Aaa Member Loyalty Travel Accident Insurance Reviews

Are you planning your next adventure and want to make sure you’re covered in case of an accident? Look no further than Aaa Member Loyalty Travel Accident Insurance. This insurance option provides peace of mind for all types of travelers, whether you’re heading out on a solo backpacking trip or taking the whole family on a vacation.

In this blog post, we’ll review the benefits and drawbacks of Aaa Member Loyalty Travel Accident Insurance, who it’s best suited for, and how to get the most out of this coverage option. So sit back, relax, and let us guide you through everything you need to know about Aaa Member Loyalty Travel Accident Insurance!

What is Aaa Member Loyalty Travel Accident Insurance?

Aaa Member Loyalty Travel Accident Insurance is a type of insurance plan that provides coverage for travelers in the event of an accident while traveling. This particular insurance option is available to members of Aaa, or the American Automobile Association, which is a well-known organization that offers various services and benefits to its members. This travel accident insurance covers a wide range of accidents that may occur while you’re on the road or in another country. It can include anything from accidental death and dismemberment to emergency medical evacuation and repatriation. Depending on your specific policy, it may also provide coverage for trip cancelations or delays due to unforeseen circumstances. One important aspect to note about Aaa Member Loyalty Travel Accident Insurance is that it only provides coverage for accidents related directly to travel. If you have any pre-existing medical conditions or other health concerns, be sure to check with your insurer regarding what might be covered under this plan. Aaa Member Loyalty Travel Accident Insurance is an excellent option for anyone who travels frequently and wants added peace of mind knowing they’re protected should an unfortunate incident occur during their trip.

How does Aaa Member Loyalty Travel Accident Insurance work?

Aaa Member Loyalty Travel Accident Insurance provides coverage for accidents that occur while traveling. This can include accidental death, dismemberment, or permanent paralysis. The insurance is available to AAA members who are covered by their auto insurance policy. If a covered accident occurs while on a trip, the insured member or their beneficiary will receive compensation based on the amount of coverage they have purchased. The amount of coverage ranges from $100,000 to $500,000 and premiums vary depending on the level of coverage selected. The insurance also includes additional benefits such as emergency medical transportation and travel assistance services. These services can help coordinate emergency medical care or transportation back home in case of an unforeseen event. It’s important to note that Aaa Member Loyalty Travel Accident Insurance only covers accidents while traveling and does not provide any other type of travel protection such as trip cancellation or lost luggage reimbursement. Members should consider purchasing separate travel insurance policies if they need this type of coverage. To purchase Aaa Member Loyalty Travel Accident Insurance, members can contact their local AAA branch or visit the AAA website to get a quote and enroll online. It’s important to review all terms and conditions before enrolling in any insurance policy to fully understand what is included in your plan.

What are the benefits of Aaa Member Loyalty Travel Accident Insurance?

Aaa Member Loyalty Travel Accident Insurance offers a variety of benefits that can make traveling less stressful for you and your loved ones. One major benefit is the peace of mind that comes with knowing you are protected in case of an accident while traveling. Traveling can be unpredictable, which makes having insurance all the more important. With Aaa Member Loyalty Travel Accident Insurance, you’ll have coverage for medical expenses related to accidents that occur during travel. This includes emergency medical transportation, hospital stays, and surgeries. Another great benefit is the 24/7 assistance provided by Aaa’s travel team. Whether it’s help finding a doctor or arranging transportation back home after an accident, they’re there to assist you every step of the way. Aaa Member Loyalty Travel Accident Insurance also offers coverage for loss of life or limb due to an accident while traveling. This can provide financial security for your loved ones in case something were to happen on your trip. Aaa Member Loyalty Travel Accident Insurance offers valuable benefits that can give you peace of mind when traveling. It’s always better to be safe than sorry!

What are the drawbacks of Aaa Member Loyalty Travel Accident Insurance?

While Aaa Member Loyalty Travel Accident Insurance offers a range of benefits, there are also some drawbacks to consider. One potential drawback is the limited coverage amount provided by this insurance policy. If you’re looking for more comprehensive and higher coverage limits, then this policy may not be suitable for your needs. Another potential concern with Aaa Member Loyalty Travel Accident Insurance is that it only provides accidental death and dismemberment coverage. This means that if you become ill during your travels or sustain injuries in an accident that doesn’t result in death or dismemberment, you won’t be covered under this policy. Additionally, while Aaa Member Loyalty Travel Accident Insurance does offer 24/7 customer support and emergency assistance services, their response time may not always be as quick as other travel insurance providers. This could potentially leave you stranded without immediate help in case of an emergency situation. It’s also important to note that pre-existing conditions aren’t covered under this policy, which can limit its usefulness for those with ongoing medical issues. Ultimately, when considering whether or not to purchase Aaa Member Loyalty Travel Accident Insurance, it’s crucial to weigh both the benefits and drawbacks carefully before making a decision.

Who is Aaa Member Loyalty Travel Accident Insurance best for?

Aaa Member Loyalty Travel Accident Insurance is best for those who frequently travel long distances, especially internationally. This insurance plan offers coverage for accidents that may occur while traveling, such as accidental death or dismemberment. It’s also ideal for those who participate in high-risk activities during their travels, like extreme sports or adventure activities. These types of activities can increase the risk of accidents and injuries, so having a reliable insurance plan can provide peace of mind. Furthermore, Aaa Member Loyalty Travel Accident Insurance is suitable for individuals with pre-existing medical conditions who are concerned about not being covered by other insurance plans. It offers coverage regardless of pre-existing conditions and doesn’t require any medical exams before enrollment. This insurance plan is perfect for frequent flyers looking to save money on trip-by-trip policies. With Aaa Member Loyalty Travel Accident Insurance annual policy options available at affordable prices, it eliminates the need to purchase individual travel accident policies every time you go on a trip. If you’re someone who values safety and security while traveling and wants an affordable way to protect yourself against unforeseen circumstances that could arise during your journeys – then Aaa Member Loyalty Travel Accident Insurance might be right up your alley!

How to get the most out of Aaa Member Loyalty Travel Accident Insurance

To get the most out of Aaa Member Loyalty Travel Accident Insurance, it’s important to thoroughly research and understand the policy before purchasing. Make sure you know what is covered and what isn’t, as well as any limits or exclusions that may apply. When traveling, always carry your insurance card with you and keep a copy stored digitally in case of loss or theft. In case of an accident or emergency, contact the 24/7 assistance service provided by Aaa for help navigating medical care and making claims. It’s also important to stay up-to-date on any changes or updates to your policy. Take advantage of any resources provided by Aaa for members, such as online account management tools and customer support services. Aaa Member Loyalty Travel Accident Insurance can be a valuable addition to your travel planning toolkit. While it may not cover every possible situation that could arise while traveling, having this type of coverage can provide peace of mind knowing that you’re protected in case something unexpected does happen.

Table of Contents

Privacy Overview

AAA Member Loyalty Travel Accident Insurance: A Comprehensive Guide

Traveling can be an amazing experience, full of fun, excitement, and new adventures. But accidents and emergencies can happen anywhere, even on vacation. That’s why having travel accident insurance is so valuable for AAA members.

AAA Member Loyalty Travel Accident Insurance provides protection in case you suffer an accidental injury or even death while traveling. This article will explain everything you need to know about this valuable coverage.

Overview of AAA Member Loyalty Travel Accident Insurance

This AAA insurance policy provides the following core benefits:

Accidental Death – Pays up to $300,000 if you die in a covered travel accident.

Dismemberment – Pays up to $300,000 for loss of limbs or eyesight from an accident.

Loss of Speech/Hearing – Provides benefits if you suffer loss of speech or hearing due to an accident.

It covers accidents that occur when traveling via common carrier, such as a plane, train, or bus. It also covers accidents during the process of boarding or disembarking these transportation methods.

This policy is automatically included with AAA Premier membership at no added cost.

Who is Eligible for Coverage?

To be eligible for AAA Member Loyalty Travel Accident Insurance, you must:

- Have a valid AAA Premier membership

- Purchase travel through the AAA Travel Agency

- Be under 70 years old

The insurance covers the primary AAA member as well as their spouse/domestic partner and any unmarried dependent children under 26 years old.

One key advantage is that there are no medical exams or health questions required to qualify. Coverage is guaranteed for all eligible Premier members.

When Does AAA Travel Accident Coverage Apply?

This AAA insurance policy covers accidents that occur:

While riding as a ticketed passenger on any licensed common carrier, such as a plane, train, bus, taxi, or rideshare.

During the process of boarding or disembarking these transportation methods.

While riding to/from the terminal or station immediately before or after your trip.

While riding in a rental car or personal vehicle to/from an airport, station or terminal.

So you have protection for accidents throughout your travels when booked through AAA.

AAA Travel Accident Insurance Benefits

Here are details on the benefits provided by AAA Member Loyalty Travel Accident Insurance:

Accidental Death

- Pays $300,000 for accidental death while traveling

Dismemberment

- $300,000 for loss of 2+ limbs, eyesight, speech, and hearing

- $150,000 for loss of 1 limb, eye, speech, or hearing

- $75,000 for loss of 1 hand, 1 foot, or thumb/index finger of same hand

Loss of Life Benefit for Dependent Child(ren)

- $25,000 per child if caused by a covered accident

Benefits are paid directly to you or your selected beneficiaries. The coverage has a maximum limit of $20 million per any one accident.

Additional AAA Member Benefits

AAA Member Loyalty Travel Accident Insurance also includes these extra benefits:

Spouse Membership – If the primary member passes away in a covered accident, the spouse receives a complimentary AAA membership for life.

Bereavement Counseling – Up to 5 sessions of grief counseling are provided if you suffer a covered loss.

Seat Belt Benefit – An additional 10% is paid, up to $50,000, if you die while properly wearing a seat belt in a private vehicle accident.

Airbag Benefit – An extra 5%, up to $5,000, is paid if you die while wearing a seat belt and the airbag deploys in a private vehicle accident.

Job Assistance – Up to $5,000 is provided to your spouse for job skills training and job placement assistance if you die in an accident.

AAA Members receive comprehensive support and protection while traveling with this coverage.

What Accidents and Losses Are Not Covered?

While AAA Travel Accident Insurance provides valuable benefits, there are some limitations on what is covered:

Excluded Accidents/Losses:

Illness or disease

Mental or emotional disorders

Pregnancy and childbirth

Strokes or cerebrovascular accidents

Suicide or attempted suicide

Declared or undeclared war

Commuting accidents (only covers while in direct transit to the trip)

Other Exclusions:

Injuries while piloting an aircraft

Accidents on personally owned, leased, or chartered aircraft

Races or speed contests

Injuries while driving under the influence

Be sure to read the full exclusions section of the policy. But in general, the coverage is designed for unforeseen accidents while traveling, not pre-existing conditions or high risk activities.

How Much Does AAA Travel Accident Insurance Cost?

A major advantage of this coverage is that there are no direct costs for eligible AAA Premier members.

The travel accident insurance is included automatically when you join AAA Premier. The premium costs are built into the AAA Premier membership dues.

AAA Premier membership starts at just $99 per year in most states, with rates varying based on your location. This covers the entire household, including spouse/partner and dependents under 26 years old.

Considering a AAA Premier membership can save you hundreds on travel, automotive and shopping discounts, the travel accident insurance coverage provides even more value and protection.

How to File a AAA Travel Insurance Claim

If you need to file a claim due to an accident on your trip, follow these steps:

Report the accident to AAA as soon as possible. Claims should be filed within 60 days.

Submit a written claim form, which can be obtained from your local AAA branch.

Provide documentation such as medical records, death certificates, and police reports to verify the loss.

You or your beneficiaries will need to provide proof of travel purchases through AAA and documentation of the accident.

A claims examiner will review the documentation and investigate the circumstances of the accident.

If approved, the applicable benefit amount will be paid via check.

Contact your local AAA branch anytime you need assistance filing a claim.

Why AAA Travel Accident Insurance is Worth It

Travel insurance is always smart when venturing away from home. With AAA Member Loyalty Travel Accident Insurance, you get these key benefits:

Peace of Mind – Travel worry-free knowing your accident risks are covered.

Convenient – The coverage is built into your AAA membership automatically.

Affordable – There are no extra costs or premiums for eligible members.

Comprehensive – Benefits cover everything from small injuries to the unthinkable.

Worldwide – Protection applies wherever you travel globally.

Worry-Free Claims – AAA agents help handle paperwork if a claim occurs.

For AAA members, this insurance provides protection for life’s unexpected events without the hassle or cost of a separate policy. Learn more about this coverage when planning your next adventure away from home.

AAA Member Loyalty Accident Insurance Review: Pros and Cons

What does AAA travel Accident Insurance cover?

What does travel Accident Insurance cover?

What is AAA loyalty program?

What is group travel Accident Insurance?

Related posts:

- Finding the Best Car Insurance Quotes in Jacksonville, North Carolina

- Finding the Best Oklahoma Small Business Health Insurance

- The Costly Consequences of Driving Without Insurance in Michigan

- Can You Sell a Car Without Insurance? What to Know Before Transferring Ownership

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

404 Not found

AAA Insurance Review – My Experience Using AAA Insurance

AAA doesn’t just offer valuable roadside assistance and TripTiks (Google it if you’re too young to remember these). They also offer some pretty good insurance products – but the catch is, they’re not available in every state.

Read on to learn more about AAA Insurance and whether it’s a good option for you.

What is AAA Insurance?

AAA, also known as the American Automobile Association, is a popular membership club that allows you to receive all kinds of travel benefits. But what most people don’t realize is that they’re one of the biggest auto insurance companies across the globe, too.

I’ll tell you right now – if you’re looking for something incredibly barebones, AAA is probably not going to be the best solution for you. But, if you are looking for a bunch of bells and whistles that come with your auto insurance, you might love AAA.

Plus, there are a lot of discounts you can take advantage of (more on that below). I’ll cover some of the pros and cons below, so you can determine if paying a membership fee to your car insurance provider is worth it or not.

How does AAA Insurance work?

Across the country, there are quite a few different AAA Auto Clubs. A lot of them actually offer insurance products, too – such as homeowners insurance, life insurance, and (of course) auto insurance, as well as several other types of insurance products.

Each of the clubs, and their corresponding insurance businesses, are independently operated. They also have a wide range of affiliations with one another.

The reason this is important (and slightly frustrating) is that insurance coverage, benefits, and discounts will have a huge amount of variance depending on the location.

AAA in some locations will act as a broker. This means they’ll get your information and refer you elsewhere – like Allstate or Liberty Mutual – who will then sell you insurance.

Even though you aren’t getting insurance through AAA, because they brokered the deal, you’ll still get your AAA member discount.

I’ve found that this happens a lot, particularly with homeowners insurance. My insurance provider, Geico, did this for my homeowners insurance and referred me to another provider but I still got the awesome rate.

But in most cases, AAA will directly sell you insurance. And their ratings are a little better than average in most categories, across the board, according to J.D. Power.

If you’re eligible for their homeowners insurance, you’ll probably find pretty good rates, but coverage options that are somewhat limited when compared to other insurance providers.

In fact, their homeowners insurance isn’t as accessible as their car insurance, and sometimes the only way to get it is by bundling with car insurance. As is with most insurance providers, bundling your home and auto insurance can save a significant amount of money.

So, if for any reason you already have AAA auto insurance, I strongly suggest you look into homeowners, too.

To be eligible for AAA insurance, you’re going to have to be a member of AAA first. This is typically under $100 per year and comes with a bunch of benefits, but only in rare circumstances will you be able to get insurance with them if you’re not a member.

Even though you’ll need to be a member, the discounted insurance rate you’ll receive through AAA should more than compensate for the additional cost of membership. Simply put, it really doesn’t matter that you need to be a member.

One way of looking at the additional expense is to think of it as an extension of your AAA membership. A good example of this is the roadside assistance you get through a AAA membership.

Nearly every other insurance company will charge you a fee for this, or force you to upgrade your insurance policy. AAA includes it in their membership.

Pricing for AAA Insurance

AAA insurance pricing is going to vary, especially because their primary product is car insurance. There are several factors that go into determining a rate for car insurance, so it’s best to just get a quote directly from AAA.

You can do this by going to the AAA website and punching in your zip code to see if insurance is available in your area. From everything I’ve seen, AAA’s pricing on auto insurance is excellent.

AAA Insurance features

Auto insurance.

As I mentioned before, there are several AAA clubs across the country, and many of them offer insurance through a variety of companies. For instance, Arizona residents are able to purchase auto insurance through CSAA (California State Auto Association) Insurance Group, with AAA acting as the broker.

Residents in Texas, however, are eligible for insurance, but it’ll be through the Auto Club Enterprise Group. So, whether or not you’ll have coverage in your area, what that coverage will be, and what discounts you’ll have available to you will depend on where you live.

That said, some of the more common benefits you’ll find (though not ALL customers will find) are as follows:

- Bodily injury and property damage liability. Property damage protects you if you’re at fault in an accident, whereas liability will cover the costs of medical care.

- Collision. Covers the cost of damages to your car if you’re in an accident.

- Comprehensive. Covers any non-collision damage to your vehicle, and also pays for damages that are caused by collision with an animal.

- Uninsured/underinsured motorist. If you’re in an accident and the other driver is at fault, this will protect you if they either don’t have insurance, or don’t have enough insurance.

- MedPay/Personal Injury Protection. This pays for the cost of medical care for anyone in your car during an accident – and it doesn’t matter who was at fault.

- AAA mobile app. AAA has an app that allows you to do several things, including pull up your proof of insurance immediately if you’re pulled over or in an accident, and some locations allow you to get quotes and pay your bill through the app, too.

Remember, there are some areas that offer additional features, benefits, and coverage options. Below are some of the more standout options I found – just keep in mind if they are available, they’ll come with an added cost.

- Gap insurance. If your car is deemed a total loss, this will cover the difference between what you owe on your loan or lease and the cost to replace your car.

- Accident forgiveness. If you have a good driving record (“good” depends on your insurance product and where you live) this benefit will guard you against insurance increases after an accident.

- Rental car coverage. As long as you decline the coverage from a car rental agency, this option will cover you if you cause any damage to a rental car.

- Rental car reimbursement. This benefit will pay for a rental if your car is in the repair shop following an accident. Depending on where you live, this might be a rideshare credit as opposed to a rental car (which frankly might be less of a hassle, anyway).

- Pet coverage. Becoming more and more common, this benefit will pay veterinarian bills if your pet is hurt or dies in a car accident.

- Non-owners insurance. If you don’t own a car but you still drive (like borrowing a car or renting one through Turo), you’ll have liability coverage with this benefit.

Discounts for auto

Like coverage options, discounts for auto insurance are going to vary, too. Most auto insurers, however, offer discounts for bundling, having multiple vehicles, and safe driving.

Plus, you’ll get a AAA discount in almost every case – even if AAA refers you to another insurance provider.

If you’re getting AAA auto insurance in areas in the southwest – like California and Texas, or northeast – like the Boston-area, you’ll find more discount options than in other parts of the country.

Some examples of discounts I have seen are:

- Good student discount. Student drivers with good grades are eligible for 15% off their bill.

- Low mileage. If you drive very little throughout the year, you can get up to 12% off your bill.

- Advance purchase discount. If you buy AAA car insurance at least a week before your existing policy expires, they’ll give you 5% off.

- Paid in full discount. You’ll get 5% off if you pay your entire premium in full, upfront.

- Longevity discount. If you have been with the same auto insurance provider for 3 or more years, you may be eligible for a 12% discount.

- Student away from home. If you’re a student and your school is at least 100 miles away from home, and you don’t have a car, you’ll get 15% off your bill.

- Professional group association. If you’re a part of a specific affinity group, you can get up to 10% off your bill.

- AAA OnBoard. Get up to a 20% discount for equipping your car with a safe driving monitor. Note that this option is only available for Texas residents.

AAA membership perks

One of the things I love about my AAA membership is the roadside assistance feature.

You’ll get coverage for minor roadside repairs, fuel delivery, towing, or jump-starts with a simple phone call to AAA. Also, if you happen to get in a car accident more than 100 miles from where you live, AAA will cover the cost of things like a hotel, rental car, and other expenses so you can continue on your way.

And in case you haven’t seen the “AAA” sticker at businesses like hotels and airlines, know that they work with thousands of companies to get their members reduced rates on all kinds of things.

So if you travel frequently, this can add a ton of value to your insurance package (since you’ll need to be a AAA member, too). Another feature of AAA offers is travel accident insurance. If you pay for your trip through AAA, they’ll cover you for things like loss of limbs and loss of life in the event you are in an accident while traveling.

Homeowners insurance

AAA homeowners insurance coverage is much less widely accessible nor fully featured as its auto insurance coverages. Much like AAA’s automobile insurance coverages, there are lots of insurance companies that sell insurance under the AAA brand.

However, generally speaking, homeowners can expect to discover the normal policies related to home insurance, including policies for your house’s construction and roofing, your private possessions, and liability protection if someone is injured within your house.

Some AAA home insurance companies also provide extended coverage for an added charge. More commonly available choices include extra security for valuables, including furs and jewelry, coverage for living expenses if your house is uninhabitable, umbrella insurance, and insurance coverage for natural disasters such as hurricanes.

Homeowners insurance discounts

Again, discounts on homeowners insurance (like auto) are going to vary greatly based on where you live. However, there are a few discounts that are almost always offered.

Like auto, you’ll most likely receive a discount for being a AAA member, or if you buy AAA auto insurance (and remember, sometimes buying auto is the ONLY way you can get homeowners with AAA).

And residents of the southwest (Texas and California), as well as the Boston-area, will tend to find more discounts on their homeowners insurance (just like auto).

Some of the more notable ones include:

- Claim-free discount. Get up to 13% off your bill if you don’t make a claim for 3 years or more.

- Protective device discount. Install things like a security system, smoke detectors, or flood notification systems, and you can get up to 15% off your bill.

- Hail-resistant roof discount. Get a discount of up to 35% if you install a new roof with materials that are hail-resistant.

- Retirement discount. If you’re over 55 and retired, you can get a 10% discount on your bill.

- Age of home discount. Depending on the age of your home, you can get a discount of up to 40%. The newer your home is, the greater your discount will be.

- Renovation discount. Get up to 23% off your bill if you do any renovations to your home, such as new pipes or a new roof.

My experience using AAA insurance

Unfortunately, AAA Insurance isn’t available in my area, so I used my old address from California to get a sample quote. I’m saying that because rates are going to be skewed – i.e., I will obviously pay a much higher rate in California than I would in the midwest – so I can’t accurately compare how their pricing is. Just food for thought.

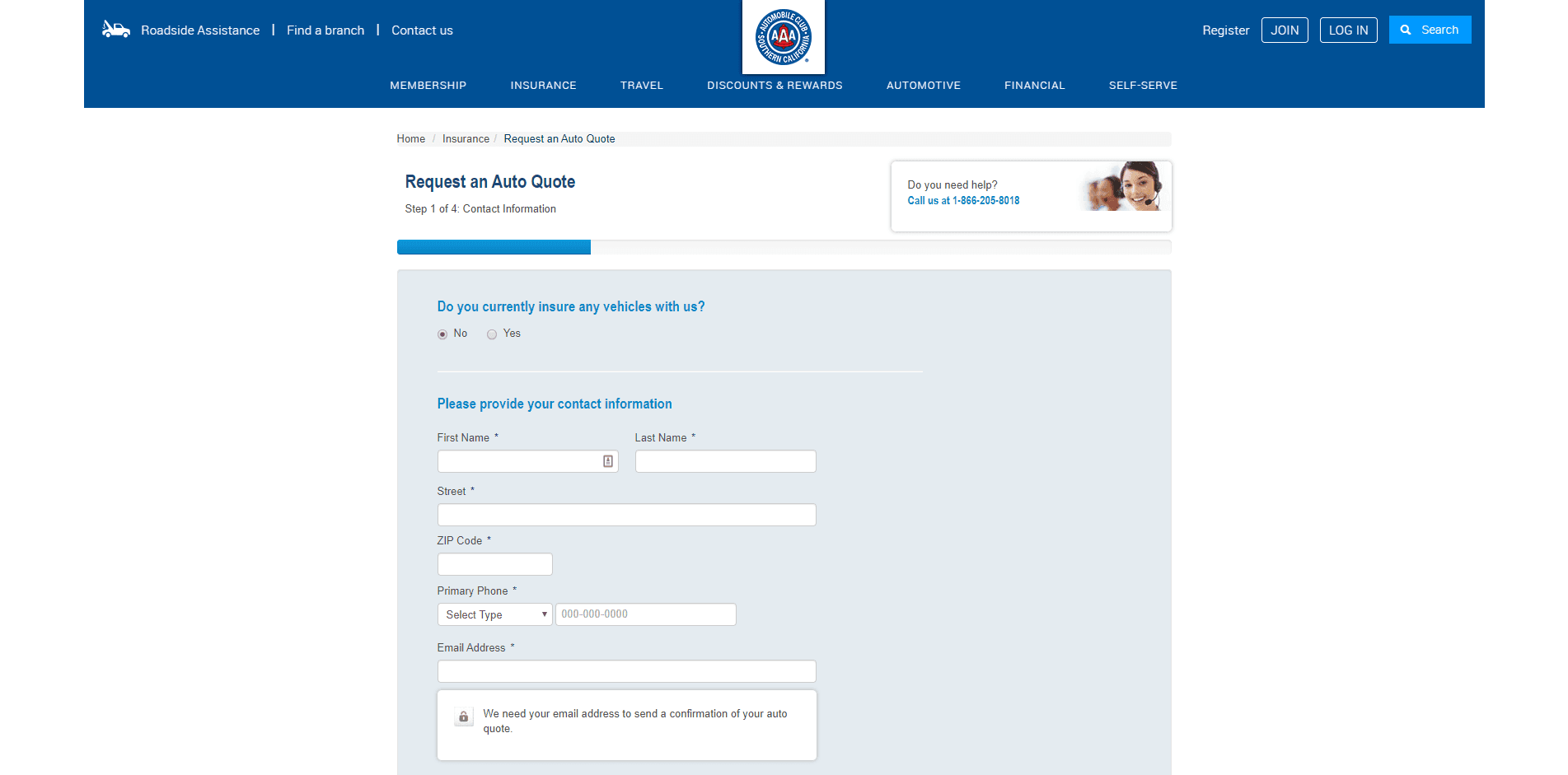

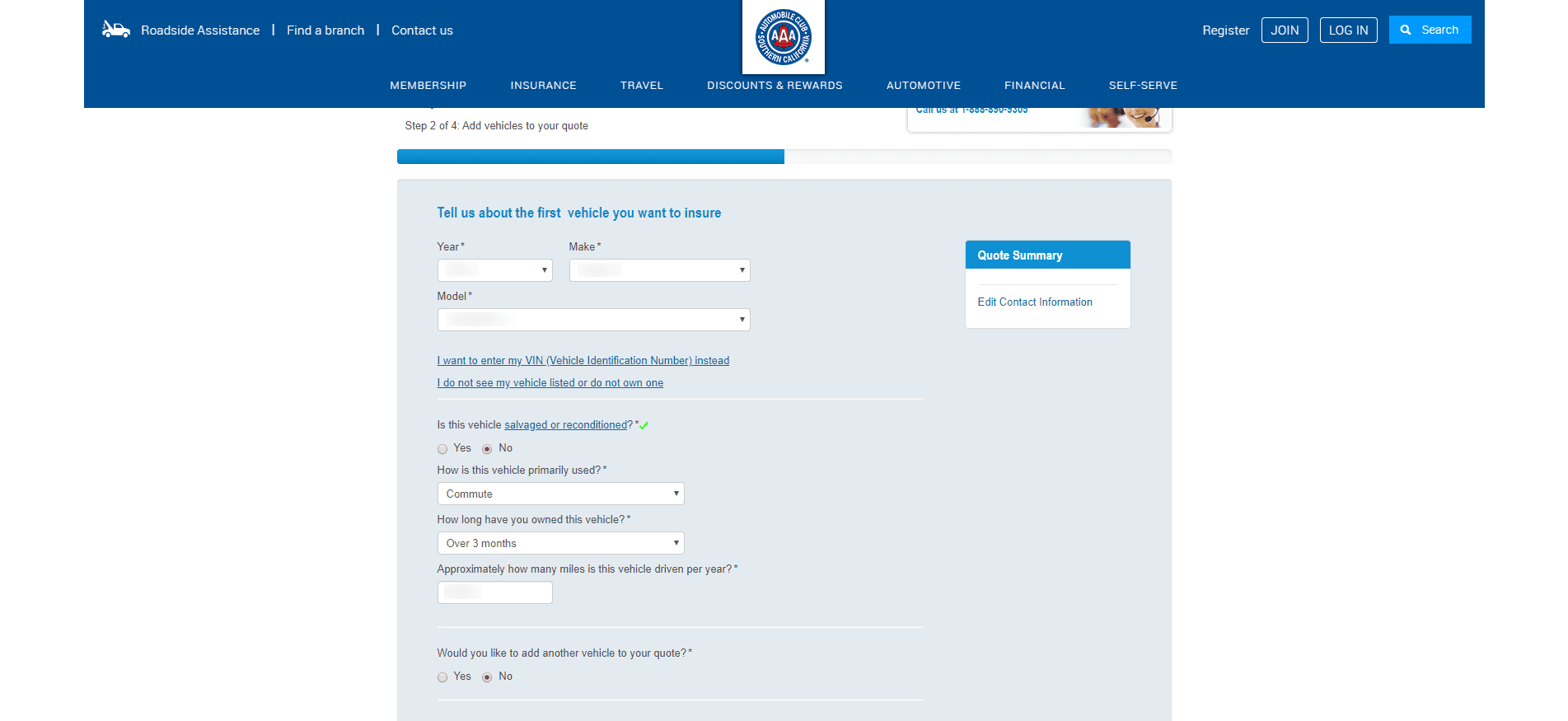

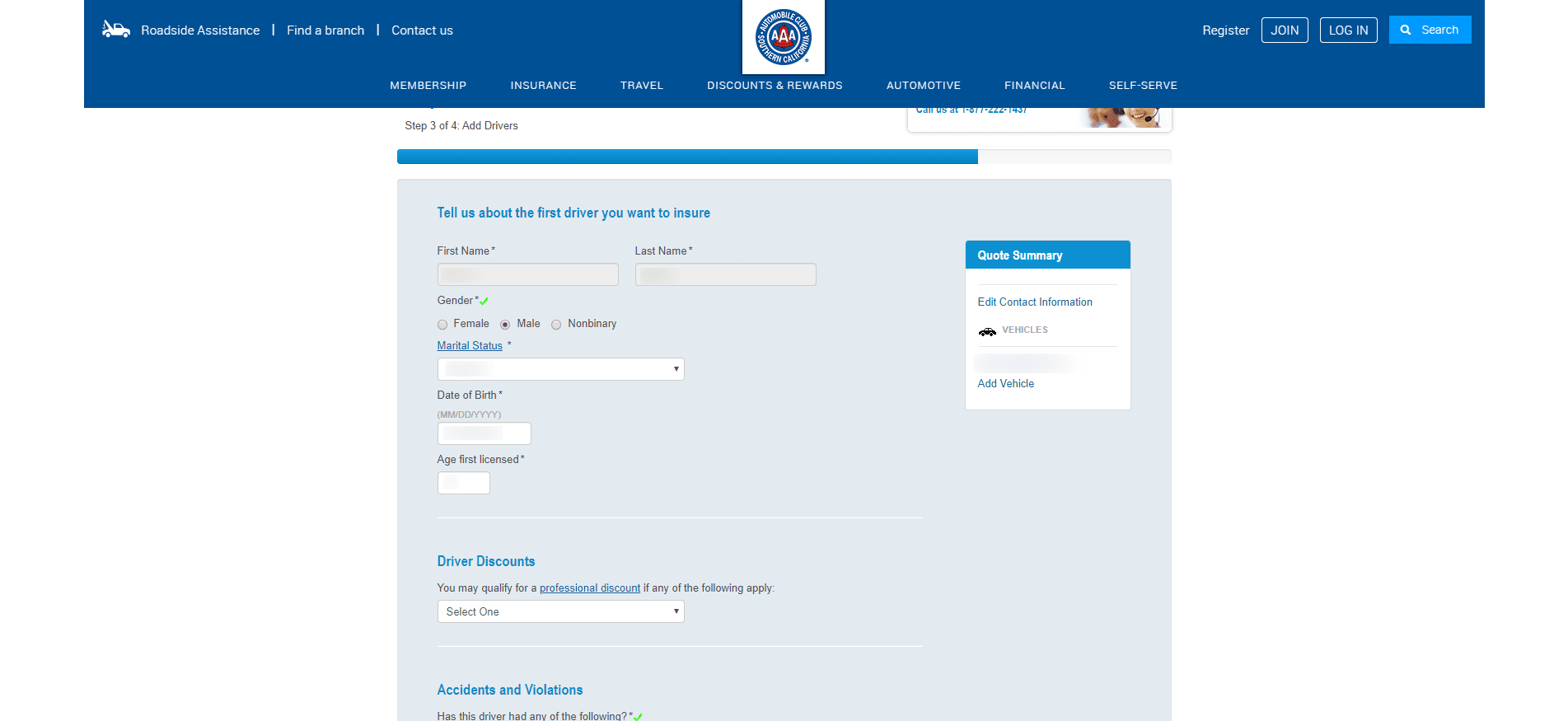

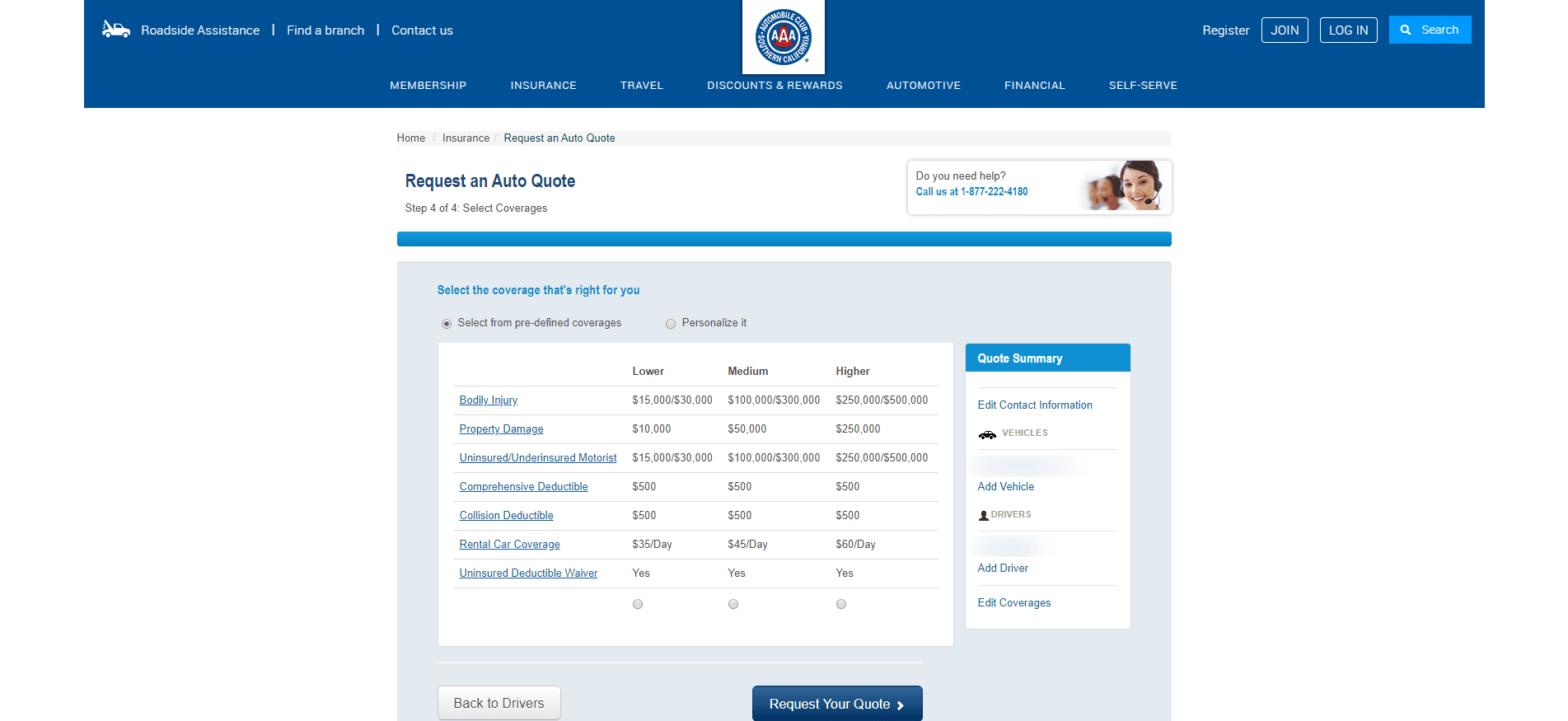

I went to the AAA Insurance quote website and entered some basic information. I see there’s a four-step process. I started by entering some info about my car:

Then I put in my own information – note that they didn’t ask for my Social Security Number, which I appreciated.

From there, I get to choose from 3 pre-defined coverage options OR customize my own. For simplicity, I chose the mid-tier.

Finally, I got my quote, along with a note saying they’ll contact me shortly. Honestly, despite the ugly website, the process was amazingly fast and easy. I also like how they gave me a quote and said they’ll give me a call – usually, it’s one or the other. Overall, I highly recommend at least getting a quote if it’s available in your area.

Who is AAA insurance for?

AAA won’t be for everyone. In fact, not everyone is even able to get AAA insurance, as I’ve probably beaten into the ground at this point. You won’t find the best prices, but there is definitely a reason why you’d want AAA insurance.

Their auto insurance is incredible when you bundle it with a AAA membership. Their membership offers 3 different levels of benefits. Each one of these gives you free towing, locksmith service, battery installation, fuel delivery, identity-theft monitoring, members-only discounts, and seriously a ton more.

Just go to their w e bsite to check out all the perks you’ll get with a AAA membership. I’ve even had them come to my house to install a new car battery – they’re excellent.

So those loyal to AAA, or those looking to take advantage of all their membership has to offer, will appreciate the discounts you’ll get when you are already a member and you bundle in auto insurance and (potentially) homeowners insurance.

Who AAA Insurance isn’t for

Frankly, AAA Insurance won’t be for you if you have no allegiance to them and if they’re not located in your area. You’re going to tend to pay a premium for AAA insurance, but if you don’t already have a AAA membership and don’t want one, their insurance products may not make the most sense for you.

Pros & cons

- Unmatched roadside assistance — You seriously won’t find a better roadside assistance program anywhere. When I bought my last car new, it came with 2 years of their roadside assistance for FREE, but I still opted to pay for AAA since it was that much better.

- Better than average ratings — J.D. Power rates AAA insurance better than average in all categories. While this isn’t top of the list, it’s a nice feature when you consider the other perks you’re getting.

- AAA membership — Having the membership adds a plethora of discounts at your fingertips. In addition to roadside assistance, you’ll be able to save money on travel and other things pretty much anywhere you go.

- A bit expensive — If you aren’t a AAA member and don’t want to become one, or if you have a new car and don’t feel the need to have roadside assistance (though I’d challenge that — flat tires can happen to anyone), you might find AAA to be a tad too pricey.

- Not available everywhere — Only some of the AAA locations offer insurance, so if yours doesn’t, you’re out of luck.

AAA Insurance vs. competitors

Allstate is more widely-known and more accessible to most. Pricing-wise, you’ll find them to be a bit cheaper than AAA – but remember that you are going to have to pay for extras like roadside assistance.

Allstate has way more insurance products and offers about the same amount of discounts, but through bundling, you can probably save more (since there are more opportunities to do so), like if you add in life insurance.

Rating-wise, they rank about the same as AAA across the board from J.D. Power’s survey. You can also quickly get a quote online, which you can’t do with AAA.

Liberty Mutual is an insurance company that has been around for over 100 years and has consistently marketed themselves as an insurer that really cares. In fact, one of their main slogans is: “we believe insurance should ease your concerns, not cause them.”

Liberty Mutual offers a big selection of policies, including home, renters, auto, life (term and whole life), flood, business, accident, and pet insurance.

- Lots and lots of discounts

- Make a claim in minutes

- Fast quotes

- Pay-per-mile option

- A company who cares

- Not the best customer service reviews

- Not all coverage is available in every state

Liberty Mutual is one of the biggest insurance providers in the country, and they’ve been around for a very long time. Like Allstate, they’re way more accessible and have far more insurance products for you to utilize. But you won’t get any add-ons like roadside assistance for free.

Also like Allstate, Liberty ranks in the middle of the pack with customer satisfaction, so you aren’t necessarily gaining anything by picking them over AAA or Allstate. Where you might win is through their discounts, of which they offer many, and bundling options.

AAA Insurance is really interesting. They aren’t the cheapest option, nor do they have the best and most coverages and discounts. But for some reason, they’re super-appealing.

I think it’s the fact that it comes with a AAA membership, assuming you sign up for one, which gives you all kinds of perks. Plus, with that, you get a discount on your insurance, which will bring it back to more realistic pricing.

I would totally suggest getting a quote from AAA if they are available in your area. Even if they’re a bit more expensive, weigh the pros and cons of the extra (and FREE) perks you’ll end up getting.

For me at this point, less expensive insurance overall is probably overall just more appealing.

- 7 Ways To Lower Your Auto Insurance Premium

- How Much Does It Really Cost To Own Your Car? You’ll Be Amazed

Your money deserves more than a soundbyte.

Get straightforward advice on managing money well.

Most financial content is either an echo chamber for the "Already Rich" or a torrent of dubious advice designed only to profit its creators. For nearly 20 years, we've been on a mission to help our readers acheive their financial goals with no judgement, no jargon, and no get-rich-quick BS. Join us today.

We hate spam as much as you do. We generally send out no more than 2-3 emails per month featuring our latest articles and, when warranted, commentary on recent financial news. You can unsubscribe at any time.

Is AAA membership worth it?

I've been a AAA member for more than 15 years, and I can confidently say that the perks and benefits have come in handy — especially the well-known roadside assistance benefit.

Over the years, AAA has opened up its network to provide vast options and money-saving discounts for travelers beyond roadside assistance.

I'm also partial to the regional magazine AAA produces six times a year; Arizona's is called Via and California's is called Westways. Each issue is full of travel inspiration and valuable tips. AAA even has a travel service you can use to book vacations.

How I've used AAA benefits

Living in Arizona, you can expect that your car battery will not survive more than two years due to the heat. In my case, the two-year timing always seemed to happen in August — the hottest month of the year. I have called AAA on more than one occasion to take advantage of its mobile battery service , and workers have come to my location with a new car battery.

Usually, they will test your current battery power and sell you a new one on the spot if needed. Members receive a $25 discount on batteries purchased during the on-the-spot installation. They even offer a battery warranty, so there's a chance if you purchased your last battery from AAA, your replacement might be free.

It has been a fantastic time saver and more convenient than getting jumper cables and making it to the nearest auto shop. Additionally, AAA membership covers the individual, not just the vehicle. So, you can use your membership for a service call even if you're a passenger in a stalled car.

To request 24/7 roadside assistance , use the AAA online assistance tool, call 800-AAA-HELP (800-222-4357) or you can text HELP to that same phone number and follow the prompts from there.

According to the AAA website, response time varies depending on several factors including time of day, breakdown location, and severity of the issue, and that AAA strives to provide the fastest and most efficient service possible. If you make your request online, you can track the progress of your request and the location of your technician.

What does AAA membership cost?

Membership rates are determined by the local club and may vary, a AAA spokesperson confirmed. The pricing below is provided as an example and is based on Arizona's current club pricing.

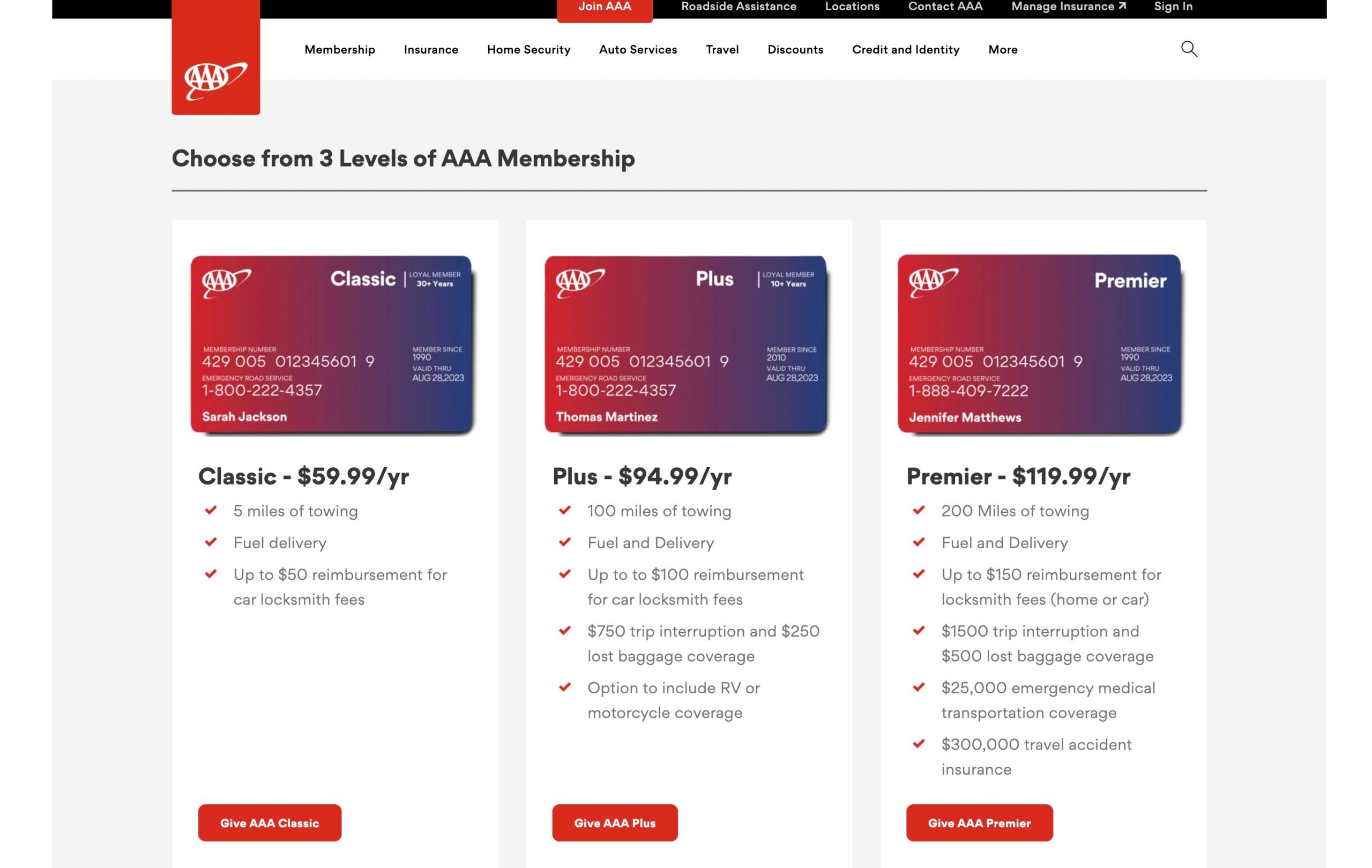

There are three AAA membership levels based on the types of services included.

The entry-level "Classic" membership starts at just $59.99 per year. This basic option allows for 5 miles of towing, fuel delivery and up to a $50 reimbursement for locksmith fees.

The next membership level is called "Plus" and is $94.99 annually. This level will more than pay for itself if you had to use just the locksmith option which is up to $100 reimbursement. This option also includes 100 miles of towing, fuel and delivery, $750 trip interruption, $250 lost baggage coverage and an option to include RV or motorcycle coverage.

The third option, called "Premier" costs $119.99 annually and has upgraded levels of everything in the Plus membership, but also adds $25,000 of emergency medical transportation coverage and $300,000 of travel accident insurance.

Does AAA offer discounts and perks?

AAA can help you save on everything from theme park tickets to car insurance and car repair. AAA membership offers a vast network of discounts and perks when you show your card or make online reservations with certain companies that provide AAA member discounts.

Guide: 6+ unexpected travel discounts to save you money.

A quick look at the AAA merchant list for attractions, zoos, museums and tours reveals discounts for CityPass for some major U.S. cities, Legoland Discovery Centers, Busch Gardens, Six Flags Theme Parks, AMC Theatres and Regal Cinemas, to name a few. You can search by city on the website to narrow down your results.

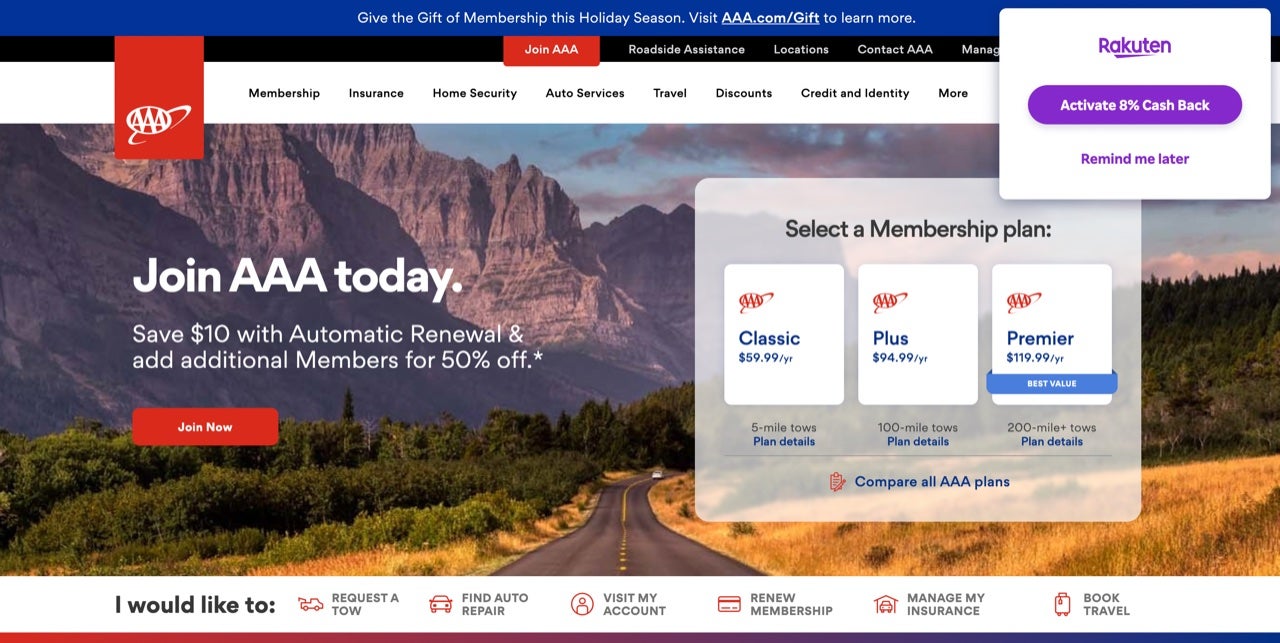

As I navigated to the AAA website, my Rakuten browser extension popped up and offered me 8% back, so there are ways to stack offers while using your AAA membership.

AAA is a trusted name in the auto industry and not just for its roadside assistance. Auto repair shops can be AAA trust-certified which means as a consumer which means you can access this network and receive discounts on regular automotive service or repairs; the work carries a warranty for 24 months/24,000 miles. You will also get access to priority service and a minimum of 10% off labor costs.

Through AAA Smart Home you can save money on items for your home such as a home security system, smart door locks, energy-efficient thermostats and even home automation.

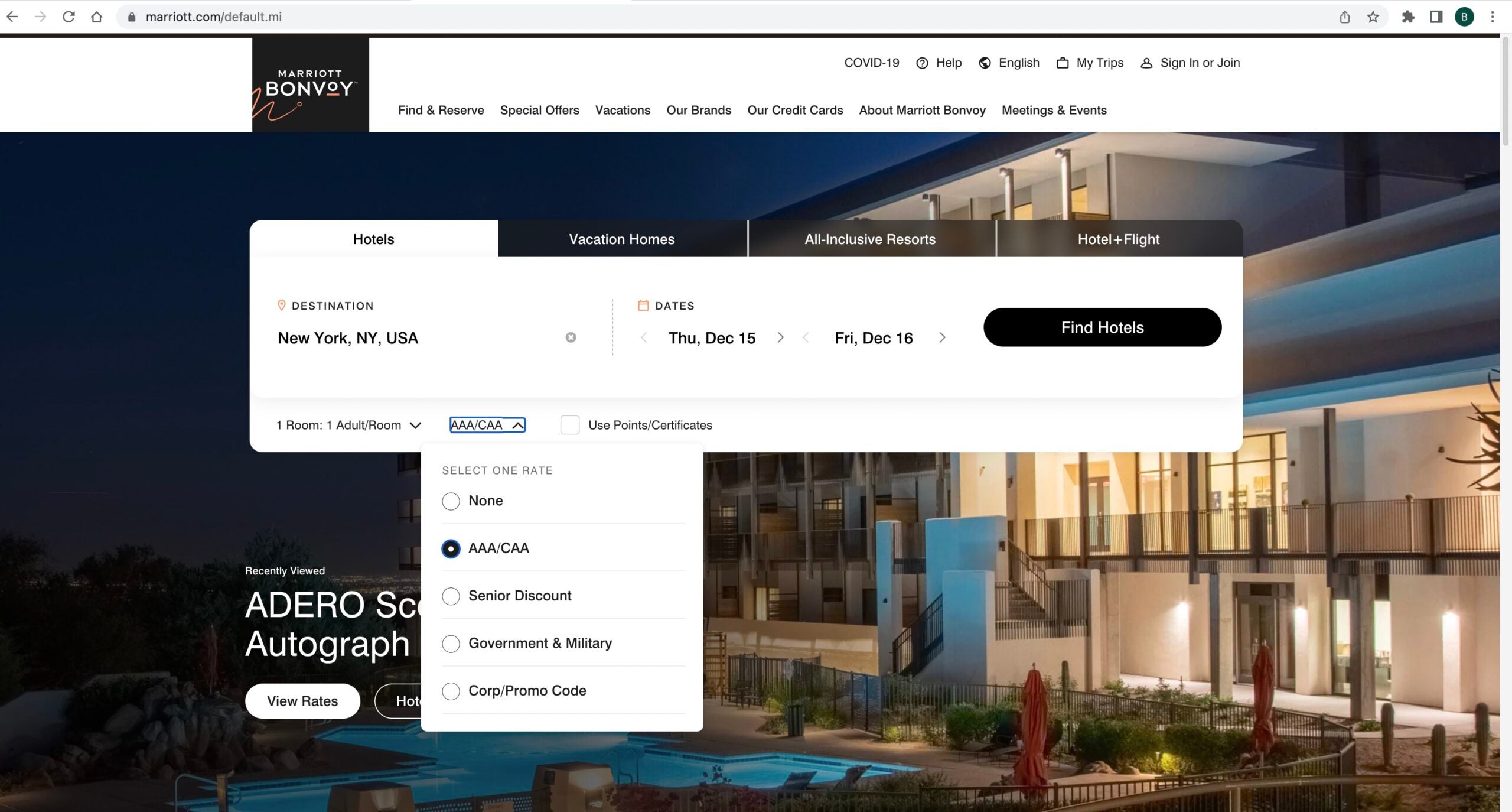

Many hotel companies offer AAA discounted rates which usually hover around 10% off the best available rate. If you click for rate options, you'll see a AAA rate option on many hotel booking websites.

Another way to utilize AAA perks is for car rentals — many rental companies offer AAA corporate rates which you can find using the AAA travel portal. If you are a renter under 25 , you can rent through Hertz, which specifically honors the AAA discount for younger drivers.

Can I gift AAA membership to a friend or family member?

According to the AAA website, gift memberships are available for purchase in some regions of the country: Northern California, Nevada, Utah, Arizona, Montana, Wyoming and Alaska. If the person you want to gift membership to lives in another region, you can search by zip code to find the local AAA club where they live.

Is AAA worth it?

If you enjoy saving money and getting additional home and travel perks, I recommend checking out AAA to see if it is a program you can benefit from. If you are a T-Mobile customer, see if your plan includes the Coverage Beyond program — this includes AAA membership free for customers (a $60 value).

Related: AAA tests program to allow California users to get Real ID

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

AAA Life Insurance Review 2024

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

on Nerdwallet

Financial strength rating These ratings indicate an insurer’s ability to pay future claims.

Online purchase This indicates whether the company offers a way to apply for and purchase policies entirely online.

NAIC complaints Ratings are based on complaints to state regulators relative to a company’s size, according to three years’ worth of data from the National Association of Insurance Commissioners. NerdWallet conducts its data analysis and reaches conclusions independently and without the endorsement of the NAIC.

Policies offered Term policies last a set number of years, while permanent policies typically last a lifetime. No-exam policies don’t require a medical exam.

- Large term life coverage amounts are available with a medical exam.

- Potential discounts for AAA members.

- Low coverage amount on whole life, making it function more as a final expense policy.

In our life insurance reviews, our editorial team considers the customer and the insurer. These are some of the factors we take into account:

Policies offered. There are many types of life insurance on the market, and they fall into three key categories:

Term life insurance offers temporary coverage and a guaranteed payout if the policyholder dies during the term.

Permanent life insurance typically lasts a lifetime and builds cash value that can be borrowed against in the future.

No-exam life insurance issues coverage without the need for a medical exam.

Financial strength. We use AM Best ratings to confirm an insurer’s long-term financial stability and ability to pay claims. For life insurance, NerdWallet typically recommends considering insurers with ratings of A- or higher. Here’s the breakdown:

Exceptional: A+, A++.

Strong: A-, A.

Moderate: B, B+.

Complaints. These ratings are based on complaints to state regulators relative to a company’s size, according to three years’ worth of data from the National Association of Insurance Commissioners. The best life insurance companies have fewer than the expected number of complaints.

Buy online. This indicates whether an insurer allows you to apply for and buy a policy completely online.

Dive deeper: Ratings methodology for life insurance

AAA Life Insurance Company was founded in 1969 by AAA, the group of motor clubs best known for emergency roadside assistance and travel services. The company offers term, whole and universal life insurance. You don’t have to be an AAA member to buy life insurance from the company, but there are some discounts for those who are.

» MORE: Compare life insurance quotes

AAA life insurance

AAA Life Insurance Company earned 3 stars out of 5 for overall performance. NerdWallet’s ratings are determined by our editorial team. The scoring formula takes into account consumer experience, complaint data from the National Association of Insurance Commissioners and financial strength ratings.

» MORE: Best life insurance companies

AAA life insurance policies

Term life insurance. AAA offers two types of term life insurance , both of which are available in 10-, 15-, 20- and 30-year terms. Members save 10% on premiums.

Traditional term life insurance. You’ll need to answer health questions and agree to a possible life insurance medical exam to qualify for this policy. Coverage amounts range from $50,000 to more than $5 million depending on your age, and you can add a return of premium rider. AAA members may be able to get discounts on their home or auto insurance by bundling with traditional term life.

Instant life insurance. ExpressTerm offers life insurance with no medical exam in most cases. You can choose $25,000 to $500,000 in coverage and apply for and buy this policy online after answering questions about your health. Coverage goes into effect right away if you’re approved.

Whole life insurance. These whole life insurance policies provide lifelong coverage and build cash value over time.

Traditional whole life insurance. You’ll need to work with an agent to apply for this policy. Coverage ranges from $5,000 to $75,000, though you may need to take a medical exam if you want $30,000 or more. An AAA membership will get you 10% off the base rate.

Guaranteed issue life insurance. AAA offers $5,000 to $25,000 of guaranteed issue life insurance , which doesn’t require a questionnaire or medical exam. Applicants ages 45 to 85 can qualify automatically, but if the insured dies during the first two years, AAA won’t pay out the full policy amount, unless the death is accidental. AAA members and their spouses are eligible for a $60 annual discount.

Universal life insurance. Coverage amounts range from $100,000 to more than $5 million. AAA offers two types of universal life insurance : LifeTime and Accumulator. The Accumulator product is geared toward people who may want to use the cash value later to supplement retirement or cover other expenses, such as their children’s college education. The LifeTime product features more guarantees, like fixed premiums.

» MORE: Best instant life insurance companies

AAA life insurance rates

Below are monthly rates for a 20-year, $500,000 term life insurance policy from AAA. These are sample rates for a nonsmoking man and woman in excellent health — the final quote you’re offered will depend on factors like your age, health, lifestyle, occupation and driving record.

AAA non-member rates

Aaa member rates.

» MORE: Cheapest life insurance companies

AAA customer complaints and satisfaction

Over three years, AAA has drawn more than the expected number of complaints to state regulators than expected for a company of its size, according to a NerdWallet analysis of data from the National Association of Insurance Commissioners.

More about AAA

AAA Life Insurance Company also sells accident insurance to AAA members only, and the amount of coverage you can get depends on how long you’ve been a member. The policy covers injuries and death caused by accidents such as falling off a roof. It doesn’t cover accidents caused by extreme sports, acts of war or self-inflicted injuries like suicide or drunk driving.

AAA offers three annuity options, two with $3,000 minimum deposits and one requiring $10,000 upfront. If you’re considering an annuity, you should talk to a fee-only financial advisor to find the right option for your retirement needs.

Other AAA products include:

AAA auto insurance .

AAA homeowners insurance .

AAA renters insurance .

Boat insurance.

Flood insurance.

Motorcycle insurance.

RV insurance.

Travel insurance .

How to contact AAA

AAA’s life insurance department can be reached by:

Phone: Call 888-422-7020 on weekdays from 8 a.m. to 8 p.m. ET, and Saturdays from 11 a.m. to 3 p.m. ET.

Email: For general questions, send a message to [email protected] .

Live chat: Launch the live chat feature from any page on AAA’s site.

Life insurance buying guide

Before you start comparing companies, choose the type of life insurance you want, such as term or whole life. Decide which life insurance riders , if any, you want the policy to include. Calculate how much life insurance you need and how long you want the coverage to last. Check that the insurers you’re considering offer the coverage you’re looking for.

When comparing rates, be sure the quotes are for the same amount of coverage over the same period of time. It’s also important to make sure the policy’s medical requirements match your needs. For example, if you want to skip the life insurance medical exam but don’t mind answering health questions, confirm that the application process for each policy you're comparing aligns with that.

Price may not be the biggest driver behind your decision to buy. Look at the number of consumer complaints each company receives, as high numbers can be a red flag about the quality of service.

For more guidance, see our life insurance buying guide .

Life insurance ratings methodology

NerdWallet’s life insurance ratings are based on consumer experience, complaint index scores from the National Association of Insurance Commissioners for individual life insurance, and weighted averages of financial strength ratings, which indicate a company’s ability to pay future claims. Within the consumer experience category, we consider ease of communication and website transparency, which looks at the depth of policy details available online. To calculate each insurer’s rating, we adjusted the scores to a curved 5-point scale.

These ratings are a guide, but we encourage you to shop around and compare several insurance quotes to find the best rate for you. NerdWallet does not receive compensation for any reviews. Read our editorial guidelines .

Insurer complaints methodology

NerdWallet examined complaints received by state insurance regulators and reported to the National Association of Insurance Commissioners in 2020-2022. To assess how insurers compare with one another, the NAIC calculates a complaint index each year for each subsidiary, measuring its share of total complaints relative to its size, or share of total premiums in the industry. To evaluate a company’s complaint history, NerdWallet calculated a similar index for each insurer, weighted by market shares of each subsidiary, over the three-year period. NerdWallet conducts its data analysis and reaches conclusions independently and without the endorsement of the NAIC. Ratios are determined separately for auto, home (including renters and condo) and life insurance.

On a similar note...

Compare term life insurance rates

Get free quotes from top companies.

More From Forbes

Is travel insurance refundable here’s everything you need to know.

- Share to Facebook

- Share to Twitter

- Share to Linkedin

Sometimes, travel insurance is refundable. Here's when you can get your money back.

Peter Hoagland always checks to see if his travel insurance is refundable. That's because anything can happen between the time you book your vacation and when you leave — and because travel insurance isn't always refundable.

During the pandemic, he discovered that the hard way. He had to cancel a trip and asked for his money back from the insurance company. It refused.

"Since then, I always read the fine print on the policy," he says.

The refundability of travel insurance has always been an open question. Some countries and U.S. states regulate refundability. Travel insurance companies put refundability details in the fine print of the policy. And, as Hoagland found out, there are always exceptions.

Like the pandemic, when refund policies were all over the map. Some insurance companies adhered to their published policies. Others offered a credit that could be reused within a year, which was minimally useful because the pandemic was still happening a year later. Others quietly gave their customers a refund.

Hoagland says he fought for his money. Eventually, he contacted a manager at his travel insurance company.

"That produced a quick result," he says. "I got my money back."

It s Possible The Russian Army Is Tricking The Ukrainian Army With A Fake Offensive

Ufc st louis results bonus winners from night of memorable finishes, vasiliy lomachenko vs. george kambosos results: winner, ko, reaction.

But let's face it: Getting a refund for travel insurance can be difficult. There are times when insurance is always refundable because it's required by law. There are times when it's sometimes refundable. And there are times when it's almost never refundable. But even then, there may be a way to recover some — or all — of the value of your policy.

Getting a refund for travel insurance can be a challenge

If you have a travel insurance policy and would like to get a refund, it might be easier said than done, say experts.

"While travel insurance is regulated like auto and home insurance, it’s often less standardized," says Stuart Winchester, CEO of Marble, a digital wallet for your insurance. "So first off, it’s important to check the fine print of your specific policy. Don’t assume it’s like the last one you got."

Even when you have something in writing, a refund can require some serious negotiating skills.

"Getting a refund for travel insurance can be complicated and frustrating," says Peter Hamdy, the managing director of a tour operator in Auckland, New Zealand. He's asked for a refund on policies numerous times and says that despite what travel insurance companies may tell you, there are no hard-and-fast rules when it comes to getting a refund on your policy.

"Some situations can warrant a refund," he says. "It depends on your policy."

What does a typical refundability clause look like? For example, the World Explorer Guardian from Insured Nomads notes that it's refundable only during the 10-day review period from the date of delivery or 15 days from the date of delivery if mailed, provided you have not already departed on your trip and you have not incurred any claimable losses during that time. If you depart on your trip before the expiration of the review period, the review period ends and the policy can't be refunded.

"We go a bit further with our World Explorer Travel Medical plans," notes Andrew Jernigan, CEO of Insured Nomads. "If no claims have been filed then we can refund the unused portion of the policy if you cut your trip short.”

When can you get a refund for travel insurance?

Here are the most common cases where travel insurance can be refunded:

- If you cancel during the "free look" period required by the government. Most states require what's called a "free look" period of anywhere from 10 to 14 days. "During this period, travelers can review the purchase and make sure it fits their needs," explains James Nuttall, general manager of Insubuy . "If it does not, they can cancel it for any reason and get a full refund, no questions asked, so long as you haven’t departed yet.

- If you cancel during the travel insurance company grace period. Many insurance companies also have a grace period for refunds (usually, they are the same as the "free look" although some grace periods can be longer). "If you’re outside your grace period, which typically lasts one to two weeks after signing, you’re contractually obliged to pay your premiums," says David Ciccarelli, CEO of the vacation rental site Lake . "Still, it doesn’t hurt to ask your company for a refund or alternative options if you’re outside your grace window. You might not get a yes, but it could lead to some cost savings or better solutions."

- When someone else cancels your trip. "For instance, if your cruise is canceled due to low river tide, you are not at fault and would typically receive a full refund or credit for a future sailing, thus eliminating the need for the travel insurance policy," explains Rhonda Abedsalam vice president of travel insurance for AXA Assistance US.

- If you die. Typically, the policy would be refunded to your next of kin. Generally, you can also ask for a refund if your travel companion dies before your trip.

Remember, it depends on where you buy your insurance

The refundability of your insurance can depend on where you purchased it. Commercial policies bought from a cruise or tour company are generally canceled and refunded if you cancel the trip far enough in advance of your departure date.

"The travel insurance cancellation provisions are generally tied to the cancellation provisions for the cruise or tour," explains Dan Skilken, president of TripInsurance.com . "After you have paid the last deposits on the cruise and are close enough to departure that they will not provide a refund on the cruise, they generally will also not provide a refund on the travel insurance. But if you cancel early enough to get all or most of your deposit back, you will also get your travel insurance premium refunded."

If you’ve purchased retail travel insurance from a third-party provider or comparison website, you can often get a refund if you can show receipts proving that you received a full refund of all trip deposits and have not had any cancellation penalties or taken any travel credits when you canceled your trip.

That's because retail travel insurance is sold for a specific traveler and for a specific trip. If you have proof of a complete refund and have not received travel credits, then you no longer have what's called an "insurable interest" in the trip. The insurance company must cancel and refund your premium in full, says Skilken.

Insider tip: If the insurance company refuses, just tell them you have proof that you no longer have an insurable interest in the trip. You have to have an insurable interest in a trip to own a travel insurance policy.

Your agent may be able to help you get a refund

You may also be able to lean on the agent who sold you the policy. For example, all policies on Squaremouth come with a money-back guarantee.

"The purpose of this benefit is to give travelers extra time to review their policy documentation to be sure it’s the best policy for their coverage needs," says spokeswoman Jenna Hummer. At Squaremouth, the money-back period typically lasts between 10 and 14 days, which is in line with the mandated "free look" period.

However, I have also seen agents negotiate with travel insurance companies for a more generous refund period in case of extenuating circumstances. There's no guarantee that you'll get it, but it's worth asking — and one reason to work with a third party.

Agents can also help you avoid this problem. Susan Sherren, who runs Couture Trips , a travel agency, notes that American Airlines Vacation Packages offers a predeparture protection insurance plan, which allows cancellation for any reason before the outbound departing flight time. Other restrictions apply, she adds.

"More flexibility will often cost you more," she says. "But having the flexibility is a great way to sleep well at night."

Can't get a refund? Look for other kinds of flexibility from your travel insurance company

Even if your travel insurance company says no to a refund, it doesn't necessarily mean you've lost the value of your policy.

"If a travel supplier changes or cancels your trip, you should be able to change your travel insurance policy to match the new dates of your trip or even cover a new trip, sometimes up to two years into the future," says Daniel Durazo, director of external communications at Allianz Partners USA .

Pro tip: Be sure to change the dates of your travel insurance policy before the departure date of your current itinerary. You can do that online or by calling your agent. Once the policy's effective date has passed, making any changes or initiating a refund or credit becomes much more difficult.

Don't forget to do your due diligence

Bottom line: Travel insurance is refundable under certain circumstances. But knowing when can require research.

"It's important for consumers to carefully read their policy upon receipt to understand the specific terms offered by their insurance provider," says Robert Gallagher, president of the US Travel Insurance Association.

The more you know, the likelier you are to get the refund you want when your plans change.

- Editorial Standards

- Reprints & Permissions

Join The Conversation

One Community. Many Voices. Create a free account to share your thoughts.

Forbes Community Guidelines

Our community is about connecting people through open and thoughtful conversations. We want our readers to share their views and exchange ideas and facts in a safe space.

In order to do so, please follow the posting rules in our site's Terms of Service. We've summarized some of those key rules below. Simply put, keep it civil.

Your post will be rejected if we notice that it seems to contain:

- False or intentionally out-of-context or misleading information

- Insults, profanity, incoherent, obscene or inflammatory language or threats of any kind

- Attacks on the identity of other commenters or the article's author

- Content that otherwise violates our site's terms.

User accounts will be blocked if we notice or believe that users are engaged in:

- Continuous attempts to re-post comments that have been previously moderated/rejected

- Racist, sexist, homophobic or other discriminatory comments

- Attempts or tactics that put the site security at risk

- Actions that otherwise violate our site's terms.

So, how can you be a power user?

- Stay on topic and share your insights

- Feel free to be clear and thoughtful to get your point across

- ‘Like’ or ‘Dislike’ to show your point of view.

- Protect your community.

- Use the report tool to alert us when someone breaks the rules.

Thanks for reading our community guidelines. Please read the full list of posting rules found in our site's Terms of Service.

Explore Lyubertsy

Plan your lyubertsy holiday: best of lyubertsy.

Essential Lyubertsy

View prices for your travel dates

Hotel Djaz is an excellent choice for travelers visiting Elektrostal, offering many helpful amenities designed to enhance your stay.

A 24 hour front desk is one of the conveniences offered at this small hotel. In addition, Hotel Djaz offers an on-site restaurant, which will help make your Elektrostal trip additionally gratifying. If you are driving to Hotel Djaz, free parking is available.

Travelers looking for pubs can head to Beer Club Tolsty Medved or 400 Krolikov.

Should time allow, Statue of Lenin is a popular that is relatively easy to get to.

Enjoy your stay in Elektrostal!

- Excellent 0

- Very Good 0

- English ( 0 )

Own or manage this property? Claim your listing for free to respond to reviews, update your profile and much more.

IMAGES

VIDEO

COMMENTS

Learn about the benefits and drawbacks of Aaa Member Loyalty Travel Accident Insurance, a plan that covers accidents related to travel. Find out who it's best for, how to get it, and what it costs.

Learn about the types, benefits and drawbacks of AAA travel insurance policies offered in partnership with Allianz. Compare coverage, costs and exclusions of different plans and find out how to buy online or by phone.

Compare AAA's single-trip and annual travel insurance plans for domestic and international trips. Learn what's covered, what's excluded and how to buy online.

Here are details on the benefits provided by AAA Member Loyalty Travel Accident Insurance: Accidental Death. Pays $300,000 for accidental death while traveling. Dismemberment. $300,000 for loss of 2+ limbs, eyesight, speech, and hearing. $150,000 for loss of 1 limb, eye, speech, or hearing. $75,000 for loss of 1 hand, 1 foot, or thumb/index ...

Compare AAA's annual and single-trip travel insurance plans that cover trip cancellation, medical expenses, luggage and rental car damage. Learn how to buy online, get quotes and find out the benefits and drawbacks of AAA travel insurance.

Purchase Travel Insurance. Find Agent Call 877.721.3977. Terms, conditions, and exclusions apply. Benefits/Coverage may vary by state, and sublimits may apply. Refer to your plan for restrictions and full details. Insurance coverage is underwritten by BCS Insurance Company, rated A- (Excellent) by A.M. Best Co., under BCS Form No. 52.201 or 52. ...

AAA travel insurance policies are provided by Allianz Global Assistance. With AAA's cancel for any reason (CFAR) travel insurance policy, a member can cancel at any time and receive a refund of up to 75%. Whether you're planning a vacation or a business trip, AAA travel insurance provides peace of mind and financial security. As a trusted ...

As a AAA member, you receive Travel Accident Insurance coverage automatically when your trip is arranged and purchased through your AAA Travel Agency. Coverage levels are $100,000 for Classic, $300,000 for Plus and $500,000 for Premier. This program covers you for accidental loss of life, limbs, sight, speech or hearing while traveling in a ...

AAA Travel Accident Insurance is a valuable coverage option that provides travelers with essential financial protection during their journeys. To assist pote...

Low mileage. If you drive very little throughout the year, you can get up to 12% off your bill. Advance purchase discount. If you buy AAA car insurance at least a week before your existing policy expires, they'll give you 5% off. Paid in full discount. You'll get 5% off if you pay your entire premium in full, upfront.

Accident insurance can help cover costs of recovery or loss of life from a covered accident. Learn how to get accident insurance for AAA members with no health questions or medical exam, and see how benefits increase with years of membership.

AAA Travel Insurance Review. AAA is a travel insurance carrier based in Livonia, MI. The company was founded in 1902 and offers travel insurance in 50 states (and Washington, DC). If you're considering whether AAA Travel Insurance is a good option for you, read on.

Chase's 24-hour travel accident insurance only covers you for the first 30 days you're out of the country. The Platinum Card® from American Express, meanwhile, will only provide you with common ...

Our top-tier Premier benefit level for AAA members starts at only $17 per month for ages 18-69. You can cover your whole family for $4 more per month.*. Call (800) 684-4222 today to get covered. * If you choose Family Coverage, your spouse is covered at 60% of the primary insured's benefits; eligible children are covered at 20%.

The IMG Travel SE provides $250k of medical coverage and $500k of medical evacuation as well as trip cancellation at 100% of our trip cost and trip interruption at $150% of our trip cost. It will also provide 100% refund if we need to cancel for a work-related reason.

The third option, called "Premier" costs $119.99 annually and has upgraded levels of everything in the Plus membership, but also adds $25,000 of emergency medical transportation coverage and $300,000 of travel accident insurance. Does AAA offer discounts and perks?

How to contact AAA. AAA's life insurance department can be reached by: Phone: Call 888-422-7020 on weekdays from 8 a.m. to 8 p.m. ET, and Saturdays from 11 a.m. to 3 p.m. ET. Email: For general ...

Enter your ZIP Code. Go. AAA is a federation of independent clubs throughout the United States and Canada. Whether you're traveling internationally or within the United States, AAA members have access to travel insurance which could help with non-refundable costs if you have to cancel your trip.

Some countries and U.S. states regulate refundability. Travel insurance companies put refundability details in the fine print of the policy. And, as Hoagland found out, there are always exceptions ...

Apelsin Hotel, Elektrostal: See 43 traveler reviews, 19 candid photos, and great deals for Apelsin Hotel, ranked #1 of 4 hotels in Elektrostal and rated 4 of 5 at Tripadvisor. ... I am used to travel in Russia in minor cities and villages so I do not pretend a continental breakafst like a 5 star hotel but a minimum accpetable yes. I suggest ...

Lyubertsy Tourism: Tripadvisor has 1,952 reviews of Lyubertsy Hotels, Attractions, and Restaurants making it your best Lyubertsy resource.

64 reviews. Location 4.2. Cleanliness 3.5. Service 3.7. Value 3.6. The sanatorium "Valuevo" is a historical health resort located in a unique location of the New Moscow on the territory of 30 hectares of the ancient noble estate of Count Musin-Pushkin with a perfectly preserved architectural ensemble and a landscape park, in an ecologically ...

Hotel Djaz, Elektrostal: See traveler reviews, 8 candid photos, and great deals for Hotel Djaz, ranked #2 of 2 B&Bs / inns in Elektrostal and rated 3 of 5 at Tripadvisor.