- New Zealand

- United Kingdom

- Latin America

- North America

- Sustainability & Community

- Products and Services

- Geographies

Life at Cover-More is caring, committed and packed with opportunity.

Working with cover-more group opens a world of opportunity..

Careers at Cover-More Group

Wherever you work in our global network, caring is at the core of your career with us.

We care – about our colleagues, our customers and our partners. We are optimistic and motivated.

We can be trusted to live up to our promises and be there when our customers, partners and colleagues need us the most. We’re determined and agile. We will always choose the best path forward, not the easiest. We know we are stronger together – none of us can have as big an impact than all of us together. We collaborate, we innovate, we are driven to succeed and grow. We know who we are and how to get to where we want to be.

We all belong to one global group with a shared goal of looking after our colleagues, customers, our business partners and collaborators – their dreams, aspirations and success.

By reaching across international borders and internal team structures, we’re creating a brighter future by working together.

Leadership: Driven to Inspire

Justin Sebire

Interim Group Chief Executive Officer

Justin Sebire was appointed Interim Group CEO in February 2024. In this role he oversees the group’s day-to-day operations, on top of his responsibilities as Group Chief Financial Officer, a position he has held since March 2023.

With an accomplished background as a finance executive, Justin has more than 25 years of global leadership experience in financial services, insurance and consulting in Australia, France, the UK and Japan, working with major insurance companies.

He is focused on driving growth for Cover-More Group through strategic operational and management reporting, analysis, and business planning.

Justin is based in Sydney, Australia.

Todd was promoted to Chief Executive Officer, Australia in 2023 after more than 11 years with Cover-More in progressively more senior leadership roles.

As CEO, Todd is responsible for travel insurance distribution partnerships and operations in Australia, Cover-More’s foundation travel insurance market.

Todd has deep experience in global travel and financial services industries and specialist expertise in managing large scale growth strategies and teams.

Prior to joining Cover-More, Todd spent 10 years with IBM Australia in the digital and channel partner teams. He is based in Sydney, Australia.

Donna Dorairajoo

Chief Executive Officer, Europe

Donna joined Cover-More in November 2021 as Head of Strategic Relationships and was appointed CEO of Cover-More Europe in February 2022.

With more than 20 years’ experience in the travel industry, Donna manages the integration and establishment of our European businesses, both in the business to business and direct to consumer markets. Prior to joining us, Donna was with Chubb for nine years, including three years as Vice President, Regional Head of Travel Insurance, Asia Pacific and before that she worked in Chubb’s EMEA region.

Donna is responsible for the growth of Cover-More Group’s European Business. She is based in the UK.

Will leads our Travelex Insurance Services business in the US and Canada. He brings 20 years of experience in revenue growth, distribution expansion, customer experience, customer growth and profitability in the United States and around the globe to this position. He joins Cover-More Group from his role as North America Head of Sales and Distribution, Zurich Global Ventures.

He is based in Omaha, Nebraska.

Fernando García Ruiz

Chief Executive Officer, Latin America

Fernando is an experienced regional business and people leader with a demonstrated history of achieving business goals in the insurance and services industries, and of building and developing purpose-driven high performing teams. He was promoted to CEO, Latin America for Cover-More Group in April 2024 after more than six years as CEO of Universal Assistance S.A. which was acquired by Zurich Group in 2018.

Previously Fernando was CFO with Universal Assistance and has also worked in senior roles with both Chubb and PWC in Latin America.

He is based in Buenos Aires, Argentina.

Will joined Cover-More in July 2019 and is responsible for travel insurance distribution partners and operations in New Zealand and Malaysia.

Will has 20 years’ experience in the travel industry, 14 of which have been in travel insurance.

Before joining Cover-More, he was Chief Sales Officer at Allianz Partners in New Zealand, where he worked for 10 years. Originally from the UK, Will is based in Auckland, New Zealand.

Adrian Leach

Chief Executive Officer, World Travel Protection

Adrian joined Cover-More in 2019 to head Cover-More’s global medical assistance business which spans three continents and involves highly skilled teams of doctors, registered nurses, case managers, and travel and logistics specialists.

Previously Adrian worked with International SOS in Asia Pacific, leading the assistance organisation’s business in the region for the past three years, most recently as CEO Asia Pacific. Before joining International SOS in 2010, Adrian worked as a senior executive for Linfox in logistics and supply chain specialisation. He possesses a Bachelor of Economics from La Trobe University in Melbourne and a Masters of Science from the University of Denver.

Kate Hughes

Group Chief People Officer

Kate is responsible for leading all aspects of Group Human Resources and ensuring our group has the optimum global workforce, skills and talent to achieve our strategic objectives.

Kate has more than 20 years of HR experience and joined Cover-More from Zurich Group in Switzerland where she was Group Head of Employee Experience, Diversity and Wellbeing.

She has also worked with Westpac Banking Corporation, American Express Limited and the law firm Ashurst Australia. Kate holds a Bachelor of Arts from the University of Canberra, and an MBA from Charles Sturt University.

Kate is based in Sydney, Australia.

Manuel Lewin

Group Chief Risk and Compliance Officer

Manuel is a highly experienced risk, investment and sustainability professional and joined Cover-More following 12 years with Zurich in Switzerland and the US, most recently as Head of Risk Strategy and Reporting.

His in-depth working knowledge of Zurich’s global risk and compliance frameworks is pivotal for Cover-More’s global operations and strategic growth aspirations.

Manuel is a graduate of the London School of Economics and holds a Master’s Degree in Business and Economics from the University of Basel. He is a charterholder with the Chartered Financial Analyst (CFA) institute.

Manuel is based in Sydney, Australia.

Charles Whattam

Group General Counsel

Charles leads the legal teams across our global businesses and provides critical support for the implementation of Cover-More’s growth strategy. He brings considerable industry experience in travel insurance to Cover-More as well as strong commercial acumen and understanding of government regulatory frameworks in Australia and internationally.

Before joining Cover-More, Charles was General Counsel with Chubb in Sydney and also previously worked with nib/World Nomads and with Allianz in Australia.

Charles is based in Sydney, Australia.

Interim Group Chief Information Officer

Rob joined Cover-More as Interim Group CIO in January 2024. He brings to the role more than 25 years’ experience in sectors including IT, travel, financial services and retail.

With specialist skills and experience in shaping technology and business strategy, transformation programs, cybersecurity uplift, digital and data transformations, and operating model design, Rob has worked for, and with, brands including Vodafone, TPG, iiNet, AAPT and Qantas. He is based in Sydney.

Chris Noble

Group Chief Marketing Officer

Chris joined Cover-More Group in 2021 and leads our global priorities in digital and direct channels. He oversees marketing in 15 countries across the UK, Europe, US, Latin America and Asia Pacific.

Previously General Manager and Chief Marketing Officer with online travel insurance provider World Nomads, Chris is a highly respected digital marketing specialist. He has more than 20 years’ experience in brand strategy development, e-commerce growth, strategic partnership development, team development and leadership, and community development.

Chris is based in Sydney, Australia.

Your next career move

It takes people from all our teams, all over the world, to keep Cover-More Group improving, growing and offering the trusted insurance and assistance for which we’re known. We’re always looking for bright, creative minds to join our teams.

HOW WE HIRE

Open up a world of opportunity at cover-more.

A world of opportunity exists for Cover-More Group team members. We care, we communicate, and we empower our people to be the best they can be. The trajectory to incredible opportunities follows our trusted hiring process. Here’s what you can expect:

1: Search and apply

Start your next career move with a job search for our latest opportunities here , on LinkedIn and on other job sites, to find the perfect fit for you. Follow the application steps and attach your updated CV, if required.

2: Hello, it’s us

Our Talent team will contact successful candidates via phone or email and arrange an informal screening chat to discuss role details and your expectations. If you don’t hear within two weeks, it’s not you.

3: Interview time

If you advance, our Talent team will arrange an interview, providing all details to ensure you are fully prepared. Interviews are conducted onsite or via Teams, with two interviewers, across one to three meetings, depending on the role.

4: After the interview

The Talent team will provide feedback and advise if you will progress to the next round or receive an offer. If unsuccessful, constructive feedback will be provided, and we will keep your details on file for future opportunities.

Equal opportunity

Cover-More Group values diversity and is proud to be an equal opportunity workplace. We promote merit and fairness in our selection processes and are committed to equal employment opportunity regardless of a person’s race, ancestry, national origin, religion, age, sex, gender identity, sexual orientation, citizenship, marital status or disability. See Cover-More Group’s Policy for more information. If you have a need that requires accommodation, please let us know by contacting us or specifying in your application.

Get a Travel Insurance Quote

- Show more sharing options

- Copy Link URL Copied!

AIG confirms $600mn sale of travel business to Zurich

This publication reported yesterday that the two carriers were nearing a deal..

AIG has agreed to sell its global individual personal travel and assistance business to Zurich for $600mn in cash, as well as an additional earn-out consideration.

Login to continue

Please enter your email address below.

Opening your single sign-on provider...

Questions about your access? Refer to our FAQs for answers or appropriate contacts

Uncover exclusive insights tailored for insurance leaders

- Stay Informed: Access exclusive industry insights

- Gain a competitive advantage: Hear first about tactical developments

- Make better decisions: Understand market dynamics in crucial lines of business

As a premium subscriber, you can gift this article for free

You have reached the limit for gifting for this month

There was an error processing the request. Please try again later.

- Travel Insurance Compare Our Plans Popular Benefits COVID-19 Benefits International Plans Domestic Plans Comprehensive Insurance Annual Multi-Trip Inbound Plan Cruise Ski & Snowboard Motorcycle & Moped Adventure Activities Seniors Medical Conditions

- Emergency Assistance

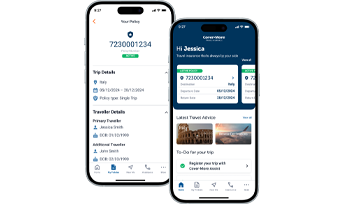

- Travel Alerts Cover-More App

- Manage Policy

Travel insurance that’s always by your side

- travel_explore Not sure? See region list.

Your policy in your pocket... and more

Register your trip in our app for access to your travel insurance policy details, as well as up-to-date travel advice, real-time safety alerts and 24/7 emergency assistance, all in the palm of your hand.

Travel's back on - and we've got your back

Feel in control by choosing the most suitable plan for you

Feel safe with 24/7 access to Emergency Assistance

Feel joy with 80+ adventure activities included

Feel confident with our 35+ years of travel expertise

Looking for the best travel insurance plan for your holiday?

Whatever your travel budget, style or needs, let's travel the world together - safely.

International Basic

Essential cover designed for Australian travellers on a budget.

Pre-trip cover if you're diagnosed with COVID-19

On-trip cover if you're diagnosed with COVID-19^##

Unlimited~ overseas emergency medical expenses^

Up to $5,000 luggage cover

Existing medical conditions cover available

Optional cancellation cover

Single Trip policies

Annual Multi-Trip policies^

Rental vehicle insurance excess

International Comprehensive

Extensive cover and benefit limits to provide extra financial protection.

Pre-trip cover if you're diagnosed with COVID-19#

On-trip cover if you’re diagnosed with COVID-19 while travelling^##

Up to $15,000 luggage cover*

Optional cancellation cover with Cancellation Extensions

Single Trip or Annual Multi-Trip^^ policies

Rental vehicle comprehensive cover

International Comprehensive +

Everything our Comprehensive Plan includes and more + higher benefit limits.

Pre-trip cover if you’re diagnosed with COVID-19 before travelling#

Up to $25,000 luggage cover*

Business trip benefits

* Item limits apply.

~ Cover will not exceed 12 months from onset of the illness, condition, or injury.

^ For cruise-related expenses, Cruise Cover must be included in the policy. There is no cover for cabin confinement related to COVID-19.

^^ Policy availability subject to age, trip duration and area of travel. Policies may not be available to all travellers.

# Up to $5,000 per policy (or the amount chosen if this is less) applies to International Comprehensive Plan and Comprehensive+ Plan policyholders with Amendment or Cancellation Costs cover included. You must be diagnosed with COVID-19 and certified by a qualified medical practitioner as being not fit to travel for cover to apply.

## Up to $5,000 per policy (or the amount chosen if this is less) applies per policy for policyholders with Amendment or Cancellation Costs cover included. You must be diagnosed with COVID-19 and certified by a qualified medical practitioner as being not fit to travel for cover to apply. A special excess applies.

Searching for COVID-19 cover?

To help you explore the world with confidence, our travel insurance provides cover for COVID-19-related:

Overseas medical costs*~#

Amendment and cancellation costs*^

Additional expenses*#^

*Limits, sub-limits, conditions, and exclusions apply.

~Medical cover will not exceed 12 months from onset.

#Cover for medical costs related to COVID-19 is not available on our Domestic Plans.

^A special excess will apply.

Holiday hasn't gone to plan?

You can submit a Cover-More travel insurance claim online at any time – and from anywhere.

Get emergency support, fast. We're here 24/7.

When adventure awaits... we can help provide cover.

Setting sail for two or more nights? You'll need to let us know and Cruise Cover will be added to your policy.

Snow Sports

Hitting the slopes? Consider protecting your winter getaway with one of our two levels of Snow Sports Cover.

Adventure Activities

Planning on engaging in extreme activities? We've got two additional Adventure Activities Cover options for you.

Motorcycle & Moped

Want to take to the road on two wheels? See if one of our Motorcycle/Moped Riding Cover options is right for your trip.

We're by your side when you need us most

We've been protecting Australian travellers for over 35 years. Read our customers' Cover-More travel insurance reviews to discover how our expert team provides exceptional care during uncertain times.

Mosquito bite in Bali

Shannon was bitten by a mosquito in Bali, which caused Dengue Fever.

"Cover-More were absolutely fantastic. I wasn't responding well to medical treatment, so they flew in a specialist from Singapore to accompany me all the way home. I'm so glad I had Cover-More travel insurance."

Boat crash in Thailand

Natalie was involved in a speedboat crash in Thailand, which resulted in a fractured pelvis and a brain haemorrhage.

"Luckily I had Cover-More insurance. They took care of everything and made sure we had the best medical treatment available."

Accidental fall in Poland

Irene was visiting family in Poland when she had a fall, which resulted in a bad fracture and extensive medical costs.

"Amazing. I can't praise them highly enough. Wonderful, wonderful people... Nobody should travel without insurance."

Protect your trip with us - get a free travel insurance quote now.

How can we help you travel smarter.

Whether you’re a seasoned traveller or a first-timer, we’re here to help you feel empowered to travel further, safely.

Finding cover for Existing Medical Conditions (EMCs)

Have an EMC? We can provide cover for various conditions to help keep you exploring, safely.

7 ways COVID-19 has changed the way we travel

Worried about travel risks during COVID-19? Discover how you can help ensure a safer trip.

What you should know before you hit the slopes

Planning a ski trip at home or abroad? Don't depart without reading our expert advice.

Got a question about travel insurance? We're here to help

What is travel insurance.

Travel insurance is a specific type of insurance that helps cover several costs and disruptions when travelling both domestically and overseas. Levels of cover differ per plan; however, travel insurance typically protects against trip cancellation, delays, lost luggage and personal belongings, overseas medical expenses and repatriation, and personal liability.

Most travel insurance providers offer single or multi-trip policies, which can cover multiple countries within a specific timeframe. Things like the destination, length of trip, optional additional cover for specific activities and pre-existing medical conditions all help determine the cost of a travel insurance policy.

How much does travel insurance cost?

The cost of a travel insurance policy varies from traveller to traveller because various factors affect the amount payable.

At Cover-More, we consider a number of factors when calculating the total amount payable. The following is a guide on these key factors, how they combine and how they may impact the assessment of risk and therefore the premium paid:

- Area: higher risk areas cost more.

- Departure date and trip duration: the longer the period until you depart and the longer your trip duration, the higher the cost may be.

- Age: higher risk age groups cost more.

- Plan: International Comprehensive+, which provides more cover, costs more than International Comprehensive or Domestic.

- Excess: the higher the excess the lower the cost.

- Cruise cover: additional premium applies.

- Cancellation cover: on some policies you can choose your own level of cancellation cover. The more cancellation cover you require, the higher the cost may be.

- Adding cover for Existing Medical Conditions and pregnancy (where available): additional premium may apply if a medical assessment is completed and cover is accepted by us.

- Options to vary cover (where available): additional premium applies.

While a cheaper policy cost upfront may seem appealing, always read the Product Disclosure Statement to ensure your needs are adequately covered should an incident occur.

How does travel insurance work?

Travel insurance protects you when travelling domestically or internationally by providing coverage against unforeseen circumstances that may impact your travel plans. By purchasing travel insurance with cancellation cover prior to departure, your policy can help by providing cover for the costs of trip cancellations should you no longer be able to travel, as well as the costs of overseas medical treatment, lost passports, and personal items while you’re travelling.

The customer usually pays for these costs upfront, before being reimbursed by the travel insurer upon claim approval. To approve a claim, travel insurers require documentation such as medical reports, itemised medical bills or police reports to confirm the incident occurred.

However, at Cover-More, if our customer becomes ill overseas, they can also contact our 24-Hour Emergency Assistance team for support and to seek approval for expensive medical bills to be paid directly by us to the medical care provider/s instead.

Always read the Product Disclosure Statement before purchasing a travel insurance policy to ensure it provides adequate coverage for your circumstances.

What does – and doesn’t – travel insurance cover?

Unfortunately, travel insurance can’t cover absolutely everything. This highlights the importance for travellers to read the Product Disclosure Statement before purchasing to avoid becoming frustrated if claims are unsuccessful. It will contain details on the situations you likely won’t be covered in, including cancellation, pre-existing medical conditions, theft or loss of belongings, adventure sports, COVID-19 scenarios and more.

For full details of the exclusions within our Cover-More travel insurance plans, consult the Product Disclosure Statement .

When is the best time to purchase travel insurance?

The best time to purchase travel insurance is as soon as a trip is booked, as this can increase protection. When purchased ahead of time, a Cover-More customer can cancel their travel insurance policy for a full refund within the 21-day cooling-off period. If the policy is purchased before departing on the trip, claims for rearrangements and cancellations caused by unforeseen circumstances can also be made where cancellation cover is added to the policy.

- MyNewMarkets.com

- Claims Journal

- Insurance Journal TV

- Academy of Insurance

- Carrier Management

Featured Stories

- Beryl Becomes Earliest Ever Cat 5 Hurricane in Atlantic

- Cancer Victims Lose Bid to Block J&J Talc Bankruptcy

Current Magazine

- Read Online

Zurich to Buy AIG’s Travel Insurance Business for $600 Million

Zurich early Wednesday said it is purchasing the global personal travel insurance business of American International Group (AIG) for $600 million.

The deal, according to Zurich, may include an additional payment if specific targets are met after the sale, which is expected to close by the end of 2024. .

Zurich called travel insurance a “priority” and said AIG’s Travel Guard business will expand its U.S. footprint as a part of Zurich’s travel insurance provider, Cover-More Group, making it a leader in the line.

“This transaction is a great strategic fit, which enhances Zurich’s existing capabilities and makes us a leading travel insurance provider across all regions,” said Cara Morton, CEO of Zurich Global Ventures. “The acquisition expands our retail customer base and aligns with our ambition to continuously enhance our offerings, while providing world-class protection during every step of our customers’ travels.”

Cover-More’s capabilities will be enhanced by AIG’s global IT platform. The deal also includes AIG’s global service centers. AIG said the transaction excludes travel coverages offered through AIG’s A&H business.

AIG CEO Peter Zaffino said the sale is “another important strategic step in positioning AIG for the future.” He said AIG will work closely with Zurich “to ensure a seamless transition for employees, customers and our global distribution partners.”

Zurich said the bolt-on should result in annual gross written premiums of about $2 billion for the new Cover-More Group.

Bank of America analysts said Zurich looks to have made a “sensible acquisition” that could increase earnings per share 1-2% after integration.

Topics Mergers & Acquisitions AIG

Was this article valuable?

Thank you! Please tell us what we can do to improve this article.

Thank you! % of people found this article valuable. Please tell us what you liked about it.

Here are more articles you may enjoy.

Written By Chad Hemenway

Chad is National News Editor at Insurance Journal. He has been covering the insurance industry since 2007, reporting on trends and coverage in most lines of insurance as well as natural catastrophes, modeling, regulation, legislation, and litigation. Chad can be reached at [email protected]

Latest Posts:

- State Farm Seeking Large Rate Increases in Wildfire-Prone California

- US P/C Underwriting Results: Two Years in a Row Over $20 Billion in the Red

- Big ‘I’ Report: Independent Agency Channel Placed 62% of Premiums in 2023

- Dellwood Insurance Files to Dismiss ‘Insufficient’ Case Brought by AIG

Interested in Mergers ?

Get automatic alerts for this topic.

- Categories: National News Topics: AIG , Business Moves & Mergers , travel insurance , Zurich

- Have a hot lead? Email us at [email protected]

Insurance Jobs

- Operations Manager, Service Operations - Hartford, CT

- Warranty Claims Adjusting Specialist – Remote - Chicago, IL

- Health and Benefits – Lead Associate - Boston, MA

- Clinic Nurse Medical Case Manager – Workers’ Compensation - Morristown, NJ

- North America – P&C Reserving Director - New York, NY

- Cyber Risk Strategies to Minimize Business Disruption, Control Liability and Litigation Exposure

- D&O Risks to Consider When Exploring the New Frontier of Gen AI

- Securing Life Insurance Alternatives for Clients in War Risk Zones

- Property Restoration Industry: A Culture in Need of Repair?

- Underwriters' Dilemma: Is AI a Cyber or Tech E&O Risk?

- U.S. P/C Underwriting Results: Two Years in a Row Over $20 Billion in the Red

- Hurricane Beryl Roars Toward Jamaica on Destructive Path

- NHTSA Closes Recall Query Into About 420,000 Volkswagen Vehicles

- Jury Awards $68.5M to Family of Worker Who Fell to Death at Philly Construction Site

- July 11 Cyber Liability in 2024: The Expanding Need for Coverage

- July 18 HO-14: More Than a Mature HO-4

- July 25 Climate Change Challenges for the Insurance World

- Motor Insurance

- Home Insurance

- Travel Insurance

- Pet Insurance

- Bike Insurance

- Van Insurance

- Daily Price Benchmarking

- Market View

- Trading View

- Offers and Incentives Benchmarking

- Additional Product Benchmarking

- GIPP Performance Tracker

- Data Mapping Diagnostic

- PCW Question Set Monitor

- Advertising Substantiations

- Insurance Behaviour Tracker

- Fair Value Benchmarking

- Consumer Survey Panel

- Consumer Outcomes Benchmarking

- Consumer Intelligence Awards

- Client Success Stories

- Viewfinder Login

- Company News

- Media Centre

Unveiling travel insurance trends: What you need to know now!

03/07/24 12:12

Posted by Charlotte Hynes

In our latest Consumer Intelligence webinar, we dove deep into the evolving landscape of travel insurance. From market pressures to consumer behaviour, here are the standout points you need to know.

Travel insurance premiums on the rise

We kicked off by examining the inevitable impact of inflation on travel insurance. According to our Travel Insurance Price Index, prices have surged by 11% for P1 quotes and 8% for P1-5 quotes since April last year. Our Insight Analyst, Michael Dingwall, added, “Price only inflated roughly 11% and 8% retrospectively. I say ‘only’ because when comparing to other insurance sectors such as motor, which has seen a staggering levels of inflation, it doesn’t come across as significant.” This has resulted in an average market premium of £63 in April 2024, up by £6 from April 2023.

Additionally, Michael, highlighted, “While consumers may welcome more stable prices, insurers face challenges from ongoing market constriction. Younger travellers, particularly 18-19 year olds, saw the highest inflation at around 12%, while those over 60 saw the lowest at 7%.”

Worldwide destinations see double-digit price increases

Destination matters! We saw significant inflation of 15% to 20% for worldwide travel excluding the US and Canada over the past year. Interestingly, all destinations experienced a slight deflation from October to December 2023, continuing into February 2024.

But why is this? Michael explained, “Traveling across the pond isn’t financially viable at the moment for many singles, couples, and families due to the cost-of-living crisis. Looking back to 2022 and 2021, it does not seem to be a trend related to the time of year.”

Number of travel insurance brands up 18%

The travel market has seen a significant increase of 18% in the total number of brands between April 2023 and April 2024. Pre-existing brands have introduced new tiered propositions, while new brands have entered the PCW marketplace, diversifying the options available to consumers.

Michael explained, “Within this ever changing landscape we are also noticing an increased abundance of brands opting for abandoning the common product naming convention of 'bronze, silver, gold, platinum' for other more unique options.”

England overtakes Spain as top destination

Our consumer data revealed a surprising shift: staycations in England have surpassed Spain as the top holiday destination for Brits. This trend is driven by the cost-of-living crisis, making domestic travel more appealing.

Additionally, Brits are now favouring September for holidays over the traditional summer months of July and August. This shift is likely due to high prices and extreme summer temperatures. The trend towards traveling during ‘shoulder months’ is especially prominent among those over 65.

Millennials shun annual policies

Consumer buying behaviour shows a positive trend, with 36% planning to purchase annual policies and 24% opting for single-trip policies. Catherine Carey, our Head of Marketing, noted, “Younger people are less likely to buy annual policies and more inclined to buy single-trip policies or only for specific holidays.”

Our panel also explored policy uptakes, revealing that 29% have already purchased travel insurance for trips planned within the next 12 months, slightly up from 28% last year. This behaviour is still influenced by the pandemic and past travel disruptions.

Insurers must adapt to stay ahead

In the webinar’s final discussion, Michael emphasised the importance of pricing strategies for UK travel, with staycations on the rise. He also noted the significance of pricing short-notice policies, as highlighted by a Go.Compare press release stating that nearly a third of travel insurance buyers purchase insurance on the day of travel.

Addressing product stagnation, our CEO Ian Hughes discussed innovation opportunities for insurers, such as leveraging AI to enhance customer experiences and ensure comprehensive coverage. He stressed, “Anything that enhances customer enjoyment while ensuring protection is an opportunity.”

Key takeaways: navigating a volatile market

Our panel concluded with essential takeaways. Ian emphasised the need for a clear strategy with the ability to tactically flex in a volatile market . Catherine Carey highlighted the importance of understanding evolving consumer behaviour, and Michael Dingwall advocated for a data-driven approach in uncertain times.

Don’t be the last to know the top tips and trends in travel insurance!

Sign up now to watch the full webinar and gain further insight into the travel market by receiving our exclusive, free travel report (featured at ITIC 2024).

Comment . . .

Like it? Share it:

Submit a comment, you may also like.

Zurich Insurance buys AIG travel business in $600 mln deal

- Medium Text

Sign up here.

Editing by Ludwig Burger

Our Standards: The Thomson Reuters Trust Principles. New Tab , opens new tab

Markets Chevron

TSX climbs to four-week high as metal mining shares jump

Canada's main stock index rose to a near four-week high on Wednesday, with metal mining stocks leading a broad-based rally as the U.S. dollar fell ahead of employment data that could support prospects of Federal Reserve interest rate cuts.

- Trawick International Travel Insurance Review

Trawick International Plans

- Trawick Travel Insurance Cost

Filing a Claim with Trawick Travel Insurance

Compare trawick travel insurance.

- Why You Should Trust Us

Trawick International Travel Insurance FAQs

Trawick travel insurance review 2024: a comprehensive overview.

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

If you're planning a trip, one of the most important things you can do is ensure you're protected if something goes wrong. That's where travel insurance comes in. Trawick International is among the best travel insurance companies with a variety of plans for different types of travelers, so you can find the coverage that's right for you.

Here we'll look at the variety of plans Trawick offers, coverage amounts, costs, and how to file a claim. We'll also compare Trawick's most popular policies and other leading travel insurance providers' coverage.

Trawick International Travel Insurance Summary

Trawick International travel insurance is one of the most popular travel insurance companies on the market, earning spots on our guides on the best cheap travel insurance and the best CFAR travel insurance .

Trawick offers a wide array of policies, so you're sure to find one that will fit your travel plans. Even if you can't find a plan that is one-to-one with your trip, one of Trawick's stand-out options is its Safe Travel Flex plan, which allows you to build your own insurance plan from scratch. It includes travel cancellation and interruption insurance in addition to travel assistance. Everything else is optional, from medical coverage to baggage delay.

Trawick has received an average Trustpilot rating of 4.2 across nearly 500 reviews and 4.1 across over 3,100 SquareMouth reviews. Trawick reviews on its headquarters in Alabama are mixed, averaging 3.3 stars across nearly 350 reviews. Negative reviews cited a difficult claims process and unresponsive customer service.

Types of Plans Available

- Safe Travels Trip Protection: With 10 plans under this umbrella, Trawick Trip Protection is highly customizable. You can even build a plan from the ground up with Safe Travels Flex. It covers domestic and international trips for US residents.

- SafeTreker: Trawick's plan for adventure sports travel, SafeTreker covers sports equipment rental, search and rescue, and non-medical evacuation for over 450 sports.

- Safe Travels USA: Trawick offers four tiers of insurance for non-US citizens and non-US residents traveling in the USA, offering accident and sickness coverage, emergency medical evacuation, and unexpected recurrence of a pre-existing conditions (limitations apply).

- Safe Travels International: Trawick offers two plans for non-US citizens and non-US residents traveling outside the US, covering emergency medical procedures, emergency evacuation, and repatriation.

- Safe Travels Outbound: This plan offers primary but temporary travel insurance for US citizens and residents traveling outside the US. It includes medical and emergency evacuation coverage, including COVID-related illnesses.

- Safe Travels Annual: Trawick offers three multi-trip annual travel insurance plans that offers emergency medical, baggage delay, and trip delay coverage for trips up to 30 days long. Trip cancellation coverage spans between $2,500 to $10,000 per year.

- Safe Travels Vacation Rental Protection plan: This plan covers non-refundable expenses such as airfare, hotels, vacation rentals, and other pre-paid trip deposits. It's only available for US residents.

- Collegiate Care Essential plan: This plan is designed for students studying abroad for study and research purposes. It offers coverage for up to $300,000 in medical expenses, with a limit of $150,000 per injury or sickness. COVID-19 medical expenses are covered with the plan, as is coverage for sports activities.

Regardless of which policy you choose, it's vital to study each of them closely to see what is and isn't covered in the one you choose.

Key Features and Benefits

Trawick International travel insurance offers several plans for different types of travelers with different needs. The coverage levels and premiums will vary depending on the traveler's age, trip costs, and destination.

Below is a list of six travel insurance plans Trawick offers with its Trip Protection plan:

Additional Coverage Options

Trawick International travel insurance offers additional coverage options on specific plans. Some come with no extra charge. Others cost extra. And only some policies allow for these additional coverage options.

Additional coverage options include:

Rental car damage coverage: It's possible to add this coverage to certain plans from Trawick, like its Safe Travels First plan. This coverage will reimburse damage to a rental car up to an allowed amount.

Pre-existing condition coverage: Pre-existing condition waivers are available if you purchase travel insurance within seven to 21 days of booking your flight, depending on the policy.

CFAR coverage: "Cancel for any reason" coverage can only be added to Trawick's Armor, Journey, Voyager, First Class, Flex, and Rental Plus plans. This add-on allows travelers to cancel their trip, for any reason, up to two days before departure and get 75% of trip costs reimbursed. CFAR coverage is only available for US residents and US citizens.

How Much Does Trawick International Cost?

Getting a quote from Trawick is a straightforward process. You can visit its website or use an insurance comparison site like Squaremouth.

You must provide traveler and trip details like your date of birth, state of residence, destination, and trip costs. With this information, you should be able to get quotes for the different plans available almost instantly.

Below are a few real-world examples of coverage options and costs from Trawick as of April 2024.

For example, let's look at what it would cost to insure a 35-year-old resident of Ohio spending $8,000 on a two-week trip to France. Below are the costs for each of the six different coverage options.

The cost of coverage ranges from the bottom-tier Safe Travels Explorer plan at $257.04 to the top-tier Safe Travels First Class policy for $453.33. That equates to about 3% to 6% of the total trip cost, which is on the lower end when compared to the average cost of travel insurance .

Now let's look at the cost of coverage for a 55-year-old from Colorado traveling to Argentina and spending $6,000 on a three-week trip.

The premiums for this traveler are higher, but that's to be expected given their age. The lowest-cost Safe Travels First Class plan costs $243.23 and the top-tier Safe Travels Voyager costs $574.14. That represents a cost of between 4% and 9.5% of the total trip cost, higher than the previous example but still within industry averages.

Lastly, we'll look at the premium costs for a 45-year-old resident of Texas traveling to Fiji for two weeks and spending $7,000 on the trip.

The lowest cost plan in this scenario is the Safe Travels Explorer plan, which runs $284.28. And the most expensive is the Safe Travels First Class, at $405.54. You're paying between 4% and 5.8% of the total trip cost at these prices. Again, that's right on track with the averages in the travel insurance industry.

Trawick International travel insurance has several different claims departments and forms, so how you file a claim will vary depending on the coverage you purchase.

You can find claims forms and contact information on Trawick's claims forms page. That's where you'll find information regarding where to mail or email your claim form and contact information for the appropriate claims group.

Reviews on SquareMouth and Google say the claims process can take up to several months and require constant hassling. To avoid additional issues with the claims process, be sure to keep thorough documentation of any unexpected costs incurred during travel. Additionally, you should be as specific as possible when filing a claim.

See how Trawick stacks up against the competition.

Trawick International vs. Allianz Travel Insurance

Allianz and Trawick International travel insurance are similar in offering several different coverage options.

Allianz offers 10 travel insurance plans, including one-off and multi-trip policies. So you'll have options whether you're looking to cover a specific trip or plan to take multiple trips a year. Of course, the different plans offer varying levels of coverage, and the premiums depend on the traveler and trip specifics.

Allianz's most popular single-trip travel insurance option, the OneTrip Prime plan, offers up to $100,000 in trip cancellation coverage, up to $150,000 in trip interruption coverage, $50,000 in emergency medical coverage, up to $1,000 in coverage for baggage loss, theft, or damage, and up to $800 in travel-delay coverage.

Trawick's most comparable plan is its Safe Travels Explorer Plus plan, which offers up to $100,000 in trip cancellation and interruption coverage, $50,000 in emergency medical coverage, up to $750 for personal effects, and trip delay coverage of $500.

The best way to decide which company to go with is to compare quotes using your specific trip details and personal information, as those are the details that will affect the cost the most.

Read our Allianz travel insurance review here.

Trawick International vs. Nationwide Travel Insurance

Nationwide is a household name when it comes to insurance providers and one of the most well-known and recognized insurance firms in the US. By providing just two single-trip options, the Essential and Prime plans, Nationwide travel insurance has made it simple to find coverage. Nationwide also offers yearly trip insurance for those who travel a lot throughout the year, as well as cruise-specific plans and annual trip insurance.

To compare the two companies, we'll put Nationwide's Essential plan beside Trawick International travel insurance's middle-of-the-road Safe Travels Single Trip plan.

Nationwide's Essential Plan provides up to $10,000 in trip cancellation coverage, up to $250,000 in emergency medical evacuation, up to $150 per day ($600 maximum) reimbursement for travel delays of six or more hours, and coverage for delayed or lost baggage.

In comparison, Trawick's Safe Travels Single Trip plan offers 100% of the insured trip (up to two times the trip cost) in trip cancellation coverage, $350,000 in emergency medical evacuation, and up to $200 per day ($600 maximum) for travel delays of 12 or more hours, and lost and delayed baggage coverage.

So, this particular plan from Trawick offers slightly higher coverage limits for most of the coverages compared.

The high-tier Prime Plan from Nationwide offers even more coverage, including up to $30,000 in trip cancellation, up to $1 million in coverage for emergency medical evacuation, up to 200% of the trip cost (maximum of $60,000) in trip interruption coverage, and $250 per day for trip delays of six or more hours.

To compare, Trawick's highest-tier Safe Travels Voyager plan comes with trip cancellation coverage of up to $100,000, up to $1 million in emergency medical evacuation, up to 150% of the insured trip cost for trip interruption, up to $2,000 maximum reimbursement for travel delays, and coverage for delayed or lost baggage.

Comparing these two policies, you see how it's somewhat of an apples-to-oranges comparison, as some coverage limits are higher or lower. And don't forget that the coverage premiums will vary depending on the traveler and trip specifics.

Read our Nationwide travel insurance review here.

Trawick International vs. Credit Card Travel Insurance Benefits

Be sure to compare the coverage of travel insurance plans with the coverage offered by your rewards credit cards before purchasing a travel insurance policy. Some basic coverage, like rental car insurance, could already be available through one of your existing cards.

If you're on a road trip and all your expenses are refundable, or if your health insurance covers you while abroad and you don't think you'll have many medical bills, the coverage from your credit card may be sufficient.

It's also worth noting that in most cases, credit card travel protection is only supplementary to a travel insurance policy. This implies you'll have to file your claim with the other relevant insurance (such as the airline) before filing a claim with your credit card company.

Read our guide on the best credit cards with travel insurance here.

Why You Should Trust Us: How We Reviewed Trawick International

We compared Trawick International's travel insurance offerings to those of the best travel insurance companies to help you find the policy that fits your needs. When reviewing a policy, we considered coverage options and limits, what's included in your plan, add-ons available, and costs. The best policy for you is one that offers adequate coverage without breaking the bank.

Choosing the best policy for you and any co-travelers is about selecting a policy with the right type of coverage and adequate coverage limits. Ideally, you should ensure that it works well in your budget and allows you to submit a claim quickly. You can read more about how we rate travel insurance products here.

Trawick International travel insurance is a very popular and reputable travel insurance provider. The company has been in business since 1998 and is known for offering solid coverage options at affordable prices.

Trawick's policies included access to 24/7 travel assistance. Travelers can reach a customer service representative by phone, email, and live chat. Representatives can answer questions about the travel insurance and trip cancellation plans available, help purchase the right plan for an upcoming trip or cruise, and assist with changes to already purchased plans. The toll-free number is 888-301-9289. You can reach the company by email at [email protected] . Live chat is available on its website.

CFAR (cancel for any reason) is one of the many coverages buyers can expect in Trawick International plans. Always check individual plans to ensure you get all the coverages you want.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

- Main content

Iowa DOT: Travel ‘strongly discouraged’ in northwest Iowa counties

CEDAR RAPIDS, Iowa (KCRG) - Multiple road closures on state and federal highways have authorities urging drivers to skip inessential travel.

Widespread flooding of rivers and streams in northwest Iowa has caused major highways to become blocked by the rising waters, according to the Iowa Department of Transportation. Officials said that travel was strongly discouraged due to the potentially dangerous conditions in Lyon, Sioux, O’Brien, Clay, Emmet, Dickinson, and Plymouth Counties.

Drivers should check local road conditions before venturing out. If a roadway is flooded, do not drive through it and find another way around. Several inches of flowing water is enough to lift a vehicle and carry it, potentially putting you in danger. Remember the saying: Turn around, don’t drown.

Broad portions of northwest Iowa, southeast South Dakota, and southern Minnesota are under Flood Warnings after 8 to 16 inches of rain fell over the last few days. No new rainfall is expected through Monday.

Copyright 2024 KCRG. All rights reserved.

Severe weather hits multiple counties in Eastern Iowa

One arrested after police chase on I-380 in Linn County

Fatal crash in Fayette County

8-year-old killed in Ottumwa after being hit by truck while riding a bike

Teen snow cone stand employee puts rude customer in her place: ‘You are a grown woman’

Cedar Rapids man arrested after standoff on Highway 30

Police make arrest in Marion robbery

State Board finds probable cause against 3 Mid-Prairie administrators

Latest news.

‘1-Bag Challenge’ breaks litter collection record in Cedar Rapids

CDC: Human bird flu case is tied to dairy cow outbreak

Gov. Reynolds issues disaster proclamation for additional counties hit by widespread flooding

Local doctor explains atrial fibrillation

Keokuk County Sheriff’s Office searching for missing Keota teen

i9 investigation update Board of Educational Examiners

Former Iowa Hawkeye Keegan Murray to tee off at John Deere Classic Pro-Am

Everyday Iowa - Everyday Iowa Reads: You Are Here by David Nicholls

COMMENTS

Donna joined Cover-More in November 2021 as Head of Strategic Relationships and was appointed CEO of Cover-More Europe in February 2022. With more than 20 years' experience in the travel industry, Donna manages the integration and establishment of our European businesses, both in the business to business and direct to consumer markets.

A senior manager with deep experience in the Travel and Financial services industries. I manage large scale growth strategies and teams with some of Australia and the Regions greatest brands. · Experience: Cover-More Group · Location: Australia · 500+ connections on LinkedIn. View Todd Nelson's profile on LinkedIn, a professional community of 1 billion members.

Health Insurance Doesn't Cover Everything. According to the US Department of State - Bureau of Consular Affairs some domestic health insurance may cover "customary and reasonable" costs overseas. However, they often won't pay for a medical evacuation back to the US which can cost upwards of $50,000. That's where travel insurance can help.

Cover-More Group is a leading global travel insurance, assistance and travel risk management provider. Part of Zurich Group since 2017, Cover-More Group has operations in more than 15 countries across five continents, including the USA, Australia, Brazil, Argentina, Ireland and New Zealand.

Cover-More Group is a global specialist and integrated travel insurance, medical assistance, and employee assistance provider with operations across five continents. Cover-More Group is headquartered in Sydney, Australia. In 2017, Cover-More became part of Zurich Insurance Group emerging as the third largest travel insurance provider in the world.

Protect your trip investment and receive emergency travel assistance with a travel insurance plan from Covermore. Anywhere you go, we're there to protect you. Get a Travel Insurance Quote ... Cover-More Inc. 810 North 96th Street, Suite 300, Omaha, NE, 68114. CA Agency License # 0N13321.

Cruise Insurance in partnership with Cover-More - Travel insurance that's always by your side.

The announcement confirms reporting yesterday from Insurance Insider that AIG was close to sealing a deal with Zurich. Zurich said the business will be combined with its existing travel insurance provider Cover-More Group and help expand the carrier's footprint in the US.

Covermore Insurance | 36 followers on LinkedIn. ... Anand Jois Agile Coach, CSPO, PMI-ACP, CSM, Mobile iOS and Android, Rest API, Security / Baseline Clearance

Extensive cover and benefit limits to provide extra financial protection. Pre-trip cover if you're diagnosed with COVID-19#. On-trip cover if you're diagnosed with COVID-19 while travelling^##. Unlimited~ overseas emergency medical expenses^. Up to $15,000 luggage cover*. Existing medical conditions cover available.

Zurich early Wednesday said it is purchasing the global personal travel insurance business of American International Group (AIG) for $600 million. The

Many travelers still don't see the need for insurance. About 62% of travelers surveyed did not purchase travel insurance; of those travelers, 35% said their primary reason to forgo insurance was ...

Number of travel insurance brands up 18% The travel market has seen a significant increase of 18% in the total number of brands between April 2023 and April 2024. Pre-existing brands have introduced new tiered propositions, while new brands have entered the PCW marketplace, diversifying the options available to consumers.

, opens new tab global personal travel insurance and assistance business. The business will be combined with Zurich's travel insurance provider Cover-More Group (Cover-More) and will expand its ...

I wish I'd bought travel insurance for my whole family and hadn't relied on the hop-on, hop-off bus. We should've explored more in the morning and at night to avoid the sweltering midday heat.

A new state law means more options to pay for ways to detect breast cancer. The law requires health insurance companies to cover breast cancer screening of more than just a mammogram. It will also ...

World Nomads Travel Insurance Summary. Among the best international travel insurance companies, World Nomads is particularly good at insuring athletes, covering well over 300 sports, including ...

Luxury air travel is on the rise, including the use of private jets and premium tickets. The pandemic's 'revenge travel' trend has people spending more on luxury air experiences. Semi-private jets ...

1. Travel discounts. Think of Costco the next time you're daydreaming about a vacation. Through Costco Travel, your membership unlocks a world of travel discounts that can make those dreams a reality.

Coverage. First Class. Single Trip. Explorer. Explorer Plus. Journey. Voyager. Trip cancellation. 100% of trip cost (up to $15,000) 100% of trip cost (up to $14,000)

Officials said that travel was strongly discouraged due to the potentially dangerous conditions in Lyon, Sioux, O'Brien, Clay, Emmet, Dickinson, and Plymouth Counties.