- Understanding Poverty

- Competitiveness

Tourism and Competitiveness

- Publications

The tourism sector provides opportunities for developing countries to create productive and inclusive jobs, grow innovative firms, finance the conservation of natural and cultural assets, and increase economic empowerment, especially for women, who comprise the majority of the tourism sector’s workforce. Before the COVID-19 pandemic, tourism was the world’s largest service sector—providing one in ten jobs worldwide, almost seven percent of all international trade and 25 percent of the world’s service exports —a critical foreign exchange generator. In 2019 the sector was valued at more than US$9 trillion and accounted for 10.4 percent of global GDP.

Tourism offers opportunities for economic diversification and market-creation. When effectively managed, its deep local value chains can expand demand for existing and new products and services that directly and positively impact the poor and rural/isolated communities. The sector can also be a force for biodiversity conservation, heritage protection, and climate-friendly livelihoods, making up a key pillar of the blue/green economy. This potential is also associated with social and environmental risks, which need to be managed and mitigated to maximize the sector’s net-positive benefits.

The impact of the COVID-19 pandemic has been devastating for tourism service providers, with a loss of 20 percent of all tourism jobs (62 million), and US$1.3 trillion in export revenue, leading to a reduction of 50 percent of its contribution to GDP in 2020 alone. The collapse of demand has severely impacted the livelihoods of tourism-dependent communities, small businesses and women-run enterprises. It has also reduced government tax revenues and constrained the availability of resources for destination management and site conservation.

Naturalist local guide with group of tourist in Cuyabeno Wildlife Reserve Ecuador. Photo: Ammit Jack/Shutterstock

Tourism and Competitiveness Strategic Pillars

Our solutions are integrated across the following areas:

- Competitive and Productive Tourism Markets. We work with government and private sector stakeholders to foster competitive tourism markets that create productive jobs, improve visitor expenditure and impact, and are supportive of high-growth, innovative firms. To do so we offer guidance on firm and destination level recovery, policy and regulatory reforms, demand diversification, investment promotion and market access.

- Blue, Green and Resilient Tourism Economies. We support economic diversification to sustain natural capital and tourism assets, prepare for external and climate-related shocks, and be sustainably managed through strong policy, coordination, and governance improvements. To do so we offer support to align the tourism enabling and policy environment towards sustainability, while improving tourism destination and site planning, development, and management. We work with governments to enhance the sector’s resilience and to foster the development of innovative sustainable financing instruments.

- Inclusive Value Chains. We work with client governments and intermediaries to support Small and Medium sized Enterprises (SMEs), and strengthen value chains that provide equitable livelihoods for communities, women, youth, minorities, and local businesses.

The successful design and implementation of reforms in the tourism space requires the combined effort of diverse line ministries and agencies, and an understanding of the impact of digital technologies in the industry. Accordingly, our teams support cross-cutting issues of tourism governance and coordination, digital innovation and the use and application of data throughout the three focus areas of work.

Tourism and Competitiveness Theory of Change

Examples of our projects:

- In Indonesia , a US$955m loan is supporting the Government’s Integrated Infrastructure Development for National Tourism Strategic Areas Project. This project is designed to improve the quality of, and access to, tourism-relevant basic infrastructure and services, strengthen local economy linkages to tourism, and attract private investment in selected tourism destinations. In its initial phases, the project has supported detailed market and demand analyses needed to justify significant public investment, mobilized integrated tourism destination masterplans for each new destination and established essential coordination mechanisms at the national level and at all seventeen of the Project’s participating districts and cities.

- In Madagascar , a series of projects totaling US$450m in lending and IFC Technical Assistance have contributed to the sustainable growth of the tourism sector by enhancing access to enabling infrastructure and services in target regions. Activities under the project focused on providing support to SMEs, capacity building to institutions, and promoting investment and enabling environment reforms. They resulted in the creation of more than 10,000 jobs and the registration of more than 30,000 businesses. As a result of COVID-19, the project provided emergency support both to government institutions (i.e., Ministry of Tourism) and other organizations such as the National Tourism Promotion Board to plan, strategize and implement initiatives to address effects of the pandemic and support the sector’s gradual relaunch, as well as to directly support tourism companies and workers groups most affected by the crisis.

- In Sierra Leone , an Economic Diversification Project has a strong focus on sustainable tourism development. The project is contributing significantly to the COVID-19 recovery, with its focus on the creation of six new tourism destinations, attracting new private investment, and building the capacity of government ministries to successfully manage and market their tourism assets. This project aims to contribute to the development of more circular economy tourism business models, and support the growth of women- run tourism businesses.

- Through the Rebuilding Tourism Competitiveness: Tourism Response, Recovery and Resilience to the COVID-19 Crisis initiative and the Tourism for Development Learning Series , we held webinars, published insights and guidance notes as well as formed new partnerships with Organization of Eastern Caribbean States, United Nations Environment Program, United Nations World Tourism Organization, and World Travel and Tourism Council to exchange knowledge on managing tourism throughout the pandemic, planning for recovery and building back better. The initiative’s key Policy Note has been downloaded more than 20,000 times and has been used to inform recovery initiatives in over 30 countries across 6 regions.

- The Global Aviation Dashboard is a platform that visualizes real-time changes in global flight movements, allowing users to generate 2D & 3D visualizations, charts, graphs, and tables; and ranking animations for: flight volume, seat volume, and available seat kilometers. Data is available for domestic, intra-regional, and inter-regional routes across all regions, countries, airports, and airlines on a daily, weekly, or monthly basis from January 2020 until today. The dashboard has been used to track the status and recovery of global travel and inform policy and operational actions.

Traditional Samburu women in Kenya. Photo: hecke61/Shutterstock.

Featured Data

We-Fi WeTour Women in Tourism Enterprise Surveys (2019)

- Sierra Leone | Ghana

Featured Reports

- Destination Management Handbook: A Guide to the Planning and Implementation of Destination Management (2023)

- Blue Tourism in Islands and Small Tourism-Dependent Coastal States : Tools and Recovery Strategies (2022)

- Resilient Tourism: Competitiveness in the Face of Disasters (2020)

- Tourism and the Sharing Economy: Policy and Potential of Sustainable Peer-to-Peer Accommodation (2018)

- Supporting Sustainable Livelihoods through Wildlife Tourism (2018)

- The Voice of Travelers: Leveraging User-Generated Content for Tourism Development (2018)

- Women and Tourism: Designing for Inclusion (2017)

- Twenty Reasons Sustainable Tourism Counts for Development (2017)

- An introduction to tourism concessioning:14 characteristics of successful programs. The World Bank, 2016)

- Getting financed: 9 tips for community joint ventures in tourism . World Wildlife Fund (WWF) and World Bank, (2015)

- Global investment promotion best practices: Winning tourism investment” Investment Climate (2013)

Country-Specific

- COVID-19 and Tourism in South Asia: Opportunities for Sustainable Regional Outcomes (2020)

- Demand Analysis for Tourism in African Local Communities (2018)

- Tourism in Africa: Harnessing Tourism for Growth and Improved Livelihoods . Africa Development Forum (2014)

COVID-19 Response

- Expecting the Unexpected : Tools and Policy Considerations to Support the Recovery and Resilience of the Tourism Sector (2022)

- Rebuilding Tourism Competitiveness. Tourism response, recovery and resilience to the COVID-19 crisis (2020)

- COVID-19 and Tourism in South Asia Opportunities for Sustainable Regional Outcomes (2020)

- WBG support for tourism clients and destinations during the COVID-19 crisis (2020)

- Tourism for Development: Tourism Diagnostic Toolkit (2019)

- Tourism Theory of Change (2018)

Country -Specific

- COVID Impact Mitigation Survey Results (South Africa) (2020)

- COVID Preparedness for Reopening Survey Results (South Africa) (2020)

- COVID Study (Fiji) (2020) with IFC

Featured Blogs

- Louise Twining-Ward and Alba Suris , Bridging the Tourism Data Divide: New Tools for Policymaking

- Fiona Stewart, Samantha Power & Shaun Mann , Harnessing the power of capital markets to conserve and restore global biodiversity through “Natural Asset Companies” | October 12 th 2021

- Mari Elka Pangestu , Tourism in the post-COVID world: Three steps to build better forward | April 30 th 2021

- Hartwig Schafer , Regional collaboration can help South Asian nations rebuild and strengthen tourism industry | July 23 rd 2020

- Caroline Freund , We can’t travel, but we can take measures to preserve jobs in the tourism industry | March 20 th 2020

Featured Webinars

- Destination Management for Resilient Growth . This webinar looks at emerging destinations at the local level to examine the opportunities, examples, and best tools available. Destination Management Handbook

- Launch of the Future of Pacific Tourism. This webinar goes through the results of the new Future of Pacific Tourism report. It was launched by FCI Regional and Global Managers with Discussants from the Asian Development Bank and Intrepid Group.

- Circular Economy and Tourism . This webinar discusses how new and circular business models are needed to change the way tourism operates and enable businesses and destinations to be sustainable.

- Closing the Gap: Gender in Projects and Analytics . The purpose of this webinar is to raise awareness on integrating gender considerations into projects and provide guidelines for future project design in various sectoral areas.

- WTO Tourism Resilience: Building forward Better. High-level panelists from Sri Lanka, Costa Rica, Jordan and Kenya discuss how donors, governments and the private sector can work together most effectively to rebuild the tourism industry and improve its resilience for the future.

- Tourism Watch

- Tourism Factsheets

- [email protected]

Launch of Blue Tourism Resource Portal

Financial Instruments for Tourism Development: Challenges and Opportunities

- Conference paper

- First Online: 19 January 2021

- Cite this conference paper

- Aleksandr Gudkov ORCID: orcid.org/0000-0002-4006-4522 10 ,

- Elena Dedkova ORCID: orcid.org/0000-0003-3392-2952 10 &

- Elena Rozhdestvenskaia ORCID: orcid.org/0000-0001-8235-0060 10

Part of the book series: Lecture Notes in Networks and Systems ((LNNS,volume 186))

Included in the following conference series:

- International Conference on Comprehensible Science

527 Accesses

1 Citations

Currently, the development of tourism faces many challenges that make this industry extremely unstable due to political, medical and economic fluctuations. All the ups and downs are usually outside the control of tourism. One of the most important economic problems associated with tourism is the lack of investment and financing. This is a serious problem, considering that tourism is one of the largest employers of labor in the world, and its development has huge benefits for the economy. The purpose of this article is to consider the problems and opportunities in the field of tourism financing. For the purposes of the study, we have achieved a substantial and relevant analysis and research on the main areas of financial support of tourism.

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

Subscribe and save.

- Get 10 units per month

- Download Article/Chapter or eBook

- 1 Unit = 1 Article or 1 Chapter

- Cancel anytime

- Available as PDF

- Read on any device

- Instant download

- Own it forever

- Available as EPUB and PDF

- Compact, lightweight edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

Tax calculation will be finalised at checkout

Purchases are for personal use only

Institutional subscriptions

Similar content being viewed by others

Financial impact of cost of capital on tourism-based SMEs in COVID-19: implications for tourism disruption mitigation

Improving the Process of the Financial Potential Management of Tourism Enterprises

Some Directions for the Future Development of a Tourism Satellite Account: The Case of Investments and Government Collective Consumption in Tourism

Carrillo-Hidalgo, I., Pulido-Fernández, J.I.: The role of the world bank in the inclusive financing of tourism as an instrument of sustainable development. Sustainability 12 , 285 (2020)

Article Google Scholar

Chang, C., Hsu, H., McAleer, M.: A tourism financial conditions index for tourism finance. Tinbergen Institute Discussion Papers 17-071/III (2017)

Google Scholar

Chugunov, I., Pasichnyi, M.: Fiscal stimuli and consolidation in emerging market economies. Invest. Manag. Finan. Innov. 15 (4), 113–122 (2018)

Dedkova, E., Gudkov, A.: Tourism export potential: problems of competitiveness and financial support. In: Antipova, T. (ed.) Integrated Science in Digital Age. ICIS 2019. Lecture Notes in Networks and Systems, vol 78. Springer, Cham (2020). https://doi.org/10.1007/978-3-030-22493-6_17

Dedkova, E., Gudkov, A., Dudina, K.: Perspectives for non-primary export development in Russia and measures of its tax incentives. Prob. Perspect. Manag. 16 (2), 78–89 (2018)

Gaibulloev, K., Sandler, T.: The impact of terrorism and conflicts on growth in Asia. Econ. Polit. 21 (3), 359–383 (2009)

Gasic, M., Oklobdžija, S., Perić, G., Ilić, D.: Financial instruments of the European union for the development of tourism in rural areas of Serbia. Manag. Educ. 11 (2), 19–25 (2015)

Gudkov, A., Dedkova, E.: Development and financial support of tourism exports in the digital economy. In: JDS, vol. 2, no. 1, pp. 54–66 (2020). https://doi.org/10.33847/2686-8296.2.1_5

Gudkov, A., Dedkova, E.: What does ICT mean for tourism export development? In: Antipova, T., Rocha, Á. (eds.) Digital Science 2019. DSIC 2019. Advances in Intelligent Systems and Computing, vol 1114. Springer, Cham (2020). https://doi.org/10.1007/978-3-030-37737-3_15

Gudkov, A., Dedkova, E., Dudina, K.: Tax incentives as a factor of effective development of domestic tourism industry in Russia. Prob. Perspect. Manag. 15 (2), 90–101 (2017)

Gudkov, A., Dedkova, E., Dudina, K.: The main trends in the Russian tourism and hospitality market from the point of view of Russian travel agencies. Worldwide Hosp. Tour. Themes 10 (4), 412–420 (2018)

Kukharenko, O.G., Gizyatova, A.Sh.: Sources of investment and financing of social tourism. IOP Conf. Ser.: Earth Environ. Sci. 204 , 012022 (2018)

Mahmoodi, M., Mahmoodi, E.: Foreign direct investment, exports and economic growth: evidence from two panels of developing countries. Econ. Res. 29 (1), 938–949 (2016)

MathSciNet Google Scholar

Manta, O.: Financial instruments for tourism and agrotourism in Romania. In: Caring and Sharing: The Cultural Heritage Environment as an Agent for Change, pp. 345–359 (2019).

McAleer, M.: The fundamental equation in tourism finance. J. Risk Finan. Manag. 8 , 369–374 (2015)

Nyikos, G., Soós, G.: Financial instruments now and after 2020. In: A World of Flows: Labour Mobility, Capital and Knowledge in an Age of Global Reversal and Regional Revival, pp. 150–151 (2018).

Sheresheva, M., Polukhina, A., Oborin, M.: Marketing issues of sustainable tourism development in Russian regions. J. Tour. Herit. Serv. Mark. 6 (1), 33–38 (2020)

Sheresheva, M.Y.: The Russian tourism and hospitality market: new challenges and destinations. Worldwide Hosp. Tour. Themes 10 (4), 400–411 (2018)

Shirvani, A., Stoyanov, S.V., Rachev, S.T., Fabozzi, F.J.: A new set of financial instruments (2019). https://ssrn.com/abstract=3486655

Trynko, R., Grygorieva, Y.: Sources of financing tourism: challenges and solutions. Bull. Taras Shevchenko Natl. Univ. Kyiv. Econ. 11 (176), 35–39 (2015)

Vujović, S., Vukosavljević, D., Beljac, Ž.: Financing of tourist activity. Proc. Geogr. Inst. "Jovan Cvijic" 64 (2), 207–214 (2014)

Zameer, A.: Significance of relation between retailing and tourism in designing credit derivative products for financing tourism and retailing infrastructure. In: Conference on Tourism in India – Challenges Ahead, pp. 279–287 (2012)

Zeren, F., Koç, M., Konuk, F.: Interaction between finance, tourism and advertising: evidence from Turkey. Tour. Hosp. Manag. 20 (2), 185–193 (2014)

Download references

Author information

Authors and affiliations.

Orel State University, 302020, Orel, Russia

Aleksandr Gudkov, Elena Dedkova & Elena Rozhdestvenskaia

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Aleksandr Gudkov .

Editor information

Editors and affiliations.

Institute of Certified Specialists (ICS), Perm, Russia

Tatiana Antipova

Rights and permissions

Reprints and permissions

Copyright information

© 2021 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper.

Gudkov, A., Dedkova, E., Rozhdestvenskaia, E. (2021). Financial Instruments for Tourism Development: Challenges and Opportunities. In: Antipova, T. (eds) Comprehensible Science. ICCS 2020. Lecture Notes in Networks and Systems, vol 186. Springer, Cham. https://doi.org/10.1007/978-3-030-66093-2_7

Download citation

DOI : https://doi.org/10.1007/978-3-030-66093-2_7

Published : 19 January 2021

Publisher Name : Springer, Cham

Print ISBN : 978-3-030-66092-5

Online ISBN : 978-3-030-66093-2

eBook Packages : Intelligent Technologies and Robotics Intelligent Technologies and Robotics (R0)

Share this paper

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

UN Tourism | Bringing the world closer

Investment readiness for green finance mechanisms initiative, share this content.

- Share this article on facebook

- Share this article on twitter

- Share this article on linkedin

Green Investments for Sustainable Tourism

- All Regions

Registration

In order to continue with the collaboration between UNWTO and IFC. It was decided to launch pilot phase in the following countries: India, Indonesia, Jamaica, Philippines, South Africa, Thailand, and Vietnam, with the view of expanding to several other countries in the next phase.

This pilot will be focus on an Investment Readiness Diagnostic that will be the basis for IFC’s proposed investment program. The program is a post-COVID medium-term credit line made available for hotels impacted by the downturn in tourism caused by the pandemic, coupled with provisions for retrofit greening, and disbursed in partnership with local financial institutions starting in 2021.

Please see the brief presentation .

Under the new Investment Readiness for Green Finance Mechanisms initiative, the UNWTO will work alongside the IFC, which is a member of the World Bank Group and the largest global development institution focused exclusively on the private sector in developing countries, on a series of training programmes. One of the main focuses of the new initiative will be working with private sector partners to promote green finance and share experience in resourcing sustainable buildings. The initial cooperation will consist in a series of trainings to promote green investments for a long term the recovery of the tourism sector. The first training is planned to start on 4 June, 2020 at 15:00 CET (Madrid time) in a webinar format, and it will culminate with an accreditation training provided by the EDGE Experts.

Presentations

- Download the Investments Readiness For Green Finance Mechanisms Presentation

- Access to Green Finance Mechanisms UNWTO and IFC Webinar Series

- One Planet Vision for a Responsible Recovery of the Tourism Sector

- Government Incentives for Green Hotels

- IFC Manuel Buttler

UNWTO is partnering with the IFC for a series of technical training programmes aimed at promoting green finance and unlocking its potential to accelerate tourism’s recovery and stimulate sustainable growth.

Objectives:

- Identify aggregators across the hotel value chain in order to promote and implement sustainability measures (Performance and Efficiency).

- Provide skills training on green building adoption and transitions to enable sustainable investments (Accreditations and Certifications).

- Facilitate sustainable investment mechanisms to access green finance opportunities (Compliance and Brand Reputation).

Audience and registration:

We invite government officials, hospitality investors, aggregators and tourism investment consultants to register .

Programme Structure:

P rogramme Timeline and Key dates:

4 june | tourism investments overview, 11 june | access to green finance mechanisms (sustainable hotels), 18 june | government green incentives (case studies), 25 june | green investment strategies (boost profitability), 9-10 july | edge experts training (accreditation), business case for sustainable hotels:.

1. Boost profit margins through utility savings

2. Increase revenue through satisfying consumer preference and reducing reputational risk

3. Future proof investment strategies

4. Safeguard against regulatory risk and benefit from incentives

5. Increase value and validation through certification

6. Ensure a long-term energy supply

BUSINESS CASE FOR SUSTAINABLE HOTELS: A publication by the International Tourism Partnership in collaboration with IFC

- Other Services

- Our Culture

- OUR CLIENTS

- Aviso Blogs

Charting Success in Philippine Tourism: Economic Milestones and the Ripple Effect on Real Estate Industry

The tourism industry has been a crucial driver of economic development in the Philippines. According to the Philippine Statistics Authority (PSA), the sector made a significant contribution to the national GDP (8.6%). The increase in both foreign and local visitors has stimulated economic activities, benefiting various businesses such as hospitality, transportation, and retail. Among the forms of tourism expenditure, inbound tourism expenditure posted the highest annual growth of 87.7%, amounting to Php697.5 billion (US$11.9 billion) in 2023, while domestic tourism expenditure grew by 72.3% to Php2.67 trillion (US$45.5 billion). This industry’s widespread impact showcases its capacity to enhance regional development and ultimately contribute to economic progress across the archipelago.

Last year, the Philippine tourism sector achieved notable success, surpassing its targets and gaining international recognition. The country welcomed a total of 5,450,557 tourists (see Table 1), exceeding the projected figure of 4,800,000 by a considerable margin.

This substantial influx of tourists resulted in foreign tourism receipts totaling Php482.54 billion, underscoring the economic significance of the industry. South Korea accounted for the highest number of visits at 1,450,858, followed by the United States (903,299), Japan (305,580), Australia (266,551), and China (263,836).

The Philippines has further solidified its standing as a premier vacation destination through its notable success in obtaining recognitions at the esteemed World Travel Awards in 2023. These accolades encompass being honored as the World’s Leading Dive Destination, World’s Leading Beach Destination, World’s Leading City Destination (Manila), Asia’s Best Cruise Destination, and receiving the Global Tourism Resilience Award. These commendable achievements underscore the country’s increasingly prominent position in the global tourism sector and its effective endeavors to elevate its attractions and services for international visit.

- World’s Leading Dive Destination

- World’s Leading Beach Destination

- World’s Leading City Destination (Manila)

- Asia’s Best Cruise Destination

- Global Tourism Resilience Award

Tourism investments in the Philippines reached an impressive Php509 billion, marking a significant 34% increase from the previous year according to the Department of Tourism (DOT). Tourism Secretary Christina Frasco highlighted that the accommodation sector was the largest contributor to this growth, accounting for 51% of the total investments. This substantial influx of capital underscores the robust recovery and expansion of the Philippine tourism industry, reflecting heightened investor confidence and the sector’s vital role in the nation’s economic landscape.

The surge in investments not only enhances the country’s tourism infrastructure but also promises to boost economic activities and job creation. The Impact of Tourism in Providing Jobs Tourism has become a significant driver of job creation in the Philippines, particularly in emerging tourist destinations. As these areas gain popularity, the demand for hospitality services, transportation, guided tours, and other tourism-related activities increases, leading to a surge in employment opportunities. This trend has been particularly evident in provinces such as Siargao, Palawan, and Bohol, where tourism has rapidly expanded, transforming local economies. Employment in tourism industries was estimated at 6.21 million in 2023, higher by 6.4% compared with the 5.84 million employed in 2022. The share of employment in tourism industries to the total employment in the country in 2023 was recorded at 12.9% (see Figure 2).

The influx of tourists necessitates a broad spectrum of jobs, from hotel and restaurant staff to tour guides and transport operators. These positions often provide a stable source of income for local residents, contributing to poverty alleviation and fostering economic development. Additionally, the rise in tourism supports indirect employment in sectors such as agriculture and handicrafts, as local products and services are increasingly sought after by visitors. By diversifying economic activities and reducing reliance on traditional industries, tourism in these emerging destinations not only boosts employment but also enhances community resilience and sustainable development. The continuous growth of the tourism sector, fueled by strategic marketing and infrastructure improvements, promises to further strengthen job creation and economic stability in the Philippines.

Infrastructure Projects to Accommodate Tourism Activities

In order to support the flourishing tourism industry, substantial infrastructural investments have been undertaken by both the government agencies and private enterprises. The construction and enhancement of bridges, airports, seaports, and access roads have been among the most significant advancements in 2023. These infrastructural upgrades are vital for ensuring a seamless travel experience for visitors, making locations more attractive and accessible. Such initiatives enhance connection and mobility, thereby benefiting local economies through the improvement of transportation linkages and the promotion of increased travel and business activities.

The government’s commitment to infrastructure development is evident in projects such as the North-South Commuter Railway (NSCR) and the Metro Manila Subway Project (MMSP). These projects aim to improve transportation efficiency, reduce travel time, and enhance the overall tourist experience. The expansion and modernization of airports in key tourist destinations also play a crucial role in accommodating the increasing number of international and domestic travelers.

According to the Philippine Development Report 2023, the rise in tourist arrivals has spurred real estate developers to invest heavily in infrastructure projects that cater to tourists. The development of mixed-use properties, including residential units, retail spaces, and entertainment facilities, reflects the changing landscape of real estate influenced by the tourism boom.

However, the impact of tourism on real estate is not without challenges. It can lead to increased property prices, making housing less affordable for local residents. Moreover, over-reliance on tourism can create economic volatility in some regions, particularly during economic downturns or global crises that affect travel patterns. While tourism stimulates economic growth and development in real estate, sustainable planning and management are crucial to balance the benefits and challenges associated with tourism-driven real estate markets.

The Importance of Property Valuation, Market Study, and Feasibility Study

Property valuation is instrumental in determining the equitable market value of real estate assets, enabling investors to make well-informed decisions based on prevailing market conditions. Market studies yield insights into consumer preferences, competitive landscapes, and emerging trends, allowing investors to tailor their strategies to meet market demands effectively. Feasibility studies are crucial for assessing the financial viability of projects, identifying potential challenges and opportunities, and establishing a clear roadmap for successful project execution.

For investors eyeing tourism-related real estate projects, conducting thorough property valuation, market studies, and feasibility studies is indispensable. These analyses provide critical insights into the potential profitability and viability of investments. In previous years, such studies conducted by Aviso Valuation and Advisory for its clients were instrumental in helping them identify lucrative opportunities and mitigate risks.

Accurate property valuation ensures fair pricing, while comprehensive market and feasibility studies offer an in-depth understanding of demand trends and financial projections. This information is crucial for informed decision-making and strategic planning, ensuring the success and sustainability of tourism ventures.

Charting Progress #Beyond7641

The Philippine tourism industry continues to make remarkable strides, extending its allure far beyond the famed 7,641 islands. The performance of the Philippine tourism industry in 2023 underscores its pivotal role in national development, job creation, and real estate growth.

The sector’s expansion necessitates significant infrastructure investments and highlights the importance of detailed market analysis for potential investors. As the industry continues to grow, these elements will remain critical in harnessing tourism’s full potential to drive economic progress and development in the Philippines.

Tourism’s contribution to the Philippine economy extends beyond mere numbers; it enriches communities, preserves cultural heritage, and promotes sustainable development. The sector’s continuous growth and its adaptability to evolving global trends are pivotal to the nation’s long-term economic resilience and success.

Written By: Angelo M. Gandia

Aviso Valuation and Advisory Corp. is a real estate consultancy firm that offers valuation and business advisory services that are compliant with international standards such as the International Valuation Standards (IVS) and International Financial Reporting Standards (IFRS). To assure that we only produce high-quality deliverables, as needed, we do tasks beyond the usual appraisal process like verifying pertinent property documents (i.e. land titles, tax declarations, etc.) with the appropriate government agencies for due diligence purposes prior to the acquisition of the properties.

Featured Posts

The Economics and Valuation of Data Centers

Valuation in the Food and Beverage Industry: A Beginner’s Guide

SIQUIJOR: An Enchanting Island of Natural Wonders and boundless opportunities

The Economics and Valuation of Telecommunications Towers

Islamic Finance Versus Conventional Finance: Implications on Valuation

A Market Study of the Tourism and Hospitality Sectors in El Nido, Palawan

GREEN BUILDING: REAL ESTATE SECTOR’S INITIATIVE TOWARDS ENVIRONMENTAL PROTECTION

Beyond the Shoreline: Why Local Sustainability Should Be a Major Consideration Before Diving into Beachfront Real Estate

What you should know about Rent Control Act (R.A. 9653)

Connect with us.

Aviso Valuation & Advisory

Launch of new scheme under ECLGS

"Tourism Finance Corporation of India Limited would be extending loans under Emergency Credit Line Guarantee Scheme (ECLGS) to its eligible customers.

For detailed guidelines and FAQs on ECLGS kindly visit

- Our Offerings

Events and Updates

Projects Funded

Investor updates

Submission of Reclassification Application with Stock Exchanges

35th AGM Chairman Speech

35th AGM Proceedings

35th AGM Voting Results and Scrutinizer Report

Outcome of the Board Meeting 13.08.2024

Tenders and Notices

Information Memorandum for e-Auction of Aishwarya Regancy

E-Tender Sale Notice Aishwarya Regency

Possession Notice M/s Genesis Infratech Pvt. Ltd.

EOI - Appointment of Statutory Auditors

TFCI – Supporting Nation Building

Tourism Finance Corporation of India Ltd.(TFCI) has been set-up as an All India Financial Institution, pursuant to the recommendations of “National Committee on Tourism” set-up under the aegis of Planning Commission in 1988. The main object of setting-up the specialised financial institution was to expedite the growth of tourism infrastructure in the country by providing dedicated line of credit on long term basis to tourism related projects in the country.

Marque projects funded by us

Heritage and 5-star hotels.

ChatGPT has doubled its weekly active users to 200 million

OpenAI said that ChatGPT now has 200 million weekly active users, twice what it had as of last November.

Intuitive Machines wins $116.9M contract for a moon mission in 2027

Intuitive Machines, the venture-backed startup that went public last year, will send a moon lander to the lunar south pole in 2027 as part of a $116.9 million contract awarded by NASA on Thursday. This is NASA’s tenth award under its Commercial Lunar Payload Services (CLPS) program; of these, four have gone to Intuitive Machines. The company will deliver six NASA payloads to the moon as part of the deal, though there will be additional payload capacity on the lander for commercial customers.

South Korean tech giant Naver launches crypto wallet in partnership with Chiliz

Many tech companies are expanding their reach into the web3 market, integrating blockchain and web3 technologies into their products and services. In the latest development, South Korean internet giant Naver is launching its first digital asset wallet, Naver Pay Wallet, for the Korean market. It is partnering with Chiliz, a blockchain provider for sports and entertainment, as the inaugural blockchain for the wallet.

It's a rich man's world — but ABBA says no to Trump. They're not alone.

The Swedish band is one of several musicians asking the campaign to stop playing their music without permission.

My Airbnb didn't have a CO detector so I got this portable one: It's down to $20

This top-seller — on sale for Labor Day — can be used at home and on the go.

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- Biden Economy

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds Rates

- Top Mutual Funds

- Options: Highest Open Interest

- Options: Highest Implied Volatility

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Stock Comparison

- Advanced Chart

- Currency Converter

- Credit Cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Credit Card Offers

- Best Free Checking

- Student Loans

- Personal Loans

- Car insurance

- Mortgage Refinancing

- Mortgage Calculator

- Morning Brief

- Market Domination

- Market Domination Overtime

- Asking for a Trend

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Financial Freestyle

- Capitol Gains

- Living Not So Fabulously

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

Italy is mulling a €25-a-night tax for tourists staying at its most expensive hotels to turn overtourism into economic gain.

It feels great to be popular—until the fame gets out of hand. That’s become Italy’s battle this summer.

With hundreds of millions of tourists flocking to the sunny European destination this summer, the uptick seems relentless. It’s now become a source of public anger across the region.

Some of Italy’s most sought-after cities, such as Venice, have tried to address the issue with an entry fee and measures to curb big groups of visitors .

While it’s early to gauge the success of those measures, the country looks determined to turn a corner on its overtourism problem. Its solution? Jacking up the fees tourists pay when staying at Italy’s most expensive hotels.

The Italian government is mulling a hotel tax of up to €25 a night, the Financial Times reported Friday, to achieve the dual goals of deterring some visitors while filling cities’ coffers.

The measure will add to the existing tax in cities like Venice, where a charge of between €1 to €5 already applies to overnight stays. Those levies could go higher in Rome and are aimed at safeguarding the legacy and improving the quality of services amid higher demand, according to Venetian tourism’s official website .

If the new proposal kicks in, it’ll have different tiers—for instance, the cheapest room will be charged €5, whereas rooms that cost over €750 a night will face €25 in fees, according to documents seen by the FT .

The move could, in theory, bring in generous revenues for municipalities. Part of the funds would be used to tidy up cities by improving trash collection.

However, tourism industry bodies are concerned that the potential fee goes too far to the point of disincentivizing visitors.

“If we scare travelers who come to us by giving the impression that we want to take what we can, we are not doing a good service to the country,” Barbara Casillo, the head of hotel industry representative Confindustria Alberghi, told the outlet. “We must be very careful.”

The trend of overtourism has gripped much of Europe—and specifically, Italy—this summer. The likes of Amsterdam have also sought to clamp down on it by imposing a future ban on cruises . The mayor of Athens has spoken out of about tourism in the city not being economically viable as it stands today. Affordable travel and accommodation options have spurred this trend over time, experts told Fortune .

This, coupled with Italy’s sky-high public debt at 140% of its GDP, has put pressure on the government to ease its burden. Tourism, being one of Italy’s key industries, could be a way to do it. Airbnb has started collecting and remitting taxes on behalf of its short-term rental properties as of this year.

The additional fees are only fair so tourists become “more responsible” as legions visit Italy annually, tourism minister Daniela Santanche wrote in a social media post.

“Not all taxes are a tax,” she said.

Still, policies addressing mass tourism must tread a fine line between making monetary gains and allowing hospitality and tourism to flourish.

“The sector is making an important contribution to the country's economy, especially with the growth of international travelers, after the difficult years of Covid,” Confindustria Alberghi’s president Maria Carmela Colaiacovo said in a statement earlier this month.

“But foreign competition is strong and fierce, we need careful policies that do not compromise the competitiveness of our businesses and our destinations. We cannot be a mere ATM for municipalities.”

Italy’s tourism ministry plans to discuss the tax proposal and possible modifications to it with industry bodies next month.

The Italian tourism ministry didn’t immediately return Fortune ’s request for comment.

This story was originally featured on Fortune.com

- Technical Signals

- Live Stream

- My Watchlist

- Stock Recos

- BigBull Portfolio

- Stock Reports Plus

- Market Mood

- Investment Ideas

- Sector: Term Lending In...

- Industry: Term Lending - Gener...

Tourism Finance Corporation of India Share Price

- 178.72 -1.65 ( -0.91 %)

- Volume: 2,92,941

- 178.80 -1.70 ( -0.94 %)

- Volume: 63,208

- Last Updated On: 30 Aug, 2024, 03:57 PM IST

- Last Updated On: 30 Aug, 2024, 03:54 PM IST

Tourism Finance Corpora...

- Shareholdings

- Corp Actions

- English English हिन्दी ગુજરાતી मराठी বাংলা ಕನ್ನಡ தமிழ் తెలుగు

Tourism Finance share price insights

Company has sufficient cash reserves to pay off its contingent liabilities. (Source: Standalone Financials)

Company has spent 41.47% of its operating revenues towards interest expenses and 5.25% towards employee cost in the year ending Mar 31, 2024. (Source: Standalone Financials)

Stock gave a 3 year return of 189.97% as compared to Nifty Smallcap 100 which gave a return of 91.39%. (as of last trading session)

Tourism Finance Corporation of India Ltd. share price moved down by -0.91% from its previous close of Rs 180.36. Tourism Finance Corporation of India Ltd. stock last traded price is 178.72

Insights Tourism Finance

Do you find these insights useful?

Key Metrics

- PE Ratio (x) 17.96

- EPS - TTM (₹) 9.95

- Dividend Yield (%) 1.40

- VWAP (₹) 180.15

- PB Ratio (x) 1.53

- MCap (₹ Cr.) 1,654.87

- Face Value (₹) 10.00

- BV/Share (₹) 117.68

- Sectoral MCap Rank 8

- 52W H/L (₹) 267.55 / 90.85

- MCap/Sales 6.51

- PE Ratio (x) 17.97

- VWAP (₹) 180.41

- PB Ratio (x) 1.55

- MCap (₹ Cr.) 1,655.61

- 52W H/L (₹) 267.40 / 91.00

Tourism Finance Share Price Returns

Et stock screeners top score companies.

Check whether Tourism Finance belongs to analysts' top-rated companies list?

Tourism Finance News & Analysis

Compliances-Reg. 39 (3) - Details of Loss of Certificate / Duplicate Certificate

Tourism Finance Share Analysis

Unlock stock score, analyst' ratings & recommendations.

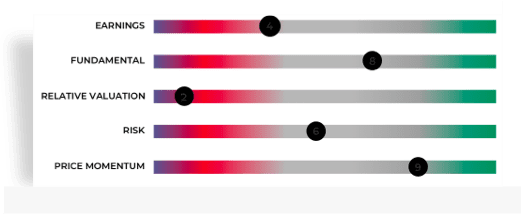

- View Stock Score on a 10-point scale

- See ratings on Earning, Fundamentals, Valuation, Risk & Price

- Check stock performance

Tourism Finance Share Recommendations

No Recommendations details available for this stock. Check out other stock recos.

Tourism Finance Financials

- Income (P&L)

- Balance Sheet

Employee & Interest Expense

All figures in Rs Cr, unless mentioned otherwise

Contingent Liabilities Coverage

Financial Insights Tourism Finance

Tourism finance peer comparison, tourism finance stock performance, ratio performance.

Stock Returns vs Nifty Smallcap 100

Choose from Peers

Choose from Stocks

Peers Insights Tourism Finance

Tourism finance shareholding pattern, total shareholdings, mf ownership.

MF Ownership details are not available.

Top Searches:

Corporate actions, tourism finance board meeting/agm, tourism finance dividends.

No other corporate actions details are available.

About Tourism Finance

Tourism Finance Corporation of India Ltd., incorporated in the year 1989, is a Small Cap company (having a market cap of Rs 1,670.05 Crore) operating in Term Lending Institutions sector. Tourism Finance Corporation of India Ltd. key Products/Revenue Segments include Interest, Income From Sale Of Share & Securities, Fees & Commission Income, Other Operating Revenue and Dividend for the year ending 31-Mar-2024. For the quarter ended 30-06-2024, the company has reported a Standalone Total Income of Rs 61.84 Crore, up 7.27 % from last quarter Total Income of Rs 57.65 Crore and up 4.48 % from last year same quarter Total Income of Rs 59.19 Crore. Company has reported net profit after tax of Rs 25.40 Crore in latest quarter. The company’s top management includes Dr.S Ravi, Mr.Anoop Bali, Mr.Aditya Kumar Halwasiya, Mr.Parkash Chand, Mr.Ashok Kumar Garg, Mr.Bapi Munshi, Mr.Deepak Amitabh, Dr.M S Mahabaleshwara, Mrs.Thankom T Mathew, Mr.Sanjay Ahuja. Company has Suresh Chandra & Associates as its auditors. As on 30-06-2024, the company has a total of 9.26 Crore shares outstanding. Show More

Aditya Kumar Halwasiya

Parkash Chand

Ashok Kumar Garg

Bapi Munshi

Deepak Amitabh

M S Mahabaleshwara

Thankom T Mathew

Sanjay Ahuja

- M Verma & Associates Suresh Chandra & Associates

Term Lending - General

Key Indices Listed on

BSE SmallCap, BSE Financial Services, BSE AllCap, + 1 more

4th Floor,Tower-1,NBCC Plaza,Pushp Vihar,New Delhi, Delhi - 110017

http://www.tfciltd.com

More Details

- Tourism Finance Chairman's Speech

- Tourism Finance Company History

- Tourism Finance Directors Report

- Tourism Finance Background information

- Tourism Finance Company Management

- Tourism Finance Listing Information

- Tourism Finance Finished Products

Trending in Markets

- Sensex Today

- Bharti Hexacom Share Price

- Paytm Share Price

- Tata Motors DVR Share Price

- Balrampur Chini Share Price

- Baazar Style Retail IPO

- Boss Packaging Solutions IPO

- Reliance AGM 2024 Live

- Stocks in News Today

- Reliance Industries Bonus Issue

Tourism Finance Quick Links

Equity quick links, more from markets.

DATA SOURCES: TickerPlant (for live BSE/NSE quotes service) and Dion Global Solutions Ltd. (for corporate data, historical price & volume, F&O data). Sensex & BSE Quotes and Nifty & NSE Quotes are real-time and licensed from BSE and NSE respectively. All timestamps are reflected in IST (Indian Standard Time).

DISCLAIMER: Any and all content on this website including tools/analysis is provided to you only for convenience and on an “as-is, as- available” basis without representation and warranties of any kind. The content and any output of such tools/analysis is for informational purposes only and should not be relied upon or construed as an investment advice or guarantee for any specific performance/returns advice or considered as recommendation for the purchase or sale of any security or investment. You are advised to exercise caution, discretion and independent judgment with regards to the same and seek advice from professionals and certified experts before taking any decisions.

By using this site, you agree to the Terms of Service and Privacy Policy.

- Trending Stocks

- Ola Electric INE0LXG01040, OLAELEC, 544225

- HUDCO INE031A01017, HUDCO, 540530

- Suzlon Energy INE040H01021, SUZLON, 532667

- Mazagon Dock INE249Z01012, MAZDOCK, 543237

- Hind Zinc INE267A01025, HINDZINC, 500188

- Mutual Funds

- Commodities

- Futures & Options

- Cryptocurrency

- My Portfolio

- My Watchlist

- FREE Credit Score ₹100 Cash Reward

- Fixed Deposits

- My Messages

- Price Alerts

- Chat with Us

- Download App

Follow us on:

- Global Markets

- Indian Indices

- Economic Calendar

- Technical Trends

- Big Shark Portfolios

- Seasonality Analysis

- Auri ferous Aqua Farma , 519363

- Loans @ 12% Up to ₹ 15 Lakhs!

- Zero Ads Get Premium Content Daily Stock Calls Stock Insights Daily Newsletters Stock Forecasts Technical Indicators Go Pro @₹99

- Top Stories Technical Trends

- Financial Times Opinion

- Learn GuruSpeak

- Webinar Interview Series

- Business In The Week Ahead Research

- Technical Picks Personal Finance

- My Subscription My Offers

- Loans

- Home FII & DII Activity

- Earnings Technical Trends

- Webinar Bonds

- Web Stories

- Silver Rate

- Storyboard18

- Economic Indicators

- Home Tech/Startups

- Auto Research

- Opinion Politics

- Home Loans

- Home Performance Tracker

- Top ranked funds My Portfolio

- Top performing Categories Forum

- MF Simplified

- Home Gold Rate

- Trade like Experts

- Policybazaar MF Summit

- Startup Conclave Mutual Fund Summit

- IFBA Season 3 Pharma Industry Conclave

- Unlocking opportunities in Metal and Mining Advanced Technical Charts

- International

- Go pro @₹99

- Assembly Elections

- Instant ₹15 Lakhs!

- Personal Finance

- Moneycontrol /

- Share/Stock Price /

- Finance Term Lending

Samco Stock Rating

Tourism Finance Corp of India Ltd.

As on 30 Aug, 2024 | 03:57

* BSE Market Depth (30 Aug 2024)

As on 30 Aug, 2024 | 04:01

- Top 5 Trending Stocks

- #KnowBeforeYouInvest

Forecast

Investors should be very cautious while exercising investment decision for

The Estimates data displayed by Moneycontrol is not a recommendation to buy or sell any securities. Estimates data is a third party aggregated data provided by S&P Global Market Intelligence LLC for informational purposes only. The Company advises the users to check with duly registered and qualified advisors before taking any investment decision. The Company does not guarantee the accuracy, adequacy or completeness of any information/data and is not responsible for any errors or omissions or for the results obtained from the use of such information/data. The Company or anyone involved with the Company will not accept any liability for loss or damage as a result of reliance on the Estimates data. The Company does not subscribe or endorse any of the services and/or content offered by such third party.

Hits/Misses

- MC Insights

- MC Technicals

- Price & Volume

- Corp Action

- Shareholding

Note: High PE if PE ≥ 80 percentile, Low PE if PE ≤ 30 percentile and Average PE if 30 < PE < 80 percentile (calculations based on 3 years data)

Note: High P/B if P/B ≥ 80 percentile, Low P/B if P/B ≤ 30 percentile and Average P/B if 30 < P/B < 80 percentile (calculations based on 5 years data)

- Advanced Chart

*Delayed by 20 seconds.

Share Price Forecast

Earnings forecast, consensus recommendations.

- Underperform

Get detailed analysis with Moneycontrol Stock Insights.

- 33.20% away from 52 week high

- Market Cap - Low in industry

- Promoters have decreased holdings from 8.04% to 7.85% in Jun 2024 qtr

- Management Interviews

- --> Investor Presentation

- Earnings Transcripts

- Credit Rating

- Resignation

Pivot levels

Note : Support and Resistance level for the day, calculated based on price range of the previous trading day.

Note : Support and Resistance level for the week, calculated based on price range of the previous trading week.

Note : Support and Resistance level for the month, calculated based on price range of the previous trading month.

- Very Bullish

- Very Bearish

Decreasing Debt to Equity

Companies decreasing their debt to equity ratio, decreasing roe, companies that are decreasing efficiency in utilisation of shareholders funds, improving roce, companies increasing efficiency in utilisation of all sources of capital.

- D/E< D/E 1 yr Back

- Market Capitalization >250

- ROE<ROE 1 yr Back

- ROE<ROE 3 yr Avg

- ROCE>ROCE 1 yr Back

- ROCE>ROCE 3 yr Avg

Rising Profits, Falling Margins

Companies that have grown their net profits but decreased net profit margins over the past 12 months, profit margin leaders, companies with npms consistently in excess of 25%, promoter decreasing holding, list of companies in which promoters have reduced holding.

- NetProfit>NetProfit1YrBack AND

- NPM<NPM1YrBack AND

- NetProfit1YrBack>0 AND

- MarketCap>250

- NPM latest quarter >25 AND

- NPM last year >25 AND

- NPM5yrAvg>25

- Market Capitalization >500

- PromoterHolding<PromoterHolding1QtrBack AND

- MarketCap>500

FII Selling

Companies in which fiis are reducing holding, rising book value, book value of these companies rising over last 3 years.

- FIIHolding<FIIHolding1QtrBack AND

- BookValue>BookValue1YrBack AND

- BookValue1YrBack>BookValue3YrsBack AND

Price to Book Value Above Industry

Companies with price to book value above industry, premium to peers, companies trading at premium pe valuation as compared to their industry peers.

- Price to book value >Industry PBV AND

- Price to Earning >Industry PE AND

FII Selling, DII Buying

List of companies in which fiis have reduced and diis increased holding qoq, triple dhamaka, companies reporting higher sales, npm and profits.

- DIIHolding>DIIHolding1QtrBack AND

- QuarterlySales>Sales1QtrBack AND

- QuarterlySales>0 AND

- QuarterlyNPM>0 AND

- QuarterlyNetProfit>0 AND

- QuarterlyNPM>NPM1QtrBack AND

- QuarterlyNetProfit>NetProfit1QtrBack AND

Increasing Net Profit Margins

Companies showing growth in net profit margins.

- NPM1QtrBack>0 AND

Price and Volume

Seasonality analysis.

16 out of 24 years Tourism Finance Corp of India has given positive returns in August .

Tourism Finance Standalone June 2024 Net Sales at Rs 61.80 crore, up 4.45% Y-o-Y

HFT Scan : Aditya Birla Money and Tourism Finance Corporation in focus Jun 10 2024 07:08 AM

Tourism Finance Standalone March 2024 Net Sales at Rs 57.62 crore, down 4.03% Y-o-Y May 20 2024 12:42 PM

HFT Scan: Algo traders zoom in on Tourism Finance Corp, Foods and Inns Mar 18 2024 06:25 AM

HFT Scan: Infibeam Avenues zooms, Tourism Finance & India Pesticides see some action Mar 12 2024 06:28 AM

Community Sentiments

What's your call on Tourism Finance today?

Read 6 investor views

Thank you for your vote

You are already voted!

Good company worst stock. Its a manipulated paradise. Operators stock View more

Posted by : Dev2023

Repost this message

Good company worst stock. Its a manipulated paradise. Operators stock

all buying suggestions are fake sell karo dabaa ke evey dip and rise pe View more

Posted by : Bigpicker

all buying suggestions are fake sell karo dabaa ke evey dip and rise pe

holding sell kr do no point to hold now target 100 rs now in jan 2025 sell all pls View more

holding sell kr do no point to hold now target 100 rs now in jan 2025 sell all pls

- Broker Research

ADITYA KUMAR HALWASIYA

Pransatree holdings pte. limited, koppara sajeeve thomas, varanium india opportunity ltd, varanium capital advisors private limited.

*Transaction of a minimum quantity of 500,000 shares or a minimum value of Rs 5 crore.

GRAVITON RESEARCH CAPITAL LLP

Giriraj ratan damani, marwadi chandarana intermediaries brokers private limited.

*A bulk deal is a trade where total quantity of shares bought or sold is more than 0.5% of the equity shares of a company listed on the exchange.

Insider Transaction Summary

Pransatree holdings pte limited, koppara sajeeve thomas, life insurance corporation of india, india opportunities iii pte. limited.

*Disclosures under SEBI Prohibition of Insider Trading Regulations, 2015

Merling Holdings Pvt Ltd & PACs Disposal

Aditya kumar halwasiya acquisition, pransatree holdings pte ltd & pac disposal, merlin holdings pvt ltd & pacs disposal, rajasthan global securities pvt ltd disposal, pransatree holdings pte ltd & pac acquisition.

*Disclosures under SEBI SAST (Substantial Acquisition of Shares and Takeovers) Regulations, 2011

Corporate Action

- Announcements

- Board Meetings

Tourism Finance Corp of India - Announcement under Regulation 30 (LODR)-Credit Rating

Tourism finance corp of india - announcement under regulation 30 (lodr)-newspaper publication, tourism finance corp of india - reg. 34 (1) annual report..

- Consolidated

- Income Statement

- Balance Sheet

- Debt to Equity

- Half Yearly

- Nine Months

Detailed Financials

- Profit & Loss

- Quarterly Results

- Half Yearly Results

- Nine Months Results

- Yearly Results

- Capital Structure

- Mutual Funds holding remains unchanged at 0.00% in Jun 2024 qtr

- Number of MF schemes remains unchanged at 1 in Jun 2024 qtr

- FII/FPI have decreased holdings from 3.41% to 2.97% in Jun 2024 qtr

About the Company

Company overview, registered office.

4th Floor,Tower-1,,NBCC Plaza,,Pushp Vihar,

11-47472200

http://www.tfciltd.com

F-65, Ist Floor, Okhla Industrial Area, Phase-I,,

New Delhi 110020

011-41406149

011-41709881

http://www.mcsregistrars.com

Designation

Non Executive Chairman

WholeTime Director & CFO

Non Executive Director

Non Exe. & Nominee Director

Independent Director

Included In

INE305A01015

Your feedback matters! Tell us what we got right and what we didn’t? Click here>

- Know Before You Invest

- Shareholding Pattern

- Deals & Insider

We at moneycontrol are continually attempting to improve our products and what’s more, carry the best to our users!

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500

Which stock to buy and why? Make an informed investment decision with advanced AI-based features like SWOT analysis, investment checklist, technical ratings and know how fairly the company is valued.

An analysis of stocks based on price performance, financials, the Piotroski score and shareholding. Find out how a company stacks up against peers and within the sector.

Read research reports, investor presentations, listen to earnings call and get recommendations from the best minds to maximise your gains.

Is the company as good as it looks? Track FII, DII and MF trends. Keep a tab on promoter holdings along with pledge details. Get all the information on mutual fund schemes and the names of institutions which invested in a company.

Advanced charts with more than 100 technical indicators, tools and studies will give you the edge, making it easier to negotiate the market and its swings.

Who is raising the stake and who is exiting? Stay updated with the latest block and bulk deals to gauge big investor mood and also keep an eye on what Insiders are doing.

- Share Price & Valuation Forecast

- MC Essentials

- Sharpest Opinions & Actionable Insights

- Exclusive Webinars

- Research & Expert Technical Analysis

You got 30 Day’s Trial of

- Ad-Free Experience

- Actionable Insights

- MC Research

You are already a Moneycontrol Pro user.

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Newsletters

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

- Labor Day sales

Entertainment

- How to Watch

- My watchlist

- Stock market

- Biden economy

- Personal finance

- Stocks: most active

- Stocks: gainers

- Stocks: losers

- Trending tickers

- World indices

- US Treasury bonds

- Top mutual funds

- Highest open interest

- Highest implied volatility

- Currency converter

- Basic materials

- Communication services

- Consumer cyclical

- Consumer defensive

- Financial services

- Industrials

- Real estate

- Mutual funds

- Credit cards

- Balance transfer cards

- Cash back cards

- Rewards cards

- Travel cards

- Online checking

- High-yield savings

- Money market

- Home equity loan

- Personal loans

- Student loans

- Options pit

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

New on Yahoo

- Privacy Dashboard

Blue Origin successfully completes 8th manned New Shepard space tourism flight

Aug. 29 (UPI) -- Jeff Bezos' space tourism venture Blue Origin on Thursday successfully completed its eighth human suborbital spaceflight and the 26th flight in its New Shepard program.

A crew including Nicolina Elrick, Rob Ferl, Eugene Grin, Dr. Eiman Jahangir, Karsen Kitchen and Ephraim Rabin touched down in the reusable RSS First Step capsule at Blue Origin's Corn Ranch spaceport in West Texas at 9:07 a.m. EDT, 12 minutes after takeoff.

During the flight, the crew of the NS-26 mission reached a maximum altitude of about 341,000 feet and experienced weightlessness for about 1 minute.

The company noted that, at age 21, Kitchen made history Thursday as the youngest woman ever to cross the Kármán line -- the boundary separating Earth's atmosphere and outer space. She is a student at the University of North Carolina who has conducted research in radio astronomy at the Green Bank Observatory.

In another accomplishment for the New Shepard program Thursday, Ferl became the first NASA-funded researcher to conduct an experiment, or "payload," as part of a commercial suborbital space crew.

The payload from the University of Florida in Gainesville sought to understand how changes in gravity during spaceflight affect plant biology. During the flight, Ferl activated small, self-contained tubes pre-loaded with plants and preservative to biochemically freeze the samples at various stages of gravity, which will be compared to ground-based control samples, according to NASA .

The samples will be studied to determine the effects of gravity transitions on the plants' gene expression to support future missions to the moon and Mars.

Recommended Stories

Columbus blue jackets' johnny gaudreau, brother matthew gaudreau killed in new jersey bicycle accident.

Gaudreau played 763 NHL games with the Flames and Blue Jackets.

VinFast VF9 gets $12K-$16K price cut, starts at $71,000

VinFast cuts big chunks off the prices of the VF9 Eco and VF9 Plus. The Eco now starts at $71,000, which is $12,000 off the $83,000 announced last year.

Labor Day sales to shop right now: The best tech deals we found from Apple, Amazon, Samsung and others

These are the best Labor Day sales on tech you can get this year, as curated by Engadget editors.

Italian Grand Prix 2024: How to watch the next F1 race without cable

Everything you need to know about streaming the next Formula 1 Grand Prix.

Mortgage and refinance rates today, August 30, 2024: Rates fall 83 basis points in a year

These are today's mortgage and refinance rates. Rates are down for the second straight week and much lower than this time last year. Lock in your rate today.

7 takeaways from Kamala Harris’s CNN interview

Vice President Kamala Harris gave her first in-depth media interview since becoming the Democratic nominee for president, answering questions Thursday from CNN’s Dana Bash.

Amazon's bestselling cardigan is a J.Crew lookalike — get 75% off for Labor Day

'Fashion doesn't have to be expensive': This polished fall-ready staple is down to an insane $15.

Labor Day sales: Kick off the long weekend with massive sales from Amazon, Wayfair, Apple, Walmart and more

These are the only Labor Day deals that matter — shop our editors' top picks to save up to 70% off at our favorite retailers.

ChatGPT has doubled its weekly active users to 200 million

OpenAI said that ChatGPT now has 200 million weekly active users, twice what it had as of last November.

South Korean tech giant Naver launches crypto wallet in partnership with Chiliz

Many tech companies are expanding their reach into the web3 market, integrating blockchain and web3 technologies into their products and services. In the latest development, South Korean internet giant Naver is launching its first digital asset wallet, Naver Pay Wallet, for the Korean market. It is partnering with Chiliz, a blockchain provider for sports and entertainment, as the inaugural blockchain for the wallet.

We asked a flight attendant to share her travel must-haves — all under $25

You can never be too prepared when you're away from home — take it from a professional jet-setter.

'My feet never get sore': Snag this anti-fatigue kitchen mat while it's $27

Made of cushy memory foam, this cooking season must-have makes everything from food prep to dishwashing way more comfy.

Race for the Case week 1: Georgia vs Clemson, West Virginia vs Penn State & Notre Dame vs Texas A&M

On today's episode, Dan Wetzel, Ross Dellenger and SI's Pat Forde preview week 1 of the 2024 college football season. They dive deep into the top matchups of Georgia vs Clemson and Miami vs Florida, while also touching on West Virginia vs Penn State.

After winning a landmark case against real estate agents, this startup aims to replace them with a flat fee

One of the people who successfully sued the National Association of Realtors (NAR) to change real estate commissions has co-founded a new real estate startup. It all began in 2017 when Josh Sitzer and his wife listed their home for sale in Kansas City. The couple was frustrated by the fact they had to pay a 3% commission to a buyer’s agent.

'My feet never hurt': Podiatrists love these sneakers — 50% off for Labor Day

Snag a pair of these memory-foam walkers before there's a price "hike."

New Yahoo News/YouGov poll: RFK Jr. hasn't upended the 2024 election by dropping out and endorsing Trump

Whatever bump Harris has received since launching her bid — a bump that likely includes some former RFK Jr. voters — is bigger than whatever bump Trump has received since Kennedy dropped out.

Stephen Curry signs one-year, $62.6 million extension to stay with Golden State through 2027: report

Curry is sticking with the Warriors for the 2026-27 season.

Typhoon Shanshan leaves at least 3 dead in Japan as storm brings 'unprecedented' winds, storm surge and rainfall

Typhoon Shanshan made landfall in Southwest Japan, causing at least three deaths, hundreds of thousands of power outages and flight cancellations as heavy winds and rainfall bear down on the country.

X caught blocking links to NPR, claiming the news site may be 'unsafe'

X, the Elon Musk-owned platform formerly known as Twitter, is marking some links to news organization NPR's website as "unsafe" when users click through to read the latest story about an altercation between a Trump campaign staffer and an Arlington National Cemetery employee. On Thursday X users began to notice that a link to the NPR story about the Arlington Cemetery event, when clicked, would display the following message: "Warning: this link may be unsafe" followed by the URL of the web page in question, https://npr.org/2024/08/29/nx-s1-5092087/trump-arlington-cemetery-altercation-tiktok.

This $7 lipstick is comparable to Charlotte Tilbury's ultra-popular Pillow Talk

Thanks to vitamin E and argan oil, the L'Oreal formula feels luxuriously smooth and soft.

IMAGES

VIDEO

COMMENTS

Although, the investment cycle remained strong throughout 2019, with tourism mobilizing $61.8bn in global FDI, which, in turn, created more than 135,000 jobs. The trend appeared particularly consistent in Latin America and the Caribbean, where FDI reached new record levels. For example it created more than 56.000 jobs in Mexico from 2015 - 2019.

Section Information. This section publishes leading research on tourism economics, finance, and management. It covers the business aspects of tourism in the wider context and takes account of constraints on development, such as social and community interests, global environmental change, and the sustainable use of tourism and recreation ...

The International Journal of Finance & Economics is a leading economics and finance journal that publishes issues in finance which impact global economies. Abstract We revisit the tourism-led growth hypothesis by utilising a panel set of 108 countries over the period 1996-2017. We quantify the effects of tourism on the entire conditional ...

Tourism and Competitiveness. The tourism sector provides opportunities for developing countries to create productive and inclusive jobs, grow innovative firms, finance the conservation of natural and cultural assets, and increase economic empowerment, especially for women, who comprise the majority of the tourism sector's workforce.

The purpose of Tourism Finance is to set criteria on which value-adding tourism projects should receive investment funding; and to evaluate a tourism organization's financial needs to better ...

Access to financing is vital to promote entrepreneurship and SME development and build an innovative, competitive and sustainable tourism sector. This report examines mechanisms to improve access to finance for tourism SMEs and entrepreneurs at each stage of the business lifecycle, with a particular emphasis on small and micro-enterprises.

sector facilities, tourism firms may be able to more easily finance their investment operations, which, in turn, will lead to increases in not only cash flows but also their stock prices and returns. Changes in BCs are likely to exert influence on tourism sector growth, as documented in the relevant litera-ture (M. H. Chen, 2007b).

All over the world, tourism-dependent economies are working to finance a broad range of policy measures to soften the impact of plummeting tourism revenues on households and businesses. Cash transfers, grants, tax relief, payroll support, and loan guarantees have been deployed. Banks have also halted loan repayments in some cases.

Similar to other industries, tourism and hospitality finance managers regularly make investing and financing decisions that significantly influence business performance and risk management (Jang et al. 2008).Recently, tourism and hospitality firms have increasingly become international businesses. Thus, they are exposed to even more financial risks, such as foreign exchange risk, international ...

Abstract. Currently, the development of tourism faces many challenges that make this industry extremely unstable due to political, medical and economic fluctuations. All the ups and downs are usually outside the control of tourism. One of the most important economic problems associated with tourism is the lack of investment and financing.

Tourism economy is a key component of a region's GDP. Taking advantage of a panel data of 267 prefectures in China between 2010 and 2022, this research investigates the impact of inclusive finance on regional tourism economic development. We find that inclusive finance initiatives can significantly improve the tourism industry.

The purpose of Tourism Finance is to set criteria on which value-adding tourism projects should receive investment funding; and to evaluate a tourism organization's financial needs to better decide on what capital structure (i.e., debt and/or equity) to appropriately raise to minimize the weighted average cost of capital. ...

Tourism can be depended upon to stimulate India׳s economic prosperity and, for this reason, policy makers ought to give careful consideration toward encouraging inbound tourism. ... Finance and trade: A cross-country empirical analysis on the impact of financial development and asset tangibility on international trade. World Development, 34 ...

The initial cooperation will consist in a series of trainings to promote green investments for a long term the recovery of the tourism sector. The first training is planned to start on 4 June, 2020 at 15:00 CET (Madrid time) in a webinar format, and it will culminate with an accreditation training provided by the EDGE Experts. Registration.

Topics such as the relationship between tourism and economic impact, its potential benefits and negative externalities are characterized by both vastness and heterogeneity of contents. ... Journal of Banking and Finance 55: 1-8. Crossref. Google Scholar. Snepenger DJ, Johnson JD, Rasker R (1995) Travel-stimulated entrepreneurial migration ...

Access to financing is vital to promote entrepreneurship and SME development and build an innovative, competitive and sustainable tourism sector. This report examines mechanisms to improve access to finance for tourism SMEs and entrepreneurs at each stage of the business lifecycle, with a particular emphasis on small and micro-enterprises. It discusses key issues and policy considerations to ...

The most popular and primary sources of funds for financing tourism and hospitality projects are own funds in the form of shares (share capital) and other assets in the form of loans (Vujovic and ...

A tourism surge since the pandemic goes a long way to explaining the nation's escape from decades of deflation and recent palpitations in global markets. Why it matters: For years, Japan's government leaned on aggressive monetary policy — including negative interest rates, central bank purchases of all types of securities, and more — to try ...

Tourism investments in the Philippines reached an impressive Php509 billion, marking a significant 34% increase from the previous year according to the Department of Tourism (DOT). Tourism Secretary Christina Frasco highlighted that the accommodation sector was the largest contributor to this growth, accounting for 51% of the total investments.

In addition, the tourism firms' stock index prices, reflecting the stock financial performance of listed tourism firms in the stock exchange market, such as airlines, travel and tourism, gambling, restaurants and bars, recreation services, and hotels following (Demir et al., 2017; Hadi et al., 2019). The selection of both the data period and ...

Tourism Finance Corporation of India Ltd. 4th Floor, Tower-1, NBCC Plaza, Sector-V, Pushp Vihar Saket, New Delhi-110017 +91-11-2956 1180. Mumbai Office. Tourism Finance Corporation of India Ltd. C-304, Marathon Innova, Veer Santoshi Lane, off. Ganpatrao Kadam Marg, Lower Parel, Mumbai - 400 013

Tourism economy is a key component of a region's GDP. Taking advantage of a panel data of 267 prefectures in China between 2010 and 2022, this research investigates the impact of inclusive finance on regional tourism economic development. We find that inclusive finance initiatives can significantly improve the tourism industry.

Space tourism is controversial, and there are a multitude of reasons why. ... Yahoo Finance. Gap shares rise after it resumes trading, Q2 results show growing sales and margin.

The relationship between international tourism and inequality has been well discussed in the literature from various aspects. There has been a long tradition of investigating seasonal variation in tourism demand from foreign tourists, particularly in cold-water tourism destinations, and seasonality-induced inequality as tourism demand directly contributes to employment and may also affect ...