Your complete guide to travel protections on American Express cards

Editor's note: This is a recurring post, regularly updated with new information.

Numerous American Express cards offer travel protections that can take the headache out of your vacations. However, the coverage you get (and the limits of said coverage) differ by card. Rather than trying to remember all of this on your own, we will guide you through the travel protections offered by American Express cards.

This guide provides a comprehensive, detailed look at the variety of travel protections offered across the American Express card portfolio. Each section outlines a type of coverage and the cards offering this coverage. We also include coverage limits and any additional caveats to keep in mind.

Here's what you need to know about American Express travel insurance coverage.

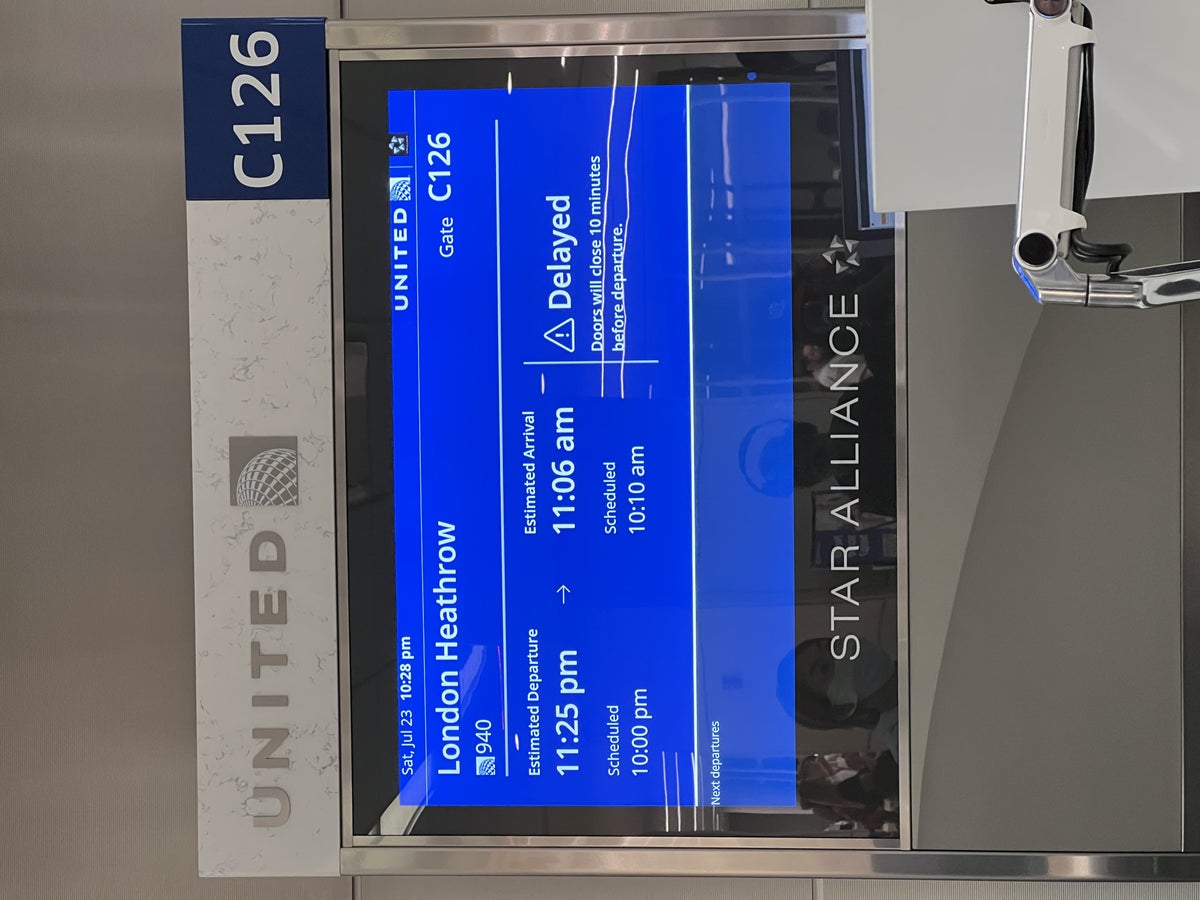

Trip delay insurance

Trip delay insurance covers you when you encounter travel delays. This could be a delayed flight due to mechanical issues or an unexpected overnight due to a weather-related cancellation. Other reasons are covered, but individual policies vary in what they do and don't cover. If the reason for your delay is not specifically mentioned in your policy, assume that it's not covered.

With trip delay protection, there are two different "levels" of coverage, depending on the card you carry.

Level 1: Higher-end cards

Some of American Express' top products offer trip delay reimbursement of up to $500 per covered trip that is delayed for more than six hours, capped at two claims per eligible card per 12 consecutive months.*

This protection becomes effective when you purchase a ticket using any of the following cards:

- The Centurion® Card from American Express**

- The Business Centurion® Card from American Express**

- The Platinum Card® from American Express

- The Platinum Card® from American Express for Schwab**

- The Platinum Card® from American Express for Goldman Sachs**

- The Platinum Card® from American Express for Morgan Stanley**

- The Platinum Corporate Card from American Express**

- The Business Platinum Card® from American Express

- Delta SkyMiles® Reserve American Express Card

- Delta SkyMiles® Reserve Business American Express Card

- Hilton Honors American Express Aspire Card **

- Marriott Bonvoy Brilliant® American Express® Card

- The American Express Corporate Platinum Card®**

*Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. Policies are underwritten by New Hampshire Insurance Company, an AIG Company.

**The information for these cards has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Level 2: Mid-tier cards

Other American Express cards offer trip delay reimbursement of up to $300 per covered trip that is delayed for more than 12 hours, capped at two claims per 12 consecutive months.*

Here are the cards that include this protection when you use them to purchase your tickets:

- American Express® Gold Card

- American Express® Green Card**

- American Express® Business Gold Card

- Delta SkyMiles® Platinum American Express Card

- Delta SkyMiles® Platinum Business American Express Card

- Marriott Bonvoy Bevy™ American Express® Card

Trip cancellation and interruption insurance

This type of coverage is for situations in which your trip is canceled or interrupted (meaning you started the trip but must end it to return home). As a result, you're forced to forfeit prepaid, nonrefundable reservations. Again, be sure that your policy mentions your specific reason for it to be covered.*

All Amex cards with this benefit provide the same level of protection. If your trip is canceled or interrupted for a covered reason, you can receive a maximum of $10,000 per covered trip and a maximum of $20,000 per eligible card in a 12-month period.

Here are the cards that include this protection when you use them to purchase travel:

- The Corporate Platinum Card® from American Express**

- The Corporate Centurion® Card from American Express**

Global Assist Hotline

Eligible cardholders can rely on the Global Assist Hotline 24 hours a day, 7 days a week for medical, legal, financial or other select emergency services coordination and assistance while traveling more than 100 miles from home.*

The Global Assist Hotline coordinates services but is not the service provider. Any third-party service costs may be your responsibility.

Here are the cards that include this protection when you use them to pay for your tickets:

- American Express® Cash Rebate Credit Card**

- Blue for Business® Credit Card**

- Blue Cash® from American Express**

- Blue Sky from American Express®**

- Blue Cash Everyday® Card from American Express

- Blue Cash Preferred® Card from American Express

- Business Green Rewards Card from American Express **

- Clear from American Express®**

- Delta SkyMiles® Blue American Express Card

- Delta SkyMiles® Gold American Express Card

- Delta SkyMiles® Gold Business American Express Card

- Hilton Honors American Express Card

- Hilton Honors American Express Surpass® Card

- The Hilton Honors American Express Business Card

- Marriott Bonvoy™ American Express® Card**

- Marriott Bonvoy Business® American Express® Card

- The Plum Card® from American Express

- The Blue Business® Plus Credit Card from American Express

- The American Express Blue Business Cash™ Card

- Amazon Business Card**

- Amazon Business Prime Card**

- Lowe's Business Rewards Card**

- American Express® Corporate Gold Card**

- Corporate Green Credit Card**

- American Express Cash Magnet® Card **

- The Amex EveryDay® Credit Card from American Express**

- The Amex EveryDay® Preferred Credit Card from American Express**

- Blue from American Express®**

- SimplyCash® Plus Business Credit Card**

- SimplyCash® Business Card**

- American Express® Platinum Credit Card**

- American Express® Credit Card**

- One from American Express®**

- Zync from American Express®**

- Schwab Investor Card® from American Express**

- Morgan Stanley Credit Card from American Express**

- Platinum Optima® Card**

- Optima® Card**

- Bluebird® American Express® Reloadable Prepaid Card**

- Serve® American Express® Reloadable Prepaid Card**

- The Corporate Platinum® Card from American Express**

- American Express® Corporate Green Card**

- Business Extra℠ Corporate Card**

- American Express® Corporate Accenture Gold**

- American Express® Corporate Meeting Card**

- American Express® Corporate Defined Expense Program Card**

- American Express® Corporate Purchasing Card**

- Morgan Stanley Blue Cash Preferred® American Express Card**

*Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. Cardmembers are responsible for the costs charged by third-party service providers.

Premium Global Assist Hotline

Like the benefit above, eligible cardholders for certain premium Amex cards can rely on the Global Assist Hotline 24/7 for medical, legal, financial or other select emergency services coordination and assistance services while traveling more than 100 miles from home. With the Premium benefit, emergency medical transportation assistance and related services may be provided at no cost.*

If approved and coordinated by the Premium Global Assist Hotline, emergency medical transportation assistance may be provided at no cost to you. Otherwise, third-party service costs may be your responsibility.

*Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. If approved and coordinated by Premium Global Assist Hotline, emergency medical transportation assistance may be provided at no cost. In any other circumstance, cardmembers are responsible for the costs charged by third-party service providers.

Baggage insurance plan

Baggage insurance applies to covered persons for eligible lost, damaged or stolen baggage during travel on a common carrier vehicle (such as a plane, train, ship or bus) when the entire fare for a ticket on the trip (one-way or round trip) is charged to an eligible card.

This benefit has two different "levels" of coverage, depending on the card you carry.

Some of American Express' top products offer baggage insurance coverage of up to $2,000 for checked baggage and up to a combined maximum of $3,000 for checked and carry-on baggage. This coverage is in excess of coverage provided by the common carrier. Coverage is subject to a $3,000 aggregate limit per covered trip.*

For New York state residents, there is a $2,000 per bag/per suitcase limit for each covered person, with a maximum of $10,000 aggregate for all covered persons per covered trip.*

Other American Express cards offer baggage insurance coverage of up to $1,250 for carry-on baggage and up to $500 for checked baggage. This coverage is in excess of coverage provided by the common carrier.*

For New York state residents, there is a maximum of $10,000 aggregate for all covered persons per covered trip.*

- American Express® Green Card

- American Express® Gold Card for Ameriprise Financial**

- American Express® Corporate Accenture Gold Card**

- American Express® Executive Business Card**

*Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. Policies are underwritten by AMEX Assurance Company.

Car rental loss and damage insurance

Car rental loss and damage insurance applies to the theft of or damage to most rental vehicles when you use an eligible card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the rental car company. Note that this product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered, and geographic restrictions apply.

Some of American Express' top products offer car rental loss and damage insurance of up to $75,000 for theft of or damage to eligible rental vehicles.*

Here are the cards that include this protection when you use them to pay for eligible rentals:

- Centurion® Card from American Express**

- Business Centurion® Card from American Express**

Other American Express cards offer car rental loss and damage insurance of up to $50,000 for theft of or damage to eligible rental vehicles.*

- Amex EveryDay® Credit Card**

- Amex EveryDay® Preferred Credit Card**

- SimplyCash® Plus Business Card**

- American Express® Business Purchase Account**

*Eligibility and benefit level varies by card. Not all vehicle types or rentals are covered, and geographic restrictions apply. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. Policies are underwritten by AMEX Assurance Company. Coverage is offered through American Express Travel Related Services Company, Inc.

Bottom line

Understanding what benefits your card has to protect you when things go wrong during a trip can help reduce headaches. To that end, American Express provides multiple travel protections across many of its card products.

Coverage limits within the same benefit can vary by the card you have, so consult your card's detailed benefits at americanexpress.com/benefitsguide for full details.

AnnaStills / Getty Images

Advertiser Disclosure

American Express travel insurance benefits

The right Amex card can save you money if a trip gets interrupted unexpectedly

Published: May 13, 2022

Author: Ana Staples

Editor: Barri Segal

Reviewer: Kaitlyn Tang

How we Choose

American Express cards offer valuable travel insurance benefits, with premium cards providing higher levels of protection.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards , or use our CardMatch™ tool to find cards matched to your needs.

COVID-19 disrupted the travel industry and kiboshed many travel plans around the globe. Having to cancel a vacation or postpone an important trip indefinitely isn’t only frustrating – it can be expensive, too. Can travel insurance benefits offered with your credit card cover the costs?

Most American Express cardholders enjoy some kind of travel insurance benefit, though it varies by card. Read on to learn more about which travel insurance benefits are available with each Amex card and how they can help you cover unexpected costs during your trip.

Types of Amex travel insurance vary by card

On Jan. 1, 2020, American Express dropped travel accident insurance and roadside assistance from its cards’ travel insurance benefits. Fortunately, the issuer replaced them with arguably more valuable protections: trip delay, cancellation and interruption insurance. Each benefit is offered on select cards.

What American Express trip delay insurance covers

Trip delay insurance covers expenses caused by delays resulting from the following:

- Weather conditions that prevent you from continuing the trip – for example, if your flight was rescheduled due to severe weather

- Terrorist action or hijacking

- A carrier’s equipment failure, as documented by the airline

- Stolen or lost passports or other travel documents

This type of travel insurance covers expenses such as meals, hotel stays, medication and personal-use items.

Amex cards that include trip delay insurance

What american express trip cancellation and interruption insurance covers.

If a trip that you booked using a qualifying Amex card gets interrupted or canceled, American Express can reimburse you for nonrefundable round-trip tickets. These can include everything from airfare to train tickets, plus tickets you booked through a tour operator – and more.

Note that in order to be covered, your trip must be canceled or interrupted due to one of the following reasons:

- Accidental injury, illness or death

- Severe weather

- Military orders

- Jury duty or subpoena by the courts that can’t be postponed or waived

- Traveler’s home has been made uninhabitable

- Quarantine imposed by a doctor for health reasons

Tip: Note that if you’re canceling your trip because you’re still worried about COVID-19, you might not be eligible for this coverage. According to a Coronavirus FAQ published on the company’s website, “American Express travel insurance covers only specified covered reasons. Fear of contracting the coronavirus is not a covered reason under the American Express travel insurance certificate of insurance/policy.”

The maximum reimbursement amount is $10,000 per trip and $20,000 per year. This coverage is secondary, meaning it kicks in only after any other applicable policy you have offers reimbursement.

Here’s the list of American Express cards that offer this travel insurance benefit:

- The Platinum Card from American Express

- The Business Platinum Card from American Express

- Delta SkyMiles Reserve American Express Card

- Delta SkyMiles Reserve Business American Express Card

- Hilton Honors American Express Aspire Card

- Marriott Bonvoy Brilliant American Express Card

What American Express baggage insurance covers

Another valuable travel insurance benefit available to some Amex cardholders is baggage insurance. It’s also secondary coverage, meaning you can receive compensation after being reimbursed by the carrier.

The level of protection varies by card, with premium cards offering more coverage.

What American Express car rental loss and damage insurance covers

If you rent a car during your trip and charge it on your eligible Amex card, you can be reimbursed if the vehicle is damaged or stolen. Premium cards, such as the Platinum and Business Platinum cards, offer up to $75,000 in coverage. The rest of the American Express cards that provide this benefit can cover up to $50,000.

To calculate the amount needed to cover repairs, Amex compares the actual cost of repairs, the car’s wholesale book value and purchase invoice price. The most cost-effective option becomes the reimbursement amount.

Note that the policy only covers rentals for up to 30 consecutive days, and not all cars are included. For example, the policy excludes commercial vehicles, certain types of vans and trucks, cars that are at least 20 years old, limousines and some other types of vehicles. Additionally, this travel benefit doesn’t work for car rentals in Australia, Italy, New Zealand or any country that’s subject to U.S. sanctions.

It’s essential to read your benefits guide carefully since there are many other instances in which damage to your car rental won’t be covered. And keep in mind that like other travel insurance benefits American Express offers, its car rental insurance policy is secondary to any other coverage you may have.

What American Express Global Assist offers

Last but not least, American Express cards offer Global Assist, a hotline that can help cardholders with valuable information and advice during their travels. This can include translation services, help with missing luggage, medical referrals and more.

You can call the hotline toll-free at 1-800-333-AMEX (2639).

If you have a premium Amex card, such as the Platinum or Business Platinum, you get access to the Premium Global Assist hotline. It offers the same assistance as the basic version does but can fully cover some of the services. For instance, it can provide reimbursement for medical transportation.

The following co-branded Amex cards also offer Premium Global Assist:

- Delta SkyMiles® Reserve American Express Card

- Delta SkyMiles® Reserve Business American Express Card

- Marriott Bonvoy Brilliant™ American Express® Card

- Marriott Bonvoy Business® American Express® Card

You can call the Premium Global Assist Hotline at 1-800-345-AMEX (2639).

How to make a travel insurance claim with American Express

Before filing a claim using your Amex travel insurance benefits, you need to use your primary policy or file with the common carrier first. Remember that the coverage provided by your American Express card is secondary, meaning you won’t be reimbursed until you’ve exhausted your other policies first.

After that, file a claim with Amex as soon as possible. Check your benefits guide to find out how long you have to make a claim and read about the terms of your policy.

You can start your claim using the following numbers and websites:

- For baggage insurance claims: 1-800-645-9700 or online

- For car rental insurance claims: 1-800-338-1670 or online

- For trip delay, cancellation and interruption insurance claims: 1-844-933-0648

Next, American Express will provide you with claim forms and instructions for filing proof of loss. You can find examples of which documentation may be required in your benefits guide.

Which is the best card for American Express travel insurance benefits?

Premium cards like the Platinum card offer the most comprehensive travel insurance benefits of all American Express cards. If you travel a lot and want to have the highest level of protections available, this kind of coverage may justify high annual fees . On the other hand, if you only travel occasionally, it might make more sense for you to find a travel credit card with a lower or no annual fee and invest more in your primary travel insurance.

Note that some Amex cards don’t offer all of these benefits, so make sure you examine a card’s terms before you apply.

Bottom line

If you’re an Amex cardholder, you’ll find the card issuer can assist you in many situations when you travel. With an abundance of travel insurance benefits across its suite of cards, American Express is a great addition to your wallet wherever you go. Make sure to put all major travel purchases on your qualifying card, and always read the terms and conditions in full to be aware of the benefits it offers. That way, you can rely on those benefits in case of unexpected events.

*All information about the American Express Green Card, Business Green Rewards Card from American Express and Hilton Honors American Express Aspire Card has been collected independently by CreditCards.com and has not been reviewed or approved by the issuer.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.

Ana Staples is a staff reporter and young credit expert reporter for CreditCards.com and covers product news and credit advice. She loves sharing financial expertise with her reader and believes that the right financial advice at the right time can make a real difference. In her free time, Anastasiia writes romance stories and plans a trip to the French Riviera she'll take one day—when she has enough points, that is.

On this page

- Trip delay insurance coverage

- Trip cancellation coverage

- Baggage insurance coverage

- Car rental insurance coverage

- American Express Global Assist

- How to make a travel insurance claim with Amex

- Best card for Amex travel insurance

Essential reads, delivered straight to your inbox

Stay up-to-date on the latest credit card news 一 from product reviews to credit advice 一 with our newsletter in your inbox twice a week.

By providing my email address, I agree to CreditCards.com’s Privacy Policy

Your credit cards journey is officially underway.

Keep an eye on your inbox—we’ll be sending over your first message soon.

Learn more about Card advice

7 ways to earn American Express points

Here’s how you can use your everyday spending to rack up American Express points faster.

What you need to know about American Express credit card benefits

American Express credit cards offer cardholders stand-out benefits in travel protection and retail protections. Plus, the issuer grants cardholders access to pre-sale tickets, unique experiences and valuable offers with partner merchants and services.

Best ways to spend American Express points

Earn up to 120,000 bonus points with the Platinum cards from American Express

Is the Blue Business Plus card from American Express worth it?

How to add an authorized user to an American Express card

Explore more categories

- Credit management

- To Her Credit

Questions or comments?

Editorial corrections policies

CreditCards.com is an independent, advertising-supported comparison service. The offers that appear on this site are from companies from which CreditCards.com receives compensation. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within listing categories. Other factors, such as our own proprietary website rules and the likelihood of applicants' credit approval also impact how and where products appear on this site. CreditCards.com does not include the entire universe of available financial or credit offers. CCDC has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

Since 2004, CreditCards.com has worked to break down the barriers that stand between you and your perfect credit card. Our team is made up of diverse individuals with a wide range of expertise and complementary backgrounds. From industry experts to data analysts and, of course, credit card users, we’re well-positioned to give you the best advice and up-to-date information about the credit card universe.

Let’s face it — there’s a lot of jargon and high-level talk in the credit card industry. Our experts have learned the ins and outs of credit card applications and policies so you don’t have to. With tools like CardMatch™ and in-depth advice from our editors, we present you with digestible information so you can make informed financial decisions.

Our top goal is simple: We want to help you narrow down your search so you don’t have to stress about finding your next credit card. Every day, we strive to bring you peace-of-mind as you work toward your financial goals.

A dedicated team of CreditCards.com editors oversees the automated content production process — from ideation to publication. These editors thoroughly edit and fact-check the content, ensuring that the information is accurate, authoritative and helpful to our audience.

Editorial integrity is central to every article we publish. Accuracy, independence and authority remain as key principles of our editorial guidelines. For further information about automated content on CreditCards.com , email Lance Davis, VP of Content, at [email protected] .

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards ›

- Amex Gold Card

Full List of Travel Insurance Benefits for the Amex Gold Card [2023]

Christine Krzyszton

Senior Finance Contributor

312 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Jessica Merritt

Editor & Content Contributor

92 Published Articles 506 Edited Articles

Countries Visited: 4 U.S. States Visited: 23

Senior Editor & Content Contributor

106 Published Articles 705 Edited Articles

Countries Visited: 41 U.S. States Visited: 28

![amex travel insurance claim Full List of Travel Insurance Benefits for the Amex Gold Card [2023]](https://upgradedpoints.com/wp-content/uploads/2022/09/Amex-Gold-Upgraded-Points-LLC-19-Large.jpg?auto=webp&disable=upscale&width=1200)

Table of Contents

Amex gold card — snapshot, amex gold card — travel insurance benefits, travel benefits, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

The American Express ® Gold Card is known for being a go-to card for everyday purchases at restaurants and at U.S. supermarkets. The card also doubles as a travel rewards card offering elevated earnings on select flight purchases and a nice selection of flexible travel redemption options.

The card is far less known for its travel insurance benefits. Today, we’re turning the spotlight on some of the useful travel insurance benefits that come with the card and talking about how these benefits can add value to the cardholder.

First, let’s look at the overall earning and redemption features of the Amex Gold card, then jump right into the list of travel insurance benefits you can expect to find on the card.

This is the best card for food lovers who dine out at restaurants (worldwide), order take-out and want big rewards at U.S. supermarkets!

Apply With Confidence

Know if you're approved with no credit score impact.

If you're approved and accept this Card, your credit score may be impacted.

The American Express ® Gold Card is a game-changer.

With this card, you can earn 4x Membership Rewards points at restaurants and you’ll also earn 4x Membership Rewards points at U.S. supermarkets on up to $25,000 per calendar year in purchases, then 1x.

There isn’t another card on the market that offers a 1-2 punch like this. Of course, there are several other benefits of the Gold Card as well, including extra monthly dining rewards and more.

- 4x points per dollar at restaurants, plus takeout and delivery in the U.S.

- 4x points per dollar at U.S. supermarkets, up to $25,000 per calendar year in purchases; and 1x thereafter

- 3x points per dollar on flights purchased directly from airlines or at AmexTravel.com

- $250 annual fee (see rates and fees )

- No lounge access

- Earn 60,000 Membership Rewards ® points after you spend $6,000 on eligible purchases with your new Card within the first 6 months of Card Membership.

- Earn 4X Membership Rewards ® Points at Restaurants, plus takeout and delivery in the U.S., and earn 4X Membership Rewards ® points at U.S. supermarkets (on up to $25,000 per calendar year in purchases, then 1X).

- Earn 3X Membership Rewards ® points on flights booked directly with airlines or on amextravel.com.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and each month automatically get $10 in Uber Cash for Uber Eats orders or Uber rides in the U.S., totaling up to $120 per year.

- $120 Dining Credit: Satisfy your cravings and earn up to $10 in statement credits monthly when you pay with the American Express ® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, Milk Bar and select Shake Shack locations. Enrollment required.

- Get a $100 experience credit with a minimum two-night stay when you book The Hotel Collection through American Express Travel. Experience credit varies by property.

- Choose the color that suits your style. Gold or Rose Gold.

- No Foreign Transaction Fees.

- Annual Fee is $250.

- Terms Apply.

- APR: See Pay Over Time APR

- Foreign Transaction Fees: None

American Express Membership Rewards

Hot Tip: Check to see if you’re eligible for a welcome bonus offer of up to 90,000 points with the Amex Gold card. The current public offer is 60,000 points. (This targeted offer was independently researched and may not be available to all applicants.)

Why We Like the Card Overall

We like that you can jumpstart your earnings with a generous welcome bonus after meeting minimum spending requirements in the first 6 months after card approval.

The Amex Gold card also strikes a nice balance between functioning as an everyday spending card and offering accelerated earnings on flights. It also offers flexible travel redemption options.

You’ll earn 4x Membership Rewards points at restaurants worldwide and at U.S. supermarkets (on up to $25,000 in purchases each year). Plus, you’ll receive 3x earnings on flights purchased directly with the airline and via AmexTravel.com .

With monthly statement credits for select purchases, it’s easy to find enough value to offset the annual fee.

When it’s time to use your rewards, you’ll have options such as redeeming points for flights via AmexTravel.com or transferring your points to the American Express transfer partners for even more potential value.

While the Amex Gold card doesn’t come with a long list of comprehensive travel benefits, you’ll find these core travel insurance benefits useful for saving money and for access to assistance should something go wrong during your journey.

Car Rental Loss and Damage Insurance

Having car rental insurance can save you money and provide a level of peace of mind when renting a vehicle . The Amex Gold card comes with secondary car rental insurance that would require you to first file a claim with any other applicable insurance before card coverage kicks in.

Secondary coverage can still be valuable coverage, but there is another car rental coverage option included on the card that is a much better choice.

Premium Protection

The option to purchase Premium Protection car rental insurance on the Amex Gold card is a game changer.

You’ll pay one low price of $12.25 to $24.95 for the entire period, up to 42 total days, for primary theft and damage coverage. The actual rate will depend on your state of residence and the level of coverage chosen. Note that this is not a per-day rate like the car rental agencies charge.

Just enroll in the coverage via your online card account, then whenever you charge your rental car to your card, you’ll have the coverage automatically. You are not charged prior to renting a car.

There is no deductible. Accidental death/dismemberment coverage is included. Liability coverage, uninsured/under-insured motorist coverage, or disability coverage is not included.

Cardholders and authorized listed drivers are covered.

Applicable coverages for both secondary and Premium Protection include rental car damage, theft, and loss of use.

Coverage is not available when renting vehicles in Australia, Ireland, Israel, Italy, Jamaica, and New Zealand.

There are several additional exclusions, including the theft of an unlocked vehicle, illegal activity, intoxication of the driver, and war. Access the Guide to Benefits for a complete list of exclusions, terms, and conditions.

Filing a Claim

You can file a claim online or call 800-338-1670. You must file the claim within 30 days of the event and submit the required claim form within an additional 15 days. You’ll then have 60 days to submit the required documentation.

Bottom Line: The Amex Gold card comes with secondary car rental insurance with the option to purchase primary Premium Protection for one low rate that covers the entire rental period.

Trip Delay Insurance

To be eligible for trip delay insurance, you must pay for your entire trip with your Amex Gold card, associated rewards, or a combination of the 2. Using airline vouchers, certificates, or discounts, such as those associated with your frequent flyer account, in combination with your card, are also acceptable. Eligible travelers include family members, travel companions, and a spouse or domestic partner.

Trip delay insurance reimburses an eligible traveler for incidental expenses incurred after a 12-hour or greater trip delay. Eligible expenses can include lodging, meals, toiletries, medication, and necessary personal items.

Eligible Losses and Coverage Limits

The following types of losses are eligible covered losses :

- Inclement weather preventing a traveler from beginning a trip or continuing on a trip

- Terrorism or hijacking

- A common carrier’s equipment failure (documented)

- Lost/stolen travel documents, such as passports

You could receive up to $300 per trip with a limit of 2 claims per card, per 12-month period. Coverage is secondary to any other applicable coverage including reimbursement by the airline.

Loss exclusions include prepaid expenses, losses that were known to the public or the traveler prior to the trip, and intentional acts by the covered traveler. Access the card’s Guide to Benefits for more details on loss exclusions under trip delay coverage.

You’ll have 60 days from the date of the loss to file a claim. You can do so by calling 844-933-0648 or the number on the back of your card to be directed to the claims department.

You’ll then have 180 days to submit the required documentation, which can include a statement from the common carrier validating the delay, receipts, your card statement showing the trip charge, and other requested supporting information.

Bottom Line: The Amex Gold card comes with trip delay insurance that provides up to $300 per trip for eligible expenses incurred after a 12-hour or greater delay due to a covered loss.

Baggage Insurance Plan

To be eligible for baggage insurance, pay for your common carrier ticket entirely with your Amex Gold card and/or associated rewards. Trips paid for, in full or in part, with non-American Express rewards such as airline loyalty programs are not eligible.

You, your spouse or domestic partner, children under 23, and certain dependent handicapped children are covered for baggage insurance as long as the trip is paid for in full with your card and/or associated rewards.

Lost, damaged, or stolen baggage is covered, except in the event of war, government confiscation, or acts arising out of customer actions, for the following coverage limits.

High-risk items such as jewelry, gold, silver, platinum, electronics, furs, and sporting equipment, are limited to $250 per item maximum, per trip.

Certain items are not covered under baggage insurance — here is a condensed list of those items:

- Credit cards, cash, securities, or money equivalents (such as money orders or gift cards)

- Travel documents, tickets, passports, or visas

- Plants, animals, or food

- Glasses, contact lenses, hearing aids, prosthetic devices, and prescription or non-prescription drugs

- Property shipped prior to departure

You’ll have 30 days from the date of the loss to file a claim. To file a claim, you can go online or call 800-228-6855 within the U.S. To call from outside of the U.S., call 303-273-6498 collect.

You’ll then have 60 days to submit supporting documentation including a list of items lost, receipts, a statement showing the trip was purchased with the card or associated rewards, and common carrier reports.

Please note that we have abbreviated coverage descriptions and all terms and conditions are not spelled out in their entirety. You’ll want to access the benefits guide for full information.

Bottom Line: You and certain family members are covered for baggage insurance of up to $1,250 per person when traveling with a common carrier. You’ll need to pay for your entire trip with your card or rewards associated with your card for coverage to be valid.

Travel Accident Insurance

Travel accident insurance that comes with the Amex Gold card pays a benefit in the unlikely event of accidental death or dismemberment of the primary card member, additional card member, spouse or domestic partner, or children under the age of 23.

The trip must be paid for with the Amex Gold card and/or associated Membership Rewards points (Pay With Points).

The coverage pays a benefit for death or severe injury suffered as a result of riding in, boarding, exiting from, or being struck by a common carrier.

The benefit paid is based on a table provided and can be up to $100,000.

While not travel insurance specifically, these additional benefits can provide assistance when planning a trip or if an unexpected event should disrupt your trip.

Emergency Travel Assistance

The Amex Global Assist Hotline provides important 24/7 assistance when traveling more than 100 miles from home. Receive help finding medical, legal, and translation referrals as well as assistance securing emergency transportation.

In addition, you could receive help securing a replacement passport or finding missing luggage.

You can reach the Global Assist Hotline at 800-333-2639. Outside the U.S., call 715-343-7977.

Actual services provided by third parties that incur costs are the responsibility of the cardholder.

Services are also not available in areas such as Cuba, Iran, Syria, North Korea, or the Crimea region.

No Foreign Transaction Fees

You’ll want to include the Amex Gold card during your next trip, as the card does not charge foreign transaction fees ( rates & fees ).

Additional Travel Benefits

Receive help planning your trip with Insider Fares via AmexTravel.com, upgrade your flights with points , American Express Travel Insurance , onsite benefits at The Hotel Collection , Amex Offers , and more.

While the Amex Gold card comes with several valuable travel insurance benefits, you would not select the card for this specific reason. The card shines when it comes to earning on select everyday purchases, for purchasing airline tickets, and its flexible travel redemption options. Those should be key reasons for selecting the card.

The fact that there are travel insurance benefits that come complimentary with the card is just one more reason to consider the card.

If having premium travel insurance benefits is a priority for you, you might consider the Chase Sapphire Preferred ® Card , The Platinum Card ® from American Express , the Chase Sapphire Reserve ® , or the Capital One Venture X Rewards Credit Card , all of which offer some of the best travel insurance benefits.

You can read about more credit cards with travel insurance in our article on this specific topic.

For the car rental collision damage coverage benefit of the American Express Gold Card, car rental loss and damage insurance can provide coverage up to $50,000 for theft of or damage to most rental vehicles when you use your eligible card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the Commercial Car Rental Company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. Geographic restrictions apply. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company. Car rental loss or damage coverage is offered through American Express Travel Related Services Company, Inc. For the trip delay insurance benefit of the American Express Gold Card, up to $300 per covered trip that is delayed for more than 12 hours; and 2 claims per eligible card per 12 consecutive month period. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company. For the baggage insurance plan benefit of the American Express Gold Card, baggage insurance plan coverage can be in effect for eligible persons for eligible lost, damaged, or stolen baggage during their travel on a common carrier (e.g. plane, train, ship, or bus) when the entire fare for a common carrier vehicle ticket for the trip (one-way or round-trip) is charged to an eligible account. Coverage can be provided for up to $1,250 for carry-on baggage and up to $500 for checked baggage, in excess of coverage provided by the common carrier (e.g. plane, train, ship, or bus). For New York State residents, there is a $10,000 aggregate maximum limit for all covered persons per covered trip. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company. For the global assist hotline benefit of the American Express Gold Card, you can rely on the Global Assist Hotline 24 hours a day / 7 days a week for medical, legal, financial or other select emergency coordination and assistance services while traveling more than 100 miles away from your home. Third-party service costs may be your responsibility. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for more details. Card members may be responsible for the costs charged by third-party service providers.

The information regarding the Capital One Venture X Rewards Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

For rates and fees of the American Express ® Gold Card, click here . For rates and fees of The Platinum Card ® from American Express, click here .

Frequently Asked Questions

Does the amex gold card have travel insurance benefits.

While the list of travel insurance benefits on the Amex Gold card is not extensive, you will find coverage such as secondary car rental insurance, the option to purchase Premium Protection car rental insurance, trip delay, baggage insurance, a Global Assist Hotline, and travel accident insurance.

Does the Amex Gold card have trip interruption or trip cancellation insurance?

No. The Amex Gold card does not offer trip interruption or trip cancellation insurance. The card does come with trip delay insurance.

Does the Amex Gold card charge foreign transaction fees?

No. You will not be charged foreign transaction fees when using the Amex Gold card for foreign purchases ( rates & fees) .

Does the Amex Gold card cover lost luggage?

Yes, the Amex Gold card can cover lost, stolen, or damaged luggage. The coverage is secondary to any coverage or reimbursement received by the airline or other applicable insurance.

Does the Amex Gold card have good car rental insurance?

The Amex Gold card comes with secondary car rental insurance, which means that you must first file a claim with any other applicable insurance before card coverage kicks in. You will have the option, however, to purchase Premium Protection for one low rate that covers the entire rental period, up to 42 days.

Was this page helpful?

About Christine Krzyszton

Christine ran her own business developing and managing insurance and financial services. This stoked a passion for points and miles and she now has over 2 dozen credit cards and creates in-depth, detailed content for UP.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

![amex travel insurance claim Amex Gold Card vs. Amex Rose Gold Card [Are They Different?]](https://upgradedpoints.com/wp-content/uploads/2022/08/Amex-Gold-vs-Amex-Rose-Gold-Upgraded-Points-LLC.jpg?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Best Travel Insurance 2024

- Cheapest Travel Insurance

- Trip Cancellation Insurance

- Cancel for Any Reason Insurance

- Seniors' Travel Insurance

- Annual Travel Insurance

- Cruise Insurance

- COVID-19 Travel Insurance

- Travel Medical Insurance

- Medical Evacuation Insurance

- Pregnancy Travel Insurance

- Pre-existing Conditions Insurance

- Mexico Travel Insurance

- Italy Travel Insurance

- France Travel Insurance

- Spain Travel Insurance

- Canada Travel Insurance

- UK Travel Insurance

- Germany Travel Insurance

- Bahamas Travel Insurance

- Costa Rica Travel Insurance

- Disney Travel Insurance

- Schengen Travel Insurance

- Is travel insurance worth it?

- Average cost of travel insurance

- Is airline flight insurance worth it?

- Places to travel without a passport

- All travel insurance guides

- Best Pet Insurance 2024

- Cheap Pet Insurance

- Cat Insurance

- Pet Dental Insurance

- Pet Insurance That Pays Vets Directly

- Pet Insurance For Pre-Existing Conditions

- Pet Insurance with No Waiting Period

- Paw Protect Review

- Spot Pet Insurance Review

- Embrace Pet Insurance Review

- Healthy Paws Pet Insurance Review

- Pets Best Insurance Review

- Lemonade Pet Insurance Review

- Pumpkin Pet Insurance Review

- Fetch Pet Insurance Review

- Figo Pet Insurance Review

- CarePlus by Chewy Review

- MetLife Pet Insurance Review

- Average cost of pet insurance

- What does pet insurance cover?

- Is pet insurance worth it?

- How much do cat vaccinations cost?

- How much do dog vaccinations cost?

- All pet insurance guides

- Best Business Insurance 2024

- Business Owner Policy (BOP)

- General Liability Insurance

- E&O Professional Liability Insurance

- Workers' Compensation Insurance

- Commercial Property Insurance

- Cyber Liability Insurance

- Inland Marine Insurance

- Commercial Auto Insurance

- Product Liability Insurance

- Commercial Umbrella Insurance

- Fidelity Bond Insurance

- Business Personal Property Insurance

- Medical Malpractice insurance

- California Workers' Compensation Insurance

- Contractor's Insurance

- Home-Based Business Insurance

- Sole Proprietor's Insurance

- Handyman's Insurance

- Photographer's Insurance

- Esthetician's Insurance

- Salon Insurance

- Personal Trainer's Insurance

- Electrician's Insurance

- E-commerce Business Insurance

- Landscaper's Insurance

Best Credit Cards of 2024

- Best Credit Card Sign-Up Bonuses

- Best Instant Approval Credit Cards

- Best Cash Back Credit Cards

- Best Rewards Credit Cards

- Best Credit Cards for Bad Credit

- Best Balance Transfer Credit Cards

- Best College Student Credit Cards

- Best 0% APR Credit Cards

- Best First Credit Cards

- Best No Annual Fee Cards

- Best Travel Credit Cards

- Best Hotel Credit Cards

- Best American Express Cards

- Best Amex Delta SkyMiles Cards

- Best American Express Business Cards

- Best Capital One Cards

- Best Capital One Business Cards

- Best Chase Cards

- Best Chase Business Cards

- Best Citi Credit Cards

- Best U.S. Bank Cards

- Best Discover Cards

- Amex Platinum Card Review

- Amex Gold Card Review

- Amex Blue Cash Preferred Review

- Amex Blue Cash Everyday Review

- Capital One Venture Card Review

- Capital One Venture X Card Review

- Capital One SavorOne Card Review

- Capital One Quicksilver Card Review

- Chase Sapphire Reserve Review

- Chase Sapphire Preferred Review

- United Explorer Review

- United Club Infinite Review

- Amex Gold vs. Platinum

- Amex Platinum vs. Chase Sapphire Reserve

- Capital One Venture vs. Venture X

- Capital One Venture X vs. Chase Sapphire Reserve

- Capital One SavorOne vs. Quicksilver

- Chase Sapphire Preferred vs. Capital One Venture

- Chase Sapphire Preferred vs. Amex Gold

- Delta Reserve vs. Amex Platinum

- Chase Sapphire Preferred vs. Reserve

- How to Get Amex Pre-Approval

- Amex Travel Insurance Explained

- Chase Sapphire Travel Insurance Guide

- Chase Pay Yourself Back

- CLEAR vs. TSA PreCheck

- Global Entry vs. TSA Precheck

- Costco Payment Methods

- All Credit Card Guides

- Citibank Savings Account Interest Rate

- Capital One Savings Account Interest Rate

- American Express Savings Account Interest Rate

- Western Alliance Savings Account Interest Rate

- Barclays Savings Account Interest Rate

- Discover Savings Account Interest Rate

- Chase Savings Account Interest Rate

- U.S. Bank Savings Account Interest Rate

- Marcus Savings Account Interest Rate

- Synchrony Bank Savings Account Interest Rate

- Ally Savings Account Interest Rate

- Bank of America Savings Account Interest Rate

- Wells Fargo Savings Account Interest Rates

- SoFi Savings Account Interest Rate

- UFB Direct Savings Account Interest Rate

- Best Savings Accounts & Interest Rates

- Best High Yield Savings Accounts

- Best 7% Interest Savings Accounts

- Best 5% Interest Savings Accounts

- Savings Interest Calculator

- Emergency Fund Calculator

- Pros and Cons of High-Yield Savings Accounts

- Types of Savings Accounts

- Checking vs Savings Accounts

- Average Savings by Age

- How Much Should I Have in Savings?

- How to Make Money

- How to Save Money

- Compare Best Checking Accounts

- Compare Online Checking Accounts

- Best Business Checking Accounts

- Compare Best Teen Checking Accounts

- Best Student Checking Accounts

- Best Joint Checking Accounts

- Best Second Chance Checking Accounts

- Chase Checking Account Review

- Bluevine Business Checking Review

- Amex Rewards Checking Account Review

- Best Money Market Accounts

- U.S. Bank Money Market Account

- Money Market vs. Savings Account

- Best CD Rates

- Best 1-Year CD Rates

- Best 6-Month CD Rates

- Best 3-Month CD Rates

- 6% CD Rates

- Synchrony Bank CD Rates

- Capital One CD Rates

- Barclays CD Rates

- E&O Professional Liability Insurance

- Best Savings Accounts & Interest Rates

- Credit Cards

- American Express Travel Insurance

On This Page

- Key takeaways

How does American Express travel insurance work?

Complimentary amex travel insurance, our picks for american express cards with travel insurance, standalone american express travel insurance plans, should i use the complimentary benefits or purchase a standalone policy, how to file an amex travel insurance claim, amex travel insurance faqs.

- Our readers also like

2024 Complete Guide to American Express Travel Insurance

- American Express offers two main forms of travel insurance: complimentary benefits for cardholders and standalone travel insurance policies .

- Complimentary travel insurance benefits for eligible cardholders include coverage for trip cancellations and interruptions, car rental loss and damage, baggage insurance and more.

- The top cards that offer Amex travel insurance are the Platinum Card® from American Express , the American Express® Gold Card , and the Blue Cash Preferred® Card .

- You can also purchase standalone travel insurance from Amex with any major credit card. There are four types of policies: basic, silver, gold and platinum.

- Depending on the type of coverage you select, you may be eligible for medical protection, travel accident protection, baggage protection and reimbursement for trip cancellation.

- Cancel for any reason (CFAR) insurance is not included , and medical coverage tends to be low unless you purchase a premium package. If you need additional coverage, you can compare quotes from other travel insurance providers .

American Express offers a variety of travel-related benefits. If you have an Amex card , you may already have access to numerous travel perks, such as trip cancellation and baggage insurance. You can also purchase standalone coverage from Amex for more comprehensive protection.

We created this guide to help you determine if you should rely on free travel insurance from American Express or purchase a standalone insurance policy before your next business or leisure trip.

We’ll cover:

- How Amex travel insurance works

- Complementary Amex travel insurance

- Standalone Amex travel insurance plans

- If the complementary insurance is enough, or if you need to purchase a plan

- How to file a claim

Our top picks for the best american express travel insurance

- The Platinum Card® from American Express: Best Overall for Travel Insurance

- The Business Platinum Card® from American Express: Best for Businesses

- American Express® Gold Card: Best for Basic Coverage

Featured American Express offers

The platinum card® from american express.

The Business Platinum Card® from American Express

American Express® Gold Card

American Express offers two forms of travel insurance:

- Travel insurance as a complimentary benefit for certain cards

- Standalone travel insurance packages that you can purchase

While the complimentary Amex travel insurance perks may be enough for your trip, you should consider purchasing a standalone policy if you want more comprehensive coverage that includes medical insurance .

If you’re not an American Express cardholder, you can purchase one of four standalone travel insurance packages using any major credit card.

All four standalone travel insurance packages include:

- 24/7 travel assistance

- Baggage protection

- Medical coverage

- Trip interruption and trip cancellation coverage

The high-end packages also include travel accident protection and coverage for global trip delays.

Many American Express credit card comes with six types of complimentary travel insurance:

Trip cancellation and interruption insurance

Trip delay insurance, car rental loss and damage insurance, baggage insurance, premium global assist, global assist.

Let’s dive more into each of these types of travel insurance and what they cover.

American Express offers 13 credit cards with complimentary trip cancellation and trip interruption insurance.

If you need to cancel your trip for a covered reason, American Express will reimburse you for any nonrefundable expenses paid to an airline, hotel or other travel supplier using your Amex card.

Here’s how it works. Imagine you used your American Express Platinum Card to book a $10,000 vacation to the Bahamas. Included in the $10,000 total was a $1,000 nonrefundable deposit. If you have to cancel your trip due to a medical condition, American Express will reimburse you $9,000 — the original cost of your trip, less the $1,000 nonrefundable deposit.

If your trip is interrupted for a covered reason, American Express will reimburse you for:

- The pre-paid, non-refundable land, air and sea transportation arrangements that you missed

- Additional transportation expenses for you to rejoin your common carrier or return home

The following are considered American Express covered reasons:

- Accidental bodily injury or sickness (must provide proof from a physician)

- Inclement weather

- Change in military orders

- Terrorist action or hijacking

- Call to jury duty or subpoena by the courts (and unable to postpone or waive)

- You’re home becoming uninhabitable

- Quarantine ordered by a physician for health reasons

The trip coverage does have some limitations, including:

It doesn’t cover cancellations or interruptions caused by a pre-existing condition.

This is an illness or injury that began in the 60 days prior to your purchase of a covered trip. That means if you purchased your trip to the Bahamas on April 1, you wouldn’t be eligible for reimbursement if you had to cancel due to a medical condition that developed between January 31 and April 1.

Additional transportation expenses can’t cost more than an economy-class airline ticket by the most direct route.

Amex won’t cover business class tickets for you to return home or join your common carrier. In travel lingo, a common carrier is a transportation provider that offers its services to the general public.

Additional expenses to purchase new tickets can’t exceed the difference between your original fare and the economy fare for your rescheduled trip.

American Express checks the most direct route to determine how much to refund. For example, if your original ticket cost $500 and an economy ticket for your new departure date costs $750, you’ll receive the $250 difference. Amex doesn’t refund the entire ticket price.

Amex travel insurance only covers $10,000 per trip and $20,000 per eligible credit card per 12-month period.

This applies to trip cancellations and trip interruptions.

American Express won’t refund any expenses covered by other travel suppliers.

This includes refunds, vouchers, credits, goodwill payments or other benefits provided by airlines, cruise lines, tour companies and other travel providers. For example, if you have to miss a theater performance due to a trip interruption, American Express won’t cover the cost of the tickets if the theater gives you a full refund.

American Express offers 20 cards with free trip delay insurance , from the Amex Platinum Card to the Delta SkyMiles Reserve Card.

This type of travel insurance covers trip delays due to:

- lost or stolen travel documents

- terrorist activity

- inclement weather

- equipment failure

For example, if your flight is canceled due to a mechanical problem with the aircraft, you may be eligible for reimbursement under trip delay insurance.

American Express has more than 50 cards with complimentary car rental loss and damage insurance. This type of insurance covers vehicle damage or theft of a vehicle from a covered territory.

If your rental car is damaged, Amex will pay the lowest amount of the following:

- The invoice price of the vehicle, minus reasonable depreciation and salvage costs

- The wholesale book value of the vehicle, minus reasonable depreciation and salvage costs

- The actual cost to repair the vehicle

For example, if the rental company purchased your vehicle for $25,000, the vehicle is worth $18,500 today and it will cost $7,500 to repair the vehicle, your insurance will pay $7,500 since it’s the lowest amount.

To activate this type of insurance, you must reserve and pay for your rental with an eligible Amex credit card, such as the Platinum Card or Cash Magnet Card.

You must also decline these optional coverages at the car rental counter:

- Personal property coverage

- Personal accident insurance

- Full collision damage waiver

- Similar insurance coverage

Finally, you must sign the rental agreement as the person responsible for taking control of the vehicle . Therefore, you can’t use your rental loss and damage insurance on a vehicle rented by your spouse, parent, child, sibling or friend, even if you have a Platinum card or other eligible credit card.

American Express has more than 40 cards with baggage insurance benefits, including the Amex Gold Card and the American Express Executive Business Card.

Amex covers lost and damaged bags under the following circumstances:

- The loss or damage occurs while in direct transit to or from the carrier’s terminal (carry-on bags only).

- The loss or damage occurs while you’re at the carrier’s terminal (carry-on bags only).

- The loss or damage occurs while traveling in a carrier’s vehicle (carry-on bags and checked bags).

Amex has different coverage limits for high-risk items, such as sporting equipment and jewelry, so make sure you understand what’s covered before you pack your bags.

If you have an American Express Card with Premium Global Assist, you’ll have access to a variety of travel assistance services any time you travel more than 100 miles from home.

These Premium Global Assist services include:

- Lost item search

- Missing baggage

- Passport replacement

- Emergency transportation

- Translation

- Card cancellation

- Embassy referrals

- Medical assistance

- Financial assistance

- Legal referrals

- Urgent message relay

The Premium Global Assistant service also helps with pre-trip research and planning. With this service, you can get information about customs requirements, foreign exchange rates, vaccination requirements, local weather, travel warnings and visa requirements.

Global Assist provides many of the same benefits as the Premium Global Assist coverage included with the Platinum card and other high-end Amex cards. The main difference is that Premium Global Assist provides better coverage for medical emergencies.

For example, Global Assist will not cover the cost of returning your minor child to their principal residence if you’re unable to continue traveling with them due to a covered illness or injury. If you have a Platinum Card with Premium Global Assist, you may get this protection.

Best Overall for Travel Insurance

Earn 5X Membership Rewards® points for flights booked directly with airlines or with American Express Travel (on up to $500,000 per calendar year), 5X points on prepaid hotels booked with American Express Travel, and 1X points on other eligible purchases.

Card Details

Travel Insurance Details

- Trip cancellation/interruption: $10,000 per covered trip or up to $20,000 in a 12-month period

- Trip delay: Up to $500 per trip for delays over 6 hours

- Car rental: Secondary

- Lost/damaged baggage coverage: Up to $2,000 per person for checked bags and $3,000 per person for carry-ons (up to $3,000 per person total)

- Global Assist: Yes, Premium

*Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by Amex Assurance Company.

- Excellent rewards rate for travel purchases

- Qualify for $1,500+ in statement credits

- Very generous welcome offer

- High annual fee of $695

- Many statement credit offers are too specific and hard to use

- Non-travel-perks aren’t spectacular

This is quite a spectacular card with incredibly valuable benefits, but the annual fee is objectively very high.

Best for Businesses

Earn 5 Membership Rewards® points per dollar on flights and prepaid hotels through American Express Travel, 1.5 points per dollar on eligible business expenses and purchases of $5,000+ (up to $2 million yearly), and 1 point per dollar on other eligible purchases.

- Global Assist: Premium

- Excellent welcome offer

- Easy to earn points

- Great travel benefits

- No intro APR offer

- Hefty $695 annual fee

- High spending requirement for welcome offer

The annual fee certainly has a shock factor but for the premium business traveler, this card’s luxury perks could make it well worth it.

Best for Basic Coverage

Earn 4X points at U.S. supermarkets (on up to $25,000 per year in purchases, then 1X) and restaurants (plus takeout and delivery in the U.S.), 3X points on flights booked directly with airlines or on amextravel.com, and 1X points on other eligible purchases.

- Trip cancellation/interruption: N/A

- Trip delay: Up to $300 per trip for delays over 12 hours

- Lost/damaged baggage coverage: Up to $500 per person for checked bags and $1,250 per person for carry-ons (up to $$1,250 per person total)

- Global Assist: Yes

- Generous welcome offer

- High rewards potential

- Many transfer partners available

- High annual fee

- Complicated statement credits

- Good or excellent credit recommended

If you like to dine out frequently, the $200+ worth of dining-related annual statement credits can easily help justify the yearly fee.

You don’t need to have a Platinum Card or another high-end American Express Card to get travel insurance. All you have to do is purchase a standalone plan with any major credit card.

The company offers four standalone insurance plans: Basic, Silver, Gold and Platinum.

Basic travel insurance plan

The basic plan is a good option if you want cheap travel insurance . While it includes various types of coverage, these levels tend to be low.

Basic plan benefits:

- Cancellation: Up to $1,000

- Trip interruption: Up to $1,000

- Global medical protection: Medical up to $5,000; dental up to $750; evacuation/repatriation up to $5,000

- Global luggage protection: Baggage loss up to $250; up to $100 for a delay of 24 hours or more

- 24-hour travel assistance

Silver travel insurance plan

With the silver plan, most coverage levels are much higher than with the basic plan. For example, trip cancellation will cover up to 100% of the total trip cost instead of up to just $1,000.

However, medical coverage is still low compared to most travel insurance plans at just $25,000.

Silver plan benefits:

- Cancellation: Up to 100% of the trip cost

- Trip interruption: Up to 100% of the trip cost

- Global medical protection: Medical up to $25,000; dental up to $750; evacuation/repatriation up to $100,000

- Travel accident protection: $50,000 to $100,000, depending on circumstances

- Global luggage protection: Baggage loss up to $500; up to $300 for a delay of 6 hours or more

- Global delay: Up to $150 per day; limit of $500 per trip

Gold travel insurance plan

The gold plan is very similar to the silver plan. The main differences are the increases in medical evacuation limits, accident protection and baggage loss.

Gold plan benefits:

- Trip interruption: Up to 150% of the trip cost

- Global medical protection: Medical up to $25,000; dental up to $750; evacuation/repatriation up to $500,000

- Travel accident protection: $100,000 to $200,000, depending on circumstances

- Global luggage protection: Baggage loss up to $1,000; up to $300 for a delay of 6 hours or more

- Global delay: Up to $150 per day; limit of $750 per trip

Platinum travel insurance plan

This is the most comprehensive plan. It covers up to $100,000 for medical expenses, which is similar to other insurance providers. However, it still does not include cancel for any reason (CFAR) coverage .

Platinum plan benefits:

- Global medical protection: Medical up to $100,000; dental up to $750; evacuation/repatriation up to $1 million

- Travel accident protection: Up to $200,000

- Global luggage protection: Baggage loss up to $2,500; up to $500 for a delay of 3 hours or more

- Global delay: Up to $300 per day; limit of $1,000 per trip

For most people, the complimentary benefits available with the Platinum Card and other types of American Express travel credit cards are more than adequate.

However, the company doesn’t offer medical coverage with any of its free insurance benefits. If you have a chronic health condition, consider purchasing a standalone policy from Amex or another insurance provider.

You should also consider a standalone policy if you’re concerned about getting into an accident during your trip, as the free insurance options don’t include any kind of travel accident coverage.

Note: Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by Amex Assurance Company.

If you need to file a travel insurance claim, you must contact your benefits administrator.

Here’s what to do for each type of claim:

- Rental car coverage: Call (800) 338-1670 within 30 days of the covered event. You can also submit a claim online .

- Luggage: Call (800) 228-6855 within 30 days of the covered event. You can also submit a claim online .

- Delays, interruptions or cancellations: Call (844) 933-0648 within 60 days of the covered event.

Is American Express travel insurance worth it?

If you already have an American Express Card with complimentary travel insurance benefits, these perks are absolutely worth it since you pay nothing extra to access several types of insurance coverage.

Paying for a standalone Amex travel insurance plan may be worth it if you’re going on a long trip or a trip with multiple stops. These trips are more complex, so it’s more likely you’ll encounter a problem, making good insurance coverage essential.

However, Amex travel insurance is lacking when it comes to medical coverage and cancel for any reason (CFAR) insurance. For more comprehensive travel insurance that includes the types of protection, we recommend comparing travel insurance policies from other providers to find one that suits your needs.

Do I get travel insurance with my American Express card?

Each Amex credit card comes with some type of travel insurance. The amount of coverage depends on the type of credit card you have.

Do all American Express cards offer travel insurance?

Every Amex credit card comes with rental car loss and damage insurance. You may qualify for additional insurance benefits if you have the Platinum American Express Card or another high-end credit card from American Express.

In addition to travel insurance, some Amex credit cards come with additional travel benefits, such as airline credits or a fee credit for Global Entry or TSA Precheck membership.

Do I have to have an American Express credit card to get American Express travel insurance?

No. You can purchase an Amex travel insurance policy with any major credit card, including Visa, Mastercard and Discover .

Does American Express travel insurance cover COVID?

It depends on the circumstances. If you choose to travel after the government issues COVID-related travel restrictions, your travel insurance won’t cover any medical or quarantine costs related to COVID-19.

If you qualify for Amex insurance, it may cover the following:

- Your destination has new travel restrictions that were imposed after you’d already booked your trip.

- Your flight is canceled due to COVID-19.

- You develop a COVID-19 infection and can’t travel.

- Your origin country advises against nonessential travel after you’ve already booked your trip.

Does American Express travel insurance cover pre-existing conditions?

No, this type of travel insurance does not cover pre-existing conditions. These are medical conditions that develop within 60 days prior to booking your trip.

About the Author

Leigh Morgan is a seasoned personal finance contributor with over 15 years of experience writing on a diverse range of professional legal and financial topics. She specializes in subjects like navigating the complexities of insurance, savings, zero-based budgeting and emergency fund development.

In the last five years, she’s authored over 300 articles for credit unions, digital banks, and financial professionals. Morgan is also the author of “77 Tips for Preventing Elder Financial Abuse,” a book focused on helping caregivers protect the elderly from financial scams.

In addition to her writing skills, she brings real-world financial acumen thanks to her previous experience managing rental properties as part of a $34 million real estate portfolio.

Explore related articles by topic

- Travel Cards & Benefits

- Card Rewards & Perks

- All Credit Card Articles

- Credit Card Reviews

- Compare Cards

- American Express

- Capital One

- Types of Credit Cards

- Learn The Basics: Credit Cards 101

- Tips For Building & Rebuilding Credit

- Credit Scores & Reports Explained

Best Credit Cards for College Students in June 2024

Best Travel Credit Cards of 2024 | Compared & Reviewed

Best 0% Interest Credit Cards of June 2024 | 0% APR until 2025

Best Balance Transfer Credit Cards with 0% APR of 2024

Best Credit Cards with No Annual Fee in June 2024

Best Airline Credit Cards of 2024

Best Business Credit Cards of 2024

Best Starter Credit Cards If You Have No Credit History

Best Cash Back Credit Cards of 2024

Best Rewards Credit Cards of 2024

Best Credit Cards for Bad Credit 2024 | Cards for Credit Scores Below 690

Best Gas Credit Cards of June 2024

Best Hotel Rewards Credit Cards of 2024 | Earn Hotel Loyalty Points

Best AmEx Credit Cards of 2024

Best Discover Credit Cards 2024

Best Chase Credit Cards of 2024

Compare the Best Citi Credit Cards of 2024

What is a Good APR for a Credit Card?

What is a Bad Credit Score?

Does Closing a Credit Card Hurt Your Credit?

How Do Credit Cards Work? Understanding the Basics of Credit Cards

Difference Between Credit Cards and Charge Cards

How to Withdraw Money from a Credit Card - Cash Advances Explained

How to Build Credit: Steps to Build & Improve Your Credit Score

How Does Credit Card Interest Work? Understanding APR

What Is a Charge-off & How Can I Remove One from My Credit?

How to Increase Your Credit Card Limit Without Hurting Your Credit Score

What is the Credit Utilization Ratio? Calculate Your Ratio

How to Get Pre-Approved for an Amex Credit Card

Best Secured Credit Card of June 2024

How to Raise Your Credit Score Fast

What is a Good Credit Score? [And Why You Should Care]

How to Check Your Credit Score

How to Safely Get a Free Credit Report

How to Pay A Credit Card Bill - Payment Options & Tips

Differences Between a Soft Credit Check and a Hard Inquiry

Global Entry vs. TSA PreCheck: Which Should You Get?

How Many Credit Cards Should You Have? (Can You Have Too Many?)

What Are Credit Card Numbers & What Do They Mean?

Can I Pay My Mortgage with a Credit Card?

Can You Transfer Money From a Credit Card to a Bank Account?

Payment Methods You Can Use At Costco

Chase's Pay Yourself Back Feature: Is it Worth it?

Renting a Car With A Debit Card: Everything You Need to Know

CLEAR vs. TSA PreCheck: What You Need to Know

Best U.S. Bank Credit Cards 2024

Chase Sapphire Travel Insurance Coverage: What To Know & How It Works

American Express® Gold Card vs. The Platinum Card®: Platinum Wins for Travel Benefits

American Express® Gold Card Review: Superior Dining Benefits

The Platinum Card® from American Express: Level-Up Your Travel

The Platinum Card® from American Express vs. Chase Sapphire Reserve®: Travel Card Duel

Best American Express Business Cards of 2024

Best Delta Air Lines Credit Cards of June 2024

Best Capital One Credit Cards 2024

How to Use CardMatch to Get the Best Credit Card Offers

Capital One Venture X Rewards Credit Card Review: Premium Travel Benefits