Air Miles Required for Flights – A Complete Guide with Examples

Air Miles Required for Flights

When you travel anywhere, airfare is often one of the biggest expenses. With air miles, however, you can cut the cost of your flight and save money to spend on other things during your holidays. It can seem difficult to save air miles, but that need not be the case. Continue reading to learn more and see how you can maximize the benefits of air miles.

Examples of Air Miles Schemes

Different reward programs operate in different ways, and the number of air miles you can earn often depends on how many miles you actually fly, the date when your flight is booked, and the class in which you travel. Your departure country and destination can also be factors, so it is difficult to list any hard and fast rules. Each scheme also has a different number of air miles needed for a journey.

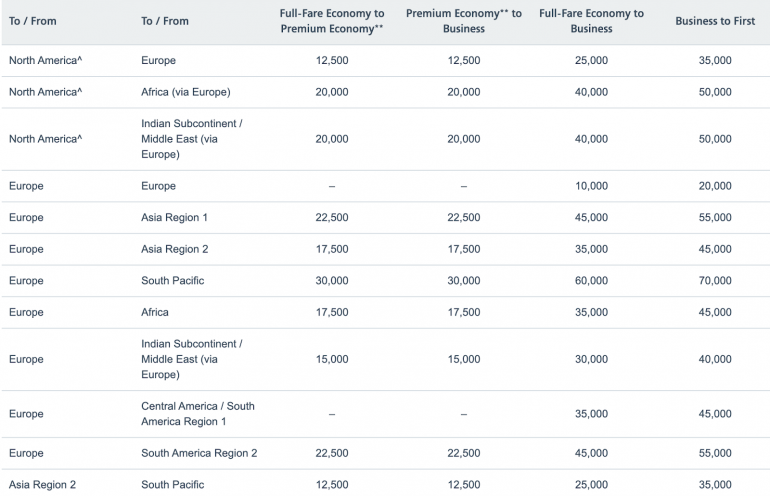

For example (updated in April 2014) , with United Airlines, for a standard economy flight between the mainland US, Canada, or Alaska and another point in the mainland US, Canada, or Alaska you will need 25,000 air miles. A similar flight to Central America will need 37,500, and for Europe 65,000. The same routes with business class will need 50,000, 70,000, and 150,000 respectively, and for first class flights the amounts would be 70,000, 85,000, and 170,000. Flights starting in southern South America and finishing in South Asia will need 100,000, 190,000, and 210,000 air miles for standard economy, business, and first class flights.

The figures are for a one-way flight. For a return journey you should simply double the amounts. If your flight is with a Star alliance partner, the amounts are different.

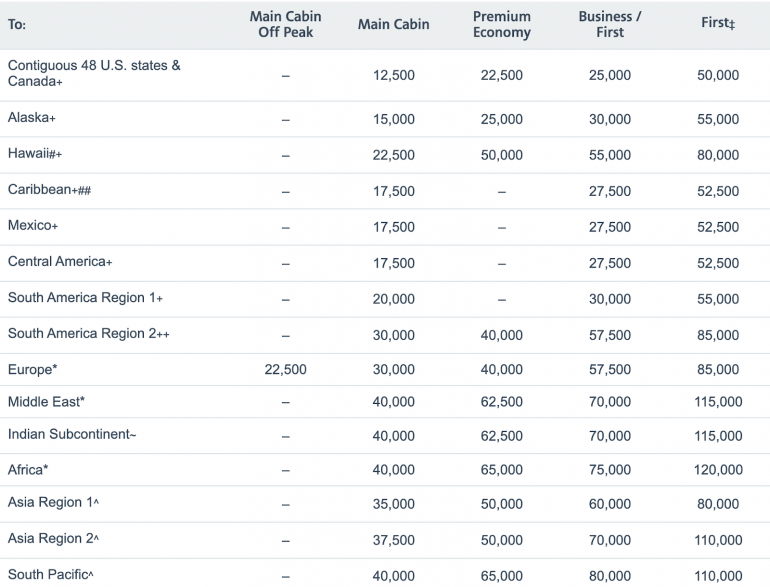

American Airlines calculate the air miles needed based on the distance that is traveled. For example, a journey of up to 1,500 miles will require 30,000 air miles (economy), 60,000 air miles (business class), and 80,000 air miles (first class). A trip that is between 1,501 and 4,000 miles will need 35,000, 75,000, and 100,000 air miles for economy, business, and first class.

The amounts keep increasing according to defined distances. A longer flight that is between 14,001 and 20,000 miles will need 100,000, 130,000, and 180,000 air miles for economy, business, and first class flights. A journey that is between 35,001 and 50,000 miles will need 160,000, 220,000, and 330,000 air miles for the three different classes of travel.

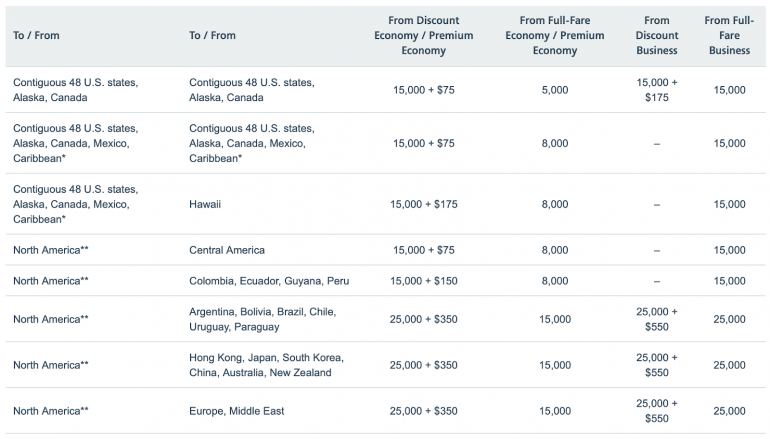

Flying with Delta from Europe will need the following amounts (for flights on or after the 1 st of June 2014 and booked before the 1st of January 2015):

– Economy class Saver within Europe 15,000, economy class Standard within Europe 20,000, economy class Peak within Europe 30,000.

– BusinessElite / First / Business Class Saver within Europe 25,000, Standard within Europe 40,000, Peak within Europe 50,000.

– Air miles can only be used on Saver flights to Africa, so for economy class you would need 35,000 and for BusinessElite / First / Business Class you would need 50,000.

These are just a few examples of different requirements for air miles.

What are Air Miles?

The basic idea behind air miles is that you accrue points that can be redeemed against flying. So many points equal one mile in the air. So if you need X amount of points for one mile, and your flight costs Y, when you redeem your points you pay for less miles making your overall flight cheaper. You can use the air miles as full or part payment towards the base ticket cost.

Can I fly for Free?

Almost! With enough air miles you can cover the base cost of the ticket. You will, however, still need to pay taxes.

How do I Accrue Air Miles?

Many airlines offer loyalty programs where customers are rewarded with points to use towards air miles. The points generally correspond to the distance flown, so a longer flight will give greater rewards. Several credit and debit cards offer air miles when the card is used to make purchases. The important thing to remember is that without being a scheme member, you cannot collect points or air miles. So sign up for the reward schemes with the airlines that you use most often to start collecting, and redeeming, points! However, keep in mind that some frequent flyer programs have expiration dates for air miles, so make sure to use them before you lose them.

What Can I use Air Miles For?

As well as using air miles for discounted flights, you can also often use them for a variety of other products and services. These may include access to airport lounges, on-board meals, upgraded seats, and priority bookings.

How Can I Redeem Air Miles?

You can use airline air miles when you make your reservation. If you collect with a specific airline you can only use your rewards with that airline or a partner. There are some generic schemes though that can be used with a number of airlines – to gain the benefits of your air miles you must make a booking through one of the partner travel agents.

Can I Always Use Air Miles?

Some flights are subject to restrictions whereby you cannot use your air miles. This is often the case on flights that are already heavily discounted. You cannot usually use air miles in conjunction with promotions and special deals. Sometimes, you have a choice – to use air miles and forego other benefits, or save your air miles and take advantage of other deals. It may be the case that there are some really great savings to be made and deals to be found without using your air miles. Redeeming air miles is not always the cheapest way to fly. Comparison is important, therefore, to make sure that you really are getting the best deals.

Must I Use My Air Miles?

Not at all. You can save your air miles for future flights. Sometimes it is actually better to do just this. You can take advantage of other deals and allow your points to continue to build, giving you more savings for future air travel. In some situations, the taxes form a significant part of the overall ticket cost. As you cannot use your air miles towards taxes it is better, in such a case, to pay for the ticket in full and save your air miles. It may also be more cost effective to fly with another airline altogether, as their ticket price may be cheaper even when taking into account any potential savings made with air miles.

How Can I Get the Best Deals on Flights?

Compare flight prices and terms before you book! This easy comparison form makes it quick and convenient to compare different flights, thus making sure that you are getting the very best prices. Save yourself money and enjoy having extra to spend on sightseeing, souvenirs, a night in a luxury hotel, a romantic slap up meal, or anything else that tickles your fancy!

In short, collecting air miles is a great idea and can really help you to save money on flights. They are not, though, always the best way to get cheaper flights. A quick comparison of flights will set you on the way to making sure that you are not spending money unnecessarily and that you really are getting the very best prices for your trip.

Copyright © 2024 Save70. All rights reserved.

Air Miles Calculator

Air Miles Calculator helps you calculate how many miles it is from one airport to another and provides a map, estimated flight time, time difference between cities, and estimated CO2 emissions.

Calculate Flight Distance

Search by airport name, city or IATA airport code.

Search Airport

Search airline.

Search by airline name or IATA airline code.

Search flights

Airports in africa.

Airports in Asia

Airports in Australia and Oceania

Airports in Europe

Airports in North-America

Airports in South-America

- Search Please fill out this field.

- Manage Your Subscription

- Give a Gift Subscription

- Newsletters

- Sweepstakes

- Airlines + Airports

Everything You Need to Know About Earning and Redeeming Airline Miles

Want to fly for free? Here's everything you need to know about earning and using airline miles.

:max_bytes(150000):strip_icc():format(webp)/Stefanie-Waldek-7eed18a8c9734cb28c5d887eb583f816.jpg)

onurdongel/Getty Images

If you're thinking about dipping your toe in the airline miles game, don't delay. While points and miles can often feel overwhelming, it's easy to handle the basics — and that's enough to get you free flights and upgrades. Best of all, every frequent flier program is free to join, and you don't even have to be a frequent flier to sign up. We're here to help you understand airline miles so that you can start boosting your travel experience ASAP.

What to Know About Airline Miles

Airline miles — sometimes referred to as airline points, frequent flier miles, or award miles — are a form of currency used in frequent flier programs. Generally speaking, you earn miles for flying with an airline, and you redeem those miles for free flights, upgrades, or other purchases. Some credit cards also have similar points and miles rewards programs, but airline miles are specific to an airline (and sometimes its partners). Airline miles are often valued anywhere from just below one cent to two cents per mile.

How to Earn Airline Miles

There are numerous ways to earn airline miles, and they vary based on the specific frequent flier program. In order to earn airline miles, you must be signed up for an airline's frequent flier program — this is free to do, and you can sign up for multiple airlines' programs.

Flying with an airline (and sometimes its partners) is the primary way most travelers earn airline miles. For each flight you take, you'll receive a certain number of miles; the exact number of miles depends on your airline's policy. Most airlines base the number of miles awarded on either the distance flown or the amount paid for the ticket. Just remember that you must input your frequent flier number on your booking to earn airline miles. (Although you can request miles after your trip if you forget to add your number before).

Using Airline Credit Cards

If you have a co-branded airline credit card , you will likely be able to earn one to three airline miles for every dollar you spend on that card. Pay attention to earning bonuses for certain categories, which vary per card. In many cases, you'll earn higher bonuses for paying for flights with your credit card directly through the airline — for example, five miles per dollar instead of one mile per dollar.

Transferring Points From Other Credit Cards

If you have a credit card that has its own points system — like Chase Ultimate Rewards, AmEx Membership Rewards , Citi ThankYou Points, and Bank of America Travel Rewards — you may be able to transfer those points into an airline frequent flier program. Airline partnerships vary by credit card issuer.

Shopping and Dining Partnerships

Some airlines have e-shopping portals through which any purchases will earn you miles. Similarly, some airlines also have dining partnerships that reward you for eating at eligible restaurants.

Related: How to Get More Miles With AAdvantage Dining — No Flights Required

Other Partnerships

Many airlines develop partnerships with rental car companies and hotel groups, so if you rent a car or book a room with one of these partners, you can actually earn airline miles. Typically you're not able to "double dip" and earn miles or points for both the airline and the travel partner, so advanced points players will want to be strategic about which account earns the points. Some airlines allow you to link your account to other businesses, too, like Lyft and Starbucks.

Me 3645 Studio/Getty Images

How to Redeem Airline Miles

Many travelers use airline miles to book free flights and pay for upgrades, but there are other ways to spend them.

Once you accumulate enough miles — at least a few thousand, but more realistically a few tens of thousands — you'll be able to spend those miles on flights. Since miles are free, you're essentially getting free flights, but there is a tiny catch. You'll still have to pay taxes and fees on the flight, which usually nets out to less than $100 per ticket.

To use miles as payment for flights, you'll need to book your flights with the airline directly, not through a third-party booking site. When you search for the flights, simply click the box that says something to the effect of "pay with miles."

You can also use miles to upgrade to a higher class of service or preferred seats within your current cabin, such as an exit row seat. After you've made your booking, check your booking on the airline's website or app to see if upgrades are available. Keep in mind that some airlines price upgrades dynamically, meaning the price will change based on demand. So if you don't like the price you see for an upgrade, you can take your chances to see if it will drop. But beware — the cabin could fill up before you find the price you like, leaving you in economy.

Other Redemptions

Each airline offers miles redemptions outside of flights and upgrades. You can use miles to pay for other aspects of air travel, from lounge memberships to top-shelf drinks in the lounges to in-flight WiFi, depending on the airline. But you can also use miles to pay for other parts of your travel experience too, including hotels, car rentals, and even special events or experiences.

Airline Miles and Elite Status

While airline miles and elite status are both part of a carrier's frequent flier program, they're two distinct branches with different purposes. Airline miles are simply an airline-specific currency, whereas elite status is a rewards program where you earn perks typically based on how much you spend and how much you fly with an airline. If you're not flying enough to achieve elite status, don't worry — you can still earn airline miles without it. But those with elite status do earn more miles per flight than non-elite members of a frequent flier program.

Kiwis/Getty Images

Tips for Making the Most of Your Airline Miles

Use award calendars to find the best deals..

The more flexible you are with timing, the more likely you are to score a great miles redemption deal. Most airlines allow you to view award flights on a calendar, showing you the best deals across an entire month. Sometimes bumping your flight earlier or later by a few days can net you huge savings.

Keep expiration dates in mind.

Each airline has a different policy when it comes to expiration dates. Some airlines have no expiration dates for miles, while others set expiration dates based on your most recent account activity. Read the fine print to ensure your hard-earned miles don't expire before you can use them.

Research change fees.

While you can typically change flights booked with miles, there's often a fee associated with any amendments, but this depends on the airline. If you want to cancel your booking made with miles, you can often redeposit those miles back into your account for a fee, with fees varying by airline.

Don't agonize over the redemption value of your miles.

It's natural to want the best bang for your buck — or in this case, redemption for your miles. But there's no reason to agonize over the value of your redemption. The threshold for a "good" redemption is unique to each individual and their circumstances at any given time. At the end of the day, anything you put your miles toward will be (mostly) free, and that's always a good price.

Related Articles

- SAVE UP TO 41% Bundles

Accessories

DOUBLE COMFORT BUNDLE

Includes Free Gift

TRAVEL PILLOW

The most comfortable sleep you'll ever have traveling

PILLOW COOL

Stay cool & comfy on your journey

PILLOW PLUS

Height adjustable for your comfort

PILLOW JUNIOR

Help you kids sleep easier (ages 8+)

DEEP SLEEP BUNDLE

The ultimate bundle for making sure you travel in comfort and arrive refreshed, recharged, and ready to go.

Wake up refreshed at your destination. The pillow for travelers who want a real sleeping experience.

SNOOZE BUNDLE

Arrive feeling cool, calm, and collected.

PACKED-TO-PERFECTION BUNDLE

ALL ABOARD BUNDLE

'GLIMPSE' SLEEP MASK

The sleep mask that puts you in control.

PASSPORT COVER

Keep all your essential travel documents safely in one place.

PACKING PODS

Designed to fit well in all luggage without the need to cram a square cube in a round bag.

TRAVEL SOCKS

Made and knitted with the best technologies for a comfortable fit and experience.

Don't let dehydration spoil your trip, keep your cool and keep hydrated.

Sep 26, 2023

A beginner's guide to air miles: how they work and how to earn them.

Karin Svensson

Share this article

In today's fast-paced world, air travel is more than just a convenience — it's a lifestyle. Whether you’re a seasoned jet-setter or someone who hops on a plane once in a blue moon, there's an exhilarating sense of possibility every time you hear a plane's engines roar.

But, if you’re catching flights a lot of the time, you might be familiar with the term ‘air miles’.

If you’re looking to start your air miles journey or simply enhance your flying experience, this Trtl Travel blog covers everything you need to know about air miles, how to earn them and how they can be used. The world of air miles awaits, and the horizon has never looked so rewarding!

What are air miles?

Air miles — sometimes known as frequent flyer miles — are points that passengers can collect with loyalty programs offered by major airlines.

By flying with airlines or making purchases with its partners, like credit card companies, hotels, and car rental agencies, you can earn miles and redeem them for free or discounted flights, upgrades and other travel-related rewards.

Why are air miles important to frequent flyers?

If you’re a frequent flyer, air miles are a must-have! By accumulating these points, travellers can even get ticket upgrades from economy to premium classes without incurring the usual charge.

Beyond these savings, frequent flyer programs are laden with perks such as priority boarding, increased baggage allowances, and access to luxurious airport lounges across the globe for those with higher-tier memberships.

For airlines, these loyalty programs help foster repeated patronage, ensuring their most frequent customers stay loyal. For the frequent traveller, air miles and their programs translate into a blend of financial advantages and an improved travel experience.

What are the benefits of air miles?

Air miles offer a wide range of benefits, not just for flights!

- Free flights — One of the most coveted benefits, air miles can be redeemed to cover either an entire or partial cost of an airline ticket. This allows passengers to utilise significant savings on their journeys, meaning they can spend this on a once-in-a-lifetime adventure!

- Flight upgrades — Air miles can be used to upgrade seating class, meaning passengers can move from economy to business or even first class.

- Priority boarding — Members of frequent flyer programs, especially those who have accumulated a lot of miles, have the opportunity to board the plane ahead of regular passengers.

- Access to airport lounges — Higher tiers in loyalty programs can sometimes grant access to exclusive airport lounges. These spaces provide an environment where passengers can relax, eat, drink, or work away from the hustle and bustle of regular terminals.

- Extra baggage allowance — Travellers with significant air mile totals or certain membership levels may sometimes be given an increased baggage allowance. This perk can either provide a discount on checked baggage fees or allow for additional free checked bags.

How do you earn air miles?

There are a few ways that you can earn air miles:

1. Enrolment

First, you’ll need to sign up for the airline’s frequent flyer program, which is usually free.

Once registered, you’ll receive a unique member number, which you should reference when booking any flights or using services from partnered businesses to ensure your miles are credited to your account.

2. Earn miles

Earning air miles in the UK can be extremely useful for travellers looking to maximise their benefits. You can earn air miles by:

- Joining air loyalty programmes — Many major airlines operating in the UK offer frequent flyer programmes. British Airways, for instance, has its "Executive Club", where members earn "Avios" points for flights. By joining these programmes, every flight you take accumulates points or miles.

- Flying regularly — The most straightforward way to earn miles is by flying. The more you fly, especially on long-haul routes or in premium cabins, the more miles you'll typically accrue.

- Signing up for co-branded credit cards — Several credit card companies in the UK are co-branded with airline loyalty programmes. British Airways American Express Card allows you to earn Avios on everyday spending. These cards will usually come with sign-up bonuses and sometimes even additional benefits like company vouchers or exclusive lounge access.

- Partnerships — Lots of airlines have partnerships with different businesses, like credit card companies, hotels, rental cars and sometimes even restaurants and retailers. Using these services or products can earn you extra miles, which means you’ll be better off in the long run.

- Special promotions — Airlines frequently run promotions where you can earn bonus miles for certain activities or if you meet specific criteria, such as spending a certain amount when booking tickets to a destination.

- Purchasing miles — Some airlines allow you to buy miles directly, although this usually isn’t the most cost-effective way of acquiring them. However, if you’re only a few miles short of a reward, it can be a great alternative to get you what you need.

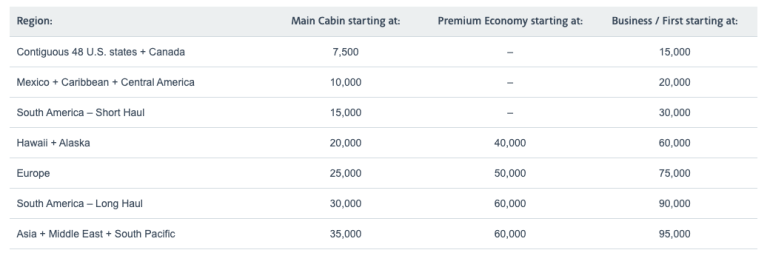

How many air miles do you need for a free flight?

The amount of air miles that you need for a free flight will vary depending on who you’re flying with, the distance and the fare class you want to take.

Avios, for example, is used by several different airlines, including:

- British Airways Executive Club

- Iberia Plus

- Aer Lingus AerClub

- Qatar Airways Privilege Club

Avios can be transferred between any of these programs at a 1:1 ratio, which basically means that all points are worth the same amount in each program. However, there are different ways that Avios points can be redeemed in each.

Tier points count toward status, and there are four different status levels:

- Blue — The most basic level that everyone starts.

- Bronze — Achieved after 300 tier points are earned in a membership year.

- Silver — Achieved after 600 tier points are earned in a membership year.

As of 18 October 2023, you’ll collect Avios on British Airways-marketed flights based on the ticket price instead of the distance you fly.

The total you spend is then multiplied according to the tier you sit in:

- Executive Club Blue — Collect 6 Avios per pound (GBP) spent.

- Executive Club Bronze — Collect 7 Avios per pound spent.

- Executive Club Silver — Collect 8 Avios per pound spent.

- Executive Club Gold — Collect 9 Avios per pound spent.

To travel directly from MAN to JFK on Wednesday, 27 September, with a return flight on Monday, 2 October, would cost £1,543.17, including any charges and fees. This means you’d earn 9,259 Avios on Executive Club Blue and 13,888 points for Executive Club Gold.

Can I transfer my airline miles to another person?

Frequent travellers often end up with a stash of award miles that they might not be able to use before they expire (yes, they have an expiry date!).

The simple answer is yes, you can transfer your air miles; however, there are usually some limitations to this. Most airlines set a cap on the number of miles that can be transferred between accounts.

British Airways, for example, allows you to share up to 27,000 Avios with another Executive Club Member each year. United Airlines lets members transfer 500 to 100,000 miles from an account to another member’s MileagePlus account with a processing fee of $30 per transaction.

Prepare yourself for any journey with Trtl Travel

If you’re a seasoned traveller, you’ll know just how important air miles are and how they’re accumulation can be extremely beneficial on any journey. And, you’ll know just how important it is to be comfortable when you’re flying too. That’s why our travel pillows will leave you feeling refreshed at your destination, whether it’s a quick trip of a few hours or a long-haul flight.

To find out more helpful tips and tricks for all things flying, check out our blog page .

- Choosing a selection results in a full page refresh.

Spend $5.02 more to qualify for free priority shipping

GET YOUR ORDER WITHIN THE NEXT 5 DAYS

priority shipping

Priority shipping unlocked.

Over 10,000+ 5-star reviews

I actually slept!

Comfortable and very useful. Hated those around the neck pillows and the head bobbing and this erased that. Got some actual sleep on a flight for the first time.

Love this product!

This product made sitting upright in a coach airline seat comfortable! Would definitely recommend to anyone who has a plane right and must sit in coach.

JS Newman (Amazon customer)

Game changer/Best travel pillow

It is so comfortable and I actually fell asleep in the middle seat of the plane! I also used it on a long car ride and it was awesome to help me feel comfortable with my neck supported. Game changer!!

Slept on international flights

I usually can’t sleep for long on international flights, but with this product, ear plugs and an eye mask, I slept for the majority of my flights to and from India (I live in the Midwest).

Madeline (Amazon customer)

- Book Travel

Credit Cards

Best ways to earn:

Best ways to redeem:.

AIR MILES ® is one of Canada’s most ubiquitous loyalty programs. While the name suggests that it’s a frequent flyer program of some sort, the reality is that AIR MILES®

is more of a multifaceted rewards program with a vast network of in-store and online partners throughout Canada.

While AIR MILES® won’t necessarily fuel your aspirational travel dreams, its flexibility will help you with other expenses, even ones outside of travel. Hence, the program should definitely be on your radar.

Earning AIR MILES®

There are more ways to earn with AIR MILES® these days than ever before, with some of them introduced only recently. AIR MILES® classifies its means of earning into:

Linked Loyalty

Before delve into the methods of earning AIR MILES®, it’s important to note that there are really two different types of AIR MILES® you can earn: Cash Miles and Dream Miles. Collectively, they’re also known as Reward Miles.

Cash Miles are easily redeemed at partner retailers or as gift cards at a fixed ratio of 95 Miles = $10 in value , while Dream Miles are redeemed towards other types of rewards, such as merchandise, attraction tickets, and travel.

You can specify your preference between Cash and Dream Miles in your AIR MILES® account, and you can even choose how to split your earnings between the two categories by assigning percentages.

Currently, BMO is the sole issuer of AIR MILES® credit cards. While there used to be an American Express variants of AIR MILES® credit cards, the current lineup is issued exclusively under the Mastercard network.

BMO’s AIR MILES® flagship offering is the BMO AIR MILES ®† World Elite ®* Mastercard ®* , which comes with a generous welcome bonus of AIR MILES® upon meeting a spend requirement, along with the annual fee waived on the first year.

- Earn 2,000 AIR MILES ® † upon spending $3,000 in the first three months†

- Earn 1x 3x AIR MILES ® † per $12 spent at AIR MILES ® † partners†

- Earn 1x 2x AIR MILES ® † per $12 spent at grocery stores, wholesale clubs, and alcohol retailers†

- Use AIR MILES ® † for Cash Rewards or Dream Rewards†

- Minimum income: $80,000 personal or $150,000 household†

- Annual fee: $120 (rebated in the first year)†

To further increase the value of this card, it also comes with the following benefits:

- Travel and medical insurance with 15 days out-of-province/country emergency medical protection

- Mastercard Travel Pass by DragonPass membership

- Access to Boingo hotspots, including on flights

- Extended warranty and purchase protection insurance

Note that the card comes with a minimum annual income requirement of $80,000 (CAD) for individuals, or $150,000 (CAD) for households.

BMO also offers the entry-level BMO AIR MILES ®† Mastercard ®* , which is a no-fee card. Its welcome bonus is much more modest than its World Elite counterpart, but with no stated income requirement, the card is easier to attain.

- Earn 800 AIR MILES ® † upon spending $1,000 in the first three months†

- Plus, earn 1x 3x AIR MILES ® † per $25 spent at AIR MILES ® † partners†

- Use your AIR MILES for Cash Rewards or Dream Rewards

- Annual fee: $0

Aside from elevated AIR MILES® earning on groceries, the card features the following:

- Free additional cardholders

- Extended warranty and purchase protection

AIR MILES® has partnered with retailers and other establishments to allow its users to earn Reward Miles directly in-store. Among the program’s biggest in-store partners and their respective default earn rates are:

- Shell (retail gas stations): 1 Mile per 10/20 litres of gas, depending on grade

- Metro (Ontario grocery stores): 1 Mile per $20 spent

- IHG Hotels and Resorts: 1 Mile per $5 spent

- National and Alamo Car Rental: 1 Mile per $10 spent

- Budget Car Rental: 1 Mile per $15 spent

- Samsung (in-store and online): 1 Mile per $20 spent

In addition to your base Reward Miles earning, you’ll earn Bonus Miles on offers that you’ll find on the AIR MILES® app, wesbite, or in-store. Most of these offers require you to opt in through the AIR MILES® app or website.

You’ll also find bonus offers on the weekly flyer, as well as the mobile app for Metro grocery stores in Ontario.

Lastly, a recent addition to earning in-store is AIR MILES Receipts. This sub-program offers AIR MILES® with purchase of featured grocery products at participating stores. Basically, all you need to do is scan your paper receipt after your purchase.

Online earning of Reward Miles is mainly through AIR MILES® Shops , an online shopping portal rivaling Aeroplan eStore and Rakuten.

To earn AIR MILES® through AIR MILES ® Shops, you’ll need to log into your account, search for the shop you’re intending to make a purchase at, and click “Shop Now”.

With shopping portals, it’s important for you to check-out and finish your shopping in the same window that popped up after clicking the “Shop Now” button. This way, your browser will accurately track your purchase.

Moreover, you’ll want to take note of the terms and conditions, as well as the exclusions applicable to a specific store. For instance, Apple and Amazon.ca usually have a list of excluded products or categories.

For more AIR MILES® Shops offers, be sure to periodically check the AIR MILES ® app, where there might be special promotions or “flash offers” for Bonus Miles.

AIR MILES® Card Linked Offers allows you to earn AIR MILES® by using your registered Mastercard at participating retailers, without having to present your AIR MILES® number. As its name suggests, offers are automatically linked to your credit card, and your miles are awarded based on your card transactions.

To participate, you must register the number of your Canadian-issued Mastercard, along with your AIR MILES® collector number. Keep in mind that supplementary cards must be registered separately, either to your AIR MILES ® account or to another account to qualify for card-linked offers as well. You may link more than one Mastercard per account.

Again, with card-linked offers, you won’t need to quote your AIR MILES® collector number, nor will you be asked for it. Simply pay directly with your registered Mastercard, and your Reward Miles will be issued accordingly.

AIR MILES® recently revamped its travel portal, implementing changes that include how you can earn Reward Miles.

Currently, the earning rates for booking travel through the portal depend on your status tier, and are structured as follows:

- Blue: 1 Reward Mile per $15 spent

- Gold: 1 Reward Mile per $10 spent

- Onyx: 1 Reward Mile per $5 spent

You’ll earn more miles by bundling trip items together under a single booking. An example of a bundle is a flight and a hotel.

The earning multipliers on bundles also depend on your status tier, and are structured as follows:

- Blue: 3x Reward Miles on bundles

- Gold: 4x Reward Miles on bundles

- Onyx: 5x Reward Miles on bundles

Redeeming AIR MILES®

As mentioned, AIR MILES® are subclassified as Cash Miles and Dream Miles. Accordingly, what you can redeem them for are Cash Rewards and Dream Rewards.

Cash Rewards can be in-store rebates or gift cards, while Dream Rewards can be travel, merchandise, events, and attractions.

In-Store Partners

You can use your Cash Miles at Shell gas stations nationwide and at Metro grocery stores in Ontario. With either partner, you can redeem at the rate of 95 Cash Miles = $10 in value, as an instant rebate against your bill.

Make sure to redeem your Cash Miles before finalizing your transaction by informing the cashier that you’d like to redeem your AIR MILES®. At self-checkout, you’ll be offered the option to do so.

Occasionally, Shell and Metro offer promotions on redemptions. For instance, Metro might offer 25 AIR MILES® back when you redeem 95 Cash Miles. These offers can be found on the AIR MILES ® app or other promotional materials, such as flyers.

AIR MILES® lets you redeem your Cash Miles for a wide variety of e-vouchers or gift cards. Unlike other loyalty programs, you won’t lose value redeeming this way — you’ll still get the standard redemption rate of 95 Cash Miles = $10 in value.

Gift cards on offer include Uber Eats, Doordash, Sephora, Lululemon, Cineplex, VIA Rail, and more.

Redemptions may be made on the AIR MILES® website or app. Since you’ll be getting e-vouchers, delivery is digital and instant.

The primary use of Dream Miles is for travel. Through the revamped AIR MILES Travel portal , you can redeem your Dream Miles for flights, accommodations, car rentals, vacation packages, cruises, and extras. The redemption rate you’ll be getting is roughly around 95 Dream Miles = $10 in value.

The new travel portal also now allows you to pay for flights with a sliding amount of Dream Miles, whereas previously, you needed to have the entire amount of Dream Miles available to use the Cash + Miles feature. The minimum Dream Miles required depends on your AIR MILES® tier, and is structured as follows:

- Blue: minimum 50% Dream Miles to use Cash + Miles

- Gold: minimum 25% Dream Miles to use Cash + Miles

- Onyx: no minimum to use Cash + Miles

Merchandise

AIR MILES® has an extensive catalogue of merchandise you can redeem with Dream Miles. Products range from electronics to sports and fitness.

The value you’ll get redeeming merchandise largely varies, though you’ll generally get poor value, compared to other means of redemption. Hence, you should compare the price of the product with another merchant, such as Amazon or Best Buy, and use the standard redemption rate of 95 Reward Miles = $10 in value as a benchmark.

Also, keep an eye on products being offered for fewer Dream Miles. You’ll see them being offered on the AIR MILES® Merchandise landing page.

Events and Attractions

AIR MILES® allows you to redeem your Dream Miles for cinema and attraction tickets. Like merchandise, you should compare the retail value of what you’re redeeming against its value in Dream Miles.

AIR MILES® Status and Benefits

AIR MILES® has three status tiers, namely Blue, Gold, and Onyx. Blue is the starting point for most AIR MILES® “collectors”.

However, holding the BMO AIR MILES ®† World Elite ®* Mastercard ®* propels you to Onyx status, while the no-fee BMO AIR MILES ®† Mastercard ®* automatically qualifies you for Gold status.

Alternatively, without a credit card, you’ll qualify for Gold status upon accumulating 500 Reward Miles in a calendar year, or for Onyx status upon accumulating 5,000 Reward Miles per year.

In terms of benefits, they’re mostly for AIR MILES Travel. For one, you’ll receive more Reward Miles on your travel bookings as a Gold or Onyx member. As mentioned above, the earn rate on travel is structured as follows:

- Blue: 1 Reward Mile per $15 spent or 3x Reward Miles on bundles

- Gold: 1 Reward Mile per $10 spent or 4x Reward Miles on bundles

- Onyx: 1 Reward Mile per $5 spent or 5x Reward Miles on bundles

Likewise, you’ll need fewer Dream Miles to book select flights with AIR MILES® — you’ll get up to a 30% discount as a Gold member, or up to 40% as an Onyx member.

With merchandise, you’ll also need fewer miles to redeem. As a Gold member, you’ll get up to 5% discount, while as an Onyx member, you’ll get up to 10%.

In addition, as an Onyx member, you may, rather uniquely, enlist the help of a personal shopper, who can quote you in Dream Miles for items not in the AIR MILES® catalogue.

A full list of Gold and Onyx benefits can be found on the AIR MILES website .

With BMO’s acquisition of AIR MILES , we’re seeing what seems to be the program’s renaissance. There are more options to earn and redeem Reward Miles now than ever, and even better, AIR MILES® is putting out many lucrative offers these days to attract Canadians back into the program.

Thus, while AIR MILES® won’t necessarily fly you in business class, it can help with other expenses. With the inflation we’re experiencing these days, you just might find the program valuable.

† Terms and conditions apply. Please refer to the BMO Website for the most up to date information.

In the past years I found it much easier to redeem AirMiles for flights. Now in 2024 they have removed the option for multi-city routing ( ie arriving in a different city than departing) even for round trip back to Canada as well as removing the ability to pay for the taxes using AirMiles ( an Onyx card previous benefit). What is more upsetting as these changes were not announced. This represents, at least for me, a significant devaluation in the program.

I used to be able to redeem $0.17 for every airmile points, but that was the good old days 🙂 Air Miles have been undergoing negative changes one after another, we are glad they are still around.

Did a AI/chatgpt write this article ?whats the travel hack? Best value of air mile?Just regurgitating

Airmiles needed to fly within Canada have increased dramatically in the past month. What was costing 2125 airmiles yxe to yow return in may-june is now over 3600. I hate this new system

They aren’t a very good ‘travel agent’. In 2019 I had an AC flight purchased with AM cancelled (airline decision). That means going through AM to get your refund. I was told AC was making in difficult (I don’t know why) and after weeks of back and forth, AM eventually gave up! AC wouldn’t discuss it with me directly and AM wouldn’t spend anymore time on it. I’m an ‘Onyx’ holder which shows you what that distinction is worth.

Shell currently offers 20 air miles for each gift card purchased, for example Playstation. Today I went to my local Shell and the clerk said their system could not process the air mile card. They said they have one computer/cash register for gas and one for everything else. Since the playstation card is rung through the other cash, I’m out luck.

They said I have to find a Shell station with only one cash. I am not sure those exist. I doubt you can find a Shell station that is not attached to a convenience store. This story I am telling you doesn’t make sense but I tried to reason with the local manager to no avail. Any advice on buying gift cards at Shell to get the 20 air miles? I need about 150.00 worth of gift cards so it would be worth 150 air miles which is pretty good. Do you know if the story is true? Do you know how to buy gift cards at Shell and earn those elusive air miles?

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

What exactly are airline miles, anyway?

Airline miles. You've certainly heard of them. Maybe you rabidly chase them. Or maybe you view them akin to snake oil, in that they entice you but don't ultimately turn out to be as valuable or useful as you might have hoped.

Or, if your job doesn't require you to travel regularly, and you make most of your purchases with a debit card or non-travel credit card, you might not be familiar with the massive world of airline points and miles.

But no matter which of those buckets applies to you, know that airline miles are a big business.

It has been over 40 years since the modern airline loyalty programs were launched — and plenty has changed in those decades.

Commercial air travel went mainstream, and airline miles underwent a major transformation of their own. Long gone are the days when you earned them just for flying. These days, you can earn them when buying your mom flowers or buying yourself a toaster. With airline-cobranded credit cards , you can earn miles for anything you can charge on a credit card.

Let's cover the basic playbook you need to know to take advantage of airline miles no matter your situation.

New to points and miles? Learn the ropes with the free TPG App !

why were airline miles created?

In the beginning, a mile flown was a mile earned.

The miles were earned mostly by business travelers making the weekly slog from Atlanta to Topeka, Kansas, or a hundred other cities. It didn't take long for that to change.

Today, airline miles come in many shapes, sizes and values and can be earned (and redeemed) without you ever needing to step foot on a plane.

It's been over 40 years since the first airline mileage programs started , first at American Airlines and shortly thereafter at United Airlines. At that time, and for several decades thereafter, any time you boarded a flight you'd earn miles based on how far you flew. Fly a few round-trip flights and you could redeem your miles for a free airline ticket.

Over the years that equation got a lot more complicated (though one surprising benefit of the pandemic was relaxed rules surrounding the use of airline miles ).

In the decades before the creation of frequent flyer programs, U.S. airlines had been regulated by the government, which restricted their ability to compete.

In the new era of deregulation, airlines were eager to keep their customers coming back and to acquire new ones. Airline miles were a way to keep road warriors from having a wandering eye. For a period of time, some airlines were so worried about a customer cashing out their miles and moving to another carrier they would actually deposit some fresh miles in accounts when a customer redeemed their entire balance.

Needless to say, things are a little different these days.

Related: Why loyalty programs are a lifeline for airlines and hotels during COVID-19

What is an airline mile now?

It's been quite some time since a mile was awarded for each mile flown across most programs.

In some cases, airlines aren't even calling them miles anymore. You'll find Southwest Airlines' Rapid Rewards program issuing "points," just like JetBlue's TrueBlue loyalty program . It might be easier to think of miles (or points) as a form of currency. Just like saving up for a new TV, most people save their points and miles while planning a dream vacation somewhere.

But these points and miles can also come in handy for a quick trip to see grandma, family emergencies or a weekend away.

It used to be much easier to understand how to redeem airline miles, with only two published "prices" for most flights: standard and some sort of less expensive, "saver" pricing.

Back in the early days, 25,000 miles was a "magic" number, because that was the price for a saver award ticket anywhere in the domestic U.S. Going way back, those awards also used to come with a certificate for a hotel and rental car that you could potentially redeem for an entire vacation.

Generally speaking, flights were less full in the early days, which meant you had a reasonable shot of finding that 25,000-mile award for your whole family, whether you wanted to head to Disney World or Hawaii.

When you did need to fly during busier times, the most expensive seat you'd find would require 50,000 miles round-trip for a domestic flight. For the most part, this was "last-seat availability," meaning if there was an empty economy-class seat to Hawaii, 50,000 miles would get you there. These days, the busiest flights can cost you double that 50,000 miles one-way.

Current award flight pricing is much more dynamic, as airlines set the number of points needed much closer to the cash value of each flight. Airline miles are also awarded in many different ways and only rarely based on how far you fly.

Most airlines award miles based on how much you spend, and even that can depend on complicated formulas. Generally, you won't earn miles for any portion of your ticket that's a government tax or fee. Buy the cheapest ticket, and you'll earn significantly fewer miles than if you bought that snazzy first-class seat at the last minute.

These days, travelers earn more airline miles from activities other than hopping on an airplane.

Credit cards are a huge part of earning miles. You can earn miles for shopping through online portals that include hundreds of retailers you already patronize. You can also earn miles for renting cars, staying in hotels, paying your energy bill, filling your car up with gas, and applying for insurance.

For example, instead of just shopping online at Macy's and earning credit card points, if you click through a shopping portal first , you can also earn a multiple of 2 to 4 American Airlines AAdvantage miles per dollar for those purchases. United offers hundreds of bonus miles if you book a rental car through its website (though you want to be careful to check the price versus booking your rental car directly).

You can redeem those miles to buy a blender or steak knives or magazines – but please don't unless that's really what you want. The price, in miles, is generally pretty horrible for merchandise relative to what you could get from travel redemptions.

Related: The complete history of credit cards, from antiquity to today

What are airline miles worth?

Just to make things more complicated, not all airline miles (or points, as the case may be) are created equally.

The least valuable miles or points are generally those where the airline has given them a defined value. Southwest and JetBlue are two airlines that have essentially fixed the price of award tickets to the cost of buying a ticket outright.

Meanwhile, some airlines, such as Delta, moved away from fixed award charts years ago. While there are still plenty of ways to get great value from Delta SkyMiles , they aren't usually worth as much as American Airlines AAdvantage miles.

A few programs that have chosen to maintain some form of published award charts, such as Alaska Airlines' Mileage Plan and Air Canada's Aeroplan , have miles that are worth even more.

Part of the reason for the higher valuations from those airlines who maintain award charts is that there's generally a maximum number of miles you need to redeem for an award, whether that's a "saver" award or a more expensive standard award.

Need an example? If a round-trip flight from New York to Los Angeles will set you back 25,000 miles, it's a much better value when the cash price of that same ticket is $800 versus $300. For programs that have a fixed value for their miles, or even dynamic pricing where there's generally no cap on how many miles a ticket costs, it's just hard to get as much value since a dynamically priced program will charge far more points when the cash price is $800 than when it's $300.

All of these factors drive the methodology behind TPG's valuations of various miles and points .

Related: How (and why) to calculate award redemption values

How can I use airline miles?

How much time do we have?

The list of ways to use your airline miles is virtually endless. On top of being able to redeem miles for travel to virtually any airport with commercial service in the world, you can use them to upgrade paid airline tickets to a better class of service .

There are the most basic options to redeem miles, such as for a family trip to Disney World . In a world of dynamic pricing for award flights, an off-peak trip to Orlando can be one of the most affordable you'll find due to the sheer volume of flights.

Hawaii has plenty of flights as well but can be incredibly popular during the holidays. For those who live on the East Coast and would prefer not to fly 10-plus hours in economy class, you may need to put in a bit of elbow grease searching for flights .

International travel presents many more options.

For starters, the major U.S. airlines – American , Delta and United – all offer premium economy as an extra class of service on many international flights. Premium economy can, in some cases, be a much better experience than economy without the steep price of a business-class or first-class cabin. The seats resemble a domestic first-class seat, with more legroom and sometimes footrests. Additionally, you'll usually enjoy better food, increased baggage allowances and comfort items like a pillow and blanket.

Where international travel gets incredibly interesting is when you begin to leverage airline alliances. All three major U.S. carriers belong to one of the three biggest worldwide alliances . American Airlines is part of Oneworld , Delta is part of SkyTeam and United is part of the Star Alliance . Each airline in these alliances has its own award charts (or just pricing if it has eliminated charts) and the prices can vary widely.

These alliances can help you in two primary ways. First, they can serve as additional award inventory for a flight from the U.S. to a major international gateway. For example, United Airlines operates flights from San Francisco International Airport (SFO) to Tokyo's Narita International Airport (NRT) and Haneda International Airport (HND). In addition, its Star Alliance partner ANA operates flights from SFO to both Tokyo airports as well, giving you more award options.

ANA flies to dozens of destinations from Tokyo's airports that can be booked as connecting itineraries along with a United or ANA flight from the U.S. to get you to secondary or tertiary cities all on the same award ticket. So while United doesn't fly to Bangkok, you can still fly there with your United miles by connecting through Tokyo on an ANA flight.

Related: Book this, not that: SkyTeam award tickets

How can I earn airline miles?

You'd think that earning airline miles would be something that you primarily accomplish while flying. Thirty years ago you would have been correct. Today, there's a broad menu of options to earn airline miles. Spoiler alert: Many folks earn very few miles from actually flying.

Pretty much every airline will award you some sort of miles or points when you pay for one of its flights.

That means road warriors can still earn plenty of miles traveling, but only if they're big spenders. Virtually all of the major programs have changed their earning structure to award miles based on how much you spend, not how many times you travel or how far you fly. Alaska Airlines is the lone exception in the U.S., but that could change in the coming months .

For everyone else, you pay to play (or earn miles).

With the larger legacy carriers such as American, Delta and United you can also earn bonus miles for flying in a higher class of service or holding elite status with the airline. Southwest awards points based on which of its four fare classes you purchase and how much your ticket costs. The rest of the low-cost carriers generally award you airline miles or points based solely on the price of your ticket.

Related: How to stack rewards when you book flights with online travel agencies

Credit cards

Credit cards are big, big business for the airlines. Some airlines, such as Delta, lean in heavily on a partnership with one bank.

Delta has a relationship with American Express that includes entry-level credit cards and premium ones that come with benefits like lounge membership. Their relationship extends further to being a major transfer partner with the American Express Membership Rewards program, Amex's proprietary currency.

Other airlines, such as American, have partnerships with more than one bank. That, in theory, gives customers more choices.

That said, you're probably better off without an airline's credit card in your wallet unless you plan to give that airline quite a bit of money. That might sound counterintuitive, but it pays to follow the math. For example, the United Explorer Card earns 2 miles per dollar spent on United flights, hotels and dining.

For the exact same $95 annual fee you can hold the Chase Sapphire Preferred Card . That card earns 2 Ultimate Rewards points per dollar on all travel purchases (including airfare) and 3 points per dollar on dining, online grocery store purchases and streaming services.

In almost all cases, you'll earn more points on everyday spending on the Chase Sapphire Preferred card. Not only can you transfer the Ultimate Rewards points you earn instantly to United on a 1:1 basis, you also have the flexibility to transfer to Air Canada, Southwest, Hyatt and other great partners.

Related: How (and why) you should earn transferable points in 2022

Shopping portals

Earning bonus airline miles via shopping portals can be ridiculously easy.

You typically only need a few extra clicks to navigate to your favorite merchant. Those extra clicks through the shopping portal of your choice will earn you bonus miles for the items you already planned to buy, from the exact place you planned to buy it. With the exception of very few online merchants (the biggest being Amazon), you can find hundreds of the most popular online retail sites on a shopping portal.

Use a shopping portal aggregator like Cashback Monitor to determine where to earn the most airline miles for your purchases.

How should I redeem my airline miles?

You'll generally get the most value by redeeming them for award tickets. You can usually find award flights on the airline where you have your miles and on its partners. For example, your American Airlines AAdvantage miles can get you from Washington, D.C., to Miami on American but can also get you from Madrid to Rome on Iberia, one of its Oneworld partners.

While we maintain a full list of valuations of various airline miles and hotel points , there are some basic guidelines. For starters, if you're getting over 2 cents per airline mile you're redeeming, you're in pretty good shape. For example, let's say you want to redeem 25,000 miles for a flight. If that flight costs $500 (2 cents per mile) or more, that's generally a good use of your miles.

However, when money is tight, keeping a stash of airline miles can help with emergencies. If a family member falls ill and you absolutely have to be there, redeeming miles (even at a poor value) can help you preserve cash.

Generally, you won't get as much value when transferring your airline miles to hotel loyalty programs (and vice versa). And buying merchandise through the online retail sites some airlines operate is usually pretty horrible.

Related: From newbie to expert: 6 ways to up your mileage redemption game

Which airline miles program is the best?

Asking which airline miles program is the best is sort of like asking which of Baskin-Robbins' 31 flavors is best.

Some folks like vanilla, others like rocky road. If international travel is your goal, stick with Alaska, American, Delta and United. On the other hand, if you're perfectly fine in North America, Southwest can be an excellent value.

In short, there's no "best" airline miles program. Rather, there's a best fit for each style of travel.

Why you should care about airline miles

If you've made it this far in life without investing time and energy in learning the advantages of airline miles, you might be wondering why you should start caring now.

One of the biggest reasons to care is that it's easier than ever to earn airline miles. Most, if not all, travel credit cards have a sign-up bonus when you get approved for a card and meet the card's spending requirement. These sign-up bonuses are what jump-start your points and miles-earning potential.

Credit cards also have bonus purchase categories that can allow you to earn bonus miles that can far exceed the value of a cash-back credit card or a debit card. For example, the American Express® Gold Card earns 4 points per dollar at U.S. supermarkets (on up to $25,000 per year, then 1 point per dollar) and at restaurants worldwide.

Another major reason to get into the points and miles game is the destinations they can unlock. Even some of the stingiest programs have phenomenal award opportunities from time to time.

Delta is famous for flash sales that can make a trip across the country or to Europe or Asia incredibly affordable. When you reduce the cost of an airline ticket to virtually zero, you have so many options. It opens up your budget so you can splurge on a special dinner on your trip or cut the cost enough to make that dream trip a reality.

You can also use your miles to upgrade to business class or first class, which means you can treat yourself to incredible lie-flat seats, fine wines and dining on your way to your chosen paradise. Also, points and miles are not an all-or-nothing proposition. If you only have enough miles for one airline ticket, you can still cut the cost in half for you and a loved one to head to Hawaii. This is especially key for families, where the price of four airline tickets may literally be the barrier to even being able to plan a vacation.

There are unique opportunities with airline miles as well, like United's Excursionist Perk , which means you may not have to choose between Spain and Italy on a European trip — you may be able to do both for the same amount of miles.

Related: TPG beginners guide: Everything you need to know about points, miles, airlines and credit cards

Bottom line

Would it be a bit cheeky to say that airline miles can make your travel dreams come true? Maybe. But there are reasons airline loyalty programs issue billions (with a "B") of miles every year. Customers with even a tiny bit of strategy can come out miles ahead when they use them — and by default that includes you, because you're here.

Points and miles can change your life, or at least your travel frequency and costs. They can open up the world and allow you to take more trips, visit more far-flung destinations, bring along friends and family or simply enjoy the good seats every once in a while.

With that being said, airline miles don't generally get more valuable over time, so don't hoard them for a retirement trip many years down the road and expect them to still be worth later what they are today. Big sign-up bonuses and lucrative bonus categories make it easy to build up enough points or miles now to redeem them for a flight quickly.

While airline miles aren't what they were in the early 1980s, they are now much easier to earn and easier to use in everyday life — which means even infrequent travelers can unlock an award trip to a destination they never thought possible.

Additional reporting by Ehsan Haque.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Determining When to Use Points and Miles to Book a Flight

Andrew Kunesh

Former Content Contributor

69 Published Articles

Countries Visited: 28 U.S. States Visited: 22

Keri Stooksbury

Editor-in-Chief

35 Published Articles 3241 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

Director of Operations & Compliance

6 Published Articles 1178 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

Table of Contents

What are points and miles valuations, determining the cent per point value of a flight, covering a cheap flight with points, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Using points and miles to book your flights is great. Not only do you save money, but you can use your points to book flights that may not be feasible when paying cash.

Think about flights in Singapore Suites, Emirates first class, and ANA first class; more often than not, these flights cost over $10,000 if you were to pay cash, putting them far out of reach for the majority of us (unless you have a stash of points!).

However, there are still times when you may opt to book a ticket with money over miles. For example, if a paid flight is excessively cheap, you’d actually lose money if you used your miles to book.

This is because miles are worth real money, and you should only use them when the price is right. In this article, we’ll walk you our method of determining if a flight is worth using miles to book. We’ll start out by discussing points and miles valuations and then dive into determining the cent-per-point value of a flight.

Let’s dive in!

The first thing you should do when deciding whether or not to book an award ticket is to find the cheapest way to book the ticket in question. If you have a stash of transferable points and airline miles, go through your stash and find the best transfer partners and award charts to use.

Hot Tip: New to points and miles and don’t know where to start? Check out our beginner’s guide for a crash course on earning miles.

Additionally, find the cost of a paid ticket. You can use a website like Google Flights or Orbitz to find the price of a ticket easily — just search as if you were booking any other paid flight.

For example, say you want to book a flight from New York (LGA) to Chicago (ORD) and the average cost of a paid ticket is $175. You also have 100,000 Delta SkyMiles miles, 25,000 United MileagePlus miles, and 50,000 American Express Membership Rewards points.

United and Delta both employ dynamic award pricing, meaning that the price of award tickets varies based on the date of travel, passenger load, and other factors. So, the first thing you’d want to do is search both the Delta and United websites and find the mileage price of the ticket.

In this case, the mileage cost was:

- United MileagePlus: 10,000 miles

- Delta SkyMiles: 8,000 miles

Likewise, you can transfer American Express Membership Rewards points to book the LGA to ORD flight for 9,000 British Airways Avios or 10,000 Avianca LifeMiles.

Hot Tip: If redemptions are the same cost across multiple mileage programs, use whichever mileage option you value less. We’ll discuss mileage valuations later in the article.

For this example, it would make the most sense to book your flight using Delta SkyMiles as it has the lowest award cost. However, you shouldn’t book just yet.

First, you want to find the cent-per-point value of redeeming your 8,000 hard-earned SkyMiles for this $175 ticket. You can find this by simply diving the cash cost of the ticket by the number of SkyMiles required. The math looks like this:

$175 (cost of a paid ticket) / 8,000 SkyMiles = 2.18 cents per point

To us, this is an excellent use of points as we — per our monthly points and miles valuation — value Delta SkyMiles at 1.2 cents per point at a minimum. This is almost twice our assigned value, so we think it’s a great deal!

On the other hand, flights between New York and Chicago can be really cheap — sometimes as low as $50 one-way. This would give you a valuation of only 0.625 cents per point, making it — per our valuations — not a great deal.

So the trick here is to always compare the flight’s cash cost to the number of miles required to book the flight. If it’s below your valuations, you should consider paying cash. On the other hand, you may want to use points if you get a value that’s at or above your assigned valuations.

But how do you determine the value of your points? We’ll discuss in the next section of this article.

Now, there are a couple of ways you can assign values to your miles and points: the easy way and the hard way. Here’s an in-depth look at how you can use both of these valuation methods to assign values to your credit card points, airline miles, and hotel points.

The Easy Way to Valuate Your Points

Here at Upgraded Points, our staff pays constant attention to the happenings of the miles and points world. We meticulously track each new devaluation, change in terms and conditions, and promotion that pops up amongst all of the major airline, credit card, and hotel loyalty programs.

Because of this, we publish a monthly points valuation article that shows our up-to-date valuations of all the major points programs.

We found our initial valuations by making a handful of redemptions — some domestic economy, some business class international, and more — with each points currency and calculated the average value of all points.

Then, each month we adjust our initial valuations to reflect changes in award charts, new routes, general award availability, and other news surrounding the points currency in question. We even outline our reasoning for these changes in the Movers section of the valuations article .

So, the easy way to determine the value of your points is to simply refer to our valuations guide. We think our valuations give a good baseline for determining the value of your points and can help guide you towards getting the best value when you redeem your miles.

The Harder Way to Value Your Points

Alternatively, you can figure your own points and miles valuations.

There are a few ways to do this, but our personal favorite is by finding 3 (or more) types of redemptions you make the most, figuring their cent-per-point value, and then averaging these values together. The more redemptions you add, the more accurate your valuations become.

Here’s a quick example we developed for United MileagePlus miles:

- Domestic short-haul economy ticket: 1.1 cents per point

- International long-haul business class ticket (U.S. to Europe): 3.1 cents per point

- International long-haul economy class ticket (U.S. to Asia): 1.45 cents per point

In this case, you’d have a 1.83 cent per point value assigned to your United MileagePlus miles.

This is relatively easy to do with airline miles and hotel points, but it gets more difficult with transferable points currencies due to their vast number of transfer partners.

To find valuations for transferable points currencies, you can perform the above exercise with all of a program’s transfer partners, or just the partners you think you’ll use the most.

Then, take other factors into account like the cent-per-point valuation for redeeming towards paid flights and cash-back.

Of course, you’re free to modify these valuations to your liking, too. You may want to tweak the calculated value for redemption flexibility, the ease in which you can cancel award tickets, and the ease of booking online. There’s no set valuation for these factors, so you should figure out how much they mean to you.

What happens when you find a flight you want to book, but it’s a bad use of airline points?

Aside from paying for the ticket with cash, you can also use the Chase Travel Portal or Citi ThankYou Travel Portal to book your flight. In short, these travel booking portals let you use your credit cards at a fixed cent-per-point rate to book paid travel.

Chase Travel Portal

Citi ThankYou Travel Portal

As you can see, these portals still offer less value than our points valuations. However, in some cases, they’re a better deal than if you were to book a cheap ticket using transfer partners. Make sure to compare your options before you book to see what booking method offers the best deal.

Since these portals process redemptions as paid tickets, you’ll still earn airline miles when you fly.

Hot Tip: Make sure to add a frequent flyer number to all redemptions made through credit card travel portals to take advantage of earning airline miles.

Using the Chase Travel Portal

Using the Chase Travel Portal is a super-easy way to redeem your Ultimate Rewards points towards paid travel. Here’s a look at how to book an airline ticket using the portal.

- All flight options will be presented in the middle of the screen. You can view the points cost to the right of the flight’s info alongside the cash cost of the flight. When you find a flight you like, click the Select button and you’ll be taken through the booking process.

And that’s all there is to it! You’ll be able to use points to cover all or part of your flight in the Chase Travel Portal, so this also makes for a good way to use up small amounts of points if you plan on closing a Chase credit card .

Using the Citi ThankYou Travel Portal

The Citi ThankYou Travel Portal is remarkably similar to the Chase Travel Portal. It’s just as easy to use, and the booking process feels a lot similar. Here’s a look at how to use your ThankYou points to book a paid flight through the portal.

- Now, you can search through available flights. Like on the Chase Travel Portal, all flight options will show their points and cash cost to the right of the flight details. You can book a flight by clicking the blue Select button beneath the flight’s pricing.

You can use your points to cover some or all of a paid ticket through the Citi ThankYou Travel Portal. Just note that you must use your Citi card to pay the remainder of the flight ticket if you opt for partial payment with points — other cards are not accepted.

A Word on AmexTravel.com and the Capital One Travel Portal

It’s worth noting that American Express and Capital One have their own travel portals too. However, they’re not usually a great deal .

Unlike Chase and Citi, all Capital One cards can only redeem flights at 1.0 cents per point through the Capital One travel portal . This isn’t a great use of points, so we highly recommend using other points (or cash) to cover low-cost paid tickets. Then, consider using one of Capital One’s awesome transfer partners to get more value from your Capital One miles.

On the Amex side of things, there are only 2 instances in which we’d recommend using Membership Rewards points to cover airfare booked with AmexTravel.com .

The first is if you have The Business Platinum Card ® from American Express . This card has a 35% points rebate on some flights booked through the AmexTravel.com portal, so you effectively get 1.35 cents per point in value through AmexTravel.com. To put this into perspective, a $100 flight would cost 7,407 points with this card.

Something to note about this benefit is that the points (35% of the redemption) are rebated to your account within a few weeks of the redemption. Unfortunately, this means you need to have enough Membership Rewards points in your account to cover the transaction at 1.0 cents per point at the time of booking.

Also, remember how we said “some” flights when explaining the feature? You can only use this benefit on 1 airline of your choosing OR when booking a first or business class ticket. So if your airline of choice is United Airlines and you want to book an economy ticket with American Airlines, you can only redeem at 1.0 cents per point.

You can choose this airline annually in the Airline Benefit section of your card’s Benefits screen.

In this article, we showed you how to determine if a flight is worth booking with points.

As a general rule of thumb, always find the cent-per-point value of a redemption of a flight before you book with points. Only book a flight if the value meets or exceeds your mileage valuation — if it doesn’t, consider paying cash or using an alternative method of booking your flight.

Let us know how you determine your personal point valuations in the comments — we’re excited to hear from you!

The information for the Citi Prestige ® Card has been collected independently by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Citi Strata Premier℠ Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

For rates and fees of The Business Platinum Card ® from American Express, click here .

Frequently Asked Questions

Where can i find sample points valuations.

You can view our sample points valuations on our monthly points valuations guide . We keep this guide updated monthly, so you can be sure the valuations are accurate.

What are Citi ThankYou Points worth?

We value Citi ThankYou points at 1.6 cents per point when utilizing transfer partners.

How much are Chase Ultimate Rewards points worth?

We value Chase Ultimate Rewards points at 1.95 cents per point when utilizing various transfer partners.

How much are Amex Membership Rewards points worth?

We value Amex Membership Rewards points at 2.2 cents per point when utilizing Amex transfer partners.

Was this page helpful?

About Andrew Kunesh

Andrew was born and raised in the Chicago suburbs and now splits his time between Chicago and New York City.

He’s a lifelong traveler and took his first solo trip to San Francisco at the age of 16. Fast forward a few years, and Andrew now travels just over 100,000 miles a year, with over 25 countries, 10 business class products, and 2 airline statuses (United and Alaska) under his belt. Andrew formerly worked for The Points Guy and is now Senior Money Editor at CNN Underscored.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Travel Planning Center

- Ticket Changes & Refunds

- Airline Partners

- Check-in & Security

- Delta Sky Club®

- Airport Maps & Locations

- Flight Deals

- Flight Schedules

- Destinations

- Onboard Experience

- Delta Cruises

- Delta Vacations

- Delta Car Rentals

Delta Stays

- Onboard Wi-Fi

- Delta Trip Protection

- How to Earn Miles

- Ways to Redeem Miles

- Buy or Transfer Miles

Travel with Miles

- SkyMiles Partners & Offers

- SkyMiles Award Deals

- SkyMiles Credit Cards

- SkyMiles Airline Partners

- SkyMiles Program Overview

- How to Get Medallion Status

- Benefits at Each Tier

- News & Updates

- Help Center

- Travel Planning FAQs

- Certificates & eCredits

- Accessible Travel Services

- Child & Infant Travel

- Special Circumstances

- SkyMiles Help

In-page Links

- Award Travel , Go to footer note

- Travel with Miles on Partner Airlines , Go to footer note

- Book with Delta Vacations , Go to footer note

- Delta Stays , Go to footer note

- Miles + Cash , Go to footer note

- Pay with Miles , Go to footer note

- Frequently Asked Questions , Go to footer note

Award Travel

Use your miles to travel to 1,000+ destinations around the world with Delta and our partners. You can book Award Travel for yourself or for someone else – even if you’re not flying with them. And there are no blackout dates on any Delta Air Lines flight.

- Select ' Book ' at delta.com or in the Fly Delta app

- Check the box next to "Shop with Miles" on delta.com or "Show Price in Miles" on the app

- Enter your flight preferences and select ‘Find Flights’

- Our flexible Award calendar shows the lowest price options for the dates you select

- Choose your flight(s), complete your purchase and you’re on your way

GET THE MOST OUT OF AWARD TRAVEL:

- Earn MQDs toward your next Medallion Status tier with Award Travel on Delta and our partners (excluding Basic Economy fares)

- We've made it easy for you to find the best deals for your miles by compiling all of our latest SkyMiles Deals