How to book travel (and save points) with Chase Travel

Editor's note : This is a recurring post, regularly updated with the latest information.

Chase Ultimate Rewards is one of the best flexible rewards currencies available, and you can get some incredible value from your Ultimate Rewards points .

Generally, we recommend transferring Chase points to the program's airline and hotel partners for award bookings. However, sometimes redeeming Ultimate Rewards points for paid travel through Chase Travel℠ is more advantageous. This option can save you money, particularly when traditional award space is unavailable, as you can book almost any available flight or hotel through Chase Travel.

Here's what you need to know about Chase Travel.

Related: New Chase Sapphire Preferred offer: Earn 75,000 of the most valuable points

What is Chase Travel?

To maximize your Ultimate Rewards points, it's often best to transfer them to partner programs like United MileagePlus , World of Hyatt or British Airways Executive Club for award reservations. However, it's important to compare the points needed for a direct booking through Chase Travel to those required for an award booking. Sometimes, booking through the portal can be beneficial, as the points price is tied to the cash cost of the flight or hotel stay, potentially resulting in lower point requirements.

However, you need to have some Chase points before using Chase Travel. If you're unfamiliar with Chase's most popular cards and welcome offers, here are a few current ones to be aware of.

Ink Business Preferred® Credit Card

The Ink Business Preferred® Credit Card is a TPG favorite. It currently comes with one of the highest sign-up bonuses from Chase — 100,000 bonus points after you spend $8,000 on purchases in the first three months of account opening.

Based on our valuations , the bonus points alone are worth $2,050. However, you can redeem these points through Chase Travel for a fixed value of 1.25 cents apiece.

Read more: Ink Business Preferred Credit Card review: A great all-around business card

Chase Sapphire Preferred® Card

The Chase Sapphire Preferred® Card is another fantastic addition to your wallet. For a limited time, you'll earn an elevated 75,000 bonus points after you spend $4,000 on purchases in the first three months from account opening. The bonus is worth $1,538 based on TPG valuations .

Like the Ink Business Preferred, you'll get a value of 1.25 cents per point when booking directly through Chase Travel with the Sapphire Preferred. You'll also earn 5 points per dollar on paid travel purchased through Chase (excluding the first $50 in hotel purchases that qualify for the card's annual hotel credit ).

Read more: Chase Sapphire Preferred credit card review: 75,000-point bonus for a top travel card

Chase Sapphire Reserve®

For a limited time only, the Chase Sapphire Reserve® offers 75,000 bonus points after you spend $4,000 on purchases in the first three months from account opening, which is worth $1,538 based on TPG valuations.

This card includes additional perks, like a PreCheck or Global Entry credit , Priority Pass lounge access and a $300 annual travel credit . This card also boosts your portal redemption rate to 1.5 cents per point, giving you 0.25 cents per point in additional purchase power over the Sapphire Preferred. When you book travel through Chase with the Sapphire Reserve, you'll earn 10 points per dollar on hotels and car rentals and 5 points per dollar on flights (excluding purchases that qualify for the $300 travel credit).

Read more: Chase Sapphire Reserve credit card review: Luxury perks and valuable rewards, plus a 75,000-point bonus

Cash-back cards

Chase also issues a number of cash-back credit cards — including the Chase Freedom Unlimited® , Ink Business Cash® Credit Card and Ink Business Unlimited® Credit Card . The rewards you earn on these cards are worth 1 cent apiece toward travel in Chase Travel. However, Chase allows you to combine your earnings into a single account . This means that you can effectively convert these cash-back rewards into fully transferable Ultimate Rewards points if you also have the Sapphire Preferred, Sapphire Reserve or Ink Business Preferred.

How to use Chase Travel

You can book flights, hotels, car rentals, cruises and other travel through Chase Travel, and it's relatively simple to access. First, you'll need to log into your Chase account, then navigate to the right side of the page, where you'll see a little box with your total Ultimate Rewards balance.

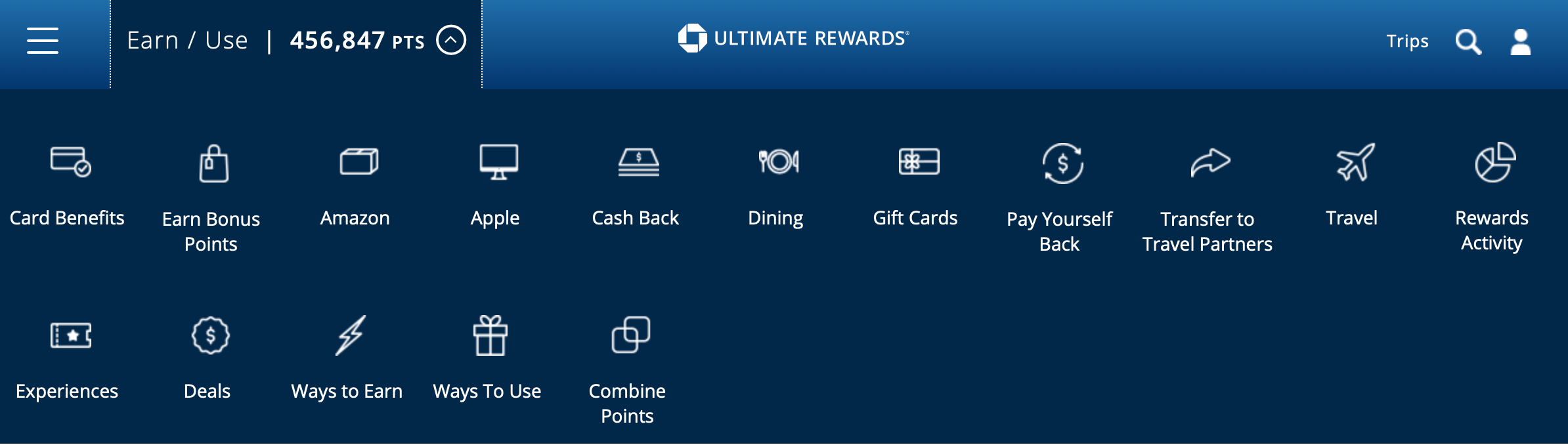

Click the box and it will bring you to the Ultimate Rewards dashboard, which looks like this:

Click "Travel" to access the travel homepage and search for airfare, hotels or vacation rentals.

Remember that when you book hotels through the portal with Ultimate Rewards points, you typically will not earn hotel points and elite credits and may not receive elite status perks because it's considered a third-party booking.

However, flights booked through the portal will typically earn frequent flyer miles and qualify for elite status.

How to book flights using Chase Travel

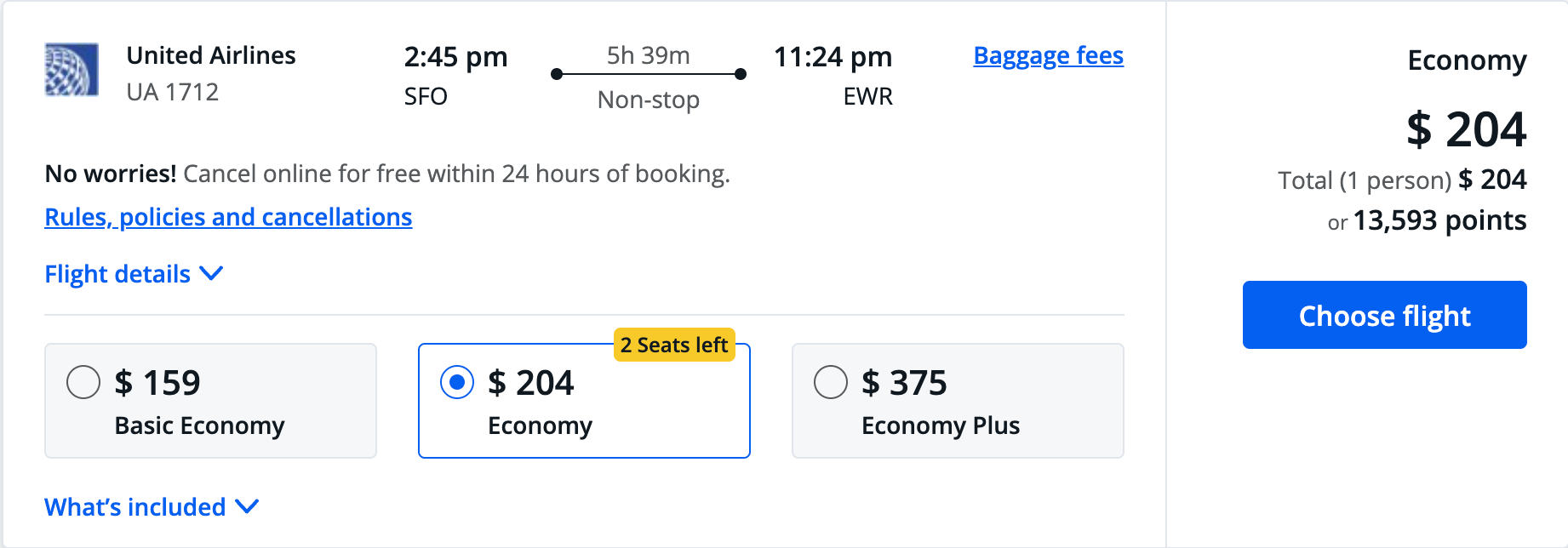

Booking your flights is a straightforward process once you've navigated to the portal's travel page. Type in your arrival and departure airports and travel dates, then hit the search button. For this search, I looked for a one-way flight from San Francisco International Airport (SFO) to Newark Liberty International Airport (EWR).

You'll then see the available flight options. When you find a flight you like, select the fare type you want to book and click the blue "Choose flight" button.

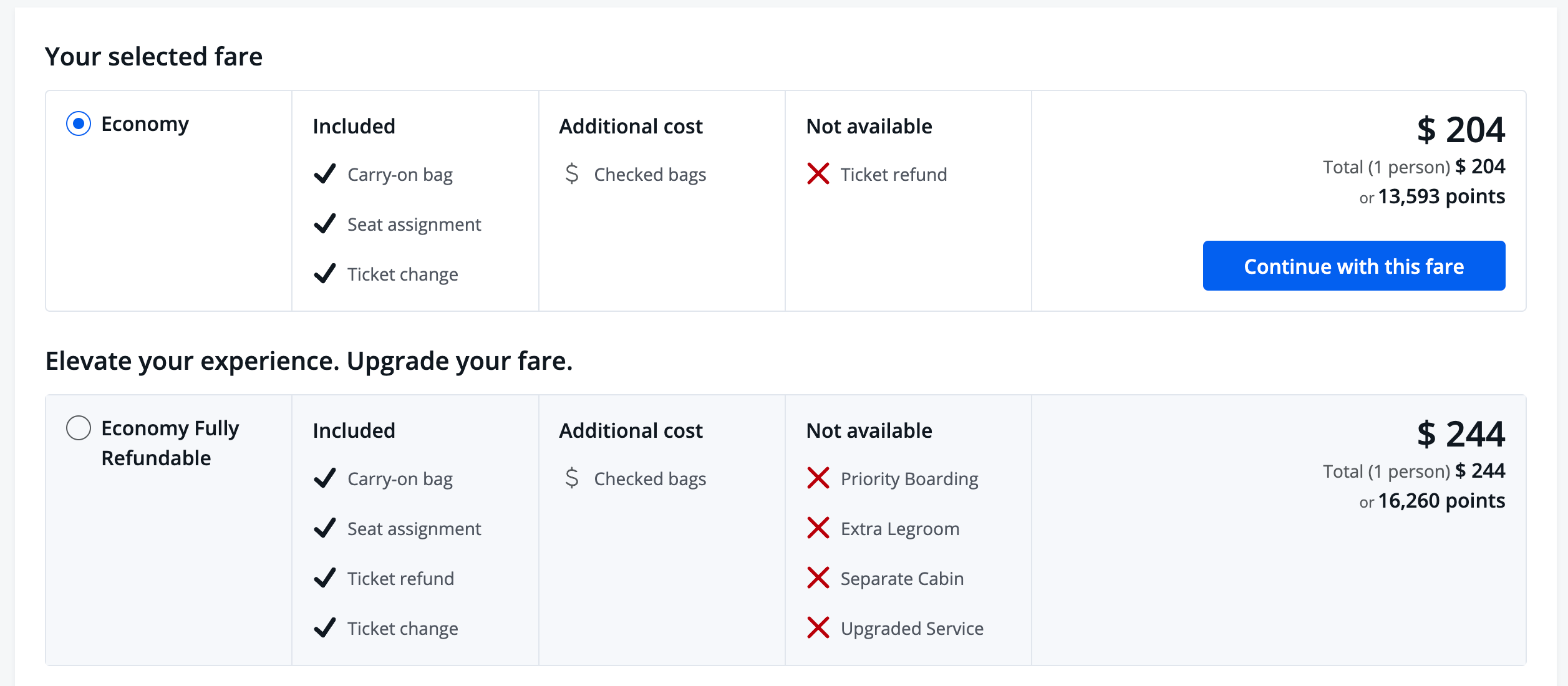

Once you've selected your preferred flights, you'll be taken to the next page to review your flight information and look over any upgrades you'd like to make.

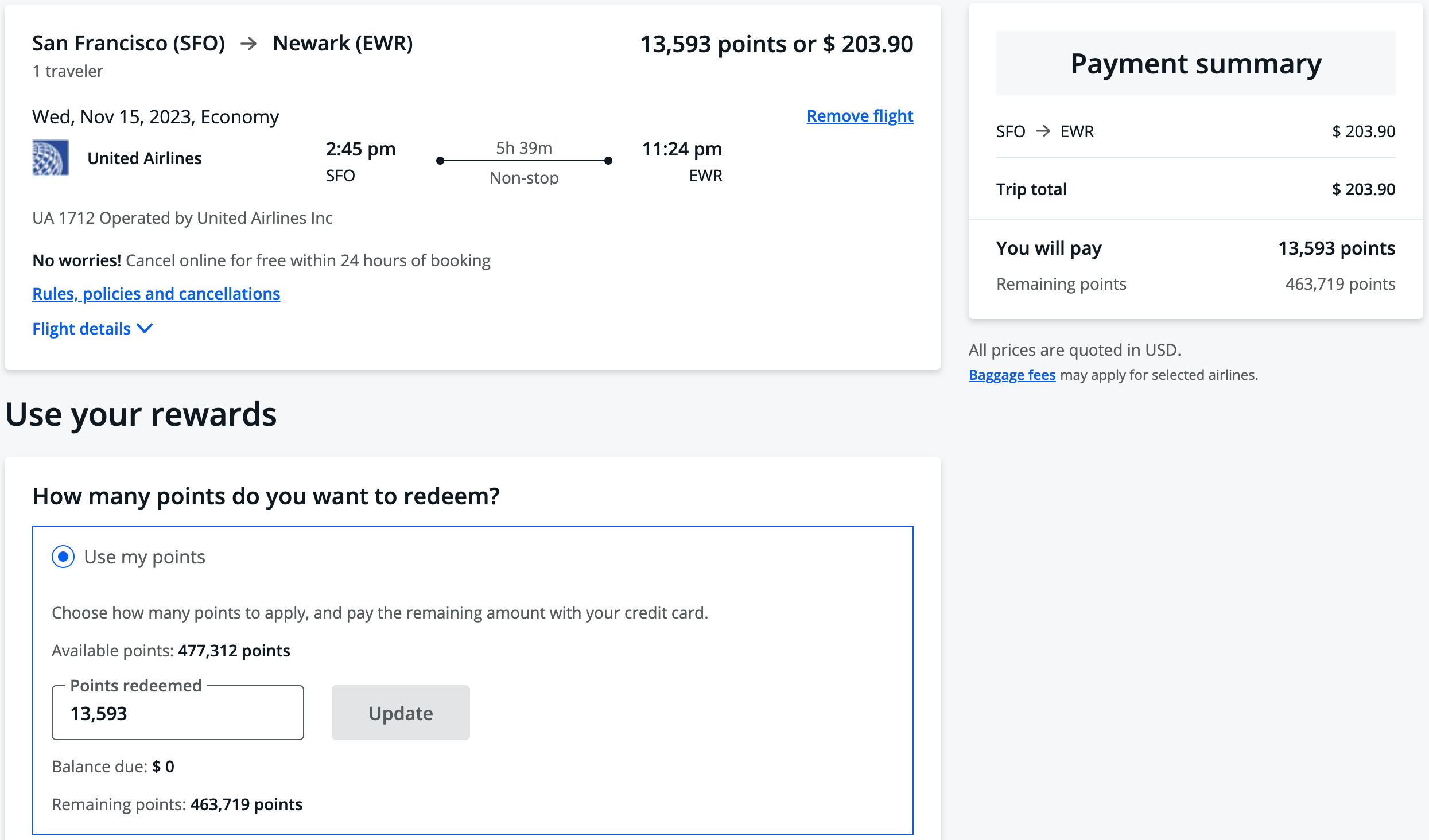

Then, you'll be directed to the checkout page, where you can pay with cash, points or a combination of the two. Again, points linked to a Chase Sapphire Reserve account are worth 1.5 cents each. If you have a Chase Sapphire Preferred Card or Ink Business Preferred Credit Card , points are worth 1.25 cents each.

Finally, you'll be directed to a page where you will enter the traveler's information and finalize your flights.

How to book hotels using Chase Travel

Booking hotels is similar to booking flights on the travel portal. This can be advantageous if you're looking at hotels outside of major chains that partner with Ultimate Rewards ( Hyatt , IHG and Marriott ). Regardless of how you book your hotel, compare the award rates required by these hotel loyalty programs to ensure you're getting the best deal.

Also, if you have an eligible card, you can access the Chase Luxury Hotel & Resort Collection , which gives you perks at around 1,000 luxury properties worldwide. Participating cards include the Chase Sapphire Reserve , United℠ Explorer Card , United Club℠ Infinite Card , United Quest℠ Card and United℠ Business Card .

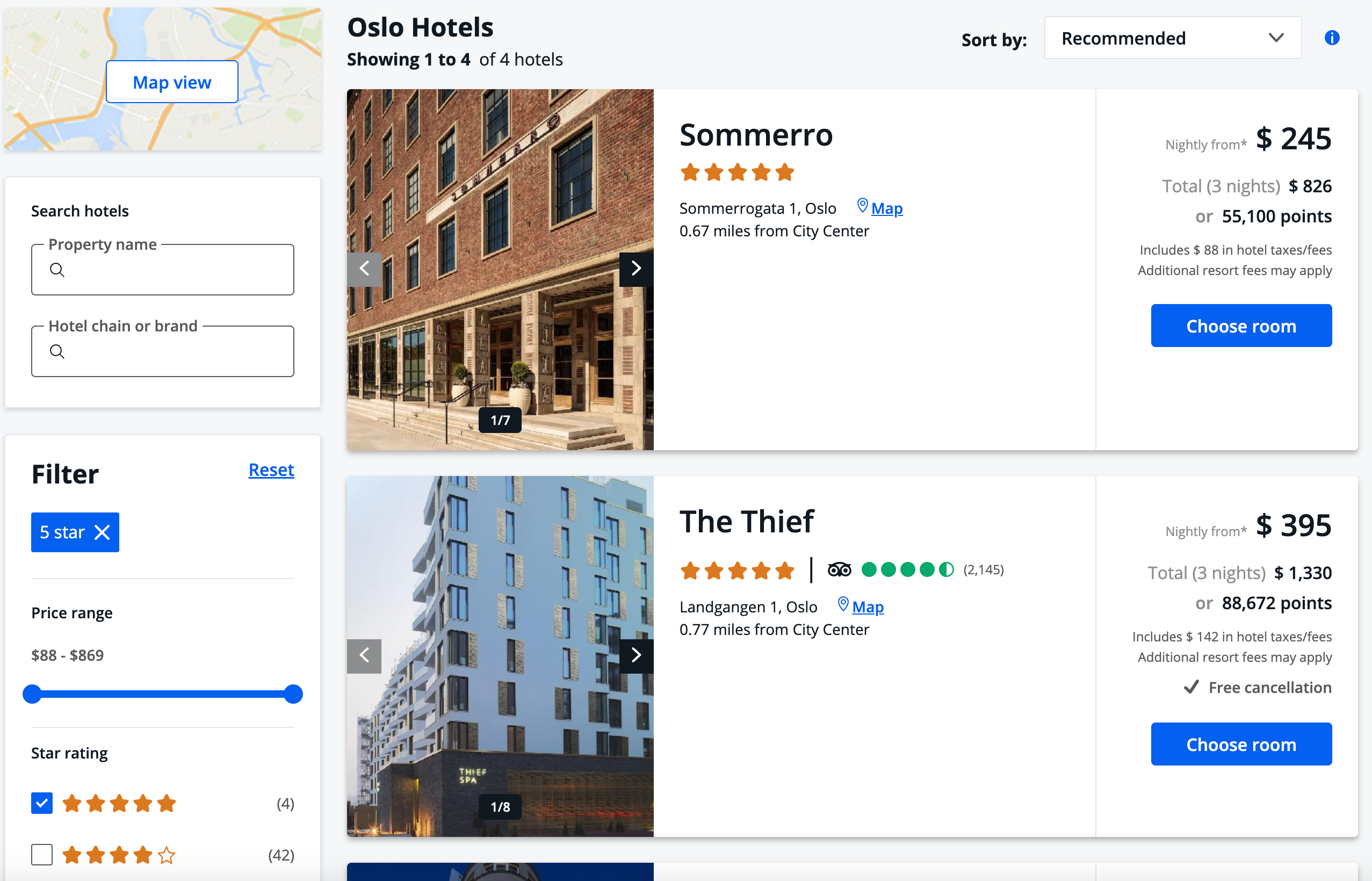

Here's a sample search for hotels in Olso, Norway, which hosts mostly boutique hotels.

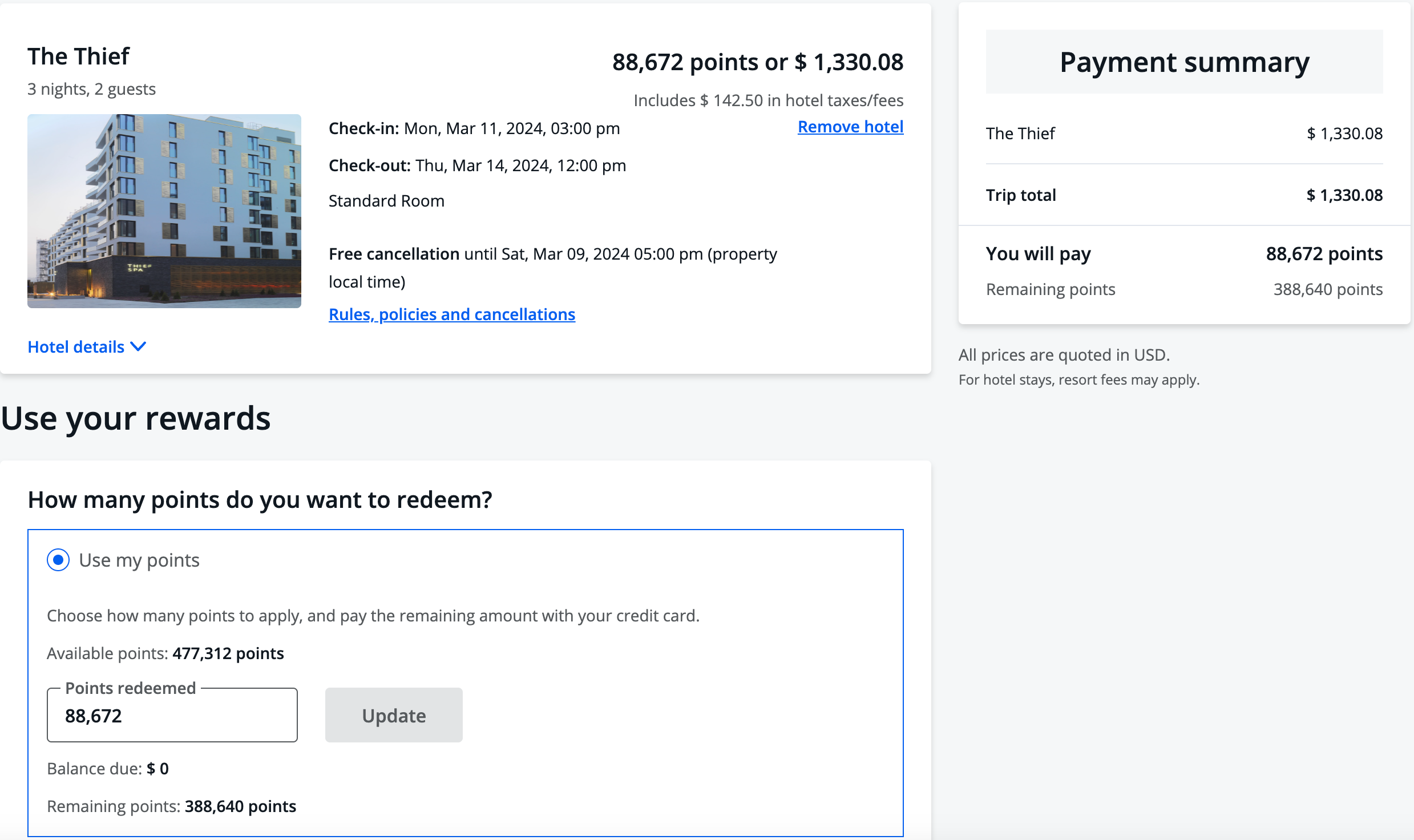

Once you've selected your desired property, room and rate, you can specify how many points you want to use on the checkout page.

Then, run through the on-screen prompts to finalize your booking, and you'll get an email confirmation.

Remember, you'll receive up to $50 in statement credits yearly for hotel reservations made through Chase Travel as a Sapphire Preferred cardholder.

Related: Book low-end or luxury hotels to get the best value from your points

How to book car rentals, cruises and other travel using Chase Travel

Using Chase Travel, you can rent cars, pay with points and still receive the excellent primary car rental insurance offered by the Chase Sapphire Reserve and Chase Sapphire Preferred Card .

The process of renting cars is similar to booking flights and hotels. Navigate to the "Cars" header from the main landing page and type in your itinerary, even if it's a one-way rental. Then, select "Search," and the results page will pop up. Once you choose your car, you'll be prompted to select add-ons.

When you've finished selecting, you'll head to the booking page, where you'll input your personal information and choose how many points you'd like to spend. Remember that to qualify for rental car insurance, you must decline the car rental company's collision damage waiver and ensure that anyone driving the car is on the rental agreement.

You can also book activities and cruises through Chase. Regarding activities, you can use your points to book fantastic tours like a Washington, D.C., night monument tour or Singapore heritage food tour at 1.25 or 1.5 cents each. This can be an excellent way to make a vacation free, instead of just your hotels and flights.

Cruises are also available, though you'll have to call to book those.

Related: The easiest ways to save on rental cars

More things to consider about Chase Travel

Below is some general guidance to maximize your experience with the portal.

We recommend comparing the points needed through Chase Travel with those required for partner transfers, factoring in taxes and fees. If you have or want hotel elite status, avoid booking hotels through the portal. These stays generally won't count toward status or qualify for hotel elite status benefits.

Booking through Chase Travel with cash can earn you extra points; Ink Business Preferred and Sapphire Preferred cardholders earn 5 points per dollar on all travel and Sapphire Reserve cardholders earn 5 points per dollar on flights and 10 points per dollar on hotels and rental cars. You might find better rates by booking directly with the travel provider; however, if your plans are firm and rates are comparable, booking through the portal can be worthwhile for earning extra points.

Remember that booking through third-party sites may result in issues if you change your plans, though. Travel providers are more likely to assist you if you've booked directly with them.

Bottom line

Chase Travel lets you use your points to book flights, hotels, rental cars, cruises and activities. If award flights aren't available or you find a cheap fare that requires fewer points, booking through the portal can be a good option.

With the Chase Sapphire Preferred and Chase Sapphire Reserve cards offering elevated welcome bonuses of 75,000 Ultimate Rewards points, now is a great time to look at Chase Travel.

Similarly, for hotels, it can be a good deal if you find a cheap rate or book a boutique property, but keep in mind that you may not earn hotel points or receive elite benefits. Whether booking rental cars, activities or cruises, always compare the options to see if using the portal or transferring to partners for an award is more advantageous.

Please turn on JavaScript in your browser It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

How to use the chase travel portal.

One of the many perks of using a Chase branded credit card is the opportunity to earn and redeem points for travel-related purchases. What’s more, did you know that you could maximize your points value and reap even more rewards points by booking through the Chase Travel portal?

To make the most of your purchases for travel, you can book your flights, hotels and more through the Chase Travel portal.

To help you navigate the rewards program, we’ll go over:

How to earn and redeem Chase Ultimate Rewards points

Accessing the chase travel portal.

- How to book flights through the Chase Travel portal

Booking hotels through the Chase Travel portal

How to book rental cars, cruises and other types of travel.

- The benefits of booking travel in the Chase Travel portal

- Additional tips and tricks for the Chase Travel portal

Chase Ultimate Rewards points are earned by using your Chase branded card on everyday purchases. When you use your Chase card(s), you can also earn points by making purchases on:

- Paid reservations

- Restaurant bookings

- Hotel reservations

Depending on the Chase credit card you use, you can be eligible for a wide range of perks and rewards. All Chase family cards, such as Freedom ® , Sapphire ® and Ink ® , earn points that can be redeemed on the Chase Ultimate Rewards portal.

To access the portal, go to the booking platform at www.chasetravel.com or login to your Chase Ultimate Rewards account and go to your Chase credit card’s main dashboard.

Next, click on the “Earn/Use” button where the number of points you have is listed. Choose “Travel” from the options listed, and this will take you to the travel portal.

How to book flights through Chase Travel portal

Rather than making your flight purchases externally, book your flights using the Chase Travel portal so you can get rewards on airfare. To do this, access the travel portal and search for the flight you want. You can filter your search by cost, airline, departure/arrival time and departure airport.

Once you’ve found the flight of your choice, select your option and purchase your flight using your Chase card. If you have Ultimate Rewards points available, you can use them to pay for all or part of your flight, and/or other travel-related purchases.

Similar to flights, you can redeem your Ultimate Rewards for hotel reservations. To do this, search by destination to see available hotels. You can narrow your search by filtering for price/amenities/ratings, type of property, number of bedrooms, neighborhood and more.

Select your hotel option, then continue to confirm your booking using your Chase card or redeeming your Ultimate Rewards to help make your purchases.

You can use the portal to book rental cars, activities and other travel-related purchases. To book a cruise line, you need to call directly.

For car rentals, be sure to use the appropriate points connected to your specific card to get additional perks, such as car insurance.

The benefits of booking travel in Chase Travel portal

Travel costs can add up easily, but if you’re using the portal to redeem your points, you are giving your points good use with certain cards. On the other hand, using the portal could also help you earn more points on your purchases. For example, you can get even more points on flights if you book through portal. These points can later be redeemed on your future travels.

Chase Travel portal summary

No matter where your next adventure takes you, use the Chase Travel portal to book hotels, flights and more. Earning points through the portal can unlock future opportunities for you to take trips in one platform.

- card travel tips

What to read next

Credit card basics hyatt hotels to stay at in louisville, kentucky.

Learn about the top Hyatt hotels to book in Louisville, Kentucky.

credit card basics The guide to the Chase Sapphire Terrace in Austin

Learn about the new Chase Sapphire Terrace at Austin-Bergstrom International Airport, including features, operating hours, and how to get in.

rewards and benefits Guide to the Chase Sapphire Lounge at LaGuardia Airport

The Sapphire Lounge at LaGuardia can be a calm place to unwind and relax before your flight. Learn about the features and amenities of the Sapphire airport lounge at LGA airport.

credit card basics What is trip interruption insurance?

Trip interruption insurance offers travelers reimbursements for prepaid, unused, or nonrefundable expenses if their trip is unexpectedly cut short.

Chase Sapphire Preferred® Card Review 2024

As the preferred travel credit card for beginners and travel pros alike, the Chase Sapphire Preferred® Card earns its name.

Expert take: The Chase Sapphire Preferred’s popularity in the travel rewards card space makes sense—it earns valuable Chase Ultimate Rewards points, offers perks like an annual travel credit and charges just a $95 annual fee. With so much to offer, and for a modest fee, it’s a great choice for beginner travelers and seasoned pros alike.

- Valuable food-related bonus categories

- Welcome offer is worth over $900 when redeemed for travel through Chase Travel

- Get a 10% point bonus each account anniversary

- $95 annual fee could be too much for beginners

- Redeeming for the highest value can be complex

- Not as many perks as travel rewards cards with higher fees

Vault’s Viewpoint on the Chase Sapphire Preferred Card

The Chase Sapphire Preferred is a great card for travelers of all frequencies. Whether you’re just starting out with travel rewards or already have a handful of travel cards, the Chase Sapphire Preferred can be a useful tool for earning rewards toward free or discounted travel.

The Chase Ultimate Rewards points you earn with this card can be redeemed for flights, hotel stays, rental cars and more through the Chase Travel portal—and for 25% more value. Further, if you’re able to meet the minimum spending threshold within the first three months of account opening, you can start off with enough points to fund or partially cover your next trip.

Still, there are a few reasons you might pass on the Sapphire Preferred. Though it can easily pay for itself, the presence of an annual fee is a dealbreaker for some. In the same vein, some people prefer simplicity over learning a rewards currency’s intricacies, and there’s definitely a learning curve with Chase Ultimate Rewards.

Chase Sapphire Preferred Highlights

- Annual fee: $95

Sign-up bonus: Earn 75,000 bonus points after you spend $4,000 on purchases in the first three months from account opening, equal to over $900 when you redeem for travel through Chase Travel

Earning Rewards With the Chase Sapphire Preferred Credit Card

For most people, the bulk of everyday rewards earning is going to be done at restaurants and on online groceries. Here’s a look at the Chase Sapphire Preferred’s rewards structure:

- 5X points on travel purchased through Chase Travel

- 5X points on qualifying Lyft rides (through March 31, 2025)

- 3X points on dining (including eligible delivery services, takeout and dining out)

- 3X points on online groceries (excluding Target, Walmart and wholesale clubs)

- 3X points on select streaming services

- 2X points on other travel purchases

- 1X points on all other purchases

Redeeming Rewards

When it’s time to cut into your points balance, you have a lot of options. Redeem your points for travel purchases through the Chase Travel portal at 1.25 cents apiece or transfer your points to a Chase hotel or airline partner for even greater value.

Other options include cash back , gift cards, paying with points on Amazon and via PayPal, exclusive experiences, dining through Chase and credits for previous purchases through Chase’s Pay Yourself Back program.

Rates and Fees

There’s more to know about the Chase Sapphire Preferred’s fee structure than just the annual fee. Like most travel cards , it’s not a great option for carrying a balance—especially since there’s no 0% introductory APR offer.

- Intro APR: None

- Regular APR: 21.49% – 28.49% variable

- Foreign transaction fees: None

- My Chase Plan fee: Monthly fee of 1.72% of the amount of each eligible purchase or amount selected to create a My Chase Plan

- Balance transfer fee: Either $5 or 5% of the amount of each transfer, whichever is greater

- Late payment fee: Up to $40

- Penalty APR: 29.99% maximum

- Cash advance fee: Either $10 or 5% of the amount of each transaction, whichever is greater

- Cash advance APR: 29.99%

Chase Sapphire Preferred Benefits

Travel perks.

- Annual hotel credit: Get up to $50 in annual credits on hotel stays purchased through Chase Travel.

- Anniversary points bonus: On each account anniversary, get a point bonus that equals 10% of your spending from the previous year.

- 25% points boost: Get 25% more value for your Chase Sapphire Preferred points when you redeem for travel through Chase Travel

- Chase transfer partners: Transfer points to Chase’s travel partners, including JetBlue, Southwest, United, Hyatt and Marriott, for heightened value.

Travel Protections

- Trip cancellation/interruption insurance: If your trip is canceled or cut short by illness, severe weather or other protected situations, you can be reimbursed up to $10,000 per person and $20,000 per trip for your prepaid, nonrefundable travel expenses. This includes passenger fares, tours and hotels.

- Auto rental collision damage waiver: If you decline the rental company’s collision insurance and charge the entire rental cost to your card, this primary coverage reimburses up to the actual cash value of the vehicle for theft and collision damage for most rental cars both in the U.S. and internationally.

- Baggage delay insurance: Get up to $100 per day in reimbursement for essential purchases like clothing and toiletries for baggage that’s delayed by more than six hours for up to five days.

- Trip delay reimbursement: This covers unreimbursed expenses, such as meals and lodging, for up to $500 per ticket. It applies when your common carrier travel is delayed more than 12 hours or requires an overnight stay.

- Emergency assistance services: Get help with legal and medical referrals or other travel and emergency assistance while away from home.

Shopping Benefits

- Instant use: Receive instant access to your card upon approval by adding it to a digital wallet like Apple Pay.

- Pay over time: With My Chase Plan, break up eligible purchases of $100 or more into monthly payments with no interest—just a fixed monthly fee of 1.72%.

- Lyft rewards : Earn 5X points on qualifying Lyft rides through March 31, 2025.

- Doordash DashPass: Get a complimentary one-year DashPass membership, which includes $0 delivery fees and lower service fees on eligible orders when you activate by December 31, 2024.

- Instacart+ membership : Get six months of complimentary Instacart+ membership and up to $15 in quarterly statement credits when you activate by July 31, 2024.

- Peloton rewards : Earn 5X points on Peloton equipment and accessory purchases over $150 (up to 25,000 total points) through March 31, 2025.

Shopping Protections

- Purchase protection: Your new purchases are covered for 120 days against damage or theft, up to $500 per claim and $50,000 per account.

- Extended warranty protection: This extends the time period of the U.S. manufacturer’s warranty by an additional year on eligible warranties of three years or less.

Who Is the Chase Sapphire Preferred Best For?

First-time travel rewards credit card holders will love the value they get from this card. The annual fee cuts into the Chase Sapphire Preferred’s value a little, but the current welcome bonus pays for that fee almost ten times over if you redeem your points through Chase Travel.

You’ll get even more value if you transfer your points to hotel or airline transfer partners. These are just some examples we put together of what you can get for 75,000 points or less, plus taxes and fees where applicable:

- Two round-trip economy tickets from select cities in North America to select cities in Europe via Air France/KLM Flying Blue starting from 30,000 miles each , or one round-trip premium economy ticket for the same route from 60,000 miles

- 21 nights at a Category 1 Hyatt hotel during off-peak dates (from 3,500 points/night) or 15 nights during standard dates (from 5,000 points per night)

- One one-way ticket from the U.S. West Coast to Singapore or several other countries in Southeast Asia in economy (from 42,000 miles) or premium economy (from 75,000 miles) via Singapore Airlines KrisFlyer when saver award space is available

With enough points to fully or partially cover your next roundtrip flight or hotel stay, this is a gratifying card right off the bat.

The rewards categories are also beginner-friendly, not requiring outlandish spending on travel to earn a great rate. Plus, with the inclusion of categories for dining and online groceries, you can use this card for some of your daily spending—helping your points pile up more quickly.

The Sapphire Preferred’s more complicated redemption options, including transferring to Chase travel partners, keep the card interesting for rewards maximizers who aren’t afraid to do some math to get the best bang for their buck.

If you travel a lot, you’ll want this card in your wallet for the travel protections. One thing you can guarantee if you’re catching flights often is that, at some point, you’re going to run into a baggage delay, inclement weather or something else. When you do, the Sapphire Preferred has you covered.

Who Should Consider an Alternative to the Chase Sapphire Preferred?

Though it’s a great card for beginners, not everyone begins from the same place or with the same goals. For example, maybe you really don’t love the idea of an annual fee. If you’re just hoping to earn enough points for a domestic flight every year or so, there are cards that offer travel points or miles with no annual fee.

What’s more, the rewards structure isn’t the simplest. Some people would rather earn a flat rate of rewards on all purchases and know the standard value per point for every redemption.

How Does the Chase Sapphire Preferred Card Stack Up to Its Competitors?

As one of the top travel credit cards, the Chase Sapphire Preferred is always being compared to other premier travel cards. Here are a few options you should consider:

Chase Sapphire Preferred vs. Capital One Venture Rewards Credit Card

These two travel rewards card titans are often compared with each other. They both offer generous ongoing rewards rates and welcome bonuses worth hundreds of dollars in travel redemptions while only charging $95 annual fees. Further, both cards let you transfer rewards to airline partners (though Chase’s roster of airline partners is likely more useful for most people).

While the Chase Sapphire Preferred offers 1X points on general purchases and boosted rates in bonus categories, the Capital One Venture keeps it simple: earn a flat 2X miles on all purchases (plus 5X miles spent on hotels and rental cars booked through Capital One Travel). When it’s time to redeem your rewards, you’ll likely get a slightly higher value from Chase Sapphire points.

Travel benefits are another differentiator for these cards. While the Chase Sapphire Preferred offers a long list of travel protections, the Capital One Venture’s setup is pared down. It offers rental car coverage and travel accident insurance, but that’s about it in the way of protections. However, the Venture does offer a Global Entry or TSA PreCheck credit of up to $100—a huge missing piece for the Chase Sapphire Preferred.

The bottom line is that you have the opportunity to get more value out of your rewards redemptions with the Chase Sapphire Preferred. But if simplicity is valuable to you and you aren’t worried about maximizing every reward, the Capital One Venture is another solid option.

Chase Sapphire Preferred vs. American Express® Green Card

Another mid-level travel credit card with food-focused rewards, the Amex Green Card is a common choice for beginners in the points and miles space. Both cards offer elevated rewards rates on dining and travel, but there’s a key difference in the third category: the Chase Sapphire Preferred offers 3X points on online groceries, while the Amex Green offers 3X points on transit, including trains, taxicabs, rideshare services, ferries, tolls, parking, buses and subways.

It’s also worth making a distinction about the Amex Green Card’s travel category. The card offers 3X points on travel, while the Chase Sapphire Preferred rewards 5X points on travel purchased through Chase and 2X points on all other travel purchases.

The Amex Green Card’s annual fee is a bit steeper at $150, but you get access to additional credits that, if you use them, more than make up for the cost of the annual fee. Those credits include a $189 CLEAR credit and a $100 LoungeBuddy credit.

Still, most people will find the Chase Sapphire Preferred to be a more versatile and lucrative card, considering the inclusion of rewards on online groceries and higher rewards rates on travel. Plus, the Sapphire Preferred’s welcome bonus is higher.

All information about the American Express® Green Card has been collected independently by Newsweek.com. The American Express® Green Card is no longer available through Newsweek.com.

Chase Sapphire Preferred vs. Chase Sapphire Reserve®

The Chase Sapphire Reserve is the upgraded version of the Preferred, offering more travel perks and a larger collection of rewards categories. It also comes with a far heftier annual fee—$550, compared to the Sapphire Preferred’s $95 annual fee.

Still, the Sapphire Preferred has a few things the Reserve does not. Most importantly, the Reserve does not offer an anniversary point bonus or a boosted rewards rate on online groceries. It justifies its annual fee with a long list of travel benefits, though, including a Global Entry or TSA PreCheck credit, airport lounge access and a $300 annual travel credit.

Paying the annual fee for the Sapphire Reserve might be worth it if you’re traveling all the time and value luxury perks. But if you don’t consider yourself a luxury traveler, you’ll get plenty of value from the Chase Sapphire Preferred for a far lower fee.

Is the Chase Sapphire Preferred Worth It?

For a $95 annual fee, the Chase Sapphire Preferred packs a ton of value. Between the welcome bonus (worth over $900 when redeemed for travel through Chase Travel and potentially much more if you transfer your points to travel partners), 3X points on valuable categories like dining and online groceries and its list of travel perks and protections, even those who only take a trip or two a year can get plenty of value out of this card.

If you use the $50 annual hotel credit, that makes up for over half of the annual fee’s cost. Between the rewards you’ll earn on your spending and all of the perks available, it’s hard not to get your money’s worth with this card.

The Sapphire Preferred’s current bonus is the highest we’ve seen from the card in a year, up 15,000 points from the 60,000-point bonus that may be considered typically offered. We don’t know how long this elevated bonus will last, so if you’re interested in the card, it may be best to get it sooner rather than later.

Valuations by Vault: Our Thoughts on the Chase Sapphire Preferred’s Value

Newsweek values Chase Sapphire Preferred points at 1.38 cents apiece when redeemed toward high-value transfer partner travel—which is higher than the rewards value of competitors like American Express Membership Rewards points (1.19 cents apiece) and Capital One Venture miles (1.21 cents apiece). Also remember that, when redeeming rewards for travel through Chase Travel, your Chase Sapphire Preferred points are worth 1.25 cents apiece.

Point valuations are based on a sampling of the face values of the most usable Chase Sapphire Preferred redemption options. We ignore low-value redemptions and redemptions requiring extensive knowledge of international airline programs.

Frequently Asked Questions

Do rewards on the chase sapphire preferred expire.

Your Chase Ultimate Rewards points will remain available for as long as your account is open and in good standing. If you close your account before redeeming your points, they will expire.

Is the Chase Sapphire Preferred Card Hard To Get?

Like most rewards cards, you’ll likely need at least good credit (or a FICO Score of 670 and higher) to be approved for the Chase Sapphire Preferred. This isn’t a firm rule set by Chase, but rather a rule of thumb.

What Is Chase’s 5/24 Rule?

If you’re perusing Chase credit cards, you should know about Chase’s 5/24 rule. While not confirmed by Chase, it’s known that Chase likely won’t approve a credit card application if you’ve opened five or more new credit card accounts with any issuer in the last 24 months.

When Will the Chase Sapphire Preferred’s Elevated Welcome Bonus End?

We don’t know exactly when the Chase Sapphire Preferred’s elevated welcome bonus will end. Chase typically doesn’t release this information until a few weeks or days before the welcome bonus receives an update. In the past, from what we’ve seen, elevated welcome bonuses on this card typically lasted a few months or less. If you’re eyeing the Chase Sapphire Preferred, it may be better to get it sooner rather than later.

The post Chase Sapphire Preferred® Card Review 2024 first appeared on Newsweek Vault .

This article may contain affiliate links that Microsoft and/or the publisher may receive a commission from if you buy a product or service through those links.

Chase Sapphire Reserve ® Credit Card

60,000 75,000 75,000 not sixty thousand bonus points

$1,000 one thousand dollars partnership value

$300 travel credit

New cardmember offer

60,000 75,000 75,000 not 60,000 bonus points.

after you spend $4,000 on purchases in the first 3 months from account opening. * Opens offer details overlay

At a glance

Exceptional travel rewards and benefits.

Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel SM after the first $300 is spent on travel purchases annually. * Opens offer details overlay

Interest Rate

--> 22.49 Min. of (8.50+13.99) and 29.99 %– 29.49 Min. of (8.50+20.99) and 29.99 % variable APR. † Opens pricing and terms in new window

--> $550 annual fee † Opens pricing and terms in new window ; $75 for each authorized user † Opens pricing and terms in new window * Opens offer details overlay

Travel Credit Card Rewards & Benefits

New cardmember offer, 75,000 bonus points.

after you spend $4,000 on purchases in the first 3 months from account opening. * Opens offer details overlay That's $1,125 toward travel when you redeem through Chase Travel.

This product is available to you if you do not have any Sapphire card and have not received a new cardmember bonus for any Sapphire card in the past 48 months.

Partnership Benefit

$1,000 in additional partnership benefit value.

Take advantage of over $1,000 in partner value Opens overlay. with Sapphire Reserve. * Opens offer details overlay

Travel Credit

$300 annual travel credit.

Take advantage of the most flexible travel credit available Opens overlay. by receiving up to $300 in statement credit reimbursements each anniversary year for more of your travel purchases than any other card. * Opens offer details overlay

Earn Rewards

More ways to earn.

Earn 5x total points on flights when you purchase travel through Chase Travel after the first $300 is spent on travel purchases annually. * Opens offer details overlay

Earn 10x total points on hotels (excluding The Edit SM ) and car rentals when you purchase travel through Chase after the first $300 is spent on travel purchases annually. * Opens offer details overlay

Earn 3x points on dining at restaurants, including eligible delivery services, takeout, and dining out. * Opens offer details overlay Plus earn 3x points on other travel worldwide after the first $300 is spent on travel purchases annually. * Opens offer details overlay

Earn 10x total points on Chase Dining purchases with Ultimate Rewards ® . * Opens offer details overlay

Get 50% more value when you redeem for travel through Chase. For example, 75,000 points are worth $1,125 toward travel. * Opens offer details overlay Plus, ultimate rewards points do not expire as long as the account is open. * Opens offer details overlay

No Expiration

Complimentary airport lounge access.

Complimentary access to 1,300+ airport lounges worldwide with up to two guests, plus every Chase Sapphire Lounge by The Club location, after an easy one-time enrollment in Priority Pass ™ Select. * Opens offer details overlay

application fee credit

Global entry or tsa precheck ® or nexus fee credit.

Receive one statement credit of up to $100 every four years as reimbursement for the application fee charged to your card. * Opens offer details overlay

Explore Additional Benefits

1:1 point transfer opens drawer that reveals additional content, your points get you more.

Turn Points into Travel Experiences and So Much More

50% More in Travel Redemption

Get 50% more value when you redeem for travel through Chase Travel. For example, 75,000 points are worth $1,125 toward travel. * Opens offer details overlay

No Blackout Dates or Travel Restrictions

As long as there's a seat on the flight or room at the hotel, you can book it through Chase Travel.

1:1 Point Transfer

Transfer your points to leading airline and hotel loyalty programs at 1 to 1 value. That means 1,000 Chase Ultimate Rewards points equal 1,000 partner miles/points.

Ultimate Rewards Points Do Not Expire

Ultimate Rewards points do not expire as long as the account is open.

No foreign transaction fees † Refer to Pricing and Terms Opens drawer that reveals additional content

You will pay no foreign transaction fees when you use your card for purchases made outside the United States. † Opens pricing and terms in new window For example, if you spend $5,000 internationally, you would avoid $150 in foreign transaction fees.

Premium travel benefits Opens drawer that reveals additional content

Elevate your travels from door to door $300 annual travel credit.

Automatically receive up to $300 in statement credits as reimbursement for travel purchases charged to your card each account anniversary year. * Opens offer details overlay

Rest and revive before your flight at one of the 1,300+ VIP lounges in over 500 cities worldwide after an easy, one-time enrollment in Priority Pass ™ Select. * Opens offer details overlay

The Edit SM

Book through The Edit SM and discover a curated collection of inspired stays with cardmember benefits including daily breakfast for two, a $100 property credit, room upgrades (upon availability) and more. * Opens offer details overlay

Reserved by Sapphire

Explore the extraordinary line up of experiences including culinary, sports, music and entertainment.

24/7 access to Customer Service Specialists

Count on 24/7 access to a dedicated customer service specialist from anywhere in the world.

Your Sapphire Reserve Visa Infinite card unlocks special car rental benefits

Enjoy VIP amenities, complimentary status upgrades, and discounts with Avis ® , Hertz ® , National ® and Audi On Demand when you book with your Sapphire Reserve Visa Infinite card. * Opens offer details overlay

Travel protection Opens drawer that reveals additional content

You're covered with built-in benefits

The most comprehensive suite of travel benefits

Auto Rental Collision Damage Waiver

Decline the rental company's collision insurance and charge the entire rental cost to your card. Coverage is primary and provides reimbursement up to $75,000 for theft and collision damage for rental cars in the U.S. and abroad. ^ Same page link to disclaimer

Trip Cancellation/Interruption Insurance

If your trip is canceled or cut short by sickness, severe weather and other covered situations, you can be reimbursed up to $10,000 per person and $20,000 per trip for your pre-paid, non-refundable travel expenses, including passenger fares, tours, and hotels. ^ Same page link to disclaimer

Trip Delay Reimbursement

If your common carrier travel is delayed more than 6 hours or requires an overnight stay, you and your family are covered for unreimbursed expenses, such as meals and lodging, up to $500 per ticket. ^ Same page link to disclaimer

Travel Accident Insurance

When you pay for your air, bus, train or cruise transportation with your card, you are eligible to receive accidental death or dismemberment coverage of up to $1,000,000. ^ Same page link to disclaimer

Travel and Emergency Assistance Services

If you run into a problem away from home, call the Benefit Administrator for legal and medical referrals or other travel emergency assistance. (You will be responsible for the cost of any goods or services obtained.) ^ Same page link to disclaimer

Lost Luggage Reimbursement

If you or an immediate family member check or carry-on luggage that is damaged or lost by the carrier, you're covered up to $3,000 per passenger. ^ Same page link to disclaimer

Baggage Delay Insurance

Reimburses you for essential purchases like toiletries and clothing for baggage delays over 6 hours by passenger carrier up to $100 a day for 5 days. ^ Same page link to disclaimer

Emergency Evacuation and Transportation

If you or a member of your immediate family are injured or become sick during a trip far from home that results in an emergency evacuation, you can be covered for medical services and transportation up to $100,000. ^ Same page link to disclaimer

Roadside Assistance

If you have a roadside emergency, you can call for a tow, jumpstart, tire change, locksmith or gas. You're covered up to $50 per incident 4 times a year. ^ Same page link to disclaimer

Emergency Medical and Dental Benefit

If you're 100 miles or more from home on a trip, you can be reimbursed up to $2,500 for medical expenses if you or your immediate family member become sick or injured. ^ Same page link to disclaimer

^ Same page link to disclaimer reference These benefits are available when you use your card. Restrictions, limitations and exclusions apply. Most benefits are underwritten by unaffiliated insurance companies who are solely responsible for the administration and claims. There are specific time limits and documentation requirements. Once your account is opened we will send you a Guide to Benefits, which includes a full explanation of coverages.

Partner benefits Opens drawer that reveals additional content

Earn more points.

Earn 10x total points on Lyft rides. * Opens offer details overlay Plus, get a complimentary 2 year Lyft Pink All Access membership including member-exclusive pricing and benefits – activate by Dec 31, 2024. Membership auto renews annually. * Opens offer details overlay

Earn 10x total points on Peloton equipment and accessory purchases over $150 with a max earn of 50,000 total points now through March 31, 2025. * Opens offer details overlay

DashPass subscription

Get complimentary access to DashPass – a membership for both DoorDash and Caviar – which unlocks $0 delivery fees and lower service fees on eligible orders for a minimum of one year when you activate by December 31, 2024. * Opens offer details overlay With DashPass you also get $5 in DoorDash credits each month, redeemed at checkout. * Opens offer details overlay

Instacart benefit

Skip the trip and have your groceries delivered to your doorstep with 1 year of complimentary Instacart+. * Opens offer details overlay Plus, Instacart+ members earn up to $15 in statement credits each month through July 2024. Membership auto-renews. * Opens offer details overlay

Purchase coverage Opens drawer that reveals additional content

Purchase protection.

Your new purchases will be covered for 120 days against damage or theft up to $10,000 per claim and $50,000 per year. ^ Same page link to disclaimer

Return Protection

You can be reimbursed for eligible items that the store won't take back within 90 days of purchase, up to $500 per item, $1,000 per year. ^ Same page link to disclaimer

Chip-enabled for enhanced security

You'll carry a credit card with an embedded chip that provides enhanced security and wider acceptance when you make purchases at chipenabled card readers in the U.S. and abroad.

24/7 Fraud Monitoring

We help safeguard your credit card purchases using sophisticated fraud monitoring. We monitor for fraud 24/7 and can text, email or call you if there are unusual purchases on your credit card. * Opens offer details overlay

Zero liability protection

You won't be held responsible for unauthorized charges made with your card for account information. If you see an unauthorized charge, simply call the number on the back of your card. * Opens offer details overlay

Extended warranty protection

Extends the time period of U.S. manufacturer's warranty by an additional year on eligible warranties of three years or less. ^ Same page link to disclaimer

Chase Pay Over Time SM Opens drawer that reveals additional content

Chase Pay Over Time * Opens offer details overlay lets eligible Chase customers break up credit card purchases into budget friendly payments. There are two potential ways to pay over time:

After purchase: Pay off an eligible purchase you've already made of $100 or more * Opens offer details overlay in smaller, equal monthly payments. No interest - just a fixed monthly fee † Opens pricing and terms in new window with plan durations that range from 3-24 months. Start a plan by selecting an eligible purchase with the "Pay Over Time" option next to the transaction amount in your credit card account activity.

At checkout: Chase credit card members may have the option to create a payment plan at checkout on Amazon.com. Orders totaling $50 or more * Opens offer details overlay using your eligible Chase credit card at Amazon.com could be eligible for Chase Pay Over Time. You will be able to view Chase Pay Over Time plan options (including the fixed APR and durations) at checkout.

Keep in mind: Even though you may have an eligible card, access to Chase Pay Over Time is not guaranteed. Your ability to create a Chase Pay Over Time plan is based on a variety of factors, such as your creditworthiness, credit limit and account behavior, and may change from time to time.

For more information on Chase Pay Over Time features, please visit chase.com/chasepayovertime Opens in a new window .

Spend Instantly Opens drawer that reveals additional content

Apply for a card, use it the same day.

Receive instant access to your card by adding it to a digital wallet, like Apple Pay ® , Google Pay ™ or Samsung Pay. Find out how at chase.com/digital/spend-instantly Opens in a new window .

Cardmember Reviews

This card has been fantastic. The sign up bonus was amazing. Great value added.

Submitted by: garry

Amazing Travel Card

I am obsessed with this card. The points are so easy to earn and so easy to redeem. I love how easy it is to transfer to travel partners, and so many of them! As a military family, we have used the travel protection when we get surprise orders after booking a trip. Keep up the great work, Chase!

Submitted by: Military Family

Awesome Travel Credit Card

I travel every week for business and several times a year for family vacation. No card has the benefits or service or reward points that the Chase Sapphire Reserve card offers. If you travel, you must have this card in your wallet. It's a must have. Thank you to the Chase Team for offering such an amazing travel card...

Submitted by: Road Warrier

Curious about the Chase Sapphire Reserve ® credit card?

Read our customers reviews to learn how to take advantage of our travel credit card today!

See All Reviews . Opens overlay containing additional reviews.

Refer Friends if you already have a Chase Sapphire ® Credit Card!

Click the button below to start referring.

Browse credit cards by category

Offer details, offers may vary depending on where you apply, for example online or in a branch, and can change over time. to take advantage of this particular offer now, apply through the method provided in this advertisement. review offer details before you apply..

75,000 Bonus Points After You Spend $4,000 On Purchases In The First 3 Months From Account Opening: The product is not available to either (i) current cardmembers of any Sapphire credit card, or (ii) previous cardmembers of any Sapphire credit card who received a new cardmember bonus within the last 48 months. If you are an existing Sapphire customer and would like this product, please call the number on the back of your card to see if you are eligible for a product change. You will not receive the new cardmember bonus if you change products. To qualify and receive your bonus, you must make Purchases totaling $4,000 or more during the first 3 months from account opening. (“Purchases” do not include balance transfers, cash advances, travelers checks, foreign currency, money orders, wire transfers or similar cash-like transactions, lottery tickets, casino gaming chips, race track wagers or similar betting transactions, any checks that access your account, interest, unauthorized or fraudulent charges, and fees of any kind, including an annual fee, if applicable.) After qualifying, please allow 6 to 8 weeks for bonus points to post to your account. To be eligible for this bonus offer, account must be open and not in default at the time of fulfillment.

$300 Annual Travel Credit: A statement credit will automatically be applied to your account when your card is used for purchases in the travel category, up to an annual maximum accumulation of $300. Annual means the year beginning with your account open date through the first statement date after your account open date anniversary, and the 12 monthly billing cycles after that each year. (For applications submitted before May 21, 2017, annual means the year beginning with your account open date through the first December statement date of that same year, and the 12 billing cycles starting after your December statement date through the following December statement date each year.) Call the number on the back of your card to see when you are eligible for your next $300 Annual Travel Credit. Purchases are when you, or an authorized user, use a card to make purchases of products and services. Buying products and services with your card, in most cases, will count as a purchase; however, the following types of transactions won't count: balance transfers, cash advances, travelers checks, foreign currency, money orders, wire transfers or similar cash-like transactions, lottery tickets, casino gaming chips, race track wagers or similar betting transactions, any checks that access your account, interest, unauthorized or fraudulent charges, and fees of any kind, including an annual fee, if applicable. We do not determine whether merchants correctly identify and bill transactions as being of a certain type. For more information about Chase rewards categories, see chase.com/RewardsCategoryFAQs Opens in a new window . Statement credit(s) will post to your account the same day your travel category purchase posts to your account and will appear on your monthly credit card billing statement within 1-2 billing cycles. The Annual Travel Credit will be issued for the year in which the transaction posts to your account. For example, if you pay for baggage fees, but the airline does not post the transaction until after the current annual period ends, the cost of the baggage fees will be allocated towards the following year's Annual Travel Credit maximum of $300.

Earning Points: Rewards Program Agreement: For more information about the Chase Sapphire Reserve rewards program, view the latest Rewards Program Agreement (PDF) Opens in a new window . We will mail your Rewards Program Agreement once your account is established. If you become a Chase Online customer, your Rewards Program Agreement will also be available after logging in to chase.com/ultimaterewards Opens in a new window . How you can earn points: You'll earn points on purchases of products and services, minus returns or refunds, made with a Chase Sapphire Reserve credit card by you or an authorized user of the account. Buying products and services with your card, in most cases, will count as a purchase; however, the following types of transactions won't count and won't earn points: any purchases that qualify for the $300 Annual Travel Credit, balance transfers, cash advances and other cash-like transactions, lottery tickets, casino gaming chips, race track wagers or similar betting transactions, any checks that access your account, interest, unauthorized or fraudulent charges, and fees of any kind, including an annual fee, if applicable. 3 points ("3X points") on travel purchases: You'll earn 3 points for each $1 spent on purchases made in the travel category after the $300 Annual Travel Credit is earned. 5 points ("5X points") on Chase Travel airline ticket purchases: You'll earn 5 points total for each $1 spent on airline ticket purchases made using your card through Chase Travel after the $300 Annual Travel Credit is earned in the travel category (2 additional points on top of the 3 points earned on each purchase in the travel category). 10 points ("10X points") on Chase Travel hotel accommodation and car rental purchases: You'll earn 10 points total for each $1 spent on qualifying hotel accommodation and car rental purchases made using your card through Chase Travel after the $300 Annual Travel Credit is earned in the travel category (7 additional points on top of the 3 points earned on each purchase in the travel category). Hotel accommodation purchases made using your card with The Edit (previously The Luxury Hotel & Resort Collection) will qualify to earn 3 points for each $1 spent in the travel category, but will not qualify to earn 7 additional points for each $1 spent. Any purchases that qualify for the $300 Annual Travel Credit, won't earn points. "$300 Annual Travel Credit" means the statement credit that is automatically applied to your account annually on purchases made using your card in the travel category, up to an annual maximum accumulation of $300. "Annually" means the year beginning with your account open date through the first statement date after your account open date anniversary, and the 12 monthly billing cycles after that each year. 10 total points ("10X points") on qualifying Lyft rides through 03/2025: You'll earn an additional 7 points for each $1 spent when your card is used for qualifying Lyft products and services purchased through the Lyft mobile application through 03/31/2025. Qualifying Lyft products and services include rides taken in Classic, Shared, Lux, or XL modes; bike and scooter rides; and subscription and membership products. Purchase of gift cards, car rentals, vehicle service centers, miscellaneous fees and other Lyft products and services are excluded from this promotion. Future Lyft products or services may not be eligible for additional points. You may see "10X" in marketing materials to refer to the 7 points in addition to the 3 points earned on travel purchases (see above). The additional 7 points will appear on your billing statement in a separate line from the 3 points. Lyft is not responsible for the provision of, or the failure to provide, Chase benefits or services. 3 points ("3X points") on dining at restaurants purchases: You'll earn 3 points for each $1 spent on purchases in the following rewards category: dining at restaurants including takeout and eligible delivery services. 10 points ("10X points") on Ultimate Rewards Chase Dining purchases: You'll earn 10 points for each $1 spent on Chase Dining purchases made using your card through the Ultimate Rewards program. 1 point ("1X points"): You'll earn 1 point for each $1 spent on all other purchases. How you can use your points: You can use your points to redeem for any available reward options, including cash, gift cards, travel, and pay with points for products or services made available through the program or directly from third parties. Redemption values for reward options vary. Points expiration/losing points: Your points don't expire as long as your account remains open, however, you will immediately lose all your points if your account status changes, or your account is closed for program misuse, fraudulent activities, failure to pay, bankruptcy, or other reasons described in the terms of the Rewards Program Agreement. Rewards Categories: Merchants who accept Visa/Mastercard credit cards are assigned a merchant code, which is determined by the merchant or its processor in accordance with Visa/Mastercard procedures based on the kinds of products and services they primarily sell. We group similar merchant codes into categories for purposes of making rewards offers to you. Please note: We make every effort to include all relevant merchant codes in our rewards categories. However, even though a merchant or some of the items that it sells may appear to fit within a rewards category, the merchant may not have a merchant code in that category. When this occurs, purchases with that merchant won't qualify for rewards offers on purchases in that category. Purchases submitted by you, an authorized user, or the merchant through third-party payment accounts, mobile or wireless card readers, online or mobile digital wallets, or similar technology will not qualify in a rewards category if the technology is not set up to process the purchase in that rewards category. For more information about Chase rewards categories, see chase.com/RewardsCategoryFAQs Opens in a new window .

Adding An Authorized User: All correspondence, including credit cards, statements, and notifications will be sent to the name and address on file for the primary cardmember. The primary cardmember is responsible for repaying all balances on this account. Authorized users will have the same account number and charging privileges as the primary cardmember but will not be financially responsible. Chase provides account information to the credit reporting agencies for all account users. This information could impact an authorized user’s credit score. When you tell us to add a user to your account, you’re confirming that you have a relationship with the person or people whose name(s), address(es), and date(s) of birth you’ve told us, that all their information is correct, and that you have their consent to add them. If Chase determines you’ve given us fraudulent name, address, or date of birth information or did not have such consent, Chase can close this account.

Priority Pass ™ Select Membership: One time activation required. Priority Pass Select membership includes access to airport lounges and select airport experiences participating in the Priority Pass Select network. There is no additional cost to activate your membership and certain terms, conditions and exclusions apply. Primary Cardmembers and Authorized Users are granted complimentary access to the Priority Pass lounges and are allowed a maximum of two accompanying guests each. For any additional guests, your card will be charged $27 per guest, per visit. Your card will be charged after you have signed for the additional guest visits in the participating lounge and the visits have been reported to Priority Pass. Access may be denied if the lounge is at capacity. Participating lounges are owned and operated by independent third parties and their participation and/or facilities may change. To access a lounge, member must show his/her valid Priority Pass Select membership card. Priority Pass Select membership is subject to the Priority Pass Select Terms and Conditions. Your Chase Sapphire Reserve account must be open and not in default to maintain membership. For complete Priority Pass Select Terms and Conditions and a listing of participating lounges and select airport experiences, please visit www.prioritypass.com/select .

Global Entry or TSA PreCheck ® or NEXUS Application Fee Statement Credit: You will receive one statement credit (up to $100) every four years after the first program (either Global Entry or TSA PreCheck ® or NEXUS) application fee is charged to your Chase Sapphire Reserve card, by you or an authorized user. This benefit applies only to the Global Entry, TSA PreCheck ® or NEXUS programs, other Trusted Traveler programs are not eligible. The statement credit will appear on your credit card billing statement within 1-2 billing cycles. You are responsible for payment of all charges until the statement credit posts to the account. Chase has no control or liability regarding these programs including, but not limited to, applications, approval process or enrollment, or fees charged by CBP or TSA or DHS. For more information about the Global Entry, TSA PreCheck ® and NEXUS programs, including application details and full terms and conditions, go to https://ttp.cbp.dhs.gov/ . Websites and other information provided by government agencies are not within Chase's control and may not be available in Spanish. To receive statement credits, your account must be open and not in default at the time of fulfillment. TSA PreCheck ® is a registered trademark and is used with the permission of the U.S. Department of Homeland Security.

2-year complimentary Lyft Pink All Access membership: Your Chase Sapphire Reserve account will receive one complimentary Lyft Pink All Access membership for 2 consecutive years, a value of $199/year, when the membership is activated with a Chase Sapphire Reserve card by 11:59 PM Eastern Standard Time on 12/31/2024. After your complimentary 2-year period ends, you'll be automatically enrolled in an annual membership at 50% off the then current annual Lyft Pink All Access rate for one year. After the discounted year, you will continue to be enrolled and charged the then current annual Lyft Pink All Access rate, every year unless canceled. You can cancel auto-renewal anytime on the Lyft mobile application and continue to enjoy the benefits of your Lyft Pink All Access membership through the end of your complimentary or discounted membership term. Cardmembers who do not utilize any services associated with their membership during the last six (6) months of their complimentary membership term, will not be auto-renewed and will not be eligible for the Lyft Pink All Access discounted membership. Lyft Pink All Access will be registered in the name of the primary cardmember or an authorized user, whoever activates the benefit first. PayPal or digital wallets (like Apple Pay and Google Pay), or memberships purchased through third parties are excluded from this offer. Mobile applications, websites, and other information provided by Lyft are not within Chase's control and may or may not be available in Spanish. All Lyft products and services are subject to the Lyft Terms of Service and Lyft Pink Terms & Conditions. Chase is not responsible for the provision of, or the failure to provide, Lyft benefits and services. Your Chase Sapphire Reserve account must be open and not in default, and your Chase Sapphire Reserve card must be included as a payment method within the Lyft App to maintain complimentary two-year membership benefits and purchase the discounted membership in your third year.

Complimentary DashPass: You and your authorized user(s) will receive at least 12 months of complimentary DashPass for use on both the DoorDash and Caviar applications during the same membership period based on the first activation date, when the membership is activated with a Chase Sapphire Reserve card by 12/31/2024. Membership period for all users on this Chase Sapphire account will begin and end based on when the first user activates the membership on DoorDash or Caviar. The same login credentials must be used on DoorDash and Caviar in order for the DashPass benefit to be used on both applications. To receive the membership benefits, the primary cardmember and authorized user(s) must first add their Chase Sapphire card as a default payment method on DoorDash or Caviar, and then click the activation button. Once enrolled in DashPass, you must use your Chase Sapphire card for payment at checkout for DashPass-eligible orders to receive DashPass benefits. Benefits of DashPass include no delivery fee on orders above the minimum subtotal (as stated in the DoorDash and Caviar apps and sites) from DashPass eligible merchants (amounts subject to change). However, other fees (including service fee), taxes, and gratuity on orders may still apply. Current value of the DashPass membership is as of 04/01/2022. DashPass orders are subject to delivery driver and geographic availability. Membership must be activated with a United States address. Payment through third-party payment accounts, or online or mobile digital wallets (like Apple Pay and Google Pay), or memberships purchased through third parties are excluded from this offer. Mobile applications, websites and other information provided by DoorDash or Caviar are not within Chase's control and may or may not be available in Spanish. Chase is not responsible for the provision of, or the failure to provide, DoorDash or Caviar benefits and services. If you product change to another Chase credit card eligible for a DashPass membership during the promotional period, your DashPass benefits may change. You may experience a delay in updating your applicable DashPass benefits on DoorDash or Caviar; please note, once you product trade, the benefits from your previous credit card are no longer available for your use. You can only access the benefits available with your current credit card. Your Chase Sapphire account must be open and not in default to maintain membership benefits. See full DoorDash terms and conditions at: https://help.doordash.com/consumers/s/article/offer-terms-conditions?language=en_US .

Earn $5 monthly DoorDash/Caviar Credits through 12/31/2024: Get $5 in DoorDash/Caviar credits each calendar month while enrolled in DashPass through 12/31/2024. When applied to an order, the $5 credit will apply only to the subtotal of your DoorDash or Caviar order at checkout. The credit does not apply to fees, taxes, or tip and gift card purchases are excluded. You or up to 7 authorized users must be enrolled in DashPass and use your Chase Sapphire Reserve or J.P. Morgan Reserve card for payment at checkout to receive the credit. Once you spend the issued credits on one platform (e.g., DoorDash), it will be automatically deducted from your balance on the other (e.g., Caviar). Any monthly credit issued before you create an account on the other platform will only be available on the original platform for that month. Once you have accounts opened on both platforms, any credits issued will be available for onetime use on either DoorDash or Caviar. Your credit balance may be different on each platform, but your credit usage will still be linked from that point on. If a credit is not used within the calendar month, it will be carried over for a maximum of 2 months. Up to $15 in credit can be accrued before a $5 credit expires. DoorDash credits have no cash value and are non-transferable. Chase is not responsible for the provision of, or the failure to provide, DoorDash benefits and services. Credit card product changes during the promotional period will forfeit this offer. Additional DoorDash promotional terms and conditions available at: https://help.doordash.com/consumers/s/article/offer-terms-conditions?language=en_US . All deliveries subject to availability. Must have or create a valid DoorDash account. Qualifying orders containing alcohol will be charged a $0.01 Delivery Fee. No cash value. Non-transferable. See full terms and conditions at: help.doordash.com/consumers/s/article/offer-terms-conditions .

Complimentary Instacart+ Membership: You will receive one complimentary Instacart+ membership per eligible card account for 12 months (for Chase Sapphire Reserve and J.P. Morgan Reserve cardmembers) when the membership is activated on http://www.instacart.com/chase with an eligible card between 6/15/2022 and 7/31/2024. ("You" and "your" mean you as the primary cardmember or any authorized user, depending on which user activates first). This offer is non-transferrable. Membership must be activated with a United States address. Payment through third-party payment accounts, or online or mobile digital wallets (like Apple Pay and Google Pay), or memberships purchased through third parties are excluded from this offer. Benefits of Instacart's membership include no delivery fee on orders that total over $35 (amount subject to change – see Instacart.com for current minimum); however, other fees, taxes, and/or tips may apply. Delivery subject to availability. If you do not currently have a paid or trial Instacart+ membership, by activating your Instacart+ membership, you agree to the Instacart+ Terms and you agree that after the complimentary Instacart+ membership period ends, you will be automatically enrolled in an annual Instacart+ membership and billed at $99/year or the then current annual Instacart+ membership rate for each membership activated, unless you have not placed any orders or you cancel during your complimentary Instacart+ membership period. If you currently have a paid or trial Instacart+ membership, you agree that your existing membership will be paused for the duration of this benefit and resume upon expiration. Your existing membership will automatically renew based on the Instacart+ Terms previously agreed upon unless you cancel. Your membership fees will be billed to any active payment method on file until you cancel. You can cancel your Instacart+ membership prior to the end of your complimentary Instacart+ membership period or at any time thereafter by selecting "Cancel Membership" in your Account Settings. Cancellation goes into effect during the next billing cycle. You may cancel within the first 15 calendar days of your paid Instacart+ membership and receive a refund of the Instacart+ membership fee you paid, but only if you have not placed any orders using your Instacart+ membership. If you change to another Chase credit card during the promotional period, your benefits may change. Mobile applications, websites and other information provided by Instacart are not within Chase's control and may or may not be available in Spanish. Chase is not responsible for the provision of, or the failure to provide, Instacart benefits and services. Your complimentary membership benefits may be removed if your eligible credit card account is closed or in default.

Statement Credit on Instacart Purchases: Earn up to $15 per calendar month (for Chase Sapphire Reserve and J.P. Morgan Reserve cardmembers) in statement credits on qualifying Instacart purchases from 8/1/2022 through 7/31/2024 when you activate a complimentary Chase Instacart+ membership on Instacart.com/chase with your eligible Chase credit card. You can check the status of your enrollment in the Chase benefit within the Instacart+ section of the Instacart mobile app. You will continue to receive statement credit benefits regardless of whether you choose to renew your Instacart+ membership at the end of your complimentary period. Qualifying Instacart purchases include only those orders purchased by you, or an authorized user, with a Chase Sapphire Reserve credit card through Instacart.com or the Instacart mobile application (gift cards excluded). Statement credit(s) will post to your account within 48 hours of your qualifying Instacart purchase posting to your account and will appear on your monthly credit card billing statement within 1-2 billing cycles. Statement credits will be issued for the calendar month in which the transaction posts to your account. For example, if you pay for an Instacart order, but Instacart does not post the transaction until after the current calendar month ends, the cost of the Instacart purchase will be allocated towards the next calendar month's maximum, or will not qualify if the promotional period has ended. If you change to another Chase credit card during the promotional period, your benefits may change. Mobile applications, websites and other information provided by Instacart are not within Chase's control and may or may not be available in Spanish. Chase is not responsible for the provision of, or the failure to provide, Instacart benefits and services. Accounts must be open and not in default at the time the statement credit posts to your account.

The Edit: The Edit program benefits are available exclusively on select Chase credit cards. To receive benefits, reservations must be made for "The Edit" properties through Chase Travel. Benefits are per room and based on double occupancy. Benefits may be subject to availability at check-in and are not redeemable for cash. Benefits may not be combined with other offers, including tour operator or wholesaler rates and packages. Complimentary Wi-Fi benefit provided, with the exception of locations where Wi-Fi is already complimentary or not available. Program benefits and participating properties may change without notice. Visit theeditbychase.com to learn more, other terms may apply.

Earn 10 or 5 total points ("10X or 5X total points") on Peloton equipment and accessory purchases through 03/31/2025: You'll earn a total of 10 (Sapphire Reserve or J.P. Morgan Reserve) or 5 (Sapphire Preferred) points for each $1 spent on up to $5,000 in total purchases when your card is used for Peloton equipment and accessory purchases over $150 through Peloton from 02/01/2023 through 03/31/2025. That's 9 (Sapphire Reserve or J.P. Morgan Reserve) or 4 (Sapphire Preferred) points on top of the 1 point you already earn on these purchases with your card. Only purchases made directly through Peloton – through onepeloton.com , over the phone, or in a Peloton showroom – are eligible. Purchases made outside the U.S. are not eligible. Gift cards, and apparel are not eligible. Points earned on the purchase of Peloton equipment and accessory purchases will be deducted from the cardmember's account if the order is cancelled or returned. Purchases must post to your account by the last day of the promotional period to qualify. Sometimes your card will be charged on a date after you make a purchase, such as the shipping date, and as a result the purchase may not post to your account until after the last day of the promotional period. Please allow 6 to 8 weeks after qualifying purchases post to your account for points to post to your account. To qualify for this bonus offer, account must be open and not in default at the time of fulfillment. This bonus offer is non-transferable.

Book Through Chase Travel: When you use points to redeem for cash, each point is worth $.01 (one cent), which means that 100 points equals $1 in redemption value. Each point you redeem for travel booked through Chase Travel is worth $.0150 (one and a half cents), which means that 100 points equals $1.50 in redemption value, and points are worth 50% more than if redeemed for cash. For example, 75,000 points are worth $1,125 when redeemed for travel purchases, or $750 when redeemed for cash. The cost of travel is based on the rates and fares available through Chase Travel, including the online portal and call center, and may not reflect all rates and fares that are available through other sales channels. If you choose to use points and your Chase Sapphire Reserve credit card to pay for your purchase, each point will be worth $.0150, but your credit card will be charged the full remaining dollar amount.

Avis Terms and Conditions Discount applies to base rate only at participating locations when booked directly through Avis by using the Visa Infinite code. These discounts are administered by the rental car providers directly and cannot be used when booking through Chase Travel nor can Ultimate Rewards points be used as payment when booking directly with the merchant. Discount varies by rental date, location and vehicle type. Taxes, other governmentally-authorized or imposed surcharges, license and concession recoupment fees, airport and airport facility fees, fuels, additional driver fee, one-way rental charge and optional terms such as Loss Damage Waiver (LDW) up to $30 per day are extra. Renter must meet standard age, driver and credit requirements. 24-hour advance reservation required. May not be combined with other discounts. Availability is limited. Subject to change without notice. Blackout dates may apply. National Terms and Conditions Discount applies to base rate only at participating locations when booked directly through National Car Rental by using the Visa Infinite code. These discounts are administered by the rental car providers directly and cannot be used when booking through Chase Travel nor can Ultimate Rewards points be used as payment when booking directly with the merchant. Discount varies by rental date, location and vehicle type. Taxes, other governmentally-authorized or imposed surcharges, license and concession recoupment fees, airport and airport facility fees, fuels, additional driver fee, one-way rental charge and optional items such as Loss Damage Waiver (LDW) up to $30 per day are extra. In the U.S., check your insurance and/or credit card for rental vehicle coverage. Renter must meet standard age, driver and credit requirements. 24-hour advance reservation required. May not be combined with other discounts. Availability is limited. Subject to change without notice. Blackout dates may apply. Visa Terms and Conditions Benefits referenced on this page are current as of 03/2024 . Benefits are subject to change by Visa at any time, in accordance with Visa's notification policies, and are based on the individual merchant's terms and conditions. Only the benefits listed on this page are available with this Chase Visa Infinite product; Visa's website may describe additional Visa Infinite benefits not offered on this card. Void where prohibited or restricted by law. Any taxes are the sole responsibility of the purchaser. Many of the stated benefits and services of this product are provided by third parties who are solely responsible for their provision or fulfillment. The US Visa Infinite card does not include global application of all Visa Infinite related benefits at this time. There are some benefits Visa has sourced that are global but as a general matter Visa Infinite benefits are specifically sourced by region unless otherwise stated.

Account Alerts: Delivery of alerts may be delayed for various reasons including technology failures and capacity limitations. There is no charge from Chase, but message and data rates may apply.