screening for visitors to Dubai.

Visitors asked to proceed for eye screening are required to present a hard copy of their visa or a printed version of the visa number confirmation page at the screening counter. If you do not have a copy with you, a charge of AED 30 per copy applies - payable only in AED.

Important information

Before you travel to the UAE, please check your visa requirements and make sure you have a valid visa if needed, or if your passport needs to be valid for 6 months. Holders of non-standard passports and travel documents may also have different entry requirements: find out if you need to apply for a visa and other passport requirements.

As of 29 April 2016, GCC residence permit holders will need to apply for a UAE visa before arriving in Dubai.

New visit entry permit to the UAE for Indian nationals

From 7 January 2024, eligible Indian nationals with a normal passport valid for a minimum of six months can obtain a single entry, 14-day visa on arrival. A fee of USD 63 applies.

Eligibility

- Indian passport holder with USA visa valid for a minimum of six months

- Indian passport holder with USA green card valid for a minimum of six months

- Indian passport holder with UK residence card valid for a minimum of six months

- Indian passport holder with EU residence card from the following countries valid for a minimum of six months

How and where to apply for a pre-approved UAE visa

Eligible Indian nationals can apply for their UAE entry permit on emirates.com through Manage your booking .

- For Extension, Original passport and ticket copy required.

- Extensions can be made at the airport office only.

Required applicant documents.

- Colour photograph of applicant

- Colour copy of applicant's passport. The passport must be valid for at least six months

- You can download the application form (available at all Emirates Ticketing Offices) in Arabic (Opens a PDF in a new tab) or English (Opens a PDF in a new tab) depending on the applicant’s nationality.

- A copy of your Emirates Airline ticket, or codeshare flight that starts with the code “EK”, and the ticket number should start with “176”.

- Proof of relationship if applying for family member - birth certificate, marriage certificate and family book

- All Documents to be submitted as hard copy

- Additional documents may be required by the authorities.

Additional documents are required for visitors of some countries

Additional documents may be required, depending on your country of residence. Please use our visa search tool above or visit our visa requirements page for more information.

Rules and conditions

- Sponsor or applicant will be responsible for a visitor overstay and overstay fines.

- A Refundable deposit of AED 1000 for friend. Sponsor must claim the deposit within a maximum of 2 years from the application submission date.

- Refund of visa fee before processing of an application, AED 50 will be deducted on refund process.

- Visa fees must be paid upon application.

- Additional visa processing fees may apply.

- Visa fees are non-refundable.

- The ticket is non-refundable if the visa has been issued and utilized.

- Visa processing time is approximately 3 to 4 working days.

- Entry into the UAE is subject to immigration approval.

- All visas are valid to enter Dubai for 60 days from the date of issue, except the 96-hour and 48-hour visas, which are valid for 30 days from the date of issue.

How and where to apply for your prearranged UAE visa

- Apply online through Manage your booking

- 48-hour and 96-hour transit visas are valid for travel with Emirates tickets outbound from Dubai. You can only apply for a transit visa online or at the Emirates Commercial Visa APT office at Dubai International airport Terminal 3.

Apply online

Nationals of countries requiring a prearranged UAE visa can now apply and pay for their visas online through emirates.com.

If you are travelling to or stopping over in Dubai with Emirates, you can submit an application and receive your UAE visa entirely online – without having to submit your passport for stamping. You can apply for your UAE visa through our Manage your booking after you book your Emirates flight. VFS processing fees apply. For more information please visit VFS Global.

The online visa application service is available for residents and nationals of many countries around the world. Find out if you can apply for a UAE visa. Applicants' passports must have at least six months' validity as of their date of travel to Dubai, and must be machine readable passports – handwritten passports are not accepted.

This service is only available to passengers with a confirmed Emirates booking where an Emirates ticket has already been issued and the flight itinerary already includes the desired time in Dubai. The itinerary into and out of Dubai should be on one ticket (PNR), and these flights must be Emirates flights. Note that any itineraries including any flights to or from Dubai on other carriers are not eligible for the online visa service.

A minimum of four international working days prior to arrival in Dubai is required, however Emirates does recommend that online applications are made as early as possible.

Apply in the UAE

If you have a family member or near relative who is a UAE resident, they can apply for a visa on your behalf at any of our ticketing offices in the UAE. Please note that this service is only available to residents of the UAE.

Download the prearranged visa application form

Get started on your prearranged visa application by downloading and filling out the form.

Required applicant documents:

- A colour passport photograph

- A colour copy of your passport (must be valid for six months)

- The visa application form

Required sponsor documents:

Minimum salary required, download the sponsorship application form.

Get started on your sponsorship application by downloading and filling out the form.

Visa and sponsorship applications can be submitted to:

Abu Dhabi Emirates Ticketing Office: Al Sawari Tower C, Corniche Road, Abu Dhabi, UAE. Visa Services: Monday to Thursday (8:30am to 5pm) Friday (8:30am to 4:30pm) Closed on Saturday, Sunday, and public holidays.

Ajman Emirates Ticketing Office Escape Tower, Sheikh Rashid Bin Humaid Street Visa Services: Monday to Saturday (9am to 8pm) Closed on Sunday and public holidays

Al Ain Emirates Ticketing Office Commercial Complex, Sheikh Khalifa Street Visa Services: Monday to Friday (8:30am to 6pm) and Saturday (8:30am to 5:30pm) Closed on Sunday and public holidays

Dubai International: Terminal 3 Arrivals Phone: 04 504 7300 E-mail: [email protected] Visa Services: Monday to Friday (7am to 7pm) and Saturday (9am to 4pm) Closed on Sunday and public holidays

Emirates Ticketing Office: Emirates Group Technology Centre, Ground Floor Entrance B, Al Ittihad Road, near Clock Tower, Deira Visa Services: Monday to Saturday (10am to 4pm) Closed on Sunday and public holidays

Emirates Ticketing Office: Town Centre, Jumeirah Visa Services: Daily from (10am to 4pm)

VFS Global Services GCC VASCO Worldwide 2nd floor, WAFI Mall, Level 2, Falcon Phase 2, Umm Hurair 2, Dubai, UAE

Sharjah Emirates Ticketing Office: Crystal Plaza, Buhaira Corniche Visa Services: Monday to Saturday (9am to 7pm) Closed on Sunday and public holidays

- Before You Fly

- Visa and Passport

- UAE visa information

+971 55 879 4786

Contact info, welcome to uae entry portal.

Planning for a visit to the UAE? Get your entry in 3 simple steps

Fill the application

Pay The Fees

Submit Your Application

Featured on.

Select the entry that fits your requirement.

All entry are valid across the United Arab Emirates and can be used for all modes of transport.

30 Days Single Entry GCC Resident

14 days single entry, 30 days single entry, 60 days single entry, 30 days multiple entry, 60 days multiple entry, 60 days job seeker, 90 days single entry, what our clients say about us.

Great Experience! Got my entry within less than 48 hours I advice everyone to work with them.

Brilliant service. Received my entry on the same day using the express application. Would definitely recommend.

It was excellent services. It is not first time I am using their service, but every time it is same fast, simple and outstanding job from their side.

James Thomas

I applied to my entry here and all about the expierience was amazing. Great people working there and super fast service. Thanks a lot!!!

- Other languages

- Accessibility

- Information and services

- About the UAE

- Finance and investment

- Value added tax (VAT)

- Tax refund for tourists

VAT refund for tourists

Tourists and visitors can claim refund on VAT paid on purchases they made during their stay in the UAE. Recovery of payment will be done through a fully integrated electronic system which connects retailers registered in the ‘ Tax Refund for Tourists Scheme’ with all ports of entry and exit from the UAE. Read the details.

Tax-free shopping for tourists

Federal Tax Authority (FTA) introduced Value Added Tax (VAT) of 5 per cent in January 2018 and launched 100 per cent digital tax-free shopping service for tourists in the last quarter of 2018.

What is tax-free shopping?

Tax-free shopping is the purchasing of taxable goods in the UAE which will be exported, subject to terms and conditions. Eligible tourists may request a refund on the VAT incurred on their purchases, after they validate their purchases at the point of exit. Refunds for already export validated tags can be claimed within one year from the date of export validation.

Operator of the VAT refund system

Planet is the exclusive operator of the tax refund system for tourists which FTA executes in the UAE. Most popular stores are registered with the scheme, and refund is secured on departure via land, sea or air.

How to shop tax-free?

- At the store, a tourist can request for a tax-free purchase, which is valid on a minimum expenditure of AED 250.

- The tourist must present a valid travel document to be scanned for use on the payment system.

- The shop assistant will capture the tourist’s information using the Planet system.

- The shop assistant will place the ‘tax-free’ tag on the back of the sales receipt.

- A digital tax-free form is then created.

- The tourist must validate the transaction at the airport within 90 days of the purchase date.

Find out how to shop tax-free in the UAE - Planet website

Conditions for tourists to claim their VAT refunds

Refunds are not applicable on:

- anything that has been consumed, fully or partly in the UAE, and

- goods that are not in the possession of the tourist when leaving the country.

Other conditions to claim refund include:

- The tourist must be at least 18 years old

- Goods must be purchased from a retailer who is participating in the 'Tax Refund for Tourists’ scheme

- Goods are not excluded from the refund scheme of the FTA

- The tourist must physically present the tax invoice, ‘tax-free’ tags and relevant goods.

How to collect VAT refund?

Tourists can collect their refunds through a special device placed at the departure port - airport, seaport or border port. They must submit:

- the tax invoices for their purchases from the outlets registered in the scheme

- a copy of their passport and

- a copy of their credit card.

After they submit these documents, tourists can recover the VAT either in cash in UAE dirhams, or have it refunded to their credit card.

Tourists can use this eService from FTA, in cooperation with Planet, to have their VAT reimbursed upon their departure from the UAE.

Note: The tourist will receive 85 per cent of the total VAT amount paid, after the deduction of a fee of AED 4.80 per tax-free tag.

Find in this ‘ Guide to Tax Free Shopping’ (PDF, 416 KB) more information on the following:

- Who is eligible for tax-free shopping?

- What goods are eligible for tax-free shopping?

- How can you shop tax-free?

- How to validate your goods?

- How much time do you have to complete the procedure?

- Where to collect vat refund on purchases?

More useful links:

- Vat Refund for tourists - Abu Dhabi Airport

- Guide to tax-free shopping in Dubai - VisitDubai website .

Was this information helpful?

Give us your feedback so we can improve your experience.

Thank you for submitting your feedback.

Popular searches

- Government services around the clock

- Visa and Emirates ID

- Moving to the UAE

- العربية Other languages

- Hi, My Account Subscriptions --> My KT Trading Contact Us Privacy Notice Sign Out

Tue, Jul 09, 2024 | Muharram 3, 1446

Dubai 20°C

- Expo City Dubai

- Emergencies

- Ras Al Khaimah

- Umm Al Quwain

- Life and Living

- Visa & Immigration in UAE

- Banking in UAE

- Schooling in UAE

- Housing in UAE

- Ramadan 2024

- Saudi Arabia

- Philippines

- Cryptocurrency

- Infrastructure

- Currency Exchange

- Horse Racing

- Local Sports

Entertainment

- Local Events

Dubai World Cup

- Track Notes

- Big Numbers

- Daily Updates

- Arts & Culture

- Mental Health

- Relationships

- Staycations

- UAE Attractions

- Tech Reviews

- Motoring Reviews

- Movie Reviews

- Book reviews

- Restaurant Reviews

- Young Times

Supplements

- Back To School

- Eid-Al-Adha

- It’s Summer Time

- Leading Universities

- Higher Education

- India Real Estate Show

- Future Of Insurance

- KT Desert Drive

- New Age Finance & Accounting Summit

- Digital Health Forum

- Subscriptions

- UAE Holidays

- Latest News

- Prayer Timings

- Cinema Listings

- Inspired Living

- Advertise With Us

- Privacy Notice

KT APPDOWNLOAD

Dubai tourist visa extension: Fees, process, everything you need to know

Do you want to extend your holiday or do you wish stay to explore employment opportunities here's a guide.

Elizabeth Gonzales

- Follow us on

Top Stories

Dubai: Sheikh Mohammed announces Dh30-billion rain drainage network

Paid parking in Dubai: Residents face up to Dh4,000 extra yearly costs when new rates kick in

UAE: Worker wins Dh1 million in National Bonds draw after saving Dh100 every month

Published: Mon 13 May 2024, 3:35 PM

Last updated: Mon 13 May 2024, 10:19 PM

Dubai is a prime destination for business and leisure, so it's no wonder that people from all around the world want to visit the city. Since Dubai has a lot to offer, guests often find themselves wanting to stay a little longer.

Do you want to extend your holiday in Dubai? Do you want to stay to explore employment opportunities? Here's all you need to know:

Stay up to date with the latest news. Follow KT on WhatsApp Channels.

If you're on a 30 or 60-day tourist visa, you can extend your stay within the country by another 30 days. You can renew your tourist visa through the following channels:

GDFRA website

- Register in the General Directorate of Residency and Foreigners Affairs (GDFRA) website using your email address

- Log in through your username

- Click New Application

- Click For Myself

- Fill in the application data, where applicable.

- Attach your passport

- Pay the service fee.

The visa extension fee is Dh600, in addition to the five per cent value added tax.

- Sign up or log in to the General Directorate of Residency and Foreigners Affairs Dubai (GDRFA) app.

- Go to the dashboard and open dependent visa details.

- Tap the 'Renew Residence' icon.

- Fill up the details.

- Select delivery method.

- Submit the fee.

- Wait for SMS/email confirmation.

ICP website

- Register in the Federal Authority for Identity and Citizenship (ICP) website using your email address

- Click Public Visa Services

- Click 'Extension of Current Visa'

- Fill in the application data

- Pay the fee

- Wait for SMS/email confirmation

Amer Service Centre:

- Visit the nearest Customer Happiness Centre.

- Get the automated turn ticket and wait.

- Submit the application that fulfils all conditions

- Submit your your passport and visa copy to the customer service employee.

- Pay the service fee

Amer website

- Go to amer247.com

- Click “UAE tourist visa” in the top-right corner.

You will be redirected to a new tab featuring 14 types of tourist visas varying based on the number of days, validity and prices.

- Select the most relevant one for you and click “Apply Now”.

- Pay the fee. Proceed to the completion of the process

While the visa extension fee is Dh600 plus five per cent tax, it is worth noting that the total amount of the visa fee may vary depending on your circumstances.

Once you're done with the process, you can expect a result of your request for visa extension in 48 hours or less.

- GCC 'Grand Tours' visa: For Dh4,000, visitors can soon explore multiple Gulf countries

- Dubai: How to apply for Golden Visa as a student; process explained

- UAE: 4 residency visa options for students; cost, process explained

- Newsletters

- [email protected]

More news from Life and Living

life and living

UAE residence visa cancelled? How to apply for entry permit

The application fee is Dh200 and can go up to Dh420

life and living 1 week ago -->

UAE: Building a new website? Here's how to get a '.ae' domain name

The Telecommunications and Digital Government Regulatory Authority has created a simple way to register for a domain name online

life and living 2 weeks ago -->

UAE: Rising interest rates, household bills; how to avoid credit card debt

Credit cards can be powerful financial tools when used wisely, but beware of the pitfalls

life and living 3 weeks ago -->

UAE: How to renew Russian passport, all you need to know

For Russians in the country, the process of getting a passport renewed is relatively simple and straightforward

How to bring medicines into the UAE: Step-by-step guide for residents, visitors

It's essential to be aware of local medication laws when travelling to the UAE, as non-compliance can lead to serious consequences

UAE: Loud neighbours or construction disturbing you? Here's how to file a noise complaint

In Dubai, any noise that is louder than normal conversation or the hum of an air conditioner can be reported

UAE: Need a loan? How to check and improve your credit score

From cost to process to raising complaints, here's all you need to know

UAE: Want to set up a clinic? Here's how to obtain the licence

A guide on the documents required, process and fees for different types of medical facilities

Type your keywords

You are using an outdated browser. Please upgrade your browser to improve your experience and security.

- Our Services

- Our Knowledge

- Our Offices

- Arbitration

- Banking & Finance

- Capital Markets

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

- Digital & Data

- Dispute Resolution

- Employment & Incentives

- Family Business & Private Wealth

- Innovation, Patents & Industrial Property (3IP)

- Intellectual Property

- International Litigation

- Legislative Drafting

- Private Client Services

- Private Equity

- Private Notary

- Real Estate

- Shipping, Aviation & Logistics

- Sustainable Business

- Turnaround, Restructuring & Insolvency

- Venture Capital & Emerging Companies

- White Collar Crime & Investigations

- Defence & Security

- Energy & Resources

- Financial Services

- Healthcare & Life Sciences

- Hotels & Leisure

- Real Estate & Construction

- Retail & Consumer

- Sports & Events Management

- Technology, Media & Telecommunications

- Transport & Logistics

- Transformation & The Future Economy

- Al Wakeel – Real Estate Solutions

- Doing Business in MENA

- Podcasts: Tamimi Talks

- Video Gallery

- Eyes on 2024: Legal Updates in MENA

- Publications

- Saudi Arabia

- United Arab Emirates

Select Your Region

Find a Lawyer

Book an appointment with us, or search the directory to find the right lawyer for you directly through the app.

Legacy: Putting the Family First

This comprehensive guide is designed to help you navigate the intricate landscape of family business and private wealth in the Middle East, where family businesses constitute approximately 60% of GDP and employ 80% of the workforce in the GCC, offering unparalleled opportunities for wealth creation and preservation.

Packed with insights, strategies, and expert advice from our talented lawyers, Legacy provides tailored solutions to the unique challenges of asset protection, succession planning, and dispute resolution in this dynamic region.Read the publication and equip yourself with the knowledge and tools necessary to thrive, whether you’re a seasoned investor, a family business owner, part of the next generation, or a newcomer exploring opportunities in the region.

The leading law firm in the Middle East & North Africa region.

- Responsible Business

- Our Partners

A complete spectrum of legal services across jurisdictions in the Middle East & North Africa.

- All Practices

- All Sectors

- Sports and Events Management

- Technology, Media and Telecommunications

- Transport and Logistics

- All Country Groups

Today's news and tomorrow's trends from around the region.

17 offices across the middle east & north africa..

- All Locations

Our Firm Back

Our services back, our knowledge back, our offices back, dubai tourists to face the new tourism dirham fee.

Aruna Mukherji - Associate - Real Estate

Further clarifications have now been issued by the Department of Tourism and Commerce Marketing (“DTCM”), and we have taken the opportunity to report on these below.

The DTCM have held various workshop sessions for hotel industry finance personnel to introduce DTCM’s dedicated team who will be supporting the implementation of the Tourism Dirham Fee. Attendance at the sessions is mandatory and is required in order to acquire an ‘Administrative Account Number’ for each establishment, which will be registered on DTCM’s system.

(A) Executive Council Resolution No. 2 OF 2014

As mentioned in the March edition, Executive Council Resolution No. 2 of 2014 introduced the Tourism Dirham Fee in Dubai (“ECR 2 of 2014”) which is applicable to all hotel establishments operating in Dubai, including hotel apartments, holiday homes, and any such establishments which are located in special development zones and free zones such as DIFC.

The Tourism Dirham Fee is payable for each night of occupancy per room in accordance with Schedule 1 of the ECR 2 of 2014. We have provided a summary of ECR 2 of 2014 as follows:

- The hotel establishment shall submit the proceeds collected towards the Tourism Dirham Fee to DTCM before the 16th day of the month following collection of such fees;

- The hotel establishment shall maintain books and records regarding collection of the Tourism Dirham Fee in accordance with recognized accounting standards for at least five (5) years. A monthly account report on occupancy and fees collected shall be provided to DTCM;

- The hotel establishment shall have its final accounts audited by an licensed auditor at the end of the financial year and provide DTCM a copy within six (6) months;

- In the event of suspension of the hotel establishment’s activities, no Tourism Dirham Fee shall be collected during this period subject to the prior notification and approval of the suspension by DTCM;

- The hotel establishment shall be deemed to have evaded payment of the Tourism Dirham Fee in the event that it, (i) fails to pay the Tourism Dirham Fee within the stipulated time frame to DTCM; (ii) fails to collect the Tourism Dirham Fee from guests; (iii) fails to maintain accounting books recording payment of the Tourism Dirham Fee and submission to DTCM; (iv) manipulates accounting data or provides false information; (v) obstructs DTCM employees in performing inspections or audits; (vi) performs any act deemed by DTCM as an evasion of payment of the Tourism Dirham Fee.

- Failure to pay the Tourism Dirham Fee to DTCM within the stipulated time frame or failure to collect such fee from guests would entail a fine of ten per cent (10%) of the unpaid fee amount provided that the fine is not less than AED 1,000. The complete list of violations and fees payable by the hotel establishment are provided in Schedule 2 of ECR 2 of 2014.

- In addition to imposition of the various fines, DTCM may also adopt additional stringent measures such as temporary closure of the hotel establishment up to three (3) months or more serious cases, permanent closure.

- DTCM employees nominated by a resolution of the Director General of DTCM, in coordination with the Director General of the Government of Dubai Legal Affairs Department, shall work in the capacity of law enforcement officers pursuant to ECR 2 of 2014.

- An affected party shall be entitled to submit his written grievance to the Director General of DTCM against any decision, procedure or measure issued or taken against him within fifteen (15) days of its notification. Upon receipt of the grievance, a DTCM committee formed specifically to consider the grievance shall issue its final decision within thirty (30) days with this decision being final and binding.

(B) DTCM Circulars

Since the issue of ECR 2 of 2014, three circulars have been issued by DTCM to clarify certain matters, and to introduce guidelines for implementation of the scheme.

The key issues addressed by these Circulars can be summarized as follows. The Tourism Dirham Fee:

- is a separate fee to be listed separately on any invoice/receipt. It should not be included in a room rate for calculation of the existing Dubai Municipality Fee and Service Charges;

- is not applicable to:

– any late checkout extension (even if a fee for same is charged by the hotel); or

– a room which is not classified by DTCM to be rented to guests as part of the hotel establishment’s inventory (ie. rooms designated as accommodation supplied by the hotel to its own employees that are registered under the hotel trade licence).

- is charged on a room per night basis, irrespective of the number of guests occupying the room (eg. a 2 room suite would be subject to a charge for 2 rooms);

- is calculated at a maximum stay of 30 (thirty) nights in respect of any guest’s stay which exceeds 30 (thirty) nights.

For your information, we have provided more detailed summaries of the Circulars below:

(1) Circular no. D/000/152/187 dated 23 February 2014 (“Circular 1”)

Circular 1 provides the guidelines for the implementation of the Tourism Dirham Fee together with a form of notice which has been approved by the DTCM for use by hotels to provide to their guests at the time of check-in.

- A notification in accordance with the template attached to Circular 1 shall be provided to the customers at the time of check-in by the hotel establishment. The Tourism Dirham Fee shall be paid by the guest at the time of check-out in accordance with Schedule 1 of ECR 2 of 2014;

- The Tourism Dirham Fee is also applicable to commercial stays, complimentary stays, promotional stays, upgrades and short stays less than 24 hours. However the Tourism Dirham Fee is not applicable in cases of late checkout and house use rooms (i.e. rooms in a hotel designated for its employees);

- The Tourism Dirham Fee shall be calculated based on each day’s stay and the number of bedrooms. For example, a guest staying two (2) nights in a one bedroom hotel apartment in the Standard Hotel Apartment category will be charged: 2 nights x 1 bedroom x AED 10 = AED 20;

- Transition Period: The Tourism Dirham Fee shall be applicable for the transition period i.e. any stays on or before 31 March 2014 irrespective of payment as well as booking made for a stay prior to 1 June for which payment was completed prior to 23 February 2014. Any extension or contract renewals on or after 31 March 2014 would attract the Tourism Dirham Fee.

(2) Circular No. D/000/152/187/1 dated 30 March 2014 (“Circular 2”)

Circular 2 provides clarity on the following two matters namely:

- In case of stays exceeding 30 consecutive nights, the Tourism Dirham Fee would be capped and payable at 30 nights; and

- The last date for exempted bookings was 31 March 2014 where bookings were fully paid up prior to 23 February 2014, regardless of the date of payment collected by the hotel establishment.

(3) Circular No. D/000/152/187 dated 26 March 2014 (“Circular 3”)

Circular 3 announced the formation of the dedicated team at DTCM and the dates of those workshops which shall take place on the implementation of the Tourism Dirham Fee.

Spread the news

Stay updated.

To learn more about our services and get the latest legal insights from across the Middle East and North Africa region, click on the link below.

Dubai Tourism Taxes and Fees for Hotels & Airbnb

As an ever-evolving cosmopolitan hub, Dubai has become a beacon for tourists worldwide. This vibrant emirate offers a wealth of opportunity for those seeking to invest in the holiday home business. However, to navigate this venture smoothly, it's essential to understand the different taxes and fees involved in the process. Ahmed, a new holiday home owner, is eager to learn the ropes and share his insights on taxes after his story on getting DTCM Permit and basic criteria for holiday homes .

Overview of Tourism Taxes in UAE

Accommodation businesses, including hotels, hotel apartments, resorts, restaurants, and holiday homes in the UAE, typically charge a variety of taxes and fees. The commonly imposed charges include:

- 10% tax on the room rate

- 10% service charge

- 7% municipality fees

- 6 to 10% city tax

- Tourism Dirham fee

These are designed to ensure that the booming tourism industry continues to be supported and can contribute effectively to the local economy.

The Tourism Dirham Fee

One specific tax of note is the 'Tourism Dirham Fee,' applied per room, per night of occupancy, capped at a maximum of 30 consecutive nights. In Dubai, this fee varies from AED 7 to 20, contingent on the category/grade of the hotel or holiday home. For instance, in Ras Al Khaimah, hotels impose a flat AED 15 tourism fee per room per night.

Tourism Dirham Fee Breakdown for Holiday Homes and Hotels

For holiday home owners like Ahmed, the Tourism Dirham fee per room, per night, is determined by the classification of the property:

- Luxury Holiday Home: AED 15 per room per night.

- Tourist Holiday Home: AED 10 per room per night.

Hotels have their specific charges, too:

- Five-star hotels: AED 20

- Four-star hotels: AED 15

- Three-star hotels: AED 10

- One-star/budget hotels: AED 7

In each case, this fee is collected when the guest checks in, and it must be shown as a separate line item on the bill.

Paying the Tourism Dirham Fee

The procedure for paying the Tourism Dirham Fee is crucial to keep in mind. If you provide inaccurate documents or incomplete information, or manipulate accounts in relation to the Tourism Dirham, you could face a fine of AED 15,000.

Payment methods include check deposit directly or bank transfer to the department bank account. You will need the following details:

- Bank name: Emirates NBD (any branch)

- Account name: DTCM-Tourism Dirham

- (IBAN) No: AE450260001012049366501

Upon successful transfer, ensure to confirm the update of the e-tourism dirham system when a confirmation screen appears. Always include your company's commercial license number or Holiday Home Foundation when making necessary Tourism Dirham payments.

Remember, for long stays spanning more than 30 consecutive nights, the Tourism Dirham fee will only be charged for the initial 30 nights. As a licensee, you are required to enter the Tourism Dirham data by the 15th of each month.

Operating a holiday home or a hotel business in Dubai is an exciting venture. By being aware of the different taxes and fees, and understanding the importance of timely and accurate payment, you can navigate the process with confidence, just like Ahmed.

- Next Post DTCM Tourism Dirham Fee Guide for Hotels and Holiday Homes

- Previous Post Holiday Homes Property Standards & Guidelines in Dubai

Related Posts

- Aug. 3, 2023, 4:20 p.m.

Subletting for Airbnb - A Profitable Business in Dubai

- Aug. 3, 2023, 4:08 p.m.

Dubai Municipality Fee for Hotels & Holiday Homes

Add comment, trending posts.

DTCM Tourism Dirham Fee Guide for Hotels and Holiday Homes

Social profiles.

For Consultants

- Login to Dashboard

- Add Services

- Find Consultants

- Browse Category

- Post Requirements

Helpful Links

- Privacy Policy

- Terms of Use

Sign Up For a Newsletter

Weekly breaking news, analysis and cutting edge advices for consultants.

- Latest News

- Emergencies

- Ask the Law

- GN Fun Drive

- Visa+Immigration

- Phone+Internet

- Reader Queries

- Safety+Security

- Banking & Insurance

- Dubai Airshow

- Corporate Tax

- Top Destinations

- Corporate News

- Electronics

- Home and Kitchen

- Consumables

- Saving and Investment

- Budget Living

- Expert Columns

- Community Tips

- Cryptocurrency

- Cooking and Cuisines

- Guide to Cooking

- Art & People

- Friday Partner

- Daily Crossword

- Word Search

- Philippines

- Australia-New Zealand

- Corrections

- Special Reports

- Pregnancy & Baby

- Learning & Play

- Child Health

- For Mums & Dads

- UAE Success Stories

- Live the Luxury

- Culture and History

- Staying Connected

- Entertainment

- Live Scores

- Point Table

- Top Scorers

- Photos & Videos

- Course Reviews

- Learn to Play

- South Indian

- Arab Celebs

- Health+Fitness

- Gitex Global 2023

- Best Of Bollywood

- Special Features

- Investing in the Future

- Know Plan Go

- Gratuity Calculator

- Notifications

- Prayer Times

Abu Dhabi to reduce tourism, municipality fee for hotels, restaurants from September 1

Travel & tourism.

Municipality fee of Dh15 per night will also be cancelled

Dubai: The Department of Culture and Tourism— Abu Dhabi (DCT - Abu Dhabi) on Friday announced that it has reduced government fees applied to hotels in the emirate. As per the circular issued to managers of hotel and tourism establishments, the fees levied on hotel guests, including tourism and municipality fees, will be reduced. The move aims to encourage residents to enjoy hospitality offerings in the Emirate.

The changes will come into effect from September 1.

The alterations to the government fees affecting hotel establishments entail a lowering of the tourism fee from 6 per cent to 4 per cent of the total value of the customer's bill. Meanwhile, the municipality fees will remain steady at 4 per cent of the bill's value.

The update includes elimination of the Dh15 Municipality fee per room/night, alongside the elimination of the 6 per cent tourism fee and the 4 per cent Municipality fee that were formerly applied to hotel restaurants.

- Summer travel surge cools as post-pandemic boom reaches peak

- Ras Al Khaimah welcomes record number of tourists in H1-2023

- Dubai surpasses pre-pandemic international visitation levels in first half of 2023

- Here's why UAE residents will spend more on travel

“As part of its mandate, DCT Abu Dhabi continuously elevates the standards of the emirate’s tourism, culture, and hospitality offerings in the emirate," Abu Dhabi Media Office said in a statement.

DCT has also directed hotel establishments to diligently report their monthly revenues within the initial five business days of the subsequent month. It is mandatory for them to provide supporting financial details and collaborate with revenue auditors appointed by the Department. The primary aim of this cooperation is to guarantee the precision of declarations and fees that have been authenticated and/or resolved for earlier periods, according to DCT.

More From Tourism

Why more tourists are choosing 'coolcations' in Europe

Uber launches yacht services in 6 European cities

Saudi Arabia: Foreign tourists spent SR45 billion in Q1

Athens Acropolis introduces private visits for €5,000

Saudi tech sector surges in Q2 this year

Indian airline Air Kerala inches closer to reality

Vision Golfe 2024 boosts cultural and economic ties

FAA orders Boeing inspections over oxygen mask issue

Saudi Arabia’s liquidity hits highs of $753 billion

Aramco denies reports on bids for Australia’s Santos

See: monsoon storms whip india with floods, lightning, spain have ‘blind faith’ despite ‘genius’ mbappe, watch: djokovic blasts fans' 'disrespect' at wimbledon, singapore approves 16 types of insects for food, uae motorcycle safety: 7 must-know rules.

Get Breaking News Alerts From Gulf News

We’ll send you latest news updates through the day. You can manage them any time by clicking on the notification icon.

- Afghanistan

- Daily Cartoon

Home Featured UAE 60-day visit visa latest fee for Pakistanis from July 2024

UAE 60-day visit visa latest fee for Pakistanis from July 2024

DUBAI – Pakistani nationals and others who intend to travel to the United Arab Emirates (UAE) as tourist are required to obtain the visit visa to enter the Gulf country.

Tourists can directly apply for the visa or a sponsor or host in the UAE can also obtain it for them after paying certain fee and submitting guarantee amount.

The foreigner is granted an entry visa for a single visit for the purpose of tourism for a period of 30 or 60 days and the sponsor / host in UAE should be one of the establishments working in the field of tourism, after paying the prescribed fee and financial security deposit.

UAE Visit Visa Requirements

One personal photo.

Copy of the passport.

Identity card for the country of origin for some nationalities (Iraq – Pakistan – Iran – Afghanistan).

Medical insurance valid in UAE.

A travel ticket to continue his journey or a ticket to leave UAE.

Steps to Apply for the Visit Visa

The digital channels (GDRFA website / smart application):

- Login to the smart services system using (UAE pass or username)

- Search for your required service.

- Fill out the application information where applicable.

UAE Visit Visa Latest Fee

As of July 2024, the latest fee for 30-day tourist visa stands at AED 200 while the fee for 60-day visa stands at AED 300.

– In addition to value added tax (5%).

– Additional fees (if the sponsored person is inside UAE):

Knowledge dirham: AED 10.