Our products and plans are tailored to fit your needs based on your country of residence. If you are not a US resident, please select your country of residence below to receive travel insurance plans tailored to your needs.

Not a US Resident?

Welcome to Advisor Connect (formerly Agentlink). Log into our new user-friendly travel insurance plan booking platform. This enhanced platform has a full suite of tools designed to help our travel advisors and other Travel Guard partners quote and offer travel insurance plans to clients.

If you are having problems logging in or can’t remember your username or password, please contact our Travel Guard Tech Support at 866-729-5215; Monday - Friday 7 a.m. to 6 p.m. CDT.

The California Consumer Privacy Act gives California residents the right to opt-out of the sale or sharing of their personal information. A “sale” is the exchange of personal information for payment or other valuable consideration and includes certain advertising and analytics practices. “Sharing” means the disclosure of personal information for behavioral advertising purposes, where the information used to serve ads is collected across different online services.

Opt-out from the sale or sharing of your personal information.

Your request to opt out will be specific to the browser from which you submit your request, and you will need to submit another request from any other browser you use to access our website. Additionally, if you clear cookies from your browser after submitting an opt-out request, you will clear the cookie that we use to honor your request. For this reason, you will have to submit a new opt-out request.

For information about our privacy practices, please review our Privacy Policy .

We have received your request to opt out of the sale/sharing of personal information..

More information about our privacy practices.

‹ Trip Types

Ski Travel Insurance Plans

Understand the importance of ski travel insurance plans for your next vacation and make sure you’re covered with the right Travel Guard plan.

Ski travel insurance plans are designed to help cover your adventures down the slopes. Whether you’re about to enjoy a New England winter or glide down The Alps, Travel Guard has plans to help cover your ski vacation.

If your ski vacation does take you out of the country, remember your U.S. health insurance plan may not cover you while traveling internationally. And regardless of where you’re skiing, be sure and purchase Travel Guard’s Adventure Sports Bundle add-on (available on our Deluxe and Preferred plans) to make sure you have coverage for adrenaline-pumping activities like skiing.

Ready to book your ski vacation?

Travel Guard’s award-winning travel insurance plans provide excellent coverage options and access to 24-hour emergency travel assistance. Compare our travel insurance plans to find the best option for your travels today. Get travel insurance the way you want it!

What is a ski travel insurance plan?

Ski travel insurance plans provide travelers with coverage for ski vacations including baggage coverage for sporting or ski equipment that you are bringing with you. Typically ski travel insurance plans offer higher benefit limits for baggage knowing that you’re likely traveling with extra gear. It’s also important to make sure there are no extreme sport exclusions on your travel insurance plan, so you’re covered if you get injured while skiing.

What does a ski travel insurance plan cover?

Travel Guard offers customizable travel insurance plans for your ski vacation. Look for a plan that has the coverage and benefits limits you need. Popular plan features include:

- Medical expense coverage – your U.S. health plan may not cover you out of country

- Travel inconvenience benefit – a one-time payment for covered inconveniences you encounter on your trip like a closed attraction due to lack of snow (included with certain plans)

- Emergency travel assistance – specialized representatives are available day or night to assist with unexpected travel issues

- Lodging expense – coverage for certain reentry requirements into the U.S. (optional add-on coverage available on certain plans)

- Adventure sports bundle – perfect for covering activities like skiing and snowboarding (optional add-on coverage available on certain plans)

- Baggage coverage

- Trip cancellation

- Cancel For Any Reason (optional add-on coverage available on certain plans)

Do I need a ski travel insurance plan?

It’s smart to cover your travel investment on any vacation, and that’s especially true for your ski vacation. When you’re traveling to a snowy destination, inclement weather can become a problem for your trip whether you’re traveling in the air or on the roads. Plus, you’ll want to make sure you’re covered for certain medical expenses you may encounter on your travels – especially if your vacation is outside the U.S.

With a Travel Guard travel insurance plan your travel investment can be protected, and you have access to our specially trained representatives for 24-hour travel emergency assistance . A missed flight doesn’t have to mean missing out on skiing – our representatives will work to help you through any unexpected travel mishaps.

Which Travel Guard travel insurance plan is best for my ski trip?

Travel Guard has a variety of options to help protect your trip depending on the coverage you need. For ski vacations, having Travel Guard’s Adventure Sports Bundle is going to be important, and that coverage is available as an optional add-on with both our Deluxe and Preferred plans. Travel Guard’s Deluxe plan has the highest benefit limit for baggage coverage. If you’re bringing any ski equipment or gear with you, the higher limit might be a good idea.

No matter which Travel Guard insurance plan you choose, you’ll have access to our specially trained representatives for 24/7 emergency travel assistance .

How much is a ski travel insurance plan?

Typically, a travel insurance plan costs 5-7% of your total trip cost, meaning that your overall cost will depend on the details of your vacation, including if you add additional coverage to your insurance plan. If you’re planning a ski vacation, you’ll most likely want to include Travel Guard’s Adventure Sports bundle to ensure you have coverage for more extreme activities.

What is the best travel insurance plan for families going on a ski vacation?

Travel Guard’s Deluxe Plan includes our highest benefit limits for our coverages including medical expense coverage, trip cancellation, trip interruption, missed connection and more. With add-ons like our Adventure Sports bundle, you’ll have even more coverage for the whole family on your ski vacation.

Why purchase your ski travel insurance plan through Travel Guard?

Travel Guard is one of the world’s leading travel insurance providers. We have a network of service centers located in Asia, Europe and the Americas ensuring the highest quality emergency travel services and travel medical assistance while you’re traveling. With early purchase benefits and optional add-on coverages you can customize the plan and coverages you need for your ski vacation.

Get travel insurance the way you want it!

Reviews and testimonials.

“I was riding a luge in Rotorua, New Zealand when my phone flew out of my pocket and landed in the lane of the next rider. It was crushed! My Travel Guard insurance paid $500 to help cover cost of my new phone. Very happy customer!”

Discover more about ski travel

Destination guides, travel safety.

Travel News

Call us at: 800-826-5248

Travel Guard on Facebook Travel Guard on LinkedIn Travel Guard's You Tube Channel

Travel Insurance Education Center Our Plans Compare Plans Coverage Information Frequently Asked Questions Get a Quote Non-US Residents COVID Information

Traveler Resources Travel Safety Travel News Travel Tips

Travel Guard About Us Contact Us Press Releases Careers Sell Travel Guard Affiliate Program Media Contact

Self Service Help Center Get a Quote View My Policy Modify My Policy Cancellations & Refunds Claims Strike List Alert List Certificate of Insurance Library

Copyright © 2024, Travel Guard. Non insurance services are provided by Travel Guard. Terms of Use | Privacy Policy | Accessibility Statement | Our Underwriter | Do Not Sell or Share My Personal Information | About AIG Ads

Coverage available to U.S. residents of the U.S. states and District of Columbia only. This plan provides insurance coverage that only applies during the covered trip. You may have coverage from other sources that provides you with similar benefits but may be subject to different restrictions depending upon your other coverages. You may wish to compare the terms of this policy with your existing life, health, home, and automobile insurance policies. If you have any questions about your current coverage, call your insurer or insurance agent or broker. Coverage is offered by Travel Guard Group, Inc. (Travel Guard). California lic. no.0B93606, 3300 Business Park Drive, Stevens Point, WI 54482, travelguard.com . CA DOI toll free number: 800-927-HELP . This is only a brief description of the coverage(s) available. The Policy will contain reductions, limitations, exclusions and termination provisions. Insurance underwritten by National Union Fire Insurance Company of Pittsburgh, Pa., a Pennsylvania insurance company, with its principal place of business at 1271 Avenue of the Americas, 37th FL, New York, NY 10020-1304. It is currently authorized to transact business in all states and the District of Columbia. NAIC No. 19445. Coverage may not be available in all states. Your travel retailer may not be licensed to sell insurance, and cannot answer technical questions about the benefits, exclusions, and conditions of this insurance and cannot evaluate the adequacy of your existing insurance. The purchase of travel insurance is not required in order to purchase any other product or service from the Travel Retailer.

June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova; North Korea; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

Ski Travel Insurance Benefits

White powder, cozy lodges, stunning views: A ski vacation is an unforgettable experience, whether you're traveling solo or with the family. But winter sports are as risky as they are exhilarating, and that's why you need ski travel insurance.

Three Things You Need To Know Before Buying Ski Travel Insurance

Comprehensive ski travel insurance coverage is essential if you're planning a winter adventure anytime soon. Here are the three reasons smart travelers buy trip insurance.

1. Ski travel insurance helps protect your investment.

With lift tickets, ski rentals, airline tickets and peak-season hotel prices, the expenses add up fast for a ski vacation. If you have to make a last-minute trip cancellation , you could lose a lot of money.

A good ski travel insurance policy covers not only trip cancellations, but also travel interruptions and stolen or lost baggage. If something goes awry, having travel insurance may help you recoup your investment and save your vacation.

2. Accidents and medical emergencies happen on a ski trip when you least expect it.

You might glide gracefully down black-diamond trails, but serious accidents can happen to the most experienced skiers. Or a sneaky cold or flu could ruin your long-planned vacation. Ski travel insurance policies may cover emergency medical evacuations and medical care, even on international trips . Look for a ski trip insurance policy that also covers trip interruptions, so if you have to cut your ski trip short, you can get back on the slopes when you're better.

3. When everything depends on the weather, ski travel insurance is a must.

You're wishing for fresh snow, but instead you get slush. Or a record-breaking blizzard closes the airport, leaving you stuck at home. You can't control the weather, but ski travel insurance keeps you from worrying about it. Many travel insurance policies cover ski trip cancellations, interruptions and delays due to weather. Make sure you review your insurance plan carefully before you buy, because not all plans offer the same coverage.

Get a Quote

{{travelBanText}} {{travelBanDateFormatted}}.

{{annualTravelBanText}} {{travelBanDateFormatted}}.

If your trip involves multiple destinations, please enter the destination where you’ll be spending the most time. It is not required to list all destinations on your policy.

Age of Traveler

Ages: {{quote.travelers_ages}}

If you were referred by a travel agent, enter the ACCAM number provided by your agent.

Travel Dates

{{quote.travel_dates ? quote.travel_dates : "Departure - Return" | formatDates}}

Plan Start Date

{{quote.start_date ? quote.start_date : "Date"}}

Share this Page

- {{errorMsgSendSocialEmail}}

Your browser does not support iframes.

Popular Travel Insurance Plans

- Annual Travel Insurance

- Cruise Insurance

- Domestic Travel Insurance

- International Travel Insurance

- Rental Car Insurance

View all of our travel insurance products

Terms, conditions, and exclusions apply. Please see your plan for full details. Benefits/Coverage may vary by state, and sublimits may apply.

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best's 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Return To Log In

Your session has expired. We are redirecting you to our sign-in page.

800-874-2442

"Generali wins out among the best travel insurance companies for its happy combination of below average fees for above average travel coverage."

“I go to France for skiing every year for a month and always feel super safe carrying Generali. I use them for every trip just because that one time, when it happened, they were there for me 100%.”

“We were thrilled when we found out everything was being covered.”

“My husband and I were really surprised by how very smoothly and quickly we received our check.”

Get Travel Insurance for Your Ski Trip

Terms of Use | Privacy Policy | California Privacy Policy | Do Not Sell My Personal Information | © Forbes Advisor, 2021

Trusted by over 6 million travelers every year

Copyright© 1997 - 2023 CSA Travel Protection DBA Generali Global Assistance & Insurance Services, Company Code: 805-93, Approval Code: A8511912

Travel insurance coverages are underwritten by: Generali U.S. Branch, New York, NY; NAIC # 11231, for the operating name used in certain states, and other important information about the Travel Insurance & Assistance Services Plan, please see Important Disclosures .

Compare Plans

Frequently Asked Questions

What types of winter sports can travel insurance cover.

Our travel insurance plans can cover skiing, snowboarding, snow tubing/rafting, cross country skiing on marked trails, snow shoeing, sledding, ice skating and more.

The Premium and Preferred plans include Sporting Equipment and Sporting Equipment Delay coverages that can cover winter sports equipment you might bring on a trip, except motorized equipment, dental wear and eyewear.

If your sporting equipment is damaged, lost or stolen during your trip, Sporting Equipment coverage can reimburse the costs to repair or replace your sporting equipment. The Premium plan covers up to $2,000 and the Preferred plan covers up to $1,500.

Sporting Equipment Delay can reimburse you for the cost of locating your delayed Sporting Equipment and having it returned to you, and the cost of renting equipment in the meantime, up to the coverage limit.

The fine print says: "We will not pay for damage to or loss of boats, motors, motorcycles, motor vehicles, aircraft, and other conveyances or equipment, or parts for such conveyances." See Plan Documents for more details.

How can travel insurance help in case of weather delays on my trip?

Bad weather is always a risk when traveling during the winter. If a winter storm hits, flight cancellations and delays are bound to happen and you may take on some unplanned costs. If this happens, the Trip Interruption coverage included with travel insurance can cover for additional expenses to help get you to your destination and onto the slopes or back home, in addition to reimbursing you for lost trip costs. Travel Delay coverage is also included for certain out-of-pocket costs, such as meals, local transportation or even additional lodging or parking charges.

If a weather event, like a blizzard is foreseeable prior to you purchasing the insurance plan, then travel insurance may not cover it. If the plan is purchased after a storm is named, coverage is not provided for losses resulting from that named storm.

Read more about how travel insurance can help when you travel during the winter

What Can Wreck a Ski Trip and How Travel Insurance Can Help

Problems happen with travel plans more often than you might think. One in six U.S. adults reported having to cancel, interrupt or delay their trip.¹ Travel insurance can help protect your vacation investment from certain unforeseen events that could upset your travel plans and cost you.

Find the Plan That Fits Your Trip Best

There’s no better way to understand how travel insurance and assistance can help protect you and your trip than reading real life examples from fellow travelers.

How can travel insurance help me if I get sick or injured?

If you become critically sick or injured during your trip and no suitable local care is available, all of our plans provide coverage for emergency medical evacuation and coverage to reimburse your medical and dental costs. In addition, Trip Interruption coverage can reimburse you for lost trip costs while you're in hospital, including prepaid lift tickets.

This can be extremely helpful if, for example, you have a ski accident on the slopes — it could even require medical transportation by helicopter, which could cost a lot.

Our plans also include 24-hour emergency assistance services that can provide immediate assistance if a traveler becomes seriously ill or injured on their trip.

Could I be covered if I cancel my trip because of work obligations or job loss?

If you lose your job and cancel your trip as a result, you could be reimbursed for your prepaid, nonrefundable, trip costs. Some requirements must be met.

Our plans don't include Trip Cancellation coverage for work obligations that cause you to cancel your trip, except in the case of unexpected active military duty due to a natural disaster or military leave being revoked. If you want travel insurance that can cover for this reason, consider purchasing our Premium plan and adding Trip Cancellation for Any Reason coverage . This coverage reimburses you up to 60% of the penalty amount when you cancel your trip for any reason ( requirements apply ).

- U.S. Consumer Product Safety Commission

- SITA Baggage Report 2018

*Terms and conditions apply. See plan details for more details .

If you're brave enough to take on a black diamond, or maybe vacationing with kids just starting out on the bunny slope, chances are you could use ski insurance. Travel insurance for your ski trip can cover injuries on the slopes and during your vacation and is designed to help with winter travel mishaps like flight delays, cancellations, illness and more.*

What winter sports are covered?

Our travel insurance plans can cover winter sports on your trip, such as skiing, snowboarding, snow tubing/rafting, cross country skiing on marked trails, snow shoeing, sledding, ice skating and more.

You can also choose a plan designed to cover your sporting equipment if it gets damaged, lost, stolen or delayed. Just be sure that the purpose of your trip is not to participate in any organized amateur sports, professional athletic competitions or sporting events, as those are not covered by our plans.*

This website will be unavailable due to scheduled maintenance on Saturday, May 14, 2022 from 8:00am-11:59pm.

We are currently experiencing unusually high call volume. For faster service, please email us at [email protected] .

1-800-937-1387

Monday - Friday | 9am - 7pm Eastern

Trip Cancellation Plans

- Road Trip Insure

- Travel Insurance Select ®

- Trip Care Complete

Global Medical Plans

- InterMedical Insurance ®

- Study USA-HealthCare TM

- Visit USA-HealthCare ®

- Voyager Annual Insurance

- WorldMed Insurance ®

- Worldwide Group Protector ®

Products By Need

- Annual Travel Insurance

- Cancel for Any Reason

- Cruise & Tour Insurance

- Custom Group Plans

- International Medical Insurance

- Medical Evacuation Insurance

- RV Travelers

- Student Health Insurance

- Visitors to the United States

- Business Travelers/Employers

- People With Medicare

- People Traveling Outside Their Home Country

- U.S. Visitors & Immigrants

- U.S. Citizens & Residents who Need Study & Travel Insurance

- Claim Forms

- Compare Plans (chart)

- COVID-19 Info

- Real Customer Stories

- Insurance Agents

- Tour Operators

- Travel Advisors

- Groups & Organizations

- Travel Insurance Services

- Ski Travel Insurance

Do you have adequate travel insurance for your ski trip?

Would skiing and snowboarding be as much fun without the element of danger involved? Even if you've been lucky enough to avoid an accident on the slopes so far, you've probably seen ski patrol teams providing emergency care to others. In case you are injured on the slopes, ski travel insurance can help you with these benefits:

- Medical Expense benefits cover medical care on the slopes and at a medical facility in the countries you visit.

- Emergency Medical Evacuation benefits provide medical transportation to get you off the mountain and to a medical facility or back home.

- Multilingual Emergency Assistance Services helps coordinate your emergency medical care and keeps your medical staff in touch with your family back home.

Trip Cancellation benefits can help if you need to cancel your ski trip after you've paid non-refundable trip payments:

- Reasons for cancellation include you or a family member getting sick or hurt.

- When purchased early, you can get Cancel for Any Reason coverage.

Last, be sure that you have adequate life insurance or accidental death coverage to address the risk of a fatal injury.

Some travel insurance plans in the marketplace exclude coverage for skiing and snowboarding; others require that you purchase an optional "hazardous sports" benefit to include winter sports coverage, so read the fine print.

The following plans offer ski travel insurance benefits:

Individual Travel and Study Plans

Looking for more guidance.

Questions? Concerns?

We're here for you.

Email: [email protected]

Products By Name

- Trip Care Complete ®

- Baggage Insurance

- Travel Health Insurance

- Trip Cancellation Insurance

- Long Stay Travel Insurance

- Repatriation

- People Traveling Outside Home Country

- U.S. Visitors & Immigrants Need of Travel Insurance

- U.S. Citizens & Residents in Need of Study & Travel Insurance

Partner Resources

- Brokers/Producers

Privacy · Compensation Disclosure

- Study USA HealthCare TM

- Visit USA HealthCare TM

- Lost Baggage Coverage

- RV Travel Insurance

- Travel Medical Insurance

- Compensation Disclosure

- What is Travel Insurance?

- Choice Plan

- Pandemic Plus Plan

- Trip Cancellation Plan

- Cruise Plan

- Annual/Multi-Trip Preferred Plan

- Annual/Multi-Trip Primary Plan

- File a Claim

- Assistance & Services

- Alerts & Advisories

- Schengen Visa

- Travel Tips

- Partner Insurance Solutions

- (800) 774-3959

- Why Do You Need Annual Ski Travel Insurance When Hitting the Slopes?

Are you an avid skier who loves to hit the slopes every winter? Whether it’s a weekend trip or a week-long getaway, you should consider investing in annual ski travel insurance.

What is Annual Ski Travel Insurance?

Annual travel insurance for skiing is a policy that offers coverage for any unforeseen circumstances related to your ski and snowboarding trips. In addition, it provides financial protection in case of medical emergencies or other unexpected events that arise while on a ski vacation.

This type of insurance is designed specifically for skiers and snowboarders. It differs from a standard travel insurance policy that usually covers general trips, such as sightseeing excursions or beach holidays.

Travel insurance for skiing takes into account all the essential aspects associated with winter sports activities, such as:

- Cover for medical expenses

- Lost luggage

- Repatriation costs

Of course, no one plans to get injured or have their equipment getting damaged during transport by the airline is covered. That’s why it’s so important to have adequate travel insurance for skiing before you head off for your winter vacation.

Benefits of Annual Ski Travel Insurance

Having an annual ski travel insurance policy offers several benefits. Here are some of the most important ones:

Financial Protection

The main benefit of travel insurance for skiing is financial protection in case of unforeseen circumstances that may arise on a ski trip. This coverage includes medical expenses, lost luggage, repatriation costs, etc.

Peace of Mind

Skiing can be hazardous, so you must protect yourself financially in case of an accident. With ski travel insurance, you will have the assurance that your finances are covered if something unforeseen happens while on this journey – from a collision to damaged equipment.

Convenience

With an annual policy, you don’t need to worry about taking out a new policy every time you go skiing. Instead, you’ll have the same policy year after year, so you enjoy your vacation without worrying about sorting out insurance.

Consequently, annual ski travel insurance is necessary for any winter traveler. By taking the time to find the right policy, you can ensure you’re fully covered. Aegis Insurance offers ski travel insurance policies to suit the needs of any skier or snowboarder. You can get comprehensive coverage for all your winter trips and save money with our multi-trip annual rates.

How to Choose the Right Annual Ski Travel Insurance Policy

When choosing an annual ski travel insurance policy, it’s essential to look at the coverage types and limits offered. The right policy should cover medical expenses, lost luggage, repatriation, and travel delays.

Check what’s covered and what’s excluded from your chosen policy. Furthermore, you should also consider any deductibles and premiums associated with the policy, as these can impact your overall costs.

Finally, understand any exclusions that may apply to your chosen ski travel insurance policy. For example, Aegis’s policies will exclude the following:

- Snow skiing and snowboarding outside marked trails

- Heli-skiing

- Heli-snowboarding

- Heli-snowmobiling

- Backcountry skiing

- Backcountry snowboarding

- Backcountry snowmobiling

Following these simple tips and comparing different policies, you can find an annual ski travel insurance policy that fits your needs and budget.

More Travel Insurance Blog Posts for You

- Business Travel Insurance

- Family Travel Insurance Guide [with FAQ]

- International Travel Insurance Protection

- How Does Insurance Help When You Need Travel Medical Assistance?

- Is Trip Insurance Worth It? The Real Cost of Travel Mishaps

- Reasons to Buy Trip Interruption Insurance

- Travel to Cuba

- Backpacker Travel Insurance: Why You Need It and How to Choose the Right Plan

- Travel Insurance Pregnancy Coverage

- Protect Your Spontaneous Trips: Last Minute Travel Insurance Tips

- Affordable Student Travel Insurance

Aegis General Annual Ski Travel Insurance

At Aegis, our annual travel insurance provides comprehensive coverage for skiers and snowboarders who frequently travel to ski resorts. Our plans offer a range of features such as medical expenses, lost luggage, repatriation costs, and more.

You can save money with our multi-trip annual rates. Check out Aegis’s annual multi-trip preferred plan is ideal for those looking to protect their vacation investment in case of cancellation or travel delays. Aegis’s annual primary multi-trip plan is perfect for those seeking Primary Emergency Medical insurance. Ensure you’re adequately protected before hitting the slopes!

Annual Ski Travel Insurance FAQ

Is annual ski travel insurance worth it.

Absolutely. It provides financial protection in case of unforeseen circumstances that may arise while on the slopes. When traveling with skis, you’ll also be covered financially in case of an accident or damage to your equipment.

What does ski travel insurance cover?

Travel insurance for skiing typically covers medical expenses, repatriation costs, lost luggage, and some expenses arising from travel delays, such as accommodations & meals.

What is the difference between ski insurance and snowboarding insurance?

The difference is some policies may provide additional coverage for skiing activities, whereas others will offer more coverage for snowboarding activities.

Does annual ski travel insurance cover off-piste skiing?

It depends, some policies may provide coverage for off-piste skiing , but this should be clarified before taking out a policy.

Is medical evacuation covered under annual ski travel insurance?

Yes, most policies will provide coverage for medical evacuation costs. However, checking the limits and exclusions before taking out a policy is essential, as some may have lower limits than others.

Get an instant quote!

Stress less benefits included with every plan.

This amazing feature allows our clients to potentially avoid fronting their own monies and going through a claim reimbursement process. By contacting Aegis immediately when experiencing any covered event such as a flight disruption, illness, or injury, our team can coordinate the solution and pay for it on the spot. This includes booking or rearranging flights and hotels, coordinating medical care, or arranging a medical evacuation or repatriation. Learn More →

Aegis General Insurance Agency Inc. Travel Insurance Division CA License No. 0I66850 National Producer No. 957388

- Get a Quote

- Terms & Conditions

- Privacy and Cookie Policy

A winter break is a lovely experience, but every sporting holiday comes with risks. Make sure you're covered for an injury or the loss or damage of expensive equipment.

Ski travel insurance

What is ski insurance.

Not every travel insurance policy covers winter sports , and as holidays to ski resorts are rarely cheap it's best to make sure you're covered for the unexpected, so the costs don't keep adding up. As there's a high risk of injury or equipment damage, it's best to be as prepared as you can be.

Ski holiday insurance will cover your own injuries as well as others you may harm on the piste. You'll also be covered for skiing expenses if an injury early in your winter getaway keeps you off the slopes.

Ski travel insurance is very specific and covers everything that might occur during a trip to the mountains.

AXA Ski Travel Insurance

Please visit our dedicated travel insurance store by clicking the button below.

How to choose the best ski travel insurance?

Whether you're an expert or a novice, a regular or a first-time skier, make sure you're covered, even if you think such speciality insurance is just an added expenditure. In many instances you won't need to call on your ski travel insurance , but the day you will need it – you will really need it, and you'll be really happy to have it.

What should you look for when comparing ski travel insurance?

- Off piste: if you're planning to avoid the crowds and ski off piste, make sure all your ski travel requirements are covered.

- Travelling abroad: if you're planning trip abroad, make sure you're covered where you are heading. Not all insurance companies provide emergency medical assistance for skiing overseas.

- Bad weather conditions: as weather in the mountains can change rapidly, make sure you’re covered if conditions ruin your plans. Some travel insurance companies will reimburse you for expenses, such as transport, pre-purchased ski passes, and accommodation.

- Cancellation policies: make sure you're covered if you have to cancel your ski trip due to unforeseen circumstances. You might be reimbursed for all or part of your travel expenses.

Why should you choose AXA ski travel insurance?

With AXA ski travel insurance , you will be covered for search and rescue costs , which could be an absolute necessity if a worst-case-scenario becomes a real-life drama. You may also benefit from domestic help at home after medical repatriation. And, if you accidentally break or damage your gear, you’re covered.

Disclaimer : This article provides a broad summary of benefits and is intended solely for informational purposes. To learn about the specific coverage, exclusions, and benefits included in your personal travel insurance policy, please refer to your individual certificate of insurance or local IPID document. If you have any questions or concerns, we recommend reaching out to one of our local travel insurance store for further assistance. Prices, cover types & guarantees at the moment of publication may vary depending on your country. Local Terms & Conditions apply. Please download T&Cs from your local store for more information.

Ski Travel Insurance

Protect yourself, and your plans

Travel Insurance

Discover the right Travel Insurance Covers for you

Why Insure with us?

AXA, 1st insurance brand in the world

AXA is rated 4.5/5 by users

Certified global medical network

Ski Travel Insurance Beginners Guide

While you might pride yourself in being an expert-level skier, accidents don't care about the amount of experience you have on the slopes. No matter how long you've been skiing, there is always a chance of getting hurt, damaging your equipment, or losing money on prepaid tickets.

If you are planning a ski trip, you may consider paying for ski travel insurance. It has features similar to other travel insurance plans, but covers costs that are unique to a ski vacation. Buying ski travel insurance could save you a lot of money if there are any unforeseen problems on your trip.

We are reader supported. We may collect a share of sales from the links on this page. As an Amazon Associate, we earn from qualifying purchases.

What is Ski Travel Insurance?

Ski travel insurance covers snow sports like skiing and snowboarding in case of an accident or mishap. Unlike regular travel insurance, ski insurance covers your ski gear in the case that it gets lost or stolen. It can also include travel-related problems like delayed or canceled flights or lost luggage. Most importantly, ski travel insurance covers your health in case of an injury caused by a skiing accident or travel-related illness.

Why Do You Want It?

It is reported that around 600,000 people are injured in ski or snowboard activities in the US each year. You don't have to be taking black diamonds and skiing off cliffs to get hurt. In fact, the most common accident is a 37-year-old male skier that runs into a tree or another skier on a groomed slope.

Even though many of these are minor, any amount of medical attention will cost money. While your health insurance should cover you if you get into an accident within your own country, that won't always help you if you are skiing abroad.

Most of the time, you will only get compensated for medical emergencies abroad if you pay a little extra for travel insurance. Often this includes emergency flights back into your country of origin so you can get treated closer to home.

Ski travel insurance goes a step further than the average travel insurance by covering ski-related mishaps as well as covering other winter sports. By being insured when you ski abroad, you can have the peace of mind that if anything goes wrong with your trip, you could be compensated.

What Does Ski Travel Insurance Cover?

Generally, all of your equipment is covered by ski insurance. That includes your skis, poles, boots, bindings, and helmet. Even if you are planning on renting ski gear at the resort, it is usually covered as well, so you won't have to pay any hefty damage or replacement fees in case of an accident.

Your equipment is also covered if it is stolen or lost as long as the theft is reported to the police.

Most resorts won't refund tickets once you pay for them. If you buy them at the counter five minutes before you get on the lift, it's not likely you'll even want to refund them. However, many resorts offer discounts if you buy several days' worth of lift tickets at once. The problem with buying the tickets days in advance is that while you are saving money, you are also taking the chance that you won't get a refund if for some reason you can't ski.

For example, if you get sick or injured after day one of skiing, you might have to eat your tickets for days two and three. Or if you bought your tickets online and your flight gets canceled or delayed so that you miss your first day of skiing, generally you lose the money you spent on those tickets.

Pro Tip: To find cheap flights to ski resorts, we use Skyscanner , which searches all airlines in one go.

If you buy ski travel insurance, it will most likely cover the price of your tickets in the event that an unforeseen emergency prevents you from skiing one or all days. So you can go ahead and buy those discounted tickets ahead of time or pay for the three-day ski pass without the worry of something happening that prevents you from skiing.

Another instance in which ski insurance will cover your ski pass is if it is lost or stolen. Once you buy your ski pass, it is your responsibility to keep it safe. Most resorts will tell you upfront that they are not responsible for lost or stolen ski tickets. Thankfully companies that provide ski travel insurance will pay you back for the remaining value of your ski pass so you won't have to pay for a second ticket.

Back Country Skiing Protection

If you like to venture off the groomed trails and explore the slopes less skied, you won't have to worry about ski insurance not covering you as long as the area is not deemed unsafe by the ski resort. That means you will be covered for injury and gear damage where you most need the protection.

Package Deals

In the long run, it will save you a lot of money to buy a package deal and pay for ski-school, ski rentals, and a lift ticket all at once. Unfortunately, that means losing a lot of money all at once as well if you are sick or injured.

Thankfully, ski travel insurance covers package deals and will pay for anything that cannot be refunded.

Other Winter Sports

Many insurance companies put ski travel insurance into the same category as winter sports travel insurance. So while you're mainly paying for protection while skiing on your vacation, you can try out other fun winter sports while you're there without the worry of not being protected by your insurance. Other winter sports covered by many insurance companies include:

- Cross country skiing

- Snowboarding

- Off-piste skiing/snowboarding

- Freestyle skiing

- Heli-skiing

- Mono skiing

- Recreational ski racing

- Ski acrobatics

- Ski bob racing

- Ski stunting

- Ski touring

- Bobsleighing

- Glacier walking

- Supervise ice climbing

- Ice fishing

- Ice Skating

- Snowmobiling

- Tobogganing

Before you head out into the snow, make sure you fully understand your policy as coverage varies between insurance companies.

What Does It Not Cover?

Knowing ahead of time what your ski insurance won't cover is just as important to understand as what it will cover. If a scenario could have been easily avoided, ski travel insurance typically won't cover it.

For example, if you decide not to lock up your backpack and extra gear in a locker and leave it vulnerable to the public, your insurance company probably won't cover the costs of anything that was stolen.

Also, if anything is stolen despite your best efforts to keep it safe, you must report it to the police within 24 hours. Failing to do so could mean your belongings are not covered.

The same goes for if you take unnecessary risks while skiing. If you choose to go past blocked off areas of the ski resort considered dangerous and prohibited and you get hurt, again, your insurance will not cover those medical costs.

Being under the influence of drugs or alcohol while skiing is also an unnecessary and dangerous risk that could cause your insurance company to deny your claim.

Again, do your research to understand how you are covered on a ski trip by your insurance. Then make sure you are doing everything in your power to prevent having to make a claim, especially if your policy does not cover that claim.

Cost of Ski Travel Insurance

The price of ski travel insurance is different for everyone, and it will depend on a variety of factors that your final cost ends up being. The following circumstances will affect how much you pay into ski travel insurance:

Ski travel insurance and other travel insurance policies have this in common. The older you are, the more you will have to pay to be covered. Yes, it isn't fair, but insurance companies deem you more of a liability the older you are. The risk of falling and getting hurt increases with age, as does the chance that you have a pre-existing medical condition.

Your Health

If you have any pre-existing medical conditions or previous injuries that could easily be reinjured, make sure your insurance company knows before you pay for the policy. You might have to pay more upfront for insurance when you disclose this information. In the long run, however, it could protect you if you need to make a claim later. Not being upfront about pre-existing conditions might mean that they are more likely to deny your request.

The Country to Which You Are Traveling

The cost of healthcare is not international. It changes from country to country. Therefore, if you are traveling to the United States or Canada, travel insurance will be more expensive because healthcare in these countries generally costs more. On the other hand, traveling to certain European or South American countries for skiing will cost you much less in travel ski insurance. Again, that is because those countries have much more affordable healthcare, to begin with.

The Size of Your Family

Bundling insurance with other members of your family could save you quite a bit per person. The more people you have under a specific policy, the bigger discounts you will get in many cases. If you travel on your own, you can count on paying a bit more.

Length of Policy

Ski travel insurance allows you to pay only during your ski holiday, and the payment and coverage end when you return home. This route is your best option if you are only planning on taking one ski trip in the year.

In other cases, some families take multiple trips per year. For them, it would be cheaper to choose an annual plan.

Because there are so many variables that go into the price of travel insurance, we will give just a couple of examples so you can estimate how much you are going to pay for ski travel insurance.

On average, you can expect to pay between $40 and $70 to be covered for one week. For a family of four, the price ranges from $165 to $350 for a week.

It may be more economical for your family to pay for annual ski travel insurance if you plan on taking several ski trips over the course of the year.

Other Coverage You Might Need

Having basic health insurance is always a good idea, especially if you are spending time skiing or doing other winter sports. That way, even if you are skiing locally, you will be covered by medical insurance in case of any accidents. Don't think that you only need to be protected abroad. You can just as easily get injured skiing in your back yard. Make sure you're protected.

You might also want to consider getting a regular traveler's insurance if you are skiing abroad. Not all skiing travel policies cover things like hotel stays because of canceled or late flights, or loss of luggage. Traveler's insurance will also cover you if you get sick or injured outside the ski resort and need medical attention.

Best Rated Ski Travel Insurance Companies

It is hard to know where to begin when you shop for ski travel insurance. These highly rated companies are an excellent place to start. They will offer you free quotes after you answer a few simple questions about your health, age, and ski trip plans.

- Travel Guard

- Allianz Travel

- Generali Global Assistance

- World Nomads

- Square Mouth

Is It Really Worth It?

Ski travel insurance is only worth it if you pay for the right policy. Don't take the first policy you can afford. Instead, take time to research all the ins and outs of your policy. All insurance companies offer varying plans, so make sure you're covered for things like trip cancellations, medical emergencies, equipment that is lost, stolen, or damaged, and prepaid non-refundable ski passes.

Ski vacations should be remembered for the fun you had on the slopes deep within nature. Don't let an accident or unforeseen problem add stress and cost to your trip. By paying ahead of time for ski travel insurance, you can ski free from worry and stress.

Hello, I'm Simon & I love skiing. I started skiing in 2007 and I founded this website to help new skiers learn everything there is to know about skiing. NewToSki.com has grown to be a trusted resource for over a million skiers to plan their ski trips each year and learn more about every aspect of skiing. Be sure to join my email list for the best tips and handpicked deals each week.

About The Founder

Hello, I'm Simon & I love skiing. I started skiing in 2007 and I founded this website to help new skiers learn everything there is to know about skiing.

NewToSki.com has grown to be a trusted resource for over a million skiers to plan their ski trips each year and learn more about every aspect of skiing.

Be sure to join thousands of clever skiers who read my emails for the best tips and handpicked deals each week.

Featured In

Subscribe & follow.

Annual Multi Trip Ski Insurance

Keen on skiing or snowboarding? Want to find an annual travel insurance policy that will cover you for skiing and winter sports for more than just a week?

It's not the most glamorous part of the holiday, multi-trip ski insurance allows you to go skiing or snowboarding on multiple breaks with a limit of up to 90 days per year. That means a lot of weekends and a few weeks thrown in!

Finding the right annual multi-trip ski travel insurance policy will be important as different inclusions and exclusions will apply depending on the insurer. From a family quote through to an individual policy that covers you worldwide including North America, this travel insurance could save you thousands if you do have an injury.

Quick Quote for Multiple Trip :

Multi Trip Ski Insurance Policies

Choose from the following most popular types of multi-trip policy.

European Annual Ski Cover

Covering you for multiple journies to the slopes in Europe - perfect!

Annual Family Ski Insurance

Covering the whole family, this annual multi trip policy is worth comparing

Worldwide Annual Multi Trip

Wherever you go in the world, get an annual policy that covers you

Worldwide Annual Multi Trip with USA

So anywhere now and you're covered. Check the small print but compare policies now.

Things To Consider

Tips on choosing the right multi-trip cover.

If you think it likely you'll take a number of ski trips over a 12 month period, then not only are we envious, but you may also want to look at an annual policy rather than taking out lots of single trip policies. Here we explore what an annual policy involves and what to look for when purchasing one.

Why Have Insurance At All?

It is staggering to learn that many Brits go skiing without taking out special winter sports cover. Many simply rely on their EHIC card and normal travel insurance.

EHIC is the European Health Insurance Card. It used to be called the E111 and is a reciprocal health agreement between European countries including Switzerland. This gives you access to state provided healthcare during a temporary stay in another European economic area. You can apply for EHIC through the EHIC online application form, this is free of charge, so do beware as unofficial websites will try and charge you.

You cannot however rely solely on this for a ski holiday. The reason for this is that EHIC will not cover many of the things you may need should you have an accident on the slopes. So for example mountain rescue is not covered, nor is being flown back to the UK. Lost or stolen property is also not included. So for anyone skiing, EHIC alone may not cover you.

A normal travel insurance policy will also not cover you for a ski holiday. If you are unlucky enough to hurt yourself then those injuries can be quite serious. You may break a bone and need to be airlifted off the slopes which can run into thousands of pounds. Or you could cause a serious accident to another skier or boarder and be liable for their costs. Skiing and boarding are dangerous sports which can cause life threatening injuries, so always make sure you take out specialist ski insurance.

Another consideration is your equipment. The equipment you use for skiing and boarding is expensive. If someone steals your board or skis then that could set you back thousands of pounds. This may not be covered under most general travel insurance policies.

What Is Annual Multi Trip Ski Insurance?

With an annual trip ski policy you are covered for a number of ski trips within a 12 month period. This is a good idea if you are either a single person or a couple and you are looking to take more than three ski holidays over a year. An annual policy can work out more expensive than other insurance policies so it is essential that you can predict the ski holidays you will be taking to make it cost effective.

What Does An Annual Policy Cover?

When you look for quotes you will see a range of things covered including injury and illness, holiday cancellation, public liability, repatriation and loss of equipment. Another aspect that many people find useful is also to find a company that offers a 24 hour manned emergency phone line. If you are away and need to speak to an adviser this can be very helpful.

What To Look For When Buying Annual Trip Cover?

It is always good to compare different policies, don’t just go for the cheapest policy, do consider the following when you are purchasing an annual policy.

Level of Cover Required

Look for medical cover that is at least £2million , personal liability should be around £1million so you are covered should you be deemed to be responsible for someone else’s accident. Also check out cancellation cover. Also ensure that the value of your equipment is covered should you lose your skis or board.

A final tip is to really check the small print of any policy. What looks cheap may for example come with a high excess making a claim not cost effective. For example some cheaper policies set excess levels at £200, lose your gloves and the policy isn’t really worth it.

Days You Can Travel

Do be clear about the days you will be holidaying for. Most annual policies will limit you to 31 days of consecutive travel per trip. The number of trips per year are often unlimited as long as you return within the number of days specified. So if you are planning to stay for longer this type of insurance may not be suitable.

Pre-Existing Medical Conditions

If you are undergoing tests for a medical condition do also be careful here. You may have results that could not affect you now but could affect a trip taken later in the year. In this case a single trip cover could be a better option.

Be Clear About What You Will Be Doing On Holiday

When you take out ski insurance you will be asked for the activities you will be doling on holiday. Do not presume that off piste is covered, you will need to declare this if you plan to ski off piste. Likewise be clear if there are any other activities that an insurer would deem to be a risk including heli skiing or cat skiing.

Are You Skiing In More Than One Country?

You will need to declare where you are skiing but that resort may border two countries. If this is the case and you think there may be a chance that you will ski over borders do check your insurance policy.

© Copyright Stung Limited 2008-2024

sign up and keep track of your travel insurance events

Get Ski Travel Insurance

Wander More. Worry Less.

If you're brave enough to take on a black diamond, or maybe vacationing with kids just starting out on the bunny slope, chances are you could use ski insurance. Travel insurance for your ski trip can cover injuries on the slopes and during your vacation and is designed to help with winter travel mishaps like flight delays, cancellations, illness and more.*

What winter sports are covered?

Our travel insurance plans can cover winter sports on your trip, such as skiing, snowboarding, snow tubing/rafting, cross country skiing on marked trails, snow shoeing, sledding, ice skating and more. You can also choose a plan designed to cover your sporting equipment if it gets damaged, lost, stolen or delayed. Just be sure that the purpose of your trip is not to participate in any organized amateur sports, professional athletic competitions or sporting events, as those are not covered by our plans.*

What can wreck a ski trip and how travel insurance can help

- Injury & Illness

- Equipment Issues

Winter Travel Chaos Each year winter storms cause cancellations and delays across the country, wrecking travel plans. If you’re forced to cancel or interrupt your trip, how much of that prepaid trip cost could you get back? Travel insurance can help you recoup losses for 20 different covered events that could cause you to cancel your travel plans. Pre-purchased lift tickets can even be covered.

Travel Delays Your flight is delayed for who knows how long in a winter blizzard. You need to decide whether to get a hotel, what necessities you'll need to buy, where to get dinner... Don't worry—Travel Delay coverage is included with every Generali travel insurance plan, so you can be reimbursed for reasonable out-of-pocket expenses, such as hotel accommodations, meals and transportation if you are delayed during your trip.*

Emergency Medical Accidents happen. Even to the most experienced skiers. Our travel insurance plans can help you with a wide range of medical needs while you’re traveling. Whether it’s a case of utilizing our emergency assistance services to see a local doctor for a prescription refill, filing a Medical and Dental claim after a visit to the emergency room because you slipped on ice during your trip, or the rare need to use the Emergency Assistance and Transportation coverage for medical evacuation by air ambulance, we’re there for you 24/7/365.

Flu Season Last winter was one of the most severe flu seasons in recent memory. If your trip is canceled or interrupted for certain medical reasons, trip insurance can help you get reimbursed for non-refundable, pre-paid trip costs that weren't used and additional transportation costs to return home or rejoin your group on the slopes.

Medical Evacuation Get up to $1 Million in Emergency Assistance and Transportation coverage — crucial for the slopes. More than 220,000 people a year are treated for winter sports injuries in the U.S. 1 Medical evacuation from a ski resort or even from the mountain could require a helicopter, which is not cheap.*

Lost, Damaged or Delayed Sporting Equipment Flying with skis, a snowboard or other equipment? Travel insurance is one of the best ways to help protect your gear. Our Preferred and Premium plans include coverages especially helpful if your equipment is damaged, lost, stolen or delayed on your trip. And, you can get reimbursed for your rentals while your equipment is lost. INFO: Airlines worldwide lose or misplace more than 22 million bags a year. The property that was returned took an average of 1.76 days to get back to their owners.² How long could you go without your gear on a ski trip?

Compare Ski Travel Insurance Plans

Frequently asked questions.

If you lose your job and cancel your trip as a result, you could be reimbursed for your prepaid, nonrefundable, trip costs. Some requirements must be met.

Our plans don't include Trip Cancellation coverage for work obligations that cause you to cancel your trip, except in the case of unexpected active military duty due to a natural disaster or military leave being revoked. If you want travel insurance that can cover for this reason, consider purchasing our Premium plan and adding Trip Cancellation for Any Reason coverage . This coverage reimburses you up to 60% of the penalty amount when you cancel your trip for any reason ( requirements apply ).

If you become critically sick or injured during your trip and no suitable local care is available, all of our plans provide coverage for emergency medical evacuation and coverage to reimburse your medical and dental costs. In addition, Trip Interruption coverage can reimburse you for lost trip costs while you're in hospital, including prepaid lift tickets.

This can be extremely helpful if, for example, you have a ski accident on the slopes — it could even require medical transportation by helicopter, which could cost a lot.

Our plans also include 24-hour emergency assistance services that can provide immediate assistance if a traveler becomes seriously ill or injured on their trip.

Our travel insurance plans can cover skiing, snowboarding, snow tubing/rafting, cross country skiing on marked trails, snow shoeing, sledding, ice skating and more.

The Premium and Preferred plans include Sporting Equipment and Sporting Equipment Delay coverages that can cover winter sports equipment you might bring on a trip, except motorized equipment, dental wear and eyewear.

If your sporting equipment is damaged, lost or stolen during your trip, Sporting Equipment coverage can reimburse the costs to repair or replace your sporting equipment. The Premium plan covers up to $2,000 and the Preferred plan covers up to $1,500.

Sporting Equipment Delay can reimburse you for the cost of locating your delayed Sporting Equipment and having it returned to you, and the cost of renting equipment in the meantime, up to the coverage limit.

The fine print says: "We will not pay for damage to or loss of boats, motors, motorcycles, motor vehicles, aircraft, and other conveyances or equipment, or parts for such conveyances." See the DOC/Policy for more details.

Bad weather is always a risk when traveling during the winter. If a winter storm hits, flight cancellations and delays are bound to happen and you may take on some unplanned costs. If this happens, the Trip Interruption coverage included with travel insurance can cover for additional expenses to help get you to your destination and onto the slopes or back home, in addition to reimbursing you for lost trip costs. Travel Delay coverage is also included for certain out-of-pocket costs, such as meals, local transportation or even additional lodging or parking charges.

If a weather event, like a blizzard is foreseeable prior to you purchasing the insurance plan, then travel insurance may not cover it. If the plan is purchased after a storm is named, coverage is not provided for losses resulting from that named storm.

Read more about how travel insurance can help when you travel during the winter

- U.S. Consumer Product Safety Commission

- SITA Baggage Report 2018

*Terms and conditions apply. See plan details for more details .

Thank you for visiting csatravelprotection.com

As part of the worldwide Generali Group we have rebranded our travel protection plans to Generali Global Assistance, offering the same quality travel insurance, emergency assistance and outstanding customer service as you've come to rely on for the last 25 years. Welcome to our new website!

Final step before you're signed up

Please verify that you're human.

We're experiencing high call volumes, and there may be delays to answering any calls.

You can create and manage quotes online , and buy policies at any time.

Our online portal is available 24/7 for all your policy needs. You can: view your documents; change your travel plans (dates and destinations); add travellers; update your medical history; add extra cover, and more.

You can access our portal 24/7, without needing to call us.

- Help and Support

- Travel Insurance

- Ski Insurance

Winter Sports Insurance

Stay stress-free on the slopes with our winter sports cover, up to £500 safety net.

If you’re too ill or injured to use hired gear, lift passes or ski lessons

Protect your equipment

Up to £1k if your winter sports equipment is lost, stolen or damaged

5 Star rated cover

Our Platinum Travel Insurance has Defaqto’s highest rating

What’s winter sports insurance?

Winter sports insurance (or winter sports cover) financially protects you and your equipment if anything goes wrong on your skiing or winter sports holiday.

As well as the cover from your core travel insurance, you’ll also have protection for things like lost or damaged gear, piste closure and costs for hired equipment you’re too ill or injured to use.

If you’re going on a winter sports trip, you need to add this specialist cover when buying your regular travel insurance policy. You won’t be covered without it.

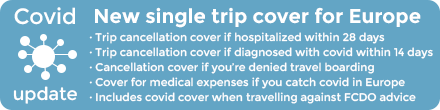

Covid-19 - what our travel insurance covers

Our travel insurance now covers you for certain events related to Coronavirus (COVID-19), provided you have proof of a positive Covid-19 test and your cover is active at the time of the event.

What we cover

We provide cover for some costs related to Covid-19: please see Section 1 'emergency medical costs and repatriation' and Section 2 'cancelling or cutting short your trip' in your policy book for full details on what's covered.

We'll cover you if:

- you were diagnosed with Covid-19 before your trip was due to start

- a close relative died or became seriously ill as a result of Covid-19 before your trip was due to start

- you weren't allowed to board your pre-booked outbound travel due to symptoms of Covid-19

- an insured person or a close relative died during the trip because of Covid-19

- you couldn't take part in an excursion due to you self-isolating after getting Covid-19

What we don’t cover

You won't be covered if:

- you had reason to believe your trip may be cancelled, postponed or cut short when you booked it, purchased your policy or started your trip

- any government or public authority imposes travel restrictions or quarantine on a community, location, or vessel because of Covid-19 (this includes, but is not limited to, local lockdowns, entry requirements, being denied entry and airspace closures)

- you have to quarantine after arriving in the UK or abroad

- the Foreign Commonwealth & Development Office (FCDO) change their advice to avoid ‘all travel’ or ‘all but essential travel’ to your destination because of Covid-19

For more information about how Coronavirus (COVID-19) affects your travel cover, see our FAQ page . And remember to check the policy booklet carefully before you buy to make sure our cover meets your needs.

Do I need ski travel insurance?

Adventure sports and winter sports are often not covered by a standard travel policy, so you may need to get specialist cover – like Admiral's Winter Sports Upgrade.

Not only will you get the standard protection against:

- Lost or stolen luggage

- Medical treatment expenses

- Cancellation cover

You're also covered for:

- Lost, stolen or damaged ski equipment

- Piste closure

- Delays caused by avalanche

If you're only planning on skiing once a year, Admiral's single trip cover with the Winter Sports add-on may suit you.

If you want annual ski travel insurance for more than one break in the season, take a look at our annual cover with the Winter Sports add on. This would cover you for every holiday you take in a year, up to 31 days per trip. However, bear in mind you can only do a maximum of 21 days of winter sports throughout the year in total during the policy term .

What's covered by ski travel insurance?

Whether you’re an experienced skier or a nervous beginner, you can enjoy your trip knowing you don’t have to worry about having the right cover in place.

You can choose from three levels of cover to suit your budget and needs:

Is my equipment protected with travel insurance?

Sports equipment isn't often covered by standard travel insurance policies. If you're insured with Admiral, you just need to add our Winter Sports upgrade to your travel insurance to get protection against damage to your own, or hired, equipment.

You'll be covered up to a maximum of £1,000 for your equipment (depending on the level of cover you choose.)

We also pay up to £25 (per complete 24 hours) towards the cost of hiring replacements (up to a maximum £250 per person), if yours is delayed more than 12 hours following your arrival at your destination or is lost, stolen or damaged during your trip.

Our ski and snowboarding insurance upgrade will help you out if an unforeseen slope closure happens during your break (pistes must closed for more than 24 hours) and protects against delays caused by an avalanche (cover limits apply).

What's classed as a winter sport?

Winter sports insurance gives protection for you to enjoy a whole host of activities on your holiday including:

- Piste skiing

- Snowboarding

- Glacier walking/trekking

- Tobogganing

Please check your policy document for a complete list of all activities we cover.

Travel insurance covering off-piste skiing

Our winter sports insurance add-on covers adventurous off-piste skiers and boarders as long as it’s on recognised paths within resort boundaries and accompanied by a qualified guide or instructor.

Ski insurance - Europe

Any skier and snowboarder will know there are incredible resorts to hit the slopes around the world, but in 2018, Europe was hit with unprecedented amounts of snow and saw many popular resorts opening the lifts early. The glacier pistes of Val-d'Isère opened in June.

So if you want to check out what Europe has to offer – and there's a lot – you'll need to select our European Travel Insurance with the Winter Sports add-on. You'll be covered in all the top resorts such as France's Meribel, Val, La Plagne, and Courchevel, Italy's Cervinia and Zermatt in Switzerland to name a few.

Ski insurance - Canada and America

If the powdery slopes of Canada or America are calling you, you'll need worldwide cover , with the winter add on.

Ski insurance - Japan

Our final cover zone is worldwide excluding USA, Canada & Caribbean, so if Japan is taking your fancy – Niseko is often touted as a powder hound's paradise – this option with winter sports insurance added will get you onto the mountains with the right cover in place.

What happens if my skiing or snowboarding holiday is cancelled?

Depending on the level of cover you choose for your ski or snowboarding insurance – Admiral, Admiral Gold or Admiral Platinum – you could get up to £5,000 to cover the costs of your trip, in the unfortunate event of it being cancelled for any of the following reasons:

- Death, illness, injury or complications of pregnancy or childbirth of you, your travel companion, close relative, close business associate or anyone outside your home area you planned to stay with

- Court cases and quarantine if you or your travel companion, or anyone outside your home area you planned to stay with, is quarantined, called for jury service or as a witness and a court official refuses to postpone

- Unemployment if you or your travelling companion is made redundant from the company you’ve worked at continuously for at least two years

- Armed forces and emergency services if you or your travel companion has authorised leave cancelled due to an unexpected emergency

- Home damage you or your travel companion have to stay at home if it’s seriously damaged by a fire, storm or flood or is burgled within seven days of your departure

- Passport or visa your passport or visa is stolen in a burglary at your home in the seven days before your departure and you’re unable to get a replacement in time

What if I have a pre-existing condition?

A pre-existing condition is a short or long term illness or injury you have or have had before you buy travel insurance. This includes having symptoms, tests, diagnosis or medical treatment for a condition.

You can declare your pre-existing conditions during the quote process to see if we can offer cover. If you’re unsure what needs to be declared or if you're unable to find your condition on the medical conditions list, please contact us on 0333 234 9913.

Your pre-existing conditions won’t be covered unless you’ve:

- Declared them all on your policy

- Received written confirmation that we’ll cover your medical condition

- Paid any additional premium in full

Policy terms and conditions apply. Please note, if you’ve had a positive diagnosis of Covid-19 and been prescribed medication, received treatment, or had a consultation with a doctor or hospital specialist for any medical condition in the past two years, this needs to be declared on your policy.

If you don’t tell us about your pre-existing conditions or give us incorrect information, your policy may be invalid, and we may refuse all or part of any claim you submit.

For a quote with us, click the green button above.

The MoneyHelper directory

If you require cover for more serious medical conditions, MoneyHelper may be able to help you find specialist travel insurance through their medical directory.

If you wish to get in touch with them you can call them on 0800 138 7777 or find them online . (Monday to Friday 8:00-18:00, closed on Saturday, Sunday and bank holidays.)

How do I get a quote?

You can call 0333 234 9913 for an Admiral Travel Insurance quote and ask to add on Winter Sports insurance upgrade, or you can buy online and select 'Winter Sports Upgrade'.

Your questions answered

We're sure you'll love our great products but maybe you have a few questions. You can find answers in this section.

Do you need winter sports insurance for trips to Lapland?

If you plan on taking part in any of the activities listed above, such as husky sledge driving, you will need to add the upgrade onto your Admiral Travel Insurance policy

Are there any age restrictions for ski insurance?

We don’t offer the upgrade to anyone over 75 years old for trips within Europe and over 70 years old for trips outside of Europe.

Am I covered to ski or board off-piste?

You can go off-piste provided you go with a qualified guide or instructor and remain on recognised paths, within resort boundaries

Does winter sports cover me anywhere in the world?

Admiral Travel Insurance covers the UK, Europe and Worldwide - but there are places that we don't cover.

Your travel insurance won't cover you if you visit somewhere the Foreign, Commonwealth and Development Office (FCDO) advises not to. Information from the FCDO can be found at www.gov.uk/foreign-travel-advice or by calling 020 7008 1500 .

What's covered if the piste closes?

We'll pay up to £20 per 24 hours for each day the pistes and ski lifts are closed in your resort due to lack of snow or bad weather (up to a maximum of £200). This can be used to cover travel expenses to the next open resort or to compensate you if there are no slopes nearby.

Are all winter sports covered?

Our Winter Sports Upgrade covers the following activities: cross country skiing, dry slope skiing and snowboarding, glacier walking/trekking, husky sledge driving, ice hockey, mono-skiing, snowmobiles, sledging, snowshoeing and tobogganing. If you want to take part in an activity not on the list please call us on 0333 234 9913 to discuss.

Am I covered if I’m injured on the slopes and not wearing a helmet?

You won't be covered for any head injuries that happen on your winter sports holiday if you weren't wearing a helmet. We always recommend wearing a helmet for winter sports.

Are lift passes covered?

Unused lift passes due to illness or injury are covered but you can't claim for lost or stolen lift passes

Is mountain and helicopter rescue included?

Yes, our add-on covers mountain and helicopter rescue in the event of injury or illness; search and rescue isn't covered.

Do under 18s need ski insurance?

Yes they do, you can add a child onto a parent or guardian's cover. Take a look at our Family Travel Insurance page for more information.

Can seasonaires buy the winter sports upgrade?

While there's no restriction on seasonaires buying our cover, the add-on's limited to 21 days in total so we couldn't cover a seasonaire for the entire season.

What’s the age limit on winter sports cover?

We cover people up to and including 75 years old in Europe, or 70 years old everywhere else.

What does winter sports travel insurance cover?

Our winter sports travel insurance upgrade covers:

- Delay caused by avalanche

- Replacement equipment hire

You’ll also get all the benefits of the standard travel insurance you bought – our winter sports upgrade gives you extra cover for when you’re skiing or snowboarding.

Can I take out a family winter sports insurance policy?

Absolutely – we offer family holiday insurance for families living at the same address. This can be parents, step-parents, grandparents, aunts, uncles, cousins and children under 18.

You can add up to two adults and a maximum of five children to the cover. Simply add on our winter sports upgrade for cover on the slopes.

Do I need travel insurance for skiing in Bulgaria?

Yes you’ll need to add our winter sports upgrade onto our European Travel Insurance for any skiing holidays in Bulgaria.

Do I have Personal accident and Personal liability for my Winter sports trip activities?

We cover personal accident up to the policy limits and personal liability cover up to £3 million, for winter sports activities listed in the winter sports cover section of our policy wording except Snowmobile/Ski-Doos which excludes personal accident and personal liability cover. Please note, this cover cannot be added to the Snowmobile/Ski-Doos activity for an additional premium.

Getting the most out of your trip

Going anywhere nice.

Off to one of the destinations below? Take a look at our guides for some hints and tips on what you need to remember.

Travel insurance that suits you

Whether you're travelling solo, with your family, or with a little one on the way, read our guides to make sure our cover is right for you.

Family Travel Insurance

Student travel insurance, travelling while pregnant, travel insurance over 65, travelling with medical conditions, travel insurance upgrades.