Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

GeoBlue Travel Insurance Coverage Review — Is It Worth It?

Christine Krzyszton

Senior Finance Contributor

311 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Director of Operations & Compliance

6 Published Articles 1179 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

Table of Contents

Why purchase travel insurance, why choose geoblue, travel medical insurance and the covid-19 virus, geoblue policy comparisons, how to obtain a quote, the value of travel insurance comparison sites, how geoblue compares — summary, everything else you need to know, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

We frequently discuss travel insurance and look closely at companies that offer the coverage , but today we’re narrowing our focus from comprehensive travel insurance to a specific type of travel coverage — travel medical insurance.

Chances are you’ve heard of BlueCross BlueShield (BCBS), one of the leading healthcare insurance providers in the U.S. The company was established in 1929 and currently insures over 107 million members. GeoBlue, an independent licensee of BCBS, picks up where BCBS leaves off, offering travel medical coverage worldwide .

You do not have to be a member of BCBS to purchase travel medical insurance from GeoBlue as the company makes its products widely available to U.S. citizens and permanent residents.

In an effort to determine the benefits of GeoBlue as a viable option for purchasing travel medical insurance, join us as we explore the following in today’s review:

- Why you should consider travel insurance and specifically GeoBlue

- An overview of the types of plans the company offers

- Comparing plans and obtaining a quote

- How the company measures up versus other companies and to credit card travel insurance

Insurance products, in general, serve the purpose of indemnifying you and making you whole (or nearly whole) should a covered event cause you to incur a financial loss. Travel insurance , and in this case travel medical insurance, is designed to accomplish the same objective.

Since our topic for this article is narrowed to travel medical insurance , let’s look at several reasons you’d want to consider this coverage.

- Your current health insurance policy does not provide coverage outside of the U.S. and/or its territories

- Your current health insurance policy covers you outside of the country but has a high deductible

- You are on Medicare and do not have a supplement plan

- You want a primary travel medical policy that gives you access to a network of medical providers in the country you’re visiting

- You have insurance from your credit card for trip cancellation, trip interruption , and other travel disruptions, but not travel medical coverage

- You are traveling to a remote area and want to have emergency evacuation insurance

This is just a sampling of some of the situations where you’d want to consider purchasing a travel medical insurance policy. Fortunately, the coverage is affordable and widely available.

Bottom Line: If your current health insurance policy does not cover you while traveling abroad or has a high deductible if it does provide coverage, you’ll want to consider purchasing travel medical insurance . Additionally, you should consider travel medical insurance if you’re concerned about emergency medical evacuation, or want to have 1 primary policy that covers you during your travels.

If you have the need to purchase travel medical insurance, there are certainly a lot of companies from which to select. GeoBlue stands tall among those competitors for several reasons.

First, the company has been providing global health insurance options since 1997, is a licensee of BCBS with a rating of excellent by financial insurance rating company, AM Best, and has an A+ rating by the Better Business Bureau.

Additionally, you can expect the following benefits when insuring with GeoBlue:

- GeoBlue has a vetted group of elite doctors in a network that spans 190 countries. Physicians must be certified by the American or Royal Board of Medical Specialties.

- Visits to network doctors/facilities are handled cashless, eliminating the need to file a claim for reimbursement.

- In addition to in-person care, GeoBlue utilizes alternative telemedicine options available 24/7 and provides access to a global network of physicians and facilities.

- Access is available to 24/7 assistance including translation services, physician referrals, prescription services, destination assistance, and more.

Bottom Line: GeoBlue is an established, highly-rated company that specializes in providing travel medical insurance with associated care via its global physician network, telemedicine services, and 24/7 medical assistance services.

Travel insurance, in general, does not cover voluntary trip cancellations due to the fear of getting ill for any reason, including the fear of contracting the COVID-19 virus. In addition, some travel insurance companies specifically exclude COVID-19 for most coverages. Other travel insurance companies provide limited coverage for COVID-19-related illnesses under trip interruption and medical care coverages only.

You’ll want to review any policy you’re considering to make sure your greatest concerns are covered.

In order to have any coverage that provides reimbursement for a voluntary trip cancellation, for example, you’ll need to consider Cancel for Any Reason (CFAR) insurance .

Travel medical insurance does not normally include extensive coverage for trip cancellations or disruptions but focuses more on providing medical care and reimbursement for the associated expenses that occur as a result of becoming ill or having an accident during your travels.

Fortunately, many of the medical insurance policies offered by GeoBlue do cover COVID-19-related illness . Let’s look closer at the available options.

Bottom Line: In order to have coverage for trip cancellation due to the fear of getting ill, you would need to purchase Cancel for Any Reason insurance. Some policies provide limited coverage for COVID-19 under trip cancellation and trip disruption coverages should you contract the virus prior to or during your travels. Many of the travel medical policies offered by GeoBlue cover COVID-19-related illness care .

GeoBlue offers single trip, multi-trip, and long-term plans. The company also issues specialty travel medical plans for students, workers on assignment, missionaries, volunteers, and maritime workers while abroad.

First, let’s look at the policy options for individuals and group travelers.

Short-Term Single-Trip Plan Options — GeoBlue Voyager

GeoBlue Voyager plans are designed for individual single-trip travel or group single-trip events. Groups are defined as 5 or more persons traveling together and a 10% discount off of individual pricing is provided.

Voyager plans include coverage for COVID-19-related illness care.

Here’s how the 2 Voyager policy options compare.

Multi-Trip Plan Options — GeoBlue Trekker

If you’re a frequent traveler, it could make sense to purchase 1 annual policy that covers multiple trips. GeoBlue Trekker multi-trip plans cover all trips made within a 12-month period (up to 70 days in length) and offer 2 levels of coverage options.

Here is a comparison of the 2 GeoBlue Trekker plans.

Both plans cover pre-existing conditions and emergency and non-emergency medical care. Both plans require that you have a primary health plan in place to qualify for purchasing these plans.

Long-Term Plan Options

If you’re a U.S. citizen or permanent resident living abroad and need medical insurance, GeoBlue offers 2 plans that may provide the coverage you need for you and your family.

These plans are different from short-term plans in that medical underwriting is needed in order to qualify. Here’s a brief summary of GeoBlue plans for U.S. expats.

All GeoBlue plans offer 24/7 global medical assistance, translation services, doctor searches, and destination health/security information.

GeoBlue Navigator, Xplorer, and Voyager plans include coverage for COVID-19-related illness .

Additional Plans Available

GeoBlue provides additional medical plans for specific types of travelers working abroad, on assignment, or participating in study programs.

- Incoming international students studying in the U.S.

- Students studying abroad

- Employees of multi-national companies working abroad

- Expatriate Crew International Health Plan — for those working on ships

- Expatriate Missionary and Volunteer International Health Plan — covers missionaries, aid workers, and volunteers worldwide

Bottom Line: GeoBlue offers several comprehensive individual travel medical plan options, comprehensive student plans including coverage for international visiting students, and plans for U.S. students, faculty, and family when studying abroad. GeoBlue also offers employer plans that provide coverage to employees working abroad and their families. Missionaries, those who volunteer internationally, and maritime workers will also find policies designed specifically for those situations.

Obtaining a quote for any type of travel insurance can be quick, easy, and can even result in securing immediate coverage. The process is similar for travel medical insurance.

To obtain a quote from GeoBlue for a single trip plan, you’ll need to input your travel destination, your state of residence, the length of your trip, age, cost of the trip, and the date you made the first trip deposit.

For a multi-trip annual plan quote, the process is similar. You’ll need to input your zip code, age, and the desired effective date of the policy.

Obtaining a quote with GeoBlue for a single or multi-trip policy can be done in just a few minutes. To obtain a long-term policy quote, you’ll need to submit some of the same basic information and a quote will be emailed to you.

Bottom Line: Obtaining a quote for a single or multi-trip policy is a quick and simple process completed on the GeoBlue website. A long-term quote for qualifying applicants must be requested via email.

While purchasing a travel medical policy from GeoBlue ensures you’re dealing with a highly-rated established company, it’s always good to do some comparison shopping when looking for any type of insurance.

Viewing a selection of policies side-by-side makes it easy to compare coverages and costs. This task is easily accomplished by utilizing a travel insurance comparison website such as the ones listed here.

Additionally, comparison sites allow you to narrow the number of policies to those that contain the coverages most important to you. Here are a few we recommend:

- InsureMyTrip — great for stand-alone medical travel insurance policy comparisons but also offers comprehensive travel insurance policies from over 20 providers

- Squaremouth — easy to navigate site that allows you to compare dozens of travel insurance companies and filter by desired coverage, including travel medical insurance

- TravelInsurance.com — you’ll want to use this site for comparing travel insurance plans, including those with medical coverage, however, no stand-alone medical plan quotes are available

Bottom Line: Utilize a travel insurance comparison site to help you easily compare several plans, filter by desired coverage, and select those that best match your coverage priorities.

We know that GeoBlue is a reputable choice for travel medical insurance but let’s look at how the company’s offerings compare to other travel medical providers and to the coverage that comes with your credit cards.

GeoBlue vs. Other Travel Insurance Companies

When we searched for a quote using the criteria of a traveler, age 40, for a trip to Mexico for 1 week that costs $3,000, the top 4 results above were shown. You’ll notice by the results that single-trip travel medical insurance can be an affordable option.

The next key element in selecting a policy will be to compare coverages. We know that GeoBlue Voyager policies include coverage for COVID-19 with the Voyager plans, for example, so this may be a key factor in our selection.

Digging deeper into our comparison we find that 1 policy does not include coverage for COVID-19. If we narrow our search to plans that only include this coverage, the next step will be to look at other coverages and limits that are important to us.

In this case, coverages for these policies are similar and costs do not vary widely. GeoBlue, however, remains competitive in both coverages offered and premiums charged.

Bottom Line: While GeoBlue holds its own and is competitive in both coverages and cost when compared to other travel medical insurance companies for single-trip plans, we know that coverage for multi-trip plans does not include coverage for COVID-19-related illness.

GeoBlue vs. Credit Card Travel Insurance

We frequently remind travelers that even the best credit cards for travel insurance are not a replacement for a comprehensive travel insurance policy. This is especially true for travel medical insurance coverage as you won’t find comprehensive medical coverage on any credit card .

There are very few cards that do offer emergency evacuation insurance and other ancillary medical/dental coverage. Here are 2 of the best options for travel-related coverages and benefits.

The Platinum Card ® from American Express

The Amex Platinum reigns supreme for luxury travel, offering the best airport lounge access plus generous statement credits, and complimentary elite status.

Apply With Confidence

Know if you're approved with no credit score impact.

If you're approved and accept this Card, your credit score may be impacted.

When it comes to cards that offer top-notch benefits, you’d be hard-pressed to find a better card out there than The Platinum Card ® from American Express.

Make no mistake — the Amex Platinum card is a premium card with a premium price tag. With amazing benefits like best-in-class airport lounge access , hotel elite status, and tremendous value in annual statement credits, it can easily prove to be one of the most lucrative cards in your wallet year after year.

- The best airport lounge access out of any card (by far) — enjoy access to over 1,400 worldwide lounges, including the luxurious Amex Centurion Lounges, Priority Pass lounges, Plaza Premium Lounges, and many more!

- 5x points per dollar spent on flights purchased directly with the airline or with AmexTravel.com (up to $500,000 per year)

- 5x points per dollar spent on prepaid hotels booked with AmexTravel.com

- $695 annual fee ( rates and fees )

- Airline credit does not cover airfare (only incidentals like checked bags)

- Earn 80,000 Membership Rewards ® Points after you spend $8,000 on eligible purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards ® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards ® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts ® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card ® . The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card ® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- The American Express Global Lounge Collection ® can provide an escape at the airport. With complimentary access to more than 1,400 airport lounges across 140 countries and counting, you have more airport lounge options than any other credit card issuer on the market. As of 03/2023.

- $155 Walmart+ Credit: Save on eligible delivery fees, shipping, and more with a Walmart+ membership. Use your Platinum Card ® to pay for a monthly Walmart+ membership and get up to $12.95 plus applicable taxes back on one membership (excluding Plus Ups) each month.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card ® .

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $189 CLEAR ® Plus Credit: CLEAR ® Plus helps to get you to your gate faster at 50+ airports nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Card. CLEARLanes are available at 100+ airports, stadiums, and entertainment venues.

- Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 year period for TSA PreCheck ® application fee for a 5-year plan only (through a TSA PreCheck ® official enrollment provider), when charged to your Platinum Card ® . Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card ® . That's up to $50 in statement credits semi-annually. Enrollment required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card ® to your Resy profile.

- $695 annual fee.

- Terms Apply.

- APR: See Pay Over Time APR

- Foreign Transaction Fees: None

American Express Membership Rewards

To learn more about all the travel insurance coverages that come with the Amex Platinum card, you’ll want to review our in-depth article on the topic. Note that terms apply and enrollment may be required for some benefits, so make sure you enroll through your American Express account.

Chase Sapphire Reserve ®

A top player in the high-end premium travel credit card space that earns 3x points on travel and dining while offering top luxury perks.

If you’re looking for an all-around excellent travel rewards card, the Chase Sapphire Reserve ® is one of the best options out there.

The card combines elite travel benefits and perks like airport lounge access , with excellent point earning and redemption options. Plus it offers top-notch travel insurance protections to keep you covered whether you’re at home or on the road.

Don’t forget the $300 annual travel credit which really helps to reduce the annual fee!

- 10x total points on hotels and car rentals when you purchase travel through Chase TravelSM immediately after the first $300 is spent on travel purchases annually

- 10x points on Lyft purchases March 31, 2025

- 10x points on Peloton equipment and accessory purchases over $250 through March 31, 2025

- $550 annual fee

- Does not offer any sort of hotel elite status

- Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 75,000 points are worth $1125 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™ Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck ®

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Member FDIC

- APR: 22.49%-29.49% Variable

Chase Ultimate Rewards

For more information on Chase Sapphire Reserve card travel insurance coverages , you’ll want to access our expanded overview.

Bottom Line: While credit cards may offer travel accident, trip delay , and other ancillary travel insurance coverages, these cards do not offer travel medical insurance.

Here’s some additional information we need to pass along applicable to the GeoBlue policies mentioned in our article:

- Eligibility includes U.S. citizens and permanent residents only

- Single and multi-trip medical insurance policies must be purchased in your home country before you travel

- Long-term policies, such as those for expats, may be purchased while abroad

- Travelers under 96 are generally eligible for coverage; other age limits may apply to specific policies

- Coverage is valid in all countries other than where the plan would violate U.S. economic trade sanctions

- Some GeoBlue policy options are secondary and require you to have an underlying medical insurance policy

- All policies issued by GeoBlue have a 10-day money-back guarantee

GeoBlue’s expertise at providing travel medical insurance makes it a good choice for purchasing coverage for a single or group trip, or if you’re an expat needing longer-term medical coverage while abroad. Students, faculty, and employers will also find comprehensive medical plans that fit their international medical insurance needs.

Finally, keep in mind that our article today is simply an overview and abbreviated summary of GeoBlue’s policy offerings — plenty of terms and conditions apply. The company’s website provides everything you need to select the appropriate policy, review coverages, obtain a quote, and purchase a plan.

All information and content provided by Upgraded Points is intended as general information and for educational purposes only, and should not be interpreted as medical advice or legal advice. For more information, see our Medical & Legal Disclaimers .

For rates and fees of The Platinum Card ® from American Express, click here .

Frequently Asked Questions

How does geoblue travel insurance work.

GeoBlue specializes in travel medical insurance. Care is provided internationally primarily via a comprehensive, vetted, and certified worldwide network of physicians and hospitals in 190 countries, but out-of-network international care is also covered. Additionally, the company provides worldwide care via telemedicine appointments.

The company offers international single trip, multi-trip, and group travel medical insurance plans.

It’s specialty travel medical insurance plans include policies for visiting international students, U.S. students studying abroad, and faculty members.

Additional plans include plans for those who work abroad for multi-national companies, maritime works, missionaries, and volunteers.

Is GeoBlue a good travel insurance company?

Yes. GeoBlue, a licensee of Blue Cross Blue Shield, is an established travel medical insurance company that has been offering international health insurance since 1997.

The company received a high financial rating from insurance rating company A.M. Best and an A+ rating from the Better Business Bureau.

Does GeoBlue meet Schengen visa insurance requirements?

Yes. GeoBlue travel medical insurance plans meet Schengen visa insurance requirements.

Does GeoBlue cover dental?

GeoBlue Voyager and Trekker plans offer ancillary dental coverage with limits between $100 and $500, depending on the plan, which includes emergency dental care for injury or relief of pain.

Voyager plans have additional dental and vision care riders which are optional add-ons.

Was this page helpful?

About Christine Krzyszton

Christine ran her own business developing and managing insurance and financial services. This stoked a passion for points and miles and she now has over 2 dozen credit cards and creates in-depth, detailed content for UP.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

![geoblue voyager choice plan Citi Simplicity® Card — Review [2024]](https://upgradedpoints.com/wp-content/uploads/2019/11/Citi-Simplicity-Card.png?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

- Skip to footer

- Best Global Medical Insurance Companies

- Student Insurance

- Overseas Health Insurance

- Insurance for American Expats Abroad

- Canadian Expats – Insurance and Overseas Health

- Health Insurance for UK Citizens Living Abroad

- Expat Insurance for Japanese Abroad

- Expat Insurance for Germans Living Abroad

- Travel Medical Insurance Plans

- Trip Cancellation Insurance

- Annual Travel Insurance

- Visitors Insurance

- Top 10 Travel Insurance Companies

- Best Travel Insurance for Seniors

- Evacuation Insurance Plans

- International Life Insurance for US Citizens Living Abroad

- The Importance of a Life Insurance Review for Expats

- Corporate and Employee Groups

- Group Global Medical Insurance

- Group Travel Insurance

- Group Life Insurance

- Foreign General Liability for Organizations

- Missionary Groups

- School & Student Groups

- Volunteer Programs and Non-Profits

- Bupa Global Health Insurance

- Cigna Close Care

- Cigna Global Health Insurance

- Cigna Healthguard

- Xplorer Health Insurance Plan

- Navigator Health Insurance Plan

- Voyager Travel Medical Plan

- Trekker Annual Multi-Trip Travel Insurance

- Global Medical Insurance Plan

- Patriot Travel Insurance

- Global Prima Medical Insurance

- Student Health Advantage

- Patriot Exchange – Insurance for Students

- SimpleCare Health Plan

- WorldCare Health Plan

- Seven Corners Travel Insurance

- Trawick Safe Travels USA

- SafeTreker Travel Insurance Plan

- Unisure International Insurance

- William Russell Life Insurance

- William Russell Health Insurance

- Atlas Travel Insurance

- StudentSecure Insurance

- Compare Global Health Insurance Plans

- Compare Travel Insurance Plans

- Health Insurance in the USA

- Health Insurance in Mexico

- Health Insurance in Canada

- Health Insurance in Argentina

- Health Insurance in Colombia for Foreigners

- Health Insurance in Chile

- UK Health Insurance Plans for Foreigners

- Health Insurance in Germany

- French Health Insurance

- Italian Health Insurance

- Health Insurance in Sweden for Foreigners

- Portuguese Health Insurance

- Health Insurance in Spain for Foreigners

- Health Insurance in China

- Health Insurance in Japan

- Health Insurance in Dubai

- Health Insurance in India

- Thailand Health Insurance

- Malaysian Health Insurance for Foreigners

- Health Insurance in Singapore for Foreigners

- Australian Health Insurance for Foreigners

- Health Insurance in New Zealand

- South Africa Health Insurance for Foreigners

- USA Travel Insurance

- Australia Travel Insurance

- Mexico Travel Insurance

- News, Global Health Advice, and Travel Tips

- Insurance Articles

- Travel Advice and Tips

- Best Hospitals in the United States

- Best International Hospitals in the UK

- Best Hospitals in Mexico

Or call for a quote: 877-758-4881 +44 (20) 35450909

International Citizens Insurance

Medical, Life and Travel Plans!

U.S. 877-758-4881 - Intl. +44 (20) 35450909

GeoBlue Voyager Travel Medical Insurance Plan

Single-Trip Blue Cross Blue Shield Travel Insurance

Voyager Choice is a single-trip travel medical plan that offers emergency medical coverage while you are traveling abroad. This highly-rated plan ensures subscribers the same access and quality health care abroad that they are used to at home. Excellent customer care is available 24/7/365, and claims are paid on a timely basis. The plan offers a choice of varying medical limits and deductibles to meet your specific needs and budget. You are required to have primary health insurance in place, but there is no exclusion for pre-existing conditions.

The GeoBlue Travel Insurance plan, Voyager, provides high-quality Blue Cross travel insurance for people aged 95 or younger who are U.S. citizens or residing in the USA. Voyager is designed for people who will be traveling abroad for six months or less. For longer trips abroad, we recommend the GeoBlue Xplorer plan.

Voyager is a single-trip travel medical plan that offers emergency medical coverage while you are traveling abroad. This highly-rated GeoBlue travel insurance plan gives subscribers access to some of the leading doctors and hospitals around the world for medical care and treatment. Customer service is excellent, and claims are paid on a timely basis. The plan offers a choice of varying medical limits and deductibles to meet your specific needs and budget. You must have primary health insurance in place, but there is no exclusion for pre-existing conditions.

GeoBlue Voyager Plan Highlights

No hospital precertification penalty.

GeoBlue Voyager does not require you to obtain prior approval for your choice of hospital, giving you one less thing to worry about in a health emergency.

Pre-Existing Condition Coverage

The Voyager Choice plan offers subscribers coverage for pre-existing conditions.

Pregnancy Coverage

If you are traveling while pregnant and experience complications, the Voyager plan has you covered.

Trip Interruption

Subscribers are covered for up to $500.

Ready to purchase Voyager?

Receive a personalized quote and purchase online in just minutes!

GeoBlue Travel Insurance Plan Benefits

Voyager insurance coverage details, global health and safety, additional benefits, geoblue voyager plan daily rates.

Rates for this Blue Cross travel insurance plan are based on the traveler's age and the total number of days traveling (7 days). Rates are available at the deductible and medical limits shown and are subject to change without notice.

Voyager Choice

Voyager Essential

Rates were last updated on March 4, 2024

Voyager Travel Medical Plan Eligibility Requirements

- Subscriber's home country is the U.S.

- Subscriber must be under age 95

- Subscriber must be enrolled in a primary medical insurance plan (Voyager Choice only); that plan does not need to be a Blue Cross Blue Shield plan

- Children under age 6 must be enrolled with a parent

- Initial purchase must be made in the U.S. prior to departure

Family members included in the plan (if applicable) must be:

- Your spouse; civil union partner or domestic partner age 95 or younger, and/or your eligible child(ren) or other eligible dependents

- Resident(s) of the United States

- Traveling outside the U.S. and scheduled to spend at least 24 hours away from his/her home

If you have questions as to whether your primary insurance plan qualifies or whether your dependents are eligible, please consult the plan booklet.

Frequently Asked Questions about GeoBlue Voyager

Who should buy geoblue travel insurance.

Anyone whose home country is the U.S. needs an international travel medical plan when leaving the U.S. for leisure, educational, missionary, or business travel.

The Voyager plan offers emergency medical insurance for your travel abroad. If you get sick or injured during your trip, you will have access to an emergency hotline for assistance in finding medical care abroad and the plan will cover your medical expenses incurred.

Travel insurance from GeoBlue makes it easy for clients to access care while traveling the world. Their mobile app helps you locate doctors and hospitals anywhere in the world, provides access to unlimited telemedicine visits, provides advice on similar medicines in the country, alerts you to local safety and health issues, and more.

Additional benefits include trip interruption, repatriation, coverage for lost luggage, and medical evacuation.

What are the minimum and maximum trip lengths?

A trip can be as short as one day or as long as 180 days. The minimum charge assessed for this Blue Cross travel insurance plan is seven days.

Does GeoBlue Travel Insurance Plans Include Trip Cancellation Insurance

GeoBlue Travel Insurance plans do not include trip cancellation benefits. The plans provide comprehensive emergency medical benefits and coverage for trip interruption, lost luggage, emergency evacuation, repatriation, etc.

For trip insurance, visit trip cancellation insurance .

What methods of payment are accepted?

Premiums can be paid by a major credit card online. If you want to purchase now, just click the link to proceed to the Voyager online application .

How are medical evacuation decisions made?

The evacuation benefit pays for a medical evacuation to the nearest hospital, appropriate medical facility or back to the U.S. Transportation must be by the most direct and economical route. All evacuations require written certification by the attending physician that the evacuation is medically necessary and must be approved by GeoBlue.

Are acts of terrorism covered under this plan?

Yes. The GeoBlue Voyager plan does not exclude illnesses or injuries related to terrorism or a terrorist act. To be covered in countries where there are open hostilities, such as Iraq and Afghanistan, a member must not be engaged in hostile or combative activities.

How do I access participating medical providers outside the U.S. and avoid claim forms?

GeoBlue’s Global Health and Safety services help members identify, access, and pay for quality healthcare all over the world. This includes a contracted community of elite providers in 180 countries. Members can access these carefully selected providers and arrange for the bills to be sent directly to GeoBlue. Please note, a member is responsible for their deductible at the time of service, if applicable. Members can request direct billing by calling the assistance telephone number listed on their member ID card, or by emailing [email protected].

Will my pre-existing condition be covered under a GeoBlue Voyager plan?

Pre-existing medical conditions are treated differently depending on the plan you have selected. The GeoBlue Voyager Choice plan is available to those who have primary insurance inside the U.S. and will cover medical treatments for pre-existing conditions. Please refer to the definition of a primary health plan for more specific information on what plans qualify as primary insurance. Under the GeoBlue Voyager Essentials plan, benefits are not available for any services received on or within six months after the Eligibility Date of an Insured Person, if those services are related to a Pre-existing Condition as defined in the Definitions section of the Plan Description. This exclusion does not apply to a Newborn that is enrolled within 31 days of birth or a newly adopted child that is enrolled within 31 days from either the date of placement of the child in the home, or the date of the final decree of adoption. The pre-existing conditions exclusion under GeoBlue Voyager Essential does not apply to the Medical Evacuation benefit, Repatriation of Remains benefit, or the Bedside Visit benefit. GeoBlue Voyager Essential does not require that insureds have primary insurance at the time of enrollment.

How do I read the fine print for Voyager Plans?

To view a sample policy, visit:

- GeoBlue Voyager Choice Certificate

- GeoBlue Voyager Essential Certificate

Will GeoBlue Voyager cover me inside the U.S.?

No. The GeoBlue Voyager plans are designed to cover a member anywhere outside the U.S. U.S. means the 50 states of the United States of America as well as the District of Columbia, Puerto Rico, and the US Virgin Islands.

Do I file claims with my primary insurance first?

GeoBlue Voyager plans are secondary insurance. However, GeoBlue will process and pay claims upfront as a primary payor and reserves the right, where applicable, to contact your primary insurance company to coordinate benefits.

I am leaving before my policy materials arrive in the mail. How will I receive the information I need in time?

Upon a successful purchase, you will receive an email confirmation which contains all your necessary policy information and essential contact information for emergencies. Once enrolled, members can instantly log in to the Member Hub area of GeoBlue’s website and download an electronic ID card and other policy documents.

How far in advance do you need to purchase a GeoBlue Voyager plan?

A GeoBlue Voyager plan may be purchased up to one day before your departure date. GeoBlue recommends that customers wishing to receive a hard copy ID card should allow two weeks before their effective date when purchasing.

I already left on my trip. Can I buy a GeoBlue Travel Insurance plan when I am outside the U.S.?

No. GeoBlue Voyager plans have been approved to be sold to customers purchasing from inside the U.S. Once issued; you may request a policy extension while overseas.

Who is eligible to be on the same GeoBlue Voyager policy?

For GeoBlue Voyager Choice, dependents may include your spouse, age 84 or younger, and your eligible child(ren) or other eligible dependents.

GeoBlue Navigator

GeoBlue Insurance

GeoBlue Trekker Multi-Trip Travel Medical Insurance

GeoBlue is the trade name of Worldwide Insurance Services, LLC, an independent licensee of the Blue Cross and Blue Shield Association. Made available in cooperation with Blue Cross and Blue Shield companies.

Get a fast, free, international insurance quote.

Global medical plans, specialty coverage, company info, customer service.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

GeoBlue Travel Insurance Review: Is it Worth the Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What does GeoBlue travel insurance offer?

Geoblue travel insurance cost and coverage, what isn’t covered, how to choose a geoblue plan online, is geoblue travel insurance worth it.

- Flexible deductible options.

- Wide ranging medical coverage.

- Low prices for medical only needs.

- Lacks in traditional travel insurance coverage options such as trip Interruption, bag delays, etc.

- Better when paired with travel credit card insurance coverage.

If you’re going on a trip soon, you may be wondering whether to invest in travel insurance. This type of insurance can offer protection in the event that you fall ill, your plans change unexpectedly or you experience unavoidable delays.

GeoBlue is one insurance provider offering plans to travelers, with a number of plans available based on your needs. Here's a review of GeoBlue travel insurance, including the options offered and how to choose your plan.

GeoBlue insurance offers two different plans for travelers, though it focuses mainly on medical coverage . These plans are called Voyager Essential and Voyager Choice. The former offers lower coverage options than the latter and is generally cheaper (though as you'll see, not always by a large amount).

The company also provides multitrip, long-term and group options for those who need them.

» Learn more: How much is travel insurance?

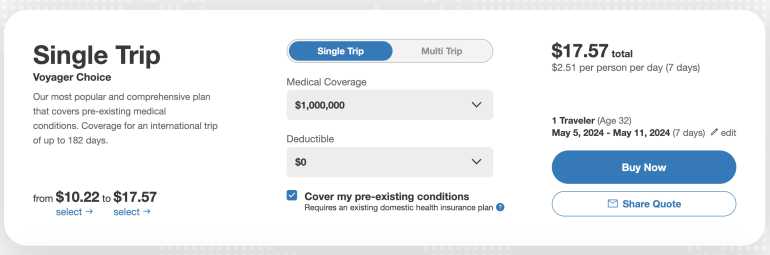

How much does GeoBlue cost? GeoBlue’s travel insurance is mostly medical-based and includes a comprehensive list of inclusions, though it also has coverage for some travel mishaps.

To get an idea of costs, we used a sample trip for a 33-year-old traveler from California with existing insurance heading out in August on a two-week trip.

Note that for this GeoBlue insurance review, we selected the highest coverage amount with no deductible. There are choices that allow you to include a higher deductible and a lower coverage limit, which may lower your plan cost.

Here’s what the two GeoBlue plans cover:

As you can see, there’s not a big difference when it comes to how much GeoBlue’s plans cost, with just about $7 between the two different offerings.

In terms of benefits, most are the same as well — the biggest difference between the Voyager Essential and Voyager Choice plans comes down to prescription medication coverage and coverage related to accidental death and dismemberment .

The less-expensive Essential plan pays 50% of your prescription costs, while the Choice plan covers the full 100%. As well, the Choice plan doubles accidental death coverage from Essential's $25,000 to $50,000.

Other than that, differences are minimal. You’ll get less coverage for emergency dental care and quarantine expenses , but otherwise, everything else is the same.

» Learn more: How does travel insurance work?

Is GeoBlue travel insurance good? Unlike many other travel insurance policies, GeoBlue’s products include coverage for hazardous activities and medical quarantine.

However, while GeoBlue shines when it comes to medical coverage, it falls short in other travel insurance aspects. Many travel insurance plans provide better options in the event that your bags are delayed , your flight is canceled or you miss nonrefundable bookings.

In GeoBlue’s case, the low levels of reimbursement for these types of issues may be problematic. However, bear in mind that many travel credit cards provide complimentary travel insurance that would pair well with a GeoBlue plan.

» Learn more: What to know before buying travel insurance

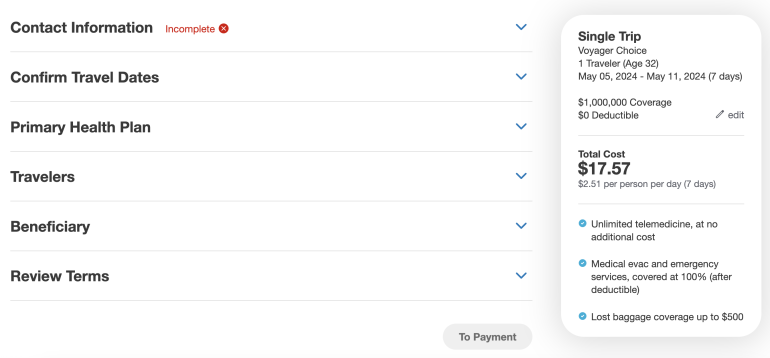

To purchase a GeoBlue plan online, go to the company’s website .

You’ll see the option to generate a quote and you’ll type in your trip dates, traveler's age and ZIP code.

Once you hit "Get A Quote" the results page pops up, which will give you the option to choose your deductible amount and maximum level of coverage. You can also toggle between single trip and multi trip.

Once you’ve decided on a plan, you’ll need to fill out all pertinent information including your contact information, your health plan details and beneficiary. Once you review the terms of the plan, select to payment and input your credit or debit card information.

After that, your policy will be issued.

» Learn more: 6 common travel insurance myths

While it offers excellent medical care for low prices, GeoBlue’s policies fall short when it comes to other travel coverage. However, if you also have a travel credit card , you may be able to pair the two together for relatively strong travel insurance coverage at a low cost.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

85,000 Earn 85,000 bonus points after spending $3,000 on purchases in the first 3 months from account opening.

Travel Insurance Review

GeoBlue – Voyager Choice

Editor review.

The Good: A single-trip travel medical plan for individuals and families from the U.S. heading abroad. Ideal for travelers under age 85. Choose your deductible and your medical limits to control premium costs.

The Drawbacks: Medical benefits for adventure activities are limited.

The Bottom Line: Â This is a good all-around travel medical insurance plan that gives the traveler a lot of choice in how much they want to spend for their coverage.

Get GeoBlue quotes now

Instant quotes & secure online purchasing

Plan Details

This plan is unique in that it provides the following:

- Choose your medical expense limit and control premium costs.

- Choose your deductible amount as well (0$, $100, $250, $500 per insured).

- Pre-existing conditions are covered.

- 100% outpatient prescription drug reimbursement (outside the U.S.) up to $5,000.

- Bedside visit benefits up to $1,500 for one person.

- Dependent children can be covered up to age 26.

- Injuries and illnesses resulting from terrorism and pandemics are covered as any other injury or illness.

Limitations

The following are the limitations on this plan’s coverage:

- A primary health plan is required for this insurance.

- Medical benefits for downhill skiing and SCUBA diving are limited to a maximum of $10,000.

- Pre-existing conditions included with a 180-day exclusion.

Related GeoBlue International Health Insurance Plans

- Voyager Essential

Popular Companies

- Allianz Insurance

- CSA Travel Insurance

- Seven Corners Insurance

- Travel Guard Insurance

- Travel Insured

- Travelex Insurance

- TravelSafe Insurance

Learn about Travel Insurance

- Beginner’s Guide

- Coverage Guide

- Tips and Advice

- Company Reviews

- Types of Plans

- Types of Trips

Blog Article Categories

- In The News

GeoBlue Travel Insurance Overview

- GeoBlue's Travel Insurance Plans

Purchasing and Managing Your GeoBlue Policy

Geoblue customer service reviews, compare geoblue travel insurance.

- Why You Should Trust Us

GeoBlue Travel Insurance Review 2024

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

Travel medical insurance can save you from steep costs if you experience a medical emergency while traveling, especially when traveling abroad, where your primary health insurance won't cover you. GeoBlue Travel Insurance can offer the protection you seek at low rates. Here's what you need to know before investing in a GeoBlue plan.

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. A subsidary of Blue Cross Blue Shield

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Offers strong medical plans as long as you have a regular health insurance plan, but it doesn't have to be through Blue Cross

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Offers long-term and multi-trip travel protection

- con icon Two crossed lines that form an 'X'. Multiple complaints about claims not being paid or being denied

- con icon Two crossed lines that form an 'X'. Does not provide some of the more comprehensive coverage like CFAR insurance

- con icon Two crossed lines that form an 'X'. Buyers who do get claims paid may need to file multiple claim forms

GeoBlue travel insurance specializes in medical travel insurance plans . These plans cover healthcare costs while traveling abroad but lack trip cancellation, lost luggage, and other coverages often associated with travel insurance. As such, this medical-only travel insurance option may only be suitable for some globetrotters.

Like many other travel insurance companies, GeoBlue offers very good coverage for a specific group of people. In this case, GeoBlue provides extremely cheap travel insurance for younger travelers with no pre-existing conditions.

Older travelers may need to look elsewhere, as there is a steep increase in premiums. Additionally, GeoBlue charges extra to cover pre-existing conditions . The extra cost isn't as noticeable when you're younger, but it's more substantial for older travelers.

One great benefit that GeoBlue has is a refund policy. GeoBlue allows you to cancel your policy and receive a full refund up to the day before your policy goes into effect.

GeoBlue's Travel Insurance Plans

GeoBlue offers three distinct medical travel insurance plans for individual travelers with varying levels of coverage. It also has a few group travel insurance plans for larger parties. Regular health insurance plans, destination, budget, and other factors play into the shopping experience. GeoBlue recommends each program for specific groups, but all three can be used for extended periods or multiple trips.

Here's an overview of the types of coverage included in each GeoBlue individual plan:

Additional Coverage Options from GeoBlue

GeoBlue offers fewer riders or additional coverage options compared to other providers. Looking at the descriptions above, the three plans give a detailed list of included services, not all of which will be applicable during the average trip. The Voyager and Trekker plans have no additional coverage options.

However, the Xplorer plan is aimed at long-term travelers (including those who temporarily work internationally). So it provides two optional riders that come in handy if you're outside your home country for months at a time:

- Enhanced Prescription Drug Rider: Provides up to $25,000 of coverage for prescription drugs per calendar year.

- Basic US Benefits Rider: Provides healthcare benefits in the United States, emergency medical care, inpatient hospital coverage, and prescription drugs coverage.

GeoBlue Travel Insurance Cost

Travel insurance coverage varies greatly, and the amount you pay reflects the range of protection . However, since travel insurance protects your financial investment, it's typically worth spending a few extra dollars for higher coverage maximums, especially for medical insurance and evacuation expenses.

To receive a quote with GeoBlue, you need to provide your age, duration of travel, and ZIP code. You do not need to input your budget for the trip or your destination to receive a quote.

We ran a few simulations to offer examples of how much GeoBlue single trip Voyager plan will cost for travelers of various ages. Rates vary based on deductibles, desired coverage limits, and whether they want pre-existing condition coverage.

- A 23-year-old from an Illinois ZIP code taking a week-long trip: $8.56 to $16.16.

- A 30-year-old from a California ZIP code for two weeks: $20.55 to $38.40

- A 65-year-old couple from a New Jersey ZIP code for two weeks: $139.20 to $270 ($69.60 to $135 per person)

GeoBlue offers a multi-trip plan, that can cover multiple trips over a year. A 35-year-old would pay $184 for annual travel insurance with GeoBlue.

How to File A Claim with GeoBlue

The easiest way to submit a claim with GeoBlue travel insurance is to file it through its online Member Services page or mobile app.

Policyholders can also file claims via mail, fax, or email. If you wish to submit physical paperwork, the company asks that you send it to one of the following addresses:

Mail: GeoBlue

Attn: Claims

933 First Avenue

King of Prussia, PA 19406

Fax: +1.610.482.9623

Email: [email protected]

Customer reviews of GeoBlue are relatively scarce. The greatest concentration of reviews is on its SquareMouth page, where it averages 4.6 stars out of five across just over 100 reviews. Its Trustpilot page paints a negative picture of GeoBlue's services, receiving 1.8 stars across an admittedly small sample size of 25 reviews. Google reviews on its headquarters in Pennsylvania add shades of grey to the black and white reviews on Trustpilot and SquareMouth, averaging 3.2 stars across over 110 reviews.

Customers complained that GeoBlue refused to issue payouts due to issues out of their control. One reviewer reported that they did not receive their payout because the clinic they received care at couldn't itemize their costs when filing paperwork with GeoBlue. Complaints also mentioned agents unfamiliar with policy specifics.

Despite mixed reviews, GeoBlue has a highly rated mobile app on both the Apple app store and Google Play store. Its iOS app has 4.7 stars across 4,300 reviews. Its Android app has 4.2 stars across 800 reviews.

See how GeoBlue travel insurance stacks up against the competition.

GeoBlue Travel Insurance vs. Allianz Travel Insurance

Both GeoBlue and Allianz offer single-trip, standalone medical insurance plans. In addition, both provide coverage for emergency medical transportation, emergency medical claims, and baggage loss. However, there are a few differences.

GeoBlue supplies coverage for non-emergent inpatient and outpatient visits and accidental death or dismemberment. It also explicitly includes preexisting conditions pending you travel with a regular health insurance plan. Meanwhile, Allianz issues coverage for epidemics and other travel services like cancel for any reason coverage.

In addition, the two plans are structured differently. Allianz offers payouts up to a set dollar amount. GeoBlue covers a certain percentage of qualifying medical costs after a met deductible.

Read our Allianz travel insurance review here.

GeoBlue Travel Insurance vs. AIG Travel Guard

AIG 's essential travel insurance plan provides medical evacuation coverage, security evacuation coverage, trip delay, and other coverages. In line with the low price, the essential plan's limits for each section are limited. For example, travelers would get a max of $15,000 medical travel insurance coverage. The company does not offer a standalone medical plan.

AIG Travel Guard customers may or may not be eligible for a preexisting conditions waiver, whereas GeoBlue's plans specify preexisting coverage as long as you have a permanent health insurance plan from your work or otherwise.

AIG focuses primarily on single-trip coverage options, though it does provide an annual travel insurance plan. GeoBlue's website recommends plans for different travelers, but all three programs allow for multiple trips or extended travel times.

Regardless, if you want broader protection for necessary medical treatments, you will likely be served with a plan from GeoBlue. On the other hand, if you're looking for more trip cancellation and other standard travel insurance coverages, you will steer towards AIG.

Read our AIG Travel Guard travel insurance review here.

GeoBlue Travel Insurance vs. World Nomads Travel Insurance

The travel insurance plans sold by World Nomads differ slightly from GeoBlue's. Rather than focusing exclusively on covering your medical costs and limited baggage loss, World Nomads offers a comprehensive insurance option. Its plan also includes trip cancellation, interruption, and more coverage.

In addition, World Nomads' plan covers a wide range of adventure sports, compared to the two (downhill skiing & scuba diving) covered by GeoBlue. Looking at the two companies side by side, you may see many of the same services. However, the two companies offer staggered benefits. World Nomads has a more extensive list to cover whatever comes your way.

However, GeoBlue is more thorough in covering preexisting conditions and other medical services if its terms are followed. If you look at the details, GeoBlue covers higher amounts for the services it includes.

Read our World Nomads travel insurance review here.

Why You Should Trust Us: How We Rated GeoBlue Travel Insurance

When reviewing GeoBlue travel insurance, we compared its products against those of other top travel insurance providers. In particular, we examined the available plan options, supplemental policies, claim limits, inclusions, exclusions, and sample policy premiums.

Selecting the best policy for you and your travel companions is about finding a policy with the correct type of coverage and adequate claim limits. That said, price is also an essential factor for many consumers. In addition, trip-specific riders for things like rental care coverage or adventure activities may be necessary for some travelers.

As such, we take all that into account when writing our reviews. Then individual readers can make decisions based on their travel plans and needs. You can learn more about how we rate travel insurance products here.

GeoBlue FAQs

GeoBlue lacks any trip cancellation coverage and other trip inconvenience benefits. However, it's also far cheaper than many comprehensive travel insurance policies.

While GeoBlue covers pre-existing conditions, you'll have to pay extra.

GeoBlue coverage targets international travel for US residents or US residents traveling abroad. GeoBlue provides secondary medical, so it'll kick in after your primary health insurance plan has issued its payout. As such, it's less useful for US residents traveling within the US.

You can utilize GeoBlue's resources such as its highly rated mobile app and online directory to find a healthcare provider.

To file a claim with GeoBlue, you typically need to submit necessary documentation, including medical records and receipts, within a specified timeframe. Timely submission is crucial for efficient claim processing, especially since customer reviews allude to a long and difficult claims process.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

- Main content

Frequently Asked Questions

- Does the Voyager cover me inside the United States? - No. The GeoBlue Voyager plans are designed to cover a member anywhere outside the U.S.. U.S. means the 50 states of United States of America including the District of Columbia, Puerto Rico, and the US Virgin Islands.

- Does the Voyager meet all schengen Visa requirements? - Yes, GeoBlue plans meet all of the Schengen Visa requirements. If you will be traveling to any of the countries within the Schengen area and depending on your nationality, you may be required to show proof that your insurance plan has certain benefits. GeoBlue can provide you with a Visa letter that you can use as proof to show the consulate that your policy meets all the Schengen visa requirements. The Visa letter contains all the specific wording the consulate is looking for. The countries within the Schengen area requiring a short-stay visa and proof of insurance include Austria, Belgium, Czech Republic, Denmark, Estonia, Finland, France and Monaco, Germany, Greece, Hungary, Iceland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden, Switzerland. See the most current list of countries within the Schengen area and find out which nationalities require a visa and Schengen travel health insurance .

- Are acts of terroism covered under the this plan? - Yes. The GeoBlue Voyager plan does not exclude illnesses or injuries related to terrorism or a terrorist act. In order to be covered in countries where there are open hostilities, such as Iraq and Afghanistan, a member must not be engaged in hostile or combative activities.

- How are medical evacuation decisions made? - The evacuation benefit pays for a medical evacuation to the nearest hospital, appropriate medical facility or back to the U.S. Transportation must be by the most direct and economical route. All evacuations require written certification by the attending physician that the evacuation is medically necessary and must be approved by the Global health and Safety team.

- Will my pre-existing conditions be covered under the GeoBlue Voyager Choice? - Pre-existing medical conditions are treated differently depending upon the plan you have selected. The GeoBlue Voyager Choice plan is available to those who have primary insurance inside the U.S. and will cover medical treatments for pre-existing conditions. Please refer to the definition of a primary health plan for more specific information on what plans qualify as a primary insurance. Under the GeoBlue Voyager Essentials plan, benefits are not available for any services received on or within 6 months after the Eligibility Date of an Insured Person, if those services are related to a Pre-existing Condition as defined in the Definitions section of the Plan Description. This exclusion does not apply to a Newborn that is enrolled within 31 days of birth or a newly adopted child that is enrolled within 31 days from either the date of placement of the child in the home, or the date of the final decree of adoption. The pre-existing conditions exclusion under GeoBlue Voyager Essential does not apply to the Emergency Medical Transportation benefit, Repatriation Of Mortal Remains benefit, or the Emergency Family Travel Arrangements benefit. GeoBlue Voyager Essential does not require that insureds have primary insurance at the time of enrollment.

- How far in advance do you need to purchase a GeoBlue Voyager plan? - A GeoBlue Voyager plan may be purchased up to one day before your departure date. GeoBlue recommends that customers wishing to receive a hard copy ID card should allow 2 weeks prior to their effective date when purchasing.

- I already left on my trip. Can I buy a GeoBlue Voyager pla when I am oustide the U.S.? - A GeoBlue Voyager plan may be purchased up to one day before your departure date. GeoBlue recommends that customers wishing to receive a hard copy ID card should allow 2 weeks prior to their effective date when purchasing.

- Who is eligible to be on the same GeoBlue Voyager policy? - Dependents may include your spouse, age 74 or younger, and/or your eligible child(ren) or other eligible dependent(s)—see Eligible Dependents . For GeoBlue Voyager Choice, dependent may include your spouse, age 84 or younger, and/or your eligible child(ren) or other eligible dependent(s)

Emergency Medical Evacuation

As a global traveler you need to be prepared for the possibility that you could find yourself in a location where the Medical Care is poor or inaccessible. In the event you find yourself in a situation where you need to be evacuated to an area where you can receive the appropriate level of care then you need to make sure your International coverage includes a comprehensive Emergency Medical Evacuation benefit. Medical evacuations are not a simple procedures and they can be extremely complicated and expensive. This must be available to you 24/7 no matter where in the world your travels take you. In addition you need a partner who is capable of organizing and carrying out the evacuation no matter where you find yourself.

Considerations for any medical evacuation are:

- Evaluating the appropriateness of local health care providers

- Identifying the closest facility where a high level of care is available

- Determining the risk vs rewards of moving the patient

- Choosing the best method of transport (ie: ambulance, helicopter, fixed wing air ambulance)

- Securing the cooperation of the local treating physician, including a determination that the patient is stable enough to move

- Enlisting the most appropriate team to handle the transport (ie: doctor, nurses, therapist)

- Arranging for speedy and appropriate intake at the receiving facility

- Having someone on your side helping guide you through the whole process - that is GeoBlue...

Make sure when you travel, you travel with a full service, travel health plan that provides a higher level of protection and peace of mind than standard evacuation memberships offer. If you are not sure about your current plan or one you are considering make sure you get a copy of your certificate of coverage and read it. Make sure you have a completepicture of what you are buying. Then cover yourself with the Power of Blue. GeoBlue offers this type of comprehensive coverage and it is built into their Voyager Choice and Voyager Essential Travel Medical plans.

Global Access On Your Mobile Device

GeoBlue provides access to amazing tools and level of care via a Smart Phone application which you download to your phone prior to departure. The GeoBlue mobile app called mMobile provides access to the best local doctors, hospitals and resources anywhere in the world. HTH's mMobile App helps you make the most of your travels by providing you with the tools to manage existing and unanticipated health conditions in faraway places where finding a doctor and explaining your symptoms should not be left to chance. mMobile brings you specific information and expert assistance to prepare and protect you no matter your destination.

Features of mMobile

- Search Providers for medical, dental, or meta health care. Mapping via GPS technology

- Request an appointment with a trusted HTH Worldwide or GeoBlue Provider

- Arrange Direct Pay

- Access Guarantees of Payment

- File a Claim via your phone

- Find a medication

- Destination Intelligence

- Translate Medicare terms and phrase.

- Display an ID Card on a smart phone and send copy directly to provider

- GeoBlue Mobile travels with your 24/7

Save 10% When you apply as a group with GeoBlue

Eligibility requirements.

- Home Country is the U.S. and;

- You must be under age 85 and;

- Enrolled in a Primary Plan** and ;

- For Children under age 6, must be enrolled with a parent and;

- Initial purchase must be made in home country prior to departing on trip from a GeoBlue eligible state

Why Choose GeoBlue?

Go with a name and brand you can trust. GeoBlue is the trade name for the international health insurance programs of Worldwide Insurance Services, LLC (Worldwide Services Insurance Agency, LLC in California and New York), an independent licensee of the Blue Cross and Blue Shield Association. GeoBlue is the administrator of coverage provided under insurance policies issued by 4 Ever Life International Limited, Bermuda, an independent licensee of the Blue Cross Blue Shield Assiciation.

GeoBlue Pays their Claims...

Geoblue is different.

- Enjoy 24/7 Phone, Web and Mobile Support

- Prompt Access to Trusted Doctors and Hospitals

- Cashless Appointment Scheduling

- Paperless Claims Resolution

- Destination Health Intelligence

- Access to Worldwide Travel Alerts via GeoBlue website

Physician & Provider Network - What Good Is Health Insurance If You Can’t Find a Doctor You Trust?

GeoBlue has an elite network of doctors from most every specialty ready to see you in over 180 countries. Only a small fraction of doctors around the world meet GeoBlue’s exacting standards—participation is by invitation only. We seek out professionals certified by the American or Royal Board of Medical Specialties who speak English, and we factor in recommendations by over 158 Physician Advisors from all over the world.

GeoBlue assembles in-depth provider profiles so their members can choose with confidence, and they put formal contracts in place to ensure preferred patient access. GeoBlue doctors and hospitals bill GeoBlue directly so you don’t have to worry about filing a claim.

For members choosing a GeoBlue plan that offers benefits in the United States, you gain access to the largest national network and facilities that have been awarded the coveted Blue Distinction for superior medical outcomes. In the U.S., more than 80 percent of physicians and 90 percent of hospitals contract directly with Blue Cross and Blue Shield Plans.

I am Here Before, During & After the Sale

I make myself available pretty much 24/7 to ALL of my clients and I am always ready to assist you and your family no matter where and when the need arises. I have direct access to the entire GeoBlue support system and in extreme cases I will work tirelessly to make sure you and your family are receiving the direct service required to meet you needs.

Living and working abroad is gift not many experience throughout their lives but for those of you who are blessed to be truly global in your work and personal lives it is my sincere wish that the only time we need to work together is the say hi at different points throughout the year and that you never have to experience the level of service GeoBlue is capable of delivering. But should that day come both GeoBlue and I are here to help you through the crises.

If you would like to explore the International Cover options for your family reach out to me by phone +1 (307) 690-0427 or email me at " [email protected] " or simply complete the brief Quote Request Form below.

- Best Extended Auto Warranty

- Best Used Car Warranty

- Best Car Warranty Companies

- CarShield Reviews

- Best Auto Loan Rates

- Average Auto Loan Interest Rates

- Best Auto Refinance Rates

- Bad Credit Auto Loans

- Best Auto Shipping Companies

- How To Ship a Car

- Car Shipping Cost Calculator

- Montway Auto Transport Reviews

- Best Car Buying Apps

- Best Websites To Sell Your Car Online

- CarMax Review

- Carvana Reviews

- Best LLC Service

- Best Registered Agent Service

- Best Trademark Service

- Best Online Legal Services

- Best CRMs for Small Business

- Best CRM Software

- Best CRM for Real Estate

- Best Marketing CRM

- Best CRM for Sales

- Best Free Time Tracking Apps

- Best HR Software

- Best Payroll Services

- Best HR Outsourcing Services

- Best HRIS Software

- Best Project Management Software

- Best Construction Project Management Software

- Best Task Management Software

- Free Project Management Software

- Best SEO Services (2024 Rankings)

- Best Mass Texting Services 2024

- Best SEO Software 2024

- Best Email Marketing Software 2024

- Best Personal Loans

- Best Fast Personal Loans

- Best Debt Consolidation Loans

- Best Loans for Bad Credit

- Best Personal Loans for Fair Credit

- HOME EQUITY

- Best Home Equity Loan Rates

- Best Home Equity Loans

- Best Checking Accounts

- Best Free Checking Accounts

- Best Online Checking Accounts

- Best Online Banks

- Bank Account Bonuses

- Best High-Yield Savings Accounts

- Best Savings Accounts

- Average Savings Account Interest Rate

- Money Market Accounts

- Best CD Rates

- Best 3-Month CD Rates

- Best 6-Month CD Rates

- Best 1-Year CD Rates

- Best 5-Year CD Rates

- Best Jumbo CD Rates

- Best Hearing Aids

- Best OTC Hearing Aids

- Most Affordable Hearing Aids

- Eargo Hearing Aids Review

- Best Medical Alert Systems

- Best Medical Alert Watches

- Best Medical Alert Necklaces

- Are Medical Alert Systems Covered by Insurance?

- Best Online Therapy

- Best Online Therapy Platforms That Take Insurance

- Best Online Psychiatrist Platforms

- BetterHelp Review

- Best Mattress

- Best Mattress for Side Sleepers

- Best Mattress for Back Pain

- Best Adjustable Beds

- Best Home Warranty Companies

- American Home Shield Review

- First American Home Warranty Review

- Best Home Appliance Insurance

- Best Moving Companies

- Best Interstate Moving Companies

- Best Long-Distance Moving Companies

- Cheap Moving Companies

- Best Window Replacement Companies

- Best Gutter Guards

- Gutter Installation Costs

- Best Window Brands

- Best Solar Companies

- Best Solar Panels

- How Much Do Solar Panels Cost?

- Solar Calculator

- Best Car Insurance Companies

- Cheapest Car Insurance Companies (June 2024)

- Best Car Insurance for New Drivers

- Cheap Same Day Car Insurance

- Best Pet Insurance

- Pet Insurance Cost

- Cheapest Pet Insurance

- Pet Wellness Plans

- Best Life Insurance

- Best Term Life Insurance

- Best Whole Life Insurance

- Term vs. Whole Life Insurance

- Best Travel Insurance Companies

- Best Homeowners Insurance Companies

- Best Renters Insurance Companies

- Best Motorcycle Insurance

Partner content: This content was created by a business partner of Dow Jones, independent of the MarketWatch newsroom. Links in this article may result in us earning a commission. Learn More

GeoBlue Travel Insurance Review (2024)

Get a free quote to protect your next vacation below.

from Geoblue via Squaremouth.com

Sabrina Lopez is a senior editor with over seven years of experience writing and editing digital content with a particular focus on home services, home products and personal finance. When she’s not working, Sabrina enjoys creative writing and spending time with her family and their two parrots.

Tori Addison is an editor who has worked in the digital marketing industry for over seven years. A journalist by trade, her experience includes communications and marketing management in the nonprofit, governmental and academic sectors.

GeoBlue is a bit different from other top travel insurance providers . In a world of comprehensive trip insurance, this independent licensee of Blue Cross Blue Shield keeps it simple by offering straightforward single-trip and multi-trip health plans.