213-489-4182

For A Holiday

Exciting new specials, awesome & exclusive deals on all-inclusive resorts, escorted tours, cruises, hotels, air fares. book your travel now with the flexibility to change later., see details, handpicked airfares.

Mumbai ------------------- $910* New Delhi ----------------- $890* Paris --------------------- $650* Tokyo --------------------- $869* Dubai --------------------- $799*

Beach vacations.

Puerto Vallarta ------------- $585*

Jamaica ------------------ $1025*, anitgua ------------------ $1025*, riviera maya --------------- $919*, honolulu ------------------ $799*, london & paris escape escorted tour.

48-Hour Sale, 3-5 Days Carnival Cruise

Ancient epicenters via the corinth canal 7 day cruise.

- Search Please fill out this field.

- Manage Your Subscription

- Give a Gift Subscription

- Newsletters

- Sweepstakes

- Travel Tips

7 Professional Travelers Share Their Absolute Favorite Travel Rewards Program — and Why

Top experts pick their favorite travel loyalty program.

:max_bytes(150000):strip_icc():format(webp)/AllPhotos-1of116-ChrisDong-679580407cc64e35a239dd17a4fb804f.jpeg)

myLoupe/Getty Images

For frequent travelers, having a go-to loyalty program can be a game-changer. If you tend to fly on planes, stay at hotels, or spend on credit cards — or like me, you do all of the above — sticking with a program (or two) can make travel more accessible, enjoyable, and sometimes, downright luxurious. And if you play your cards right (pun intended), the rewards can add up relatively quickly.

Take my favorite travel rewards program of the moment, Bilt Rewards. Bilt lets me earn points on rent payments, my biggest monthly expense, without incurring additional fees. These points, similar to Amex Membership Rewards points , Chase Ultimate Rewards points , and Capital One miles , are considered a transferable currency. That means they are programs that are more versatile than traditional airline miles or hotel points since you can move them to a variety of loyalty accounts on an as-needed basis. In the case of Bilt, I can transfer my existing points to more than a dozen travel programs instantly, including the two that I am most loyal to. With Hyatt and American — my hotel and airline of choice, respectively — I can stay at luxury hotels or book business-class flights by transferring my Bilt points.

Wondering what programs other experienced travelers can’t live without? I asked eight professional jet-setters (and trendsetters) what their favorite loyalty programs are — and how they maximize those rewards.

World of Hyatt

Justin Sullivan/Getty Images

“My love of luxury hotels had a very definitive start a little over 10 years ago when another miles and points enthusiast introduced me to the Hyatt loyalty program, now known as World of Hyatt. I had been deeply entrenched in the world of luxury airline travel with miles for several years at that point, but never cared where I stayed once I got to my destination — until my first stay at a luxury hotel, using Hyatt points, changed my perspective entirely. World of Hyatt offers a combination of value, strong loyalty recognition, and transfer accessibility. I regularly book award stays valued at over two cents per point, upgrade perks as an elite member are consistent, and what I don’t earn from stays, I can transfer from Chase Ultimate Rewards for redemptions. While their global footprint isn’t the largest, they make continuous efforts to expand their portfolio through strategic acquisitions and partnerships, and their focus is very clearly on establishing a strong luxury positioning. The established Small Luxury Hotels partnership and the upcoming integration of Mr. and Mrs. Smith-marketed properties are both great examples of ways Hyatt thinks outside of the box to bring members additional opportunities to earn and redeem points on luxury stays.” — Michelle González, Luxury Travel Expert and Creator ( @laxtoluxury )

American Express Membership Rewards

Silas Stein/Getty Images

"My favorite rewards program is Amex Membership Rewards and has been since day one. I got my first Amex credit card over 10 years ago when I was fresh out of college and working as an executive chef, and it literally opened up the world to me. Thanks to Amex points, I learned very quickly that if you spend smarter, you travel better. I’ve traveled to almost 80 countries, flown across the globe in style on the most aspirational first-class airlines, and spent countless nights at the most luxurious hotels. Most importantly, I’ve created lifelong memories and had travel experiences that I never thought were possible. There are two main reasons why I prefer Amex above all others. First, you can earn a significant amount of points without needing to spend substantial amounts of money to earn them by using the Amex Platinum, Amex Gold, and Amex Green cards. I’ve done this all while living within my means and keeping my credit pristine. Secondly, there’s so much power behind these points when they are redeemed properly. When transferring Amex points to its airline and hotel partners, you are able to substantially increase the value of these points by leveraging the award charts and breaking away from the fixed value of the points when used directly with Amex Travel." — Tommy Lonergan, Partner at Freedom Travel Systems ( @travelliketommy )

Delta SkyMiles

Courtesy of Delta Airlines

There is an airline loyalty program that I think pound for pound, knocks most of the other competition out. Delta’s SkyMiles program has so many benefits that I have discovered. I love how Delta makes it easy to earn miles which I can then use to book flights and vacation packages. Then, I really enjoy the perks at each status level, especially as I level up like being able to upgrade faster and easier. I appreciate Delta’s SkyTeam alliance partners and redeeming miles with over a dozen other affiliated airlines. Delta also makes me feel like I am appreciated because when I choose to fly with them, I receive personal greetings and have even gotten handwritten letters congratulating me on my new status placed in my seat before I boarded. They also sent me my own Delta location tag that will track my bag wherever. Outside of the loyalty programs, I enjoy their lounges, which are world-class and make my airport experience more relaxing. — Jeff Jenkins, Host of Never Say Never on National Geographic ( @chubbydiaries )

Editor's note: Delta SkyMiles has recently changed how travelers earn status and its lounge admissions policies. Read more here .

American Airlines AAdvantage

"As a full-time traveler, my favorite loyalty program is American Airlines. Determining the best loyalty program is subjective. All loyalty programs, obviously, have their strengths and weaknesses — and it’s really about what you prioritize as a traveler and where you land when it comes to the tier. The first thing I tend to look at is the advantages of utilizing partner airlines, because I travel internationally so often. American has quite a number of partners in the Oneworld alliance; it’s a huge advantage to have partners all over the world to redeem miles. For instance, I love Qatar Airways Qsuites, it’s my favorite way to fly. In my opinion, it’s the best redemption of American miles. As an Executive Platinum Elite member, I receive free upgrades domestically, and that also includes flights to Mexico. Of course, these are subject to availability but I’ve received numerous upgrades between Los Angeles and New York. For the price of an economy ticket, I often get a lie-flat business seat for that journey." — Valerie Joy Wilson, Solo Travel Expert ( @trustedtravelgirl )

British Airways Executive Club

"My favorite loyalty program is the British Airways Executive Club because I find the benefits to be amazing, especially as someone who is a British-American dual citizen. I live in New York and frequently travel to the United Kingdom. Plus, I don't have to spend a lot of money to earn top-tier status, because, with British Airways, I earn points toward status based on distance flown, not just the cost of the ticket. This makes it easier to achieve Oneworld Emerald status, which gives me a lot of great benefits, even on domestic economy flights on British Airways partner American Airlines. For example, I get exit row seats, three bags at 70 pounds each, and access to the exclusive Flagship First check-in area with American Airlines. Even better, I get to enter some of the best airport lounges in the world with this status, like the Qantas First Lounge at LAX, all complimentary." — Will Taylor, TV Host and Content Creator ( @brightbazaar )

Air Canada Aeroplan

Gary Hershorn/Getty Images

"I really like the Air Canada Aeroplan rewards program, because it offers so many benefits. Earning points is easy and redeeming them is incredibly flexible. I can accumulate points quickly by transferring credit card points from American Express Membership Rewards, Capital One Miles, Chase Ultimate Rewards points, and Bilt Rewards points at a one-to-one ratio to Aeroplan. Redeeming my Aeroplan points is also so flexible because they can be used for Star Alliance partner airlines, as well as non-alliance partners like Emirates, Etihad, Bamboo Airlines, and Oman Airlines. This opens up numerous options for finding award flights worldwide. The online search feature is quick, accurate, and user-friendly, making the process of redeeming points enjoyable. One of the best things about the Aeroplan program is that I can add a stopover for just an additional 5,000 points, and the stopovers are bookable online. This is perfect for me because I love exploring multiple destinations and maximizing my travel experience. Plus, transfer bonuses are occasionally available when transferring credit card points to Air Canada Aeroplan, which helps me earn even more points. Overall, I think Air Canada Aeroplan is an excellent rewards program that offers a wide range of benefits for its users." — Max Do, Loyalty and Rewards Expert ( @maxmilespoints )

Alaska Mileage Plan

Chad Slattery/Courtesy of Alaska Airlines

"As a videographer and owner of a media company that travels around the world, Alaska has been my loyalty program of choice for the last several years. I have held airline status on three different airlines, but never received anywhere near the same number of upgrades per flight taken as I do on Alaska. In the old days, airlines awarded you miles based on the distance flown (instead of the money spent), Alaska is one of the few that continues to do this, which benefits me when I fly on cheaper fares over longer distances. They partner with a unique group of airlines all over the world, which makes it easy to use their miles to travel globally for competitive rates. Plus, they have the best chocolate chip cookies." — Ian Agrimis, Founder of Capture Unlimited ( @agrimisadventures )

Related Articles

Advice, staff picks, mythbusting, and more. Let us help you.

How to Get the Most Out of Your Travel Reward Points

Published June 24, 2019

A version of this post was sent to our weekly newsletter mailing list. If you’d like to receive this in your inbox, subscribe here .

Happy midsummer! Every year at this time, I wish I could revisit Sweden for the longest days of the year. But flying from Los Angeles to Stockholm is not cheap, and financing tickets for the whole family can be a challenge. I thought I’d ask Taylor Tepper, senior staff writer on our Money team, for tips on how to make the most of travel rewards cards for the summer.

Wirecutter Money is reader-supported. When you are approved for a product through partner links on our site, we earn a commission. Learn more about our advertiser disclosure and our partners .

Ganda Suthivarakom: Do you have any tips for families trying to find a way to finance tickets for everyone using points?

Taylor Tepper: Financing an entire trip for a family of four, as an example, can get tricky. Before you apply for a card, or even rev up your Google machine, make sure you can actually afford the vacation. A credit card is a tool, not magic.

That caveat aside, one option could be for one parent to apply for the Chase Sapphire Reserve , while the other goes for the Chase Sapphire Preferred . Once the two meet the spending requirements for the welcome offer (about $8,000 across both cards), they’d have 110,000 points between them. The Preferred parent would then transfer their points to the Reserve parent. The 110,000 points would be worth $1,650 in flights booked through the Chase travel portal. With an average domestic round-trip flight costing around $421, per the Bureau of Transportation Statistics , they’d have just about enough to cover four flights.

The real question, though, is which family member would have to sit out a visit to a Priority Pass lounge (or stump up the $27 for entrance).

Ganda: I have the Chase Sapphire Reserve. What should I be doing that I’m not doing yet?

Taylor: If you don’t already, you should transfer your points to a partner airline for a reward flight.

If you use your points on the Ultimate Rewards travel center, where you look up flights on the Expedia-run search engine and then use your points to buy a ticket, each point is worth 1.5¢ there, so a $450 ticket costs 30,000 points. That’s good value.

But travel experts will go a step further. Rather than using your points to buy a ticket through Chase’s travel center, you can transfer your points to a partner loyalty program to book an award ticket.

You’ll have to do more research, but you might be able to get a business-class overseas ticket through, say, Singapore Airlines’s KrisFlyer program for the cost of a main-cabin fare. I would use this trick only on long-haul flights, though, especially for choice seats.

Ganda: Everyone knows about the Chase Sapphire Reserve. What do you think is the best credit card deal more people should take advantage of?

Taylor: If you tend to fly one specific airline, I’d check out our best airline credit card guide . Travelers who frequent Southwest Airlines, for example, could do better with an airline-specific card. You can avoid some fees, take advantage of benefits like priority boarding, and enjoy valuable travel credits, depending on the card you fancy. We have recommendations for loyal flyers of all the nation’s largest carriers.

Editorial note: Opinions expressed here are Wirecutter’s alone and have not been reviewed, approved, or otherwise endorsed by any third party.

New this week

9 Great Wedding Gifts (That You Won’t Find on the Couple’s Registry) Published June 17

Chase Ink Business Preferred Review: Best Business Card for Travel Published June 17

The Best Bike Panniers Updated June 17

Our Favorite Educational Apps and Learning Games for Kids Updated June 18

The Best Mandoline Updated June 18

The Best Ductless Mini Split Air Conditioner Published June 18

List: Every Dyson Product We’ve Tested, Ranked Published June 19

Companies Are Now Selling Sleep Aids to Treat Adults Like Babies. And It’s Actually Not a Bad Idea. Published June 19

The Best Counter-Depth Refrigerators Published June 19

Buyer Beware: Used Nest Cams Can Let People Spy on You Published June 19

Discover it Miles Review: The Travel Card for People Who Also Like Cash Back Published June 19

The Best Dry Food Storage Containers Updated June 20

9 Muji Items That Are Beautifully Simple Published June 20

The Best Budget Android Phones Updated June 20

The Best Cheap Sunglasses Updated June 21

The Best Budget Subwoofer Updated June 21

The Five Cs of Subwoofer Setup Published June 21

Mentioned above

- After spending three years testing dozens of panniers, we’ve chosen eight that’ll be great for daily duty no matter what you’re toting or where you’re going. The Best Bike Panniers

- We spent 40-plus hours testing more than 50 recommendations from educators, experts, and parents to find the best educational apps and games for kids. Some of the Best Online Learning Games for Kids

- After considering more than 70 models and spending 60 hours in research and testing, we found that the new-model Super Benriner is the best mandoline. The Best Mandoline

- Everything we know about ductless mini-split heating and cooling systems after interviewing installers, manufacturers, and homeowners with systems of their own. The Best Ductless Mini Split Air Conditioner

- After testing 19 food storage container sets over the years, we recommend the Rubbermaid Brilliance Containers and the Rubbermaid Commercial Containers. The Best Dry Food Storage Containers

- You don’t have to pay a lot for a full-featured phone, and Samsung’s Galaxy A15 features a beautiful OLED screen and good performance for under $200. The Best Budget Android Phones

Further reading

How to Shop for the Best Pet Insurance

by Kaitlyn Wells and Mark Smirniotis

Buying pet insurance is an exercise in confusing language and policies—so we’ve put together some advice to help you find the best option for you and your pet.

Making Espresso at Home Is Kind of a Nightmare—But If You Insist, Here’s How to Do It Well

by Brian Lam

Making home espresso is hard to do right. But if you really want café-quality drinks, here’s what you need to know.

When Romance Ruins Your Southwest Companion Pass Master Plan

by Sally French

One woman applied for a credit card just to get the Southwest Companion Pass. But after breaking up with her boyfriend, the pass turned into a huge headache.

How to Become an Adult Lego Master

by Joshua Lyon

Adult Fans of Lego, or AFOLs, are a growing number of enthusiasts who say that playing with Lego isn’t just for kids.

Discover A World of Adventure

Earn vacation reward points while on vacation.

Travel Rewards is a loyalty program for using your favorite travel advisor.

“Double Your Fun” by collect your bank card reward points and, also, collecting Travel Reward “TripCoins”.

TripCoins are awarded for your current vacation purchase. TripCoins may be used to purchased additional amenities or banked in your personal Travel Rewards account for purchasing future vacation/holidays.

Travel Rewards TripCoins are free when purchasing a vacation/cruise from a Travel Rewards associate Travel Advisor or Travel Agency.

Exclusive Member Benefits

- Membership is complimentary for purchasing vacations from a Travel Rewards advisor/associate or a Travel Agency member.

- Usage of Travel Reward TripCoins for current purchased vacation ancillary items, such as additional feature or upgrades.

- Personal TripCoins online account – access your account and use it for calculating your future vacations.

- Special membership card with your favorite Travel Advisor or Agency.

- Special bonus awards from your travel agency.

- Membership specials direct from your travel advisor.

Travel Reward Membership FAQs

You may view your points online at my.travelrewardsinc.com. The Travel Reward Points may be used for preferred vacation packages, cruises, and tours. They also may be used to tailor your vacation such as onboard cruise credits and other amenities. You can redeem points via contacting your Travel Rewards Advisor.

The Travel Rewards accounts expires only if there is no account activity for 36 months.

In other words, your account is indefinite unless there is no purchase or redemption in three years.

Travel Rewards typically send you an alert six months before the 3 year expiration.

The Travel Rewards website has current members points. You may access it by entering your email address and password.

With the Travel Rewards program, points are flexible, unlimited, and easy to earn. Benefits as a Travel Rewards Member of Travel Rewards Inc:

- Access to Travel Rewards site with instant member point access.

- Special sales by the world’s largest cruise lines, travel wholesalers, and top quality resorts.

- Bonus Reward points on selected vacations.

- Special insiders travel expertise on selected independent travel.

- Notifications on special interest and event holidays.

- No charge for currency exchange.

Departure city, extended stays, cabin upgrades, vehicle upgrades, time period of trip, day of departure and return, single occupancy request, additional members to party, and additional features of itinerary (shore excursions, park tickets, tours, transfers, etc.)

Any and all changes to the vacation reward package must be paid for with dollars or previously earned points from the client’s account.

Changes may be required for new bookings. Check with your Travel Rewards Advisor.

Customers may buy companion packages for additional traveler(s) at best pricing available to them. The package can be paid for entirely with Travel Reward Points. Without sufficient number of points, the companion travel must be paid for in a combination of owned points and dollars.

Vacation reward selections come directly from National Travel Service and encompass virtually all major airlines, cruise lines, and tour companies. The preferred travel vendors of American Express are all preferred vendors of National Travel Service/ Travel Rewards since National Travel is an American Express Representative Travel Company.

On resort recommendations which include inclusive resorts, Travel Rewards will only recommend 4 and 5 star resorts. This is part of our Consumer Value Policy.

The Travel Rewards Preferred Client Club is a free rewards program for travelers who book vacation packages, cruises, tours, and group vacation travel through National Travel Inc. and Travel Rewards services.

Any client who has booked these types of travel may enroll by visiting our website at my.travelrewardsinc.com or ask your Travel Advisor to enroll you at the time of booking.

Travel Rewards Points have no cash value. The travel points are 1% of purchase price and may be used in combination with acceptable currency.

Once you make a purchase of a Travel Rewards/National Travel Inc. preferred cruise, tour, or resort vacation, you will be enrolled automatically.

Members must follow the terms and conditions of the cruise or tour operator as to cancellations and refund policies.

- Check with your Travel Rewards Advisor for cancellations and refunds for your purchased vacations.

Change in property and change in itinerary.

Yes, customers may own extra points which may be combined with dollars.

Absolutely, you may receive bank reward points as well as American Express Rewards. You may receive a two for one when purchasing a Travel Rewards Preferred vacation and utilizing your awards credit card.

Do you have an Offer ID?

Vacation Reward Deals - Go further for less

Check out some of our featured destinations and preferred cruise packages to plan your next dream getaway! Earn bonus Travel Rewards on select vacations. New specials posted regularly.

All-Inclusive Crown Paradise Resort Cancun

Summer 2022 Highlights of Peru Tour

4th Person Travels Free!

Winter National Parks by Private Air

2023 Cruising the Greek Isles

Best of Scotland Tour

AutoVenture – Southern Comforts Tour

Monograms Europe Vacation Packages under $1,000 per person

Experience Iceland with Kensington Tours

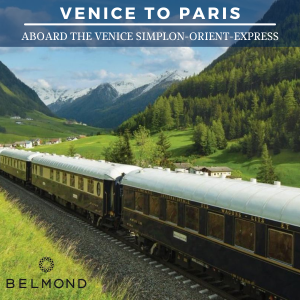

Discover the Romance of the Rails with Belmond

FREE Honeymoon Luxuries with Sandals Resorts

Earn AAdvantage Miles for Marriott Bonvoy Stays

Earn vacation rewards while on vacation, relaxing resorts, luxurious cruises, epic journeys, book today & receive, a tailored experience to make your dream vacation like no other, 24/7 assistance, passport assistance, event, tour, & excursion assistance, featured vendor, american queen steamboat company.

America’s most authentic paddlewheel riverboats move you forward in relaxation and backward in time. Soak up the view as the wonders of the rivers gently slide by. Enjoy the admiration of bystanders who gather to appreciate the beauty of your riverboat’s design. Explore your vessel’s stunning art collection throughout the boat. Share your experience with fellow guests who, like you, have come not only to see, but to experience these magnificent rivers.

- Book Travel

- Credit Cards

The Beginner’s Guide to TD Rewards Credit Cards

TD Rewards is the in-house points currency offered exclusively by TD Bank. The rewards program allows TD Rewards credit card holders to earn TD Rewards Points.

The rewards program is available through three of TD’s personal credit cards: the TD Rewards Visa* Card, the TD Platinum Travel Visa* Card, and the TD First Class Travel® Visa Infinite* Card.

In This Post

What is td rewards, td rewards credit cards, redeeming td rewards points.

TD Rewards is TD Bank’s in-house points currency that’s accessible through three personal credit cards and one business TD Rewards credit card.

Credit cards in the TD Rewards program earn TD Rewards Points, which are a fixed-value points currency that’s exclusive to the bank.

The fact that the currency has fixed value means that the value of the points doesn’t fluctuate, and instead its value is based on the way in which you choose to redeem them (more on this below).

TD Rewards Points can be earned exclusively through credit card welcome bonuses that you can access as a first-time cardholder when you get a TD Rewards credit card, and through spending on the same eligible card.

As you earn a welcome bonus and additional points through day-to-day spending, your TD Rewards account balance will grow.

These accumulated points can be redeemed several ways, with the fixed value of a single TD Rewards Point ranging from 0.25 cents per point to 0.5 cents per point (all figures in CAD).

This means that if you had 100,000 TD Rewards Points in your account, you could redeem these for a value of between $250 and $500, depending on which type of redemption you choose.

The most valuable way to redeem TD Rewards Points is for travel, which we’ll explore in detail below.

TD Rewards Points are a great points currency to collect if you’re someone who wants to be able to redeem points for travel, and especially if you often book your trips through Expedia.

TD Rewards Points are also a great currency to collect in addition to other airline and hotel points, since they’re useful in offsetting other travel costs, such as cruises, independent hotels, and short-term rentals that aren’t covered by brand-specific programs (e.g., Aeroplan, Marriott Bonvoy, WestJet Rewards ).

Since TD Rewards Points are redeemable at a fixed value that’s tied to the cash value of the redemption, they’re not the best choice for aspirational travel like business class or First Class flights; however, they remain a valuable currency for other travel expenses.

As we mentioned above, TD Rewards Points can only be earned through TD Rewards credit cards.

TD currently offers three personal credit cards for this program: the TD First Class Travel® Visa Infinite* Card, the TD Platinum Travel Visa* Card, and the TD Rewards Visa* Card.

To sort out which of the above three is best for you, let’s look at each of the personal credit cards’ features and eligibility requirements.

TD First Class Travel® Visa Infinite* Card

This is the TD Rewards program’s flagship card, offering the strongest earning rates and the best welcome bonus.

The card’s welcome bonus fluctuates depending on the bank’s current offer, often coming in around 100,000 TD Rewards Points and with an all-time high of 135,000 TD Rewards Points.

Given this, it’s ideal to time your application to coincide with an elevated welcome bonus, as this is a one-time opportunity for new cardholders.

The fees and eligibility requirements of this card are as follows:

- Annual fee: $139

- Supplementary cardholders: $50

- Minimum income requirement: $60,000 (personal), $100,000 (household)

- Estimated credit score needed: Good to Excellent

Since this is a premium credit card, you can enjoy elevated earning rates in specific categories, with earning rates as follows:

- Earn 8 TD Rewards Points† per dollar spent on eligible travel booked through Expedia® for TD†

- Earn 6 TD Rewards Points† per dollar spent on eligible grocery and restaurant purchases†

- Earn 4 TD Rewards Points† per dollar spent on eligible recurring bill payments set up on your account†

- Earn 2 TD Rewards Points† per dollar spent on all other eligible purchases†

As an example of the earning power of these rates, let’s imagine that you spend $500 on groceries and restaurants in a month.

Given the earning rate of 6 TD Rewards Points per dollar spent, $500 in spending within this category will earn you 3,000 points. These 3,000 TD Rewards Points can then be redeemed for between $7.50 and $15 in value, depending on the redemption path you choose.

This value is equivalent to a 1.5–3% return on your $500 in purchases ($7.50/$500 = 1.5%, $15/$500 = 3%).

Since TD Rewards Points can be redeemed for a maximum value of 0.5 cents per point, the return on spending you get is 4%, 3%, 2%, or 1%, depending on your purchase.

Plus, as an annual birthday perk, you can earn 10% of the TD Rewards Points earned in the previous 12 months back on your cardholder anniversary,† up to 10,000 TD Rewards Points per year.†

The TD First Class Travel® Visa Infinite* Card also comes with a range of perks and benefits.

For example, cardholders are eligible to earn a $100 TD Travel Credit† on accommodations and vacation packages of at least $500 booked through Expedia® for TD†, and can also enjoy car rental discounts at Avis and Budget to the tune of 10% in Canada and the US, and 5% internationally.†

Additionally, the card often offers a first-year annual fee rebate, and it comes with strong insurance coverage for travel and eligible purchases.

Overall, the TD First Class Travel® Visa Infinite* Card is best suited for individuals who meet the income requirements and who are looking to accumulate TD Rewards Points rapidly with the elevated earning rates.

More in-depth information about the TD First Class Travel® Visa Infinite* Card can be found in our dedicated guide for the card.

- Earn 20,000 TD Rewards Points upon making your first purchase †

- Earn 55 ,000 TD Rewards Points upon spending $5,000 within 180 days of account opening †

- Plus, earn up to 10,000 TD Rewards Points back on your birthday †

- Plus, earn 8x TD Rewards Points † on eligible travel purchases when you book through Expedia ® for TD †

- Get an annual TD Travel Credit † of $100 when you book through Expedia ® for TD †

- Use your rewards for any travel bookings available on Expedia ® for TD †

- Minimum income: $60,000 personal or $100,000 household

- Annual fee: $139, rebated for the first year †

- Application must be approved by September 3, 2024 to receive this offer

TD Platinum Travel Visa* Card

The TD Platinum Travel Visa* Card is the mid-tier card in the TD Rewards lineup, and it offers good earning rates and an enticing welcome bonus.

- Annual fee: $89

- Supplementary cardholders: $35

- Minimum income requirement: N/A

Similarly to the TD First Class Travel® Visa Infinite* Card , the TD Platinum Travel Visa* Card also earns elevated rates in specific categories, just at a slightly lower rate than its premium counterpart.

These earning rates are as follows:

- 6 TD Rewards Points† per dollar spent on eligible Expedia® for TD†

- 4.5 TD Rewards Points† per dollar spent on eligible groceries and dining†

- 3 TD Rewards Points† per dollar spent on eligible recurring bill payments set up on your account†

- 1.5 TD Rewards Points† per dollar spent on all other eligible purchases†

To see these rates in action, let’s again imagine that you spent $500 on groceries and restaurants in a month.

With the 4.5 TD Rewards Points per dollar rate, $500 in spending within this category will earn you 2,250 points. These 2,250 TD Rewards Points can then be redeemed for between $5.60 and $11.25 in value, depending on the redemption path you choose.

This value is equivalent to a 1.12–2.25% return on your $500 in purchases ($5.60/$500 = 1.12%, $11.25/$500 = 2.25%).

In terms of perks and benefits, the TD Platinum Travel Visa* does not provide much, which is expected with a mid-tier card.

Cardholders can often enjoy a first-year annual fee rebate as well as car rental discounts at Avis and Budget to the tune of 10% in Canada and the US, and 5% internationally†. The card also provides some basic insurance coverage.

This card is best suited for individuals who would like to earn TD Rewards Points with elevated earning rates, but who don’t meet the eligibility requirements of the TD First Class Travel® Visa Infinite* Card.

More in-depth information about the TD Platinum Travel Visa* Card can be found in our dedicated guide for the card.

- Earn 15,000 TD Rewards Points upon first purchase †

- Earn 35,000 TD Rewards Points upon spending $1,000 in the first 90 days †

- Plus, earn 6x TD Rewards Points † on eligible travel purchases when you book through Expedia ® for TD †

- Earn 4.5x TD Rewards Points † on eligible grocery and restaurant purchases †

- No minimum income requirement

- Annual fee: $89, rebated in the first year †

TD Rewards Visa* Card

The TD Rewards Visa* Card is the program’s entry-level, no-fee card. It offers the lowest earning rates of the three TD Rewards credit cards, and it typically comes with the opportunity to earn a modest welcome bonus.

- Annual fee: $0

- Supplementary cardholders: $0

- Estimated credit score needed: N/A

As can be expected with any no-fee credit card, the earning rates for the TD Rewards Visa* Card are lower than the other TD Rewards cards; however, there are still elevated rates in specific categories.

The TD Rewards Visa* comes with the following earning rates:

- 4 TD Rewards Points† per dollar spent on eligible Expedia® for TD purchases†

- 3 TD Rewards Points† per dollar spent on eligible groceries and dining purchases†

- 2 TD Rewards Points† per dollar spent on eligible recurring bill payments set up on your account†

- 1 TD Rewards Point† per dollar spent on all other eligible purchases†

To help understand the value of these earning rates, let’s look at the same monthly spend of $500 on groceries and restaurants as above.

Since you earn 3 TD Rewards Points per dollar in the groceries and dining category, $500 of spending within this category will earn you 1,500 points. These 1,500 TD Rewards Points can then be redeemed for between $3.75 and $7.50 in value, depending on the redemption path you choose.

This value is equivalent to a 0.75–1.5% return on your $500 in purchases ($3.75/$500 = 0.75%, $7.50/$500 = 1.5%).

In terms of perks and benefits, the TD Rewards Visa* Card comes with very little.

Cardholders can enjoy car rental discounts at Avis and Budget to the tune of 10% in Canada and the US, and 5% internationally†, and they will have access to some minimal insurance coverage, such as extended warranty, purchase protection, and Mobile Device Insurance.

The TD Rewards Visa* Card is best suited for individuals who are looking for a no-fee way to earn TD Rewards Points.

More in-depth information about the TD Rewards Visa* Card can be found in our dedicated guide for the card.

- Earn 15,152 TD Rewards Points when you spend $500 within 90 days of Account opening+ †

- Plus, earn 4x TD Rewards Points † on eligible travel purchases when you book through Expedia ® for TD †

- Application must be approved by January 6, 2025 to receive this offer

TD Rewards Points can be redeemed for travel, gift cards and merchandise, higher education, statement credits, and on amazon.ca,

We’ll focus on the travel options in the sections below since these are the most valuable options, and given that you’re on our website, they’re likely the options that most intrigue you.

That said, if you’re interested in learning more about the other available options, check out our Essential Guide to TD Rewards, which goes over each alternative in detail.

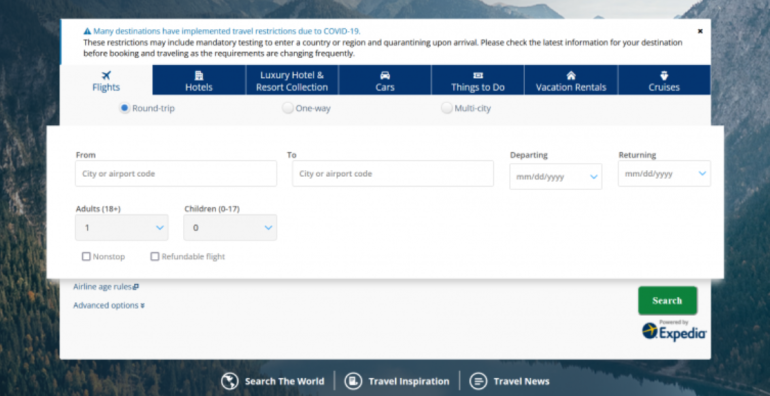

Redeeming TD Rewards Points on Expedia for TD

The most valuable way to redeem TD Rewards Points is by using them through Expedia for TD.

When redeemed this way, each TD Rewards Point is worth 0.5 cents per point, meaning that 100,000 TD Rewards Points can be redeemed for $500 worth of travel.

Expedia for TD is essentially the same as the regular Expedia platform, except it’s linked with your TD Rewards Points account, and you log in with your TD credentials.

To access Expedia for TD, simply sign in to your TD Rewards account, click “Expedia for TD” under the “Redeem” tab, and then click through to the Expedia for TD portal.

You can use Expedia for TD the same way you would use regular Expedia, allowing you to book flights, hotels, car rentals, and other travel purchases.

Notably, through this redemption avenue, you can also redeem your TD Rewards Points for cruises, tours, and Disney tickets.

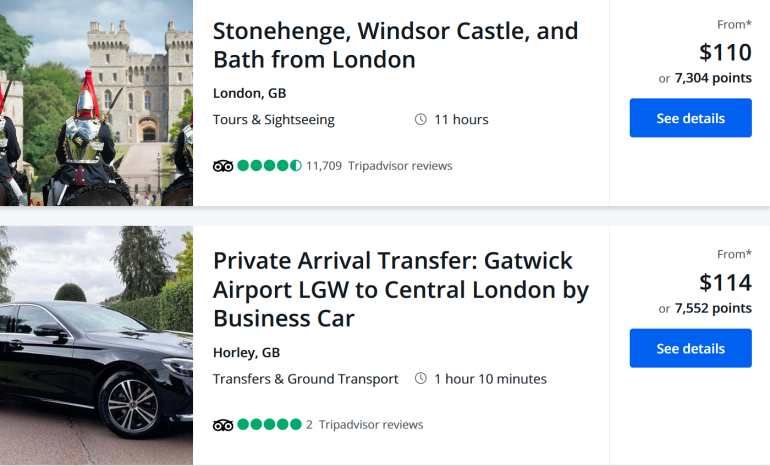

After signing in to Expedia for TD, you can search for your desired hotel, cruise, tour, or whatever else you might like to book.

As an example, let’s say you’d like to redeem your TD Rewards Points for tickets to Universal Orlando Resort.

Once you’ve selected your purchase on Expedia for TD, look for “Use your TD Points” on the check-out page. From there, select the number of points you’d like to redeem and then proceed with your purchase.

The minimum redemption amount is 200 points (equal to $1), and you’re able to make the purchase with a combination of cash and points, allowing you to decide how much of the purchase you’d like offset with your TD Rewards Points.

When redeeming your points through Expedia for TD, you still need to pay the full purchase amount up front. The value from your redeemed points will be credited to your TD Rewards credit card statement after the purchase is completed and within 3–5 business days.

When booking through Expedia for TD, it’s important to remember that you’re booking through a third-party vendor (Expedia) and not directly with the airline, hotel, car rentals, etc.

For hotel bookings, this means that you won’t earn any hotel status benefits or accrue elite qualifying nights. For car rentals, you won’t earn things like Hertz points or free rentals through National Free Days.

However, you will still be able to accrue elite-qualifying points/miles with airlines as long as you attach your associated membership number to your booking at the time of purchase or add it at the check-in counter.

Most importantly, when booking a flight through Expedia for TD, be aware that any and all changes and cancellations must be pursued through Expedia for TD, and can’t be done through the airline.

Redeeming TD Rewards Points with Book Any Way Travel

If you’d rather book travel directly with vendors (e.g., Hyatt, WestJet, VIA Rail) instead of using Expedia for TD, you can still get great value from your points.

When redeemed for purchases made outside of Expedia for TD, each of your TD Rewards Points is worth 0.4 cents. This means that 100,000 TD Rewards Points is worth $400 for travel booked using your TD Rewards credit card.

To redeem your TD Rewards Points through the Book Any Way option, all you need to do is charge the eligible flight, hotel, train ticket, etc. to your TD Rewards credit card.

Once the purchase has posted to your credit card account, you can redeem your TD Rewards Points to offset the cost by using the TD Rewards website or by calling 1-800-983-8472 within 90 days of the purchase date.

To redeem TD Rewards Points online, log in to your TD Rewards account and select “Book Any Way Travel” from the “Redeem” tab.

On the next screen, fill in the information about the transaction against which you’d like to redeem points.

You’ll need to have the purchase transaction date, its description, and the exact dollar amount before proceeding. This information can be found on your credit card account statement.

If you’d like to redeem points for multiple transactions at once, simply click on “add another transaction” and fill in the additional information.

Once you’ve submitted your request for redemption, you can expect to receive the value back as a statement credit within 3–5 business days.

While you won’t get the best value from your TD Rewards Points this way, this option does offer excellent flexibility as TD has one of the most generous definitions of an eligible “travel expense” in the industry.

Using Book Any Way, you can redeem your TD Rewards Points for the vast majority of travel expenses, including campsites, jet-ski rentals, and even theatre tickets as long as they were purchased while travelling.

Keep in mind though that in the cases involving more unique travel expenses, you may need to speak with a customer service representative in order to redeem your points.

If you’d like more details about how you can redeem your TD Rewards Points through other redemption methods, we’ve included more options and additional details in our Essential Guide for TD Rewards.

Alternatively, you can always check out the TD Rewards website to explore the program further.

TD Bank offers three personal TD Rewards credit cards that allow you to earn TD Rewards Points.

These points are a valuable currency that can be redeemed for almost all your travel expenses at a fixed value, making them one of the most flexible fixed-value currencies on offer in Canada.

If you’re looking for a credit card that earns points redeemable for travel expenses and you prioritize flexibility, the TD Rewards travel cards are great options to consider.

Can I have a TD Rewards credit card if I don’t bank with TD?

Yes, you can. To pay your TD Rewards credit card bill without a TD bank account, simply search for TD as a payee within your online banking’s bill payment feature, and then add your TD credit card number as the account number.

Can I book travel for other people with my TD Rewards Points?

Yes, you can make a booking for someone else using your TD Rewards Points. To do so, go through the search and booking process as usual, using your friend/family member’s name and information in lieu of your own.

Do I have to redeem my TD Rewards Points for travel?

No. TD Rewards Points can also be redeemed for merchandise, gift cards, statement credits, higher education, and on amazon.ca.

Can I exchange my TD Rewards Points for cash?

TD Rewards Points can be redeemed for a cash credit towards your TD credit card statement at a rate of 400 points = $1 (CAD).

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Prince of Travel is Canada’s leading resource for using frequent flyer miles, credit card points, and loyalty programs to travel the world at a fraction of the price.

Join our Sunday newsletter below to get weekly updates delivered straight to your inbox.

Have a question? Just ask.

Business Platinum Card from American Express

120,000 MR points

American Express Aeroplan Reserve Card

85,000 Aeroplan points

American Express Platinum Card

100,000 MR points

TD® Aeroplan® Visa Infinite Privilege* Card

Up to 75,000 Aeroplan points†

Latest News

WestJet Expands Partnership with Condor Airlines

News Jun 25, 2024

Upcoming Change to the American Express Cobalt Card’s Earning Rate

Bilt Rent Day Promotion July 2024: Up to 100% Alaska Mileage Plan Transfer Bonus

Deals Jun 25, 2024

Recent Discussion

How my family travelled to hawaii for cheap, is flying in canada getting more expensive, getting us credit cards for canadians, air canada pauses changes to seat selection policy at check-in, anna rozenberg, the best ways to book aer lingus with avios, prince of travel elites.

Points Consulting

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

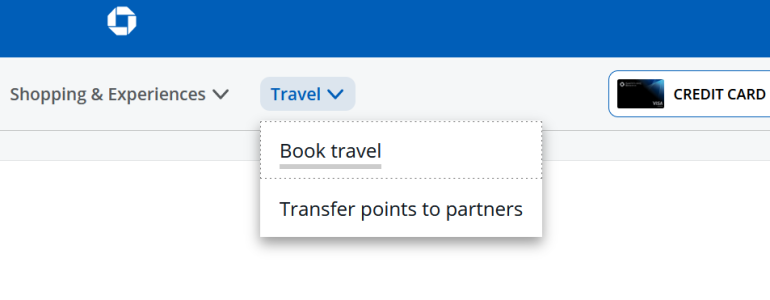

The Guide to Chase’s Travel Portal

Ramsey is a freelance travel journalist covering business travel, loyalty programs and luxury travel. His work has appeared in Travel+Leisure, Condé Nast Traveler, Reader's Digest, AFAR, BBC Worldwide, USA Today, Frommers.com, Fodors.com, Business Traveler, Fortune, Airways, TravelAge West, MSN.com, Bustle.com and AAA magazines. As someone who flies more than 450,000 miles per year and has been to 173 countries, he is well-versed in the intricacies of credit cards and how to maximize the associated perks and services.

Giselle M. Cancio is an editor for the travel rewards team at NerdWallet. She has traveled to over 30 states and 20 countries, redeeming points and miles for almost a decade. She has over eight years of experience in journalism and content development across many topics.

She has juggled many roles in her career: writer, editor, social media manager, producer, on-camera host, videographer and photographer. She has been published in several media outlets and was selected to report from the 2016 Summer Olympics in Rio de Janeiro.

She frequents national parks and is on her way to checking all 30 Major League Baseball parks off her list. When she's not on a plane or planning her next trip, she's crafting, reading, playing board games, watching sports or trying new recipes.

She is based in Miami.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Who can use Chase's travel portal?

How to use chase's travel portal, other things you can do in chase's portal, chase travel contact options, chase's travel portal can be lucrative.

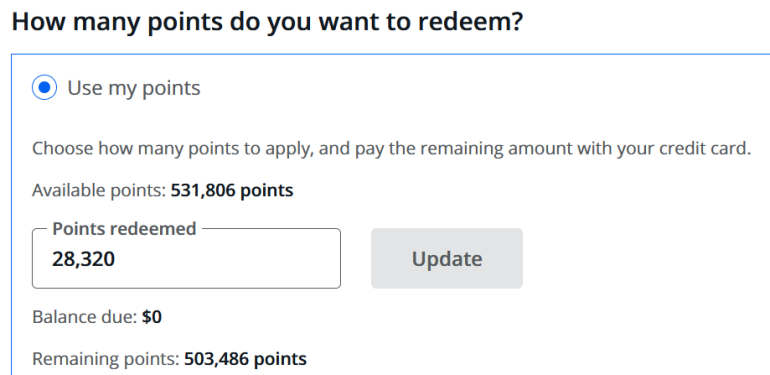

Chase Ultimate Rewards® points are among the most useful rewards you can earn. When it comes time to redeem them, you will be directed to Chase's travel portal. This is where you can book flights, hotels and rental cars with points, redeem them for merchandise and gift cards, or transfer points to other programs.

Should you redeem points to pay for a trip instead of using cash or transfer them to a loyalty program partner to get better value? You'll need to do a little homework to find the right answer as each situation is different.

Chase points are the currency you earn when using cards like Chase Sapphire Preferred® Card or Chase Sapphire Reserve® . They are superior in many ways to other point currencies because you earn more than one penny in value per point with these two cards. For example, when redeeming through Chase's travel portal, the Chase Sapphire Reserve® will net you 1.5 cents in value per point and the Chase Sapphire Preferred® Card will net you 1.25 cents in value per point. When you transfer to a partner, your per-point-value may be even greater.

With the travel portal, you can redeem points to pay for an entire trip or you can use a mix of points and cash to cover a travel booking. You can also pay all in cash, earning 5 to 10 points per $1 spent, depending on the card you have. Using points for travel is the most valuable way to extract value from Chase Ultimate Rewards® for most people.

It's an efficient website, but some irritants snag even savvy travelers. Let's dig into Chase's travel portal's good and bad. You'll find that it is mostly good, if not great.

Chase cards vary in earning and redemption benefits so you will want to pay attention to which one you use, especially if you have more than one card. The most valuable cards earn Ultimate Rewards® points, but some Chase cards, like the United℠ Explorer Card , earn miles or points in that co-branded program (in this example, United MileagePlus miles ).

Let’s review the cards that earn Chase Ultimate Rewards®, with the most rewarding cards first. Keep in mind that if you have more than one of these cards, you can move points between Chase Ultimate Rewards® accounts to redeem them from an account that delivers more cents per point in value.

These cards earn Chase Ultimate Rewards® and provide access to Chase's travel portal:

Chase Sapphire Reserve® .

Chase Sapphire Preferred® Card .

Ink Business Preferred® Credit Card .

Chase Freedom Unlimited® .

Chase Freedom Flex® .

Ink Business Cash® Credit Card .

Ink Business Unlimited® Credit Card .

Chase Freedom Rise Credit Card.

There is an important perk to remember if you have multiple cards. Since the Chase Sapphire Reserve® card offers 1.5 cents in value per point and the Ink Business Preferred® Credit Card and the Chase Sapphire Preferred® Card offer 1.25 cents in value, it is best to redeem points from these accounts rather than any other Chase card.

If you have one of those two premium cards and another Chase card (like Chase Freedom Unlimited® , for example), you can move your Ultimate Rewards® points from the Chase Freedom Unlimited® account to a premium card’s account (like the Chase Sapphire Reserve® card).

This strategy allows you to unlock half a cent more in value in seconds. It’s one of the best benefits of Ultimate Rewards® when you have a premium card and one of its no-fee cards.

Want to earn a bunch of points quickly to make a redemption? The sign-up bonuses on these cards can rake in extra points if you meet the terms and conditions.

on Chase's website

• 5 points per $1 on travel booked through Chase.

• 3 points per $1 on dining (including eligible delivery services and takeout), select streaming services and online grocery purchases (not including Target, Walmart and wholesale clubs).

• 2 points per $1 on other travel.

• 1 point per $1 on other purchases.

Point value in Chase's travel portal: 1.25 cents apiece.

• 10 points per $1 on Chase Dining, hotel stays and car rentals purchased through Chase.

• 5 points per $1 on air travel purchased through Chase.

• 3 points per $1 on other travel and dining not booked with Chase.

Point value in Chase's travel portal: 1.5 cents apiece.

• In the first year, 6.5% cash back on travel purchased through Chase, 4.5% cash back on drugstores and restaurants, and 3% on all other purchases on up to $20,000 in spending.

• After that, 5% cash back on travel purchased through Chase, 3% cash back at drugstores and restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

Point value in Chase's travel portal: 1 cent apiece.

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening.

» Learn more: The best travel credit cards right now

Here’s a primer on what you can and cannot do with Ultimate Rewards® points.

Log in to your account, then navigate to the Chase Ultimate Rewards® tab on the right of the screen. If you have more than one card that earns this currency, you can see each balance and select the account from which you want to redeem points.

Once you select the card, you’ll be taken to a homepage that shows the points you have earned and how you can redeem them. We recommend sticking to travel redemptions rather than using points for merchandise as the value diminishes significantly with the latter.

Select the "Travel" tab at the top of the screen. From here, you can decide whether to transfer points to a partner or redeem them as cash for a trip.

One of the best perks of using this travel portal to make a points redemption is that you still earn frequent flyer miles on most airline tickets since these are booked as a revenue ticket (not as an award redemption like when using airline miles to book a flight).

How to book award flights in Chase's travel portal

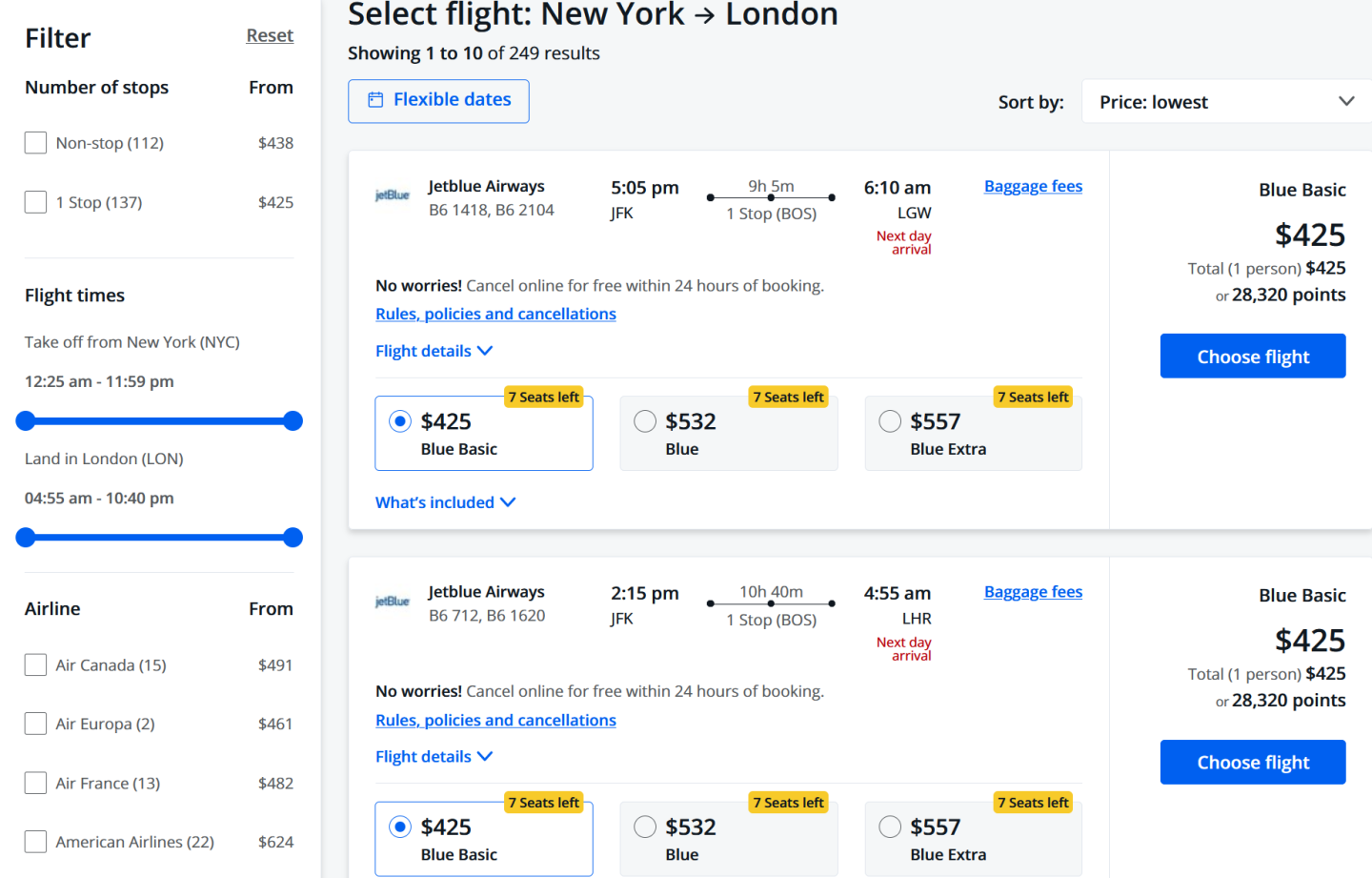

This is one of the more popular features of using points, but keep in mind it doesn't feature all airlines, which can be frustrating. Even if you find a flight on an airline's website or third-party booking site, it doesn't mean it will be available at Chase.

Enter the relevant details in the search bar to find a flight. Results can be filtered by stops, airline or price. Another benefit of this portal is that you aren't subject to award seat availability in the same way you might be when redeeming miles through an airline's program.

If there is a seat that could be bought with cash, you can usually redeem points for it. Plain and simple.

Compare how many miles you would need if booking directly with the airline with what Chase is charging.

If it would cost fewer points to book directly with the airline, you’ll want to use miles instead. For example, Delta co-branded American Express cardholders can often redeem their miles like cash on Delta’s website (at 1 cent per mile’s value). That’s just average, but if it is cheaper than what Chase is charging, consider that the better option. But don’t forget that airlines will add on taxes and fees when redeeming miles . Airfare booked with Chase Ultimate Rewards® points don't have additional costs tacked on — these are already bundled into the fare.

Another important note is that some low-cost airlines like Allegiant don't appear in search results. If you want to travel on a budget airline, then you'll need to visit those websites to compare fares.

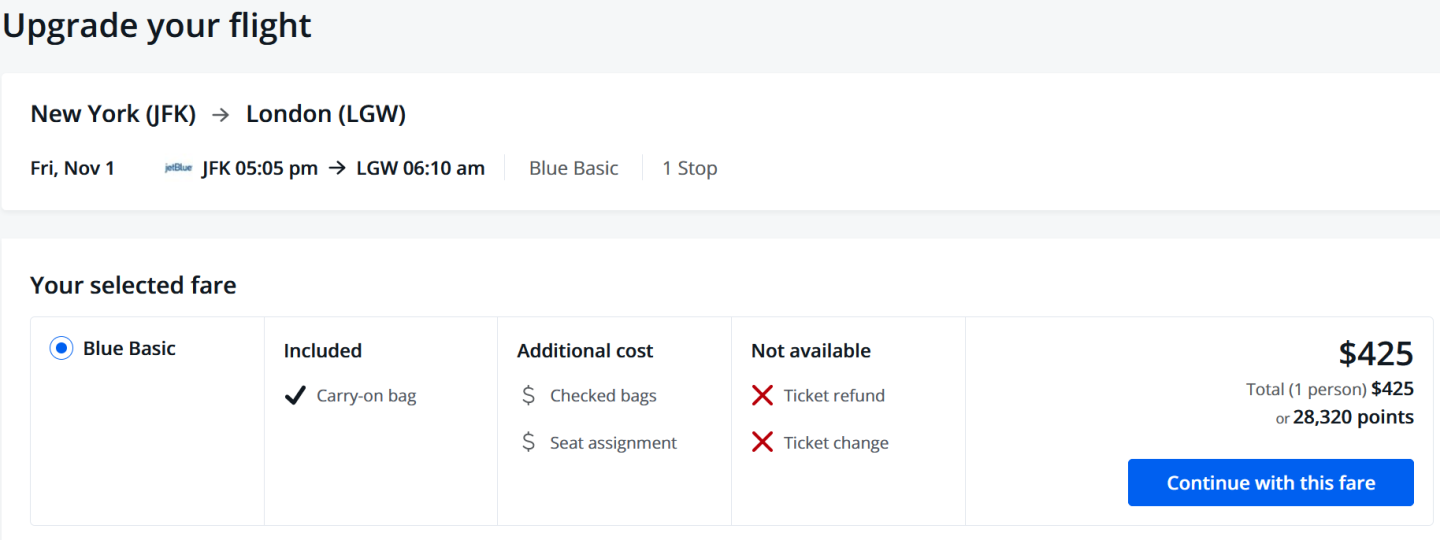

You can pay in cash, points or a combination. Chase will display particular details about your fare, like whether assigned seats or checked bags are included. This may not take into account any elite status perks you hold.

How to book hotels in Chase's travel portal

You can also redeem points for hotel stays using Ultimate Rewards® points. This is great news, especially when staying at hotels where you may not have elite status or don't care about elite perks or points earned.

Keep in mind that when making a reservation outside a hotel’s official reservation channels, you won’t earn points in its program or be able to take advantage of elite status benefits. So if you have status with a hotel chain, this isn't the best value unless you are willing to forgo those benefits.

Making a reservation is straightforward. Enter the city and travel dates to see a list of hotels available for redemption. Then, you can redeem points or pay in cash for your trip.

Like with flights, compare the cost of Chase Ultimate Rewards® points with the number of points a hotel’s program is charging. A particular favorite is World of Hyatt, which still uses an award chart and, as a transfer partner of Chase Ultimate Rewards®, can often deliver more favorable deals when using Hyatt’s points rather than Chase points.

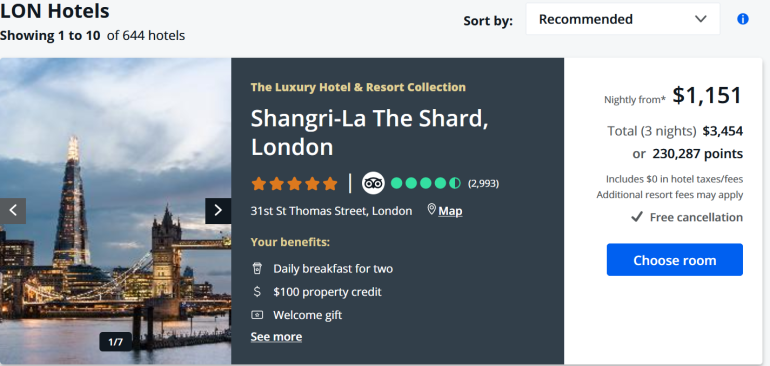

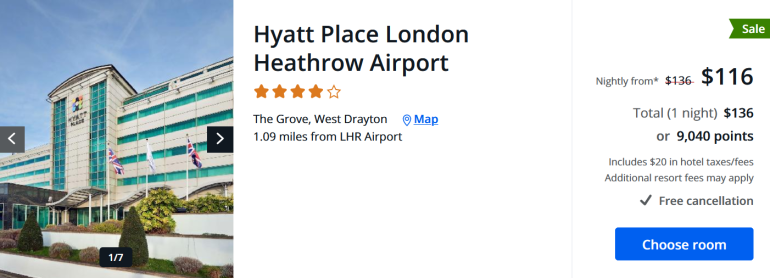

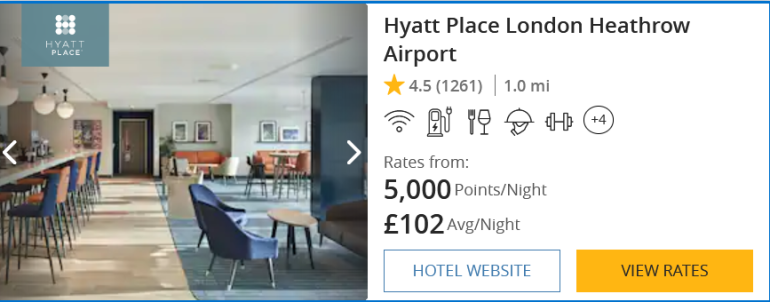

For example, it would cost about 9,000 Chase Ultimate Rewards® points to redeem a night at Hyatt Place London Heathrow Airport. But, if you transfer points to World of Hyatt, you would need 5,000 points for the same night’s stay.

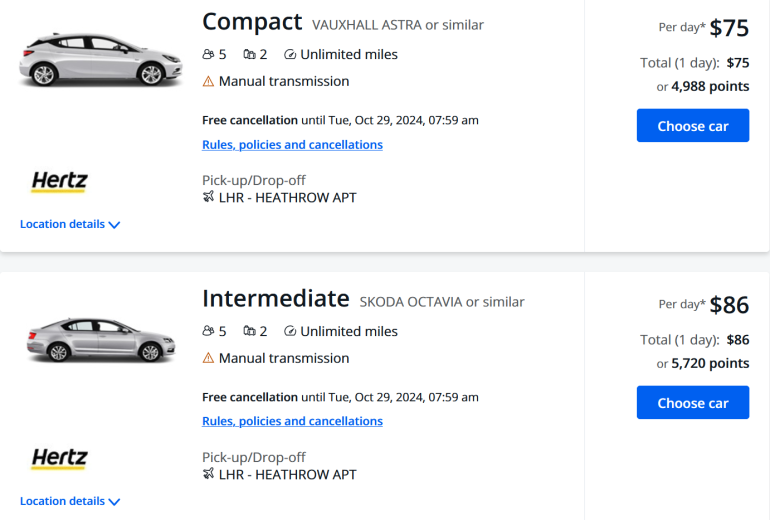

How to book car rentals in Chase's travel portal

This is a great place to reserve rental cars using points, and Chase rental car insurance benefits apply when using the card and paying with points. But, for that to be the case, you will want to pay for part of the rental in cash so the insurance benefits are activated. To do that, pay with a combination of cash and points, and decline the rental company's insurance first.

How to book activities in Chase's travel portal

Activities available for booking through Chase's travel portal include tours and experiences at home or when traveling and airport transfers. Price comparison plays a role here, too, since many hotel brands have their own platforms like Marriott Bonvoy Moments or FIND Experiences from World of Hyatt. These allow you to redeem points for experiences.

Check which program is cheaper before redeeming Chase points if you find similar options in either program.

How to book cruises in Chase's travel portal

Since cruise bookings can be more complex, you will need to call Chase Ultimate Rewards® at 855-234-2542 to make a reservation. There are many ways to earn multiple points when booking a cruise that may be better than using Chase, but when redeeming points for a cruise , there can be a lot of value.

Using Chase's portal to make a travel reservation is also strategic, as depending on your card, you can earn a healthy stash of points this way. Just be sure to compare the benefits you can earn with the opportunity cost of booking elsewhere.

Benefits of booking travel in Chase's portal

Let’s say you have a premium card like Chase Sapphire Reserve® . It earns 5x points per $1 when booking flights through the portal. The sweet spot is when using this card for hotel stays and rental cars booked via the portal for 10x points per dollar spent. Consider what’s in your wallet, and decide which card will net the most points.

Another benefit is that you will earn miles from flights booked through the portal, even when redeeming Chase Ultimate Rewards® points since these are viewed as a revenue ticket.

Remember, you will want to compare if it is cheaper to redeem airline miles directly through a carrier’s redemption program or if you can use fewer points by redeeming Chase points via the portal.

Sometimes it might make more sense to transfer points from Chase to an airline partner when redeeming a flight (or a hotel program when making a hotel stay). Be as vigilant with price comparison when redeeming miles and points as you would when using cash.

Does Chase's travel portal price match?

No. You cannot submit a lower fare elsewhere for a price guarantee here since this isn't a publicly available site. It is only available to those who have a Chase card.

What else you need to know

When booking through this reservation site, keep in mind that most airlines and hotels cannot assist directly with a reservation. They see this as a third-party booking through Expedia and will direct you to Chase's agents.

Many travelers report the experience can be frustrating when travel disruptions or cancellations occur. Agents are friendly but can sometimes be limited in their abilities, often reading prompts on their screens in international call centers.

It can be a hazard booking a reservation with a third party, but the trade-off in redeeming points is worth it for some travelers.

If you do need to contact a Chase portal agent for support on a reservation made through the site — whether for a flight, hotel booking, car rental or activity — you've got one option: a good, old-fashioned telephone call.

Dial 866-331-0773 for assistance regarding changes or cancellations to your bookings.

You might have better luck dialing the support line for your specific Chase card. You might opt to give one of these a try:

Chase Sapphire Reserve® : 855-234-2542.

Chase Sapphire Preferred® Card : 866-331-0773.

All other cards: 866-951-6592.

If you compare prices and consider the opportunity cost of using the portal instead of booking elsewhere, you can almost always come out ahead.

You can save money, earn bonus points and travel better with transferable loyalty points like Chase Ultimate Rewards®. They have the flexibility and versatility necessary to deliver excellent value on travel (rather than being locked into one airline or hotel loyalty program). With the right card (or suite of cards), you’ll be able to accumulate points and benefits.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

1.5%-5% Enjoy 5% cash back on travel purchased through Chase Travel℠, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

Up to $300 Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1%-5% Earn 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate. Earn 5% on Chase travel purchased through Chase Travel®, 3% on dining and drugstores, and 1% on all other purchases.

$200 Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening.

- Suggested Resorts

Current Available Points

- Buzzworthy News Owner Testimonials Pride of Ownership Tour the Club Using My Ownership VIP by Wyndham Presidential Reserve

- Search Resorts Featured Destinations Travel Inspiration Resort News Vacation Planner Explore Destinations

- New Owner Quick Start Dig into Club Life Education Webinars Resources

- Non-Owner Travel Deals Owner Exclusives Club Wyndham Travel Travel Up by Travel + Leisure Owner Travel Deals Partner Offers VIP Exclusives

- Make A Payment Ask and Answer Glossary Contact Us

- Sign In Register

- Skip to Main Content

- Buzzworthy News

- Owner Testimonials

- Pride of Ownership

- Tour the Club

- Using My Ownership

- VIP by Wyndham

- Presidential Reserve

- Search Resorts

- Travel Inspiration

- Resort News

- Vacation Planner

- Explore Destinations

- Dig into Club Life

- Education Webinars

- Non-Owner Travel Deals

- Club Wyndham Travel Travel Up by Travel + Leisure

- Owner Travel Deals

- Partner Offers

- VIP Exclusives

- Make A Payment

- Ask and Answer

- Current Available Points >

CLUB WYNDHAM TRAVEL

Club wyndham owner tours.

Transform your vacations into an adventure with PlusPoints, an opportunity for owners with PlusPartner benefits to use points + cash towards select cruises, tours and activities.

PlusPoints Offers

Call Club Wyndham Travel at 800-732-0203 to book.

Owners with PlusPartner benefits have the opportunity to use a combination of points + cash towards select cruises, tours, and activities. Explore the below PlusPoints offers and give us call when you're ready to book!

Subject to change and availability. Rates are per person based on double occupancy per cabin and include port charges and government taxes. Club Wyndham Travel Booking Benefit is listed per cabin. Flight, gratuities, excursion activities, incidental expenses, and beverages not part of the regular menu are not included. Regular shipboard meals and entertainment are included. Passengers are responsible for all required travel documents, including but not limited to passports or travel visas. Minimum age requirements may apply to purchase. Cruises arranged by Club Wyndham Travel, 6277 Sea Harbor Drive, Orlando, FL 32821.

*Subject to change and availability. All rates are per person based on double occupancy and include port charges and government taxes. Rates marked with a ‘†’ require a combination of credits and cash to book. Airfare, gratuities, excursion activities, incidental expenses, and beverages not part of the regular menu are not included. All regular shipboard meals and entertainment are included. Passengers are responsible for all required travel documents, including but not limited to passports or travel visas. Minimum age requirements may apply to purchase. Cruises arranged by Club Wyndham, 6277 Sea Harbor Drive, Orlando, FL 32821. CSR 2067820-50.

- Pride of Ownership Using My Ownership Owner Testimonials How To Use a Club Wyndham Timeshare Buying a Club Wyndham Timeshare Buzzworthy News

- Explore Resorts Featured Destinations Resort News Traveler's Pledge

- New Owner Quick Start Resources

- Owner Exclusives Partner Offers Wyndham Vacation Packages Wyndham Sweeps

- Publications

- Wyndham Cares

- Terms of Use

- Privacy Notice

- Seller of Travel

- Cookie Settings

- Do Not Sell Or Share My Personal Information - Consumers

- Do Not Sell Or Share My Personal Information - Former Employees (California)

10 Tips for Using the Chase Ultimate Rewards Travel Center

Update: Some offers mentioned below are no longer available. View the current offers here .

Among the numerous benefits of the Chase Sapphire Reserve, one of the least appreciated is the ability to receive 1.5 cents in value per point redeemed at the Ultimate Rewards Travel Center. In fact, this benefit should change how you redeem your Ultimate Rewards points, when you want to earn redeemable miles and elite status credit on flights or when the hotel you want can't be booked through a Chase transfer partner, among other situations .

The problem is that the Ultimate Rewards Travel Center is not exactly the best designed website, but there are many tips and tricks that can help you use it and get more value from your points.

Here are 10 things that you might not know about the Ultimate Rewards Travel Center:

1. Save time by creating traveler profiles.

If you're going to be using the Ultimate Rewards Travel Center regularly, you might as well spend a few minutes creating traveler profiles for yourself and anyone else who you'll be booking travel for.

These profiles contain the basic information needed to book reservations, such as your name, address, birth date and contact information. You can also add your preferred departure airport, your passport information and even special meal requests. There are even fields to add in your frequent flyer numbers and your account numbers for hotel and rental car programs. This can save you lots of time when you book reservations.

2. Earn points and miles from your award bookings.

With your loyalty program information on file, you're free to earn the points and miles from many of your award reservations, the same way you would if you booked directly. You can earn rewards from all of your flights and rental car reservations, although most hotel programs won't offer rewards unless you book directly with them. For example, I often use the Ultimate Rewards Travel Center to book rental cars with National, and by supplying my Emerald number I still receive access to the Executive Aisle due to the elite status I received as a Sapphire Reserve cardholder.

3. Book rental cars one-way.

For several years, you were unable to book a rental car at the Ultimate Rewards Travel Center unless you were dropping it off at the same location you picked it up. But recently, a new field appeared that allows you to specify a different drop-off city or airport. Having more options is always a good thing.

4. Be very careful when booking hotels.

I often book hotels using the Ultimate Rewards Travel Center, especially when my hotel points fail to offer 1.5 cents in value or when I need to stay somewhere that isn't part of one of the hotel programs I have rewards with. But one of the real problems with the Ultimate Rewards Travel Center is that it fails to include taxes and fees in its initial quote, and you'll only see the total price after you click "book" and add it to your card.

What's worse is that even this price may not include "resort fees," "urban destination" fees or any other of the new bogus fees that are rapidly infecting the hospitality industry. This means that the total price you must pay will not be disclosed by the first, or even the last, price you see, and the hotel can hit you up in person for undisclosed fees when you check out. For more information on this problem, see my post on Comparing Hotel Price Transparency Across Booking Sites .

5. You probably won't get points on hotel bookings.

I know that the Chase Ultimate Rewards Travel Center is operated by a company called Connexions Loyalty, but I'm not aware of any connection it has to Expedia and it's group of online travel agencies including Hotels.com, Hotwire.com , Orbitz and Travelocity . What I do know is that on several different occasions hotel staff has told me that they thought my room was booked through Expedia.

Whether or not Expedia has anything to do with Chase or Connexions Loyalty doesn't matter. What you need to know is that the hotels you book through the Chase Ultimate Rewards Travel Center will be treated as third-party travel agency bookings. This means that you're unlikely to receive hotel points from your stay, and you may not even receive some of the benefits of any elite status you hold.

6. You can filter out basic economy fares.

When so-called basic economy fares began proliferating through the travel world, online travel agencies like the Chase Ultimate Rewards Travel Center were slow to inform customers of the numerous restrictions imposed on these fares. Thankfully, the Chase Ultimate Rewards Travel Center now displays basic economy fares somewhat clearly. You even have the option to exclude basic economy fares , but only after you see the initial search results. Unfortunately, I've frequently found this option to be less than functional, returning no results on occasion.

7. The baggage and hotel cancellation policies are as clear as mud.

When you book a ticket directly with an airline, it will tell you exactly what your carry-on and checked baggage allowance is, the cost of purchasing additional bags. But when you book a ticket using the Chase Ultimate Rewards Travel Center, you simply get a link titled "baggage fees." This link takes you to Airlinebaggagecosts.com , which simply offers links to each airline's web page that discusses baggage fees. This multi-step process is no better than Googling it yourself, and it offers no clarity on the baggage allowance that applies to your particular fare and routing.

Likewise, if you want to know what the hotel cancellation rules are, the Chase Travel Center will just reference the hotel's "cancellation window," and it's up to figure out what that is.

8. You can book Southwest and Allegiant flights, but only by calling.

Southwest and Allegiant flights don't ever appear in the online results when searching the Ultimate Rewards Travel Center. But after you perform a search, you'll see this note buried in the disclaimers; "Some airlines don't offer advance seat selection. Southwest and Allegiant tickets can only be purchased by calling us at 1-855-234-2542."

But that's not all — you can also book Norweigian and Gol (a Brazilian low-cost carrier) flights by calling the Ultimate Rewards Travel Center.

9. The call center can be frustrating, but the representatives do a decent job.

There are few things more annoying in travel than having to listen to long, irrelevant messages before reaching a human. You mean I have to know the names and birth dates of the travelers before I can book an airline ticket? I had no idea! And I certainly don't care when I'm calling for help with a hotel or rental car issue. Yet you have to listen to this message each and every time you call.

Thankfully, I've had pretty good experiences with the representatives once I got through to them. For example, one reached out directly to a small hotel in Mexico, and got them to waive the cancellation fee after I became sick and couldn't travel.

10. Don't forget "activities."

When you book something online at the Ultimate Rewards Travel Center, you have four options: flights, hotels, car rentals and something called "activities." This last one can be a great opportunity to redeem your Ultimate Rewards points rather than spend cash on tours and attractions on your next trip.

Transferring Credit Card Rewards to a Travel Partner? Do This First

E arning rewards when swiping your credit card is an excellent strategy. With a travel credit card, you can redeem your rewards for travel purchases, making an upcoming vacation cheaper.

If you have a travel rewards credit card that allows you to transfer your rewards to travel partners, there are two steps you should take before transferring them. Here's what you should know.

Featured offer: save money while you pay off debt with one of these top-rated balance transfer credit cards

Some cards allow you to transfer your rewards to travel partners

Some travel credit cards give cardholders multiple ways to redeem the rewards they earn. One redemption option may be to transfer your points or miles to select airline or hotel partners.

Transferring your rewards could be an excellent way to get more value. You can transfer your rewards and book flights or hotel stays. This redemption choice may provide better value, allowing you to stretch your rewards further and save more on travel costs.

But before you rush to transfer your rewards to an eligible travel partner, ensure availability for your award flight or hotel stay booking. You should also research all costs to know what to expect before you finalize your redemption. Here are the steps I suggest you take.

Step one: Search for availability

Whether you're hoping to use your rewards for a flight or hotel stay, you'll want to research availability first. Search for your desired flight or hotel with your preferred dates to see if bookings are available. You can log in to the travel partner's website to do this.

Why is this an important step to take? Once you transfer your rewards to a travel partner, you can't transfer them back to your credit card's issuer's rewards program. The last thing you want to do is find out there is no availability and be forced to use your rewards with one partner.

As a heads up, many travelers book award flights six to 12 months before their trip. If you're looking for last-minute availability, you may need to adjust your trip plans.

Step two: Review all prices

The next step is to review all costs associated with your intended booking. Most credit card reward hotel bookings don't charge additional taxes and fees. However, if you're making a redemption with points and cash, you may be charged additional taxes and fees.

If you use your rewards to book an award flight, expect to pay taxes and fees. Costs start at $5.60 per one-way flight for flights flying out of the United States. But these expenses can vary significantly depending on the carrier and the airport you're flying in and out of for your flights.

These fees can easily cost hundreds of dollars in addition to the points or miles required to book your award flight. Researching the total cost before you transfer your rewards is wise. This way, you don't end up with a big surprise when you get to the checkout screen.

Strategize before using your credit card rewards

It pays to strategize the best way to use your credit card rewards. As you earn rewards, review your available redemption choices to see if there's an option that offers more value. You worked hard to earn your rewards, so finding a way to stretch them is beneficial. If you're looking for a credit card that earns travel rewards, check out our list of the best travel credit cards .

Alert: highest cash back card we've seen now has 0% intro APR until 2025

This credit card is not just good – it's so exceptional that our experts use it personally. It features a 0% intro APR for 15 months, a cash back rate of up to 5%, and all somehow for no annual fee!

Click here to read our full review for free and apply in just 2 minutes.

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. Natasha Gabrielle has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy .

Advertiser Disclosure