- Embassy News

- Travel and Tour

Tourism industry in PH shares optimistic outlook, growth in investment

Latest article

Is ‘sustainable mining’ a contradiction of terms sweden presents its ‘mining with nature’ to ph, bpi, sgv, and 8 others join fintech alliance ph, ₱8.5-billion modernized food hub eyed at clark with global tech firms deal, grand toast to 70th year of hilton-born piña colada.

THEPHILBIZNEWS Partner Hotels

By Marinel E. Peroy

Bouncing back from the brunt of the pandemic , the Philippines welcomes the upward trajectory it experiences as the fastest-growing economy in Southeast Asia. Brandishing the GDP growth of 5.6% last year and bullish outlook of 6.2% projected growth in 2024, these indications Spearheaded by the Philippine Hotel Owners Association, Inc. (PHOA), the 1st Philippine Tourism and Hotel Investment Summit hosted an event discussing trends, opportunities, challenges, and strategies for 2024 in both sectors.

In cooperation with Tourism Infrastructure and Enterprise Zone Authority (TIEZA), the event was held at the New World Hotel Makati which gathered various experts, industry leaders, and investors from government, private, and other stakeholders last June 21.

According to UN Tourism, the country holds a strong position as a premier destination of tourism investments with its positive economic growth and stability, growing investment destination, government initiatives and incentives, and attracting significant foreign direct investment in the tourism sector.

Moreover, the presentation of Peter Janech, Coordinator of Innovation, Education, and Investments of United Nations Tourism — Insights into the Global & Regional Tourism Investments — believes that the Philippines has its competitive advantage in safety, price competitiveness, and environmental sustainability on the Travel and Tourism Development Index – Asia and the Pacific (World Economic Forum 2024), respectively.

The Philippines’ commitment to developments in sustainable tourism development, hotel, and hospitality infrastructure, and post-pandemic strategies for the hospitality sector are some of the efforts that make the country a ‘leading and resilient destination’ for international tourists and investors. According to the UN Tourism data, there were 5 million international tourist arrivals to the Philippines in 2023. The country also met a completion of 3,900 new hotel rooms in 2023, a record-high for the industry.

Meanwhile, the Department of Tourism shared that ₱509 billion in total tourism investment in 2023, with a growth rate of 11.7% to the entire Philippine economy from the previous year.

To make the Philippines a tourism powerhouse in Asia, a national tourism development plan 2023-2028 was established with the following objectives: a) improve tourism infrastructure and accessibility; b) cohesive and comprehensive digitalization and connectivity; c) enhancement of overall tourist experience; d) equalization of tourism product development and promotion; e) diversification of portfolio through multidimensional tourism; f) maximization of domestic and international tourism; and g) strengthening tourism governance through close collaborations with national and local stakeholders.

Aside from revitalizing tourist arrivals to make the country a tourism investment destination, the hotel industry is expected to fully recover by 2025, as stated in the forecast of real estate brokerage company, Leechiu Property Consultants, Inc. (LPC) with PHOA. It is interesting to note that based on the information provided by the Philippine Investment Outlook Survey (PIOS) report from March to April 2024, there is a robust responders’ confidence of 89% for a positive outlook in the hospitality industry over the medium term. The report also revealed that the Highest Investment Interest in the following locations in the Philippines: Bohol, Metro Manila, Cebu City, Siargao, and El Nido. For the investors, their top three (3) key priorities in post-pandemic financial strategy are cash flow management, stakeholder relationships, and sustainability.

In conclusion, the report emphasized the crucial collaboration between the government and the private sector to sustain the momentum of mutually beneficial relationships and ensure success in the industry’s ever-changing demands.

- 1st Philippine Tourism and Hotel Investment Summit

- Foreign direct investment in the tourism sector

- Highest Investment Interest in tourism in the Philippines

- Investment Interest in Bohol

- Investment Interest in Cebu City

- Investment Interest in El Nido

- Investment Interest in Metro Manila

- Investment Interest in Siargao

- Leechiu Property Consultants Inc.

- Marinel Peroy

- Philippine foreign direct investment in the tourism

- Philippine Hotel Owners Association Inc.

- Philippine Investment Outlook Survey

- Tourism Infrastructure and Enterprise Zone Authority

- Travel and Tourism Development Index Asia

- United Nations Tourism

- United Nations Tourism Insights into the Global & Regional Tourism Investments

- World Economic Forum 2024

More articles

Ph snares re investment projects from thailand and singapore, leave a reply cancel reply.

Save my name, email, and website in this browser for the next time I comment.

PH records surge in agri investments

Japan’s envoy visits and spends 3 days in barmm to check areas of cooperation, instituto cervantes highlights melecio figueroa’s legacy, korean plant-based stemcell enters ph market, israel highlights resiliency on 76th independence day, cherishes friendship with ph.

Loft Unit 3006, 30th Floor, One Corporate Center, Julia Vargas Ave, Ortigas Center, Pasig City 1605, Philippines

- Advertise with us

Latest Stories

- Secretary’s Corner

- GAD Activities

- GAD Issuances

- Mission and Vision

- Department Structure

- Key Officials

- Citizen’s Charter

- Attached Agencies

- General Info

- Culture & Arts

- People & Religion

- Tourism Industries Products

- Promotional Fair and Events

- Doing Business

- Philippines RIA Pilot Program

- Tourism Demand Statistics

- Standards Rules and Regulations

- Online Accreditation

- Accredited Establishments

- Learning Management System (LMS)

- News and Updates

- Announcements

- Publications

- Bids and Awards

Accreditations

- Who May Apply

- Benefits and Incentives

- Accreditation Requirements

- DOT-certified Establishments

What is the DOT Accreditation?

A certification issued by the Department to a tourism enterprise that officially recognizes it as having complied with the minimum standards for the operation of tourism facilities and services.

Learn how to use Online Accreditation System

Who may apply for a dot accreditation, primary tourism enterprises.

These are facilities and services directly related to tourism. DOT-certified primary tourism enterprises shall be periodically required to obtain accreditation from DOT to ensure the quality of its facilities and services.

Accommodation Establishments

- Apartment Hotel

- Mabuhay Accommodation (tourist inns, motels, pension houses, and bed and breakfast, among others)

Travel and Tour Services

- Travel and Tour Agency

- Travel Agency

- Tour Operator

- Online Travel Agency

Tourist Transport Operators

- Tourist Land Transport Operator

- Tourist Water Transport Operator

- Tourist Air Transport Operator

- Motorized Banca

Meetings, Incentives, Conventions and Exhibitions (MICE)

- MICE Organizer

- MICE Facility/ Venue

Adventure/ Sports and Ecotourism Facilities

Tourism Frontliner

Secondary Tourism Enterprises

These are facilities and services that may be related to tourism. Accreditation shall be voluntary for secondary tourism enterprises that follows minimum DOT standards.

Tourism-related Enterprises

- Tourism Training Center

- Target Shooting Range

- Department Store/ Shopping Mall/ Tourist Shop/ Specialty Shop

- Farm Tourism Camp

- Gallery/ Museum

- Tourism Entertainment Complex

- Tourism Recreation Center

- Rest Area/ Restroom

- Surfing Camp

Health and Wellness Services

- Ambulatory Clinic

- Tertiary Hospital

- Tourism Trainer

- Surfing Instructor

What are the Benefits and Incentives of Accreditation?

- Endorsement to COMELEC for exemption from liquor ban during election-related events*

- Endorsement to embassies and travel trade associations for utilization of establishment’s facilities and services.

- Being prioritized for DOT training programs

- Endorsement to international and domestic airports (if appropriate) for Issuance of Access Pass to Qualified Personnel**

- Qualification for Exemption from the United Vehicular Volume Reduction Program (UVVRP) of the Metro Manila Development Authority (MMDA).***

- Endorsement to Land Transportation Franchising and Regulatory Board (LTFRB) for Issuance of Tourist Transport Franchise.*** Technical / Security / Facilitation Support or Assistance

*For accommodation establishments and restaurants only. **For Tour Operators and Accommodation Establishments only. ***For Tourist Land Transport Vehicles only.

GET STARTED WITH YOUR ACCREDITATION

Documentary requirements for accreditation, documentary requirements – primary tourism enterprises, documentary requirements – secondary tourism enterprises, accreditation fees, accreditation fees – primary tourism enterprises, complaints handling process flow, accreditation fees – secondary tourism enterprises, documentary otsr feedback form – secondary tourism enterprises, endorsement procedure for the issuance of tourist transport service franchise, dot accredited tourism enterprises.

- Open Data Portal

- Official Gazette

- Office of the President

- Sandiganbayan

- Senate of the Philippines

- House of Representatives

- Department of Health

- Department of Finance

- Supreme Court

- Court of Appeals

- Court of Tax Appeals

- Judicial Bar and Council

- Bureau of Internal Revenue

- Bureau of Customs

- Bureau of Treasury

- Bureau of Local Government Finance

- Philippines Tourism And Hotel Market Trends

Statistics for the 2023 & 2024 Philippines Tourism And Hotel market trends, created by Mordor Intelligence™ Industry Reports. Philippines Tourism And Hotel trend report includes a market forecast to 2029 and historical overview. Get a sample of this industry trends analysis as a free report PDF download.

Single User License

Team License

Corporate License

Market Trends of Philippines Tourism And Hotel Industry

Expanding airways network in philippines.

Air travel benefits the economy as a whole and consumers by enabling quick connectivity between places. The essential drivers of economic growth, the flows of people, capital, goods, and ideas, are made possible by these virtual bridges in the sky. During the busiest travel season, which runs from March to April, there is an extraordinary demand from tourists and expats for travel between the United Arab Emirates and popular places in the Philippines, such as Manila, Cebu, and Clark. Travel agencies in the industry claim that increased traffic from the United Arab Emirates resulted from the start of the super-peak tourist season during Holy Week/Easter. Additionally, carriers in the Philippines and the United Arab Emirates are working hard to capitalize on the seasonal demand.

By collaborating with Philippine Airlines, Emirates will be able to increase its presence in East Asia and create new channels for trade and tourism that will bring in more visitors. In the upcoming months, they want to grow the partnership by adding more points via Cebu and providing the partner airline's customers with more travel options to Emirates destinations in the Americas, Europe, and the Middle East.

Increase in Sales in the Food and Beverages Sector

In the Philippines, the food and beverage industry is a rapidly expanding sector that makes a substantial economic contribution. It encompasses a variety of companies, ranging from tiny food carts to large international enterprises. Jobs in the industry range from those for cooks and waiters to those in marketing and sales. One of the main drivers of the Philippine economy is the quickly expanding food and beverage sector, which accounts for roughly half of the country's manufacturing sector. Food production in the Philippines is among the highest in Asia, with the food processing industry. For the food and beverage business in particular, brand reputation is crucial due to rising brand consciousness, worries about food safety, and the comparatively high rate of counterfeiting in the nation.

The food and beverage business is growing rapidly as a result of the rise in restaurants, fast-food franchises, and meal delivery applications like Grub Hub, Caviar, and others that increase customer access. In addition, one of the main factors predicted to boost demand for the food and beverage market is consumers' growing desire for fresh, natural, and organic foods as a result of growing health consciousness.

Philippines Tourism And Hotel Market Report Snapshots

- Philippines Tourism And Hotel Market Size

- Philippines Tourism And Hotel Market Share

- Philippines Tourism And Hotel Companies

- Philippines Tourism And Hotel News

Hospitality Industry in the Philippines Size & Share Analysis - Growth Trends & Forecasts (2024 - 2029)

Philippines Tourism And Hotel Market Get a free sample of this report

Please enter your name

Business Email

Please enter a valid email

Please enter your phone number

Please enter your requirement

Thank you for choosing us for your research needs! A confirmation has been sent to your email. Rest assured, your report will be delivered to your inbox within the next 72 hours. A member of our dedicated Client Success Team will proactively reach out to guide and assist you. We appreciate your trust and are committed to delivering precise and valuable research insights.

Please be sure to check your spam folder too.

Sorry! Payment Failed. Please check with your bank for further details.

Want to use this image? X

Please copy & paste this embed code onto your site:

Images must be attributed to Mordor Intelligence. Learn more

About The Embed Code X

Mordor Intelligence's images may only be used with attribution back to Mordor Intelligence. Using the Mordor Intelligence's embed code renders the image with an attribution line that satisfies this requirement.

In addition, by using the embed code, you reduce the load on your web server, because the image will be hosted on the same worldwide content delivery network Mordor Intelligence uses instead of your web server.

Licence or Product Purchase Required

You have reached the limit of premium articles you can view for free.

Already have an account? Login here

Get expert, on-the-ground insights into the latest business and economic trends in more than 30 high-growth global markets. Produced by a dedicated team of in-country analysts, our research provides the in-depth business intelligence you need to evaluate, enter and excel in these exciting markets.

View licence options

Suitable for

- Executives and entrepreneurs

- Bankers and hedge fund managers

- Journalists and communications professionals

- Consultants and advisors of all kinds

- Academics and students

- Government and policy-research delegations

- Diplomats and expatriates

This article also features in The Report: Philippines 2021 . Read more about this report and view purchase options in our online store.

How does the Philippines envision tourism after the pandemic?

The Philippines | Tourism

Tourism played a central role in the Philippines’ economic development in the years leading to 2020, and an increasing emphasis on sustainability and responsibility underscores the sector’s importance for the years to come. While the popular island of Boracay has long drawn tourists, local authorities continue work to diversify destinations through the creation of tourism enterprise zones (TEZs). These endeavours, as well as those aimed at widening source markets, have laid the groundwork for an expanded yet more tailored offering.

Although the Covid-19 pandemic had a negative effect on the sector and the economy as a whole in 2020, policymakers and stakeholders are looking to adapt the sector’s offering and prioritise domestic tourism to support the national recovery. Enhanced health and safety measures have been implemented to align hotels, tourism sites and other services with the demands of the new normal. Meanwhile, a shift towards digitalisation and the use of technology to upskill the workforce are readying the sector for the future.

Structure & Oversight

The Department of Tourism (DOT) is the sector’s main regulator and also markets the Philippines as a destination via its overseas offices. While international arrivals were banned for much of 2020 due to Covid-19 restrictions, these branches are expected to be key to reviving international tourism once international restrictions are eased. Meanwhile, the Tourism Promotions Board (TPB) is responsible for designing promotions and marketing campaigns. In 2019 the TPB began new programmes to market alternative destinations such as Pampanga, Southern Cebu, Samar and the Bangsamoro Autonomous Region in Muslim Mindanao.

The Tourism Infrastructure and Enterprise Zone Authority (TIEZA) – which operates under the auspices of the DOT – works to drive investment in designated areas through fiscal and non-fiscal incentives such as six-year income tax holidays. Created in 2009, it also develops, manages and supervises tourism infrastructure projects, as well as designing, regulating and supervising TEZs. There are five TEZs: Bucas Grande, a 167.7-ha area in Socorro, Surigao del Norte; the Amorita Resort in Panglao, Bohol; Aton Land and Leisure in Negros Occidental; the Magikland Cultural Zone inside Aton Land and Leisure; and the King Dome Stadium in Davao. TIEZA is also looking to develop tourism clusters, with different areas of the country focusing on specific segments. “Clark could be an appealing destination for business and shopping tourists from China and other Asian markets, while remote islands can be attractive to European and other western markets,” Pocholo Paragas, COO of TIEZA, told OBG. “It is not possible to base all tourism on ecotourism; there has to be variety, and clusters are a promising way of facilitating diversification,” he added.

The DOT’s National Tourism Development Plan (NTDP) 2016-22 is the framework that guides the industry’s development. It aims to encourage sustainable and socially responsible tourism. It identified 20 tourism clusters around the country, each including priority tourism development areas. It was designed with the aim of almost doubling tourism revenue from P2.1trn ($41.8bn) in 2015 to P3.9trn ($77.6bn) in 2022, while also increasing the number of inbound visitors from 5.4m to 12m. “It is important to prioritise some products and services in order to reach the NTDP’s goals of improving access, developing the product and protecting the environment,” Aileen Clemente, chairman and president of travel service provider Rajah Travel, told OBG. The roadmap also aims to boost the sector’s competitiveness on a global scale. In 2019 the Philippines ranked 75th out of 140 countries in the World Economic Forum’s travel and tourism competitiveness index, up from 79th in 2017. It performed best on price competitiveness (24th), natural resources (36th), and human resources and the labour market (37th).

Visitor arrivals had steadily increased since the implementation of the NTDP’s baseline of 5.4m in 2015. The country welcomed 6m visitors in 2016, above the plan’s target of 5.9m, with 6.6m arriving the following year, above the targeted 6.5m. However, in 2018 visitor arrivals fell short of the targeted 7.4m, totalling 7.1m. This was largely attributed to the closure of Boracay, one of the country’s most popular destinations, between April and October in order to rehabilitate the island from the effects of unchecked development, overburdened wastewater facilities and overpopulation. Upon reopening, measures were put in place to prevent future damage, including a maximum allowance of tourists and workers, and strict environmental accreditation procedures. Arrivals bounced back in 2019, surpassing the NTDP’s target of 8.2m to reach almost 8.3m – a 15.2% increase. The Philippines’ most popular destination for foreign arrivals in 2019 was the newly reopened Boracay, which hosted 1.6m foreign guests, according to the DOT; followed by Cebu, with 1.4m; and Davao del Sur, with 1.3m.

Covid-19 was an understandable setback for the NTDP’s goal of 9.2m foreign visitors in 2020. In late March the country closed its borders to most foreign arrivals, with exceptions for the spouses of citizens, diplomats, airline crew and holders of certain special long-term visas. In the first seven months of 2020 arrivals dropped by 73%, from 4.9m to 1.3m. Pandemic-related lockdowns also imposed restrictions on business operations and domestic travel, limiting the potential for local travellers to make up for international visitors. Tourism revenue similarly fell by 72% year-on-year (y-oy) to P81bn ($1.6bn) as a result. While the country is expected to remain closed to most foreigners through mid-2021, in October 2020 the Inter-Agency Task Force for the Management of Emerging Infectious Diseases ordered a technical working group to review the ban on foreign arrivals. Exemptions and other issues remained under discussion as of late 2020.

Looking ahead, a July 2020 survey of around 250 businesses in tourism-related segments by PwC found that 79% of respondents were optimistic about a recovery by mid-2021, while 21% expected a longer time frame. PwC similarly forecast that international arrivals would bounce back in the medium term, from an estimated 3.9m in 2020 to 6.2m by 2024.

Hotel Infrastructure

As visitor arrivals grew over the 2010-19 period, hotel infrastructure expanded by an average of 2000 hotel rooms per year – with around 2800 rooms completed in 2018. While real estate consultancy Colliers initially expected 6870 new hotel rooms to come on-line between 2020 and 2022, for an average of 2300 rooms per year, this projection was revised downwards in light of the pandemic. Nonetheless, even after hotel room construction slowed to 375 rooms in the first half of 2020, the agency noted in August that it still expected 1725 rooms to enter the market by the end of the year.

Hotel performance similarly reflected rising visitor numbers, with the average hotel occupancy rate countrywide reaching 72% in 2019, before falling to 50% in April and May 2020 amid Covid-19-related restrictions ; full-year occupancy is expected to drop to 30%. Continued air transport disruptions are likely to affect the segment for some time, with Colliers forecasting occupancy rates will hover below 50% through 2021. Meanwhile, average daily room rates in Metro Manila are expected to fall by 30.4% from $79 in the second half of 2019 to $55 by the end of 2020.

Spending, Employment & Investment

The rise in visitors in recent years saw higher expenditure, with tourism spend reaching P3.7trn ($73.6bn) in 2019, up 12.1% from P3.3trn ($65.6bn) in 2018. Domestic tourists contributed the majority, at P3.1trn ($61.7bn), while foreign visitors spent P548.8bn ($10.9bn). These totals were considerably higher than the previous year, up 10.7% and 23.2%, respectively. Tourism revenue also rose, reaching a record $9.3bn, up 20.8% from $7.7bn in 2018. Higher levels of spending and revenue had a trickle-down effect, increasing the number of jobs in the sector from 5.4m to 5.7m, with 14% of employed Filipinos working in tourism-related industries.

Investors, in turn, were attracted to the burgeoning market. Investment from the private and public sector reached P663.2bn ($13.2bn) in 2019 – P569.1bn ($11.3bn) of which came from private investment and P94.1bn ($1.9bn) from the government – according to figures from the Philippine Statistics Authority. Government spending on tourism grew by 23.5% over the year, highlighting the sector’s importance to economic development. Indeed, tourism contributed 12.7% to GDP in 2019, up from 12.3% in 2018 and 11.7% in 2017. Tourism direct gross value added reached P2.5trn ($49.7bn), 10.8% above 2018’s figure of P2.2trn ($43.8bn).

Source Markets

Even as the number of travellers to the Philippines rose, the composition of visitors remained relatively consistent. South Korea has been the top source market since 2010, with nearly 2m visiting in 2019, comprising 24% of all tourists. These figures were up from 1.6m visitors and 22.7% of all arrivals in 2018. Visitors from China – the second-largest source market – also rose, from 1.3m in 2018 to over 1.7m in 2019, increasing from 17.6% to 21.1% of the total. Other major source markets are the US, with 1.1m visitors and 12.9% of the total, Japan (683,000, 8.3%) and Taiwan (327,000, 4%). Of the top-12 markets by volume, China was the fastest growing in 2019, with visitor numbers expanding by 38.6%, followed by Taiwan (35%), South Korea (22.5%) and Germany (12.7%).

Domestic Tourism

With an eye on reopening and recovery, in early September 2020 the government announced a gradual resumption of domestic tourism starting in October. “The year 2021 will be about local tourism,” Bernadette Romulo Puyat, secretary of tourism, told local press. Under the plan, domestic travel bubbles were created within specified regions to facilitate travel while adhering to health mandates. The popular island of Boracay, however, was opened to all domestic tourists, with travellers required to show a negative Covid-19 PCR test result and a confirmed booking with an accredited establishment. The government also encouraged Filipinos to take staycations in local hotels in some low-risk areas starting in May, gradually expanding to areas under general community quarantine (GCQ) – characterised by a lifting of the stay-at-home order, the resumption of limited public transport and the reopening of some establishments – in October. In mid-October it was also announced that some hotels in areas under GCQ, or the more relaxed modified GCQ, would be permitted to return to 100% operational capacity – subject to DOT approval and based on hotel compliance with safety guidelines.

Indeed, the volume of local tourists could even offset the loss of foreign tourists, according to a September 2020 report from the Asian Development Bank (ADB): around 8m Filipinos travelled abroad in 2018, exceeding the 7.1m international arrivals. In a positive sign for tourism players, 77% of 12,000 respondents to a DOT poll released in June reported a willingness to travel domestically upon the easing of restrictions. Participants stated a preference for destinations closer to home, although Boracay, Siargao and Baguio were also named as top destinations. With regard to priority tourism activities, beach trips ranked highest, selected by 69% of respondents as a likely reason for travel, followed by road trips (54%) and staycations (41%).

Health & Safety

Integral to the DOT’s efforts to reopen to both domestic and international tourists is ensuring health and safety; however, some hard-hit players have voiced concerns about their ability to finance the necessary changes to enable social distancing and enhance sanitation. To facilitate these alterations, in June 2020 the DOT and the Board of Investments (BOI) announced the approval of incentives to help entities upgrade and modernise tourism facilities to ensure the health of customers. Included in these incentives was a BOI-led, three-year income tax holiday, with the list of eligible project types including barriers and deionisers in transport, as well as the renovation of rooms and the installation of partitions, automatic doors and elevators, thermal scanners and ventilation in hotels. The DOT also issued new health-related guidelines for accommodation facilities, with protocols launched in late May for activities such as guest handling; housekeeping; food and beverage services; kitchen sanitation and disinfection; transport; and the treatment of symptomatic guests. In June the DOT and the Department of Trade and Industry issued recommendations for restaurants, such as advisories for delivery services, sanitation, and employee and customer health. As the country moved to reopen domestic tourism, in September the DOT issued rules for beaches and other island operations. Under the guidelines, visitors must present bookings at an accredited establishment upon arrival, with walk-in guests prohibited unless they are part of an organised day tour or present a return ticket for the same day.

The DOT worked to align its health-related protocols with international standards. In late September 2020 the World Travel & Tourism Council (WTTC) gave the department the SafeTravels Stamp, certifying it complied with global health standards. This enabled the DOT to grant the stamp, in turn, to hotels, airlines, restaurants, tour operators, attractions and transport that follow the WTTC’s health and safety protocols.

Government Assistance

In response to Covid-19, President Rodrigo Duterte signed the first national stimulus package, the Bayanihan to Heal as One Act, into law in late March. The legislation, supported with P275bn ($5.5bn) of funding, granted the president emergency powers to address the pandemic.

The Bayanihan to Recover as One Act, or Bayanihan 2, was signed by President Duterte in mid-September 2020 and provided a further P165.5bn ($3.3bn) to aid recovery. This package specified a P10bn ($198.9m) allocation for the tourism industry and micro-, small and medium-sized enterprises (MSMEs). MSMEs comprise around 99.9% of all accommodation and food service businesses, and will therefore be instrumental in the recovery of the tourism sector. Some P6bn ($119.3m) of this sum was designated for a loan programme: DOT-accredited MSMEs and businesses licensed by local government units will be prioritised for no-collateral, interest-free loans, payable in three years with a one-year grace period. P3bn ($59.7m) of the remaining assistance was earmarked for financial aid for displaced and unemployed tourism workers, with the remaining P1bn ($19.9m) for road infrastructure improvements.

The DOT has altered its marketing strategies to reflect the new reality. In April 2020 it launched the Travel from Home campaign, encouraging potential travellers to explore destinations virtually – including virtual backgrounds of top travel spots for video calls. The following month, it launched the Wake Up in the Philippines campaign, featuring videos from all 16 regions, 360-degree underwater virtual tours and instructional cooking videos from well-known Filipino chefs, to continue the promotion of local destinations. These campaigns followed the relaunch of It’s More Fun in the Philippines in 2019, which crowdsourced photos and videos to promote new travel destinations and highlight the importance of sustainable tourism.

Like much of the economy, the pandemic prompted the tourism industry to digitalise. In addition to marketing and online expos embracing trends like virtual meetings, in September 2020 the DOT digitalised its accreditation system, which certifies that enterprises adhere to minimum standards and environmental regulations. The portal handles accreditation requests, contactless transactions and government services, and features real-time application status notifications and online payments. The gateway aims to ease the burden on MSMEs, which often lack the resources of larger companies. There were 10,042 accredited tourism enterprises by mid-September, marking a 32.4% increase y-o-y, according to the DOT.

Technology is also being used to upskill tourism workers to enable them to capitalise on post-pandemic opportunities. In April the DOT launched an online training programme to help stakeholders manage pandemic-related challenges, aiming to enhance the quality of tourist services by analysing previous performance and unlocking the full potential of human capital.

Technology has also been used in the meetings, incentives, conferences and exhibitions (MICE) segment. In late September 2020 the 19th Philippine Travel Exchange was held virtually, with 161 Filipino tourism service providers, 124 customers and 350 delegates in attendance. Participants from Africa, Europe and South America, as well as players from the region, signed into the online platform to generate P4.5m ($89,500) worth of future bookings. Highlighting the importance of the segment, in July the DOT announced it would allow MICE events in certain areas, at 50% capacity, with safety measures such as distanced seating, wide aisles and pre-packaged individual meals.

While 2020 proved to be a challenging year for tourism, the Philippines’ push to encourage domestic travel and staycations could provide a short-term cushion. Meanwhile, efforts to improve infrastructure and adjust to the new normal are readying hotels, tour operators and other service providers for the eventual return of international guests, expected in 2021.

Request Reuse or Reprint of Article

Read More from OBG

In Philippines

The Philippine roadmap for inclusive, balanced, long-term growth is aligned with environmental, social and governance (ESG) principles and the UN Sustainable Development Goals (SDGs).

Culture stock: Tan Huism, Executive Director, Qatar National Library (QNL), on collaborative efforts to preserve the country’s heritage Interview: Tan Huism How have libraries adapted in response to behavioural shifts caused by the Covid-19 pandemic? TAN HUISM: During the pandemic libraries adopted innovative approaches to ensure uninterrupted access to knowledge. In QNL’s case, this included the expansion of online services and the migration of in-person services to digital platforms. As such services proved popular and convenient, we have retained many of them despite returning to pre-pandemic levels of physical books…

Ghana underscores its pivotal role as a regional and international trade partner Oxford Business Group has launched The Report: Ghana 2024. This latest edition offers a detailed analysis of the country’s economic trajectory, focusing on fiscal consolidation and structural reforms. It examines the nation's progress in managing expenditure and debt, alongside the impact of IMF programmes and strategic reforms aimed at enhancing revenue mobilisation. Despite challenges such as financial sector stress and the upcoming elections, Ghana remains optimistic…

Register for free Economic News Updates on Asia

“high-level discussions are under way to identify how we can restructure funding for health care services”, related content.

Featured Sectors in Philippines

- Asia Agriculture

- Asia Banking

- Asia Construction

- Asia Cybersecurity

- Asia Digital Economy

- Asia Economy

- Asia Education

- Asia Energy

- Asia Environment

- Asia Financial Services

- Asia Health

- Asia Industry

- Asia Insurance

- Asia Legal Framework

- Asia Logistics

- Asia Media & Advertising

- Asia Real Estate

- Asia Retail

- Asia Safety and Security

- Asia Saftey and ecurity

- Asia Tourism

- Asia Transport

Featured Countries in Tourism

- Indonesia Tourism

- Malaysia Tourism

- Myanmar Tourism

- Papua New Guinea Tourism

Popular Sectors in Philippines

- The Philippines Agriculture

- The Philippines Construction

- The Philippines Economy

- The Philippines Financial Services

- The Philippines ICT

- The Philippines Industry

Popular Countries in Tourism

- The Philippines Tourism

- Thailand Tourism

- Oman Tourism

Featured Reports in The Philippines

Recent Reports in The Philippines

- The Report: Philippines 2021

- The Report: Philippines 2019

- The Report: Philippines 2018

- The Report: The Philippines 2017

- The Report: The Philippines 2016

- The Report: The Philippines 2015

Privacy Overview

- Agri-Commodities

- Asean Economic Community

- Banking & Finance

- Business Sense

- Entrepreneur

- Executive Views

- Export Unlimited

- Harvard Management Update

- Monday Morning

- Mutual Funds

- Stock Market Outlook

- The Integrity Initiative

- Editorial cartoon

- Design&Space

- Digital Life

- 360° Review

- Biodiversity

- Climate Change

- Environment

- Envoys & Expats

- Health & Fitness

- Mission: PHL

- Perspective

- Today in History

- Tony&Nick

- When I Was 25

- Wine & Dine

- Live & In Quarantine

- Bulletin Board

- Public Service

- The Broader Look

Today’s front page, Wednesday, June 26, 2024

- Covid-19 Updates

- Photo Gallery

Seda Hotels wins as ‘Philippines Leading Hotel Group’ in the World Travel Awards and ‘Employer of Choice’ in HRD Awards Asia 2021

- BusinessMirror

- November 21, 2021

- 2 minute read

October 2021….Seda Hotels won as “Philippines’ Leading Hotel Group” for the eighth consecutive year in the World Travel Awards Asia, in addition to Seda Residences Makati bagging an independent trophy for “Philippines’ Leading Serviced Apartments.” Seda Hotels was also honored with two awards from HRD Awards Asia—“Employer of Choice” and “Best Health and Wellness Program.”

The World Travel Awards is considered “The Oscars of the travel and tourism industry,” celebrating excellence across all key sectors of the travel, tourism and hospitality industries.

Running for just two years, HRD Awards Asia has been recognized as one of the region’s leading independent awards for the HR profession. The “Employer of Choice” award recognizes the best organization to work for in Asia. Nominees are judged on leadership, engagement, communication and employee benefits. In its winning entry, Seda Hotels emphasized its determination to fulfill its obligations to all its stakeholders during the pandemic while remaining steadfast to its company values. The “Best in Health and Well-Being” Program award recognized Seda Hotels’ excellence and innovation in workplace health and well-being programs and initiatives.

Seda Hotels is owned and operated by AyalaLand Hotels and Resorts Corp. Its President and CEO, Javier Hernandez, says, “We dedicate these prestigious awards to all our employees who have kept our hotels operating seamlessly even under very challenging circumstances. The entire team remained focused and united throughout the pandemic, allowing the properties to rise to the challenge and emerge stronger and victorious despite the situation.”

Seda has 11 city hotels, resorts and serviced residences in 10 destinations throughout the Philippines. Its first hotel opened in late-2012 in BGC, Taguig and since then, its properties have received various recognitions for product and service excellence from various award-giving bodies, including online booking sites and restaurant guides, and pioneered innovations that resulted in elevating the customer experience. Seda hotels are located in Bacolod, Cagayan de Oro, Cebu, Iloilo, Nuvali, Laguna, Makati, Quezon City, El Nido, Palawan and BGC, Taguig.

Related Topics

Dauin for the win.

- Bernard L. Supetran

- October 17, 2021

Hail to the chieftain

Expo boosts potentials of phl’s food tourism.

- May 19, 2024

Living the community ‘lyf’ in Manila and Cebu

Travel Madness Expo 2024: The ultimate event to look forward to

- April 21, 2024

The New Star in the South

The resurgence of farm tourism

- March 17, 2024

Kalinga: A Hideaway in the Highlands

- February 18, 2024

Revelry and staycations in Cebu’s Sinulog Festival

- January 20, 2024

CPGI bullish on its hospitality joint venture with Accor

- Rizal Raoul Reyes

- December 17, 2023

Island Holiday Hideaway

D’CHEF MADY CAFÉ: A culinary journey for your body, spirit, and soul

- November 19, 2023

Team Lhuillier tops 8th Tour de Cebu vintage car rally

AHG introduces Niyama Wellness program

Access Travel celebrates 12 years of pioneering female leadership and tourism excellence

- October 15, 2023

A sweet journey to Camiguin

Kada-kada Like A Panda at Davao’s 38th Kadayawan Festival

- September 17, 2023

Anya Resort Tagaytay wins prestigious World Travel Awards 2023

Amigos Para Siempre

15 Pinoy Pasalubong No Traveler Should Miss Out

- August 30, 2023

Culture and adventure on two wheels

- August 20, 2023

Piña Cloth Weaving: Exploring Its History, Production, and Current State

- August 17, 2023

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Input your search keywords and press Enter.

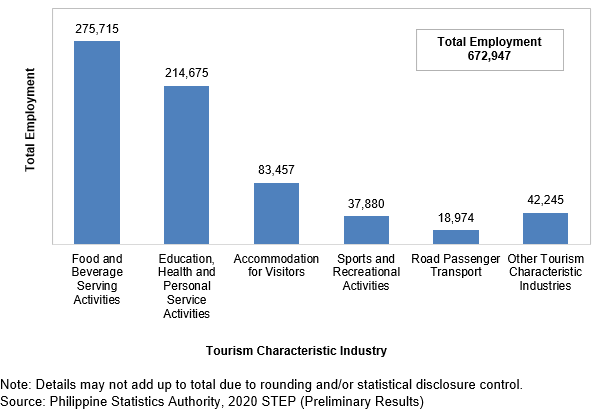

2020 Survey of Tourism Establishments in the Philippines (STEP) - Economy-Wide: Preliminary Results

This Special Release highlights the preliminary results of the 2020 Survey of Tourism Establishments in the Philippines (STEP) for tourism characteristic industries classified according to the 2016 Philippine Tourism Statistical Classification System (PTSCS).

Number of establishments in the tourism characteristic industries increased by 5.5 percent

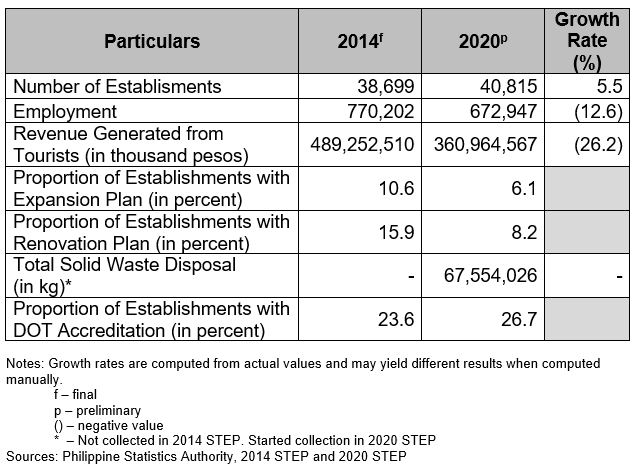

The preliminary results of the 2020 Survey of Tourism Establishments in the Philippines (STEP) showed that a total of 40,815 establishments in the formal sector of the economy were engaged in tourism characteristic activities. This was higher by 5.5 percent compared with the 38,699 recorded tourism characteristic establishments in 2014. (Table A)

Among the tourism characteristic industries, food and beverage serving activities recorded the highest share to the total number of establishments at 24,584 or 60.2 percent. Education, health and personal service activities followed with 7,591 establishments (18.6%). On the third spot was accommodation for visitors with 4,070 establishments (10.0%). (Table 1 and Figure 1)

Food and beverage serving activities hired the highest number of workers

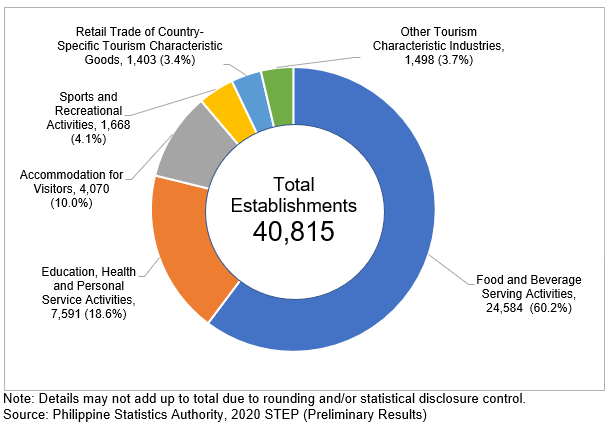

A total of 672,947 workers were engaged in tourism characteristic activities in 2020. This represents a decrease of -12.6 percent compared with the reported 770,202 workers in 2014. (Table A)

By tourism characteristic industry, food and beverage serving activities hired the highest number of workers of 275,715 or 41.0 percent of the total. This was followed by education, health and personal service activities with 214,675 workers or 31.9 percent. Far behind was accommodation for visitors with 83,457 workers (12.4%). (Table 1 and Figure 2)

Figure 2. Distribution of Employment by Tourism Characteristic Industry: Philippines, 2020

Food and beverage serving activities reported the biggest share to revenue generated from tourists

The total revenue generated from tourists in 2020 amounted to PhP 360.96 billion. Compared with the total revenue generated from tourists in 2014, this reflects a decrease of -26.2 percent. (Table A)

The top three industries in terms of revenue generated from tourists in 2020 were as follows:

1. Food and beverage serving activities with PhP 188.45 billion (52.2%); 2. Air passenger transport with PhP 58.87 billion (16.3%); and 3. Accommodation for visitors with PhP 40.45 billion (11.2%). (Table 1 and Figure 3).

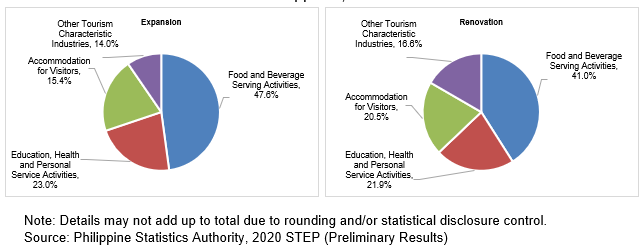

About 6.1 percent of the establishments planned to expand and 8.2 percent planned to renovate within the next five years

Of the total 40,815 tourism characteristic establishments registered in 2020, 6.1 percent planned to expand their business operations within the next five years. This was lower by 4.5 percentage points from the 2014 proportion of 10.6 percent.

Meanwhile, the proportion of establishments with plan to renovate within the next five years was 8.2 percent, lower by 7.7 percentage points from the 15.9 percent recorded in 2014. (Figure 4, Tables A and 1)

Listed below are the top tourism characteristic industries relative to their expansion and renovation plans within the next five years:

1. Food and beverage serving activities with 47.6 percent of the establishments with expansion plan and 41.0 percent with plan to renovate; 2. Education, health and personal service activities with 23.0 percent of the establishments with plan to expand and 21.9 percent with plan to renovate; and 3. Accommodation for visitors with 15.4 percent of the establishments with expansion plan and 20.5 percent with plan to renovate. (Table 1 and Figure 4)

Solid waste generated from tourism characteristic industries totaled to 67.55 million kilograms in 2020

More than 95.0 percent of the total solid waste disposed by tourism characteristics industries in 2020 were generated by three out of the 12 tourism characteristics industries. These three industries with highest solid waste disposal in 2020 were food and beverage serving activities with 49.5 percent share, followed by education, health and personal service activities, and accommodation for visitors with 25.4 percent and 20.2 percent share, respectively. (Table 1)

Air passenger transport recorded the highest proportion of establishments with DOT accreditation

About 27.0 percent of the total tourism characteristics establishments reported in 2020 were accredited by the Department of Tourism (DOT). This was higher by 3.1 percentage points than the reported proportion of 23.6 percent in 2014. (Table A)

DIVINA GRACIA L. DEL PRADO, Ph.D. (Assistant National Statistician) Officer-in-Charge, Deputy National Statistician Sectoral Statistics Office

TECHNICAL NOTES

I. Introduction

This Special Release presents the preliminary results of the 2020 Survey of Tourism Establishments in the Philippines (STEP).

The 2020 STEP is the third survey conducted on tourism establishments in the Philippines. It is a rider to the 2020 Annual Survey of Philippine Business and Industry (ASPBI). Data collected from the survey provide information on the availability of supply of tourism goods, products and services, which are valuable inputs in the compilation of the Philippine Tourism Satellite Account (PTSA).

The conduct of the 2020 STEP is authorized under Republic Act 10625 known as the Philippine Statistical Act of 2013, which mandates reorganizing and strengthening of the Philippine Statistical System (PSS), its agencies and instrumentalities.

II. Data Collection and Processing

The survey was conducted nationwide in 2021 with the year 2020 as the reference period of data, except for employment which is as of 15 November 2020.

Sample establishments were given various options in accomplishing the survey questionnaire. These were the following:

• online questionnaire available at https://step.psa.gov.ph; • electronic copy of the questionnaire either in portable document format (.pdf) or Excel (.xlsx) file format; and • printed copy of the questionnaire.

The Establishment Data Management System (EDMS) was utilized in the decentralized processing of 2020 STEP questionnaires in the provinces.

Data are presented by tourism characteristic industries classified according to the 2016 Philippine Tourism Statistical Classification System (PTSCS).

III. Taxonomy of Establishments

An establishment is defined as an economic unit under a single ownership or control which engages in one or predominantly one kind of economic activity at a single fixed location.

An establishment is categorized by its economic organization, legal organization, industrial classification, employment size, and geographic location.

Economic Organization refers to the organizational structure or role of the establishment in the organization. An establishment may be single establishment, branch, establishment and main office with branches elsewhere, main office only, and ancillary unit other than main office.

Legal Organization refers to the legal form of the economic entity, which owns the establishment. An establishment may be single proprietorship, partnership, government corporation, stock corporation, non-stock corporation, or cooperative.

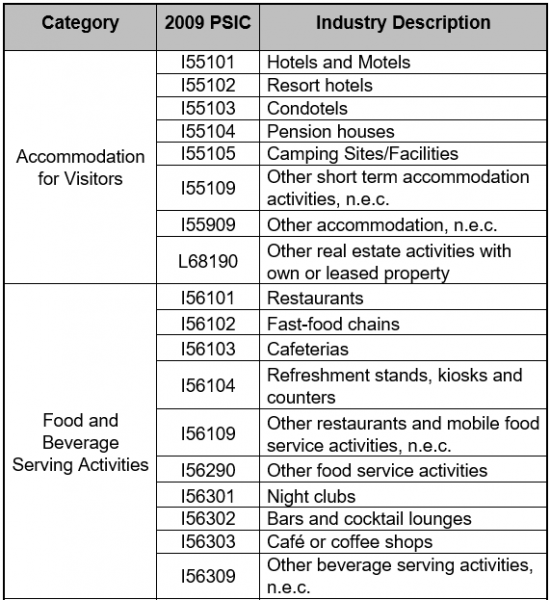

Industrial Classification of an economic unit was determined by the activity from which it derives its major income or revenue. The 2009 PSIC, which was approved for adoption by government agencies and instrumentalities through PSA Resolution No. 01 Series of 2017-158 signed on 14 February 2017 was utilized to classify economic units according to their economic activities.

Size of an establishment is determined by its total employment as of the time of visit during the latest Updating of the List of Establishments.

T otal Employment (TE) refers to the total number of persons who work in or for the establishment. This includes paid employees, working owners, unpaid workers and all employees who work full-time or part-time including seasonal workers. Also included are persons on short-term leave such as those on sick, vacation or annual leaves and on strike.

Geographic Classification refers to the grouping of establishments by geographic area using the Philippine Standard Geographic Code (PSGC) classification. The PSGC contains the latest updates on the official number of regions, provinces, cities, municipalities, and barangays in the Philippines. The PSGC as of 31 December 2020 was used for the 2020 STEP.

IV. Scope and Coverage

The 2020 STEP was a nationwide undertaking and covered tourism characteristic industries classified according to the 2016 Philippine Tourism Statistical Classification System (PTSCS) as defined in Table 1.

Table 1. Scope and Coverage of the 2020 STEP

The survey was confined to the formal sector of the economy, which consists of the following:

• Corporations and partnership • Cooperatives and foundations • Single proprietorship with employment of 10 and over; and • Single proprietorships with branches

Hence, the 2020 STEP covered only the following economic units:

All establishments with total employment (TE) of 10 or more, and;

• All establishments with TE of less than 10, except those establishments with Legal Organization = 1 (single proprietorship) and Economic Organization = 1 (single establishment), that are engaged in economic activities classified according to the 2009 Philippine Standard Industrial Classification (PSIC).

V. Sampling Design

The 2020 STEP uses stratified systematic sampling design with 5-digit PSIC serving as industry strata (industry domain) and the employment size as the second stratification variable.

Stratified systematic sampling is a process of dividing the population into homogeneous groups, called strata , and then selecting independent samples in each stratum systematically. This method ensures that all important subgroups of the population are represented in the sample and increases the precision of “overall” survey estimates.

The geographic domain of the 2020 STEP is at the national level. The industry domain/stratum is 5-digit industry classification, and the employment domain/stratum is the MSME classification.

Unit of Enumeration

The unit of enumeration for the 2020 STEP is the establishment.

Sampling Frame of Establishments

The frame for the 2020 STEP was the list of samples of the 2020 ASPBI, which was extracted from the preliminary 2020 List of Establishments (LE) as of 06 January 2021. This is to ensure that the sample of STEP is a sample of ASPBI as well.

Estimation Procedure

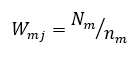

By MSME Classification

a. Total Estimate by MSME Classification

m denotes the employment stratum based on MSME classification j 1, 2, 3,…, nm establishments X mj value of the j th establishment in the employment stratum based on MSME classification at the national level W mj weight of the j th establishment in the employment stratum based on MSME classification at the national level

N m total number of establishments in the employment stratum based on MSME classification at the national level n m number of sample establishments in the employment stratum based on MSME classification at the national level

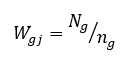

By Industry Domain

a. Non-certainty stratum (All other establishments not classified as MICE)

g denotes the non-certainty stratum for an industry domain j 1, 2, 3,…, ng establishments X gj value of the jth establishment in the non-certainty employment stratum for an industry domain at the national level W gj weight of the jth establishment in the non-certainty employment stratum for an industry domain at the national level

N g total number of establishments in the non-certainty employment stratum for an industry domain at the national level n g number of sample establishments in the non-certainty employment stratum for an industry domain at the national level

b. Certainty stratum (Establishments under Meetings, Incentives, Conferences and Exhibitions (MICE) as identified by the Department of Tourism (DOT)

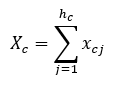

The estimate of the total of a characteristic ( X c ) for the certainty stratum in an industry domain at the national level is

c denotes the certainty stratum j 1, 2, 3, …, hc establishments X cj value of the jth establishment in the certainty employment stratum in an industry domain at the national level h c number of establishments in the certainty employment stratum industry domain within each region

c. Total Estimate by MSME and Industry Domain

where d denotes the MSME or industry domain

Weight Adjustment Factor for Non-Response

To account for non-response and non-eligible respondents of the survey, the base weight was multiplied with the adjustment factor for each of the sampling unit. The computation of the weights is as follows.

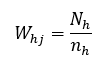

a. Base Weight

W hj = weight of the j th establishment in the h th stratum N h = total no. of establishments belonging to the h th stratum n h = total no. of sample establishments in the h th stratum

a. Adjustment Factor

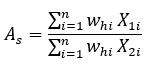

To take into account for the non-responding sample establishments and non-eligible respondents, the adjustment factor by region and industry domain is as follows:

A s = adjustment factor for industry domain s X 1i = eligibility status of the ith establishment (1 if eligible, 0 otherwise) X 2i = responding status of the ith establishment (1 if responding, 0 otherwise)

b. Final Weights

The final weights is the product of the base weight and adjustment factor. That is,

VI. Response Rate

Response rate for 2020 STEP was 92.7 percent (9,132 out of 9,849 establishments). This included receipts of "good" questionnaires, partially accomplished questionnaires, and reports of closed, moved out or out of scope establishments.

Of the total respondents, 226 establishments responded online.

Reports of establishments which were found to be duplicate of another establishment, out-of-scope and out of business in 2020 were not included in the generation of statistical tables.

VII. Concepts and Definitions of Terms

Accreditation refers to a certification issued by the Department of Tourism, which recognizes the holder to having complied with its minimum standards in the operation of the establishment concerned.

Bed capacity is the maximum number of beds, which can be installed or set up in an assisted living facility at any given time for use of residents.

Booking office is a room where tickets are sold and booked, especially in a theater or station.

Carrier refers to a transportation company, such as an airline, motor coach, cruise line, or railroad, which carries passengers and/or cargo carrying capacity: the amount of tourism a destination can handle.

Carrying capacity is the amount of visitor activity that a site or destination can sustain.

Commission refers to the percentage of selling price paid to a retailer by a supplier. In the travel industry, travel agents receive commissions for selling tour packages or other services.

Computer reservation systems (CRS) are used for inventory management by airlines, hotels and other facilities. CRS can allow direct access through terminals for intermediaries to check availability, make reservations and print tickets.

Composting refers to the controlled decomposition of organic matter by micro-organisms, mainly bacteria and fungi, into a humus-like product.

Contractual employee refers to one employed by a contractor or subcontractor to perform or complete a job, work or service pursuant to an arrangement between the latter and a principal.

Disposal refers to the discharge, deposit, dumping, spilling, leaking or placing of any solid waste into or in any land.

Domestic tourism refers to tourism of resident visitors within the economic territory of the country of reference.

Electronic payment (e.g. Credit card, ATM) refers to money paid electronically. Also known as e-money, electronic cash, electronic currency, digital money, digital cash or digital currency.

Inbound tourism refers to tourism of non-resident visitors within the economic territory of the country of reference.

Non-supervisory employees include any employee who does not have authority to hire, discharge, promote, transfer, suspend, layoff, or discipline other employees or to effectively recommend such action, or who is not in a confidential relationship with management. Determination of non-supervisory and confidential status shall be made by the manager.

Outbound tourism refers to tourism of resident visitors outside the economic territory of the country of reference.

Regular or permanent employment is when an employee performs activities that are usually necessary or desirable in the usual business or trade of the employer.

Seasonal workers are individuals who were hired for a specific period to augment the regular employees due to high demand of clients and/or increased work demands during peak months.

Solid waste includes all discarded household, commercial waste, non-hazardous institutional, ports/harbour and industrial waste, street sweepings, construction debris, agriculture waste, and other non-hazardous/non-toxic solid waste.

Supervisory employee refers to an employee who, in the interest of the employer, effectively recommends managerial actions if the exercise of such authority is not merely routinely or clerical in nature but requires the use of independent judgement,

Tourism refers to activities of foreign and domestic visitors traveling to and staying in places outside their usual environment for not more than one year for leisure, business and other purposes not related to employment with pay from within the place visited. Traveling for the purpose of conducting businesses, for education and training, etc., can also be part of tourism. Both foreign visitors (country of residence is other than the Philippines) and domestic visitors (Philippine residents) are covered in the survey.

Tourist/Visitor refers to a person traveling to a place other than that of his/her usual environment for less than 12 months and whose main purpose of the trip is other than the exercise of an activity remunerated within the place visited.

Tourism activities encompass all that foreign and domestic visitors do for a trip or while on a trip. It is not restricted to what could be considered as “typical” tourism activities such as sightseeing, sunbathing, visiting site, etc. From an economic point of view, the basic activity of foreign and domestic visitors is consumption, that is, the acquisition of consumption goods and services to satisfy individual or collective needs and wants.

Worker displacement is defined as the separation of workers to their jobs or termination of the employment relationship that is involuntary on the part of the worker, with a permanent effect without assurance of re-employment to the same employer or industry, and that is not caused by the worker’s job performance, work behavior and attitude, or work relations and other factors that are not attributable to the characteristics of the individual worker.

- Asia Briefing

- China Briefing

- ASEAN Briefing

- India Briefing

- Vietnam Briefing

- Silk Road Briefing

- Russia Briefing

- Middle East Briefing

- Asia Investment Research

Tourism Industry in the Philippines: Part II

Op-ed by Bob Shead

In the second part of this article, I will discuss the various sectors of the Philippine tourism industry. The first part of the article, covering the opportunities and incentives for foreign investors in the tourism industry, can be read here .

The main sectors of tourism in the Philippines are:

Casino and Gambling

The gaming/casino industry in the Philippines is becoming more developed, on the back of growing supply and heightened competition, a recent independent report stated. The Philippine Amusement and Gaming Corporation (PAGCOR), the gaming industry regulator, has said that the casino industry continues to grow. This has led to an 18.1 percent increase in PAGCOR’s net income in 2016 to P4.46 billion (US$89 million) from gaming operations. The total gaming revenues in 2016 increased by 22.9 percent to P53.31 billion (US$1.06 billion). PAGCOR also owns and operates 13 casinos in the Philippines, including three in Manila.

RELATED: Corporate Establishment Services from Dezan Shira & Associates

A recent report by Fitch states, “We expect high single-digit gross gaming revenues in 2017 driven by the opening of the US$2.4 billion Okada Manila Resort and the continued economic growth in the Philippines. Longer term, competition from Macau and other Asia Pacific countries will restrain growth.” It should also be noted that junket sourced VIP business, makes up about one third of gross gaming revenues at private casinos. However, Fitch also noted that while the initial results of the first three casinos operating under the licenses granted by PAGCOR are encouraging, relative to the investments made, this may not be the case in the longer term.

The current major private casinos, include Travellers International Hotel Group, a joint venture between Genting Hong Kong and a local conglomerate Alliance Global; Bloomberry Resorts Corporation, owned by Enrique Razon; City of Dreams Manila operated by Melco Resorts Leisure (PHP) Corporation, a subsidiary of Melco Resorts and Entertainment (Philippines) Corporation; and Tiger Resorts (still under construction) owned by Kazuo Okada.

There is much speculation at present as to whether the interest in the Philippine gaming industry by Chinese nationals will continue to improve. The current Philippine Government has promoted stronger ties with China, as more tourists from the Chinese Mainland come to the Philippines to play. However, the Chinese Government has, in the past couple of years, also clamped down on Chinese nationals taking their funds outside of China.

It is recognised that gaming companies, particularly casinos, stand to benefit the most from stronger ties with China as the growing number of tourists from China should boost gaming revenues. In the past four years, the number of tourists coming from China to the Philippines increased by 19.2 percent, and during the first eight months of 2016, Chinese tourist arrivals jumped 50.3 percent to 484,567. China is now the Philippines’ third largest visitor market, accounting for 12 percent of total tourist arrivals during the first eight months of 2016.

Cruise Lines

The Philippines is in the process of becoming one of Asia’s top international cruise destinations, and there is an increasing interest from Cruise Lines to boost infrastructure development in order to support international cruise ships. To date, Philippine ports have hosted cruise ships from Royal Caribbean Cruise Ltd (RCCL) and Star Cruises amongst other smaller expedition cruise companies. International cruise calls at ports in the Philippines grew annually at 27.8 percent from 2014 to 2016, and now expect to host approximately a hundred port calls in 2017, with around 122,000 passengers. The Department of Tourism’s National Cruise Tourism Strategic Plan is targeting 300 port calls by 2020.

The Department of Tourism (DOT) has said that cruise tourism is one of its priorities for 2017, and the agency plans to create more ports that will be attractive to, and able to meet the standards of, international cruise ships. Manila, Puerto Princesa in Palawan, Boracay, and Davao City in Mindanao, have been identified as cruise ship destinations. Included in the DOT’s plans is the construction of a cruise port with a terminal in Manila that will be able to host international cruise liners carrying over 3,000 passengers.

The DOT, along with the Province of Aklan recently signed an agreement with RCCL that allows Aklan Province to work with RCCL, who wish to develop a partnership to support the construction of a purpose built terminal in Caticlan, adjoining Boracay, the Philippines’ most popular beach resort. The Japanese cruise company JCL will now include the Philippines as a regular port of call, the DOT recently announced following an investment-promotion visit to Japan by the Philippines Secretary for Tourism Wanda Teo.

Cruise tourism is one of the nine product portfolios identified in the DOT’s National Tourism Development Plan (NTDP) which aims to enhance the country’s competitiveness as a tourist destination in the Asia-Pacific region. The promotion of cruises was further elaborated in the National Cruise Tourism Strategy, completed by the DOT last year, and the ASEAN Cruise Brand, an intra-regional and multi-country initiative.

Island Resorts

The Philippines is made up of 7,107 islands (only 2000 are inhabited); each island offers a rich biodiversity ranging from tropical rain forests, mangroves, and coral reefs to mountain ranges, world class beaches, beautiful islands and a diverse range of flora and fauna. There is increasing interest in investments in island resorts. Coron Islands in Palawan is a good example of recent environment friendly resort development.

General Tourism/Business Visits and Hotels

The hotel industry in the Philippines is expected to see a continued growth over the next five years, although a decline in hotel occupancy rates in the first half is forecasted. Hotel occupancy rates in Manila slipped to an average of 68 percent in the first half of 2016, lower than occupancy rates the previous year, however still better than in other ASEAN countries. Hotel chains continue to pursue their respective expansion projects. The Filinvest Group is increasing its hotel portfolio in both Alabang and Cebu, plus the Filinvest Group’s Chroma Hospitality, that focusses on hotel management services, is investing P2.6 billion (US$52 million) for two Canvas brands – a 228 room Canvas Hotel in Cubao, and a 185 room Canvas Hotel in Mactan. Additionally, Filinvest is introducing a Crimson Hotel in Boracay, Quest Hotels in Dumaguete and Tagaytay. It is planned that these hotels will open between 2018 and 2019. Chroma Hospitality is also looking to expand in Pasig, Quezon City, Batangas, Cavite, Laoag, Baguio, Cebu and Davao.

Another leading investor, Ayala Land plans to launch the Seda hotel chain across the Philippines over the next five years. This will be in addition to Seda Hotels currently located in Bonifacio Global City, Cagayan de Oro City, Davao City and Laguna. Ayala Land are planning 2,000 new hotel rooms by 2018, and 6,000 hotel rooms by 2020. Red Planet, formerly Tune Hotel, is also planning to expand in the Philippines over the next five years. The rebranded hotel currently has 10 hotels, and plans to have 20 hotels in the Philippines over the next five years.

Along with the anticipated 7 million foreign tourists this year, there are approximately 50 million domestic tourists. Obviously, the continuing improvements in infrastructure such as airports, roads and rail transport systems is seen as the key that can unlock the Philippines potential for tourism growth. Research has also found that tourists constitute 79 percent of total hotel guests outside Metro Manila.

Yachting and Sailing

Tourism in the Philippines has grown steadily during the last few years. There are increasing numbers of sailing enthusiasts looking for sailing and yachting experience amongst the Philippines archipelago. The only way to get to many of the Philippines islands is by sea, and many of the islands are inhabited. Palawan is one of the favourite destinations for those yacht and sailing enthusiasts. The main ports where charter boats can be rented, are Puerto Galera, Boracay, Coron, Puerto Princesa, and Cebu.

The industry of yacht chartering in the Philippines is still in early stages. The yachting and sailing fleets available for rent are mainly composed of privately owned boats, and skippered by the owners who want to share the sailing experience in the Philippines. The priority destinations tend to be Boracay, Puerto Galera, Palawan, Subic Bay, Cebu and Bohol, with other destinations becoming popular.

More generally, Southeast Asia is fast emerging as the yachting hub of Asia, with industry watchers highlighting the potential in markets like Thailand and Indonesia. However, there is not a large yachting culture in Asia, despite the region’s growing wealthy population. Currently only 4.3 percent of the world’s super yachts are Asia-based, despite the region boasting a large number of high net worth individuals. For general information, a super yacht is typically at least 25-30 meters in length.

The countries that have the highest potential in yacht growth are Thailand, Indonesia, the Philippines and Malaysia. This is due to the natural beauty of the islands, existing yacht clubs, a viable and strong tourism industry, as well as a strong expat community who have a history and support for yachting.

Scuba Diving

The Philippines have the most species in the least space of anywhere in the planet. Out of the planet’s 500 coral species, more than 400 are in the Philippines. The Philippines is at the center of the world’s Coral Triangle, and host to a very rich marine biodiversity, the whole Philippine archipelago can be considered a dive location.

There are over 100 identified diving spots across the Philippine islands that are rich in corals and marine species. The Philippines is currently working at tapping a larger share of the world’s diving market. The current figures for foreign dive tourists in the Philippines is expected to be 200,000 in 2017. Previous figures released by DOT were 59,572 in 2010, 89,911 in 2011 and 126,200 in 2012. The biggest markets were South Korea, USA and Germany.

Medical Tourism

Medical tourism in Philippines is a rapidly growing market. In 2015, the Philippines was ranked eighth among the top medical tourism destinations globally, according to the International Healthcare Research Center and the Medical Tourism Association (MTA). Patients arriving in the Philippines for medical tourism, come mainly from East Asia (China, Japan, Korea, Taiwan), USA, Australia, and increasingly from Europe.

The Philippine Government’ Departments of Tourism (DOT), Health (DOH), Trade and Industry – Board of Investments (DTI–BOI) have combined for a joint programme to promote Philippine medical tourism. This informal partnership has resulted in a programme that identified five major priorities in the medical travel sector – tourists who come for wellness services; medical tourists, who need low-acuity medical procedures; medical travelers, who need more complex procedures; international patients, including overseas Filipino workers, including retirees; accompanying guests, and immediate next of kin.

To date, medical tourism in the Philippines caters to approximately 80,000 to 250,000 patients or clients annually. Currently, 62 hospitals around the country are now internationally accredited, and to date, five Philippine medical institutions, the Asian Hospital and Medical Center (Muntinlupa City), Makati Medical Center (Makati City), St. Luke’s Medical Center (Bonifacio Global City and Quezon City), and The Medical City (Pasig City) have been certified for international medical care and treatment.

A 2014 study reported that the Philippine medical tourism industry generated US$145 million in 2014. Among the factors cited in the survey included competitive price for health and wellness services, high standards of healthcare provided in internationally accredited hospitals and English speaking healthcare professionals. The Philippines proximity to major international hubs, along with good tourism destinations for recovery periods were also factors.

Negative Aspects of the Philippine Tourism Industry

There is, of course, some issues concerning tourism in the Philippines, and these need to be discussed further. These mainly concern infrastructure, personal security and safety hazards. However, much is being done to improve these issues, and tourists must realise the potential problems before they chose to visit the Philippines.

Although the recent Resorts World Manila tragic incident, that left at least 38 dead was very disturbing, and opened up many questions concerning security and safety, it is predicted that this is not likely to affect general investor sentiment although it may well affect tourism in general. The Philippine Travel Agencies Association (PTAA)has acknowledged that tourist arrivals would likely take a short term hit for this year, particularly also because of the ongoing crisis in Marawi City, Mindanao, which has led to a Presidential declaration of Martial Law in Mindanao.

This has meant that security in general has been stepped up, especially in public places like shopping malls, resorts and hotels. It has also been recognised by organisations such as the Makati Business Club, the Philippine Chamber of Commerce and Industry, the American and European Chambers of Commerce that a better Crisis Management system is necessary and important. Although the Resorts World incident has been recognised as an isolated incident, it is recognized that, also in the light of the Marawi invasion that Crisis Management and security procedures must be improved, and that tourists will continue to feel confident to travel to the Philippines. Financially, all the casinos lost revenue in the days following the Resorts World attack and resulting tragic loss of lives.

RELATED: Biomass Industry in the Philippines

However, at the end of the day, the Philippine tourism investment industry is increasing rapidly, despite the various and sometimes overplayed downsides. It is still a destination that to some extent is off the main radar of ASEAN countries, compared to Thailand, Malaysia and Singapore. However, this on the other hand makes it a more exotic destination for dedicated travelers and those who would like to get off the beaten track. Manila as a hub for the casino and gaming industry will increase in size, and stands a good chance of replacing Macao as the casino hub of Asia.

The hotel and resort industry in the Philippines is rapidly expanding – and of course, linked to the casino and gaming industry. This is especially true in the luxury 5 star hotel sector and luxury hotels continue to appear on the skyline in Manila. I will in the future cover the different aspects of the tourism industry in more detail, including the retirement programme. The tourism market in the Philippines is immense and diverse and will continue to remain so.

In this issue of ASEAN Briefing magazine, we provide an introduction to the Philippines as well as analyze the various market entry options available for investors interested in expanding to the island nation. We also discuss the step-by-step process for setting up a business entity in the Philippines, highlighting the various statutory requirements for overseas investors. Finally, we explore the potential for Singapore to serve as a viable base to administer investors’ Philippine operations.

- Previous Article Tourism Industry in the Philippines: Part I

- Next Article The Southern Economic Corridor: Boosting Trade and Investment in Cambodia

Our free webinars are packed full of useful information for doing business in ASEAN.

DEZAN SHIRA & ASSOCIATES

Meet the firm behind our content. Visit their website to see how their services can help your business succeed.

Want the Latest Sent to Your Inbox?

Subscribing grants you this, plus free access to our articles and magazines.

Get free access to our subscriptions and publications

Subscribe to receive weekly ASEAN Briefing news updates, our latest doing business publications, and access to our Asia archives.

Your trusted source for India business, regulatory and economy news, since 1999.

Subscribe now to receive our weekly ASEAN Edition newsletter. Its free with no strings attached.

Not convinced? Click here to see our last week's issue.

Search our guides, media and news archives

Type keyword to begin searching...

This Giant Hospitality Group Is Betting Big on Philippine Tourism

O ne of the world’s biggest names in hospitality is betting on the local tourism industry and is set to expand its footprint in the Philippines. Marriott International said two new properties are expected to open by the first quarter of 2025: AC Hotel Ortigas, with 150 keys, and Fairfield by Marriott Mahi in Mactan, with 196 keys.