Preview Mode

Subscribe to our News & Services

- To B, or Not to Be

- Cryptocurrency Education

- Fintech Education

- Industry Terms

- Quarterly Intelligence Reports

- Annual Subscription

- Custom Reports

- Terms of Use

FM ALL News

Follow us on Twitter

Follow us on Linkedin

Western Union Partners with Travel Wallet for Expansion in South Korea

- Travel Wallet is a prominent fintech company in the region.

- The users of Travel Wallet in South Korea now have the option to send money through WU.

One of the world’s leading cross-border payment companies, Western Union (WU) has recently announced its expansion in South Korea through a collaboration with Travel Wallet, a financial technology firm in the region.

Western Union has announced the launch of its money transfer services on the Travel Wallet app. Users of the Korean fintech company now have a choice to send money through WU. Additionally, clients can fund their cross-border money transfers via local bank accounts.

According to the details shared by the company, Travel Wallet’s users will be able to receive WU money transfers through the Travel Wallet app in the coming months.

“At Travel Wallet, we adopt a customer-centric approach, and are glad to collaborate with a like-minded company like Western Union,” said Hyungwoo Kim, the CEO of Travel Wallet. “We are excited to enable our customers to connect to their loved ones around the world through one of the world's widest-reaching financial networks. We look forward to putting our collective strengths to work and catering to who really matters—our customers.”

Earlier this month, Western Union reported its financial results for the fourth quarter of 2021. For the reported period, the financial services provider saw a marginal increase in revenue as the number touched $1.3 billion. Adjusted EPS in the fourth quarter came in at $0.64, compared to $0.45 in the same period last year.

Western Union and South Korea

The overall cross-border payment volumes across South Korea have surged substantially in the past few years. According to WU, the partnership with Travel Wallet will make cross-border payments more convenient and secure for the users.

“Remittances connect people, places, economies and societies. We are delighted to offer our services to Travel Wallet users, enabling convenient and reliable financial flows powered by technology,” K. Premmananth, the Head of Network, Singapore, Indonesia and North Asia at Western Union, said.

Share this article

- 2440 Articles

- 71 Followers

Finance Magnates Daily Update

Get all the top financial news delivered straight to your inbox. Stay informed, stay ahead.

By subscribing, you agree to our Terms of Use and Privacy Policy . You may unsubscribe at any time.

Most Viewed

Revolut X: Fintech Firm Ventures into Crypto Exchange Arena

Exclusive: IC Markets Obtains Regulatory License in Kenya

Latest news.

- Binance Recognized in Kazakhstan with ISO Certifications Monday, 13/05/2024 | 18:14 GMT

- CFTC Warns Youth: Don't Fall Prey to Crypto "Money Mule" Scams Monday, 13/05/2024 | 17:19 GMT

- Freetrade CEO Adam Dodds Steps Down amidst Shifting Market Dynamics Monday, 13/05/2024 | 16:59 GMT

Education Center

Europe's Economic Crossroads: Recession Fears and S&P Global's Contrasting Outlook

7 Things We Wish Someone Had Told Us Before We Started Trading

Keep reading.

- Revolut Aims to Generate $370 Million by 2026 from Ads: Report

- Leaving Your Wallet Behind: Pros and Cons of Digital Wallets

- Talk Nerdy to Me: New Siri from Apple Set to Challenge ChatGPT? Monday, 13/05/2024 | 11:16 GMT

- FTX Has the Funds, But Creditors Claim Payout Is “Insulting” Friday, 10/05/2024 | 07:05 GMT

- Liquid Gold Rush: Climate Change and Economic Shifts Fueling the Surge in Olive Oil Prices Thursday, 09/05/2024 | 07:37 GMT

More from the Author

Trading Point of Financial Instruments UK Sees 56% Dip in Revenues during 2021

DMALINK Strengthens FX and Bullion Presence, Onboards Crédit Agricole CIB

Cornerstone’s H1 2022 Revenues Climb by 127%

eToro Partners with OpenPayd to Introduce Embedded Finance Proposition in Europe

Talos Announces Expansion of EU and US Teams

Marilu Revelli Joins GCEX as Marketing Director

The Growing Threat of CNP Fraud

Why Your Receipt Might Be Lying to You

The E-CNY: China's Digital Dilemna

American Express and Worldpay Forge Agreement to Empower Small Business

Broadridge Strengthens Presence in Canada with Acquisition of Wealth Management Platform

United Fintech Opens DIFC Office, Targets UAE's Financial Sector

Featured Videos

Hannelé de necker, ceo, ifx brokers | fmas:24, 1 week to go until fmas:24 kicks off and we couldn't skip our interviews with some of this year's sponsors 🤩 starting off strong with hannelé de necker, ceo of ifx brokers. see you there #fmas24 #fmas #fmevents #financeinafrica #traders #investors #affiliates #forextraders #investmentopportunities #b2bnetworking #fintech #innovations #tradingcommunity #businessopportunities #africanbusiness #johannesburg #southafrica 📣 stay updated with the latest in finance and trading follow fmevents across our social media platforms for news, insights, and event updates. connect with us today: 🔗 linkedin: https://www.linkedin.com/showcase/financemagnates-events/ 👍 facebook: https://www.facebook.com/financemagnatesevents 📸 instagram: https://www.instagram.com/fmevents_official 🐦 twitter: https://twitter.com/f_m_events 🎥 tiktok: https://www.tiktok.com/@fmevents_official ▶️ youtube: https://www.youtube.com/@financemagnates_official don't miss out on our latest videos, interviews, and event coverage. subscribe to our youtube channel for more, network, learn, grow | fmas:24, get ready to mark your calendars for fmas:24, returning this may take a quick glimpse of what awaits at the sandton convention centre in sandton, south africa from may 20-22, 2024. don't miss out on this 5-second invite packed with energy and urgency secure your free ticket now 🔗 https://events.financemagnates.com/yqx0lutm_source=youtube&utm_campaign=fmas-is-back&utm_medium=video&refid=fmas24+video+ad+%5b1%5d #fmas24 #fmas #fmevents #financeinafrica #traders #investors #affiliates #forextraders #investmentopportunities #b2bnetworking #fintech #innovations #tradingcommunity #businessopportunities #africanbusiness #johannesburg #southafrica 📣 stay updated with the latest in finance and trading follow fmevents across our social media platforms for news, insights, and event updates. connect with us today: 🔗 linkedin: https://www.linkedin.com/showcase/financemagnates-events/ 👍 facebook: https://www.facebook.com/financemagnatesevents 📸 instagram: https://www.instagram.com/fmevents_official 🐦 twitter: https://twitter.com/f_m_events 🎥 tiktok: https://www.tiktok.com/@fmevents_official ▶️ youtube: https://www.youtube.com/@financemagnates_official don't miss out on our latest videos, interviews, and event coverage. subscribe to our youtube channel for more, fmas:24 | sneak peak, here's a sneak peek into the fmas:24 vibrant atmosphere join us at africa’s premium financial event for a transformative experience that combines the best of finance and technology. from may 20-22, 2024, the sandton convention centre in sandton, south africa, will be the hub for over 3,500 attendees to engage in unparalleled networking opportunities, learn from over 150 industry-leading speakers, and explore innovations from 120+ exhibitors. secure your free ticket now 🔗 https://events.financemagnates.com/yqx0lutm_source=youtube&utm_campaign=fmas-is-back&utm_medium=video&refid=fmas24+video+ad+%5b1%5d #fmas24 #fmas #fmevents #financeinafrica #traders #investors #affiliates #forextraders #investmentopportunities #b2bnetworking #fintech #innovations #tradingcommunity #businessopportunities #africanbusiness #johannesburg #southafrica 📣 stay updated with the latest in finance and trading follow fmevents across our social media platforms for news, insights, and event updates. connect with us today: 🔗 linkedin: https://www.linkedin.com/showcase/financemagnates-events/ 👍 facebook: https://www.facebook.com/financemagnatesevents 📸 instagram: https://www.instagram.com/fmevents_official 🐦 twitter: https://twitter.com/f_m_events 🎥 tiktok: https://www.tiktok.com/@fmevents_official ▶️ youtube: https://www.youtube.com/@financemagnates_official don't miss out on our latest videos, interviews, and event coverage. subscribe to our youtube channel for more, join 3500+ attendees at fmas:24 | africa's premium financial event, looking to expand your network in #africa join 3500+ attendees at fmas:24, where online trading, fintech, payments, and crypto meet connect with industry leaders and innovators for an unmatched networking experience. 20-22 may 2024 sandton convention center, sandton, south africa register now to secure your spot: https://bit.ly/3jbupck #fmas #fmas24 #fmevents #networking #finance #africa 📣 stay updated with the latest in finance and trading follow finance magnates for news, insights, and event updates across our social media platforms. connect with us today: 🔗 linkedin: https://www.linkedin.com/company/financemagnates/ 👍 facebook: https://www.facebook.com/financemagnates/ 📸 instagram: https://www.instagram.com/financemagnates_official 🐦 x (twitter): https://twitter.com/financemagnates/ 📡 rss feed: https://www.financemagnates.com/feed/ ▶️ telegram: https://t.me/financemagnatesnews don't miss out on our latest videos, interviews, and event coverage. 🔔 subscribe to our youtube channel for more🔔, join 3500+ attendees at fmas:24 - africa's premium financial event, looking to expand your network in #africa join 3500+ attendees at fmas:24, where online trading, fintech, payments, and crypto meet connect with industry leaders and innovators for an unmatched networking experience. 20-22 may 2024 sandton convention center, sandton, south africa register now to secure your spot: https://bit.ly/3jbupck #fmas #fmas24 #fmevents #networking #finance #africa.

- Global Citizen

- Money Works

- Global Issues

- Getting Around

- WU Partners

- Regional News

- Europe & CIS

- Middle East & Africa

- Asia & Pacific

Western Union, Travel Wallet offer in app cross-border money transfers

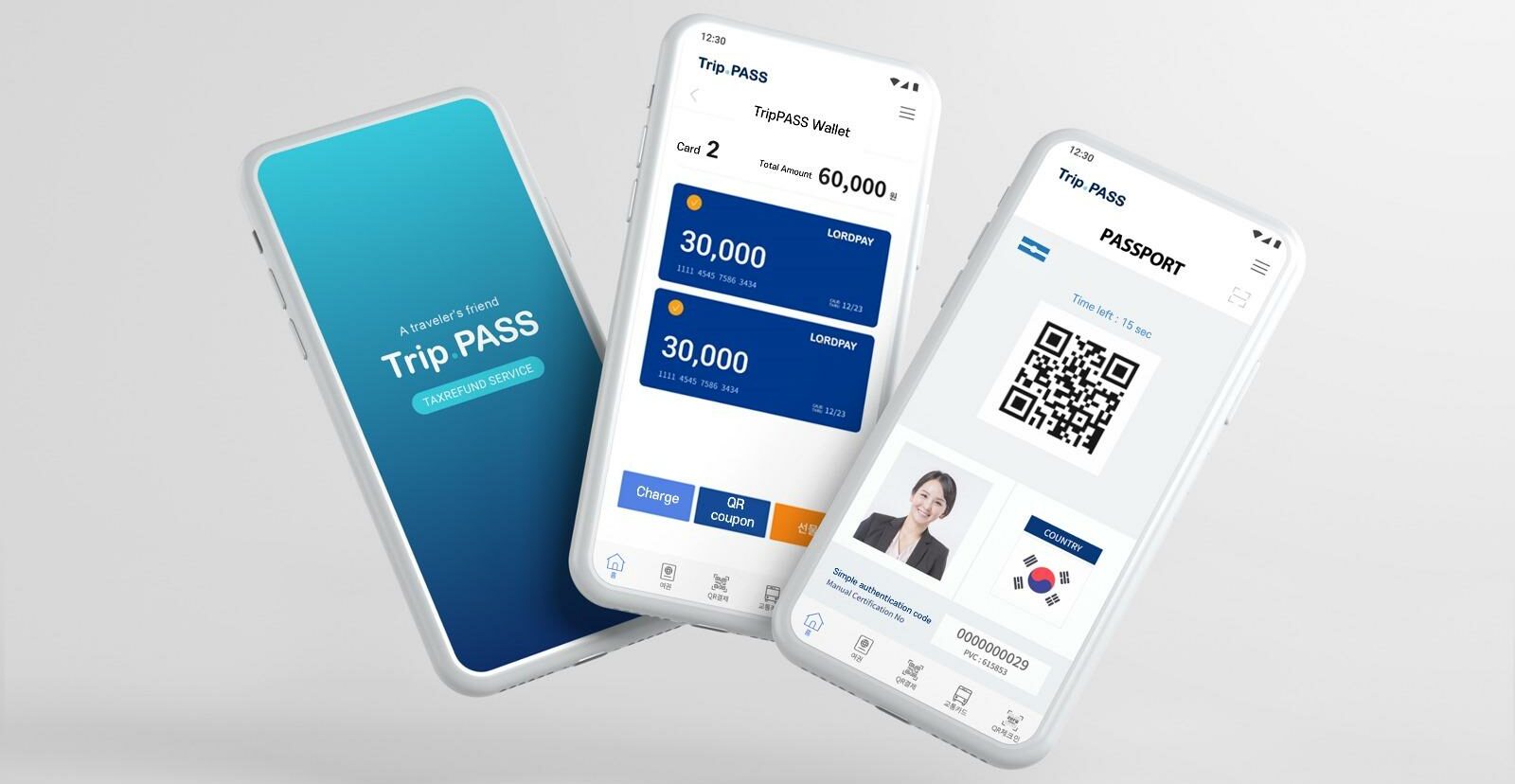

Western Union and Travel Wallet , one of the leading fintech companies in South Korea, have come together to launch Western Union money transfer services on the Travel Wallet App.

Travel Wallet customers can now transfer money abroad

Travel Wallet customers in South Korea now have the option to send money internationally through Western Union. Travel Wallet, which operates through its app, is available to both Android and iPhone users. Those receiving the transfers overseas can collect their funds in cash or have it deposited directly into their bank accounts. At the moment, customers can transfer money to select countries. Soon, they will be able tap into Western Union’s global network of over 200 countries and territories.

Western Union services to soon broaden to include receive capability

In the next few months, Travel Wallet customers will also be able to receive Western Union money transfers to their Travel Wallet app. The incoming transfers can be sent through Western Union’s digital services or retail agent worldwide.

“For 170 years, Western Union has put technology to work connecting people—bringing boundless possibilities within reach,” said K. Premmananth, Head of Network, Singapore, Indonesia and North Asia, Western Union. “Remittances connect people, places, economies and societies. We are delighted to offer our services to Travel Wallet users, enabling convenient and reliable financial flows powered by technology.”

“At Travel Wallet, we adopt a customer-centric approach, and are glad to collaborate with a like-minded company like Western Union,” said Hyungwoo Kim, CEO, Travel Wallet. “We are excited to enable our customers to connect to their loved ones around the world through one of the world’s widest-reaching financial network. We look forward to putting our collective strengths to work and catering to who really matters—our customers.”

For more information about the service, customers can email [email protected] .

Send money with Western Union

Similar Blogs

What is the currency in argentina currency and payment, what is the currency in brazil currency and payment, international wire regulations: what you need to know, what is the currency in china currency and payment.

- Customer Care

- Intellectual Property

- Terms & Conditions

Cookie Settings

KoreaTechDesk | Korean Startup and Technology News

Mon, May 13, 2024

Travel Wallet attracts Series C investment, plans to launch cloud-based B2B payment solution

Travel Wallet is a global payment service

Korean FinTech startup Travel Wallet, a global payment service, has secured 19.7 billion won ($15 million) in Series C investment from investors including SK Securities, Golden Oak Investment, Smilegate Investment, CJ Investment, and BNK Investment & Securities. This investment brings the cumulative amount of investment in Travel Wallet to 50 billion won ($38 million).

With this latest funding, Travel Wallet’s financial stability is expected to be further enhanced. The company now has 37.5 billion won in equity capital and 70 billion won in cash assets, a scale more than 10 times that of its customer prepaid charges.

Travel Wallet provides a global payment service that eliminates payment and exchange fees when traveling abroad or making purchases overseas. Users can exchange currencies of 38 countries through the Travel Wallet app and pay at over 100 million VISA online and offline stores worldwide, without any payment fees. The payment service is available in 38 currencies, including the US dollar, euro, yen, and various Asian currencies. Travel Wallet only charges the lowest level of fees in the country for other currencies.

By simplifying the complex international settlement and payment process, Travel Wallet has built its own modern foreign exchange trading system, drastically lowering the costs of existing international transactions. The company also offers Travel Pay, a service that provides the lowest level of overseas payment fees.

This year, Travel Wallet plans to launch a cloud-based B2B payment solution after three years of development. This solution aims to help domestic and foreign companies enter the payment business without initial cost investment by providing the necessary infrastructure for domestic and international payment business on a cloud basis.

- On Vacation, a Chat-Based Personalized Travel Platform, Secures Pre-A Investment from Fast Ventures

- Korean startup, Travelai will enter Thailand and Malaysia by early 2023

- PaymentInApp wants to provide better service than ‘Uber’ for Smart City public transit systems

- Korean Fintech startup Paywatch’s EWA service garners attention as a financial welfare service for employees

WeBudding partners with the most popular free app Goodnotes 5 to provide Korean digital stationery content to users globally

Korean space startup innospace successfully launches suborbital test rocket hanbit-tlv from brazil.

POPULAR POSTS

MOST READ ARTICLE OF THE WEEK

List article, similar articles.

Lord System’s ‘Mobile Passport’ Simplifies Identification Authentication & Elevates Duty-Free Shopping

‘Unicorn’ Korea Credit Data Secures $75.7 Million Funding from Morgan Stanley Tactical Value

Fintech Startup Finda Attracts $ 36 million Series C Investment from JB Financial Group & 500 Global

You can see how this popup was set up in our step-by-step guide: https://wppopupmaker.com/guides/auto-opening-announcement-popups/

We hope you enjoy our content, May you please give us Feedback regarding our website!

Single post feedback, what you think about koreatechdesk, share your idea with us, feedback popup.

- Rate your experience * Very Good Good Normal Poor Very Poor

- Describe your experience

Invitation submission has been closed

Insert/edit link.

Enter the destination URL

Or link to existing content

- Digital Payments

Western Union Expands in South Korea with Travel Wallet

Collaboration will Enable Customers to Send and Receive Western Union Money Transfers on the Travel Wallet app

Western Union, a global leader in cross-border, cross-currency money movement and payments, and Travel Wallet, one of the leading fintech companies in the country, have announced the launch of Western Union money transfer services on the Travel Wallet App.

“Remittances connect people, places, economies and societies. We are delighted to offer our services to Travel Wallet users, enabling convenient and reliable financial flows powered by technology.”

Travel Wallet users in South Korea now have the choice to send money through Western Union. The Travel Wallet app is available for both Android and iOS users. Customers can fund their cross-border money transfers through their local bank accounts. Cash and bank account payout in select countries is currently available, with plans to scale up to the entire scope and reach of Western Union’s global payout network.

Latest Fintech News: PCI Pal Announces New Global Partnership with VoiceFoundry

Over the next few months, Travel Wallet users will also be able to receive Western Union money transfers via the Travel Wallet app, for transactions sent through Western Union’s digital money transfer services or Western Union’s worldwide retail Agent network.

“For 170 years, Western Union has put technology to work connecting people—bringing boundless possibilities within reach,” said K. Premmananth, Head of Network, Singapore, Indonesia and North Asia, Western Union. “Remittances connect people, places, economies and societies. We are delighted to offer our services to Travel Wallet users, enabling convenient and reliable financial flows powered by technology.”

Latest Fintech News: Symphony Partners With Digital Asset to Tackle Inefficiencies in the Syndicated Loans Market

“At Travel Wallet, we adopt a customer-centric approach, and are glad to collaborate with a like-minded company like Western Union,” said Hyungwoo Kim , CEO, Travel Wallet. “We are excited to enable our customers to connect to their loved ones around the world through one of the world’s widest-reaching financial network. We look forward to putting our collective strengths to work and catering to who really matters—our customers.”

Latest Fintech News: Edelweiss Asset Management Launches ‘eInvest’

[To share your insights with us, please write to [email protected] ]

Monneo Launches a Unique Solution for the Affiliate Marketing Industry

Stronghold launches $100 million investment fund.

Fintech News Desk

Related posts, whiplash launches partner program to deliver best-in-class ecommerce solutions, socure closes new round of funding, with participation from major banks, signifyd deepens its partnership with adobe by integrating guaranteed fraud protection into payment services for adobe commerce.

Western Union, Travel Wallet Team on Remittances in S. Korea

Western Union, which works in cross-border and cross-currency payments, announced Tuesday (Feb. 15) that it has teamed with Travel Wallet to offer money transfer services on that company’s Travel Wallet app.

In South Korea, Travel Wallet users will now gain the option of sending money through Western Union. The app will be available for both Android and iOS users, and customers will be able to fund cross-border money transfers even through their local accounts.

Cash and bank payouts in some countries is available and will further expand later on. In the next few months, Travel Wallet users will gain the ability to receive Western Union money transfers from the Travel Wallet app.

That will apply to transactions sent through Western Union’s digital money transfer services or Western Union’s Agent network.

“For 170 years, Western Union has put technology to work connecting people — bringing boundless possibilities within reach,” said K. Premmananth, head of network, Singapore, Indonesia and North Asia, Western Union. “Remittances connect people, places, economies and societies. We are delighted to offer our services to Travel Wallet users, enabling convenient and reliable financial flows powered by technology.”

Meanwhile, Travel Wallet CEO Hyungwoo Kim said the company was “excited to enable our customers to connect to their loved ones around the world through one of the world’s widest-reaching financial network.”

Western Union, posting its fourth-quarter results, showed more forward momentum in digital transactions, which were up in double-digit percentages year over year.

See also: Western Union’s Digital Money Transfer Business Now 24% of C2C Revenues

The consolidated top line for the period hit $1.3 billion, and was up 2% year over year as measured on a constant currency basis.

However, there were still difficulties — the revenue for the quarter was affected by the growth of digital money transfers and its Business Solutions segment, with a fall in retail money transfers.

According to new CEO Devin B. McGranahan, “The digital business has generated strong growth while our retail business declined due to uneven economic recovery negatively impacting our customers.”

Recommended

Trending news, the big story, featured news, partner with pymnts.

We’re always on the lookout for opportunities to partner with innovators and disruptors.

- Argentina

- Australia

- Deutschland

- Magyarország

- Nederland

- New Zealand

- Österreich

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

5 Best Travel Cards for South Korea

Getting an international travel card before you travel to South Korea can make it cheaper and more convenient when you spend in South Korean Won. You'll be able to easily top up your card in USD before you leave the US, to convert seamlessly to KRW for secure and flexible spending and withdrawals.

This guide walks through our picks of the best travel cards available for anyone from the US heading to South Korea, like Wise or Revolut. We'll walk through a head to head comparison, and a detailed look at their features, benefits and drawbacks.

5 best travel money cards for South Korea:

Let's kick off our roundup of the best travel cards for South Korea with a head to head comparison on important features. Here's an overview of the providers we've picked to look at, for customers looking for ways to spend conveniently overseas when travelling from the US:

Each of the international travel cards we’ve picked out have their own features and fees, which may mean they suit different customer needs. Keep reading to learn more about the features, advantages and disadvantages of each - plus a look at how to order the travel card of your choice before you head off to South Korea.

Wise travel card

Open a Wise account online or in the Wise app, to order a Wise travel card you can use for convenient spending and withdrawals in South Korea. Wise accounts can hold 40+ currencies, so you can top up in USD easily from your bank or using your card. Whenever you travel, to South Korea or beyond, you’ll have the option to convert to the currency you need in advance if it’s supported for holding a balance, or simply let the card do the conversion at the point of payment.

In either case you’ll get the mid-market exchange rate with low, transparent fees whenever you spend in KRW, plus some free ATM withdrawals every month - perfect if you’re looking for easy ways to arrange your travel cash.

Wise features

Wise travel card pros and cons.

- Hold and exchange 40+ currencies with the mid-market rate

- Spend seamlessly in KRW when you travel

- Some free ATM withdrawals every month, for those times only cash will do

- Ways to receive payments to your Wise account conveniently

- Manage your account and card from your phone

- 9 USD delivery fee for your first card

- ATM fees apply once you've exhausted your monthly free withdrawals

- Physical cards may take 14 - 21 days to arrive

How to apply for a Wise card

Here’s how to apply for a Wise account and order a Wise travel card in the US:

Open the Wise app or desktop site

Select Register and confirm you want to open a personal account

Register with your email, Facebook, Apple or Google ID

Upload your ID document to complete the verification step

Tap the Cards tab to order your card

Pay the one time 9 USD fee, confirm your mailing address, and your card will be on the way, and should arrive in 14 - 21 days

Revolut travel card

Choose a Revolut account, from the Standard plan which has no monthly fee, to higher tier options which have monthly charges but unlock extra features and benefits. All accounts come with a smart Revolut card you can use in South Korea, with some no fee ATM withdrawals and currency conversion monthly, depending on the plan you pick. Use your Revolut account to hold and exchange 25+ currencies, and get extras like account options for under 18s, budgeting tools and more.

Revolut features

Revolut travel card pros and cons.

- Pick the Revolut account plan that suits your spending needs

- Hold and exchange 25+ currencies, and spend in 150 countries

- Accounts come with different card types, depending on which you select

- All accounts have some no fee currency exchange and some no fee ATM withdrawals monthly

- Some account tiers have travel perks like complimentary or discounted lounge access

- You need to upgrade to an account with a monthly fee to get all account features

- Delivery fees may apply for your travel card

- Fair usage limits apply once you exhaust your currency conversion and ATM no fee allowances

- Out of hours currency conversion has additional fees

How to apply for a Revolut card

Set up your Revolut account before you leave the US and order your travel card. Here’s how:

Download and open the Revolut app

Register by adding your personal and contact information

Follow the prompts to confirm your address and order your card

Pay any required delivery fee - costs depend on your account type

Chime travel card

Use your Chime account and card to spend in South Korea with no foreign transaction fee. You’ll just need to load a balance in USD and then the money is converted to KRW instantly with the Visa rate whenever you spend or make a withdrawal. There’s a fee to make an ATM withdrawal out of network, which sits at 2.5 USD, but there are very few other costs to worry about. Plus you can get lots of extra services from Chime if you need them, such as ways to save.

Chime features

Chime travel card pros and cons.

- No Chime foreign transaction fees

- No ongoing charges for your account

- Lots of extra products and services if you need them

- Easy ways to manage your money online and in app

- Virtual cards available

- You'll need to inform Chime you're traveling to use your card abroad

- Low ATM limits

- Cards take 7 - 10 days to arrive by mail

How to apply for a Chime card

Here’s how to apply for a Chime account and order a travel card in the US:

Visit the Chime website or download the app

Click Get started and add your personal details

Add a balance

Your card will be delivered in the mail and you can use your virtual card instantly

Monzo travel card

Monzo cards can be ordered easily in the US and used for spending in South Korea and globally. Monzo accounts are designed for holding USD only - but you can spend in KRW and pretty much any other currency easily, with no foreign transaction fee. Your funds are just converted using the network exchange rate whenever you pay or make a withdrawal.

Monzo doesn’t usually apply ATM fees, but it’s worth knowing that the operator of the specific ATM you pick may have their own costs you’ll need to check out.

Monzo features

Monzo travel card pros and cons.

- Good selection of services available

- No foreign transaction fee to pay

- No Monzo ATM fee to pay

- Manage your card from your phone conveniently

- Deposits are FDIC protected

- You can't hold a foreign currency balance

- ATM operators might apply their own fees

How to apply for a Monzo card

Here’s how to apply for a Monzo account and order a travel card in the US:

Visit the Monzo website or download the app

Click Get Sign up and add your personal details

Check and confirm your mailing address and your card will be delivered in the mail

Netspend travel card

Netspend has a selection of prepaid debit cards you can use for spending securely in South Korea. While these cards don’t usually let you hold a balance in KRW, they’re popular with travelers as they’re not linked to your regular checking account. That increases security overseas - plus, Netspend offers virtual cards you can use to hide your physical card details from retailers if you want to.

The options with Netspend vary a lot depending on the card you pick. Usually you can top up digitally or in cash in USD and then spend overseas with a fixed foreign transaction fee applying every time you spend in a foreign currency. You’ll be able to view the terms and conditions of your specific card - including the fees - online, by entering the code you’ll find when your card is sent to you.

Netspend features

Netspend travel card pros and cons.

- Large selection of different card options depending on your needs

- Some cards have no overseas ATM fees

- Prepaid card which is secure to use overseas

- Manage your account in app

- Change from one card plan to another if you need to

- You may pay a monthly fee for your card

- Some cards have foreign transaction fees for all overseas use, which can be around 4%

- Selection of fees apply depending on the card you pick

How to apply for a Netspend card

Here’s how to apply for a Netspend account and order a travel card in the US:

Visit the Netspend website

Click Apply now

Complete the details, following the onscreen prompts

Get verified

Your card will arrive by mail - add a balance and activate it to get started

What is a travel money card?

A travel money card is a card you can use for secure and convenient payments and withdrawals overseas.

You can use a travel money card to tap and pay in stores and restaurants, with a wallet like Apple Pay, or to make ATM withdrawals so you'll always have a bit of cash in your pocket when you travel.

Although there are lots of different travel money cards on the market, all of which are unique, one similarity you'll spot is that the features and fees have always been optimised for international use. That might mean you get a better exchange rate compared to using your normal card overseas, or that you run into fewer fees for common international transactions like ATM withdrawals.

Travel money cards also offer distinct benefits when it comes to security. Your travel money card isn't linked to your United States Dollar everyday account, so even if you were unlucky and had your card stolen, your primary bank account remains secure.

Travel money vs prepaid card vs travel credit card

It's helpful to know that you'll be able to pick from several different types of travel cards, depending on your priorities and preferences. Travel cards commonly include:

- Travel debit cards

- Travel prepaid cards

- Travel credit cards

They all have distinct benefits when you head off to South Korea or elsewhere in the world, but they do work a bit differently.

Travel debit and prepaid cards are usually linked to an online account, and may come from specialist digital providers - like the Wise card. These cards are usually flexible and cheap to use. You'll be able to manage your account and card through an app or on the web.

Travel credit cards are different and may suit different customer needs. As with any other credit card, you may need to pay an annual fee or interest and penalties depending on how you manage your account - but you could also earn extra rewards when spending in a foreign currency, or travel benefits like free insurance for example. Generally using a travel credit card can be more expensive compared to a debit or prepaid card - but it does let you spread out the costs of your travel across several months if you'd like to and don't mind paying interest to do so.

What is a prepaid travel money card best for?

Let's take a look at the advantages of using a prepaid travel money card for travellers going to South Korea. While each travel card is a little different, you'll usually find some or all of the following benefits:

- Hold and exchange foreign currencies - allowing you to lock in exchange rates and set a travel budget before you leave

- Convenient for spending in person and through mobile wallets like Apple Pay, as well as for cash withdrawals

- You may find you get a better exchange rate compared to your bank - and you'll usually be able to avoid any foreign transaction fee, too

- Travel cards are secure as they're not linked to your everyday USD account - and because you can make ATM withdrawals when you need to, you can also avoid carrying too much cash at once

Overall, travel cards offer flexible and low cost ways to avoid bank foreign transaction and international ATM fees, while accessing decent exchange rates.

How to choose the best travel card for South Korea

We've picked out 5 great travel cards available in the US - but there are also more options available, which can make choosing a daunting task. Some things to consider when picking a travel card for South Korea include:

- What exchange rates does the card use? Choosing one with the mid-market rate or as close as possible to it is usually a smart plan

- What fees are unavoidable? For example, ATM charges or top up fees for your preferred top up methods

- Does the card support a good range of currencies? Getting a card which allows you to hold and spend in KRW can give you the most flexibility, but it's also a good idea to pick a card with lots of currency options, so you can use it again in future, too

- Are there any other charges? Check in particular for foreign transaction fees, local ATM withdrawal fees, inactivity fees and account close fees

Ultimately the right card for you will depend on your specific needs and preferences.

What makes a good travel card for South Korea

The best travel debit card for South Korea really depends on your personal preferences and how you like to manage your money.

Overall, it pays to look for a card which lets you minimise fees and access favourable exchange rates - ideally the mid-market rate. While currency exchange rates do change all the time, the mid-market rate is a good benchmark to use as it’s the one available to banks when trading on wholesale markets. Getting this rate, with transparent conversion fees, makes it easier to compare costs and see exactly what you’re paying when you spend in KRW.

Other features and benefits to look out for include low ATM withdrawal fees, complimentary travel insurance, airport lounge access or emergency cash if your card is stolen. It’s also important to look into the security features of any travel card you might pick for South Korea. Look for a card which uses 2 factor authentication when accessing the account app, which allows you to set instant transaction notifications, and which has easy ways to freeze, unfreeze and cancel your card with your phone.

For South Korea in particular, choosing a card which offers contactless payments and which is compatible with mobile wallets like Apple Pay could be a good plan. Card payments are extremely popular in South Korea - so having a card which lets you tap and pay easily can speed things up and make it more convenient during your trip.

Ways to pay in South Korea

Cash and card payments - including contactless, mobile wallet, debit, credit and prepaid card payments - are the most popular ways to pay globally.

In South Korea card payments are common in most situations. You’ll be able to make Chip and PIN or contactless payments or use your favourite mobile wallet like Apple Pay to tap and pay on the go. It’s still worth having a little cash on you just in case - and for the odd situations where cash is more convenient, such as when tipping or buying a small item in a market.

Which countries use KRW?

You’ll find that KRW can only be used in South Korea. If you don’t travel to South Korea frequently it’s worth thinking carefully about how much to exchange so you’re not left with extra foreign currency after your trip. Or pick a travel card from a provider like Wise or Revolut which lets you leave your money in USD and convert at the point of payment with no penalty.

What should you be aware of when travelling to South Korea

You’re sure to have a great time in South Korea - but whenever you’re travelling abroad it's worth putting in a little advance thought to make sure everything is organised and your trip goes smoothly. Here are a few things to think about:

1. Double check the latest entry requirements and visas - rules can change abruptly, so even if you’re been to South Korea before it’s worth looking up the most recent entry requirements so you don’t have any hassle on the border

2. Plan your currency exchange and payment methods - you can change USD to KRW before you travel to South Korea if you’d like to, but as card payments are common, and ATMs widely available, you can actually leave it until you arrive to get everything sorted as long as you have a travel money card. Top up your travel money card in USD and either exchange to KRW in advance or at the point of payment, and make ATM withdrawals whenever you need cash. Bear in mind that currency exchange at the airport will be expensive - so hold on until you reach South Korea to make an ATM withdrawal in KRW if you can.

3. Get clued up on any health or safety concerns - get travel insurance before you leave the US so you have peace of mind. It’s also worth reading up on any common scams or issues experienced by tourists. These tend to change over time, but may include things like rip off taxis or tour agents which don’t offer fair prices or adequate services.

Conclusion - Best travel cards for South Korea

Ultimately the best travel card for your trip to South Korea will depend on how you like to manage your money. Use this guide to get some insights into the most popular options out there, and to decide which may suit your specific needs.

FAQ - best travel cards for South Korea

When you use a travel money card you may find there’s an ATM withdrawal fee from your card issuer, and there may also be a cost applied by the ATM operator. Some of our travel cards - like the Wise and Revolut card options - have some no fee ATM withdrawals every month, which can help keep down costs.

Travel money cards may be debit, prepaid or credit cards. Which is best for you will depend on your personal preferences. Debit and prepaid cards are usually pretty cheap and secure to spend with, while credit cards may have higher fees but often come with extra perks like free travel insurance and extra reward points.

There’s no single best prepaid card for international use. Look out for one which supports a large range of currencies, with good exchange rates and low fees. This guide can help you compare some popular options, including Wise, Revolut and Monzo.

Yes, you can use your local debit card when you’re overseas. However, it’s common to find extra fees apply when spending in foreign currencies with a regular debit card. These can include foreign transaction fees and international ATM charges.

Usually having a selection of ways to pay - including a travel card, your credit or debit card, and some cash - is the best bet. That means that no matter what happens, you have an alternative payment method you can use conveniently.

Yes. Most travel debit cards have options to make ATM withdrawals. Check the fees that apply as card charges do vary a lot. Some cards have local and international fees on all withdrawals, while others like Wise and Revolut, let you make some no fee withdrawals monthly before a fee kicks in.

Both Visa and Mastercard are globally accepted. Look out for the logo on ATMs and payment terminals in South Korea.

The cards you see on this page are ordered as follows:

For card providers that publish their exchange rates on their website, we used their USD / KRW rate to calculate how much South Korean Won you would receive when exchanging / spending $4,000 USD. The card provider offering the most KRW is displayed at the top, the next highest below that, and so on.

The rates were collected at 15:54:21 GMT on 19 February 2024.

Below this we display card providers for which we could not verify their exchange rates. These are displayed in alphabetical order.

Send international money transfer

More travel card guides.

Western Union expands in South Korea through Travel Wallet app

Juanmonino/E+ via Getty Images

- Western Union (NYSE: WU ) partners with Travel Wallet, a popular fintech app in South Korea, to expand its presence in that country.

- Travel Wallet users in South Korea will be able to send and receive money through the app. They can fund their cross-border money transfers through their local bank accounts.

- Cash and bank account payout in select countries is currently available with plans to scale up to Western Union's global payout network.

- In November, Western Union partnered with Metrobank for inbound money transfers in the Philippines and, separately, with Mastercard (NYSE: MA ) to integrate Mastercard Send into its global money movement network.

Recommended For You

More trending news, about wu stock, related stocks, trending analysis, trending news.

- Open Banking

- Cryptocurrency

- Machine Learning

- Travel Technology

- Health Tech

- Success stories

- Fintech Companies

Here’s why Cryptocurrency is popular in iGaming

Bitcoin and ethereum whales buying at every price dip, relief rally…, which crypto has the most potential avalanche, cardano, polygon, and furrever…, cryptocurrency: top 3 ai gem coins to invest now, how blockchain technology is transforming the business, how does blockchain revolutionize fintech applications, the future is near: what technologies are used in gambling today, scorpion casino vs. decentraland vs. the sandbox: revolutionizing online gaming with…, how is ai shaping online casino strategies, ai and web 3.0 – a risky convergence of technologies, defi-ai: revolutionizing finance through ai-integrated wallets and real business asset tokenization, these four trends are shaping how fintech should be using generative…, western union expands in south korea with travel wallet.

Collaboration will Enable Customers to Send and Receive Western Union Money Transfers on the Travel Wallet app

SEOUL, South Korea–(BUSINESS WIRE)– Western Union , a global leader in cross-border, cross-currency money movement and payments, and Travel Wallet , one of the leading fintech companies in the country, have announced the launch of Western Union money transfer services on the Travel Wallet App.

Travel Wallet users in South Korea now have the choice to send money through Western Union. The Travel Wallet app is available for both Android and iOS users. Customers can fund their cross-border money transfers through their local bank accounts. Cash and bank account payout in select countries is currently available, with plans to scale up to the entire scope and reach of Western Union’s global payout network.

Over the next few months, Travel Wallet users will also be able to receive Western Union money transfers via the Travel Wallet app, for transactions sent through Western Union’s digital money transfer services or Western Union’s worldwide retail Agent network.

“For 170 years, Western Union has put technology to work connecting people—bringing boundless possibilities within reach,” said K. Premmananth, Head of Network, Singapore, Indonesia and North Asia, Western Union. “Remittances connect people, places, economies and societies. We are delighted to offer our services to Travel Wallet users, enabling convenient and reliable financial flows powered by technology.”

“At Travel Wallet, we adopt a customer-centric approach, and are glad to collaborate with a like-minded company like Western Union,” said Hyungwoo Kim, CEO, Travel Wallet. “We are excited to enable our customers to connect to their loved ones around the world through one of the world’s widest-reaching financial network. We look forward to putting our collective strengths to work and catering to who really matters—our customers.”

For more information about the service, customers can email [email protected] .

About Western Union

The Western Union Company (NYSE: WU) is a global leader in cross-border, cross-currency money movement and payments. Western Union’s platform provides seamless cross-border flows and its leading global financial network bridges more than 200 countries and territories and over 130 currencies. We connect consumers, businesses, financial institutions, and governments through one of the world’s widest reaching networks, accessing billions of bank accounts, millions of digital wallets and cards, and a substantial global network of retail locations. Western Union connects the world to bring boundless possibilities within reach. For more information, visit www.westernunion.com .

About Travel Wallet

Travel Wallet is a leading fintech company in Korea providing mobile based currency exchange, remittance and cross-border payment services. Launching the app service in 2019 under the same name, Travel Wallet is the first company in Korea to target such cross-border related financial services to overseas travelers, especially visiting the Asian region. Travel Wallet also became the 1st fintech company in Asia to receive a principal card issuing license from Visa in 2020, and launched the cross-border payment service TravelPay in 2021. TravelPay supports payment in 15 currencies at the lowest payment and currency exchange fees in the Korean market. Travel Wallet has received over 20 million USD in investments and currently has over 100k active users.

Western Union Karen Santos; [email protected]

Travel Wallet Robert Lee; [email protected]

Related articles More from author

Bilt rewards and douglas elliman property management announce new landmark partnership, druva and nextgen group extend partnership agreement, phenom named a finalist for 2024 sap® pinnacle award in the intelligent enterprise innovation category.

Latest article

The future of mobile gaming: Innovations in monetization and user experience

- Privacy policy

- Legal notice

- Cookies policy

- Meet the Team

- Work with Us

- Czech Republic

- Netherlands

- Switzerland

- Scandinavia

- Philippines

- South Korea

- New Zealand

- South Africa

- Budget Travel

- Work & Travel

- The Broke Backpacker Manifesto

- Travel Resources

- How to Travel on $10/day

Home » Gear » best travel wallets

Best Travel Wallets to Match Your Style in 2024

You might well be thinking ‘do I really need a travel wallet?’ Isn’t my everyday wallet good enough? And here’s our answer: yes, and, no, in that order. How’s that then? Why should you get a dedicated travel wallet? And why isn’t what you use every day good enough when you’re traveling?

For one thing, being on the road requires supreme organization – there are different currencies, passports, insurance details, and a whole lot more than normal to keep hold of.

But don’t worry! We’ve got you covered, with the best travel wallets on offer reviewed and examined in the greatest of detail.

Quick Answer: The Best Travel Wallets

Overall best travel wallet, best tri fold wallet, best minimal travel wallet, best rfid-blocking security travel wallet, best travel wallet with a passport holder, best travel wallet for europe, best travel wallet for women, best travel wallet for men, best travel wallet belt, best of the rest, how to choose the best travel wallet, faq about the best travel wallets, happy holidays.

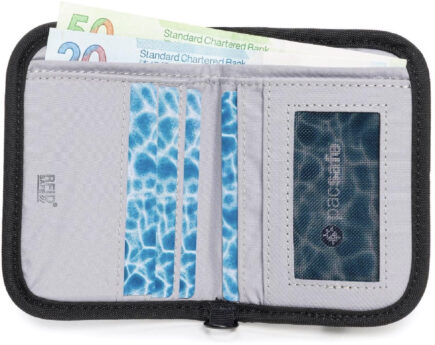

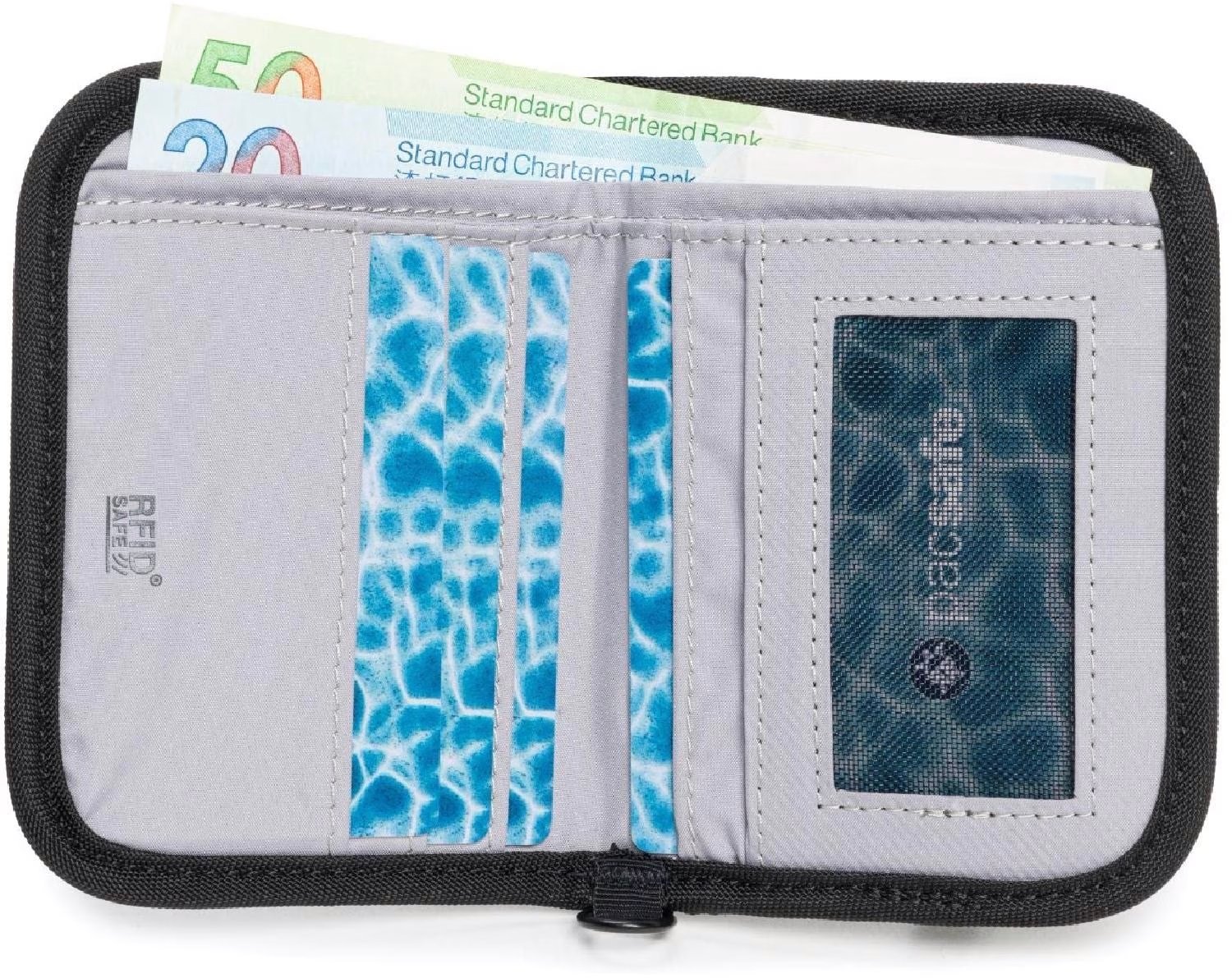

- Overall Best Travel Wallet – Pacsafe V50 RFID Blocking Bi-Fold Wallet

- Best Minimal Travel Wallet – Nomatic Slim Minimalist Wallet

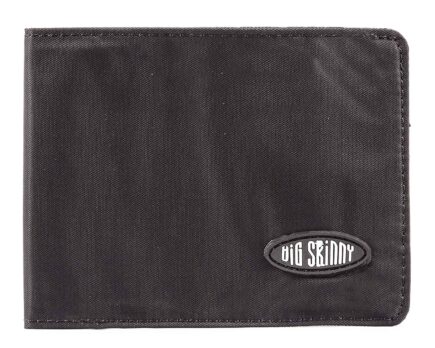

- Best Thin Travel Wallet – Big Skinny Slimline bifold wallet

- Best Leather Travel Wallet – Harber London RFID Travel Wallet

- Best RFID-Blocking Security Travel Wallet – Pacsafe RFIDsafe Bi-Fold Wallet

- Best Travel Wallet for Europe – Zoppen Multi-purpose RFID blocking travel wallet

- Best Travel Wallet for Women – Lilly Pulitzer Travel Wallet

- Best Travel Wallet with a Passport Holder – VULKIT Passport Holder Wallet

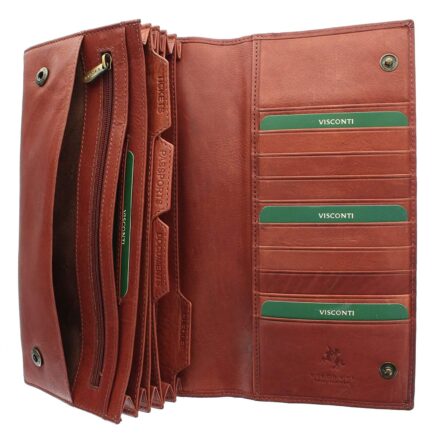

- Best Travel Wallet for Men – Visconti Leather Travel Organiser Wallet

Pacsafe V50 RFID Blocking Bi-Fold Wallet

- > RFIDsafe blocking material

- > Not too bulky

Big Skinny Tri Fold Wallet

- > Full-length banknote section

- > RDIF-blocking tech

Nomatic Slim Minimalist Wallet

- > As minimal as they come!

- > Great price point

Harber London RFID Travel Wallet

- > Several organisation pockets

- > Main zip closure for security

Pacsafe RFIDsafe V50 RFID Blocking Bi-Fold Wallet

- > Full RFID-protection

- > Water resistant

VULKIT Passport Holder Wallet

- > Fun designs

- > Big enough for a passport and smart phone

Zoppen Multi-purpose RFID blocking travel wallet

- > Eco and ethical

- > RFID-blocking

Lilly Pulitzer Travel Wallet

- > High capacity

- > Detachable hand strap

Visconti Leather Travel Organiser Wallet

- > Good number of pockets

Security Belt

- > Combined belt and money pouch

- > Very discreet

The Broke Backpacker is supported by you . Clicking through our links may earn us a small affiliate commission, and that's what allows us to keep producing free content 🙂 Learn more .

When it comes to organizing the most important personal items, you need a wallet that is practical, functional and keeps your s*** safe. The Pacsafe V50 RFID Blocking Bi-Fold Wallet is just the unit to do that. Along with using a portable travel safe , its a great way to keep your stuff safe.

The Pacsafe V50 is tough , and provides enough in the way of of security and organizational features to keep your money and cards easily accessible to you and away from the hands of potential thieves. A wallet is one of those things you don’t think about too much – but for backpackers a fine balance of practical and secure is what we are after – and I think Pacsafe achieved both of those things here.

Need more ideas? Check out the best travel organisers out there.

- RFIDsafe blocking material

- Well priced

- Wrist strap included

- Not too bulky

- No space for a passport

- Coin pocket is a bit small

- Doesn’t automatically refill with money after a night at the bar

Is the Pacsafe V50 RFID Blocking Bi-Fold Wallet for me?

If you’re looking for a slimlined minimalist wallet that’s going to provide a place for your cards (5), cash, and ID while traveling without being over bulky and immediately obvious to those pickpockets out there, then the Pacsafe V50 RFID Blocking Bi-Fold Wallet is undoubtedly the overall best travel wallet for you, with card and cash space without the drama!

REI is one of America’s biggest and most-loved outdoor gear retailers.

Now, for just $30, get a lifetime membership that entitles you to 10% OFF on most items, access to their trade-in scheme and discount rentals .

Big Skinny Trifold Wallet

This traditionally styled slimline tri-ifold wallet by Big Skinny is equally balanced and incredibly lightweight for what it is, meaning no awkward moments with one side flapping about as you try and retrieve something from the second. There’s a full-length section for bank notes, pockets for up to 4 credit cards (do you need more when traveling? It’s unlikely!), a clear fronted pocket for an ID card or driving license, and an additional two hidden pockets. What’s more, its pockets are lined with RFID-blocking technology, so you have no need to worry about your electronic data getting scanned and stolen!

- Equally balanced sides

- Full-length banknote section

- RDIF-blocking tech

- Hidden pockets

- Just 4 credit card pockets

- Imported for UK customers

- Designed for US banknotes

- Not fully waterproof

Is the Big Skinny Tri Fold Wallet for me?

Like an everyday wallet in slimline form, the Big Skinny Slimline Bifold Wallet manages to provide a full-length banknote section and place for credit cards, so if you’re looking for a travel-friendly version of your main wallet, we say go for the Big Skinny!

Update : We no longer recommend this product. As of November 2020, many Nomatic customers have experienced problems with their orders and zero customer support – therefore we do NOT recommend you buy products with Nomatic. Instead, go with one of our other top picks above.

Has someone made a mistake here? Haven’t we already reviewed the Nomatic Slim Minimalist Wallet as our overall best travel wallet? Well, yes we have! But this wallet is so perfect we just had to bring it up again! There’s simply no arguing with its minimalist tendencies, its lovingly small overall size, or its weight of just a few grams. Then there’s the fact it can hold a whopping 15 cards should you be traveling like Jeff Bezos, with a tab that makes it super easy to grab the top four you use most often. And there’s still that little pocket for cash or keys too!

Looking for more info? We wrote a more detailed post on the Nomatic Wallet for your reading pleasure!

- As minimal as they come!

- Great price point

- Easy access tab for most used cards

- Small change/key pocket

- Not large enough to hold a passport

- Just four color choices

- No RFID-blocking pocket

- Too small for some users?

Is the Nomatic Slim Minimalist Wallet for me?

We can’t quite believe how much can be stored in such a small size with the Nomatic Slim Minimalist Wallet! So for anyone looking for a travel wallet that’s going to keep their valuables safe and in one place without the need for a daypack for oversized pocket, we’ll just shift the Nomatic in your direction!

Best Leather Travel Wallet

Harber london rfid travel walle t.

For those of you who want a high end, stylish, cool as f**k leather wallet then come and meet Harber London. This lush leather RFID protected wallet is exactly what James Bond would carry if he ever bothered to pay for anything. So, there are enough credit card slots for more cards then it’s likely you’ll need when traveling, sections for keeping those freshly-minted banknotes crisp, and a further zipped pocket which you can either use for coins, keys, or other small valuable items.

Minimal yet spacious, this wallet will last you for many a year.

- Several organization pockets

- Internal zip close pocket

- RFID Protected

- Leather is not an ethical choice for some people

Is the Wildman Travel Document Wallet for me?

Add a touch of class to your business trips or family vacations with the Wildman Travel Document Wallet! Not only does it have a classically styled look about it, but an unbelievable amount of space for all those items you need when traveling – including space for your passport!

Unzip the Pacsafe RFIDsafe V50 RFID Blocking Bi-Fold Wallet and it falls open like a book, which is great for being able to rapidly spot what you’re looking for. It is fully RFID-protected, meaning data thieves are unable to scan your credit card of ID details without your knowledge, but also means you don’t have to worry about the exact placement of your most at-danger valuables. Just slip them anywhere inside the wallet! Also included are card pockets, one with a clear window for your ID, banknote sleeves, and an additional two stash pockets. To round things off, this wallet-cum-lifesaving organiser also comes with a slash-proof wrist strap.

- Full RFID-protection

- Banknote sleeves

- Change pockets

- Slash resistant

- Larger style travel wallet

- Four credit card slots

- Just one colour available

Is the Pacsafe RFIDsafe V50 RFID Blocking Bi-Fold Wallet for me?

For anyone who wants a larger travel wallet to keep everything organised and in one place the Pacsafe RFIDsafe V50 RFID Blocking Bi-Fold Wallet is the answer. With full RFID protection, there’s space for cards, banknotes, change, and passports and documentation too!

The VULKIT Passport Holder Wallet is certainly worthy of the name, with enough space to include all the valuables and items you need when traveling. Not only are there pockets for banknotes, coins, and credit/debit cards, there is also a dedicated passport pocket, all securely enclosed within a zip-close book-style opening. On the outside surface, you’ll also find a smartphone-friendly pocket suitable for phones the size of the iPhone 7, meaning users are able to keep all their valuables together in one place! The Tuscall Travel Wallet is also lightweight when empty and weatherproof, and comes in a number of fun, attractive patterns.

- Cool designs

- built RFID-protection

- Weatherproof

- Big enough for a passport and smartphone

- Too large for most pockets

- Too small for a whole family

Is the VULKIT Passport Holder Wallet for me?

Keep everything from your passport to your smartphone safe and in one place with the TVULKIT Passport Holder Wallet. Pretty much the perfect size – large enough for a passport but not so large you don’t know what to do with it – this travel wallet also offers some protection from the weather, and looks great too!

Do You Want to Travel FOREVER??

Pop your email in below to get a FREE copy of ‘How to Travel the World on $10 a Day!’.

The Zoppen travel wallet has a tri-fold design for a slimmer overall design while still being large enough to hold a passport, banknotes, and even an airline boarding card – without the need to fold it up! Made from eco and ethical PU faux leather, its classic style comes in a huge range of colors. The banknote sleeve is suitably-sized to fit US dollars – longer than many other currencies, all the while protecting your data from theft due to its in-built RFID blocking materials. On top of that, there are credit and ID card slots as you might expect, and the possibility to slip your smartphone inside too!

- Can hold a passport

- Eco and ethical

- Range of colors

- RFID-blocking

- Faux leather

- Slightly heavier than other travel wallets

- Not the trendiest look

- Not for the great outdoors

Is the Zoppen Multi-purpose RFID blocking travel wallet for me?

Buy the Zoppen Multi-purpose RFID blocking travel wallet and you’re pretty much guaranteed to have space for all the valuable items you need to travel with, from passport to boarding card and credit cards. The RFID-blocking technology also means you’re safe from data theft wherever you are in the world!

The Lilly Pulitzer Travel Wallet is another of the higher capacity travel wallets we’re bringing to your attention in this review. This nature makes it incredibly easy to keep everything not only in one handy place but organized throughout too. The book-like form provides an almost unending series of pockets, some zipped, for passports, documentation, and money. There’s a detachable hand strap that can be slipped over the wrist to make this travel wallet even more secure when being used.

- High capacity

- Great organization

- Detachable hand strap

- Intended for women only

- 250 grams delivery weight

Is the Lilly Pulitzer Travel Wallet for me?

Are you the one responsible for the family’s documents? Or maybe you’re just a woman who likes to be organized and have everything in one place? If either is you, then the Lilly Pulitzer Travel Wallet is going to make your life a hell of a lot easier, thanks to its huge array of pockets!

This delightful travel wallet is constructed from soft leather for a luxurious feel and has a simple but stylish look. There’s a zip close pocket the size of the whole wallet on the outer rear side, which has a multitude of users. Inside, the travel wallet opens out to reveal a variety of pouches and a further zip close pocket, as well as a good number of credit card slots on the flap opening. For supreme organization, sections are labeled ‘tickets’, ‘passports’, ‘documents’, and ‘cheques’. What’s more, there’s an additional slip sleeve hidden beneath the credit card slots that’s perfect for banknotes.

- Stylish look

- Good number of pockets

- Organisational sleeves

- ‘Cheques’?, who uses cheques?

- No RFID-blocking pockets

- Wallet closes with studs rather than zip

- Large for the average male pocket

Is the Visconti Leather Travel Organiser Wallet for me?

This stylish travel wallet will leave many a person asking where you’ve got it from! Not only does it look and feel great, but its highly usable too. There are zip close pockets inside and out, as well as helpfully-labeled sleeves to keep you on the straight and narrow when it comes to organization while away from home.

If you’re worried about the need to carry high-denomination banknotes on you when you’re traveling, the a Security Belt could be the answer. Combining the belt you’ll probably be taking in any case with a wallet, the basic premise is a belt that incorporates a hidden zipped pocket on its inner side. Made from sturdy black nylon, the belt weighs just four ounces and fits men’s and women’s waists of 26 to 42 inches. The downside to a security belt is that it cannot be used as an everyday wallet since the money is nicely tucked away, and banknotes need to be folded lengthways to fit.

- Combined belt and money pouch

- Zip close pocket

- Sturdy nylon construction

- Very discreet

- Cannot be used as an everyday wallet

- Banknotes must be folded

- Cannot take credit card/passport

- Plastic buckle

Is a Security Belt for me?

A further feather in the cap for security when traveling, this Security Belt is a nice way of separating out some emergency cash from your other valuables. Alternatively, it’s a way of minimizing spending and the risk of pickpockets.

Bellroy Leather Travel Wallet

Using environmentally certified leather, the Bellroy Leather Travel Wallet is another of the slimline travel wallets in this review. However, that doesn’t mean this travel wallet doesn’t have the capacity to hold everything you need for a successful time away. In fact, the Bellroy Leather Travel Wallet has a dedicated passport pocket, as well as another two for banknotes of different currencies, documents, and up to 10 credit cards too! Flipping open like a police notebook rather than a paperback book, there’s a narrow pen has been cleverly added into the center fold. In addition, the Bellroy also includes protection from electronic snooping, with RFID-blocking incorporated!

- Environmentally certified leather

- Passport pocket

RFID-protection

- High delivery price for UK customers

- Won’t take a family’s passports

- No outer zip

Is the Bellroy Leather Travel Wallet for me?

A crisp, clean look is just the start of the benefits of owning this leather travel wallet from Bellroy. Designed with travel in mind, there’s a dedicated passport pouch, pockets for multiple currencies, and place for a good number of credit cards too! And then there’s the RFID-blocking technology we should also mention again….

Valante Travel Wallet

The Valante Travel Wallet opens out in the same way a book does, giving easy access and even easier sighting of all the items you’re storing within. The rear exterior side has a large pocket in which you could slip in your smartphone, while inside there are a further three large pockets big enough to take a passport. There are two sleeves for holding banknotes of various currencies, an identity card or driving license pouch, and slots for an additional seven credit cards. Its lightweight, but is still made from water-resistant nylon. Finally, the Valante travel wallet also includes RFID-blocking technology too!

- Book opening

- Smartphone and passport pockets

- RFID-blocking tech

- Polyester material

- Weight of 9.1 oz.

- Just one color available

Is the Valante Travel Wallet for me?

If you need a travel wallet capable of holding all of your travel documents, the Valante is a good way to go. There are pockets large enough for a smartphone and passports, as well as those for banknotes and slots for credit cards. There’s also the fact it has RFID-protection, and resistance against the rain too!

Now, you could spend a fat chunk of $$$ on the WRONG present for someone. Wrong size hiking boots, wrong fit backpack, wrong shape sleeping bag… As any adventurer will tell you, gear is a personal choice.

So give the adventurer in your life the gift of convenience: buy them an REI Co-op gift card! REI is The Broke Backpacker’s retailer of choice for ALL things outdoors, and an REI gift card is the perfect present you can buy from them. And then you won’t have to keep the receipt. 😉

The best travel wallet for one person isn’t necessarily the best travel wallet for the next person in the queue. So which is the best travel wallet for you? Here are a few points to take note of when working out which of our top picks might be the best for you.

Most of the travel wallets in our review list are made from water-resistant synthetic materials, which are ideal for anyone worried about getting caught in the rain (or even ruined by a splash of spilt coffee). But we’ve also covered a few travel wallets made in faux or real leather, for that extra look of sophistication!

Do you want your travel wallet to contain RFID-protection ? Firstly, let’s explain exactly what RFID stands for: Radio-Frequency Identification Devices. Basically, the wallets that promise RFID-protection stop electronic pickpockets from stealing your data by scanning the data stored on credit cards, identity cards, and even in passports, which could then be used to spend, spend, spend, or even duplicate your identity. You have been warned!

Frequency of use

If you’re only going to use your travel wallet once or twice a year, you’re probably going to be looking for a travel wallet at the lower end of the price bracket. However, if you’re a regular traveler, you definitely do get what you pay for, so keep this in mind when working out how to choose the best travel wallet for you!

Still have some questions? No problem! We’ve listed and answered the most commonly asked questions below. Here’s what people usually want to know:

What makes a travel wallet so different?

Travel wallets need to be more durable and offer more organisation than normal wallets. In the best case, they’re also made from cut-proof material.

Are there wallets that fit passports?

Yes, the VULKIT Passport Holder Wallet fits all of your cards, money and even your passport. It’s obviously not the size that you can put into your pocket, but to keep all of your valuables together, it’s perfect.

What is the safest travel wallet?

The Pacsafe RFIDsafe V50 RFID Blocking Bi-Fold Wallet is a great anti-theft wallet. It is fully RFID-protected, meaning data thieves are unable to scan your credit card or ID details.

What is the overall best travel wallet?

Our favorite is the Pacsafe V50 RFID Blocking Bi-Fold Wallet . It offers plenty of compartments which makes organisation a breeze.

Our GREATEST Travel Secrets…

Pop your email here & get the original Broke Backpacker Bible for FREE.

One of the best ways to ensure a stress-free and happy vacation period is by buying the best travel wallet you can afford. Then all your most valuable travel items will be safe and secure, leaving you to relax and have fun!

These travel wallets not quite cutting it for you? How about checking out the best travel purses instead!?

Share or save this post

Nice Post. very well written and very impressive

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Notify me of followup comments via e-mail.

In My Korea

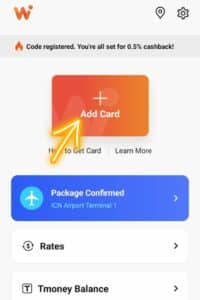

WOWPASS Korea Review: How To Use WOWPASS With T-Money 2024

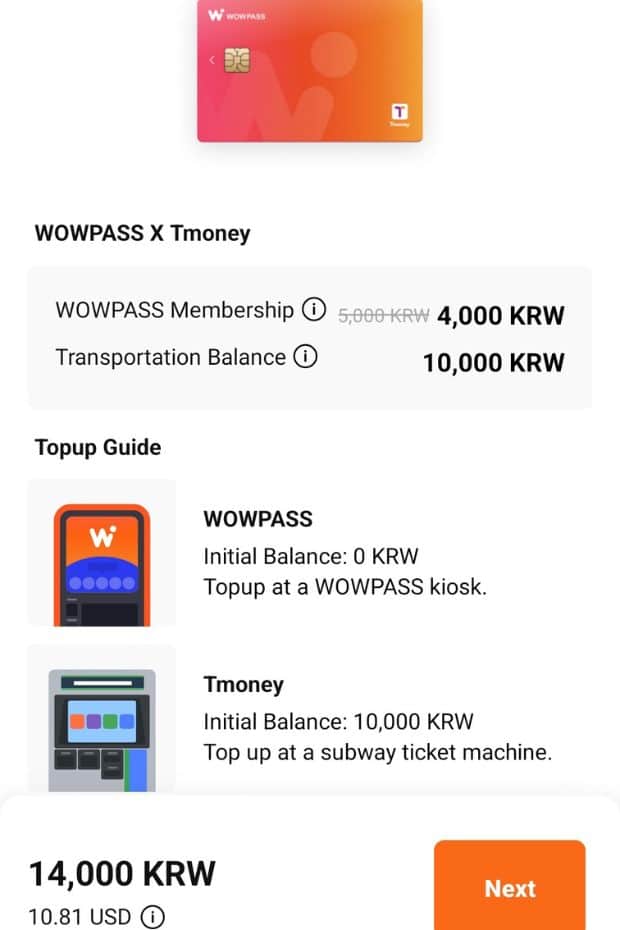

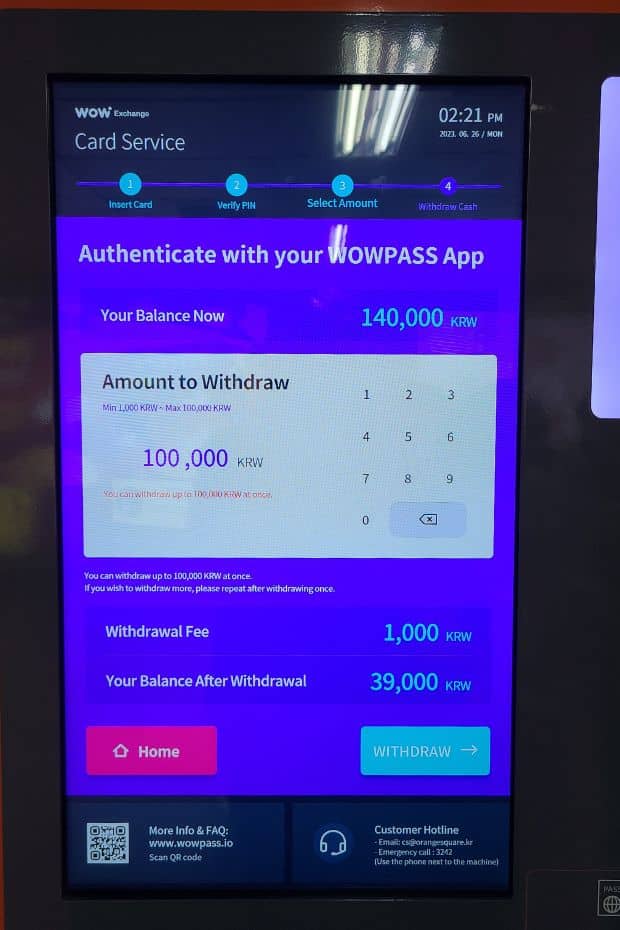

Travelling to Korea soon and worried about high fees when you use your credit card? Not sure if you will be able to withdraw cash at an ATM or use your credit card when shopping? Want to avoid paying high rates to exchange cash at home or in Korea? Then you should definitely learn about the WOWPASS card, the Korean travel card that comes with T-Money.

WOWPASS is a new type of travel card and truly one-of-a-kind. It allows you to pay in local currency in Korea, but can be topped up using 15 different foreign currencies. Because it’s issued in Korea, it’s more reliable and is accepted almost everywhere that local Korean bank cards are.

What’s more, there’s a package designed for tourists to Korea that offers not only a WOWPASS travel card, but also an extremely useful Korean sim card and 10,000 KRW T-Money balance, which is perfect for getting around Korea on day 1 of your journey to Korea. Full details in this article.

Table of Contents

Affiliate Disclaimer : This site contains affiliate links and I may earn commission for purchases made after clicking these links.

What Is A WOWPASS Card?

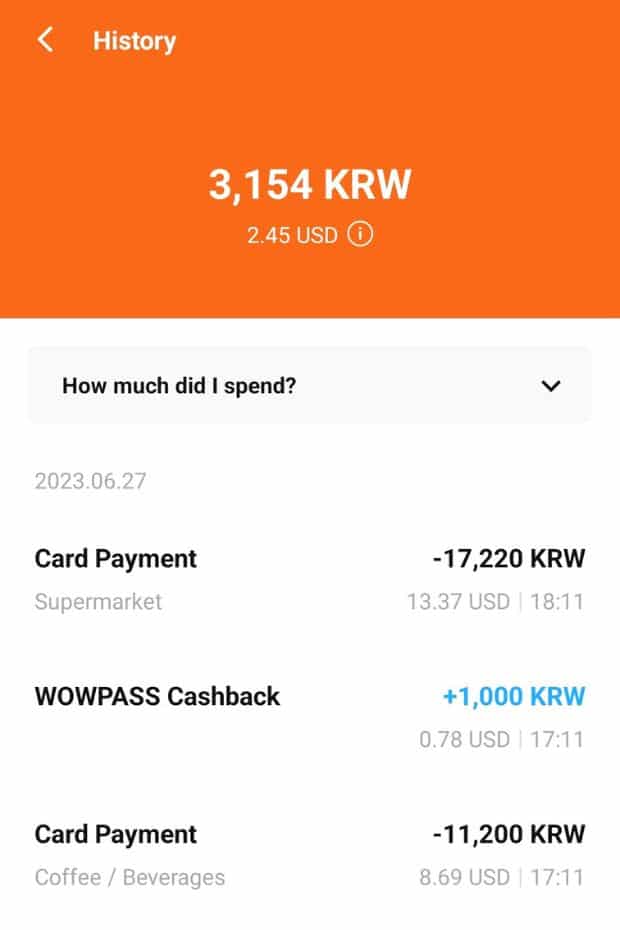

The WOWPASS card is an all-in-one prepaid Korean travel money card that allows you to pay like a local in Korea and pay for public transportation using foreign currency or Korean won. The WOWPASS allows you to avoid expensive fees or bad exchange rates from using your home bank card in Korea.

One of the biggest benefits of the WOWPASS is the ability to top it up in one of 15 foreign currencies and use it straight away to pay for things in Korea with no fees. The exchange rates are better than you’ll find at the airport and you can avoid the problem of having to carry loads of cash with you.

Here are some more benefits of the WOWPASS card:

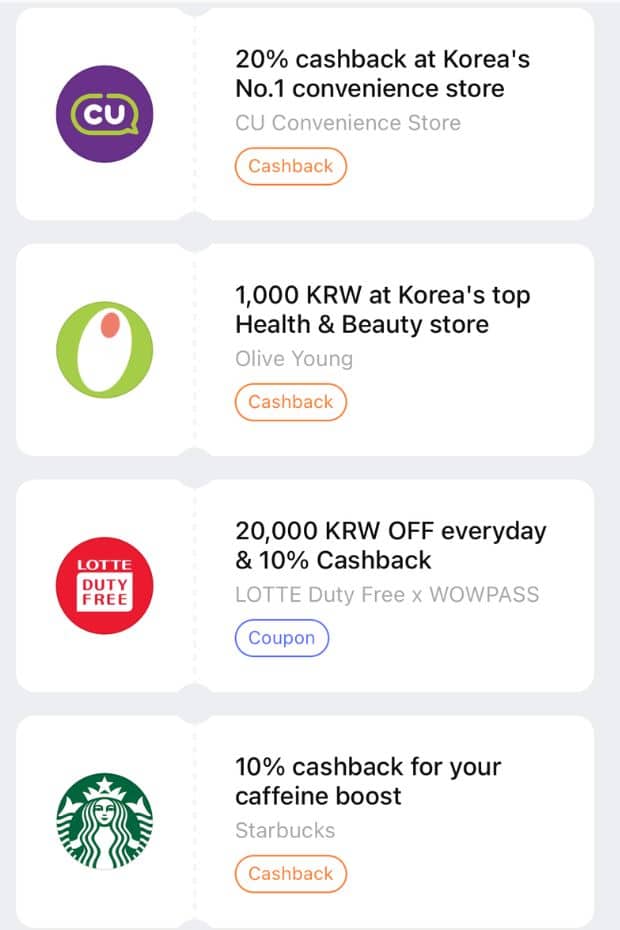

How much does the WOWPASS card cost? Only 5,000 KRW. That’s less than $5 USD. WOWPASS includes a T-Money card, which can cost 4,000 KRW alone. If you use an invitation code (such as INMYKOR1) you’ll get 0.5% cashback when you top-up your WOWPASS with a foreign currency.

Korea is fast becoming a cash-free society… and the WOWPASS is an answer to this issue.

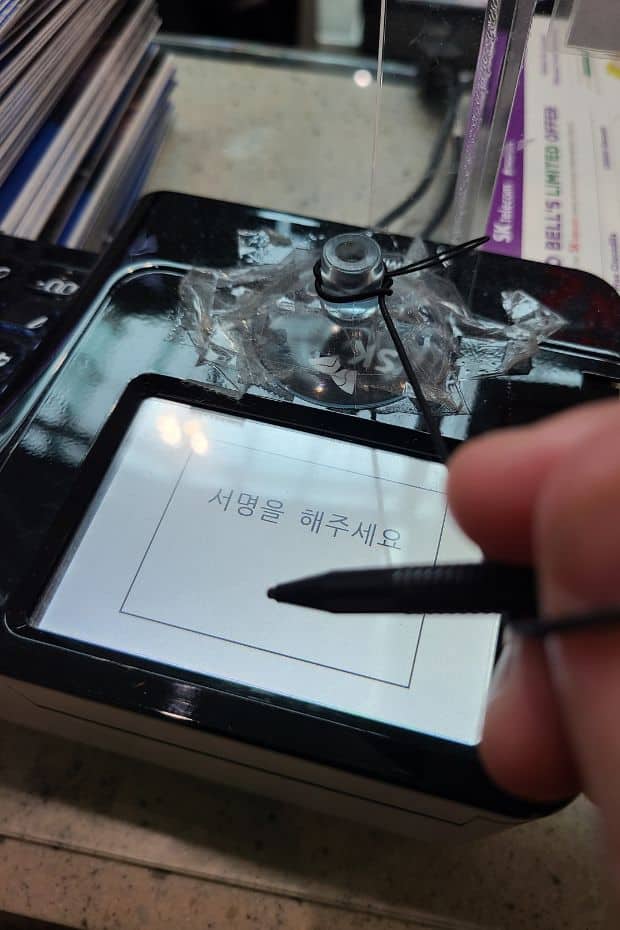

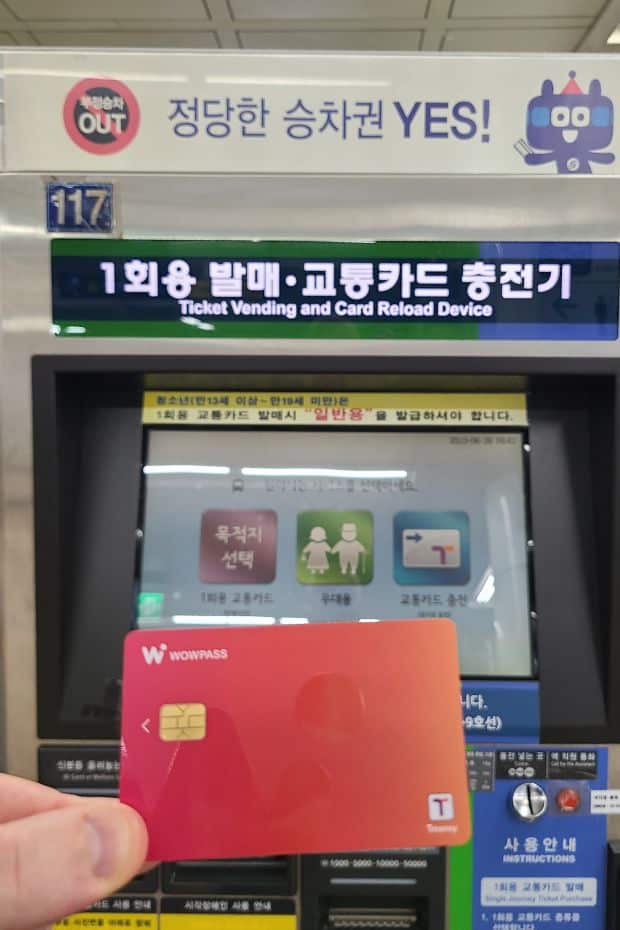

As you can see in the pictures below, Korea is fast becoming a cash-free society with more places only accepting card payments, including buses, restaurants, cafes, and attractions. The need for a travel money card in Korea has never been stronger and the WOWPASS is an answer to this issue.

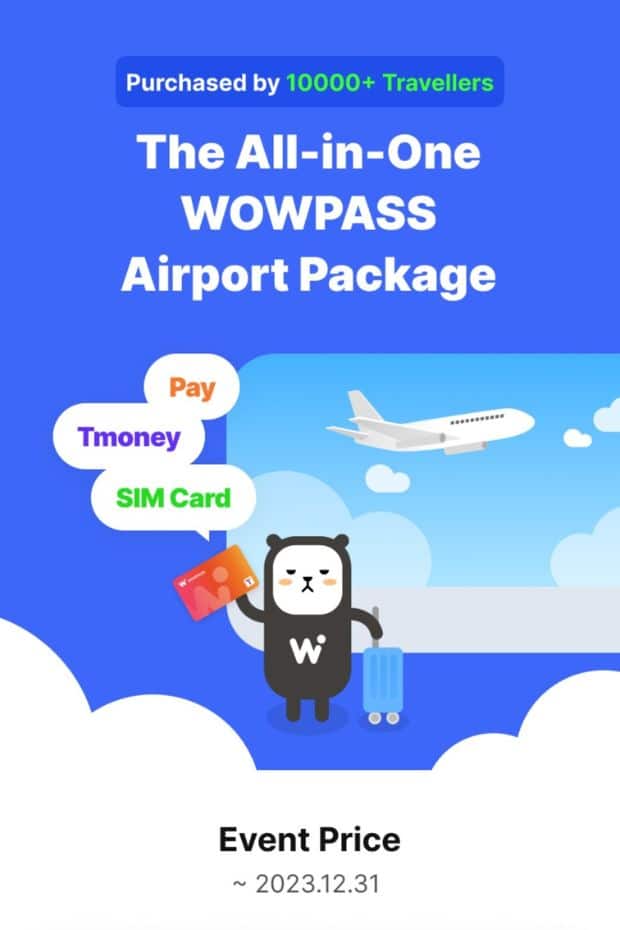

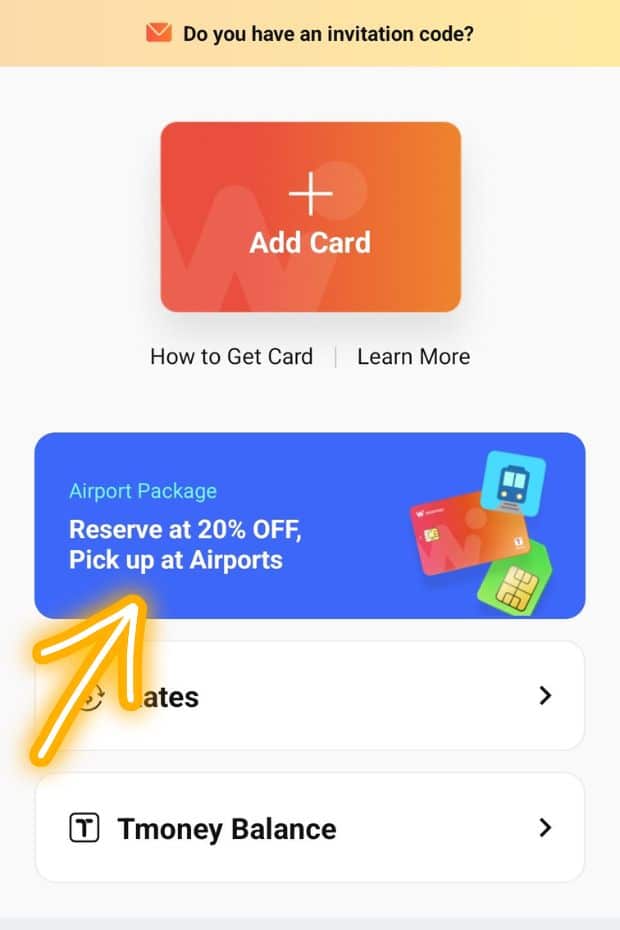

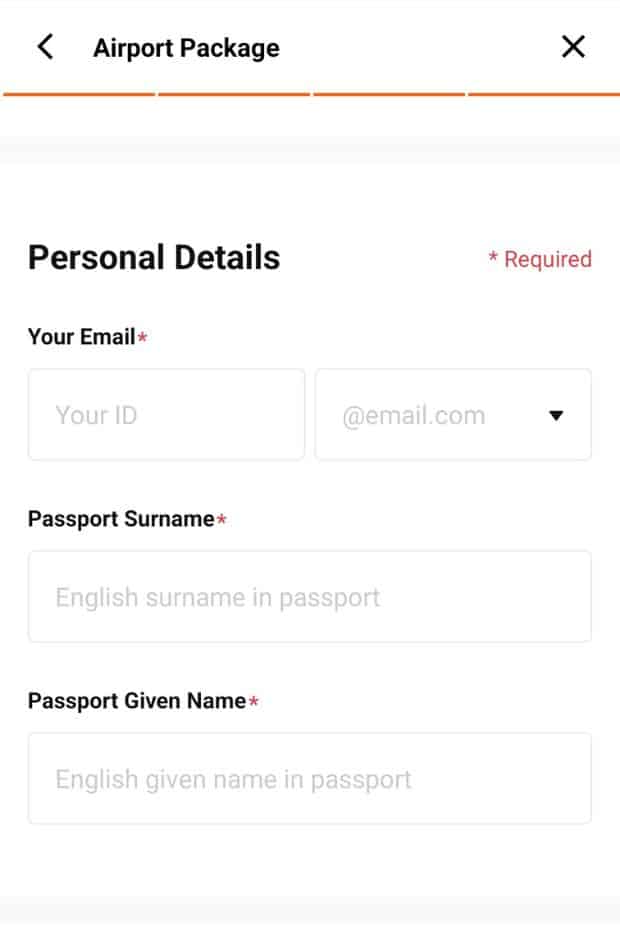

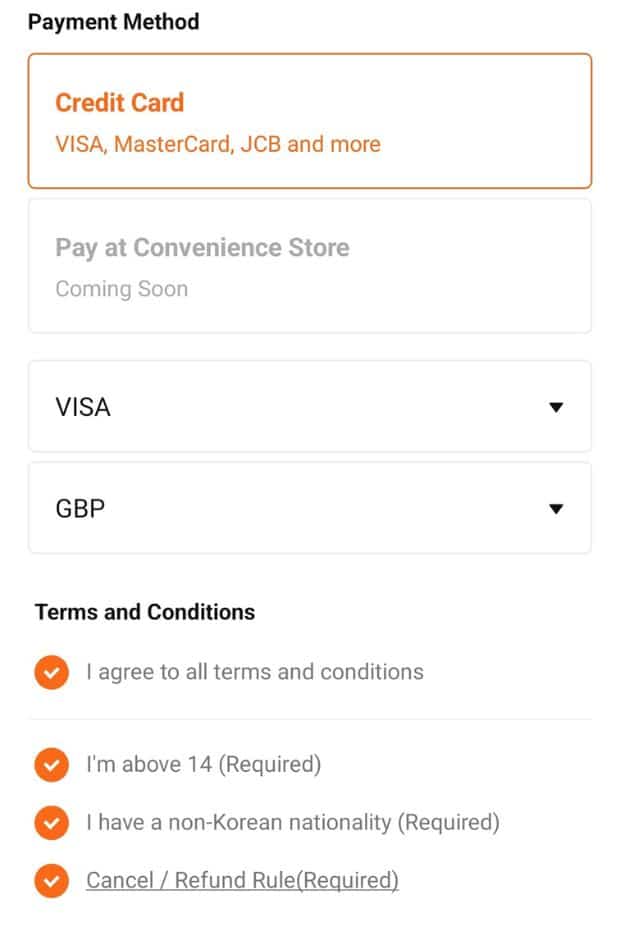

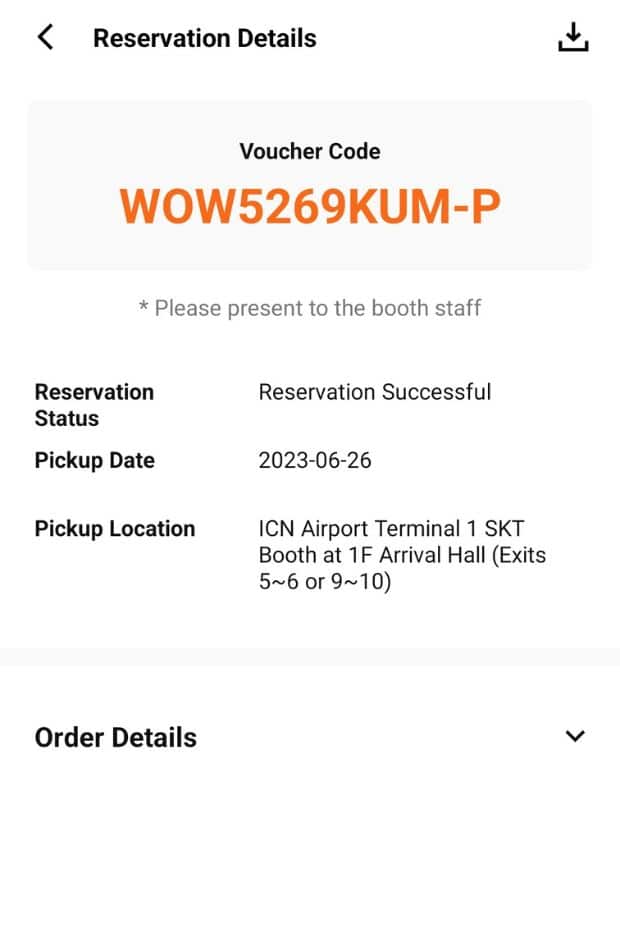

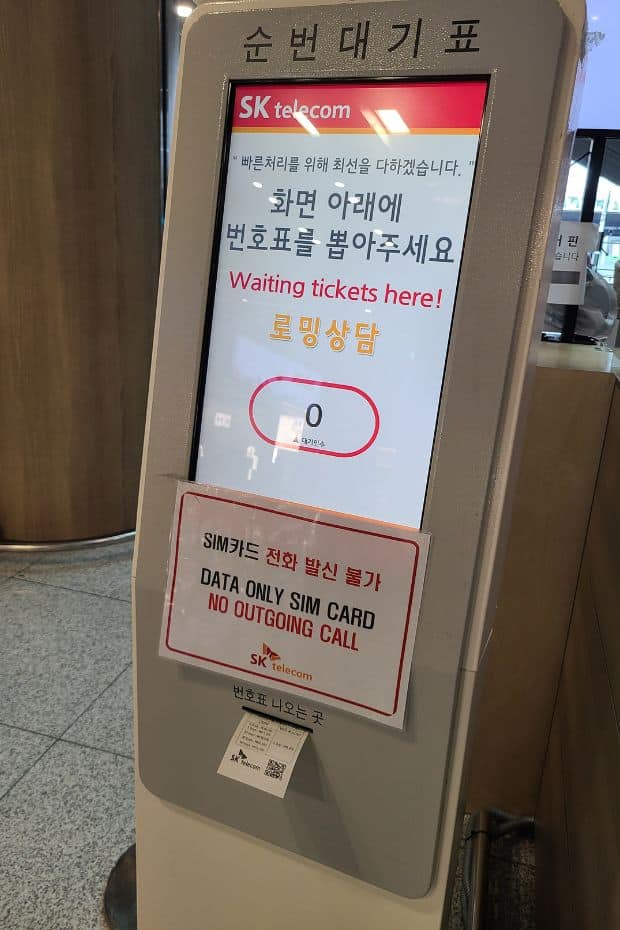

WOWPASS Airport Package: Saving You More

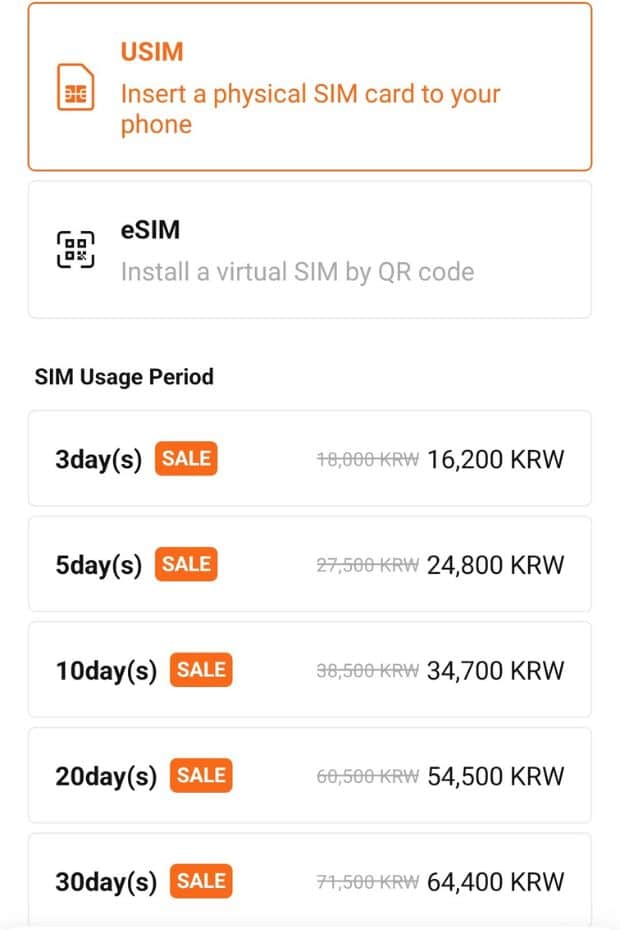

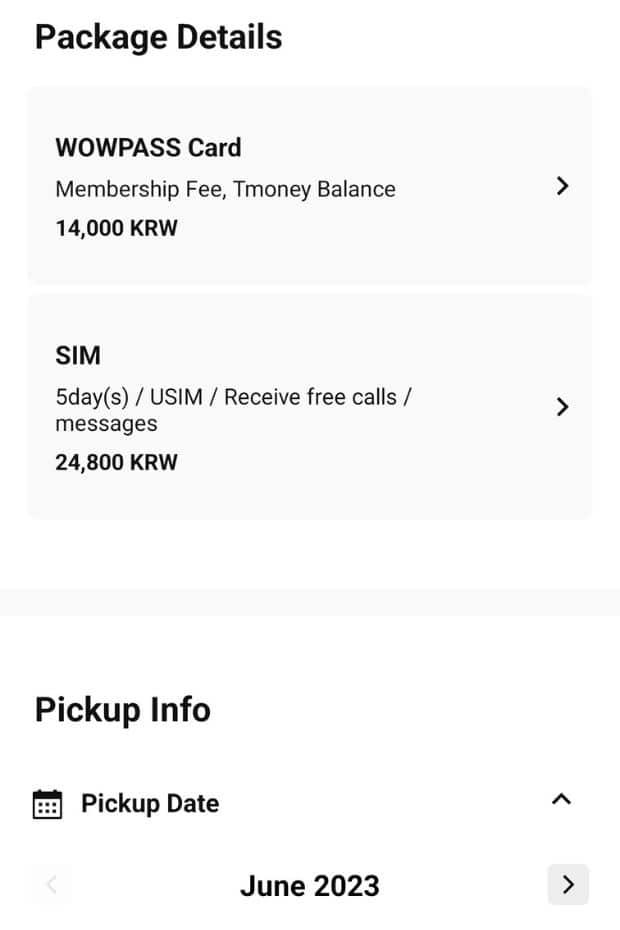

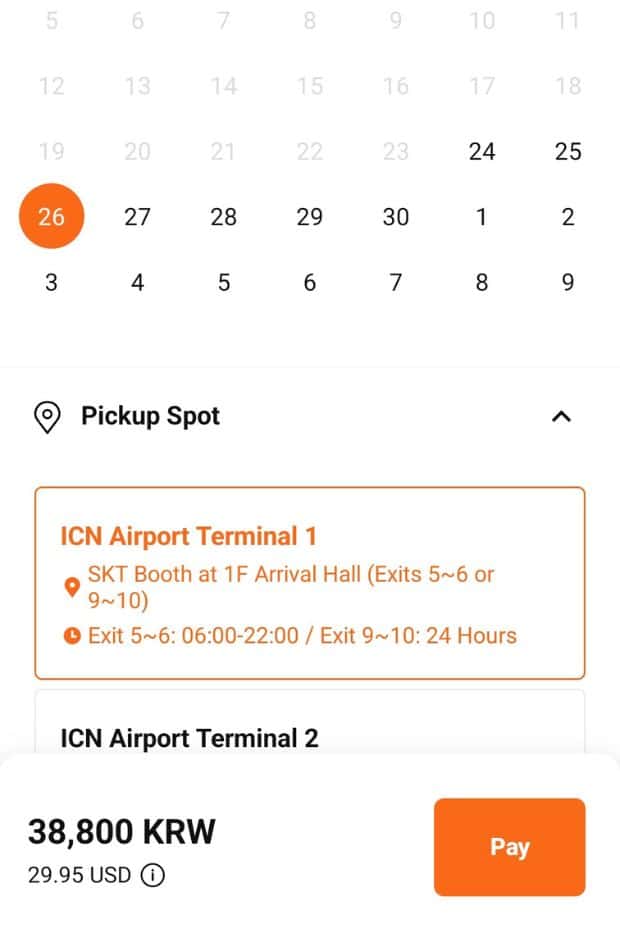

As well as all the great benefits of getting a WOWPASS card, there is also a special package for tourists to Korea called the Airport Package . This complete package includes a WOWPASS , 10,000 KRW T-Money balance , and a discounted uSim or eSim with unlimited data to connect to the net.

The Airport Package is great value for money as it offers all of those benefits but at a lower price vs. buying them separately at the airport. Here’s what you get and how much you can save:

*The price of the WOWPASS Airport Package depends on the cost of the sim card you get and all of them are cheaper than what you’ll pay at the airport counters. The sim cards are available for 3 / 5 / 10 / 20 / 30 days so there’s something to suit you, however long you plan to travel in Korea.

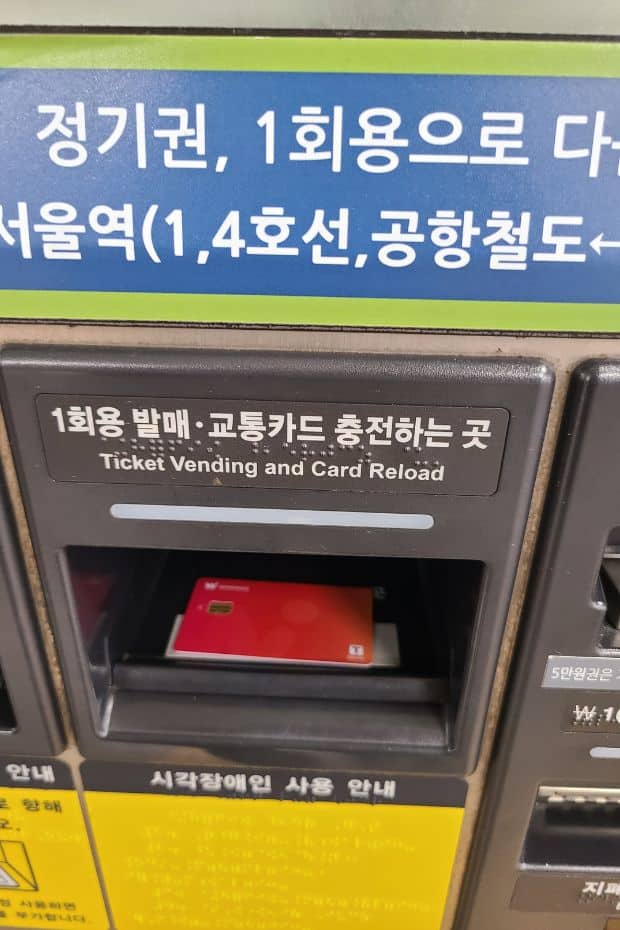

A regular WOWPASS card doesn’t come pre-loaded with a 10,000 KRW T-Money balance, so the Airport Package allows you to jump straight onto the subway from Incheon Airport into Seoul. Use the WOWPASS from the Airport Package and touch the barriers at the subway station to travel.

The Airport Package allows you to jump straight onto the subway from Incheon Airport into Seoul.

A T-Money card is an essential purchase for any traveller to Korea. Getting a tourist sim card is also really useful for staying connected so you can surf the web, use apps, and check the weather. The WOWPASS Airport Package gives you both of these at a discount and a WOWPASS card, too.

In the rest of this article, I’ll tell you about how to issue a WOWPASS card and how to get the Airport Package, as well as provide details about where and how you can use WOWPASS in Korea. I’ll also explain some of the key benefits of the WOWPASS app and share my experience using WOWPASS.

Planning to visit Korea? These travel essentials will help you plan your trip, get the best deals, and save you time and money before and during your Korean adventure.

Visas & K-ETA: Some travellers to Korea need a Tourist Visa , but most can travel with a Korean Electronic Travel Authorisation (K-ETA). Currently 22 Countries don’t need either one.

How To Stay Connected : Pre-order a Korean Sim Card or a WiFi Router to collect on-arrival at Incheon Airport (desks open 24-hours). Alternatively, download a Korean eSIM for you travels.

Where To Stay : For Seoul, I recommend Myeongdong (convenient), Hongdae (cool culture) or Gangnam (shopping). For Busan, Haeundae (Beach) or Seomyeon (Downtown).

Incheon Airport To Seoul : Take the Airport Express (AREX) to Seoul Station or a Limo Bus across Seoul. Book an Incheon Airport Private Transfer and relax to or from the airport.

Korean Tour Operators : Tour companies that have a big presence in Korea include Klook , Trazy , Viator , and Get Your Guide . These sites offer discounted entry tickets for top attractions

Seoul City Passes : Visit Seoul’s top attractions for free with a Discover Seoul Pass or Go City Seoul Pass . These passes are great for families and couples visiting Seoul – you can save lots.

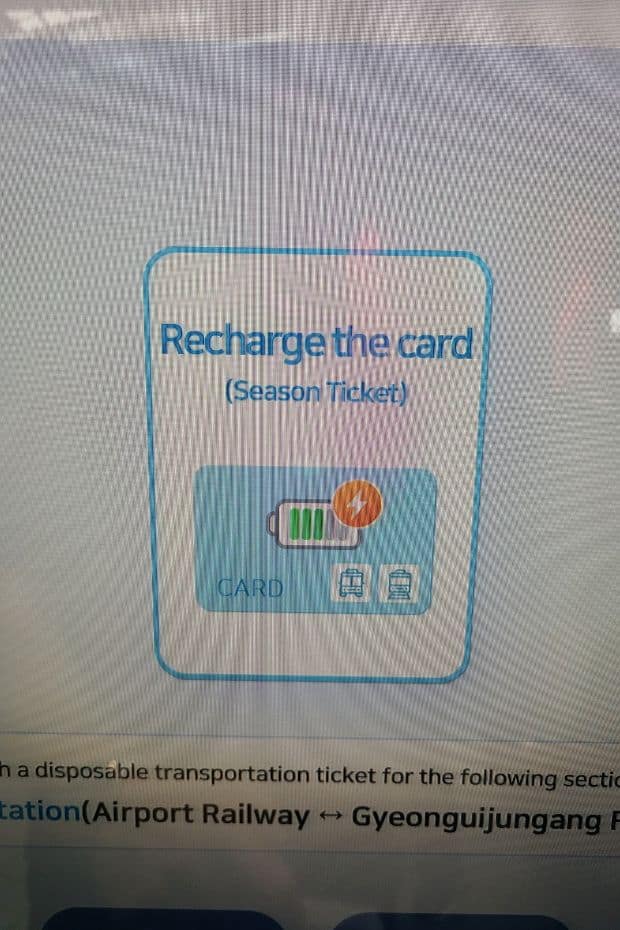

How To Get Around : For public transport, grab a T-Money Card . Save money on Korea’s high speed trains with a Korea Rail Pass . To see more of Korea, there are many Rental Car Options .

Travel Money : Use money exchanges near Myeongdong and Hongdae subway stations for the best exchange rates. Order a Wise Card or WOWPASS to pay by card across Korea.

Flights To Korea : I use flight comparison sites such as Expedia and Skyscanner to find the best flights to Korea from any country. Air Asia is a good option for budget flights from Asia.

How To Learn Korean : The language course from 90 Day Korean or Korean Class 101 both have well-structured lessons and lots of useful resources to help you learn Korean.

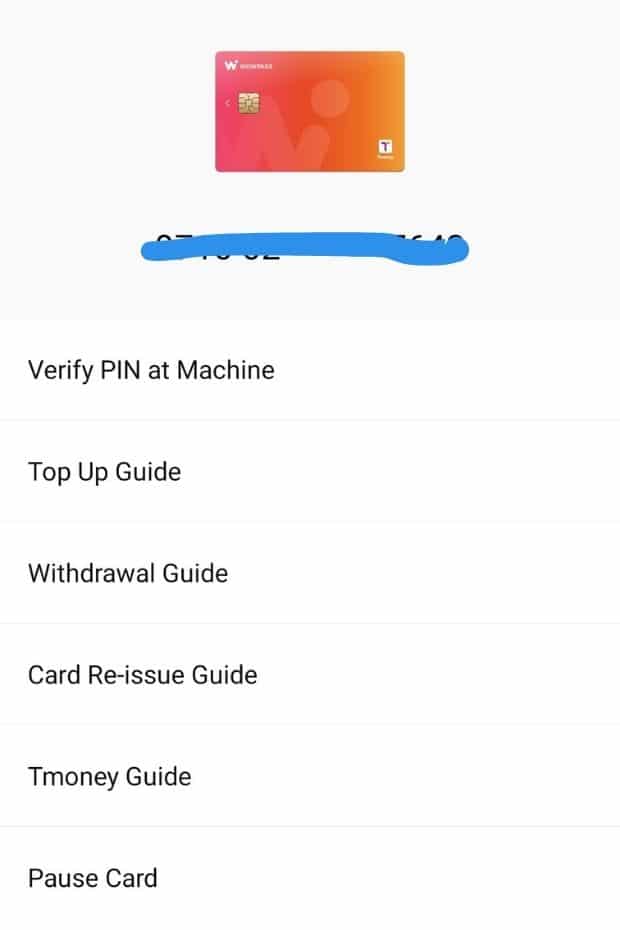

How To Issue WOWPASS At A WOW Machine

Getting a WOWPASS card is really simple for travellers to Korea. Here’s a step-by-step guide to help you download the app, collect your WOWPASS and start using it when you travel in Korea. That’s why I recommend it in my South Korea Travel Guide , which is full of essential Korean travel tips.

How To Issue WOWPASS In Korea

1: Download The WOWPASS App

The WOWPASS app is available for Android and Apple and is essential for using your WOWPASS in Korea. You’ll need to download the app to be able to issue the card.

2: Create A WOWPASS Account

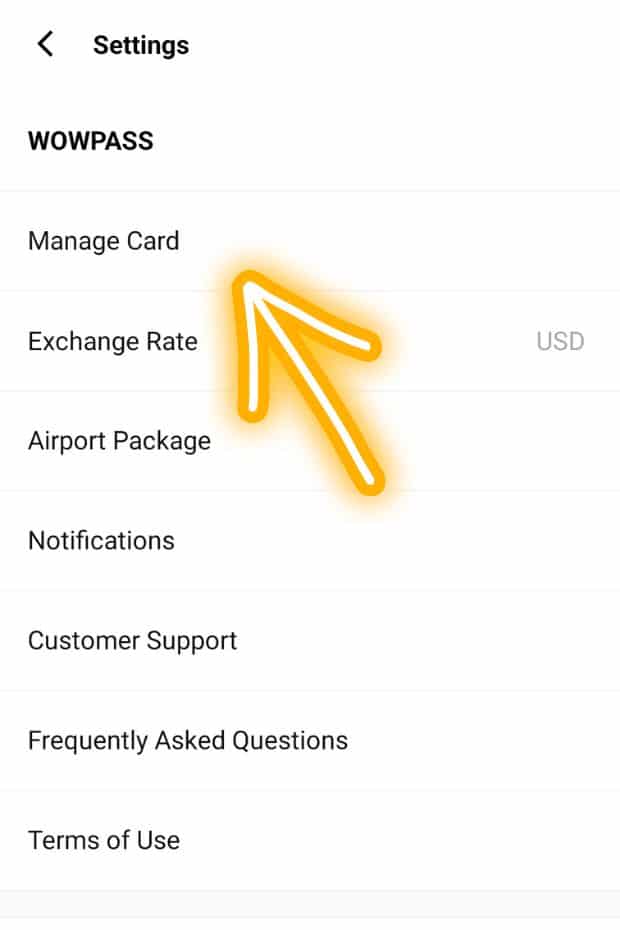

To use the WOWPASS app, you’ll need to create an account. This is simple and all you need to do is enter an email address, password, select your preferred currency, and accepts the T&Cs. Click ‘Finish Sign-Up’ to complete your account and confirm your email address.

3: Enter Your Invitation Code

Open the WOWPASS app and there is an option to enter an invitation code at the top of the screen. If you enter an invitation code, you will receive up to 0.5% cash back on foreign currency top-ups worth a maximum of 1,000,000 KRW. Invitation Code : INMYKOR1

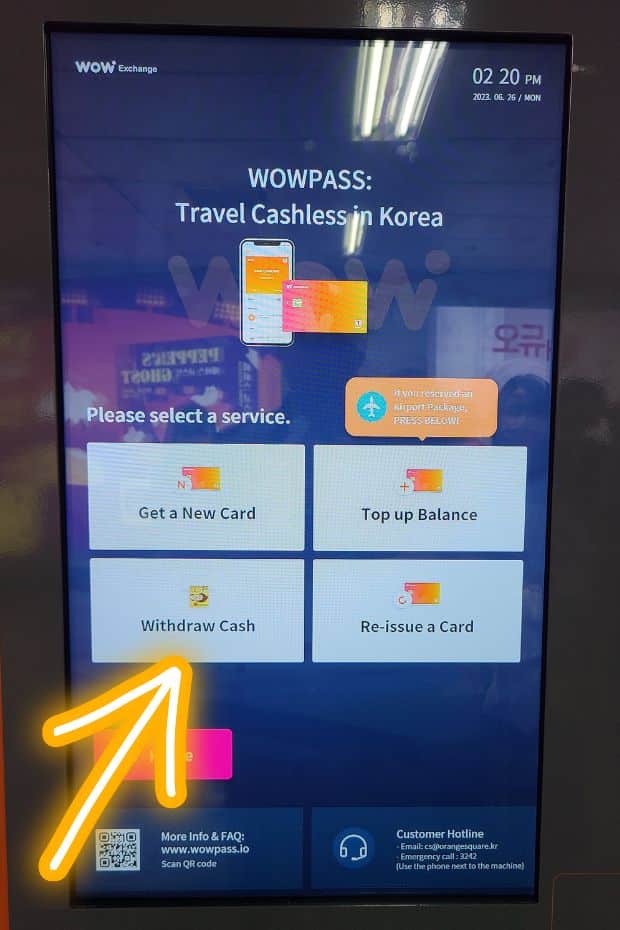

4: Go To A WOW Exchange Machine

Bring your passport and phone with the WOWPASS app installed to one of more than 90 WOW Exchange machines across Korea, including at Incheon Airport inside the Airport Express non-stop train terminal. Select your preferred language and touch the start screen. Select the service ‘WOWPASS Card’ to issue your WOWPASS.

5: Select ‘Get A New Card’

After reading about the benefits of the WOWPASS card, select the option to ‘Get a New Card’ on the WOW Exchange machine.

6: Select The Currency You Want To Top-Up With

To issue a new WOWPASS card, you need to add credit to the card. You can do this in 16 different currencies, including Korean won. If you registered an invitation code when you registered your app, you will get 0.5% cash back when adding credit with a foreign currency.

7: Scan Your Passport

Before you actually add any money to the WOWPASS card, you first need to validate your identity by showing your passport. This rule applies any time you exchange money in Korea, whether it’s at a WOW Exchange machine, a money changer, or in a bank.

8: Agree To The WOWPASS Membership Agreement

After you confirm your identity, you need to confirm one last time that you accept the WOWPASS terms and conditions. You can view these on the WOW Exchange machine and they’re also stated in the app. Select ‘Agree All’ to continue to

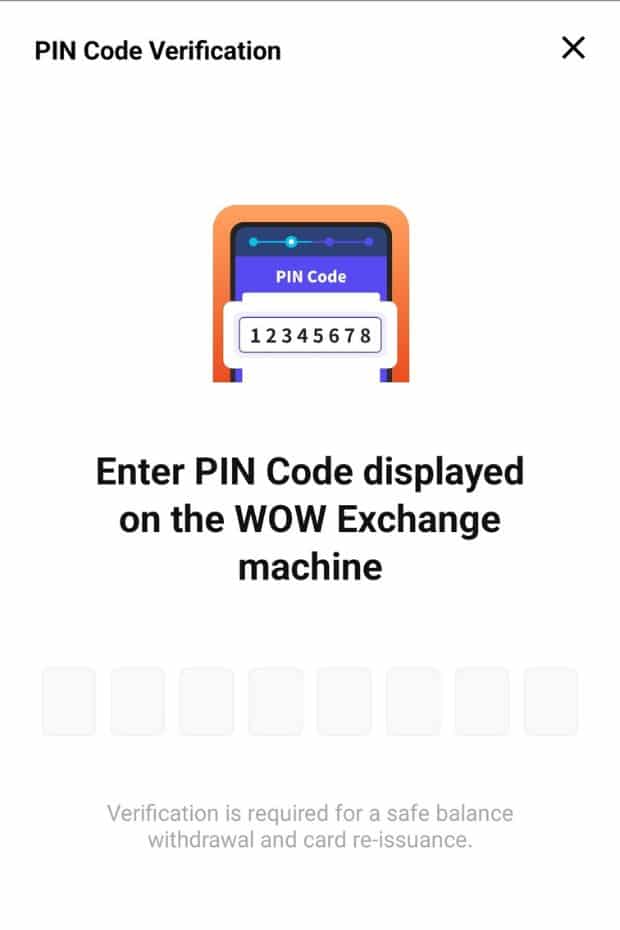

9: Deposit Cash Into The WOW Exchange Machine