- Search Please fill out this field.

- Manage Your Subscription

- Give a Gift Subscription

- Newsletters

- Sweepstakes

- Travel Tips

16 Airlines That Let You Book Flights Now and Pay Later

Planning a trip but don't want to pay for it all at once? These sites offer book-now, pay-later flights.

Orbon Alija/Getty Images

If you think a vacation is out of your reach, think again. Some airlines and online travel agencies have services that allow you to book a trip now and pay for it over time.

Affirm, PayPal, Uplift, and Klarna are among the book-now, pay-later services travel companies and airlines offer. Here, we break down the basics of these and airlines' own "BNPL" options so you can secure flights when the prices are lowest, even if you don't want to pay for them in full upfront.

Airlines Offering Book-now, Pay-later Flights

AeroMexico connects major U.S. cities to Latin American destinations like Guadalajara and Puerto Vallarta. The airline partners with Uplift to provide a monthly payment option. When you go to book a flight, you'll see an option to pay in monthly installments. Click through and you'll be asked for any personal information Uplift needs to process the loan.

You can also pay in installments through Klarna. Download the Klarna extension for Chrome or the app and you should see a pink "K" icon that will show you financing options. AeroMexico takes PayPal, which means you can use PayPal Credit to split up payments if you're approved.

Pay monthly for Air Canada flights and Air Canada Vacations packages with Uplift or PayPal Credit.

Alaska Airlines

Alaska Airlines partners with Uplift and Klarna to offer financing for flights.

Allegiant also uses Uplift and Klarna to provide payment plans. Select the Allegiant Pay option at checkout to choose financing through Uplift.

American Airlines

American Airlines offers several ways to buy now and pay later, including Klarna; PayPal Credit; Citi Flex Pay for select Citi cardholders; and Affirm, which has biweekly, monthly, and interest-free options but doesn't cover the cost of any flight extras, like luggage. American Airlines Vacations also gives you the option to pay monthly with Uplift.

Azul Airlines is a low-cost Brazilian airline that accepts payments through Uplift and PayPal.

Delta Air Lines

Delta offers PayPal Credit as a payment option, and you can pay using Affirm if you book your trip through Delta Vacations, a service for SkyMiles members that bundles flights, hotels, transportation, and activities.

One of the United Arab Emirates' two flag carriers, this airline partners with financing institutions Uplift and Klarna. You can also pay with PayPal Credit.

Frontier Airlines

Budget carrier Frontier Airlines lets you pay monthly installments through Uplift on purchases of $49 or more. If eligible, you will see the option at checkout. Frontier is also a Klarna retail partner.

KLM offers customers the option of holding a fare for 72 hours for a non-refundable fee. This is great if you find a fare that you want to book but need a few days to think about it. In addition, the airline takes PayPal Credit. This service is shown on the payment page as a "Bill Me Later" option, but directs you to your PayPal wallet.

Lufthansa has a list of payment methods on its website. Some monthly payment options are available specifically for residents of Brazil and Colombia. U.S. residents may pay monthly through PayPal Credit.

Porter Airlines

Porter , a Canadian airline, allows customers to use Uplift and PayPal to purchase flights across the U.S. and Canada.

Qatar Airways

Unless you're flying from Brazil, Brunei, or Kazakhstan, you can hold any Qatar Airways booking for up to 72 hours. How long prospective travelers can hold their Qatar flights depends on where they intend to fly to and from. The "Hold My Booking" option, available on the payment page, requires a non-refundable fee that doesn't go toward the price of your ticket. In most cases, you can also use PayPal Credit.

Southwest Airlines uses Uplift to break the cost of the flight up into fixed monthly payments. It also accepts PayPal Credit and Klarna.

Sunwing connects Canadian cities with destinations in Mexico and the Caribbean. You can pay for plane tickets in monthly installments through Uplift.

United Airlines

Use Uplift, PayPal Credit, or Klarna to pay for United Airlines flights in monthly installments. The company also has a program called FareLock that allows you to pay a fee to hold a fare for three, seven, or 14 days before paying for it in full. If you decide not to buy the ticket, you forfeit the fee. This service is offered only on itineraries wholly operated by United Airlines and/or United Express.

Online Travel Agencies Offering Monthly Payment Options

Alternative airlines.

Any ticket booked through Alternative Airlines can be paid for in weekly, biweekly, or monthly installments with Uplift. The online travel agency markets itineraries by more than 600 airlines, and Uplift financing can be used for all of them. You can also split payments through Klarna.

CheapOair.com

CheapOair uses Affirm to offer customers a monthly payment option.

Funjet Vacations

Funjet Vacations uses Uplift to offer monthly payments for its flights and vacation packages.

Priceline uses Affirm to handle monthly payments. Select the "monthly payments" option on the secure billing step of the booking process and choose from three-, six-, or 12-month options. Alternatively, break it up into four payments over six weeks using Klarna.

How Buy-now, Pay-later Services Work

Airlines and travel agencies partner with BNPL services like the travel-specific Uplift or the more broadly available Affirm to offer monthly payment options. Some take payments through PayPal Credit and/or Klarna. Learn about the differences between these services and how they work.

Affirm allows customers to pay monthly or every two weeks. Terms can last up to 48 months for the largest loans, but more typically, they last up to a year. Interest rates vary by person, ranging from 0% to 36% APR, and are determined at the time of sign-up. A down payment and credit check might be required when you apply for a loan.

To use Affirm, you will need a phone number to use as an account login. The service is available only in the U.S. and Canada. Once you've created your account and gotten approved for a loan amount, you can set up auto-pay or pay each month via the app or website. You can find a full list of Affirm's travel partners, including airlines and accommodations, on its website.

PayPal Credit

This is a monthly payment option provided by travel companies that take PayPal. Typically, you'll choose PayPal as your payment method, and once you sign into your PayPal account, you can choose PayPal Credit. As of 2023, the variable purchase APR is about 28% for new accounts, but you can avoid paying interest altogether if you pay the loan off within six months. Loan applications are subject to credit approval.

Uplift is the leading pay-over-time financing service in the travel space, partnering with cruise lines, hotel chains, airlines, and more. Once you have selected a product, like your flight, you are shown a per-month rate based on the price of the items in your shopping cart. When you get to the payment page and choose monthly payment as your option, you will be asked for some personal details, and once you click "check rate," you will be told whether you've been approved. Uplift offers an APR of 0% to 36% based on your credit. You won't be penalized for paying late or early, and you can set up autopay so the money comes out of your account automatically.

Klarna breaks up the price of your ticket into monthly payments or four equal payments to be made two weeks apart. Add the Klarna extension to your Chrome browser or download the app on your phone, then book your flight as usual, selecting Klarna at checkout. The first payment will be due upfront. Klarna offers an APR of 0% to about 30%.

Related Articles

Expedia Rewards is now One Key™

Vacation payment plans - book now, pay later.

- Things to do

I only need accommodations for part of my trip

Better together

Save up to $580 when you book a flight and hotel together*

Find the right fit

With over 300,000 hotels worldwide, it's easy to create a perfect package

Plan, book, and manage your trip all in one place

Vacation payment plans

Jet off on your dream 2024 getaway with vacation payment plans by Expedia Affirm. From relaxing beach escapes to European city breaks, your next adventure is more affordable than you think thanks to Expedia’s book now, pay later vacations. Instead of paying the entire trip cost up front, pay-later travel deal lets you make monthly payments towards your adventure whether it’s in 2024 or 2025. Expedia Affirm gives you the option to spread the cost over 3, 6, or 12 months, with no hidden fees. This means you can bag the best travel deals with monthly vacation payment plans.

Wondering where to take your kids for a summer break in the sun? Choose from a vast array of family vacation packages with payment plans. Your kids could soon be swimming with dolphins in Cancun or riding rollercoasters in Florida’s theme parks. If it’s a romantic retreat you’re seeking, whisk your partner away to an adults-only resort by the beach. You’ll encounter a plethora of all-inclusive vacations with payment plans to hot destinations, including the Caribbean and the Maldives. Play around with the easy-to-use search wizard to view a wide range of book now, pay later vacations. Simply select “Monthly payments” at checkout to book your pay-later travel deal.

Worried your 2024 plans may change? No problem. Expedia Affirm lets you cancel or modify your booking at no extra cost. You’ll encounter epic vacation payment plans with flexible booking conditions for a vast array of accommodation, car rental, and travel packages. Read on for ideas and inspiration, with everything from romantic weekend getaways to all-inclusive vacations with payment plans.

Book now, pay later vacations

1. choose your dream expedia vacation.

Take your pick from hundreds of book now, pay later vacation packages. Need inspiration for 2024? Scroll down and you’ll encounter plenty of ideas for relaxing vacations with payment plans, including short getaways and international adventures. If you’ve got somewhere in mind, tap your dates and destination into the search wizard to compare the best pay-later travel deals.

2. Select the plan that works for you

Ready to snatch up one of Expedia’s book now, pay later vacations? Then click “Monthly payments” at checkout, “Continue to Affirm”, and enter a few pieces of information. It’ll give you an instant, real-time decision and display the vacation payment plans available. Pick the one that suits you best and you’re all set – your dream escape is booked.

3. Make simple and easy payments

Once you’ve reserved one of Expedia’s book now, pay later vacation packages, create your account to set up monthly payments. You can do so through the Affirm website or by downloading the app. Whichever option you choose, you can set up automatic payments in a few quick and easy steps.

Why book now, pay later with Expedia?

Whether it’s catching a tan in the Caribbean or soaking up the culture in Europe, you can now jet off on the adventure you’ve been dreaming of for years. With a vast array of destinations and vacation types available, Expedia Affirm makes travel more affordable than ever. Here are just some of the benefits of booking Expedia’s buy now, pay later vacations.

waiting until pay day to score the best discounts.

Frequently asked questions about payment plans to book now, pay later on Expedia

Can i pay monthly for my vacation with expedia.

Yes, you can pay monthly for your vacation with Expedia Affirm vacation payment plans. Simply choose your dream travel package and select “Monthly payments” at checkout. You’ll have the option to spread the cost over 3, 6, or 12 months, giving you financial flexibility when planning your dream getaway. These pay-later travel deals include all-inclusive escapes, family breaks, weekend getaways, and more. Thanks to Expedia’s vacation payment plans, you can now jet off on the adventure you’ve been dreaming of for years.

How to use Affirm on Expedia and where can I find this payment option?

To take advantage of Affirm’s vacation payment plans, choose your travel package and select “Monthly payments” at checkout. Click “Continue to Affirm”, enter your details, and you’ll get an instant, real-time decision. It’ll then display the final cost for spreading the cost over 3, 6, or 12 months. Choose the plan that’s right for you and you’re all set. You can then log in to Affirm or download the app to set up automatic payments.

How do I use Afterpay on Expedia?

Affirm is Expedia’s trusted partner for pay-later travel. Book with Expedia Affirm to spread the cost over 3, 6, or 12 monthly payments with simple interest and no hidden fees. You can even set up automatic payments on Affirm’s website or through the app. Expedia’s vacation payment plans are available on a vast array of packages, accommodation, and car rentals.

Is there a credit check when paying with a payment plan?

Yes, there is a credit check to see if you qualify for Expedia Affirm’s vacation payment plans. The good news is this pre-check will have no impact on your credit score. It’s quick and easy to perform, and you’ll get a real-time decision instantly. All you need to do is enter a few brief details to do the check.

Can I book all-inclusive vacations with payment plans?

With Expedia Affirm, you can book a vast array of all-inclusive vacations with payment plans. Choose to split the total cost of your escape into 3, 6, or 12 monthly installments. If you’re open to ideas and need inspiration, check out Expedia’s all-inclusive vacation packages to view some of the most popular deals. If you know where you’d like to jet off to, tap your dates and destination into the search wizard. Select the “All-inclusive” filter under “Meal plans available” to view hundreds of the best vacations with payment installments. Whether you’re craving white-sand beaches in the Bahamas or the tropical shores of Hawaii, your next getaway is more affordable than you think.

Can I book family vacation packages with payment plans?

You can book a wide range of family vacation packages with payment plans thanks to Expedia Affirm. Once you’ve found your perfect 2024 escape, click the “Monthly payment” tab at checkout and follow the quick and easy steps. You’ll have the option to pay in 3, 6, or 12 monthly installments with simple interest and no hidden fees. Take a peek at Expedia’s family vacations for ideas and inspiration. If you’ve got somewhere in mind already, enter your dates and destination into the search wizard to view hundreds of the best pay-later travel deals. From Florida’s exhilarating theme parks to the Dominican Republic’s fun-filled kid-friendly resorts, your family adventure is just a few clicks away.

What are the benefits of vacation payment plans?

Expedia’s book now, pay later vacations mean you can jet off on the dream trip you wouldn’t otherwise be able to afford in 2024. From romantic sunsets on Jamaica’s beaches to the elegant streets of Paris, the world is more accessible with Expedia Affirm. You’ll have the option to pay in 3, 6, or 12 monthly installments, and you’ll see the total cost up front. There are no hidden fees or late payment fees either, so you can rest assured that what you see is what you pay. Automatic payments are easy to set up and make for a hassle-free booking. Many of Expedia’s vacation packages even allow you to modify or cancel your trip at no extra cost, giving you peace of mind in case your 2024 plans change. As you no longer have to pay up front, you can nab the best travel deals before they’re gone – no need to save up or wait until payday.

How can I find great deals on vacation packages with payment plans?

If you’re keen to score the best deals on book now, pay later vacations in 2024, it’s a good idea to be flexible with your dates. You may find cheaper vacations on different days. For travel during peak season dates, be sure to book early to nab the best prices and your first choice of hotels – accommodation can fill up during busier months. If you plan to get away in low season, you may score a great deal for a last-minute escape. Another way to score great travel discounts is to take advantage of special offers, discounts, and promotions.

Are there any additional fees or interest charges for pay monthly vacations?

You’ll be pleased to know there are no hidden fees with Expedia Affirm’s monthly payment vacation plans. What you see is what you’ll pay. Before you confirm, you’ll be able to view the total cost of your book now, pay later vacation package. While most credit cards charge compound interest that’s complicated to work out, with Affirm you’ll pay simple interest on your monthly installments. Best of all, there are no late payment fees or just-because fees. Expedia Affirm’s simple and transparent pricing make booking your dream 2024 escape a breeze.

Save with our bundle deals!

Car, Stay, Flight... book everything you need for your perfect weekend getaway with Expedia and save!

Vacation rental

Apartments, Villas, Cabins... we have everything you need!

Car Rentals

Hit the road with one of our car rental deals

All Inclusive Vacations

Beach Vacations

Kid Friendly Vacations

Golf Vacations

Luxury Vacations

Romantic Vacations

Ski Vacations

Adventure Vacations

Honeymoon Vacations

Mountain Vacations

Fishing Vacations

Adults Only Vacations

Waterpark Vacations

Scuba Diving Vacations

Yoga Vacations

Cheap Vacations

- More Vacation Ideas

- Getaway Ideas

- Vacation Deals & Tips

- Top Vacation Destinations

- Best Travel Destinations by Month

- New Year's vacation deals

- Christmas vacation deals

- Spring travel deals

- Spring break vacation deals

- National Park Vacation Deals

- Northern Lights Vacations

- Memorial Day Weekend Getaways

- Fourth of July Weekend Getaways

- Labor Day Weekend Getaways

- MLK Day Weekend Getaways

- Thanksgiving Getaways

- Weekend Getaways

- 1 Day Getaways

- 2 Day Getaways

- 3 Day Getaways

- 4 Day Getaways

- 5 Day Getaways

- 6 Day Getaways

- One Week Getaways

- 8 Day Getaways

- Las Vegas Getaway

- Vacation Rental Deals

- Vacations under $1000

- Vacations under $500

- Last Minute Vacation Deals

- Last Minute Hotel Deals

- Travel Deals + Vacation Ideas

- Plan a vacation

- Deposit and Vacation Payment Plans

- London Vacations

- Paris Vacations

- Cabo San Lucas Vacations

- Playa Del Carmen Vacations

- New York Vacations

- New Orleans Vacations

- Punta Cana Vacations

- Montego Bay Vacations

- Puerto Vallarta Vacations

- Honolulu Vacations

- Orlando Vacations

- Miami Vacations

- Cancun Vacations

- Los Angeles Vacations

- Fort Lauderdale Vacations

- January Vacations

- February Vacations

- March Vacations

- April Vacations

- May Vacations

- June Vacations

- July Vacations

- August Vacations

- September Vacations

- October Vacations

- November Vacations

- December Vacations

Jan. 11, 2023 Posted in Italy , Working Holiday , Australia , France , Japan , New Zealand , Spain , United Kingdom Share Post

Where to Travel and Work Abroad in 2023

Have you ever dreamed of taking a year off to travel and work abroad? If so, a working holiday program might be just what you’re looking for – and 2023 is the year to go for it.

These programs allow Canadians (like you!) to work and travel in participating countries for an extended period of time, giving you the opportunity to experience new cultures, learn new skills, and make some money while you’re at it. If you need any more convincing, we’ve rounded up the best countries to work and travel abroad in 2023.

The Lowdown on Working Holiday Visas

Wondering what a working holiday program is? Basically, Canada has an agreement with over 30 countries allowing Canadian youth to travel to a participating country and work while they and there to supplement their travels. Each country has its own requirements, such as age bracket and funds, but we’ll cover that in more detail below.

So, now that you know the intel, discover the top 7 places to travel and work abroad in 2023:

#1 The United Kingdom

With the UK Youth Mobility Visa, Canadians can travel and work across England, Scotland, Ireland and Wales in search of what is truly great in the UK: creative cities, charming countryside and cozy pubs; historical landmarks and a thriving arts, music, beer and culinary scene – whatever floats your boat, the UK has it. Plus, the UK Youth Mobility Visa allows you to work in most jobs (with the exception of being a professional sportsman), making it one of the most flexible visas out there. Ergo, you can gain work experience and build your career while experiencing the best of British culture.

Work visa age: 18 – 30 Work visa duration: two years

To see the full working holiday visa requirements, check out our UK Working Holiday Program page.

There is so much to see and do in Japan in 2023, we’ve written a dedicated blog post on why you need to travel to Japan on a working holiday in 2023 . From truly unique culture to rich history, breathtaking landscapes, futuristic cities and iconic food, Japan is a great destination for those who want to experience something different.

Work visa age: 18 – 30 Work visa duration: one year

To see the full working holiday visa requirements, check out our Japan Working Holiday Program page.

A working holiday in Spain will give you ample time to uncover this country’s culture, history and, of course, sunny beaches. Not only that, but it can also be a great opportunity to learn Spanish or improve your existing language skills – all best practiced over tapas and sangria, naturally. Plus, Spain has some of the best festivals in Europe, including our personal favourites: Sónar Barcelona and La Tomatine Festival.

Work visa age: 18 – 35 Work visa duration: one year

To see the full working holiday visa requirements, check out our Spain Working Holiday Program page.

#4 Australia

Home to some of the best beaches in the world, surfing, the Great Barrier Reef, rainforests and deserts; unique wildlife, festivals, Sydney and Melbourne… life in Australia is top-notch. There’s still time to swap Canada’s brutal winter for life under the Aussie sun, check out our Australia Working Holiday Program page to find out how.

Work visa age: 18 – 35 Work visa duration: one to three years

France is a great destination for those who love art, food, and culture. And quite frankly, who doesn’t? Spend a year perfecting your French surrounded by the stunning architecture of Paris, in the beautiful countryside of the Loire Valley, on the glamorous beaches of St, Tropez… you get the gist.

Want to travel and work abroad in France? Check out our blog on How To Apply for the France Working Holiday Visa .

Aside from being the birthplace of pizza and pasta, there are so many other reasons to travel and work in Italy in 2023. From Renaissance towns and dramatic peaks to the Italian Riviera and postcard-perfect road trips, it’s hard to beat Italian living. And we haven’t even touched upon the history, the art, the people and the culture…

Wondering how to get a working holiday visa for Italy? Check out our blog on How To Apply for the Italian Working Holiday Visa . Bellissimo.

#7 New Zealand

The home of Middle earth, New Zealand lives up to Tolkien’s imagination. Spend a year uncovering unspoiled natural wonders, experience Maori culture first-hand and take your pick of extreme sports (think: bungee jumping, sky diving, rafting and mountain biking). If you need any more reason to go, New Zealand is also set to host the FIFA Women’s World Cup 2023 in July. Plans sorted.

To see the full working holiday visa requirements, check out our New Zealand Working Holiday Program page.

Stepabroad’s Travel and Work Abroad Programs

Whether you want to experience the charm of Europe, the unique culture of Japan, the beauty of Spain, the art and culture of France, or the natural beauty of New Zealand, our working holiday programs will set you up for success. From guiding you through your visa application to providing personalized job support, here are just a few of the perks of using our programs:

- Personal trip coordinator

- Step-by-step visa application guidance

- Resume revisions and job support

- Pre-departure support

- In-country orientation

- Support throughout your time abroad

All you have to do is decide where you want to go.

Ready to travel and work abroad?

Get in touch to learn more about our working holiday programs and start planning your epic adventure abroad.

" * " indicates required fields

Previous Article Next Article

Browse Categories

- City Guides

- Working Holiday

- Working Abroad

- New Zealand

- South Korea

- United Kingdom

Let’s Travel Together

“Stepabroad has been nothing short of amazing! We would not be in Spain right now without them, and we are forever grateful for the incredible experience working with them. THANK YOU!”

“They helped me get my resume out to Japanese companies they are partnered with and I was able to get interviews and a job from there! If you’re looking into working abroad, definitely get in contact.”

“Stepabroad was paramount in making my transition from Canada-Australia smooth and efficient! I would recommend the company to anyone looking for travel guidance, and I will be using the company again.”

“I mean Robyn is great. Always very quick to respond and even after I got to England and still had questions, she helped me out. Also emailed me to make sure I was okay as well which warmed my heart.”

“The support and help I received all throughout the months leading to departure were indispensable! I’m very glad to have chosen to travel with Stepabroad for my Working Holiday in New Zealand. Thanks!”

“Yeosong has been very friendly and helpful. The ease of mind of knowing someone is there to answer your questions is worth the price alone.”

Become A StepMember

Join the club.

Become a StepMember for Rewards & Discounts , access to exclusive promos and top travel tips!

Unsubscribe from this group at any time.

- Go to content

- Go to search

- SOGECASHNET

Travel Now, Pay Later

Spread your wings, jet off and see the world. now you can travel with no wahala.

Spread your wings and explore the world, thanks to the Societe Generale Ghana "Travel now, pay later" offer. Soceite Generale Ghana in collaboration with Adansi Travels, is giving you the opportunity to go to dream locations around the world without being restricted by a lack of immediate funds.

Bali, Singapore, Seychelles, Dubai, Kigali, Maldives... the world is your oyster. Simply decide where you want to go, get an invoice from Adansi Travels, share with SG Ghana and start getting ready to set off.

THE PROCESS IS SIMPLE, JUST:

Visit Adansi Travels, explore the destination packages on offer and select where you would like to go. Once the selection is made, you must: • Fill out an application form • Produce all necessary documents requested by Adansi and SGGH (document list will be provided by Adansi and SGGH) • Get a proforma invoice from Adansi and submit to SGGH • You must contribute 50% of the total cost of the package and spread the rest of the cost over 6 months. • SGGH will provide 50% of the cost of the total package as a loan • When the loan is approved, the funds will be disbursed for the sole purpose of paying for the trip • Lien is placed on the equity and loan • Adansi will then provide travel packages/tickets to you • You go on trip

FOR CAGD WORKERS

The option laid out above holds. However, you may choose another option which involves the same process, except that: • You can choose to pay nothing as contribution • You may go on the trip and spread the cost over 3 years.

Find out more about the Travel Now, Pay Later offer, simply visit any branch or call the Contact Centre on +233 (0) 302-214 314. Ts & Cs apply

Enjoy interest free loan to travel now and pay later

Zero Interest

Ease of Payment

Financial Freedom

The Travel Now Pay Later is an innovative financing package by Adansi Travels in partnership with Société General Ghana, Dukab and Carbon Zero that enables staff of SG Bank, salaried workers, registered business owners, etc to travel and pay back with 6months (for customers and staff of SG Bank Only), 1 to 3 years (for employees on the Controller & Accountant General's payroll) and 6 months (for business owners and all other salaried workers).

You can purchase any of the Travel Packages on sale by Adansi Travels as well as Tickets with a flexible financial arrangement leaving you with more opportunities to manage your trips

Easy steps to access the Travel Loan

Fill the application form here

A coordinator will get in touch to facilitate the travel package and the loan process

Get your loan approved

travel and have all the fun with Adansi Travels

Pay your loan later

FREQUENTLY ASKED QUESTIONS (FAQs)

- Call us now :

- +233 59 404 8765

- +233 59 385 0092

Powered By

<- Back to adansitravels.com

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Best Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Acne Week 2024

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

Find the best credit card for you

'buy now, pay later' can help fund your next trip but here's what you need to know about these loans, cnbc select walks you through what you need to know if you're considering a point-of-sale loan to finance your next trip.

When it comes to planning your next vacation , travel expenses can quickly add up — even if you managed to save a little cash ahead of time. You might be tempted to choose the 'buy now, pay later' option that's offered at checkout on many travel websites, including Carnival or Expedia.

These point-of-sale loans are seductive to consumers who don't want to pay for their vacations with one lump-sum payment, allowing people to make payments over a fixed period of time, sometimes without high interest rates.

But is using the 'buy now, pay later' option to pay for your flights or hotel stays too good to be true?

CNBC Select explores some of the benefits and drawbacks of using 'buy now, pay later' for travel.

What we'll cover

What are point-of-sale loans, how do point-of-sale loans work, should you use point-of-sale loans for travel, bottom line.

'Buy now, pay later' providers (also known as point-of-sale loans) offer consumers the option to sign up for a payment plan either when they're buying something on a retailer's website or directly through the loan provider's website ahead of purchase

Point-of-sale loans give consumers the ability to make installment payments over a fixed period of time until they completely pay off their purchase. This means that you'll make payments toward your purchases bi-monthly or monthly depending on the plan and/ or provider.

These payments can typically be automated by providing your debit card or bank account information. While many providers boast 0% interest rates, some point-of-sale loans can have interest rates upwards of 30%, higher than the APRs on many credit cards.

Some of the most popular providers are Afterpay , Affirm , Klarna and Uplift . Klarna offers point-of-sale loans, some with 0% APR, that allow you to make four payments every two weeks and require a deposit at checkout, while Afterpay allows you to pay over six weeks. Afterpay, Uplift, Klarna and Affirm also offer consumers longer payment periods of up to one, two or even three years.

When you purchase a flight or an item, you're given different financing options at checkout, such as the opportunity to pay with a credit card, gift card or point-of-sale loan . You'll be redirected to the POS provider website where you can enter your personal information.

Some companies won't perform a credit check while others will perform either a soft or hard credit inquiry . Soft credit checks don't negatively impact your credit score , but hard inquiries will temporarily decrease your score. Based on the information you enter, you'll either be approved or denied for the loan.

Afterpay doesn't do any credit checks while Klarna does soft and hard credit checks, depending on the loan.

The impact a point-of-sale one has on your credit score depends on whether the provider reports your payment history to the credit bureaus . For example, Affirm only reports your credit history to Experian for some loans and not others. For the loans that Affirm does report to Experian, your payment history, the length of your credit history with Affirm, the amount of your loan and your late payments can all show up on your credit report.

Make sure to read the terms and conditions of your POS loan to see if your negative payment history is reported to the credit bureaus.

Travel expenses might seem like the perfect opportunity to use a point-of-sale loan because it's oftentimes a big purchase that you might not have the immediate cash on hand to cover.

Klarna, Afterpay, Affirm and Uplift all offer 'buy now, pay later' option for certain travel partners. Affirm has partnerships with Delta Vacations, Priceline, StubHub and Alternative Airlines, a flight booking website. Uplift is exclusively focused on providing point-of-sale loans for travel, with around 200 travel partners , including United Airlines, Kayak , Southwest Airlines and Royal Caribbean.

Uplift will help you cover transactions costing anywhere from $100 to $25,000. Interest rates range from 7% to 30%, but there are a few travel partners such as Carnival Cruise Line and Atlantis that have a 0% APR, according to Tom Botts, chief commercial officer at Uplift. The average APR for an Uplift point-of-sale loan is 15%, which is similar to the average APR for credit cards .

"We use a variety of factors to determine eligibility," Botts says. "Interest rates are based on a number of factors including credit history, transaction amount and time to travel."

Uplift also only performs a soft credit check which won't negatively impact your credit score.

If you're able to secure a loan with 0% APR and make your payments on time, a point-of-sale loan could be a good choice for funding a trip. But if those monthly payments won't easily fit within your budget, be wary of a POS loan and read the fine print beforehand to determine how much you'll end up paying in interest.

For example, if you use Affirm to finance your purchases on Alternative Airlines , you can only get a 0% APR on your point-of-sale loan if you buy a flight that costs less than $500. If your ticket costs more than $500 , you could incur an interest rate of up to 30%, depending on your creditworthiness.

If you spend $1,000 on a flight and choose a 12-month payment plan with Affirm, you'll have to cough up nearly $100 in interest if you have a 20% APR on your loan. One perk of using Affirm over a credit card is that you'll have a longer payment period (of 3, 6, 12 or 18 months) which helps to spread the expenses over time into more manageable payments. And with an installment loan from Affirm or Uplift, the interest doesn't compound month over month, so your payment stays the same over the loan's term.

But a big drawback of using point-of-sale loans for travel is having to deal with unexpected problems, like trip cancellations or delays, says Priya Malani, the CEO and founder of Stash Wealth.

"If a trip is canceled or delayed with unexpected fees, your loan is still due. You're on the hook for the agreed upon total. Even though you may have checked out in one fluid process, you're still working with two separate entities — the travel provider and the POS loan provider," Malani says.

When it comes to funding your resort stay in Cancun or your flight to the Maldives, there are other options for financing your trip.

Travel rewards credit cards offer higher rewards rates for money spent on travel and the points you earn can go toward booking flights or hotels. While travel credit cards typically come with an annual fee, some offer a 0% introductory period, so you won't have to worry about high interest rates kicking in for 12 months or longer. If you go the 0% APR route, make sure you set up a repayment plan and pay the minimum each month so you don't end up paying late fees or big interest charges.

The Chase Sapphire Preferred® Card is currently offering a welcome bonus offer where new cardholders can earn 75,000 points after they spend $4,000 on purchases in the first three months from account opening. Points can be redeemed for over $900 worth of travel when booked through Chase Travel℠.

Chase Sapphire Preferred® Card

Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, and $50 annual Chase Travel Hotel Credit, plus more.

Welcome bonus

Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

Regular APR

21.49% - 28.49% variable on purchases and balance transfers

Balance transfer fee

Either $5 or 5% of the amount of each transfer, whichever is greater

Foreign transaction fee

Credit needed.

Excellent/Good

Terms apply.

Read our Chase Sapphire Preferred® Card review .

The Capital One Venture Rewards Credit Card is also a solid choice but comes with a smaller welcome bonus and higher rewards rate than the Preferred, giving 2X miles per dollar on every purchase and a welcome offer of 75,000 bonus miles if you spend $4,000 within three months of account opening.

Capital One Venture Rewards Credit Card

5 Miles per dollar on hotel and rental cars booked through Capital One Travel, 2X miles per dollar on every other purchase

Earn 75,000 bonus miles once you spend $4,000 on purchases within 3 months from account opening

N/A for purchases and balance transfers

19.99% - 29.99% (Variable)

$0 at the Transfer APR, 4% of the amount of each transferred balance that posts to your account at a promotional APR that Capital One may offer to you

Travel cards also often come with additional perks such as car rental insurance, trip cancellation insurance and purchase protection. You won't get any of these perks when you use a POS loan for travel.

If you worry about putting a big expense on your credit card or you're only eligible for a POS loan with high APR, you should also consider creating a travel fund instead.

By saving your money in a high-yield savings account , you'll be earning more (thanks to compound interest ) than you would be if you put your money in either a checking account or a traditional savings account. Creating a separate fund for travel can also give you a money goal to strive for and setting up automatic monthly transfers can help you avoid spending money on other short-term, more frivolous purchases.

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here .

Point-of-sale loans are attractive because of how easy they are to use — you simply provide some basic information about yourself to the loan provider before checking out and you can instantaneously get a loan that will allow you to spread the cost of your trip over a few months. If you're not diligent about reading the fine print, however, there can be a lot of caveats to using the 'buy now, pay later' option, including high interest rates and late fees.

Why trust CNBC Select?

At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Every article is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of buy now, pay later loan products . While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics.

Catch up on CNBC Select's in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date.

- Federal student loan rates are soaring — are private loans the answer? Elizabeth Gravier

- Best homeowners insurance companies in California of 2024 Liz Knueven

- Guardian life insurance: High age limit and no-medical-exam policies Liz Knueven

Members save 10% or more on over 100,000 hotels worldwide when you’re signed in

Book now, pay later: no-deposit holidays.

- Things to do

I only need accommodation for part of my trip

You can save up to 10% when you bundle your flight + hotel, flight + car or hotel + car together

ATOL protection & fully refundable rates on most hotels. Because flexibility matters

Customize your holiday with ease all in one place

No-deposit holidays - book now, pay later

Whether you want to lie back and relax on the beach or take in the sights on a city break, with our flexible payment plans you're closer than ever to starting your buy now, pay later holidays. Expedia allows you to select different payment options to suit your unique needs. Pay in full, pay in 30 days, or divide the cost of the holiday to pay in instalments . It's your holiday and your choice to pay in the best way for you.

Going on a group trip? No-deposit holidays give holiday planners like you the power to organise every aspect of your family reunion, holidays with friends, or hen and stag trips without having to worry about shouldering the entire cost up front. Instead with book now, pay later holidays you can get the whole crew on board ready to pay their share and make instalment payments that work with everyone's budgets.

Expedia is known for sourcing great deals, so when you see an unbelievable special offer, don't let it slip away. Lock in low prices on 0 deposit holidays and start planning your dream getaway. You can also combine options like accommodations, flights, and car hire as an Expedia bundle or add on special requests or excursions, then when you get to your destination all you need to do is enjoy yourself.

Ready to start planning an all-inclusive multigenerational family holiday with zero deposit down, a girls' no-deposit holiday to Benidorm , or a couple's weekend away with a no-deposit holiday in Amsterdam ? From cheap holidays in the sun with the kids on no-deposit holidays to Turkey to once-in-a-lifetime long-haul bucket trips around the world, Expedia's flexible payment options help you get there.

How do book now, pay later holidays work?

Ready to start planning your next holiday in 2024? Follow our simple step-by-step guide on choosing a no-deposit holiday.

Step 1: Find your holiday

Search through the top destinations, hotels, and resorts on Expedia to find your ideal holiday. Decide when and where you want to travel or, if you need a little inspiration, browse the top deals below to find bargain 0 deposit holidays. Being flexible with your dates and destination can help source some of the best prices. On the destination page, you’ll find accommodation photographs and comprehensive information about the local area and nearby attractions. You can also filter the search results by payment type to narrow down your choices to those that have flexible payment terms available.

When you're ready, follow the prompts to complete your booking.

Step 2: Choose your payment plan

On the checkout page, you’ll see an option to buy now and pay later. Expedia has partnered with Klarna to make it easier to book and plan your holiday while keeping your budget balanced. You can book now and take care of the bill in 30 days' time or pay in instalments.

Step 3: Finish your checkout

Read through the terms and ensure you understand when you’ll need to pay and the total bill due. Then get ready to enjoy a holiday paid for on your terms.

Why book a holiday now and pay later?

Expedia's no-deposit holidays offer you the flexibility to plan without paying up front. Ideally suited for trips with multiple travellers, those who may have irregular income, or anyone who needs a little time to transfer their holiday savings to their bank account, these deals let you lock in savings and give you time to work out the details of paying for your holiday.

You’ll also benefit from these additional perks of buy now, pay later holidays:

No-deposit holidays deals

Check out the latest deals to plan your next holiday without having to lay down a deposit. Simply scroll through all the latest travel deals to top destinations like Turkey, Greece, and Tenerife, or choose from family holiday hotspots, destinations perfect for all your mates to get together, or trips designed with couples in mind. Then select the buy now, pay later option and let the anticipation begin. Your holiday countdown starts now.

Frequently asked questions about book now, pay later holidays on Expedia:

What are 'book now, pay later' holidays.

Book now, pay later holidays let you secure your travel plans by making a reservation in advance but postponing the full payment until a later date. You can choose your hotel, flights, and additional services, locking in the price and availability. Then all you have to do is choose a payment plan of 30 days, or any additional instalment plans that may be offered, and schedule payments to suit your budget.

Can I book a no-deposit holiday abroad?

Yes, no-deposit holidays are offered to a variety of international destinations. Simply add no-deposit holidays as a search term and see deals available today.

Can I choose any destination for a 'book now, pay later' holiday?

Your options for no-deposit holidays in 2024 are comprehensive and usually include the most popular destinations. However, book now, pay later holiday arrangements may not be available for all destinations.

How can I find a cheap no-deposit holiday?

Expedia offers many affordable cheap holidays with no deposit. Some simple tips to increase your options include being flexible with your travel dates, travelling during off-peak seasons or weekdays when prices tend to be lower, and being open to different destinations or alternative locations that offer more affordable holidays.

How can I find an all-inclusive no-deposit holiday?

Use Expedia's search filters to find all-inclusive holiday packages that also offer no-deposit all-inclusive holidays. You can also select all the features that matter to you from swimming pools to beach access to spas.

How can I find a family holiday with no deposit?

Expedia's search filters include a family-friendly 'traveller experience' option. Search these properties to find family holidays with no deposit.

What are the advantages of booking a 'book now, pay later' holiday?

The advantages of buy now, pay later holidays include the financial flexibility to spread the total cost of the trip, opportunity to secure the flights and hotels you want without a deposit, and the ease of booking without having to organise finances first.

Are there any credit checks involved in securing a 'book now, pay later' holiday?

Book now, pay later holidays do not usually require a credit check as they reserve your travel plans and defer payment until later, rather than obtaining credit or financing. However, some options, including Klarna pay in 30 days, may include financing, which could involve credit checks. Read all terms and conditions carefully to understand the payment agreement you choose.

How can I find no-deposit holiday deals and packages?

Expedia is one of the best places to find travel deals, including no-deposit holiday deals and packages. Simply enter your desired destination and see the latest prices and packages to plan your next holiday.

Are there any additional fees or interest charges for 'book now, pay later' holidays?

If you pay your Klarna payment within the first 30 days, there will be no additional fees or interest charged. For longer arrangements, check your individual payment plan and agreement to see if any interest charges apply.

What happens if I miss my payment for my holiday?

If you miss a payment for your holiday, you may incur late payment fees and your reservation could be cancelled. Carefully check the terms and conditions of your payment plan to know your obligations and avoid any additional charges.

Can I cancel or change my 'book now, pay later' holiday booking?

To benefit from the convenience of free cancellation and pay-later choices, filter your search results based on your payment preferences. You’ll enjoy the peace of mind of knowing that your holiday plans are flexible, allowing you to make adjustments as needed. Keep in mind that cancellation policies may vary for different holiday packages, so read the details carefully before booking.

Why should I book now, pay later with Expedia?

Booking your no-deposit holiday with Expedia in 2024 lets you start planning your dream holiday now and gives you time to arrange your finances. Benefit from securing the flights and hotels you want today and splitting the payments over time to best meet the needs of your budget.

What is the difference between 'pay monthly holidays' and 'book now, pay later' holidays?

The difference between pay monthly holidays and book now, pay later holidays is that paying monthly gives you a predictable payment plan spread over a term to suit your needs. It helps you manage the cost of a holiday by breaking up the total into affordable monthly payments. Buy now pay later holidays defer the payment and give you time to transfer money, to collect payments from multiple travellers or to save up before the bill is due. Both options help make paying for your next holiday easy and flexible.

Top Destinations

- Top Beach Holidays

- Top Countries

- Amsterdam Holidays

- Barcelona Holidays

- Belfast Holidays

- Berlin Holidays

- Budapest Holidays

- Dubai Holidays

- Dublin Holidays

- Istanbul Holidays

- Las Vegas Holidays

- London Holidays

- New York Holidays

- Paris Holidays

- Prague Holidays

- Rome Holidays

- Tokyo Holidays

- Venice Holidays

- Australia Holidays

- Bahamas Holidays

- Bali Holidays

- Barbados Holidays

- Bora Bora Holidays

- British Virgin Islands Holidays

- Dominica Holidays

- Fiji Holidays

- Greece Holidays

- Hawaii Holidays

- Maldives Holidays

- Malta Holidays

- Philippines Holidays

- Turks And Caicos Holidays

- Canada Holidays

- Cayman Islands Holidays

- France Holidays

- Gibraltar Holidays

- Iceland Holidays

- Ireland Holidays

- Isle Of Man Holidays

- Italy Holidays

- Japan Holidays

- Jersey Holidays

- New Zealand Holidays

- Norway Holidays

- Spain Holidays

- Turkey Holidays

- United States Of America Holidays

- Vietnam Holidays

- Flight Multi-City

Book Your travel & enjoy a flexible payment plan that’s great for you

Desperate to jet off somewhere but prefer spreading the cost?

You can book now and pay later! We just charge a transaction fee at the time of booking and spread the cost over 3-12 months from 0% APR!

Flexible Repayments

Choose to pay for your trip over a three to 12 month period with no hidden extras. You can pay off your balance early completely free of charge.

Fast and Easy

It only takes a few minutes to sign up for Fly Now Pay Later and you can access your account any time to check your remaining balance.

Safe & Secure

You benefit from total protection in the unlikely event of financial failure for your booking.

Do you live in the UK?

you must be a resident of the uk to apply

Are you over 18?

you must be over 18 to apply

Do you have a mobile?

you must have a UK mobile number to apply

Do you have a UK debit card?

you must have a UK debit card (Not Electron or Amex)

Choose your next flight

Search our worldwide flights provided by over 200 airlines

Go to the checkout

At Checkout, select the 'Fly Now Pay Later' option.

Sign up & pay

Set up your account in seconds, and then book!

Frequently Asked Questions

When will i receive my flight tickets if i book fly now pay later flights.

You will receive your flight ticket after completing the booking process and you can choose to pay off the balance before or after your departure date, the choice is yours!

Is there a credit check?

Yes, Fly Now Pay Later will carry out all of the necessary checks before offering you a payment plan to suit you.

Are there any charges if my application is declined?

No, you will not be charged if you are not offered a Fly Now Pay Later payment plan.

Can I book multi-city trips on a Fly Now Pay Later plan?

Yes, if it’s available to book on our website, you can select the Fly Now Pay Later option.

Can I change my repayment date?

Yes, however some conditions apply. If your due date is within the next seven days and you request a repayment date change, this change cannot take effect until the following month.

What could my repayment plan look like?

The approval of your application depends on your financial circumstances and borrowing history, so do the terms you may be offered.

Flex representative example: Cash price of a holiday £1,000, borrowing £1,000 over 12 months, you will repay an initial 10% deposit of £100 followed by 12 monthly instalments of £87.91. Total amount payable is £1,154.88. The total charge for credit is £154.88. *Representative APR is 34.99%.

Legal Statement

Fly Now Pay Later Limited acts as a credit intermediary and not a lender and is authorised and regulated by the Financial Conduct Authority under registration number 726937.

Regulatory Statement

Credit accounts are provided by Pay Later Financial Services Limited (t/a Fly Now Pay Later) who are authorised and regulated by the Financial Conduct Authority under registration number 672306. Pay Later Financial Services Limited registered office: 4th floor, 33 Cannon Street, London, EC4M 5SB, United Kingdom. Registered in England and Wales No. 09020100. Fly Now Pay Later ® & Travelfund ® are registered trademarks of Pay Later Group Limited.

Travel made simple with our easy to use app!

please wait...

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Fly Now Pay Later: What to Know

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What is Fly Now Pay Later?

Who can use fly now pay later, how does fly now pay later work, is fly now pay later legit, downsides to fly now pay later, is fly now pay later worth it.

Whether you're taking a long-awaited vacation or need to book travel urgently for an emergency, you may not currently have all of the funds necessary to book a trip. Enter a service like Fly Now Pay Later that lets you "buy now, pay later" for flights, hotels and other travel expenses.

But you may be wondering how Fly Now Pay Later works or if it's legit. Let's dive into the details and discuss the advantages and disadvantages of using the deferred-payment service.

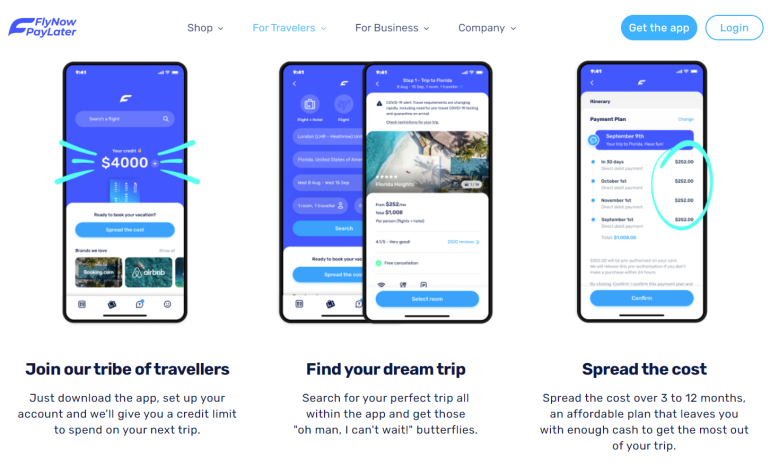

Not to be confused with a general term for deferring travel costs, Fly Now Pay Later is a company offering services that allow you to spread the cost of your vacation over time. After you are approved, Fly Now Pay Later will pay for the travel upfront and charge you monthly installments. You can choose to split up the cost of your trip over a time period of up to 12 months.

At the time of writing, the interest rate on these installments is between a 9.99% and 29.99% annual percentage rate, depending on your credit.

You can use Fly Now Pay Later to pay for all types of travel expenses. You can buy now and pay later for:

Attractions.

Vacation packages.

» Learn more: Easy tricks to save money on travel

U.S. residents hoping to use Fly Now Pay Later must be 18 or older. If you reside in Alabama and Nebraska, you must be at least 19 years old. You'll also need a debit card and a mobile phone with a U.S. number, as the Fly Now Pay Later service is currently only available through its app. You'll also need a driver's license or passport to verify your identity.

A debit card is the only accepted form of payment for Fly Now Pay Later.

You’ll also need to undergo a soft credit check, which doesn't affect your score. Fly Now Pay Later doesn’t disclose its credit score requirements. But it recommends checking your score before applying, so you may want to double-check your credit profile for any mistakes and make sure your credit accounts aren’t frozen in order to be eligible.

In addition to being available to United States residents, Fly Now Pay Later is also currently available to residents of the United Kingdom and Germany.

» Learn more: Can Americans travel to Europe?

To start using Fly Now Pay Later, you'll need to download the app and set up an account. As part of setting up a new account, Fly Now Pay Later will run a credit check to determine your eligibility, interest rate and credit limit. Then you can use the app to find the flights, hotels or travel packages you wish to book.

Depending on which airline or hotel you want, you may be able to book the trip directly through the app. For example, you can buy now and pay later for flights with American Airlines, United, Qatar Airways or TAP Portugal through the app. For other travel purchases, you'll be issued a virtual card that you can use to pay for the travel expenses.

After making your travel purchase or during the process of issuing the travel card, Fly Now Pay Later will prompt you to choose the number of installments you want to pay. You can spread the cost of your trip across — and up to — 12 months.

Your first installment is due one month from the date your account was set up, and subsequent payments will be taken on the same day each month after that. However, you can change your payment date by contacting Fly Now Pay Later customer support.

Fly Now Pay Later is legit. Its payment options are provided by Pay Later Financial Services Inc. in partnership with an FDIC member bank Cross River Bank.

Fly Now Pay Later mostly receives positive reviews from customers, carrying a 4.2 Trustpilot rating. However, negative reviews of Fly Now Pay Later focus on the difficulty of contacting a representative when something goes wrong and also on issues using Fly Now Pay Later's virtual payment card to book directly with travel providers.

» Learn more: Should you use buy now, pay later services on travel?

Using Fly Now Pay Later may sound appealing. After all, you only have to pay a deposit now to book your travel. However, there are several downsides to using Fly Now Pay Later — and similar deferred travel payment plans:

High interest rates: At the time of writing, Fly Now Pay Later charges between 9.99% and 29.99% APR on installments. You may be able to pay a lower interest rate by using a low- or no-interest credit card instead of Fly Now Pay Later for your purchase. Other BNPL options, including Uplift, could offer as low as 0% APR for certain eligible applicants.

A credit check is required: As part of the process of setting up an account, Fly Now Pay Later checks your credit to determine what interest rate to charge.

Requirement to use the app: Fly Now Pay Later has a splashy, well-designed website. However, you can't actually use the service on the website. Instead, you have to download and use the Fly Now Pay Later app.

Issues booking with the virtual card: For some types of travel expenses, Fly Now Pay Later issues travelers a virtual card that they then can use to book travel with a travel provider. Some travelers report having their virtual card declined by travel providers.

Lack of travel protections: You won't get travel protections offered by travel rewards credit cards — such as trip delay insurance, delayed baggage insurance, and trip cancellation insurance.

No rewards on travel purchases: As you'll be paying a travel provider through Fly Now Pay Later, you won't earn any rewards on the purchase. Additionally, Fly Now Pay Later only accepts payments through debit cards. So, you won't earn rewards when paying your balance unless you use a debit card that earns rewards.

» Learn more: The best travel credit cards right now

Fly Now Pay Later is an appealing service for avoiding having to pay your travel expenses immediately. Just note that there are several downsides to doing so — everything from having to pay interest to losing out on credit card rewards and travel protections.

If you're OK with these tradeoffs and don't have a better alternative, using Fly Now Pay Later can be a good option. Just make sure to set realistic payment goals to balance minimizing interest and avoiding late payment fees.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1.5%-5% Enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

Up to $300 Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

on Capital One's website

2x-5x Earn unlimited 2X miles on every purchase, every day. Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options.

75,000 Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel.

- Best Overall

- Best for No-Annual-Fee

Best for Independent Hotel Purchases

- Best for Beginners

- Best for Everyday Spending

- Best for Students

- Best Premium Travel Card for Affordability

- Best for Dining and Groceries

- Best for Travel Insurance

- Best for Luxury Travel Benefits

- Why You Should Trust Us

Best Travel Credit Cards of June 2024

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate credit cards to write unbiased product reviews .

The information for the following product(s) has been collected independently by Business Insider: Wells Fargo Autograph Journey℠ Visa® Card, Citi Strata Premier℠ Card, Bank of America® Travel Rewards Credit Card for Students. The details for these products have not been reviewed or provided by the issuer.

- Best overall travel credit card : Chase Sapphire Preferred® Card

- Best travel credit card for beginners : Capital One Venture Rewards Credit Card

- Best no-annual-fee travel credit card : Capital One VentureOne Rewards Credit Card ( rates and fees )

- Best for spending at hotels : Wells Fargo Autograph Journey℠ Visa® Card

- Best for travel rewards on everyday spending : Citi Strata Premier℠ Card

- Best travel card for students : Bank of America® Travel Rewards Credit Card for Students

- Most affordable premium travel credit card : Capital One Venture X Rewards Credit Card

- Best travel credit card for earning travel credit on dining and groceries : American Express® Gold Card

- Best premium card for travel bonus categories : Chase Sapphire Reserve®

- Best for luxury travel benefits and airport lounge access : The Platinum Card® from American Express

Introduction to Travel Credit Cards

Whether you're just dipping your toe into the world of rewards credit cards or you've already flown thousands of miles on points alone, we can tell you: There's a travel credit card for everyone. There's a card if you're looking for free flights, if you're hoping for free hotel stays, or if you're just doing whatever it takes to realize your dream of an overwater bungalow. There are even no-annual-fee travel credit cards that won't cost you anything to keep.

Compare the Top Travel Credit Cards

Earn 5x on travel purchased through Chase Travel℠. Earn 3x on dining, select streaming services and online groceries. Earn 2x on all other travel purchases. Earn 1x on all other purchases.

21.49% - 28.49% Variable

Earn 75,000 bonus points

Good to Excellent

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. High intro bonus offer starts you off with lots of points

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Strong travel coverage

- con icon Two crossed lines that form an 'X'. Doesn't offer a Global Entry/TSA PreCheck application fee credit

If you're new to travel rewards credit cards or just don't want to pay hundreds in annual fees, the Chase Sapphire Preferred® Card is a smart choice. It earns bonus points on a wide variety of travel and dining purchases and offers strong travel and purchase coverage, including primary car rental insurance.

- Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 75,000 points are worth $937.50 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

Earn 5 miles per dollar on hotels and rental cars booked through Capital One Travel. Earn unlimited 1.25X miles on every purchase.

0% intro APR on purchases and balance transfers for 15 months (intro fee of 3% for the first 15 months, then 4% of the amount of each balance transfer at a promotional APR that Capital One may offer you at any other time)

19.99% - 29.99% Variable

Earn 20,000 miles

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. No annual fee or foreign transaction fees

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Versatile rewards

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Earn 1.25 miles per dollar on all purchases with no bonus categories to track

- con icon Two crossed lines that form an 'X'. Lower earning rate than some other no-annual-fee rewards cards

- con icon Two crossed lines that form an 'X'. Limited benefits

The VentureOne Rewards Card is a slimmed-down version of the popular Capital One Venture Rewards Credit Card. It's one of the few no-annual-fee cards on the market that gives you the option to redeem miles for cash back or transfer them to travel partners.

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Use your miles to get reimbursed for any travel purchase-or redeem by booking a trip through Capital One Travel

- Transfer your miles to your choice of 15+ travel loyalty programs

- Enjoy 0% intro APR on purchases and balance transfers for 15 months; 19.99% - 29.99% variable APR after that; balance transfer fee applies

Earn unlimited 5x points per dollar on hotels. Earn 4x points on airlines. Earn 3x points on other travel and dining. Earn 1x on other purchases.

21.24%, 26.24%, or 29.99% Variable

Earn 60,000 bonus rewards points

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Trip cancellation and lost baggage protection

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Airline and hotel transfer partners available

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Welcome bonus

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Generous cellphone protection

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Low annual fee

- con icon Two crossed lines that form an 'X'. Transfer partner network not as diverse or robust as competitors

The Wells Fargo Autograph Journey℠ Visa® Card is a true travel credit card, with benefits that rival many of the best travel rewards credit cards currently on the market. This card has a low annual fee on par with that of popular competing credit cards and Wells Fargo's newly announced Points Transfer program allows cardholders to juice maximum value from every point they earn.

Earn 5x miles per dollar on hotels and rental cars booked through Capital One Travel. Earn unlimited 2x miles on every purchase.

19.99% - 29.99% variable

Earn 75,000 miles

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. No bonus categories to keep track of

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Includes up to a $100 statement credit for Global Entry or TSA PreCheck

- con icon Two crossed lines that form an 'X'. Other credit cards offer higher rewards in certain categories of spending

If you want an easy, no-fuss travel rewards credit card, the Capital One Venture Rewards Credit Card is a great fit. For a moderate annual fee, it offers plenty of value, useful benefits, and a substantial welcome bonus.

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Enrich every hotel stay from the Lifestyle Collection with a suite of cardholder benefits, like a $50 experience credit, room upgrades, and more

Earn a total of 10 ThankYou® Points per $1 spent on hotel, car rentals and attractions booked through CitiTravel.com. Earn 3X points per $1 on air travel and other hotel purchases, at restaurants, supermarkets, gas stations and EV charging stations. Earn 1X point per $1 on all other purchases.

21.24% - 29.24% variable

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Earn 3x points on most travel, restaurants, gas/EV charging, and supermarkets

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Earn 10x points on hotels, rental cars, and attractions booked via Citi Travel