- Best Travel Insurance 2024

- Cheapest Travel Insurance

- Trip Cancellation Insurance

- Cancel for Any Reason Insurance

- Seniors' Travel Insurance

- Annual Travel Insurance

- Cruise Insurance

- COVID-19 Travel Insurance

- Travel Medical Insurance

- Medical Evacuation Insurance

- Pregnancy Travel Insurance

- Pre-existing Conditions Insurance

- Mexico Travel Insurance

- Italy Travel Insurance

- France Travel Insurance

- Spain Travel Insurance

- Canada Travel Insurance

- UK Travel Insurance

- Germany Travel Insurance

- Bahamas Travel Insurance

- Costa Rica Travel Insurance

- Disney Travel Insurance

- Schengen Travel Insurance

- Is travel insurance worth it?

- Average cost of travel insurance

- Is airline flight insurance worth it?

- Places to travel without a passport

- All travel insurance guides

- Best Pet Insurance 2024

- Cheap Pet Insurance

- Cat Insurance

- Pet Dental Insurance

- Pet Insurance That Pays Vets Directly

- Pet Insurance For Pre-Existing Conditions

- Pet Insurance with No Waiting Period

- Paw Protect Review

- Spot Pet Insurance Review

- Embrace Pet Insurance Review

- Healthy Paws Pet Insurance Review

- Pets Best Insurance Review

- Lemonade Pet Insurance Review

- Pumpkin Pet Insurance Review

- Fetch Pet Insurance Review

- Figo Pet Insurance Review

- CarePlus by Chewy Review

- MetLife Pet Insurance Review

- Average cost of pet insurance

- What does pet insurance cover?

- Is pet insurance worth it?

- How much do cat vaccinations cost?

- How much do dog vaccinations cost?

- All pet insurance guides

- Best Business Insurance 2024

- Business Owner Policy (BOP)

- General Liability Insurance

- E&O Professional Liability Insurance

- Workers' Compensation Insurance

- Commercial Property Insurance

- Cyber Liability Insurance

- Inland Marine Insurance

- Commercial Auto Insurance

- Product Liability Insurance

- Commercial Umbrella Insurance

- Fidelity Bond Insurance

- Business Personal Property Insurance

- Medical Malpractice insurance

- California Workers' Compensation Insurance

- Contractor's Insurance

- Home-Based Business Insurance

- Sole Proprietor's Insurance

- Handyman's Insurance

- Photographer's Insurance

- Esthetician's Insurance

- Salon Insurance

- Personal Trainer's Insurance

- Electrician's Insurance

- E-commerce Business Insurance

- Landscaper's Insurance

- Best Credit Cards of 2024

- Best Credit Card Sign-Up Bonuses

- Best Instant Approval Credit Cards

- Best Cash Back Credit Cards

- Best Rewards Credit Cards

- Best Credit Cards for Bad Credit

- Best Balance Transfer Credit Cards

- Best College Student Credit Cards

- Best 0% APR Credit Cards

- Best First Credit Cards

- Best No Annual Fee Cards

- Best Travel Credit Cards

- Best Hotel Credit Cards

- Best American Express Cards

- Best Amex Delta SkyMiles Cards

- Best American Express Business Cards

- Best Capital One Cards

- Best Capital One Business Cards

- Best Chase Cards

- Best Chase Business Cards

- Best Citi Credit Cards

- Best U.S. Bank Cards

- Best Discover Cards

- Amex Platinum Card Review

- Amex Gold Card Review

- Amex Blue Cash Preferred Review

- Amex Blue Cash Everyday Review

- Capital One Venture Card Review

- Capital One Venture X Card Review

- Capital One SavorOne Card Review

- Capital One Quicksilver Card Review

- Chase Sapphire Reserve Review

- Chase Sapphire Preferred Review

- United Explorer Review

- United Club Infinite Review

- Amex Gold vs. Platinum

- Amex Platinum vs. Chase Sapphire Reserve

- Capital One Venture vs. Venture X

- Capital One Venture X vs. Chase Sapphire Reserve

- Capital One SavorOne vs. Quicksilver

- Chase Sapphire Preferred vs. Capital One Venture

- Chase Sapphire Preferred vs. Amex Gold

- Delta Reserve vs. Amex Platinum

- Chase Sapphire Preferred vs. Reserve

- How to Get Amex Pre-Approval

- Amex Travel Insurance Explained

- Chase Sapphire Travel Insurance Guide

- Chase Pay Yourself Back

- CLEAR vs. TSA PreCheck

- Global Entry vs. TSA Precheck

- Costco Payment Methods

- All Credit Card Guides

- Citibank Savings Account Interest Rate

- Capital One Savings Account Interest Rate

- American Express Savings Account Interest Rate

- Western Alliance Savings Account Interest Rate

- Barclays Savings Account Interest Rate

- Discover Savings Account Interest Rate

- Chase Savings Account Interest Rate

- U.S. Bank Savings Account Interest Rate

- Marcus Savings Account Interest Rate

- Synchrony Bank Savings Account Interest Rate

- Ally Savings Account Interest Rate

- Bank of America Savings Account Interest Rate

- Wells Fargo Savings Account Interest Rates

- SoFi Savings Account Interest Rate

- Best Savings Accounts & Interest Rates

- Best High Yield Savings Accounts

- Best 7% Interest Savings Accounts

- Best 5% Interest Savings Accounts

- Savings Interest Calculator

- Emergency Fund Calculator

- Pros and Cons of High-Yield Savings Accounts

- Types of Savings Accounts

- Checking vs Savings Accounts

- Average Savings by Age

- How Much Should I Have in Savings?

- How to Make Money

- How to Save Money

- Compare Best Checking Accounts

- Compare Online Checking Accounts

- Best Business Checking Accounts

- Compare Best Teen Checking Accounts

- Best Student Checking Accounts

- Best Joint Checking Accounts

- Best Second Chance Checking Accounts

- Chase Checking Account Review

- Bluevine Business Checking Review

- Amex Rewards Checking Account Review

- E&O Professional Liability Insurance

- Best Savings Accounts & Interest Rates

- All Insurance Guides

- Travel Insurance for Thailand

On This Page

- Key takeaways

Do I need travel insurance to visit Thailand?

Our top picks for the best thailand travel insurance, thailand travel information & requirements, why thailand travel insurance is important, what does travel insurance for thailand cover, what isn’t covered by travel insurance for thailand, how much does travel insurance for thailand cost, tips for getting the best thailand travel insurance, faq: travel insurance for thailand, related topics.

Travel Insurance for Thailand: US Visitor Requirements & Tips

- U.S. health insurance is typically not accepted in Thailand , so it’s a good idea to purchase travel medical insurance for your trip.

- Based on our research, our top picks for travel insurance for a trip to Thailand come fro m Tin Leg, Seven Corners, and John Hancock.

- Comprehensive travel insurance policies will usually cover medical emergencies and evacuation, trip delays, cancellations and interruptions, and lost or stolen baggage.

- Travel insurance can cost as little as around $1 per day for the most basic medical and medical evacuation coverage.

- To find the best travel insurance for your trip to Thailand, try using an online comparison tool . This way, you get multiple quotes and compare all your coverage options to find the best deal.

Our top picks for the best travel insurance for thailand

- Tin Leg: Best Rated Travel Isurance

- Seven Corners: Best Value for Medical Emergencies

- John Hancock Insurance Agency, Inc.: Best plan for a Solid Coverage

Seven Corners

John hancock insurance agency, inc..

You are not legally required to have travel insurance to visit Thailand, but it’s advised so you have the protection and support you need in case of illness, injury, theft or other travel hiccups.

Below are some risks that could make getting travel insurance worthwhile for your trip to Thailand.

Best Rated Travel Isurance

Why we like it.

- Excellent primary coverage for medical expenses

- High limit for emergency evacuation coverage

- Optional cancel for any reason (CFAR) coverage available

- Comes with coverage for hurricanes and inclement weather

- Coverage for pre-existing conditions is available if purchased within 14 days of the trip deposit

- Baggage delay coverage requires a 24-hour waiting period

- Low coverage limits for baggage and personal effects

Best Value for Medical Emergencies

- Offers coverage for pre-existing conditions

- Money-back guarantee

- Cancellation & Interruption coverage standard

- Covers action sports & equipment

- Cancel for any reason not included standard

- Must meet waiver for pre-existing conditions to be covered

Best plan for a Solid Coverage

- Travel delay coverage kicks in after just three hours

- Generous coverage for emergency evacuation and repatriation of remains

- Optional CFAR upgrade available

- Baggage insurance comes with generous limits of up to $2,500

- Terror attack coverage included

- Baggage delay coverage requires a 12-hour waiting period

Are there COVID-19 restrictions for U.S. tourists?

As of January 2024, there are no COVID-19 restrictions in place for U.S. tourists hoping to visit Thailand.

Do I need a visa or passport to travel to Thailand?

You only need a visa to travel to Thailand if you intend to stay longer than 30 days . Short-term stays that fall under that threshold do not require a visa. You do need a passport to enter the country, and it’s recommended your passport be valid for at least six months past your intended entry date to avoid being turned away at the border/customs.

Is it safe to visit Thailand?

According to the latest updates from the U.S. Department of State, it’s safe to travel to most parts of Thailand . The DOS puts Thailand’s overall threat rating at Level 1, which means you should exercise normal precautions. That said, there is civil unrest and a higher risk of violence in the provinces of Yala, Pattani, Narathiwat, and Songkhla, which the U.S. DOS has put at Level 3 (reconsider travel).

When is the best time to visit Thailand?

Thailand is beautiful year-round. November through March marks the dry months, following the wet season from May through October. If you’re sensitive to heat, consider avoiding Thailand in April . That’s the country’s hottest month, and temperatures then regularly hit 105° F (40° C).

Risk of insect-borne diseases

Mosquitos are prevalent in Thailand, and they can transmit diseases like malaria, dengue fever, chikungunya, Japanese encephalitis, filariasis and Zika. Using insect repellents and mosquito nets, avoiding affected areas and taking prophylactic medications can help prevent infection. But if you do get sick, travel insurance could make all the difference in getting care fast.

Extreme weather conditions

Thailand is a beautiful country full of waterfront vistas and lush, tropical forests, but it’s also situated in a geographic area that’s prone to floods, earthquakes and tsunamis, similar to visiting Japan . Travel insurance policies that include trip cancellation protection and emergency evacuation clauses can protect you financially if your trip is canceled or you need to get out of the country ASAP because of a natural disaster.

Petty theft and pickpockets

Petty theft, including pick-pocketing, is a concern in many tourist areas throughout the world, and Thailand’s major cities of Bangkok and Chiang Mai are no exception. Certain travel insurance policies also include reimbursement for stolen goods, such as a wallet that was snatched during a pick-pocketing event or travel documents that disappeared when your luggage vanished at the airport.

Travel insurance policies can differ greatly depending on the insurer and other factors, such as the size of the deductible or the provider you choose.

Consider these types of coverage when purchasing travel insurance for your trip to Thailand.

Trip cancellation insurance

If you need to cancel your trip to Thailand for a covered reason, trip cancellation insurance can reimburse you for pre-paid travel expenses that are non-refundable.

It’s important to note, though, t hat trip cancellation insurance is far from universal . If you just decide you don’t feel like going to Thailand anymore or your boss refuses to give you the time off, your cancellation clause may not apply. Some medical conditions, like pregnancy , are also not covered as a covered reason for cancellation.

Read the fine print carefully to see what’s covered and what isn’t, and consider a CFAR (cancel for any reason) policy if you have additional concerns. With this type of coverage, you can cancel your travel plans for any reason at all and get back around 50% to 70% of your prepaid travel expenses.

Trip delay insurance

Chances are you don’t have a direct flight from your hometown to Thailand. Most people will have to grab one, if not two or three, connecting flights, and that means more layovers and more opportunities for your schedule to go awry. If your flight is delayed and you miss a connection, trip delay insurance kicks in to cover your expenses while you’re stuck in an airport or intermediary city.

Most delay policies have a grace period before they kick in, so you may have to wait 6 or 12 hours before you get reimbursement for delay-related expenses. But once that period has passed, you can make a claim for things like temporary accommodations and food plus the cost of anything you’re missing out on in Thailand while you navigate the delay.

Trip interruption insurance

Trip interruption insurance is like trip cancellation and delay policies except that it applies to a trip that’s already in progress but has to be cut short . Imagine you’re already in Thailand when you get a call about an emergency back home. You have another week of hotel, car and entertainment costs you’ve already paid for, but now you need to return home early.

Your trip interruption insurance could cover those costs so you can go home worry-free, but your reason for flying out ASAP needs to be an emergency covered by your policy (e.g., illness or death in the family, terrorism at your travel destination, etc.).

Travel medical insurance

It’s extremely doubtful your U.S. health insurance company offers any coverage while you’re abroad, so travel medical insurance is crucial . Look for policies that cover medical expenses related to both illnesses and accidents, so you’re taken care of whether you contract the common cold or need an ambulance ride after you slip and fall at the Temple of Dawn.

Medical evacuation insurance

If you become sick or are hurt beyond what a local hospital or doctor’s office can handle, you may need to be moved to another country where trauma care is more readily available. Medical evacuation insurance goes beyond medical expenses to cover transportation, like Medevac rides to get you to an advanced facility as soon as possible.

Insurance for personal items

Some travel insurance companies offer coverage that includes replacing or reimbursing you for baggage and personal items that are lost and stolen. This is a good thing to have in areas where petty theft is common, but there are always exceptions. You will likely need to file a police report to turn into your insurance company when you file a claim, and there are typically caps on how much your policy will cover.

Rental car coverage

Rental car coverage is not automatically included in Thai travel insurance, so you’ll need to ask your insurance company or consider an add-on policy. Read the fine print to see what’s covered. Collision, theft and damage due to a natural disaster are all possibilities but may not all be covered.

The most common travel insurance exclusions are cancellations or trip interruptions caused by what insurance companies call “known or foreseeable events.” That might be something like wanting to cut your trip short because you don’t like all the bugs in Thailand or bailing on the trip altogether because you heard it’s been raining really hard.

Other things that may not be covered include:

- Endemics and pandemics (some companies have or had temporary COVID-19 policies )

- Cancellations due to poor paperwork or malfeasance, such as if you’re detained at customs or tried to travel with a soon-to-expire passport

- Medical expenses or repatriation needs resulting from a risky activity (e.g., cliff diving or hot air ballooning with a non-licensed company) or due to a pre-existing condition.

Travel insurance can cost as little as around $1 per day for the most basic medical and medical evacuation coverage . For a more comprehensive policy, you can expect to pay around $7 to $11 per day.

To give you a better idea of how much travel insurance will cost for a trip to Thailand, we got price quotes from some popular travel insurance providers.

We applied these details to our quotes:

- Age: 35 years old

- Destination: Thailand

- Trip Length: 7 days

- Trip cost: $2,000

We’ve displayed our price quotes for basic travel insurance coverage in the table below. These plans range from less than $1 per day to $6 per day.

Example Where Plan Doesn’t Reimburse the Full Trip Cost

A more comprehensive travel insurance policy that covers trip cancellation and trip interruption will be a bit more expensive. Our quotes from the same providers show that this type of protection costs around $7 to $11 per day.

Example Where Plan Does Reimburse the Full Trip Cost

Keep in mind that the final cost of your Thailand travel insurance will depend on a variety of factors, including the following:

- The amount of coverage you need

- How long you’re traveling for

To get the best Thailand travel insurance, think about when you’re going, how you’ll get there and when you want to buy your policy.

Then, follow these tips:

- If you travel often, consider an annual multi-trip policy and you could save by bundling.

- Get lower premiums by increasing the excess/amount you’ll pay if you do need to make a claim.

- Get quotes for a Thailand-specific policy rather than one that covers all of Asia.

- For longer stays, look at extended-stay insurance or backpacker policies.

Do I really need travel insurance for Thailand?

Travel insurance for Thailand is not legally required, but a policy is recommended so you can protect yourself against everything from a canceled or delayed trip to catching the flu or dengue fever during your visit.

Is health insurance still required in Thailand?

Health insurance was required for visitors to Thailand during the height of the COVID-19 pandemic, but that policy is no longer in place.

What is the best health insurance in Thailand for foreigners?

The best health insurance in Thailand for foreigners is the policy that offers the best coverage for your specific needs, health history, length of stay and the level of risk associated with your health or the type of activities you have planned. Try using our online comparison tool to find the best travel insurance policy for you.

Alana Luna (Musselman) is a versatile storyteller with over a decade of writing experience. She is passionate about helping people build their business through unique and engaging content. Some examples of her current freelance projects include building content strategies for small businesses, completing industry research to build case studies, crafting buyer guides and more.

She has a passion and keen ability to simplify complex ideas through storytelling to make it easier for readers to understand hard-to-digest information. As such, Alana’s writing holds strong three principles – content that educates, engages and entertains.

Apart from her contributions to LA Times Compare, Alana has freelanced and ghostwritten for large publications and prestigious brands such as Orbitz, Groupon, Amazon, JCPenney, Walmart and more.

Explore related articles by topic

- All Travel Insurance Articles

- Learn the Basics

- Health & Medical

- Insurance Provider Reviews

- Insurance by Destination

- Trip Planning & Ideas

Best Travel Insurance Companies & Plans in 2024

Best Medical Evacuation Insurance Plans 2024

Best Travel Insurance for Seniors

Best Cruise Insurance Plans for 2024

Best COVID-19 Travel Insurance Plans for 2024

Best Cheap Travel Insurance Companies - Top Plans 2024

Best Cancel for Any Reason (CFAR) Travel Insurance

Best Annual Travel Insurance: Multi-Trip Coverage

Best Travel Medical Insurance - Top Plans & Providers 2024

- Is Travel Insurance Worth It?

Is Flight Insurance Worth It? | Airlines' Limited Coverage Explained

Guide to Traveling While Pregnant: Pregnancy Travel Insurance

10 Romantic Anniversary Getaway Ideas for 2023

Best Travel Insurance for Pre-Existing Medical Conditions April 2024

22 Places to Travel Without a Passport in 2024

Costa Rica Travel Insurance: Requirements, Tips & Safety Info

Best Spain Travel Insurance: Top Plans & Cost

Best Italy Travel Insurance: Plans, Cost, & Tips

Best Travel Insurance for your Vacation to Disney World

Chase Sapphire Travel Insurance Coverage: What To Know & How It Works

2024 Complete Guide to American Express Travel Insurance

Schengen Travel Insurance: Coverage for your Schengen Visa Application

Mexico Travel Insurance: Top Plans in 2024

Best Places to Spend Christmas in Mexico this December

Travel Insurance to Canada: Tips & Quotes for US Visitors

Best Travel Insurance for France Vacations in 2024

Travel Insurance for Germany: Tourist Information & Tips

Best UK Travel Insurance: Coverage Tips & Plans April 2024

Travel Insurance for Trips to the Bahamas: Tips & Safety Info

Europe Travel Insurance: Your Essential Coverage Guide

Best Trip Cancellation Insurance Plans for 2024

What Countries Require Travel Insurance for Entry?

Philippines Travel Insurance: Coverage Requirements & Costs

Travel Insurance for the Dominican Republic: Requirements & Tips

Travel Insurance for Trips Cuba: Tips & Safety Info

AXA Travel Insurance Review April 2024

Travel Insurance for a Trip to Ireland: Compare Plans & Prices

Travel Insurance for a Japan Vacation: Tips & Safety Info

Faye Travel Insurance Review April 2024

Travel Insurance for Brazil: Visitor Tips & Safety Info

Travel Insurance for Bali: US Visitor Requirements & Quotes

Travel Insurance for Turkey: U.S. Visitor Quotes & Requirements

Travel Insurance for India: U.S. Visitor Requirements & Quotes

Australia Travel Insurance: Trip Info & Quotes for U.S. Visitors

Generali Travel Insurance Review April 2024

Travelex Travel Insurance Review for 2024

Tin Leg Insurance Review for April 2024

Travel Insured International Review for 2024

Seven Corners Travel Insurance Review April 2024

HTH WorldWide Travel Insurance Review 2024: Is It Worth It?

Medjet Travel Insurance Review 2024: What You Need To Know

Antarctica Travel Insurance: Tips & Requirements for US Visitors

Travel Insurance for Kenya: Recommendations & Requirements

Travel Insurance for Botswana: Compare Your Coverage Options

Travel Insurance for Tanzania: Compare Your Coverage Options

Travel Insurance for an African Safari: Coverage Options & Costs

Nationwide Cruise Insurance Review 2024: Is It Worth It?

- Travel Insurance

- Travel Insurance for Seniors

- Cheap Travel Insurance

- Cancel for Any Reason Travel Insurance

- Travel Health Insurance

- How Much is Travel Insurance?

- Is Flight Insurance Worth It?

- Anniversary Trip Ideas

- Travel Insurance for Pre-Existing Conditions

- Places to Travel Without a Passport

- Christmas In Mexico

- Europe Travel Insurance

- Compulsory Insurance Destinations

- Philippines Travel Insurance

- Dominican Republic Travel Insurance

- Cuba Travel Insurance

- AXA Travel Insurance Review

- Ireland Travel Insurance

- Japan Travel Insurance

- Faye Travel Insurance Review

- Brazil Travel Insurance

- Travel Insurance Bali

- Travel Insurance Turkey

- India Travel Insurance

- Australia Travel Insurance

- Generali Travel Insurance Review

- Travelex Travel Insurance Review

- Tin Leg Travel Insurance Review

- Travel Insured International Travel Insurance Review

- Seven Corners Travel Insurance Review

- HTH WorldWide Travel Insurance Review

- Medjet Travel Insurance Review

- Antarctica Travel Insurance

- Kenya Travel Insurance

- Botswana Travel Insurance

- Tanzania Travel Insurance

- Safari Travel Insurance

- Nationwide Cruise Insurance Review

Policy Details

LA Times Compare is committed to helping you compare products and services in a safe and helpful manner. It’s our goal to help you make sound financial decisions and choose financial products with confidence. Although we don’t feature all of the products and services available on the market, we are confident in our ability to sound advice and guidance.

We work to ensure that the information and advice we offer on our website is objective, unbiased, verifiable, easy to understand for all audiences, and free of charge to our users.

We are able to offer this and our services thanks to partners that compensate us. This may affect which products we write about as well as where and how product offers appear on our website – such as the order in which they appear. This does not affect our ability to offer unbiased reviews and information about these products and all partner offers are clearly marked. Given our collaboration with top providers, it’s important to note that our partners are not involved in deciding the order in which brands and products appear. We leave this to our editorial team who reviews and rates each product independently.

At LA Times Compare, our mission is to help our readers reach their financial goals by making smarter choices. As such, we follow stringent editorial guidelines to ensure we offer accurate, fact-checked and unbiased information that aligns with the needs of the Los Angeles Times audience. Learn how we are compensated by our partners.

Thailand arrival & survival guide

The only guide you need to prepare for a trip to Thailand! Find out about visas, insurance, vaccinations, currencies, SIM cards, airport taxis and loads more.

- Destinations

- Things to do

The best travel insurance providers for Thailand trips in 2024

Congratulations on even making it to this page!

We get it, buying insurance for a trip is the single worst part of the planning process, but it’s also one of the most important.

You’ve already got the hardest part out of the way — sitting down to do it — the rest of it is usually much easier than you anticipate.

If you just want to know where to go to purchase solid coverage, we recommend SafetyWing because their pricing is competitive, and unlike other sites, they are upfront about what activities are covered and which are not. Their basic policy includes coverage for motorbikes which can be difficult to find.

Important: SafetyWing advertises itself as “Nomad Insurance” targeted at digital nomads and remote workers. They work on a monthly subscription model by default, but if you have a trip with start and end dates just tick the “specific travel dates” box and you’ll be buying traditional travel insurance.

Get a quote

Get a quote quickly here, or keep reading to find out why we recommend SafetyWing and details on coverage for motorbikes, adventure sports, Muay Thai etc.

Why you need insurance

Since you’re already on this page, you probably know why you need insurance. You most likely won’t use it, but if you have to, you’ll be very glad you have it. That’s pretty much the point of insurance.

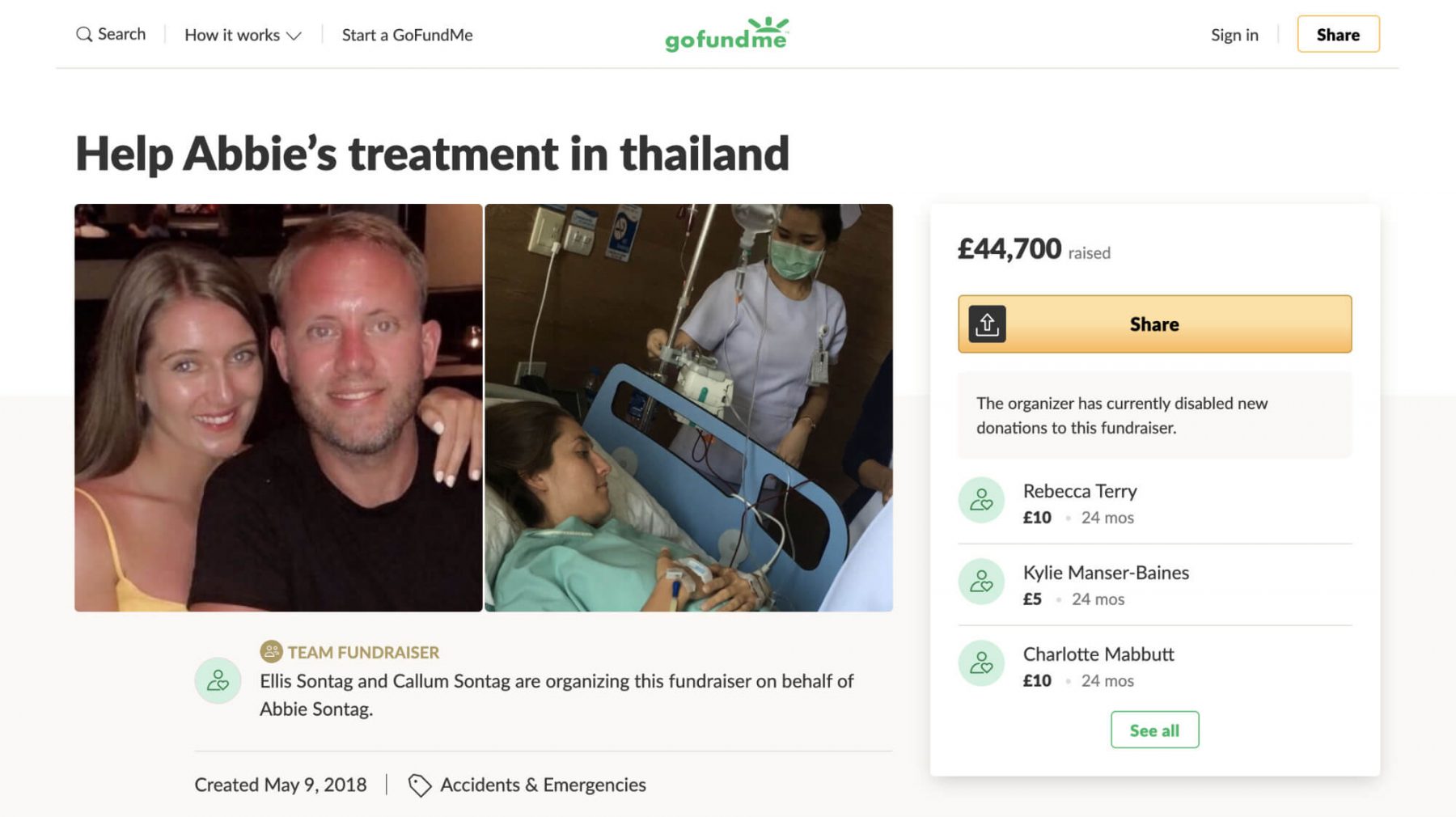

Millions of people travel around Thailand every year with no travel or health insurance, and most of them get away with it. But thousands of people also get stuck with huge medical bills leaving them begging family at home for money, or turning to sites like Go Fund Me to raise cash.

In some cases, not having insurance coverage costs people their lives. The private hospitals that provide the best care in Thailand are businesses. If you are in an accident, you can expect a basic level of care, but the reality is that major emergency surgeries and medical evacuations are reserved for people who can pay for them.

In 15 years of traveling in Thailand, I’ve met dozens of people who were at a minimum saved from massive medical bills by having insurance.

My friend Gavin even owes his life to having travel medical insurance. He had a motorbike accident in a rural area in Northeastern Thailand. It was only for his insurance which got him an emergency evacuation to Bangkok that he is still alive today.

Insurance is not that expensive. Just think of it as a necessary expense of your trip, no different than your flight or hotels. You pay for it up front, then it’s out of sight, with peace of mind.

Important: You may already have travel insurance coverage. If you have private health insurance in your home country, they may provide enough medical cover for your trip. Certain credit cards also provide some medical coverage, and many of them give trip cancellation coverage when you book with that card. Your home or renters insurance might also cover your belongings while on the road. Check your policy guide, or give them a call to see if you are already covered.

What coverage do you need?

There are a lot of different types of insurance that cover different things, but in general, travel insurance can cover:

- Medical emergencies

- Medical evacuation

- More minor health issues

- Trip cancellations

- Loss or damage of your personal belongings while traveling

The first two are by far the most important. You can probably do without the others, but having coverage for medical emergencies and evacuations is crucial. SafetyWing policies do include some coverage for delay and cancellations, and loss or damage of personal belongings.

If you want to shop around we like the site SquareMouth which aggregates policies from a number of different providers. Depending on your personal needs you may find a better option that from SafetyWing. It’s harder to tell what adventure sports/motorbike exclusions there are with these policies though which is why we personally avoid them.

Note: If you are an American, it’s pretty easy to get good insurance coverage for your belongings, and for trip delays and cancellations through a good credit card. Check out our guide to the best credit card for traveling abroad to learn more.

Our top provider recommendation

We’ve spent more hours than we’d like to admit browsing dozens of travel insurance aggregation websites trying to find the best one (or the least bad one). We’ve concluded that SafetyWing is the easiest site to use to shop around for a travel insurance quote.

Enter in just a few personal details like your age and home country or US State, and where you plan to travel, and within a minute you can have the most competitive plans listed. Use the filters to set minimum coverage amounts to make sure you have good enough coverage.

Insurance coverage for motorcycles and adventure sports in Thailand

It can be really difficult to find coverage for motorbikes, and even when you think you may have it, a lot of providers use fine print to make it diffcult to actually tell. That’s why we recommend SafetyWing . They are totally upfront about what they cover.

SafetyWing offers their basic policy which includes motorbike coverage, but certain other common activities travelers to Thailand might want to do are excluded unless you add on adventure sports coverage (currently $10 per month for travelers under 40.

Some of these excluded activities include Muay Thai and all boxing and martial arts, cave diving, dirt bikes and ATVs, kitesurfing, and whitewater rafting.

Your motorcycle coverage will only work if you have a valid motorcycle license in your home country and carry an international driver’s permit with it (or you have a Thai motorcycle license ). You must also be following all laws at the time of any accident, so you have to wear a helmet and not be intoxicated.

Better safe than sorry

It’s fairly unlikely you’ll need to use your insurance, but if you do, you will be glad you have it. It might save you tens or even hundreds of thousands of dollars, and a huge amount of stress and aggravation. It might even save your life. It’s worth it, get it.

Important: Final note: Sadly, all insurance providers kind of suck and will sometimes try to weasel out of paying a claim, or hide exclusions in the fine print. We cannot take responsibility for any info in this guide being 100% true all of the time since ultimately the only thing that is legally binding is the policy contract. Also, we are experienced travelers, not lawyers or insurance experts. Be sure to do your due dilligence and read through any policy. Buying from a reputable insurer is a good idea too since some are definitely better than others. SquareMouth shows the ratings of each provider right on the search page which we find useful.

Start a conversation

Contact us privately with a DM, or send a public Tweet.

Complete Guide: The Best Travel Insurance For Thailand

by Melissa Giroux | Last updated Feb 4, 2023 | Asia , Thailand , Travel Tips

Heading to Thailand soon? Wondering if you need travel insurance in Thailand ? In this post, you’ll understand why you need travel insurance and I’ll be recommending my favorite travel insurance company.

We all heard travel nightmares and crazy things happening abroad – and Thailand is no exception. These nightmares can happen there too. To avoid these nightmares, it is recommended to travel with medical travel insurance.

Ready To Travel? Don't Go Without Travel Insurance.

Check Prices

This way, you won’t have to worry about the worst-case scenario and you will get peace of mind.

Do you need travel insurance in Thailand?

The answer is yes. It’s recommended to have medical insurance when traveling to Thailand. It might not be mandatory, but to be on the safe side, you should always travel with travel insurance.

Still unsure if you can afford it or if you should get one? Let’s skip to the part where we imagine worst-case scenarios.

Worst-case scenarios

These are the common mishaps that can happen while in Thailand. You can decide for yourself if travel insurance is necessary. Note that whether I’ve heard some of my friends experiencing these things or if I read them in the news – it does happen.

For the purpose of entertaining you, these worst-case scenarios are pushed a bit far – note that you’ve been warned. Ha!

Scooter crash

Planning your upcoming adventures? Travel by bus! (It's cheap!)

You decide to rent a scooter in Thailand and you aren’t afraid because you are an experienced driver. As you’re slowing down at the traffic light, your friend (the beginner driver) hits you and there you are – flying over your scooter.

Zip-lining accident

Have you heard of the fatal accidents that happened at the famous Gibbon experience? To be clear – the Gibbon experience is in Laos – but still, these things can happen when the adventure activities aren’t well maintained.

Trekking accident

Did you decide to go climb that famous waterfall not too far from Chiang Mai ? Climbing a waterfall sounds epic… but what if the climb comes with a fall? Add a few leeches in there – you might not die, but it might not be that fun.

Food poisoning

Ever heard of the phenomenon called the Thai Tummy? So, as you are walking around the street market, you decide to grab a chicken satay when… you first get cramps, the fever hits you and there you are running for that first toilet. Food poisoning in Thailand is a pretty common thing – at some point, it could definitely hit you.

You decide to go for a snorkeling trip around the Thai Islands – because you read my blog post about Koh Lanta . As you jump into the water, you come face to face with a big jellyfish. It’s too late, you got stung already.

Dengue Fever

After driving to Pai , you finally have to relax in one of the most chill towns in Thailand. You sit down while enjoying the rice field views. Damn. This mosquito just bit you during the day. You should have used mosquito spray. Let’s hope, this tiny monster wasn’t carrying Dengue. Oops. Unless it did.

Best-case scenario

Now, this is the part where I reassure you. You might wonder if it’s a good idea to head to Thailand , and yes – I’m telling you – Thailand is one of my favorite countries. That said, it’s probably too late to cancel this flight of yours (unless, you actually had travel insurance, ha).

No kidding – Thailand is a beautiful country – and you should go. With all these scenarios in mind, you should know by now that it’s safer to travel with medical insurance.

You might not use it – but it’s better to be safe than sorry.

When should you buy travel insurance?

Usually, it’s recommended to buy travel insurance before you leave. Although, some insurance companies allow you to buy it when you’re abroad.

SafetyWing is one of them. Keep reading to learn more about this company.

SafetyWing offers travel medical insurance for people all over the world. It’s one of the most affordable insurances out there – with plans that start at $45.08 for 4 weeks. You can see the prices here .

SafetyWing is a good option, especially for digital nomads or long-term travelers. You can read this comparison for long-term travel insurance here .

Read our complete SafetyWing review to learn more.

What’s included?

Medical Insurance

They cover you if you’re sick or if you are in an accident outside your home country. Of course, you have to respect the conditions and the exclusions to be able to claim your insurance.

Travel Insurance

You are also covered for travel delay, lost checked luggage, natural disasters, emergency response, and personal liability.

Go To SafetyWing

Final Thoughts About Thailand Travel Insurance

Traveling to Thailand can be a great experience, but it’s essential to have the right insurance in case of an emergency. In this article, we’ve outlined what you need to know about travel insurance for Thailand and how to choose the best policy for your needs.

So, whether you’re traveling for business or pleasure, make sure you have adequate insurance coverage before hitting the road.

Traveling soon? Read one of the following guides:

- iVisa review

- SIM or eSIMs

- Holafly review

MY TOP RECOMMENDATIONS

BOOK HOTEL ON BOOKING.COM

BOOK HOSTEL ON HOSTELWORLD

GET YOUR TRAVEL INSURANCE

LEARN HOW TO START A TRAVEL BLOG

LEARN HOW TO VOLUNTEER ABROAD

- Meet the Team

- Work with Us

- Czech Republic

- Netherlands

- Switzerland

- Scandinavia

- Philippines

- South Korea

- New Zealand

- South Africa

- Budget Travel

- Work & Travel

- The Broke Backpacker Manifesto

- Travel Resources

- How to Travel on $10/day

Home » Southeast Asia » Thailand » Travel Insurance

Guide To Thailand Travel Insurance – ALL You Need To Know

Oh, Thailand. The ‘Land of Smiles’, with gleaming palaces and sleek cities. A country where you can take your pick of a golden beach or temple for every day of the year. Dive deep to explore vibrant coral reefs or frolic in a mud bath with an elephant then let your hair down until the sun rises. Try your hand at Muay Thai or whip up your own Pad Thai. Did we even need to remind you about Thai food?

Thailand is as much a mecca for intrepid backpackers as it is a magnet for luxury holidaymakers – and for good reason. This tropical, friendly, and cultural destination has heaps to offer visitors. In fact, Thailand attracted a whopping 39 million tourists in 2019 alone.

But before you slide into your elephant-print pants and grab yourself a chilled Chang, there’s one more thing you need to swot up on about Thailand. What could be more riveting than a guide to Thailand travel insurance?

Month to month payments, no lock-in contracts, and no itineraries required: that’s the exact kind of insurance digital nomads and long-term traveller types need. Cover yo’ pretty little self while you live the DREAM!

Do I Need Travel Insurance For Thailand?

What should travel insurance in thailand cover, what is the best thailand travel insurance, how to choose the right thailand travel insurance for you, final thoughts on thailand travel insurance.

Technically, no. Travel insurance is not mandatory for Thailand. A lot of backpackers in Thailand enter without it so you won’t be expected to show proof of purchase at immigration. So when you weigh up Chiang Mai treks and rooftop bars in Bangkok, you might consider shrugging off travel insurance in Thailand. But what if you have a trekking accident or end up losing your smartphone at the Sky Bar? That Bangkok travel insurance will be your new best friend.

Overall, Thailand is a pretty safe country for travellers, although it’s not without its dangers. Violence against tourists is rare, but assaults are still reported. While you are unlikely to get caught up in any political turbulence, sadly, Thailand isn’t without its unrest . As with all major traveller hubs, pickpocketing is common. There is a risk of catching a tropical disease.

And, crucially, if you’re planning on revving up a scooter, be mindful that crashes are frequent in Thailand and can be fatal. In 2018, motorbikes accounted for up to 70% of fatal crashes . Even if you’re only riding pillion, insurance for Thailand holidays can have your back.

At the end of the day, Thailand is an awesome country with so many cool things to do. We encourage all travellers to consider investing in travel insurance in Thailand. That way, you can try all the exciting things this country has to offer with peace of mind!

Need more convincing? Check out these other reasons why you should have travel insurance!

Unlock Our GREATEST Travel Secrets!

Sign up for our newsletter and get the best travel tips delivered right to your inbox.

Healthcare in Thailand

If you do get into a pickle, healthcare in Thailand is some of the best in the world; the sixth-best , to be precise. It’s so good, in fact, that Bangkok has become one of the hotspots for medical, cosmetic, and dental tourism. Not that your Bangkok travel insurance will cover you for a new nose, we’re afraid to report.

Thailand’s health service is three-tiered. Appointments are the priciest, and you can expect to be seen swiftly in the private sector, where facilities are of the highest standard. Government-funded healthcare is funded by the Ministry of Public Health. These services are reliable but can be extremely busy. Rates are lower than private healthcare. Non-profit health organisations operate to help disadvantaged Thais.

It’s worth noting that most medical practitioners in Thailand are specialists in their field, so some tourists may struggle to find a suitable doctor for minor health complaints. English-speaking medical practitioners can be found across the country, particularly in popular tourist destinations, such as major cities and the Thai islands.

Costs vary depending on the level of treatment you require and the hospital you visit. Healthcare in Thailand is significantly cheaper than in the West. All hospitals and clinics set their own fees, which will be provided on request. Typically, a Thai Doctor consultation will set you back 500 – 1000 baht ($15 – $30 ). Further fees apply for treatment, laboratory tests, and prescription medicine. Bear in mind that prescription medicine is more expensive at the hospital pharmacy. Shop locally for cheaper meds.

Travel insurance for visitors to Thailand should cover medical costs. Always check that the hospital accepts travel insurance and check that your Thailand travel insurance permits you to choose your own facility. Remember that if you plan to stray off the banana pancake trail, you might find healthcare is more basic.

Crime in Thailand

Violent crime against tourists in Thailand is very rare. Such instances are more likely to happen at night, so do be cautious when out partying or walking back to your hostel late at night, particularly if you’re on your own. Female travellers should exercise caution after drinking and late at night, as sexual assaults are more commonly reported following Full Moon Parties .

It’s not uncommon for travellers to fall victim to pickpocketing or petty theft in Thailand. Theft typically occurs when valuables are left unattended or shown off in the street as easy pickings. Thai thieves are not known for being confrontational, so muggings are rare, but they still can happen. It’s not unheard of for a sly motorcyclist to swipe a smartphone as they glide past an unsuspecting backpacker. So again, keep your valuables safe. Pick up a ‘bumbag’ at Khao San Road. You should be particularly cautious at beach bars, markets, on public transport, and in tourist-populated areas.

Back in the day, night buses in Thailand had a shady reputation for theft. Nowadays, theft is less common, but it does still happen. Keep your valuables secure on your person. Consider what the best insurance for Thailand is if you intend on travelling on overnight transport regularly. Most hotels and hostels in Thailand will have a 24-hour reception desk, CCTV, and lockers are usually provided. However, the cheapest dorms are likely to have less security.

Issues Facing Travellers in Thailand

We can harp on about the wonders of Thailand all day. But instead, we want to draw your attention to the key issues facing explorers in Thailand. Namely:

- Theft of personal goods – smartphones, laptops and expensive cameras attract the eyes of thieves. It’s also remarkably easy to drop your phone down the side of the seat during your island-hopping cruise or misplace it at a party.

- Motorbike crashes – one of the best ways to travel in Thailand is by motorbike. It’s also one of the best ways to wind up in the emergency room in Thailand. Even the most competent motorcyclist can be caught out by inclement weather or less able drivers. Before you purchase Thailand Travel Insurance, make sure you carry the right licence to cover you in the event of an accident.

- Tropical diseases – Dengue is endemic in Thailand. Usually, it can be treated in the same way you would treat the flu, but this disease can become more complicated and require hospitalisation. Trust us, a week in a Thai hospital is going to set you back way more than that $5 a night dorm bed.

When purchasing travel insurance for Thailand, we recommend checking that your policy covers all the issues above.

Common Activities in Thailand

Where can we begin! There are a number of high-octane activities to choose from in Thailand (we’re not just talking about sitting in the back of a tuk-tuk in Bangkok). Depending on what floats your boat, make sure your Thailand travel insurance covers the following activities:

- Hiring a motorbike – we’ve already said this, but to reiterate: the cheapest Thailand travel insurance may not include a clause about motorbiking. Make sure you’re covered with the correct license and check whether or not your insurance covers any damage to the vehicle.

- Trekking – whether in the mountainous north or while chasing waterfalls in one of the country’s glorious national parks , like Khao Sok, hiking in Thailand is something you should definitely try. But if you turn over on your ankle and need to hail a helicopter to the nearest emergency room, you might want to check you’re covered.

- Rock climbing – we’re looking at you, Tonsai. Tonsai Beach is renowned for its rock climbing, so if you fancy being shown the ropes, make sure your Krabi travel insurance has your back.

- Scuba diving – if you’ve got your heart set on finding Nemo, ensure that your Ko Tao travel insurance covers your underwater activities before taking that giant stride off the boat.

- And a note on full-moon parties – the backpacker rite of hedonistic passage is to attend one of these monthly shindigs. But remember, before you abandon your inhibitions (and your passport) for a dip in the moonlit ocean, thieves may be prowling along the sand. Check that your valuables are covered on your Thailand Travel Insurance.

Things go wrong on the road ALL THE TIME. Be prepared for what life throws at you.

Buy an AMK Travel Medical Kit before you head out on your next adventure – don’t be daft!

More often than not, the majority of Thailand travel insurance policies will include the following;

Emergency Accident & Sickness Medical Expenses

Luggage and personal property, emergency evacuation and repatriation, non-medical emergency evacuation, trip cancellation, trip interruption.

These are some key terms to look out for when you are comparing different insurance policies. Now, let’s take a closer look at each one of these to see what they actually mean!

Emergency Medical costs cover, is the most important aspects of most travel insurance policies. If you are involved in an accident or get very sick with a mystery illness, you want to rest easy knowing that any medical costs and hospital bills will be taken care of.

Many of you will have never seen a medical bill. Good. But let me tell you, they can get very expensive very easily. My friend was once billed $10,000 in Costa Rica. Even 2 days in a Thai hospital cost him nearly $2,000.00 ( that boy has no luck… ).

Pre-existing medical and health conditions may not be covered or may be covered for an additional premium.

Ideally, Emergency Accident & Sickness Medical insurance should offer at least $100,000.00 of coverage. Some run into the millions.

Luggage and Personal Stuff coverage covers the value of your personal property. It’s most common application is for lost luggage and However, many policies also extend this to cover “on the ground” theft which comes in useful if you are robbed once you reach your destination.

The limits on this vary between policies. However, the maximum value rarely exceeds $1000 with a maximum item value between – $250 – $500.

This is ok for many travellers. However if you travel with a lot of electrical gear (laptop & camera), or are packing ski-ing gear, you may also wish to think about taking out a separate gadget cover.

We’ve tested countless backpacks over the years, but there’s one that has always been the best and remains the best buy for adventurers: the broke backpacker-approved Osprey Aether and Ariel series.

Want more deetz on why these packs are so damn perfect? Then read our comprehensive review for the inside scoop!

Emergency evacuation covers the cost of sending you back to your home country in a sickbed. Let’s say that the above mentioned illness is a nasty one, and the decision is taken to send you home for further treatment; this will take care of the high costs of flying you home with tubes stuck into your arms.

Repatriation is the cost of sending your body home in the unlikely event that you die on your trip. The costs of this are usually very high. Repatriation costs are not a burden I would want to leave to my family. Whilst this is thankfully rare, I do sometimes come across Facebook or “Go Fund Me” campaigns for somebody’s body to be flown home.

Non-medical Emergency Evacuation is when you have to be evacuated from your destination because of some unexpected crisis. Examples can be outbreaks of war/civil unrest and earthquakes that decimate infrastructure such as the Nepal earthquake.

In more recent times, the Corona COVID-19 outbreak created the biggest international emergency evacuation situation ever. ( FYI – it straddled both the medical and non-medical evacuation boundaries ).

Emergency evacuation insurance covers the costs of having to book a last-minute flight home ( which can be very expensive ) and will also cover accommodation costs if you end up being flown to a random, “safe” country rather than going straight home.

Having to cancel a trip that you were psyched about is heartbreaking. However, then being left out of pocket just adds scurrilous insult to grievous injury. Trip Cancellation cover can help you recover the non-refundable costs of your trip such as flight and hotel costs.

Obviously, you can’t claim this simply because you changed your mind about the trip or broke up with your girlfriend. Legitimate cancellation reasons are things like sickness, family emergencies, bereavement, natural disaster and war – you get the gist.

Trip Interruption is when something goes wrong, or interrupts, your trip leaving you out of pocket. One example, when your pre-paid hotel burns down and you are forced to book another one. Another example is when your flight home is cancelled and you need a few extra nights at your hotel.

Anything Else? The above are what we consider to be the basic, bare-bones of travel insurance policies. However, some policies do offer a few more aspects to them. The very best Thailand travel insurance policies may also include the following;

Adventure Sports and Activities

Adventure sports and activities are not covered by all travel insurance policies. The definition of adventure sports and activities really does vary between providers but for example, can include;

- Martial Arts

- Bungee Jumping

- Scuba Diving

- Informal basketball games….

If you are even thinking about doing anything physical or outdoorsy on your trip, it is very wise to check that your insurance provider is in fact covering it. Snapped tendons tend to hurt plenty enough without having hefty medical bills attached to them.

Accidental Death and Dismemberment

This one is perhaps a bit macabre. It doesn’t cover any travel related expenses as such but instead it basically provides you (or your next of kin) with monetary compensation in the event that something happens to you. If you die, your loved ones get a payout. Or, if you lose a toe or something, YOU get a payout.

It’s kind of like having a bit of life cover attached to your travel insurance.

“ Well dear, I’m afraid there is good new and bad news. The bad news is that our beloved daughter little Jenny died on her trip to Thailand. The good news is that we get $10k! Thailand here WE come! ”

Gear and Electronics Cover

Some insurance policies cover electronic gadgets but others do not. Those that do, sometimes charge an additional fee and they also usually limit the maximum item value. If you only travel with a phone or a tablet then your travel insurer may well cover it entirely. However, if like us if you are traveling with a decent laptop and camera, then you may wish to consider obtaining gadget cover.

I have personally had separate gadget cover on my MacBook Pro for years.

A new country, a new contract, a new piece of plastic – booooring. Instead, buy an eSIM!

An eSIM works just like an app: you buy it, you download it, and BOOM! You’re connected the minute you land. It’s that easy.

Is your phone eSIM ready? Read about how e-Sims work or click below to see one of the top eSIM providers on the market and ditch the plastic .

Whilst they may all seem the same, not all insurers are. Some insurers offer lower prices than others and others offer higher coverage amounts. Some are infamous for not paying claims whilst others are celebrated for being fair and helpful.

Travel insurers – always the same yet always different. It isn’t possible (or legal) for us to say that anyone of them is the best, or is “better” than the others. No. Insurance is a very complex product and any policy takes into account a whole lot of data and a wide set of variables.

Remember that the “best” travel insurance always depends on where you are going, when you are going there and ultimately upon you and your needs. The best travel insurer for one trip, may not be the best for a different trip.

Below, we will introduce a few of the many travel insurance providers on offer. These are all firms we have used ourselves over the years.

SafetyWing are a relatively new player in the travel insurance space but are already making big waves. They specialise in cover for digital nomads and they offer open-ended cover on a monthly subscription basis. Because they primarily cover digital nomads, they don’t offer much in the way of trip cancellation or delay so do take that into consideration.

However, SafetyWing really excels on the health side of travel insurance, covering dental and some complimentary treatments. In fact they even allow young children to be covered for free.

If cancellation and delay is not a concern for you or if you will be spending some considerable time on your trip, then maybe SafetyWing are right for you

- Emergency Accident & Sickness Medical Expenses – $250,000

- Baggage and Personal Property – $3000

- Emergency Evacuation and Repatriation – $100,000

- Non-Medical Emergency Evacuation – $10,000

- Trip Cancellation -$0

- Trip Interruption – $5000

If you need more information or want to get a quote, then you can visit the website for yourself.

Talk about efficient and effective, Heymondo are up-to-date when it comes to combining travel insurance with technology in the digital world of 2022. What truly sets them apart is their assistance app offering a 24-hour medical chat, free emergency assistance calls and incident management. How reassuring is that?! They also have a convenient and complication-free way to make a claim straight from your phone.

Medical expenses are covered up to $10,000,000 USD so try not to damage yourself anything over that amount… If you’d like travel insurance that operates with that little extra swiftness and ease, give these guys a go. They offer multiple options – single trip, annual multi-trip and long stay. We’ve focused on single trip, but do check out the others and find what fits your next adventure.

- Emergency Accident & Sickness Medical/Dental Expenses –$10,000,000 USD

- Baggage and Personal Property – $2,500 USD

- Repatriation and Early Return – $500,000 USD

- Non-Medical Emergency Evacuation – $10,000 USD

- Trip Cancellation – $7,000 USD

- Trip Disruption – $1,500 USD

- Covid 19 coverage included in all plans

If you need more convincing, click the link below to get 5% off your Heymondo travel insurance plan!

Columbus Direct

Named after one of history’s greatest (and most divisive explorers), Columbus Direct also specialise in insuring adventure-hungry explorers like us. They have been providing award-winning insurance for 30 years. What we like about this plan is that it does cover small amounts of personal cash. However, Gadget Cover is not available.

Columbus Direct actually offers a number of different travel insurance plans. Below we have focused on 1 of these and have set out the coverage amounts for the Globetrotter plan.

- Emergency Accident & Sickness Medical Expenses – $1,000,000

- Baggage and Personal Property – $750

- Emergency Evacuation and Repatriation – $1,000,000

- Non-Medical Emergency Evacuation – $0

- Trip Cancellation -$1,000

- Trip Interruption (“Catastophe”) – $750

World Nomads

World Nomads have been supporting and encouraging travellers to explore their boundaries since 2002. Designed by travellers for travellers, they offer simple and flexible travel insurance covering multiple countries and a lot of adventure activities.

If you leave home without travel insurance or your policy runs out, you can buy or extend while on the road.

World Nomads provides travel insurance for travelers in over 100 countries. As an affiliate, we receive a fee when you get a quote from World Nomads using this link. We do not represent World Nomads. This is information only and not a recommendation to buy travel insurance.

Iati Seguros

Iati Seguros is a Spanish based travel insurance company who we have personally used and loved. You will notice that they provide competitive cover amounts for the key travel insurance areas, and are competitively priced. So far we have heard nothing but good things about them.

They also offer multiple ones, but we have focused on the Standard Plan although we wholly encourage checking out all plans for yourself to identify the best one for your needs.

Standard Plan

- Emergency Accident & Sickness Medical Expenses – $200,000

- Baggage and Personal Property – $1000

- Emergency Evacuation and Repatriation – 100% of cost

- Trip Cancellation -$1,500

- Trip Interruption – 100% of cost

Insure My Equipment

Insuremyequipment.com does precisely what the name suggests. They are an online insurer for expensive equipment (like camera gear & gold clubs). You can use them to get specific pieces of gear insured but please bear in mind this policy is only for your specified gear.

An Insure My Equipment policy works well in combination with other travel insurance. Insure My Equipment policies are an excellent choice for professionals and backpackers with more $0000’s worth of camera equipment, expensive laptops or fishing rods.

I also know a few travelling musicians and DJs who use these guys so you are in cool company.

Choosing the right travel insurance for your Thailand holiday is like choosing a pair of shoes. Only you can really say how well they fit, and how many miles you can manage in them.

To decide who the right insurer for you is, you need to add up how much your trip is worth, how much equipment you plan to take with you and what activities you intend to engage in.

You also need to ask yourself how much you can afford. This means how much you can afford to pay for cover but also how much you can afford to be out of pocket in the unlikely event of an incident. Sometimes, the cheapest Thailand travel insurance will be enough and sometimes it will be worth spending a bit more.

Hopefully the information provided in this post will help you to decide. If not, then I guess I just wasted 7 hours of my life in writing it.

Backpacking BangkokIs Thailand Safe?

Where To Stay in Thailand

Is Thailand Expensive?

Still awake? We know travel insurance isn’t the wildest travel topic to muse over when planning your next trip, but needs must. And in a crazy place like Thailand, it’s useful to know what to expect should a medical or emergency situation arise.

Hopefully, this guide has helped you find the most suitable – or at least the cheapest – Thailand travel insurance for your needs. Now, you can focus on researching the best Thai island and browsing (ethical) elephant sanctuaries. Once you’ve found your match with the best insurance for Thailand, check out some of our travel guides to the Land of Smiles.

And for transparency’s sake, please know that some of the links in our content are affiliate links . That means that if you book your accommodation, buy your gear, or sort your insurance through our link, we earn a small commission (at no extra cost to you). That said, we only link to the gear we trust and never recommend services we don’t believe are up to scratch. Again, thank you!

Aiden Freeborn

Share or save this post

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Notify me of followup comments via e-mail.

Travel Insurance for holidays in Thailand

Travel insurance for thailand.

Welcome to Thailand, a gem packed with both nature’s wonders and incredible human creations. The nation draws millions of tourists each year to explore its temple ruins, visit elephant sanctuaries and enjoy tropical beaches. If you’re itching to book your next adventure to Thailand, don’t forget one critical thing first: travel insurance ! In this article, we’ll cover what you need to know about travel insurance for Thailand.

- What should your Travel insurance cover for a trip to Thailand?

How does Travel Insurance for Thailand Work?

- Do I need Travel Insurance for Thailand?

- How much does Travel Insurance cost for Thailand?

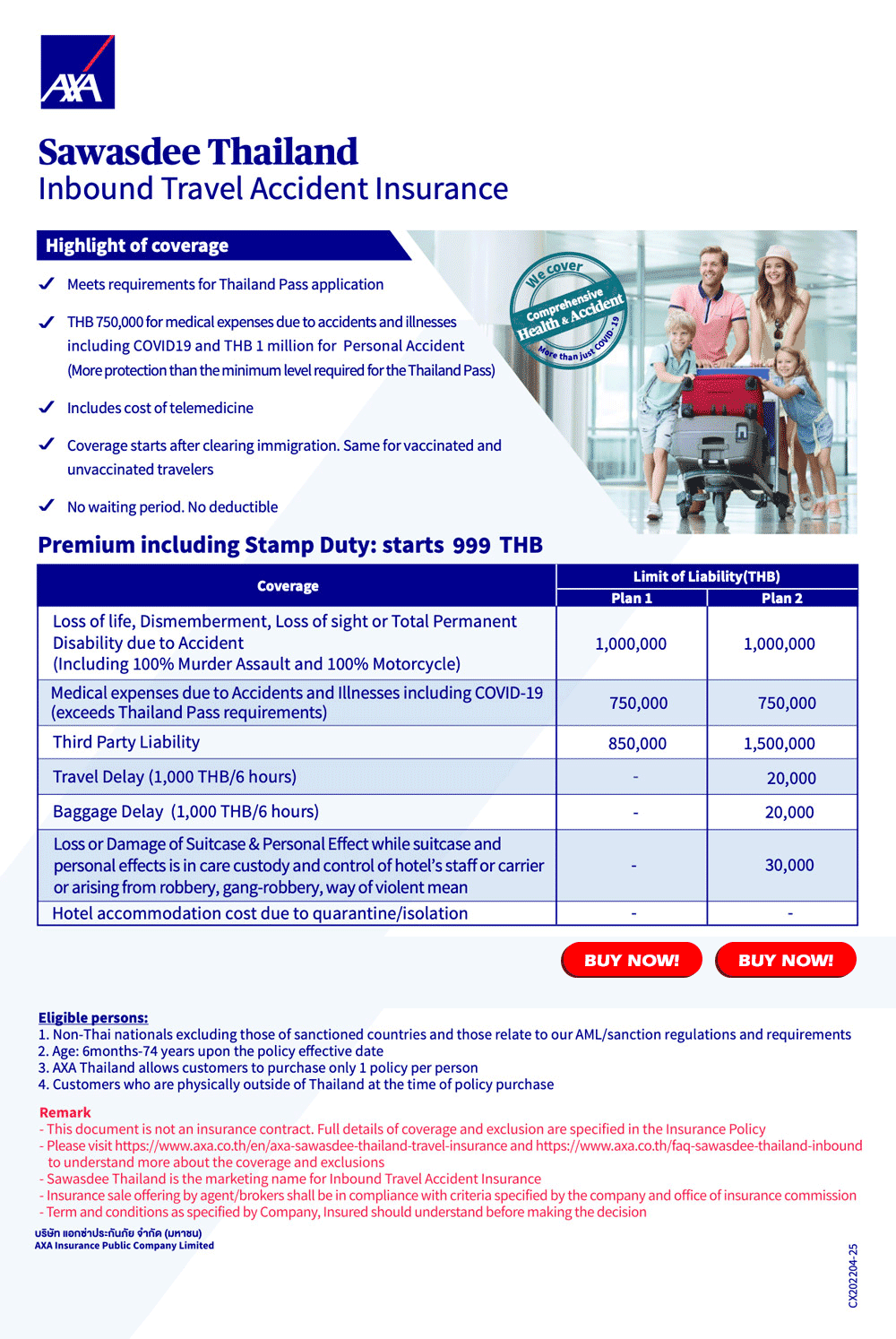

- Our Suggested AXA Travel Protection Plan

- What types of medical coverage does AXA Travel Protection plans offer?

- Are There Any COVID-19 Restrictions for Travelers to Thailand?

- Traveling with pre-existing Medical Conditions?

What should your Travel Insurance cover for a trip to Thailand?

At a minimum, your travel insurance to Thailand should cover trip cancellation, trip interruption and emergency medical expenses. When it comes to international travel, the US Department of State outlines key components that should be included in your travel insurance coverage. AXA Travel Protection plans are designed with these minimum recommended coverages in mind.

- Medical Coverage – The top priority is making sure your health is in order. With AXA Travel Protection, you can have access to quality healthcare during your trip overseas in the event of unexpected medical emergencies.

- Trip Cancellation & Interruptions – Assistance against unexpected trip disruptions can dampen the mood, AXA Travel Protection offers coverage against unforeseen events.

- Emergency Evacuations and Repatriation – In situations where transportation is dire, AXA Travel Protection offers provisions for emergency evacuation and repatriation.

- Coverage for Personal Belongings – AXA offers coverage for your belongings with assistance against lost or delayed baggage.

- Optional Cancel for Any Reason – For added flexibility, AXA offers optional Cancel for Any Reason coverage, allowing you to cancel your trip for non-traditional reasons. Exclusive to Platinum Plan holders.

In just a few seconds, you can get a free quote and purchase the best travel insurance for Thailand.

Imagine this: you’re exploring the night markets of Patpong, trying new foods and exotic tastes that Thailand has to offer. Suddenly, you feel queasy and uneasy, the snacks you have been snacking on seem to have been spoiled and you’re feeling ill. With AXA Travel Protection, we could help assist or guide you to the nearest hospital. Whether the situation goes from bad to worse, AXA is there to help you create a plan of action. Here’s how travelers can benefit from an AXA Travel Protection Plan:

Medical Benefits:

- Emergency Medical Expenses: Should you fall ill or have an accident during your trip, your policy may offer coverage for medical expenses, including hospital stays and doctor's fees.

- Emergency Evacuation & Repatriation: In case of a serious medical emergency, your policy may include provisions for evacuation to the nearest appropriate medical facility or repatriation.

- Non-Emergency Evacuation & Repatriation : In non-medical crises (e.g., political unrest), your policy may cover evacuation or repatriation, subject to policy terms.

Pre-Departure Travel Benefits:

- Trip Cancellation: You may be eligible for reimbursement if you cancel your trip due to a sudden illness or injury.

- COVID-19 Travel Insurance: Coverage is available for trip cancellation and medical expenses related to COVID-19, subject to policy terms and conditions.

- Trip Delay: If your flight faces delays due to unforeseen circumstances, you may have coverage for additional expenses such as meals and accommodations.

Post-Departure Travel Benefits

- Trip Interruption: In case of an unexpected event, you could be eligible for reimbursement for the unused portion of your trip.

- Missed Connection: If you miss a connecting flight due to delays or cancellations, this coverage may help with expenses like rebooking fees and accommodations.

Baggage Benefits:

- Luggage Delay: If the airline delays your checked baggage, your policy might offer reimbursement for essential items like clothing and toiletries.

- Lost or Stolen Luggage: In the unfortunate event of permanent loss or theft of your luggage, your policy may offer reimbursement for its value, assisting you in replacing your belongings.

Additional Optional Travel Benefits:

- Rental Car (Collision Damage Waiver): Exclusive to Gold & Platinum plan policy holders, this optional benefit gives travelers extra coverage on their rental car against damage and theft.

- Cancel for Any Reason: Exclusive to Platinum plan policy holders; this optional benefit gives travelers more flexibility to cancel their trip for any reason outside of their standard policy.

- Loss Skier Days: Exclusive to Platinum plan policy holders, this optional benefit offers reimbursement to mitigate some costs associated with pre-paid ski tickets that you or your traveling companion cannot use due to specified slope closures.

- Loss Golf Days: Exclusive to Platinum plan policy holders, this optional benefit offers reimbursement to mitigate the expenses linked to prepaid golf arrangements that you or your travel companion are unable to utilize due to specified golf closures.

Do I need Travel Insurance for Thailand?

So, do you need travel insurance for Thailand? The short answer is no. Since the end of the COVID-19 pandemic, Thailand has dropped its requirement for travelers to have insurance for entry. However, it’s still highly recommended that you have a plan before embarking on your next trip.

Medical Emergencies: Your health is a top priority. If you face a sudden illness or injury in Thailand, travel insurance offers the means to receive prompt and quality medical care.

Lost Baggage: Airlines sometimes mishandle baggage, and the last thing you want is to be without your essentials in an unfamiliar place. Travel insurance offers to cover the cost of replacing necessary items, allowing you to continue on.

Flight Delays: Travel disruptions like flight delays can happen. If you miss a connecting flight or incur additional expenses due to delays, travel insurance can help cover the costs.

How much does Travel Insurance cost for Thailand?

In general, travel insurance to Thailand costs about 3 – 10% of your total prepaid and non-refundable trip expenses. The cost of travel insurance depends on two factors for AXA Travel Protection plans:

- Total Trip cost: The total non-prepaid and non-refundable costs you have already paid for your upcoming trip. This includes prepaid excursions, plane tickets, cruise costs, etc.

- Age: Like any other insurance type, the correlation is rooted in increased health risks associated with older individuals. It's important to note that this doesn't make travel insurance unattainable for older individuals.

With AXA Travel Protection, travelers to Thailand will be offered three tiers of insurance: Silver, Gold and Platinum . Each provides varying levels of coverage to cater to individual's preferences and travel needs.

Our Suggested AXA Travel Protection Plan

AXA presents travelers with three travel plans – the Silver Plan , Gold Plan , and Platinum Plan , each offering different levels of coverage to suit individual needs. Given that Thailand hospitals often do not accept U.S. health insurance or Medicare, we genuinely recommend travelers consider purchasing any of these plans, particularly for the crucial coverage they offer for emergency accident and sickness medical expenses. The Platinum Plan is your go-to choice if you're looking for extra coverage for Thailand’s experience. "Cancel for Any Reason" offers greater flexibility for those unexpected twists in your travel plans and the "Rental Car (Collision Damage Waiver)" offers assistance when you're out exploring Thailand's stunning landscapes in a rental car.

What types of medical coverage do AXA Travel Protection plans offer?

AXA covers three types of medical expenses:

- Emergency Medical

- Emergency evacuation & repatriation

- Non-medical emergency evacuation & repatriation

Emergency Medical: Unexpected incidents that arise, such as broken bones, burns, unexpected illnesses and allergic reactions.

Emergency Evacuation and Repatriation: Can cover your immediate transportation home in the event of an accidental injury or illness.

Non-Medical Emergency Evacuation and Repatriation: This can cover evacuation assistance when you need to leave a destination immediately for non-medical-related events. These could be things like natural disasters or civil unrest.

Are there any COVID-19 restrictions for Travelers to Thailand?

No. Thailand has dropped all COVID-19 restrictions for travelers from the United States.

Traveling with pre-existing Medical Conditions?

Traveling with pre-existing medical conditions can complicate your plans, but with AXA Travel Protection, we're here to support you during your trip. Our Gold and Platinum Plans offer coverage for pre-existing medical conditions. The Platinum plan, in particular, is our highest-offered choice for travelers who want our highest coverage limits and optional add-ons, What does this mean for you? If you've got a medical condition hanging around, you can qualify for coverage under our Gold and Platinum plan with a preexisting medical condition, so long as it’s within 14 days of placing your initial trip deposit and in our 60-day look-back period. We're here to make sure you travel with ease, no matter your health situation.

1. Can you buy travel insurance after booking a flight?

You can buy travel insurance even after your flight is booked. It's advisable to purchase travel insurance for your trip as soon as you have made your initial trip deposit (prepaid and non-refundable trip costs.) AXA Travel Protection offers coverage as soon as you purchase your protection plan. We can give coverage against unforeseen events before you leave for your trip. Additionally, our policies offer coverage for preexisting medical conditions and Cancel for Any Reason if you purchase your protection within 14 days of making your initial trip deposit.

2. Do Americans need travel insurance in Thailand?

No, travel insurance is not currently required to visit Thailand.

3. What is needed to visit Thailand from the USA?

If you're visiting Thailand from the USA, all you need is your passport. Your passport needs to be valid at least six months beyond the date of your arrival.

4. What happens if a tourist gets sick in Thailand?

If you become sick in Thailand, travelers with AXA Travel protection can contact the AXA Assistance hotline at 855-327-1442 . Contact information is typically provided within the insurance documentation. Please ensure to read through your policy details and information.

Disclaimer: It is important to note that Destination articles are for editorial purposes only and are not intended to replace the advice of a qualified professional. Specifics of travel coverage for your destination will depend on the plan selected, the date of purchase, and the state of residency. Customers are advised to carefully review the terms and conditions of their policy. Contact AXA Travel Insurance if you have any questions. AXA Assistance USA, Inc.© 2023 All Rights Reserved.

AXA already looks after millions of people around the world

With our travel insurance we can take great care of you too

Get AXA Travel Insurance and travel worry free!

Travel Assistance Wherever, Whenever

Speak with one of our licensed representatives or our 24/7 multilingual insurance advisors to find the coverage you need for your next trip.

- Best Extended Auto Warranty

- Best Used Car Warranty

- Best Car Warranty Companies

- CarShield Reviews

- Best Auto Loan Rates

- Average Auto Loan Interest Rates

- Best Auto Refinance Rates

- Bad Credit Auto Loans

- Best Auto Shipping Companies

- How To Ship a Car

- Car Shipping Cost Calculator

- Montway Auto Transport Reviews

- Best Car Buying Apps

- Best Websites To Sell Your Car Online

- CarMax Review

- Carvana Reviews

- Best LLC Service

- Best Registered Agent Service

- Best Trademark Service

- Best Online Legal Services

- Best CRMs for Small Business

- Best CRM Software

- Best CRM for Real Estate

- Best Marketing CRM

- Best CRM for Sales

- Best Free Time Tracking Apps

- Best HR Software

- Best Payroll Services

- Best HR Outsourcing Services

- Best HRIS Software

- Best Project Management Software

- Best Construction Project Management Software

- Best Personal Loans

- Best Fast Personal Loans

- Best Debt Consolidation Loans

- Best Loans for Bad Credit

- Best Personal Loans for Fair Credit

- HOME EQUITY

- Best Home Equity Loan Rates

- Best Home Equity Loans

- Best Checking Accounts

- Best Free Checking Accounts

- Best Online Checking Accounts

- Best Online Banks

- Bank Account Bonuses

- Best High-Yield Savings Accounts

- Best Savings Accounts

- Average Savings Account Interest Rate

- Money Market Accounts

- Best CD Rates

- Best 3-Month CD Rates

- Best 6-Month CD Rates

- Best 1-Year CD Rates

- Best 5-Year CD Rates

- Best Jumbo CD Rates of April 2024