0800 YOU TRAVEL or 0800 968 872 Find a Store Subscribe to latest deals

Gem Visa is a smart, everyday credit card that gives you the freedom to take advantage of great deals and travel opportunities at YOU Travel. That’s right – at YOU Travel we have a range of finance options available in our stores, nationwide, just ask for the Gem deal that suits you!

Start paying the clever way today, go interest free with Gem Visa.

Don’t have a Gem Visa? That’s fine, applying is easy just click here .

*Terms & conditions apply. Please check with your local YOU Travel & Cruise specialist who will assist with the current rates & terms & conditions.

- " id="mainPhoneNumber">

- Single Travel Insurance

- Annual Travel Insurance

- Cruise Travel Insurance

- Family Travel Insurance

- Seniors Travel Insurance

- Ski Travel Insurance

- NZ Travel Insurance

- Zoom Travel Insurance

- See more companies...

- Travel Insurance Guide

- Covid-19 Help

- Read Reviews

- Write a Review

Need Quotes?

Use our travel insurance comparison to help you save time, worry & loads of money!

Please Note - If you are cruising around Australia you need to select Pacific. With Regions, variances can apply for Bali, Indonesia, Japan and Middle East. You are not required to enter stop-over countries if your stop-over is less than 48 hours.

If you don’t know where you’re traveling to within the next 12 months, choose Worldwide to ensure you’re covered no matter where you go. If you’re travelling to multiple countries choose the region that you are visiting that is furthest away (excluding stopovers less than 48 hours). In most cases you will be covered for the closer regions as well. For example, if you choose Europe, you will also be covered in the Middle East, Asia and Pacific.

Worldwide means anywhere in the world

Americas means USA, Canada, South America, Latin America, Hawaii and the Caribbean

Europe means all European countries, including UK

Middle East refers to the area from Syria to Yemen; Egypt to Iran

Asia generally means Asia and the Indian subcontinent. For some insurers this excludes Japan*

Pacific means the South West Pacific, Australia and Indonesia/Bali*. Select Pacific for domestic cruises in New Zealand waters

New Zealand means domestic travel within New Zealand only

*Note: Variances apply for Bali, Indonesia, Japan and Middle East. Check that your destination is covered once directed to your chosen insurer’s site.

Credit Card Travel Insurance | The Truth

When planning a holiday, oddly, travel insurance is often the first expense to bite the dust with budget-conscious travellers. Utilising complimentary travel insurance offered by your credit card could be the answer, but you’ll need to know the ins and outs. You’ve already paid the credit card annual fee – so why not use the free travel insurance?! Like most insurances, the true value of the policy only becomes apparent when it is time to make a claim, and then…it could be too late. If you fall outside the fine print of a travel insurance policy and the insurer refuses to pay up, what seemed like a bargain at the time, could end up being a daft deal. Cost aside, the most important thing to consider when taking out any travel insurance policy is that you understand what you are covered for and any restrictions that apply. The same applies for ‘free’ credit card travel insurance.

Not all credit cards offer travel insurance

- Firstly, uncertainty around what customers need to do to kickstart their travel cover; and

- Secondly, who is covered under the policy.

Activate your travel cover

- Auto-Activation on Purchase: In most cases, your travel insurance is automatically activated when making any travel-related purchases on the card, such as flights and accommodation.

- Notify Your Card Provider: On other cards, you may need to notify your card provider when you wish to activate your travel insurance.

Know who is covered

Consider your trip length, other traps to look out for.

The term 'free' does not necessarily mean 'free'. Credit cards that provide ‘complimentary’ travel insurance typically have annual fees ranging from $87 to over $500. If you're a healthy, savvy traveller who takes more than two standard short trips a year, credit card travel insurance could be the winning ticket. When you compare the card annual fee cost to the cost of standalone travel insurance, it may save you some cash. It’s good to weigh up the options but make sure you read the terms of cover paying particular attention to exclusions. Be it business or leisure, there are many affordable options out there for covering your travels. Your focus should be ensuring you have enough cover for your planned trip. Use our comparison to instantly compare travel insurance quotes and levels of cover from 20+ reputable travel insurance companies .

- Who doesn't love 'free' stuff!?

Activate your 'free' travel insurance

Eugene Wylde

Eugene is the king of insurance! Having spent more than ten years raising awareness on the importance of holiday protection, he is a self-confessed insurance geek extraordinaire when it comes to the world of travel cover. Eugene loves helping people save time, worry and loads of money with the right policy at the right price. His ideal holiday is any one where he has a pina colada in his hand. Salut!

Our Travel Insurance Comparision Helps You

Save time, worry and loads of money.

Stay up to date with our latest news, deals and special offers.

Your privacy is important to us.

CoverDirect NZ Limited (INC 3526051) owns and operates this website.

Our comparison is a free service that makes it easy for users to compare multiple quotes, saving both time and money. Our comparison ranks quotes according to price and is limited to those insurers that have agreed to participate on the site. CoverDirect NZ Limited does not hold a financial services licence. The comparison does not take your personal circumstances into account; as such, all information provided should be considered general and should not be considered as advice or a recommendation. Whilst we take all reasonable care when preparing this information, we do not warrant its accuracy. Pricing information is supplied by the insurance providers and ALL policy details should be verified with the before you purchase. This site links users to the website of the insurance provider to verify quotes and access the relevant PDS to understand what is, and is not, covered by a policy prior to purchase. We do not issue insurance. Users purchase directly from the travel insurance provider.

Loading Quotes...

Please login or register to continue. It'll only take a minute.

Login with Facebook

Login with Google

- There was an error logging in, please try again.

Enter your email and password

- There was an error on your registration, please try again.

Don't you have an account?

Just checking you are a human

Quick Links

- Cancel Policy

- Make a claim

Visiting New Zealand

Eligibility criteria.

So, you’re looking to apply for our Visiting New Zealand travel insurance policy for yourself or for a family member coming to visit. It’s important to understand whether you qualify for the Visiting New Zealand travel insurance policy.

You can find the eligibility criteria for this policy below.

You can only get cover under this policy if you meet all the criteria below:

- You hold a current New Zealand work visa or visitor visa; or

- be exempt from the requirements to hold a visa to visit New Zealand; or

- be exempt from the requirements to hold a visa to visit New Zealand but must instead hold a New Zealand Electronic Travel Authority (NZeTA).

- You are aged 75 years or younger at the date your insurance starts

- You are not a citizen or permanent resident of New Zealand

What you need to know

This page provides a summary of the key terms only. As with all insurance policies, terms and conditions apply. For our terms and conditions (including information about exclusions, excesses and sub limits) we recommend you read the travel insurance Policy Document .

- 151 King Street Pukekohe Auckland

- [email protected]

- 0800 873 636

- Tour Packages

- Travel Insurance

Our Best Deals

Best deals on flights

Amazing Deals on Hotels

Luxury Cruises

Create Beautiful memories with our travel packages

Welcome to Touris, a family-owned and operated travel company that offers exceptional travel experiences to clients worldwide. Our team is led by a widely travelled person who has explored the world and gained valuable insight and access to world travel information. We are passionate about travel and committed to providing personalized and customized travel services to our clients.

Our owners are fluent in English, Punjabi, Hindi, and Mandarin, enabling us to serve clients from diverse backgrounds and locations. At Touris, we understand that every client is unique and has specific travel requirements. Our team works closely with clients to understand their preferences and create bespoke travel itineraries that suit their needs.

Unlock The Ultimate Echelon of Experiencing Adventure

Get in touch, it's time to explore the real wonders of life...

We bring to you the best deals and discounts on flights, hotels, activities, etc. so that you can have the best holiday experience with your loved ones.

READY FOR HOLIDAY?

We are here with both adventure and enjoyment.

Why Choose Us

Best customer service, profound industry experience, multilingual workforce, comprehensive services, reliable travel partner, value for money, book your travel now & get 10 months of interest free.

Also, get 6 months’ interest-free on all

Visa purchases $250 and over * anywhere Visa is accepted, worldwide

The minimum purchase is $250. Minimum monthly payments are required. Available on participating Gem Visa or Gem CreditLine credit cards only. New customers must apply and be approved for a Gem Visa credit card.

*Credit and lending criteria and fees apply, including a Gem Visa $55 establishment fee and annual fees ($52 Gem Visa (charged $26 half yearly) / $55 Gem CreditLine (charged $27.50 half yearly). The prevailing interest rate (currently Gem Visa 26.99% p.a/ Gem CreditLine 29.95% p.a.) applies after the interest-free term ends. Credit provided by Latitude Financial Services Ltd.

Long term interest free finance options available on Q card & Gem Visa

Flights & Hotels across the world

Dubai & middle-east

Indian destinations

Travel to Europe

Flights & Hotels to London

Travel Packages - USA

Travel to Canada

Air Tickets to Australia

Maldives Travel Packages

Achievements, here's what our customers are saying.

- New Zealand

- American Samoa

- Cook Islands

- New Caledonia

- Papua New Guinea

- Philippines

- Solomon Islands

- Timor Leste

- United Arab Emirates

- United Kingdom

- United States of America

Credit card travel insurance

How do I qualify for travel insurance using my credit card?

If you have an ANZ Airpoints Visa Platinum credit card, and you pay for at least half of your pre-paid travel expenses with your card you may be eligible to receive overseas travel insurance.

To check your eligibility, please visit our ANZ travel insurance website

Secure email via Internet Banking

- Send bank mail

0800 269 296

Monday to Friday, 8am - 8pm Saturday and Sunday, 8am - 6pm

- All phone numbers

Visit a branch

- Find an ANZ branch

Gem Visa Credit Card

- Enjoy 6 months interest-free on purchases worth more than $250.

- Long-term 0% deals on select partners from 6 to 60 months, which can be paid off early without penalties.

- Up to 55 days interest-free.

Pros and cons

- Get 6 months interest-free on purchases if you spend $250 or more.

- Up to 55 interest-free days on purchases as standard.

- Long-term payment plans at 0% p.a. can be paid off early without penalties.

- Compatible with Apple Pay, Fitbit Pay, Garmin Pay, and Google Pay.

- A one-off $55 establishment fee on top of the annual fee.

- An $8.95 monthly service fee.

- High 25.90% p.a. interest rate on purchases.

- Cash advance interest is also high.

Convenience

Customer service, rates and fees.

- Additional cardholders . Additional cardholders are not supported for this card.

- Digital wallets. This card is compatible with Apple Pay, Fitbit Pay, Google Pay, and Garmin Pay.

- Gambling transactions. Latitude Financial Services classify gambling-related transactions as cash advances.

Rewards and benefits

- Complimentary travel insurance. The Gem Visa Credit Card does not offer complimentary international travel insurance.

- Concierge services. There is no concierge service with this card.

- Insurances. Comes with fraud protection but no additional credit card insurance policies.

- Rewards points. This credit card does not have a rewards program.

- Sign-up bonus. Latitude Financial Services do not offer a signup bonus for new customers.

- Annual fee. The annual fee for this card is $52 p.a. This fee is similar to others in this market tier.

- Balance transfers. There is no introductory balance transfer offer at the moment.

- Cash advances. Cash advances will be charged interest at 25.90% p.a. Interest will accrue from the cash advance transaction date. Additionally, there will be a one-off fee. This card's cash advance rate is among the highest.

- Foreign exchange fee. All international transactions in a foreign currency incur a 2% foreign exchange fee, which is around average.

- Interest-free period. Provides up to 55 days interest-free on purchases (except cash advances) when you have paid off your previous balance or made the required minimum repayments.

- Purchases. Get 6 months at 0% p.a. on purchases if you spend $250 or more. After the introductory period, the ongoing interest rate of 25.90% p.a. will apply to purchases. This purchase rate is higher than most cards on the market.

Reviewed by Nilooka Dissanayake

User reviews

This product has not been reviewed yet. Click here to write your review and help others make a better decision.

This credit card is listed in these comparisons

- Latitude Financial Services credit cards

Advertiser disclosure

At Finty we want to help you make informed financial decisions. We do this by providing a free comparison service as well as product reviews from our editorial staff.

Some of the products and services listed on our website are from partners who compensate us. This may influence which products we compare and the pages they are listed on. Partners have no influence over our editorial staff.

For more information, please read our editorial policy and find out how we make money .

Finty members get

I don't want rewards

I want rewards

Disclaimer: You need to be logged in to claim Finty Rewards. If you proceed without logging in, you will not be able to claim Finty Rewards at a later time. In order for your rewards to be paid, you must submit your claim within 45 days. Please refer to our T&Cs for more information.

Free comprehensive travel insurance now available on the Latitude 28° Global Platinum Mastercard®

Latitude Financial today launched free comprehensive travel insurance for Latitude 28° Global Platinum Mastercard ® customers and their eligible family members, providing benefits if they contract COVID-19 while travelling.

For a limited time until 31 March 2022, customers booking travel will automatically unlock free domestic and comprehensive international no-excess travel insurance when they spend $1,000 or more on flights using their Latitude 28° Global.

The free comprehensive international protection includes Travel Accident, Travel Medical Benefits, Trip Inconvenience Protection, Baggage Protection and Assistance Department Services.

The coverage related to contracting COVID-19 includes:

- covered medical expenses of up to $700,000 per person if you contract COVID-19 during an overseas covered trip and require treatment;

- non-refundable travel and accommodation deposits if you contract COVID-19 and a doctor certifies you unfit to commence or continue a covered trip;

- administrative costs of postponing a covered trip if just before departure COVID-19 forces you into compulsory quarantine.

- travel disruption due to border closures, such as the cost of additional accommodation or missed flights;

- additional costs due to quarantine.

“Travel is particularly important to our Latitude 28° Global customers and after almost two years of closed borders we are excited to support their adventures by providing comprehensive travel insurance for a limited period, on top of no annual fee and no international transaction or currency conversion fees.”

The coverage is activated for 12 months from the initial purchase of $1,000 or more on flights booked directly with an airline or travel agent in a single transaction. Other trips within this period can be covered if the entire cost of all flights is paid on Latitude 28° Global. These trips are covered if they’re up to 180 days long and completed within the original 12-month period.

For more details on the coverage in this comprehensive travel insurance, full policy details (including the terms, conditions, limits and exclusions) are available at www.28degreescard.com.au/insurance

The launch of free comprehensive travel on Latitude 28° Global, which has no annual fees, comes ahead of an expected travel boom this summer and across 2022.

Google statistics show searches for the term “travel insurance” in Australia reached a 12-month high in November as Australians seek to protect their plans.

A Latitude survey has found Australians want to travel in greater numbers than ever as borders reopen, with as many as 80 per cent planning a trip this summer.

Catching up with family and friends is the principal driver of people’s holiday plans, with the survey of 1000 Australians showing 91 per cent of respondents are looking forward to connecting with loved ones.

Holiday makers are also wanting adventure after two years of COVID-19 disruption spent in the sanctuary of their home. Seventy-six per cent of travellers are seeking active holidays, particularly where they can experience the great outdoors.

While most Australians are planning domestic travel (79 per cent), half of 18-44 year olds surveyed want to travel overseas as soon as they can, especially as more international destinations open up to fully vaccinated travellers.

Media contact

Mark Gardy [email protected] +61 412 376 817

You could also read

Latitude go offers six-months interest free in time for christmas, travel boom as nine in 10 new zealanders expected to travel this summer.

Credit Cards

Personal loans.

Log in to continue your loan application, or access your loan account information.

Gotta have it? Let's make it happen.

Enjoy 6 months interest free on everyday purchases of $250 or more*.

Let's shop with Gem Visa.

Enjoy 6 months interest free on all purchases of $250 or more * , anywhere Visa is accepted.

* Gem Visa T&Cs and fees apply including a $55 establishment fee and $55 annual fee (charged $27.50 half-yearly). Prevailing interest rate (currently 29.49% p.a.) applies to any remaining balance on the expiry of the interest free term. For cash advances, an interest rate of 29.95% p.a. and a $2 fee applies. Available to approved Gem Visa credit card customers only. Credit provided by Latitude Financial Services Ltd.

We’re taking on new retailers now

Growth. No integration. New Customers. Zero merchant fees. Ready now.

We are currently experiencing high call volume and chats due to COVID-19 outbreak.

Please email your inquiry to [email protected]

Our response time may be higher than normal, but one of our consultant will reach you surely.

We Appreciate your patience

- Flight Deals

- GEM Visa & Q Card

- Money Transfer

GEM Visa and Q Card

GEM Visa and Q-card, two of our premium products have helped our clients in their overseas trips. We ensure a safe and hassle-free visa processing, for all.

10 Months Interest Free

Minimum monthly payments required, 9 months interest free, no minimum payment due*, booking fee applies*.

06 months interest free option

12 months interest free option, 17 months interest free option, *terms and conditions apply, *lending criteria apply.

Offers may change anytime without prior notice

Get a Quote

IMPORTANT NOTICE ON CORONA VIRUS OUTBREAK

Want the Shore Travel Bucket List Travel brochure? Download Now .

- Escorted Tours

- Current Deals

- Destinations

Shore Travel are delighted to be able to provide our customers with flexibility when booking and paying for travel. Travel now & pay later with our range of finance options.

15 months no interest & no payments*, available on purchases $100 and over a shore travel fee of 2.5% applies offer available for in-store purchases only , enquiry form.

Terms & Conditions:

*15 MONTHS, NO INTEREST & NO PAYMENTS: Minimum purchase is $100. Normal credit and lending criteria and fees (including a $55 establishment fee and a $52 annual fee for Gem Visa and a $50 annual fee for Gem CreditLine) apply. A Shore Travel fee of 2.5% applies. GENERAL: Offer available for in-store purchase only. Payment for your purchase will be deferred for the stated period. During the deferred payment period, no interest will accrue and no monthly payments need to be made. If you do not pay the outstanding balance in full before the end of the deferred payment period, the amount payable will accrue interest and will be included in the minimum monthly payment amount shown on your monthly statement. Prevailing interest rate (currently Gem Visa 25.99% p.a./ Gem CreditLine 29.95%) applies to any outstanding balance on the expiry of the interest free period. Gem Visa/ Gem CreditLine is provided by Latitude Financial Services Limited.

sign up to our newsletter

Discover the world from your inbox

Ready to start planning your dream holiday.

- Travel Insurance

- Travel Consultants

- Interest Free Travel Options | Gem Visa & Q Card Deals

- Click here to Book Online!

- Book Online

- UK & Europe

- North & South America

- Arctic & Antarctica

- South Pacific, Australia & NZ

- Philippines Tours

- Top Destinations

- General Information

- Travel To & In Philippines

- Tourist Information

- Things To See & Do In Philippines

- 0800 11 11 31

Pay With Q Card

and Q Mastercard

Q Card or Q Mastercard is your perfect shopping partner to purchase your holidays, combining the benefits of a credit card with a range of interest-free deals.

We offer interest-free deals ranging from 6, 12 & 17 months. Ask us about out current finance offers.

An applicable merchant service fee will apply for new business and add-ons.

Interest Free Flexi Payment Plans (without a Payment Holiday):

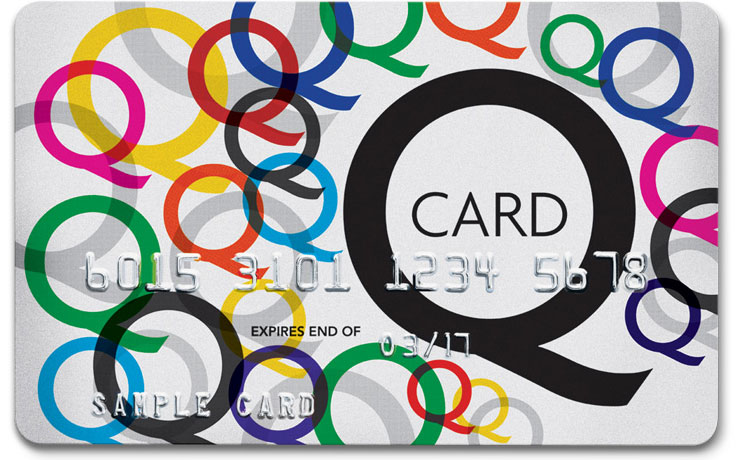

No interest for 6, 12 or 17 months is available until further notice. Minimum spend $250. Annual Account Fee of $50 applies. A $55 Establishment Fee for new Q Mastercard Cardholders and a $35 Advance Fee for existing Q Mastercard Cardholders will apply. Minimum payments of 3% of the monthly closing balance or $10 (whichever is greater) are required throughout interest free period. Paying only the minimum monthly payments will not fully repay the loan before the end of the interest free period.Q Mastercard Standard Interest Rate, currently 25.99% p.a. applies to any outstanding balance at end of a payment holiday or interest free period. Q Mastercard lending criteria, fees, terms and conditions apply. Rate and fees are correct as at date of publication, subject to change.

Payment Holiday and Interest Free Flexi Payment Plans:

No payments and no interest for 6 months (“Payment Holiday”) is available until further notice. Minimum spend $250. Annual Account Fee of $50 applies. A $55 Establishment Fee for new Q Mastercard Cardholders and a $35 Advance Fee for existing Q Mastercard Cardholders will apply. Q Mastercard Standard Interest Rate, currently 25.99% p.a. applies to any outstanding balance at end of a payment holiday or interest free period. Q Mastercard lending criteria, fees, terms and conditions apply. Rate and fees are correct as at date of publication, subject to change.

See Q Card Terms & Conditions

See Q Card Fees & Charges

Pay with Gem Visa

and Gem CreditLine

Travel Better with Gem Visa and Gem CreditLine. Get 9 months no interest & no payments when you purchase travel over $250. We also offer interest free finance for 6, 10 or 12 months interest free. Ask us about out current interest free finance offers.

Minimum purchase $250 for 6 ,10 or 12 months. Minimum monthly payments required. An applicable merchant service fee will apply for new business and add-ons.

*Minimum purchase $250. Minimum monthly payments required. Available on participating Gem Visa or Gem CreditLine credit cards only. New customers must apply and be approved for a Gem Visa credit card. *Credit and lending criteria and fees apply, including a Gem Visa $55 establishment fee and annual fees ($55 Gem Visa (charged $27.50 half yearly) / $55 Gem CreditLine (charged $27.50 half yearly). Prevailing interest rate (currently Gem Visa 27.99% p.a/ Gem CreditLine 29.95% p.a.) applies after interest free term ends. Credit provided by Latitude Financial Services.

More about Gem Visa

Interest Free Travel Options

Gem Visa Credit Card

Latitude is a lending business that operates in Australia and New Zealand, it issues Gem credit cards.

Compare Low Rate Credit Cards

Gem credit cards

- 6 months interest free on all purchases $250 and over at participating stores

- Cashback offers from selected retailers

- 0% p.a. on long-term deals at some of NZ’s leading brands

Fees and charges:

- $55 annual fee

- $55 establishment fee

- Purchase interest rate: 29.49% p.a.

- Cash advance rate: 29.95% p.a.

- $5 card replacement fee

Gem Essential

Gem Essential is currently not open to new applicants.

- No interest for up to 55 days

- Purchase interest rate: 22.49% p.a.

- Cash advance interest rate: 29.95% p.a.

Gem CreditLine

Gem CreditLine is currently not open to new applicants.

- 0% interest for 120 days when you spend over $100 at a participating store

- 0% interest on long term deals with select brands

- Purchase interest rate: 29.95% p.a.

Canstar’s free comparison tool gives you the ability to compare Gem credit cards with those from other lenders in the credit card market. For more details, just click on the button below.

Compare Credit Cards with Canstar

Written by: Caitlin Bingham | Last updated: March 26, 2024

Other Gem Products

- Personal Loans

Other Credit Cards from

American Express

Purple Visa

The Cooperative Bank

Credit Card Colour Comparison: What’s the Difference?

Best Ways to Earn Frequent Flyer Points

What is Flybuys and is it Worth it?

Quick Links

- STORE & CONSULTANT FINDER

- My Wishlist

Register / Login

- Sign up for emails

- Cheap Flights

- Destinations

- Storefinder

Latest deals to

Central & South America

Cook Islands

Egypt & Morroco

North America

Pacific Islands

Last Minute Cruise Deals

Ski Holidays

All on sale

As Advertised

MID YEAR MEGA SALE

2024 ‘BOOK IT’ LIST

Fiji Luxe Yasawa Islands

Small Group Asia Adventures

Disney Magic

Disney Magic at Sea NZ Summer 2025/26

Bucket List Med Cruise 2025 & 2026

Mediterranean Odyssey

Disney Magic at Sea NZ Summer 2024/25

Royal Caribbean

South Australia

The Islands of Tahiti

Explore Europe with Back Roads Touring

Australia on sale with Air New Zealand

All Inclusive Holidays

Escape winter to the sunny Gold Coast

Online Brochures

Travel Articles

Inspire Magazine

Discover a Different Australia

Holidays@Home

Make Travel Matter Journeys

Face2Face Video Appointments

New Zealand

South Pacific

Asia flights

UK & Europe

USA & Canada

South America

South Africa & Middle East

Business Class flights

Book online.

Special needs or children (2-15yrs) travelling alone?

Stopover or Multi-city? Please fill in this enquiry form .

MID YEAR MEGA SALE - FLIGHTS WITH AIR NEW ZEALAND

North America & Asia Flights

North America & Asia with Air New Zealand

Return economy flights from $1205 per person flying Air New Zealand

Australia Flights

Aussie Flights with Air New Zealand

Return economy flights from $529 per person flying Air New Zealand

NOT QUITE WHAT YOU ARE LOOKING FOR?

Send us an enquiry or pop in-store and talk to one of our travel experts today. Let's make holidays better, together.

Kiwi Owned & Operated

Creating better holidays & supporting local for 30+ years..

Interest Free Travel.

Pay by q card, gem visa/gem creditline & more..

Your travel info at your fingertips.

Download the app to manage your booking and itinerary..

ASB True Rewards.

Redeem your asb true rewards for travel..

IMAGES

VIDEO

COMMENTS

Prevailing interest rate (currently Gem Visa 29.49% p.a./Gem CreditLine 29.95% p.a.) applies after any interest free term ends. Paying only the minimum monthly repayment of 3% of the outstanding monthly balance or $20 (whichever is more), will not be sufficient to repay the purchase amount (s) within the promotional period.

GEM Visa. Gem Visa is a smart, everyday credit card that gives you the freedom to take advantage of great deals and travel opportunities at YOU Travel. That's right - at YOU Travel we have a range of finance options available in our stores, nationwide, just ask for the Gem deal that suits you! Start paying the clever way today, go interest ...

The term 'free' does not necessarily mean 'free'. Credit cards that provide 'complimentary' travel insurance typically have annual fees ranging from $87 to over $500. If you're a healthy, savvy traveller who takes more than two standard short trips a year, credit card travel insurance could be the winning ticket.

Enjoy 6 months Interest Free on everyday purchases of $250 or more with your Gem Visa credit card. Apply now. * T&Cs & fees apply incl. a $55 estb. fee & $65 annual fee (charged $32.50 half yearly). Interest rate currently 29.49% p.a. applies after interest free term ends. For cash advances, an interest rate of 29.95% p.a. and a $2 fee applies.

While it dates back to 2016, this Stuff.co.nz article has useful tips for anyone relying on credit card travel insurance policies, which we summarise: Activation typically requires paying for part of the holiday with the credit card, and this needs to happen before you leave New Zealand.; Credit card insurance almost always excludes pre-existing medical conditions.

Gem Visa/ Gem CreditLine: Credit and lending criteria and fees apply, including a Gem Visa $55 establishment fee and annual fees ($55 Gem Visa (charged $27.50 half yearly) / $55 Gem CreditLine (charged $27.50 half yearly)). Prevailing interest rate (currently Gem Visa 29.49% p.a./Gem CreditLine 29.95% p.a.) applies to any remaining balance on ...

Fixed Loans - 8.99% p.a. to 28.99% p.a. for Secured Loans and 9.99% p.a. to 29.99% p.a. for Unsecured loans. Your interest rate depends on your personal circumstances. If you choose to pay your loan off sooner, we will not charge you an early repayment fee. Credit and lending criteria, and fees apply including a $240 establishment fee.

Updated 16 June 2024. Summary: GEM Visa offers a generous 6 month interest-free and no-repayment period on any single purchase above $250, but to avoid higher-than-credit-card interest rates, the balance due MUST be paid off at the end of the interest free period. The true cost of "interest free" is not $0.

Credit and lending criteria and fees apply, including a Gem Visa $55 establishment fee and annual fees ($55 Gem Visa/$55 Gem CreditLine (charged $27.50 half-yearly)). Prevailing interest rate (currently Gem Visa 29.49% p.a./Gem CreditLine 29.95% p.a.) applies after any interest free term ends. Paying only the minimum monthly repayment of 3% of ...

You hold a current New Zealand work visa or visitor visa; or. be exempt from the requirements to hold a visa to visit New Zealand; or. be exempt from the requirements to hold a visa to visit New Zealand but must instead hold a New Zealand Electronic Travel Authority (NZeTA). You are aged 75 years or younger at the date your insurance starts.

Amount payable will be shown on your monthly statement. For cash advances, an interest rate of 29.95% p.a. and a $2 fee applies. Further information on rates and fees can be found at gemfinance.co.nz. Available to approved Gem Visa credit card customers only. Credit provided by Latitude Financial Services Ltd.

[email protected]; 09 3928288 ; 0800 873 636 ; Home; About Us; Flights; Hotels; Cruises; Tour Packages ... Call Us Now Contact Us Travel Insurance Book your travel insurance with us ... Available on participating Gem Visa or Gem CreditLine credit cards only. New customers must apply and be approved for a Gem Visa credit card. *Credit and ...

If you have an ANZ Airpoints Visa Platinum credit card, and you pay for at least half of your pre-paid travel expenses with your card you may be eligible to receive overseas travel insurance. To check your eligibility, please visit our ANZ travel insurance website. Cards. Credit cards. Foreign currency & travel. Travel insurance.

Complimentary travel insurance. The Gem Visa Credit Card does not offer complimentary international travel insurance. Concierge services. There is no concierge service with this card. ... Finty New Zealand. Office 2 Suite 92, Level 1, 515 Kent Street, Sydney, NSW 2000, Australia. ABN: 28 158 551 743. ...

Latitude Financial today launched free comprehensive travel insurance for Latitude 28° Global Platinum Mastercard ® customers and their eligible family members, providing benefits if they contract COVID-19 while travelling.. For a limited time until 31 March 2022, customers booking travel will automatically unlock free domestic and comprehensive international no-excess travel insurance when ...

Enjoy 6 months interest free on everyday purchases of $250 or more*. Apply Now. * Gem Visa T&Cs and fees apply including a $55 establishment fee and $55 annual fee (charged $27.50 half-yearly). Prevailing interest rate (currently 29.49% p.a.) applies to any remaining balance on the expiry of the interest free term.

Plus, with the Gem Visa card you can get cash back credit from a range of NZ leading brands. At time of writing (03/10/23) some of the biggest high street names have great long-term interest-free deals going with Gem by Latitude: Apple. 0% interest for 12 months on purchases over $600; Freedom. 6 months interest free when you spend $250 or more

GEM Visa and Q Card. GEM Visa and Q-card, two of our premium products have helped our clients in their overseas trips. We ensure a safe and hassle-free visa processing, for all. ... +64 9-392 7777 [email protected]. Quick Links. Home; About Us; Flight Deals; GEM Visa & Q Card; Money Transfer; Careers; Contact Us; Services;

Normal credit and lending criteria and fees (including a $55 establishment fee and a $52 annual fee for Gem Visa and a $50 annual fee for Gem CreditLine) apply. A Shore Travel fee of 2.5% applies. GENERAL: Offer available for in-store purchase only. Payment for your purchase will be deferred for the stated period.

What the Gem Visa credit card offers, in addition to its VOX cashback rewards program. Features: Six months interest free on all purchases $250 and over. Cashback offers from selected retailers. 0% p.a. on long-term deals at some of NZ's leading brands. Fees and charges: $55 one-off establishment fee. $55 annual fee.

Travel Better with Gem Visa and Gem CreditLine. Get 9 months no interest & no payments when you purchase travel over $250. We also offer interest free finance for 6, 10 or 12 months interest free. Ask us about out current interest free finance offers. Minimum purchase $250 for 6 ,10 or 12 months. Minimum monthly payments required.

Gem Visa Credit Card. Features: 6 months interest free on all purchases $250 and over at participating stores. Cashback offers from selected retailers. 0% p.a. on long-term deals at some of NZ's leading brands. Fees and charges: $55 annual fee. $55 establishment fee. Purchase interest rate: 29.49% p.a.

North America & Asia with Air New Zealand. Return economy flights from $1205 per person flying Air New Zealand. ... Interest Free Travel. Pay by Q Card, Gem Visa/Gem CreditLine & more. ... Travel Insurance; Video Appointments; Cheap flights. Domestic; South Pacific; Queenstown; Rarotonga; Fiji; Christchurch;