Everything you need to know about Amex Travel

The American Express Travel portal allows you to redeem Membership Rewards points directly for travel reservations and activities rather than transfer your rewards to airline or hotel partners like Delta Air Lines SkyMiles and Marriott Bonvoy .

You also can book discounted premium tickets, use benefits like a 35% points rebate on certain bookings and even book premium hotels with additional perks through Amex Travel.

Let's explore this booking portal to uncover all its benefits and potential disadvantages.

What is the American Express Travel portal?

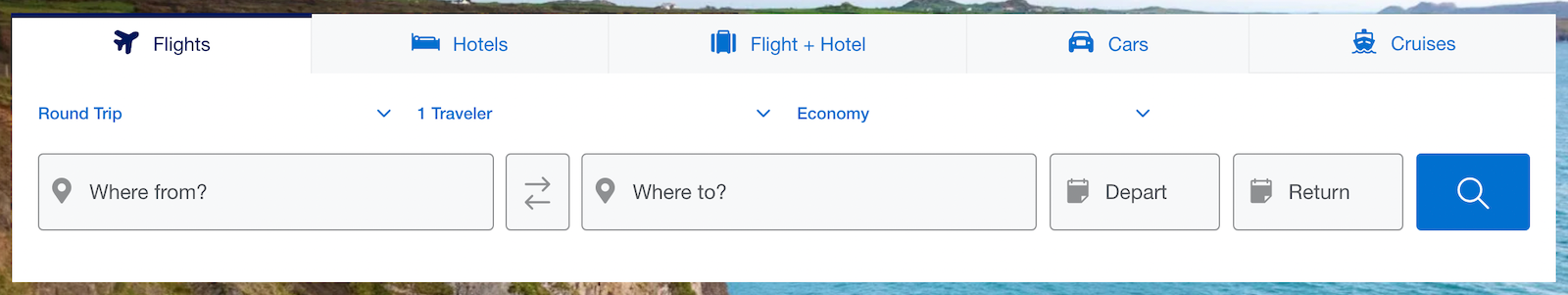

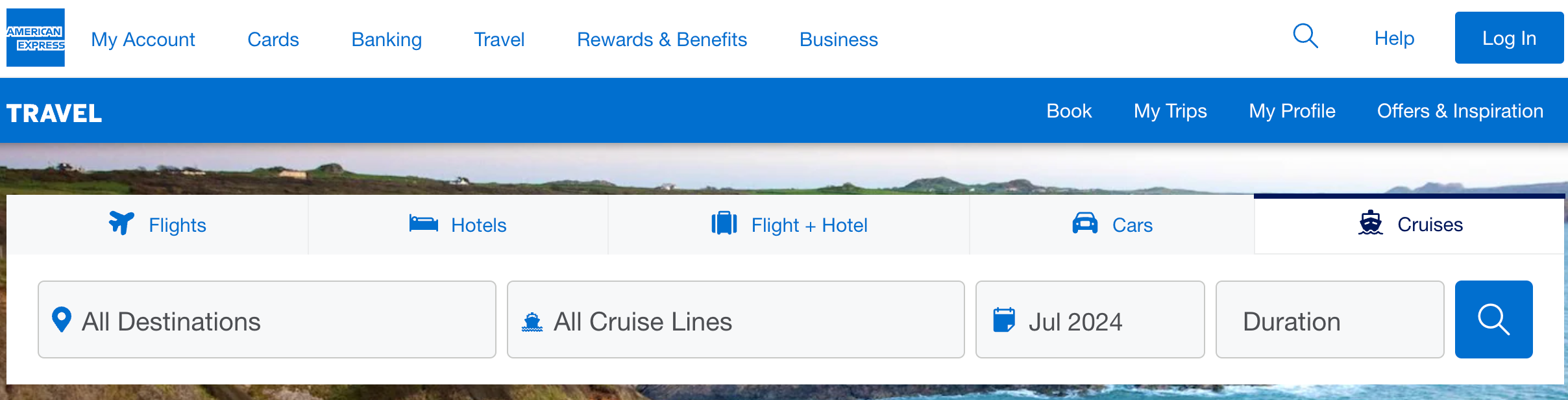

Amex Travel is the booking portal for most American Express cards . You can book flights, hotels, rental cars and cruises through the site, and you can pay with points, cash or a combination of the two.

How to book flights on the Amex Travel portal

To find flights on American Express Travel, visit this webpage . The flight booking process on the Amex Travel portal is similar to other popular sites like Kayak and Orbitz. You'll find a search box where you can enter your departure and destination cities.

If you're flexible with your departure airport, you can choose an entire city, such as New York, which has multiple airports. Additionally, you can customize your booking by selecting your preferred class and the number of travelers, and choosing between one-way and round-trip flights.

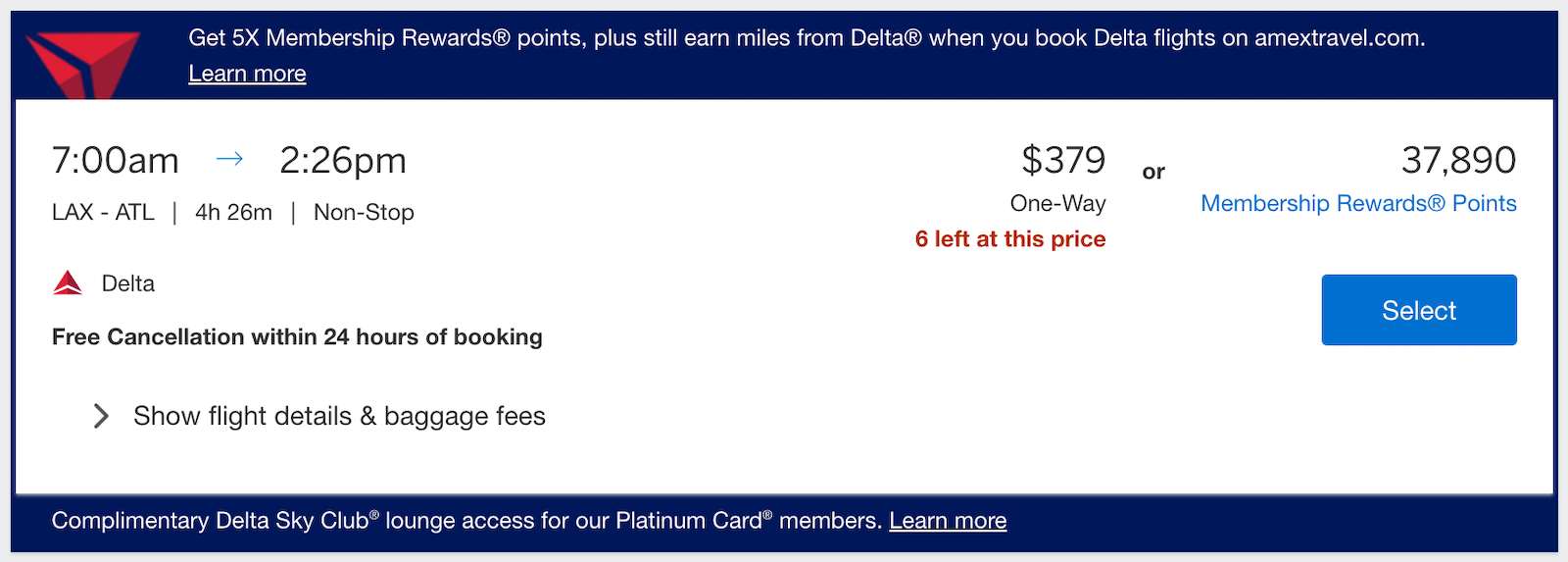

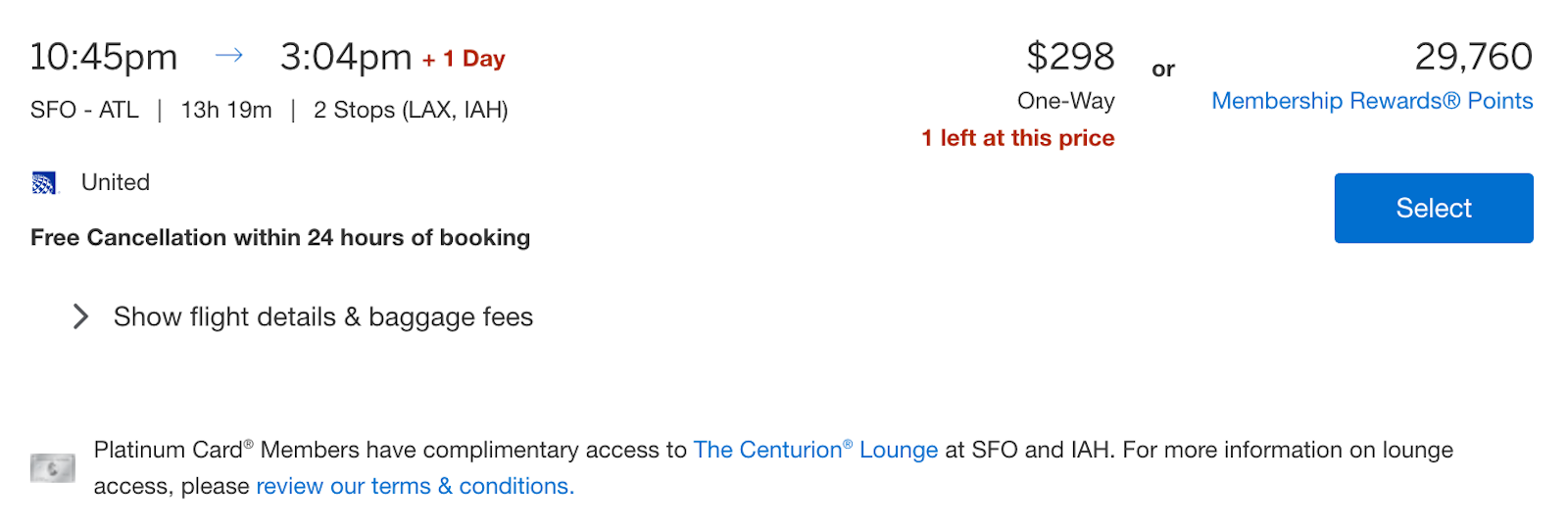

You'll see the price listed in dollars and the number of Amex Membership Rewards points during the booking process.

You can also use the options on the left-hand side to filter flights by number of stops, departure and arrival times, flight duration and airline.

Delta Air Lines is a featured airline in the Amex Travel portal. Sometimes, Delta flights appear at the top of your results, listed as "recommended," but this doesn't mean those flights are always the cheapest.

Additionally, if you have The Platinum Card® from American Express or The Business Platinum Card® from American Express and are flying from an airport with a Centurion Lounge , you'll see an indicator that a lounge is available.

Points vs. cash

When paying for your flights on Amex Travel, several American Express cards offer elevated earning rates:

You can also pay with Amex Membership Rewards points to cover the cost of your flight.

You'll see the number of points required next to the cash price of a flight. You can expect a value of 1 cent per point when using Pay with Points . However, TPG values Membership Rewards points at 2 cents apiece when you maximize Amex's transfer partners.

Related: How to redeem American Express Membership Rewards for maximum value

It's important to compare the number of points required for bookings on Amex Travel with the points you'd need to transfer to an airline program . If you can't book a flight through transfer partners and prefer to use your points, Amex Travel remains an option.

There's an additional benefit for Amex Business Platinum cardmembers: You can get 35% of your points back when paying with points on Amex Travel. This applies to first- and business-class flights on any airline plus tickets in any class on your preferred airline (the same one used for your airline incidental credits ; enrollment is required in advance). This 35% points rebate can provide a value of 1.54 cents per point, which may influence your decision to pay with cash or points.

Similarly, the Business Centurion® Card from American Express offers a 50% Pay with Points rebate on eligible flights. Note that Centurion cards are available by invitation only.

The information for the Business Centurion Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

More details about flights through Amex Travel

During the payment process, you can use points, your credit card or a combination of both. The minimum number of points you can use is 5,000, and each point is valued at 1 cent.

You can upgrade your flights using cash or points in the Amex Travel portal. This generally gives you a return of 1 cent each, and you can book using your Amex card, points or a combination of both.

During your flight search, you might come across "Insider Fares" that offer a discounted price. But to benefit from the discount, you must redeem points to cover the full fare amount.

Amex Platinum and Amex Business Platinum cardmembers have another benefit: discounted premium tickets through Amex Travel's International Airline Program . This program offers discounts on first-class, business-class and premium economy tickets from over 20 participating airlines.

To book a premium ticket using the IAP, go to the Amex Travel portal and pay with cash or points, including the Business Platinum card's 35% airline rebate. Keep in mind that not all flights are eligible and there are restrictions:

- The cardmember must travel on the itinerary.

- A maximum of eight tickets can be booked per itinerary; travel must begin and end in the U.S. or Canadian international airports.

- Tickets are nonrefundable unless stated otherwise.

- Name changes for passengers are not allowed.

Finally, note that flights booked through Amex Travel are typically treated as normal paid tickets, meaning you're eligible to earn points or miles with participating airline loyalty programs.

Related: Why I love the Amex Business Platinum's Pay with Points perk

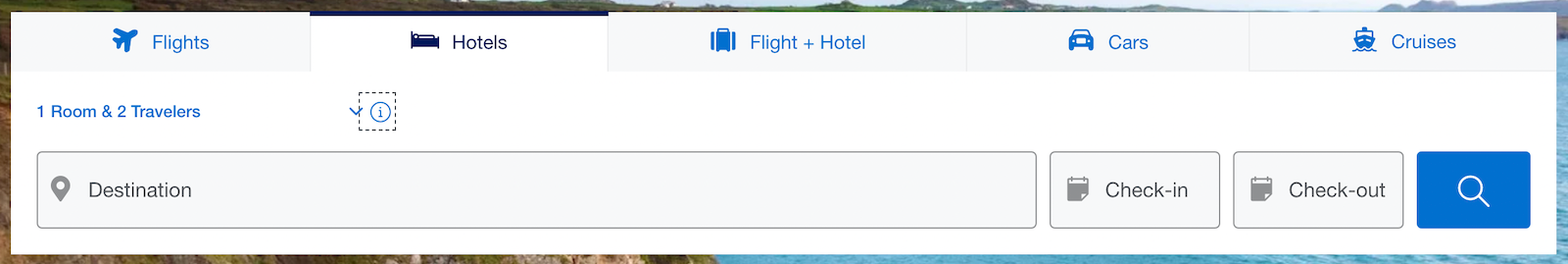

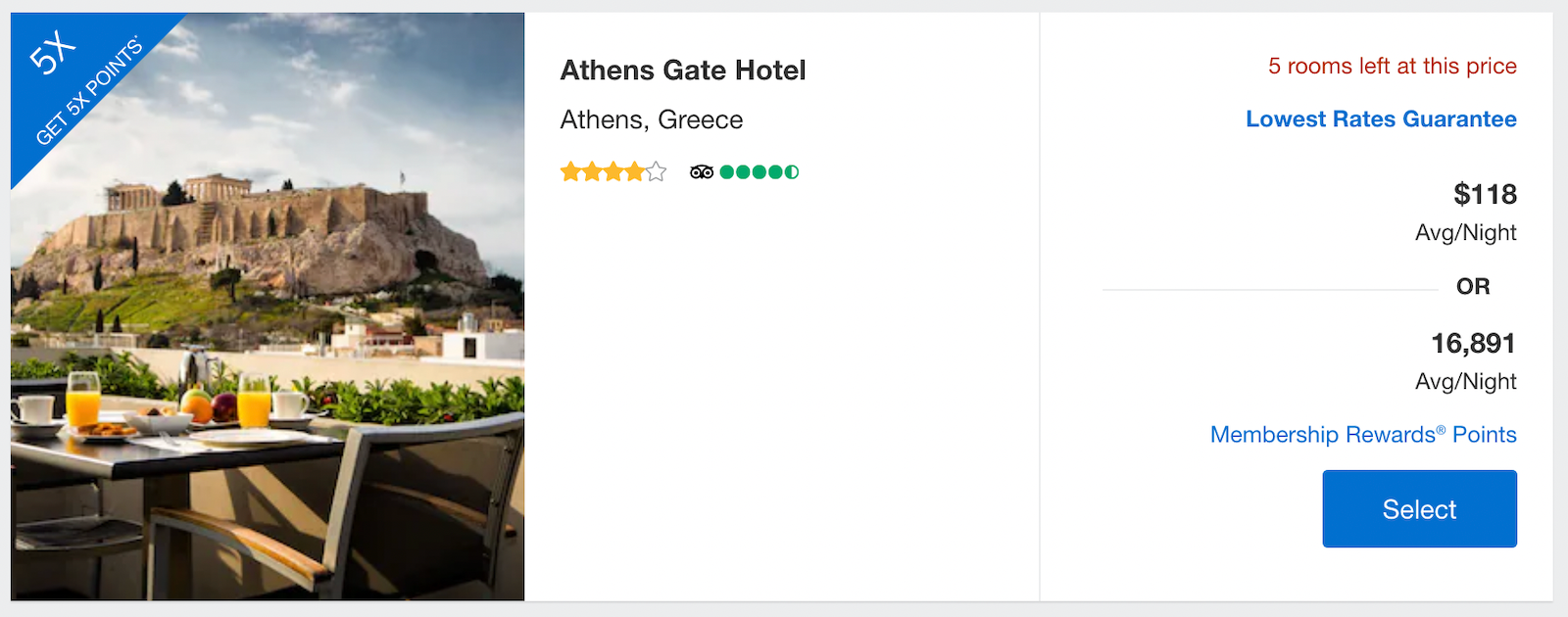

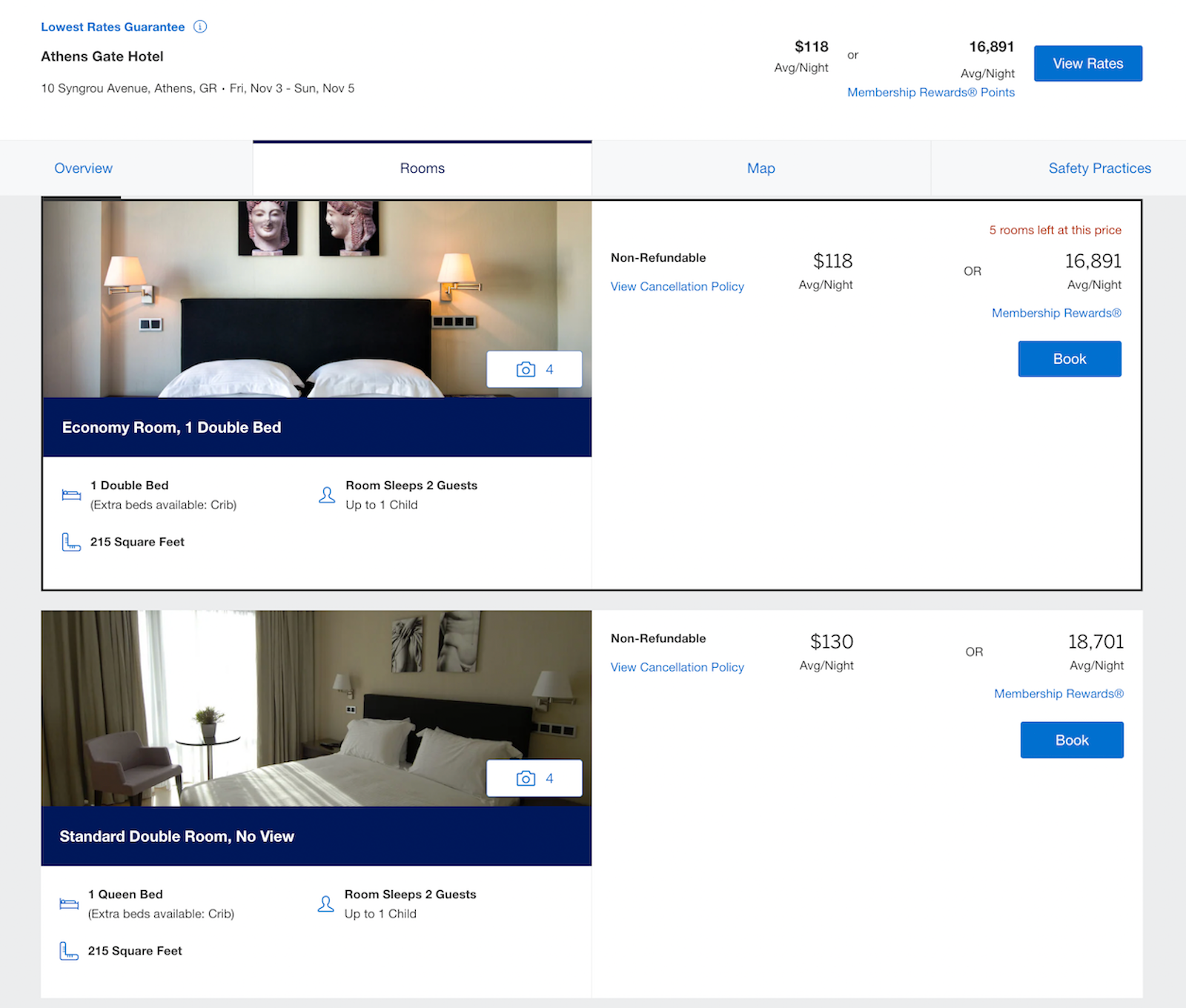

How to book hotels on the Amex Travel portal

You can book hotels through American Express Travel with a Gold, Platinum or Centurion card. As with other travel portals, you can input your destination, dates, number of rooms and number of guests (with separate input fields for adults and children).

Platinum and Business Platinum cardmembers earn 5 points per dollar on prepaid hotel reservations.

After selecting your hotel, you'll choose your preferred room and pay with points or cash. If you pay with points, you'll only get a value of 0.7 cents per point (compared to 1 cent when you book flights).

Note that these are considered third-party bookings, so you likely won't earn hotel points or elite credits for your stay . While there are reports of people receiving stay credits with Marriott Bonvoy or Hilton Honors on rooms booked through Amex Travel, the hotel is not guaranteed to recognize your elite status in these programs or provide status-qualifying stay credits.

Related: 9 things to consider when choosing to book via a portal vs. booking directly

Amex Fine Hotels + Resorts

Platinum and Centurion cardholders also have access to the Fine Hotels + Resorts program through Amex Travel. This can add some great benefits to your hotel stays — and may not cost much more than booking directly with the hotel.

Here are the perks you'll receive with every FHR booking, regardless of the length of your stay:

- Room upgrade upon arrival (when available): Some room types may be excluded, but you could receive an upgrade to preferred rooms with better views or a better location in the hotel.

- Daily breakfast for two people: The provided breakfast must be, at a minimum, a continental breakfast.

- Guaranteed 4 p.m. late checkout

- Noon check-in when available

- Complimentary Wi-Fi

- Unique property amenity: The amenity varies by hotel but should be valued at $100 or more and usually consists of a property credit, dining credit, spa credit, private airport transfer or similar amenity.

You'll need to book these stays through Amex Travel, but note that FHR is considered a separate program from Amex Travel.

In addition, if you have the personal Amex Platinum , you can also get up to $200 in statement credits every year for prepaid reservations through Fine Hotels + Resorts or The Hotel Collection — which we'll discuss next. Enrollment is required.

Related: A comparison of luxury hotel programs from credit card issuers: Amex, Capital One, Chase and Citi

The Hotel Collection

A lesser-known American Express benefit is The Hotel Collection , which allows you to book in cash or with points. Those with Amex Gold, Platinum and Centurion cards have access to this program, which offers the following benefits:

- A room upgrade at check-in (if available)

- $100 on-property credit for qualifying dining, spa and resort activities

Note that The Hotel Collection bookings require a minimum stay of two nights, though they too are eligible for the $200 hotel credit on the Amex Platinum.

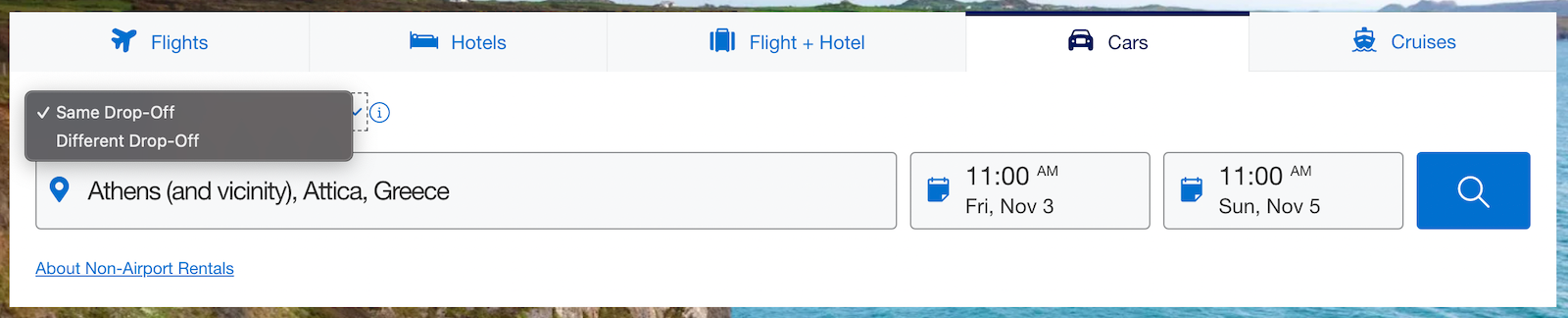

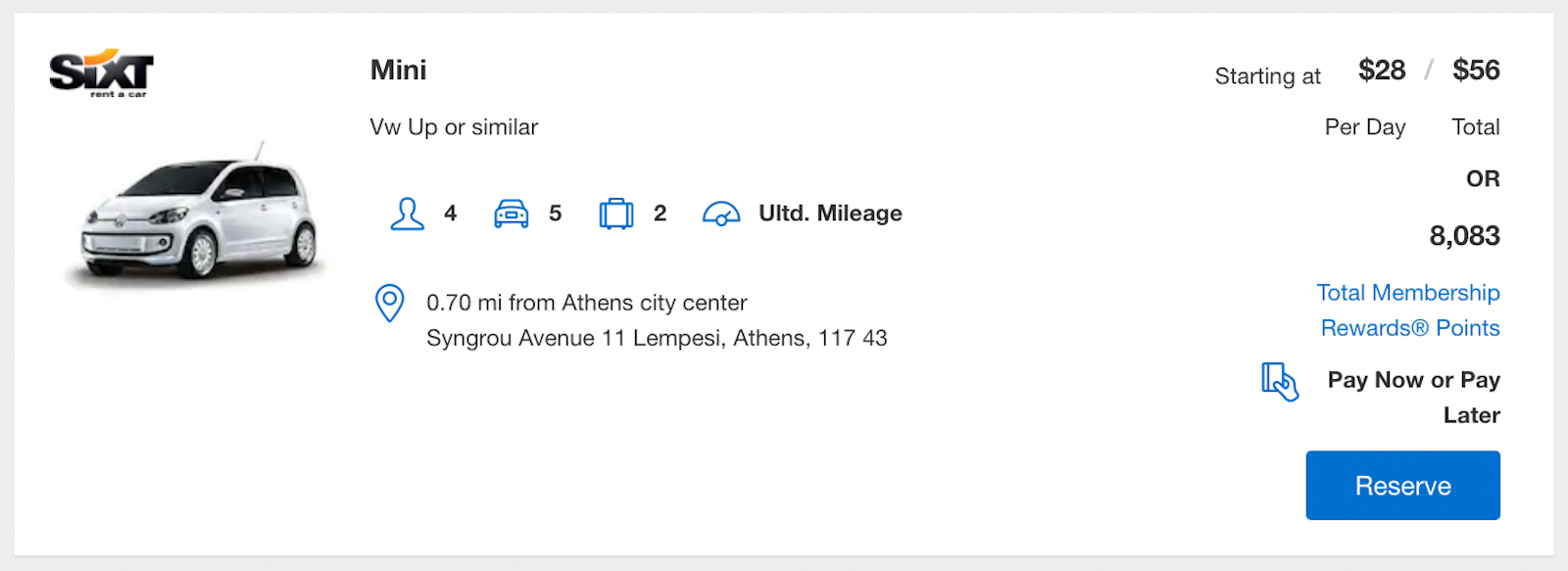

How to book rental cars and cruises on the Amex Travel portal

Reserving a car in the Amex portal is relatively simple. You'll input your pickup and drop-off times and location.

You'll see rental car prices listed in cash and points. When using Pay with Points , your points are worth 0.7 cents — just over a third of TPG's valuation of Amex Membership Rewards points.

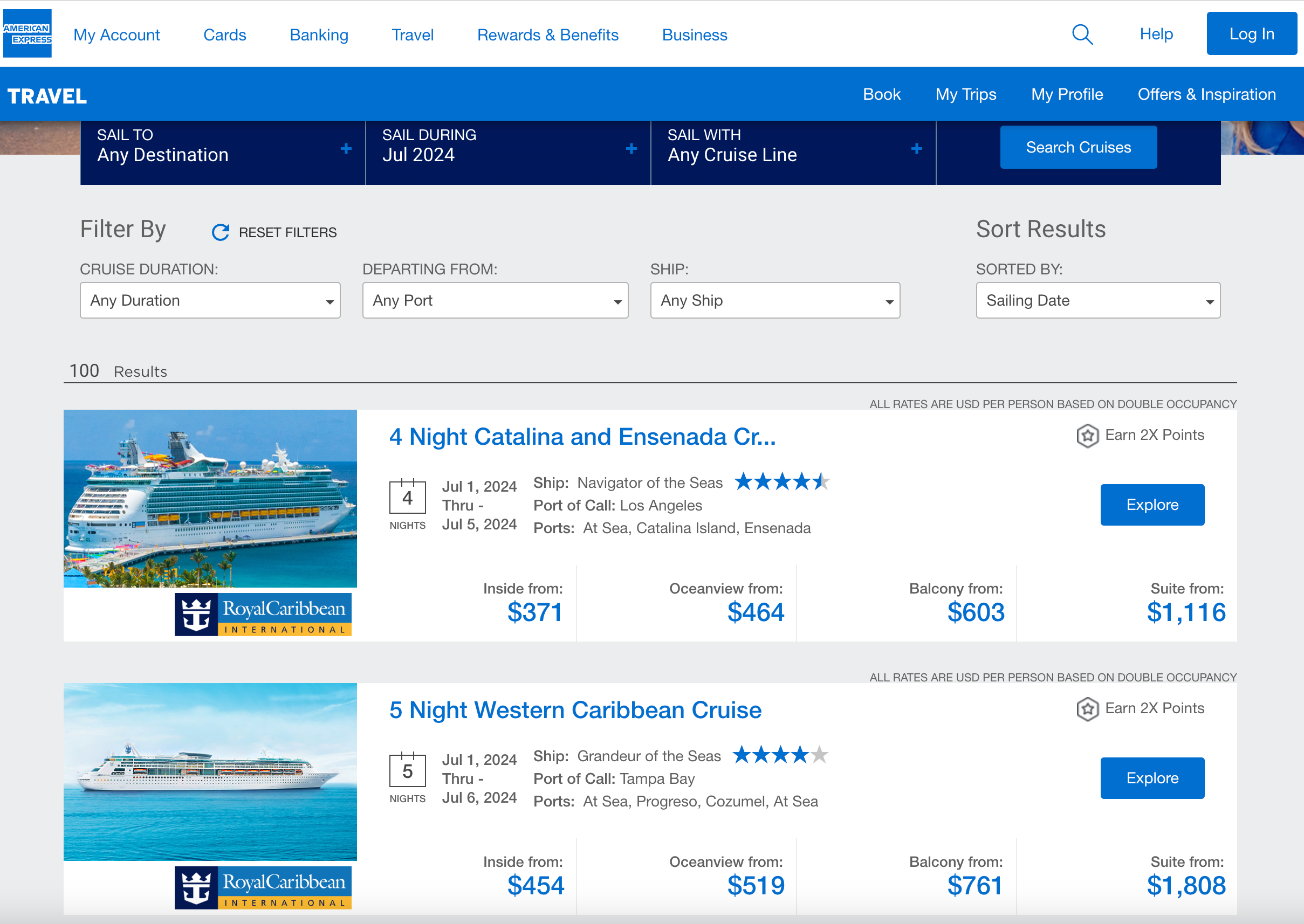

Although the format differs, you can also search for cruises on Amex Travel.

Rather than typing specific dates and numbers of passengers, you'll see four drop-down menus. These allow you to choose a destination (by region), filter by cruise lines and choose a month for travel — though not specific dates — on this first page. You can also select your desired cruise duration.

From here, you can filter by cruise duration, departure port and ship. You can sort your results by sailing date, value, price or ship rating.

On the final payment page, you can use your card or redeem points, ranging from 1 point to enough to cover the entire cost. Using points for a cruise will result in a low valuation of 0.7 cents per point, but it can be a money-saving option if you prefer not to spend cash.

There's another benefit available if you're a Platinum or Centurion cardholder (including personal and business versions of these cards): the Cruise Privileges Program .

This is available on cruises of five nights or more with select cruise lines, and it offers the following perks:

- $100-$500 in onboard ship credit (note that this cannot be used for casino or gratuity charges)

- Additional onboard amenities vary by line, such as spa vouchers, a bottle of Champagne, shore excursion credits or a private ship tour

Note that the Platinum cardmember must be one of the travelers on the cruise to enjoy these benefits.

Related: How to book a cruise using points and miles

Further things to consider about Amex Travel

When booking through the Amex Travel portal, there are a few factors to consider.

First, using Amex Membership Rewards points on Amex Travel may not provide the best value compared to transferring points to airline or hotel loyalty programs. The Pay with Points feature typically values points at 0.7 to 1 cent per point, which is far lower than our 2-cent valuation .

Additionally, the prices on Amex Travel may not always be the most competitive, so we recommend checking other platforms like Google Flights before booking your travel. Also, booking directly with hotels is advised for those seeking to utilize elite status benefits.

When you need to change your upcoming trips booked through Amex Travel, it can get complicated. You may encounter change and cancellation fees, often around $75, and making a change requires a phone call. Flight credit vouchers from cancellations can only be used for rebooking through Amex Travel via phone.

On the positive side, Amex Travel allows a 24-hour cancellation window for most reservations, and booking flights through the site generally still qualifies for earning miles and status with airline loyalty programs.

Related: Redeeming American Express Membership Rewards for maximum value

Bottom line

American Express Travel offers an array of booking options, including the ability to earn bonus Membership Rewards points on select purchases. Although you can use your points to book hotels, flights, rental cars and cruises through Amex Travel, you can get more from your points when you transfer them to Amex's airline and hotel partners .

However, there are exceptions, such as when there is no award availability for last-minute travel. In addition, Amex Travel offers perks like discounted premium flights, added benefits with Amex Fine Hotels + Resorts and a user-friendly interface. And with a simple redemption scheme that doesn't involve complicated loyalty programs and transfer partners, many Amex cardholders prefer it when planning their trips.

Additional reporting by Ryan Patterson and Kyle Olsen.

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Debt relief Best debt management Best debt settlement A debt management plan: Is it best for you? What is debt settlement and how does it work? Debt consolidation vs. debt settlement Should you settle your debt or pay in full? How to negotiate a debt settlement on your own

- Debt collection Can a debt collector garnish my bank account or my wages? Can credit card companies garnish your wages? What is the Fair Debt Collection Practices Act?

- Bankruptcy How much does it cost to file for bankruptcy? What is Chapter 7 bankruptcy? What is Chapter 13 bankruptcy? Can medical bankruptcy help with medical bills?

- More payoff strategies Tips and tricks to get of your debt in a year Don't make these mistakes when climbing out of debt How credit counseling can help you get out of debt What is the debt avalanche method? What is the debt snowball method?

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best personal loans

Auto Insurance

Best car insurance

Best high-yield savings

CREDIT CARDS

Best credit cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Credit Cards

Best business credit cards for travel of May 2024

Ariana Arghandewal

Glen Luke Flanagan

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Updated 3:57 a.m. UTC May 2, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

Business doesn’t just get done in the office. Whether you’re attending conferences and trade shows, hosting business lunches or traveling to far-flung client meetings, the right credit card can make your journey more comfortable — and rewarding. The best business credit cards for travel offer lucrative welcome bonuses and generous rewards for ongoing value. They also provide luxury perks and travel protections to improve your travel experience. While many come with high annual fees, the benefits are often worth the price tag. Here’s our list of the best business credit cards for travel for 2024.

Best business credit cards for travel

- American Express® Business Gold Card *: Best overall.

- United Club℠ Business Card *: Best business credit card for airline travel.

- World of Hyatt Business Credit Card *: Best business credit card for hotels.

- The Business Platinum Card® from American Express *: Best business card for premium travel perks.

- Delta SkyMiles® Reserve Business American Express Card *: Best business card for Delta flyers.

- Ink Business Preferred® Credit Card *: Best business card for general purpose business travel.

- Wyndham Rewards Earner® Business Card *: Best business credit card for value travel.

All information about American Express® Business Gold Card, The Business Platinum Card® from American Express , Delta SkyMiles® Reserve Business American Express Card has been collected independently by Blueprint.

Why trust our credit card experts

Our team of experts evaluates hundreds of credit cards and analyzes thousands of data points to help you find the best card for your situation. We use a data-driven methodology to determine each rating. Advertisers do not influence our editorial content. You can read more about our methodology below.

- 25+ cards analyzed.

- 9+ data points considered.

- 5-step fact-checking process.

Best overall

American express® business gold card.

The information for the American Express® Business Gold Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

Welcome bonus

Earn 70,000 Membership Rewards® points after you spend $10,000 on eligible purchases with the Business Gold Card within the first 3 months of Card Membership.

Regular APR

Credit score.

Credit Score ranges are based on FICO® credit scoring. This is just one scoring method and a credit card issuer may use another method when considering your application. These are provided as guidelines only and approval is not guaranteed.

Editor’s take

- Earn big rewards on purchases from the top two business categories you spend the most on each month.

- Benefits to give you peace of mind while traveling and shopping.

- $375 annual fee.

- Elevated rewards rate is subject to an annual spending cap.

- No introductory APR offer.

Card details

- Annual fee: $375.

- Rewards: 4 Membership Rewards points per $1 on up to $150,000 in combined purchases each calendar year on the 2 select categories your business spends the most each month, 3 points per $1 on flights and prepaid hotels booked on amextravel.com and 1 point per $1 for other purchases.

- Welcome bonus: 70,000 Membership Rewards points after spending $10,000 on purchases in the first three months of card membership.

- APR: 19.49% to 28.49% variable APR.

- Perks and benefits: This card includes baggage insurance, car rental insurance and trip delay coverage. You also receive extended warranty and purchase protection.

All information about American Express® Business Gold Card has been collected independently by Blueprint.

Best business credit card for airline travel

United club℠ business card.

The information for the United Club℠ Business Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

Earn 50,000 bonus miles and 1,000 Premier qualifying points (PQP) after you spend $5,000 on qualifying purchases in the first 3 months your account is open.

- Elite perks when flying United.

- Ability to earn elite status through credit card spending.

- Above-average earn rate on everyday purchases.

- High annual fee.

- Approval is subject to Chase 5/24 rule.

- Rewards rate on United spending is just OK.

- Annual fee: $450.

- Rewards: 2 miles per $1 on United purchases and 1.5 miles per $1 on all other purchases.

- Welcome bonus: 50,000 miles and 1,000 Premier qualifying points after spending $5,000 on qualifying purchases in the first three months of account opening.

- APR: 21.99% to 28.99% variable APR on purchases and balance transfers .

- Perks and benefits: No foreign transaction fees, complimentary United Club membership, United Premier Access service, free checked bags, 500 Premier Qualifying Points (PQP) for every $12,000 spent (up to 1,000 PQP per calendar year), Premier upgrades on award tickets, 25% discount on in-flight purchases, Avis President’s Club membership, Luxury Hotel & Resort collection benefits, trip cancellation and interruption insurance, baggage delay insurance, lost luggage reimbursement, trip delay reimbursement and primary rental car insurance.

Best business credit card for hotels

World of hyatt business credit card.

The information for the World of Hyatt Business Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

Earn 60,000 Bonus Points after you spend $5,000 on purchases in your first 3 months from account opening.

- Rewards program adapts to your top spending categories.

- Provides Discoverist status.

- No foreign transaction fee.

- $199 annual fee.

- Hyatt has a smaller geographic footprint than some competing hotel chains.

- No intro APR periods.

- Annual fee: $199.

- Rewards: 4 points per $1 at Hyatt hotels, 2 points per $1 on the top three spend categories each quarter through 12/31/24, then the top two categories each quarter, 2 points per $1 on fitness club and gym memberships and 1 point per $1 on all other purchases.

- Welcome bonus: 60,000 points after spending $5,000 on purchases in the first three months of account opening.

- APR: 21.49% to 28.49% variable APR on purchases and balance transfers. A balance transfer fee of either $5 or 5% of each balance transfer, whichever is greater, applies .

- Foreign transaction fees: $0.

- Perks and benefits: Discoverist status, up to $100 per year in Hyatt statement credits, discounted room rates through Hyatt Leverage membership, 10% redemption bonus after meeting the $50,000 spending target (limits apply), primary rental car coverage, trip cancellation and interruption insurance, travel and emergency assistance, purchase protection, extended warranty and free employee cards.

Best business card for premium travel perks

The business platinum card® from american express.

The information for the The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

Earn 150,000 Membership Rewards® points after you spend $20,000 on eligible purchases with the Business Platinum Card within the first 3 months of Card Membership.

- No foreign transaction fees.

- High reward potential.

- High-end airport lounge access.

- $695 annual fee.

- No low introductory APR period.

- Some of the potential credits may not be a fit for your business needs.

- Annual fee: $695.

- Rewards: 5 Membership Rewards® points per $1 on flights and prepaid hotels through American Express Travel, 1.5 points per $1 at U.S. construction material & hardware suppliers, electronic goods retailers and software and cloud system providers, shipping providers, and purchases of $5,000 or more on up to $2 million per calendar year and 1 point per $1 on other eligible purchases.

- Welcome bonus: 150,000 Membership Rewards® points after spending $20,000 on eligible purchases in the first three months of card membership.

- Other perks and benefits: No foreign transaction fees, the following annual statement credits: up to $400 Dell statement statement credit for eligible U.S. purchases, up to $360 Indeed statement credit, up to $150 Adobe Creative Solutions statement credit, up to $120 wireless telephone statement credit (with U.S. wireless telephone service providers), up to $200 airline incidental fee credit, up to $189 CLEAR® Plus statement Credit, up to $100 Global Entry or TSA PreCheck application fee statement credit, get 35% points back after you use points for all or part of an eligible flight booked with Amex Travel, up to 1,000,000 points back per calendar year plus elite hotel status and travel and purchase protections and insurances. Enrollment is required for select benefits.

All information about The Business Platinum Card® from American Express has been collected independently by Blueprint.

Best business card for Delta flyers

Delta skymiles® reserve business american express card.

The information for the Delta SkyMiles® Reserve Business American Express Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

Earn 75,000 Bonus Miles after spending $10,000 in purchases on your new Card in your first 6 months of Card Membership.

- Companion certificate.

- Delta Sky Club and Amex Centurion lounge access.

- Main Cabin 1 priority boarding and a first checked bag free on Delta flights.

- Non-Delta spending rewards are lackluster.

- Annual fee: $650.

- Rewards: 3 Delta SkyMiles per $1 spent on eligible Delta purchases, 1.5 miles per $1 on eligible transit, U.S. shipping, and U.S. office supply store purchases, 1 mile per $1 on other purchases. After spending $150,000 in a calendar year, earn 1.5 miles per $1 on eligible purchases for the rest of the year.

- Welcome bonus: Earn 75,000 miles after spending $10,000 in purchases in the first six months of card membership.

- APR: 20.99% to 29.99% variable APR.

- Foreign transaction fees: None.

- Perks and benefits: Purchase a Delta flight with your card and access The Centurion ® Lounge or Escape Lounge (The Centurion ® Studio Partner), take 15% off when booking Award Travel with miles and receive four Delta Sky Club ® one-time guest passes each year upon card renewal.

All information about Delta SkyMiles® Reserve Business American Express Card has been collected independently by Blueprint.

Best business card for general purpose business travel

Ink business preferred® credit card.

The information for the Ink Business Preferred® Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

Earn 100,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That’s $1,000 cash back or $1,250 toward travel when redeemed through Chase Ultimate Rewards®.

- Significant welcome bonus.

- Substantial earn rate on travel and business spending.

- Points transfer 1:1 to over a dozen airline and hotel loyalty programs.

- Chase’s 5/24 rule applies.

- Chase Ultimate Rewards® program has fewer transfer partners than competing programs.

- No intro APR.

- Annual fee: $95.

- Rewards: 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year and 1 point per $1 on all other purchases.

- Welcome bonus: 100,000 points after spending $8,000 on purchases in the first three months of account opening.

- APR: 21.24% to 26.24% variable APR on purchases and balance transfers. A balance transfer fee of either $5 or 5% of each transfer, whichever is greater, applies .

- Perks and benefits: 25% increase in points value when booking travel through Chase, no foreign transaction fees, trip cancellation/interruption insurance, primary rental car insurance, cell phone protection.

Best business credit card for value travel

Wyndham rewards earner® business card.

The information for the Wyndham Rewards Earner® Business Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

Earn up to 100,000 bonus points, enough for up to 13 free nights at participating properties — Earn 50,000 bonus points after spending $4,000 on purchases in the first 90 days and earn 50,000 bonus points after spending $15,000 on purchases within the first 12 months. Free nights can require up to 30,000 points per bedroom at participating properties and are subject to availability. Resort fees may apply and cannot be paid with points.

- Eye-popping rewards on spending at the pump.

- Generous rewards within the hotel brand.

- Receive top-tier Diamond status automatically.

- $95 annual fee.

- Wyndham properties are mostly value-branded hotels.

- Non-Wyndham travel earns only 1 point per $1.

- Rewards: 8 points per $1 spent on Hotels By Wyndham and gas purchases, 5 points per $1 on marketing, advertising and utility purchases and 1 point per $1 on all other purchases.

- Welcome bonus: 50,000 points after spending $4,000 on purchases in the first 90 days plus an additional 50,000 points after spending $15,000 on purchases within the first 12 months of account opening. Free nights can require up to 30,000 points per bedroom at participating properties and are subject to availability. Resort fees may apply and cannot be paid with points.

- APR: 0% intro APR for six billing cycles from the transaction date on all qualifying Wyndham Timeshare purchases. The standard APR of 21.24%, 25.24% or 30.24% variable applies to purchases and balance transfers. A balance transfer fee of either $5 or 3% of the amount of each transfer, whichever is greater, applies .

- Perks and benefits: No foreign transaction fees, receive Wyndham Rewards Diamond member level and enjoy suite upgrades, welcome amenity at check-in, and more, anniversary bonus of 15,000 bonus points each anniversary year—enough for up to two free nights at participating hotels every year, redeem 10% fewer Wyndham Rewards points for go free® awards, so you earn your free nights faster.

Compare the best business credit cards for travel

All information about American Express® Business Gold Card, Delta SkyMiles® Reserve Business American Express Card and The Business Platinum Card® from American Express has been collected independently by Blueprint.

Why this card made the list

The American Express® Business Gold Card * The information for the American Express® Business Gold Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. (terms apply) offers the highest potential payout on business spending of any card on this list. Cardmembers earn 4 Membership Rewards points per $1 on up to $150,000 in combined purchases each calendar year on the 2 select categories your business spends the most each month, 3 points per $1 on flights and prepaid hotels booked on amextravel.com and 1 point per $1 for other purchases.

The Membership Rewards® program is one of the best out there for travel rewards, offering flexibility and a host of exceptional airlines and hotels you can transfer points to.

The Business Gold Card also includes eligibility for Amex Offers, a valuable program with discounts and deals at hundreds of merchants. It can potentially save you hundreds of dollars a year, possibly helping offset the card’s $375 annual fee. Not to be overlooked are the card’s travel protections like baggage¹ and trip delay insurance², along with secondary rental car coverage³. Cardmembers also qualify for hotel perks through The Hotel Collection, including an up to $100 stay credit and room upgrades.

- Rewards: Earn 4 Membership Rewards points per $1 on up to $150,000 in combined purchases each calendar year on the 2 select categories your business spends the most each month, 3 points per $1 on flights and prepaid hotels booked on amextravel.com and 1 point per $1 for other purchases.

- Welcome bonus: Earn 70,000 Membership Rewards points after spending $10,000 on purchases in the first three months of card membership.

- F oreign transaction fees: None.

The United Club℠ Business Card * The information for the United Club℠ Business Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. is ideal for United flyers looking for premium travel perks. The card offers a generous 50,000 miles and 1,000 Premier qualifying points after spending $5,000 on qualifying purchases in the first three months of account opening. Beyond the welcome bonus, you’ll earn 2 miles per $1 on United purchases and 1.5 miles per $1 on all other purchases, which can add up substantially on business expenses. And, this card is one of the few that still offers price protection, which can save you a bundle if prices drop after you’ve purchased an item.

While you’re earning points on spending, you’ll also accrue 500 Premier Qualifying Points (PQP) for every $12,000 spent (up to 1,000 PQP per calendar year). The card has a $450 annual fee, which is steep, but the included annual United Club membership, which starts at $650, can make up for it if you frequent these lounges (note that this does not include access to the United Polaris Club lounges).

Cardholders also get complimentary United Club membership, Premier Access service, free checked bags, Premier upgrades on award tickets, 25% discount on in-flight purchases. Travel protections include trip cancellation and interruption insurance, baggage delay insurance, lost luggage reimbursement, trip delay reimbursement and primary rental car insurance. The card also comes with Avis President’s Club membership and Luxury Hotel & Resort collection benefits.

Be aware that approval for the card is subject to Chase’s unwritten 5/24 rule , which means anyone who has opened five or more credit cards from any issuer in the past 24 months will likely be denied.

- Rewards: Earn 2 miles per $1 on United purchases and 1.5 miles per $1 on all other purchases.

- Welcome bonus: Earn 50,000 miles and 1,000 Premier qualifying points after spending $5,000 on qualifying purchases in the first three months of account opening.

The World of Hyatt Business Credit Card * The information for the World of Hyatt Business Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. is ideal for business travelers looking to take advantage of the brand’s hotel portfolio at a discounted rate. Cardmembers save on hotel rates through the Hyatt Leverage program, and get a 10% rebate on award redemptions (on up to 200,000 points per year) after spending $50,000 on the card in a year. The card also comes with a $50 Hyatt credit issued twice a year to knock down the overall cost of a hotel stay.

Cardholders and up to five employees can get automatic Discoverist elite status, with the option to earn an additional five elite night credits for every $10,000 spent in a year. Plus the card comes with an array of travel protections, which is helpful when you’re on the move and want peace of mind.

- Rewards: Earn 4 points per $1 at Hyatt hotels, 2 points per $1 on the top three spend categories each quarter through 12/31/24, then the top two categories each quarter, 2 points per $1 on fitness club and gym memberships and 1 point per $1 on all other purchases.

- Welcome bonus: Earn 60,000 points after spending $5,000 on purchases in the first three months of account opening.

The Business Platinum Card® from American Express * The information for the The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. (terms apply) is one of the best premium business travel cards on the market, offering access to elite airport lounges and hundreds of dollars in annual business and travel credits. Big spenders will appreciate the elevated earning rate on eligible purchases over $5,000 (subject to an annual spending cap) while frequent travelers can accumulate substantial rewards by booking through Amex Travel.

The Business Platinum Card also provides the most comprehensive airport lounge benefits of any business card on the market, which includes access to Amex’s Global Lounge Collection, which includes Priority Pass Select and the exclusive Centurion lounge network. Plus, through American Express Fine Hotels & Resorts, cardholders can secure benefits on hotel stays that are typically reserved for elite members like complimentary breakfast, discounted stays, late checkout, resort credits and more. Enrollment is required for some benefits.

You can redeem points for statement credits, travel bookings or maximize their value by transferring them to nearly two dozen airline and hotel loyalty programs for premium award redemptions.

- Rewards: Earn 5 Membership Rewards® points per $1 on flights and prepaid hotels through American Express Travel, 1.5 points per $1 at U.S. construction material & hardware suppliers, electronic goods retailers and software and cloud system providers, shipping providers, and purchases of $5,000 or more on up to $2 million per calendar year and 1 point per $1 on other eligible purchases.

- Welcome bonus: Earn 150,000 Membership Rewards® points after spending $20,000 on eligible purchases in the first three months of card membership.

If Delta is your preferred airline, the Delta SkyMiles® Reserve Business American Express Card * The information for the Delta SkyMiles® Reserve Business American Express Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. (terms apply) offers premium travel perks with the airline plus a pathway to elevate your elite status. Cardholders receive $2,500 Medallion ® Qualification Dollars each qualification year with MQD Headstart. Additionally, cardholders can earn $1 MQD for each $10 of eligible purchases each calendar year.

Cardholders also get an annual companion certificate, complimentary upgrades, priority boarding, free checked bags, and an up to $100 Global Entry or TSA PreCheck statement credit to reimburse the program application fee. Plus, enjoy complimentary access to Delta Sky Club*, Amex Centurion and Escape Lounges when flying Delta. The Centurion lounge access alone is substantial, considering this is one of a very select lineup of cards to offer such access.

- Rewards: Earn 3 Delta SkyMiles per $1 spent on eligible Delta purchases, 1.5 miles per $1 on eligible transit, U.S. shipping, and U.S. office supply store purchases, 1 mile per $1 on other purchases. After spending $150,000 in a calendar year, earn 1.5 miles per $1 on eligible purchases for the rest of the year.

*Effective 2/1/25, Reserve card members will receive 15 visits per year to the Delta Sky Club; to earn an unlimited number of visits each year starting on 2/1/25, the total eligible purchases on the card must equal $75,000 or more between 1/1/24 and 12/31/24, and each calendar year thereafter. Once all 15 visits have been used, eligible card members may purchase additional Delta Sky Club visits (including grab and go) at a per-visit rate of $50 per person using the card.

The Ink Business Preferred® Credit Card * The information for the Ink Business Preferred® Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. offers a substantial welcome bonus, though you can squeeze more value out of it by transferring points to one of more than a dozen Chase travel airline and hotel partners The card also earns a generous reward rate on common business spending categories (subject to an annual spending cap) making it easy to quickly earn points for travel.

Aside from earning rewards, the card provides valuable travel protections when you hit the road. Primary rental car insurance is a useful perk, as is trip cancellation and interruption insurance. The card’s cellphone protection is also top-notch, providing up to $1,000 worth of coverage per claim in exchange for a $100 deductible.

- Rewards: Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year and 1 point per $1 on all other purchases.

- Welcome bonus: Earn 100,000 points after spending $8,000 on purchases in the first three months of account opening.

Wyndham Rewards is a great loyalty program for business travelers who want the option to book multiple rooms without forking over tons of points. Free nights at Wyndham start at just 7,500 points per bedroom. This means you can book entire apartments at eligible timeshare properties and pay per room, which often works out cheaper compared to booking multiple rooms with other hotel programs.

The Wyndham Rewards Earner® Business Card * The information for the Wyndham Rewards Earner® Business Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. also comes with valuable perks like Diamond elite status and discounts on award and paid nights. The $95 annual fee is partially offset by a 15,000-point annual renewal bonus, no foreign transaction fees and cellphone protection.

- Rewards: Earn 8 points per $1 spent on Hotels By Wyndham and gas purchases, 5 points per $1 on marketing, advertising and utility purchases and 1 point per $1 on all other purchases.

- Welcome bonus: Earn 50,000 points after spending $4,000 on purchases in the first 90 days plus an additional 50,000 points after spending $15,000 on purchases within the first 12 months of account opening. Free nights can require up to 30,000 points per bedroom at participating properties and are subject to availability. Resort fees may apply and cannot be paid with points.

- Foreign transaction fees: 0% of each transaction in U.S. dollars.

Methodology

Our team of credit card experts analyzed hundreds of credit cards. We compared the travel benefits on a variety of business credit cards, looking at every card’s rewards structure, flexibility of the earnings, annual fees, and any and all other valuable travel perks that came with each card.

We took a deep dive into the details of each product and that analysis, combined with our years of experience covering credit cards, informed us as we developed these credit card rankings. Factors we considered included:

- Annual fees.

- Rewards potential and value of rewards.

- Flexibility of rewards.

- Welcome bonuses.

- Travel-related benefits like TSA Precheck or Global Entry application fee reimbursements, checked bag perks or airport lounge access.

- Travel protections and insurances like primary auto rental coverage, trip delay or cancellation insurance and baggage delay insurance.

Should you get a business card for travel?

“ Business cards are a great option for anyone looking to get the most travel rewards out of their spending. Whether you run a traditional business or have a side hustle like reselling items on Facebook Marketplace, these cards can have a wide variety of bonus spending categories with reasonable annual fees,” says Kathleen Porter Kristiansen, travel and money expert and owner of Triplepassport.com.

An ideal candidate for a travel business credit card is someone whose business has significant expenses, and who wants to leverage those expenses for travel rewards. Many business cards offer bonus rewards on common spending categories. By paying with a rewards card that fits your business expense spending patterns, you can typically generate a substantial points or miles balance and then use your credit card rewards to cover travel expenses.

Guide to business cards for travel

A business credit card for travel can benefit anyone with a business who flies, drives or stays overnight for work. A travel business credit card can help manage cash flow, earn rewards to save you money on your next outing and make it easy to keep track of their spending.

Business credit cards for travel sometimes come with features beneficial for business owners like higher spending limits and exclusive travel rewards programs . Keep in mind that nearly all business credit cards typically require a strong personal credit score and may require additional information like an Employee Identification Number or company financial statements. Small business credit cards for travel, like other business credit cards, are also likely to require a personal guarantee, meaning if the business defaults on their debt, the primary cardholder will be held responsible for outstanding debt.

Once you’ve chosen the best business travel card for your needs, it’s important to use it responsibly. Make sure you pay your bill on time every month to avoid late fees or higher interest rates. Also, be aware of any spending limits or restrictions set by the issuer so that you don’t exceed them. Consider tracking your spending regularly so that you can stay on top of your budgeting goals and maximize your rewards program benefits.

Choosing the best business card for travel

Choosing a business card based on your travel goals and habits is a good place to start, but it also makes sense to factor in the rewards structure of any card. For example, if you rarely fly, a card that earns high rewards on flight spending isn’t going to be beneficial. Consider where your business spends the most on a credit card and select a card that offers bonus rewards in those areas. Be sure to factor any annual fees that will eat into the value of any rewards earned.

Other important considerations: Do you want a card that earns rewards with a specific hospitality or airline brand? Or do you want a card that earns flexible rewards that can be redeemed for a variety of travel options?

If you regularly fly with a particular airline or stay within a hotel chain, a cobranded card is likely to be a great fit as these cards tend to earn high rewards on purchases within the brand plus often come with money-saving benefits and other perks like free checked bags, elite status with the brand and more.

Selecting a general purpose travel rewards card comes down to which flexible rewards program works best for your needs. The most popular rewards programs include Chase Ultimate Rewards® , American Express Membership Rewards , Citi ThankYou Points and Capital One miles.

Other issuers, like Bank of America and U.S. Bank, offer credit cards with rewards that can be used to book various types of travel but don’t allow you to transfer your rewards to various travel loyalty programs, which can limit your options.

Explore travel insurance : The best travel insurance companies

Frequently asked questions (FAQs)

Most business cards for travel have no foreign transaction fees. While some credit cards charge a fee of around 3% on each transaction made abroad, you can avoid this fee by getting a card that doesn’t charge foreign transaction fees — such as The Business Platinum Card® from American Express * The information for the The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. or any of the selections on this list.

When using a business credit card, it is possible to earn rewards such as points or miles that you can use for travel redemptions. Just make sure you get a business card that earns rewards that will allow redemptions that fit with your needs.

The best type of rewards for those who value flexibility are transferable points like Chase Ultimate Rewards, American Express Membership Rewards, Capital One miles and Citi ThankYou points, since they can be transferred to airline and hotel partners and then redeemed to book travel through your preferred loyalty program.

You can apply for a business credit card like any other credit card. One difference is that you will most likely have the option to include an Employer Identification Number (EIN) in the application. You can apply online and you’ll typically receive an answer within a minute or two.

As is standard, you’ll also have to enter your name on the application, and since you’re applying for a business card, will likely be asked to provide your annual revenue (or estimated revenue if your business is new), as well as address, phone number and number of employees.

For business owners who travel frequently, a credit card that earns travel rewards is likely the better choice. If you’re willing to put the work into transferring rewards to airline and hotel partners, you can potentially get outsize value from your rewards.

But if you aren’t sure how you want to use your travel rewards, or it seems daunting to try and maximize your earnings through various partners, there’s nothing wrong with a cash-back card. After all, cash-back is the most flexible reward of them all. If you think that might be a better fit for your needs, our list of the best cash-back business cards is a great place to start.

¹Eligibility and Benefit level varies by Card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company.

²Eligibility and Benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

³Eligibility and Benefit level varies by Card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company. Car Rental Loss or Damage Coverage is offered through American Express Travel Related Services Company, Inc.

*The information for the American Express® Business Gold Card, Delta SkyMiles® Reserve Business American Express Card, Ink Business Preferred® Credit Card, The Business Platinum Card® from American Express, United Club℠ Business Card, World of Hyatt Business Credit Card and Wyndham Rewards Earner® Business Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Ariana Arghandewal is a travel hacker and travel rewards expert who leverages credit cards to earn over a million miles every year. She is the founder of Pointchaser, an award-winning blog where she covered rewards travel and credit cards since 2012.

Glen Luke Flanagan is a deputy editor on the USA TODAY Blueprint credit cards team. Prior to joining Blueprint, he served as a deputy editor on the credit cards team at Forbes Advisor, and covered credit cards, credit scoring and related topics as a senior writer at LendingTree. He’s passionate about helping people understand personal finance so they can make the best decisions possible for their wallet. Glen holds a master's degree in technical and professional communication from East Carolina University and a bachelor's degree in journalism from Radford University.

New Citi Strata Premier Card layers on the perks, replaces the Citi Premier Card

Credit Cards Carissa Rawson

How do credit card refunds work?

Credit Cards Tamara Aydinyan

I’m an expat, and here’s why I love my Bank of America Travel Rewards card

Credit Cards Kelly Dilworth

Amex purchase protection benefits guide

Credit Cards Ryan Smith

Limited-time 75K offers on Chase Sapphire Preferred and Sapphire Reserve

Credit card statement balance vs current balance: What’s the difference?

Credit Cards Michelle Lambright Black

Check it out: This is what the average household spends on grocery costs per month

Credit Cards Stella Shon

Capital One Quicksilver benefits guide 2024

Credit Cards Lee Huffman

United Airlines credit cards have a secret perk that makes it easier to book awards

Credit Cards Jason Steele

Can you pay off one credit card with another?

Credit Cards Louis DeNicola

Amex Gold vs. Platinum

Credit Cards Harrison Pierce

Why I chose the Chase Sapphire Preferred as my first ever rewards card

Credit Cards Sarah Li Cain

How to use Alaska Airlines Companion Fare

Credit Cards Ariana Arghandewal

How I maximize my Chase Ink Business Unlimited Card

How to do a balance transfer with Discover

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards ›

The 8 Best American Express Business Cards in 2024

Jarrod West

Senior Content Contributor

441 Published Articles 1 Edited Article

Countries Visited: 21 U.S. States Visited: 24

Keri Stooksbury

Editor-in-Chief

35 Published Articles 3198 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

Michael Y. Park

17 Published Articles 167 Edited Articles

Countries Visited: 60+ U.S. States Visited: 50

Table of Contents

Why should you get an amex business card, the best amex business cards, other amex business cards, how to select a business credit card, which types of businesses qualify for a business credit card, how to apply for an american express business credit card, how to choose an american express business card, what credit score do i need for an amex business card, how long does it take for an amex business card application to be approved, how many amex business cards can i have, how much are amex points worth, are american express cards the best business credit cards, business credit cards vs. personal credit cards, deciding between an american express business charge card and a business credit card, how we selected our list of best amex business credit cards, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

American Express is a known leader when it comes to business credit cards, with many great options for business owners.

Finding the perfect Amex business credit card that brings the most value to your business operation may seem challenging. So we’re here to walk you through various choices and help you determine which card fits your business best.

Put simply, American Express offers some of the best business credit cards on the market. Additionally, Amex offers a variety of business cards that fit many different business needs.

This includes business owners looking for a premium solution like The Business Platinum Card ® from American Express, business owners looking to maximize large expenses with the American Express ® Business Gold Card, and those looking for a simple, no-annual-fee card like The Blue Business ® Plus Credit Card from American Express ( rates & fees ).

Beyond the benefits specific to each card, many Amex business cards offer helpful business tools that may include a pay-over-time option, no preset spending limit, the ability to add employee cards for a reduced or no additional fee, easy connection to partners like QuickBooks and Bill.com, and more.

No preset spending limit means your spending limit is flexible. Unlike a traditional card with a set limit, the amount you can spend adapts to factors such as your purchase, payment, and credit history.

- The Business Platinum Card ® from American Express — Best for Travel, Lounge Access

- American Express ® Business Gold Card — Best for Earning Points

- The American Express Blue Business Cash™ Card — Best for Start-ups, Cash-back

- The Blue Business ® Plus Credit Card from American Express — Best for No Annual Fee ( rates & fees )

- The Plum Card ® from American Express — Best for Cash-back

- Delta SkyMiles ® Reserve Business American Express Card — Best Delta Loyalists, Lounge Access

- Marriott Bonvoy Business ® American Express ® Card —Best for Hotels

- The Hilton Honors American Express Business Card — Best for Hotels, Lounge Access

Amex Business Card Comparison Table (2024)

Amex business platinum card (best for travel and lounge access).

This card is ideal for business travelers who enjoy luxury travel and are looking for a card loaded with benefits!

The Business Platinum Card ® from American Express is a premium travel rewards card tailored toward business owners who are frequent travelers with a high number of annual expenses.

When you factor in the large number of perks that the card offers like the best airport lounge access at over 1,400 lounges , along with tons of annual credits, it’s easy to see why this card can is a top option for frequent traveling business owners.

Hot Tip: Check to see if you’re eligible for a huge welcome bonus offer of up to 170,000 points with the Amex Business Platinum. The current public offer is 150,000 points. (This targeted offer was independently researched and may not be available to all applicants.)

- 5x Membership Rewards points per $1 on flights and prepaid hotels at Amex Travel

- Access to over 1,400 worldwide airport lounges as part of the American Express Global Lounge Collection

- Get 50% more Membership Rewards points (1.5 points per $1) on eligible purchases in key business categories, as well as on purchases of $5,000 or more (cap applies)

- High annual fee of $695 ( rates & fees )

- Airline fee credit does not cover airfare, only incidentals like checked bags

- Welcome Offer: Earn 150,000 Membership Rewards ® points after you spend $20,000 in eligible purchases on the Card within the first 3 months of Card Membership.

- 5X Membership Rewards ® points on flights and prepaid hotels on AmexTravel.com, and 1X points for each dollar you spend on eligible purchases.

- Earn 1.5X points (that’s an extra half point per dollar) on each eligible purchase at US construction material, hardware suppliers, electronic goods retailers, and software & cloud system providers, and shipping providers, as well as on purchases of $5,000 or more everywhere else, on up to $2 million of these purchases per calendar year.

- Unlock over $1,000 in statement credits on select purchases, including tech, recruiting and wireless in the first year of membership with the Business Platinum Card ® . Enrollment required. See how you can unlock over $1,000 annually in credits on select purchases with the Business Platinum Card ® , here.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to the Card.

- $189 CLEAR ® Plus Credit: Use your card and get up to $189 in statement credits per calendar year on your CLEAR ® Plus Membership (subject to auto-renewal) when you use the Business Platinum Card ® .

- The American Express Global Lounge Collection ® can provide an escape at the airport. With complimentary access to more than 1,400 airport lounges across 140 countries and counting, you have more airport lounge options than any other credit card issuer on the market as of 03/2023.

- $695 Annual Fee.

- Terms Apply.

- APR: 19.49% - 28.49% Variable

- Foreign Transaction Fees: None

American Express Membership Rewards

Hot Tip: Check to see if you’re eligible for a huge welcome bonus offer of up to 170,000 points with the Amex Business Platinum. The current public offer is 150,000 points. (This targeted offer was independently researched and may not be available to all applicants.)

The Amex Business Platinum card sets the bar high when it comes to earning, redemptions, and the endless benefits that come with the card.

Cardholders can earn 5x points on flights and prepaid hotels on Amex Travel and 1.5x points on eligible purchases with U.S. sellers of construction materials, hardware suppliers, electronic goods retailers, software and cloud system providers, and shipping providers, as well as on purchases of $5,000 or more everywhere else (on up to $2 million of these purchases per calendar year).

Praised by business travelers everywhere, the card delivers all the perks a traveler would value . Lounge access alone covers the annual fee, and when you add in 35% Pay With Points rebates on travel purchases, hotel and rental car status and benefits , and luxury hotel benefits with Amex Fine Hotels + Resorts and The Hotel Collection , there’s no better fit for the frequent business traveler seeking an American Express travel business card.

The card also comes with a host of statement credits, including:

- Up to $200 in airline credits

- Up to $189 in CLEAR Plus credit

- Up to $400 in Dell statement credits

- Up to $360 in Indeed statement credits

- Up to $150 in Adobe statement credits

- Up to $120 in wireless phone service statement credits

You must enroll for some of these benefits, which you can do on your Amex account. When we look at all of the American Express Business cards, there isn’t any other that comes close to delivering more value for travelers than the Amex Business Platinum card.

Yes, it does come with a high annual fee, but it delivers value for the frequent traveler far beyond the amount of that fee.

Amex Business Gold Card (Best for Earning Points)

Get 4x points in 2 select categories where your business spends the most each month (on your first $150,000 spent each year).

The American Express ® Business Gold Card is excellent at racking up rewards for your business spend.

The card earns a whopping 4x points per $1 in the 2 categories (from a list of 6) that your business spends the most money on each month. With no need to opt-in or preselect your categories, so you can focus on what matters most — running your business.

- NEW! Transit purchases including trains, taxicabs, rideshare services, ferries, tolls, parking, buses, and subways

- NEW! U.S. purchases made from electronic goods retailers and software & cloud system providers

- NEW! Monthly wireless telephone service charges made directly from a wireless telephone service provider in the U.S.

- U.S. purchases at gas stations

- U.S. purchases at restaurants, including takeout and delivery

- Purchases at U.S. media providers for advertising in select media (online such as Google Ads, Facebook Ads, plus TV and radio)

- 3x points per dollar on flights and prepaid hotels booked on amextravel.com using your Business Gold Card

- Access to Amex’s The Hotel Collection

- $375 annual fee ( rates and fees )

- No elite travel benefits like airport lounge access or elite status

- Welcome Offer: Earn 70,000 Membership Rewards ® points after you spend $10,000 on eligible purchases with the Business Gold Card within the first 3 months of Card Membership.*

- Earn 4X Membership Rewards ® points on the 2 categories where your business spends the most each billing cycle from 6 eligible categories. While your top 2 categories may change, you will earn 4X points on the first $150,000 in combined purchases from these categories each calendar year (then 1X thereafter). Only the top 2 categories each billing cycle will count towards the $150,000 cap.

- Earn 3X Membership Rewards ® points on flights and prepaid hotels booked on amextravel.com using your Business Gold Card.

- Earn up to $20 in statement credits monthly after you use the Business Gold Card for eligible U.S. purchases at FedEx, Grubhub, and Office Supply Stores. This can be an annual savings of up to $240. Enrollment required.

- Get up to a $12.95** statement credit back each month after you pay for a monthly Walmart+ membership (subject to auto-renewal) with your Business Gold Card. **Up to $12.95 plus applicable taxes on one membership fee.

- Your Card – Your Choice. Choose from Gold or Rose Gold.

- *Terms Apply

Hot Tip: Check to see if you’re eligible for a huge welcome bonus offer of up to 110,000 points with the Amex Business Gold card! The current public offer is 70,000 points. (This targeted offer was independently researched and may not be available to all applicants.)

Another solid business card is the Amex Business Gold card , which rewards your greatest purchases with 4x points on the 2 select categories where your business spent the most each month for the first $150,000 annually (then 1x). This ensures your greatest spending categories earn the greatest rewards. You select eligible bonus categories from a list of 6 common business-expense categories:

- Transit purchases including trains, taxicabs, ride-share services, ferries, tolls, parking, buses, and subways

- Monthly wireless telephone service charges made directly from a wireless telephone service provider in the U.S.

- U.S. purchases made from select technology providers of computer hardware, software, and cloud solutions

- U.S. purchases for advertising in select media

- U.S. purchases at restaurants

Points add up quickly if your business spends significantly in a particular category.

Hot Tip: The Amex Business Gold card also ranks high on our list of the best business credit cards for advertising purchases .

Amex Blue Business Cash Card (Best for Startups, Cash-Back, Introductory APR Offer )

Take control of your cash-back with the Amex Blue Business Cash card, and earn 2% cash-back on up to $50,000 in purchases each year.

Looking for a way to keep tabs on your office supply costs and business travel expenses while earning cash-back? Then The American Express Blue Business Cash™ Card could be a good fit.

This card offers expense management solutions that are designed to give companies more control, along with a much clearer picture of their business spending. In doing so, the more you spend, the more cash-back you can earn.

- 2% cash-back on up to $50,000 in spend, then 1% back thereafter

- No annual fee

- Travel and purchase protection

- Not ideal for those who spend a lot on a specific category like groceries or gas

- Earn a $250 statement credit after you make $3,000 in purchases on your Card in your first 3 months.

- 0.0% intro APR on purchases for 12 months from the date of account opening, then a variable rate, 18.49% – 26.49%, based on your creditworthiness and other factors as determined at the time of account opening. APRs will not exceed 29.99%

- Earn 2% cash back on all eligible purchases on up to $50,000 per calendar year, then 1%. Cash back earned is automatically credited to your statement.

- From workflow to inventory to floor plans, your business is constantly changing. That’s why you’ve got the power to spend beyond your credit limit with Expanded Buying Power.

- Just remember, the amount you can spend above your credit limit is not unlimited. It adjusts with your use of the Card, your payment history, credit record, financial resources known to us and other factors.

- No Annual Fee

- Terms Apply

- APR: 0.0% intro APR on purchases for 12 months from the date of account opening, then a variable rate, 18.49% - 26.49%, based on your creditworthiness and other factors as determined at the time of account opening. APRs will not exceed 29.99%

- Foreign Transaction Fees: 2.7% of each transaction after conversion to U.S. dollars

Startup businesses may have an initial mix of expenses that differ from established businesses, as they may need to build technology infrastructure, open a brick-and-mortar storefront, or launch a massive marketing campaign.

For this reason, selecting a business credit card that rewards startup expenses is critical to getting the most value back from a business credit card.

The Amex Blue Business Cash card is a solid card for a startup business because it offers the business owner a simple cash-back earning structure: 2% cash-back on every eligible purchase their business makes (up to $50,000 per year, and 1% after that). The card also offers a 0.0% intro APR on purchases for 12 months from the date of account opening, then a variable rate, 18.49% - 26.49%, based on your creditworthiness and other factors as determined at the time of account opening. APRs will not exceed 29.99% .

Amex Blue Business Plus Card (Best for No Annual Fee, Introductory APR Offer )

Earn Membership Rewards for your business spending the easy way: get 2x points for the first $50,000 in purchases per year.

As a business owner, getting a credit card that maximizes each dollar you spend does not have to be complicated or expensive. Especially when you opt for The Blue Business ® Plus Credit Card from American Express .

With the Amex Blue Business Plus card, you’ll earn 2x Membership Rewards points on everyday business purchases throughout the year (up to $50,000; 1x thereafter) and receive purchase protections and no-additional-charge employee cards all for no annual fee (see rates and fees ).

The simple and straightforward earning structure makes it a great fit for those looking to earn flexible rewards, without having to fixate on which purchases earn the most points.

Let’s take look at all that the Amex Blue Business Plus card has to offer.

- 2x Membership Rewards points per $1 on everyday business purchases (up to $50,000; 1x thereafter)

- Purchase protection and extended warranty protection

- No annual fee and employee cards at no additional cost

- No unique bonus categories and 2x earnings are capped at $50,000 in annual spend

- No elite travel benefits like lounge access or elite status

- Earn 15,000 Membership Rewards ® points after you spend $3,000 in eligible purchases on the Card within your first 3 months of Card Membership.

- 0.0% intro APR on purchases for 12 months from the date of account opening, then a variable rate, 18.49% - 26.49%, based on your creditworthiness and other factors at account opening. APR will not exceed 29.99%

- Earn 2X Membership Rewards ® points on everyday business purchases such as office supplies or client dinners. 2X applies to the first $50,000 in purchases per year, 1 point per dollar thereafter.

- You’ve got the power to use your Card beyond its credit limit* with Expanded Buying Power.

- *The amount you can spend above your credit limit is not unlimited. It adjusts with your use of the Card, your payment history, credit record, financial resources known to us, and other factors.

- APR: 18.49% - 26.49% Variable,0% on purchases for 12 months from date of account opening

- Foreign Transaction Fees: 2.7% of each transaction after conversion to US dollars.

Looking for a rewards-earning business credit card without an annual fee? Consider the Amex Blue Business Plus card .

With it, you earn 2x points on all purchases of up to $50,000 in spend per year and 1x points after that.

Further, the Amex Blue Business Plus card is one of the few business credit cards to come with a 0.0% intro APR on purchases for 12 months from the date of account opening, then a variable rate, 18.49% - 26.49%, based on your creditworthiness and other factors at account opening. APRs will not exceed 29.99% .

Amex Plum Card (Best for Cash-Back)

Instead of normal cash-back, get an unlimited 1.5% discount when you pay early for eligible days within 10 days of your statement closing date. The discount will be applied to your next statement when you pay at the least the Minimum Payment Due by the Please Pay By date.

Cash flow can be unpredictable. Sometimes you can pay bills right away, and other times it may be easier to wait. Either way works out in your favor with The Plum Card ® from American Express !

With this card, you can pay your bill early and get an unlimited 1.5% Early Pay Discount on eligible charges within 10 days of your statement closing date. You’ll see the discount applied to your next statement when you pay at the least the Minimum Payment Due by the please pay by date. Alternatively, you can take up to 60 days to pay with no interest, when you pay your minimum due by the payment due date.

For those who run seasonal businesses or whose incoming cash flow is unpredictable, the card can provide you with payment alternatives that most other cards don’t.