- Travel Insurance Plans

- AXA Assistance USA Cost

Compare AXA Travel Insurance

- Why You Should Trust Us

AXA Assistance USA Travel Insurance Review 2024

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

Travel insurance is important because it can help cover the cost of unexpected medical expenses while you're traveling. It can also reimburse you for lost or stolen baggage, canceled flights, and other unforeseeable problems that may occur while you're away from home.

Simply put, there's a lot to consider.

But not all policies are created equal, and you must understand what you're covered for before you purchase a policy. This article will look in-depth at AXA Assistance USA travel insurance. We'll discuss the costs, coverage limits, exclusions, and more to help you make an informed decision about whether or not this particular travel insurance provider is right for you.

- Trip cancellation coverage of up to 100% of the trip cost

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Generous medical evacuation coverage

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Up to $1,500 per person coverage for missed connections on cruises and tours

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Covers loss of ski, sports and golf equipment

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Generous baggage delay, loss and trip delay coverage ceilings per person

- con icon Two crossed lines that form an 'X'. Cancel for any reason (CFAR) coverage only available for most expensive Platinum plan

- con icon Two crossed lines that form an 'X'. CFAR coverage ceiling only reaches $50,000 maximum despite going up to 75%

AXA Assistance USA keeps travel insurance simple with gold, silver, and platinum plans. Emergency medical and CFAR are a couple of the options you can expect. Read on to learn more about AXA.

- Silver, Gold, and Platinum plans available

- Trip interruption coverage of up to 150% of the trip cost

- Emergency medical coverage of up to $250,000

Introduction to AXA Travel Insurance

AXA Assistance USA is among the best travel insurance companies . It covers the fundamentals of travel insurance, with coverage for trip cancellations, medical expenses, and emergency medical/non-medical evacuation. With three plans, AXA also offers coverage for travelers with various budgets.

It's worth noting that many important add-ons aren't available for AXA's cheapest Silver plan, such as pre-existing condition coverage, rental car add-ons, and Schengen travel insurance. Cancel for any reason coverage is also only available for AXA's most expensive Platinum plan.

Coverage Options Offered by AXA

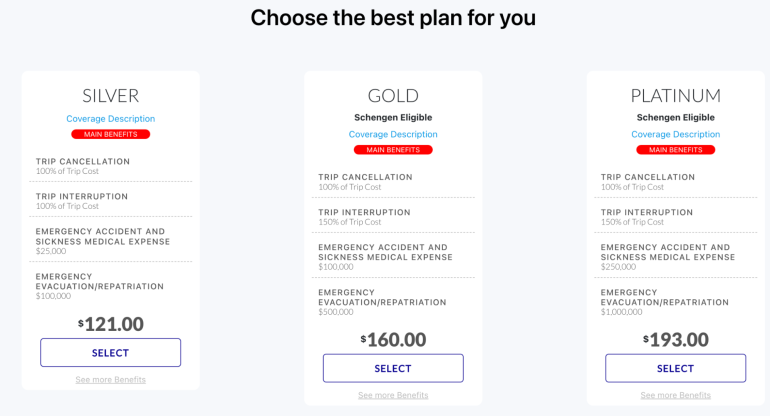

AXA Assistance USA offers three levels of coverage: Silver, Gold, and Platinum. Each plan comes with different protections and varying coverage limits, with the Silver being the most basic option and Platinum offering the most premium coverage.

Some policies might even include added coverage free of charge, such as a waiver for pre-existing conditions , which is free for Gold and Platinum plans as long as you purchase your plan within 14 days of your trip deposit.

Specialized Coverage Options

The plan you purchase will determine which add-ons are available. For example, those with a Platinum plan can add CFAR (cancel for any reason) coverage , allowing you to receive a full refund if you cancel your trip within 14 days of making the initial deposit.

Or, if you want extra protection for your rental car, depending on your AXA plan, you might be able to add a collision damage waiver (CDW). Policyholders with Gold plans can add $35,000 CDW, and those with Platinum plans can include $50,000 CDW.

If you're traveling within the Schengen Territory, which is made up of 27 European countries, you may eligible for Schengen Travel Insurance, which covers you in all 27 countries. This option is only available for Gold and Platinum travelers and coverage lasts up to 90 days.

AXA Assistance USA Travel Insurance Cost

The premium you pay will depend on various factors, including the age of the travelers, destination, and total trip costs. The average cost of travel insurance is 4% to 8% of your travel costs.

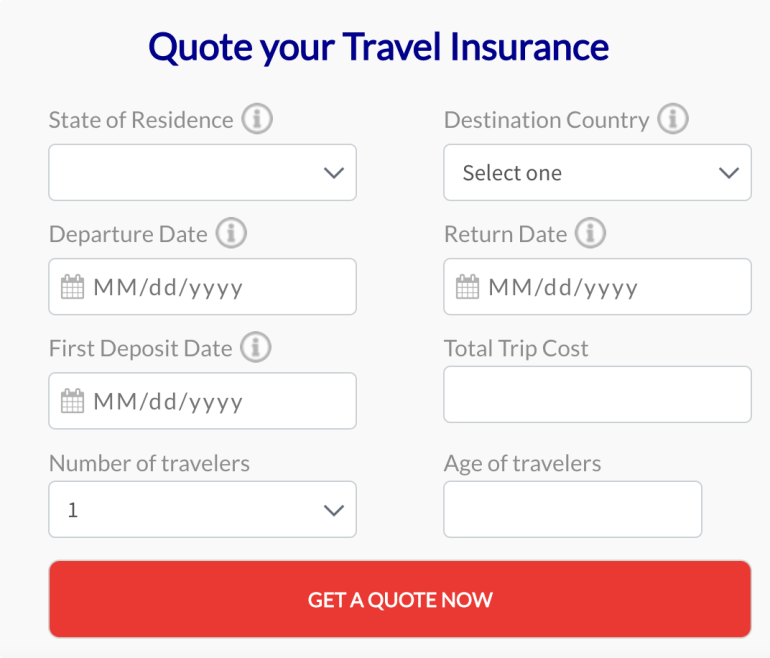

After inputting some personal information, such as your age and state of residence, along with your trip details, like travel dates, destination, and trip costs, you'll get an instant quote for the plans available for your trip. And from there, it's easy to compare each option based on your coverage needs and budget.

Now let's look at a few examples to estimate AXA's coverage costs.

As of 2024, a 23-year-old from Illinois taking a week-long, $3,000 budget trip to Italy would have the following AXA travel insurance quotes:

- AXA Silver: $83

- AXA Gold: $107

- AXA Platinum: $127

Premiums for AXA plans are between 2.7% and 4.2% of the trip's cost, well below the average cost of travel insurance. It's also relatively cheap compared to many of its competitors

AXA provides the following quotes for a 30-year-old traveler from California heading to Japan for two weeks on a $4,000 trip:

- AXA Silver: $109

- AXA Gold: $128

- AXA Platinum: $153

Once again, premiums forAXA plans are between 3.6% and 3.8%, below the average cost for travel insurance.

A 65-year-old couple looking to escape New York for Mexico for two weeks with a trip cost of $6,000 would have the following AXA quotes:

- AXA Silver: $392

- AXA Gold: $462

- AXA Platinum: $550

Premiums for AXA plans are between 6.5% and 9.2%, which is roughly in line with the average cost for travel insurance. This is to be expected, as travel insurance is often more expensive for older travelers.

How to Purchase and Manage Your AXA Policy

The process of purchasing an AXA policy is simple. After obtaining your quote, you'll need to decide which of AXA's three plans you want to buy. When you pay for your plan, be prepared to provide additional personal information, like your birthday, phone number, and address.

Once you finalize your purchase, you'll have a 10-day free look period, in which you can cancel your policy and get your money back.

How to File a Claim with AXA Travel Insurance

To file a claim with AXA Assistance USA, head to the claims forms online to find the appropriate form. Once you've filled out your form and gathered the required documentation, you can email them to [email protected] or send them by mail to:

AXA Assistance USA

On Behalf of Nationwide Mutual Insurance Company and Affiliated Companies

P.O. Box 26222

Tampa, FL 33623

If you need assistance when filing claims, AXA's claims office can be reached at 1-888-957-5015 (within the U.S.) and 1-727-450-8794 (outside the U.S.). Office hours are 9:30 a.m.-5 p.m. ET on Thursdays and 8:30 a.m.-5 p.m. ET on all other weekdays.

AXA Customer Service Reviews

AXA's U.S. branch has few reviews on Trustpilot and the Better Business Bureau — just over 20 between the two sites. Its UK branch has over 1,100 reviews, most of which are overwhelmingly negative. However, the quality of AXA Travel Insurance UK isn't necessarily indicative of its U.S. coverage.

In fact, on SquareMouth, where the majority of AXA U.S.'s reviews, reviews are generally positive. It received an average of 4.22 stars out of five across over 900 reviews. Customers reported that adjusting an AXA policy was easy and the customer service team was responsive. However, reviews on the claims process was more mixed, with spotty communication and long wait times.

See how AXA travel insurance compares to top travel insurance providers.

AXA Assistance USA vs. AIG Travel Guard

When comparing AXA to Travel Guard , we'll look at the coverage levels from their mid-tier plans, the Silver plan and Travel Guard Preferred plan, respectively.

With Travel Guard Preferred plan, you'll get:

- Trip cancellation coverage up to $150,000

- Trip interruption coverage up to $225,000

- Emergency medical coverage of $50,000

- Coverage for baggage loss, theft, or damage up to $1,000

- Travel delay coverage of up to $800

Comparing those Travel Guard coverages with AXA's Silver plan, you'll see that AXA's coverage limits are a bit higher. With AXA's Silver plan you'll get $100,000 in emergency medical coverage, for example. And the baggage loss coverage limit is up to $1,500.

If you're looking for greater coverage limits, AXA makes the most sense in this scenario. But premiums will also vary based on factors like the traveler's age, trip destination, and trip cost. So you'll have to run your own numbers to make a final decision.

Read our AIG Travel Insurance review here.

AXA Assistance USA vs. Allianz Travel Insurance

Allianz Travel Insurance provides single-trip and multi-trip insurance for travelers who want to go abroad for an extended period of time. And, like with all insurance, the various plans have varying degrees of coverage.

Allianz Travel Insurance's most popular single-trip option is the OneTrip Prime plan, which offers:

- Trip cancellation coverage up to $100,000

- Trip interruption coverage up to $150,000

- Emergency medical coverage for $50,000

- Coverage for baggage loss, theft or damage up to $1,000

- Travel delay coverage up to $800

Looking at AXA's mid-tier Silver plan, you'll see that, again, AXA offers more coverage for emergency medical and baggage loss, theft, or damage than Allianz Travel Insurance. That said, if cost is an essential factor for you, you'll have to get quotes using your personal trip information to make an informed decision.

Read our Allianz Travel Insurance review here.

AXA Assistance USA vs. Credit Card Travel Insurance

Already have a great travel credit card, like the Chase Sapphire Reserve or American Express Platinum? Some of the standard coverages, such as rental car insurance, may be included in the card you already have. It's a good idea to research the terms of your credit card's travel protection before purchasing a separate travel insurance policy.

If you're driving to your destination and don't have any non-refundable trip expenses, the coverage from your credit card may be enough. Another time it might work is if you have health insurance covering you while abroad and you're in good health without worrying about possible medical costs.

It's essential to remember that credit card coverage is usually secondary. This means you'll have to file a claim with the other applicable insurance before filing a claim with your credit card company.

Read our guide on the best credit cards with travel insurance here.

Why You Should Trust Us: How We Reviewed AXA Assistance USA

We researched AXA by evaluating its travel insurance plans compared to other plans from the top travel insurance companies. The aspects we looked at included, but were not limited to, different coverage options, claims limits, what is covered, available add-ons, and extra services for policy holders.

What's important when choosing a policy isn't just the price — it's making sure you're getting adequate coverage that meets your needs without breaking the bank. Filing a claim should also be easy and stress-free if you ever have to use your policy.

Read more about how Business Insider rates insurance products here.

AXA Assistance USA FAQs

If you're diagnosed with COVID-19 before a trip and need to cancel, AXA may cover your expenses. Additionally, a COVID-19 diagnosis during a trip may be covered under AXA's medical expense, trip interruption, and trip delay benefits. Be sure to review your policy to ensure coverage details.

While you may extend your coverage in certain circumstances, such as extended hospitalization, and update your travel dates prior to your departure, you can't extend AXA travel insurance plans while you're traveling.

AXA's Gold and Platinum plan cover pre-existing medical conditions as long as you purchase your policy within 14 days of your initial trip deposit. AXA's Silver plan does not cover pre-existing conditions and has a 60-day look-back period.

You can download AXA claims forms on its website and email them to [email protected].

AXA isn't the most flexible travel insurance company and isn't great at specializing, but it offers comprehensive general coverage. Its prices aren't significantly more expensive or cheaper than its competitors.

- Main content

AXA Contact US

Still have a question.

Be sure to get in touch with our expert travel team. Remember to have your policy number available when contacting us.

Emergency Assistance

24 hours / 7 days a week 855-327-1442

Questions about your policy

Monday-Saturday from 8am-7pm CST 855-327-1441 Option 1

Claims status

Monday-Friday from 7:30am-4pm CST 888-957-5015

Monday-Saturday from 8am-7pm CST 855-327-1441 Option 2

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

AXA Travel Insurance Review: Is it Worth The Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What is AXA?

Axa travel insurance plans, which axa travel insurance plan is best for me, can you buy axa travel insurance online, is axa legit, what isn't covered by axa travel insurance, is axa travel insurance worth it.

- Lowest-cost plan includes some medical coverage.

- Pre-existing conditions waiver add-on available for higher-cost plans.

- No add ons are available for Silver-level policyholders.

- CFAR upgrade is only available for highest-cost plan.

In the era of staff shortages and extreme weather, your trip may not go exactly to plan. When that happens, travel insurance can be a big help. Although an insurance policy can’t prevent a delay or cancellation from happening, it can help relieve the financial burden if something unpredictable does occur on your trip.

But how do you know which insurance provider to go with? Here's a look at AXA travel insurance to help you determine if one of its plans is right for you.

AXA is a French insurance company that does business in over 200 countries. It offers many different types of insurance, including policies for travelers. These include coverage for baggage loss , trip cancellation and interruption, emergency evacuation and emergency medical costs. Cancel for any reason coverage is also offered.

AXA Assistance USA is part of the AXA Group.

» Learn more: How much is travel insurance?

AXA Assistance USA offers travelers three insurance plans: Silver, Gold and Platinum. The plans are underwritten by Nationwide Mutual Insurance Company and their affiliates in Columbus, Ohio. Here's the coverage you can expect from each policy.

Silver: This is the least expensive plan that offers 100% trip cancellation and trip interruption coverage, $25,000 in emergency accident and sickness medical coverage and $100,000 in emergency evacuation and repatriation coverage.

Gold: The mid-range Gold policy comes with 100% trip cancellation and 150% trip interruption coverage, $100,000 in emergency accident and sickness medical coverage and $500,000 in emergency evacuation and repatriation coverage.

Platinum: The AXA Platinum travel insurance plan includes 100% trip cancellation and 150% trip interruption coverage, $250,000 in emergency accident and sickness medical coverage and $1,000,000 in emergency evacuation and repatriation coverage.

If you want to add Cancel For Any Reason coverage, you’ll need to select the Platinum plan and purchase a policy within 14 days of paying the initial trip deposit. It’ll cover 75% of the prepaid nonrefundable expenses for your travel.

If you’d like coverage for pre-existing medical conditions , a waiver is available on the Gold and Platinum plans as long as you buy coverage within 14 days of your first trip payment.

» Learn more: How does travel insurance work?

Let’s compare AXA’s plans, the costs and coverage for a 19-day trip to Indonesia that costs $1,500 for a 36-year-old traveler who lives in Utah.

Coverage and limits for the Silver-level plan include:

Trip delay: $100 per day, with a $500 maximum.

Trip cancellation: 100% of the trip cost.

Trip interruption: 100% of the trip cost.

Baggage delay: $200.

Lost baggage: $750, up to $150 per article.

Missed connection: $500.

Emergency evacuation: $100,000.

Accidental death and dismemberment: $10,000 ($25,000 if on a common carrier).

Emergency accident and medical expense: $25,000.

The plan cost for our sample trip is $55.

For $79, the Gold-level tier offers the following coverage and limits:

Trip delay: $200 per day, with a $1,000 maximum.

Trip interruption: 150% of the trip cost.

Baggage delay: $300.

Lost baggage: $1,500, up to $250 per article.

Missed connection: $1,000.

Emergency evacuation: $500,000.

Accidental death and dismemberment: $25,000 ($50,000 if on a common carrier).

Emergency accident and medical expense: $100,000.

Collision damage waiver: $35,000.

Platinum is AXA’s highest tier level. This plan includes:

Trip delay: $300 per day, with a $1,250 maximum.

Baggage delay: $600.

Lost baggage: $3,000, up to $500 per article.

Missed connection: $1,500.

Emergency evacuation: $1,000,000.

Accidental death and dismemberment: $50,000 ($100,000 if on a common carrier).

Emergency accident and medical expense: $250,000.

Collision damage waiver: $50,000.

Lost golf rounds: $500.

Lost skier days: $25 per day.

Pet boarding fees: $25 per day (up to five days).

This level of coverage costs $95.

» Learn more: The best credit cards for travel insurance benefits

To get an AXA travel insurance quote, go to AXATravelInsurance.com and start by inputting your information in the quote box. Enter your state of residence, destination country, trip dates, date of first trip deposit, total trip cost, the number of travelers and their ages.

Once you’ve filled out the form, click on the “Get a quote now” button.

You’ll be presented with three quotes, one for each plan level. Make sure to click on the “See more benefits” link to get more information on each plan’s coverage limits. The plans with the highest coverage limits will be the most expensive.

If you need a pre-existing conditions waiver, select the Gold or Platinum plan. You’ll also have to purchase the plan within 14 days of making your initial trip deposit to be eligible.

The Gold and Platinum levels are also the two plans that offer Schengen zone coverage and a collision damage waiver . The Platinum plan is the only one that offers a Cancel For Any Reason add-on, so keep that in mind if you need more protection.

Overall, if you’re looking for emergency medical and emergency evacuation coverage specifically, the limits are good on all the plans, including the least expensive one.

To compare plans from multiple insurance providers at once, we recommend checking out Squaremouth, a travel insurance comparison site and a NerdWallet partner. The website helps you pick the right plan by displaying multiple quotes from many insurance providers, including AXA, in one spot.

AXA began in the early 19th century as a small insurance company specializing in property and casualty insurance.

Since then, the company has evolved, changing names and acquiring other insurance brands, until it became AXA in the 1980s. It is now one of the largest insurance companies in the world. In other words, yes, AXA is a legitimate travel insurance provider.

» Learn more: The best travel insurance companies

Every plan has different exclusions, so it's important to look at your coverage summary. Generally, pre-existing conditions without a previously purchased waiver are not covered.

Other limitations include:

Intentionally self-inflicted injuries.

Participation in bodily contact or extreme sports.

Traveling for the purpose of securing medial treatment.

Accidental injury or sickness when traveling against the advice of a physician.

Non-emergency treatment or surgery.

AXA handles more than 14 million cases each year, and every plan includes access to their 24/7 assistance hotline. The company is well established and has three plans for travelers to choose from.

AXA travel insurance covers several benefits including but not limited to 100% trip cancellation and trip interruption, medical emergencies, emergency evacuations, baggage delay or lost baggage, and accidental death and dismemberment. The Platinum plan also lets you add Cancel For Any Reason coverage.

AXA's least expensive plan, Silver, and its mid-range Gold policy do not have the option to add-on Cancel For Any Reason coverage. For travelers who opt to purchase the Platinum insurance plan, you can add Cancel For Any Reason coverage a la carte within 14 days of paying the initial trip deposit.

In the event that you need to make a claim, you can upload supporting documents online. If the claim is accepted, you will receive reimbursement within 30 days.

It's said that travel is the only thing you buy that makes you richer. But you don’t want to become poorer if something goes wrong before or during a trip. We don’t know what the universe has in store for us, so buying a travel insurance policy is one way we can protect our investment.

AXA offers budget, mid-range and premium policies that are easy to understand, provide adequate coverage and don’t cost a fortune.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

How does Travel Insurance Work?

How does travel insurance work.

Picture this: You and your siblings organize a cruise for the whole family to celebrate your parents’ 50 th anniversary. Everyone else has uneventful travel to the destination, but a delay in your outbound flight results in a missed connection. You finally arrive a day late and hours after the ship has departed without you.

Now what? In the worst-case scenario, you’re still stuck at the airport hours later. You feel powerless to do anything more than stare glumly at the vacation photos on your family’s social media feeds.

But if your trip is insured, your AXA-Assist representative already knows about that missed connection and started working on a solution even before you landed. Instead of having to figure it all out on your own, you have a team with the experience and contacts necessary to get you to the next port of call. Our priority is to get you aboard the ship as soon as possible so you can make everyone a little weepy with that toast you’ve been perfecting for weeks.

That’s how travel insurance works. It lets you offload the troubleshooting to the experts and frees you to just enjoy your trip.

What does travel insurance cover?

What exclusions should i be aware of, can i add options to a plan after i buy it but before my trip begins, can i extend my plan after my trip begins, do policies cover travelers individually, or are plans available for couples or families, how much time do i have to file a claim, what documentation do i need to present to support a claim, for trip interruption or trip delay, for medical or dental claims.

- For baggage delay, loss or theft claims

At the baseline, travel insurance covers:

Trip cancellation

Trip interruption

Lost, Misdirected or Damaged Luggage

Medical Emergencies (including Emergency Medical Evacuation).

You can also choose plans that cover medical or dental treatment, car rentals, or optional add-ons such as lost ski days or lost golf rounds.

But those “baseline” bullet points cover more than you might expect at first glance.

For example, if your medical emergency requires hospitalization, our network of doctors and nurses are on call to review your medical records, monitor the care you’re receiving and ensure you’re getting appropriate treatment.

If your condition doesn’t require hospitalization but you need to see a doctor, we can secure an appointment for you at a reputable facility. And we’ll follow up with you by phone after you’re treated to review the care you received and provide further assistance if needed.

Or let’s say you and a group of school friends book a one-week tour together. Prices are based on double occupancy, so everyone pairs up with a roommate, but your roommate gets sick at the last minute and has to cancel. Your travel insurance protects you from getting stuck paying the single supplement.

We’re a global brand, but we’re also people with the same interests and concerns as you. So we get it: even something that others might regard as a little thing can throw your trip off. That’s why we immerse ourselves in details that you might not even think about, like what happens to your pet if your flight home is delayed overnight. The answer? Your Travel Insurance covers reimbursement for that unexpected extra day of boarding your best friend.

We define a pre-existing medical condition as an illness, disease or other condition that you had during the 60-day period immediately prior to the effective date of your travel insurance coverage. That restriction extends to your traveling companions, business partners or family members who are booked to travel with you.

The condition is excluded from coverage unless it is treated or controlled solely by taking prescription drugs or medicine and remains controlled during the 60-day look-back period.

There are options for waiving the pre-existing conditions exclusion if you purchase an AXA-Assist Gold or Platinum plan within 14 days of paying your initial trip deposit.

For additional information, be sure to read your policy’s Terms and Conditions or call one of our representatives to discuss your specific concerns.

We allow you to make changes to your travel protection plan as long as your trip has not already started and you have not filed a claim. Refer to our contact page to get in touch with an AXA-Assist representative about any changes you wish to make to your plan.

Your AXA-Assist policy can cover up to 10 people per plan. They can be, but don’t have to be, family members. The only restriction is that each member of the group covered by your travel insurance plan must live in the same state. (That’s because travel insurance coverage is regulated by state.) If everyone in your travel group lives in the same state, but there are more than 10 people total, you’d have to buy multiple plans to extend coverage to everyone.

The time limit for filing a claim can vary depending on the specific policy you have purchased. It's crucial to carefully review the terms and conditions of your insurance policy document provided by AXA Partners US.

For any type of claim, you must provide your completed claim form, policy verification and booking confirmation. Additional documentation will depend on the reason for your claim and could include, but not be limited to:

claims, a cancellation statement from the travel supplier, documentation of the circumstances (such as injury or illness) that caused the interruption and documentation of expenses you need to have reimbursed.

receipts for costs you paid, a report detailing your diagnosis and the treatment you received and an explanation of the benefits statement from your primary insurance provider, if applicable. Note that if you have a Medicare supplement policy, you must submit charges to your Medicare supplement carrier before you submit your claim to AXA-Assist.

For baggage delay, loss or theft claims

your Property Irregularity Report from your airline, cruise line, or tour company and a copy of the carrier’s written response to the report you filed. In the event of theft, we will need to see a police report. You will also have to provide receipts for essential items you purchased or had repaired and for which you need reimbursement.

Refer to the File a Claim page on our website for additional details and phone contact information for team members who can answer any questions you have.

We wish you safe, happy travels, and we’re here 24/7 to help you resolve your concerns and get back to enjoying your best vacation experiences!

AXA already looks after millions of people around the world

With our travel insurance we can take great care of you too

Get AXA Travel Insurance and travel worry free!

Travel Assistance Wherever, Whenever

Speak with one of our licensed representatives or our 24/7 multilingual insurance advisors to find the coverage you need for your next trip.

We are here to help you every step of the way, please feel free to contact us through our online or offline touchpoints.

What can we help you with today?

WhatsApp Us At

Write to US

Self serve on our website

Have Us Call You

Our expert will call you to advise on buying a new policy or any other question you might have.

Branch Locator

You can also reach us through our toll-free number 1800-102-4444 Mon- Sat : 9 a.m. to 7 p.m. (IST)

Reach out for other things

Ready to create your own growth story at Bharti AXA Life?

You can join Bharti AXA as an Advisor or as an Employee, each career track gives you the opportunity to grow

An Employee

Help Center

How do i connect us through ivr.

Click here to detail IVR chart

Connect us through IVR

If a Bharti AXA Life Flexi Term policyholder is a resident of India & dies on his visit abroad, is he still entitled to receive the Sum Assured?

The customer must ensure he provides his travel details correctly under question number one in Lifestyle detail – “do you plan to live or travel outside India for more than 100 days?” Based on the details provided by the customer, the underwriter may allow or decline the policy. The Underwriting decision will be on case to case basis depending on the details provided.

What will be the difference if I take the policy from an aggregator?

There is no difference. Web aggregators just advertise the benefits of Bharti AXA Life products on their website. All applications for purchasing the policy are directly routed to the Bharti AXA Life website. A customer cannot directly purchase the policy from an aggregator.

COMMENTS

Get In Touch Today - AXA Travel Insurance Phone Number. Still have a question? Be sure to get in touch with our expert travel team. Remember to have your policy number available when contacting us. Emergency Assistance. 24 hours / 7 days a week 855-327-1442 312-935-1719.

Have questions or concerns in regards to your AXA Travel insurance policy purchased in the US. Please get us a call or email us. Our Plans Our Plans Protect your trip from unforeseen events while traveling. Be it domestic or international, get a quote and compare our three plans that includes benefits like cancel for any reason, emergency ...

Travel Assistance Wherever, Whenever. Speak with one of our licensed representatives or our 24/7 multilingual insurance advisors to find the coverage you need for your next trip. From Medical Coverage to Trip Cancellation Protection, our team of travel experts will help you choose the right coverage. 855- 327- 1441.

Present in 51 countries, AXA's 145,000 employees and distributors are committed to serving our 93 million clients. Our areas of expertise are applied to a range of products and services that are adapted to the needs of each and every client across three major business lines: property-casualty insurance, life, savings & health and asset management.

AXA Group - Individual Shareholder Relations Department. 25 avenue Matignon. 75008 Paris - France. Phone: +33 1 40 75 48 43 (from outside France) Contact Us.

An icon in the shape of a person's head and shoulders. It often indicates a user profile. ... AXA's claims office can be reached at 1-888-957-5015 (within the U.S.) and 1-727-450-8794 (outside the ...

Partnering with AXA to offer travel insurance means you and your clients benefit from the support of an industry leader with extensive experience and outstanding customer service. We will assist you in choosing the best plans to offer your customers, ensuring they are protected by the most suitable coverage for their trip, at the most cost ...

Axa S.A. is a French multinational insurance company headquartered in the 8th arrondissement of Paris.It also provides investment management and other financial services as part of its subsidiaries. As of 2023, it is the largest financial services company by revenue in France, and the 4th largest French company.. The Axa Group operates primarily in Western Europe, North America, the Indian ...

This summary does not replace or change any part of your plan document. If there is a conflict between this summary and your plan document, the plan document will govern. Please contact AXA for additional information regarding plan features and pricing at [email protected]. Plans contain insured benefits and non-insurance assistance ...

AXA Partners Travel Insurance CEO and Global head of Travel at AXA Partners. Appetite for Travel post Covid is widespread, with greater importance attached to insurance. To support this accelerated growth, cutting edge e-commerce capabilities are a key element, particularly to optional models that present a greater technical challenge for e ...

Platinum. Platinum is AXA's highest tier level. This plan includes: Trip delay: $300 per day, with a $1,250 maximum. Trip cancellation: 100% of the trip cost. Trip interruption: 150% of the trip ...

Learn about how travel insurance can help you on your next adventure based on your destination. Find out more ... If your policy was purchased outside of the USA please check your policy documents or visit www.axa-travel-insurance.com. The below contact form is meant for residents of the USA with a SILVER, GOLD, or PLATINUM plan. ...

With our travel insurance we can take great care of you too. GET A QUOTE. Whether traveling domestically or internationally, you want to plan for the unexpected. Our travel protection plans include many benefits such as Trip Cancellation, Trip Interruption, Emergency Medical Expense, Emergency Evacuation and Baggage Delay to help give you peace ...

Get AXA Home Insurance from as little as £181 (10% of AXA Plus Home Insurance customers paid this or less between 1 January and 31 March 2024). We pay out 88.2% of home insurance claims (Data relates to home insurance claims for policies underwritten by AXA Insurance UK plc from January to December 2023).

Travel Insurance; Group Personal Accident Insurance; Marine Insurance; ... AXA MANSARD INSURANCE PLC. PLOT 1412, AHMADU BELLO WAY, VICTORIA ISLAND, LAGOS. CORPORATE HEAD OFFICE: 0815 064 9610. LAGOS: AXA MANSARD INVESTMENTS LIMITED. 2ND FLOOR. PLOT 927/928, BISHOP ABOYADE COLE STREET, VICTORIA ISLAND, LAGOS ...

Car insurance. Get AXA Car Insurance from as little as £311 (10% of AXA Comprehensive Car Insurance customers paid this or less between 1 January and 31 March 2024). We pay out 99.8% of car insurance claims (Data relates to personal car insurance claims for policies underwritten by AXA Insurance UK plc from January to December 2023). Find out more

Your AXA-Assist policy can cover up to 10 people per plan. They can be, but don't have to be, family members. The only restriction is that each member of the group covered by your travel insurance plan must live in the same state. (That's because travel insurance coverage is regulated by state.)

With AXA travel insurance you benefit from assistance throughout your trip: before, during and after and everywhere in the world. Take advantage of our comprehensive guarantees: coverage of your medical expenses abroad, 24-hour medical assistance, teleconsultation, travel cancellation insurance, repatriation insurance and loss of luggage. ...

Travel Insurance. Car Insurance. Health Start Lite. Goal Getter. Understand Your Needs Understand Your Needs ... Chat with an AXA Representative Consult with a Financial Advisor . Call or Visit Us . For customer inquiries, support, and complaints: ... For corporate transactions: (+632) 8 885-0101 (+63) 919 057-0101 ...

Car insurance. Get AXA Car Insurance from as little as £311 (10% of AXA Comprehensive Car Insurance customers paid this or less between 1 January and 31 March 2024). We pay out 99.8% of car insurance claims (Data relates to personal car insurance claims for policies underwritten by AXA Insurance UK plc from January to December 2023). Find out more

Al-Kabir Center, 4th Floor, 13-2-392-1, Ramachandra Nagar, Anantapur, East Godavari District, Andhra Pradesh - 515001. 10 am to 5.30 pm [ Mon to Sat ] 2nd & 3rd Saturday is a Holiday. Get directions. You can also reach us through our toll-free number 1800-102-4444 Mon- Sat : 9 a.m. to 7 p.m. (IST)