The Travel Sisters

How to complete a bank of america travel notice online.

by The Travel Sisters | Mar 12, 2017 | Credit Cards | 1 comment

One of the things I do before I travel, is to let my banks that issued my credit or ATM cards know that I will be traveling abroad. While you can call your bank, some banks make it easy to quickly notify them of your travel plans online. Fortunately, Bank of America has an online travel notification form which makes it really easy to let them know of your travel plans.

When Should You Notify Bank of America of Your Travel Plans?

According to BofA, a travel notice can be set no more than 60 days prior to departure and can last for up to 90 days from the first day of your trip. Also, you can only have one travel notice set at a time.

While I usually complete travel notifications only when traveling internationally, the form also allows you to notify Bank of America when traveling to another state in the US. If you will be charging a lot of things on your credit card, it does not hurt to take a minute to complete the form.

How to Set Up a Bank of America Travel Notification Online

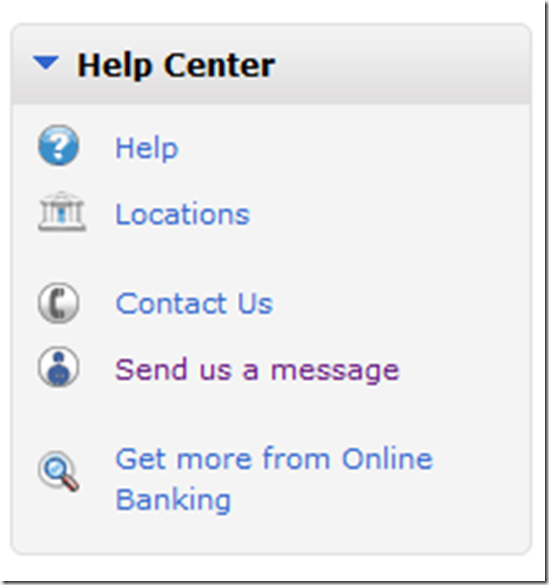

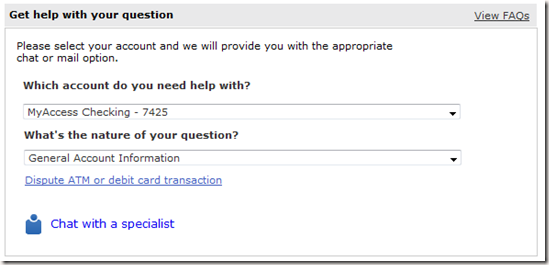

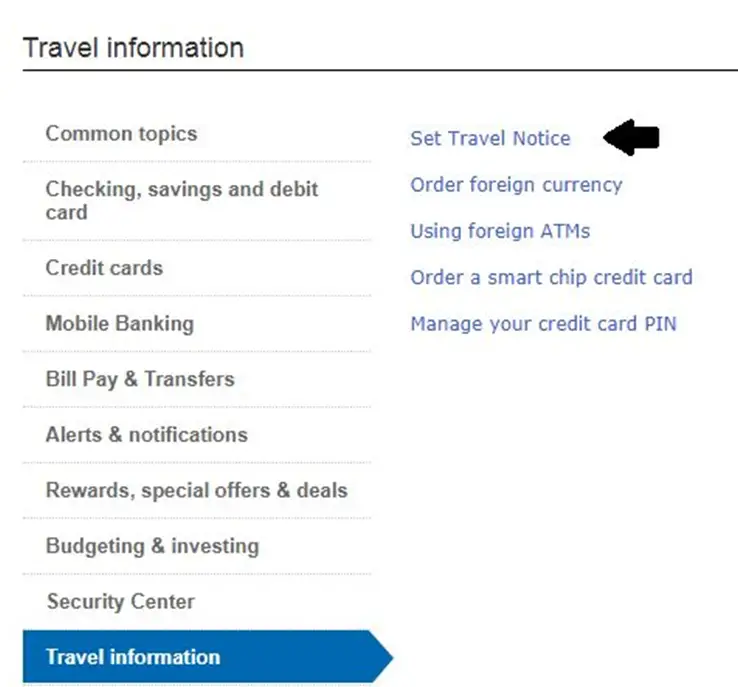

Log into your bankofamerica.com account and hover your mouse over “Help & Support” on the top right.

You will see a few options – click on “Set Travel Notice” and the Travel notification form will come up.

If you click on “Help & Support” you can reach the travel notification form either by clicking on “Set Travel Notice” under “Common Topics” or by clicking under “Travel Information”:

Complete, the Travel Notice form. You can complete the form for either domestic travel or international travel. The form even has a box where you can provide details of your trip.

While some people don’t notify their banks before travel and they don’t have any issues, I always make sure to complete an online travel notification form online. It only takes a minute and it is worth it to avoid getting your credit card declined in a foreign country.

Hello this Ysabel and Francisco Collado, we’re going to Europe and want to know we’re we can use atm in Rome to withdraws euro. Also let you guys know we’re goin away.

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Notify me of follow-up comments by email.

Notify me of new posts by email.

Subscribe to Blog via Email

Recent posts.

- 30+ BEST Mother’s Day Gifts for Moms That Love Travel

- Chase Freedom Flex 2024 2nd Quarter 5% Bonus Categories

- Discover 5% Cashback Calendar 2024: Categories That Earn 5% Cash Back

- Chase Freedom Calendar 2024 Categories That Earn 5% Cash Back

- All Southwest Airlines International Flight Destinations

Follow us on Facebook

Pin It on Pinterest

What are your financial priorities?

Answer a few simple questions, and we’ll direct you to the right resources for every stage of life.

Welcome back. Your personalized solutions are waiting.

Welcome back. Here's where you left off.

You might also be interested in:

Your travel checklist: 10 tips for a worry-free vacation

Vacations should be a relaxing and rejuvenating experience. But surprises, especially those tied to your finances, can derail the fun. A vacation checklist can help you plan ahead and reduce stress. Here are 10 travel tips to get you started.

Pay your bills and hold your mail before you go

When your toes are in the sand, the last thing you want to worry about is if you paid the electric bill. Instead of wondering, pay those bills in advance. If you’ve set up online banking, you can arrange for automatic payments to be sent while you’re away. You might also want to consider signing up for paperless billing so you’ll have less paper waiting for you when you return. Speaking of paper, contact the post office about holding your mail . In addition to keeping your mailbox clear, this helps keep sensitive information in your mail, like bank and credit card statements, more secure.

Protect your accounts while traveling

While shopping or dining in a new city or country, you may swipe your debit or credit cards often. Consider using tools that help protect your card transactions from fraud while you travel. For example, when turned on, your phone’s location services may be able to verify card transactions when you make a purchase in an unusual place. Bank of America no longer requests that customers set travel notifications, due to ongoing security efforts that include monitoring your accounts and sending automatic alerts to your phone or email if suspicious activity is detected. Just make sure your bank and credit card company have your email address and mobile phone number so you can be reached while you’re traveling.

Sign up for mobile or online banking

Many people do some of their banking online or through a mobile app. But for the frequent traveler, online and mobile banking are invaluable ways to monitor and manage your accounts from almost anywhere, including the beach. Just remember, it’s important you know the answer to your online banking security question—you’ll need it if you log in from a new computer.

Make copies of your important documents

Think of this one as a security blanket. In case of emergencies, make two copies of your passport, credit cards and other travel documents. Leave one copy with a friend or relative at home and bring the other copy with you. Some travel sites even recommend taking photos of these documents and storing them in the cloud so you can access them if your belongings are stolen. Also, it’s a good idea to let someone know your exact travel itinerary.

Be careful with what you share online

Posting photos to social media while traveling may be a fun way to share the experience with others, but it’s important to make sure you’re aware of who can see them. Update your privacy settings on your social media accounts to ensure you’re only sharing with those you know and trust. Be mindful of the Wi-Fi networks you’re connecting to as well. Avoid public Wi-Fi to prevent strangers from seeing what you’re doing on your device. When public Wi-Fi cannot be avoided, look for HTTPS:// in your browser window for a secure connection or use a virtual private network (VPN). Update your device’s security software, operating system and applications, too, for the best defenses against viruses, malware and other online threats. For more protection online, stay up to date with new trends in cybersecurity.

Take extra precautions when going abroad

If you’re traveling internationally, take steps to ensure you can safely access your accounts from outside the United States. It’s a good idea to prepare your PIN before traveling abroad. Some international ATMs only support four-digit PINs. Be sure your PIN does not start with a zero and know your PIN by the numbers, as some foreign ATMs do not have letters on the keypads. Some foreign card readers may require you to use a PIN with your credit card. In these cases, you’ll need to use the PIN assigned to your card, so make sure you know it ahead of time. Try to memorize your PIN and avoid writing it on your card or keeping it in your wallet.

Check your health coverage

On the off chance you need medical care while traveling, make sure you know what your health insurance will and won’t cover. If you have a medical condition, you may want to plan ahead and be aware of in-network doctors in the area. If you’re traveling internationally, your insurance may not cover you while you’re away. If that’s the case, private companies offer short-term insurance plans specifically for international travel.

Make sure your credit cards are travel-ready

Bring at least two valid, permanent cards with you on your trip, in case one gets lost or stolen. Keep in mind that temporary cards don’t always work, and replacement cards can take several days to arrive. Double-check the cards’ expiration dates, and write down the numbers for customer service; keep them in a separate, safe place in case you need to call them for any reason. If you’re traveling internationally, look into a bank or other issuer of chip cards , as the chip data is more difficult to capture for a new fraudulent card to be used elsewhere. You may even consider adding eligible debit and credit cards to your device’s digital wallet to pay for purchases using a virtual card number on your phone so merchants don’t receive your actual card number.

When it comes to cash, plan ahead

If you’re traveling domestically, it’s a good idea to make sure you have cash on hand in case your bank doesn’t have locations or ATMs where you’re headed. If you’re traveling internationally, you’ll probably want to order foreign currency ahead of time. This way, when you land, you’ll have local currency ready to go so you can pay for taxis, snacks and other incidentals without having to track down a currency exchange.

Find out where you can bank locally

Your bank may not have a location or ATM convenient to where you’re traveling, even if the bank is a national chain. Look up the closest location to your destination. This is true of international travel as well. If you’re headed abroad, check and see if your home bank has partnered with banks abroad. Using a partner bank’s ATM may help you avoid certain fees. Generally, you can find your bank's partner network on its website or by calling. Bank of America’s locator allows you to search for international partner ATMs .

The material provided on this website is for informational use only and is not intended for financial or investment advice. Bank of America Corporation and/or its affiliates assume no liability for any loss or damage resulting from one’s reliance on the material provided. Please also note that such material is not updated regularly and that some of the information may not therefore be current. Consult with your own financial professional when making decisions regarding your financial or investment management. ©2024 Bank of America Corporation.

More from Bank of America

See exchange rates and order currency online.

We're here to help. Reach out by visiting our Contact page or schedule an appointment today.

- Schedule an appointment

You're continuing to another website

You're continuing to another website that Bank of America doesn't own or operate. Its owner is solely responsible for the website's content, offerings and level of security, so please refer to the website's posted privacy policy and terms of use. It's possible that the information provided in the website is available only in English.

Va a ir a una página que podría estar en inglés

Es posible que el contenido, las solicitudes y los documentos asociados con los productos y servicios específicos en esa página estén disponibles solo en inglés. Antes de escoger un producto o servicio, asegúrese de haber leído y entendido todos los términos y condiciones provistos.

Advertising Practices

We strive to provide you with information about products and services you might find interesting and useful. Relationship-based ads and online behavioral advertising help us do that.

Bank of America participates in the Digital Advertising Alliance ("DAA") self-regulatory Principles for Online Behavioral Advertising and uses the Advertising Options Icon on our behavioral ads on non-affiliated third-party sites (excluding ads appearing on platforms that do not accept the icon). Ads served on our behalf by these companies do not contain unencrypted personal information and we limit the use of personal information by companies that serve our ads. To learn more about ad choices, or to opt out of interest-based advertising with non-affiliated third-party sites, visit YourAdChoices powered by the DAA or through the Network Advertising Initiative's Opt-Out Tool . You may also visit the individual sites for additional information on their data and privacy practices and opt-out options.

To learn more about relationship-based ads, online behavioral advertising and our privacy practices, please review the Bank of America Online Privacy Notice and our Online Privacy FAQs .

Connect with us

Your Privacy Choices

Some materials and online content may be available in English only.

Bank of America, N.A. Member FDIC. Equal Housing Lender

© 2023 Bank of America Corporation. All rights reserved.

Investment products:

Bank of America and its affiliates do not provide legal, tax or accounting advice. You should consult your legal and/or tax advisors before making any financial decisions.

We'll Be Right Back!

How to Set Up Credit Card Travel Notifications

Putting a travel notification on your credit card may prevent a major travel headache.

Set Up Credit Card Travel Notifications

Getty Images

Travel notifications prevent a credit card issuer from flagging a purchase you make out of the country as fraudulent.

You might be ready for an upcoming trip, but is your credit card? Depending on your card issuer, you might need to set up a travel notification for your account.

Adding a card travel notification is easy. For most credit cards, you'll follow these steps:

- Call your credit card company, log in to its website or access its app.

- Share your travel dates and locations, if applicable.

- Submit and verify your travel notification.

This will help you avoid potential hassles and embarrassing situations when you're away.

What Are Travel Notifications?

A travel notification is essentially a setting you activate on your credit card account. "Basically, you're just telling the credit card issuer you're going to be using the card outside of the normal places you (use it). That way, they don't think someone stole your credit card," says Simon Zhen, research analyst at personal finance website MyBankTracker.com.

If you're on a road trip, you could make a card purchase in one town and then try to shop in another distant location but have your card rejected. Dan Hanks, senior vice president of credit card loyalty and servicing at PNC Bank, says if a transaction appears to be fraudulent, it may be declined, even if it is a legitimate purchase. Purchase location is just one factor credit card companies consider when flagging fraudulent transactions .

"If a customer suddenly starts using a card in a place they've never been, especially in another country, it doesn't mean we'll decline them, but it increases the chance we might stop the transaction if we think it's fraud," Hanks says.

Transactions may be marked as fraudulent and your card deactivated as a precaution, particularly if your issuer can't reach you to confirm them. If you only bring one credit card on your trip, you may have a major problem on your hands. Luckily, setting up a travel notification before you leave is an easy solution.

How to Set Up Travel Notifications

A travel notification usually requires you to provide your planned destinations and trip dates to your credit card issuer. With that information, the issuer has more knowledge to weed out fraudulent transactions from legitimate ones.

You usually have a few options to set up a travel notification. First, you can call the card issuer. "Look on the back of the card, and you can find the phone number to call. You just tell the customer service rep that you'll be traveling," Zhen says. If you prefer digital communication, you can typically set up a travel notification through the credit card company's website or app.

Each credit card company has its own travel notification policies. While many companies allow you to set up travel notifications, others may not need you to tell them about your travel plans. Below are the policies of major credit card issuers:

American Express does not request travel notifications, citing industry-leading fraud detection capabilities.

Bank of America allows you to create a travel notice up to 60 days before your trip, and it can last up to 90 days from the first day of your excursion. With one travel notice, you can set up multiple itineraries for various cards. You must provide Bank of America a contact number for when you're away from home. You can also supply details about where you'll be staying, any planned layovers and other information that may help the company monitor your account for fraud while you're traveling.

According to Barclays , a travel notification is not mandatory, but it could be wise to avoid declined purchases simply because you are traveling abroad or to a different part of the U.S. Contact the bank by phone, or access your account online or with the Barclays app to set up a notification. If you will be traveling for more than 365 days, connect with the bank by phone to set up a notification.

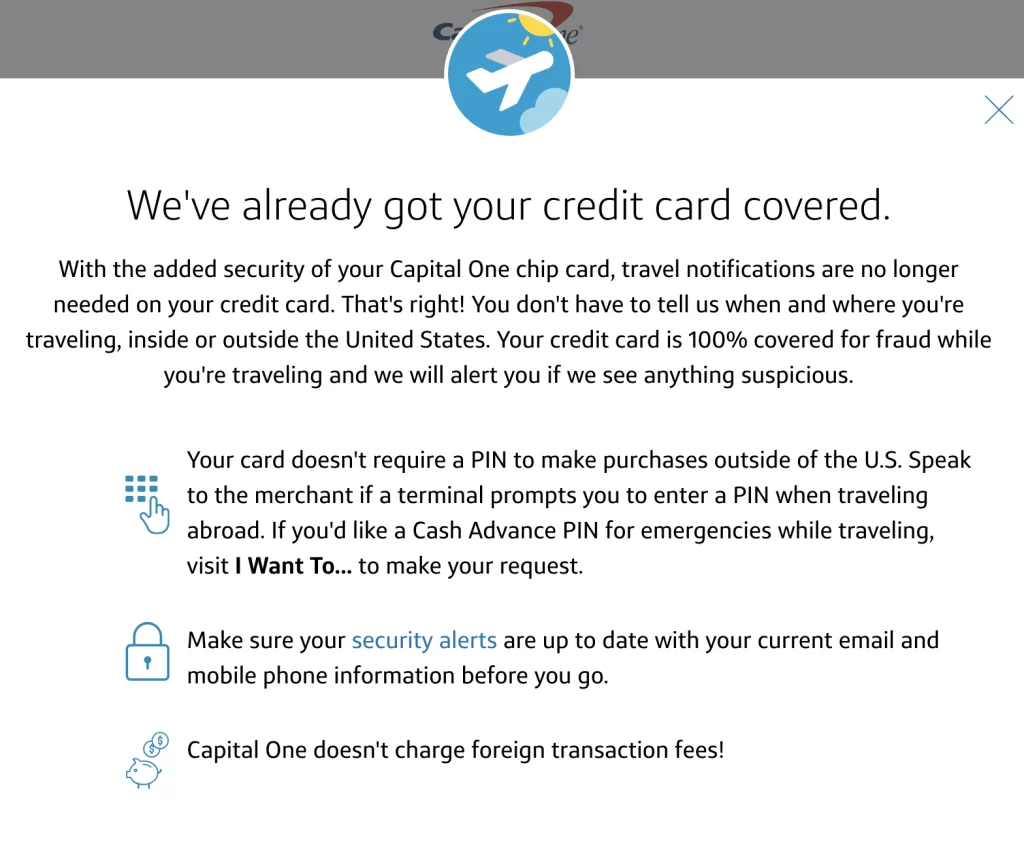

Capital One doesn't need notification of travel plans because of the added security of the bank's chip cards.

Chase lets you set up a travel notification up to a year before your trip. The notification can last up to 90 days. You can apply the notification to multiple cards simultaneously and list multiple destinations.

Citi permits you to add a travel notification up to 180 days before your journey and up to 89 days after your trip begins. You can set the notification for more than one card and report several destinations with one travel notification.

Discover advises setting up a notification before you embark on a trip abroad. Your travel start date can be up to 24 months in the future, and travel notifications can last up to 24 months.

PNC Bank suggests notifying it of the locations and dates of your planned travel to help eliminate phone calls to confirm your account activities. You can create travel notifications up to two years before you depart, and notifications can last up to 30 days. If your travel plans exceed 30 days, you can set up more than one travel alert.

USAA recommends a travel notification to reduce the chance of your card being blocked or flagged for unusual activity. You can set up a notification up to one year before your trip, and the notification will last up to one year from your departure. USAA does not request travel destinations.

U.S. Bank allows you to establish a travel notification for any trip within the next 90 days. Notifications can last up to 90 days. If your travel plans exceed 90 days, you can set up an additional notification at a later date.

Wells Fargo favors notification of when and where you plan to travel. Wells Fargo's travel notifications do not have any time-based restrictions, so you can set up your travel alert for as long as you'll be away and not have to set up subsequent ones.

Overall, setting up a travel notification doesn't have a downside for the customer, Hanks says. Making travel notifications easy to activate is in a credit card company's best interest. And notifications reduce the chance that a real transaction may be classified as fraudulent, which makes everyone happier.

Don't Forget About Debit Cards

"Some people set up a travel notification on a credit card but forget to set one up on their debit card," Zhen says.

While credit cards offer many protections that can be useful when traveling, especially abroad, some people may still plan to use their debit cards. If you do, make sure you set up a travel notification on your debit cards, too, so your purchases on those cards don't get flagged as fraudulent transactions when you're on your next trip.

Tags: credit cards

Comparative assessments and other editorial opinions are those of U.S. News and have not been previously reviewed, approved or endorsed by any other entities, such as banks, credit card issuers or travel companies. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired.

How to Set Up A Travel Notification for 9 Major Credit Cards

- Updated May 18, 2023

- Posted in Travel Planning

- Tagged as Travel Hacks and Tips , Travel Planning

A travel notification can prevent credit cards from declining charges due to suspected fraudulent activity.

Being stranded in a foreign country without a credit card is a nightmare.

Do you agree?

Thankfully, this is avoidable.

We have compiled step-by-step instructions for how how set up travel notifications for major credit card carriers.

Due to evolving security features, some credit cards do not recommend or require travel notifications. I, however, still like to notify my credit card prior to a trip for peace of mind!

Setting Up A Travel Notification: A Step-by-Step Guide

American express.

American Express does not require or recommend you set a travel notification. They feel confident in their security measures because of the fraud detection practices implemented. Actually, there is not even an option online to create a travel notification.

American Express recommends that you keep your contact information updated in case they need to reach you during your travels.

Fun Fact : Amex credit cards are not as widely accepted globally. So if you are a frequent international traveler, it may be wise to look for a credit card with a Mastercard or Visa logo as they are more widely accepted among merchants across seas.

Bank Of America

Bank of America lets you set a travel notice online, through the mobile app, or by phone at (800) 432-1000 .

According to Bank of America, a travel notice can be set no more than 60 days prior to departure and last up to 90 days from the first day of your trip. You can only have one travel notice set at a time.

How To Set A BoA Travel Notification

Step 1: Log into your bankofamerica.com account.

Step 2: Hover over “Help & Support” tab.

Step 3: Click on “Set Travel Notice” in the drop-down menu.

Step 4: Complete the Travel Notification Form and submit!

As you complete the travel notification form, enter your destination(s), travel dates, contact number(s), and card(s) you’re taking with you.

Barclaycard

You can set a travel notice for Barclays credit cards online or by phone at 1-866-928-8598.

How To Set a Barclaycard Travel Notification

Step 1: log into your barclaycard account or on the mobile app, step 2: select the “tools” tab and click “my travel”, step 3: enter your travel dates and destinations.

If you choose to set a travel notification by phone, call the toll free number listed above. You will need to enter your card number and ask to speak with a representative regarding a travel notice.

Capital One

Surprise! Like American Express, there is no need to set a travel notice for Capital One credit cards. You still, however, have the option to set a travel notice.

If you log into your capitalone.com account and click “Set Travel Notification,” you will get this window:

To notify Chase of travel plans, you can do this through your online account, by calling the number on the back of your card, or through their mobile app.

According to Chase, a travel notice can be set up to 1 year prior to departure and last up to 1 year from the first day of your trip.

If you will be gone for longer than this period of time, you will just need to let Chase know at some point to extend the travel notice.

How to set a Chase travel notification

Step 1: Log into your Chase.com account.

Step 2: Click on the menu icon in the left hand corner.

Step 3: Click on “Profile & Settings” in the drop-down menu.

Step 4: Click on “Travel” (located under “more settings”)

Step 5: Click “Update” on the right side of the screen (Located next to the credit card section).

Step 6: Finally, you will be able to enter your travel information. Here you should enter your destination(s) and travel date(s). Click Save!

Already out of the country? No problem! You can call Chase collect at 1-302-594-8200 to alert the issuer of your travel plans.

Citibank also lets you easily set up a travel notice online.

How to set a Citibank travel notification

Step 1: Sign into your Citi.com account.

Step 2: Click on “Services” and then “Travel Services.”

Step 3: Select “Add a Travel Notice.”

Step 4: Enter your destination(s) and travel date(s).

Step 5: Verify the phone number and email address that Citi has on file to ensure they are up to date.

To set a travel notice for Discover, you can do this by logging into your online account or by calling Discover customer service at 1-800-347-2683.

How to set a Discover travel notification

Online Instructions:

Step 1: Log into your discover.com account.

Step 2: select the card you will be taking with you on your trip., step 3: click on the “manage” tab at the top of your screen., step 4: click on “register travel” under the “manage cards” section., step 5: enter your destination(s) and travel date(s)..

F un Fact: Like Amex, Discover credit cards are not the best when traveling internationally because they are not as widely accepted.

Wells Fargo

If trying to notify Wells Fargo of your travel plans, you can do this online, through their mobile app, or by calling the number on the back of your card.

How to set a Wells Fargo travel notification

To do this online:

Step 1: Log into your wellsfargo.com bank account.

Step 2: hover over the “accounts” drop-down menu that is located at the top of the screen., step 3: click on “manage travel plans” (located under the “manage cards” section)., step 4: enter your destination(s) and travel date(s).

Unfortunately, U.S. Bank does not allow you to set up a travel notification through your online account. You will have to contact its customer service team directly.

Why is it Important to Set up a Travel Notification?

Avoid fraudulent activity.

When you travel, especially to a different country or region, your credit card transactions may appear suspicious to the card issuer. They might flag these transactions as potentially fraud and take measures to protect your account, such as freezing it temporarily. By setting up a travel notification, you inform your credit card company about your travel plans in advance, reducing the likelihood of your legitimate transactions being blocked.

Enhanced Security

Travel notifications act as an additional layer of security for your credit card. When you notify your credit card issuer about your travel plans, they can monitor your account more closely during that period. If they notice any unusual activity, they can reach out to you to verify its authenticity or take appropriate action to protect your account.

Convenience

Without a travel notification, your credit card company might see foreign transactions as suspicious and decline them. This can be inconvenient when you’re traveling and relying on your credit card for expenses. By notifying your credit card company in advance, you can ensure uninterrupted access to your funds and enjoy a hassle-free travel experience.

Preventing Account Lockouts

Some credit card issuers have strict security measures in place, and if they detect unusual activity, they may freeze your account for your protection. While this is done to prevent fraudulent charges, it can be frustrating and time-consuming to resolve the issue while you’re away. By setting up a travel notification, you reduce the chances of your account being locked due to your legitimate transactions.

Assistance in Emergencies

In case of an emergency, having a travel notification in place allows your credit card company to better assist you. If you encounter any issues with your card while traveling, such as loss, theft, or unauthorized transactions, notifying your credit card company beforehand ensures they can provide immediate support and guidance.

To enjoy a smooth and secure experience while using your credit cards during your travels, it’s highly recommended to set up travel notifications. The process is typically straightforward and can usually be done through your credit card company’s website, mobile app, or by calling their customer service.

We know the challenges with traveling and hope that this guide will answer any questions regarding travel notifications. Our goal is to make travel simple, easier, and more fun for you!

Until next time!

xxx Sara + Josh

Travel Notification FAQ’s

What are travel notifications, how do you tell your bank you're traveling chase, how do i notify bank of america that i am traveling, how do i set up a travel notice with citibank, need more travel tips.

10 Travel Hacks For Stress Free Adventure

How To Make Planning Your Next Trip Easier

And please do me a little favor and share this article with others, for there’s a good chance that it will help them with their travels!

Share my adventures Share this content

- Opens in a new window X

- Opens in a new window Facebook

- Opens in a new window Pinterest

Sara & Josh

You might also like.

TSA Pre✓ vs. Global Entry: Which is Better for Your Travels?

Southwest Check-In Time: Tips for a Smooth Travel Experience

Trip Planning 101: How To Plan Your Next Vacation

Leave a reply cancel reply.

Save my name, email, and website in this browser for the next time I comment.

How to Set a Travel Notice for Your Credit Cards

Susan Shain

Susan is a freelance writer who specializes in turning complex financial topics into engaging and accessible articles. She's been writing about personal finance for six years, and was previously the senior writer at The Penny Hoarder and a staff writer at Student Loan Hero. Her personal finance writing has also appeared in publications like MarketWatch and Lifehacker.

When I worked at a ski rental shop in Breckenridge, Colorado, I witnessed many international (and some out-of-state) customers’ credit cards get declined.

Not because their credit limits were too low or because they were purchasing too much — but because they failed to set up travel notifications with their card issuers.

So now, any time I travel to a foreign country, I always set up a travel notice on my credit card beforehand.

Since I travel with the Chase Sapphire Reserve® (Review), I create a Chase travel notice, but you can take this step with most major credit or debit cards. Here’s how.

What Is a Credit Card Travel Notice?

As a way to prevent fraud , your credit card issuer monitors your spending activity. If it notices a suspicious purchase — in an unusually large amount, or from a new location — it may decline the transaction. This could be more likely in countries where fraud is a bigger problem.

Which is why the answer to the question “Should I notify my credit card company when traveling?” is usually yes.

Although you can often get away with shopping in another state without triggering a red flag, international travel is another story.

By notifying your credit card of your travel plans, you’ll reduce the chances of getting your transaction declined in the checkout line — which, trust me, is never fun — and having to call your card issuer to verify your purchases. It’s still possible to have your purchases declined after setting a travel notice, but it’s much less likely.

How to Set Up Travel Notices for 8 Major Credit Card Issuers

Ready to create your first travel alert? While you could call your card issuer, it’s easier to do it online.

Here’s how to set up travel notices with eight different credit card issuers.

When you visit MoneyTips, we want you to know that you can trust what’s in front of you. We are an authoritative source of accurate and relevant financial guidance. When MoneyTips content contains a link to partner or sponsor affiliated content, we’ll clearly indicate where that happens. Any opinions, analyses, reviews or recommendations expressed in our content are of the author alone, and have not been reviewed, approved or otherwise endorsed by the advertiser.

We make every effort to provide up-to-date information; however, we do not guarantee the accuracy of the information presented. Consumers should verify terms and conditions with the institution providing the products. Some articles may contain sponsored content, content about affiliated entities or content about clients in the network. While reasonable efforts are made to maintain accurate information, the information is presented without warranty.

Chase travel notice

Because of the company’s abundant travel perks and partnership with the Visa network — which is widely accepted worldwide — Chase cards are a favorite among globetrotters.

You can create Chase travel notifications up to a year in advance for credit cards, and up to 14 days for debit cards. Your travel dates can span an entire year — if you’re away for longer, you’ll simply have to adjust your dates once you’re on the road. Chase will have your request on file within 24 hours from the time you submit.

To set up Chase travel notifications, you’ll need to log in to your account and click on the credit card you plan to use. Under the “Things you can do” dropdown menu on the right, you’ll see the “Travel notification” option. That will take you to your “Profile & Settings” page, where you’ll be able to create a travel alert.

Insider tip

Depending on the type of Chase account you have, the process may be slightly different for you. In any case, just look for your “Profile & Settings” page, and then look for a button to set a travel notice.

Alternatively, if you’re already outside the country, you can call Chase collect at 1-302-594-8200 to alert the issuer of your travel plans.

Setting up a travel notice with the Chase bank app

After logging in to the Chase mobile app, tap the profile icon (this should appear as the outline of a person) and select “My settings.” Choose “Travel” within the settings menu and tap “Update” near any credit or debit card products you’ll be taking.

This will allow you to enter the details for your upcoming trip, which can be edited at a later time. Saving this information will successfully set up a travel notice.

Our favorite Chase travel card: While many Chase credit cards are adventure-ready, we’d recommend the Chase Sapphire Preferred® Card for new travelers. Not only does it earn 2X Chase Ultimate Rewards points per dollar on travel, but you’ll also get a great introductory bonus: 60,000 bonus points after spending $4,000 on purchases in the first 3 months. You’ll also earn 5X Ultimate Rewards points per dollar on Lyft rides and travel purchased through Chase Ultimate Rewards. You can transfer the points you earn to a variety of airline and hotel loyalty programs. The Sapphire Preferred has a $95 annual fee.

American Express travel notice

Surprise! You actually can’t create an Amex travel notice.

On its site, the issuer says it uses “industry-leading fraud detection capabilities” that help it recognize when you’re on the road, thereby eliminating the need to create an American Express travel notification.

The issuer does recommend you update your contact information, so it can reach you in case of any complications, and download the Amex app, so you can manage your account on the go.

Note that Amex credit cards aren’t as widely accepted across the globe. If you’re a frequent international traveler, we’d recommend looking for a card with a Visa or Mastercard logo instead because they’re accepted by most merchants.

Our favorite American Express travel card: For its $695 Rates & Fees annual fee, The Platinum Card® from American Express offers a slew of travel perks. They include extensive airport lounge access; 5X Membership Rewards points per dollar on eligible flights and hotels (starting 1/1/21, on up to $500,000 spent per calendar year); and up to $200 in Uber credits per year. Its introductory bonus is Earn 100,000 Membership Rewards® points after you spend $6,000 on purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum Card®, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu..

Capital One travel notice

As with Amex, there’s no need to set a travel notice for Capital One credit cards.

If you log in and click “Set Travel Notification,” you’ll be greeted by this window:

The issuer, long popular with international travelers for its lack of foreign transaction fees, says: “With the added security of your Capital One chip card, travel notifications are no longer needed on your credit card.”

It notes Capital One will cover you with its $0 fraud liability policy, and will also be on the lookout for any suspicious activity.

Our favorite Capital One travel card: The Capital One Venture Rewards Credit Card is a fantastic, easy-to-use travel rewards card, offering 2X Venture miles per dollar on everything. The introductory bonus is 60,000 bonus miles for spending $3,000 in the first 3 months. It comes with a $95 annual fee.

Bank of America travel notice

Ready to travel with your Bank of America card? Log in to your account, and in the menu at the top right, you’ll see “Help & Support.”

Hover over those words, and a drop-down menu will appear. Click on “Set Travel Notice” — and voila! You’ll be able to add your travel dates and destinations, as well as extra details about your trip, like any planned layovers.

Setting a travel notice with Bank of America.

Bank of America cards allow you to set travel notices up to 60 days in advance, and they can last for up to 90 days. If you’ll be traveling longer than that you’ll need to adjust your travel notice later on.

Our favorite Bank of America travel credit card: If you don’t want to pay an annual fee, the Bank of America® Travel Rewards Credit Card might work for you. You’ll earn 3X points per dollar at the Bank of America travel center and 1.5X points on everything else. After you make $1,000 in purchases in the first 90 days, you’ll earn 25,000 points — enough for a $250 statement credit toward travel purchases.

Citi travel notice

If you have a Citi credit card, the first step is to log in to your account.

Then you should hover over the “Services” button in the menu, and then select “Travel Services.” Next you can select “Manage Travel Notices,” before selecting the card for which you want to set a notice. Unlike some other issuers, you’ll need to set a separate notice for each card you plan to travel with.

Citi advises making sure your contact information is up to date before traveling, and also to download the Citi Mobile App to more easily monitor your account.

Here’s what setting a Citi travel notice looks like:

Setting a travel notice with Citi.

Then, once you fill out your destination and dates and verify your info, you’ll be good to go!

Our favorite Citi travel credit card: The offers a generous 3X ThankYou points per dollar on air travel and at gas stations, restaurants, supermarkets, and hotels. You can earn None. There’s a None annual fee to pay for this card.

Discover travel notice

Although Discover credit cards aren’t the best for traveling internationally, as they aren’t accepted as widely as Visa or Mastercard, you should still set up a travel notice if you bring your Discover card overseas.

You can do this from your online account by selecting “Manage” at the top of your screen, then clicking “Manage Cards” and then “Register Travel.”

Setting a travel notice with Discover.

Our favorite Discover travel card: For a card with no annual fee, the Discover it® Miles isn’t a bad choice. You’ll get 1.5X miles per dollar spent on everything, with double your miles at the end of your first cardholder year.

PNC travel notice

If you have a PNC credit or debit card, the bank recommends you set up a travel notice, explaining: “You typically use your card at local merchants and online, but suddenly you’re buying tapas in Madrid or sushi in Tokyo. This unexpected activity is what triggers the alert. Although less likely, this kind of predicament also can happen when traveling domestically.”

To notify PNC, you can either call the financial institution at 1-888-PNC-BANK or set up an alert online. After logging in to your account, you’ll select: “Customer Service” –> “Account Services” –> “Debit/ATM Card Services” –> “Edit/View Preferences.”

Then, in the bottom right corner of your screen, you’ll see an option to “Notify PNC of Foreign Travel.” After filling it out with your dates, destinations, and phone number, you’ll be ready to go.

Recommended PNC travel credit card: Like the BofA card, the PNC Premier Traveler® Visa Signature® isn’t the best option out there — but it’s fine for PNC loyalists. It offers a 30,000-mile introductory bonus when you spend $3,000 in the first three billing cycles, and 2X miles per dollar spent on everything. Its $85 annual fee is waived the first year.

Wells Fargo travel notice

If you’d like to tell Wells Fargo of your travel plans, you can either call the number on the back of your card, use the bank’s mobile app, or log in to your online account.

If you choose the latter method, you’ll hover over the “Accounts” dropdown menu, then click on “Manage Cards” –> “Manage Travel Plans.” As with the other issuers, you’ll enter your dates and destinations before submitting.

Recommended Wells Fargo travel credit card: There aren’t any Wells Fargo travel cards at the moment.

If you’d prefer a Visa card from Wells Fargo for traveling, consider the Wells Fargo Active Cash℠ Card . It offers 2% cash back on everything you buy, with a solid introductory bonus, but it also has a foreign transaction fee.

4 Things to Consider When Choosing a Travel Credit Card

If you’re looking for another piece of plastic to add to your wallet, here are four things to consider when choosing the best travel rewards credit card:

- Foreign transaction fees: Some credit cards charge a 3% fee for making purchases in a foreign currency. If you plan to travel abroad, make sure your chosen card has no foreign transaction fees.

- Annual fees: Many of the top-tier travel rewards credit cards have hefty annual fees. But before getting scared off, see if the card offers any credits or benifits that offset it. For example, while the Chase Sapphire Reserve® has a $550 annual fee, it also offers a $300 annual travel credit that applies toward flights, car rentals, and even Lyft rides.

- Rewards and perks: One of the most compelling reasons to get a travel credit card is the opportunity to earn points and miles that you can exchange for free travel. So take a look at your potential card’s introductory bonus and earning ability. You should also read the fine print to learn all about its travel perks, which might include airport lounge access or travel insurance.

- Loyalty programs: The majority of hotel chains and airlines have co-branded cards that earn additional rewards when you spend money with them. So if you are loyal to a particular brand, it’s wise to consider the co-branded options. For hotel cards, examples include the IHG® Rewards Club Premier Credit Card, Marriott Bonvoy Boundless™ Credit Card, and The World of Hyatt Credit Card. For airline cards, you can choose from options like the United℠ Explorer Card or Southwest Rapid Rewards® Plus Credit Card.

Whichever card you choose, be sure to set a travel notice before you board your next train or cruise or flight — and then enjoy your vacation free of worries!

You don’t have to stick to “travel credit cards” just because you want to, you know, travel with your credit card. As long as you set up a travel notification when you go, you can use any card you’d like. So, in case they’re a better fit, here are links to the best cash back, balance transfer, and 0% intro APR credit cards.

Share Article

On This Page Jump to Close

You should also check out….

Setting up a travel notification on a Bank of America card

December 4, 2012 by alex

Most big banks have an online travel notification form where you can alert your bank that your card will be used overseas. If you fail to alert your bank there is a high chance they will reject any transactions abroad if you have not alerted them as a precaution.

I have a Bank of America debit card that I use as a backup to my new No Foreign Transaction Fee ING Direct debit card . For years I have been putting a call in to BOA and wasting 20+ minutes transferring from here to there to here to there until I finally find the right person who can add the simple travel notification to my account.

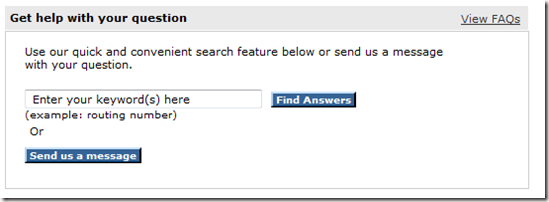

This time around I tried using the BOA chat feature and completed the transaction in exactly 57 seconds. The chat went like this.

Lana: Hello! Thank you for being a valued Bank of America customer! My name is Lana. Lana: May I have your complete name please? You: alex ….. Lana: Thank you Alex! Please give me one moment while I access your information. Lana: How may I assist you with your personal accounts today? You: I want to put a travel notification on my debit card for Japan and Germany. You: I will be using the card outside the country in the upcoming week from XXX to XXX Lana: I have successfully made the travel notification in your account. Lana: Is there anything else I can assist you with today? You: Nope, that is it. Thank you! Lana: You’re Welcome and have a Safe Trip!

To get into the chat, login and look to the bottom right.

Click Send us a message.

From there click, Send us a message AGAIN.

And finally click, Chat with a specialist. They make this too easy……

Checkout more Credit card offers here.Â

The bottom line

Alex loves to travel and does so a lot. Logging 100,000 flight miles each year over the past 4 years, Alex uses points and miles to power his passion. Alex is continuously striving to experience the far reaches of the globe. In his day job, Alex is a Management Consultant frequently on the road advising Technology organizations. I love thinking about, reading about, and talking about all things travel. Feel free to reach me at [email protected]

Sign up for Email || Twitter || Facebook | | Tips & Tricks Hotel Offers || Airline Offers || Bank Offers || Cash Back Offers

I have been with BOFA for a long time now. In the past, I had to tell them every time I am traveling, however, now I have an established “pattern” of traveling abroad quite often, I have since [maybe 4 years ago] stopped notifying them when I travel. I have never had any issues *knock on wood*. I think this is paramount for people who does not travel abroad often and a charge taking place in Germany will trigger a red flag in their account for potential fraud/theft.

However, for travelers like us, with a repeated and established travel history, it is not as crucial. It is good to err on the safe side and notify the bank nonetheless.

Thanks for sharing this tip and this definitely save a lot of time! 🙂

I was happy to see your post and immediately did a chat session to have my account noted. Unfortunately it doesn’t work for all their customers:

Alex Smith: As a valued Wealth Management client, you not only have an assigned Financial Advisor that provides you thoughtful guidance to help you reach your financial goals, you also have access to a dedicated Wealth Management Client Services team that is available to assist you with your servicing needs.

Alex Smith: May I provide you the contact number of our Wealth Management Client Services team for immediate service with your request today?

You: Can we just do it through chat to note the account?

Smith: I am so sorry I see you are a valued Wealth Management customer and you have a dedicated department where your request can be placed

Thanks for the tip. Chat specialist was available immediately and “Katherine” helped me sort out my travel plans. I’m glad I didn’t have to deal with those robots over the phone 🙂

Just did this, worked perfectly and got a chat much faster than the phone calls work. They did ask for some extra info – full name and driver’s license number but still very fast and painless.

Great information! – What do you think of your bank automatically placing a travel note on your account when you book your travel plans online (ie – expedia, Priceline, etc)? Good idea?

Apparently this is now possible online 🙂

https://www.bankofamerica.com/deposits/manage/faq-atm-fees.go

How can I avoid problems if I plan to use my ATM card or debit card while traveling internationally?

To help prevent an interruption in ATM or debit card access, it’s necessary to set a travel notice on the cards you plan to use while traveling either at home or abroad. To set a travel notice, sign in to Online Banking. You may also call 1.800.432.1000.

I will be traveling to France Oct. 14, returning Oct 23. And will be using my B of A debit cards whilst Im away.

I will be traveling to Cape Town South Africa on March. 25, 2015 returning on April. 6, 2015. And will be using my B of A debit card whilst Im away.

I need to know how to use my points for traveling

I will be traveling to Canada, Netherlands, Germany, France and Switzerland from April 14, 2016, returning May 26, 2016. I will be using my B of A debit card while I am away.

I’m so frustrated right now. I called to inform of travel plans and as of about 3 weeks ago I guess we the customer have to do it all on line now. The online site is not user friendly because I can’t find anywhere how to put that info in. So I’m. Using the card anyway and hoping for the best and that you don’t shut it down while in Canada for the week

Traveling to San Diego Feb 2nd- March 1st

Travel notification

I go to London I try to notifica. the bank af America of my travel guess what I no going to use this card I call I look in the cp cero buy bank of america

I need help with my travel notification.please change date when card should be actuvated for travel to 3/10/17 -4/10/17. Thank you.

Dear Bank of America,

I am currently in Myanmar. Before getting here, I placed a travel alert on my card as you suggest.

Yesterday, after 2 withdrawals from the ATM, Bank of America blocked my card. I called the international number you provided (it is not collect, international roaming charges still apply) as this is the only to un-block the card. I spoke to an associate for about 15 minutes to un-block the card. I also notified him that I will be using my Bank of America card to withdraw below my daily limit from the ATM for the following three days.

Today, my card was declined at the ATM again. I called the international number you have provided. I was on hold for 37 minutes. The customer representative assured me that the card was now unblocked and would not be blocked again and that I could have access to my money without any worries.

I tried the ATM again after the call and the transaction was declined again. I am now calling for the third time and am on hold.

My husband who has a Charles Schwab account has had none of these problems after he notified his Bank of his travels. I travel internationally quite frequently and I will be moving to Myanmar soon. If you are unable to resolve this issue, I will need to move my account to a Bank that can assure that I have access to my money in my checking account, while handling security and fraud concerns. It is rather lucky that I have multiple hours free today to call Bank of America repeatedly and wait, and I do not have immediate need for the money. If the circumstances were different, I could also be in quite a difficult situation.

I want to send a travel notification. I will be traveling to Ireland – April 22 -29, 2017.

How do I let my Bank America Credit Card know that I am traveling?

My account has been locked even though my credit card is now under $2000 of the limit. Thank you for your kind attention!

I shall be in France from 4/22/2017 until 4/29/2017.

Driving from Arizona to Seattle via California, Oregon and into Washington to arrive in Seattle on April 28. We will be leaving Arizona April 28.

I will be traveling to Des Moines Iowa between May 18th and returning May 23rd.

BOA credit card – needed travel notification. The phone line threw me off because I had more than 6 states in my travels. SIX! Got a person – no help – using some kind of bank lingo about a “travel flag”. (?) A flag on my car? She couldn’t add the 7th state. Who decided on only 6? Called again – only used 6 and hope for the best. Don’t bank on line – couldn’t sign in. Spent way too much time on the phone.

alert. I will be in greece and italy.

I will travel to Philippines and possible China effective July 18,2017 thru 01/10/2018

Please leave a message that I am safe to use my Visa debit card and my BOA mastercard ending in 1940 without any rejections…

Account No. —-4411. Will be traveling to London, Scotland, and Norway. July 20 to August 1 2017.

I will be in different parts of Spain from 8/6/17 until 8/15/17. i do not want any restrictons put on my card while I am away. Had a horrible experience my daughter’s wedding 5 years ago and even with proper notification could not use my card for 3 days. Quite the embarassment. I do not want this to happen agan.

I’ll be traveling 8-23-17 thru 9-3-17. Unusual charges in Aruba, Curaçao, and Turks and Caicos plus Disneyworld before . So just for you info.

I want to leave a travel notice as I will be in Roatan with Mayan Princess & Mayan Divers October 21 through October 28, 2017. So just for your info.

I will be in Guatemala from Nov. 23 to Nov. 29 and plan to use my Bank of America visa card. I was not able to reach you by phone. How can I notify BofA? Lucile E. Leard

I will be in Israel and Jordan from Jan 10 to Jan 23 and would like to notify Bank of America in the event I need to use my card.

I will be in Israel from February 17 to February 28 and would like to notify Bank of America in the event I need to use my card.

My husband and I will be traveling to Florida by car, from Tuesday, April 3rd, 2018, to Tuesday, April 17th, 2018. The states that our card may be used will be: Delaware, Maryland, Virginia, North Carolina, South Carolina, Georgia, and Florida.

I want to post a travel notification on my Bank of America Visa credit card

Another comment from Nancy Wakeman. I will be traveling in Italy from October 5, 2018 through October 25, 2018 and wish to use my Bank of America Visa card in Italy.

Voy a viajar por primera vez a Suecia, Helsinki, san petersburgo, Estonia y Letonia . Deseo programar mis tarjetas para ser usadas sin problemas durante mi viaje

my travel agent will be using my visa card to pay for reservations for travels to Italy, Germany and Denmark please allow the charges to be placed on my card. I will be using the card Sept 20,2018 to Oct 11,2018 in the same country’s. you need to allow these charges to be placed on my visa card. thank you

Need to change states traveing to Sept 23 to Oct 1, 2018

new states same dates Sept 23 to Oct 1, 2018 Texas, New Mexico, Colorado

Going to San Diego, then on a Cruise to Ensenada. Feb. 13-22

Leave a Reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Notify me of follow-up comments by email.

Notify me of new posts by email.

Free Newsletter

Enter your email to receive the latest travel deals, news and updates direct to your inbox.

You have Successfully Subscribed!

Do you need to set up travel alerts on your credit cards?

Whether you have two or 22 travel rewards credit cards in your wallet, chances are you enjoy hitting the road. Unfortunately, it can be extremely frustrating when your card gets flagged while traveling, and you're suddenly unable to use it. While it's great when an issuer correctly flags unauthorized account activity as fraudulent, the opposite is true when the issuer inadvertently prevents you from swiping a card.

Thankfully, most major issuers no longer require users to set travel alerts ahead of time.

In this guide, we'll walk through the details for different cards so you know what to expect before your trip.

What is a travel alert?

Before diving into issuer-specific guidelines, let's start with a quick overview of what a travel alert is and why this is important.

Most of today's credit cards have mechanisms to prevent fraud and abuse. When an issuer notices unusual account activity, it may flag it as potentially fraudulent. This happened to me when an unauthorized individual called Chase and inputted the full 16-digit account number of my Chase Freedom Unlimited. I immediately requested a new card, preventing the thief from actually using the compromised card number — a minor inconvenience but not a significant hassle.

However, this protection can also kick in if you try to use a card abroad or in an area of the U.S. that's far from your primary residence. Suppose you've spent months (or even years) swiping a card solely within a specific area and then you suddenly try to use it in another state or country. In that case, this activity might get flagged — and it could be a substantial roadblock to continuing your trip. If you haven't set up your cellphone to work abroad — or if you're in an area with limited service — there may be no quick way to let the issuer know that the purchase is (in fact) valid and authorized.

If you notify the issuer ahead of time, a sudden charge in another part of the country or the world (one that you specifically said you'd be visiting during the given time period) won't be flagged. This allows you to continue swiping your card and — most importantly — keep enjoying your trip.

So, how exactly do you do this? As noted above, many major credit card issuers no longer require proactive travel alerts ahead of time — but let's go through some of the largest ones.

Related: Best credit cards with no foreign transaction fees

How to set American Express travel alerts

Amex doesn't require you to set up travel alerts. In fact, if you log in to your account at AmericanExpress.com, you won't even see this as an option. Here's the rationale, per the issuer's FAQ page on the topic:

We use industry-leading fraud detection capabilities that help us recognize when our card members are traveling, so you don't need to notify us before you travel.

It does suggest that you keep updated contact information on your account and download the Amex app before your trip. However, you shouldn't have any trouble using your cards when traveling.

Applicable cards include: American Express® Gold Card , The Platinum Card® from American Express , Marriott Bonvoy Brilliant® American Express® Card , The Business Platinum® Card from American Express .

How to set Bank of America travel alerts

Like Amex, Bank of America no longer requires travel alerts ahead of time. If you search in the Help & Support center, you'll see the following message:

You no longer need to let us know when you travel. We monitor your accounts and will send automatic alerts if we detect suspicious activity. Should you need us while traveling, call the number on the back of your card anytime.

TIP: It's important that your email address and mobile phone number are up to date on your account profile, so we can notify you quickly about unusual activity.

Note that this applies to both credit and debit cards associated with your Bank of America login, which can be nice if you're planning to withdraw money from an ATM using your debit card.

Applicable cards include : Alaska Airlines Visa Signature® credit card , Bank of America® Premium Rewards® credit card .

How to set Capital One travel alerts

Capital One uses the same approach as American Express — you don't need to set these up in advance. When you log in to your Capital One account and click on the "I Want To…" button, you'll see what appears to be an option to set a travel notification. However, when you click on it, you'll receive the following message:

With the added security of your Capital One chip card, travel notifications are no longer needed on your credit card. That's right! You don't have to tell us when and where you're traveling, inside or outside the United States. Your credit card is 100% covered for fraud while you're traveling and we will alert you if we see anything suspicious.

You're covered by $0 Fraud Liability on unauthorized charges. Remember that none of Capital One's credit cards impose foreign transaction fees for purchases made abroad.

Applicable cards: Capital One Venture X Rewards Credit Card (see rates and fees ), Capital One Venture Rewards Credit Card (see rates and fees ), Capital One SavorOne Cash Rewards Credit Card (see rates and fees ), Capital One Spark Miles for Business (see rates and fees ).

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

How to set Chase travel alerts

Chase offers a wide variety of valuable credit cards, including many that you may want to use when traveling. Like previous issuers on the list, you no longer need to proactively set up travel notifications ahead of your trip. When you log in to your Chase account, you'll still see the "Travel notification" option under account services, but here's the message you'll find there:

We've got you covered! With our enhanced security measures:

- You don't need to set up travel notifications anymore.

- We'll send you fraud alerts if we see any possible identity theft.

- We'll alert you if we notice any suspicious behavior on your account.

Applicable cards include: Chase Sapphire Reserve® , Chase Sapphire Preferred Card® , World of Hyatt Credit Card , United℠ Explorer Card , Aeroplan Credit Card® , Ink Business Preferred® Credit Card .

How to set Citi travel alerts

Unlike previous issuers, Citi still allows you to set up travel notifications on your credit cards. Here's how to do so:

- Log in to your account at citi.com

- Hover over "Services" at the top, then click on "Travel Services"

- Click on "Add a Travel Notice"

- Select the applicable cardholders, enter your dates, then click "Next"

- Review the details, then click "Confirm"

Note that you don't even need to select the individual destination (or destinations) you're visiting. The only required pieces of information are the cardholders who'll be on the trip (including authorized users ) and the dates of the trip.

Applicable cards include: Citi Premier® Card (see rates and fees ), Citi Rewards+® Card (see rates and fees ), Citi® / AAdvantage® Executive World Elite Mastercard® (see rates and fees ).

What if a travel alert doesn't work?

Unfortunately, even the advanced technology credit card issuers use nowadays isn't guaranteed. There may be certain instances where a legitimate transaction is flagged as potentially fraudulent, especially when traveling. Alternatively, an issuer may require an extra verification step before approving a purchase instead of being declined immediately. This especially applies to many online transactions thanks to 3D card security measures .

This is one reason why it's critical to have updated contact information on file with your card issuers and a working mobile phone when you're outside the country. This ensures that you can complete any verification requests in a timely fashion.

It's also critical to always have at least one backup credit card in your wallet when traveling (or load alternate options into your mobile wallet ). Ideally, this card would be from a different card issuer and work with a different payment network, which minimizes the chance that neither card will work.

Related: Best travel credit cards

Bottom line

From full flights to weather delays to traffic, travel can be stressful — and that's without any financial issues. Fortunately, most major credit card issuers no longer require advance travel notices on your accounts. However, you should still carry at least one backup payment method in case your primary card is declined. It's also critical to have a working phone number to receive email or text notifications when things go wrong.

If you want to maintain your ability to swipe your favorite travel rewards credit cards on your next trip, follow these instructions before you depart.

Alistair Berg/Getty Images

Advertiser Disclosure

How to use your rewards to book a trip through the Bank of America Travel Center

Some cardholders can earn bonus points on trips booked through the bank's travel center

Published: February 15, 2022

Author: Emily Sherman

Editor: Kaitlyn Tang

Reviewer: Liz Bingler

How we Choose

If you are a Bank of America travel cardholder, booking a trip through the bank’s travel center is a great option for redeeming points. However, you might be able to find a better deal on another booking platform.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards , or use our CardMatch™ tool to find cards matched to your needs.

The Bank of America content was last updated on Feb. 14, 2022.

If you have the Bank of America® Travel Rewards credit card , Bank of America® Premium Rewards® credit card or Bank of America® Business Advantage Travel Rewards World Mastercard® credit card* , you might have considered booking your next trip through the Bank of America Travel Center. However, does the Bank of America Travel Center offer good value, or are you better off redeeming points for an outside travel purchase?

Bank of America points are very flexible, and cardholders can book travel on a third-party travel site and redeem rewards for that purchase up to a year after it was made. That means you can hunt for a great deal without worrying about losing any point value. On the flip side, Bank of America Travel Rewards and Business Advantage Travel Rewards cardholders get a higher rewards rate on purchases made through the Travel Center – making it tempting to book through Bank of America.

What is the Bank of America Travel Center?

The Bank of America Travel Center is the bank’s travel booking platform, designed for travel rewards cardholders to easily redeem their points for flights, hotels and car rentals. Eligible cardholders can access the Travel Center directly from their online account to make booking their next vacation simple.

How to book a trip through the Bank of America Travel Center

When you sign into your Bank of America credit card account, you can view all the ways you can redeem your points. To get to the Travel Center right from this page, just select “Book now.”

Through your account, you’ll be able to search for a flight, hotel or car rental just like you would with any third-party booking site.

Booking flights

When you search for your preferred flight in the Bank of America Travel Center, you’ll be able to easily filter between your preferred airlines. Each search result has a score out of 10 to help you determine if it’s a good deal and flight path.

Booking hotels

Like booking a flight, booking a hotel on the Bank of America Travel Center is very straightforward. You just enter in information about your destination and travel dates. In the search results, some properties with good deals or temporary discounts are flagged as “Special Price” to help you ensure you find the best deal.

Booking car rentals

The final travel purchase you can book on the Bank of America Travel Center is a rental car. Once again, the search is very straightforward, and you’ll be presented with a wide variety of rental car providers.

Unfortunately, the Bank of America Travel Center doesn’t offer vacation packages, cruises, experiences or other kinds of travel purchases – like many other bank travel portals.

Drawbacks to booking travel through the Bank of America Travel Center

Though the Bank of America Travel Center is certainly easy to use, there are a few drawbacks to booking this way.

No hotel elite benefits

If you are part of a hotel loyalty program , you might not be able to take advantage of your elite status perks when you book through a third-party booking site. Since Bank of America points are flexible and can be redeemed for most travel purchases, frequent travelers who want to enjoy these benefits might be better off booking directly with the property itself and redeeming points for a statement credit after the fact.

Only Bank of America travel cardholders can book through the Travel Center

While some travel portals – like American Express Travel – allow anyone to book a trip on the site, the Bank of America Travel Center is limited to cardholders who earn travel rewards with the bank. If you have a checking or savings account with Bank of America or a card that just earns cash back, you can’t take advantage of the platform.

Is booking through the Bank of America Travel Center worth it?

While booking through the Bank of America Travel Center is certainly convenient, it doesn’t have much that separates it from booking on another site. You’ll get the same point value either way, and prices are competitive across booking platforms.

Bank of America Travel Center rates compared to other booking sites

In general, the prices you can find on the Bank of America Travel Center are competitive with rates on other sides. For example, take this flight from Charlotte to Chicago.

Whether you book the trip through Bank of America, United or Priceline, it’ll cost you the same amount.

Though prices are not typically better than other sites, there is one case where booking through Bank of America makes more sense. If you have a Bank of America Travel Rewards or Business Advantage Travel Rewards card, you get a higher rewards rate on purchases made through the portal. To quickly rack up points to use toward your next trip, book on the Bank of America Travel Center.

Tips for maximizing the Bank of America Travel Center

- Always compare prices to other booking sites to ensure you are getting the best deal. You can redeem points for a statement credit to cover an outside travel purchase.

- Pay any cost you can cover with points with a Bank of America Travel Rewards card or Business Advantage Travel Rewards card to earn bonus points on those purchases.

- Keep an eye out for special prices on hotels to save on your next trip.

Bottom line

The Bank of America Travel Center is a straightforward booking platform and an easy way to redeem your rewards. If you have a Bank of America Travel Rewards card, you can also earn extra points on purchases made there. However, since you can redeem points for an outside travel purchase retroactively, there aren’t many other perks to booking through Bank of America.

*All information about the Bank of America Business Advantage Travel Rewards World Mastercard credit card has been collected independently by CreditCards.com. The issuer did not provide the content, nor is it responsible for its accuracy.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.

Emily Sherman is a senior editor at CreditCards.com, focusing on product news and recommendations. She is also one of the founders of To Her Credit, a biweekly series of financial advice by women, for women. When she's not writing about credit cards, she's putting her own points and miles to use planning her next big vacation.

Essential reads, delivered straight to your inbox

Stay up-to-date on the latest credit card news 一 from product reviews to credit advice 一 with our newsletter in your inbox twice a week.

By providing my email address, I agree to CreditCards.com’s Privacy Policy

Your credit cards journey is officially underway.

Keep an eye on your inbox—we’ll be sending over your first message soon.

Learn more about Card advice

BankAmericard benefits guide

The BankAmericard offers many compelling rewards and benefits, including 18 billing cycles of 0% APR promotional financing on both new purchases and balance transfers (followed by 12.99% to 22.99% variable APR). You can also receive a $100 statement credit if you meet the spending requirement, plus access to other valuable benefits.

BankAmeriDeals program guide

Bank of America credit and debit card holders can earn extra cash back on everyday purchases with BankAmeriDeals.

Credit score needed for the BankAmericard

Is the BankAmericard credit card worth it?

Is the Bank of America Travel Rewards credit card worth it?

How to add an authorized user to a Bank of America credit card

Explore more categories

- Credit management

- To Her Credit

Questions or comments?

Editorial corrections policies

CreditCards.com is an independent, advertising-supported comparison service. The offers that appear on this site are from companies from which CreditCards.com receives compensation. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within listing categories. Other factors, such as our own proprietary website rules and the likelihood of applicants' credit approval also impact how and where products appear on this site. CreditCards.com does not include the entire universe of available financial or credit offers. CCDC has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

Since 2004, CreditCards.com has worked to break down the barriers that stand between you and your perfect credit card. Our team is made up of diverse individuals with a wide range of expertise and complementary backgrounds. From industry experts to data analysts and, of course, credit card users, we’re well-positioned to give you the best advice and up-to-date information about the credit card universe.

Let’s face it — there’s a lot of jargon and high-level talk in the credit card industry. Our experts have learned the ins and outs of credit card applications and policies so you don’t have to. With tools like CardMatch™ and in-depth advice from our editors, we present you with digestible information so you can make informed financial decisions.

Our top goal is simple: We want to help you narrow down your search so you don’t have to stress about finding your next credit card. Every day, we strive to bring you peace-of-mind as you work toward your financial goals.

A dedicated team of CreditCards.com editors oversees the automated content production process — from ideation to publication. These editors thoroughly edit and fact-check the content, ensuring that the information is accurate, authoritative and helpful to our audience.

Editorial integrity is central to every article we publish. Accuracy, independence and authority remain as key principles of our editorial guidelines. For further information about automated content on CreditCards.com , email Lance Davis, VP of Content, at [email protected] .

- Sign In Secure Sign In. Sign in to your Bank of America account.

- bankofamerica.com

- En Español

Get the card that makes your travel more rewarding. Apply now »

For complete program details, view the Program Rules Bank of America ® Travel Rewards ® Program Rules (PDF) .

© 2024 Bank of America Corporation. All rights reserved.

You have selected to redeem your points for travel.

If you want to redeem your points, select Continue . If you wish to purchase travel, select Purchase Travel and you will be directed to the Bank of America Travel Center where you can purchase travel without using your points.

En este momento, estamos actualizando nuestros sistemas para incorporar caracterÃÂsticas mejoradas a la experiencia de recompensas en lÃÂnea. Como resultado, este sitio web se encuentra temporalmente fuera de servicio. El canje de recompensas no estará disponible hasta las últimas horas de la tarde el 20 de mayo. Gracias por su paciencia.

We are currently updating our systems to bring enhanced features to the online rewards experience. As a result, this website is temporarily unavailable. Rewards redemption will not be accessible until late afternoon on May 20. Thank you for your patience.

Va a entrar a una página que pordrÃa estar en inglés

Es posible que el contenido, las solicitudes y los documentos asociados con los productos y servicios especÃÂficos en esa página estén disponibles solo en inglés. Antes de escoger un producto o servicio, asegúrese de haber leÃÂdo y entendido todos los términos y condiciones provistos.

En este momento, estamos actualizando nuestros sistemas para incorporar características mejoradas a la experiencia de recompensas en línea. Como resultado, este sitio web se encuentra temporalmente fuera de servicio. El canje de recompensas no estará disponible hasta las últimas horas de la tarde el 20 de mayo. Gracias por su paciencia.

Important Notice

We are in the process of converting your BankAmericard Privileges ® with Travel Rewards credit card to a BankAmericard Travel Rewards ® credit card. As a result, you will not be able to access the rewards site at this time. Thank you for your patience.

Your BankAmericard Privileges ® with Travel Rewards credit card has recently been converted to a BankAmericard Travel Rewards ® credit card. Please visit bankofamerica.com to access your new rewards site and find out what your new credit card program has to offer.

How to Set Up A Travel Notification Bank of America?