Budget Direct Travel Insurance

Our verdict: budget direct offers a broad range of customisations and is one of the few insurers to make covid-19 benefits optional..

In this guide

Summary of Budget Direct's Comprehensive policy

How does budget direct travel insurance cover covid-19, what policies does budget direct offer, here's a breakdown of budget direct travel insurance features, standard features, optional add-ons, how to make a budget direct travel insurance claim, here's the bottom line about budget direct travel insurance, frequently asked questions, request travel insurance quotes and compare policies.

Destinations

- Budget Direct offers cover for high-risk activities that many other brands don’t, including trekking to Everest Base Camp and trekking the Kokoda Trail.

- There are a broad range of customisations available so you can tailor cover to suit your specific needs.

- Even if you choose to add COVID-19 cover to your policy, it doesn’t offer the most comprehensive protection.

- Cover for pregnancy complications is only available up until the 24th week, but there are many brands that extend cover for longer .

Compare other options

Table updated October 2023

Budget Direct is one of the few travel insurers that lets you customise your cover for COVID-19.

As standard, you will receive cover for overseas medical expenses, including emergency evacuation or repatriation if you’re diagnosed with COVID-19. You’ll also be able to claim up to $2,500 for additional expense if you’re diagnosed with COVID-19 while overseas.

However, if you want cover for amendment or cancellation costs, you’ll have to add that to your policy. If you add the benefit to your policy, you’ll be covered for amendment or cancellation costs if you or your travelling companion are diagnosed with COVID-19.

There are many scenarios that are not covered by Budget Direct, even if you add on the policy. For example, you won’t be covered if your tour or accommodation cancels due to COVID-19.

There is also no cover if you were diagnosed with COVID-19 before heading on your trip but you went anyway.

Budget Direct offers four insurance policies to travellers. Comprehensive, Essential, Basic and Domestic. All of these policies can be taken out as a single or multi-trip policy, with the exception of basic which is only available as a single-trip policy.

Comprehensive

The insurer of this product is Zurich Australian Insurance Limited. It comes with a cooling-off period of 21 days and choice of $200 standard excess for international plans.

These are some of the main insured events that Budget Direct will cover. Some of these benefits may only apply on the comprehensive international policy.

- Overseas medical treatment

- Emergency dental costs

- Trip cancellation or amendment costs

- Lost, damaged or stolen property

- Luggage and travel delay

- Additional accommodation and transport

- Theft of money

- Rental car excess

- Permanent disability

- Kidnap and hijack

- Personal liability

- Accidental death

Budget Direct also offers six add-on options that provide cover for a wider range of risks or activities while you’re on holiday.

- Cruise Cover Extends your insurance policy to cover cruises and a range of cruise-specific risks such as missed ports, sea sickness, and cabin confinement.

- Adventure Covers you for participation in a range of activities such as risky activities such as quad biking, rock climbing, and horse trekking.

- Adventure+ Extends your cover to even higher risk activities, such as trekking to Everest Base Camp or the Kokoda Track.

- Snow sports Covers you for on-piste snow skiing, snowboarding, snowmobiling and cross-country skiing.

- Snow sports+ Extends your snow sports cover to include skiing and snowboarding off-piste as well as heli-skiing and heli-boarding.

- COVID-19 cover. Protection for cancellations and amendment costs if you or a travelling companion are diagnosed with COVID-19.

- Increase item limits. Boost your coverage for valuable items to ensure you're fully protected during your travels.

- Motorcycle cover. Stay secure on your rides with optional coverage specifically designed for motorcycles.

Unfortunately, travel insurance doesn’t cover everything. Generally, Budget Direct will not pay your claim if it relates to:

- Unlawful, wreckless or unreasonably unsafe behaviour by you

- Behaviour while you were drunk or under the influence of drugs

- Expenses related to a pre-existing medical condition

- An act of war, invasion or revolution

- Insolvency of a travel agent , tour operator or accommodation provider

- Mandatory quarantines or isolations

- You being unfit to travel or travelling against medical advice

- Childbirth or pregnancy complications after the 23rd week of gestation or if you have had previous pregnancy complications

- A multiple pregnancy or one where the conception was medically assisted

- An elective medical or dental treatment , cosmetic procedure or body modification (including tattoos or piercing)

- Self-inflicted injury or illness, suicide or attempted suicide

Make sure you review the Budget Direct PDS for a detailed breakdown of what won't be covered, found under its list of general exclusions .

To lodge your claim online, visit claims.travelinsurancepartners.com.au/budgetdirect and follow the prompts.

Alternatively, you can download, print and complete a claim form from budgetdirect.com.au/travel-insurance/claims.html and then send it to the following address.

Budget Direct Travel Insurance C/o-Travel Insurance Partners Claims Department PO Box 168, North Sydney NSW 2060

Budget Direct could be a good option for high-adrenaline travellers as it was one of the few brands we found to offer cover for risky activities such as trekking the Kokoda Trail or heli-skiing.

Don’t forget to add the optional adventure or snow sports packs if you want cover for these activities though.

If you're still not sure about Budget Direct, you can compare other travel insurance companies here .

When will I hear back about a claim?

You will hear back within 10 working days from the time Budget Direct receives your claim.

Am I covered if I’m pregnant?

For uncomplicated pregnancies, cover is only provided up until the 24th week of pregnancy. You will need to apply for cover if there have been complications with this pregnancy or a previous pregnancy, if you have a multiple pregnancy, or if the contraception was medically assisted.

Use a comma or space to separate ages. Add kids under the age of 1 by typing a “0” 0 traveller(s)

Include travel deals and helpful personal finance content from Finder

By submitting this form, you agree to our Privacy & Cookies Policy and Terms of Service

Nicola Middlemiss

Nicola Middlemiss is a contributing writer at Finder, with a special interest in personal finance and insurance. Formerly a business and finance journalist, Nicola has written thousands of articles helping Australians better understand insurance and grow their personal wealth. She has contributed to a wide range of publications, including Domain, the Educator, Financy, Fundraising and Philanthropy, Insurance Business, MoneyMag, Mortgage Professional, Yahoo Finance, Your Investment Property, and Wealth Professional. Nicola has a Tier 1 General Insurance (General Advice) certification and a Bachelor's degree from the University of Leeds.

More guides on Finder

From last minute cover for those on the go to unlimited hospital and medical for complete peace of mind, Budget Direct Travel Insurance offers cover for all types of travellers and all kinds of travel scenarios.

Ask a Question

Click here to cancel reply.

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

22 Responses

How do i cancel my Basic Travel Insurance within the prescribed period

You’ll need to contact Budget Direct to cancel your policy. You can reach them on 1800 182 310.

We are trekking in Nepal to 4500m. Will we be covered for this please and does it cover emergency evacuation by helicopter in case of injury or illness?

Thanks for getting in touch!

You can request a quote for trekking travel insurance for Nepal . Normally, cancellations, medical expenses, and helicopter evacuation are covered if you become ill or if you’re injured while trekking to Everest base camp or on other guided treks in Nepal which can be provided by your insurer’s medical assistance team.

While Budget Direct is not on the list of brands who can cover you for the Everest Base Camp or Nepal trekking, use the online form on top of the page, enter the information needed in the fields provided and click “Get my quote”. This will show a full list of providers for your trip.

As a friendly reminder, carefully review the Product Disclosure Statement of the product before applying. You may also contact the insurance provider should you have any questions about their policy.

Hope this helps!

Best, Nikki

Hi! I require 12 months travel insurance for Germany. The consul requires 30,00 euro for medical evacuation/ repatriation of body in case of death. Can you please advise if the unlimited medical covers this?

Hi Jo-anne,

Thank you for reaching out to Finder.

Budget Direct will cover for medical evacuation or repatriation based on your specific needs. You may need to check with your specific policy it the 30,000 EU so covered by your policy as the approval is still subject to an assessment and approval by Budget Direct.

You can reach out to Budget Direct to verify so they can check on your policy coverage too.

Hope this helps! 😊

Kind Regards, Mai

Hi, on a 7 month trip to the UK, how can we make sure we’re covered for countries that we suddenly decide to visit? Or, can we add to our insurance whilst away, i.e. If we decide to go to Canada for 2 weeks, can we pay the extra prior to departure?

Thanks for contacting Finder and for leaving a question about Budget Direct Travel Insurance.

Once you are on a trip in the UK and decided to go to another country that is not supported by the region that you purchased, you can log in to your Budget Direct account and purchase a policy to add a new country, say Canada for instance. You can also head to Budget Direct’s website and chat with one of their representatives who can add add a cover for you. It can be done anytime even if you are already on a trip.

Hope this helps and please feel free to contact us back should you require further assistance.

I have a 125cc motorcycle in Philippines am I coverd if im riding it there

Thanks for reaching out! As it says on our page, Budget Direct covers overseas emergency medical assistance – it offers unlimited cover for all plans excluding the domestic plan. For further information, you can check the part on the page that says “Budget Direct Travel Insurance benefits.”

Hope this was helpful. Don’t hesitate to message us back if you have more questions.

How likely would you be to recommend finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Important information about this website

Advertiser disclosure.

finder.com.au is one of Australia's leading comparison websites. We are committed to our readers and stands by our editorial principles

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labeling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

How we make money

We make money by featuring products on our site. Compensation received from the providers featured on our site can influence which products we write about as well as where and how products appear on our page, but the order or placement of these products does not influence our assessment or opinions of them, nor is it an endorsement or recommendation for them.

Products marked as 'Top Pick', 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money .

Sorting and Ranking Products

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

Terms of Service and Privacy Policy

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

- " id="mainPhoneNumber">

- Annual Travel Insurance

- Cruise Travel Insurance

- Family Travel Insurance

- Seniors Travel Insurance

- Ski Travel Insurance

- Budget Direct

- Fast Cover Travel Insurance

- Insure4Less

- InsureandGo

- Simply Travel Insurance

- Ski-Insurance

- Travel Insurance Saver

- Travel Insuranz

- Wise Traveller

- Zoom Travel Insurance

- See more companies...

- Travel Insurance Tips

- Covid-19 Help

- Read Reviews

- Write a Review

Need Quotes?

Use our travel insurance comparision to help you save time, worry & loads of money!

Please Note - If you are cruising around Australia you need to select Pacific. With Regions, variances can apply for Bali, Indonesia, Japan and Middle East. You are not required to enter stop-over countries if your stop-over is less than 48 hours.

If you don’t know where you’re traveling to within the next 12 months, choose Worldwide to ensure you’re covered no matter where you go. If you’re travelling to multiple countries choose the region that you are visiting that is furthest away (excluding stopovers less than 48 hours). In most cases you will be covered for the closer regions as well. For example, if you choose Europe, you will also be covered in the Middle East, Asia and Pacific.

Worldwide means anywhere in the world

Americas means USA, Canada, South America, Latin America, Hawaii and the Caribbean

Europe means all European countries, including UK

Middle East refers to the area from Syria to Yemen; Egypt to Iran

Asia generally means Asia and the Indian subcontinent. For some insurers this excludes Japan*

Pacific means the South West Pacific, Australia and Indonesia/Bali*. Select Pacific for domestic cruises in New Zealand waters

New Zealand means domestic travel within New Zealand only

*Note: Variances apply for Bali, Indonesia, Japan and Middle East. Check that your destination is covered once directed to your chosen insurer’s site.

Budget Direct Travel Insurance Reviews

Budget Direct Travel Insurance offers a range of international products; for last minute travellers, essential cover for the middle of the range, and comprehensive cover for all your needs. 24/7 emergency assistance no matter where you are in the world. Underwritten by Auto & General Insurance Company Limited.

Customer Experience

Claims experience, value for money.

Costumer service

I had an accident and it wasn’t my fault, my husband tried many times to get to better conclusion wit... Read more

I had an accident and it wasn’t my fault, my husband tried many times to get to better conclusion with them they are terrible. The guy(who hit me) was nice and spoke to his insurance which was Toyota we were treated fairly by his insurance than budget direct, don’t bother getting budget direct and if you have better cancel and get something else before you even need it, half star for their rude representative.

0 comment on this review

Your comment text is too long. Max is 700 characters including linebreaks.

Repaired car, introduced a major problem and refused to fix

Made a claim after an acciden, they repaired the damage but introduced an engine malfunction. Refused... Read more

Made a claim after an acciden, they repaired the damage but introduced an engine malfunction. Refused to acknowledge and fix it

Worst company highly not recommended (claims)

I have a car and a van under budget direct insurance for more than 2 years. I am so disappointed wit... Read more

I have a car and a van under budget direct insurance for more than 2 years. I am so disappointed with my recent claim. A car hit my van from behind. It wasn't my fault. I don't feel these people assess my case properly. They are only interested in the excess payment. They increased my insurance amount for both vehicles by almost $100-$150 per month and reduced my ratings. On top of this, I have to pay few thousand for the excess. Don't fall for them. I decided to change my insurance provider. I am extremely sad and helpless. I wish to give them 0 ratings.

Car insurance - good at selling - terrible at paying

Easily the best value car insurance when shopping around. However, I definitely have a bad case of ba... Read more

Easily the best value car insurance when shopping around. However, I definitely have a bad case of bargain regret. My wife crashed it a couple of times late last year which coincided with loss of parking sensors and major loss of power issues and eventually unable to even start now. Despite paying $1700 on servicing costs, several mechanics all blamed it on damage to the electricals done in the damage to the front. Hence, I made two insurance claims on 2 January 2022. Firstly, Budget Direct would not accept the claims unless I paid $1340.33 to renew the car insurance for 2022. After many complaints, they eventually agreed to refund the entire amount. However, only $876.95 was refunded on 10 May despite the car being off the road and in the workshop for most of January and towed back to the workshop on Monday 31 January after breaking down and unable to start since. It has been to towed all over Melbourne to many different assessors since. I have been on the phone for many hours on many days to lots of different people from different departments since. I have done everything they have asked only to get a phone call today by a James to notify me that the claim has not been approved and where can they tow the car to return it to me. The reason given was a complete fabrication without any facts. Disgusting.

Worth insurance

Very very poor assistance and costumer service. Unhelpful staff at all times. Never recommend roa... Read more

Very very poor assistance and costumer service. Unhelpful staff at all times. Never recommend roadside assistance from this insurance at all.

Car insurance claim

It is my first year with Buget Direct (BD) when I was so nageived believing on TV advertisement to sa... Read more

It is my first year with Buget Direct (BD) when I was so nageived believing on TV advertisement to say how wonderful this insurance company is. I am so disappointed of my recent experience with BD's customer service team because I was involved in car accident which was not even my fault as other driver reversed and hit my car on the driver side rear panel. When I contacted the BD to report my incident, I didn't feel they have given me the support I should be receiving. I spoke with few customer service officers (CSO), all they were interested in the excess payment not my accident. They said they will only review my case after I paid the excess, eventhough the accident was not my fault and I have a dash-cam footage and a witness. Didn't show any interest in the evidences at all. BD is not as they said on their website that "You do not have to pay an excess if you have a no fault accident." My claim has not been resolved since December 2021 as I am disputing the liability and insurance excess. I noticed that BD has punished me by increasing my policy premium and dropped car rating from 1 down 3, when my case is still my review stage.

MISLEADING SCAMMING CLAIMS PROCESS

Submitted a building claim after the recent storms in Melbourne..for 1 weeks these con SCAMMERS did n... Read more

Submitted a building claim after the recent storms in Melbourne..for 1 weeks these con SCAMMERS did not organise the MAKE SAFE PROCESS...and handed over to a building conmen who all act for the insurance company and they all lie. Each call to JP FLING a scamming insurance builder also conned the process and over a week never showed up. JP FLING builders staff ALISHA a big conwoman kept telling us lie after lie. Quick to sell insurance policies by fraud and deception misleading behavior by these insurance thugs..DO NOT USE THEM to even cover your pet, leave alone your home, car, investment properties...as they will fraud you when you need support. The claim will in the end be rejected. Then you have to go to the other assholes AFCA. Do not pay a cent to buy any insurance products from these frauds!!

Misleading deceptive sales to win new business

Hi, i have got caught to this mob after seen their tv ads. A 55 year woman sent a letter from BUDGET ... Read more

Hi, i have got caught to this mob after seen their tv ads. A 55 year woman sent a letter from BUDGET DIRECT saying $1000 will be charged to the excess if i drive more than $5000 KM. the policy was NOT CHEAP NOR WAS IT DISCOUNTED. after joining i was sent this letter in the mail . So in othrr words paying a $600 excess and a futher $1000 , what a joke??? I have my home content policy , roadside assistance and 1 investment home. MY VISA CARD WAS RETAINED WITHIN THE BUDGET DIRECT SYSTEM FOR AUTOMATIC RENEWALS WITH NO PERMISSION AT ALL. quick to take your money and nil service and if a CLAIM is made they may give you hell on earth... IS BUDGET DIRECT WORTH THE MONEY YOU PAY. NIL CUSTOMER LOYALTY AND SUPPORT. SHOP AROUND PLEASE...

1 comment on this review

Budget Direct finds a way to win!

I purchased a comprehensive travel policy long before COVID was a known event. Unhappily, our once in... Read more

I purchased a comprehensive travel policy long before COVID was a known event. Unhappily, our once in a life-time extended holiday to Iceland & Norway was cancelled. The airlines and most of our hotel bookings were happily refunded but I had used hotels.com and bookings.com for over $3,600 worth of bookings (it was to be a long vacation!). Both of these companies refused to refund the money and offered vouchers instead. I did not seek the vouchers, nor did I want them. The original vouchers were due to expire in May 2021 but were then automatically extended - not at my request. I decided that enough is enough as we are not prepared to undertake this trip any longer, as the virus is continually evolving and it is not worth risking our health or being stuck overseas due to unforeseen border closures. Budget Direct has refused to honour my claim because "You have been offered credits for the bookings you are claiming and accepting these is considered as recovering the costs from the source and a step which you could take to reduce your loss. Therefore, the costs you have claimed are outside the scope of the policy." Last year I called Budget Direct and was told that IF I DECLINED the vouchers I was not making sufficient efforts to recover the costs. Today I was informed after a Stage 2 appeal that because I DID NOT DECLINE the vouchers I was deemed not to have made sufficient effort to recover costs. This is despite sending copies of repeated requests to the companies for refunds instead of vouchers. So with Budget Direct you are damned whichever way you go!! If you read this and other reviews of Budget Direct, please note the cut and paste responses from their representatives. When they say that all disputes are resolved with reference to the terms and conditions, go back to what I say above about the contradictory advice from them on two different occasions. They seem to have terms and conditions that accept two different realities.

3 comments on this review

Don't fall for the good price!

In short they didn't pay out my lost luggage (which was lost for 3 days by the airline I travelle... Read more

In short they didn't pay out my lost luggage (which was lost for 3 days by the airline I travelled with). It said on the policy they cover it up to $600. In that time I had to buy clothes, toiletries etc.. They said they wanted airline reports and receipts of items. I sent them documents signed by the airlines and sent receipts on my bank statement of purchased items as requested. Over 1 year later THEY STILL HAVE NOT REIMBURSED ME. An absolute joke of a company. They make the process that hard so people give up on trying to get their money. I hope their company is struggling extremely badly during covid because after seeing all these other reviews like mine, they don't deserve to exist. If someone from budget sees this, there's my claim reference number below, sort it out! ref: LU024368-01

Worst company ever

The business model of budget is to provide cheaper cover and then deter people from making a claim. W... Read more

The business model of budget is to provide cheaper cover and then deter people from making a claim. With budget you don’t even get what you pay for. They make the claims process as slow and painful as possible. It doesn’t matter if you are at fault or not, they will make the claims process so difficult that it’s not even worth having a comprehensive insurance. Do not fall for the fake reviews on their website as they are all paid reviews bought from bazaar voice. Try posting a review on their website. If you just want to have insurance and will not ever make a claim or are willing to get your life sucked out of you than budget direct is the company for you. No matter how many times you call, make an internal complaint or even make a complaint to AFCA it won’t make any difference to them. It is better to pay more with any other company and if you can’t afford to pay more better opt for third party insurance from any other company than a comprehensive policy from budget.The claim process takes months not days. They are the worst insurance company I ever had to deal with.

Budget Direct suck, sadly.

When my car was written off by a drunk driver Budget Direct literally tittered with happiness when th... Read more

When my car was written off by a drunk driver Budget Direct literally tittered with happiness when they told me I wasn't covered under my 'uninsured' clause because the drunk had insurance even though her company disowned her and left me high and dry. The Budget Direct claims manager then tried to tell me that being hit by a drunk who ran a give way sign versus me hitting a kangaroo at night on a country road was essentially the same claim. Awesome, thanks guys. Moved to RACV.

Budget Direct FAQ

How many people can i include in my policy.

The more the merrier right? You can purchase insurance for parties of 10 online. Call up Budget Direct to see how many additional people can be added to your policy.

Am I covered if I go on a cruise?

Yes, Budget Direct does provide cover for cruises, but make sure you check ‘pacific’ on your destination selection. Once your ship has set sail you are no longer considered to be in Australian waters.

Am I covered for skiing and my equipment?

You will only be covered for skiing and snow sports if you have purchased the Snow Sports Cover upgrade. This upgrade will cover you for ski and snow sport equipment, piste closure and for avalanche.

Can I pay to reduce or cancel my excess?

With Budget Direct Travel Insurance you can choose the standard excess of $200 or you can pay a higher premium and waive your excess or halve your excess.

Am I covered if my tour company collapses?

No, Budget Direct does not cover for insolvency.

I’m not an Australian resident- can I buy cover?

Non-permanent residents can purchase a Budget Direct travel insurance policy providing that you have a valid Medicare Card, a Private Health Fund or Overseas Student Travel Insurance.

What size moped or motorbike am I covered to ride overseas?

You can ride any size motorbike provided you hold a driving licence appropriate for the country you are in. If you are using a motor cycle rated 125 cc or higher, you must hold a current and valid licence for driving the equivalent rated motorcycle in Australia.

How long is their single trip cover for?

Can i extend my policy from overseas.

Having too much fun? No problems! If you decide to lengthen you trip you can do so for up to 12 months. Call Budget Direct on 1800 444 424.

Do they cover for my rental vehicle excess?

Budget Direct includes cover of up to $6,000 for the excess of a rental vehicle in case of collision, damage or theft.

Who underwrites them?

Auto & General Insurance Company Ltd.

Where are they based?

Our travel insurance comparision helps you, save time, worry and loads of money.

Stay up to date with our latest news, deals and special offers.

Your privacy is important to us.

Comparetravelinsurance.com.au is Australia’s leading comparison site solely focused on travel insurance.

Our comparison is a free service that allows users to compare quotes in a few simple steps based on limited personal criteria. Comparisons supplied are not a recommendation or opinion about the suitability of a policy for a user. Comparisons are default ranked according to price and users have the ability to sort by popular cover levels. Whilst we compare a vast range of policies, we do not compare all providers in the market. This site compares the following brands: 1Cover, AllClear, Budget Direct, Downunder, Fast Cover Travel Insurance, Insure4Less, InsureandGo, iTrek, Simply Travel Insurance, Ski-Insurance, Travel Insurance Saver, Travel Insuranz, Wise Traveller, Zoom Travel Insurance . The directors and shareholders are common with companies i-Trek Pty Ltd, Zoom Travel Insurance and 1Cover Pty Ltd including it’s subsidiary brand Ski-insurance. CoverDirect takes all reasonable care when preparing this information but does not warrant its accuracy. Pricing information is supplied by the providers who participate on this site and should be verified with the insurer before you purchase. This site links users to the website of the provider to verify quotes and access the relevant PDS to understand what is, and is not, covered by a policy prior to purchase.

CoverDirect Pty Ltd owns and operates this website under AFS Licence 383590. Located at Level 12, 338 Pitt Street, Sydney, NSW 2000 Australia.

For further information view our FSG and Terms of Use . Contact us by calling 1300 659 411.

Loading Quotes...

Please login or register to continue. It'll only take a minute.

Login with Facebook

Login with Google

- There was an error logging in, please try again.

Enter your email and password

- There was an error on your registration, please try again.

Don't you have an account?

Just checking you are a human

Credit Cards

- Best Rewards Credit Cards

- Best Credit Card Promotions

- Best Credit Cards for Dining

- Best Credit Cards for Shopping

- Best Cashback Credit Cards

- Best Miles Credit Cards for Travel

- Best No Annual Fee Credit Cards

- Best Credit Cards for Petrol

- Best Credit Cards for Businesses/SMEs

- Best Personal Loans

- Best Home Mortgage Loans

- Best Renovation Loans

- Best Car Loans

- Best Education Loans

- Best Debt Consolidation Loans

- Best Business/SME Loans

- Best Car Insurance

- Best Travel Insurance

- Best Home Insurance

- Best Mortgage Insurance

- Best Health Insurance

- Best Endowment Insurance

- Best Critical Illness Insurance

- Best Maid Insurance

- Best Whole Life Insurance

- Best Term Life Insurance

- Best Personal Accident Insurance

- Best Motorcycle Insurance

- Best Pet Insurance

Investments

- Best Online Brokerages

- Best Robo Advisors

- Best P2P/Crowdfunding Platforms

Bank Accounts

- Best Savings Accounts

- Best Fixed Deposit Accounts

- Best Debit Cards

- Best Hotel Booking Sites

- Best Wire Transfers

- Best Electrical Retailers

- Best Travel Deals

Personal Finance Guides

We'll help you make informed decisions on everything from choosing a job to saving on your family activities.

- Average Cost of Home Renovation

- Average Cost of Monthly SP Bills

- Average Cost of Domestic Help

- Average Cost of Moving Your Home

- Average Cost of Renting a Car

- Average Cost of a Wedding

- Average Cost of a Divorce

- Average Cost of a Funeral

- Average Cost of an Engagement Ring

- Research Reports

- Evaluation Methodology

- Budget Direct Travel Insurance: Is It Right For You?

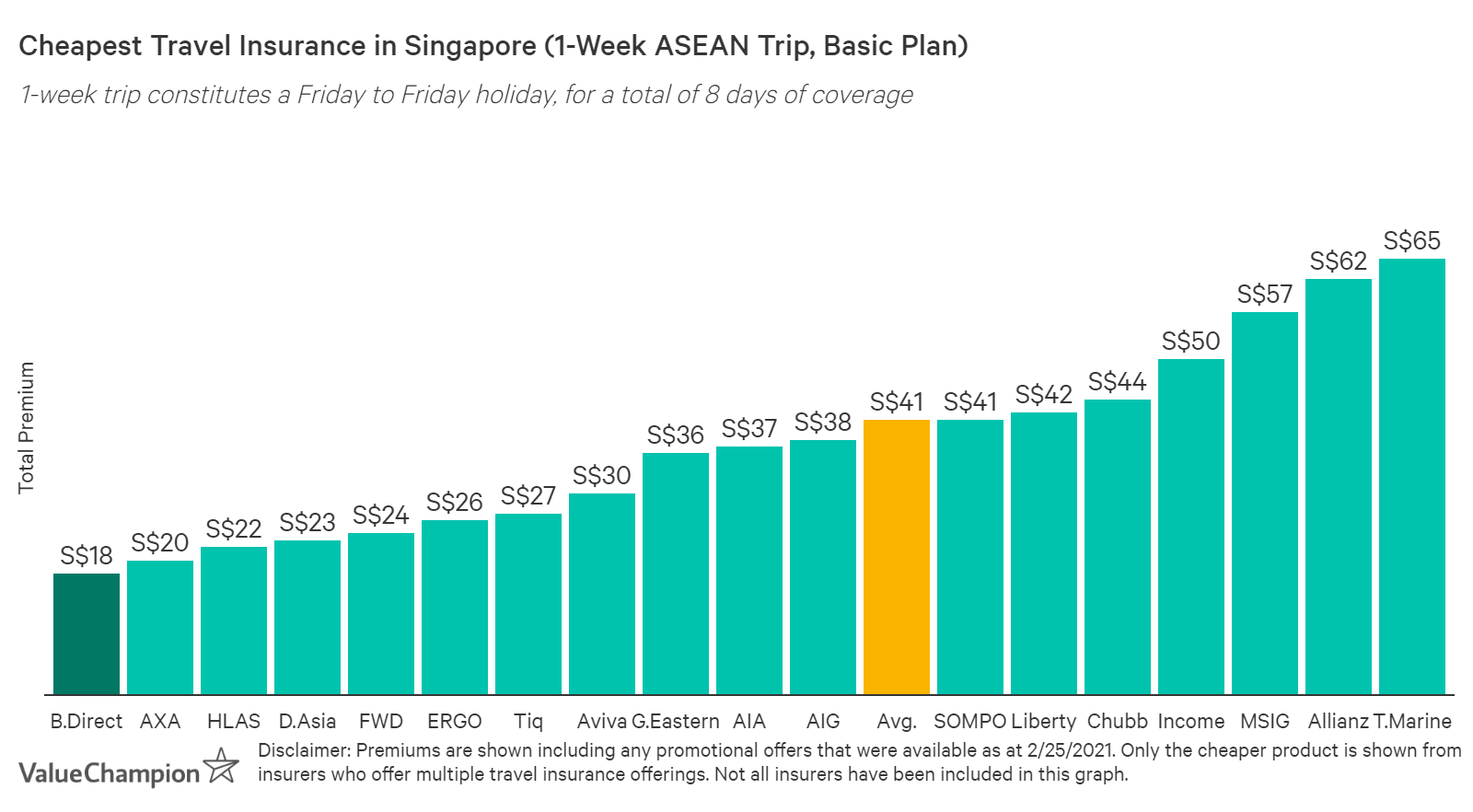

- Basic plan is cheapest within its repsective tier

- Comprehensive plan provides good value for price

- Basic plan lacks trip delay and cancellation coverage

- May not appeal to travellers who want a lot of coverage

Budget Direct places an emphasis on offering among the cheapest prices on the market for its insurance products, and its two travel insurance plans are no exception. If you're seeking to spend as little as possible on travel insurance, Budget Direct could have a solution for you. To help you get a better feel for what Budget Direct's travel insurance plans are all about, we've broken down the major things you need to know.

Table of Contents

Budget Direct Basic Plan

Budget direct comprehensive plan, sports coverage, claims information.

- Budget Direct Coverage & Benefits

Budget Direct Travel Insurance: What You Need to Know

Budget Direct's two travel insurance policies, the Basic and Comprehensive plans, stand out as consistently tending to be the cheapest in their class. The Basic Plan provides baseline coverage for rock-bottom prices, while the Comprehensive Plan offers good value, boasting a fairly typical level of coverage for the industry while maintaining Budget Direct's financial products' reputation for affordability. Below, we discuss Budget Direct's two travel insurance policies, the Basic and Comprehensive plans, in detail to help you plan your next business trip or holiday.

Notable Exclusions

Budget Direct has a fairly large number of exclusions that include pre-existing conditions, expenses for non-refundable expenses unrelated to transportation or accommodation, business goods or samples and wear or tear due to climate or pest conditions. Additionally, the home contents cover only covers damage or loss due to fire. Below is a table showing some of the exclusions, but it is highly recommended to always read the policy wording to see the full list of what you will or won't be covered for.

The Budget Direct Basic Plan is notable for its tendency to be one of the cheapest, if not the cheapest, travel insurance plans you can buy in all of Singapore regardless of where you're headed or how long you're planning to be there. Its affordability makes it a good option to look at if you want to ensure at least some protection on your trip for what tends to be the cheapest price possible.

However, the Budget Direct Basic Plan achieves its low prices by providing only a minimal level of coverage. It is the only travel insurance plan on the Singapore market out of the dozens we studied that cuts out any coverage in an area that affects all travellers: trip delays and cancellations. This plan also provides significantly less coverage for personal accident/death, medical expenses, emergencies, and baggage loss, damage or delay than even the next-cheapest options such as Etiqa, DirectAsia, FWD and HL Assurance. Adventurous spirits should also keep in mind that neither of Budget Direct's travel insurance plans include coverage for any losses, damages or injuries resulting from bungee jumping or skydiving.

Furthermore, you should keep in mind that while Budget Direct Basic may in some cases be the cheapest travel insurance plan available, depending on the destination and duration of your trip, you may be able to purchase significantly higher coverage for just a few more dollars. For example, for 1-week trips to ASEAN countries, you'd only need to pay S$0.30 more to buy the cheap Etiqa Basic Plan , which provides greater coverage in every area except baggage delay. And for roughly S$2 more, you would be able to buy the Allianz Global Assistance Bronze Plan , a high-value pick that includes generous coverage in the area of travel inconvenience - including trip cancellations and delays. In these kinds of scenarios, we would encourage you to consider carefully the bang you are getting for your buck.

The Budget Direct Comprehensive Plan outshines the Basic Plan in that it preserves the Budget Direct emphasis on cheap prices while providing considerably more value for your money. Not only is it consistently the cheapest second-tier travel insurance plan on the market, but it also offers a level of coverage that generally tends to meet the industry average within this tier.

Unlike the Budget Direct Basic Plan, the Comprehensive Plan does provide coverage for trip cancellations and delays. One way to think of this plan is that, compared to its immediate competitors such as the Etiqa Economy Plan and the HL Assurance Enhanced Plan, it provides roughly the same amount of coverage for fewer bucks. As a result, we consider the Comprehensive Plan from Budget Direct to be one of the highest-value picks among the cheapest mid- or business-tier travel insurance plans.

If you're interested in a mid- or business-tier travel insurance plan for the extra cushion of protection and quality-of-life benefits it might provide over an entry-level plan, however, the Budget Direct Comprehensive Plan may not be the best choice for you. So if you're the type of person who flies business class, likes some extra legroom, and wants a travel insurance plan to match, we might recommend that you also consider the Allianz Global Assistance Silver Plan or the Aviva Travel Plus Plan .

Budget Direct automatically covers you for medical and accident expenses relating to most common sports and activities including skiing, snowboarding, scuba diving (less than 30 metres in depth and with an instructor) and trekking (below 4,000 metres). You will not be covered for extreme sports such as skydiving, hang-gliding, ice climbing, free flying, BASE jumping, parachuting, hunting and caving. There is no specific mention of golf coverage.

You must submit your claim form within 30 days of any event and have the supporting documentation based on the type of claim you are submitting, including passport, air ticket, boarding pass and travel itinerary. You can either email the form or mail it.

Details of Budget Direct Travel Insurance

Getting a great deal on travel insurance means you'll have more money left over to enjoy your vacation. Below, you'll find a summary of how budget direct compares to the industry average for premiums and coverage. If you'd like to know how it compares to other plans in more detail, we've prepared a guide to the best travel insurance in Singapore.

- Best Travel Insurance in Singapore

- Average Costs and Benefits of Travel Insurance

- How to Pick the Best Travel Insurance

Anastassia is a Senior Research Analyst at ValueChampion Singapore, evaluating insurance products for consumers based on quantitative and qualitative financial analysis. She holds degrees in Economics and International Business Management and her prior working experience includes work in the capital markets sector. Her analyses surrounding insurance, healthcare, international affairs and personal finance has been featured on AsiaOne, Business Insider, DW, Vice, Her World, Asia Insurance Review, the Australian Institute of International Affairs and more.

Our Top Travel Insurance

- Best Travel Insurance Promotions

- Best Annual Travel Insurance

- Best Travel Insurance for Sports

- Best Travel Insurance for Families & Groups

- Best Travel Insurance for Seniors

- Best Insurance Companies in Singapore

Keep up with our news and analysis.

Stay up to date.

Featured Travel Insurance Companies

- Allianz Travel Insurance

- FWD Travel Insurance

- Direct Asia Travel Insurance

- Etiqa Travel Insurance

- Aviva Travel Insurance

- HL Assurance Travel Insurance

- Wise Traveller Travel Insurance

Travel Insurance Basics

- What is Travel Insurance

- Why You Need Travel Insurance

- Average Cost and Benefits of Travel Insurance

- Average Cost of a Staycation

- Average Cost of a Vacation

- Who Should Get Annual Travel Insurance

- Airline Travel Insurance vs. Traditional Travel Insurance

- Travel Insurance and Terrorism Coverage

- Travel Insurance and Haze Coverage

- Travel Insurance and Zika Coverage

- Travel Insurance and Overbooked Flight Coverage

- Travel Insurance and Trip Cancellation Coverage

- How to Successfully File an Insurance Claim

Other Financial Products for Travellers

- Best Air Miles Credit Cards

- Best Credit Cards for Complimentary Lounge Access

- Best Credit Cards for Overseas Spending

Related Articles

- Best Year-End Travel Destinations to Beat the Crowd

- Travel Diaries: 5 Safest Travel Destinations in the World

- Travel Essentials Checklist For Your Family Vacation

- How To Survive and Thrive as a Solo Traveller

- How Travel Insurance Can Protect Your Refund Rights for Flight Cancellations and Delays

- Travel Essentials for Every Trip – From the Best Travel Insurance to Miles Credit Card

- Best Frequent Flyer Plans to Upgrade Your Travels in 2023

- Travel Insurance

- Copyright © 2024 ValueChampion

Advertiser Disclosure: ValueChampion is a free source of information and tools for consumers. Our site may not feature every company or financial product available on the market. However, the guides and tools we create are based on objective and independent analysis so that they can help everyone make financial decisions with confidence. Some of the offers that appear on this website are from companies which ValueChampion receives compensation. This compensation may impact how and where offers appear on this site (including, for example, the order in which they appear). However, this does not affect our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services

We strive to have the most current information on our site, but consumers should inquire with the relevant financial institution if they have any questions, including eligibility to buy financial products. ValueChampion is not to be construed as in any way engaging or being involved in the distribution or sale of any financial product or assuming any risk or undertaking any liability in respect of any financial product. The site does not review or include all companies or all available products.

- Travel Insurance

- Best Travel Insurance Companies

11 Best Travel Insurance Companies Of May 2024

Expert Reviewed

Updated: May 6, 2024, 12:22pm

We evaluated 39 policies and found that Travel Insured International, WorldTrips and Travel Safe are among the best travel insurance companies. We evaluated costs and a variety of coverage features to find the best options. See all our top picks.

Considering Travel Insurance?

Via Forbes Advisor's Website

- Best “Cancel For Any Reason” Travel Insurance

- Cheapest Travel Insurance Plans

- Best Cruise Insurance

Summary: Best Travel Insurance Companies

Best for travel medical coverage, best for medical evacuation coverage, best for travel delays, best for baggage delays, what does travel insurance cover, what’s not covered by travel insurance, how much does travel insurance cost, what affects travel insurance costs, how to get travel insurance, do i need travel insurance, top travel destinations in may 2024, list of may 2024 top travel destinations, methodology, other travel insurance policies we rated, best travel insurance companies frequently asked questions (faqs), compare travel insurance quotes, compare & buy travel insurance, how we chose the best travel insurance.

We assessed cost, travel medical and evacuation limits, baggage and trip delay benefits, the availability of cancellation and interruption upgrades, and more. Our editors are committed to bringing you unbiased ratings and information. Our editorial content is not influenced by advertisers. You can read more about our editorial guidelines and the methodology for the ratings below.

- 39 travel insurance policies evaluated

- 1,482 coverage details analyzed

- 102 years of insurance experience on the editorial team

Our Picks For The Best Travel Insurance Companies

Best for non-medical evacuation, travel insured international.

Top-scoring plan

Worldwide Trip Protector

Average price

Medical & evacuation limits per person

$100,000/$1 million

We recommend Travel Insured’s Worldwide Trip Protector policy because it offers robust benefits at the lowest average price among top-rated plans we analyzed. We also like its superior non-medical evacuation coverage.

- “Cancel for any reason” and “interruption for any reason” upgrades available.

- Top-notch non-medical evacuation benefits of $150,000 per person.

- Good travel delay and baggage delay benefits kick in after just a 3-hour delay.

More: Travel Insured International Travel Insurance Review

I have been working with Travel Insured for over 15 years, and have been using them almost exclusively. Typically, they have been quite responsive and pay their claims in a timely fashion. – Stephanie Goldberg-Glazer, chief experience officer of Live Well, Travel Often

- Medical coverage of $100,000 per person is on the low side compared to top competitors but might be enough for your needs.

- Missed connection benefits of $500 are low compared to top-rated competitors and for cruise and tours only.

Here’s a look at whether top coverage types are included in the Worldwide Trip Protector policy.

Also included:

- Pet kennel benefits of up to $500 are included if you return home three hours or more later than your planned return date.

Optional add-ons offered:

- Rental car damage and theft coverage of up to $50,000.

- Event ticket protection pays up to $1,000 if you can’t attend for a reason covered by the policy.

- Travel inconvenience coverage allows you to recoup money for unforeseen circumstances, such as closed beaches and attractions, rainy weather, tarmac delays and more.

- Bed rest benefits pay up to $4,000 if a doctor requires you to stay on bed rest for at least 48 hours during your trip.

GREAT FOR ADD-ON COVERAGE

Atlas Journey Premier

Average cost

$150,000/$1 million

We like the Atlas Journey Premier plan for its wide choice of add-ons. These add-ons provide extra coverage for pets traveling with you, adventure sports, destination weddings, hunting and fishing equipment and more. We also like that this plan has a low average cost compared to competitors.

- Very good travel delay benefits of $2,000 per person after only 5 hours.

- Very good missed connection coverage of $2,000 per person after 3 hours.

Another option is the Atlas Journey Preferred plan, but this policy doesn’t offer the “interruption for any reason” upgrade and has lower travel medical benefits of $100,000 per person. Still, it hits all the marks for great benefits at a low price. It also offers lots of choices for add-on coverage.

More: WorldTrips Travel Insurance Review

WorldTrips offers a streamlined process for purchasing insurance online and filing claims. A user-friendly interface and efficient claims handling contribute to a positive customer experience and increased satisfaction. – Joe Cronin , advisory board member

- Medical coverage limits of $150,000 aren’t as high compared to some top-rated competitors but you might find it’s sufficient.

- Baggage delay benefits have a 12-hour waiting period.

Here’s a look at whether top coverage types are included in the Atlas Journey Premier policy.

- Travel inconvenience benefits of $750 if your arrival home is delayed due to a transportation delay and you can’t work for at least two days, your flight lands at a different airport than scheduled, your passport is stolen and can’t be reissued, and more.

- “Cancel for any reason” and “interruption for any reason” coverage.

- Destination wedding coverage in case the wedding is canceled.

- Baggage insurance upgrade to $4,000 per person.

- Rental car theft and damage coverage of $50,000.

- Political or security evacuation benefits of $150,000 per person.

- Vacation rental accommodations coverage of $500 if unclean or overbooked.

- Adventure sports add-on to extend coverage to safaris, bungee jumping and more.

- Hunting and fishing coverage for equipment and cancellation due to government restrictions.

- School activities coverage if trip has to be canceled due a test, sporting event, etc.

BEST FOR MISSED CONNECTIONS

Classic Plus Plan

TravelSafe’s Classic Plus plan stood out in our analysis for its superior missed connection benefits of $2,500. We also like the Classic Plus plan’s top-notch medical evacuation coverage of $1 million.

- “Cancel for any reason” upgrade available.

- Superior baggage loss coverage limits of $2,500.

- Great travel delay limits of $2,000 per person after a 6-hour delay.

More: TravelSafe Travel Insurance Review

TravelSafe packs essential coverage into budget-friendly rates without skimping on key benefits, and its responsive claims handling preserves peace of mind. – Timon van Basten, tour guide and founder of Travel Spain 24

- $100,000 in medical benefits is on the low side compared to top competitors but might be sufficient for your needs.

- Baggage delay coverage is a little skimpy at $250 per person after a 12-hour delay.

Here’s a look at whether top coverage types are included in the Classic Plus policy.

- Itinerary change coverage of $250 per person if your travel supplier makes a change that forces you to lose non-refundable costs for missed activities.

- Reimburses $300 for fees if you have to redeposit frequent traveler awards for reasons covered by your trip cancellation insurance.

- Pet kennel coverage of $100 a day if your return home is delayed by 24 hours or more due to a reason covered in your policy.

- “Cancel for any reason” coverage of 75% of lost trip costs.

- Accidental death and dismemberment for flights, up to $500,000 per person.

- Rental car damage and theft up to $35,000.

- Business equipment and sports equipment coverage of $1,000 if lost, stolen or damaged.

BEST FOR POLICY PERKS

Cruise Luxury

Nationwide’s Cruise Luxury plan is one of our favorites because it has a treasure trove of benefits such as “interruption for any reason” and “cancel for work reasons” coverage. You can upgrade to “cancel for any reason” coverage. Some competitors offer none or one of those options. We also like its excellent missed connection benefit of $2,500 per person.

Note that you do not have to be going on a cruise to take advantage of this policy’s coverage.

- “Interruption for any reason” benefit of $1,000 per person is included.

- Includes $25,000 per person in non-medical evacuation benefits for problems such as a natural disaster or security or political problem.

- Good travel delay benefits of $1,000 per person.

More: Nationwide Travel Insurance Review

Count me in as a believer in Nationwide’s trusted track record in insurance. Their travel policies check all the boxes, especially for cruises. My only gripe is that some of their medical limits seem lower than other guys. But the rates are easy on the wallet. – Tim Schmidt, travel expert, entrepreneur, published travel author and founder of All World

- Medical coverage of $150,000 per person is lower than most other top-rated plans but might be sufficient for your needs.

- 24-hour delay required for hurricane and weather coverage, compared to some competitor policies with only a 12-hour delay requirement.

Here’s a look at whether top coverage types are included in the Cruise Luxury policy.

- Inconvenience benefit of $250 per person if your cruise ship’s arrival at the next port of call is delayed for two or more hours due to mechanical breakdown or fire.

- “Interruption for any reason” up to $1,000.

- Coverage for extension of the school year, terrorism in an itinerary city, work-related emergency issues.

- Coverage if the CDC issues a health warning at your destination.

Optional add-on offered:

- “Cancel for any reason” upgrade that provides 75% reimbursement of insured trip cost if you cancel two or more days prior to your departure for a reason not listed in the base policy.

BEST FOR CUSTOMIZATION

Travel Guard Deluxe

The Travel Guard Deluxe plan impressed us with its optional pet, wedding, security, baggage, medical, adventures sports and travel inconvenience upgrades. These add-ons allow you to customize the policy to your needs. We also like that the policy includes benefits if, under certain conditions, you must start your trip earlier than planned—a feature not found in all policies.

- Offers upgrades to meet the needs and budgets of many kinds of travelers.

- Includes $100,000 per person for security evacuation and superior medical evacuation coverage of $1 million per person.

- Provides up to $750 per person for “travel inconveniences” such as a flight delay to your return destination, runway delays and cruise diversions.

- Has good travel delay coverage of $1,000 per person, with a short waiting period of 5 hours.

More: AIG Travel Insurance Review

AIG’s TravelGuard offers an easy-to-use online platform for purchasing insurance and filing claims. A streamlined process minimizes hassle for customers, making it convenient to obtain coverage and receive reimbursement for eligible expenses. – Joe Cronin , advisory board member

- The Travel Guard Deluxe policy has robust coverage across the board but also a high average cost ($539) compared to other top-rated policies.

- Medical expense coverage of $100,000 per person is on the low side but might be adequate for your needs.

Here’s a look at whether top coverage types are included in the Travel Guard Deluxe policy.

- Travel inconvenience benefits of $750 total ($250 per problem) if you encounter issues such as closed attractions, cruise diversion, hotel infestation, hotel construction and more.

- Trip exchange benefits of 50% of your trip cost that pay the difference in price between your original reservation and the new one.

- Ancillary evacuation benefits up to $5,000 for expenses related to return of children, bedside visits, baggage return and more.

- Flight accidental death and dismemberment coverage of $100,000 per person.

- “Cancel for any reason” upgrade.

- Rental vehicle damage coverage.

- “Name Your Family” upgrade allows you to add a person to your policy who will qualify for family member-related unforeseen events that can apply to claims for trip cancellation and interruption.

- Adventure Sports Bundle for adventure and extreme activities.

- Pet Bundle for boarding and medical expenses for illness or injury of dog or cat while traveling. Includes trip cancellation or trip interruption if your pet is in critical condition or dies within seven days before your departure.

- Wedding Bundle to cover trip cancellation due to wedding cancellation. Sorry cold-feeters: Coverage does not apply if you are the bride or groom.

The Travel Guard Preferred plan also earned 4.3 stars in our analysis. We recommend this policy if you’re looking for a lower price and don’t need the higher coverage amounts provided by the Deluxe plan. The Preferred plan provides $50,000 for medical expenses and $500,000 for medical evacuation benefits per person.

GREAT FOR MEDICAL & EVACUATION COVERAGE

Seven corners.

Trip Protection Choice

$500,000/$1 million

We like Seven Corners’ Trip Protection Choice plan because it has superior travel medical expenses and evacuation benefits. It also provides great upgrade options and benefits across the board.

- “Cancel for any reason” and “interruption for any reason” upgrade available.

- Very good travel delay coverage of $2,000 per person.

- Includes $20,000 for non-medical evacuation

More: Seven Corners Travel Insurance Review

With over two decades of experience in the insurance industry, Seven Corners has built a reputation for reliability and customer service. Their track record of handling claims efficiently and providing support to customers in need adds to their credibility. Their Choice plan offers primary coverage, meaning they will pay all claims as if they are the primary insurer, so your claims will be processed faster. – Joe Cronin , advisory board member

- Hurricane and weather coverage has a 48-hour delay, compared to some competitors that require only 12-hour delays.

- Average cost ($527) is only so-so compared to other top-rated policies we evaluated.

Here’s a look at whether top coverage types are included in the Trip Protection Choice policy.

- Accidental death and dismemberment coverage of $40,000 per person for qualifying common carrier events

- Change fee compensation of $300 per person if you have to change your flight or original travel arrangements due to qualifying events.

- Pet kennel benefits of $500 if your return home is delayed by six hours or more due to qualifying missed connection, interruption or delay problems.

- Frequent traveler coverage of $500 to pay for the cost to redeposit awards due to a trip cancellation caused by a reason listed in your policy.

- “Cancel for any reason” coverage.

- “Interruption for any reason” coverage.

- Rental car damage coverage of $35,000.

- Sports & golf equipment rental coverage up to $5,000.

- Event ticket fee registration coverage of $15,000 if you can’t attend an event due to unforeseen reasons listed in trip cancellation and interruption coverage.

BEST FOR BAGGAGE

Axa assistance usa.

Platinum Plan

$250,000/$1 million

AXA’s Platinum plan is among our favorites because it hits all the high points for coverage that you’ll want if you’re looking for top-notch protection, including excellent baggage benefits of $3,000 per person. Excellent medical and non-medical evacuation benefits are another reason we like the Platinum plan.

- Generous medical and evacuation limits, plus $100,000 per person in non-medical evacuation—among the highest for plans we analyzed.

- Coverage for lost ski days, lost golf rounds and sports equipment rental.

More: AXA Assistance USA Travel Insurance Review

AXA Assistance USA impresses with its strong global reach and access to an extensive network of medical providers. This is particularly valuable in travel insurance, where emergencies can occur in any part of the world. Their attention to detail in crafting policies that include benefits for trip cancellations and interruptions adds a layer of security that reaffirms their strengths in protecting travelers against a wide array of potential issues. – John Crist, founder of Prestizia Insurance

- Travel delay and baggage coverage kicks in only after a 12-hour delay.

- The average cost for the Platinum plan is only so-so compared to other top-rated plans, although you do get robust coverage for the money.

Here’s a look at whether top coverage types are included in the Platinum policy.

- “Cancel for any reason” coverage

- Rental car damage coverage of $50,000.

- Lost ski days

- Lost golf rounds

GREAT FOR PRE-EXISTING MEDICAL CONDITION COVERAGE

Generali global assistance.

Generali’s Premium policy stood out in our analysis for its generous window for pre-existing condition coverage. Travelers with pre-existing conditions can get coverage as long as you buy a Premium policy up to or within 24 hours of your final trip deposit. Competitors often have a deadline of 10 to 20 days after making your first trip deposit .

We also like the policy’s excellent trip interruption insurance and superior medical evacuation benefits of $1 million per person.

- Excellent trip interruption coverage of up to 175% of your trip costs.

- Very good baggage loss coverage at $2,000 per person.

More: Generali Global Assistance Travel Insurance Review

Generali Global Assistance excels in providing user-friendly services and efficient claims processing, which enhances customer experience significantly. Their policies are particularly valuable due to the inclusion of concierge services, which can be a lifesaver during unforeseen travel disruptions. – Pradeep Guragain, co-founder of Magical Nepal

- If you want “cancel for any reason” coverage you must buy it within 24 hours of making your initial trip deposit, compared to 10 to 20 days from top competitors.

- This plan’s “cancel for any reason” coverage will reimburse you for only 60% of lost trip costs; most competitors provide 75%.

- Baggage delay benefits kick in only after a 12-hour delay.

Here’s a look at whether top coverage types are included in the Premium policy.

- Rental car coverage for theft and damage of $25,000.

- Sporting equipment coverage of $2,000.

- Sporting equipment delay coverage of $500.

- “Cancel for any reason” upgrade that reimburses you 60% of your insured trip cost if you cancel at least 48 hours prior to your scheduled departure.

BEST FOR FAMILIES

Travelex insurance services.

Travel Select

$50,000/$500,000

We recommend Travelex’s Travel Select plan for families because it provides coverage for children at no extra cost (when accompanied by an adult covered by the policy). Its average price is also among the lowest among the companies we evaluated, making it an option to take a look at

- Very good travel delay coverage of $2,000 per person after a 5-hour delay.

More: Travelex Travel Insurance Review

Travelex is a go-to for many of our clients due to its straightforward coverage options and ease of use. The company excels in offering plans that are simple to understand, which is great for first-time buyers of travel insurance. However, their basic plans might lack the depth of coverage seen with more premium offerings. – Jim Campbell, independent travel agent and founder of Honeymoons.com

- Medical coverage of $50,000 per person is on the low side, but you can buy an upgrade to double it.

- Baggage delay coverage requires a 12-hour delay and has a low $200 per person limit.

- Missed connection benefits of $750 per person are lower than many other competitors.

Here’s a look at whether top coverage types are included in the Travel Select policy.

- Sporting and golf equipment delay benefits of $200 after 24 hours or more.

Optional add-ons & upgrades offered:

- Medical coverage upgrade to $100,000 per person.

- Medical evacuation upgrade to $1 million per person.

- “Cancel for any reason” coverage of 75% (up to max of $7,500).

- Accidental death and dismemberment coverage of $200,000 per person for flights.

- Financial default coverage if your travel supplier goes out of business that provides 100% reimbursement of your insured trip cost.

- Car rental collision coverage of $35,000.

- Adventure sports upgrade to cover activities that would otherwise be excluded.

BEST FOR TRIP INTERRUPTION

Hth worldwide.

TripProtector Preferred Plan

We were impressed by TripProtector Preferred’s superior trip interruption benefits—200% of the trip cost. Most competitors provide 150%. Luxury-level benefits are another reason we recommend the TripProtector Preferred plan.

- Top-notch coverage limits for medical expenses and evacuation.

- Coverage for adventure sports—such as zip-lining, snowmobiling, whitewater rafting, and more—are included.

- Very good travel delay coverage of $2,000 per person after a 6-hour delay.

More: HTH Worldwide Travel Insurance Review

My experience with HTH Worldwide Travel Insurance has been positive. While their policies may come at a slightly higher cost, the peace of mind and level of coverage they offer make it worth considering for travelers seeking comprehensive protection. HTH Worldwide stands out for its extensive coverage of medical emergencies, which is essential for international travel. Their policies are flexible, allowing travelers to customize coverage based on their specific requirements, and their worldwide assistance services ensure travelers have access to support wherever they are in the world. – Kevin Mercier, travel expert and founder of Kevmrc.com

- Higher average price ($602) compared to most companies we evaluated, but you’re buying robust benefits.

- Baggage delay coverage requires a 12-hour delay.

Here’s a look at whether top coverage types are included in the TripProtector Preferred policy.

- Pet medical expense coverage of $250 if your dog or cat traveling with you gets injured or sick during your trip.

- Rental car coverage of $35,000 for damage and theft.

- “Cancel for any reason” upgrade available that provides 75% reimbursement of trip costs if you cancel at least two days prior to your scheduled departure.

GREAT FOR CRUISE ITINERARY CHANGE/INCONVENIENCE

Cruise Choice

$100,000/$500,000

The Cruise Choice plan gets our attention for its compensation if you miss activities because your cruise ship changes its itinerary and for the inconvenience of delays to the next port of call. The Cruise Choice plan’s competitive price is another reason we recommend taking a look.

- Includes ”interruption for any reason” coverage of $500 if you buy policy within 14 days of trip deposit.

- Includes $25,000 per person in non-medical evacuation benefits.

- Provides benefits if your cruise ship has a fire or mechanical breakdown that delays arrival at the next port of call for two or more hours.

Nationwide stands out primarily for its versatility in coverage options catering to diverse travel needs—a vital advantage often overlooked by travelers until they face a mishap. They have built a robust system for handling claims efficiently, which I find crucial for travel insurance, where timely support can dramatically impact the customer experience. – John Crist, founder of Prestizia Insurance

- Medical coverage of $100,000 per person is lower than most other top-rated plans but might be sufficient for your needs.

- 24-hour delay required for hurricane and weather coverage, compared to many competitors with shorter required times.

- “Cancel for any reason” coverage not available.

Here’s a look at whether top coverage types are included in the Cruise Choice policy.

- Shipboard service disruption of $200 per person if your cruise ship has a fire or mechanical breakdown that delays the next port of call for 2 or more hours or changes the scheduled itinerary.

- Coverage for an extended school year, terrorism in an itinerary city and work-related emergency issues.

These policies offer the highest level of medical coverage among the plans that we judged to be the best.

These policies offer the highest level of emergency medical coverage among the plans in our top picks.

These policies offer the highest maximum coverage limits for travel delays among the plans that we judged to be the best.

Nationwide’s Cruise Luxury policy offers the highest maximum coverage for delayed baggage among the plans that were our top picks.

Comprehensive travel insurance policies package together a number of valuable benefits. You can also buy policies that cover only trip cancellation or only medical expenses. With the wide variety of travel insurance plans available, you can find coverage levels that will fit your budget and trip needs.

Problems not covered by travel insurance tend to be similar among policies. We recommend that you read a policy’s exclusions so you’re not caught by surprise later if you try to make a claim. Typical exclusions include:

- Injuries from high-risk activities such as scuba diving.

- Problems that happen because you were drunk or using drugs.

- Medical tourism such as going abroad for a face lift or other elective procedure.

- Lost or stolen cash.

The average cost of travel insurance is 6% of your trip cost , based on our analysis. The cost of travel insurance is usually mainly based on the age of travelers and the trip cost being insured.

Unlike many other types of insurance, there are usually only a few factors that go into travel insurance pricing.

You can buy travel insurance from a travel agent, website or a travel supplier like an airline or cruise company. We’ve bought travel insurance online and it’s relatively easy. In our experience you can purchase a policy online within a few minutes.

- Begin shopping for a policy right after you make your first trip deposit. It’s wise to buy travel insurance right after you make your first trip deposit. That way you get the maximum length of time for cancellation coverage. Plus, you’ll qualify for time-sensitive benefits, such as CFAR and pre-existing medical condition exclusion waivers .

- Start by estimating your non-refundable trip cost. If you’re unsure of your trip cost, estimate the amount and then update it later with the travel insurance company, as long as it’s before your departure date.

- Get quotes online or through a travel insurance agent. To get a quote, you typically need the travelers’ ages (or dates of birth), destination, travel dates, and the trip cost being insured.

- Assess policy options and prices. You’ll usually be presented with a selection of policies at different price points, with the more expensive ones usually providing higher coverage levels. Look at the coverage limits for each line item so you know what you’re buying. Once you select a policy, you can buy it online.

- Review the policy. You usually have two weeks or so to further review the policy. If you change your mind, you can get a refund, as long as it’s during the specified review period.

Here are some reasons you may need travel insurance.

You’re Traveling Overseas and Your Health Plan Doesn’t Have Global Coverage

Many health plans lack robust global coverage, or impose high out-of-network deductibles for care outside the U.S. We suggest that you check your health plan details to see what it provides outside the U.S. Travel medical insurance fills the gap.

You’re Going to a Remote Area or Out to Sea

If you won’t be near any quality medical facilities, even a small injury could turn into a major medical event. Medical evacuation coverage will pay to medevac you to an adequate facility.

You’re Traveling to a Hurricane-Prone Destination

If you’re concerned about hurricanes or other severe weather affecting your travel plans, you’ll want to make sure to buy a travel insurance policy that has trip interruption and trip cancellation insurance for hurricanes and other weather events.

If your trip is interrupted or canceled due to severe weather, you can file a claim and be reimbursed 100% for prepaid, non-refundable deposits.

To be eligible to file a travel insurance claim because of a storm, you must have bought your policy before the storm was named. Also, generally one of the following requirements must be met:

- Your destination is under a hurricane warning.

- Your destination is uninhabitable due to severe weather.

- Your (common carrier) airline is delayed for a specified amount of time listed in your policy—for example, six hours.

You Want Emergency Backup

The 24/7 travel assistance lines that are included with travel insurance can assist you with finding a pharmacy, language translation, replacing a lost passport and much more.

You Will Lose a Lot of Money in Non-Refundable Deposits if You Cancel the Trip

You want trip cancellation coverage you’re worried about the money you will lose if you have to cancel the trip.

Trip cancellation will cover 100% of the prepaid money you’ll lose, as long as you cancel for a reason listed in the policy. Problems typically covered for trip cancellation insurance claims include sickness, injury, severe weather, natural disasters, jury duty and more.

Ask an expert

How to Choose the Best Travel Insurance Policy

Shayla Northcutt

Forbes Advisor board member

Michelle Megna

Insurance Lead Editor

Insurance Managing Editor

Les Masterson

Insurance Editor

Ashlee Valentine

Assess Your Needs, Read Reviews

Choosing the right travel insurance policy is like packing an essential item for your trip—you never know when you might need it. I recommend considering not only your travel plans, but also who you are traveling with and their circumstances as well as personal health requirements. That way you can find a policy that offers peace of mind, covering everything from lost luggage to unexpected medical emergencies. It’s also crucial to look into each insurer’s customer service reputation and the ease of their claims process, because if something does happen, you’ll want support that’s both reliable and accessible.

Purchase a Policy When You Book Your Trip

I strongly recommend buying travel insurance as soon as you book your trip. That way you get the maximum length of coverage for trip cancellation benefits. I don’t think many people realize that buying a policy shortly after you make your first deposit also makes you eligible to buy upgrades, such as “cancel for any reason” coverage, and to get other time-sensitive benefits, such as a pre-existing medical condition exclusion waiver.

Buy Travel Medical Insurance for International Trips

If you’re traveling outside of the U.S., I would make sure you buy a policy with ample travel medical and emergency medical evacuation insurance. It’s important because you may have little to no coverage under your U.S. health plan. Look for a policy where the medical insurance is primary, meaning the policy will pay out first, before any other health insurance you have.

Review Travel Delay and Missed Connection Benefits

If you’re flying to your destination, your itinerary could be derailed by weather, airplane mechanical issues or missed connections. If you’re worried about paying extra money due to a delay or missed connections, I recommend that you look for a policy that has a generous amount of travel delay and missed connection insurance.

Determine If You Need Adventure Activities Coverage

If you plan to participate in extreme sports or adventure excursions, I suggest buying a plan that specifically covers these activities, as they’re often excluded. A travel insurance agent can help you pinpoint a policy that will cover your particular adventures.

Decide How Much Flexibility You Want

I like the idea of “cancel for any reason” travel insurance because you never know what life will bring, and unfortunately it might bring a reason to cancel a trip that’s not covered by the base policy. Having CFAR coverage ensures you can get partial reimbursement for any oddball problems that crop up.

Americans are ready to take trips abroad in May: 86% of travel insurance purchases for trips taking place May 1-31, 2024, are for international trips, based on our analysis of policy sales.

Italy is the top international destination for trips this month, followed by Great Britain and France. In addition:

- The average trip cost being insured for people traveling outside the U.S. in May is $6,339.

- The average trip cost being insured for folks traveling within the U.S. this month is $7,111.

- Americans traveling internationally are paying an average of $405 for their travel insurance policies for May trips and domestic travelers are paying an average of $228.

Average Trip Cost for Popular Destinations