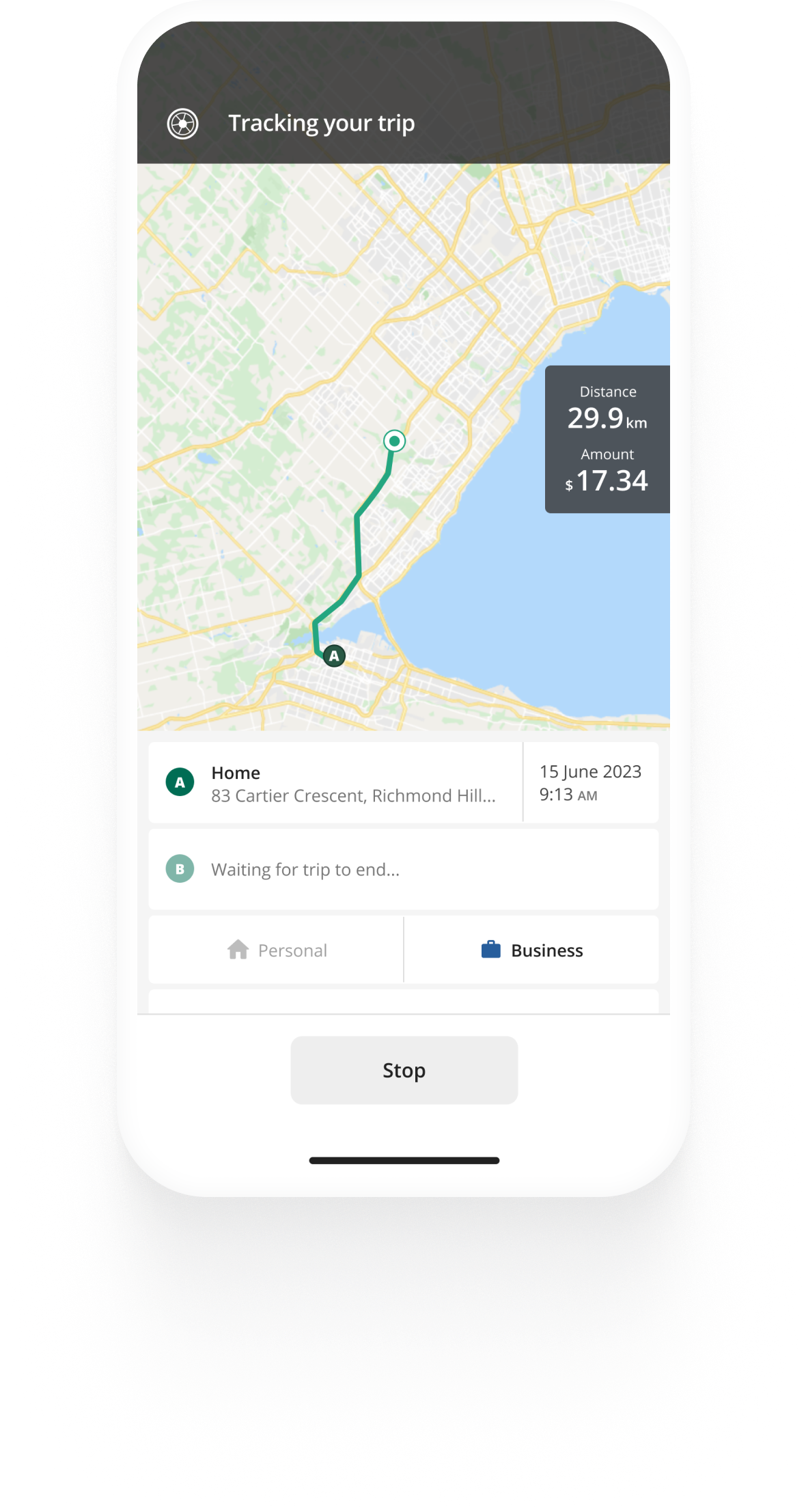

Track mileage automatically

Medical travel in canada, in this article, cra rules on medical travel, medical travel if you travel more than 40 kilometres, medical travel over 80 kilometres in canada and abroad, cra medical travel rates 2023, medical travel rates 2022.

If you need to receive medical care, you may be able to deduct medical travel expenses for your medical mileage. The deductions can represent a big chunk of savings that you can claim at tax time. Here’s an overview of the rules for claiming medical travel from the CRA.

Firstly, you will need proof that you attended the medical service you needed. You can provide receipts for the services you’ve received or a document or letter signed by the provider of the medical service.

You cannot claim medical travel expenses if you travelled less than 40 kilometres in one direction to receive medical attention.

If you travelled more than 40, but less than 80 kilometres one way, you will be able to claim medical travel, and if you travelled more than 80 kilometres, you will be able to claim mileage, as well as accommodation, meal and parking costs.

You will also be able to claim travel expenses if you had to receive medical care outside of Canada.

If a medical practitioner certifies that you needed to be accompanied to receive medical attention, you will be able to claim the expenses of the attendant.

You will only be able to claim medical expenses for which you have not, and will not be reimbursed. If medical reimbursement has been included in your income (ergo, it will be taxed) you will be able to claim your medical travel expenses.

Track business driving with ease

Trusted by millions of drivers

You will be able to claim medical travel from the CRA such as bus, train and taxi fares, and vehicle mileage (if public transportation is not readily available) if you meet the following conditions:

- You were not able to receive the needed medical care near your home

- You took a reasonable and direct route

- It was reasonable for you to travel to a farther destination in order to receive medical attention.

You can claim medical mileage from the CRA by the detailed or simplified method.

If you use the detailed method, you need to keep all receipts of your medical travel expenses in order to claim them. You are able to deduct all qualified public transport fares, and if you travel with your vehicle - all costs of operating and owning it. These include fuel, oil, insurance, maintenance, depreciation and more.

With the simplified method, you will be able to claim a flat medical mileage rate and you won’t need to keep detailed records. However, the CRA may still ask you to provide documentation to support your medical mileage claim, so we recommend keeping a logbook of your medical travel.

If you need to travel more than 80 kilometres in order to receive medical care, you will be able to claim medical expenses such as bus, train and taxi fares, vehicle mileage (if public transportation is not readily available), meals, parking and accommodation if you meet the following conditions:

Again, you can claim medical travel and other expenses by the detailed or simplified method.

The detailed method of claiming medical travel and other expenses requires you to keep all receipts of your accrued expenses, such as for travel, parking (if applicable), meals and accommodation.

The simplified method lets you use a medical mileage rate and a per-meal rate for your expenses. Keep receipts of your accommodation costs, as there are no flat rates. While you don’t need to keep detailed receipts for medical travel and meals, the CRA may ask for documentation to support your mileage expenses claim.

If you claim medical travel with the flat per-kilometre medical rate, note that there are different rates for each Canadian territory.

Use the medical travel rates above to claim your medical travel expenses for 2023.

Are you claiming work-related mileage besides medical travel expenses? See our CRA mileage guide for all the rules on mileage reimbursement and deductions in Canada.

How to automate your mileage logbook

Latest posts

Izev rebates in canada.

- Mileage Calculator Canada

- CRA Mileage Rate 2023

Automate your logbook

Related posts, per diem allowance.

In Canada, Per diem often refers to a meal or travel allowance. The CRA doesn’t set fixed rates, so what is a fair rate, and what about tax?

CRA Mileage Rate 2024

The CRA announces 2024 rates for vehicle allowance: From January 1st, 2024, per kilometre rates will increase 2 cents over 2023.

You can benefit from federal and provincial iZEV rebates when buying or leasing electric vehicles. See how much you can get per province.

Choose your Country or region

- Credits & Deductions

- Income & Investments

- CRA Tax Updates

- Getting Organized

- Family & Children

- Homes & Rental Properties

- Medical & Disability

- Expats & Non-Residents

- Employment & Employees

- Foreign Income & Property

- Self-Employed & Freelance

- Small Business

- Unemployment

- After you File

Claiming Medical Expense Travel Credits

Canada is vast and some of the most beautiful places in our great country to live are quite remote. One of the drawbacks of living outside a major city center can be that if you need medical care, you may need to travel a long way to get it. Thankfully, depending upon how far you have to go for your care, the government of Canada may allow you to claim medical expense travel credits.

Many of the expenses that you may incur to travel for medical treatment or expenses that you incur on behalf of your spouse or dependants are tax-deductible. Eligible expenses may include transportation costs, meals, and accommodation for both the patient and an attendant if required. Let’s explore the allowed eligible expenses and how to claim them .

How Far Do I Need to Have Travelled to be Eligible for Claiming Medical Expense Travel Credits?

Anyone who has had to pay for parking at a hospital knows how expensive it can get. While it would be nice to be able to deduct those expenses , unless you traveled more than 80 km for medical care, your parking expenses aren’t deductible.

To claim transportation and travel expenses with the CRA, the following conditions must be met:

- There were no equivalent medical services near your home

- You took a direct route

- It was reasonable for you, under the circumstances, to travel to the place you did for those medical services

If you traveled at least 40 km (one way) to get medical services, you can claim the cost of public transportation (ex. bus, train, or taxi fare). If public transportation isn’t available, you may be able to claim vehicle expenses.

If you traveled more than 80 km (one way), you can claim vehicle expenses, accommodation, meals, and parking expenses.

Whether you traveled more than 40km or 80 km, if a medical practitioner has certified that you can’t travel without help, you may also claim the travel expenses you pay for an attendant.

File your taxes with confidence

Get your maximum refund, guaranteed*.

How are Vehicle Costs Calculated by the CRA?

If driving to get medical care is necessary, you can claim the cost of fuel, oil, license fees, insurance, maintenance, and repairs, including parts . Depreciation, provincial tax, and finance charges are all eligible.

There are two methods to calculate vehicle expenses — the detailed and the simplified method . If you use the detailed method, keep track of the number of kilometers driven in the 12-month period you choose for medical expenses. Then, calculate the percentage of your total vehicle expenses that relate to the kilometers driven for medical treatment.

For example; if you drove 10,000 km during the year and 5000 of those kilometers were related to medical treatment (more than 40 km away), you can claim half of your total vehicle expenses on your tax return.

If you chose the simplified method, you only need to determine how many km you traveled for medical treatment in the 12-month period. Multiply the km by the rate for your province . The rates are different for each province or territory, are updated annually, and can be found at the Canada Revenue Agency’s website.

Whether you choose the detailed method or the simplified method, be sure to save all your receipts in case the Canada Revenue Agency (CRA) asks to see them later.

How do I Claim Meals?

- You need to have traveled more than 80 km for care to claim meals with the CRA. Just like vehicle costs, you can choose the use the detailed method or the simplified method.

- To use the detailed method, you tally the actual cost of each meal .

- If you choose the simplified method, you may claim up to $17 per meal, up to a maximum of $51 per day , including sales tax.

- Whether you choose the detailed method or the simplified method, be sure to keep those receipts.

What are the Rules for Accommodations?

- To claim accommodations, like meals, you need to have traveled more than 80 km for medical services.

- Accommodation claims are based on your receipts, and only the cost — with taxes — of the stay is eligible . Extra costs like room service, movies, and phone calls are not included.

Travel outside of Canada

Outside of Canada medical expenses may also be eligible. You have to meet all the following conditions:

- practitioners must be authorized in their country of service by law. In the case of hospital stays, the institution must be public or a licensed private hospital.

- the health care services you receive must not be available in your area, and you must be required to travel to access them .

Travel Companions

If your spouse, your common-law partner, or another individual travels with you, you may be able to include that person’s expenses as part of your medical expense tax credit. To include these expenses, you need to have a note from your physician or another authorized medical practitioner that certifies that you were unable to travel alone .

If you qualify, you can write off the cost of your travel companion’s transit tickets, accommodation, and meals, depending on how far you have traveled for your medical care.

Related articles

Tax tip: can i transfer my disability tax credit to my spouse, tax tip: can i claim nursing home expenses as a medical expense, new baby some tax credits you may be eligible to claim.

Our homepage has a new look! Share your thoughts about it in a short survey

Alberta Blue Cross ® will be closed Friday, March 29 and Monday, April 1. Regular hours resume on Tuesday, April 2. Our member site and app are available 24/7.

It’s tax season—access a claims total report of your medical expenses and tax receipt for premiums paid. Learn how to access these important tax documents.

Looking for a COVID-19 immunization or an influenza vaccine? Find a participating pharmacy near you.

Give us your feedback

Pharmacy asymptomatic testing program.

Albertans are encouraged reach out to a participating pharmacy for more information about how to arrange a test. A list of participating pharmacies is available here .

This is banner news

Random info about things and stuff

- Frequently asked questions

Travel advice

Have questions about travel?

Contents: Travel insurance

- Emergency Medical Care

- Trip Cancellation or Interruption coverage

- Visitors to Canada

- Top-Up insurance

- Cancellations and refunds

- Compare travel coverages

- Flight Delay Service

- Baggage loss coverage

- Accidental Death and Dismemberment

- Optional Protection: Pandemic

- Travel advisories

- Travel insurance eligibility

- How to choose travel coverage

- Pre-travel checklist

- Comprehensive

- Travelling in Canada

- Study abroad

- Family vacations

- Weekend getaways

- Backpacking

- Winter escapes

- Romantic retreats

- Travel policy

COVID-19 travel questions

If i test positive for covid-19 while travelling, what am i covered for, for medical emergencies.

You will be covered for emergency medical expenses if you have not had any symptoms or a diagnosis in the 90 days before your departure date. If you test positive during your trip, you will be covered for the cost of taking a COVID-19 test when prescribed by a physician following a medical emergency or sudden illness.

For when you or travel partner test positive for COVID-19 and need to stay at your destination

Some costs related to COVID-19 may be covered. If you purchased Trip Cancellation or Interruption coverage before November 1, 2022 or Optional Protection: Pandemic coverage , your insurance contract will be extended free of charge for:

- the period you are unable to board, and

- the following 24-hour period when your return home is postponed due to a positive COVID-19 test or contact tracing

Will I have coverage for COVID-19 if I test positive while travelling within Canada?

If you are sick or injured due to COVID-19 while travelling within Canada, most costs will be coordinated through your provincial health plan, but not all. For example, if you are hospitalized within Canada:

- hospital and physician expenses are covered by provincial health plans

- air ambulance expenses are not covered by provincial health plans

- transfer to another hospital to your home province to the nearest facility may be considered when medically necessary

You could be subject to another provincial government restriction. For example:

- you may be refused entry

- you may need to self-isolate as you enter the province and when you return to your home province

Emergency travel benefits do not cover quarantine expenses. We encourage you to check the government recommendations and restrictions for the province you are travelling to closer to your travel date.

What happens if I need to quarantine at my destination?

If you or your travel partner test positive for COVID-19 during your trip and you need to stay at your destination, your insurance contract will be extended free of charge for:

- the following 24-hour period when your return home is postponed due to a positive COVID-19 test or contact tracing.

Does Alberta Blue Cross ® cover COVID-19 testing at my destination or prior to boarding my flight home to Canada?

The cost of taking a COVID-19 test while travelling is covered when prescribed by a physician following a medical emergency or sudden illness.

Will I be reimbursed by Trip Cancellation or Interruption insurance if my travel agency or airline offers me a travel credit?

No, you will not be able to submit a claim for this amount if your service provider (travel agency or airline) offers a travel credit.

If I have been previously diagnosed with COVID-19, am I still eligible to buy travel insurance?

You are eligible to purchase travel coverage if you haven’t been diagnosed with COVID-19 and you aren’t showing symptoms of COVID-19 within the 90 days prior to your departure date.

I purchased and received a COVID-19 vaccine in another country. Can I claim the cost on my Alberta Blue Cross ® benefit plan?

COVID-19 vaccinations can be claimed under your Health Spending Account as long as they are submitted with all the required information, such as the pharmacy receipt, Drug Identification Number (DIN), patient’s name and any other relevant information.

Will I have emergency medical coverage if I go on a cruise?

Yes, the Government of Canada lifted its notice advising Canadians to avoid all cruise travel. Emergency medical coverage will cover you if you get sick or injured due to COVID-19.

Am I covered if I travel to Ukraine or Russia?

There are some limitations to your coverage in the event of war. Please give our travel specialists a call at 1-800-394-1965 .

Do you have travel insurance plans for seniors and snowbirds?

Yes we do! We have single-trip emergency medical plans , Trip Cancellation or Interruption coverage, Baggage loss coverage , and Accidental Death and Dismemberment for seniors. Whether escaping the snow to go to Arizona or adventure-seeking in Europe, seniors can get coverage with Alberta Blue Cross ® .

Should I purchase travel insurance while travelling in Canada?

We recommend purchasing travel insurance when travelling within Canada. Medically necessary health care services—hospital care and physician services—are typically covered in other provinces, but additional services like ambulance, hospital transfers, air ambulance and repatriation to your province are not covered. The additional coverage provided by our medical travel insurance goes beyond what is covered by the provincial government and helps keep medical costs in check.

Does my vaccination status affect my premiums?

No, your vaccination status does not affect whether you are eligible for insurance or your premium costs.

Changing travel plans

Can i change the dates on my travel insurance contract.

If you purchased travel insurance through a broker or travel agency, it's best to call them to confirm. If you purchased a plan directly from us, give our travel specialist a call at 1-800-394-1965 .

I already purchased Alberta Blue Cross ® travel insurance, but I decided to stay longer than planned—what should I do?

Our single-trip and multi-trip annual plans can be extended. For a single-trip, you’ll need to call us before the return date of your original travel agreement. For multi-trip annual plans, you need to call us before the trip exceeds the maximum stay of your annual plan.

I already have travel insurance included in my Alberta Blue Cross ® employer or personal health plan, but I am travelling longer than it allows. Can I get the additional days’ coverage I need from you?

Of course you can! We will also give you a discount for this extension—just for being a valued Alberta Blue Cross ® member. Unfortunately, you can’t purchase your additional days of travel online, but please give us a call at 1-800-394-1965 and we can set you up. Make sure you call prior to the end of the existing trip limit on your employer or personal health plan.

Learn more about Emergency Medical Care coverage

What is covered by emergency medical insurance.

It covers medical or related expenses caused by an accident or emergency when you’re outside of Alberta. Our emergency medical travel insurance covers medical costs up to $5 million with optional deductibles to reduce premiums. Covered costs can include:

- hospital services

- health care professional expenses

- prescriptions and diagnostic services

- medical appliances

- emergency dental services

- meals and accommodations

- return flights because of medical delays

- return of dependents, pets, personal items and vehicles

Does emergency medical insurance cover COVID-19-related expenses?

Emergency medical insurance will cover the cost of taking a COVID-19 test when prescribed by a physician following a medical emergency or sudden illness.

Can I add Trip Cancellation or Interruption coverage?

You can add it to our Emergency Medical Care plan. If you have existing coverage through your employer, you can still add Trip Cancellation or Interruption coverage to further protect your trip.

Do you provide Emergency Medical Care to seniors?

We provide quality medical coverage for seniors. Review our coverage options or give us a call to learn more.

What trip activities are covered?

Our travel plans are designed for Albertans looking to enjoy a relaxed vacation, so depending on the kinds of activities you want to do, there is a limit on what Alberta Blue Cross ® will cover. Activities that we consider to be extreme sports will not be eligible for coverage should you get hurt. In other words, if it’s not considered a traditional sport, or it’s made extreme and dangerous by modifying the equipment or locale, the claim isn’t likely to be covered. Here are some examples of extreme sports:

- ballooning or parachuting

- bungee jumping

- climbing or mountaineering, rock climbing

- hang gliding, gliding

- heli-skiing

- rodeo activity

- white water rafting

- para-gliding

- para-sailing

- amateur scuba diving, unless you hold at least a basic scuba diving license from a certified school

- downhill skiing or snowboarding outside marked trails

Be sure to read the exclusions, limitations and definition section of your contract for more details.

Learn more about Trip Cancellation or Interruption coverage

Is covid-19 an eligible reason for trip cancellation or interruption.

Some costs related to COVID-19 may be covered. If you purchased Trip Cancellation or Interruption coverage before November 1, 2022 or Optional Protection: Pandemic coverage , you could be covered when:

- you test positive for COVID-19 before you leave and need to postpone your trip

- you test positive for COVID-19 during your trip and need to extend your stay

See your travel insurance policy for more information.

If you wish to cancel or postpone your trip due to COVID-19, first contact your service provider (e.g., travel agency or air carrier) that sold your trip to request a refund or postponement. Then, please contact our customer service agents to explain your situation.

Trip Cancellation or Interruption coverage purchased after November 1, 2022 without Optional Protection: Pandemic coverage will not cover costs due to COVID-19 or any other pandemic.

Am I covered if my flights are delayed due to weather?

Bad, unpredictable weather is the cause of many flight delays or cancellations. If you purchased a travel insurance plan from us, it includes Flight Delay Service . This service offers access to an airport lounge, hotel room or per person allowance, depending on how long the delay is.

When should I buy Trip Cancellation or Interruption coverage?

It’s best to buy as soon as you book your trip. Cancellation insurance protects you from unexpected circumstances that arise before you leave.

Can I add this to my existing medical travel insurance plan?

You can add Trip Cancellation or Interruption coverage to your existing medical travel insurance plan, whether it’s through your employer or a personal plan.

Get a quote

Finding the right coverage you need for your trip starts with a quote. Get started online or give our travel team a call. We are here to help you.

Métis Nation of Alberta

Medical travel program.

Need to travel more than 100 km for your medical appointment? Let us help you on your journey.

Through increased funding, the Otipemisiwak Métis Government has expanded the reach of this well-utilized health initiative to provide both mileage reimbursement and accommodations for Métis Citizens across the province.

To apply for this program, you must:

- Be a Citizen of the Otipemisiwak Métis Government.

- Be travelling within Alberta to a medical appointment that is 100km from your residence to receive mileage reimbursement.

- Be travelling to a medical appointment more than 100km from your residence to Edmonton, Calgary, Grande Prairie, Fort McMurray, or Lethbridge to receive medical accommodations.

- Provide proof of medical appointment (appointment confirmation, schedule of appointment, letter from a clinician, etc.).

- Indicate whether you are applying for medical accommodations or mileage reimbursement. If both, a separate application needs to be submitted for each request.

Accommodations and travel reimbursements will be provided to Citizens while funds last. If you have questions or would like more information, please contact the Health Program Coordinator at 780-455-2200 or [email protected] .

Apply Today!

Note: Requests for accommodations cannot be made more than 60 days in advance of a medical appointment and no less than 7 days before . This program is not intended for emergency accommodations. If you or an immediate family member is experiencing a medical emergency, you may still apply, however, we cannot guarantee the application will be processed on short notice.

Medical Travel Program FAQ

How far in advance do I need to apply for hotel accommodations?

Requests for accommodations cannot be made more than 60 days in advance of a medical appointment and no less than 7 days before . This program is not intended for emergency accommodations. If you or an immediate family member is experiencing a medical emergency, you may still apply, however, we cannot guarantee the application will be processed on short notice.

What can I be reimbursed for, other than transportation costs?

Parking costs associated with travel to a medical appointment can be reimbursed with receipts up to a maximum of $40 per appointment. This rate was based on the average cost to purchase a weeklong parking pass at most Alberta medical hospitals.

Can you pay for my hotel instead?

No, we cannot cover privately booked hotel costs through this program. The Otipemisiwak Government will book eligible participants to stay at select hotels that they have direct billing accounts with.

I paid out of pocket for accommodations. Can you reimburse me?

No, for this program we cannot cover personal accommodation expenditures.

How long does it take to get reimbursed?

Cheques can sometimes take up to a month or more to be processed and mailed by the Otipemisiwak Métis Government.

Join our newsletter to stay up to date.

- Region Select... Region 1 Region 2 Region 3 Region 4 Region 5 Region 6 I don't know

- Social Media

- Text Message

- Consent * I consent to receive emails from The Métis Nation of Alberta * By submitting this form, you are consenting to receive marketing emails from: The Métis Nation of Alberta, 11738 Kingsway Avenue, Edmonton, Alberta, T5G 0X5, Canada, http://albertametis.com. You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact.

Making a Claim for Medical Expense Travel Credits in Canada

by dellendo | Income Tax Return Preparation

Making a Claim for Medical Expense Travel Credits

Taxpayers can use the medical expense tax credit to offset taxes paid or owed. If you paid for healthcare, you may be allowed to deduct them from your taxes and benefits.

- Details of medical expenses

Medical Expense Tax Credit

- Eligible medical expenses

CRA Medical Expenses in Canada

Canada is the world second largest country. In addition to its immense size, some of the country’s most attractive places to reside are found in rural communities. Traveling long distances for medical care is a hassle, and it’s an issue if you live outside of a big city. If you have to travel for your treatment, you may be able to claim travel expenses on your tax return according to the Canadian government.

A range of costs incurred when traveling for medical treatment, as well as those incurred on behalf of your spouse or family, may be eligible for tax deductions. All reimbursements will cover travel, food, and housing costs for the patient and an escort, if needed. To help with tax season, let’s consider the allowable deductions and how to claim them.

How far must I travel to qualify for Medical Expense Travel Credits?

It is likely that you have spent a lot of money on parking at a hospital in the past, so be prepared for that expense. When traveling for medical treatment, parking charges are not deductible unless you travel more than 80 kilometers.

When submitting a claim to the CRA for transportation and travel expenses, it is necessary to meet the following requirements:

- In your neighborhood there were no comparable medical services.

- You avoided detours and followed the shortest route.

- It was appropriate for you to go to the place you did in order under the circumstances to acquire such medical care.

If you take public transportation to travel more than 40 kilometers (one way) for medical treatment, you may be entitled to claim the costs (eg. bus, train, or taxi fare). Even if you don’t use public transportation, you may be able to deduct the cost of your car.

If you traveled more than 80 kilometers (one way), you can deduct your automobile expenses, as well as your housing, meals, and parking fees, from your tax return.

If a medical professional has determined that you cannot travel without assistance, you may be able to claim reimbursement for expenses incurred by someone who traveled with you as a caretaker.

How does the CRA calculate vehicle costs?

If you need to drive to get medical attention, you can claim expenses such as gasoline, oil, license fees, insurance, maintenance and repair costs, and replacement parts on your tax return. Depreciation, provincial taxes, and loan charges are all considered tax-deductible expenses in the United States.

There are two techniques to determining automobile expenses: the complete methodology and the streamlined method. The comprehensive technique is the more thorough approach. If you select the detailed option, you will be required to keep track of the total amount of kilometers driven over a 12-month period. Assess the relationship between the overall cost of your vehicle and the number of kilometers travelled for medical treatment.

You can deduct half the cost of your car on your tax return, for example, if you drive 10,000 kilometers in a year, with 5,000 kilometers of those being for medical treatment (which was more than 40 kilometers away).

You may easily calculate how many miles you traveled throughout the 12-month period in which you choose to seek medical attention by following this straightforward procedure. Calculate the distance traveled by multiplying the distance traveled by the provincial rate that is in effect. Tariffs vary by province or territory and are subject to change on a yearly basis. The document is available on the website of the Canada Revenue Agency.

Keep all of your receipts for future Canada Revenue Agency inspection applications, regardless of whether you choose a detailed or a simple approach (CRA).

What are the Accommodations Policies?

- To be eligible for payment for housing and food you must have covered more than 80 km for medical care.

- Receipts are based on accommodation claims and only stay costs, including taxes, are reimbursable. No additional price is included for items like room service, movies and telephone calls.

What is the process for claiming meals?

- You must have gone more than 80 kilometers to be eligible for food refunds from CRA. You have the possibility, as well as with car costs, to choose the detailed manner or the simplified method.

- You must keep track of the actual cost of each meal with the detailed way.

- You can deduct up to $17 for each meal up to $51 a day including sales tax and up to a maximum of $17 per meal for people who choose for the simpler option.

- Keep in mind whether you employ the detailed technique or the simplified method always to save receipts.

Travel Partners / Companions

You may be entitled to deduct the expenses of your spouse or common-law partner, as well as any other person who travels with you, as part of the tax credit for medical expenses if they accompany you on your journey. To include these charges, your doctor or other authorized practitioner must present you with a certificate showing that you were unable to travel alone at the time the incident happened.

When you meet certain qualifications, you may be able to cover the costs of transportation, lodging, and meals for your travel companion, depending on how far you traveled for medical care.

Travel outside of Canada’s borders

In addition to being able to claim expenditures incurred while out of the country, qualified medical expenses for traveling within Canada may also be reimbursed. Every single one of the following requirements must be met:

- Practitioners must have the legal right to practice in the country where they work. When it comes to hospitalizations, the institution must be either public or privately licensed private.

- The program requires that the health-care services you receive be unavailable in your neighborhood and that you travel to seek them.

Related Projects

Service title.

The costs involved with traveling to receive medical attention can be significant when you factor in accommodation, meals, and related expenses.

Find out how to claim your CRA medical travel expenses.

IMPORTANT: All claims related to Medical Travel require documentation provided by the practitioner confirming your attendance (whether this be a receipt for services, or a letter signed by your service provider).

Claiming Mileage

There are two ways to claim transportation costs as a CRA travel medical expense but you have to travel at least 40 kilometers one way to obtain medical service that were not available locally.

Example: for trips to and from the hospital, clinic, or doctor’s office.

Record the distance of travel, calculate your mileage according to the province in which you reside. (2021 rates):

Example: 55¢ x 160km = $88.00; you may claim $88.00 as an eligible medical expense.

Vehicle expenses may be claimed as CRA medical travel expenses by submitting gas receipts for the date(s) of travel/service.

Claiming Meals, Accommodations and Parking

In addition to the transportation costs above, you may claim reasonable expenses during your trip for medical attention provided that you had to travel more than 80 kilometers to attend your appointment. The travel costs of one accompanying individual are also allowable, if it is deemed necessary to have a companion.

Meals can be claimed one of two ways: 1. Meal receipts can be submitted for reasonable costs for the patient and one attendant (alcoholic beverages will not be reimbursed) OR 2. A flat rate of $23 per meal may be claimed for the patient and one attendant up to a maximum of $69 per day per person.

Accommodations

Receipts must be enclosed for any reasonable accommodation fees that are being claimed (ie: hotel receipt). Coverage applies to the accommodations ONLY; telephone, movie charges and the like are not eligible for reimbursement.

Receipts must be enclosed for any parking lot fees incurred. Please refer to the CRA medical travel expenses website for further details

A farmer lives in rural Alberta. There is not much in the way of medical services, vision care, or therapeutic care, such as physiotherapy, available in this small town. Consequently, most treatment modalities require travelling to a center that has the appropriate medical facilities. The closest center is 44 kilometers from their home.

On a recent trip, they had chiropractic services performed and managed to visit the dentist for a check-up and teeth cleaning. They were eligible to be reimbursed for the cost of the travel between their home and where the services took place.

In Alberta, that amounts to 53 cents a kilometer – so they were also able to claim $46.64 for travel expenses (there and back). An alternative is to submit gas receipts for the dates of travel service.

On occasion, the same farmer requires a medical service that was only available on a timely basis in a major medical facility in the USA. This service was available in Canada but the wait time was over six months and the inconvenience to our customer as a result of their condition necessitated a faster remedy. They chose the US destination for the service.

As the travel distance now exceeded 80 Kilometers, in addition to the travel costs (economy class air fare), our customer can claim reimbursement for meals, accommodations, parking as well as the costs associated with a companion travelling with the patient if deemed necessary. An eligible travel expense claim of this magnitude represents a significant savings.

How to write off 100% your medical expenses

Are you an incorporated business owner with no arm's length employees? Learn how to use a Health Spending Account to pay for your medical expenses through your corporation:

Do you own a corporation with arm's length employees? Discover a tax deductible health and dental plan that has no premiums:

Write off 100% of your medical expenses

Are you an incorporated business owner with no employees? Learn how to use a Health Spending Account to pay for your medical expenses through your corporation:

Do you own a corporation with employees? Discover a tax deductible health and dental plan that has no premiums:

What's in this article

Subscribe to the blog

Discover more.

What is a health care spending account?

Health care spending accounts help business owners save on medical costs by turning after-tax...

By Alden Hui on December 8, 2020

What's covered in a Health Spending Account?

One of the great benefits of a Health Spending Account is the freedom it provides through an ...

By Alden Hui on October 15, 2019

7 Key Health Spending Account Rules that you should know

A Health Spending Account (HSA) is a tax-free benefit which allows small business owners and their...

By Alden Hui on April 25, 2019

This website stores cookies on your computer. To find out more about the cookies we use, see our Privacy Policy .

Language selection

- Français fr

Lines 33099 and 33199 – Eligible medical expenses you can claim on your tax return

On this page, medical expenses you can claim, how to claim eligible medical expenses on your tax return, documents you need to support your medical expenses claim.

- Claiming medical expenses for a person who died

Credits and deductions related to medical expenses

Doing taxes for someone who died.

To know for whom you can claim medical expenses, see How to claim eligible medical expenses on your tax return .

You can claim only eligible medical expenses on your tax return if you, or your spouse or common-law partner:

- paid for the medical expenses in any 12-month period ending in 2023

- did not claim them in 2022

Generally, you can claim all amounts paid, even if they were not paid in Canada.

For all expenses, you can only claim the part of the expense that you or someone else have not been and will not be reimbursed for. However, the expense can be claimed if the reimbursement is included in your or someone else's income (such as a benefit shown on a T4, Statement of Remuneration Paid (slip) , and the reimbursement was not deducted anywhere else on the tax return.

List of common medical expenses

This list of common medical expenses shows:

- types of medical expenses

- if the expense is eligible

- if you need any supporting documents (such as Form T2201, Disability Tax Credit Certificate )

This list is not exhaustive. You can use the search feature of this list to quickly find a specific medical expense. For more information on eligible medical expenses, see Income Tax Folio S1–F1–C1 , Medical Expense Tax Credit .

You can claim eligible medical expenses on line 33099 or line 33199 of your tax return (Step 5 – Federal tax).

Line 33099 – Medical expenses for self, spouse or common-law partner, and your dependant children under 18

Use line 33099 to claim the total eligible medical expenses that you or your spouse or common-law partner paid for any of the following persons:

- your spouse or common-law partner

- your or your spouse or common-law partner's children who were under 18 years of age at the end of the tax year

Line 33199 – Allowable amount of medical expenses for other dependants

Use line 33199 to claim the part of eligible medical expenses that you or your spouse or common-law partner paid for any of the following persons who depended on you for support:

- your or your spouse or common-law partner's children who were 18 years of age or older at the end of the tax year, or grandchildren

- your or your spouse or common-law partner's parents, grand-parents, brothers, sisters, uncles, aunts, nephews, or nieces who were residents of Canada at any time in the year

Amounts you can claim

Follow these steps to find out how to calculate the amount to enter on lines 33099 and 33199 of your tax return.

On line 33099 of your tax return (Step 5 – Federal Tax), enter the total amount that you or your spouse or common-law partner paid in 2023 for eligible medical expenses.

On the line below line 33099, enter the lesser of the following amounts:

- 3% of your net income ( line 23600 ) or

Subtract the amount of step 2 from the amount on line 33099, and enter the result on the following line of your tax return (Step 5 – Federal tax ) .

Claim the corresponding provincial or territorial tax credits for individuals on line 58689 of your provincial or territorial Form 428 . If you live in Quebec, visit Revenu Québec .

Compare the amount you can claim with the amount your spouse or common-law partner would be able to claim. It may be better for the spouse or common-law partner with the lower net income (line 23600) to claim the eligible medical expenses.

You have to do the following calculation for each dependant.

Add up the total amount that you, or your spouse or common-law partner paid in 2023 for eligible medical expenses.

Find out which amount is less between:

- 3% of your dependant's net income ( line 23600 ) or

Subtract the lesser amount from Step 2 from the amount from Step 1. Enter the result on line 33199 of your tax return ( Step 5 – Federal Tax) .

Claim the corresponding provincial or territorial tax credits for individuals on line 58729 of your provincial or territorial Form 428. If you live in Quebec, visit Revenu Québec .

Richard and Pauline have two children, Jen and Rob. They have reviewed their medical expenses and decided that the 12-month period ending in 2023 they will use to calculate their claim is July 1, 2022, to June 30, 2023. They had the following expenses:

- Richard – $1,500

- Pauline – $1,000

- Jen (their 16-year-old daughter) – $1,800

- Rob (their 19-year-old son) – $1,000

Total medical expenses = $5,300

Since Jen is under 18, Richard and Pauline can combine her medical expenses with theirs, for a total of $4,300. Either Richard or Pauline can claim this amount on line 33099 of their tax return (Step 5 – Federal tax). Since Rob is over 18, his medical expenses should be claimed on line 33199.

Pauline’s net income (on line 23600 of her return) is $32,000. She calculates 3% of that amount, which is $960. Because the result is less than $2,635, she subtracts $960 from $4,300. The difference is $3,340, which is the amount she could claim on her tax return.

Richard’s net income is $48,000. He calculates 3% of that amount, which is $1,440. Because the result is less than $2,635, he subtracts $1,440 from $4,300. The difference is $2,860, which is the amount he could claim on his tax return.

In this case, it is better for Pauline to claim all the expenses for Richard, herself, and their daughter Jen on line 33099.

To decide who should claim the medical expenses for Rob on line 33199, Richard and Pauline will have to make the same calculation using Rob’s net income.

Do not send any documents with your tax return. Keep them in case the Canada Revenue Agency (CRA) asks to see them later.

- Receipts – Receipts must show the name of the company or individual to whom the expense was paid.

- Prescription – The List of common medical expenses indicates if you need a prescription to support your claim. A medical practitioner can provide the prescription.

- Certification in writing – The List of common medical expenses indicates if you need a certification in writing to support your claim. A medical practitioner can provide the certification.

- Form T2201, Disability Tax Credit Certificate – The List of common medical expenses indicates if you need to have this form approved by the CRA for your claim. For more information about this approval process, see Disability Tax Credit . If the person for whom you are claiming the medical expense is already approved for the disability tax credit for 2023, you do not need to send a new Form T2201.

Claiming medical expenses for a person who died

A claim can be made for expenses paid in any 24-month period that includes the date of death. It only applies if the expenses were not claimed for any other year.

Disability supports deduction (line 21500)

If you have an impairment in physical or mental functions, you may be able to claim some medical expenses as a disability supports deduction. You can claim these expenses on line 21500 or line 33099. You can also split the claim between these two lines, as long as the total of the amounts claimed is not more than the total expenses paid. You may claim whichever is better for you. For more information, go to Line 21500 – Disability supports deduction .

Refundable medical expense supplement (line 45200)

The refundable medical expense supplement is a refundable tax credit available to working individuals with low incomes and high medical expenses. For more information, go to Line 45200 – Refundable medical expense supplement .

There may be special considerations when claiming amounts on lines 33099 and 33199 for someone who died .

Forms and publications

- Get a T1 Income tax package

- Guide RC4065, Medical Expenses

- Income Tax Folio S1-F1-C1, Medical Expense Tax Credit

- Form T2201, Disability Tax Credit Certificate

- Guide RC4064, Disability-Related Information

Related links

- Tax credits and deductions for persons with disabilities

- Line 21500 – Disability supports deduction

- Disability Tax Credit (DTC)

- Line 45200 – Refundable medical expense supplement

Page details

IMAGES

COMMENTS

Meal expenses. If you choose the detailed method to calculate meal expenses, you must keep your receipts and claim the actual amount that you spent. If you choose the simplified method, claim in Canadian or US funds a flat rate of $23 per meal, to a maximum of $69 per day (sales tax included) per person, without receipts.

The AHCIP covers only limited physician and hospital costs outside of Canada. If you get medical or hospital care when outside of Canada, you will be responsible for paying the difference between the amount charged and the amount the AHCIP reimburses you. If you claim coverage under the AHCIP, you still have to pay the health service provider.

If you need to receive medical care, you may be able to deduct medical travel expenses for your medical mileage. The deductions can represent a big chunk of savings that you can claim at tax time. ... Medical travel rate 2022: Alberta: 55.0: British Columbia: 58.0: Manitoba: 56.0: New Brunswick: 59.5: Newfoundland and Labrador: 62.0: Northwest ...

Your Alberta Health Care Insurance Plan (AHCIP) coverage can be used across Canada, but there are limits on what is covered. Not all health services available to you in Alberta are covered by AHCIP outside of Alberta. You should have additional travel or medical insurance when you leave Alberta. Emergency medical care and transportation can be ...

Follow the advice on MyHealth Alberta when travelling outside of Alberta or Canada. Contact AHS Travel Health Services for recommended vaccinations. Check with your healthcare provider about which vaccinations are right for you. The Government of Canada offers resources for travelling outside of Canada: Travel Health and Safety.

To claim transportation and travel expenses with the CRA, the following conditions must be met: If you traveled at least 40 km (one way) to get medical services, you can claim the cost of public transportation (ex. bus, train, or taxi fare). If public transportation isn't available, you may be able to claim vehicle expenses.

You made a claim for medical expenses on line 33200 of your tax return (Step 5 - Federal tax) or for the disability supports deduction on line 21500 of your tax return. You were resident in Canada throughout 2023. You were 18 years of age or older at the end of 2023. You must also meet the criteria related to income.

It covers medical or related expenses caused by an accident or emergency when you're outside of Alberta. Our emergency medical travel insurance covers medical costs up to $5 million with optional deductibles to reduce premiums. Covered costs can include: hospital services; health care professional expenses; prescriptions and diagnostic services

Travel and expense disclosure. Approved expenses are disclosed to the public on a bi-monthly basis. Expenses are reported after they are approved, which is why an expense may be posted several months after the transaction date. Under the Public Disclosure of Travel and Expenses Policy: The information is released publicly and without restriction.

P© Alberta Health Services (AHS) AGE: 2 OF 22 Expenses for travel are necessary, provide a cost-effective means to support AHS' business and clinical objectives, and regard the health and safety of individuals. Only legitimate, approved expenses incurred during the course of AHS business are reimbursed or paid.

Actual cost of the most economical means of public transportation; or. When the individual cannot reasonably be expected to use public transportation, or there is no public transportation: $0.35 per kilometre for private vehicle, or. The actual cost of taxi fare. Rate History - Transportation Rate.

Description. This policy provides a framework of accountability and rules to guide the effective oversight of public resources in the reimbursement and payment of travel, meal, hospitality, and other expenses and allowances not addressed by regulations under the Public Service Act. The policy is intended to ensure fair and reasonable practices ...

If both, a separate application needs to be submitted for each request. Accommodations and travel reimbursements will be provided to Citizens while funds last. If you have questions or would like more information, please contact the Health Program Coordinator at 780-455-2200 or [email protected]. Apply Today!

If you have to travel for your treatment, you may be able to claim travel expenses on your tax return according to the Canadian government. A range of costs incurred when traveling for medical treatment, as well as those incurred on behalf of your spouse or family, may be eligible for tax deductions. All reimbursements will cover travel, food ...

Meal expenses. If you choose the detailed method to calculate meal expenses, you must keep your receipts and claim the actual amount that you spent. If you choose the simplified method , claim in Canadian or US funds a flat rate of $23/meal, to a maximum of $69/day (sales tax included) per person, without receipts.

Purpose and Principles. This policy provides a framework of accountability and rules to guide the effective oversight of public resources in the reimbursement and payment of travel, meal, hospitality, and other expenses and allowances not addressed by regulations under the Public Service Act. This policy is intended to ensure fair and ...

travel expenses outside of Canada, when a person is required to travel 80 km or more one way from their home to get medical services outside of Canada, which are eligible medical expenses - the expenses include transportation, travel, accommodations, meals and parking. costs of the following devices (Income Tax Act s. 118.2 (2) (i))

Record the distance of travel, calculate your mileage according to the province in which you reside. (2021 rates): Example: 55¢ x 160km = $88.00; you may claim $88.00 as an eligible medical expense. Method 2. Vehicle expenses may be claimed as CRA medical travel expenses by submitting gas receipts for the date (s) of travel/service.

Line 25500 - Calculate your travel deduction. You can claim the travel deduction for a trip for medical or other reasons (such as vacation) that started from a prescribed zone and was taken either by you or by an eligible family member. Determine who an eligible family member is. An eligible family member is someone who lived with you at the ...

The maximum amount of other eligible expenses that is reimbursed through a written attestation is $200 per claim for each travel (including multiple, consecutive days), working session, or hospitality event. 12. Reimbursement. 12.1 AHS reimburses expenses, in accordance with this policy.

The Alberta Health Care Insurance Plan (AHCIP) provides eligible Alberta residents with full coverage for medically necessary physician services, and some dental and oral surgical health services. Your physician determines what insured services are considered medically necessary. You must be registered with the AHCIP, using your personal health ...

The extraordinary transportation benefit may be provided if a member of the household unit has a severe health problem and needs regular access to health services paid for by Alberta Health (doctors, radiologists, lab technicians, physiotherapists, etc.). The person must use the nearest appropriate health service provider and travel by the most ...

Add up the total amount that you, or your spouse or common-law partner paid in 2023 for eligible medical expenses. Subtract the lesser amount from Step 2 from the amount from Step 1. Enter the result on line 33199 of your tax return ( Step 5 - Federal Tax). Claim the corresponding provincial or territorial tax credits for individuals on line ...