Best travel credit cards with no annual fee for 2023

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn LinkedIn

- Share this article via email Email

At Bankrate, we take the accuracy of our content seriously.

“Expert verified” means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced.

Their reviews hold us accountable for publishing high-quality and trustworthy content.

- Connect with Holly D. Johnson on Twitter Twitter

- Connect with Holly D. Johnson on LinkedIn LinkedIn

- • Rewards credit cards

- • Credit card comparisons

- • Rewards strategy

- • Small business marketing

- Connect with Cathleen McCarthy on Twitter Twitter

- Connect with Cathleen McCarthy on LinkedIn LinkedIn

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money . The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

At Bankrate, we have a mission to demystify the credit cards industry — regardless or where you are in your journey — and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you're well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Many popular travel credit cards come with flashy perks like airport lounge access and annual travel credits. The downside of these luxury perks is that they usually only come at the expense of a high annual fee. And with that, you’ll have the constant stress of making sure you’re using the perks enough to justify the fee .

Luckily, there are plenty of no-annual-fee travel credit cards. The benefits may not be as robust as you’ll find with premium cards, but you can get some travel-related perks without forking over an annual fee for the privilege. The best no-annual-fee travel credit card for you depends on your spending style, how you want to redeem your rewards and the travel benefits you are hoping to get. This guide highlights the best travel credit cards with no annual fee and everything you should consider before you choose one.

Capital One VentureOne Rewards Credit Card: Best for beginners

Why we picked it: The Capital One VentureOne Rewards Credit Card is a great way to ease yourself into travel rewards. You’ll earn 1.25X miles on all of your spending, along with 5X miles on hotels and rental cars booked through Capital One Travel. You can also earn a welcome bonus of 20,000 miles after spending $500 within the first three months. You can redeem your miles for travel, cash back, gift cards and more, but you’ll get the best value when you redeem for travel or transfers to travel partners (an uncommon feature with no-annual-fee travel cards).

- Generous rewards rate on select travel purchases

- Earn a bonus offer with a low minimum spending requirement

- No foreign transaction fees

- Ability to transfer rewards to Capital One travel partners

- Lower rewards rate than other no-annual-fee travel credit cards

- No major travel perks included

Who should apply: Consider this card if you want some flexibility when it comes to redeeming your rewards. A lot of travel cards require you to book through their sites, but the VentureOne gives you the option of booking with a third-party airline, hotel or travel service and later redeeming your miles for a statement credit to cover the cost.

Who should skip: Capital One’s travel partners are good, but not great. If you’re looking for a credit card issuer with a fantastic list of airline and hotel transfer partners, you might be better off with a credit card from Chase or American Express, but note that you may have to pay an annual fee .

Delta SkyMiles Blue American Express Card: Best for Delta Air Lines

Why we picked it: With the Delta SkyMiles® Blue American Express Card , you’ll earn 2X miles at restaurants worldwide and 2X miles on Delta purchases, plus 1X miles on everything else. The welcome offer is easily obtainable, too — you can earn 10,000 miles by spending $1,000 within the first six months of card membership.

- Earn bonus miles on dining and Delta purchases

- Get a 20 percent discount on eligible in-flight purchases

- Frequent flyer perks are minimal (no free checked bags or priority boarding)

- The welcome offer may not be enough for a one-way flight

Who should apply: Consider the Delta SkyMiles Blue American Express Card if you want the chance to rack up miles in the Delta SkyMiles program but you don’t spend enough to justify paying an annual fee.

Who should skip: If you travel with Delta frequently, you’ll benefit more from a Delta card that offers free checked bags , priority boarding , a better welcome offer and more miles for each dollar you spend.

American Airlines AAdvantage® MileUp®: Best for American Airlines

Why we picked it: While you won’t get major frequent flyer benefits like a free checked bag or priority boarding with the American Airlines AAdvantage MileUp℠ Card *, you will get the chance to rack up miles through credit card spending: You’ll earn 2X AAdvantage miles on groceries, 2X miles on American Airlines purchases and 1X miles on all other purchases. Additionally, you’ll get a 25 percent discount on eligible in-flight purchases, such as food and beverages.

- Earn 2X miles on groceries and American Airlines purchases

- 25 percent discount on eligible in-flight purchases

- Charges a 3 percent foreign transaction fee

Who should apply: Consider the American Airlines AAdvantage MileUp if you prefer to fly with American Airlines but fly infrequently and don’t want to pay an annual fee.

Who should skip: If you fly with American or its Oneworld partners frequently, you may be better off with a co-branded credit card that offers frequent flyer perks like a free checked bag or priority boarding. For example, you may want to consider the Citi® / AAdvantage® Platinum Select® World Elite Mastercard® *, which waives its $99 annual fee for the first 12 months. Also, consider a different card if you travel internationally and want to avoid foreign transaction fees.

Hilton Honors American Express Card: Best for frequent Hilton stays

Why we picked it: Travelers who frequent Hilton hotel locations will find the Hilton Honors American Express Card to be a solid no-annual-fee option. This card offers a generous welcome bonus of 80,000 Hilton Honors Bonus Points after spending $2,000 in the first six months of card membership. You’ll also earn high rewards rates in numerous categories: 7X points on eligible Hilton purchases; 5X points at U.S. supermarkets, U.S. gas stations and U.S. restaurants; and 3X points on all other purchases.

- Comes with complimentary Hilton Silver status

- Earns a generous rewards rate on Hilton stays

- Minimal elite hotel benefits (for example, no room upgrades or complimentary breakfast)

- Hilton points are worth 0.6 cents apiece on average , so take the high rewards rates with a grain of salt

Who should apply: Anyone who stays at Hilton properties regularly and isn’t interested in premium perks will get a fair amount of value out of this card.

Who should skip: Hilton travelers interested in better perks like annual resort credits and free weekend nights should consider other Hilton credit cards, including options that come with a higher tier of elite status, annual travel credits and other premium perks.

Bank of America Travel Rewards credit card: Best for Bank of America customers

Why we picked it: The Bank of America® Travel Rewards credit card is a good choice for earning travel rewards on each purchase, but it’s even better if you already do your banking with Bank of America. The card earns 1.5X points on every dollar spent, but you can bump up your rewards by 25 percent to 75 percent if you qualify for membership in Bank of America’s Preferred Rewards program .

- Earns a flat 1.5X points per dollar on all purchases

- Bank of America Preferred Rewards members can earn 25 to 75 percent more rewards

- Flexible redemption options

- No major travel perks

Who should apply: This is a solid card for those who want to earn a flat rate of flexible travel points on each dollar spent. Bank of America customers with a considerable amount of savings will especially benefit due to the boosted rewards rates for Preferred Rewards customers.

Who should skip: Skip this card if you want travel-related perks like free checked bags or elite status.

Chase Freedom Unlimited: Best for pairing with a premium travel card

Why we picked it: The Chase Freedom Unlimited® isn’t a travel rewards card, but it is a no-annual-fee card that you can pair with Chase’s premium travel cards, the Chase Sapphire Preferred® Card or Chase Sapphire Reserve ® , to boost your points value by 25 percent to 50 percent when booking travel through Chase Ultimate Rewards. Essentially, you can combine the points you earn with your Chase Freedom Unlimited with the points you earn with your Sapphire card. Then, with your Sapphire card, you can redeem your rewards for higher-value redemptions like transfers to Chase travel partners or travel through Chase.

- 5 percent cash back on travel purchased through Chase Ultimate Rewards; 5 percent cash back on Lyft purchases (through March 2025); 3 percent cash back on dining and drugstore purchases; 1.5 percent cash back on all other purchases

- Additional 1.5 percent cash back on top of all purchases’ original cash back rate (on up to $20,000) for the first year (exclusive offer through Bankrate)

- Trip cancellation and interruption insurance

- 3 percent foreign transaction fee

- Can’t transfer points to Chase’s travel partners without a premium card

Who should apply: Consider this cash back credit card if you already have a Sapphire card and want to earn better-than-average rewards on drugstore purchases and non-category purchases.

Who should skip: Skip this card if you need an option that doesn’t charge foreign transaction fees, or if you want travel perks that are specific to a frequent flyer or hotel loyalty program.

Discover it Miles: Best for flexible redemptions

Why we picked it: The Discover it® Miles is a flat-rate card that earns an unlimited 1.5X miles on all purchases. Like all other Discover cards, the rewards you earn within your first 12 months will be doubled at the end of that year.

- A generous flat rate of 1.5X miles on all purchases

- Discover matches your first-year earnings

- No foreign transaction fees (this is true for all Discover credit cards)

- Redeem rewards for flexible travel options

- You have to wait a full year for the welcome bonus

- No travel perks

Who should apply: Consider the Discover it Miles if you want to earn flexible rewards that you can redeem for any type of travel.

Who should skip: Skip this card if you want travel-related benefits or if you want to earn a generous sign-up bonus within the first few months of account opening.

Compare the best travel credit cards with no annual fee

Benefits of no-annual-fee travel credit cards.

In general, no-annual-fee travel cards come with many perks:

- They’re great for beginners who are new to the travel card space.

- You won’t have to worry about recouping a high annual fee through spending or earning credits.

- With a co-branded card , you can earn rewards in a hotel or airline loyalty program through credit card spending.

- You may receive a 0 percent intro APR on purchases or balance transfers for a limited time.

- You’ll typically receive more travel-related perks than other no-annual-fee rewards cards, such as rewards on travel purchases or travel-related redemption options.

How to choose a travel credit card with no annual fee

As you review the best travel credit cards with no annual fee, there are a number of important factors to keep in mind. Here’s everything you need to think about as you choose your next card .

- Consider your spending style and habits. Ideally, you’ll find a no-annual-fee travel card that’s suited to your budget. Look for a card that gives boosted rewards on the types of purchases you spend the most on each month. If your spending is pretty scattered, a flat-rate card may be best.

- Compare welcome offers. Earning rates are important, but you should also consider welcome offers. Many travel credit cards with no annual fee make it easy to earn $200 or more in rewards right off the bat (as long as you meet the terms ).

- Pay attention to cardholder perks. Airline cards and hotel cards with no annual fee tend to offer in-flight discounts or automatic elite status, while some general travel credit cards in this niche offer travel insurance benefits .

- Look closely at redemption options. Be sure to select a travel credit card that lets you redeem your rewards for the type of rewards you want. If you’re unsure, look for a flexible travel credit card that lets you redeem for statement credits to cover numerous types of travel purchases.

The bottom line

Many of the best travel credit cards charge annual fees, but there are plenty of good no-annual-fee options, too. Find a card that works with your spending habits and your future travel plans to maximize your earnings , then work to pay your balances off each month so you don’t take on added costs in the form of interest payments.

*The information about the American Airlines AAdvantage® MileUp® and Citi® / AAdvantage® Platinum Select® World Elite Mastercard® has been collected independently by Bankrate.com. The card details have not been reviewed or approved by the card issuer.

Related Articles

Best travel credit cards for people with bad or fair credit

Best credit cards for international travel

Best travel credit cards for beginners

Act fast! Why October is the best time to apply for a Southwest Rapid Rewards card

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

16 Best Travel Credit Cards of October 2024

The best travel credit card is one that brings your next trip a little closer every time you use it. Purchases earn points or miles you can use to pay for travel. If you're loyal to a specific airline or hotel chain, consider one of that company's branded travel credit cards. Otherwise, check out our picks for general-purpose travel cards that give you flexible travel rewards without the restrictions and blackout dates of branded cards.

Why trust NerdWallet

400+ credit cards reviewed by our team of experts ( See our top picks )

80+ years of combined experience covering credit cards and personal finance

27,000+ hours spent researching and reviewing financial products in the last 12 months

Objective comprehensive ratings rubrics ( Methodology )

NerdWallet's credit cards content, including ratings and recommendations, is overseen by a team of writers and editors who specialize in credit cards. Their work has appeared in The Associated Press, USA Today, The New York Times, MarketWatch, MSN, NBC's "Today," ABC's "Good Morning America" and many other national, regional and local media outlets. Each writer and editor follows NerdWallet's strict guidelines for editorial integrity .

Show summary

Nerdwallet's best travel credit cards of october 2024.

Chase Sapphire Preferred® Card : Best for Max flexibility + big bonus

Capital One Venture Rewards Credit Card : Best for Flat-rate rewards

Capital One Venture X Rewards Credit Card : Best for Travel portal benefits

Chase Freedom Unlimited® : Best for Cash back for travel bookings

American Express® Gold Card : Best for Big rewards on everyday spending

Wells Fargo Autograph℠ Card : Best for Bonus rewards + no annual fee

The Platinum Card® from American Express : Best for Luxury travel perks

Ink Business Preferred® Credit Card : Best for Business travelers

Citi Strata Premier℠ Card : Best for Triple points on multiple categories

Capital One VentureOne Rewards Credit Card - Miles Boost : Best for Flat-rate rewards + no annual fee

Chase Sapphire Reserve® : Best for Bonus rewards + high-end perks

World of Hyatt Credit Card : Best for Best hotel card

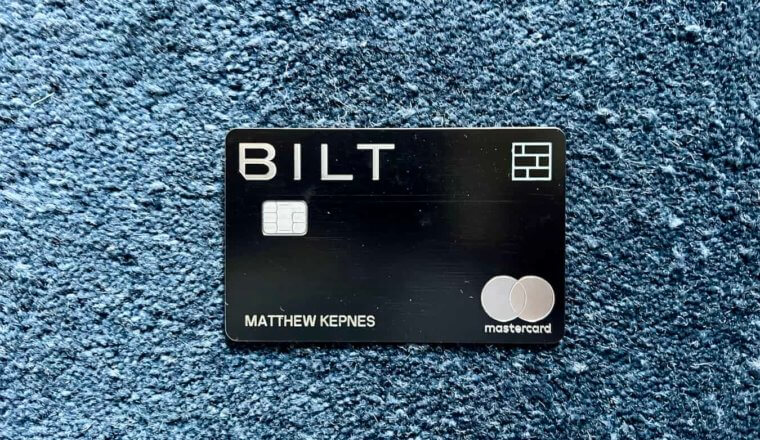

Bilt World Elite Mastercard® Credit Card : Best for Travel rewards for rent payments

United℠ Explorer Card : Best for Best airline card

PenFed Pathfinder® Rewards Visa Signature® Card : Best for Credit union benefits

Wells Fargo Autograph Journey℠ Card : Best for Booking directly with airlines/hotels

Best Travel Credit Cards

Find the right credit card for you..

Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.

Max flexibility + big bonus

Flat-rate rewards, travel portal benefits, cash back for travel bookings, big rewards on everyday spending, bonus rewards + no annual fee, luxury travel perks, business travelers, triple points on multiple categories, flat-rate rewards + no annual fee, bonus rewards + high-end perks, best hotel card, travel rewards for rent payments, best airline card, credit union benefits, booking directly with airlines/hotels, full list of editorial picks: best travel credit cards.

Before applying, confirm details on the issuer’s website.

Capital One Venture Rewards Credit Card

Our pick for: Flat-rate rewards

The Capital One Venture Rewards Credit Card is probably the best-known general-purpose travel credit card, thanks to its ubiquitous advertising. You earn 5 miles per dollar on hotels and car rentals booked through Capital One Travel and 2 miles per dollar on all other purchases. Miles can be redeemed at a value of 1 cent apiece for any travel purchase, without the blackout dates and other restrictions of branded hotel and airline cards. The card offers a great sign-up bonus and other worthwhile perks ( see rates and fees ). Read our review.

Capital One VentureOne Rewards Credit Card - Miles Boost

Our pick for: Flat-rate rewards + no annual fee

With the Capital One VentureOne Rewards Credit Card - Miles Boost , you don't pay an annual fee, but you also don't get rewards as rich as those on the regular Venture card ( see rates and fees ). Still, the bonus offer makes this a solid card for starting out with travel rewards. Read our review.

Chase Sapphire Reserve®

Our pick for: Bonus rewards + high-end perks

The high annual fee on the Chase Sapphire Reserve® gives many potential applicants pause, but frequent travelers should be able to wring enough value out of this card to more than make up for the cost. Cardholders get bonus rewards (up to 10X) on dining and travel, a fat bonus offer, annual travel credits, airport lounge access, and a 50% boost in point value when redeeming points for travel booked through Chase. Points can also be transferred to about a dozen airline and hotel partners. Read our review.

Chase Sapphire Preferred® Card

Our pick for: Max flexibility + big bonus

For a reasonable annual fee, the Chase Sapphire Preferred® Card earns bonus rewards (up to 5X) on travel, dining, select streaming services, and select online grocery purchases. Points are worth 25% more when you redeem them for travel booked through Chase, or you can transfer them to about a dozen airline and hotel partners. The sign-up bonus is stellar, too. Read our review.

Wells Fargo Autograph Journey℠ Card

Our pick for: Booking directly with airlines/hotels

The Wells Fargo Autograph Journey℠ Card stands out among general-purpose travel cards because it pays its highest rewards rates on travel bookings made directly with airlines and hotels, rather than requiring you to go through the issuer's travel agency, where prices might not be competitive. The points are flexible, you get a good bonus offer, and the card comes with a few other nice perks. Read our review.

Wells Fargo Autograph℠ Card

Our pick for: Bonus rewards + no annual fee

The Wells Fargo Autograph℠ Card offers so much value, it's hard to believe there's no annual fee. Start with a great bonus offer, then earn extra rewards in a host of common spending categories — restaurants, gas stations, transit, travel, streaming and more. Read our review.

Citi Strata Premier℠ Card

Our pick for: Triple points on everyday categories

The Citi Strata Premier℠ Card earns bonus points on select travel, supermarkets, dining, gas stations and EV stations. There's a solid sign-up bonus as well. Read our review.

U.S. Bank Altitude® Connect Visa Signature® Card

Our pick for: Road trips

The U.S. Bank Altitude® Connect Visa Signature® Card is one of the most generous cards on the market if you're taking to the skies or the road, thanks to the quadruple points it earns on travel and purchases at gas stations and EV charging stations. It's also a solid card for everyday expenses like groceries, dining and streaming, all for a $0 annual fee. Read our review .

Capital One Venture X Rewards Credit Card

Our pick for: Travel portal benefits

Capital One's premium travel credit card can deliver terrific benefits — provided you're willing to do your travel spending through the issuer's online booking portal. That's where you'll earn the highest rewards rates plus credits that can make back the bulk of your annual fee ( see rates and fees ). Read our review.

Chase Freedom Unlimited®

Our pick for: Cash back for travel bookings

The Chase Freedom Unlimited® was already a fine card when it offered 1.5% cash back on all purchases. Now it's even better, with bonus rewards on travel booked through Chase, as well as at restaurants and drugstores. On top of all that, new cardholders get a 0% introductory APR period and the opportunity to earn a sweet bonus. Read our review.

The Platinum Card® from American Express

Our pick for: Luxury travel perks

The Platinum Card® from American Express comes with a hefty annual fee, but travelers who like to go in style (and aren't afraid to pay for comfort) can more than get their money's worth. Enjoy extensive airport lounge access, hundreds of dollars a year in travel and shopping credits, hotel benefits and more. That's not even getting into the high rewards rate on eligible travel purchases and the rich welcome offer for new cardholders. Read our review.

American Express® Gold Card

Our pick for: Big rewards on everyday spending

The American Express® Gold Card can earn you a pile of points from everyday spending, with generous rewards at U.S. supermarkets, at restaurants and on certain flights booked through amextravel.com. Other benefits include hundreds of dollars a year in available dining and travel credits and a solid welcome offer for new cardholders. There's an annual fee, though, and a pretty substantial one, so it's not for smaller spenders. Read our review.

Bilt World Elite Mastercard® Credit Card

Our pick for: Travel rewards on rent payments

The Bilt World Elite Mastercard® Credit Card stands out by offering credit card rewards on rent payments without incurring an additional transaction fee. The ability to earn rewards on what for many people is their single biggest monthly expense makes this card worth a look for any renter. You also get bonus points on dining and travel when you make at least five transactions on the card each statement period, and redemption options include point transfers to partner hotel and loyalty programs. Read our review.

PenFed Pathfinder® Rewards Visa Signature® Card

Our pick for: Credit union rewards

With premium perks for a $95 annual fee (which can be waived in some cases), jet-setters will get a lot of value from the PenFed Pathfinder® Rewards Visa Signature® Card . It also offers a generous rewards rate on travel purchases and a decent flat rate on everything else. Plus, you’ll get travel credits and a Priority Pass membership that offers airport lounge access for $32 per visit. Read our review.

United℠ Explorer Card

Our pick for: B est airline card

The United℠ Explorer Card earns bonus rewards not only on spending with United Airlines but also at restaurants and on eligible hotel stays. And the perks are outstanding for a basic airline card — a free checked bag, priority boarding, lounge passes and more. Read our review.

» Not a United frequent flyer? See our best airline cards for other options

World of Hyatt Credit Card

Our pick for: Best hotel card

Hyatt isn't as big as its competitors, but World of Hyatt Credit Card is worth a look for anyone who spends a lot of time on the road. You can earn a lot of points even on non-Hyatt spending, and those points have a high value compared with rival programs. There's a great sign-up bonus, free nights, automatic elite status and more. Read our review.

» Not a Hyatt customer? See our best hotel cards for other options.

Ink Business Preferred® Credit Card

Our pick for: Business travelers

The Ink Business Preferred® Credit Card starts you off with one of the biggest sign-up bonuses of any credit card anywhere: Earn 90,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening. You also get bonus rewards on travel expenses and common business spending categories, like advertising, shipping and internet, cable and phone service. Points are worth 25% more when redeemed for travel booked through Chase, or you can transfer them to about a dozen airline and hotel partners. Learn more and apply .

OTHER RESOURCES

How travel rewards work.

Modern-day adventurers and once-a-year vacationers alike love the idea of earning rewards toward their next big trip. According to a NerdWallet study , 68% of American adults say they have a credit card that earns travel rewards.

With a travel rewards credit card, you earn points or miles every time you use the card, but you can often earn more points per dollar in select categories. Some top travel credit cards, such as the Chase Sapphire Reserve® , offer bonus points on any travel spending, while the Marriott Bonvoy Boundless® Credit Card grants bonus points when you use the card at Marriott hotels, grocery stores, restaurants or gas stations.

Not all points and miles earned on travel rewards credit cards are the same:

General-purpose travel credit cards — including the Chase Sapphire Preferred® Card , the American Express® Gold Card and the Capital One Venture Rewards Credit Card — give you rewards that can be used like cash to pay for travel or that can be exchanged for points in airline or hotel loyalty programs. With their flexible rewards, general-purpose options are usually the best travel credit cards for those who don't stick to a single airline or hotel chain.

Airline- and hotel-specific cards — such as the United℠ Explorer Card and the Hilton Honors American Express Card — give points and miles that can be used only with the brand on the card. (Although it's possible in some cases to transfer hotel points to airlines, we recommend against it because you get a poor value.) These so-called co-branded cards are usually the best travel credit cards for those who always fly one particular airline or stay with one hotel group.

How do we value points and miles? With the rewards earned on general travel cards, it's simple: They have a fixed value, usually between 1 and 1.5 cents per point, and you can spend them like cash. With airline miles and hotel points, finding the true value is more difficult. How much value you get depends on how you redeem them.

To better understand what miles are worth, NerdWallet researched the cash prices and reward-redemption values for hundreds of flights and hotel rooms. Our results:

Keep in mind that the airline values are based on main cabin economy tickets and exclude premium cabin redemptions. Hotel values are based on basic rooms. See our valuations page for more details.

Our valuations are different from many others you may find. That’s because we looked at the average value of a point based on reasonable price searches that anyone can perform, not a maximized value that only travel rewards experts can expect to reach.

You should therefore use these values as a baseline for your own redemptions. If you can redeem your points for the values listed on our valuations page, you are doing well. Of course, if you are able to get higher value out of your miles, that’s even better.

HOW TO CHOOSE A TRAVEL CREDIT CARD

There are scores of travel rewards cards to choose from. The best travel credit card for you has as much to do with you as with the card. How often you travel, how much flexibility you want, how much you value airline or hotel perks — these are all things to take into account when deciding on a travel card. Our article on how to choose a travel credit card recommends that you prioritize:

Rewards you will actually use (points and miles are only as good as your ability to redeem them for travel).

A high earning rate (how much value you get in rewards for every dollar spent on the card).

A sign-up bonus (a windfall of points for meeting a spending requirement in your first few months).

Even with these goals in mind, there are all kinds of considerations that will influence your decision on a travel rewards credit card.

Travel cards are for travelers

Travel cards vs. cash-back cards.

The very first question to ask yourself when choosing a travel credit card is: Should I get a travel card at all? Travel credit cards are best for frequent travelers, who are more likely to get enough value from rewards and perks to make up for the annual fees that the best travel credit cards charge. (Some travel cards charge no annual fee, but they tend to offer lesser rewards than full-fee cards.) A NerdWallet study found that those who travel only occasionally — say, once a year — will probably get greater overall rewards from cash-back credit cards , most of which charge no annual fee, than from a travel card.

Flexibility and perks: A trade-off

Co-branded cards vs. general travel cards.

Travel credit cards fall into two basic categories: co-branded cards and general travel cards.

Co-branded cards carry the name of an airline or hotel group, such as the United℠ Explorer Card or the Marriott Bonvoy Boundless® Credit Card . The rewards you earn are redeemable only with that particular brand, which can limit your flexibility, sometimes sharply. For example, if your credit card's co-branded airline partner doesn't have any award seats available on the flight you want on the day you want, you're out of luck. On the other hand, co-branded cards commonly offer airline- or hotel-specific perks that general travel cards can't match.

General travel cards aren't tied to a specific airline or hotel, so they offer much greater flexibility. Well-known general travel cards include the Capital One Venture Rewards Credit Card and the Chase Sapphire Preferred® Card . Rewards on general travel cards come as points (sometimes called "miles" but they're really points) that you can redeem for any travel expense. You're not locked into using a single airline or hotel, but you also won't enjoy the perks of a co-branded card.

Evaluating general travel credit cards

What you get with a general travel card.

The credit cards featured at the top of this page are general travel cards. They're issued by a bank (such as Chase or Capital One), carry only that bank's name, and aren't tied to any single airline or hotel group. With these cards, you earn points on every purchase — usually 1 to 2 points per dollar spent, sometimes with additional points in certain categories.

Issuers of general travel cards typically entice new applicants with big sign-up bonuses (also known as "welcome offers") — tens of thousands of miles that you can earn by spending a certain amount of money on the card in your first few months.

» MORE: NerdWallet's best credit card sign-up offers

What do you do with those points? Depending on the card, you may have several ways to redeem them:

Booking travel. With this option, your points pay for travel booked through the issuer's website, using a utility similar to Orbitz or Expedia. For example, if points were worth 1 cent apiece when redeemed this way, you could book a $400 flight on the issuer's portal and pay for it with 40,000 points

Statement credit. This lets you essentially erase travel purchases by using your points for credit on your statement. You make travel arrangements however you want (directly with an airline or hotel, through a travel agency, etc.) and charge it to your card. Once the charge shows up on your account, you apply the necessary points and eliminate the cost.

Transferring to partners. The card issuer may allow you to transfer your points to loyalty programs for airlines or hotel chains, turning your general card into something like a co-branded card (although you don't get the perks of a co-brand).

Cash back, gift cards or merchandise. If you don't plan to travel, you can burn off your rewards with these options, although you'll often get a lower value per point.

Airline and hotel cards sharply limit your choice, but they make up for it with perks that only they can offer, like free checked bags or room upgrades. General travel cards, on the other hand, offer maximum flexibility but can't provide the same kinds of perks, because the banks that issue them don't operate the airlines or hotels. Still, there are some noteworthy perks on general travel cards, including:

Travel credit. This is automatic reimbursement for travel-related spending. Some top travel credit cards offer hundreds of dollars a year in travel credit.

Trusted traveler reimbursement. More and more travel credit cards are covering the application fee for TSA Precheck and Global Entry, programs that allow you to move through airport security and customs more quickly.

Airport lounge access. Hundreds of lounges worldwide operate separately from airlines under such networks as Priority Pass and Airspace, and several general travel cards offer access to these lounges.

Points programs

Every major card issuer has at least one travel card with a points program. American Express calls its program Membership Rewards, while Chase has Ultimate Rewards® and Citi pays in ThankYou points. Wells Fargo has Wells Fargo Rewards, and U.S. Bank has FlexPerks. Bank of America® travel cards offer points without a fancy name. Travel cards from Capital One, Barclays and Discover all call their points "miles."

These programs differ in how much their points are worth and how you can use them. Some offer the full range of redemption options, including transfers to loyalty programs. Others let you use them only to book travel or get statement credit.

» MORE: Travel loyalty program reviews

Evaluating airline credit cards

What you get with an airline credit card.

Airline credit cards earn "miles" with each purchase. You typically get 1 mile per dollar spent, with a higher rate (2 or more miles per dollar) on purchases with the airline itself. (Some airline cards have also begun offering extra miles for purchases in additional categories, such as restaurants or car rental agencies.) These miles go into the same frequent-flyer account as the ones you earn by flying the airline, and you can redeem them for free flights with the airline or its alliance partners.

Co-branded airline cards typically offer sign-up bonuses (or welcome offers). But what really sets them apart are the perks they give you. With some cards, for example, the checked-bag benefit alone can make up for the annual fee after a single roundtrip by a couple. Common perks of airline cards include:

Free checked bags. This commonly applies to the first checked bag for you and at least one companion on your reservation. Some cards extend this perk to more people, and higher-end cards (with higher annual fees) may even let you check two bags apiece for free.

Priority boarding. Holders of co-branded airline credit cards often get to board the plane early — after the airline's elite-status frequent flyers but before the general population. This gives you time to settle in and gives you a leg up on claiming that coveted overhead bin space.

In-flight discounts or freebies. You might get, say, 25% off the cost of food and beverages during the flight, or free Wi-Fi.

Airport lounge access. High-end cards often include a membership to the airline's airport lounges, where you can get away from the frenzy in the terminal and enjoy a complimentary snack. Some less-expensive airline cards give you only limited or discounted lounge access; others give you none at all.

Companion fares. This perk lets you bring someone with you for a lower cost when you buy a ticket at full price.

A boost toward elite status. Miles earned with a credit card, as opposed to those earned from actually flying on the airline, usually do not count toward earning elite status in an airline's frequent-flyer program. However, carrying an airline's high-end card might automatically qualify you for a higher tier within the program.

The biggest U.S. airlines — American, United and Delta — offer an array of credit cards. Each airline has a no-annual-fee card that earns miles on purchases but provides little in the way of perks (no free bags or priority boarding). Each has a high-end card with an annual fee in the neighborhood of $450 that offers lounge access and sumptuous perks. And each has a "middle-class" card with a fee of around $100 and solid ongoing perks. Southwest offers three credit cards with varying fees; smaller carriers may just have a single card.

» MORE: NerdWallet's best airline credit cards

Choosing an airline

Which airline card you get depends in large part on what airline you fly, and that's heavily influenced by where you live. Alaska Airlines, for example, has an outstanding credit card, but the airline's routes are concentrated primarily on the West Coast. So it's not a great option for those who live in, say, Buffalo, New York, or Montgomery, Alabama.

If your local airport is dominated by a single airline, then you're probably flying that carrier most (or all) of the time by default. Delta, for example, is the 800-pound gorilla at Minneapolis-St. Paul and Salt Lake City. United has the bulk of the traffic at Newark and Washington Dulles. American calls the shots at Charlotte and Dallas-Fort Worth. That airline's credit card may be your only realistic option. If you're in a large or midsize market with frequent service from multiple airlines, you have more choice.

» MORE: How to choose an airline credit card

Evaluating hotel credit cards

What you get with a hotel card.

Hotel credit cards earn points with each purchase. As with airline cards, you typically get more points per dollar for purchases from the co-brand partner, and some cards also give bonus points in additional categories. (Hotel cards tend to give you a greater number of points overall than airline cards, but each individual point is generally worth less than a typical airline mile.) Similar to the airline model, the points you earn with the card go into the same loyalty account as the points you earn from actually staying at a hotel. You redeem your points for free stays.

Hotel cards usually offer a sign-up bonus, but like airline cards, they really make their bones with the ongoing perks. Common perks on hotel cards include:

Free nights. Several cards offer this perk, which can make up for the card's annual fee. You may get a free night automatically every year, or you may unlock it by spending a certain amount within a year. In the latter case, it comes on top of the points you earn for your spending.

Upgrades and freebies. Cardholders may qualify for automatic room upgrades when available, or free or discounted amenities such as meals or spa packages.

Early check-in/late check-out. No one likes having to cool their heels in the hotel lobby waiting for 3 o'clock to check in. And no one likes have to vacate their room by 11 a.m. when their flight doesn't leave till evening.

Accelerated elite status. Some hotel cards automatically bump you up a level in their loyalty program just for being a cardholder.

» MORE: NerdWallet's best hotel credit cards

Choosing a hotel group

If you decide to go the hotel-card route, you'll need to decide which hotel group gets your business. Hotels aren't as market-concentrated as airlines, so if your travels take you mostly to metropolitan areas, you'll have a decent amount of choice. Keep in mind that even though there are dozens of nationally recognizable hotel brands, ranging from budget inns to luxury resorts, many of them are just units in a larger hotel company, and that company's card can unlock benefits across the group.

Marriott, for example, includes not only its namesake properties but nearly 30 other brands, including Courtyard, Fairfield, Renaissance, Residence Inn, Ritz-Carlton, Sheraton and Westin. The Hilton family includes DoubleTree, Embassy Suites, Hampton Inn and Waldorf-Astoria. InterContinental includes Holiday Inn, Candlewood, Staybridge and Crowne Plaza. Wyndham and Choice have more than 15 mid-tier and budget-oriented brands between them.

HOW TO COMPARE TRAVEL CREDIT CARDS

No travel rewards credit card is going to have everything you want. You're going to be disappointed if you expect to find a high rewards rate, a generous sign-up bonus, top-notch perks and no annual fee. Each card delivers value through a different combination of features; it's up to you to compare cards based on the following features and choose the best travel credit card for your needs and preferences.

Most of the best travel cards charge an annual fee. Fees in the range of $90 to $100 are standard for travel cards. Premium cards with extensive perks will have fees of $450 or more. Weigh the value of the rewards and perks you'll get to make sure they'll make up for the fee.

Can you find good cards without an annual fee? Absolutely! There are no-fee options on our list of the best travel credit cards, and we've rounded up more here . Just be aware that if you go with a no-fee travel card, you'll earn rewards at a lower rate, your sign-up bonus will be smaller, and you won't get as many (if any) perks.

Rewards rate

Rewards can be thought of in terms of "earn rate" and "burn rate".

The earn rate is how many points or miles you receive per dollar spent. Some general travel cards offer flat-rate rewards, meaning you get the same rate on all purchases, all the time — 2 miles per dollar, for example, or 1.5 points per dollar. Others, including most co-branded cards, offer a base rate of maybe 1 point per dollar and then pay a higher rate in certain categories, such as airline tickets, hotel stays, general travel expenses or restaurant meals.

The burn rate is the value you get for those points or miles when you redeem them. The industry average is about 1 cent per point or mile. Some cards, particularly hotel cards, have lower value per point on the "burn" side but give you more points per dollar on the earning side.

When comparing rewards rates, don't just look at the numbers. Look at the categories to which those numbers apply, and find a card that matches your spending patterns. Getting 5 points per dollar seems great — but if those 5X points come only on purchases at, say, office supply stores, and you don't spend money on office supplies, then you're getting lousy value.

Sign-up bonus

Travel cards tend to have the biggest sign-up bonuses — tens of thousands of points that you earn by hitting a certain amount of spending. But there's more to consider when comparing sign-up bonuses than just how many points or miles you earn. You must also take into account how much you have to spend to earn the bonus. While cash-back credit cards often require just $500 to $1,000 in spending over three months to unlock a bonus, travel cards commonly have thresholds of $3,000 to $5,000.

Never spend money you don't have just to earn a sign-up bonus. Carrying $3,000 in debt for a year in order to earn a $500 bonus doesn't make economic sense — the interest you'll pay could easily wipe out the value of the bonus.

Finally, keep in mind that the biggest bonuses will come on cards with annual fees.

Foreign transaction fees

A good travel card will not charge a foreign transaction fee. These fees are surcharges on purchases made outside the U.S. The industry standard is about 3%, which is enough to wipe out most if not all of the rewards you earn on a purchase. If you never leave the U.S., then this isn't much of a concern, but anyone who travels abroad should bring a no-foreign-transaction-fee card with them.

Some issuers don't charge foreign transaction fees on any of their cards. Others charge them on some cards but not all.

International acceptance

Not all travel credit cards are great companions for international travel. While Visa and Mastercard are good pretty much worldwide, you may encounter limited acceptance for American Express and, especially, Discover, depending on the destination. This doesn't mean world travelers should dismiss AmEx and Discover. Just know that if you take one of these cards with you overseas, you'd be smart to bring along a backup in case you run into acceptance problems. (Having a backup card is good advice within the U.S., too, really.)

Travel protections

Consider which travel protections — car rental insurance , trip cancellation coverage , lost baggage protection — are important to you.

"Rewards" are what you get for using a credit card — the points earned with each transaction and the bonuses you unlock with your spending. "Perks" are goodies that you get just for carrying the card. There's a very close correlation between the annual fee on a card and the perks you get for carrying it. Cards with no annual fee are all about rewards and go very light on perks. Premium cards with annual fees of $450 or more are laden with perks (although sometimes their rewards aren't too special). Midtier cards (in the $100 range) tend to have solid rewards and a handful of high-value perks.

Assuming you take advantage of them, the perks often make up for the annual fee on a card quite easily. This is especially true with co-branded cards. Free checked bags can pay for an airline card several times over, and a free night is usually worth more than the fee on a hotel card. When comparing the perks of various cards, be realistic about which ones you will and won't use. Sure, that card may entitle you to a free spa package the next time you're at a five-star hotel, but how often do you stay at five-star hotels?

SHOULD YOU GET A TRAVEL CARD? PROS AND CONS

Pros: why it's worth getting a travel card.

The sign-up bonus gives you a big head-start on travel. Bonuses on the best travel credit cards typically run $500 or more — enough for a roundtrip ticket in many instances.

Perks make travel less expensive and more relaxing. You won't have to worry about cramming a week's worth of clothes into a carry-on if your travel credit card gives you a free checked bag (or automatically reimburses you for the bag fee). Hate the crush of travelers in the terminal? Escape to the airport lounge. Renting a car? Use a travel card that provides primary rental car insurance.

Rewards get you closer to your next trip with every purchase. Spending money on the mundane activities of daily life has a silver lining when you know that every $1,000 you spend will knock $10 or $20 off the cost of that future beach vacation or trip home to see Mom and Dad.

No foreign transaction fee can mean big savings. Take just any old credit card with you on vacation outside the U.S., and $1,000 worth of purchases can cost you $30 off the top due to the foreign transaction surcharge. Good travel cards don't charge this fee.

"Double dipping" gives you more points on travel purchases. Buy a plane ticket or book a hotel room, and you'll earn loyalty points or miles regardless of how you pay. Use the right credit card, though, and you'll earn even more points and miles on top of those.

Strategic redemption can multiply your value. With cash-back credit cards, 1 cent is worth 1 cent, and that's just how it goes. The points and miles on many travel credit cards have variable value based on how you redeem them — booking travel with them vs. transferring them to a partner, booking domestic vs. international flights and economy vs. business class, staying at budget hotels vs. high-end resorts, and so on.

Cons: Why a travel card might not be for you

The best cards charge annual fees. In many cases, the value you get from a credit card more than makes up for the annual fee. But some people are dead set against paying a fee under any circumstances. If that's you, your options in travel cards will be sharply limited, and you won't get the perks that provide a big portion of the value on many cards.

Sign-up bonus spending requirements can be steep. A bonus worth $500, $600 or $700 is attractive, but only if you can afford to earn it with spending you were going to do anyway. If you have to amass thousands of dollars in debt and then pay interest on it, it's not worth it.

Travel cards aren't ideal for infrequent travelers. In the first year with a travel card, you're probably going to come out ahead: You can earn a big sign-up bonus, and several popular cards waive the first year's annual fee, too. In subsequent years, though, you'll break even on that fee only if you use the card enough to make up for it (with the rewards you earn and redeem and the perks you use). Infrequent travelers are more likely to get more total rewards from a cash-back card with no annual fee.

Cash back is simpler and more flexible. Some travel cards allow you to redeem your rewards only for travel. Others give you poor value unless you redeem for travel. Still others have complicated redemption options, making it hard to get the most out of your rewards. With cash-back credit cards, you can use your rewards on anything, you know exactly how much your rewards are worth, and redemption is usually simple.

Rewards cards tend to charge higher interest rates. If you regularly carry a balance from month to month, a travel credit card — or any rewards credit card — probably isn't your best choice. The interest you pay is eating up the value of your rewards. You're better off with a low-interest card that reduces the cost of carrying debt.

MAKING THE MOST OF YOUR TRAVEL CARD

Maximize your rewards with the following tips:

Plan your credit card application around a big purchase to earn the sign-up bonus.

Seize every opportunity to pick up the tab, especially if your travel credit card pays bonus rewards on dining; your friends can pay you back while you collect rewards.

Redeem rewards for travel instead of gift cards, merchandise or (in most cases) cash back to get the best value.

Join the loyalty program associated with a co-branded card — a frequent-flyer or frequent-guest program.

Shop for essentials in your card’s online bonus mall or through its exclusive offers, if available, to get extra rewards.

OTHER CARDS TO CONSIDER

It’s worth considering whether a travel credit card is even right for you in the first place. A NerdWallet study found that cash-back credit cards often earn more money — even for many travelers.

If you carry a balance from month to month, the higher interest rates typically charged by rewards cards can cancel out any rewards earned. If you have a good credit score, you're better off with a low-interest credit card that can save you money on interest.

A good travel credit card shouldn't charge foreign transaction fees, but there are good non-travel cards that also don't charge them. See our best cards with no foreign transaction fee .

If you value transparency and flexibility in your rewards, you can't go wrong with a cash-back card — and you can still use the rewards for travel, if you want.

Finally, if you're still not sure what's right for you, take a look at our best rewards credit cards for options beyond travel and cash back.

NerdWallet's Sam Kemmis contributed to this article.

To view rates and fees of the American Express® Gold Card , see this page . To view rates and fees of The Platinum Card® from American Express , see this page .

Last updated on September 25 , 2024

Methodology

NerdWallet's Credit Cards team selects the best travel rewards credit cards based on overall consumer value, as evidenced by star ratings, as well as their suitability for specific kinds of travelers. Factors in our evaluation include each card's annual fee, foreign transaction fees, rewards earnings rates, ease of use, redemption options, domestic and international acceptance, promotional APR period, bonus offers, and cardholder perks such as automatic statement credits and airport lounge access. Learn how NerdWallet rates credit cards.

Frequently asked questions

How do travel credit cards work.

Travel credit cards earn points (sometimes called miles) each time you buy something. The standard earning rate is 1 to 2 points per dollar spent, and many cards give you extra points for certain purchases, particularly travel expenses. The value of a point depends on the card that earned it and how you redeem it, but a good rule of thumb is to assume each point is worth an average of about 1 cent.

Your points accumulate in a rewards account, where you can use them to pay for travel. Most cards let you book travel directly using a portal similar to those at online travel agencies or on airline and hotel websites, but instead of paying cash, you pay with your points. Depending on the card, you may also have the option of booking travel any way you want, paying for it with the card and then cashing in your points for a credit against those expenses.

What’s the difference between points and miles on a credit card?

Points and miles are just different names for the same thing: the currency used in a travel rewards program. Some travel credit cards call them points, some call them miles.

Airline frequent flyer programs have long used the term “miles” to refer to the rewards you earn for flying. That’s because at one time, you really did earn rewards according to how many miles you flew — the longer the flight, the more miles you earned. Nowadays, most domestic airlines give out “miles” based on how much you spend, not how far you fly, so they’re really just points. (There are a few exceptions, though, notably Alaska Airlines.)

Especially when it comes to redeeming your rewards, there’s no difference between points and miles. The number of points or miles you need is based mostly on the cost of what you’re redeeming them for. It takes more than 500 miles (value about: $5) to get a free 500-mile flight!

How much is a point or mile worth on a travel credit card?

The value of a point or mile depends on the card you earned it with and how you redeem it. A common rule of thumb is to assume that each point or mile is worth an average of 1 cent, although you can certainly get a much higher (or lower) redemption value. See our travel loyalty roundup page for NerdWallet’s current valuations for airline miles and hotel points.

What kinds of travel credit cards are there?

Travel credit cards fall into two main categories: co-branded and general-purpose.

• Co-branded travel cards carry the name of an airline or hotel chain. The rewards you earn on the card can typically be redeemed only with that brand (or maybe its partners). Co-branded cards limit your flexibility, but because they are issued in partnership with an airline or hotel, they can give you special perks, like free checked bags or room upgrades.

• General-purpose travel cards are issued by a credit card company and are not directly tied to any particular airline or hotel. They earn points in the issuer's own program, such as American Express Membership Rewards, Chase Ultimate Rewards® or Citi ThankYou. These points are a lot more flexible, as you can use them to pay for a range of travel expenses, including flights on any airline or stays at any hotel. However, they don’t offer the airline- or hotel-specific perks of co-branded cards.

What credit score do I need to get a travel rewards credit card?

Travel cards — like rewards cards in general — typically require good to excellent credit for approval. Good credit is generally defined as a credit score of 690 or better. However, credit scores alone do not guarantee approval. Every issuer has its own criteria for evaluating applications.

Can you get travel rewards for business travel?

Business travel can earn credit card rewards just like leisure travel. Credit cards that earn rewards for travel purchases don't distinguish between one or the other — meaning, if a card pays 3X points on airfare, for example, it's going to pay it no matter why you're buying the ticket. There are also travel credit cards specifically designed for business operators, with benefits and perks better aligned with their needs.

Where things get complicated is when you're not arranging the travel yourself. With credit card points, the rewards go to the cardholder. So if you arrange travel through your employer and the cost goes on the "company card," then the company card gets the points. Put it on your own card and get reimbursed later, and you get the points. (And if you have a company card with your name on it? That may come down to company policy.)

When should you use rewards instead of cash?

When redeeming travel rewards, you want to get as much value as possible. If you can get more value by using your rewards than by using cash, then it's smart to do so. (And of course, the reverse also applies.) NerdWallet has calculated the baseline values of most major credit card points, airline miles and hotel points. When you get a value that exceeds these baselines, go ahead and use your rewards. If not, consider using cash.

For example, say you could book a trip by paying $400 cash for a ticket or by redeeming 50,000 points or miles. In that case, your points would be getting you a value of 0.8 cents apiece (50,000 x 0.8 cents = $400). If the baseline value of each point is 1 cent, then you're better off paying cash and saving the points for when you can redeem them for 1 cent or better.

That said, you don't want to be overthinking it and hoarding points indefinitely in search of the deal to end all deals. Like any other currency, travel rewards lose value over time. That flight that costs 50,000 points today might cost 55,000 next year. Do you have enough points to get you where you want to go, when you want to go, in the way you want to get there? If so, don't let fractions of a penny stop you from booking your trip. It's your money, and you get to decide how to spend it.

What travel credits are easiest to redeem?

A number of travel credit cards come with "travel credits," which reimburse you for specific expenses. The Chase Sapphire Reserve® , for example, has a $300 annual travel credit; several cards offer credits toward things like airline fees or hotel bookings; and a bunch of cards have a credit for the application fee for TSA PreCheck or Global Entry .

The less restrictive a credit is, the easier it is to redeem. The easiest travel credit to redeem is one that:

Applies to a broad range of expenses. Some credits are very fickle. You may get $200 a year in "airline credit," but it applies only to incidental fees (not airfare) on a single airline that you have to choose ahead of time. A card may offer hundreds of dollars in credit toward travel, but you have to go through the issuer's booking portal, where rates may be more expensive and options more limited. Other credits, however, are broad and open-ended: $300 on any travel expense, $100 toward any airline booking, and so on.

Shows up automatically on your statement. Your issuer's system should be able to recognize qualifying expenses and then apply the credit to them without you having to do anything. If the only way to receive the credit is by calling a phone number or submitting receipts or other documentation, that makes it harder to redeem, which in turn makes it less likely that you'll redeem (and that may be the point).

RyanJLane/Getty Images

Advertiser Disclosure

Best no-annual-fee travel credit cards of 2023

Choose the best credit card for travel and start reaping rewards today

Published: April 26, 2023

Author: Aja McClanahan

Editor: Kaitlyn Tang

How we Choose

A good travel card doesn’t have to come with an exorbitant annual fee. There are plenty of great no-annual fee travel cards you can explore to help you earn and redeem rewards for travel.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards , or use our CardMatch™ tool to find cards matched to your needs.

If you aren’t quite ready to splurge for a premium card for travel — which typically has an annual fee in exchange for premium features — your next best option would be a travel card with no annual fee . But with so many options to choose from, how do you know which card is right for you?

Here we’ll review some of our top-rated travel card options that don’t charge a pesky annual fee. Use this guide to help choose the best credit card that works for your spending habits and specific travel lifestyle.

Bank of America Travel Rewards credit card: Best for flexible spending

Why we picked it : The Bank of America® Travel Rewards credit card is ideal for anyone who wants simple, hassle-free cash back options in a travel rewards card . There’s no need to activate spending categories or watch for special bonus categories every quarter. The rewards simply accrue to your account at the same flat rate of 1.5X points on every purchase.

Another plus is that if you are a Bank of America or Merrill account holder, you can boost your rewards rate 25 percent to 75 percent with Preferred Rewards . You’ll also get 25,000 online bonus points after spending $1,000 in the first 90 days.

- You can earn unlimited points.

- Your points won’t expire if your account remains open.

- You don’t have to worry about blackout dates.

- You don’t have to pay foreign transaction fees .

- The rewards rate is relatively low.

Who should apply : The Bank of America Travel Rewards card could be a good fit if you’re looking for a no-annual-fee card with a good sign-up bonus . If you tend to spend across a wide array of categories — online shopping, dining, streaming sites and gas — the card’s flat rate will earn you reliable rewards.

Who should skip : This card might not be a good match for those who are looking to maximize their spending. Cardholders who don’t mind paying an annual fee should also keep shopping.

Capital One VentureOne Rewards Credit Card: Best for simplicity

Why we picked it : This entry-level travel card is so simple to use that any beginner in travel rewards could use it. Though Capital One VentureOne Rewards Credit Card rewards rate isn’t especially high, it’s slightly higher than cards that offer unlimited cash back at the industry-standard 1 percent. The flat 1.25X miles rate applies to all spending, no matter the time or category.

Redeeming points is pretty straightforward, too. You can redeem miles for a travel statement credit that allows you to book travel yourself or through a travel agent. On top of that, the Capital One VentureOne will give you a 20,000-mile bonus (equal to $200 in travel) once you spend $500 on purchases within three months.

- You won’t have to deal with any blackout dates.

- There is no mileage minimum to redeem for travel.

- You can transfer miles to more than 15 of Capital One’s transfer partners .

- You can earn unlimited rewards.

- Large U.S. airlines are excluded from the list of airline partners.

Who should apply : This could be a good match for frequent fliers who spend $396 or more each month, and you can earn a pretty decent bonus with a relatively low spending requirement within the first three months from account opening. The card can also be beneficial if you’re looking for a 0 percent introductory APR on purchases and balance transfers for 15 months (then 19.99 percent to 29.99 percent variable APR).

Who should skip : This might not be a good fit for infrequent flyers who don’t spend a lot each month.

Chase Freedom Unlimited: Best for pairing with a premium travel card

Why we picked it : The Chase Freedom Unlimited* is a great card because it offers one of the highest cash back rates. The Chase Freedom Unlimited earns 5 percent cash back on travel purchased through Chase Ultimate Rewards, 3 percent cash back on dining and drugstore purchases, and 1.5 percent cash back on everything else.

The Freedom Unlimited’s cash back is also fulfilled as Ultimate Rewards points. This makes it a great card to pair with another Ultimate Rewards card such as the Chase Sapphire Preferred® Card to multiply the rewards you earn across different categories and redeem your points at 25 percent boosted value for Chase travel, thanks to the Sapphire Preferred’s card perk.

- The card offers flexibility for redeeming rewards.

- The card provides a sign-up bonus of an additional 1.5 percent cash back on everything you buy (on up to $20,000 spent in the first year).

- You can earn 5 percent cash back on Lyft rides through March 2025.

- Points won’t expire if your account remains open.

- There is a foreign transaction fee of 3 percent.

Who should apply : Frequent travelers looking for flexibility should consider this card. Also, frequent Lyft riders can earn a solid cash back when they use the card for every ride.

Who should skip : Cardholders who want to transfer miles to a frequent-flier program of an American airline should probably skip this one.

Discover it Miles: Best first-year bonus

Why we picked it : The Discover it® Miles card has a great first-year offer that has the potential to boost your miles’ earnings substantially. The Discover it Miles matches all the miles you earn at the end of your first year as an account holder — essentially turning your 1.5 miles per dollar into 3 miles per dollar — with no annual fee.

You can choose to redeem miles for cash, travel purchases, Amazon.com purchases, gift cards and more.

- You can earn unlimited 1.5 miles on every dollar you spend.

- You can redeem any number of miles.

- There are no blackout dates or expiration on miles earned.

- Discover matches all miles earned after your first year.

- You can’t transfer your miles to airline frequent-flier programs.

- Partners and perks have limited international acceptance.

Who should apply : Occasional travelers looking for fewer restrictions can take advantage of the Discover it Miles. This flat-rate card enables customers to choose cash back or redeem miles to pay your bill.

Who should skip : Since 1.5 miles per dollar is not the best reward rate for a frequent flier, you might want to consider another option.

Hilton Honors American Express Card: Best for frequent Hilton stays

Why we picked it : The Hilton Honors American Express Card is a good choice for those who stay at Hilton properties frequently. You’ll earn 70,000 points plus a Free Night Reward after you spend $1,000 in purchases on the card in the first three months of card membership. You can also get 7X points at Hilton hotel properties. Eligible purchases at U.S. restaurants, supermarkets and gas stations will get you 5X points, and everything else gets you 3X points. Plus, there are no blackout dates or expiration dates on points.

The Hilton Honors American Express Card also provides complimentary Hilton Honors silver status, which includes an annual fifth-night free reward (when you book at least four consecutive nights with points) and a 20 percent bonus on each Hilton Honors base point you earn.

- You can earn an unlimited number of points.

- You can transfer points to over 20 travel partners.

- There are no foreign transaction fees.

- Points are redeemable for hotel stays, airfare, car rentals, cruises, shopping, dining or charitable giving.

- You can redeem points only for travel booked through Amex Travel .

- You can use the free night’s stay certificate only if a standard room is available.

Who should apply : Travelers who frequent Hilton stays will get the most out of this card because they can earn points on their everyday purchases, then redeem them for stays.

Who should skip : Although this card offers some of the best hotel benefits, it might not be a great fit for travelers looking for high-value points (according to Bankrate , Hilton Honors points are worth an average of 0.6 cents per point). It could take a while to accumulate the points to redeem for your next stay.

Delta SkyMiles Blue American Express Card: Best card for Delta Air Lines passengers

Why we picked it : If you live near a Delta hub, taking advantage of their co-branded Amex card could be a great choice. With the Delta SkyMiles® Blue American Express Card , you can earn 2X miles at restaurants worldwide and on eligible Delta purchases. Other purchases get you 1X point.

As a co-branded American Express card, the Delta SkyMiles Blue Card provides card benefits other Amex cardholders receive, such as car rental insurance, event presales, lowest hotel rate guarantee, purchase protection and extended warranty coverage. New cardholders will be rewarded 10,000 miles if they spend $1,000 within six months.

- Your Delta miles won’t expire.

- You can book trips without blackout dates.

- You can earn unlimited miles.

- Miles are redeemable for flights, flight upgrades, car rentals, merchandise and more.

- Stopovers are not allowed.

- You’ll likely pay fuel surcharges on some partners and on Delta one-way flights from Europe.

Who should apply : This card is suitable for casual travelers who are loyal to Delta Air Lines but don’t require the luxury of free checked bags or priority seating.

Who should skip : Frequent fliers looking for free checked bags or priority boarding should consider another credit card. People who fly a variety of airlines, not just Delta, have no need to tie themselves to a co-branded Delta card, and they could opt for a flexible rewards card instead.

Compare the best no-annual-fee travel cards

How to choose a no-annual-fee travel credit card.

When narrowing down the choices among the best travel credit cards with no annual fee, you should keep in mind what features you want. Because these cards don’t have an annual fee, like elite or luxury travel cards, it might be difficult to find all the best features in just one card. Try to focus on the card benefits that matter most to you, such as extended warranty coverage, to help you eliminate the cards that don’t have them and decide on the ones that do.

Here are a few features to look for in a no-annual-fee travel card:

- You may earn a welcome bonus.

- The card offers an intro APR period for balance transfers or purchases (or both).

- There is a high earning potential for travel-related spending.

- You may combine rewards with other cards to boost rewards value.

- The rewards program has minimal restrictions like blackout dates or expiration on rewards.

- The redemption options are flexible, offering redemptions, such as cash, gift cards, statement credits, Amazon.com purchases or travel booked through the issuer’s portal.

- The card benefits include trip protection, luggage insurance, hotel discounts, airline discounts, roadside assistance and more.

Bottom line

If you match your spending and travel habits to the available options, finding the best travel credit card with no annual fee shouldn’t be difficult. The best card will ultimately be the one that enables you to earn decent rewards on everyday expenses. Then you can use those rewards to cover your travel expenses.

*Information about the Chase Freedom Unlimited has been collected independently by CreditCards.com. The issuer did not provide the details, nor is it responsible for their accuracy.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.

Aja McClanahan is a CreditCards.com personal finance contributor.

On this page

- Best for flexible spending

- Best for simplicity

- Best for a travel card combo

- Best first-year bonus

- Best for Hilton stays

- Best for Delta Air Lines

- Comparing cards

- How to choose a card

Essential reads, delivered straight to your inbox