Andrew Henderson

Founder of Nomad Capitalist and the world’s most sought-after expert on global citizenship.

ABOUT THE COMPANY

What we’re all about

MEET OUR TEAM

Meet our 80+ global team

We’re here to serve you

Your questions answered

TESTIMONIALS

Read our testimonials

Get free email updates

ACTION PLAN

Our flagship service for entrepreneurs and investors

ACTION PLAN ELITE

Create your Action Plan directly with the Mr. Henderson himself

CITIZENSHIP BY DESCENT

Claim a second passport based on familial connections

ALL SERVICES

Click here to see all our products and services

GOING OFFSHORE

Offshore Banking

Offshore Company

Offshore Trust

Offshore Gold Storage

Offshore For Americans

SECOND CITIZENSHIP

Second Passport

Citizenship By Investment

Citizenship By Ancestry

Dual Citizenship Benefits

EU Citizenship

SECOND RESIDENCE

Second Residence

Golden Visas

Residence By Investment

EU Residence

Tax Residence

FINANCE & INVESTMENTS

Tax Reduction

International Investment

Cryptocurrency

Foreign Real Estate

Asset Protection

NOMAD LIFESTYLE

Flag Theory

Lifestyle Design

Plan B Strategy

Hiring Overseas

Living In Eastern Europe

PASSPORT INDEX

Discover the world’s best passports to have in an ever-changing world

CITIZENSHIP MAP

Explore the citizenship options using our interactive citizenship map

Explore the tax details for countries using our interactive tax map

ALL RESEARCH

Click here to see all of our research and interactive tools

THE WORLD’S #1 OFFSHORE EVENT

Kuala lumpur | september 25-28, 2024.

Learn from our R&D playbook and meet like-minded people at our annual event.

NOMAD CAPITALIST THE BOOK

Andrew Henderson wrote the #1 best-selling book that redefines life as a diversified, global citizen in the 21st century… and how you can join the movement.

How to Open an Australian Bank Account as a Non-Resident

When you think of opening a foreign bank account, Australia probably isn’t the first place that comes to mind. It’s not a classic offshore hub like the Cayman Islands or Vanuatu, nor is it a finance center like Singapore or Hong Kong.

However, Australian banking offers two primary benefits for its users – stability and ease of business. In fact, banking in Australia can be incredibly beneficial if you frequently visit the country or do business there.

If you’re interested in opening an Australian bank account, this article will give you a good overview of what to expect and how to go about navigating the process.

Find out more about our offshore tax planning and banking strategies here .

Why Open an Australian Bank Account?

Although Australian banks aren’t the best banks in the world , they’re nowhere near the worst. In fact, a few of the largest banks in the country are among the world’s safest.

They don’t offer exciting interest rates or other unique banking benefits, but an Australian bank account is often a stable one, which can make it an attractive option if you tend to bank in less stable jurisdictions or if you simply want to diversify your assets.

Australian banking is also highly useful if you conduct any business down under.

If you have Australian employees or vendors, for instance, it might be easier to transfer them money from an Australian bank account than from a bank account in another country. Alternatively, you may plan to invest in Australia, and having an Australian bank account may make that process a bit easier.

Overall, an Australian bank account is like a dependable minivan. It’s not fun or glamorous in any sense, but it serves its purpose well.

How to Open an Australian Bank Account

If you want to open a bank account in Australia, then we have some good news – it’s rather easy to do so even as a non-resident.

In fact, thanks to Australian banking laws, you can even open an account if you don’t have an Australian address (provided you haven’t been in the country for more than six weeks).

The process to open an Australian bank account is also rather simple. To open an account, you only need to follow three simple steps.

1. Choose an Australian Bank

Before you arrive in Australia, you should take the time to research Australian banks to find one that meets your needs.

As with most overseas banks, larger banks will tend to be more open to non-residents than smaller ones due to the inherent risk involved in accepting foreigners.

Much like banks in the US , banks in Australia aren’t always very globally-minded. A tiny bank with a few branches around Melbourne likely won’t know what to do when it receives a non-resident application, but larger banks like the Commonwealth Bank of Australia have much more experience dealing with non-residents.

With most Australian banks that cater to non-residents, you can generally get the application process started online. This process usually is quite simple, but you should be sure to select the correct visa and residency status (tourist/ETA) on your application.

2. Travel to Australia

If your application is accepted, you will receive an invitation from the bank to come finalize your account and collect your Australian debit card.

This is the part of the process that requires some planning. Unless you’re based in Southeast Asia, simply getting to Australia is an ordeal in itself. Flights to Australia from Europe or the US are long and expensive, so you should book well in advance.

You should also allocate enough time to recover from the flight and open your account, and if you’re traveling from far away, you may as well give yourself time to actually enjoy the country.

Finally, as you plan your trip, you should ensure that you’re traveling to the correct city. During the application process, most banks will have you select a particular branch to visit, so when you plan your trip, you don’t want to hop off a 24-hour flight to Sydney only to discover that the branch you selected is across the country in Perth.

3. Open Your Australian Bank Account

After you arrive in Australia, you’ll then need to visit the bank you applied to in person to finalize your new bank account.

When you visit the bank, the process is rather easy. All you need is your passport – no proof of address or any other documents. They’ll likely ask you why you want to open the account, but simply telling them that you’re a frequent visitor or considering moving there will satisfy most banks.

Once you prove your identity and answer a few cursory questions, the bank will officially open your account, hand you your debit card, and grant you online banking access.

Tips for Opening a Bank Account in Australia

While the process for opening an Australian bank account is straightforward, you should keep a few things in mind as you’re opening an account.

Don’t Use an Australian Address

Unless you legitimately plan to move to Australia, then you shouldn’t use an Australian address to open your account – else you may inadvertently become an Australian tax resident.

The Australian Taxation Office (ATO) is on par with the IRS in terms of aggression – meaning that it will do everything in its power to rope you into the Australian tax net.

Therefore, if you open an Australian bank account with an Australian address, the ATO may decide that you’re an Australian tax resident and charge you accordingly.

Get a Local SIM Card

Like most banks around the world, Australian banks often require that users authenticate their information through their phone numbers, so you’ll likely need to provide an Australian number when you open your account.

Some banks may allow you to provide a foreign phone number, but they usually prefer to reach you on a local line. Since this phone number is essential to accessing your account, it’s worthwhile to take the extra time to grab a SIM card before you head to the bank.

Make Sure It’s Worth Your Time

One of the things that we frequently warn against is collecting shiny things for the sake of having them.

Although the process of opening an Australian bank account isn’t too difficult, traveling there costs time and money. You should therefore check your intentions before you apply to be a customer at an Australian bank.

That intention can be as simple as “I’ve always wanted to visit Australia, and opening a bank account there seems like a good way to diversify my assets.”

However, you shouldn’t go through the trouble of taking a 20+ hour flight if you have no desire to visit and no specific reason to open an Australian bank account.

Although opening a foreign bank account in Australia isn’t the right choice for everyone, it can be highly useful if you do business in the country or if you’re seeking a stable banking jurisdiction.

Plus, the process is quite easy – once you complete your online application, you merely need to show up at the bank, prove your identity, and collect your new debit card.

As always, however, Australian banking isn’t the right choice for everyone – particularly given the travel requirement.

If you’re wondering whether opening an Australian or other foreign bank account is right for you, feel free to reach out .

GET ACTIONABLE TIPS FOR REDUCING TAXES AND BUILDING FREEDOM OVERSEAS

Sign up for our Weekly Rundown packed with hand-picked insights on global citizenship, offshore tax planning, and new places to diversify.

Are you a US citizen?

YOU MAY ALSO LIKE

Expatriation Tax Planning for Citizens Leaving The US

‘The two hardest things to say in life are hello for the first time and goodbye for the last.’...

7 Ways to Prepare for Higher Taxes in Your Home Country

If you think high taxes are inevitable, or you're so worn down by the increasing financial demands...

A US Expat’s Guide to Foreign Tax Credit

The threat of double taxation – being taxed twice on income earned outside the US – isn’t a new...

Why Establish an Offshore Company in Hong Kong?

With its unique position to offer connectivity between mainland China and the rest of the world,...

A Guide to Unearned Income and How It’s Taxed

Passive income is great, right? A 'fire and forget' financial missile that, once set up, will...

Offshore Tax Strategy: Go Where You’re Treated Best

On the subject of giving advice, perhaps the American poet and civil rights activist Maya Angelou...

Reduce Your Taxes And Diversify Your Wealth

Nomad Capitalist has helped 1,500+ high-net-worth clients grow and protect their wealth safe from high taxes and greedy governments. Learn how our legal, holistic approach can help you.

What do you want to accomplish?

Let us know your goal and we will tell you how we can help you based on your details.

REDUCE TAXES OFFSHORE

CREATE A GLOBAL PLAN B

DIVERSIFY AND PROTECT WEALTH

UNITED STATES

UNITED KINGDOM

EU COUNTRIES

Tax Amount ($US Dollars)

POLITICAL INSTABILITY

ECONOMIC INSTABILITY

MISSED OPPORTUNITIES

TRAVEL RESTRICTIONS

HIGH TAX LIABILITIES

RISK MANAGEMENT

MARKET PROTECTION

WEALTH PRESERVATION

OPPORTUNITY CAPITALIZATION

ESTATE PLANNING

Email Address

We handle your data according to our Privacy Policy . By entering your email address you grant us permission to send you the report and follow up emails later.

- Investing & super

- Institutional

- CommBank Yello

- NetBank log on

- CommBiz log on

- CommSec log on

Help & support

Popular searches

Travel insurance

Foreign exchange calculator

Discharge/ Refinance authority form

Activate a CommBank card

Cardless cash

Interest rates & fees

Moving to Australia / Banking

An explanation of the types of cookies we use and why.

Open an Australian bank account

Open a bank account in Australia if you are moving from overseas.

Everyday Account

Get started with your Australian banking

Open account

Student Everyday Account

Studying in Australia? Open your student account now

Bank account options

Everyday account smart access.

Open a CommBank account up to 14 days before you arrive in Australia, or up to three months after you arrive. You’ll need to visit a branch once you arrive in Australia and provide identification documents and tax residency details before you can use your new account.

Features & benefits

- No Australian address needed to set up the account 1

- Track your everyday spending with Spend Tracker in the CommBank app 2

- Use Cardless Cash 3 in the CommBank app to get money out of any CommBank ATM, fee-free

- Lock and block 4 your Debit Mastercard in the CommBank app

Rates & fees

Apply via the ‘Open account’ button below and we’ll waive the monthly account fee for the first year. 5 After this, a monthly fee applies unless you’re under 30 or eligible for a further waiver. 6

See all rates and fees .

Everyday Account Smart Access for students

Open your bank account up to 14 days before you arrive in Australia, or up to three months after you arrive. You’ll need to visit a branch once you arrive in Australia and provide identification documents and tax residency details before you can use your new account.

- No Australian address needed to set up the account 1

- Use Cardless Cash 3 in the CommBank app to get money out of any CommBank ATM, fee-free

- Lock and block 4 your Debit Mastercard in the CommBank app

Apply via the ‘Open account’ button below and we’ll waive the monthly account fee if you’re under 30 or meet other conditions. 7 See all rates and fees .

Use your Debit Mastercard instantly

Verify your identification at any Australian CommBank branch to use your digital Debit Mastercard. You can use it to shop in-store or online, pay bills or set up recurring payments. Simply view your card details in the CommBank app.

Find out more about Debit Mastercard

Who can apply?

You can apply if you:.

- Are aged 14 years and over 8

- Will arrive in Australia in the next 14 days or;

- Have arrived in Australia in the past three months

- Are opening the account in your personal name

If you are already in Australia and arrived more than three months ago, please apply here .

How to apply

1. complete the short application form.

We recommend:

- You have your passport with you when completing this form

- You know the city you will be staying in when you arrive

- You know your entry visa information

2. Visit a branch

Once you get to Australia, visit your chosen branch to collect your Debit Mastercard. 9 You'll need to provide your ID for verification within 20 days of opening your account or your account may automatically close. You can reapply at any CommBank branch.

Make sure you bring:

- Your current passport (original document required)

- Your Tax Identification Number (TIN) for each country of foreign tax residency

3. Download the CommBank app or log on to NetBank

Start banking straight away after your identification check. Download the CommBank app 2 or log on to NetBank to:

- Withdraw money from CommBank ATMs using Cardless Cash 3

- Shop using the CommBank app to tap and pay, or choose from our range of digital wallets - like Apple Pay, Google Pay or Samsung Pay.

- Pay friends using just their Australian mobile number 10

About the application process

- You should complete the application form with your Australian details if you know them ahead of your move. For example, if you know your new Australian address, apply using that. If not, use your overseas address

- Once you have completed the application form you will need to identify yourself and provide your tax residency information in branch in Australia before you can use your account, including full access to NetBank and the CommBank app

- If any of your documents are in a foreign language you’ll need to get them translated into English by a professional translator accredited by the National Accreditation Authority for Translators and Interpreters (NAATI) , or an equivalent accreditation.

Ready to open your bank account?

Open your Everyday Account Smart Access in a few minutes.

Everyday Account

We can help.

Locate your nearest branch

CommBank support

Things you should know

1 To gain full access to your account, an Australian residential address will need to be provided when you visit a Commonwealth Bank of Australia branch to be identified.

2 Full terms and conditions of the CommBank app are available on the app. The CommBank app is free to download however your mobile network provider charges you for accessing data on your phone. Find out about the minimum operating system requirements on the CommBank app page . NetBank access with NetCode SMS is required.

3 Cardless cash is available from any CommBank ATM. Withdrawals are limited to a total of $500 per day. CommBank app, NetBank, NetCode and account access required. Full conditions on app.

4 Lock, Block and Limit enables customers with card account access to lock certain transaction types and unlock them only when needed. Excludes transaction flagged as recurring (e.g. direct debits), and transactions not sent to us for authorisation, or made via Tap & Pay set up on an Android device. Other conditions apply.

5 We’ll automatically apply a waiver to the Monthly Account Fee for 12 months on the Smart Access account if you apply via this button. Find out more about rates and fees .

6 After the initial 12-month period, a monthly fee applies unless you are eligible for a further waiver. A Monthly Account Fee waiver will also apply if you’re under 30 years of age, or if you deposit at least $2,000 each calendar month (excludes Bank initiated transactions). You may also be eligible for a different Monthly Account Fee exemption if you have an aged, disability or war veterans’ pension deposited in your account, have a balance of $50,000 or more in eligible contributing accounts, are reliant on over the counter services because of a disability or have an eligible home loan. Find out more about rates and fees .

7 A monthly account fee waiver will apply if you’re under 30 years of age, or if you deposit at least $2,000 each calendar month (excludes Bank-initiated transactions). You may also be eligible for a different Monthly Account Fee exemption if you have an aged, disability or war veterans’ pension deposited in your account, have a balance of $50,000 or more in eligible contributing accounts, are reliant on over the counter services because of a disability, or have an eligible home loan. Find out more about rates and fees .

8 If you are aged under 14 years of age, please apply for a Smart Access Account for Youth once you arrive.

9 To ensure that your card is ready and waiting for you at your chosen branch, you must have opened your account online more than 7 days before arriving in Australia. If you opened your account less than 7 days before, or after you arrive in Australia, or you opened your account as a student, your Debit Mastercard will be mailed out to your Australian address once ID has been verified in branch.

10 The recipient needs to have an Australian bank account (with BSB and account number) and have an active mobile phone number.

The target market for this product will be found within the product’s Target Market Determination, available here .

The advice on this website has been prepared without considering your objectives, financial situation or needs. Because of that, you should, before acting on the advice, consider its appropriateness to your circumstances. Please view our Financial Services Guide . Full terms and conditions for the transaction and savings accounts mentioned and Electronic Banking are available here or from any branch of the Commonwealth Bank.

Mastercard and the Mastercard brand mark are registered trademarks of Mastercard International Incorporated.

Latest offers

Update your browser..

This website doesn't support your browser and may impact your experience.

NAB Mobile Banking app

Banking in Australia

Learn how to open a bank account and manage your money when you move to Australia.

A trusted Australian bank

We’re one of Australia’s ‘big 4’ banks, serving over 8 million customers.

Products to suit you

Get started with a bank account that charges no monthly fees. We have credit cards, loans and more to help you set up your life in Australia.

Always here to help

Use the NAB app to access your money 24 hours a day, seven days a week, visit us in person at a branch, or call us to organise a translator.

Keeping your money safe

We’re protecting you from fraud and scams, and our Fraud team is ready to help if you need them.

Open an Australian bank account

Opening a NAB bank account is easy. Just follow these steps.

1. Check you’re eligible

You can open a NAB account if you:

Are planning to stay in Australia for at least six months

Have a valid visa Check your visa As long as you do not have a tourist or visitor visa, you should be eligible to open an account.

Have an Australian address and mobile number

2. Visit a branch

At the moment, you’ll need to visit us at a NAB branch once you arrive in Australia to open your account. We have over 4,000 branches.

3. Bring your ID

To help us verify your identity, please bring the following documents:

Foreign passport

Foreign drivers licence, if you have one

Copy of a valid visa

Call Australia home

Bank accounts

Get to know our transaction and savings accounts before you arrive.

Working in Australia

Learn how to set up your banking and find a job when you come here to work.

International students

Manage your money while you study. Learn about bank accounts, the NAB app and other digital features.

Sending and receiving money

Transfer money overseas.

Find key information for international payments, see our transfer fees and learn how to transfer money overseas.

How to receive money from overseas

Here are the details you will need to provide in order to receive money from overseas.

Foreign exchange calculator and rates

NAB's foreign exchange calculator gives you indicative exchange rates and the costs of foreign currencies.

Common questions about opening an account

Do i need a tax file number (tfn).

You don’t need a TFN to open a bank account. However, you’ll need to provide your tax payer identification number (TIN) if you’re a US tax resident.

What type of visa do I need?

Most visa types are accepted, other than tourist or visitor visas. You’ll need to have at least six months left on your visa and be intending to stay in Australia for at least that time too.

Learn about banking basics

- How different types of bank accounts work

- What is my bank account name, BSB and account number?

- Easy guide to everyday banking (PDF, 4MB) , opens in new window

Get in touch

Get help and support

Visit a NAB branch

Our bankers can help you in person.

Find an interpreter

Ask for an interpreter to help with your banking.

Important Information

Terms and conditions.

This section contains Important Information relevant to the page you are viewing, but you can't see it because you have JavaScript disabled on your browser. Please enable JavaScript and come back so you can see the complete page. It's important that you read the Important Information in this section before acting on any information on this page.

Apologies but the Important Information section you are trying to view is not displaying properly at the moment. Please refresh the page or try again later.

Target Market Determinations for these products are available at nab.com.au/TMD .

- Argentina

- Australia

- Brasil

- Česko

- Canada

- Deutschland

- España

- France

- India

- Italia

- Magyarország

- Malaysia

- Nederland

- New Zealand

- Österreich

- Polska

- Portugal

- România

- Schweiz

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

- 简体中文 (中国)

How to Open an Australian Bank Account Online from Overseas

If you’re heading to live life under the Aussie sun or if you’re already here enjoying the laidback lifestyle, then opening an Australian bank account for your money is something you’ll want to do soon. It’s possible and in most cases very easy and inexpensive to open an Australian bank account online if you are travelling here from overseas.

First the basics. There are four big banks in Australia. They are National Australia Bank (NAB), Commonwealth Bank (CBA) the Australia and New Zealand Banking Group (ANZ Bank), and Westpac. They all allow non-residents from overseas to open an Australian bank account online and you can even do this before you get to Australia .

In five short steps, here’s the easiest way to open an Australian bank account online:

Go to the website of the bank you've chosen. From there you will be able to fill in the details they need. If you prefer to do it over the phone, most banks will have contact numbers. Just make sure you're calling within Australian business hours.

Make sure you know your exact arrival date in Australia if you’re not here yet. In some cases you'll need to provide this date to the bank when you apply for an account.

Have a permanent Aussie address. Banks require proof of residency and not all will accept an overseas one when you complete your application.

Scan and upload all of the requested documents including your passport and visa.

Once approved online and when you are in Australia, head to your nearest branch to verify your documents and complete your application.

If you’d like to know more about your options of the best banks in Australia and ways to open an account online then read on. This guide tells you everything you need to know!

- Can I open an Australian bank account online if I'm overseas?

What are my options?

- Choosing the right account for you

- What documents do I need to supply?

- What are the fees of opening an Australian bank account if I’m from overseas?

- How to transfer money to Australia without a bank account

Can I open an Australian bank account online from overseas?

Yes. you can open a bank account online in australia without any problems..

Australia's four main banks NAB, Commonwealth Bank, ANZ and Westpac offer online applications for their standard current and savings accounts which are open to anyone, including those travelling on visas.

With simple eligibility requirements, it's easy to apply:

Banks require you to arrive anywhere between 3 and 12 months after your application.

- Know where you’ll be living. Like your arrival date, most banks want to know where you’ll be living if you’re not here already. If you can’t provide an Australian address then you can provide your overseas one until you have a residential address here.

- Upload your documents.

- Be 18 or over. This is a usual requirement of all banks in Australia. However, Westpac and Commonwealth do have accounts for younger customers.

- Employer and salary details. You may find that banks request this information from you when you complete your digital application. This is usually dependent on the type of visa you are travelling on.

We recommend you verify your documents as soon as you can after you arrive. This will mean you can start withdrawing and spending in Australia.

What documents do I need to supply to the bank?

When applying online for an Australian bank account , you’ll need to supply documents that prove your identity and right to work and earn in Australia.

In most cases, these documents are:

- Your passport

- Proof of address

- Tax information e.g. TFN (Tax File Number)

- Employer details and salary

After you open your account, you will need to visit your chosen branch to verify your identity.

This appointment should be booked as soon as possible after you’ve completed your application – the sooner you can verify yourself, the sooner your bank account in Australia is open and ready to use. In this appointment, the bank may ask for documents such as:

- An Australian residential address if you provided an overseas one on your online application

- An Australian Medicare card or National Identity card (or other form of ID e.g. birth certificate)

We know people have many different reasons to travel to Australia and although we recommend to open a bank account to ensure the security and safety of your money, we also know this might not suit everyone’s situation. If this applies to you, then you might want to take a look at the Wise multi-currency account (formerly TransferWise).

The Wise Account

The multi-currency Wise account has no set up fees, no monthly fees and no receiving fees.

Available to people in Europe, the UK, USA, Singapore, Canada, Australia and New Zealand, this account allows you to open up a local bank accounts in all of these countries. Plus it holds over 50 currencies and also comes with a debit card so you can withdraw money from your account.

Although we’d recommend opening a bank account if you’re in Australia for an extended time, this is a great option if you’re looking for something to temporarily hold your currencies while you settle in.

Be aware that the card does takes 7-14 days to be delivered, so manage your time and prepare if you think you might need it soon.

For more information on the Wise Debit Card, read our review .

How to choose the right account for you

If you’re living life down under already then you’re likely to have an idea of how accessible banks and ATMs are here. This is important to consider, but with each bank offering different packages and accounts, it’s definitely worth taking the time to understand which one suits you and your situation best.

Cheque, Savings or Credit?

Australia’s banking system uses EFTPOS (Electronic Funds Transfer as Point of Sale) rather than a debit card system. Essentially the same, EFTPOS is native to Australia and New Zealand and is a very easy way to pay for goods during your stay.

There are three main types of accounts available to you in Australia, and it’s important to know the difference as you’re generally asked which account you’d like to use to pay for most items.

Here's our take on them:

Cheque – A standard current account for everyday purchases. Linked to your EFTPOS or debit card, money will be deducted from your current account.

Savings – A savings account is a great option to put some money aside and is usually opened together with a current account. This account allows you to earn some interest on the money you're holding in your account.

Credit – A credit card will be harder to get in Australia and dependent on more factors than a cheque or savings account. If you do wish to get one, it will need to be a few months after you’ve settled in Australia so the bank can monitor your financial trends.

Best option when you're on a Working Holiday Visa

If you’re travelling on a Working Holiday Visa then you here’s a quick breakdown of what you can apply for when you’re here:

- Westpac has a separate Migrant Banking section online. You’ll need to fill in the application form specifically in this section to open a current account. No fees for the first year when you apply online and if you’re not here yet then you have 12 months after your application to arrive in Australia.

- Commbank is a great choice for travellers. An easy application form with a zero-monthly fee for a year if you open an account online. If you’re not here yet, then you have 3 months after your application to arrive in Australia.

- ANZ has a good option of current accounts open to travellers. For a low monthly fee, you can submit your application easily online and have 12 months after your application to arrive in Australia.

- NAB is also a great option for travellers as they offer a great current account with no monthly fees. Unfortunately, you can’t apply online with NAB. If you’re travelling on a Working Holiday visa, book yourself an in-branch appointment to open your account.

Best option for Expats

If you are relocating with work, with your family or alone, then you might want to explore some of the features of other accounts Australian banks can offer.

A lot of accounts beyond a current account require in-branch discussion, so we would recommend opening a current account with any of the big four, and then looking to open Savings or Credit accounts when you’re settled in Australia.

Opening a Bank Account in Australia from New Zealand

Many New Zealanders make the move to Australia each year, and vice versa. The great news is, opening a bank account online in Australia from New Zealand is relatively easy. Because there isn't a huge time difference it becomes easier if you'd prefer to do it over the phone too. In addition to this, some banks work out of both New Zealand and Australia. For example, ANZ bank .

Before you leave New Zealand it's a good idea to check that the name on your passport matches your other forms of identification. This way you won't have any issues when you get to Australia and need to confirm your identity at the bank.

What are the fees of opening an Australian bank account online from overseas?

Australian banks have very minimal fees linked to them, whether you apply from overseas or in Australia. If you're looking to open your account, then it won't cost you much.

That being said, it’s important to know what you’re signing up for as banks are never completely free of charges. Here is a list of the common fees attached to the standard current accounts of all of Australia’s big four banks:

ANZ (Australia and New Zealand Bank)

ANZ provides everyday banking with their Access Advantage current account.

$100 upfront for an overdraft of <$20,000

For other account fees, click here for more information.

Commbank (Commonwealth Bank)

Commbank offer an Everyday Account Smart Access current account for shopping, paying bills, withdrawing cash and more.

$4/month, 12 months free with new account

$15 per account per day overdrawn, nab (national australia bank).

NAB offers a Classic Banking current account. Once you have an Australian working visa you can apply through the migrant banking channel before you arrive in Australia. However, you won't be able to withdraw any money from your accounts until you get to Australia and visit a branch .

Westpac has a Choice current account for everyday banking. They are a great choice as they have a separate migrant banking section designated to help foreigners get set up ahead of their move to Australia.

$4/month; 12 months free with new account

Anz, commonwealth bank and westpac waive their monthly fees if you:, deposit $2,000 a month, are under 25 or over 60 years old, or a full-time student.

Depending on what type of account/s you are wanting to open, the above fees should give you a basic idea of how much a standard current account will cost you.

When applying for a bank account, you will also want to consider additional fees so that you understand what you’re signing up for including ATM fees and international money transfer fees.

ATM fees are uncommon in Australia and were largely removed back in 2017 when the four big banks - ANZ, Westpac, NAB and Commbank - agreed to eradicate charges for ATMs between their customers collectively.

Nowadays, this means that not only will you find it relatively easy to locate an ATM nearby, you'll have many more options beyond your own bank's ATM and you'll be able to withdraw your money for free.

That being said, this alliance doesn't extend to all banks in Australia. Most of the smaller providers will often still charge you an average of $2.

Some ATM fees for commonly used banks in Australia:

- 'Big four' (ANZ, NAB, Westpac and Commbank) - Free

- Citi Group ATMs - $2 excluding Westpac Customers (Free)

- Bendigo Bank ATMs - $2.50 excluding Suncorp Customers (Free)

- Bankwest ATMs - Free. $2.50 excluding Commbank Customers (Free) for use of ATMs in 7/11 stores

- St. George Bank ATMs - Free

Westpac and Commbank are our recommended choices to avoid ATM fees in Australia. They have alliances with other smaller banks as well as the big four banks too. Westpac also have what they call the Westpac Global ATM Alliance which includes deals with international banks as well as Australia - a great choice if you're going to be a frequent traveller.

International transfer fees

If you’re looking to open a bank account in Australia, you’re likely going to need to transfer some money from your current account back home to your new Australian account. Otherwise known as an international transfer, it can cost you a lot if you're not careful.

There are many options to transfer your cash in today’s technological world, and whether you’re looking for ease, value or just the fastest route, you’ve got a lot of choices.

A transfer through your bank will always have multiple fees linked so we wouldn’t recommend this route. These fees can cost you up to 8% of your total transfer:

- An upfront fee

- A service fee

- A mark up on the exchange rate

If you’re looking for alternative ways to send your cash to your new Australian account, then we recommend using our money transfer comparison table to choose the best option to transfer your cash abroad.

How can I transfer money to Australia without a bank account?

There are ways to transfer money to Australia without actually opening a traditional bank account. Although there are many benefits of opening a bank account, your circumstances may not suit doing so. We've already mentioned the TransferWise Borderless Account , but if you’re travelling from the UK, USA or Europe, then the alternative options below are also good alternatives to the big four banks:

Revolut is a British digital banking app and can be a great alternative while you get settled in your new life down under. Easy to set up, you will be automatically given a UK bank account and a Euro IBAN account when you apply. From there, it holds 29 currencies with AUD included and interbank rates when exchanging.

Not a long-term option but certainly a smart one while you get set up.

Starling Bank/ Monzo/ N26

All of these banks are app-based ‘neobanks’ and have forged a new way of banking that leaves traditional and often unfair methods behind. Easy to use, each aim to let you spend and transfer in multiple currencies without paying multiple exchange rates.

While N26 is German-based and specifically for Europeans only (since Brexit), Starling and Monzo are British-based and very easy and quick to set up. At the moment, none are available in the US.

If you'd like to read up on more options, then check out our money transfer page .

If you’re not keen to set up an Australian bank account before you arrive, both Starling Bank and Monzo are great options to spend and protect your money while you get set up in Australia. All you need is 10 minutes, identification and a UK address to apply on your phone.

Please be aware of scammers that pretend to be from HSBC. Scammers may ask you for security codes over the phone or via text messages. They might try to contact you in the same text message thread that has legitimate messages from HSBC. Never share your log on credentials or authorisation codes with anyone, such as codes to register your device for mobile banking, to verify your identity, or to authorise a transaction. Contact us now if you are worried about fraud on your account, or to learn more about common types of fraud or scams.

- Online Banking

- HSBC Invest

How to apply for an HSBC Australia bank account

Open your bank account before you arrive in australia.

Make managing your money easy with an HSBC Everyday Global Account. Apply for your account from outside Australia and take full control of your finances before you arrive.

Apply for an HSBC Everyday Global Account online

If you are applying from one of the following locations and wish to open an individual HSBC Everyday Global Account, you can do so online in Canada, Egypt, Hong Kong SAR, India, Malaysia, Philippines, Qatar, Singapore, UAE, UK, and USA * . Please note that following the sale of HSBC Bank Canada and its subsidiaries to Royal Bank of Canada, we will no longer be able to offer branch support for overseas account opening from Canada.

HSBC Everyday Global Account

- No monthly account 1 , transaction or ATM fees 2

- Make purchases in Australia, overseas and online without hidden fees 1

- Buy, hold and spend in up to 10 major foreign currencies under one account

- Banking designed for your international needs

- Earn 2% cashback on eligible tap and pay transactions in Australia under $100 3

Eligibility:

- You are 16 or older

- You have a valid reason for opening an Australian account

- You do not have an existing account with HSBC Australia

- You are currently located in one of the countries or regions listed above

HSBC Premier Everyday Global Account

All the benefits of the HSBC Everyday Global Account supported by:

- A Premium banking service with priority global support and no monthly fees

- Transfer instantly between all your global HSBC accounts, free of charge via Global Transfer 4

See all of your international accounts in one place with Global View

- You are 18 or older

- You will meet one of the following HSBC Premier criteria:

- hold qualified HSBC Premier or Jade status in another country or region; OR

- maintain regular 'money in' deposits totalling AUD9,000 into your account with HSBC Australia each month; OR

- maintain a minimum combined balance of AUD150,000 equivalent in an HSBC Australia transaction, savings 5 or HSBC Invest 6 account

Other ways to apply

If you wish to apply from a location not listed above, need to open a joint account, or are interested in opening a different transaction account, we can help you via the steps below.

If you're an HSBC Premier or Jade customer, you can contact your Relationship Manager. Otherwise, request a call back from us.

One of our International Banking Specialists will set up a phone appointment to complete the Australian account opening forms with you.

Visit your preferred HSBC branch in your home country to verify your ID.

What do you need?

To complete your application, you'll need to provide proof of identity. We accept documents such as your passport, national ID card or driver's license.

Once all your documentation has been verified, your new account will be open in a few days. If you think you might not have enough time to complete the process before you travel to Australia, you can always open an account by visiting an HSBC branch after you arrive. Find the HSBC branch that's most convenient for you.

If you are an existing HSBC Australia customer you can apply for new products and services using online banking or the HSBC Australia app.

Ready to open an HSBC Australia bank account?

Cross-border disclosures.

If you are not located in Australia, the laws and regulations of your country of residence could affect the offering, negotiation, discussion, provision, and/or use of HSBC Australia products and services. If you are not an Australian resident, please read the specific cross-border product and service disclaimers .

You might also be interested in

Our international services.

Find out how we'll support your international journey and help you bank more easily.

Send, store and receive up to 10 foreign currencies easily with our multi-currency account.

HSBC Premier

Unlock everything HSBC Premier in Australia has to offer.

* USA Premier customers only.

1. Other banking service fees and charges may apply.

2. Non-HSBC branded ATMs and HSBC Group ATMs in Argentina, France, Greece, Malta, Mexico and Turkiye may charge an ATM operator fee for withdrawals or balance enquiries at their ATMs.

3. You will earn 2% cashback on eligible purchases under $100 when you tap and pay with Visa payWave, Apple Pay or Google Pay™. This will be paid into your Everyday Global Account with the maximum cashback you can earn being $50 per calendar month. Eligible purchases must be made in Australian Dollars and where the merchant or its financial institution/ payment processor is registered in Australia. Purchases which are excluded for cashback include business, gambling and government transactions (including public transport). For the full exclusion list, refer to the Transaction and Savings Account Terms .

4. Global Transfer allows instant transfers between your international and domestic HSBC Premier accounts, at no extra charge. Global View and Global Transfers is not available in all markets.

5. This does not include funds held in HSBC Offset Savings account or an HSBC home loan account. Savings held in a foreign currency contributes to the AUD150,000 in savings criteria. HSBC has the discretion to determine the AUD equivalent foreign currency amount based on our own internal currency exchange rate calculation.

6. HSBC Invest is a service provided by Third Party Platform Pty Ltd (“TPP”) ABN 74 121 227 905 AFSL No. 314341, a wholly owned but non-guaranteed subsidiary of Bell Financial Group Ltd (ASX:BFG), at the request of HSBC Bank Australia Limited ABN 48 006 434 162 AFSL 232595 (“HSBC”). TPP is a Participant of the ASX Limited Group and a Trading Participant of Cboe. For a copy of the terms and conditions relating to the HSBC Invest service and the Financial Services Guide for TPP, please contact us on 1300 782 811 . Neither TPP nor HSBC are representatives of each other. To the extent permitted by law, HSBC will not guarantee or otherwise support TPP’s obligations under the contracts or agreements connected with the HSBC Invest service. HSBC receives a commission from TPP for each client referral provided to TPP. TPP and HSBC do not provide investment advice in relation to HSBC Invest. You should consider your own financial situation, particular needs and investment objectives before acting on any of the information available on this website. HSBC does not guarantee or accept liability for any products offered by TPP.

How to open a bank account in Australia for foreigners

If you're migrating, studying or working in australia, you open a bank account. it's even possible to open an australian bank account before you arrive..

In this guide

What type of account do you need?

How to open a bank account in australia as a foreigner, how to compare bank accounts, benefits to foreigners of opening a bank account in australia, frequently asked questions.

Investments

If you're coming to Australia to work, study or migrate you can open a local bank account. You'll need to verify your identity in a bank branch when you arrive before you can activate and start using the account.

- Transaction account. This option is an everyday bank account to make daily purchases, pay bills, send and receive money and manage your daily expenses. You can link a debit card to your transaction account.

- Savings account. A savings account pays you interest on the money in your account: the more you have, the more interest you earn. You have to pay tax on the interest you earn, so banks require an Australian Tax File Number to open these accounts. And you may need to be an Australian resident for tax purposes.

Transaction accounts are the easiest accounts for new arrivals to open because there are no tax considerations.

Some Australian banks let you open an account online before you arrive, then require you to visit a bank branch to establish your identity after you arrive. Some banks will only create your account if you visit a branch in person.

To open a transaction account after you arrive in Australia, you will need the following documents:

- Your passport (the original, current passport, not a copy).

- Details of your Australian visa. Your passport may contain these details, including an arrival stamp.

- You need to provide a Tax Identification Number for the country (or countries) you are a resident of for tax purposes.

- Your student ID or a letter of enrolment (if you're on a student visa).

If any of your documents aren't in English then you'll need to bring along translations completed by an accredited translator.

Finder survey: How long do Australians keep their savings account for?

If you want to open an Australian bank account as a non-resident, you can start by researching different options online. Here are a few of the main things to consider as a when choosing a bank account:

- The fees. Look for an account that charges low or no account keeping fees or ATM fees.

- Branch access. If you'll be making regular in-branch transactions (such as depositing foreign cash or cheques), make sure you select a bank with branches in your local area. Some banks are online only with no branches.

- International transfers. If you'll need to send money back home, check what the fees are for transferring money internationally , as well as the exchange rates.

- Multiple currencies. Some bank accounts let you hold several foreign currencies in the one account, which could be handy if you're going back home regularly and need the local currency there.

- Immediate access to your money. If you transfer money to your Australian bank account before you leave, you'll be able to withdraw from your account as soon as you land in Australia and verify your identity with the bank.

- Lower fees when using domestic services. Moving or withdrawing money between international and Australian accounts incurs high fees, whereas you'd pay low transaction fees when using a local account.

- Professional advantage. When you open an account before leaving, you can provide your future employer with your bank details ahead of time, saving yourself time on administration.

What documents do I need to open a bank account in Australia?

You'll need your passport, your visa details (this could include visa details and entry stamps in your passport or a Visa Entitlement Verification Online (VEVO) check), evidence of your enrolment and student ID if you're a student and your tax identification number if applicable.

What are the Big Four banks in Australia?

The Big Four banks include CommBank, Westpac, NAB and ANZ which are the largest banks in Australia.

What bank account should an international student open?

Some bank accounts are more suited to students as they have minimal fees and extra features.

How safe are Australian banks?

Australian banks are very safe, and your deposit up to $250,000 is covered under the government's Financial Claims Scheme.

Alison Banney

Alison Banney is the money editorial manager at Finder. She covers all areas of personal finance, and her areas of expertise are superannuation, banking and saving. She has written about finance for 10 years, having previously worked at Westpac and written for several other major banks and super funds. See full profile

More guides on Finder

Get an everyday transaction account for over 50s with no monthly fees, no ATM withdrawal fees in Australia and with Apple Pay, Google Pay and Samsung Pay available.

Having a local bank account makes an international student's life easier and even saves them money.

Spriggy is an app and prepaid card that helps Australian kids understand how to manage digital money, with the help of their parents.

This account offers tiered interest and easy access, and is suited for businesses that carry large balances and make minimal transactions.

Enjoy easy access to your funds and minimal fees with an Adelaide Bank MyEveryday Account. Find out more here.

Consider opening a Greater Bank Access Account if you want to access your money easily, at any time.

The Australian Military Bank Junior Saver Account is for those up to 17 years of age. It provides easy access to funds and lets you earn interest.

The Australian Military Bank Mess Account requires your attention if you wish to simplify managing the daily finances of your ADF related organisation.

If you’re a new Australian Defence Force recruit this everyday account with the Australian Military Bank deserves your attention. Here’s why.

Opening a joint bank account is a big step for any couple. Find out more about what to look for in an account and how to avoid the common pitfalls.

Ask a Question

Click here to cancel reply.

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

62 Responses

I am not an Australian and am not intending to stay in Australia. I have a property in Australia which is collecting rent and I would like to open a bank account for this monthly rentals. What are the bank accounts which I can apply? And if I am physically at the bank for the application, how long is the process for the approval?

Hi Keith, Thankyou for your question.

However, as a non-resident who owns property in Australia and collects rent, you can open a bank account to manage your rental income. Refer to our guide above will give you a basic idea about various accounts and requirements on the same.

The approval process usually involves verifying your identity, and this can be done at a local branch after you arrive in Australia. The time it takes for approval may vary depending on the bank and your individual circumstances, but it’s typically a straightforward process.

Keep in mind that each bank may have specific requirements, so it’s a good idea to contact the bank of your choice and discuss your situation with them to ensure you choose an account that suits your needs and to get more precise information about the application process.

I hope this helps.

I was working and living in Australia for 10 years, and had my bank account at ANZ. I moved back home and still have my account open. If changing my address and mobile number online, will I be able to keep my account open and thereby keeping my savings safe? I would like to transfer my savings with an international transfer, and I am wondering if I can change my daily allowance and change my mobile number without running into difficulties. Please advise.

Hi Gudi, Thanks for contacting Finder.

One of ANZ requirements for a bank account is customers will need an Australian residential address. If you’re changing your address to a New Zealand address, then it goes against their requirements. It would be best to contact ANZ and speak to them about your specific needs in keeping the account open and transferring the money.

I am an Australian citizen with dual citizenship and passports. Can i open a bank account using my foreign passport for use when travelling overseas with my foreign passport?

Hi Peter, In the case of using just your foreign passport, you’ll need to speak to a local bank that has international ties with a bank in Australia for you to be able to open an account. Ideally, the same country as the country of your foreign passport.

Usually, most Australian banks require Australian documentation and residence to open an account.

Hi, I live in Australia, my mom visits every 2 years. Can she open an account and keep it open/active during the time she is not residing in Australia?

Yes, your mom can keep an account open even when she’s overseas. Her account can only become dormant/inactive if the account has not received a deposit or a withdrawal for seven years. When this happens, it will be taken over by the Australian Securities and Investment Commission (ASIC).

Best, Alison

I will send my daughter to Sidney to study. Now we live in Indonesia. Can I open bank account in Sidney although I don’t have Australian Tax File number and residential address? I’d like to be able to transfer money from Indonesia to Sidney each month as low cost as possible. I’ll use this bank account also to auto debit my daughter’s credit card account. What bank is recommended?

While an Australian address and foreign tax details may be required, you can reach out to some banks to see if you can have an account set up without these details. Most banks in Australia will allow you to open an account up to three months before your daughter’s arrival in Australia through an online application form on their website. Please feel free to check our guidelines for opening a bank account for the list of the requirements needed.

When it comes to choosing the best bank, it would depend on the factors that are most important to you and your daughter and your current circumstances. There’s no one account that is considered best. You could utilize our comparison table to check and compare banks.

How likely would you be to recommend Finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Important information about this website

Advertiser disclosure.

finder.com.au is one of Australia's leading comparison websites. We are committed to our readers and stands by our editorial principles

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labeling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

How we make money

We make money by featuring products on our site. Compensation received from the providers featured on our site can influence which products we write about as well as where and how products appear on our page, but the order or placement of these products does not influence our assessment or opinions of them, nor is it an endorsement or recommendation for them.

Products marked as 'Top Pick', 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money .

Sorting and Ranking Products

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

Terms of Service and Privacy Policy

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

Learn how we maintain accuracy on our site.

- Visa Process

- Personalised Assistance

Moving To Australia : How To Open A Bank Account From Overseas

A guide for opening an overseas bank account.

Opening a bank account is one of the first things every new migrant should do before coming to Australia. Australia is one of the very few countries that allows you to open a bank account from your home country. There are four main banks in Australia:

1. Australia and New Zealand Banking Group (or ANZ) 2. Commonwealth Bank of Australia 3. National Australia Bank (or NAB) 4. Westpac

Apart from the “Big 4” banks, there are other popular banks in Australia like Bank Of Queensland, Macquarie Bank, Bendigo Bank, AMP Bank, Suncorp Bank and Bankwest.

You can choose a bank by studying the benefits that they offer. Know Which Is The Best Banking Solution For You?

All the main banks offer the convenience of opening a bank account from overseas. This allows you to access money in your bank account when you arrive in Australia.

The process to open a bank account is smooth and hassle-free and takes no longer than 15 minutes.

1. Apply online

Submit application with personal details. Documents required for personal identification include date of birth, current place of residence etc. This can be done up to 12 months before traveling to Australia.

2. Confirm Your Identity

An executive from the bank will call you to confirm your identity, and activate the account for money transfer from overseas . This allows you to transfer money from overseas into your bank account in Australia.

3. Travel to Australia

4. activate your account.

Visit any nearest bank branch within 6 weeks of arriving in Australia. Do not forget to carry your passport and visa grant letter to establish your identity. After your account is activated, you can start operating it.

While applying online select a bank branch that is close to your place of accommodation. Your starter kit will be kept for you at that branch. Visit the branch and activate your account.

You can alternatively open an account after moving to Australia .

If you have any more queries about how to open a bank account in Australia, please contact us and we will be happy to answer your queries.

How to transfer money to Australia from other country?

Flight ticket booking: read this to grab the best deal.

How to get your first dream IT job in Australia?

How can I learn Australian accent quickly?

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

© 2018 Chalo Australia - All Rights Reserved

Questions ? Email us : [email protected]

- Legal / TOS

Visa Traveler

Exploring the world one country at a time

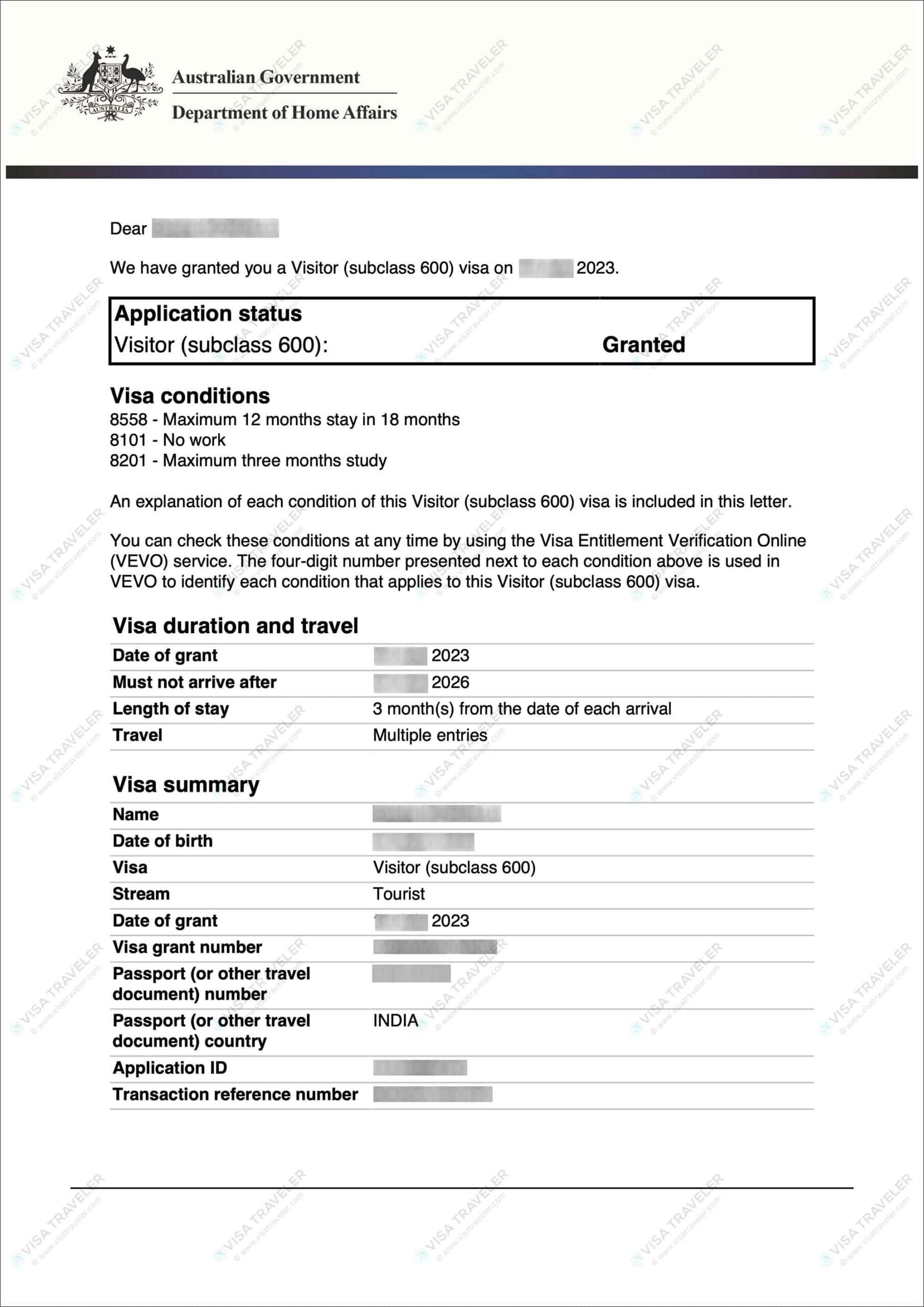

Australia Visitor Visa: Requirements, Eligibility and Application Process

Updated: February 7, 2024

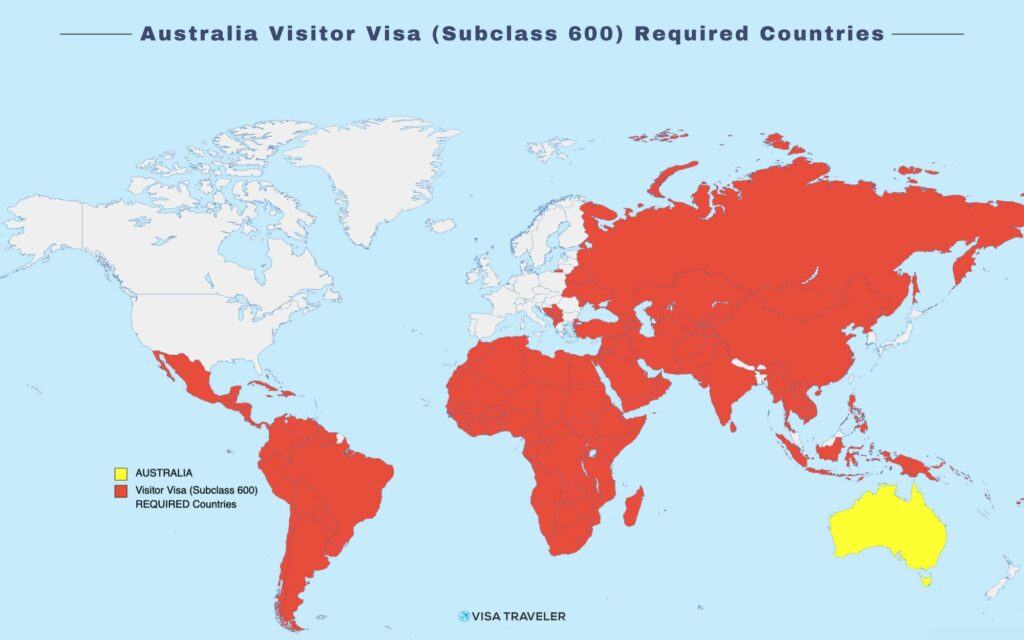

Australia Visitor Visa is the only option to visit Australia as a tourist for many nationalities. If you don’t qualify for either the Electronic Travel Authority(ETA) or the eVisitor Visa, then you will need to get a Visitor Visa.

Australia no longer accepts paper applications for the visitor visa. All applications must be lodged online through the Australian Government Immi Portal.

The Visitor Visa has subclass 600 in Australia’s visa documentation and the subtype we’re interested in is the “Tourist stream (apply outside Australia)”.

Quick summary:

- Eligibility: All nationalities are eligible

- Validity: Valid for 6 months, 1 year or 3 years with single or multiple entries

- Duration of stay: Generally, 3 months allowed stay, but up to 6 or 12 in some cases

- Visa fee: Visitors visa fee is 190 AUD

- Processing time: 50% of applications are processed in 7 days and 90% in 21 days.

If you haven’t already, read the Australia Visa Guide to familiarize yourself with Australian tourist visa types, requirements, eligibility and entry procedures at the border.

Table of Contents

Understanding australia visitor visa.

Visitor visa validity

The Australian Visitor visa is valid for 6 months, 1 year or 3 years from the date of issue. The validity of the visa depends on your nationality and circumstances. For example, most Indian passport holders get a 3-year valid Australian visa, whereas Phillippine passport holders get a 1-year valid visa. Pakistan nationals get a 6-month validity.

You must visit Australia within the validity of your visa.

Duration of stay

Most Visitor visas granted allow for 3 months of continuous stay in Australia. Depending on circumstances, you might be granted a stay of 6 months or even 12 months.

Allowed number of entries

Most Visitor visas are multiple-entry , but Home Affairs also issues single visas in certain circumstances for certain nationalities.

When to apply

Since the tourist visas are valid for at least 3 months, it’s a good idea to apply well in advance. Most applications get processed in 3 weeks or fewer.

Visa extension

Australia Visitor visa is non-extendable . If you need to extend your stay in Australia , you are allowed to apply for another Visitor Visa (onshore) from within the country.

Australia Visitor Visa Requirements

Who requires a Visitor Visa?

Australia Visitor Visa is REQUIRED for all nationalities to enter Australia as a tourist, except for the below.

- New Zealand passport holders

- Electronic Travel Authority (ETA)

- eVisitor Visa

- Those transiting in Australia for less than 72 hours and can get a Transit visa .

Documents required

To support your application, you can attach as many as 60 documents online. You don’t have to attach that many but the more documents you provide, the better your chances of approval.

You have to satisfy the Home Office that:

- You are who you say you are

- You are a genuine visitor who will not overstay or work illegally

- You are of good character and not have a criminal record

- You won’t be a burden to Australia’s healthcare system

To do this, attach as many of these documents as you can :

Identity documents

- Valid passport (must be valid for the duration of the stay)

- Valid National ID card (if from a country that issues them)

- marriage or divorce certificate;

- change of name documents;

- documents that show other names you have been known by

- Residence Permit/Visa (if residence and citizenship differ)

- One passport-size photo

Genuine visitor documents

- Itemized personal bank statements for the last 3 months. Aim to have at least 5000 AUD in your bank account. The money cannot be deposited suddenly and inexplicably – it should be from legitimate sources and savings over time.

- Tax returns

- Credit card statements

- their relationship to you

- the purpose of your visit and length of stay

- if you will be staying with them

- Proof of their funds (if they will be paying for your stay)

- Your plans or travel itinerary while in Australia

- a letter from your employer stating you plan to return to your job

- proof that you study at a school, college or university in your home country

- proof that you have immediate family members in your home country

- proof that you own a house or other major assets in your home country;

- Confirmed return flight ticket;

- Health Insurance

At a later date, you may be required to obtain and submit the following:

- Medical Certificate

- Police Clearance Certificate (PCC)

All non-English documents (except for police certificates) must be translated into English and all documents’ copies (both original and translations) must be certified.

Photo requirements

You need one passport-size digital photo for the Visitor Visa application. The photo must meet the following requirements.

- Taken in the last 6 months

- Showing your head and shoulders against a plain background

- Neutral facial expression with mouth closed, eyes open, and looking at the camera

- Religious head coverings are allowed but must not obscure the face

- Piercing is allowed but must not cause any reflections or shadows

There is no official guidance for the size and resolution of pictures uploaded online but the file type must be JPG. You will get to move the photo to position your face within a frame.

As long as the picture is clear, crisp, and not excessively big, it will be accepted.

Visitor visa fee

The Australian Tourist Visa application fee is 190 AUD , payable online.

You may also have to pay for:

- Health checks

- Police certificates

Processing time

Australian immigration reports that 50% of applications are processed in 7 days and 90% are processed in 21 days . These periods start after you submit your biometrics (if required).

Visitor Visa Application Process

How to apply

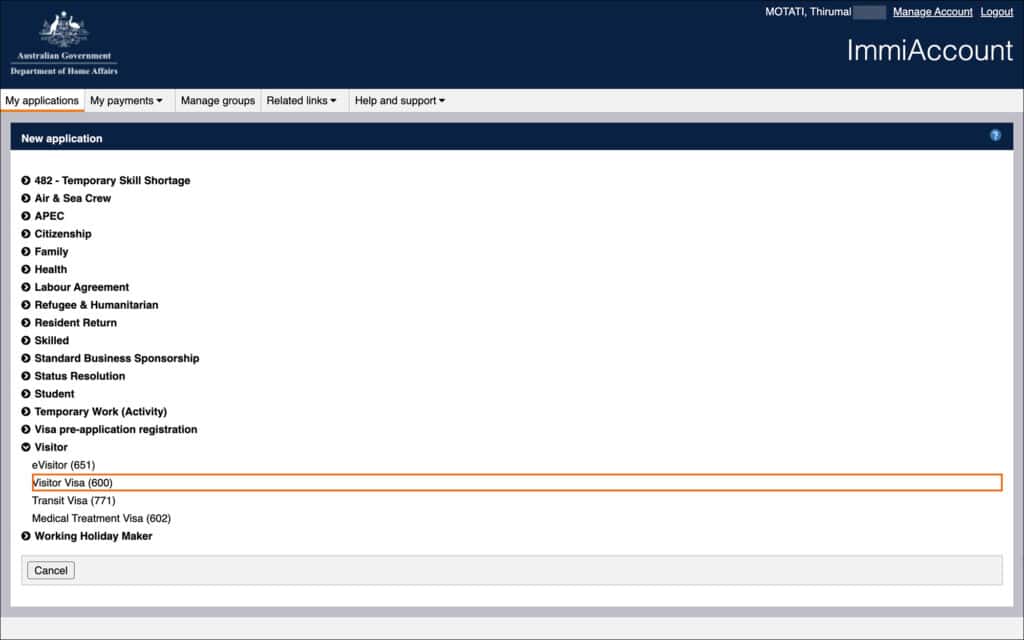

You must apply for your tourist visa online through the Immi Portal. Applying on paper is not possible for the visitor visa anymore. Follow the below steps:

- Go to the ImmiAccount portal and create an account

- Click on “New application” and pick “Visitor Visa (600)”.

- Enter your personal information, passport details, employment details and financial information

- Upload your documents such as passport, photo, etc.

- Pay the required visa fee

- Submit the application

The Visitor Visa is part of Australia’s biometrics program. If you apply for a Visitor Visa from any of the below countries, regardless of your nationality, you must give your biometrics.

- Afghanistan

- Bosnia and Herzegovina

- Kazakhstan

- New Zealand

- Papua New Guinea

- Philippines

- Saudi Arabia

- Solomon Islands

- South Africa

- South Korea

- United Arab Emirates

If you apply from one of these countries, you will receive an email informing you that you need to visit an Australian Biometrics Collection Centre (ABCC) to have your biometrics collected. The biometrics are usually a face photo and fingerprint scan.

You must complete the biometrics procedure within 14 days of getting this email otherwise your application becomes void without a refund!

AABCs are typically managed by VFS Global. They charge a service fee for biometric collection. This fee depends on AABC and the country you are applying from.

For example, the biometric service at AABC in Dubai, UAE is AED 109.17. The biometric service fee at AABC in Manila, Philippines is PHP 557.

How to schedule biometric appointment?

Within 24 hours of applying for your Visitor Visa, you will receive an email with a biometric request letter from Home Affairs. Follow these steps to schedule your biometric appointment.

Find the nearest ABCC to you and follow the prompts to schedule your biometric appointment.

How to attend biometric appointment?

Follow the below steps to attend your biometric appointment at an AABC.

- Arrive at the AABC at least 15 minutes before your appointment time

- Original passport

- Biometric appointment confirmation

- Biometric fee receipt and

- Biometric request letter received in the email from Home Affairs

- Your facial photo is taken and your 10 fingertips are scanned

What if you can’t attend your appointment?

If you can’t make an appointment, you can reschedule your appointment up to 24 hours before your scheduled appointment date and time. You can reschedule up to 2 times.

What if you miss your appointment?

If you miss your scheduled appointment, you will lose the fee paid as the biometric fee is nonrefundable. You will also have to wait 24 hours to schedule a new appointment.

How to track status

You will receive the status of your application in your email. You can also track the status of the visa in your ImmiAccount.

How to download approved visa

When your Visitor Visa is approved, you will receive a grant letter in your email from Home Affairs. The grant letter is your Visitor Visa.

The Visitor visa is electronically linked to your passport, so you don’t need to download or print your Visitor Visa.

If you’re ever asked to show any proof, you can use the Grant Notification you received in your email. You can also download it from your ImmiAccount under “Visa Grant Details”.

How to check the validity of your Visitor Visa

The expiration date of your Australia eVisitor visa is indicated as “Must not arrive after” on the visa letter. If you lost your grant letter or don’t have a copy of your Visitor Visa, you can check the validity details on the Visa Entitlement Verification Online (VEVO) portal by using either your Visa Grant Number or Transaction Reference Number.

Customer service

Refer to the Self-help Guidelines for information to troubleshoot any issues. If facing issues with your ImmiAccount or the Visitor visa application, contact customer service using the below webform

Web: ImmiAccount Technical Support Form

Procedure at the border

The Visitor Visa is digitally attached to your passport so you don’t need to print anything. When you enter Australia, simply present your passport and be ready to answer a few basic questions about your visit.

Eligible passport holders can use the Smart Gates for faster arrival and departure procedures.

All visitors including Australian citizens are required to fill out an Incoming Passenger Card on arrival.

Frequently Asked Questions (FAQs)

How long does it take to get an australian tourist visa.

It can take up to 3 weeks to get an Australian tourist visa, especially if submitting your biometrics. It can be faster or slower depending on where you are applying from, your circumstances and the number of documents you submit.

How hard is it to get a tourist visa to Australia?

It is easy to get a tourist visa to Australia if you submit a complete application with as many documents. You must convince the Home Office that you won’t overstay or break the conditions of the visa.

How much bank balance is required for Australia tourist visa?

Australian Home Office doesn’t specify the minimum bank balance required for a tourist visa. Your bank account must show continuous cash flow and not a lump sum deposited recently.

Based on the reports from travelers reports and recommendations from embassies, you should aim for at least 5,000 AUD in your bank account when you apply.

Can you get a 3-year visitor visa to Australia?

Yes, you can get a 3-year visitor visa to Australia if are from an eligible country and meet the requirements. Australian Visitor Visa is issued for 6 months, 1 year or 3 years depending on your nationality and circumstances. For example, Indian nationals can get an Australian tourist visa valid for 3 years.

WRITTEN BY THIRUMAL MOTATI

Thirumal Motati is an expert in tourist visa matters. He has been traveling the world on tourist visas for more than a decade. With his expertise, he has obtained several tourist visas, including the most strenuous ones such as the US, UK, Canada, and Schengen, some of which were granted multiple times. He has also set foot inside US consulates on numerous occasions. Mr. Motati has uncovered the secrets to successful visa applications. His guidance has enabled countless individuals to obtain their visas and fulfill their travel dreams. His statements have been mentioned in publications like Yahoo, BBC, The Hindu, and Travel Zoo.

PLAN YOUR TRAVEL WITH VISA TRAVELER

I highly recommend using these websites to plan your trip. I use these websites myself to apply for my visas, book my flights and hotels and purchase my travel insurance.

01. Apply for your visa

Get a verifiable flight itinerary for your visa application from DummyTicket247 . DummyTicket247 is a flight search engine to search and book flight itineraries for visas instantly. These flight itineraries are guaranteed to be valid for 2 weeks and work for all visa applications.

02. Book your fight

Find the cheapest flight tickets using Skyscanner . Skyscanner includes all budget airlines and you are guaranteed to find the cheapest flight to your destination.

03. Book your hotel

Book your hotel from Booking.com . Booking.com has pretty much every hotel, hostel and guesthouse from every destination.

04. Get your onward ticket

If traveling on a one-way ticket, use BestOnwardTicket to get proof of onward ticket for just $12, valid for 48 hours.

05. Purchase your insurance

Purchase travel medical insurance for your trip from SafetyWing . Insurance from SafetyWing covers COVID-19 and also comes with a visa letter which you can use for your visas.

Need more? Check out my travel resources page for the best websites to plan your trip.