- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Traveling Internationally? Order Foreign Currency Before You Go

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Upon landing in a foreign country, expect a lot of lines. There’s immigration, passport control and customs inspection. But there’s one line you can — and absolutely should — skip: the airport currency exchange.

Not only does the airport currency exchange counter’s line cut into precious time abroad, but it’s typically a terrible money move. Airport currency exchange rates are among the worst you’ll find.

It’s not uncommon to see airport exchanges charging 14% more than the current International Monetary Fund (IMF) exchange rate. NerdWallet even found some premiums exceeding 17%. Some also charge additional fees on top of the poor exchange rate.

So what do you do if you need cash upon arrival to order a cab or tip the bellhop? Consider ordering foreign currency before you fly.

Most banks allow you to order foreign currencies, which you can typically pick up at a local branch before your trip. Some banks offer to ship currencies to you, and sometimes they don’t even charge extra for postage if you order a certain amount.

Plus, the exchange rate are usually quite good. For instance, at Bank of America, the exchange rates we checked in January 2024 average roughly 6% more than the IMF rates — and less than half of what the airport currency exchanges are charging.

Just check your own bank's exchange rate to ensure it's optimal before initiating the transaction.

» Learn more: The best travel credit cards right now

How to order foreign currency from your bank

While the exact process varies by bank, most major banks make it easy to order online.

Typically you can access the currency exchange webpage through your bank’s website or mobile app, or by phone. From there, you usually enter the currency you need, add the desired amount, select the pickup method and place your order.

While you can generally expect a solid exchange rate, use a trusted source such as Reuters or the International Monetary Fund to find current exchange rates and ensure you get a fair deal.

Additionally, understand all the fees involved. For example, Citi charges a $5 service fee for transactions under $1,000, though it’s waived for clients with premium bank accounts .

Or you might get charged a shipping fee. Bank of America’s standard shipping costs $7.50, but overnight shipping is $20. Sometimes you can avoid shipping fees by opting to pick up the cash at a local branch or by being a loyal customer. Bank of America Preferred Rewards program members get free standard shipping.

There’s also generally a minimum amount of foreign currency you can order ($100 or $200 is common) and a maximum ($10,000 within a 30-day period is common).

Other good ways to pay abroad

If it’s too late to order foreign currency from your bank, here are other ways to curtail currency fees :

Find an in-network ATM abroad

Major banks usually have branches abroad or partner with other banks to create a network. Using those ATMs often provides a decent exchange rate while eliminating out-of-network ATM fees.

If you end up using a non-network ATM, pay attention to ATM fees , which vary but usually run about $5 per transaction. Given that, consider limiting ATM debit transactions by withdrawing the amount you think you’ll need for the entire trip, or at least a large portion of it.

ATM availability is more common in some places than others. Macau has the highest number of ATMs per capita with 316 ATMs per 100,000 adults, based on 2021 data from the World Bank Group. Uruguay, Canada and Austria are other destinations with the most ATMs per capita.

But other countries tend to have far fewer. For example, Kenya had fewer than 7 ATMs per 100,000 adults and Nepal had only 20 ATMs per 100,000 adults, according to the same data.

Pay with a credit card that doesn’t charge foreign transaction fees

Depending on the card, you might get dinged with foreign transaction fees of 1%-3% when you make purchases at non-U.S. retailers abroad.

That’s why it’s wise to carry a no-foreign-transaction-fee credit card abroad.

on Chase's website

Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠. .

Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel. .

Earn a one-time $200 cash bonus after you spend $500 on purchases within the first 3 months from account opening. .

» Learn more: The best no-foreign-transaction-fee cards

And more international merchants are taking plastic. This wider card acceptance and increased security are reasons travelers are ditching cash, according to the Visa Global Travel Intentions Study 2023, which polled more than 15,000 people in the Asian Pacific region between April and June 2023.

While this type of card won’t help you pay at cash-only businesses or get money for tips, it’s otherwise one of the smartest ways to pay internationally.

» Frequent travelers: Consider a multicurrency account

Try paying in cash dollars

If all else fails, offer to pay in U.S. dollars. In fact, some merchants or individuals accepting tips prefer it in certain countries. You might find vendors willing to give you an even better deal if you pay with U.S. dollars.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

On a similar note...

- Money Transfer

- Rate Alerts

Xe offers an assortment of Travel Tools for your next trip! Whether it’s a currency app on your mobile phone, or Travel Reviews to help you pick your destination, Xe Travel is the perfect resource for you.

Travel Tools

Currency email.

Subscribe to free daily email updates with currency rates for the top 170 currencies. The Xe Currency email also includes news headlines, and central bank interest rates.

Xe Currency Encyclopedia

Read currency profiles with live rates, breaking forex news, and other facts for every world currency. You can also learn about services available for each currency.

Free Currency Charts

Create a chart for any currency pair in the world to see their currency history. These currency charts use live mid-market rates, are easy to use, and are very reliable.

Download the App

Keep track of live mid-market rates for every world currency on your Smartphone. That’s 170+ currencies that you can convert on the go!

Travel Blog Posts

What’s the Best Way to Exchange Your Currency for a Trip Abroad?

Got an international trip coming up? Need to make a currency exchange? Let us talk you through your options.

How to save money on your next European trip

The currency you choose to use will impact the cost of your trip in several ways. By knowing the Euro to Dollar conversion exchange rate, you can save yourself a lot of money on your European getaway.

Your Checklist for International Travel During COVID-19

Do you need to travel overseas soon? Here’s what you’ll need to know before (and during) your time abroad.

Destination Wedding Planning: How to Plan, Execute, and Stay on Budget

It’s no surprise that couples increasingly choose to avoid the high costs of a UK wedding by heading overseas, where costs tend to be more affordable.

Best Travel Money Exchange Rates

This guide explains the cheapest and most expensive ways to buy travel money. It can help save you money if you are thinking about going abroad and trying to work out the best way to spend while you’re there.

Commission charges when you buy foreign currency have mostly been phased out. Now most currency operators make money on the difference between the interbank exchange rate and the rate they actually give you.

So the best way to know if you’re getting a good deal is to compare the actual exchange rate you’re getting.

For each of the currency exchange locations below we have used the euro as an example – but where you see a location giving a bad rate (versus the benchmark interbank rate) for euros, you can be pretty much guaranteed you’ll get a bad rate on any other currency at that place too.

Here are the ways to get the most for your money when buying foreign currency, ranked best to worse.

(All exchange rate figures accessed on 31 May 2023.)

1. Currency cards – BEST RATE

Currency cards are debit card-style payment cards designed to be used while you are on holiday or travelling outside the UK to pay for goods and services, usually anywhere you see the Visa or Mastercard symbol. They either come as regular debit cards with travel money functions, or as a separate card that connects to your current account.

Currency cards offer some of the best exchange rates around, and are available from, for example, Starling, Monzo, Revolut , and Curresea.

The euro rates for Monzo and Starling are based on the Mastercard rate so are the same:

- £1 = €1.152 (vs €1.16 inter bank rate)

- On the (free) Curresea Essential plan the euro rate is:

- £1 = €1.152

- On the (paid for) Curresea Elite and Premium Plans the euro rate is:

- £1 = €1.163

- Ease : Currency cards are easy to apply for and usually arrive within a few days. If your bank already offers a travel card service as part of your account you may not even need to apply for a new card. Plus you don’t need to worry about changing up loads of cash before you go away.

- Safety : If you lose cash, it’s usually gone forever. If you lose your currency card you can cancel or freeze it in the app that comes with it to prevent anyone else using your holiday money.

- Virtual wallet: You can add most currency travel cards to your phone’s virtual wallet, so you can still pay if you only have your phone with you.

- Charges : Fees and charges to use your currency card abroad can vary significantly so it’s a good idea to compare different providers before you choose which one to go with. Be aware the card provider – typically either Visa or Mastercard – can add its own fees of 1% to 3% on top of transactions.

- ATM limits : Some card providers limit how much you can withdraw from an ATM in another currency, after which point more charges will kick in.

- No section 75 protection : Debit card payments and purchases are not covered by section 75 of the Consumer Credit Act. But you might be able to make a claim for a refund under a voluntary scheme called ‘chargeback’.

2. Cash point abroad

Withdrawing cash from an ATM abroad can be a good option if you use one of the cards mentioned above, or a travel credit card. They are designed for use while travelling, so give the best rates on foreign exchange, and limit the fees and charges you pay while using them abroad. It is for this reason that cash point abroad is 2nd on this list.

Currensea , for example, as well as offering one of the best exchange rates, allows free ATM withdrawals of up to £500 using its Essential Card (2% fees over), and with its Premium Card (which costs £25 a year) you can make fee free ATM withdrawals up to £500 (1% over).

Just remember – if the ATM tells you a fee applies, always choose to be charged in the local currency of the country you’re in (this also applies to card purchases).

However beware – this is important – if you just take your normal debit card or credit card abroad you can expect high fees from both your bank and the ATM you withdraw cash from every time you use it.

For example, Barclays charges a 2.99% fee for using your standard debit card abroad when making purchases, withdrawing cash or for refunds.

So while you get a pretty decent exchange rate with Barclays (which uses the Visa rate), once the fee is added the real rate is much less. It works out as:

- Visa rate: £1 = €1.161 (vs €1.16 inter bank rate) before charges

- Barclays debit rate after 2.99% fee added £1 = €1.128

- Cheap if you use the right cards: Taking money out at an ATM abroad can be one of the cheapest ways to access cash if you use a card designed for travel that has fee-free options and a good exchange rate (see out Best Rated above).

- Don’t have to carry so much cash : Carrying huge wads of cash is a theft risk. Carrying a couple of cards (one for use and one for back up) is much safer.

- High costs if you use the wrong card : Avoid taking your regular debit or credit card abroad as to use it you will have to pay high fees.

3. Highstreet in the UK

UK highstreets offer a number of exchange rate options, from inside department stores like John Lewis, to specialist foreign exchange rate shops like No1 Currency. The rates will vary from place to place.

At No1 Currency, for example, the online rates are below, although the website says the in store rates may differ from what is advertised.

- £1 = €1.136 (vs €1.16 inter bank rate)

- £100 = €113.67

At John Lewis, on the same day the rate was a little lower.

- £1 = €1.133 (vs €1.16 inter bank rate)

- £100 = €113.38

At Marks & Spencer, the rate was:

- Click & Collect: £1 = €1.138 (vs €1.16 inter bank rate)

- £100 = €113.80

- In-store bureau de change: £1 = €1.119

- £100 = €111.90

At a TUI branch the rate was:

- £1 = €1.139 (vs €1.16 inter bank rate)

- £100 = €113.90

- Click and collect rates : No1 Currency for example gives you a better rate if you order online then pick up in store, rather than have your currency delivered.

- Perks: For example at John Lewis you can earn points when you pay for currency with your Partnership Credit Card.

- Delivery charges : No1 Currency only offers free delivery for orders of £800 or more. At John Lewis the minimum for free home delivery is over £500.

- Minimum orders online: John Lewis, for example, has a £250 minimum for online orders.

4. Online with a supermarket

Most supermarkets sell travel money these days and it can be a convenient way to pick up some currency while you do your weekly shop. You can buy on the day or order online to collect.

As an added bonus, supermarkets offer a better rate on foreign currency for their loyalty card holders, pushing supermarkets up the ranking in terms of rates.

- Standard rate: £1 = €1.130 (vs €1.16 interbank rate)

- £100 = €113

- Tesco Clubcard rate: €1.135

- £100 = €113.50

Sainsbury’s

- £1 = €1.131 (vs €1.16 interbank rate)

- £100 = €113.17

- Sainsbury’s Nectar card rate: €1.1340

- £100 = €113.40

- Loyalty perks and points : Loyalty card holders get better exchange rates, plus you can earn loyalty points when you pay for the currency just like any other purchase.

- Convenience : Order online then pick up when you do your weekly shop.

- Minimum order amounts: For example Tesco has a minimum order amount of £400 worth of currency when you buy online, and a minimum of £500 to have a free home delivery. There is no minimum order amount for Sainsbury’s but a £4.99 fee to have currency bought online delivered at home.

5. Post office

The Post Office is a handy one-stop-shop for lots of holiday related things, from travel insurance to international driving permits, and including travel money. While the Post Office doesn’t offer the best rates on the market, it does have several other advantages that could make it a good option, especially if you are in a hurry.

- £1 = €1.116 (vs €1.16 inter bank rate)

- £100 = €111

- Rate increases : Order online for the best rates on every currency. The more you buy, the better the rate.

- Fast pick up service : You can pick up euros and US dollars from your nearest branch in as little as 2 hours, from selected branches. Order by 2pm (1pm Saturday) to collect the same day, from 2 hours later. Order after 2pm (1pm Saturday) to collect the next working day, from 11am. Or you can choose delivery to your home.

- Refund policy : Will refund 100% of the holiday money you bought if your trip abroad is cancelled

- Queuing : With a number of Post Offices closing, and banks shutting branches that force Post Offices to do more services with less, queues to get you travel money in person can be long.

- Limited currencies: Post Office in my experience don’t carry that much currency and only in a few of the most common types. Beware buying last minute – if you try to just pop in on the day to buy your currency without pre-ordering you may find they have run out, or don’t stock it.

- Buying limits : The minimum you can buy online of a currency is £400 worth, and the maximum is £2,500.

6. At the airport

The only times I have bought currency at the airport it has been out of desperation and from a lack of forward planning – and I have always regretted it. It is typically one of the most expensive (i.e. worst exchange rate) places to buy foreign currency.

But if you’re in a panic because you forgot to get out any cash before your trip, it is at least convenient to be able to grab some foreign currency before your flight.

Two of the most common foreign exchange kiosks you’ll find at UK and global airports are Travelex and Eurochange. The rates below are for their online services – rates in the airport are likely to be worse.

Travelex (online)

- £1 = €1.130 (vs €1.16 inter bank rate)

Eurochange (online)

- £1 = €1.131 (vs €1.16 inter bank rate)

- £100 = €113.10

- Location : If in the rush to get away you forgot to pick up any currency, airport foreign exchange kiosks offer a last minute lifeline.

- Availability of currencies: Because of their location, currency kiosks in international airports tend to be well stocked in multiple currencies, even the less common ones.

- Switching currency : If you are visiting multiple countries on a trip but don’t want to carry large amounts of currency, changing up just what you need at each airport you pass through is an option.

- Expense : You will never get the best foreign exchange rate at an airport.

- Lack of comparison : Even if there is more than one currency store at the airport, they all tend to offer the same rates. Once you’re there you have no other options, you have to take what you can get.

7. Online with a bank

Buying travel money from your local bank might seem like the obvious choice, but surprisingly the rates on offer are likely among the worst you’ll get anywhere in the UK. However the limits on how much you can purchase can be higher (though you won’t get a better rate the more you buy so why bother?)

- £1 = €1.105 (vs €1.16 inter bank rate)

- £100 = €110.51

- £1 = €1.106 (vs €1.16 inter bank rate)

- £100 = €110.67

- High purchase limits : At Barclays, for example, you can order up to £5,000 per person within a 90-day period, and a maximum of £2,500 from that amount can be sent for home delivery to a single residential address.

- Fee free deliveries : HSBC, for example, offers fee-free deliveries on your travel money to HSBC Full and Cash Service branches or to your home. Other banks may charge.

- Limited to customers : You may find you have to be a customer. For example, you’ll need a Barclays debit card or Barclaycard to place your order for currency online there.

- Expensive : Among the worst rates for currency exchange you’ll find anywhere in the UK.

8. Bureau de change abroad – WORST RATE

Bureau de changes abroad are typically in tourist hotspots. And what do we know about tourist hotspots? Rife for pickpockets and overinflated prices. This is the attitude you should take to foreign currency shops in these locations.

One example that proves the ‘expensive option’ point is Ria Money Transfer & Currency Exchange, situated in the busy Plaza de Callao in central Madrid, Spain.

Ria’s exchange rate on 31 May 2023 was:

- £1.00 = €0.99 (vs €1.16 inter bank rate)

Convenient : If you really need cash while you’re abroad, maybe because you’re in a place where your cards are not widely accepted, a local bureau de change may be a lifeline – just expect to pay heavily for that life raft.

- Cost, cost, cost: Buying foreign currency from a currency shop or kiosk in a tourist hotspot (where you are most likely to find them) is an extremely expensive way of getting your hands on cash. Avoid if at all possible.

- Theft risk : Pickpockets may hang around bureau de change just like they hang around ATMs, because they know you have just withdrawn what is probably a large amount of money. Secure your cash hidden away before you leave the kiosk.

Is it still worth getting travel cash ahead of your holidays?

Yes. Absolutely. Cards aren’t accepted everywhere, as I found to my detriment when I arrived in Buenos Aires and tried to take out local currency on my credit card at the foreign exchange desk at the airport.

“Absolutely not possible”, I was told. A combination of a lack of provision to buy currency on credit card there, and the Argentinian peso being just too volatile for credit card providers to let you buy it on their service.

All I had in hard currency was US$100 in Argetininian pesos I had changed in the airport at Rio De Janeiro, Brazil, where I had just come from, and a US$100 bill. Luckily I’d pre-paid my Buenos Aires hotel in advance, and I could easily find restaurants that would accept my credit card. But taxis only took cash, so I spent a lot of time walking – thinking about how I should have brought more pesos with me.

We’ve answered some of the most commonly asked questions when it comes to travel money.

Yes, in most cases. Cash withdrawal fees will probably apply of around 3%, just like they would at home for taking cash out on a credit card, and these will be on top of any currency conversion fees.

Be aware though – in countries with a highly fluctuating exchange rate, like Argentina, you may not be able to buy foreign cash with your credit card (not even at the bureau de change at the airport, for example). You still may be able to pay for goods and services with your credit cards, but check how widely they are accepted before you travel.

Yes, on the whole. When buying travel money online, like with buying anything online, you’re best off sticking to well known brands, whether that be banks, supermarkets, or currency exchange stores.

A large institution or well known brand is less likely to go bust, and that is important because foreign exchange is not a regulated service. This means your cash is not protected if the company you tried to get your foreign currency from closes suddenly.

Yes. Most places that sell you travel money will buy it back from you. But just like when you’re swapping your pounds for foreign currency, when you swap it back you should compare the exchange rates on offer. As a general rule, a location that offers a good rate one way, offers a good rate the other way.

Travel money providers – from the currency shops and bureau de change, to the banks and supermarkets, anywhere basically that sells currency – make money by giving you slightly less than the central banks give them for the foreign money you want to buy.

For example, if a currency provider tells you they will give you €1.131 for every pound you give them, but the central bank rate for euros is €1.157 per pound, the difference is €0.026, which they pocket. This may not sound much, but multiplied over millions of transactions a year, it adds up.

Compare, compare, compare the single unit price – which means the £1 for a €1 rate, or whichever currency you choose, versus the interbank rate, which you can get by just Googling “1 GBP in EUR”.

Places that sell currency, online or in a shop, have to show you the exchange rate for that day. While it’s probably not practical to go traipsing around comparing shops, it’s easy enough to do so online. If you run up against minimum purchase amounts online, still go with the company providing the best rate but visit their location in person.

Also try not to get yourself in a position where you’re desperate to buy foreign currency, either at home or abroad. This means having enough cash on you in remote locations, and tourist hotspots, and before you travel (to avoid the airport currency shops).

Laura Miller has been a financial journalist for more than 10 years, and was on staff at the Telegraph before going freelance in 2019. Her experience includes hosting podcasts and panels, and she writes for the Times and Sunday Times, Daily Mail, Mail on Sunday and the Sun, as well as trade titles. She now lives by the sea in Aberystwyth, west Wales.

You may also be interested in:

Privacy Overview

Travel Money

- Clubcard Prices Clubcard Prices

Clubcard Prices are available for all currencies, just enter your Clubcard number on the next page. Full T&Cs below.

- Click & Collect Click & Collect

Collect for free from more than 350 Tesco stores with a Bureau de change.

- Home Delivery Home Delivery

Free delivery on orders worth £500 or more.

Exchange rates may vary during the day and will vary whether buying in store, online or via phone.

Select currency

Error: Please select if you have a Clubcard to continue

Do you have a Tesco Clubcard?

How much would you like?

Error: Please enter an amount between £75 and £2,500

Find a Store to get your Travel Money

With Click & Collect you can order your travel money online and pick it up from selected Tesco stores near you, or you can buy instantly from an in-store travel money bureau.

Enter a postcode or location

Search results

3 easy ways to purchase Travel Money

Click & collect.

- Order online and choose to collect from over 500 Tesco store locations Order online and choose to collect from over 500 Tesco store locations

- Pick a collection day that works for you Pick a collection day that works for you

- Order euro or US Dollars Order Euros or US Dollars before 2pm and you can pick-up from most stores the next day

About Click & Collect

Home delivery

- Order online by 2pm Mon-Thurs for next day delivery (excludes bank and public holidays), to most parts of the UK Order online by 2pm Mon-Thurs for next day delivery (excludes bank and public holidays), to most parts of the UK

- Free delivery for orders of £500 or more Free delivery for orders of £500 or more

- Secure delivery via Royal Mail Special Delivery Secure delivery via Royal Mail Special Delivery

About Home Delivery

Buy in-store

- Buy your foreign currency instantly in our travel money bureaux in selected Tesco stores across the UK Buy your foreign currency instantly in our travel money bureaux in selected Tesco stores across the UK

- Turn unspent travel money back into Pounds with our Buy Back service Turn unspent travel money back into Pounds with our Buy Back service

About Buy Back

Best Travel Money Provider 2023/24

Now in it’s 26th year and voted for by the public, the Personal Finance Awards celebrate the best business and products in the UK personal finance market. We’re delighted that you voted us as Best Travel Money Provider 2023/24.

Additional Information

Ordering and collection.

You can pick a collection date when you're ordering your money. Order before 2pm and you can pick up Euros and US Dollars from most Tesco Travel Money bureaux the next day. Other currencies can take up to five days. Alternatively, you can order any currency for next weekday delivery to most of the selected customer service desks.

Please make sure you collect your money within four days of your chosen date. If you don't, your order will be returned and your purchase will be refunded, minus a £10 administration charge.

Will I be charged if I cancel my order?

Collection fees

Click and collect from stores with a Bureaux de change:

- Free for all orders

For non-bureaux stores with a click and collect function:

- £2.50 for orders of £100.00 - £499.99

- Free for orders of £500 or more

What to bring

For security, travel money will need to be picked up by the person who placed the order.

- a valid photo ID – either a passport, EU ID card, or full UK driving license (we do not accept provisional driving licenses)

- your order reference number

- the card you used to place the order (you’ll also need to know the card’s PIN)

Home Delivery

We can send your travel money directly to you via secure Royal Mail Special Delivery. You can even pick the delivery date that suits you best.

We also offer next-day home delivery on all currencies to most parts of the UK if ordered before 2pm Monday-Thursday.

Check the Royal Mail site to find out if your postcode is eligible for next day delivery

Delivery costs

£4.99 for orders of £100 - £499.99 Free for orders of £500 or more

- You’ll need to make sure there’s someone at home to sign for your delivery.

- Bank holidays and public holidays will affect delivery times.

- We are unable to cancel or amend home delivery orders after they have been placed.

Clubcard Prices

Clubcard Prices are available on the sell rate only for currencies in stock online, on your date of purchase. The Clubcard Price will be better than the standard rate advertised online on the date of purchase. When purchasing online you must enter a valid Clubcard number to obtain the Clubcard Price rate. Exchange rates may vary whether buying in store, online or by phone.

Clubcard Prices apply to foreign currency notes in stock on your date of online purchase. Due to constant market and currency fluctuations, rates on the date of purchase cannot be compared to another day’s rates. The actual rate you receive may vary depending on market fluctuations. Clubcard data is captured by Travelex on behalf of Tesco Bank.

Check out the Tesco Bank privacy policy to find out more.

Buying foreign currency using a credit or debit card

No matter how you purchase your travel money, whether it be in store, online or over the phone, you will not be charged any card handling fee by us. However, regardless of your card type, your card provider may apply fees, e.g. cash advance fees or other fees, so please check with them before you purchase your travel money.

Click & Collect cancellations

You can cancel a Click & Collect order any time prior to collection. We'll refund you with the full Sterling amount that you paid for your order, unless you cancel less than 24 hours before your collection date, in which case we'll charge a £10 late cancellation fee.

We are unable to refund any fees charged by your card issuer, so please contact them if you have any further queries.

When you get home, we'll buy your travel money back

Let us turn your unspent holiday money into Pounds. It couldn't be simpler.

Just pop into one of our in-store Travel Money Bureaux when you get home. We buy back all the currencies we sell in most banknote values and also the Multi-currency Cash Passport™. Buy back rates may vary during the day.

It doesn't matter where you bought your travel money, even if it wasn't from a Tesco Travel Money Bureau, we'll still buy it back.

More about currency buy back

How our Price Match works

If you find a better exchange rate advertised by another provider within three miles of your chosen Tesco Travel Money Bureau, on the same day, we'll match it.

Price Match only applies in store on a like-for-like basis on sell transactions and does not apply to any exchange rate advertised online or by phone. This is not available in conjunction with any other offer. We reserve the right to verify the rate you have found and the three mile distance (using an appropriate route planning tool).

See full terms and conditions below.

Tesco Travel Money is provided by Travelex

Tesco Travel Money ordered in store is provided by Travelex Agency Services Limited. Registered No. 04621879. Tesco Travel Money ordered online or by telephone is provided by Travelex Currency Services Limited. Registered No. 03797356. Registered Office for both companies: Worldwide House, Thorpewood, Peterborough, PE3 6SB.

Multi-currency Cash Passport is issued by PrePay Technologies Limited pursuant to license by Mastercard® International. PrePay Technologies Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 (FRN: 900010) for the issuing of electronic money and payment instruments. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

How much travel money will I need?

Whether it’s a burger in Brisbane or a taxi in Toronto, get a feel for how far your travel money might go with our foreign currency guides. We’ll help you manage your travel budget like a pro.

Helping you make the most out of your money

Searching Money Mentor . . .

The best and cheapest travel money providers.

Updated March 12, 2024

In this guide

If you’re going abroad, it’s never a bad idea to carry some of the local currency. Since it’s normally cheaper to organise your cash before you jet off, we list some of the best and cheapest providers around.

If you’re holidaying overseas to catch some sun or you’re on an urgent business trip abroad, there are a variety of ways to spend your money. One of these is to exchange your cash for foreign currency to provide a great alternative to card payments.

But making sure your wallet is topped up with the right notes is different to choosing the right credit card. In this article we explain:

What is the best option for travel money?

Is a prepaid card better than cash, how to get the best deals on a currency exchange.

Read more: How do exchange rates work?

While you’ll be able to make all your purchases on a card in many countries, it’s never a bad idea to have a backup spending option. It’s always useful to have cash. You might you lose your card or it could be declined and some places just do not have the facilities to accept cards.

However, if cash is stolen or lost to a scam there aren’t any protection schemes in place. A travel credit card, meanwhile, does offer some level of protection through Section 75 of the Consumer Credit Act.

Our guide explains this law in more detail , but in essence it says that your credit card provider is jointly responsible if the goods you purchase are faulty or if you don’t receive a promised service. The protection only kicks in on spending between £100 and £30,000.

Read more: Consumer rights UK: what you need to know

Instead of a travel credit card, you could choose to keep your spending on a prepaid card. Some people prefer the latter option because it’s easier to manage their cash. Once the money is spent there’s no risk of running into debt.

It’s important to remember that prepaid travel cards aren’t covered by the Financial Services Compensation Scheme, which means that if your provider goes bust you can’t claim compensation for your losses.

Still, these cards must adhere to some regulation. The Financial Conduct Authority requires your e-money institution to ringfence this money within a regulated bank so that it can’t be lent out.

If you do want this protection, then consider another card such as Chase* which enables fee-free spending abroad. Our guide explains and lists other alternatives.

But when compared to cash, prepaid cards typically offer better rates – meaning you’ll get more for your money. Some people may wish to keep the bulk of their money on a prepaid card and have some cash on hand for emergencies.

If you’re planning to take some foreign currency with you on holiday, you can order your travel money online or via a high-street lender.

To help you figure out who to use, we list some of the best and cheapest providers below:

Post Office

M&S Bank

It’s almost always best to avoid using the bureau de change in the airport. By the time you get to the terminal, these providers know your options are limited and use this as a reason to increase their prices.

Last year Eurochange, a currency broker, released a survey which explored the difference in cost. It found that someone buying £1,000 worth of euros at three of the UK’s largest airports spends about £176 more than if they were to buy their currency through one of their high-street branches.

“These figures are striking and show how crucial it is for travellers to plan ahead when it comes to travel money,” said Charles Stewart, managing director at Eurochange.

As listed above, there are several other providers matching or bettering Eurochange’s exchange rates, so it pays to shop around for the best deals.

When comparing your options, also consider checking your local supermarket for travel money offers and see if you can use your loyalty card to your advantage. Examples of loyalty schemes include Tesco’s Clubcard or Sainsbury’s Nectar card memberships, which sometimes can be used to gain better rates from their respective banks.

Read more: Tesco, Asda, Lidl and Sainsbury’s loyalty cards compared

Sign up to our newsletter

Your information will be used in accordance with our Privacy Policy.

You’re now subscribed to our newsletter, you’ll receive the first one within the next week.

How long does it take to receive my money.

This depends on a variety of factors such as your provider, the demand of the currency, and how you’ll have it delivered. Some providers allow you to collect your order within 60 seconds, while others will deliver it to your door within three to five working days.

Will the money be delivered to me?

Travel money brokers are not the only ones who will deliver money to your home. In our listings above you can see which providers offer this service.

Can I use a credit card to buy foreign currency?

Buying foreign currency on a credit card is often considered as a cash advance, which incurs its own fees and daily interest charges. So, to keep things cheaper, it’s often recommended you buy your travel money through other means.

Will I have to pay a commission on my currency exchange?

Some brokers charge a commission to buy foreign currency. This usually works out as a percentage of your purchase. For example, one broker charges 0.7% commission on its foreign exchanges. If you bought £1,000 worth of euros this works out to a £7 fee.

Important information

Some of the products promoted are from our affiliate partners from whom we receive compensation. While we aim to feature some of the best products available, we cannot review every product on the market.

The best and cheapest ways to send money abroad from the UK

Whether it be family in another country or buying property abroad, there are many reasons you may wish to send money overseas. We list the best and cheapest international money transfer providers on the market. According to the World Bank, sending $200 (or about £160) abroad from the UK in 2023 would cost around $11.94 […]

The best GBP to euro exchange rate today: Compare currency to British pounds

Planning your next trip abroad, tracking your UK pension or investments while living in Europe, or arranging an overseas property purchase; there are lots of reasons why you might want to keep an eye on the euro to pound (GBP) exchange rate. Many things can affect the exchange rate – the amount of euros you’ll […]

What is an exchange rate and how are currencies calculated?

From dollars, to euros, to pound sterling, if you’re travelling abroad you’ll need to exchange currencies. We explain what you need to know about foreign currency and exchange rates. While a travel card is a viable way to spend money abroad, some people still enjoy the reliability of cash. Ultimately it could come in handy […]

For the latest money tips, tricks and deals, sign up to our weekly newsletter today

Thanks for signing up

You’re now subscribed to our newsletter, you’ll receive the first one within the next week.

- Blog Full + Grid Fullwidth

- Blog Full + Grid Left Sidebar

- Blog Full + Grid Right Sidebar

- Blog Fullwidth

- Blog Grid Fullwidth

- Blog Grid Left Sidebar

- Blog Grid Right Sidebar

- Blog Left Sidebar

- Blog Right Sidebar

- Destination Fullwidth

- Destination Left Sidebar

- Destination Right Sidebar

- Home 1 – Background Image

- Home 2 – Youtube Video

- Home 3 – Google Inspired

- Home 4 – Travel Site

- Page + Video Header

- Page Fullwidth

- Page Left Sidebar

- Page Right Sidebar

- Privacy Policy

- Accordion & Toggles

- Alert Boxes

- Animated Content

- Image Frame & Animation

- Image Teasers

- Pricing Tables

- Tour 2 Columns Classic

- Tour 2 Columns Classic Left Sidebar

- Tour 2 Columns Classic Right Sidebar

- Tour 2 Columns Grid

- Tour 3 Columns + Video Header

- Tour 3 Columns Classic

- Tour 3 Columns Grid

- Tour 4 Columns Classic

- Tour 4 Columns Grid

- Tour Grid Left Sidebar

- Tour Grid Right Sidebar

- Tour List Left Sidebar

- Tour List Right Sidebar

- Unlock the Secrets of Booking Cheap Flights: Insider on the Best Deals

- Travel Money | The Best Currency Exchange Post Office – Tesco Bank Now!

- Ultimate Essential Schengen Visa: How to for UK Travellers

- Most Beautiful Places in the World to Visit

- Ultimate Guide for Applying for a Canadian Tourist Visa

Colorful Singapore

- Travel News

- Inspirations

- Family Travel

- Solo Travel

- Dollar Rate

- Travel Shop

Morrisons Travel Money: Secure & Competitive Rates

Morrisons Travel Money Exchange: Your Gateway to Secure & Competitive Rates

Morrisons, one of the UK’s leading supermarket chains, offers a currency exchange service called No 1 Currency . They provide secure and competitive rates for travellers looking to exchange their currency

Morrisons doesn’t offer its currency exchange service. However, they have partnered with Eurochange to provide currency exchange services at select Morrisons stores across the UK.

Here’s what you need to know about Morrisons’ currency exchange service:

Not available at all Morrisons stores: The service is only available at select Morrisons stores. You can check if your local Morrisons store offers currency exchange by using the Eurochange store locato r: https://www.eurochange.co.uk/travel-money Currencies offered: Eurochange offers a wide range of currencies, including euros, US dollars, Australian dollars, Canadian dollars, and more. Exchange rates: The exchange rates are set by Eurochange and are competitive with other currency exchange providers. You can check the live exchange rates on the Eurochange website

If your local Morrisons store offers currency exchange, you can simply visit the customer service desk and ask for a currency exchange form. You will need to provide your ID and the amount of money you want to exchange. Fees: There is a small fee for using the currency exchange service. The fee varies depending on the amount of money you are exchanging.

Key Takeaways:

- Morrisons offers a secure currency exchange service

- No 1 Currency provides competitive rates for travellers

- Currency can be conveniently exchanged at Morrisons stores or through online services

- Home delivery and Click-and-collect options are available

- Morrisons also offers prepaid travel money cards and international money transfers

Morrisons Currency Exchange Service: No 1 Currency

No 1 Currency is the currency exchange service available at Morrisons. They offer a range of foreign exchange services , including buying and selling over 60 different currencies. No 1 Currency is known for its convenient and high-quality service.

Whether you’re planning an overseas trip or simply need to exchange currency, Morrisons’ No. 1 Currency service can assist you. With a wide selection of available currencies, you can easily buy or sell foreign currency at competitive rates .

At No 1 Currency, customer satisfaction is a top priority. Their team of trained professionals is dedicated to providing you with a seamless and hassle-free experience. You can trust that your currency exchange needs will be met efficiently and securely .

When you choose Morrisons for your currency exchange, you can enjoy the following benefits:

- Access to over 60 different currencies

- Competitive exchange rates

- Convenient locations within Morrisons stores

- Expert guidance from friendly staff

No matter where your travels may take you, Morrisons’ No. 1 Currency service is here to help you easily obtain the foreign currency you need. Whether it’s Euros, US Dollars, or any other currency, you can rely on their trusted service.

With competitive rates and a convenient location at Morrisons stores, No 1 Currency is the trusted choice for all your currency exchange needs. Visit your nearest Morrisons store today to experience their reliable and efficient service.

Morrisons Travel Money Services

Morrisons offers a wide range of travel money services to cater to the needs of their customers. Whether you’re buying or selling currencies, Morrisons has you covered. Their convenient and reliable services include:

Buying and Selling Currencies

At Morrisons, you can easily buy and sell currencies for your travels. They offer a variety of currencies for different destinations, ensuring that you can always find what you need.

Home Delivery

Morrisons provides a hassle-free home delivery service for your currency orders . Simply place an order online and have your travel money delivered right to your doorstep, ensuring a convenient and secure transaction.

Click and Sell

For those who prefer a quicker option, Morrisons’ Click and Sell service allows you to sell your unused foreign currency online. Simply select the currency you wish to sell, follow the easy steps, and receive your payment directly into your bank account.

Click and Collect

With Morrisons’ Click and Collect service, you can conveniently reserve your currency online and pick it up at a local store at a time that suits you. This saves you time and ensures that your travel money is ready when you need it.

Prepaid Travel Money Cards

One of the convenient options available at Morrisons is their Prepaid Travel Money Card. This card allows you to load multiple currencies onto a single card, providing you with a secure and convenient way to spend money abroad. Simply top up the card and use it like a debit card at millions of locations worldwide.

When it comes to exchange rates and commission charges , Morrisons ensures that its customers enjoy competitive rates and transparent pricing. They offer exchange rates that are in line with current market rates, allowing you to get the most value for your money. Plus, Morrisons charges 0% commission for currency exchanges, saving you additional costs.

With Morrisons Travel Money Services , you can trust that your currency needs will be met with convenience, reliability, and competitive rates.

Morrisons Click and Collect Service

If you need foreign currency for your travels, Morrisons offers a convenient Click and Collect service. With just a few clicks, you can reserve your desired currencies online and pick them up at your local Morrisons store. Avoid the hassle of searching for currency exchanges or waiting in long queues – Morrisons has got you covered.

Here’s how the Morrisons Click and Collect service works:

- Visit the Morrisons Travel Money website and select the currencies you need.

- Reserve up to 4 currencies at a time.

- Choose your preferred Morrisons store for collection.

- Complete your reservation and pay for your currencies online.

- Collect your reserved currencies within 4 working days.

By using the Morrisons Click and Collect service, you have the convenience of reserving the currencies you need in advance, ensuring their availability when you visit the store. Plus, you can avoid any surprises with the exchange rate since you’ll know the rate at the time of reservation.

Quick Collection Times for Popular Currencies

For popular currencies like Euros and USD, you can enjoy even quicker collection times. In most cases, Euros and USD are available for collection within 1 working day, allowing you to get your travel money promptly and conveniently.

With Morrisons Click and Collect , you can experience a stress-free currency reservation process and a convenient collection experience. Say goodbye to last-minute currency exchanges and hello to a smoother travel planning experience.

Morrisons Home Delivery Service

Morrisons offers a convenient home delivery service for currency orders , ensuring that you can get the cash you need without leaving the comfort of your own home. Whether you’re planning a holiday or need foreign currency for any other purpose, Morrisons has got you covered.

With Morrisons’ easy-to-use online platform, you can place currency orders up to 10 days in advance. Simply choose your desired currency and the amount you require, and Morrisons will take care of the rest.

Orders are delivered using the reliable Royal Mail Special Delivery service, ensuring that your currency arrives safely and on time. Please note that there is a minimum order requirement of £100 for home delivery.

By choosing Morrisons’ home delivery service, you can avoid the hassle of going to a physical store and can have peace of mind knowing that your currency will be delivered securely to your doorstep.

“Morrisons’ home delivery service for currency orders is so convenient ! I was able to order the foreign currency I needed without leaving my house. The delivery arrived on time, and I didn’t have to worry about carrying cash while travelling. Highly recommended!” – Sarah Thompson, Morrisons Customer

Morrisons Currency Exchange at No 1 Currency Outlets

Morrisons customers have the flexibility to exchange their currency at any of the No 1 Currency outlets conveniently located within Morrisons stores. Whether you’re planning a holiday or returning from one, these outlets provide a quick and efficient way to exchange your currency .

When you visit a No 1 Currency outlet at Morrisons, you’ll benefit from competitive exchange rates and a guaranteed rate for two days. This ensures that you receive a fair and up-to-date rate when exchanging your currency.

Customers can exchange up to four different currencies per order, making it convenient for those traveling to multiple destinations or requiring various currencies .

To make a currency exchange at the No. 1 Currency outlets , you can place your order online or over the telephone. This allows you to choose the most convenient method for you.

With No 1 Currency outlets located within Morrisons stores, customers can easily access currency exchange services while conducting their regular shopping. This saves time and effort, making it a convenient solution for all your currency collection needs.

Morrisons Travel Money Card and Other Services

In addition to its currency exchange services, Morrisons offers a range of other financial services to cater to the diverse needs of its customers.

Morrisons Travel Money Card

One of the standout offerings is the Morrisons Travel Money Card . This prepaid card provides a secure and convenient way for travelers to access their funds while abroad. The card can be loaded with multiple currencies, allowing users to manage their spending without the hassle of carrying cash or dealing with foreign exchange rates.

With the Morrisons Travel Money Card , customers can enjoy the following benefits:

- Accepted worldwide: The card can be used wherever Mastercard is accepted, providing convenience and peace of mind.

- Competitive exchange rates: Morrisons offers competitive exchange rates for loading currencies onto the card.

- 24/7 card management: Customers can easily manage their card online, allowing them to check balances, view transaction history, and reload funds as needed.

- Secure and protected: The card is protected with chip and PIN technology, ensuring the safety of funds.

Whether it’s for business travel or a well-deserved holiday, the Morrisons Travel Money Card is a reliable and practical option for managing finances abroad.

Western Union Transfers

In addition to prepaid cards , Morrisons partners with Western Union to provide international money transfer services. This partnership allows customers to send money quickly and securely to friends and family around the world. With Western Union’s global network and trusted reputation, customers can have peace of mind knowing that their funds will reach their intended recipients efficiently.

Key features of Morrisons’ Western Union transfers include:

- Convenience: Money transfers can be initiated online or at a Morrisons store, making it convenient for customers to send funds at their preferred location.

- International reach: Western Union enables transfers to over 200 countries and territories, ensuring that customers can send money to virtually any destination.

- Competitive exchange rates: Morrisons offers competitive exchange rates for Western Union transfers , providing value to customers.

- Reliability: With Western Union’s extensive network and reliable service, customers can trust that their money will be delivered safely and on time.

Whether it’s sending money to loved ones or providing financial support to those in need, Morrisons’ partnership with Western Union makes international money transfers quick, convenient, and secure.

With these additional services, Morrisons ensures that customers have access to a comprehensive suite of financial solutions to meet their travel and money transfer needs.

Morrisons Travel Money

Morrisons Travel Money offers a secure and convenient currency exchange service for travelers across the United Kingdom. With their commitment to providing competitive rates, along with a range of services such as click-and-collect and home delivery, Morrisons ensures that customers can easily access the currency they need for their travels .

Whether you’re planning a holiday or a business trip, Morrisons Travel Money makes it simple to exchange your money with peace of mind. Their secure currency exchange service ensures that your funds are protected throughout the process, giving you confidence in your financial transactions.

With a wide range of available currencies, Morrisons caters to the diverse needs of different travelers. Whether you require Euros, US Dollars, or any other currency, Morrisons has you covered. You can conveniently collect your currency from their No 1 Currency outlets, reserve it for Click and Collect, or opt for home delivery, ensuring a hassle-free experience.

When it comes to travel money, trust Morrisons to provide secure currency exchange , competitive rates, and convenient services . Make your travel experience seamless with Morrisons Travel Money, your trusted partner for all your currency exchange needs.

What is Morrisons Travel Money?

Morrisons Travel Money is a currency exchange service provided by Morrisons, one of the UK’s leading supermarket chains. They offer secure and competitive rates for travelers looking to exchange their currency.

What is the No. 1 Currency?

What travel money services does morrisons offer.

Morrisons offers a variety of travel money services, including buying and selling currencies, home delivery, click and sell, click and collect, and prepaid travel money cards. They have competitive exchange rates in line with the current market rates and charge 0% commission for currency exchanges.

How does the Click and Collect service work?

The Click and Collect service allows customers to order currency online and pick it up at a local Morrisons store. Customers can reserve up to 4 currencies at a time and collect them within 4 working days. Euros and USD are generally available for collection within 1 working day.

Can I get the currency delivered to my home?

Yes, Morrisons provides a home delivery service for currency orders. Orders can be placed up to 10 days in advance and are delivered using Royal Mail Special Delivery. There is a minimum order requirement of £100, and orders over £750 qualify for free home delivery.

Can I exchange currency at any Morrisons store?

Yes, Morrisons customers can exchange their currency at any No 1 Currency outlet located in Morrisons stores. Customers can exchange up to 4 currencies per order, and the exchange rate is guaranteed for 2 days. Currency orders can be placed online or over the telephone.

What other services does Morrisons offer?

In addition to currency exchange, Morrisons offers other services such as prepaid travel money cards and Western Union international money transfers. Customers can order a Morrisons Travel Money Card, which can be loaded with multiple currencies for use abroad.

Why should I choose Morrisons for my travel money needs?

Morrisons Travel Money provides a secure and convenient currency exchange service for travelers . With competitive rates, a variety of services including Click and Collect and home delivery, and a wide range of available currencies, Morrisons is a convenient choice for all travel money needs.

You might also like

Travel Money Tesco: Secure Currency Exchange

Get Gatwick Travel Money: Best Rates & Tips

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Subscribe my Newsletter for new blog posts, tips & new photos. Let's stay updated!

Destinations

- Error: Please check if you enter Instagram username and Access Token in Theme Setting > Social Profiles

Connect to Us

5 lake of fuji san.

- Terms & Conditions

- Disclaimers

Contact Info

1-567-124-44227

184 Main Street East Perl Habour 8007

Mon - Sat 8.00 - 18.00 Sunday CLOSED

Maximise your holiday money

Compare exchange rates, find local currency bureaux and get the best deal on your foreign exchange

Travel Money

Currency buyback, currency cards, money transfers.

Whether you're looking to buy currency for an upcoming holiday, exchange leftover currency back to pounds, or send money to an account overseas; our currency comparisons can save you money by showing you the best deals available right now from the UK's biggest foreign exchange providers

Get the best exchange rate

From Argentine pesos to Vietnamese dong; get the best travel money deal by comparing the exchange rates, fees and commission from the UK's top currency brands.

Popular currency suppliers

NatWest exchange rates

Hays Travel exchange rates

Sterling exchange rates

We use cookies to improve your experience on our website. Please confirm you're happy to receive these cookies in line with our Privacy & Cookie Policy .

YOUR MONEY YOUR WAY

Travel money, hays travel foreign exchange, 4 great ways to buy your holiday money, click & collect.

Great rates & currency expertise come as standard with our Click & collect service & with no minimum spend, your holiday money is just a few clicks away.

This brings the total quotes to £000.00

£000.00 for currency

£000.00 for Buy Back Guarantee

Guarantee Peace of mind when buying your currency from Hays Travel

Save money on your unused currency with our Buyback Guarantee^

Return your unused currency for the same rate as you purchased it.

Available on all currencies sold in cash.

Available on multiple currency transactions

Available Instore & online

Terms & Conditions

Exchange Rates

Always great value and no minimum spend*

- Euro 1.1431

- US Dollar 1.2296

- Australian Dollar 1.8355

- Bulgarian Lev 2.1436

- Canadian Dollar 1.6572

- Czech Koruna 27.1071

- Danish Krone 8.2789

- Hungarian Forint 427.6141

- Icelandic Krona 160.8586

- Indonesia Rupiah 18355.3525

- Mexican Peso 19.4839

- New Zealand Dollar 2.0068

- Norwegian Krone 12.9675

- Polish Zloty 4.6809

- South African Rand 22.2886

- Sweden Krona 12.949

- Swiss Franc 1.0996

- Turkish Lira 37.0359

- Thai Baht 42.8982

- United Arab Emirates Dirham 4.2908

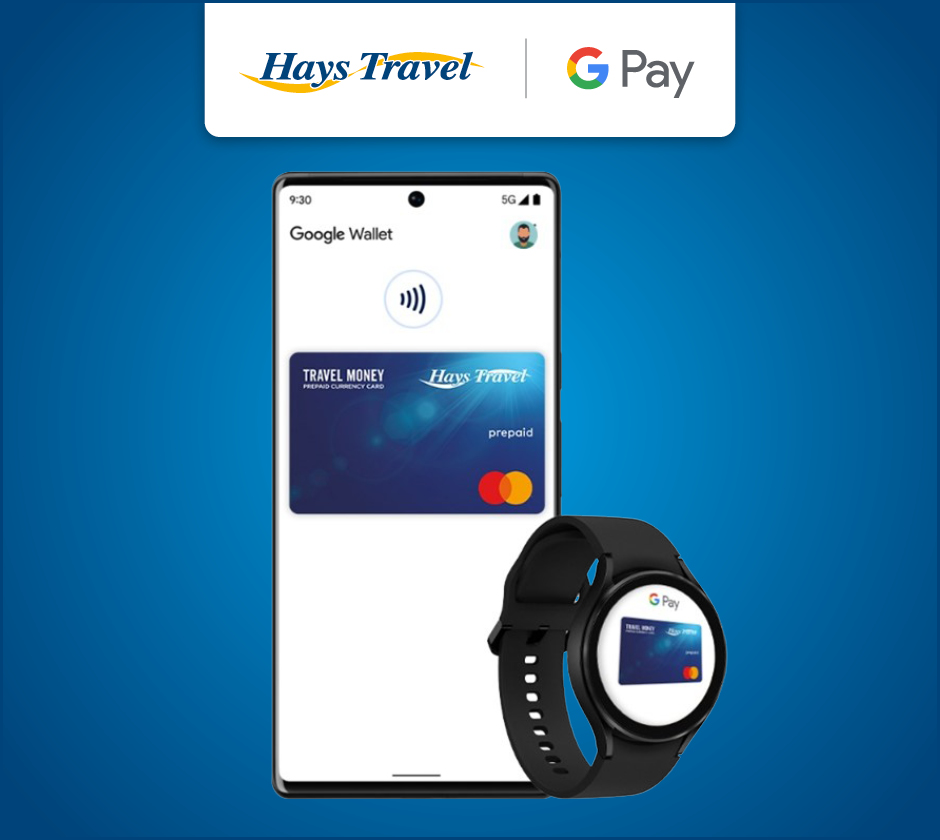

Travel Money Card

- Use anywhere Mastercard® prepaid is accepted worldwide.

- Carry less cash.

- Top up in 15 currencies including Euro, US Dollar, Australian Dollars and UAE Dirhams.

- Phone support available worldwide 24/7.

- Manage on the go via Hays Travel Currency Card App.

Connect to your google pay wallet

You can now link your Hays Travel Mastercard with Google Pay for swift and secure transactions wherever you go. Say goodbye to carrying physical cards and hello to effortless payments with just a tap of your phone. Simplify your travel experience today!

BUY YOUR HAYS TRAVEL MASTERCARD

The Hays Travel Money Card is the safe and easy way to take your money on holiday!

It is free to use in millions of locations worldwide where Mastercard Prepaid is accepted: including restaurants, bars, and shops when you spend in a currency loaded on the card.

This easy-to-use pre-paid card allows contactless transactions, chip and PIN, worldwide cash withdrawals wherever you see the Mastercard Acceptance Mark, and also 24/7 phone support.

Take your money card with you on every holiday, simply top up and go!

- BUY IN BRANCH

WHY CHOOSE HAYS TRAVEL?

For your next departure, buy your holiday money from Hays Travel. Always commission free currency with competitive online and high street exchange rates.

- Wide selection of currencies available

- Hundreds of nationwide Hays Travel branches offering on-demand Foreign Exchange; buy from branch to receive high quality customer service from the travel experts or order online for convenient home delivery

- 0% commission when we buy and sell foreign currency

Home Delivery

Ordering currency from the comfort of you own home has never been easier, with our great rates & over 60 currencies to choose from as well as next day delivery why not chose your currency to be delivered to your doorstep?

Holiday Money to your door

Order before 3pm for next working day home delivery via Royal Mail Special Delivery. *Customer must be home to sign for delivery. Over 60 currencies to select from. Free delivery on all orders £500 and over Convenient Saturday delivery available for no extra charge Minimum order value of £200 up to a maximum of £2500 Peace of mind, your local Hays Travel branch will buy back any leftover currency purchased through Hays Home Delivery commission free

Call Into a Branch

With over 400 branches to choose from arranging your holiday money has never been more convenient – Why not call into branch today where one of our experienced & Friendly Foreign Exchange Consultants will be on hand with our great rates, expert advice & fantastic service.

Bank on our branches for your Holiday Money

Over 400 branches Nationwide - Use our branch locator to find your nearest Hays Travel branch.

A wide selection of currencies & Hays Travel Money Cards available Instantly in-store

Competitive high street rates and always commission free

Exotic Currency Ordering service – Over 70 currencies available to order

Buyback Guarantee – Save money on your leftover Currency.

All major currencies Bought Back Commission Free

Experienced & Friendly Staff instore

- FIND YOUR NEAREST BRANCH

How to get the best travel money deals

We round up the best travel money deals so you can make the most of your trips without denting your wallet.

- Newsletter sign up Newsletter

Travel money may be the last thing on your mind when preparing for a much-needed holiday.

While you may be swamped with finding the right travel insurance or sorting out travel delay compensation , it’s important to pick the right spending option to maximise your holiday savings. Leaving it too late to swap your cash could mean getting stung by high exchange rate debit card fees or bank fees.

Specialist apps and credit and debit cards for travelling abroad or even your supermarket could help with your currency needs, ultimately boosting your spending money.

- Subscribe to MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Here’s how to secure better exchange rates and get the best deal on travel money.

1. Don’t exchange currency in the airport

The general rule when it comes to travel money is to avoid airport exchanges. A survey by travel money experts eurochange last year found that holidaymakers buying €1,000 at Gatwick, Birmingham and Heathrow typically lose out on around £176 compared with high-street branches.

Exchange bureaux at the airport have a captive audience as once you are ready to fly, there isn’t much choice about where you get your cash. This means you will typically get poorer exchange rates and will be left with less spending money once abroad.

That’s why it’s important to sort out your travel money and currency exchange rates before you reach the airport and make your money go further.

2. Use the right travel money cards

It may be tempting to just use your credit or debit card when spending abroad. But you could be hit with high charges on overseas spending and as much as 5% for cash withdrawals when using a mainstream high street bank card.

According to research by TotallyMoney, some credit card providers charge a huge £4.59 in fees on a £20 withdrawal. In real terms, this represents a 22.95% charge.

Some specialist travel credit cards including the Halifax Clarity MasterCard and Barclays Rewards Visa don’t charge for overseas spending or ATM withdrawals.

A number of current account providers also offer fee-free spending abroad as well as competitive exchange rates. This includes Chase’s current account, First Direct’s 1st account and Santander ’s Edge account.

Meanwhile, challenger banks Monzo and Starling provide fee-free spending and withdrawals abroad too.

Check your account terms though as while most of these cards can be used in well-known European or American destinations , it’s unlikely you’ll be able to use them in more far-flung places.

Another option is using a prepaid travel card or a currency card that links with your current account from providers such as Currensea , FairFX, and Revolut .

Similar to a travel debit card , there won’t be charges for overseas spending or withdrawals and the exchange rate will be better than what you would get at the airport.

3. Supermarket loyalty programmes

Most savvy shoppers are familiar with supermarket loyalty schemes that give you discounts on your grocery shopping.

Tesco customers can access discounts on items if they are a Clubcard member, while Sainsbury’s offers cheaper products if you sign up to its Nectar scheme. This is part of the latest phase of the supermarket price wars, with shoppers essentially getting their food cheaper as long as they are registered on one of the loyalty schemes.

But it isn’t just cheaper sausages and soap on offer from these supermarket giants. Registered customers can also get lower exchange rates on travel money, ultimately giving them more to spend abroad.

For example, Sainsbury’s customers can currently get a euro exchange rate of 1.1428 EUR for £1. But if you are a Nectar member, that rate improves to 1.1451 EUR, which means you end up with slightly more in your pocket instead.

It’s the same for Tesco Bank and Clubcard members. Tesco Bank offers a euro exchange rate of 1.1435 EUR, but if you’re a Clubcard member, you get 1.1458 EUR.

Though this won’t make much difference if you’re taking out smaller amounts, the savings start to add up the more you withdraw, and could give you some extra spending money for, say, a two-week family holiday.

4. Shop around

Your supermarket may seem convenient, especially if you can make a saving as a loyalty scheme member. But it’s important to shop around for the best deal, by using comparison websites such as Go.Compare and Travel Money Max .

MoneyWeek found bureaux offering better euro exchange rates but much will depend on what is available near you and if you want the convenience of using a card abroad or getting your holiday cash with your frozen chips.

5. Find the best travel money providers

When converting pounds to other currencies, you can either go to your high-street bank or order travel money online. We’ve rounded up the best travel money providers to help you find the best deal. Note that this is based on withdrawals of £1,000.

Rates on Wednesday, 10 April 2024.

Marc Shoffman is an award-winning freelance journalist specialising in business, personal finance and property. His work has appeared in print and online publications ranging from FT Business to The Times, Mail on Sunday and The i newspaper. He also co-presents the In For A Penny financial planning podcast.

- Oojal Dhanjal Graduate trainee

Meta's decision to join the AI race is driving investors away

By Dr Matthew Partridge Published 3 May 24

Temple Bar Investment Trust is a diversified bet on British equities and looks excellent value, says Max King

By Max King Published 3 May 24

Useful links

- Get the MoneyWeek newsletter

- Latest Issue

- Financial glossary

- MoneyWeek Wealth Summit

- Money Masterclass

Most Popular

- Best savings accounts

- Where will house prices go?

- Contact Future's experts

- Terms and Conditions

- Privacy Policy

- Cookie Policy

- Advertise with us

Moneyweek is part of Future plc, an international media group and leading digital publisher. Visit our corporate site . © Future Publishing Limited Quay House, The Ambury, Bath BA1 1UA. All rights reserved. England and Wales company registration number 2008885.

IMAGES

VIDEO

COMMENTS

Compare travel money with MoneySavingExpert. Find a better exchange rate for spending overseas. Choose from a number of different currencies. Compare rates in minutes. Compare rates. Explore page: Pros and cons. Top tips.

You're in the right place. From euros to zloty, dollars to lev, we monitor the foreign exchange market every day to bring you transparent, fair and up-to-date rates - always with 0% commission. Fast, simple and secure. Free home delivery on orders of £500 or more. Click and collect in just 60 seconds.

Airport currency exchange rates are among the worst you'll find. It's not uncommon to see airport exchanges charging 14% more than the current International Monetary Fund (IMF) exchange rate ...

Top 5 exchange rate need-to-knows. 1. The RIGHT cards consistently beat travel cash rates. 2. Beware charges for using credit cards to buy your travel money. 3. Avoid the debit cards from HELL - some fine you for spending abroad. 4. Don't let bureaux hold your cash for long - you've little protection.

What we do Compare Travel Cash is a non-biased travel money comparison site. To ensure our independence, we always use transparent, objective and verifiable criteria in our comparisons. Our mission is to show you the best rates so you can save when buying your travel money. We constantly update our exchange rates as they change for each money exchange supplier, and whilst we try to do this in ...

How this rate is determined depends on a number of factors, which we'll look at in a bit more detail later. If the rate of the euro to the pound is €1.09 to £1, this means that for every £1 you exchange, you will get €1.09 back. So, if you exchange £100, you should receive back €109. In this case, the pound is the stronger currency ...

Download the App. Keep track of live mid-market rates for every world currency on your Smartphone. That's 170+ currencies that you can convert on the go! Xe offers an assortment of travel tools for your next trip!

Currency cards offer some of the best exchange rates around, and are available from, for example, Starling, Monzo, Revolut, and Curresea. The euro rates for Monzo and Starling are based on the Mastercard rate so are the same: £1 = €1.152 (vs €1.16 inter bank rate) On the (free) Curresea Essential plan the euro rate is: £1 = €1.152.

Whether it's a burger in Brisbane or a taxi in Toronto, get a feel for how far your travel money might go with our foreign currency guides. We'll help you manage your travel budget like a pro. Purchase travel money online with Tesco Bank and benefit from competitive exchange rates and 0% commission.

Take dollars to euros. On a day when currency markets suggest $100 should buy you €93, a currency exchange desk might hand you just €81, while a more modern method would net you a rate closer ...

Last year Eurochange, a currency broker, released a survey which explored the difference in cost. It found that someone buying £1,000 worth of euros at three of the UK's largest airports spends ...

It may not sound like a lot, but that's an instant saving of £55 if you were buying £1000 worth - just by choosing the best place to exchange your cash. Less-common currencies offer even more potential savings: you could get 11.4% more Turkish lira by going with the best deal. For Indian rupees, the saving is 8.5%, and for Thai baht it's 13.0%.

Morrisons Travel Money Exchange: Your Gateway to Secure & Competitive Rates. Morrisons, one of the UK's leading supermarket chains, offers a currency exchange service called No 1 Currency.They provide secure and competitive rates for travellers looking to exchange their currency. Morrisons doesn't offer its currency exchange service.

From Argentine pesos to Vietnamese dong; get the best travel money deal by comparing the exchange rates, fees and commission from the UK's top currency brands. Compare travel money rates. Euros. US dollars. Turkish lira. Thai baht. UAE dirham. Mexican pesos. Australian dollars.

Option 1: Travel credit cards. Spend on a credit card abroad and normally your card provider gets near-perfect rates, but then adds a 3%-ish 'non-sterling exchange fee'. This means that every £100 worth of euros or dollars costs you £103, and some add even more fees on top.

For your next departure, buy your holiday money from Hays Travel. Always commission free currency with competitive online and high street exchange rates. Wide selection of currencies available; Hundreds of nationwide Hays Travel branches offering on-demand Foreign Exchange; buy from branch to receive high quality customer service from the ...

Buy online. Order your travel money without leaving the house with our online service. Simply use your credit or debit card to order your currency on our online portal and then choose from Click & Collect service or home delivery from £4.99 or FREE on orders over £500. Buy online.

Travel money provider Exchange rate Amount Notes; The Currency Club: 1.1539: €1,153.90: 0.29% fee on debit card with next-day delivery. Free delivery over £700