Adventure Travel Hub

Travel Resources for Adventurers

Home » Travel Insurance » Reviews » Best Travel Insurance For Mountaineering & High Altitude Trekking

Best Travel Insurance for Mountaineering & High Altitude Trekking

Written by Antonio Cala.

- Affiliate Disclosure

Table of Contents

Whether you’re a seasoned mountaineer, nature enthusiast, or an avid adventurer, securing the appropriate insurance is crucial. In this article, we will explore the best travel insurance for mountaineering and high-altitude trekking. We’ll delve into the distinctive aspects of insurance for these adventurous pursuits, emphasize important features to take into account, and showcase our top recommendations for 2024.

For a comprehensive exploration of insurance options designed specifically for adventure travelers, be sure to explore the Ultimate Guide to Adventure Travel Insurance .

Quick Recommendations

If you want some quick recommendations, here is our infographic to help you choose the best insurance for your high altitude & mountaineering trips.

Mountaineering Travel Insurance Overview

What is mountaineering & high altitude trekking insurance.

Many insurance providers incorporate coverage for trekking and mountaineering into their standard policies, often labeling it as regular travel insurance or “adventure travel insurance.” Occasionally, opting for an adventure package may be necessary to ensure coverage at high altitudes.

Nevertheless, the primary limitation of these insurance policies lies in the altitude at which coverage ceases. Most companies impose a cap at 15,000 – 20,000 feet (4,500 – 6,000 meters), although some may not have a cap at all.

In the following section, we will delve into the specifics of what a typical insurance policy for mountaineering trips covers and does not cover.

What Does It Cover?

The majority of insurance policies typically provide coverage for the following four categories:

Medical Expenses

Should an unexpected injury or illness occur during your mountaineering or high-altitude trekking expedition, reliable insurance designed for these specific adventures provides coverage for overseas emergency medical expenses incurred at a hospital or medical center.

This comprehensive coverage caters to various medical needs, from essential treatments to more intricate procedures. Whether it involves immediate first aid or extensive medical care, a well-structured insurance plan ensures financial support for your well-being while navigating the challenging terrains of high altitudes and the great outdoors.

Equipment Coverage

In the unfortunate event of damage, theft, or loss of your mountaineering or trekking equipment, such as trekking poles or backpack, specialized insurance for these adventures typically offers coverage. The coverage amount can vary, ranging from a few hundred dollars to several thousand. This provision allows you to file a claim to offset the costs associated with repairing or replacing your essential mountaineering gear.

Trip Cancellation or Interruption

Should the need arise to cancel or cut short your mountaineering or high-altitude trekking expedition due to injury, specialized insurance for these activities offers the flexibility to claim reimbursement for the missed portions of your adventure.

Emergency Evacuation

Arguably the most crucial coverage for a mountaineering or high-altitude trekking expedition, it facilitates emergency medical evacuation to the most suitable medical facility for treatment or repatriation back to your country of residence.

What Doesn't Cover?

Every insurance provider has its own limitations on what they cover and what they don’t. Here are the most common exclusions:

Very High Altitude: Trekking at an altitude over 19,500 feet (6,000 meters) is normally not covered by some insurance companies, unless you purchase an add-on. If you plan to go higher than that, make sure you choose a company that doesn’t have an altitude limit.

Traveling contrary to government advice: If you choose to travel against the recommendations of the U.S. Department of State, it is unlikely that your policy will provide coverage.

Extreme activities: Some companies might not cover activities like free mountaineering, climbing in remote or inaccessible regions, exploratory expeditions or opening new routes. Verify if your chosen activities require additional coverage or specialist insurance.

Remote Regions: Activities in remote locations such as Antarctica, the Arctic Circle, or Greenland might not be covered by certain insurance companies.

Best Travel Insurance for Mountaineering in 2024

Our Pick For

Remote Locations + High Altitude + Any Nationality

Global Rescue

Nationalities: all nationalities are covered.

Pre-existing conditions: Yes.

Seniors Over 65: People aged 65-75 are included in the Individual Plan. Extended Plan memberships are available to those age 75-84 and include all services but are contingent upon completion of a medical form and a physician’s medical verification.

Trip Duration: Short term policies (7, 14 or 30-days) and long term policies (1 to 5 years) available.

Groups: Individual, family and student plans available.

Situations covered: It covers civil unrest, natural disasters, government evacuation orders and other security emergencies (when purchasing the Security package).

- Pros & Cons

Reasons To Buy

Remote locations coverage. Coverage available for 65-84. Pre-existing conditions accepted. All nationalities accepted.

Reasons To Avoid

The price is a bit higher than other insurance policies. However, no other company provides the same coverage as Global Rescue. It doesn’t cover trip cancellations or delays. It doesn’t cover equipment.

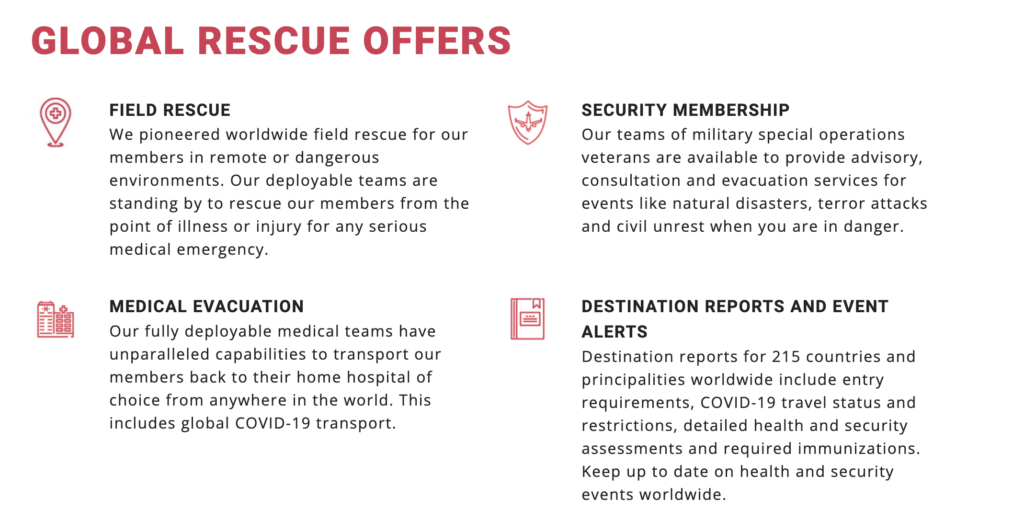

Worldwide field rescue (up to $500,000) in remote or dangerous environments. Global Rescue’s deployable teams are standing by to rescue their members from the point of illness or injury for any serious medical emergency.

Medical Evacuation. Global Rescue’s fully deployable medical teams have unparalleled capabilities to transport our members back to their home hospital of choice from anywhere in the world. This includes global COVID-19 transport.

Medical & Security Advisory Services. Global Rescue’s operations centers are staffed by experienced nurses, paramedics and military special operations veterans. Global Rescue also has partnerships with the Johns Hopkins Emergency Medicine Division of Special Operations, Elite Medical Group and Partners HealthCare, the Harvard Medical School affiliate.

Security Membership. Global Rescue’s teams of military special operations veterans are available to provide advisory, consultation and evacuation services for events like natural disasters, terror attacks and civil unrest when you are in danger.

Destination Reports & Event Alerts. Destination reports for 215 countries and principalities worldwide include entry requirements, COVID-19 travel status and restrictions, detailed health and security assessments and required immunizations. Keep up to date on health and security events worldwide.

My Global Rescue Mobile App. Access Global Rescue services in one location. Browse destination reports and alerts, activate emergency assistance, real-time virtual health visits and keep track of the people you care about with GPS tracking and messaging.

Security Package. Physical extraction when you are in danger of bodily harm. It includes civil unrest, natural disasters, government evacuation orders and other security emergencies.

Global Rescue is the most comprehensive travel protection available worldwide. It has the least restrictions and biggest coverage than any other medical insurance.

This medical-only protection covers individuals of all nationalities and offers options for individuals aged 75 and above. When purchasing the high altitude evacuation add-on, there’s no altitude limit.

Global Rescue is our preferred option for mountaineering and high altitude trekking trips.

Americans + High Medical Coverage + Trip Protection

Nationalities: Only US citizens and residents are eligible.

Pre-existing conditions: Pre-existing conditions can be covered for Trip Cancellations and Interruptions, as long as you purchase your plan within 14 days of your initial trip deposit, and are medically able to travel when you purchase your plan.

Seniors Over 65: There is no maximum age limit.

Trip Duration: All plans cover trips up to 180 days.

Groups: Insurance policies for solo travelers, couples and families are available.

The prices are very competitive.

Plans are very customizable with plenty of extras available and the option of removing items you don’t need.

Pre-existing medical conditions accepted.

24/7 chat available with the Faye Mobile App

Only available to American residents.

Emergency Medical Expenses: Up to $250,000. If you experience sudden illness or injury in-trip, including COVID-19. We can cover prescription drugs, hospitalization and physician costs.

Emergency Evacuation: Up to $500,000. Coverage of transportation in the case of illness or injury that is acute, severe or life threatening when adequate medical treatment is not available in the immediate area.

Trip Cancellation: Up to 100%. If you need to cancel your trip for covered reasons, including if you get sick, contract COVID-19, or a travel provider goes bankrupt. We can cover flights, hotel bookings, tickets & activities, and quarantine accommodation.

Trip Interruption: Up to 150%. When you must unexpectedly cut your trip short or extend it for covered reasons, including if you contract COVID-19.

Trip Delay: Up to $4,500. Up to $300/day, for delays of more than 6 hours. When you’re stranded in transit due to reasons outside of your control such as flight delay or theft of passport.

Lost or damaged Belongings: Up to $2,000. Reimbursement for lost, stolen, or damaged luggage, including clothing, personal items and professional equipment like a phone or laptop.

Cancel for Any Reason: Up to 75% of Trip Cost. The ability to nix your trip for reasons other than those covered in your plan’s trip cancellation coverage, including fear of contracting COVID-19, as long as you purchase this coverage within 14 days of your initial trip deposit and cancel at least 48 hours in advance of your scheduled departure date.

Pet Care: Up to $2,500 in veterinary expenses & $250 for kenneling. Coverage of veterinary expenses if you take your furry friend along (including pet sickness or injury), or kenneling costs if you arrive back home later than expected.

Adventure & Extreme Sports: Up to $250K (international trips) or $50K (domestic trips) for accidental & sickness expenses. Medical and transportation coverage if you become injured while participating in an adventure or extreme sport, like skydiving, bungee jumping, motocross or free diving.

Faye insurance provides American residents one of the biggest medical coverages on the market at a very competitive price.

There’s no age limit and, with the Adventure & Extreme Sports Protection, you can get cover for high altitude trekking over 9,000 feet (2,700 meters).

We recommend Faye for Americans who want a complete travel protection for their mountaineering trip in high altitude, including high medical coverage, trip protection cancellation & interruption, and baggage coverage.

Non Americans + Budget

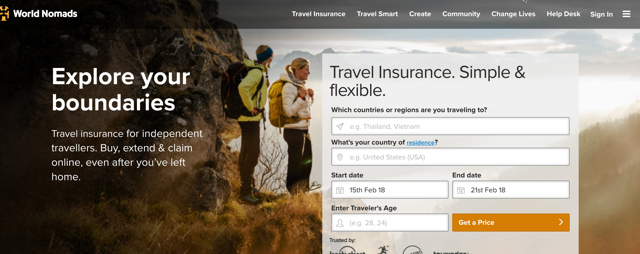

World Nomads

Nationalities: Most nationalities can purchase insurance from World Nomads, including residents of the United States, Canada, the United Kingdom, India, Australia, or New Zealand. However, as of the current writing, most European residents are unable to buy a World Nomads policy.

Pre-existing conditions: Not covered.

Seniors Over 65: Travelers aged 70 and over are not covered.

Trip Duration: All plans cover trips up to 365 days.

The price is competitive.

Prices and coverage vary greatly by the country of residence.

Some European nationalities are not covered.

Pre-existing medical conditions not covered

Max age is 70 years old.

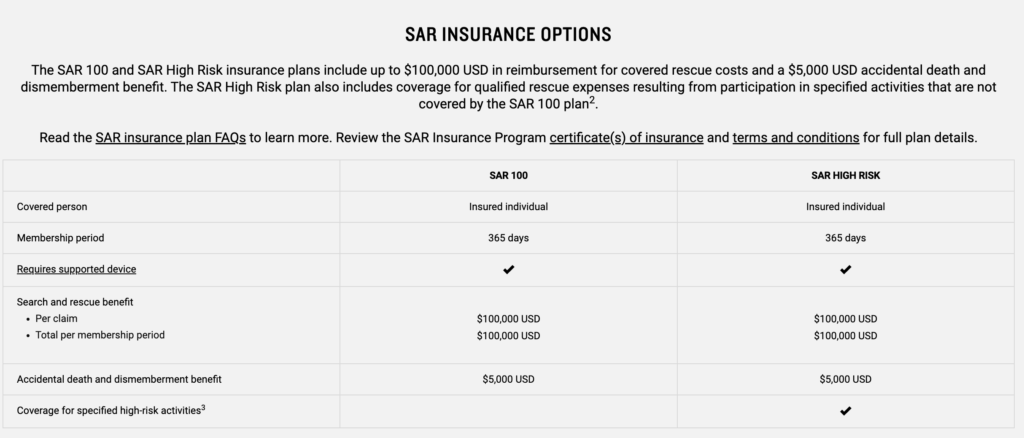

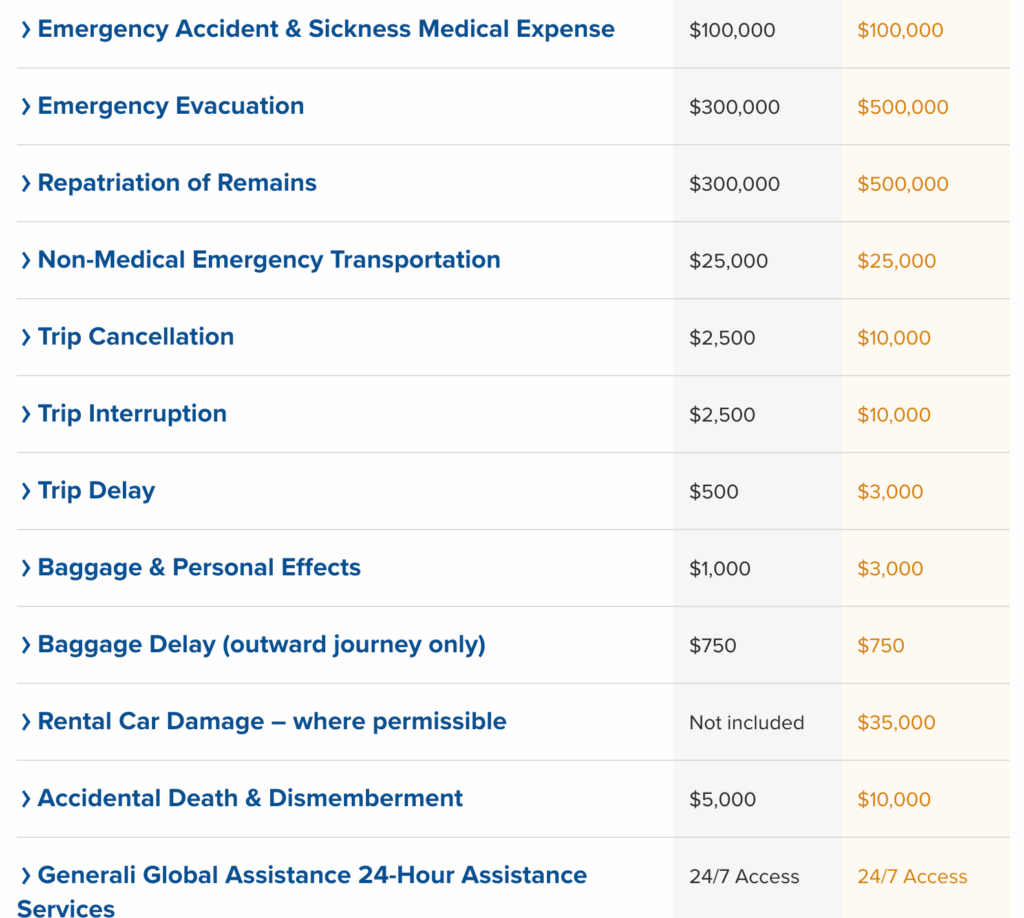

Emergency Accident & Sickness Medical Expense: Up to $100,000. Coverage is for medical expenses for emergency treatment of an accidental injury that occurs during the trip. Emergency treatment must be medically necessary and performed during the trip. Refer to the certificate / policy for complete details.

Emergency dental treatment: Up to $750. Coverage is for emergency dental treatment for accidental injury to sound, natural teeth. The injury and treatment must occur during the trip.

Emergency Evacuation: Up to $500,000. Coverage is for an accidental injury or sickness occurring during the trip that results in your necessary emergency evacuation. An emergency evacuation must be ordered by a physician who certifies that the severity of your accidental injury or sickness warrants your emergency evacuation. Refer to the certificate / policy for complete details.

Trip Cancellation: Up to $10,000. Reimburses for prepaid, non-refundable cancellation charges if you must cancel your trip (after the effective date) due to covered sickness, accidental injury, or death of you, a family member or traveling companion; inclement weather, unforeseen natural disaster at home or at your destination, strike or other covered reasons. Refer to the certificate / policy for complete details.

Trip Interruption: Up to $10,000. Reimburses for prepaid, non-refundable, unused expenses if you must interrupt your trip (after departure) due to a covered sickness, accidental injury, or death of you, a family member or traveling companion; inclement weather, unforeseen natural disaster at home or at your destination, strike, or other covered reasons. Refer to the certificate / policy for complete details.

Trip Delay: Up to $3,000. Coverage is for unused portion of pre-paid accommodation or additional expenses, on a one-time basis, if you are delayed en route to or from the trip for 6 or more hours due to a defined hazard as explained in the certificate / policy.

Baggage & Personal Effects: Up to $3,000. Reimbursement is for loss, theft or damage during the trip to baggage and personal effects (including sporting equipment) owned by you, provided you have taken all reasonable measures to protect, save and recover the property. Per article limit of $500.

Activities covered based on 4 groups. You pay more for higher group. The Explorer plan includes more activities than the Standard Plan. Extreme activities not covered (cave diving, free soloing, etc)

The World Nomads Explorer Plan is a great option if you’re looking for an affordable travel insurance with good medical coverage and some equipment coverage (up to $3,000) under the same policy.

Their altitude limit is 19,500 feet (6,000 meters).

We recommend World Nomads Explorers plan for mountaineering and high altitude trekking trips if you are not American, your maximum altitude is below 6,000 meters (19,500 feet) and want the trip & baggage protection that Global Rescue doesn’t provide.

Comparison Table

When it comes to finding insurance for your mountaineering trip, everything boils down to what’s the maximum altitude you plan to go and how remote is the area you’re traveling to.

If you plan to go trekking over 19,000 feet or remote areas, the absolute best choice is Global Rescue . Its robust medical evacuation system is simply unmatched by any other provider.

If you are not planning to go very remote and you are a US resident, the optimal insurance choice is Faye . It provides high medical coverage, accepts pre-existing conditions, imposes no age limit, and with the adventure sports protection you are covered when trekking at over 9,000 ft.

For non-US residents who don’t plan to go trekking in remote areas, a good option is the Explorer Plan from World Nomads . It provides a substantial amount of medical coverage, covers you up to 19,500 feet (6,000 meters) and their policies are very affordable.

Insurance for Specific Hiking Trails

If you would like to read about insurance options for some of the most popular hiking routes from around the world, you can check out the other trails we’ve written about below:

Himalayas Region

- Travel Insurance for Annapurna Circuit

- Travel Insurance for Everest Base Camp Trek

- Travel Insurance for K2 Base Camp Trek

- Travel Insurance for Stok Kangri Trek

Andes Region

- Travel Insurance for Inca Trail

- Travel Insurance for Lares Trek

- Travel Insurance for Salkantay Trek

- Travel Insurance for Mount Kilimanjaro Climb

- Travel Insurance for Tour du Mont Blanc

- Travel Insurance for Kokoda Track

Other Travel Insurance Reviews

If you would like to read more about insurance options for other type of adventure trips, you can check out our other reviews below:

- Travel Insurance for Ski Trips

- Travel Insurance for Hiking Trips

- Travel Insurance for Mountaineering & High Altitude Trekking

- Travel Insurance for Mountain Bike Holidays

- Travel Insurance for Adventure Cruises

- Travel Insurance for Diving Liveaboards

- Travel Insurance for Adventure Motorcycle Trips

- Travel Insurance for Seniors Over 65

- Travel Insurance for People with Pre-existing Conditions

Mountaineering & High Altitude Trekking Insurance Reviews Online

During your research, you might want to consider checking out articles from various publications that provide insights into the best insurance companies for mountaineering trips and trekking at high altitude.

Below are a few articles that caught my interest.

3 Best Trekking Travel Insurance Policies for high Altitude Trekking & Expeditions – We Seek Travel

The Ultimate Guide to Travel Insurance for High Altitude Trekking – The Bucket List Company

About the Author

Antonio was born and raised in Southern Spain, and quit his job in 2013 to travel the world full-time with his wife Amanda for 10 years straight. Their passion for adventure took them to visit 150+ countries.

They cycled 25,000km + from California to Patagonia, sailed over 10,000NM around the Caribbean & Sea of Cortez, rode their motorbikes 30,000 kms+ across West Africa (Spain to South Africa) and visited Antarctica, among many other adventure expeditions. Today, they’re still traveling, currently around the USA with an RV.

Traveling to so many places, remote destinations and by different means taught them a lot about travel insurance, which policies to hold depending on the area and the type of adventure they were doing. Antonio now publishes regular content to help other travelers choose the best travel insurance for adventure trips.

Together, they also run the travel community Summit , the RV site Hitched Up , the boutique accommodation blog Unique Places and the popular newsletter Adventure Fix , where they share their knowledge about the places they’ve visited and the ones still remaining on their list.

Antonio Cala

Co-Founder of Adventure Fix

Privacy Overview

You are our first priority. every time..

We believe everyone should be able to make decisions with confidence. And while our site doesn’t feature every company or travel service available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.

Best Trekking Insurance: High Altitude Trekking Travel Insurance

- April 3, 2023

Trekking, hiking, and mountain climbing can be one of the most exhilarating activities for nature lovers. Climbing to new heights, taking in the mountains that tower above us, and feeling a sense of peace and freedom as we trek into the unknown. However, it is important to know what trekking insurance is , to make sure you are protected from any risks associated with it. If you already know the basics, then read on, and find out about the 5 best trekking insurance options to protect yourself in case of an emergency.

In this article, we are going to provide information on the five best trekking and travel insurance and review the best policy providers for trekking, climbing, and mountaineering insurance!

Quick Answer: Best Trekking Insurance

Editors Choice

World Nomads Insurance

- Coverage for Trekkers

- Coverage until 22,965 feet (7,000 meters)

- Up to $500,000 in coverage

2nd Best Choice

Travelex Trekking Insurance

- Coverage until 20,000 feet (6,000 meters)

- Up to $1 million in coverage

3rd Best Choice

WorldTrips’ Insurance

- Coverage until 15,000 feet (4,500 meters)

Best Trekking and Hiking Insurance Providers

The information below highlights our top five choices for trekking insurance. We must insist that you look through the policies and what they cover before you purchase any hiking insurance. Whereas, it is important that you know 100% that the insurance will cover your climbing trip and all other activities you plan on engaging in before you purchase the insurance.

Our top five choices for trekking insurance are:

1. World Nomads Trekking Insurance

As an entity, World Nomads has been recommended by well known companies in the travel industry such as Lonely Planet and National Geographic — add with the thousands of customer reviews from Trust Pilot that they have garnished over the years, it is easy to see the great reputation that World Nomads has.

They are also backed by secure, trusted, and specialist underwriters who provide travelers with great cover, 24-hour emergency assistance, and the highest levels of support and claims management!

Let’s first start with who World Nomads is. You can also read my full World Nomads Insurance Review to take a deep dive into the insurance provider.

Who are World Nomads?

Since 2002, World Nomads have been protecting, connecting and inspiring independent travelers.

They offer simple and flexible travel insurance and safety advice to help you travel.

Because they believe in giving back to the places we travel to, World Nomads also enables you to make a difference with a micro-donation when you buy a policy.

And they’ll help you plan your trip with free downloadable guides, travel tips, responsible travel insights and recommendations from their global community.

World Nomads provides travel insurance for travelers in over 100 countries. As an affiliate, we receive a fee when you get a quote from World Nomads using this link. We do not represent World Nomads. This is information only and not a recommendation to buy travel insurance.

7 things to know about World Nomads trekking insurance

Below are seven things that you should know about World Nomads trekking insurance while considering to purchase a policy.

1. Internationally recognized underwriters: World Nomads is backed by a suite of specialist travel insurers that provide 24/7 emergency assistance, customer service and claims support.

2. 24/7 emergency assistance: If you need medical assistance or emergency medical evacuation, World Nomads’ multi-lingual team is available 24/7 to connect you with medical treatment and transportation during your trip.

3. Buy and claim on the road: Had a change of plans? You can extend your period of cover or claim online at any point in your journey. You can even buy a policy if you’re already travelling.

4. Adventure activity coverage: Designed by travelers, for travelers, World Nomads covers over 150 adventure sports and activities so you can explore your boundaries.

5. Travel safety tips and alerts: World Nomads provides useful and up-to-date travel insurance information and global travel safety advice to help you plan for your journey and navigate the risks.

6. Donate and make a difference: When you buy travel insurance with World Nomads, you can make a micro-donation to a community development project to help change lives in the destinations that need it most.

7. Travel content to help inspire, educate and plan: Plan your trip with free destination guides, develop your travel storytelling skills and learn how you can be a more responsible traveler with World Nomads as your travel companion.

Main Features:

- Standard Plan until 19,685 feet (6,000 meters)

- $500,000 in coverage

- Trip cancellation insurance

- Standard Plan until 22,965 feet (7,000 meters)

- Emergency medical evacuation

Pros and Cons of World Nomads Insurance:

The following are a list of pros and cons, things that we love and hate about the insurance policy:

- Covers a Lot of Countries Worldwide

- High Coverage for Medical Expenses

- Flexible Prices

- Buy or Extend Anytime, Anywhere

- Perfect for adventure-loving travelers

- 24/7 customer service with online claims option

- Limited age coverage for seniors

- Coverage can differ depending on location and nationality

- Limited COVID coverage

Some of the adventure sports and other activities that World Nomad’s trekking insurance covers include:

World Nomads’ Trekking Insurance Covers the Following Adventure Activities:

- Backpacking

- Bungee jumping

- Cage fighting

- Caving and spelunking

- Cliff diving

- Dog sledding

- Free diving (up to 197 feet)

- Hang gliding

- Kiteboarding

- Mixed martial arts

- Mountaineering/Trekking (up to 22,965 feet)

- Paddle boarding

- Rappelling (up to 22,965 feet)

- Rock climbing

- Running of the bulls

- Safari tours

- Salsa dancing

- Scuba diving (up to 165 feet with a commercial instructor or guide)

- Shark cage diving

- Skateboarding

- Skiing or snowboarding by helicopter or snowcat

- Swimming with whales

- Trampolining

- Tree climbing (up to 33 feet)

- Ultimate Frisbee

World Nomads’ Hiking Insurance Does Not Cover the Following:

Additionally, it is important to know about what the climbing insurance does not cover. It is best to talk directly to World Nomads to understand the exclusions and limitations you may face while using this insurance. World Nomads’ insurance for trekking does not cover the following:

- Pre-existing conditions

- Non-emergency medical treatment or surgery

- Routine physical exams

- Traveling for the purpose of medical treatment

- Pregnancy or childbirth (except for complications of pregnancy)

- Participation as an athlete in professional sports

- Participation in extreme sports

- Pregnancy or childbirth costs

- Intentionally harming yourself

- Piloting or learning to pilot an aircraft

- Suicide or attempted suicide

- Cancellations due to war, civil war, acts of foreign enemies, or civil unrest

World Nomads’ Standard Plan vs. Explorer Plan

Below is a comparison table of World Nomads’ Standard plan and Explorer plan and how much coverage travelers can get.

The amount that you will have to pay for your trekking and mountaineering insurance varies depending on your trekking destination, age, country of residence, overall trip cost as well as other factors.

2. Travelex Trekking Insurance:

Our second choice of mountaineering insurance is Travelex insurance. It is a great budget-friendly travel insurance provider that offers affordable rates and coverage for families. Moreover, they offer plan extensions that will allow you to be insured while trekking at high elevations. They provide coverage on individual bases and will allow you to get trekking insurance up to 20,000 feet (6,000 meters) above sea level. This makes it great for climbers looking to hike up to Everest Base Camp trek in Nepal or other places around the world like the Alps, the Andes or Kilimanjaro!

Another great aspect that we like about the Travelex’s service, is that they have an app that you can download which will provide important information about the country you are traveling to. It will help keep you safe by providing real-time security alerts, information about food and water safety, as well as ATM locations!

If you are looking for a budget travel insurance plan that will cover the adventure sports aspect of your vacation, Travelex climbing insurance will be a great fit for you! You can get a free quote from hen Travelex climbing insurance . You can also read our full Travelex Insurance review , to learn more about how they are one of the best trekking insurance providers!

- Coverage up to 20,000 feet (6,000 meters) above sea level

- Free coverage for children under 17

- Can apply for pre-existing medical condition waivers

- Travel delay coverage of $2,000

Pros and Cons of Travelex Trekking Insurance:

- The travel insurance will include free coverage for children under the age of 17 if they are with an adult that is covered by the insurance policy

- Offers an adventure sports upgrade, including for high elevation trekking

- You can upgrade the plan to get a “cancel for any reason”

- Medical expense coverage is primary, compared to some competitors’ secondary coverage.

- Provides great travel delay coverage. Providing USD $2,000 per person after an initial five-hour delay.

- “Cancel for any reason” coverage provides 50% reimbursement of the non-refundable deposits – which is lower than most travel insurance providers, who usually provide 75%

- The emergency medical expense coverage for the Travel Select plan is $50,000, compared to higher levels from top competitors.

- Baggage delay benefits only apply after an initial 12-hour wait – longer than most companies

Some of the adventure sports and other activities that Travelex’s trekking insurance covers include:

Travelex’s Trekking Insurance Covers the Following Adventure Activities:

- Travel medical insurance

- Travel delay insurance

- Travel interruption insurance

- Baggage and personal effects

- Car rental collision coverage of $35,000 (upgradable)

- Flight accident or death (upgradable)

- Medical expenses and emergency evacuation (upgradable).

- Coverage for adventure sports activities (upgradable)

Travelex’s Trekking Insurance Does Not Cover the Following:

Additionally, it is important to know about what their climbing insurance does not cover. It is best to talk directly to Travelex to understand the exclusions and limitations you may face while using this insurance. Travelex’s insurance for trekking does not cover the following:

- Intentionally self-inflicted injury

- Normal pregnancy or childbirth

- Mental, nervous or psychological disorders

- Experimental medical treatments

- Injuries due to intoxication or drug abuse

- Routine physical examinations

Travelex Trekking insurance Pricing:

Here are a few examples of trips and costs associated with them, so you can get an idea of what you may have to pay for your trekking insurance with a Travelex Select Plan:

3. WorldTrips’ Trekking Insurance:

For our third choice, we suggest WorldTrips travel insurance plan, as it is a flexible plan that allows travelers to pick and choose which add-on coverage they need. WorldTrips, flexible plans include coverage for pets, adventure sports like high altitude climbing and hiking, destination weddings, and even hunting and fishing equipment.

For travelers looking to take part in various adventure activities, WorldTrips high altitude travel insurance is going to be best for you. However, the elevation coverage is less than the other two plans mentioned above. Whereas, WorldTrips’ only provides trekking travel insurance under 15,000 feet (4,500 meters) above sea level.

Therefore, if you plan on hiking to extreme elevations, you will have to choose a different trekking insurance provider. If the elevation issue is not a problem for your vacation, then WorldTrips is a great hiking travel insurance provider because of the options and upgrades it gives travelers.

- Coverage up to 15,000 feet (4,500 meters) above sea level

- Up to $150,000 in coverage

- Upgrade to “cancel for any reason”

- Flexible plans – travelers can pick and choose coverages

Pros and Cons of WorldTrips Hiking Insurance:

- You can get a “cancel for any reason” upgrade

- You can add an upgrade to your policy to get “interruption for any reason” coverage

- Includes excellent missed connection coverage of $2,000 per person after a three-hour delay.

- Provides travel delay benefits of $2,000 per person.

- WorldTrips offers coverage for travel inconveniences

- The elevation coverage they offer, up to 15,000 feet (4,500 meters) above sea level, is significantly lower than other trekking insurance providers.

- Emergency medical expense coverage of $150,000 is quite low when compared to other policy providers

- You have to wait 12 hours to get baggage delay benefits

Some of the adventure sports and other activities that WorldTrips’ hiking insurance covers include:

WorldTrips’ Trekking Insurance Covers the Following Adventure Activities:

- Indoor and outdoor rock climbing

- Mountain biking

- Mountaineering (at elevations under 4,500 meters)

- Rock scrambling

- Snowboarding (recreational downhill and/or cross country)

- Snow skiing (recreational downhill and/or cross country)

- Zip trekking

- Bodyboarding

- Scuba diving

- Wakeboarding

WorldTrips’ Trekking Insurance Does Not Cover the Following:

Additionally, it is important to know about what the climbing insurance does not cover. It is best to talk directly to WorldTrips to understand the exclusions and limitations you may face while using their trekking insurance plan. WorldTrips’ insurance for trekking does not cover the following:

- Mental, nervous or psychological disorders (unless hospitalized for more than 72 hours)

- Intoxication

- Participating in organized or contact sports

- Traveling against the advice of a physician

- Elective treatment and procedures

- Medical tourism

- Self-inflicted injury

WorldTrips’ Trekking insurance Pricing:

WorldTrips’ pricing for trekking insurance is broken down by age, and is charged per day. Moreover, depending on the plan you choose, and the amount of medical maximum you are looking for, will also change the overall policy price.

The table below shows the breakdown of costs for traveling outside of the United States. The table is pulled directly from WorldTrips website

4. Global Rescue Insurance:

Global Rescue Trekking Insurance is a well-known provider of rescue memberships in high-altitude and trekking circles. This plan is highly recommended by many of Nepal’s travel and expedition companies.

The most significant advantage for trekkers with Global Rescue’s rescue and evacuation insurance is no elevation limit. Meaning that this policy covers you even when you decide to go to the summit of Everest!

You can get a membership on long term or even short-term basis (7, 14, or 30 days), making the plan extremely flexible and affordable! However, it is important to note that the Global Rescue membership is different than a traditional travel insurance plan. Their altitude travel insurance does not cover travel cancellations, delays, baggage, or medical and dental expenses.

They do offer add-on travel insurance policy with IMG (IMG Signature Travel Insurance), which provides coverage for all these items in addition to your high-altitude and rescue/evacuation coverage.

Make sure to check out my Global Rescue Insurance review blog, it will go into depth about what the medical Helicopter evacuation coverage offers!

- No limitation on altitude for coverage

- Emergency medical coverage — up to $100,000

- Trip cancellation — up to $100,000

- Lost luggage/baggage delay — up to $2,500

- Up to 150% of trip cost insured for trip interruption

Pros and Cons of WorldTrips Hiking Travel Insurance:

The following are a list of pros and cons, things that we love and hate about the hiking insurance policy:

- Secure the value of your entire trip

- Industry’s most complete travel insurance products

- Field Rescue services from the point of injury or illness

- Face-to-face video consultations and advice about your diagnosis

- Prescriptions, lab work, diagnostic imaging

- Help determining the best possible treatment options

- Can be expensive depending on the trekkers usage of the plan

- Have to buy annual membership

- Emergency medical expense coverage of $100,000 is quite low when compared to other altitude insurance policies

Global Rescue Trekking Insurance Membership Covers the Following:

- Worldwide Field Rescue: teams on standby to rescue members in dangerous or remote locations.

- Medical Evacuation: teams capable of transporting members back to their home country hospitals from anywhere in the world.

- Medical & Security Advisory: on-call paramedics, nurses, and military special operations veterans to provide virtual medical assistance and security advice in emergencies.

- Other Travel Assistance Services: include visa and passport support, hospital referrals when needed, translation services, and even logistics management.

Global Rescue Insurance Policy Pricing

Below are the prices you can expect to pay depending on the length of your trekking trip:

*Additional memberships are available. For members adventuring to higher altitudes, the High-Altitude Evacuation Package provides medical transport services to members who travel above 15,000 feet or 4,600 meters at any point during their trip (excluding airplane travel) and who require emergency transport due to injury or illness.

5. SafetyWing

SafetyWing is a well-known travel insurance provider that offers policies designed specifically for digital nomads and long-term travelers. While they offer coverage for some adventure activities like hiking, trekking, and mountaineering, it is important to carefully review their policy to ensure that it covers the specific activities you plan to undertake.

Unfortunately, they will not cover you while trekking above 4,500 meters. This is still pretty high, and depending on the elevation of your trek, it might be just enough for you to get by with!

Their policies generally provide medical coverage, emergency medical evacuation, trip interruption, and travel delay coverage. However, they may not offer as comprehensive adventure activity coverage as other travel insurance providers. It’s essential to carefully read the policy’s terms and conditions, including any exclusions or limitations.

Ultimately, whether or not SafetyWing is a good insurance provider for trekking depends on your individual needs and the level of coverage you require. If you plan to undertake high-risk activities or travel to remote areas, you may want to consider a policy from a provider specializing in adventure travel insurance.

You can read my entire SafetyWing Insurance review for more information about if their travel and trekking insurance are right for you!

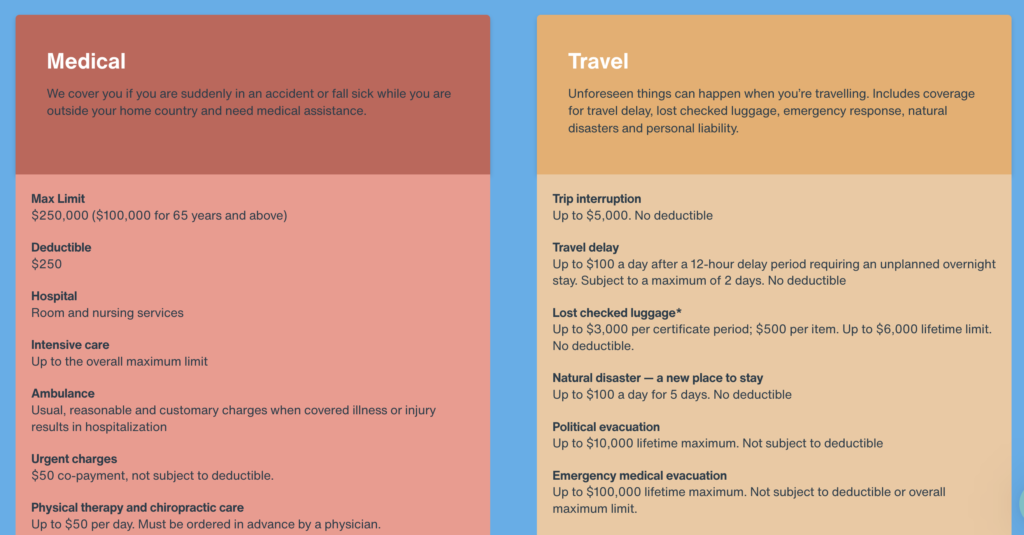

- Up to $250,000 for intense care unit

- Up to $5,000 for trip interruption

- Up to $100 a day for Travel delay after a 12-hour delay

- Up to $100,000 for emergency medical evacuation

Pros and Cons of SafetyWing Hiking Insurance:

- Website is easy to navigate and understand

- Can sign up while abroad and be covered immediately

- Young children included – 2 children under 10 per family (1 per adult)

- Trip interruption – Up to $5,000. No deductible

- Easiest and fastest insurance to sign up for

- Visits to home country are covered – After 90 days abroad, you’re covered for brief visits back home for up to 30 days (15 days for US residents).

- Limitations on the adventure activities you will be covered for

- The maximum altitude trekkers are covered is relatively lower than other providers

- Maximum is lower than other providers and is cumulative amongst the family or group the trekker is traveling with

SafetyWing Insurance Covers the Following:

Here are only some of the things that are covered:

- Emergency medical treatment

- Lost luggage

- Travel delay

- Evacuation in the event of terrorism, political disruption, or medical emergencies

- Accommodation in the event of natural disasters

- Transportation of a family member from your home country to you in case you have to stay in the hospital for an extended duration

- Personal liability for losses or injuries to third-parties

SafetyWing Insurance Does Not Cover the Following:

- Trip cancellation and

- Most adventure sports

SafetyWing insurance Pricing:

Below is a breakdown of how much you can expect to pay for insurance with SafetyWing per month. Please note that the price does not include traveling in the USA.

Best travel insurance for trekking up to 6000m

The best trekking insurance up to 6000 meters, are World Nomads, Travelex or Global Rescue insurance policies.

Global Rescue’s coverage does not have an altitude cap. However, World Nomads and Travelex will void your insurance if you go above 6000 meters. Here are a couple of popular trekking routes below 6000 meters that these plans will cover:

- Everest Base Camp Trek (5,364 m): This iconic trek takes you to the base camp of Mount Everest, offering breathtaking views of the Himalayas, Sherpa culture, and stunning landscapes.

- Annapurna Circuit Trek (5,416 m): Known for its diverse scenery, the Annapurna Circuit is a classic trek that takes you through lush valleys, high mountain passes, and traditional villages in the Annapurna region.

- Inca Trail (4,215 m): The Inca Trail is a historic route that leads to the magnificent ruins of Machu Picchu. This trek combines beautiful Andean landscapes, ancient Inca sites, and rich cultural experiences.

- Kilimanjaro Machame Route (5,895m): Mount Kilimanjaro’s Machame Route is a challenging trek that takes you through diverse ecosystems, including rainforests, moorlands, and alpine deserts, culminating in a summit attempt to the highest peak in Africa.

Best Trekking Insurance for Everest Base Camp in Nepal?

While there is no specific travel insurance exclusively for the Everest Base Camp trek , either of my previous three suggestions will provide coverage for this trek. The highest elevation typically reached on the trek is Kala Patthar at 5,644 meters (18,519 feet).

Key Things To Consider When Looking for High Altitude Trekking Insurance:

Having conducted extensive research on travel insurance for my own high-altitude expeditions and treks, and having personally dealt with making insurance claims during my five years of travel, my top recommendation is to thoroughly review the product disclosure statement (PDS).

Here are three things to look for when purchasing trekking insurance:

- Altitude Limits: Check for hidden altitude limit clauses and special conditions regarding the use of ropes or ice axes in trekking insurance.

- Medical Coverage: Consider if medical expenses, overseas hospitalization, and emergency care are included in the insurance policy. Non-traditional rescue memberships may not cover in-country medical treatment.

- Pre-Existing Medical Conditions: Review insurers’ requirements for pre-existing conditions, as complications from altitude-related illnesses may affect coverage for existing heart, brain, or lung issues.

FAQs: High altitude trekking travel insurance

Below are some of the most frequently asked questions when it comes to high altitude trekking travel insurance in Nepal!

The four best trekking insurance for Nepal are: – World Nomads – Travelex – WorldTrips – Global Rescue Membership – SafetyWing

Yes and no. Travel insurance is not mandatory to visit Nepal. However trekking insurance is mandatory to get a TIMS pass and go trekking in most of the routes in the Himalayas.

Yes you can get travel insurance for Nepal. Many companies offer some form of coverage for tourists visiting Nepal. However, if you are going to engage in adventure activities like trekking, you will need a specialize insurance for high altitude treks.

Leave a Reply Cancel Reply

Your email address will not be published. Required fields are marked *

Add Comment *

Save my name, email, and website in this browser for the next time I comment.

Post Comment

Trekking Insurance: Everything You Need to Know

We use affiliate links and may receive a small commission on purchases. Read more about us.

As you prepare for a trek overseas, understanding your insurance needs is crucial. Knowing the specifics of trekking insurance can make all the difference in managing the risks associated with such adventures.

High altitude treks, especially those reaching up to 6,000 meters, require careful consideration of insurance coverage to ensure that you are protected against the inherent risks of the wilderness and demanding physical activity.

It’s also important to seek policies that cover mountaineering equipment such as ropes, crampons, and ice axes, as these signify activities that standard travel insurance may not cover.

While trekking, the fine details of insurance policies can have significant implications . A specialist insurance provider can give you the peace of mind you need to fully engage with the rugged outdoors.

Quick Verdict: no time to read the whole article? No problemo, here’s my top recommendation for trekking insurance.

Global Rescue

- Truly Global Coverage

- Helicopter Rescue

- Medical Evacuation and Field Rescue

- Destination Reports and Alerts

- 24/7 telehealth staffed by experienced nurses, paramedics and military special operations veterans.

- Membership + Individual Trips - Add-on Tradtional Travel Insurance

What we liked: Extremely good communication, 24/7 help line to address problems that can be solved without full rescue.

- Visa and passport services

- Translation services in 190 languages

- Legal service location in 160 countries

- Logistics management and coordination

Note: Based in New Hampshire and supports NASA and US Ski Team

- Comprehensive Emergency Services : Members have access to a wide array of emergency services, including medical and security evacuations, field rescues, and telemedicine consultations.

- Global Coverage : Global Rescue operates around the world, offering support and evacuation services in both remote and urban settings, which is particularly beneficial for travelers and adventurers.

- Expertise and Resources : The company is well-regarded for its team of medical and security experts and has a partnership with Johns Hopkins Medicine, ensuring high-quality advice and care.

- Cost Factor : The membership can be expensive, especially for those who travel infrequently or are on a limited budget.

- Membership vs. Per-Trip Insurance : Since the services are membership-based, they may not be as cost-effective for those seeking coverage for a single trip as opposed to regular travelers.

- Limited Traditional Travel Insurance Benefits : The membership focuses on emergency evacuation and rescue, which means it may lack comprehensive trip insurance features like trip cancellation, baggage loss, or delay coverage.

Being informed about the various offerings and the scope of coverage will empower you to make the best choice for your journey.

Keep in mind, the specific terms and conditions of insurance policies are vital, and thoroughly reviewing them is just as important as picking the right trek itself.

Key Takeaways: How to Choose Trekking Insurance

- Evaluating trekking insurance options is vital for overseas treks or high-altitude adventures.

- Specialist insurance may be necessary for activities involving mountaineering gear.

- Careful review of policy details is essential before making an insurance purchase.

Trekking Protection Plans

Important factors to evaluate.

When embarking on high-altitude adventures, several critical elements must be weighed regarding insurance for trekking activities. Here’s a breakdown of major aspects to consider:

- Altitude Limitations : Typical vacation coverage doesn’t extend to the risks encountered in high-altitude treks such as those to Everest Base Camp or Kilimanjaro peak. Ensure your plan explicitly covers heights up to 6,000 meters to mitigate risks like Acute Mountain Sickness, which becomes a significant concern above 2,800 meters.

- Trail Injuries : From minor incidents like sprained ankles to serious accidents, the unpredictability of hiking requires comprehensive coverage that includes costs of both emergency medical services and potential evacuations.

- Unforeseen Sickness : Apart from on-trail injuries, general health issues, notably gastrointestinal ones, are not uncommon. Coverage for these off-trail medical incidents is vital.

- Gear and Baggage : Issues with baggage – such as theft, damage, or loss – can drastically affect your trek. Most insurance plans cover these, but check the coverage limits if you carry expensive gear.

- Comprehensive Travel Issues : Beyond trekking, general travel incidents like flight delays or tour cancellations should also be covered to ensure peace of mind.

Features of Trekking Insurance

Navigating the intricacies of trekking coverage requires careful examination. For any inquiries, your chosen insurance provider is equipped to deliver thorough responses.

Ensure altitude coverage, medical assistance, evacuation services, repatriation expenses, and acute mountain sickness care are included.

Yes, it should encompass specific mountaineering incidents, search and rescue operations, and potentially helicopter rescue.

Common illnesses, especially those linked to travel like gastrointestinal issues, should be covered.

Baggage protection should cover loss, theft, and damage, with options to increase limits for high-value items.

Look for policies that help mitigate financial impacts of travel delays, trip cancellations, and operator defaults.

For tailored guidance and more comprehensive details, always review the terms and conditions of your insurance policy and maintain direct contact with your insurer for 24/7 emergency assistance.

It can cost upwards of $3000,000 to repatriate a body , so this insurance protects your loved ones in case of serious accident.

In case of emergency 👉 Rescue Insurance

Crave the Planet partners with Global Rescue to offer the world’s leading travel protection services. Medical and security emergencies happen. When they do, we rely on Global Rescue to provide our clients with medical, security, travel risk and crisis response services.

Without a membership, an emergency evacuation could cost over $100,000. More than one million members trust Global Rescue to get them home safely when the unexpected happens. Learn more about trekking insurance , but we highly recommend our audience enroll with Global Rescue .

Pros and Cons

Related 👉 review of global rescue travel insurance, final verdict: best trekking insurance.

A combination of rescue and travel insurance is best for adventure travelers. Rescue insurance is to protect yourself and travel insurance is to protect your wallet.

Rescue Insurance [Protect Your Body and Health]

It’s a very good idea to get insurance for this trip just in case you twist an ankle or worse on the trail. Parts of these trails are totally inaccessible to vehicles so if you did get hurt you would have to get a helicopter rescue.

Crave the Planet partners with Global Rescue to offer the world’s leading travel protection services. Medical and security emergencies happen. When they do, we rely on Global Rescue to provide our clients with medical, security, travel risk and crisis response services. Without a membership, an emergency evacuation could cost over $100,000. More than one million members trust Global Rescue to get them home safely when the unexpected happens.

👉 We highly recommend hikers enroll with Global Rescue for peace of mind.

Travel Insurance [Protect Your Wallet]

| TL;DR From Author

Don’t let unexpected changes derail your travel plans – with travel insurance you can have peace of mind knowing that you’re covered if you need to alter your bookings. Protect your investment and travel with confidence by securing travel insurance today.

Become a European Adventure Travel Insider in Just 5 minutes

✨Unlock Europe’s best-kept secrets with our free bi-weekly newsletter.

Common Questions

Choosing the right travel insurance for high-altitude hiking.

When selecting insurance for high-altitude hiking, consider these factors:

- Policy Coverage : Ensure the policy covers altitudes beyond your intended trek.

- Medical Coverage : Look for comprehensive medical coverage, including conditions related to altitude sickness.

- Emergency Evacuation : Confirm that your policy includes air evacuation and rescue services.

Trekking Insurance in the Era of COVID-19

How COVID-19 impacts trekking insurance:

- Trip Cancellation : Check if the policy covers cancellations due to pandemic-related restrictions.

- Medical Treatment : Verify if COVID-19 treatment is included if you fall ill during the trek.

Advantages of Hiking-Specific Insurance Compared to General Travel Policies

Reasons to opt for specialized hiking insurance:

- Activity Coverage : Tailored to cover common hiking risks, like trail injury.

- Equipment Protection : Offers protection for specialized hiking gear.

Insurance Distinctions Between Hiking and Trekking

Understanding the nuances in coverage:

- Risk Level : Trekking often requires additional coverage due to increased risks.

- Duration and Distance : Longer treks could necessitate more comprehensive insurance due to extended exposure to elements.

Top Travel Insurance Plans for Treks Up to 6000 Meters

Look for policies with:

- High-altitude coverage

- Medical and emergency services

- Gear and personal belongings protection

Inclusion of Rescue and Medical Evacuation in Trekking Insurance

Most trekking insurance plans include:

- Rescue Services : Availability of mountain rescue services.

- Medical Evacuation : Coverage for transportation to the nearest medical facility.

My Guides to Bucketlist Hikes in Europe (That I’ve personally done and loved.)

- Alta Via 1 Trail in the Dolomites

- Olpererhütte Hike in Austria

- The Fisherman’s Trail in Portugal

- The Tour du Mont Blanc Hike vs the Alta Via 1

We hope this quick guide to trekking insurance helps you plan your next adventure.

Author profile : Morgan Fielder is a Doctor of Physical Therapy and passionate hiker who believes in exploring the world on foot with good food. Follow her journey as she shares science-based hiking tips and advocates for sustainable tourism.

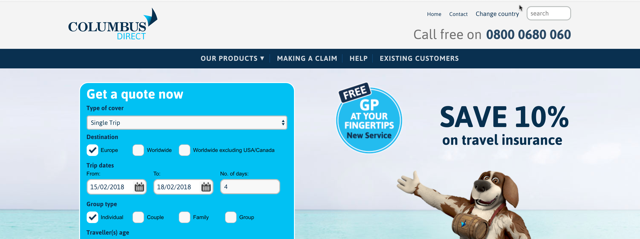

Where do you live

All persons to be insured must reside at a permanent address within the EEC ( Excluding Switzerland, Russia, Belarus, Montenegro and the Ukraine) to be eligible for cover.

Can I take out this insurance if I am already travelling?

When cover is purchased after an Insured Person has departed their home to commence their journey, there is a fixed period of 48 hours prior to cover commencing. Any illness arising during this initial 48 hour period will be an excluded Pre-existing Medical Condition. In the event of serious injury in connection with an accident, you will be covered from the date you take out cover subject to the accident being independently witnessed and also verified by a Medical Practitioner.

There is no 14 Day Cooling off Period and no premium refund will be made if the insured Person has already travelled.

family family

Definition of a couple

A couple is defined as 2 adults who have been permanently living together at the same address for more than six months, who intend to travel together.

If you do not qualify as a couple, please select individual(s)

Annual Multi-Trip Durations

Annual Multi Trip policies are designed for multiple short holidays leaving from and returning to your home country.

Annual Multi Trip trip limits:

Standard policy - 30 days

Premier policy - 70 days

If you need continuous cover for a year (home visits allowed on policies over 4 months long) select Single Trip or One Way. You can travel around as much as you like, to as many different countries as you like, with a Single Trip or One Way policy.

One Way Trip

Please note a Single Trip policy can cover travels with no return ticket booked, a One Way policy is intended for:

Emigrating to new country where you intend to permanently live

Returning to your home country permanently

All cover ceases upon arrival at final destination

Select the type of policy most suitable for your needs.

Single Trip: A flexible policy with no limits on how many countries you visit or how long you’re away for. Suitable for all types of travel whether it be short term/long stay or backpacking. No return ticket required and unlimited home visits offered on policies over 4 months long.

One Way Trip: Means you are Emigrating to a new country where you intend to live permanently or, returning to your home country permanently. Cover will end upon arrival at your final destination. Please note: There is no cover for emergency return travel expenses if you do not have an original return ticket.

Annual Multi-Trip: This policy covers an unlimited number of trips throughout the 12 month Period of Insurance. Each trip has a maximum stay validity depending on the type of policy chosen. For example, for Standard Policies, the maximum duration of any trip shall not exceed 30 days and for Premier policies, the maximum duration of any trip must not exceed 70 days.

If you are already travelling it is not possible to purchase the annual multi-trip policy.

Geographical Areas

Europe: Europe means the continent of Europe West of the Ural Mountains, and includes the Isle of Man, the Channel Islands, Iceland, Jordan, Madeira, the Canary Islands, the Azores and Mediterranean Islands as well as all countries bordering the Mediterranean. Australia & New Zealand: a) For any period of cover purchased, a 48 hour stop-over anywhere in the World for both outward and return travel will be included. b) If the period of cover purchased is two months or more, a stop-over of 7 days/nights anywhere in the World will be included. Worldwide excluding North America & Mexico: (North America means the USA, Canada & Mexico.) a) For any period of cover purchased, a 48 hour stop-over anywhere in the World for both outward and return travel will be included. b) If the period of cover purchased is two months or more, a stop-over of 7 days/nights anywhere in the World will be included. Worldwide including North America & Mexico: Worldwide means anywhere in the World including the USA, Canada & Mexico.

Automatic Trip Extension If the Insured Person is prevented from completing their travel before the expiration of this Insurance as stated under the Period of Insurance on the Booking Invoice or Validation Certificate (as applicable) for reasons which are beyond their control, including ill health or failure of public transport, this Insurance will remain in force until completion but not exceeding a further 31 days on a day by day basis, without additional premium. In the event of an Insured Person being hijacked, cover shall continue whilst the Insured Person is subject to the control of the person(s) or their associates making the hijack during the Period of Insurance of a period not exceeding twelve months from the date of the hijack. Please ensure you arrange cover for the entire duration of your travel

Where you normally reside

Where do you normally reside? Where do you normally reside? Please use the drop down box to choose your country of residence. Note we can only insure residents of the UK & EEA Countries. Can I take out this Insurance if I’m already abroad? If you are normally a resident of the UK or EEA Countries and your insurance has run out, you may take out cover online with us. This is on the understanding that nothing has occurred at the time of taking out the cover which has led to a claim or may lead to a potential claim. Note you cannot take out our Multi-Trip Insurance if you are already abroad. Do you have minimum residency requirements? No. If you are, for example, a British Passport holder and have right of abode in the UK, we are not concerned as to how many months in the past year you have been in the UK provided at the time of arranging this insurance you have a UK residential address.

Age Restriction Error

We are unable to quote, Please ring our Offices on 0333 0033 161 for further assistance.

Get a Quote

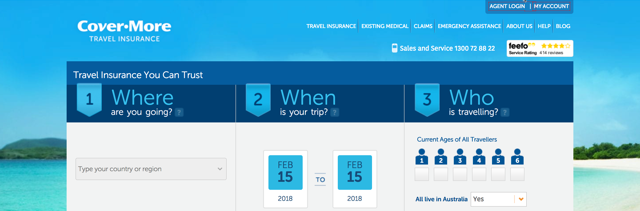

Trekking up to 2,500m

Included in all the Policies, The Standard Pack covers you for walking , hiking or trekking up to 2,500 metres. This is serious mountain altitude as our highest peak, Ben Nevis, is just 1,344 metres up .

Trekking up to 4,600m

But if you want to go higher, then our Activity Pack covers you up to 4,600 metres, which would just include reaching the peak of the Matterhorn at 4,478 metres or the highest part of the Inca Trail to Machu Picchu at 4,430 metres.

Trekking over 4,600m

Our Extreme Activity Pack covers above 4,600 metres, with no upper altitude limit and is suited to the most challenging of mountain treks such as Mt Kilimanjaro, Aconcagua, and Mont Blanc.

Medical & Repatriation

Medical Cover is the most important part of your travel insurance. Our Premier policy covers up to £10m for hospitalisation, medical and repatriation expenses, up to £5m for our standard and up to £2m for our budget policies.

Get Cover If Already Travelling

You don't need to be in your Home Country to get cover, you can buy a policy from anywhere in the world, as long as you're residential status is still in the UK or EU. Just follow the Quote form to get a price and complete your purchase.

Gadgets & Valuables

Protect your gadgets (mobile phones, iPods, iPod touch and/or accessories, ), sports equipment (golf clubs, bicycles) and other valuables such as watches and jewellery up to £1,000.

Baggage Cover included

24 hour emergency helpline, up to £10m medical cover, extend cover on the go, trekking insurance.

Whether you choose to walk alone, with friends, or as part of an organised group, you need to have the right insurance in place to give you peace of mind and to cover any mishaps along the way. Don’t forget that trekking is often undertaken in remote areas where medical or other assistance is not always close at hand. What could be a relatively minor complication in normal circumstances, such as a sprained ankle or fractured bone, could necessitate a helicopter rescue if such an accident occurs in mountainous or isolated terrain. Add the costs of any hospital treatment or if repatriation to the UK is medically necessary, makes it essential that you have suitable insurance to cover all of these eventualities.

Key benefits of our Trekking Insurance include:

- Emergency Medical and Repatriation Expenses up to £10 million.

- Helicopter emergency rescue

- Emergency Dental Cover.

- Cover duration of up to 24 months.

- Baggage Cover

- Gadgets & Valuable Cover

- No altitude limits with our extreme activity pack. (For trekking in Nepal the Nepal Trekking Pack add-on will need to be included. A 7,000m altitude limit is applied to this.)

- One Way Travel.

- No return ticket requirement.

- Free Home visits.

- 156+ Sports and Activities.

- Winter Sports Cover.

- Loss of Passport & Visa replacement costs.

- Facility to arrange or extend Insurance when already travelling.

Frequently asked questions:

To add any of our Activity Packs, just follow the Quote form - to stage 3 - there you will find all of the optional extras.

The Additional Mountain Rescue section of cover is a specific level of cover that takes effect when helicopter rescue is deemed necessary by the local Rescue Authorities due to a non-medical emergency such as natural disasters or adverse weather conditions.

This section of cover does not apply to Medically Necessary helicopter evacuations - these costs are covered under the Medical & Repatriation section of cover.

It is recommended that when travelling to any remote areas, you go in a group of at least 3 people with a 2 way working communications device, a navigation device, you let someone(s) know your route and when you should arrive, as Search and Rescue costs are not covered.

We have no upper altitude limit with our Extreme Activity Pack Add-on. Otherwise, with the Activity Pack you can trek up to 4,600m. And if you're only trekking up to 2,500m, there's no need to add anything on - Trekking up to 2,500m is one of the 64 activities we cover for free.

Please note for trekking in Nepal the Nepal Trekking Pack add-on will need to be included. A 7,000m altitude limit is applied to this.

How do you include these Add-ons? See question below.

Yes, Helicopter Rescue is covered.

Helicopter rescue is classed as a necessary Medical Expense, so is covered by the Medical & Repatriation expenses section of cover (limit of either £2m, £5m or £10m depending on the policy)

To get a quote, please visit our Trekking Insurance page by following this link .

Some popular Trails:

Everest base camp.

While only the very few ever get to scale the mighty 8,848m peak of Everest, the next best thing for the seasoned adventurer is the classic route to Everest Base Camp.

Read more..

Annapurna Circuit

The Annapurna Circuit, a 15 to 20 day trek within the Annapurna mountain range of central Nepal, is prized as one of the best treks in the world. The route encompasses a rich mix of terrain from jungle to paddy fields, waterfalls to canyons, as well as a cultural variety from Hindu villages

Read more...

Trekking to the lost Inca city of Machu Picchu, with its spectacular mountain-top location in the Andes, is one of the world’s most iconic hikes. Machu Picchu was named one of the New Seven Wonders of the World in 2007 and is classed a UNESCO World Heritage Site .

Mount Kilimanjaro

Mount Kilimanjaro, at 5,895 metres (19,341 ft) above sea level, is the highest mountain on the African continent. It is one of the Seven Summits – the highest mountain peaks of each of the seven continents – that requires no technical climbing skills since all of its trekking routes are pure hiking paths.

Mount Aconcagua

Aconcagua, at 6,961 metres, is the highest mountain in the Southern Hemisphere. It is located in Argentina within the Andes mountain range, close to the border with Chile. It is one of the Seven Summits - the highest mountains of each of the seven continents - and the second highest peak in the world outside of the Himalayas.

Pacific Crest Trail

The Pacific Crest Trail is a spectacularly scenic long-distance hiking trail stretching from Mexico via the USA to Canada through California, Oregon, and Washington. It follows the highest section of the Sierra Nevada and Cascade mountain ranges and, along the way,

Big Cat Travel Insurance Services, a trading name of Flynow.com Ltd (registration No.FRN 745388) is an Appointed Representative of Campbell Irvine Ltd (registration No.306242) who are authorised and regulated by the Financial Conduct Authority. You may check this on the Financial Services register www.fca.org.uk or by contacting them on (0) 800 111 6768. © 2023 Big Cat Travel Insurance Services. All rights reserved.

A fantastic plugin that allows you to display age restriction message to the visitors while visiting site

List of automatically covered medical conditions that do not need to be declared

Acne, ADHD, Allergic reaction (Anaphylaxis) provided that you have not needed hospital treatment for this in the last 2 years, Allergic rhinitis, Arthritis (the affected person must be able to walk independently at home without using mobility aids), Asthma (the diagnosis must have been made when the affected person was under the age of 50, and the asthma be controlled by no more than 2 inhalers and no other medication), Blindness or partial sightedness, Carpal tunnel syndrome, Cataracts, Chicken pox - if completely resolved, Common cold or flu, Cuts and abrasions that are not self-inflicted and require no further treatment, Cystitis - provided there is no on-going treatment, Deafness, Diabetes (which is controlled by diet or tablets only), Diarrhoea and vomiting - if completely resolved, Eczema, Enlarged prostate - benign only, Essential tremor, Glaucoma, Gout, Haemorrhoids, Hay fever, Ligament or tendon injury - provided you are not currently being treated, Macular degeneration, Menopause, Migraine - provided there are no on-going investigations, Nasal polyps, PMT, RSI, Sinusitis - provided there is no on-going treatment, Skin or wound infections that have completely resolved with no current treatment, Tinnitus, Underactive Thyroid (Hypothyroidism), Urticaria, Varicose veins in the legs.

Important information

If you have a medical condition in addition to any of the automatically covered medical conditions, all conditions will be excluded from cover unless declared to the medical screening helpline.

What is classed as a medical condition?

a Any respiratory condition (relating to the lungs or breathing), heart condition, stroke, Crohn’s disease, epilepsy, allergy, or cancer for which you have ever received treatment (including surgery, tests or investigations by your doctor or a consultant/ specialist or prescribed medication).

b Any psychiatric or psychological condition (including anxiety, stress and depression) for which you have suffered which you have received medical advice or treatment or been prescribed medication for in the last five years.

c Any medical condition for which you have received surgery, in-patient treatment or investigations in a hospital or clinic within the last 12 months, or for which you are prescribed medication.

Any premium for medical screening quoted can be paid directly. This can be done either before or after taking out a policy with us. The policy and medical extension connect automatically, no reference numbers need to be exchanged.

Choosing not to declare a medical condition will not invalidate cover, but any costs incurred in relation to an undeclared condition will not be covered.

If making a declaration all medical conditions must be declared, you can't choose to only declare certain conditions.

Medical conditions can only be declared for up to 12 months at a time. A second declaration will have to be made after 12 months if necessary.

You are about to leave the site, this text will be refined later.

- K2 Base Camp Trek

- Snow Lake Hispar La Trek

- Spantik Expedition

Discover the Hunza Valley

- Hunza Valley Express

- Hunza Valley Yoga and Hiking

- Island Peak Climbing Expedition

- Horse Trekking in Mongolia Expedition

- Trekking in the Fann Mountains

- Discover the Celestial Mountains

- Svaneti Trekking in Georgia

- Volcanoes of Kamchatka

- Lost World of Europe

- Madeira Day Hikes

- Featured trip!

- New 2024 Expedition in Mongolia

- Trip Calendar

- Our Mission Statement

- Why Choose Us

- Collaborations

- Client Testimonials

- Meet the Team

- K2 Gondogoro La Trek: What you need to know

- 10 Reasons Why the K2 Base Camp Trek Should Be On Your Bucket List

- Everest Base Camp vs K2 Base Camp: Which is better?

- How to Prepare for the K2 Base Camp Trek

- K2 Base Camp Trek Packing List

- K2 Base Camp Height: How to Manage the Altitude

- The Glaciers of Pakistan – An Overview

- Hunza Valley Culture: People Born in the Mountains

- All About Food in Pakistan

- A Poetic Narrative of our Journey Along the Snow Lake Trek in Pakistan

- How to Start Mountaineering: A Beginner’s Guide

- Hiking in Asian Patagonia: Kyrgyzstan’s Paradise Lost

- 10 Fascinating Kyrgyzstan Facts: Lenin Peak to Alcoholic Horse Milk

- Can Americans Visit Iran? A Complete Guide

- Fann Mountains Trekking in Tajikistan: 6 Things You Did Not Know

- Madeira Island: Epic’s First European Expedition!

- Travel to Iran: Photo Diaries of our Epic Journey

- Kyrgyzstan: The Celestial Mountains in Photos

- Snow Lake Trek 2022: Across the World’s Longest Glaciers

Join us for the K2 Base Camp Trek this summer! Only a few spots left…

Best Trekking Travel Insurance: Ultimate Guide

If you are planning to do a big trek or climb, probably on of the first questions you should be asking yourself is what kind of trekking travel insurance should I get?

Trekking or climbing comes with inherent risks and in the event of injury, the potential cost of medical treatment in a foreign country is massive. The point being, you want to have insurance that will leave you feeling fully covered before you depart on your next big adventure.

Finding the best trekking travel insurance is not easy though. Once you start reading the fine print of many common travel insurance providers, you will immediately notice that high-altitude trekking or climbing is not covered or prompts some question marks about what is covered and what is not.

Well, we have taken the hard work and guessing game out of the equation by providing you with honest advice and tips for selecting the best trekking travel insurance that best suits your needs. Let’s jump right in…

Why Choose Trekking Travel Insurance?

Engaging in high-risk activities like trekking and mountaineering means that at some point during a lifetime of big adventures, there will come a point when an injury occurs and you will need to be protected from the exorbitant costs that come with emergency medical attention and helicopter evacuations.

For perspective, getting a helicopter in Pakistan can cost as much as $25,000. The treatment of a broken bone can cost thousands too, especially if you need emergency surgery.

Whether you are looking for Everest Base Camp insurance or insurance for trekking up to 6000m – one thing is for sure, you must have adequate trekking travel insurance.

Best Trekking Insurance Quick Answer: Global Rescue

If you want to just get straight to the point without having to scroll any further, we understand. Our staff’s top pick for the best trekking insurance: Global Rescue

The Overall Best Trekking Travel Insurance: Global Rescue

Being someone who has organized trekking and adventure trips around the world for the last seven years, I can tell you that I have not found a better travel insurance option for trekking activities than Global Rescue.

These guys specialize in helicopter rescue and extraction as well, and in most situations, you can count on them to come through for you with a helicopter evaluation when you need it most.

There are two different products that Global Rescue offers and you should understand the difference between both.

Global Rescue Membership : Cover is provided for emergency helicopter evacuations pretty much anywhere in the world. GR pioneered worldwide field rescue for their members in remote or dangerous countries. They literally have deployable teams standing by to rescue their clients in case of a remote illness or injury for any serious medical emergency. It is worth noting that the GR membership only includes the helicopter or emergency evacuation and it not medical insurance.

Here is what is covered with a Global Rescue Membership:

- Global Rescue emergency staff operators on call 24 hours a day, seven days a week.

- No limit on altitude. Even if you are planning on climbing Mount Everest, you will be covered.

- Fast Deployment: If you are injured, the last thing you want to do is need to haggle with insurance companies or to have delays with your helicopter coming.

- Destination reports: for 215 countries and principalities worldwide including entry requirements, COVID-19 travel status and restrictions, detailed health and security assessments and required immunizations.

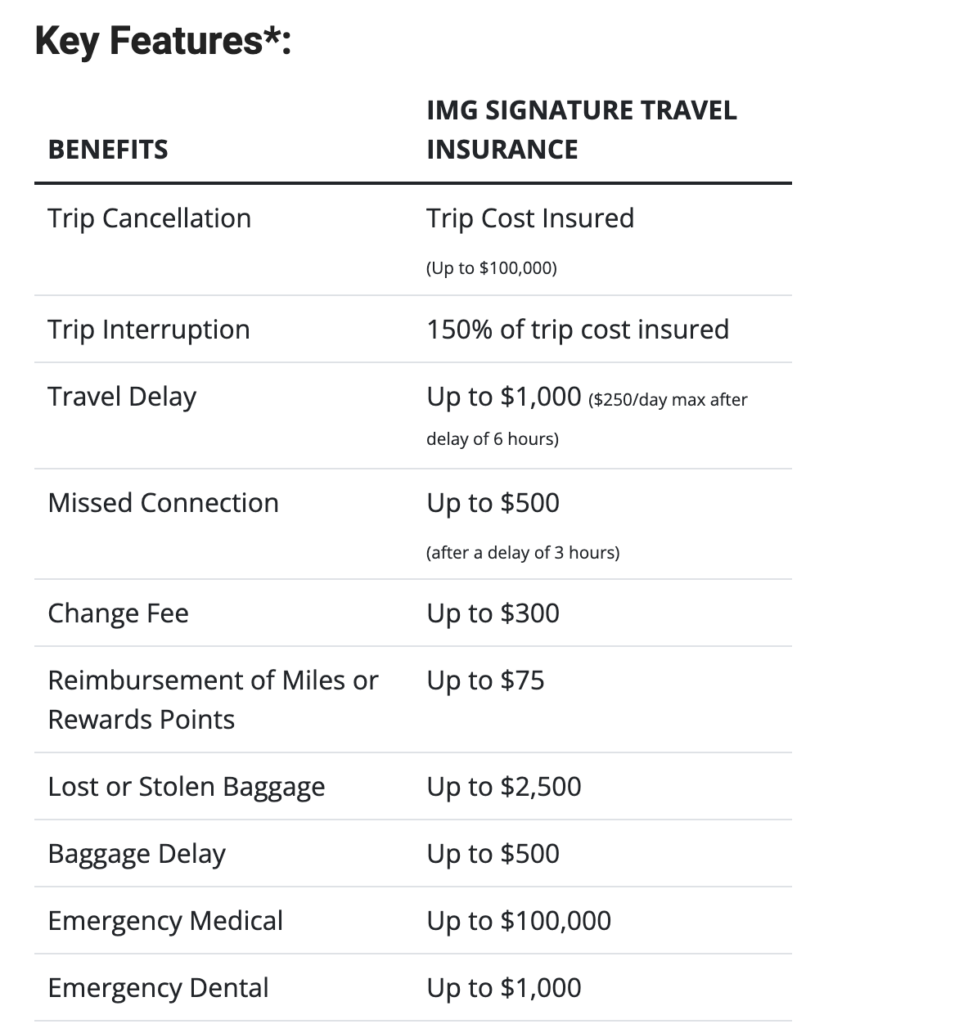

Global Rescue IMG Signature Travel Insurance : This is the medical insurance part of what Global Rescue offers. The travel insurance is essentially an add-on to the Global Rescue membership outlined above, though it is also possible to get the insurance without having a membership too.

The best part about the Global Rescue travel insurance is that there are no exclusions for trekking-based activities or being at high altitudes; a common exclusion for other travel insurance companies.

The policy also covers things like lost or stolen baggage, search and rescue operations costs, and rental car damage.

The main downside we can find for Global Rescue is that it is expensive – but like most things in life, you get what you pay for and that certainly rings true when it comes to the best trekking travel insurance.

If you are going to climb a mountain higher than 6000m – like Island Peak in Nepal as an example – then this is the right insurance for you.

Here are some of the key features of the Global Rescue IMG Signature Travel Insurance: