- Best Extended Auto Warranty

- Best Used Car Warranty

- Best Car Warranty Companies

- CarShield Reviews

- Best Auto Loan Rates

- Average Auto Loan Interest Rates

- Best Auto Refinance Rates

- Bad Credit Auto Loans

- Best Auto Shipping Companies

- How To Ship a Car

- Car Shipping Cost Calculator

- Montway Auto Transport Review

- Best Car Buying Apps

- Best Sites To Sell a Car

- CarMax Review

- Carvana Review (June 2024)

- Best LLC Service

- Best Registered Agent Service

- Best Trademark Service

- Best Online Legal Services

- Best Accounting Software

- Best Receipt Scanner Apps

- Best Free Accounting Software

- Best Online Bookkeeping Services

- Best Mileage Tracker Apps

- Best Business Expense Tracker Apps

- Best CRMs for Small Business

- Best CRM Software

- Best CRM for Real Estate

- Best Marketing CRM

- Best CRM for Sales

- Best SEO Services

- Best Mass Texting Services

- Best Email Marketing Software

- Best SEO Software

- Best Free Time Tracking Apps

- Best HR Software

- Best Payroll Services

- Best HR Outsourcing Services

- Best HRIS Software

- Best Project Management Software

- Best Construction Project Management Software

- Best Task Management Software

- Free Project Management Software

- Best Personal Loans

- Best Fast Personal Loans

- Best Debt Consolidation Loans

- Best Personal Loans for Fair Credit

- HOME EQUITY

- Best Home Equity Loan Rates

- Best Home Equity Loans

- Best Checking Accounts

- Best Online Checking Accounts

- Best Online Banks

- Bank Account Bonuses

- Best High-Yield Savings Accounts

- Best Savings Accounts

- Average Savings Account Interest Rate

- Money Market Accounts

- Best CD Rates

- Best 3-Month CD Rates

- Best 6-Month CD Rates

- Best 1-Year CD Rates

- Best 5-Year CD Rates

- Best Hearing Aids

- Best OTC Hearing Aids

- Most Affordable Hearing Aids

- Eargo Hearing Aids Review

- Best Medical Alert Systems

- Best Medical Alert Watches

- Best Medical Alert Necklaces

- Are Medical Alert Systems Covered by Insurance?

- Best Online Therapy

- Best Online Therapy Platforms That Take Insurance

- Best Online Psychiatrist Platforms

- BetterHelp Review

- Best Mattress

- Best Mattress for Side Sleepers

- Best Mattress for Back Pain

- Best Adjustable Beds

- Best Home Warranty Companies

- Best Home Appliance Insurance

- American Home Shield Review

- Liberty Home Guard Review

- Best Moving Companies

- Best Interstate Moving Companies

- Best Long-Distance Moving Companies

- Cheap Moving Companies

- Best Window Brands

- Best Window Replacement Companies

- Cheap Window Replacement

- Best Gutter Guards

- Gutter Installation Costs

- Best Solar Companies

- Best Solar Panels

- How Much Do Solar Panels Cost?

- Solar Calculator

- Best Car Insurance Companies

- Cheapest Car Insurance Companies

- Best Car Insurance for New Drivers

- Cheap Same Day Car Insurance

- Best Pet Insurance

- Cheapest Pet Insurance

- Pet Insurance Cost

- Pet Insurance in Texas

- Pet Wellness Plans

- Best Life Insurance

- Best Term Life Insurance

- Best Whole Life Insurance

- Term vs. Whole Life Insurance

- Best Travel Insurance Companies

- Best Homeowners Insurance Companies

- Best Renters Insurance Companies

- Best Motorcycle Insurance

- Cheapest Homeowners Insurance

- Cheapest Renters Insurance

Partner content: This content was created by a business partner of Dow Jones, independent of the MarketWatch newsroom. Links in this article may result in us earning a commission. Learn More

The Best Backpacker Travel Insurance (2024)

Explore our top picks for travel insurance for backpacking trips and compare options to find the right coverage below.

with our partner, Travelinsurance.com

Alex Carver is a writer and researcher based in Charlotte, N.C. A contributor to major news websites such as Automoblog and USA Today, she’s written content in sectors such as insurance, warranties, shipping, real estate and more.

Tori Addison is an editor who has worked in the digital marketing industry for over five years. Her experience includes communications and marketing work in the nonprofit, governmental and academic sectors. A journalist by trade, she started her career covering politics and news in New York’s Hudson Valley. Her work included coverage of local and state budgets, federal financial regulations and health care legislation.

The best travel insurance for backpacking trips is Travelex due to its affordable coverage for mult-destination trips. Travelex offers three plan options and a Travel America plan for backpackers making their way across the states.

From beachfront hostels in Thailand to campgrounds in Europe, a backpacker insurance policy can help you enjoy your adventure with peace of mind. Whether you’re traveling as a digital nomad or launching into adventure sports like trekking or scuba diving, travel insurance can cover the cost of unforeseen events or accidents during short or long-term backpacking trips.

Key Features To Look For in Backpacker Travel Insurance

Backpacker travel insurance is subject to your individual needs. According to the U.S. Department of State, the government does not cover medical bills overseas. Therefore, the agency recommends travel medical emergency insurance, especially if you’re participating in adventure activities. However, not all travel insurance companies cover adventure sports.

Trip interruption insurance can help you prepare for potential cancellations and flight delays, offering reimbursement of prepaid costs if interruptions occur for a covered reason. Emergency evacuation coverage is important in the event of natural disasters or civil unrest, especially if you plan on adventuring in rural areas. Ensuring your policy offers baggage and personal effects coverage also offers a financial safety net for lost or stolen belongings, including sporting gear.

While you may be able to find basic travel insurance with these features, the benefit limits may vary. It’s also important to note that not all policies cover adventure sports gear or medical expenses. Make sure to look for a plan with this coverage if you plan on adding sporting events to your backpacking trip.

Top 5 Travel Insurance Providers for Backpackers

Here is our list of travel insurance plans and providers to suit backpackers:

- Travelex Insurance: Our top pick

- AIG Travel Guard : Our pick for families

- IMG Travel Insurance : Our pick for medical coverage

- Allianz Global Assistance: Our pick for concierge services

- World Nomads: Our pick for adventure travelers

Compare Backpacking Travel Insurance Companies

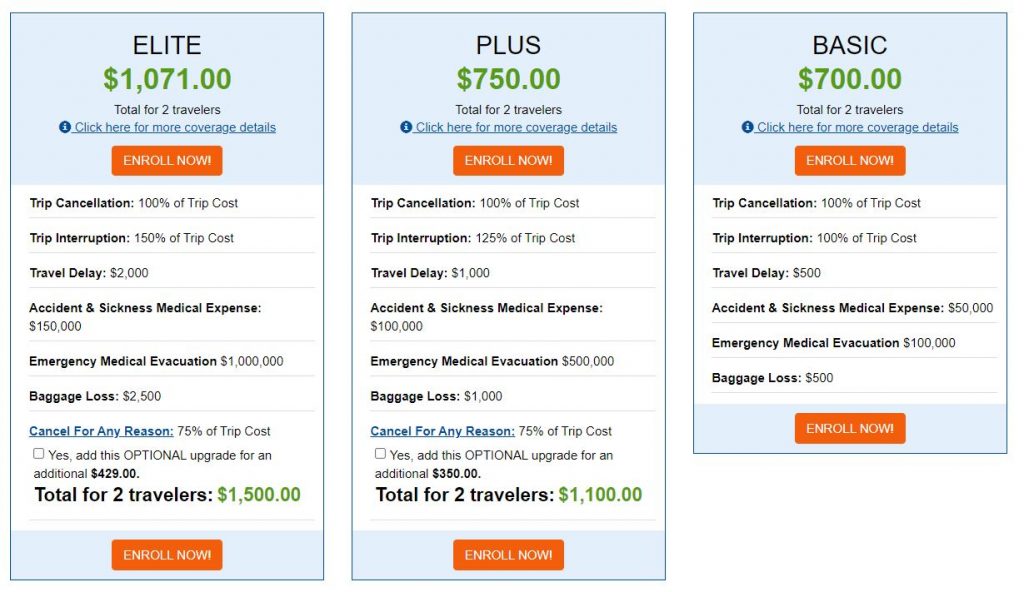

We requested online quotes for our top travel insurance providers so you can see how much coverage costs . The chart below includes estimates for a 25-year-old backpacker from New York taking a three-week trip to Mexico, with a total trip cost of $2,500. Quotes are for basic plans with travel medical insurance, trip cancellation coverage and more. We also included unique coverage options, including cancel for any reason or CFAR coverage.

Why Trust MarketWatch Guides

Our editorial team follows a comprehensive methodology for rating and reviewing travel insurance companies. Advertisers have no effect on our rankings.

Companies Reviewed

Quotes Collected

Rating Factors

Best Backpacker Insurance in Detail

You can choose from three plans with Travelex Insurance: Travel Basic, Travel Select and Travel America. Travel Basic is a budget-friendly option for backpackers with sufficient coverage. Five optional upgrades are available with the more comprehensive Travel Select Plan, with a $50,000 limit for emergency medical costs.

If you are planning to backpack around the U.S., the Travel America plan provides emergency medical expenses and reimbursement for canceled events, such as ski resort closures.

Pros & Cons

Coverage & cost.

Add-On Options

Travelex offers a variety of add-on options, depending on the plan you choose. Upgrades include:

- CFAR coverage

- Car rental collision

- Adventure sports coverage

- Additional medical coverage

- Flight accidental death and dismemberment

Based on our quote process, the Travel Basic Plan costs $87 for a 25-year-old traveler on a 20-day trip to Spain worth $3,000.

If you’re looking for a travel insurance policy for backpacking as a family, AIG Travel Guard plans include coverage for one child under age 17 with the rate for a paying adult. The Deluxe Plan offers high-level medical evacuation and healthcare coverage up to $100,000, while

the Preferred Plan features up to $50,000 for travel medical costs.

If you are on a budget during long-term backpacking trips, the Essential Plan covers the basics, with 24/7 emergency assistance and medical care coverage up to $15,000. The Pack N’ Go Plan is available if you plan a trip last minute and don’t need cancellation coverage.

AIG Travel Guard provides a range of add-ons depending on your chosen plan. Some examples include:

- Cancel for any reason (CFAR) coverage

- Rental vehicle damage coverage

- Security evacuations and interruptions bundle

- Adventure sports bundle

- Medical bundle

- Wedding bundle

- Baggage bundle

Based on the quote we requested for a 25-year-old backpacker traveling to Spain for 20 days on a $3,000 trip, the Essential Plan would cost $134.

*AM Best ratings are accurate as of June 2023.

From rafting to skydiving and bungee jumping, extreme sports fans can take advantage of IMG’s iTravelInsured Travel Sport Plan. It includes sports equipment rental reimbursement and natural disaster evacuation coverage.

For long backpacking trips, the most affordable option is the iTravelInsured Travel Lite Plan, which includes benefits for trip cancellation, travel delays and emergency medical assistance. You can also opt for more comprehensive options with the iTravelInsured Travel SE and iTravelInsured Travel LX plans.

IMG offers the following add-ons with the iTravelInsured Travel LX plan:

- Interrupt for any reason (IFAR) coverage (up to 75% of trip costs)

- CFAR coverage (up to 75% of the trip costs)

Based on our quote, the iTravelInsured Travel Lite Plan would cost $83 for a 25-year-old traveler backpacking around Spain for a 20-day trip worth $3,000.

Allianz offers a range of affordable plans for backpackers, including the AllTrips Basic Plan, a multi-trip policy with year-long protection. Or, if you’re primarily looking for health insurance and have a flexible itinerary with minimal prepaid expenses, you can save money with the OneTrip Emergency Medical Plan. It only covers post-departure benefits, including unexpected events after your trip begins.

While Allianz also provides comprehensive insurance policies, budget travelers may prefer the OneTrip Basic plan for affordable, all-around coverage.

Allianz Global provides the following add-on options, which you can add depending on your plan:

- OneTrip Rental Car Protector

- Terrorism Extension cover

- Required to Work cover

Based on our quote, the OneTrip Basic Plan would cost $91 for a 25-year-old backpacker taking a 20-day trip to Spain for $3,000.

Whether you love Alpine skiing or rock climbing, World Nomads is a popular choice for adventurous backpackers. Its two policies, the Standard Plan and Explorer Plan, cover over 200 adventure activities and sports. The main difference between the plans is the Explorer Plan offers higher coverage limits.

World Nomads offers rental car damage coverage with the Explorer Plan.

We pulled quotes for both plans for a 25-year-old backpacker taking a 20-day trip to Spain. You could expect to pay $96 for the Standard Plan and $180 for the Explorer Plan.

Factors To Consider When Choosing Backpacking Insurance

Everyone’s different, so choosing the best insurance for your backpacking trip means considering your personal needs. Ask yourself the following questions as you consider travel insurance policies:

- Does the travel insurance cover all the destinations you want to visit?

- How long is your backpacking trip and if needed, does the policy suit long-term travel?

- Does the policy include sufficient medical coverage for potential health issues or participation in sports?

- Are there adequate coverage limits for baggage, gear and high-value equipment?

- Does the policy sufficiently cover missed activities and flight cancellations ?

- Do you require coverage for a pre-existing conditio n and if so, does the policy include a waiver?

If you are planning a long-term backpacking trip, pay attention to the duration of your travel insurance policy. For example, if you apply for a multi-trip plan with six months versus a year of coverage. And if you plan to trek around the globe, make sure your policy includes your intended destinations.

It also helps to check the coverage you already have before purchasing a policy. For example, your credit card may include rental car coverage or other forms of travel insurance.

What Does Travel Insurance Not Cover?

Most travel insurance plans cover medical emergencies, trip cancellations and delays , and baggage loss or theft. However, most policies don’t cover the following:

- Alcohol and drug-related incidents

- Extreme sports such as cliff diving

- Non-emergency medical treatment

- Flexibility in trip cancelation, such as changing your mind about flights or destinations

- Incidents due to negligence

Some providers may offer add-on coverage for extreme sports, non-emergency medical treatment and cancellation flexibility (CFAR coverage).

Travel Tips for Comparing Backpacker Insurance

Before buying travel insurance, it’s important to shop around, compare prices and read customer reviews. We suggest obtaining online quotes from at least three providers before selecting a policy.

Once you’ve found a few options that suit your coverage needs and budget, read the policy documents to ensure the coverage is right for you. Look for any exclusions or limits that may impact your coverage, such as a lack of adventure sports protection. If you don’t understand something, speak to the provider directly before making your decision.

Is Backpacking Travel Insurance Worth It?

Backpacking is often an adventure of a lifetime, but it is also an investment. Safeguarding your prepaid and nonrefundable costs, along with having financial safety nets for unforeseen medical emergencies, can help you enjoy a stress-free journey.

Ultimately, it is up to you to decide if backpacking travel insurance is worth it . If you’re planning to launch into adventure activities, top providers such as World Nomads, IMG and Travelex offer extra coverage. You can also opt for a basic plan from Allianz or choose AIG Travel Guard if you need coverage for a child. Regardless of your choice, each of our top providers can provide affordable options with sufficient coverage for backpackers.

Frequently Asked Questions About Travel Insurance for Backpacking Trips

Should i purchase travel insurance for a backpacking trip.

While your need for travel insurance is up to you, purchasing a policy can be worth it. Travel insurance for backpacking can cover medical costs in an emergency. Policies can also safeguard you against financial loss by providing reimbursements if your trip is canceled or delayed or your baggage or gear gets stolen. Some providers offer add-ons to cover rental car damage, highly valuable items and more.

What type of insurance do you need for backpacking?

The type of insurance you need depends on your destination, the duration of your trip and the activities you plan to do. At a minimum, backpackers should consider a policy with the following coverage:

- Trip cancellation , interruption and delay

- Emergency medical expenses

- Emergency evacuation and repatriation

- Lost or stolen baggage

Consider policies with adequate add-on coverage, like if you plan on participating in adventure sports or need a rental car.

What is the difference between backpacking insurance and travel insurance?

Backpacking insurance is simply a type of travel insurance with coverage tailored to backpackers. While some providers offer adventure-specific policies, you may find that a standard travel insurance plan suits your backpacking trip. Researching policy options can help you find coverage for your unique needs, including annual multi-trip plans for long-term trips.

Methodology: Our System for Rating Travel Insurance Companies for Backpacking Trips

- A 30-year-old couple taking a $5,000 vacation to Mexico.

- A family of four taking an $8,000 vacation to Mexico.

- A 65-year-old couple taking a $7,000 vacation to the United Kingdom.

- A 30-year-old couple taking a $7,000 trip to the United Kingdom.

- A 19-year-old taking a $2,000 trip to France.

- A 27-year-old couple taking a $1,200 trip to Greece.

- A 51-year-old couple taking a $2,000 trip to Spain.

- Plan availability (10%): We look for insurers with a variety of travel insurance plans and the ability to customize a policy with coverage upgrades.

- Coverage details (29%): We review the baseline coverage each company offers in its cheapest comprehensive plan. A provider with robust coverage earns full points, including baggage delay and loss, COVID-19 coverage, emergency evacuation and medical coverage, trip delay and cancellation coverage, and more. Companies also receive points for offering a variety of policy add-ons like accidental death and dismemberment, extreme sports, valuable items, cancel for any reason coverage and more.

- Coverage times and amounts (34%): We compare each company’s waiting periods and maximum reimbursement amounts for baggage, travel and weather delays. Companies that offer customers reimbursement after fewer than 12 hours of delays earn full points in this category. We also reward travel insurance providers that cover more than 100% of trip costs in the event of cancellations or interruptions.

- Company service and reviews (17%): We look for indicators that a company is well-prepared to respond to customer needs. Companies with an established global resource network, 24/7 emergency hotline, mobile app, multiple ways to file a claim and concierge services score higher in this category. We assess reputation by evaluating consumer reviews, third-party financial strength and customer experience ratings, specifically from AM Best and the Better Business Bureau (BBB).

For more information, read our full travel insurance methodology.

A.M. Best Disclaimer

More Travel Insurance Guides

- Best covid travel insurance companies

- Best cruise insurance plans

- Best travel insurance companies

- Cheapest travel insurance

- Best group travel insurance companies

- Health insurance for visitors to usa

- Best senior travel insurance

- Best travel insurance for families

- Best student travel insurance plans

- Travel insurance for parents visiting USA

- Best travel medical insurance plans

- How much does travel insurance cost?

If you have feedback or questions about this article, please email the MarketWatch Guides team at editors@marketwatchguides. com .

More Resources:

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Best COVID-19 Travel Insurance in June 2024

Natasha is a freelance writer and frequent traveler. She writes about luxury travel, travel hacking and credit card rewards. Her goal is to encourage more people to experience the world around them.

Meghan Coyle started as a web producer and writer at NerdWallet in 2018. She covers travel rewards, including industry news, airline and hotel loyalty programs, and how to travel on points. She is based in Los Angeles.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Factors we considered when picking travel insurance that covers COVID

An overview of the best travel insurance for covid , top travel insurance for covid options , additional resources for covid-19 travel insurance shoppers.

No matter how well you prepare, travel plans don’t always go as expected. Some travelers buy travel insurance to protect their investment in prepaid travel costs. Amid the ongoing pandemic, exploring travel insurance with COVID-19 coverage is recommended. With the right policy, you can protect yourself if you need to cancel your trip or end it early due to illness. Many insurers offer travel insurance policies with this kind of coverage.

This is the shortlist of the best travel insurance for COVID options:

Berkshire Hathaway Travel Protection .

John Hancock Insurance Agency, Inc.

Seven Corners .

Travelex Insurance Services .

Travel Insured International .

WorldTrips .

We used the following factors to choose insurance providers to highlight in our best travel insurance for COVID list:

Range of coverage: We looked at how many plans each company offered with COVID-19 coverage, plus the range of available plans.

Depth of coverage: We compared the maximum caps for trip cancellation and trip interruption claims between carriers and plans.

Medical benefits: We examined whether plans included emergency medical benefits for COVID-19 reasons and whether plans included medical evacuation and repatriation benefits.

Cost: We determined an average cost for shoppers to benchmark plan prices by looking at the basic coverage costs for plans with COVID-19 benefits across multiple companies.

We looked at quotes from various companies for a six-night trip in May 2023 to Croatia. The traveler was 30 years old, from Texas and planned to spend $1,500 on the trip, including airfare.

On average, the price of each company’s most basic coverage plan with COVID-19 coverage was $47.22. The prices listed below are for the most basic COVID-19 travel insurance coverage. All insurers offer multiple COVID-19 policies with greater coverage coming at a higher cost.

Let's take a closer look at our eight recommendations for travel insurance with COVID coverage:

Berkshire Hathaway Travel Protection

What makes Berkshire Hathaway Travel Protection great:

Several plans allow policyholders to cancel for COVID-19 sickness as part of trip cancellation and trip interruption insurance benefits.

Several plans include COVID-19 medical coverage benefits.

Medical evacuation benefits are included in these plans.

Plans include limited sports and activities coverage and sports equipment loss benefits.

Basic Berkshire Hathaway Travel Protection will run you $50 for an ExactCare Value policy, the company’s most basic COVID-19 travel insurance coverage option.

What makes IMG great:

Many plans include COVID-19 cancellation benefits.

Most of these plans also include COVID-19 medical benefits (the Travel Essentials plan doesn’t include this).

Medical evacuation coverage is available on select plans.

Coverage for adventure travel is available for an extra cost.

IMG is a good option for the budget-minded: Its Travel Essential plans cost more than $10 less than average based on our comparison.

John Hancock Insurance Agency, Inc.

What makes John Hancock Insurance Agency great:

Multiple plans offer COVID-19 cancellation benefits as part of the included trip interruption and trip cancellation coverage.

These plans offer COVID-19 medical benefits.

Medical evacuation coverage is included in all COVID-19 coverage plans.

The John Hancock Insurance Agency, Inc. basic plan (Bronze) costs $56.

Seven Corners

What makes Seven Corners great:

Multiple plans offer COVID-19 cancellation benefits as part of the included trip interruption and trip cancelation coverage.

These plans include COVID-19 medical benefits and evacuation and repatriation benefits.

There is no medical deductible.

Seven Corners’ basic coverage plan (RoundTrip Basic) for our trip to Croatia costs $44.

Travelex Insurance Services

What makes Travelex Insurance Services great:

Multiple plans include Covid-19 sickness coverage, which reimburses prepaid and nonrefundable trip payments if a trip is canceled or interrupted due to a traveler contracting the virus.

These plans also include COVID-19 medical benefits.

Medical evacuation and repatriation benefits are included.

Basic coverage (Travel Basic) from Travelex Insurance Services costs $44 for our sample trip, which is slightly cheaper than average.

Travel Insured International

What makes Travel Insured International great:

Multiple plans cover COVID-19 cancellation benefits as part of the included trip interruption and trip cancelation coverage.

These plans also include COVID-19 medical benefits, including medical evacuation.

Limited sports and activities coverage is included in plans with COVID-19 coverage.

Travel Insured International's basic coverage (Worldwide Trip Protector Edge) begins at $55 — only a few dollars more than the average basic policy price.

What makes Tin Leg great:

A wide range of plans offer COVID-19 cancellation benefits as part of the included trip interruption and trip cancelation coverage.

All of these plans also include COVID-19 medical benefits.

All of these include medical evacuation benefits.

An adventure travel policy is available.

Another plus: Tin Leg’s basic coverage plan (Basic) for our trip to Croatia costs $48.85 — making it right around the average price for the policies we covered.

WorldTrips

What makes WorldTrips great:

Several plans include medical coverage for COVID-19.

Sports and activities and sports equipment loss are included.

Coverage can be extended for up to thirty days, including for medical quarantine purposes.

WorldTrips’ most affordable plan with COVID-19 coverage (Atlas Journey Economy) starts at $44, making it a low-cost option.

Do you want to learn more about travel insurance before you spend money on a policy? Take a look at these resources:

What is travel insurance?

What does travel insurance cover?

The best travel insurance companies

How to find the right travel insurance for you

10 credit cards that provide travel insurance

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

The 5 Best COVID-19 Travel Insurance Options

Travelex Insurance Services »

Allianz Travel Insurance »

World Nomads Travel Insurance »

Generali Global Assistance »

IMG Travel Insurance »

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best COVID Travel Insurance Options.

Table of Contents

- Travelex Insurance Services

- Allianz Travel Insurance

- World Nomads Travel Insurance

Even though COVID-19 is no longer considered a global emergency, concerns around illness-related costs remain for many travelers. If you're looking for travel insurance that covers COVID – as well as other potential disruptions like flight delays and lost luggage – these are your best options.

- Travelex Insurance Services: Best Optional Coverage Add-ons

- Allianz Travel Insurance: Best for Multitrip and Annual Plans

- World Nomads Travel Insurance: Best for Active Travelers

- Generali Global Assistance: Best for Comprehensive Travel Insurance

- IMG Travel Insurance: Best for Travel Medical Insurance

Plans include coverage for COVID-19

Optional CFAR coverage is available with Travel Select plan

Some coverages require an upgrade, including rental car collision, accidental death and dismemberment, and more

Not all add-ons are available with every plan

SEE FULL REVIEW »

Allianz offers some travel insurance plans that come with an epidemic coverage endorsement

Single-trip, multitrip and annual plans available

COVID-19 benefits don't apply to every plan

Low coverage limits with some plans (e.g., only $10,000 in emergency medical coverage with OneTrip Basic plan)

24-hour travel assistance services included

More than 200 sports and activities covered in every plan

Low trip cancellation benefits ($2,500 maximum) with Standard plan

No CFAR option is offered

Free 10-day trial period

Some coverage limits may be insufficient

Rental car damage coverage only included in top-tier Premium plan

Offers travel medical insurance, international travel health insurance and general travel insurance plans

Some plans include robust coverage for testing and quarantine due to COVID-19

Not all plans from IMG offer coverage for COVID-19

Cancel for any reason coverage not available with every plan

Frequently Asked Questions

When comparing COVID-19 travel insurance options, you'll want to make sure you fully understand the coverages included in each plan. For example, you should know the policy inclusions and limits for COVID-related claims, including coverage for testing, treatments, trip cancellation or COVID-related interruptions that can occur. Meanwhile, you should understand how your coverage will work if you contract some other illness while away from home.

Also ensure your travel insurance coverage will kick in for other mishaps that occur, and that limits are sufficient for your needs. If you're planning a trip to a remote area in a country like Costa Rica or Peru , you'll want to have emergency evacuation and transportation coverage with generous limits that can pay for emergency transportation to a hospital if you need treatment.

You can also invest in a travel insurance policy that offers cancel for any reason coverage. This type of travel insurance plan lets you cancel and get a percentage of your prepaid travel expenses back for any reason, even if you just decide you're better off staying home.

It depends on your private health insurance provider and/or travel insurance policy. As of May 11, 2023, private health insurers are no longer required to cover the cost of COVID-19 testing. Out-of-pocket costs for COVID-19 test kits at local drugstores and on Amazon are relatively affordable, however.

As you search for plans that will provide sufficient coverage for your next trip, you'll find travel insurance that covers COVID-19 quarantine both inside and outside the United States. However, you'll typically need to have your condition certified by a physician in order for this coverage to apply. Also make sure your travel insurance plan includes coverage for travel claims related to COVID-19 in the first place.

Many travel insurance plans do cover trip cancellation as a result of COVID-19, although the terms vary widely. You typically need to be certified by a physician in order to prove your condition. Disinclination to travel because of COVID-19 – such as fear of exposure to illness – will generally not be covered. This means you will actually have to test positive for coronavirus for benefits to apply; simply not wanting to travel is not a sufficient reason to make a claim.

If you want more flexibility in your COVID-19 travel insurance, ensuring you have a cancel for any reason policy may be your best bet, but be sure to check with your chosen travel insurance provider to assess your options.

Why Trust U.S. News Travel

Holly Johnson is an award-winning writer who has been covering travel insurance and travel for more than a decade. She has researched the best travel insurance options for her own trips to more than 50 countries around the world and has experience navigating the claims and reimbursement process. Over the years, Johnson has successfully filed several travel insurance claims for trip delays and trip cancellations. Johnson also works alongside her travel agent partner, Greg, who has been licensed to sell travel insurance in 50 states.

You might also be interested in:

5 Best Travel Insurance Plans for Seniors (Medical & More)

Holly Johnson

Discover coverage options for peace of mind while traveling.

Does My Health Insurance Cover International Travel?

Private health insurance typically doesn't cover international travel expenses.

8 Cheapest Travel Insurance Companies Worth the Cost

U.S. News rates the cheapest travel insurance options, considering pricing data, expert recommendations and consumer reviews.

Is Travel Insurance Worth It? Yes, in These 3 Scenarios

These are the scenarios when travel insurance makes most sense.

How do you choose travel insurance that covers COVID-19?

Oct 26, 2021 • 5 min read

COVID-19 has made it more important to check the health coverage on your travel insurance © Maskot/Getty Images

After 18 months of pandemic-related travel restrictions, you may be itching to act on your pent-up wanderlust—but the situation and the rules are still continuously evolving. So before you go anywhere, it’s best to have a travel insurance plan that protects the investment you’ve made in a long-awaited trip.

A robust travel insurance plan will reimburse pre-paid trip costs and non-refundable deposits if you have to cancel or interrupt your trip, encounter trip delays, experience baggage loss or require medical expense and medical evacuation. Your policy will also reimburse “covered reasons” in your plan, such as death, illness or injury, serious family emergencies, unplanned jury duty, military deployment, acts of terrorism, or your travel supplier going out of business.

But COVID-19 has added an additional checklist to your usual insurance needs—it’s now important to check to ensure your travel insurance plan includes coverage for COVID-19 medical expenses, and losses related to illness. Your policy should also cover quarantine costs if you need to self-isolate after testing positive for the virus.

What do I look for in COVID-19 insurance coverage?

When you’re shopping for a travel insurance plan that covers COVID-19, you need to do your research and read the fine print of your plan.

Look for a travel insurance product that will protect your non-refundable, prepaid expenses if you have to cancel your trip due to illness caused by COVID-19. Your policy should also cover emergency medical treatment and emergency medical transportation. With regard to COVID-19 coverage, be sure your policy covers medical care, medicine, hospitalization and quarantine expenses.

“The type of coverage you should look for depends on you, your needs, travel dates, and the type of trip you’re taking,” says Sasha Gainullin, CEO of battleface , a travel insurance carrier. He says some travel insurance companies have now excluded COVID-19 coverage because it has been labeled a “known/foreseeable event”, while others may exclude pandemics altogether.

“It’s important to search for plans that include medical and quarantine expenses as well—this will be critical in the event you become ill and need to receive treatment while traveling,” continues Gainullin.

One additional tip is to confirm there are no exclusions based on the destinations you’re traveling to—this can happen with countries under government-issued travel warnings, Gainullin says.

“If a traveler feels uncertain, I recommend speaking with the travel insurance company directly. They can review the policy details with you, answer all of your questions, and confirm all of your required coverage options are included,” he adds.

Is getting coverage dependent on vaccination?

While it’s a good idea to be fully vaccinated before traveling, vaccination is not required to purchase a travel insurance policy, says Daniel Durazo, spokesperson with Allianz Partners USA.

What are the medical costs that are covered by travel insurance?

Travel insurance can cover the cost of both medical treatment and emergency medical transportation. A US health insurance plan, as well as Medicare, generally will not cover overseas medical expenses, so it’s best to check with your personal health insurance provider if any global coverage is available.

“While losing the cost of a trip due to an unexpected cancellation would be painful, paying for expensive emergency medical treatment or emergency medical transportation can be financially devastating,” Durazo says.

Under a travel insurance plan, medical costs could range doctor visits, pharmacy expenses, imaging costs and covering a hospital stay if required. Other expenses that can be covered are transportation to medical care and medicine.

Read more: Will my health insurance cover getting COVID-19 while traveling in the US—or abroad?

What about covering an unexpected quarantine due to COVID-19?

Many international destinations are now requiring that visitors purchase travel insurance coverage for an unexpected quarantine. Allianz Travel Insurance has added coverage to many of its products that includes reimbursement for quarantine-related accommodations if you or a traveling companion is individually-ordered to quarantine while on their trip, says Durazo.

This coverage typically covers the cost of additional food, lodging and transportation while quarantined. In addition, trip interruption and travel delay benefits on certain Allianz plans also provide coverage if you or your travel companion is denied boarding by your travel carrier due to suspicion of illness.

The benefits for quarantine coverage vary from carrier to carrier. For example, on select Trawick International plans, they offer $2,000 in quarantine benefits and for an additional charge, and you can increase it up to $7,000.

What about pre-flight COVID-19 testing?

Your plan may provide coverage for flights if you are turned away at a border for not passing a health inspection. Foster says Trawick’s travel insurance plans that cover COVID-19 would cover the expenses if you could not pass your pre-health inspection. Also, the plan would cover the costs of the failure of your PCR test to return to the United States, such as having to quarantine abroad.

It’s important to note that the actual cost of the PCR test is not covered by your policy, just the loss associated with the negative test.

Read more: PCR tests for travel: everything you need to know

Some destinations require COVID-specific insurance coverage—how do I comply with those restrictions?

Before any international travel, you should check the country where you are headed to make sure you comply with insurance coverage requirements. Countries like Spain, Turks and Caicos and Thailand are among the nations that mandate COVID-19 insurance coverage.

“You first must check the countries’ specific COVID regulations for entry into the country. Some countries require travelers to provide proof of travel insurance that covers COVID-19 related expenses purchased from a third party,” explains Foster. Providing proof coverage is key; so travelers need to ensure they receive documentation from their insurance provider that their policy covers COVID-19 related expenses to show customs officials, she says.

Should you arrive in a country that requires proof of insurance to cover COVID-19 medical expenses and quarantine costs, and you don’t hold a policy, you will not be granted entry.

For more information on COVID-19 and travel, check out Lonely Planet's Health Hub .

You may also like: What happens if I'm denied entry to a country on arrival? What is a vaccine passport and do I need one to travel? What is the IATA Travel Pass and do I need it to travel?

Explore related stories

Destination Practicalities

Mar 28, 2023 • 3 min read

Here’s all you need to know about getting a traveler visa to visit China now that “zero COVID” has come and gone.

Sep 12, 2022 • 4 min read

Jun 29, 2024 • 8 min read

Jun 29, 2024 • 9 min read

Jun 28, 2024 • 6 min read

Jun 28, 2024 • 5 min read

Jun 28, 2024 • 9 min read

Jun 28, 2024 • 7 min read

- Mexico Travel News

- Seaweed Updates

- Hidden Travel Gems

6 Best Travel Insurance For USA with Covid-19 Coverage

The U.S. finally reopened for international visitors after nearly two years of strict travel bans. Considering a trip there? Even though you might be vaccinated, which is now one of the key requirements to enter the U.S. for foreign nationals, you are still at risk of contracting and spreading the virus.

Additional expenses might come with COVID-19 hospitalization and treatment. And as we are committed to supporting the health and well-being of our fellow travelers, we have chosen the 5 best insurance plans to have your back even if you travel to the U.S. during the coronavirus crisis.

So read on. These are the 5 best COVID-19 insurance plans for traveling, working, living, or studying in the U.S.

Best Covid Travel Insurance For the U.S.

- SafetyWing Travel Insurance – Best Rated

- Explore North America® Plus

- CoverAmerica – Gold Insurance – The Best Benefits

- Staysure Travel Insurance – Best for U.K. Travelers

- Allianz Travel Insurance – Most Trusted

- Travel Insurance Select® – Best for couples and Families

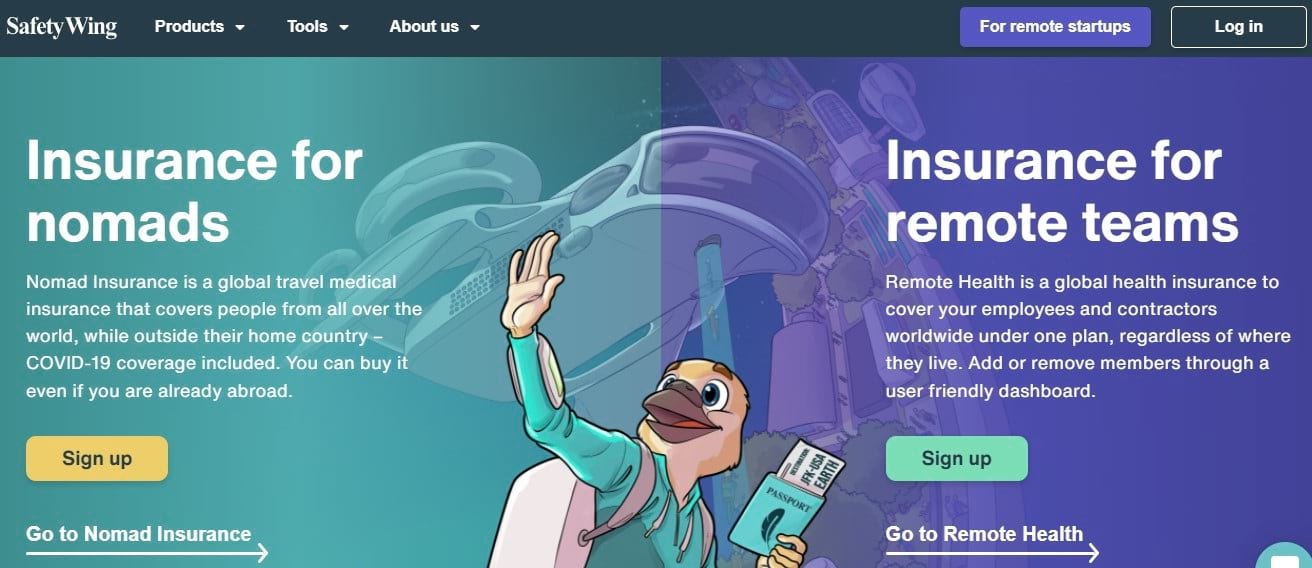

1. SafetyWing Travel Insurance – BEST RATED

This travel medical insurance is the best option for travelers to U.S. It is also a great choice for both short and long-term tourists or remote workers.

- Safety Wing covers COVID-19 the same way as any other illness as long as it was not contracted before your coverage start date.

- It covers you in your home country as well, as long as your visit there is incidental.

- Since April 15, 2021, it covers quarantine outside your home country of $50/day for up to 10 days. Note that the quarantine can be covered only once a year and if mandated by a physician or governmental authority.

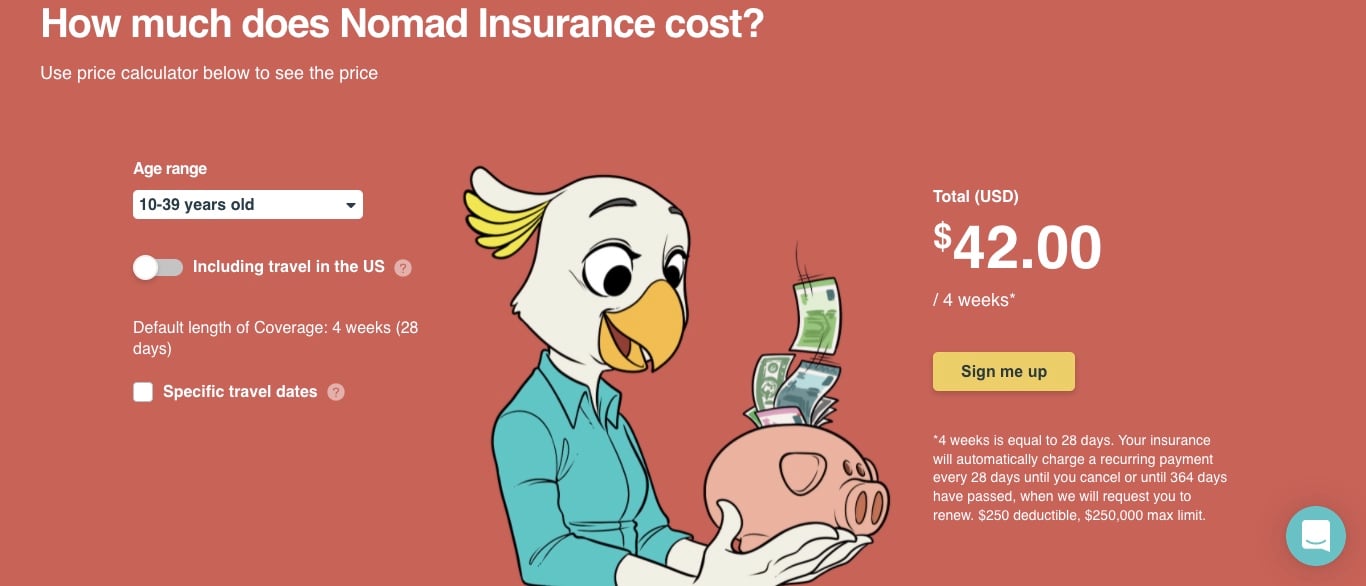

- SafetyWing Nomad Insurance is also pretty affordable . Depending on your age, the prices are as follows for a 4-week period: 10-39 years old: USD 76.72, 40-49 years old: USD 126.56. For other age groups, you can find the prices here.

- Testing for COVID-19 is covered only if deemed necessary by a physician. That is rather inconvenient, as most countries require testing before entry.

- It does not cover citizens from Iran, Syria, North Korea, or Cuba.

If you are new to SafetyWing, the COVID-19 coverage will be added automatically to your plan. On the other hand, if you are already part of SafetyWing, we recommend you reach out to their customer service team, and they will upgrade your plan.

SafetyWing also offers Remote Health insurance which is suitable for long-term nomads. It is more pricey but covers pre-existing conditions, cancer treatment, and you can use it in your home country as well.

What else does this insurance cover?

On top of everything, SafetyWing covers more than 94 recreational activities, including surfing, biking, hiking, and snowboarding.

2. Explore North America® Plus — Coronavirus Travel Insurance

Explore North America Plus travel insurance is a comprehensive medical coverage administered by Seven Corners that offers extensive coverage for Covid19 and other diseases.

This insurance plan also covers Non-U.S. residents and Non-U.S. citizens who are traveling outside their home country to the United States, Mexico, Canada, or all Caribbean countries except Cuba.

Special COVID-19 coverage:

We have chosen Explore North America Plus because of its special benefits when it comes to coronavirus medical expenses.

Most travel insurances that claim to cover COVID-19 medical treatments include a “convenient” fine print that says they won’t cover you if the country you are visiting has a government no-travel alert, which most countries have.

That does not happen with Explore North America® Plus. If you contract COVID-19 on your trip, you’re covered, as simple as that.

- The plan covers medically Usual, Reasonable and Customary (URC) treatment for COVID-19 up to $100,000 or whichever is less.

- Emergency Room Services – (URC) up to medical maximum – $100 copay

- Urgent Care Visit – (URC) up to medical maximum – $20 copay

Other benefits:

- It also covers some onset of pre-existing conditions

- Hospital Indemnity – Only applies to Canada, Mexico and the unrestricted Caribbean countries* – Up to $150 per day, 30-day limit

- Incidental trips on your home country – Up to $10,000

- Dental – Relief of pain – Up to $200

- Dental – Accident – Up to $5,000

- Evacuation and Repatriation – Up to $500,000 (separate from the medical maximum)

- It only covers trips of up to one year

- It does not cover people older than 74

- *The plan does not cover trips to Cuba.

Interested? – Get your quote here !

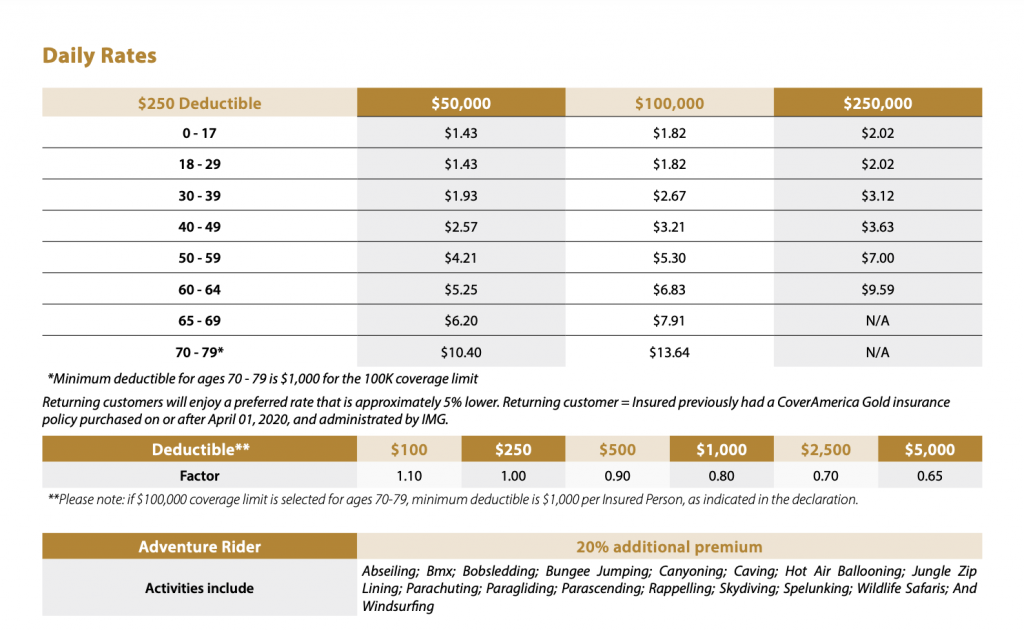

3. CoverAmerica – Gold Insurance – The Best Benefits

CoverAmerica is perfect for travelers and tourists visiting the U.S. who are not citizens or residents of the country.

- CoverAmerica covers COVID-19 as any other medical condition. However, note that it has to be purchased for at least 30 days to be eligible for the benefit.

- Unlike other travel plans, it has comprehensive coverage for COVID-19 . That means you can get reimbursement for delays, quarantine days, or missed flight connections if you get infected with the coronavirus.

- The coverage limit is up to USD 1,000,000 (conditions may apply).

- NOT available for U.S. citizens and residents.

- Citizens from Iran, Syria, the Virgin Islands, Ghana, Nigeria, and Sierra Leone cannot contract this insurance.

- This travel insurance covers emergency treatment of pre-existing conditions, acute dental treatment, and eye exams.

To learn more about CoverAmerica and its plans, click here .

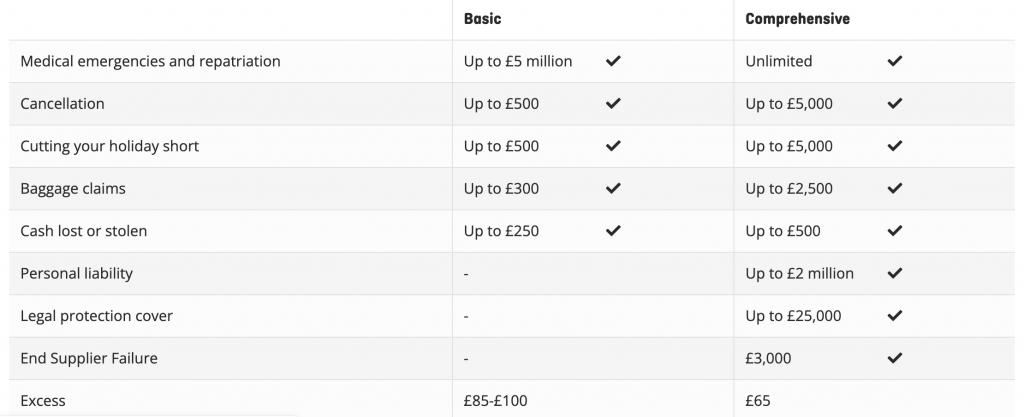

4. Staysure Travel Insurance – BEST FOR U.K. TRAVELERS

Staysure Travel Insurance is the best choice for visitors traveling from the U.K., Spain, France, or Portugal.

- Staysure covers trip cancellations , emergency medical treatment, as well as repatriation expenses if you get affected by COVID-19 (conditions may apply).

- It also offers daily benefits if you have to self-isolate, additional accommodation, and transport, but only if mandated by a health official.

- If your close relative or a member of your household is hospitalized or dies of COVID-19, you can cancel or cut your trip short and claim reimbursement.

- Moreover, it is reasonably priced. To get a quote, visit the website here .

- ONLY for travelers traveling from the U.K., Spain, France, or Portugal.

- You won’t be covered if you have refused any dose of the COVID-19 vaccine.

- Does not cover COVID-19 testing, which is often needed to be able to travel.

What’s covered?

Note that Staysure doesn’t cover you if you travel during government or regional lockdown.

5. Allianz Travel Insurance – Most Trusted

Allianz Travel Insurance is suitable for all types of travelers traveling from Ireland. From digital nomads and remote workers to students and backpackers, they offer a variety of plans in three different levels – bronze, silver, and gold.

Pros:

- This travel insurance covers general COVID-19 medical treatment, as well as additional accommodation , transport , or cancellation of your trip if you contract the virus.

- They offer several insurance plans, such as Single Trip Insurance, Backpacker Travel Insurance, or Annual Multi-Trip Travel Insurance.

- You can cancel or cut your trip short if your close relative or travel companion gets seriously ill from the disease.

- If the DFA (Department of Foreign Affairs) advises against all non-essential travel, you can make your claim only if you provide documentation that you travel for a specific reason, not leisure.

- It is ONLY for citizens and residents of the Republic of Ireland.

- Allianz Travel Insurance offers an extensive Winter Sports and Ski add-on.

Interested in this insurance travel plan? Get your quote .

6. Travel Insurance Select®

This plan is a great fit for American couples, families, and friends traveling together around the country or overseas. Tours, business trips, and those traveling with social groups can also be covered by Travel Insurance Select®

Benefits and non-insurance:

- Trip cancellation coverage – it refunded you up to 100% of the money you invested in your trip.

- Coverage for trip interruption – you can get up to 150% of your trip expenditures back (depending on the coverage you choose).

- Travel Delay – If your trip is delayed for 12 hours or more due to covered circumstances such as carrier-caused delays, lost passports, strikes, or bad weather, you may be eligible for reimbursement for certain extra charges, up to the maximum for the option you chose.

- Missed Connection – Depending on your plan, you may be eligible for reimbursement of up to $1,500.

- Covid Quarantine Benefit: “Travel Insurance Select Elite plan offers coverage for accommodations due to a covered Trip Delay $2,000/$250 per person per day (12 hours) is included in the basic coverage.”

- Emergency support services are available 24/7, so you may get aid whenever you need it.

Example – Quote for a couple in their late 30’s traveling for two weeks from California to Washington :

Medical Expense

All plans include emergency medical evacuation, medical repatriation and return of remains.

It can pay reasonable expenses for an emergency medical evacuation ordered by a physician for a covered injury or sickness to the next acceptable medical facility or home, if medically necessary, up to the limit for your preferred option.

Waiver of Pre-Existing Medical Conditions available for the Plus and Elite plans.

Special COVID-19 coverage

COVID-19 is treated as any other illness. Trip Cancellation benefits may be available if you are treated by a legally certified physician.

A person who gets ill while traveling in an affected nation may be eligible for Emergency Medical Expense or Emergency Medical Evacuation benefits.

A person who is required to enter quarantine in their destination due to a positive Covid-19 test can be eligible for Trip Interruption, Travel Delay, or Cancel For Any Reason (CFAR) – this option must be purchased as an upgrade within 21 days of your initial trip deposit/payment.

The basic plan does not cover Cancel for Any Reason.

So, what do you think? Have you chosen your favorite? We hope our comparison has helped you at least a bit, and you will have peace of mind even while traveling during unpredictable times such as the pandemic. Enjoy, stay safe, and see you in the U.S.!

Disclaimer: Most travel insurance companies are still adapting to the “new normal” way to travel the world. We strongly advise you to check with your insurance company before committing to any insurance plan.

Coronavirus Update & FAQs

We now provide cover for Covid-19 on our policies, click here to find out more

- Get a Quote

- Existing Customers

- Retrieve a Quote

- Single Trip

- Winter Sports

- Coronavirus Travel Insurance

- View All Policies

- Cruise Extension

- Gadget Extension

- Golf Extension

- Large Scale Events Extension

- Snowboarding

- UK Travel Insurance

- South Africa

- Customer Area

- Cancel Your Policy

- Amend Policy Dates

- Upgrade Policy

- Customer Reviews

- Trustpilot Reviews

- Customer Testimonials

- Write a Review

- Our Insurer

- Holiday Extras

- COVID-19 Swab Test

- Alpha and WDC

- Travel Tips & Advice 'Travel Tips and Advice Mobile', 'walker' => new mobile_menu_walker(), 'container' => '', 'items_wrap' => ' %3$s ' )); ?>

- Travel FAQs

- Policy Wordings

- Jargon Busters

- Not Sure What You’re Looking For?

- Refer a Friend

- Money Helper Directory

- Benefits of Travel Insurance

- Which Countries Are Covered By Our Policies?

- Which Activities Are Covered By Our Policies?

- Claims Information

- Cancellation

- Curtailment

- Departure Delay

- Personal Possessions

- Access To Medical Records

- 24/7 Emergency Medical Assistance

- Press Office

- 'Travel Tips and Advice Col 1', 'container' => '', 'items_wrap' => ' %3$s ' )); ?>

- 'Travel Tips and Advice Col 2', 'container' => '', 'items_wrap' => ' %3$s ' )); ?>

- 'Travel Tips and Advice Col 3', 'container' => '', 'items_wrap' => ' %3$s ' )); ?>

- Cover available from 54p per day¹

- Cover for trips up to 18 months

- Mobile phone,Ipad and gadget cover available

- 14-day cooling off period

Backpacker Travel Insurance

The world is your oyster- and what better time to explore and have an adventure than now? Whether it’s backpacking, working abroad, a gap in education or simply leaving the comfort of your home town and all its familiarities in search of something new, then a Backpacker & Longstay policy might just be for you.

We know that the hardest part of planning a backpacking trip is deciding where you’re going to go. So, we’ve done the dirty work and found you the top backpacking destinations according to Instagram - so rest assured you’re guaranteed to have the most visually pleasing social media out of all your followers!

If you do decide on a gap year, then you must ensure you’ve got the right travel insurance. We’ve got you covered with our Longstay insurance- so you can just relax and discover the world. Life’s too short, so go have an adventure!

What is backpacker insurance?

Unlike Annual or Multi-trip policies, Longstay policies provide cover for those travelling across numerous destinations over a period from 1 to 18 months (depending on your age and destination of choice).

Backpacker or Longstay trips can be unpredictable, and often you’ll end up going to a destination spontaneously which wasn’t in your original travelling plans. When you purchase your policy, you’ll most likely be asked to choose a group of destinations, so you have the flexibility to travel to any that are included, or call your insurer to extend and cover even more! And, if you thought this policy couldn’t get any better, it also provides cover for cancellation, curtailment, emergency medical attention and repatriation, personal possessions and activities- so you can travel knowing that everything is taken care of!

Do I need backpacker insurance?

Regardless of where you’re going, you always need some form of travel insurance. Given that a backpacking, gap year or charity work trip may differ considerably from, let’s say a 2-week family holiday to Benidorm, Single Trip and Multi Trip policies simply won’t provide you with enough cover. For example, the Long stay policies even allow you to come home twice during your trip for up to 21 days if you begin to miss those home comforts and need a pitstop for Mum’s cooking (without rendering your policy invalid).

There are several reasons why our Backpacker & Longstay insurance is so important:

- Alpha’s Backpacker & Longstay policies provide medical cover up to £10 million as well as offering repatriation - so you know you’re in the best possible hands. If you are travelling within Europe, From 1st January 2021 rules around travel to Europe have changed, visit the Government website for up-to-date information on passports, EHIC/GHIC, healthcare and more. We’ll update this page with more information as and when the Government release it.

- Cover for activities: When you’re travelling, you’ll be offered experiences and excursions beyond your imagination. But what if you end up getting hurt? We don’t reckon you’ll be happy about a huge medical bill! Alpha’s Backpacker & Longstay policy automatically includes cover for a wide range of sports and activities which you may participate in during your trip without the need to pay an additional premium*

- Scheduled Airline Failure: You may have heard about airlines going out of business and cancelling holidays, but when it happens if you don’t have insurance, you could lose a lot of money. Gap Years are often funded by savings (and a lot of them). So, why risk losing all that money when Backpacker & Longstay Insurance offers scheduled airline failure cover as part of the policy?

What does Alpha’s backpacker insurance cover?

Despite popular belief, Backpacking isn’t just for students. That’s why we’ve established a Backpacking & Longstay policy catering to a wide scope of travellers. This policy is ideal for:

- Students - taking a gap year from studying;

- Adults after a career break

- Charity or volunteer workers;

- Backpackers;

- People who want to work or study abroad;

- Adrenaline and adventure junkies - our policies automatically cover hundreds of activities free of charge, with the option to extend your cover to include many more;

- Anyone aged 55 or under who wants an extended holiday - because we all need a break sometimes.

What does Alpha’s Backpacker & Longstay Insurance cover?

Wherever your journey takes you, rest assured- we’ve got you covered, which includes:

- A choice of policy excess

- Two return home trips allowed up to a maximum duration of 21 days each time* -

- Cover for Worldwide and European trips as long as you’re not travelling against the advice of the FCDO

- A wide range of activities covered as standard

- 24/7 Access to emergency assistance team

- £10 million emergency medical cover which includes cover for medical expenses repatriation

- Discounts for couples

- A 14-day cooling off period

- Free access to our Customer Area, with the ability to view, resend and download your policy documents whenever, wherever!

Backpacker Travel Insurance FAQs

How long will i be covered for with a backpacker & longstay insurance.

If you take out Backpacker & Longstay Insurance, it can provide cover for 1 to 18 months. Alpha provides significantly longer cover than most travel insurers (most cover up to 18 months as standard).

If I want to travel longer than planned, can I extend my policy?

Yes- providing you do not exceed the 18-month cover. For example, if you initially take out cover for 6 months, you can contact us and extend cover for a further 12 months. There is no limit on the number of times you can extend your cover, as long as your overall trip does not exceed 18 months.

Is Gadget Insurance included in my policy?

No, we have several extensions which you can add to your policy, including cover for gadgets .

Can I return home during my period of insurance and will I still be covered when I continue with my trip?

Yes- you’re allowed two ‘return home trips’ of up to 21 days during your policy cover period, without invalidating your policy. So, if you’re worried you might feel a little homesick, this policy is perfect for you.

If your trip home exceeds 21 days your policy will terminate immediately and you will need to purchase a new policy should you wish to travel again.

When using the return home cover, all cover is suspended on clearance of customs in your home country and restarts after the baggage check-in at your international departure point to your overseas destination.

¹Pricing based on a 30 year old, travelling to Australia and New Zealand , if purchased within the two weeks prior to travelling on an Alpha 175 Longstay policy for 94 days. Prices correct as of 19/12/2023

- Terms & Conditions

- Privacy Policy

- Cookie Policy

Alpha Travel Insurance is a trading name of Travel Insurance Facilities Plc, which is authorised and regulated by the Financial Conduct Authority FRN306537. tifgroup is trading name of Travel Insurance Facilities Plc registered in England No. 3220410. tifgroup; all rights reserved. Registered Office: 1 Tower View, Kings Hill, West Malling, ME19 4UY. All policies offered are on a non-advised basis

Travelling is ultimately a tool for growth. If you want to venture further, click this banner and take the leap 😉

- Meet the Team

- Work with Us

- Czech Republic

- Netherlands

- Switzerland

- Scandinavia

- Philippines

- South Korea

- New Zealand

- South Africa

- Budget Travel

- Work & Travel

- The Broke Backpacker Manifesto

- Travel Resources

- How to Travel on $10/day

Home » Budget Travel » Is SafetyWing The Best Travel Insurance For Long Term Travellers? Updated For 2024

Is SafetyWing The Best Travel Insurance For Long Term Travellers? Updated For 2024

“The worst can happen and does happen…so you had better make sure you’re Insured” – Fargo Season 1.

Usually, whenever I buy something I like to get my money’s worth and use it as much as possible. Take for example those Levi jeans that I wore everyday for a year until the knees wore out. Or take my trusty MacBook Pro which I use to beat out at least 10,000 words a day.

Travel Insurance on the other hand, is one of those rare things in life whereby you pay for it, and yet you hope that you never ever need to use it. But whenever you hit the road and head out on an adventure, it’s very important to get travel insurance. Whether you’re headed to Prague for a boozy weekend, or to Southeast Asia to spend 6 months finding yourself, disaster could be waiting for you at any point.

So here we run down what SafetyWing insurance offers and how they stack up against the competition. So with that, here’s our SafetyWing insurance review!

Do SafetyWing Cover COVID?

Safetywing review, do you need travel insurance, breakdown of safetywing travel insurance, what travel insurance plans does safetywing offer, what’s covered by safetywing travel insurance, what’s not covered by safetywing, who is safetywing travel insurance suitable for.

- Who isn’t SafetyWing Travel Insurance Suitable For?

How Much Does SafetyWing Travel Insurance Cost?

Other travel insurance providers, when should you buy travel insurance, staying safe on your adventure, frequently asked questions about safetywing travel insurance, final thoughts on safetywing travel insurance.

The Broke Backpacker is supported by you . Clicking through our links may earn us a small affiliate commission, and that's what allows us to keep producing free content 🙂 Learn more .

When COVID-19 first rocked the world in 2020, most travel insurers were quick to invoke their cancellation clauses and pull all cover relating to either illness, cancellation or disruption caused by the pesky pandemic.

These days, most insurance providers are offering some form of COVID coverage included within their policies, but some are more useful than others. Whilst many now cover hospitalisation caused by COVID infections, fewer are offering any kind of cover for disruption or cancellation such as being refused boarding on a flight for displaying symptoms, or having to cancel your trip because of a positive test.

Whilst the pandemic has largely subsided , COVID is still able to severely disrupt travel plans. Therefore do consider paying close attention to the finer details of any insurers COVID-19 cover.

SafetyWing can offer COVID-19 coverage in their policies and may be able to cover you for illness, evacuation cancellation and interruption.

These days there are countless travel insurance providers out there and choosing between them can be overwhelming. Furthermore, some of these providers have better reputations than others and there are some very unfortunate instances of insurers not paying out on claims. Finally, deciphering between policies and reading their fine print can be exhausting. But we’re here to help.

In this SafetyWing Review, we’ll take a good, detailed look at SafetyWing and its travel insurance policy. We’ll run through the various types of cover they offer, look at what is and is not included in their policy, and we’ll assess their value for money. We’ll also have a quick look at some of their best competitors (including World Nomads insurance).

Need help deciding between Safety Wing or Hey Mondo ? Check out our helpful guide.

Do you really even need travel insurance ? It’s a fair question. After all, the vast majority of trips end happily and safely without incident.

We at the Broke Backpacker have probably spent a combined total of maybe 10 years on the road and have easily visited over 100 countries. During all of that travel, we’ve clocked up a fair few mishaps ranging from inflected legs that almost needed amputating, to the inevitable bike crashes, all the way to gun-point robberies. These incidents were all traumatic enough themselves leaving physical or mental scars.

But mercifully, we were all insured at the time meaning that were spared the further trauma of paying out $10,000 medical bills and emergency medical evacuation or having to find $700 for a new iPhone.

Basically, nobody ever thinks it will happen to them and yet, it has to happen to somebody. Besides that, the law of averages tells us that if you travel enough, something somewhere will eventually go wrong.

Furthermore, some countries do actually require you to obtain insurance before even letting your enter.

What Does Travel Insurance Cover?

In order for you to decide whether you really do need travel insurance, let’s look at some of the things it can help with, and where you would be without travel insurance coverage.

Lost Luggage

The aviation industry watchdog estimates that 5.73 items of luggage are lost for every 1000 passengers. This is not a bad statistic but it means that if you take 10 flights, there is a 5% chance of your luggage being lost forever. Also, note that some airlines and airports (the black hole of Charles De Gaulle anybody?) are a lot worse than others for this.

Lost luggage can easily mean your trip is ruined as you’re forced to walk around Ibiza for a week sweating your ass off in the same inappropriate jeans and jumper combo you left home in. Replacing everything you own though, can mean you then have to find $1000 to replenish your wardrobe, refill your toiletry shelf and get a new travel camera . Any good travel insurance policy, therefore, covers lost luggage, usually up to at least $1000.

We’ve tested countless backpacks over the years, but there’s one that has always been the best and remains the best buy for adventurers: the broke backpacker-approved Osprey Aether and Ariel series.

Want more deetz on why these packs are so damn perfect? Then read our comprehensive review for the inside scoop!

Medical Expenses

Medical expenses can be seriously expensive. For example a friend of mine was once hospitalised whilst volunteering in Costa Rica and ran up bills in excess of $10,000. He recently spent 1 night in a Thai hospital, was billed $1,000 and his passport was used as a ransom. Personally, I don’t have $10,000 to pay Costa Rican Doctors but I do have maybe $50 to get myself some comprehensive health insurance.

Coming from the UK where we (just about) have the NHS, the cost of medical care in some parts of the world is quite a revelation. If you are reading this in the US you already know all about health extortion but do remember that your domestic health insurance will not cover your medical expenses outside of the US.

Accidents happen without warning and ill health can strike at any time, anywhere. In fact, if you have experienced driving or hygiene standards in India, then you’ll probably agree that you’re actually at a much higher risk of coming to harm on the road than you are at home!

Travel Disruption

Travel disruption and trip interruption comes in all shapes and sizes but let’s take a classic, topical example. Every year a few airlines and travel agents go bust leaving passengers stranded. Booking flights home at short notice is expensive, but not getting home ASAP can mean getting fired from your job. Having to stay an extra few nights in a hotel can also put undue strain on an already tired travel budget.

Having travel insurance can therefore mean the difference between desperately raiding your overdraft to pay a hotel, or your travel insurance company covering a few extra nights at your destination free of charge! Trip interruption is upsetting enough without it costing a fortune!

Robbery

In many parts of the world, tourists are a target for thieves. I’ve had my phone stolen by knife-wielding bandits in Colombia and know people whose hotels have been raided leaving them without gold jewellery and laptops.

Getting jacked is scary, but having to find $700 for a new iPhone is seriously fucking depressing. Thankfully, many travel insurance companies cover it.

Stash your cash safely with this money belt. It will keep your valuables safely concealed, no matter where you go.

It looks exactly like a normal belt except for a SECRET interior pocket perfectly designed to hide a wad of cash, a passport photocopy or anything else you may wish to hide. Never get caught with your pants down again! (Unless you want to…)

Who Are SafetyWing?

If you have never heard of SafetyWing, it’s probably because they are still a new company. Launched in 2018, founded by Norwegians and based in the US, SafetyWing is one of the newest travel insurance providers in the space.

In case you are nervous about entrusting your wellbeing to a baby company, don’t be. SafetyWing’s Insurance partner is Tokio Marine, one of the biggest and most established insurance companies in Japan, and the Insurance is underwritten by Lloyds. Furthermore, Insurers are required to go through a shed load of vetting and have erm, insurance, in place before they are even allowed to trade.

SafetyWing identifies as long-term travellers and digital nomads describing their mission as “insurance for nomads by nomads”. In practice, this means that they focus on long term travellers and digital nomads who are not served by other providers and can often fall between the cracks of healthcare systems.

SafetyWing is pretty unique in that they offer a kind of hybrid between travel insurance and health insurance. Their package is nowhere near as comprehensive as standard travel insurance as they have ripped out some of the features which are less likely to apply to digital nomads and long term travellers. This is reflected in the pricing which makes them one of the most reasonable and competitive travel insurance companies.

Whereas most travel insurance companies offer multiple different plans, SafetyWing insurance keeps things straightforward and offers one simple plan.

One Simple SafetyWing Plan

The headline is that SafetyWing plan may be able to cover you up to a maximum value of $250,000 per cover period with direct billing. The excess is $250 meaning that you must pay the first $250 of any claim yourself. For example, if you end up in hospital for stitches and the bill comes to $197, then unfortunately the entire bill comes out of your pocket and you cannot claim. That is however pretty standard across insurance cover.

In case you are in a hurry, the key points are set out below.

- Medical emergencies may be covered up to $250,000. This also includes emergency dental treatment up to $1,000 which is perfect if you fancy a bit of 2am gutter boxing!

- Medical Evacuation may be covered up to $100,000. Note that emergency medical evacuation means been transferred to a hospital in your home country and does not mean been rescued from a mountain after breaking your leg whilst trekking.

- Emergency evacuation in case of civil unrest or something may be covered up to $10,000.00. So, if London erupts into riotous, murderous, anarchy following Brexit, you can get yourself a flight either all the home, or simply to safety in Paris!

- In the event of a natural disaster , cover may be $100 per day for 5 days for accommodation costs.

- Whilst trip cancellation is not included, trip interruption up to $5,000.00 is included. This means that if you are forced to cut your trip short, you may receive up to $5,000 to help you get home.

- Lost Luggage may be covered up to $3,000. However, note that the maximum value per item is $500. Therefore, if you plan on checking-in that diamond necklace, you may wish to obtain different cover.

Please remember that international travel insurance coverage changes from time to time. It is important for you to read the policy yourself and make sure you understand it. If you are uncertain of anything, it is a good idea to speak with the provider for clarification especially when it comes to things like trip interruption and specific medical coverage.

Remote Health

SafetyWing quite recently launched a second policy; Remote Health. Remote Health was initially designed to cover remote working teams and was a pioneering form of workplace health insurance for the age of the Digital Nomad.

However, SafetyWing has now evolved the concept and it is available for individuals. Remote Health differs from the standard policy in a number of ways offering a more robust cover. Crucially, it may be able to cover pandemics like the COVID-19 outbreak of 2020 and for this reason, appeals to a growing number of travellers. Not all insurance will cover Covid 19 so this is a great addition.

Remote Health is more expensive than the standard policy but may still be a good investment for those seeking stronger cover.

Emergency Accident & Sickness Medical Expenses

Got food poisoning in Delhi? Got hit by a moped in Bangkok? Or maybe you just slipped in the shower and broke your wrist at a hostel in Madrid ? These things can, and do happen and will all require emergency medical treatment. Being sick, infirm and unable to jerk yourself off is bad enough as it is, so the last thing you want is a hefty medical bill which you have to pay out of your own pocket.

Emergency accident, sickness and medical coverage is quite likely the most important aspect of any travel insurance plan – I certainly know it is for me. If you get ill, get hurt, or otherwise need medical attention, you may have medical coverage up to $250,000 and direct billing is available too.

If you need emergency dental care, you may be covered up to $1000.

Besides the above medical coverage, SafetyWing also offers a few additional benefits: