- Privacy Policy

- Disclosures

- Do Not Sell My Information

Guide on How To Use United’s TravelBank

by The Frugal Tourist | Jan 6, 2024 | American Express , Travel , United | 22 comments

ADVERTISER DISCLOSURE: The Frugal Tourist is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as MileValue.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Additionally, the content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. All information about the Hilton Honors American Express Aspire Card has been collected independently by The Frugal Tourist. The card details on this page have not been reviewed or provided by the card issuer.

In this blog post, I will walk you through the steps on how to fund and use United’s TravelBank.

Since some credit cards provide travel credits that expire within a year, depositing money in United’s TravelBank is a viable option to utilize those credits so they won’t go to waste.

Funds diverted into United’s TravelBank have a 5-year lifespan, offering some level of longevity and a lot of flexibility, especially since travel is not expected to pick up again anytime soon.

Whether you have plans this year or in the near future, funding your United TravelBank with free cash from your credit cards is a wallet-friendly strategy that can potentially save you a few hundred dollars when the time comes that you need to book your next flight.

United TravelBank

According to United, your TravelBank funds can either be used alone or in combination with select forms of payment only when booking United or United Express flights .

Therefore, we are unable to use United TravelBank to purchase flight itineraries that include segments on partner airlines such as Air Canada, Lufthansa, etc.

I was also unsuccessful in tapping my TravelBank reserves to pay for taxes when booking an award ticket or paying additional fees to cover the airfare difference when redeeming a voucher or rebooking a travel credit.

However, I did not encounter any roadblocks when I booked paid United tickets, even if the airfare was Basic Economy .

Terms and Conditions

The information below was taken from United.com

- Passengers can select from six purchase amount options, and once purchased, the value remains valid for five years from the date it is deposited in your TravelBank account.

- Purchases are not refundable and are limited to $5,000 per day per MileagePlus account.

- This purchase is also subject to all of the TravelBank terms and conditions .

- United has the right to terminate this promotion or to change the promotion’s terms and conditions, rules, regulations, policies and procedures, benefits, and/or conditions of participation, in whole or in part, at any time, with or without notice.

Guide on How to Fund United’s TravelBank

Access United TravelBank by clicking the button below. You will need to log in to your United Mileage Plus Account to purchase.

Do not have a United membership yet?

It is free and easy to register. Click the button below to enroll in United’s Mileage Plus Program.

After logging in, you will see your United Mileage Account, any United miles you have available for redemption, and your TravelBank Cash Balance.

Plus Points – a points system that passengers can utilize to upgrade their flights – will also show up, but we will not go over that in this post. You can read more about this program here.

Select the amount of travel cash you want to purchase.

As previously stated, there are six possible amounts that you can elect to deposit to your TravelBank.

The next page will ask for you to type in your Payment Information.

In this case, you would want to use a credit card that provides an Airline Credit.

I will list these credit cards in one of the sections below.

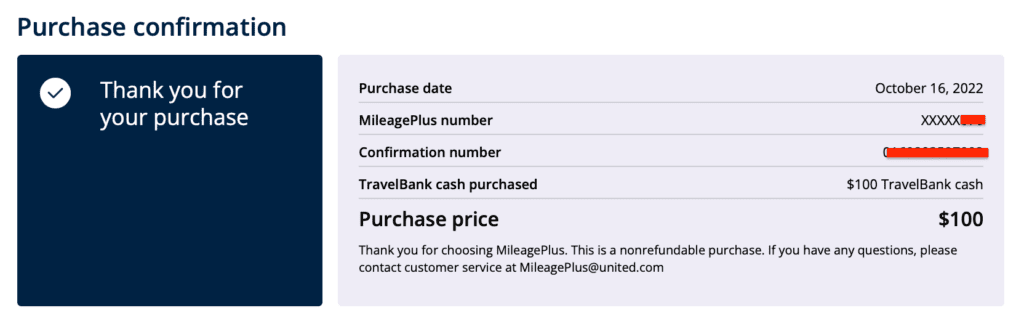

You will then get confirmation that your purchase was successful. A receipt will be emailed immediately after as well.

In this example, I used my The Business Platinum Card® from American Express to buy $100 worth of travel cash in United’s TravelBank.

Guide on How to Use Your United Travel Bank Cash

Thankfully, we are generously given five years to spend our travel cash.

Once you are ready to book your flight, log back on to your United.com profile and enter your travel details.

United TravelBank purchased using certain IHG Credit Cards has a shorter lifespan. Please check the terms of your IHG Credit Cards for the most current UnitedTravel Bank policy.

Select your particular flight, verify your personal information, and pick your seat.

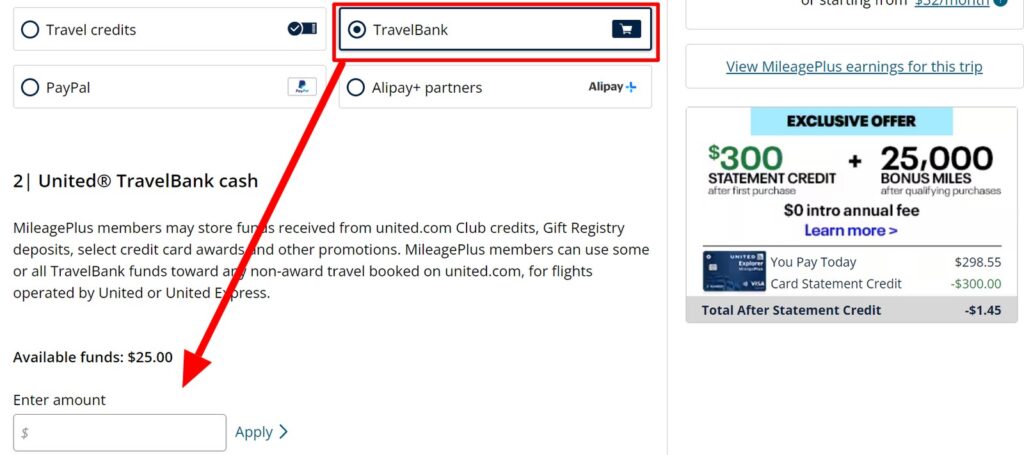

Afterward, you will be directed to the Payment Page.

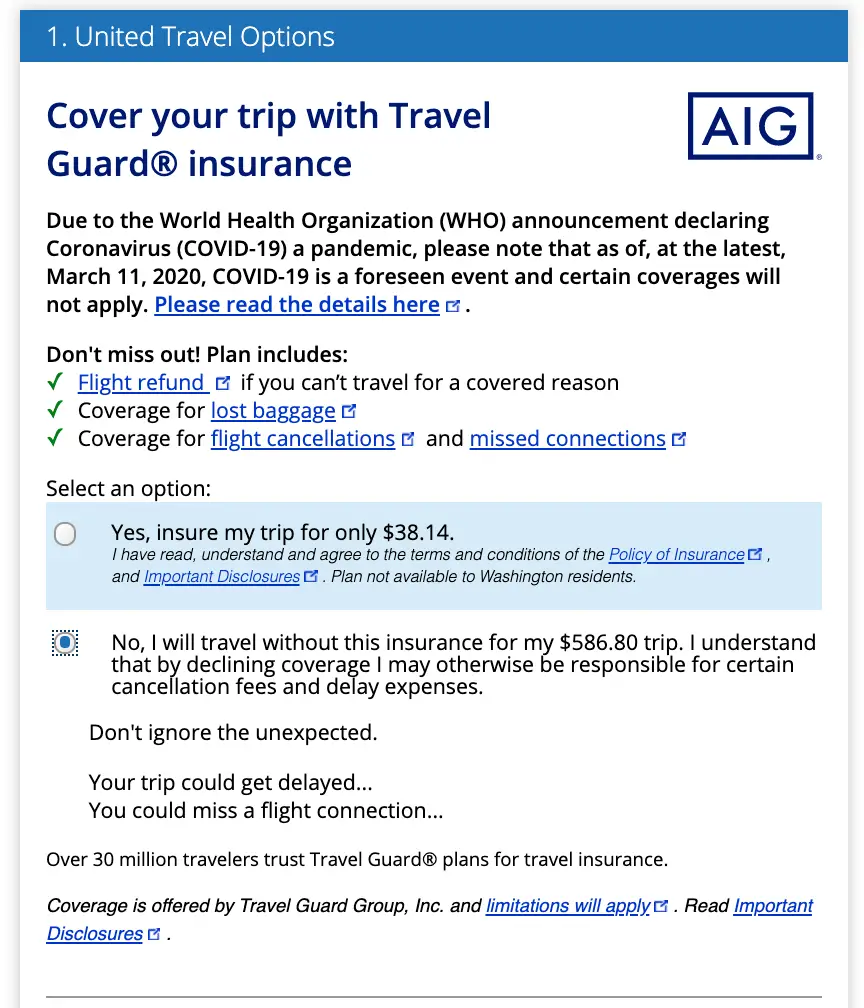

Next, United will offer you travel insurance (select yes/no), priority boarding, and miles for purchase.

Regardless of whether you decide or decline to purchase these additional bells and whistles, the payment section comes right after.

You have the following payment options:

- Pay In Full

- Pay Monthly

- Travel Certificates and United TravelBank Cash (if this option does not appear, then the ticket you’re buying is not a permitted purchase using travel cash.)

- Other Forms of Payments (PayPal, etc)

- Debit / Credit Card

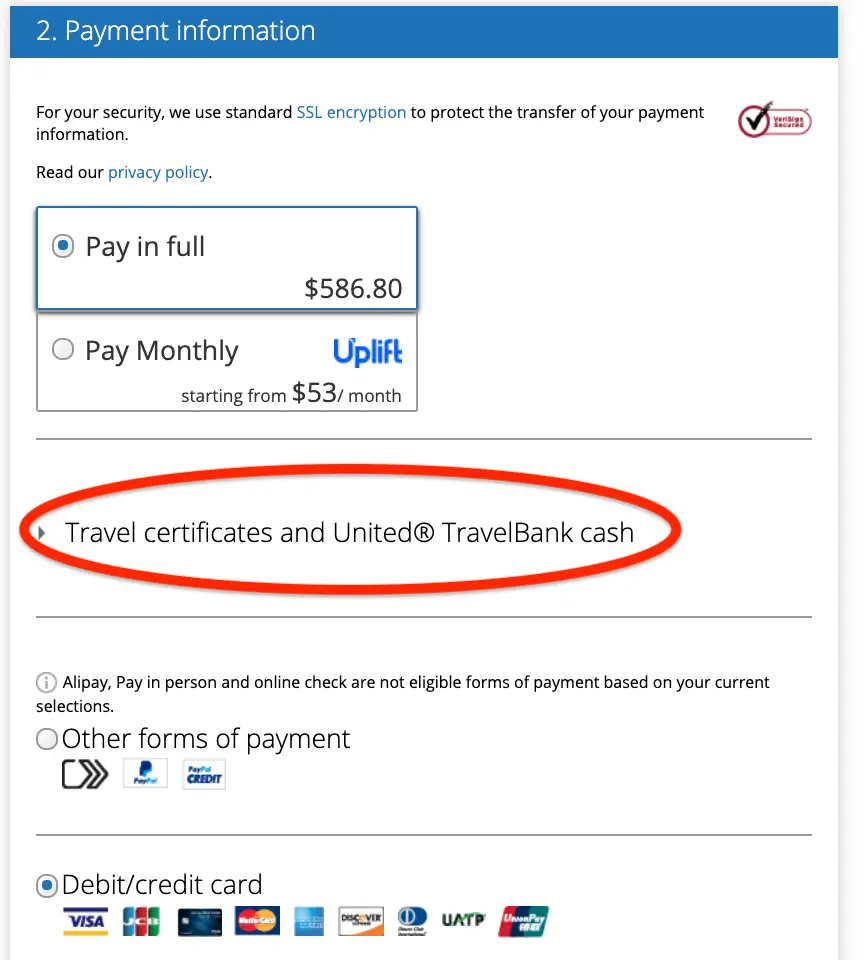

Select “Travel Certificates and United TravelBank Cash.”

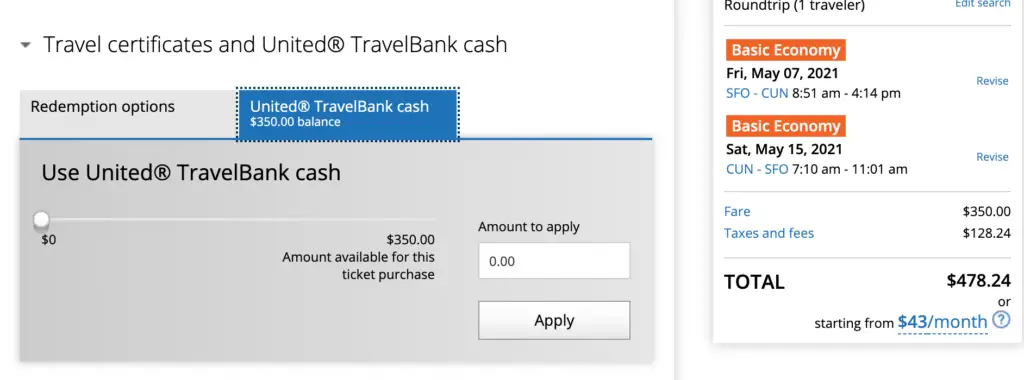

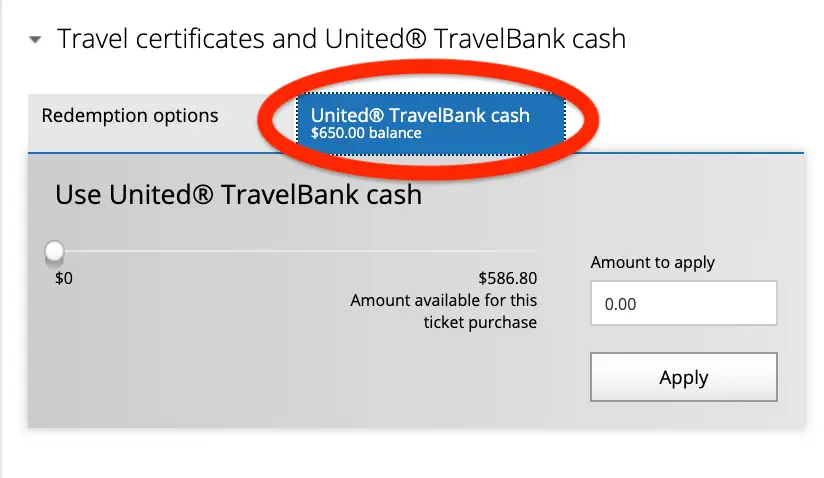

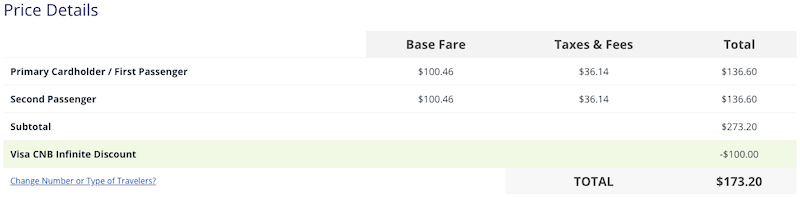

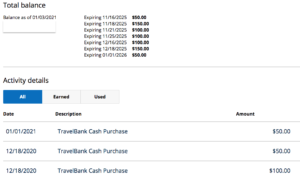

As you can see, my $100 travel bank deposit is already reflected in my account.

Next, enter the amount you want to use for the flight you wish to book.

It is not necessary to spend your entire stash of United travel cash if you have other plans to spend it later.

Once you have a final amount in mind, click apply.

In this example, I decided to spend $75 of the $100 currently in my United TravelBank.

After your travel cash is deducted, the total amount you still owe will automatically be calculated.

Continue with your purchase by selecting the mode of payment you want to use for the remaining balance.

I highly recommend paying a portion of the flight with a credit card that offers travel protections, such as the Chase Sapphire Preferred® Card or the Chase Sapphire Reserve®.

Alternatively, you can purchase travel insurance to cover your entire trip.

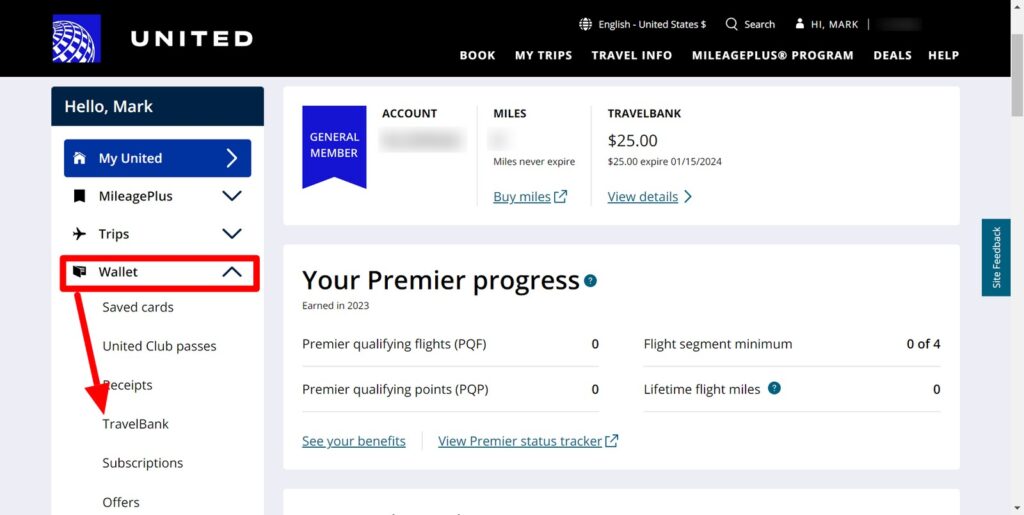

Where Do I Find My TravelBank Account?

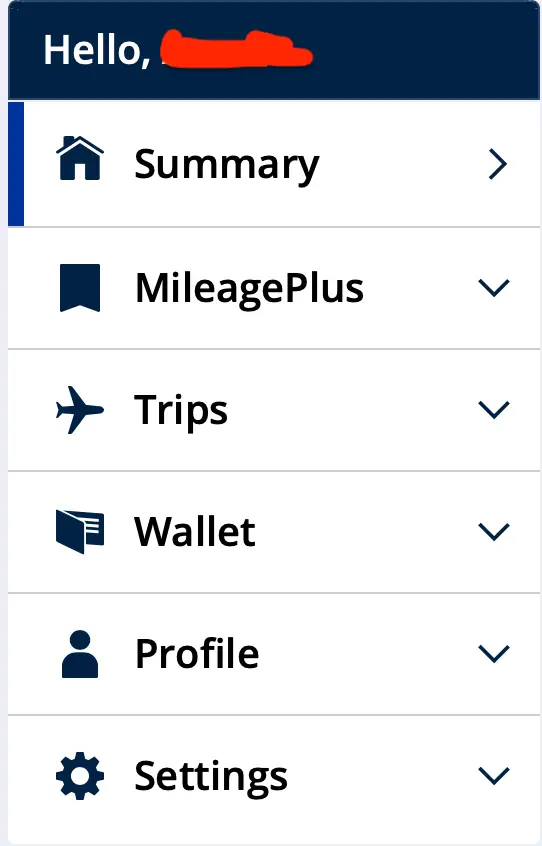

United has recently updated its website. You can find your United TravelBank account information and balance by navigating to your United Wallet on the app and the computer.

Troubleshooting Potential Issues

Issue 1: united travelbank does not show up.

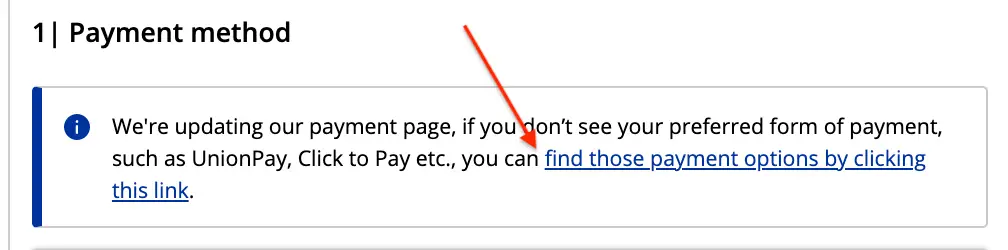

A few readers have expressed that they are having difficulty locating the TravelBank option on United’s website.

It appears that United’s site is currently updating its payment page. When you see the notice below under “Payment Method, ” click the “find those payment options…” link.

This link will direct you to the “United Travel Options” section, where you can add travel insurance to your purchase. Make your selection.

Afterward, you will be directed to “Payment Information,” where the TravelBank option appears.

Click “Travel Certificates and United TravelBank Cash” and select Travel Cash as your mode of payment.

Type the amount you would like to spend.

As suggested, charge a small portion of your airfare on a credit card that provides travel insurance, like the Chase Sapphire Preferred® Card or the Chase Sapphire Reserve®.

You may also elect to purchase travel insurance for additional coverage.

Issue 2: United TravelBank Keeps On Freezing

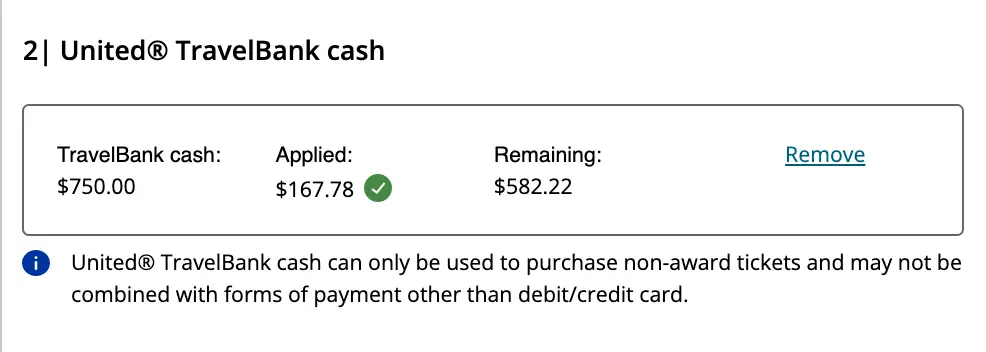

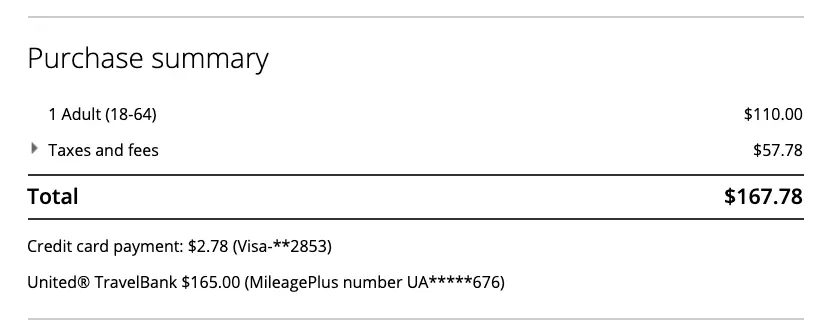

While booking a plane ticket to Cabo costing $167.78 recently, I found the United website struggling to process my TravelBank payment, ultimately freezing the payment page.

After attempting various troubleshooting strategies, I eventually made it work by typing a whole number into the TravelBank box.

In this case, I redeemed $165 of my TravelBank credits towards the purchase of this ticket and used a credit card that gives travel protections ( Chase Sapphire Reserve® ) to cover the remaining amount ($2.78).

Issue 3: TravelBank is Unable to Add a New Credit Card (Payment Error)

United.com can only save a certain number of credit cards on your profile.

If the website is not allowing you to add another credit card to your United TravelBank account, you will need to log in to your main United.com account, go to “Wallet,” remove the credit cards that you no longer use, and then add the ones you would like saved.

Once your new credit card is linked, note the last four digits of your card and its expiration date so you can easily find it on your list of saved cards when you try to purchase United TravelBank funds again.

Issue 4: Unable to Purchase

As mentioned above, your United TravelBank funds can either be used alone or in combination with select forms of payment when booking United or United Express flights only.

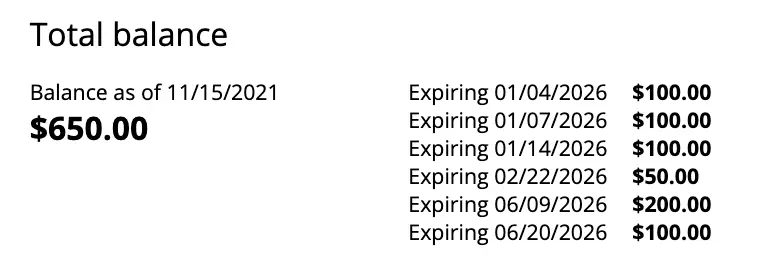

When Do United TravelBank Funds Expire?

As of this update, TravelBank funds appear to expire after five years.

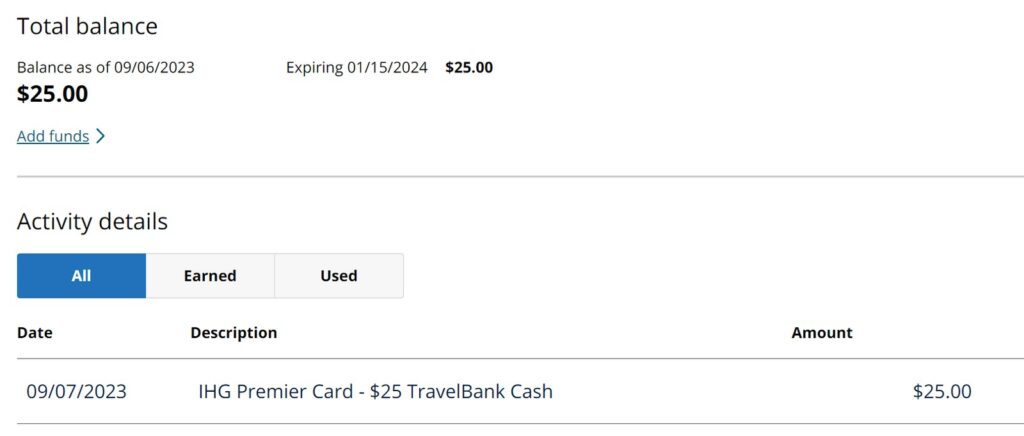

The screenshot below, captured from my TravelBank account, supports this assertion.

While the money deposited in our United TravelBank accounts has a 5-year validity, it can be forfeited if no activity is recorded in our TravelBank accounts for 18 consecutive months.

Therefore, ensure that you either add money to your TravelBank or use your TravelBank funds to purchase tickets at least once every 18 months.

Heads Up: United also stipulated that any re-deposited funds originating from canceled tickets purchased with TravelBank money do not qualify as an eligible activity. In short, any re-deposited funds will NOT reset the expiration date.

United may also change the expiration date of subsequent deposits or discontinue the program altogether. Only time will tell.

For now, this option to convert our credit card airline credits to some form of flexible currency is available, so certainly consider this method if you are running out of ways to redeem your expiring credits.

Which Credit Cards to Use?

You should only purchase TravelBank funds when you anticipate no other eligible travel-related purchases for the remainder of the year.

Chase Credit Cards

Chase sapphire reserve® (csr).

The Chase Sapphire Reserve (CSR) comes with a $300 travel credit that resets every year on the card member’s anniversary date and does not roll over onto the following year; therefore, you either use it or lose it.

I do not recommend using your CSR travel credits to purchase funds on United’s TravelBank, given that Chase provides an extensive array of valuable avenues to redeem this credit.

In addition to the traditional airfare purchase, you can also trigger the travel credit when paying for public transit, ride-sharing services, parking, hotels, campgrounds, cruises, etc.

Citi Credit Cards

Citi prestige® credit card.

This card is no longer available to new applicants.

This credit card comes with a $250 travel credit, which can now be conveniently spent on groceries, restaurants, and take-out.

Like the Chase Sapphire Reserve, this credit resets every calendar year and likewise does not roll over.

I do not suggest using your Citi Prestige travel credits to purchase United TravelBank funds because of other beneficial spending options you have at your disposal.

American Express Credit Cards

American express® credit cards with airline fee credits.

- The Platinum Card® from American Express ($200 Annual Airline Credit)

- The Business Platinum Card® from American Express ($200 Annual Airline Credit)

- Hilton Honors American Express Aspire Card ($50 Quarterly Airline Credit)

American Express’s airline fee credit is challenging to redeem compared to Chase’s and Citi’s more flexible identical offerings.

In the past several years, consumers consistently find themselves jumping through hoops in search of effective methods to capitalize on these generous offers.

First and foremost, Chase and Citi do not require activation – their credits apply to all airlines and other forms of travel.

Whereas Amex’s airline fee credit will not work unless you activate it.

Plus, it can only be used on one airline you pre-select, ideally at the beginning of the year.

Even though there are data points (DP) that Amex has been lenient in allowing the preferred airline to be changed via chat as of late, there is no way to predict until when they will allow this.

AMEX Airline Fee Credit Restrictions

AMEX has strict restrictions on what fees qualify under this credit.

Technically, only incidental purchases, such as seat assignments, baggage fees, change fees, lounge access fees, and food/beverage inflight purchases, are eligible.

As such, traditional expenses such as award fees, plane tickets, upgrades, and gift cards do not qualify.

But occasionally, we see additional methods that temporarily open up that trigger this airline fee credit – and for now, United TravelBank is one of them.

While no language explicitly states this particular purchase will not qualify, I have to underscore that Amex can undoubtedly claw back this credit at any moment if they deem that TravelBank is not eligible. So, just be aware of that possibility.

Hence, please utilize this tactic only if you do not anticipate using your airline fee credit throughout the rest of the year.

Steps in Selecting Your Airline With Amex

Before you go ahead with your purchase, follow the steps below on selecting your preferred airline, as AMEX does not make it simple to locate where to activate this benefit.

To optimize this TravelBank strategy, make sure that the airline you selected is United.

Go to AmericanExpress.com, then log in to your account.

Select the particular AMEX credit card that currently offers an airline fee credit.

- The Platinum Card® from American Express

- The Business Platinum Card® from American Express

- Hilton Honors American Express Aspire Card

On the main page, click “More, ” then select “ Benefits .”

On the Benefits page, scroll down to locate “ Airline Fee Credit. ”

This is where you can also change your selected airline for the year.

It bears repeating that you’re technically not allowed to change your preferred airline mid-year, so choose wisely.

With that said, there are data points from people reporting that they have successfully modified their airline choice by contacting AMEX through chat, but this is YMMV (your mileage might vary).

As of this writing, you can use your airline fee credit with the following U.S. carriers:

While on the Benefits page, enroll in all the offers available to you even if you are not sure you will use them.

It is practically money you had already paid for when you paid your annual fee, so you might as well take advantage of it.

At any rate, maximizing this airline fee credit is a fantastic way to offset the steep annual fees Amex charges on their ultra-premium cards.

Add funds to your travel credit using your AMEX card.

If you are unsure how much airline credit you have left, AMEX generates a tracker under this benefit to display your remaining funds.

Periodically check your Amex credit card to see if the airline fee credit was successfully triggered.

If not, Amex has likely terminated this redemption method.

Final Thoughts

Indeed, United’s TravelBank is a wonderful addition to the dwindling menu of possible purchases that can activate Amex’s elusive airline credit.

Being fully aware that this method is temporary, I try to take advantage of it while it’s still possible, especially when I am on the verge of running out of redemption alternatives for my Amex airline fee credit.

I hope that Amex follows Chase’s and Citi’s lead and relaxes this benefit, making it much easier to redeem in the future.

Until then, we will have to adjust to American Express’ policies.

Ultimately, I am glad that United’s TravelBank provides us with another fantastic alternative for using our travel credits.

Not only does it prolong the shelf-life of our funds, but it also affords us the flexibility we genuinely need.

EDITORIAL DISCLOSURE – Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. The content has not been reviewed, approved, or otherwise endorsed by any of the entities included within the post.

Related posts:

22 comments.

Bank of America Premium card also include benefits of $100 incidental travel credits, can I use it to purchase United Travel Bank fund too?

Hi Angie, I am not familiar with Bank of America rules but upon checking what qualifies under “incidental”, I got the following info: Get up to $100 in Airline Incidental Statement Credits annually for qualifying purchases such as seat upgrades, baggage fees, in-flight services, and airline lounge fees – automatically applied to your card statement.

It seems to me that this is similar to Amex. I would suggest purchasing the lowest allowed denomination of $50 to see if it would trigger it but if you have anticipated travel in the near future, I suggest redeeming the credits there instead.

Hi, I booked the ticket and when I entered the payment page, there is no Travel Bank part, I got 200+ dollars in travel bank and cannot seem to use it. Why is this? I can only see “Travel certificates” instead of “Travel certificates and United Travel Bank Cash”. What should i do?

Hi Tristan, thanks for asking. Sorry about that. Not all purchases in United.com are eligible. I wonder if the ticket you are purchasing includes a partner airline. From the Terms and Conditions: “TravelBank Cash is valid for air travel purchases on United and United Express® flights and as otherwise permitted by United. After a TravelBank Award is issued, a service charge may be imposed for each change or cancellation requested by the Member.”

I have encountered this exact problem and I am definitely booking a United airline airfare (from LAX – EWR): any more update on this?

HI Cindy, I had updated the post with hopefully a potential solution to your problem. Jump to the section “What to do? United Travel Bank Does Not Show Up”. I tried your route (LAX-EWR) and the steps I outlined worked in making Travel bank re-appear! Good luck and please let me know if it worked for you too!

Thank you for this post and the very detailed instructions!!! Really helpful as I’ll be using this as long as we can get that $200 credit from Amex Plat!

Thank you Tony for the kind feedback. I am glad you found it useful. Please feel free to ask questions anytime.

Great information, thank you!

Thank you so much!

Its unfortunate you can’t use your Travel Bank just to upgrade your seat. Or pay for the bundles upon checkout

I am sorry! Sadly, it is just not as flexible 🙁 But United might make some changes in the future that will allow us to use it for incidentals.

Newbie to United Travel Funds.

Is it possible to use it for booking a ticket for anyone else, any restrictions?

You can book it for anyone else. When they cancel though, the travel credits will be under their account.

This article saved me 30mins! I was typing a non-whole number to use my United Travel Bank and it would NOT take it. Apparently, it needs to be a WHOLE NUMBER. Thanks for the tip!

Glad you found it useful!

Can you combine miles and a travel bank balance? I have 33k miles I need to use and $600 in travel bank credits.

Unfortunately, you can not mix miles and travel bank balance. I’d use the travel bank first if you find cheap tickets as those expire. United miles do not expire.

Hi, how long does the Amex Airline Credit usually take? It’s been a week now and my credits have not shown up yet.

HI Kunal. It’s been about 10 days, on average, for me.

I wanted to add that you Travel Bank does not come up as an option to pay if your flight involves a leg operated by a partner airline (eg. Swiss Air).

I called United to see if they could book the ticket but it errored out for the representative and he gave me that as the reason.

This might be helpful to incorporate in your article.

HI Stephanie, thank you for sharing. That’s correct. Apologies that it was not clear in the article. Yes, it is sadly for United and United Express flights only. I highlighted that part of the article and added additional language under Troubleshooting so it’s much clearer. Thanks so much again for the feedback and Safe travels!

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

JOIN OUR FREE FACEBOOK TRAVEL MILES AND POINTS COMMUNITY!

TRAVEL MILES AND POINTS

- Earn 5X Chase Points Per Dollar: Staples Fee-Free Visa Gift Cards

- Earn 5X Travel Points: Staples Fee-Free Mastercard Gift Cards

- $15 Discount On $300+ Visa Gift Cards At Office Max / Depot

- $15 Discount On $300+ Mastercard Gift Cards At Office Max / Depot

- Transfer American Airlines Business Credit Card Miles to AAdvantage Accounts

Travel on Point(s)

- Playing Around With The IHG Card United TravelBank Perk

- January 3, 2024

- Mark Ostermann

Travel on Point(s) is an independent, advertising-supported website. This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites like Cardratings.com. This compensation does not impact how or where products appear on this site. Travel on Point(s) has not reviewed all available credit card offers on this site. Reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any partner entities.

IHG Card United TravelBank Credit

If you have been following along then you know I decided to update my old IHG Mastercard to the IHG Premier card . It just made too much sense for me not to. If you want more info on why you can read my full breakdown . One of the perks that comes with the IHG Premier card, and IHG Business card as well, is the IHG card United TravelBank credit perk. I finally got around to getting mine set up so I thought I would share the process of getting your yearly United TravelBank credits locked in. I'll also go over all the details on the perk and how to maximize it.

Table of Contents

Update 1/3/24: This is now reset and ready to be used. Pay attention to the details on a potential double dip if you don't have an immediate use, or how to lock it in for longer, below.

What Is The IHG Card United TravelBank Credit?

The IHG card United Travel bank credit allows you to earn up to $50 in United TravelBank Cash each calendar year. It is broken into two different $25 credits throughout the calendar year, which is a little annoying. Here is how they divide up the credits, which you may notice will overlap for a few days:

- This credit will be valid through July 15th

- This credit will be valid through January 15th

How To Register Your IHG Card For Your TravelBank Credit

Now that we know when we get this IHG card United TravelBank credit on our IHG Premier and IHG Business card, how do we go about earning them? Here is a step by step process:

- Log into your United account to grab your United Mileageplus number

- Next you need to link your IHG and United accounts HERE .

- Once you open the link you will be prompted to log into your IHG account.

- If you have an eligible card it will ask for your United Mileagplus number and last name. Enter your info hit submit.

- It may take up to two weeks for your registration to take effect.

- TravelBank Cash can only be used on United® or United Express® purchases and cannot be refunded or exchanged to be used for reservations at IHG® Hotels & Resorts or other purchases.

- Unfortunately you can only get the credit on one IHG card even if you carry both the Premier and the Business cards.

Even though it says it can take up to two weeks for your $25 to show up mine was in my United account within seconds.

What About In The Future?

It appears that after your initial activation the credit should automatically hit your account in the future. This could take a few days after the first of January and first of July.

Where To Find Your United TravelBank Balance

Once you have the programs linked you will want to head back over to your United Mileageplus account and locate your TravelBank balance. Here is how you do that.

When logged into your United account go to the My United section. Once you are there you can see the TravelBank balance at the ToP of your account page. To get a more detailed look you click on

- Then the Wallet drop down

- Las select TravelBank

After opening the TravelBank section you get a little more of a breakdown of your credits. If you use the United TravelBank for your Amex airline incidentals credit you will see those in here too. It will give you the expiration date for each credit as well.

How To Redeem Your United TravelBank Balance

Now that we know how to activate our IHG Card United TravelBank credit, how to maximize it (in theory) and where it is located in our United account, how do we actually go about using it? It is pretty simple.

When you go to pay for a flight just select your TravelBank credit on the payment screen and then enter how much you want to use. You can pay for the rest of your flight, if there is anything left over, with your favorite travel rewards credit card. Hopefully it is one with great travel protections like the Chase Sapphire Reserve or Chase Sapphire Preferred . You do not, and should not, need to use your IHG Premier or IHG Business card to pay the remainder of the flight.

IHG Card United TravelBank Credit: ToP Thoughts

I had not given the IHG card United TravelBank credit much thought in the past since I don't often fly United and I didn't have a Premier card before. After diving into the perk a bit I like how easy it is to set up and use. I ended up using it within the first week of getting my card, but more on that in a future article. Even if you don't have an immediate use for the United TravelBank credit you can hopefully turn it into a United travel credit that extends the life and usefulness of this perk.

What value do you give the IHG card United TravelBank credit? Let us know over in the ToP Facebook Group .

- Join Facebook Group

Recent Posts

(new offers) juice up your earnings with a new batch of authorized user bonus offers, get free $10 on amazon with amex, enterprise status match & favorite amex transfer partners, new amex offers for grocery, gas & personal care (targeted), (new offers) how to maximize target circle offers for discounted gift cards, top zoom recording: booking trips for under 200k points, top posts & pages.

- (1 New) Current Transfer Bonus List & History of Transfer Bonus Offers

- (Up To 100% Transfer Bonus) Bilt Rent Day: Double Points & Other Goodies To Kick Off The Month

- 5% Categories & Activation Links For 2024 3rd Quarter

- New Hyatt Promo: Earn Double Nights & Bonus Points In Florida

Amex Authorized User Bonus Offers It looks like a new batch of Amex authorized user

ToP Roundup In this series I will share articles I found interesting from all over

Amex Offers For General Spend There are multiple Amex Offers for general spend on people’s

Target Circle Bonus You all know that I love myself some Target, even if their

Travel on Point(s) Zoom The Travel on Point(s) team hosts monthly Zoom sessions covering different

SIGN UP TO RECEIVE ToP TIPS STRAIGHT TO YOUR INBOX

We promise to keep things short, sweet, and packed with awesome insights!

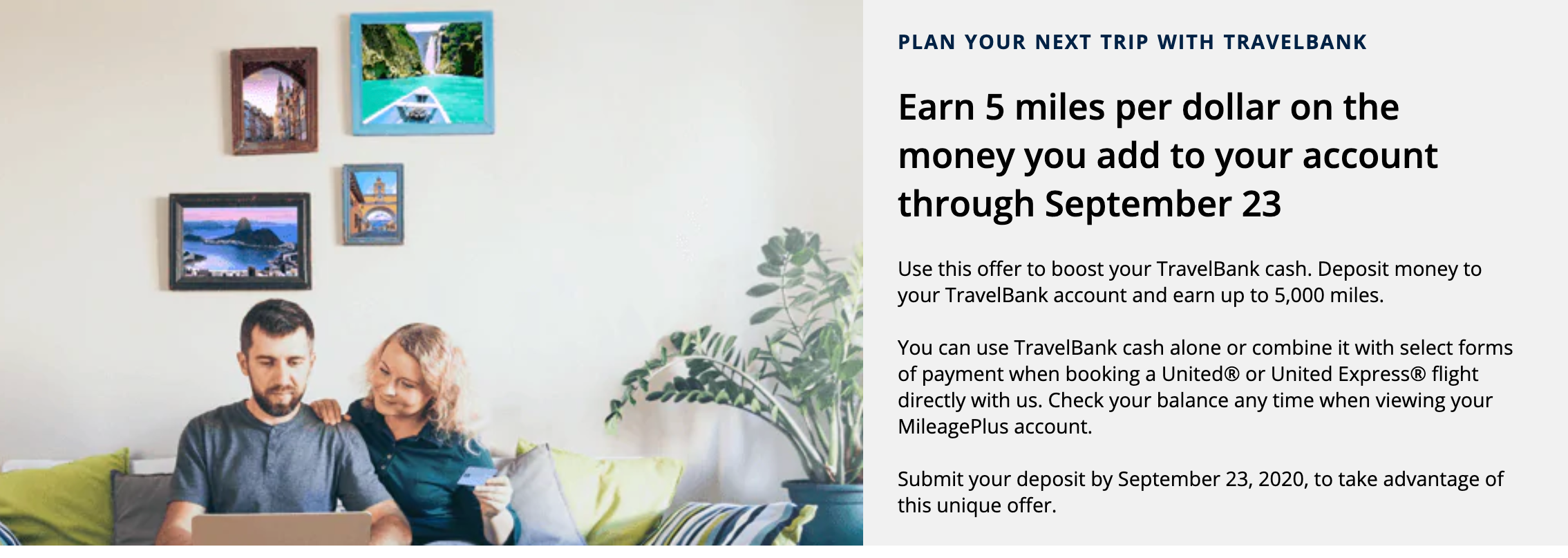

Why you may want to buy future United flight credits to earn a 5x miles bonus

Airlines are doing some interesting things to raise cash, while many would-be travelers are still on the ground. And while many of these sales and offers won't be a great deal for travelers who aren't sure when they'll fly next, there are exceptions to every rule. Sometimes these offers can make sense in the right situation.

United has brought back the opportunity to deposit future flight credits into a TravelBank account. The airline has offered this type of account at various times in the past. Now, it's incentivizing travelers to put money in by Sept. 23 by awarding five bonus United miles per dollar spent as a special offer. You are limited to $1,000 (5,000 bonus miles) per promotion, per MileagePlus account.

For more TPG news and deals delivered each morning to your inbox, sign up for our free daily newsletter .

Once you have funds in your account, they're available for use on United flights for five years. You can make deposits in the following denominations: $50, $100, $250 or $750.

In my tests, United TravelBank funds are available for immediate use -- which is different than some other airline gift cards that have a waiting period before you can use them. However, there are some potential downsides to consider before taking advantage of this offer.

Related: What it's like to fly in the U.S. right now

First, you can't stack TravelBank funds and credit from a previously canceled flight in the same transaction. You also can't use the funds on flights that aren't operated by United or United Express. Additionally, if you want built-in travel protections that may come from purchasing the trip with your credit card , you won't have those if you are using TravelBank funds to pay for the ticket. (Though you could likely still use a purchased trip insurance plan to cover your trip if you do go that route.)

I bought a little bit of United TravelBank credit to earn a bonus 5x redeemable United miles per dollar because I fly United frequently enough that I know it'll go to good use well before its five-year expiration date. I also paid with a credit card that has some unused 2020 airline fee credits ... just in case that happens to kick in.

Related: Guide to the United MileagePlus program

It won't make sense for everyone to stock up on United TravelBank credit to earn 5x miles on the purchase, but in my case, I was happy to buy a little bit of United credit -- and earn bonus miles in the process -- that I know I'll use in the coming months and years.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

United TravelBank Card: Closed to Applications, Replaced by United Gateway

What’s on This Page

The bottom line, pros and cons, detailed review, compare to other cards, benefits and perks, drawbacks and considerations, how to decide if it's right for you.

The card was suited to those who didn't travel much, but who flew United when they did travel. But it did not offer flexibility or traditional airline-card perks.

Rewards rate

Bonus offer

$150 in United TravelBank cash after you spend $1,000 on purchases in the first 3 months from account opening.

Ongoing APR

APR: 15.99%-22.99% Variable APR

Cash Advance APR: 24.99%, Variable

Balance transfer fee

Either $5 or 5% of the amount of each transfer, whichever is greater.

Foreign transaction fee

- Earn 2% in TravelBank cash per $1 spent on tickets purchased from United.

- Earn 1.5% in TravelBank cash per $1 spent on all other purchases

- No foreign transaction fees

- Enjoy 25% back as a statement credit on purchases of food, beverages and Wi-Fi onboard United®-operated flights when you pay with your United TravelBank Card.

- TravelBank cash is easy to use. $1 in TravelBank cash = $1 when used toward the purchase of a United ticket.

- Your TravelBank cash accumulates in your United TravelBank account on United.com.

- $0 Annual fee

High rewards rate

No annual fee

No foreign transaction fee

» This card is no longer available.

The United℠ TravelBank Card is no longer accepting applications. United Airlines and Chase have introduced a new credit card with no annual fee, the United Gateway℠ Card , which effectively takes the place of the TravelBank Card. Read our review of the United Gateway℠ Card , or explore other United Airlines credit card options . Below is our review of the United℠ TravelBank Card from when the card was still on the market.

If you fly United Airlines, the United℠ TravelBank Card might be tempting because of its annual fee of $0 . But it ultimately might not be worthwhile for most United flyers because of all that it lacks as an airline card.

The card has its own rewards currency that you can use to book free United flights. And its rewards rate is decent for both United spending and all other spending. It’s kind of like a cash-back card, where you can spend the cash only at United.

But you won't get free checked bags or early boarding like you do with many airline cards. And you won’t earn United MileagePlus miles, the airline’s frequent-flyer miles that have a chance at returning huge value.

If you want a card like this one, just get a true cash-back card . Then, you can spend your cash rewards on anything, not just United flights. Otherwise, ante up for a United card with an annual fee that comes with useful airline perks. There’s a good option in the United℠ Explorer Card .

» MORE: How to choose an airline credit card

United℠ TravelBank Card : Basics

Card type: Airline .

Annual fee: $0 .

2% in TravelBank cash per $1 spent on tickets purchased from United.

1.5% in TravelBank cash per $1 spent on all other purchases.

Sign-up bonus: $150 in United TravelBank cash after you spend $1,000 on purchases in the first 3 months from account opening.

Foreign transaction fee: None.

Interest rate: The ongoing APR is 15.99%-22.99% Variable APR .

Noteworthy perks:

25% back as a statement credit on purchases of food, beverages and Wi-Fi onboard United-operated flights when you pay with your card.

No foreign transaction fees.

Trip cancellation/interruption insurance.

Rental car insurance.

Purchase protection.

» MORE: Benefits of United Airlines credit cards

Simple rewards earning

With a typical airline card, you earn frequent flyer miles or points with every purchase. You then redeem those rewards for free flights or seat upgrades. But frequent flyer programs can be exceedingly complicated. The number of miles you’ll need for a particular flight depends on an array of factors. On top of that, the flight you want might not have award seats available. And your preferred travel dates might be “blacked out” — that is, reserved for paying customers.

The United℠ TravelBank Card eliminates the whole idea of miles. Instead, you earn “TravelBank cash,” which is redeemable for travel with United on a simple dollar-for-dollar basis.

The card earns 2% back on United purchases and 1.5% back on everything else. A $500 United flight, for example, would earn $10 in TravelBank cash. A $500 purchase elsewhere would earn $7.50.

Simple rewards redemption

When booking a flight with United, you can pay some or all of the fare with your accumulated TravelBank cash rewards. Consider a ticket that costs $400. If you had at least $400 in TravelBank cash, you could use it to pay the entire fare. If you had only $50 in rewards accumulated, you could apply it to the fare and reduce the cost to $350.

Some travel credit cards have annual fees measured in hundreds of dollars, while the typical airline card often charges a fee of close to $100 per year. This card has an annual fee of $0 .

Sign-up bonus

For a simple credit card with an annual fee of $0 , it’s a pleasant surprise to have a sign-up bonus: $150 in United TravelBank cash after you spend $1,000 on purchases in the first 3 months from account opening.

» MORE: NerdWallet's best airline cards

The United℠ TravelBank Card is light on flash compared with most travel cards, but it comes with minor perks:

In-flight discount: 25% back as a statement credit on purchases of food, beverages and Wi-Fi onboard United-operated flights when you pay with the card.

No foreign transaction fees: Travel cards generally don’t charge a fee — 3% is common — for making purchases abroad. This United card doesn’t, either. And it uses the Visa network, which is widely accepted abroad.

Travel-related insurances: Trip cancellation/interruption insurance and secondary rental car insurance are nice-to-haves on an airline card.

Purchase protection: Covers new purchases made with the card for 120 days against damage or theft, up to $500 per claim and $50,000 per account.

How it compares with other United cards

The United℠ TravelBank Card is one of three co-branded consumer United Airlines credit cards. Its siblings pack more perks.

Here’s how they compare on key features:

Business owners, even those with side gigs, might consider the United℠ Business Card .

» MORE: Full review of the United℠ Business Card

No checked bags or early boarding

At $35 per bag each way when you don't prepay, fees for first checked bags add up in a hurry, especially when you’re traveling with others on your itinerary. That’s why typical airline cards are so valuable. But this card has no checked-bag-fee waivers, so you’ll have to pay. And you won’t get boosted toward the front of the boarding line, because the card lacks a priority boarding perk. That could hurt you when looking for overhead bin space.

» MORE: Airline credit cards that offer free checked bags

The logical solution is the United℠ Explorer Card . It offers:

2 MileagePlus miles per dollar spent on purchases from United.

2 miles per dollar spent on restaurant purchases and hotel stays.

1 mile per dollar spent on all other purchases.

First checked bag free for you and a companion on your reservation, if you use the card to purchase your ticket.

Two United Club one-time use passes per year.

Global Entry/TSA Precheck statement credit every four years.

25% off in-flight purchases.

Sign-up bonus: Limited-time offer: Earn 60,000 bonus miles after you spend $3,000 on purchases in the first 3 months your account is open.

It has an annual fee of $0 intro for the first year, then $95 .

» MORE: Full review of the United℠ Explorer Card

You won’t earn United MileagePlus miles with this card. That keeps things simple, but you also lose the potential to reap outsize value by scoring a great awards seat — like a business-class international fare worth thousands of dollars — for relatively little spending.

Fewer benefits

Some airline cards give you perks at the airport. They might reimburse you the application cost of Global Entry or TSA Precheck to get through security lines quicker, or get you free or discounted passes to an airport lounge.

This card offers none of those.

» MORE: Cards that offer airport lounge access

Limited reward redemptions

Redeeming rewards is relatively simple, but you’re still locked into United Airlines. That's limiting compared with general travel credit cards , which allow you to apply rewards to a wide range of travel-related expenses.

An option for those looking to avoid an annual fee is the Bank of America® Travel Rewards credit card .

1.5 points per dollar spent.

3 points per dollar spent on eligible travel booked through the Bank of America® Travel Center.

A value of 1 cent per point when redeemed for travel credit and a little over half a cent per point for cash.

A sign-up bonus.

The Bank of America® Travel Rewards credit card isn't tied to an airline or hotel chain. Book travel any way you want, with no restrictions and no blackout dates, and then use points to wipe out the cost on your statement. Bank of America® also has one of the broadest definitions of "travel" of any major issuers. You can use points to get credit for airfare, hotel stays, cruises, car rentals, campgrounds, art galleries, amusement parks, carnivals, circuses, aquariums and zoos.

» MORE: Full review of the Bank of America® Travel Rewards credit card

The United℠ TravelBank Card offers a simpler way to earn free flights on United Airlines for casual flyers committed to that airline. But honestly, you’re better off with a cash-back credit card .

If you spread your flying among a number of carriers or want more flexibility, consider a general travel credit card . United loyalists are likely to get more value from the United℠ Explorer Card .

Information related to the United℠ TravelBank Card has been collected by NerdWallet and has not been reviewed or provided by the issuer of this card.

This card earns bonus rewards in multiple categories, including dining and travel. You can transfer points on a 1:1 basis to about a dozen hotel and airline programs, including United, or you can use them to book travel through Chase at 1.25 cents per point. However, you won't get any airline-specific perks. Annual fee: $95 .

Looking For Something Else?

Methodology.

NerdWallet reviews credit cards with an eye toward both the quantitative and qualitative features of a card. Quantitative features are those that boil down to dollars and cents, such as fees, interest rates, rewards (including earning rates and redemption values) and the cash value of benefits and perks. Qualitative factors are those that affect how easy or difficult it is for a typical cardholder to get good value from the card. They include such things as the ease of application, simplicity of the rewards structure, the likelihood of using certain features, and whether a card is well-suited to everyday use or is best reserved for specific purchases. Our star ratings serve as a general gauge of how each card compares with others in its class, but star ratings are intended to be just one consideration when a consumer is choosing a credit card. Learn how NerdWallet rates credit cards.

About the author

Gregory Karp

milenomics.com

Learn, Use, Repeat. A detailed trip into the world of Points, Miles, and Travel. How to earn more Miles and how to use those miles more effectively

Things to Keep in Mind About Airline Travel Bank Credits

Editor’s Note: The following Post is Guest written by Matt from Miles Earn and Burn. Special thanks to Matt for putting this resource together.

In Episode 48 of the Milenomics No-Annual Fee Edition Podcast, Robert and Sam talked about the perils involved in holding funds in airline travel banks or certificates. To summarize this excellent discussion, each airline has different expiry rules, travel banks are held and redeemed in different ways, and sometimes you can extend the validity of the funds, but sometimes not. Of course these funds are still useful in travel hacking, especially for cashing out certain types of travel credits from premium credit cards.

Perhaps it goes without saying, but if you have the choice between a full cash-out and a travel bank, always take the full cash out. Travel banks aren’t the same as cash and shouldn’t be treated as such. Cash, for example doesn’t expire, cash can be used to buy seat-upgrades and pay change fees, cash doesn’t tie you to a particular airline, cash can be invested to earn a return. Cash is fungible, travel bank funds are not. For those times when cash isn’t an option, here are the basic rules for the major US airlines in order of my perceived ease of use:

United Travel Bank

United’s Travel Bank is arguably the most straight forward to use and keep active. It unfortunately can’t be used on non-United or United Express flights, and as of January 14, 2021 it doesn’t seem to work as a way to cash out American Express Platinum airline credit.

Note: United’s Travel Bank Terms and Conditions only mention an expiration at 18 months, but they show a different expiration date next to each load at this link . It’s unclear whether either or both apply. To be safe, I’d assume both.

JetBlue Travel Bank

JetBlue’s Travel Bank is managed by Sabre, not JetBlue itself, a fact which is painfully obvious when you try and interact with it and see how disconnected from JetBlue’s website it truly is.

Alaska Airlines Credit Certificates

Alaska doesn’t have a travel bank, but they have a wallet which lets you combine certificates into something that looks like a bank. You can see your wallet funds at this link . During the height of the travel downturn caused by the COVID pandemic Alaska let you convert certificates into miles, however that offer has expired and I don’t expect it to come back.

Southwest Airlines Travel Funds

Southwest travel funds are easy to see and manage , but there’s a huge caveat with them: if you book airfare using multiple funds, the earliest expiration date applies to the new booking — you must complete travel before expiration and if you cancel the newly booked ticket, you’ll get a new travel fund certificate that expires on the date of the earliest expiration original funds.

Delta Air Lines eCredits

Delta has no formal travel bank program, but they do have eCredits for non-refundable fares cancelled more than 24 hours after booking. You can use up to three of them per ticket, but the eCredit must be booked in the name of the certificate holder. If everything is working with Delta’s IT, you should be able to see them at this link . (Note: This never works for me, but I’ve seen it work for others. I have to call reservations to find out what I’ve got.)

Note that unlike most other airlines, Delta’s eCredits just require that you book by expiration, even if your flight is months after the expiry of the eCredit, it can still be used to pay for airfare.

American Airlines Vouchers

American doesn’t have a full travel bank like some other airlines, but they do have eVouchers, Travel Vouchers, and Trip Credits, all of which are largely similar.

Matt is the creator of Miles Earn And Burn , a travel hacking short-post blog that posts once per day, Monday through Friday.

About the author

Related posts.

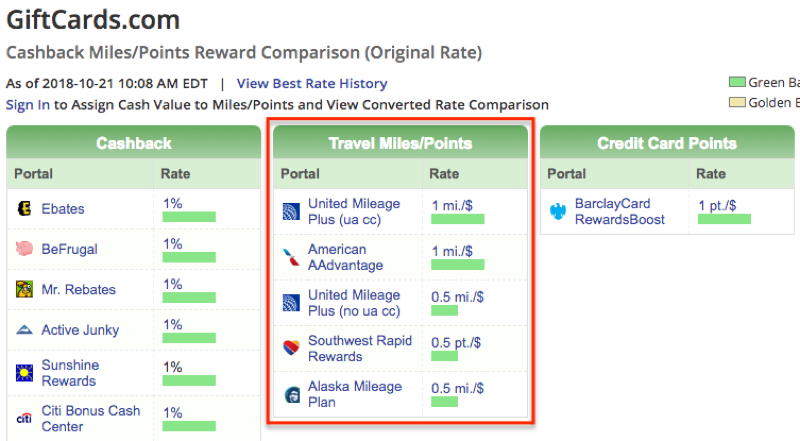

You Can Now Earn Airline Miles for Shopping at GiftCards.com

Airline Portal Holiday Bonuses

My Experience Stacking CNB Rewards with the $100 Visa Infinite Discount Air Benefit

Helpful overview, thanks for the work Matt

Thank you Mike and Maria!

- Pingback: Southwest Companion Pass, Bank Bonuses, TikTok Financial Advice, Biden Era Begins - TravelBloggerBuzz

- Pingback: Weekend Vibes – Miles Earn and Burn

- Pingback: Tuesday Triple Threat – Miles Earn and Burn

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Notify me of follow-up comments by email.

Notify me of new posts by email.

- Our Bloggers

Select Page

Your United TravelBank funds may expire a lot earlier than you think

Posted by The Points Pundit | Jan 5, 2021 | Airlines , Deals | 4

Image Credit: Unsplash

For many in this hobby, using travel credits is often a tough task. Over the last few months, we’ve seen many blogs report how United’s Travel Bank can be an option to use up your airline free credit. However, you’ll need to keep the terms and condition in mind before you load up your United TravelBank account with funds.

United TravelBank

Over the last few months, many data points have indicated that this has worked successfully for many people in different denominations, right from a $50 load to a $250 load across different card products and issuers. However, unlike United’s MileagePlus miles which no longer expire, United’s Travel Bank funds do expire .

Expiration Dates

You’ll need to remember two sets of rules here. Firstly, the T & C’s that determine when your individual travel fund loads will expire. As soon as you load an amount to the Travel Bank, you can use that amount for five years on any United operated flight. The flight must be on United metal. However, you can use your travel bank funds to book flights for someone else.

Members can choose from six purchase amount options and once purchased the value remains valid for five years from the date it is deposited in your TravelBank account. Purchases are not refundable and are limited to $5,000 per day per MileagePlus account. This purchase is also subject to all of the TravelBank terms and conditions .

These funds expire in batches, on a rolling basis every five years. Here’s a snapshot of how it looks in my account.

Secondly, there are T & Cs that also determine travel fund expiration due to inactivity.

As a general rule (and unless stated otherwise by United under the terms of a particular offer or the terms of certain qualifying activity as determined by United from time to time) all accrued TravelBank Cash in an Account is subject to expiration and/or forfeiture for any Member who fails at any time to engage in Account Activity (as defined above) for a period of eighteen (18) consecutive months. United may, but shall have no obligation to, send a Member a notification of TravelBank Cash nearing or subject to expiration.

The Pundit’s Mantra

While United TravelBank is a great option to use your credits, you’ll need to keep a couple of things in mind. Firstly, the funds you load will expire every 5 years, but in batches. Secondly, if your TravelBank account has no activity for 18 months, you may lose all the funds in your account. Moreover, United may or may not send you any notification about expiring funds well in advance.

I hope this post was able to shed light on the complexities of travel bank fund expiration. While this option is great, the last thing you’d want is to load thousands of dollars into it and lose all the funds due to lack of activity for 18 months.

___________________________________________________________________________________________________________________

The American Express Gold Card is currently offering a welcome bonus of 60,000 Membership Rewards points. You’ll earn a welcome bonus of 60,000 Membership Rewards points after you spend $4,000 in the first 6 months after you’re approved for the card.

Moreover, the card offers lucrative bonus earning categories, benefits and credits.

- 4x points on dining (including takeout and delivery) and grocery spend

- 3x points on flights

- $120 dining credit annually

- $120 Uber Eats/Uber credit annually

- $100 airline credit (ends on December 31, 2021)

- No foreign transaction fees

Never miss out on the deals, analysis, news and travel industry trends. Like us on Facebook , follow us on Instagram and Twitter and get the latest content!

Disclosure: The Points Pundit receives NO compensation from credit card affiliate partnerships. Support the blog by applying for a card through my personal referral links . This article is meant for information purposes only and doesn’t constitute personal finance, health or investment advice. Please consult a licensed professional for advice pertaining to your situation.

Join our mailing list to receive the latest news and updates from our team.

You have successfully subscribed, the points pundit.

Ashish's quest to travel the world was fueled by an insatiable appetite to experience language, culture, people and music all over the world. By using miles, points and loyalty programs astutely, he has now traveled to 6 continents! A marketing executive by profession, he leverages his marketing acumen to analyze the business side of loyalty programs and travel industry trends.

More Posts from The Points Pundit

Welcome to The Points Pundit, your new home for travel

February 18, 2019

The fastest way to fly from San Diego, CA to India

February 20, 2019

My favorite hotel points redemption to date

February 25, 2019

This site uses Akismet to reduce spam. Learn how your comment data is processed .

Does the 18 month account activity requirement still apply? I can’t find the clause in the terms and conditions.

I’m almost at 18 months no activity, so am worried about expiration

i tried to book with my travelbank, leaving ~$1 to pay with my united credit card so i could get a free checked bag. it didn’t go through. anyone had success with this?

[…] Your United TravelBank funds may expire a … – TravelUpdate […]

Here are my TB purchases: 01/04/2021 $100.00

01/04/2021 $100.00

01/02/2021 $50.00

10/18/2020 $50.00

10/18/2020 $100.00

So does that mean my earliest TB deposit on 10/18/20 will expire on 4/18/22? I heard the 18 month thing was phased out, but the verbage is still there on the T&C. If I buy another $50 TB on 4/17/22, then do ALL of my TB then reset to expire 18 months from that purchase date? (e.g. 18 mos from 4/17/22)?

Or Can I just book a fully refundable ticket for $400 (my total TB amount) and then refund it after a couple days?

[…] 资金过期规则一直有点迷惑,根据 TravelUpdate […]

Most Popular Posts

Our Authors

The Unaccompanied Flyer

Travel Gadget Reviews

The Flight Detective

Takeoff To Travel

The Hotelion

Bucket List Traveler

MJ on Travel

Family Flys Free

Maple Miles

Recent reviews.

- St Regis Cairo Review – A perfect stay Score: 100%

- Six Passengers in Two Business Class Seats in Gulf Air Score: 90%

- Review: Hyatt Place Waikiki Score: 83%

- Review: Hyatt Centric Waikiki Score: 81%

- Gulf Air Business Class from Mumbai to Bahrain Score: 65%

How do travel credit cards work?

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

- Connect with Holly D. Johnson on Twitter Twitter

- Connect with Holly D. Johnson on LinkedIn Linkedin

- • Credit cards

- • Travel loyalty programs

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money . The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

At Bankrate, we have a mission to demystify the credit cards industry — regardless or where you are in your journey — and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you're well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Key takeaways

- A travel credit card offers points or miles for the purchases you make with the card that you can redeem for future travel.

- Travel credit cards come in all shapes and sizes, from co-branded hotel or airline cards to general travel cards that allow points and miles transfers to partner brands.

- In terms of redemption, you'll typically get the most value by redeeming toward travel in your issuer's portal or by transferring rewards to hotel and airline loyalty programs.

- Before applying for a travel card, consider its fees, ongoing rewards structure and first-year welcome bonus opportunity.

Travel credit cards make it easy to earn rewards — usually offered in the form of points or miles — for certain types of purchases. You can typically redeem your travel rewards for the big expenses associated with your next trip such as flights, hotels, car rentals and vacation packages. Some issuers also let you redeem travel rewards for statement credits and other non-travel options.

Some travel credit cards are associated with a specific airline or hotel loyalty program, whereas others let you earn rewards within a credit card’s rewards program . At the end of the day, you’ll want to understand the type of travel rewards your card offers, as well as available redemption options before you sign up.

Regardless of which type of card you choose, becoming a savvy travel rewards credit card holder can help offset travel costs and enhance your overall travel experience.

Types of travel credit cards

No matter your spending habits and rewards preferences, there’s likely a travel credit card that fits. Top travel credit cards include flexible rewards cards and those that are co-branded with another program, such as hotel credit cards and airline credit cards.

Flexible travel credit cards

Hotel credit cards, airline credit cards, how to redeem points and miles.

Once you’ve met the requirements for a hefty welcome offer or earned enough miles to cover your next flight or hotel stay, how do you redeem them? The kind of travel card you have and its respective rewards program determine how you can apply those rewards. If you have a hotel or airline credit card, you can typically only redeem those points with their respective loyalty programs, with a few exceptions. However, there are more ways to redeem flexible travel rewards , like booking through your card issuer’s online travel portal or transferring your points or miles to an issuer’s travel partners.

Redeeming rewards on an issuer’s online portal

Your card issuer will typically have a portal on its website that lists redemption options and points values. Examples of redemption options include statement credits, travel purchases, gift cards and cash back.

Rewards programs typically use a 1 point:1 cent conversion rate, meaning every 100 points or miles is worth $1. Some issuers, like Chase, also offer boosted points values or other perks for travel purchases made through their online portal. To get an idea of how much your points and miles are worth, take a look at Bankrate’s points and miles valuations page for an in-depth look at airline, hotel and credit card program rewards values.

To redeem your rewards on an issuer’s online portal, simply log in to your account and locate the appropriate rewards or travel section.

Redeeming rewards by transferring to a travel partner

Some travel rewards cards let you transfer points or miles to the issuer’s travel partners, which may include frequent flyer programs or hotel loyalty programs. This is often how to get the most value out of your travel rewards.

You can redeem travel rewards by transferring to an eligible travel partner through the issuer’s online portal. Transfer times can range from instantly to a few days — so plan ahead. Note, once you transfer points or miles from an issuer to a travel partner, you won’t be able to transfer them back to the issuer.

After you’ve transferred your points, you can book travel directly through the airline or hotel’s own loyalty program. Your credit card issuer is no longer involved in the process.

Other ways to redeem points and miles

Some credit cards allow you to redeem your points and miles for things like statement credits, cash back, gift cards or other merchandise. This is usually the least valuable way to redeem your points and miles so you’d be better off using them towards travel most times.

What’s the best way to maximize travel rewards?

When you want to make the most of your rewards, there’s no shortage of ways to spend a stockpile of points or miles. But here are some of the best ways to use your travel rewards :

- Book luxury accommodations

- Cover or lower the cost of your next flight

- Reserve a rental car at your destination

- Upgrade a flight or hotel stay

Be sure to check your card issuer’s online portal and travel partners for deals — such as a travel portal redemption bonus or transfer bonus to a specific hotel or airline — to help stretch your rewards further. In many cases, you can also choose to exchange your travel rewards for cash or a statement credit. But keep in mind that doing so usually dilutes the value of those rewards. Once you get the hang of using your travel credit card, you can maximize those rewards on bigger, better travel plans.

In general, the best value for flexible travel rewards will come from transferring them to various loyalty programs. For instance, the Chase Sapphire Preferred® Card’s rewards points are worth 1 cent each when redeemed for cash back, 1.25 cents each when redeemed for travel through the Chase Travel portal and 2 cents each on average when transferred to a travel partner (according to Bankrate’s valuations ).

However, the value you get out of transferring points ultimately depends on how you redeem them. If you transfer 10,000 points from your travel credit card to an airline partner to book a flight that would’ve cost $300 in cash, your points would be worth 3 cents apiece in this case. However, if you used those same points to book a flight worth $100, your points would only be worth 1 cent apiece.

How to maximize your travel rewards

As we’ve mentioned, the best way to redeem points or miles is to transfer your rewards to one of the issuer’s airline or hotel partners and redeem them for accommodations or airline tickets. But making good use of a travel rewards card is about more than just earning and redeeming rewards — it’s also about managing the card itself well.

Whether you’re trying to get the best possible redemption value or want to know which pitfalls to avoid, here are a few tips to help you get the most out of your travel rewards.

Use your card responsibly

The most important rule of using a travel credit card is to always pay your bill on time and in full and never carry a balance if you can help it. To do this, make sure you never charge more than you can afford to pay off each month, and don’t let the prospect of rewards cause you to overspend. Credit card rewards aren’t worthwhile if you’re going into debt or racking up interest charges and fees to get them.

Don’t miss out on a sign-up bonus

Many travel credit cards come with generous sign-up bonuses requiring you to spend a certain amount within the first few months of opening the account. Although these bonuses are often an attractive incentive to apply for a card, make sure the spending requirement is realistic for your budget and travel plans before you choose a travel credit card . You don’t want to end up in debt for the sake of earning extra rewards.

Don’t ignore the card’s fees

Credit card fees don’t directly affect the rewards you earn, but the cost of the fees does affect a card’s overall value to you. Take note of all the fees associated with any card you’re interested in getting.

One of the biggest fees to watch out for with travel credit cards is the annual fee some cards charge. Not all travel cards come with an annual fee, but those that do can range from an approachable $95 to $695 (or more). If you’re interested in a travel card that has an annual fee, be sure that the rewards and benefits will offset the cost. Otherwise, consider our list of the best travel credit cards with no annual fee .

Watch out for foreign transaction fees

Some credit cards charge a foreign transaction fee for purchases made abroad or in a foreign currency. This fee is usually around 3 percent of a purchase, and you’ll pay this fee for every transaction you make overseas. If you travel abroad frequently, you should consider getting a credit card with no foreign transaction fees .

Luckily, many of the best travel rewards cards don’t charge foreign transaction fees, but it’s always a good idea to verify that before applying.

Make sure you have the right card

It’s important to find the right travel card for your needs, which you can do after comparing options and considering all their pros and cons . For example, if you’re partial to a certain airline or hotel chain, a co-branded credit card can offer better rewards rates, discounts and perks related to that specific airline or hotel compared to a generic travel card.

Additionally, pay attention to a travel credit card’s rewards categories. For example, earning points or miles at restaurants won’t deliver a lot of value if you rarely dine out. But if you use services like Lyft or Uber a lot, you may want to look into a card that offers points or miles for rideshares.

How to choose a travel rewards card

Choosing the right travel rewards card is a highly personalized decision. Ultimately your spending habits, goals, finances and credit history will determine which travel card works best for you. This may require some self-reflection and an assessment of your financial situation to find the right travel card. Review these factors in your financial life to get clear on which travel card you need:

- Travel preferences. Do you prefer using one specific airline or hotel chain when you travel? Or would you rather have the freedom to use your points on whichever hotel and flight you choose? For loyalty-based rewards, go for a co-branded travel card. If you prefer flexibility, generic travel cards will give you more options.

- Spending habits. What do you spend the most money on? One of the best ways to choose a travel card is finding one that offers the highest rewards for the categories you spend the most in.

- Welcome offers. You may find welcome offers for travel credit cards where you can earn extra rewards by meeting purchase requirements within a certain timeframe. As long as you’re able to comfortably meet the spending requirements, a bonus offer could be a deciding factor.

- Credit history. Like most credit cards, applying for a travel rewards card means a hard credit check to determine eligibility. If you know where your credit score stands, it’s best to choose travel rewards cards that fit your credit profile to avoid unnecessary denials and credit inquiries. For cards that match your credit, use Bankrate’s CardMatch™ tool .

- Annual fee. There are plenty of travel credit cards with no annual fee if that’s what works for your budget. However, some cards with annual fees are worth it thanks to extra perks and benefits.

Travel rewards cards for beginners

When you’re ready to earn rewards, it’s best to start with a beginner-friendly travel card so you can get the hang of things. Here are our picks for beginner travel rewards credit cards:

- Discover it® Miles . Earn unlimited 1.5X miles on all of your purchases without an annual fee. With a simple rewards structure and a mile-for-mile match on all of the miles you earn at the end of your first year, you’ll find plenty of ways to make the most of this flexible travel rewards card.

- Capital One Venture Rewards Credit Card . Get flexible travel rewards that are easy to use and understand, for a modest $95 annual fee. Earn 2X miles on all purchases and 5X the miles on hotels and rental cars booked through the Capital One Travel portal.

- Bilt Mastercard® . If you want to earn travel rewards by paying your rent, the Bilt Mastercard has you covered. Earn 1X points on rent (up to 100,000 points each year) without any transaction fees, 2X on travel and 3X on dining. Plus you’ll access exclusive benefits on the first of every month as part of Bilt’s monthly “ Rent Day ” promotions.

- Chase Sapphire PreferredⓇ Card . If you’re looking for your first travel credit card, but it’s not your first time using a credit card, the Sapphire Preferred offers tons of cardholder perks and high rewards on travel and everyday categories like dining. For $95 per year, you’ll benefit from a $50 annual hotel credit through the Chase Travel portal, a solid lineup of travel protections and 25% more value when you redeem your points through Chase Travel.

These might not be your forever cards, but they’re a good starting point for learning how travel credit cards work. They’ll also help you get familiar with earning, redeeming and eventually maximizing travel rewards.

The bottom line

Using a travel rewards credit card can help you elevate your travel experiences by earning points or miles from your purchases. When you choose a travel card that aligns with your budget and goals, it can significantly reduce your travel costs or provide perks that enhance your trip. There’s a learning curve to using a travel card, but once you get the hang of it, you may be surprised by how much you can accomplish with your redemptions.

To make sure a travel credit card is ultimately worth it for you , be sure to select a card that rewards you for the type of purchases you make most often or the categories you spend the most in. Ideally, it won’t charge a fee that costs more than you’ll earn in rewards. If you’re ready to jump into the travel rewards lifestyle and start earning points toward your next trip, take a look at the best travel rewards cards to make your decision a little easier.

A guide to earning and redeeming frequent flyer miles

Do I need credit card travel insurance?

5 benefits you need from a travel credit card

Are travel credit cards worth it?

The pros and cons of travel credit cards

Should I get a travel credit card that earns points, miles or both?

5 steps to choose the best travel card

Best Travel Credit Cards of 2024

We’re sorry, this site is currently experiencing technical difficulties. Please try again in a few moments. Exception: request blocked

Foreign Banks Target Switzerland After UBS Takeover of Credit Suisse

FILE PHOTO: A UBS logo is pictured on the branch of the Swiss bank in Lucerne, Switzerland, June 14, 2024. REUTERS/Denis Balibouse/File Photo

By Oliver Hirt and Noele Illien

ZURICH (Reuters) - As Credit Suisse fades into history following its takeover by UBS last year, global banks are expanding in Switzerland to take advantage of companies' desire to spread their business.

France's BNP Paribas, Deutsche Bank and U.S. lenders Citi and Bank of America are among those increasing staffing and courting smaller companies that form the bedrock of the Swiss economy.

"When one player is absorbed, the musical chairs are being rearranged and that creates opportunities," said Enna Pariset, who heads BNP's Swiss operations. "Sometimes you're lucky."

Still, it is far from clear whether their gradual expansion will seriously challenge UBS, whose market strength is already making some firms uneasy, and has caused concerns at the Swiss competition watchdog COMCO.

Credit Suisse, which unravelled after a string of scandals, was long regarded by Swiss industry as the natural partner for business in a banking landscape it dominated alongside UBS.

"Shortly after the collapse of Credit Suisse, corporates immediately opened discussions with foreign banks like us," said Jürg Hobi, head of Citi's Swiss commercial banking arm.

Citi, which in September 2022 began serving smaller local firms with international business, was benefitting from concerns about over-dependency on a single bank and a shortage of credit, Hobi said.

Today, Citi employs eight staff in Swiss commercial banking, and aims to double that by 2028.

Nicola Tettamanti, president of Swissmechanic, which represents small and medium-sized industrial companies in Switzerland, welcomed the moves by foreign banks, although he said the benefits might take some time to filter down.

"As a fan of competition I am quite comfortable with more players in the market, which will lead to improved services and better prices," he told Reuters.

"I think they will focus on the big companies first, but the smaller companies will eventually see the benefits after the banks have built up their business," added Tettamanti, who also wanted Swiss banks to do well abroad.

COMPETITION FEARS

At Deutsche Bank, 50 people work at its Swiss corporate banking arm, 10% more than at the start of 2023, said Veronique Voser, head of the unit for Germany, Switzerland and Austria.

The fall of Credit Suisse helped to convince the German bank to expand in Switzerland and take on businesses with annual turnover of at least 500 million Swiss francs ($560 million), she said.

"We managed both to win new business and increase our business volumes with existing customers," Voser said, pointing to double-digit revenue growth in 2022 and 2023.

But UBS, easily Switzerland's biggest bank, looms over them all.

Choice for retail banking clients, for the wealthy and for large corporations like Nestle, Roche and Novartis may still be broad - but smaller firms feel less comfortable.

"In terms of the loans financing, I've seen instances where competitors have been increasing pricing and the clients have asked us to step in as an alternative", said BNP's Pariset.

Swiss financial regulator FINMA last week said the UBS-Credit Suisse takeover had not created competition worries, despite concerns flagged by antitrust authority COMCO.

COMCO said the deal warranted a deeper review and that there were no "fully-fledged alternatives" in corporate banking to UBS, urging authorities to encourage "effective competition".

Asked about the competitive landscape, a UBS spokesperson pointed to previous statements from the bank in which it has, among other things, rejected criticism about its size.

UBS's Switzerland boss, Sabine Keller-Busse, told the Neue Zuercher Zeitung newspaper this month that rival banks had been looking to poach its clients ever since Credit Suisse failed.