- Guide to Health Insurance Abroad

- Understanding international insurance

Our complete guide to understanding the importance of international health insurance

- My destination

- North America

- Latin America

- Middle East

Assur Travel

Since February 2004, Assur Travel is a company dedicated exclusively to travel and expatriation insurance.

The strong points

More than 1,000 corporate customers, SMEs, SMIs, international groups based around the world.

12,000 expatriates of all nationalities insured in health, providence and assistance.

- Flexible contract : 6 health plans available + annual deductibles + assistance option + liability option + providence option

- Reimbursement of medical expenses within 72 hours

- Technology : Gapi Members application for your reimbursements

- Assistance available 24 hours a day, 7 days a week

Long-term solutions from

4 levels of coverage, 4 guarantees.

- Hospitalization

- Routine Care

- Optical/Dental

The options

- Repatriation assistance

- Private civil liability

- Death benefit

- Compensation for work stoppage

Expat Assurance opinion

It is a small player on the international market with a nice offer, reactive and quite agile.

We do not advise people over 50 years old who wish to stay abroad for many years to take out these solutions, which are not for life, as premiums increase considerably after the age of 60.

If you live in a provincial city, you will have to verify the hospital network before subscribing.

Health insurance, simplified

- Rates in 2 mins

- We help you choose

- Dedicated management team

- Transparency guaranteed!

Mieux vous connaitre pour mieux vous accompagner

Informations sur l'entreprise:, contact de l'entreprise:, partenaires :, en savoir plus :, © copyright expat assurance 2023 | tous droits réservés.

- Guide de l'assurance à l'étranger

- Ma destination

- L'Amérique du Nord

- L'Amérique latine

- Le Moyen-Orient

Assur Travel - CFE Expatriate insurance

You are presently well insured by your Assur Travel policy.

To enjoy all its advantages and get fast reimbursements, simply follow the few instructions below.

Your management center

Emergency hospitalization.

The insurer can make a direct payment to the hospital or clinic, just follow these steps.

Make sure you are always up to date with your premiums otherwise the insurer my refuse direct payment.

In case of emergency hospitalization

Hospitalization planned in advance, medical procedures with prior agreement.

Some medical procedures must be validated by the insurer before they can be performed. This allows you to guarantee the reimbursement before incurring expenses. If you don't make the prior agreement, the insurer may refuse the refund.

Send your claims

Your remote consultation service, download the app to manage your insurance policy, any questions, documents to download.

You wish to modify your policy or have a problem with your insurer (it may happen), contact your HealthForExpats advisor immediately at 00 33 (0)5 31 61 84 50.

HelloSafe » Assurance voyage » Assur Travel

Assur Travel Assurance Voyage I Avis, prix et garanties 2024

informations vérifiées

Informations vérifiées par Alexandre Desoutter

Nos articles sont écrits par des experts dans leurs domaines (finance, trading, assurances etc.) dont vous verrez les signatures au début et à la fin de chaque article. Ils sont également systématiquement relus et corrigés avant chaque publication, et mis à jour régulièrement.

Assur Travel est un courtier grossiste en assurance voyage créé en 2004. Spécialiste de la mobilité internationale, Assur Travel propose des solutions d'assurance pour les voyageurs, les professionnels et les expatriés.

Mais quelles sont les formules d'assurance voyage Assur Travel ? Quelles sont les garanties proposées par cet assureur et les plafonds de prise en charge ? Combien coûte une assurance voyage chez Assur Travel ?

Découvrez notre revue complète sur cet assureur et le détail de ses offres pour tous les types de voyages, de vacances à l'étranger à l'expatriation en passant par l'assurance sports d'hiver ou location saisonnière.

Assurance voyage Assur Travel : à retenir

- Formules : courts séjours, long séjour, étudiant, expatrié, schengen, professionnel, location saisonnière, sports d'hiver

- Prix : à partir de 12 €

- Garantie médicale : jusqu'à 500 000 €

- Assurance visa Schengen :

- Assurance annulation :

- Assurance Covid :

Notre avis sur l’assurance voyage Assur Travel

Assur Travel propose une large palette de formules adaptées à divers besoins en matière de voyage, incluant des options pour les courts séjours, longs séjours, expatriés, PVT, étudiants, professionnels, locations saisonnières, humanitaires, Au Pair, et sports d'hiver. Cette diversité dépasse celle de nombreux concurrents, offrant ainsi une flexibilité appréciable pour les voyageurs aux besoins spécifiques.

Concernant les plafonds de garanties, Assur Travel offre jusqu'à 500 000 € pour les frais médicaux à l'étranger , un plafond inférieur à celui de certains concurrents comme Chapka qui propose jusqu'à 1 000 000 €. Le plafond pour les bagages s'élève à 2 000 € , ce qui est dans la moyenne basse comparé à d'autres assureurs. En termes d'annulation, Assur Travel se distingue avec un plafond de 25 000 € , surpassant la plupart des concurrents.

Le prix minimum pour une assurance court séjour est fixé à 12 € , se situant dans une fourchette moyenne par rapport aux autres acteurs du marché. C'est légèrement plus cher que les offres de base d'autres assureurs, mais le niveau de couverture et les spécificités des garanties peuvent justifier cette différence.

Avec une note Trustpilot de 3,8/5 , Assur Travel se positionne dans une zone moyenne de satisfaction client. Les points forts incluent la rapidité de devis et de paiement, ainsi que la facilité de souscription. Néanmoins, la société doit faire face à des critiques concernant la fourniture de nombreux documents lors de la souscription. Cette note se compare de manière compétitive aux autres assureurs, avec certains ayant de meilleures évaluations et d'autres affichant des performances inférieures.

Avis d’expert

Assur Travel s'adresse principalement aux voyageurs recherchant une couverture complète avec des options spécifiques, comme pour les expatriés, les étudiants, ou les professionnels, grâce à sa large gamme de formules et ses plafonds de garanties élevés pour l'annulation. Son approche est idéale pour ceux qui priorisent une assurance flexible et adaptée à des besoins particuliers, malgré un coût légèrement supérieur et une couverture de responsabilité civile et de bagages plus restreinte.

- Large éventail de formules adaptées à divers besoins de voyage.

- Flexibilité appréciable pour les voyageurs aux besoins spécifiques.

- Plafond pour les frais médicaux compétitif à 500 000 €.

- Plafond d'annulation élevé à 25 000 €, surpassant la plupart des concurrents.

- Prix de départ pour une assurance court séjour raisonnable à 12 €.

- Note Trustpilot de 3,8/5, reflétant une satisfaction client moyenne.

- Rapidité de devis, de paiement, et facilité de souscription comme points forts.

- Nécessité de fournir de nombreux documents lors de la souscription.

- Plafond pour les frais médicaux inférieur à certains concurrents.

- Plafond pour les bagages à 2 000 €, considéré comme bas comparé à d'autres assureurs.

Avant de vous décider à souscrire une assurance voyage chez Assur Travel, il est recommandé de réaliser un comparatif complet des meilleurs contrats du marché grâce à notre comparateur d'assurances voyage en ligne.

Comparez les meilleures assurances voyage en quelques clics

Quelles sont les assurances voyage proposées par Assur Travel ?

Assurance voyage court séjour assur travel.

L'assurance voyage court séjour, simplement nommée "assurance voyage" chez Assur Travel, est un contrat qui vous couvre pour vos voyages en France ou à l'étranger dont la durée n'excède pas 90 jours. Voici le détail de ses garanties et plafonds principaux :

Assurance Assur Travel Globe Trotter

L'assurance Globe Trotter proposée par Assur Travel s'adresse cette fois aux expatriés ou aux voyageurs envisageant de séjourner plus de 3 mois à l'étranger avec un maximum d'un an. Cette assurance voyage longue durée n'inclut pas d' assurance annulation ni de prise en charge des bagages mais se concentre sur les garanties médicales. Voici le détail de ses caractéristiques et plafonds :

Assurance Assur Travel Etudiants - WHV - Au pair - VSI

Pour les voyageurs souhaitant étudier à l'étranger, y suivre des stages ou encore profiter du visa vacances travail, Assur Travel propose également une assurance voyage étudiant spécifique conçue sur-mesure et dont voici le détail des garanties et plafonds.

Assurance Assur Travel Voyageur d'affaires

Assur Travel couvre aussi vos déplacement professionnels ou ceux de vos collaborateurs grâce à une offre spécifique. Cette assurance intègre des garanties uniques dont voici le détail :

Assurance Assur Travel Sports d’Hiver

Pour la pratique du ski ou des autres sports de montagne, Assur Travel propose une assurance sports d'hiver spécifique dont voici le détail des garanties et plafonds :

Assurance Location Saisonnière Assur Travel

Un autre contrat intéressant proposé par Assur Travel est l'assurance location saisonnière qui vous couvre lors de la location d'un hébergement de vacances en France ou à l'étranger. Voici le détail de ses garanties et plafonds :

Assurance Impatriés Schengen Assur Travel

Enfin, pour les voyageurs souhaitant obtenir un visa Schengen, l' assurance voyage Impatriés Schengen offre une couverture complète à un prix abordable. Voici le détail de ses garanties et plafonds :

Quel est le prix de l’assurance voyage Assur Travel ?

Le prix d'une assurance voyage Assur Travel varie principalement en fonction de la durée du voyage, de la destination ainsi que du type d'assurance choisie. Voici quelques exemples de tarifs actuellement pratiqués par cet assureur :

Comment obtenir une attestation d’assurance voyage Assur Travel ?

Pour obtenir une attestation d'assurance voyage chez Assur Travel, il suffit de souscrire à l’une de leurs offres d’assurance voyage, en particulier aux formules Premium, Summum ou Excellence.

Dès la souscription réalisée, vous recevrez automatiquement votre attestation d’assurance par e-mail.

Cette attestation comprendra les détails de vos garanties, y compris celles liées à la COVID, et sera disponible en deux langues : français et anglais. Cette démarche garantit une facilité de gestion et une reconnaissance internationale de votre couverture d'assurance, idéale pour voyager en toute sérénité.

Comment contacter l’assurance voyage Assur Travel ?

Si vous souhaitez obtenir des informations sur les assurances voyage proposées par Assur Travel ou effectuer une réclamation, vous avez la possibilité de contacter un conseiller par différents moyens dont voici le détail :

Comment résilier son assurance voyage Assur Travel ?

Les démarches de résiliation d'une assurance voyage Assur Travel dépendent de la situation :

1. Souscription à distance (en ligne, par téléphone):

- Droit de rétractation de 14 jours: Vous disposez de 14 jours calendaires après la souscription pour annuler votre contrat sans frais ni justificatif.

- Téléchargez le modèle de lettre de résiliation sur le site d'Assur Travel ou rédigez votre propre lettre en mentionnant vos coordonnées, le numéro de contrat et la date de souscription.

- Envoyez la lettre en recommandé avec accusé de réception

2. Souscription en agence:

- Résiliation à tout moment: Vous pouvez résilier votre contrat à tout moment, sans frais ni justificatif.

- Suivez les mêmes instructions que pour la résiliation d'un contrat souscrit à distance.

Si vous souhaitez résilier votre assurance voyage Assur Travel pour un autre assureur, prenez le temps de comparer les meilleures assurances voyage actuelles.

Adeline Harmant est une rédactrice financière expérimentée travaillant pour HelloSafe depuis 3 ans. Elle bénéficie d'une solide expérience de 15 ans en rédaction financière, ayant travaillé pour des sites financiers de renom. Adeline a acquis de solides compétences financières jusqu’à devenir une experte de la bancassurance, des marchés financiers, de la bourse mais également des crypto-monnaies.

Ce message est une réponse à . Annuler

Email Address

Lost Password?

Wherever You Are, Home is Within Reach

Why is Return Assured Important?

So many Americans are away from home these days for business, family visits and recreation. Traveling has become second nature to most of us and we tend to forget that when we’re away from home… anything can happen, including death. Our plan takes care of everything for you in the event that a death takes place more than 75 miles away from home.

Key Benefits of Being A Member

Worldwide coverage, return of mortal remains, setting procedures for time of need, no unexpected costs.

We Partner with APASI

The pioneers of travel assurance, are you an agent.

If you aren't already an agent and would like to be, follow the link below to complete your registration.

A full service travel agency specializing in

Disney destinations.

Offer Ends Soon!

NEW Walt Disney World Discounts!

WDW 2020 Bookings Available!

We are a full service travel agency specializing in family vacations, cruises, all inclusive resorts and Disney Destinations. Please contact us for a no-obligation quote!

We have years of experience in the travel industry, with a focus on Disney destinations. We started Assurance Travel because we are committed to providing superior customer service and being known for our great communication, dedication to clients, and integrity.

Our home office is in Lexington, South Carolina and we have agents working across the United States.

We are looking for agents to join our team. Please contact us for more information.

POPULAR POSTS

STAY UPDATED

Subscribe to Our Newsletter

Thanks for submitting!

Ashley Jackson, CEO

Tara Macklin, Vice President

Success! Message received.

COVID Information | Click here to learn more about our COVID Travel Insurance

Why should I purchase Travel Insurance?

Whether you're embarking on a weekend getaway or a month-long adventure, unexpected events can happen. An AXA protection plan can help ease your mind and help safeguard your trip, offer reimbursement for covered medical costs, and provide travelers with 24/7 access to assistance services, among other benefits.

Need to cancel your trip due to an unforeseen event?

Get coverage for your trip against illnesses, injuries, and natural disasters. Travel insurance can reimburse you for your prepaid, non-refundable trip costs.

Was your luggage lost or stolen?

Our travel plans can offer reimbursement for the value of your belongings, up to the policy limit. This includes coverage for lost or stolen passports, visas, or other important travel documents, as well as any necessary expenses related to replacing these items.

Stranded due to unexpected travel delays?

Whether it’s rebooking your flight, finding alternative transportation, or providing a place to stay, our 24/7 travel assistance team is here to help!

Is domestic and international medical coverage provided?

Our travel plans can provide up to $250,000 in medical coverage domestically and internationally for emergencies and accidents while traveling.

SILVER PLAN

Best for Domestic Travel

- 100% of Insured Trip Cost for Trip Cancellation

- $25,000 Emergency Accident & Sickness Medical

- $750 Baggage & Personal Effects

Best for Cruise

- $100,000 Emergency Accident & Sickness Medical

- $1,500 Baggage & Personal Effects

PLATINUM PLAN

Optional Cancel For Any Reason Coverage

- $250,000 Emergency Accident & Sickness Medical

- $3,000 Baggage & Personal Effects

Compare Our Silver, Gold, Platinum Plans

Axa travel insurance benefits.

Medical Travel Benefit

AXA offers coverage for certain emergency medical expenses that result from an accidental injury or illness while traveling as well as emergency medical evacuation and repatriation. Learn more

Trip Cancellation

We can reimburse you up to the maximum benefit of your selected travel plan, that is due to an unforeseen event including illness and inclement weather and other covered reasons. Learn more

Emergency Evacuation

AXA Offers coverage for medically necessary evacuations and repatriation as directed by a physician to the nearest adequate medical facility or your home. Learn more

Baggage Loss

AXA offers reimbursement coverage in the event your baggage or personal effects are lost damaged or stolen during your trip. Learn more

Cancel For Any Reason

AXA offers coverage up to 75% of your prepaid nonrefundable trip costs if your trip is cancelled for any reason. Learn more

Trip Interruption

AXA offers coverage for your non-refundable trip costs in the event you cannot continue on your trip due to a covered reason. Learn more

MY TRIP COMPANION

Not just a travel app but a comprehensive travel assistant that enhances your travel experience.

Frequently asked questions about travel insurance, what is travel insurance, what does travel insurance cover on a cruise, why choose axa, how much does travel insurance cost, what is a pre-existing medical condition, does travel insurance have covid benefits.

Travel Assistance Wherever, Whenever

Speak with one of our licensed representatives or our 24/7 multilingual insurance advisors to find the coverage you need for your next trip. From Medical Coverage to Trip Cancellation Protection, our team of travel experts will help you choose the right coverage.

Make the most out of your travels. Get AXA Travel Insurance and travel worry free!

Over 20 Years of Experience | Located in 30+ Countries | 24/7 Travel Assistance

Common concerns about travel insurance.

- It is a clever idea to purchase travel insurance If you are willing to protect your trip from variety of common travel-related incidents, including trip cancellations, flight delays or cancellations, lost or stolen baggage, and medical emergencies.

- Travel insurance provides coverage against medical expenses, reimbursement for lost or stolen luggage, compensation for expenses incurred due to travel delays and more while you are travelling.

- Travel insurance is to provide financial protection to travelers in case of unexpected events. Without adequate insurance coverage, travelers may face significant financial losses and hardships if they encounter any unforeseen circumstances while traveling in the Schengen Territory.

- A good option for travelers who are concerned about unforeseeable events or who want the freedom to cancel their trip for any reason. When you purchase CFAR coverage, you can cancel the trip without losing your entire prepaid, nonrefundable vacation expenses. Exclusive to Platinum Package holders.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

The Guide to American Express Travel Insurance

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

American Express travel insurance vs. coverage provided by AmEx cards

Complimentary travel insurance provided by amex cards.

Trip cancellation and interruption insurance

Trip delay insurance

Car rental loss and damage insurance

Baggage insurance

Premium global assist.

Global Assist Hotline

Standalone American Express travel insurance plans

Should you use the complimentary benefits or purchase a policy, amex travel insurance recapped.

You can get AmEx travel insurance via your card or as a standalone policy.

AmEx cards typically include coverage for trip delays, interruptions, cancellations, baggage and car rentals.

Coverage tends to be secondary.

Policies vary by card.

American Express has two different types of travel insurance offerings: standalone travel insurance plans that customers can purchase and travel insurance that is included as a complimentary benefit on certain cards.

So if you’re thinking about getting travel insurance before a trip, get familiar with American Express travel insurance benefits that are included on your credit cards. Knowing what protections you already have will prevent you from spending money on a separate policy with benefits that overlap.

A standalone travel insurance policy from American Express may offer more robust coverage, but depending on your needs, the travel insurance perks provided by your AmEx card may be sufficient.

If you primarily want specific coverage for cancellations, delays or rental cars and baggage, it’s likely your card will be enough.

If, however, you’re mainly concerned with emergency health coverage while traveling , you’re better off with a separate medical insurance policy because the benefits provided by credit cards are limited in those areas. You can purchase this from American Express directly or shop around other travel insurance companies .

» Learn more: How to find the best travel insurance

There are six travel insurance benefits offered on many American Express cards:

Trip cancellation and interruption insurance .

Trip delay insurance .

Car rental loss and damage insurance .

Baggage insurance plans .

Premium Global Assist Hotline .

Global Assist Hotline .

Here's a closer look at each.

Trip cancellation will protect you if you need to cancel your trip for a covered reason (more below), and you will be reimbursed for any nonrefundable amounts paid to a travel supplier with your AmEx card. Bookings made with Membership Reward Points are also eligible for reimbursement. Travel suppliers are generally defined as airlines, tour operators, cruise companies or other common carriers.

Trip interruption coverage applies if you experience a covered loss on your way to the point of departure or after departure. AmEx will reimburse you if you miss your flight or incur additional transportation expenses due to the interruption. American Express considers the following to be covered reasons:

Accidental injuries.

Illness (must have proof from doctor).

Inclement weather.

Change in military orders.

Terrorist acts.

Non-postponable jury duty or subpoena by a court.

An event occurring that makes the traveler’s home uninhabitable.

Quarantine imposed by a doctor for medical reasons.

There are many reasons that are specifically called out as not covered (e.g., preexisting conditions, war, self-harm, fraud and more), so we recommend checking the terms of your coverage carefully.

If you want a higher level of coverage for trip cancellation, consider purchasing Cancel For Any Reason (CFAR) travel insurance . CFAR is an optional upgrade available on some standalone travel insurance plans. This supplementary benefit allows you to cancel a trip for any reason and get a partial refund of your nonrefundable deposit.

Alternately, if you want what essentially amounts to CFAR insurance on your flights specifically, purchase your fares through the AmEx Travel portal and tack on Trip Cancel Guard for an extra fee. Trip Cancel Guard guarantees you an up to 75% refund on nonrefundable airfare costs when you cancel at least two days before departure, regardless of why. This isn't as comprehensive as other CFAR policies, but it can add some peace of mind for people who want the cash back (as opposed to a travel credit) for flights they may not take.

AmEx cards with trip cancellation, interruption coverage

The following American Express credit cards offer trip cancellation and trip interruption coverage:

on American Express' website

Additional AmEx cards that offer trip cancellation and interruption coverage include:

The Business Platinum Card® from American Express .

Centurion® Card from American Express.

Business Centurion® Card from American Express.

The Corporate Centurion® Card from American Express.

The Platinum Card® from American Express for Ameriprise Financial.

The American Express Platinum Card® for Schwab.

The Platinum Card® from American Express for Goldman Sachs.

The Platinum Card® from American Express for Morgan Stanley.

Corporate Platinum Card®.

Delta SkyMiles® Reserve Business American Express Card .

Terms apply.

Covered amount

The maximum benefit amount for Trip Cancellation and Interruption Insurance is $10,000 per Covered Trip and $20,000 per Eligible Card per 12 consecutive month period. Coverage is secondary and applies after your primary policy provides reimbursement. Claims must be filed within 60 days. To start a claim, call 844-933-0648.

This benefit will reimburse you for reasonable, additional expenses incurred if a trip is delayed by a certain number of hours. Examples of eligible expenses include meals, lodging, toiletries, medication and other charges that are deemed appropriate by American Express. It makes sense to use your judgment in terms of what will get approved based on your policy's fine print.

Acceptable delays include those that are caused by weather, terrorist actions, carrier equipment failure, or lost/stolen passports or travel documents. There are also plenty of exclusions, such as intentional acts by the traveler.

AmEx cards with trip delay insurance

The reimbursable amount depends on which card you hold.

Up to $500 per Covered Trip that is delayed for more than 6 hours; and 2 claims per Eligible Card per 12 consecutive month period.

Up to $300 per Covered Trip that is delayed for more than 12 hours; and 2 claims per Eligible Card per 12 consecutive month period.

As expected, the more premium travel credit cards offer higher compensation for shorter delays. Trip delay insurance is offered on the following American Express credit cards:

When you decline the collision damage waiver offered by the car rental agency, you will be covered if the car is damaged or stolen through your AmEx Travel Insurance. Depending on the card you have, the coverage is $50,000 or $75,000.

» Learn more: How AmEx car rental insurance works

In addition, the cards offering car rental damage and theft insurance up to of $75,000 also provide secondary benefits:

Accidental death or dismemberment coverage.

Accidental injury coverage.

Car rental personal property coverage.

To qualify, you must decline the personal accident coverage and personal effects insurance provided by your car rental company.

The entire rental must be charged on the American Express credit card to receive coverage for car rental loss and damage. And keep in mind that you do still need liability insurance when making your rental car reservation (you may have this through your personal auto insurance policy), as these credit card-provided coverage options don't include personal liability.

AmEx cards with car rental coverage

American Express lists over 50 different cards on its site that come with one of the two forms of car rental insurance. Cards that link to the Tier 1 policies are the $50,000-coverage cards, and Tier 2 policies are the $75,000 cards.

Car Rental Loss and Damage Insurance can provide coverage up to $75,000 for theft of or damage to most rental vehicles when you use your eligible Card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the Commercial Car Rental Company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. Geographic restrictions apply.

Car Rental Loss and Damage Insurance can provide coverage up to $50,000 for theft of or damage to most rental vehicles when you use your eligible Card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the Commercial Car Rental Company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. Geographic restrictions apply.

The amount reimbursed is calculated as whichever is lowest:

The cost to repair the rental car.

The wholesale book value (minus salvage and depreciation).

The invoice purchase price (minus salvage and depreciation).

Here are some key exclusions to be aware of with this coverage:

These policies don't cover theft or damage that was caused by a driver’s illegal operation of the car, operation under the influence of drugs/alcohol or damage caused by any acts of war.

Policies don't cover drivers not named as "authorized drivers" on your rental agreement.

The benefit only covers car rentals up to 30 consecutive days.

Not all cars are included in the policy. Certain trucks, vans, limousines, motorcycles and campers are excluded from coverage.

Insurance protection doesn't apply in Australia, Italy, New Zealand and any country subject to U.S. sanctions .

You can file a claim online or call toll-free in the U.S. at 800-338-1670. From overseas, call collect 216-617-2500. Your claim must be filed within 30 days of the loss. Additionally, some benefits vary by state, so check the policy for your specific card.

» Learn more: The guide to AmEx Platinum’s rental car insurance

As an American Express cardholder, you are eligible to receive compensation if your luggage is lost or stolen. This benefit is in addition to what you may receive from the carrier. However, the AmEx policy is secondary, which means that it kicks in after the carrier provides any compensation for losses.

AmEx provides this insurance to "covered persons," who are defined as:

The cardmember.

Their spouse or domestic partner.

Their dependent children who are under 23 years old (there are age exceptions for handicap children).

Some business travelers (Tier 2 coverage only).

To qualify, all covered individuals need to be traveling on the same reservation and must be residents of the U.S., Puerto Rico or the U.S. Virgin Islands.

AmEx cards with baggage insurance

Naturally, the higher-end cards offer more protection — but even the basic cards have decent coverage. The compensation limits per person are as follows (note that the maximum payout per covered person for lost luggage is $3,000 on all of these cards).

Below are the limits for cardholders of the The Platinum Card® from American Express , The Business Platinum Card® from American Express , The American Express Platinum Card® for Schwab, The Platinum Card® from American Express for Goldman Sachs, The Platinum Card® from American Express for Morgan Stanley, Hilton Honors American Express Aspire Card , Marriott Bonvoy Brilliant™ American Express® Card, Centurion® Card from American Express and Business Centurion® Card from American Express:

Baggage in-transit to/from common carrier: $3,000.

Carry-on baggage: $3,000.

Checked luggage: $2,000.

Combined maximum: $3,000.

High-end items: $1,000.

Disclosure: Baggage Insurance Plan coverage can be in effect for Covered Persons for eligible lost, damaged, or stolen Baggage during their travel on a Common Carrier Vehicle (e.g. plane, train, ship, or bus) when the Entire Fare for a ticket for the trip (one-way or round-trip) is charged to an Eligible Card. Coverage can be provided for up to $2,000 for checked Baggage and up to a combined maximum of $3,000 for checked and carry on Baggage, in excess of coverage provided by the Common Carrier. The coverage is also subject to a $3,000 aggregate limit per Covered Trip. For New York State residents, there is a $2,000 per bag/suitcase limit for each Covered Person with a $10,000 aggregate maximum for all Covered Persons per Covered Trip.

And here are the coverage limits for cardholders of the American Express® Gold Card , American Express® Business Gold Card , American Express® Green Card , Business Green Rewards Card from American Express , Hilton Honors American Express Surpass® Card , Marriott Bonvoy™ American Express® Card, Marriott Bonvoy Business® American Express® Card , Delta SkyMiles® Reserve American Express Card , Delta SkyMiles® Reserve Business American Express Card , Delta SkyMiles® Platinum American Express Card , Delta SkyMiles® Platinum Business American Express Card , Delta SkyMiles® Gold American Express Card and Delta SkyMiles® Gold Business American Express Card , The Hilton Honors American Express Business Card :

Baggage in-transit to/from common carrier: $1,250.

Carry-on baggage: $1,250.

Checked luggage: $500.

High-end items: $250.

Disclosure: Baggage Insurance Plan coverage can be in effect for Eligible Persons for eligible lost, damaged, or stolen Baggage during their travel on a Common Carrier (e.g. plane, train, ship, or bus) when the entire fare for a Common Carrier Vehicle ticket for the trip (one-way or round-trip) is charged to an eligible Account. Coverage can be provided for up to $1,250 for carry-on Baggage and up to $500 for checked Baggage, in excess of coverage provided by the Common Carrier (e.g. plane, train, ship, or bus). For New York State residents, there is a $10,000 aggregate maximum limit for all Covered Persons per Covered Trip.

AmEx also offers limited reimbursement for high-end items (coverage varies by card), such as:

Sports equipment.

Photography or electronic equipment.

Computers and audiovisual equipment.

Wearable technology.

Furs (including items made mostly of fur and those trimmed/lined with fur).

Items made fully or partially of gold, silver or platinum.

Claims must be filed within 30 days of your baggage loss. To file a claim, call 800-645-9700 from the U.S. or collect to 303-273-6498 if overseas. You can also file a claim online.

» Learn more: Compare travel insurance options: airline or credit card?

This benefit helps with events like replacing a lost passport, missing luggage assistance, emergency legal and medical referrals, and in some instances, emergency medical transportation assistance.

The service can also help you figure out important travel-related details like customs information, currency information, travel warnings, tourist office locations, foreign exchange rates, vaccine recommendations for the country you’re visiting, passport/visa requirements and weather forecasts.

AmEx cards with Premium Global Assist

Premium Global Assistance is offered on the following American Express credit cards:

The Platinum Card® from American Express .

Delta SkyMiles® Reserve American Express Card .

Hilton Honors American Express Aspire Card .

Marriott Bonvoy Brilliant™ American Express® Card.

Services provided by Premium Global Assist Hotline

You can rely on Global Assist Hotline 24 hours a day / 7 days a week for medical, legal, financial or other select emergency coordination and assistance services while traveling more than 100 miles away from your home. Plus, the Premium Global Assist Hotline may provide emergency medical transportation assistance and related services. Third-party service costs may be your responsibility.

The hotline isn’t so much a concierge as a service that provides logistical assistance, which can include the following:

General travel advice

Emergency translation if you need an interpreter to help with legal or medical documents (cost isn't covered).

Lost item search if your belongings are lost while traveling.

Missing luggage assistance if an airline loses your luggage. The hotline will contact your airline on a daily basis on your behalf to help locate your bags.

Passport/credit card assistance if your credit card or passport is lost or stolen.

Urgent message relay if you need to contact a family member and/or friend in the event of an emergency.

Medical assistance

Emergency medical transportation assistance if the cardmember or another covered family member traveling on the same itinerary gets sick or injured and needs medical treatment (there are many conditions for this coverage; review your policy’s fine print).

Physician referral if you need a doctor or dentist (cardmember is responsible for costs).

Repatriation of remains in the event of death.

Financial assistance

Emergency wire service to get help obtaining cash (fees will be reimbursed).

Emergency hotel check in/out if your card has been lost or stolen.

Legal assistance

Bail bond assistance if you need access to an agency that accepts AmEx (cardmember is responsible for paying bail bond fees).

Embassy and consulate referral if you need help finding or accessing local embassies.

English-speaking lawyer referral if you’re traveling and need a list of available attorneys (cardmember is responsible for any legal fees).

To use this benefit, call the Premium Global Assist Hotline toll-free at 800-345-AMEX (2639). You can also call collect at 715-343-7979.

The main difference between the Global Assist Hotline and the Premium version is that some of the services that are fully covered by Premium Global Assist aren't covered in the more basic version (cited examples include emergency medical transportation assistance and repatriation of mortal remains).

You can rely on Global Assist Hotline 24 hours a day / 7 days a week for medical, legal, financial or other select emergency coordination and assistance services while traveling more than 100 miles away from your home. Third-party service costs may be your responsibility.

AmEx cards with Global Assist Hotline access

The Global Assist Hotline is available to holders of the following cards:

American Express® Gold Card .

American Express® Business Gold Card .

American Express® Green Card .

Business Green Rewards Card from American Express .

Delta SkyMiles® Platinum American Express Card .

Delta SkyMiles® Platinum Business American Express Card .

Delta SkyMiles® Gold American Express Card .

Delta SkyMiles® Gold Business American Express Card .

Delta SkyMiles® Blue American Express Card .

Hilton Honors American Express Surpass® Card .

Hilton Honors American Express Card .

The Hilton Honors American Express Business Card .

Marriott Bonvoy™ American Express® Card.

Marriott Bonvoy Business® American Express® Card .

The Amex EveryDay® Preferred Credit Card from American Express .

Amex EveryDay® Credit Card .

Blue Cash Preferred® Card from American Express .

The American Express Blue Business Cash™ Card .

The Blue Business® Plus Credit Card from American Express .

You can call the Global Assist Hotline toll-free at 800-333-AMEX (2639), or collect at 715-343-7977.

If you don’t have any of the credit cards above and are thinking about purchasing a policy from American Express or just simply want to price compare to see if you get better perks by purchasing a policy, you can go to the AmEx travel insurance website and input your trip plans to build a quote. You’ll need to provide your departure and return date, state of residence, age of traveler, number of travelers covered by the policy and the trip cost per traveler. Then, you can select the option of choosing a package or building your own.

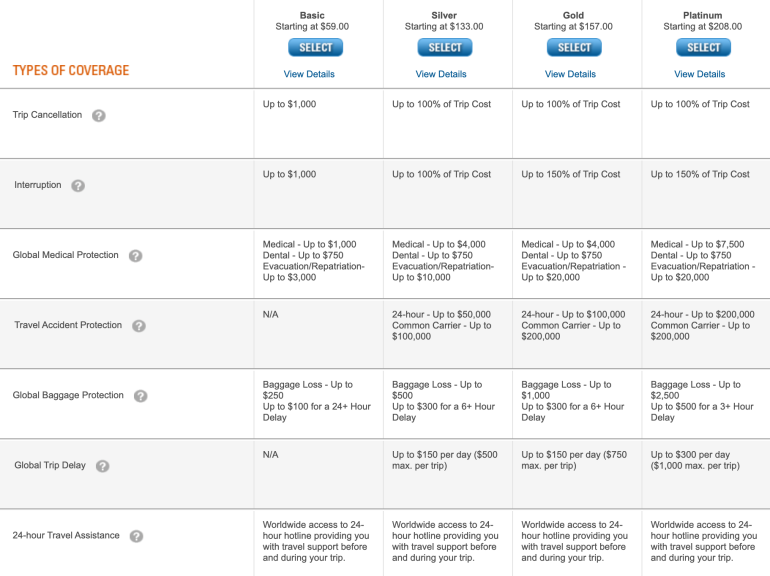

To see which plans are available, we input a sample $3,000, one-week trip by a 35-year-old from South Dakota. Our search result yielded four different plans ranging from $59 for a Basic plan to $208 for a Platinum plan.

Global medical protection (not included on AmEx cards)

Medical protection includes coverage for emergency healthcare and dental costs as well as medical evacuation and repatriation of remains . The limits increase as the plans become more expensive. Although AmEx cards offer an array of travel insurance benefits, medical coverage isn't included. So if medical protection benefits are important to you, a standalone travel insurance policy is what you’ll want to look for.

Travel accident protection (not included on AmEx cards)

Another benefit not included with AmEx cards is travel accident protection. This benefit provides coverage in case of death or dismemberment while traveling . Although this is a topic no one wants to think about, it's good to be familiar with this coverage. While travel accident protection isn’t offered on the Basic plan, all of the higher plans offer it.

Standalone policy benefits that are also included on AmEx cards

These elements of coverage are offered on the AmEx cards mentioned, although in some, the limits may be higher or lower.

Trip cancellation

The Basic plan only covers a trip up to $1,000, however, all the other plans cover 100% of the trip cost. To compare this with the perks included as a benefit on the cards, all AmEx cards that include trip cancellation coverage provide up to $10,000 per covered trip.

Keep in mind that, all the cards included have annual fees and the card with the lowest fee is the Hilton Honors American Express Aspire Card , with a $550 annual fee.

Trip interruption

Trip interruption coverage ranges from $1,000 on a Basic plan to 150% of trip cost on the Gold and Platinum plans. The trip interruption benefit offered by the AmEx cards is included on all the same cards that offer trip cancellation insurance, with the trip interruption limit capped at $10,000 per covered trip.

Global baggage protection

If your luggage is lost or stolen this benefit will provide monetary compensation to reimburse you for your lost items. AmEx cards offer baggage coverage as a complimentary benefit, with the higher-end cards naturally providing higher limits. Interestingly, the cards with the lower annual fees (i.e. Hilton Honors American Express Surpass® Card , annual fee $150 ) have a high limit as well, offering a total combined limit for lost luggage of $3,000, which is higher than the coverage offered by the standalone Platinum plan.

Global trip delay

If your trip is delayed, you’re eligible for reimbursement of any necessary expenses incurred up to a specific limit. The Basic plan doesn’t offer this benefit, but all the other plans do, with the Platinum plan providing up to $300 per day (maximum of $1,000 per trip). This coverage is also included on the higher-end AmEx cards.

AmEx cards offer key travel insurance benefits: trip cancellation and interruption insurance, trip delay insurance, car rental loss and damage insurance, baggage insurance, Premium Global Assist Hotline (or Global Assist Hotline). However, they don't offer any sort of emergency medical coverage. This is pretty typical of travel credit cards, as the travel insurance perks they offer don't provide coverage for emergency health care costs.

If you’re looking for emergency medical coverage, you’ll need to purchase a separate policy, such as the standalone one offered by American Express. The other limits provided in the American Express travel insurance policy are comparable to what you get on the AmEx cards, so it makes sense to shop around to make sure that the benefits you’re paying for are sufficient for your needs.

» Learn more: What to know about American Express Platinum travel insurance

Yes, if you have one of the cards listed above. If you have a credit card that isn’t listed in this guide or the card is no longer available by American Express, call the number on the back of your card for more information. Generally, AmEx offers a number of travel insurance benefits on its credit cards that shouldn't be overlooked.

Yes, but it depends on which card you have. To qualify for reimbursement, the trip cancellation must be for a covered reason. Refer to the section "Trip Cancellation and Interruption Insurance" for a list of cards and explanations of covered reasons.

American Express offers a solid range of travel insurance protection across its credit cards, with the premium cards providing the most coverage. However, if you need insurance benefits with higher limits, we recommend purchasing a separate travel insurance policy . If you only need emergency medical coverage , there are policies that provide that as well.

Call the number on the back of your card to ask for guidance. Some benefits may require authorization from American Express before coverage kicks in, so make sure you follow all the correct steps for reimbursement.

Refer to the AmEx credit card policy for the specific benefit because it will include instructions for submitting a claim. If you cannot find the policy, you should call the customer service number on the back of your American Express card for more assistance.

Yes. American Express offers travel insurance as a benefit of some of its cards, but it also sells standalone coverage that you can purchase out-of-pocket. The latter tends to be more comprehensive and customizable to your needs.

No, you do not get automatic travel insurance with American Express. It is available as a benefit on certain cards. Refer to your terms and conditions to learn if you are covered.

American Express cards do not include medical coverage; instead, you will want to purchase a standalone travel insurance policy with medical protections, such as repatriation of remains or medical evacuation coverage .

American Express offers a solid range of travel insurance protection across its credit cards, with the premium cards providing the most coverage. However, if you need insurance benefits with higher limits, we recommend purchasing a

separate travel insurance policy

. If you only need

emergency medical coverage

, there are policies that provide that as well.

American Express cards do not include medical coverage; instead, you will want to purchase a standalone travel insurance policy with medical protections, such as

repatriation of remains or medical evacuation coverage

American Express travel insurance offers a wide array of benefits, especially on its premium cards. Knowing what benefits are available to you is important in the event of unforeseen circumstances. Determine whether an individual policy is a better fit for your risk tolerance than coverage that is included on an eligible card, then go from there.

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

Please visit americanexpress.com/benefitsguide for more details.

Underwritten by New Hampshire Insurance Company, an AIG Company.

Underwritten by AMEX Assurance Company.

Baggage insurance plans

Please visit americanexpress.com/benefit sguide for more details.

Premium Global Assist Hotline

If approved and coordinated by Premium Global Assist Hotline, emergency medical transportation assistance may be provided at no cost. In any other circumstance, Card Members may be responsible for the costs charged by third-party service providers.

Card Members are responsible for the costs charged by third-party service providers.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- 1 Understand

- 3 Fees and permits

- 4 Get around

- 11 Stay safe

Assur is an ancient Assyrian ruin in Northwestern Iraq . In the Bronze Age, it was an important trade hub. The city remained continuously inhabited for over 4000 years, but was abandoned in the 14th century after the residents were massacred by the Timurid Empire .

Understand [ edit ]

Get in [ edit ].

Assur is off Highway 1, that runs between Baghdad and Mosul. From Mosul, the distance is about 140 km. Nearest town is Al-Shirqat.

Fees and permits [ edit ]

Get around [ edit ].

Due to its relatively small size, you could (in safer times) get around on foot quite easily.

See [ edit ]

Due to the unstable security situation on site, the architectural heritage has not been assessed by experts since Assur was overrun by terrorists in 2015. The current status of the structures below is therefore unknown. Do not assume they are still intact nor that they can be visited.

- 35.4597 43.2611 1 Assur Ziggurat . ( updated Nov 2020 )

- 35.4574 43.2585 2 Temple of Nabu . ( updated Nov 2020 )

- Royal Tombs . ( updated Nov 2020 )

Do [ edit ]

Buy [ edit ], eat [ edit ], drink [ edit ], sleep [ edit ], stay safe [ edit ].

Parts of the archaeological site were reportedly demolished in 2015 by terrorists using explosives, and some of these unexploded devices may still be around. Do not stray from marked foot paths.

See the warning on the Iraq article.

Go next [ edit ]

In safer times, Hatra and Mosul would have been next on many travelers' itineraries, but as of 2019 they are very dangerous and best avoided.

- UNESCO World Heritage Sites

- UNESCO tag to be fixed

- Has custom banner

- Has map markers

- See listing with no coordinates

- Northwestern Iraq

- All destination articles

- Outline parks

- Outline articles

- Park articles

- Has Geo parameter

- Pages with maps

Navigation menu

Vous souhaitez apporter des modifications à votre contrat ?

Contacts utiles.

Besoin d'une assistance médicale pendant votre voyage ?

Un doute sur un symptôme ?

Déclarer et suivre un sinistre

Une question sur votre devis ? Besoin d'un conseil ?

Gérez votre contrat en ligne 7j/7 & 24h/24 !

Vous n'êtes pas encore client Allianz Travel ?

Vous êtes sourd ou malentendant ?

Une mauvaise expérience à partager .

Je souhaite faire une réclamation

Nous vous accompagnons

IMAGES

VIDEO

COMMENTS

Une question sur un de nos produits ? Nos conseillers sont à votre disposition pour vous aider à choisir la garantie la plus adaptée à votre situation. Vous pouvez nous contacter par téléphone au 03 28 04 69 85 ou remplir le formulaire ci-dessous, nous vous répondrons dans les plus brefs délais. Découvrez notre formulaire de contact.

Partenaire de votre mobilité. Leader des assurances santé expatriés, étudiants à l'étranger et assurances voyages. Spécialiste de la mobilité internationale, ASSUR TRAVEL propose des solutions d'assurance avec épidémies sur mesure. pour vos études ou en voyage d'affaires ?

Expat Assurance opinion. It is a small player on the international market with a nice offer, reactive and quite agile. We do not advise people over 50 years old who wish to stay abroad for many years to take out these solutions, which are not for life, as premiums increase considerably after the age of 60. If you live in a provincial city, you ...

Who is Assur Travel ? Established in 2004 by three experts in travel and expatriate insurance, each with significant experience at Europ Assistance, Assur Travel is a brokerage firm specializing in international mobility. Today, they provide insurance coverage for nearly 30,000 expatriates or students abroad and serve around 300,000 travelers ...

Contact us: +33 (0)3 28 04 69 85. contact @ assur-travel.fr. 04/03/2021. Health, Assistance and Civil Liability cover . for Schengen impatriates. Schengen Impatriate . ... ASSUR TRAVEL has designed, for foreigners staying in France, for a few days to a whole year, Premium, Confort . and .

Assur-Travel, Villeneuve-d'Ascq. 78 likes · 3 talking about this. Courtier grossiste gestionnaire, nous assurons via nos agences de voyages, courtiers et blogs parten

ASSUR TRAVEL | 357 followers on LinkedIn. Assur Travel, partenaire de votre mobilité ! | Créé en 2004, Assur-Travel, est un courtier grossiste français, spécialisé dans la conception et la ...

Number to call: 00 33 (0)3 28 54 03 20. Email: [email protected]. What to do: Send prior agreement by email, as soons as the hospitalization is planned. Documents to be submitted are listed in the practical guide. In case of hospitalization over 24h, your insurer will make a direct payment to avoid you to pay in advance.

[email protected] www.assur-travel.fr Conditions 2024. Globe-trotters - temporary expatriates ASSUR TRAVEL, ... ASSUR TRAVEL - Service Souscriptions ZONE D'ACTIVITE ACTIBURO 99 Rue Parmentier - 59650 Villeneuve d'Ascq Upon receipt of membership and payment, we will

En termes d'annulation, Assur Travel se distingue avec un plafond de 25 000 €, surpassant la plupart des concurrents. Le prix minimum pour une assurance court séjour est fixé à 12 €, se situant dans une fourchette moyenne par rapport aux autres acteurs du marché.

ASSUR TRAVEL | 346 followers on LinkedIn. Assur Travel, partenaire de votre mobilité ! | Créé en 2004, Assur-Travel, est un courtier grossiste français, spécialisé dans la conception et la ...

Contact. The only travel insurance solution with COVID certificate recommended by the French & Costa Rican Chamber of Commerce and Industry! ... 150€ ($180) per night for 14 nights . Subscribe in a few clicks and take advantage of the competitive rates offered by Assur Travel. Our assets : • the most competitive rates on the market

The Pioneers of Travel Assurance. Contact Us About Our Plans . ... Contact. Return Assured P.O. Box 8505 Mandeville, LA 70470. Phone: 800-418-7316 Fax: 877-514-7910 [email protected]. Hours. Monday - Thursday 9:00am - 4:00pm CST. Friday 9:00am - 12:00pm CST. Report Death. To report death while traveling, please call one of the ...

Find company research, competitor information, contact details & financial data for ASSUR-TRAVEL of VILLENEUVE D ASCQ, HAUTS DE FRANCE. Get the latest business insights from Dun & Bradstreet.

We are a full service travel agency specializing in family vacations, cruises, all inclusive resorts and Disney Destinations. Please contact us for a no-obligation quote! We have years of experience in the travel industry, with a focus on Disney destinations. We started Assurance Travel because we are committed to providing superior customer ...

For travel insurance coverage that's tailored to your needs, you can count on SecuriGlobe! Continue to SecuriGlobe You will be rerouted automatically to SecuriGlobe's website. Fr. Assurancevoyages.ca is now owned by SecuriGlobe. For travel insurance coverage that's tailored to your needs, you can count on SecuriGlobe! ...

contact About Us File a Claim Contact Form Website Cookies Nationwide 855-327-1441

However, the contact can be subscribed from destination country, when it follows the . coverage of another travel insurance without any interruption between both insurance. The insured person will be asked a proof of its prior insurance in case of a claim. tre, l'assuré devra communiquer à Assur-Travel la preuve de la souscription. Date of ...

Travel Assistance Wherever, Whenever. Speak with one of our licensed representatives or our 24/7 multilingual insurance advisors to find the coverage you need for your next trip. From Medical Coverage to Trip Cancellation Protection, our team of travel experts will help you choose the right coverage. 855- 327- 1441.

Covered amount. The maximum benefit amount for Trip Cancellation and Interruption Insurance is $10,000 per Covered Trip and $20,000 per Eligible Card per 12 consecutive month period. Coverage is ...

Assur is an ancient Assyrian ruin in Northwestern Iraq.In the Bronze Age, it was an important trade hub. The city remained continuously inhabited for over 4000 years, but was abandoned in the 14th century after the residents were massacred by the Timurid Empire.. Assur has been a UNESCO World Heritage Site since 2003, as a reaction to plans to submerge parts of the archaeological site ...

Vous avez souscrit un contrat Allianz Travel via un de nos partenaires (Air France, SNCF Connect...) ? Contactez le service client dédié au 01 42 99 82 81. ... Monsieur le Médiateur de l'Assurance - TSA 50110 - 75441 Paris Cedex 09. Nous vous accompagnons. Mon Compte. Retrouvez vos contrats et effectuez vos démarches en un clin d'oeil. Je ...

www.assurancetravelassist.com