- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

6 Things to Know About United TravelBank

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Whether you're saving up for a special occasion — like a honeymoon — or just an upcoming getaway, many travelers opt to save future travel funds in a dedicated bank account. For United Airlines loyalists, this process can be even simpler.

United MileagePlus account members can access a budgeting tool called United TravelBank. Let's dive into the things you'll want to know about the service, how to use it and if it's worth "saving" money in this account at all.

What is United TravelBank? How does it work?

United's TravelBank is pretty much what it sounds like — an online account designed for accumulating travel funds for future United flights. It aims to simplify United MileagePlus members’ budgeting for future personal and/or business flights.

Once the account is set up and has money in it, it syncs with both united.com or the United mobile app as a payment option.

» Learn more: How to use the United MileagePlus X app to earn miles

What to know about United TravelBank

1. you can purchase united travelbank credits for your account.

United gives MileagePlus members the opportunity to buy deposits for their own TravelBank account. However, you can only purchase TravelBank credits in one of six amounts:

If you want to deposit a different amount, you can do so across multiple transactions. Say you want to deposit $150. Just purchase $50 in funds and then make another purchase of $100.

The only limitation is that you can't exceed $5,000 per day per MileagePlus account, meaning that you can do at least five purchases per day.

2. United TravelBank credits are valid for five years

Does United TravelBank expire? Yes. Purchased funds are valid for five years from the date the funds are deposited into your TravelBank account. That gives you plenty of time to use the funds.

That's a much longer validity than other types of airline travel credits. For instance, when purchasing airfare on United, you generally only have 12 months from the date of purchase to use those funds for a flight. So, if you really aren't sure that you'll be able to travel in the next year, you can use the United TravelBank to stash money away for future airfare purchases.

Even with the generous expiration policy, we recommend using up your full TravelBank balance whenever possible to avoid leaving money on the table.

3. You can get United TravelBank credits by holding an IHG card

One of the unexpected ways to get United TravelBank credits is through select IHG credit cards. IHG One Rewards Premier Credit Card and IHG One Rewards Premier Business Credit Card customers can enroll to get up to $50 in TravelBank Cash each calendar year. Cardholders get one deposit of $25 in early January of each year and another $25 deposit in early July.

However, these funds work differently from purchased TravelBank funds. Instead of having five years of validity, you only have a little over six months to use these funds before they expire. The $25 deposited in early January expires on July 15 of the same calendar year, and the $25 funded in July will expire on Jan. 15 of the next year.

During the two-week crossover period, you could have up to $50 in active TravelBank funds from this IHG credit card benefit. That's probably not going to be enough to cover an entire flight, but at least it can save you some out-of-pocket cost on your next United flight.

Eligible cardholders can go to ihg.com/united to register to start receiving this new card benefit. You'll need to log into your IHG One Rewards account and then provide your United MileagePlus number and last name to complete registration. The terms and conditions note that it may take up to two weeks after registration before you receive your first $25 TravelBank deposit.

on Chase's website

4. It’s possible to use credit card travel credits to fund your United TravelBank

United TravelBank purchases often code as travel expenses on your credit card bill. That means you can earn bonus points when using credit cards with a travel bonus category. And you might even be able to use credit card travel credits — such as the Chase Sapphire Reserve® $300 annual travel credit , the Citi Prestige® Card $250 air travel credit or certain other credit card incidental fee credits.

» Learn more: The best airline credit cards right now

5. You can't use United TravelBank funds for other travel purchases

A major downside of the United TravelBank is that funds can only be used to book United-operated or United Express-operated flights, plus certain subscription products.

Travelers living near an airport with a strong United presence may not mind being limited to flying United. However, if Delta Air Lines, Alaska Airlines or American Airlines offers a much cheaper airfare, you won't be able to use your United TravelBank funds to purchase those flights.

Likewise, United TravelBank funds can't be used for hotels or car rental purchases.

» Learn more: United vs. Delta — Which is best?

6. The United TravelBank doesn't earn interest

Another downside of saving funds through the United TravelBank is that you won't earn interest on the saved funds. Over the past few years, interest rates have been so low that you wouldn't have missed out on much interest income by placing funds in the United TravelBank instead.

However, now that interest rates are increasing , you might be able to grow your travel funds faster by saving funds in an actual savings account rather than the United TravelBank.

» Learn more: Compare savings account rates in your ZIP code

How to use United TravelBank

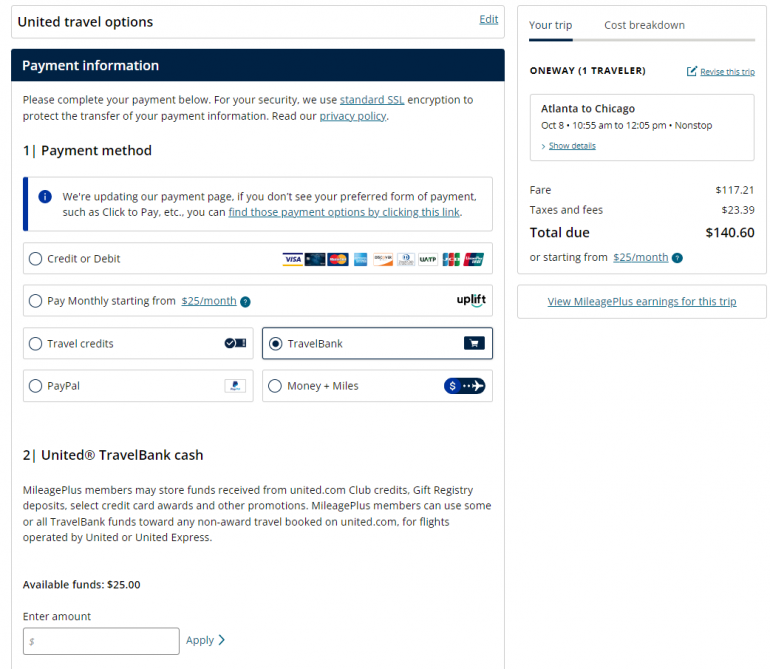

Once you’ve added money to the TravelBank account, you can select TravelBank cash as a payment option when logged into united.com or the United app.

When you're ready to use your travel funds, just log into your United MileagePlus account and search for a paid flight. On the checkout page, select the TravelBank payment option. Then, you can then enter precisely how much of your funds you want to apply to this booking.

Note that you can only use TravelBank funds for flights priced in U.S. dollars. And unfortunately, you can't use TravelBank funds to pay taxes and fees on a MileagePlus award ticket. For cash bookings, TravelBank monies can be used to cover the ticket price, taxes and surcharges.

Even if you have enough funds to cover the entire purchase, you may want to charge part of your flight booking to a credit card that provides travel insurance .

TravelBank cash can be used alone or in combination with other accepted forms of payment, such as Apple Pay, Visa Checkout or PayPal.

Is United TravelBank worth it?

The United TravelBank provides travelers with another way of stashing away funds for future travel. MileagePlus members can fund as little as $50 at a time, up to $5,000 per day. Your funds are valid for five years from the date of deposit, giving you plenty of time to use them.

However, funding the United TravelBank locks you into booking paid flights through United, decreasing the flexibility of your money. You can't even use TravelBank to pay for taxes and fees on award travel. So, you may only want to deposit funds in the TravelBank if you're sure that you will be paying for a United flight in the near future.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

1x-2x Earn 2 miles per $1 spent on dining, hotel stays and United® purchases. 1 mile per $1 spent on all other purchases

50,000 Earn 50,000 bonus miles after you spend $3,000 on purchases in the first 3 months your account is open.

1x-2x Earn 2 miles per $1 spent on United® purchases, dining, at gas stations, office supply stores and on local transit and commuting. Earn 1 mile per $1 spent on all other purchases.

75000 Earn 75,000 bonus miles after you spend $5,000 on purchases in the first 3 months your account is open.

1x-3x Earn 3x miles on United® purchases, 2x miles on dining, select streaming services & all other travel, 1x on all other purchases

60,000 Earn 60,000 bonus miles and 500 Premier qualifying points after you spend $4,000 on purchases in the first 3 months your account is open.

- United States

- United Kingdom

Use it or lose it: The Virgin Australia credits expiring in December

I'm about to lose $296 in Virgin Australia flight credit – are you at risk too?

Virgin Australia Future Flight credits expire on 31 December 2023.

This type of credit was issued for bookings made on or before 20 April 2020 and then cancelled.

What's important about this date is that it was just before Virgin Australia went into voluntary administration.

That process means the funds are treated differently to flight credits issued after 20 April 2020.

And because of that, anyone with Future Flight credits now has around 2 weeks to use them.

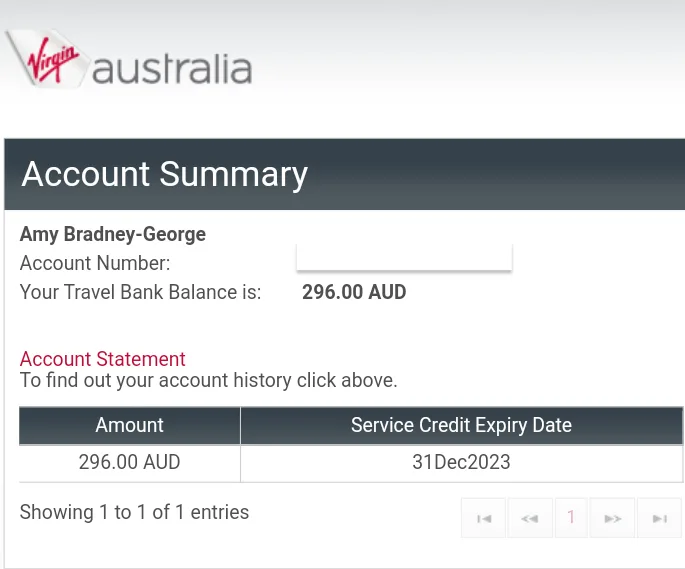

My Virgin Australia Travel Bank account summary, with $296 of Future Flight Credit due to expire at the end of the year. Image: Finder (Amy Bradney-George)

How I tried (and failed) to use this travel credit

I had 2 Virgin Australia Travel Bank accounts set up, and managed to successfully use the funds in one of them.

But then Virgin Australia stopped flying to my nearest airport (Coffs Harbour).

It also extended the expiry date for Future Flight credits, so using them became a problem I planned to deal with "in the future".

When I got an email reminding me about the definite expiry on 31 December, I considered a few ways to use them, including:

- Asking for a refund (I also tried this in 2020)

- Asking friends and family if they could use them for upcoming trips

- Booking a flight from a different airport

- Booking a flight and then cancelling it

The last two options seemed to be my best bet – and I got close to booking flights from Sydney to Perth to visit friends next year.

Then I realised the 31 December 2023 deadline was for both the booking and the actual flight.

So I started looking at flexible flights that I could book and then cancel.

I was hoping to get a credit with a later expiry date.

But when I checked the Future Flight credit terms and conditions, I discovered cancelling would only get me a new "Future Flight credit".

And this particular type of credit would still expire on 31 December 2023.

So now I'm resigned to that fact that the $296 in credit is going to expire.

Getting myself to Sydney or another airport to make use of them would cost more than they're worth.

How to check when your Virgin Australia flight credit expired

Virgin Australia has 2 types of flight credit:

- Future Flight credit: For bookings made on or before 20 April 2020. These expire at the end of this year.

- Standard credit: For bookings made on or after 21 April 2020. These credits expire on 30 June 2025.

You can view details about your flight credit by logging in to your Virgin Australia Travel Bank account.

These accounts are set up when credit is issued, with login information sent by email.

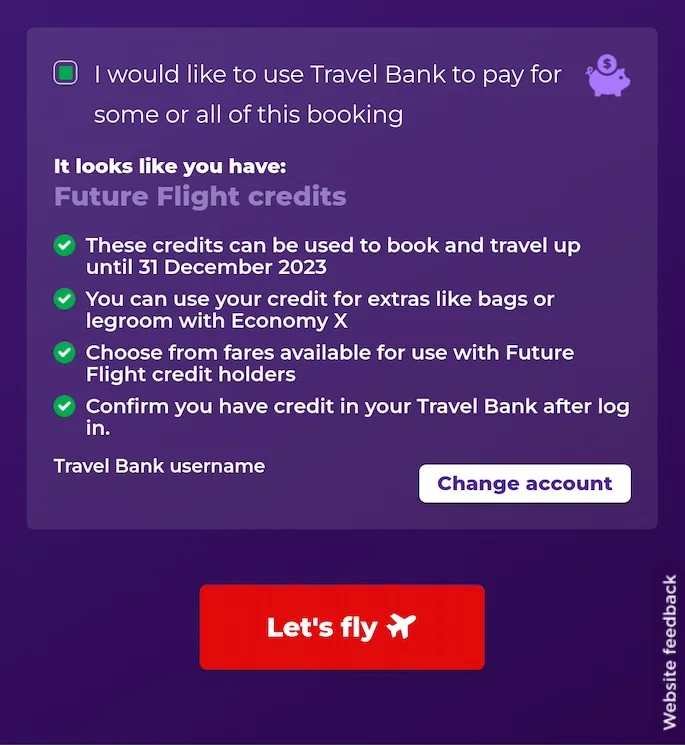

You can also enter your Travel Bank username on Virgin Australia's booking page to check the type of credit and (hopefully) use it.

You can view and redeem your travel credit by entering your Travel Bank username on the Virgin Australia booking page. Image: Finder (Amy Bradney-George)

In October, the ABC reported that Virgin Australia had $270 million in Future Flight Credits.

So if you have any credits, make sure you check the expiry to avoid losing them at the end of the year.

Planning your next trip? Check out our frequent flyer tips for ways to earn points and use them for flights instead of cash.

Ask a Question

Click here to cancel reply.

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

Latest headlines

- Losing sleep, hair and their cool: 10 million Aussies suffer unexpected consequences from high cost of living

- 2024 Polestar 2 Long Range Single Motor Review

- Scratched, cracked and bald: 1 in 4 drivers delaying car service due to financial trouble

- 4 ways you can leverage a globally distributed team

- Consumer report: Economic factors that could influence your decision to buy

Get exclusive money-saving offers and guides

Straight to your inbox

How likely would you be to recommend finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Important information about this website

Advertiser disclosure.

finder.com.au is one of Australia's leading comparison websites. We are committed to our readers and stands by our editorial principles

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labeling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

How we make money

We make money by featuring products on our site. Compensation received from the providers featured on our site can influence which products we write about as well as where and how products appear on our page, but the order or placement of these products does not influence our assessment or opinions of them, nor is it an endorsement or recommendation for them.

Products marked as 'Top Pick', 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money .

Sorting and Ranking Products

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

Terms of Service and Privacy Policy

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

- Travel Advice

Virgin Australia extends Covid flight credit expiry date

Virgin Australia has, for the third time, made a huge change to those who have Covid flight credits that is due to expire in a few months.

Jetstar drops epic sale for $29 to hotspot

Hostie exposes passenger’s ‘heinous’ act

Huge blow for passengers of bust airline

Virgin Australia passengers have won in their battle to have Covid flight credits extended.

The $120 million worth of Covid-related travel credits, which apply to bookings for flights departing before 31 July 2022, were due to expire in December.

Gold Coast man David Nelson told A Current Affair he has just shy of $2000 worth of credit.

“There is no budging on it and everyone like me in this boat is probably getting the same answer – use it or lose it,” Mr Nelson said. “Give it back or extend the credits.”

However, following pressure from the Australian Competition and Consumer Commission (ACCC), Virgin has now extended the expiry date to June 2025.

“Virgin Australia has extended its ‘Covid Credits’ for the third time, giving our customers nearly two more years to use these credits,” a Virgin spokesperson told news.com.au.

“Customers will now be able to use their ‘Covid Credits’ to book and fly by 30 June 2025.

“Covid Credits’ are Standard Credits issued on or before 31 July 2022, for bookings made from 21 April 2020 through 31 July 2022.

“During this period, over $1.2 billion of ‘Covid Credits’ were issued.”

The spokesperson said 90 per cent of those credits have already been used by customers, with approximately $120 million remaining.

News.com.au understands the decision to extend Covid credits was made on Friday last week and at that time the airline started communicating this information directly with customers by email, on its website and through the airline’s trade partners.

While the extension will be automatically applied to all ‘Covid Credits’, the airline advised new expiry date may take up to eight weeks to appear in guests’ Travel Banks.

Those credits can be used to book travel on any Virgin Australia flight, including international codeshare flights with partners such as ANA, Singapore Airlines, United Airlines and Qatar Airways which carry a VA flight number.

There’s no minimum spend, and the credits are not limited to travellers named on the original booking – although there’s no option to have the credits refunded.

Meanwhile, it’s important to note these are different to the Future Flight Credits issued for flights cancelled when the airline was in administration in 2020.

It has an estimated $290 million in unredeemed Future Flight credits, which are still set to expire at the end of this year.

Prior to Virgin agreeing to an extension, an ACCC spokesperson told The Australian the watchdog encourages the airline to extend its expiry dates for all Covid flight credits “to ensure consumers are able to effectively use these credits”.

“This included providing a guidance for the travel industry recommending that businesses should allow consumers a reasonable period in which to use Covid-related credits,” the spokeswoman said.

The ACCC acknowledged that travel credits issued to customers before Virgin Australia entered administration in April 2020 were a special case.

“In such administration processes, the new business is generally able to choose what liabilities of the old business it will or won’t take on,” the spokeswoman said earlier this month.

“As part of the sale to Bain Capital, it agreed to continue to honour existing Virgin credit notes and the administration process included a federal court decision that endorsed the approach taken to Virgin credits that were outstanding at the time of the administration.”

The ACCC accepted these would expire on December 31, if customers were unable to use them, the publication reported.

Qantas also recently succumbed to pressure from the ACCC to do the same thing with its $570 million worth of Covid travel credits.

In late August, former Qantas boss Alan Joyce announced the airline will scrap its December 31 expiry date giving travellers more time to redeem the money on flights or seek a refund.

“Today we’re scrapping the expiry dates on all travel credits that came out of Covid,” Mr Joyce said in a video at the time.

“If you have a Qantas Covid credit, you can request a cash refund at any point in the future.

More Coverage

“And if you have a Jetstar Covid voucher, you can use it for travel indefinitely.”

Mr Joyce said the company had “listened” to furious customers, admitting the credit system “was not as smooth as it should have been”.

Separately, the consumer watchdog also launched Federal Court action against Qantas, alleging the airline advertised tickets for 8000 flights that had already been cancelled.

Jetstar’s huge return for free sale is about to end but the budget airline has just dropped another massive sale with prices starting from $29.

A flight attendant has shared the “most heinous, evil, diabolical” things passengers do on planes.

Passengers who were left stranded across multiple Aussie airports on Tuesday have been served another blow by Bonza’s administrator.

Guide to Virgin Red

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

- • Personal finance

- • Budgeting

- • Rewards credit cards

- • Travel credit cards

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money . The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

At Bankrate, we have a mission to demystify the credit cards industry — regardless or where you are in your journey — and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you're well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU — the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Key takeaways

- Virgin Red allows you to earn points redeemable for flights, hotel stays, cruises, gift cards and unique travel experiences.

- Virgin Red is not a replacement for Virgin Flying Club.

- Members can link their Virgin Red and Flying Club accounts together to pool points.

- New Flying Club members are automatically enrolled in Virgin Red.

Frequent flyers know the value of airline rewards programs . Most, if not all, airline carriers offer a loyalty program where members can earn and redeem rewards for flights, airline upgrades and various redemptions.

For fans of Virgin, there are now two rewards programs you can earn rewards through. Virgin Red is the newest loyalty rewards program from the Virgin Group. The program was launched in the UK in 2021 and in the U.S. later that year. Virgin Atlantic already has a frequent flyer program called Flying Club . Virgin Red is not the replacement for Flying Club. Instead, the two programs pair together for more rewards-earning potential.

In this guide, we’ll dive into the Virgin Red program, how to earn and redeem points and how to link your account with your Flying Club account to pool your points.

What is Virgin Red?

In February 2021, the Virgin Group announced the arrival of Virgin Red in the UK, a new rewards club that earns points redeemable to spend on hundreds of rewards across the Virgin Group and beyond. The loyalty program was later launched in the U.S. in November 2021. The American version is not an exact copy of the UK program, though — it’s structured with American members in mind.

The Virgin Group launched Virgin Red not to replace Flying Club but to complement the popular airline loyalty program. In fact, Virgin Red gives members hundreds of other ways to earn and spend Virgin Points, which aren’t just related to travel. Members can link their Virgin Red and Flying Club accounts to pool points to use with either platform.

How to earn Virgin Points

Virgin Red members can earn Virgin Points, the universal currency used by Virgin brands going forward, in several ways. The number of points you can earn varies depending on the offer.

- Online shopping : Virgin Red members can earn points shopping through select retail partners.

- Travel : You can earn points by booking stays at Virgin Hotels, flights with Virgin Atlantic, Delta , Air France/KLM and travel booked through Booking.com and other Virgin Red travel partners.

- Unique experiences : Virgin offers distinctive experiences that can earn Virgin Points. For example, you currently can earn 55,000 points by booking a seven-night stay at Necker Island, Sir Richard Branson’s 74-acre private island in the Caribbean.

- Transfer partners : Both Virgin Red and Flying Club are transfer partners for many popular rewards programs, including Chase Ultimate Rewards , American Express Membership Rewards , Citi ThankYou Rewards and Bilt Rewards. All four programs allow you to transfer points to your Flying Club account at a 1:1 ratio.

- Credit cards : Virgin Atlantic offers a co-branded airline credit card that earns Virgin Points — the Virgin Atlantic World Elite Mastercard® *. The card earns 3X points per dollar on Virgin Atlantic purchases and 1.5 points per dollar on all other purchases for a $90 annual fee.

How to redeem Virgin Red rewards

Virgin Red offers various ways to redeem points, including some noteworthy options you won’t find anywhere else. Point values vary depending on the redemption. Virgin Points don’t expire either, so you can bank your points as long as you want if you have larger redemptions in mind.

You can redeem Virgin Points for award flights through Virgin Atlantic. Redemptions start at 18,000 for Economy Classic reward seats and go up based on when and where you travel — you only pay for any taxes and fees imposed. There are also options to use points and money toward flights or redeem your points for seat or cabin upgrades on eligible flights. Virgin Atlantic is part of the SkyTeam Airline Alliance, so you can redeem points for flights on SkyTeam partner airlines. The full list of SkyTeam airlines includes:

SkyTeam airlines

- Aerolineas Argentinas

- China Airlines

- China Eastern

- Czech Airlines

- Delta Air Lines

- Garuda Indonesia

- ITA Airways

- Kenya Airways

- Middle East Airlines

- Saudia (Saudi Arabian Airlines)

- Vietnam Airlines

- Virgin Airlines

- Xiamen Airlines

SkyTeam airlines aren’t the only airline partners of Virgin Atlantic. You can earn and redeem Virgin Points for flights with the following airline partners:

Additional airline partners

- Air New Zealand

- All Nippon Airways (ANA)

- Hawaiian Airlines

- LATAM Airlines

- SAS Scandinavian Airlines

- Singapore Airlines

- South African Airways

- Virgin Australia

There are plenty of redemption options outside of flights available through both Virgin rewards programs. Virgin Red and Flying Club members can also redeem their points for:

Other redemption options

- Virgin Atlantic Holidays

- Virgin hotel stays

- Stays at Virgin partner hotels (Marriott Bonvoy, IHG One Rewards, Hilton Honors and Kaligo)

- Transfer points to another Flying Club member

- Donate points to charity and causes

- Entertainment and experiences

- Virtual culinary masterclasses

- Live events

Not only can you earn Virgin Points for a stay on Sir Richard Branson’s private island, as mentioned earlier, but you can also redeem points for an exclusive private island getaway at Necker Island. As you might expect, you’ll need to save a significant points balance and pay cash to cover this one-of-a-kind redemption. A minimum four-night stay at Necker Island costs 540,000 points plus $5,400, which includes one free night. Each additional night runs 180,000 points plus $1,800. This redemption is only available during select Celebration weeks throughout the year. A lot of fine print is included with a redemption of this nature. Read through the offer guidelines and restrictions carefully before booking a stay at this island retreat.

Getting started with Virgin Red

Anyone over the age 18 can sign up for Virgin Red for free online or through the app. You don’t need to be an existing Virgin customer to set up an account. New Virgin Atlantic Flying Club members are automatically enrolled in Virgin Red.

One of the most unique features of Virgin Red is that it pairs with the existing Virgin Atlantic frequent flyer program, Flying Club. To link your account, navigate to the “Link accounts” section of your Virgin Red account and enter your Flying Club account number. Once linked, members can view and redeem Virgin points through either program platform.

Frequently asked questions

Do i need to spend with virgin to use virgin red, how do i link my virgin atlantic flying club account, the bottom line.

Virgin Red is a valuable rewards program that builds on the brand’s existing Flying Club program. The ability to earn points through two programs and pool your points together is unique, although many airline and credit card loyalty programs allow you to earn points beyond booking travel through their brands.

Still, signing up is a no-brainer if you fly on Virgin Atlantic or regularly shop online with any of its retail or travel partners. The program is free, and rewards never expire. Virgin Red is also an excellent option for travelers who want to redeem rewards for one-of-a-kind travel experiences.

*The information about the Virgin Atlantic World Elite Mastercard® has been collected independently by Bankrate.com. The card details have not been reviewed or approved by the card issuer.

Related Articles

A guide to earning and redeeming frequent flyer miles

Guide to JetBlue TrueBlue

Want an Amex Platinum without the $695 annual fee?

Guide to Virgin Atlantic Flying Club

Happy Hour sale extended!

Extended today until 11pm AEST Thursday*

Ends 11pm AEST tonight. Travel periods and conditions apply.

Transfer to take off sooner with 15% bonus Velocity Points*

Manually transfer your credit card reward points from participating partners to Velocity this May and June - transfer in both months and earn 15% bonus Points*

*Minimum points transfer, exclusions and T&Cs apply.

Earn 12 Points per $1 spent when you book an eligible hotel with Rocket Travel*

Earn 4x Points when you book an eligible hotel stay with Rocket Travel. Hurry, offer ends 5 May 2024 for stays until 30 September 2024.

*Terms and conditions apply

- Transfer credit card points 2 months in a row for a 15% bonus

- Earn 12 Points per $1 spent with Rocket Travel

Special Offers

Points to Paradise fast Enjoy the latest Velocity member offers

Dreaming of a Balinese escape? Indulge in paradise with these incredible hotel and resort packages from Luxury Escapes.*

Plus, you can now earn 1 Velocity Point per $1 of eligible spend when you ride with DiDi*. And that’s on every ride – for a night out, a work meeting or a trip to the airport.

When you apply online for the American Express Velocity Platinum Card by 15 May 2024, are approved, and spend $3,000 on eligible purchases on your new Card within the first 3 months. New Card Members only^. T&Cs apply.

Apply, be approved and spend $5,000 on eligible purchases in the first two months from Card approval date. Plus join Virgin Australia Business Flyer to receive additional benefits. *^T&Cs apply.

Purchase any Cover-More policy through Virgin Australia by 31 May 2024 and earn 6 Velocity Points per $1 spent.*

Velocity Frequent Flyer, the loyalty program of Virgin Australia Velocity means fast

As the frequent flyer program of Virgin Australia, we make it wonderfully easy for our members to get to their dream reward sooner.

Redeem your Velocity Points on flights, flight upgrades, car hire, hotels, products, gift cards - even wine. The choice is yours.

With over 70 program partners and over 200 e-Store partners, earning Points on the things you do every day has never been easier.

Earn and Redeem points on wonderful travel experiences with Virgin Australia and Velocity's network of airline partners.

Velocity Frequent Flyer Partners

Earn and Redeem Points on Flights, Credit Cards, Car Hire, Hotels and more. Select a logo to find out more.

Never miss a Point with Velocity Shop & Earn

Our brand new Shop & Earn Google Chrome extension tells you when you can earn Points while you're browsing online at your favourite stores. Terms & conditions apply.

Compare Velocity Points earning credit cards

Velocity Points on your everyday spend are automatically loaded into your Velocity account each month, getting you to your next Points Redemption fast.

Download the Velocity app

Join Velocity, check your account activity on the go, Earn and Redeem Points or set your next dream destination goal all in the Velocity app.

Questions? We've got answers.

Velocity Frequent Flyer, is the Frequent Flyer program of Virgin Australia. Membership is free and you can start earning Points and Status Credits from the moment you join. You can then Redeem Points with Velocity partners and when you fly with Virgin Australia.

With over 70 program partners and over 200 e-Store partners, earning Points on the things you do every day has never been easier. View all the ways to earn Points with Velocity

Redeem your Velocity Points on flights, flight upgrades, car hire, hotels, products, gift cards - even wine. The choice is yours. The best value of redemptions are with Virgin Australia flights. View all the ways to redeem and use your Points

Yes, you get more from being part of a family with Velocity and Virgin Australia. With things like Family Pooling, Points Transfer and Parental Pause, whether you're a solo traveler or a traveling family, we've got you covered! Find out more information on our family perks

Visit our member support page to find out all the ways to get in contact with Velocity. We have options for you to self serve, or if you need to call we've got that covered too.

Online chat is available to members who are logged in using the 'Live chat' button.

Points expire 24 months after the last date you earned or redeemed Points, transferred Points to or from your Singapore Airlines Krisflyer account, or bought Points using Points Booster. You can read more about this in our membership terms and conditions

Simply click the Log in button at the top of the Velocity or Virgin Australia website. If you're having issues remembering your Velocity number or password you can get help here.

You can transfer Points from your account to the account of an eligible family member, who is also a Velocity frequent flyer member of Velocity, up to four times per membership year. Each transfer must be for between 5,000 and 125,000 Points. You'll need to log in to complete transfers. Transfer now

Yes, you can set up a Family Points Pool to accrue Velocity Points and Status Credits when you travel. Sign up the whole household - that's two family members over 18 and up to four under 18 who all live at the same address. Set up now

Yes you can. You can compare all of our Velocity Points earning credit cards via our website. Points earned via a Frequent Flyer credit card are automatically applied to your account each month.

You can also transfer your existing reward points from an eligible credit card or charge card from our partner network.

*Membership T&Cs apply.

Our Travel Support is available 24/7

Our Travel Concierge is available 24 hours a day, 7 days a week to serve you with your travel needs including changes and cancellations to travel booked through TravelBank. You can get in touch with our team via email, in-app chat, or via telephone at 866-682-8785.

They can also assist you with travel discounts and exclusive travel inventory. Get in contact with our Customer Success team to learn more.

Best Banks for International Travelers for May 2024

Find a Qualified Financial Advisor

Finding a financial advisor doesn't have to be hard. SmartAsset's free tool matches you with up to three fiduciary financial advisors that serve your area in minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. Start your search now.

The offers and details on this page may have updated or changed since the time of publication. See our article on Business Insider for current information.

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate banking products to write unbiased product reviews.

If you're an avid traveler at heart, then your bank account should help make your experiences abroad easier. Depending on what you need more help with — planning or on-site spending — we've found options for you.

Best Bank Accounts for International Travel Benefits

- Ally Savings Account

Bask Bank Mileage Savings Account

- Capital One 360 Checking

Schwab Bank High Yield Investor Checking® Account

- SoFi Checking and Savings

Revolut Account

We picked the top savings, checking, and all-in-one accounts for travel, to help you save or manage your money.

Compare the Top Bank Accounts for International Travel

The top bank accounts for international travel help make planning and spending for trips easier. We looked for the accounts that can help you save for travel and top checking accounts that allow you to access your money with ease when you're on the road and overseas.

Below, you'll see our top picks for international travel. All of the financial institutions on our list are protected by FDIC or NCUA insurance. Money is safe at a federally insured financial institution. When an institution is federally insured, up to $250,000 per depositor is secure in a bank account.

Best Savings Accounts for International Travel: Ally Savings Account

The Ally High Yield Savings Account provides easy tools to set savings goals for your next trip, and you'll earn interest without having to take on any risk.

You can also set up a checking account through Ally . When you need access to your savings, just transfer money from the savings account to the checking account through the online portal, and you'll be able to spend the money almost instantly.

Ally also offers an easy-to-use mobile app and 24/7 customer support, making it simple to access your account while you're on the road.

You won't be able to deposit cash directly into your bank account. Instead, you'll have to transfer money from another bank account.

Ally Savings Account Review

You might find the Bask Bank Mileage Savings Account appealing if you are a frequent American Airlines flyer. This savings account lets you earn earn 2.5 American Airlines AAdvantage miles for every $1 saved annually on a Bask Bank Mileage Savings Account. You can redeem miles for booking flights or hotels, upgrading flights, renting transportation, or planning vacation activities.

Bask Bank is also offering a savings account bonus for new customers: earn up to 10,000 bonus AAdvantage® miles for new Bask Mileage Savings Account customers who open and fund their account within 15 business days from account opening and maintain a minimum daily balance of $50,000 for 90 consecutive days out of the first 120 days (open account by May 31, 2024)

AAdvantage miles earned through the Bask Bank Mileage Savings Account will not go toward boosting your AAdvantage status.

Bask Bank also doesn't have a checking account, ATM cards, or debit cards, so you'll have limited access to your account. You'll need to link an external bank account and initiate a bank transfer to deposit or withdraw money.

Bask Bank Review

Best Checking Accounts for International Travel: Capital One 360 Checking

Capital One 360 Checking might be a solid choice if you're most comfortable with a well-known retail bank and want no-fee cash withdrawals at home and in select countries abroad.

You can withdraw up to $1,000 a day at any ATM worldwide using your MasterCard and Capital One won't charge a fee, though the ATM operator may. The bank ranks No. 1 on J.D. Power's US National Banking Satisfaction Study , and it made Business Insider's list of the best checking accounts.

Capital One also offers a solid high-yield savings account, which is a good choice if you want to keep your savings at the same bank as your checking.

If you travel to Europe, Asia, or any other place where Capital One and AllPoint don't have ATMs, you may have to pay third-party ATM operator fees to take cash out (Capital One will never charge you an additional fee).

As for branch access, the bank only operates about 280 branches in seven US states, though Capital One Cafés are in some big cities around the US.

Capital One 360 Review

Charles Schwab is an investment platform, but it also has banking products. The Schwab Bank High Yield Investor Checking® Account is a great choice if you'd like a fee-free international spending bank account. It notably offers unlimited refunds for ATM fees worldwide, and it doesn't charge foreign transaction fees.

You must open a brokerage account with Charles Schwab before opening a checking account, though.

Charles Schwab Bank Review

Best All-in-One Accounts for International Travel: SoFi Checking and Savings

SoFi Checking and Savings offers the best of both worlds. It's a hybrid savings/checking account with a competitive interest rate and a MasterCard debit card for easy access to your cash.

SoFi is part of the Allpoint ATM network, so you have free access to 50,000 ATMs worldwide, and SoFi doesn't charge a foreign transaction fee when you make a purchase with your debit card abroad.

Again, SoFi is completely online — you'll need to call customer service when you want help with your account rather than walking into a physical location.

While SoFi doesn't charge any foreign transaction fees when you withdraw cash at an international bank or ATM, MasterCard will charge 0.20%, and SoFi won't reimburse you.

SoFi Checking and Savings Review

You might like the Revolut Account if you're looking for an alternative to traditional banking.

Revolut is a British fintech company with an international finance and investing app. You can open accounts from anywhere in the US.

The Revolut Account is a prepaid debit card linked to a bank account. You can easily spend money internationally in over 150 types of currency. The account also allows you to make one fee-free international or domestic wire transfer per month with the Standard plan, three with the Premium plan, and five with the Metal plan.

The account also has budgeting features that let you round up prepaid debit card purchases or set up individual savings goals through Vaults. The Revolut Account and Savings Vault are FDIC-insured by Metropolitan Commercial Bank and Sutton Bank.

Revolut has three plans: Standard (Free), Premium ($9.99 per month), or Metal ($16.99 per month). Access to certain app features will depend on your monthly plan.

Revolut Review

Bank Account Alternatives for Travelers

- Chase Total Checking® : This account appeared on our best checking accounts list, but it charges $3 fee per withdrawal at a non-Chase ATM in the U.S., Puerto Rico and the U.S. Virgin Islands. Surcharge Fees from the ATM owner/network still apply. $5 fee per withdrawal at a non-Chase ATM outside of the U.S., Puerto Rico and the U.S. Virgin Islands. Surcharge Fees from the ATM owner/network still apply.

- Discover® Cashback Debit Account: Discover's checking account has no monthly service fees and allows you to earn 1% cash back on up to $3,000 in debit card purchases every month (see website for details), but its use is limited to the US, Canada, Mexico, and the Caribbean.

- Citi Regular Checking : A fine checking account with options to waive the $15 monthly service fee and branch locations abroad, but customer satisfaction is below average, according to J.D. Power's US National Banking Satisfaction Study .

- HSBC Premier Checking : HSBC (Member FDIC) offers a good variety of checking accounts, although only those with high minimum balance or deposit requirements get ATM fees reimbursed.

- Wealthfront Cash Account : Although this account operates similarly to a high-yield savings account, it's technically a cash management account. You might like this option if you already invest with Wealthfront and want to earn a high interest rate on your savings. However, keep in mind Wealthfront doesn't offer other types of accounts like CDs or checking accounts.

- Betterment Checking Account : Betterment reimburses all foreign transaction fees and ATM fees worldwide, and the app is easy to use. However, our top picks for checking accounts may also offer more banking options, such as CDs or brokered CDs.

- Marcus High Yield Online Savings Account : Marcus has a good high-yield savings account; Marcus savings rates current pays 4.40% APY. However, the high-yield savings account doesn't have as many goal-setting features as Ally, if that's important to you.

- American Express® High Yield Savings Account (Member FDIC): With a solid savings rate, this high-yield savings account is a good option if you don't mind not having mobile access.

Introduction to Banking for International Travel

When you're traveling abroad, bear in mind many financial institutions have fees for using a debit card internationally.

For example, if you use an ATM provider to withdraw money that isn't in your network, you may have to pay out-of-network ATM fees from the provider and your financial institution.

Many banks also have foreign transaction fees. A foreign transaction fee is a debit or credit card charge that can happen when you buy something internationally and it needs to be processed through a foreign financial institution.

There are many financial institutions that can help you avoid common international bank fees, though.

Key Features of Ideal Banks for International Travel

The right bank can make saving for travel goals easier. It can also help you avoid common bank fees, like out-of-network ATM and foreign transaction fees. Below, we've highlighted key features among the top banks for multi-country travel.

Competitive Savings Rates

One key feature to look for in a bank is a competitive savings rate. High-yield savings accounts, in particular, can be strong banking options because they offer better rates than traditional savings accounts. These bank accounts might also be a good choice if you want to set savings goals for specific travel trips. Money in a high-yield savings account can deposited at any time, so you can contribute to a travel goal in stages. If you open a high-yield savings account at an online bank, you also usually won't have to worry about dealing with monthly service fees.

Exchange Rates

If you want to have cash on hand during a trip, it may be beneficial to bank with a financial institution or platform that offers straightforward foreign exchange services. Banking institutions usually offer better exchange rates than airport exchange services or on-site travel spots.

Low Foreign Transaction Fees

If you plan on using a debit card or credit card frequently, make sure to look for a bank that has low foreign transaction fees. That way, you won't have to worry about fees piling up when you use your card to buy things abroad.

Some financial institutions on our list, like SoFi, do not charge foreign transaction fees.

Wide Global ATM Network Accessibility

If you want to use an ATM abroad, the best option is to find a national bank with a global ATM network or one that provides reimbursements for out-of-network ATM fees. Charles Schwab, for example, offers unlimited worldwide ATM fee reimbursements.

Additional Services and Tips for International Banking

If you're planning on traveling abroad soon, it's best to be prepared beforehand so you can avoid unnecessary stress. Sometimes, credit or debit cards may not work if you don't give your bank notice that you're traveling. This is done as a measure to protect you against fraudulent activity. To avoid having your card declined internationally, make sure to call your financial institution before traveling so you can make sure it works during the time you're abroad.

It's also helpful to have cash on hand when traveling in case you need it for an emergency situation. Experts recommend getting foreign currency before you begin travel because airports and on-site currency exchange locations tend to involve more costly service fees and unsatisfactory exchange rates.

Bank Trustworthiness and BBB Ratings

The Better Business Bureau assesses companies based on responses to customer complaints, honesty in advertising, and transparency about business practices. Here are the BBB grades for our favorite travel accounts:

Revolut has an F rating from the BBB due to a high volume of customer complaints filed against the business, and Revolut hasn't responded to or resolved some of the complaints.

Bask Bank received a B grade from the BBB because of its volume of customer complaints. However, its parent company, Texas Capital Bank, has an A+ rating from the BBB.

A great BBB score doesn't guarantee your relationship with a company will be perfect. You'll also want to speak with current customers or read online customer reviews.

Capital One is the only bank on our list that has been involved in a recent public controversy. Capital One used to have an account called 360 Savings. In 2019, the bank launched the new 360 Performance Savings Account, which paid a much a higher interest rate. Many customers thought their old savings accounts would transition into this new one, but in reality, they had to manually open a new 360 Performance Savings Account to earn the higher rate. So some customers have been earning a significantly lower savings rate for years.

In the lawsuit, the plaintiffs' lawyers allege that Capital One didn't inform 360 Savings customers that these were two distinct accounts, or that 360 Performance Savings paid a higher rate. However, Capital One wants this case dismissed because it claims people had every opportunity to learn these facts on their own. This case is still ongoing.

Which banks offer the best international ATM access?

Charles Schwab is our top pick for international ATM access. It offers unlimited refunds for ATM fees worldwide.

How can I minimize fees when using my bank card abroad?

To minimize fees when using a bank card abroad, you want to limit making ATM withdrawals unless you find an ATM that's in your network. Some debit cards also have foreign transaction fees, so it's best to use cash or one of the best credit cards with no foreign transaction fees .

Are there banks that automatically convert currency at favorable rates?

Yes. Many banks and credit unions pay good rates to exchange foreign currency. Most financial institutions will require you to have a bank account with them in order to exchange currency , though.

Can I get travel insurance through my bank?

Yes. Some banks offer travel insurance if you get a credit card with features like travel accident insurance and trip delay reimbursements.

Should I inform my bank before traveling internationally?

Yes. You should call your bank before traveling so you're well prepared. If you forget to contact your bank, your debit card may be denied when you make purchases to protect you from potential fraudulent activity.

Can I open a bank account internationally?

Yes. You may open a bank account in another country. However, make sure that you report your bank account information to the IRS annually .

Why You Should Trust Us: Our Expert Panel for the Best Banks for International Travel

We consulted banking and financial planning experts to inform these picks and provide their advice on finding the best accounts for your needs.

Here's what they had to say about banking for travel. (Some text may be lightly edited for clarity.)

How can someone determine whether a bank is the right fit for them?

Tania Brown, certified financial planner and vice president of coaching strategy at OfColor :

"Obviously, you want to make sure it's FDIC insured. Also, your banking experience — do you like walking into a bank? Well, then you need someone local. Do you just not care if you ever see your bank? Then you're okay online. Do you write checks? Do you not write checks? So it's thinking through how your experience with it is going to be before you make that decision."

Sophia Acevedo, banking editor, Business Insider :

"I would create a list of what I prioritize most in a bank account. For example, some banks have accounts that charge monthly service fees. I would look to see what the requirements are for waiving the monthly service fee and whether I think I could feasibly meet those requirements each month. If I'm searching for an interest-earning bank account I'll pay attention to interest rates. I would make sure the account pays a higher interest rate than the average bank account ."

What should someone look for in an online bank?

Roger Ma, certified financial planner with lifelaidout® and author of "Work Your Money, Not Your Life" :

"How onerous the transfer process is, transferring money in and transferring money out. Is it same day, next day? Is it pretty easy to sync a brick-and-mortar checking account to this particular high-yield savings account?"

Mykail James, MBA, certified financial education instructor, BoujieBudgets.com :

"When it comes to online banks, you want to be a little bit more strict about what type of interest rates they're providing. That's the biggest thing, because online banks are supposed to have the higher interest rate because they don't have the overhead of the brick-and-mortar. You want to make sure that it's well above the national average.

"What types of securities do they provide? Do they have two-factor identification? If it's an online bank, they should definitely have — at the bare minimum — two-factor authentication in how easy it is to change your passwords and things like that, because you want to be a little more hypersensitive about the cyber security for a strictly online bank."

What should someone look for in a bank account if they travel frequently?

Sophia Acevedo:

"You'll want to be mindful of bank account limits and fees. You might be charged fees if you use an ATM from another bank. Banks and credit unions also have limits on how much you can withdraw from your ATM each day. When you're looking for a bank account, see if your bank provides refunds for out-of-network ATMs and what the ATM withdrawal limits are."

Methodology: How Did We Choose the Best Bank Accounts for International Travel?

At Business Insider, we strive to help smart people make the best decisions with their money. We spent hours comparing and contrasting the features and fine print of savings accounts and checking accounts so you don't have to. You can read more about how we review and rate product on our editorial standards page .

We understand that "best" is often subjective, however, so in addition to highlighting the clear benefits of an account — a high APY, for example — we outline the limitations, too.

Generally, bank accounts are designated either savings or checking. When you're saving up for a big trip, a high-yield savings account is appropriate because you'll be able to earn some interest on your money, but still be able to access it when you need to.

A checking account may be more appropriate to use while traveling, as you'll be provided with a debit card to use at shops, restaurants, and ATMs. You may also consider using a credit card , which could provide rewards and other travel-related benefits.

That said, the best bank accounts to use for international travel expenses should be appropriate for your everyday life too, with low fees, good earning potential, and easy access.

See our full ratings methodology for checking, business checking, savings, and money market accounts »

If you enjoyed this story, be sure to follow Business Insider on Microsoft Start.

What to do if you've booked a ticket on a Bonza flight

By Jemima Skelley | 7 hours ago

Low-cost Aussie airline Bonza has gone into voluntary administration , following discussions around the ongoing viability of the business.

Customers were left stranded at airports around Australia, which begs the question: what should you do if you have an upcoming Bonza flight booking?

READ MORE: The 10 experiences you didn't know you could enjoy in New Caledonia

Bonza not issuing refunds

In unwelcome news for anyone holding an upcoming Bonza ticket, it's been announced they won't be able to cash in refunds any time soon.

"Unfortunately, the administrators and/or the company are not in a position to process or issue refunds at this time," read a statement from firm Hall Chadwick, which Bonza appointed for the administration process.

However, if passengers have already got travel insurance for their trip, they may be able to lodge a claim and get a refund that way.

Unfortunately, not all travel insurers provide insolvency cover, so it pays to read the fine print.

Qantas steps up to cover cancelled flights

Qantas Group has stepped in to give assistance to Bonza passengers whose flights have been cancelled.

The airline is offering complimentary seats to those passengers to allow them to fly on Qantas or Jetstar flights at no cost, where seats are available.

Of Bonza's 36 routes, there are six overlapping routes with either Jetstar or Qantas:

Melbourne – Gold Coast (Jetstar)

Melbourne – Sunshine Coast (Jetstar)

Avalon – Gold Coast (Jetstar)

Gold Coast – Cairns (Jetstar)

Melbourne – Mildura (QantasLink)

Melbourne – Alice Springs (Qantas)

READ MORE: Places around the world referenced in Taylor Swift's music that you can actually visit

READ MORE: How I stay in London for under $100 a night

What do I do if I have an upcoming Bonza flight?

There has been no official word yet from Bonza on the status of upcoming flights, or how they will compensate passengers if upcoming flights are cancelled.

Legally speaking, under Australia's consumer guarantees, passengers are entitled to a refund when an airline cancels a flight and a replacement isn't offered "within a reasonable time".

A passenger told the ABC that she phoned up her bank this morning to try and get a refund on her upcoming Bonza trip.

She says that she could lodge a dispute for a recovery of funds, which could take up to 55 days to be repaid.

Auto news : Elon Musk fires two senior staff and all their direct reports.

Jet off to the Whitsundays with $29 fares

Drunk idiots or screaming kids: Which plane act is worse?

New cruise ship features A-list-favourite magic club

Introducing Brilliant Lady to Virgin Voyages’ award-winning fleet

Set to hit the high seas in September 2025, Brilliant Lady is the highly anticipated fourth and final vessel in the Virgin Voyages Lady Fleet. She’s not just a ship but a chance to see the world in a whole new way.

Perhaps the most exciting part of Brilliant Lady’s launch is the opportunity to explore new horizons. With its adapted frame, the ship is designed to navigate new landscapes like the glaciers of Alaska and the vibrant waters of the Panama Canal.

Brilliant Lady's inaugural season will kick off with the ultimate cross-country sea trip before debuting itineraries with exciting new ports like New York, Los Angeles and Alaska.

Let’s talk itineraries:

New York City, September 2025 - October 2025. Brilliant Lady’s journey begins in the city that never sleeps. Following a premiere showcase for New Yorkers, Brilliant Lady will sail to Bermuda and Canada’s Quebec City. Other new ports of call include Maine, Charleston, Boston, Halifax, and New Brunswick.

Miami, October 2025 - April 2026. Warming up for the winter season, Brilliant Lady will embark on a collection of extended Caribbean getaways to Aruba, Bonaire, Curaçao, and Cartagena. Brilliant Lady will also head back to sailor favorites like Turks & Caicos, Antigua and Grand Cayman along with newcomer Ocho Rios, Jamaica’s most coveted port.

Panama Canal Crossing, March 2026. This epic 16-night voyage crosses from Miami to Los Angeles, sailing south towards Colombia before a jaunt through the Panama Canal. Sailors will then explore Costa Rica, Antigua, a UNESCO World Heritage Site overlooking Guatemala’s acclaimed Lake Atitlán as well as a final stop in Los Cabos.

Los Angeles, April 2026 - May 2026. Sailors can explore California’s stunning west coast with calls in Baja, Puerto Vallarta, Santa Barbara, Catalina Island and San Diego.

Seattle, May 2026 - September 2026. Departing from Seattle, summer 2026 will take Brilliant Lady to the vast landscapes of Alaska’s breathtaking shores where sailors can spot an abundance of wildlife including bald eagles, orca, seals, bears and humpback whales.

From the glittering archipelago of Bermuda to the lush rainforests of Jamaica, Brilliant Lady offers a range of voyages spanning from 5 to 14 nights. Whether you’re seeking adventure or relaxation, there’s something for everyone on board.

Of course it’s not just about the destinations, but also the experience on board. Named the best large-ship liner by Condé Nast Traveler and Travel + Leisure, Virgin Voyages continues to disrupt the travel industry with its unparalleled offerings.

Virgin Voyages started as a simple idea for me and has blossomed into the world’s top cruise line with a full fleet of ships. This ship is going to be brilliant in every possible way, and that includes the incredible new places we can travel to. Alaska, LA, New York - here we come! – Richard Branson

Virgin Voyages prides itself on thoughtful design, culinary experiences from Michelin-Star chefs, and award-winning entertainment from the Happenings Cast to ensure every moment is filled with excitement. From the signature red balcony hammocks to a mermaid-inspired spa, every detail has been carefully crafted to surprise and delight.

True to her name, the newest ship will be nothing short of Brilliant.

For those eager to secure their spot on board, Virgin Voyages is offering the Brilliant 4 You Pass, which grants access to all of Brilliant Lady’s MerMaiden voyages complete with a RockStar Suite and one complimentary Shore Thing per voyage.

And for those dreaming of an Alaskan adventure, the Alaska Front(ier) of the Line Pass ensures priority booking for limited itineraries beginning May 8, 2024. To secure the priority window, sailors can submit an early deposit. Placeholders are $500 for Sea Terraces, $1,000 for RockStar Quarters and $2,500 for Mega RockStar Quarters.

Sailors previously slated to sail on Brilliant Lady will be given priority access to book a MerMaiden voyage.

Can’t wait? Virgin Red , Virgin’s Group-wide rewards club, has anchored some extraordinary exclusive deals for its members with Summer 2024 Mediterranean, Caribbean and Transatlantic sailings. Beginning today, members can use Virgin Points to book a Virgin Voyages sailing from just 115,000 Virgin Points. Find out more at Virgin Red or download the Virgin Red app on your smartphone.

So, are you ready to set sail with Virgin Voyages ? Visit Virgin Voyages or contact your First Mate to start planning your brilliant getaway.

Seas the day with a Virgin Voyage on Virgin Red this year

Work from helm with virgin voyages new scarlet summer season pass.

Exclusive offer: Unleash the holiday you with Virgin

Virgin Atlantic Flying Club: How to earn and redeem points for maximum value

Years after diving into the points and miles world, you may not realize that a loyalty program you had overlooked could have been one of your most powerful tools.

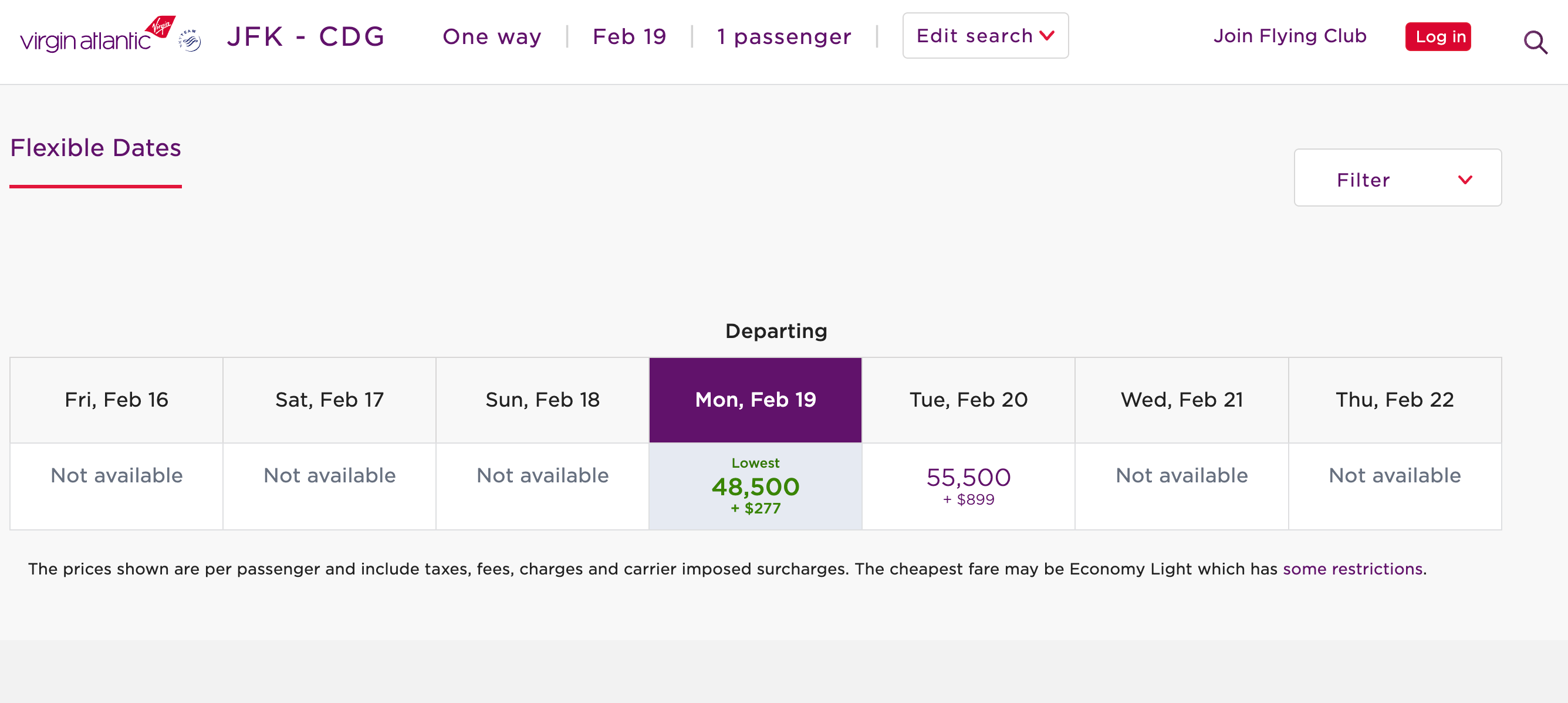

I didn't look closely at Virgin Atlantic 's loyalty program for a long time because I didn't immediately see it playing into my travel rewards strategy , but Virgin Atlantic offers something enticing: attractive partner award charts, a rarity among other airline programs nowadays.

Despite changes to Virgin Atlantic's partner award charts , Virgin points currently stand out for offering incredible value with many uses.

Let's go over the basics of Virgin Atlantic Flying Club and show you the sweet spots that make Virgin points so valuable.

How to earn Virgin points

There are four primary ways to earn Virgin points directly.

You can certainly still earn points the old-fashioned way by flying.

If you're flying on Virgin Atlantic, you can use the airline's earning calculator to determine how many points you'll earn for your flight. If you're flying one of the carrier's partners , such as Delta Air Lines, Air France or Hawaiian Airlines, you can opt to earn Virgin points by adding your Flying Club membership number to your reservation. Virgin Atlantic is now a member of the SkyTeam alliance .

You can check your operating carrier and fare class on Where to Credit for the best option for your flight.

Credit card rewards

You can earn Virgin Points directly through the Virgin Atlantic World Elite Mastercard® .

The information for the Virgin Atlantic Mastercard has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

However, it's easy to boost your Virgin points balance with the right credit card, as Flying Club is a transfer partner of every major transferable point currency , including:

- American Express Membership Rewards (1:1)

- Bilt Rewards (1:1)

- Capital One (1:1)

- Chase Ultimate Rewards (1:1)

- Citi ThankYou Rewards (1:1)

- Marriott Bonvoy (3:1 with a 5,000-point bonus for transferring 60,000 points and a 48-hour transfer time )

Some of the above programs offer regular transfer bonuses to Flying Club , meaning you might need even fewer points than you first thought.

Many of these programs offer cards that feature terrific welcome bonuses . Here's just a sample of the travel rewards credit cards that earn these transferable points that can be converted to Virgin points:

- The Business Platinum Card® from American Express

- The Platinum Card® from American Express

- American Express® Gold Card

- Capital One Venture Rewards Credit Card

- Capital One Venture X Rewards Credit Card

- Ink Business Preferred® Credit Card

- Chase Sapphire Preferred Card

Points Booster

If you've flown a Virgin Atlantic-operated flight — whether you paid cash or points for it — you can use Flying Club's Points Booster to score extra points for cheap. You can usually pay 0.01 British pounds (or $0.013) per point, but the program periodically offers bonus promotions.

You can even use the Points Booster for flights you have already taken up to six months back.

Other earning partners

There are several partners through which you can earn Virgin points by shopping or traveling:

- Car rental partners : Virgin Atlantic partners with Avis, Alamo, Enterprise, Hertz, National and Sixt to let members earn Virgin points.

- Heathrow Rewards : You can earn points for shopping or parking at London's Heathrow Airport (LHR) and transfer them to Flying Club.

- Rocketmiles : You can earn between 500 and 10,000 Virgin points per night for booking hotels through Rocketmiles.

- Shops Away : Earn Virgin points by making purchases at over 1,000 retailers through Virgin Atlantic's shopping portal.

- The Virgin Group : From Virgin Hotels to luxury Virgin properties, you can earn Virgin points through several Virgin Group partners.

Related: The beginners guide to airline shopping portals

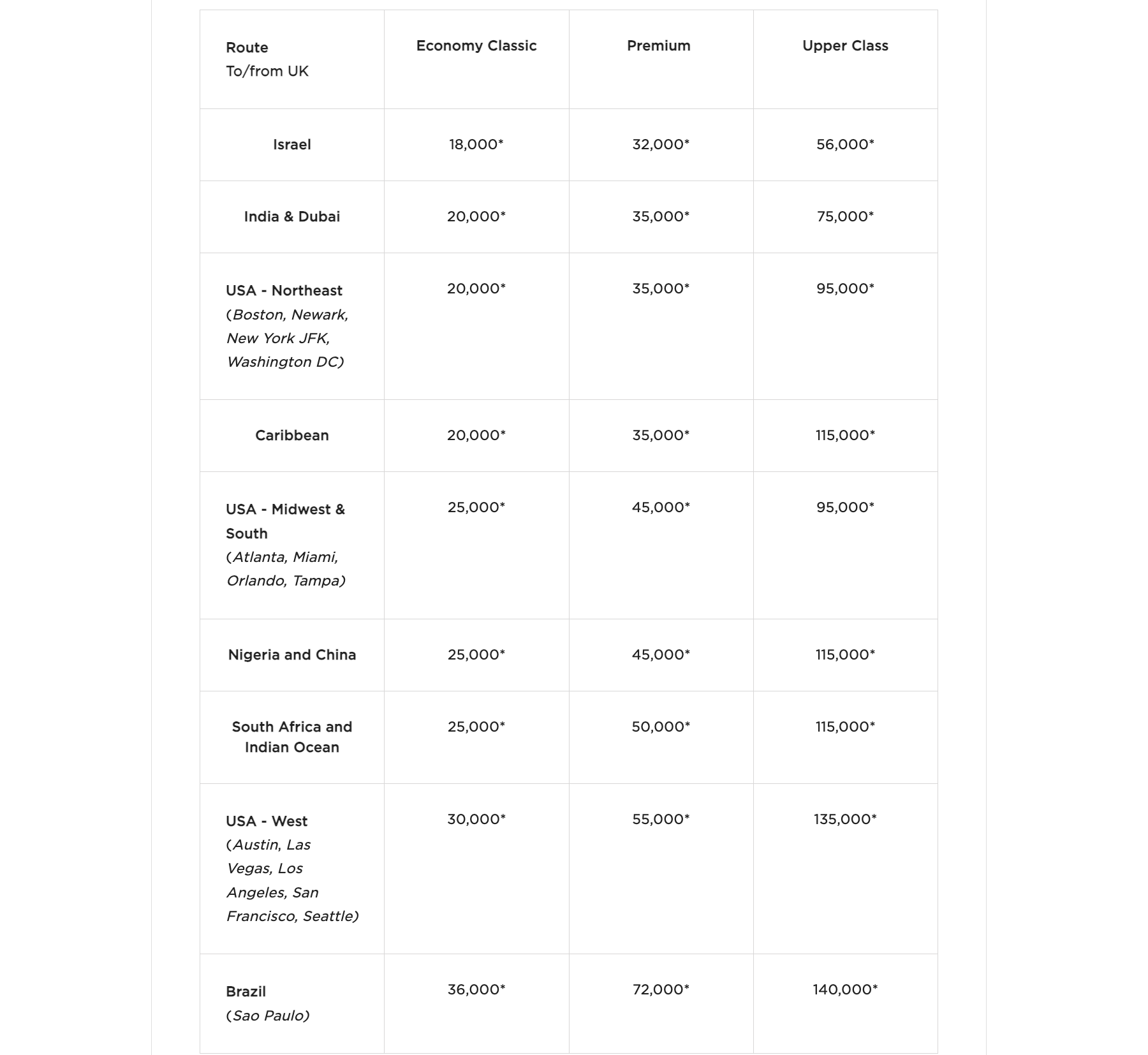

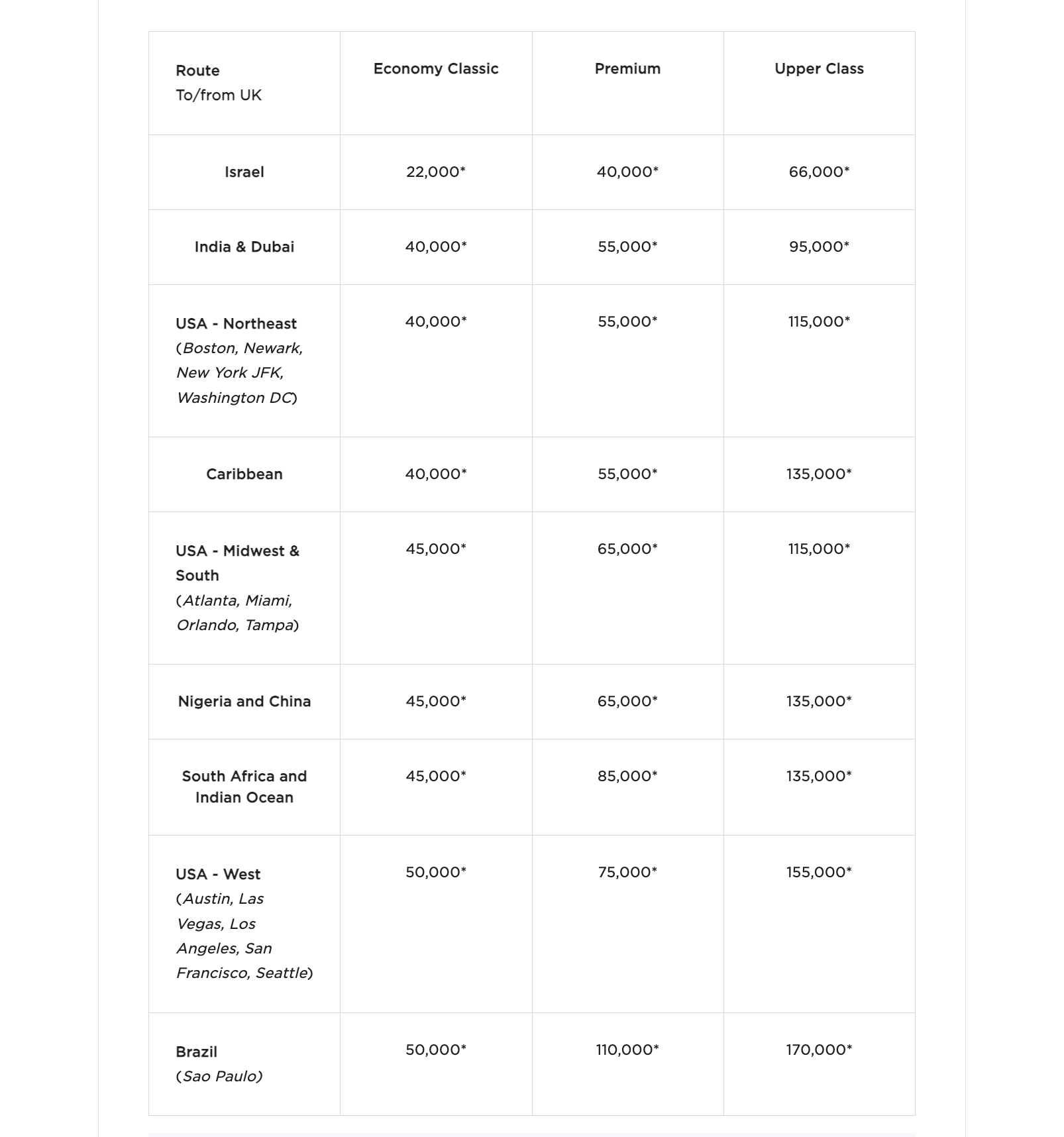

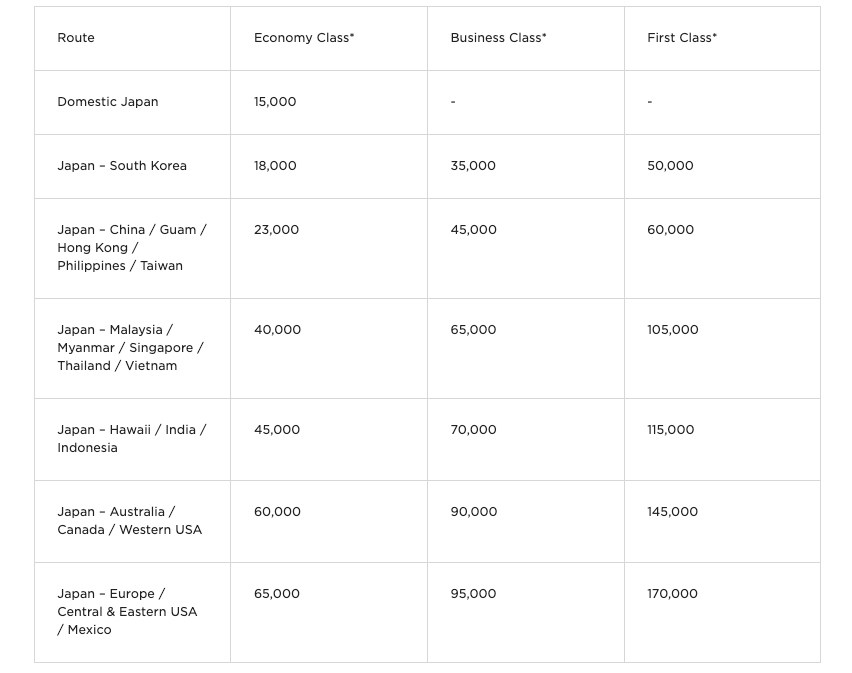

Virgin Atlantic award chart

The award prices Virgin Atlantic charges are reasonable. Here are the round-trip prices you can expect during the standard (i.e., off-peak) season.

If you want to stretch your points further, consider booking travel during the following (off-peak) standard season dates:

Round-trip prices increase during the peak season.

Here's the complete list of peak travel dates to be aware of:

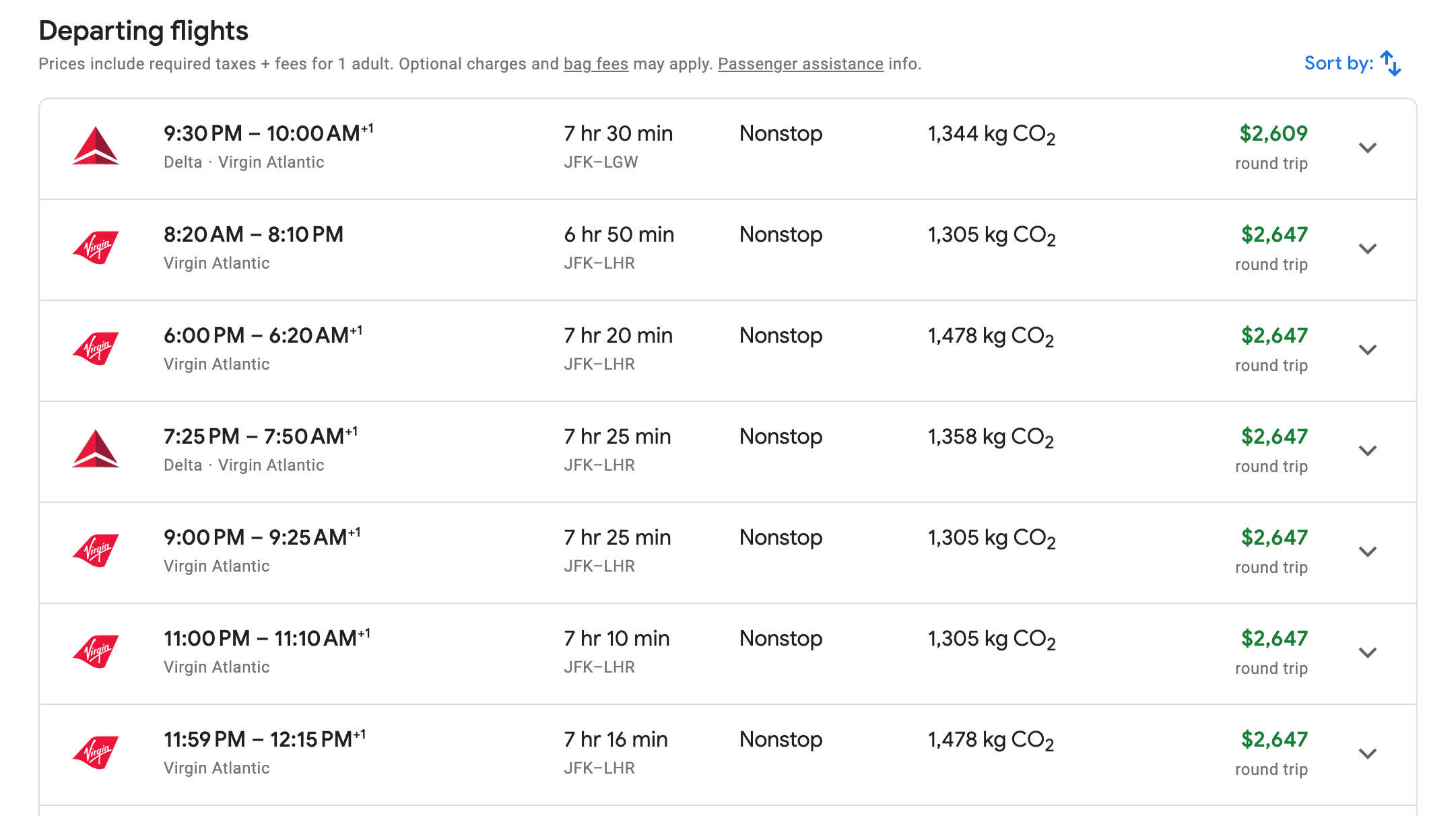

The value you may save by spending relatively few points (i.e., 20,000 round-trip itineraries between the East Coast and the United Kingdom) you will lose on the outrageous carrier surcharges Virgin Atlantic tacks onto award flights. Round-trip flights between the U.S. and the U.K. usually cost $450 for economy flights. Meanwhile, Upper Class seats (Virgin Atlantic's business class) could have well over $2,000 in fees round trip.

Related: How to avoid fuel surcharges on award travel

Virgin regularly discounts the number of points required for Virgin-operated flights by 20% to 50% during its Promo Awards offers , though, unfortunately, the fees, taxes and carrier surcharges are not discounted.

There are plenty of occasions where you may find paid tickets for less than these fuel surcharges, especially if you aren't fussy about the operating carrier. Your points won't save you money in these scenarios. Even nonstop cash fares in Virgin Atlantic Upper Class are readily available for under $3,000 round trip, so always check tickets before committing to those high surcharges.

Booking one-way award flights instead of round trips will often reduce the taxes and fees on award flights, potentially by hundreds of dollars. You may also benefit from booking Virgin Atlantic flights to London but not from London. Fees tend to be higher for flights departing London thanks to government-imposed surcharges, so if you've got another award currency you can use for your return flight, go with that.

Related: Save money on Virgin Atlantic award tickets by booking one-way flights

Flying Club airline partners

The real magic of Virgin points lies in partner award charts thanks to nearly two dozen additional airlines to book with your rewards.

Virgin Atlantic joined the SkyTeam alliance earlier this year. With the current exceptions of China Eastern (coming later in 2024, according to Virgin Atlantic), you can now redeem Virgin points on all SkyTeam airlines, including recently added ITA Airways .

Redemptions on SkyTeam airlines are distance-based. Excluding flights operated by Air France-KLM and Delta Air Lines, you will need the following Virgin points each way per person on all dates (no peak/off-peak pricing):

You can only redeem Air France-KLM, Delta Air Lines, China Airlines, Korean Air, Middle East Airlines, ITA Airways and Xiamen Air online.

Virgin uses three different Delta award charts on its website:

- U.S. to U.K. nonstop flights (note availability in premium cabins is very rare)

- U.S. to Europe (excluding the U.K.) nonstop flights (note availability in premium cabins is very rare)

- All other Delta award flights

While there are some sharp increases for redemption prices in 2024, Flying Club will still charge fewer points than Delta's SkyMiles program may charge for the same flights thanks to SkyMiles' dynamic pricing. Therefore, it is worth checking the prices of both programs where you have transferable credit card points, as there is still value to be had.

Partner redemption charts do not include first class. This means you can't redeem your Virgin points for SkyTeam airlines that offer first class, including Garuda Indonesia, Korean Air, Saudia and Xiamen.

Air France also offers first class but restricts redemptions to elite members of its own Flying Blue program .