- + 1-888-961-4454 (TOLL-FREE)

- +1 (917) 444-1262 (US)

- [email protected]

COVID-19 has impacted all businesses across the globe.

our reports from the

CONSUMER GOODS CATEGORY

The novel coronavirus has affected all businesses across the globe

to access all our reports from the CONSUMER GOODS Category, featuring the impact of the pandemic

featuring the impact of the pandemic

Avail the Christmas season discount on the Travel Retail Market Report 20% OFF

(offer valid only till season lasts)

A Guide on Travel Retail: Definition, Growth Factors, and Future Prospects

Travel retail industry is one of the major subsidiary yet standalone industries of the travel and tourism sector. Since the last few years, barring the pandemic period, this industry has seen a substantial rise in terms of its growth number. Though one of the obvious reasons behind the growth in travel retail industry is the growth in number of travelers, there are certain growth factors which are characteristic to the travel retail industry itself.

In the 1700s, there was a shift from primary economic activities like agriculture, mining, etc. to secondary sector constituting manufacturing, construction, etc. This shift was primarily facilitated by the Industrial Revolution which was kickstarted in the Great Britain. Consequently, on similar lines, the ICT revolution enabled a shift from secondary to tertiary sector which predominantly constituted of service-oriented economic activities. One of the biggest industries that emerged out of the tertiary sector was the travel and tourism industry.

What is Travel Retail and Why is it on the Rise Since the Last Few Years?

In the last few decades, especially after the opening of majority of the global economies post-1991, travel and tourism industry has grown like anything else. Some economists even consider it to be a separate economic sector altogether. On account of this growth, several subsidiary and standalone industries have propped up and thrived under the travel and tourism sector. One such standalone industry is the global travel retail industry. Travel retail pertains to creating, planning, and providing travel services, while at the same time, engaging in sales activities to cater to the shoppers’ demands while they are in transit.

The growth in the travel retail market is mainly attributed to four main factors which are discussed below:

- Boom in the Travel Industry on the Whole

Except the aberration witnessed in the last two years due to the Covid-19 pandemic, there has been a steady growth in the number of people travelling across the globe. Though the reasons for travel might be different for each individual, the travel retail industry has been able to fulfill their varied demands efficiently. Hence, a growth in the travel industry has been mirrored by the travel retail industry. Also, since people have been exploring countries and places that were previously not so often visited, the travel retail industry has found new ways and avenues to offer their services.

- Travelers Tend to Shop More

Studies by various behavioral economists have shown that travelers, especially the ones going out for vacations, tend to shop more. This shift from a thrift behavior, according to these experts, is due to the leisurely atmosphere and stress-free state of mind. Also, since travelers have a lot of free time at their disposal, they can shop for longer periods of time. Another interesting theory as to why people spend more at transit channels, such as airports , is that the infrastructure inside airports is built on the concept of open-plan setups. As a result, luxury shopping and casual shopping spaces are intertwined in each other, thus blurring the lines between the two.

- Accurate Data Insights

The retailers engaging in travel retail and sales activities have an added advantage of accurate information about their customers. Their travel and departure times, the type of aircrafts they are travelling, their destination, etc. helps the retailer in getting a brief idea as to what the traveler might be looking for. This helps these retailers to plan their sale strategy accordingly, which helps in maximizing their profits. Also, providing customer service to the passengers or people in transit becomes much easier due to these vital data points.

- Better Showcasing of Products

Since travelers tend to shop more products and spend more on luxury items during their travel, they tend to appreciate certain products more than in normal circumstances. This provides the companies and travel retailers to showcase their products and test whether the products are sellable. Hence, various international brands of different sectors tend to launch and market their unique products through the travel retail industry.

Future of Travel Retail Industry

Though the Covid-19 pandemic and the subsequent lockdowns put a strain on the travel and the travel retail industries, market analysts are confident that both these industries will register huge growth rates in the post-pandemic world. Also, digitization of financial services has improved the quality of shopping experience at the transit channels and has helped in reducing the complexities associated with foreign currency exchange. Moreover, the introduction of smart technologies has further improved data collection, which has helped travel retailers to improve their business strategies in a much better way. All these factors point toward a great future of the global retail travel industry.

About the Author(s)

Princy A. J

Princy holds a bachelor’s degree in Civil Engineering from the prestigious Tamil Nadu Dr. M.G.R. University at Chennai, India. After a successful academic record, she pursued her passion for writing. A thorough professional and enthusiastic writer, she enjoys writing on various categories and advancements in the global industries. She plays an instrumental role in writing about current updates, news, blogs, and trends.

Related Post

How popularly do capsule hotels takeover the position of conventional hotels in developed countries, why camping and caravanning are becoming more popular than ever, how does adventure tourism turn a person’s world around, which top 3 companies are in the process of designing world-class urban air mobility.

How is Cybersecurity Becoming a Vital Measure to Combat Emerging Threats in the Banking Sector Globally?

Wood Pellet Biomass Boilers: An Eco-Friendly Heating Solution

5 Ways Vanilla Oil Can Transform Your Life

Discovering the Magic of Toasted Flour: Why & How to Use It

Request Sample Form

Subscribe to our newsletter and get our newest updates right on your inbox.

Blog Name Here

Obtain comprehensive insights on the Travel Retail Industry

Preview an Exclusive Sample of the Report of Travel Retail Market

The Company

- Why Research Dive?

- Research Methodology

- Syndicate Reports

- Customize Reports

- Consulting Services

- Design your research

- GDPR Policy

- Privacy Policy

- Return Policy

- Delivery Method

- Terms and Condition

30 Wall St. 8th Floor, New York, NY 10005 (P).

- + 1-800-910-6452 (USA/Canada) - Toll Free

- + 1-888-961-4454 (USA/Canada) - Toll - Free

- +1 (917) 444-1262 (US) - U.S

- [email protected]

Get Notification About Our New Studies

- © 2024 Research Dive. All Rights Reserved

Ready for departure: How the travel retail sector can succeed in the post-Covid environment

By Gabriel Schillaci

Recommendations and case studies for airports and retailers

Like all aviation-related industries, the travel retail sector has been turned on its head by the Covid-19 pandemic. A change in the passenger mix at airports, as well as longer idle times due to Covid-related delays, are driving new trends and behaviors. Digital channels are becoming increasingly important, for example, and shoppers are buying more because shops are quieter. Travel retailers need to adapt to these changes, or risk being left behind. In this article we assess the transformation taking place in the sector and present a series of recommendations for airports and retailers on how they can not only adapt to the new challenges, but also thrive. We also offer two case studies outlining successful Roland Berger travel retail projects.

"Airports, retailers and the entire ecosystem must embrace the new market dynamics."

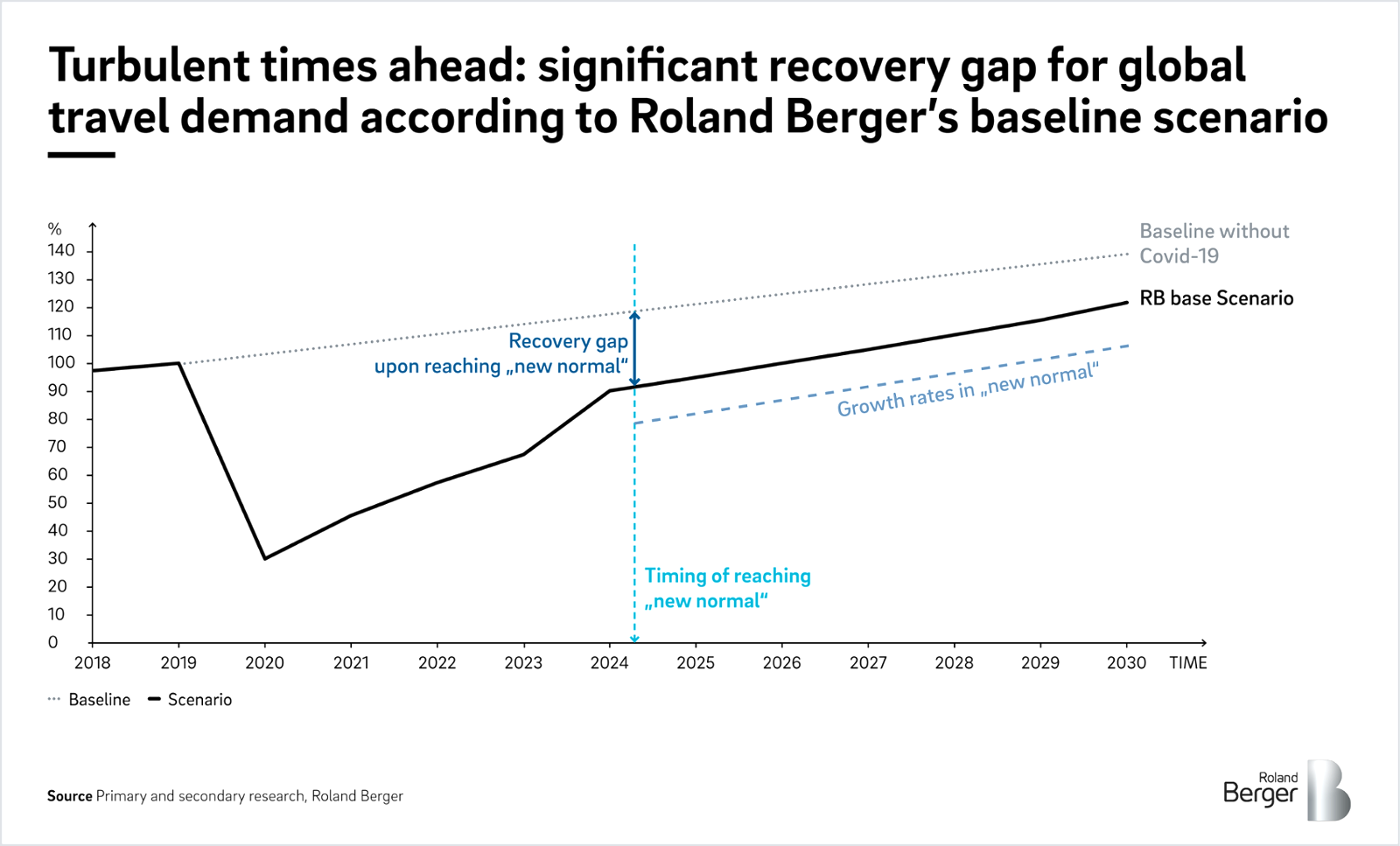

The Covid-19 pandemic has likely changed the air travel market for some time to come. Business travel has been decimated as workers switch to virtual mobility tools, one in five private travelers are choosing to fly domestically rather than internationally and passenger demand is set to remain well below pre-Covid forecasts for years to come, according to a recent Roland Berger study.

While airlines and airports have borne the brunt of the crisis, this reshuffled passenger mix has also had a profound impact on the travel retail sector. For example, fewer big-spending intercontinental passengers from Asia or Brazil mean fewer high-end sales, with retailers now having to adapt their offer to better suit the growing proportion of continental / domestic passengers, and especially low-cost passengers. On the other hand, less traffic and strong concerns over Covid-related delays at airports mean passengers are spending longer periods in airports, pushing up idle times available for shopping.

"Airports need to refocus their offer on their core passengers. They must adapt their product assortment and merchandizing to target the growing share of low-cost passengers."

New trends = new behaviors

This shift has accelerated several trends in travel retail, some that existed pre-Covid and some a result of the pandemic. First, the digital effect has become more pronounced. Retailers’ and brands’ omnichannel strategies are increasingly influencing clients, and e-commerce is driving up pricing transparency. Second, new forms of competition, such as social media use and music and video streaming are vying for passengers’ idle time. Third, the range of offers at some airports, which for years have been focused on either luxury or high-volume items, are becoming less attractive. Fourth, passengers now expect more than just traditional airport “shopping”, with demand growing for experience-based events, especially virtual ones. Finally, opportunities are growing to capture and exploit passenger data.

These trends and the reshuffled passenger mix are driving changes in buyer behavior. With less traffic in airports, passengers are buying more because the quieter environment makes it more appealing to spend time in airport shops. Increased idle times also mean they stay longer. In addition, better price transparency means that passengers can more easily compare duty free offers against online or Main Street prices, and dismiss offers that are not the bargain they purport to be.

Recommendations: How can travel retailers adapt?

The upshot is that travel retail players need to adapt to survive. In short, airports, retailers and the entire ecosystem must embrace the new market dynamics. To do this, we believe they need to focus on two key areas: revamping their traditional offer and reinventing their business models. Below we give our recommendations.

"Collaboration between airlines, airports and travel retailers is essential to realize the potential of new business models."

Revamp the offer

Refocus on core passengers: Travel retailers know that some passengers spend more than others. Their traditional offer has always included a premium element (designer stores, upmarket boutiques and restaurants, etc.) to cater to them. But this low volume/high value market has been badly hit by travel restrictions placed on some of its biggest spenders, such as Asian or Brazilian passengers. As a result, airports need to refocus their offer on their core passengers. They must adapt their product assortment and merchandizing to target the growing share of low-cost passengers, who while traveling low cost, do not necessarily have lower purchasing power at the airport.

Renew formats: To stay fresh, travel retailers need to frequently reinvent their formats. These might include pop-up stores, shop-in-shops, live performances and games. Integrating modularity into the design of commercial spaces helps with this.

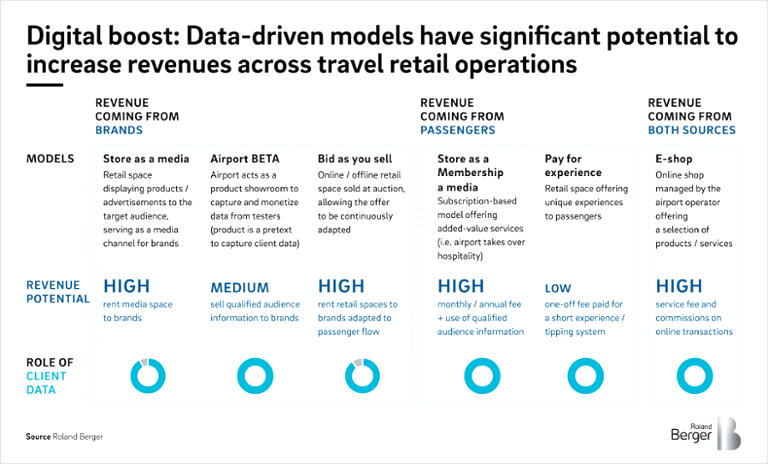

Modernize concepts: A purely transactional approach to travel retail is no longer enough. Players must develop concepts such as retail-as-a-media, where capturing data points on passengers is more valuable than making a sale. This involves showcasing, for example, electronics, with customers able to try out new products provided they register first.

Offer experiences: Memorable events can improve brand awareness, customer relations and sales. With their captive audiences, airports provide a perfect platform for surprising, entertaining events, such as concerts, virtual reality experiences and selfie-worthy backdrops.

Leverage data and AI: Good use of data can help turbocharge a retailer. For example, ultra-personalization can help to cement client relationships and performance can be improved by closely monitoring datapoints and adapting to changes accordingly.

"Our expert teams have considerable knowledge of travel retail, and have supported airports, travel retailers, brands and airlines through a host of strategic and operational challenges."

Reinvent business models

Leverage cooperation and value sharing: Collaboration between airlines, airports and travel retailers is essential to realize the potential of new business models. This could include developing loyalty cards for a retailer or airline, or a branded payment card for a retailer.

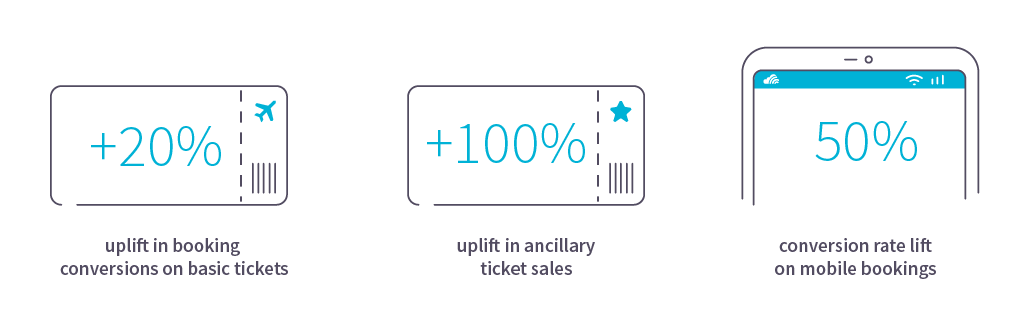

Case studies: Roland Berger success stories

Our expert teams have considerable knowledge of travel retail, and have supported airports, travel retailers, brands and airlines through a host of strategic and operational challenges. The following case studies highlight two recent success stories. Feel free to get in touch for more information.

Case study 1: Airport

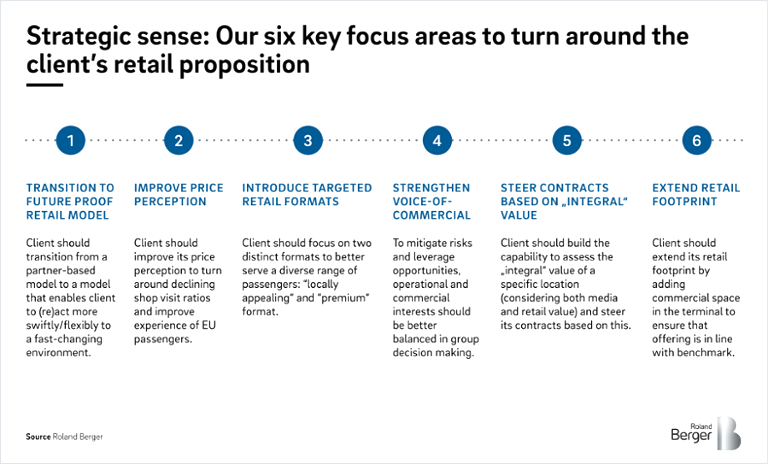

Project: A well-known European airport had a bottleneck in travel retail sales growth. Roland Berger was tasked with identifying the root cause and finding a transformation solution.

Approach: A comprehensive internal diagnosis identified declining sales per passenger as the root cause. Key factors behind this included passengers perceiving the retail offer to be expensive, an indifferent quality of assortment, insufficient consumer traction and a below-average commercial footprint.

Benchmarking against best practices at the airport’s leading competitors revealed it needed to step up to remain competitive. As such, we designed a commercial strategy with six key focus areas:

Case study 2: Duty-free retailer

Project: A leading Asian duty-free player wanted to win a concession in a major airport in Japan.

Approach: We conducted a thorough analysis of the retail RFP issued by the airport and compared it to the airport's specificities to determine the perfect requirements of its retail business. We identified three key needs, and proposed three corresponding KSFs:

Partial recovery: How three trends are changing long-distance travel

We calculated the impact of three trends on four key travel dimensions to determine the "recovery gap" between pre-crisis long-distance travel and the post-pandemic situation.

The future of long-distance mobility: How Covid jolted long-distance business travel

The outbreak of Covid-19 affected especially long-distance business traveling which is shown by a 66% globally decrease in air traffic last year.

The future of long-distance mobility: How Covid changed consumer appetites

The first part of our article series on long-haul mobility examines how private travel has forever changed, and why European demand might not return until 2025.

Transportation, Tourism & Logistics

Roland Berger supports the mobility and logistics industry in digitization along the entire value chain.

Smart Mobility

Smart Mobility contributes to a more sustainable and value-adding state of mobility. Find out more about new mobility scenarios for our society here.

- Publications

- Recommendations for successful travel retail

Select a market

- South Korea

- Netherlands

- New Zealand

- Philippines

- Switzerland

Please leave a message

- Fast Moving Consumer Goods

- Food Services

- Luxury & Lifestyle

Access a full range of integrated solutions to support your business growth.

Stay updated with our latest insights on Asia and beyond.

- Pharmaceuticals

- OTC & Consumer Health

- Medical Devices

- Commercial Services

- Patient Services

- Distribution Services

- Regulatory Services

- Food & Beverage Ingredients

- Personal Care Ingredients

- Pharmaceutical Ingredients

- Specialty Chemicals

- Innovation and Formulation

- Distribution

- Commercial and Industrial Applications

- Precision Machinery

- Scientific Solutions

- Semiconductor & Electronics

- Market Analysis and Strategies

- Marketing and Sales

- Application Engineering

- Distribution and Logistics

- After-Sales Services

Our products

Search our product database.

Accessing a global sourcing network.

Market insights

Generating ideas for growth.

Marketing and sales

Opening up new revenue opportunities.

Distribution and logistics

Delivering what you need, when you need it, where you need it.

After-sales services

Servicing throughout the entire lifespan of your product.

Learn about our global hub for Digital & IT services.

- Global website Australia Brunei Cambodia Canada China Finland Denmark France Germany UK Guam Hong Kong India Indonesia Italy Japan South Korea Laos Latvia Hong Kong Malaysia Myanmar Netherlands New Zealand Philippines Poland Portugal Singapore Spain Sri Lanka Sweden Switzerland Taiwan Thailand USA Vietnam

- Sustainability

- Our expertise

Five potential indicators for the future of travel retail

“Experiences are more important than possessions.” This has become a mantra of Asia’s tourism industry as it seeks to understand how travel behaviors may evolve post-pandemic.

The underlying precept is that travelers may want to escape to nature, to experience freedom in serene landscapes rather than spend time shopping when travel bans are eventually lifted. Tourists radiating away from urban centers could dampen the much-hoped-for revival of travel retail spending.

Yet, predicting future trends in Asian travel is risky. Having been unable to fly beyond borders for 15 months and counting may mean that caution and safety remain paramount, at least initially. Alternatively, grounded travelers may take to the skies in large numbers as soon as the airport gates are opened.

But when travel does resume, will “revenge spend” travelers stimulate visitor economies once more? And how should businesses prepare? At the same time, has skyrocketing pandemic-era growth in eCommerce altered travel retail forever? If so, what new spending patterns could emerge?

Amid the current uncertainty, here are five factors to consider:

1. Charting domestic consumer spending

There will be a temptation to compare reopening travel retail activity with 2019, the last year for which measurable data is available. A more effective way to benchmark spending patterns soon will be to analyze domestic Asian markets in 2020 and 2021.

Scrutinizing vacation expenditure flows in markets that enjoyed strong domestic travel during the pandemic such as China, Vietnam, South Korea and Taiwan will help gauge the degree to which consumer sentiment is shifting either temporarily or long term.

Although, shopping priorities for domestic tourists tend to differ from when they travel overseas, analyzing local consumer markets can provide buying insights that are otherwise missing.

- Unlocking travel spend will require retailers to scrutinize realigned consumer attitudes and purchasing triggers during the pandemic

- Pre-COVID-19, domestic tourism was frequently overlooked as a guide to how travelers might behave and purchase when they take an overseas vacation

- eCommerce demand has grown and diversified and may continue while on vacation. Travelers may, for instance, use local shopping sites to buy daily use items

2. Watching the Hainan experience

China has proved to be a rare holiday retail hotspot in Asia during COVID-19. Hainan Island, which is China’s offshore duty-free shopping destination, has delivered impressive results since domestic travel reopened last summer.

Although visitors to Hainan from China fell 22 percent in 2020, there were still nearly 65 million visitors and sales of duty-free items increased by 127 percent from 2019. With COVID-19 under control, Chinese travelers are displaying more confidence to travel and shop using e-payment apps such as AliPay and WeChat Pay.

In the first quarter of 2021, Hainan recorded duty-free sales of RMB 13.6 billion, a spectacular 356 percent increase in the same 2020 period.

- To boost travel retail during the pandemic, China increased the annual tax-free shopping limit for its travelers visiting Hainan Island on vacation

- The enhanced sales cap helped expand the volume of duty-free sales and encouraged brands and retailers to unveil new products and promotions in Hainan

- Monitoring domestic trends are important as the proven spending power of Chinese travelers will likely drive retail competition once international tourism restarts

3. Innovating in travel shopping

While international travel has been on pause in most of Asia since March 2020, imaginative solutions have been tested to promote travel shopping. In South Korea, “flights to nowhere” by seven local airlines take off and return to the same Korean airport without landing elsewhere. However, each flight route crosses into Japanese airspace enabling passengers to purchase tax-free items at the airport as if taking an international flight.

We are also starting to see an acceleration of duty-free shopping beyond airport outlets. South Korea’s Lotte plans to open a duty-free store in downtown Hanoi in 2021, followed by Da Nang. This follows the opening of Lotte city outlets in Melbourne and Tokyo. Meanwhile, Da Nang plans to build an international duty-free zone to attract luxury shoppers and tourists, and bolster the visitor economies of nearby destinations like Hue and Hoi An.

- Introducing new duty-free formats will help cosmetics, fragrance, jewelry and drinks brands to tap pent-up “revenge spend” and breathe new life into travel retail

- Pre- and post-flight stores will likely diversify and regularly refresh their product ranges to tempt travelers to make in-the-moment purchases

- Offering duty-free shopping in downtown locations could generate more foot traffic and benefit existing retailers in the initial post-pandemic period

4. Making travel payments seamless

During COVID-19, Asian consumers have relied on smartphone shopping and payment apps. The frictionless safety of cashless transactions is here to stay. Ongoing development of digital currencies should also make it smoother and more secure for travelers to make touchless purchases while overseas.

As mentioned in our previous article five reasons why digital currencies will influence consumer behaviors , Cambodia, Thailand and Malaysia plan to standardize cross-border payments, and Thailand and Vietnam may introduce a QR code payment app for tourists from each country. Meanwhile, JPMorgan is trialing an international payments tool using Blockchain in Indonesia and Taiwan, and Vietnam’s e-wallet apps Sacombank Pay and Liên Việt 24h signed with Lotte Duty-free to help tourists shop without cash and enjoy customized promotions.

Offering digital payment options that are safe, secure and seamless are important for enticing Asian consumers to spend while traveling

Creative promotions incorporating elements of personal participation and gamification may help retailers and brands unlock latent travel spend

Asia’s digital wallet and e-currency landscape is changing fast, and retailers will need to adapt quickly to a dynamic and unpredictable cashless future

5. Buying into the travel experience

Despite widespread social restrictions, brand innovation has gained a new impetus during the pandemic with a focus on local consumers. The Made in Vietnam campaign has inspired young creatives from Hanoi to Ho Chi Minh City to launch stylish lifestyle accessories and organic products reflecting both local culture and people’s pandemic-era experiences.

In Indonesia, the Philippines and Malaysia, artistically branded product lines reflect the shifting zeitgeist. Meanwhile, international clothing and footwear brands are commissioning local artists to create uplifting designs for limited-edition releases. Social media advocacy may result in some of these innovations becoming coveted in the future by inbound visitors seeking “sense of place” shopping experiences.

Travel consumers will be on the lookout for unique, locally produced mementos that combine the culture and creative renaissance of their chosen destination

Gift giving is popular with Asian tourists and post-pandemic travelers will desire locally branded items launched during a time when travel overseas was not possible

Destinations boasting clearly defined brand appeal, such as whisky in Japan, cosmetics in South Korea and organic products in Australia and New Zealand, may experience strong travel shopping demand

Related stories

VR and storytelling: a fairy tale ending

NFTs Are Hitting All the Right Notes in Southeast Asia

Five Reasons Why Digital Currencies Will Influence Consumer Behaviors

Five Factors Driving Digital Expansion in Southeast Asia

Four Factors Driving Southeast Asia’s Economic Future

Five Reasons Why “Escape to Nature” Will Be a Hot Topic in 2022

Switzerland Tops the List of World’s Most Innovative Markets

Related links.

- Global website

"People want to travel": 4 sector leaders say that tourism will change and grow

The global travel and tourism industry's post-pandemic recovery is gaining pace as the world’s pent-up desire for travel rekindles. Image: Unsplash/Anete Lūsiņa

.chakra .wef-1c7l3mo{-webkit-transition:all 0.15s ease-out;transition:all 0.15s ease-out;cursor:pointer;-webkit-text-decoration:none;text-decoration:none;outline:none;color:inherit;}.chakra .wef-1c7l3mo:hover,.chakra .wef-1c7l3mo[data-hover]{-webkit-text-decoration:underline;text-decoration:underline;}.chakra .wef-1c7l3mo:focus,.chakra .wef-1c7l3mo[data-focus]{box-shadow:0 0 0 3px rgba(168,203,251,0.5);} Anthony Capuano

Shinya katanozaka, gilda perez-alvarado, stephen kaufer.

Listen to the article

- In 2020 alone, the travel and tourism industry lost $4.5 trillion in GDP and 62 million jobs - the road to recovery remains long.

- The World Economic Forum’s latest Travel & Tourism Development Index gives expert insights on how the sector will recover and grow.

- We asked four business leaders in the sector to reflect on the state of its recovery, lessons learned from the pandemic, and the conditions that are critical for the future success of travel and tourism businesses and destinations.

The global travel and tourism sector’s post-pandemic recovery is gaining pace as the world’s pent-up desire for travel rekindles. The difference in international tourist arrivals in January 2021 and a similar period in January 2022 was as much as the growth in all of 2021. However, with $4.5 trillion in GDP and 62 million jobs lost in 2020 alone, the road to recovery remains long.

A few factors will greatly determine how the sector performs. These include travel restrictions, vaccination rates and health security, changing market dynamics and consumer preferences, and the ability of businesses and destinations to adapt. At the same time, the sector will need to prepare for future shocks.

The TTDI benchmarks and measures “the set of factors and policies that enable the sustainable and resilient development of the T&T sector, which in turn contributes to the development of a country”. The TTDI is a direct evolution of the long-running Travel and Tourism Competitiveness Index (TTCI), with the change reflecting the index’s increased coverage of T&T development concepts, including sustainability and resilience impact on T&T growth and is designed to highlight the sector’s role in broader economic and social development as well as the need for T&T stakeholder collaboration to mitigate the impact of the pandemic, bolster the recovery and deal with future challenges and risks. Some of the most notable framework and methodology differences between the TTCI and TTDI include the additions of new pillars, including Non-Leisure Resources, Socioeconomic Resilience and Conditions, and T&T Demand Pressure and Impact. Please see the Technical notes and methodology. section to learn more about the index and the differences between the TTCI and TTDI.

The World Economic Forum's latest Travel & Tourism Development Index highlights many of these aspects, including the opportunity and need to rebuild the travel and tourism sector for the better by making it more inclusive, sustainable, and resilient. This will unleash its potential to drive future economic and social progress.

Within this context, we asked four business leaders in the sector to reflect on the state of its recovery, lessons learned from the pandemic, and the conditions that are critical for the future success of travel and tourism businesses and destinations.

Have you read?

Are you a 'bleisure' traveller, what is a ‘vaccine passport’ and will you need one the next time you travel, a travel boom is looming. but is the industry ready, how to follow davos 2022, “the way we live and work has changed because of the pandemic and the way we travel has changed as well”.

Tony Capuano, CEO, Marriott International

Despite the challenges created by the COVID-19 pandemic, the future looks bright for travel and tourism. Across the globe, people are already getting back on the road. Demand for travel is incredibly resilient and as vaccination rates have risen and restrictions eased, travel has rebounded quickly, often led by leisure.

The way many of us live and work has changed because of the pandemic and the way we travel has changed as well. New categories of travel have emerged. The rise of “bleisure” travel is one example – combining elements of business and leisure travel into a single trip. Newly flexible work arrangements, including the opportunity for many knowledge workers to work remotely, have created opportunities for extended travel, not limited by a Monday to Friday “9 to 5” workweek in the office.

To capitalize on this renewed and growing demand for new travel experiences, industry must join governments and policymakers to ensure that the right conditions are in place to welcome travellers as they prepare to get back on the road again, particularly those who cross international borders. Thus far, much of the recovery has been led by domestic and leisure travel. The incremental recovery of business and international travel, however, will be significant for the broader industry and the millions who make their livelihoods through travel and tourism.

Looking ahead to future challenges to the sector, be they public health conditions, international crises, or climate impacts, global coordination will be the essential component in tackling difficult circumstances head-on. International agreement on common – or at least compatible – standards and decision-making frameworks around global travel is key. Leveraging existing organizations and processes to achieve consensus as challenges emerge will help reduce risk and improve collaboration while keeping borders open.

“The travel and tourism sector will not be able to survive unless it adapts to the virtual market and sustainability conscience travellers”

Shinya Katanozaka, Representative Director, Chairman, ANA Holdings Inc.

At a time when people’s movements are still being restricted by the pandemic, there is a strong, renewed sense that people want to travel and that they want to go places for business and leisure.

In that respect, the biggest change has been in the very concept of “travel.”

A prime example is the rapid expansion of the market for “virtual travel.” This trend has been accelerated not only by advances in digital technologies, but also by the protracted pandemic. The travel and tourism sector will not be able to survive unless it adapts to this new market.

However, this is not as simple as a shift from “real” to “virtual.” Virtual experiences will flow back into a rediscovery of the value of real experiences. And beyond that, to a hunger for real experiences with clearer and more diverse purposes. The hope is that this meeting of virtual and actual will bring balance and synergy the industry.

The pandemic has also seen the emergence of the “sustainability-conscious” traveller, which means that the aviation industry and others are now facing the challenge of adding decarbonization to their value proposition. This trend will force a re-examination of what travel itself should look like and how sustainable practices can be incorporated and communicated. Addressing this challenge will also require stronger collaboration across the entire industry. We believe that this will play an important role in the industry’s revitalization as it recovers from the pandemic.

How is the World Economic Forum promoting sustainable and inclusive mobility systems?

The World Economic Forum’s Platform for Shaping the Future of Mobility works across four industries: aerospace and drones; automotive and new mobility; aviation travel and tourism; and supply chain and transport. It aims to ensure that the future of mobility is safe, clean, and inclusive.

- Through the Clean Skies for Tomorrow Coalition , more than 100 companies are working together to power global aviation with 10% sustainable aviation fuel by 2030.

- In collaboration with UNICEF, the Forum developed a charter with leading shipping, airlines and logistics to support COVAX in delivering more than 1 billion COVID-19 vaccines to vulnerable communities worldwide.

- The Road Freight Zero Project and P4G-Getting to Zero Coalition have led to outcomes demonstrating the rationale, costs and opportunities for accelerating the transition to zero emission freight.

- The Medicine from the Sky initiative is using drones to deliver vaccines and medicine to remote areas in India, completing over 300 successful trials.

- The Forum’s Target True Zero initiative is working to accelerate the deployment and scaling of zero emission aviation, leveraging electric and hydrogen flight technologies.

- In collaboration with the City of Los Angeles, Federal Aviation Administration, and NASA, the Forum developed the Principles of the Urban Sky to help adopt Urban Air Mobility in cities worldwide.

- The Forum led the development of the Space Sustainability Rating to incentivize and promote a more safe and sustainable approach to space mission management and debris mitigation in orbit.

- The Circular Cars Initiative is informing the automotive circularity policy agenda, following the endorsement from European Commission and Zero Emission Vehicle Transition Council countries, and is now invited to support China’s policy roadmap.

- The Moving India network is working with policymakers to advance electric vehicle manufacturing policies, ignite adoption of zero emission road freight vehicles, and finance the transition.

- The Urban Mobility Scorecards initiative – led by the Forum’s Global New Mobility Coalition – is bringing together mobility operators and cities to benchmark the transition to sustainable urban mobility systems.

Contact us for more information on how to get involved.

“The tourism industry must advocate for better protection of small businesses”

Gilda Perez-Alvarado, Global CEO, JLL Hotels & Hospitality

In the next few years, I think sustainability practices will become more prevalent as travellers become both more aware and interested in what countries, destinations and regions are doing in the sustainability space. Both core environmental pieces, such as water and air, and a general approach to sustainability are going to be important.

Additionally, I think conservation becomes more important in terms of how destinations and countries explain what they are doing, as the importance of climate change and natural resources are going to be critical and become top of mind for travellers.

The second part to this is we may see more interest in outdoor events going forward because it creates that sort of natural social distancing, if you will, or that natural safety piece. Doing outdoor activities such as outdoor dining, hiking and festivals may be a more appealing alternative to overcrowded events and spaces.

A lot of lessons were learned over the last few years, but one of the biggest ones was the importance of small business. As an industry, we must protect small business better. We need to have programmes outlined that successfully help small businesses get through challenging times.

Unfortunately, during the pandemic, many small businesses shut down and may never return. Small businesses are important to the travel and tourism sector because they bring uniqueness to destinations. People don’t travel to visit the same places they could visit at home; they prefer unique experiences that are only offered by specific businesses. If you were to remove all the small businesses from a destination, it would be a very different experience.

“Data shows that the majority of travellers want to explore destinations in a more immersive and experiential way”

Steve Kaufer, Co-Founder & CEO, Tripadvisor

We’re on the verge of a travel renaissance. The pandemic might have interrupted the global travel experience, but people are slowly coming out of the bubble. Businesses need to acknowledge the continued desire to feel safe when travelling. A Tripadvisor survey revealed that three-quarters (76%) of travellers will still make destination choices based on low COVID-19 infection rates.

As such, efforts to showcase how businesses care for travellers - be it by deep cleaning their properties or making items like hand sanitizer readily available - need to be ingrained within tourism operations moving forward.

But travel will also evolve in other ways, and as an industry, we need to be prepared to think digitally, and reimagine our use of physical space.

Hotels will become dynamic meeting places for teams to bond in our new hybrid work style. Lodgings near major corporate headquarters will benefit from an influx of bookings from employees convening for longer periods. They will also make way for the “bleisure” traveller who mixes business trips with leisure. Hotels in unique locales will become feasible workspaces. Employers should prepare for their workers to tag on a few extra days to get some rest and relaxation after on-location company gatherings.

Beyond the pandemic, travellers will also want to explore the world differently, see new places and do new things. Our data reveals that the majority want to explore destinations in a more immersive and experiential way, and to feel more connected to the history and culture. While seeing the top of the Empire State building has been a typical excursion for tourists in New York city, visitors will become more drawn to intimate activities like taking a cooking class in Brooklyn with a family of pizza makers who go back generations. This will undoubtedly be a significant area of growth in the travel and tourism industry.

Governments would be smart to plan as well, and to consider an international playbook that helps prepare us for the next public health crisis, inclusive of universal vaccine passports and policies that get us through borders faster.

Understanding these key trends - the ongoing need to feel safe and the growing desire to travel differently - and planning for the next crisis will be essential for governments, destinations, and tourism businesses to succeed in the efforts to keep the world travelling.

- Commerce Media Platform The connected commerce media environment for the open internet

- Commerce Growth For marketers & agencies looking for automated acquisition & retention

- Commerce Max For brands & agencies looking for retail media on the open internet

- Commerce Grid For media owners, agencies, and retailers looking to connect media and commerce with programmatic

- Commerce Yield For retailers, marketplaces & commerce companies looking to control, scale, and maximize digital and physical asset monetization

- Addressability Learn about our multi-pronged addressability strategy for the ecosystem

- AI Engine Removes the guesswork to save time and reach your KPIs

- Predictive Bidding Bids based on the predicted value of each user to save you money

- Product Recommendations Intent-based recommendations that drive more sales

- Shopper Graph Connects shopper IDs & commerce data to scale and optimize your campaigns

- Customer Acquisition Reach new people who are likely interested in you but don't know you yet

- Customer Retention Increase customer lifetime value from people who already know you

- Dynamic Retargeting Increase conversions from people who know you with personalized product ads

- Audiences Find and keep your next top customer with the largest commerce dataset

- Video Advertising Drive discovery and engagement with CTV, OTT and online video

- Contextual Advertising Level up your targeting by combining commerce data and contextual data

- Retail Media Reach and convert shoppers with relevant ads near the digital point of sale

- Resource Center Reports, guides, webinars, and more to inform your ad strategy

- Blog Fresh insights on commerce media and digital advertising

- Success Stories How others have realized their goals by partnering with Criteo

- Consumer Trends The latest consumer data for 20 countries and 600+ product categories

- Glossary Definitions of the most common digital advertising terminology

- Support Center FAQs, guides, and more to help you maximize your Criteo campaigns

- Events See where Criteo will be next

- Digital Ad Formats Explore our ad formats for video, adaptive, rich media, and more

- Ad Gallery Real-world examples for a variety of formats, verticals, and regions

- Dynamic Creative Optimization+ Real-time creative decisioning that scales to make sure your ads are seen

- Ad Trust and Safety Maintain the highest level of quality and performance

- Company Get to know Criteo

- Investors Information for investors

- In the News Press releases and mentions

- Diversity, Equity and Inclusion Our DEI pillars, goals, and more

- Sustainability Our approach for a sustainable future

- Product Ethics How we ensure ethical advertising

- Careers Explore open opportunities

Global travel industry trends 2024: Travelers become master planners

So far in 2024, the global travel industry is seeing a significant resurgence, accompanied by a noticeable trend: People are becoming more skilled at planning their trips and are mastering the art of travel.

Equipped with a wealth of online tools, these travelers are tailoring their itineraries to ensure enriching experiences at maximum value. Resources like AI assistants to one-stop-shop booking platforms empower travelers to curate highly personalized getaways.

To understand the state of global travel in 2024, we analyzed Criteo’s dataset from hundreds of travel players and results from a survey of 10,000+ travelers globally. These are the trends that will help advertisers adapt to this year’s evolving landscape.

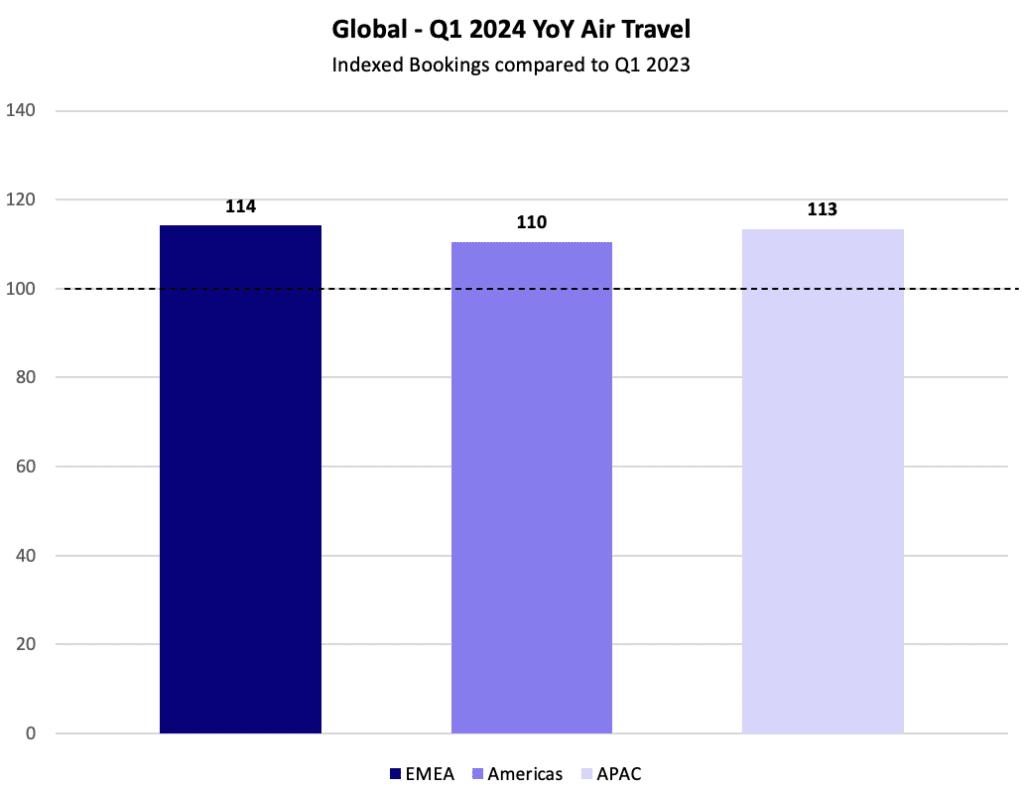

1. People are surfing the travel surge.

Across all major regions, bookings for air travel soared by double digits year-over-year during the first quarter of 2024, signaling a robust boost in travel for the upcoming months. Air bookings rose +14% in EMEA, +13% in APAC, and +10% in the Americas YoY.

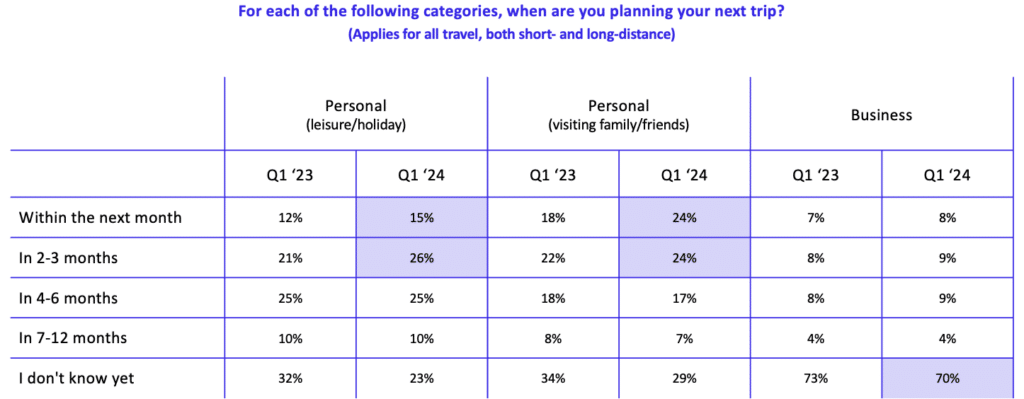

Anticipate a surge in personal getaways this spring and early summer. According to Criteo’s survey, more people around the world plan to travel for leisure or visit friends/family in the next 1-3 months.

2. AI and booking sites offer algorithmic adventures.

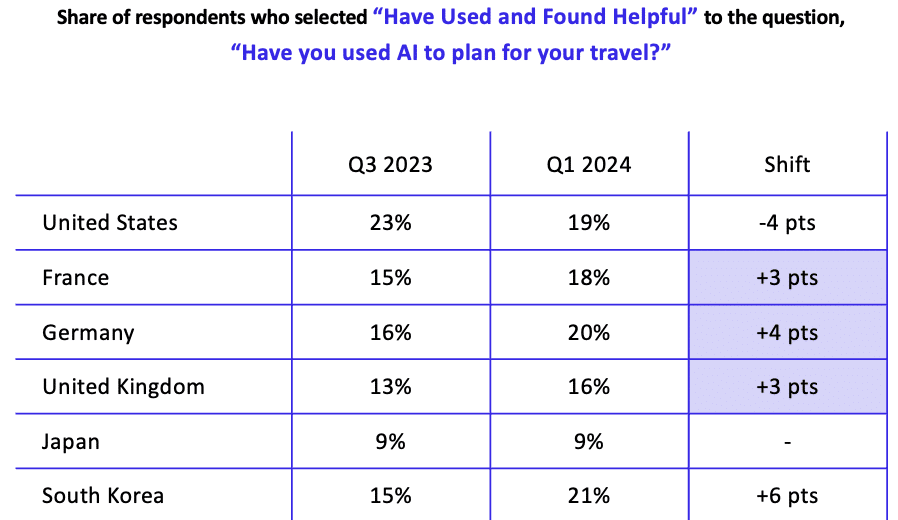

In the past 6 months, more travelers are finding AI tools useful for recommendations—especially for dining experiences, accommodations, and activities. This shift is the strongest among travelers in South Korea, with a 6-point growth when comparing Q3 2023 and Q1 2024.

The adoption of AI tools by travelers is also gaining momentum in Europe. More travelers in Germany (+4 points), France (+4 points), and the UK (+3 points) said they found AI tools useful over the same period.

Throughout the online booking journey, travelers are also open to suggestions from travel providers. Half of travelers around the world (48%) get inspiration from travel booking sites.

3. People value personal travel advice.

While assistance from AI and travel booking websites influence the planning journey, travelers still prefer word-of-mouth suggestions. A full 61% of travelers globally said that recommendations from family and friends is a strong decision-making factor. Over one-third of people globally also find inspiration from personal travel content sites like blogs.

Positive reviews are another highly influential factor and are gaining traction. When choosing a travel provider, two-thirds of travelers globally consider positive reviews. This was up 8 points in Q1 2024 compared to in Q3 2023.

4. Travelers are finding ways to adapt to rising costs.

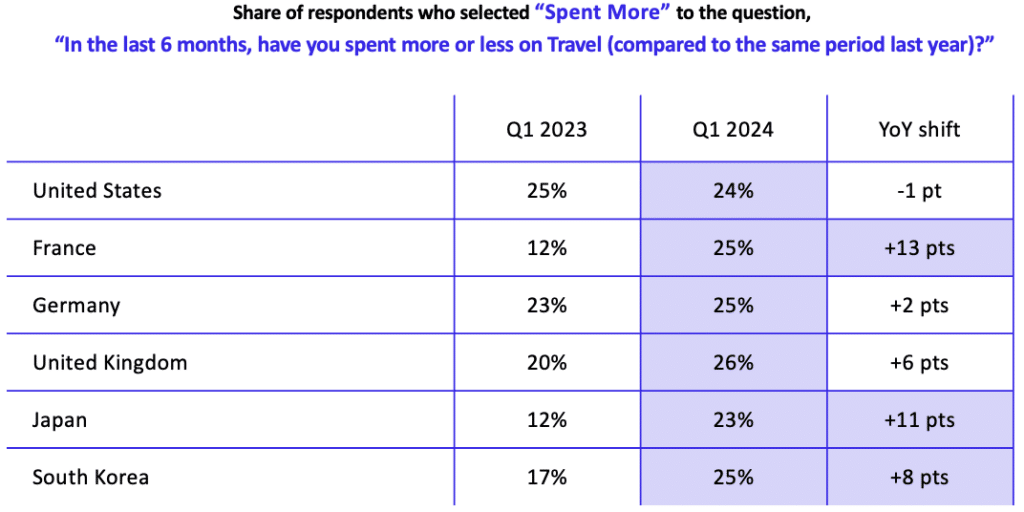

In Q1 2024, 25% of travelers around the world said they spent more on travel within the last six months compared to the same period a year prior.

Rising costs were felt most by travelers in France (+13 points), Japan (+11 points), and South Korea (+8 points).

To secure better travel deals, 38% of people globally said they have or would consider changing the timing of their trips. This trend is even more pronounced among travelers in Japan, where 52% are open to adopting this strategy.

One in four travelers worldwide also plan to save money by engaging in fewer activities and opting for more affordable dining experiences. A third of US travelers will also leverage rewards from loyalty programs.

While many travelers aim to cut costs, a growing portion are embracing higher expenditures . A striking 75% of those who spent more on travel in the last six months also splurged on non-essential costs like luxury goods, dining out, health and beauty products, and apparel and accessories.

5. Booking everything from one source offers convenience.

Half of travelers compare multiple (3+) travel providers in search of the best deals.

However, many people prefer to book all travel services from a single source for added convenience and ease of coordination. Three in five travelers globally booked all aspects of their most recent trip—such as flights, hotels, rental cars, and activities—through a single platform, website, app, or provider.

6. Mobile helps travelers embrace their spontaneity.

Travelers enjoy having the freedom to make spur of the moment decisions. Nearly 1in 5 opt to leave some bookings for mid-trip. US travelers lead in flexibility, with 77% stating they booked most aspects of their trip right before departure.

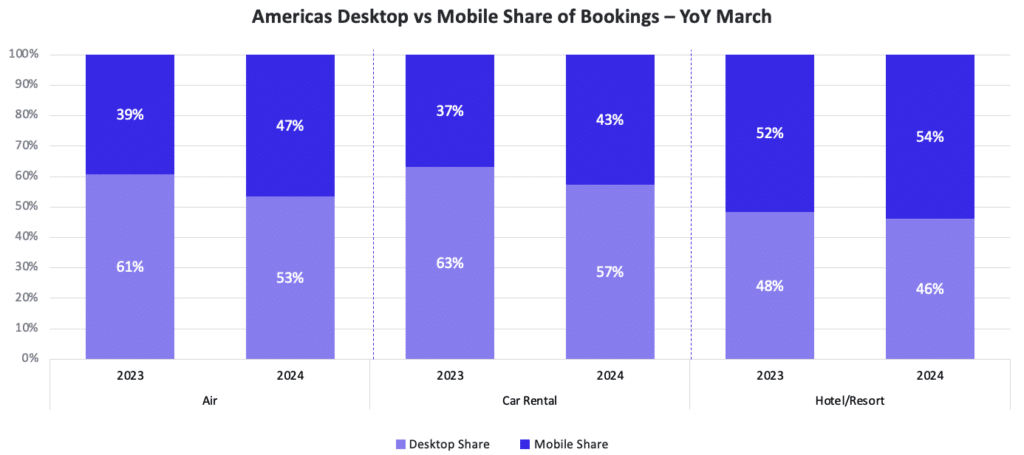

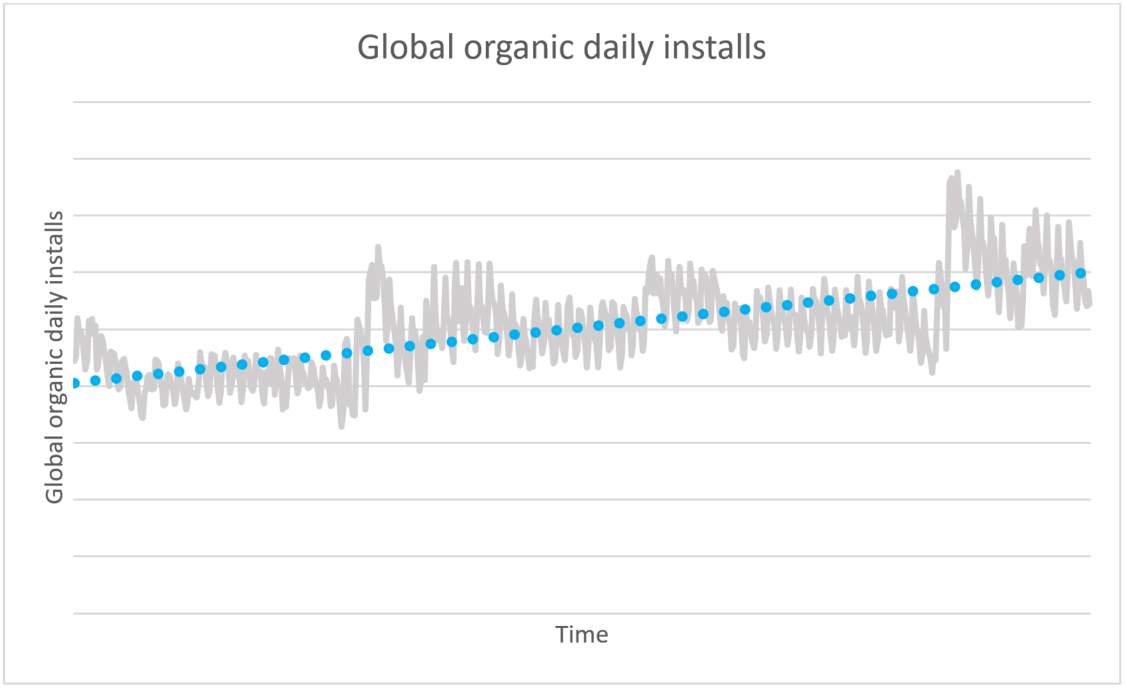

Booking while on-the-go is also popular. In the Americas and EMEA, the share of air travel bookings completed on mobile devices increased by 8 points in March 2023 compared to March 2024. Similarly, there was a 6-point increase in APAC.

Source: Organic Criteo Data. Americas Travel Partners. Comparing March Bookings in 2023 vs 2024. Desktop and Mobile included, App and Tablet included in Mobile, sample permitting.

Embark on your advertising odyssey

Capturing the attention of travelers demands a highly personalized approach. By crafting ads that directly address their needs and interests—like discounts, loyalty rewards, destination ideas, and activity recommendations—advertisers can boost engagement and bookings.

Given that travelers explore multiple options before making a purchase, a retargeting strategy also helps keeps users engaged until they decide where to go and what they want to experience on their next trip. Meanwhile, retention campaigns can encourage stronger lifetime value as existing travel customers tend to have higher spend compared to first-time buyers.

For more global travel trends, read our full report, Travel Insights: Unpacking the Landscape of the Escape Industry and register for immediate access to our on-demand webinar.

Discover why 19,000+ global clients trust Criteo as their preferred advertising partner.

Elizabeth Kim is a Global Content Strategist captivated by technology, culture, and consumer behavior. Before joining the world of adtech, Elizabeth crafted brand and content strategies at agencies for clients spanning startups to household name giants. Outside of work, Elizabeth finds creative ...

Recommended reading:

How Will Retailers and Brands Utilize Omnichannel?

Retail media, the smart marketer’s guide to customer loyalty, latest resources, the great defrag, criteo’s 2024 addressability strategy, leveraging google’s privacy sandbox with commerce grid, subscribe to our newsletter.

Fresh sales trends and consumer insights to help you plan and win.

Related content

Stay in the know on all things digital marketing

Criteo expands its TAG certifications, ensuring safer digital advertising

10 commerce media truths: The principles behind digital advertising’s hottest opportunity

The state of retail media today: How does your maturity level compare?

Alternative IDs: The future of cookieless advertising?

2024 will be a year of change. Here’s how publishers are gearing up for it.

The Bottom Line of Privacy Sandbox Testing: What You Need to Know

9 questions on modern retailing for travel agencies to ask themselves

Agencies & OTAs

- Around the Industry

- Corporate Travel

- Data & Analytics

- Developers & Startups

- General Blog

Retailing & Merchandising

- Sabre Direct Pay

- Sustainability

- Travel Providers

- Travel Trends

- Traveler Experience

- Modern Retailing

- Sabre Travel AI

- Google Partnership

- Sabre Labs & Research

- News & Views

- Customer Success

- Share on Facebook

- Share on Twitter

- Share on LinkedIn

Are you discussing modern, offer- and order-based travel retailing with other leaders at your agency? Airlines, tech providers, and many travel retailers are figuring out what the future means for them, and now is a great time for you to do the same. Here are nine questions agency leaders should think about.

- What’s new about ‘modern’ travel retailing?

- What do travelers want ?

- What about us? The role of agencies

- How do we build a successful strategy?

- How will our operations need to change?

- What does an effective tech stack include?

- How can tech providers like Sabre help?

- Are airlines making progress?

- The transition: how do we get there?

1. What’s new about ‘modern’ travel retailing ?

To get started, it’s helpful to consider the basics….

Travel retailing is the process of selling and servicing travel and related products. ‘Retailing’ goes beyond selling to consider the holistic customer experience, not just a simple transaction.

Modern travel retailing refers to retail experiences that meet and exceed the expectations of today’s travelers. It involves frictionless, intuitive, and personalized shopping, booking, and servicing. The travel industry today is disjointed across stakeholders and falls behind other industries in delivering this level of experience.

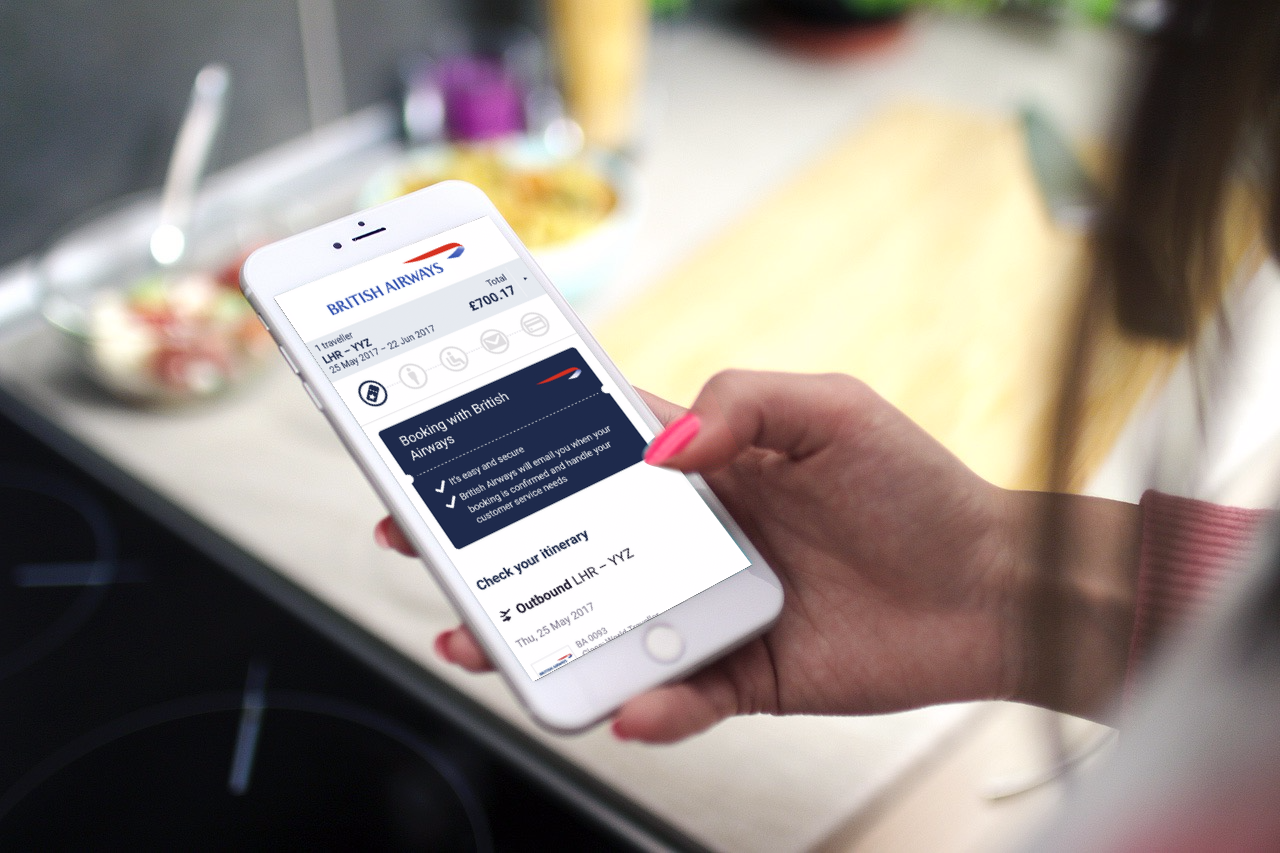

Offers and orders is an airline initiative driven by IATA that replaces the traditional sales and service infrastructure between tech providers, travel suppliers, retailers and buyers with a modular infrastructure enabled by offers and orders. It’s underpinned by industry standards: NDC and ONE Order. NDC enables richer messages and content to be sent from an airline to third parties . ONE Order combines PNRs, e-tickets, and electronic miscellaneous documents to be combined in a single record.

Airlines can use these standards to create modern retailing experiences by distributing new content and capabilities through third parties:

- New products and non-air extras beyond traditional ancillaries

- Personalized product bundles tailored with contextual information

- More relevant search results based on traveler profile or persona

- Improved self-service and automated order management

Agency leaders should make sure they understand these opportunities and stay up to date with industry standards to make informed decisions about what it means for their businesses and customers.

2. What do travelers want?

Offers and orders is an airline initiative driven by IATA that replaces the traditional sales and service infrastructure between tech providers, travel suppliers, retailers and buyers with a modular infrastructure enabled by offers and orders. It’s underpinned by industry standards: NDC and ONE Order. NDC enables richer messages and content to be sent from an airline to third parties. ONE Order combines PNRs, e-tickets, and electronic miscellaneous documents to be combined in a single record.

3. What about us? The role of agencies

In Stuck in the middle seat: how agencies can take control of their future , we looked at the role and perspectives of agencies in the evolving airline distribution landscape. We considered how the bulk of development work needed for the industry to transition to offer and order-based retailing relies on airlines and tech providers.

But agencies aren’t necessarily on the sidelines. They are expected to account for more than 40% of gross airline bookings this year, representing hundreds of millions of customer interactions. This gives agencies a strong position from which to understand and address customer needs.

In a future enabled by offers and orders, the scope of travel retailing and customer experiences will broaden beyond what’s possible today. Many agencies are already delivering intuitive and personalized retailing experiences, and they can use the industry’s transformation as an opportunity to innovate further: redefine their role in the ecosystem, streamline processes, deepen relationships with customers, and open new partnership and revenue opportunities.

As we’ve seen recently with tech giants like Google, Microsoft, Meta and Baidu launching artificial intelligence (AI) products in quick succession, the travel industry will reach a tipping point in the next few years when modern retailing experiences become table stakes. Agency leaders need to start thinking about how to position themselves in the travel industry of the future.

4. How do we build a successful strategy?

Offer- and order-based retailing, enhanced by AI/ML solutions, presents new ways for agencies to interact with customers. New products, more relevant offers, richer content displays, and streamlined servicing all influence conversion rates, revenue opportunities, customer satisfaction and loyalty.

To capitalize on new opportunities and stay competitive, agency leaders should think about implications to their business strategies:

- Value proposition and service offerings

- Customer acquisition and loyalty tactics

- Target customer segments and marketing activities

- Product scope beyond flights and traditional ancillaries

- Supplier contracts and partnerships for new ancillaries and non-air products and services

- Supporting NDC in requests for proposals/information from corporations

- Retailing and communication opportunities throughout the customer journey

5. How will our operations need to change?

Agencies’ organizational structures and operations will need to adapt for new retailing capabilities. Orders will become more complex as they increasingly feature new products and data from multiple suppliers. Operational processes will change, for example, with the NDC shopping-led workflow and the phasing out of the PNR.

Order management will eventually be more streamlined with a single order record. However, it’s time-consuming for agents in the short-term with disparate servicing capabilities across distribution channels and suppliers.

To minimize disruption and future-proof their businesses, agency leaders need to consider how they operate:

- Organizational and team structures to address new capabilities

- Duty of care responsibilities for increasingly complex orders

- Automation, disruption management, and self-service opportunities

- Redefined service level agreements as the product scope increases

- Training on new reconciliation, accounting, analytics and reporting workflows

- Redeployment of individual travel agents to complex servicing and revenue-generating tasks

6. What does an effective tech stack include?

The transition to modern retailing is primarily a technological one: using NDC instead of EDIFACT and phasing out PNRs and EMDs in favor of ONE Order records. These standards introduce new data types and change the size, frequency and quantity of messages sent between systems. This has a knock-on effect on system latency, uptime, scalability and ultimately on customer experience.

To introduce tailored offers, airlines will also rely on more contextual information and customer data from the indirect channel. As traditional technologies are discontinued and new opportunities arise, agency leaders need to consider the technological implications on their systems and processes:

- The interdependence of internal and external systems across front, mid and back office

- Customer relationship management and data stewardship within agencies and between industry stakeholders

- Privacy, security and regulatory compliance for customer and booking data

- Data needs across marketing, accounting, reconciliation, duty of care and more

- The capabilities of marketing and customer relationship management tools

- AI/ML and data science opportunities and challenges

- Internal tech team capabilities and the mix of in-house bespoke software vs bought solutions

7. How can tech providers like Sabre help?

8. are airlines making progress.

Progress varies across the industry and some airlines have made more progress than others: dozens of airlines like Singapore Airlines and Qantas are working on NDC solutions as a stepping-stone towards modern retailing; some airlines like Finnair are going all-in with a plan to phase out EDIFACT distribution by 2025; and many airlines haven’t yet shared plans to adopt NDC.

Agency leaders can communicate directly with suppliers and leverage relationships with tech providers like Sabre to show and help accelerate progress. These are some of the considerations for discussions with suppliers:

- Availability of new and exclusive NDC offers

- Differences between NDC and existing ATPCO/EDIFACT content and capabilities

- Willingness to introduce or renew corporate negotiated offers

- Data and customer stewardship between suppliers, retailers and customers

- New benchmarks for success and service levels

- Potential changes to business reporting and reconciliation

9. The transition: how do we get there?

The travel industry is a complex web of stakeholders with different priorities. The transition to modern retailing is a long journey and we’ll undoubtedly face challenges and surprises along the way. IATA set 2030 as the target date for airline industry readiness, but there won’t be a big ‘switch on’ of new content and capabilities or a big ‘switch off’ of traditional technologies – we’ll operate in a world of multi-distribution workflows for many years.

Suppliers are building new solutions and they’re matching existing content and capabilities before experimenting with new ones. Tech providers like Sabre are expanding intelligent aggregation solutions to normalize content and workflows. Agencies have their own work to do on the strategic, operational, and technological considerations.

In the short term, we’re working on overcoming a few core challenges that impact agencies and the broader industry: multiple technical schema versions, shopping versus schedule-led workflows, and the technical performance of NDC-enabled systems. Additionally, 19 airlines currently make their NDC offers available to Sabre-connected agencies . By activating NDC capabilities from Sabre, you can maximize access to leading content with end-to-end workflow support, including servicing.

About the Author

Jonny Blackler is part of the Sabre team exploring what the future of travel will look like, what it means for travel agencies, and how agencies can transition their businesses to make the most of emerging technologies.

Take the conversation further with Sabre

As a global travel technology provider, we deeply understand the industry today, where we can go tomorrow, and the work needed to get us there.

Related Post

April 17, 2024

Tech Takeoff: paving the way for truly traveler-centric airline retailing

In today's dynamic airline landscape, where competition is fierce, margins slim and consumer choice abundant, airlines must prioritize the end-to-end traveler experience to not only survive but thrive.

April 2, 2024

Beyond NDC supports multi-passenger offers

The reason for booking a trip usually informs how many people will be involved. Corporate travel often includes one adult, while leisure trips typically involve multiple adults, or families with young children in tow. Sabre’s NDC...

April 1, 2024

Booking NDC content is easy in the Sabre GDS. Here’s why.

Looking for more detail? Check out our resources for getting started with NDC: Don’t miss out on NDC updates from Sabre! Subscribe to stay up to date on news and fresh resources.

February 26, 2024

Performing while transforming: Three ways to unlock revenue along the path to modern airline retailing

In recent months, there has been a noticeable shift in the industry conversation around airlines’ transition to offer- and order-enabled retailing, with questions like ‘if’, ‘why’ and ‘when’ being replaced by ‘how’. Many have already started...

September 25, 2023

Can your agency tech stack meet the demands of modern retailing?

Agency tech stacks will need to be updated to consume new data standards and process more data in new ways. Sabre supports leisure agencies, travel management companies, and online travel agencies to achieve modern retailing success...

August 31, 2023

Rethink your agency operations to achieve modern retailing success

Modern travel retailing, enabled by offers and orders and enhanced with AI/ML solutions, presents new ways for agencies to interact with customers. It also means new processes, increasingly fragmented content, shopping-led instead of schedule-led workflows, and...

July 27, 2023

What Top Gun can teach us about the future of airline retailing

Few movies have stood the test of time as well as Top Gun, and while I’ve let go of my childhood dreams of becoming a fighter pilot, I’m now focused on technological advancements in air travel...

July 25, 2023

Building a strategy for modern agency retailing success

Modern travel retailing, enabled by offers and orders and enhanced with AI/ML solutions, presents new ways for agencies to interact with customers. To capitalize on new opportunities and stay competitive, agency leaders should consider implications to...

Unsupported browser detected, for a better experience please upate to a newer version of Internet Explorer.

For the brave

The Future of Travel Retail Webinar

Where others see uncertainty, we see a world of possibility.

Times have changed. Radically so. Yet while other industries have pushed the boundaries of retailing innovation, travel stayed the same. Now, we want what they’ve got – and that demands huge transformation.

Watch our webinar about the future of travel retail and the monumental change that’s to come.

Listen to Jen Catto, CMO at Travelport, delving into the minds of travelers, to uncover why travel retailing is broken — and how it can be fixed —exclusively revealing the results of our retailing research.

Then find out from Travelport’s CPTO, Tom Kershaw, how we’re reinventing travel retailing and what we’re doing in Travelport to deliver on our vision for the future.

Finally hear from Sam Hilgendorf, CIO at Fox World Travel, about how they’re navigating the complex world of retailing and how Travelport is helping them on their journey.

The Future of Travel Retail

Webinar recordings are also available in other languages: German , Italian , Japanese , Spanish

Want to learn more about modern retailing? Visit our ‘The Future of Travel Retail’ hub and learn from experts across all industries.

New Strategy Guide: Why the Future of Airline Retailing Is Open

Sabre + Skift

October 26th, 2022 at 10:00 AM EDT

Airlines of all sizes are looking for smarter and more efficient ways to sell more products and services. A new strategy guide by Sabre explores how moving toward an offer and order retailing model will help them achieve this goal while maximizing revenue, operating with more agility, and improving customer satisfaction.

This sponsored content was created in collaboration with a Skift partner.

Airlines are struggling to maximize revenue amidst unprecedented change, including flight delays and cancellations, understaffed airports, pent-up demand, and a growing sense that unpredictability in the marketplace is here to stay. To stay ahead of the game, both full-service and low-cost carriers are looking to sell new products in new ways.

But meeting this challenge isn’t easy without a strong technology partner to enable broader digital transformation. Legacy systems are limited in their ability to deliver against the expectations of today’s travelers, who want a higher level of personalization, richer content, greater transparency, and convenient payment methods.

Advanced retailing capabilities powered by offers and orders promise to enable airlines to enhance the traveler experience and generate more revenue opportunities, with the ability to tailor offers across multiple channels.

“We’re actively building a retail travel marketplace that intelligently enables airlines to dynamically retail and distribute a broad choice of tailored offers across any channel,” said Mike Reyes, vice president of product management at Sabre. “Orders can be fulfilled and delivered with ease on an open, flexible, and cloud-native platform, resulting in value creation for the airline at each step in the process.”

Sabre’s new strategy guide, “The Future is Open: A Smarter Approach to Airline Retailing”, offers a comprehensive breakdown of the advanced retailing capabilities enabled by the transition to an offer and order model.

For full-service carriers, this transition may take more time and necessitate an extended period where legacy systems and new systems need to co-exist. For many low-cost carriers, which may already have advanced retailing capabilities, the focus could be on transitioning to scalable technology that extends their existing capabilities through partnerships, access to third-party content, or other modular elements.

“There’s no one-size-fits-all approach to transition, and I believe how airlines transition to a retail-powered future is equally as important as the end-state itself,” said Greg Gilchrist, senior vice president of global sales at Sabre. “We’ll stand shoulder-to-shoulder with our airline partners throughout the process, turning unknowns into knowns along the path to our shared goal of modern travel retailing.”

In this report, you’ll find:

- A vision for enabling airlines to become advanced digital retailers, all while improving customer satisfaction, creating new sources of revenue, and optimizing existing sources

- A deep dive into why Sabre’s strategy for offers and orders is built on choice, intelligence, and ease

- How airlines can evolve beyond traditional product models and sell a wider variety of travel-related products and services

- How an offer and order strategy benefits both full-service carriers and low-cost carriers

- An overview of the design and technology behind Sabre’s cloud-native infrastructure

For more information about Sabre’s journey toward travel retailing modernization, visit Sabre.com/open .

This content was created collaboratively by Sabre and Skift’s branded content studio, SkiftX .

Have a confidential tip for Skift? Get in touch

Tags: airline retail , airlines , retail , revenue , revenue management , revenue strategy , sabre , SkiftX Showcase: Aviation

The Future of Travel Retailing

Click the button to download the report.

As modern retailers, some people view the travel industry as a laggard, relatively unchanged over the past decade while other mass consumer industries such as video, music, telecom and media have been completely transformed, primarily by technology. The travel industry, however, has not been stagnant and is slowly responding to the consumer pressures and expectations that are forcing innovation. This report - created in cooperation with Sabre - seeks to highlight the opportunities and challenges within the industry, and how technological innovations can help drive collaboration to break down barriers and bring about transformation. To gain perspective on the current and future state of travel retailing, Phocuswright conducted in-depth interviews with more than a dozen senior executives representing various industry segments including airlines, hotels, leisure and travel management company agencies, and online travel agencies. These industry leaders discussed the developments and innovations they saw in travel retailing, the technological solutions enabling these developments, how data and its application factor into these solutions, how travel industry retailing compares to other industries' retailing innovations and solutions, and the challenges and opportunities travel-specific solutions present.

What is Open Access

An Open Access subscription provides company-wide access to the whole library of Phocuswright’s travel research and data visualization.

Curious? Contact our team to learn more:

What is open access+.

With Open Access+, your company gets access to Phocuswright's full travel research library and data visualization PLUS Special Project deliverables.

Provide your information and we'll contact you:

Curious contact our team to learn more:, free download registration.

The path forward for the US retail industry

Today, months after COVID-19 first hit US shores, it’s increasingly clear that most retailers won’t be able to rely on their old strategies and business models to compete effectively in the next normal. In this episode of the McKinsey on Consumer and Retail podcast, McKinsey’s Steven Begley, Becca Coggins, and Steve Noble consider how the US retail landscape has changed and what companies must do to thrive in the postpandemic world. An edited version of their conversation with McKinsey Global Publishing’s Monica Toriello follows. Subscribe to the podcast .

Monica Toriello: Hello, and thanks for joining us today. We’re now three-quarters of the way through the year 2020, and it’s been a year like no other for people and businesses all over the world. In this episode, we’ll talk about one of the industries most greatly affected by the pandemic: the retail industry. We’ll focus today’s discussion on the US retail sector, but many of the lessons and imperatives we’ll discuss apply to retailers all around the world.

Joining us to share their perspectives are three McKinsey partners who have worked extensively with retailers from every subsector, including grocery, restaurant, and fashion. They’ve each written several articles on the retail sector, which you can find on McKinsey.com. Recently, the three of them coauthored an article titled, “ The next normal in retail: Charting a path forward .” Let’s meet our guests. First, we have Steven Begley, a partner in McKinsey’s New Jersey office. Also joining us is Becca Coggins, a senior partner based in the Chicago office and a longtime leader of McKinsey’s global Retail Practice. And finally, Steve Noble is a senior partner in Minneapolis who coleads McKinsey’s global work in retail transformation.

To start, I’d like to ask each of you for a short answer to my first question. One of the things that McKinsey has been tracking and that you’ve all been writing about is the shifts in consumer behavior , which have become evident over the past few months. What’s one way that your own shopping behavior has changed during this pandemic?

Becca Coggins: Monica, I might sound like a cliché. My shopping was already very heavily online. It has accelerated that way, but, like many Americans , what I buy has shifted a fair bit. I’m a bit of an apparel junkie, but that’s taken a backseat to new hobbies, new things for the home, and things to keep the kids engaged around the house.

Steven Begley: My grocery experience has gone completely digital. And my grocery experience has actually accelerated. I live in Manhattan, and I didn’t frequent grocery stores prior to the pandemic, but now I’m constantly purchasing groceries, and I only do it online. So it’s a different experience for me.

Steve Noble: I’ll break the rule of one thing, but I’ll be brief. One, my front porch looks like a warehouse full of boxes each day, so lots of online shopping. I no longer buy pants; I buy a lot more wine instead.

The migration to e-commerce

Monica Toriello: You’ve all brought up the migration to e-commerce, which has been one of the biggest and most obvious shifts during this period. What has worked there, and what hasn’t worked? In other words, as consumers have shifted more of their spending online, what are retailers getting right? And what are they still getting wrong?

Steve Noble: I’ve been impressed with how quickly retailers have adapted to this new way consumers are shopping—ramping up online and curbside delivery. I live in Minneapolis; Hy-Vee is one of the local grocers, and they’ve always had a curbside drive-through pickup. But that capability, as you might imagine, was quickly overwhelmed. While it wasn’t pretty, I was impressed with how quickly they mobilized to create more scale. They basically cordoned off a section of the parking lot and set it up with refrigerated shipping containers. You place the order online, and you give them an indication of when you’ll be coming. They don’t give you a slot; rather, you give them a slot. You pull up, they load the groceries in the back of your vehicle, and you drive off.

It was a great experience, and I appreciated how quickly they adapted. I imagine that over time they will reimagine the look and feel of that experience. Because things, in many cases, were stood up so quickly, they weren’t done initially with, “How do you create a great customer experience ?” They were done with just, “How do you get the bare minimum in place?” Now there’s an opportunity to continue to think about how to make some of those delivery or fulfillment models better, more sustainable, and more enduring customer experiences.

Becca Coggins: It almost makes me think we’re in the foothills of what omnichannel-driven convenience will look like—and that there’ll be some big innovations that scale now that consumer expectations have been reset. That’s where we’ll start to see some more innovative models and some more interesting partnerships—as players try to think about new ways to meet those needs.

If you look at how many more consumers are using e-commerce—such as using curbside pickup and buying online and picking up in store—most of them like it and plan to stick with it after the pandemic. So you have the consumer need. And retailers have done a good job of standing up things, as Steve said, to be able to meet that need. The next challenge is figuring out how to do it as a more seamless experience—in a way that’s not temporary but that meets these emerging needs around convenience and speed, especially.

Subscribe to the McKinsey on Consumer and Retail podcast

A ‘shock to loyalty’.

Monica Toriello: Becca, you mentioned that consumers plan to stick with behaviors they tried for the first time during the pandemic and that they liked. Another shift you describe in your article is the “shock to loyalty”—a greater willingness among consumers to switch brands and retailers. As you say in your article, “The beneficiaries of this shift include big brands, which are seeing 50 percent growth during the crisis,” and private labels. “Some 80 percent of consumers who started buying private-label products during the pandemic indicate that they intend to continue doing so even after the COVID-19 crisis subsides.” A couple of questions about that. First, should we believe consumers? Will they indeed stick with big brands and private labels postpandemic? And what are the implications for retailers?