- Reward types, points & expiry

- What card do I use for…

- Current Credit Card Sign Up Bonuses

- Credit Card Lounge Benefits

- Credit Card Airport Limo Benefits

- Credit Card Reviews

- Points Transfer Partners

- Singapore Airlines First & Business Class Seat Guide

- Singapore Airlines Book The Cook Wiki

- Singapore Airlines Wi-Fi guide

- The Milelion’s KrisFlyer Guide

- What is the value of a mile?

- Best Rate Guarantees (BRGs) for beginners

- Singapore Staycation Guide

- Trip Report Index

- Credit Cards

- For Great Justice

- General Travel

- Other Loyalty Programs

- Trip Reports

My thoughts on the HSBC TravelOne Card

The HSBC TravelOne Card is a great general spending card- and maybe that's the problem.

This week saw the launch of the TravelOne Card, HSBC’s first mass market miles card in Singapore. HSBC certainly took its time entering this segment — almost every other bank already has one — but hey, there’s no harm in being fashionably late.

I’ve spent the past couple of days poring over the details of this card and analysing its use cases. Like every new launch, the TravelOne has generated a ton of online discussion, which has been very helpful in spotting things I missed the first time round!

And as I was drafting this post, I suddenly had an epiphany.

The biggest strength of the HBSC TravelOne? It’s a great general spending card. The biggest weakness of the HSBC TravelOne? It’s a great general spending card.

If that sounds confusing, don’t worry- it’ll get clearer as we go along.

The earn rates are great (for a general spending card)

HSBC TravelOne Cardholders earn:

- 3X HSBC points per S$1 (1.2 mpd) on local spend

- 6X HSBC points per S$1 (2.4 mpd) on foreign currency spend

There is no minimum spend required, nor cap on the points that can be earned.

It speaks volumes about where the market is right now that more than a few comments have basically said “Not 4 mpd? Pfffft”. But that’s understandable in a way. Cards like the UOB Preferred Platinum Visa and UOB Visa Signature have made us so accustomed to earning 4 mpd almost everywhere that it’s become the de facto expectation for some.

And yet, it’s important to remember that the TravelOne is intended to be a general spending card , and we need to benchmark it to the appropriate segment.

In fact, given its earn rates and rounding policies, I’d say it more than holds its own against the competition; all the more so for HSBC Everyday Global Account customers who can earn a bonus 1% cashback on all transactions (capped at $300 per month).

Furthermore, I’m quite amazed that the HSBC TravelOne outearns the top-of-the-line HSBC Visa Infinite (1/2 mpd on local/overseas spend, upgraded to 1.25/2.25 mpd on local/overseas spend with a hefty minimum spend of S$50,000 in a membership year). That must have been a fascinating internal discussion, since product managers are loath to have their baby upstaged- especially by a card for the unwashed masses!

It’s not just raw earn rates, mind you. Quality of points matters as much as quantity .

If HSBC had launched a card with 1.6/2.4 mpd earn rates, yet kept Asia Miles and KrisFlyer as its only transfer partners, I’d be much more indifferent. Yes, those would be excellent earn rates for a general spending card, but at the end of the day what’s changed? It’s not breaking any new ground.

The TravelOne’s claim to fame is not its earn rates, solid though they may be. It’s the new transfer partners it’s added and will continue to add throughout 2023 (more on that later). That, to me, is more important than incrementally higher earn rates.

I’ve often believed that banks are getting the market for general spending cards wrong. It seems as if the thought process goes something like, “What’s better than 1.2 mpd? 1.3 mpd. What’s better than 1.3 mpd? 1.4 mpd…”

While this might be good for consumers in the short run, it’s ultimately not sustainable (just look at the BOC Elite Miles Card as an example). Margins get squeezed, banks have to come up with shenanigans to advertise higher rates while awarding less in practice (e.g. OCBC/UOB and their S$5 earning blocks), and it limits the scope to add other benefits that customers might value more, such as lounge visits or airport limo rides.

A much more sustainable approach would be to compete not on headline earn rates, but card features . In other words: “I can make my 1.2 mpd better than your 1.3 mpd if I offer more partners, if I offer free conversions, if I offer instant transfers.” That’s exactly what HSBC is attempting with the TravelOne.

Still, not everything is hunky dory.

- HSBC TravelOne Card does not have a bonus earn category

- HSBC excludes CardUp/ipaymy transactions from earning rewards

- HSBC no longer offers a tax payment facility

- HSBC points don’t pool (though it’s on the roadmap…more on that later)

This means there’s currently no way of turbocharging your accumulation, and at a pace of 1.2/2.4 mpd, it’d take a lot of spending to reach the critical mass needed for a redemption (especially if you’re redeeming for a family).

It’s what I call the “AMEX Platinum Problem”. While Membership Rewards points are extremely valuable, it’s hard to earn them at a decent rate (0.69 mpd for AMEX Platinum Credit Card , 0.78 mpd for AMEX Platinum Charge ). But even then, at least AMEX has 10Xcelerator partners (3.47 mpd for AMEX Platinum Credit Card , 7.8 mpd for AMEX Platinum Charge )- something HSBC lacks!

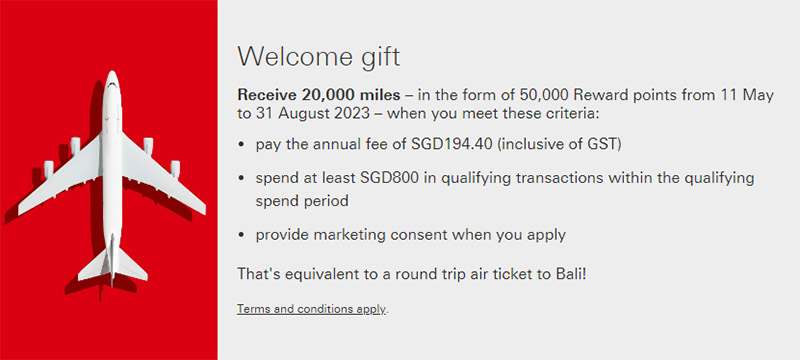

A solid sign-up bonus, with a quirk

From now till 31 August 2023 , customers who apply for a HSBC TravelOne Card will enjoy 20,000 bonus miles (in the form of 50,000 HSBC points) when they:

- Pay the annual fee of S$194.40

- Spend at least S$800 by the end of the month following approval

- Opt-in for marketing communications during the sign-up process

Since the annual fee must be paid, you’re basically buying miles at a cost of 0.97 cents each (S$194.40/20,000 miles), or 1.09 cents if you want to adjust for the opportunity cost of spending on a 4 mpd card (S$194.40/(20,000-800*2.8) miles).

That’s a very good price indeed, and before someone says “but Citi PayAll”, remember the S$8,000 minimum spend for the current offer.

What’s noteworthy about this offer is that it’s available to both new and existing HSBC cardholders . Most of the time, the latter get left out in the cold.

But offering the same sign-up bonus to new and existing customers also creates a strange quirk. If you count as a new HSBC cardholder, you might want to apply for a HSBC Revolution Card first (seriously, why don’t you have one yet?).

New cardholders will receive:

- S$30 cash from SingSaver, no min. spend (T&Cs)

- S$150 cashback from HSBC with a min. spend of S$1,000 (T&Cs)

After the Revolution is approved, you can then apply for the TravelOne as an existing customer, since you enjoy the same 20,000 bonus miles as a new cardholder anyway.

Don’t sweat the annual fee

And since we’re talking annual fees: the HSBC TravelOne Card is not offering a first year fee waiver option at the moment. In other words, if you want the card, you have to pay the S$194.40 annual fee, though with 20,000 miles + eight lounge visits in the first membership year (not four- see below), I’d argue you’re still coming out on top.

What happens in the second year, though?

At this point, we don’t know. The official stance is that cardholders who spend at least S$25,000 in a membership year will receive a fee waiver for the second year. However, many other banks say similar things, yet offer waivers nonetheless to those who fall short of the minimum spend (either automatically or on request).

I’m not that concerned at the moment, quite frankly. The card is virtually brand new; we’ll cross that bridge when we come to it. I certainly wouldn’t pay S$194.40 just for a few lounge visits, and I suspect that HSBC knows that unless there’s a very compelling reason to pay the second year’s annual fee, the lack of waiver could spark a significant exodus.

The market has already demonstrated it’s not willing to pay annual fees in the S$30,000 card segment. OCBC tried it for a while with their 90°N Card by adding a non-waivable S$53.50 annual fee (with a further S$139 top-up to buy 10,000 miles). That experiment didn’t last very long.

So the way I see it, why not just take it one year at a time? It’s hardly something to get worked up about at this point. If the value proposition doesn’t make sense in the second year, you still have the freedom to walk away.

Expiring points aren’t a deal-breaker

Points earned on the HSBC TravelOne Card expire after 37 months , the same as other HSBC cards.

Some don’t like expiring points, but it’s not that big a deal for me. As I’ve explained in this article, non-expiring points don’t really influence my decision whether or not to get a card. Granted, nothing beats evergreen, but 37 months is a long time, and you still have additional validity once points are transferred to the airline side.

However, an argument could be made that because of the 1.2/2.4 mpd earn rates, you’d need to keep the points on the bank side for a longer time before transferring. Fair enough, though at most it means paying an additional conversion fee at the end of 37 months; not really something to lose sleep over.

Moreover, with the pace of frequent flyer devaluations, holding on to your points too long is a bad idea. The golden rule is still to earn and burn!

First year sweet spot for lounge visits

HSBC TravelOne Cardholders enjoy four lounge visits per year, a relatively generous allowance for the segment in which the card competes.

What’s more, the allowances are granted on a calendar year basis instead of membership year. This means that a cardholder can enjoy eight visits in their first membership year, regardless of whether they choose to renew.

For example, when you’re approved in 2023 you get four visits to use till 31 December 2023, and on 1 January 2024 you get another four visits to use till 31 December 2024. Whether or not you renew the card in 2024 is irrelevant.

There’s also a qualitative aspect to this: TravelOne lounge visits are provided by DragonPass, which is the only major lounge network to retain access to Plaza Premium Lounges after the operator terminated its agreements with Priority Pass and Lounge Key. In some airports (e.g. Penang, Phnom Penh) Plaza Premium lounges are the only contract lounge option (or even the only lounge option).

If there’s one fly in the ointment, it’s that lounge visits cannot be shared with a guest. Whether that’s a HSBC or DragonPass restriction I do not know, but it feels odd: if I have four visits in total, who cares whether I use all four on myself or split them with my companion for two visits together?

Fast, free points conversions

There’s three things I look for in a card:

Conversion speed

Conversion fees, conversion blocks.

The HSBC TravelOne gets two out of three right, with the last one coming agonisingly close.

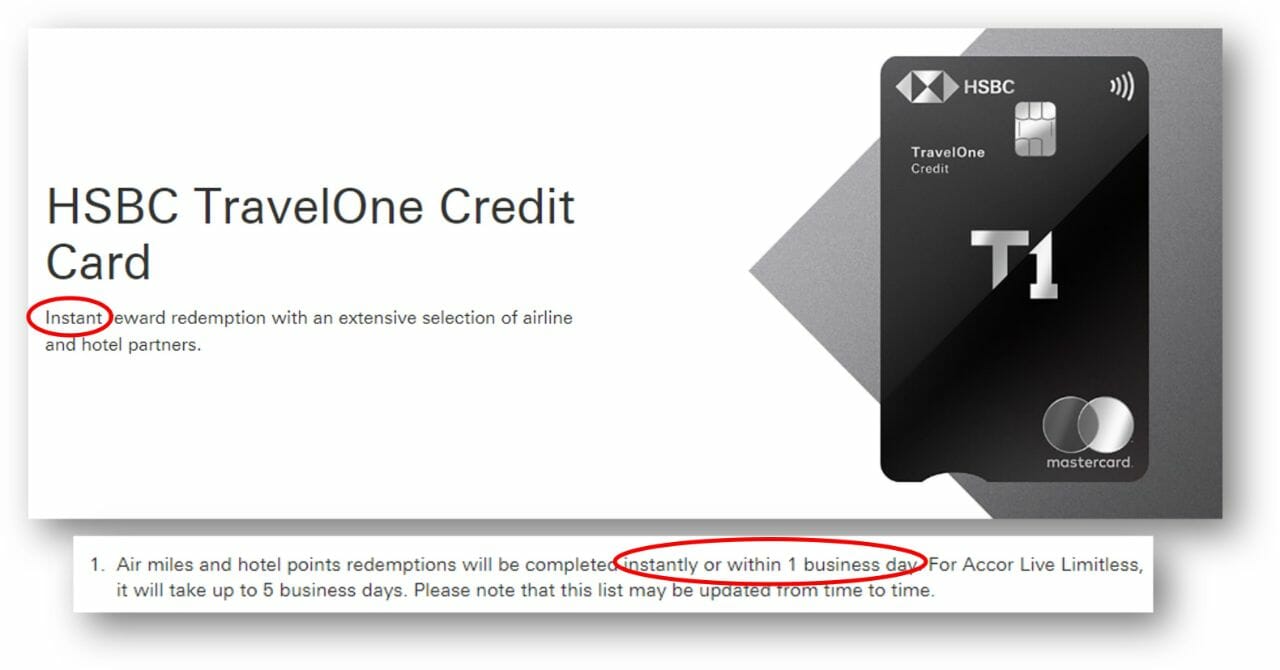

The HSBC TravelOne Card has a bit of a semantics issue when it comes to conversions.

In some places, it advertises “ instant” rewards redemptions. In others, it says “instantly or within 1 business day”. The two, obviously, are not the same, and in the miles game where award space can disappear as fast as it pops up, can make all the difference.

Having spoken to both the product team as well as Ascenda (the loyalty company that’s behind the new partners), the overall sense I got was that this is a CYA thing, just in case something goes wrong.

Given the API integration Ascenda has with its partners, there’s really no reason not to expect instant conversions for all programmes except Accor Live Limitless (where transfers take up to five business days).

In any case, I’ll be testing this soon and posting the results, and I’m sure the Telegram Group will be full of data points as well.

HSBC normally requires cardholders to join its Mileage Programme to convert points, which costs S$43.20 a year for unlimited conversions to Asia Miles or KrisFlyer. You only pay one fee, regardless of how many HSBC cards you have.

With the TravelOne Card, all conversion fees are waived till 31 December 2023 . That reduces the friction in making ad-hoc top-ups to your frequent flyer account.

It’s not been confirmed whether HSBC will switch to a “per conversion” model come 1 January 2024, but if you ask me, it looks more likely than not. I’d expect to pay the usual S$25 + GST.

Unfortunately, it’s the last leg of the triangle that’s missing. While the TravelOne offers fast, free top-ups, the minimum conversion block is 10,000 miles.

While that’s on par with the market, I feel they’ve missed a great opportunity here. 10,000 miles, after all, is a significant chunk of change to move at one go. If they broke it down into smaller blocks, the utility of the card would be even greater.

If it’s any consolation, after the first 10,000 miles the subsequent conversion block is just 2 miles. This is confirmed in the FAQs:

In other words, you could convert 25,005 points to 10,002 air miles. This is great news for anyone intending to spend S$800 for the sign-up bonus in local currency then cash out. You’d have:

- 50,000 bonus points (for meeting min. spend)

- 2,400 base points (S$800 @ 3 points per S$1)

52,400 points can be cashed out exactly for 20,960 miles, avoiding orphan points.

I just wish they’d gone one step further and made the minimum conversion block 2 miles, though that may be wishful thinking on my part.

By the way, this also means that if you want an insurance policy against orphan miles, one thing you can do is keep a minimum of 25,000 points in your account at all times.

Transfer partner bonanza

HSBC TravelOne Cardholders can transfer points to a total of 12 different partners : nine airlines and three hotels.

This takes the crown of “most transfer partners” from Citi (10 airlines, 1 hotel), and HSBC isn’t done. The plan is to have more than 20 airline and hotel partners by the end of 2023.

That’s the real game-changer here. For too long, we’ve seen new partners added at a glacial pace ( Standard Chartered and OCBC (eventually) being the notable exceptions; no surprise it was Ascenda behind those too). Now HSBC has kicked things into overdrive, and while not every new partner will be “useful” from a miles chaser perspective, more options can only be a good thing.

At the same time, there’s one thing I want to make abundantly clear: there’s little point in using the HSBC TravelOne Card if all you want is Asia Miles and KrisFlyer. If that’s your goal, you’d do much better by sticking with other cards on the market. Why earn KrisFlyer miles at 1.2/2.4 mpd when you can earn them at 4/6 mpd elsewhere?

Getting the most out of TravelOne means exploring other programmes, and I can’t help but wonder if there’s an inherent paradox. Are the people most likely to give a general spending card heavy usage also the same people who would default to familiar programmes like Asia Miles and KrisFlyer?

How you feel about the HSBC TravelOne Card really boils down to what standards you’re measuring it by.

Compared to general spending cards, it excels: 1.2/2.4 mpd earn rates, 1% extra cashback for EGA customers, a favourable rounding policy, four lounge visits per calendar year, fast and free conversions, and a 20,000 miles sign-up bonus even for existing customers. I’m not about to say it’s the absolute best — the Citi PremierMiles Card may have lower earn rates and fewer lounge visits, but Citi PayAll is a fearsome beast — though it certainly ticks all the right boxes.

Compared to specialised spending cards , it pales in comparison, obviously. No general spending card, no matter how good, is going to beat 4/6 mpd!

Here’s the thing though: even if the HSBC TravelOne isn’t directly competing with a specialised spending card, it’s indirectly competing for share of wallet, because in most cases, every S$1 I put on the TravelOne is S$1 I could have put on a 4/6 mpd card.

That’s a problem that all general spending cards face, not just the HSBC TravelOne. It begs a more existential question: do you even need a general spending card?

To be sure, there are situations where it can come in useful:

- Maybe you’ve busted the 4/6 mpd caps on your specialised spending card

- Maybe the bank affiliated with your general spending card has some sort of tie-up with the merchant that grants an additional discount that would more than offset the lost miles

- Maybe this particular category of spend doesn’t qualify for any bonuses (though it’s hard to think of an example, given the wide coverage of specialised spending cards)

- Maybe you don’t know the MCC of a given merchant, and just want to be safe (but you could always find out for free )

I don’t know how common those scenarios are for you, but keep in mind this won’t even be a dilemma for the vast majority of cardholders out there. If you read this blog, chances are you’re in the minority- not just in terms of looks, charisma and sheer muscle mass, but also in terms of card usage. For every one of us who obsessively optimises each and every transaction, there’s five, maybe ten people who just put everything on their DBS Altitude, Citi PremierMiles or UOB PRVI Miles Card and call it a day.

All the same, it’d be horribly premature to write it off. My understanding is that HSBC is working on adding points pooling , and if they pull that off, a lot of things would fall into place.

Imagine what you could do with Revolution earn rates, 20+ partners and instant transfers. Imagine being able to avoid fuel surcharges and tap new sweet spots by choosing the right frequent flyer programme. Imagine a spillover effect on the rest of the market, where other banks look at the HSBC, StanChart and OCBC case studies and decide there’s value in partnering with a platform like Ascenda and bringing dozens of partners onboard at once instead of negotiating individual contracts.

As John Lennon once said “That’s very nice Yoko but I’m trying to perform with Chuck Berry” “You can say that I’m a dreamer, but I’m not the only one”.

The HSBC TravelOne poses a crucial question: is there space for a general spending card in the wallet of a miles optimiser? Or perhaps more accurately: is there space for another general spending card in the wallet of a miles optimiser?

That’s something well worth thinking about this weekend, but I personally pulled the trigger yesterday and sent in my application. I’m not about to say no to that kind of sign-up bonus, and if things work out the way I hope they will, having an extra 50,000 HSBC points in the bag would be very welcome come end-2023. HSBC has ambitious plans that go beyond just the TravelOne, and if they can deliver on that, it’d be a huge shake-up to the miles game in Singapore.

Scoffers gonna scoff, but I like what I see so far.

- credit cards

Similar Articles

The problem with hsbc rewards points, review: citi premiermiles card, 24 comments.

Should this be added into the article on how to calculate general spending posted on 10 Jan?

I believe the plaza premium lounge in kuching is no longer around.

You’re right. No more at Kuching airport. Penang Plaza Premium still around.

removed that!

Me again. Interesting follow up. – My biggest gripe about the AF waivability uncertainty was that if you can’t get a waiver, you’d have to cash out and cancel and with usual 10k blocks you’d be hard pressed to meet the next 10k block (most people won’t put $8k+ on a gen spend card in a year given the plethora of 4mpd options). I had missed that it was an effective 10k minimum instead of blocks – thanks for pointing this out. More agreeable that it would be easier to try on this basis. Although by that time, you’ll have … Read more »

For a mass market general spending card that is not even a week old, I think we are being too critical. As far as the annual fee is concerned, if one wants to be safe, they can wait until a year later when data points about waivability become available, but of course, there’s the tantalizing FOMO that the welcome offer might be pulled soon, cause what are the odds that existing-to-bank customers are eligible for such a thing? All in all, I think it’s only fair that we have to “pay” for the 20k miles with a bit of uncertainty … Read more »

If Aeroplan is part of the 20 in the future, I’m in.

Likely. The Malaysian version of the card launched with Aeroplan

Ya, the $800 spending is an issue to hit for a general spending card…

Maybe I’m missing something, but aren’t we buying miles at: [(194.4+800)/20,960] = 4.7 cents per mile?

Can’t count the $800 – you’re not throwing the $800 away, it is expected you are spending $800 on things you would have otherwise spent anyway. But there is an opportunity cost for that $800 if you ordinarily would have earnt 4mpd on it instead.

Fairer to say your are forgoing 800×2.8 miles since $800 spend on a 4 miles/$ card would have yielded 3200 miles so 194.40/ 17760?

Another general spending card split means you have to deal with low usage or manage too many orphan miles and low miles redemption. Unless if HSBC has a killer feature like Citi Payall (where you can almost guarantee miles volume) – I will stick with Citi for the general spending card. How much more do you spend on “general” card if you maximize your 4MPD specialized card?

Orphan miles not really an issue here though, because of how the conversions work

Yes but it is free only until end of the year – afterward it is gonna be pain to transfer if they start imposing fee per transfer. Well technically the jury is still up in the air

yup, got it- but when we use the term “orphan miles”, we’re generally referring to miles that cannot be transferred out because of min. block size, not miles that can be transferred out, but there’s a fee involved. if it were the latter, then virtually every card on the market would suffer from “orphan miles”- even the OCBC VOYAGE with its 1 mile transfer blocks (since there’s still a $25 xfer fee). and just because a card doesn’t have xfer fees doesn’t mean the orphan mile problem doesn’t exist! UOB Reserve cardholders have no xfer fees, but their transfer block … Read more »

I’ll wait till they add points pooling

If I’m HSBC customer, is still a must for me to sign up this via Singsaver or can sign-up with HSBC directly? thanks.

If you are an existing customer, can apply directly with HSBC cuz you are not NTB, hence no incentive to go through SingSaver.

So… is this better than the DBS Vantage, which currently seems like the best general all-around spending card, though with limited partners…?

it would be very difficult to compare this with a $120k card, since the two of them have such different annual fees and benefits

If we were to do that comparison, what would the outcome be?

What I struggle to find is the best overall general spending card if you’ve got a monthly spend in the $20k+ range. Conversion partners become important, and the fee can be justified if it makes sense… Most of the benefits beyond those associated with travel are not really used (e.g. sometimes dining benefits that are hard to use, etc.)

This card seems interesting due to the increased number of conversion partners, as award space with SQ seems quite limited lately.

“If it’s any consolation, after the first 10,000 miles the subsequent conversion block is just 2 miles. This is confirmed in the FAQs” — How does this compare to other cards/banks/points systems? Would be very interested to add this to the table alongside the minimum size and the fee.

Hello, how does one pay the annual fee after just getting the card? Is it similar to how we pay our credit card bills, by transferring the sum to the card account?

CREDIT CARD SIGN UP BONUSES

Featured Deals

© Copyright 2024 The Milelion All Rights Reserved | Web Design by Enchant.sg

Is the HSBC TravelOne Card the One and Only Travel Card You Need?—MoneySmart Review 2023

Let’s talk about the HSBC TravelOne card’s name—“Travel One”. It aims to be the 1 travel card you need. HSBC says so as well: “Unlock instant travel rewards and elevated travel experiences everywhere you go with the one and only travel card you need.”

But does the HSBC TravelOne card (literally) live up to its name? If I only have 1 travel card, I want good miles earn rates, low (or no!) annual fees, and a slew of travel benefits and privileges.

Let’s take a look at how the HSBC TravelOne Card fares. We review the card’s earn rates, travel rewards, privileges, and more.

See our credit card ranking rubric to find out how we rank credit cards.

- HSBC TravelOne Card: Summary

- HSBC TravelOne Card: Eligibility

- HSBC TravelOne Card: Annual fees

- HSBC TravelOne Card: Earn rates

- HSBC TravelOne Card: Bonus earn categories

- HSBC TravelOne Card: Rewards points redemption

- HSBC TravelOne Card: Benefits and privileges

- HSBC TravelOne Card: Sign-up promotion

- Should I get the HSBC TravelOne Card?

- Alternatives to the HSBC TravelOne Card

1. HSBC TravelOne Card: Summary

HSBC TravelOne Card

[FLASH DEAL | STRYV GIVEAWAY] Earn 5,040 SmartPoints or S$200 Cash via PayNow when you apply and spend a min. of S$1,000 from Card Account Opening Date to end of the following calendar month. T&Cs apply . PLUS stand a chance to win exciting prizes: • A Stryv Bundle [Hairdryer & Prostyler (Flat Iron & Curler)] (worth S$288) from MoneySmart when you meet the giveaway criteria! • An all-electric Mercedes-Benz EQB and round-trip air tickets to Paris from HSBC when you apply, activate and spend with HSBC credit card! T&Cs apply . Use 5,040 SmartPoints to fully redeem a product from our Rewards Store . If the product costs more, redeem with your points and top up the rest by purchasing additional SmartPoints e.g. get an Apple 10.9-inch iPad Wi‑Fi 64GB (10th Generation) at only S$110 on top of your earned SmartPoints.

Key Features

Instant reward redemption with an extensive selection of airline and hotel partners via HSBC Singapore mobile app

Accelerated earn rate: up to 2.4 miles for your spending

Travel privileges: Complimentary travel insurance coverage (including COVID-19), 4 x complimentary airport lounge visits for primary cardholders and more

Split flexibly: Split your purchases across a range of flexible tenors that suits your needs with HSBC Instalment Plans

Receive complimentary access to ENTERTAINER with HSBC app, with over 1,000 worldwide 1-for-1 deals on dining, lifestyle and travel.

At MoneySmart, we strive to keep our information accurate and up to date. This information may be different from what you see when you visit a financial institution, service provider, or specific product site. MoneySmart shall not be liable to compensate the Customer should the information is not as updated as our Partner.

The HSBS TravelOne card is an entry-level air miles card that’s good for general spending. It doesn’t come with any bonus earn categories, but does come with a good mix of travel benefits and privileges. These include travel perks (such as cashback and discounts when you shop overseas) and travel protection in the form of complimentary travel insurance.

Back to top

2. HSBC TravelOne Card: Eligibility

Let’s first talk about who’s eligible for the HSBC TravelOne Card.

An entry-level miles card, the HSBC TravelOne Card has pretty typical age and minimum income requirements:

- Age requirement: 21 years old

- For Singaporean and PR salaried workers: $30,000

- For Singaporeans and PRs who are self-employed or commission-based: $40,000

- For foreigners: $40,000

3. HSBC TravelOne Card: Annual fees

The HSBC TravelOne Card comes with a pretty standard annual fee of S$194.40 . Generally, this is the standard annual fee for most entry-level credit cards, barring credit cards with $0 annual fee .

Of course, the annual fee doesn’t matter if a fee waiver is available. HSBC doesn’t say anything about the first year’s annual fee (you can always try your luck requesting a fee waiver !). However, they will waive the annual fee for the second year onwards if you spend over S$25,000 per year. That’s about $2083 per month.

4. HSBC TravelOne Card: Earn rates

Here’s a quick look at how the HSBC Travel One Card’s earn rates compare to other entry-level miles cards:

The HSBC TravelOne Card local spend earn rates are average at best —there are miles cards with lower local earn rates, such as the BOC Elite Miles World Mastercard , which clocks in at just 1 mile per dollar (mpd).

However, the HSBC TravelOne Card’s foreign spend earn rates are above average . The only other miles credit card out there with a comparable rate is the UOB PRVI MASTERCARD Miles Card, which comes with a $5 minimum spend caveat—you need to spend S$5 to earn UNI$6/2.4 miles.

5. HSBC TravelOne Card: Bonus earn categories

At its heart, the HSBC TravelOne Card is meant for everyday, general spending. That comes with 1 downside: it doesn’t have any bonus earn categories . These refer to specific spend categories with which you can earn a greater number of miles per dollar.

Bonus earn rates are miles credit cards are usually between 3 mpd to 10 mpd. Here are some examples:

- Standard Chartered Journey Credit Card : 3 mpd on online transactions in Transportation, Grocery and Food Delivery Merchants categories

- UOB PRVI MASTERCARD Miles Card : 6 mpd (UNI$15 per S$5 spend) on major airlines and hotels booked through Expedia, UOB Travel, and Agoda

- Citi PremierMiles Card : Up to 10 mpd on online travel bookings via Kaligo and Agoda

- DBS Altitude Visa Signature Card : Up to 10 mpd on hotel transactions at Kaligo (capped at S$5,000/month); up to 6 miles per S$1 on flight, hotel and travel packages at Expedia (capped at S$5,000/month)

Is it a big disadvantage that the HSBC TravelOne card doesn’t have bonus earn categories? We would say not necessarily. It really depends on if you’d spend more on those bonus earn categories in the first place. For example, if you don’t want to book via Kaligo, Expedia or Agoda, the Citi PremierMiles Card and DBS Altitude Visa Signature Card bonus earn rates are basically made defunct.

6. HSBC TravelOne Card: Rewards points redemption

HSBC rewards you with Rewards points for each dollar of your spending—they don’t just give you miles directly. Here’s a breakdown of the points earn rates:

- 2.4 miles (6 Reward points) per S$1 foreign spending

- 1.2 miles (3 Reward points) per S$1 local spending

The good news is that from now till 31 Dec 2023, HSBC won’t charge you any conversion fee for redeeming your points for air miles or hotel points. Usually, you have to pay an annual HSBC Mileage Programme fee of S$40, subject to GST.

On top of that, HSBC rewards redemptions are fast . According to HSBC’s TraveIOne Card page, they’ll complete redemptions for air miles and hotel points instantly or in 1 business day.

Do note that HSBC Reward points expire after 37 months . 3+ years sounds like a lot of time, but you know how these expiry dates can creep up on us without us realising—fellow points hoarders, you know what I mean.

Prefer a rewards system with points/miles that never expire? Consider the Standard Chartered Journey Credit Card for 360 Rewards Points that never expire, or the Citi PremierMiles Card for Citi Miles that never expire.

7. HSBC TravelOne Card: Benefits and privileges

Although the HSBC TravelOne Card doesn’t have any bonus point categories, it does come with a generous slew of travel benefits and privileges. Broadly, these fall into 2 categories: travel perks, and travel protection.

HSBC TravelOne Card travel perks

- Airport lounge access : As the primary cardholder, you get 4 complimentary lounge visits per year to over 1,300 airport lounges around the world.

- Travel rewards : With the HSBC TravelOne Card, you get to enjoy cashback and discounts when you travel and do your shopping overseas under the Mastercard Travel Rewards catalogue . These apply to both in-store and online merchants across over 25 countries, including Daimaru Matsuzakaya Department Stores in Japan and Bloomingdale’s in the United States.

- Mastercard Priceless™ Specials : This is another MasterCard rewards programme that you get with the HSBC TravelOne card, but this one is a bit more upmarket. It offers privileged access to benefits across travel, culinary, shopping, sports, entertainment, and arts and culture.

HSBC TravelOne Card travel protection

- Travel insurance : If you charge your air ticket (in full) to your HSBC TravelOne Card, you’ll get complimentary travel insurance coverage (including COVID-19) of up to USD100,000.

- ID Theft Protection™ : The HSBC TravelOne Card doesn’t just want to give you peace of mind while on holiday—it also aims to do so while you’re browsing and making purchases online. You can register for Mastercard ID Theft Protection™ to ensure your personal data is safe and secure, protecting you from identity theft and fraud.

- Checking travel and health restrictions : It is such a chore to check for travel and health restriction/documentation. The HSBC TravelOne gives you access to Sherpa, a travel advisory tool that tells you what Visa requirements, travel documents, and even if COVID-19 tests are needed prior to your trip.

Hungry for more benefits? Even if you aren’t travelling, the HSBC TravelOne Card comes with a dining perk you can use right here in Singapore. You’ll get complimentary access to ENTERTAINER with HSBC , which comes with tons of 1-1 deals on dining, lifestyle and travel. These deals are available worldwide, but there are plenty to choose from locally too.

ALSO READ : Best Food Discount and Rewards Apps in Singapore—Chope, Burpple, Entertainer & More

8. HSBC TravelOne Card: Sign-up promotion

From now till 31 Aug 2023, you can get up to 20,000 Miles (in the form of 50,000 Rewards Points) when you apply for the HSBC TravelOne Card.

The downside is that you need to pay the card’s annual fee of S$194.40 (GST already included), as well as spend at least S$800 in qualifying transactions within 1 month. Depending on your lifestyle, this minimum spend could be easily doable, or a tall order.

9. Should I get the HSBC TravelOne Card?

If you’re looking for a general spending travel card (that means no bonus earn categories!), the HSBC TravelOne Card is a decent choice. Its earn rates are average or slightly above average (especially when it comes to foreign spending), and we like that you earn Rewards points per dollar spent. For some other cards with similar earn rates, you need to spend say $5 before you chalk up any points. This means that the HSBC TravelOne Card can help you earn points on even the smallest purchases.

Don’t forget that the HSBC Reward points expire after a 37-month period. This could be a pro or a con, depending on how much of a points hoarder you are.

The HSBC TravelOne Card does live up to its name as the 1 and only travel card you’ll need…if you’re looking for a general spending miles card. We suggest you get the HSBC TravelOne Card if you want a general spend card, if you value travel benefits, and if you’re looking for a higher than average earn rate for foreign spending. This card isn’t for you if you want a high bonus earn rate on selected categories, or if you want miles that never expire.

10. Alternatives to the HSBC TravelOne Card

Here are some other entry-level miles cards for you to consider. These rewards points/miles never expire:

Standard Chartered Journey Credit Card : This card rewards you with a bonus earn rate of 3 miles for online transactions on transport, food delivery, and groceries. The best part is that the 360 Rewards Points you earn never expire.

Standard Chartered Journey Credit Card (No Annual Fee)

Up to 3 miles for every $1 spent

2 complimentary visits to Priority Pass lounges around the world each year

S$0 foreign transaction fee for overseas spend made and posted in June-July, November-December 2023

Complimentary travel insurance coverage of up to S$500,000.

360 Rewards Points do not expire

S$10 off Grab rides to or from Changi Airport

Citi PremierMiles Card : Citi Miles never expire! Plus, earn up to 10 miles per $1 spent on selected hotel bookings.

Citi PremierMiles Card

S$1 = 1.2 Citi Miles on Local spend (no min. spend)

S$1 = 2 Citi Miles on Foreign currency spend

Earn 10,000 Citi Miles upon renewal of annual membership and payment of annual fee

Citi Miles never expire

Principal Cardholder gets to enjoy 2 complimentary visits every year to over 1,300 airport lounges worldwide.

OCBC 90 N Card : Travel$ never expire. You’ll also get up to 7 miles per $1 spent on Agoda accommodations worldwide.

OCBC 90°N Card

Earn 1,890 SmartPoints or S$200 Cash via PayNow when you apply and spend a min. of S$500 in qualifying spends within 30 days from card approval date. T&Cs apply . Use 1,890 SmartPoints to fully redeem a product from our Rewards Store. If the product costs more, redeem with your points and top up the rest by purchasing additional SmartPoints e.g. get an Apple 10.2 inch iPad Wi-Fi (9th Generation) 64GB at only S$315 on top of your earned SmartPoints.

Designed with an LED light feature, the 90°N MasterCard Card lights up whenever you make a contactless payment.

Travel$ that do not expire - Convert Travel$ to loyalty points at 9 airline and hotel partner programmes.

Get cash rebates at up to 2.1% from your earned Travel$. No minimum spend and no caps

All online purchases on your OCBC 90°N Card come with e-Commerce Protection, which safeguards you against non-delivery or defective goods or if the seller fails to reimburse you.

Check out and easily compare the other air miles credit cards in Singapore .

P.S. Here’s our MoneySmart credit card ranking rubric

In case you’re wondering, here’s how we decide on our credit card rankings.

Don’t miss our ultimate list of credit card reviews for the low-down on credit cards in Singapore.

Found this article useful? Share it with a fellow traveller considering a miles card!

Related Articles

Air Miles vs Cashback vs Rewards – Which is the Best Credit Card Type to Use?

9 Best Air Miles Credit Cards in Singapore (Jun 2024)

7 Best Rewards Credit Cards in Singapore (2024): Citibank, OCBC, DBS & More

Best Credit Card Promotions in Singapore (Jul – Sep 2024): Citibank, DBS, HSBC, UOB, and More

- Credit Cards

First Impressions: HSBC TravelOne Credit Card

HSBC just announced their latest travel credit card offering, the HSBC TravelOne (T1) Credit Card.

This is probably one of the most exciting credit card launches in Singapore in recent years. There haven’t been many revolutions or improvements, even with the recent lacklustre launch of the DBS Vantage Card.

As such, when HSBC suddenly released their much-awaited travel card, many travellers (including us!) in Singapore were really excited about it.

This post is my first impression of the HSBC TravelOne Credit Card .

Sign up bonus

This bonus applies to new-to-bank customers only! To be eligible for the promotion, you’ll need to activate and spend S$500 and pay the annual fee of S$196.20.

Miles Earn Rates

The HSBC TravelOne Card has a fairly standard travel credit card earning rate. It is comparable to other general spend cards in the market such as the DBS Altitude Card and the Citi Premiermiles Card.

Free Lounge Access

As a travel credit card, the HSBC TravelOne Credit Card provides complimentary lounge access via the DragonPass lounge membership (also known as the Mastercard Travel Pass).

The 4 yearly complimentary limit is much better than many of its counterparts. However, this limit only applies to the primary cardholder. Supplementary cardholders and guests have to purchase their lounge access through the mobile app.

The membership provided is DragonPass instead of the typical Priority Pass provided by other cards. The downside of this is that there are fewer lounges in the network.

In Singapore’s Changi Airport, you can access almost every lounge that Priority Pass members have access to. In addition, you can also access the Plaza Premium Lounge in Terminal 1 which is one of our favourite lounges in the terminal.

Instant Points Transfers

Perhaps the biggest selling point of the HSBC TravelOne Card is its ability to instantly transfer points to its various transfer partners. HSBC promises that points transfers will go through instantly or latest within 1 business day.

This can come in very useful whenever people are booking high in demand seats. Although I don’t think by itself, this perk is applicable to people most of the time.

Huge Range of Transfer Partners

Another big selling point of the HSBC TravelOne Credit Card is its huge number of transfer partners.

There is a lot of value in having a lot of travel transfer partners to choose from. The value of each mile in different loyalty programs varies widely. Different loyalty programs have different award availabilities, and sometimes you can get only book certain redemptions on one program and not on another.

For travellers who prefer luxury hotels to business class flights, the HSBC TravelOne also provides 3 hotel partners which is unheard of in Singapore.

From the initial list of partners, there aren’t any that stand out in particular in terms of great value. Hotel redemptions are also usually of lower value than flight redemptions. However, we remain hopeful while the list of partners expands as promised by HSBC.

Requirements

The HSBC TravelOne credit card has a typical “entry-level” credit card requirement.

For Singaporeans , a minimum of S$30,000 annual income. For foreigners or permanent residents, a minimum of S$40,000 annual income.

Our Thoughts

The HSBC TravelOne Credit Card is certainly an interesting new addition to the travel hacking space in Singapore. Its headline features are very intriguing and the benefits can really only be verified after using the card for a while.

However, I wouldn’t be using the card, in general, to earn miles as it doesn’t have the highest earning rates. For that, I’ll be using my trusty HSBC Revolution Card or the Citi Rewards Card .

Overall, I think that this is a good sign for what’s to come from both HSBC and the other banks!

- Telegram icon Telegram

- Facebook icon Facebook

- Pinterest icon Pinterest

Filed under

- Credit Cards 26

- credit-cards

- travel-hacking

Related posts

HSBC Revolution will have 21 Transfer Partners and Points Pooling

Citi Rewards Great Sign-Up Bonus for February 2024

Amazing HSBC Credit Card Sign Up Offers

There are 4 comments.

can the annual fee be waived on first year?

Yes, you can request to have the annual fee waived. However, in that case you won’t be able to get the welcome bonus of 20,000 miles.

You wrote 4 lounge visits are also applicable guest but it’s only for cardholders.

Also, how does this compare with DBS Altitude? If I value different airlines I should definitely take the HSBC card, correct? And assuming we don’t need to guest any visits to the lounge. (Also ignoring the points expiry because we always use it before 3 years is up since miles devaluation can happen anytime)

Thank you for catching it! Yes, the 4 lounge visits by HSBC TravelOne are only applicable to primary cardholders.

I would say it really depends when comparing the DBS Altitude Card. Since DBS points can be pooled, and if you have the DBS Woman’s World Card, you can actually rack up points pretty fast and redeem them in 1 go.

The HSBC Card only has free redemptions until the end of 2023. If you do not spend a lot of money, earning just 1.2/2.4 mpd might not be fast enough to redeem anything meaningful.

Personally, I would still go for the DBS Altitude Card given that I have the WWMC.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Username or Email Address

Remember Me

Synchrony CheapOair & OneTravel Credit Card Reviews

Synchrony and Fareportal (CheapOair & OneTravel) have just launched new credit cards, they are offering three different cards:

- Visa signature

You apply using the same link and the card you receive is dependent on your credit worthiness.

- 1 Card Basics

- 2 How Much Are Points Worth?

- 3 Our Verdict

Card Basics

- Purchases of $399 or more (after discounts) give access to special financing for six months

- Sign up bonus of a $50 statement credit after $500 in purchases within the first 90 days of account opening (excludes any purchases with special financing)

- 6x points on CheapOair.com and OneTravel.com purchases

- 4x points on dining purchases

- 2x points on all other purchases

Keep in mind that you’ll add the 6x points in addition to the points you normally earn. The rates for that is as follows:

- Airline tickets: 1 point per $1 spent

- Hotel rooms: 3 points per $1 spent

- Rental cars: 3 points per $1 spent

- Trip Extras: 1 point per $1 spent

Keep in mind that the store card will only earn 6x points on CheapOAir/OneTravel purchases as it can’t be used outside of this.

How Much Are Points Worth?

Points can be redeemed for hotel bookings or redeeming them for gift cards. Both programs give you 500 points for joining. Thanks to reader Dov we know that points are worth 0.5¢ each when redeemed for airfare or CheapOair/OneTravel gift cards. A $10 third party gift card will cost you 4,000 points (0.25¢ per point).

Our Verdict

As points are worth a maximum of 0.5¢, the card realistically looks like this (and this is a best case scenario):

- 3% on CheapOAir/Onetravel purchases

- 2% on dining purchases

- 1% on all other purchases

There are better cards for dining purchases and every day purchases and 3% back on travel isn’t exactly exciting either. We originally posted this on September 30th, 2016, we are reposting because the cards are now live.

You may also like

[Targeted] Chase United Cards: Spending Bonus

American Express Schwab 1.1% Cashout Now Limited To One Million Points Per Year

Chase Ink Preferred 120,000 Points Offer With $8,000 Spend Requirement (Branch Only Until July 3rd)

Imprint Launches Turkish Airlines Credit Card With 40,000 Point Sign Up Bonus

U.S. Bank Triple Cash Rewards Business Card $750 Signup Bonus (No Annual Fee)

Chase spending offers: up to 5x points (7/1 – 9/30).

This company is nothing but a joke all around. They did not charge my card on the due date. I got several notifications my payment was late. I had to call them 5 times. Oh They do not have 24-hour customer service or chat. Then they asked me something about my card I could not find the card then they suggested me to cancel the card and request another one, Then the nightmare got even worse. They charged me a late fee and , they reduced my credit line without notifying me from 3k to 450 dollars. I owed them only 180 dollars. and for months I did not owe them anything. So they do not value their customers at all. I have 14 cards with a total credit limit close to 90k and my credit utilization is 8% and this stupid company claimed I owe too much debt I mean. I did not even use half of the credit they gave me 180 dollars??? are you serious??? Learn from Amex and Discover this company can not be taken seriously. Avoid as much as you can

I got $1100 SL with a FCO-8 of 640. Likely the private label store card though.

My FICO score 8 classic is 740 and Synchrony Bank said about my CheapOair card application: NO.

so you think with fico score of TU 609 EX 579 and other one 616 i have chance

This is the worst credit card ever. The terms and disclosures are not clear. When you call they tell you 6 month 0% interests and it is actually deferred and if you don’t pay in full within the six months they change you all the backdated interest at once. Customer service is the worst. Would not recommend it.

i wouldnt recommended paying interest… ever.

No prior experience with CHEAPO Air, apped, got 5K, no signature, TU score 730, interest rate 26%. Booked a couple of days at a hotel, advertised cancellation at no charge. Found the hotel cheaper without booking through CHEAPO….had to fight to avoid a cancellation fee with CHEAPO. The customer service rep was shady and going back and forth about charging a fee. Once I told her that the hotel indicated there was no cancellation fee up to 24 hours prior to arrival, after a long hold, indicated no charge. It took 2 weeks for the charge to be removed from my card. Definitely will be closing this card!

I have no interest in this card, but the one thing CheapOAir has going for them as opposed to any other online broker I have found is that you can split a ticket purchase across multiple cards. This would allow you, say, to put a small portion of a ticket on a Citi Prestige for the insurance benefits, while putting the remainder on the card you want to actually earn points on.

With that said, all the horror stories I’ve read about them with regard to ticket changes, upsell, and awful service makes me think I shouldn’t chance it.

40,000 points for a $10 third party gift card? Typo?

Yes, haha. Fixed.

Points are worth 0.5 for hotel and chepoair gift cards

Maximum that could be redeemed towards chepoair gift card is $100 20K points at a time

Merchant gift cards is $10 for 4K

This new card is a 3.5% back in travel card on chepoair or one travel

It’s a weak rewards travel card considering the fact that chepoair usually adds huge (hidden) fees to every ticket that is booked through them

Also there is no real 24 hour Cancellation period they give you 4 hours to cancel and after that it’s $25 up to 24 hours

Thanks, very useful information

Has anyone had good experiences with OneTravel/CheapoAir. Booked tickets twice with them, they were supposed to be cheaper than other websites, got a call the next day saying the tickets have not been issued; but I had an option of buying a higher priced ticket!

HSBC TravelOne Credit Card

Refined points metric (rpm): 11.8, recommendation: poor, annual fee , annual income, airport lounge access.

6X access per year

International Lounges

Supplementary Access

RM60,000 per annum

Airline Miles Earn Rate

Local: 1 Airline Mile = RM21.00

Overseas: 1 Airline Mile = RM2.62

Dining/Travel = 1 Airline Mile = RM4.20

Payment Network

Review | HSBC TravelOne Mastercard Credit Card

HSBC Malaysia recently unveiled its HSBC TravelOne Mastercard Credit Card, in line with a parallel launch in Singapore. For the purposes of this discussion, we'll focus solely on the Malaysian iteration.

The launch was accompanied by significant fanfare, underscored by HSBC Malaysia's extensive promotional efforts. This included roadshows in major Klang Valley malls like Mid Valley and collaborations with digital content creators and influencers. Commendably, their marketing approach was pervasive, leading many within my circle to seek my perspective on the card's value proposition.

However, it's imperative to delve deeper than the surface-level allure. A notable aspect that catches the eye is the promotion of "8x reward points" on HSBC's official site. Many, understandably, may misconstrue this to mean 8x air miles, which is a significant misunderstanding.

Airline Miles Conversion

The distinction between reward points and air miles is crucial. To provide a straightforward assessment: if one were to critically evaluate the conversion rate of these reward points to air miles, the HSBC TravelOne might not rank among the best credit card options in Malaysia for those prioritizing air miles accumulation.

The information above shows how many airline miles you get when you use HSBC's "Reward Points". To get one Enrich air mile, you need to spend RM2.62 overseas, but if you spend locally and specifically on dining or travel, it costs more, RM4.20, to get the same one mile.

Any other transactions with the HSBC TravelOne credit card only earns you 1X points.

Here's a simpler way to see it:

For regular spending in Malaysia, you need to spend RM21.00 to get 1 airline mile.

If you spend money on dining or travel in Malaysia, you need to spend RM4.20 to get 1 airline mile.

When you spend money in other countries, you need to spend RM2.62 to get 1 airline mile.

Compared to other banks that focus on travel, HSBC's rates don't look as good. For example, the CIMB Travel Platinum Credit Card gives you 1 airline mile for every RM2.50 you spend in other countries, and you only need to earn RM24,000 a year to get this card.

Likewise, the Alliance Bank Visa Infinite credit card grants you 1 Airline Mile for every RM1.875 spent when strategically topping up your E-Wallets and spending using your E-Wallets.

You can choose to convert HSBC points into miles with other programs, not just Enrich Miles, but these rates aren't great either. For those who fly a lot from Malaysia, finding the best way to turn spending into miles is very important.

For example, to turn your points into JAL Mileage Bank miles, it costs RM7.50 for one JAL mile. This rate is high, but not many people might use their HSBC Reward Points for JAL miles anyway.

Be sure to check out my Ultimate Guide, KrisFlyer Ultimate Guide and Asia Miles Ultimate Guide for comparisons on the airline miles earning rates for various credit cards.

I know how important it is to obtain information about lounge access at a glance, so if you're queuing up to enter a lounge in ASEAN, here's the important details about the HSBC TravelOne Mastercard credit card:

Number of Lounge Access Passes: 6X per year

Supplementary Access: Yes, quota is shared with principal cardholder

Spend Conditions: No spend conditions

Lounge Access List by HSBC TravelOne Mastercard credit card:

Plaza Premium Lounge KLIA Terminal 1 Main Terminal Building

Plaza Premium Lounge Singapore Changi Terminal 1

TGM & Root98 Singapore Changi Terminal 1

BLOSSOM - SATS & Plaza Premium Lounge Singapore Changi Terminal 4

Plaza Premium Lounge Hong Kong International Airport Terminal 1 (Gate 1)

Plaza Premium Lounge Hong Kong International Airport Terminal 1 (Gate 35)

Plaza Premium Lounge Hong Kong International Airport Terminal 1 (Gate 60)

HSBC may update it's list from time to time, so be sure to check out their list here if you don't see your lounge on the list above and in the table below.

Lounge access by the HSBC TravelOne Mastercard are the only nominal advantages to the credit card on the whole, as the airline miles accrual package is underwhelming. The accompanying table above underscores that the HSBC TravelOne Credit Card provides lounge access to merely three airports: Kuala Lumpur International Airport, Singapore Changi Airport, and Hong Kong International Airport.

Interestingly, the provisions at Singapore Changi Airport are confined to the Plaza Premium Lounge in Terminal 1 and the Blossom Lounge in Terminal 4. Given that Terminal 4 isn't seamlessly connected via the skytrain, cardholders departing from Terminals 2 and 3 are left with the sole option of the Terminal 1 lounge.

Another detail of note is the shared access between principal and supplementary cardholders, capped at six visits per annum. This isn't really a big issue, as generally you'll find it difficult to enter 6 lounges in an entire year, unless you travel frequently for work. Nevertheless, the shortcoming in this case is that you'll only be able to enter the lounges a limited number of times if you are travelling with your partner or spouse.

Be sure to check out my Airport Lounge Ultimate Guide to compare the best credit cards for airport lounge access in Malaysia.

Final Thoughts

In assessing the HSBC TravelOne Credit Card, it's challenging to pinpoint any commendable features. While their marketing strategy was indeed captivating, given the card's increased visibility in Klang Valley, this might be more indicative of consumers not diligently scrutinizing the details and not undertaking necessary conversion assessments prior to application.

It's crucial to note that other perks, such as the Mastercard Concierge, Priceless, and associated Mastercard benefits, are far from exclusive to the HSBC TravelOne offering.

To be eligible for the HSBC TravelOne credit card, a minimum annual income of RM60,000 is stipulated, averaging to approximately RM5,000 monthly. For individuals within this income bracket, it might be disconcerting to recognize that alternative credit cards in the market offer a far more comprehensive suite of benefits, particularly in the domain of air miles and travel.

Join the Mailing List

Subscribe to our newsletter to stay on top of the latest credit card updates and news.

Thank you for subscribing!

We're Now on Social Media!

To celebrate reaching 100,000 views, we're officially launching our social media pages!

Follow us on social media to stay up to date on the latest and greatest from Refined Points.

Credit Card News

First Look | Ambank Co-Branded Enrich Credit Cards

TNG eWallet Visa Prepaid Card offers 2% Cashback on Overseas Spend

AmBank Teases Its Enrich Co-Branded Credit Cards, Launching in July

Credit Card Updates

Hong Leong Bank Discontinues Emirates Credit Cards | An Expected Move

CIMB Revamps Its Visa Infinite & Visa Signature Credit Cards

Alliance Bank Credit Cards Devalued Again? Not Really

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

Travel & Food, Itineraries & Guides, Hotel Reviews

HSBC TravelOne Credit Card – Is It Worth Getting?

June 5, 2023 by Bino Leave a Comment

HSBC has recently launched a new general spending credit card called the HSBC TravelOne Credit Card which offers a range of benefits for frequent flyers. Although it is fundamentally a general spending card, it is designed to cater to the needs of travelers based on the benefits that come with it. These benefits include access to airport lounges, travel insurance and rewards points that can be redeemed for flights.

One of the key features of the HSBC TravelOne credit card is that it is linked to nine frequent flyer programs, including some less common carriers. This means that cardholders can earn rewards points on their HSBC TravelOne card, which can then be transferred to their preferred frequent flyer program. In this article, I aim to break down the features and the cost of getting the HSBC TravelOne Card and determine if it is worth getting.

P.S. Before you apply for this card, make sure to read this article until the end, especially if you don’t have any existing HSBC card. You’ll thank me later.

The HSBC TravelOne Credit Card comes with a range of benefits, including:

- Rewards: 1.2 mile per S$1 on local spend / 2.4 mile per S$1 on foreign currency spend

- Lounge access: Customers can enjoy complimentary 4x access to over 1,300 airport lounges worldwide.

- Travel insurance: Customers are covered for up to $100,000 for travel insurance including Covid-19.

- Reward points: Rewards points earned can be redeemed for miles or hotel points with no conversion fee until 31st December 2023.

- Frequent flyer partners: Customers can earn miles on 9 different frequent flyer programs, including Singapore Airlines, Cathay Pacific, British Airways and Vietnam Airlines.

Plus, until 31st August 2023, HSBC is giving cardholders 20,000 miles as a welcome gift for each successful application of the HSBC TravelOne Card . This is provided cardholders pay the annual fee of S$194.40 and spend at least S$800 by the end of the following month after card approval date. This promotion is applicable for both new and existing HSBC cardholders.

Eligibility

To be eligible for the HSBC TravelOne Credit Card , customers must meet certain criteria, including:

- Age: Customers must be at least 21 years old.

- Income: Customers must have a minimum annual income of $30,000 (Singaporeans/PR) and S$40,000 (Foreigners or Self-Employed).

- Credit score: Customers must have a good credit score.

Frequent Flyer Partners

singapore airlines dreamliner business class

The HSBC TravelOne credit card offers its cardholders the ability to earn miles with 9 frequent flyer partners. These partners include:

- Singapore Airlines KrisFlyer

- Cathay Pacific Asia Miles

- Eva Air Infinity Mileagelands

- Etihad Guest

- British Airways Executive Club

- Qantas Frequent Flier

- Air France/KLM Flying Blue

- Vietnam Airlines Lotus Miles

- airasia Rewards

Overall, this is quite a solid list as the presence of Star Alliance and OneWorld partners allow cardholders to redeem their miles with partner airlines with these respective alliances as well. Avios miles for British Airways Executive Club can also be used to transfer to Qatar Airways, for example.

This is in contrast to most other credit cards in Singapore that are limited to Singapore Airlines and Cathay Pacific. Only Citi has more transfer partners for air miles, with 10 partners. Citi has the addition of Qatar Airways, Thai Airways and Turkish Airlines but does not have Vietnam Airlines or airasia which are both part of HSBC TravelOne’s list.

No Miles Conversion Fee Until 31st December 2023

HSBC is launching the HSBC TravelOne Card with no fees for transferring miles from the credit card to one’s preferred frequent flyer program until 31st December 2023. This will make it easier to transfer as little (or as much) miles – considering that many frequent flyer programs also have an expiry of about 3 years from the time the miles are deposited. Cardholders can also choose to split the miles they earn from the card between multiple frequent flyer programs without having to worry about incurring the conversion fee multiple times.

Minimum quantity to transfer is 10,000 miles and in subsequent multiples of 2 miles thereafter. The subsequent multiple of 2 miles is a plus as it helps to avoid having “unredeemable miles.” Most other credit cards require a hard 10,000 miles multiple to redeem.

Miles Earning

Cardholders can earn 2.4 miles per dollar spent on foreign currency transactions and 1.2 mile per dollar spent on local transactions. The earn rate for local spend is in line with the earn rates for DBS Altitude and Citi PremierMiles. For foreign currency spend, the 2.4 miles per dollar is at the higher end of the range, and is matched only by the UOB Prvi Miles.

It is also worth noting that HSBC awards rewards points even for fractional spends, i.e. 50 cents. This is in contrast with OCBC or UOB where points are only awarded for spends in multiples of S$5. For cardholders that spend a lot on small paywave transactions, HSBC cards can help to capture more points.

Lounge Access

Cardholders can get 4x airport lounge access per year. The lounge access is through the Mastercard Travel Pass which by itself is under DragonPass.

To those familiar with Priority Pass, DragonPass contains roughly the same lounges as Priority Pass. There is a notable inclusion however – the Plaza Premium network of lounges is included as well under DragonPass which opens up a relatively wide number of additional lounges in airports across Asia-Pacific.

The 4x lounge access is also more generous than other general spend cards. Both DBS Altitude and Citi PremierMiles come with just 2x access for Priority Pass lounges.

Conclusion – Should You Get It?

The HSBC TravelOne credit card is a new offering in the credit card space, boasting partnerships with nine frequent flyer programs. While the miles earning rate is relatively standard, this can prove to be a nifty card to have when one properly takes advantage of the free miles conversion feature.

The introductory sign-up offer of 20,000 miles from paying the annual fee of S$194.40 is a good deal. The cost works out to be less than 1 cent per mile – and with no miles conversion fee to sweeten the deal.

By virtue of this alone, the card is worth getting if you are looking to redeem your miles for flights in the next couple of months or years. Their expanded number of travel partners means that you may also be able to choose another carrier which is not Singapore Airlines or Cathay Pacific. This gives you more options to redeem with other carriers that may have more award ticket availability, for instance.

As long as this sign-up offer is available, the HSBC TravelOne credit card seems to be a good choice for those looking to earn travel rewards while also enjoying additional perks such as lounge access and travel insurance. The partnerships with multiple frequent flyer programs provide added flexibility for travelers.

Do This Before Applying For the HSBC TravelOne Card!

Since the HSBC TravelOne Card provides the same welcome gift for both new and existing customers, it may be better to apply for another HSBC card first as your first HSBC card in order to get the sign-up reward for that and then apply for the HSBC TravelOne Card after.

If you are thinking which HSBC card to get as your first, the HSBC Revolution Card is one which provides for a great miles earning rate. I personally use it for my day-to-day spends. It gives 4 miles per S$1 for contactless payments made through paywave, Apple Pay, Google Pay or online shopping. Currently, HSBC is giving away a Samsonite Prestige 69cm Spinner luggage or S$150 if you apply as a new HSBC cardholder (those who have not had an HSBC card the last 12 months or more) and make the qualifying spend. You can apply here .

After applying for the HSBC Revolution Card, you can then apply for the HSBC TravelOne Card and enjoy the welcome gift for both. You’re welcome.

You can apply for the HSBC TravelOne Credit Card here rather than applying directly from HSBC website and get an additional cash payout of S$30 via PayNow from Singsaver.

You May Also Like

Hi, my name is Bino and I started I Wander around 15 years ago with the aim of sharing about some of my personal journeys and experiences, hoping that the information may benefit readers like yourselves. Let me know your thoughts by leaving a comment below. Alternatively, you can also email me at b i n o (at) iwandered.net. You can follow I Wander on Facebook , Telegram , or Instagram . Also, if you liked this article, please feel free to SHARE or RETWEET

More Posts - Website

Reader Interactions

Older posts, leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Best Travel Insurance 2024

- Cheapest Travel Insurance

- Trip Cancellation Insurance

- Cancel for Any Reason Insurance

- Seniors' Travel Insurance

- Annual Travel Insurance

- Cruise Insurance

- COVID-19 Travel Insurance

- Travel Medical Insurance

- Medical Evacuation Insurance

- Pregnancy Travel Insurance

- Pre-existing Conditions Insurance

- Mexico Travel Insurance

- Italy Travel Insurance

- France Travel Insurance

- Spain Travel Insurance

- Canada Travel Insurance

- UK Travel Insurance

- Germany Travel Insurance

- Bahamas Travel Insurance

- Costa Rica Travel Insurance

- Disney Travel Insurance

- Schengen Travel Insurance

- Is travel insurance worth it?

- Average cost of travel insurance

- Is airline flight insurance worth it?

- Places to travel without a passport

- All travel insurance guides

- Best Pet Insurance 2024

- Cheap Pet Insurance

- Cat Insurance

- Pet Dental Insurance

- Pet Insurance That Pays Vets Directly

- Pet Insurance For Pre-Existing Conditions

- Pet Insurance with No Waiting Period

- Paw Protect Review

- Spot Pet Insurance Review

- Embrace Pet Insurance Review

- Healthy Paws Pet Insurance Review

- Pets Best Insurance Review

- Lemonade Pet Insurance Review

- Pumpkin Pet Insurance Review

- Fetch Pet Insurance Review

- Figo Pet Insurance Review

- CarePlus by Chewy Review

- MetLife Pet Insurance Review

- Average cost of pet insurance

- What does pet insurance cover?

- Is pet insurance worth it?

- How much do cat vaccinations cost?

- How much do dog vaccinations cost?

- All pet insurance guides

- Best Business Insurance 2024

- Business Owner Policy (BOP)

- General Liability Insurance

- E&O Professional Liability Insurance

- Workers' Compensation Insurance

- Commercial Property Insurance

- Cyber Liability Insurance

- Inland Marine Insurance

- Commercial Auto Insurance

- Product Liability Insurance

- Commercial Umbrella Insurance

- Fidelity Bond Insurance

- Business Personal Property Insurance

- Medical Malpractice insurance

- California Workers' Compensation Insurance

- Contractor's Insurance

- Home-Based Business Insurance

- Sole Proprietor's Insurance

- Handyman's Insurance

- Photographer's Insurance

- Esthetician's Insurance

- Salon Insurance

- Personal Trainer's Insurance

- Electrician's Insurance

- E-commerce Business Insurance

- Landscaper's Insurance

Best Credit Cards of 2024

- Best Credit Card Sign-Up Bonuses

- Best Instant Approval Credit Cards

- Best Cash Back Credit Cards

- Best Rewards Credit Cards

- Best Credit Cards for Bad Credit

- Best Balance Transfer Credit Cards

- Best College Student Credit Cards

- Best 0% APR Credit Cards

- Best First Credit Cards

- Best No Annual Fee Cards

- Best Travel Credit Cards

- Best Hotel Credit Cards

- Best American Express Cards

- Best Amex Delta SkyMiles Cards

- Best American Express Business Cards

- Best Capital One Cards

- Best Capital One Business Cards

- Best Chase Cards

- Best Chase Business Cards

- Best Citi Credit Cards

- Best U.S. Bank Cards

- Best Discover Cards

- Amex Platinum Card Review

- Amex Gold Card Review

- Amex Blue Cash Preferred Review

- Amex Blue Cash Everyday Review

- Capital One Venture Card Review

- Capital One Venture X Card Review

- Capital One SavorOne Card Review

- Capital One Quicksilver Card Review

- Chase Sapphire Reserve Review

- Chase Sapphire Preferred Review

- United Explorer Review

- United Club Infinite Review

- Amex Gold vs. Platinum

- Amex Platinum vs. Chase Sapphire Reserve

- Capital One Venture vs. Venture X

- Capital One Venture X vs. Chase Sapphire Reserve

- Capital One SavorOne vs. Quicksilver

- Chase Sapphire Preferred vs. Capital One Venture

- Chase Sapphire Preferred vs. Amex Gold

- Delta Reserve vs. Amex Platinum

- Chase Sapphire Preferred vs. Reserve

- How to Get Amex Pre-Approval

- Amex Travel Insurance Explained

- Chase Sapphire Travel Insurance Guide

- Chase Pay Yourself Back

- CLEAR vs. TSA PreCheck

- Global Entry vs. TSA Precheck

- Costco Payment Methods

- All Credit Card Guides

- Raisin (SaveBetter) Interest Rates

- Citibank Savings Account Interest Rate

- Capital One Savings Account Interest Rate

- American Express Savings Account Interest Rate

- Western Alliance Savings Account Interest Rate

- Barclays Savings Account Interest Rate

- Discover Savings Account Interest Rate

- Chase Savings Account Interest Rate

- U.S. Bank Savings Account Interest Rate

- Marcus Savings Account Interest Rate

- Synchrony Bank Savings Account Interest Rate

- Ally Savings Account Interest Rate

- Bank of America Savings Account Interest Rate

- Wells Fargo Savings Account Interest Rates

- SoFi Savings Account Interest Rate

- UFB Direct Savings Account Interest Rate

- Best Savings Accounts & Interest Rates

- Best High Yield Savings Accounts

- Best 7% Interest Savings Accounts

- Best 5% Interest Savings Accounts

- Savings Interest Calculator

- Emergency Fund Calculator

- Pros and Cons of High-Yield Savings Accounts

- Types of Savings Accounts

- Is Savings Account Interest Taxable?

- Checking vs Savings Accounts

- Average Savings by Age

- How Much Should I Have in Savings?

- How to Save Money

- Compare Best Checking Accounts

- Compare Online Checking Accounts

- Best Business Checking Accounts

- Compare Best Teen Checking Accounts

- Best Student Checking Accounts

- Best Joint Checking Accounts

- Best Second Chance Checking Accounts

- Chase Checking Account Review

- Bluevine Business Checking Review

- Amex Rewards Checking Account Review

- Best Money Market Accounts

- U.S. Bank Money Market Account

- Money Market vs. Savings Account

- Best CD Rates

- Best 1-Year CD Rates

- Best 6-Month CD Rates

- Best 3-Month CD Rates

- 6% CD Rates

- Synchrony Bank CD Rates

- Capital One CD Rates

- Barclays CD Rates

- Credit Cards

- Travel Credit Cards

- Best Travel Credit Cards With No Annual Fee

On This Page

- Key takeaways

Our top picks for the best no-annual-fee travel credit cards

Comparing the best travel credit cards with no annual fee, more info on our top picks for no-annual-fee travel credit cards: editorial reviews, what is a travel credit card with no annual fee, who should get a no-annual-fee travel credit card, pros and cons of travel credit cards with no annual fee, how to choose the best travel credit card with no annual fee, how to apply for a travel credit card with no annual fee , are no-annual-fee travel credit cards worth it, faqs: best travel credit cards with no annual fee.

Best Travel Credit Cards With No Annual Fee for 2024

- Travel credit cards make it easy to earn points, miles or cash back on your most common travel expenses.

- Several travel credit cards have no annual fees, making them even more valuable.

- Our top picks for the best no-annual-fee travel credit cards include the Capital One VentureOne Rewards Credit Card , Delta SkyMiles® Blue American Express Card , Hilton Honors American Express Card , and Chase Freedom Unlimited® among others.

- A travel credit card with no annual fee may not be a great fit for your needs if you only travel once or twice a year.

- Cards with no annual fees may have foreign transaction fees, so check the terms of each card carefully if you plan to travel internationally.

Travel credit cards help you earn free hotel stays, airline discounts and other valuable benefits. Add in no annual fee on top of this and you can maximize the value of your travel credit card and enjoy even more benefits on your next vacation.

Before you apply for a travel card with no annual fee, it’s important to compare your options. To make the process easier, we reviewed seven no-annual-fee travel credit cards to determine which ones pack the biggest punch in terms of interest rates, fees and other considerations.

Join us as we look at the best travel credit card with no annual fee based on the following criteria:

- Earning rates on popular travel categories

- Status matching with hotel and airline loyalty programs

- Reward redemption methods

Our top picks for the best travel credit cards with no annual fee

- Capital One VentureOne Rewards Credit Card: Best for simple rewards

- Delta SkyMiles® Blue American Express Card: Best for Delta SkyMiles® loyalists

- Hilton Honors American Express Card: Best for loyal Hilton customers

- IHG One Rewards Traveler Credit Card: Best for loyal IHG customers

- Chase Freedom Unlimited®: Best for extra benefits

- Blue Cash Everyday® Card from American Express: Best for road trips in the U.S.

- United Gateway℠ Card: Best for United Airlines loyalists

Best for simple rewards

Capital one ventureone rewards credit card.

Earn unlimited 1.25X miles on all purchases and 5X miles on hotels and rental cars booked through Capital One Travel.

Card Details

More card info

- 0% intro APR on purchases and balance transfers for 15 months, then 19.99% - 29.99% variable APR.

- Balance transfer fee of 3% for the first 15 months; 4% at a promotional APR that Capital One may offer you at any other time

- Miles won’t expire for the life of the account and there’s no limit to how many you can earn

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Transfer your miles to your choice of 15+ travel loyalty programs

- No annual fee

- Intro APR offer

- Low spending requirement for welcome offer

- Good or excellent credit recommended

- Few travel perks

Best for Delta SkyMiles® loyalists

Delta skymiles® blue american express card.

Earn 2X miles on Delta purchases, 2X miles at restaurants (including takeout and delivery in the U.S.), and 1X miles on all other eligible purchases.