Everything you need to know about Costco Travel — and why I love it for saving money

Costco isn't just the place where you can buy toilet paper in bulk, inexpensive gas, cheap hot dogs and gift cards. You can also book great trips via the company's online travel agency, Costco Travel.

I know, I know: At TPG, we're often staunchly against booking travel through third-party sites , as there can be tradeoffs versus booking directly. But in recent years, I've become a big fan of the travel deals I can find via Costco Travel.

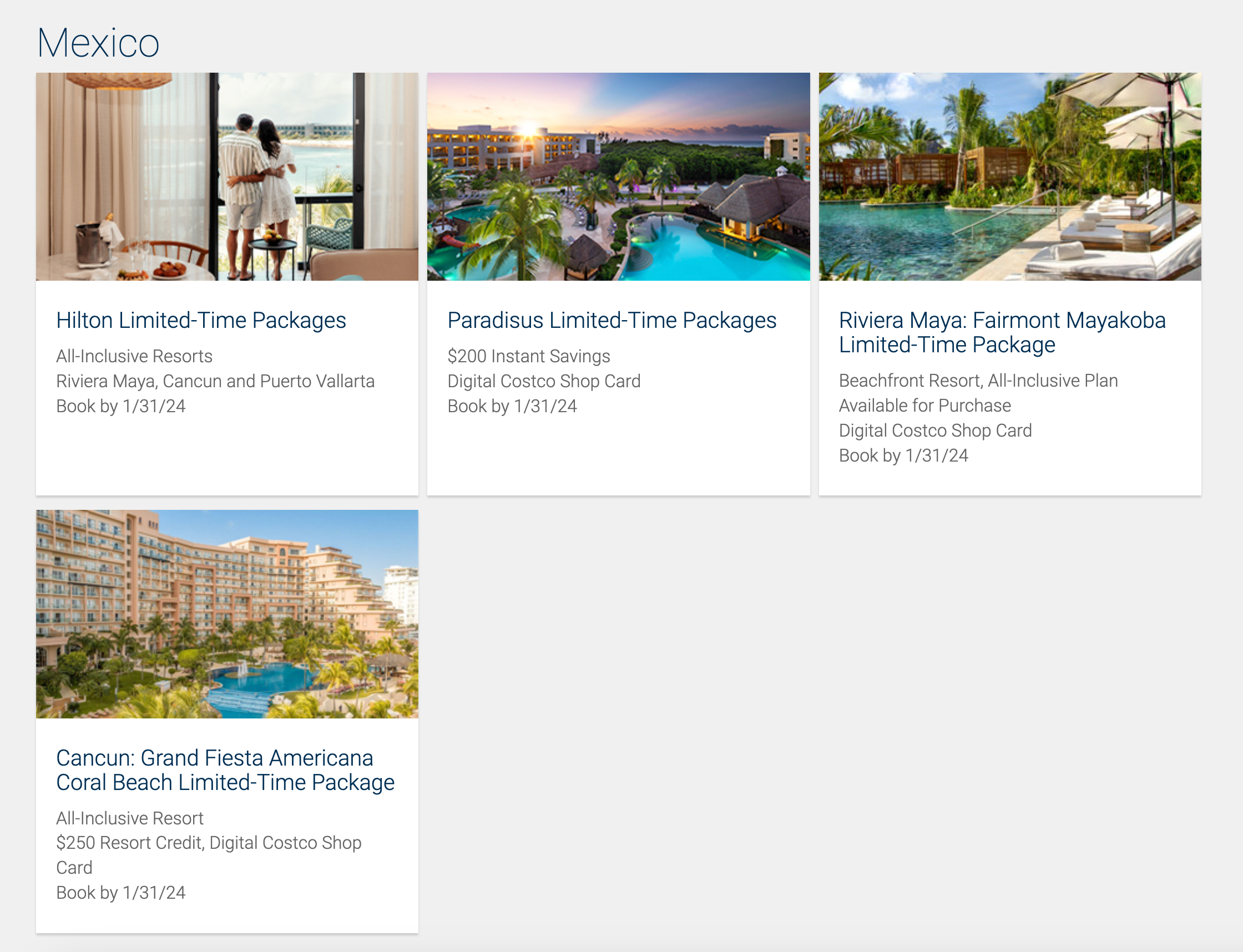

When planning our annual beach trip back in 2022, my best friend found a few options for Mexican all-inclusive resorts on Costco Travel and shared the links with me. I promptly told her we'd probably be better off booking directly and brushed off the idea of booking through Costco — neither of us even had a membership at the time.

However, comparing the prices and benefits at a few of the resorts proved my initial reaction wrong.

I actually got a Costco membership to book the deal since the cost of the membership was less than what we'd save by booking through Costco. We saved around $300 on a three-night stay at TRS Coral near Cancun (one of TPG's best all-inclusive resorts in Cancun ), not including the free hydrotherapy spa circuit and the $241 Digital Costco Shop Card included in the package.

View this post on Instagram A post shared by Madison Blancaflor (@madison_ave18)

Our stay was fantastic, and I officially became a Costco Travel convert.

If you're curious about how to use Costco Travel to find deals, here's everything you need to know about Costco Travel — and why I love it for saving money on travel.

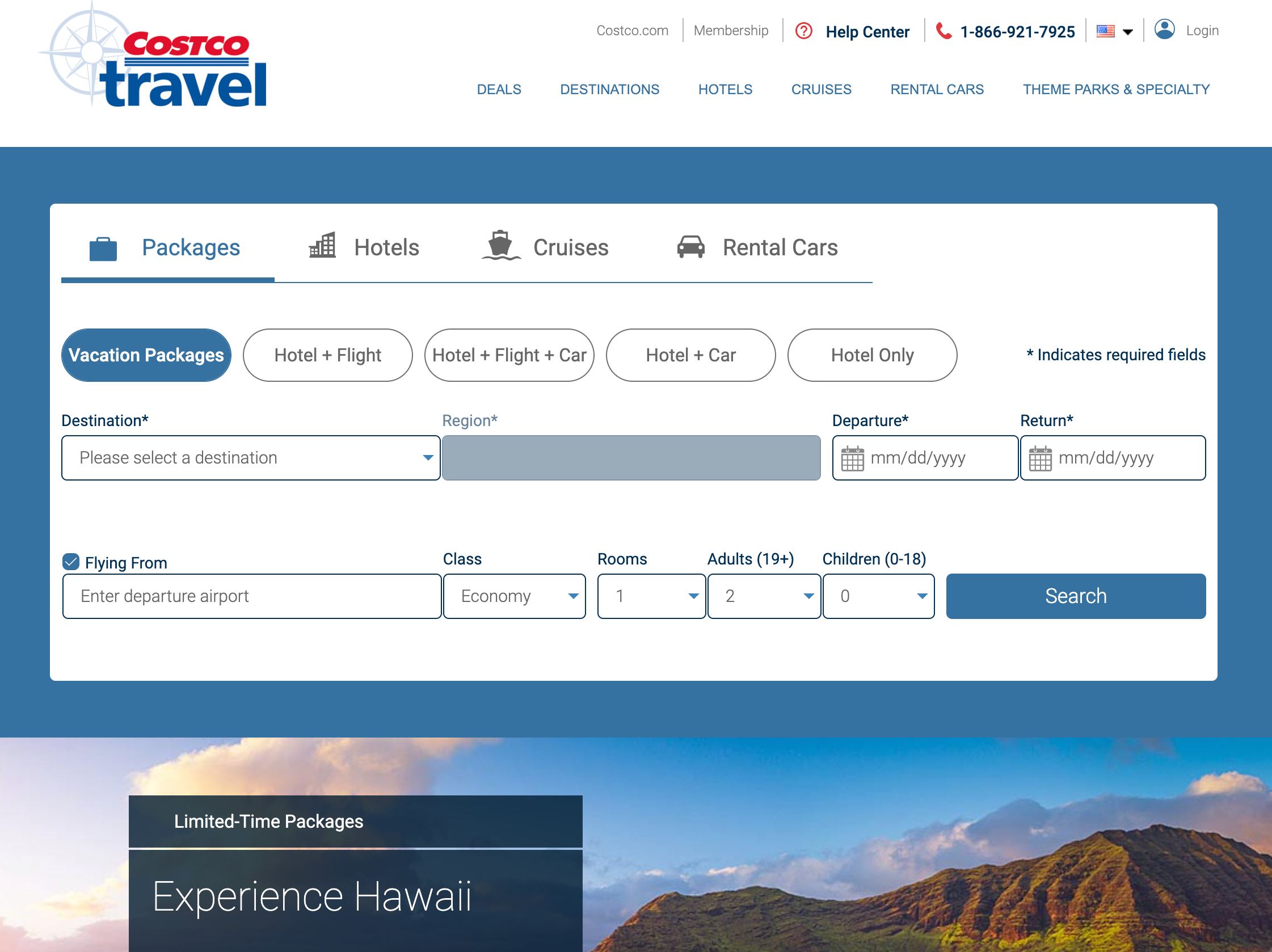

What is Costco Travel?

All Costco members have access to the Costco Travel booking platform, where you can find and book a wide range of travel — from vacation packages to hotels, cruises and rental cars. You can even book theme park vacation packages to Disney and Universal or specialty vacations such as an African safari.

Related: Costco cruise deals: How to save money booking travel at a warehouse club

Once you log in to Costco Travel, you can search for specific dates or destinations or browse through available deals and featured destinations. I personally love perusing the limited-time deals when I know I want to plan a getaway but don't have a specific destination in mind.

Trips booked through Costco Travel are often discounted and/or include perks and benefits you may not get by booking directly or through other booking portals. Usually, a trip booked through Costco Travel will also include a Digital Costco Shop Card (essentially a type of Costco gift card) of varying value.

What travel can you book through Costco Travel?

You can book hotels, cruises, rental cars and vacation packages through Costco Travel. Vacation packages range from hotel-only offers to all-encompassing packages that include airfare, hotel stays and rental cars. You can even build your own package.

However, one thing to note is that you can't book stand-alone flights via Costco Travel. There is an option to book flights through some vacation packages, but if you're only looking for airfare, you'll want to head to Google Flights to check out your options and book.

You can book Costco Travel offers both online and by phone.

Do you have to be a Costco member to use Costco Travel?

Yes. Costco Travel is an exclusive service for Costco members.

There are two personal membership levels: Gold Star and Executive. Gold Star costs $60 per year, while an Executive membership costs $120. The basic membership will give you access to all of Costco's services, including Costco Travel, while the Executive membership also comes with a 2% reward on all Costco (and Costco Travel) purchases.

I've found that the Costco Travel deals alone are worth paying the $60 Gold Star annual membership fee, even though I don't regularly use Costco for my grocery store runs.

Check sites like Groupon for discount Costco memberships, as you can sometimes save on that rate — or get an included gift card that helps offset the cost.

Is Costo Travel worth it?

Costco Travel has its pros and cons, but there are definitely times when it's worth it.

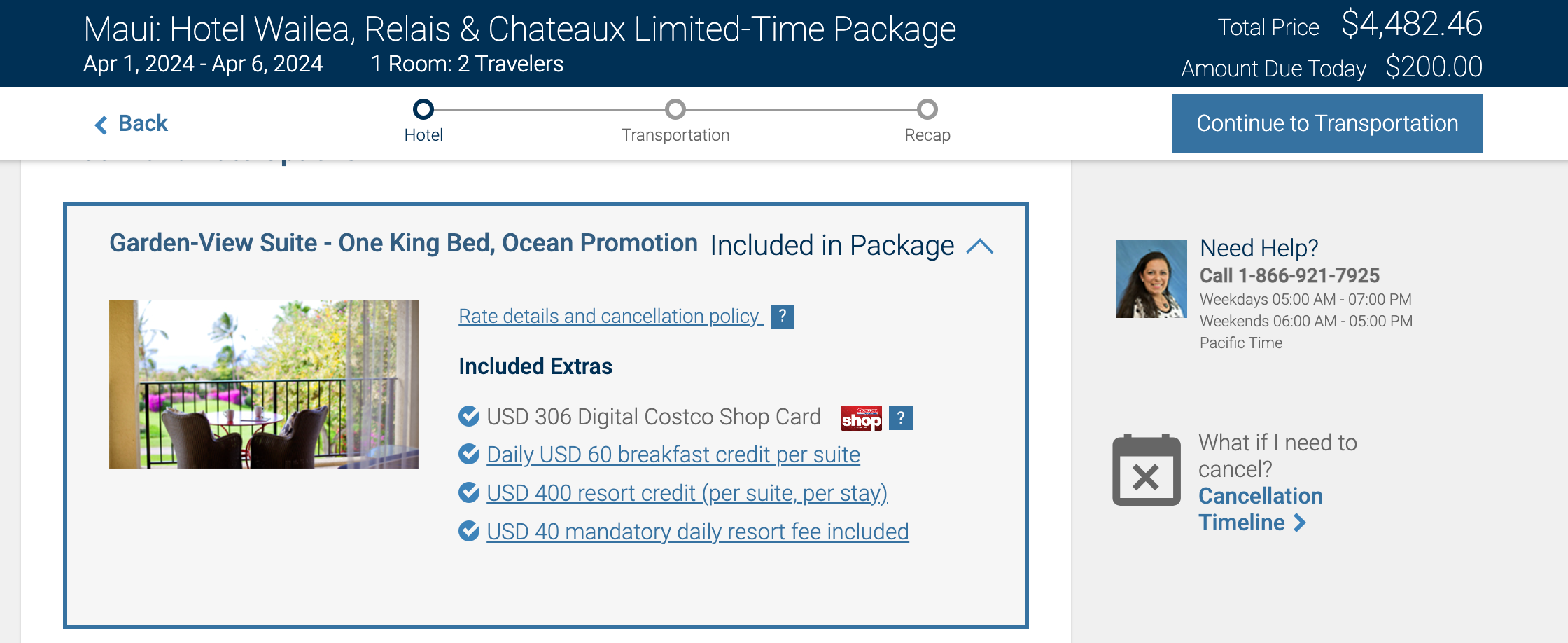

For example, let's look at a five-night stay in Maui in early April. At the time of writing, Costco is currently offering a hotel and rental car package for Hotel Wailea, a Relais & Chateaux affiliated property and one of TPG's favorite Maui hotels .

Here's one cost comparison breakdown of Costco Travel's deal versus booking directly:

Even without including the additional benefits, you're already saving more than $400 via the Costco deal. Add in the value you get from the card, daily breakfast and resort credit (which is more than $1,000 in value if you maximize all benefits), and you're looking at $1,442.45 in savings by booking through Costco Travel versus directly.

And since Hotel Wailea isn't a member of any major hotel loyalty program, booking through Costco Travel wouldn't mean missing out on elite night credits or other loyalty program benefits.

Here's another example — this time for a Universal Orlando theme park trip from June 4-6 for one adult and two children from Houston. The total cost when booking each part (hotel, tickets and airfare) individually came to $2,701.35, while booking it as a package via Costco saved just over $300.

That's a fair amount of savings you could use for some frozen butterbeer or even a new wand inside the Wizarding World of Harry Potter .

When is Costco Travel not worth it?

Not every offer on Costco is worth booking.

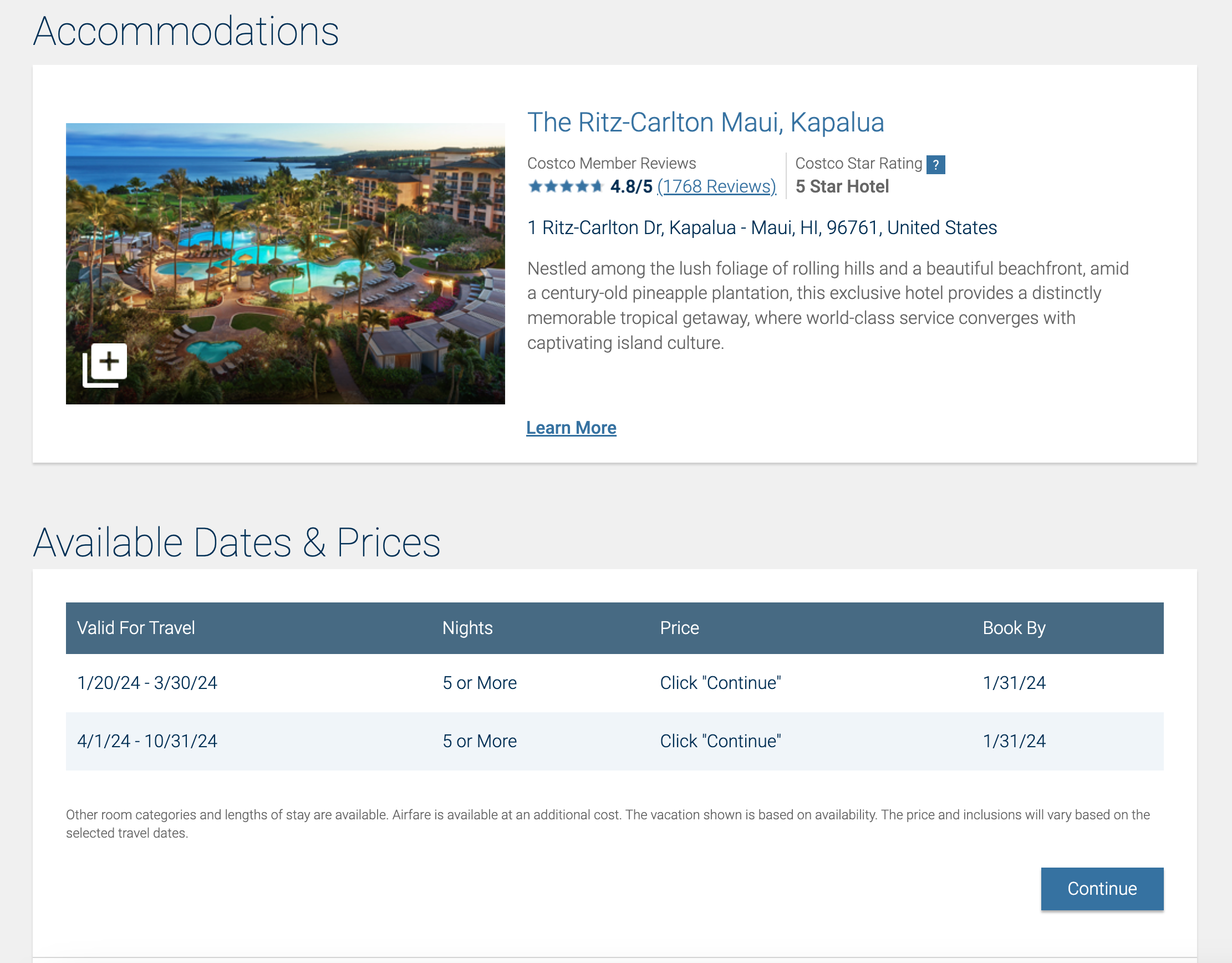

For one, you won't necessarily find the same availability on Costco Travel. For example, flights booked through Costco may have some seats blocked off, and certain dates for hotel stays may be unavailable. Additionally, not all rental car companies are bookable through Costco Travel (such as Hertz*, which is my preferred rental car company due to the perks I get through my Capital One Venture X Rewards Credit Card ).

Plus, some hotel stays have a minimum stay requirement. If you're on the hunt for a long weekend getaway, you may not be able to take advantage of some Costco Travel deals.

Even when you do find availability, you should always price-check what you can find by booking directly or through your credit card travel portal and hotel programs.

After booking our fantastic stay at TRS Coral just north of Cancun through Costco, I looked at booking through Costco again in 2023 when planning our annual beach vacation.

While Costco had a deal available for the same resort, we happened to be booking when the resort chain was having a Mother's Day sale for anyone booking directly. We were able to try out a new TRS resort closer to Playa Del Carmen, TRS Yucatan; we saved more than $100 on an even nicer suite than Costco Travel offered by booking directly (even when considering the Digital Shop Card we would have gotten by booking with Costco).

Something else to consider when booking hotels through Costco Travel is loyalty program rewards and elite status. There are a lot of hotels available to book through Costco Travel that are part of major loyalty programs, from Hyatt Honors to Marriott Bonvoy to IHG One Rewards and more. But booking through Costco Travel — just like booking through most other third-party services such as Expedia — means you likely won't earn loyalty rewards, elite night credits or have any elite night benefits honored.

You'll also have to use Costco customer service if you run into any issues rather than going directly to the brand. This is especially important when considering booking a vacation package that includes flights, given the higher potential for delays or cancellations.

Why I love Costco Travel

I am typically a staunch proponent of booking directly, but Costco Travel is an exception. I've found that the benefits I can get by booking some trips via Costco outweigh the cons (some of which include having to go through Costco for any customer service help or occasionally losing out on elite night credits).

Digital Costco Shop Cards

My favorite thing about booking trips through Costco Travel is the Digital Costco Shop Card I get after booking. The card's value varies from trip to trip (generally depending on how expensive the package you book), but you can get hundreds of dollars back to use at Costco.

The Digital Costco Shop Cards can be used for Costco warehouse purchases (a game changer with grocery prices so high due to inflation), but you can also use them toward future Costco Travel bookings. And remember — Costco doesn't just carry bulk grocery items. You could use a Digital Costco Shop Card to buy a new flat-screen TV for movie nights and game days, a new outdoor patio setup ahead of summer or even Costco Pharmacy prescriptions.

I admittedly don't use Costco for groceries often (buying in bulk doesn't make a lot of sense for someone who lives alone), but I have used shop cards to help pay for Christmas presents and future Costco Travel trips. I've actually been looking into using my most recent Digital Costco Shop Card on a new pair of AirPods and a new TV mount for my living room.

Deals on non-points hotel stays and all-inclusive resorts

When I'm looking at booking a hotel stay at a brand like Hyatt or Marriott, I generally choose to book directly in order to earn elite night credits and points. However, when looking at properties not part of a major loyalty program, Costco Travel is often a go-to anytime I can find a deal.

Costco Travel has a nice deals section, and I usually look there first if I'm not sold on a specific destination for a getaway. While deals found on Costco generally have a narrow booking window, I've found that many offer a lot of flexibility for the actual trip dates.

A few examples of limited-time deals for January include Hotel Wailea from the example earlier in this guide, all-inclusive resorts in Mexico's Riviera Maya, and Disney and Universal theme park packages.

Simplifying group vacations

I'm often the travel planner in my friend group (which makes sense, considering what I do for a living), but not everyone is an avid points and miles user like myself. For group trips where we're splitting the cost of hotel rooms among multiple people, it often doesn't make sense to use points and miles to book.

Costco Travel vacation packages offer a way for all of us to save money, and it makes narrowing down potential destinations and hotels easier. Rather than everyone having to spend hours researching ideas and prices from across the internet — which might be my idea of a fun Wednesday night but isn't for some of my friends — I typically just send them to Costco Travel to see if any of the featured deals catch their eye.

Having reservation information for multiple aspects of a trip, such as a hotel and rental car package, makes sharing and saving the itineraries a breeze.

Bottom line

Whether or not you currently have a Costco membership, you shouldn't dismiss Costco Travel as just another online travel agency.

If you know where to look and are willing to price-check the deals you find, you can save a lot of money with Costco Travel deals. I've personally had a lot of success booking friends getaways to popular destinations like Mexico through Costco. Using the service has helped me save on other expenses with the Digital Costco Shop Card I've gotten with my bookings.

For me, the $60 annual membership fee to Costco has been more than worth it to utilize Costco Travel.

*Upon enrollment, accessible through the Capital One website or mobile app, eligible cardholders will remain at upgraded status level through Dec. 31, 2024. Please note, enrolling through the normal Hertz Gold Plus Rewards enrollment process (e.g. at Hertz.com) will not automatically detect a cardholder as being eligible for the program and cardholders will not be automatically upgraded to the applicable status tier. Additional terms apply.

Related reading:

- Key travel tips you need to know — whether you're a beginner or expert traveler

- The best travel credit cards

- How my Costco Anywhere Visa Card by Citi is a workhorse when it comes to cash back

- Where to go in 2024: The 16 best places to travel

- 6 real-life strategies you can use when your flight is canceled or delayed

- 8 of the best credit cards for general travel purchases

- 13 must-have items the TPG team can't travel without

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- Premium News

- Biden Economy

- EV Deep Dive

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds

- Top Mutual Funds

- Highest Open Interest

- Highest Implied Volatility

- Stock Comparison

- Advanced Charts

- Currency Converter

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Mutual Funds

- Credit cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Personal Loans

- Student Loans

- Car Insurance

- Morning Brief

- Market Domination

- Market Domination Overtime

- Asking for a Trend

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

These 2 perks alone could make a costco membership worth it for seniors.

Retirees often have to be careful with their money. After all, they don't have a paycheck coming in any more and they often need to make their savings last.

If you're out of the workforce and considering spending some of your limited cash on a Costco membership, it's worth it to think about whether the fees to join are justified. With the price of a membership starting at $60 for a Gold Star membership and jumping to $120 for an Executive Membership, this may not seem like an easy choice.

In reality, though, there are two specific perks Costco offers that could make joining an especially smart personal finance choice for seniors.

1. Discounted prescription drugs

The ability to save on prescription medications is one huge motivator for retirees to join Costco.

According to the Georgetown University Health Policy Institute, among Americans between the ages of 65 and 79, 87% use prescription medications. For those over the age of 80, that number jumps to 91%. The average number of prescriptions filled each year is 20 for 65 to 79 year olds and 22 for those 80 and over.

These medications come at a cost, even with Medicare coverage. Individuals between the ages of 65 and 79 spend an average of $456 per year out of their pockets to cover prescription costs, while those 80 and over have to budget for an average of $510 for meds.

Joining Costco can help seniors cut those costs. The Costco Member Prescription Program makes it possible to save up to 80% on popular medications. That means a typical senior who is spending $456 annually could reduce that amount by as much as $364.80. The prescription savings alone would more than justify the annual membership fee.

Let's take a look at one popular drug. Celebrex treats rheumatoid arthritis and osteoarthritis -- two common ailments in the elderly. The generic version, Celecoxib, was more than $10 cheaper from Costco compared with Target or CVS in multiple markets across different states including Florida, Pennsylvania, and California. The discount on this one med alone covers Costco's annual fees and then some, assuming you get a 30-day monthly supply.

2. Discounted travel

Travel is a passion for many seniors who have the money, time, and health to see the world. Over half (52%) of seniors ages 50 and up describe travel or vacations as their top priority when it comes to spending their discretionary income. Costco can make those trips less expensive.

The warehouse club offers tons of vacation packages at great prices. When The Ascent compared costs of Costco versus alternatives, there were multiple trips offering savings of $500 or more. Plus, Costco also allows you to earn a 2% cash back reward when you book vacations through Costco Travel if you upgrade to the Executive Membership, which can help lower the cost even more.

These two perks alone are often well worth joining Costco for, especially if you're like most seniors and tend to spend a lot on medications and vacations.

The good news is, if you aren't happy with your membership, Costco will also offer a refund at any time. So you can join to see if your prescriptions or destinations are cheaper, and if it turns out you aren't saving enough to justify your membership fee, you haven't really lost anything in the end.

Top credit card to use at Costco (and everywhere else!)

If you’re shopping with a debit card, you could be missing out on hundreds or even thousands of dollars each year. These versatile credit cards offer huge rewards everywhere, including Costco, and are rated the best cards of 2024 by our experts because they offer hefty sign-up bonuses and outstanding cash rewards. Plus, you’ll save on credit card interest because all of these recommendations include a competitive 0% interest period.

Click here to read our expert recommendations for free!

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. Christy Bieber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Costco Wholesale and Target. The Motley Fool has a disclosure policy .

These 2 Perks Alone Could Make a Costco Membership Worth It for Seniors was originally published by The Motley Fool

Recommended Stories

Ask an advisor: ‘prove me wrong.' i think investing in cds is a better deal than working with a financial advisor.

Why hire a financial advisor who will take around 1% percent of your assets per year when you can get a certificate of deposit (CD) at over 5% with no fee? That alone amounts to a 6% return on your … Continue reading → The post Ask an Advisor: ‘Prove Me Wrong.' I Think Investing in CDs Is a Better Deal Than Working With an Advisor appeared first on SmartAsset Blog.

Jamie Dimon is right. The number of U.S. public companies is plummeting—and that’s bad news for the democratic component of the economy

Without taking the right measures to allow companies to grow and prosper in the public markets, America could lose its edge.

Nvidia Stock Analysis: 3 Things Smart Investors Know

Savvy investors keenly understand the factors to which they should pay close attention.

In the Market: In Asia, people ask, how do I derisk from America?

A European private wealth manager in Hong Kong told me last week he recently got the catalyst he needed to land a Taiwanese billionaire's account: geopolitics. The billionaire was down to two major wealth managers -- UBS and JPMorgan Chase -- after Credit Suisse’s demise last year. In recent years, as the Sino-U.S. saber rattling has increased, I have repeatedly heard from sources in the United States about how companies and investors are de-risking from China, building resiliency in their supply chains, reducing their exposure and putting a higher risk premium to business there.

New BYD Hybrid Can Drive Non-Stop for More Than 2,000 Kilometers

(Bloomberg) -- BYD Co. unveiled a new hybrid powertrain capable of traveling more than 2,000 kilometers (1,250 miles) without recharging or refueling, intensifying the EV transition war against Toyota Motor Corp. and Volkswagen AG.Most Read from BloombergWall Street Returns to T+1 Stock Trading After a CenturyTreasuries Hit as US Sales Struggle to Lure Buyers: Markets WrapFor Private Credit’s Top Talent, $1 Million a Year Is Not EnoughMortgages Stuck Around 7% Force Rapid Rethink of American Dre

Did QuantumScape Just Say "Checkmate" to Tesla?

QuantumScape just shipped a new version of its solid-state batteries.

Watch CBS News

What's the best credit card for travel perks?

By Jeff Wagner

May 28, 2024 / 10:10 PM CDT / CBS Minnesota

MINNEAPOLIS — The summer travel season is now in full swing. And while the average cost of a flight is down compared to last year, there are still ways to save.

So, what's the best credit card for travel perks? Good Question.

More swipes equal more flights when your credit card rewards you for spending.

"I have the United Adventure Card," said Katie Converse as she walked through Minneapolis-St. Paul International Airport.

"The card I use is a Chase Sapphire Card," added traveler Luke Bonney.

"The first one I got was called Capitol One Rewards," said Rebecca Hermos, who was traveling with her daughter, Rosalie.

All three agree that cashing in your miles and points feels great, especially if it lands them a free plane ticket.

The options for picking plastic that pays off feel endless, so what's best? Is it a card that offers travel miles? What about points? Getting cashback is also tempting.

"My weakness is this (card) also has that thing where you can delete purchases," said Hermos about her cashback option that eliminates purchases from her bill.

First tip: Know the difference between an airline credit card and a travel credit card.

An airline credit card lets you accrue miles to earn a free flight. They also include perks for faster boarding, free checked bags and the chance to earn "elite" status for how often you use the airline. The catch is you are tied to that specific airline.

"Sometimes they have a spending limit that if you achieve you get extra miles," said Converse of her United Airlines card.

Travel credit cards are more flexible with your rewards.

You get points, which can converted to get tickets to multiple airlines, as well as hotels and even cashback.

"You're not boxed in," said Hermos. "What if Delta doesn't fly where you want when you want?"

So, which is the better choice? It depends on your travel and spending habits.

According to The Points Guy, airline credit cards are great if you fly often and if your local airport is a hub for that airline. Converse has a United Airlines card, in part, because Denver International Airport is a United hub.

If you fly less frequently and like to keep your options open for multiple airlines, as well as hotel stays, travel credit cards might be best.

"I know people who have a Southwest card and a United card and a Delta card," Converse said.

Why is it a good idea to only have one or just a few credit cards with rewards?

"I rack up more rewards and that way I'm not spread too thin," said Converse.

She makes a good point. By limiting the number of perks credit cards, owners have a chance to maximize the rewards. It also puts them on a path to achieving a higher status with certain airlines.

Another tip to remember is to use the points quickly as they can lose value over time. That's why some financial experts say cashback is the most valuable option, especially when used immediately.

Lastly, pay your credit card balance each month in full. If not, the interest rate on your bill could lead to charges that outweigh the card's perks.

Some cards carry a high annual fee pushing $500 or more. Keep that in mind when choosing a card and whether your usage of the benefits offsets those initial costs.

- Credit Cards

Jeff Wagner joined the WCCO-TV team in November 2016 as a general assignment reporter, and now anchors WCCO's Saturday evening newscasts. Although he's new to Minnesota, he's called the Midwest home his entire life.

Featured Local Savings

More from cbs news.

3 women hurt in shooting near St. Paul's Crosby Farm Park

University of Minnesota gymnasts scramble to find new practice space

Minnesota woman leads charge on new law requiring adult changing tables in U.S. airports

How common is boat ownership in Minnesota compared to the rest of the U.S.?

8 Reasons You Should Pay for a Costco Membership This Summer

C ostco has three membership options — Gold Star for $60 a year, Business for $60 a year and Executive for $120 a year. For the average family, the Gold Star option is generally enough, as it includes a free household Costco card and is valid at Costco locations worldwide. But for some perks, an Executive membership may be required.

For many, it’s easy to see the value of having a membership to this warehouse club. Bulk buys, discounts and quality goods can lead to significant savings for regular shoppers. In the summer, especially, consumers can often find great deals on food, clothes, party supplies, beach accessories, outdoor furniture and accessories, and even sports equipment.

Discover More: 6 Expensive Costco Items That Are Definitely Worth the Cost

Find Out: How To Get $340 Per Year in Cash Back on Gas and Other Things You Already Buy

But despite this potential value, GOBankingRates’ recent Summer of Savings survey found that 43% of people don’t shop at Costco. If you’re on the fence about getting a Costco membership this summer, here are some reasons why it’s worth it.

Exclusive Travel Deals and Savings

If you’re thinking about taking a trip this summer, Costco Travel could make it worth your while to get a membership.

“Costco offers discounts on travel, including flights, cruises, hotels and even packages that include everything,” said David Bakke, budgeting expert at DollarSanity . “If you pay for your travel with the Costco Anywhere Visa Card, you can save even more.”

With the Costco Anywhere Visa Card by Citi®, you can earn cash back on your purchases. This includes 3% cash back on travel and restaurants, 4% on eligible gas and EV charging for the first $7,000 spent per year and 1% after, 2% on Costco-specific purchases, and 1% on all other purchases. There’s no annual fee or foreign transaction fees.

To get this card and to take advantage of these exclusive deals, you’ll need to be a current Costco member.

Check Out: 12 Best Aldi Items Dropping in Price Just in Time for Summer

Deals on New and Used Cars

If you’re thinking about getting a new or used vehicle or an RV, or doing some maintenance on your current vehicle, you can find some good deals and discounts through the Costco Auto Program .

This program is only available to Costco members. Once you are a member, however, you can often find some exclusive incentives and specials on vehicles and repairs that more than make up for the price of membership.

For example, you could get 15% off parts, service and accessories — or up to $500 off per visit to any participating service center across the country. Depending on when you shop, you can also find incentives — like lower rates or down payment requirements — on cars.

Lower Everyday Prices on High-Quality Goods

Costco’s very own Kirkland Signature brand is generally lower priced than national brands, but you can still expect high quality. And, of course, the store does carry national brands, which are also high-quality — and sometimes discounted at Costco.

While not everything is cheaper at Costco, you can still save money on a per-unit basis on many items — but you’re especially likely to get your money’s worth from your membership if you buy in bulk.

Buying in bulk can bring about some significant savings, especially if you have a larger family or tend to cook larger meals. Doing this could save you money on groceries, everyday household essentials, and more at Costco.

In the summer, you can also find deals on grilling supplies, snacks, drinks, fresh produce, meats, ready-to-eat meals and more. This is especially convenient if you plan on hosting backyard barbecues or having picnics.

There Are Other Discounts, Too

There are other, lesser-known discounts at Costco, too. One of them is on gift cards.

“The discounted gift cards you can get at Costco are the closest thing to free money [that] there is,” said Bakke. “As a quick example, you can buy $100 worth of Domino’s Pizza gift cards for $80. Just make sure you’re only buying gift cards for places you’d be shopping at anyway.”

Lower Prices on Fuel

To use the fuel station at Costco, you’ll need to be a member. The only exception is if you have a Costco Shop Card. This card gives you some of the perks of being a member without actually having to purchase a membership.

With that being said, Costco’s fuel prices are generally lower than average. According to GasBuddy, the price of regular fuel at Costco hovers around $3.09 per gallon. Premium is $3.56 per gallon. The current national average price of regular fuel is $3.61 per gallon, or $4.41 for premium.

If you drive a lot, you’ll start to see those savings on fuel add up and eventually overtake the annual cost of membership.

You Can Get Refunds

Like many stores, Costco has its own return policy. On merchandise, it guarantees satisfaction or your money back. If you’re returning an electronic device, like a phone, computer, projector or camera, you’ll need to do so within 90 days of purchase. The item must also be in its original packaging.

This might not seem like a major perk, but Costco takes it one step further. It will even refund your membership fee if you’re not satisfied.

Take the executive membership as an example.

“An executive membership costs $120 per year, twice that of a regular membership. That said, it offers 2% rewards on all purchases up to $1,000 annually,” said Bakke. “The best part is that if the rewards don’t recoup the extra money you spend for the upgraded membership, Costco pays you the difference in cash.”

Summer Deals Abound

Costco carries just about everything you need for summer — outdoor furniture, grills, food and drinks, and even camping gear. While it’s a good idea to compare prices and check reviews to make sure you’re really getting the best deal, chances are very good that you’ll save money buying these items at Costco.

And long after summer’s passed, you can still use your membership to find seasonal discounts and other limited-time offers on goods storewide and online.

Lower Prices on Certain Medical Services and Prescriptions

You don’t need to be a Costco member to go to the pharmacy. But if you join the Costco Member Prescription Program , an add-on to the original membership, you and your dependents could get lower prices on prescription medications.

As a regular Costco member, you can also get free hearing screenings, discounted vaccinations, lower-cost medical devices and more. This isn’t only for the summer, meaning you can still take advantage of these discounts all year long.

Methodology: GOBankingRates surveyed 999 Americans aged 18 and older from across the country between May 3 and May 7, 2024, asking twenty-two different questions: (1) What will you spend the most on this summer?; (2) Has inflation impacted your summer vacation or travel plans this year?; (3) If you’re going on a vacation, how do you plan to travel? (select all that apply); (4) If you’re going on a vacation, where do you plan to stay? (select all that apply); (5) How much do you expect to spend on vacation this summer?; (6) What’s the best way to save money on vacation costs?; (7) If you are a parent, how much will you spend on summer activities/camps for your child(ren)?; (8) If you are a parent, how much will you spend on weekly child care costs this summer?; (9) Which retailer do you shop at most for your summertime needs?; (10) Which retailer do you think has the worst deals on summertime essentials?; (11) If you shop at Dollar Tree, what’s your summertime must-buy? (select all that apply); (12) If you shop at Costco, what’s your summertime must-buy? (select all that apply); (13) If you celebrate Memorial Day, how much money do you plan to spend?; (14) If you celebrate the Fourth of July, how much money do you plan to spend?; (15) If you celebrate Labor Day, how much money do you plan to spend?; (16) If you’re shopping during Memorial Day weekend, what are you planning to buy? (select all that apply); (17) If you’re shopping during the Fourth of July, what are you planning to buy? (select all that apply); (18) If you’re shopping during Labor Day weekend, what are you planning to buy? (select all that apply); (19) Do you plan on working a side hustle this summer to cover expenses?; (20) What are some ways you plan to save extra money this summer? (select all that apply); (21) How do you plan to build your wealth this summer? (select all that apply); and (22) Which summer purchase is worth every penny, in your opinion? (select all that apply). GOBankingRates used PureSpectrum’s survey platform to conduct the poll.

More From GOBankingRates

- Barbara Corcoran: 3 Cities To Invest in Real Estate Now Before Prices Skyrocket

- 10 Best New Buys at Big Lots That Are Worth Every Penny

- This is The Single Most Overlooked Tool for Becoming Debt-Free

- 3 Things You Must Do When Your Savings Reach $50,000

This article originally appeared on GOBankingRates.com : 8 Reasons You Should Pay for a Costco Membership This Summer

As rewards credit cards face regulation, what are the alternatives?

- Rewards credit cards are not for everyone.

- There are other ways to pay for travel, including debit cards, no-annual-fee credit cards and money transfer services.

- The government is concerned about rewards credit cards and is likely to regulate them soon.

Ronald Duben is ready to give up his credit card. He thinks there's something better out there – and there almost certainly is.

Duben has been dutifully shelling out $120 a year for his co-branded airline rewards card, which promises he'll get "free" flights if he spends enough money. It was a good deal at first. Once he collected about 60,000 points by late February, he could cash in his rewards for a flight to Asia.

Check out Elliott Confidential , the newsletter the travel industry doesn't want you to read. Each issue is filled with breaking news, deep insights, and exclusive strategies for becoming a better traveler. But don't tell anyone!

But when Duben tried to redeem his loyalty points for an economy class ticket to Japan recently, he was stunned that his airline more than tripled the miles he had to pay. Then it asked him for another $375 in taxes and fees on top of the 200,000 points.

So much for "free."

Learn more: Best travel insurance

"I feel like I'm deeply involved in a rip-off," said Duben, a retired chef from San Rafael, California, "and I want to get out."

It turns out there is a way out.

Will new airline consumer protection rules help you when you fly this summer?

Tipping is 'not an entitlement': Should travelers stop tipping for everything?

Making a U-turn on rewards credit cards

Rewards credit cards – and especially those high-fee, high-interest mileage-earning credit cards – are not for everyone. You're probably just as likely to pay an absurdly high interest rate and add to that $1 trillion in credit card debt as you are to get a "free" airline ticket.

The government is concerned about these cards, too. Earlier this month, the Consumer Financial Protection Bureau (CFPB) issued a report on rewards cards that identified multiple problems with these payment systems. Consumers complained that rewards are often devalued or denied even after they meet program terms. And consumers who carry revolving balances often pay more in interest and fees than they get back on rewards.

The CFPB and the Department of Transportation also held a hearing on rewards credit cards , a likely precursor to regulating these programs.

So if this is the beginning of the end for rewards credit cards, then what's next?

Here are the alternatives to rewards cards

Read a travel blog or newspaper travel section, or look at a travel Instagram account, and you might think the only way to travel is with one of those high-fee travel cards. But there are other ways to pay:

- A debit card : A debit card or bank card deducts money directly from your bank account. No need to worry about spending more than you have because it usually won't let you overdraw. "Debit cards are a straightforward option," said Shawn Plummer, a financial expert and frequent traveler. "They're widely accepted and eliminate the risk of accumulating debt because they only allow you to spend what you have."

Many debit cards even have travel benefits such as no currency conversion fees, but there are limits: Car rental companies and hotels may not accept a debit card.

- A no-annual-fee, low-interest-rate credit card : You shouldn't pay an annual fee for your credit card. And if you do a little research, you can find a card with less than a 10% annual interest rate. Hint: Check with a credit union. Many of these cards also have all the travel benefits you need, including coverage for car rentals and medical evacuations – and no currency exchange fees.

By the way, if you do want to pay a membership fee, try joining one of the warehouse clubs like Sam's or Costco. Peter Hoagland, a consultant from Warrenton, Virginia, swears by his Costco Visa. He said it's a no-nonsense payment system with relatively reasonable fees.

"I use the card everywhere," said Hoagland.

- Money transfer services : A service like Revolut or Wise will allow you to transfer money to a company or individual, completely bypassing the credit card network. These companies are on the bleeding edge of digital banking. I visited Wise's headquarters while I was in London recently and really loved its plan to remove "all the friction" between you and your money. That means eliminating a lot of the high fees you've been paying for years.

Andy Abramson, a communications consultant from Las Vegas, uses both and likes the speed of transfer and the favorable exchange rates when moving dollars to another currency.

"They're both incredible," he said.

This type of vacation rental cancellation is on the rise. Are you next?

'Expensive in every way': What travelers should expect this summer

What is the future of payment systems for travelers?

Are rewards credit cards obsolete? Have they become bloated and inefficient, with their high swipe fees and exorbitant interest rates and empty promises of free tickets? Some industry watchers believe the answer is yes.

As an intermediate step, many travelers are switching to a debit card or a digital payment system. That allows them to lower their interest rates and make smarter decisions about their purchases instead of mindlessly spending money to accumulate points or giving all of their loyalty to one airline.

Financial experts see a better future just ahead. It's a place where digital peer-to-peer payment systems are used to transfer money at virtually no cost to you. In that future, cards are as antiquated as traveler's checks. All transactions happen on a phone with a tap and a biometric "OK." And loyalty programs have evolved into something more sophisticated than today's bait-and-switch cards that just make you spend more.

Will the government regulate rewards credit cards?

After this month's joint hearings with the CFPB and DOT, rewards credit cards are likely to be regulated soon.

Even if regulators don't act, Congress could. A new bill called the Credit Card Competition Act could bring much-needed competition to credit cards. That would make rewards cards a little less generous and could bring some sobriety back to rewards programs.

It's about time. Rewards credit cards make promises they can't keep, bait you into spending more than you should, and ultimately reward only the airlines and credit card companies that issue trillions of often worthless points. The sooner we can find an alternative to reward credit cards, the better. The current system is completely unsustainable.

That's what Duben, the retired chef who wanted to go to Japan, did. He clicked on the United Airlines website and booked a regular ticket. He'll use his miles for another ticket and then close his rewards credit card for good.

Christopher Elliott is an author, consumer advocate, and journalist. He founded Elliott Advocacy , a nonprofit organization that helps solve consumer problems. He publishes Elliott Confidential , a travel newsletter, and the Elliott Report , a news site about customer service. If you need help with a consumer problem, you can reach him here or email him at [email protected] .

The Key Points at the top of this article were created with the assistance of Artificial Intelligence (AI) and reviewed by a journalist before publication. No other parts of the article were generated using AI. Learn more .

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Your 2024 Credit Card Checklist for Summer Travel

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Checklists are a key step in travel preparation for many people. Passport — check. Phone charger — check. But have you checked to make sure you’re fully utilizing the travel perks offered by your credit card?

Whether you’re a seasoned jetsetter or a novice traveler seeing the world for the first time, benefits from the right credit card can make a trip more convenient and more comfortable. That’s good news for the 50% of Americans who plan to travel more in 2024 than 2023, according to a survey by IPX1031, a Fidelity National Financial Company.

Here’s a credit card checklist to review before you hit the road this summer.

1. Bring a card

First things first — be sure to bring a credit card! Many airlines, and even entire airports, are now cash-free. That means you’ll need a card to pay for that pre-departure drink or in-flight snack. You might even earn bonus rewards.

For example, if restaurants are a bonus category for your card, sit-down establishments within the airport will usually still earn that higher rewards rate. If your card earns a bonus on travel purchases, you'll usually earn that bonus for in-flight purchases.

2. Register for TSA PreCheck, Global Entry or Clear

Airports are more crowded than ever, with air passenger growth up 6% and foreign travel up 24% year over year, according to a study conducted by the U.S. Travel Association and Tourism Economics.

To ease the burden of long lines, check if your card offers a credit that covers the cost of TSA PreCheck , Global Entry or Clear . These programs allow you to speed through the line at security or customs, but since they all require a background check and an in-person interview, you'll need to register well before your trip. Even if you haven’t been verified for this trip, register today to prepare for your next trip.

3. Register for lounge access

Airport lounges offer a reprieve from the hustle and bustle of the airport terminal, with most offering free food and drinks. If your card offers access to Priority Pass lounges, you’ll need to register for that benefit before you hit the road.

Don’t forget your physical membership card, or even easier, download the Priority Pass app and use your phone to access the lounge.

4. Notify your issuer of your travel plans

Few things can create issues like having your card unexpectedly stop working when you’re away from home, especially internationally. With rates of credit card fraud increasing, it’s possible your card could stop working if you’re spending outside of your normal patterns or locations. To preempt this, notify your issuer before you travel. Often you can do this online or through the app, but just in case, be sure to travel with at least two cards .

5. Avoid paying foreign transaction fees

If you’re traveling abroad, make sure you have a card that doesn’t charge foreign transaction fees . If your card does levy those fees, try to get a different card before you leave the country.

6. Pay with your most rewarding card

Be sure to identify opportunities to leverage your trip and earn outsized rewards. For example, if you know you’ll be staying at a Hilton brand hotel, you might consider applying for one of the Hilton credit cards offered by American Express and earn up to 14 Hilton points per dollar you spend at the hotel. Those points can stack up fast and easily defray costs for your future travel.

But you'll need to bring the physical card with you. Many hotels aren't able to accept digital wallet payments, so if you can't swipe your card, you'll miss out on those heightened rewards.

7. Check your card’s money-saving offers

Many issuers have programs, such as AmEx Offers, Chase Offers and BankAmeriDeals from Bank of America, that let you add rotating promotional offers to your card and earn additional points or cash back for making purchases at specific merchants. Be sure to review these offers for any merchants where you might spend during your travels. Just be aware of the fine print — often these offers exclude, or only include, international merchants.

On a similar note...

Find the right credit card for you.

Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.

- Help Center

- 1-866-921-7925

Start Searching

- Packages

- Hotels

- Cruises

- Rental Cars

* Indicates required fields

Rental Period:

pickUpDate - dropOffDate

Pick-Up: pickUpTime - Drop-Off: dropOffTime

Pick-Up Location:

pickUpAddress

pickUpAgencyName

pickUpAgencyAddress

Drop-Off Location:

Same as Pick-Up Location

dropOffAddress

dropOffAgencyName

dropOffAgencyAddress

Coupon Override

Please call.

For drivers under the age of 25, additional fees and/or restrictions may apply.

For information and assistance in completing your reservation, please call:

We're unable to find your location.

Alaska Cruise Tours:

A cruise tour is a voyage and land tour combination, with the land tour occurring before or after the voyage. Unless otherwise noted, optional services such as airfare, airport transfers, shore excursions, land tour excursions, etc. are not included and are available for an additional cost.

Executive Member Benefits

Select packages include a resort, spa, or shipboard credit, or other values exclusive to Executive Members.

Executive Members get more.

If you’re already an Executive Member, or you're considering upgrading your membership, check out the special extras on select vacations, just for you. Plus, Executive Members receive an annual 2% Reward on Costco Travel purchases.†

Featured Deals

Tahiti: hotel kia ora resort & spa package.

Daily Buffet Breakfast for Two Special Savings

5 Nights with Airfare from $3,649 Per Person*

Fiji: Matangi Private Island Meals Included Package

Daily Breakfast, Lunch and Dinner Ocean-View Bure

5 Nights with Airfare from $3,209 Per Person*

Dominican Republic: Majestic Colonial Package

Family-Friendly, All-Inclusive Resort Beachfront, Digital Costco Shop Card Executive Member Benefit

Turks and Caicos: Sands at Grace Bay Package

Family-Friendly Beachfront Resort Executive Member Benefit

Los Cabos: Zadun, a Ritz-Carlton Reserve Package

Luxury Resort Daily Breakfast for Two Executive Member Benefit

Puerto Vallarta: Villa Premiere Package

Adults-Only, Boutique Hotel Executive Member Benefit All-Inclusive Plan Available for Purchase

Venice & The Jewels of Veneto

Uniworld River Cruises | S.S. La Venezia Digital Costco Shop Card, Round-Trip Venice Executive Member Benefit

7 Nights from $1,999*

Eternal Sunshine Voyage

Regent Seven Seas | Seven Seas Navigator® Digital Costco Shop Card, Round-Trip San Juan

7 Nights from $3,599*

Enchanting Danube Cruise

Uniworld River Cruises | S.S. Maria Theresa Digital Costco Shop Card, Passau to Budapest Executive Member Benefit

7 Nights from $2,969*

Paris & Normandy Cruise

Uniworld River Cruises | S.S. Joie de Vivre Digital Costco Shop Card, Round-Trip Paris Executive Member Benefit

7 Nights from $3,499*

Caribbean Warmth

Regent Seven Seas | Seven Seas Navigator® Digital Costco Shop Card, San Juan to Miami

11 Nights from $4,275*

Iconic Asian Capitals

Regent Seven Seas | Seven Seas Explorer® Digital Costco Shop Card, Hong Kong to Tokyo

14 Nights from $6,499*

†For Executive Member purchases made directly from Costco Travel, a 2% Reward will be earned and applied after travel is completed. Must be an Executive Member when travel starts. Excludes taxes, fees, surcharges, gratuities, trip protection, and portions of travel purchased through a third party such as activities, tours, baggage fees, upgrades, rental car equipment, resort charges, port charges, resort and cruise line fees and similar extras. Reward is capped at and will not exceed $1,000 for any 12-month period. Other terms, conditions and exclusions applicable to the 2% Reward apply.

*Unless otherwise stated, prices are per person based on double occupancy.

Think Costco Travel First

- Exclusively for Costco members

- We are Costco and we know travel

- The value you want with the quality you expect

- No surprises when you're ready to pay

- Additional advantages of membership

Learn more about the Costco Travel difference.

- Executive Members earn an annual 2% reward

- 3% cash back rewards on Costco Travel with the Costco Anywhere Visa® Card by Citi

Click here to maximize your rewards.

Explore More Travel

Walt disney world® resort.

Packages Include Theme Park Tickets,

Benefits and More

Annual 2% Reward on Costco Travel Purchases

Additional Value in Select Packages

Oahu: AULANI, A Disney Resort & Spa

Family-Friendly, Beachfront Resort

No Resort Fee, Digital Costco Shop Card

Travel Items on Costco.com

Shop costco wholesale.

Visit Costco.com

Accessories

Headphones & earbuds.

We are processing your payment.

Do not refresh your browser or exit this page.

Points influencers are everywhere. Some trips look too good to be true.

In the age of affiliate links and sponsored content, some travel influencers are overselling the lifestyle.

If you binge-watch videos on your phone for long enough, you’re likely to run into at least one clip about travel “hacking.”

Discover ways to fly free , one video might say. Crisscross the globe and stay at hotels without paying a dime, another may declare. These TikTok and Instagram posts are popular for a reason.

Leveraging loyalty and rewards programs from airlines, hotels and credit cards has helped travelers save for decades; American Express and American Airlines were some of the first players in the 1980s .

Complex rules have made the universe of points and miles seem inaccessible to people outside the world of frequent business travel, but that audience is expanding as barriers to entry are lowered. Today there are hundreds of blogs and social media accounts dedicated entirely to breaking down the nuances of points and miles. However, you can’t trust them all .

The world of points and miles is a game, albeit a long one. It can be worth it, but only if you play responsibly.

The business of influencing

Max Do, a former full-time graphic designer in San Diego, pivoted to creating content about points, miles and travel rewards in 2019 under the MaxMilesPoints account. Do says there has been an explosion of influencers who have joined in since then.

“I certainly wasn’t one of the first, but the number of points and miles creators that focus on travel has saturated Instagram and TikTok in the last couple of years,” he says.

Creators hook their audiences with travel experiences. Often, these are clips of extravagant business- and first-class flights and stays at five-star hotels and resorts — all, supposedly, booked with points.

Other accounts, meanwhile, focus more on the educational component of travel rewards, breaking down the specific methods to collect points and miles to later redeem with exacting detail (commonly referred to as “earn and burn”).

“When creating my posts and videos, I like to think about avid rewards people but also someone making their first redemption,” Do says.

@maxmilespoints ⬇️ More Info ALL ONE-WAY, double it if you want round-trip ✈️ Iberia Business Class Off-Peak 35,000 from the Midwest / East Coast to Madrid 42,500 from the West Coast to Madrid Book directly with Iberia, or you can book through British Airways. Amex, Bilt, and other points transfer directly to Iberia. Amex, Bilt, Capital One, and other points transfers to British Airways. ✈️ TAP Portugal 35,000 Avianca LifeMiles New York (JFK) to Lisbon, Portugal Book directly with Avianca LifeMiles Amex, Bilt, Capital One, Citi points transfers to Avianca Lifemiles This is the only route ✈️ ANA 45,000 Virgin Points (west coast) 47,500 Virgin Points (east coast) Find award availability and then book through Virgin Atlantic by calling them. Amex, Bilt, Capital One, Citi, and other credit card points are transfers to Virgin Atlantic. ♬ original sound - Max Miles Points

For creators who focus on rewards programs, posting travel videos can be lucrative. As the business of influencing continues to flourish, creators typically can earn revenue in the form of paid partnerships, sponsored content or, in this case, selling products.

“The trend I see generally is that personal finance creators will leverage stories of their own travels to promote travel credit cards,” says Katie Gatti Tassin, founder of personal finance brand Money With Katie . Since starting her site and social media profiles in 2020, she’s seen an uptick in accounts with credit card affiliate links.

Here’s how those links work: Let’s say you open Instagram, watch a creator’s video and later feel compelled to apply for a credit card through them (often via a link found in their account bio). If approved, the creator will earn a commission — sometimes hundreds of dollars per card, according to Gatti Tassin.

For consumers, credit card bonus offers are the quickest way to earn points and miles in a hurry. It’s not unusual to see sign-up offers exceed 100,000 points. Apply for a card, get approved, spend a certain amount within a set period and those points will be deposited into your account.

Travel inspo vs. smart finances

Gen Z and millennials are increasingly reliant on social media apps as a search and recommendation tool. And when it comes to points and miles, there’s often a blurry line between two niches: travel inspiration and personal finance advice.

“There are many creators out there who just reveal clips of incredible first-class seats or an overwater villa, say they redeemed everything on points, and shove a credit card in your face,” Do says. According to Do, that content is “oversimplified” to get people to pay attention.

Among a few of the issues that Do sees as red flags:

- Videos that promote first-class and business-class seats that are extremely difficult to redeem

- Claiming an ability to earn hundreds of thousands (or even millions) of miles quickly

- An assertion that there’s only one “correct” way to redeem points for travel

Overall, there’s often a lack of nuance that creates more questions than answers for audiences.

“We also always see the humblebrags about the number of credit cards in someone’s wallet, but the average person likely does not want to deal with 20 cards — no matter how many bonus points are available,” Do says.

Credit card rewards can provide immense value to travelers, but it’s important to know when content is too good to be true or an impractical get-points-rich-quick scheme.

“Rewards can save you a ton of money or provide travel experiences you otherwise wouldn't be able to afford,” Gatti Tassin says.

Advertising rules for influencers

Because of the inherent financial implications with credit cards, there’s more at stake than, say, someone sharing an outfit that can be purchased through affiliate links.

Organizations such as the Federal Trade Commission (FTC) and the Consumer Financial Protection Bureau (CFPB) require influencers to disclose when paid affiliate links are being used.

Meanwhile, although the Transportation Department doesn’t have direct oversight of credit card marketing practices, it still works closely with the CFPB. That’s because travel is so closely interconnected with the U.S. financial system. At a joint hearing on May 9 with the CFPB on credit card, airline and hotel rewards, Transportation Secretary Pete Buttigieg said, “If a customer makes significant decisions that might include not just what airlines to fly, but what credit card to use … it matters that the reward they get for that is as advertised.”

Each credit card company also has a compliance team that ensures products are communicated appropriately to audiences. “How our products are presented is important to us, both so prospective customers have accurate information when making decisions about applying for a credit card, and so our current customers understand the benefits their cards offer,” a Capital One spokesperson said.

“Travel rewards require a level of financial literacy the average consumer probably does not have, so as a creator, you are responsible for educating before encouraging them to apply,” Gatti Tassin said.

That includes subtleties about how credit works.

Advice for new cardholders

The first rule of playing points is simple: If you’re already struggling with credit card debt, you shouldn’t be charging more to chase the fantasy of a “free” vacation.

“If you have credit card debt, it doesn’t make sense to pay 20 percent or more in interest just to get a few percentage points’ worth of airline miles, hotel points or cash back,” says Ted Rossman, a senior industry analyst for Bankrate. “About two-thirds of people with credit card debt are making the mistake of chasing rewards while paying high interest charges.”

Rossman notes that applying for a rewards card may initially ding your credit score, but there could be a positive impact in the long term.

“Your credit score usually declines a little bit (often five to 10 points) after applying for a credit card, but after a few months of responsible card usage, there’s a good chance your credit score could be even higher than before,” he adds. “Positive payment history helps, as does keeping your card usage low.”

As for collecting points and miles responsibly with credit cards? Well, don’t even think about the world of rewards until after your first or second card and you’re able to build strong credit habits. Paying in full each month is key.

“Over time, you can layer in more expenses and eventually get to a point where you’re putting all of your routine purchases on a credit card and paying in full to avoid interest while earning rewards,” Rossman says.

And remember that cash-back cards are out there, too. Cash back is the top credit card feature in the United States by a wide margin, according to Bankrate.

“Travel rewards can be more lucrative, but they’re also more work,” Rossman stresses.

More travel tips

Vacation planning: Start with a strategy to maximize days off by taking PTO around holidays. Experts recommend taking multiple short trips for peak happiness . Want to take an ambitious trip? Here are 12 destinations to try this year — without crowds.

Cheap flights: Follow our best advice for scoring low airfare , including setting flight price alerts and subscribing to deal newsletters. If you’re set on an expensive getaway, here’s a plan to save up without straining your credit limit.

Airport chaos: We’ve got advice for every scenario , from canceled flights to lost luggage . Stuck at the rental car counter? These tips can speed up the process. And following these 52 rules of flying should make the experience better for everyone.

Expert advice: Our By The Way Concierge solves readers’ dilemmas , including whether it’s okay to ditch a partner at security, or what happens if you get caught flying with weed . Submit your question here . Or you could look to the gurus: Lonely Planet and Rick Steves .

IMAGES

VIDEO

COMMENTS

These benefits and more can make the Costco Anywhere Visa a great card for travel. Let's look at how it works. Cash back rewards on travel. Cardholders earn unlimited 3% cash back at restaurants and eligible travel purchases. This can include airfare, hotel stays, car rentals, travel agencies, cruises and Costco travel.

1. Cash back rewards. Shopping at Costco can be more rewarding. Costco members can earn cash back rewards with a Costco Anywhere Visa ® Card by Citi. Here's what qualified cardmembers can expect on eligible purchases: 4% on eligible gas and EV charging for the first $7,000 per year and then 1% thereafter; 3% on restaurants and eligible travel

Costco Anywhere Visa Business Card by Citi. The variable APR for purchases is 20.49%. For Citi Flex Plans subject to an APR, the variable APR is 20.49%. For Citi Flex Pay Plans subject to a Plan Fee, a monthly fee of up to 1.72% will apply, based on the Citi Flex Plan duration, the APR that would otherwise apply to the Transaction, and other ...

Executive Members earn an annual 2% reward. 3% cash back rewards on Costco Travel with the Costco Anywhere Visa® Card by Citi. Click here to maximize your rewards. Costco Travel offers everyday savings on top-quality, brand-name vacations, hotels, cruises, rental cars, exclusively for Costco members.

Yes. Earn Costco cash back rewards with the Costco Anywhere Visa ® Card anywhere Visa ® is accepted, with the Costco Anywhere Visa® Card by Citi. Earn 4% cash back rewards on eligible gas and EV charging for the first $7,000 per year, and then 1% thereafter. Earn 3% on restaurants and eligible travel. Earn 2% on all other purchases from ...

Our Verdict. The Costco Anywhere Visa® Card by Citi *, from our partner, Citi, could stand on its own as a top-tier cash-back credit card. With rewards of 4% cash back on eligible gas and EV ...

20.49% (Variable) Annual Fee. $0. Recommended Credit. 740-850. Excellent. More details. Discover one of Citi's best cash back rewards cards designed exclusively for Costco members. 4% cash back on eligible gas and EV charging purchases for the first $7,000 per year and then 1% thereafter.

Rates & Fees. When you're buying gas, the Costco Anywhere Visa® Card by Citi is a good card to use because it earns 4% cash back on gas and EV charging purchases on up to $7,000 of spending a ...

The Costco Anywhere Visa® Card by Citi (see rates and fees) is one of the best store credit cards on the market. If you already have a Costco membership, this card is a solid way to earn rewards across a wide range of purchases, including eligible gas, restaurants, eligible travel and at Costco — both in-store and online. Card Rating*: ⭐ ...

Rewards: 4% cash back on eligible gas and electric vehicle charging purchases (up to the first $7,000 spent each year, then 1%) 3% cash back at restaurants. 3% cash back on eligible travel ...

Costco Travel package Booking directly; Hotel Wailea (garden-view suite for two adults) $4,482.46 ($896.50 per night) $4,595.78 ($919.16 per night) Alamo intermediate car (Toyota Corolla or similar) Included in the total package cost: $323.13 ($64.63 per night) Additional perks and benefits $306 Digital Costco Shop Card

(After $7,000 in spending, the rewards rate goes down to 1%.) The card also earns 3% cash back on restaurants and most travel purchases, 2% back at Costco and Costco.com, and 1% back on all other ...

Earn 4% Cash Back on Gas and EV Charging. The Costco Anywhere Visa Card offers a high 4% cash back on eligible gas and EV charging purchases for the first $7,000 spent annually, 1% thereafter, 3% ...

Costco Anywhere Visa Card by Citi. Annual fee: $0. Welcome offer: N/A. Rewards: 4% cash back on eligible gas and EV charging (up to the first $7,000 spent per year, then 1%) 3% cash back at ...

Simply enter your promo code at checkout to receive the bonus Digital Costco Shop Card valued at 20% of your total package price. Valid for travel through 8/31/24, book between 2/6/24 - 4/30/24. In addition, you can earn 3% cash back rewards on Costco Travel purchases when you use the Costco Anywhere Visa® Card by Citi.‡.

Annual fee: $0 for the card, but you have to be a Costco member. A baseline Gold Star membership costs $60 per year, while the higher-tier Executive membership is $120 per year. Rewards: 4% cash ...

The Wells Fargo Active Cash® Card, the Costco Anywhere Visa® Card by Citi, and the Bank of America® Customized Cash Rewards credit card all earn 2% there. Other good options include the Chase ...

Costco Travel offers everyday savings on top-quality, brand-name vacations, hotels, ... Disney Cruise Line Round-Trip Port Canaveral 7-Night Cruise Aboard Disney Fantasy Digital Costco Shop Card Courtesy of Costco Travel. ... 3% cash back rewards on Costco Travel with the Costco Anywhere Visa® Card by Citi

Rewards Circle with letter I in it. 4% back on gas and EV charging ($7,000 annual spending cap), 3% back on restaurants and travel, 2% back on Costco purchases, 1% back on other purchases 1% - 4% back

These versatile credit cards offer huge rewards everywhere, including Costco, and are rated the best cards of 2024 by our experts because they offer hefty sign-up bonuses and outstanding cash ...

The Costco Executive membership costs $120 a year, but you could easily make up the difference depending on what you buy. You can get up to $1,000 back a year in rewards with an Executive ...

Converse has a United Airlines card, in part, because Denver International Airport is a United hub. If you fly less frequently and like to keep your options open for multiple airlines, as well as ...

Call to Apply 1-800-970-3019TTY Use Relay Service. 1Costco Anywhere Visa® Card by Citi and Costco Anywhere Visa® Business Card by Citi - Pricing Details. Costco Anywhere Visa Card by Citi. The variable APR for purchases and balance transfers is 20.49%. For Citi Flex Plans subject to an APR, the variable APR is 20.49%.

According to GasBuddy, the price of regular fuel at Costco hovers around $3.09 per gallon. Premium is $3.56 per gallon. The current national average price of regular fuel is $3.61 per gallon, or ...

Ronald Duben is ready to give up his credit card. He thinks there's something better out there - and there almost certainly is. Duben has been dutifully shelling out $120 a year for his co ...

5. Avoid paying foreign transaction fees. If you're traveling abroad, make sure you have a card that doesn't charge foreign transaction fees. If your card does levy those fees, try to get a ...

7 Nights from $4,349*. †For Executive Member purchases made directly from Costco Travel, a 2% Reward will be earned and applied after travel is completed. Must be an Executive Member when travel starts. Excludes taxes, fees, surcharges, gratuities, trip protection, and portions of travel purchased through a third party such as activities ...

Some trips look too good to be true. In the age of affiliate links and sponsored content, some travel influencers are overselling the lifestyle. If you binge-watch videos on your phone for long ...