WARNING RE COVID-19

Policies purchased after [23rd Mar 2020] will not provide any cover for claims directly or indirectly arising from, relating to or in any way connected with COVID-19 (or any mutation or variation thereof or any related strain). We will not therefore cover claims relating to any inability to travel, any decision not to travel or any changes to travel plans, nor any medical or health related loss or expense incurred, as a result of COVID-19. Refer to the FAQ for more details.

- What is covered?

- What is not covered?

- When am I covered?

- Where can I travel?

- Who is covered?

- Travel Tips

- Types of Plan & Eligibility

- Medical Cover

- Baggage Cover

- Sports and Sporting Equipment

- Trip Cancellation

- Nomination of Beneficiary/IES

Chubb Assistance

Travel Smarter with Chubb Travel Insurance

24 Hour Emergency Hotline +63 2 8864 0865 No matter where you are in the world. Ask for a reverse charge call in your visiting country and we’ll help you through with access to medical and dental treatment and emergency evacuation as the situation demands.

Claims Made Easy

Process your claim as quickly as possible. What to do in the event of an insured loss under your policy, how to submit your claim and an outline of the required documents to support your claim.

Quality travel insurance at an affordable price

With millions of travellers served, Chubb Travel Insurance offers high-quality insurance. We have plan options for all types of travellers, from frequent flyers and families to holidaymakers on a budget and adventure seekers.

Access to a global team of travel experts

Purchasing travel insurance from Chubb means access to a truly global network. In addition to our wealth of local expertise, Chubb's operation in the Philippines is backed by our extensive global travel network and breadth of resources to serve your every need.

Fast, fair and efficient handling of claims

Experience has taught us the importance of being proactive when managing claims. Chubb understands that a fast, fair and efficient approach to claims handling will bring about an expedited outcome and can help to deliver an improved result.

24hours emergency assistance +63 2 8864 0865

When you purchase Chubb Travel Insurance, you are instanly covered by Chubb Assistance, our 24-hour emergency hotline that provides the support that you expect in your time of need, anywhere, anytime.

You may contact us via the following

Insurance Company of North America (a Chubb Company)

24th Floor Zuellig Building Makati Avenue corner Paseo De Roxas Makati City 1226 Philippines

Chubb Customer Hotline

Tel: +63 2 8849 6000 Mondays – Fridays, 08:30 a.m. – 5:30 p.m. (excluding public holiday) E-mail: [email protected]

For 24-hour emergency medical and travel assistance, call Chubb Assistance +63 2 8864 0865

Chubb Worldwide Offices

For the mailing address, telephone number and email address of any Chubb office in our global network, use our office locator.

Chubb.Insured.™

- About Chubb

- Terms of Use

- Chubb Insurance

© Insurance Company of North America (a Chubb Company). This policy is underwritten by Insurance Company of North America (a Chubb Company), a registered non-life insurance company with Certificate of Authority No. 2016/34R issued by the Insurance Commission. Full details of the terms, conditions and exclusions of this insurance are provided for in the Policy Wording documentation. Please read our Personal Data Protection Policy .

- Skip to primary navigation

- Skip to main content

- Skip to footer

10 Best Travel Insurance Companies & Plans in the Philippines

Last Updated on – Jul 13, 2023 @ 1:17 pm

What’s the best travel insurance in the Philippines? When it comes to the best travel insurance providers in the country, AXA’s iON – Smart Traveler stands out. This insurance is not only affordable but also has a comprehensive list of coverage including medical expenses, personal accident, travel inconveniences, personal belongings, emergency medical evacuation, and many more. Other insurance plans worth considering include Pioneer Insurance, Standard Insurance, World Nomads Explorer Plan, and AIG Travel Guard.

See the Full List

He finally pulled it off—a quick weekend getaway in Kuala Lumpur to give his frayed nerves the much-needed rest they deserve.

Exploring the majestic rock formation inside Batu Caves was the first item in his itinerary. As he was climbing up the steps of this popular Malaysian destination, he notices the monkeys roaming around.

He goes near one to tries to pet it. As he reaches for its head, the monkey jumps, grabs his hand and bites it.

After wiping off the blood from his palm, he looks for a guide who takes him to the nearest hospital for a rabies shot. He was advised to take antibiotics, anti-inflammatory, and pain medicine for the next few days.

Doctors told him he had nothing to worry, he can continue on with his trip the same day.

But even if his trip was off to a bad start, he was still thankful for one thing:

His travel insurance paid for all medical expenses.

Who was the guy? Dunno, really.

But it was an actual testimonial posted by one of the customers of a travel insurance company which we’ll check out later.

The lesson?

Don’t touch ‘em monkeys.

Also, travel insurance is valuable whenever these kinds of things happen.

Because while we’re all hopeful that the trip will go smoothly and according to plan, sometimes, sh*t happens.

And it’s not only tourist-biting monkeys were talking about here.

Travel insurance can also provide protection for your gear/belongings, pay for trip cancellations, problems with baggage, emergency medical situations, and more.

So read on to learn everything you need to know about travel insurance. It’s a small price to pay to get protection and peace of mind for your whole trip.

Related: 79 Visa-Free Countries (+eVisa & VOA) for Philippine Passport Holders

What is a Travel Insurance?

It’s a contract or arrangement with an insurer to guarantee some form of compensation for a specified loss, illness, accident, damage, interruption, and others during your travels.

Put simply, it provides you with coverage for unexpected situations whether traveling domestically or abroad.

How Travel Insurance works?

Like regular insurance, it works by paying a fee to buy a policy. The policy is essentially the contract that states the types of reimbursements or refunds that your insurance can pay for.

For example, say you have a business trip to Spain. Three days before your flight, you experience chest pains and decide to get a checked by a doctor. He concludes that you contracted pneumonia through some form of bacteria.

You were advised to cancel the trip. Will you get reimbursed for travel expenses you already paid like tickets and accommodation?

Yes—if you have travel insurance.

Depending on the type of policy you purchased, expenses incurred for the trip will be reimbursed by your insurance company .

What does a Travel Insurance cover?

Travel insurance can reimburse you on the following expenses:

- Canceled trips

- Medical emergencies

- Lost baggage

- Emergency Evacuation

- Legal costs (for unexpected incidents you didn’t cause)

- Protection of property (gear and possessions) and more.

Related: 40+ Ways to Save Money while Traveling

Types of Travel Insurance in the Philippines

While you’ll see different types of travel insurance policies out there, the two main types are Vacation Plan and Travel Medical Plan .

1. Vacation Plan Insurance

This type of travel insurance is considered to be the widest in terms of coverage. Most sub-types fall under this category. Package plan, trip cancellation, trip insurance, and the generic, “travel insurance” are considered as types of vacation plan insurance.

What coverage does vacation plan insurance provide? Here are some of the most common items covered:

- Interrupted/Cancelled Trips

- Medical Emergencies

- Lost/Delayed Baggage

- Gear protection

- 24/7 Assistance

You’ll notice that medical emergencies are still included under Vacation Plan insurance. This is because some all-in-one policies also include it on the coverage.

However, if you only seek to have medical coverage when traveling and feel like you won’t need the rest, then the next type of travel insurance is what you should get.

Related: Complete International Travel Checklist

2. Travel Medical Plan

Your health insurance provider usually provides only partial or zero coverage when traveling.

A travel medical plan ensures you have adequate medical assistance should the need arise when you’re away from your home country.

- Medical Expenses

- Emergency Evacuations

Related: Easiest Countries to Get a Citizenship

Why do you need Travel Insurance?

The answer will vary from one person to another. Essentially, however, you’re paying for peace of mind. It’s protection for your pockets.

Same reason why you get a car insurance or life insurance : It helps sidestep any headaches caused by unforeseen expenses during your travels.

Think about it: Say the guy who got bit with the monkey earlier didn’t have insurance. He’ll be forced to shell out money from his own pockets to pay for the medical expenses.

That could have affected his budget for the trip, forcing him to cancel some of the items on his itinerary to make up for the expense.

Or maybe someone fell ill back home and you need to go back ASAP. With the right travel insurance, you can reimburse the fees you paid and get back home without worrying about “wasting” what you paid for.

The same applies if your destination country is suddenly reported to experience some form of weather disturbance or natural calamities (typhoons/hurricanes/earthquakes) and you are forced to bail out. Travel insurance keeps you compensated for the expenses you already paid for.

Also Useful: How to Get a Philippine Passport: DFA Online Appointment & Requirements

How much does Travel Insurance cost in the Philippines?

It varies. Most will fall within the range of Php 500 to Php 3000 for a single trip (4 days to a week, based on the estimated quotes provided by each insurer. More on this later).

There are several factors that affect how much your quote will be.

These are age, type of activities you’ll do during your travel, level of coverage, destination country, length of travel, medical conditions, and others.

To give you an idea of how much travel insurance costs, I’ve pulled up some sample quotes from GoBear (a comparison website).

For travel insurance packages for trips to Asian countries (single trip):

Price range: Anywhere from Php 400 to Php 800

For travel insurance packages to other countries/worldwide (single trip):

Price range: Anywhere from Php 500 to Php 3000

Best Travel Insurance Companies for Filipinos Traveling Abroad

We’ve compiled a list of travel insurance companies currently offering various policies depending on your needs. Read on to compare, you might find this useful on your next travel abroad.

Note: Please make sure to visit each insurer’s official website to get up-to-date rates. Policy coverage shown here may vary from the insurer’s product page depending on the type of plan you will avail of.

1. World Nomads

Service coverage: Worldwide Prices start at: $38 for Standard Plan; $42 for Explorer Plan

World Nomads Pty Ltd is a travel insurance company based in Sydney, Australia. It was founded in 1999 and has been a go-to insurance provider for most independent (and adventurous) travelers worldwide.

Policy coverage:

They provide emergency medical support, evacuation assistance, trip cancellation, and even include coverage for adventure sports and activities (which is not usually provided by other insurance companies).

If you check their site, you’ll see that they offer a myriad of insurance features that the more “Active” nomads will find useful. These include the following:

- Pain relieving dental treatment

- Prescribed medicines by a doctor or specialist

- Daily emergency cash allowance in hospital

- Hospitalization or treatment by a doctor or specialist

- Physiotherapy or chiropractic treatment

- Treatment by acupuncture or osteopath

- Counseling after an assault or mugging

- Sports & adventure activities

- Study, work and volunteer

2. AXA iON – Smart Traveler

Service coverage: Worldwide Prices start at: Php 990 (Essential Plan)

AXA iON is AXA Philippines’ travel insurance service. They have a pretty comprehensive list of options which includes the following:

Policy Coverage:

- Personal accident

- Emergency Medical Evacuation and Repatriation

- Travel Inconveniences

- Personal Belongings

- Other Benefits (Personal liability, hijacking, kidnapping, funeral and burial expenses)

3. AIG Travel Guard

Service coverage: Worldwide Prices start at: Php 400 (1 to 4 days)

AIG is a global insurance company that has been around for decades, catering to businesses, institutions, and individuals worldwide. One of their products is AIG Travel Guard, which is focused on providing insurance solutions to traveling individuals.

- Medical expense

- Medical evacuation

- Repatriation expense

- Child Guard

- Compassionate visit

- Baggage delay

- Trip cancellation

- Trip termination

- Baggage and personal effects

- Flight delay

- Loss of travel documents

- Personal liability

4. Fortune General

Service coverage: Worldwide Prices start at: Php 900 (1 week)

Fortune General (FGen), has revamped its travel insurance services to include more features. They provide insurance for people traveling to Asia, Schengen (Europe), and to the rest of the world.

- Accidental benefit

- Medical expense and hospitalization

- Medical evac or repatriation

- Emergency Dental Care

- Repatriation of Family Member

- Repatriation of Mortal Remains

- Compassionate Emergency Visits

- Compassionate Emergency Return

- Care for Minor Children

- Flight Delay

- Missed connecting flight

- Trip diversion

- Strikes and aircraft hijacking

- Emergency trip cancellation

- Emergency trip termination

- Personal belongings and baggage

- Other services

5. Pacific Cross

Service coverage: Worldwide Prices start at: Php 500 (Executive Peso Plan)

Pacific Cross is a medical, accident, and travel insurance service provider. It was founded in the Philippines and now operates across various branches across Asia.

Their market focus is on ASEAN countries, providing insurance products to residents in the Philippines, Thailand, Vietnam, Cambodia, Indonesia, and Hong Kong.

- In-patient and Out-Patient care

- Emergency dental treatment

- Emergency room availment and in-patient reimbursement for pre-existing conditions

- Recreational activities

- Recreational extreme sports

- Implants coverage necessitated by a covered accident

- Hospital income

- Funeral and burial expenses

- Land vehicle rental excess protection

6. Malayan Travel Master

Service coverage: Worldwide Prices start at: Php 375 (4 days in ASEAN)

Malaysian Travel Master touts itself as “The most comprehensive international travel health insurance in the Philippines”. They offer competitive pricing on their packages and caters to both local and international travels.

- Personal Accident

- Emergency medical treatment (excluding pre-existing conditions)

- Recovery of travel expenses

- Travel inconvenience benefits

- Travel assistance benefits

- Value-added features

7. MAPFRE Philippines

Service coverage: Worldwide Get a quote: Contact MAPFRE at [email protected]

MAPFRE Insular offers non-life insurance packages which are mainly focused on motor vehicles and other niche areas like engineering, marine cargo, fire, and allied lines, surety and microinsurance.

They currently offer a Travel Insurance package for both international and domestic use.

- Medical expenses and hospitalization benefits

- Trip cancellation and curtailment benefit

- Accidental death and permanent disability of insured

- Repatriation of mortal remains

8. FPG Insurance

Service coverage: Worldwide Prices start at: Php 450 (Classic Plan – 4 days)

Operating under the Zuellig Group of Companies, FPG Travel is the company’s insurance offering for individuals who need protection during their travels.

- Medical treatment/expenses

- Emergency dental care

- Medical evacuation and repatriation

- Return of a family member when traveling with the insured

- Trip cancellation and curtailment

- Delayed departure

- Loss of travel documents and money

- Luggage delay

9. Standard Insurance

Service coverage: Worldwide Prices start at: Php 495 (Asia Protect Peso – 8 days)

Standard Insurance offers both ASEAN and International travel insurance packages. They offer competitive rates for as little as Php 500 for a coverage of up to Php 500,000 (ASEAN).

- Emergency Medical Assistance

- Emergency Travel Assistance

- Travel Inconvenience Benefits

- Personal Liability Benefit

- Personal Accident Liability

10. Pioneer Insurance

Service coverage: Worldwide Prices start at: Php 399 (ASEAN 4 days)

Pioneer Life Inc was established in 1964 and is currently 100% Filipino-owned after the joint venture with Allianz AG of Germany in 2003.

- Emergency trip cancellation and termination

- Damage to baggage

- Loss of baggage

- Loss of personal money

- Loss of Travel documents

5 Tips for Buying the Best Travel Insurance

Tip #1: determine what type of insurance you need.

Before choosing a travel insurance, you should ask yourself the following questions:

- What type of activities will I be doing on the trip?

- Will I be carrying valuable possessions or baggage?

- Is there a chance or reason for the trip to get canceled?

- How much am I willing to pay for insurance?

- Does this company have a decent track record?

And other similar questions. The goal is to have a nice checklist that ticks off everything you think you’ll need for the trip.

For example, say you’re a professional photographer. You’ll be traveling to Europe for a paid assignment. Since you’ll be carrying valuable (read: expensive) gear, it’s crucial that the travel insurance you get prioritizes coverage for possessions and/or baggage-related assistance.

Tip #2: Make sure it has sufficient medical coverage

Seasoned travelers will tell you that the most expensive potential money drain (if you don’t have travel insurance) are medical-related. Accidents and injuries can range from minor to serious, easily costing you thousands of pesos from your own pocket.

A good travel insurance policy should be big enough to cover both minor and major medical issues.

Also, try to get one that has separate coverage for emergency evacuation. Since you’ll be getting insurance anyway, better get the best one you can afford.

Having the option to have a helicopter fly you off to the nearest hospital during a medical emergency (during your travels to hard-to-reach locations) or natural disaster/calamity is highly valuable and could spell the difference between life or death.

Tip #3: As with any agreements or contracts, you should always check the fine print.

Two companies might offer similar-looking plans but the other is cheaper.

What’s the deal?

Almost always, you’ll know it by reading the fine print carefully. One might be cheaper, but with it comes a slower and more painful claims process.

The speed of getting your claims can make or break a trip, so better be careful in choosing your insurance so you won’t regret it later.

Tip #4: Take advantage of your credit card perks

Most credit card companies include travel insurance as one of the perks for their travel-focused credit cards. It’s part of their “Frequent Traveler’s” package and it can prove valuable for saving yourself a couple of hundred to a few thousand pesos for travel insurance.

Check out our list for best credit cards for travel to know more which ones provide free travel insurance.

Tip #5: Know what’s not included in your policy

Again, this goes along with doing your homework as you decide on which travel insurance company to go with.

What’s not usually covered:

- Extreme adventure activities (though some insurers provide packages for these types of activities)

- Alcohol and drug-related incidents

- Baggage/luggage issues due to the carelessness of policyholder

- Pre-existing conditions (double-check with the insurer)

Bonus tip: Purchase travel insurance at least 2 days before your trip.

Most policies get activated within 24-48 hours within approval. You don’t want to head out without adequate protection activated yet. Be safe, apply and get approved early.

Check with the insurer to confirm the exact date of when the insurance will apply.

How to Claim your Travel Insurance

It’s quite easy, actually. You just need to contact your insurer via their preferred method.

They will then ask you to submit the required documents to serve as proof of the validity of the claim.

In general, it’s a good idea to provide as much documentation as you can so as to avoid any further delay brought about by insufficient requirements.

Always check with your insurance provider what they will need exactly to approve your claim as it may vary from one insurer to another.

Required documents for claiming travel insurance due to trip cancellation:

- Documentation supporting the reason why you need/had to cancel the trip

- Invoice of trip expenses which may include the details (what, when, where) of the trip itself, airline tickets, room or hotel accommodation receipts

- Receipts and itemized bills for all trip expenses

- Physician’s statement (for medical-related incidents)

- Police reports (for stolen baggage or vehicular accidents)

- Unused tickets

In conclusion:

Benjamin Franklin once said, “By failing to prepare, you are preparing to fail”.

Travel insurance is one of those things that you need but hope you’ll never need to use. That’s just the way insurance works. Should you do, however, you’ll be thankful you have it.

Remember: Don’t be penny wise and pound foolish . A few hundred pesos for travel insurance is a tiny price to pay for protection from potentially massive expense later. Save yourself from this trouble and get adequate protection.

Disclaimer: Grit PH strives to post up-to-date information on all investment, banking, and other financial products we feature. However, information may change without notice. Therefore, we do not guarantee the accuracy of the information listed on the website, including those provided by third parties at any particular time.

It is best to review the updated terms and conditions of your chosen financial institution. Grit PH is not affiliated with the companies mentioned in the article. All testimonials and opinions are representative only of the writer’s experience, but the results will be unique to each individual.

About Amiel Pineda

Amiel Pineda is the Head of Content at Grit PH.

He started freelance writing in 2010 doing product reviews and tech news. In 2018, he became a full-time freelancer, writing in the financial space and creating content for clients in various niches.

Prior to freelancing full-time, he worked 7 years in the financial services industry for a Fortune 500 company.

He also writes on his personal blog, Homebased Pinoy (https://homebasedpinoy.com/), where he shares tips and guides as a work-from-home freelancer, along with NFT-game guides.

Education: Technological Institute of the Philippines (Bachelor of Science in Electrical Engineering) Focus: Freelancing, Entrepreneurship, Financial Products, Investing & Personal Finance

Reader Interactions

February 10, 2019 at 1:04 pm

What travel insurance for old but fit, 86 year old can you recommend?

April 15, 2019 at 2:31 am

This is actually helpful, thanks.

May 22, 2019 at 12:42 pm

Medical insurance to use working abroad such as USA?

August 12, 2019 at 3:33 am

Hi Amiel, thanks for this. When World Nomads stopped supporting Filipino travelers early this year, we had to search for alternatives which are not as good as what World Nomads offered. This is really helpful. I just have some follow up questions: 1. Are these the “best” or “the only” providers offering travel insurance to Filipinos? 2. If the best, what was your criteria for saying that? 3. Is your list ranked from best to worst among the list of the best? 4. What then in your opinion is the best among these and why? Thanks. Gio

September 28, 2019 at 1:30 am

Do you know any travel insurance companies that offer insurance to travelers aged 70+? It seems like all of them stops at 70 year olds 😭

November 15, 2021 at 9:42 pm

Hi, would you know insurance companies offering travel insurance with covid19 coverage and covers travelers 75 years old and above as well? Thank you.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

We need your help!

Our team is currently conducting research for an upcoming guide focusing on starting a business in the Philippines . We would greatly appreciate your contribution, which should only require a few seconds of your time.

Thank you in advance!

- Digital Marketing

- Search Engine Optimization (SEO)

- Digital PR & Link Building

- Social Media Marketing

- Digital Advertising (PPC & Social)

- Content Marketing

- Copywriting

- Email Marketing

- Conversion Optimization

- Web/App Development

- Ecommerce Development

Please enable JavaScript in your browser to complete this form. Name * Location of Business * Number of Employees * 1 - 10 11 -50 51 - 100 100 - 500 500+ Phone Number * Email * Insurance Company Standard Insurance AXA Philippines BDO AIG Submit

Please enable JavaScript in your browser to complete this form. Full Name * Company Name * Mobile Number * Email Address * Submit

Please enable JavaScript in your browser to complete this form. Name * Contact Number * Email Address * Target Location Preferred Developer * Ayala Land SM Prime Megaworld Alveo Land DMCI Homes Federal Land Robinsons Land Corp Vista Land and Lifescapes Filinvest Land Shang Properties Century Properties Empire East Rockwell Land Email Submit

Disclosure: Your personal details will not be shared with any third-party companies. We’ll just need your contact details so our resident real estate agents can reach you to provide you with the details for any of the listed property developments you’re interested to invest in.

Please enable JavaScript in your browser to complete this form. Name * Age * Location* Phone Number * Email Address * Insurance Company Sun Life Financial Pru Life U.K. AXA Philippines AIA Philippines Manulife Insular Life BPI-AIA BDO Life Etiqa FWD Insurance Allianz PNB Life Email Get a Quote

Disclosure: Your personal details will not be shared with any third-party companies. We’ll just need your contact details so our resident financial advisors can reach you to provide you with the details for any of the listed insurance company you’re interested in.

- Chubb in Philippines

- Corporate News

- Philippines News

- Media Resources

- General enquiry form

Individual Travel Insurance

Traveling is more enjoyable when you’re insured against the unexpected – be it lost passports or flight delays. We provide a travel insurance cover directly to you and your family members, with access to a medical services hotline no matter where you are. So whether you’re an occasional traveler or a global jetsetter, there’s tailor-made protection for you.

Coverage Highlights

What it covers.

- Necessary Medical Expenses

- Emergency Medical Evacuation and Repatriation

- Travel Delay or Cancellation

- 24/7 Emergency Medical and Travel Assistance

- Chubb Travel Insurance provides you with cover for risks including medical expenses, trip cancellation costs, flight or baggage delay and personal accidents

- Chubb offers Single Trip and Annual Plans for international and domestic travels

- Chubb Travel Insurance policyholders have access to Chubb Assistance, a global support network comprised of a team of medical experts who can assist by providing you a referral service if you become sick or injured overseas. No matter where you are in the world, a simple reverse charge call will give you 24-hour access to our assistance hotline.

Related Articles

- Travel Safe And Sound

Have a question or need more information?

How to Buy Affordable Travel Insurance Online (PGA SOMPO TravelJOY Plus – Philippines)

It’s a question we get all the time in varying forms: Is travel insurance really necessary? Kailangan ba talaga ng travel insurance?

And our resounding answer is always the same: YES!

It’s easy to dismiss insurance. When planning a trip, we only picture ourselves having a blast, with everything running smoothly. We don’t really (want to) think about accidents, illnesses or untoward events. Most of the time, we don’t feel it because you don’t need to use it. But that’s exactly the point. Travel insurance is that one thing you wish you won’t have to use, but when something unfortunate happens, you’d be thanking the heavens that you have it. Because, guess what, when traveling, things don’t always go as planned.

Bad things can happen when traveling. We know travelers who met a severe accident in Taiwan, who lost their baggage in Europe, and who were terribly inconvenienced by flight delays. We don’t even need to look far. One of our close friends was rushed to the hospital after his appendix suddenly burst with no warning in Thailand. And we, ourselves, have been robbed while on the road.

So yes, without question, we always recommend getting a travel insurance. But how do you find one that is easy to get and easy on the pocket?

Thankfully, getting a budget-friendly insurance is now more convenient than ever before. PGA SOMPO , a joint venture of the two of the most trusted insurance companies in the Philippines and Japan, brings you TravelJOY Plus . And it’s collaborating with The Poor Traveler to make travel insurance more affordable and more accessible to the readers of this blog.

By visiting the PGA Sompo page and using the code WORTHIT , you can get a special affordable rate on your TravelJOY Plus insurance.

Whether you’re traveling in or out of Asia or you’re applying for a Schengen visa , you can use this code to score a special rate on TravelJOY Plus products.

If you need more help, here’s our step-by-step process on how you could easily purchase an affordable policy online.

WHAT'S COVERED IN THIS GUIDE?

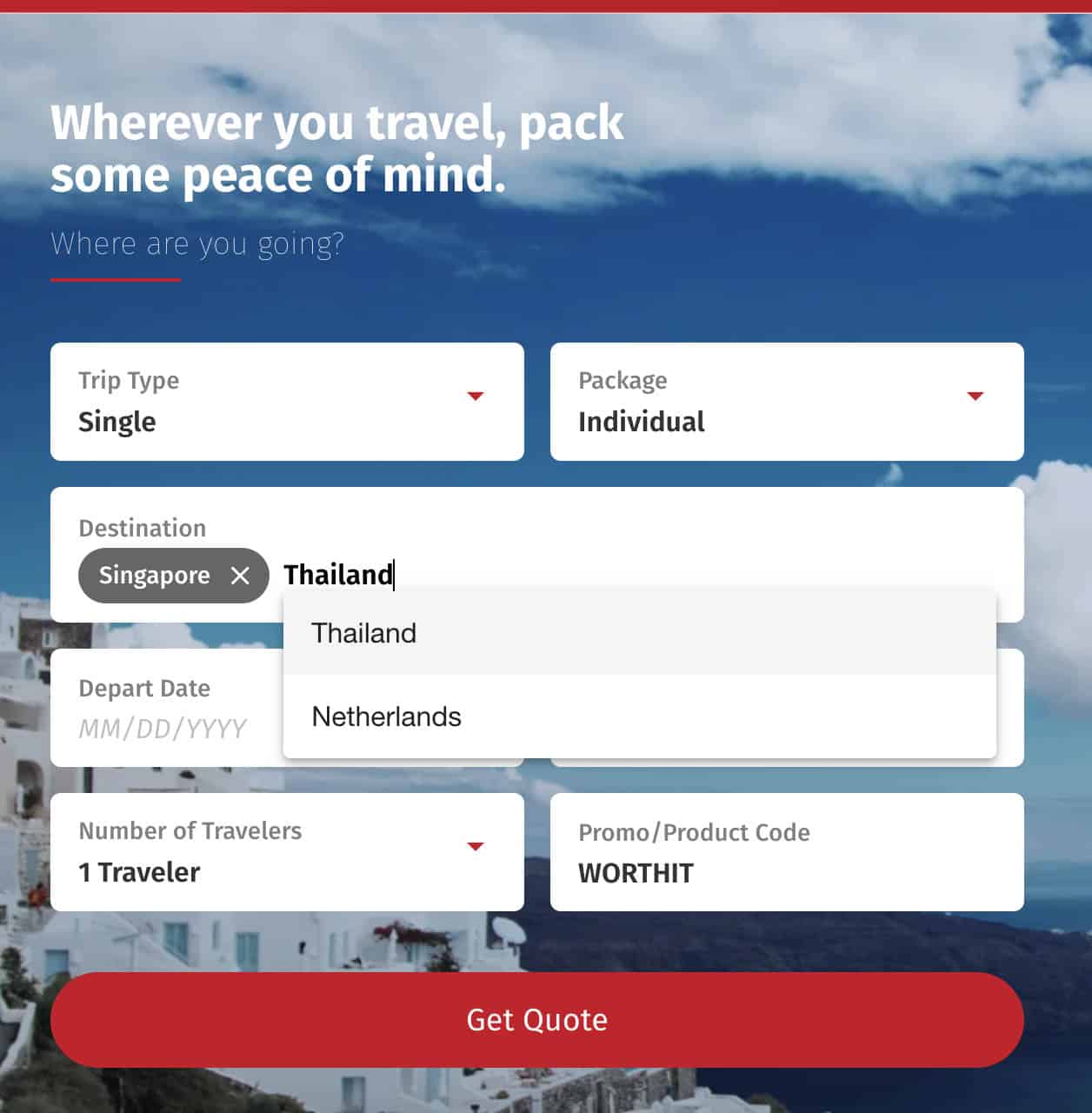

1. Visit the TravelJOY Plus website.

You can find it right here .

You’ll be greeted by a short form asking for the following information:

- Trip type (single or annual multi-trip): If you need a policy for just one trip, choose SINGLE . (If you’re traveling a lot, consider the ANNUAL MULTI-TRIP option, which covers the trips you make for the entire year.)

- Package: Choose INDIVIDUAL .

- Destinations: Enter ALL the countries or territories that you intend to visit. The system will choose the appropriate plan for you, depending on the countries you select. For example, if you enter a country within the Schengen Zone, the system will automatically detect that you need a plan that meets the Schengen visa requirement and is accredited in that country.

- Depart Date: the date you’re leaving your usual residence for the trip.

- Return Date: the date you’ll arrive at your usual residence after the trip.

- Number of Travelers: You can choose up to five. If you’re a bigger group, you may book another batch.

- Promo/Product Code: Enter WORTHIT to avail of a special rate.

Once the form is filled out, click GET QUOTE .

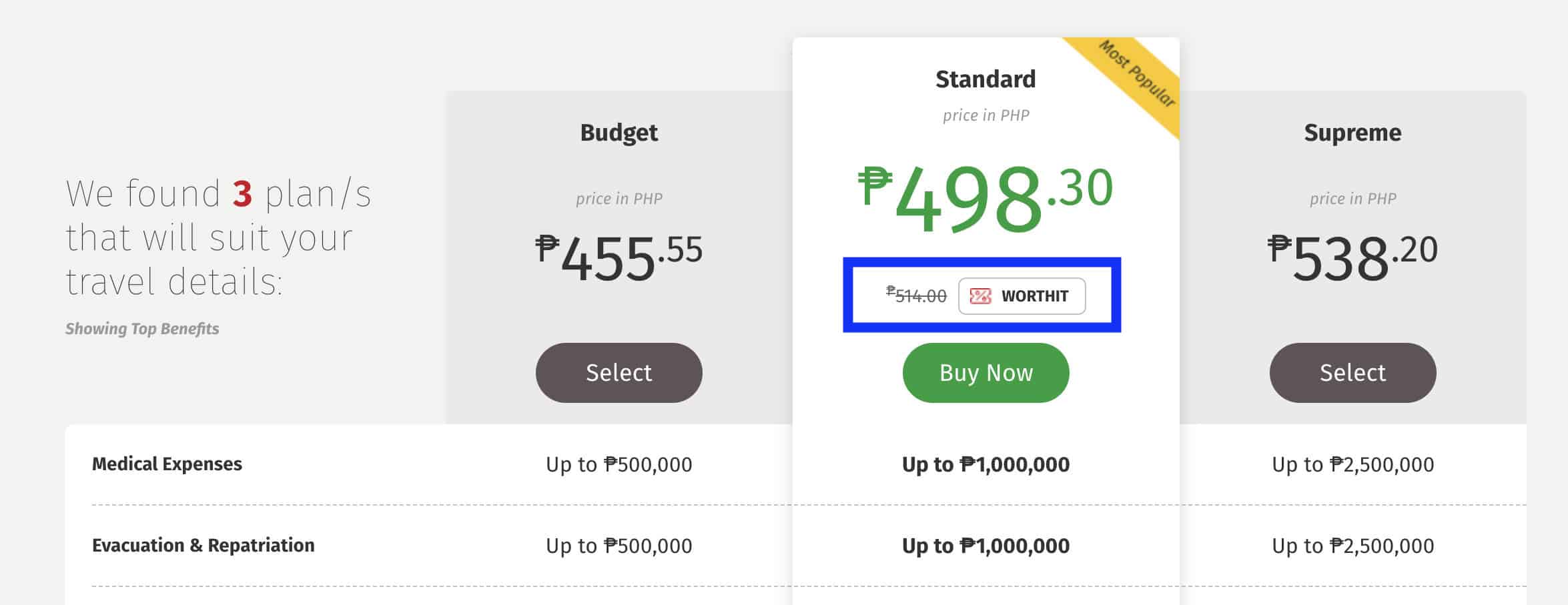

2. Pick the plan that suits your budget and requirements.

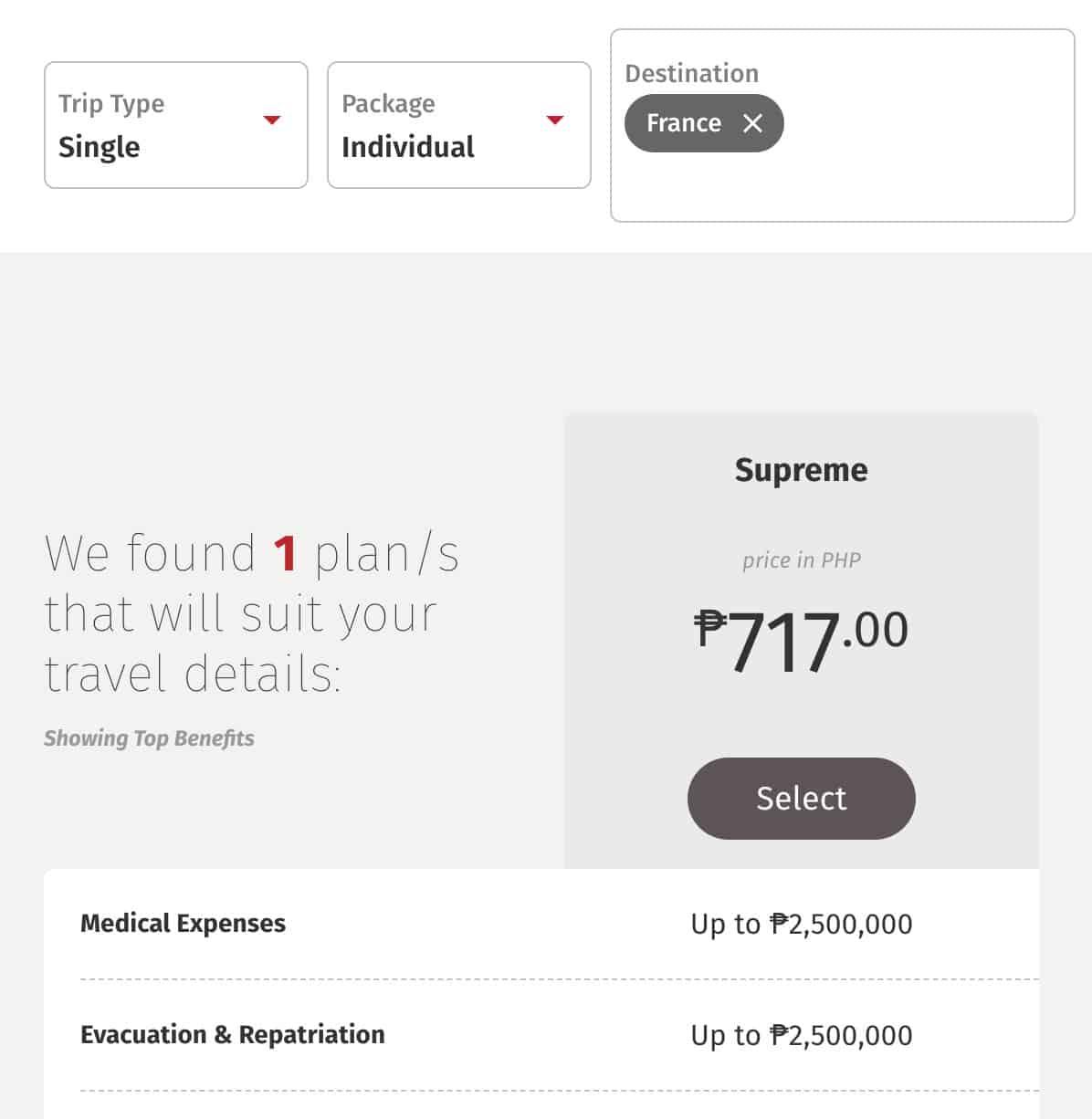

On the next page, you’ll be presented with your options. In most cases, you’ll have three options: BUDGET, STANDARD, and SUPREME. Check out the corresponding benefits in the column under each plan.

Note that the system automatically filters out the plans that don’t apply to the countries you entered in the previous page. For example, if you enter any Schengen country — say, France or Italy — it will show you only one plan, SUPREME, because it’s the one that is acceptable to the Schengen embassies. It’s pretty smart and savvy!

Note: The price varies depending on the destination countries and the duration of your trip.

Once you’ve made up your mind, click in SELECT (if the plan you choose isn’t highlighted yet) or BUY NOW .

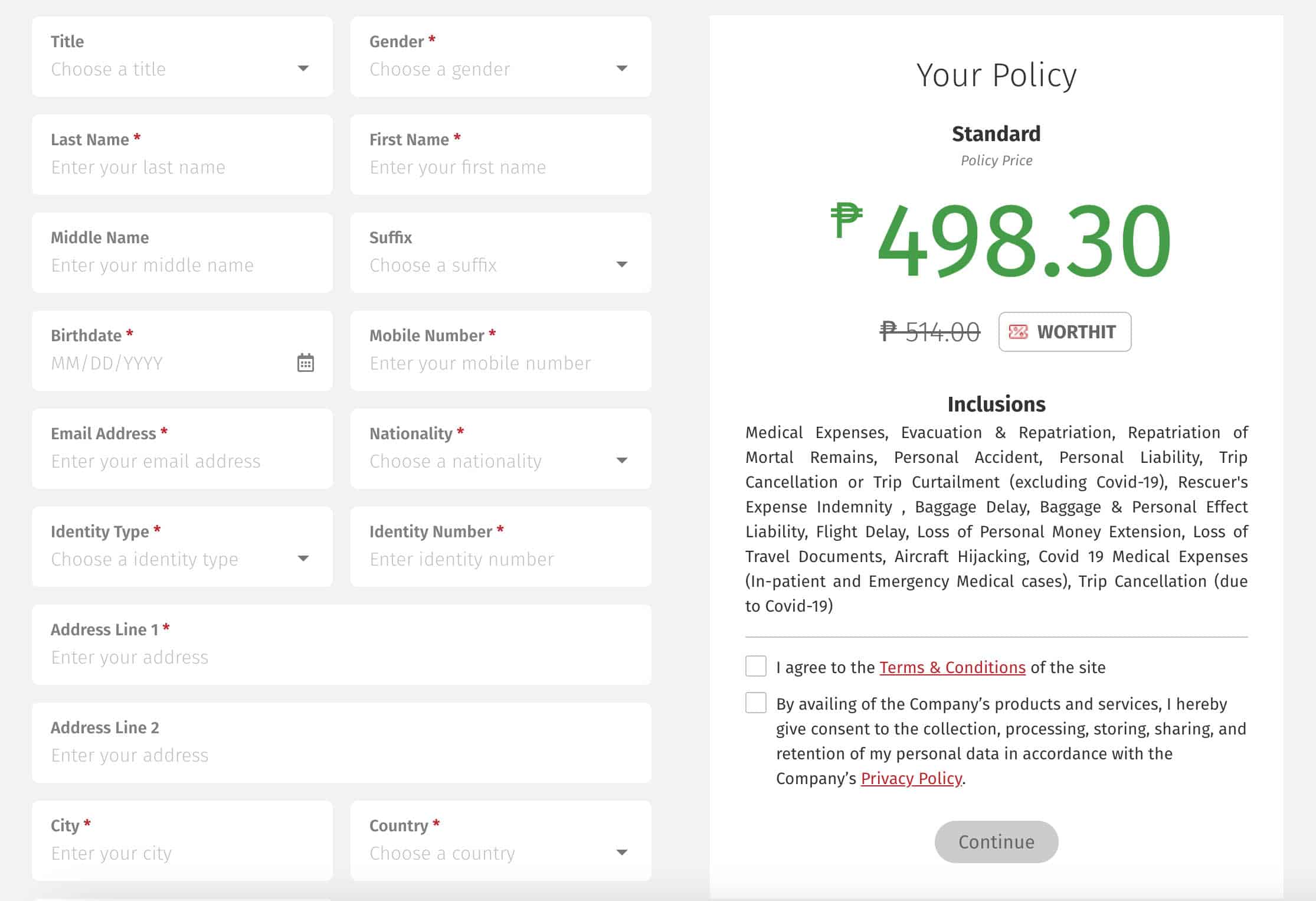

3. Enter your personal information.

The next page will show you a form. Input your personal details correctly.

You’ll find two (3) main sections here: the Applicant, the Insured Person(s), and the Beneficiary.

Under the Applicant Details part, type in your information. If you’re a group, only one needs to fill it out. Below it are the fields for the insured persons, which can be up to 5 heads. If you, the applicant, is part of the party to be insured, you may just tick the “ Copy Applicant details to Insured Persons ” button to automatically duplicate your answers and avoid typing them all over again.

Here are some of the details needed:

- contact number

- email address

- nationality

- ID type and number

Towards the bottom, you’ll find a short form about your beneficiary. Enter their details. This is optional, though. If you leave it blank, it will automatically consider “Succession of Law”.

Agree to the Terms and Conditions as well as the Privacy Policy , and click CONTINUE .

4. Pay for your policy.

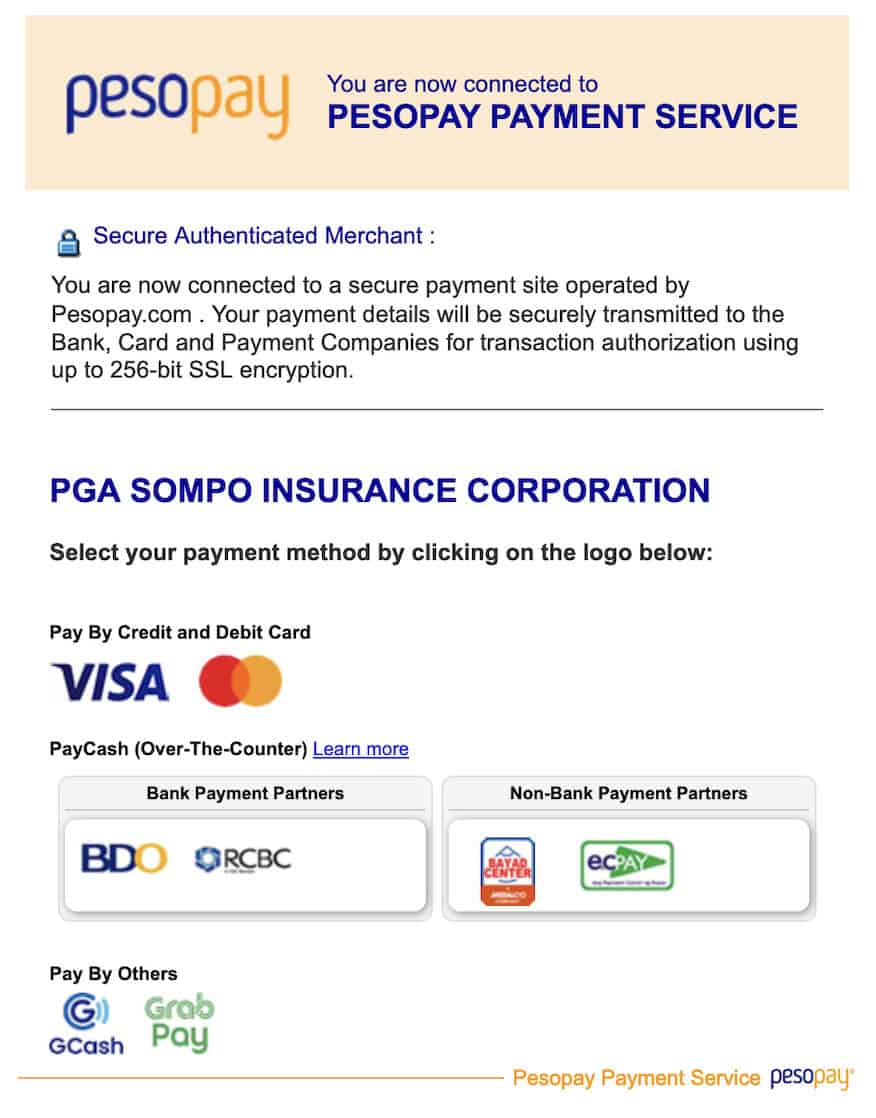

You will be redirected to the PesoPay Payment Service . Don’t freak out if the look and feel of the page changes. PesoPay which is the official payment partner of PGA SOMPO.

It will list down the available payment options, which are:

- Visa or MasterCard credit card or debit card

- BDO (over the counter)

- RCBC (over the counter)

- Bayad Center

Click on the logo of your chosen payment method.

If via card, you’ll be required to enter your credit card or debit card details.

If via GCash, you’ll be required to log in to your GCash account.

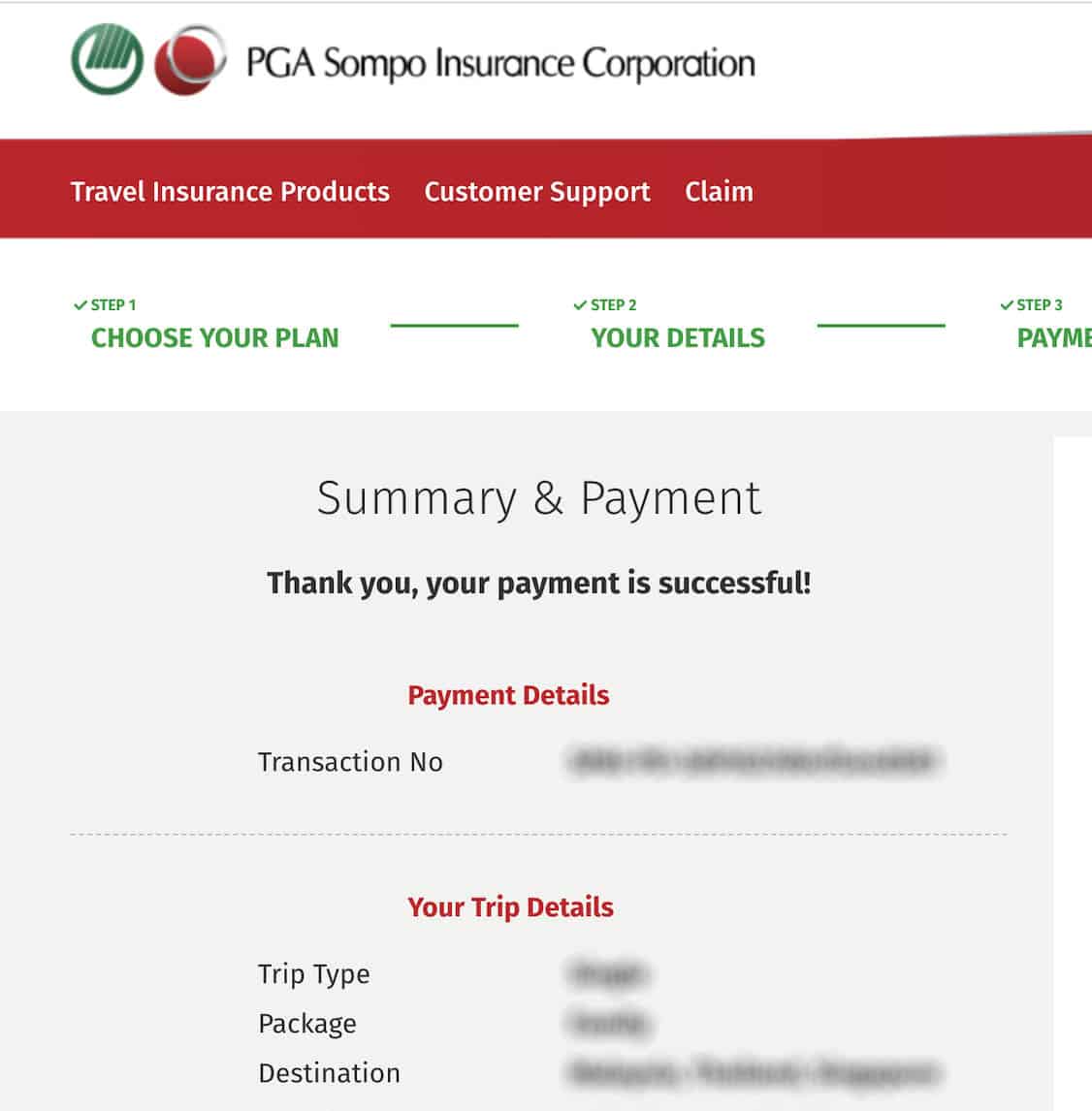

Once payment is complete, the screen will display a Transaction Result. Save or take a screenshot of it before moving on.

Then click CONTINUE . It will take you back to the PGA SOMPO website with a summary of your purchase.

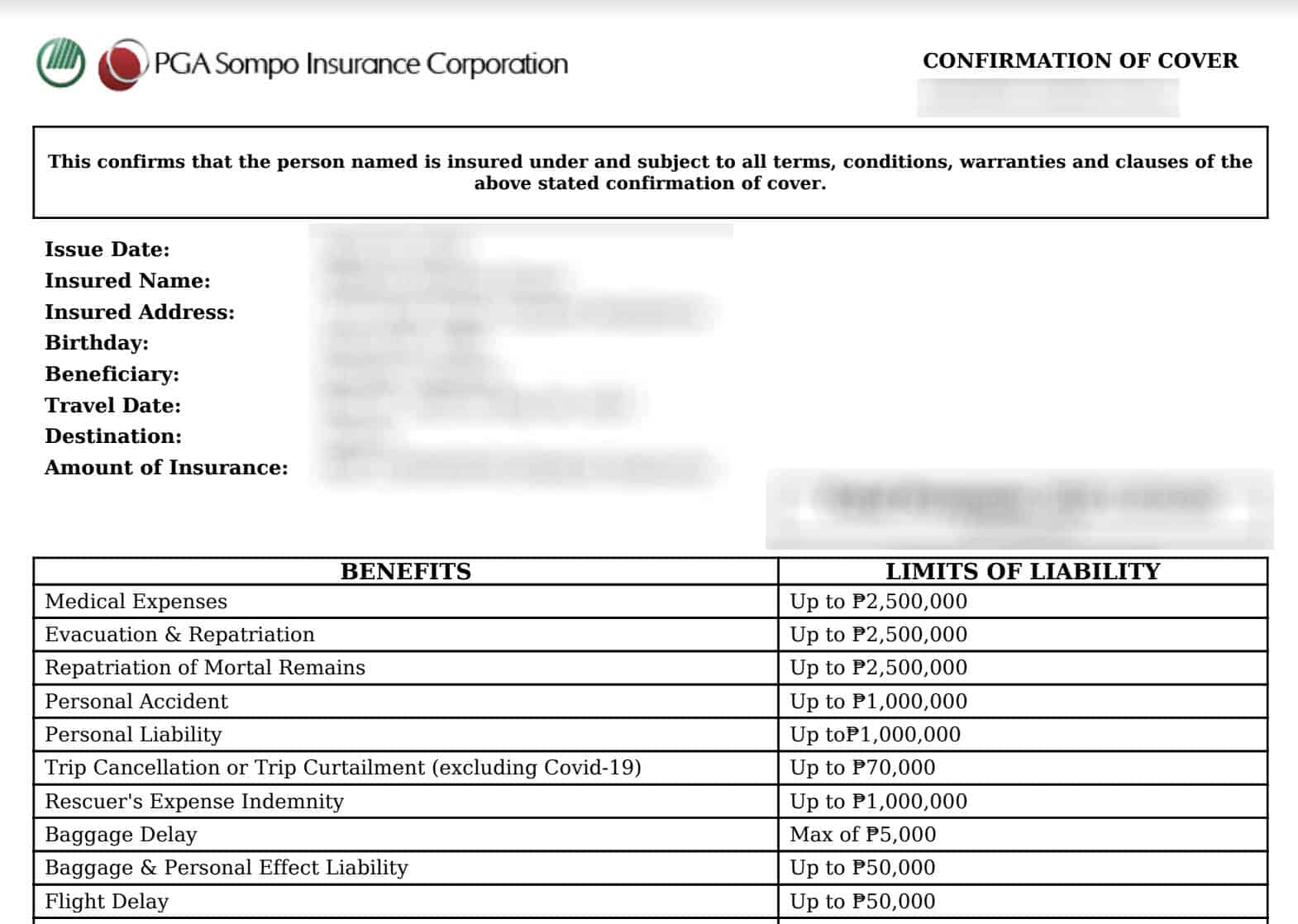

5. Save your Confirmation of Cover.

Check your email, where you’ll receive a copy of the Confirmation of Cover (COC).

It looks like this:

Keep a copy of it or print it out as needed.

FREQUENTLY ASKED QUESTIONS

Is travel insurance required when traveling abroad.

That depends on your destination country or territory. Some countries do require a travel insurance in their visa application process. The best example of that is the Schengen visa, used to enter these 27 European states:

Austria Belgium Croatia Czech Republic Denmark Estonia Finland France Germany Greece Hungary Iceland Italy Latvia Liechtenstein Lithuania Luxembourg Malta Netherlands Norway Poland Portugal Slovakia Slovenia Spain Sweden Switzerland

Some countries and territories may also require travel insurance upon entry, so best to double check with the respective embassy to be sure.

For many others, insurance is not required. But even so, we urge you to get one and be protected. Just because it’s not required in your destination doesn’t mean you should dismiss it. Bad things can happen when traveling, and you’ll never know when you’d actually need it. Best to be prepared. With travel insurance, you can enjoy your trips worry-free!

What is PGA SOMPO TravelJOY Plus? What are its benefits?

TravelJOY Plus is the travel insurance offered by PGA SOMPO , a joint venture of Prudential Guarantee and Assurance, the top non-life insurance company in the Philippines, and Sompo Holdings, a leading non-life insurance company in Japan. Both are known for providing high-quality service.

Together, they put together TravelJoy, which can give travelers like you relief and compensation for untoward incidents like personal accidents, medical emergencies, flight or baggage delays, trip cancellation, evacuation, loss of money, and more! COVID-19 coverage is also included!

How much is TravelJOY Plus?

One great thing about TravelJOY Plus is its competitive pricing. It is one of the most value-for-money travel insurance products out there. Not only that, aside from its Standard and Supreme plans, it also has a BUDGET OPTION, perfect for shoestring travelers.

You can avail of a plan for as low as PHP 469 for Asia or PHP 475 for Japan, Middle East, and many other countries (for 1-4 days). The Schengen-accredited Supreme plan costs PHP 717 (1-4 days), and this also applies not just to the countries within the Schengen Zone but also the UK, Ireland, Turkey, and European Russia.

Here’s the full price list. But just in case there are cost movements in the future, best to visit this page to get a more updated quote.

Please take note of the following:

- ASIA – excluding Japan, the Philippines, and the Middle Eastern Countries.

- WORLDWIDE – including Japan, Australia, New Zealand, and the Middle East (excluding the Philippines)

- SCHENGEN – Schengen countries + UK, Ireland, Turkey, European Russia (St. Petersburg and Moscow), and the Euro Zone countries.

No need to worry much about it. If you visit PGA Sompo’s booking page , the system will automatically offer you the right plan based on the countries you enter.

Is there a GROUP or FAMILY option?

There used to be a FAMILY option, but it’s currently unavailable. In the meantime, you may choose INDIVIDUAL and select the number of pax that applies to you.

Why choose TravelJOY Plus?

Aside from its competitive prices, PGA SOMPO is part of the Sompo Group which is present in over 30 countries around the world. These Sompo offices worldwide can provide necessary assistance and support should the time come that you need it.

How to contact PGA SOMPO in case something happens?

The TravelJOY Plus Hotline is +632 8866 7388. It’s open 24/7.

Disclosure: This article is made possible through collaboration with PGA SOMPO.

More Tips on YouTube ⬇️⬇️⬇️

Is this post helpful to you?

Related Posts:

- HOW TO AVOID PICKPOCKETS IN EUROPE: 10 Things I Learned from Experience

- Cebu Pacific NEW TRAVEL GUIDELINES: Before, During & After Flight

- List of DOH-BOQ-Accredited QUARANTINE Hotels in CEBU (Near Mactan Cebu Airport)

- List of DOH-BOQ-Accredited QUARANTINE HOTELS in Metro Manila & Near NAIA

- List of DOH-BOQ-Accredited QUARANTINE HOTELS Near CLARK AIRPORT

- BORACAY TRAVEL REQUIREMENTS + How to Visit

- What to Do When You Witness Gender-Based Violence when Traveling

- How to Get Accredited TRAVEL INSURANCE for SCHENGEN VISA Application Online

- Recent Posts

- 2024 Resorts World One HONG KONG CRUISE Guide for First Timers - 13 April 2024

- FLIGHT RESERVATION for VISA • How to Get Dummy Ticket for Schengen, Canada, China and Other Visa Applications - 22 March 2024

- 2024 Cebu Pacific Promos & PISO SALE with List of Covered Destinations - 4 March 2024

Travel insurance is a must when visiting any foreign country not because of the pandemic but for other unforeseen circumstances as well. This blog nicely presents sources to buy budget-friendly insurance.

Featured On

We heard you!

Your comment is now queued for moderation! We’ll try to get back to you soonest. While waiting, follow us on these channels.

Subscribe on Youtube! Follow us on Instagram!

- CTPL Insurance

- Car Insurance

- Travel Insurance

- Flight Delay Insurance

- All Products

- Pay Premium

- How to Claim

- Make a Claim

- Distribution Portal

Travel Insurance in the Philippines

Get started on a journey to fearless adventures. Your passport to worry-free, worldwide travels starts at ₱ 299!

INCLUDES COVID

Annual multi-trip?

Popular Country You can select more than one

- Iran (Islamic Republic of)

- Lao People's Democratic Republic

- Micronesia (Federated States of)

I agree to the Terms & Conditions and Privacy Policy

Insure Instantly. Roam Fearlessly.

Embark on your adventures with confidence, thanks to Oona Travel Insurance. Our flexible coverage plans cater to all kinds of journeys, from international trips requiring Schengen visas to local getaways. Stay a step ahead with our comprehensive policies, including essential Covid-19 protection, flight delay coverage, and lost or delayed baggage assistance. With Oona, you're not just covered; you're ready to take on the world.

Explore a variety of travel insurance plans tailored to meet your travel essentials

International Travel

Starts From

/all-product/travel-insurance/

Domestic Travel

Flight Delay

/all-product/smart-flight-delay/

Why Choose Oona Travel Insurance?

Up to ₱5 million medical coverage, plus more, covid-19 coverage of up to ₱2.5 million, quick online purchase get your policy in minutes, got a question about travel insurance in the philippines.

Explore our FAQ page to find all the information you need.

What happens to my travel insurance if my trip is cancelled?

If your trip is cancelled, your travel insurance typically covers the expenses. This includes reimbursement for unused travel, accommodation, meals, and prepaid activities due to unforeseen events such as death, injury, illness (excluding pre-existing conditions), court summonses, serious home damage, job loss, and more. The coverage starts from when you purchase the policy and lasts until you board your transportation.

What is over booking and does my policy cover it?

Overbooking happens when the airline sells more seats than they have available. If your flight is delayed by over 6 hours because of overbooking, the policy covers reasonable costs for meals, lodging, and airport transfers, as long as the airline or others didn't already provide these for free.

Is travel insurance typically required for Filipino travelers?

Travel insurance isn't required for traveling within the Philippines, or many other places in Asia and worldwide. But if you're heading to Schengen countries, you need international travel insurance, with at least 30,000 EUR coverage. While not necessarily needed elsewhere, we strongly recommend securing travel insurance to ensure a smoother and worry-free experience during your travels.

Is pre-exsiting illness covered under medical & emergency expenses?

No, we don't cover pre-existing conditions initially. However, we do provide first medical aid for emergencies, which includes treatment at hospitals, surgeries, and ambulance services. If it turns out that your condition existed before you got the insurance, we won't cover any further treatments related to it. If your initial coverage limit is reached before we can determine if it's a pre-existing condition, we'll keep providing assistance until we have a diagnosis. If it's not pre-existing, you'll get the regular medical benefits. But if it is, you'll need to pay for any extra costs beyond the initial limit and any excess charges.

What does travel insurance typically not cover?

Travel insurance doesn't usually cover: 1. Actions by the Insured: Such as misconduct, criminal activities, fraud, negligence, recklessness, or mental disorders. 2. Natural Disasters: Like floods, earthquakes, or volcanic eruptions. 3. Terrorism and Conflicts: Including incidents related to terrorism, uprisings, wars, or conflicts. 4. Risky Activities: Such as hazardous sports or dangerous recreational activities. 5. Travel Advisories: Losses in areas with "DO NOT TRAVEL" warnings or due to government actions. 6. Pre-existing Conditions: Such as known health conditions, self-harm, or substance misuse. 7. Other Exclusions: Like personal errors, financial failures of providers, or major unforeseen events. These exclusions help define what's covered and manage risks.

Can I still get travel insurance while already at the airport?

Definitely! With Oona Insurance Travel Online, you can easily purchase travel insurance, anytime, anywhere, and as quickly as possible -- even while waiting for your flight. Just head over to www.myoona.ph and select the Oona travel insurance plan that's right for you. You'd get your policy straight to you inbox with just a few clicks.

What should I do if my checked-in luggage goes missing during my flight and I need to make a claim?

There are just two (2) important steps to make a claim for your lost luggage: 1. Notify the Airline via their Customer Service 2. Report the incident by calling our 24/7 Hotline numbers: +00 632 8459 4727 (outside PH) / (02) 8459 4727 (within PH) , and our team will guide you throughout the whole claims process.

Can I still get travel insurance after booking a trip?

Yes! While airlines typically offer travel insurance as an add-on, you can still avail travel insurance from providers like Oona Insurance. Just be sure to purchase at least a day before you are scheduled to fly out!

Does my policy cover COVID-19? If yes, what are the coverages?

Your policy does not cover COVID-19 by default, but you can easily get travel insurance with COVID-19 coverage as an add-on.

This add-on covers medical treatment/expenses, repatriation of mortal remains, and reimbursements for when your trip is cancelled or cut short, because of COVID-19.

What expenses does my insurance cover if my flight is delayed?

The insurance covers costs like transportation, hotel stay, meals, toiletries, and clothing, up to the limit set in the policy.

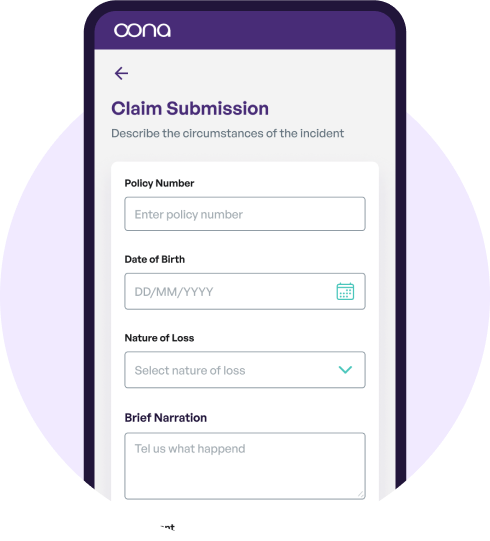

How to file a claim for your travel insurance?

Before you claim

Prepare and collate all the required documents and claim details for submission. Click here to see the required documents .

Submitting the claim

Fill out the online claim form and upload the required documents online.

Make a Claim ----- Other Ways to File a Claim

You can also call our Claims Assistance Hotline (8am to 5pm, M-F) at: Landline: (632) 8876 4400 Smart: 0920 918 6242 Globe: 0917 581 7175 or email: [email protected] (for Motor and Personal Accident Claims) [email protected] (for Non-motor claims) For travel claims: Outside the PH: (+00) 632 8459 4727 Within the PH: (02) 8459 4727 Email: [email protected]

Track your claim

Claim result will be informed within 5 business days upon submissions of all required documents to Oona.

Other Ways to File a Claim

Alternately, you may reach out to our Claim Operation team through the following channels:

Claims Assistance Hotline (8am to 5pm, M-F)

Travel Claims

Providing quality insurance services with leading partners

1220 Acacia Ave., Madrigal Business Park Ayala Alabang Muntinlupa City 1770, Philippines

Follow us on social

Don’t miss out on any updates

- Personal Accident Insurance

- Property Insurance

- OFW Insurance

- Business Insurance

Legal & Compliance

- Privacy Policy

- General Terms & Conditions

Useful Links

- Branch Locators

- Corporate Governance

- Kahoona (Distribution Portal)

Oona Insurance Philippines is licensed by the Insurance Commission of the Philippines with a Non-Life Insurance Certificate of Authority No. 2022/03-R-A.

People applied for our Travel Plan

In the last 2 hours

Additional Covid-19 Coverage available for Individuals and Families ages 0-65 years old. Applicable for International Travel only

Travel Information

Personal Information

Beneficiaries

(excluding surcharge)

Subscribe To Our Newsletter

Join our mailing list to receive latest news and updates., terms of use, privacy policy, customer security, fund price and statistics, head office, 2/f & 3/f morning star center 347 sen. gil j. puyat avenue 1200 makati city philippines, +63 2 8890 1758 +63 2 8895 8519 / 8895 8524.

You will be directed to our secure payment portal to complete your purchase.

Multiple payment options available including credit/debit card, GCash wallet, and over-the-counter.

Please confirm that the details provided below are true and complete.

Travel assistance plan, premium: php xxx, schedule of benefits.

Your password already expired. Please change your password

Dear Valued Clients,

In our continuing effort to improve our services, Etiqa Philippines’ e-commerce systems will be undergoing a scheduled maintenance on October 22, 2019 from 1:00 AM to 3:30 AM .

During this period, you will temporarily be unable to purchase our products online. For your convenience, please purchase before 1:00 AM or after 3:30 AM.

If you have any questions or concerns, you may get in touch with us via our Facebook Page ( https://www.facebook.com/etiqaphilippines/ ) or you may email us at [email protected] Thank you for your continuing support.

Great News!

Terms and conditions of covid 19 rider.

- RT-PCR Test is part of the medical expenses limit and is ONLY covered for symptomatic patients

- Hospitalization due to COVID 19 will only be covered IF medically required and necessary as determined by a medical practitioner based on the condition of the Insured patient.

- Any quarantine expenses are NOT covered either as a requirement upon arrival in the foreign country (i.e., known risk) or as a requirement for a COVID positive Insured.

- We do not cover any medical evacuation / repatriation of people with the active virus.

- We do NOT cover the hospitalization expenses IF the quarantine facility for an asymptomatic or mild case patient is in a hospital in that particular country abroad.

- Medical check-ups due to COVID 19 for symptomatic patients that do not require hospitalizations (i.e., mild cases) IS NOT covered; Only the RT PCR Tests are covered for MILD cases that would not require hospitalization.

- For Trip Cancellation coverage (Prior to leaving the Philippines): “Serious illness understood as any unexpected alteration of the Insured's state of health that involves risk of death or implies hospitalization and makes it impossible to start the contracted tripâ€. If the reason for cancellation is due to COVID 19, the insured is obliged to submit a positive COVID 19 test performed 14 days before the start of the trip. [Contracting COVID 19 would require a positive COVID 19 test to validate that Insured has COVID 19, and would not rely on self-diagnosis or unsubstantiated doctors report.

- EXCLUDES coverage on expenses due to prolonging the stay of a positive COVID 19 who cannot travel but is asymptomatic and has not required medical attention and carrying out COVID 19 tests as a preventive measure or in asymptomatic policyholders, expenses related to mandatory quarantines without medical criteria. For those who have undergone hospitalization, our policy has a standard wording that only allows allow automatic extension of up to 10 days only from the initial expiry date if extension is due to a covered illness.

- Commercial gestures related to COVID 19 Coverages, by general definition, will not be allowed unless covered under the Terms and Conditions of this COVID 19 Travel Rider Indemnified Package.

- We reserve the right to the possibility of cancelling the travel insurance subscription to certain destinations if we see the possibility of adverse loss experience or increase in utilization in that particular destination abroad.

- This COVID Rider is specific to COVID-19 ONLY and will not extend to cover any other epidemic, pandemic and any communicable disease declared by any government agency, entity or in an executive order causing a state of emergency in any area and necessitating the setting up of appropriate quarantine measures therein.

- This is applicable to International Travel ONLY

PREMISES OF THE COVERAGE

- Can only be covered as a rider to the Travel Assistance Reinsurance Program and not as a separate / stand-alone new program

- For the purposes of issuance, it can go as an additional coverage or an optional rider that is attached to the contracted policy under the Travel Reinsurance Contract within its particular conditions.

IMPORTANT NOTES

- Quota Sharing

- Annual Minimum Reinsurance Premium (Quarterly Payment)

- Maximum Days of Coverage allowed (Indemnified Program)

- Maximum Age

- Eligible Individuals

- Declaration Mode

- We do NOT cover any medical evacuation / repatriation of people with the active virus.

- Any other epidemic, pandemic and any communicable disease declared by any government agency, entity or in an executive order causing a state of emergency in any area and necessitating the setting up of appropriate quarantine measures therein are also NOT covered under the main travel contract.

- This is applicable to International and Domestic Travel

- Best Travel Insurance 2024

- Cheapest Travel Insurance

- Trip Cancellation Insurance

- Cancel for Any Reason Insurance

- Seniors' Travel Insurance

- Annual Travel Insurance

- Cruise Insurance

- COVID-19 Travel Insurance

- Travel Medical Insurance

- Medical Evacuation Insurance

- Pregnancy Travel Insurance

- Pre-existing Conditions Insurance

- Mexico Travel Insurance

- Italy Travel Insurance

- France Travel Insurance

- Spain Travel Insurance

- Canada Travel Insurance

- UK Travel Insurance

- Germany Travel Insurance

- Bahamas Travel Insurance

- Costa Rica Travel Insurance

- Disney Travel Insurance

- Schengen Travel Insurance

- Is travel insurance worth it?

- Average cost of travel insurance

- Is airline flight insurance worth it?

- Places to travel without a passport

- All travel insurance guides

- Best Pet Insurance 2024

- Cheap Pet Insurance

- Cat Insurance

- Pet Dental Insurance

- Pet Insurance That Pays Vets Directly

- Pet Insurance For Pre-Existing Conditions

- Pet Insurance with No Waiting Period

- Paw Protect Review

- Spot Pet Insurance Review

- Embrace Pet Insurance Review

- Healthy Paws Pet Insurance Review

- Pets Best Insurance Review

- Lemonade Pet Insurance Review

- Pumpkin Pet Insurance Review

- Fetch Pet Insurance Review

- Figo Pet Insurance Review

- CarePlus by Chewy Review

- MetLife Pet Insurance Review

- Average cost of pet insurance

- What does pet insurance cover?

- Is pet insurance worth it?

- How much do cat vaccinations cost?

- How much do dog vaccinations cost?

- All pet insurance guides

- Best Business Insurance 2024

- Business Owner Policy (BOP)

- General Liability Insurance

- E&O Professional Liability Insurance

- Workers' Compensation Insurance

- Commercial Property Insurance

- Cyber Liability Insurance

- Inland Marine Insurance

- Commercial Auto Insurance

- Product Liability Insurance

- Commercial Umbrella Insurance

- Fidelity Bond Insurance

- Business Personal Property Insurance

- Medical Malpractice insurance

- California Workers' Compensation Insurance

- Contractor's Insurance

- Home-Based Business Insurance

- Sole Proprietor's Insurance

- Handyman's Insurance

- Photographer's Insurance

- Esthetician's Insurance

- Salon Insurance

- Personal Trainer's Insurance

- Electrician's Insurance

- E-commerce Business Insurance

- Landscaper's Insurance

- Best Credit Cards of 2024

- Best Credit Card Sign-Up Bonuses

- Best Instant Approval Credit Cards

- Best Cash Back Credit Cards

- Best Rewards Credit Cards

- Best Credit Cards for Bad Credit

- Best Balance Transfer Credit Cards

- Best College Student Credit Cards

- Best 0% APR Credit Cards

- Best First Credit Cards

- Best No Annual Fee Cards

- Best Travel Credit Cards

- Best Hotel Credit Cards

- Best American Express Cards

- Best Amex Delta SkyMiles Cards

- Best American Express Business Cards

- Best Capital One Cards

- Best Capital One Business Cards

- Best Chase Cards

- Best Chase Business Cards

- Best Citi Credit Cards

- Best U.S. Bank Cards

- Best Discover Cards

- Amex Platinum Card Review

- Amex Gold Card Review

- Amex Blue Cash Preferred Review

- Amex Blue Cash Everyday Review

- Capital One Venture Card Review

- Capital One Venture X Card Review

- Capital One SavorOne Card Review

- Capital One Quicksilver Card Review

- Chase Sapphire Reserve Review

- Chase Sapphire Preferred Review

- United Explorer Review

- United Club Infinite Review

- Amex Gold vs. Platinum

- Amex Platinum vs. Chase Sapphire Reserve

- Capital One Venture vs. Venture X

- Capital One Venture X vs. Chase Sapphire Reserve

- Capital One SavorOne vs. Quicksilver

- Chase Sapphire Preferred vs. Capital One Venture

- Chase Sapphire Preferred vs. Amex Gold

- Delta Reserve vs. Amex Platinum

- Chase Sapphire Preferred vs. Reserve

- How to Get Amex Pre-Approval

- Amex Travel Insurance Explained

- Chase Sapphire Travel Insurance Guide

- Chase Pay Yourself Back

- CLEAR vs. TSA PreCheck

- Global Entry vs. TSA Precheck

- Costco Payment Methods

- All Credit Card Guides

- Citibank Savings Account Interest Rate

- Capital One Savings Account Interest Rate

- American Express Savings Account Interest Rate

- Western Alliance Savings Account Interest Rate

- Barclays Savings Account Interest Rate

- Discover Savings Account Interest Rate

- Chase Savings Account Interest Rate

- U.S. Bank Savings Account Interest Rate

- Marcus Savings Account Interest Rate

- Synchrony Bank Savings Account Interest Rate

- Ally Savings Account Interest Rate

- Bank of America Savings Account Interest Rate

- Wells Fargo Savings Account Interest Rates

- SoFi Savings Account Interest Rate

- Best Savings Accounts & Interest Rates

- Best High Yield Savings Accounts

- Best 7% Interest Savings Accounts

- Best 5% Interest Savings Accounts

- Savings Interest Calculator

- Emergency Fund Calculator

- Pros and Cons of High-Yield Savings Accounts

- Types of Savings Accounts

- Checking vs Savings Accounts

- Average Savings by Age

- How Much Should I Have in Savings?

- How to Make Money

- How to Save Money

- Compare Best Checking Accounts

- Compare Online Checking Accounts

- Best Business Checking Accounts

- Compare Best Teen Checking Accounts

- Best Student Checking Accounts

- Best Joint Checking Accounts

- Best Second Chance Checking Accounts

- Chase Checking Account Review

- Bluevine Business Checking Review

- Amex Rewards Checking Account Review

- E&O Professional Liability Insurance

- Best Savings Accounts & Interest Rates

- All Insurance Guides

- Philippines Travel Insurance

On This Page

- Key takeaways

Is travel insurance required to visit the Philippines?

Our top picks for the best philippines travel insurance, philippines travel information & requirements, what does travel insurance for the philippines cover, what isn’t covered by travel insurance for the philippines, how much does travel insurance for the philippines cost, how to get the best philippines travel insurance, faq: philippines travel insurance, related topics.

Philippines Travel Insurance: Coverage Requirements & Costs

- You’re not required to purchase travel insurance to visit the Philippines, but you should purchase a policy anyway.

- Our top picks for travel insurance for a trip to the Philippines come from Tin Leg, Seven Corners, and Generali Global Assistance.

- It’s especially important to have travel medical insurance because US private insurance and Medicare will not work in the Philippines.

- In addition to medical emergencies, travel insurance can also protect you against flight delays, trip interruptions, loss of luggage, and other unexpected events.

- We recommend using an online comparison tool to find the right travel insurance to suit your needs for your trip to the Philippines. This way, you can compare multiple quotes and coverage options at once and get the best deal.

Our top picks for the best philippines travel insurance

- Tin Leg: Best Rated Travel Insurance

- Seven Corners: Best Value for Medical Emergencies

- Generali Global Assistance: Best Value Travel Insurance

Seven Corners

Generali global assistance.

Travel insurance isn’t legally required to visit the Philippines. However, we strongly recommend that you buy travel insurance before your trip. Your US health insurance will not be valid during your vacation to the Philippines . A travel insurance policy minimizes your losses in the event of a medical emergency or other covered event.

Best Rated Travel Insurance

Why we like it.

- Excellent primary coverage for medical expenses

- High limit for emergency evacuation coverage

- Optional cancel for any reason (CFAR) coverage available

- Comes with coverage for hurricanes and inclement weather

- Coverage for pre-existing conditions is available if purchased within 14 days of the trip deposit

- Baggage delay coverage requires a 24-hour waiting period

- Low coverage limits for baggage and personal effects

Best Value for Medical Emergencies

- Offers coverage for pre-existing conditions

- Money-back guarantee

- Cancellation & Interruption coverage standard

- Covers action sports & equipment

- Cancel for any reason not included standard

- Must meet waiver for pre-existing conditions to be covered

Best Value Travel Insurance

- Lowest cost of all Generali Global Assistance plans

- 24/7 emergency travel assistance included

- Telemedicine included

- Lower coverage than other Generali plans

- Pre-existing conditions are not covered by the Standard plan

- No coverage for accidental death and dismemberment during on-land travel

Here’s an overview of what you can expect when traveling to the Philippines

Do I need a visa to travel to the Philippines?

You don’t need a visa to travel to the Philippines unless you plan to stay there for more than 30 days.

Do I need a passport to visit the Philippines?

Yes. You must have a passport that’s valid for at least six months after your travel date

COVID-19 requirements

All travel restrictions related to COVID-19 have been lifted. You don’t have to present proof of vaccination, test for COVID-19 , or quarantine yourself upon arrival in the Philippines.

Travel insurance for the Philippines covers a wide range of circumstances.

It’s important to understand that some travel insurance policies may be more comprehensive and cover more potential issues than others. The following is a breakdown of standard coverages, but you should always review a provider’s plan to ensure you’re comfortable with the coverage.

Trip cancellation insurance

When you’re excited about a trip, the last thing you want to do is cancel it. Unfortunately, you may have to cancel your trip to the Philippines due to circumstances outside your control. For example, if a close family member passes away a few days before you’re set to depart, you may have to cancel to attend the funeral.

Trip cancellation insurance reimburses you for the prepaid, nonrefundable portion of your trip. This includes hotel accommodations, flights, and prepaid bookings. To qualify for reimbursement, you must cancel the trip for a covered reason. Many companies allow you to cancel due to illness, job loss, or the death of your travel companion.

If you’re concerned about trip cancellation, consider purchasing cancel for any reason (CFAR) insurance . This type of coverage reimburses a significant portion of your prepaid expenses.

Trip delay insurance

Trip delay insurance reimburses you for additional expenses associated with common carrier delays. In travel lingo, a common carrier is a company that offers transportation services to the public as part of its business model. Airlines, railroads, bus companies, and ferries are all examples of common carriers that may be covered by this type of travel insurance.

Once you purchase trip delay insurance, read the policy carefully. You won’t be reimbursed for additional expenses unless the delay lasts for a specific amount of time. For example, you probably won’t qualify for reimbursement due to a 30-minute delay, but you may qualify if your flight is delayed by six hours or more.

This type of coverage reimburses you only for necessary expenses. You can’t go out and buy a new wardrobe, but your insurance company may reimburse you for accommodations, transportation to and from your hotel, meals, toiletries, medication, and other personal items.

Trip interruption insurance

Like trip cancellation insurance, trip interruption coverage reimburses you for prepaid, nonrefundable expenses. The difference is that it only reimburses you if you start your trip and have to end it early for a covered reason. For example, if your travel companion has a heart attack while you’re in the Philippines, your travel insurance may reimburse you for the unused portion of your hotel stay.

Travel medical insurance

Even if you’ve never had any medical problems, there’s always a chance that you’ll develop one during your visit to the Philippines. Travel health insurance covers the cost of lab tests, X-rays, surgery, and other types of medical care, ensuring you don’t have to pay the whole bill yourself.

Medical evacuation insurance

Many types of travel insurance also include medical evacuation coverage , which pays to transport you to the nearest suitable medical facility in an emergency. Let’s say you’re climbing one of the many volcanoes in the Philippines when you fall and break several bones. If you’re in a remote area, the nearest adequate hospital maybe 50 miles away.

Baggage insurance

No one wants to arrive in the Philippines and discover that their luggage is missing or damaged. Unfortunately, it’s possible for a common carrier to lose one of your bags or damage it during the handling process. Thieves also target travelers, which may leave you without your favorite piece of jewelry or the dress you purchased just for your trip.

This type of travel insurance usually covers baggage loss and baggage delays. If you bring two suitcases to the airport and only get one upon your arrival to the Philippines, your travel insurance should reimburse you for the missing bag. Note that many travel insurance plans have per-item and per-person limits.

Baggage delay coverage reimburses you for certain expenses if your bag doesn’t arrive as scheduled. This type of coverage doesn’t kick in right away, so don’t assume that you can buy a new outfit just because your bag is an hour late. The purpose of baggage delay coverage is to reimburse you for the money you spend replacing certain items. For example, if you have to buy shampoo, bar soap, toothpaste, and a toothbrush, your travel insurance should reimburse you for these expenses.

Rental car coverage

Many types of travel insurance also cover rental car damage and theft. For example, if you accidentally hit the curb while trying to park on a busy street in the Philippines, your travel insurance may pay to repair the scratch. If you get into an accident, your travel insurance may cover the cost of repairs or reimburse the rental company for the fair market value of the car, whichever costs less.

Although travel insurance covers you in many situations, it doesn’t cover every possible emergency.

- Pre-existing conditions: In most cases, travel insurance doesn’t cover pre-existing health conditions. These are conditions that you have on or before the date you book your trip. For example, if you’ve had chronic kidney disease for 20 years, CKD is a pre-existing condition. This type of coverage won’t pay your medical expenses if you experience a complication of kidney disease while traveling in the Philippines.

- Risky activities: If you plan to climb volcanoes, go skydiving or engage in other risky activities, check with your insurance agent first. Many plans exclude coverage for adventure sports and other high-risk activities, so you may need to purchase extra insurance if you’re a bit of a daredevil.

- Known storms: Travel insurance generally doesn’t cover you if you experience an emergency due to a known storm. For example, if there’s a storm brewing in the South China Sea, your insurer may deny your claim if you choose to travel to the Philippines anyway.

- Foreseeable events: Your travel insurance may not cover you if you experience a loss due to a foreseeable event. This is an event that a reasonable person could have predicted.

For basic medical coverage for your trip to the Philippines, travel insurance can cost as little as $1 per day . For a more comprehensive policy that includes trip cancellation and trip interruption coverage, you can expect to pay around $9 to $11 per day for insurance.

To give you a better understanding of how much travel insurance for the Philippines cost, we got sample quotes from some popular travel insurance providers.

We used these travel details for our quotes:

- Age: 35 years old

- Destination: Philippines

- Trip Length: 7 days

- Trip cost: $2,000

This first table shows four quotes for basic travel insurance coverage.

Example Where Plan Doesn’t Reimburse the Full Trip Cost

To have financial protection in case your trip is canceled or interrupted, you’ll need more comprehensive coverage. For this next table, we got four quotes that show the cost of coverage which includes trip cancellation and trip interruption insurance.

Example Where Plan Does Reimburse the Full Trip Cost

Several factors affect the cost of travel insurance:

- Age: The younger you are, the less it costs to buy coverage for your upcoming trip. This is because older people have a higher risk of accidents and illnesses.

- Destination: Some destinations are riskier than others. Insurers charge more to provide coverage for trips to those destinations.

- Trip price: The more your trip costs, the more coverage you need. It costs extra to extend your coverage.

To get the best travel insurance for your trip to the Philippines, follow these tips:

- Consider what type of coverage you need: Evaluate the risks you face when traveling. If you plan to do any adventure activities, you should consider a plan that includes extra coverage.

- Check to see what coverage you get with your credit card: If you book your trip with your credit card , you may already receive some types of coverage, such as trip cancellation and interruption. Once you know what you already have, you can then decide what additional types of protection you want.

- Compare plans and providers: Request multiple quotes and take the time to compare them. Make sure you understand each plan and what it requires for reimbursement. To easily compare coverage options, try using our online comparison tool .

- Purchase a policy early: If you purchase your travel insurance soon after making your initial trip deposit, you may be able to get a better deal.

Do I need travel insurance to visit the Philippines?

Although you’re not required to purchase Philippines travel insurance, we strongly recommend that you purchase this type of coverage. The right insurance plan can prevent you from losing thousands of dollars.

What does travel insurance cover in the Philippines?

It depends on what type of policy you buy. The most basic insurance plans usually cover medical expenses, medical evacuation, unexpected delays, trip cancellations, and trip interruptions. You can also buy travel insurance that covers your baggage and your rental vehicle.

How much is Philippines travel insurance?

Philippines travel insurance can cost as little as $1 per day for the most basic policy. For a more comprehensive plan, you can expect to pay around $9 to $11 per day.

Can I use my U.S. insurance in the Philippines?

U.S. health insurance doesn’t cover medical expenses incurred in the Philippines. This includes Medicare, Medicaid, military insurance plans, and private health insurance.

Can U.S. citizens get free health care in the Philippines?

The Philippines has a public health system, but non-citizens aren’t eligible for free health care. Therefore, it’s important to purchase health insurance designed to cover medical emergencies in other countries. If you don’t have travel health insurance, you may end up owing thousands of dollars in medical expenses.

Leigh Morgan is a seasoned personal finance contributor with over 15 years of experience writing on a diverse range of professional legal and financial topics. She specializes in subjects like navigating the complexities of insurance, savings, zero-based budgeting and emergency fund development.

In the last 5 years, she’s authored over 300 articles for credit unions, digital banks, and financial professionals. Morgan is also the author of “77 Tips for Preventing Elder Financial Abuse,” a book focused on helping caregivers protect the elderly from financial scams.

In addition to her writing skills, she brings real-world financial acumen thanks to her previous experience managing rental properties as part of a $34 million real estate portfolio.

Explore related articles by topic

- All Travel Insurance Articles

- Learn the Basics

- Health & Medical

- Insurance Provider Reviews

- Insurance by Destination

- Trip Planning & Ideas

Best Travel Insurance Companies & Plans in 2024

Best Medical Evacuation Insurance Plans 2024

Best Travel Insurance for Seniors

Best Cruise Insurance Plans for 2024

Best COVID-19 Travel Insurance Plans for 2024

Best Cheap Travel Insurance Companies - Top Plans 2024

Best Cancel for Any Reason (CFAR) Travel Insurance

Best Annual Travel Insurance: Multi-Trip Coverage

Best Travel Medical Insurance - Top Plans & Providers 2024

- Is Travel Insurance Worth It?

Is Flight Insurance Worth It? | Airlines' Limited Coverage Explained

Guide to Traveling While Pregnant: Pregnancy Travel Insurance

10 Romantic Anniversary Getaway Ideas for 2023

Best Travel Insurance for Pre-Existing Medical Conditions April 2024

22 Places to Travel Without a Passport in 2024

Best Spain Travel Insurance: Top Plans & Cost

Best Italy Travel Insurance: Plans, Cost, & Tips

Best Travel Insurance for your Vacation to Disney World

Chase Sapphire Travel Insurance Coverage: What To Know & How It Works

Schengen Travel Insurance: Coverage for your Schengen Visa Application

Mexico Travel Insurance: Top Plans in 2024

Best Places to Spend Christmas in Mexico this December

Travel Insurance to Canada: Tips & Quotes for US Visitors

Best Travel Insurance for France Vacations in 2024

Travel Insurance for Germany: Tourist Information & Tips

Best UK Travel Insurance: Coverage Tips & Plans April 2024

Travel Insurance for Trips to the Bahamas: Tips & Safety Info

Europe Travel Insurance: Your Essential Coverage Guide

Best Trip Cancellation Insurance Plans for 2024

Travel Insurance for the Dominican Republic: Requirements & Tips

Travel Insurance for Trips Cuba: Tips & Safety Info

AXA Travel Insurance Review April 2024

Travel Insurance for Thailand: US Visitor Requirements & Tips

Travel Insurance for a Trip to Ireland: Compare Plans & Prices

Travel Insurance for a Japan Vacation: Tips & Safety Info

Faye Travel Insurance Review April 2024

Travel Insurance for Brazil: Visitor Tips & Safety Info

Travel Insurance for Bali: US Visitor Requirements & Quotes

Travel Insurance for Turkey: U.S. Visitor Quotes & Requirements

Travel Insurance for India: U.S. Visitor Requirements & Quotes

Australia Travel Insurance: Trip Info & Quotes for U.S. Visitors

Generali Travel Insurance Review April 2024

Travelex Travel Insurance Review for 2024

Tin Leg Insurance Review for April 2024

Travel Insured International Review for 2024

Seven Corners Travel Insurance Review April 2024

HTH WorldWide Travel Insurance Review 2024: Is It Worth It?

Medjet Travel Insurance Review 2024: What You Need To Know

Antarctica Travel Insurance: Tips & Requirements for US Visitors

Travel Insurance for Kenya: Recommendations & Requirements

Travel Insurance for Botswana: Compare Your Coverage Options