Citigold Lounges

More than a bank — a destination.

As a Citigold client, you have access to lounges located in cities around the world.

Catch your breath, rest in comfortable seating and enjoy design inspired by the local culture

Enjoy complimentary coffee, tea and refreshments to help you re-energize for the rest of your day

Stay connected to what matters with complimentary Wi-Fi and device charging 1

Meet Your Team

Meet in a private setting with your Dedicated Team to discuss your financial needs 2, 3

Attend invitation-only events featuring unique speakers, experiences and entertainment 3

Find a Citigold Lounge Location:

If you’re interested in finding out more, contact your Dedicated Wealth Team or click to learn more about the benefits of Citigold.

Disabled JavaScript

This website requires JavaScript to be viewable. Please revisit the website with a JavaScript-enabled web browser.

- Credit Cards

- View All Credit Cards

- See If You're Pre-Selected

- Balance Transfer Credit Cards

- 0% Intro APR Credit Cards

- Rewards Credit Cards

- Cash Back Credit Cards

- Travel Credit Cards

- Retail Store Cards

- Small Business Credit Cards

Quick Links

- Banking Overview

- Certificates of Deposit

- Banking IRAs

- Small Business Banking

- Personal Loans

- Overdraft Line of Credit

- Home Lending

- Refinance Your Home

- Use Your Home Equity

- Small Business Lending

- Investing Overview

- Self-Directed Investing

- Guided Investing

- Working with an Advisor

- Wealth Management

- Citigold ® Private Client

- Citi Priority

- Open an Account

Notificación importante

Por favor, tenga en cuenta que las comunicaciones verbales y escritas de Citi podrían estar únicamente en inglés, ya que, tal vez, no podamos proporcionar comunicaciones relacionadas con los servicios en todos los idiomas. Estas comunicaciones podrían incluir, entre otras, contratos, divulgaciones y estados de cuenta, cambios en los términos o en los cargos, así como cualquier documento de mantenimiento de su cuenta.

Please be advised that verbal and written communications from Citi may be in English as we may not be able to provide servicing related communications in all languages. These communications may include, but are not limited to, account agreements, statements and disclosures, change in terms or fees; or any servicing of your account. If you need assistance in a language other than English, please contact us as we have language services that may be of assistance to you.

CITI TRAVEL with Booking.com

Introducing citi travel℠: your first stop to your next destination.

Earn ThankYou ® Points when you pay for part, or all, of your trip with your eligible Citi Card through the Citi Travel portal. Plus, you can redeem your points towards even more adventures through the Citi Travel portal. With customizable options and booking right from your Citi Mobile ® App for eligible cardholders, the way to go is now way easier.

Earn More ThankYou ® Points on Select Bookings Through the Citi Travel portal

10x the fun with citi premier ®.

Earn a total of 10x ThankYou ® Points on hotels and car rentals when you book on the Citi Travel portal. Offer expires June 30, 2024. 1

5X the Fun with Rewards+ ®

Earn a total of 5x ThankYou ® Points on hotels and car rentals when you book on the Citi Travel portal. Offer expires December 31, 2025. 2

More Points, More Fun with Double Cash ®

Earn a total of 5 ThankYou ® Points per $1 spent on hotels and car rentals when you book on the Citi Travel portal. Offers expires December 31, 2024. 3

Offer provides 3 additional points on top of the 1 point per dollar on purchases and 1 point per dollar for payments on purchases

Earn More Points with Custom Cash ®

Earn an unlimited additional 4 ThankYou ® Points per $1 spent on hotels and car rentals when you book on the Citi Travel portal. Offers expires June 30, 2025. 4

Additional Citi Travel Portal Benefits

The citi travel portal offers perks to make your travel booking experience easier and more convenient., access to over 1.4 million hotel and resort options, competitive prices when booking flights, hotels, cars and attractions, 24/7 customer service support for your booking needs.

ThankYou ® Cards Make Every Day More Rewarding

It's easy to earn ThankYou ® Points with Citi credit cards. Find the one that helps you earn the most on your daily spending.

Citi Travel: Frequently Asked Questions

What is the citi travel portal.

Citi Travel is a travel booking portal that gives eligible Citi card members access to book flights, hotels, rental cars, and attractions at competitive prices, along with 24/7 customer support. Additionally, when you book through the Citi Travel portal using ThankYou ® rewards cards, you can earn ThankYou ® points on your travel spending which can then be redeemed to be used on your next journey.

How do I book through the Citi Travel portal?

To book through the Citi Travel portal:

- Login into your Citi Mobile App or directly into the Citi Travel portal using your Citi Online User ID and password.

- After that, search for the flights, hotels, car rentals or attractions you want to book and enter the necessary information (such as number of guests or passengers, travel dates, etc.)

- Confirm your booking and choose whether you want to pay with card, points, or a combination of these purchase options.ns.

Can I use any Citi ® card to book through Citi Travel?

All Citi ThankYou ® Rewards Credit Cards

Citi Travel℠ is powered by Rocket Travel Inc., part of the Booking Holdings Inc. group of companies together with Booking.com.

1 Earn a total of 10 ThankYou ® Points per $1 spent on hotel, car rental and attractions excluding air travel when booked through the Citi Travel℠ portal on cititravel.com or by calling 1-833-737-1288 (TTY: 711). Offer is valid through 11:59 PM 06/30/2024. You earn 3 ThankYou ® Points per $1 spent on the Citi Travel portal bookings. You will earn an additional 7 bonus ThankYou ® Points per $1 spent on hotel, car rental and attractions excluding air travel when booked through the Citi Travel portal or by calling 1-833-737-1288 (TTY: 711) through 11:59 PM 06/30/2024. The booking must post to your account during the promotional period to qualify. This offer may overlap with other special offers in which you are currently enrolled. You must use your Citi Premier ® Card registered at the Citi Travel portal to earn the bonus points. For bookings made with a combination of points and your Citi Premier ® Card, only the portion paid with your card will earn points. Bonus points will take up to 3 billing cycles to post to your account. To qualify for this offer, this account must be open and current. Points will not be earned on canceled bookings. If your account is closed for any reason, including if you convert to another card product, you will no longer be eligible for this offer. Citi Travel is powered by Rocket Travel Inc., part of the Booking Holdings Inc. group of companies together with Booking.com.

2 Earn a total of 5 ThankYou ® Points per $1 spent on hotel, car rental and attractions excluding air travel when booked through the Citi Travel℠ portal on cititravel.com or by calling 1-833-737-1288 and saying "Travel". Offer is valid through 11:59 PM 12/31/2025. You earn 1 ThankYou ® Point per $1 spent on the Citi Travel portal bookings. You will earn an additional 4 bonus ThankYou ® Points per $1 spent on hotel, car rental and attractions excluding air travel when booked through the Citi Travel portal or by calling 1-833-737-1288 through 11:59 PM 12/31/2025. The booking must post to your account during the promotional period to qualify. This offer may overlap with other special offers in which you are currently enrolled. You must use your Citi Rewards+ ® Card registered at the Citi Travel portal to earn the bonus points . For bookings made with a combination of points and your Citi Rewards+ ® Card, only the portion paid with your card will earn points. Bonus points will take up to 3 billing cycles to post to your account. To qualify for this offer, this account must be open and current. Points will not be earned on canceled bookings. If your account is closed for any reason, including if you convert to another card product, you will no longer be eligible for this offer. Citi Travel is powered by Rocket Travel Inc., part of the Booking Holdings Inc. group of companies together with booking.com.

3 Earn a total of 5 ThankYou Points per $1 spent on hotel, car rental, and attractions excluding air travel when booked through the Citi Travel℠ portal on cititravel.com or by calling 1-833-737-1288 and saying "Travel". Offer is valid through 11:59 PM Eastern Time (ET) 12/31/2024. You earn 1 ThankYou Point per $1 spent on the Citi Travel portal bookings and an additional 1 ThankYou Point per $1 paid on Eligible Payments (as defined in the Citi ThankYou ® Rewards Terms and Conditions for Citi Double Cash ® Card Accounts) made to your Citi Double Cash card account. You will earn an additional 3 bonus ThankYou Points per $1 spent on hotel, car rental, and attractions excluding air travel when booked through the Citi Travel portal or by calling 1-833-737-1288 through 11:59 PM Eastern Time (ET) 12/31/2024. The booking must post to your account during the promotional period to qualify. This offer may overlap with other special offers in which you are currently enrolled. You must use your Citi Double Cash Card registered at the Citi Travel portal to earn the bonus points . For bookings made with a combination of points and your eligible Citi Double Cash card, only the portion paid with your card will earn the additional points. Bonus points may take one or two billing cycles to post to your account. To qualify for this offer, this account must be open and current. Points will not be earned on canceled bookings. If your account is closed for any reason, including if you convert to another card product, you will no longer be eligible for this offer. Citi Travel is powered by Rocket Travel Inc., part of the Booking Holdings Inc. group of companies together with booking.com.

4 Earn an additional 4 Thank You Points per $1 spent on hotel, car rental, and attractions excluding air travel through the Citi Travel℠ portal or by calling 1-833-737-1288 (TTY: 711). Offer is valid through 11:59 PM Eastern Time (ET) 6/30/2025. The booking must post to your account during the promotional period to qualify. This offer may overlap with other special offers in which you are currently enrolled. You must use your Citi Custom Cash ® Card registered at the Citi Travel portal to earn the bonus points . For bookings made with a combination of points and your eligible Citi card, only the portion paid with your card will earn the additional points. Bonus points may take one or two billing cycles to post to your account. To qualify for this offer, this account must be open and current. Points will not be earned on canceled bookings. If your account is closed for any reason, including if you convert to another card product, you will no longer be eligible for this offer. Citi Travel is powered by Rocket Travel Inc., part of the Booking Holdings Inc. group of companies together with booking.com.

To provide you with extra security, we may need to ask for more information before you can use the feature you selected.

Just a moment, please...

Get Citibank information on the countries & jurisdictions we serve

You are leaving a Citi Website and going to a third party site. That site may have a privacy policy different from Citi and may provide less security than this Citi site. Citi and its affiliates are not responsible for the products, services, and content on the third party website. Do you want to go to the third party site?

Citi is not responsible for the products, services or facilities provided and/or owned by other companies.

Por favor, tenga en cuenta que las comunicaciones verbales y escritas de Citi podrían estar únicamente en inglés, ya que, tal vez, no podamos proporcionar comunicaciones relacionadas con los servicios en todos los idiomas. Estas comunicaciones podrían incluir, entre otras, contratos, divulgaciones y estados de cuenta, cambios en los términos o en los cargos, así como cualquier documento de mantenimiento de su cuenta. Si necesita ayuda en un idioma distinto al inglés, por favor, comuníquese con nosotros, ya que tenemos servicios de idiomas que podrían serle útiles.

Share Your Screen With A Phone Representative

During your call, you may be asked to share your screen for a faster, more efficient experience. If you agree, the phone representative you're speaking with will give you a Service Code to enter below.

If you need assistance from a Citi representative, contact us via chat or phone

- Best Credit Cards

- Lifetime Free

- Forex Credit Cards

- RuPay Credit Cards

- International Travel

- Railway Lounge

- Credit Card Guides

- News & Offers

- Credit Score Guide

- Credit Card Limit

- Lounge Access

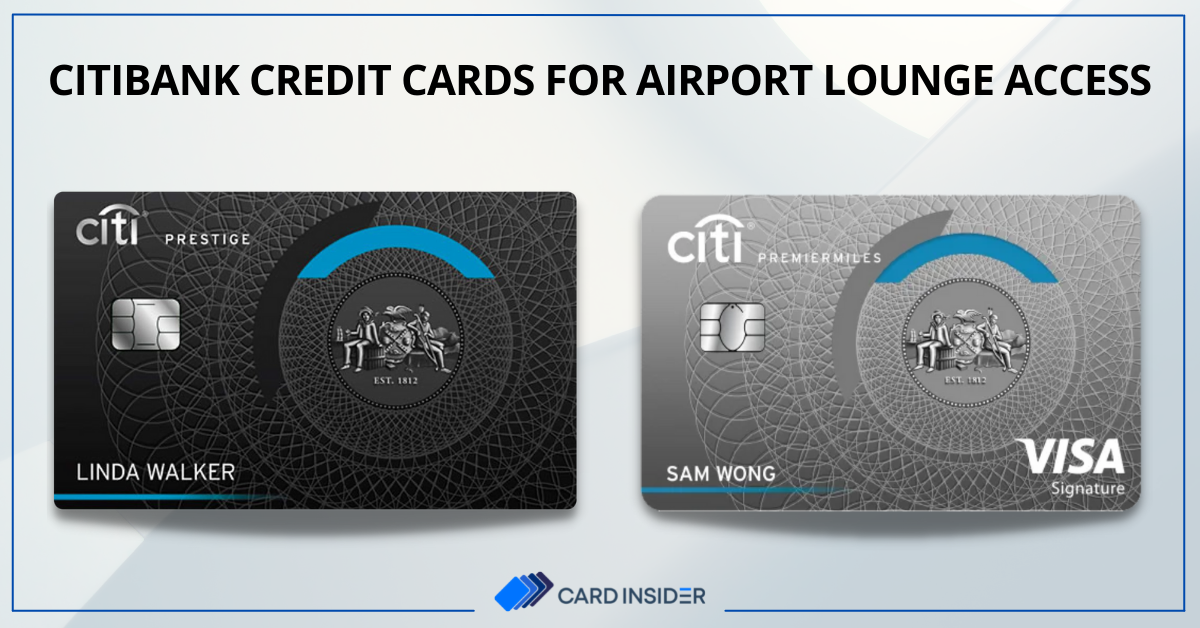

Citibank Credit Cards For Airport Lounge Access

CitiBank is one of the oldest and most popular banks in India. CitiBank has launched very few credit cards in India but each Citi Credit card offers compelling privileges across various categories like shopping, entertainment, dining, travel, and much more. Also, the bank has provided cards in every tier, ie, from basic to premium, so that one can find the best-suited card as per their needs. One of the best features provided by Citi Bank is the complimentary airport lounge access. With this feature, cardholders have the facility to access a lounge at the airport during flight layovers.

Every CitiBank credit card provides amazing features and benefits, but the airport lounge access benefit has been provided with the top two premium Citibank credit cards. In this article, you will find the complete information about the complimentary lounge visits provided by CitiBank credit cards along with the list of lounges accessible with the credit cards. So, keep reading to know more about Airport Lounge Access with Citibank Credit Cards.

Best Citibank Credit Cards that offer Lounge Access

Currently, there are two premium Citibank credit cards that offer complimentary airport lounge access. The details of the lounge visits provided on the Citbank credit cards are mentioned below:

Citibank Prestige Credit Card

The Citibank Prestige Credit Card is a super premium credit card offered by Citibank. The Prestige Card welcomes you with a plethora of benefits like Rs. 10,000 vouchers from Taj, 2,500 bonus reward points, a Complimentary Taj Epicure Plus plan, and InnerCircle Silver membership. With this card you also get 4 complimentary rounds and 4 lessons of golf every year and insurance benefits worth up to Rs. 5 crores. The Airport lounge benefits provided with the card are:

– Unlimited Complimentary Domestic Airport Lounge Access in a year. – Unlimited Complimentary International Airport Lounge Access in a year.

Lounge List for Citibank Prestige Credit Card

The list of lounges that are accessible with the Prestige Credit Card is mentioned in the table given below:

For the complete list of lounges for Citibank Prestige Card refer to this page.

Citibank PremierMiles Credit Card

The CitiBank PremierMiles Credit Card is a popular travel credit card issued at an annual fee of Rs. 3,000. The card welcomes you with 10,000 Miles and you earn up to 10 Miles for every Rs. 100 spent with the card. Apart from this, the premier miles card offers up to a 20% discount on your dining bills and offers personal accident insurance worth Rs. 1 crore. The lounge benefit provided with the card are as follows:

– 8 Complimentary Domestic Airport Lounge Access per quarter. (for Visa Signature variant) – 6 Complimentary Domestic Airport Lounge Access per quarter. (for Mastercard variant)

Lounge List for Citibank PremierMiles Mastercard Credit Card

As the Citibank PremierMiles card is issued at both Visa and Mastercard variants, the lounge visits and list of lounges are separate with both cards. The lounge list for the card issued with the Mastercard variant is mentioned below:

For the complete list of lounges for Citibank PrimerMiles Mastercard refer to this page.

Lounge List for Citibank PremierMiles Visa Signature Credit Card

The lounge list for the CitiBank PremierMiles Visa Credit Card has been mentioned below:

For the complete list of lounges for Citibank PrimerMiles Visa Signature refer to this page.

Bottom Line

The Airport lounge facility on a credit card is undoubtedly a great benefit. The cardholders, with this benefit, can access any lounge with their credit cards during flight layovers or for any other reason. If you travel frequently, then you should carry a travel credit card that would not only provide you with lounge access but also other travel benefits like discounted hotel rates, car rentals, Rewards in Miles, etc. If you are holding any of the above Citibank credit cards, then the information provided above will help you to know the list of lounges applicable to your card.

Find the perfect credit card in India by comparing the most rewarding options in one place!

- Privacy Policy

- Terms & Conditions

Contact Info

© Copyright 2024 Card Insider

Made With ❤ in India.

Type above and press Enter to search. Press Esc to cancel.

Credit cards" data-destinationurl="https://www1.citibank.com.au/credit-cards?intcid=Meganav-CC" data-ctaposition="header:meganav" data-aria-label="Click here to view all Credit cards" href="https://www1.citibank.com.au/credit-cards?intcid=Meganav-CC" rel="" innerhtml="Credit cards">Credit cards

Features & Benefits

Citi rewards program, citi rewards program > citi rewards" data-destinationurl="https://www1.citibank.com.au/rewardsintcid=meganav-cc" data-ctaposition="header:meganav" data-aria-label="click here to view the citi rewards program" href="https://www1.citibank.com.au/rewardsintcid=meganav-cc" rel="" innerhtml="citi rewards">citi rewards, citi rewards program >pay with points" data-destinationurl="https://www1.citibank.com.au/rewards/pay-with-pointsintcid=meganav-cc" data-ctaposition="header:meganav" data-aria-label="click here to learn more about pay with points" target="_self" href="https://www1.citibank.com.au/rewards/pay-with-pointsintcid=meganav-cc" rel="" innerhtml="pay with points">pay with points, instalment plans" data-destinationurl="https://www1.citibank.com.au/credit-cards/instalment-plansintcid=meganav-cc" data-ctaposition="header:meganav" data-aria-label="click here to learn about citi instalment plans" target="_self" href="https://www1.citibank.com.au/credit-cards/instalment-plansintcid=meganav-cc" rel="" innerhtml="instalment plans">instalment plans, account information, account information > setting up repayments" data-destinationurl="https://www1.citibank.com.au/personal-loans/help-and-support/repaymentsintcid=meganav-cc" data-ctaposition="header:meganav" data-aria-label="click here to setting up repayments" target="_self" href="https://www1.citibank.com.au/personal-loans/help-and-support/repaymentsintcid=meganav-cc" rel="" innerhtml="setting up repayments">setting up repayments, account information > useful forms and links" data-destinationurl="https://www1.citibank.com.au/help-and-support/useful-forms-and-links" data-ctaposition="header:meganav" data-aria-label="click here to view the useful forms and links page" target="_self" href="https://www1.citibank.com.au/help-and-support/useful-forms-and-links" rel="" innerhtml="useful forms and links">useful forms and links, calculators & tools" data-destinationurl="https://www1.citibank.com.au/credit-cards/calculatorsintcid=meganav-cc" data-ctaposition="header:meganav" data-aria-label="click here to use our credit card calculators" target="_self" href="https://www1.citibank.com.au/credit-cards/calculatorsintcid=meganav-cc" rel="" innerhtml="calculators & tools">calculators & tools, loans" data-destinationurl="https://www1.citibank.com.au/personal-loansintcid=meganav-pl" data-ctaposition="header:meganav" data-aria-label="click here to view our personal loans page" target="_self" href="https://www1.citibank.com.au/personal-loansintcid=meganav-pl" rel="" innerhtml="loans">loans, citi ready credit" data-destinationurl="https://www1.citibank.com.au/personal-loans/ready-creditintcid=meganav-pl" data-ctaposition="header:meganav" data-aria-label="click here to view citi ready credit page" target="_self" href="https://www1.citibank.com.au/personal-loans/ready-creditintcid=meganav-pl" rel="" innerhtml=" citi ready credit"> citi ready credit, personal loan plus" data-destinationurl="https://www1.citibank.com.au/personal-loans/personal-loan-plusintcid=meganav-pl" data-ctaposition="header:meganav" data-aria-label="click here to view citi personal loan plus page" target="_self" href="https://www1.citibank.com.au/personal-loans/personal-loan-plusintcid=meganav-pl" rel="" innerhtml=" personal loan plus"> personal loan plus, loans > help me choose" data-destinationurl="https://www1.citibank.com.au/personal-loans/help-me-chooseintcid=meganav-pl" data-ctaposition="header:meganav" data-aria-label="click here to view the help me choose page" target="_self" href="https://www1.citibank.com.au/personal-loans/help-me-chooseintcid=meganav-pl" rel="" innerhtml="help me choose">help me choose, loans > compare loans" data-destinationurl="https://www1.citibank.com.au/personal-loans/compare-loansintcid=meganav-pl" data-ctaposition="header:meganav" data-aria-label="click here to view the compare loans page" target="_self" href="https://www1.citibank.com.au/personal-loans/compare-loansintcid=meganav-pl" rel="" innerhtml="compare loans">compare loans, view all loans" data-destinationurl="https://www1.citibank.com.au/personal-loansintcid=meganav-pl-view-all" data-ctaposition="header:meganav" data-aria-label="click here to view all loans page" target="_self" href="https://www1.citibank.com.au/personal-loansintcid=meganav-pl-view-all" rel="" innerhtml="view all loans >">view all loans >, help with credit cards" data-destinationurl="" href="unsafe:javascript:void(0);" rel="" innerhtml=" help with credit cards"> help with credit cards.

Account management

The move to nab" data-destinationurl="https://www1.citibank.com.au/nabintcid=meganav-au" data-ctaposition="header:meganav" data-aria-label="click here to learn about the move to nab" target="_self" href="https://www1.citibank.com.au/nabintcid=meganav-au" rel="" innerhtml="the move to nab">the move to nab, sign into nab >" data-destinationurl="https://ib.nab.com.au/login" data-ctaposition="header:meganav" data-aria-label="click here to sign in to nab" target="_blank" href="https://ib.nab.com.au/login" rel="" innerhtml="sign into nab >">sign into nab >, report lost or stolen card" data-destinationurl="https://www1.citibank.com.au/help-and-support/lost-or-stolen-cardintcid=meganav-cu" data-ctaposition="header:meganav" data-aria-label="click here to report a lost or stolen card" target="_self" href="https://www1.citibank.com.au/help-and-support/lost-or-stolen-cardintcid=meganav-cu" rel="" innerhtml="report lost or stolen card">report lost or stolen card, report a scam" data-destinationurl="https://www1.citibank.com.au/help-and-support/scamsintcid=meganav-cu" data-ctaposition="header:meganav" data-aria-label="click here to report a scam" target="_self" href="https://www1.citibank.com.au/help-and-support/scamsintcid=meganav-cu" rel="" innerhtml="report a scam">report a scam.

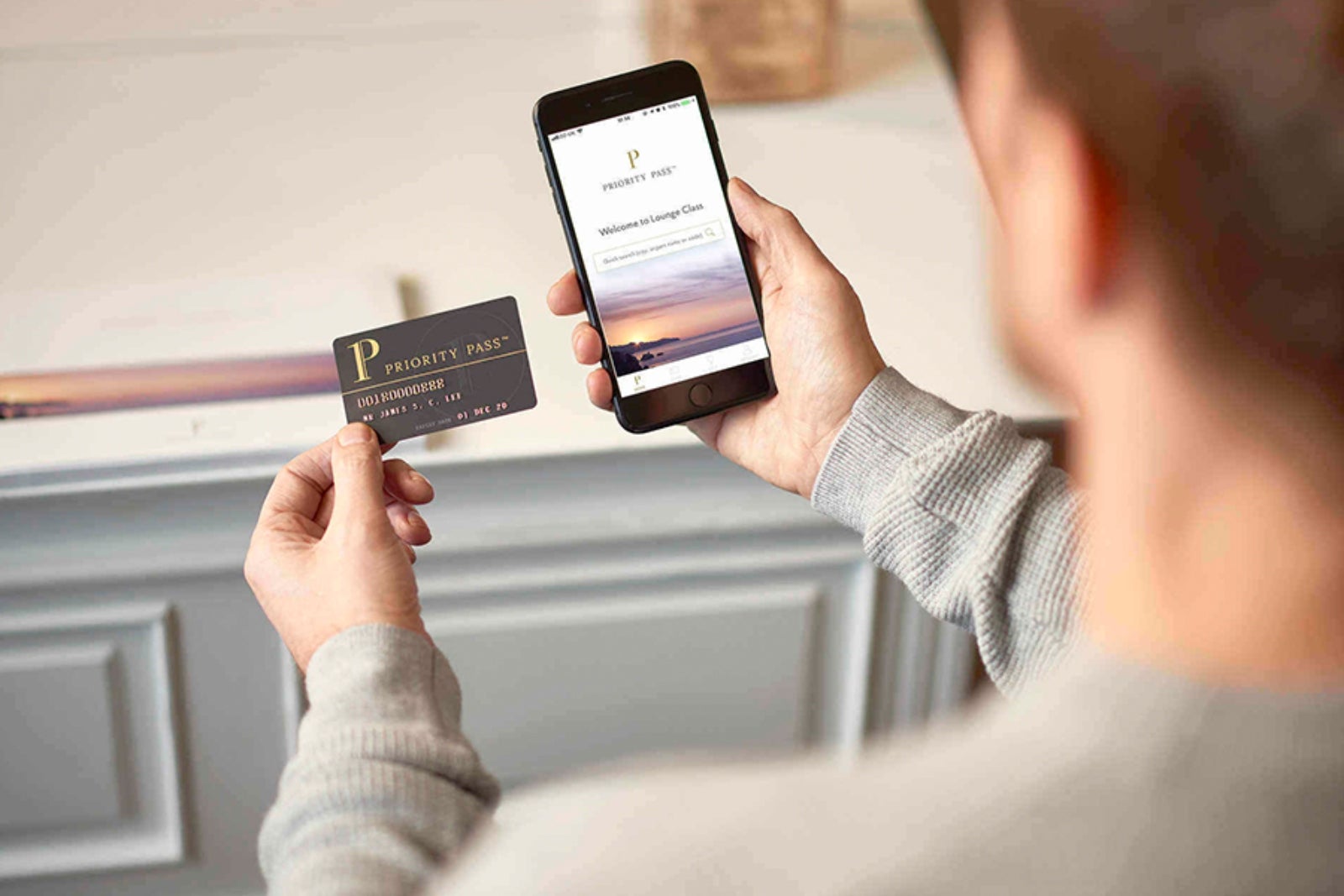

Complimentary Priority Pass™ Membership

Complimentary priority pass™ membership.

As a Citi Prestige or Citi Premier primary cardholder, receive complimentary Priority Pass™ Membership with airport lounge access to make your travel experience more enjoyable.

Find out more about your membership and how to enrol by selecting your card below.

As a Citi Prestige or Citi Premier primary cardholder, receive complimentary Priority Pass™ Membership with airport lounge access to make your travel experience more enjoyable.

If you are a Citi Prestige primary cardholder, you are entitled to a complimentary Priority Pass™ Membership with unlimited airport lounge access for you and a guest. 1

Follow the easy steps below to obtain your membership to the world’s largest independent airport lounge access program.

- Download the Priority Pass TM App via your Apple App Store or get it on Google Play

- Visit prioritypass.com/prestigeaumc

- Enter Invitation Code: CTPRSG333

- Complete the digital form, including your Citi Prestige Card details.

You will be automatically enrolled into the Priority Pass™ Membership with a Digital Membership Card which can be accessed via the Priority Pass™ mobile app.

For more information on your Priority Pass Membership or for the list of up-to-date airport lounges, visit prioritypass.com or call Priority Pass on +852 2866 1964.

If you are a Citi Prestige primary cardholder, you are entitled to a complimentary Priority Pass™ Membership with unlimited airport lounge access for you and a guest. 1

Follow the easy steps below to obtain your membership to the world’s largest independent airport lounge access program.

You will be automatically enrolled into the Priority Pass™ Membership with a Digital Membership Card which can be accessed via the Priority Pass™ mobile app.

If you are a Citi Premier primary cardholder, you are entitled to a complimentary Priority Pass™ membership with two complimentary airport lounge visits per membership year. 2

- Visit prioritypass.com/premieraumc

- Enter Invitation Code: CTPRM331

- Complete the digital form, including your Citi Premier Card details

If you are a Citi Premier primary cardholder, you are entitled to a complimentary Priority Pass™ membership with two complimentary airport lounge visits per membership year. 2

Important information

- Citi Prestige Card : One complimentary digital Priority Pass™ Membership, with unlimited lounge visits, for the primary cardholder is a Special Feature of the Citi Prestige Card. Citi Prestige Credit Cardholders must enrol for the Priority Pass Standard Membership at www.prioritypass.com/prestigeaumc . The primary cardholder may bring one guest for free per visit. Any additional guests will be charged directly by the lounge. You will need to download the Priority Pass™ App via the Apple App Store or get it on the Google Play Store to access your Digital Membership Card. The membership is subject to the Priority Pass™ Conditions of Use. Please note that within Australia, Priority Pass is available at select airports. For the full list of up-to-date airport lounges and Priority Pass™ Conditions of Use please refer to www.prioritypass.com along with the Citi Prestige Credit Card Benefit Terms and Conditions for further information.

- Citi Premier Card : One complimentary digital Priority Pass™ Standard Membership, with two complimentary lounge visits, for the primary cardholder is a Special Feature of the Citi Premier Card. Citi Premier Cardholders must enrol for the Priority Pass Standard Membership at www.prioritypass.com/premieraumc and follow the prompts. You will need to download the Priority Pass TM App via the Apple App Store or get it on the Google Play Store to access your Digital Membership Card. The first two visits within each 12-month membership period from registration (membership year) are complimentary to the primary cardholder only, after which any additional visits by you and visits by your guests will be charged directly to you by Priority Pass at their ordinary standard rates. Unused visits cannot be carried forward to the following membership year. The total number of complimentary visits will be reset to two at the beginning of each membership year while you remain a Citi Premier Cardholder. The membership is subject to the Priority Pass™ Conditions of Use. Please note that within Australia, Priority Pass is available at select airports. For the full list of up-to-date airport lounges and Priority Pass™ Conditions of Use please refer to www.prioritypass.com .

- Citi Prestige Card : One complimentary digital Priority Pass™ Membership, with unlimited lounge visits, for the primary cardholder is a Special Feature of the Citi Prestige Card. Citi Prestige Credit Cardholders must enrol for the Priority Pass Standard Membership at www.prioritypass.com/prestigeaumc . The primary cardholder may bring one guest for free per visit. Any additional guests will be charged directly by the lounge. You will need to download the Priority Pass™ App via the Apple App Store or get it on the Google Play Store to access your Digital Membership Card. The membership is subject to the Priority Pass™ Conditions of Use. Please note that within Australia, Priority Pass is available at select airports. For the full list of up-to-date airport lounges and Priority Pass™ Conditions of Use please refer to www.prioritypass.com along with the Citi Prestige Credit Card Benefit Terms and Conditions for further information.

- Citi Premier Card : One complimentary digital Priority Pass™ Standard Membership, with two complimentary lounge visits, for the primary cardholder is a Special Feature of the Citi Premier Card. Citi Premier Cardholders must enrol for the Priority Pass Standard Membership at www.prioritypass.com/premieraumc and follow the prompts. You will need to download the Priority Pass TM App via the Apple App Store or get it on the Google Play Store to access your Digital Membership Card. The first two visits within each 12-month membership period from registration (membership year) are complimentary to the primary cardholder only, after which any additional visits by you and visits by your guests will be charged directly to you by Priority Pass at their ordinary standard rates. Unused visits cannot be carried forward to the following membership year. The total number of complimentary visits will be reset to two at the beginning of each membership year while you remain a Citi Premier Cardholder. The membership is subject to the Priority Pass™ Conditions of Use. Please note that within Australia, Priority Pass is available at select airports. For the full list of up-to-date airport lounges and Priority Pass™ Conditions of Use please refer to www.prioritypass.com .

Important notice

Please note that between 8PM to 8AM, our phone banking services are only available for critical services like card replacement, fraudulent transactions & service interruption. For all other queries during this period, please use Citi Online or our Mobile App. For further assistance you may also use the 'Write to us' option on Citi Online. For any critical escalations, email us on: [email protected] . Alternatively, you may continue to call us between 8AM to 8PM for full services.

Get up to AED 10,000 cash back per year for Citi Credit Card Referrals

Refer your family members or work colleagues for Citi Credit Cards and earn up to AED 10,000 cash back annually (up to 5 referrals per year). T&C Apply

Refer a friend for a Citigold or Citigold Private Client account.

Get rewarded up to AED 6,000 on every successful referral, while your friends receive up to AED 21,000.

Citi Credit Cards

GET UP TO AED 5,000 CASH BACK PER YEAR FOR CITI CREDIT CARD REFERRALS

Apply Now Learn More

Citibank brings you a range of flexible Financial Planning and Insurance products that help you realize your dreams and offer you protection against the unexpected.

There's more to wealth

Join Citigold and receive up to AED 21,000 Cash reward.

Get rewarded for starting a Citigold relationship

Join Citigold and receive up to AED 9,500 Cash reward.

*T&C Apply

Get up to 25% cashback for 6 months on all grocery and fuel spend!

Apply for a Citi Credit Card and get up to 25% cashback for 6 months on all grocery & fuel spend!

Apply for a Personal Loan in 10 minutes

Pay 0% processing fees & earn Noon e-vouchers up to AED 1,250 to spend on the things you love, when you apply for a Citi Personal Loan.

T&Cs Apply

Get a chance to win AED 15,000

Get a Citi Credit Card, Loan or join Citigold to get a chance to win AED 15,000 in statement credit, dnata vouchers or cashback!

Troubleshoot your questions with step by step guides, video demos, and more at the Help Center.

Sign on to Citibank Online and send us a secure message or request.

Fill this form to enquire about our products and services.

View our Branch and ATM network.

Dear Customer, Due to current circumstances, please note that between 8 PM to 8 AM, our Phone Banking services are only available for critical services like card replacement, fraudulent transactions & service interruption. For all other queries during this period, please use Citi Online or our Mobile App. For further assistance you may also use the ‘write to us’ option on Citi Online. For any critical escalations, email us on: [email protected] . Alternatively, you may continue to call us between 8 AM to 8 PM for full services.

Schedule Of Charges

Freedom to do more with the new Citi Mobile ® App

By using this service, you will be authorizing Citibank to share your mobile number with a third party service provider to send you an SMS with the download link.

Airport Lounge Access Credit Cards

Airport lounge access with citi credit cards.

You get access to Airport Lounge at a number of airports if you have any of these Citi Cards. Click on your card image to see the offer details.

Emirates Citibank Ultima Mastercard

1,100 + airport lounge access with mastercard travel pass app.

Your Emirates-Citibank Ultima MasterCard brings you unlimited complimentary access to 1,100+ airport lounges globally for you and your supplementary cardholders plus one guest each per visit.

To enjoy this benefit and to avoid unnecessary lounge charges simply follow the steps when travelling.

- Download the "MasterCard Travel Pass" app from Google Play or the App Store.

- Register your Citibank Mastercard credit card

- See the lounges near you and clearly view if you are eligible for complimentary access.

- Generate and present the app QR code or membership number to the lounge receptionist to access the lounge. Each cardholder, primary and supplementary, should show their individual QR code (by registering their cards separately using individual email IDs).

- You and your supplementary cardholders are entitled to bring 1 guest each with MasterCard Travel Pass app

- A $32 charge will apply to all guests above your allowance entering the lounge and will be billed directly to your card.

- Children over 1 year old are considered as paying guests.

- In case of discrepancy with the above instructions not being followed could result in non refundable charges

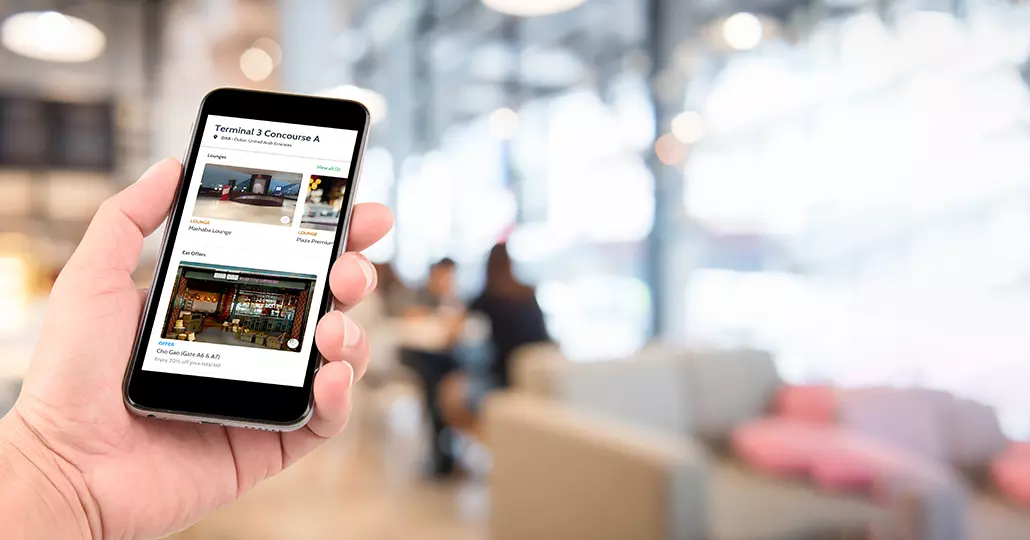

Check the airport lounges available any time, any place, whilst on the move

Emirates Citibank Ultimate Mastercard

Your Emirates-Citibank Ultimate MasterCard brings you unlimited complimentary access to 1,100+ airport lounges globally for you and your supplementary cardholders plus one guest each per visit.

Emirates Citibank World Mastercard

Your Emirates-Citibank World MasterCard brings you unlimited complimentary access to 1,100+ airport lounges globally for you and your supplementary cardholders.

- You and your supplementary cardholders are entitled to use lounges with MasterCard Travel Pass app

Emirates Citibank Ultima Visa

1,000 + airport lounge access with loungekey.

Your Emirates-Citibank Ultima Visa card brings you unlimited complimentary access to 1,000+ airport lounges globally for you and your supplementary cardholders plus one guest each per visit.

- You and your supplementary cardholders are entitled to bring 1 guest each when using LoungeKey lounges

- Always ensure both primary and supplementary cards are swiped at the lounge for access

- A $32 charge will apply to all guests above your 1 guest each allowance entering the lounge and will be billed directly to your card.

- Always inform the lounge you are entering with LoungeKey

Incase of discrepancy with the above instructions not being followed could result in non refundable charges

LoungeKey Mobile App:

Emirates citibank ultimate visa, emirates citibank gold, access to veloce lounges.

Enjoy free unlimited access to over 20+ airport lounges worldwide for you and your Supplementary Cardmembers. Check the list of participating lounges at www.veloceworld.com . To enter please show your card to the lounge staff.

Citi Prestige

Your Citi Prestige card brings you unlimited complimentary access to 1,100+ airport lounges globally for you and your supplementary cardholders plus one guest each per visit.

Citi Premier

Your Citi Premier card brings you unlimited complimentary access to 1,100+ airport lounges globally for you and your supplementary cardholders plus one guest each per visit.

Citi Rewards

Your Citi Rewards card brings you unlimited complimentary access to 1,100+ airport lounges globally for you and your supplementary cardholders.

Citi Cashback

Your Citi Cashback Card brings you unlimited complimentary access to 1,100+ airport lounges globally for you and your supplementary cardholders.

Citi Premiermiles Signature

Your Premier Miles Signature Visa card brings you unlimited complimentary access to 1,000+ airport lounges globally for you and your supplementary cardholders.

- You and your supplementary cardholders are entitled to use LoungeKey lounges

- A $32 charge will apply to all guests entering the lounge with you and will be billed directly to your card.

Citi Premiermiles Titanium

Access to 10+ airport lounges in the middle east and levant.

You and your supplementary cardmember can enjoy complimentary unlimited free* access to over 10 lounges in UAE, KSA, Jordan, Kuwait and Egypt. For more information click here *Note: Guests will be charged

Citi Premiermiles Elite

Your Premiermiles Elite Visa card brings you unlimited complimentary access to 1,000+ airport lounges globally for you and your supplementary cardholders plus one guest each per visit.

Citilife Platinum

Your Citilife Platinum MasterCard brings you unlimited complimentary access to 1,100+ airport lounges globally for you and your supplementary cardholders.

- A $32 charge will apply to all guests above your allowance entering the lounge and will be billed directly to your card.

Citilife World Elite Mastercard

Your Citilife Elite MasterCard brings you unlimited complimentary access to 1,100+ airport lounges globally for you and your supplementary cardholders plus one guest each per visit.

Citilife Infinite

Your Citilife Infinite Visa card brings you unlimited complimentary access to 1,000+ airport lounges globally for you and your supplementary cardholders plus one guest each per visit.

Citi Life Platinum Visa

Citi simplicity, unlimited access to 25 regional and international lounges.

Enjoy free unlimited access to select airport lounges in the Middle East and internationally for you and your Supplementary Card members.

Before visiting check lounge availability and terms and conditions at: https://www.priceless.ae/en-ae/consumers/lounge-platinum.html

Incase of discrepancy with the above instructions not being followed could result in non-refundable charges

Start Every Journey with Priority Pass

For the occasional Traveller

Standard plus, for the regular traveller, for the frequent traveller, priority pass excellence awards winners.

Celebrating outstanding airport lounge and travel experience partners in the Priority Pass global network. Discover the winners of this year’s awards.

PRE-BOOK YOUR LOUNGE NOW

Access to lounges is subject to space availability. Pre-book is available at select locations for a small fee. Log in to reserve your space in the lounge.

Unlock More with Priority Pass

Beyond premium lounges, explore a world of exclusive advantages. Refuel, relax and unwind with a variety of additional benefits to enhance your experience both within and beyond the airport.

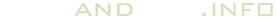

ENRICH YOUR AIRPORT EXPERIENCE WITH THE PRIORITY PASS APP

Download the app to help you find and access lounges and experiences, navigate airports, manage your account and much more.

Priority Pass Airport Guides

Enhance your airport experience using our bespoke airport guides.

The Benefits of Priority Pass

YOUR MEMBERSHIP BENEFITS

WORTH ARRIVING EARLY

WHEREVER YOUR TRAVEL TAKES YOU

Recently added.

Belfast George Best City

Belfast, northern ireland.

ASPIRE LOUNGE

Rio de Janeiro Galeao International, Terminal 2

Rio de janeiro, brazil.

GOL SMILES (INTERNATIONAL)

Kuala Lumpur Intl, KLIA Terminal 1 (Satellite)

Kuala lumpur, malaysia.

TRAVEL CLUB LOUNGE

Washington DC Dulles International, Concourse A

Washington dc, usa.

VIRGIN ATLANTIC CLUBHOUSE

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

New Citi Strata Premier Card Open for Applications [Details and Benefits]

Keri Stooksbury

Editor-in-Chief

35 Published Articles 3194 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

Editor & Content Contributor

153 Published Articles 760 Edited Articles

Countries Visited: 35 U.S. States Visited: 25

![citibank travel card lounge access New Citi Strata Premier Card Open for Applications [Details and Benefits]](https://upgradedpoints.com/wp-content/uploads/2024/04/2-men-reviewing-laptop.jpeg?auto=webp&disable=upscale&width=1200)

Table of Contents

Citi strata premier card welcome offer, citi strata premier card benefits, is it worth it, transition from citi premier card to citi strata premier card, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Citi has debuted its newest ThankYou Rewards card, the Citi Strata Premier℠ Card , which is now open for applications.

Let’s learn more about the new Citi Strata Premier card and see if it deserves a spot in your wallet.

New applicants of the Citi Strata Premier card can take advantage of the following welcome offer by meeting the minimum spending requirements:

- For a limited time: Earn 75,000 bonus points after spending $4,000 in the first 3 months of account opening, redeemable for $750 in gift cards or travel rewards on thankyou.com.

Note that if you’ve received a new account bonus for the Citi Premier ® Card in the last 48 months, you are not eligible for this welcome offer.

The Citi Strata Premier card has similar earning rates to the Citi Premier card:

- 10x points on hotel, car rentals, and attractions booked through CitiTravel.com

- 3x points on air travel, other hotel purchases, at restaurants, supermarkets, gas stations, and EV charging stations

- 1x points on all other purchases

The 10x points category for select Citi Travel bookings is an ongoing benefit (for existing Citi Premier cardholders, this benefit expires on June 30, 2024). EV charging stations is also a new category that the Citi Premier card did not offer.

Both cards charge a $95 annual fee.

The Citi Strata Premier card also has these additional benefits and travel coverages:

- $100 off of a single hotel stay of $500 or more (excluding taxes and fees) when booked through CitiTravel.com (once per calendar year)

- No foreign transaction fees

- Travel insurance coverage , including trip delay, trip cancellation and interruption, lost or damaged luggage, and MasterRental Coverage (car rental insurance)

The Citi Premier card had its travel protections stripped in 2019, so including these benefits with the Citi Strata Premier card is a win for both existing and new cardholders.

Compared to similar midtier cards like the Chase Sapphire Preferred ® Card , the earning rates for the travel portal, general air/hotel travel, supermarkets, gas stations, and EV charging stations are all higher with the Citi Strata Premier card.

New cardholders could earn from 79,000 to 115,000 ThankYou Points between the welcome offer and required minimum spending, depending on the earning categories.

While ThankYou Points can be redeemed for statement credits or gift cards, they are best redeemed with Citi’s travel partners . Citi ThankYou Rewards’ transfer partners include Air France – KLM Flying Blue , JetBlue Airways , and Qatar Airways .

Some of our favorite ways to redeem Citi ThankYou Points for maximum value include flying some of the best business and first class cabins in the sky — such as Singapore Suites, Qsuite, and Lufthansa first class — and utilizing Flying Blue Promo Rewards for discounted business class awards to Europe.

Upgraded Points staff members have independently confirmed that their Citi Premier card accounts are now showing as Citi Strata Premier cards in their online accounts:

The Citi Premier card is also closed to new applications, so the Citi Strata Premier card appears to now be the highest-tier ThankYou Rewards card available to new applications.

The Citi Strata Premier card offers competitive earning rates for a modest annual fee. It’s an everyday purchase workhorse and rewards cardholders for many of their frequent purchases.

With an attractive new welcome offer, the Citi Strata Premier card could be a fantastic addition to your travel rewards wallet.

The information regarding the Citi Strata Premier℠ Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Citi Premier ® Card has expired and the card is no longer open to applicants.

Was this page helpful?

About Keri Stooksbury

With years of experience in corporate marketing and with a nonprofit, Keri is now editor-in-chief at UP, overseeing daily content operations and reviewing thousands of UP articles in the process.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

How to choose a credit card for airport lounge access

Update : Some offers mentioned below are no longer available. View the current offers here .

This post has been updated with information that the Chase Sapphire Reserve will lose Priority Pass restaurant access from July 1, 2024.

When people find out my job is to write about travel credit cards, they usually ask for expert advice. They want to know which of our favorite credit cards I recommend, which cards will complement their existing portfolio and whether their current everyday card is a good one.

Just as often, they also want to know which credit card they should get if they want airport lounge access.

Until recently, this question was fairly easy to answer since many cards offered similar lounge benefits. But lately, it's gotten more complicated. The issuer lounge space has more options than ever, while some cards have lost perks like guest privileges and restaurant access.

It can feel overwhelming, but we've got you. Here's a breakdown of what to consider when choosing a credit card for airport lounge access .

Access with top cards

If you have a lounge in your home airport.

Presumably, your home airport is where you spend the most time. If you live in an airline hub or have a perfectly placed lounge that you want access to, let that drive your decision.

For instance, if Los Angeles International Airport (LAX) is your home airport, you probably pass an airline lounge regardless of your preferred airline since it is a hub for American Airlines, Delta Air Lines and United Airlines.

Similarly, if you have an issuer lounge in your home airport, you may want to choose the premium card from that issuer that includes lounge access. Someone whose home base is Dulles International Airport (IAD), for example, will likely want access to the Capital One Lounge that's conveniently located just past the airport's security lines.

On the flip side, not all of us have a wide range of lounge options at home. I'm based in Nashville, and as much as I love Nashville International Airport (BNA), it has limited lounge options. As such, I've based my lounge access decision on the airports I frequently travel through rather than my home base.

If you're loyal to a specific airline

If you're loyal to American, Delta or United, you'll likely benefit from airline-specific lounge access since you'll most frequently fly through hubs with a lounge.

American Airlines

Frequent American flyers will want to go with the Citi® / AAdvantage® Executive World Elite Mastercard® (see rates and fees ) since it's the only credit card with an Admirals Club membership.

Delta Air Lines

If you're a regular Delta passenger, note that the Delta SkyMiles® Reserve American Express Card includes unlimited complimentary Sky Club access through January 2025. After that, cardmembers will receive 15 complimentary visits per year and can receive unlimited visits by spending $75,000 on the card each calendar year.

United Airlines

Similarly, United fans will benefit most from the United Club Infinite Card , the only card with a United Club membership as one of its perks.

Of course, if you're loyal to an airline that doesn't have its own airport lounges, you can cross these off the list. As a Southwest Airlines loyalist , I knew I didn't want to limit my lounge access to a specific airline, so I was able to turn my attention elsewhere.

If you want issuer-specific lounge access

For quite a while, American Express had the issuer lounge market cornered. But as Capital One and Chase continue to grow their own lounge networks, you may decide you want to choose your credit card based on the issuer's lounge access it gets you.

American Express

You can find American Express Centurion Lounges in over 20 locations, making them the most prominent issuer lounge. If you want access, you'll most likely want either the Amex Platinum or the Amex Business Platinum .

Delta SkyMiles Reserve and Delta SkyMiles Reserve Business cardmembers can also access Centurion Lounges when flying Delta, as long as the flight was booked on their card (excluding basic economy tickets).

Related: I'm an Amex Platinum newbie — here's why lounge access is surprisingly my favorite perk

Capital One

While not as well established as Centurion Lounges, Capital One Lounges have grown rapidly. Currently, you can find them in three airports: Dallas Fort Worth International Airport (DFW) , Denver International Airport (DEN) and Dulles International Airport (IAD) .

A planned location in Harry Reid International Airport (LAS) in Las Vegas has been announced but is not yet open. To access these lounges, you'll want either the Venture X or the Venture X Business .

Additionally, Chase has been asserting its presence in the lounge space with Chase Sapphire Lounges. With their impressive designs and amenities like complimentary facials, they may be gunning for the No. 1 spot.

Currently, you can find Sapphire Lounges in four locations: Boston Logan International Airport (BOS) , Hong Kong International Airport (HKG) , John F. Kennedy International Airport (JFK) in New York and LaGuardia Airport (LGA) in New York. There's also a smaller terrace location at Austin-Bergstrom International Airport (AUS) .

To get unlimited access to these lounge concepts, you'll need the Chase Sapphire Reserve . You can also get one complimentary visit to a Sapphire Lounge per calendar year if you have a Priority Pass Select membership from another credit card.

If you want more diverse lounge options

If you want a wider range of airport lounge access options, opt for a card with a complimentary Priority Pass Select membership. Priority Pass is a network of over 1,500 lounges, Minute Suites , Be Relax spas and various restaurants located in 600-plus airports in more than 150 countries.

Airline cobranded cards don't include Priority Pass access, but you'll get it with the premium cards that unlock issuer lounge access: Amex Platinum (enrollment required), Amex Business Platinum (enrollment required), Chase Sapphire Reserve , Capital One Venture X and Capital One Venture X Business .

Additionally, you can get Priority Pass access with some other cards:

- Marriott Bonvoy Brilliant American Express Card : Unlimited complimentary access for the primary cardholder and up to two guests (enrollment required)

- Hilton Honors American Express Business Card : 10 complimentary visits annually (enrollment required)

- U.S. Bank Altitude® Reserve Visa Infinite® Card : Eight complimentary visits annually

- U.S. Bank Altitude® Connect Visa Signature® Card : Four complimentary visits annually

The information for the U.S. Bank Altitude Reserve and U.S. Bank Altitude Connect have been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Related: Is a Priority Pass lounge membership actually worth it?

If you want access to Priority Pass restaurants

If you frequently pass through airports with a Priority Pass-affiliated restaurant, getting a card with access can save you big bucks. This perk will comp a certain amount of the restaurant bill for you and up to one registered guest. The amount varies by restaurant and is typically $28 to $30 per person; you can look up the exact values for each restaurant on the Priority Pass website .

Many cards with Priority Pass Select access have eliminated restaurant access in recent years, but you can still get it as a part of the Priority Pass Select membership included with the Chase Sapphire Reserve ( through June 30 ) and the Venture X Business .

While my home airport in Nashville doesn't have much to offer in the way of lounges, it does have a Priority Pass restaurant. With my Chase Sapphire Reserve, I get a $28 credit toward my bill for me and another $28 credit for a guest. This benefit was a major factor in my decision to go with the Chase Sapphire Reserve over other credit cards that include airport lounge access since I can get at least $28 of value from it every time I fly.

Related: Better food and more options: Why I value the Priority Pass' airport restaurant credit over lounge access

If you want to bring guests for no additional cost

If you frequently travel with a partner or family, you'll want to choose a card that includes guest access. While some cards like the Amex Platinum and the Delta SkyMiles Reserve allow you to bring guests for an additional fee, the following cards include complimentary access for the primary cardholder and up to two guests:

- Citi® / AAdvantage Executive World Elite Mastercard (can be either immediate family — spouse, domestic partner and children up to 18 years old — or up to two guests)

- Marriott Bonvoy Brilliant

- Chase Sapphire Reserve

- United Club Infinite Card

- Capital One Venture X (also includes access for authorized users and up to two guests with them; see rates and fees )

- Capital One Venture X Business (see rates and fees )

Related: A guide to guest policies for airport lounges

If you're unsure

If you're new to the airport lounge world, committing to a credit card with a hefty annual fee can feel daunting. If you aren't ready to make the jump, consider one of these options to dip your toes in first.

Go as someone's guest

As outlined above, several credit cards come with lounge access, allowing cardholders to bring guests into a lounge. If you have a friend with this access, try to find a time to visit a lounge as their guest to see how you like it.

Become a Venture X authorized user

One of the most valuable perks of the Capital One Venture X is the ability to add up to four authorized users, each with their own airport lounge access benefit, for no additional cost (see rates and fees ). If you have a friend who has the Venture X, ask them to add you as an authorized user .

Doing so will give you access to Capital One Lounges, as well as Priority Pass Select lounges for no additional cost.

Get a card with a set number of visits

You can get a limited number of lounge visits without paying a premium annual fee. Consider one of these options if you're aiming to keep your annual fee costs down:

- U.S. Bank Altitude Connect : With this card, you'll get four complimentary visits to Priority Pass Select lounges annually for just a $95 annual fee, making it a great way to try out some lounges without committing to a high annual fee.

- American Express® Green Card : The Amex Green has a $150 annual fee (see rates and fees ) and comes with a up to $100 LoungeBuddy credit , which you can use to try out some airport lounges before committing to a card with unlimited access.

- United Explorer Card and United Business Card : With either card, you'll get two one-time United Club passes per year for an annual fee of under $100.

The information for the Amex Green has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Related: 11 credit cards that offer Priority Pass airport lounge access

Pay for a one-time pass

You don't necessarily have to have a membership or access through a credit card to get into a lounge. Most lounges give you the option to pay out of pocket per visit. If there's a lounge you pass often and are considering getting a credit card to access, paying for a visit to see if it's worth it to you can be a great option.

Bottom line

You have some great options when choosing a credit card for airport lounge access. The different types of access can feel overwhelming, but deciding which type of access matters most to you is key to landing on a card that's the perfect fit. No matter which you choose, you'll be well on your way to lounging in style on your next layover.

Related: The best premium credit cards: A side-by-side comparison

For rates and fees of the Amex Platinum, click here . For rates and fees of the Amex Business Platinum, click here . For rates and fees of the Delta SkyMiles Reserve, click here . For rates and fees of the Delta SkyMiles Reserve Business, click here . For rates and fees of the Bonvoy Brilliant, click here . For rates and fees of the Hilton Honors Business, click here. For rates and fees of the Amex Green, click here .

- REGULATORY DISCLOSURES

Citi Prestige

- The Benefits

- The Experience

- At a glance

- Luxury stay

- Exclusive access

Airline Credit Card

Relax into your journey with access to more than 1300+ airport lounges through Priority Pass ™ and your Citi Prestige credit card.

Fly in style for less

Exceptional comfort and impeccable service doesn’t have to cost the world. Make every journey memorable with up to 15% savings on full fare first- or business-class tickets with some of the best international airlines in the world. The finest way to travel just got even better.

Airfare program

Call your Citi Prestige Concierge at 0008008522006 or +44 207 479 3649 (overseas) for details of all participating airlines and reservations.

TERMS & CONDITIONS

Only available at seven participating airlines. Must be booked through the Citi Prestige Concierge. Airline tickets are subject to taxes, fees, fuel surcharges and must be charged to main cardmember.

Airport Lounge Access

Depart for every destination relaxed and refreshed, with access to more than 1300 airport lounges through Priority Pass™ and via your Citi Prestige credit card. Whether you're staying connected with Wi-Fi and workstations, or passing the time with a complimentary drink, savor some moments of tranquility before you fly.

Airport lounge access

For further information, please check the terms and conditions

Airport assistance and limousine service

Enjoy the convenience and efficiency of fast track immigration at major international airports at discounted retail rates.

Avail discounts on retail rates for Luxury Airport Transfer Service.

Meet and Assist and Airport Transfer services

British airways upgrade membership.

With your Citi Prestige Credit Card, get upgraded to the next tier of the British Airways Executive Club membership and receive 5,000 bonus miles. You will enjoy a first class experience no matter which class you fly.

To upgrade your membership and receive your bonus miles, please call your Citi Prestige Concierge at 0008008522006.

Your first flight as a British Airways Executive Club member booked with your Citi Prestige Credit Card entitles you to a membership upgrade. Please register at www.britishairways.com for a British Airways Executive Club membership within the first 12 months of your Citi Prestige membership. On upgrade through Citi Prestige concierge, Membership card will be mailed out within 6-8 weeks after registration. Upgrade to next status will take place up to 15 working days after registration through the Citi Prestige concierge. This membership is valid for the primary cardmember only. Bonus Miles are non transferable.

Etihad Guest Gold membership

Travel in style with the Etihad Guest Gold Membership and 5,000 bonus miles on the Etihad Guest program. Additionally, transfer 20,000 air miles to the Etihad Guest Program and get 6,000 Bonus Miles from Etihad.

Etihad Guest Gold Membership

To upgrade to Gold Membership, please call your Citi Prestige Concierge at 0008008522006.

Valid for primary cardmember only within the first 12 months of Citi Prestige Credit Card booking. To register, visit www.etihadguest.com.

Membership kit will be mailed out within 6-8 weeks after registration. Upgrade to Etihad Guest Gold status will take place up to 15 working days after registration through the Citi Prestige Concierge. For 6,000 bonus miles, the primary cardmember must make a single transfer of 20,000 air miles to the Etihad Guest program within the first 6 months of card booking.

Other air travel benefits

- " tabindex="0" href="javascript:void(0);">OPEN ALL +

Private Jets - JetSetGo

Fly in the height of luxury with savings on private jet bookings with JetSetGo.

To book, call the Citi Prestige Elite Desk at XXXX-XXXX.

Advance booking is required. Cancellation policy applies.

The Citi Prestige Credit Card. Your passport to a world of unforgettable experiences.

OR EXPLORE Luxury stay BENEFITS

Back to Top

Existing Citi Prestige cardmembers to avail the services, can reach the Citi Prestige Concierge desk on 000-800-8522-006 (Domestic Toll-Free Number) or +91-22-4232-0253

View the Citi Prestige Events terms and conditions . View the Citi Prestige Offers terms and conditions .

Terms and conditions apply. View the terms and conditions .

Please click here to view the Most Important Terms & Conditions.

- Follow us on

- TERMS AND CONDITIONS

- KEY POLICIES & COMMITMENTS

Important Information

You are leaving a Citibank Website and going to a third party site. That site may have a privacy policy different from Citibank and may provide less security than this Citibank site. Citibank and its affiliates are not responsible for the products, services, and content on the third party website. Do you want to go to the third party site?

Citi is not responsible for the products, services or facilities provided and/or owned by other companies.

Citi launches Strata Premier Card, a refresh of the Citi Premier

Fortune Recommends™ has partnered with CardRatings for our coverage of credit card products. Fortune Recommends™ and CardRatings may receive a commission from card issuers.

The Citi Premier® Card just got a new look and some extra perks. Citi announced the Citi Strata Premier Card in early May 2024, refreshing the popular mid-tier travel card with more value for cardholders without hiking the annual fee.

Whether you’ve had your eye on applying for the Premier Card or you’re an existing cardholder, here’s what you need to know about the revamp.

The Strata Premier offers more rewards and protections

Before the announcement, the Citi Premier Card offered 10 points per dollar on hotels, car rentals and attractions booked through the Citi Travel portal through June 30, 2024. With the redesigned Strata Premier Card, that rewards rate will become permanent.

The new card also offers 3 points per dollar spent at electric vehicle charging stations.

These bonus categories are offered in addition to the 3 points per dollar cardholders already earn on restaurants, supermarkets, gas stations, air travel and hotels, and 1 point per dollar on all other purchases.

Additionally, the card now offers more travel protection perks, making it a better choice to cover your travel purchases. New and existing cardholders will get the following benefits:

- Trip cancellation and interruption insurance: Provides a reimbursement for certain non-reimbursable expenses charged by a common carrier if your trip is canceled or cut short due to a covered reason.

- Trip delay insurance: Offers reimbursement for certain expenses, such as food and hotel accommodations, if your trip is delayed by a common carrier for a qualifying period of time.

- Lost or damaged luggage insurance: Provides coverage for personal belongings that are lost or damaged by a common carrier.

- MasterRental coverage: Offers collision damage waiver coverage if you get in an accident with a rental car (when you pay with this card and decline the rental company’s coverage at the counter).

The new Strata Premier Card is also retaining the original card’s hotel credit perk, which gives cardholders $100 off a single hotel stay of $500 or more (excluding taxes and fees) when booked through the Citi Travel portal. You can get the benefit once per calendar year.

Apply now and get an increased welcome offer

To celebrate the card relaunch, Citi is offering an elevated welcome bonus for a limited time: 75,000 bonus points when you spend $4,000 in the first three months from account opening.

For context, the card’s standard bonus is 60,000 bonus points when you spend $4,000 in the first three months. In other words, you’ll get $150 more value in the form of travel, cash back or gift cards if you apply before the offer ends.

Keep in mind, too, that you can potentially get even more value from your redemptions by transferring your ThankYou points to one of Citi’s numerous airline and hotel loyalty program partners and booking award travel.

Should you apply for the new Citi Strata Premier Card?

If you already have the Premier Card, you’ll automatically get the Citi Strata Premier Card’s new rewards rates and trip protection benefits. If you want the new card design, however, you’ll need to wait until your current card expires. The $95 annual fee is remaining unchanged with this revamp.

If you’re not a cardholder yet, the new welcome bonus is attractive—though Citi has offered as much as 80,000 bonus points in the past.

If you’re thinking about applying for the new Citi Strata Premier Card, though, it’s important to look at the full picture. Take a look at your spending habits and travel plans to evaluate whether the card’s rewards rates and benefits are the right fit for you.

Also, take some time to shop around and compare the card with other top travel credit cards . Whether you’re looking for a card with no annual fee or one that offers more premium perks, there could be options available that are better suited to your habits and needs.

Those who don’t want to pay an annual fee might prefer a card like the Bilt Mastercard® , which rewards spending on dining, travel, and rent payments. Meanwhile, those seeking a truly premium experience and willing to pay an annual fee in exchange for them might want a card like the The Platinum Card® from American Express with its extensive airport lounge access .

To view rates and fees of the The Platinum Card® from American Express , see this page

Bilt Mastercard®

See Rates and Fees

Special feature

Rewards Rates

- Make at least 5 transactions in a statement period, in order to earn points on rent and qualifying net purchases (purchases minus returns /credits) for that statement period.

- 3X 3X Bilt Points on dining

- 2X 2X Bilt Points on flights, hotels, rental cars, and cruises when booked directly with airlines, hotels, and car rental agencies

- 1X 1X Bilt Points on rent paid through the Bilt App with your card account up to a maximum of 100,000 points each calendar year

- 1X 1X Bilt Points on purchases

- Rewards and benefits terms.

- Uniquely earns points on rent

- Rent Day bonus every first of the month offers double points (excluding rent)

- Robust travel transfer partners

- Cash redemption rate is poor

- No traditional welcome bonus

- Travel perks: Trip Cancellation and Interruption Protection, Trip Delay Reimbursement, Auto Rental Collision Damage Waiver. See this page for details.

- Foreign Transaction Fee: None

The takeaway

The biggest winners with the new Citi Strata Premier are existing cardholders, who don’t need to do anything to enjoy the new rewards rates and travel perks. However, new applicants will appreciate the limited-time welcome offer that accompanies the card relaunch.

If you’re considering the new Strata Premier Card, carefully review the card’s features and research alternatives to ensure you get the very best card for you.

In any case, it’s refreshing (pardon the pun) to see a card revamp that adds value without increasing an annual fee, as that bucks the trend we’ve seen in many recent credit card overhauls.

Please note that card details are accurate as of the publish date, but are subject to change at any time at the discretion of the issuer. Please contact the card issuer to verify rates, fees, and benefits before applying.

Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefits guide for more details. Underwritten by Amex Assurance Company.

EDITORIAL DISCLOSURE : The advice, opinions, or rankings contained in this article are solely those of the Fortune Recommends ™ editorial team. This content has not been reviewed or endorsed by any of our affiliate partners or other third parties.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

The Guide to Chase Sapphire Preferred Lounge Access

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

The Chase Sapphire Preferred® Card is a midlevel travel credit card with some solid benefits and points-earning potential, along with a $95 annual fee.

But does the Chase Sapphire Preferred® Card get you into airport lounges? The short answer is no.

The Chase Sapphire Preferred® Card does not include any type of Priority Pass membership or regular entrance into Chase Sapphire Lounges or other airline-specific clubs.

If you want to stay within the Chase family of cards and you’re looking for lounge access, you’ll need the Chase Sapphire Reserve® card instead.

But don’t write off getting the Chase Sapphire Preferred® Card . It still has some good benefits.

Chase Sapphire Preferred® Card includes one complimentary lounge visit, with strings attached

Chase Sapphire Preferred® Card holders are allowed one complimentary access to the Chase Sapphire Lounge by The Club annually, if they have a Priority Pass membership that they’ve purchased separately.

Priority Pass members can then buy additional passes to the Chase Sapphire Lounge by The Club for $75 a pop, if they are available.

Otherwise, the Chase Sapphire Preferred® Card does not inherently include airport lounge access.

What to do instead

Purchase lounge membership.

Cardholders can pay out-of-pocket for a membership to a qualifying airline lounge program, including:

Priority Pass for $99-$469 annually, depending on your membership tier.

Delta Sky Club for $695 or 69,500 miles per year.

American Airlines’ Admirals Club individual annual memberships cost between $750-$850, depending on your elite status level.

United Club for $550-$650, or 75,000 miles to 85,000 miles. Prices are also dependent on your elite status level. Membership is included for United Club℠ Infinite Card holders.

Cardholders can also buy day passes at eligible lounges.

Purchasing Priority Pass or an airline-branded lounge membership does not qualify as a travel category expense on the Chase Sapphire Preferred® Card , so you will not earn 2x points.

Upgrade your card to the Chase Sapphire Reserve®

If you want included lounge access in the Sapphire family of cards, you’ll need to upgrade to the Chase Sapphire Reserve® card .

» See how these two cards compare

Because the Chase Sapphire Reserve® is a premium card, the annual fee is higher at $550 (and $75 for each authorized user), but many additional benefits help offset the cost.

First, there is the $300 annual travel credit that reimburses you for travel purchases.

Then there are the increased points bonuses in certain spending categories:

5x points on flights purchased through the Chase's travel portal .

10x points on hotels and car rentals purchased through Chase's portal.

3x points on dining.

A 50% increased value when redeeming points through the portal.

Lounge access is included as part of the Priority Pass Select membership; Chase Sapphire Lounges are included as well. Currently, there are lounges in Boston, Hong Kong and at New York’s LaGuardia and John F. Kennedy International airports. More clubs are on the way.

» Learn more: How Chase Sapphire Reserve lounge access works

The card also includes:

$100 in Global Entry or TSA PreCheck or Nexus fee every four years.

Two-year Lyft Pink All Access membership.

A DoorDash subscription.

One year of complimentary Instacart+.

» Learn more: The best airline credit cards right now

An overview of the Chase Sapphire Preferred® Card

The annual fee for the Chase Sapphire Preferred® Card is $95 with no additional fee for authorized users.

Spending on the card earns Chase Ultimate Rewards® points, flexible points you can redeem for travel or other things like cash back or purchases.

The Chase Sapphire Preferred® Card earns 1 point per dollar on most purchases, but there are ways to earn additional points.

2x points on travel purchases or 5x points on purchases made through Chase's travel portal.

3x points on online grocery shopping.

3x points on select streaming services.

You can then use those points in several ways, including transferring them to partners or redeeming them through Chase's travel portal.

For redemptions in Chase's portal, Chase Sapphire Preferred® Card holders get 25% more value per point than they would if they didn’t have the card.

The Chase Sapphire Preferred® Card also includes several travel insurance benefits:

Trip cancellation and interruption insurance.

Baggage delay insurance.

Trip delay reimbursement.

Primary car rental collision damage waiver.

Services for travel and emergency assistance.

» Learn more: Chase Ultimate Rewards®: How the program works